- MUX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

McEwen Mining (MUX) CORRESPCorrespondence with SEC

Filed: 3 Feb 23, 12:00am

February 3, 2023

Via EDGAR

Division of Corporation Finance

Office of Energy and Transportation

U.S. Securities and Exchange Commission

100 F Street, NE

Washington DC 20549

| Attention: | Craig Arakawa, Accounting Branch Chief |

| George K. Schuler, Mine Engineer | |

| Steve Lo, Staff Accountant |

| Re: | McEwen Mining Inc. |

Form 10-K for the Fiscal Year Ended December 31, 2021

Filed March 7, 2022

Form 10-Q for the Quarter Ended September 30, 2022

Filed on November 4, 2022

File No. 001-33190

Dear Messrs. Arakawa, Schuler and Lo:

We refer to your correspondence dated December 20, 2022, addressed to Perry Ing, Chief Financial Officer of McEwen Mining Inc. (“McEwen Mining”, the “Company” or “we”), relating to the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2022.

The Company’s responses are as follows:

Form 10-K for the Year Ended December 31, 2021

Gold Bar Mine, page 35

Comment No. 1

Please modify your filing to provide a brief description of your property/mineral rights for all your material properties as required by Item 1304(b)(1)(iii) of Regulation S-K.

Response

As discussed on the Company’s telephone call with the Securities and Exchange Commission’s staff (“Staff”) on January 27, 2023, with respect to our mineral rights in the United States, we describe our material Gold Bar Mine and Tonkin Properties on pages 33 to 35, including the names, numbers and sizes of our claims listed in tabular format on page 33, in compliance with the requirements in Item 1304(b)(1)(iii) of Regulation S-K.

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 2

Black Fox Mine, page 37

Comment No. 2

We note your Black Fox properties is not located using a common coordinate system. Please modify your filing and locate all your material properties to be within 1-mile using a common coordinate system. See Item 1304(b)(1)(i) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Form 10-K filings to add location information using a common coordinate system for all material properties, in order to comply with Item 1304(b)(1)(i) of Regulation S-K, beginning with its Form 10-K for the fiscal year ended December 31, 2022.

Specifically, the Company intends to revise its disclosure as follows:

The Black Fox and Froome Mines are located 6 miles east of Matheson, Ontario, and accessed directly from Highway 101 East. Matheson, in turn, is located approximately 45 miles from Timmins, which has a commercial airport. Timmins is approximately 342 miles north of Toronto by air. The approximate coordinates for the geographic center of the Black Fox and Froome Mines are N48°32'2" and W80°20'2".

The Stock Mill is located approximately 17 miles from the Black Fox and Froome Mines. Mineralized material is shipped to the mill from the Froome Mine by truck. The approximate coordinates for the geographic center of the Stock Mill is N48°33'0" and W80°45'1".

Exhibit 96.1 San Jose

Mineral Resource Estimate, page ES-18

Comment No. 3

We note you have disclosed your resources inclusive of reserves in this section. Please modify your filing to provide a similar tabulation of your resources exclusive of reserves as required by Instruction 2 to Paragraph 601(b)(96)(iii)(B)(11) of Regulation S-K.

Response

As discussed on the Company’s telephone call with the Staff on January 27, 2023, footnote 2 of the Mineral Resource Estimate on page ES-18 indicates that the mineral resource estimate is disclosed exclusive of mineral reserves in compliance with Instruction 2 to Item 601(b)(96)(iii)(B)(11) of Regulation S-K.

Product Pricing, page ES-184

Comment No. 4

We note you base your commodity price on consensus pricing. Please modify your filing to describe the basis of this consensus pricing, listing the financial institutions that provided the forecasts and the dates these forecasts were released. See Item 601(b)(96)(iii)(B)(16)(i) of Regulation S-K.

Response

As discussed on the Company’s telephone call with the Staff on January 27, 2023, the basis of the commodity price consensus pricing was provided by S&P Global Market Intelligence Metals and Mining with an effective date of November 30, 2020 and disclosed on page ES-184 as part of Table 16-1 Gold and Silver Price Forecast, in compliance with Item 601(b)(96)(iii)(B)(16)(i) of Regulation S-K.

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 3

Mine Closure Plan, page ES-194

Comment No. 5

Please modify your report to provide your QP’s opinion on the adequacy of your environmental plans as required by Item 601(b)(96)(iii)(B)(17)(iv) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add an explicit statement of adequacy of our environmental plans as required by Item 601(b)(96)(iii)(B)(17)(vi) of Regulation S-K, beginning with its Form 10-K for the fiscal year ended December 31, 2022.

As an example, the Company intends to revise its disclosure as follows:

Qualified Person’s Opinion on Adequacy of Current Plans to Address Issues

Based on the information provided to the QP by the Company, there are no material issues known to the QP. The San José operations are mature mining operations and currently have the approval to operate within its local communities.

Capital and Operating Costs, page ES-195

Comment No. 6

Please modify your report to define the accuracy of your capital and operating costs estimates as required by Item 601(b)(96)(iii)(B)(18)(i) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add a statement to define accuracy of our capital and operating cost estimates, as required by Item 601(b)(96)(iii)(B)(18)(i) of Regulation S-K, beginning with its Form 10-K for the fiscal year ended December 31, 2022.

As an example, the Company intends to revise its disclosure as follows:

Capital and operating costs at San José have been estimated to an accuracy of +/- 10% to 15%.

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 4

Economic Analysis, page ES-205

Comment No. 7

Please modify your report to provide additional line items supplementing your annual production by including your recovered and salable product quantities which generate your revenues, with text describing this calculation as required by Item 601(b)(96)(iii)(B)(19) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add line items supplementing our annual production by including our recovered and salable product quantities which generate our revenues, including text describing this calculation as required by Item 601(b)(96)(iii)(B)(19) of Regulation S-K.

An example of the intended revision is included in Appendix A to this letter.

Exhibit 96.2 Los Azules

Mineral Resource Estimate, Section 1.4, page ET-1

Comment No. 8

We note you have disclosed your resources inclusive of reserves in this section. Please modify your report to provide a similar tabulation of your resources exclusive of reserves as required by Instruction 2 to Paragraph 601(b)(96)(iii)(B)(11) of Regulation S-K.

Response

As discussed on the Company’s telephone call with the Staff on January 27, 2023, footnote 1 of the Mineral Resource Estimate on page ET-1 indicates that the mineral resource estimate is disclosed exclusive of mineral reserves in compliance with Instruction 2 to Item 601(b)(96)(iii)(B)(11) of Regulation S-K.

Mineral Process and Metallurgical testing, Section 12, page ET-12

Comment No. 9

Please modify your report to provide your QP’s opinion on the adequacy of your metallurgical data as required by Item 601(b)(96)(iii)(B)(10)(v) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add an explicit statement of adequacy of our metallurgical data as required by Item 601(b)(96)(iii)(B)(10)(v) of Regulation S-K, beginning with its Form 10-K for the fiscal year ended December 31, 2022.

As an example, the Company intends to revise its disclosure as follows:

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 5

Qualified Person’s Opinion on Data Adequacy

In the opinion of the QP, the metallurgical test work and reconciliation and production data support the metallurgical assumptions used in the mineral resources, the mine plans and the economic analysis.

Economic Analysis, Section 19, page ET-19

Comment No. 10

Please provide numerical values for your annual cash flow, including your annual production, salable product quantities, revenues, major cost centers, taxes and royalties, capital, and final closure costs. See Item 601(b)(96)(iii)(b)(19) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add numerical values for annual cash flow, including annual production, salable product quantities, revenues, major cost centers, taxes and royalties, capital and final closure costs as required by Item 601(b)(96)(iii)(B)(19) of Regulation S-K.

An example of the intended revision is included in Appendix B to this letter.

Exhibit 96.3 Gold Bar

Gold Bar Recovery Projection, page EU-127

Comment No. 11

Please modify your report to provide your QP’s opinion on the adequacy of your metallurgical data as required by Item 601(b)(96)(iii)(B)(10)(v) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add an explicit statement of adequacy of our metallurgical data as required by Item 601(b)(96)(iii)(B)(10)(v) of Regulation S-K, beginning with its Form 10-K for the fiscal year ended December 31, 2022.

As an example, the Company intends to revise its disclosure as follows:

Qualified Person’s Opinion on Data Adequacy

In the opinion of the QP, the metallurgical test work and reconciliation and production data support the metallurgical assumptions used in the mineral resources, the mine plans and the economic analysis.

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 6

Mine Production Schedule, page EU-207

Comment No. 12

Please provide annual numerical values for your life of mine production schedule. This would include annual processed ore with associated grades for the life of mine. See Item 601(b)(96)(iii)(b)(13) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add annual numerical values for our life of mine production schedules, including annual processed ore with associated grades for the life of mine as required by Item 601(b)(96)(iii)(B)(13) of Regulation S-K.

An example of the intended revision is included in Appendix C to this letter.

Capital and Operating Costs, page EU-236

Comment No. 13

Please modify your report to define the accuracy of your capital and operating costs estimates as required by Item 601(b)(96)(iii)(B)(18)(i) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add a statement to define accuracy of our capital and operating cost estimates, as required by Item 601(b)(96)(iii)(B)(18)(i) of Regulation S-K, beginning with its Form 10-K for the fiscal year ended December 31, 2022.

As an example, the Company intends to revise its disclosure as follows:

Capital and operating costs at Gold Bar have been estimated to an accuracy of +/- 10% to 15%.

Net Present Value, page EU-240

Comment No. 14

Please provide numerical values for your annual cash flow, including your annual production, salable product quantities, revenues, major cost centers, taxes and royalties, capital, and final closure costs. See Item 601(b)(96)(iii)(b)(19) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add numerical values for annual cash flow, including annual production, salable product quantities, revenues, major cost centers, taxes and royalties, capital and final closure costs as required by Item 601(b)(96)(iii)(B)(19) of Regulation S-K.

An example of the intended revision is included in Appendix D to this letter.

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 7

Exhibit 96.4 Fox Complex

Recoveries, page EV-10

Comment No. 15

Please modify your report to provide your QP’s opinion on the adequacy of your metallurgical data as required by Item 601(b)(96)(iii)(B)(10)(v) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add an explicit statement of adequacy of our metallurgical data as required by Item 601(b)(96)(iii)(B)(10)(v) of Regulation S-K, beginning with its Form 10-K for the fiscal year ended December 31, 2022.

As an example, the Company intends to revise its disclosure as follows:

Qualified Person’s Opinion on Data Adequacy

In the opinion of the QP, the metallurgical test work and reconciliation and production data support the metallurgical assumptions used in the mineral resources, the mine plans and the economic analysis.

Preliminary Closure Planning, page EV-17

Comment No. 16

Please modify your report to provide your QP’s opinion on the adequacy of your environmental plans as required by Item 601(b)(96)(iii)(B)(17)(iv) of Regulation S-K.

Response

As discussed on its telephone call with the Staff on January 27, 2023, the Company will revise its disclosures in future Technical Report Summaries included with its Form 10-K filings to add an explicit statement of adequacy of our environmental plans as required by Item 601(b)(96)(iii)(B)(17)(vi) of Regulation S-K, beginning with its Form 10-K for the fiscal year ended December 31, 2022.

As an example, the Company intends to revise its disclosure as follows:

Qualified Person’s Opinion on Adequacy of Current Plans to Address Issues

Based on the information provided to the QP by the Company, there are no material issues known to the QP. The Fox Complex operations are mature mining operations and currently have the approval to operate within its local communities.

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 8

Form 10-Q for the Quarter Ended September 30, 2022

Note 4 Other Income, page 10

Comment No. 17

We note your disclosure related to the gain recognized on your Blue Chip Swap arrangements. You state that you acquire and transfer marketable securities of large, well established companies with high trading volumes and low volatility as part of these transactions and that this strategy improves cash management for funding your Argentinian subsidiary. Please address the following points:

| · | provide your accounting policy for these transactions, identifying the specific authoritative guidance that you are following, |

| · | tell us where the marketable securities are captured on your balance sheet and where the purchases and sales of these marketable securities are captured in your statement of cash flows, and |

| · | clarify how you calculate the foreign currency gains on these transactions and identify the amounts that are realized and unrealized for each of the periods presented. |

Response

With respect to the disclosure of the Blue Chip Swap arrangements:

| · | The Company’s accounting policies in respect of the Blue Chip Swap arrangements follow accounting policies stated in our Form 10-K filed on March 7, 2022 for the fiscal year ended December 31, 2021, under the heading Investments on page 86 of that Form 10-K as well as Foreign Currency on page 90. We follow the guidance set out in ASU 2016-01, Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, as well as ASC 830, Foreign Currency Matters. The Company purchases securities on US exchanges using US Dollars. These securities are swapped for equivalent securities on Argentinean exchanges known as CEDEARs which are denominated in Argentine Pesos, and on the sale of the CEDEARs the Company receives Argentine Pesos. On the settlement of our Blue Chip Swap arrangements, a gain or loss on investment is recognized on the realized fair value change in the marketable securities, as well as a gain or loss on foreign exchange; the calculation of gain or loss on foreign exchange is further described below. |

| · | The marketable securities relating to Blue Chip Swaps are not captured on our balance sheet as of September 30, 2022, as no marketable securities relating to Blue Chip Swaps were outstanding at the end of the period. The cash inflows and outflows of the sales of these marketable securities, including the foreign exchange impact, are reported in cash flows from operations, under the Net Income heading. |

| · | Foreign currency gains or losses on transactions are calculated by comparing the realized amount of Argentine Pesos yielded through the Blue Chip Swap arrangement against the spot USD/ARG Official Exchange Rate determined by the Argentine Central Bank on the date of settlement. As all transactions were fully settled as of September 30, 2022, all amounts presented in our financial statements are realized, with nil unrealized value. No Blue Chip Swap arrangements were completed in prior comparative periods. |

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 9

With the forgoing undertaking and explanation, we believe that we have responded to all the comments in the Staff’s letter. Should you have any additional questions or comments, please contact the undersigned at 647-258-0395.

Sincerely,

MCEWEN MINING INC.

| /s/ Perry Ing | |

| Perry Ing | |

| Chief Financial Officer |

| cc: | Mr. Robert McEwen, Chief Executive Officer – McEwen Mining Inc. |

Ms. Carmen Diges, General Counsel – McEwen Mining Inc.

Mr. Richard W. Brissenden, Chair of the Audit Committee – McEwen Mining Inc.

Mr. Dean Braunsteiner, Audit Partner – Ernst & Young LLP

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 10

Appendix A

As discussed in the Company’s response to Comment No. 7, as an example, the Company intends to make the following revisions to mine production tables included in future Form 10-K filings, beginning with its Form 10-K for the fiscal year ended December 31, 2022:

Table 19-1 – Mine Physicals

| Physicals | ||||||||||||

| Year | 2021 | 2022 | Total | |||||||||

| Mine life: | 1 year | .96 years | 1.96 years | |||||||||

| Process plant production capacity: | 1,650 tpd. | 1,650 tpd. | 1,650 tpd. | |||||||||

| Total mine production: | ||||||||||||

| Tonnes (t) | 501,600 | 500,700 | 1,002,300 | |||||||||

| Au Grade (gr/t) | 6.35 | 6.63 | 6.49 | |||||||||

| Ag Grade (gr/t) | 364 | 433 | 399 | |||||||||

| Stockpile: | ||||||||||||

| Tonnes (t) | -8,300 | 19,300 | 11,000 | |||||||||

| Au Grade (gr/t) | 6.35 | 7.29 | 8.00 | |||||||||

| Ag Grade (gr/t) | 364 | 348 | 336 | |||||||||

| Total process plant production: | ||||||||||||

| Tonnes (t) | 493,400 | 519,900 | 1,013,300 | |||||||||

| Au Head Grade (gr/t) | 6.35 | 6.66 | 6.51 | |||||||||

| Ag Head Grade (gr/t) | 364 | 430 | 398 | |||||||||

| Concentrate: | ||||||||||||

| Ratio of concentration: | 16.37 | 16.37 | 16.37 | |||||||||

| Dry metric tonnes (dmt) | 30,100 | 31,800 | 61,900 | |||||||||

| Flotation Recovery: | ||||||||||||

| Au | 90.0 | % | 90.0 | % | 90.0 | % | ||||||

| Ag | 89.7 | % | 89.7 | % | 89.7 | % | ||||||

| Fines: | ||||||||||||

| Au (koz) | 90.7 | 100.2 | 190.9 | |||||||||

| Ag (koz) | 5,184 | 6,444 | 11,628 | |||||||||

| AgEq. (koz) | 12,982 | 15,063 | 28,045 | |||||||||

| Concentrate for Sale (kt): | 15.9 | 16.7 | 32.6 | |||||||||

| Leached doré: | ||||||||||||

| Leached Concentrate (kt): | 14.3 | 15.0 | 29.3 | |||||||||

| Au Grade (gr/t) | 93.6 | 98.1 | 95.9 | |||||||||

| Ag Grade (gr/t) | 5,350 | 6,311 | 5,843 | |||||||||

| Precipitate production capacity: | 47.8 | 47.8 | 47.8 | |||||||||

| CCD recovery: | ||||||||||||

| Au Recovery Dore (%) | 93.60 | % | 93.60 | % | 93.60 | % | ||||||

| Ag Recovery Dore (%) | 92.80 | % | 92.80 | % | 92.80 | % | ||||||

| Au (koz) | 40.2 | 44.4 | 84.7 | |||||||||

| Ag (koz) | 2,279 | 2,833 | 5,113 | |||||||||

| AgEq. (koz) | 5,738 | 6,656 | 12,393 | |||||||||

| Total fines: | ||||||||||||

| Au (koz)* | 87.9 | 97.2 | 185 | |||||||||

| Ag (koz)* | 5,007 | 6,224 | 11,231 | |||||||||

| AgEq. (koz) | 12,569 | 14,582 | 27,150 | |||||||||

*Saleable product is calculated as follows:

(Tonnes processed x head grade x flotation recovery %) – (Au oz in concentrate to CCD x CCD loss %)

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 11

Appendix B

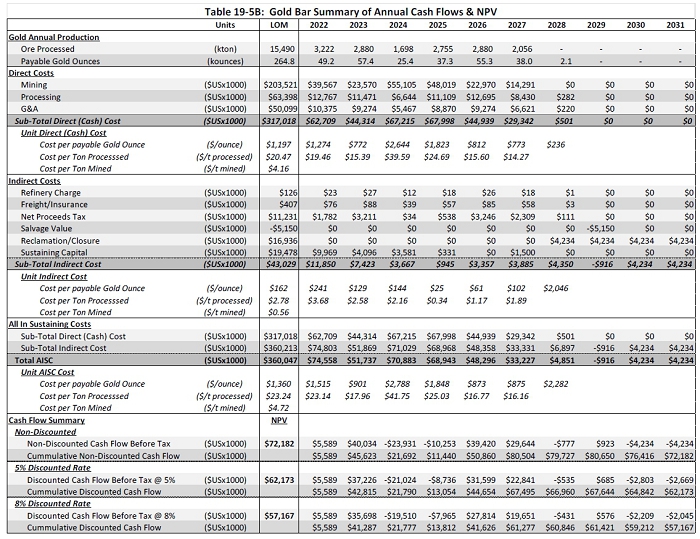

As discussed in the Company’s response to Comment No. 10, as an example, the Company intends to make the following revisions to mine production and economic analysis tables included in future Form 10-K filings, beginning with its Form 10-K for the fiscal year ended December 31, 2022:

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 12

Appendix C

As discussed in the Company’s response to Comment No. 12, as an example, the Company intends to make the following revisions to mine production tables included in future Form 10-K filings, beginning with its Form 10-K for the fiscal year ended December 31, 2022:

| Mineralized Material to Leach Pad | WASTE | TOTAL | ||||||||||||||||||||||||||||||

| Period | kTons | Gold (oz/ton) | Contained (k-oz) | Recoverable (k-oz) | Gold Grade (PPM) | Recoverable Grade (PPM) | kTons | kTons | ||||||||||||||||||||||||

| JAN - 2022 | 240 | 0.017 | 4 | 3.1 | 0.593 | 0.438 | 1,238 | 1,478 | ||||||||||||||||||||||||

| FEB - 2022 | 240 | 0.024 | 5.9 | 4.4 | 0.836 | 0.630 | 921 | 1,161 | ||||||||||||||||||||||||

| MAR - 2022 | 241 | 0.025 | 6.0 | 4.5 | 0.853 | 0.646 | 1,406 | 1,647 | ||||||||||||||||||||||||

| APR - 2022 | 241 | 0.020 | 4.9 | 3.6 | 0.691 | 0.513 | 1,405 | 1,646 | ||||||||||||||||||||||||

| MAY - 2022 | 260 | 0.021 | 5.5 | 4.0 | 0.729 | 0.529 | 1,337 | 1,597 | ||||||||||||||||||||||||

| JUN - 2022 | 300 | 0.019 | 5.6 | 4.1 | 0.636 | 0.464 | 700 | 1,000 | ||||||||||||||||||||||||

| JUL - 2022 | 300 | 0.025 | 7.6 | 5.1 | 0.867 | 0.585 | 873 | 1,173 | ||||||||||||||||||||||||

| AUG - 2022 | 280 | 0.022 | 6.1 | 4.1 | 0.752 | 0.507 | 720 | 1,000 | ||||||||||||||||||||||||

| SEP - 2022 | 280 | 0.025 | 6.9 | 4.8 | 0.849 | 0.592 | 804 | 1,084 | ||||||||||||||||||||||||

| OCT - 2022 | 280 | 0.024 | 6.6 | 4.7 | 0.814 | 0.575 | 720 | 1,000 | ||||||||||||||||||||||||

| NOV - 2022 | 280 | 0.019 | 5.2 | 3.5 | 0.642 | 0.429 | 720 | 1,000 | ||||||||||||||||||||||||

| DEC - 2022 | 280 | 0.023 | 6.5 | 4.6 | 0.799 | 0.562 | 747 | 1,027 | ||||||||||||||||||||||||

| QTR1 - 2023 | 720 | 0.028 | 20.1 | 13.8 | 0.958 | 0.659 | 1,133 | 1,853 | ||||||||||||||||||||||||

| QTR2 - 2023 | 720 | 0.031 | 22.4 | 14.3 | 1.065 | 0.680 | 1,778 | 2,498 | ||||||||||||||||||||||||

| QTR3 - 2023 | 720 | 0.030 | 21.7 | 14.2 | 1.033 | 0.678 | 1,851 | 2,571 | ||||||||||||||||||||||||

| QTR4 - 2023 | 720 | 0.032 | 23.1 | 16.3 | 1.101 | 0.775 | 1,435 | 2,155 | ||||||||||||||||||||||||

| QTR1 - 2024 | 217 | 0.021 | 4.5 | 3.1 | 0.706 | 0.490 | 3,283 | 3,500 | ||||||||||||||||||||||||

| QTR2 - 2024 | 269 | 0.014 | 3.9 | 2.8 | 0.494 | 0.362 | 5,620 | 5,889 | ||||||||||||||||||||||||

| QTR3 - 2024 | 666 | 0.018 | 11.9 | 8.8 | 0.614 | 0.451 | 5,288 | 5,954 | ||||||||||||||||||||||||

| QTR4 - 2024 | 545 | 0.016 | 8.6 | 6.2 | 0.540 | 0.389 | 5,237 | 5,782 | ||||||||||||||||||||||||

| QTR1 - 2025 | 595 | 0.018 | 11.0 | 7.9 | 0.632 | 0.458 | 2,905 | 3,500 | ||||||||||||||||||||||||

| QTR2 - 2025 | 720 | 0.018 | 13.1 | 9.4 | 0.621 | 0.449 | 5,169 | 5,889 | ||||||||||||||||||||||||

| QTR3 - 2025 | 720 | 0.021 | 15.1 | 11.1 | 0.719 | 0.527 | 4,698 | 5,418 | ||||||||||||||||||||||||

| QTR4 - 2025 | 720 | 0.021 | 15.2 | 10.7 | 0.723 | 0.511 | 2,703 | 3,423 | ||||||||||||||||||||||||

| QTR1 - 2026 | 720 | 0.027 | 19.3 | 14.1 | 0.920 | 0.670 | 2,326 | 3,046 | ||||||||||||||||||||||||

| QTR2 - 2026 | 720 | 0.027 | 19.5 | 14.4 | 0.930 | 0.684 | 1,418 | 2,138 | ||||||||||||||||||||||||

| QTR3 - 2026 | 720 | 0.025 | 17.7 | 12.8 | 0.841 | 0.608 | 872 | 1,592 | ||||||||||||||||||||||||

| QTR4 - 2026 | 720 | 0.032 | 23.2 | 16.0 | 1.103 | 0.763 | 529 | 1,249 | ||||||||||||||||||||||||

| QTR1 - 2027 | 720 | 0.027 | 19.3 | 13.0 | 0.919 | 0.617 | 933 | 1,653 | ||||||||||||||||||||||||

| QTR2 - 2027 | 720 | 0.022 | 15.5 | 10.9 | 0.737 | 0.517 | 1,109 | 1,829 | ||||||||||||||||||||||||

| QTR3 - 2027 | 478 | 0.022 | 10.4 | 7.4 | 0.750 | 0.528 | 748 | 1,225 | ||||||||||||||||||||||||

| QTR4 - 2027 | 139 | 0.024 | 3.4 | 2.6 | 0.840 | 0.632 | 139 | 278 | ||||||||||||||||||||||||

| Total | 15,490 | 0.024 | 369.8 | 260.2 | 0.818 | 0.576 | 60,768 | 76,258 | ||||||||||||||||||||||||

NOTES:

Pick & GBS (June 2022) & Ridge (Q4-2023) - Tr14

All tons and grade are reported in English units

Scheduled tons and grade may differ from the reported Reserve due to rounding

November 2020 Pick Model (Pick & Ridge Area) | September 2020 GBS Model (GBS Area)

Based on Cutoff Grades Reported in Table 12-2

Mineralized tons are based on Measured and Indicated only

Based on topography at the end of December 2021

Division of Corporation Finance

U.S. Securities and Exchange Commission

Attention: Mr. Craig Arakawa

February 3, 2023

Page 13

Appendix D

As discussed in the Company’s response to Comment No. 12, as an example, the Company intends to make the following revisions to Economic Analysis tables included in future Form 10-K filings, beginning with its Form 10-K for the fiscal year ended December 31, 2022: