Use these links to rapidly review the document

TABLE OF CONTENTS

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

LA QUINTA CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

LA QUINTA CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 23, 2002

The annual meeting of stockholders of La Quinta Corporation ("La Quinta") will be held at La Quinta Inn D/FW Airport South, 4105 West Airport Freeway, Irving, Texas, 75062 on Thursday, May 23, 2002 at 10:00 a.m. local time (together with all adjournments and postponements thereof, the "La Quinta Meeting"), for the following purposes:

- 1.

- To elect three directors of La Quinta, each to serve for a term of three years and until his successor is duly elected and qualified.

- 2.

- To approve the appointment of PricewaterhouseCoopers LLP as our independent auditors for the fiscal year ended December 31, 2002.

- 3.

- To consider and act upon such other business and matters or proposals as may properly come before the La Quinta Meeting.

The Board of Directors of La Quinta has fixed the close of business on April 16, 2002 as the record date for determining the stockholders having the right to receive notice of and to vote at the La Quinta Meeting. Only stockholders of record at the close of business on such date are entitled to notice of and to vote at the La Quinta Meeting. A list of stockholders entitled to vote at the La Quinta Meeting will be available during ordinary business hours at La Quinta's executive offices, 909 Hidden Ridge, Suite 600, Irving, Texas, 75038 for ten days prior to the La Quinta Meeting, for examination by any La Quinta stockholder for purposes germane to the La Quinta Meeting.

|

|

By order of the Board of Directors

Sandra K. Michel

Secretary |

Irving, Texas

April 18, 2002

| | |

WHETHER OR NOT YOU PLAN TO ATTEND THE LA QUINTA MEETING, YOU ARE REQUESTED TO SIGN, DATE AND MAIL PROMPTLY THE ENCLOSED PROXY WHICH IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. A RETURN ENVELOPE, WHICH REQUIRES NO POSTAGE, IF MAILED IN THE UNITED STATES, IS ENCLOSED FOR THAT PURPOSE. RETURNING THE ENCLOSED PROXY WILL NOT AFFECT YOUR RIGHT TO ATTEND THE LA QUINTA MEETING AND VOTE YOUR SHARES IN PERSON.

This proxy statement is dated April 18, 2002 and was first mailed to stockholders of La Quinta on or about April 22, 2002.

TABLE OF CONTENTS

i

April 18, 2002

LA QUINTA CORPORATION

909 HIDDEN RIDGE

SUITE 600

IRVING, TX 75038

PROXY STATEMENT

This proxy statement and the enclosed proxy card are being mailed to stockholders on or about April 22, 2002 and are furnished in connection with the solicitation of proxies by the Board of Directors of La Quinta Corporation, for use at the 2002 annual meeting of stockholders of La Quinta Corporation ("La Quinta") to be held on Thursday, May 23, 2002 at 10:00 a.m., local time, at La Quinta Inn—D/FW Airport South, 4105 West Airport Freeway, Irving, Texas, 75062, and at any adjournments or postponements thereof.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What is the purpose of the annual meeting?

At the annual meeting, stockholders will act upon the matters set forth in the accompanying notice of meeting, including the election of directors and the ratification of the selection of our independent accountants.

Who is entitled to vote?

As you may know, La Quinta and La Quinta Properties, Inc. ("LQ Properties") completed a restructuring of the companies' organization on January 2, 2002. This restructuring was approved at special meetings of stockholders held on December 20, 2001. As a result of this restructuring, LQ Properties became a subsidiary controlled by La Quinta. We will no longer hold a separate meeting of LQ Properties stockholders as we did in prior years. Instead, you will exercise your voting rights as a stockholder of La Quinta at its annual meeting, which is the subject of this proxy statement. If our records show that you are a stockholder as of the close of business on April 16, 2002, which is referred to as the record date, you are entitled to receive notice of the annual meeting and to vote the shares of common stock that you held on the record date. Each outstanding share of common stock entitles its holder to cast one vote for each matter to be voted upon. As of the record date there were 143,001,824 shares of common stock outstanding and entitled to vote at the annual meeting.

Can I attend the meeting?

All stockholders of record of La Quinta's shares of common stock at the close of business on the record date, or their designated proxies, are authorized to attend the annual meeting. Each stockholder or proxy may be asked to present a government issued form of picture identification, such as a driver's license or passport.

1

What constitutes a quorum?

The holders of a majority of the common stock outstanding and entitled to vote, present in person or represented by proxy, shall constitute a quorum at the La Quinta meeting. Votes cast in person or by proxy at the La Quinta meeting will be tabulated by the inspector of elections appointed for the meeting and will determine whether or not a quorum is present. The inspector of elections will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as unvoted for purposes of determining the approval of any matter submitted to the stockholders for a vote. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will be considered as present but not entitled to vote with respect to that matter.

How do I vote?

Voting by Proxy Holders for Shares Registered in the Name of a Brokerage Firm or Bank. If your shares are held by a broker, bank or other nominee (i.e., in "street name"), you will receive instructions from your nominee which you must follow in order to have your shares voted.

Voting by Proxy Holders for Shares Registered Directly in the Name of the Stockholder. If you hold your shares in your own name as a holder of record, you may instruct the proxy holders named in the enclosed proxy card how to vote your shares by using the toll-free telephone number, the Internet website listed on the proxy card or by signing, dating and mailing the proxy card to EquiServe in the postage-paid envelope that has been provided to you by La Quinta. Each of these voting methods are described below:

Vote by Telephone. If you hold your shares in your own name as a holder of record, you may vote by telephone by calling the toll-free number listed on the accompanying proxy card. Telephone voting is available 24 hours a day until 11:59 p.m. on May 22, 2002. When you call you will receive a series of voice instructions which will allow you to vote your shares. A control number, located above the registration line of your proxy card, verifies your identity as a stockholder and allows you to vote your shares and confirm that your voting instructions have been recorded properly.IF YOU VOTE BY TELEPHONE, YOU DO NOT NEED TO RETURN YOUR PROXY CARD.

Vote by Internet. You also have the option to vote via the Internet. The website for Internet voting is printed on your proxy card. Internet voting is available 24 hours a day until 11:59 p.m. on May 22, 2002. As with telephone voting, you will be given the opportunity to confirm that your instructions have been properly recorded.IF YOU VOTE VIA THE INTERNET, YOU DO NOT NEED TO RETURN YOUR PROXY CARD.

Vote by Mail. If you would like to vote by mail, mark your proxy card, sign and date it, and return it to EquiServe in the postage-paid envelope provided.

Vote in Person. If you are a registered stockholder and attend the annual meeting, you may deliver your completed proxy card in person. "Street name" stockholders who wish to vote at the meeting will need to obtain a proxy form from the broker, bank or other nominee that holds their shares of record.

Will other matters be voted on at the annual meeting?

We are not now aware of any other matters to be presented at the annual meeting other than those described in this proxy statement. If any other matters not described in the proxy statement are properly presented at the meeting, proxies will be voted in accordance with the best judgment of the proxy holders.

2

Can I revoke my proxy instructions?

You may revoke your proxy at any time before it has been exercised by:

- •

- filing a written revocation with the Secretary of La Quinta at the address set forth below;

- •

- filing a duly executed proxy bearing a later date; or

- •

- appearing in person and voting by ballot at the annual meeting as described above under "How do I vote?—Vote in Person."

Any stockholder of record as of the record date attending the annual meeting may vote in person whether or not a proxy has been previously given, but the presence (without further action) of a stockholder at the annual meeting will not constitute revocation of a previously given proxy.

What other information should I review before voting?

For your review, our 2001 annual report, including financial statements for the fiscal year ended December 31, 2001, is being mailed to stockholders concurrently with this proxy statement. The annual report, however, is not part of the proxy solicitation material. For your further review, a copy of our annual report filed with the Securities and Exchange Commission (the "SEC") on Form 10-K, including the financial statements, may be obtained without charge by writing to: Secretary of La Quinta Corporation, 909 Hidden Ridge, Suite 600, Irving, Texas 75038.

PROPOSAL 1: ELECTION OF DIRECTORS

Introduction

Our Board of Directors currently consists of seven members who are divided into three classes. Each director of La Quinta also serves as a director of LQ Properties, which is now a subsidiary controlled by La Quinta as a result of the restructuring completed in January 2002. At the annual meeting, three directors will be elected to serve until the 2005 annual meeting or until their respective successors are duly elected and qualified.

Our Board of Directors, based upon the recommendation of its nominating committee, has nominated Clive D. Bode, James P. Conn, and Stephen E. Merrill to serve as directors. The nominees are currently serving as directors of La Quinta. Our Board of Directors anticipates that the nominees will serve, if elected, as directors. However, if any person nominated by our Board of Directors is unable to accept election, the proxies will be voted for the election of such other person or persons as our Board of Directors may recommend. Our Board of Directors will consider a nominee for election to our Board of Directors recommended by a stockholder of record if the stockholder submits the nomination in compliance with the requirements of our bylaws.

Vote Required

Directors must be elected by a plurality of the votes of the shares of stock present in person or represented by proxy and entitled to vote on the election of directors at the La Quinta annual meeting. Votes may be cast for or withheld from each nominee. Votes cast for the nominees will count as "yes votes;" votes that are withheld from the nominees will not be voted with respect to the director or directors indicated, although they will be counted when determining whether there is a quorum.

Recommendation

THE BOARD OF DIRECTORS OF LA QUINTA UNANIMOUSLY RECOMMEND A VOTEFOR THEIR NOMINEES, CLIVE D. BODE, JAMES P. CONN, AND STEPHEN E. MERRILL. PROXIES SOLICITED BY THE BOARD WILL BE VOTEDFOR EACH OF THE NOMINEES UNLESS INSTRUCTIONS TO WITHHOLD OR TO THE CONTRARY ARE GIVEN.

3

Information Regarding the Nominees, Other Directors and Executive Officers

The following table provides information about the current directors of La Quinta.

Name and Principal Occupation or Employment

| | Age

| | Director of La Quinta and its

Predecessor Since

| | Term Expires

|

|---|

Clive D. Bode

Chairman of the Board

Director, Kelly, Hart & Hallman | | 58 | | 1999 | | 2002 |

Francis W. Cash

Chief Executive Officer and President of La Quinta and LQ Properties |

|

60 |

|

2000 |

|

2004 |

William C. Baker

Former Chief Executive Officer, Santa Anita Realty Enterprises, Inc. and Santa Anita Operating Company |

|

68 |

|

1991 |

|

2003 |

William G. Byrnes

Financial Consultant, Private Investor and Director, JDN Realty Corporation |

|

51 |

|

1998 |

|

2004 |

James P. Conn

Former Managing Director and Chief Investment Officer of Financial Security Assurance, Inc. |

|

64 |

|

2000 |

(1) |

2002 |

John C. Cushman, III

Chairman of the Board, Cushman & Wakefield, Inc. |

|

61 |

|

2000 |

(2) |

2003 |

Stephen E. Merrill

President, Bingham Consulting Group, LLC |

|

55 |

|

1998 |

|

2002 |

- (1)

- Mr. Conn has served as a director of LQ Properties and its predecessor since 1995.

- (2)

- Mr. Cushman has served as a director of LQ Properties and its predecessor since 1996.

The following biographical descriptions set forth certain information with respect to the three nominees for re-election as directors at the annual meeting, each director who is not up for election and the executive officers who are not directors, based on information furnished to La Quinta by each director and executive officer. The following information is correct as of April 8, 2002.

Clive D. Bode has been Chairman of the Board of La Quinta since October 1999. Mr. Bode also serves as Chairman of the Board of LQ Properties. Mr. Bode has been a special advisor to certain members of the Bass Family of Fort Worth, Texas for the past 10 years. Mr. Bode is also a director of Kelly, Hart & Hallman, a Fort Worth based law firm.

James P. Conn has been a director of La Quinta since April 2000. Mr. Conn also serves as a director of LQ Properties and was also a director of La Quinta's predecessor prior to the 1997 Santa Anita merger. Mr. Conn was the Managing Director and Chief Investment Officer of Financial Security Assurance, Inc. from 1992 through 1998. He was also the President and Chief Executive Officer of Bay Meadows Operating Company from 1988 to 1992. Mr. Conn is a Trustee of Gabelli Equity Trust, Gabelli Global Multimedia Trust, Gabelli Utility Trust and a member of the Board of Directors of First Republic Bank. Mr. Conn is also a Trustee of Gabelli Asset Fund, Gabelli Growth Fund and Gabelli Westwood Funds.

4

Stephen E. Merrill has been a director of La Quinta since May 1998. Mr. Merrill is also a director of LQ Properties. Mr. Merrill is the President of Bingham Consulting Group, LLC and was Of Counsel to the law firm Choate, Hall & Stewart from March 1997 to February 1999. Previously, Mr. Merrill served as Governor of the State of New Hampshire from 1993 through 1997. He was a senior partner in the law firm Merrill & Broderick from 1989 through 1993 and served as Attorney General for the State of New Hampshire from 1985 through 1989. Mr. Merrill also served as legal counsel and Chief of Staff to the Governor of New Hampshire from 1982 through 1985.

William C. Baker has been a director of La Quinta since October 1991. He was a director of LQ Properties' predecessor prior to the 1997 Santa Anita merger and was appointed a director of LQ Properties in April 2000. Mr. Baker served as President and Treasurer of La Quinta from August 1998 through April 2000. Mr. Baker was Chief Executive Officer of Santa Anita Realty Enterprises, Inc. and Santa Anita Operating Company from April 1996 to December 1998. Mr. Baker was the President of Red Robin International, Inc. from 1993 to 1995, a private investor from 1988 to 1992 and Chairman of the Board and Chief Executive Officer of Del Taco, Inc. from 1976 to 1988. He served as Chairman of the Board of Coast Newport Properties from 1991 to 1999. Mr. Baker is a director of Callaway Golf Company and Public Storage, Inc.

John C. Cushman, III has been a director of La Quinta since April 2000. Mr. Cushman also serves as a director of LQ Properties and was a director of La Quinta's predecessor prior to the 1997 Santa Anita merger. Mr. Cushman has been the Chairman of the Board at Cushman & Wakefield, Inc. since July 1, 2001. Previously Mr. Cushman had been the President and Chief Executive Officer of Cushman Realty Corporation since 1978. He is a director of National Golf Properties, Inc., Los Angeles Turf Club, Incorporated, Digital Gene Technologies, Inc., Cushman & Wakefield, Inc., Cushman Winery Corporation, Culinary Holdings, Inc. and Inglewood Park Cemetery.

Francis W. Cash has been President, Chief Executive Officer and a Director of La Quinta since April 17, 2000. Mr. Cash also serves as President, Chief Executive Officer and a Director of LQ Properties. Mr. Cash served as the Treasurer of La Quinta from April 17, 2000 until June 2000. Mr. Cash was the Chairman of the Board, Chief Executive Officer, President and a director of Mariner Post-Acute Network, Inc. ("Mariner") from September 8, 1999 until March 2000. In January 2000, while Mr. Cash was Chief Executive Officer and President of Mariner, the company filed for bankruptcy protection under Chapter 11 of the United States Bankruptcy Code. From July 1995 to August 1999, Mr. Cash served as President and Chief Executive Officer of Red Roof Inns, Inc. ("Red Roof Inns"). He also served as Chairman of the Board of Red Roof Inns from June 1996 to August 1999. Prior to his service at Red Roof Inns, Mr. Cash served as President and Chief Operating Officer of NovaCare, Inc. from October 1992 to June 1995. Prior to that, Mr. Cash served in a number of senior executive positions for 18 years at Marriott Corporation, most recently as President, Marriott Service Group.

William G. Byrnes has been a director of La Quinta since April 1998. Mr. Byrnes also serves as a director of LQ Properties. Mr. Byrnes served as Chief Executive Officer of LQ Properties from January 2000 through Mr. Cash's appointment in April 2000. He was Chairman of the Board and Chief Executive Officer of Inceiba, LLC, a start-up incubator, from June 1999 to December 2000. Mr. Byrnes was previously a Distinguished Teaching Professor of Finance at the McDonough School of Business at Georgetown University from August 1988 to May 1999, and was associated with Alex.Brown and Sons, investment bankers, from 1981 through 1998. Mr. Byrnes is a financial consultant and private investor and is a director of JDN Realty Corporation, a real estate development and asset management company traded on the New York Stock Exchange, a director of Security Capital Preferred Growth

5

Incorporated and non-executive Chairman of Pulpfree, Inc. Mr. Byrnes also serves on the Board of Regents of Georgetown University.

David L. Rea has been Executive Vice President and Chief Financial Officer of La Quinta since June 2000. Mr. Rea also serves as Executive Vice President and Chief Financial Officer of LQ Properties. Mr. Rea also served as Treasurer of La Quinta and LQ Properties from June 2000 until January 2002. Prior to joining La Quinta, Mr. Rea served as Chief Financial Officer of the start-up e-commerce company, SingleSourceIT.com. Prior to that he was with Red Roof Inns, Inc. from 1996 through 1999, where he served in various roles including Executive Vice President, Chief Financial Officer and Treasurer. From 1995 through 1996, he served as Vice President of Finance at DeBartolo Realty Corporation and held various investment management related positions with T. Rowe Price Associates from 1986 through 1995.

Alan L. Tallis has been Executive Vice President and Chief Development Officer of La Quinta since July 2000. He previously served in various executive positions with La Quinta from 1980 to 1992. Prior to returning to La Quinta in 2000, Mr. Tallis served as Executive Vice President-Development and General Counsel of Red Roof Inns, Inc. and Managing Director of Tallis & Associates.

Michael F. Bushee has been Chief Operating Officer of LQ Properties since September 1994. He was Senior Vice President of Operations of LQ Properties from November 1993 through August 1994, Vice President from December 1989 through October 1993, Director of Development from January 1988 to December 1989 and has been associated with La Quinta since April 1987. Mr. Bushee was previously associated with The Stop & Shop Companies, Inc., a retailer of food products and general merchandise, for three years and Wolf & Company, P.C., independent accountants, for four years.

A. John Novak has been Senior Vice President and Chief Information Officer of La Quinta since January 2001. Prior to joining La Quinta, Mr. Novak was Senior Vice President and Chief Information Officer for Resort Condominiums International (RCI), a division of Cendant Corporation, beginning in April 1999. He served as Vice President of Lodging Property Systems for Marriott International from 1996 to 1999. Mr. Novak also served as Vice President of Resorts and Sales Systems for Walt Disney World Company from 1990 until 1996.

Stephen T. Parker has been Executive Vice President of Sales and Marketing of La Quinta since June 2001. From May 2000 to June 2001, he served as Senior Vice President of Sales and Marketing of La Quinta. From August 1999 to May 2000, he was a hospitality/marketing consultant in Phoenix, Arizona. From March 1997 until August 1999, Mr. Parker served as Senior Vice President, Sales and Marketing for Red Roof Inns, Inc. He served as Vice President, Marketing for North America for Choice Hotels International, Inc. from October 1986 until March 1997.

Wayne B. Goldberg has been Senior Vice President of Operations of La Quinta since October 2001 and, prior to that, was Group Vice President of Operations since July 2000. Prior to joining La Quinta, Mr. Goldberg was Chief Operating Officer for BridgeStreet Accommodations. Prior to BridgeStreet, Mr. Goldberg spent over 22 years at Red Roof Inns, Inc. Mr. Goldberg served in various roles at Red Roof Inns, including: Group Vice President, District Vice President, Regional Manager, Area Manager and General Manager.

A. Brent Spaeth has been Senior Vice President of Human Resources and Administration of La Quinta since October 2001 and, prior to that, was Group Vice President of Operations since August 2000. Mr. Spaeth has been with La Quinta since February of 1989. He has served in various roles including Regional Vice President of the Inn & Suites in the Western Regions and Divisional Vice

6

President for the Central Division of La Quinta. He formerly had various regional operations positions with the Drury and Holiday Inn corporations.

Sandra K. Michel has been Senior Vice President and General Counsel of La Quinta since December 2001 and Secretary of La Quinta since January 2002. Ms. Michel also serves as Senior Vice President, General Counsel and Secretary of LQ Properties. Prior to joining La Quinta, Ms. Michel served as General Counsel and Secretary at Sunterra Corporation from June 2000 through April 2001 and Deputy General Counsel and Assistant Secretary from August 1999 through June 2000. Prior to that, Ms. Michel served as Senior Counsel to W.R. Grace & Co. from December 1991 through August 1999 assuming the additional role of Assistant Secretary in September 1998. Ms. Michel was an attorney in private practice with nationally recognized firms for eleven years prior to joining W.R. Grace & Co.

The Board of Directors and its Committees

Board of Directors. La Quinta is managed by a seven member Board of Directors, a majority of whom are independent of our management. Our Board of Directors is divided into three classes, and the members of each class of directors serve for staggered three-year terms. At each annual meeting of stockholders, directors will be re-elected or elected for a full term of three years to succeed those directors whose terms are expiring.

Our Board of Directors met nine times in 2001. Each of the directors attended at least 75% of the aggregate of (i) the total number of meetings of our Board of Directors and (ii) the total number of meetings of all committees of our Board of Directors on which the director served.

Audit Committee. Our Board of Directors has established an audit committee consisting of Messrs. Conn (Chairman), Bode and Cushman. The audit committee makes recommendations concerning the engagement of independent public accountants, reviews with the independent public accountants the scope and results of the audit engagement, approves professional services provided by the independent public accountants, reviews the independence of the independent public accountants, considers the range of audit and non-audit fees, and reviews the adequacy of our internal accounting controls. Our Board has adopted an audit committee charter. Each member of the audit committee is "independent" as that term is defined in the rules of the SEC and the applicable listing standards of the New York Stock Exchange ("NYSE"). LQ Properties' audit committee is comprised of the same directors. Because the audit committee of LQ Properties is identical to that of La Quinta, the function of the two audit committees has been carried out jointly by the members of the two audit committees. The audit committee met seven times during the year ended December 31, 2001.

Compensation Committee. La Quinta has established a compensation committee consisting of Messrs. Merrill (Chairman), Baker, Bode and Cushman. The compensation committee has been composed of entirely non-employee members since April 13, 2001, the date Francis W. Cash, the President and Chief Executive Officer of La Quinta, resigned from the compensation committee. Messrs. Merrill, Baker, Bode and Cushman are not, and have not been, officers or employees nor do they have any other business relationship or affiliation with La Quinta, other than through serving on the Board of Directors and owning La Quinta's shares. Messrs. Merrill, Baker, Bode and Cushman have not had any relationships with La Quinta requiring disclosure under applicable rules and regulations of the SEC or the NYSE. LQ Properties compensation committee is comprised of the same directors. Because the compensation committee of LQ Properties is identical to that of La Quinta, the function of the two compensation committees has been carried out jointly by the members of the two compensation committees. The compensation committee met four times during the year ended December 31, 2001.

7

Executive Committee. La Quinta has established an executive committee consisting of Messrs. Conn (Chairman), Baker, Bode, Byrnes, and Cash. The executive committee exercises all of the powers of the Board of Directors between meetings of the Board of Directors, except such powers as are reserved to the Board of Directors by law. Because the executive committee of LQ Properties is identical to that of La Quinta, the function of the two executive committees has been carried out jointly by the members of the two executive committees. The executive committee did not meet in 2001.

Nominating Committee. La Quinta has established a nominating committee consisting of Messrs. Bode (Chairman), Baker, Byrnes, Conn, Cushman and Merrill that makes recommendations to the Board of Directors concerning the Board's size and composition and suggests prospective candidates for director. The nominating committee will consider stockholder recommendations for nominees for director. Stockholders of La Quinta wishing to make recommendations should write to the nominating committee c/o Secretary of La Quinta Corporation, 909 Hidden Ridge, Suite 600, Irving, Texas 75038. In 2001, the nominating committee met one time. LQ Properties nominating committee is comprised of the same directors.

Our Board of Directors may from time to time establish other special or standing committees to facilitate the management of La Quinta or to discharge specific duties delegated to the committee by the full Board of Directors.

PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT ACCOUNTANTS

PricewaterhouseCoopers LLP were the independent auditors of La Quinta for the fiscal year ended December 31, 2001. The Board of Directors recommend their selection as independent auditors of La Quinta for the fiscal year ended December 31, 2002. Representatives of PricewaterhouseCoopers LLP will be present at the La Quinta meeting and will be afforded an opportunity to make a statement if they desire to do so. Such representatives of PricewaterhouseCoopers LLP will also be available at that time to respond to appropriate questions addressed to the officer presiding at the La Quinta annual meeting.

Recommendation

THE BOARD OF DIRECTORS OF LA QUINTA UNANIMOUSLY RECOMMEND THAT YOU VOTEFOR THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE INDEPENDENT AUDITORSFOR THE FISCAL YEAR ENDED DECEMBER 31, 2002. PROXIES SOLICITED BY THE BOARD WILL BE VOTED FOR THE RATIFICATION UNLESS INSTRUCTIONS TO WITHHOLD OR TO THE CONTRARY ARE GIVEN.

8

PRINCIPAL AND MANAGEMENT STOCKHOLDERS

The following table sets forth as of March 31, 2002, except as otherwise noted, the number of shares of La Quinta common stock and class B common stock of LQ Properties, which are paired and trade together as a single unit and are hereinafter referred to as paired shares, beneficially owned, directly or indirectly, by (i) each of the directors of La Quinta, (ii) the chief executive officer of La Quinta for the year ended December 31, 2001, (iii) each of the named executive officers for the year ended December 31, 2001, (iv) all directors and current executive officers of La Quinta as a group, and (v) all persons who, to the knowledge of La Quinta, beneficially own five percent or more of the paired shares as of March 31, 2002. Unless otherwise indicated, all information concerning beneficial ownership was provided by the respective director, executive officer or five percent beneficial owner, as the case may be. All directors and current executive officers have a mailing address of c/o La Quinta Corporation, 909 Hidden Ridge, Suite 600, Irving, Texas 75038.

Name of Beneficial Owner

| Amount and Nature of Beneficial Ownership(1)

| | Percent of Class

|

|---|

| Directors and Executive Officers: | | | |

| | William C. Baker | 221,400 | (2) | * |

| | Clive D. Bode | 2,912,836 | (3) | 2.04%(4) |

| | William G. Byrnes | 262,872 | (5) | * |

| | Francis W. Cash | 1,880,000 | (6) | 1.30%(4) |

| | James P. Conn | 135,046 | (7) | * |

| | John C. Cushman, III | 387,145 | (8) | * |

| | Stephen E. Merrill | 89,452 | (9) | * |

| | Michael F. Bushee | 513,104 | (10) | * |

| | Wayne B. Goldberg | 93,750 | (11) | * |

| | Sandra K. Michel | 50,000 | (12) | * |

| | A. John Novak | 100,000 | (13) | * |

| | Stephen T. Parker | 100,000 | (14) | * |

| | David L. Rea | 900,000 | (15) | * |

| | Brent Spaeth | 110,045 | (16) | * |

| | Alan L. Tallis | 128,906 | (17) | * |

| | | All Directors and executive officers of La Quinta as a group | 7,884,556 | | 5.40%(4) |

5% Stockholders: |

|

|

|

| | Joint Schedule 13G/A Filing (18): | | | |

| | | Sid R. Bass, Inc. | 2,442,067 | (19) | |

| | | Lee M. Bass, Inc. | 2,442,067 | (20) | |

| | | The Airlie Group, L.P. | 269,633 | (21)(22) | |

| | | William P. Hallman, Jr. | 3,354,345 | (23) | |

| | | Annie R. Bass Grandson's Trust for Lee M. Bass | 527,188 | (24) | |

| | | Annie R. Bass Grandson's Trust for Sid R. Bass | 527,188 | (25) | |

| | | Peter Sterling | 337,600 | (26) | |

| | | Sterling 1990 Trust | 106,999 | (27) | |

| | | Lee C. Hallman Trust | 67,334 | (28) | |

| | | Mary S. Hallman Trust | 67,334 | (29) | |

| | | William P. Hallman, III Trust | 67,334 | (30) | |

| | | Herbert T. Hughes | 35,000 | | |

| |

| | |

| | Total | 10,244,089 | (18) | 7.16%(4) |

| Merrill Lynch & Co., Inc. | 14,013,114 | (31) | 9.80%(4) |

| European Investors Inc. | 8,907,600 | (32) | 6.23%(4) |

- *

- Denotes less than 1%

- (1)

- Unless otherwise indicated, the number of shares stated as being owned beneficially includes (i) shares beneficially owned by spouses, minor children and/or other relatives in which the director or officer may share voting power and (ii) any of the shares listed as being subject to options exercisable within sixty days of March 31, 2002.

9

- (2)

- Includes 151,400 shares of common stock, 25,000 shares of restricted stock awarded under the 1995 Stock Award Plan that vest (i) in three equal annual installments which began on September 7, 2001 or (ii) upon a change of control of La Quinta, and 45,000 currently exercisable options.

- (3)

- Includes 2,892,836 shares of common stock and 20,000 currently exercisable options.

- (4)

- Percent of Class is as of March 31, 2002 and is based on 142,995,568 outstanding shares of La Quinta.

- (5)

- Includes 192,872 shares of common stock, 25,000 shares of restricted stock awarded under the 1995 Stock Award Plan that vest (i) in three equal annual installments which began on September 7, 2001 or (ii) upon a change of control of La Quinta, and 45,000 currently exercisable options.

- (6)

- Includes 500,000 shares of restricted stock awarded under the 1995 Stock Award Plan that vest (i) three years from the grant date of April 17, 2000, (ii) upon an automatic, non-discretionary, formulaic stock price performance test on the first business day after the closing price of a paired share equals or exceeds $8.0625 for 30 consecutive days, or (iii) upon a change of control of La Quinta. Also includes 780,000 currently exercisable options. 180,000 of the currently exercisable options vested as part of an automatic, non-discretionary, formulaic stock price performance test as follows: 90,000 on May 29, 2001, the date on which the closing price of a paired share equaled or exceeded $4.0312 for 30 consecutive days; and 90,000 on December 28, 2001, the date on which the closing price of a paired share equaled or exceeded $5.375 for 30 consecutive days. Also includes 600,000 currently unexercisable options that will become exercisable within 60 days of March 31, 2002.

- (7)

- Includes 65,046 shares of common stock, 25,000 shares of restricted stock awarded under the 1995 Stock Award Plan that vest (i) in three equal annual installments which began on September 7, 2001 or (ii) upon a change of control of La Quinta, and 45,000 currently exercisable options.

- (8)

- Includes 317,145 shares of common stock of which 315,919 shares are beneficially owned by Mr. Cushman as Trustee of the Cushman Family Trust, 25,000 shares of restricted stock awarded under the 1995 Stock Award Plan that vest (i) in three equal annual installments which began on September 7, 2001 or (ii) upon a change of control of La Quinta, and 45,000 currently exercisable options.

- (9)

- Includes 19,452 shares of common stock, 25,000 shares of restricted stock awarded under the 1995 Stock Award Plan that vest (i) in three equal annual installments which began on September 7, 2001 or (ii) upon a change of control of La Quinta, and 45,000 currently exercisable options.

- (10)

- Includes 27,678 shares of common stock. Also includes 90,000 shares of restricted stock awarded under the 1995 Stock Award Plan as follows: 50,000 shares issued on July 31, 1998, 10,000 shares issued on August 5, 1999, and 30,000 shares issued on January 3, 2000 that all vest (i) on the earlier of the eighth year from the date of the grant or (ii) upon achievement of the following performance criteria: achievement of Funds from Operations of $2.92 per share in 2000, $3.10 per share in 2001, $3.28 per share in 2002, $3.48 per share in 2003 and $3.69 per share in 2004. All of the restricted stock immediately vests upon a change of control of La Quinta. Also includes 395,426 currently exercisable options.

- (11)

- Includes 75,000 shares of restricted stock awarded under the 1995 Stock Award Plan as follows: 25,000 shares issued on September 7, 2000 and 50,000 shares issued on November 1, 2001 that vest (i) on the third anniversary of the date of issuance or (ii) upon a change of control of La Quinta. Also includes 18,750 currently exercisable options.

- (12)

- Includes 50,000 shares of restricted stock granted as of January 18, 2002 that vest (i) on the third anniversary of December 28, 2001, the commencement of Ms. Michel's employment with La Quinta or (ii) upon a change of control of La Quinta.

- (13)

- Includes 75,000 shares of restricted stock awarded under the 1995 Stock Award Plan as follows: 50,000 shares issued on December 29, 2000 and 25,000 shares issued on November 1, 2001 that vest (i) on the third anniversary of the date of issuance or (ii) upon a change of control of La Quinta. Also includes 25,000 currently exercisable options.

- (14)

- Includes 75,000 shares of restricted stock awarded under the 1995 Stock Award Plan as follows: 50,000 shares issued on September 7, 2000 and 25,000 shares issued on November 1, 2001 that vest (i) on the third anniversary of the date of issuance or (ii) upon a change of control of La Quinta. Also includes 25,000 currently exercisable options.

- (15)

- Includes 900,000 currently exercisable options. 675,000 of the currently exercisable options vested as part of an automatic, non-discretionary, formulaic stock price performance test on February 22, 2002, the date on which the closing price of a paired share equaled or exceeded $5.82 for 30 consecutive days.

10

- (16)

- Includes 45 shares of common stock and 75,000 shares of restricted stock awarded under the 1995 Stock Award Plan as follows: 25,000 shares issued on September 7, 2000 and 50,000 shares issued on November 1, 2001 that vest (i) on the third anniversary of the date of issuance or (ii) upon a change of control of La Quinta. Also includes 35,000 currently exercisable options.

- (17)

- Includes 85,938 shares of restricted stock awarded under the 1995 Stock Award Plan on September 7, 2000 that vest (i) on the third anniversary of the date of issuance or (ii) upon a change of control of La Quinta. Also includes 42,968 currently exercisable options.

- (18)

- Information provided is based solely on information contained in a Schedule 13G /A filed February 14, 2002. The principal business office for each reporting person set forth in the Schedule 13G/A is 201 Main Street, Suite 3200, Fort Worth, Texas 76102. Clive D. Bode, La Quinta's Chairman, is also a reporting person within the Schedule 13G/A, although, for purposes of this table, his shares are presented above under the heading "Directors and Executive Officers." The aggregate number of shares reported in this Schedule 13G/A, including Mr. Bode's 2,912,836 shares, is 13,156,925 or 9.1% of the class.

- (19)

- Mr. Sid R. Bass, solely in his capacity as President of Sid R. Bass, Inc., may also be deemed a beneficial owner of such shares.

- (20)

- Mr. Lee M. Bass, solely in his capacity as President of Lee M. Bass, Inc., may also be deemed a beneficial owner of such shares.

- (21)

- Mr. Dort A. Cameron, III, solely in his capacity as one of two general partners of EBD L.P., which is the sole general partner of The Airlie Group, L.P., may also be deemed a beneficial owner of such shares.

- (22)

- Mr. William P. Hallman, Jr., solely in his capacity as President and sole stockholder of TMT-FW, Inc., which is one of two general partners of EBD L.P., which is the sole general partner of The Airlie Group, L.P., may also be deemed a beneficial owner of such shares.

- (23)

- This amount does not include (a) 527,188 shares held by Annie R. Bass Grandson's Trust for Sid R. Bass of which Mr. Hallman is the Trustee, (b) 527,188 paired shares held by Annie R. Bass Grandson's Trust for Lee M. Bass of which Mr. Hallman is the Trustee, (c) 269,633 shares held by the Airlie Group, L.P., which is indirectly controlled by TMT-FW, Inc. of which Mr. Hallman is the President and sole stockholder and (d) 106,999 shares held by the 1990 Sterling Trust, of which Mr. Hallman is a trustee.

- (24)

- Mr. Hallman, solely in his capacity as Trustee of the Annie R. Bass Grandson's Trust for Lee M. Bass, may also be deemed a beneficial owner of such shares.

- (25)

- Mr. Hallman, solely in his capacity as Trustee of the Annie R. Bass Grandson's Trust for Sid R. Bass, may also be deemed a beneficial owner of such shares.

- (26)

- This amount does not include 419,398 shares held by FW Trinity Limited Investors, L.P., whose sole general partner is TF-TW Investors, Inc., of which Mr. Sterling is one of two stockholders.

- (27)

- Mr. Hallman, solely in his capacity as Trustee of the Sterling 1990 Trust, may also be deemed a beneficial owner of such shares.

- (28)

- Mr. W. R. Cotham, solely in his capacity as Trustee of the Lee C. Hallman Trust, may also be deemed a beneficial owner of such shares.

- (29)

- Mr. W. R. Cotham, solely in his capacity as Trustee of the Mary S. Hallman Trust, may also be deemed a beneficial owner of such shares.

- (30)

- Mr. W. R. Cotham, solely in his capacity as Trustee of the William P. Hallman III, Trust, may also be deemed a beneficial owner of such shares.

- (31)

- Information provided is based solely on information contained in a Schedule 13G/A filed by Merrill Lynch & Co., Inc. on behalf of Merrill Lynch Investment Managers and ML Global Allocation Fund, Inc. on February 5, 2002 and, as reported in such schedule, is as of December 31, 2001. Certain of the Merrill Lynch entities have disclaimed beneficial ownership of the paired shares holdings described in the Schedule 13G/A such that there is no violation of the ownership limitations as set forth in the charters.

- (32)

- Information provided is based solely on information contained in a Schedule 13G filed by European Investors Inc. on February 13, 2002 and, as reported in such schedule, is as of December 31, 2001. This amount includes 2,426,600 shares owned by European Investors Inc. and 6,481,000 shares owned by EII Realty Securities Inc., a wholly-owned subsidiary of European Investors Inc.

11

The information reflected for certain beneficial owners listed under the heading "5% Stockholders" is based on statements and reports filed with the SEC and furnished to La Quinta by such holders. No independent investigation concerning the accuracy thereof has been made by La Quinta.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Director Compensation

Directors of La Quinta who are also employees of La Quinta or LQ Properties receive no additional compensation for their service as directors. La Quinta pays each non-employee director a fee of $30,000 per year for services as a director, and the Chairman and each director receive $1,250 and $1,000, respectively, per day for attendance at each meeting of the full Board of Directors. In addition, the Chairman and each member of a committee of the Board of Directors are paid $1,250 and $1,000, respectively, for attendance at a committee meeting. Non-employee directors may elect to take a portion of their directors' fees as paired shares in lieu of cash compensation. La Quinta reimburses the directors for travel expenses incurred in connection with their duties as directors of La Quinta and LQ Properties. In addition, La Quinta from time to time pays directors additional fees in connection with various special projects. William G. Byrnes was the only director to receive additional fees for consulting on a special project for the year ended December 31, 2001. Mr. Byrnes received $19,000 in connection with consulting services related to the sale of Nursing Home Properties Plc stock held by La Quinta in January 2001.

Beginning in 2002, non-employee directors of La Quinta receive automatic formulaic grants of non-qualified options to purchase paired shares under the La Quinta 2002 Stock Option and Incentive Plan approved by La Quinta stockholders in December 2001. The first automatic formulaic grant of non-qualified options to purchase 20,000 paired shares was made on January 9, 2002, the fifth business day after the closing of La Quinta's recently completed restructuring. An annual formulaic grant of a non-qualified options to purchase 20,000 paired shares will be made to each non-employee director on the fifth business day after each annual meeting of La Quinta stockholders commencing with the annual meeting discussed in this proxy statement.

Executive Compensation

The following table provides information with respect to the compensation that La Quinta paid in 1999, 2000 and 2001 to those individuals who served as La Quinta's Chief Executive Officer and the four most highly compensated executive officers of La Quinta and LQ Properties other than the Chief Executive Officer whose base salary and bonus exceeded $100,000 for the fiscal year ended December 31, 2001. In prior years, the joint proxy statement of The La Quinta Companies has included a separate summary compensation table for La Quinta and LQ Properties. However, since LQ Properties has become a subsidiary of La Quinta pursuant to the restructuring, La Quinta believes that it is more appropriate to provide a single summary compensation table for La Quinta as a whole. The restructuring has been treated as an amalgamation of companies for the purpose of reporting executive compensation in this proxy statement, and, accordingly, the reporting of executive compensation has been made on a combined basis, taking into account both La Quinta and LQ Properties before the restructuring.

12

Summary Compensation Table

| |

| |

| |

| | Long-Term Compensation Awards

| |

|---|

| |

| | Annual Compensation

| |

| | Awards Securities Underlying Options/ SARs (#)

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)(a)

| | Restricted Stock Award(s) ($)

| | All other Compensation ($)

| |

|---|

Francis W. Cash(1)

Chief Executive Officer and President |

|

2001

2000

1999 |

|

800,000

553,846

— |

|

566,120

- -0-

— |

|

- -0-

1,065,000

— |

(3)

|

- -0-

2,400,000

— |

|

5,262

797,543

— |

(2)

(4)

|

David L. Rea(5)

Executive Vice President and Chief Financial Officer |

|

2001

2000

1999 |

|

375,000

194,712

— |

|

150,615

- -0-

— |

|

- -0-

582,000

— |

(7)

|

150,000

900,000

— |

|

8,350

179,821

— |

(6)

(8)

|

Michael F. Bushee

Chief Operating Officer—LQ Properties |

|

2001

2000

1999 |

|

425,000

392,900

300,000 |

|

425,000

425,000

221,608 |

(10)

(10) |

- -0-

178,200

95,600 |

(11)

(13) |

- -0-

- -0-

- -0- |

|

12,018

18,282

6,627 |

(9)

(12)

|

Alan L. Tallis(14)

Executive Vice President and Chief Development Officer |

|

2001

2000

1999 |

|

275,000

112,115

— |

|

90,728

- -0-

— |

|

- -0-

284,455

— |

(16)

|

75,000

171,875

— |

|

13,973

2,940

— |

(15)

(17)

|

Stephen T. Parker(18)

Executive Vice President and Chief Marketing Officer |

|

2001

2000

1999 |

|

309,750

190,385

— |

|

78,033

- -0-

— |

|

126,000

165,500

— |

(19)

(21)

|

75,000

100,000

— |

|

13,380

10,023

— |

(20)

(22)

|

- (a)

- Bonus amounts listed reflect all bonus payments actually made during the fiscal year ended December 31, 2001. Bonus payments earned during such fiscal year, but paid in 2002, will be reflected in La Quinta's proxy statement for the fiscal year ended December 31, 2002.

- (1)

- Mr. Cash became Chief Executive Officer and President of La Quinta on April 17, 2000. Accordingly, no compensation information is presented for Mr. Cash for 1999.

- (2)

- Consists of moving expenses.

- (3)

- Mr. Cash received an award of 500,000 shares of restricted stock on April 17, 2000 and the fair market value of a share on the date of grant was $2.13. Mr. Cash received such grant of restricted stock in his capacity as an executive officer of LQ Corporation. The restricted stock vests (i) three years from the grant date of April 17, 2000, (ii) upon an automatic, non-discretionary, formulaic stock price performance test on the first business day after the closing price of a paired share equals or exceeds $8.0625 for 30 consecutive days, or (iii) upon a change of control of La Quinta. Dividends, if and when declared, are payable on the restricted stock. The value of the restricted stock as of December 29, 2000 was $1,280,000 based on the closing market price as reported on the NYSE on December 29, 2000 of $2.56.

- (4)

- Includes primarily a $600,000 sign-on bonus and $169,659 in moving expenses.

- (5)

- Mr. Rea became Chief Financial Officer and Treasurer of La Quinta in June 2000. Accordingly, no compensation information is presented for Mr. Rea for 1999.

- (6)

- Includes primarily La Quinta's $7,000 matching contribution under our 401(k) and $1,242 paid on the executive's behalf for life insurance.

- (7)

- Mr. Rea received an award of 300,000 shares of restricted stock on June 12, 2000 and the fair market value of a share on the date of grant was $1.94. The restricted stock vested pursuant to an automatic, non-discretionary, formulaic stock price performance test in February 2002.

- (8)

- Includes primarily a $150,000 sign-on bonus, certain moving expenses, and other expenses.

13

- (9)

- Includes La Quinta's $10,563 matching contributions under our 401(k) plan and $1,455 paid on the executive's behalf for life insurance.

- (10)

- Mr. Bushee received his bonus for 2000 in cash. Mr. Bushee received his bonuses for 1999 and 1998 in cash and shares. For 1999, $215,000 was cash and $6,607 was shares (428 shares at $15.44 per share on January 4, 2000). All issuance prices were the closing prices for shares on the NYSE on the respective dates of issuance.

- (11)

- Mr. Bushee received an award of 30,000 shares of restricted stock on January 3, 2000 and the fair market value of a share on the date of grant was $5.94. The restricted stock vests on the earlier of the 8th year or upon achievement of certain performance criteria. All of the restricted stock immediately vests upon a change of control of LQ Properties and dividends, if and when declared, are payable on the restricted stock.

- (12)

- Includes $1,627 paid on the executive's behalf for life insurance.

- (13)

- Mr. Bushee received an award of 10,000 shares of restricted stock on August 5, 1999 and the fair market value of a share on the date of grant was $9.56. The restricted stock vests on the earlier of the 8th year or upon achievement of certain performance criteria. All of the restricted stock immediately vests upon a change of control of LQ Properties and dividends, if and when declared, are payable on the restricted stock.

- (14)

- Mr. Tallis became Executive Vice President and Chief Development Officer of La Quinta in July 2000. Accordingly, no compensation information is presented for Mr. Tallis for 1999.

- (15)

- Includes primarily La Quinta's $9,188 matching contribution under our 401(k) plan and $2,715 paid on the executive's behalf for life insurance.

- (16)

- Mr. Tallis received an award of 85,938 shares of restricted stock on September 7, 2000, and the fair market value on the date of grant was $3.31. The restricted stock vests three years from the date of grant. All restricted stock immediately vests upon a change of control of La Quinta and dividends, if and when declared, are payable on the restricted stock.

- (17)

- Includes primarily $552 paid on the executive's behalf for life insurance and $1,672 in moving expenses.

- (18)

- Mr. Parker became Senior Vice President Sales & Marketing in 2000 and Executive Vice President and Chief Marketing Officer in 2001. Accordingly, no compensation information is presented for Mr. Parker for 1999.

- (19)

- Mr. Parker received an award of 25,000 shares of restricted stock on November 1, 2001 and the fair market value of a share on the date of grant was $5.24. The restricted stock vests three years from the date of grant. All of the restricted stock immediately vests upon a change of control of La Quinta and dividends, if and when declared, are payable on the restricted stock.

- (20)

- Includes primarily La Quinta's $7,428 contribution under our 401(k) plan and $3,702 paid on the executive's behalf for life insurance.

- (21)

- Mr. Parker received an award of 50,000 shares of restricted stock on September 7, 2000 and the fair market value of a share on the date of grant was $3.31. The restricted stock vests three years from the date of grant. All of the restricted stock immediately vests upon a change of control of La Quinta and dividends, if and when declared, are payable on the restricted stock.

- (22)

- Includes primarily $6,095 in moving expenses and $1,440 paid on the executive's behalf for life insurance.

14

The following table provides information with respect to stock options granted by La Quinta in recognition of services rendered in the fiscal year ended December 31, 2001 to La Quinta's named executive officers. All stock options are granted at an exercise price equal to the fair market value on the date of grant.

Option Grants in Last Fiscal Year for La Quinta

Name

| | Number of Securities Underlying Options Granted(#)

| | Percent of Total Options Granted To Employees In 2001

| | Exercise or Base Price ($/Share)

| | Expiration Date

| | Grant Date Present Value($)(1)

|

|---|

| Francis W. Cash | | -0- | | -0- | | | — | | — | | — |

| David L. Rea | | 150,000 | | 4.88 | | $ | 5.24 | | 11/01/11 | | 372,300 |

| Michael F. Bushee | | -0- | | -0- | | | — | | — | | — |

| Alan L. Tallis | | 75,000 | | 2.44 | | $ | 5.24 | | 11/01/11 | | 186,690 |

| Stephen T. Parker | | 75,000 | | 2.44 | | $ | 5.24 | | 11/01/11 | | 186,690 |

- (1)

- The Black-Scholes option pricing model was used to estimate the present value of the options at date of grant. The following assumptions were used in this table: a risk-free interest rate of 3.24%, a four-year option term, no dividend yield and a 58.18% expected volatility rate. There is no assurance that the actual values realized, if any, by the named executive officers will approximate the values estimated by the Black-Scholes model.

The following table provides information with respect to the aggregated number of options to purchase paired shares exercised by the La Quinta named executive officers as of December 31, 2001. The value of unexercised in-the-money options is based on the closing price of a paired share, as reported on the NYSE, on December 29, 2001 of $5.74, minus the exercise price, multiplied by the number of paired shares underlying the options. An option is "in-the-money" if the fair market value of the paired shares underlying the option exceeds the exercise price.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values for La Quinta

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options at Year-End(#)

Exercisable/Unexercisable

| | Value of Unexercised

In-the-Money Options at Year-End($)

Exercisable/Unexercisable

|

|---|

| Francis W. Cash | | -0- | | -0- | | 780,000/1,620,000 | | 497,712/746,568 |

| David L. Rea | | -0- | | -0- | | 225,000/825,000 | | 746,573/2,314,718 |

| Michael F. Bushee | | -0- | | -0- | | 395,426/147,097 | | 0/0 |

| Alan L. Tallis | | -0- | | -0- | | 42,968/203,907 | | 104,305/350,422 |

| Stephen T. Parker | | -0- | | -0- | | 25,000/150,000 | | 60,688/219,563 |

Employment Arrangements with Executive Officers

Employment Arrangement with Chief Executive Officer and President Francis W. Cash. Effective April 17, 2000, Francis W. Cash entered into an employment agreement with LQ Properties. Mr. Cash's employment agreement provides that he will serve as President and Chief Executive Officer of LQ Properties until the third anniversary of the effective date of his employment agreement, at which time the employment agreement will renew automatically thereafter for successive one-year terms unless six (6) months notice of non-renewal is given by either party to the other. Mr. Cash is eligible to receive an annual bonus to be determined by the compensation committee of 100% of his base salary, which amount can be increased to an amount up to 200% of his base compensation in the event he

15

significantly exceeds annual goals for the fiscal year. Mr. Cash is also the President and Chief Executive Officer of La Quinta.

Mr. Cash's performance shares and stock options granted pursuant to his employment agreement are subject to scheduled and accelerated vesting. The performance shares vest (i) on the third anniversary of the grant date, April 17, 2000, (ii) upon an automatic, non-discretionary, formulaic stock price performance test that triggers acceleration on the next business day after 30 consecutive days in which the closing price equals or exceeds $8.0625, which is three times the closing price of a paired share on March 22, 2000, or (iii) upon a change of control (as discussed below). Mr. Cash's stock options vest in 25% increments on each anniversary after the grant date or upon a change of control (as discussed below). Twenty percent of the unvested stock options are subject to acceleration upon an automatic, non-discretionary, formulaic stock price performance test that triggers acceleration on the next business day after 30 consecutive days in which the closing price exceeds the exercise price, and the stock options are subject to an additional twenty percent acceleration on the next business day after 30 consecutive days in which the closing price equals or exceeds $8.0625, which is three times the closing price of a paired share on March 22, 2000.

Upon termination of Mr. Cash's employment due to death or disability of Mr. Cash, LQ Properties shall pay to Mr. Cash (or his beneficiary in the event of his death) any base salary, bonus or other compensation earned but not paid and the pro rata amount of the annual base target bonus payable. Additionally, LQ Properties will continue to provide health benefits for at least two years.

Upon termination of Mr. Cash's employment by LQ Properties other than "for cause" or by Mr. Cash for "good reason"(as defined in Mr. Cash's employment agreement), LQ Properties shall pay Mr. Cash, in addition to the amounts described in the immediately preceding paragraph, a lump sum payment equal to two times the sum of Mr. Cash's base salary and base target bonus. Further, 20% of the original number of Mr. Cash's "performance shares" and "options" (as defined in Mr. Cash's employment agreement) covering 20% of the original number of paired shares in each option shall accelerate and become vested and exercisable. Additionally, LQ Properties will continue to provide health benefits for at least two years.

Upon the consummation of a "change in control" (as defined in Mr. Cash's employment agreement) 20% of Mr. Cash's paired shares subject to an option shall become fully exercisable as of the date of consummation of the change in control.

If a change in control occurs and Mr. Cash's employment is terminated within two years of such change in control as a result of an "executive termination event" (as defined in Mr. Cash's employment agreement), Mr. Cash shall be entitled to the following severance benefits: (i) an amount equal to three times the average of his annual base salary (for the three fiscal years preceding the change in control) and three times the average of his cash bonuses paid (for the two fiscal years preceding the change in control); (ii) an amount equal to Mr. Cash's full base salary through the termination date and the pro rata amount of the maximum base target bonus available during such year; and (iii) all unvested equity, including performance shares and options, shall become fully vested and exercisable. Additionally, LQ Properties will purchase Mr. Cash's house at market value, provide certain outplacement assistance and will continue to provide health care benefits for the balance of the term.

On November 1, 2001 Mr. Cash entered into an executive supplemental retirement agreement with La Quinta. The agreement provides that Mr. Cash will receive $8,638,000 upon reaching his 65th birthday provided that he remains employed by La Quinta subject to the discussions below. This lump sum retirement benefit also becomes fully vested and payable upon a "change of control" of the company (as defined in the agreement). The agreement also provides for the payment of benefits in the event of Mr. Cash's death or disability. If Mr. Cash dies while employed by La Quinta, his wife, if she succeeds him, will receive $4,319,000 as a death benefit. In the event that Mr. Cash's employment is

16

terminated without cause, is terminated as a result of his disability, or is terminated by Mr. Cash for good reason, he will be entitled to 100% of this benefit upon reaching his 65th birthday.

Employment Arrangement With Executive Officer David L. Rea. Effective June 12, 2000, David L. Rea entered into an employment agreement with LQ Properties, which agreement was subsequently amended in August 2000 to provide that both LQ Properties and La Quinta are parties to the agreement. Mr. Rea's employment agreement provides that he will serve as Executive Vice President, Chief Financial Officer and Treasurer of La Quinta and LQ Properties until the third anniversary of the effective date of the employment agreement, at which time the employment agreement will be renewed automatically thereafter for successive one-year terms unless six (6) months notice of non-renewal is given by either party to the other. Mr. Rea is eligible to receive an annual bonus to be determined by the compensation committee of 75% of his base salary, which amount can be increased to an amount up to 150% of his base compensation in the event he significantly exceeds annual goals for any fiscal year.

Mr. Rea's performance shares and stock options granted pursuant to his employment agreement are subject to scheduled and accelerated vesting. The performance shares vest (i) on the third anniversary of the grant date, June 12, 2000, (ii) upon an automatic, non-discretionary, formulaic stock price performance test that triggers acceleration on the next business day after 30 consecutive days in which the closing price equals or exceeds $5.8125, which is three times the closing price of a paired share on the grant date, or (iii) upon a change of control (as discussed below). Mr. Rea's stock options vest (i) in 25% increments on each anniversary after the grant date, (ii) upon an automatic, non-discretionary, formulaic stock price performance test that triggers acceleration on the next business day after 30 consecutive days in which the closing price equals or exceeds $5.8125, which is three times the closing price of a paired share on the grant date, or (iii) upon a change of control(as discussed below). All of Mr. Rea's performance shares and stock options under his employment agreement vested on February 25, 2002 as a result of satisfying the non-discretionary, formulaic, stock price performance test.

Upon Mr. Rea's termination of employment due to death or disability, La Quinta shall pay to Mr. Rea (or his beneficiary in the event of his death) any base salary, bonus or other compensation earned but not paid and the pro rata amount of the annual base target bonus payable. Additionally, La Quinta will continue to provide health benefits for at least two years.

Upon termination of Mr. Rea's employment by La Quinta other than "for cause" or by Mr. Rea for "good reason" (as defined in Mr. Rea's employment agreement), La Quinta shall pay Mr. Rea, in addition to the amounts described in the immediately preceding paragraph, a lump sum payment equal to two times the sum of Mr. Rea's base salary and base target bonus. Further, 20% of the original number of Mr. Rea's "performance shares" and "options" (as defined in Mr. Rea's employment agreement) covering 20% of the original number of paired shares in each option shall accelerate and become vested and exercisable. Additionally, La Quinta will continue to provide health benefits for at least two years.

Upon the consummation of a "change in control" (as defined in Mr. Rea's employment agreement) all unvested performance shares shall fully vest and all options shall fully vest and become exercisable immediately prior to the consummation of the change in control.

If a change of control occurs and Mr. Rea's employment is terminated within two years of such change of control as a result of an "executive termination event" (as defined in Mr. Rea's employment agreement), Mr. Rea shall be entitled to the following severance benefits: (i) an amount equal to three times the average of his annual base salary (for the three fiscal years preceding the change of control) and three times the average of his cash bonuses paid (for the two fiscal years preceding the change of control); (ii) an amount equal to Mr. Rea's full base salary through the termination date and the pro rata amount of the maximum base target bonus available during such year; and (iii) all unvested equity,

17

including performance shares and options, shall become fully vested and exercisable. Additionally, La Quinta will purchase Mr. Rea's house at market value, provide certain outplacement assistance and will continue to provide health benefits for the balance of the term.

Employment Arrangement With Executive Officer Michael F. Bushee. Effective January 1, 1999, Michael F. Bushee entered into an employment agreement with LQ Properties, which agreement was subsequently amended in January 2000 and June 2000. Mr. Bushee's employment agreement provides that he will serve as the Chief Operating Officer of LQ Properties until December 31, 2002, (the "anticipated termination date") and continue to implement La Quinta's strategic plan. Mr. Bushee's base salary is $425,000 and he is eligible to receive an annual bonus to be determined by the compensation committee of an amount up to 100% of his base compensation, provided, however, that with respect to each such bonus payment, 80% of each such bonus shall be based on performance criteria and 20% of each such bonus payment shall be discretionary. Upon Mr. Bushee's termination of employment due to death or disability, all unexercisable stock options and non-vested stock-based grants and performance units will immediately vest and will be exercisable for 90 days. Additionally, LQ Properties will provide health insurance coverage for at least three years.

If Mr. Bushee terminates his employment for "good reason," or if LQ Properties terminates his employment without "cause," LQ Properties will pay Mr. Bushee a severance payment equal to, at a minimum, three times the sum of his average base compensation (determined in accordance with his employment agreement) and average incentive compensation (determined in accordance with his employment agreement).

If a "change in control" (as defined in his employment agreement) occurs or is deemed to have occurred and Mr. Bushee's employment is terminated for any reason other than death, disability or voluntary resignation within three years of such change in control, LQ Properties must pay Mr. Bushee a lump sum amount equal to Mr. Bushee's severance payment and all stock options and other stock-based awards and performance units will become immediately exercisable or non-forfeitable.

Employment Arrangement With Executive Officer Stephen T. Parker. Stephen T. Parker received a letter agreement regarding his employment status with La Quinta effective May 3, 2000, and later modified on October 2, 2000. Mr. Parker's letter agreement provides that he will serve as Senior Vice President of Sales & Marketing and his employment may be terminated with or without cause by either party. Mr. Parker is eligible to receive an annual bonus with a target of 40% of his base compensation. On June 28, 2001, Mr. Parker became Executive Vice President of Sales & Marketing and as a result became eligible to receive an annual bonus with a target of 75% of his base compensation and a maximum potential bonus of 150% of his base compensation.

If Mr. Parker is terminated without cause, La Quinta will pay Mr. Parker one year's salary and his target bonus. If Mr. Parker is terminated as a result of a "change of control" (as defined in the letter agreement) then La Quinta will pay Mr. Parker two years salary and two years target bonus. No severance is due to Mr. Parker in the event that his employment is voluntary terminated or terminated by reason of death, disability, or for cause.

Employment Arrangement With Executive Officer Alan L. Tallis. Effective July 24, 2000, Alan L. Tallis received a letter agreement from La Quinta. Mr. Tallis's letter agreement provides that he will serve as Executive Vice President—Chief Development Officer and his employment may be terminated with or without cause by either party. Mr. Tallis is eligible to receive an annual bonus with a target of 75% of his base compensation and a maximum potential bonus of 150% of his base compensation.

If Mr. Tallis is terminated without cause, La Quinta will pay Mr. Tallis one year's salary and his target bonus. If Mr. Tallis is terminated as a result of a "change of control" (as defined in the letter agreement) then La Quinta will pay Mr. Tallis two years salary and two years target bonus. No severance is due to Mr. Tallis in the event that his employment is voluntary terminated or terminated by reason of death, disability, or for cause.

18

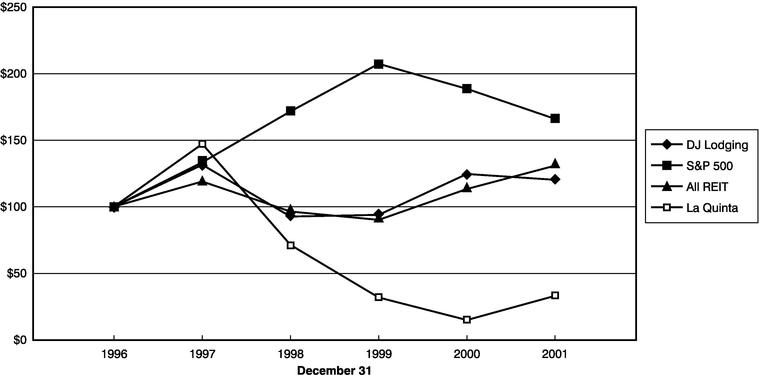

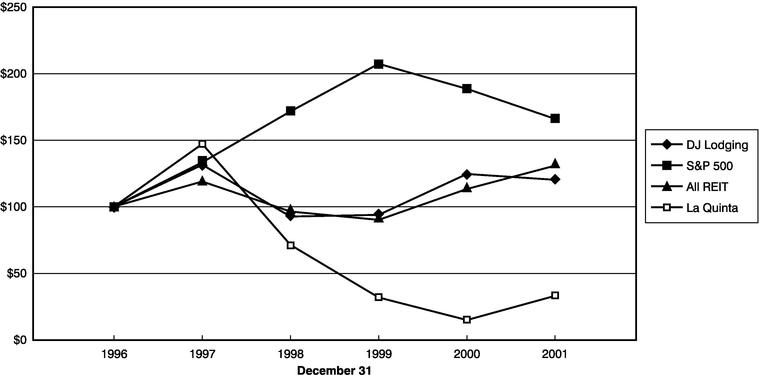

Stock Performance Graph

La Quinta has selected a different industry index for comparison purposes for the fiscal year ended 2001 as compared to the fiscal year ended 2000. La Quinta has selected a new index of lodging peers to reflect (i) its focus on its lodging operations and (ii) its recent corporate restructuring. Accordingly, the following graph compares the yearly percentage change in the cumulative total stockholder return on shares of La Quinta against (i) the cumulative market-weighted return of the Standard & Poor's Composite 500 Stock Index (the "S&P 500"), (ii) La Quinta's newly selected industry index, the Dow Jones Lodging Index (the "DJ Lodging"), and (iii) La Quinta's former industry index, the National Association of Real Estate Investment Trusts ("NAREIT") All REIT Total Return Index ("All REIT Index"). The comparison period consists of the previous five fiscal years commencing January 1, 1997 and ending December 31, 2001. The DJ Lodging index includes Extended Stay America, Inc., Hilton Hotels Corporation, Marriott International, Inc., Prime Hospitality Corporation and Starwood Hotels & Resorts Worldwide, Inc. The All REIT Index is composed of all tax-qualified real estate investment trusts, without regard to investment focus, listed on the NYSE. The stock performance graph assumes that the value of an investment in paired shares and in each index was $100.00 on December 31, 1996 and that all dividends were reinvested on a monthly basis. The historical information set forth below is not necessarily indicative of future performance. The data shown is based on the share prices or index values, as applicable, as of December 31 for each year shown.

Index

| | 1996

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

|

|---|

| DJ Lodging | | 100.00 | | 131.65 | | 92.81 | | 94.01 | | 124.94 | | 120.21 |

| S&P 500 | | 100.00 | | 133.36 | | 171.48 | | 207.56 | | 188.66 | | 166.24 |

| All REIT | | 100.00 | | 118.86 | | 96.49 | | 90.24 | | 113.60 | | 131.21 |

| La Quinta | | 100.00 | | 147.34 | | 71.66 | | 31.74 | | 14.79 | | 33.13 |

19

Compensation Committee Report on Executive Compensation

Introduction

La Quinta's executive compensation program is administered under the direction of the compensation committee of the Board of Directors. The current members of the La Quinta compensation committee are Stephen E. Merrill (Chairman), William C. Baker, Clive D. Bode and John C. Cushman, III. The compensation committee has been composed of entirely non-employee members since April 13, 2001, the date Francis W. Cash, the President and Chief Executive Officer of La Quinta, resigned from the compensation committee.

Compensation Philosophy

It is the duty of the compensation committee to formulate, approve and implement the compensation philosophy of La Quinta. The philosophy of La Quinta's executive compensation program is to:

- •

- Attract, motivate and retain highly trained and talented executive officers who are vital to La Quinta's short-term and long-term success, profitability and growth.

- •

- Reward executive officers for achievement of strategic goals and the enhancement of stockholder value.

- •

- Provide executive officers with compensation packages that consist of competitive base salaries supplemented by a cash bonus based on La Quinta and individual performance and long term incentive compensation consisting of restricted stock, stock options, or a combination of both. The cash bonus and long term incentive compensation are designed to link compensation with La Quinta and individual performance by providing a substantial potential upside to executive officers based on successful La Quinta and individual performance.

- •

- Position executive compensation levels to be competitive with other similarly situated lodging companies. When target objectives are met or exceeded, La Quinta's overall philosophy is to provide its executive officers base salaries at a target level around the 50th percentile for executives in comparable positions in its peer groups, total cash compensation (consisting of base salary and cash bonus) in the 75th percentile and long term compensation in the 85th percentile.

- •

- Reflect, for fiscal year 2001, the need to reward and retain the executives (i) involved in the disposition of La Quinta's healthcare assets, (ii) involved in the restructuring of La Quinta, and (iii) involved in La Quinta's growth initiatives including its newly implemented franchising program, all in accordance with La Quinta's strategic plan to shift its focus to the lodging industry. La Quinta has therefore set cash bonus and long term compensation awards for certain executive officers based upon targeted criteria relating to their success in achieving these goals.

- •

- Be committed to open communications with employees regarding La Quinta's policies and procedures, the salary administration process, the job evaluation process and the timing of performance and salary reviews, bonus plans and long term compensation.

Compensation Program

The elements of compensation for La Quinta executive officers consists of the following, with all three elements together being utilized to satisfy the ultimate goal of enhancing stockholder value: