- PHG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SD Filing

Koninklijke Philips (PHG) SDConflict minerals disclosure

Filed: 26 May 20, 6:11am

Exhibit 1.01

Philips Conflict Minerals Report

This Conflict Minerals Report for Koninklijke Philips N.V. (hereafter ‘’Royal Philips’’, “Philips”, or “our”) covers the reporting period from January 1,2019 to December 31, 2019, and has been prepared pursuant to Rule13p-1 and Form SD promulgated under the Securities Exchange Act of 1934.

This Conflict Minerals Report is filed as Exhibit 1.01 to Philips’ Specialized Disclosure Report on Form SD and is also posted on the Philipsconflict minerals website12.

| 1 | More information can be found here:https://www.philips.com/a-w/about/company/suppliers/supplier-sustainability/our-programs/responsible-sourcing-of-minerals.html |

| 2 | The content of any website, including any website of Royal Philips, referred to in this Conflict Minerals Report is included for general information only and is not incorporated by reference in the Conflict Minerals Report or Form SD. |

1

Contents

1. Introduction | 3 | |||

2. Philips conflict-free minerals program | 3 | |||

Philips | 3 | |||

Supply chain characteristics for 3TG | 3 | |||

Philips due diligence program | 4 | |||

OECD Step 1: Company Management system | 4 | |||

OECD Step 2: Risk identification and assessment | 6 | |||

OECD Step 3: Strategy to respond to identified risks | 7 | |||

OECD Step 4: Audits of smelter due diligence practices | 7 | |||

OECD Step 5: Report annually on supply chain due diligence. | 7 | |||

3. Reasonable Country of Origin Inquiry results | 7 | |||

4. Due diligence framework & measures | 9 | |||

Framework | 9 | |||

Measures | 9 | |||

5. Due diligence outcomes | 11 | |||

6. Determination | 11 | |||

7. Steps to improve future due diligence | 12 | |||

8. List of smelter facilities | 13 | |||

9. Data sources used | 27 | |||

10. Abbreviations | 27 | |||

2

1. Introduction

Rule13p-1 under the Securities Exchange Act of 1934, as amended, requires a company to make disclosures, for each calendar year, if conflict minerals are necessary to the functionality or production of a product manufactured by the registrant or contracted by the registrant to be manufactured. The specified minerals are gold, columbite-tantalite (coltan), cassiterite and wolframite, including their derivatives, which are limited to tantalum, tin and tungsten (henceforth referred to as “3TG”).

Philips has concluded that for the period from January 1,2019 to December 31, 2019:

| • | Philips has manufactured and contracted to manufacture products as to which 3TGs are necessary to the functionality or production; |

| • | Based on the reasonable country of origin inquiry (RCOI), Philips knows or has reason to believe that a portion of its necessary 3TGs originated or may have originated from the DRC or an adjoining country and knows or has reason to believe that they may not be solely from recycled or scrap sources; and |

| • | Based on Philips’ due diligence measures on the source and chain of custody of those necessary 3TGs used in its products, Philips is unable to determine for all 3TGs used in its products whether they originated from the DRC or an adjoining country. |

2. Philips conflict minerals program

Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people’s health and enabling better outcomes across the health continuum from healthy living and prevention to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. The company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care.

In 2019, Royal Philips was organized around the following reportable segments:

| • | Diagnostic & Treatment businesses: Diagnostic Imaging, Image-Guided Therapy, Ultrasound, Enterprise Diagnostic Informatics |

| • | Connected Care businesses: Monitoring & Analytics, Sleep & Respiratory Care, Therapeutic Care, Population Health Management, Connected Care Informatics |

| • | Personal Health businesses: Oral Healthcare, Mother & Child Care, Personal Care, Domestic Appliances |

| • | Other: Innovation, IP Royalties, Central Costs, Other |

On January 28, 2020, Philips announced that it will review options for future ownership of the Domestic Appliances business, and start the process of creating a separate legal structure for this business.

Supply chain characteristics for 3TG

The supply chain for 3TGs consists of many tiers. Before reaching Philips’ direct suppliers, in general, 3TGs will go from mines to traders, exporters, smelters or refiners (collectively referred to in this report as smelters), alloy producers and component manufacturers, and sometimes intermediate suppliers. One or more of the 3TG metals are contained in the vast majority of Philips products, typically in small quantities. Philips sources products and components from approximately 4,200 first tier suppliers globally. First tier suppliers are those

3

suppliers that Philips selected and with whom Philips has a direct business relationship. These first tier suppliers may select their suppliers (second tier suppliers), which in turn may have their own group of suppliers (third tier), and so on. There may be seven or more tiers in the supply chain between a 3TG mine and Philips. Philips works with its first tier suppliers to investigate the deeper levels of the supply chain, to determine the origin of 3TGs contained in Philips products.

Philips conflict minerals due diligence program

Due to Philips’ position in the supply chain and its limited insight in and leverage over the lower levels of the supply chain, Philips engages and actively cooperates with other industry members. As encouraged in the third edition of theOrganization for EconomicCo-operation and Development Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas(including its supplements on 3TG, referred to in this report as “OECD Guidance”), the internationally recognized standard on which Philips’ system is based, Philips supports an industry initiative, the Responsible Minerals Initiative (RMI), that uses an independent third-party audit to identify smelters that have systems in place to assure sourcing of only conflict-free materials. The RMI, formerly known as the Conflict Free Sourcing Initiative (CFSI), was founded by members of the Responsible Business Alliance (RBA), formerly known as the Electronic Industry Citizenship Coalition (EICC), and the Globale-Sustainability Initiative(GeSI).

The data on which certain statements in this report are based were obtained through Philips’ membership in the RMI, using the RMI Reasonable Country of Origin Inquiry report3. In addition, Philips uses the tools and supports the initiatives developed by the RMI especially the Conflict Minerals Reporting Template (CMRT) and Responsible Minerals Assurance Process (RMAP), formerly known as the Conflict Free Smelter Program (CFSP).

Philips designed its conflict minerals supply chain due diligence program with reference to the OECD Guidance and the five steps described in the supplements on 3TG.

OECD Step 1: Company Management system

Philips adopted aposition paper on responsible sourcing in relation to conflict minerals. The position paper is posted on Philips’ website. In addition, Philips has communicated its position on conflict minerals to all priority

| 3 | This list provides country of origin information for smelting and refining facilities that are validated through the Responsible Minerals Assurance Process. This data is based on the results of independent third-party audits and is available to RMI member companies only. The audit standard is developed according to global standards including the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas and the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act. |

4

suppliers (see below section “OECD Step 2” for the definition of priority suppliers). Philips has committed not to purchase raw materials, subassemblies, or supplies which Philips knows contain conflict minerals that directly or indirectly finance or benefit armed groups in the DRC or an adjoining country. Philips’ program goals, as described in the position paper, encourage the development of initiatives to:

| • | Minimize the trade in conflict minerals from mines that directly or indirectly finance or benefit armed groups anywhere in the world. |

| • | Enable legitimate minerals from the conflict and high-risk regions to enter global supply chains, thereby supporting the economies and the local communities that depend on these exports. |

Philips created and maintains an internal conflict minerals team to manage the implementation and progress of Philips’ due diligence efforts. The internal team consists of representatives from Procurement, Sustainability, Finance, Export Control, Legal and the Secretariat of the General Business Principles (GBP) Review Committee.

Philips established a system of control and transparency over its 3TG supply chains by creating a process to engage a group of first tier priority suppliers and request them to submit information to Philips using the CMRT4. The information submitted by priority suppliers includes information gathered by those suppliers about the smelters identified in their own supply chains. The information has been used by Philips to assess the due diligence efforts implemented by priority suppliers, and to identify smelters in the supply chain.

Philips made responsible sourcing of minerals a supplier contract requirement. The Philips Supplier Sustainability Declaration5 (SSD) includes a provision about Responsible Sourcing of Minerals. The SSD is part of the general conditions of purchase, and of the purchasing agreements signed with suppliers. It requires suppliers to have a policy in place to reasonably assure that their 3TG does not directly or indirectly finance or benefit armed groups that are perpetrators of serious human rights abuses in the DRC or an adjoining country, and to exercise due diligence on the source and chain of custody.

For first tier suppliers, Philips has a supplier sustainability performance program6 in place in which, amongst others, the implementation of the SSD is assessed. Responsible Sourcing of Minerals is one of the topics reviewed in this program. In casenon-conformances are identified during the assessment, suppliers are requested to make a corrective action plan and Philips monitors the implementation of this plan until thenon-conformance is corrected.

Multiple communication channels exist to serve as grievance mechanisms for early-warning risk awareness. Philips has the GBP7 reporting policy and underlying Speak Up mechanism that enables its stakeholders (including employees, former employees and third parties) to inform Philips of any concerns they may have. Internally, its personnel can report (anonymously) possible violations of Philips GBP and other policies including those related to 3TG supply chains via the GBP Compliance Officer or Philips Speak Up (Ethics Line) using the hotline or a web intake form. Third parties can also use the Philips Speak Up (Ethics Line) to file a complaint via

| 4 | The CMRT is a survey tool developed by the RMI to standardize collection of due diligence information in the supply chain. |

| 5 | More information on the Supplier Sustainability Declaration can be found here:https://www.philips.com/a-w/about/company/suppliers/supplier-sustainability/our-programs/supplier-sustainability-assessment.html |

| 6 | More information about the Philips supplier sustainability performance program can be found here:https://www.philips.com/a-w/about/company/suppliers/supplier-sustainability/our-programs/supplier-sustainability-assessment.html |

| 7 | More information about the Philips General Business Principles can be found here:https://www.philips.com/a-w/about/investor/governance/business-principles.html |

5

telephone or a web intake form.8 In addition, stakeholders can use the email address Conflict_Free_Minerals@Philips.com or existing industry grievance mechanisms like RMI and ITRI’s Tin Supply Chain Initiative (iTSCi) to file complaints related to 3TG.

OECD Step 2: Risk identification and assessment

Given the large number and diversity of Philips’ suppliers, Philips focuses its efforts on a group of first tier priority suppliers (referred to as “priority suppliers”) and works with them to identify the smelters in their supply chain. Priority suppliers are selected based on two primary elements:

| • | Purchasing spend |

The suppliers in the top 80% of Philips’ spend of relevant commodities are selected as priority suppliers. Philips uses a system to classify suppliers in commodity groups, for example, plastics, packaging, and metals. Philips excluded suppliers in commodity groups for which it is unlikely that one or more of the 3TGs are contained in the products, for example, software suppliers and packaging suppliers.

| • | Usage of 3TG |

The suppliers which provide a high quantity of 3TG materials are selected as priority suppliers. Even if these suppliers are not part of the top 80% relevant purchasing spend, Philips includes the suppliers as they are supplying a relatively high quantity of 3TG materials.

All identified priority suppliers receive a letter formally requesting them to:

| • | Adopt a policy to reasonably assure that the 3TG in their products does not directly or indirectly finance or benefit armed groups in the DRC or an adjoining country. |

| • | Identify all 3TG smelters in their supply chain. If they do not source directly from smelters, they are asked to pass on this request to their suppliers (who may have to pass it on to their suppliers, until the smelters are identified). |

| • | Cascade Philips’ request to only source from RMAP (or equivalent) compliant smelters to their suppliers and ask them to do the same with their next tier partners. |

| • | Report back to Philips by filling in the CMRT. |

A Philips conflict minerals team is available to increase awareness amongst priority suppliers and to help them meet Philips’ expectations/requirements. Different background and training materials are made available to suppliers.

Philips reviews each received supplier CMRT and assesses whether it meets Philips’ acceptance criteria regarding completeness, adoption of a conflict-free policy, data collection from next tier suppliers, and smelter identification and disclosure. Suppliers who provided a CMRT that did not meet the acceptance criteria, and suppliers who provided incomplete or potentially inaccurate information, were requested to take corrective actions and update their CMRT accordingly.

Philips reviews the supplier CMRTs to determine if there are any findings that indicate a need to conduct further due diligence and gather more detailed information.

| 8 | More information can be found here:https://secure.ethicspoint.eu/domain/media/en/gui/100518/index.html |

6

Philips evaluates the smelters identified in the supplier CMRTs based on various sources of available information. Philips mainly uses the Responsible Minerals Assurance Process (RMAP) compliant and active9 smelter list to evaluate the identified smelters. RMAP recognizes and includes smelters from other lists such as the London Bullion Metal Association (LBMA) and Responsible Jewelry Council (RJC). Philips may also use other sources of information to assess potential risk. For example, Philips may review publicly available reports or consider information that Philips may have about a smelter’s sourcing practices.

OECD Step 3: Strategy to respond to identified risks

Progress and findings of the supply chain risk assessment are regularly reported to senior management. The risk management plan adopted by Philips is in accordance with its policy to ultimately discontinue doing business with any supplier found to be purchasing 3TG material which directly or indirectly finances or benefits armed groups in the DRC or adjoining countries, after attempts at corrective actions are not successful.

To monitor and track performance of risk management efforts, Philips uses data reported by suppliers in the CMRTs and updates of the RMAP compliant smelter list. The status is discussed internally in monthly reviews with the conflict minerals team and reported to senior management.

Philips requests priority suppliers to update and resend their CMRT when additional information becomes available to such suppliers. When updates are received, the CMRT review step as described above is repeated to assess and mitigate risks.

OECD Step 4: Audits of smelter due diligence practices

The fourth step in the OECD guidance is to carry out independent third-party audits of supply chain due diligence at identified points in the supply chain. Philips is a member of RMI and uses information provided by the RMI for this step. Through its membership, Philips has access to the RMI RCOI report data which is used to identify the minerals country of origin and conflict-free status of smelters.

Philips contributes to the RMI as a member company and encourages smelters to participate in the RMAP through direct communication and smelter outreach communication.

OECD Step 5: Report annually on supply chain due diligence.

Since 2014, Philips reports annually on supply chain due diligence by filing a Form SD and Conflict Minerals Report with the SEC. Philips has been including certain disclosures about the use of conflict minerals since 2009, even before the SEC’s rules first became effective. A dedicated conflict minerals website with information for consumers, customers and suppliers is available. In 2012, Philips was the first company to publish its smelter list, and continues to regularly update this list as more information becomes available.

3. Reasonable country of origin inquiry results

As described above, SEC rules provide that if, after conducting in good faith, a reasonable country of origin inquiry, an SEC registrant determines, or has reason to believe, that any of the 3TGs used in connection with the products for which it is responsible may have originated in the DRC or an adjoining country, or did not come from recycled or scrap sources, the registrant should conduct due diligence on the source and chain of custody of its conflict minerals, following a nationally or internationally recognized framework.

| 9 | RMI active smelter and refiners are at various stages of the audit cycle (undergoing or committed to undergo the audit). The full definition of RMI “active” smelters can be found here:http://www.responsiblemineralsinitiative.org/active-smelters-refiners/ |

7

Philips identified 190 priority suppliers and used the data provided by these suppliers in their CMRTs to identify the smelters in the Philips supply chain. These smelters may have been used to process 3TG metals contained in Philips products.

Philips achieved a 99% response rate in its supply chain investigation and 86% of the submitted CMRTs met or exceeded the Philips 2019 minimum acceptance criteria. Names of 331 different entities were provided by priority suppliers as part of their smelter lists.

However, some of the entities named by the priority suppliers may not be smelters. Philips used the “SmelterLook-up” in the CMRT version 5.12 and RMI smelter database information as a reference to compile the Philips Smelter List.

Based on the CMRT “SmelterLook-up”, Philips identified a total of 324 listed smelters in the supply chain out of the 331 names reported to Philips. According to the RMI smelter database information, among the 324 listed smelters, 2 have discontinued operations as smelters.

Philips researched the remaining 7non-listed entities and concluded that 1 of them is most likely a smelter that has ceased operations and the other 6 have been recognized in the RMI smelter database after the release of CMRT version 5.12. Therefore, in 2019, Philips identified 328 eligible smelters, excluding the smelters that have discontinued operations, and did not identify any named entities that we could not determine the status.

As a result of focusing on improving the smelter data quality received from the priority suppliers, Philips was able to reduce the number ofnon-recognized smelters from 85 reported in 2015, to 9 reported in 2016, to 5 reported in 2017, to 3 reported in 2018, and finally to 0 in 2019.

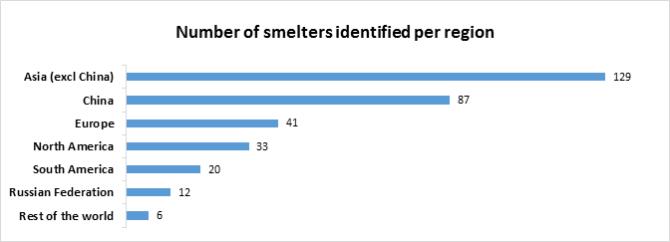

The majority of the identified smelters are located in Asia, with 87 smelters in China, followed by Indonesia (37) and Japan (31).

8

Results of the RCOI (Reasonable Country of Origin Inquiry)

| Gold | Tantalum | Tin | Tungsten | Total | ||||||||||||||||

Smelters known to source from the DRC | 0 | 19 | 7 | 3 | 29 | |||||||||||||||

Smelters known to source from the DRC adjoining countries | 2 | 24 | 8 | 9 | 43 | |||||||||||||||

Smelters known to process onlyrecycled or scrap materials | 10 | 1 | 5 | 3 | 19 | |||||||||||||||

Smelters known to source from outside the DRC or adjoining countries | 103 | 15 | 69 | 34 | 221 | |||||||||||||||

Smelters that disclosed mineral country of originto auditors only | 1 | 0 | 0 | 0 | 1 | |||||||||||||||

Smelters withunknown mineral origin | 43 | 1 | 11 | 5 | 60 | |||||||||||||||

For the 328 identified smelters, Philips used the RMI Reasonable Country of Origin Inquiry (RCOI) report. This country of origin data is available for smelters that successfully completed an RMAP audit and chose to disclose their sourcing countries to the RMI. One of the identified RMAP compliant gold smelters chose to disclose its mineral country of origin to auditors only. The table above shows the results of the RCOI. The total number shown in the table is not equal to the total number of identified smelters, because a smelter may fall into more than one category (e.g., a smelter can source from both the DRC as well as from countries outside the DRC). As the RMI generally does not specify individual countries of origin of 3TGs processed by audited smelters and some of the smelters do not disclose origin information, we were not able to determine with certainty the specific countries of origin of 3TGs processed by the identified smelters.

In the CMRTs received, 119 suppliers indicated that their products contain 3TG metals that originated or potentially originated from the DRC or adjoining countries.

4. Conflict minerals due diligence framework & measures

Framework

The Philips conflict minerals due diligence framework for the reporting period of calendar year 2019 has been designed to conform in all material respects to the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, Third Edition (2016), as applicable for downstream companies.

Measures

Below is a description of the measures Philips performed in due diligence on the source and chain of custody of the necessary conflict minerals contained in Philips’ products.

| • | Philips updated itsposition paperon responsible sourcing in relation to conflict minerals. |

| • | Once a month, the Philips conflict minerals team met to review progress and results of supplier data collection, supplier due diligence and smelter identification. Internal performance reports were created for these meetings. Using data from Supplier Sustainability Scorecards, these reports included an overview of the monthly progress of priority suppliers, as well as, progress highlights, areas of concern, outlook for coming weeks, and identified risks. |

9

| • | In total, 12 Supplier Sustainability Scorecards were shared with senior management. Regarding Conflict Minerals, the main topics addressed in the scorecards included: |

| • | The progress of CMRT collection from priority suppliers |

| • | The status of supplier CMRTs with regards to meeting Philips’ CMRT acceptance criteria |

| • | Philips contacted priority suppliers via an invitation letter. Using this letter, Philips requested suppliers to perform supply chain due diligence and fill out a CMRT. In addition, the letter referred to Philips’ expectations and requirements regarding the CMRT. A copy of this letter is posted on the Philipsconflict minerals website. |

| • | In the letter, Philips requests priority suppliers to steer their supply chain towards RMAP (or equivalent) validated smelters only. |

| • | Philips requested priority suppliers to identify smelters in their supply chain and to report the identified smelters to Philips using the CMRT. In case a lack of progress was observed, Philips followed up with suppliers by sending out multiple reminders via email, as well as, by reaching out via phone. |

| • | Philips facilitated the learning and development of suppliers. The Philips Conflict Minerals team regularly contacted suppliers via email and phone to monitor the suppliers’ progress, provide additional training, and check whether the conflict minerals requirements of Philips were interpreted correctly. |

| • | Philips reviewed all received supplier CMRTs to evaluate whether they met Philips’ acceptance criteria regarding completeness, adoption of a conflict-free policy, data collection from next tier suppliers, and smelter identification and disclosure. Suppliers that provided a CMRT that did not meet the acceptance criteria, and suppliers that provided incomplete or potentially inaccurate information, were requested to take corrective actions and update their CMRT accordingly. |

| • | Philips reviewed all received supplier CMRTs to determine if there were any areas of concern giving rise to the need to conduct further due diligence and thus gather more information. During the course of the year, Philips has followed up on areas of concern in a number of cases. |

| • | Philips reviewed all received supplier CMRTs against the list of smelters that were audited through the RMI’s Responsible Minerals Assurance Process (RMAP) or other independent third party audit programs. |

| • | As a member of the RMI, Philips utilized the due diligence conducted on smelters by the RMI’s RMAP. This program uses independent third-party auditors to audit the source and chain of custody of the conflict minerals used by smelters that agree to participate in the RMAP. |

| • | Philips devised and adopted a risk management plan according to the level of risk in 3TG supply chains. Philips determined the level of risk, taking into account available information on mineral origin, RMAP compliance status, and possible connection to conflict as reported from credible sources. To mitigate risk, Philips might require high-risk suppliers to take corrective actions, or request smelters with unknown mineral origin to participate in the RMAP. |

| • | Philips published the “Philips Conflict Minerals Reporting Template” on the Philipsconflict minerals website, including a list of all smelters identified by the selected priority suppliers during 2019. |

| • | Philips has filed the Conflict Minerals Report (and the Exhibits thereto) with the SEC for 2013, 2014, 2015, 2016, 2017 and 2018 and is filing this the Conflict Minerals Report for 2019 on May 26, 2020 as Exhibit 1.01 to Form SD. The report is available on Philips’conflict minerals website. |

| • | Philips archives relevant evidence related to its Conflict Minerals Program for at least five years. Records are stored in a manner allowing timely and easy access while protecting the records from unauthorized alteration. |

10

| • | Philips has established an internal mechanism allowing its employees to, anonymously, raise possible violations of Philips GBP and other policies including those relating to conflict minerals. In addition, a central conflict minerals email address can be used by external stakeholders to file complaints. Additionally, Philips encourages anyone who suspects a breach of ethical standards in any of Philips’ business activities to report their concerns, in strictest confidence, via the externally hosted Philips Speak Up (Ethics Line). Moreover, as a member of the RMI, Philips encourages submissions of grievance via the RMI Grievance Mechanism. The RMI also serves as a source for an early-warning risk-awareness. |

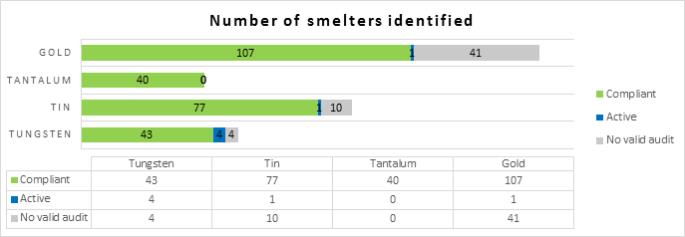

5. Conflict minerals due diligence outcomes

To the best of Philips’ knowledge, none of the smelters identified in Philips’ supply chain are known to source 3TG that directly or indirectly benefit armed groups in the DRC. 273 (83%) of the 328 smelters identified by Philips participated in the RMAP or equivalent audit program. 267 (81%) of the identified smelters successfully passed the RMAP or equivalent audit, thereby confirming their conflict-free status under those standards. 6 (2%) of the identified smelters are in various stages of the audit(so-called “RMI active smelters”). The remaining 55 (17%) identified smelters have not started a valid independent third-party audit to confirm their conflict-free status. Accordingly, the conflict-free status of these 55 unaudited smelters as well as the 6 active smelters that are in various stages of the audit process is reported in this conflict minerals report as undeterminable.

Philips did not discontinue business with any direct suppliers in the reporting period because Philips did not identify any reason to believe that any of the suppliers were purchasing 3TG that directly or indirectly finances or benefits armed groups in the DRC or adjoining countries. Philips nevertheless will review and potentially remove smelters from its supply chain when Philips has concerns regarding their due diligence process and/or sourcing practices. Given the fact that neither Philips nor its suppliers have a direct business relationship with the entities with respect to which Philips is further investigating concerns, the process takes time.

6. Determination

Philips has not been able to confirm the identification of a conflict-free status under the RMAP standards for all smelters used in its supply chain. However, none of the smelters identified in Philips’ supply chain is known to Philips as sourcing 3TG that directly or indirectly finances or benefits armed groups in the DRC or adjoining countries.

11

As a result of the due diligence measures performed, Philips provides below the known smelter facilities that may have been used to process 3TG metals contained in Philips products, and their conflict-free status. The conflict-free status is based on information the RMI provides to its members. Philips includes the category “RMI Active” as it shows smelters that committed to or are currently in the process of undertaking an audit. The list of smelter facilities provided in Section 8 of this Conflict Minerals Report includes all 328 entities that were confirmed to be eligible smelters.

This Conflict Minerals Report is intended to cover Philips’ entire product portfolio that uses 3TG. Given Philips’ large product portfolio and extensive supplier base, Philips does not have component level information from all of its 4,200 first tier suppliers. As a result thereof, the approach is to conduct supply chain due diligence and report at the company level for the entire product portfolio, rather than for specific Philips products. This enables Philips to focus its efforts on building, maintaining, and improving a robust due diligence program.

7. Steps to improve future Philips conflict minerals due diligence program

For reporting year 2020, Philips plans to:

| • | Continue to leverage its position as a strategic partner in the European Partnership for Responsible Minerals (EPRM), a public-private cooperation that supports and complements the EU conflict minerals legislation. As a strategic partner, Philips will engage in responsible sourcing projects (with a scope broadened to other conflict and high-risk areas world-wide as well as a wider array of human rights and environmental issues addressed) in order to increase the supply and demand for responsibly sourced minerals. Furthermore, Philips will act as a liaison between EPRM and other responsible sourcing initiatives in which Philips participates (e.g., the Dutch Covenant on Gold). |

| • | Continue engagement with existing industry programs and groups, such as responsible sourcing and upstream impact programs and workgroups initiated under the Responsible Minerals Initiative (RMI), to encourage further adoption, improvement, and reliability in relevant programs, tools and standards. |

| • | Continue to reach out to smelters to encourage their participation in relevant responsible sourcing initiatives. |

| • | Continue to work with priority suppliers to: |

| • | help them understand and satisfy Philips’ responsible sourcing expectations |

| • | help them implement or further improve their due diligence process |

| • | investigate their supply chain and identify smelters |

| • | confirm the conflict-free status of identified smelters |

| • | Communicate to priority suppliers Philips’ expectation that they steer their supply chain towards smelters audited as conformant to the Responsible Minerals Assurance Process (RMAP) or other equivalent programs. |

| • | Start exploring its supply chain for cobalt and expand minerals due diligence to include cobalt, which is not included in the definition of “conflict minerals” but has been linked to human rights risks in the DRC. As a first step, Philips will investigate the use of cobalt in the batteries that it purchases and question suppliers about their due diligence. |

12

8. List of smelter facilities

The table below represents a consolidated list of smelters (328 in total) identified by Philips’ priority suppliers. The results are based on:

| • | Information provided by the selected priority suppliers in their CMRTs |

| • | RMI smelter reference list, as included in the CMRT version 5.12 (released April 26, 2019) |

| • | Smelter database information available to the RMI members – version April 28, 2020 |

Metal | ID | Smelter name | RMAP Compliant | RMI Active | ||||

Gold | CID000015 | Advanced Chemical Company | YES | NO | ||||

Gold | CID000019 | Aida Chemical Industries Co., Ltd. | YES | NO | ||||

Gold | CID000035 | AllgemeineGold-und Silberscheideanstalt A.G. | YES | NO | ||||

Gold | CID000041 | Almalyk Mining and Metallurgical Complex (AMMC) | YES | NO | ||||

Gold | CID000058 | AngloGold Ashanti Corrego do Sitio Mineracao | YES | NO | ||||

Gold | CID000077 | Argor-Heraeus S.A. | YES | NO | ||||

Gold | CID000082 | Asahi Pretec Corp. | YES | NO | ||||

Gold | CID000090 | Asaka Riken Co., Ltd. | YES | NO | ||||

Gold | CID000103 | Atasay Kuyumculuk Sanayi Ve Ticaret A.S. | NO | NO | ||||

Gold | CID000113 | Aurubis AG | YES | NO | ||||

Gold | CID000128 | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | YES | NO | ||||

Gold | CID000157 | Boliden AB | YES | NO | ||||

Gold | CID000176 | C. Hafner GmbH + Co. KG | YES | NO | ||||

Gold | CID000180 | Caridad | NO | NO | ||||

Gold | CID000185 | CCR Refinery - Glencore Canada Corporation | YES | NO | ||||

Gold | CID000189 | Cendres + Metaux S.A. | YES | NO | ||||

Gold | CID000197 | Yunnan Copper Industry Co., Ltd. | NO | NO | ||||

Gold | CID000233 | Chimet S.p.A. | YES | NO |

13

Gold | CID000264 | Chugai Mining | YES | NO | ||||

Gold | CID000343 | DayeNon-Ferrous Metals Mining Ltd. | NO | NO | ||||

Gold | CID000359 | DSC (Do Sung Corporation) | YES | NO | ||||

Gold | CID000362 | DODUCO Contacts and Refining GmbH | YES | NO | ||||

Gold | CID000401 | Dowa | YES | NO | ||||

Gold | CID000425 | Eco-System Recycling Co., Ltd. East Plant | YES | NO | ||||

Gold | CID000493 | OJSC Novosibirsk Refinery | YES | NO | ||||

Gold | CID000522 | Refinery of Seemine Gold Co., Ltd. | NO | NO | ||||

Gold | CID000651 | Guoda Safina High-Tech Environmental Refinery Co., Ltd. | NO | NO | ||||

Gold | CID000671 | Hangzhou Fuchunjiang Smelting Co., Ltd. | NO | NO | ||||

Gold | CID000689 | LT Metal Ltd. | YES | NO | ||||

Gold | CID000694 | Heimerle + Meule GmbH | YES | NO | ||||

Gold | CID000707 | Heraeus Metals Hong Kong Ltd. | YES | NO | ||||

Gold | CID000711 | Heraeus Precious Metals GmbH & Co. KG | YES | NO | ||||

Gold | CID000767 | Hunan Chenzhou Mining Co., Ltd. | NO | NO | ||||

Gold | CID000773 | Hunan Guiyang yinxing Nonferrous Smelting Co., Ltd. | NO | NO | ||||

Gold | CID000778 | HwaSeong CJ CO., LTD. | NO | NO | ||||

Gold | CID000801 | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | YES | NO | ||||

Gold | CID000807 | Ishifuku Metal Industry Co., Ltd. | YES | NO | ||||

Gold | CID000814 | Istanbul Gold Refinery | YES | NO | ||||

Gold | CID000823 | Japan Mint | YES | NO | ||||

Gold | CID000855 | Jiangxi Copper Co., Ltd. | YES | NO | ||||

Gold | CID000920 | Asahi Refining USA Inc. | YES | NO | ||||

Gold | CID000924 | Asahi Refining Canada Ltd. | YES | NO |

14

Gold | CID000929 | JSC Uralelectromed | YES | NO | ||||

Gold | CID000937 | JX Nippon Mining & Metals Co., Ltd. | YES | NO | ||||

Gold | CID000956 | Kazakhmys Smelting LLC | NO | NO | ||||

Gold | CID000957 | Kazzinc | YES | NO | ||||

Gold | CID000969 | Kennecott Utah Copper LLC | YES | NO | ||||

Gold | CID000981 | Kojima Chemicals Co., Ltd. | YES | NO | ||||

Gold | CID001029 | Kyrgyzaltyn JSC | YES | NO | ||||

Gold | CID001032 | L’azurde Company For Jewelry | NO | NO | ||||

Gold | CID001056 | Lingbao Gold Co., Ltd. | NO | NO | ||||

Gold | CID001058 | Lingbao Jinyuan Tonghui Refinery Co., Ltd. | NO | NO | ||||

Gold | CID001078 | LS-NIKKO Copper Inc. | YES | NO | ||||

Gold | CID001093 | Luoyang Zijin Yinhui Gold Refinery Co., Ltd. | NO | NO | ||||

Gold | CID001113 | Materion | YES | NO | ||||

Gold | CID001119 | Matsuda Sangyo Co., Ltd. | YES | NO | ||||

Gold | CID001147 | Metalor Technologies (Suzhou) Ltd. | YES | NO | ||||

Gold | CID001149 | Metalor Technologies (Hong Kong) Ltd. | YES | NO | ||||

Gold | CID001152 | Metalor Technologies (Singapore) Pte., Ltd. | YES | NO | ||||

Gold | CID001153 | Metalor Technologies S.A. | YES | NO | ||||

Gold | CID001157 | Metalor USA Refining Corporation | YES | NO | ||||

Gold | CID001161 | MetalurgicaMet-Mex Penoles S.A. De C.V. | YES | NO | ||||

Gold | CID001188 | Mitsubishi Materials Corporation | YES | NO | ||||

Gold | CID001193 | Mitsui Mining and Smelting Co., Ltd. | YES | NO | ||||

Gold | CID001204 | Moscow Special Alloys Processing Plant | YES | NO | ||||

Gold | CID001220 | Nadir Metal Rafineri San. Ve Tic. A.S. | YES | NO | ||||

Gold | CID001236 | Navoi Mining and Metallurgical Combinat | NO | NO |

15

Gold | CID001259 | Nihon Material Co., Ltd. | YES | NO | ||||

Gold | CID001325 | Ohura Precious Metal Industry Co., Ltd. | YES | NO | ||||

Gold | CID001326 | OJSC “The Gulidov KrasnoyarskNon-Ferrous Metals Plant” (OJSC Krastsvetmet) | YES | NO | ||||

Gold | CID001352 | PAMP S.A. | YES | NO | ||||

Gold | CID001362 | Penglai Penggang Gold Industry Co., Ltd. | NO | NO | ||||

Gold | CID001386 | Prioksky Plant ofNon-Ferrous Metals | YES | NO | ||||

Gold | CID001397 | PT Aneka Tambang (Persero) Tbk | YES | NO | ||||

Gold | CID001498 | PX Precinox S.A. | YES | NO | ||||

Gold | CID001512 | Rand Refinery (Pty) Ltd. | YES | NO | ||||

Gold | CID001534 | Royal Canadian Mint | YES | NO | ||||

Gold | CID001546 | Sabin Metal Corp. | NO | NO | ||||

Gold | CID001555 | Samduck Precious Metals | YES | NO | ||||

Gold | CID001562 | Samwon Metals Corp. | NO | NO | ||||

Gold | CID001585 | SEMPSA Joyeria Plateria S.A. | YES | NO | ||||

Gold | CID001619 | Shandong Tiancheng Biological Gold Industrial Co., Ltd. | NO | NO | ||||

Gold | CID001622 | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | YES | NO | ||||

Gold | CID001736 | Sichuan Tianze Precious Metals Co., Ltd. | YES | NO | ||||

Gold | CID001756 | SOE Shyolkovsky Factory of Secondary Precious Metals | YES | NO | ||||

Gold | CID001761 | Solar Applied Materials Technology Corp. | YES | NO | ||||

Gold | CID001798 | Sumitomo Metal Mining Co., Ltd. | YES | NO | ||||

Gold | CID001875 | Tanaka Kikinzoku Kogyo K.K. | YES | NO | ||||

Gold | CID001909 | Great Wall Precious Metals Co., Ltd. of CBPM | NO | NO | ||||

Gold | CID001916 | The Refinery of Shandong Gold Mining Co., Ltd. | YES | NO | ||||

Gold | CID001938 | Tokuriki Honten Co., Ltd. | YES | NO |

16

Gold | CID001947 | Tongling Nonferrous Metals Group Co., Ltd. | NO | NO | ||||

Gold | CID001955 | Torecom | YES | NO | ||||

Gold | CID001977 | Umicore Brasil Ltda. | YES | NO | ||||

Gold | CID001980 | Umicore S.A. Business Unit Precious Metals Refining | YES | NO | ||||

Gold | CID001993 | United Precious Metal Refining, Inc. | YES | NO | ||||

Gold | CID002003 | Valcambi S.A. | YES | NO | ||||

Gold | CID002030 | Western Australian Mint (T/a The Perth Mint) | YES | NO | ||||

Gold | CID002100 | Yamakin Co., Ltd. | YES | NO | ||||

Gold | CID002129 | Yokohama Metal Co., Ltd. | YES | NO | ||||

Gold | CID002224 | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | YES | NO | ||||

Gold | CID002243 | Gold Refinery of Zijin Mining Group Co., Ltd. | YES | NO | ||||

Gold | CID002282 | Morris and Watson | NO | NO | ||||

Gold | CID002290 | SAFINA A.S. | NO | YES | ||||

Gold | CID002312 | Guangdong Jinding Gold Limited | NO | NO | ||||

Gold | CID002314 | Umicore Precious Metals Thailand | YES | NO | ||||

Gold | CID002459 | Geib Refining Corporation | YES | NO | ||||

Gold | CID002509 | MMTC-PAMP India Pvt., Ltd. | YES | NO | ||||

Gold | CID002511 | KGHM Polska Miedz Spolka Akcyjna | YES | NO | ||||

Gold | CID002516 | Singway Technology Co., Ltd. | YES | NO | ||||

Gold | CID002525 | Shandong Humon Smelting Co., Ltd. | NO | NO | ||||

Gold | CID002560 | Al Etihad Gold Refinery DMCC | YES | NO | ||||

Gold | CID002561 | Emirates Gold DMCC | YES | NO | ||||

Gold | CID002562 | International Precious Metal Refiners | NO | NO | ||||

Gold | CID002580 | T.C.A S.p.A | YES | NO | ||||

Gold | CID002582 | REMONDIS PMR B.V. | YES | NO |

17

Gold | CID002584 | Fujairah Gold FZC | NO | NO | ||||

Gold | CID002605 | Korea Zinc Co., Ltd. | YES | NO | ||||

Gold | CID002606 | Marsam Metals | YES | NO | ||||

Gold | CID002615 | TOOTau-Ken-Altyn | YES | NO | ||||

Gold | CID002708 | Abington Reldan Metals, LLC | NO | NO | ||||

Gold | CID002761 | SAAMP | YES | NO | ||||

Gold | CID002762 | L’Orfebre S.A. | YES | NO | ||||

Gold | CID002763 | 8853 S.p.A. | YES | NO | ||||

Gold | CID002765 | Italpreziosi | YES | NO | ||||

Gold | CID002777 | SAXONIA Edelmetalle GmbH | YES | NO | ||||

Gold | CID002778 | WIELAND Edelmetalle GmbH | YES | NO | ||||

Gold | CID002779 | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH | YES | NO | ||||

Gold | CID002850 | AU Traders and Refiners | YES | NO | ||||

Gold | CID002852 | GCC Gujrat Gold Centre Pvt. Ltd. | NO | NO | ||||

Gold | CID002853 | Sai Refinery | NO | NO | ||||

Gold | CID002857 | Modeltech Sdn Bhd | NO | NO | ||||

Gold | CID002863 | Bangalore Refinery | YES | NO | ||||

Gold | CID002865 | Kyshtym Copper-Electrolytic Plant ZAO | NO | NO | ||||

Gold | CID002866 | Morris and Watson Gold Coast | NO | NO | ||||

Gold | CID002867 | Degussa Sonne / Mond Goldhandel GmbH | NO | NO | ||||

Gold | CID002872 | Pease & Curren | NO | NO | ||||

Gold | CID002918 | SungEel HiMetal Co., Ltd. | YES | NO | ||||

Gold | CID002919 | Planta Recuperadora de Metales SpA | YES | NO | ||||

Gold | CID002973 | Safimet S.p.A | YES | NO | ||||

Gold | CID003153 | State Research Institute Center for Physical Sciences and Technology | NO | NO |

18

Gold | CID003189 | NH Recytech Company | NO | NO | ||||

Gold | CID003195 | DS PRETECH Co., Ltd. | YES | NO | ||||

Gold | CID003324 | QG Refining, LLC | NO | NO | ||||

Gold | CID003348 | Dijllah Gold Refinery FZC | NO | NO | ||||

Gold | CID003382 | CGR Metalloys Pvt Ltd. | NO | NO | ||||

Gold | CID003383 | Sovereign Metals | NO | NO | ||||

Gold | CID003424 | Eco-System Recycling Co., Ltd. North Plant | YES | NO | ||||

Gold | CID003425 | Eco-System Recycling Col, Ltd. West Plant | YES | NO | ||||

Tantalum | CID000092 | Asaka Riken Co., Ltd. | YES | NO | ||||

Tantalum | CID000211 | Changsha South Tantalum Niobium Co., Ltd. | YES | NO | ||||

Tantalum | CID000291 | Guangdong Rising RareMetals-EO Materials Ltd. | YES | NO | ||||

Tantalum | CID000456 | Exotech Inc. | YES | NO | ||||

Tantalum | CID000460 | F&X Electro-Materials Ltd. | YES | NO | ||||

Tantalum | CID000616 | Guangdong Zhiyuan New Material Co., Ltd. | YES | NO | ||||

Tantalum | CID000914 | JiuJiang JinXin Nonferrous Metals Co., Ltd. | YES | NO | ||||

Tantalum | CID000917 | Jiujiang Tanbre Co., Ltd. | YES | NO | ||||

Tantalum | CID001076 | LSM Brasil S.A. | YES | NO | ||||

Tantalum | CID001163 | Metallurgical Products India Pvt., Ltd. | YES | NO | ||||

Tantalum | CID001175 | Mineracao Taboca S.A. | YES | NO | ||||

Tantalum | CID001192 | Mitsui Mining and Smelting Co., Ltd. | YES | NO | ||||

Tantalum | CID001200 | NPM Silmet AS | YES | NO | ||||

Tantalum | CID001277 | Ningxia Orient Tantalum Industry Co., Ltd. | YES | NO | ||||

Tantalum | CID001508 | QuantumClean | YES | NO | ||||

Tantalum | CID001522 | Yanling Jincheng Tantalum & Niobium Co., Ltd. | YES | NO |

19

Tantalum | CID001769 | Solikamsk Magnesium Works OAO | YES | NO | ||||

Tantalum | CID001869 | Taki Chemical Co., Ltd. | YES | NO | ||||

Tantalum | CID001891 | Telex Metals | YES | NO | ||||

Tantalum | CID001969 | Ulba Metallurgical Plant JSC | YES | NO | ||||

Tantalum | CID002492 | Hengyang King Xing Lifeng New Materials Co., Ltd. | YES | NO | ||||

Tantalum | CID002504 | D Block Metals, LLC | YES | NO | ||||

Tantalum | CID002505 | FIR Metals & Resource Ltd. | YES | NO | ||||

Tantalum | CID002506 | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | YES | NO | ||||

Tantalum | CID002508 | XinXing HaoRong Electronic Material Co., Ltd. | YES | NO | ||||

Tantalum | CID002512 | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | YES | NO | ||||

Tantalum | CID002539 | KEMET Blue Metals | YES | NO | ||||

Tantalum | CID002544 | H.C. Starck Co., Ltd. | YES | NO | ||||

Tantalum | CID002545 | H.C. Starck Tantalum and Niobium GmbH | YES | NO | ||||

Tantalum | CID002547 | H.C. Starck Hermsdorf GmbH | YES | NO | ||||

Tantalum | CID002548 | H.C. Starck Inc. | YES | NO | ||||

Tantalum | CID002549 | H.C. Starck Ltd. | YES | NO | ||||

Tantalum | CID002550 | H.C. Starck Smelting GmbH & Co. KG | YES | NO | ||||

Tantalum | CID002557 | Global Advanced Metals Boyertown | YES | NO | ||||

Tantalum | CID002558 | Global Advanced Metals Aizu | YES | NO | ||||

Tantalum | CID002568 | KEMET Blue Powder | YES | NO | ||||

Tantalum | CID002707 | Resind Industria e Comercio Ltda. | YES | NO | ||||

Tantalum | CID002842 | Jiangxi Tuohong New Raw Material | YES | NO | ||||

Tantalum | CID002847 | PRG Dooel | YES | NO | ||||

Tantalum | CID003402 | CP Metals Inc. | YES | NO | ||||

Tin | CID000228 | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | YES | NO |

20

Tin | CID000292 | Alpha | YES | NO | ||||

Tin | CID000306 | CV Gita Pesona | YES | NO | ||||

Tin | CID000309 | PT Aries Kencana Sejahtera | YES | NO | ||||

Tin | CID000313 | PT Premium Tin Indonesia | YES | NO | ||||

Tin | CID000315 | CV United Smelting | YES | NO | ||||

Tin | CID000402 | Dowa | YES | NO | ||||

Tin | CID000438 | EM Vinto | YES | NO | ||||

Tin | CID000448 | Estanho de Rondonia S.A. | NO | NO | ||||

Tin | CID000468 | Fenix Metals | YES | NO | ||||

Tin | CID000538 | GejiuNon-Ferrous Metal Processing Co., Ltd. | YES | NO | ||||

Tin | CID000555 | Gejiu Zili Mining And Metallurgy Co., Ltd. | YES | NO | ||||

Tin | CID000760 | Huichang Jinshunda Tin Co., Ltd. | YES | NO | ||||

Tin | CID000942 | Gejiu Kai Meng Industry and Trade LLC | YES | NO | ||||

Tin | CID001070 | China Tin Group Co., Ltd. | YES | NO | ||||

Tin | CID001105 | Malaysia Smelting Corporation (MSC) | YES | NO | ||||

Tin | CID001142 | Metallic Resources, Inc. | YES | NO | ||||

Tin | CID001173 | Mineracao Taboca S.A. | YES | NO | ||||

Tin | CID001182 | Minsur | YES | NO | ||||

Tin | CID001191 | Mitsubishi Materials Corporation | YES | NO | ||||

Tin | CID001231 | Jiangxi New Nanshan Technology Ltd. | YES | NO | ||||

Tin | CID001314 | O.M. Manufacturing (Thailand) Co., Ltd. | YES | NO | ||||

Tin | CID001337 | Operaciones Metalurgicas S.A. | YES | NO | ||||

Tin | CID001399 | PT Artha Cipta Langgeng | YES | NO | ||||

Tin | CID001402 | PT Babel Inti Perkasa | YES | NO | ||||

Tin | CID001406 | PT Babel Surya Alam Lestari | YES | NO | ||||

Tin | CID001419 | PT Bangka Tin Industry | YES | NO |

21

Tin | CID001421 | PT Belitung Industri Sejahtera | YES | NO | ||||

Tin | CID001428 | PT Bukit Timah | YES | NO | ||||

Tin | CID001434 | PT DS Jaya Abadi | YES | NO | ||||

Tin | CID001448 | PT Karimun Mining | YES | NO | ||||

Tin | CID001453 | PT Mitra Stania Prima | YES | NO | ||||

Tin | CID001457 | PT Panca Mega Persada | YES | NO | ||||

Tin | CID001458 | PT Prima Timah Utama | YES | NO | ||||

Tin | CID001460 | PT Refined Bangka Tin | YES | NO | ||||

Tin | CID001463 | PT Sariwiguna Binasentosa | YES | NO | ||||

Tin | CID001468 | PT Stanindo Inti Perkasa | YES | NO | ||||

Tin | CID001471 | PT Sumber Jaya Indah | YES | NO | ||||

Tin | CID001477 | PT Timah Tbk Kundur | YES | NO | ||||

Tin | CID001482 | PT Timah Tbk Mentok | YES | NO | ||||

Tin | CID001490 | PT Tinindo Inter Nusa | YES | NO | ||||

Tin | CID001493 | PT Tommy Utama | YES | NO | ||||

Tin | CID001539 | Rui Da Hung | YES | NO | ||||

Tin | CID001758 | Soft Metais Ltda. | YES | NO | ||||

Tin | CID001898 | Thaisarco | YES | NO | ||||

Tin | CID001908 | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. | YES | NO | ||||

Tin | CID002036 | White Solder Metalurgia e Mineracao Ltda. | YES | NO | ||||

Tin | CID002158 | Yunnan ChengfengNon-ferrous Metals Co., Ltd. | YES | NO | ||||

Tin | CID002180 | Yunnan Tin Company Limited | YES | NO | ||||

Tin | CID002455 | CV Venus Inti Perkasa | YES | NO | ||||

Tin | CID002468 | Magnu’s Minerais Metais e Ligas Ltda. | YES | NO | ||||

Tin | CID002478 | PT Tirus Putra Mandiri | YES | NO |

22

Tin | CID002500 | Melt Metais e Ligas S.A. | YES | NO | ||||

Tin | CID002503 | PT ATD Makmur Mandiri Jaya | YES | NO | ||||

Tin | CID002517 | O.M. Manufacturing Philippines, Inc. | YES | NO | ||||

Tin | CID002530 | PT Inti Stania Prima | YES | NO | ||||

Tin | CID002570 | CV Ayi Jaya | YES | NO | ||||

Tin | CID002572 | Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Company | NO | NO | ||||

Tin | CID002573 | Nghe TinhNon-Ferrous Metals Joint Stock Company | NO | NO | ||||

Tin | CID002574 | Tuyen QuangNon-Ferrous Metals Joint Stock Company | NO | NO | ||||

Tin | CID002592 | CV Dua Sekawan | YES | NO | ||||

Tin | CID002593 | PT Rajehan Ariq | YES | NO | ||||

Tin | CID002703 | An Vinh Joint Stock Mineral Processing Company | NO | NO | ||||

Tin | CID002706 | Resind Industria e Comercio Ltda. | YES | NO | ||||

Tin | CID002756 | Super Ligas | NO | NO | ||||

Tin | CID002773 | Metallo Belgium N.V. | YES | NO | ||||

Tin | CID002774 | Metallo Spain S.L.U. | YES | NO | ||||

Tin | CID002776 | PT Bangka Prima Tin | YES | NO | ||||

Tin | CID002816 | PT Sukses Inti Makmur | YES | NO | ||||

Tin | CID002829 | PT Kijang Jaya Mandiri | YES | NO | ||||

Tin | CID002834 | Thai Nguyen Mining and Metallurgy Co., Ltd. | YES | NO | ||||

Tin | CID002835 | PT Menara Cipta Mulia | YES | NO | ||||

Tin | CID002844 | HuiChang Hill Tin Industry Co., Ltd. | YES | NO | ||||

Tin | CID002848 | Gejiu Fengming Metallurgy Chemical Plant | YES | NO | ||||

Tin | CID002849 | Guanyang Guida Nonferrous Metal Smelting Plant | YES | NO | ||||

Tin | CID002858 | Modeltech Sdn Bhd | NO | NO |

23

Tin | CID003116 | Guangdong HanheNon-Ferrous Metal Co., Ltd. | YES | NO | ||||

Tin | CID003190 | Chifeng Dajingzi Tin Industry Co., Ltd. | YES | NO | ||||

Tin | CID003205 | PT Bangka Serumpun | YES | NO | ||||

Tin | CID003208 | Pongpipat Company Limited | NO | NO | ||||

Tin | CID003325 | Tin Technology & Refining | YES | NO | ||||

Tin | CID003356 | Dongguan CiEXPO Environmental Engineering Co., Ltd. | NO | NO | ||||

Tin | CID003379 | Ma’anshan Weitai Tin Co., Ltd. | YES | NO | ||||

Tin | CID003381 | PT Rajawali Rimba Perkasa | YES | NO | ||||

Tin | CID003397 | Yunnan YunfanNon-ferrous Metals Co., Ltd. | YES | NO | ||||

Tin | CID003409 | Precious Minerals and Smelting Limited | NO | YES | ||||

Tin | CID003410 | Gejiu City Fuxiang Industry and Trade Co., Ltd. | NO | NO | ||||

Tin | CID003387 | Luna Smelter, Ltd. | YES | NO | ||||

Tungsten | CID000004 | A.L.M.T. Corp. | YES | NO | ||||

Tungsten | CID000105 | Kennametal Huntsville | YES | NO | ||||

Tungsten | CID000218 | Guangdong Xianglu Tungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID000258 | Chongyi Zhangyuan Tungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID000281 | CNMC (Guangxi) PGMA Co., Ltd. | NO | NO | ||||

Tungsten | CID000499 | Fujian Jinxin Tungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID000568 | Global Tungsten & Powders Corp. | YES | NO | ||||

Tungsten | CID000766 | Hunan Chenzhou Mining Co., Ltd. | YES | NO | ||||

Tungsten | CID000769 | Hunan Chunchang Nonferrous Metals Co., Ltd. | YES | NO | ||||

Tungsten | CID000825 | Japan New Metals Co., Ltd. | YES | NO | ||||

Tungsten | CID000875 | Ganzhou Huaxing Tungsten Products Co., Ltd. | YES | NO | ||||

Tungsten | CID000966 | Kennametal Fallon | YES | NO |

24

Tungsten | CID001889 | Tejing (Vietnam) Tungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID002044 | Wolfram Bergbau und Hutten AG | YES | NO | ||||

Tungsten | CID002082 | Xiamen Tungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID002095 | Xinhai Rendan Shaoguan Tungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID002313 | Jiangxi Minmetals Gao’anNon-ferrous Metals Co., Ltd. | NO | NO | ||||

Tungsten | CID002315 | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID002316 | Jiangxi Yaosheng Tungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID002317 | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | YES | NO | ||||

Tungsten | CID002318 | Jiangxi TongguNon-ferrous Metallurgical & Chemical Co., Ltd. | YES | NO | ||||

Tungsten | CID002319 | Malipo Haiyu Tungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID002320 | Xiamen Tungsten (H.C.) Co., Ltd. | YES | NO | ||||

Tungsten | CID002321 | Jiangxi Gan Bei Tungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID002494 | Ganzhou Seadragon W & Mo Co., Ltd. | YES | NO | ||||

Tungsten | CID002513 | Chenzhou Diamond Tungsten Products Co., Ltd. | YES | NO | ||||

Tungsten | CID002541 | H.C. Starck Tungsten GmbH | YES | NO | ||||

Tungsten | CID002542 | H.C. Starck Smelting GmbH & Co. KG | YES | NO | ||||

Tungsten | CID002543 | Masan Tungsten Chemical LLC (MTC) | YES | NO | ||||

Tungsten | CID002551 | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | YES | NO | ||||

Tungsten | CID002579 | Hunan Chuangda Vanadium Tungsten Co., Ltd. Wuji | YES | NO | ||||

Tungsten | CID002589 | Niagara Refining LLC | YES | NO | ||||

Tungsten | CID002641 | China Molybdenum Co., Ltd. | NO | NO | ||||

Tungsten | CID002645 | Ganzhou Haichuang Tungsten Co., Ltd. | YES | NO | ||||

Tungsten | CID002647 | Jiangxi Xianglu Tungsten Co., Ltd. | NO | YES | ||||

Tungsten | CID002649 | Hydrometallurg, JSC | YES | NO |

25

Tungsten | CID002724 | Unecha Refractory metals plant | YES | NO | ||||

Tungsten | CID002815 | South-East Nonferrous Metal Company Limited of Hengyang City | NO | NO | ||||

Tungsten | CID002827 | Philippine Chuangxin Industrial Co., Inc. | YES | NO | ||||

Tungsten | CID002830 | Xinfeng Huarui Tungsten & Molybdenum New Material Co., Ltd. | YES | NO | ||||

Tungsten | CID002833 | ACL Metais Eireli | YES | NO | ||||

Tungsten | CID002843 | Woltech Korea Co., Ltd. | YES | NO | ||||

Tungsten | CID002845 | Moliren Ltd. | YES | NO | ||||

Tungsten | CID003182 | Hunan Litian Tungsten Industry Co., Ltd. | YES | NO | ||||

Tungsten | CID003388 | KGETS Co., Ltd. | YES | NO | ||||

Tungsten | CID003401 | Fujian Ganmin RareMetal Co., Ltd. | YES | NO | ||||

Tungsten | CID003407 | Lianyou Metals Co., Ltd. | YES | NO | ||||

Tungsten | CID003408 | JSC “Kirovgrad Hard Alloys Plant” | NO | YES | ||||

Tungsten | CID002502 | Asia Tungsten Products Vietnam Ltd. | YES | NO | ||||

Tungsten | CID003427 | Albasteel Industria e Comercio de Ligas Para Fundicao Ltd. | NO | YES | ||||

Tungsten | CID003448 | CP Metals Inc. | NO | YES |

26

9. Data sources used

| • | RMI Reasonable Country of Origin Inquiry report – version March 27, 2020 |

| • | CMRTs received from priority suppliers until May 2020 |

| • | RMI smelter reference list, as included in the CMRT version 5.12 (released April 26, 2019) |

| • | Smelter database information available to the RMI members – version April 28, 2020 |

10. Abbreviations

Abbreviation | Term | |

| 3TG | Tin, tantalum, tungsten, and gold | |

| CFSI | Conflict Free Sourcing Initiative | |

| CFSP | Conflict Free Smelter Program | |

| CMRT | RMI Conflict Minerals Reporting Template | |

| EICC | Electronics Industry Citizenship Coalition | |

| EPRM | European Partnership for Responsible Minerals | |

| Form SD | Specialized Disclosure Form | |

| GBP | General Business Principles | |

| GeSI | Globale-Sustainability Initiative | |

| OECD | Organization for Economic Cooperation and Development | |

| RBA | Responsible Business Alliance | |

| RCOI | Reasonable Country of Origin Inquiry | |

| RMAP | Responsible Minerals Assurance Process | |

| RMI | Responsible Minerals Initiative | |

| SEC | Securities and Exchange Commission | |

| SSD | Supplier Sustainability Declaration |

27