- PHG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SD Filing

Koninklijke Philips (PHG) SDConflict minerals disclosure

Filed: 22 May 23, 11:01am

Exhibit 1.01

Philips Conflict Minerals Report

This Conflict Minerals Report for Koninklijke Philips N.V. (hereafter ‘’Royal Philips’’, “Philips”, or “our”) covers the reporting period from January 1, 2022 to December 31, 2022, and has been prepared pursuant to Rule 13p-1 and Form SD promulgated under the Securities Exchange Act of 1934.

This Conflict Minerals Report is filed as Exhibit 1.01 to Philips’ Specialized Disclosure Report on Form SD and is also posted on the Philips conflict minerals website1 2.

| 1 | More information can be found here: https://www.philips.com/a-w/about/environmental-social-governance/environmental/supplier-sustainability/responsible-sourcing-of-minerals.html. |

| 2 | The content of any website, including any website of Royal Philips, referred to in this Conflict Minerals Report is included for general information only and is not incorporated by reference in the Conflict Minerals Report or Form SD. |

1

Contents

1. | Introduction | 3 | ||||

2. | Philips conflict minerals program | 3 | ||||

Philips | 3 | |||||

Supply chain characteristics for 3TG | 4 | |||||

Philips conflict minerals due diligence program | 4 | |||||

OECD Step 1: Company Management system | 5 | |||||

OECD Step 2: Risk identification and assessment | 6 | |||||

OECD Step 3: Strategy to respond to identified risks | 8 | |||||

OECD Step 4: Audits of smelter due diligence practices | 8 | |||||

OECD Step 5: Report annually on supply chain due diligence. | 8 | |||||

3. | Reasonable country of origin inquiry results | 8 | ||||

4. | Conflict minerals due diligence framework & measures | 11 | ||||

Framework | 11 | |||||

Measures | 11 | |||||

5. | Conflict minerals due diligence outcomes | 13 | ||||

6. | Determination | 13 | ||||

7. | Steps to improve future Philips conflict minerals due diligence program | 14 | ||||

8. | List of smelter facilities | 16 | ||||

9. | Data sources used | 24 | ||||

10. | Abbreviations | 24 | ||||

2

1. Introduction

Rule 13p-1 under the Securities Exchange Act of 1934, as amended, requires a company to make disclosures, for each calendar year, if conflict minerals are necessary to the functionality or production of a product manufactured by the registrant or contracted by the registrant to be manufactured. The specified minerals are gold, columbite-tantalite (coltan), cassiterite and wolframite, including their derivatives, which are limited to tantalum, tin, and tungsten (henceforth referred to as “3TG”).

Philips has concluded that for the period from January 1, 2022 to December 31, 2022:

| • | Philips has manufactured and contracted to manufacture products as to which 3TGs are necessary to the functionality or production; |

| • | Based on the reasonable country of origin inquiry (RCOI), Philips knows or has reason to believe that a portion of its necessary 3TGs originated or may have originated from the Democratic Republic of the Congo (DRC) or an adjoining country and knows or has reason to believe that they may not be solely from recycled or scrap sources; and |

| • | Based on Philips’ due diligence measures on the source and chain of custody of those necessary 3TGs used in its products, Philips is unable to determine for all 3TGs used in its products whether they originated from the DRC or an adjoining country. |

2. Philips conflict minerals program

Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people’s health and well-being through meaningful innovation. Philips’ patient- and people-centric innovation leverages advanced technology and deep clinical and consumer insights to deliver personal health solutions for consumers and professional health solutions for healthcare providers and their patients in the hospital and the home. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, ultrasound, image-guided therapy, monitoring and enterprise informatics, as well as in personal health. Philips generated 2022 sales of EUR 17.8 billion and employs approximately 77,000 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

In 2022, Royal Philips was organized around the following reportable segments:

| • | Diagnosis & Treatment businesses: Diagnostic Imaging, Ultrasound, Enterprise Diagnostic Informatics, and Image Guided Therapy |

| • | Connected Care businesses: Hospital Patient Monitoring, Emergency Care, Sleep & Respiratory Care, and Connected Care Informatics |

| • | Personal Health businesses: Oral Healthcare, Mother & Child Care, and Personal Care |

| • | Other: Innovation, IP Royalties, Central Costs, Other |

3

Supply chain characteristics for 3TG

The supply chain for 3TGs consists of many tiers. Before reaching Philips’ direct suppliers, in general, 3TGs will go from mines to traders, exporters, smelters or refiners (collectively referred to in this report as smelters), alloy producers and component manufacturers, and sometimes intermediate suppliers. One or more of the 3TG metals are contained in the vast majority of Philips products, typically in small quantities. Philips sources products and components from approximately 5,300 first-tier suppliers globally. First-tier suppliers are those suppliers that Philips selected and with whom Philips has a direct business relationship. These first-tier suppliers may select their suppliers (second-tier suppliers), which in turn may have their own group of suppliers (third-tier), and so on. There may be seven or more tiers in the supply chain between a 3TG mine and Philips. Philips works with its first-tier suppliers to investigate the deeper levels of the supply chain, to determine the origin of 3TGs contained in Philips products.

Philips conflict minerals due diligence program

Due to Philips’ position in the supply chain and its limited insight in and leverage over the lower levels of the supply chain, Philips engages and actively cooperates with other industry members. As encouraged in the third edition of the Organization for Economic Co-operation and Development Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (including its supplements on 3TG, referred to in this report as “OECD Guidance”), the internationally recognized standard on which Philips’ system is based, Philips supports an industry initiative, the Responsible Minerals Initiative (RMI), that uses an independent third-party audit to identify smelters that have systems in place to assure sourcing of only conflict-free materials. The RMI, was founded by members of the Responsible Business Alliance (RBA), and the Global e-Sustainability Initiative (GeSI).

The data on which certain statements in this report are based were obtained through Philips’ membership in the RMI, using the RMI Reasonable Country of Origin Inquiry report3. In addition, Philips uses the tools and supports the initiatives developed by the RMI especially the Conflict Minerals Reporting Template (CMRT) and Responsible Minerals Assurance Process (RMAP).

| 3 | This list provides country of origin information for smelting and refining facilities that are validated through the Responsible Minerals Assurance Process. This data is based on the results of independent third-party audits and is available to RMI member companies only. The audit standard is developed according to global standards including the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas and the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act. |

4

Philips designed its conflict minerals supply chain due diligence program with reference to the OECD Guidance and the five steps described in the supplements on 3TG.

OECD Step 1: Company Management system

Philips adopted a position paper on responsible sourcing in relation to conflict minerals. The position paper is posted on Philips’ website. In addition, Philips has communicated its position on conflict minerals to all priority suppliers (see below section “OECD Step 2” for the definition of priority suppliers). Philips has committed not to purchase raw materials, subassemblies, or supplies, which Philips knows contain conflict minerals that directly or indirectly finance or benefit armed groups in the Democratic Republic of the Congo (DRC), an adjoining country or any conflict-affected or high-risk areas (CAHRAs). Philips’ program goals, as described in the position paper, encourage the development of initiatives to:

| • | Stop the trade in conflict minerals from mines that directly or indirectly finance or benefit armed groups anywhere in the world. |

| • | Enable responsible sourcing of minerals from conflict-affected and high-risk areas, the DRC, and, adjoining countries, thereby supporting the development of the local economy and communities. |

Philips created and maintains an internal conflict minerals team to manage the implementation and progress of Philips’ due diligence efforts. The internal team consists of representatives from Procurement, Sustainability, Finance, Export Control, Legal and the Secretariat of the General Business Principles (GBP) Review Committee.

Philips established a system of control and transparency over its 3TG supply chains by creating a process to engage a group of first-tier priority suppliers and request them to submit information to Philips using the CMRT4. The information submitted by priority suppliers includes information gathered by those suppliers about the smelters identified in their own supply chains. The information has been used by Philips to assess the due diligence efforts implemented by priority suppliers, and to identify smelters in the supply chain.

Philips made responsible sourcing of minerals a supplier contract requirement. The Philips Supplier Sustainability Declaration5 (SSD) includes a provision about Responsible Sourcing of Minerals. The SSD is part of the general conditions of purchase, and of the purchasing agreements signed with suppliers. It requires suppliers to have a policy in place to reasonably assure that their 3TG does not directly or indirectly finance or benefit armed groups that are perpetrators of serious human rights abuses in the DRC, an adjoining country or CAHRAs, and to exercise due diligence on the source and chain of custody.

| 4 | The CMRT is a survey tool developed by the RMI to standardize collection of due diligence information in the supply chain. |

| 5 | More information on the Supplier Sustainability Declaration can be found here: |

https://www.philips.com/c-dam/corporate/about-philips/company/suppliers/supplier-sustainability/policies/philips-supplier-sustainability-declaration.pdf

5

For first-tier suppliers, Philips has a supplier sustainability performance program6 in place in which, amongst others, the implementation of the SSD is assessed. Responsible Sourcing of Minerals is one of the topics reviewed in this program. In case non-conformances are identified during the assessment, suppliers are requested to make a corrective action plan and Philips monitors the implementation of this plan until the non-conformance is corrected.

Multiple communication channels exist to serve as grievance mechanisms for early-warning risk awareness. Philips has the Philips Speak Up policy and underlying Speak Up mechanism that enables its stakeholders (including employees, former employees and third parties) to inform Philips of any concerns they may have. Internally, its personnel can (anonymously) report possible violations of Philips General Business Principles (GBP)7 and other policies including those related to 3TG supply chains via the GBP Compliance Officer or Philips Speak Up using the hotline or a web intake form. Third parties can also use Philips Speak Up to file a complaint.8 In addition, stakeholders can use the email address Conflict_Free_Minerals@Philips.com or existing industry grievance mechanisms like RMI and ITRI’s Tin Supply Chain Initiative (iTSCi) to file complaints related to 3TG.

OECD Step 2: Risk identification and assessment

Given the substantial number and diversity of Philips’ suppliers, Philips focuses its efforts on a group of first-tier priority suppliers (referred to as “priority suppliers”) and collaborates with them to identify the smelters in their supply chain. Priority suppliers are selected based on two primary elements:

| • | Purchasing spend |

The suppliers in the top 80% of Philips’ spend of relevant commodities are selected as priority suppliers. Philips uses a system to classify suppliers in commodity groups, for example, plastics, packaging, and metals. Philips excluded suppliers in commodity groups for which it is unlikely that one or more of the 3TGs are contained in the products, for example, software suppliers and packaging suppliers.

| • | Usage of 3TG |

| 6 | More information about the Philips supplier sustainability performance program can be found here: https://www.philips.com/a-w/about/company/suppliers/supplier-sustainability/our-programs/supplier-sustainability-assessment.html |

| 7 | More information about the Philips General Business Principles can be found here: https://www.philips.com/a-w/about/investor/governance/business-principles.html |

| 8 | More information can be found here: https://secure.ethicspoint.eu/domain/media/en/gui/100518/index.html |

6

The suppliers which provide a high quantity of 3TG materials are selected as priority suppliers. Even if these suppliers are not part of the top 80% relevant purchasing spend, Philips includes the suppliers as they are supplying a relatively high quantity of 3TG materials.

All identified priority suppliers receive a letter formally requesting them to:

| • | Adopt a policy to reasonably assure that the 3TG in their products does not directly or indirectly finance or benefit armed groups in the DRC, an adjoining country, or any conflict-affected or high-risk areas (CAHRAs). |

| • | Identify all 3TG smelters in their supply chain. If they do not source directly from smelters, they are asked to pass on this request to their suppliers (who may have to pass it on to their suppliers, until the smelters are identified). |

| • | Cascade Philips’ request to only source from RMAP (or equivalent) compliant smelters to their suppliers and ask them to do the same with their next tier partners. |

| • | Report back to Philips by filling in the CMRT. |

A Philips conflict minerals team is available to increase awareness amongst priority suppliers and to help them meet Philips’ expectations/requirements. Different background and training materials are made available to suppliers.

Philips reviews each received supplier CMRT and assesses whether it meets Philips’ acceptance criteria regarding completeness, adoption of a conflict-free policy, data collection from next tier suppliers, and smelter identification and disclosure. Suppliers who provided a CMRT that did not meet the acceptance criteria, and suppliers who provided incomplete or potentially inaccurate information, were requested to take corrective actions, perform additional due diligence and update their CMRT accordingly.

Philips reviews the supplier CMRTs to determine if there are any findings that indicate a need to conduct further due diligence and gather more detailed information.

Philips evaluates the smelters identified in the supplier CMRTs based on various sources of available information. Philips mainly uses the Responsible Minerals Assurance Process (RMAP) compliant and active9 smelter list to evaluate the identified smelters. RMAP recognizes and includes smelters from other lists such as the London Bullion Metal Association (LBMA) and Responsible Jewelry Council (RJC). Philips may also use other sources of information to assess potential risk. In addition, Philips uses numerous factors to determine the level of risk that each smelter poses to the supply chain by identifying red flags. These factors include geographic proximity to the DRC, Covered Countries, or an embargoed country/region; Known mineral source country of origin; RMAP audit status; Credible evidence of unethical or conflict sourcing; and Peer Assessments conducted by credible third-party sources, including international organizations.

| 9 | RMI active smelter and refiners are at various stages of the audit cycle (undergoing or committed to undergo the audit). The full definition of RMI “active” smelters can be found here: http://www.responsiblemineralsinitiative.org/active-smelters-refiners/ |

7

OECD Step 3: Strategy to respond to identified risks

Progress and findings of the supply chain risk assessment are regularly reported to senior management. The risk management plan adopted by Philips is in accordance with its policy to ultimately discontinue doing business with any supplier found to be purchasing 3TG material which directly or indirectly finances or benefits armed groups in the DRC, adjoining countries, or CAHRAs, after attempts at corrective actions are not successful.

To monitor and track performance of risk management efforts, Philips uses data reported by suppliers in the CMRTs and updates of the RMAP compliant smelter list. The status is discussed internally in monthly reviews with the conflict minerals team and reported to senior management.

Philips requests priority suppliers to update and resend their CMRT when additional information becomes available to such suppliers. When updates are received, the CMRT review step as described above is repeated to assess and mitigate risks.

OECD Step 4: Audits of smelter due diligence practices

The fourth step in the OECD guidance is to conduct independent third-party audits of supply chain due diligence at identified points in the supply chain. Philips is a member of RMI and uses information provided by the RMI for this step. Through its membership, Philips has access to the RMI RCOI report data which is used to identify the minerals country of origin and conflict-free status of smelters.

Philips contributes to the RMI as a member company and encourages smelters to participate in the RMAP through direct communication and smelter outreach communication.

OECD Step 5: Report annually on supply chain due diligence.

