QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007 |

o |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number 001-33190

US GOLD CORPORATION

(Name of registrant as specified in its charter)

| Colorado | | 84-0796160 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

|

|

|

| 165 South Union, Suite 565, Lakewood, CO | | 80228 |

| (Address of principal executive offices) | | (Zip Code) |

(303) 238-1438

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, no par value | | American Stock Exchange |

| Title of each class | | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

As of June 29, 2007 (the last business day of the registrant's second fiscal quarter), the aggregate market value of the registrant's voting and non-voting common equity held by non-affiliates of the registrant was $413,315,194 based on the closing sale price of $5.50 per share as reported on the American Stock Exchange. There were 74,150,306 shares of common stock outstanding (and 22,492,547 exchangeable shares exchangeable into US Gold Corporation common stock on a one-for-one basis) on March 7, 2008.

DOCUMENTS INCORPORATED BY REFERENCE:Portions of the Proxy Statement for the 2008 Annual Meeting of Shareholders are incorporated into Part III, Items 10 through 14 of this report.

TABLE OF CONTENTS

| |

| | Page

|

|---|

| PART I |

ITEM 1. |

|

BUSINESS |

|

1 |

| ITEM 1A. | | RISK FACTORS | | 5 |

| ITEM 1B. | | UNRESOLVED STAFF COMMENTS | | 12 |

| ITEM 2. | | PROPERTIES | | 12 |

| ITEM 3. | | LEGAL PROCEEDINGS | | 29 |

| ITEM 4: | | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | | 29 |

PART II |

ITEM 5. |

|

MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

|

30 |

| ITEM 6. | | SELECTED FINANCIAL DATA | | 33 |

| ITEM 7. | | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 33 |

| ITEM 7A. | | QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK | | 39 |

| ITEM 8. | | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | | 40 |

| ITEM 9. | | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | | 71 |

| ITEM 9A. | | CONTROLS AND PROCEDURES | | 71 |

| ITEM 9B. | | OTHER INFORMATION | | 71 |

PART III |

ITEM 10. |

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

|

72 |

| ITEM 11. | | EXECUTIVE COMPENSATION | | 72 |

| ITEM 12. | | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | | 72 |

| ITEM 13. | | CERTAIN RELATIONSHIPS, RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | | 72 |

| ITEM 14. | | PRINCIPAL ACCOUNTING FEES AND SERVICES | | 72 |

PART IV |

ITEM 15. |

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

|

73 |

| SIGNATURES | | 76 |

| EXHIBIT INDEX | | 77 |

ADDITIONAL INFORMATION

Descriptions of agreements or other documents in this report are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see the Exhibit Index at the end of this report for a complete list of those exhibits.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Please see the note under "ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS," for a description of special factors potentially affecting forward-looking statements included in this report.

PART I

ITEM 1. BUSINESS

History and Organization

US Gold Corporation ("US Gold," "we," "us," or the "Company") is engaged in the exploration for gold, other precious metals, and base metals. We presently hold an interest in numerous properties in the State of Nevada and one property in Utah, as well as properties in the Country of Mexico. We presently hold an interest in approximately 264 square miles in the United States and approximately 1,379 square miles in Mexico. We are currently in the exploration stage and have not generated revenue from operations since 1990.

We were organized under the laws of the State of Colorado on July 24, 1979 under the name Silver State Mining Corporation. On June 21, 1988, we changed our name to U.S. Gold Corporation and on March 16, 2007, we changed our name to US Gold Corporation.

We are in the business of acquiring, exploring, and developing mineral properties in the United States, emphasizing the State of Nevada, and in Mexico. Our objective is to increase the value of our shares through the exploration, development, and extraction of gold, silver and other valuable minerals. We generally conduct our business on a 100% basis, but may enter into arrangements with other companies through joint venture or similar agreements in an effort to achieve our objectives. We own our mineral interests and property and operate our business through various subsidiary companies, each of which is owned entirely, directly, or indirectly, by us. All references to US Gold in this report include our subsidiaries as the circumstances require.

During 2007, we completed the acquisition of three Canadian companies engaged in the exploration for gold and other metals with operations adjacent to or in proximity to our Tonkin property, located in the State of Nevada. For a more detailed description of these acquisitions,see "Developments During 2007—Acquisitions."

Our principal executive offices are located at 165 South Union, Suite 565, Lakewood, Colorado, 80228 and our telephone number is (303) 238-1438. Our website is www.usgold.com. We make available our periodic reports and press releases on our web site. Our common stock is listed on the American Stock Exchange (AMEX) and on the Toronto Stock Exchange (TSX), each under the symbol "UXG."

As used in this report, opt represents ounces per ton, gpt represents grams per tonne, ft. represents feet, m represents meters, km represents kilometer, and sq. represents square.

Developments During 2007

In June 2007, we completed three simultaneous acquisitions and significantly increased our land position. These acquisitions transformed US Gold from a single 36 square mile (58 sq. km) property into one of the Cortez Trend's largest land holders, with interests in over 170 square miles (274 sq. km). We now control a total of over 263 square miles (423 sq. km) in Nevada, giving us one of the largest and most prospective land positions in the state. We also acquired a large prospective land position in Mexico with approximately 1,379 square miles (2,219 sq. km) of mineral rights, including a former producing mine. This mine is presently held on a care and maintenance basis.

Our exploration program for 2007 incorporated what we perceived to be high priority targets acquired with the acquisitions of three Canadian companies, as well as our previously-owned Tonkin property. We completed a total of approximately 180,845 feet in exploration drilling during 2007, all in Nevada. In addition to drilling, we pursued geologic mapping, sampling, and geophysical surveys on the high priority properties.

1

Acquisitions. On June 28 and 29, 2007, US Gold and its subsidiary, US Gold Canadian Acquisition Corporation ("Canadian Exchange Co."), completed the acquisition of all of the outstanding common shares of Nevada Pacific Gold Ltd. ("Nevada Pacific"), Tone Resources Limited ("Tone") and White Knight Resources Ltd. ("White Knight"), which we refer to individually as an "Acquired Company" and collectively as the "Acquired Companies." The transactions completed on June 28 and 29, 2007 represent the second stage of these acquisitions that were originally commenced as tender offers in February 2007 ("Tender Offer"). The first stage of the acquisitions was completed on March 28, 2007, at which time we acquired at least 80% of the common shares of each Acquired Company and took control of their operations. The Acquired Companies were acquired in exchange for the issuance of exchangeable shares of Canadian Exchange Co. (as explained below) on the following terms:

- •

- 0.23 of an exchangeable share of Canadian Exchange Co. for each outstanding common share of Nevada Pacific;

- •

- 0.26 of an exchangeable share of Canadian Exchange Co. for each outstanding common share of Tone, and

- •

- 0.35 of an exchangeable share of Canadian Exchange Co. for each outstanding common share of White Knight.

With these second stage acquisition transactions, the minority interests in the Acquired Companies not previously owned by us were acquired. Therefore, effective as of June 29, 2007, US Gold and Canadian Exchange Co. own 100% of the Acquired Companies.

In connection with these acquisitions, Canadian Exchange Co. issued approximately 42,615,227 exchangeable shares for the Acquired Companies. The exchangeable shares, by virtue of the redemption and exchange rights attached to them and the provisions of certain voting and support agreements, provide the holders with the economic and voting rights that are, as nearly as practicable, equivalent to those of a holder of shares of our common stock. The exchangeable shares trade on the TSX and are exchangeable for shares of common stock on a one-for-one basis. Through December 31, 2007, approximately 50% of the exchangeable shares originally issued in connection with the acquisitions had been converted into an equivalent amount of our common stock.

We believe the acquisition of the Acquired Companies was beneficial because each of them was exploring in the Cortez Trend in Nevada and controlled exploration properties that are adjacent to or near our Tonkin property, and because the acquisitions resulted in US Gold having a larger land position within the Cortez Trend and elsewhere in Nevada. US Gold also added technical expertise by retaining certain key employees of the Acquired Companies. In addition, one of the acquired companies owned properties located in Utah and in Mexico. We are presently in the exploration stage at all of the mineral properties acquired from the Acquired Companies.

Nevada Pacific's property portfolio in Nevada consists of exploration stage properties with over 80 square miles of mineral rights (expanded to approximately 90 sq. miles (145 sq. km) by end of 2007), including portions of the Cortez and Carlin Trends, and a single mineral property in Utah. Its Mexican exploration portfolio covers approximately 1,379 square miles (2,219 sq. km) of mineral rights in Mexico, including the Magistral Gold Mine in Sinaloa state, Mexico. The Magistral Mine, a former producing property, has not been in production since 2005 and as of March 8, 2008, is held on care and maintenance basis.

White Knight has been exploring for Carlin-type gold deposits in Nevada since 1993, and has participated in option and joint venture agreements on its properties. It holds interests in 19 properties in Nevada that encompass approximately 115 square miles.

2

Tone controls interests in eight properties in Elko, Eureka, Lander, and Pershing counties in Nevada that encompass approximately 14.6 sq. miles (24 sq. km). The properties are subject to various royalty interests. In addition, up to a maximum of two of the Tone mineral properties are subject to earn-in rights by Teck Cominco American Inc. ("Teck"), pursuant to a 2004 agreement. Teck generally has the right to acquire a 50% joint venture interest in selected properties by spending approximately $2.84 million on each property after Tone has first spent an aggregate of $.94 million on each property, or they may acquire up to a 70% joint venture interest upon other elections by Teck and performance of other obligations. Tone has not reached the initial approximate $.94 million expenditure on any property subject to the Teck agreement and, as stated above, that agreement is limited to earn-in rights to a maximum of two of the mineral properties.See"ITEM 2. PROPERTIES" for a more detailed explanation of these properties.

Annual holding costs of the US properties total approximately $4.3 million and include approximately $1.4 million in federal and county mineral claim fees and $0.5 million in payments to third parties under leases. Annual holding costs of the Mexican mineral concessions and the Magistral Mine are approximately $1.6 million.

Exploration Overview. With the acquisitions completed, the Company increased its US land position from approximately 36 square miles (58 sq. km) to approximately 264 sq. miles (425 sq. km). Three top priority exploration areas have been identified subsequent to the acquisitions and are designated the Tonkin, Gold Bar, and Limo Complexes. The 2007 exploration drilling program was developed to test targets in these areas of priority. For 2007, company-wide exploration drilling totaled 180,849 ft. (55,123 m), all of which was in Nevada. During 2007, the Company incurred total exploration expenses of approximately $20 million, including drilling and assay costs, geophysical and geophysical studies, reclamation, and costs of employees and consultants. From our exploration program in 2007, we have increased our geologic knowledge of the high priority target areas, including in some cases, reinterpretation of regional geology. We have confirmed that we have favorable lower plate host rocks in some areas on our properties (which are a good host rock for gold deposition), identified a number of mineralizing structures, and added information expected to result in expansion of known gold mineralization.

In 2008, we will evaluate the 2007 results and will be aggressively exploring key projects in Nevada. In addition, we plan to undertake exploration, including drilling, at our Magistral Mine in Mexico and possibly on our prospective Mexican mineral concessions outside the Magistral area.

The 2007 exploration program, property holding and general and administrative costs, as well as the costs of acquisitions, were generally funded with proceeds of a financing completed in 2006. We spent approximately $30 million during 2007 in all our business activities.SeeITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Competitive Business Conditions

We compete with many companies in the mining business, including large, established mining companies with substantial capabilities, personnel, and financial resources. There is a limited supply of desirable mineral lands available for claim-staking, lease, or acquisition in the United States, as well as in Mexico and other areas where we may conduct exploration activities. We may be at a competitive disadvantage in acquiring mineral properties, since we compete with these individuals and companies, many of which have greater financial resources and larger technical staffs. From time to time, specific properties or areas which would otherwise be attractive to us for exploration or acquisition, are unavailable due to their previous acquisition by other companies or our lack of financial resources.

Competition in the industry is not limited to the acquisition of mineral properties, but also extends to the technical expertise to find, advance, and operate such properties; the labor to operate the

3

properties; and the capital for the purpose of funding such properties. Many competitors not only explore for and mine precious metals, but conduct refining and marketing operations on a world-wide basis. Such competition may result not only in our company being unable to acquire desired properties, but also to recruit or retain qualified employees, to obtain equipment and personnel to assist in our exploration activities, or to acquire the capital necessary to fund our operation and advance our properties. Our inability to compete with other companies for these resources would have a material adverse effect on our results of operation and business.

General Government Regulations

United States. Mining in the States of Nevada and Utah are subject to federal, state and local law. Three types of laws are of particular importance to our United States located mineral properties: those affecting land ownership and mining rights; those regulating mining operations; and those dealing with the environment.

The development, operation, closure, and reclamation of mining projects in the United States requires numerous notifications, permits, authorizations, and public agency decisions. Compliance with environmental and related laws and regulations requires us to obtain permits issued by regulatory agencies, and to file various reports and keep records of our operations. Certain of these permits require periodic renewal or review of their conditions and may be subject to a public review process during which opposition to our proposed operations may be encountered. We are currently operating under various permits for activities connected to mineral exploration, reclamation, and environmental considerations. Unless and until a mineral resource is proved, it is unlikely our operations will move beyond the exploration stage. If in the future we decide to proceed beyond exploration, there will be numerous notifications, permit applications, and other decisions to be addressed at that time.SeeITEM 2, "DESCRIPTION OF PROPERTIES—Environmental and Governmental Regulations," for additional information on government regulation affecting our business.

Mexico. Exploration and development of minerals in Mexico may be carried out through Mexican companies incorporated under Mexican law by means of obtaining exploration and development (exploitation) concessions. Exploration concessions are granted by the Mexican government for a period of six years from the date of their recording in the Public Registry of Mining and are not renewable. Holders of exploration concessions may, prior to the expiration of such concessions, apply for one or more development concessions covering all or part of the area covered by an exploration concession.

Environmental law in Mexico provides for general environmental policies, with specific requirements set forth under regulations of the Ministry of Environment, Natural Resources and Fishing, which regulate all environmental matters with the assistance of the National Institute of Ecology and the Procuraduria Federal de Proteccion al Ambiente.

The primary laws and regulations governing environmental protection for mining in Mexico are found in the General Law, the Ecological Technical Standards, and also in the air, water and hazardous waste regulations, among others. In order to comply with the environmental regulations, a concessionaire must obtain a series of permits during the exploration stage. Generally, these permits are issued on a timely basis after the completion of an application by a concession holder. We believe we are currently in full compliance with the General Law and its regulations in relation to our mineral property interests in Mexico.

Employees

As of March 7, 2008, we had 64 employees including 18 employees based in the United States, 2 in Canada and 44 in Mexico. One of our employees serves as an executive officer. That officer devotes a majority of his business time to our affairs. Robert R. McEwen serves as our Chief Executive Officer, presently in an unpaid capacity. He does not devote 100% of his business time to our affairs. None of

4

our employees are covered by labor contracts and the Company believes we have good relations with our employees. We also engage independent contractors in connection with the exploration of our properties, such as drillers, geophysicists, geologists, and other technical disciplines.

ITEM 1A. RISK FACTORS

This report, including Management's Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements that may be materially affected by several risk factors, including those summarized below:

The feasibility of mining any of our properties has not been established, meaning that we have not completed exploration or other work necessary to determine if it is commercially feasible to develop any property. We are currently an exploration stage company. We have no proven or probable reserves on our properties. A "reserve," as defined by regulation of the SEC, is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. A reserve requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically extracted and produced. We have not carried out any feasibility study with regard to all or a portion of our properties. As a result, we currently have no reserves and there are no assurances that we will be able to prove that there are reserves on our properties.

The mineralized material identified on our Tonkin property does not and may never have demonstrated economic viability. Substantial expenditures are required to establish reserves through drilling and there is no assurance that reserves will be established. The feasibility of mining on our Tonkin property or any other property has not been, and may never be, established. Whether a mineral deposit can be commercially viable depends upon a number of factors, including the particular attributes of the deposit, including size, grade and proximity to infrastructure; metal prices, which can be highly variable; and government regulations, including environmental and reclamation obligations. If we are unable to establish some or all of our mineralized material as proven or probable reserves in sufficient quantities to justify commercial operations, we may not be able to raise sufficient capital to develop a mine, even if one is warranted. If we are unable to establish such reserves, the market value of our securities may decline.

We have incurred substantial losses since our inception in 1979 and may never be profitable. Since our inception in 1979, we have not been profitable. As of December 31, 2007, our accumulated deficit was approximately $139 million (including a non-cash expense of approximately $52 million related to derivative instrument accounting in the year ended December 31, 2006). To become profitable, we must identify additional mineralization and establish reserves at our mining properties, and then either develop our properties or locate and enter into agreements with third party operators. It could be years before we receive any revenues from gold production, if ever. We may suffer significant additional losses in the future and may never be profitable. We do not expect to receive revenue from operations in the foreseeable future, if at all. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

We will require significant additional capital to continue our exploration activities, and, if warranted, to develop mining operations. Substantial expenditures will be required to determine if proven and probable reserves exist at any of our properties, to develop metallurgical processes to extract metal or develop the mining and processing facilities and infrastructure at our existing or any of our newly-acquired properties or mine sites. We will be required to expend significant amounts for geological and geochemical analysis, assaying, and, if warranted, feasibility studies with regard to the results of our exploration. We may not benefit from these investments if we are unable to identify commercially exploitable mineralized material. If we are successful in identifying reserves, we will require significant additional capital to construct a mill and other facilities necessary to extract those reserves. Our ability to obtain necessary funding, in turn, depends upon a number of factors, including the status of the

5

national and worldwide economy and the price of gold. We may not be successful in obtaining the required financing for these or other purposes on terms that are favorable to us or at all, in which case, our ability to continue operating would be adversely affected. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and the possible, partial or total loss of our potential interest in certain properties.

Historical production of gold at our Tonkin or Magistral property may not be indicative of the potential for future development or revenue. Historical production of gold from our Tonkin property came from relatively shallow deposits, in very limited quantities and for a very limited period of time. Although we commenced exploration of deeper zones in 2006 in an effort to identify additional mineralized material, due to the uncertainties associated with exploration, including variations in geology and structure, there is no assurance that our efforts will be successful. While the Magistral Mine produced gold from 2002 through 2004, it was shut down in 2005 and is currently held by us on a care and maintenance basis. Investors in our securities should not rely on our historical operations as an indication that we will ever place any of our mining properties into commercial production again. We expect to incur losses unless and until such time as one or more of our properties enters into commercial production and generates sufficient revenue to fund our continuing operations.

Estimates of mineralized material at our Tonkin property are based on drill results from shallow deposits and are not necessarily indicative of the results we may achieve from drilling at greater depths. Previous operators at the Tonkin property were focused on producing gold from shallow deposits in an effort to achieve immediate revenue. Our drilling program, which commenced in 2006 and continued into 2007, targeted mineralization at greater depths and at different locations on our property. Estimates of mineralization in shallow zones are not necessarily indicative of mineralization at greater depths. In addition, estimates of mineralization are based on limited samples and many assumptions, and are inherently imprecise. Our ability to identify and delineate additional mineralization depends on the results of our future drilling efforts and our ability to properly interpret those results. We may be unable to identify any significant additional mineralization or any reserves.

We may have overpaid for the shares of the Acquired Companies. The price that we paid for the Acquired Companies was based in part on the perceived benefits of those acquisitions. However, there is no assurance that the acquisition of the Acquired Companies will result in any or all of the benefits that we envision. In the event that one or more of the acquisitions does not prove to be beneficial to us, the market price of our common stock may decline.

Fluctuating gold prices could negatively impact our business plan. The potential for profitability of our gold mining operations and the value of our mining properties are directly related to the market price of gold. The price of gold may also have a significant influence on the market price of our common stock. If we obtain positive drill results and progress one of our properties to a point where a commercial production decision can be made, our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before any revenue from production would be received. A decrease in the price of gold at any time during future exploration and development may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold prices. The price of gold is affected by numerous factors beyond our control, including inflation, fluctuation of the United States dollar and foreign currencies, global and regional demand, the purchase or sale of gold by central banks, and the political and economic conditions of major gold producing countries throughout the world. During the

6

last five years, the average annual market price of gold has ranged between $364 per ounce and $696 per ounce, as shown in the table below:

Average Annual Market Price of Gold (per oz.)

2003

| | 2004

| | 2005

| | 2006

| | 2007

|

|---|

| $ | 364 | | $ | 406 | | $ | 445 | | $ | 604 | | $ | 696 |

The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event gold prices decline and remain low for prolonged periods of time, we might be unable to develop our properties or produce any revenue.

Our continuing reclamation obligations at the Tonkin property and other properties could require significant additional expenditures. We are responsible for the reclamation obligations related to disturbances located on all of our properties, including the Tonkin property. The current estimate of reclamation costs for existing disturbances on the Tonkin property to the degree required by the BLM and NDEP is approximately $3.8 million. As required by applicable regulations, we currently have in place a cash bond in the amount of $3.8 million to secure the reclamation of the property. Reclamation bond estimates are required to be updated every three years or prior to new disturbances taking place that are not already bonded. Our review of the projected reclamation costs at the Magistral Mine has resulted in an initial cost estimate of $2.7 million. However, no surety bonding is required for reclamation in Mexico. There is a risk that any cash bond, even if augmented upon update of the reclamation obligations, could be inadequate to cover the costs of reclamation which could subject us to additional costs for the actual reclamation obligations. The satisfaction of bonding requirements and continuing reclamation obligations will require a significant amount of capital. There is a risk that we will be unable to fund these additional bonding requirements, and further, that the regulatory authorities may increase reclamation and bonding requirements to such a degree that it would not be commercially reasonable to continue exploration activities.

Title to mineral properties can be uncertain, and we are at risk of loss of ownership of one or more of our properties. Our ability to explore and operate our properties depends on the validity of title to that property. The mineral properties making up our United State properties consist of leases of unpatented mining claims, and unpatented mining and millsite claims. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the federal government, which makes the validity of unpatented mining claims uncertain and generally more risky. These uncertainties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work and possible conflicts with other claims not determinable from descriptions of record. Since a substantial portion of all mineral exploration, development and mining in the United States now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry. We have not obtained a title opinion on our entire property, or on any of the properties of the Acquired Companies, with the attendant risk that title to some claims, particularly title to undeveloped property, may be defective. There may be valid challenges to the title to our property which, if successful, could impair development and/or operations.

We remain at risk that the mining claims may be forfeited either to the United States, or to rival private claimants due to failure to comply with statutory requirements as to location and maintenance of the claims or challenges to whether a discovery of a valuable mineral exists on every claim.

Our properties in Mexico are subject to changes in political conditions and regulations in that country. Our Magistral Mine and the surrounding concessions are located in Mexico. In the past, that country has been subject to political instability, changes and uncertainties which may cause changes to existing government regulations affecting mineral exploration and mining activities. Civil or political unrest could disrupt our operations at any time. Our exploration and mining activities may be adversely

7

affected in varying degrees by changing government regulations relating to the mining industry or shifts in political conditions that could increase the costs related to our activities or maintaining our properties. Finally, Mexico's status as a developing country may make it more difficult for us to obtain required financing for this property.

Our ongoing operations and past mining activities are subject to environmental risks, which could expose us to significant liability and delay, suspension or termination of our operations. All phases of the operations of the Acquired Companies, like our historic Tonkin property, are subject to federal, state and local environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. Future changes in environmental regulation, if any, may adversely affect our operations, make our operations prohibitively expensive, or prohibit them altogether. Environmental hazards may exist on the properties in which we may hold interests in the future, including the properties of the Acquired Companies, that are unknown to us at the present and that have been caused by us, one of the Acquired Companies, or previous owners or operators, or that may have occurred naturally. Under applicable federal and state environmental laws, prior property owners may be liable for remediating any damage that those owners may have caused. Mining properties that the Acquired Companies may have transferred may cause us to be liable for remediating any damage that those companies may have caused. The liability could include response costs for removing or remediating the release and damage to natural resources, including ground water, as well as the payment of fines and penalties.

A significant portion of the lode claims comprising our Tonkin property are subject to a lease in favor of a third party which may expire in 2009 and which provides for a 5% royalty on production. A total of 348 of our mining and millsite claims at the Tonkin property are subject to this lease. The lease requires annual payments of $150,000 or 455 ounces of gold, whichever is greater, and payment of a royalty of 5% of the gross sales price of gold or silver from the property before deduction of any expenses from the gross sales price. The term of this lease expires January 1, 2009 and can be extended from year to year, up to a maximum of 99 years, by production from or other activities on the leased claims. This lease covers a portion of the claims in the mine corridor where most of our mineralized material has been identified. In the event the lease is not extended and/or we are unable to purchase the claims from the owner, we may be forced to forfeit the underlying claims, which in turn may adversely affect our ability to explore and develop the property. If we are successful in identifying sufficient mineralization to warrant placing the property into production, we will be obligated to pay the leaseholder a royalty of 5% of the production. The payment of this royalty, together with other royalties payable to third parties in respect of certain claims, will reduce our potential revenue.

We cannot assure you that we will have an adequate supply of water to complete desired exploration or development of our mining property. In accordance with the laws of the State of Nevada, we have obtained permits to drill the water wells that we currently use to service the Tonkin property and we plan to obtain all required permits for drilling water wells to serve other property we may acquire in the future. However, the amount of water that we are entitled to use from those wells must be determined by the appropriate regulatory authorities. A final determination of these rights is dependent in part on our ability to demonstrate a beneficial use for the amount of water that we intend to use. Unless we are successful in developing the property to a point where we can commence commercial production of gold or other precious metals, we may not be able to demonstrate such beneficial use. Accordingly, there is no assurance that we will have access to the amount of water needed to operate a mine at the property.

8

We depend on a limited number of personnel and the loss of any of these individuals could adversely affect our business. Our company is primarily dependent on two persons, namely our Chairman and Chief Executive Officer, and our Vice President and Chief Financial Officer. Robert R. McEwen, our Chairman and Chief Executive Officer, is responsible for strategic direction and the oversight of our business. William F. Pass, our Vice President and Chief Financial Officer, is responsible for our public reporting and administrative functions. We rely heavily on these individuals for the conduct of our business. Mr. Pass announced his intention of retiring in the spring of 2008, and in March 2008 the company hired his replacement. The loss of any of our existing officers would significantly and adversely affect our business. In that event, we would be forced to identify and retain an individual to replace the departed officer. We may not be able to replace one or more of these individuals on terms acceptable to us. We have no life insurance on the life of any officer.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses that could materially and adversely affect our operations. Exploration for minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Few properties that are explored are ultimately advanced to the stage of producing mines. Our current exploration efforts are, and any future development or mining operations we may elect to conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to:

- •

- economically insufficient mineralized material;

- •

- fluctuations in production costs that may make mining uneconomical;

- •

- labor disputes;

- •

- unanticipated variations in grade and other geologic problems;

- •

- environmental hazards;

- •

- water conditions;

- •

- difficult surface or underground conditions;

- •

- industrial accidents;

- •

- metallurgical and other processing problems;

- •

- mechanical and equipment performance problems;

- •

- failure of pit walls or dams;

- •

- unusual or unexpected rock formations;

- •

- personal injury, fire, flooding, cave-ins and landslides; and

- •

- decrease in reserves due to a lower gold price.

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures and production commencement dates. We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a writedown of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable.

9

We do not insure against all risks to which we may be subject in our planned operations. While we currently maintain insurance to insure against general commercial liability claims, our insurance will not cover all of the potential risks associated with our operations. For example, we do not have insurance on the mill at our Tonkin property nor the mine assets associated with the Magistral property and we do not have business interruption insurance. We may also be unable to obtain insurance to cover other risks at economically feasible premiums or at all. Insurance coverage may not continue to be available, or may not be adequate to cover liabilities. We might also become subject to liability for environmental, pollution or other hazards associated with mineral exploration and production which may not be insured against, which may exceed the limits of our insurance coverage or which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could materially adversely affect our financial condition and our ability to fund activities on our property. A significant loss could force us to reduce or terminate our operations.

We are required to annually evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 and any adverse results from such evaluation could result in a loss of investor confidence in our financial reports and have a material adverse effect on the price of our common stock. Under Section 404 of the Sarbanes-Oxley Act of 2002, we are required to furnish a report by our management on internal control over financial reporting commencing with the fiscal year ended December 31, 2007. Such a report must contain, among other matters, an assessment of the effectiveness of our internal control over financial reporting, including a statement as to whether or not our internal control over financial reporting is effective. This assessment must include disclosure of any material weaknesses in our internal control over financial reporting identified by our management. The completion of the acquisition transactions described in this report and the subsequent integration of the Acquired Companies into our operations have made it more difficult for us to comply with Section 404. If we are unable to maintain and to assert that our internal control over financial reporting is effective, or if we disclose significant deficiencies or material weaknesses in our internal control over financial reporting, investors could lose confidence in the accuracy and completeness of our financial reports, which could have a material adverse effect on our stock price.

Our stock price may be volatile and as a result you could lose all or part of your investment. The value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock:

- •

- changes in the worldwide price for gold;

- •

- disappointing results from our exploration or development efforts;

- •

- failure to meet our operating budget;

- •

- decline in demand for our common stock;

- •

- downward revisions in securities analysts' estimates or changes in general market conditions;

- •

- technological innovations by competitors or in competing technologies;

- •

- investor perception of our industry or our prospects; and

- •

- general economic trends.

In addition, stock markets generally have experienced extreme price and volume fluctuations and the market prices of securities generally have been highly volatile. These fluctuations are often unrelated to operating performance of a company and may adversely affect the market price of our common stock. As a result, investors may be unable to resell their shares at a fair price.

The exercise of outstanding options and warrants and the future issuances of our common stock will dilute current shareholders and may reduce the market price of our common stock. As of March 7, 2008,

10

we have outstanding options and warrants to purchase a total of 12,314,749 shares of our common stock, which if completely exercised, would dilute existing shareholders' ownership by approximately 13%. A significant portion of the outstanding options are exercisable at prices significantly below the market price of our common stock as of March 8, 2008. If the market price of our stock remains at or above the exercise price, it is likely that these options will be exercised. Our board of directors has the authority to authorize the offer and sale of additional securities within certain limits without the vote of or notice to existing shareholders. Based on the need for additional capital to fund expected growth, it is likely that we will issue additional securities to provide such capital and that such additional issuances may involve a significant number of shares. Issuance of additional securities underlying outstanding options as authorized by our board of directors in the future will dilute the percentage interest of existing shareholders and may reduce the market price of our common stock.

A small number of existing shareholders own a significant portion of our common stock, which could limit your ability to influence the outcome of any shareholder vote. Our executive officers and directors beneficially own approximately 24% of our common stock as of March 7, 2008. Under our articles of incorporation and the laws of the State of Colorado, the vote of a majority of the shares voting at a meeting at which a quorum is present is generally required to approve most shareholder action. As a result, these individuals and entities will be able to significantly influence the outcome of shareholder votes for the foreseeable future, including votes concerning the election of directors, amendments to our articles of incorporation or proposed mergers or other significant corporate transactions.

We have never paid a dividend on our common stock and we do not anticipate paying any in the foreseeable future. We have not paid a dividend on our common stock to date, and we may not be in a position to pay dividends in the foreseeable future. Our ability to pay dividends will depend on our ability to successfully develop one or more properties and generate revenue from operations. Further, our initial earnings, if any, will likely be retained to finance our growth. Any future dividends will depend upon our earnings, our then-existing financial requirements and other factors, and will be at the discretion of our Board of Directors.

Our operations are subject to permitting requirements which could require us to delay, suspend or terminate our operations on our mining property. Our operations, including ongoing exploration drilling program, require permits from the state and federal governments. We may be unable to obtain these permits in a timely manner, on reasonable terms, or at all. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration of our properties will be adversely affected.

Legislation has been proposed that would significantly affect the mining industry. Periodically, members of the US Congress have introduced bills which would supplant or alter the provisions of the General Mining Law of 1872, which governs the unpatented claims that we control with respect to our U.S. properties. One such amendment has become law and has imposed a moratorium on patenting of mining claims, which reduced the security of title provided by unpatented claims such as those on our United States properties. If additional legislation is enacted, it could substantially increase the cost of holding unpatented mining claims by requiring payment of royalties, and could significantly impair our ability to develop mineral resources on unpatented mining claims. Such bills have proposed, among other things, to make permanent the patent moratorium, to impose a federal royalty on production from unpatented mining claims and to declare certain lands as unsuitable for mining. Although it is impossible to predict at this time what royalties may be imposed in the future, the imposition of such royalties could adversely affect the potential for development of such mining claims, and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our business.

11

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Introduction

Throughout 2007, we continued to hold a 100% interest in the historic Tonkin property in Eureka County, Nevada. We also acquired Nevada Pacific, White Knight and Tone (the "Acquisitions") in transactions described above in "Item 1. BUSINESS". With the Acquisitions, we have increased our total Nevada land position to approximately 263 square miles (423 sq. km), of which approximately 170 square miles (274 sq. km) are located on the Cortez Trend. We also acquired approximately 0.8 square miles in Utah, and approximately 1,379 square miles (2,219 sq. km) of mineral rights in Mexico, including the Magistral Gold Mine located in the state of Sinaloa, Mexico. The following table summarizes the US land position of our company as of December 31, 2007 and indicates these properties grouped by Acquired Company:

| | All Nevada except as

noted, and County

| | Trend/Location

| | Claims

| | Approx

Sq. miles

|

|---|

| Nevada Pacific | | | | | | | | |

| Bat Ridge (Utah) | | Utah-Beaver | | Beaver Lake | | 161 | | .80 |

| BMX | | Humbolt/Lander | | Cortez | | 531 | | 16.30 |

| Buffalo Canyon | | Nye | | Walker Lane | | 33 | | 1.50 |

| Clover Valley | | Elko | | Spruce Mtn. | | 54 | | 1.68 |

| Cornerstone | | Eureka | | Cortez | | 158 | | 4.80 |

| Keystone | | Cortez | | Cortez | | 371 | | 11.60 |

| Limo | | White Pine | | Carlin | | 1,330 | | 40.00 |

| South Carlin | | Elko | | Carlin | | 72 | | 2.00 |

| Timber Creek | | Humboldt | | Cortez | | 311 | | 8.00 |

| Valmy | | Humboldt | | Cortez | | 94 | | 2.90 |

| | | | | | |

| |

|

| Subtotal of US properties for Nevada Pacific | | | | | | 3,115 | | 89.58 |

White Knight |

|

|

|

|

|

|

|

|

| Benmark | | Eureka | | Cortez | | 100 | | 2.53 |

| Celt | | Eureka | | Cortez | | 608 | | 19.64 |

| Cottonwood | | Eureka | | Cortez | | 216 | | 6.09 |

| Fye Canyon | | Eureka | | Cortez | | 345 | | 9.88 |

| Gold Bar Horst | | Eureka | | Cortez | | 183 | | 5.71 |

| Gold Pick | | Eureka | | Cortez | | 27 | | 0.94 |

| | Fee Land | | | | | | | | 0.30 |

| Goldstone | | Eureka | | Cortez | | 62 | | 1.86 |

| Hunter | | Eureka | | Cortez | | 48 | | 1.74 |

| Ian | | Eureka | | Cortez | | 56 | | 1.72 |

| Knolls | | Humboldt | | Getchell | | 180 | | 5.68 |

| McClusky Pass | | Eureka | | Cortez | | 243 | | 7.83 |

| New Pass | | Churchill | | Austin-Lovelock | | 107 | | 3.49 |

| Pat Canyon | | Eureka | | Cortez | | 178 | | 5.60 |

| Patty | | Eureka | | Cortez | | 544 | | 15.64 |

| Slaven Canyon | | Lander | | Cortez | | 258 | | 8.08 |

| | Fee Land | | | | | | | | 2.23 |

| South Cabin Creek | | Eureka | | Cortez | | 84 | | 2.71 |

| Squaw Creek | | Elko | | Carlin | | 151 | | 4.75 |

| Tonkin Summit | | Eureka | | Cortez | | 186 | | 5.98 |

| Vermouth | | Eureka | | Cortez | | 85 | | 2.74 |

| | | | | | |

| |

|

| Subtotal for White Knight | | | | | | 3,661 | | 115.14 |

12

Tone |

|

|

|

|

|

|

|

|

| Big Antelope Springs | | Lander | | Getchell | | 24 | | .80 |

| Fish Creek | | Lander | | Getchell | | 75 | | 2.30 |

| Gold Bar North | | Eureka | | Eureka | | 19 | | .60 |

| Kent Springs | | Pershing | | Getchell | | 10 | | .30 |

| Kobeh | | Eureka | | Eureka | | 133 | | 4.10 |

| Red Ridge | | Elko | | Carlin | | 23 | | 3.90 |

| Roberts Creek | | Eureka | | Eureka | | 54 | | 1.70 |

| South Keystone | | Eureka | | Eureka | | 28 | | .90 |

| | | | | | |

| |

|

| Subtotal for Tone | | | | | | 366 | | 14.60 |

Total Acquired US Properties |

|

|

|

|

|

7,142 |

|

216.67 |

US Gold's Historic Tonkin Property |

|

Eureka |

|

Cortez |

|

1,445 |

|

46.00 |

| | | | | | |

| |

|

Total US Properties |

|

|

|

|

|

8,587 |

|

263.56 |

| | | | | | |

| |

|

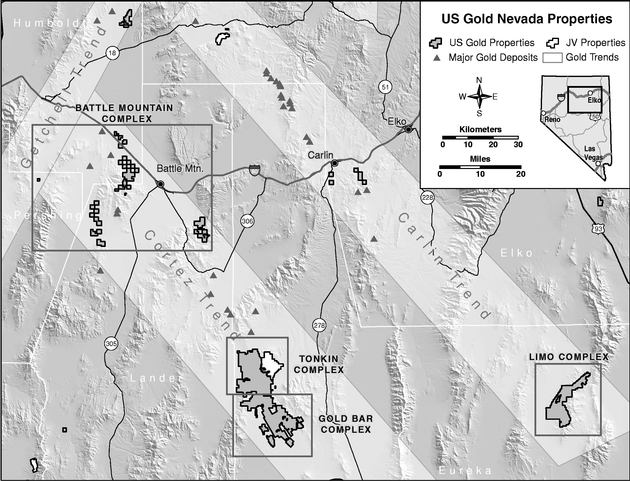

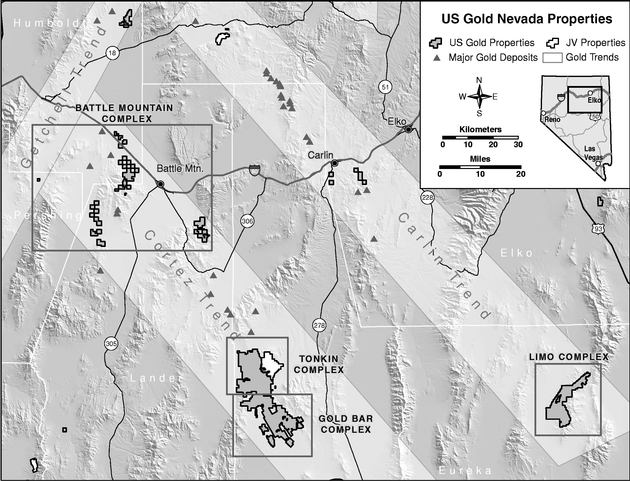

The following Nevada trend map and property location map is presented to generally indicate the location of the trends and our properties:

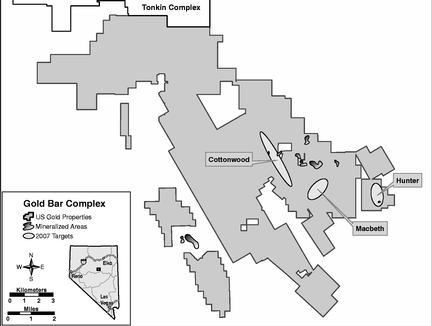

For purposes of organizing and describing our exploration efforts in the United States, we have grouped our properties into four complexes, the Tonkin Complex, the Gold Bar Complex, the Limo Complex and the Battle Mountain Complex. Mineral properties outside these areas and where limited exploration work has been performed by us to date are grouped as "Other United States Properties."

13

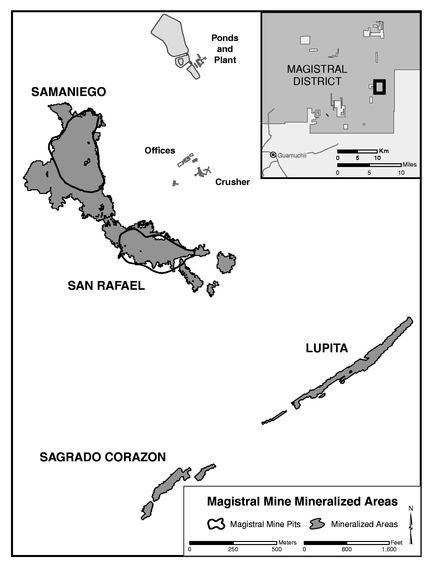

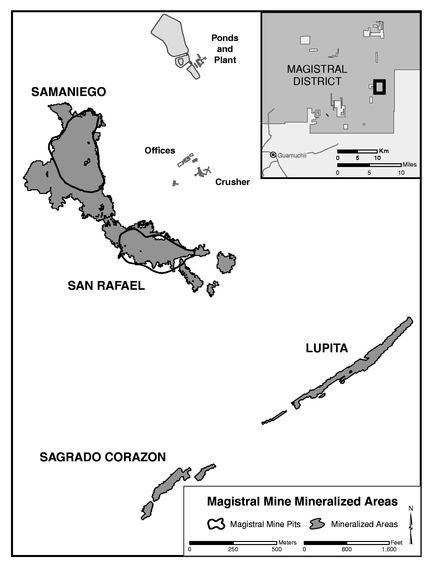

In addition to the above US properties, we acquired mineral concessions in Mexico from Nevada Pacific, including the Magistral Mine. The Magistral Mine was previously operated as an open pit mining operation historically producing approximately 70,000 ounces of gold through heap leach processing facilities, and last operated in July 2005. The Magistral Mine is located in northwestern México, within Sinaloa state, Mocorito Municipality, México. In addition to the Magistral Mine complex of approximately 38 sq. miles (61 sq. km), we acquired exploration concessions consisting of approximately 1,341 sq. miles (2,158 sq. km) located in the Mexican states of Sinaloa, Nayarit and Durango. In aggregate, we control approximately 1,379 sq. miles (2,219 sq. km) of mineral concessions in Mexico.

The following map illustrates the general location of the Magistral Mine and surrounding mineral concessions in Mexico:

Tonkin Complex

The Tonkin Complex includes our historic Tonkin property, together with additional properties and interests acquired from the Acquired Companies. As shown in the graphic on page 16, the Tonkin Complex is divided functionally into five areas: the Mine Corridor, Tonkin North, Patty, Keystone, and Tweed. The Tonkin Complex represents our largest holding in the State of Nevada at approximately 95 square miles.

14

The Tonkin Complex is located on the Cortez Trend, approximately 48 miles (77 km) by road northwest from Eureka, Nevada, 85 miles (137 km) by road southwest from Elko and 245 miles (394 km) by road east from Reno. The nearest commercial airport is located in Elko.

The Tonkin Complex includes a mine site from operations in the 1980's with several small open pits, stockpile areas, plant and established infrastructure. In 1988 and 1989, an integrated carbon-in-leach bacterial oxidation plant was built. The plant and associated infrastructure was decommissioned and put on care and maintenance in June 1990, but apart from the SAG mill, which has been removed, it is complete and we believe it is in relatively good condition. The existing infrastructure also includes a water supply, water storage and distribution, sewage disposal, trailer park, fuel storage and distribution, grid and emergency power supply and distribution. Electrical power is supplied via existing 64kV power lines and a substation on the property. The power lines and substation are owned and maintained by Sierra Pacific Power Company. Existing facilities include an administration building, truck shop, assay laboratory, mill building, warehouse, and plant maintenance shop.

We obtained the first claims which now comprise the Tonkin Complex in 1985. Between 1985 and 1988, we produced approximately 26,000 ounces of gold from the heap leach operation from about 871,000 tons of ore.

In 1988 and 1989, we constructed a mill with the proceeds of a debt financing. In 1989, we processed ore from the "Rooster" deposit, producing 1,753 ounces of gold. In 1990, using bio-oxidation and the carbon-in-leach circuits of the mill, we produced 2,735 additional ounces of gold from approximately 70,000 tons of sulfide ore mined from the property. To date, a total of approximately 30,517 ounces of gold has been produced at the Tonkin property.

Since 1990, we have had a series of joint venture partners at the Tonkin property. These partners include Homestake Mining Company, Sudbury Contact Mines Limited, a subsidiary of Agnico-Eagle Mines Limited, and BacTech Mining Corporation. As a group, these companies conducted various types of exploration, including data compilation, geologic mapping, rock, soil and chemical sampling, and drilling, primarily focused on the development of near-surface oxide and later, sulfide mineralization. For a variety of reasons, some of which are unknown to us, these relationships were terminated, returning 100% ownership of the property to us in 2005. We commenced a comprehensive drilling program in 2006, following an equity financing.

The following table summarizes drilling at our Tonkin Complex during 2006 and 2007 (drilling in 2006 was limited to our historic Tonkin property, while drilling in 2007 was expanded to include certain properties acquired from the Acquired Companies):

| | 2006

| | 2007

|

|---|

| Total Footage | | 59,530 | | 138,760 |

| Number of Holes | | 48 | | 147 |

| Reverse circulation drilling (ft.) | | 14,851 | | 72,916 |

| Core drilling (ft.) | | 44,679 | | 65,844 |

As noted in the table above, exploration drilling of the Tonkin Complex for 2007 totaled 138,760 ft. (42,294 m) in 147 drill holes. Additional exploration efforts at the Complex included geologic mapping, sampling and geophysical surveys. The objective of the 2007 program at the Tonkin Complex was to identify feeders to the known mineralization in the Mine Corridor and to expand that known mineralization, as well as to test new targets elsewhere within the complex.

15

The following graphic depicts the Tonkin Complex:

Drilling results from 2007 in the Mine Corridor are expected to modestly expand estimated mineralization in the Complex, with an updated independent engineering study currently underway and scheduled to be completed during the first half of 2008. A prior estimate of mineralized material at the historic Tonkin property was made in 2004 by NI 43-101 (defined below) qualified report issued by Micon International Limited ("Micon") as 29.7 millions tons with an average grade of 0.043 ounces of gold per ton. The 2007 exploration program was also designed to search for the source of the gold mineralization already identified in the Mine Corridor. The 2007 results suggest that the source of gold mineralization could be trending north and east from the known mineralization.

The prior estimate of mineralized material at the Tonkin project is based on a technical report by Micon which we requested in December 2005. This report provides a technical summary of the then-existing exploration and development activities and results, and the mineral potential of the Tonkin property. This report was prepared in accordance with the standards on mineral resources of the Canadian Institute of Mining, Metallurgy and Petroleum. As a company listed on the Toronto Stock Exchange, we are required to comply with Canadian National Instrument 43-101 (NI 43-101). The preparation of a technical report is a requirement of NI 43-101 and includes estimates of potential mineral resources for further targeted exploration disclosed pursuant to the applicable provisions of NI 43-101. However, U.S. reporting requirements for disclosure of mineral properties are governed by the SEC and included in the SEC's Securities Act Industry Guide 7 entitled "Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations" ("Guide 7"). NI 43-101 and Guide 7 standards are substantially different. For example, the SEC only permits the disclosure of proven or probable reserves, which in turn, require the preparation of a feasibility study demonstrating the economic feasibility of mining and processing the mineralization. We have not received a feasibility study with regard to our Tonkin property and therefore the Tonkin property has no "reserves" as defined by Guide 7.We cannot be certain that any part of the mineralized material at the Tonkin property will ever be confirmed or converted into Guide 7 compliant "reserves". U.S. investors are cautioned not to assume that all or any part of the mineralized material will ever be confirmed or converted into reserves or that a potential mineral resource can be economically or legally extracted.

The mineral resource estimates prepared by Micon for the Tonkin property are based on resource models that were constructed by Ore Reserves Engineering in 1996, with revision to certain parts of the

16

model in 2001 to incorporate new drilling data. The mineral envelopes were drawn for the 1996 and 2001 resource models to restrict interpolation within areas that could be classified as at least an indicated resource. The cut-off used in the estimate was 0.012 opt of gold for oxides and 0.018 opt of gold for sulfides. These cut-offs are slightly higher than internal cut-offs assuming a price of $400 per ounce of gold, a recovery rate of 70% and costs of $2.00 per ton for processing of oxides and a recovery rate of 75% and costs of $4.50 per ton for processing of sulfides. The breakeven cut-off for oxides is 0.015 opt, which will pay for $1.15 per ton mining costs, $1.13 per ton engineering costs, general and administrative expenses and processing costs. The breakeven cut-off for sulfides is 0.030 opt, which will pay for $1.15 per ton mining costs, $3.36 per ton engineering, general and administrative expenses, and processing costs. Micon believes that these figures demonstrate that the mineralization has reasonable prospects for economic extraction.

The Keystone area of the Tonkin Complex includes both gold and base metal targets and the 2007 program was focused on testing the base metal potential as well as typical Carlin-style gold systems. Potential for mineralization at Keystone occurs within lower plate Nevada Group Limestone in close proximity to a granodiorite intrusive. A historic surface sample at Keystone returned values of silver/zinc/copper/lead with an approximate metal value of $2,200 per ton in 2007 prices. Two Carlin style gold targets and the base metal target were drilled in 2007 with twenty-three reverse circulation and core holes. Assay results from the gold targets generally showed little gold but did exhibit strongly anomalous pathfinder elements. Assay results from the base metal target contained only low grade silver/zinc/copper/lead mineralization. Targets farther from the intrusive are now believed to hold the best potential for mineralization and additional drilling is proposed for 2008.

The North Tonkin area of the Tonkin Complex consists of two targets, Fye Canyon and Twin Peaks. Nine drill holes were completed on the Fye Canyon target in 2007 and ended in upper plate rubble zones of Vinini Formation and/or Slaven Chert formations with occasional dikes. Lower plate rocks were not encountered and assay results showed no significant gold intercepts, so no further work is planned. Drilling is now recommended to the northeast in the Twin Peaks area, where one 2007 drill hole and historic drill holes have encountered gold mineralization in lower plate rocks.

In the Tweed area of the Tonkin Complex, the northeast structures believed to control mineralization in the mine corridor are intersected by a major northwest structure that may be the southeast continuation of the Cortez Fault. The area is covered by Tertiary volcanics, but structural intersections in the underlying sediments were identified by geophysical studies. The initial five drill holes intersected hydrothermal alteration and anomalous pathfinder elements. Further drilling in 2008 is proposed to test this possible source of mine corridor gold mineralization.

In November 2007 we entered into a contract with Diagnos Inc. ("Diagnos") for the generation of exploration targets in North Central Nevada (including our current property position), based upon an artificial intelligence analysis of our proprietary technical data, combined with other information available to Diagnos. We consider the Diagnos approach to be an additional tool in evaluating the exploration opportunities of our Nevada properties. The initial results from the Diagnos work for Nevada are anticipated to be available at the end of first quarter 2008 and will be used in planning the exploration program for that year. Additional exploration drilling in the Tonkin Complex for 2008 is expected to expand upon 2006 and 2007 exploration results as well as incorporate the product of the Diagnos study.

The Tonkin Complex also includes the Patty Project in which the Company holds a non-operating minority interest (30%) and where Barrick Gold U.S. Inc. ("Barrick") is manager and holds a 60% interest. The Patty Project is a large property (approximately 15.6 sq. miles) located in the northeast portion of the Tonkin Complex. The 2007 exploration program expenditures totaled approximately $631,106, of which our portion was $189,317. The 2008 exploration program is budgeted for $222,350, of which our share is $66,705. The 2008 program includes detailed project review, review of historic

17

drilling at the property, and target generation. Barrick has indicated that the potential exists to increase the 2008 program to include exploration drilling as the program develops. From discussions with Barrick, we believe that certain of the gold mineralizing structures being evaluated at Patty could extend on to our other properties to the north and east of existing mineralization located in the Mine Corridor.

In addition to exploration conducted during 2007, we completed the reclamation of the historic heap leach pad, certain access roads, and other existing disturbed areas at the Tonkin Complex.

The geology of the Tonkin Complex area is complicated. The primary host for mineralization is the Cambro-Ordovician Hales Formation, which consists of sandy limestones, siltstones, shales, and greenstones in the Mine Corridor area. These rocks are in apparent structural contact with Ordovician rocks of the Vinini, Devonian Slaven Chert, Devonian McColly Canyon Formations and the Devonian Devils Gate Limestone. This assemblage has been intruded locally by Tertiary porphyritic dacite and andesite dikes. All rocks east and west of the Mine Corridor are overlain by Tertiary volcanic rocks. Gold mineralization is found in all of the rock types of the Hales, Slaven Chert and McColley Canyon Formations as well as at the contact between internal units. Spotty gold occurs in other units in the Mine Corridor, but it has not been recorded in economic amounts to date.

The mineral interests included in the Tonkin Complex are set forth in the following table:

Tonkin Complex Properties

| | Properties

Acquired from

| | Claims

| | Approx

Sq. miles

|

|---|

| Tonkin | | Historic US Gold | | 1,445 | | 46.00 |

| Cornerstone | | Nevada Pacific | | 158 | | 4.80 |

| Keystone | | Nevada Pacific | | 371 | | 11.60 |

| Fye Canyon | | White Knight | | 345 | | 9.88 |

| Pat Canyon | | White Knight | | 178 | | 5.60 |

| Patty | | White Knight | | 544 | | 15.64 |

| South Keystone | | Tone | | 28 | | .90 |

| | | | |

| |

|

| | | Total | | 3,069 | | 94.42 |

We generally hold mineral interests in the Tonkin Complex through unpatented mining and millsite claims, leases of unpatented mining claims and joint venture and other agreements. Unpatented mining claims are held subject to paramount title in the United States. In order to retain these claims, we must pay annual maintenance fees to the Bureau of Land Management, or BLM, and counties within which the claims are located. Rates for these jurisdictions vary and may change over time. Other obligations which must be met include obtaining and maintaining necessary regulatory permits and lease and option payments to claim owners.

Approximately 348 claims covering the area of the property known as Tonkin North are owned by unaffiliated parties and held by us under a lease agreement. The term of this lease expires January 1, 2009 and can be extended from year to year, up to a maximum of 99 years, by production from or other activities on the leased claims. We believe that current and past exploration are sufficient to hold the lease and the Company has a significant carry-forward work commitment balance.

The lease requires payment of an annual advance royalty in the amount of $150,000 or the value of 455 ounces of gold, whichever is greater, due in January of each year. The lease also requires payment of production royalties of 5% of the gross sales price of gold or silver but provides for recapture of annual advance royalties previously paid. The existing balance of the advance royalties paid by us, after taking into account the January 2008 payment, is approximately $3.89 million, meaning that we would not be required to pay any production royalties until we produced approximately $78 million of gross revenue from the leased claims. Our interests in other claims included in the Tonkin Complex are subject to royalties ranging from 1% to 2% of any production from those claims.

18

Cornerstone Property Lease. The Company, through Nevada Pacific, holds an undivided portion of the Cornerstone property (106 claims) pursuant to a mining lease made effective as of May 25, 2004 (the "Lease") which extends for a period of 10 years and is renewable in 5-year increments to a maximum term not exceeding 99 years, subject to certain conditions. The lessor has a sliding-scale gross production royalty of 3-4% of gross production in respect to gold and silver, as well as other royalties on other valuable materials. The Lease requires annual minimum advance royalty payments of the greater of $50,000 or the dollar equivalent of 130 ounces of gold. In addition, the Lease requires annual work expenditures of $50,000. We believe that current and past exploration are sufficient to hold the lease and the Company has a carry-forward work commitment balance. The Company has a legal dispute with the Lessor concerning Nevada Pacific's rights of first refusal under the Lease, related to the 2007 sale of a 70% interest in the lease and to the covered mineral claims. If the Company is successful in this dispute it may have the opportunity to acquire a 70% undivided interest in the Lease and the mineral claims subject thereto.

Tone properties are generally subject to certain royalty and back in rights. Please see the "Other United States Properties" section below for further information.

Patty Property Joint Venture. The Patty Property is located in Eureka County, Nevada and consists of 544 unpatented mining claims totaling approximately 15.64 sq. miles. As noted above, the Company, through White Knight, owns a 30% undivided interest in the Patty Property subject to a joint venture with Barrick as 60% owner and operator. Chapleau Resources Ltd. owns the remaining 10% undivided interest.

Gold Bar Complex

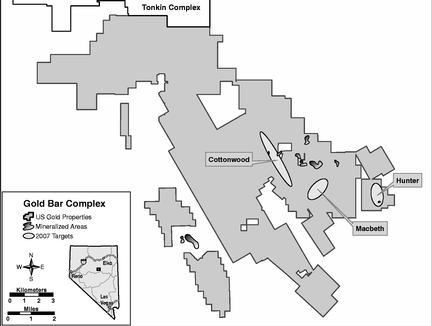

The Gold Bar Complex is located south of the Tonkin Complex on the continuation of the Cortez Trend and includes property acquired from White Knight and Tone. The Gold Bar Complex is in the Roberts Creek Mountains, in Eureka County, Nevada, approximately 30 air miles northwest of the town of Eureka. The Complex may be accessed by traveling approximately 26 miles west of Eureka on U.S. Highway 50, 17 miles north on county maintained and graded Three Bar Road. Several unimproved dirt roads lead from there up into the project area.

The following graphic depicts the Gold Bar Complex:

19

Exploration drilling on priority targets at the Gold Bar Complex in 2007 totaled approximately 21,150 ft. (6,447 m) and included the Cottonwood and Macbeth areas. Geologic mapping and geochemical sampling were also conducted on the property. While favorable host rocks were encountered in the 2007 drilling, no strong gold mineralization was identified.

The Cottonwood area occurs along the western edge of the Roberts Mountains window covering a major northwest window bounding structure. Numerous Carlin-type silicified breccias with areas of anomalous surface gold mineralization are present along the major structure and at intersections with structures of other orientations.

At Macbeth, two parallel northeast-trending features have been identified that parallel another feature with historic gold mineralization which was mined by a third party in the 1980's. The information gathered on stratigraphy and fault zones in 2007 will be useful in developing the 2008 exploration program. In addition, results of all drilling, mapping, and sampling, both historic and recent, are currently being modeled in a 3-D (three dimensional) geologic framework to assist in directing our future exploration.

We have also commenced an updated independent engineering estimate of remaining gold resources for the Gold Bar Complex which will reflect historic and updated technical data, along with relevant gold price assumptions. This estimate is scheduled to be completed during the first half of 2008.

Geologically, known mineralization at the Gold Bar Complex is hosted by Devonian limestones and limy siltstones and is located along the Battle Mountain-Eureka mineral belt. Compilation of historic data is ongoing and has led to new interpretations in certain areas. Geochemical data from soil sampling reveal linear features trending to the NE that parallel a geologic structure near the historically mined Gold Pick and Gold Canyon open pits. From the early 1980's through approximately 1994, the Gold Bar district produced slightly less than 500,000 oz gold for independent third parties from five Carlin-type gold deposits (Gold Bar, Gold Stone, Gold Pick, Gold Ridge, and Gold Canyon.)

Mineral interests included in the Gold Bar Complex are set forth in the following table:

Gold Bar Complex Properties

| | Properties

Acquired from

| | Claims

| | Approx

Sq. miles

|

|---|

| Benmark | | White Knight | | 100 | | 2.53 |

| Celt | | White Knight | | 608 | | 19.64 |

| Cottonwood | | White Knight | | 216 | | 6.09 |

| Gold Bar Horst | | White Knight | | 183 | | 5.71 |

| Gold Pick | | White Knight | | 27 | | .94 |

| Goldstone | | White Knight | | 62 | | 1.86 |

| Hunter | | White Knight | | 48 | | 1.74 |

| McClusky Pass | | White Knight | | 243 | | 7.83 |

| South Cabin Creek | | White Knight | | 84 | | 2.71 |

| Tonkin Summit | | White Knight | | 186 | | 5.98 |

| Gold Bar North | | Tone | | 19 | | .60 |

| Kobeh | | Tone | | 133 | | 4.10 |

| Roberts Creek | | Tone | | 54 | | 1.70 |

| | | | |

| |

|

| | | Total | | 1,963 | | 61.43 |

Tone properties are generally subject to certain royalty and back-in rights. Please see the "Other United States Properties" section below for further information.

20

Limo Property

The Limo Property is located in east-central Nevada, along the eastern portion of Butte Valley and along the western edge of the Cherry Creek Range. The property is within White Pine County and about 40 miles northwest of Ely, the county seat. It is located at the southern end of the Carlin Trend.