0000031266eatonvance:EATONVANCEIndexBloombergUSAggregateBondIndex19314AdditionalIndexMember2017-03-310000031266eatonvance:EATONVANCEIndexBloombergUSAggregateBondIndex19417AdditionalIndexMember2019-11-300000031266eatonvance:C000014213Member2017-12-310000031266eatonvance:EATONVANCEIndexSP500Index19204BroadBasedIndexMember2016-10-310000031266eatonvance:EATONVANCEIndexRussell1000Value19375AdditionalIndexMember2016-09-300000031266eatonvance:EATONVANCEIndexRussell200019224AdditionalIndexMember2016-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-01545

Eaton Vance Special Investment Trust

(Exact Name of Registrant as Specified in Charter)

One Post Office Square, Boston, Massachusetts 02109

(Address of Principal Executive Offices)

Deidre E. Walsh

One Post Office Square, Boston, Massachusetts 02109

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

December 31

Date of Fiscal Year End

December 31, 2024

Date of Reporting Period

| Item 1. | Reports to Stockholders |

Eaton Vance Balanced Fund

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Balanced Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference*

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $106 | 0.97% |

|---|

| Footnote | Description |

Footnote* | Expenses in the table reflect the expenses of both the Fund and Stock Portfolio and Core Bond Portfolio, the Portfolios in which it invests. |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index (the Index), and the Bloomberg U.S. Aggregate Bond Index (the Secondary Index):

• The Fund invests in a blend of Stock Portfolio — the Fund’s equity allocation — and Core Bond Portfolio — the Fund’s fixed-income allocation

↓ Core Bond Portfolio underperformed the Index and detracted from Index-relative returns during the period — but outperformed the Secondary Index

↓ An underweight exposure to agency mortgage-backed securities (MBS), yield-curve positioning, and the use of derivatives detracted from returns during the period

↑ Bond selections ― notably in investment-grade corporate bonds ― and sector allocations ― notably an overweight exposure to commercial MBS ― aided returns

↑ Stock Portfolio outperformed the Index; an overweight position in artificial intelligence chipmaker NVIDIA Corp. contributed to Index-relative returns

↑ Among sectors, stock selections and underweight exposures to health care and consumer staples, and stock selections in information technology, helped returns

↓ An overweight position in energy exploration and production firm ConocoPhillips fell in value as global energy demand and oil prices weakened during the period

↓ Among sectors within the Index, the Fund’s stock selections in the energy and real estate sectors detracted from Index-relative performance during the period

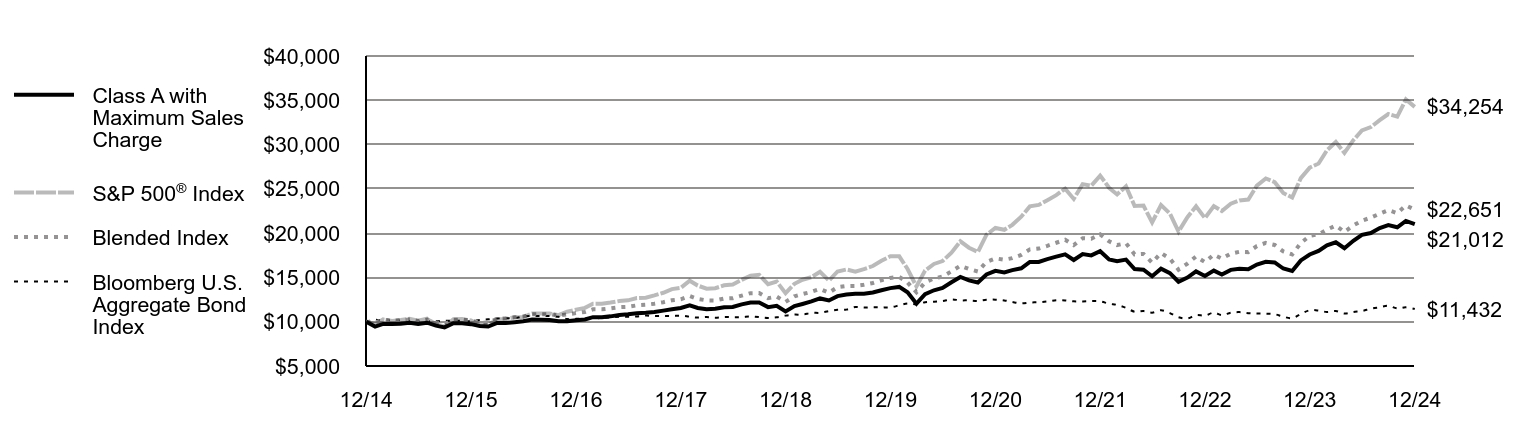

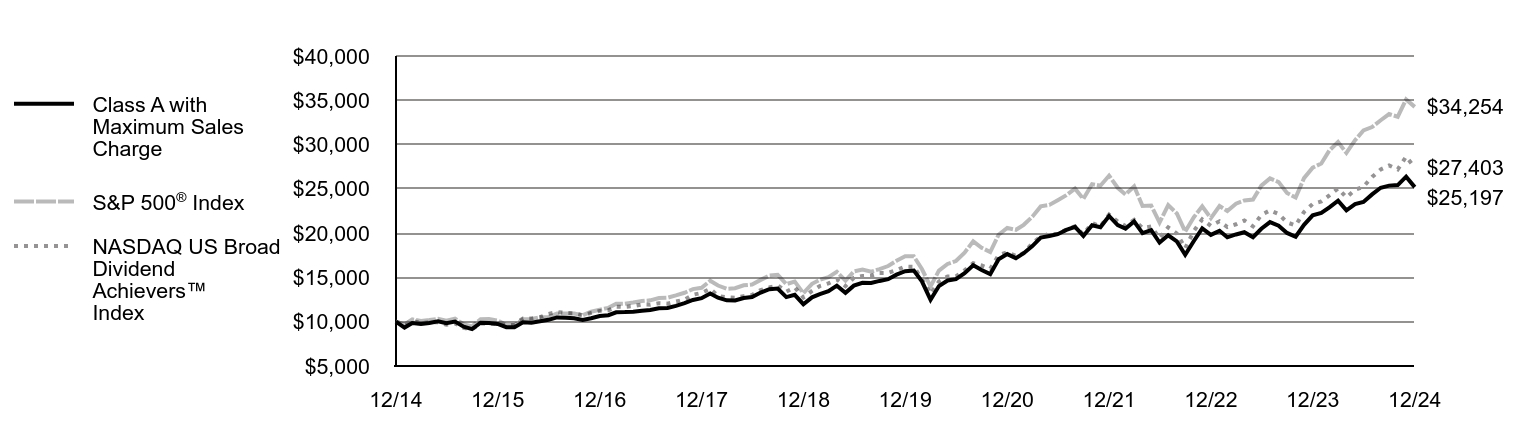

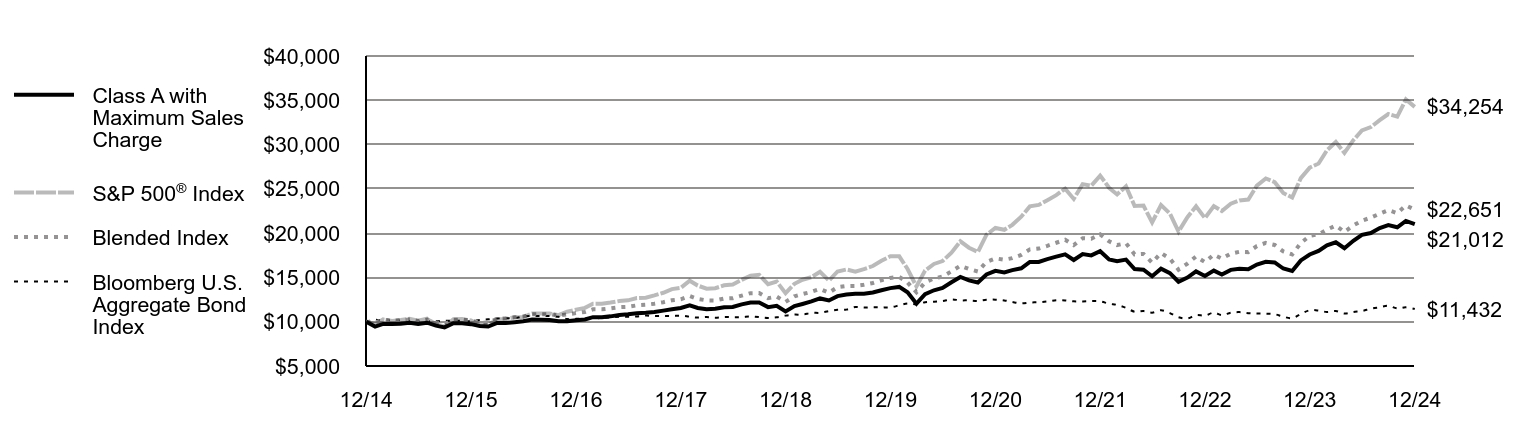

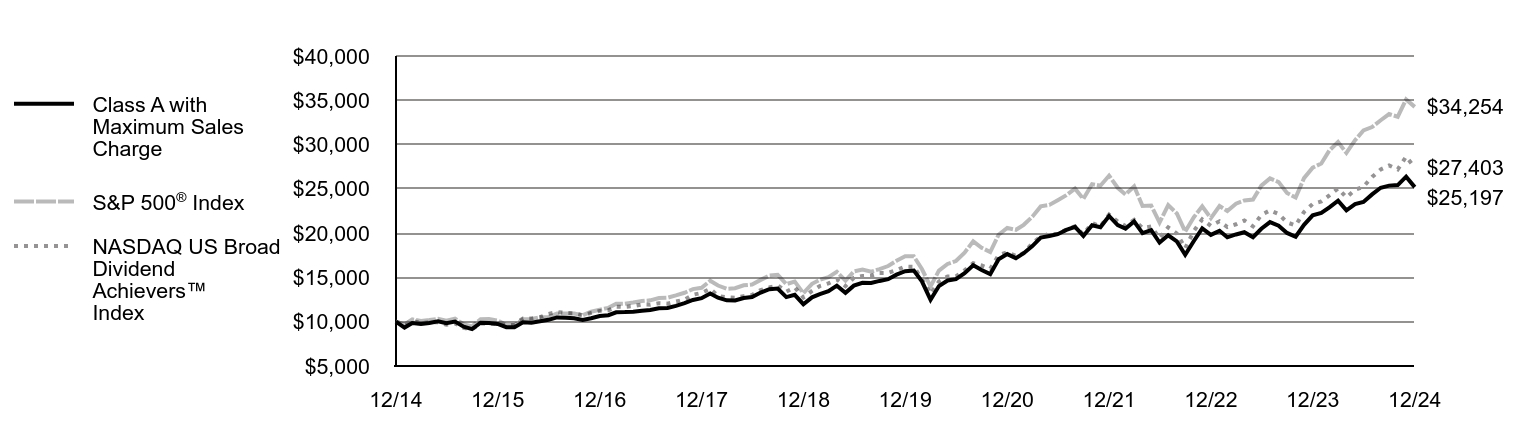

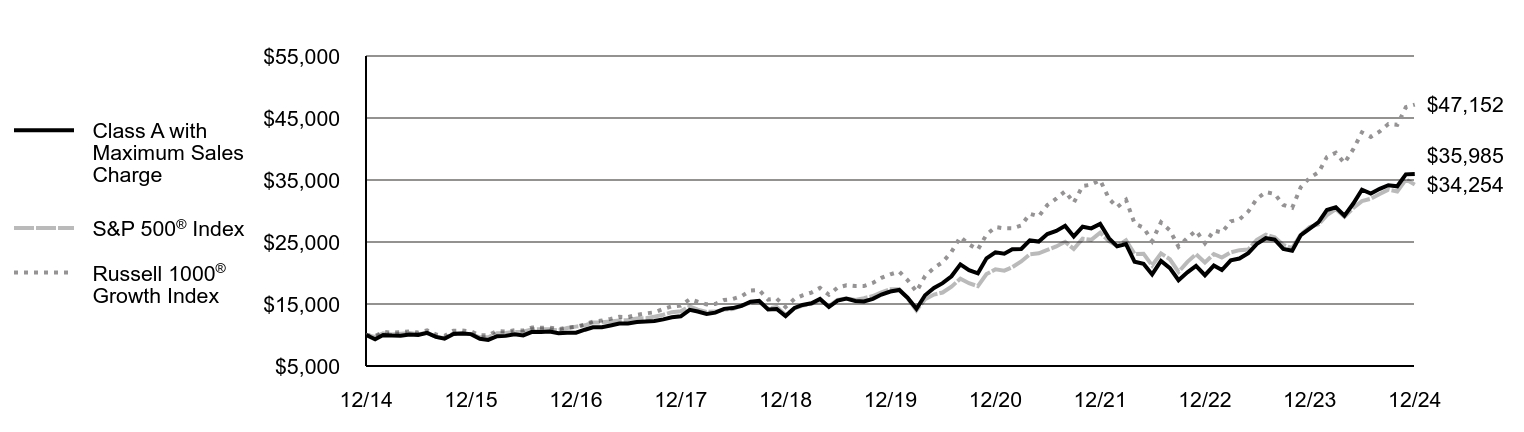

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | S&P 500® Index | Blended Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 12/14 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

| 1/15 | $9,453 | $9,700 | $9,904 | $10,210 |

|---|

| 2/15 | $9,755 | $10,257 | $10,208 | $10,114 |

|---|

| 3/15 | $9,747 | $10,095 | $10,130 | $10,161 |

|---|

| 4/15 | $9,759 | $10,192 | $10,174 | $10,124 |

|---|

| 5/15 | $9,879 | $10,323 | $10,243 | $10,100 |

|---|

| 6/15 | $9,750 | $10,123 | $10,079 | $9,990 |

|---|

| 7/15 | $9,889 | $10,335 | $10,234 | $10,059 |

|---|

| 8/15 | $9,552 | $9,712 | $9,857 | $10,045 |

|---|

| 9/15 | $9,354 | $9,471 | $9,738 | $10,113 |

|---|

| 10/15 | $9,820 | $10,270 | $10,231 | $10,114 |

|---|

| 11/15 | $9,832 | $10,301 | $10,239 | $10,088 |

|---|

| 12/15 | $9,726 | $10,138 | $10,128 | $10,055 |

|---|

| 1/16 | $9,512 | $9,635 | $9,883 | $10,193 |

|---|

| 2/16 | $9,453 | $9,622 | $9,903 | $10,266 |

|---|

| 3/16 | $9,865 | $10,275 | $10,342 | $10,360 |

|---|

| 4/16 | $9,865 | $10,315 | $10,382 | $10,400 |

|---|

| 5/16 | $9,948 | $10,500 | $10,495 | $10,402 |

|---|

| 6/16 | $10,044 | $10,527 | $10,587 | $10,589 |

|---|

| 7/16 | $10,248 | $10,915 | $10,848 | $10,656 |

|---|

| 8/16 | $10,212 | $10,931 | $10,852 | $10,644 |

|---|

| 9/16 | $10,186 | $10,933 | $10,851 | $10,638 |

|---|

| 10/16 | $10,042 | $10,733 | $10,699 | $10,556 |

|---|

| 11/16 | $10,054 | $11,131 | $10,835 | $10,307 |

|---|

| 12/16 | $10,174 | $11,351 | $10,970 | $10,321 |

|---|

| 1/17 | $10,258 | $11,566 | $11,103 | $10,341 |

|---|

| 2/17 | $10,512 | $12,025 | $11,398 | $10,411 |

|---|

| 3/17 | $10,507 | $12,039 | $11,403 | $10,406 |

|---|

| 4/17 | $10,604 | $12,163 | $11,509 | $10,486 |

|---|

| 5/17 | $10,750 | $12,334 | $11,641 | $10,567 |

|---|

| 6/17 | $10,831 | $12,411 | $11,680 | $10,556 |

|---|

| 7/17 | $10,962 | $12,667 | $11,844 | $10,601 |

|---|

| 8/17 | $11,011 | $12,705 | $11,909 | $10,696 |

|---|

| 9/17 | $11,090 | $12,967 | $12,033 | $10,645 |

|---|

| 10/17 | $11,250 | $13,270 | $12,205 | $10,652 |

|---|

| 11/17 | $11,410 | $13,677 | $12,423 | $10,638 |

|---|

| 12/17 | $11,551 | $13,829 | $12,529 | $10,687 |

|---|

| 1/18 | $11,855 | $14,621 | $12,901 | $10,564 |

|---|

| 2/18 | $11,550 | $14,082 | $12,567 | $10,464 |

|---|

| 3/18 | $11,412 | $13,724 | $12,408 | $10,531 |

|---|

| 4/18 | $11,462 | $13,777 | $12,399 | $10,452 |

|---|

| 5/18 | $11,641 | $14,108 | $12,614 | $10,527 |

|---|

| 6/18 | $11,659 | $14,195 | $12,654 | $10,514 |

|---|

| 7/18 | $11,953 | $14,724 | $12,938 | $10,516 |

|---|

| 8/18 | $12,164 | $15,203 | $13,224 | $10,584 |

|---|

| 9/18 | $12,173 | $15,290 | $13,235 | $10,516 |

|---|

| 10/18 | $11,646 | $14,245 | $12,651 | $10,433 |

|---|

| 11/18 | $11,787 | $14,535 | $12,836 | $10,495 |

|---|

| 12/18 | $11,155 | $13,223 | $12,235 | $10,688 |

|---|

| 1/19 | $11,761 | $14,282 | $12,875 | $10,801 |

|---|

| 2/19 | $12,003 | $14,741 | $13,120 | $10,795 |

|---|

| 3/19 | $12,290 | $15,027 | $13,374 | $11,003 |

|---|

| 4/19 | $12,628 | $15,636 | $13,700 | $11,005 |

|---|

| 5/19 | $12,398 | $14,642 | $13,275 | $11,201 |

|---|

| 6/19 | $12,890 | $15,674 | $13,903 | $11,341 |

|---|

| 7/19 | $13,080 | $15,899 | $14,035 | $11,366 |

|---|

| 8/19 | $13,154 | $15,648 | $14,047 | $11,661 |

|---|

| 9/19 | $13,159 | $15,940 | $14,175 | $11,599 |

|---|

| 10/19 | $13,296 | $16,286 | $14,376 | $11,634 |

|---|

| 11/19 | $13,556 | $16,877 | $14,686 | $11,628 |

|---|

| 12/19 | $13,791 | $17,386 | $14,948 | $11,620 |

|---|

| 1/20 | $13,931 | $17,379 | $15,060 | $11,843 |

|---|

| 2/20 | $13,315 | $15,949 | $14,424 | $12,056 |

|---|

| 3/20 | $12,032 | $13,979 | $13,321 | $11,985 |

|---|

| 4/20 | $13,100 | $15,771 | $14,441 | $12,198 |

|---|

| 5/20 | $13,550 | $16,522 | $14,880 | $12,255 |

|---|

| 6/20 | $13,807 | $16,850 | $15,095 | $12,332 |

|---|

| 7/20 | $14,456 | $17,801 | $15,696 | $12,517 |

|---|

| 8/20 | $15,058 | $19,080 | $16,322 | $12,416 |

|---|

| 9/20 | $14,671 | $18,355 | $15,947 | $12,409 |

|---|

| 10/20 | $14,428 | $17,867 | $15,664 | $12,353 |

|---|

| 11/20 | $15,328 | $19,823 | $16,754 | $12,475 |

|---|

| 12/20 | $15,750 | $20,585 | $17,150 | $12,492 |

|---|

| 1/21 | $15,562 | $20,377 | $16,997 | $12,402 |

|---|

| 2/21 | $15,822 | $20,939 | $17,180 | $12,223 |

|---|

| 3/21 | $16,034 | $21,856 | $17,545 | $12,071 |

|---|

| 4/21 | $16,756 | $23,022 | $18,163 | $12,166 |

|---|

| 5/21 | $16,756 | $23,183 | $18,262 | $12,206 |

|---|

| 6/21 | $17,067 | $23,724 | $18,570 | $12,291 |

|---|

| 7/21 | $17,342 | $24,288 | $18,917 | $12,429 |

|---|

| 8/21 | $17,603 | $25,026 | $19,248 | $12,405 |

|---|

| 9/21 | $16,965 | $23,863 | $18,644 | $12,298 |

|---|

| 10/21 | $17,632 | $25,534 | $19,426 | $12,294 |

|---|

| 11/21 | $17,487 | $25,357 | $19,368 | $12,331 |

|---|

| 12/21 | $17,956 | $26,494 | $19,869 | $12,299 |

|---|

| 1/22 | $17,035 | $25,123 | $19,081 | $12,034 |

|---|

| 2/22 | $16,832 | $24,371 | $18,653 | $11,900 |

|---|

| 3/22 | $17,014 | $25,276 | $18,861 | $11,569 |

|---|

| 4/22 | $15,950 | $23,071 | $17,588 | $11,130 |

|---|

| 5/22 | $15,871 | $23,114 | $17,653 | $11,202 |

|---|

| 6/22 | $15,135 | $21,206 | $16,668 | $11,026 |

|---|

| 7/22 | $15,982 | $23,161 | $17,753 | $11,296 |

|---|

| 8/22 | $15,480 | $22,217 | $17,118 | $10,977 |

|---|

| 9/22 | $14,510 | $20,170 | $15,876 | $10,502 |

|---|

| 10/22 | $14,982 | $21,804 | $16,565 | $10,366 |

|---|

| 11/22 | $15,675 | $23,022 | $17,364 | $10,748 |

|---|

| 12/22 | $15,159 | $21,696 | $16,732 | $10,699 |

|---|

| 1/23 | $15,770 | $23,059 | $17,569 | $11,028 |

|---|

| 2/23 | $15,324 | $22,496 | $17,130 | $10,743 |

|---|

| 3/23 | $15,852 | $23,322 | $17,682 | $11,016 |

|---|

| 4/23 | $15,985 | $23,686 | $17,890 | $11,083 |

|---|

| 5/23 | $15,918 | $23,789 | $17,859 | $10,962 |

|---|

| 6/23 | $16,460 | $25,361 | $18,541 | $10,923 |

|---|

| 7/23 | $16,759 | $26,176 | $18,894 | $10,915 |

|---|

| 8/23 | $16,693 | $25,759 | $18,665 | $10,846 |

|---|

| 9/23 | $16,006 | $24,531 | $17,941 | $10,570 |

|---|

| 10/23 | $15,722 | $24,015 | $17,602 | $10,403 |

|---|

| 11/23 | $16,924 | $26,208 | $18,885 | $10,874 |

|---|

| 12/23 | $17,592 | $27,399 | $19,689 | $11,291 |

|---|

| 1/24 | $17,996 | $27,859 | $19,866 | $11,260 |

|---|

| 2/24 | $18,620 | $29,347 | $20,390 | $11,101 |

|---|

| 3/24 | $18,971 | $30,291 | $20,859 | $11,203 |

|---|

| 4/24 | $18,294 | $29,054 | $20,137 | $10,920 |

|---|

| 5/24 | $19,140 | $30,494 | $20,873 | $11,105 |

|---|

| 6/24 | $19,810 | $31,589 | $21,401 | $11,210 |

|---|

| 7/24 | $20,013 | $31,973 | $21,757 | $11,472 |

|---|

| 8/24 | $20,573 | $32,749 | $22,199 | $11,637 |

|---|

| 9/24 | $20,902 | $33,448 | $22,602 | $11,793 |

|---|

| 10/24 | $20,664 | $33,145 | $22,255 | $11,500 |

|---|

| 11/24 | $21,379 | $35,090 | $23,133 | $11,622 |

|---|

| 12/24 | $21,012 | $34,254 | $22,651 | $11,432 |

|---|

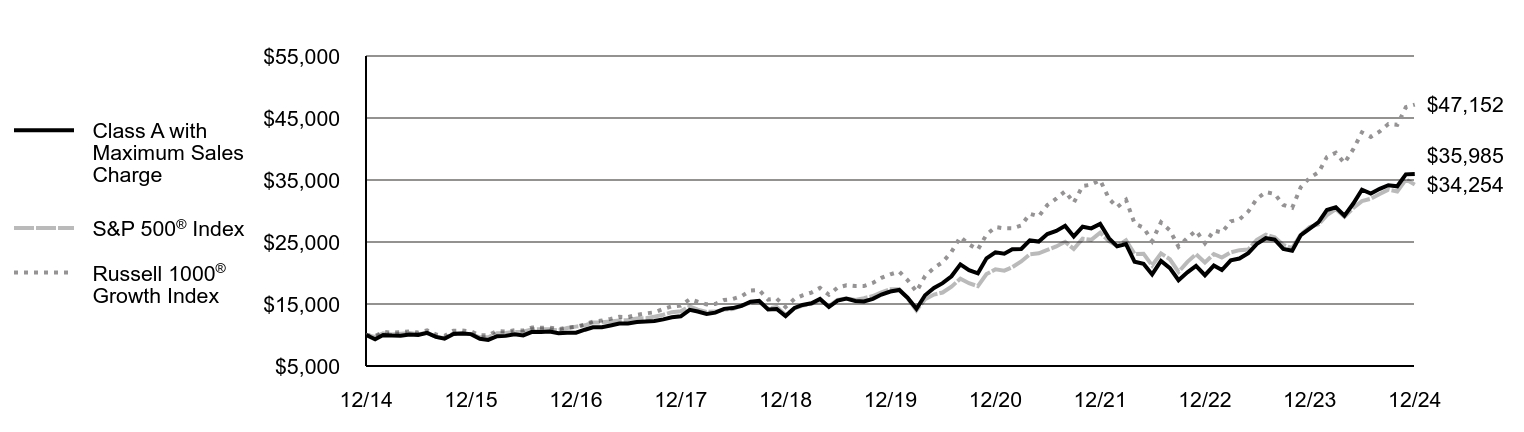

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class A | 19.46% | 8.78% | 8.28% |

