- DHR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Danaher (DHR) DEF 14ADefinitive proxy

Filed: 20 Mar 09, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

DANAHER CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

DANAHER CORPORATION

2099 Pennsylvania Avenue, N.W., 12th Floor

Washington, D.C. 20006

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 5, 2009

To the Shareholders:

Notice is hereby given that the 2009 Annual Meeting of Shareholders of Danaher Corporation, a Delaware corporation (“Danaher”), will be held at the Mayflower Hotel, 1127 Connecticut Avenue, N.W., Washington, D.C., on May 5, 2009 at 3:00 p.m., local time, for the following purposes:

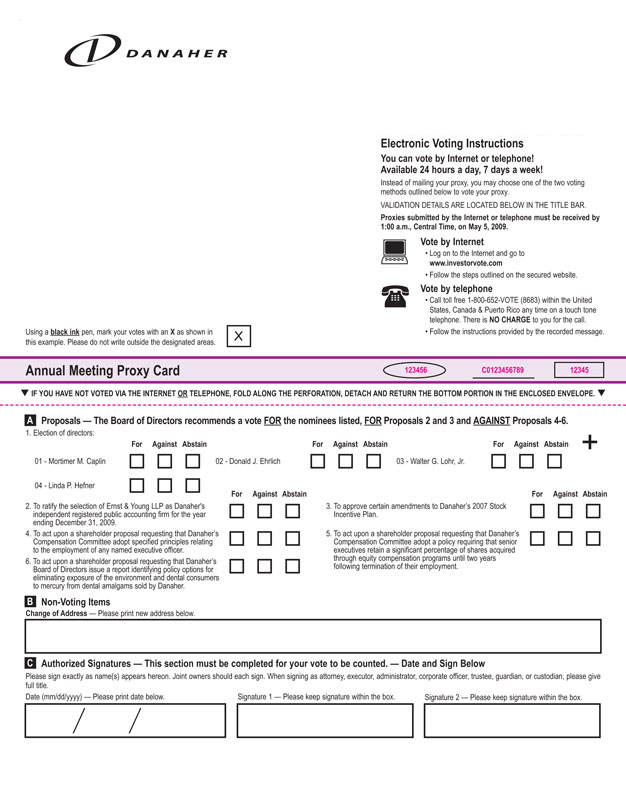

| 1. | To elect the four directors named in the attached proxy statement to hold office for a term of three years and until their successors are elected and qualified. |

| 2. | To ratify the selection of Ernst & Young LLP as Danaher’s independent registered public accounting firm for the year ending December 31, 2009. |

| 3. | To approve certain amendments to Danaher’s 2007 Stock Incentive Plan |

| 4. | To act upon a shareholder proposal requesting that Danaher’s Compensation Committee adopt specified principles relating to the employment of any named executive officer, if properly presented at the meeting |

| 5. | To act upon a shareholder proposal requesting that Danaher’s Compensation Committee adopt a policy requiring that senior executives retain a significant percentage of shares acquired through equity compensation programs until two years following termination of their employment, if properly presented at the meeting. |

| 6. | To act upon a shareholder proposal requesting that Danaher’s Board of Directors issue a report identifying policy options for eliminating exposure of the environment and dental consumers to mercury from dental amalgams sold by Danaher, if properly presented at the meeting. |

| 7. | To consider and act upon such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors has fixed the close of business on March 9, 2009 as the record date for determination of shareholders entitled to notice of and to vote at the meeting and any adjournment thereof.

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE DANAHER CORPORATION ANNUAL MEETING. Most stockholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 5, 2009.

This proxy statement and the accompanying annual report are available at:

http://www.danaher.com/proxy.

BY ORDER OF THE BOARD OF DIRECTORS

JAMES F. O’REILLY

Secretary

March 20, 2009

PROXY STATEMENT

DANAHER CORPORATION

2099 Pennsylvania Avenue, N.W., 12th Floor

Washington, D.C. 20006

2009 ANNUAL MEETING OF SHAREHOLDERS

MAY 5, 2009

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (“Board”) of Danaher Corporation, a Delaware corporation (“Danaher”), of proxies for use at the 2009 Annual Meeting of Shareholders (“Annual Meeting”) to be held at the Mayflower Hotel, 1127 Connecticut Avenue, N.W., Washington, D.C. on May 5, 2009 at 3:00 p.m., local time, and at any and all adjournments thereof. Danaher’s principal address is 2099 Pennsylvania Avenue, N.W., 12th Floor, Washington, D.C. 20006. The date of mailing of this Proxy Statement is on or about March 20, 2009. The purpose of the meeting is to: elect the four directors named in the attached proxy statement to hold office for a term of three years and until their successors are elected and qualified; ratify the selection of Ernst & Young LLP as Danaher’s independent registered public accounting firm for the year ending December 31, 2009; approve certain amendments to Danaher’s 2007 Stock Incentive Plan; act upon a shareholder proposal requesting that Danaher’s Compensation Committee adopt specified principles relating to the employment of any named executive officer, if properly presented at the meeting; act upon a shareholder proposal requesting that Danaher’s Compensation Committee adopt a policy requiring that senior executives retain a significant percentage of shares acquired through equity compensation programs until two years following termination of their employment, if properly presented at the meeting; act upon a shareholder proposal requesting that Danaher’s Board of Directors issue a report identifying policy options for eliminating exposure of the environment and dental consumers to mercury from dental amalgams sold by Danaher, if properly presented at the meeting; and consider and act upon such other business as may properly come before the meeting or any adjournment thereof.

OUTSTANDING STOCK AND VOTING RIGHTS

In accordance with Danaher’s Bylaws, the Board has fixed the close of business on March 9, 2009 as the record date for determining the shareholders entitled to notice of, and to vote at, the Annual Meeting. Only shareholders of record on that date will be entitled to vote. Proxies will be voted as specified in the shareholder’s proxy. In the absence of specific instructions, proxies will be voted (1) FOR each of the nominees named herein as directors, or their respective substitutes as may be appointed by the Board, (2) FOR ratification of the selection of Ernst & Young LLP as Danaher’s independent registered public accounting firm for the year ending December 31, 2009, (3) FOR the amendments to Danaher’s 2007 Stock Incentive Plan, (4) AGAINST the shareholder proposal requesting the adoption of specified principles relating to the employment of any named executive officer, (5) AGAINST the shareholder proposal requesting the adoption of a policy requiring senior executives to retain a significant percentage of shares acquired through equity compensation programs until two years following termination of their employment, (6) AGAINST the shareholder proposal requesting the issuance of a report identifying policy options for eliminating exposure of the environment and dental consumers to mercury from dental amalgams sold by Danaher, and (7) in the discretion of the proxy holders on any other matter which properly comes before the meeting or any adjournment thereof. The Board has selected Steven Rales and Mitchell Rales to act as proxies with full power of substitution.

The proxies being solicited hereby are being solicited by Danaher’s Board. The total expense of the solicitation will be borne by Danaher, including reimbursement paid to brokerage firms and others for their expenses in forwarding material regarding the Annual Meeting to beneficial owners. Solicitation of proxies may be made personally or by mail, telephone, internet, e-mail or facsimile by officers and other management employees of Danaher, who will receive no additional compensation for their services. We have retained Georgeson Shareholder Communications, Inc. to aid in the solicitation of proxies. For these services, we expect to pay Georgeson a fee of less than $15,000 and reimburse it for certain out-of-pocket disbursements and expenses.

1

The only outstanding securities of Danaher entitled to vote at the Annual Meeting are shares of Common Stock, $.01 par value. As of the close of business on March 9, 2009, the record date for determining the shareholders of Danaher entitled to vote at the Annual Meeting, 318,704,681 shares of Danaher Common Stock were outstanding, excluding shares held by or for the account of Danaher. Each outstanding share of Danaher Common Stock entitles the holder to one vote on all matters brought before the Annual Meeting. The quorum necessary to conduct business at the Annual Meeting consists of a majority of the issued and outstanding shares of Danaher Common Stock entitled to vote at the Annual Meeting as of the record date. Abstentions and broker non-votes are counted as present in determining whether the quorum requirement is satisfied.

If you are a beneficial owner and do not provide the shareholder of record with voting instructions, your shares may constitute broker non-votes. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. With respect to Proposals 3, 4, 5 and 6, brokers or other nominees that are New York Stock Exchange member organizations are prohibited from voting unless they receive specific instructions from the beneficial owner of the shares. Broker non-votes will not affect the required vote with respect to Proposals 4, 5 and 6 but, as discussed below, could affect the required vote with respect to Proposal 3.

If a quorum is present, the vote required to approve each of the proposals is as follows:

| • | With respect to Proposal 1, the election of directors, you may vote “for” or “against” any or all director nominees or you may abstain as to any or all director nominees. In uncontested elections of directors, such as this election, a nominee is elected by a majority of the votes cast by the shares present in person or represented by proxy and entitled to vote. A “majority of the votes cast” means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that nominee. A vote to abstain is not treated as a vote “for” or “against,” and thus will have no effect on the outcome of the vote. Under our director resignation policy, our Board will not nominate a director for election, or appoint a director to fill a vacancy or new directorship, unless the individual has tendered in advance an irrevocable resignation effective in such circumstances where the individual does not receive a majority of the votes cast in an uncontested election. If an incumbent director is not elected by a majority of the votes cast in an uncontested election, our Nominating and Governance Committee will make a determination whether to accept or reject the director’s resignation and will submit such recommendation for prompt consideration by the Board. The Board expects the director whose resignation is under consideration to abstain from participating in any decision regarding that resignation. |

| • | For Proposals 2, 3, 4, 5 and 6, the affirmative vote of a majority of the shares of Danaher Common Stock represented in person or by proxy and entitled to vote on the proposal is required for approval. For these proposals, abstentions are counted for purposes of determining the minimum number of affirmative votes required for approval of a particular proposal and, accordingly, have the effect of a vote against the proposal. In addition, in order for Proposal 3 to be approved, the New York Stock Exchange listing standards require that the total votes cast must represent more than 50% of the Danaher Common Stock issued, outstanding and entitled to vote at the Annual Meeting (with abstentions counting as votes cast and broker non-votesnot counting as votes cast).As a result, the failure to give your broker instructions for how to vote on Proposal 3 could, depending on the number of votes cast, result in the proposal not being adopted. |

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A. (“Computershare”), you are considered theregistered holder of those shares. As theregistered stockholder, you can ensure your shares are voted at the meeting by submitting your instructions by telephone, over the Internet, by completing, signing, dating and returning the enclosed proxy card in the envelope provided, or by attending the annual meeting and voting your shares at the meeting. You may obtain directions to the annual meeting in order to vote in person by calling Danaher’s Investor Relations department at 202-828-0850. Most

2

Danaher stockholders hold their shares through a broker, bank, trustee or another nominee, rather than registered directly in their name. In that case, you are considered thebeneficial owner of shares held in street name, and the proxy materials are being forwarded to you by your broker, bank, trustee or nominee, together with a voting instruction card. As thebeneficial owner, you are entitled to direct the voting of your shares by your intermediary. Brokers, banks and nominees typically offer telephonic or electronic means by which thebeneficial owners of shares held by them can submit voting instructions, in addition to the traditional mailed voting instruction cards.

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of Danaher a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke your proxy or vote at the meeting, you must follow the instructions provided to you by the record holder and/or obtain from the record holder a proxy issued in your name. Attendance at the meeting will not, by itself, revoke a proxy. All votes will be counted by an independent inspector of election appointed for the meeting.

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our proxy statement and annual report to stockholders may have been sent to multiple stockholders in your household. You may revoke your consent to householding at any time by sending your name, the name of your brokerage firm, and your account number to Householding Department, 51 Mercedes Way, Edgewood, NY 11717 or telephoning 1-800-542-1061. The revocation of your consent to householding will be effective 30 days after its receipt. We will promptly deliver a separate copy of our annual report and proxy statement to you if you contact us at Danaher Corporation, Attn: Investor Relations, 2099 Pennsylvania Avenue, N.W., 12th Floor, Washington, D.C. 20006; telephone us at 202-828-0850; or email us at ir@danaher.com. If you want to receive separate copies of the proxy statement or annual report to stockholders in the future; if you and another shareholder sharing an address would like to request delivery of a single copy of the proxy statement or annual report to stockholders at such address in the future; or if you would like to make a permanent election to receive either printed or electronic copies of the proxy materials in the future, you may contact us at the above address, telephone number or email address.

If you participate in the Danaher Stock Fund through the Danaher Corporation & Subsidiaries Retirement and Savings Plan or the Danaher Corporation & Subsidiaries Savings Plan (collectively, the “Savings Plans”), your proxy will also serve as a voting instruction for Fidelity Management Trust Company (“Fidelity”), the trustee of the Savings Plans, with respect to shares of Common Stock attributable to your Savings Plan account as of the record date. Fidelity will vote your Savings Plan shares as of the record date in the manner directed by you. If Fidelity does not receive voting instructions from you by April 30, 2009, Fidelity will not vote your Savings Plan shares on any of the proposals brought at the Annual Meeting.

3

BENEFICIAL OWNERSHIP OF DANAHER COMMON STOCK BY

DIRECTORS, OFFICERS AND PRINCIPAL SHAREHOLDERS

The following table sets forth as of March 9, 2009, the number of shares and percentage of Danaher Common Stock beneficially owned by (1) each person who owns of record or is known to Danaher to beneficially own more than five percent of Danaher’s Common Stock, (2) each of Danaher’s directors and nominees for director and each of the executive officers named in the Summary Compensation Table (the “named executive officers”), and (3) all executive officers and directors of Danaher as a group. As of March 9, 2009, 318,704,681 shares of Danaher Common Stock were outstanding, excluding shares held by or for the account of Danaher. Except as otherwise indicated and subject to community property laws where applicable, each person or entity included in the table below has sole voting and investment power with respect to the shares beneficially owned by that person or entity. Under applicable SEC rules, the definition of beneficial ownership for purposes of this table includes shares over which a person or entity has sole or shared voting or investment power, whether or not the person or entity has any economic interest in the shares, and also includes shares for which the person has the right to acquire beneficial ownership within 60 days of March 9, 2009.

Name | Number of | Percent | ||||

Mortimer M. Caplin | 339,638 | (2) | * | |||

H. Lawrence Culp, Jr. | 3,329,368 | (3) | * | |||

Donald J. Ehrlich | 97,200 | (4) | * | |||

Linda P. Hefner | 14,657 | (5) | * | |||

Walter G. Lohr, Jr. | 349,336 | (6) | * | |||

Mitchell P. Rales | 28,207,684 | (7) | 8.9 | % | ||

Steven M. Rales | 31,081,748 | (8) | 9.8 | % | ||

John T. Schwieters | 24,001 | (9) | * | |||

Alan G. Spoon | 45,054 | (10) | * | |||

Daniel L. Comas | 283,928 | (11) | * | |||

Thomas P. Joyce, Jr. | 285,234 | (12) | * | |||

Philip W. Knisely | 1,109,173 | (13) | * | |||

James A. Lico | 311,572 | (14) | * | |||

T. Rowe Price Associates, Inc. | 37,688,641 | (15) | 11.8 | % | ||

FMR Corp. | 22,900,360 | (16) | 7.2 | % | ||

All executive officers and directors as a group (18 persons) | 65,931,720 | (17) | 20.3 | % |

| (1) | Pursuant to the definition of beneficial ownership, balances credited to an officer’s account under the Amended and Restated Danaher Corporation Executive Deferred Incentive Program (the “EDIP”), which could under the terms of the EDIP be converted into shares of Danaher Common Stock within 60 days of March 9, 2009, are reflected in the table. EDIP participants generally have the right to terminate employment at any time and at their election receive an immediate distribution of their vested EDIP balance in the form of Danaher Common Stock. For purposes of the table, the number of shares of Danaher Common Stock attributable to a person’s EDIP account is equal to (all amounts rounded to the next lowest whole share) (1) the person’s outstanding EDIP balance as of March 9, 2009 (to the extent such balance is vested or will become vested within 60 days of March 9, 2009), divided by (2) the closing price of Danaher Common Stock as reported on the New York Stock Exchange on March 9, 2009 ($48.03 per share). For purposes of the table, the number of shares attributable to each executive officer’s 401(k) account is equal to (all amounts rounded to the next lowest whole share) (a) the officer’s balance, as of March 9, 2009, in the Danaher stock fund included in the executive officer’s 401(k) account (the “401(k) Danaher Stock Fund”), divided by (b) the closing price of Danaher Common Stock as reported on the New York Stock Exchange on March 9, 2009. The 401(k) Danaher Stock Fund consists of a unitized pool of Danaher Common Stock and cash, and as such does not allocate a specific number of shares of Danaher Common |

4

Stock to each participant. The table also includes shares that may be acquired upon (x) exercise of options that are exercisable within 60 days of March 9, 2009, or (y) vesting of restricted stock units (“RSUs”) that vest within 60 days of March 9, 2009. |

| (2) | Includes options to acquire 40,000 shares and 237,240 shares, in each case owned by a revocable trust of which Mr. Caplin and his spouse are the sole trustees, 46,960 shares owned by grantor retained annuity trusts of which Mr. Caplin is trustee and the sole annuitant, 14,148 shares held by a charitable foundation of which Mr. Caplin is director and president, and 1,290 phantom shares attributable to Mr. Caplin’s account under the Non-Employee Directors’ Deferred Compensation Plan. The 237,240 shares owned outright by the revocable trust are pledged to a bank as security. Mr. Caplin disclaims beneficial ownership of the shares held by the charitable foundation. |

| (3) | Includes options to acquire 2,650,000 shares held directly by Mr. Culp and options to acquire 500,000 shares held by a limited liability company of which Mr. Culp and a family trust are the sole members, 1,833 shares attributable to Mr. Culp’s 401(k) account and 150,082 shares attributable to Mr. Culp’s EDIP account. |

| (4) | Includes options to acquire 40,000 shares, 16,000 shares owned by Ripple Creek Limited Partnership, of which Mr. Ehrlich is a general partner, 6,400 shares owned by an IRA for the benefit of Mr. Ehrlich and 1,000 shares owned by Mr. Ehrlich’s spouse. Mr. Ehrlich disclaims beneficial ownership of the shares held by his spouse. |

| (5) | Includes options to acquire 12,000 shares. The 2,657 shares owned outright by Ms. Hefner are pledged as security under a real property mortgage. |

| (6) | Includes options to acquire 40,000 shares. Also includes 32,000 shares held by a charitable foundation of which Mr. Lohr is president, and 53,336 shares held by Mr. Lohr as trustee of a trust for his children, as to each of which Mr. Lohr disclaims beneficial ownership. |

| (7) | Includes 4,714,617 shares owned directly, 22,000,000 shares owned by limited liability companies of which Mr. Rales is the sole member, 428,040 shares owned by an IRA for the benefit of Mr. Rales, 1,000,000 shares owned by grantor retained annuity trusts as to which Mr. Rales is trustee and the sole annuitant and 65,027 shares attributable to Mr. Rales’ 401(k) account. All of the shares of Danaher Common Stock held by the limited liability companies of which Mr. Rales is the sole member, and 2,000,000 of the shares held directly by Mr. Rales, are pledged to secure lines of credit with certain banks and each of these entities and Mr. Rales is in compliance with these lines of credit. 2,012,284 of the shares of Danaher Common Stock held directly by Mr. Rales are pledged as collateral to secure a loan of shares to him by Capital Yield Corporation, an entity owned by Messrs. Steven Rales and Mitchell Rales, and Mr. Rales is in compliance with this loan. The business address of Mitchell Rales, and of each of the limited liability companies, is 2099 Pennsylvania Avenue, N.W., Washington, D.C. 20006. On a combined basis, Steven Rales and Mitchell Rales own 59,289,432 shares, or 18.6% of the Danaher Common Stock. |

| (8) | Includes 9,007,370 shares owned directly, 22,000,000 shares owned by limited liability companies of which Mr. Rales is the sole member, 3,378 shares attributable to Mr. Rales’ 401(k) account and 71,000 shares owned by a charitable foundation of which Mr. Rales is a director. Mr. Rales disclaims beneficial ownership of those shares held by the charitable foundation. All of the shares of Danaher Common Stock held by the limited liability companies of which Mr. Rales is the sole member, and 2,000,000 of the shares held directly by Mr. Rales, are pledged to secure lines of credit with certain banks and each of these entities and Mr. Rales is in compliance with these lines of credit. 2,000,000 of the shares of Danaher Common Stock held directly by Mr. Rales are pledged as collateral to secure a loan of shares to him by Capital Yield Corporation, an entity owned by Messrs. Steven Rales and Mitchell Rales, and Mr. Rales is in compliance with this loan. The business address of Steven Rales, and of each of the limited liability companies, is 2099 Pennsylvania Avenue, N.W., Washington, D.C. 20006. On a combined basis, Steven Rales and Mitchell Rales own 59,289,432 shares, or 18.6% of the Danaher Common Stock. |

| (9) | Includes options to acquire 20,000 shares. The 4,001 shares owned outright by Mr. Schwieters are held in a margin account. |

5

| (10) | Includes options to acquire 40,000 shares and 1,053 phantom shares attributable to Mr. Spoon’s account under the Non-Employee Directors’ Deferred Compensation Plan. |

| (11) | Includes options to acquire 270,000 shares, 3,256 shares attributable to Mr. Comas’ 401(k) account, 5,422 shares attributable to Mr. Comas’ EDIP account and 2,264 shares held by Mr. Comas’ spouse. Mr. Comas disclaims beneficial ownership of the shares held by his spouse. |

| (12) | Includes options to acquire 220,000 shares, 10,000 shares underlying RSUs, 23,696 shares attributable to Mr. Joyce’s 401(k) account and 27,516 shares attributable to Mr. Joyce’s EDIP account. |

| (13) | Includes options to acquire 1,096,193 shares, 2,391 shares attributable to Mr. Knisely’s EDIP account and 5,010 shares held jointly by Mr. Knisely and his spouse. |

| (14) | Includes options to acquire 273,733 shares, 13,333 shares underlying RSUs, 4,947 shares attributable to Mr. Lico’s 401(k) account and 16,235 shares attributable to Mr. Lico’s EDIP account. |

| (15) | The amount shown and the following information is derived from Schedule 13G dated February 13, 2009 filed by T. Rowe Price Associates, Inc. (“Price Associates”), which sets forth Price Associates’ beneficial ownership as of December 31, 2008. According to the Schedule 13G, Price Associates has sole voting power over 10,872,127 shares and sole dispositive power over 37,594,041 shares. These shares are owned by various individual and institutional investors for which Price Associates serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. The address of Price Associates is 100 E. Pratt Street, Baltimore, Maryland 21202. |

| (16) | The amount shown and the following information is derived from Schedule 13G dated February 12, 2009 filed by FMR LLC and Edward C. Johnson 3d, which sets forth their respective beneficial ownership as of December 31, 2008. Pursuant to the Schedule 13G, 21,765,940 of the shares reported (including 1,890 shares which may be acquired by the holder at any time upon conversion of $130,000 principal amount of Danaher’s zero coupon Liquid Yield Option Notes due 2021 (the “LYONs”)) are beneficially owned by Fidelity Management & Research Company, an investment adviser and a wholly-owned subsidiary of FMR LLC, as a result of acting as investment adviser to various investment companies (collectively, the “Fidelity Funds”), and with respect to these shares, FMR LLC, Mr. Edward C. Johnson 3d and each of the Fidelity Funds exercise investment power and the Fidelity Funds’ Boards of Trustees exercises voting power; 2,760 shares are beneficially owned by Strategic Advisors, Inc., an investment advisor and wholly owned subsidiary of FMR LLC; 27,108 shares (including 4,608 shares which may be acquired by the holder at any time upon conversion of $317,000 principal amount of Danaher’s LYONs) are owned by Pyramis Global Advisors, LLC, a wholly-owned subsidiary of FMR LLC, as to which each of Mr. Johnson and FMR LLC, through its control of Pyramis Global Advisors, LLC, has investment and voting power; 415,718 shares (including 291 shares which may be acquired by the holder at any time upon conversion of $20,000 principal amount of Danaher’s LYONs) are owned by Pyramis Global Advisors Trust Company, a bank and a wholly-owned subsidiary of FMR LLC, as to which each of Mr. Johnson and FMR LLC, through its control of Pyramis Global Advisors Trust Company, has investment power, and voting power with respect to 311,208 of such shares; and the remaining 688,834 shares reported are beneficially owned by Fidelity International Limited, an investment adviser and an entity independent of FMR LLC, as to which shares Fidelity International Limited exercises sole investment and voting power. The address of FMR LLC is 82 Devonshire Street, Boston, Massachusetts 02109. |

| (17) | Includes options to acquire 5,368,726 shares, 57,333 shares underlying RSUs, 148,011 shares attributable to executive officers’ 401(k) accounts and 276,917 shares attributable to executive officers’ EDIP accounts. In addition to the shares identified in the footnotes above as being pledged as security, an additional 79,030 of the aggregate shares beneficially owned by directors and executive officers are pledged as security. |

| * | Represents less than 1% of the outstanding Danaher Common Stock. |

6

PROPOSAL 1.

ELECTION OF DIRECTORS OF DANAHER

Danaher’s Certificate of Incorporation provides that the Board is divided into three classes with the number of directors in each class to be as equal as possible. The Board has fixed the number of directors at ten. At the 2009 Annual Meeting, shareholders will be asked to elect the four directors set forth below to serve until the 2012 annual meeting of shareholders and until their successors are duly elected and qualified. The Board has nominated Mortimer M. Caplin, Donald J. Ehrlich, Linda P. Hefner and Walter G. Lohr, Jr. to serve as directors in the class whose term expires in 2012. Messrs. Steven M. Rales, John T. Schwieters and Alan G. Spoon will continue to serve as directors in the class whose term expires in 2010. Messrs. Mitchell P. Rales and H. Lawrence Culp, Jr. will continue to serve as directors in the class whose term expires in 2011.

The names of the nominees and the directors continuing in office, their principal occupations, the years in which they became directors and the years in which their terms are scheduled to expire are set forth below. In the event a nominee shall decline or be unable to serve, the proxies may be voted in the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this will occur.

NOMINEES FOR ELECTION AT THIS YEAR’S ANNUAL MEETING

TO SERVE IN THE CLASS WHOSE TERM EXPIRES IN 2012

Name | Age | Principal Occupation | Director Since | |||

Mortimer M. Caplin (a,b) | 92 | Member of Caplin & Drysdale, a law firm in Washington, D.C., for over five years; director of Presidential Realty Corporation. | 1990 | |||

Donald J. Ehrlich (a,b) | 71 | President and Chief Executive Officer of Schwab Corp., a manufacturer of fire-protective safes, files, cabinets and vault doors, from January 2003 to July 2008; consultant to Wabash National Corp., a manufacturer of standard and customized truck trailers, from July 2001 to July 2004. | 1985 | |||

Linda P. Hefner (c) | 49 | Executive Vice President and General Manager of the Home Division of Wal-Mart Stores Inc., an operator of retail stores, since May 2007; Executive Vice President, Global Strategy and Business Development for Kraft Foods Inc., a company that manufactures and sells branded foods and beverages, from May 2004 through December 2006; served in various management positions with Sara Lee Corporation, a manufacturer and marketer of food and household products, from 1989 to May 2004. | 2005 | |||

Walter G. Lohr, Jr. (c) | 65 | Partner of Hogan & Hartson, a law firm in Baltimore, in Baltimore, Maryland for over five years. | 1983 | |||

7

Recommendation Of The Board Of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES TO THE BOARD OF DIRECTORS.

CURRENT DIRECTORS WHOSE TERM WILL CONTINUE AFTER THIS MEETING

Name | Age | Principal Occupation | Director Since | Term Expires | ||||

Steven M. Rales (d) | 57 | Chairman of the Board of Danaher since 1984; for more than the past five years, he has been a principal in private and public business entities in the areas of manufacturing and film production. | 1983 | 2010 | ||||

John T. Schwieters (a,c) | 69 | Vice Chairman of Perseus, LLC, a merchant bank and private equity fund management company, since April 2000; director of Smithfield Foods, Inc., and Choice Hotels International, Inc. | 2003 | 2010 | ||||

Alan G. Spoon (b) | 57 | Managing General Partner of Polaris Venture Partners, a company which invests in private technology firms, since May 2000; director of IAC/InterActiveCorp. | 1999 | 2010 | ||||

H. Lawrence Culp, Jr. | 46 | President and Chief Executive Officer of Danaher since May 2001; director of GlaxoSmithKline plc. | 2001 | 2011 | ||||

Mitchell P. Rales (d) | 52 | Chairman of the Executive Committee of Danaher since 1990; for more than the past five years, he has been a principal in private and public business entities in the manufacturing area. Mr. Rales also serves as a director of Colfax Corporation. | 1983 | 2011 | ||||

| (a) | Member of the Audit Committee of the Board of Directors. |

| (b) | Member of the Compensation Committee of the Board of Directors. |

| (c) | Member of the Nominating and Governance Committee of the Board of Directors |

| (d) | Mitchell Rales and Steven Rales are brothers. |

8

CORPORATE GOVERNANCE

Director Independence

At least a majority of the Board must qualify as independent within the meaning of the listing standards of the New York Stock Exchange. The Board has affirmatively determined that other than Messrs. Steven Rales, Mitchell Rales and H. Lawrence Culp, Jr., each of whom is an executive officer of Danaher, all of the remaining six members of the Board, consisting of Ms. Hefner and Messrs. Caplin, Ehrlich, Lohr, Schwieters and Spoon, are independent within the meaning of the listing standards of the New York Stock Exchange. The Board had previously concluded that A. Emmet Stephenson, Jr., who retired from the Board as of May 6, 2008, was also independent within the meaning of the listing standards of the New York Stock Exchange. Mr. Stephenson served on the Compensation Committee prior to his retirement in 2008. The Board concluded that none of the independent directors possesses any of the bright-line relationships set forth in the listing standards of the New York Stock Exchange that prevent independence, or except as discussed below, any other relationship with Danaher other than Board membership.

| • | With respect to Mr. Lohr, the Board considered the fact that Mr. Lohr and other attorneys at the Hogan & Hartson law firm (at which Mr. Lohr is a partner) provide legal services to Messrs. Steven Rales and Mitchell Rales and entities controlled by them. The Board concluded that the relationship does not constitute a material relationship because it has not impaired and does not impair Mr. Lohr’s independent judgment in connection with his duties and responsibilities as a director of Danaher. The aggregate amount of legal services provided by Hogan & Hartson in 2008 to the Rales’ and their affiliates, was less than one percent of Hogan & Hartson’s annual revenues. |

| • | With respect to Ms. Hefner, the Board considered the fact that Ms. Hefner is an officer of Wal-Mart and that certain of Danaher’s subsidiaries sold products to and purchased products from Wal-Mart in 2008 on commercial terms. The Board concluded that none of these transactions constitutes a material relationship because all of the sales and purchases were conducted in the ordinary course of business and on an arm’s-length basis and Ms. Hefner had no role in the decision-making at Wal-Mart or Danaher with respect to such transactions. The amount of sales and purchases in 2008 was in each case less than one percent of the annual revenues of each of Danaher and Wal-Mart. |

| • | With respect to Mr. Ehrlich, the Board considered the fact that certain of his immediate family members during 2008 were employed by businesses that on a commercial basis purchased products from certain of Danaher’s subsidiaries in 2008. The Board concluded that none of these transactions constitutes a material relationship because all of the sales were conducted in the ordinary course of business and on an arm’s-length basis and neither Mr. Ehrlich nor any of the immediate family members had any role in the decision-making at Danaher or such other companies with respect to such transactions. In each case, the amount of sales in 2008 was less than one percent of the annual revenues of each of Danaher and the other company. |

Majority Voting for Directors

Our Bylaws provide for majority voting in director elections, and our Board has adopted a director resignation policy. Under the policy, the Board will not nominate a director for election, or appoint a director to fill a vacancy or new directorship, unless the individual has tendered in advance an irrevocable resignation effective if the individual does not receive a majority of the votes cast in an uncontested election. If an incumbent director is not elected by a majority of the votes cast in an uncontested election, our Nominating and Governance Committee will make a determination whether to accept or reject the director’s resignation and will submit such recommendation for prompt consideration by the Board. The Board expects the director whose resignation is under consideration to abstain from participating in any decision regarding that resignation.

9

Board of Directors and Committees of the Board

General.The Board had a total of nine meetings during 2008. All directors attended at least 75% of the meetings of the Board and of the Committees of the Board on which they served during 2008.

Audit Committee.The Audit Committee operates pursuant to a written charter. The Committee assists the Board in overseeing the integrity of Danaher’s financial statements, Danaher’s compliance with legal and regulatory requirements, the qualifications and independence of Danaher’s independent auditors, and the performance of Danaher’s internal audit function and independent auditors. The Committee reports to the Board on its actions and recommendations at each regularly scheduled Board meeting. The Board has determined that all of the members of the Audit Committee are independent for purposes of Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended, and the listing standards of the New York Stock Exchange, that Mr. Schwieters and Mr. Ehrlich each qualify as an audit committee financial expert as that term is defined in Item 407(d)(5) of Regulation S-K and that each member of the Audit Committee is financially literate within the meaning of the listing standards of the New York Stock Exchange. The Audit Committee met eight times during 2008.

Compensation Committee.The Compensation Committee operates pursuant to a written charter. Each member of the Compensation Committee is an “outside director” for purposes of Section 162(m) of the Internal Revenue Code, a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act and, based on the determination of the Board, independent under the New York Stock Exchange listing standards. The Committee discharges the Board’s responsibilities relating to compensation of our executive officers, including evaluating the performance of, and approving the compensation paid to, our executive officers. The Committee also:

| • | reviews and discusses with Company management the Compensation Discussion & Analysis (CD&A) included in the Company’s annual meeting proxy statement and recommends to the Board the inclusion of the CD&A in the annual meeting proxy statement; |

| • | reviews and makes recommendations to the Board with respect to the adoption, amendment and termination of all executive incentive compensation plans and all equity compensation plans, and exercises all authority of the Board (and all responsibilities assigned by such plans to the Committee) with respect to the administration of such plans; and |

| • | monitors compliance by directors and executive officers with the Company’s stock ownership requirements. |

The Compensation Committee met 14 times during 2008. While the Committee’s charter authorizes it to delegate its powers to sub-committees, the Committee did not do so during 2008. The Committee reports to the Board on its actions and recommendations at each regularly scheduled Board meeting. The Chairman of the Committee, Mr. Ehrlich, works with our CEO to schedule the Committee’s meetings and set the agenda for each meeting. Our CEO, Senior Vice President and General Counsel, and Associate General Counsel and Secretary generally attend the Committee meetings and support the Committee in preparing meeting materials and taking meeting minutes. In particular, our CEO provides background regarding the interrelationship between our business objectives and executive compensation matters; participates in the Committee’s discussions regarding the compensation of the other executive officers and provides recommendations to the Committee regarding all significant elements of compensation paid to such officers, their annual, personal performance objectives and his evaluation of their performance; and provides feedback regarding the companies that he believes Danaher competes with in the marketplace and for executive talent. Danaher’s human resources department also provides the Committee with such data relating to executive compensation as requested by the Committee. The Committee typically meets in executive session, without the presence of management, in conjunction with each regularly scheduled meeting.

Under the terms of its charter, the Committee has the authority to engage the services of outside advisors and experts to assist the Committee. The Committee engages F. W. Cook & Co., Inc. as the Committee’s compensation consultant. F.W. Cook takes its direction solely from the Committee. F.W. Cook’s primary

10

responsibilities in 2008 were to (1) assist the Committee in the modification of the peer group used for purposes of comparing executive compensation data, (2) provide a review of the Company’s executive compensation program, including a comparison of compensation levels for the Company’s named executive officers to external market rates to determine whether pay levels are competitive with the market for senior level talent, and (3) provide advice to the Committee in connection with the Company’s potential adoption of certain compensation-related policies. The Committee does not place any material limitations on the scope of the feedback provided by the compensation consultant. In the course of discharging its responsibilities, F.W. Cook may from time to time and with the Committee’s consent, request from management certain data regarding compensation amounts and practices and the nature of the company’s executive officer responsibilities. F.W. Cook has not performed and will not perform any services for Danaher other than the services provided to or at the direction of the Committee.

Nominating and Governance Committee.The Nominating and Governance Committee operates pursuant to a written charter. The Committee assists the Board in identifying individuals qualified to become Board members, consistent with criteria approved by the Board, and determining the size and composition of the Board and its committees, oversees the operation of Danaher’s corporate governance guidelines (including the annual Board and committee self-assessment process), evaluates the overall effectiveness of the Board and its committees, reviews and makes recommendations to the Board regarding director compensation, and administers Danaher’s related person transactions policy. The Board has determined that all of the members of the Nominating and Governance Committee are independent within the meaning of the listing standards of the New York Stock Exchange. The Nominating and Governance Committee met six times in 2008.

The Nominating and Governance Committee considers candidates for Board membership suggested by its members; other Board members; management; shareholders; and/or by any third-party director search firm that the Committee may retain from time to time to assist in the identification of candidates. During 2008 and 2009, the Committee has retained the services of an executive search firm to help identify and evaluate potential director candidates. A shareholder who wishes to recommend a prospective nominee for the Board should notify the Nominating and Governance Committee in writing using the procedures described below under “—Communications with the Board of Directors” with whatever supporting material the shareholder considers appropriate.

If a prospective nominee has been identified other than in connection with a director search process initiated by the Committee, the Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. The Committee’s determination of whether to conduct a full evaluation is based primarily on the Committee’s view as to whether a new or additional Board member is necessary or appropriate at such time, and the likelihood that the prospective nominee can satisfy the evaluation factors described below and any such other factors as the Committee may deem appropriate. The Committee takes into account whatever information is provided to the Committee with the recommendation of the prospective candidate, as well as the Committee’s own knowledge of the prospective candidate, if any, and any additional inquiries the Committee may in its discretion conduct or have conducted with respect to such prospective nominee.

If the Committee determines that a prospective nominee that has been identified other than in connection with a director search process initiated by the Committee warrants additional consideration, or if the Committee has initiated a director search process and a retained third party director search firm or other party has identified one or more prospective nominees, the Committee will evaluate such prospective nominees against the standards and qualifications set out in Danaher’s Corporate Governance Guidelines, including:

| • | personal and professional integrity and character; |

| • | prominence and reputation in the prospective nominee’s profession; |

| • | skills, knowledge and expertise (including business or other relevant experience) useful and appropriate to the effective oversight of Danaher’s business; |

11

| • | the extent to which the interplay of the prospective nominee’s skills, knowledge, expertise and background with that of the other Board members will help build a Board that is effective in collectively meeting Danaher’s strategic needs and serving the long-term interests of the shareholders; |

| • | the capacity and desire to represent the interests of the shareholders as a whole; and |

| • | availability to devote sufficient time to the affairs of Danaher. |

The Committee also considers such other factors as it may deem relevant and appropriate, including the current composition of the Board, any perceived need for one or more particular areas of expertise, the balance of management and independent directors, the need for Audit Committee and/or Compensation Committee expertise and the evaluations of other prospective nominees. If the Committee determines that a prospective nominee warrants still further consideration, one or more members of the Committee (and other members of the Board as appropriate) will interview the prospective nominee in person or by telephone. After completing this evaluation and interview process, if the Committee deems it appropriate it will recommend that the Board appoint one or more prospective nominees to the Board or nominate one or more such candidates for election to the Board.

The Committee also reviews and makes recommendations to the Board regarding non-management director compensation. In connection with its periodic evaluations of non-management director compensation, the Committee reviews the compensation practices for non-management directors within Danaher’s peer group. For a description of the annual cash compensation paid to each non-management director, please see “Director Compensation—Director Summary Compensation Table.” Each non-management director receives an annual stock option grant at the Compensation Committee’s regularly scheduled July meeting. The exercise price for stock option awards under the plan is equal to the closing price of Danaher’s Common Stock on the date of grant (or a specified later date), and all options awarded to non-management directors are immediately exercisable.

Executive Sessions of Non-Management Directors

The non-management directors (all of whom are independent within the meaning of the listing standards of the NYSE) meet at least twice per year in regularly scheduled executive sessions. The sessions are scheduled and chaired by the chair of the Nominating and Governance Committee.

Director Attendance at Annual Meetings

Danaher typically schedules a Board meeting in conjunction with each annual meeting of shareholders and as a general matter expects that the members of the Board will attend the annual meeting. In 2008, nine members of the Board attended the annual meeting.

Communications with the Board of Directors

Shareholders and other parties interested in communicating directly with the Board, with specified individual directors or with the non-management directors as a group may do so by addressing communications to the Board of Directors, to the specified individual director or to the non-management directors, as applicable, c/o Corporate Secretary, Danaher Corporation, 2099 Pennsylvania Avenue, N.W., 12th Floor, Washington, D.C. 20006. The letter should indicate whether the sender is a Danaher shareholder.

Standards of Conduct

We have adopted a code of business conduct and ethics for directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees, known as the Standards of Conduct. The Standards of Conduct are available in the Investor section of our website at www.danaher.com. Shareholders may request a free copy of the Standards of Conduct from: Danaher Corporation, Attention: Investor Relations, 2099 Pennsylvania Avenue, N.W., 12th Floor, Washington, D.C. 20006.

12

We intend to disclose any amendment to the Standards of Conduct that relates to any element of the code of ethics definition enumerated in Item 406(b) of Regulation S-K, and any waiver from a provision of the Standards of Conduct granted to any of our directors, principal executive officer, principal financial officer, principal accounting officer, or any other executive officer, in the Investor section of our website, at www.danaher.com, within four business days following the date of such amendment or waiver.

Corporate Governance Guidelines and Committee Charters

We have adopted Corporate Governance Guidelines, which are available in the Investor—Corporate Governance section of our website at www.danaher.com. The charters of each of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee of the Board are also available in the Investor—Corporate Governance section of our website at www.danaher.com. Shareholders may request a free copy of these committee charters and the Corporate Governance Guidelines from the address set forth above under “—Standards of Conduct.”

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following section discusses and analyzes the compensation provided to each of the executive officers set forth in the Summary Compensation Table below, also referred to as the “named executive officers.”

Overview and Objectives

The goal of our compensation program for named executive officers is to build long-term value for our shareholders. Toward this goal, under the direction of the Compensation Committee (“Committee”) of our Board of Directors we have developed an executive compensation program designed to:

| • | attract and retain talented executives capable of performing at the levels we expect; |

| • | motivate executives to perform consistently over the long-term at or above the levels that we expect; and |

| • | tie compensation to the achievement of near-term and long-term corporate goals that we believe best advance the long-term interests of shareholders. |

To achieve these objectives we have developed a compensation program that combines annual and long-term components, cash and equity, and fixed and variable payments, with a strong bias toward compensation that is dependent on company performance, particularly long-term, equity-based compensation. Our executive compensation program rewards our executive officers when they build long-term shareholder value, achieve annual business goals and maintain long-term careers with Danaher.

Determining Named Executive Officer Compensation

The Committee exercises its judgment in making executive compensation decisions. Within the overall framework of the objectives discussed above, the factors that generally shape particular executive compensation decisions are the following:

| • | The executive’s relative level of responsibility within Danaher and the impact of his or her position on Danaher’s performance. The Committee believes that both the amount of compensation and the “at-risk” nature of the compensation should increase with the level of responsibility. We have structured our long-term compensation to be subject to greater risk than the long-term compensation awarded by many of our peers, because we pay none of our long-term compensation in cash and we believe the vesting terms for our equity awards are longer than typical for our peer group. |

13

| • | The executive’s record of performance, long-term potential and tenure with Danaher. |

| • | Danaher’s operational and financial performance, on an absolute basis and relative to its peers. |

| • | Our assessment of the competitive marketplace. As a result of our history of operating performance and shareholder value creation, our history of successfully applying the Danaher Business System and the significant resources we devote to training our executives in the Danaher Business System, we believe that our officers are particularly valued by other companies. In addition, given our expectations regarding future growth, our Board and Committee have engaged a corps of named executive officers capable of leading a significantly larger company, which makes them particularly attractive to other companies, including larger companies with greater resources. |

Though the philosophy and goals of our compensation program have remained consistent over time, the Committee considers the factors above within the context of the then-prevailing economic environment and the Committee may adjust the terms and/or amounts of compensation elements in an effort to ensure that they continue to reflect our philosophy and goals. In the context of the current economic circumstances, the Committee recognizes that it will be more difficult for management to achieve period-to-period increases in Adjusted EPS (defined below) comparable to the increases realized in prior years, which may have a moderating impact on the amounts payable under the Company’s annual incentive award program. However, the Committee also recognizes that the long-term elements of our compensation program are designed to motivate sustained, long-term performance and the creation of shareholder value over the long-term, and the Committee does not believe it is appropriate to significantly change its long-term compensation program in response to the current economic environment. The Committee also recognizes that the Company’s performance relative to peers may be an increasingly important factor in light of the current economic circumstances.

Analysis of 2008 Named Executive Officer Compensation

Our 2008 executive compensation program consisted of four elements:

Element | Form of Compensation | Primary Objectives | ||

Long-Term Incentive Awards | Stock options with extended time-based vesting periods | • Attract, retain and motivate skilled executives and encourage loyalty to Danaher

• Encourage long-term operational and financial performance that we believe will build long-term shareholder value | ||

| Performance-based restricted stock units (RSUs) with extended time-based vesting periods | • Attract and retain skilled executives and encourage loyalty to Danaher

• Encourage long-term operational and financial performance that we believe will build long-term shareholder value

• Make our total executive compensation plan competitive, given the increasing prevalence of RSUs and restricted shares in the compensation packages of our peer group

• Use fewer shares to convey value than options would, to reduce shareholder dilution | |||

Annual Incentive | Cash | • Motivate executives to achieve near-term corporate goals in key areas of operational and financial performance

• Attract, motivate and retain skilled executives | ||

14

Element | Form of Compensation | Primary Objectives | ||

Base Salary | Cash | • Minimize competitive disadvantage, while also minimizing the percentage of an executive’s compensation that is not dependent on company and/or individual performance | ||

Other Compensation | Employee benefit plans; severance and change-of-control benefits; perquisites | • Make our total executive compensation plan competitive | ||

In determining the appropriate mix of compensation elements for each named executive officer for 2008, the Committee considered the factors referred to above under “—Determining Named Executive Officer Compensation” and exercised its judgment.

| • | The most significant component of compensation for each named executive officer for 2008 was long-term, equity-based compensation with extended time-based vesting periods. Based on Danaher’s past experience we believe that this type of compensation is most effective in accomplishing all three of the objectives set forth under “—Overview and Objectives.” |

| • | Annual cash incentive compensation, the at-risk element of an executive’s annual compensation, was the next most significant component of compensation for each named executive officer. We believe its focus on near-term goals and the cash nature of the awards complement the longer-term, equity-based compensation elements of the program. |

| • | Finally, consistent with our philosophy, in 2008 we sought to pay sufficient base salary and other compensation to avoid competitive disadvantage in the marketplace for skilled executives. |

The Committee believes that the Company’s executive compensation program supports the executive compensation objectives described above without encouraging management to take unreasonable risks with respect to Danaher’s business. The Committee believes that the program’s bias toward long-term, equity based compensation coupled with vesting terms that we believe are longer than typical for our peer group; the use of both options and RSUs; and our stock ownership guidelines all encourage management to take a long-term view of Danaher’s performance and discourage unreasonable risk-taking.

Long-Term Incentive Awards

Philosophy. The long-term incentive awards that the Committee grants consist of stock options with extended time-based vesting criteria, and performance-based RSUs with extended time-based vesting criteria.

The Committee believes that stock options promote the objectives of our executive compensation program in the following ways:

| • | Long time-based vesting periods are a hallmark of both our executive stock option and RSU awards. The extended vesting terms of these awards encourage officers to take a long-term view of our performance and promote stability within our executive ranks, facilitating realization of our long-term corporate objectives. |

| • | We believe our stock option award program has contributed significantly to our historical record of operational and financial performance. That performance record, in turn, has generally made our stock option awards very valuable over the long-term. Notwithstanding the fact that recent stock market declines have diminished the value of options granted in recent years, given the long tenure of our named executive officers each holds unexercised stock options that as of the record date remain in-the-money. Stock options have been our most effective, overall compensation tool in recruiting, |

15

motivating and retaining skilled officers and we believe they will continue to be so over the long-term. |

| • | Stock options are inherently performance-based, as the recipient does not receive any benefit unless our stock price rises after the date the option is granted. This links stock option compensation directly to shareholder value creation. |

The Committee believes that stock options are the most effective, overall compensation tool at its disposal. To balance upside potential with volatility risk, however, it awards executives a combination of stock options and RSUs because RSUs offer certain benefits that complement the benefits of stock options, as described in the chart above. Given that RSUs may not offer the same level of performance motivation as stock options, our RSU’s are subject to performance-based as well as time-based vesting criteria, although the Committee views the performance criteria as ancillary in importance to the time-based vesting requirement. The performance criteria applicable to the RSUs awarded to our named executive officers in 2008 are described in the footnotes to the “Outstanding Equity Awards at 2008 Fiscal Year-End” table.

Grant practices. The Committee grants equity awards under Danaher’s 2007 Stock Incentive Plan (the “2007 Plan”). For a description of the 2007 Plan (and the 1998 Stock Option Plan, which governs most executive equity awards granted on or prior to May 15, 2007), please see “Executive Compensation—Employee Benefit Plans.”

The exercise price for stock option awards under the 2007 Plan (as under the 1998 Plan) equals the closing price of Danaher’s common stock on the date of grant (or on a specified later date). The Committee does not permit and has not permitted back-dating or re-pricing of equity awards. Executive equity awards are granted at a regularly scheduled Committee meeting, or at the time of an executive promotion or identification of a specific retention concern; the timing of equity awards is not coordinated with the release of material non-public information. Regularly scheduled meetings of the Committee are generally scheduled in advance of the calendar year in which they occur. The Committee’s general practice is to grant annual equity awards to executives at the Committee’s regularly scheduled meeting in February, because that is the time when the Committee reviews the performance of the executive officers and determines the other components of executive compensation.

Determining 2008 equity awards. In 2008, the Committee made equity grants to all of the named executive officers (except for Mr. Culp, who prior to 2009 received an equity award every three years and had last received an award in 2006), as described in the “Grants of Plan-Based Awards for Fiscal 2008” table. With the officer’s prior year grant value serving as the initial basis for consideration, the Committee identified the dollar value of the equity award to be delivered to the officer in 2008 (which also approximates the accounting expense associated with the award) based on the factors described below:

| • | The Committee reviewed peer group equity compensation data, focusing in particular on higher levels of equity compensation for the relevant position. The Committee also reviewed (1) the value of the officer’s outstanding, unvested equity awards to evaluate the extent to which such awards are providing sufficient retention incentives, and (2) the accumulated value of equity awards previously granted to the executive, including awards that have been exercised or vested and awards that remain outstanding. |

| • | The officer’s long-term potential, level of responsibility and performance record were critical factors in the Committee’s decision-making process. |

| • | To appropriately balance the risk/reward ratio, the Committee considered the amount of the award in light of the length of the time-based vesting provisions to be applied to the award. |

The dollar value awarded to each officer was divided between stock options and RSUs on approximately a 60/40 basis, respectively. The Committee used its judgment to decide upon a 60/40 split between stock options and RSUs, believing that this proportion accomplished its objective of weighting the overall equity award modestly in favor of options and is easy to communicate to executives. The dollar value attributable to stock options was translated into a number of stock options based on an assumed option value equal to 40% of the

16

closing price of Danaher’s common stock on the date of grant, which represents an approximation of the Black-Scholes value of such options. The dollar amount attributable to RSUs was translated into a number of RSUs based on the closing price of our common stock.

The equity compensation amounts for Danaher’s named executive officers in 2008 tended to be larger than the equity compensation that Danaher’s peers award to officers in comparable positions, because (1) we believe the vesting periods applicable to our awards are longer than typical for our peer group, (2) for high-level executives the Committee seeks to have equity-based compensation constitute a higher percentage of total compensation, and (3) the competitive demand for our executives requires that we make greater efforts to retain executives.

Determining 2009 equity awards. Prior to 2009, the Committee awarded Mr. Culp equity awards every three years (with the last such grant being in 2006), to enhance the retention effect of his equity awards. In February 2009, the Committee decided to grant Mr. Culp’s equity award on an annual basis and with the same vesting terms as applied to the other named executive officer grants. The Committee implemented this change because it believes that Mr. Culp’s overall compensation structure provides appropriate retention incentives, and because granting equity awards on an annual basis gives the Committee the flexibility to structure his awards in a way that takes into account year-to-year changes in circumstances.

The Committee awarded annual equity awards to Mr. Culp and certain of the Company’s other named executive officers in February 2009. In determining the amount and terms of the 2009 equity awards, the Committee considered the same factors described above relating to the 2008 awards, but considered them in light of the economic climate and the recent declines in the Company’s stock price. The Committee took the following considerations into account in particular:

| • | The Committee believes that the depressed values of public company stocks give competing businesses the opportunity to offer the Company’s executives large option grants at relatively low exercise prices. In addition, competitors may have more flexibility than we do in the size of the awards they can offer because they are not constrained by the dilutive impact and accounting expense attributable to the executive’s historical, outstanding equity awards. The diminished value of our officers’ outstanding, unvested equity awards compound this retention concern. |

| • | The Committee considered the fact that adhering to a value-based methodology for determining award amounts during a time of declining stock prices would increase the share dilution attributable to the executive compensation program. However, the Committee also recognized that strong individual and operating performance does not always result immediately in shareholder value creation, and that the Company’s equity compensation program is designed to motivate sustained, long-term performance and the creation of shareholder value over the long-term. In light of these considerations and the retention considerations noted above, the Committee concluded that it was not appropriate to significantly change its long-term compensation program in response to the immediate economic environment. |

| • | The Committee modestly adjusted the split between options and RSUs, splitting the target dollar value to be awarded to each officer on a 50/50 basis compared to the 60/40 split previously utilized. Though the Committee continues to believe that over the long-term stock options are the most effective compensation tool at its disposal, it also recognizes that the current volatility in the equity markets has moderated the retention benefits of options, at least in the near-term. |

Annual Incentive Awards

2008 Annual Incentive Awards. The Company’s annual incentive awards consist of cash incentive compensation awards granted under Danaher’s 2007 Executive Cash Incentive Compensation Plan. Under the plan, the Committee is required to establish the performance formula for a particular year within the first 90 days

17

of the year, and cannot thereafter change the performance formula. In March 2008, the Committee adopted a performance formula for determining the amounts to be paid to each named executive officer under the plan for 2008 (please see “—Employee Benefit Plans” for a summary of the 2007 Plan and “—Employment Agreements—2008 Annual Cash Incentive Compensation Formula” for a description of the 2008 performance formula). As discussed below, the Committee exercised its judgment in determining the elements of the 2008 performance formula and the payouts under the formula, focusing on the executive’s level of responsibilities and performance for the year, the amount of comparable compensation that peer companies would offer such officer and the amount of annual incentive compensation awarded to the executive in the prior year. The 2008 annual incentive awards for each of the named executive officers are set forth in the Summary Compensation Table.

The 2008 performance formula is the product of four elements: the officer’s base salary, multiplied or diminished (as applicable) by three, discrete factors:

Baseline annual bonus percentage. The first factor is the “baseline annual bonus percentage.” The committee sets this percentage for each officer at a level that (assuming the actual personal factor and company financial factor fall within the ranges experienced in recent years) would yield a payout that the Committee judges is appropriate based on the considerations noted in the preceding paragraph.

Company financial factor. The second factor is the company financial factor. This factor is intended to drive the achievement of near-term corporate performance. The company financial factor weights on an equal basis (1) year-over-year adjusted EPS growth, and (2) compounded annual adjusted EPS growth over the trailing three-year period, to ensure that the formula promotes consistent, sustainable growth. The plan formula amplifies the impact of EPS performance whether EPS performance is positive or (to a lesser degree) negative. The Committee uses adjusted EPS (“Adjusted EPS”) as the financial measure in this factor, because of the strong correlation between EPS growth and shareholder returns. Because the intent of this factor is to drive core operational performance, and to allow for evaluation of operating results on a consistent and comparable basis, the Committee adjusted GAAP EPS in a manner which focused on gains and charges that it believes are most directly related to company operating performance during the period (in addition, see the discussion below and “Employee Benefit Plans—2007 Executive Cash Incentive Compensation Plan” for a description of how the Committee used its negative discretion to modify Adjusted EPS for purposes of the 2008 performance formula). The Committee adjusts EPS in a similar manner in establishing the performance criteria applicable to RSU awards.

In determining the actual annual incentive awards for 2008 and the performance formula for 2009, the Committee determined to make two changes to the calculation of Adjusted EPS. The Committee concluded that restructuring charges are an item that should be considered in determining executive performance and compensation. Since the performance formula adopted at the beginning of 2008 provided for exclusion of restructuring charges from Adjusted EPS, the Committee exercised its negative discretion to reflect the impact of the Company’s fourth quarter 2008 restructuring charge on 2008 Adjusted EPS, thereby reducing the payment that otherwise would have been made. To the same end, the Committee modified the definition of Adjusted EPS in the 2009 performance formula so that it includes the impact of non-acquisition related restructuring charges. As a result, non-acquisition restructuring charges incurred in the performance period will adversely impact Adjusted EPS for the performance period, but such charges incurred during the periods preceding the performance period have the effect of reducing the hurdle because the formula is based on the degree of period-to-period improvement in Adjusted EPS. The Committee similarly adjusted the definition of Adjusted EPS used in the performance criteria that apply to RSU awards granted during and after February 2009. The Committee also modified the definition of Adjusted EPS for the 2009 performance formula to exclude the acquisition-related transaction costs and restructuring charges that would otherwise impact EPS as a result of the adoption of Statement of Financial Accounting Standard (SFAS) No. 141(R) at the beginning of 2009. This change has also been implemented with respect to the performance criteria applicable to RSUs granted during and after February 2009.

18

Personal factor. The third factor is the personal factor, which is a factor of 2.0 subject to reduction in the Committee’s discretion. This factor is intended to allow the Committee to adjust the final payout amount in its judgment based on individual performance and such other considerations as it deems appropriate. At the beginning of the year, the Committee establishes annual personal performance objectives for each officer. The executive’s performance against these objectives is one of the factors considered by the Committee in determining the personal factor.