Since 2014, Philips reports annually on supply chain due diligence by filing a Form SD and Conflict Minerals Report with the SEC. Philips has been including certain disclosures about the use of conflict minerals since 2009, even before the SEC’s rules first became effective. A dedicated conflict minerals website with information for consumers, customers and suppliers is available. In 2012, Philips was the first company to publish its smelter list and continues to regularly update this list as more information becomes available.

3. Reasonable country of origin inquiry results

As described above, SEC rules provide that if, after conducting in good faith, a reasonable country of origin inquiry, an SEC registrant determines, or has reason to believe, that any of the 3TGs used in connection with the products for which it is responsible may have originated in the DRC or an adjoining country, or did not come from recycled or scrap sources, the registrant should conduct due diligence on the source and chain of custody of its conflict minerals, following a nationally or internationally recognized framework.

8

Philips identified 176 priority suppliers and used the data provided by these suppliers in their CMRTs to identify the smelters in the Philips supply chain. These smelters may have been used to process 3TG metals contained in Philips’s products.

Philips achieved a 95% response rate in its supply chain investigation and 65% of the submitted CMRTs met or exceeded Philips’ 2022 minimum acceptance criteria. Striving for continuous improvement, Philips strengthened the acceptance criteria for CMRTs in 2022 as it intensified the required due diligence performed by suppliers towards the use of smelters of high concern. As a result of increasing the number of smelters of high concern, the approval rate of submitted CMRTs meeting the strengthened acceptance criteria reduced to 65%. Striving for continuous improvement, Philips is aiming to increase the acceptance percentage of CMRTs to 85% using these stricter due diligence requirements.

The names of 336 different smelters were reported by priority suppliers in their CMRT smelter lists. However, some of the entities named by the priority suppliers may not be smelters. Philips used the “Smelter Look-up” in the CMRT version 6.22 and RMI smelter database information as a reference to compile the Philips Smelter List.

Based on the CMRT “Smelter Look-up”, Philips identified a total of 310 listed smelters in the supply chain out of the 336 names reported to Philips. According to the RMI smelter database information, among the 336 names of smelters reported to Philips, 13 have ceased or suspended operations, 10 have been confirmed to no longer be actively purchased from and 3 have confirmed not to be smelters.

As a result of focusing on improving the smelter data quality received from the priority suppliers, Philips was able to reduce the number of non-recognized smelters from 85 reported in 2015, to 9 reported in 2016, to 5 reported in 2017, to 3 reported in 2018, and finally to 0 since 2019.

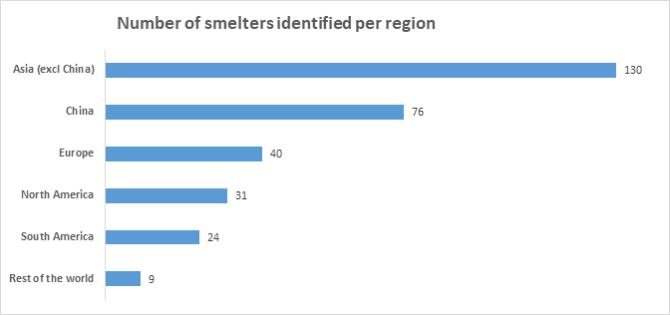

The majority of the identified smelters are located in Asia, with 76 smelters in China, followed by Indonesia (32) and Japan (30).

9

Results of the RCOI (Reasonable Country of Origin Inquiry)

| Gold | Tantalum | Tin | Tungsten | Total | ||||||||||||||||

Smelters known to source from the DRC | 0 | 19 | 6 | 5 | 30 | |||||||||||||||

Smelters known to source from the DRC adjoining countries | 1 | 1 | 1 | 5 | 8 | |||||||||||||||

Smelters known to source from CAHRAs | 6 | 22 | 7 | 11 | 46 | |||||||||||||||

Smelters known to process only recycled or scrap materials | 9 | 2 | 6 | 1 | 18 | |||||||||||||||

Smelters known to source from outside the DRC or adjoining countries | 93 | 12 | 49 | 24 | 178 | |||||||||||||||

Smelters that disclosed mineral country of origin to auditors only | 0 | 0 | 0 | 0 | 0 | |||||||||||||||

Smelters with unknown mineral origin | 65 | 0 | 21 | 4 | 90 | |||||||||||||||

For the 310 identified smelters, Philips used the RMI Reasonable Country of Origin Inquiry (RCOI) report. This country-of-origin data is available for smelters that successfully completed an RMAP audit and chose to disclose their sourcing countries to the RMI. The table above shows the results of the RCOI. The total number shown in the table is not equal to the total number of identified smelters, because a smelter may fall into more than one category (e.g., a smelter can source from both the DRC as well as from countries outside the DRC). As the RMI generally does not specify individual countries of origin of 3TGs processed by audited smelters and some of the smelters do not disclose origin information, we were not able to determine with certainty the specific countries of origin of 3TGs processed by the identified smelters.

10

In the CMRTs received, 46 suppliers indicated that their products contain 3TG metals that originated or potentially originated from the DRC, adjoining countries or CAHRAs. We then performed due diligence on the source and chain of custody of the conflict minerals in question.

4. Conflict minerals due diligence framework & measures

Framework

The Philips conflict minerals due diligence framework for the reporting period of calendar year 2022 has been designed to conform in all material respects to the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, Third Edition (2016), as applicable for downstream companies.

Measures

Below is a description of the measures Philips performed in due diligence on the source and chain of custody of the necessary conflict minerals contained in Philips’ products.

| • | Philips updated its position paper10 on responsible sourcing in relation to conflict minerals. |

| • | During the investigation phase, once a month the Philips conflict minerals team met to review progress and results of supplier data collection, supplier due diligence and smelter identification. Internal performance reports were created for these meetings. Using data from Supplier Sustainability Scorecards, these reports included an overview of the monthly progress of priority suppliers, as well as, progress highlights, areas of concern, outlook for coming weeks, and identified risks. |

| • | In total, 12 Supplier Sustainability Scorecards were shared with senior management. Regarding Conflict Minerals, the main topics addressed in the scorecards included: |

| • | The progress of CMRT collection from priority suppliers |

| • | The status of supplier CMRTs with regards to meeting Philips’ CMRT acceptance criteria |

| • | Philips contacted priority suppliers via an invitation letter. Using this letter, Philips requested suppliers to perform supply chain due diligence and fill out a CMRT. In addition, the letter referred to Philips’ expectations and requirements regarding the CMRT. A copy of this letter is posted on the Philips conflict minerals website. |

| • | In the letter, Philips requests priority suppliers to steer their supply chain towards RMAP (or equivalent) validated smelters only. |

| • | Philips requested priority suppliers to identify smelters in their supply chain and to report the identified smelters to Philips using the CMRT. In case a lack of progress was observed, Philips followed up with suppliers by sending out multiple reminders via email, as well as, by reaching out via phone. |

| • | Philips facilitated the learning and development of suppliers. The Philips Conflict Minerals team regularly contacted suppliers via email and phone to monitor the suppliers’ progress, provide additional training, and check whether the conflict minerals requirements of Philips were interpreted correctly. |

| 10 | For more information, please refer to the position paper, which is posted on the Philips conflict minerals website: https://www.philips.com/a-w/about/environmental-social-governance/environmental/supplier-sustainability/responsible-sourcing-of-minerals.html. |

11

| • | Philips reviewed all received supplier CMRTs to evaluate whether they met Philips’ acceptance criteria regarding completeness, adoption of a conflict-free policy, data collection from next tier suppliers, and smelter identification and disclosure. Suppliers that provided a CMRT that did not meet the acceptance criteria, and suppliers that provided incomplete or potentially inaccurate information, were requested to take corrective actions, and update their CMRT accordingly. |

| • | Philips reviewed all received supplier CMRTs to determine if there were any areas of concern giving rise to the need to conduct further due diligence and thus gather more information. During the year, Philips has followed up on areas of concern in several cases. |

| • | Philips reviewed all received supplier CMRTs against the list of smelters that were audited through the RMI’s Responsible Minerals Assurance Process (RMAP) or other independent third-party audit programs. |

| • | As a member of the RMI, Philips utilized the due diligence conducted on smelters by the RMI’s RMAP. This program uses independent third-party auditors to audit the source and chain of custody of the conflict minerals used by smelters that agree to participate in the RMAP. |

| • | Philips devised and adopted a risk management plan according to the level of risk in 3TG supply chains. Philips determined the level of risk, considering available information on mineral origin, RMAP compliance status, and possible connection to conflict as reported from credible sources. To mitigate risk, Philips might require high-risk suppliers to take corrective actions, or request smelters with unknown mineral origin to participate in the RMAP. |

| • | Philips published the “Philips Conflict Minerals Reporting Template” on the Philips conflict minerals website, including a list of smelters identified by the selected priority suppliers during 2022. |

| • | Since 2013, Philips has annually filed the Conflict Minerals Report (and the Exhibits thereto) with the SEC. The Conflict Minerals Report for 2022 is filed on May 22, 2023 as Exhibit 1.01 to Form SD. The report is available on Philips’ conflict minerals website. |

| • | Philips archives relevant evidence related to its Conflict Minerals Program for at least five years. Records are stored in a manner allowing timely and easy access while protecting the records from unauthorized alteration. |

| • | Philips has established an internal reporting mechanism allowing its employees to (anonymously) raise concerns regarding Philips’ GBP and its underlying policies, including those relating to conflict minerals. In addition, a central conflict minerals email address can be used by external stakeholders to file complaints. Additionally, Philips encourages anyone who suspects a breach of Philips GBP in any of Philips’ business activities to report their concerns, in strictest confidence (and anonymous if requested), via the externally hosted Philips Speak Up (Ethics Line). Moreover, as a member of the RMI, Philips encourages submissions of grievance via the RMI Grievance Mechanism. The RMI also serves as a source for an early-warning risk-awareness. |

12

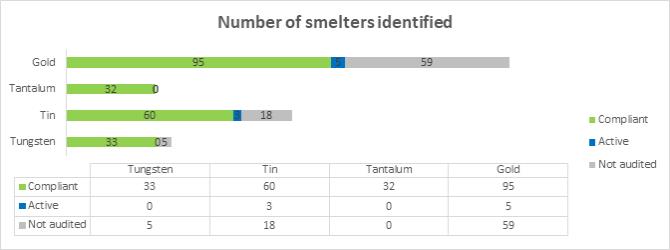

5. Conflict minerals due diligence outcomes

To the best of Philips’ knowledge, none of the smelters identified in Philips’ supply chain are known to source 3TG that directly or indirectly benefit armed groups in the DRC. 228 (74%) of the 310 smelters identified by Philips participated in the RMAP or equivalent audit program. 220 (71%) of the identified smelters successfully passed the RMAP or equivalent audit, thereby confirming their conflict-free status under those standards. 8 (3%) of the identified smelters are in various stages of the audit (so-called “RMI active smelters”). The remaining 82 (26%) identified smelters have not started a valid independent third-party audit to confirm their conflict-free status. Accordingly, the conflict-free status of these 82 unaudited smelters as well as the 8 active smelters that are in various stages of the audit process is reported in this conflict minerals report as undeterminable.

Philips did not discontinue business with any direct suppliers in the reporting period because Philips did not identify any reason to believe that any of the suppliers were purchasing 3TG that directly or indirectly finances or benefits armed groups in the DRC or adjoining countries nor has any supplier refused to continue investigating and potentially eliminate a red flag smelter from the supply chain, if confirmed. Philips nevertheless continues to review and potentially remove smelters from its supply chain when Philips has concerns regarding their due diligence process and/or sourcing practices. This includes analysis of current events and related to applicable sanctions and embargoes. Given the fact that neither Philips nor its suppliers have a direct business relationship with the entities with respect to which Philips is further investigating concerns, the process takes time.

6. Determination

Philips has not been able to confirm the identification of a conflict-free status under the RMAP standards for all smelters used in its supply chain. However, none of the smelters identified in Philips’ supply chain is known to Philips as sourcing 3TG that directly or indirectly finances or benefits armed groups in the DRC or adjoining countries.

13

As a result of the due diligence measures performed, Philips provides below the known smelter facilities that may have been used to process 3TG metals contained in Philips’s products, and their conflict-free status. The conflict-free status is based on information the RMI provides to its members. Philips includes the category “RMI Active” as it shows smelters that committed to or are currently in the process of undertaking an audit. The list of smelter facilities provided in Section 8 of this Conflict Minerals Report includes all 310 entities that were confirmed to be eligible smelters.

This Conflict Minerals Report is intended to cover Philips’ entire product portfolio that uses 3TG. Given Philips’ large product portfolio and extensive supplier base, Philips does not have component level information from all 5,300 first-tier suppliers. This means our list of processing smelters and refiners disclosed in Section 8 may contain more facilities than those that actually processed the conflict minerals contained in our products. As a result, the approach is to conduct supply chain due diligence and report at the company level for the entire product portfolio, rather than for specific Philips products. This enables Philips to focus its efforts on building, maintaining, and improving a robust due diligence program.

7. Steps to improve future Philips conflict minerals due diligence program

For reporting year 2023, Philips plans to:

| • | Continue to leverage its position as a strategic partner in the European Partnership for Responsible Minerals (EPRM), a public-private cooperation that supports and complements the EU conflict minerals legislation. As a strategic partner, Philips will engage in responsible sourcing projects (with a scope broadened to other conflict and high-risk areas world-wide as well as a wider array of human rights and environmental issues addressed) in order to increase the supply and demand for responsibly sourced minerals. Furthermore, Philips will act as a liaison between EPRM and other responsible sourcing initiatives in which Philips participates (e.g., the Dutch Covenant on Gold). |

14

| • | Continue engagement with existing industry programs and groups, such as responsible sourcing and upstream impact programs and workgroups initiated under the Responsible Minerals Initiative (RMI), to encourage further adoption, improvement, and reliability in relevant programs, tools and standards. |

| • | Continue to reach out to smelters to encourage their participation in relevant responsible sourcing initiatives. |

| • | Strengthen our work with priority suppliers to: |

| • | help them understand and satisfy Philips’ responsible sourcing expectations. |

| • | help them implement or further improve their due diligence process aligned with international best practices |

| • | investigate their supply chain and identify smelters |

| • | confirm the conflict-free status of identified smelters |

| • | Continue to communicate to priority suppliers Philips’ expectation that they steer their supply chain towards smelters audited as conformant to the Responsible Minerals Assurance Process (RMAP) or other equivalent programs. Philips will request suppliers to annually show progress in reducing the number of non-conformant smelters reported in the supply chain. |

| • | Continue exploring its supply chain for cobalt and perform due diligence to include cobalt, which is not included in the definition of “conflict minerals” but has been linked to human rights risks in the DRC. In 2022, we reached a 100% response rate from cobalt suppliers. |

15

8. List of smelter facilities

The table below represents a consolidated list of smelters (310 in total) identified by Philips’ priority suppliers. The results are based on:

| • | Information provided by the selected priority suppliers in their CMRTs |

| • | RMI smelter reference list, as included in the CMRT version 6.22 (released May 11, 2022) |

| • | Smelter database information available to the RMI members – version May 2, 2023 |

