- DHR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Danaher (DHR) DEF 14ADefinitive proxy

Filed: 30 Mar 22, 7:30am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

Danaher Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

NOTICE

OF 2022 ANNUAL MEETING

OF SHAREHOLDERS

ITEMS OF BUSINESS

| 1. | To elect the thirteen directors named in the attached Proxy Statement to hold office until the 2023 annual meeting of shareholders and until their successors are elected and qualified. |

| 2. | To ratify the selection of Ernst & Young LLP as Danaher’s independent registered public accounting firm for the year ending December 31, 2022. |

| 3. | To approve on an advisory basis the Company’s named executive officer compensation. |

| 4. | To act upon a shareholder proposal requesting that Danaher amend its governing documents to reduce the percentage of shares required for shareholders to call a special meeting of shareholders from 25% to 10%. |

| 5. | To consider and act upon such other business as may properly come before the meeting or at any postponement or adjournment thereof. |

WHO CAN VOTE

Shareholders of Danaher Common Stock at the close of business on March 11, 2022 can vote at Danaher’s 2022 Annual Meeting. YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

A list of shareholders of record will be available during the meeting for inspection by shareholders of record for any legally valid purpose related to the annual meeting at the meeting center site at www.virtualshareholdermeeting.com/DHR2022.

DATE OF MAILING

We intend to mail the Notice Regarding the Availability of Proxy Materials (“Notice of Internet Availability”), or the Proxy Statement and proxy card as applicable, to our shareholders on or about March 30, 2022.

By order of the Board of Directors,

JAMES F. O’REILLY

Vice President, Deputy General Counsel and Secretary

MAY 10, 2022

3:00 p.m. Eastern Time

Place

There is no physical location for Danaher’s 2022 Annual Meeting. Shareholders may instead attend virtually at www.virtualshareholdermeeting.com/DHR2022.

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF THE FOLLOWING WAYS:

| VIA THE INTERNET Visit the website listed on your Notice of Internet Availability, proxy card or voting instruction form |

| BY TELEPHONE Call the telephone number on your proxy card or voting instruction form |

| BY MAIL Sign, date and return your proxy card or voting instruction form in the enclosed envelope |

Please refer to the enclosed proxy materials or the information forwarded by your bank, broker, trustee or other intermediary to see which voting methods are available to you.

ATTENDING THE MEETING

To attend the virtual meeting, you will need to enter the 16-digit control number included on your proxy card, Notice of Internet Availability of Proxy Materials or voting instruction form.

2022 PROXY STATEMENT

2022 PROXY STATEMENT

IMPORTANT NOTICE Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 10, 2022. This Proxy Statement and the accompanying Annual Report are available free of charge at: https://materials.proxyvote.com/235851 or investors.danaher.com/annual-report-and-proxy.

To assist you in reviewing the proposals to be acted upon at our 2022 Annual Meeting, below is summary information regarding the meeting, each proposal to be voted upon at the meeting and Danaher Corporation’s business performance, corporate governance, sustainability program and executive compensation. The following description is only a summary and does not contain all of the information you should consider before voting. For more information about these topics, please review Danaher’s Annual Report on Form 10-K for the year ended December 31, 2021 and the complete Proxy Statement. In this Proxy Statement, the terms “Danaher” or the “Company” refer to Danaher Corporation, Danaher Corporation and its consolidated subsidiaries or the consolidated subsidiaries of Danaher Corporation, as the context requires. All financial data in this Proxy Statement refers to continuing operations unless otherwise indicated.

2022 Annual Meeting of Shareholders

|  |  |

| TIME AND DATE 3:00 p.m. Eastern time Tuesday, May 10, 2022 | LOCATION www.virtualshareholdermeeting.com/DHR2022 | RECORD DATE March 11, 2022 |

Voting Matters

| Proposal | Description | Board Recommendation |

| PROPOSAL 1 – Election of directors (page 13) | We are asking our shareholders to elect each of the thirteen directors identified below to serve until the 2023 Annual Meeting of shareholders. |  FOR each nominee FOR each nominee |

| PROPOSAL 2 – Ratification of the appointment of the independent registered public accounting firm (page 35) | We are asking our shareholders to ratify our Audit Committee’s selection of Ernst & Young LLP (“E&Y”) to act as the independent registered public accounting firm for Danaher for 2022. Although our shareholders are not required to approve the selection of E&Y, our Board believes that it is advisable to give our shareholders an opportunity to ratify this selection. |  FOR FOR |

| PROPOSAL 3 – Advisory vote to approve named executive officer compensation (page 72) | We are asking our shareholders to cast a non-binding, advisory vote on the compensation of the executive officers named in the Summary Compensation Table (the “named executive officers” or “NEOs”). In evaluating this year’s “say on pay” proposal, we recommend that you review our Compensation Discussion and Analysis, which explains how and why the Compensation Committee of our Board arrived at its executive compensation actions and decisions for 2021. |  FOR FOR |

| PROPOSAL 4 – Shareholder proposal (page 74) | You are being asked to consider a shareholder proposal requesting that Danaher amend its governing documents to reduce the percentage of shares required for shareholders to call a special meeting of shareholders from 25% to 10%. | AGAINST |

Please see the sections titled “General Information About the Meeting” and “Other Information” beginning on page 76 for important information about the proxy materials, voting, the Annual Meeting, Company documents, communications and the deadlines to submit shareholder proposals and director nominations for next year’s annual meeting of shareholders.

2022 PROXY STATEMENT 04

2022 PROXY STATEMENT 04

Business Highlights

2021 Performance

In 2021, as the world faced the second year of the COVID-19 pandemic, Danaher continued to focus on deploying the full breadth of its resources to support the health and well-being of its associates and provide crucial contributions to the fight against the pandemic:

| • | From the beginning of the pandemic through January 1, 2022, our businesses had collectively enabled or produced approximately 150 million COVID-19-related diagnostic tests. |

| • | Our bioprocessing businesses are supporting biotechnology researchers and manufacturers around the world in their efforts to develop and produce COVID-19 vaccines and therapeutics. Our services and products (such as filtration, chromatography and single-use technologies) are being used on all the major COVID-19 vaccines and therapeutics that have been approved as of January 1, 2022. |

| • | During the pandemic, we have significantly enhanced the scope and range of our health and wellness benefits to support our associates, including expanding our employee assistance program (EAP) globally; augmenting the EAP to include 24/7 confidential counseling, legal and financial support, as well as comprehensive online resources on subjects such as health and wellness, family and relationships, work and education; and specifically addressing acute needs brought about by the pandemic, including supporting children’s remote learning needs, providing back-up child, adult, elder and pet care and, in some countries, paid leaves of absence for associates taking care of children and elders, and childcare reimbursements and subsidizations. |

Notwithstanding the pandemic, in 2021 Danaher:

| • | Continued to invest in future growth, investing approximately $1.7 billion in research and development and almost $12 billion in acquisitions and strategic investments, including the $9.6 billion cash acquisition of Aldevron, L.L.C. (“Aldevron”). Aldevron manufactures high-quality plasmid DNA, mRNA and proteins, and expands Danaher’s capabilities into the important field of genomic medicine. |

| • | Returned approximately $580 million to common shareholders through cash dividends (marking the 29th year in a row Danaher has paid a dividend on its common shares). |

| • | Grew our business on a year-over-year basis as illustrated below: |

2022 PROXY STATEMENT 05

2022 PROXY STATEMENT 05

Long-Term Performance

We believe a long-term performance period most accurately compares relative performance within our peer group. Over shorter periods, performance comparisons may be skewed by the easier performance baselines of peer companies that have experienced periods of underperformance.

Danaher has not experienced a sustained period of underperformance over the last twenty-five years (i.e., 1997-2021). We believe the consistency of our performance over that period is unmatched within our peer group. Danaher ranks number one in its peer group over the past twenty-five years based on compounded average annual shareholder return, and is the only company in its peer group whose total shareholder return (“TSR”) outperformed the S&P 500 Index:

| • | over every rolling 3-year period from and including 1997-2021; and |

| • | by more than 600 basis points over every rolling 3-year period from and including 2002-2021. |

Danaher’s compounded average annual shareholder return has outperformed the S&P 500 Index over each of the last one, two, three, five-, ten-, fifteen-, twenty- and twenty-five year periods:

2022 PROXY STATEMENT 06

2022 PROXY STATEMENT 06

Corporate Governance Highlights

Our Board of Directors recognizes that Danaher’s success over the long-term requires a robust framework of corporate governance that serves the best interests of all our shareholders and promotes robust risk oversight. Below are highlights of our corporate governance framework.

| Board refreshment remains a key area of focus for us, as evidenced by the 2019 additions of Drs. Jessica L. Mega and Pardis C. Sabeti, the 2020 addition of Rainer M. Blair and the 2021 addition of A. Shane Sanders to our Board. These additions helped drive an over 20% reduction in our average director tenure from 2019 to 2021. |

| Our Bylaws provide for proxy access by shareholders. |

| Our Chairman and CEO positions are separate. |

| Our Board has established a Lead Independent Director position. |

| All of our directors are elected annually. |

| In uncontested elections, our directors must be elected by a majority of the votes cast, and we have a director resignation policy that applies to any incumbent director who fails to receive such a majority. |

| Our shareholders have the right to act by written consent. |

| Shareholders owning 25% or more of our outstanding shares may call a special meeting of shareholders. |

| We have never had a shareholder rights plan. |

| We have no supermajority voting requirements in our Certificate of Incorporation or Bylaws. |

| All members of our Audit, Compensation and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable SEC rules. |

| Danaher (including its subsidiaries during the period we have owned them) has made no political contributions since at least 2012, has no intention of contributing any Danaher funds for political purposes and discloses its political expenditures policy on its public website. The 2021 CPA-Zicklin Index of Corporate Political Disclosure and Accountability ranked Danaher as a First Tier company. |

2022 PROXY STATEMENT 07

2022 PROXY STATEMENT 07

Shareholder Engagement Program

We actively seek and highly value feedback from our shareholders. During 2021, in addition to our traditional Investor Relations outreach efforts, we engaged with shareholders representing approximately 25% of our outstanding shares on topics including our business strategy and financial performance, governance and executive compensation programs and sustainability initiatives. We shared feedback received during these meetings with our Nominating and Governance Committee and Compensation Committee, informing their decision-making.

Board of Directors

Below is an overview of each of the director nominees you are being asked to elect at the 2022 Annual Meeting.

| Name | Director Since | Principal Professional Experience | Committee Memberships | Other Public Company Boards (as of March 11, 2022) | ||||

| Rainer M. Blair | 2020 | President and Chief Executive Officer, Danaher Corporation | E, F, S | 0 | ||||

| Linda Filler* | 2005 | Former President of Retail Products, Chief Marketing Officer and Chief Merchandising Officer, Walgreen Co. | N , S , S | 0 | ||||

| Teri List* | 2011 | Former Executive Vice President and Chief Financial Officer, Gap Inc. | A, C | 3 | ||||

| Walter G. Lohr, Jr.* | 1983 | Retired partner, Hogan Lovells | A, C, F, N | 0 | ||||

| Jessica L. Mega, MD, MPH* | 2019 | Chief Medical and Scientific Officer, Verily Life Sciences LLC | S | 0 | ||||

| Mitchell P. Rales | 1983 | Chairman of the Executive Committee, Danaher Corporation | E , ,F  | 1 | ||||

| Steven M. Rales | 1983 | Chairman of the Board, Danaher Corporation | E, F, S | 0 | ||||

| Pardis C. Sabeti, MD, D.Phil* | 2019 | Investigator, Howard Hughes Medical Institute | S | 0 | ||||

| A. Shane Sanders* | 2021 | Senior Vice President of Business Transformation, Verizon Communications Inc. | A | 0 | ||||

| John T. Schwieters* | 2003 | Principal, Perseus TDC | A , N , N | 0 | ||||

| Alan G. Spoon* | 1999 | Former Managing General Partner, Polaris Partners | C | 3 | ||||

| Raymond C. Stevens, PhD* | 2017 | Chief Executive Officer, ShouTi | S | 0 | ||||

| Elias A. Zerhouni, MD* | 2009 | Former President, Global Research & Development, Sanofi S.A. | N, S | 0 |

Chair * Independent Director

Chair * Independent Director

A = Audit Committee C = Compensation Committee E = Executive Committee F = Finance Committee N = Nominating & Governance Committee S = Science & Technology Committee

2022 PROXY STATEMENT 08

2022 PROXY STATEMENT 08

Sustainability

We believe in harnessing Danaher’s scale and resources to drive company-wide sustainability initiatives while empowering our operating companies to pursue sustainability in ways that best fit the needs of their particular stakeholders. With this framework in mind and based on a robust materiality assessment reflecting a range of stakeholder perspectives, we have developed a sustainability strategy based on Danaher’s Shared Purpose (Helping Realize Life’s Potential) and Core Values, organized around three pillars: Innovation, People and the Environment. A foundation of integrity, compliance and sound governance, which we refer to as the Foundational Elements of our sustainability program, underpins these three pillars.

| Innovation

One of Danaher’s Core Values is “Innovation Defines Our Future.” Our leading-edge products and solutions give true meaning to our Shared Purpose by enhancing quality of life today and setting the foundation for a better world for future generations. At Danaher, innovation doesn’t happen by accident. It is the product of the DBS Innovation Engine, a rigorous management program that is part of a larger suite of integrated, function-specific DBS management programs and tools, as well as our IP strategy and management program (which we refer to as our IP Vision). Danaher invested approximately $1.7 billion in research and development in 2021 and as of the end of 2021 held approximately 21,900 patents worldwide, underscoring our commitment to innovation. | ||

| People

Danaher is committed to attracting, developing, engaging and retaining the best people from around the world to sustain and grow our science and technology leadership. “Consistently attracting and retaining exceptional talent” is one of our three strategic priorities and “The Best Team Wins” is one of our five Core Values, reflecting the critical role our human capital plays in supporting our strategy. Our human capital strategy addresses culture, recruitment, development, engagement and retention, with a particular focus on attracting and engaging diverse talent with the unique perspectives and fresh ideas necessary to drive innovation, fuel growth and help ensure our products effectively serve a global customer base. For more detail on our human capital strategy, please see pages 9 - 11 of our Annual Report on Form 10-K for the year ended December 31, 2021. | ||

| In 2020, we achieved base pay equity for women and for racial and ethnic minorities in the U.S. In addition, in 2021 we disclosed for the first time in our annual Sustainability Report extensive diversity representation data across geographies and career levels, as well as metrics related to turnover, internal fill rate and engagement. | ||

| Third parties have recognized our human capital initiatives. Danaher was featured on the FORTUNE World’s Most Admired Companies 2021 and Forbes 2021 Best Employers for Diversity lists and in 2021 for the ninth year in a row the Human Rights Campaign named Danaher one of the Best Places to Work for LGBTQ Equality. | ||

2022 PROXY STATEMENT 09

2022 PROXY STATEMENT 09

| Environment | ||

| We are committed to reducing the environmental impact of our operations and products, and helping our customers do the same. We continue to make progress toward this objective by implementing management programs to support our efforts, tracking key metrics to gauge improvement and setting goals to drive accountability. In particular: | |||

| • Beginning in 2019, we began leveraging the power of the Danaher Business System (“DBS”) to mitigate the environmental impact of our operations by deploying our first DBS environmental sustainability tools, focused on reducing energy use and waste. | |||

| • Since 2019, we have publicly reported our energy usage, Scope 1 and 2 greenhouse gas emissions, water usage and waste generation and recycling. | |||

| • In 2020, we reported for the first time on the key climate-related risks and opportunities our businesses face. | |||

| • In 2020, we announced our intention to achieve the following goals by 2024 (compared to the baseline year of 2019): | |||

| YEAR 2024 GOALS 15% REDUCTION IN ENERGY CONSUMED (normalized to annual revenue) 15% REDUCTION IN SCOPE 1/2 GREENHOUSE GAS (GHG) EMISSIONS (normalized to annual revenue) 15% REDUCTION IN PERCENTAGE OF NON-HAZARDOUS/NON-REGULATED WASTE SENT TO LANDFILLS OR INCINERATION | 2021 PROGRESS AGAINST OUR GOALS 9% REDUCTION IN ENERGY CONSUMED (normalized to annual revenue) 7.5% REDUCTION IN SCOPE 1/2 GREENHOUSE GAS (GHG) EMISSIONS (normalized to annual revenue) 6.1% REDUCTION IN PERCENTAGE OF NON-HAZARDOUS/NON- REGULATED WASTE SENT TO LANDFILLS OR INCINERATION | ||

| At the Board level, Danaher’s Nominating and Governance Committee oversees sustainability and social responsibility, and this responsibility is set forth in the committee’s charter. At the management level, Danaher’s Senior Vice President and General Counsel, who reports directly to our CEO, has general oversight responsibility with respect to matters of sustainability and social responsibility, and is responsible for reviewing and approving Danaher’s sustainability disclosures. | |||

| More information about Danaher’s sustainability efforts is included in our latest Sustainability Report, available in the Investors section of our public website, https://www.danaher.com. | |||

2022 PROXY STATEMENT 10

2022 PROXY STATEMENT 10

Executive Compensation Highlights

Overview of Executive Compensation Program

As discussed in detail under “Compensation Discussion and Analysis,” with the goal of building long-term value for our shareholders, we have developed an executive compensation program designed to:

| • | attract and retain executives with the leadership skills, attributes and experience necessary to succeed in an enterprise with Danaher’s size, diversity and global footprint; |

| • | motivate executives to demonstrate exceptional personal performance and perform consistently at or above the levels that we expect, over the long-term and through a range of economic cycles; and |

| • | link compensation to the achievement of corporate goals that we believe best correlate with the creation of long-term shareholder value. |

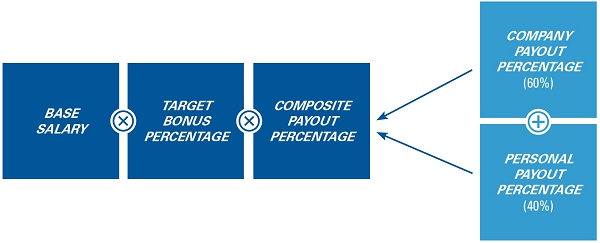

To achieve these objectives our compensation program combines annual and long-term components, cash and equity, and fixed and variable elements, with a bias toward long-term, performance-based equity awards tied closely to shareholder returns and subject to significant vesting and/or holding periods. Our executive compensation program rewards our executive officers when they help increase long-term shareholder value, achieve annual business goals and build long-term careers with Danaher.

Compensation Governance

Our Compensation Committee also recognizes that the success of our executive compensation program over the long-term requires a robust framework of compensation governance. As a result, the Committee regularly reviews external executive compensation practices and trends and incorporated best practices into our 2021 executive compensation program:

| WHAT WE DO | WHAT WE DON’T DO | |||

| Five-year vesting requirement for stock options; three-year performance period plus further two-year holding period for PSUs |  | No tax gross-up provisions (except as applicable to management employees generally such as relocation policy) | |

| Incentive compensation programs feature multiple, different performance measures aligned with the Company’s strategic performance metrics |  | No dividend/dividend equivalents paid on unvested equity awards | |

| Short-term and long-term performance metrics that balance our absolute performance and our relative performance versus peer companies |  | No “single trigger” change of control benefits | |

| Rigorous, no-fault clawback policy that is triggered even in the absence of wrongdoing |  | No active defined benefit pension program since 2003 | |

| Minimum one-year vesting requirement for 95% of shares granted under the Company’s stock plan |  | No hedging of Danaher securities permitted | |

| Stock ownership requirements for all executive officers |  | No long-term incentive compensation is denominated or paid in cash (other than PSU dividend accruals) | |

| Limited perquisites and a cap on CEO/CFO personal aircraft usage |  | No above-market returns on deferred compensation plans | |

| Independent compensation consultant that performs no other services for the Company |  | No overlapping performance metrics between short-term and long-term incentive compensation programs | |

2022 PROXY STATEMENT 11

2022 PROXY STATEMENT 11

Named Executive Officers’ 2021 Compensation

The following table sets forth the 2021 compensation of our named executive officers. Please see pages 53 - 54 for information regarding 2020 and 2019 compensation, as well as footnotes.

| Name and Principal Position | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||

| Rainer M. Blair President and CEO | 1,200,000 | 0 | 5,124,383 | 6,260,494 | 4,128,000 | 0 | 439,390 | 17,152,267 | ||||||||||||||||||||||||

| Matthew R. McGrew, Executive Vice President and CFO | 798,600 | 0 | 1,537,702 | 1,877,996 | 1,697,025 | 0 | 188,184 | 6,099,507 | ||||||||||||||||||||||||

| Jennifer L. Honeycutt, Executive Vice President | 750,000 | 0 | 1,313,474 | 1,603,093 | 1,537,500 | 0 | 155,641 | 5,359,708 | ||||||||||||||||||||||||

| Joakim Weidemanis, Executive Vice President | 936,000 | 2,049,947 | 2,504,501 | 1,965,600 | 0 | 157,966 | 7,614,014 | |||||||||||||||||||||||||

| Angela S. Lalor, Senior Vice President-Human Resources | 763,515 | 800,000 | 1,168,499 | 1,427,672 | 1,510,232 | 0 | 156,995 | 5,826,913 | ||||||||||||||||||||||||

2022 PROXY STATEMENT 12

2022 PROXY STATEMENT 12

We are seeking your support for the election of the thirteen candidates whom the Board has nominated to serve on the Board of Directors (each of whom currently serves as a director of the Company), to serve until the 2023 Annual Meeting of shareholders and until his or her successor is duly elected and qualified.

We believe the nominees set forth below have qualifications consistent with our position as a large, global and diversified science and technology company. We also believe these nominees have the experience and perspective to guide Danaher as we seek to expand our business in high-growth geographies and high-growth market segments, identify, consummate and integrate appropriate acquisitions, develop innovative and differentiated new products and services, adjust to rapidly changing technologies, business cycles and competition and address the demands of an increasingly regulated environment. Set forth below is biographical information regarding each candidate as of March 11, 2022.

Proxies cannot be voted for a greater number of persons than the thirteen nominees named in this Proxy Statement. In the event a nominee declines or is unable to serve, the proxies may be voted in the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this will occur.

Director Nominees

| RAINER M. BLAIR | |||

Age 57

Director since: 2020

CHIEF EXECUTIVE OFFICER

Committees: • Executive • Finance • Science & Technology

Other Public Directorships: • None

| Mr. Blair has served as Danaher’s President and Chief Executive Officer since September 2020. Since joining Danaher in 2010, Mr. Blair has served in a series of progressively more responsible general management positions (and as a Danaher officer since 2014), including as Vice President - Group Executive from March 2014 until January 2017 and as Executive Vice President from January 2017 until September 2020. His broad operating and functional experience across diverse end-markets and geographies, in-depth knowledge of Danaher’s businesses and of the Danaher Business System and leadership experience from his service in the U.S. Army are particularly valuable to the Board given the global, diverse nature of Danaher’s portfolio. In addition, Mr. Blair adds deep multi-cultural experience having lived and worked on three continents. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Global/international | • M&A | ||

| • Life sciences | • Public company CEO and/or President | ||

| • Product innovation | |||

| LINDA FILLER | |||

Age 62

Director since: 2005

INDEPENDENT

Committees: • Nominating & Governance • Science & Technology

Other Public Directorships: • None

| Ms. Filler retired as President of Retail Products, Chief Marketing Officer and Chief Merchandising Officer at Walgreen Co., a retail pharmacy company, in April 2017. Prior to Walgreen Co., Ms. Filler served as President, North America of Claire’s Stores, Inc., a specialty retailer, and in Executive Vice President roles at Walmart Inc., a retail and wholesale operations company, and at Kraft Foods, Inc., a food and beverage manufacturing and processing company. Prior to Kraft Foods, Inc., Ms. Filler served for a number of years at Hanesbrands Inc., a multinational clothing company, including Chief Executive Officer roles for its largest branded apparel businesses.

Ms. Filler has served in senior management roles with leading retail and consumer goods companies, with general management responsibilities and responsibilities in the areas of marketing, branding and merchandising. Understanding and responding to the needs of our customers is fundamental to Danaher’s business strategy, and Ms. Filler’s keen marketing and branding insights have been a valuable resource to Danaher’s Board. Her prior leadership experiences with large public companies have given her valuable perspective for matters of global portfolio strategy and capital allocation as well as global business practices. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Global/international | • Public company CEO and/or President | ||

| • Product innovation | • Branding/marketing | ||

| • M&A | |||

2022 PROXY STATEMENT 13

2022 PROXY STATEMENT 13

| TERI LIST | |||

Age 59

Director since: 2011

INDEPENDENT

Committees: • Audit • Compensation

Other Public Directorships: • Microsoft Corporation • Oscar Health, Inc. • DoubleVerify Holdings, Inc. | Ms. List served as Executive Vice President and Chief Financial Officer of Gap Inc., a global clothing retailer, from January 2017 until March 2020. Prior to joining Gap, she served as Executive Vice President and Chief Financial Officer of Dick’s Sporting Goods, Inc., a sporting goods retailer, from August 2015 to August 2016, and with Kraft Foods Group, Inc., a food and beverage company, as Advisor from March 2015 to May 2015, as Executive Vice President and Chief Financial Officer from December 2013 to February 2015 and as Senior Vice President of Finance from September 2013 to December 2013. From 1994 to September 2013, Ms. List served in a series of progressively more responsible positions in the accounting and finance organization of The Procter & Gamble Company, a consumer goods company, most recently as Senior Vice President and Treasurer. Prior to joining Procter & Gamble, Ms. List was employed by the accounting firm of Deloitte & Touche for almost ten years.

Ms. List’s experience dealing with complex finance and accounting matters for Gap, Dick’s, Kraft and Procter & Gamble have given her an appreciation for and understanding of the similarly complex finance and accounting matters that Danaher faces. In addition, through her leadership roles with large, global companies she has insight into the business practices that are critical to the success of a large, growing public company such as Danaher. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Global/international | • Accounting | ||

| • Digital technology | • Finance | ||

| • M&A | |||

| WALTER G. LOHR, JR. | |||

Age 78

Director since: 1983

INDEPENDENT

Committees: • Audit • Compensation • Finance • Nominating & Governance

Other Public Directorships: • None | Mr. Lohr was a partner of Hogan Lovells, a global law firm, until retiring in June 2012, and has also served on the boards of private and non-profit organizations.

Prior to his tenure at Hogan Lovells, Mr. Lohr served as assistant attorney general for the State of Maryland. He has extensive experience advising companies in a broad range of transactional matters, including mergers and acquisitions, contests for corporate control and securities offerings. His extensive knowledge of the legal strategies, issues and dynamics that pertain to mergers and acquisitions and capital raising has been a critical resource for Danaher given the importance of its acquisition program. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • M&A | • Government, legal or regulatory | ||

| JESSICA L. MEGA, MD, MPH | |||

Age 47

Director since: 2019

INDEPENDENT

Committees: • Science & Technology

Other Public Directorships: • None

| Dr. Mega has served as Chief Medical and Scientific Officer at Verily Life Sciences LLC, a subsidiary of Alphabet Inc. focused on life sciences and healthcare, since March 2015. Prior to joining Verily, she served as Cardiologist and Senior Investigator at Brigham & Women’s Hospital from 2008 to March 2015. Dr. Mega has also served as a faculty member at Harvard Medical School and a senior investigator with the TIMI Study Group, where she helped lead international trials evaluating novel cardiovascular therapies and directed the genetics program.

Dr. Mega oversees Verily’s clinical and science efforts, focusing on translating technological innovations and scientific insights into partnerships and programs that improve patient outcomes. Dr. Mega’s clinical background and experience re-imagining how clinical trial data is collected and analyzed offer valuable insights for Danaher, given our strategic focus on life sciences and healthcare applications. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Life sciences | • Government, legal or regulatory | ||

| • Health care management | |||

| • Digital technology | |||

2022 PROXY STATEMENT 14

2022 PROXY STATEMENT 14

| MITCHELL P. RALES | |||

Age 65

Director since: 1983

CHAIRMAN OF THE EXECUTIVE COMMITTEE

Committees: • Executive (Chair) • Finance (Chair)

Other Public Directorships: • Colfax Corporation | Mr. Rales is a co-founder of Danaher and has served as Chairman of the Executive Committee of Danaher since 1984. He was also President of the Company from 1984 to 1990. Mr. Rales is a brother of Steven M. Rales.

The strategic vision and leadership of Mr. Rales and his brother, Steven Rales, helped create the Danaher Business System and have guided Danaher down a path of consistent, profitable growth that continues today. In addition, as a result of his substantial ownership stake in Danaher, he is well-positioned to understand, articulate and advocate for the rights and interests of the Company’s shareholders. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Global/international | • Public company CEO and/or President | ||

| • M&A | • Finance | ||

| STEVEN M. RALES | |||

Age 70

Director since: 1983

CHAIRMAN OF THE BOARD

Committees: • Executive • Finance • Science & Technology

Other Public Directorships: • None | Mr. Rales is a co-founder of Danaher and has served as Danaher’s Chairman of the Board since 1984. He was also CEO of the Company from 1984 to 1990. Mr. Rales is a brother of Mitchell P. Rales.

The strategic vision and leadership of Mr. Rales and his brother, Mitchell Rales, helped create the Danaher Business System and have guided Danaher down a path of consistent, profitable growth that continues today. In addition, as a result of his substantial ownership stake in Danaher, he is well-positioned to understand, articulate and advocate for the rights and interests of the Company’s shareholders. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Global/international | • Public company CEO and/or President | ||

| • M&A | • Finance | ||

| PARDIS C. SABETI, MD, D.PHIL | |||

Age 46

Director since: 2019

INDEPENDENT

Committees: • Science & Technology

Other Public Directorships: • None

| Dr. Sabeti has served as an Investigator for the Howard Hughes Medical Institute (“HHMI”), a non-profit medical research organization, since November 2015. Dr. Sabeti is a professor at the Center for Systems Biology and the Department of Organismic and Evolutionary Biology at Harvard University and the Department of Immunology and Infectious Disease at Harvard T.H. Chan School of Public Health. She is an Institute Member of the Broad Institute of MIT and Harvard.

Dr. Sabeti is a computational geneticist with expertise developing new experimental technologies and computational algorithms to investigate the genomes of humans and infectious microbes. Her expertise in infectious disease research offers significant value to Danaher as we seek to develop research tools for use in determining the causes of disease, identification of new therapies and testing of new drugs and vaccines. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Life sciences | • Digital technology | ||

| • Diagnostics | |||

| A. SHANE SANDERS | |||

Age 59

Director since: 2021

INDEPENDENT

Committees: • Audit

Other Public Directorships: • None

| Mr. Sanders has served as Senior Vice President of Business Transformation at Verizon Communications Inc., a telecommunications company, since March 2020. He has served in a series of progressively more responsible leadership positions since joining Verizon in 1997, including as Senior Vice President of Corporate Finance from 2015 to March 2020. Prior to joining Verizon, Mr. Sanders served in various finance roles at Hallmark Cards, Inc., a retailer of greeting cards and gifts, and Safelite Group, Inc., a provider of vehicle glass repair, and began his career at Grant Thornton, an audit, tax and advisory firm, in 1984.

Mr. Sanders’ leadership experiences in Verizon’s accounting and finance organization have spanned a range of functional areas, including financial planning and analysis, risk management, audit and public reporting and compliance. His broad and deep experience in a large, dynamic organization give him a keen understanding of the range of finance and accounting matters and judgments Danaher encounters. In addition, his business transformation experience offers valuable perspectives as Danaher continues to grow and evolve its portfolio of businesses. Mr. Sanders was originally proposed to the Nominating & Governance Committee for election as a director by one of the Company’s independent directors. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Global/international | • Finance | ||

| • M&A | • Digital technology | ||

| • Accounting | |||

2022 PROXY STATEMENT 15

2022 PROXY STATEMENT 15

| JOHN T. SCHWIETERS | |||

Age 82

Director since: 2003

INDEPENDENT

Committees: • Audit (Chair) • Nominating & Governance

Other Public Directorships: • None

| Mr. Schwieters has served as Principal of Perseus TDC, a real estate investment and development firm, since July 2013. He also served as a Senior Executive of Perseus, LLC, a merchant bank and private equity fund management company, from May 2012 to June 2016 and as Senior Advisor from March 2009 to May 2012.

In addition to his roles with Perseus, Mr. Schwieters led the Mid-Atlantic region of one of the world’s largest accounting firms after previously leading that firm’s tax practice in the Mid-Atlantic region, and has served on the boards and chaired the audit committees of several NYSE-listed public companies. He brings to Danaher extensive knowledge and experience in the areas of public accounting, tax accounting and finance, which are areas of critical importance to Danaher as a large, global and complex public company. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • M&A | • Finance | ||

| • Accounting | |||

| ALAN G. SPOON | |||

Age 70

Director since: 1999

INDEPENDENT

Committees: • Compensation (Chair)

Other Public Directorships: • Fortive Corporation • IAC/ InterActiveCorp. • Match Group, Inc. | Mr. Spoon served as Partner Emeritus of Polaris Partners from January 2016 to June 2018, Managing General Partner from 2000 to 2010 and Partner from 2000 to 2018. Within the past five years, Mr. Spoon served on the board of directors of Cable One, Inc.

In addition to his leadership roles at Polaris Partners, Mr. Spoon has previously served as president, chief operating officer and chief financial officer of one of the country’s largest, publicly-traded education and media companies, and has served on the boards of numerous public and private companies. His public company leadership experience gives him insight into business strategy, leadership and executive compensation and his public company and private equity experience give him insight into technology and life science trends, acquisition strategy and financing, each of which represents an area of key strategic opportunity for the Company. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Product innovation | • Public company CEO and/or President | ||

| • Digital technology | • Finance | ||

| • M&A | |||

| RAYMOND C. STEVENS, PH.D. | |||

Age 58

Director since: 2017

INDEPENDENT

Committees: • Science & Technology

Other Public Directorships: • None

| Professor Stevens has served as Chief Executive Officer of ShouTi, a biotechnology company, since May 2019. He also served as Provost Professor of Biological Sciences and Chemistry, and Director of The Bridge Institute, at the University of Southern California, a private research university, from July 2014 to August 2021. From 1999 until July 2014, he served as Professor of Molecular Biology and Chemistry with The Scripps Research Institute, a non-profit research organization. Professor Stevens has also launched multiple biotechnology companies focused on drug discovery.

Professor Stevens is considered among the world’s most influential biomedical scientists in molecular research. A pioneer in human cellular behavior research, he has been involved in the creation of therapeutic molecules that led to breakthrough drugs aimed at curing influenza, childhood diseases, neuromuscular disorders and diabetes. Professor Stevens’ insights in the area of molecular research, as well as his experience bringing industry and academia together to advance drug development, are highly beneficial to Danaher given our strategic focus on the development of research tools used to understand the causes of disease, identify new therapies and test new drugs and vaccines. His extensive experience living and working in China is also valuable to Danaher given China’s strategic significance to our business. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Global/international | • Product innovation | ||

| • Life sciences | |||

2022 PROXY STATEMENT 16

2022 PROXY STATEMENT 16

| ELIAS A. ZERHOUNI, MD | |||

Age 70

Director

INDEPENDENT

Committees: • Nominating & Governance • Science & Technology (Chair)

Other Public Directorships: • None | Dr. Zerhouni served as President, Global Research & Development, for Sanofi S.A., a global pharmaceutical company, from 2011 to June 2018. From 2008 until 2011, he provided advisory and consulting services to various non-profit and other organizations as Chairman and President of Zerhouni Holdings. From 2002 to 2008, Dr. Zerhouni served as director of the National Institutes of Health, and from 1996 to 2002, he served as Chair of the Russell H. Morgan Department of Radiology and Radiological Sciences, Vice Dean for Research and Executive Vice Dean of the Johns Hopkins School of Medicine.

Dr. Zerhouni, a physician, scientist and world-renowned leader in radiology research, is widely viewed as one of the leading authorities in the United States on emerging trends and issues in medicine and medical care. These insights, as well as his deep, technical knowledge of the research and clinical applications of medical technologies, are of considerable importance given Danaher’s strategic focus in the medical technologies markets. Dr. Zerhouni’s government experience also gives him a strong understanding of how government agencies work, and his experience growing up in North Africa, together with the global nature of the issues he faced at NIH and his role at France-based Sanofi, give him a global perspective that is valuable to Danaher. | ||

| SKILLS AND QUALIFICATIONS: | |||

| • Global/international | • Health care management | ||

| • Life sciences | • Government, legal or regulatory | ||

| • Diagnostics | |||

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE FOREGOING NOMINEES. THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE FOREGOING NOMINEES. |

Board Selection and Refreshment

Director Selection

The Board and its Nominating and Governance Committee believe that it is important that our directors demonstrate:

| • | personal and professional integrity and character; |

| • | prominence and reputation in the director’s profession; |

| • | skills, expertise and background (including business or other relevant experience) that in aggregate are useful and appropriate in overseeing and providing strategic direction with respect to Danaher’s business and serving the long-term interests of Danaher’s shareholders; |

| • | the capacity and desire to represent the interests of the shareholders as a whole; and |

| • | availability to devote sufficient time to the affairs of Danaher. |

The Nominating and Governance Committee is responsible for recommending to the Board a slate of nominees for election at each annual meeting of shareholders. Nominees may be suggested by directors, members of management, shareholders or by a third-party search firm engaged by the Committee. The Committee considers a wide range of factors when assessing potential director nominees. This includes consideration of the current composition of the Board, any perceived need for one or more particular areas of expertise, the balance of management and independent directors, the need for committee-specific expertise, evaluations of other prospective nominees and the qualifications of each potential nominee relative to the attributes, skills and experience described above. The Board does not have a formal or informal policy with respect to diversity but believes that the Board, taken as a whole, should embody a diverse set of skills, knowledge, experiences and backgrounds appropriate in light of the Company’s needs, and in this regard also subjectively takes into consideration the diversity (including with respect to age, race, gender and national origin) of the Board when considering director nominees.

When Danaher recruits a director candidate, either a search firm engaged by the Committee or a member of the Board contacts the prospect to assess interest and availability. The candidate will then meet with members of the Board and at the same time, the Committee with the support of the search firm will conduct such further inquiries as the Committee deems appropriate. A background check is completed before a final recommendation is made to appoint a candidate to the Board.

A shareholder who wishes to recommend a prospective nominee for the Board should notify the Nominating and Governance Committee in writing using the procedures described below under “Other Information – Communications with the Board of Directors” with whatever supporting material the shareholder considers appropriate. If a prospective nominee has been identified other than in connection with a director search process initiated by the Committee, an initial determination is made as to whether to conduct a full evaluation of the candidate based primarily on whether a new or additional Board member is necessary or appropriate at such time, the likelihood that the prospective nominee can satisfy the evaluation factors described above, any additional inquiries the Committee may, in its discretion, conduct and any other factors the Committee may deem appropriate.

2022 PROXY STATEMENT 17

2022 PROXY STATEMENT 17

The graph below illustrates the diverse set of skills, expertise and backgrounds represented on our Board:

SKILLS AND EXPERTISE

| Blair | Filler | List | Lohr | Mega | M. Rales | S. Rales | Sabeti | Sanders | Schwieters | Spoon | Stevens | Zerhouni | |

| Global/international |  |  |  |  |  |  |  |  | |||||

| Life sciences |  |  |  |  |  | ||||||||

| Diagnostics |  |  | |||||||||||

| Health care management |  |  | |||||||||||

| Product innovation |  |  |  |  | |||||||||

| Digital technology |  |  |  |  |  | ||||||||

| M&A |  |  |  |  |  |  |  |  |  | ||||

| Public company CEO and/or President |  |  |  |  |  | ||||||||

| Accounting |  |  |  | ||||||||||

| Finance |  |  |  |  |  |  | |||||||

| Branding/marketing |  | ||||||||||||

| Government, legal or regulatory |  |  |  | ||||||||||

| Age (Board average is 63.3 years of age) | 57 | 62 | 59 | 78 | 47 | 65 | 70 | 46 | 59 | 82 | 70 | 58 | 70 |

| Gender | M | F | F | M | F | M | M | F | M | M | M | M | M |

| Race/Ethnicity* | C | C | C | C | C | C | C | M | B | C | C | C | N |

| Born outside U.S. |  |  |  |

| * | “B” refers to Black; “C” refers to Caucasian (other than Middle Eastern or North African descent); “M” refers to Middle Eastern descent; “N” refers to North African descent. |

Board Orientation

Our new director orientation program includes extensive meetings with Danaher management and familiarizes new directors with Danaher’s businesses, strategies, policies and the Danaher Business System; assists them in developing company and industry knowledge to optimize their Board service; and educates them with respect to their fiduciary duties and legal responsibilities and Danaher’s corporate governance framework.

Board Refreshment

Our Board actively considers Board refreshment. Using our Board skills matrix as a guide as well as the results of our annual Board and committee self-assessment process (discussed below), the Nominating and Governance Committee evaluates Board composition at least annually and identifies for Board consideration areas of expertise that would complement and enhance our current Board. Given the critical role of acquisitions in our overall strategy as well as the diversity of our portfolio, it is essential that our Board include members with the experience of having led the Company through a range of M&A and economic cycles. However, the Board also seeks to thoughtfully balance the knowledge and experience that comes from longer-term Board service with the fresh perspectives and new domain expertise that can come from adding new directors. The 2019 additions of Drs. Jessica L. Mega and Pardis C. Sabeti, the 2020 addition of Rainer M. Blair and the 2021 addition of A. Shane Sanders to our Board evidences our focus on refreshment and helped drive an over 20% reduction in our average director tenure from 2019 to 2021.

2022 PROXY STATEMENT 18

2022 PROXY STATEMENT 18

Proxy Access

Our Amended and Restated Bylaws (“Bylaws”) permit a shareholder, or a group of up to twenty shareholders, owning three percent or more of the Company’s outstanding shares of Common Stock continuously for at least three years to nominate and include in the Company’s annual meeting proxy materials a number of director nominees up to the greater of (x) two, or (y) twenty percent of the Board (or, if such amount is not a whole number, the closest whole number below twenty percent), provided that the shareholder(s) and nominee(s) satisfy the requirements specified in the Bylaws.

Majority Voting Standard

General

Our Bylaws provide for majority voting in uncontested director elections, and our Board has adopted a director resignation policy. Under the policy, our Board will not appoint or nominate for election to the Board any person who has not tendered in advance an irrevocable resignation effective in such circumstances where the individual does not receive a majority of the votes cast in an uncontested election and such resignation is accepted by the Board. If an incumbent director is not elected by a majority of the votes cast in an uncontested election, our Nominating and Governance Committee will submit for prompt consideration by the Board a recommendation whether to accept or reject the director’s resignation. The Board expects the director whose resignation is under consideration to abstain from participating in any decision regarding that resignation.

Contested Elections

At any meeting of shareholders for which the Secretary of the Company receives a notice that a shareholder has nominated a person for election to the Board of Directors in compliance with the Company’s Bylaws and such nomination has not been withdrawn on or before the tenth day before the Company first mails its notice of meeting to the Company’s shareholders, the directors will be elected by a plurality of the votes cast. This means that the nominees who receive the most affirmative votes would be elected to serve as directors.

2022 PROXY STATEMENT 19

2022 PROXY STATEMENT 19

Corporate Governance Overview

| Our Board of Directors recognizes that Danaher’s success over the long-term requires a robust framework of corporate governance that serves the best interests of all our shareholders. Below are highlights of our corporate governance framework, and additional details follow in the sections below. | ||

Board refreshment remains a key area of focus for us, as evidenced by the 2019 additions of Drs. Jessica L. Mega and Pardis C. Sabeti, the 2020 addition of Rainer M. Blair and the 2021 addition of A. Shane Sanders to our Board. These additions helped drive an over 20% reduction in our average director tenure from 2019 to 2021.  Our Bylaws provide for proxy access by shareholders.  Our Chairman and CEO positions are separate.  Our Board has established a Lead Independent Director position.  All of our directors are elected annually.  In uncontested elections, our directors must be elected by a majority of the votes cast, and we have a director resignation policy that applies to any incumbent director who fails to receive such a majority. |  Our shareholders have the right to act by written consent.  Shareholders owning 25% or more of our outstanding shares may call a special meeting of shareholders.  We have never had a shareholder rights plan.  We have no supermajority voting requirements in our Certificate of Incorporation or Bylaws.  All members of our Audit, Compensation and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable SEC rules.  Danaher (including its subsidiaries during the period we have owned them) has made no political contributions since at least 2012, has no intention of contributing any Danaher funds for political purposes, and discloses its political expenditures policy on its public website. The 2021 CPA-Zicklin Index of Corporate Political Disclosure and Accountability ranked Danaher as a First Tier company. | |

Board Leadership Structure, Oversight and CEO Succession Planning

Board Leadership Structure

The Board has separated the positions of Chairman and CEO because it believes that, at this time, this structure best enables the Board to ensure that Danaher’s business and affairs are managed effectively and in the best interests of shareholders. This is particularly the case in light of the fact that the Company’s Chairman is Steven Rales, a co-founder of the Company who owns approximately 6.1 percent of the Company’s outstanding shares, served as CEO of the company from 1984 to 1990 and continues to serve as an executive officer of the company. As a result of his substantial ownership stake in the Company, the Board believes that Mr. Rales is uniquely able to understand, articulate and advocate for the rights and interests of the Company’s shareholders. Moreover, Mr. Rales uses his management experience with the Company and Board tenure to help ensure that the non-management directors have a keen understanding of the Company’s business as well as the strategic and other risks and opportunities that the Company faces. This enables the Board to more effectively provide insight and direction to, and exercise oversight of, the Company’s President and CEO and the rest of the management team responsible for the Company’s day-to-day business (including with respect to oversight of risk management).

Because Mr. Rales is not independent within the meaning of the NYSE listing standards, our Corporate Governance Guidelines require the appointment of a “Lead Independent Director” and our independent directors have appointed Ms. Filler as Lead Independent Director. As Lead Independent Director, Ms. Filler:

| • | presides at all meetings of the Board at which the Chairman of the Board and the Chairman of the Executive Committee are not present, including the executive sessions of non-management directors; |

| • | has the authority to call meetings of the independent directors; |

| • | acts as a liaison as necessary between the independent directors and the management directors; and |

| • | advises with respect to the Board’s agenda. |

2022 PROXY STATEMENT 20

2022 PROXY STATEMENT 20

Board Oversight of Strategy

One of the Board’s primary responsibilities is overseeing management’s development and execution of the Company’s strategy. At least quarterly, the CEO, our executive leadership team and other business leaders provide detailed business and strategy updates to the Board. The Board annually conducts an even more in-depth review of the Company’s overall strategy. At these reviews, the Board engages with our executive leadership team and other business leaders regarding business objectives, the competitive landscape, economic trends and other developments. On an annual basis the Board also reviews the Company’s human capital, risk assessment/risk management, compliance and sustainability programs as well as the Company’s operating budget, and at meetings occurring throughout the year the Board reviews acquisitions, strategic investments and other capital allocation topics as well as the Company’s operating and financial performance, among other matters. The Board also looks to the expertise of its committees to inform strategic oversight in their areas of focus.

| SPOTLIGHT: OVERSIGHT OF STRATEGIC ACQUISITIONS |

| The Board oversees Danaher’s strategic acquisition and integration process. Danaher views acquisitions as an important element of our strategy to deliver long-term shareholder value. Our Board includes nine members with extensive business combination experience. That depth of experience allows the Board to constructively engage with management and effectively evaluate acquisitions for alignment with our strategy, culture and financial goals. Management is charged with identifying potential acquisition targets, executing transactions and managing integration, and our Board’s oversight extends to each of these elements. Management and the Board regularly discuss potential acquisitions and their role in the Company’s overall business strategy. These discussions address acquisitions in process and potential future acquisitions, and cover a broad range of matters which may include valuation, due diligence, risk and anticipated synergies with Danaher’s businesses and strategy. With respect to more significant acquisitions, such as the Company’s 2020 acquisition of Cytiva and 2021 acquisition of Aldevron, the Board typically discusses and evaluates the proposed opportunity over multiple meetings. The Board’s acquisition oversight also extends across transactions and over time; at least annually the Board reviews and provides feedback regarding the operational and financial performance of our historical acquisitions. |

| SPOTLIGHT: OVERSIGHT OF HUMAN CAPITAL MANAGEMENT AND CEO SUCCESSION PLANNING |

• The Board and Compensation Committee engage with our senior leadership team and human resources executives on a regular basis across a range of human capital management topics. As discussed above, Danaher is committed to attracting, developing, engaging and retaining the best people from around the world to sustain and grow our science and technology leadership. Working with management, the Board and Compensation Committee oversee matters including culture, succession planning and development, compensation, benefits, talent recruiting and retention, associate engagement and diversity and inclusion. The Board reviews the Company’s human capital strategy annually and at other times during the year in connection with significant initiatives and acquisitions, supported by the Compensation Committee’s oversight of our executive and equity compensation programs. • With the support of our Nominating and Governance Committee, our Board also maintains and annually reviews both a long-term succession plan and emergency succession plan for the CEO position. The foundation of the long-term CEO succession planning process is a CEO development model consisting of three dimensions: critical experiences, leadership capabilities and personal characteristics/traits. The Board uses the development model as a guide in preparing candidates, and also in evaluating candidates for the CEO and other executive positions at the Board’s annual talent review and succession planning session. At the annual session, the Board evaluates and compares candidates using the development model, and reviews each candidate’s development actions, progress and performance over time. The candidate evaluations are supplemented with periodic 360-degree performance appraisals, and the Board also regularly interacts with candidates at Board dinners and lunches, through Board meeting presentations and at the Company’s annual leadership conference. |

Board Oversight of Risk

The Board’s role in risk oversight at the Company is consistent with our leadership structure, with management having day-to-day responsibility for assessing and managing our risk exposure and the Board and its committees overseeing those efforts, with particular emphasis on the most significant risks facing the Company. On an annual basis, the Company’s Risk Committee (consisting of members of senior management) inventories, assesses and prioritizes the most significant risks facing the Company as well as related mitigation efforts and provides a report to the Board. With respect to the manner in which the Board’s risk oversight function impacts the Board’s leadership structure, as described above, our Board believes that Mr. Steven Rales’ management experience and tenure help the Board to more effectively exercise its risk oversight function.

The Board administers its risk oversight responsibilities both through active review and discussion of key risks facing the Company and by delegating certain risk oversight responsibilities to the Board committees for further consideration and evaluation. Generally, each committee has responsibility to identify and address risks that are associated with the purpose of, and responsibilities delegated to, that committee. Each committee reports to the full Board on a regular basis, including as appropriate with respect to the committee’s risk oversight activities.

2022 PROXY STATEMENT 21

2022 PROXY STATEMENT 21

| Board/Committee | Primary Areas of Risk Oversight | |

| Full Board | Risks associated with Danaher’s strategic plan, acquisition and capital allocation program, capital structure, liquidity, organizational structure and other significant risks, and overall risk assessment and risk management policies. | |

| Audit Committee | Major financial risk exposures, significant legal, compliance, reputational, cybersecurity and privacy risks and overall risk assessment and risk management policies. | |

| Compensation Committee | Risks associated with compensation policies and practices, including incentive compensation. | |

| Nominating and Governance Committee | Risks related to corporate governance, effectiveness of Board and committee oversight and review of director candidates, conflicts of interest, director independence and sustainability (including climate). | |

| Science and Technology Committee | Risks related to potentially disruptive science and technology trends and opportunities. |

| SPOTLIGHT: OVERSIGHT OF CYBERSECURITY RISK |

Danaher’s goal is to maintain a secure environment for our products, data and systems that effectively supports our business objectives and customer needs. Our commitment to cybersecurity emphasizes cultivation of a security-minded culture through security education and training, and a programmatic and layered approach that reflects industry best practice.

We have adopted a comprehensive Information Security Policy that clearly articulates Danaher’s expectations and requirements with respect to acceptable use, risk management, data privacy, education and awareness, security incident management and reporting, identity and access management, third-party management, security (with respect to physical assets, products, networks and systems), security monitoring and vulnerability identification. The policy sets forth a detailed security incident management and reporting protocol, with clear escalation timelines and responsibilities. We also maintain a global incident response plan and regularly conduct exercises to help ensure its effectiveness and our overall preparedness.

We believe cybersecurity is the responsibility of every associate. We regularly educate and share best practices with our associates to raise awareness of cyber threats. Every year, all associates in administrative, business, technical, professional, management and executive career categories are required to take information security and protection training as part of the Danaher Annual Training Program, and (in most countries where we operate) are required to certify their awareness of and compliance with the Information Security Policy. We also conduct monthly education, training and cyber-event simulations for our associates to reinforce awareness of the cyber threat landscape.

We take measures to regularly improve and update our cybersecurity program, including independent program assessments, penetration testing and scanning of our systems for vulnerabilities.

The cybersecurity program is led by the Company’s Chief Information Security Officer role, who along with Danaher’s Chief Information Officer, provide multiple updates each year to the Audit Committee regarding this program, including information about cyber-risk management governance and the status of projects to strengthen cybersecurity effectiveness. The Audit Committee regularly briefs the full Board on these matters, and the full Board also receives periodic briefings from management on our cybersecurity program. |

Board of Directors and Committees of the Board

General

The Board met eight times in 2021. All directors attended at least 85% (and eleven of the directors attended 100%) of the total number of meetings of the Board and of the committees of the Board on which they served held during the period they served. Danaher typically schedules a Board meeting in conjunction with each annual meeting of shareholders and as a general matter expects that the members of the Board will attend the annual meeting. Twelve of our directors (which constituted the entire Board as of such time) attended the Company’s annual meeting in May 2021.

The membership of each of the Board’s committees as of March 11, 2022 is set forth below. While each of the committees is authorized to delegate its powers to sub-committees, none of the committees did so during 2021. The Audit, Compensation, Nominating & Governance and Science & Technology Committees report to the Board on their actions and recommendations at each regularly scheduled Board meeting.

2022 PROXY STATEMENT 22

2022 PROXY STATEMENT 22

| Name of Director | Audit | Compensation | Nominating & Governance | Science & Technology | Executive | Finance | ||||||

| Rainer M. Blair |  |  |  | |||||||||

| Linda Filler |  |  | ||||||||||

| Teri List |  |  | ||||||||||

| Walter G. Lohr, Jr. |  |  |  |  | ||||||||

| Jessica L. Mega, MD, MPH |  | |||||||||||

| Mitchell P. Rales |  |  | ||||||||||

| Steven M. Rales |  |  |  | |||||||||

| Pardis C. Sabeti, MD, D.Phil. |  | |||||||||||

| A. Shane Sanders |  | |||||||||||

| John T. Schwieters |  |  | ||||||||||

| Raymond C. Stevens, Ph.D. |  | |||||||||||

| Alan G. Spoon |  | |||||||||||

| Elias A. Zerhouni, MD |  |  | ||||||||||

| # OF MEETINGS HELD IN 2021 | 7 | 7 | 11 | 5 | 1 | 8 |

| Chair |

Audit Committee

The Audit Committee prepares a report as required by the SEC to be included in this Proxy Statement and assists the Board in overseeing:

| • | the quality and integrity of Danaher’s financial statements; |

| • | the effectiveness of Danaher’s internal control over financial reporting; |

| • | the qualifications, independence and performance of Danaher’s independent auditors; |

| • | the performance of Danaher’s internal audit function; |

| • | Danaher’s compliance with legal and regulatory requirements; |

| • | the risks described above under “Risk Oversight”; and |

| • | the Company’s swaps and derivatives transactions and related policies and procedures. |

The Board has determined that each of the members of the Audit Committee is independent for purposes of Rule 10A-3(b) (1) under the Securities Exchange Act of 1934, as amended (“Securities Exchange Act”) and the NYSE listing standards and is financially literate within the meaning of the NYSE listing standards. In addition, the Board has determined that Ms. List and Messrs. Schwieters and Sanders each qualifies as an audit committee financial expert as that term is defined in Item 407(d)(5) of Regulation S-K under the Securities Exchange Act. Given Ms. List’s extensive experience as a Chief Financial Officer, her proficiency in accounting, and her knowledge of and dedication to Danaher, our Board has determined that Ms. List’s simultaneous service on the audit committees of more than three public companies does not impair her ability to effectively serve on our Audit Committee. In 2021, Ms. List attended all of the meetings of the Board and of the committees on which she served.

The Committee typically meets in executive session, without the presence of management, at its regularly scheduled meetings.

Compensation Committee

The Compensation Committee discharges the Board’s responsibilities relating to the compensation of our executive officers, including setting goals and objectives for, evaluating the performance of, and approving the compensation paid to, our executive officers. The Committee also:

| • | reviews and discusses with Company management the Compensation Discussion and Analysis and recommends to the Board the inclusion of the Compensation Discussion and Analysis in the annual meeting proxy statement; |

2022 PROXY STATEMENT 23

2022 PROXY STATEMENT 23

| • | reviews and makes recommendations to the Board with respect to the adoption, amendment and termination of all executive incentive compensation plans and all equity compensation plans, and exercises all authority of the Board (and all responsibilities assigned by such plans to the Committee) with respect to the oversight and administration of such plans; |

| • | reviews and considers the results of shareholder advisory votes on the Company’s executive compensation, and makes recommendations to the Board regarding the frequency of such advisory votes; |

| • | monitors compliance by directors and executive officers with the Company’s stock ownership requirements; |

| • | assists the Board in overseeing the risks described above under “Risk Oversight”; |

| • | prepares the report required by the SEC to be included in the annual meeting proxy statement; and |

| • | considers factors relating to independence and conflicts of interests in connection with the engagement of the compensation consultants that provide advice to the Committee. |

Each member of the Compensation Committee is a “non-employee director” for purposes of Rule 16b-3 under the Securities Exchange Act and, based on the determination of the Board, independent under the NYSE listing standards and under Rule 10C-1 under the Securities Exchange Act. The Committee typically meets in executive session, without the presence of management, at its regularly scheduled meetings.

Management Role in Supporting the Compensation Committee

Members of our senior management generally attend the Compensation Committee meetings. In addition, our CEO:

| • | provides background regarding the interrelationship between our business objectives and executive compensation matters and advises on the alignment of incentive plan performance measures with our overall strategy; |

| • | participates in the Committee’s discussions regarding the performance and compensation of the other executive officers and provides recommendations to the Committee regarding all significant elements of compensation paid to such officers, their annual, personal performance objectives and his evaluation of their performance (the Committee gives considerable weight to our CEO’s evaluation of and recommendations with respect to the other executive officers because of his direct knowledge of each such officer’s performance and contributions); and |

| • | provides feedback regarding the companies that he believes Danaher competes with in the marketplace and for executive talent. |

Our human resources and legal departments also assist the Committee Chair in scheduling and setting the agendas for the Committee’s meetings, preparing meeting materials and providing the Committee with data relating to executive compensation as requested by the Committee.

Independent Compensation Consultant Role in Supporting the Compensation Committee

Under the terms of its charter, the Committee has the authority to engage the services of outside advisors and experts. The Committee has engaged Frederic W. Cook & Co., Inc. (“FW Cook”) as its independent compensation consultant since 2008. The Committee engages FW Cook because it is considered one of the premier independent compensation consulting firms and has never provided any services to the Company other than the compensation-related services provided to or at the direction of the Compensation Committee and the Nominating and Governance Committee. FW Cook takes its direction solely from the Committee (and with respect to matters relating to the non-management director compensation program, the Nominating and Governance Committee). In addition to the director compensation advice provided to the Nominating and Governance Committee, FW Cook’s primary responsibilities in 2021 were to:

| • | provide advice and data in connection with the structuring of the executive and equity compensation programs and the compensation levels for the Company’s executive officers compared to their peers; |

| • | assess the Company’s executive compensation program in the context of compensation governance best practices; |

| • | update the Committee regarding legislative and regulatory initiatives as well as emerging trends and investor views in the area of executive compensation; |

| • | provide data regarding the share dilution costs attributable to the Company’s aggregate equity compensation program; and |

| • | assist in the review of the Company’s executive compensation public disclosures. |

The Committee does not place any material limitations on the scope of the feedback provided by FW Cook. In the course of discharging its responsibilities, FW Cook may from time to time and with the Committee’s consent, request from management information regarding compensation amounts and practices, the interrelationship between our business objectives and executive compensation matters, the nature of the Company’s executive officer responsibilities and other business information.

2022 PROXY STATEMENT 24

2022 PROXY STATEMENT 24

The Committee has considered whether the work performed for or at the direction of the Compensation Committee and the Nominating and Governance Committee raises any conflict of interest, taking into account the factors listed in Securities Exchange Act Rule 10C-1(b)(4), and has concluded that such work does not create any conflict of interest.

Nominating & Governance Committee

The Nominating and Governance Committee:

| • | assists the Board in identifying individuals qualified to become Board members, and makes recommendations to the Board regarding all nominees for Board membership; |

| • | makes recommendations to the Board regarding the size and composition of the Board and its committees; |

| • | makes recommendations to the Board regarding matters of corporate governance and oversees the operation of Danaher’s Corporate Governance Guidelines and Related Person Transactions Policy; |

| • | develops and oversees the annual self-assessment process for the Board and its committees; |

| • | assists the Board in CEO succession planning; |

| • | assists the Board in overseeing the risks described above under “Risk Oversight”; |

| • | reviews and makes recommendations to the Board regarding non-management director compensation; |

| • | oversees the orientation process for newly elected members of the Board and continuing director education; and |

| • | oversees the Company’s sustainability program. |