| OMB Approval | ||||||

| OMB Number: 3235-0570 | ||||||

| Expires: January 31, 2017 | ||||||

| Estimated average burden | ||||||

| Hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-2957

Keyco Bond Fund, Inc.

(Exact name of registrant as specified in charter)

27777 Franklin Road, Suite 1630 | ||

Southfield, Michigan | 48034 | |

(Address of principal executive offices) | (Zip code) |

Joel D. Tauber, President

Keyco Bond Fund, Inc.

27777 Franklin Road, Suite 1630

Southfield, Michigan 48034

(Name and Address of agent for service)

Registrant’s telephone number, including area code: (248) 353-0790

Date of fiscal year end: September 30

Date of reporting period: March 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

| Page | ||||

| 2 | ||||

| 3 | ||||

| 5 | ||||

Financial Statements | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 15 | ||||

Disclosures | 19 | |||

| 21 | ||||

1

Item 1. Semi-Annual Report to Shareholders.

KEYCO BOND FUND, INC.

27777 Franklin Road - Suite 1630

Southfield, Michigan 48034

(248) 353-0790

May 20, 2015

To Our Shareholders and Former Shareholders:

Earlier this month you were sent a mailing advising you that a reverse stock split of the common stock of Keyco Bond Fund, Inc. occurred on May 5, 2015. If you have not already done so, please complete the Letter of Transmittal and return it with your stock certificate(s) for your pre-split shares. If you are unable to locate your stock certificate(s), please complete the Affidavit of Lost Certificate and return it with the Letter of Transmittal. Only after these documents are received will the Fund be able to forward to you your new stock certificate and/or payment. Those of you who are entitled to receive post-split shares will not become shareholders of record until these documents are received.

We are pleased to send you this Semi-Annual Report of Keyco Bond Fund, Inc. for the six months ended March 31, 2015. Included in this mailing are the Fund’s financial statements, Management’s Discussion of Fund Performance, Additional Information including the actions taken at the December 2014 annual meeting and March 2015 special meeting of shareholders and the Fund’s Privacy Policy.

In November 2014, the Board of Directors declared quarterly dividends totaling $.68 per pre-split share for the year ending September 30, 2015. Regular dividends of $.19 per pre-split share have been paid during the six months ended March 31, 2015. In addition, a regular dividend of $.17 per pre-split share was paid on May 1, 2015. In April 2015, the Board of Directors adjusted the amount of the dividend per share to be paid in August and November to reflect the reverse stock split ratio. The dividend amount is subject to revision in September 2015 based upon the actual net investment income for the year.

If you have any questions concerning the reverse stock split documents or the enclosed information, please call the Fund at (248) 353-0790.

On behalf of the Board of Directors,

/s/ Joel D. Tauber

Joel D. Tauber

President

Enclosures

2

KEYCO BOND FUND, INC.

Management’s Discussion of Fund Performance

for Six Months Ended March 31, 2015

The Fund’s primary investment objective is to earn as high a level of current interest income exempt from federal income taxes as is available from municipal bonds, consistent with prudent investment management and preservation of capital. Capital appreciation is a minor investment objective of the Fund.

Net Investment Income

The Fund’s net investment income is primarily dependent upon interest rates at the times the bonds in the portfolio were purchased.

Net investment income for the six-month period was $437,891 or $.35 per share compared with $434,625 or $.35 per share last year. This $3,266 increase was the net result of an increase of $14,432 in interest income and an increase of $11,166 in expenses. Although municipal bond interest rates modestly declined, this had a minor effect on the Fund’s interest income.

As of March 31, 2015, the weighted average annual yield on the Fund’s portfolio was 4.54% based on cost and 4.34% based on market value.

Valuation of Bonds and Net Asset Value

Because the municipal bonds in the Fund’s portfolio are not actively traded and market quotations are not readily available, the bonds are stated at fair value. The fair value for each bond is provided by the Fund’s custodian, who uses an evaluation methodology.

The Fund’s net asset value is calculated by subtracting the Fund’s liabilities from its assets. The valuation of the Fund’s most significant assets, its bond portfolio, is affected by market interest rates and maturity and call dates. When market rates increase, the value of the bond portfolio decreases. When market rates decrease, the value of the bond portfolio increases. Longer maturity dates magnify the effect of interest rate changes.

During the reporting period, municipal bond interest rates declined slightly.

The net asset value of the Fund was $26,213,700 or $20.69 per share at March 31, 2015, an increase of $142,336 or $.12 per share from September 30, 2014. This change was the result of an increase in undistributed income of $53,493, reduction in accumulated net realized loss from investments of $9,814 and unrealized appreciation of investments of $79,029.