|---|

| Class A with 5.25% Maximum Sales Charge | 13.18% | 7.61% | 7.70% |

|---|

S&P 500® Index | 25.02% | 14.51% | 13.09% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

|---|

Blended IndexFootnote Reference1 | 15.04% | 8.66% | 8.51% |

|---|

| Footnote | Description |

Footnote1 | Benchmark is an internally constructed benchmark comprised of a blend of 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index, and is rebalanced monthly. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $1,013,190,430 |

|---|

| # of Portfolio Holdings (for Stock and Core Bond Portfolios) | 373 |

|---|

| Portfolio Turnover Rate | 5% |

|---|

| Total Advisory Fees Paid | $5,002,640 |

|---|

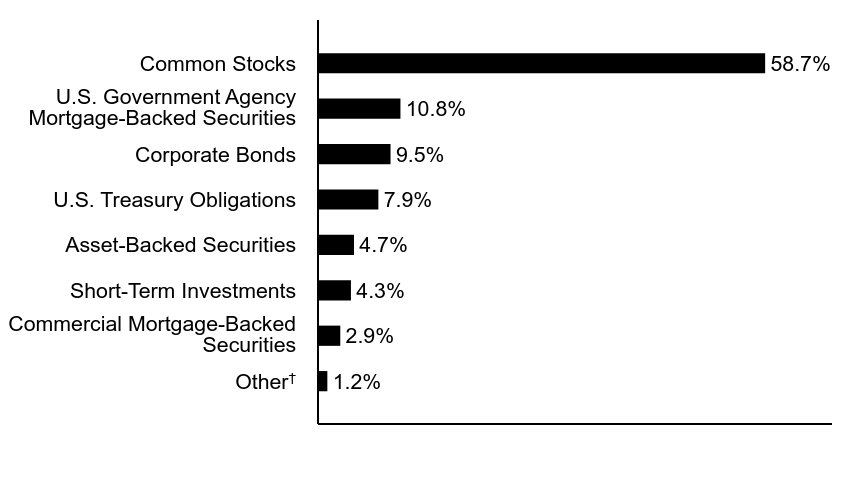

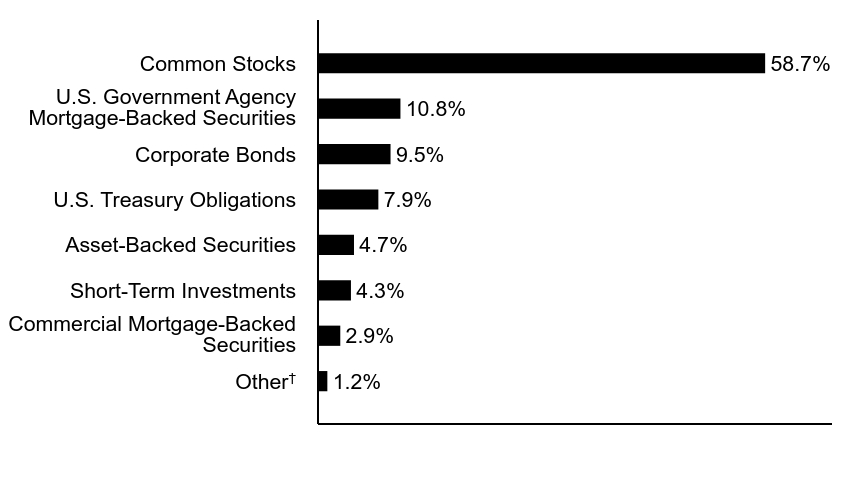

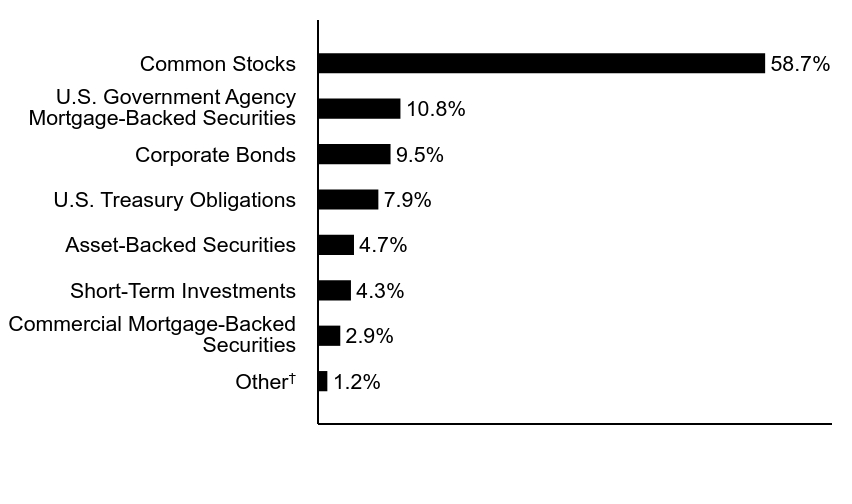

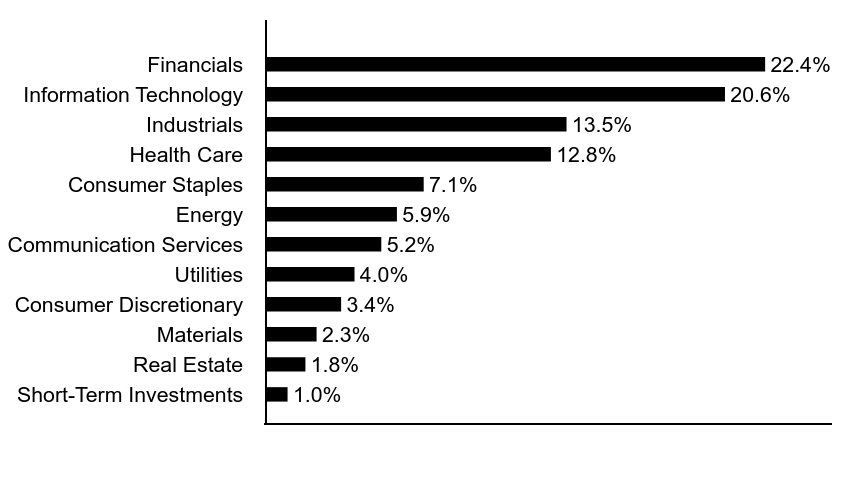

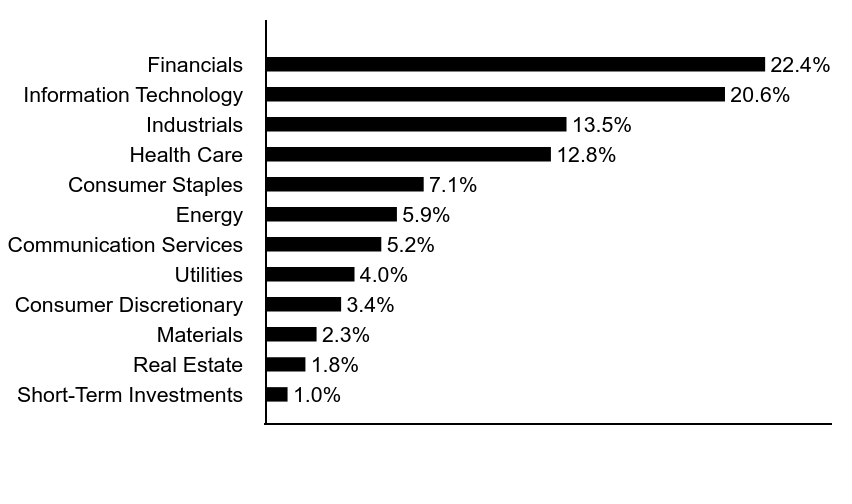

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

References to the Fund's investments are to the Fund's pro rata share of the investments of Stock Portfolio and Core Bond Portfolio, affiliated investment companies in which the Fund invests substantially all of its assets.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 1.2% |

| Commercial Mortgage-Backed Securities | 2.9% |

| Short-Term Investments | 4.3% |

| Asset-Backed Securities | 4.7% |

| U.S. Treasury Obligations | 7.9% |

| Corporate Bonds | 9.5% |

| U.S. Government Agency Mortgage-Backed Securities | 10.8% |

| Common Stocks | 58.7% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

Top Ten Holdings (% of total investments)Footnote Referencea

| Uniform Mortgage-Backed Security, 5.50%, 30-Year, TBA | 4.7% |

| Apple, Inc. | 4.5% |

| Microsoft Corp. | 4.5% |

| NVIDIA Corp. | 4.3% |

| Amazon.com, Inc. | 3.2% |

| Alphabet, Inc., Class C | 2.6% |

| Uniform Mortgage-Backed Security, 5.00%, 30-Year, TBA | 2.6% |

| Broadcom, Inc. | 2.1% |

| Meta Platforms, Inc., Class A | 1.8% |

| U.S. Treasury Notes, 0.38%, 12/31/25 | 1.5% |

| Total | 31.8% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Eaton Vance Balanced Fund

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Balanced Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference*

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $188 | 1.72% |

|---|

| Footnote | Description |

Footnote* | Expenses in the table reflect the expenses of both the Fund and Stock Portfolio and Core Bond Portfolio, the Portfolios in which it invests. |

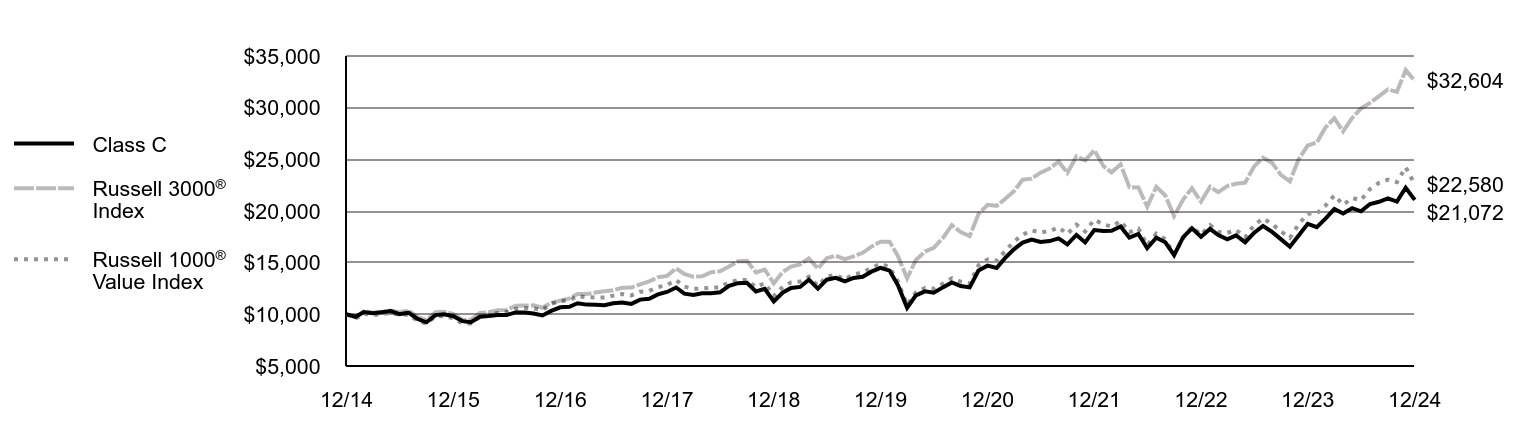

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index (the Index), and the Bloomberg U.S. Aggregate Bond Index (the Secondary Index):

• The Fund invests in a blend of Stock Portfolio — the Fund’s equity allocation — and Core Bond Portfolio — the Fund’s fixed-income allocation

↓ Core Bond Portfolio underperformed the Index and detracted from Index-relative returns during the period — but outperformed the Secondary Index

↓ An underweight exposure to agency mortgage-backed securities (MBS), yield-curve positioning, and the use of derivatives detracted from returns during the period

↑ Bond selections ― notably in investment-grade corporate bonds ― and sector allocations ― notably an overweight exposure to commercial MBS ― aided returns

↑ Stock Portfolio outperformed the Index; an overweight position in artificial intelligence chipmaker NVIDIA Corp. contributed to Index-relative returns

↑ Among sectors, stock selections and underweight exposures to health care and consumer staples, and stock selections in information technology, helped returns

↓ An overweight position in energy exploration and production firm ConocoPhillips fell in value as global energy demand and oil prices weakened during the period

↓ Among sectors within the Index, the Fund’s stock selections in the energy and real estate sectors detracted from Index-relative performance during the period

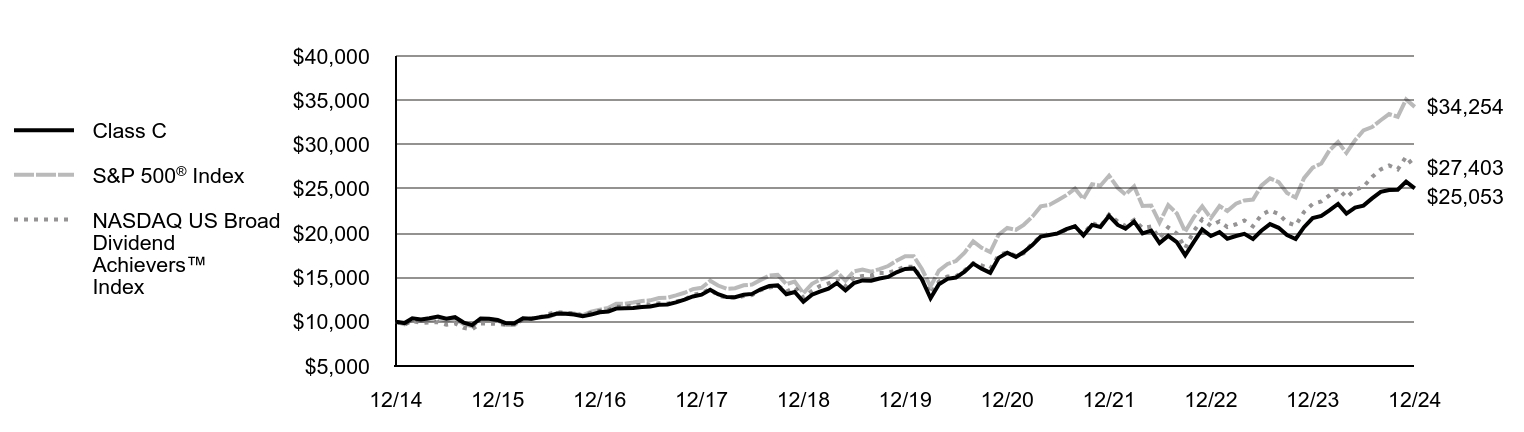

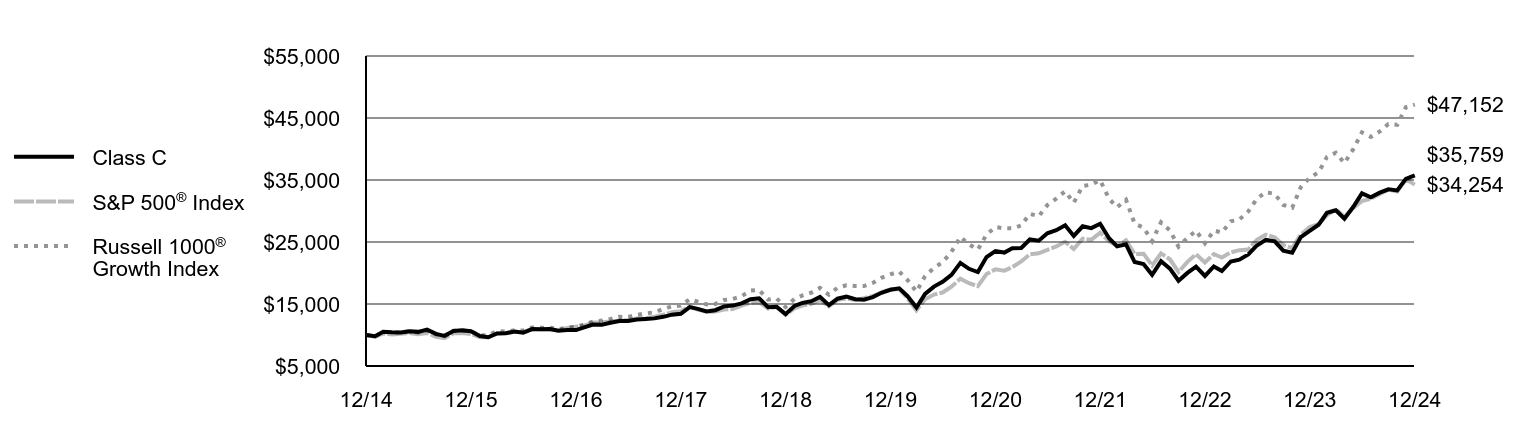

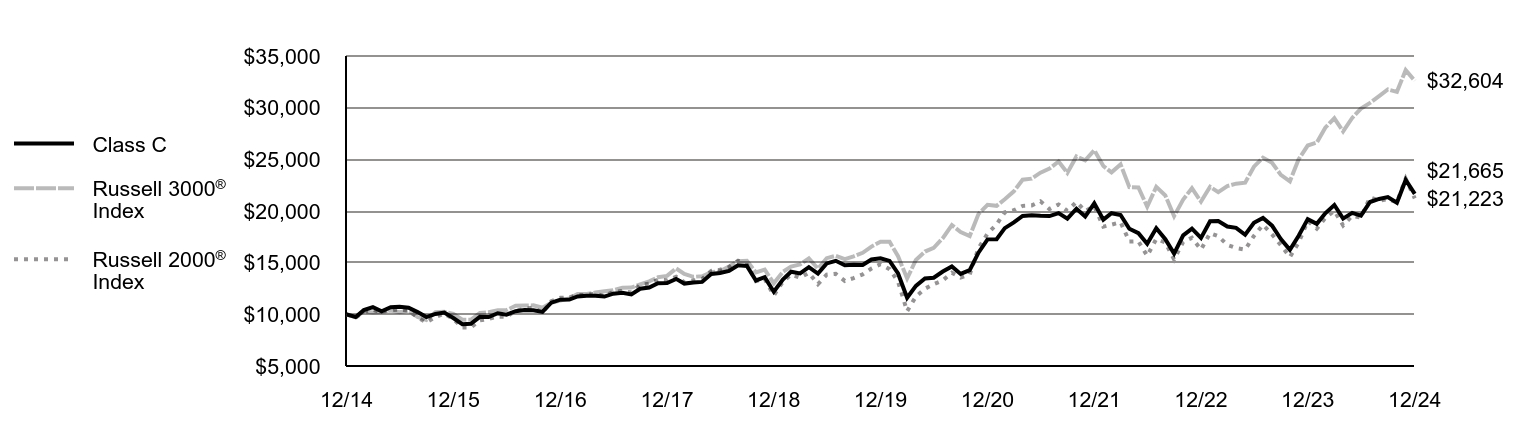

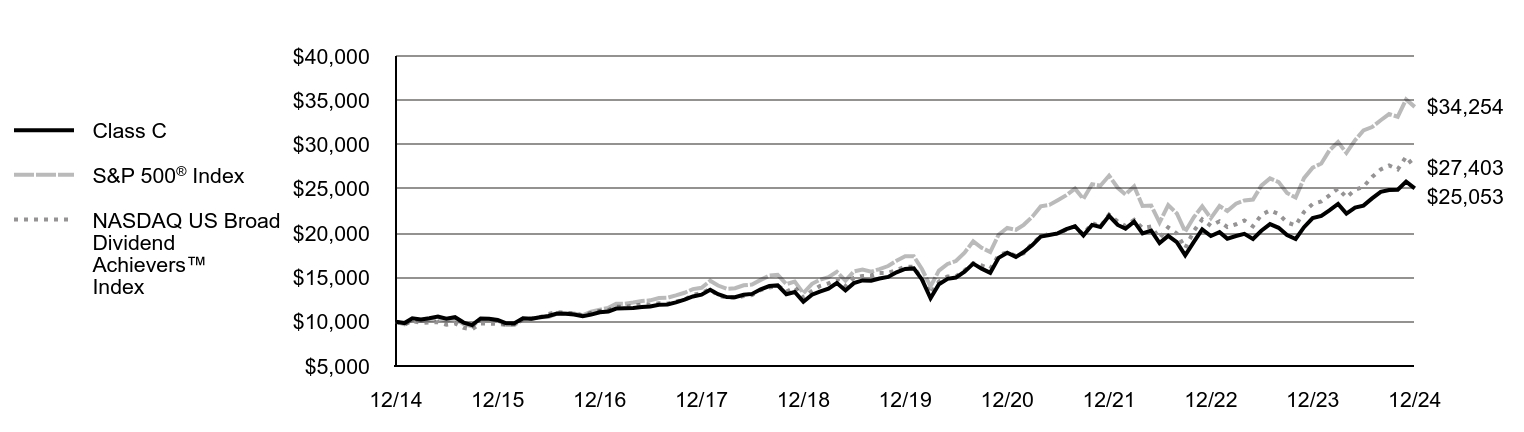

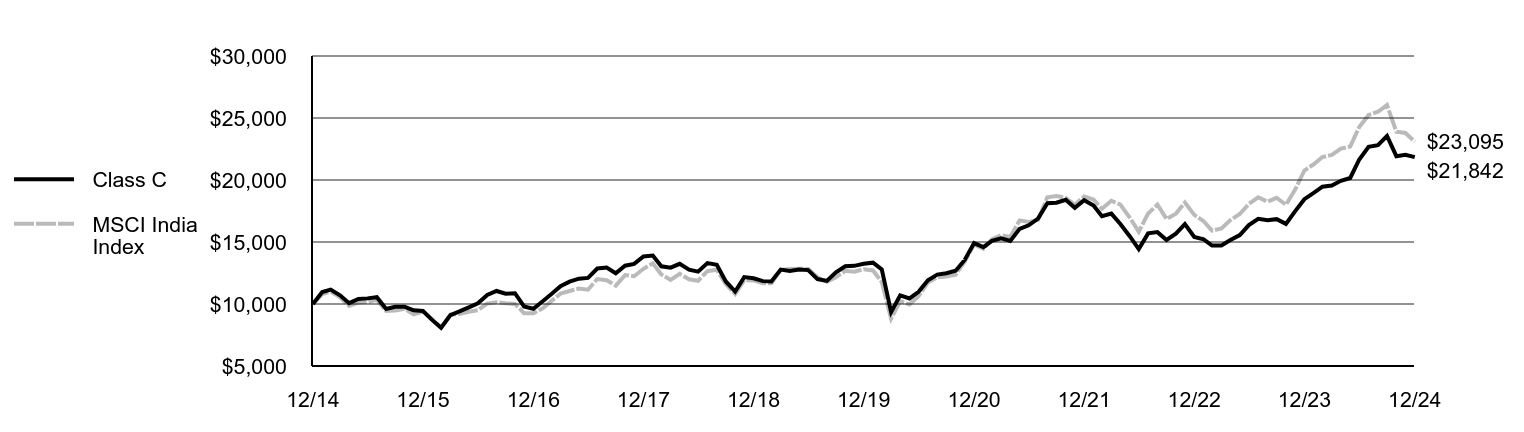

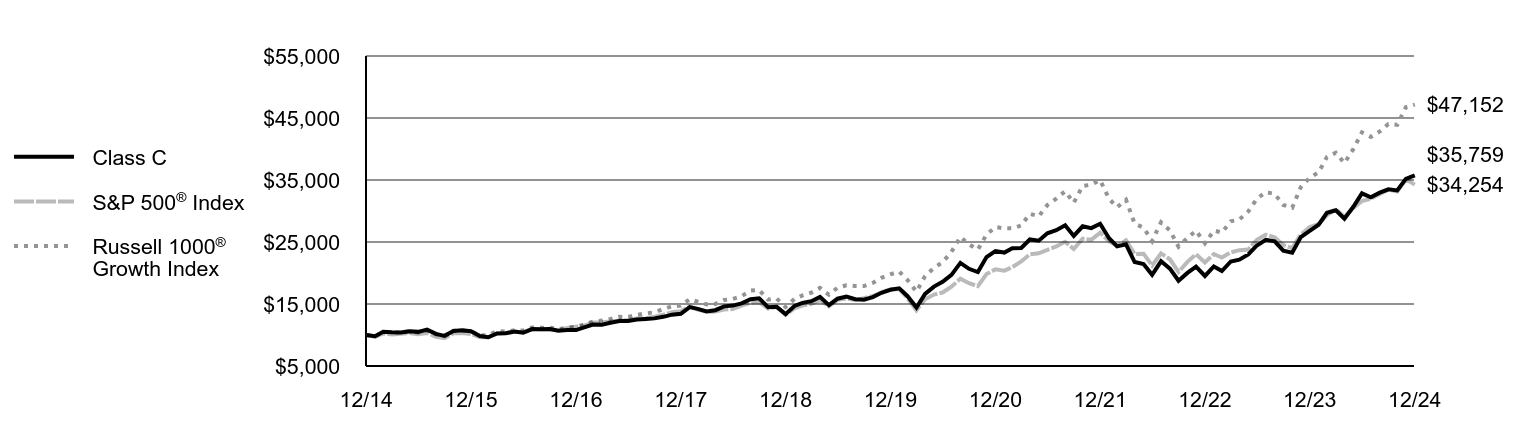

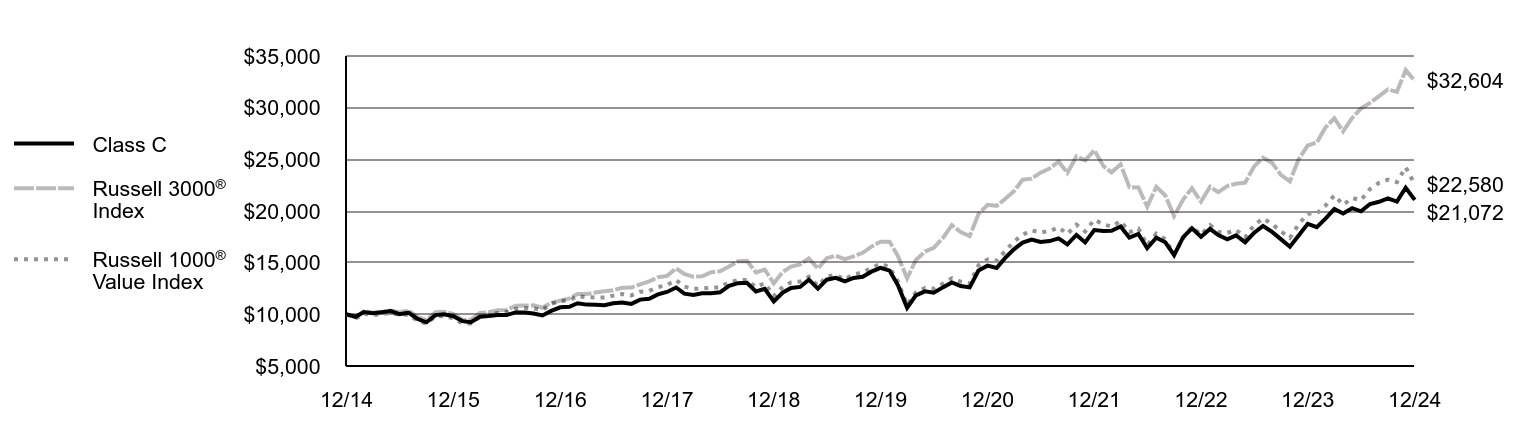

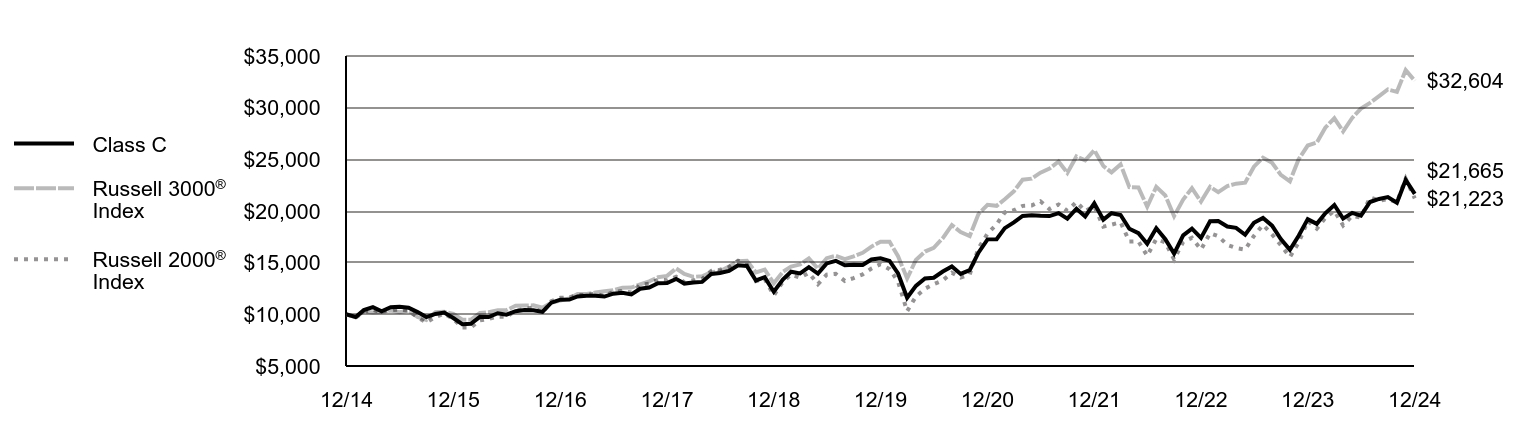

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | S&P 500® Index | Blended Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 12/14 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

| 1/15 | $9,976 | $9,700 | $9,904 | $10,210 |

|---|

| 2/15 | $10,294 | $10,257 | $10,208 | $10,114 |

|---|

| 3/15 | $10,273 | $10,095 | $10,130 | $10,161 |

|---|

| 4/15 | $10,284 | $10,192 | $10,174 | $10,124 |

|---|

| 5/15 | $10,399 | $10,323 | $10,243 | $10,100 |

|---|

| 6/15 | $10,257 | $10,123 | $10,079 | $9,990 |

|---|

| 7/15 | $10,403 | $10,335 | $10,234 | $10,059 |

|---|

| 8/15 | $10,039 | $9,712 | $9,857 | $10,045 |

|---|

| 9/15 | $9,826 | $9,471 | $9,738 | $10,113 |

|---|

| 10/15 | $10,314 | $10,270 | $10,231 | $10,114 |

|---|

| 11/15 | $10,314 | $10,301 | $10,239 | $10,088 |

|---|

| 12/15 | $10,186 | $10,138 | $10,128 | $10,055 |

|---|

| 1/16 | $9,963 | $9,635 | $9,883 | $10,193 |

|---|

| 2/16 | $9,901 | $9,622 | $9,903 | $10,266 |

|---|

| 3/16 | $10,328 | $10,275 | $10,342 | $10,360 |

|---|

| 4/16 | $10,315 | $10,315 | $10,382 | $10,400 |

|---|

| 5/16 | $10,390 | $10,500 | $10,495 | $10,402 |

|---|

| 6/16 | $10,485 | $10,527 | $10,587 | $10,589 |

|---|

| 7/16 | $10,697 | $10,915 | $10,848 | $10,656 |

|---|

| 8/16 | $10,647 | $10,931 | $10,852 | $10,644 |

|---|

| 9/16 | $10,627 | $10,933 | $10,851 | $10,638 |

|---|

| 10/16 | $10,465 | $10,733 | $10,699 | $10,556 |

|---|

| 11/16 | $10,465 | $11,131 | $10,835 | $10,307 |

|---|

| 12/16 | $10,581 | $11,351 | $10,970 | $10,321 |

|---|

| 1/17 | $10,669 | $11,566 | $11,103 | $10,341 |

|---|

| 2/17 | $10,932 | $12,025 | $11,398 | $10,411 |

|---|

| 3/17 | $10,908 | $12,039 | $11,403 | $10,406 |

|---|

| 4/17 | $11,008 | $12,163 | $11,509 | $10,486 |

|---|

| 5/17 | $11,159 | $12,334 | $11,641 | $10,567 |

|---|

| 6/17 | $11,234 | $12,411 | $11,680 | $10,556 |

|---|

| 7/17 | $11,356 | $12,667 | $11,844 | $10,601 |

|---|

| 8/17 | $11,394 | $12,705 | $11,909 | $10,696 |

|---|

| 9/17 | $11,479 | $12,967 | $12,033 | $10,645 |

|---|

| 10/17 | $11,631 | $13,270 | $12,205 | $10,652 |

|---|

| 11/17 | $11,783 | $13,677 | $12,423 | $10,638 |

|---|

| 12/17 | $11,918 | $13,829 | $12,529 | $10,687 |

|---|

| 1/18 | $12,231 | $14,621 | $12,901 | $10,564 |

|---|

| 2/18 | $11,918 | $14,082 | $12,567 | $10,464 |

|---|

| 3/18 | $11,767 | $13,724 | $12,408 | $10,531 |

|---|

| 4/18 | $11,806 | $13,777 | $12,399 | $10,452 |

|---|

| 5/18 | $11,989 | $14,108 | $12,614 | $10,527 |

|---|

| 6/18 | $11,998 | $14,195 | $12,654 | $10,514 |

|---|

| 7/18 | $12,285 | $14,724 | $12,938 | $10,516 |

|---|

| 8/18 | $12,501 | $15,203 | $13,224 | $10,584 |

|---|

| 9/18 | $12,501 | $15,290 | $13,235 | $10,516 |

|---|

| 10/18 | $11,962 | $14,245 | $12,651 | $10,433 |

|---|

| 11/18 | $12,080 | $14,535 | $12,836 | $10,495 |

|---|

| 12/18 | $11,437 | $13,223 | $12,235 | $10,688 |

|---|

| 1/19 | $12,042 | $14,282 | $12,875 | $10,801 |

|---|

| 2/19 | $12,289 | $14,741 | $13,120 | $10,795 |

|---|

| 3/19 | $12,572 | $15,027 | $13,374 | $11,003 |

|---|

| 4/19 | $12,916 | $15,636 | $13,700 | $11,005 |

|---|

| 5/19 | $12,668 | $14,642 | $13,275 | $11,201 |

|---|

| 6/19 | $13,158 | $15,674 | $13,903 | $11,341 |

|---|

| 7/19 | $13,337 | $15,899 | $14,035 | $11,366 |

|---|

| 8/19 | $13,413 | $15,648 | $14,047 | $11,661 |

|---|

| 9/19 | $13,406 | $15,940 | $14,175 | $11,599 |

|---|

| 10/19 | $13,531 | $16,286 | $14,376 | $11,634 |

|---|

| 11/19 | $13,795 | $16,877 | $14,686 | $11,628 |

|---|

| 12/19 | $14,035 | $17,386 | $14,948 | $11,620 |

|---|

| 1/20 | $14,162 | $17,379 | $15,060 | $11,843 |

|---|

| 2/20 | $13,524 | $15,949 | $14,424 | $12,056 |

|---|

| 3/20 | $12,217 | $13,979 | $13,321 | $11,985 |

|---|

| 4/20 | $13,283 | $15,771 | $14,441 | $12,198 |

|---|

| 5/20 | $13,737 | $16,522 | $14,880 | $12,255 |

|---|

| 6/20 | $14,002 | $16,850 | $15,095 | $12,332 |

|---|

| 7/20 | $14,642 | $17,801 | $15,696 | $12,517 |

|---|

| 8/20 | $15,235 | $19,080 | $16,322 | $12,416 |

|---|

| 9/20 | $14,846 | $18,355 | $15,947 | $12,409 |

|---|

| 10/20 | $14,587 | $17,867 | $15,664 | $12,353 |

|---|

| 11/20 | $15,493 | $19,823 | $16,754 | $12,475 |

|---|

| 12/20 | $15,889 | $20,585 | $17,150 | $12,492 |

|---|

| 1/21 | $15,701 | $20,377 | $16,997 | $12,402 |

|---|

| 2/21 | $15,947 | $20,939 | $17,180 | $12,223 |

|---|

| 3/21 | $16,159 | $21,856 | $17,545 | $12,071 |

|---|

| 4/21 | $16,869 | $23,022 | $18,163 | $12,166 |

|---|

| 5/21 | $16,869 | $23,183 | $18,262 | $12,206 |

|---|

| 6/21 | $17,163 | $23,724 | $18,570 | $12,291 |

|---|

| 7/21 | $17,438 | $24,288 | $18,917 | $12,429 |

|---|

| 8/21 | $17,685 | $25,026 | $19,248 | $12,405 |

|---|

| 9/21 | $17,032 | $23,863 | $18,644 | $12,298 |

|---|

| 10/21 | $17,699 | $25,534 | $19,426 | $12,294 |

|---|

| 11/21 | $17,540 | $25,357 | $19,368 | $12,331 |

|---|

| 12/21 | $17,989 | $26,494 | $19,869 | $12,299 |

|---|

| 1/22 | $17,054 | $25,123 | $19,081 | $12,034 |

|---|

| 2/22 | $16,852 | $24,371 | $18,653 | $11,900 |

|---|

| 3/22 | $17,015 | $25,276 | $18,861 | $11,569 |

|---|

| 4/22 | $15,940 | $23,071 | $17,588 | $11,130 |

|---|

| 5/22 | $15,862 | $23,114 | $17,653 | $11,202 |

|---|

| 6/22 | $15,114 | $21,206 | $16,668 | $11,026 |

|---|

| 7/22 | $15,940 | $23,161 | $17,753 | $11,296 |

|---|

| 8/22 | $15,426 | $22,217 | $17,118 | $10,977 |

|---|

| 9/22 | $14,465 | $20,170 | $15,876 | $10,502 |

|---|

| 10/22 | $14,918 | $21,804 | $16,565 | $10,366 |

|---|

| 11/22 | $15,590 | $23,022 | $17,364 | $10,748 |

|---|

| 12/22 | $15,081 | $21,696 | $16,732 | $10,699 |

|---|

| 1/23 | $15,669 | $23,059 | $17,569 | $11,028 |

|---|

| 2/23 | $15,228 | $22,496 | $17,130 | $10,743 |

|---|

| 3/23 | $15,735 | $23,322 | $17,682 | $11,016 |

|---|

| 4/23 | $15,866 | $23,686 | $17,890 | $11,083 |

|---|

| 5/23 | $15,768 | $23,789 | $17,859 | $10,962 |

|---|

| 6/23 | $16,304 | $25,361 | $18,541 | $10,923 |

|---|

| 7/23 | $16,599 | $26,176 | $18,894 | $10,915 |

|---|

| 8/23 | $16,533 | $25,759 | $18,665 | $10,846 |

|---|

| 9/23 | $15,840 | $24,531 | $17,941 | $10,570 |

|---|

| 10/23 | $15,545 | $24,015 | $17,602 | $10,403 |

|---|

| 11/23 | $16,710 | $26,208 | $18,885 | $10,874 |

|---|

| 12/23 | $17,366 | $27,399 | $19,689 | $11,291 |

|---|

| 1/24 | $17,747 | $27,859 | $19,866 | $11,260 |

|---|

| 2/24 | $18,359 | $29,347 | $20,390 | $11,101 |

|---|

| 3/24 | $18,701 | $30,291 | $20,859 | $11,203 |

|---|

| 4/24 | $18,021 | $29,054 | $20,137 | $10,920 |

|---|

| 5/24 | $18,850 | $30,494 | $20,873 | $11,105 |

|---|

| 6/24 | $19,485 | $31,589 | $21,401 | $11,210 |

|---|

| 7/24 | $19,667 | $31,973 | $21,757 | $11,472 |

|---|

| 8/24 | $20,214 | $32,749 | $22,199 | $11,637 |

|---|

| 9/24 | $20,513 | $33,448 | $22,602 | $11,793 |

|---|

| 10/24 | $20,264 | $33,145 | $22,255 | $11,500 |

|---|

| 11/24 | $20,962 | $35,090 | $23,133 | $11,622 |

|---|

| 12/24 | $20,907 | $34,254 | $22,651 | $11,432 |

|---|

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class C, with conversion to Class A after 8 years | 18.63% | 7.97% | 7.65% |

|---|

| Class C, with 1% Maximum Deferred Sales Charge and conversion to Class A after 8 years | 17.63% | 7.97% | 7.65% |

|---|

S&P 500® Index | 25.02% | 14.51% | 13.09% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

|---|

Blended IndexFootnote Reference1 | 15.04% | 8.66% | 8.51% |

|---|

| Footnote | Description |

Footnote1 | Benchmark is an internally constructed benchmark comprised of a blend of 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index, and is rebalanced monthly. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $1,013,190,430 |

|---|

| # of Portfolio Holdings (for Stock and Core Bond Portfolios) | 373 |

|---|

| Portfolio Turnover Rate | 5% |

|---|

| Total Advisory Fees Paid | $5,002,640 |

|---|

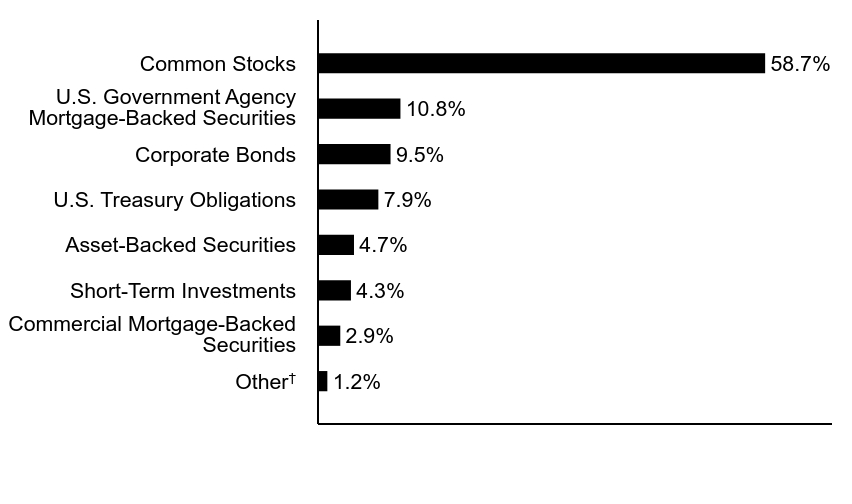

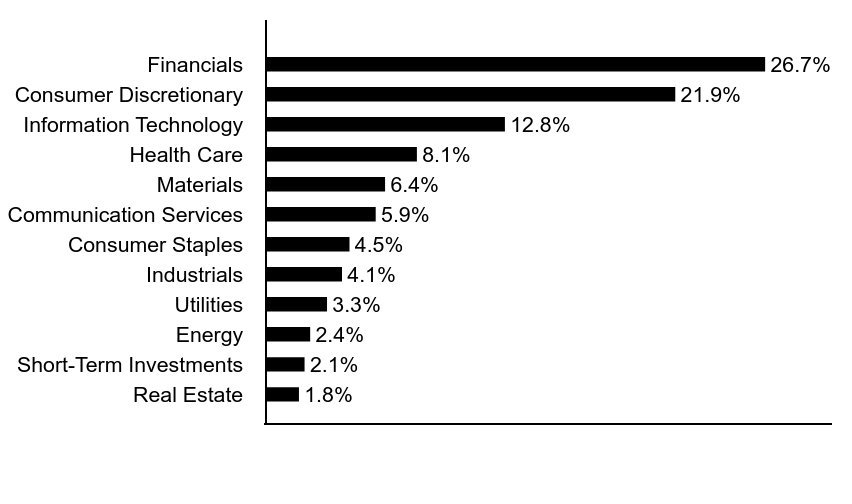

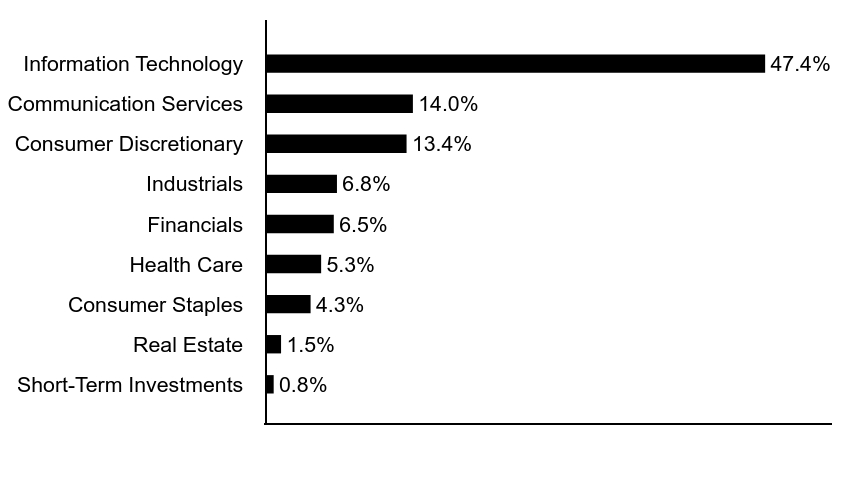

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

References to the Fund's investments are to the Fund's pro rata share of the investments of Stock Portfolio and Core Bond Portfolio, affiliated investment companies in which the Fund invests substantially all of its assets.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 1.2% |

| Commercial Mortgage-Backed Securities | 2.9% |

| Short-Term Investments | 4.3% |

| Asset-Backed Securities | 4.7% |

| U.S. Treasury Obligations | 7.9% |

| Corporate Bonds | 9.5% |

| U.S. Government Agency Mortgage-Backed Securities | 10.8% |

| Common Stocks | 58.7% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

Top Ten Holdings (% of total investments)Footnote Referencea

| Uniform Mortgage-Backed Security, 5.50%, 30-Year, TBA | 4.7% |

| Apple, Inc. | 4.5% |

| Microsoft Corp. | 4.5% |

| NVIDIA Corp. | 4.3% |

| Amazon.com, Inc. | 3.2% |

| Alphabet, Inc., Class C | 2.6% |

| Uniform Mortgage-Backed Security, 5.00%, 30-Year, TBA | 2.6% |

| Broadcom, Inc. | 2.1% |

| Meta Platforms, Inc., Class A | 1.8% |

| U.S. Treasury Notes, 0.38%, 12/31/25 | 1.5% |

| Total | 31.8% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Eaton Vance Balanced Fund

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Balanced Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference*

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $79 | 0.72% |

|---|

| Footnote | Description |

Footnote* | Expenses in the table reflect the expenses of both the Fund and Stock Portfolio and Core Bond Portfolio, the Portfolios in which it invests. |

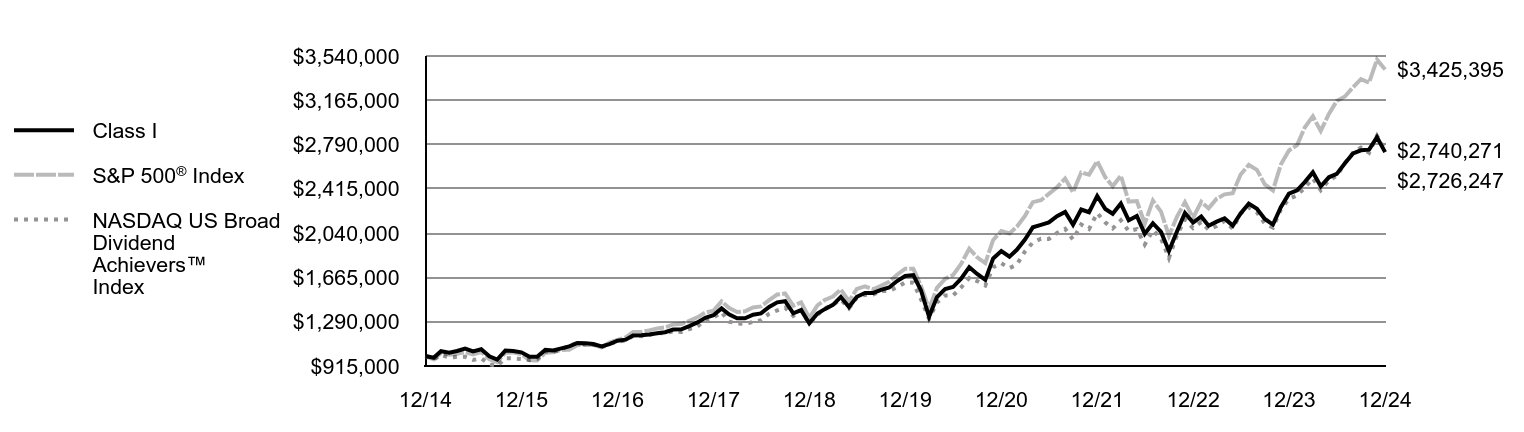

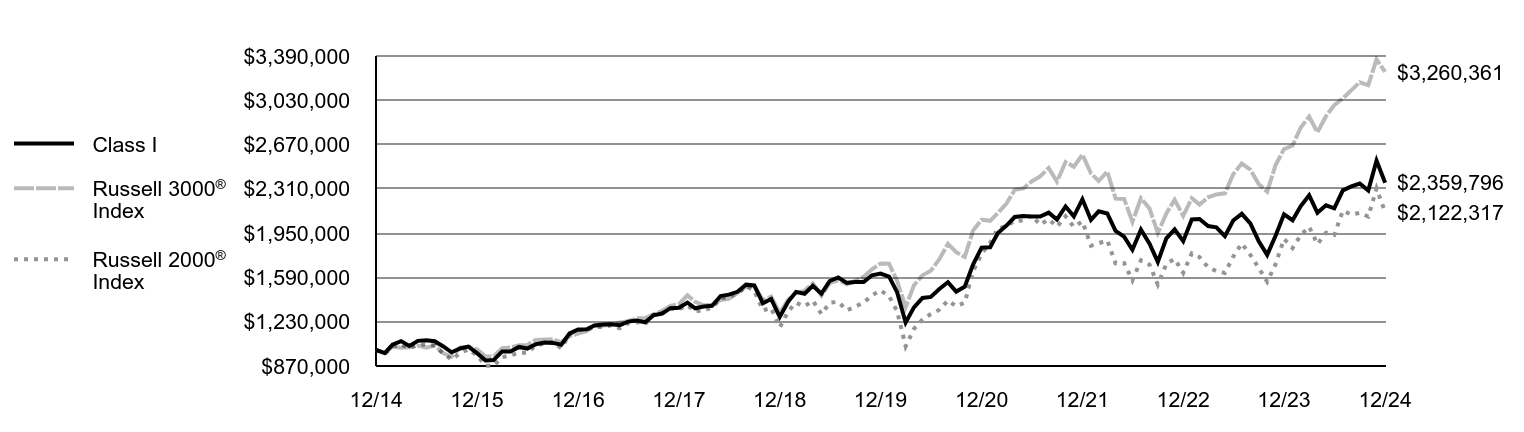

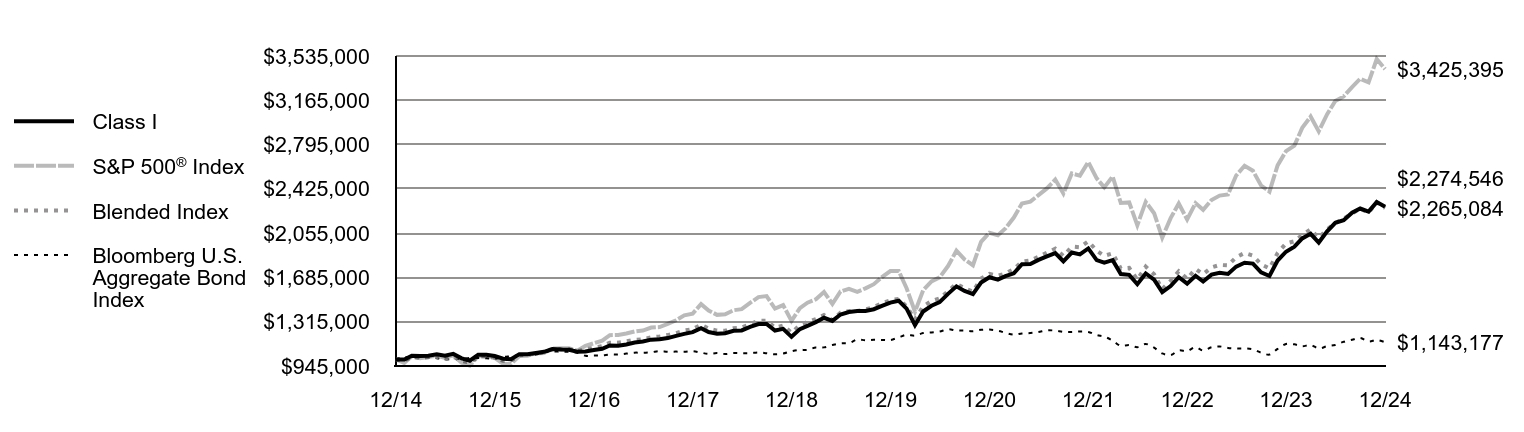

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index (the Index), and the Bloomberg U.S. Aggregate Bond Index (the Secondary Index):

• The Fund invests in a blend of Stock Portfolio — the Fund’s equity allocation — and Core Bond Portfolio — the Fund’s fixed-income allocation

↓ Core Bond Portfolio underperformed the Index and detracted from Index-relative returns during the period — but outperformed the Secondary Index

↓ An underweight exposure to agency mortgage-backed securities (MBS), yield-curve positioning, and the use of derivatives detracted from returns during the period

↑ Bond selections ― notably in investment-grade corporate bonds ― and sector allocations ― notably an overweight exposure to commercial MBS ― aided returns

↑ Stock Portfolio outperformed the Index; an overweight position in artificial intelligence chipmaker NVIDIA Corp. contributed to Index-relative returns

↑ Among sectors, stock selections and underweight exposures to health care and consumer staples, and stock selections in information technology, helped returns

↓ An overweight position in energy exploration and production firm ConocoPhillips fell in value as global energy demand and oil prices weakened during the period

↓ Among sectors within the Index, the Fund’s stock selections in the energy and real estate sectors detracted from Index-relative performance during the period

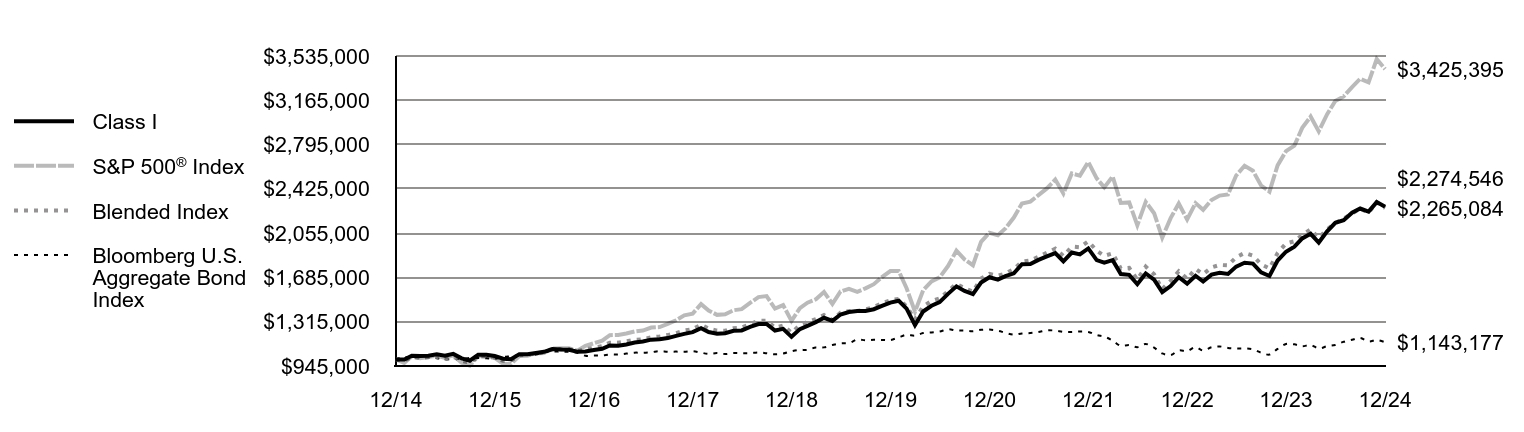

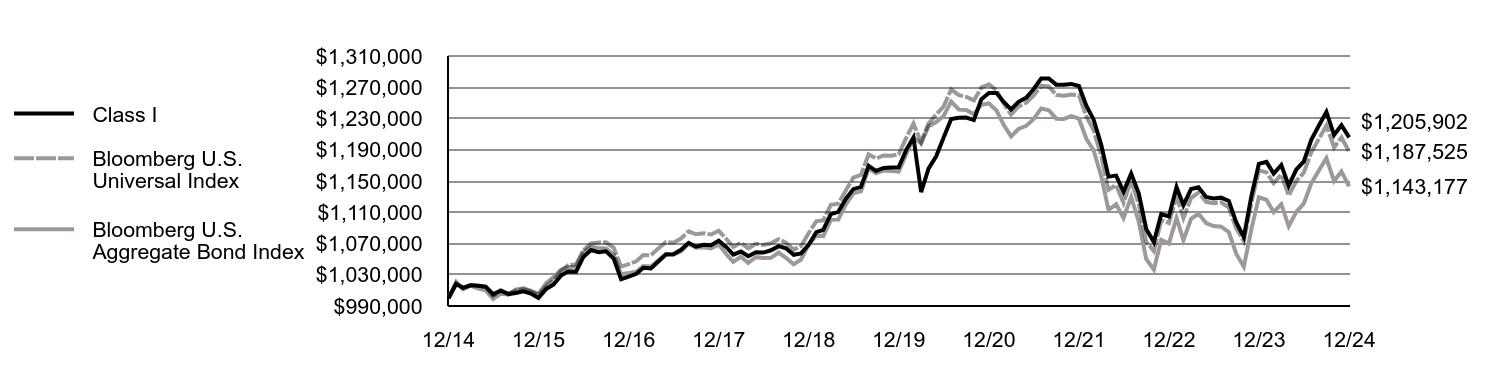

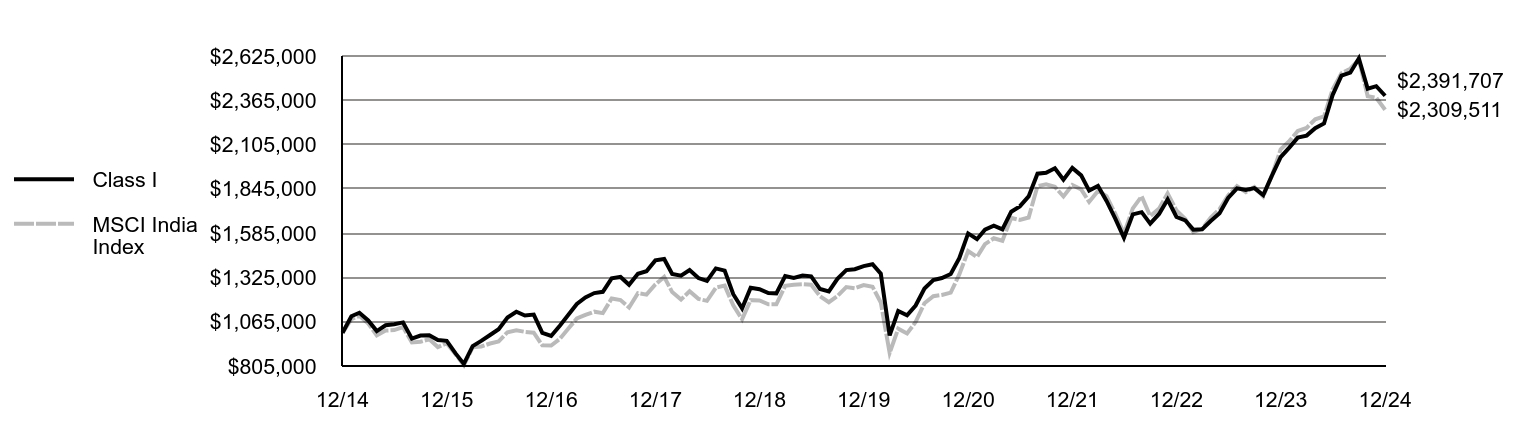

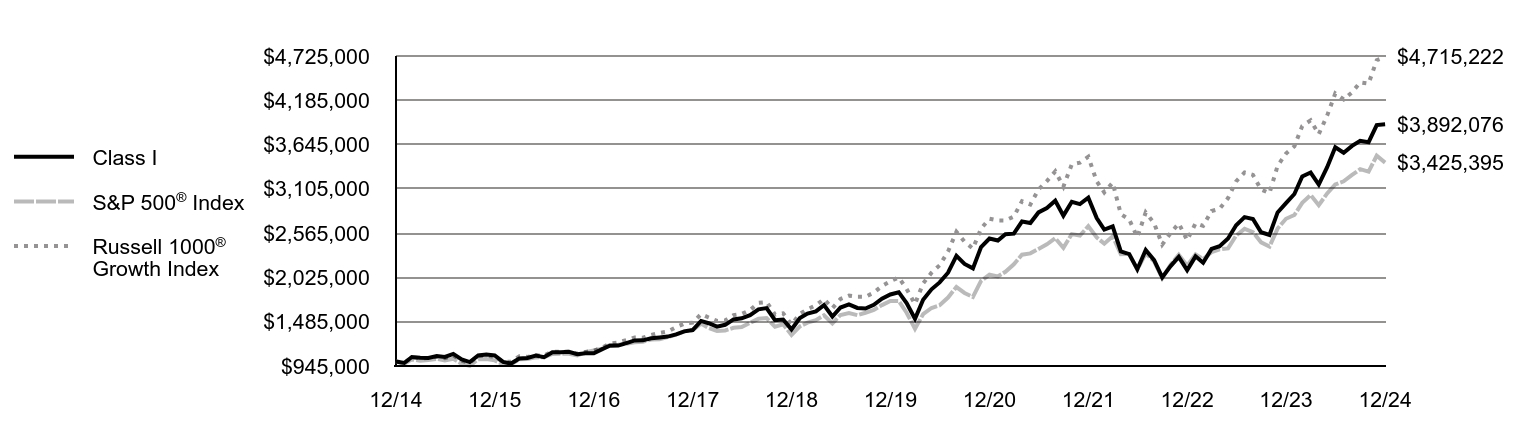

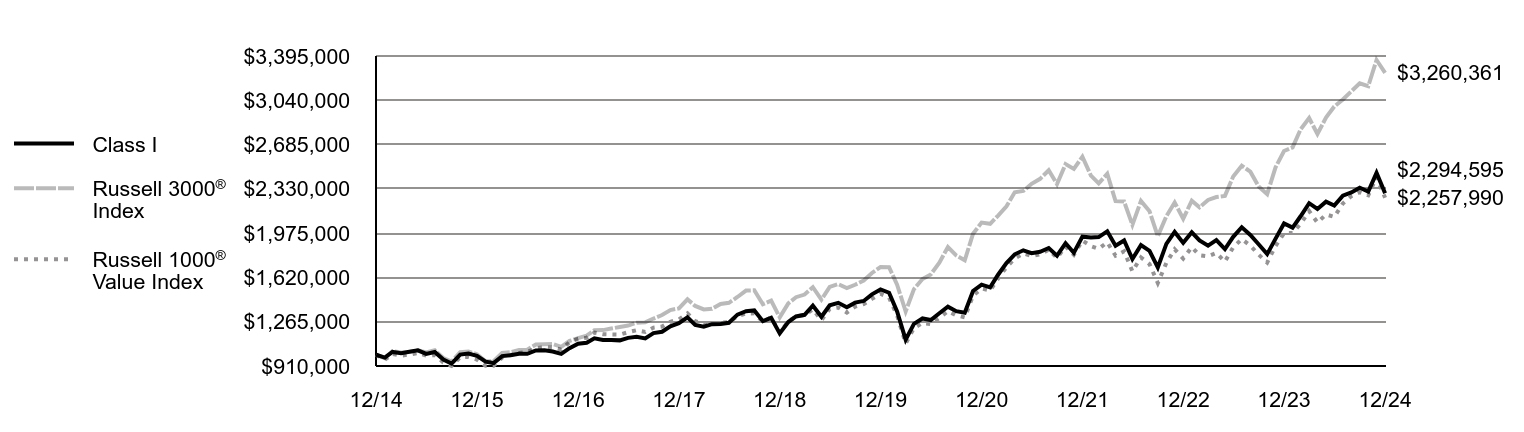

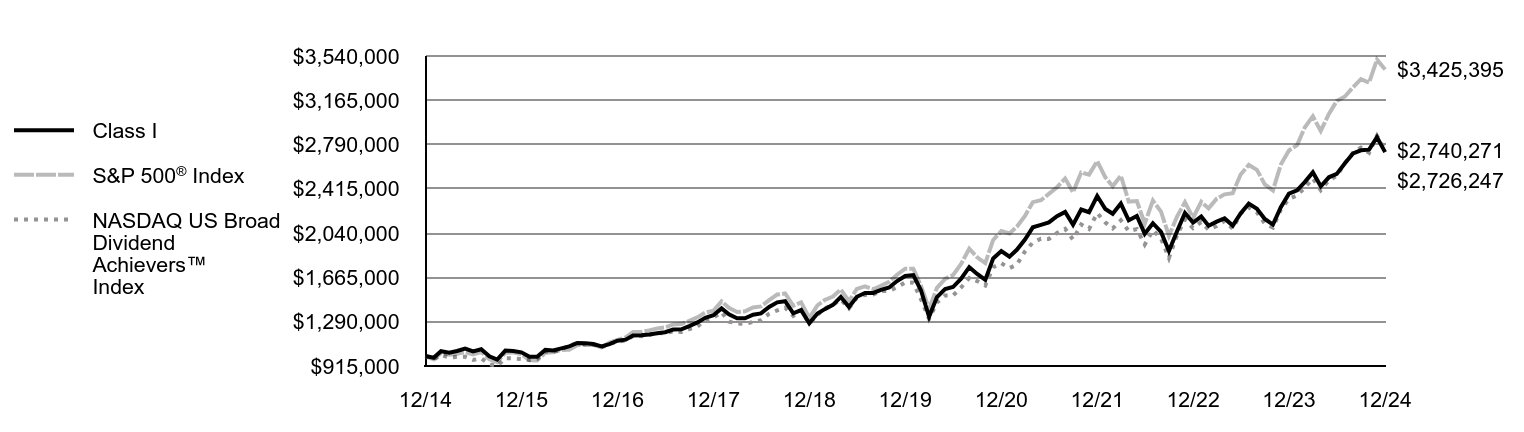

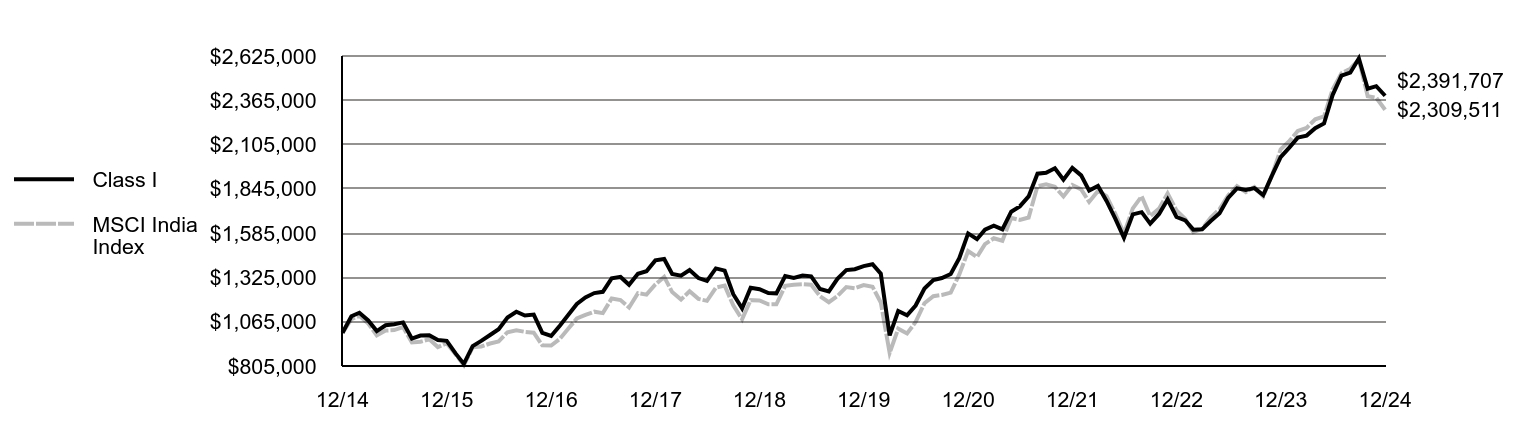

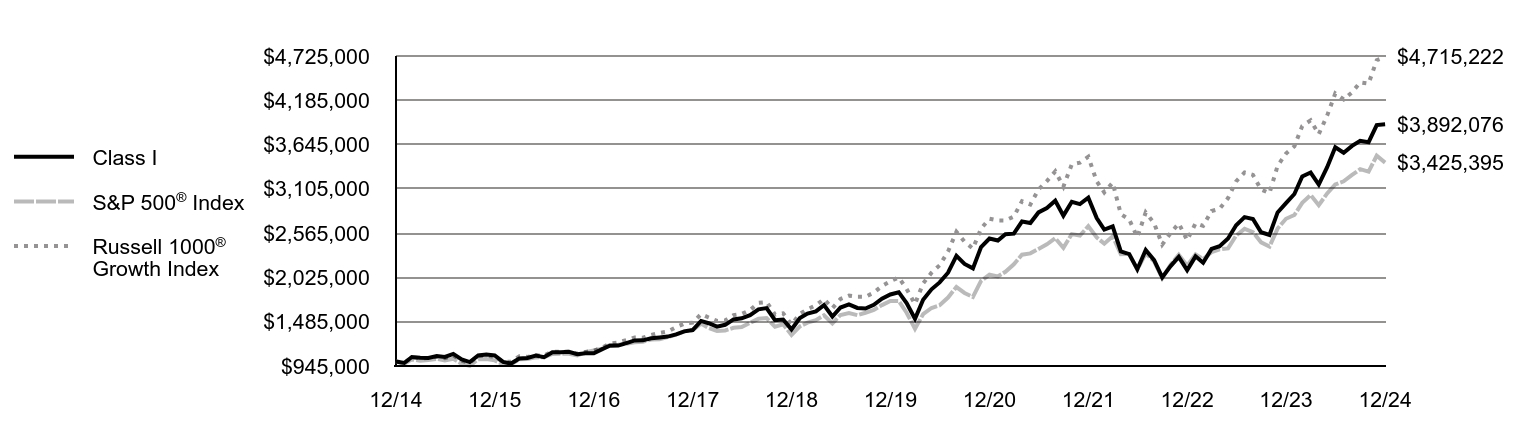

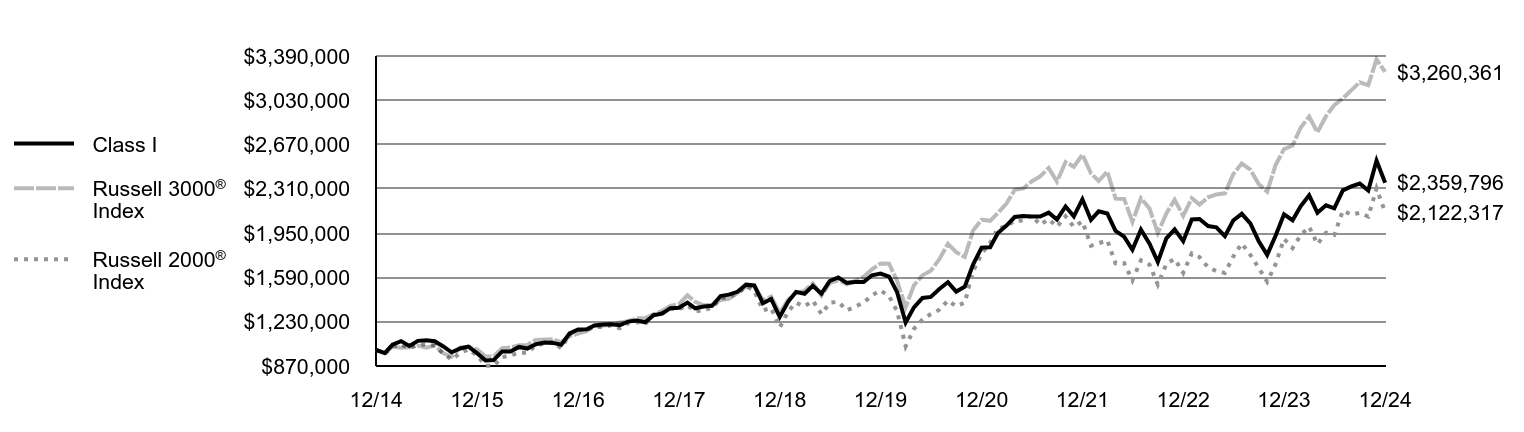

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | S&P 500® Index | Blended Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 12/14 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

| 1/15 | $998,818 | $969,981 | $990,376 | $1,020,969 |

|---|

| 2/15 | $1,030,733 | $1,025,727 | $1,020,802 | $1,011,370 |

|---|

| 3/15 | $1,029,209 | $1,009,506 | $1,013,012 | $1,016,066 |

|---|

| 4/15 | $1,031,580 | $1,019,190 | $1,017,389 | $1,012,420 |

|---|

| 5/15 | $1,043,087 | $1,032,296 | $1,024,259 | $1,009,982 |

|---|

| 6/15 | $1,030,063 | $1,012,313 | $1,007,895 | $998,970 |

|---|

| 7/15 | $1,046,005 | $1,033,522 | $1,023,368 | $1,005,914 |

|---|

| 8/15 | $1,009,217 | $971,166 | $985,733 | $1,004,469 |

|---|

| 9/15 | $988,884 | $947,136 | $973,766 | $1,011,264 |

|---|

| 10/15 | $1,039,375 | $1,027,030 | $1,023,116 | $1,011,431 |

|---|

| 11/15 | $1,039,375 | $1,030,085 | $1,023,860 | $1,008,759 |

|---|

| 12/15 | $1,028,821 | $1,013,838 | $1,012,848 | $1,005,500 |

|---|

| 1/16 | $1,006,210 | $963,527 | $988,266 | $1,019,336 |

|---|

| 2/16 | $1,001,185 | $962,227 | $990,270 | $1,026,567 |

|---|

| 3/16 | $1,044,065 | $1,027,503 | $1,034,211 | $1,035,986 |

|---|

| 4/16 | $1,044,065 | $1,031,487 | $1,038,205 | $1,039,963 |

|---|

| 5/16 | $1,054,165 | $1,050,010 | $1,049,498 | $1,040,229 |

|---|

| 6/16 | $1,063,672 | $1,052,731 | $1,058,672 | $1,058,920 |

|---|

| 7/16 | $1,086,496 | $1,091,544 | $1,084,769 | $1,065,615 |

|---|

| 8/16 | $1,082,692 | $1,093,076 | $1,085,186 | $1,064,396 |

|---|

| 9/16 | $1,080,719 | $1,093,283 | $1,085,055 | $1,063,773 |

|---|

| 10/16 | $1,064,174 | $1,073,340 | $1,069,860 | $1,055,636 |

|---|

| 11/16 | $1,065,445 | $1,113,091 | $1,083,511 | $1,030,666 |

|---|

| 12/16 | $1,078,804 | $1,135,093 | $1,096,972 | $1,032,120 |

|---|

| 1/17 | $1,089,066 | $1,156,621 | $1,110,316 | $1,034,145 |

|---|

| 2/17 | $1,116,007 | $1,202,546 | $1,139,753 | $1,041,096 |

|---|

| 3/17 | $1,114,801 | $1,203,949 | $1,140,311 | $1,040,550 |

|---|

| 4/17 | $1,125,112 | $1,216,313 | $1,150,858 | $1,048,580 |

|---|

| 5/17 | $1,141,871 | $1,233,430 | $1,164,119 | $1,056,651 |

|---|

| 6/17 | $1,149,906 | $1,241,129 | $1,168,010 | $1,055,587 |

|---|

| 7/17 | $1,165,040 | $1,266,650 | $1,184,431 | $1,060,130 |

|---|

| 8/17 | $1,168,939 | $1,270,527 | $1,190,856 | $1,069,639 |

|---|

| 9/17 | $1,178,104 | $1,296,736 | $1,203,326 | $1,064,544 |

|---|

| 10/17 | $1,196,392 | $1,326,995 | $1,220,453 | $1,065,161 |

|---|

| 11/17 | $1,213,368 | $1,367,694 | $1,242,285 | $1,063,794 |

|---|

| 12/17 | $1,227,788 | $1,382,901 | $1,252,853 | $1,068,676 |

|---|

| 1/18 | $1,261,476 | $1,462,078 | $1,290,120 | $1,056,368 |

|---|

| 2/18 | $1,229,135 | $1,408,190 | $1,256,698 | $1,046,354 |

|---|

| 3/18 | $1,215,100 | $1,372,403 | $1,240,760 | $1,053,065 |

|---|

| 4/18 | $1,219,164 | $1,377,669 | $1,239,925 | $1,045,232 |

|---|

| 5/18 | $1,239,463 | $1,410,846 | $1,261,380 | $1,052,692 |

|---|

| 6/18 | $1,242,191 | $1,419,530 | $1,265,418 | $1,051,397 |

|---|

| 7/18 | $1,272,088 | $1,472,355 | $1,293,793 | $1,051,647 |

|---|

| 8/18 | $1,295,882 | $1,520,333 | $1,322,418 | $1,058,414 |

|---|

| 9/18 | $1,296,357 | $1,528,986 | $1,323,528 | $1,051,599 |

|---|

| 10/18 | $1,241,540 | $1,424,480 | $1,265,066 | $1,043,288 |

|---|

| 11/18 | $1,255,240 | $1,453,508 | $1,283,555 | $1,049,516 |

|---|

| 12/18 | $1,188,640 | $1,322,270 | $1,223,451 | $1,068,797 |

|---|

| 1/19 | $1,253,240 | $1,428,231 | $1,287,474 | $1,080,147 |

|---|

| 2/19 | $1,280,521 | $1,474,089 | $1,311,978 | $1,079,522 |

|---|

| 3/19 | $1,311,912 | $1,502,733 | $1,337,352 | $1,100,250 |

|---|

| 4/19 | $1,347,952 | $1,563,578 | $1,369,978 | $1,100,532 |

|---|

| 5/19 | $1,322,004 | $1,464,216 | $1,327,470 | $1,120,068 |

|---|

| 6/19 | $1,375,265 | $1,567,408 | $1,390,271 | $1,134,134 |

|---|

| 7/19 | $1,395,530 | $1,589,935 | $1,403,483 | $1,136,629 |

|---|

| 8/19 | $1,404,917 | $1,564,750 | $1,404,691 | $1,166,081 |

|---|

| 9/19 | $1,404,835 | $1,594,027 | $1,417,468 | $1,159,870 |

|---|

| 10/19 | $1,419,436 | $1,628,553 | $1,437,597 | $1,163,364 |

|---|

| 11/19 | $1,447,187 | $1,687,668 | $1,468,614 | $1,162,772 |

|---|

| 12/19 | $1,474,800 | $1,738,605 | $1,494,800 | $1,161,961 |

|---|

| 1/20 | $1,489,759 | $1,737,924 | $1,505,955 | $1,184,323 |

|---|

| 2/20 | $1,423,952 | $1,594,859 | $1,442,416 | $1,205,639 |

|---|

| 3/20 | $1,286,199 | $1,397,874 | $1,332,126 | $1,198,544 |

|---|

| 4/20 | $1,400,389 | $1,577,072 | $1,444,060 | $1,219,849 |

|---|

| 5/20 | $1,448,469 | $1,652,185 | $1,488,016 | $1,225,529 |

|---|

| 6/20 | $1,478,310 | $1,685,042 | $1,509,521 | $1,233,249 |

|---|

| 7/20 | $1,547,702 | $1,780,054 | $1,569,609 | $1,251,670 |

|---|

| 8/20 | $1,610,597 | $1,908,005 | $1,632,236 | $1,241,566 |

|---|

| 9/20 | $1,571,684 | $1,835,507 | $1,594,666 | $1,240,886 |

|---|

| 10/20 | $1,545,689 | $1,786,694 | $1,566,373 | $1,235,345 |

|---|

| 11/20 | $1,642,008 | $1,982,273 | $1,675,398 | $1,247,466 |

|---|

| 12/20 | $1,686,602 | $2,058,487 | $1,714,971 | $1,249,185 |

|---|

| 1/21 | $1,666,536 | $2,037,705 | $1,699,664 | $1,240,229 |

|---|

| 2/21 | $1,695,862 | $2,093,895 | $1,717,967 | $1,222,319 |

|---|

| 3/21 | $1,719,564 | $2,185,598 | $1,754,530 | $1,207,057 |

|---|

| 4/21 | $1,795,404 | $2,302,241 | $1,816,257 | $1,216,592 |

|---|

| 5/21 | $1,796,954 | $2,318,321 | $1,826,242 | $1,220,567 |

|---|

| 6/21 | $1,831,395 | $2,372,442 | $1,856,954 | $1,229,143 |

|---|

| 7/21 | $1,860,888 | $2,428,799 | $1,891,726 | $1,242,886 |

|---|

| 8/21 | $1,888,825 | $2,502,648 | $1,924,797 | $1,240,520 |

|---|

| 9/21 | $1,819,995 | $2,386,250 | $1,864,418 | $1,229,779 |

|---|

| 10/21 | $1,893,106 | $2,553,435 | $1,942,587 | $1,229,440 |

|---|

| 11/21 | $1,877,550 | $2,535,743 | $1,936,810 | $1,233,078 |

|---|

| 12/21 | $1,927,436 | $2,649,385 | $1,986,908 | $1,229,922 |

|---|

| 1/22 | $1,830,226 | $2,512,287 | $1,908,095 | $1,203,425 |

|---|

| 2/22 | $1,808,438 | $2,437,066 | $1,865,302 | $1,189,999 |

|---|

| 3/22 | $1,829,173 | $2,527,553 | $1,886,128 | $1,156,939 |

|---|

| 4/22 | $1,713,168 | $2,307,145 | $1,758,813 | $1,113,035 |

|---|

| 5/22 | $1,706,443 | $2,311,378 | $1,765,286 | $1,120,212 |

|---|

| 6/22 | $1,628,368 | $2,120,588 | $1,666,780 | $1,102,638 |

|---|

| 7/22 | $1,717,802 | $2,316,116 | $1,775,282 | $1,129,580 |

|---|

| 8/22 | $1,665,491 | $2,221,660 | $1,711,777 | $1,097,662 |

|---|

| 9/22 | $1,562,191 | $2,017,049 | $1,587,601 | $1,050,236 |

|---|

| 10/22 | $1,613,021 | $2,180,352 | $1,656,497 | $1,036,633 |

|---|

| 11/22 | $1,687,573 | $2,302,198 | $1,736,407 | $1,074,756 |

|---|

| 12/22 | $1,633,141 | $2,169,558 | $1,673,249 | $1,069,908 |

|---|

| 1/23 | $1,698,822 | $2,305,880 | $1,756,921 | $1,102,823 |

|---|

| 2/23 | $1,650,893 | $2,249,619 | $1,713,031 | $1,074,309 |

|---|

| 3/23 | $1,708,749 | $2,332,212 | $1,768,172 | $1,101,599 |

|---|

| 4/23 | $1,723,018 | $2,368,614 | $1,789,018 | $1,108,275 |

|---|

| 5/23 | $1,714,100 | $2,378,910 | $1,785,892 | $1,096,208 |

|---|

| 6/23 | $1,775,324 | $2,536,097 | $1,854,146 | $1,092,298 |

|---|

| 7/23 | $1,807,570 | $2,617,569 | $1,889,368 | $1,091,536 |

|---|

| 8/23 | $1,800,404 | $2,575,893 | $1,866,491 | $1,084,564 |

|---|

| 9/23 | $1,727,471 | $2,453,080 | $1,794,125 | $1,057,004 |

|---|

| 10/23 | $1,696,880 | $2,401,500 | $1,760,165 | $1,040,323 |

|---|

| 11/23 | $1,826,440 | $2,620,818 | $1,888,498 | $1,087,435 |

|---|

| 12/23 | $1,899,654 | $2,739,884 | $1,968,891 | $1,129,061 |

|---|

| 1/24 | $1,941,465 | $2,785,925 | $1,986,580 | $1,125,961 |

|---|

| 2/24 | $2,010,543 | $2,934,682 | $2,038,998 | $1,110,053 |

|---|

| 3/24 | $2,049,634 | $3,029,104 | $2,085,892 | $1,120,303 |

|---|

| 4/24 | $1,976,629 | $2,905,381 | $2,013,699 | $1,092,006 |

|---|

| 5/24 | $2,069,711 | $3,049,444 | $2,087,263 | $1,110,519 |

|---|

| 6/24 | $2,141,486 | $3,158,864 | $2,140,105 | $1,121,033 |

|---|

| 7/24 | $2,163,468 | $3,197,315 | $2,175,730 | $1,147,217 |

|---|

| 8/24 | $2,225,753 | $3,274,872 | $2,219,901 | $1,163,702 |

|---|

| 9/24 | $2,260,865 | $3,344,813 | $2,260,237 | $1,179,283 |

|---|

| 10/24 | $2,235,111 | $3,314,481 | $2,225,518 | $1,150,038 |

|---|

| 11/24 | $2,314,213 | $3,509,044 | $2,313,314 | $1,162,197 |

|---|

| 12/24 | $2,274,546 | $3,425,395 | $2,265,084 | $1,143,177 |

|---|

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 19.74% | 9.04% | 8.56% |

|---|

S&P 500® Index | 25.02% | 14.51% | 13.09% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

|---|

Blended IndexFootnote Reference1 | 15.04% | 8.66% | 8.51% |

|---|

| Footnote | Description |

Footnote1 | Benchmark is an internally constructed benchmark comprised of a blend of 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index, and is rebalanced monthly. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $1,013,190,430 |

|---|

| # of Portfolio Holdings (for Stock and Core Bond Portfolios) | 373 |

|---|

| Portfolio Turnover Rate | 5% |

|---|

| Total Advisory Fees Paid | $5,002,640 |

|---|

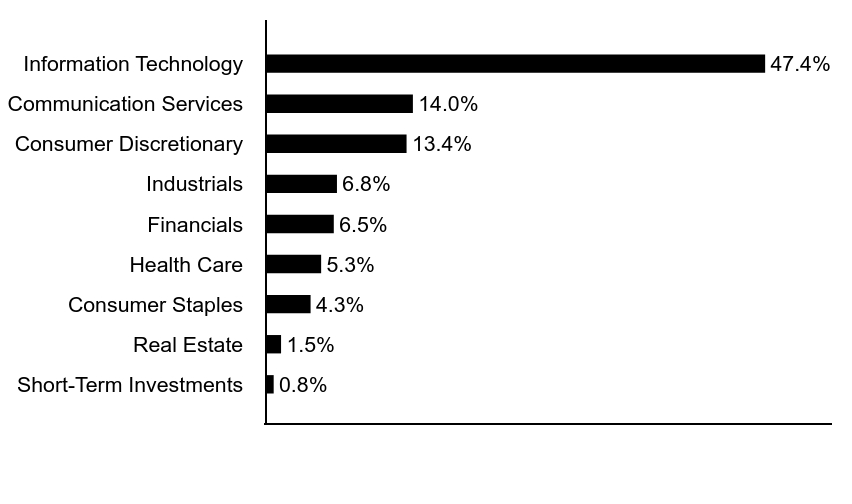

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

References to the Fund's investments are to the Fund's pro rata share of the investments of Stock Portfolio and Core Bond Portfolio, affiliated investment companies in which the Fund invests substantially all of its assets.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 1.2% |

| Commercial Mortgage-Backed Securities | 2.9% |

| Short-Term Investments | 4.3% |

| Asset-Backed Securities | 4.7% |

| U.S. Treasury Obligations | 7.9% |

| Corporate Bonds | 9.5% |

| U.S. Government Agency Mortgage-Backed Securities | 10.8% |

| Common Stocks | 58.7% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

Top Ten Holdings (% of total investments)Footnote Referencea

| Uniform Mortgage-Backed Security, 5.50%, 30-Year, TBA | 4.7% |

| Apple, Inc. | 4.5% |

| Microsoft Corp. | 4.5% |

| NVIDIA Corp. | 4.3% |

| Amazon.com, Inc. | 3.2% |

| Alphabet, Inc., Class C | 2.6% |

| Uniform Mortgage-Backed Security, 5.00%, 30-Year, TBA | 2.6% |

| Broadcom, Inc. | 2.1% |

| Meta Platforms, Inc., Class A | 1.8% |

| U.S. Treasury Notes, 0.38%, 12/31/25 | 1.5% |

| Total | 31.8% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Eaton Vance Balanced Fund

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Balanced Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference*

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R | $134 | 1.22% |

|---|

| Footnote | Description |

Footnote* | Expenses in the table reflect the expenses of both the Fund and Stock Portfolio and Core Bond Portfolio, the Portfolios in which it invests. |

