SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | ¨ | | Preliminary Proxy Statement |

| | ¨ | | Confidential, for Use of the Commission Only (as permitted by 14a-6(e)(2)) |

| | x | | Definitive Proxy Statement |

| | ¨ | | Definitive Additional Materials |

| | ¨ | | Soliciting Material Under § 240.14(a)-12 |

ECHELON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies:_______________________________ |

| | (2) | | Aggregate number of securities to which transaction applies:_______________________________ |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | ______________________________________________________________________________ |

| | (4) | | Proposed maximum aggregate value of transaction:_______________________________________ |

| | (5) | | Total fee paid:___________________________________________________________________ |

| | ¨ | | Fee paid previously by written preliminary materials. |

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid:___________________________________________________________ |

| | (2) | | Form, Schedule or Registration Statement No.:__________________________________________ |

| | (3) | | Filing Party:____________________________________________________________________ |

| | (4) | | Date Filed:_____________________________________________________________________ |

ECHELON CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 16, 2003

11:00 A.M. PACIFIC TIME

We cordially invite you to attend the 2003 Annual Meeting of Stockholders of Echelon Corporation. The meeting will be held on Friday, May 16, 2003 at 11:00 a.m., Pacific Time, in the Bay Room at Lou’s Village, 1465 West San Carlos Street, San Jose, California 95126. At the meeting we will:

| | 1. | | Elect three Class B directors for a term of three years and until their successors are duly elected and qualified; |

| | 2. | | Ratify the appointment of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2003; and |

| | 3. | | Transact any other business as may properly come before the meeting or any postponement or adjournment thereof. |

These items are fully discussed in the following pages, which are made part of this Notice. Stockholders who owned our common stock at the close of business on Monday, March 31, 2003 may attend and vote at the meeting. If you will not be attending the meeting, we request that you vote your shares as promptly as possible. You may be eligible to vote your shares in a number of ways. You may mark your votes, date, sign and return the Proxy or voting instruction form. Stockholders whose shares are registered in their own names may vote via the Internet at ADP Investor Communication Services’ voting Web site (www.proxyvote.com) or telephonically by calling the telephone number shown on your Proxy Card. If you hold our shares with a broker or bank, you may also be eligible to vote via the Internet or to vote telephonically if your broker or bank participates in the proxy voting program provided by ADP Investor Communication Services. If your shares of common stock are held in an account with a broker or a bank participating in the ADP Investor Communication Services program, you may choose to vote those shares via the Internet at ADP Investor Communication Services’ voting Web site (www.proxyvote.com) or telephonically by calling the telephone number shown on your voting form. See “Voting Via the Internet or By Telephone” in the Proxy Statement for further details. Any stockholder attending the meeting may vote in person, even though he, she or it has already returned a Proxy.

Sincerely,

M. Kenneth Oshman

Chairman of the Board and Chief Executive Officer

San Jose, California

April 14, 2003

ECHELON CORPORATION

PROXY STATEMENT

FOR

2003 ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

General

Our Board of Directors is soliciting Proxies for the 2003 Annual Meeting of Stockholders to be held in the Bay Room at Lou’s Village, 1465 West San Carlos Street, San Jose, California 95126 on Friday, May 16, 2003, at 11:00 a.m., Pacific Time. The address of our principal executive office is 550 Meridian Avenue, San Jose, California 95126 and our telephone number at this address is 408-938-5200. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters set forth in the attached Notice of Annual Meeting. Please read it carefully.

Proxy materials, which include the Proxy Statement, Proxy, letter to stockholders and Form 10-K for the fiscal year ended December 31, 2002, were first mailed to stockholders on or about April 14, 2003.

Costs of Solicitation

We will pay the costs of soliciting Proxies from stockholders. We are required to request brokers and nominees who hold our common stock in their name to furnish our Proxy materials to beneficial owners of such common stock. We may reimburse such firms and nominees for their reasonable expenses in forwarding the Proxy materials to these beneficial owners. Certain of our directors, officers and employees may solicit Proxies on our behalf, without additional compensation, personally or by written communication, telephone, facsimile or other electronic means.

QUESTIONS AND ANSWERS

Q: Who can vote at the meeting?

A: Our Board of Directors set March 31, 2003 as the record date for the Annual Meeting. All stockholders who owned Echelon common stock at the close of business on March 31, 2003 may attend and vote at the Annual Meeting. Each stockholder is entitled to one vote for each share of common stock held on all matters to be voted on. Stockholders do not have the right to cumulate votes. On March 31, 2003, 39,860,219 shares of our common stock were outstanding.

Q: How many votes do you need to hold the meeting?

A: Shares are counted as present at the meeting if you:

| | - | | are present and vote in person at the meeting; or |

| | - | | have properly submitted a Proxy Card or voted by telephone or via the Internet. |

A majority of Echelon’s outstanding shares as of the record date must be present at the meeting in order to hold the meeting and conduct business. This is called a quorum.

Q: What proposals will be voted on at the meeting?

A: There are two proposals scheduled to be voted on at the meeting:

| | - | | Election of the nominees for director set forth in this Proxy Statement; and |

| | - | | Ratification of the appointment of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2003. |

Q: How are votes counted?

A: You may vote either “FOR”, “AGAINST” or “WITHHOLD” with respect to each nominee for our Board of Directors. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the other proposal. If you abstain from voting on the other proposal, it has the same effect as a vote against. If you just sign your Proxy Card with no further instructions, your shares will be counted as a yes vote “FOR” each Director and “FOR” ratification of the appointment of our independent auditors. If you do not vote and you hold your shares in a brokerage account in your broker’s name (this is called “street name”), your shares will not be counted in the tally of the number of shares cast “FOR,” “AGAINST” or “ABSTAIN” on any proposal where your broker does not have discretionary authority to vote, and therefore will have the effect of reducing the number of shares needed to approve any of those items. However, these shares held in street name that are not voted (known as “broker non-votes”) may be counted for the purpose of establishing a quorum for the meeting. Voting results are tabulated and certified by IVS Associates, Inc., an affiliate of ADP Investor Communication Services.

Q: What is the voting requirement to approve each of the proposals?

A: For the election of directors, the three (3) individuals receiving the highest number of “FOR” votes will be elected. Votes “AGAINST” or “WITHHOLD” and broker non-votes have no legal effect on the election of directors due to the fact that such elections are by a plurality. Proposal Two requires the affirmative “FOR” vote of a majority of the shares of our outstanding common stock represented, in person or by proxy, and entitled to vote.

Q: How can I vote my shares in person at the meeting?

A: Shares held directly in your name as the stockholder of record may be voted in person at the meeting. If you choose to do so, please bring the enclosed Proxy Card or proof of identification to the meeting. If you hold your shares in street name, you must request a legal proxy from your stockbroker in order to vote at the meeting.

Q: How can I vote my shares without attending the meeting?

A: Whether you hold shares directly as a stockholder of record or beneficially in street name, you may vote without attending the meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your stockbroker or nominee. In most cases, you will be able to do this by telephone, using the Internet or by mail. Please refer to the summary instructions included on your Proxy Card. For shares held in street name, a voting instruction card will be included by your stockbroker or nominee.

BY TELEPHONE OR THE INTERNET—If you have telephone or Internet access, you may submit your proxy by following the “Vote by Telephone” or “Vote by Internet” instructions on the Proxy Card.

2

BY MAIL—You may do this by signing your Proxy Card or, for shares held in street name, by following the voting instruction card included by your stockbroker or nominee and mailing it in the enclosed, postage prepaid envelope. If you provide specific voting instructions, your shares will be voted as you have instructed.

Q: How can I change my vote after I return my Proxy Card?

A: You may revoke your proxy and change your vote at any time before the final vote at the meeting. You may do this by signing a new Proxy Card with a later date or by attending the meeting and voting in person. Attending the meeting will not revoke your proxy unless you specifically request it.

Q: What is Echelon’s voting recommendation?

A: Our Board of Directors recommends that you vote your shares “FOR” each of the three nominees to our Board of Directors and “FOR” ratification of the appointment of our independent auditors.

Q: Where can I find the voting results of the meeting?

A: The preliminary voting results will be announced at the meeting. The final results will be published in our first quarterly report on Form 10-Q filed after the date of the meeting.

DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS

Our stockholders may submit proposals that they believe should be voted upon at the Annual Meeting or nominate persons for election to our Board of Directors. Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (“Rule 14a-8”), some stockholder proposals may be eligible for inclusion in our 2004 Proxy Statement. Any such stockholder proposals must be submitted in writing to the attention of the Secretary, Echelon Corporation, 550 Meridian Ave., San Jose, California 95126, no later than December 16, 2003, or the date which is 120 calendar days prior to the anniversary of the mailing date of this Proxy Statement. Stockholders interested in submitting such a proposal are advised to contact knowledgeable legal counsel with regard to the detailed requirements of applicable securities laws. The submission of a stockholder proposal does not guarantee that it will be included in our 2004 Proxy Statement.

Alternatively, under our Bylaws, a proposal or a nomination that the stockholder does not seek to include in our 2004 Proxy Statement pursuant to Rule 14a-8 may be submitted in writing to the Secretary, Echelon Corporation, 550 Meridian Ave., San Jose, California 95126, for the 2004 Annual Meeting of Stockholders not less than 20 days nor more than 60 days prior to the date of such meeting. Note, however, that in the event we provide less than 30 days notice or prior public disclosure to stockholders of the date of the 2004 Annual Meeting, any stockholder proposal or nomination not submitted pursuant to Rule 14a-8 must be submitted to us not later than the close of business on the tenth day following the day on which notice of the date of the 2004 Annual Meeting was mailed or public disclosure was made. For example, if we provide notice of our 2004 Annual Meeting on April 15, 2004, for a 2004 Annual Meeting on May 10, 2004, any such proposal or nomination will be considered untimely if submitted to us after April 25, 2004. For purposes of the above, “public disclosure” means disclosure in a press release reported by the Dow Jones News Service, Associated Press or a comparable national news service, or in a document publicly filed by us with the Securities and Exchange Commission (the “SEC”). As described in our Bylaws, the stockholder submission must include certain specified information concerning the proposal or nominee, as the case may be, and information as to the stockholder’s ownership of our common stock. If a stockholder gives notice of such a proposal after the deadline computed in accordance with our Bylaws (the “Bylaw Deadline”), the stockholder will not be permitted to present the proposal to the stockholders for a vote at the 2004 Annual Meeting.

3

The rules of the SEC also establish a different deadline for submission of stockholder proposals that are not intended to be included in our Proxy Statement with respect to discretionary voting (the “Discretionary Vote Deadline”). The Discretionary Vote Deadline for the 2004 Annual Meeting is February 29, 2004, or the date which is 45 calendar days prior to the anniversary of the mailing date of this Proxy Statement. If a stockholder gives notice of such a proposal after the Discretionary Vote Deadline, our Proxy holders will be allowed to use their discretionary voting authority to vote against the stockholder proposal when and if the proposal is raised at the 2004 Annual Meeting.

Because the Bylaw Deadline is not capable of being determined until we publicly announce the date of our 2004 Annual Meeting, it is possible that the Bylaw Deadline may occur after the Discretionary Vote Deadline. In such a case, a proposal received after the Discretionary Vote Deadline but before the Bylaw Deadline would be eligible to be presented at the 2004 Annual Meeting and we believe that our Proxy holders at such meeting would be allowed to use the discretionary authority granted by the Proxy to vote against the proposal at such meeting without including any disclosure of the proposal in the Proxy Statement relating to such meeting.

We have not been notified by any stockholder of his, her or its intent to present a stockholder proposal from the floor at the 2003 Annual Meeting. The enclosed Proxy grants the Proxy holders discretionary authority to vote on any matter properly brought before the 2003 Annual Meeting, including any stockholder proposals received between the date of this Proxy Statement and the Bylaw Deadline for the 2003 Annual Meeting, which is April 24, 2003, or the date which is ten calendar days after the date this Proxy Statement is mailed.

PROPOSAL ONE

ELECTION OF DIRECTORS

General

We currently have eight members on our Board of Directors. Our Board of Directors is divided into three classes, with each director serving a three-year term and one class being elected at each year’s Annual Meeting of Stockholders. Directors Robert J. Finocchio, Jr., Armas Clifford Markkula, Jr. and Robert R. Maxfield are the Class B directors whose terms expire at the 2003 Annual Meeting of Stockholders and they have been nominated by our Board of Directors for reelection at Annual Meeting of Stockholders to be held May 16, 2003. Directors Michael E. Lehman, Richard M. Moley and Arthur Rock are the Class C directors whose terms will expire at the 2004 Annual Meeting of Stockholders, and M. Kenneth Oshman and Larry W. Sonsini are the Class A directors whose terms will expire at the 2005 Annual Meeting of Stockholders. All of the directors, including the Class B nominees, are incumbent directors. M. Francesco Tatò resigned from our Board of Directors in June 2002. Mr. Lehman was appointed a Class C director by the other members of our Board of Directors in November 2002. There are no family relationships among any of our directors or executive officers, including any of the nominees mentioned above. Unless otherwise instructed, the holders of Proxies solicited by this Proxy Statement will vote the Proxies received by them for the three Class B nominees. In the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the Proxy holders will vote for a nominee designated by the present Board of Directors to fill the vacancy. We are not aware of any reason that any nominee will be unable or will decline to serve as a director. Our Board of Directors recommends a vote “FOR” the election of each of the Class B nominees listed above.

4

Nominees

The names of the members of our Board of Directors, including the Class B nominees, their ages as of March 31, 2003 and certain information about them, are set forth below.

Name

| | Age

| | Principal Occupation

|

|

M. Kenneth Oshman (1) | | 62 | | Chairman of the Board and Chief Executive Officer of Echelon |

|

Robert J. Finocchio, Jr. (2) (3) | | 52 | | Corporate director, private investor and part time professor |

|

Michael E. Lehman (3) | | 52 | | Financial consultant |

|

Armas Clifford Markkula, Jr. (2) | | 61 | | Vice Chairman of our Board of Directors of Echelon |

|

Robert R. Maxfield (2) (4) | | 61 | | Private investor |

|

Richard M. Moley (4) | | 64 | | Private investor |

|

Arthur Rock (3) (5) | | 76 | | Principal of Arthur Rock & Co. |

|

Larry W. Sonsini (5) | | 62 | | Chairman and Chief Executive Officer of Wilson Sonsini Goodrich & Rosati, P.C. |

| (1) | | Member of the Stock Option Committee. |

| (2) | | Denotes nominee for election at the 2003 Annual Meeting of Stockholders. |

| (3) | | Member of the Audit Committee. |

| (4) | | Member of the Compensation Committee. |

| (5) | | Member of the Nominating and Corporate Governance Committee. |

M. Kenneth Oshmanhas been Chief Executive Officer of our company since December 1988 and Chairman of our Board of Directors since September 1989. He also served as our President from 1988 to 2001. Mr. Oshman, with three associates, founded ROLM Corporation, a telecommunications equipment company, in 1969. He was Chief Executive Officer, President and a director at ROLM from its founding until its merger with IBM in 1984. Following the merger, he became a Vice President of IBM and a member of its Corporate Management Board. He remained in that position until 1986. Prior to founding ROLM, Mr. Oshman was a member of the technical staff at Sylvania Electric Products from 1963 to 1969. Mr. Oshman also serves as a director of Sun Microsystems and Knight-Ridder. Mr. Oshman earned B.A. and B.S.E.E. degrees from Rice University and M.S. and Ph.D. degrees in Electrical Engineering from Stanford University.