The weighted average maturity was 13.9 years, slightly less than the prior year-end weighted average maturity of 14.2 years.

3

KEYCO BOND FUND, INC.

Management’s Discussion of Fund Performance

for Six Months Ended March 31, 2015

Page 2

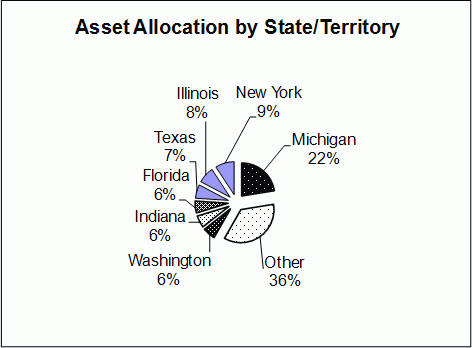

Asset Allocation

The bond portfolio is allocated by state/territory as follows:

Other

During the period, eight bonds were called or matured for total proceeds of $1,350,000. Cash from these dispositions was reinvested in bonds to mature in 13 to 20 years. Portfolio turnover was 5.1%.

4

KEYCO BOND FUND, INC.

March 31, 2015

RESULTS OF MEETING OF SHAREHOLDERS

The annual meeting of shareholders was held on Thursday, December 11, 2014. The results of the votes taken on the proposals before the shareholders are reported below. Each vote represents one share held on the record date for the meeting.

Item 1. | Election of Directors | |||||||||

| Number of Shares | ||||||||||

Nominee | For | Withheld Authority | ||||||||

Mark E. Schlussel | 1,175,588 | 0 | ||||||||

Steve Milgrom | 1,175,588 | 0 | ||||||||

Thomas E. Purther | 1,175,588 | 0 | ||||||||

Ellen T. Horing | 1,175,588 | 0 | ||||||||

Michael Pullman | 1,175,588 | 0 | ||||||||

Item 2. | Ratify the selection of registered independent accountants | |||||||||||

Ratify the selection of Grant Thornton, LLP as the Fund’s registered independent public accountants for the year ending September 30, 2015 | ||||||||||||

| Number of Shares | ||||||||||||

For | 1,175,588 | |||||||||||

Against | 0 | |||||||||||

Abstain | 0 | |||||||||||

5

KEYCO BOND FUND, INC.

Additional Information

March 31, 2015

Page 2

| Item 3. | Approve, by non-binding vote, executive compensation |

Approve, by non-binding vote, executive

compensation for the Fund’s named executive

officers as set forth in the proxy statement for the

annual meeting

| Number of Shares | ||||||

For | 1,175,563 | |||||

Against | 0 | |||||

Abstain | 25 | |||||

| Item 4. | Recommend, by non-binding vote, frequency of executive compensation vote |

Recommend, by non-binding vote, the frequency of

shareholder advisory votes on the compensation of the

Fund’s named executive officers

| Number of Shares | ||||||

Every three years | 817,280 | |||||

Every two years | 0 | |||||

Every year | 358,308 | |||||

Abstain | 0 | |||||

6

KEYCO BOND FUND, INC.

Additional Information

March 31, 2015

Page 3

A special meeting of shareholders was held on Tuesday, March 24, 2015. The result of the vote taken on the proposal before the shareholders is reported below. Each vote represents one share held on the record date for the meeting.

Item 1. | Approve reverse stock split | |||||||||

| Proposal to amend the restated Articles of Incorporation of the Company to give effect to a reverse stock split, a proportionate reduction in the number of authorized shares of common stock of the Company, and a proportionate increase in the par value of such shares | ||||||||||

| Number of Shares | ||||||||||

For | 1,126,304 | |||||||||

Against | 0 | |||||||||

Abstain | 0 | |||||||||

OBTAINING QUARTERLY PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. The Fund’s Form N-Q may be viewed and copied at the SEC’s Public Reference Room in Washington DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-202-551-8090. For a complete list of the Fund’s portfolio holdings, a copy of the Fund’s most recent quarterly holding report, semi-annual report, or annual report may be requested by writing Keyco Bond Fund, Inc., 27777 Franklin Road, Suite 1630, Southfield, MI 48034.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES AND RECORDS

The Fund has not adopted policies and procedures with respect to voting proxies because the Fund does not invest in voting securities. The Fund has not voted any proxies.

7

Keyco Bond Fund, Inc.