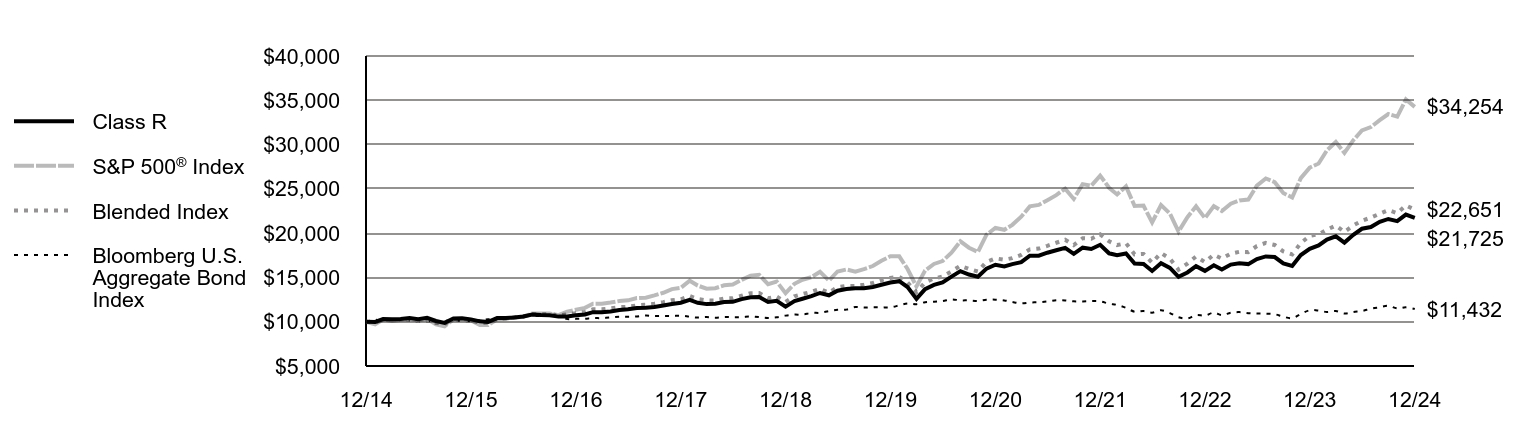

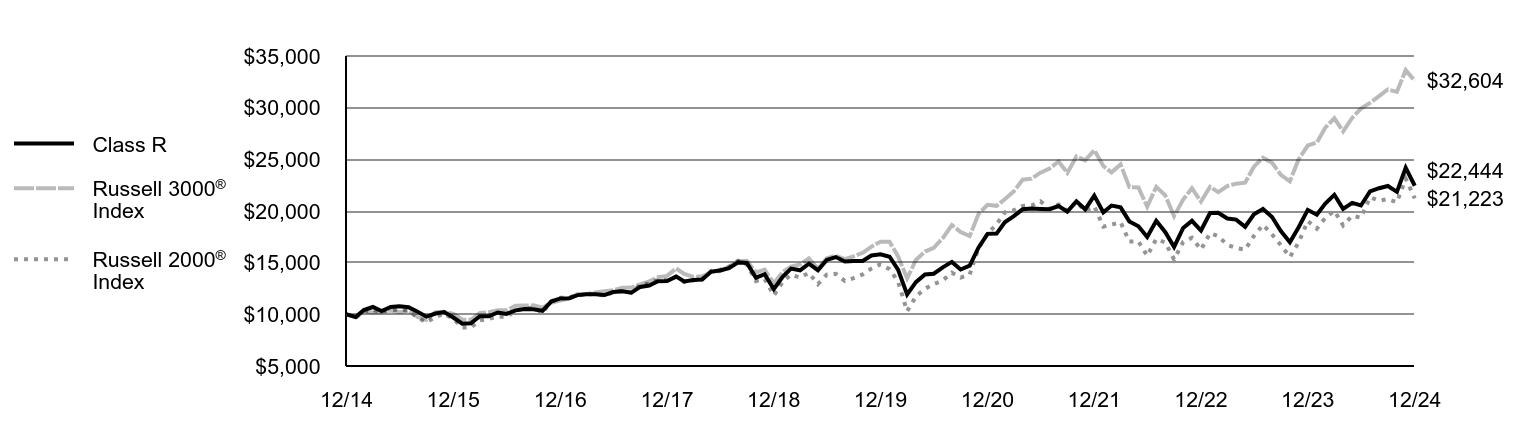

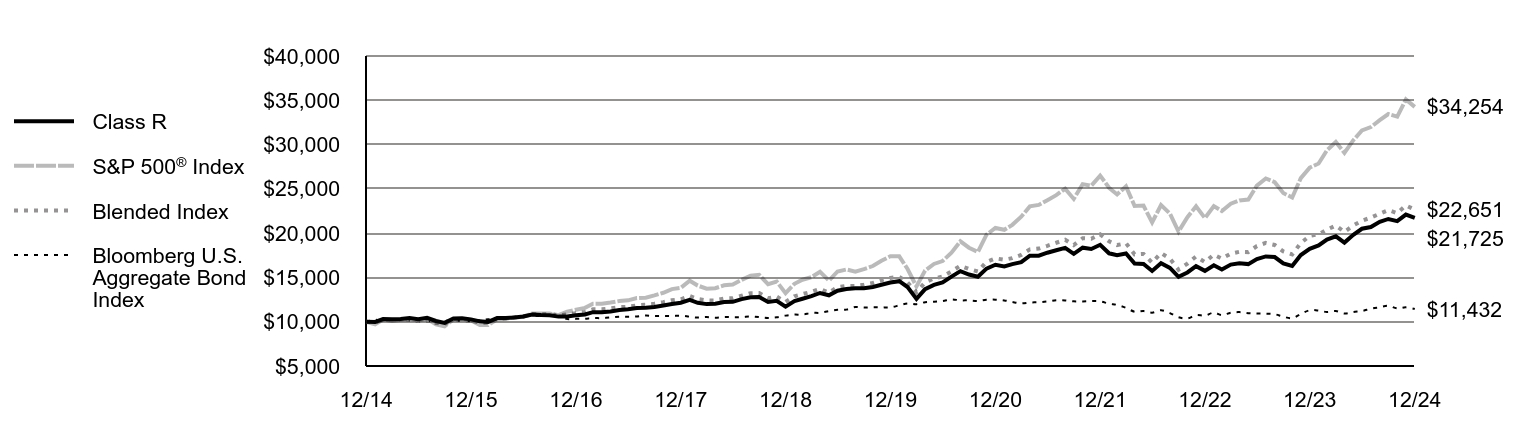

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index (the Index), and the Bloomberg U.S. Aggregate Bond Index (the Secondary Index):

• The Fund invests in a blend of Stock Portfolio — the Fund’s equity allocation — and Core Bond Portfolio — the Fund’s fixed-income allocation

↓ Core Bond Portfolio underperformed the Index and detracted from Index-relative returns during the period — but outperformed the Secondary Index

↓ An underweight exposure to agency mortgage-backed securities (MBS), yield-curve positioning, and the use of derivatives detracted from returns during the period

↑ Bond selections ― notably in investment-grade corporate bonds ― and sector allocations ― notably an overweight exposure to commercial MBS ― aided returns

↑ Stock Portfolio outperformed the Index; an overweight position in artificial intelligence chipmaker NVIDIA Corp. contributed to Index-relative returns

↑ Among sectors, stock selections and underweight exposures to health care and consumer staples, and stock selections in information technology, helped returns

↓ An overweight position in energy exploration and production firm ConocoPhillips fell in value as global energy demand and oil prices weakened during the period

↓ Among sectors within the Index, the Fund’s stock selections in the energy and real estate sectors detracted from Index-relative performance during the period

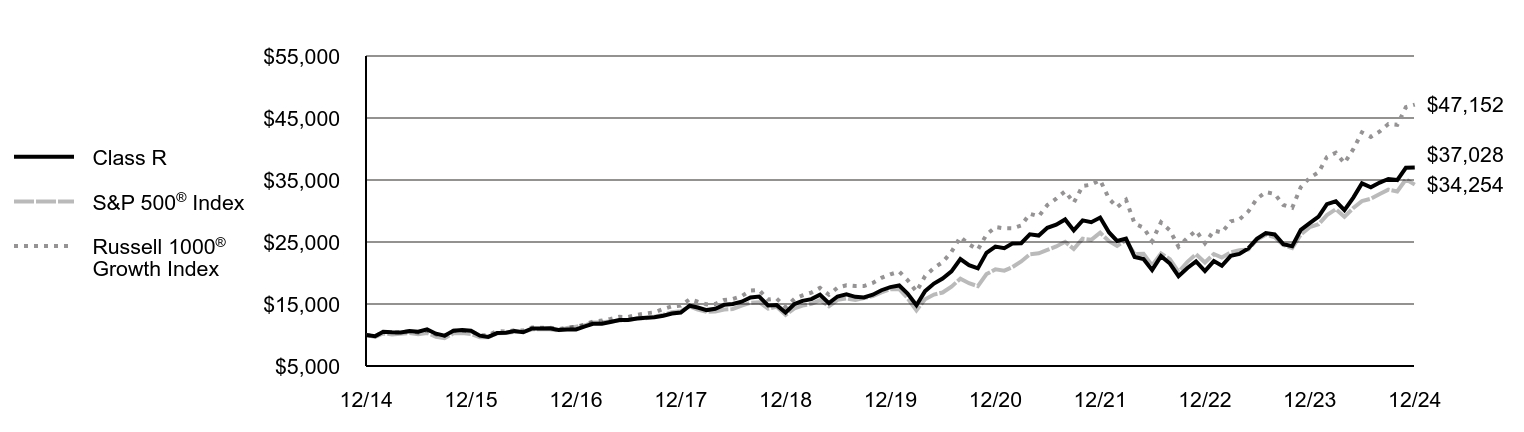

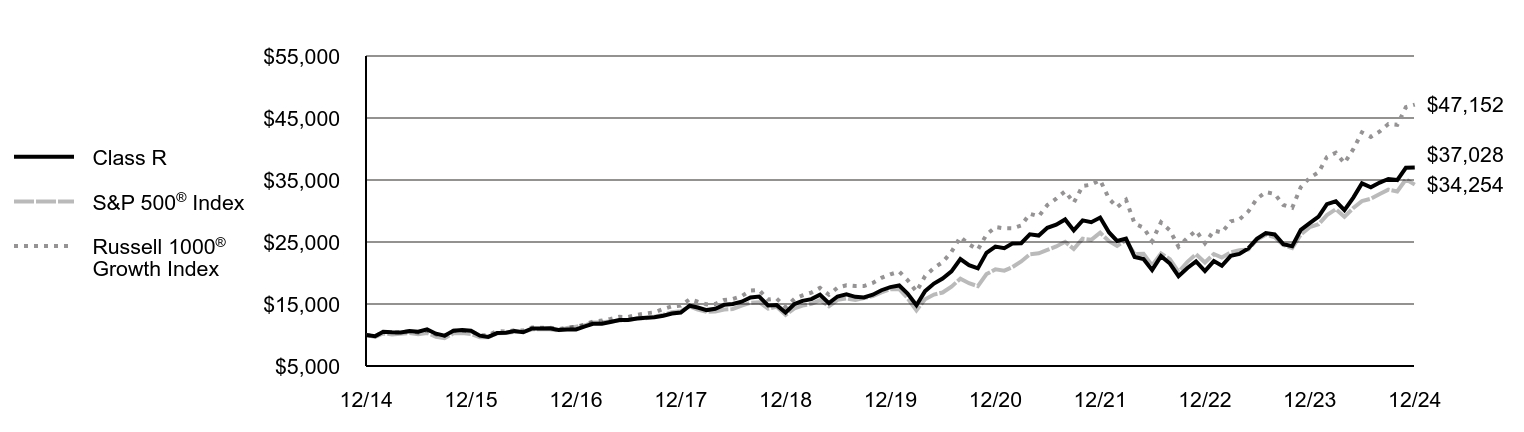

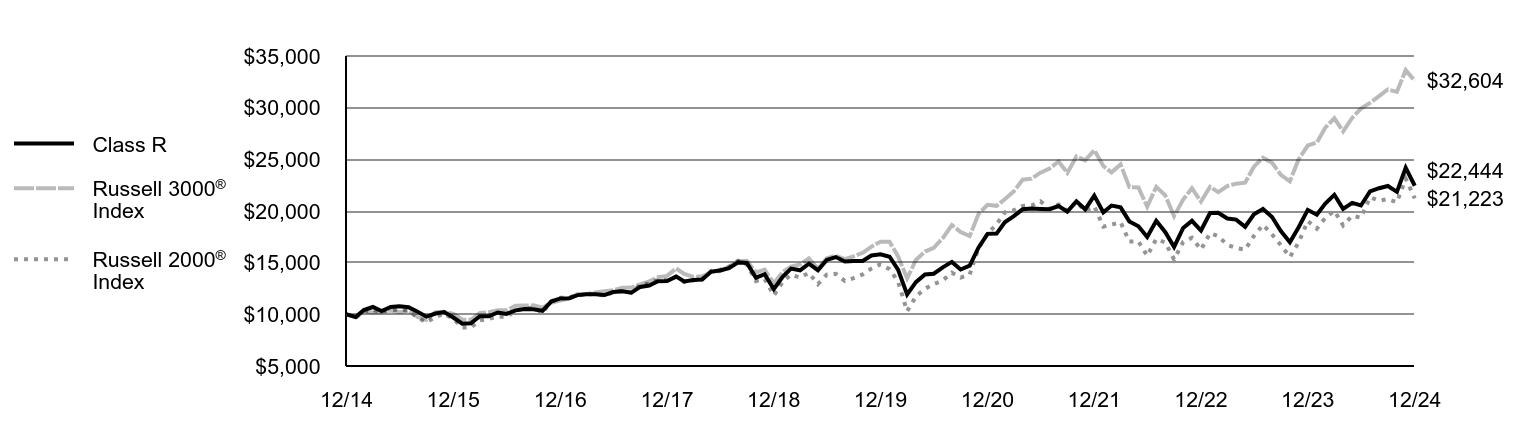

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class R | S&P 500® Index | Blended Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 12/14 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

| 1/15 | $9,976 | $9,700 | $9,904 | $10,210 |

|---|

| 2/15 | $10,296 | $10,257 | $10,208 | $10,114 |

|---|

| 3/15 | $10,287 | $10,095 | $10,130 | $10,161 |

|---|

| 4/15 | $10,299 | $10,192 | $10,174 | $10,124 |

|---|

| 5/15 | $10,426 | $10,323 | $10,243 | $10,100 |

|---|

| 6/15 | $10,290 | $10,123 | $10,079 | $9,990 |

|---|

| 7/15 | $10,437 | $10,335 | $10,234 | $10,059 |

|---|

| 8/15 | $10,082 | $9,712 | $9,857 | $10,045 |

|---|

| 9/15 | $9,873 | $9,471 | $9,738 | $10,113 |

|---|

| 10/15 | $10,364 | $10,270 | $10,231 | $10,114 |

|---|

| 11/15 | $10,377 | $10,301 | $10,239 | $10,088 |

|---|

| 12/15 | $10,265 | $10,138 | $10,128 | $10,055 |

|---|

| 1/16 | $10,039 | $9,635 | $9,883 | $10,193 |

|---|

| 2/16 | $9,977 | $9,622 | $9,903 | $10,266 |

|---|

| 3/16 | $10,411 | $10,275 | $10,342 | $10,360 |

|---|

| 4/16 | $10,411 | $10,315 | $10,382 | $10,400 |

|---|

| 5/16 | $10,487 | $10,500 | $10,495 | $10,402 |

|---|

| 6/16 | $10,587 | $10,527 | $10,587 | $10,589 |

|---|

| 7/16 | $10,814 | $10,915 | $10,848 | $10,656 |

|---|

| 8/16 | $10,763 | $10,931 | $10,852 | $10,644 |

|---|

| 9/16 | $10,741 | $10,933 | $10,851 | $10,638 |

|---|

| 10/16 | $10,577 | $10,733 | $10,699 | $10,556 |

|---|

| 11/16 | $10,589 | $11,131 | $10,835 | $10,307 |

|---|

| 12/16 | $10,722 | $11,351 | $10,970 | $10,321 |

|---|

| 1/17 | $10,811 | $11,566 | $11,103 | $10,341 |

|---|

| 2/17 | $11,079 | $12,025 | $11,398 | $10,411 |

|---|

| 3/17 | $11,068 | $12,039 | $11,403 | $10,406 |

|---|

| 4/17 | $11,158 | $12,163 | $11,509 | $10,486 |

|---|

| 5/17 | $11,311 | $12,334 | $11,641 | $10,567 |

|---|

| 6/17 | $11,403 | $12,411 | $11,680 | $10,556 |

|---|

| 7/17 | $11,540 | $12,667 | $11,844 | $10,601 |

|---|

| 8/17 | $11,579 | $12,705 | $11,909 | $10,696 |

|---|

| 9/17 | $11,656 | $12,967 | $12,033 | $10,645 |

|---|

| 10/17 | $11,837 | $13,270 | $12,205 | $10,652 |

|---|

| 11/17 | $11,993 | $13,677 | $12,423 | $10,638 |

|---|

| 12/17 | $12,139 | $13,829 | $12,529 | $10,687 |

|---|

| 1/18 | $12,459 | $14,621 | $12,901 | $10,564 |

|---|

| 2/18 | $12,139 | $14,082 | $12,567 | $10,464 |

|---|

| 3/18 | $11,988 | $13,724 | $12,408 | $10,531 |

|---|

| 4/18 | $12,041 | $13,777 | $12,399 | $10,452 |

|---|

| 5/18 | $12,229 | $14,108 | $12,614 | $10,527 |

|---|

| 6/18 | $12,242 | $14,195 | $12,654 | $10,514 |

|---|

| 7/18 | $12,551 | $14,724 | $12,938 | $10,516 |

|---|

| 8/18 | $12,759 | $15,203 | $13,224 | $10,584 |

|---|

| 9/18 | $12,777 | $15,290 | $13,235 | $10,516 |

|---|

| 10/18 | $12,222 | $14,245 | $12,651 | $10,433 |

|---|

| 11/18 | $12,358 | $14,535 | $12,836 | $10,495 |

|---|

| 12/18 | $11,701 | $13,223 | $12,235 | $10,688 |

|---|

| 1/19 | $12,324 | $14,282 | $12,875 | $10,801 |

|---|

| 2/19 | $12,593 | $14,741 | $13,120 | $10,795 |

|---|

| 3/19 | $12,888 | $15,027 | $13,374 | $11,003 |

|---|

| 4/19 | $13,243 | $15,636 | $13,700 | $11,005 |

|---|

| 5/19 | $12,987 | $14,642 | $13,275 | $11,201 |

|---|

| 6/19 | $13,497 | $15,674 | $13,903 | $11,341 |

|---|

| 7/19 | $13,696 | $15,899 | $14,035 | $11,366 |

|---|

| 8/19 | $13,775 | $15,648 | $14,047 | $11,661 |

|---|

| 9/19 | $13,771 | $15,940 | $14,175 | $11,599 |

|---|

| 10/19 | $13,915 | $16,286 | $14,376 | $11,634 |

|---|

| 11/19 | $14,173 | $16,877 | $14,686 | $11,628 |

|---|

| 12/19 | $14,428 | $17,386 | $14,948 | $11,620 |

|---|

| 1/20 | $14,575 | $17,379 | $15,060 | $11,843 |

|---|

| 2/20 | $13,914 | $15,949 | $14,424 | $12,056 |

|---|

| 3/20 | $12,576 | $13,979 | $13,321 | $11,985 |

|---|

| 4/20 | $13,682 | $15,771 | $14,441 | $12,198 |

|---|

| 5/20 | $14,153 | $16,522 | $14,880 | $12,255 |

|---|

| 6/20 | $14,431 | $16,850 | $15,095 | $12,332 |

|---|

| 7/20 | $15,096 | $17,801 | $15,696 | $12,517 |

|---|

| 8/20 | $15,712 | $19,080 | $16,322 | $12,416 |

|---|

| 9/20 | $15,326 | $18,355 | $15,947 | $12,409 |

|---|

| 10/20 | $15,072 | $17,867 | $15,664 | $12,353 |

|---|

| 11/20 | $16,000 | $19,823 | $16,754 | $12,475 |

|---|

| 12/20 | $16,432 | $20,585 | $17,150 | $12,492 |

|---|

| 1/21 | $16,236 | $20,377 | $16,997 | $12,402 |

|---|

| 2/21 | $16,508 | $20,939 | $17,180 | $12,223 |

|---|

| 3/21 | $16,720 | $21,856 | $17,545 | $12,071 |

|---|

| 4/21 | $17,461 | $23,022 | $18,163 | $12,166 |

|---|

| 5/21 | $17,461 | $23,183 | $18,262 | $12,206 |

|---|

| 6/21 | $17,792 | $23,724 | $18,570 | $12,291 |

|---|

| 7/21 | $18,065 | $24,288 | $18,917 | $12,429 |

|---|

| 8/21 | $18,337 | $25,026 | $19,248 | $12,405 |

|---|

| 9/21 | $17,660 | $23,863 | $18,644 | $12,298 |

|---|

| 10/21 | $18,357 | $25,534 | $19,426 | $12,294 |

|---|

| 11/21 | $18,206 | $25,357 | $19,368 | $12,331 |

|---|

| 12/21 | $18,686 | $26,494 | $19,869 | $12,299 |

|---|

| 1/22 | $17,723 | $25,123 | $19,081 | $12,034 |

|---|

| 2/22 | $17,511 | $24,371 | $18,653 | $11,900 |

|---|

| 3/22 | $17,707 | $25,276 | $18,861 | $11,569 |

|---|

| 4/22 | $16,579 | $23,071 | $17,588 | $11,130 |

|---|

| 5/22 | $16,513 | $23,114 | $17,653 | $11,202 |

|---|

| 6/22 | $15,733 | $21,206 | $16,668 | $11,026 |

|---|

| 7/22 | $16,602 | $23,161 | $17,753 | $11,296 |

|---|

| 8/22 | $16,078 | $22,217 | $17,118 | $10,977 |

|---|

| 9/22 | $15,072 | $20,170 | $15,876 | $10,502 |

|---|

| 10/22 | $15,565 | $21,804 | $16,565 | $10,366 |

|---|

| 11/22 | $16,272 | $23,022 | $17,364 | $10,748 |

|---|

| 12/22 | $15,740 | $21,696 | $16,732 | $10,699 |

|---|

| 1/23 | $16,376 | $23,059 | $17,569 | $11,028 |

|---|

| 2/23 | $15,895 | $22,496 | $17,130 | $10,743 |

|---|

| 3/23 | $16,452 | $23,322 | $17,682 | $11,016 |

|---|

| 4/23 | $16,590 | $23,686 | $17,890 | $11,083 |

|---|

| 5/23 | $16,504 | $23,789 | $17,859 | $10,962 |

|---|

| 6/23 | $17,075 | $25,361 | $18,541 | $10,923 |

|---|

| 7/23 | $17,369 | $26,176 | $18,894 | $10,915 |

|---|

| 8/23 | $17,300 | $25,759 | $18,665 | $10,846 |

|---|

| 9/23 | $16,592 | $24,531 | $17,941 | $10,570 |

|---|

| 10/23 | $16,296 | $24,015 | $17,602 | $10,403 |

|---|

| 11/23 | $17,530 | $26,208 | $18,885 | $10,874 |

|---|

| 12/23 | $18,232 | $27,399 | $19,689 | $11,291 |

|---|

| 1/24 | $18,617 | $27,859 | $19,866 | $11,260 |

|---|

| 2/24 | $19,283 | $29,347 | $20,390 | $11,101 |

|---|

| 3/24 | $19,637 | $30,291 | $20,859 | $11,203 |

|---|

| 4/24 | $18,933 | $29,054 | $20,137 | $10,920 |

|---|

| 5/24 | $19,812 | $30,494 | $20,873 | $11,105 |

|---|

| 6/24 | $20,497 | $31,589 | $21,401 | $11,210 |

|---|

| 7/24 | $20,690 | $31,973 | $21,757 | $11,472 |

|---|

| 8/24 | $21,272 | $32,749 | $22,199 | $11,637 |

|---|

| 9/24 | $21,601 | $33,448 | $22,602 | $11,793 |

|---|

| 10/24 | $21,354 | $33,145 | $22,255 | $11,500 |

|---|

| 11/24 | $22,096 | $35,090 | $23,133 | $11,622 |

|---|

| 12/24 | $21,725 | $34,254 | $22,651 | $11,432 |

|---|

Average Annual Total Returns (%)Footnote Reference1

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class R | 19.16% | 8.52% | 8.06% |

|---|

S&P 500® Index | 25.02% | 14.51% | 13.09% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

|---|

Blended IndexFootnote Reference2 | 15.04% | 8.66% | 8.51% |

|---|

| Footnote | Description |

Footnote1 | Class R performance prior to 5/2/16 is linked to Class A. This linked performance is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. Performance presented in the Financial Highlights included in the financial statements is not linked. |

Footnote2 | Benchmark is an internally constructed benchmark comprised of a blend of 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index, and is rebalanced monthly. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $1,013,190,430 |

|---|

| # of Portfolio Holdings (for Stock and Core Bond Portfolios) | 373 |

|---|

| Portfolio Turnover Rate | 5% |

|---|

| Total Advisory Fees Paid | $5,002,640 |

|---|

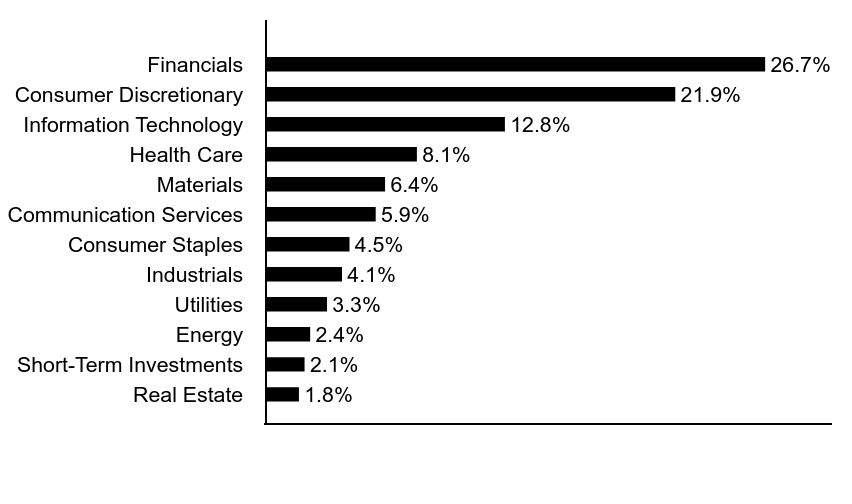

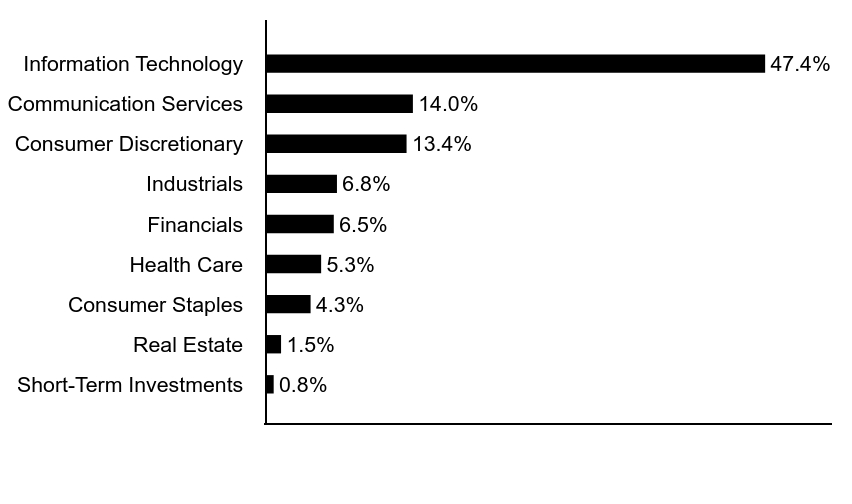

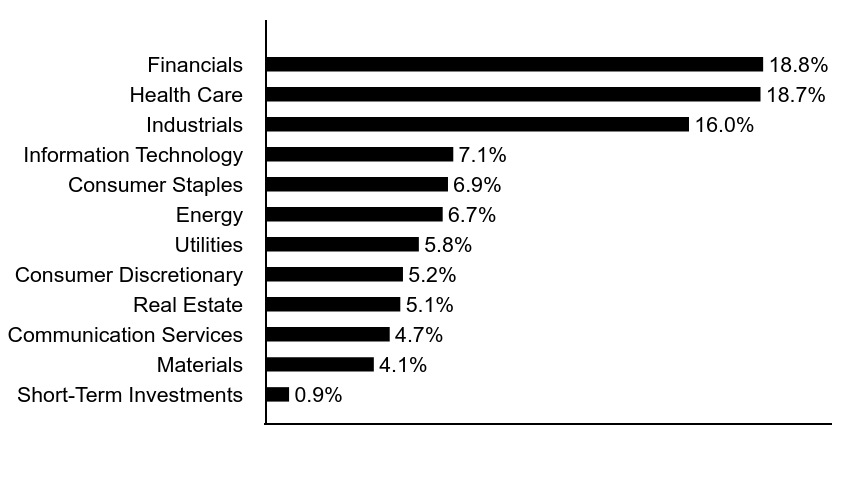

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

References to the Fund's investments are to the Fund's pro rata share of the investments of Stock Portfolio and Core Bond Portfolio, affiliated investment companies in which the Fund invests substantially all of its assets.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 1.2% |

| Commercial Mortgage-Backed Securities | 2.9% |

| Short-Term Investments | 4.3% |

| Asset-Backed Securities | 4.7% |

| U.S. Treasury Obligations | 7.9% |

| Corporate Bonds | 9.5% |

| U.S. Government Agency Mortgage-Backed Securities | 10.8% |

| Common Stocks | 58.7% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

Top Ten Holdings (% of total investments)Footnote Referencea

| Uniform Mortgage-Backed Security, 5.50%, 30-Year, TBA | 4.7% |

| Apple, Inc. | 4.5% |

| Microsoft Corp. | 4.5% |

| NVIDIA Corp. | 4.3% |

| Amazon.com, Inc. | 3.2% |

| Alphabet, Inc., Class C | 2.6% |

| Uniform Mortgage-Backed Security, 5.00%, 30-Year, TBA | 2.6% |

| Broadcom, Inc. | 2.1% |

| Meta Platforms, Inc., Class A | 1.8% |

| U.S. Treasury Notes, 0.38%, 12/31/25 | 1.5% |

| Total | 31.8% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Eaton Vance Balanced Fund

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Balanced Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference*

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 | $75 | 0.68% |

|---|

| Footnote | Description |

Footnote* | Expenses in the table reflect the expenses of both the Fund and Stock Portfolio and Core Bond Portfolio, the Portfolios in which it invests. |

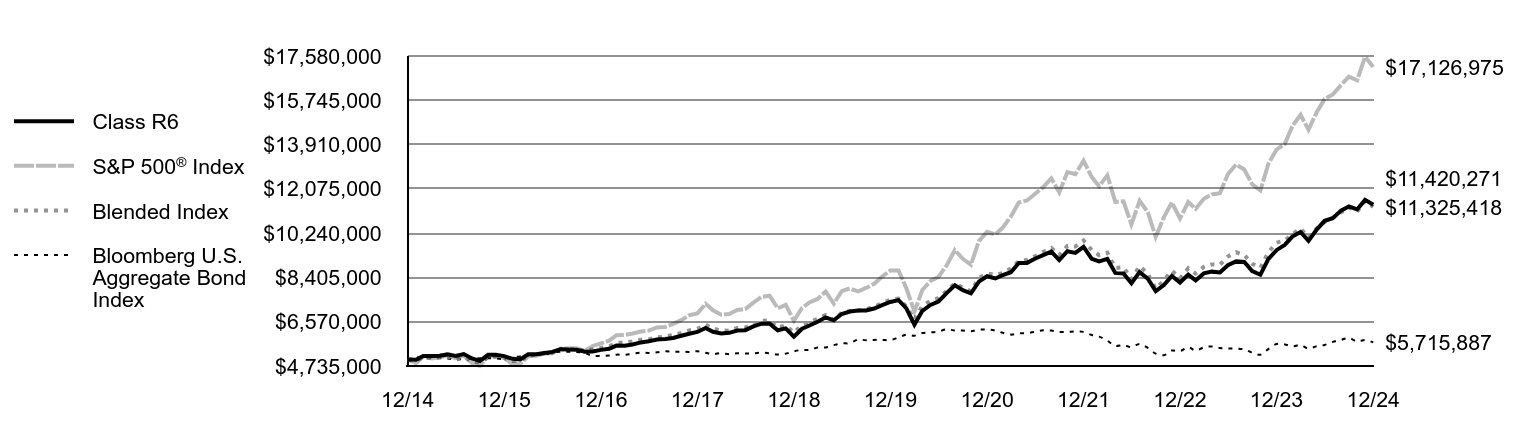

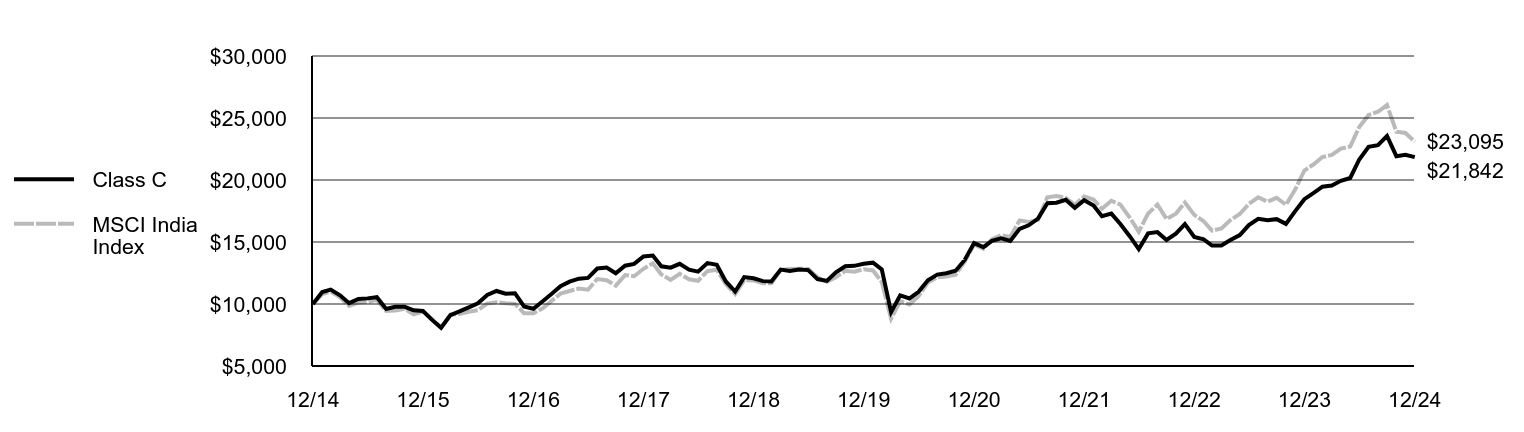

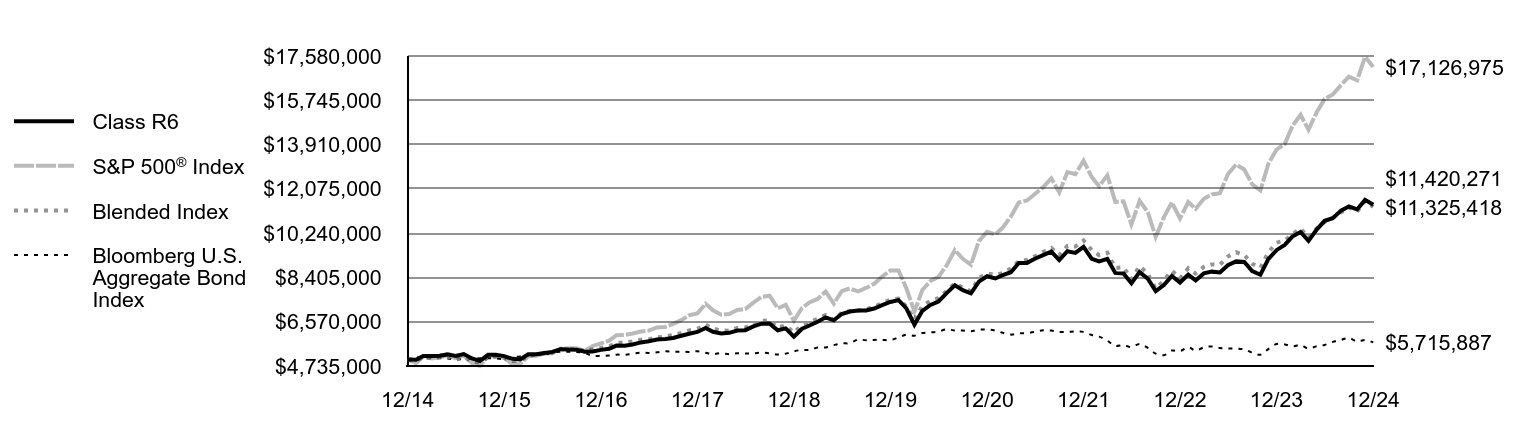

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index (the Index), and the Bloomberg U.S. Aggregate Bond Index (the Secondary Index):

• The Fund invests in a blend of Stock Portfolio — the Fund’s equity allocation — and Core Bond Portfolio — the Fund’s fixed-income allocation

↓ Core Bond Portfolio underperformed the Index and detracted from Index-relative returns during the period — but outperformed the Secondary Index

↓ An underweight exposure to agency mortgage-backed securities (MBS), yield-curve positioning, and the use of derivatives detracted from returns during the period

↑ Bond selections ― notably in investment-grade corporate bonds ― and sector allocations ― notably an overweight exposure to commercial MBS ― aided returns

↑ Stock Portfolio outperformed the Index; an overweight position in artificial intelligence chipmaker NVIDIA Corp. contributed to Index-relative returns

↑ Among sectors, stock selections and underweight exposures to health care and consumer staples, and stock selections in information technology, helped returns

↓ An overweight position in energy exploration and production firm ConocoPhillips fell in value as global energy demand and oil prices weakened during the period

↓ Among sectors within the Index, the Fund’s stock selections in the energy and real estate sectors detracted from Index-relative performance during the period

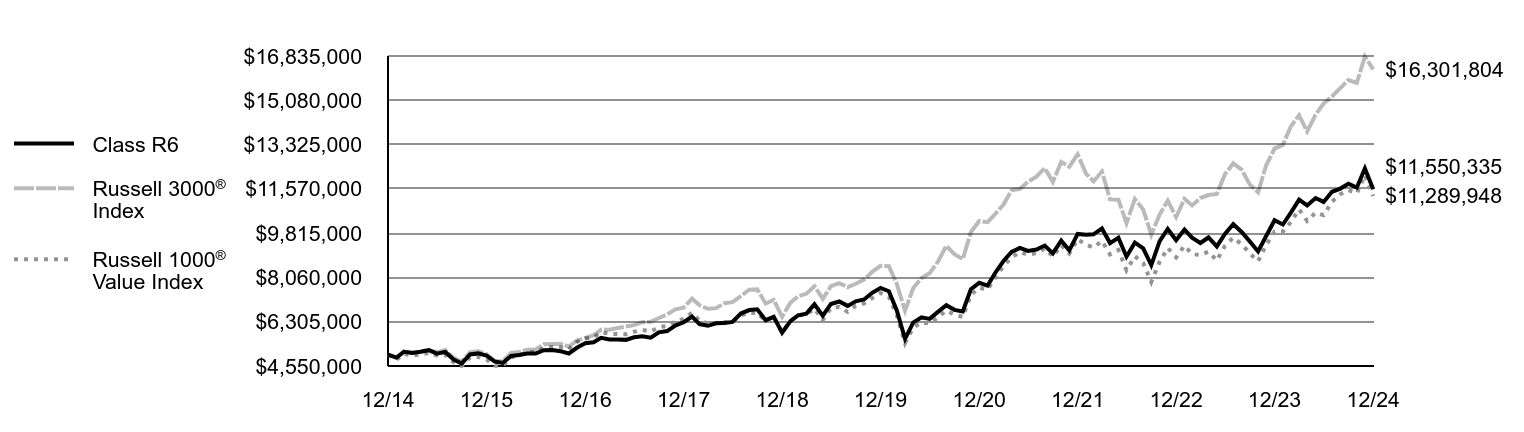

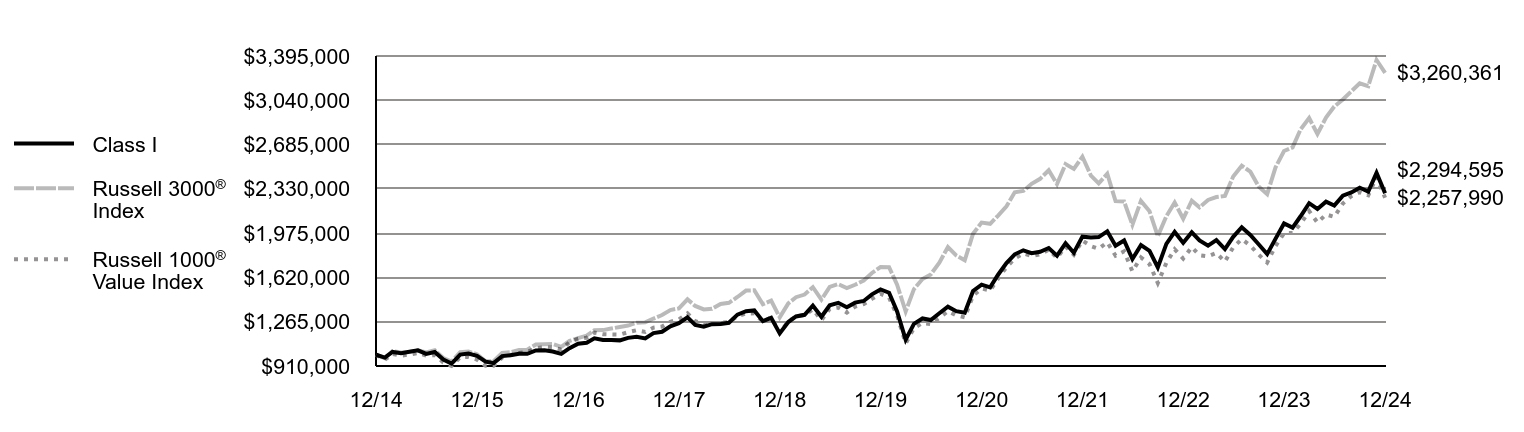

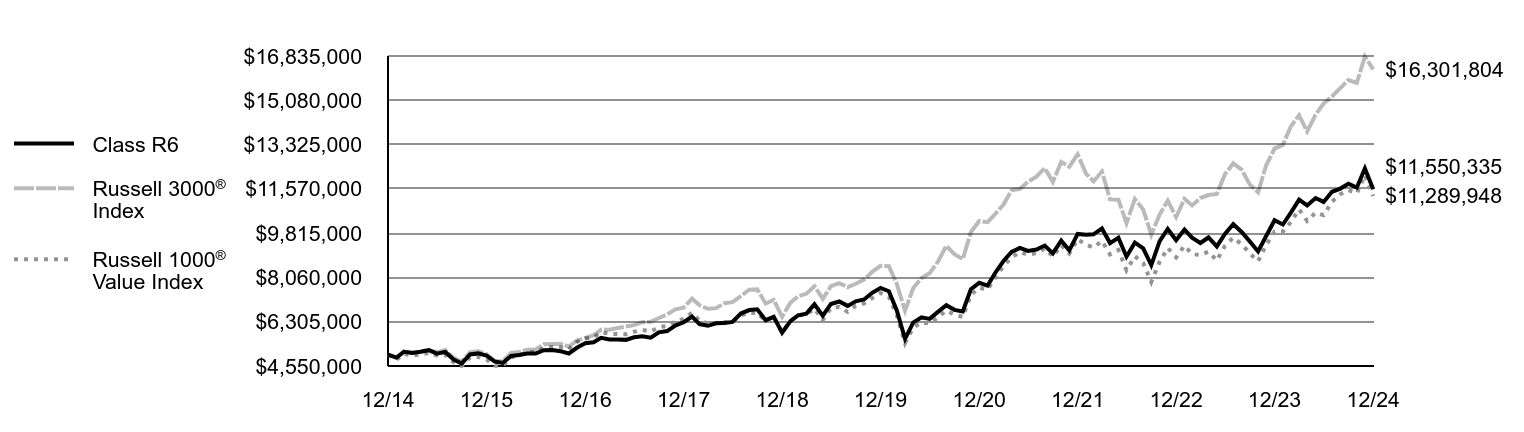

Comparison of the change in value of a $5,000,000 investment for the period indicated.

| Class R6 | S&P 500® Index | Blended Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 12/14 | $5,000,000 | $5,000,000 | $5,000,000 | $5,000,000 |

|---|

| 1/15 | $4,994,090 | $4,849,904 | $4,951,881 | $5,104,846 |

|---|

| 2/15 | $5,153,664 | $5,128,635 | $5,104,012 | $5,056,848 |

|---|

| 3/15 | $5,146,044 | $5,047,528 | $5,065,062 | $5,080,330 |

|---|

| 4/15 | $5,157,901 | $5,095,950 | $5,086,947 | $5,062,101 |

|---|

| 5/15 | $5,215,435 | $5,161,481 | $5,121,295 | $5,049,910 |

|---|

| 6/15 | $5,150,317 | $5,061,564 | $5,039,476 | $4,994,848 |

|---|

| 7/15 | $5,230,025 | $5,167,610 | $5,116,838 | $5,029,568 |

|---|

| 8/15 | $5,046,085 | $4,855,829 | $4,928,667 | $5,022,345 |

|---|

| 9/15 | $4,944,420 | $4,735,678 | $4,868,831 | $5,056,318 |

|---|

| 10/15 | $5,196,875 | $5,135,152 | $5,115,578 | $5,057,157 |

|---|

| 11/15 | $5,196,875 | $5,150,423 | $5,119,300 | $5,043,797 |

|---|

| 12/15 | $5,144,107 | $5,069,192 | $5,064,238 | $5,027,498 |

|---|

| 1/16 | $5,031,050 | $4,817,637 | $4,941,329 | $5,096,682 |

|---|

| 2/16 | $5,005,926 | $4,811,137 | $4,951,350 | $5,132,837 |

|---|

| 3/16 | $5,220,327 | $5,137,516 | $5,171,056 | $5,179,931 |

|---|

| 4/16 | $5,220,327 | $5,157,433 | $5,191,023 | $5,199,814 |

|---|

| 5/16 | $5,270,826 | $5,250,051 | $5,247,489 | $5,201,147 |

|---|

| 6/16 | $5,318,583 | $5,263,654 | $5,293,361 | $5,294,601 |

|---|

| 7/16 | $5,432,711 | $5,457,718 | $5,423,843 | $5,328,074 |

|---|

| 8/16 | $5,413,688 | $5,465,381 | $5,425,931 | $5,321,982 |

|---|

| 9/16 | $5,404,605 | $5,466,414 | $5,425,275 | $5,318,864 |

|---|

| 10/16 | $5,328,231 | $5,366,700 | $5,349,298 | $5,278,180 |

|---|

| 11/16 | $5,334,583 | $5,565,456 | $5,417,553 | $5,153,332 |

|---|

| 12/16 | $5,402,460 | $5,675,463 | $5,484,859 | $5,160,600 |

|---|

| 1/17 | $5,447,381 | $5,783,106 | $5,551,581 | $5,170,726 |

|---|

| 2/17 | $5,582,139 | $6,012,730 | $5,698,764 | $5,205,478 |

|---|

| 3/17 | $5,577,024 | $6,019,744 | $5,701,557 | $5,202,748 |

|---|

| 4/17 | $5,628,606 | $6,081,566 | $5,754,290 | $5,242,898 |

|---|

| 5/17 | $5,712,446 | $6,167,151 | $5,820,594 | $5,283,253 |

|---|

| 6/17 | $5,760,186 | $6,205,643 | $5,840,048 | $5,277,936 |

|---|

| 7/17 | $5,829,389 | $6,333,248 | $5,922,153 | $5,300,648 |

|---|

| 8/17 | $5,855,406 | $6,352,635 | $5,954,278 | $5,348,193 |

|---|

| 9/17 | $5,895,717 | $6,483,678 | $6,016,630 | $5,322,721 |

|---|

| 10/17 | $5,987,239 | $6,634,977 | $6,102,264 | $5,325,804 |

|---|

| 11/17 | $6,072,194 | $6,838,471 | $6,211,424 | $5,318,968 |

|---|

| 12/17 | $6,145,297 | $6,914,505 | $6,264,265 | $5,343,380 |

|---|

| 1/18 | $6,313,911 | $7,310,388 | $6,450,599 | $5,281,841 |

|---|

| 2/18 | $6,152,038 | $7,040,948 | $6,283,490 | $5,231,772 |

|---|

| 3/18 | $6,082,674 | $6,862,015 | $6,203,798 | $5,265,323 |

|---|

| 4/18 | $6,109,791 | $6,888,345 | $6,199,624 | $5,226,162 |

|---|

| 5/18 | $6,204,636 | $7,054,230 | $6,306,902 | $5,263,461 |

|---|

| 6/18 | $6,219,370 | $7,097,648 | $6,327,090 | $5,256,987 |

|---|

| 7/18 | $6,375,864 | $7,361,777 | $6,468,964 | $5,258,237 |

|---|

| 8/18 | $6,488,213 | $7,601,663 | $6,612,090 | $5,292,071 |

|---|

| 9/18 | $6,491,574 | $7,644,931 | $6,617,640 | $5,257,993 |

|---|

| 10/18 | $6,217,074 | $7,122,399 | $6,325,332 | $5,216,442 |

|---|

| 11/18 | $6,292,541 | $7,267,542 | $6,417,776 | $5,247,582 |

|---|

| 12/18 | $5,953,254 | $6,611,349 | $6,117,257 | $5,343,987 |

|---|

| 1/19 | $6,276,804 | $7,141,155 | $6,437,369 | $5,400,737 |

|---|

| 2/19 | $6,413,438 | $7,370,445 | $6,559,892 | $5,397,608 |

|---|

| 3/19 | $6,570,543 | $7,513,666 | $6,686,759 | $5,501,252 |

|---|

| 4/19 | $6,751,046 | $7,817,891 | $6,849,891 | $5,502,660 |

|---|

| 5/19 | $6,628,307 | $7,321,079 | $6,637,350 | $5,600,341 |

|---|

| 6/19 | $6,888,548 | $7,837,041 | $6,951,357 | $5,670,671 |

|---|

| 7/19 | $6,990,053 | $7,949,676 | $7,017,416 | $5,683,144 |

|---|

| 8/19 | $7,037,072 | $7,823,750 | $7,023,455 | $5,830,404 |

|---|

| 9/19 | $7,037,471 | $7,970,136 | $7,087,339 | $5,799,352 |

|---|

| 10/19 | $7,117,934 | $8,142,767 | $7,187,984 | $5,816,820 |

|---|

| 11/19 | $7,256,933 | $8,438,340 | $7,343,070 | $5,813,858 |

|---|

| 12/19 | $7,388,814 | $8,693,027 | $7,474,000 | $5,809,806 |

|---|

| 1/20 | $7,463,761 | $8,689,618 | $7,529,775 | $5,921,613 |

|---|

| 2/20 | $7,134,064 | $7,974,296 | $7,212,078 | $6,028,194 |

|---|

| 3/20 | $6,444,646 | $6,989,368 | $6,660,631 | $5,992,719 |

|---|

| 4/20 | $7,024,337 | $7,885,361 | $7,220,302 | $6,099,247 |

|---|

| 5/20 | $7,265,248 | $8,260,926 | $7,440,082 | $6,127,644 |

|---|

| 6/20 | $7,408,230 | $8,425,212 | $7,547,606 | $6,166,243 |

|---|

| 7/20 | $7,755,977 | $8,900,269 | $7,848,045 | $6,258,348 |

|---|

| 8/20 | $8,078,798 | $9,540,025 | $8,161,179 | $6,207,832 |

|---|

| 9/20 | $7,876,964 | $9,177,536 | $7,973,331 | $6,204,429 |

|---|

| 10/20 | $7,746,682 | $8,933,470 | $7,831,865 | $6,176,725 |

|---|

| 11/20 | $8,229,415 | $9,911,364 | $8,376,989 | $6,237,332 |

|---|

| 12/20 | $8,453,717 | $10,292,437 | $8,574,854 | $6,245,927 |

|---|

| 1/21 | $8,360,876 | $10,188,527 | $8,498,320 | $6,201,145 |

|---|

| 2/21 | $8,500,100 | $10,469,475 | $8,589,836 | $6,111,597 |

|---|

| 3/21 | $8,619,845 | $10,927,992 | $8,772,651 | $6,035,284 |

|---|

| 4/21 | $9,007,777 | $11,511,206 | $9,081,284 | $6,082,962 |

|---|

| 5/21 | $9,007,814 | $11,591,604 | $9,131,208 | $6,102,836 |

|---|

| 6/21 | $9,181,415 | $11,862,208 | $9,284,770 | $6,145,714 |

|---|

| 7/21 | $9,329,277 | $12,143,994 | $9,458,631 | $6,214,430 |

|---|

| 8/21 | $9,477,114 | $12,513,240 | $9,623,984 | $6,202,598 |

|---|

| 9/21 | $9,125,167 | $11,931,252 | $9,322,090 | $6,148,896 |

|---|

| 10/21 | $9,491,734 | $12,767,177 | $9,712,935 | $6,147,201 |

|---|

| 11/21 | $9,421,540 | $12,678,713 | $9,684,049 | $6,165,388 |

|---|

| 12/21 | $9,673,130 | $13,246,924 | $9,934,538 | $6,149,612 |

|---|

| 1/22 | $9,177,288 | $12,561,435 | $9,540,476 | $6,017,124 |

|---|

| 2/22 | $9,068,034 | $12,185,328 | $9,326,508 | $5,949,995 |

|---|

| 3/22 | $9,173,049 | $12,637,763 | $9,430,638 | $5,784,693 |

|---|

| 4/22 | $8,591,303 | $11,535,727 | $8,794,067 | $5,565,176 |

|---|

| 5/22 | $8,566,009 | $11,556,891 | $8,826,428 | $5,601,058 |

|---|

| 6/22 | $8,167,025 | $10,602,941 | $8,333,900 | $5,513,188 |

|---|

| 7/22 | $8,624,040 | $11,580,580 | $8,876,408 | $5,647,901 |

|---|

| 8/22 | $8,353,216 | $11,108,302 | $8,558,884 | $5,488,311 |

|---|

| 9/22 | $7,836,101 | $10,085,243 | $7,938,007 | $5,251,180 |

|---|

| 10/22 | $8,091,071 | $10,901,758 | $8,282,484 | $5,183,165 |

|---|

| 11/22 | $8,465,029 | $11,510,992 | $8,682,037 | $5,373,780 |

|---|

| 12/22 | $8,192,682 | $10,847,792 | $8,366,245 | $5,349,540 |

|---|

| 1/23 | $8,522,170 | $11,529,401 | $8,784,607 | $5,514,113 |

|---|

| 2/23 | $8,281,733 | $11,248,096 | $8,565,154 | $5,371,544 |

|---|

| 3/23 | $8,573,036 | $11,661,061 | $8,840,862 | $5,507,994 |

|---|

| 4/23 | $8,644,627 | $11,843,072 | $8,945,090 | $5,541,376 |

|---|

| 5/23 | $8,608,832 | $11,894,550 | $8,929,459 | $5,481,038 |

|---|

| 6/23 | $8,908,110 | $12,680,485 | $9,270,730 | $5,461,489 |

|---|

| 7/23 | $9,069,913 | $13,087,845 | $9,446,838 | $5,457,682 |

|---|

| 8/23 | $9,042,946 | $12,879,467 | $9,332,457 | $5,422,822 |

|---|

| 9/23 | $8,668,952 | $12,265,401 | $8,970,624 | $5,285,019 |

|---|

| 10/23 | $8,515,439 | $12,007,502 | $8,800,825 | $5,201,615 |

|---|

| 11/23 | $9,165,611 | $13,104,092 | $9,442,491 | $5,437,177 |

|---|

| 12/23 | $9,534,135 | $13,699,419 | $9,844,457 | $5,645,307 |

|---|

| 1/24 | $9,753,100 | $13,929,627 | $9,932,901 | $5,629,804 |

|---|

| 2/24 | $10,099,796 | $14,673,408 | $10,194,991 | $5,550,265 |

|---|

| 3/24 | $10,288,071 | $15,145,519 | $10,429,459 | $5,601,515 |

|---|

| 4/24 | $9,921,621 | $14,526,907 | $10,068,494 | $5,460,030 |

|---|

| 5/24 | $10,388,844 | $15,247,219 | $10,436,317 | $5,552,595 |

|---|

| 6/24 | $10,750,321 | $15,794,322 | $10,700,525 | $5,605,163 |

|---|

| 7/24 | $10,860,675 | $15,986,576 | $10,878,648 | $5,736,083 |

|---|

| 8/24 | $11,173,345 | $16,374,358 | $11,099,506 | $5,818,510 |

|---|

| 9/24 | $11,350,556 | $16,724,066 | $11,301,184 | $5,896,416 |

|---|

| 10/24 | $11,221,257 | $16,572,403 | $11,127,590 | $5,750,191 |

|---|

| 11/24 | $11,618,388 | $17,545,222 | $11,566,571 | $5,810,987 |

|---|

| 12/24 | $11,420,271 | $17,126,975 | $11,325,418 | $5,715,887 |

|---|

Average Annual Total Returns (%)Footnote Reference1

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class R6 | 19.79% | 9.09% | 8.60% |

|---|

S&P 500® Index | 25.02% | 14.51% | 13.09% |

|---|

| Bloomberg U.S. Aggregate Bond Index | 1.25% | (0.33)% | 1.35% |

|---|

Blended IndexFootnote Reference2 | 15.04% | 8.66% | 8.51% |

|---|

| Footnote | Description |

Footnote1 | Class R6 performance prior to 5/2/16 is linked to Class I. This linked performance is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. Performance presented in the Financial Highlights included in the financial statements is not linked. |

Footnote2 | Benchmark is an internally constructed benchmark comprised of a blend of 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index, and is rebalanced monthly. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $1,013,190,430 |

|---|

| # of Portfolio Holdings (for Stock and Core Bond Portfolios) | 373 |

|---|

| Portfolio Turnover Rate | 5% |

|---|

| Total Advisory Fees Paid | $5,002,640 |

|---|

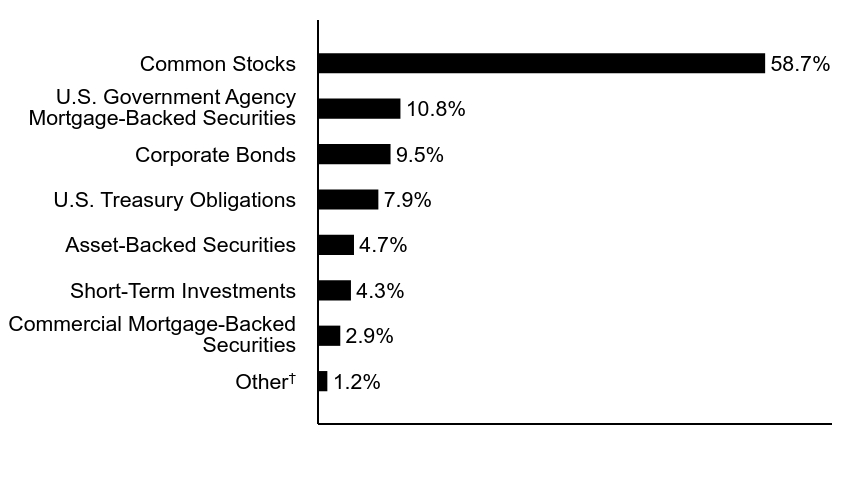

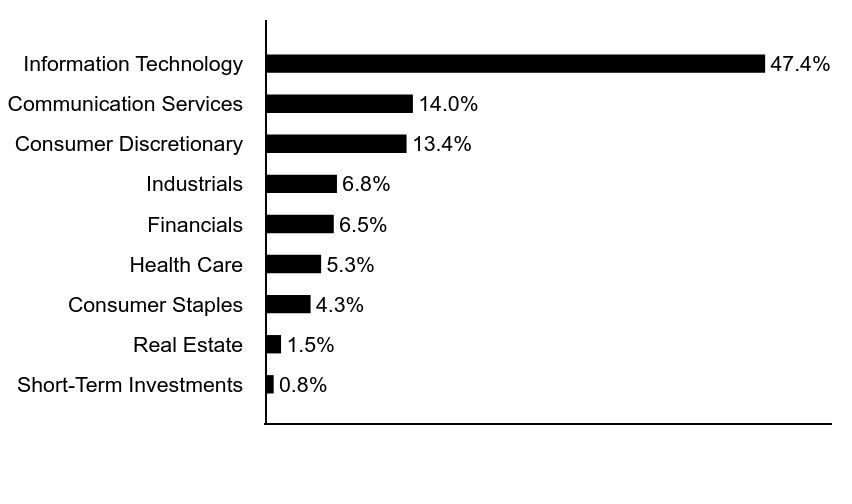

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

References to the Fund's investments are to the Fund's pro rata share of the investments of Stock Portfolio and Core Bond Portfolio, affiliated investment companies in which the Fund invests substantially all of its assets.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 1.2% |

| Commercial Mortgage-Backed Securities | 2.9% |

| Short-Term Investments | 4.3% |

| Asset-Backed Securities | 4.7% |

| U.S. Treasury Obligations | 7.9% |

| Corporate Bonds | 9.5% |

| U.S. Government Agency Mortgage-Backed Securities | 10.8% |

| Common Stocks | 58.7% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

Top Ten Holdings (% of total investments)Footnote Referencea

| Uniform Mortgage-Backed Security, 5.50%, 30-Year, TBA | 4.7% |

| Apple, Inc. | 4.5% |

| Microsoft Corp. | 4.5% |

| NVIDIA Corp. | 4.3% |

| Amazon.com, Inc. | 3.2% |

| Alphabet, Inc., Class C | 2.6% |

| Uniform Mortgage-Backed Security, 5.00%, 30-Year, TBA | 2.6% |

| Broadcom, Inc. | 2.1% |

| Meta Platforms, Inc., Class A | 1.8% |

| U.S. Treasury Notes, 0.38%, 12/31/25 | 1.5% |

| Total | 31.8% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Eaton Vance Core Bond Fund

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Core Bond Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference1

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $75 | 0.74% |

|---|

| Footnote | Description |

Footnote1 | Expenses in the table reflect the expenses of both the Fund and Core Bond Portfolio, the Portfolio in which it invests. |

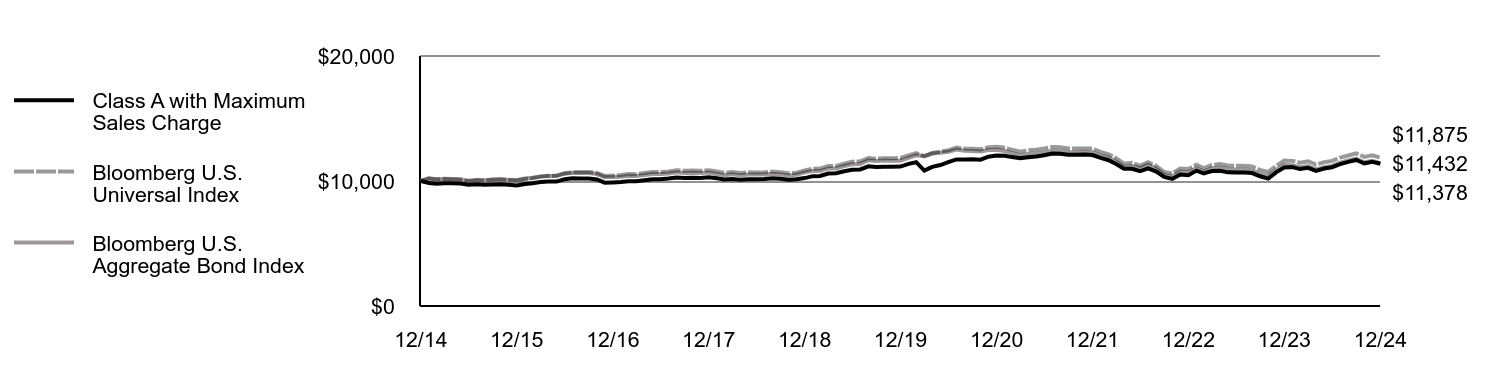

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg U.S. Aggregate Bond Index (the Index):

↑ The Fund’s security selections ― especially in investment-grade corporate bonds ― contributed to returns relative to the Index during the period

↑ The Fund’s selections in asset-backed securities contributed to performance relative to the Index during the period

↑ The Fund’s allocations by sector ― especially an overweight exposure to commercial mortgage-backed securities ― helped Index-relative returns during the period

↑ The Fund’s slightly underweight duration contributed to performance relative to the Index during the period

↓ In contrast, the Fund’s underweight exposure to agency mortgage-backed securities detracted from performance relative to the Index during the period

↓ The Fund’s yield-curve positioning detracted from performance relative to the Index during the period

↓ The Fund’s use of derivatives detracted from performance relative to the Index during the period

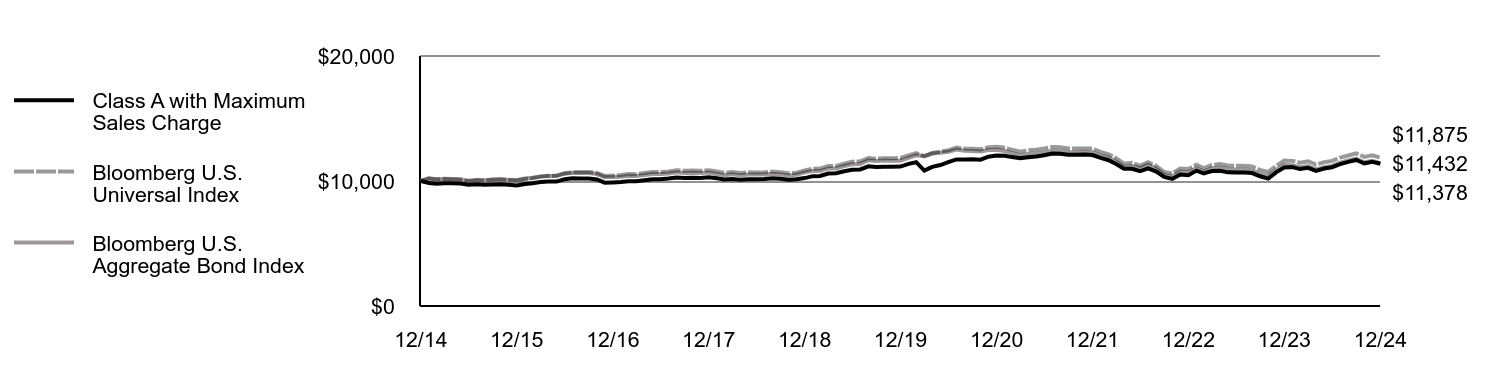

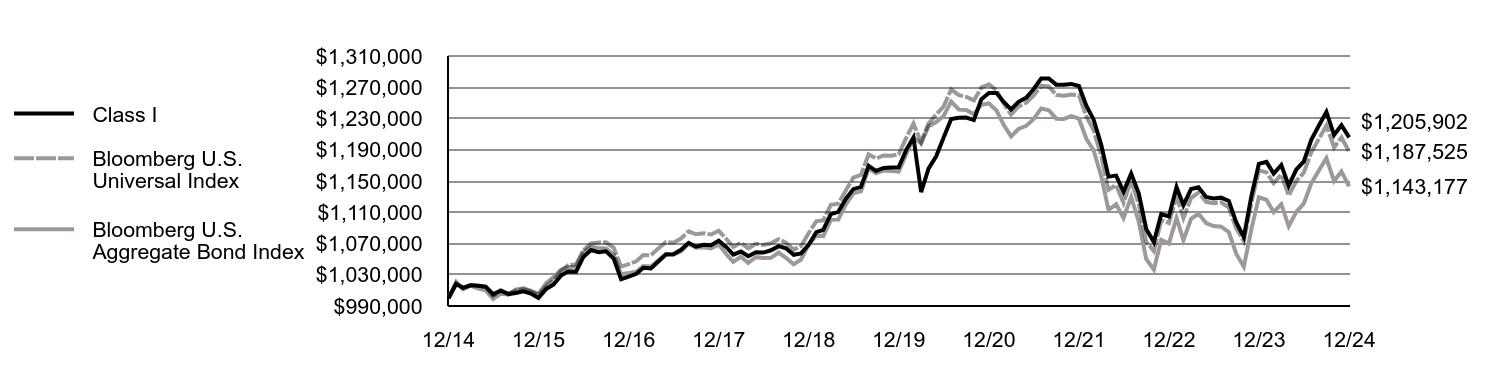

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | Bloomberg U.S. Universal Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| 12/14 | $10,000 | $10,000 | $10,000 |

|---|

| 1/15 | $9,839 | $10,190 | $10,210 |

|---|

| 2/15 | $9,789 | $10,131 | $10,114 |

|---|

| 3/15 | $9,818 | $10,173 | $10,161 |

|---|

| 4/15 | $9,812 | $10,161 | $10,124 |

|---|