Metal | Smelter ID | Standard Smelter Name | RMAP | RMI | ||||

| Gold | CID000015 | Advanced Chemical Company | Yes | No | ||||

| Gold | CID000019 | Aida Chemical Industries Co., Ltd. | Yes | No | ||||

| Gold | CID000035 | Agosi AG | Yes | No | ||||

| Gold | CID000041 | Almalyk Mining and Metallurgical Complex (AMMC) | Yes | No | ||||

| Gold | CID000058 | AngloGold Ashanti Corrego do Sitio Mineracao | Yes | No | ||||

| Gold | CID000077 | Argor-Heraeus S.A. | Yes | No | ||||

| Gold | CID000082 | Asahi Pretec Corp. | Yes | No | ||||

| Gold | CID000090 | Asaka Riken Co., Ltd. | Yes | No | ||||

| Gold | CID000103 | Atasay Kuyumculuk Sanayi Ve Ticaret A.S. | No | No | ||||

| Gold | CID000113 | Aurubis AG | Yes | No | ||||

| Gold | CID000128 | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | Yes | No | ||||

| Gold | CID000157 | Boliden AB | Yes | No | ||||

| Gold | CID000176 | C. Hafner GmbH + Co. KG | Yes | No | ||||

| Gold | CID000180 | Caridad | No | No | ||||

| Gold | CID000185 | CCR Refinery - Glencore Canada Corporation | Yes | No | ||||

| Gold | CID000189 | Cendres + Metaux S.A. | No | No | ||||

| Gold | CID000197 | Yunnan Copper Industry Co., Ltd. | No | No | ||||

| Gold | CID000233 | Chimet S.p.A. | Yes | No | ||||

| Gold | CID000264 | Chugai Mining | Yes | No | ||||

| Gold | CID000343 | Daye Non-Ferrous Metals Mining Ltd. | No | No | ||||

| Gold | CID000359 | DSC (Do Sung Corporation) | Yes | No | ||||

| Gold | CID000401 | Dowa | Yes | No | ||||

| Gold | CID000425 | Eco-System Recycling Co., Ltd. East Plant | Yes | No | ||||

| Gold | CID000522 | Refinery of Seemine Gold Co., Ltd. | No | No | ||||

| Gold | CID000651 | Guoda Safina High-Tech Environmental Refinery Co., Ltd. | No | No | ||||

| Gold | CID000671 | Hangzhou Fuchunjiang Smelting Co., Ltd. | No | No | ||||

| Gold | CID000689 | LT Metal Ltd. | Yes | No | ||||

| Gold | CID000694 | Heimerle + Meule GmbH | Yes | No |

16

| Gold | CID000707 | Heraeus Metals Hong Kong Ltd. | Yes | No | ||||

| Gold | CID000711 | Heraeus Germany GmbH Co. KG | Yes | No | ||||

| Gold | CID000767 | Hunan Chenzhou Mining Co., Ltd. | No | No | ||||

| Gold | CID000773 | Hunan Guiyang yinxing Nonferrous Smelting Co., Ltd. | No | No | ||||

| Gold | CID000778 | HwaSeong CJ CO., LTD. | No | No | ||||

| Gold | CID000801 | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | Yes | No | ||||

| Gold | CID000807 | Ishifuku Metal Industry Co., Ltd. | Yes | No | ||||

| Gold | CID000814 | Istanbul Gold Refinery | Yes | No | ||||

| Gold | CID000823 | Japan Mint | Yes | No | ||||

| Gold | CID000855 | Jiangxi Copper Co., Ltd. | Yes | No | ||||

| Gold | CID000920 | Asahi Refining USA Inc. | Yes | No | ||||

| Gold | CID000924 | Asahi Refining Canada Ltd. | Yes | No | ||||

| Gold | CID000937 | JX Nippon Mining & Metals Co., Ltd. | Yes | No | ||||

| Gold | CID000956 | Kazakhmys Smelting LLC | No | No | ||||

| Gold | CID000957 | Kazzinc | Yes | No | ||||

| Gold | CID000969 | Kennecott Utah Copper LLC | Yes | No | ||||

| Gold | CID000981 | Kojima Chemicals Co., Ltd. | Yes | No | ||||

| Gold | CID001029 | Kyrgyzaltyn JSC | No | No | ||||

| Gold | CID001032 | L’azurde Company For Jewelry | No | No | ||||

| Gold | CID001056 | Lingbao Gold Co., Ltd. | No | No | ||||

| Gold | CID001058 | Lingbao Jinyuan Tonghui Refinery Co., Ltd. | No | No | ||||

| Gold | CID001078 | LS-NIKKO Copper Inc. | Yes | No | ||||

| Gold | CID001093 | Luoyang Zijin Yinhui Gold Refinery Co., Ltd. | No | No | ||||

| Gold | CID001113 | Materion | Yes | No | ||||

| Gold | CID001119 | Matsuda Sangyo Co., Ltd. | Yes | No | ||||

| Gold | CID001147 | Metalor Technologies (Suzhou) Ltd. | Yes | No | ||||

| Gold | CID001149 | Metalor Technologies (Hong Kong) Ltd. | Yes | No | ||||

| Gold | CID001152 | Metalor Technologies (Singapore) Pte., Ltd. | Yes | No | ||||

| Gold | CID001153 | Metalor Technologies S.A. | Yes | No | ||||

| Gold | CID001157 | Metalor USA Refining Corporation | Yes | No | ||||

| Gold | CID001161 | Metalurgica Met-Mex Penoles S.A. De C.V. | Yes | No | ||||

| Gold | CID001188 | Mitsubishi Materials Corporation | Yes | No | ||||

| Gold | CID001193 | Mitsui Mining and Smelting Co., Ltd. | Yes | No | ||||

| Gold | CID001220 | Nadir Metal Rafineri San. Ve Tic. A.S. | Yes | No | ||||

| Gold | CID001236 | Navoi Mining and Metallurgical Combinat | Yes | No | ||||

| Gold | CID001259 | Nihon Material Co., Ltd. | Yes | No | ||||

| Gold | CID001325 | Ohura Precious Metal Industry Co., Ltd. | Yes | No | ||||

| Gold | CID001352 | MKS PAMP SA | Yes | No | ||||

| Gold | CID001362 | Penglai Penggang Gold Industry Co., Ltd. | No | No | ||||

| Gold | CID001397 | PT Aneka Tambang (Persero) Tbk | Yes | No | ||||

| Gold | CID001498 | PX Precinox S.A. | Yes | No |

17

| Gold | CID001512 | Rand Refinery (Pty) Ltd. | Yes | No | ||||

| Gold | CID001534 | Royal Canadian Mint | Yes | No | ||||

| Gold | CID001546 | Sabin Metal Corp. | No | No | ||||

| Gold | CID001555 | Samduck Precious Metals | No | No | ||||

| Gold | CID001562 | Samwon Metals Corp. | No | No | ||||

| Gold | CID001585 | SEMPSA Joyeria Plateria S.A. | Yes | No | ||||

| Gold | CID001619 | Shandong Tiancheng Biological Gold Industrial Co., Ltd. | No | No | ||||

| Gold | CID001622 | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | Yes | No | ||||

| Gold | CID001736 | Sichuan Tianze Precious Metals Co., Ltd. | Yes | No | ||||

| Gold | CID001761 | Solar Applied Materials Technology Corp. | Yes | No | ||||

| Gold | CID001798 | Sumitomo Metal Mining Co., Ltd. | Yes | No | ||||

| Gold | CID001810 | Super Dragon Technology Co., Ltd. | No | No | ||||

| Gold | CID001875 | Tanaka Kikinzoku Kogyo K.K. | Yes | No | ||||

| Gold | CID001909 | Great Wall Precious Metals Co., Ltd. of CBPM | No | No | ||||

| Gold | CID001916 | Shandong Gold Smelting Co., Ltd. | Yes | No | ||||

| Gold | CID001938 | Tokuriki Honten Co., Ltd. | Yes | No | ||||

| Gold | CID001947 | Tongling Nonferrous Metals Group Co., Ltd. | No | No | ||||

| Gold | CID001955 | Torecom | Yes | No | ||||

| Gold | CID001980 | Umicore S.A. Business Unit Precious Metals Refining | Yes | No | ||||

| Gold | CID001993 | United Precious Metal Refining, Inc. | Yes | No | ||||

| Gold | CID002003 | Valcambi S.A. | Yes | No | ||||

| Gold | CID002030 | Western Australian Mint (T/a The Perth Mint) | Yes | No | ||||

| Gold | CID002100 | Yamakin Co., Ltd. | Yes | No | ||||

| Gold | CID002129 | Yokohama Metal Co., Ltd. | Yes | No | ||||

| Gold | CID002224 | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | Yes | No | ||||

| Gold | CID002243 | Gold Refinery of Zijin Mining Group Co., Ltd. | Yes | No | ||||

| Gold | CID002282 | Morris and Watson | No | No | ||||

| Gold | CID002290 | SAFINA A.S. | Yes | No | ||||

| Gold | CID002312 | Guangdong Jinding Gold Limited | No | No | ||||

| Gold | CID002314 | Umicore Precious Metals Thailand | No | No | ||||

| Gold | CID002459 | Geib Refining Corporation | Yes | No | ||||

| Gold | CID002509 | MMTC-PAMP India Pvt., Ltd. | Yes | No | ||||

| Gold | CID002511 | KGHM Polska Miedz Spolka Akcyjna | Yes | No | ||||

| Gold | CID002516 | Singway Technology Co., Ltd. | No | No | ||||

| Gold | CID002525 | Shandong Humon Smelting Co., Ltd. | No | No | ||||

| Gold | CID002527 | Shenzhen Zhonghenglong Real Industry Co., Ltd. | No | No | ||||

| Gold | CID002560 | Al Etihad Gold Refinery DMCC | Yes | No | ||||

| Gold | CID002561 | Emirates Gold DMCC | Yes | No | ||||

| Gold | CID002562 | International Precious Metal Refiners | No | No | ||||

| Gold | CID002580 | T.C.A S.p.A | Yes | No | ||||

| Gold | CID002582 | REMONDIS PMR B.V. | Yes | No |

18

| Gold | CID002584 | Fujairah Gold FZC | No | No | ||||

| Gold | CID002588 | Shirpur Gold Refinery Ltd. | No | No | ||||

| Gold | CID002605 | Korea Zinc Co., Ltd. | Yes | No | ||||

| Gold | CID002606 | Marsam Metals | No | No | ||||

| Gold | CID002615 | TOO Tau-Ken-Altyn | Yes | No | ||||

| Gold | CID002708 | Abington Reldan Metals, LLC | Yes | No | ||||

| Gold | CID002761 | SAAMP | Yes | No | ||||

| Gold | CID002762 | L’Orfebre S.A. | Yes | No | ||||

| Gold | CID002763 | 8853 S.p.A. | No | No | ||||

| Gold | CID002765 | Italpreziosi | Yes | No | ||||

| Gold | CID002778 | WIELAND Edelmetalle GmbH | Yes | No | ||||

| Gold | CID002779 | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH | Yes | No | ||||

| Gold | CID002850 | AU Traders and Refiners | No | No | ||||

| Gold | CID002852 | GGC Gujrat Gold Centre Pvt. Ltd. | No | Yes | ||||

| Gold | CID002853 | Sai Refinery | No | No | ||||

| Gold | CID002857 | Modeltech Sdn Bhd | No | No | ||||

| Gold | CID002863 | Bangalore Refinery | Yes | No | ||||

| Gold | CID002867 | Degussa Sonne / Mond Goldhandel GmbH | No | No | ||||

| Gold | CID002872 | Pease & Curren | No | No | ||||

| Gold | CID002893 | JALAN & Company | No | No | ||||

| Gold | CID002918 | SungEel HiMetal Co., Ltd. | Yes | No | ||||

| Gold | CID002919 | Planta Recuperadora de Metales SpA | Yes | No | ||||

| Gold | CID002920 | ABC Refinery Pty Ltd. | No | No | ||||

| Gold | CID002973 | Safimet S.p.A | No | No | ||||

| Gold | CID003153 | State Research Institute Center for Physical Sciences and Technology | No | No | ||||

| Gold | CID003186 | Gold Coast Refinery | No | No | ||||

| Gold | CID003189 | NH Recytech Company | Yes | No | ||||

| Gold | CID003324 | QG Refining, LLC | No | No | ||||

| Gold | CID003348 | Dijllah Gold Refinery FZC | No | No | ||||

| Gold | CID003382 | CGR Metalloys Pvt Ltd. | No | No | ||||

| Gold | CID003383 | Sovereign Metals | No | No | ||||

| Gold | CID003421 | C.I Metales Procesados Industriales SAS | No | Yes | ||||

| Gold | CID003424 | Eco-System Recycling Co., Ltd. North Plant | Yes | No | ||||

| Gold | CID003425 | Eco-System Recycling Co., Ltd. West Plant | Yes | No | ||||

| Gold | CID003461 | Augmont Enterprises Private Limited | No | Yes | ||||

| Gold | CID003463 | Kundan Care Products Ltd. | No | No | ||||

| Gold | CID003487 | Emerald Jewel Industry India Limited (Unit 1) | No | No | ||||

| Gold | CID003488 | Emerald Jewel Industry India Limited (Unit 2) | No | No | ||||

| Gold | CID003489 | Emerald Jewel Industry India Limited (Unit 3) | No | No | ||||

| Gold | CID003490 | Emerald Jewel Industry India Limited (Unit 4) | No | No |

19

| Gold | CID003497 | K.A. Rasmussen | No | No | ||||

| Gold | CID003500 | Alexy Metals | No | Yes | ||||

| Gold | CID003529 | Sancus ZFS (L’Orfebre, SA) | Yes | No | ||||

| Gold | CID003540 | Sellem Industries Ltd. | No | No | ||||

| Gold | CID003548 | MD Overseas | No | No | ||||

| Gold | CID003557 | Metallix Refining Inc. | No | No | ||||

| Gold | CID003575 | Metal Concentrators SA (Pty) Ltd. | Yes | No | ||||

| Gold | CID003615 | WEEEREFINING | No | Yes | ||||

| Gold | CID003641 | Gold by Gold Colombia | Yes | No | ||||

| Tantalum | CID000460 | F&X Electro-Materials Ltd. | Yes | No | ||||

| Tantalum | CID000616 | XIMEI RESOURCES (GUANGDONG) LIMITED | Yes | No | ||||

| Tantalum | CID000914 | JiuJiang JinXin Nonferrous Metals Co., Ltd. | Yes | No | ||||

| Tantalum | CID000917 | Jiujiang Tanbre Co., Ltd. | Yes | No | ||||

| Tantalum | CID001076 | AMG Brasil | Yes | No | ||||

| Tantalum | CID001163 | Metallurgical Products India Pvt., Ltd. | Yes | No | ||||

| Tantalum | CID001175 | Mineracao Taboca S.A. | Yes | No | ||||

| Tantalum | CID001192 | Mitsui Mining and Smelting Co., Ltd. | Yes | No | ||||

| Tantalum | CID001200 | NPM Silmet AS | Yes | No | ||||

| Tantalum | CID001277 | Ningxia Orient Tantalum Industry Co., Ltd. | Yes | No | ||||

| Tantalum | CID001508 | QuantumClean | Yes | No | ||||

| Tantalum | CID001522 | Yanling Jincheng Tantalum & Niobium Co., Ltd. | Yes | No | ||||

| Tantalum | CID001869 | Taki Chemical Co., Ltd. | Yes | No | ||||

| Tantalum | CID001891 | Telex Metals | Yes | No | ||||

| Tantalum | CID001969 | Ulba Metallurgical Plant JSC | Yes | No | ||||

| Tantalum | CID002492 | Hengyang King Xing Lifeng New Materials Co., Ltd. | Yes | No | ||||

| Tantalum | CID002504 | D Block Metals, LLC | Yes | No | ||||

| Tantalum | CID002505 | FIR Metals & Resource Ltd. | Yes | No | ||||

| Tantalum | CID002506 | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | Yes | No | ||||

| Tantalum | CID002508 | XinXing HaoRong Electronic Material Co., Ltd. | Yes | No | ||||

| Tantalum | CID002512 | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | Yes | No | ||||

| Tantalum | CID002539 | KEMET de Mexico | Yes | No | ||||

| Tantalum | CID002544 | TANIOBIS Co., Ltd. | Yes | No | ||||

| Tantalum | CID002545 | TANIOBIS GmbH | Yes | No | ||||

| Tantalum | CID002548 | Materion Newton Inc. | Yes | No | ||||

| Tantalum | CID002549 | TANIOBIS Japan Co., Ltd. | Yes | No | ||||

| Tantalum | CID002550 | TANIOBIS Smelting GmbH & Co. KG | Yes | No | ||||

| Tantalum | CID002557 | Global Advanced Metals Boyertown | Yes | No | ||||

| Tantalum | CID002558 | Global Advanced Metals Aizu | Yes | No | ||||

| Tantalum | CID002707 | Resind Industria e Comercio Ltda. | Yes | No | ||||

| Tantalum | CID002842 | Jiangxi Tuohong New Raw Material | Yes | No | ||||

| Tantalum | CID003583 | RFH Yancheng Jinye New Material Technology Co., Ltd. | Yes | No |

20

| Tin | CID000228 | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | Yes | No | ||||

| Tin | CID000292 | Alpha | Yes | No | ||||

| Tin | CID000309 | PT Aries Kencana Sejahtera | Yes | No | ||||

| Tin | CID000313 | PT Premium Tin Indonesia | Yes | No | ||||

| Tin | CID000402 | Dowa | Yes | No | ||||

| Tin | CID000438 | EM Vinto | Yes | No | ||||

| Tin | CID000448 | Estanho de Rondonia S.A. | Yes | No | ||||

| Tin | CID000468 | Fenix Metals | Yes | No | ||||

| Tin | CID000538 | Gejiu Non-Ferrous Metal Processing Co., Ltd. | Yes | No | ||||

| Tin | CID000555 | Gejiu Zili Mining And Metallurgy Co., Ltd. | No | No | ||||

| Tin | CID000942 | Gejiu Kai Meng Industry and Trade LLC | No | No | ||||

| Tin | CID001070 | China Tin Group Co., Ltd. | Yes | No | ||||

| Tin | CID001105 | Malaysia Smelting Corporation (MSC) | Yes | No | ||||

| Tin | CID001142 | Metallic Resources, Inc. | Yes | No | ||||

| Tin | CID001173 | Mineracao Taboca S.A. | Yes | No | ||||

| Tin | CID001182 | Minsur | Yes | No | ||||

| Tin | CID001191 | Mitsubishi Materials Corporation | Yes | No | ||||

| Tin | CID001231 | Jiangxi New Nanshan Technology Ltd. | Yes | No | ||||

| Tin | CID001314 | O.M. Manufacturing (Thailand) Co., Ltd. | Yes | No | ||||

| Tin | CID001337 | Operaciones Metalurgicas S.A. | Yes | No | ||||

| Tin | CID001399 | PT Artha Cipta Langgeng | Yes | No | ||||

| Tin | CID001402 | PT Babel Inti Perkasa | Yes | No | ||||

| Tin | CID001406 | PT Babel Surya Alam Lestari | Yes | No | ||||

| Tin | CID001421 | PT Belitung Industri Sejahtera | No | Yes | ||||

| Tin | CID001428 | PT Bukit Timah | Yes | No | ||||

| Tin | CID001453 | PT Mitra Stania Prima | Yes | No | ||||

| Tin | CID001457 | PT Panca Mega Persada | No | No | ||||

| Tin | CID001458 | PT Prima Timah Utama | Yes | No | ||||

| Tin | CID001460 | PT Refined Bangka Tin | Yes | No | ||||

| Tin | CID001463 | PT Sariwiguna Binasentosa | Yes | No | ||||

| Tin | CID001468 | PT Stanindo Inti Perkasa | Yes | No | ||||

| Tin | CID001477 | PT Timah Tbk Kundur | Yes | No | ||||

| Tin | CID001482 | PT Timah Tbk Mentok | Yes | No | ||||

| Tin | CID001486 | PT Timah Nusantara | No | Yes | ||||

| Tin | CID001490 | PT Tinindo Inter Nusa | No | No | ||||

| Tin | CID001493 | PT Tommy Utama | Yes | No | ||||

| Tin | CID001539 | Rui Da Hung | Yes | No | ||||

| Tin | CID001898 | Thaisarco | Yes | No | ||||

| Tin | CID001908 | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. | No | No | ||||

| Tin | CID002015 | VQB Mineral and Trading Group JSC | No | No | ||||

| Tin | CID002036 | White Solder Metalurgia e Mineracao Ltda. | Yes | No |

21

| Tin | CID002158 | Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | Yes | No | ||||

| Tin | CID002180 | Tin Smelting Branch of Yunnan Tin Co., Ltd. | Yes | No | ||||

| Tin | CID002455 | CV Venus Inti Perkasa | Yes | No | ||||

| Tin | CID002468 | Magnu’s Minerais Metais e Ligas Ltda. | Yes | No | ||||

| Tin | CID002478 | PT Tirus Putra Mandiri | No | No | ||||

| Tin | CID002500 | Melt Metais e Ligas S.A. | No | No | ||||

| Tin | CID002503 | PT ATD Makmur Mandiri Jaya | Yes | No | ||||

| Tin | CID002517 | O.M. Manufacturing Philippines, Inc. | Yes | No | ||||

| Tin | CID002570 | CV Ayi Jaya | Yes | No | ||||

| Tin | CID002572 | Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Company | No | No | ||||

| Tin | CID002573 | Nghe Tinh Non-Ferrous Metals Joint Stock Company | No | No | ||||

| Tin | CID002574 | Tuyen Quang Non-Ferrous Metals Joint Stock Company | No | No | ||||

| Tin | CID002593 | PT Rajehan Ariq | Yes | No | ||||

| Tin | CID002696 | PT Cipta Persada Mulia | Yes | No | ||||

| Tin | CID002703 | An Vinh Joint Stock Mineral Processing Company | No | No | ||||

| Tin | CID002706 | Resind Industria e Comercio Ltda. | Yes | No | ||||

| Tin | CID002756 | Super Ligas | No | Yes | ||||

| Tin | CID002773 | Aurubis Beerse | Yes | No | ||||

| Tin | CID002774 | Aurubis Berango | Yes | No | ||||

| Tin | CID002776 | PT Bangka Prima Tin | Yes | No | ||||

| Tin | CID002816 | PT Sukses Inti Makmur | Yes | No | ||||

| Tin | CID002835 | PT Menara Cipta Mulia | Yes | No | ||||

| Tin | CID002858 | Modeltech Sdn Bhd | No | No | ||||

| Tin | CID003116 | Guangdong Hanhe Non-Ferrous Metal Co., Ltd. | Yes | No | ||||

| Tin | CID003190 | Chifeng Dajingzi Tin Industry Co., Ltd. | Yes | No | ||||

| Tin | CID003205 | PT Bangka Serumpun | Yes | No | ||||

| Tin | CID003208 | Pongpipat Company Limited | No | No | ||||

| Tin | CID003325 | Tin Technology & Refining | Yes | No | ||||

| Tin | CID003356 | Dongguan CiEXPO Environmental Engineering Co., Ltd. | No | No | ||||

| Tin | CID003381 | PT Rajawali Rimba Perkasa | Yes | No | ||||

| Tin | CID003387 | Luna Smelter, Ltd. | Yes | No | ||||

| Tin | CID003397 | Yunnan Yunfan Non-ferrous Metals Co., Ltd. | No | No | ||||

| Tin | CID003409 | Precious Minerals and Smelting Limited | No | No | ||||

| Tin | CID003410 | Gejiu City Fuxiang Industry and Trade Co., Ltd. | No | No | ||||

| Tin | CID003449 | PT Mitra Sukses Globalindo | Yes | No | ||||

| Tin | CID003486 | CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda | Yes | No | ||||

| Tin | CID003524 | CRM Synergies | Yes | No | ||||

| Tin | CID003582 | Fabrica Auricchio Industria e Comercio Ltda. | Yes | No | ||||

| Tin | CID003831 | DS Myanmar | Yes | No | ||||

| Tin | CID003868 | PT Putera Sarana Shakti (PT PSS) | Yes | No |

22

| Tungsten | CID000004 | A.L.M.T. Corp. | Yes | No | ||||

| Tungsten | CID000105 | Kennametal Huntsville | Yes | No | ||||

| Tungsten | CID000218 | Guangdong Xianglu Tungsten Co., Ltd. | Yes | No | ||||

| Tungsten | CID000258 | Chongyi Zhangyuan Tungsten Co., Ltd. | Yes | No | ||||

| Tungsten | CID000281 | CNMC (Guangxi) PGMA Co., Ltd. | No | No | ||||

| Tungsten | CID000568 | Global Tungsten & Powders LLC | Yes | No | ||||

| Tungsten | CID000766 | Hunan Chenzhou Mining Co., Ltd. | Yes | No | ||||

| Tungsten | CID000769 | Hunan Jintai New Material Co., Ltd. | No | No | ||||

| Tungsten | CID000825 | Japan New Metals Co., Ltd. | Yes | No | ||||

| Tungsten | CID000875 | Ganzhou Huaxing Tungsten Products Co., Ltd. | Yes | No | ||||

| Tungsten | CID000966 | Kennametal Fallon | Yes | No | ||||

| Tungsten | CID002044 | Wolfram Bergbau und Hutten AG | Yes | No | ||||

| Tungsten | CID002082 | Xiamen Tungsten Co., Ltd. | Yes | No | ||||

| Tungsten | CID002313 | Jiangxi Minmetals Gao’an Non-ferrous Metals Co., Ltd. | No | No | ||||

| Tungsten | CID002315 | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | Yes | No | ||||

| Tungsten | CID002316 | Jiangxi Yaosheng Tungsten Co., Ltd. | Yes | No | ||||

| Tungsten | CID002317 | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | Yes | No | ||||

| Tungsten | CID002318 | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. | Yes | No | ||||

| Tungsten | CID002319 | Malipo Haiyu Tungsten Co., Ltd. | Yes | No | ||||

| Tungsten | CID002320 | Xiamen Tungsten (H.C.) Co., Ltd. | Yes | No | ||||

| Tungsten | CID002321 | Jiangxi Gan Bei Tungsten Co., Ltd. | Yes | No | ||||

| Tungsten | CID002494 | Ganzhou Seadragon W & Mo Co., Ltd. | Yes | No | ||||

| Tungsten | CID002502 | Asia Tungsten Products Vietnam Ltd. | Yes | No | ||||

| Tungsten | CID002513 | Hunan Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch | Yes | No | ||||

| Tungsten | CID002541 | H.C. Starck Tungsten GmbH | Yes | No | ||||

| Tungsten | CID002542 | TANIOBIS Smelting GmbH & Co. KG | Yes | No | ||||

| Tungsten | CID002543 | Masan High-Tech Materials | Yes | No | ||||

| Tungsten | CID002551 | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | Yes | No | ||||

| Tungsten | CID002589 | Niagara Refining LLC | Yes | No | ||||

| Tungsten | CID002641 | China Molybdenum Tungsten Co., Ltd. | Yes | No | ||||

| Tungsten | CID002645 | Ganzhou Haichuang Tungsten Co., Ltd. | Yes | No | ||||

| Tungsten | CID002827 | Philippine Chuangxin Industrial Co., Inc. | Yes | No | ||||

| Tungsten | CID002833 | ACL Metais Eireli | No | No | ||||

| Tungsten | CID003407 | Lianyou Metals Co., Ltd. | Yes | No | ||||

| Tungsten | CID003417 | Hubei Green Tungsten Co., Ltd. | Yes | No | ||||

| Tungsten | CID003427 | Albasteel Industria e Comercio de Ligas Para Fundicao Ltd. | No | No | ||||

| Tungsten | CID003468 | Cronimet Brasil Ltda | Yes | No | ||||

| Tungsten | CID003609 | Fujian Xinlu Tungsten Co., Ltd. | Yes | No |

23

9. Data sources used

| • | RMI Reasonable Country of Origin Inquiry report – version March 31, 2023 |

| • | CMRTs received from priority suppliers until 30 April 2023 |

| • | RMI smelter reference list, as included in the CMRT version 6.22 (released May 11, 2022) |

| • | Smelter database information available to the RMI members – version May 2, 2023 |

10. Abbreviations

Abbreviation | Term | |

| 3TG | Tin, tantalum, tungsten, and gold | |

| CAHRA | Conflict Affected or High-Risk Area | |

| CFSI | Conflict Free Sourcing Initiative | |

| CFSP | Conflict Free Smelter Program | |

| CMRT | RMI Conflict Minerals Reporting Template | |

| EICC | Electronics Industry Citizenship Coalition | |

| EPRM | European Partnership for Responsible Minerals | |

| Form SD | Specialized Disclosure Form | |

| GBP | General Business Principles | |

| GeSI | Global e-Sustainability Initiative | |

| OECD | Organization for Economic Cooperation and Development | |

| RBA | Responsible Business Alliance | |

| RCOI | Reasonable Country of Origin Inquiry | |

| RMAP | Responsible Minerals Assurance Process | |

| RMI | Responsible Minerals Initiative | |

| SEC | Securities and Exchange Commission | |

| SSD | Supplier Sustainability Declaration |

24