Robert J. Finocchio, Jr.has been a director of our company since August 1999. Mr. Finocchio served as Chairman of the Board of Informix Corporation, an information management software company, from August 1997 to September 2000. Since September 2000, Mr. Finocchio has been a dean’s executive professor at Santa Clara University’s Leavey School of Business. From July 1997 until July 1999, Mr. Finocchio served as President and Chief Executive Officer of Informix. From December 1988 until May 1997, Mr. Finocchio was employed with 3Com Corporation, a global data networking company, where he held various positions, most recently serving as President, 3Com Systems. Mr. Finocchio also serves as a director of Altera Corp., Latitude Communications and Turnstone Systems. Mr. Finocchio is also a Trustee of Santa Clara University. Mr. Finocchio holds a B.S. degree in economics from Santa Clara University and an M.B.A. degree from the Harvard Business School.

5

Michael E. Lehmanhas been a director of our company since November 2002. During the past 15 years, Mr. Lehman held various management positions at Sun Microsystems, Inc., a provider of computer systems and professional support services. While at Sun, he served as Executive Vice President from July 2002 until his resignation from his employment position in September 2002. From July 2000 to July 2002, he served as Executive Vice President, Corporate Resources and Chief Financial Officer, and as Vice President, Corporate Resources and Chief Financial Officer from January 1998 to July 2000. He served as Vice President and Chief Financial Officer from February 1994 to January 1998. Mr. Lehman held various positions in the finance organization of Sun from August 1987 to February 1994. Prior to his tenure at Sun, Mr. Lehman was a senior manager in the San Francisco office of PricewaterhouseCoopers, the international accounting firm, where he was responsible for audits of multinational entities. Mr. Lehman is also a director of Sun Microsystems, MGIC Investment Corporation, Mercator Software and NetIQ Corporation. Mr. Lehman holds a B.B.A. degree in accounting from the University of Wisconsin-Madison.

Armas Clifford Markkula, Jr.is the founder of our company and has served as a director since 1988. He has been Vice Chairman of our Board of Directors since 1989. Mr. Markkula was Chairman of the Board of Apple Computer, Inc. from January 1977 to May 1983 and from October 1993 to February 1996 and was a director from 1977 to 1997. A founder of Apple, he held a variety of positions there, including President/Chief Executive Officer and Vice President of Marketing. Prior to founding Apple, Mr. Markkula was with Intel Corporation as Marketing Manager, Fairchild Camera and Instrument Corporation as Marketing Manager in the Semiconductor Division, and Hughes Aircraft as a member of the technical staff in the company’s research and development laboratory. Mr. Markkula is a trustee of Santa Clara University. Mr. Markkula received B.S. and M.S. degrees in Electrical Engineering from the University of Southern California.

Robert R. Maxfieldhas been a director of our company since 1989. He was a co-founder of ROLM in 1969, and served as Executive Vice President and a director until ROLM’s merger with IBM in 1984. Following the merger, he continued to serve as Vice President of ROLM until 1988. Since 1988, he has been a private investor, and is a consulting professor in the Management Science and Engineering Department at Stanford University. Dr. Maxfield was a partner with Kleiner, Perkins, Caufield & Byers, a venture capital firm, from 1989 to 1992. Dr. Maxfield received B.A. and B.S.E.E. degrees from Rice University, and M.S. and Ph.D. degrees in Electrical Engineering from Stanford University.

Richard M. Moleyhas been a director of our company since February 1997. Since August 1997, Mr. Moley has been a private investor. From July 1996 to August 1997, he served as Senior Vice President, Wide Area Business Unit and as a director of Cisco Systems, following Cisco Systems’ purchase of StrataCom, Inc., where he was Chairman of the Board, Chief Executive Officer and President. Mr. Moley also serves as a director of Linear Technology, Netro Corporation and Spirent PLC. Mr. Moley received a B.S. degree in Electrical Engineering from Manchester University, an M.S. degree in Electrical Engineering from Stanford University and an M.B.A. degree from Santa Clara University.

Arthur Rockhas been a director of our company since 1988. Mr. Rock has been Principal of Arthur Rock & Co., a venture capital firm, since 1969. Mr. Rock also serves as a director of The Nasdaq Stock Market, Inc. Mr. Rock received a B.S. degree in Political Science and Finance from Syracuse University and an M.B.A. degree from the Harvard Business School.

Larry W. Sonsinihas been a director of our company since 1993. Mr. Sonsini serves as Chairman and Chief Executive Officer of the law firm of Wilson Sonsini Goodrich & Rosati, P.C., where he has practiced since 1966. Mr. Sonsini also serves as a director of Brocade Communications Systems, Lattice Semiconductor Corporation, LSI Logic and Pixar. Mr. Sonsini received an A.B. degree in Political Science and Economics and an L.L.B. degree from the University of California at Berkeley.

6

Board Meetings and Committees

Our Board of Directors held five meetings in 2002. Each director is expected to attend each meeting of our Board of Directors and those Committees on which he serves. Each incumbent director attended at least 75% of our Board of Directors and Committee meetings during 2002 held during the period for which such director has been a director or member of a committee, except for Armas Clifford Markkula, Jr., who attended 71% of the applicable Board of Directors and Committee meetings in 2002. Certain matters were approved by our Board of Directors or a Committee of our Board of Directors by unanimous written consent. Our Board of Directors currently has a standing Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. The Audit Committee has a written charter that was approved by our Board of Directors in November 2002, a copy of which is attached as Appendix A. The Compensation Committee and the Nominating and Corporate Governance Committee each has a written charter that has been approved by our Board of Directors, copies of which can be viewed at the investor relations section of our website atwww.echelon.com. Pursuant to our 1997 Stock Option Plan, our Board delegated authority to Mr. Oshman to grant stock options to employees who are not executive officers of up to a maximum of 25,000 shares per person per year and, generally, up to an aggregate of 250,000 shares per year. The Compensation Committee, Audit Committee, and Nominating and Corporate Governance Committee are described as follows:

Audit Committee: The current members of the Audit Committee are Robert J. Finocchio, Jr., Michael E. Lehman and Arthur Rock. Mr. Lehman was appointed to the Audit Committee in November 2002 in replacement of Robert R. Maxfield, who was appointed to the Audit Committee in replacement of Armas Clifford Markkula, Jr. in October 2002. The Audit Committee held three meetings in 2002. The purposes of the Audit Committee are to:

| | • | | oversee our accounting and financial reporting processes and the internal and external audits of the financial statements; |

| | • | | assist our Board of Directors in the oversight and monitoring of (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) the independent auditor’s qualifications, independence and performance, and (iv) our internal accounting and financial controls; |

| | • | | outline to our Board of Directors the results of its monitoring and recommendations derived therefrom and improvements made, or to be made, in internal accounting controls; |

| | • | | prepare the report that the rules of the Securities and Exchange Commission require to be included in our annual proxy statement; |

| | • | | appoint independent auditors; and |

| | • | | provide to our Board of Directors such additional information and materials as it may deem necessary to make our Board of Directors aware of significant financial matters that require the attention of our Board of Directors. |

The responsibilities of the Audit Committee include the continuous review of the adequacy of our system of internal controls; oversight of the work of our independent auditors, including a post-audit review of the financial statements and audit findings; oversight of compliance with SEC requirements regarding audit related matters; review, in conjunction with counsel, any legal matters that could significantly impact our financial statements; and oversight and review of our information technology and management information systems policies and risk management policies, including our investment policies.

7

Compensation Committee: The current members of the Compensation Committee are Robert R. Maxfield and Richard M. Moley. The Compensation Committee held two meetings in 2002. The purposes of the Compensation Committee are to:

| | • | | discharge the responsibilities of our Board of Directors relating to compensation of our executive officers; |

| | • | | approve and evaluate executive officer compensation plans, policies and programs; and |

| | • | | produce an annual report on executive compensation for inclusion in our proxy statement. |

The responsibilities of the Compensation Committee include annually reviewing and approving, for our Chief Executive Officer and our other executive officers, (i) annual base salary, (ii) annual incentive bonus, including the specific goals and amount, (iii) equity compensation, (iv) employment agreements, severance arrangements and change in control agreements and provisions and (v) any other benefits, compensation or arrangements; and conducting an annual review of the performance of our Chief Executive Officer.

Nominating and Corporate Governance Committee: The current members of the Nominating and Corporate Governance Committee are Arthur Rock and Larry Sonsini. The Nominating and Corporate Governance Committee was formed in November 2002 and held no meetings in 2002. The purposes of the Nominating and Corporate Governance Committee are to:

| | • | | assist our Board of Directors by identifying prospective director nominees and to recommend to our Board of Directors the director nominees for the next annual meeting of stockholders; |

| | • | | develop and recommend to our Board of Directors the governance principles applicable to our company; |

| | • | | oversee the evaluation of our Board of Directors and management; and |

| | • | | recommend to our Board of Directors director nominees for each committee. |

The responsibilities of the Nominating and Corporate Governance Committee include evaluating the composition, organization and governance of our Board of directors and its committees, including determining future requirements; receiving and evaluating complaints that may be rendered under our code of business conduct and ethics and proposing actions in response thereto; overseeing of the performance evaluation process of our Board of Directors; making recommendations to our Board of Directors concerning the appointment of directors to committees, selecting Board committee chairs and proposing the slate of directors for election; and making recommendations to our Board of Directors regarding compensation for non-employee directors and Board committee members. Proposed candidates for nomination as director received from stockholders will be considered by the Nominating and Corporate Governance Committee. Any such recommendations may be submitted in writing to the attention of the Secretary, Echelon Corporation, 550 Meridian Avenue, San Jose, California 95126.

We have determined that all directors serving as members of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are independent under the rules prescribed as of the date of this Proxy Statement by Nasdaq and the New York Stock Exchange. In addition, in January 2003, our Board appointed Arthur Rock as our Presiding Director. Under our Corporate Governance Guidelines, adopted by our Board of Directors in November 2002, the Presiding Director was selected by our outside directors and assumed the responsibilities of chairing meetings of outside directors, serving as the liaison

8

between our Chief Executive Officer and our independent directors, approving Board of Directors meeting agendas and schedules and information flow to our Board of Directors and such further responsibilities that the outside directors as a whole designate from time to time. Our Corporate Governance Guidelines also give our Board of Directors responsibility over such matters as overseeing our Chief Executive Officer and other senior management in the competent and ethical operation of our Company, gathering and analyzing information obtained from management, counsel and expert advisors, and overseeing and monitoring the effectiveness of governance practices. A copy of our Corporate Governance Guidelines can be viewed at the investor relations section of our website atwww.echelon.com.

Director Compensation

In 2002, members of our Board of Directors did not receive any cash consideration for serving on our Board of Directors. In November 2002, we determined that in consideration for service on our Board of Directors, each non-employee director shall receive a cash payment of $20,000 per fiscal year, to be payable on or before the day of the first meeting of our Board of Directors in each fiscal year. In addition, we determined that in consideration for service on our Board of Directors or on one or more of our Compensation and/or Nominating and Corporate Governance Committees of our Board of Directors, each non-employee director shall receive a cash payment of $1,000 per Board of Directors meeting or Committee meeting attended, to be payable on the date of each such meeting so attended. In addition, we determined that in consideration of the significantly greater time commitment and potential risk exposure for serving as a member of our Audit Committee, each non-employee director shall receive a cash payment of $2,000 per Audit Committee meeting attended, to be payable on the date of each such meeting so attended. In addition, nonemployee directors are eligible to participate in our 1998 Director Option Plan which provides for the automatic grant of an option to purchase 25,000 shares of common stock to each nonemployee director who first becomes a nonemployee director after May 29, 1998. In addition, each nonemployee director shall automatically be granted a 10,000 share option on the date of each annual meeting of stockholders, provided he or she is re-elected to our Board of Directors or otherwise remains on our Board of Directors on such date and provided that on such date he or she shall have served on our Board of Directors for at least the preceding six months. All options granted under this plan are fully vested at grant. During 2002, Mr. Finocchio, Mr. Markkula, Mr. Maxfield, Mr. Moley, Mr. Rock, Mr. Tatò and Mr. Sonsini were each granted a 10,000 share option at a per share exercise price of $16.36, and Mr. Lehman was granted a 25,000 share option at a per share exercise price of $13.58. Mr. Tatò’s option expired unexercised in September 2002 following his resignation from our Board of Directors.

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

With authority granted by our Board of Directors, the Audit Committee of our Board of Directors has appointed KPMG LLP as our independent auditors to audit our consolidated financial statements for the fiscal year ending December 31, 2003, and our Board of Directors recommends that the stockholders vote “FOR” ratification of such appointment.

KPMG LLP was appointed as our independent public accountants on March 21, 2002, when we retained KPMG LLP to perform the annual audit of our financial statements for the fiscal year ending December 31, 2002. A representative of KPMG LLP is expected to be present at the Annual Meeting, will have an opportunity to make a statement if he or she so desires and is expected to be available to respond to appropriate questions from the stockholders.

9

SHARE OWNERSHIP BY PRINCIPAL STOCKHOLDERS AND MANAGEMENT

To our knowledge, the following table sets forth certain information with respect to beneficial ownership of our common stock, as of March 31, 2003, for:

| | • | | each person who we know beneficially owns more than 5% of our common stock; |

| | • | | each of our executive officers set forth in the Summary Compensation Table; and |

| | • | | all of our directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Except as indicated by footnote, and subject to applicable community property laws, each person identified in the table possesses sole voting and investment power with respect to all shares of common stock shown held by them. The number of shares of common stock outstanding used in calculating the percentage for each listed person includes shares of common stock underlying options or warrants held by such person that are exercisable within 60 calendar days of March 31, 2003, but excludes shares of common stock underlying options or warrants held by any other person. Percentage of beneficial ownership is based on 39,860,219 shares of common stock outstanding as of March 31, 2003.

Name

| | Shares Beneficially Owned

| | Percentage Beneficially Owned

| |

|

5% Stockholders: | | | | | |

ENEL S.p.A. (1) | | 3,000,000 | | 7.5 | % |

|

Directors and Executive Officers: | | | | | |

M. Kenneth Oshman (2) | | 5,999,081 | | 14.8 | % |

Armas Clifford Markkula, Jr. (3) | | 1,817,038 | | 4.6 | % |

Beatrice Yormark (4) | | 1,040,731 | | 2.6 | % |

Oliver R. Stanfield (5) | | 1,028,831 | | 2.6 | % |

Arthur Rock (6) | | 769,563 | | 1.9 | % |

Robert R. Maxfield (7) | | 455,037 | | 1.1 | % |

Frederik Bruggink (8) | | 325,832 | | * | |

Peter A. Mehring (9) | | 284,375 | | * | |

Richard M. Moley (10) | | 185,589 | | * | |

Larry W. Sonsini (10) | | 63,261 | | * | |

Robert J. Finocchio, Jr. (11) | | 75,000 | | * | |

Michael E. Lehman (12) | | 25,000 | | * | |

All directors and executive officers as a group (14 persons) (13) | | 12,152,462 | | 29.1 | % |

| (1) | | Principal address is Viale Regina Margherita 137, Rome, Italy 00198. |

| (2) | | Mr. Oshman’s principal address is c/o Echelon Corporation, 550 Meridian Avenue, San Jose, California 95126. Includes 4,672,133 shares held by M. Kenneth Oshman and Barbara S. Oshman, Trustees of the Oshman Trust dated July 10, 1979, 488,428 shares held by O-S Ventures, of which Mr. Oshman is general partner, and an aggregate of 38,520 shares held by trusts, not for the benefit of Mr. Oshman, of which Mr. Oshman serves as trustee and as to which Mr. Oshman disclaims beneficial ownership. Includes options to purchase 800,000 shares of common stock exercisable within 60 calendar days of March 31, 2003, of which 497,915 shares are vested at March 31, 2003. |

10

| (3) | | Includes 1,627,610 shares held by Armas Clifford Markkula, Jr. and Linda Kathryn Markkula, Trustees of the Restated Arlin Trust Dated December 12, 1990, and 151,928 shares held by the Markkula Family Limited Partnership. Mr. Markkula and his spouse disclaim beneficial ownership of all but 27,500 of the shares held by the Markkula Family Limited Partnership. Includes options to purchase 37,500 shares of common stock exercisable within 60 calendar days of March 31, 2003, all of which shares are vested at March 31, 2003. |

| (4) | | Includes 819,900 shares held by Justin C. Walker and Beatrice Yormark, Trustees of the Walker-Yormark Family Trust Dated October 2, 1992. Includes options to purchase 220,831 shares of common stock exercisable within 60 calendar days of March 31, 2003, of which 207,811 shares are vested at March 31, 2003. |

| (5) | | Includes 637,400 shares by held by Oliver Rueben Stanfield and Janet Helen Stanfield, Trustees of the Stanfield Family Trust UDT dated February 2, 2001. Includes an aggregate of 170,600 shares held in individual retirement accounts for the benefit of Mr. Stanfield and his spouse. Includes options to purchase 220,831 shares of common stock exercisable within 60 calendar days of March 31, 2003, of which 207,811 shares are vested at March 31, 2003. |

| (6) | | Includes 20,000 shares held by a trust for the benefit of Mr. Rock’s spouse, of which Mr. Rock serves as trustee, and as to which Mr. Rock disclaims beneficial ownership, and 2,000 shares held by a trust, not for the benefit of Mr. Rock, of which Mr. Rock serves as trustee and as to which Mr. Rock disclaims beneficial ownership. Includes options to purchase 50,000 shares of common stock exercisable within 60 calendar days of March 31, 2003, all of which shares are vested at March 31, 2003. |

| (7) | | Includes options to purchase 50,000 shares of common stock exercisable within 60 calendar days of March 31, 2003, all of which shares are vested at March 31, 2003. |

| (8) | | Includes options to purchase 103,332 shares of common stock exercisable within 60 calendar days of March 31, 2003, of which 76,666 shares are vested at March 31, 2003. We have the right, but not the obligation, to repurchase 3,125 shares owned by Mr. Bruggink if he should discontinue his employment with our company. This repurchase right expires on various dates through June 25, 2003. |

| (9) | | Includes options to purchase 194,791 shares of common stock exercisable within 60 calendar days of March 31, 2003, of which 171,978 shares are vested at March 31, 2003. |

| (10) | | Includes options to purchase 50,000 shares of common stock exercisable within 60 calendar days of March 31, 2003, all of which shares are vested at March 31, 2003. |

| (11) | | Includes options to purchase 55,000 shares of common stock exercisable within 60 calendar days of March 31, 2003, all of which shares are vested at March 31, 2003. |

| (12) | | Represents options to purchase 25,000 shares of common stock exercisable within 60 calendar days of March 31, 2003, all of which shares are vested at March 31, 2003. |

| (13) | | Includes options to purchase an aggregate of 1,935,409 shares of common stock exercisable within 60 calendar days of March 31, 2003, of which 1,549,472 shares are vested at March 31, 2003. We have the right, but not the obligation, to repurchase 3,125 shares owned by one of our executive officers if he should discontinue his employment with our company. This repurchase right expires on various dates through June 25, 2003. |

11

OTHER INFORMATION

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our executive officers, directors and persons who own more than 10% of a registered class of our equity securities to file certain reports with the SEC regarding ownership of, and transactions in, our securities. Such officers, directors and 10% stockholders are also required by the SEC to furnish us with copies of all Section 16(a) forms that they file.

Based solely on our review of such forms furnished to us and written representations from certain reporting persons, we believe that all filing requirements applicable to our executive officers, directors and more than 10% stockholders were complied with during the fiscal year ended December 31, 2002, except that our President, Beatrice Yormark, was late with one Form 4 filing.

Certain Transactions

Loans to Employees

In April 2001, we loaned Peter Mehring, our Senior Vice President of Engineering, an aggregate of $1,000,000 which Mr. Mehring used to pay his federal income taxes. Mr. Mehring issued to us two promissory notes, each in the principal amount of $500,000 and bearing interest at the rate of 4.54% per annum, compounded monthly. One of the notes is secured by a second deed of trust on his primary residence (the “First Note”) and the other note was secured by a second deed of trust on a second residence (the “Second Note”). The interest accruing under the First Note is due and payable in monthly installments over the three-year term of the note, and the principal is due and payable on April 6, 2004, subject to earlier repayment upon the occurrence of certain events. The interest accruing under the Second Note was due and payable in monthly installments over the three-year term of the note, and the principal was due and payable on April 6, 2004, subject to earlier repayment upon the occurrence of certain events. The Second Note and accrued and unpaid interest thereon were paid in full on February 21, 2003. The terms of these loans have never been amended.

On October 29, 2001, we loaned Russell Harris, our Senior Vice President of Operations, $1,000,000 to purchase a principal residence. Mr. Harris issued to us a promissory note secured by residential real estate. The note bears interest at the rate of 4.5% per annum, compounded monthly. The interest accruing under the note is due and payable in monthly installments over the nine year term of the note, and the principal is due and payable on October 29, 2010, subject to earlier repayment upon the occurrence of certain events. The terms of this loan have never been amended.

On December 31, 2001, we loaned Frederik Bruggink, our Senior Vice President and General Manager—Service Provider Group, $700,000 to exercise stock options.Mr. Bruggink issued to us a promissory note secured by a security interest in personal assets. The note bore interest at the rate of 2.48% per annum, compounded monthly. The interest accruing under the note was due and payable in monthly installments over the one year term of the note, and the principal was due and payable on December 31, 2002, subject to earlier repayment upon the occurrence of certain events. The note and accrued and unpaid interest thereon were paid in full on February 7, 2003.

On April 2, 2002, we loaned Mr. Bruggink, through our Dutch subsidiary, € 239,690 (approximately $211,000), to reimburse us for tax withholding amounts remitted to the Dutch tax authorities on Mr. Bruggink’s

12

behalf. The loan bore interest at the rate of 7.0% per annum, compounded monthly. The interest accruing under the note was due and payable in monthly installments over the six-month term of the note, and the principal was due and payable on September 30, 2002, subject to earlier repayment upon the occurrence of certain events. The note and accrued and unpaid interest thereon were paid in full in three installments in September 2002, with the last installment paid on September 23, 2002.

Agreements with ENEL

Pursuant to a research and development and technological cooperation agreement, dated June 28, 2000, as amended, between our company and ENEL Distribuzione SpA, an affiliate of ENEL S.p.A. (“ENEL”), we are cooperating with ENEL to integrate our LONWORKS system into ENEL’s remote metering management project in Italy. Under this project, ENEL intends to provide digital electricity meters and a complete home networking infrastructure to Italian households over a three-year period. If the ENEL project achieves its targeted volumes during 2003, we believe that revenues attributable to this project will account for the majority of our revenues for the year ending December 31, 2003. We continue to devote significant product development resources to this project.

Pursuant to a common stock purchase agreement, dated June 30, 2000, between our company and ENEL, ENEL agreed to purchase, for cash, three million newly issued shares of our common stock for a purchase price to be based on the average trading price prior to the closing (subject to a minimum price of $87.3 million and a maximum price of $130.9 million). The closing of this stock purchase occurred on September 11, 2000. Based on the average price of our common stock prior to that date, the total purchase price for the three million shares was $130.9 million and after deducting expenses associated with the transaction, we received $130.7 million. Until the earlier of September 11, 2003 or 30 days following the termination of the research and development and technological cooperation agreement with ENEL Distribuzione, ENEL shall not, except under limited circumstances, sell or otherwise transfer such shares. The stock purchase agreement also gives ENEL the right to nominate a member of our Board of Directors as long as ENEL owns at least two million shares of our common stock. As a condition to the closing of the stock purchase agreement, our directors and our Chief Financial Officer agreed to enter into a voting agreement with ENEL in which each of them agreed to vote the shares of our company’s common stock that they beneficially own or control in favor of ENEL’s nominee to our Board of Directors. M. Francesco Tatò served as ENEL’s representative on our Board of Directors from September 2000 until June 2002. ENEL has not nominated a replacement for Mr. Tatò on our Board of Directors.

Pursuant to a registration rights agreement, dated September 11, 2000, between our company and ENEL, ENEL may, subject to certain conditions and limitations, request that we register the shares purchased under the common stock purchase agreement. In the event we elect to register any of our securities, ENEL may, subject to certain limitations, include the shares purchased under the common stock purchase agreement in such registration.

Air Travel Arrangement

From time to time, Mr. Oshman, our Chairman and Chief Executive Officer, uses private air travel services for business trips for himself and for any employees accompanying him. These private air travel services are provided by certain entities controlled by Mr. Oshman or Mr. Markkula, a director of our Company. Our net cash outlay with respect to such private air travel services is no greater than comparable first class commercial air travel services. Such net outlays to date have not been material.

13

Legal Services

During fiscal year 2002, the law firm of Wilson Sonsini Goodrich & Rosati, P.C. acted as principal outside counsel to our company. Mr. Sonsini, a director of our company, is a member of Wilson Sonsini Goodrich & Rosati, P.C.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning the compensation that we paid during the last three fiscal years to our Chief Executive Officer and our four other most highly compensated executive officers who earned more than $100,000 during the fiscal year ended December 31, 2002. All option grants were made under our 1997 stock plan.

| | | Annual Compensation

| | Long-Term Compensation Awards

| | All Other Compensation ($)

| |

Name and Principal Position

| | Fiscal Year

| | Salary ($)

| | Bonus ($)

| | Securities Underlying Options (#)

| |

|

M. Kenneth Oshman Chairman of the Board and Chief Executive Officer | | 2002 2001 2000 | | 100,000 1 1 | | 319,200 — — | | 200,000 250,000 100,000 | | 1,584 1,584 1,584 | (1) |

|

Beatrice Yormark President and Chief Operating Officer | | 2002 2001 2000 | | 325,000 300,000 275,000 | | 90,773 — — | | 100,000 50,000 50,000 | | 1,793 1,531 1,531 | (1) |

|

Oliver R. Stanfield Executive Vice President & Chief Financial Officer | | 2002 2001 2000 | | 325,000 300,000 275,000 | | 90,773 — — | | 100,000 50,000 50,000 | | 1,815 1,502 1,386 | (1) |

|

Frederik H. Bruggink Senior Vice President and General Manager—Service Provider Group | | 2002 2001 2000 | | 300,000 250,000 220,000 | | 59,850 45,246 88,640 | | 80,000 50,000 50,000 | | 12,587 1,584 1,584 | (2) |

|

Peter A. Mehring Senior Vice President of Engineering | | 2002 2001 2000 | | 300,000 300,000 275,000 | | 59,850 — — | | 60,000 50,000 50,000 | | 1,320 1,320 1,320 | (1) |

| (1) | | Consists of premiums paid by the Company for life insurance coverage. |

| (2) | | Includes premiums of $1,584 paid by the Company for life insurance coverage and € 10,363 (approximately $11,003) in pension plan payment. |

Option Grants in Last Fiscal Year

The following table sets forth certain information with respect to stock options granted to our Chief Executive Officer and our four other most highly compensated executive officers during the fiscal year ended December 31, 2002. We have never granted any stock appreciation rights. All option grants were made under our 1997 stock plan.

14

Name

| | Individual Grants

| | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation For Option Term ($)(6)

|

| | Number of Securities Underlying Options Granted (#)

| | | % of Total Options Granted to Employees In Fiscal Year (%)(4)

| | Exercise Price Per Share ($)(5)

| | Expiration Date

| |

| | | | | | 5%

| | 10%

|

M. Kenneth Oshman | | 200,000 | (1) | | 9.1 | | 16.35 | | 02/22/2012 | | 2,056,485 | | 5,211,538 |

Beatrice Yormark | | 100,000 | (2) | | 4.6 | | 16.35 | | 02/22/2012 | | 1,028,243 | | 2,605,769 |

Oliver R. Stanfield | | 100,000 | (2) | | 4.6 | | 16.35 | | 02/22/2012 | | 1,028,243 | | 2,605,769 |

Frederik H. Bruggink | | 60,000 | (2) | | 2.7 | | 16.35 | | 02/22/2012 | | 616,946 | | 1,563,461 |

Frederik H. Bruggink | | 20,000 | (3) | | 0.9 | | 10.52 | | 09/20/2012 | | 132,319 | | 335,323 |

Peter A. Mehring | | 60,000 | (2) | | 2.7 | | 16.35 | | 02/22/2012 | | 616,946 | | 1,563,461 |

| (1) | | This option was granted on February 22, 2002 and vests as to one-fourth of the shares on February 22, 2003 and as to one-forty-eighth of the shares at the end of each month thereafter, subject to the employee’s continued employment with our company. This option may be exercised prior to full vesting, subject to the employee entering into a restricted stock purchase agreement with respect to unvested shares. |

| (2) | | All of these options were granted on February 22, 2002 and vest as to one-fourth of the shares on February 22, 2003 and as to one-forty-eighth of the shares at the end of each month thereafter, subject to the employee’s continued employment with our company. |

| (3) | | This option was granted on September 20, 2002 and vests as to one-fourth of the shares on September 20, 2003 and as to one-forty-eighth of the shares at the end of each month thereafter, subject to the employee’s continued employment with our company. This option may be exercised prior to full vesting, subject to the employee entering into a restricted stock purchase agreement with respect to unvested shares. |

| (4) | | Based on a total of 2,187,750 options granted to all employees in the fiscal year ended December 31, 2002. |

| (5) | | The exercise price per share is equal to the closing price of our common stock on the date of grant or the market trading day immediately preceding the date of grant. |

| (6) | | Potential gains are net of the exercise price but before taxes associated with the exercise. The 5% and 10% assumed annual rates of compounded stock appreciation based upon the deemed fair market value are for illustrative purposes only and do not represent the Company’s estimate or projection of the future common stock price. Actual gains, if any, on stock option exercises are dependent on several factors, including the Company’s future financial performance, overall market conditions, and the option holder’s continued employment with the Company. There can be no assurance that the amounts reflected in this table will be achieved. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth certain information for our Chief Executive Officer and our four other most highly compensated executive officers concerning shares acquired upon exercise of stock options in the fiscal year ended December 31, 2002 and exercisable and unexercisable options held as of December 31, 2002.

15

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)(1)

| | Number of Securities Underlying Unexercised Options at December 31, 2002 (#)(2)

| | Value of Unexercised In-the-Money Options at December 31, 2002 ($)(3)

|

| | | | Exercisable

| | | Unexercisable

| | Exercisable

| | Unexercisable

|

|

M. Kenneth Oshman | | — | | — | | 800,000 | (4) | | — | | 1,043,050 | | — |

|

Beatrice Yormark | | 110,000 | | 1,298,000 | | 179,166 | (5) | | 145,834 | | 521,525 | | — |

|

Oliver R. Stanfield | | 120,000 | | 1,416,000 | | 179,166 | (5) | | 145,834 | | 521,525 | | — |

|

Frederik H. Bruggink | | — | | — | | 74,166 | (6) | | 105,834 | | 13,800 | | — |

|

Peter A. Mehring | | — | | — | | 220,833 | (7) | | 89,167 | | 876,775 | | — |

| (1) | | The value realized is based on the closing price of our common stock on the date of exercise, minus the per share exercise price, multiplied by the number of shares exercised. |

| (2) | | Certain options granted to our officers under our 1997 stock plan may be exercised immediately upon grant and prior to full vesting, subject to the optionee entering into a restricted stock purchase agreement with respect to unvested shares. |

| (3) | | The value of underlying securities is based on the $11.21 per share closing price of our common stock on December 31, 2002 minus the aggregate exercise price. |

| (4) | | Includes 412,499 vested shares and 387,501 unvested shares as of December 31, 2002. |

| (5) | | Includes 169,791 vested shares and 9,375 unvested shares as of December 31, 2002. |

| (6) | | Includes 54,166 vested shares and 20,000 unvested shares as of December 31, 2002. |

| (7) | | Includes 194,791 vested shares and 26,042 unvested shares as of December 31, 2002. |

Compensation Committee Interlocks and Insider Participation

During 2002, the Compensation Committee was comprised of Robert R. Maxfield and Richard M. Moley, both of whom were nonemployee directors. No interlocking relationship exists between any member of our Board of Directors or Compensation Committee and the Board of Directors or Compensation Committee of any other company, nor has any such interlocking relationship existed in the past.

REPORT OF THE COMPENSATION COMMITTEE OF OUR BOARD OF DIRECTORS

The Compensation Committee sets the compensation of our Chief Executive Officer, reviews the design and effectiveness of compensation programs for other key executives, and approves stock option grants for our employees. The Committee is comprised entirely of outside directors who have never served as officers of our company.

The goals of the Compensation Committee are to align compensation with our performance and objectives and to attract, retain and reward executive officers and employees whose contributions are critical to the long-term success of our company.

The primary components of our executive compensation package are salary, commissions for sales executives and stock options. We set our compensation package to be competitive with the marketplace.

16

Salary

The level of base salary for executive officers is set based upon their scope of responsibility, level of experience and individual performance. The salary range for each position is reviewed against the Radford Survey (a third-party compensation survey) data for high-tech companies with similar sales volumes located in the same geographic area. Additionally, the Compensation Committee takes into account general business and economic conditions and current circumstances of our company.

Commission for sales executives

Our 2002 sales commission plan provided the opportunity for commission payments based on meeting our revenue and other business objectives.

Stock options

The Compensation Committee believes that the granting of stock options is an important method of rewarding and motivating our employees by aligning employees’ interests with our stockholders. The Compensation Committee also recognizes that a stock incentive program is a necessary element in a competitive compensation package. The program utilizes a vesting schedule to encourage our employees to continue in the employ of our Company and to encourage employees to maintain a long-term perspective. In determining the size of stock option grants, the Compensation Committee focuses primarily on the employees’ current and expected future value to our company. The Compensation Committee also considers the number of unvested options held by the employee.

Management bonus plan

On December 14, 2001, the Compensation Committee, with the approval of our Board of Directors on February 22, 2002, approved a management bonus plan for certain of our officers that provided for potential cash bonus awards, with target bonuses ranging from approximately $15,000 per year to approximately $114,000 per year (contingent on the realization of profit targets), for the fiscal year ended December 31, 2002. Actual bonuses paid ranged from $14,364 to $90,773.

Compensation of the Chief Executive Officer

On December 14, 2001, the Compensation Committee, with the approval of our Board of Directors on February 22, 2002, set Mr. Oshman’s base salary at $100,000 with a targeted cash bonus, in connection with our management bonus plan, of approximately $400,000 (contingent on the realization of profit targets) for the fiscal year ended December 31, 2002.

In February 2002, the Compensation Committee, in consultation with our Board of Directors, granted Mr. Oshman an option to purchase 200,000 shares of our common stock at an exercise price of $16.35, the then current fair market value. Twenty-five percent of the option vests on February 22, 2003. The option vests at a rate of 1/48 per month thereafter until fully vested on February 22, 2006.

17

On January 13, 2003, the Compensation Committee, in consultation with our Board of Directors, set Mr. Oshman’s base salary at $100,000 with a targeted cash bonus, in connection with our management bonus plan, of approximately $400,000 (contingent on the realization of profit targets and other measurable objectives) for the fiscal year ending December 31, 2003.

Compensation Committee

Robert R. Maxfield

Richard M. Moley

REPORT OF THE AUDIT COMMITTEE OF OUR BOARD OF DIRECTORS

The Audit Committee of our Board of Directors serves as the representative of our Board of Directors for general oversight of our financial accounting and reporting process, system of internal control, audit process, and process for monitoring compliance with laws and regulations. Our management has primary responsibility for preparing our financial statements and our financial reporting process. Our independent accountants, KPMG LLP, are responsible for expressing an opinion on the conformity of our fiscal year 2002 audited financial statements to generally accepted accounting principles. In this context, the Audit Committee hereby reports as follows:

1. The Audit Committee has reviewed and discussed the audited financial statements with our management.

2. The Audit Committee has discussed with KPMG LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (“SAS No. 61”),Communication with Audit Committees, as modified or supplemented.

3. The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, as modified or supplemented, and has discussed with them their independence.

4. Based on the review and discussions referred to in paragraphs (1) through (3) above, the Audit Committee recommended to our Board of Directors, and our Board of Directors has approved, that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2002, for filing with the SEC.

Our Board of Directors has adopted a written charter for the Audit Committee, a copy of which is attached as Appendix A. Each of the members of the Audit Committee is independent as defined under the listing standards of the National Association of Securities Dealers.

Audit Committee

Robert J. Finocchio, Jr.

Michael E. Lehman

Arthur Rock

18

AUDIT AND RELATED FEES

Audit Fees

KPMG LLP billed us an aggregate of $224,700 in fees for professional services rendered in connection with the audit of our financial statements for the most recent fiscal year and the reviews of the financial statements included in each of our Quarterly Reports on Form 10-Q during the fiscal year ended December 31, 2002.

Financial Information Systems Design and Implementation Fees

KPMG LLP did not provide any services in connection with the design and implementation of financial information systems during 2002.

All Other Fees

During the fiscal year ended December 31, 2002, KPMG LLP billed us an aggregate of $126,060 in fees for consultation and due diligence assistance regarding various acquisitions. No fees were billed with respect to either tax compliance or tax consulting services rendered to us and our affiliates for the fiscal year ended December 31, 2002.

The Audit Committee has considered whether the non-audit services provided by KPMG LLP are compatible with maintaining the independence of KPMG LLP and has concluded that the independence of KPMG LLP is maintained and is not compromised by the services provided.

19

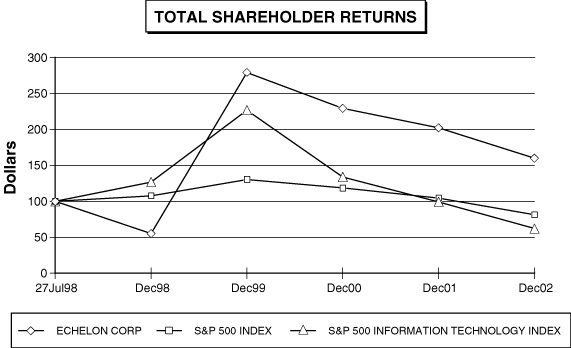

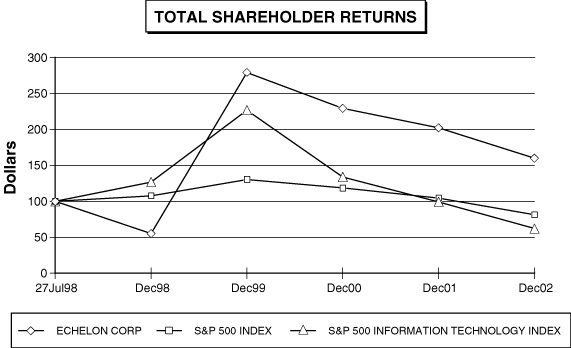

STOCK PRICE PERFORMANCE GRAPH

The graph below compares the cumulative total stockholder return on our common stock (assuming reinvestment of dividends) with the cumulative total return on the S&P 500 Index and the S&P 500 Information Technology Index (which replaced the S&P Technology 500 and is comprised of those companies in the information technology sector of the S&P 500 Index). The graph assumes that $100 was invested in our common stock on July 27, 1998, the effective date of our initial public offering, and in the S&P 500 Index and the S&P 500 Information Technology Index. Historic stock price performance is not necessarily indicative of future stock price performance.

20

OTHER MATTERS

As of the date hereof, our Board of Directors is not aware of any other matters to be submitted at the Annual Meeting. If any other matters properly come before the meeting, it is the intention of the persons named in the enclosed Proxy to vote the shares they represent as our Board of Directors recommends or as they otherwise deem advisable.

VOTING VIA THE INTERNET OR BY TELEPHONE

For Shares Directly Registered in the Name of the Stockholder

Stockholders with shares registered in their own names may vote those shares telephonically by calling 1-800-690-6903 (within the U.S. and Canada only, toll-free), or via the Internet at ADP Investor Communication Services’ voting Web site (www.proxyvote.com).

For Shares Registered in the Name of a Broker or a Bank

A number of brokers and banks are participating in a program provided through ADP Investor Communication Services that offers telephone and Internet voting options. If your shares are held in an account with a broker or a bank participating in the ADP Investor Communication Services program, you may vote those shares telephonically by calling the telephone number shown on the voting form received from your broker or bank, or via the Internet at ADP Investor Communication Services’ voting Web site (www.proxyvote.com).

General Information for All Shares Voted Via the Internet or By Telephone

Votes submitted via the Internet or by telephone must be received by 11:59 p.m., Eastern Time, on Thursday, May 15, 2003. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly. Stockholders voting via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the stockholder.

THE BOARD OF DIRECTORS

San Jose, California

April 14, 2003

21

APPENDIX A

ECHELON CORPORATION

CHARTER FOR THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

Purpose:

The purpose of the Audit Committee of Echelon Corporation (including its subsidiaries) (“Echelon” or the “Company”) shall be to:

| | 1. | | Oversee the accounting and financial reporting processes of the Company and the internal and external audits of the financial statements; |

| | 2. | | Assist the Board of Directors (the “Board”) in the oversight and monitoring of (i) the integrity of the Company’s financial statements, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the independent auditor’s qualifications, independence and performance, and (iv) the Company’s internal accounting and financial controls; |

| | 3. | | Outline to the Board the results of its monitoring and recommendations derived therefrom and improvements made, or to be made, in internal accounting controls; |

| | 4. | | Prepare the report that the rules of the Securities and Exchange Commission (the “SEC”) require to be included in the Company’s annual proxy statement; |

| | 5. | | Appoint independent auditors; and |

| | 6. | | Provide to the Board such additional information and materials as it may deem necessary to make the Board aware of significant financial matters that require Board attention. |

In addition, the Audit Committee will undertake those specific duties and responsibilities listed below and such other duties as the Board of Directors may from time to time prescribe.

Membership:

The Audit Committee will consist of at least three (3) members of the Board. The members of the Audit Committee will be appointed by and will serve at the discretion of the Board of Directors. Members of the Audit Committee must meet the following criteria (as well as any criteria required by the SEC):

| | 1. | | Each member will be an independent director as defined in (i) NASDAQ Rule 4200 and (ii) the rules of the SEC. |

| | 2. | | Each member of the Audit Committee shall be financially literate. Financial literacy shall mean the ability to read and understand, in accordance with the NASDAQ National Market Audit Committee requirements, financial statements including Echelon’s balance sheet, income statement and cash flow statement. |

A-1

| | 3. | | At least one member must also have past employment experience in accounting or related financial management experience. The experience criterion shall include past employment in finance or accounting, requisite professional certification in accounting, or other comparable experience or background, including a current or past position as a principal financial officer or other senior officer with financial oversight responsibilities. |

Responsibilities:

The responsibilities of the Audit Committee shall include:

| | 1. | | Reviewing on a continuing basis the adequacy of the Company’s system of internal controls, including meeting periodically with the Company’s management and the independent auditors to review the adequacy of such controls and to review before release the disclosure regarding such system of internal controls required under SEC rules to be contained in the Company’s periodic filings and the attestations or reports by the independent auditors relating to such disclosure. |

| | 2. | | Appointing, compensating and overseeing the work of the independent auditors (including resolving disagreements between management and the independent auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. |

| | 3. | | Pre-approving audit and non-audit services provided to the Company by the independent auditors (or subsequently approving non-audit services in those circumstances where a subsequent approval is necessary and permissible); in this regard, the Audit Committee shall have the sole authority to approve the hiring and firing of the independent auditors, all audit engagement fees and terms and all non-audit engagements, as may be permissible, with the independent auditors. |

| | 4. | | Reviewing and providing guidance with respect to the external audit and the Company’s relationship with its independent auditors by (i) reviewing the independent auditors’ proposed audit scope, approach and independence; (ii) obtaining on a periodic basis a statement from the independent auditors regarding relationships and services with the Company which may impact independence and presenting this statement to the Board of Directors, and to the extent there are relationships, monitoring and investigating them; (iii) reviewing the independent auditors’ peer review conducted every three years; (iv) discussing with the Company’s independent auditors the financial statements and audit findings, including any significant adjustments, management judgments and accounting estimates, significant new accounting policies and disagreements with management and any other matters described in SAS No. 61, as may be modified or supplemented; and (v) reviewing reports submitted to the audit committee by the independent auditors in accordance with the applicable SEC requirements. |

| | 5. | | Reviewing and discussing with management and the independent auditors the annual audited financial statements and quarterly unaudited financial statements, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” prior to filing the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, respectively, with the SEC. |

| | 6. | | Directing the Company’s independent auditors to review before filing with the SEC the Company’s interim financial statements included in Quarterly Reports on Form 10-Q, using professional standards and procedures for conducting such reviews. |

| | 7. | | Conducting a post-audit review of the financial statements and audit findings, including any significant suggestions for improvements provided to management by the independent auditors. |

| | 8. | | Reviewing before release the unaudited quarterly operating results in the Company’s quarterly earnings release. |

A-2

| | 9. | | Overseeing compliance with the requirements of the SEC for disclosure of auditor’s services and audit committee members, member qualifications and activities. |

| | 10. | | Reviewing, approving and monitoring the Company’s code of ethics for its senior financial officers. |

| | 11. | | Reviewing management’s monitoring of compliance with the Company’s standards of business conduct and with the Foreign Corrupt Practices Act. |

| | 12. | | Reviewing, in conjunction with counsel, any legal matters that could have a significant impact on the Company’s financial statements. |

| | 13. | | Providing oversight and review at least annually of the Company’s risk management policies, including its investment policies. |

| | 14. | | Reviewing the Company’s compliance with employee benefit plans. |

| | 15. | | Overseeing and reviewing the Company’s policies regarding information technology and management information systems. |

| | 16. | | If necessary, instituting special investigations with full access to all books, records, facilities and personnel of the Company. |

| | 17. | | As appropriate, obtaining advice and assistance from outside legal, accounting or other advisors. |

| | 18. | | Reviewing and approving in advance any proposed related party transactions. |

| | 19. | | Reviewing its own charter, structure, processes and membership requirements. |

| | 20. | | Providing a report in the Company’s proxy statement in accordance with the rules and regulations of the SEC. |

| | 21. | | Establishing procedures for receiving, retaining and treating complaints received by the Company regarding accounting, internal accounting controls or auditing matters and procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

In addition to the above responsibilities, the Audit Committee will undertake such other duties as the Board delegates to it, and will report, at least annually, to the Board regarding the Committee’s examinations and recommendations.

Meetings:

The Audit Committee will meet at least four times each year. The Audit Committee may establish its own schedule, which it will provide to the Board of Directors in advance.

The Audit Committee will meet separately with the Chief Executive Officer and separately with the Chief Financial Officer of Echelon at such times as are appropriate to review the financial affairs of Echelon. The Audit Committee will meet with the independent auditors of Echelon at such times as it deems appropriate, to review the independent auditor’s examination and management report and to fulfill the Audit Committee’s responsibilities under this Charter.

A-3

Reports: