- SONY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

6-K Filing

Sony (SONY) 6-KCurrent Report of Foreign Issuer

Filed: 19 May 21, 3:48pm

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of May 2021

Commission File Number: 001-06439

SONY GROUP CORPORATION

(Translation of registrant’s name into English)

1-7-1 KONAN, MINATO-KU, TOKYO, 108-0075, JAPAN

(Address of principal executive offices)

The registrant files annual reports under cover of Form 20-F.

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F,

| Form 20-F ☒ | Form 40-F ☐ |

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934, Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82-______

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SONY GROUP CORPORATION | |

| (Registrant) | |

| By: /s/ Hiroki Totoki | |

| (Signature) | |

| Hiroki Totoki | |

| Executive Deputy President and | |

| Chief Financial Officer | |

Date: May 19, 2021

List of materials

Documents attached hereto:

i) Notice of the Ordinary General Meeting of Shareholders to be held on June 22, 2021

SONY GROUP CORPORATION

Notice of the Ordinary General Meeting of

Shareholders to be held on June 22, 2021

To the Registered Holders of American Depositary Receipts representing shares of Common Stock of Sony Group Corporation (the “Corporation”):

The undersigned Depositary has received a notice that the Corporation has called an ordinary general meeting of shareholders to be held in Tokyo, Japan on June 22, 2021 (the “Meeting”) for the following purposes:

MATTERS TO BE REPORTED:

To receive reports on the business report, non-consolidated financial statements, consolidated financial statements, as well as audit reports on the consolidated financial statements by the Independent Auditors (certified public accountants) and the Audit Committee for the fiscal year ended March 31, 2021 (from April 1, 2020 to March 31, 2021) pursuant to the Companies Act of Japan.

PROPOSALS TO BE ACTED UPON:

| 1. | To elect 11 Directors. |

| 2. | To issue Stock Acquisition Rights for the purpose of granting stock options. |

EXPLANATION REGARDING THE SUBJECT MATTER OF THE MEETING

MATTERS TO BE REPORTED:

To receive reports on the business report, non-consolidated financial statements, consolidated financial statements, as well as audit reports on the consolidated financial statements by the Independent Auditors (certified public accountants) and the Audit Committee for the fiscal year ended March 31, 2021 (from April 1, 2020 to March 31, 2021).

| Note: | The Consolidated Financial Statements pursuant to the Companies Act of Japan (Translation) are available on the Sony Investor Relations website. |

This document can be accessed at

https://www.sony.com/en/SonyInfo/IR/stock/shareholders_meeting/Meeting104/

| 1 |

PROPOSALS TO BE ACTED UPON:

| 1. | To elect 11 Directors. |

The term of office of all 12 Directors currently in office will expire at the conclusion of the Meeting. In accordance with the decision of the Nominating Committee, the election of the following 11 Directors is proposed.

Policy and procedures for the selection of director candidates

With a view toward securing effective input and oversight by the Board of Directors of the Corporation (the “Board”), the Nominating Committee reviews and selects candidates for the Board with the aim of assuring that a substantial part of the Board is comprised of qualified outside Directors that satisfy the independence requirements established by Sony and by law.

The Nominating Committee selects candidates that it views as well-suited to be Directors in light of the Board’s purpose of enhancing the corporate value of the Corporation and its consolidated subsidiaries (the “Sony Group”). The Nominating Committee broadly considers various relevant factors, including a candidate’s capabilities (such as the candidate’s experience, achievements, expertise and internationality), availability, and independence, as well as diversity in the boardroom, the appropriate size of the Board, and the knowledge, experiences and talent needed for the role.

Under the Charter of the Board of Directors (the “Board Charter”), the Corporation also requires that the Board consist of not fewer than eight (8) Directors and not more than fourteen (14) Directors. In addition, since 2005, the majority of the members of the Board have been outside Directors.

Director qualifications

The qualifications for Directors of the Corporation under the Board Charter are generally as summarized below. All Director candidates satisfy the qualifications for Directors as set forth below.

Of the 11 Director candidates, 8 are candidates for outside Director. As of the date of this proposal, each of the 8 candidates for outside Director satisfies the additional qualifications for outside Directors, and the Corporation has made a filing with the Tokyo Stock Exchange, where the shares of the Corporation are listed, indicating that each of them will be an independent Director under the Securities Listing Regulations of the Tokyo Stock Exchange.

| All Directors Qualifications: |

| (1) | Shall not be a director, a statutory auditor, a corporate executive officer, a general manager or other employee of any company in competition with the Sony Group in any of the Sony Group’s principal businesses (hereinafter referred to as “Competing Company”) or own three percent (3%) or more of the shares of any Competing Company. |

| (2) | Shall not be or have been a representative partner or partner of any independent auditor of the Sony Group during the three (3) years before being nominated as a Director. |

| (3) | Shall not have any connection with any matter that may cause a material conflict of interest in performing the duties of a Director. |

| 2 |

| Outside Directors Qualifications: |

| (1) | Shall not have received directly from the Sony Group, during any consecutive twelve-month (12 month) period within the last three (3) years, more than an amount equivalent to one hundred twenty thousand United States dollars (US$120,000), other than Director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service). |

| (2) | Shall not be an executive director, a corporate executive officer, a general manager or other employee of any company whose aggregate amount of transactions with the Sony Group, in any of the last three (3) fiscal years, exceeds the greater of an amount equivalent to one million United States dollars (US$1,000,000), or two percent (2%) of the annual consolidated sales of such company. |

Also, each outside Director may, by resolution of the Nominating Committee, be nominated as a Director candidate for re-election up to five (5) times, and thereafter by resolution of the Nominating Committee and by consent of all of the Directors. Even with the consent of all of the Directors, in no event may any outside Director be re-elected more than eight (8) times.

| 3 |

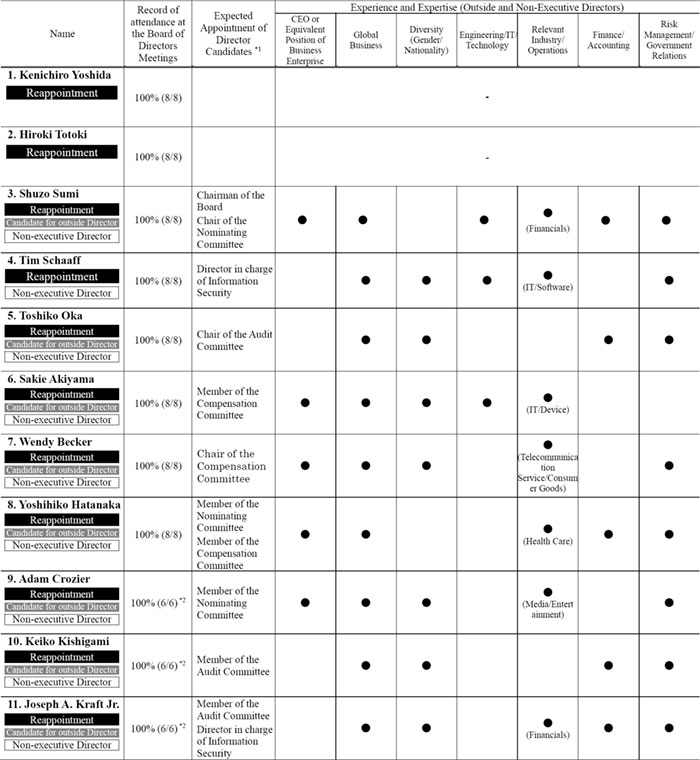

(For Reference) The candidates for Director are as follows:

Notes:

| 1. | The expected appointment of each candidate for Director will be determined at the meeting of the Board to be held after this Meeting. |

| 2. | Since Mr. Adam Crozier, Ms. Keiko Kishigami and Mr. Joseph A. Kraft Jr. were newly elected at the Ordinary General Meeting of Shareholders held on June 26, 2020, the number of Board meetings they were eligible to attend is different from other directors. |

| 3. | The Corporation has concluded agreements limiting the liability for 9 of the Director candidates, each of whom is currently an outside Director or other non-executive Director. For a summary of the limited liability agreements, please refer to page 18. |

| 4. | The Corporation has a directors and officers liability insurance policy covering all Directors and officers as insured parties. Candidates and newly appointed Directors and officers during the policy period are also included as insured parties. The policy provides coverage for damages that may occur when any insured party is responsible for the execution of his/her duties or receives a claim for damages related to the pursuit of such liability. However, there are exclusions, such as in the case of an act that is committed with the knowledge that it is in violation of laws or regulations. The Corporation also plans to renew this insurance policy with the same conditions at the time of the next renewal. |

| 5. | As of the date of this proposal, each of the 8 candidates for outside Director satisfies the additional qualifications for outside Directors, and the Corporation has made a filing with the Tokyo Stock Exchange, where the shares of the Corporation are listed, indicating that each of them will be an independent Director under the Securities Listing Regulations of the Tokyo Stock Exchange. |

| 4 |

| 1. Kenichiro Yoshida | Reappointment | |||

| ||||

| Current Responsibility as a Director | Member of the Nominating Committee | |||

| Date of Birth | October 20, 1959 | |||

| Number of Years Served as a Director | 7 years | |||

| Record of attendance at the Board of Directors Meetings | 100% (8/8) | |||

| Number of the Corporation’s Shares Held | 189,900 shares | |||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||

| April 1983 | Joined the Corporation | |||

| July 2000 | Joined Sony Communication Network Corporation (currently Sony Network Communications Inc.) | |||

| September 2000 | Outside Director, So-net M3, Inc. (currently M3, Inc.) (present) | |||

| May 2001 | Senior Vice President, Sony Communication Network Corporation | |||

| April 2005 | President and Representative Director, Sony Communication Network Corporation | |||

| December 2013 | Executive Vice President, Chief Strategy Officer and Deputy Chief Financial Officer, Corporate Executive Officer, the Corporation | |||

| April 2014 | Executive Vice President and Chief Financial Officer, Representative Corporate Executive Officer, the Corporation | |||

| June 2014 | Director, the Corporation (present) | |||

| April 2015 | Executive Deputy President and Chief Financial Officer, Representative Corporate Executive Officer, the Corporation | |||

| April 2018 | President and Chief Executive Officer, Representative Corporate Executive Officer, the Corporation | |||

| June 2020 | Chairman, President and Chief Executive Officer, Representative Corporate Executive Officer, the Corporation (present) | |||

| Reasons for the Nomination |

| As the Chief Executive Officer of the Sony Group, this candidate is responsible for the overall management of the entire Group, and he is nominated to be a candidate for Director by resolution of the Nominating Committee. |

| 5 |

| 2. Hiroki Totoki | Reappointment | |||

| ||||

| Current Responsibility as a Director | – | |||

| Date of Birth | July 17, 1964 | |||

| Number of Years Served as a Director | 2 years | |||

| Record of attendance at the Board of Directors Meetings | 100% (8/8) | |||

| Number of the Corporation’s Shares Held | 44,600 shares | |||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||

| April 1987 | Joined the Corporation | |||

| February 2002 | Representative Director, Sony Bank Incorporated | |||

| June 2005 | Director, Corporate Executive Officer and Senior Managing Director, Sony Communication Network Corporation (currently Sony Network Communications Inc.) | |||

| April 2012 | Representative Director, Corporate Executive Officer and Senior Managing Director, So-net Entertainment Corporation (currently Sony Network Communications Inc.) | |||

| April 2013 | Representative Director, Corporate Executive Officer, Deputy President and Chief Financial Officer, So-net Entertainment Corporation | |||

| December 2013 | Senior Vice President, Corporate Executive, the Corporation | |||

| November 2014 | President and Chief Executive Officer, Sony Mobile Communications Inc. | |||

| June 2015 | Director, Chairman, So-net Corporation (currently Sony Network Communications Inc.) | |||

| April 2016 | Executive Vice President, Corporate Executive Officer, the Corporation In charge of New Business Platform (Strategy) | |||

| President and Representative Director, So-net Corporation | ||||

| June 2017 | Executive Vice President, Chief Strategy Officer, Corporate Executive Officer, the Corporation In charge of Mid-to-Long Term Business Strategy, New Business | |||

| April 2018 | Executive Vice President, Chief Financial Officer, Representative Corporate Executive Officer, the Corporation | |||

| June 2018 | Senior Executive Vice President, Chief Financial Officer, Representative Corporate Executive Officer, the Corporation | |||

| June 2019 | Director, the Corporation (present) | |||

| June 2020 | Executive Deputy President, Chief Financial Officer, Representative Corporate Executive Officer, the Corporation (present) | |||

| Reasons for the Nomination |

| As the Chief Financial Officer, he is responsible for the headquarters functions of Corporate Planning and Control, Corporate Strategy, Accounting, Tax, Finance, Investor Relations, Disclosure Controls, Digital Transformation Strategy, Information Systems, Information Security, Risk Management, Internal Audit and SOX 404 management, and he is nominated to be a candidate for Director by resolution of the Nominating Committee. |

| 6 |

| 3. Shuzo Sumi | Reappointment | Candidate for outside Director | Non-executive Director | |||||

| ||||||||

| Current Responsibility as a Director | Chairman of the Board Chair of the Nominating Committee | |||||||

| Date of Birth | July 11, 1947 | |||||||

| Number of Years Served as a Director | 4 years | |||||||

| Record of attendance at the Board of Directors Meetings | 100% (8/8) | |||||||

| Number of the Corporation’s Shares Held | 4,700 shares | |||||||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||||||

| April 1970 | Joined Tokio Marine & Fire Insurance Co., Ltd. | |||||||

| June 2000 | Director and Chief Representative in London, Overseas Division, Tokio Marine & Fire Insurance Co., Ltd. | |||||||

| June 2002 | Managing Director, Tokio Marine & Fire Insurance Co., Ltd. | |||||||

| October 2004 | Managing Director, Tokio Marine & Nichido Fire Insurance Co., Ltd. | |||||||

| June 2005 | Senior Managing Director, Tokio Marine & Nichido Fire Insurance Co., Ltd. | |||||||

| June 2007 | President & Chief Executive Officer, Tokio Marine & Nichido Fire Insurance Co., Ltd. | |||||||

| President & Chief Executive Officer, Tokio Marine Holdings, Inc. | ||||||||

| June 2013 | Chairman of the Board, Tokio Marine & Nichido Fire Insurance Co., Ltd. | |||||||

| Chairman of the Board, Tokio Marine Holdings, Inc. | ||||||||

| June 2014 | Outside Director, Toyota Industries Corporation (present) | |||||||

| April 2016 | Senior Executive Advisor, Tokio Marine & Nichido Fire Insurance Co., Ltd. (present) | |||||||

| June 2017 | Director, the Corporation (present) | |||||||

| Reasons for the Nomination as Outside Director and Outline of Expected Roles |

| This candidate advises the Corporation’s management based on his knowledge, experience, and insight from managing a global company and from various activities in the industrial community. He leads the Board of Directors as the Chairman and has demonstrated supervising and monitoring capabilities. In addition, he leads the Nominating Committee as its Chair. Accordingly, the Nominating Committee has nominated him as a candidate for Outside Director as he is expected to contribute to the Board of Directors’ decision-making function and oversight function. |

| 4. Tim Schaaff | Reappointment | Non-executive Director | ||||||

| ||||||||

| Current Responsibility as a Director | Director in charge of Information Security | |||||||

| Date of Birth | December 5, 1959 | |||||||

| Number of Years Served as a Director | 8 years | |||||||

| Record of attendance at the Board of Directors Meetings | 100% (8/8) | |||||||

| Number of the Corporation’s Shares Held | 8,800 shares | |||||||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||||||

| December 1982 | Joined New England Digital Corporation | |||||||

| July 1991 | Joined Apple Computer, Inc. | |||||||

| 1998 | Vice President, Apple Computer, Inc. | |||||||

| December 2005 | Senior Vice President, Sony Corporation of America | |||||||

| November 2006 | Deputy President, Technology Development Group, the Corporation | |||||||

| June 2008 | President, Sony Media Software and Services Inc. | |||||||

| December 2009 | President, Sony Network Entertainment International LLC | |||||||

| June 2013 | Director, the Corporation (present) | |||||||

| July 2015 | Chief Product Officer, Intertrust Technologies Corporation (present) | |||||||

| Reasons for the Nomination |

| In addition to expertise in software technology and network services, this candidate has experience leading Sony’s network services business, and he is nominated to be a candidate for Director by resolution of the Nominating Committee. This candidate does not satisfy the qualification for outside Director since he worked in the Sony Group in the past. |

| 7 |

| 5. Toshiko Oka | Reappointment | Candidate for outside Director | Non-executive Director | |||||||

| ||||||||||

| Current Responsibility as a Director | Member of the Audit Committee | |||||||||

| Date of Birth | March 7, 1964 | |||||||||

| Number of Years Served as a Director | 3 years | |||||||||

| Record of attendance at the Board of Directors Meetings | 100% (8/8) | |||||||||

| Number of the Corporation’s Shares Held | 3,000 shares | |||||||||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||||||||

| April 1986 | Joined Tohmatsu Touche Ross Consulting Limited | |||||||||

| July 2000 | Joined Asahi Arthur Anderson Limited | |||||||||

| September 2002 | Principal, Deloitte Tohmatsu Consulting Co., Ltd. (currently ABeam Consulting Ltd.) | |||||||||

| April 2005 | President and Representative Director, ABeam M&A Consulting Ltd. (currently PwC Advisory LLC) | |||||||||

| April 2016 | Partner, PwC Advisory LLC | |||||||||

| June 2016 | CEO, Oka & Company Ltd. (present) | |||||||||

| Outside Director, Hitachi Metals, Ltd. (present) (She will resign as Outside Director, Hitachi Metals, Ltd. on June 18, 2021.) | ||||||||||

| June 2018 | Director, the Corporation (present) | |||||||||

| June 2019 | Outside Director, Happinet Corporation (present) | |||||||||

| June 2020 | Outside Director, ENEOS Holdings, Inc. (present) | |||||||||

| April 2021 | Professor, Meiji Business School, Graduate School of Global Business (present) | |||||||||

| Reasons for the Nomination as Outside Director and Outline of Expected Roles |

| This candidate advises the Corporation’s management based on her experience in developing management strategies as an M&A consultant, and insight into corporate management and accounting through her experience at an accounting firm and as an outside director/statutory auditor. In addition, on the Audit Committee, she provides advice and suggestions based on her expertise and experience as a financial expert. Accordingly, the Nominating Committee has nominated her as a candidate for Outside Director as she is expected to contribute to the Board of Directors’ decision-making function and oversight function. |

| * | In April 2020, Hitachi Metals, Ltd. (“Hitachi Metals”), where Ms. Toshiko Oka is an outside director, announced that Hitachi Metals had discovered misconduct including misrepresentation of test results in the inspection reports submitted to customers of Hitachi Metals and its subsidiaries. Although she was not aware of the conduct until it was discovered, she had previously made a statement regarding compliance to the Hitachi Metals’ board of directors and the audit committee. After the conduct was discovered, she has received reports regarding the investigation and progress of customer care etc. and has been recommending various measures regarding quality compliance to prevent the recurrence of similar matters and monitoring the status of such measures. |

| 8 |

| 6. Sakie Akiyama | Reappointment | Candidate for outside Director | Non-executive Director | |||||||

| ||||||||||

| Current Responsibility as a Director | Member of the Compensation Committee | |||||||||

| Date of Birth | December 1, 1962 | |||||||||

| Number of Years Served as a Director | 2 years | |||||||||

| Record of attendance at the Board of Directors Meetings | 100% (8/8) | |||||||||

| Number of the Corporation’s Shares Held | 1,900 shares | |||||||||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||||||||

| April 1987 | Joined Arthur Andersen & Co. | |||||||||

| April 1994 | Founder and CEO, Saki Corporation | |||||||||

| October 2018 | Founder, Saki Corporation (present) | |||||||||

| June 2019 | Director, the Corporation (present) Outside Director, Japan Post Holdings Co., Ltd. (present) Outside Director, Orix Corporation (present) | |||||||||

| June 2020 | Outside Director, Mitsubishi Corporation (present) | |||||||||

| Reasons for the Nomination as Outside Director and Outline of Expected Roles |

| This candidate advises the Corporation’s management based on her launch and development of an industrial robotic inspection company after working as an international business consultant, as well as her experience serving as a member of government committees/working groups. In addition, as a member of the Compensation Committee, she provides advice and suggestions based on her professional perspective. Accordingly, the Nominating Committee has nominated her as a candidate for Outside Director as she is expected to contribute to the Board of Directors’ decision-making function and oversight function. |

| 7. Wendy Becker | Reappointment | Candidate for outside Director | Non-executive Director | |||||||

| ||||||||||

| Current Responsibility as a Director | Chair of the Compensation Committee | |||||||||

| Date of Birth | November 2, 1965 | |||||||||

| Number of Years Served as a Director | 2 years | |||||||||

| Record of attendance at the Board of Directors Meetings | 100% (8/8) | |||||||||

| Number of the Corporation’s Shares Held | 1,900 shares | |||||||||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||||||||

| September 1987 | Brand Manager, Procter & Gamble Company | |||||||||

| September 1993 | Consultant, McKinsey & Company, Inc. | |||||||||

| December 1998 | Partner, McKinsey & Company, Inc. | |||||||||

| February 2008 | Managing Director, Residential, TalkTalk, The Carphone Warehouse Ltd. | |||||||||

| Board member, Member of Remuneration Committee, Whitbread plc | ||||||||||

| September 2009 | Chief Marketing Officer, Vodafone Group plc | |||||||||

| September 2012 | Chief Operating Officer, Jack Wills Ltd. | |||||||||

| October 2013 | CEO, Jack Wills Ltd. | |||||||||

| February 2017 | Board member, Chair of Remuneration Committee, Great Portland Estates plc (present) | |||||||||

| September 2017 | Board member, Logitech International S.A. (present) | |||||||||

| June 2019 | Director, the Corporation (present) | |||||||||

| September 2019 | Chairperson of the Board, Chair of Nominating Committee, Logitech International S.A. (present) | |||||||||

| Reasons for the Nomination as Outside Director and Outline of Expected Roles |

| This candidate advises the Corporation’s management based on her capabilities in global corporate management, which she has developed through her broad career in the consulting industry in North America and Europe, and experience as an executive of various companies, including telecommunications and technology companies. In addition, she draws on her professional perspective to lead the Compensation Committee as its Chair. Accordingly, the Nominating Committee has nominated her as a candidate for Outside Director as she is expected to contribute to the Board of Directors’ decision-making function and oversight function. |

| 9 |

| 8. Yoshihiko Hatanaka | Reappointment | Candidate for outside Director | Non-executive Director | |||||||

| ||||||||||

| Current Responsibility as a Director | Member of the Nominating Committee | |||||||||

| Date of Birth | April 20, 1957 | |||||||||

| Number of Years Served as a Director | 2 years | |||||||||

| Record of attendance at the Board of Directors Meetings | 100% (8/8) | |||||||||

| Number of the Corporation’s Shares Held | 1,900 shares | |||||||||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||||||||

| April 1980 | Joined Fujisawa Pharmaceutical Co., Ltd. (currently Astellas Pharma Inc.) | |||||||||

| June 2005 | Corporate Executive, Vice President, Corporate Planning, Corporate Strategy, Astellas Pharma Inc. | |||||||||

| April 2006 | Corporate Executive of Astellas Pharma Inc. and President & CEO, Astellas US LLC and President & CEO, Astellas Pharma US, Inc. | |||||||||

| June 2008 | Senior Corporate Executive of Astellas Pharma Inc. and President & CEO, Astellas US LLC and President & CEO, Astellas Pharma US, Inc. | |||||||||

| April 2009 | Senior Corporate Executive, Chief Strategy Officer and Chief Financial Officer, Astellas Pharma Inc. | |||||||||

| June 2011 | Representative Director, President & CEO, Astellas Pharma Inc. | |||||||||

| April 2018 | Representative Director, Chairman of the Board, Astellas Pharma Inc. (present) | |||||||||

| June 2019 | Director, the Corporation (present) | |||||||||

| Reasons for the Nomination as Outside Director and Outline of Expected Roles |

| This candidate advises the Corporation’s management based on his experience in, and insight into, global corporate management from his career in the United States and Europe, and in leading company integration as a corporate planning officer. In addition, as a member of the Nominating Committee, he provides advice and suggestions based on his professional perspective. Accordingly, the Nominating Committee has nominated him as a candidate for Outside Director as he is expected to contribute to the Board of Directors’ decision-making function and oversight function. |

| 10 |

| 9. Adam Crozier | Reappointment | Candidate for outside Director | Non-executive Director | |||||||

| ||||||||||

| Current Responsibility as a Director | Member of the Nominating Committee | |||||||||

| Date of Birth | January 26, 1964 | |||||||||

| Number of Years Served as a Director | 1 year | |||||||||

| Record of attendance at the Board of Directors Meetings | 100% (6/6) | |||||||||

| Number of the Corporation’s Shares Held | 1,000 shares | |||||||||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||||||||

| January 1995 | Joint CEO, Saatchi & Saatchi Group Ltd. | |||||||||

| January 2000 | CEO, The Football Association | |||||||||

| February 2003 | CEO, Royal Mail Group Ltd. | |||||||||

| April 2010 | CEO, ITV plc | |||||||||

| April 2017 | Non-Executive Chairman, Whitbread plc (present) | |||||||||

| December 2018 | Non-Executive Chairman, ASOS plc (present) | |||||||||

| February 2020 | Non-Executive Chairman, Kantar Group Ltd. (present) | |||||||||

| June 2020 | Director, the Corporation (present) | |||||||||

| Reasons for the Nomination as Outside Director and Outline of Expected Roles |

| This candidate advises the Corporation’s management based on his capabilities in global corporate management, as well as his experience across companies including the media and entertainment industries. In addition, as a member of the Nominating Committee, he provides advice and suggestions based on his experience. Accordingly, the Nominating Committee has nominated him as a candidate for Outside Director as he is expected to contribute to the Board of Directors’ decision-making function and oversight function. |

| 10. Keiko Kishigami | Reappointment | Candidate for outside Director | Non-executive Director | |||||||

| ||||||||||

| Current Responsibility as a Director | Member of the Audit Committee | |||||||||

| Date of Birth | January 28, 1957 | |||||||||

| Number of Years Served as a Director | 1 year | |||||||||

| Record of attendance at the Board of Directors Meetings | 100% (6/6) | |||||||||

| Number of the Corporation’s Shares Held | 1,000 shares | |||||||||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||||||||

| October 1985 | Joined Peat Marwick Minato (currently Ernst & Young ShinNihon LLC) | |||||||||

| August 1989 | Registered as Certified Public Accountant (present) | |||||||||

| December 1997 | Partner, Century Audit Corporation (currently Ernst & Young ShinNihon LLC) | |||||||||

| May 2004 | Representative Partner (currently Senior Partner), Ernst & Young ShinNihon (currently Ernst & Young ShinNihon LLC) | |||||||||

| September 2018 | Board Member, WWF Japan (present) | |||||||||

| June 2019 | Outside Auditor, Okamura Corporation (present) | |||||||||

| June 2020 | Director, the Corporation (present) Outside Auditor, Sumitomo Seika Chemicals Company, Limited. (present) | |||||||||

| Reasons for the Nomination as Outside Director and Outline of Expected Roles |

| This candidate advises the Corporation’s management based on her auditing experience across various companies in Japan and overseas as a certified public accountant and expertise on internal controls, as well as her knowledge regarding ESG. In addition, on the Audit Committee, she provides advice and suggestions based on her expertise and experience as a financial expert. Accordingly, the Nominating Committee has nominated her as a candidate for Outside Director as she is expected to contribute to the Board of Directors’ decision-making function and oversight function. |

| 11 |

| 11. Joseph A. Kraft Jr. | Reappointment | Candidate for outside Director | Non-executive Director | |||||||

| ||||||||||

| Current Responsibility as a Director | Member of the Compensation Committee Director in charge of Information Security | |||||||||

| Date of Birth | May 12, 1964 | |||||||||

| Number of Years Served as a Director | 1 year | |||||||||

| Record of attendance at the Board of Directors Meetings | 100% (6/6) | |||||||||

| Number of the Corporation’s Shares Held | 1,000 shares | |||||||||

| Brief Personal History and Principal Business Activities Outside the Corporation | ||||||||||

| July 1986 | Joined Morgan Stanley Inc. | |||||||||

| January 2000 | Managing Director, Morgan Stanley Inc. | |||||||||

| April 2007 | Managing Director, Head of Capital Markets Division, Dresdner Kleinwort Japan | |||||||||

| March 2010 | Deputy Branch Manager & Managing Director, Bank of America Merrill Lynch Japan | |||||||||

| July 2015 | CEO, Rorschach Advisory Inc. (present) | |||||||||

| June 2020 | Director, the Corporation (present) | |||||||||

| Reasons for the Nomination as Outside Director and Outline of Expected Roles |

| This candidate advises the Corporation’s management based on his insight into, and knowledge of, the global financial industry and capital markets based on his many years of experience and broad network spanning diverse industries. In addition, as a member of the Compensation Committee, he provides advice and suggestions based on his professional perspective. Accordingly, the Nominating Committee has nominated him as a candidate for Outside Director as he is expected to contribute to the Board of Directors’ decision-making function and oversight function. |

| 12 |

2. To issue Stock Acquisition Rights for the purpose of granting stock options.

It is proposed that the Corporation will issue stock acquisition rights (“Stock Acquisition Rights”) to corporate executive officers and employees of the Corporation, and directors, officers and employees of subsidiaries of the Corporation, for the purpose of granting stock options, pursuant to the provisions of Articles 236, 238 and 239 of the Companies Act of Japan, and that the Corporation will delegate the determination of the terms of such Stock Acquisition Rights to the Board.

In connection with this agenda, no such Stock Acquisition Rights will be issued to Non-executive Directors, including outside Directors of the Corporation.

For a summary of the stock acquisition rights issued by the Corporation in the past, please refer to pages 18 to 20. In light of the purpose for granting the stock acquisition rights (contributing to the improvement of the mid- and long-term business performance of the Sony Group and thereby improving such business performance of the Sony Group), the exercise of stock acquisition rights is restricted for a one-year period from the allotment date of the stock acquisition rights (the exercise of Tax-qualified Stock Acquisition Rights with Exercise Price Denominated in Yen is restricted for a two-year period from the date of a resolution of the Board for issuance), and the Allocation Agreement provides restrictions on the exercise of stock acquisition rights such as a limitation on the number of exercisable stock acquisition rights (in general, one-third of the total number of the allocated stock acquisition rights will vest and be exercisable each year after the restricted period, and all of the allocated stock acquisition rights will be exercisable on and after the date on which three (3) years have passed from the allotment date of the stock acquisition rights), eligibility rules and others. The Corporation intends that stock acquisition rights issued by the Corporation in the future will be under the same restrictions as the stock acquisition rights issued in the past.

| I. | The reason the Corporation needs to issue Stock Acquisition Rights on favorable terms. |

The Corporation will issue Stock Acquisition Rights to corporate executive officers and employees of the Corporation, and directors, officers and employees of subsidiaries of the Corporation, for the purpose of giving them an incentive to contribute towards the improvement of the business performance of the Sony Group and thereby improving the business performance of the Sony Group by making the economic interest which such directors, officers, or employees will receive correspond to the business performance of the Sony Group.

| II. | Terms and conditions of the Stock Acquisition Rights, the concrete terms of which the Board may determine pursuant to the delegation of such determination upon approval at the Meeting. |

1. Maximum Limit of Aggregate Numbers of Stock Acquisition Rights

Not exceeding 50,000

2. Payment in exchange for Stock Acquisition Rights

Stock Acquisition Rights are issued without payment of any consideration to the Corporation.

3. Matters regarding Stock Acquisition Rights

| (1) | Class and Number of Shares to be Issued or Transferred upon Exercise of Stock Acquisition Rights |

The class of shares to be issued or transferred upon exercise of Stock Acquisition Rights shall be shares of common stock, and the number of shares to be issued or transferred upon exercise of each Stock Acquisition Right (the “Number of Granted Shares”) shall be 100 shares.

The aggregate number of shares to be issued or transferred upon exercise of Stock Acquisition Rights shall not exceed 5,000,000 shares of common stock of the Corporation (the “Common Stock”). However, in the event that the Number of Granted Shares is adjusted pursuant to (2) below, the aggregate number of shares to be issued or transferred upon exercise of Stock Acquisition Rights shall not exceed the number obtained by multiplying the Number of Granted Shares after adjustment by the maximum limit of the aggregate number of Stock Acquisition Rights as prescribed in 1. above.

| 13 |

| (2) | Adjustment of Number of Granted Shares |

In the event that the Corporation conducts a stock split (including free distribution of shares (musho-wariate)) or a consolidation of the Common Stock after the date of a resolution of the Meeting, the Number of Granted Shares shall be adjusted in accordance with the following formula:

Number of Granted Shares after adjustment | = | Number of Granted Shares before adjustment | x | Ratio of split or consolidation |

Any fraction less than one (1) share resulting from the adjustment shall be disregarded.

| (3) | Amount of Assets to be Contributed upon Exercise of Stock Acquisition Rights |

The amount of assets to be contributed upon exercise of each Stock Acquisition Right shall be the amount obtained by multiplying the amount to be paid per share to be issued or transferred upon exercise of Stock Acquisition Rights (the “Exercise Price”), which is provided below, by the Number of Granted Shares.

(i) Initial Exercise Price

The Exercise Price shall initially be as follows:

| (A) | Stock Acquisition Rights with Exercise Price Denominated in Yen |

The Exercise Price shall initially be the average of the closing prices of the Common Stock in the regular trading thereof on the Tokyo Stock Exchange (each the “Closing Price”) for the ten (10) consecutive trading days (excluding days on which there is no Closing Price) immediately prior to the allotment date of such Stock Acquisition Rights (any fraction less than one (1) yen arising as a result of such calculation shall be rounded up to the nearest one (1) yen); provided, however, that if such calculated price is lower than either (a) the average of the Closing Prices for the thirty (30) consecutive trading days (excluding days on which there is no Closing Price) commencing forty-five (45) trading days immediately before the day immediately after the allotment date of Stock Acquisition Rights (any fraction less than one (1) yen arising as a result of such calculation shall be rounded up to the nearest one (1) yen), or (b) the Closing Price on the allotment date of Stock Acquisition Rights (if there is no Closing Price on such date, the Closing Price on the immediately preceding trading day), the Exercise Price shall be the higher price of (a) or (b) above.

| (B) | Stock Acquisition Rights with Exercise Price Denominated in U.S. Dollars |

The Exercise Price shall initially be the U.S. dollar amount obtained by dividing the average of the Closing Prices for the ten (10) consecutive trading days (excluding days on which there is no Closing Price) immediately prior to the allotment date of such Stock Acquisition Rights (the “Reference Yen Price”) by the average of the exchange rate quotations by a leading commercial bank in Tokyo for selling spot U.S. dollars by telegraphic transfer against yen for such ten (10) consecutive trading days (the “Reference Exchange Rate”) (any fraction less than one (1) cent arising as a result of such calculation shall be rounded up to the nearest one (1) cent); provided, however, that if the Reference Yen Price is lower than either (a) the average of the Closing Prices for the thirty (30) consecutive trading days (excluding days on which there is no Closing Price) commencing forty-five (45) trading days immediately before the day immediately after the allotment date of Stock Acquisition Rights, or (b) the Closing Price on the allotment date of Stock Acquisition Rights (if there is no Closing Price on such date, the Closing Price on the immediately preceding trading day), the Exercise Price shall be the U.S. dollar amount obtained by dividing the higher price of (a) or (b) above by the Reference Exchange Rate (any fraction less than one (1) cent arising as a result of such calculation shall be rounded up to the nearest one (1) cent).

| 14 |

(ii) Adjustment of Exercise Price

In the event that the Corporation conducts a stock split (including free distribution of shares (musho-wariate)) or a consolidation of the Common Stock after the allotment date of Stock Acquisition Rights, the Exercise Price shall be adjusted in accordance with the following formula, and any fraction less than one (1) yen or one (1) cent resulting from the adjustment shall be rounded up to the nearest one (1) yen or one (1) cent, respectively.

Exercise Price after adjustment | = | Exercise Price before adjustment | x | 1 |

| Ratio of split or consolidation |

In addition, in the case of a merger with any other company, corporate split or reduction of the amount of capital of the Corporation, or in any other case similar thereto where an adjustment of Exercise Price shall be required, in each case after the allotment date of Stock Acquisition Rights, the Exercise Price shall be adjusted appropriately to the extent reasonable.

| (4) | Period during which Stock Acquisition Rights May be Exercised |

The period during which Stock Acquisition Rights may be exercised will be the period from the day on which one (1) year has passed from the allotment date of Stock Acquisition Rights to the day on which ten (10) years have passed from such allotment date.

| (5) | Conditions for the Exercise of Stock Acquisition Rights |

| (i) | No Stock Acquisition Right may be exercised in part. |

| (ii) | In the event of a resolution being passed at a general meeting of shareholders of the Corporation for an agreement for any consolidation, amalgamation or merger (other than a consolidation, amalgamation or merger in which the Corporation is the continuing corporation), or in the event of a resolution being passed at a general meeting of shareholders of the Corporation (or, where a resolution of a general meeting of shareholders is not necessary, at a meeting of the Board) for any agreement for share exchange (kabushiki-kokan) or any plan for share transfer (kabushiki-iten) pursuant to which the Corporation is to become a wholly-owned subsidiary of another corporation, Stock Acquisition Rights may not be exercised on and after the effective date of such consolidation, amalgamation or merger, such share exchange (kabushiki-kokan) or such share transfer (kabushiki-iten). |

| (iii) | Conditions for the exercise of Stock Acquisition Rights other than the conditions referred to above shall be determined by the Board. |

| (6) | Mandatory Repurchase of Stock Acquisition Rights |

Not applicable

| (7) | Matters concerning the Amount of Capital and the Additional Paid-in Capital Increased by the Issuance of Shares upon Exercise of Stock Acquisition Rights |

| (i) | The amount of capital increased by the issuance of shares upon exercise of Stock Acquisition Rights shall be the amount obtained by multiplying the maximum limit of capital increase, as calculated in accordance with the provisions of Paragraph 1, Article 17 of the Company Accounting Ordinance of Japan, by 0.5, and any fraction less than one (1) yen arising as a result of such calculation shall be rounded up to the nearest one (1) yen. |

| (ii) | The amount of additional paid-in capital increased by the issuance of shares upon exercise of Stock Acquisition Rights shall be the amount obtained by deducting the capital to be increased, as provided in (i) above, from the maximum limit of capital increase, as also provided in (i) above. |

| (8) | Restrictions on the Acquisition of Stock Acquisition Rights through Transfer |

The Stock Acquisition Rights cannot be acquired through transfer, unless such acquisition is expressly approved by the Board.

| 15 |

(For reference)

1. Dilution ratio of shares

The maximum limit of the aggregate number of shares to be issued or transferred upon exercise of the Stock Acquisition Rights is 5,000,000, which represents 0.40 percent of the total shares outstanding as of March 31, 2021. The total of such number of shares and the maximum aggregate number of shares to be issued or transferred upon the exercise of all outstanding stock acquisition rights for the purpose of granting stock options is 19,022,400, which represents 1.51 percent of the total shares outstanding as of March 31, 2021.

2. Outline of Stock Acquisition Rights

| Element | Description |

| Plan Type | Issuance of stock options (Stock Acquisition Rights) in accordance with the provisions of the Companies Act of Japan ● Yen-denominated: Mainly for residents of Japan ● U.S. dollar-denominated: Mainly for non-residents of Japan |

| Exercise Price | Highest price among below 3 conditions: ● Average of closing price during 30 business days starting from 45 business days before the allotment date ● Average of closing price during 10 business days before the allotment date ● Closing Price on the allotment date |

| Period during which Stock Acquisition Rights May be Exercised | The period during which Stock Acquisition Rights may be exercised will be the period from the day on which one (1) year has passed from the allotment date of Stock Acquisition Rights to the day on which ten (10) years have passed from such allotment date. (The exercise of Tax-qualified Stock Acquisition Rights with Exercise Price Denominated in Yen is restricted during a two-year period from the date of a resolution of the Board for issuance.) |

| Restrictions on the Exercise of the Stock Acquisition Rights | Allocation Agreement provides restrictions on the exercise of Stock Acquisition Rights such as a limitation on the number of exercisable Stock Acquisition Rights (in general, one-third of the total number of the allocated Stock Acquisition Rights will vest and be exercisable each year after the restricted period, and all of the allocated Stock Acquisition Rights will be exercisable on and after the date on which three (3) years have passed from the allotment date of the Stock Acquisition Rights). |

| 16 |

[For Reference]

Outline of Liability Limitation Agreement

Pursuant to the Articles of Incorporation, the Corporation has entered into liability limitation agreements with all non-executive Directors including outside Directors.

A summary of such liability limitation agreements is as follows:

| (1) | In a case where a non-executive Director is liable to the Corporation after the execution of the liability limitation agreement for damages pursuant to Article 423, Paragraph 1 of the Companies Act, such liabilities shall be limited to the greater of either 30 million yen or an amount equal to the aggregate sum of the amounts prescribed in each item of Article 425, Paragraph 1 of the Companies Act, only where the non-executive Director acted in good faith without any gross negligence in performing his/her duties as a Director of the Corporation. |

| (2) | In a case where a non-executive Director is reelected as a non-executive Director of the Corporation and reassumes his/her office as such on the expiration of the term of his/her office as a non-executive Director of the Corporation, the liability limitation agreement shall continue to be effective after the reelection and re-assumption without any action or formality. |

Summary of Stock Acquisition Rights (SARs) issued by the Corporation in the past (outstanding as of March 31, 2021)

Name (Date of issuance) | Exercise period | Total number of SARs issued | Number of shares to be issued or transferred | Exercise price | Percentage of SARs exercised |

| The twenty-second series of Common Stock Acquisition Rights (November 22, 2011) | November 22, 2012 ~November 21, 2021 | 247 | 24,700 Common Stock | ¥ 1,523 | 96.6% |

| The twenty-third series of Common Stock Acquisition Rights (November 22, 2011) | November 22, 2012 ~November 21, 2021 | 775 | 77,500 Common Stock | U.S.$ 19.44 | 94.5% |

| The twenty-fourth series of Common Stock Acquisition Rights (December 4, 2012) | December 4, 2013 ~ December 3, 2022 | 240 | 24,000 Common Stock | ¥ 932 | 96.3% |

| The twenty-fifth series of Common Stock Acquisition Rights (December 4, 2012) | December 4, 2013 ~ December 3, 2022 | 1,026 | 102,600 Common Stock | U.S.$ 11.23 | 89.0% |

| The twenty-sixth series of Common Stock Acquisition Rights (November 20, 2013) | November 20, 2014 ~ November 19, 2023 | 885 | 88,500 Common Stock | ¥ 2,007 | 88.9% |

| The twenty-seventh series of Common Stock Acquisition Rights (November 20, 2013) | November 20, 2014 ~ November 19, 2023 | 1,409 | 140,900 Common Stock | U.S.$ 20.01 | 84.1% |

| The twenty-eighth series of Common Stock Acquisition Rights (November 20, 2014) | November 20, 2015 ~ November 19, 2024 | 2,437 | 243,700 Common Stock | ¥ 2,410.5 | 70.5% |

| The twenty-ninth series of Common Stock Acquisition Rights (November 20, 2014) | November 20, 2015 ~ November 19, 2024 | 1,673 | 167,300 Common Stock | U.S.$ 20.67 | 78.8% |

The thirtieth series of Common Stock Acquisition Rights (November 19, 2015) | November 19, 2016 ~ November 18, 2025 | 3,239 | 323,900 Common Stock | ¥ 3,404 | 71.4% |

The thirty-first series of Common Stock Acquisition Rights (November 19, 2015) | November 19, 2016 ~ November 18, 2025 | 2,188 | 218,800 Common Stock | U.S.$ 27.51 | 77.2% |

| 17 |

Name (Date of issuance) | Exercise period | Total number of SARs issued | Number of shares to be issued or transferred | Exercise price | Percentage of SARs exercised |

The thirty-second series of Common Stock Acquisition Rights (November 22, 2016) | November 22, 2017 ~ November 21, 2026 | 6,721 | 672,100 Common Stock | ¥ 3,364 | 54.5% |

The thirty-third series of Common Stock Acquisition Rights (November 22, 2016) | November 22, 2017 ~ November 21, 2026 | 4,462 | 446,200 Common Stock | U.S.$ 31.06 | 68.7% |

The thirty-fourth series of Common Stock Acquisition Rights (November 21, 2017) | November 21, 2018 ~ November 20, 2027 | 8,728 | 872,800 Common Stock | ¥ 5,231 | 34.9% |

The thirty-fifth series of Common Stock Acquisition Rights (November 21, 2017) | November 21, 2018 ~ November 20, 2027 | 7,872 | 787,200 Common Stock | U.S.$ 45.73 | 42.4% |

The thirty-sixth series of Common Stock Acquisition Rights (February 28, 2018) | February 28, 2019 ~ February 27, 2028 | 58 | 5,800 Common Stock | ¥ 5,442 | 65.7% |

The thirty-seventh series of Common Stock Acquisition Rights (February 28, 2018) | February 28, 2019 ~ February 27, 2028 | 150 | 15,000 Common Stock | U.S.$ 50.39 | — |

The thirty-eighth series of Common Stock Acquisition Rights (November 20, 2018) | November 20, 2019 ~ November 19, 2028 | 12,906 | 1,290,600 Common Stock | ¥ 6,440 | 12.9% |

The thirty-ninth series of Common Stock Acquisition Rights (November 20, 2018) | November 20, 2019 ~ November 19, 2028 | 9,873 | 987,300 Common Stock | U.S.$ 56.22 | 19.8% |

The fortieth series of Common Stock Acquisition Rights (November 20, 2019) | November 20, 2020 ~ November 19, 2029 | 16,453 | 1,645,300 Common Stock | ¥ 6,705 | 0.4% |

The forty-first series of Common Stock Acquisition Rights (November 20, 2019) | November 20, 2020 ~ November 19, 2029 | 13,934 | 1,393,400 Common Stock | U.S.$ 60.99 | 7.5% |

The forty-second series of Common Stock Acquisition Rights (April 17, 2020) | April 17, 2021 ~ April 16, 2030 | 200 | 20,000 Common Stock | U.S.$ 63.75 | — |

The forty-third series of Common Stock Acquisition Rights (November 18, 2020) | November 18, 2021 ~ November 17, 2030 | 22,520 | 2,252,000 Common Stock | ¥ 9,237 | — |

The forty-fourth series of Common Stock Acquisition Rights (November 18, 2020) | November 18, 2021 ~ November 17, 2030 | 22,228 | 2,222,800 Common Stock | U.S.$ 87.48 | — |

Note: All series of Stock Acquisition Rights were issued for the purpose of granting stock options. No cash payment was required for the allocation.

| 18 |

| (1) | Stock Acquisition Rights held by Directors and Corporate Executive Officers of the Corporation (as of March 31, 2021) |

| Name | Directors (Excluding Outside Directors) and Corporate Executive Officers | Outside Directors | ||

| Number of shares to be issued or transferred | Number of holders | Number of shares to be issued or transferred | Number of holders | |

| The twenty-second series of Common Stock Acquisition Rights | 4,000 | 1 | — | — |

| The twenty-sixth series of Common Stock Acquisition Rights | 10,000 | 1 | — | — |

| The twenty-eighth series of Common Stock Acquisition Rights | 112,000 | 4 | — | — |

| The thirtieth series of Common Stock Acquisition Rights | 52,900 | 4 | — | — |

| The thirty-second series of Common Stock Acquisition Rights | 220,500 | 6 | — | — |

| The thirty-fourth series of Common Stock Acquisition Rights | 207,500 | 5 | — | — |

| The thirty-eighth series of Common Stock Acquisition Rights | 250,000 | 6 | — | — |

| The fortieth series of Common Stock Acquisition Rights | 260,000 | 6 | — | — |

| The forty-third series of Common Stock Acquisition Rights | 260,000 | 6 | — | — |

| (2) | Stock Acquisition Rights allocated to employees and others by the Corporation during the fiscal year ended March 31, 2021 |

The details of these Stock Acquisition Rights are mentioned in the forty-second, forty-third and forty-fourth series of Common Stock Acquisition Rights above.

Stock Acquisition Rights allocated to employees of the Corporation, directors, officers and employees of the Corporation’s subsidiaries

| Name | Employees of the Corporation | Directors, officers and employees of the Corporation’s subsidiaries | ||

| Number of shares to be issued or transferred | Number of persons allocated | Number of shares to be issued or transferred | Number of persons allocated | |

The forty-second series of Common Stock Acquisition Rights | — | — | 20,000 | 1 |

The forty-third series of Common Stock Acquisition Rights | 399,000 | 363 | 1,600,900 | 1,634 |

The forty-fourth series of Common Stock Acquisition Rights | 5,500 | 2 | 2,249,200 | 1,101 |

| 19 |

Amounts of remuneration paid to Directors and Corporate Executive Officers (for the fiscal year ended March 31, 2021)

| Fixed remuneration | Remuneration linked to business results | Stock acquisition rights (Note 5) | Restricted stock (Note 7) | Phantom Restricted Stock Plan (Note 8) | ||||||

| Number of persons | Amount | Number of persons | Amount | Number of persons | Amount | Number of persons | Amount | Number of persons | Amount | |

Directors (Outside Directors) (Notes 1, 2) |

(13) | Million Yen

183 (163) | — ( — ) | Million Yen

( — ) |

( — ) | Million Yen

( — ) |

(13) | Million Yen

66 (59) |

( 1 ) | Million Yen (57) |

| Corporate Executive Officers | 6 | 424 | 6 | 561 (Note 4) | 6 | 443 | 6 | 476 | 1 | 122 (Note 9) |

| Total | 20 | 606 | 6 | 561 | 6 | 443 | 20 | 542 | 2 | 179 |

Notes:

| 1. | The number of persons does not include two Directors who concurrently serve as Corporate Executive Officers, because Sony Group Corporation does not pay any additional remuneration for services as a Director to Directors who concurrently serve as Corporate Executive Officers. |

| 2. | The number of persons includes four Directors who resigned on the day of the Ordinary General Meeting of Shareholders held on June 26, 2020. |

| 3. | Sony Group Corporation does not pay remuneration linked to business results to Directors who do not concurrently serve as Corporate Executive Officers. |

| 4. | The amount of remuneration linked to business results for the fiscal year ended March 31, 2021 that is to be paid in June 2021. |

| 5. | As to stock acquisition rights, the amount above is that of expenses Sony Group Corporation recorded during the fiscal year ended March 31, 2021 applicable to stock acquisition rights granted. |

| 6. | Sony Group Corporation does not grant stock acquisition rights to Directors who do not concurrently serve as Corporate Executive Officers. |

| 7. | As to restricted stock, the amount above is that of expenses Sony Group Corporation recorded during the fiscal year ended March 31, 2021 applicable to restricted stock. |

| 8. | The phantom restricted stock plan referenced above includes (i) the amount which is to be paid to one Director who will resign on the date of the Ordinary General Meeting of Shareholders to be held on June 22, 2021 and (ii) the amount which was paid to one former Corporate Executive Officer who retired from Sony Group Corporation on March 31, 2021. The remuneration amount under the phantom restricted stock plan shall be calculated by multiplying the common stock price (closing price) as of the date he/she retired by the points accumulated under the phantom restricted stock plan during his/her term in office, however, the amount of the phantom restricted stock plan to be paid to the foregoing one Director is based on the common stock price (closing price) as of March 31, 2021. Sony Group Corporation recorded 1,344 million yen in expenses during the fiscal year ended March 31, 2021 applicable to the phantom restricted stock plan for Directors and Corporate Executive Officers. |

| 9. | The amount applicable to points which are accumulated during his term in office as Corporate Executive Officer. |

| 20 |

Basic policy regarding remuneration for Directors and Corporate Executive Officers

The basic policy regarding remuneration for, respectively Directors and Senior Executives determined by the Compensation Committee is as follows:

(1) Basic policy regarding Director remuneration

The primary duty of Directors is to supervise the performance of business operations of Sony as a whole. In order to improve this supervisory function over the business operations of Sony, which is a global company, the following two elements have been established as the basic policy for the determination of remuneration of Directors. No Director remuneration is paid to those Directors who concurrently serve as Corporate Executive Officers.

| ● | Attracting and retaining an adequate talent pool of Directors possessing the requisite abilities to excel in the global marketplace; and |

| ● | Ensuring the effectiveness of the supervisory function of Directors. |

Based on the above, Director remuneration shall consist of the following components. The amount of each component and its percentage of total remuneration shall be at an appropriate level determined in accordance with the basic policy above and based on research conducted by a third party regarding remuneration of directors of both Japanese and non-Japanese companies.

| Type of remuneration | Description |

| Fixed remuneration | ● The amount of fixed remuneration shall be at an appropriate level determined in accordance with the basic policy above and based on research conducted by a third party regarding remuneration of directors of both Japanese and non-Japanese companies. |

Remuneration linked to stock price (restricted stock)

| ● Granted to further promote shared values between the shareholders and Directors and incentivize Directors to develop and maintain a sound and transparent management system. ● Any Director to whom restricted stock is granted, in principle, may not sell or transfer the granted shares during his/her tenure, and such restriction is to be released on the date such Director resigns. |

| Phantom restricted stock plan | ● Points determined every year by the Compensation Committee and granted to certain Directors every year during their term in office, with the remuneration amount calculated at the time of resignation by multiplying the common stock price (closing price) by the individual’s accumulated points. * Because Sony replaced the phantom restricted stock plan for Directors with restricted stock as from the fiscal year ended March 31, 2018, Sony did not grant new points to Directors during the fiscal year ended March 31, 2021. |

| 21 |

(2) Basic policy regarding Senior Executive remuneration

Senior Executives are key members of management responsible for executing the operations of Sony as a whole, or respective businesses of Sony. In order to further improve the business results of Sony, the following two elements have been established as the basic policy for the determination of remuneration of Senior Executives.

| ● | Attracting and retaining an adequate talent pool possessing the requisite abilities to excel in the global marketplace; and |

| ● | Providing effective incentives to improve business results on a short-, medium- and long- term basis. |

Based on the above, Senior Executive remuneration shall basically consist of the following components. The amount of each component and its percentage of total remuneration shall be at an appropriate level determined in accordance with the above basic policy and the individual’s level of responsibility and based on research conducted by a third party regarding remuneration of management of both Japanese and non-Japanese companies, with emphasis on linking Senior Executive remuneration to business results and shareholder value.

| Type of remuneration | Description |

| Fixed remuneration | ● The amount of fixed remuneration shall be at an appropriate level determined based on research conducted by a third party regarding remuneration of management of both Japanese and non-Japanese companies, according to his/her responsibility, and in order to maintain competitiveness in recruiting talent. |

| Remuneration linked to business results | ● Structured appropriately and based on appropriate indicators to ensure that such remuneration effectively incentivizes Senior Executives to achieve the mid- to long- term and the corresponding fiscal year’s corporate targets. ● Specifically, the amount to be paid to Senior Executives shall be determined based on the level of achievements of the targets of indicators of (1) and (2) below, and can fluctuate, in principle, within the range from 0 percent to 200 percent of the standard payment amount (“Business Results Linked Standard Payment Amount”) based on the achievement of the below-mentioned targets. (1) Certain key performance indicators linked to consolidated or individual business results of Sony of the corresponding fiscal year, such as Return of Equity (“ROE”), Net Income attributable to Sony Group Corporation’s Stockholders and Operating Cash Flow (“Financial Performance KPIs”), which indicators are selected based on the areas for which each Senior Executive is responsible. (2) The individual performance of the area(s) for which each Senior Executive is responsible. ● Efforts to accelerate collaborations among businesses of Sony from the viewpoint of value creation as One Sony as well as sustainability initiatives related to social value creation and ESG (environment, social and governance) shall be included in the evaluation factors for individual performance. ● The Business Results Linked Standard Payment Amount shall be determined so that such amount is within a certain percentage of the cash compensation (total of the fixed remuneration and the remuneration linked to business results), which percentage shall be determined in accordance with each individual’s level of responsibility. |

| 22 |

| Type of remuneration | Description |

Remuneration linked to stock price (Stock acquisition rights and restricted stock)

| ● Stock acquisition rights and restricted stock are granted to incentivize Senior Executives to increase mid-to long-term shareholder value. ● The exercise of the stock acquisition rights is restricted during a one-year period from the allotment date, and in general, one-third of the total number of exercisable stock acquisition rights will be vested and exercisable each year thereafter. (All of the allocated stock acquisition rights will be exercisable on and after three years from the allotment date.) ● The Senior Executives to whom restricted stock is granted, in principle, may not sell or transfer the granted stock before the third anniversary date of the Ordinary General Meeting of Shareholders of the fiscal year when the subject restricted stock was granted. ● In principle, remuneration for a Senior Executive who has a greater management responsibility and influence over Sony as a whole has a higher proportion of remuneration linked to stock price which is directly linked to the corporate value. (Please see below Reference: Executive Compensation Package Design to Focus on Long-Term Management) ● The amount of remuneration linked to the stock price shall be determined so that the amount is within a certain percentage of the total cash compensation (total of the fixed remuneration and the remuneration linked to business results) and remuneration linked to the stock price. |

| Phantom restricted stock plan | ● Points determined every year by the Compensation Committee shall be granted to Senior Executives every year during his/her tenure, and at the time of resignation, the remuneration amount shall be calculated by multiplying the common stock price (closing price) by the individual’s accumulated points. |

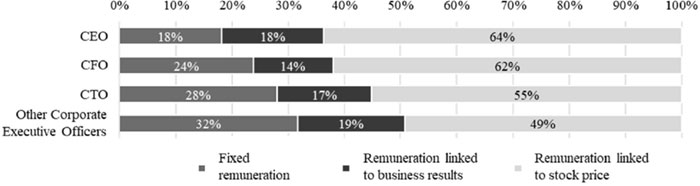

(For Reference)

Executive Compensation Package Design to Focus on Long-Term Management

The bar chart below shows the components of remuneration for Corporate Executive Officers for the fiscal year ended March 31, 2021. For this chart, the remuneration linked to business results is based on the Business Results Linked Standard Payment Amount for each Corporate Executive Officer. As to the remuneration linked to stock price, the underlying amount is calculated based on the fair value of a stock acquisition right as of the date such stock acquisition right was granted in the fiscal year ended March 31, 2021 and the issue price of the restricted stock when granted. Accordingly, the components of remuneration based on the amounts actually paid will be different from the chart below.

| 23 |

Procedures to determine the remuneration of Directors and Senior Executives

Based on the policy outlined above, the amount and content of the compensation for each Director and Senior Executive are determined by the Compensation Committee or otherwise under the supervision of the Compensation Committee. Specifically, in principle, each year at the meeting of the Compensation Committee held after the Ordinary General Meeting of the Shareholders, the amount of basic renumeration and the content of each Director’s and Senior Executive’s compensation for the corresponding fiscal year is determined. Thereafter, at the meeting of the Compensation Committee held after the corresponding fiscal year end, the final amount of compensation of each Director and Corporate Executive Officer, including the amount of remuneration linked to business results, is determined, and as for Senior Executives other than Corporate Executive Officers, such amount is otherwise determined under the supervision of the Compensation Committee.

For determining the amount of the remuneration linked to business results for each Senior Executive, the Business Results Linked Standard Payment Amount, the targets for the Financial Performance KPIs and the targets for the individual performance of the areas(s) for which each Senior Executive is responsible are determined and thereafter, the amount of such remuneration is determined based on the level of achievement of such targets for the Financial Performance KPIs and the individual performance at the meeting of the Compensation Committee held after the corresponding fiscal year end for Corporate Executive Officers or otherwise under the supervision of the Compensation Committee for Senior Executives other than Corporate Executive Officers.

The amount of compensation of each Director and Senior Executive for the fiscal year ended March 31, 2021 was also determined by the Compensation Committee or otherwise under the supervision of the Compensation Committee according to the procedure above.

Corporate Executive Officer remuneration linked to business results for the fiscal year ended March 31, 2021

The Business Results Linked Standard Payment Amount for each Corporate Executive Officer for the fiscal year ended March 31, 2021 was determined to be in the range between 60% and 100% of the amount of the fixed remuneration of such Corporate Executive Officer according to his/her responsibility.

The formula to calculate the amount of the remuneration linked to business results to be paid to Corporate Executive Officers is as follows.

| The amount of the remuneration linked to business results to be paid to Corporate Executive Officers | = | Business Results Linked Standard Payment Amount* | x | The payment rate of the remuneration linked to business results ** (0 to 200%) |

* Business Results Linked Standard Payment Amount: Determined to be in the range between 60% and 100% of the amount of the fixed remuneration of each Corporate Executive Officer.

** Payment rate of the remuneration linked to business results: Determined in principle, within the range from 0 percent to 200 percent based on the achievement of (i) Financial Performance KPIs based on the areas for which each Corporate Executive Officer is responsible and (ii) the individual performance of the area(s) for which each Corporate Executive Officer is responsible.

| 24 |

The Financial Performance KPIs and the weighting of such Financial Performance KPIs mainly used for the Corporate Executive Officers were as follows:

| KPI | Weight | Target to be achieved for the fiscal year ended March 31, 2021 (Consolidated) | Result for the fiscal year ended March 31, 2021 (Consolidated) |

| Operating CF | 50% | Amount determined in order to achieve the Operating CF (as defined below) target under Sony’s Third Mid-Range Plan of 2.2 trillion yen or more for the three-year period from the fiscal year ended March 31, 2019 | 1 trillion 122.2 billion yen |

| Net Income attributable to Sony Group Corporation’s Stockholders | 40% | 510 billion yen | 1 trillion 171.8 billion yen |

| ROE | 10% | 11.4% | 24.2% |

Operating cash flow (consolidated), excluding the Financial Services Segment (“Operating CF”), was selected as a Financial Performance KPI and was weighed the highest due to operating cash flow being determined as the most important performance metric under the Third Mid-Range Plan of Sony. ROE was also selected due to it being one of the financial targets of the Sony’s Third Mid-Range Plan. Net Income attributable to Sony Group Corporation’s Stockholders was selected in order to incentivize management to achieve the current fiscal year’s corporate target.

For the target to be achieved for the Operating CF for the fiscal year ended March 31, 2021, an amount which the Compensation Committee determined as appropriate was set in order to achieve the Operating CF target under Sony’s Third Mid-Range Plan of 2.2 trillion yen or more for the three-year period from the fiscal year ended March 31, 2019. The target for the Net Income attributable to Sony Group Corporation’s Stockholders for the fiscal year ended March 31, 2021 was set as 510 billion yen, which was the forecasted amount for the Net Income attributable to Sony Group Corporation’s Stockholders for the fiscal year ended March 31, 2021 announced in May 2020. Target for ROE was 11.4% for the fiscal year ended March 31, 2021. The results for the Financial Performance KPIs for the fiscal year ended March 31, 2021 were as follows: Operating CF: 1 trillion 122.2 billion yen, Net Income attributable to Sony Group Corporation’s Stockholders: 1 trillion 171.8 billion yen, ROE: 24.2%, each exceeding the targeted amount. In addition, the accumulated amount of Operating CF during the three-year period from the fiscal year ended March 31, 2019 was 2 trillion 638.5 billion yen, which exceeded the targeted amount under Sony’s Third Mid-Range Plan.

As outlined above under “(6) Basic policy regarding Director and Senior Executive remuneration”, remuneration linked to business results for Senior Executives for the fiscal year ended March 31, 2021 was determined based on the level of achievement of the indicators which were selected based on the areas of responsibility of the relevant Senior Executive and the individual performance of the area(s) for which the relevant Senior Executive was responsible. The amounts to be paid to the Senior Executives were determined within the range from 0 percent to 200 percent of the Business Results Linked Standard Payment Amount.

| 25 |

(For Reference)

Restricted Stock

Sony Group Corporation introduced a restricted stock plan starting from the fiscal year ended March 31, 2018, pursuant to which shares of restricted stock are allotted to Sony Group Corporation’s Corporate Executive Officers and other executives and non-executive Directors of Sony Group Corporation (the “Non-Executive Directors”). The purpose of the plan for the Corporate Executive Officers and other executives of Sony Group Corporation is to further reinforce management’s alignment with shareholder value, and to incentivize management to improve mid- to long- term performance and increase shareholder value. Furthermore, the purpose of the plan for the Non-Executive Directors is to incentivize these Directors to develop and maintain a sound and transparent management system by further promoting shared values between the shareholders and the Non-Executive Directors.

The grantees are not able to sell or transfer the granted shares during the restricted period, and Sony Group Corporation will acquire the granted shares from a grantee without any consideration to, or consent of, the grantee under certain conditions. Details of the plan, such as vesting conditions, eligibility and the number of grants, are determined by the Compensation Committee.

Dated: May 26, 2021

| 26 |