Statement of Assets and Liabilities

March 31, 2015 (unaudited)

Assets | ||||

Investments in securities, at fair value (cost $24,622,844) | $ | 25,768,618 | ||

Money market fund | 194,219 | |||

Cash | 25,013 | |||

Accrued interest receivable | 382,607 | |||

Other assets | 500 | |||

|

| |||

Total assets | 26,370,957 | |||

|

| |||

Liabilities | ||||

Accounts payable | 13,639 | |||

Dividends payable | 143,618 | |||

|

| |||

Total liabilities | 157,257 | |||

|

| |||

Net Assets | $ | 26,213,700 | ||

|

| |||

Net Assets consist of: | ||||

Capital stock, $.02 par value; 3,000,000 shares authorized; 1,267,258 shares issued and outstanding | $ | 25,345 | ||

Additional paid-in capital | 730,733 | |||

Retained earnings prior to July 1, 1979 | 24,093,500 | |||

Accumulated undistributed net investment income | 286,238 | |||

Accumulated net realized loss from investments | (67,890) | |||

Net unrealized appreciation of investments, March 31, 2015 | 1,145,774 | |||

|

| |||

| $ | 26,213,700 | |||

|

| |||

Net Asset Value per share | $ | 20.69 | ||

|

| |||

The accompanying notes are an integral part of these financial statements.

8

Keyco Bond Fund, Inc.

For the Six Months Ended March 31, 2015 (unaudited)

Interest income | $ | 522,311 | ||||||

Expenses | ||||||||

Legal and accounting | $ | 67,363 | ||||||

Custodial fee | 8,814 | |||||||

Directors’ fees | 4,000 | |||||||

Miscellaneous expense | 4,243 | |||||||

|

| |||||||

Total expenses | 84,420 | |||||||

|

| |||||||

Net investment income | 437,891 | |||||||

Realized gain on investments | ||||||||

Proceeds from maturities and calls | 1,350,000 | |||||||

Cost of securities matured and called | 1,340,186 | |||||||

|

| |||||||

Net realized gain on investments | 9,814 | |||||||

Net change in unrealized appreciation of investments | ||||||||

Investments held, March 31, 2015 | ||||||||

At fair value | 25,768,618 | |||||||

At cost | 24,622,844 | |||||||

|

| |||||||

Unrealized appreciation, March 31, 2015 | 1,145,774 | |||||||

Less: Unrealized appreciation, September 30, 2014 | 1,066,745 | |||||||

|

| |||||||

Net change in appreciation of investments | 79,029 | |||||||

|

| |||||||

Net realized and unrealized gain on investments | 88,843 | |||||||

|

| |||||||

Net increase in net assets resulting from operations | $ | 526,734 | ||||||

|

| |||||||

The accompanying notes are an integral part of these financial statements.

9

Keyco Bond Fund, Inc.

Statement of Changes in Net Assets

For the Six Months Ended March 31, (unaudited)

| 2015 | 2014 | |||||||

Net assets, beginning of year | $ | 26,071,364 | $ | 25,234,553 | ||||

|

|

|

| |||||

Changes in net assets from operations | ||||||||

Net investment income | 437,891 | 434,625 | ||||||

Net realized gain (loss) on investments | 9,814 | (76,562) | ||||||

Changes in unrealized appreciation of investments | 79,029 | 484,556 | ||||||

|

|

|

| |||||

Net increase in net assets resulting from operations | 526,734 | 842,619 | ||||||

Changes in net assets from capital transactions | ||||||||

Dividends declared from net investment income | (384,398) | (253,452) | ||||||

Dividends declared from net realized capital gains | - | (1,142) | ||||||

|

|

|

| |||||

Total distributions | (384,398) | (254,594) | ||||||

|

|

|

| |||||

Net increase in net assets | 142,336 | 588,025 | ||||||

|

|

|

| |||||

Net assets, end of period (including undistributed net investment income of $286,238 and $404,058 at March 31, 2015 and 2014) | $ | 26,213,700 | $ | 25,822,578 | ||||

|

|

|

| |||||

The accompanying notes are an integral part of these financial statements.

10

Keyco Bond Fund, Inc.

| Six Months Ended 03/31/15 (unaudited) | Years Ended September 30 | |||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | |||||||||||||||||

Per share operating performance | ||||||||||||||||||||

Net asset value, beginning of period | $ | 20.57 | $ | 19.91 | $ | 21.01 | $ | 20.41 | $ | 20.64 | ||||||||||

Net investment income | 0.35 | 0.71 | 0.68 | 0.73 | 0.84 | |||||||||||||||

Net realized and unrealized gain (loss) on investments | 0.07 | 0.65 | (1.10) | 0.62 | (0.22) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total from investment operations | 0.42 | 1.36 | (0.42) | 1.35 | 0.62 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Less distributions from | ||||||||||||||||||||

Net investment income | (0.30) | (0.70) | (0.68) | (0.73) | (0.84) | |||||||||||||||

Net realized gain on investments | 0.00 | 0.00 | (d) | 0.00 | (0.02) | (0.01) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total distributions | (0.30) | (0.70) | (0.68) | (0.75) | (0.85) | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net asset value, end of period | $ | 20.69 | $ | 20.57 | $ | 19.91 | $ | 21.01 | $ | 20.41 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total return per share net asset value (a) | 2.0% | 6.8% | (2.0%) | 6.6% | 3.0% | |||||||||||||||

Ratios and supplemental data | ||||||||||||||||||||

Net assets, end of period (in 000s) | $ | 26,214 | $ | 26,071 | $ | 25,235 | $ | 26,619 | $ | 25,860 | ||||||||||

Ratio of net investment income to average net assets | 3.3% | (b) | 3.5% | 3.3% | 3.5% | 4.2% | ||||||||||||||

Ratio of expenses to average net assets | 0.6% | (b) | 0.4% | 0.5% | 0.4% | 0.4% | ||||||||||||||

Portfolio turnover rate | 5.1% | (c) | 12.9% | 14.8% | 13.2% | 7.6% | ||||||||||||||

| (a) | Total investment return based on per share net asset value reflects the percent return calculated on beginning of period net asset value and assumes dividends and capital gain distributions were not reinvested. These percentages are not an indication of the performance of a shareholder’s investment in the Fund. |

| (b) | Annualized |

| (c) | Not annualized |

| (d) | Less than one cent per share. |

The accompanying notes are an integral part of these financial statements.

11

Keyco Bond Fund, Inc.

Schedule of Portfolio Investments

March 31, 2015 (unaudited)

Long-Term State and Municipal Obligations | Principal Amount | Cost | Fair Value | |||||||||

Michigan (22.4%) | ||||||||||||

| Bay City, Michigan, School District, 3.5%, November 2034 (Q-SBLF enhanced) | $ | 400,000 | $ | 393,932 | $ | 389,408 | ||||||

| Escanaba, Michigan, Area Public Schools, 3.25%, May 2028 (Q-SBLF enhanced) | 400,000 | 397,832 | 396,468 | |||||||||

| Fowlerville, Michigan, Community Schools, 3%, May 2025 (Q-SBLF enhanced) | 500,000 | 493,745 | 502,610 | |||||||||

| Grand Ledge, Michigan, Public Schools, 5%, May 2022 (National FGIC insured, Q-SBLF enhanced) (Pre-refunded) | 400,000 | 432,496 | 401,520 | |||||||||

| Michigan Municipal Bond Authority Revenue, Clean Water, State Revolving Fund, 5%, October 2022 (Pre-refunded) | 280,000 | 299,499 | 286,751 | |||||||||

| Michigan Municipal Bond Authority Revenue, Clean Water, State Revolving Fund, 5%, October 2022 | 45,000 | 48,134 | 46,062 | |||||||||

| Michigan State Building Authority, Revenue, 5%, October 2029 | 250,000 | 250,000 | 289,638 | |||||||||

| Michigan State Housing Development Authority, Rental Housing Revenue, Series A-2, 4.5%, October 2036 | 500,000 | 500,000 | 516,800 | |||||||||

| Michigan State Housing Development Authority, Rental Housing Revenue, Series A, 4.625%, October 2039 | 500,000 | 500,000 | 520,140 | |||||||||

| Rockford, Michigan, Public Schools, 5%, May 2028 (AGM insured, Q-SBLF enhanced) | 400,000 | 415,496 | 442,588 | |||||||||

| Rockford, Michigan, Public Schools, 4%, May 2039 (Q-SBLF enhanced) | 800,000 | 800,000 | 827,064 | |||||||||

| Walled Lake, Michigan, Consolidated School District, 5%, May 2037 (Q-SBLF enhanced) | 485,000 | 518,242 | 544,558 | |||||||||

| Wayland, Michigan, Union School District, 5%, May 2026 (AGM insured, Q-SBLF enhanced) | 650,000 | 678,177 | 720,245 | |||||||||

|

|

|

|

|

| |||||||

| 5,610,000 | 5,727,553 | 5,883,852 | ||||||||||

|

|

|

|

|

| |||||||

Other States and Territories (75.9%) | ||||||||||||

| Birmingham, Alabama, Capital Improvement, 4.5%, December 2029 (AMBAC insured) (Pre-refunded) | $ | 180,000 | $ | 176,477 | $ | 191,988 | ||||||

| Birmingham, Alabama, Capital Improvement, 4.5%, December 2029 (AMBAC insured) | 195,000 | 191,184 | 206,080 | |||||||||

| Arizona Board of Regents, University of Arizona System, Revenue, 5%, June 2038 | 250,000 | 259,830 | 284,783 | |||||||||

| Mesa, Arizona, Utility System, Revenue, 5%, July 2035 | 350,000 | 370,244 | 397,897 | |||||||||

| Colorado State Board of Governors University Enterprise System Revenue, 5.25%, March 2027 (National FGIC insured) (Pre-refunded) | 170,000 | 182,002 | 185,203 | |||||||||

| Colorado State Board of Governors University Enterprise System Revenue, 5.25%, March 2027 (National FGIC insured) | 30,000 | 32,118 | 32,378 | |||||||||

| University of Colorado, Enterprise System Revenue, 5%, June 2032 (National insured) | 500,000 | 504,310 | 546,935 | |||||||||

| District of Columbia, Series A, 4.75%, June 2031 (AGM FGIC insured) | 430,000 | 427,089 | 462,942 | |||||||||

| District of Columbia, Series A, 4.75%, June 2033 (National FGIC insured) | 400,000 | 400,000 | 430,288 | |||||||||

12

Keyco Bond Fund, Inc.

Schedule of Portfolio Investments - Continued

March 31, 2015 (unaudited)

Long-Term State and Municipal Obligations | Principal Amount | Cost | Fair Value | |||||||||

Other States and Territories (continued) | ||||||||||||

| Collier County, Florida, School Board Certificates of Participation, 4.625%, February 2026 (AGM insured) (Pre-refunded) | $ | 425,000 | $ | 441,516 | $ | 441,124 | ||||||

| Florida State Board of Education, Public Education, Series C, Capital Outlay, 4.75%, June 2034 | 500,000 | 524,045 | 538,575 | |||||||||

| Florida State Turnpike Authority, Turnpike Revenue, Department of Transportation, 5%, July 2027 (National FGIC insured) | 500,000 | 500,000 | 531,675 | |||||||||

| Georgia State Housing and Finance Authority, 3.45%, December 2032 | 500,000 | 500,000 | 513,715 | |||||||||

| Honolulu, Hawaii, City and County Wastewater System Revenue, Series A, 5%, July 2031 (National insured) | 350,000 | 368,816 | 367,846 | |||||||||

| Honolulu, Hawaii, City and County Wastewater System Revenue, Series A, 5%, July 2041 | 250,000 | 262,700 | 282,063 | |||||||||

| Hawaii State, Series DN, 5.5%, August 2028 | 500,000 | 498,775 | 572,920 | |||||||||

| Chicago, Illinois, Board of Education, Dedicated Revenue, 5%, December 2027 (AGM insured) | 470,000 | 470,000 | 507,088 | |||||||||

| Illinois Finance Authority, Revenue, 4%, October 2033 | 250,000 | 264,762 | 262,843 | |||||||||

| Southern Illinois University Revenue, 5%, April 2026 (National insured) | 750,000 | 798,225 | 781,065 | |||||||||

| Springfield, Illinois, Water Revenue, 5.5%, March 2032 | 500,000 | 488,420 | 557,805 | |||||||||

| Indiana Bond Bank Revenue, Series C-1, 4.75%, February 2030 | 480,000 | 485,726 | 515,909 | |||||||||

| Indiana Finance Authority, Highway Revenue, 4.5%, June 2029 (National FGIC insured) | 975,000 | 982,125 | 1,029,239 | |||||||||

| Maine State Housing Authority, Mortgage Purchase, Revenue, Series A-2, 4.5%, November 2034 | 250,000 | 250,000 | 266,998 | |||||||||

| Lawrence, Massachusetts, State Qualified, 5%, April 2027 (AMBAC insured) | 500,000 | 531,910 | 557,915 | |||||||||

| Massachusetts State Housing Finance Agency, 3.35%, December 2028 | 250,000 | 250,000 | 253,420 | |||||||||

| Omaha, Nebraska, Sanitary Sewer, Revenue, 4.25%, November 2038 | 250,000 | 251,740 | 264,310 | |||||||||

| Clark County, Nevada, 5%, November 2024 (AMBAC insured) | 300,000 | 324,111 | 321,336 | |||||||||

| Las Vegas Valley, Nevada, Water District, 5%, February 2037 | 250,000 | 264,687 | 272,758 | |||||||||

| Mercer County, New Jersey, Improvement Authority Revenue, State Justice Complex, 6.4%, January 2018 | 245,000 | 227,002 | 270,139 | |||||||||

| New York, New York, Series O, 5%, June 2022 (CIFG insured) (Pre-refunded) | 250,000 | 266,962 | 251,943 | |||||||||

| New York, New York, Series O, 5%, June 2022 (CIFG insured) | 75,000 | 80,089 | 75,584 | |||||||||

| New York, New York, Series M, 5%, April 2025 (FGIC insured) (partially Pre-refunded) | 315,000 | 323,026 | 316,184 | |||||||||

| New York, New York, City Transitional Finance Authority Future Tax Secured Refunding, Series A-1, 4.375%, November 2024 (Pre-refunded) | 500,000 | 498,350 | 501,690 | |||||||||

| New York, New York, City Municipal Water Finance Authority, Water and Sewer System Revenue, Series DD, 5.625%, June 2028 | 500,000 | 494,450 | 570,090 | |||||||||

| New York State Mortgage Agency, 3.1%, April 2028 | 200,000 | 200,000 | 199,638 | |||||||||

| Western Nassau County, New York, Water Authority, Water System Revenue, 5%, May 2024 (AMBAC insured) | 500,000 | 523,050 | 501,690 | |||||||||

13

Keyco Bond Fund, Inc.

Schedule of Portfolio Investments - Continued

March 31, 2015 (unaudited)

Long-Term State and Municipal Obligations | Principal Amount | Cost | Fair Value | |||||||||

Other States and Territories (continued) | ||||||||||||

| North Dakota, State, North Dakota Housing Finance Agency, Series E, Housing Finance Program, 4.75%, July 2030 | $ | 50,000 | $ | 50,000 | $ | 52,756 | ||||||

| Pennsylvania State, Series 1, 4%, June 2033 | 550,000 | 582,725 | 577,615 | |||||||||

| Puerto Rico Public Finance Corporation Commonwealth Appropriation, 5.375%, June 2017 (AMBAC insured) | 565,000 | 560,232 | 621,037 | |||||||||

| Texas A & M University, Revenue Financing System, Series B, 4.75%, May 2032 | 400,000 | 421,720 | 448,348 | |||||||||

| Crosby, Texas, Independent School District, 5%, February 2043 (PSF guaranteed) | 250,000 | 263,495 | 289,752 | |||||||||

| Texas State Transportation Mobility Fund, 4.5%, April 2032 (Pre-refunded) | 55,000 | 56,789 | 60,803 | |||||||||

| Texas State Transportation Mobility Fund, 4.5%, April 2032 | 565,000 | 583,380 | 611,386 | |||||||||

| University of Houston, Texas, Revenue, 3%, February 2028 | 340,000 | 339,990 | 341,574 | |||||||||

| Utah State Building Authority, Lease Revenue, State Facilities Master Lease, 5%, May 2030 | 400,000 | 399,968 | 451,748 | |||||||||

| Richmond, Virginia, Public Utility, Revenue, 5%, January 2043 | 250,000 | 265,580 | 286,520 | |||||||||

| Virginia College, Building Authority, Series B, 4%, February 2028 | 250,000 | 250,000 | 271,760 | |||||||||

| University of Washington, Revenue, 4.5%, April 2035 | 330,000 | 310,421 | 359,617 | |||||||||

| Washington State, Series C, 5%, January 2032 (National FGIC insured) | 365,000 | 375,191 | 393,222 | |||||||||

| Washington State, Various Purpose, Series A, 5%, July 2032 | 295,000 | 304,942 | 323,754 | |||||||||

| Washington State, Motor Vehicle Fuel Tax, Series B-2, 2%, August 2016 | 240,000 | 252,374 | 244,973 | |||||||||

| Washington State, Motor Vehicle Fuel Tax, Series B-1, 5%, August 2041 | 250,000 | 264,743 | 285,845 | |||||||||

|

|

|

|

|

| |||||||

| 18,495,000 | 18,895,291 | 19,884,766 | ||||||||||

|

|

|

|

|

| |||||||

Total bonds | 24,105,000 | 24,622,844 | 25,768,618 | |||||||||

Money Market Fund (0.7%) | ||||||||||||

Goldman Sachs Financial Square Tax-Free Money Market, 0.00%* | 194,219 | 194,219 | 194,219 | |||||||||

|

|

|

|

|

| |||||||

Total investment portfolio | $ | 24,299,219 | $ | 24,817,063 | 25,962,837 | |||||||

|

|

|

| |||||||||

Other assets less liabilities (1.0%) | 250,863 | |||||||||||

|

| |||||||||||

Net assets (100%) | $ | 26,213,700 | ||||||||||

|

| |||||||||||

| * | Seven-day yield |

| ** | This bond is covered by Financial Guaranty Insurance Company (“FGIC”). As of August 13, 2013, the conditions of the Plan of Rehabilitation previously in effect have been determined to be satisfied and FGIC is now operating under its First Amended Plan of Rehabilitation. Under this Plan, claims are currently being paid at a reduced percentage with the balance being a deferred payment obligation. |

The accompanying notes are an integral part of these financial statements.

14

Keyco Bond Fund, Inc.

Notes to Financial Statements (unaudited)

| 1. | Significant Accounting Policies |

Keyco Bond Fund, Inc. (the “Fund”) has registered under the Investment Company Act of 1940, as amended, as a closed-end, diversified management investment company. The Fund became qualified as a regulated investment company under the Internal Revenue Code on October 1, 1979. Management intends to distribute to the shareholders substantially all earnings from that date. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America.

Security Valuation

The Fund has invested substantially all of its assets in long-term state and municipal debt obligations. Investments in these tax-exempt securities are stated at fair value. The Fund’s custodian uses an evaluation methodology to determine fair value. The evaluations include information from actual trades for active issues. Evaluations are also based on reviews of current economic conditions, trading levels, spread relationships and the slope of the yield curve. Evaluations are also adjusted for various attributes such as discounts, premiums, credit, use of proceeds and callability. In the unlikely event that the Fund’s custodian is unable to value one or more of the bonds, the valuation(s) will be obtained from a brokerage firm that markets municipal bonds or a source referred by that brokerage firm. The Fund’s policies require that the Board of Directors (“Board”) be notified that this alternative valuation method was used at the next regularly scheduled meeting of the Board.

Various inputs are used to determine the value of the Fund’s investments. These inputs are summarized in three broad levels listed below:

Level 1: | Quoted prices in active markets for identical securities. | |||

Level 2: | Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). | |||

Level 3: | Significant unobservable inputs (including the Fund’s own assumptions used to determine the fair value of the investments). |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

15

Keyco Bond Fund, Inc.

Notes to Financial Statements – Continued (unaudited)

| 1. | Significant Accounting Policies – Continued |

| Level 1 | Level 2 | Level 3 | ||||||||||

Tax-exempt municipal bonds*** | $ | - | $ | 25,768,618 | $ | - | ||||||

Money market fund | 194,219 | - | - | |||||||||

|

|

|

|

|

| |||||||

| $ | 194,219 | $ | 25,768,618 | $ | - | |||||||

|

|

|

|

|

| |||||||

There were no transfers between the levels during the six-month period ended March 31, 2015.

*** Refer to Schedule of Portfolio Investment for the nature and risk of municipal bonds held by the Fund.

Federal Income Taxes

It is the Fund’s intention to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its income to its shareholders. Therefore, no federal income tax provision is recorded.

The cost of securities for federal income tax purposes approximates the cost for financial statement purposes. The components of distributable earnings on a tax basis were as follows:

Accumulated undistributed net investment income | $ | 286,238 | ||||||

Gross unrealized appreciation | $ | 1,281,273 | ||||||

Gross unrealized depreciation | (135,499 | ) | ||||||

|

| |||||||

Net unrealized appreciation | 1,145,774 | |||||||

|

| |||||||

| $ | 1,432,012 | |||||||

|

|

Under the Regulated Investment Company Modernization Act of 2010, the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and retain the character of the original loss. These capital losses are available to offset future realized capital gains. For the six-month period, the Fund offset its previous year-end capital loss carryforward of $77,704 by $9,814. The remaining capital loss of $67,890 qualifies to be carried forward for an unlimited period.

The tax character of distributions paid was as follows:

| March 31, 2015 | March 31, 2014 | |||||||

Tax-exempt income | $ | 240,779 | $ | 253,452 | ||||

Long-term capital gains | - | 1,142 | ||||||

|

|

|

| |||||

| $ | 240,779 | $ | 254,594 | |||||

|

|

|

| |||||

16

Keyco Bond Fund, Inc.

Notes to Financial Statements – Continued (unaudited)

| 1. | Significant Accounting Policies - Continued |

Michigan Corporate Income Tax

It has been determined that the Fund has no liability for the Michigan Corporate Income Tax which became effective January 1, 2012 or its predecessor tax, the Michigan Business Tax, which was in effect from January 1, 2008 until January 1, 2012.

The Fund has reviewed all open tax years for federal and State of Michigan tax returns and has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. There are no unrecognized tax benefits in the financial statements. The Fund’s tax returns are subject to examination for federal purposes for three years from the date of filing and for State purposes for four years from the date of filing. The Fund has not been subject to interest and/or penalties on its tax return filings.

Other

The Fund follows industry practice and records security transactions on the trade date. Cost of securities sold is determined by specific identification. Distributions to shareholders are recorded on the ex-dividend date. Interest income is recognized on an accrual basis.

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| 2. | Purchases and Dispositions of Securities |

The cost of purchases and the proceeds from dispositions of securities, other than United States government obligations and short-term notes, aggregated $1,316,647 and $1,350,000, respectively for the six months ended March 31, 2015.

| 3. | Portfolio Manager |

The Fund does not retain the services of an investment advisor or a third-party portfolio manager. The Fund, acting through its officers and with the review provided by the Board, makes investment decisions internally.

| 4. | Related Party Transactions |

Legal and accounting expenses incurred include $22,500 for accounting and administrative services provided by an entity owned by an officer of the Fund.

17

Keyco Bond Fund, Inc.

Notes to Financial Statements – Continued (unaudited)

| 5. | Risks and Uncertainties |

The Fund invests in municipal bonds. Municipal bonds are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with investments in municipal bonds, it is possible that changes in the values of the bonds will occur in the near term and that such changes could materially affect the amounts reported in the Statement of Assets and Liabilities. The ability of issuers of debt instruments held by the Fund to meet their obligations may also be affected by economic and political developments in a specific state or region.

| 6. | Subsequent Events |

The Board of Directors and shareholders of the Fund have determined that it is in the best interest of the Fund and its shareholders to implement a reverse stock split whereby shareholders will receive one new share for every 102 shares held plus payment for all fractional shares. In addition, the par value of the new shares is to be increased to $2.04 per share from $.02 per share. The effective date for the reverse stock split was May 5, 2015.

18

Item 2. Code of Ethics.

Not applicable to this semi-annual filing.

Item 3. Audit Committee Financial Expert.

Not applicable to this semi-annual filing.

Item 4. Principal Accountant Fees and Services.

Not applicable to this semi-annual filing.

Item 5. Audit Committee of Listed Registrant.

Not applicable to this semi-annual filing and also because registrant’s shares are not listed for trading on a national securities exchange.

Item 6. Schedule of Investments.

This Schedule is included as part of the Semi-Annual Report to Shareholders filed under Item 1 hereof.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable because the registrant invests exclusively in non-voting portfolio securities.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to this semi-annual filing.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

There were no purchases by or on behalf of the registrant or any “affiliated purchaser” of shares of the registrant’s equity securities during the period covered by this report.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the Fund’s Board of Directors since the Fund last provided disclosure in response to this item.

19

Item 11. Controls and Procedures.

(a) Based on their evaluation of registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (17 CFR 270.30a-3(c)), within 90 days prior to the filing of this report, the registrant’s principal executive officer and principal financial officer determined that the registrant’s disclosure controls and procedures are appropriately designed to ensure that information required to be disclosed by registrant in the reports that it files under the Securities Exchange Act of 1934 (a) is accumulated and communicated to registrant’s management, including its principal executive officer and principal financial officer, to allow timely decisions regarding required disclosure, and (b) is recorded, processed, summarized and reported, within the time periods specified in the rules and forms adopted by the U.S. Securities and Exchange Commission.

(b) There have been no significant changes in the registrant’s internal controls over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940 (17 CFR 270.30a-3(d)) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not applicable.

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (filed herewith).

(a)(3) Not applicable.

(b) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (furnished herewith).

20

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

KEYCO BOND FUND, INC. | ||

By: | /s/ Joel D. Tauber | |

Joel D. Tauber, President | ||

Date: May 20, 2015 | ||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/ Joel D. Tauber | |

Joel D. Tauber, President | ||

By: | /s/ Ellen T. Horing | |

Ellen T. Horing, Treasurer | ||

Date: May 20, 2015 | ||

21

EXHIBIT INDEX

| Exhibit No. | Description | |

EX.99.302CERT (a)(2) | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

EX.99.906CERT (b) | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |