UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x | |

Filed by a Party other than the Registrant o | |

Check the appropriate box: | |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

Security Capital Corporation | ||

(Name of Registrant as Specified In Its Charter) | ||

| ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| ||

Payment of Filing Fee (Check the appropriate box): | ||

x | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: |

|

|

|

| (2) | Aggregate number of securities to which transaction applies: |

|

|

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

| (4) | Proposed maximum aggregate value of transaction: |

|

|

|

| (5) | Total fee paid: |

|

|

|

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: |

|

|

|

| (2) | Form, Schedule or Registration Statement No.: |

|

|

|

| (3) | Filing Party: |

|

|

|

| (4) | Date Filed: |

|

|

|

|

|

|

|

| Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

SECURITY CAPITAL CORPORATION

EIGHT GREENWICH OFFICE PARK, THIRD FLOOR

GREENWICH, CT 06831-5149

(203) 625-0770

September 23, 2005

Dear Stockholder:

You are cordially invited to attend the 2005 Annual Meeting of Stockholders of Security Capital Corporation (the “Company”), which will be held in Conference Room 45A, 45th Floor, 101 Park Avenue, New York, New York, on Monday, October 24, 2005, commencing at 10:00 a.m. (local time). We look forward to greeting as many of our stockholders as are able to be with us.

At the meeting, you will be asked to consider and vote upon (i) the election of seven directors; and (ii) such other business as may properly come before the meeting and any adjournment thereof.

We hope you will find it convenient to attend the meeting in person. WHETHER OR NOT YOU EXPECT TO ATTEND, TO ENSURE YOUR REPRESENTATION AT THE MEETING AND THE PRESENCE OF A QUORUM, PLEASE COMPLETE, DATE, SIGN AND MAIL PROMPTLY THE ENCLOSED PROXY, for which a return envelope is provided. No postage need be affixed to the return envelope if it is mailed in the United States.

The Company’s Annual Report for the fiscal year ended December 31, 2004 accompanies the enclosed proxy materials.

Sincerely, | |

| /s/ BRIAN D. FITZGERALD |

| Brian D. Fitzgerald |

| Chairman of the Board of Directors, President and Chief Executive Officer |

| /s/ A. GEORGE GEBAUER |

| A. George Gebauer |

| Vice Chairman of the Board of Directors and Secretary |

SECURITY CAPITAL CORPORATION

EIGHT GREENWICH OFFICE PARK, THIRD FLOOR

GREENWICH, CT 06831-5149

(203) 625-0770

Notice of 2005 Annual Meeting of Stockholders

NOTICE IS HEREBY GIVEN that the 2005 Annual Meeting of Stockholders (the “Annual Meeting”) of Security Capital Corporation (the “Company”) will be held in Conference Room 45A, 45th Floor, 101 Park Avenue, New York, New York, on Monday, October 24, 2005, commencing at 10:00 a.m. (local time), for the following purposes:

(1) To elect seven directors to hold office until the next annual meeting and until their successors are duly elected and qualified; and

(2) To transact such other business as may properly come before the Annual Meeting and any adjournment thereof.

Only holders of record of the Common Stock or the Class A Common Stock of the Company at the close of business on September 9, 2005 are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof.

By Order of the Board of Directors,

/s/ A. GEORGE GEBAUER | |

| A. George Gebauer |

| Vice Chairman of the Board of Directors and Secretary |

September 23, 2005

YOUR VOTE IS IMPORTANT.

PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY

AND RETURN IT IN THE ENCLOSED ENVELOPE.

SECURITY CAPITAL CORPORATION

EIGHT GREENWICH OFFICE PARK, THIRD FLOOR

GREENWICH, CT 06831-5149

(203) 625-0770

This Proxy Statement is being furnished in connection with the solicitation of Proxies by and on behalf of the Board of Directors of Security Capital Corporation (the “Company”) to be used at the 2005 Annual Meeting of Stockholders to be held on Monday, October 24, 2005, and at any adjournment thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of 2005 Annual Meeting of Stockholders. The Company’s Annual Report for the fiscal year ended December 31, 2004 accompanies this Proxy Statement. This Proxy Statement and accompanying materials are expected to be first sent or given to stockholders of the Company on or about September 26, 2005.

The close of business on September 9, 2005 has been fixed as the record date for the determination of the stockholders entitled to notice of and to vote at the Annual Meeting. Only holders of record as of that date of shares of the Company’s Common Stock, $0.01 par value per share (the “Common Stock”), and of the Company’s Class A Common Stock, $0.01 par value per share (the “Class A Common Stock”), are entitled to notice of and to vote at the Annual Meeting. The Common Stock and the Class A Common Stock are sometimes collectively referred to herein as the “Common Equity.”

Each share of the Common Stock or the Class A Common Stock entitles the holder thereof to one vote per share on each matter presented to the stockholders for approval at the Annual Meeting. On September 9, 2005, there were 380 shares of the Common Stock and 6,770,587 shares of the Class A Common Stock, or a total of 6,770,967 shares of the Common Equity, outstanding and entitled to vote.

Execution of a Proxy by a stockholder will not affect such stockholder’s right to attend the Annual Meeting and to vote in person. Any stockholder who executes a Proxy has a right to revoke it at any time before it is voted by advising A. George Gebauer, Vice Chairman of the Board and Secretary of the Company, in writing of such revocation, by executing a later-dated Proxy which is presented to the Company at or prior to the Annual Meeting, or by appearing at the Annual Meeting and voting in person. Attendance at the Annual Meeting will not in and of itself constitute revocation of a Proxy. The Board of Directors has retained D.F. King & Co., Inc. to assist in the solicitation of Proxies.

The presence, in person or by Proxy, of the holders of a majority of the shares of the Common Equity entitled to vote at the Annual Meeting will constitute a quorum. Assuming a quorum, the seven nominees receiving a plurality of the votes of the shares of the Common Equity present in person or by Proxy at the Annual Meeting and entitled to vote on the election of directors will be elected as directors.

With regard to the election of directors, votes may be cast in favor or withheld. Votes that are withheld and broker non-votes, if any, will be counted for purposes of determining the presence or absence of a quorum, but will have no effect on the election of directors.

Unless specified otherwise, the Proxies will be voted for the election of all the nominees to serve as directors of the Company until the next annual meeting and until their successors are duly elected and qualified. In the discretion of the Proxy holders, the Proxies will also be voted for or against such other matters as may properly come before the Annual Meeting. Management is not aware of any other matters to be presented for action at the Annual Meeting.

The Company’s executive office is located at Eight Greenwich Office Park, Third Floor, Greenwich, Connecticut 06831-5149, and the Company’s telephone number is (203) 625-0770.

1

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table and the notes thereto set forth information with respect to the beneficial ownership, as of September 9, 2005, of shares of each class of voting securities of the Company by the only persons known to the Company to have beneficial ownership of more than 5% of such class, by each director of the Company, by each named executive officer of the Company and by the directors and executive officers of the Company as a group. Except as otherwise indicated, each person is believed to exercise sole voting and dispositive power over the shares reported.

| Common Stock |

| Class A Common Stock |

| Percentage |

| |||||||||||||||||||||

|

|

|

|

|

| Acquirable |

|

|

| of Total |

| ||||||||||||||||

Name and Address |

|

|

| Currently |

| Percentage |

| Currently |

| Within |

| Percentage |

| Common |

| ||||||||||||

Brian D. Fitzgerald |

|

| 128 | * |

|

| 33.7 | %* |

|

| 5,497,306 | * |

|

| 240,000 |

|

|

| 81.8 | %* |

|

| 81.8 | %* |

| ||

Eight Greenwich Office Park |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Capital Partners |

|

| 128 |

|

|

| 33.7 | % |

|

| 4,983,361 |

|

|

| — |

|

|

| 73.6 | % |

|

| 73.6 | % |

| ||

Eight Greenwich Office Park |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

A. George Gebauer(1) |

|

| — |

|

|

| — |

|

|

| 89,198 |

|

|

| 50,000 |

|

|

| 2.0 | % |

|

| 2.0 | % |

| ||

William R. Schlueter(1) |

|

| — |

|

|

| — |

|

|

| — |

|

|

| 66,000 |

|

|

| 1.0 | % |

|

| 1.0 | % |

| ||

Samuel B. Fortenbaugh III |

|

| — |

|

|

| — |

|

|

| — |

|

|

| 24,000 |

|

|

| ** |

|

|

| ** |

|

| ||

John H.F. Haskell, Jr. |

|

| — |

|

|

| — |

|

|

| 1,000 |

|

|

| 24,000 |

|

|

| ** |

|

|

| ** |

|

| ||

Edward W. Kelley, Jr. |

|

| — |

|

|

| — |

|

|

| 10,000 |

|

|

| 24,000 |

|

|

| ** |

|

|

| ** |

|

| ||

M. Paul Kelly |

|

| — |

|

|

| — |

|

|

| — |

|

|

| 24,000 |

|

|

| ** |

|

|

| ** |

|

| ||

Robert M. Williams, Sr. |

|

| — |

|

|

| — |

|

|

| — |

|

|

| 8,000 |

|

|

| ** |

|

|

| ** |

|

| ||

All Directors and Executive Officers as a Group (8 persons) |

|

| 128 |

|

|

| 33.7 | % |

|

| 5,597,504 |

|

|

| 460,000 |

|

|

| 83.8 | % |

|

| 83.8 | % |

| ||

* As more fully described in footnotes (1) and (2) to this table, these share and percentage amounts include the share and percentage amounts indicated as beneficially owned by Capital Partners.

** Less than one percent.

(1) For purposes of this table, the following related entities are referred to as “Capital Partners”: (a) Capital Partners, Inc., a Connecticut corporation, of which Brian D. Fitzgerald is the sole stockholder and director and A. George Gebauer and William R. Schlueter are officers; (b) FGS, Inc., a Delaware corporation (“FGS”), of which Mr. Fitzgerald is the controlling stockholder and Messrs. Fitzgerald and Gebauer are executive officers; and (c) CP Acquisition, L.P. No. 1, a Delaware limited partnership (“CPI”). Capital Partners, Inc., FGS and FGS Partners, L.P., a Connecticut limited partnership (“FGS Partners”), of which Capital Partners, Inc. is the general partner, are the general partners of CPI.

The share amounts in the table attributable to Capital Partners include the 4,455,672 shares of the Class A Common Stock owned of record by CPI and the 527,689 shares of the Class A Common Stock and the 128 shares of the Common Stock owned of record by FGS. By virtue of their status as general partners of CPI, each of Capital Partners, Inc., FGS and FGS Partners may be deemed to own beneficially all of the shares of the Class A Common Stock owned of record by CPI.

(2) Mr. Fitzgerald may be deemed to own beneficially the 513,945 shares of the Class A Common Stock owned of record by him, the 4,455,672 shares of the Class A Common Stock owned of record by CPI and the 527,689 shares of the Class A Common Stock and the 128 shares of the Common Stock owned of record by FGS. Mr. Fitzgerald has shared authority to vote and dispose of the FGS-owned shares of the Class A Common Stock and the Common Stock and disclaims beneficial ownership of such FGS-owned shares for all other purposes. Mr. Gebauer is also a stockholder, officer and director of FGS and an officer of Capital Partners, Inc., but he disclaims beneficial ownership of shares of the Class A Common Stock and the Common Stock owned of record by such corporations for any purpose. The ownership noted above excludes the 82,453 shares of Class A Common Stock owned by the Fitzgerald Trust (of which Mr. Fitzgerald’s brother is the trustee and Mr. Fitzgerald’s minor children are sole beneficiaries), as to which beneficial ownership is disclaimed for all purposes.

(3) The amounts shown in the “Acquirable Within 60 Days” column relate to options issued pursuant to the Company’s 2000 Long-Term Incentive Plan (the “Plan”).

2

PROPOSAL 1—ELECTION OF DIRECTORS

The Company’s Board of Directors is composed of seven members. The names of the seven nominees for election as directors are set forth below. All of the nominees are to be elected at the Annual Meeting and serve until their successors are duly elected and qualified. All of the nominees listed below are expected to serve as directors if they are elected. If any nominee should decline or be unable to accept such nomination or to serve as a director, the Board of Directors reserves the right to nominate another person or to vote to reduce the size of the Board of Directors. In the event another person is nominated, the Proxy holders intend to vote the shares to which the Proxy relates for the election of the person nominated by the Board of Directors. There is no cumulative voting for directors.

Name |

|

|

| Age |

| Director |

| Principal Occupations During the Last Five |

Brian D. Fitzgerald |

| 61 |

| 1990 |

| Chairman of the Board of the Company since January 1990 and President and CEO of the Company since July 2000; President of FGS since March 1989; and a partner, general partner, stockholder, officer and/or director of various Capital Partners entities for more than five years. | ||

A. George Gebauer |

| 72 |

| 1990 |

| Vice Chairman of the Board of the Company since July 2000 and Secretary of the Company since February 1994; Vice President, Secretary and a director of FGS since March 1989; and a partner, general partner, stockholder, officer and/or director of various Capital Partners entities for more than five years. Mr. Gebauer was also the President of the Company from January 1990 to July 2000. | ||

Samuel B. Fortenbaugh III |

| 71 |

| 2001 |

| Practicing lawyer (private practice) from August 2002; former chairman of the law firm of Morgan, Lewis & Bockius LLP (“MLB”), an international law firm; a senior partner of MLB from January 1980 to September 2001 and a senior counsel from October 2001 to August 2002; and presently serving as a director of Baldwin Technology Company, Inc., a leading international manufacturer of controls and accessories for the printing industry. | ||

John H. F. Haskell, Jr |

| 73 |

| 2001 |

| Retired; non-employee advisor at UBS Securities LLC, an investment banking firm, from March 2004 to May 2005; managing director of Dillon, Read & Co. Inc. and its successors, Warburg Dillon Read LLC and UBS Warburg LLC, from 1975 to 2003; and presently serving as a director of Pall Corporation, an international manufacturer of filtration and separation products and systems for the medical, biopharmaceutical, industrial, aerospace and microelectronic industries. | ||

Edward W. Kelley, Jr. |

| 73 |

| 2002 |

| Retired; Governor of the Federal Reserve Board of the United States from 1987 to 2001. | ||

M. Paul Kelly |

| 62 |

| 2000 |

| Founder and President of PK Enterprises, an equity investment and operational consulting practice, since 1990. | ||

Robert M. Williams, Sr. |

| 65 |

| 2004 |

| Retired; founded RFE Investment Partners in 1979 and managed six private equity funds with total assets in excess of $600 million. | ||

3

The seven nominees receiving a plurality of the votes of the shares of the Common Equity present in person or by Proxy at the Annual Meeting and entitled to vote on the election of directors will be elected as directors.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF THE SEVEN NOMINEES AS DIRECTORS.

Composition of the Board; Independence

The Board of Directors has determined that four of the nominees for election as directors (Messrs. Haskell, Kelley, Kelly and Williams) are “independent directors” as defined in Section 121A of the listing standards of the American Stock Exchange (the “AMEX”), and that three of the nominees are not independent directors. Accordingly, a majority of the Company’s Board is comprised of independent directors as defined in the AMEX listing standards.

Meetings and Committees of the Board; Nominating Process

The Board of Directors held 11 meetings and acted by written consent six times during the year ended December 31, 2004. Each of the directors, other than Mr. Williams, who was appointed effective December 23, 2004, attended at least 75% of the aggregate number of meetings of the Board and the committees on which such director served. The Company encourages, but does not require, all of its directors to attend the annual meeting. All of the directors then in office attended last year’s annual meeting.

The Board has a Compensation Committee and an Audit Committee. The Board does not have a nominating committee. The Company is a “controlled company” as such term is defined in Section 801(a) of the AMEX listing standards due to the ownership of a majority of the outstanding Common Equity by CPI. As a controlled company, the Company is not subject to the AMEX rules requiring (i) Board of Director nominees to be selected, or recommended for the Board’s selection, by either a nominating committee comprised solely of independent directors or by a majority of the independent directors on the Board, and (ii) each AMEX-listed company to have a formal written charter or Board resolutions addressing the nominating process. The Board is not particularly large and believes it is sufficient to rely on the expertise of the Board as a whole in choosing its director candidates. Each of the directors is also highly experienced and knowledgeable in board and business affairs. The nominees for election as directors named in this Proxy Statement were unanimously recommended by the full Board for submission to the stockholders as the Board’s nominees. Should the Company or the Board determine in the future that additional or other Board nominees are advisable, it is likely that a variety of sources would be consulted for possible candidates, including the directors of the Company, various advisors to the Company and possibly one or more director search firms. Appropriate consideration also would be given to nominees for director suggested by stockholders of the Company. The process by which a stockholder of the Company may suggest a nominee for director of the Company can be found under “Stockholder Communications with the Board.”

The Company adopted a Code of Conduct in September 2003, as amended in June 2004. All of the Company’s employees and officers (including senior executive, financial and accounting officers) are held accountable for adherence to the Company’s Code of Conduct. The Code of Conduct is intended to promote compliance with applicable governmental laws and regulations and help ensure adherence to the

4

highest ethical standards of conduct. The Code of Conduct covers a variety of areas, including violations of law, conflicts of interest, fair dealing, proper use of Company assets, delegation of authority, confidentiality and handling of financial information. Employees have an obligation to promptly report any known or suspected violation of the Code of Conduct, and retaliation is prohibited. Additionally, in the event of an amendment or waiver from the Code of Conduct involving the conduct of an officer or Board member, appropriate disclosure will be made to the Company’s stockholders to the extent required by listing standards or any other regulation.

A copy of the Code of Conduct can be found in its entirety on the Company’s website at www.securitycapitalcorporation.com in the Company Policies section, or may be obtained without charge upon request in writing to Security Capital Corporation, c/o Corporate Secretary, Eight Greenwich Office Park, Third Floor, Greenwich, Connecticut 06831-5149.

The Board of Directors has a Compensation Committee whose charge is to develop and make recommendations to the Board of Directors with respect to compensation for key employees of the Company and to administer the Plan. The members of the Compensation Committee are Samuel B. Fortenbaugh III and Edward W. Kelley. Mr. Kelley is an independent director as defined in the AMEX listing standards, and Mr. Fortenbaugh is not. As a controlled company, the Company is not subject to the AMEX rules with respect to executive compensation being determined, or recommended to the Board for determination, either by a Compensation Committee comprised solely of independent directors or by a majority of the independent directors on the Board. The Compensation Committee held eight meetings during the year ended December 31, 2004.

Report of the Compensation Committee

The Compensation Committee is responsible for developing and making recommendations to the Board of Directors with respect to the Company’s compensation policies and administering the Plan. The Plan was put in place so that the Company could award stock options and other long-term incentives to its executive officers and other key personnel to align their interests with those of the Company’s long-term investors and to help attract, retain and motivate these persons.

In 2004 and prior years, Capital Partners, Inc., a corporation controlled by Mr. Fitzgerald, was paid a management advisory services fee by the Company pursuant to a Management Advisory Services agreement (the “MAS Agreement”, as discussed in “Certain Relationships and Related-Party Transactions” in this Proxy Statement). Because all Company executive officers are paid compensation by Capital Partners, Inc., the Company did not directly pay any cash compensation to any executive officer for service as an officer of the Company in 2004. However, at the request of the Compensation Committee, the Company’s management performed an analysis of the time spent by the Company’s executive officers during the years ended December 31, 2004, 2003 and 2002 to ascertain the portion of each executive officer’s salary and bonus that was paid to him by Capital Partners, Inc. allocable to the services performed by him as an executive officer of the Company.

The Compensation Committee is authorized to take the following actions with respect to any future award grants and the administration of the Plan on an ongoing basis:

(i) |

| to select each person to whom awards may be granted; |

(ii) |

| to determine the type or types of awards to be granted to each such person; |

5

(iii) |

| to determine the number of awards to be granted, the number of shares of stock to which an award will relate, the terms and conditions of any award and all other matters to be determined in connection with an award; |

(iv) |

| to determine whether, to what extent and under what circumstances an award may be settled, canceled, forfeited or surrendered; |

(v) |

| to determine whether, to what extent and under what circumstances cash, stock, other awards or other property payable with respect to an award will be deferred; |

(vi) |

| to determine the restrictions, if any, to which stock received upon exercise or settlement of an award will be subject; |

(vii) |

| to prescribe the form of each award agreement, which need not be identical for each participant; |

(viii) |

| to adopt, amend, suspend, waive and rescind such rules and regulations and appoint such agents as the Committee may deem necessary or advisable to administer the Plan; and |

(ix) |

| to make all other decisions and determinations as may be required under the terms of the Plan or as the Committee may deem necessary or advisable for the administration of the Plan. |

The options granted under the Plan provide value to the recipients only if and when the market price of the Class A Common Stock increases above the option exercise price. To that end, there is an ongoing review by the Compensation Committee of the market price of the Class A Common Stock and the exercise price of options. It is the Compensation Committee’s goal to preserve this incentive as an effective tool in attracting, retaining and motivating key personnel and to evaluate the need to add other components to an executive’s compensation package if it feels it is warranted at some future date. The Company did not grant any other options under the Plan to any executive officer in 2004, 2003 or 2002.

Section 162(m) of the Internal Revenue Code (the “Code”) generally disallows a public company’s deduction for compensation to any one employee in excess of $1 million per year unless the compensation is pursuant to a plan approved by the public company’s stockholders. The Compensation Committee believes that the Plan will not be adversely impacted by Section 162(m) of the Code.

As mentioned above, because all of the Company’s executive officers are paid compensation by Capital Partners, Inc. rather than by the Company, the Company did not pay Mr. Fitzgerald any direct cash compensation during 2004. However, the portion of his Capital Partners, Inc. salary and bonus set forth in the Summary Compensation Table was determined through an analysis performed by Company management to be allocable to services performed by him as the Company’s Chief Executive Officer.

Samuel B. Fortenbaugh III (Chairman)

Edward W. Kelley, Jr.

April 18, 2005

6

The Audit Committee has the responsibility for overseeing the Company’s financial reporting process on behalf of the Board of Directors and the direct responsibility for the appointment, compensation, retention and oversight of the Company’s independent registered public accounting firm (“independent auditors”). The Audit Committee selects the independent auditors, consults with the independent auditors and with management with regard to the adequacy of the Company’s internal control over financial reporting, considers any non-audit functions to be performed by the independent auditors and carries out such activities related to the financial statements of the Company as the Board of Directors shall from time to time request. The members of the Audit Committee are M. Paul Kelly, Edward W. Kelley, Jr. and, since December 23, 2004, Robert M. Williams Sr., all of whom are independent, as defined in Section 121A of the AMEX listing standards and Rule 10A-3 under the Securities Exchange Act of 1934. The Board has determined that M. Paul Kelly is an “audit committee financial expert,” as defined by applicable Securities and Exchange Commission regulations. The Audit Committee held nine meetings and acted by written consent once during the year ended December 31, 2004. The Audit Committee is governed by a written charter approved by the Board of Directors.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Audit Committee’s policy is to pre-approve all audit, audit-related and permissible non-audit services provided by the independent auditors. These services may include audit services, audit-related services, tax services and other services. The Audit Committee may also pre-approve particular services on a case-by-case basis. The independent auditors are required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditors in accordance with such pre-approval. The Audit Committee may also delegate pre-approval authority to one or more of its members. Such member or members must report any decisions to the Audit Committee at the next scheduled meeting.

Management has the primary responsibility for the Company’s financial statements being prepared in accordance with generally accepted accounting principles. Additionally, management has responsibility for the Company’s financial reporting process as well as the related system of internal control over financial reporting. The Company’s independent auditors are responsible for auditing the Company’s consolidated financial statements in accordance with standards of the Public Company Accounting Oversight Board and for issuing an opinion regarding compliance with generally accepted accounting principles in the United States. The Audit Committee has the responsibility for overseeing the Company’s financial reporting process on behalf of the Board of Directors and the direct responsibility for the appointment, compensation, retention and oversight of the independent auditors.

The past 12 months have been extremely busy for the Audit Committee. As we will discuss below, we oversaw an internal independent investigation into related-party transactions and conflicts of interest, oversaw the restatement of the Company’s previously filed financial statements with respect to the application of lease and leasehold improvements accounting standards and selected new independent auditors to replace Ernst & Young LLP (“Ernst & Young”), who notified us that they did not wish to stand for re-appointment for the 2005 audit engagement.

In July 2004, management notified us that they discovered that CompManagement Inc. (“CMI”) and CompManagement Health Systems, Inc. (“CHS”, and collectively with CMI, the “CMI Companies”), wholly owned subsidiaries of WC, may have engaged in potential related-party transactions with an entity that was controlled by certain officers of the CMI Companies (“CMI Management”). Management

7

launched a review of the matter by making additional inquiries and performing supplemental procedures (the “Supplemental Procedures”). The Supplemental Procedures revealed that certain members of CMI Management owned, operated and controlled two entities that had certain unauthorized and undisclosed transactional, operational and financial relationships with the CMI Companies. The Supplemental Procedures also revealed that the unauthorized and undisclosed transactional, operational and financial relationships with the CMI Companies resulted in conflicts of interest, but no fraud or financial impropriety that would indicate the Company’s historical financial statements were misstated. CMI Management had either previously divested its controlling interest or, as a result of the Supplemental Procedures, divested its controlling interest, in each of these entities.

Nevertheless, in November 2004, we initiated our own internal independent investigation (the “Investigation”) into the above-described related-party transactions and conflicts of interest designed to investigate those matters previously discovered by management, to search for other instances of potential related-party transactions or conflicts of interest and to determine the impact, if any, of such matters on the Company’s previously issued financial statements. To assist us in the Investigation, we retained independent legal counsel and forensic accounting experts.

The Investigation was completed in March 2005. As a result of the findings of the Investigation, we recommended to the Company’s Board of Directors that the CEO and CFO/General Counsel of the CMI Companies be terminated for cause. The total cost of the Supplemental Procedures and Investigation was $3 million. In addition, the Company saw a significant increase in auditing cost as our then-current independent auditors significantly increased their audit procedures. We estimate that the additional auditing cost incurred as a result of the Investigation was approximately $1 million, which is in addition to the $3 million mentioned above. Apart from these costs, we do not believe that the issues uncovered were material to the Company’s financial condition, results of operations or cash flows.

In February 2005, the Office of the Chief Accountant of the Securities and Exchange Commission (the “SEC”) issued a letter to the American Institute of Certified Public Accountants expressing its views regarding certain lease accounting issues and their application under Statement of Financial Accounting Standards No. 13, Accounting for Leases and other authoritative pronouncements. In light of this letter, management initiated a review of its accounting for leases and leasehold improvements and determined that the then-current accounting practices for leases and leasehold improvements were incorrect in our Employer Cost Containment and Health Services segment and at our corporate headquarters. Accordingly, management conducted an in-depth review of the Company’s lease accounting to determine the magnitude of the potential error on the financial statements. Based on the results of that review, we determined that the previously issued financial statements should no longer be relied upon and should therefore be restated in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 (the “2004 Form 10-K”).

Due to the Investigation, the restatement, and increased auditing procedures, the Company did not file its 2004 Form 10-K until June 28, 2005. The late filing of the 2004 Form 10-K naturally caused a delay in the filing of the Company’s Quarterly Reports on Form 10-Q for the periods ended March 31, 2005 (the “First Quarter 10-Q”) and June 30, 2005 (the “Second Quarter 10-Q”). The First Quarter 10-Q was filed on September 1, 2005 and the Second Quarter 10-Q was filed on September 16, 2005. Management has informed us that the Quarterly Report on Form 10-Q for the period ended September 30, 2005 will be timely filed.

On April 15, 2005, Ernst & Young notified us that they did not wish to stand for re-appointment as the Company’s independent auditors after completion of the 2004 annual audit. We worked closely with management to interview and meet with prospective independent registered public accounting firms, and ultimately selected McGladrey & Pullen, LLP (“McGladrey”) as the Company’s independent auditors for 2005. McGladrey accepted the appointment on July 28, 2005.

8

The Audit Committee has obtained from the Company’s independent auditors a formal written statement describing all relationships between the independent auditors and the Company that might bear on their independence required by Independence Standards Board No. 1, Independence Discussions with Audit Committees. In accordance with the Sarbanes-Oxley Act of 2002, the Committee pre-approved all audit and non-audit services performed by the independent auditors.

In discharging its oversight responsibility, the Audit Committee has met and held discussions with management and the independent auditors throughout 2004 and through the date of this report. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles in the United States, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee has discussed with the independent auditors matters required to be discussed by the Statement on Auditing Standards No. 61, as amended, and the Sarbanes-Oxley Act of 2002.

The Audit Committee has reviewed with the independent auditors their overall audit scope, audit plans and identification of audit risks. The Audit Committee has met with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal control over financial reporting and the overall quality of the Company’s financial reporting.

Based on the above-mentioned reviews and discussions with management and the independent auditors , the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the 2004 Form 10-K for filing with the SEC.

The Audit Committee

M. Paul Kelly (Chairman)

Edward W. Kelley, Jr.

Robert M. Williams, Sr.

September 16, 2005

The executive officers of the Company and their positions are as follows:

Brian D. Fitzgerald |

| Chairman of the Board, President and Chief Executive Officer |

| 61 |

A. George Gebauer |

| Vice Chairman of the Board and Secretary |

| 72 |

William R. Schlueter |

| Senior Vice President and Chief Financial Officer |

| 39 |

The executive officers serve at the discretion of the Company’s Board of Directors. Biographical information concerning Mr. Schlueter is set forth below. Biographical information regarding Messrs. Fitzgerald and Gebauer is contained in “Proposal I—Election of Directors.”

William R. Schlueter has been a Senior Vice President of the Company since April 2003 and Assistant Secretary of the Company since July 2000. In April 2004, he was re-named Chief Financial Officer of the Company. He was Vice President and Chief Financial Officer of the Company from 1999 through April 2003 and Treasurer of the Company from July 2001 to April 2003. He has also been Chief Financial Officer of Capital Partners, Inc. since 1998 and Chief Financial Officer and Managing Director of Capital Partners, Inc. since 2002.

9

1. Summary Compensation Table

The following Summary Compensation Table sets forth certain information about the annual compensation earned by or awarded to the Chief Executive Officer and the other executive officers of the Company:

|

|

|

|

|

|

|

|

| Long-Term |

| |||||||||

|

| Annual Compensation(1) |

| Securities |

| ||||||||||||||

|

| Fiscal |

| Salary |

| Bonus |

| Other Annual |

| Underlying |

| ||||||||

Brian D. Fitzgerald |

|

| 2004 |

|

| $ | 335,000 |

| $ | 85,000 |

|

| — |

|

|

| — |

|

|

Chairman of the Board, |

|

| 2003 |

|

| $ | 335,000 |

| $ | 82,000 |

|

| — |

|

|

| — |

|

|

President and CEO |

|

| 2002 |

|

| $ | 325,000 |

| $ | 92,000 |

|

| — |

|

|

| — |

|

|

A. George Gebauer |

|

| 2004 |

|

| $ | 85,000 |

| $ | 50,000 |

|

| — |

|

|

| — |

|

|

Vice Chairman of the Board |

|

| 2003 |

|

| $ | 96,000 |

| $ | 29,000 |

|

| — |

|

|

| — |

|

|

and Secretary |

|

| 2002 |

|

| $ | 74,000 |

| $ | 26,000 |

|

| — |

|

|

| — |

|

|

William R. Schlueter |

|

| 2004 |

|

| $ | 150,000 |

| $ | 75,000 |

|

| — |

|

|

| — |

|

|

Senior Vice President |

|

| 2003 |

|

| $ | 150,000 |

| $ | 60,000 |

|

| — |

|

|

| — |

|

|

and Chief Financial Officer |

|

| 2002 |

|

| $ | 153,300 |

| $ | 61,700 |

|

| — |

|

|

| — |

|

|

(1) All Company executive officers are paid compensation by Capital Partners, Inc. rather than by the Company. The Company pays Capital Partners, Inc. a management advisory services fee as discussed in “Certain Relationships and Related-Party Transactions”. At the request of the Board’s Compensation Committee, the Company’s management performed an analysis of the Company’s executive officers’ time for the years ended December 31, 2004, 2003 and 2002. The table above reflects the portion of the salaries and bonuses of the Company’s executive officers paid by Capital Partners, Inc. allocable to their performance of services as executive officers of the Company.

2. Option Grants in Last Fiscal Year

There were no options granted to the Company’s executive officers during the year ended December 31, 2004.

10

3. Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

No options were exercised by any executive officer of the Company during the year ended December 31, 2004. The following table represents the value of unexercised options held by the Chief Executive Officer and the other executive officers of the Company at December 31, 2004:

Name |

|

|

| Shares |

| Value |

| Number of Securities |

| Value of |

| ||||||||

Brian D. Fitzgerald |

|

| — |

|

|

| — |

|

|

| 440,000 | (E) |

|

| 1,656,600 | (E) |

| ||

|

| — |

|

|

| — |

|

|

| 160,000 | (U) |

|

| 602,400 | (U) |

| |||

A. George Gebauer |

|

| — |

|

|

| — |

|

|

| 40,000 | (E) |

|

| 150,600 | (E) |

| ||

|

|

| — |

|

|

| — |

|

|

| 10,000 | (U) |

|

| 37,650 | (U) |

| ||

William R. Schlueter |

|

| — |

|

|

| — |

|

|

| 52,000 | (E) |

|

| 195,780 | (E) |

| ||

|

| — |

|

|

| — |

|

|

| 18,000 | (U) |

|

| 67,770 | (U) |

| |||

4. Equity Compensation Plan Information

The following table sets forth information, as of December 31, 2004, with regard to the Plan which was approved by stockholders in July 2000. There are no other equity compensation plans in effect with regard to the Company’s stock at this time.

|

|

|

| (a) |

| (b) |

| (c) |

| |||||||

Plan Category |

|

|

| Number of |

| Weighted-Average |

| Number of |

| |||||||

Equity compensation plans approved by stockholders |

|

| 843,000 |

|

|

| $ | 7.89 |

|

|

| 123,346 |

|

| ||

Equity compensation plans not approved by stockholders |

|

| — |

|

|

| — |

|

|

| — |

|

| |||

Total |

|

| 843,000 |

|

|

| $ | 7.89 |

|

|

| 123,346 |

|

| ||

11

5. Compensation of Directors

Effective July 27, 2005, the compensation schedule for directors, other than Messrs. Fitzgerald and Gebauer, is as follows:

Board of Director Fees |

|

|

| |

Annual Board Fee |

| $ | 15,000 |

|

Board Meeting Attendance Fee |

| $ | 2,000 |

|

Audit Committee Fees |

|

|

| |

Additional Annual Fee for Chairperson |

| $ | 20,000 |

|

Additional Annual Fee for Other Members |

| $ | 5,000 |

|

Committee Meeting Attendance Fee |

| $ | 2,000 |

|

Compensation Committee Fees |

|

|

| |

Additional Annual Fee for Chairperson |

| $ | 8,000 |

|

Additional Annual Fee for Other Members |

| $ | 5,000 |

|

Committee Meeting Attendance Fee |

| $ | 2,000 |

|

Special Committee Fees |

|

|

| |

Additional Annual Fee for Chairperson |

| $ | 16,000 |

|

Additional Annual Fee for Other Member |

| $ | 12,000 |

|

Committee Meeting Attendance Fee |

| $ | 2,000 |

|

All directors, including Messrs. Fitzgerald and Gebauer, are entitled to reimbursement of reasonable expenses in connection with attendance at Board and committee meetings.

For the year ended December 31, 2004 and through July 26, 2005, each director, other than Messrs. Fitzgerald and Gebauer, received an annual fee of $12,000 plus a fee of $2,000 per Board meeting. Each committee chairperson received an additional annual fee of $4,000, and each committee member, including the chairperson, received up to $1,500 per committee meeting, dependent upon the length of the meeting and as determined by the respective committee’s chairperson. All directors, including Messrs. Fitzgerald and Gebauer, were entitled to reimbursement of reasonable expenses in connection with attendance at Board and committee meetings. The annual fees for 2005 will be prorated based upon the compensation arrangements in effect during the year.

In addition to fees, each of the directors, other than Messrs. Fitzgerald and Gebauer, received, on the date of his election to the Board of Directors, an option to purchase 24,000 shares of Class A Common Stock at an exercise price equal to the fair market value per share on the date of grant. Subject to termination of the optionee’s directorship, each option expires 10 years from the date of grant. The options are not transferable other than upon death and are exercisable in three equal annual installments commencing on the date of grant.

6. Compensation Committee Interlocks and Insider Participation

For the fiscal year ended December 31, 2004, the members of the Compensation Committee were non-employee directors and not former officers. During 2004, no executive officer served as a member of a board of directors or compensation committee of a corporation where any of its executive officers served on the Company’s Compensation Committee or Board of Directors.

12

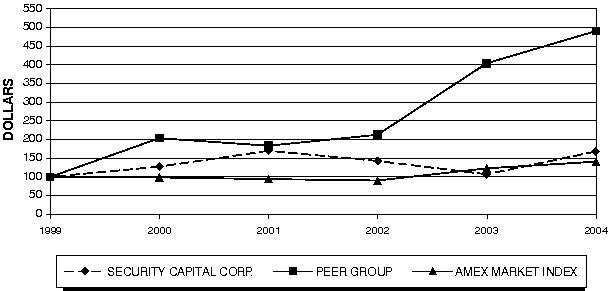

The performance graph below shows a comparison of the cumulative total return, on a dividend reinvestment basis, measured at each fiscal year end for the last five years assuming $100 invested on January 1, 2000 in Class A Common Stock, the Company’s selected peer group and the AMEX Market Index. The Company’s selected peer group consists of companies that management considers to be competitors within each of the Company’s operating segments.

Selected peer group companies within the employer cost containment and health services operating segment consist of CorVel Corp., Coventry Healthcare and Crawford & Co. Selected peer group companies within the educational services operating segment consist of Bright Horizons Family Solutions, Inc., Learning Care Group, Inc., Nobel Learning Communities, Inc. and New Horizon Kid Qwest.

The returns of each peer group company have been weighted according to its stock market capitalization for purposes of arriving at a peer group average.

|

|

|

| Fiscal Year Ended December 31, |

| ||||||||||||

Company/Index/Market |

|

|

| 1/1/2000 |

| 2000 |

| 2001 |

| 2002 |

| 2003 |

| 2004 |

| ||

SECURITY CAPITAL CORP. |

|

| 100.00 |

|

| 127.55 |

| 170.07 |

| 142.86 |

| 107.14 |

| 168.20 |

| ||

Peer Group Index |

|

| 100.00 |

|

| 203.86 |

| 183.58 |

| 213.08 |

| 404.48 |

| 490.69 |

| ||

AMEX Market Index |

|

| 100.00 |

|

| 98.77 |

| 94.22 |

| 90.46 |

| 123.12 |

| 140.99 |

| ||

13

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

The Company has the MAS Agreement with Capital Partners, Inc. whereby Capital Partners, Inc. provides certain management advisory services related to investments, general administration, corporate development, strategic planning, stockholder relations, financial matters and general business policy. The MAS Agreement is effective for the calendar year and terminable by either Capital Partners, Inc. or the Company as of any December 31 upon not less than 60 days’ prior written notice to the other. Fees paid to Capital Partners, Inc. for management advisory services were $1,550,000 for the year ended December 31, 2004. The Company also reimbursed Capital Partners, Inc. for travel-related expenses of $22,000 during 2004.

In addition, the Company has agreed to pay fees to Capital Partners, Inc. for acquisition opportunities presented to the Company at usual and customary rates for investment banking fees for transactions of similar size and complexity. Capital Partners, Inc. is under no obligation to present to the Company any or all acquisition candidates of which it becomes aware. Furthermore, the Company is under no obligation to utilize Capital Partners, Inc. for investment banking services. The payment of an investment banking fee to Capital Partners, Inc. is subject to Board of Directors’, Audit Committee and Compensation Committee approval. In 2005, the Company paid an investment banking fee of $240,000 as compensation for the services it performed relative to the acquisition of Caronia Corporation.

Fees paid to Capital Partners, Inc. are generally subordinate to the rights of the lenders to the Company.

The Audit Committee of the Board of Directors selected Ernst & Young LLP (“Ernst & Young”) as the independent auditors of the Company for the fiscal year ended December 31, 2004. On April 15, 2005, Ernst & Young notified the Chairman of the Audit Committee that it declined to stand for re-appointment as the Company’s independent auditors after completion of the 2004 annual audit. Ernst & Young ceased to be the Company’s independent auditors on June 28, 2005.

During the two most recent fiscal years and the subsequent interim period preceding the termination of Ernst & Young’s engagement on June 28, 2005, there were no disagreements between the Company and Ernst & Young on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of Ernst & Young, would have caused it to make reference to the subject matter of the disagreement in connection with its reports. In a letter provided to the Company’s Audit Committee and management, Ernst & Young stated that, during its audit, it noted various matters involving internal control over financial reporting and its design and operation that it considered to be a material weakness in the Company’s year-end close process. Ernst & Young’s reports on the Company’s financial statements for the past two years did not contain an adverse opinion or a disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope, or accounting principles.

On July 25, 2005, the Audit Committee selected McGladrey to audit and report on the financial statements of the Company for the fiscal year ended December 31, 2005 and to perform a review of the Company’s interim financial information for each of the quarterly interim periods of 2005. Prior to the engagement of McGladrey, the Company had not consulted with McGladrey during its two most recent fiscal years and the subsequent interim period from January 1 to July 25, 2005 on any matter regarding: (a) the application of accounting principles to a specified completed or proposed transaction; (b) the type of audit opinion that might be rendered on the Company’s financial statements; or (c) any matter that was the subject of either a “disagreement” (as defined in Item 304(a)(1)(iv) of SEC Regulation S-K) or a “reportable event” (as defined in Item 304(a)(1)(v) of Regulation S-K).

14

One or more representatives of McGladrey are expected to be available at the Annual Meeting to respond to appropriate questions. They will have an opportunity to make a statement if they so desire.

In addition to retaining Ernst & Young to audit the consolidated financial statements for 2004 and 2003, the Company and its subsidiaries retained Ernst & Young to provide audit-related and tax services in 2004 and 2003. The aggregate fees for professional services by Ernst & Young in 2004 and 2003 were as follows:

Audit Fees: The Company was charged $1,815,000 and $467,000 for services rendered in connection with the annual audit of the Company’s consolidated financial statements for 2004 and 2003, respectively, and $206,000 and $94,000 for services rendered for three quarterly reviews of the financial statements during 2004 and 2003, respectively. Also, in 2004, the Company was charged $732,000 for services and procedures relating to the Investigation and an additional $140,000 for services rendered for the annual audit of the Company’s consolidated financial statements for 2003. In 2003, the Company incurred an additional $89,000 for services rendered for the annual audit of the Company’s consolidated financial statements for 2002.

Audit-Related Fees: The Company was charged $170,000 in 2003 for fees associated with the audit for the acquisition of Octagon Risk Services, Inc.

Tax Fees: The Company was charged $120,000 and $90,000 for tax compliance services for the Company and its subsidiaries for 2004 and 2003, respectively. The Company was charged $30,000 in 2004 and $326,000 in 2003 for specific subsidiary tax advice.

All Other Fees: The aggregate fees for services not included above were $5,000 for subscriptions to a proprietary online database in 2003.

All of the services provided above were pre-approved by the Audit Committee pursuant to policies set forth in the Company’s Audit Committee Charter. The Audit Committee considered that the provision of these services was compatible with maintaining Ernst & Young’s independence.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s officers and directors and persons who beneficially own more than 10% of the Class A Common Stock of the Company to file initial reports of ownership of such securities and reports of changes in ownership of such securities with the SEC. Such officers, directors and 10% stockholders of the Company are also required by SEC regulations to furnish the Company with copies of all Section 16(a) reports they file.

Based solely on the Company’s review of the copies of the reports furnished by such persons, the Company believes that, for the fiscal year ended December 31, 2004, officers, directors and 10% stockholders filed all required Section 16(a) reports on a timely basis.

The total cost of the proxy solicitation will be borne by the Company. In addition to the mails, Proxies may be solicited by directors and officers of the Company by personal interviews, telephone and telegraph. The Company has retained D.F. King & Co., Inc., New York, New York, to assist in the solicitation of Proxies for a fee estimated to be $2,000 plus reimbursement of out-of-pocket expenses. It is anticipated that banks, brokerage houses and other custodians, nominees and fiduciaries will forward soliciting material to the beneficial owners of shares of Common Equity entitled to vote at the Annual Meeting and that such persons will be reimbursed for their out-of-pocket expenses incurred in this connection.

15

STOCKHOLDER COMMUNICATIONS WITH THE BOARD

The Board of Directors has implemented a process by which stockholders may communicate with the Board. Any stockholder desiring to communicate with the Board may do so in writing by sending a letter to the Company’s executive office addressed to The Board of Directors, c/o the Secretary of the Company. The Company’s Secretary has been instructed by the Board to promptly forward communications so received to the Board.

Stockholders are hereby notified that, if they intend to submit proposals for inclusion in the Company’s Proxy Statement and Proxy for its 2006 Annual Meeting of Stockholders pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such proposals must be received by the Company no later than December 30, 2005 and must otherwise be in compliance with applicable SEC regulations. In order for a proposal submitted outside of Rule 14a-8 to be considered “timely” within the meaning of Rule 14a-4 under the Exchange Act, such proposal must be received prior to March 15, 2006. Any such stockholder proposal must be sent to the Secretary of the Company at the Company’s executive office.

The Board of Directors knows of no other business to be presented at the Annual Meeting. If, however, other matters properly do come before the Annual Meeting, it is intended that the Proxies in the accompanying form will be voted thereon in accordance with the judgment of the person or persons holding such Proxies.

THE COMPANY’S ANNUAL REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2004 ACCOMPANIES THIS PROXY STATEMENT. A COPY OF THE COMPANY’S 2004 FORM 10-K IS AVAILABLE TO THE COMPANY’S STOCKHOLDERS, WITHOUT CHARGE, UPON WRITTEN REQUEST. EXHIBITS TO THE COMPANY’S 2004 FORM 10-K WILL BE FURNISHED UPON PAYMENT OF $0.50 PER PAGE, WITH A MINIMUM CHARGE OF $5.00. REQUESTS FOR COPIES SHOULD BE DIRECTED TO INVESTOR RELATIONS AT THE COMPANY’S EXECUTIVE OFFICE. THE COMPANY’S 2004 FORM 10-K IS ALSO AVAILABLE ON THE COMPANY’S WEBSITE AT WWW.SECURITYCAPITALCORPORATION.COM.

STOCKHOLDERS ARE URGED TO COMPLETE, DATE, SIGN AND MAIL PROMPTLY THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED. PROMPT RESPONSE WILL GREATLY FACILITATE ARRANGEMENTS FOR THE ANNUAL MEETING, AND YOUR COOPERATION WILL BE APPRECIATED.

By Order of the Board of Directors, | |

|

|

| A. George Gebauer |

| Vice Chairman of the Board and Secretary |

Greenwich, CT

September 23, 2005

16

SECURITY CAPITAL CORPORATION

ANNUAL MEETING OF STOCKHOLDERS – OCTOBER 24, 2005

The undersigned hereby appoints Brian D. Fitzgerald and A. George Gebauer, and each of them, proxies, with full power of substitution, to appear on behalf of the undersigned and to vote all shares of Common Stock (par value $.01) and Class A Common Stock (par value $.01) of Security Capital Corporation (the “Company”) that the undersigned is entitled to vote at the Annual Meeting of Stockholders of the Company to be held in Conference Room 45a, 45th Floor, 101 Park Avenue, New York, New York, on Monday, October 24, 2005, commencing at 10:00 a.m. (local time), and at any adjournment thereof.

WHEN PROPERLY EXECUTED, THIS PROXY WILL BE VOTED AS DIRECTED, BUT IF NO INSTRUCTIONS ARE SPECIFIED, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE LISTED NOMINEES AS DIRECTORS.

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

| Security Capital Corporation |

| P.O. Box 11161 |

| New York, N.Y. 10203-0161 |

Please sign, date and return |

| Votes MUST be indicated with an ý in Black or Blue ink. | ||||

|

|

| ||||

1. Election of |

|

|

|

|

|

|

Directors: |

| FOR all nominees listed below o |

| WITHHOLD AUTHORITY to vote for all |

| *EXCEPTIONS o |

|

|

|

| nominees listed below o |

|

|

Nominees: BRIAN D. FITZGERALD, A. GEORGE GEBAUER, SAMUEL B. FORTENBAUGH III,

JOHN H.F. HASKELL, JR., EDWARD W. KELLEY, JR., M. PAUL KELLY, ROBERT M. WILLIAMS, SR.

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark the “Exceptions” box and write that nominee’s name in the space provided below.)

*Exceptions |

|

|

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Annual Meeting and any adjournment thereof.

Please sign exactly as your name appears on the left. When signing as an attorney, executor, administrator, trustee or guardian, please give your full title. If shares are held jointly, each holder should sign.

PLEASE CHECK HERE IF YOU PLAN TO ATTEND THE ANNUAL

MEETING. o

TO CHANGE YOUR ADDRESS, PLEASE MARK THIS BOX. o

TO INCLUDE ANY COMMENTS, PLEASE MARK THIS BOX. o

Dated: |

| , 2005 | |||

|

|

| |||

|

|

| |||

| Signature |

| |||

|

|

| |||

|

|

| |||

| Signature |

| |||

1