|

| | | | | | | | | | |

| | | | | | | | |

Financial statements | | | |

| | | Independent auditor’s | | | | Group statement of | |

| | | reports | | | | changes in equity | |

| | | | | | | | |

| | | Group statement of | | | | | |

| | | | comprehensive income | | | | | | |

| | | | | | | | |

| | | | |

| | | | 1. | Significant accounting | | | 21. | Valuation and qualifying | |

| | | | | policies | | | | accounts | |

| | | | 2. | Non-current assets | | | 22. | Trade and other | |

| | | | | held for sale | | | | payables | |

| | | | 3. | Business combinations | | | 23. | Provisions | |

| | | | | and other significant | | | 24. | Pensions and other post- | |

| | | | | transactions | | | | retirement benefits | |

| | | | 4. | Disposals and | | | 25. | Cash and cash equivalents | |

| | | | | impairment | | | 26. | Finance debt | |

| | | | 5. | Segmental analysis | | | 27. | Capital disclosures and | |

| | | | 6. | Revenue from contracts | | | | net debt | |

| | | | | with customers | | | 28. | Leases | |

| | | | 7. | Income statement | | | 29. | Financial instruments and | |

| | | | | analysis | | | | financial risk factors | |

| | | | 8. | Exploration expenditure | | | 30. | Derivative financial | |

| | | | 9. | Taxation | | | | instruments | |

| | | | 10. | Dividends | | | 31. | Called-up share capital | |

| | | | 11. | Earnings per share | | | 32. | Capital and reserves | |

| | | | 12. | Property, plant and | | | 33. | Contingent liabilities | |

| | | | | equipment | | | 34. | Remuneration of senior | |

| | | | 13. | Capital commitments | | | | management and non- | |

| | | | 14. | Goodwill | | | | executive directors | |

| | | | 15. | Intangible assets | | | 35. | Employee costs and | |

| | | | 16. | Investments in joint | | | | numbers | |

| | | | | ventures | | | 36. | Auditor’s remuneration | |

| | | | 17. | Investments in | | | 37. | Subsidiaries, joint | |

| | | | | associates | | | | arrangements and | |

| | | | 18. | Other investments | | | | associates | | |

| | | | 19. | Inventories | | | 38. | Condensed consolidating | | |

| | | | 20. | Trade and other | | | | information on certain US | | |

| | | | | receivables | | | | subsidiaries | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

| | | | Supplementary information on oil and natural gas (unaudited) |

| | | | Oil and natural gas | | | | Standardized measure of | |

| | | | exploration and production | | | | discounted future net cash | |

| | | | activities | | | | flows and changes therein | |

| | | | Movements in estimated net | | | | relating to proved oil and | |

| | | | proved reserves | | | | gas reserves | |

| | | | | | | | Operational and statistical | |

| | | | | | | | | information | | |

| | | | | | | | |

| | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

|

| | | |

| | BP Annual Report and Form 20-F 2019 | | 131 |

Consolidated financial statements of the BP group

Pages 132-145 have been removed as they do not form part of BP's Annual Report on Form 20-F as filed with the SEC.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

|

| | | |

| 132 | | BP Annual Report and Form 20-F 2019 | |

Pages 132-145 have been removed as they do not form part of BP's Annual Report on Form 20-F as filed with the SEC.

This page does not form part of BP's Annual Report on Form 20-F as filed with the SEC.

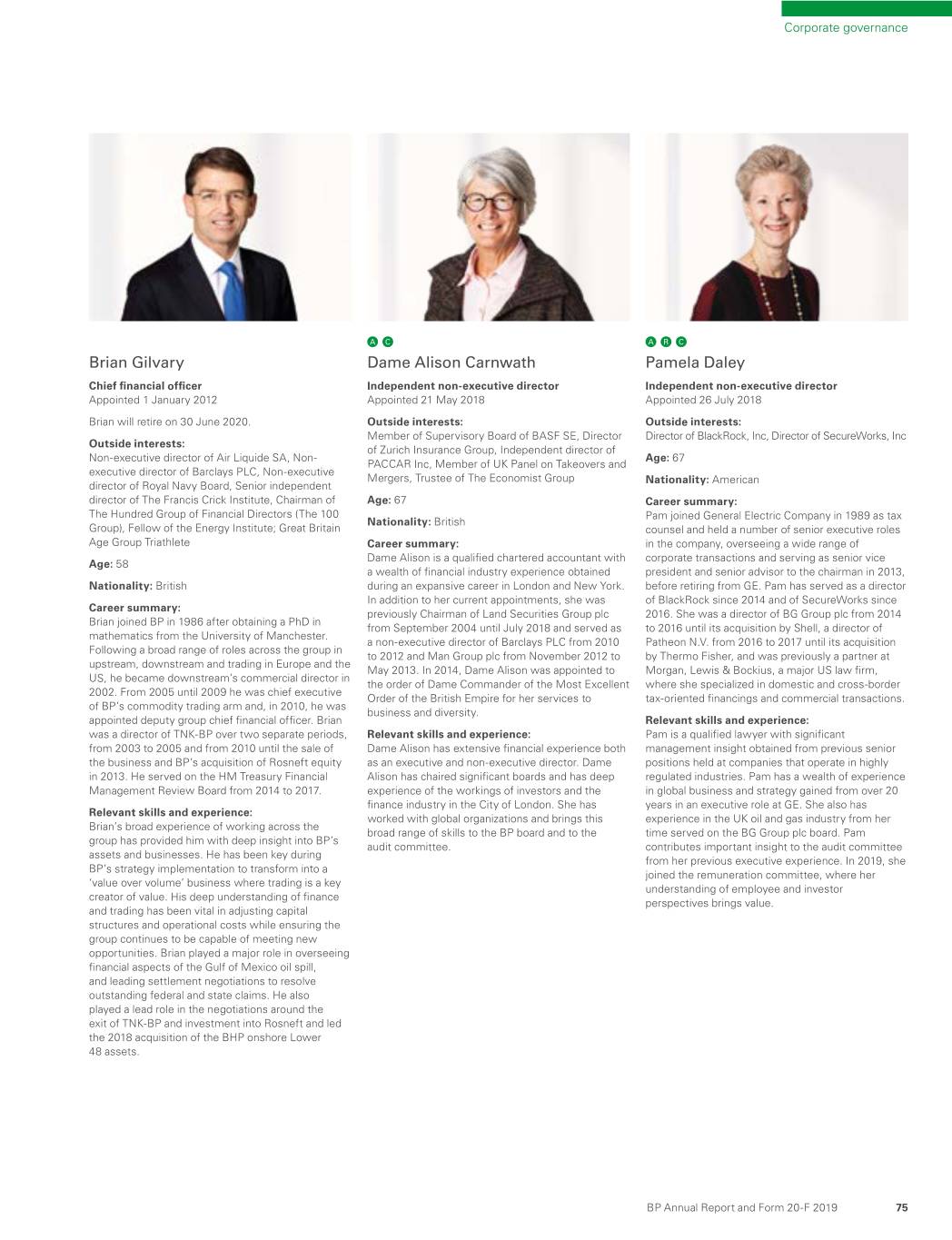

|

| | | |

| | BP Annual Report and Form 20-F 2019 | | 133 |

Consolidated financial statements of the BP group

Report of Independent Registered Public Accounting Firm

To the shareholders and board of directors of BP p.l.c.

Opinion on the financial statements

We have audited the accompanying consolidated group balance sheets of BP p.l.c. (the company) and subsidiaries (together the group) as at 31 December 2019 and 2018, and the related consolidated group income statements, group statements of comprehensive income, group statements of changes in equity, and group cash flow statements, for each of the two years in the period ended 31 December 2019, and the related notes as well as the legal proceedings described on pages 319-320 (collectively referred to as the 'group financial statements'). In our opinion, the group financial statements present fairly, in all material respects, the financial position of the group as at 31 December 2019 and 2018, and the results of its operations and its cash flows for each of the two years in the period ended 31 December 2019, in conformity with International Financial Reporting Standards (IFRS) as adopted by the European Union and IFRS as issued by the International Accounting Standards Board.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the group's internal control over financial reporting as of 31 December 2019, based on criteria established in the UK Financial Reporting Council’s Guidance on Risk Management, Internal Control and Related Financial and Business Reporting relating to internal control over financial reporting and our report dated 18 March 2020 expressed an unqualified opinion on the group's internal control over financial reporting.

Basis for opinion

These financial statements are the responsibility of the group's management. Our responsibility is to express an opinion on the group's financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the group in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current-period audit of the group financial statements that were communicated or required to be communicated to the audit committee and that (1) relate to accounts or disclosures that are material to the group financial statements and (2) involved especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Throughout the course of our audit we identify risks of material misstatement ('risks'). We consider both the likelihood of a risk and the potential magnitude of a misstatement in making the assessment. Certain risks are classified as 'significant' or 'higher' depending on their severity. The category of the risk determines the level of evidence we seek in providing assurance that the associated financial statement item is not materially misstated.

Impairment of upstream oil and gas property, plant and equipment (PP&E) assets - Notes 1 and 12 to the financial statements

Critical Audit Matter Description

The group balance sheet includes property, plant and equipment (PP&E) of $133 billion, of which $90 billion is oil and gas properties within the upstream segment.

Management announced an approximately $10 billion disposal programme for 2019 and 2020. As a consequence of this, certain assets identified for disposal have been assessed for impairment in the context of their fair value based on the expected disposal proceeds from third parties, as opposed to their value in use.

The transition to a lower carbon global economy may potentially lead to a lower oil and gas price scenario in the future due to declining demand. Management took into account considerations of uncertainty over the pace of the transition to lower-carbon supply and demand and the social, political and environmental actions that will be taken to meet the goals of the Paris climate change agreement when determining their future oil and gas price assumptions and revised the future price assumptions downwards when compared with the prior year assumptions as set out in Note 1 on page 162. As a consequence, they identified a risk of impairment across all upstream CGUs.

Accordingly, as required by International Accounting Standard (IAS) 36 'Impairment of Assets', management performed a review of all the upstream cash generating units (CGUs) for indicators of impairment and impairment reversal as at 31 December 2019. Further information has been provided in Note 1.

In large part due to the disposal programme, for the year ended 31 December 2019 BP recorded $5,871 million of upstream impairment charges and $129 million of impairment reversals. Through our risk assessment procedures, we have determined that there are three key estimates in management’s determination of the level of impairment charge/reversal to record. These are:

| |

| a. | Oil and gas prices - BP’s oil and gas price assumptions have a significant impact on CGU impairment assessments and valuations performed across the portfolio, and are inherently uncertain. Furthermore, as noted above the estimation of future oil and gas prices is subject to increased uncertainty, given climate change and the global energy transition. There is a risk that management’s oil and gas price assumptions are not reasonable, leading to a material misstatement. The assumptions are highly judgemental. |

| |

| b. | Discount rates - Given the long timeframes involved, certain recoverable amounts of assets are sensitive to the discount rate applied. There is a risk that discount rates do not reflect the return required by the market and the risks inherent in the cash flows being discounted, leading to a material misstatement. Determination of the appropriate discount rate can be judgemental. |

| |

| c. | Reserves estimates - A key input to impairment assessments and valuations is the production forecast, in turn closely related to the group’s reserves estimates and field development assumptions. CGU-specific estimates are not generally material. However, material |

|

| | | |

| 146 | | BP Annual Report and Form 20-F 2019 | |

misstatements could arise either from systematic flaws in reserves estimation policies, or due to flawed estimates in a particularly material individual impairment test.

We identified and focused on certain individual CGUs with a total carrying value of $12.3 billion which we determined would be most at risk of a material impairment as a result of a reasonably possible change in the key assumptions, particularly the oil and gas price assumptions. Accordingly, we identified these as a significant audit risk. We also focused on assets with a further $33.4 billion of combined CGU carrying value which were less sensitive. We identified these as a higher audit risk as they would be potentially at risk in aggregate to a material impairment by a change in such assumptions. Further information regarding these sensitivities is given in Note 1 to the consolidated financial statements.

How the Critical Audit Matter was addressed in the Audit

We tested management’s internal controls over the setting of oil and gas prices, discount rates and reserve estimates, as well as the controls over the performance of the impairment valuation tests. In addition, we conducted the following substantive procedures.

Oil and gas prices

| |

| • | We independently developed a reasonable range of forecasts based on external data obtained, against which we compared the company’s future oil and gas price assumptions in order to challenge whether they are reasonable. |

| |

| • | In developing this range we obtained a variety of reputable third party forecasts, peer information and market data. |

| |

| • | In challenging management's price assumptions, we considered the extent to which they and each of the forecast pricing scenarios obtained from third parties reflect the impact of lower oil and gas demand due to climate change. We specifically reviewed third party forecasts stated as being, or interpreted by us as being, consistent with achieving the 2015 COP 21 Paris agreement goal to limit temperature rises to well below 2°C (Paris 2°C Goal). |

| |

| • | We reviewed and challenged management’s disclosures including in relation to the sensitivity of oil and gas price assumptions to reduced demand scenarios whether due to climate change or other reasons. |

Discount rates

| |

| • | We independently evaluated BP’s discount rates used in impairment tests with input from Deloitte valuation specialists. |

| |

| • | We assessed whether country risks and tax adjustments were appropriately reflected in BP’s discount rates. |

Reserves estimates

| |

| • | We reviewed BP’s reserves estimation methods and policies, assisted by Deloitte reserves experts. |

| |

| • | We assessed, with the assistance of Deloitte reserves experts, how these policies had been applied to a sample of internal reserves estimates. |

| |

| • | We reviewed reports provided by external experts and assessed their scope of work and findings. |

| |

| • | We assessed the competence, capability and objectivity of BP’s internal and external reserve experts, through obtaining their relevant professional qualifications and experience. |

| |

| • | We compared hydrocarbon production forecasts used in impairment tests to estimates and reports and our understanding of the life of fields. |

| |

| • | We performed a retrospective review to check for indications of estimation bias over time. |

Other procedures

| |

| • | We challenged management’s CGU determination, and considered whether there was any contradictory evidence present. |

| |

| • | We validated that BP’s asset impairment methodology was appropriate and tested the integrity of impairment models. |

| |

| • | Where relevant, we also assessed management’s historical forecasting accuracy and whether the estimates had been determined and applied on a consistent basis across the group. |

Since 31 December 2019, the oil price has fallen sharply in large part due to the impact of the international spread of COVID-19 (Coronavirus) and geopolitical factors. As part of our post balance sheet audit procedures we considered whether these events provide evidence of conditions that existed at the balance sheet date.

Impairment of exploration and appraisal assets (included within 'intangible assets' within the group balance sheet) - Notes 1 and 15 to the financial statements

Critical Audit Matter Description

The group capitalizes exploration and appraisal (E&A) expenditure on a project-by-project basis in line with IFRS 6 'Exploration for and Evaluation of Mineral Resources'. At the end of 2019, $14 billion of E&A expenditure was carried in the group balance sheet. E&A activity is inherently risky and a significant proportion of projects fail, requiring the write-off of the related capitalized costs when the relevant criteria in IFRS 6 and BP’s accounting policy are met.

There is a significant judgement relating to the risk that certain capitalized E&A costs are not written off promptly at the appropriate time, in line with information from, and decisions about, E&A activities and the impairment requirements of IFRS 6.

Furthermore, similar to upstream PP&E assets discussed above, E&A assets are also potentially exposed to climate change and the global energy transition. A greater number of projects may be expected not to proceed as a consequence of lower forecast future demand, lower appetite by management and the board to allocate capital to certain projects, or increased objections from stakeholders to the development of certain projects.

During the current year, and subsequent to the year end, management have obtained license extensions in the Gulf of Mexico and other regions where licenses had previously expired such that we have concluded this does not represent a significant audit risk. Nevertheless, given the inherent uncertainty associated with the development and deployment of these assets, we still consider this area to be a higher risk.

How the Critical Audit Matter was addressed in the Audit

We obtained an understanding of the group’s E&A impairment assessment processes and tested management’s internal controls,

|

| | | |

| | BP Annual Report and Form 20-F 2019 | | 147 |

including the controls addressing potential climate change considerations.

We performed a licence-by-licence risk assessment of the group’s E&A balance through to year end, to identify significant carrying amounts with a current period risk of impairment (e.g. new information from exploration activities, or imminent licence expiry).

We performed a retrospective review of impairment charges recorded in the period, and assessed whether impairment charges were timely.

We reviewed and challenged management’s significant IFRS 6 impairment judgements, having regard to the impairment criteria of IFRS 6 and BP’s accounting policy. We verified key facts relevant to significant carrying amounts (by obtaining for example evidence of future E&A plans and budgets, and evidence of active dialogue with partners and regulators including negotiations to renew licences or modify key terms).

We tested the completeness and accuracy of information used in management’s E&A impairment assessment, by reviewing and testing key controls over management’s register of E&A licences and agreeing key aspects of this to underlying support (e.g. licence documentation); holding meetings and discussions with operational and finance management; considering adverse changes in management’s reserves and resource estimates associated with E&A assets; reviewing correspondence with regulators and joint arrangement partners; and considering the implications of capital allocation decisions. When considering capital allocation decision making, we considered whether the development of any projects would be inconsistent with the elements of BP’s current strategy which are designed to ensure it is resilient to the energy transition and climate change considerations or which would otherwise have a prohibitively high environmental or social impact for the directors to sanction the necessary investment.

Accounting for structured commodity transactions (SCTs) within the integrated supply and trading function (IST), and the valuation of other level 3 financial instruments, where fraud risks may arise in revenue recognition (potentially impacting all financial statement accounts, in particular finance debt) - Notes 1, 20, 22, 29 and 30 to the financial statements

Critical Audit Matter Description

In the normal course of business, IST enters into a variety of transactions for delivering value across the group’s supply chain. The nature of these transactions requires significant audit effort be directed towards challenging management’s valuation estimates or the adopted accounting treatment.

Accounting for structured commodity transactions:

IST may also enter into a variety of transactions which we refer to as SCTs. We generally consider a SCT to be an arrangement having one of the following features:

| |

| • | Two or more counterparties with non-standard contractual terms; |

| |

| • | Multiple commodity-based transactions; and/or |

| |

| • | Contractual arrangements entered into in contemplation of each other. |

SCTs are often long-dated, can have a significant multi-year financial impact, and may require the use of complex valuation models or unobservable inputs when determining their fair value, in which case they will be classified as level 3 financial instruments under IFRS 13, ‘Fair Value Measurement’.

Accounting for SCTs is often complex and involves significant judgement, as these transactions often feature multiple elements that will have a material impact on the presentation and disclosure of these transactions in the financial statements and on key performance measures, including in particular classification of liabilities as finance debt. We have identified the accounting for SCTs as a significant audit risk.

Level 3 financial instruments:

Unlike other financial instruments whose values or inputs are readily observable and therefore more easily independently corroborated, there are certain transactions for which the valuation is inherently more subjective due to the use of either complex valuation models and/or unobservable inputs. These instruments are classified as level 3 financial assets or liabilities under IFRS 13. This degree of subjectivity also gives rise to potential fraud through management incorporating bias in determining fair values. Accordingly, we have identified these as a significant audit risk.

As at 31 December 2019, the group’s total financial assets and liabilities measured at fair value were $12.5 billion and $8.8 billion, of which level 3 derivative financial assets were $5.3 billion and level 3 derivative financial liabilities were $4.4 billion.

How the Critical Audit Matter was addressed in the Audit

Accounting for SCTs

For structured commodity transactions, we performed audit procedures to:

| |

| • | Test controls related to the accounting for complex transactions. |

| |

| • | Develop an understanding of the commercial rationale of the transactions through review of transaction support documents and executed agreements, and discussions with management. |

| |

| • | Perform a detailed accounting analysis for a sample of structured commodity transactions involving significant day one profits, deferred working capital arrangements, offtake arrangements and/or commitments. |

To assess the appropriateness of the accounting treatment of SCTs, we embedded technical accounting specialists within the audit team.

During the year we identified two new SCTs which were subjected to our audit procedures listed above. We also reconsidered the SCTs which were identified during 2018 and which have been subject to ongoing assessment in 2019.

Other level 3 financial instruments:

To address the complexities associated with auditing the value of level 3 financial instruments, the engagement team included valuation specialists having significant quantitative and modelling expertise to assist in performing our audit procedures. Our valuation audit procedures included the following control and substantive procedures:

| |

| • | We tested the group’s valuation controls including the: |

|

| | | |

| 148 | | BP Annual Report and Form 20-F 2019 | |

| |

| – | Model certification control, which is designed to review a model’s theoretical soundness and the appropriateness of its valuation methodology; and |

| |

| – | Independent price verification control, which is designed to review the appropriateness of valuation inputs that are not observable and are significant to the financial instrument’s valuation. |

| |

| • | We performed substantive valuation testing procedures at interim and year-end balance sheet date, including: |

| |

| – | Engaging a Deloitte valuations specialist to develop fair value estimates, using independently sourced inputs where these were available, and challenge models to evaluate against management’s fair value estimates by evaluating whether the differences between our independent estimates and management’s estimates were within a reasonable range. In situations where we utilised management’s inputs, these were compared to external data sources to ensure they were reasonable; |

| |

| – | Evaluating management’s valuation methodologies against standard valuation practice and analysing whether a consistent framework is applied across the business period over period; and |

| |

| – | Comparing management’s input assumptions against the expected assumptions of other market participants and observable market data. |

/s/ Deloitte LLP

London

United Kingdom

18 March 2020

The first accounting period we audited was the 12 months ended 31 December 2018. In 2017, we commenced our audit planning procedures.

|

| | | |

| | BP Annual Report and Form 20-F 2019 | | 149 |

Consolidated financial statements of the BP group

Report of Independent Registered Public Accounting Firm

To the shareholders and board of directors of BP p.l.c.

Opinion on internal control over financial reporting

We have audited the internal control over financial reporting of BP p.l.c. and subsidiaries (the Company) as at 31 December 2019, based on the criteria established in the UK Financial Reporting Council’s Guidance on Risk Management, Internal Control and Related Financial and Business Reporting relating to internal control over financial reporting (UK FRC Guidance). In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of 31 December 2019, based on the criteria established in the UK FRC Guidance.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated financial statements as at and for the year ended 31 December 2019, of the Company and our report dated 18 March 2020, expressed an unqualified opinion on those financial statements.

Basis for opinion

The Company's management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s report on internal control over financial reporting. Our responsibility is to express an opinion on the Company's internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

Definition and limitations of internal control over financial reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

/s/ Deloitte LLP

London, United Kingdom

18 March 2020

|

| | | |

| 150 | | BP Annual Report and Form 20-F 2019 | |

Consolidated financial statements of the BP group

Report of Independent Registered Public Accounting Firm

To the shareholders and board of directors of BP p.l.c.

Opinion on the financial statements

We have audited the accompanying group balance sheet of BP p.l.c. (the Company) as of 31 December 2017, and the related group income statement, group statement of comprehensive income, group statement of changes in equity and group cash flow statement for the period ended 31 December 2017, and the related notes (collectively referred to as the "group financial statements"). In our opinion, the group financial statements present fairly, in all material respects, the financial position of BP p.l.c. at 31 December 2017 and the results of its operations and its cash flows for the period ended 31 December 2017, in conformity with International Financial Reporting Standards (IFRS) as adopted by the European Union and IFRS as issued by the International Accounting Standards Board.

Basis for opinion

These financial statements are the responsibility of BP p.l.c.'s management. Our responsibility is to express an opinion on these financial statements based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to BP p.l.c. in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s/ Ernst & Young LLP

We served as the Company's auditor from 1909 to 2018.

London, United Kingdom

29 March 2018

Note that the report set out above is included for the purposes of BP p.l.c.’s Annual Report on Form 20-F for 2019 only and does not form part of BP p.l.c.’s Annual Report and Accounts for 2017.

|

| | | |

| | BP Annual Report and Form 20-F 2019 | | 151 |

Group income statement

|

| | | | | | | | | |

| For the year ended 31 December | | | | | $ million |

|

| | | Note |

| 2019 |

| 2018 |

| 2017 |

|

| Sales and other operating revenues | | 5 |

| 278,397 |

| 298,756 |

| 240,208 |

|

| Earnings from joint ventures – after interest and tax | | 16 |

| 576 |

| 897 |

| 1,177 |

|

| Earnings from associates – after interest and tax | | 17 |

| 2,681 |

| 2,856 |

| 1,330 |

|

| Interest and other income | | 7 |

| 769 |

| 773 |

| 657 |

|

| Gains on sale of businesses and fixed assets | | 4 |

| 193 |

| 456 |

| 1,210 |

|

| Total revenues and other income | | | 282,616 |

| 303,738 |

| 244,582 |

|

| Purchases | | 19 |

| 209,672 |

| 229,878 |

| 179,716 |

|

| Production and manufacturing expenses | | | 21,815 |

| 23,005 |

| 24,229 |

|

| Production and similar taxes | | 5 |

| 1,547 |

| 1,536 |

| 1,775 |

|

| Depreciation, depletion and amortization | | 5 |

| 17,780 |

| 15,457 |

| 15,584 |

|

| Impairment and losses on sale of businesses and fixed assets | | 4 |

| 8,075 |

| 860 |

| 1,216 |

|

| Exploration expense | | 8 |

| 964 |

| 1,445 |

| 2,080 |

|

| Distribution and administration expenses | | | 11,057 |

| 12,179 |

| 10,508 |

|

| Profit before interest and taxation | | | 11,706 |

| 19,378 |

| 9,474 |

|

| Finance costs | | 7 |

| 3,489 |

| 2,528 |

| 2,074 |

|

| Net finance expense relating to pensions and other post-retirement benefits | | 24 |

| 63 |

| 127 |

| 220 |

|

| Profit before taxation | | | 8,154 |

| 16,723 |

| 7,180 |

|

| Taxation | | 9 |

| 3,964 |

| 7,145 |

| 3,712 |

|

| Profit for the year | | | 4,190 |

| 9,578 |

| 3,468 |

|

| Attributable to | | | | | |

| BP shareholders | | | 4,026 |

| 9,383 |

| 3,389 |

|

| Non-controlling interests | | | 164 |

| 195 |

| 79 |

|

| | | | 4,190 |

| 9,578 |

| 3,468 |

|

| Earnings per share | | | | | |

| Profit for the year attributable to BP shareholders | | | | | |

| Per ordinary share (cents) | | | | | |

| Basic | | 11 |

| 19.84 |

| 46.98 |

| 17.20 |

|

| Diluted | | 11 |

| 19.73 |

| 46.67 |

| 17.10 |

|

| Per ADS (dollars) | | | | | |

| Basic | | 11 |

| 1.19 |

| 2.82 |

| 1.03 |

|

| Diluted | | 11 |

| 1.18 |

| 2.80 |

| 1.03 |

|

|

| | | |

| 152 | | BP Annual Report and Form 20-F 2019 | |

Group statement of comprehensive incomea

|

| | | | | | | | | |

| For the year ended 31 December | | | | | $ million |

|

| | | Note |

| 2019 |

| 2018 |

| 2017 |

|

| Profit for the year | | | 4,190 |

| 9,578 |

| 3,468 |

|

| Other comprehensive income | | | | | |

| Items that may be reclassified subsequently to profit or loss | | | | | |

| Currency translation differences | | | 1,538 |

| (3,771 | ) | 1,986 |

|

| Exchange (gains) losses on translation of foreign operations reclassified to gain or loss on sale of businesses and fixed assets | | | 880 |

| — |

| (120 | ) |

| Available-for-sale investments | | | — |

| — |

| 14 |

|

| Cash flow hedges marked to market | | 30 |

| (100 | ) | (126 | ) | 197 |

|

| Cash flow hedges reclassified to the income statement | | 30 |

| 106 |

| 120 |

| 116 |

|

| Cash flow hedges reclassified to the balance sheet | | 30 |

| — |

| — |

| 112 |

|

| Costs of hedging marked to market | | 30 |

| (4 | ) | (244 | ) | — |

|

| Costs of hedging reclassified to the income statement | | 30 |

| 57 |

| 58 |

| — |

|

| Share of items relating to equity-accounted entities, net of tax | | 16, 17 |

| 82 |

| 417 |

| 564 |

|

| Income tax relating to items that may be reclassified | | 9 |

| (70 | ) | 4 |

| (196 | ) |

| | | | 2,489 |

| (3,542 | ) | 2,673 |

|

| Items that will not be reclassified to profit or loss | | | | | |

| Remeasurements of the net pension and other post-retirement benefit liability or asset | | 24 |

| 328 |

| 2,317 |

| 3,646 |

|

| Cash flow hedges that will subsequently be transferred to the balance sheet | | 30 |

| (3 | ) | (37 | ) | — |

|

| Income tax relating to items that will not be reclassified | | 9 |

| (157 | ) | (718 | ) | (1,303 | ) |

| | | | 168 |

| 1,562 |

| 2,343 |

|

| Other comprehensive income | | | 2,657 |

| (1,980 | ) | 5,016 |

|

| Total comprehensive income | | | 6,847 |

| 7,598 |

| 8,484 |

|

| Attributable to | | | | | |

| BP shareholders | | | 6,674 |

| 7,444 |

| 8,353 |

|

| Non-controlling interests | | | 173 |

| 154 |

| 131 |

|

| | | | 6,847 |

| 7,598 |

| 8,484 |

|

| |

a | See Note 32 for further information. |

|

| | | |

| | BP Annual Report and Form 20-F 2019 | | 153 |

Group statement of changes in equitya

|

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | $ million |

|

| | | Share capital and capital reserves |

| Treasury shares |

| Foreign currency translation reserve |

| Fair value reserves |

| Profit and loss account |

| BP shareholders' equity |

| Non-controlling interests |

| Total equity |

|

| At 31 December 2018 | | 46,352 |

| (15,767 | ) | (8,902 | ) | (987 | ) | 78,748 |

| 99,444 |

| 2,104 |

| 101,548 |

|

| Adjustment on adoption of IFRS 16, net of tax | | — |

| — |

| — |

| — |

| (329 | ) | (329 | ) | (1 | ) | (330 | ) |

| At 1 January 2019 | | 46,352 |

| (15,767 | ) | (8,902 | ) | (987 | ) | 78,419 |

| 99,115 |

| 2,103 |

| 101,218 |

|

| Profit for the year | | — |

| — |

| — |

| — |

| 4,026 |

| 4,026 |

| 164 |

| 4,190 |

|

| Other comprehensive income | | — |

| — |

| 2,407 |

| 52 |

| 189 |

| 2,648 |

| 9 |

| 2,657 |

|

| Total comprehensive income | | — |

| — |

| 2,407 |

| 52 |

| 4,215 |

| 6,674 |

| 173 |

| 6,847 |

|

Dividendsb | | — |

| — |

| — |

| — |

| (6,929 | ) | (6,929 | ) | (213 | ) | (7,142 | ) |

| Cash flow hedges transferred to the balance sheet, net of tax | | — |

| — |

| — |

| 23 |

| — |

| 23 |

| — |

| 23 |

|

| Repurchase of ordinary share capital | | — |

| — |

| — |

| — |

| (1,511 | ) | (1,511 | ) | — |

| (1,511 | ) |

| Share-based payments, net of tax | | 173 |

| 1,355 |

| — |

| — |

| (809 | ) | 719 |

| — |

| 719 |

|

| Share of equity-accounted entities’ changes in equity, net of tax | | — |

| — |

| — |

| — |

| 5 |

| 5 |

| — |

| 5 |

|

| Transactions involving non-controlling interests, net of tax | | — |

| — |

| — |

| — |

| 316 |

| 316 |

| 233 |

| 549 |

|

| At 31 December 2019 | | 46,525 |

| (14,412 | ) | (6,495 | ) | (912 | ) | 73,706 |

| 98,412 |

| 2,296 |

| 100,708 |

|

| | | | | | | | | | |

| At 31 December 2017 | | 46,122 |

| (16,958 | ) | (5,156 | ) | (743 | ) | 75,226 |

| 98,491 |

| 1,913 |

| 100,404 |

|

| Adjustment on adoption of IFRS 9, net of tax | | — |

| — |

| — |

| (54 | ) | (126 | ) | (180 | ) | — |

| (180 | ) |

| At 1 January 2018 | | 46,122 |

| (16,958 | ) | (5,156 | ) | (797 | ) | 75,100 |

| 98,311 |

| 1,913 |

| 100,224 |

|

| Profit for the year | | — |

| — |

| — |

| — |

| 9,383 |

| 9,383 |

| 195 |

| 9,578 |

|

| Other comprehensive income | | — |

| — |

| (3,746 | ) | (216 | ) | 2,023 |

| (1,939 | ) | (41 | ) | (1,980 | ) |

| Total comprehensive income | | — |

| — |

| (3,746 | ) | (216 | ) | 11,406 |

| 7,444 |

| 154 |

| 7,598 |

|

Dividendsb | | — |

| — |

| — |

| — |

| (6,699 | ) | (6,699 | ) | (170 | ) | (6,869 | ) |

| Cash flow hedges transferred to the balance sheet, net of tax | | — |

| — |

| — |

| 26 |

| — |

| 26 |

| — |

| 26 |

|

| Repurchase of ordinary share capital | | — |

| — |

| — |

| — |

| (355 | ) | (355 | ) | — |

| (355 | ) |

| Share-based payments, net of tax | | 230 |

| 1,191 |

| — |

| — |

| (718 | ) | 703 |

| — |

| 703 |

|

| Share of equity-accounted entities’ changes in equity, net of tax | | — |

| — |

| — |

| — |

| 14 |

| 14 |

| — |

| 14 |

|

| Transactions involving non-controlling interests, net of tax | | — |

| — |

| — |

| — |

| — |

| — |

| 207 |

| 207 |

|

| At 31 December 2018 | | 46,352 |

| (15,767 | ) | (8,902 | ) | (987 | ) | 78,748 |

| 99,444 |

| 2,104 |

| 101,548 |

|

| | | | | | | | | | |

| At 1 January 2017 | | 46,122 |

| (18,443 | ) | (6,878 | ) | (1,153 | ) | 75,638 |

| 95,286 |

| 1,557 |

| 96,843 |

|

| Profit for the year | | — |

| — |

| — |

| — |

| 3,389 |

| 3,389 |

| 79 |

| 3,468 |

|

| Other comprehensive income | | — |

| — |

| 1,722 |

| 410 |

| 2,832 |

| 4,964 |

| 52 |

| 5,016 |

|

| Total comprehensive income | | — |

| — |

| 1,722 |

| 410 |

| 6,221 |

| 8,353 |

| 131 |

| 8,484 |

|

Dividendsb | | — |

| — |

| — |

| — |

| (6,153 | ) | (6,153 | ) | (141 | ) | (6,294 | ) |

| Repurchases of ordinary share capital | | — |

| — |

| — |

| — |

| (343 | ) | (343 | ) | — |

| (343 | ) |

| Share-based payments, net of tax | | — |

| 1,485 |

| — |

| — |

| (798 | ) | 687 |

| — |

| 687 |

|

| Share of equity-accounted entities’ changes in equity, net of tax | | — |

| — |

| — |

| — |

| 215 |

| 215 |

| — |

| 215 |

|

| Transactions involving non-controlling interests, net of tax | | — |

| — |

| — |

| — |

| 446 |

| 446 |

| 366 |

| 812 |

|

| At 31 December 2017 | | 46,122 |

| (16,958 | ) | (5,156 | ) | (743 | ) | 75,226 |

| 98,491 |

| 1,913 |

| 100,404 |

|

a See Note 32 for further information.

b See Note 10 for further information.

|

| | | |

| 154 | | BP Annual Report and Form 20-F 2019 | |

Group balance sheet

|

| | | | | | | |

| At 31 December | | | | $ million |

|

| | | Note |

| 2019 |

| 2018a |

|

| Non-current assets | | | | |

| Property, plant and equipment | | 12 |

| 132,642 |

| 135,261 |

|

| Goodwill | | 14 |

| 11,868 |

| 12,204 |

|

| Intangible assets | | 15 |

| 15,539 |

| 17,284 |

|

| Investments in joint ventures | | 16 |

| 9,991 |

| 8,647 |

|

| Investments in associates | | 17 |

| 20,334 |

| 17,673 |

|

| Other investments | | 18 |

| 1,276 |

| 1,341 |

|

| Fixed assets | | | 191,650 |

| 192,410 |

|

| Loans | | | 630 |

| 637 |

|

| Trade and other receivables | | 20 |

| 2,147 |

| 1,834 |

|

| Derivative financial instruments | | 30 |

| 6,314 |

| 5,145 |

|

| Prepayments | | | 781 |

| 1,179 |

|

| Deferred tax assets | | 9 |

| 4,560 |

| 3,706 |

|

| Defined benefit pension plan surpluses | | 24 |

| 7,053 |

| 5,955 |

|

| | | | 213,135 |

| 210,866 |

|

| Current assets | | | | |

| Loans | | | 339 |

| 326 |

|

| Inventories | | 19 |

| 20,880 |

| 17,988 |

|

| Trade and other receivables | | 20 |

| 24,442 |

| 24,478 |

|

| Derivative financial instruments | | 30 |

| 4,153 |

| 3,846 |

|

| Prepayments | | | 857 |

| 963 |

|

| Current tax receivable | | | 1,282 |

| 1,019 |

|

| Other investments | | 18 |

| 169 |

| 222 |

|

| Cash and cash equivalents | | 25 |

| 22,472 |

| 22,468 |

|

| | | | 74,594 |

| 71,310 |

|

| Assets classified as held for sale | | 2 |

| 7,465 |

| — |

|

| | | | 82,059 |

| 71,310 |

|

| Total assets | | | 295,194 |

| 282,176 |

|

| Current liabilities | | | | |

| Trade and other payables | | 22 |

| 46,829 |

| 46,265 |

|

| Derivative financial instruments | | 30 |

| 3,261 |

| 3,308 |

|

| Accruals | | | 5,066 |

| 4,626 |

|

| Lease liabilities | | 28 |

| 2,067 |

| 44 |

|

Finance debta | | 26 |

| 10,487 |

| 9,329 |

|

| Current tax payable | | | 2,039 |

| 2,101 |

|

| Provisions | | 23 |

| 2,453 |

| 2,564 |

|

| | | | 72,202 |

| 68,237 |

|

| Liabilities directly associated with assets classified as held for sale | | 2 |

| 1,393 |

| — |

|

| | | | 73,595 |

| 68,237 |

|

| Non-current liabilities | | | | |

| Other payables | | 22 |

| 12,626 |

| 13,830 |

|

| Derivative financial instruments | | 30 |

| 5,537 |

| 5,625 |

|

| Accruals | | | 996 |

| 575 |

|

| Lease liabilities | | 28 |

| 7,655 |

| 623 |

|

Finance debta | | 26 |

| 57,237 |

| 55,803 |

|

| Deferred tax liabilities | | 9 |

| 9,750 |

| 9,812 |

|

| Provisions | | 23 |

| 18,498 |

| 17,732 |

|

| Defined benefit pension plan and other post-retirement benefit plan deficits | | 24 |

| 8,592 |

| 8,391 |

|

| | | | 120,891 |

| 112,391 |

|

| Total liabilities | | | 194,486 |

| 180,628 |

|

| Net assets | | | 100,708 |

| 101,548 |

|

| Equity | | | | |

| BP shareholders’ equity | | 32 |

| 98,412 |

| 99,444 |

|

| Non-controlling interests | | 32 |

| 2,296 |

| 2,104 |

|

| Total equity | | 32 |

| 100,708 |

| 101,548 |

|

a Finance debt on the comparative balance sheet has been re-presented to align with the current period. See Note 1 for further information.

Helge Lund Chairman

B Looney Chief executive officer

18 March 2020

|

| | | |

| | BP Annual Report and Form 20-F 2019 | | 155 |

Group cash flow statement

|

| | | | | | | | | |

| For the year ended 31 December | | | | | $ million |

|

| | | Note |

| 2019 |

| 2018 |

| 2017 |

|

| Operating activities | | | | | |

| Profit before taxation | | | 8,154 |

| 16,723 |

| 7,180 |

|

| Adjustments to reconcile profit before taxation to net cash provided by operating activities | | | | | |

| Exploration expenditure written off | | 8 |

| 631 |

| 1,085 |

| 1,603 |

|

| Depreciation, depletion and amortization | | 5 |

| 17,780 |

| 15,457 |

| 15,584 |

|

| Impairment and (gain) loss on sale of businesses and fixed assets | | 4 |

| 7,882 |

| 404 |

| 6 |

|

| Earnings from joint ventures and associates | | | (3,257 | ) | (3,753 | ) | (2,507 | ) |

| Dividends received from joint ventures and associates | | | 1,962 |

| 1,535 |

| 1,253 |

|

| Interest receivable | | | (441 | ) | (468 | ) | (304 | ) |

| Interest received | | | 416 |

| 348 |

| 375 |

|

| Finance costs | | 7 |

| 3,489 |

| 2,528 |

| 2,074 |

|

| Interest paid | | | (2,870 | ) | (1,928 | ) | (1,572 | ) |

| Net finance expense relating to pensions and other post-retirement benefits | | 24 |

| 63 |

| 127 |

| 220 |

|

| Share-based payments | | | 730 |

| 690 |

| 661 |

|

| Net operating charge for pensions and other post-retirement benefits, less contributions and benefit payments for unfunded plans | | 24 |

| (238 | ) | (386 | ) | (394 | ) |

| Net charge for provisions, less payments | | | (176 | ) | 986 |

| 2,106 |

|

| (Increase) decrease in inventories | | | (3,406 | ) | 672 |

| (848 | ) |

| (Increase) decrease in other current and non-current assets | | | (2,335 | ) | (2,858 | ) | (4,848 | ) |

| Increase (decrease) in other current and non-current liabilities | | | 2,823 |

| (2,577 | ) | 2,344 |

|

| Income taxes paid | | | (5,437 | ) | (5,712 | ) | (4,002 | ) |

| Net cash provided by operating activities | | | 25,770 |

| 22,873 |

| 18,931 |

|

| Investing activities | | | | | |

| Expenditure on property, plant and equipment, intangible and other assets | | | (15,418 | ) | (16,707 | ) | (16,562 | ) |

| Acquisitions, net of cash acquired | | 3 |

| (3,562 | ) | (6,986 | ) | (327 | ) |

| Investment in joint ventures | | | (137 | ) | (382 | ) | (50 | ) |

| Investment in associates | | | (304 | ) | (1,013 | ) | (901 | ) |

| Total cash capital expenditure | | | (19,421 | ) | (25,088 | ) | (17,840 | ) |

| Proceeds from disposals of fixed assets | | 4 |

| 500 |

| 940 |

| 2,936 |

|

| Proceeds from disposals of businesses, net of cash disposed | | 4 |

| 1,701 |

| 1,911 |

| 478 |

|

| Proceeds from loan repayments | | | 246 |

| 666 |

| 349 |

|

| Net cash used in investing activities | | | (16,974 | ) | (21,571 | ) | (14,077 | ) |

Financing activitiesa | | | | | |

| Repurchase of shares | | | (1,511 | ) | (355 | ) | (343 | ) |

| Lease liability payments | | | (2,372 | ) | (35 | ) | (45 | ) |

| Proceeds from long-term financing | | | 8,597 |

| 9,038 |

| 8,712 |

|

| Repayments of long-term financing | | | (7,118 | ) | (7,175 | ) | (6,231 | ) |

| Net increase (decrease) in short-term debt | | | 180 |

| 1,317 |

| (158 | ) |

| Net increase (decrease) in non-controlling interests | | | 566 |

| — |

| 1,063 |

|

| Dividends paid | | | | | |

| BP shareholders | | 10 |

| (6,946 | ) | (6,699 | ) | (6,153 | ) |

| Non-controlling interests | | | (213 | ) | (170 | ) | (141 | ) |

| Net cash provided by (used in) financing activities | | | (8,817 | ) | (4,079 | ) | (3,296 | ) |

| Currency translation differences relating to cash and cash equivalents | | | 25 |

| (330 | ) | 544 |

|

| Increase (decrease) in cash and cash equivalents | | | 4 |

| (3,107 | ) | 2,102 |

|

| Cash and cash equivalents at beginning of year | | | 22,468 |

| 25,575 |

| 23,484 |

|

| Cash and cash equivalents at end of year | | | 22,472 |

| 22,468 |

| 25,586 |

|

a The presentation of financing cash flows for the comparative periods have been amended to align with the current period. See Note 1 for further information.

|

| | | |

| 156 | | BP Annual Report and Form 20-F 2019 | |

Notes on financial statements

1. Significant accounting policies, judgements, estimates and assumptions

Authorization of financial statements and statement of compliance with International Financial Reporting Standards

The consolidated financial statements of BP p.l.c and its subsidiaries (collectively referred to as BP or the group) for the year ended 31 December 2019 were approved and signed by the chief executive officer and chairman on 18 March 2020 having been duly authorized to do so by the board of directors. BP p.l.c. is a public limited company incorporated and domiciled in England and Wales. The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), IFRS as adopted by the European Union (EU) and in accordance with the provisions of the UK Companies Act 2006 as applicable to companies reporting under IFRS. IFRS as adopted by the EU differs in certain respects from IFRS as issued by the IASB. The differences have no impact on the group’s consolidated financial statements for the years presented. The significant accounting policies and accounting judgements, estimates and assumptions of the group are set out below.

Basis of preparation

The consolidated financial statements have been prepared on a going concern basis and in accordance with IFRS and IFRS Interpretations Committee (IFRIC) interpretations issued and effective for the year ended 31 December 2019. The accounting policies that follow have been consistently applied to all years presented, except where otherwise indicated.

The consolidated financial statements are presented in US dollars and all values are rounded to the nearest million dollars ($ million), except where otherwise indicated.

Significant accounting policies: use of judgements, estimates and assumptions

Inherent in the application of many of the accounting policies used in preparing the consolidated financial statements is the need for BP management to make judgements, estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported amounts of revenues and expenses. Actual outcomes could differ from the estimates and assumptions used. The accounting judgements and estimates that have a significant impact on the results of the group are set out in boxed text below, and should be read in conjunction with the information provided in the Notes on financial statements. The areas requiring the most significant judgement and estimation in the preparation of the consolidated financial statements are: accounting for the investment in Rosneft; exploration and appraisal intangible assets; the recoverability of asset carrying values, including the estimation of reserves; derivative financial instruments; provisions and contingencies; and pensions and other post-retirement benefits. Where an estimate has a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities within the next financial year this is specifically noted within the boxed text. The group does not consider income taxes to represent a significant estimate or judgement for 2019, see Income taxes for more information.

Basis of consolidation

The group financial statements consolidate the financial statements of BP p.l.c. and its subsidiaries drawn up to 31 December each year. Subsidiaries are consolidated from the date of their acquisition, being the date on which the group obtains control, and continue to be consolidated until the date that control ceases. The financial statements of subsidiaries are prepared for the same reporting year as the parent company, using consistent accounting policies. Intra-group balances and transactions, including unrealized profits arising from intra-group transactions, have been eliminated. Unrealized losses are eliminated unless the transaction provides evidence of an impairment of the asset transferred. Non-controlling interests represent the equity in subsidiaries that is not attributable, directly or indirectly, to BP shareholders.

Interests in other entities

Business combinations and goodwill

Business combinations are accounted for using the acquisition method. The identifiable assets acquired and liabilities assumed are recognized at their fair values at the acquisition date.

Goodwill is initially measured as the excess of the aggregate of the consideration transferred, the amount recognized for any non-controlling interest and the acquisition-date fair values of any previously held interest in the acquiree over the fair value of the identifiable assets acquired and liabilities assumed at the acquisition date. The amount recognized for any non-controlling interest is measured at the present ownership's proportionate share in the recognized amounts of the acquiree’s identifiable net assets. At the acquisition date, any goodwill acquired is allocated to each of the cash-generating units, or groups of cash-generating units, expected to benefit from the combination’s synergies. Following initial recognition, goodwill is measured at cost less any accumulated impairment losses. Goodwill arising on business combinations prior to 1 January 2003 is stated at the previous carrying amount under UK generally accepted accounting practice, less subsequent impairments. See Note 14 for further information.

Goodwill may arise upon investments in joint ventures and associates, being the surplus of the cost of investment over the group’s share of the net fair value of the identifiable assets and liabilities. Any such goodwill is recorded within the corresponding investment in joint ventures and associates.

Goodwill may also arise upon acquisition of interests in joint operations that meet the definition of a business. The amount of goodwill separately recognized is the excess of the consideration transferred over the group's share of the net fair value of the identifiable assets and liabilities.

Interests in joint arrangements

The results, assets and liabilities of joint ventures are incorporated in these consolidated financial statements using the equity method of accounting as described below.

Certain of the group’s activities, particularly in the Upstream segment, are conducted through joint operations. BP recognizes, on a line-by-line basis in the consolidated financial statements, its share of the assets, liabilities and expenses of these joint operations incurred jointly with the other partners, along with the group’s income from the sale of its share of the output and any liabilities and expenses that the group has incurred in relation to the joint operation.

|

| | | |

| | BP Annual Report and Form 20-F 2019 | | 157 |

1. Significant accounting policies, judgements, estimates and assumptions – continued

Interests in associates

The results, assets and liabilities of associates are incorporated in these consolidated financial statements using the equity method of accounting as described below.

|

|

Significant judgement: investment in Rosneft Judgement is required in assessing the level of control or influence over another entity in which the group holds an interest. For BP, the judgement that the group has significant influence over Rosneft Oil Company (Rosneft), a Russian oil and gas company is significant. As a consequence of this judgement, BP uses the equity method of accounting for its investment and BP's share of Rosneft's oil and natural gas reserves is included in the group's estimated net proved reserves of equity-accounted entities. If significant influence was not present, the investment would be accounted for as an investment in an equity instrument measured at fair value as described under 'Financial assets' below and no share of Rosneft's oil and natural gas reserves would be reported. Significant influence is defined in IFRS as the power to participate in the financial and operating policy decisions of the investee but is not control or joint control of those policies. Significant influence is presumed when an entity owns 20% or more of the voting power of the investee. Significant influence is presumed not to be present when an entity owns less than 20% of the voting power of the investee. BP owns 19.75% of the voting shares of Rosneft. The Russian federal government, through its investment company JSC Rosneftegaz, owned 50% plus one share of the voting shares of Rosneft at 31 December 2019. IFRS identifies several indicators that may provide evidence of significant influence, including representation on the board of directors of the investee and participation in policy-making processes. BP’s group chief executive, as at 31 December 2019, Bob Dudley, has been a member of the board of directors of Rosneft since 2013 and remains one of BP's nominated directors following his resignation as BP's group chief executive. He is also chairman of the Rosneft board’s Strategic Planning Committee. A second BP-nominated director, Guillermo Quintero, has been a member of the Rosneft board and its HR and Remuneration Committee since 2015. BP also holds the voting rights at general meetings of shareholders conferred by its 19.75% stake in Rosneft. BP's management consider, therefore, that the group has significant influence over Rosneft, as defined by IFRS. |

The equity method of accounting

Under the equity method, an investment is carried on the balance sheet at cost plus post-acquisition changes in the group’s share of net assets of the entity, less distributions received and less any impairment in value of the investment. Loans advanced to equity-accounted entities that have the characteristics of equity financing are also included in the investment on the group balance sheet. The group income statement reflects the group’s share of the results after tax of the equity-accounted entity, adjusted to account for depreciation, amortization and any impairment of the equity-accounted entity’s assets based on their fair values at the date of acquisition. The group statement of comprehensive income includes the group’s share of the equity-accounted entity’s other comprehensive income. The group’s share of amounts recognized directly in equity by an equity-accounted entity is recognized in the group’s statement of changes in equity.

Financial statements of equity-accounted entities are prepared for the same reporting year as the group. Where material differences arise in the accounting policies used by the equity-accounted entity and those used by BP, adjustments are made to those financial statements to bring the accounting policies used into line with those of the group.

Unrealized gains on transactions between the group and its equity-accounted entities are eliminated to the extent of the group’s interest in the equity-accounted entity.

The group assesses investments in equity-accounted entities for impairment whenever there is objective evidence that the investment is impaired. If any such objective evidence of impairment exists, the carrying amount of the investment is compared with its recoverable amount, being the higher of its fair value less costs of disposal and value in use. If the carrying amount exceeds the recoverable amount, the investment is written down to its recoverable amount.

Segmental reporting

The group’s operating segments are established on the basis of those components of the group that are evaluated regularly by the group chief executive, BP’s chief operating decision maker, in deciding how to allocate resources and in assessing performance.

The accounting policies of the operating segments are the same as the group’s accounting policies described in this note, except that IFRS requires that the measure of profit or loss disclosed for each operating segment is the measure that is provided regularly to the chief operating decision maker. For BP, this measure of profit or loss is replacement cost profit before interest and tax which reflects the replacement cost of inventories sold in the period and is arrived at by excluding inventory holding gains and losses from profit. Replacement cost profit for the group is not a recognized measure under IFRS. For further information see Note 5.

Foreign currency translation

In individual subsidiaries, joint ventures and associates, transactions in foreign currencies are initially recorded in the functional currency of those entities at the spot exchange rate on the date of the transaction. Monetary assets and liabilities denominated in foreign currencies are retranslated into the functional currency at the spot exchange rate on the balance sheet date. Any resulting exchange differences are included in the income statement, unless hedge accounting is applied. Non-monetary assets and liabilities, other than those measured at fair value, are not retranslated subsequent to initial recognition.

In the consolidated financial statements, the assets and liabilities of non-US dollar functional currency subsidiaries, joint ventures, associates, and related goodwill, are translated into US dollars at the spot exchange rate on the balance sheet date. The results and cash flows of non-US dollar functional currency subsidiaries, joint ventures and associates are translated into US dollars using average rates of exchange. In the consolidated financial statements, exchange adjustments arising when the opening net assets and the profits for the year retained by non-US dollar functional currency subsidiaries, joint ventures and associates are translated into US dollars are recognized in a separate component of equity and reported in other comprehensive income. Exchange gains and losses arising on long-term intra-group foreign currency borrowings used to finance the group’s non-US dollar investments are also reported in other comprehensive income if the borrowings form part of the net investment in the subsidiary, joint venture or associate. On disposal or for certain partial disposals of a non-US dollar functional currency subsidiary, joint venture or associate, the related accumulated exchange gains and losses recognized in equity are reclassified from equity to the income statement.

|

| | | |

| 158 | | BP Annual Report and Form 20-F 2019 | |

1. Significant accounting policies, judgements, estimates and assumptions – continued

Non-current assets held for sale

Non-current assets and disposal groups classified as held for sale are measured at the lower of carrying amount and fair value less costs to sell.

Significant non-current assets and disposal groups are classified as held for sale if their carrying amounts will be recovered through a sale transaction rather than through continuing use. This condition is regarded as met only when the sale is highly probable and the asset or disposal group is available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such assets. Management must be committed to the sale, which should be expected to qualify for recognition as a completed sale within one year from the date of classification as held for sale, and actions required to complete the plan of sale should indicate that it is unlikely that significant changes to the plan will be made or that the plan will be withdrawn.

Property, plant and equipment and intangible assets are not depreciated or amortized once classified as held for sale.

Intangible assets

Intangible assets, other than goodwill, include expenditure on the exploration for and evaluation of oil and natural gas resources, computer software, patents, licences and trademarks and are stated at the amount initially recognized, less accumulated amortization and accumulated impairment losses.

Intangible assets are carried initially at cost unless acquired as part of a business combination. Any such asset is measured at fair value at the date of the business combination and is recognized separately from goodwill if the asset is separable or arises from contractual or other legal rights.

Intangible assets with a finite life, other than capitalized exploration and appraisal costs as described below, are amortized on a straight-line basis over their expected useful lives. For patents, licences and trademarks, expected useful life is the shorter of the duration of the legal agreement and economic useful life, and can range from three to fifteen years. Computer software costs generally have a useful life of three to five years.

The expected useful lives of assets and the amortization method are reviewed on an annual basis and, if necessary, changes in useful lives or the amortization method are accounted for prospectively.

Oil and natural gas exploration, appraisal and development expenditure

Oil and natural gas exploration, appraisal and development expenditure is accounted for using the principles of the successful efforts method of accounting as described below.

Licence and property acquisition costs

Exploration licence and leasehold property acquisition costs are capitalized within intangible assets and are reviewed at each reporting date to confirm that there is no indication that the carrying amount exceeds the recoverable amount. This review includes confirming that exploration drilling is still under way or planned or that it has been determined, or work is under way to determine, that the discovery is economically viable based on a range of technical and commercial considerations, and sufficient progress is being made on establishing development plans and timing. If no future activity is planned, the remaining balance of the licence and property acquisition costs is written off. Lower value licences are pooled and amortized on a straight-line basis over the estimated period of exploration. Upon internal approval for development and recognition of proved reserves of oil and natural gas, the relevant expenditure is transferred to property, plant and equipment.

Exploration and appraisal expenditure

Geological and geophysical exploration costs are recognized as an expense as incurred. Costs directly associated with an exploration well are initially capitalized as an intangible asset until the drilling of the well is complete and the results have been evaluated. These costs include employee remuneration, materials and fuel used, rig costs and payments made to contractors. If potentially commercial quantities of hydrocarbons are not found, the exploration well costs are written off. If hydrocarbons are found and, subject to further appraisal activity, are likely to be capable of commercial development, the costs continue to be carried as an asset. If it is determined that development will not occur then the costs are expensed.

Costs directly associated with appraisal activity undertaken to determine the size, characteristics and commercial potential of a reservoir following the initial discovery of hydrocarbons, including the costs of appraisal wells where hydrocarbons were not found, are initially capitalized as an intangible asset. Upon internal approval for development and recognition of proved reserves, the relevant expenditure is transferred to property, plant and equipment.

The determination of whether potentially economic oil and natural gas reserves have been discovered by an exploration well is usually made within one year of well completion, but can take longer, depending on the complexity of the geological structure. Exploration wells that discover potentially economic quantities of oil and natural gas and are in areas where major capital expenditure (e.g. an offshore platform or a pipeline) would be required before production could begin, and where the economic viability of that major capital expenditure depends on the successful completion of further exploration or appraisal work in the area, remain capitalized on the balance sheet as long as such work is under way or firmly planned.

Development expenditure

Expenditure on the construction, installation and completion of infrastructure facilities such as platforms, pipelines and the drilling of development wells, including service and unsuccessful development or delineation wells, is capitalized within property, plant and equipment and is depreciated from the commencement of production as described below in the accounting policy for property, plant and equipment.

|

| | | |

| | BP Annual Report and Form 20-F 2019 | | 159 |

1. Significant accounting policies, judgements, estimates and assumptions – continued

|

|

Significant judgement: exploration and appraisal intangible assets Judgement is required to determine whether it is appropriate to continue to carry costs associated with exploration wells and exploratory-type stratigraphic test wells on the balance sheet. This includes costs relating to exploration licences or leasehold property acquisitions. It is not unusual to have such costs remaining suspended on the balance sheet for several years while additional appraisal drilling and seismic work on the potential oil and natural gas field is performed or while the optimum development plans and timing are established.The costs are carried based on the current regulatory and political environment or any known changes to that environment. All such carried costs are subject to regular technical, commercial and management review on at least an annual basis to confirm the continued intent to develop, or otherwise extract value from, the discovery. Where this is no longer the case, the costs are immediately expensed. In scenarios where the expected time horizon for establishing the development plan is lengthy or uncertain, greater judgement is required. BP is in the exploration and appraisal phase in certain Canadian oil sands assets that require further advancement of low-carbon extraction technology in order to achieve optimum development. Sufficient technological progress is expected to be achieved and therefore BP continues to carry the capitalized costs on its balance sheet. The judgement disclosed in prior years in relation to expiring leases in the Gulf of Mexico is no longer considered to be significant following recent agreement of lease extensions with the US Bureau of Safety and Environmental Enforcement. The carrying amount of capitalized costs is included in Note 8. |

Property, plant and equipment

Property, plant and equipment owned by the group is stated at cost, less accumulated depreciation and accumulated impairment losses. The initial cost of an asset comprises its purchase price or construction cost, any costs directly attributable to bringing the asset into the location and condition necessary for it to be capable of operating in the manner intended by management, the initial estimate of any decommissioning obligation, if any, and, for assets that necessarily take a substantial period of time to get ready for their intended use, directly attributable general or specific finance costs. The purchase price or construction cost is the aggregate amount paid and the fair value of any other consideration given to acquire the asset.

Expenditure on major maintenance refits or repairs comprises the cost of replacement assets or parts of assets, inspection costs and overhaul costs. Where an asset or part of an asset that was separately depreciated is replaced and it is probable that future economic benefits associated with the item will flow to the group, the expenditure is capitalized and the carrying amount of the replaced asset is derecognized. Inspection costs associated with major maintenance programmes are capitalized and amortized over the period to the next inspection. Overhaul costs for major maintenance programmes, and all other maintenance costs are expensed as incurred.

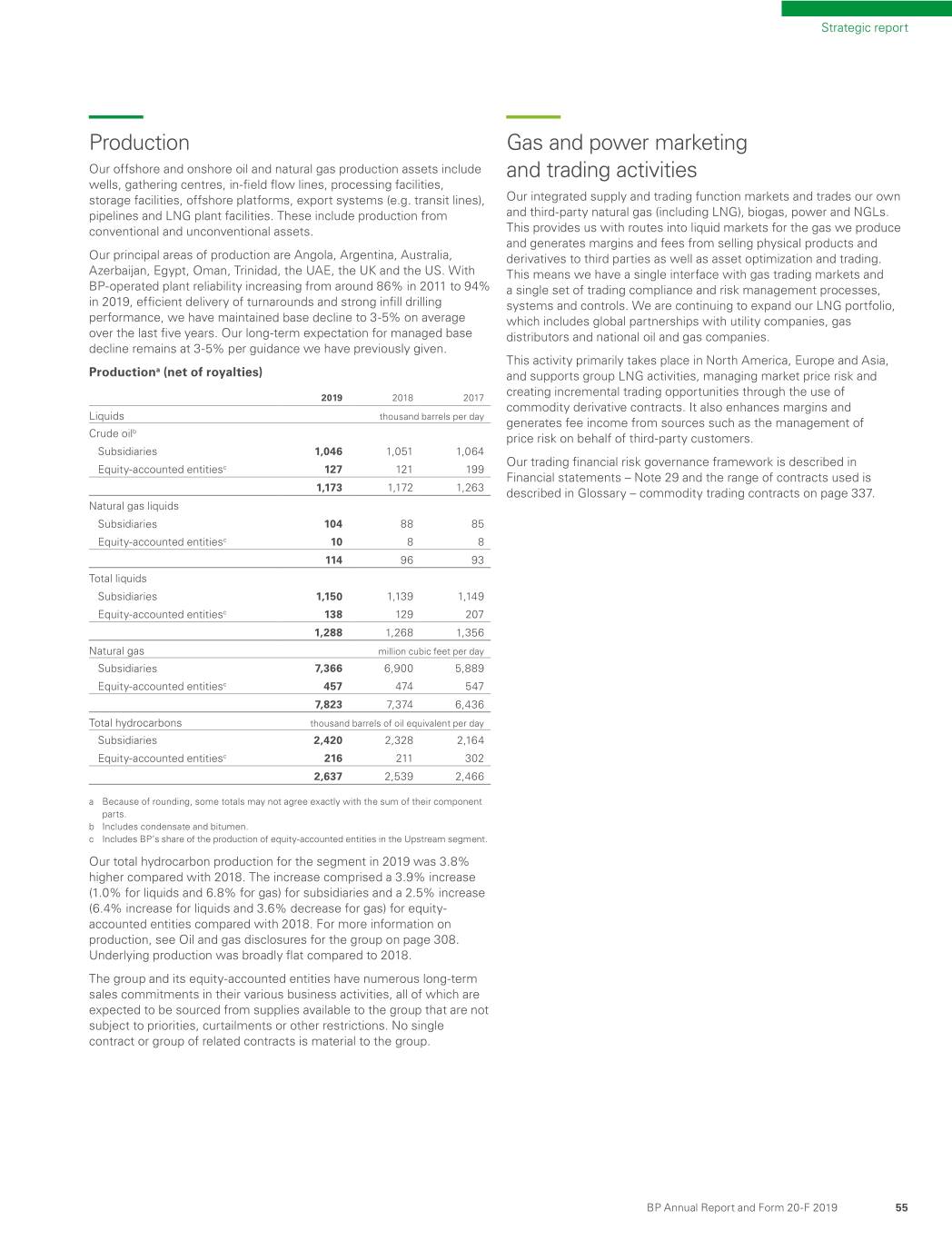

Oil and natural gas properties, including certain related pipelines, are depreciated using a unit-of-production method. The cost of producing wells is amortized over proved developed reserves. Licence acquisition, common facilities and future decommissioning costs are amortized over total proved reserves. The unit-of-production rate for the depreciation of common facilities takes into account expenditures incurred to date, together with estimated future capital expenditure expected to be incurred relating to as yet undeveloped reserves expected to be processed through these common facilities. Information on the carrying amounts of the group’s oil and natural gas properties, together with the amounts recognized in the income statement as depreciation, depletion and amortization is contained in Note 12 and Note 5 respectively.