UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-CSR CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act file number: 811-02979 Morgan Stanley Tax-Exempt Securities Trust (Exact name of registrant as specified in charter) 1221 Avenue of the Americas, New York, New York 10020 (Address of principal executive offices) (Zip code) Ronald E. Robison 1221 Avenue of the Americas, New York, New York 10020 (Name and address of agent for service) Registrant's telephone number, including area code: 212-762-4000 Date of fiscal year end: December 31, 2004 Date of reporting period: December 31, 2004 Item 1 - Report to Shareholders

Welcome, Shareholder:

In this report, you'll learn about how your investment in Morgan Stanley Tax-Exempt Securities Trust performed during the annual period. We will provide an overview of the market conditions, and discuss some of the factors that affected performance during the reporting period. In addition, this report includes the Fund's financial statements and a list of Fund investments.

| This material must be preceded or accompanied by a prospectus for the fund being offered. Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund's shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. |

| Fund Report | |

| For the year ended December 31, 2004 | |

Total Return for the 12-Month Period Ended December 31, 2004

| Class A | Class B | Class C | Class D | Lehman Brothers Municipal Bond Index1 | Lipper General Municipal Debt Funds Index2 | |||||||||||||||||||||||||||

| 3.82% | 3.34 | % | 3.24 | % | 4.05 | % | 4.48 | % | 4.14 | % | ||||||||||||||||||||||

| Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit morganstanley.com or speak with your Financial Advisor. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. |

| The performance of the Fund's four share classes varies because each has different expenses. The Fund's total return figures assume the reinvestment of all distributions, but do not reflect the deduction of any applicable sales charges. Such costs would lower performance. See Performance Summary for standardized performance information. |

Market Conditions

Growth in consumer spending and business investment helped the U.S. economy expand at a solid pace in 2004. Even with this positive backdrop, however, fixed income markets were confronted with contradictory economic data. At the beginning of the year, weak employment growth and the possibility of deflation kept interest rates at historically low levels. Market sentiment changed in April, when the release of the March employment report was significantly higher than expected and included upward revisions of previous periods. The bond market also began to focus on the rapid climb in oil prices. These new signals led investors to conclude that the Federal Open Market Committee (the "Fed") would begin to raise rates sooner than had been anticipated.

Beginning in June, the Fed raised short-term interest rates five times over the remainder of the year. This brought the overnight federal funds rate to 2.25 percent, and reversed a portion of the Fed's 13 rate reductions that occurred between January 2001 and June 2003. Despite these actions, a series of soft economic indicators caused yields on intermediate and longer maturity bonds to move lower in the second half.

Against this setting, intermediate and long-term municipal bond yields peaked in June but subsequently trended lower before ending the year with little overall change. In contrast, yields on shorter bonds rose steadily in the second half of the period when the Fed began tightening.

Municipal underwriting volume of $359 billion in 2004 finished 7 percent below last year's record level. California continued to lead all states with $55 billion in issuance. New York ranked second in issuance with $38 billion. Relative to U.S. Treasuries, municipal bonds outperformed early in the year but then gave ground. The municipal-to-Treasury yield ratio, which gauges relative performance, remained attractive for municipals. As a result, fixed income investors such as insurance companies and hedge funds that normally focus on taxable sectors supported municipals by "crossing over" to purchase bonds.

2

Performance Analysis

Morgan Stanley Tax-Exempt Securities Trust underperformed both the Lehman Brothers Municipal Bond Index and the Lipper General Municipal Debt Funds Index for the year. The Fund's performance in 2004 was primarily driven by its duration* target and quality composition. The Fund's duration during the year was gradually reduced relative to its benchmark in anticipation of rising interest rates. This reduced the Fund's exposure to securities with longer maturities, which were among the best performers in the index.

The Fund also maintained its traditional high quality profile, with more than 85 percent of the bonds in the portfolio rated AA or higher. During the period, the yield spread between higher and lower quality bonds tightened and lower quality municipal bonds generally outperformed. The Fund remained well diversified, with 159 individual credits in 17 municipal sectors located in 35 different states, the District of Columbia and Puerto Rico.

| * A measure of the sensitivity of a bond's price to changes in interest rates, expressed in years. Each year of duration represents an expected 1 percent change in the price of a bond for every 1 percent change in interest rates. The longer a bond's duration, the greater the effect of interest-rate movements on its price. Typically, funds with shorter durations perform better in rising-interest-rate environments, while funds with longer durations perform better when rates decline. |

| There is no guarantee that any securities mentioned will continue to perform well or be held by the Fund in the future. |

| TOP FIVE SECTORS | ||||||

| Transportation | 18.4 | % | ||||

| Electric | 13.2 | |||||

| Water & Sewer | 12.6 | |||||

| General Obligation | 12.5 | |||||

| Refunded | 11.0 | |||||

| LONG-TERM CREDIT ANALYSIS | ||||||

| Aaa/AAA | 72.1 | % | ||||

| Aa/AA | 13.7 | |||||

| A/A | 5.8 | |||||

| Baa/BBB | 6.2 | |||||

| Ba/BB | 0.7 | |||||

| NR | 1.5 | |||||

| Data as of December 31, 2004. Subject to change daily. All percentages for top five sectors are as a percentage of net assets. All percentages for long-term credit analysis are as a percentage of total long-term investments. Provided for informational purposes only and should not be deemed a recommendation to buy or sell the securities mentioned. Morgan Stanley is a full-service securities firm engaged in securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services. |

3

Investment Strategy

The Fund will normally invest at least 80 percent of its assets in securities that pay interest exempt from federal income taxes. This policy is fundamental and may not be changed without shareholder approval. The Fund's "Investment Manager," Morgan Stanley Investment Advisors Inc., generally invests the Fund's assets in municipal obligations. Municipal obligations are bonds, notes or short-term commercial paper issued by state governments, local governments, and/or their respective agencies.

For More Information About Portfolio Holdings

Each Morgan Stanley fund provides a complete schedule of portfolio holdings in its semiannual and annual reports within 60 days of the end of the fund's second and fourth fiscal quarters by filing the schedule electronically with the Securities and Exchange Commission (SEC). The semiannual reports are filed on Form N-CSRS and the annual reports are filed on Form N-CSR. Morgan Stanley also delivers the semiannual and annual reports to fund shareholders and makes these reports available on its public Web site, www.morganstanley.com. Each Morgan Stanley fund also files a complete schedule of portfolio holdings with the SEC for the fund's first and third fiscal quarters on Form N-Q. Morgan Stanley does not deliver the reports for the first and third fiscal quarters to shareholders, nor are the reports posted to the Morgan Stanley public Web site. You may, however, obtain the Form N-Q filings (as well as the Form N-CSR and N-CSRS filings) by accessing the SEC's Web site, http://www.sec.gov. You may also review and copy them at the SEC's Public Reference Room in Washington, DC. Information on the operation of the

SEC's Public Reference Room may be obtained by calling the SEC at (800) SEC-0330. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC's e-mail address (publicinfo@sec.gov) or by writing the Public Reference section of the SEC, Washington, DC 20549-0102. You may obtain copies of a fund's fiscal quarter filings by contacting Morgan Stanley Client Relations at (800) 869-NEWS.

Householding Notice

To reduce printing and mailing costs, the Fund attempts to eliminate duplicate mailings to the same address. The Fund delivers a single copy of certain shareholder documents, including shareholder reports, prospectuses and proxy materials, to investors with the same last name who reside at the same address. Your participation in this program will continue for an unlimited period of time unless you instruct us otherwise. You can request multiple copies of these documents by calling (800) 350-6414, 8:00 a.m. to 8:00 p.m., ET. Once our Customer Service Center has received your instructions, we will begin sending individual copies for each account within 30 days.

4

| Distribution by Maturity | |

| (% of Long-Term Portfolio) As of December 31, 2004 | |

Weighted Average Maturity: 14 Years

| Portfolio structure is subject to change. |

Geographic Summary of Investments

Based on Market Value as a Percent of Net Assets

| Alabama | 0.5 | % | ||||

| Alaska | 4.8 | |||||

| Arizona | 3.3 | |||||

| Arkansas | 0.2 | |||||

| California | 5.3 | |||||

| Colorado | 3.1 | |||||

| Connecticut | 2.9 | |||||

| District of Columbia | 0.8 | |||||

| Florida | 1.9 | |||||

| Georgia | 3.4 | |||||

| Hawaii | 1.8 | % | ||||

| Idaho | 0.1 | |||||

| Illinois | 5.0 | |||||

| Indiana | 2.8 | |||||

| Kansas | 0.5 | |||||

| Kentucky | 3.8 | |||||

| Maryland | 1.1 | |||||

| Massachusetts | 3.7 | |||||

| Michigan | 1.6 | |||||

| Missouri | 1.6 | |||||

| Nevada | 2.0 | % | ||||

| New Hampshire | 0.1 | |||||

| New Jersey | 6.3 | |||||

| New Mexico | 0.8 | |||||

| New York | 9.9 | |||||

| North Carolina | 2.7 | |||||

| Ohio | 3.7 | |||||

| Pennsylvania | 1.9 | |||||

| Puerto Rico | 1.5 | |||||

| South Carolina | 4.1 | |||||

| Tennessee | 2.1 | % | ||||

| Texas | 9.4 | |||||

| Utah | 1.7 | |||||

| Virginia | 1.6 | |||||

| Washington | 3.1 | |||||

| West Virginia | 0.3 | |||||

| Wisconsin | 0.8 | |||||

| Joint exemptions* | (1.4 | ) | ||||

| Total | 98.8 | % | ||||

| * Joint exemptions have been included in each geographic location. |

5

| Call and Cost (Book) Yield Structure | |

| (Based on Long-Term Portfolio) As of December 31, 2004 | |

Years Bonds Callable — Weighted Average Call Protection: 6 Years

Cost (Book) Yield(b) — Weighted Average Book Yield: 5.6%

| (a) | May include issues callable in previous years. |

| (b) | Cost or "book" yield is the annual income earned on a portfolio investment based on its original purchase price before the Fund's operating expenses. For example, the Fund is earning a book yield of 7.0% on 12% of the long-term portfolio that is callable in 2005. |

| Portfolio structure is subject to change. |

6

(This page has been left blank intentionally.)

7

| Performance Summary | |

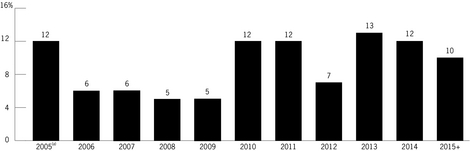

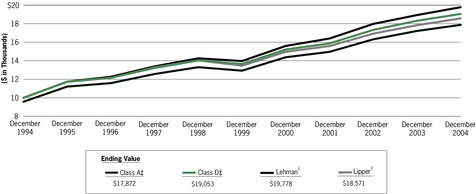

Performance of a $10,000 Investment — Class A and D

8

Average Annual Total Returns — Period Ended December 31, 2004

| Class A Shares* (since 03/27/80) | Class B Shares** (since 07/28/97) | Class C Shares† (since 07/28/97) | Class D Shares†† (since 03/27/80) | |||||||||||||||||||||||

| Symbol | TAXAX | TAXBX | TAXCX | TAXDX | ||||||||||||||||||||||

| 1 Year | 3.82 % | 3 | 3.34 % | 3 | 3.24% | 3 | 4.05% | 3 | ||||||||||||||||||

| (0.59) | 4 | (1.60) | 4 | 2.25 | 4 | — | ||||||||||||||||||||

| 5 Years | 6.69 | 3 | 6.23 | 3 | 6.13 | 3 | 6.90 | 3 | ||||||||||||||||||

| 5.77 | 4 | 5.91 | 4 | 6.13 | 4 | — | ||||||||||||||||||||

| 10 Years | 6.44 | 3 | — | — | 6.66 | 3 | ||||||||||||||||||||

| 5.98 | 4 | — | — | — | ||||||||||||||||||||||

| Since Inception | 8.15 | 3 | 4.93 | 3 | 4.79 | 3 | 8.40 | 3 | ||||||||||||||||||

| 7.96 | 4 | 4.93 | 4 | 4.79 | 4 | — | ||||||||||||||||||||

| Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit morganstanley.com or speak with your financial advisor. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class A, Class B, Class C, and Class D shares will vary due to differences in sales charges and expenses. |

| Prior to July 28, 1997 the Fund offered only one class of shares. Because the distribution arrangement for Class A most closely resembled the distribution arrangement applicable prior to the implementation of multiple classes (i.e., Class A is sold with a front-end sales charge), historical performance information has been restated to reflect the actual maximum sales charge applicable to Class A (i.e., 4.25%) as compared to the 4.00% sales charge in effect prior to July 28, 1997. In addition, Class A shares are now subject to an ongoing 12b-1 fee which is reflected in the restated performance for that class. |

| Because all shares of the fund held prior to July 28, 1997 were designated Class D shares, the Fund's historical performance has been restated to reflect the absence of any sales charge. |

| * | The maximum front-end sales charge for Class A is 4.25%. |

| ** | The maximum contingent deferred sales charge (CDSC) for Class B is 5.0%. The CDSC declines to 0% after six years. |

| † | The maximum contingent deferred sales charge for Class C is 1% for shares redeemed within one year of purchase. |

| †† | Class D has no sales charge. |

| (1) | The Lehman Brothers Municipal Bond Index tracks the performance of municipal bonds rated at least Baa or BBB by Moody's Investors Service, Inc. or Standard & Poor's Corporation, respectively and with maturities of 2 years or greater. Indexes are unmanaged and their returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index. |

| (2) | The Lipper General Municipal Debt Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper General Municipal Debt Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. |

| (3) | Figure shown assumes reinvestment of all distributions and does not reflect the deduction of any sales charges. |

| (4) | Figure shown assumes reinvestment of all distributions and the deduction of the maximum applicable sales charge. See the Fund's current prospectus for complete details on fees and sales charges. |

| ‡ | Ending value assuming a complete redemption on December 31, 2004. |

9

| Expense Example | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 07/01/04 – 12/31/04.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| BEGINNING ACCOUNT VALUE | ENDING ACCOUNT VALUE | EXPENSES PAID DURING PERIOD * | ||||||||||||

| 07/01/04 | 12/31/04 | 07/01/04 – 12/31/04 | ||||||||||||

| Class A | ||||||||||||||

| Actual (4.84% return) | $ | 1,000.00 | $ | 1,048.40 | $ | 3.96 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,021.27 | $ | 3.91 | ||||||||

| Class B | ||||||||||||||

| Actual (4.64% return) | $ | 1,000.00 | $ | 1,046.40 | $ | 5.76 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,019.51 | $ | 5.69 | ||||||||

| Class C | ||||||||||||||

| Actual (4.60% return) | $ | 1,000.00 | $ | 1,046.00 | $ | 6.27 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,019.00 | $ | 6.19 | ||||||||

| Class D | ||||||||||||||

| Actual (4.97% return) | $ | 1,000.00 | $ | 1,049.70 | $ | 2.68 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,022.52 | $ | 2.64 | ||||||||

| * | Expenses are equal to the Fund's annualized expense ratio of 0.77%, 1.12%, 1.22% and 0.52% respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

10

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments  December 31, 2004

December 31, 2004

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| Tax-Exempt Municipal Bonds (95.3%) | ||||||||||||||||||

| General Obligation (12.5%) | ||||||||||||||||||

| North Slope Borough, Alaska, | ||||||||||||||||||

| $ | 15,000 | Ser 1995 A (MBIA) | 0.00 | % | 06/30/06 | $ | 14,481,300 | |||||||||||

| 3,000 | Ser 2000 B (MBIA) | 0.00 | 06/30/09 | 2,606,520 | ||||||||||||||

| 9,500 | Ser 1999 A (MBIA) | 0.00 | 06/30/10 | 7,866,950 | ||||||||||||||

| 25,000 | Ser 2000 B (MBIA) | 0.00 | 06/30/11 | 19,710,500 | ||||||||||||||

| 5,000 | California, Various Purpose dtd 04/01/02 | 6.00 | 04/01/19 | 5,972,250 | ||||||||||||||

| 2,000 | Los Angeles Unified School District, California, 1997 Ser B (FGIC) | 5.00 | 07/01/23 | 2,107,940 | ||||||||||||||

| Connecticut, | ||||||||||||||||||

| 4,000 | College Savings 1989 Ser A | 0.00 | 07/01/08 | 3,655,480 | ||||||||||||||

| 5,000 | Refg 2002 Ser E Ser PA 1056 B RITES (FSA) | 8.411 | ‡ | 11/15/11 | 6,453,550 | |||||||||||||

| 15,000 | Refg 2002 Ser E Ser PA 1056 A RITES (FSA) | 8.411 | ‡ | 11/15/13 | 19,142,550 | |||||||||||||

| Chicago, Illinois, | ||||||||||||||||||

| 5,000 | Refg Ser 1995 A-2 (Ambac) | 6.25 | 01/01/14 | 5,991,750 | ||||||||||||||

| 2,000 | Refg 2001 A (MBIA) | 0.00 | # | 01/01/17 | 1,651,120 | |||||||||||||

| 10,300 | Neighborhoods Alive 21 (FGIC) | 5.375 | 01/01/26 | 11,103,503 | ||||||||||||||

| Chicago Board of Education, Illinois, | ||||||||||||||||||

| 1,000 | Ser 2001 C (FSA) | 5.50 | 12/01/18 | 1,123,720 | ||||||||||||||

| 3,000 | Ser 2001 C (FSA) | 5.00 | 12/01/26 | 3,092,700 | ||||||||||||||

| 4,280 | Chicago Park District, Illinois, Ser 2004 A (Ambac) | 5.00 | 01/01/26 | 4,452,356 | ||||||||||||||

| 3,000 | Clark County, Nevada, Transportation Ser 1992 A (Ambac) | 6.50 | 06/01/17 | 3,739,920 | ||||||||||||||

| 2,000 | New York City, New York 2005 Ser G | 5.00 | 12/01/25 | 2,060,640 | ||||||||||||||

| 5,000 | New York State, Refg Ser 1995 B | 5.70 | 08/15/10 | 5,156,750 | ||||||||||||||

| 10,000 | North Carolina, Public School Building Ser 1999 | 4.60 | 04/01/17 | 10,475,100 | ||||||||||||||

| 10,000 | South-Western City School District, Ohio, Ser 1999 (Ambac) | 4.75 | 12/01/19 | 10,469,200 | ||||||||||||||

| Pennsylvania, | ||||||||||||||||||

| 5,000 | RITES PA – 1112 A (MBIA) | 7.399 | ‡ | 01/01/18 | 5,760,400 | |||||||||||||

| 5,000 | RITES PA – 1112 B (MBIA) | 7.399 | ‡ | 01/01/19 | 6,145,850 | |||||||||||||

| Shelby County, Tennessee, | ||||||||||||||||||

| 5,000 | Refg 1995 Ser A | 5.625 | 04/01/11 | 5,093,150 | ||||||||||||||

| 1,000 | Refg 1995 Ser A | 5.625 | 04/01/12 | 1,018,630 | ||||||||||||||

| 4,000 | Refg 1995 Ser A | 5.625 | 04/01/14 | 4,074,520 | ||||||||||||||

| 159,080 | 163,406,349 | |||||||||||||||||

| Educational Facilities Revenue (2.9%) | ||||||||||||||||||

| 4,000 | California Public Works Board, University of California 1993 Refg Ser A | 5.50 | 06/01/21 | 4,035,240 | ||||||||||||||

| 1,000 | University of Idaho, Student Fee Ser H (FGIC) | 5.25 | 04/01/31 | 1,055,500 | ||||||||||||||

See Notes to Financial Statements

11

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments  December 31, 2004 continued

December 31, 2004 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| $ | 1,000 | Purdue University, Indiana, Student Fee Ser Q | 5.75 | % | 07/01/15 | $ | 1,122,040 | |||||||||||

| 2,000 | Maryland Health & Educational Facilities Authority, The Johns Hopkins University Refg Ser 1998 | 5.125 | 07/01/20 | 2,150,280 | ||||||||||||||

| 400 | Massachusetts Industrial Finance Agency, College of the Holy Cross 1996 Issue (MBIA) | 5.50 | 03/01/16 | 422,028 | ||||||||||||||

| New York State Dormitory Authority, | ||||||||||||||||||

| 5,000 | City University Ser 2000 A (Ambac) | 6.125 | 07/01/13 | 5,776,950 | ||||||||||||||

| 2,000 | State University 1990 Ser | 7.50 | 05/15/13 | 2,557,380 | ||||||||||||||

| 5,000 | State University 1993 Ser | 5.25 | 05/15/15 | 5,559,800 | ||||||||||||||

| 2,500 | Ohio State University, General Receipts Ser 1999 A | 5.80 | 12/01/29 | 2,786,800 | ||||||||||||||

| 4,000 | Delaware County Authority, Pennsylvania, Villanova University Ser 1995 (Ambac) | 5.70 | 08/01/15 | 4,158,000 | ||||||||||||||

| 3,500 | University of Texas, Ser 2004 D | 5.00 | 08/15/25 | 3,672,935 | ||||||||||||||

| University of West Virginia, | ||||||||||||||||||

| 2,000 | Ser C 2004 (FGIC) | 5.00 | 10/01/27 | 2,080,500 | ||||||||||||||

| 2,000 | Ser C 2004 (FGIC) | 5.00 | 10/01/28 | 2,072,500 | ||||||||||||||

| 34,400 | 37,449,953 | |||||||||||||||||

| Electric Revenue (13.2%) | ||||||||||||||||||

| Salt River Project Agricultural Improvement & Power District, Arizona, | ||||||||||||||||||

| 25,000 | Refg 1993 Ser C (Secondary MBIA) | 5.50 | 01/01/10 | 28,060,750 | ||||||||||||||

| 2,500 | Refg 2002 Ser A | 5.25 | 01/01/19 | 2,734,550 | ||||||||||||||

| 9,000 | Southern California Public Power Authority, Mead-Adelanto 1994 A (Ambac) | 8.52 | ‡ | 07/01/15 | 11,079,630 | |||||||||||||

| 15,000 | Colorado Springs, Colorado, Utilities Refg Ser 2002 (Ambac) | 5.375 | 11/15/20 | 16,642,200 | ||||||||||||||

| 9,550 | Municipal Electric Authority of Georgia, Ser Y (Secondary MBIA) | 6.50 | 01/01/17 | 11,623,114 | ||||||||||||||

| 4,000 | Indiana Municipal Power Agency, Power Supply 2004 Ser A (FGIC) | 5.00 | 01/01/32 | 4,102,920 | ||||||||||||||

| 3,050 | Wyandotte County/Kansas City, Kansas, Utility Ser 2004 B (FSA) | 5.00 | 09/01/27 | 3,181,669 | ||||||||||||||

| 5,000 | Long Island Power Authority, New York, Ser 2000 A (FSA) | 0.00 | 06/01/17 | 2,996,950 | ||||||||||||||

| North Carolina Municipal Power Agency, | ||||||||||||||||||

| 5,000 | Catawba Ser 1998 A (MBIA) | 5.50 | 01/01/15 | 5,708,400 | ||||||||||||||

| 4,000 | Catawba Ser 2003 A (MBIA) | 5.25 | 01/01/19 | 4,384,760 | ||||||||||||||

| 15,000 | Puerto Rico Electric Power Authority, Power Ser O | 0.00 | 07/01/17 | 9,053,850 | ||||||||||||||

| South Carolina Public Service Authority, | ||||||||||||||||||

| 10,000 | 1996 Refg Ser A (MBIA) | 5.75 | 01/01/13 | 10,533,100 | ||||||||||||||

| 5,000 | Refg Ser 2002 D (FSA) | 5.00 | 01/01/21 | 5,302,550 | ||||||||||||||

| 10,000 | Memphis, Tennessee, Ser 2003 A (MBIA) | 5.00 | 12/01/17 | 10,794,100 | ||||||||||||||

| 10,500 | San Antonio, Texas, Electric & Gas Refg Ser 1994 C INFLOS | 7.52 | ‡ | 02/01/06 | 11,057,445 | |||||||||||||

| 15,000 | Intermountain Power Agency, Utah, Refg 1997 Ser B (MBIA) | 5.75 | 07/01/19 | 16,389,000 | ||||||||||||||

See Notes to Financial Statements

12

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments  December 31, 2004 continued

December 31, 2004 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| $ | 3,000 | Chelan County Public Utility District #1, Washington, Hydro Ser 1997 A (AMT) | 5.60 | % | 07/01/32 | $ | 3,120,690 | |||||||||||

| 5,000 | Grant County Public Utility District #2, Washington, Refg Ser 2001 H (FSA) | 5.375 | 01/01/18 | 5,490,350 | ||||||||||||||

| 7,330 | Seattle Municipal Light & Power, Washington, Impr & Refg Ser 2001 (FSA) | 5.50 | 03/01/18 | 8,119,294 | ||||||||||||||

| 3,000 | Washington Public Power Supply System, Project #2 Refg Ser 1994 A (FGIC) | 0.00 | 07/01/09 | 2,604,090 | ||||||||||||||

| 165,930 | 172,979,412 | |||||||||||||||||

| Hospital Revenue (6.9%) | ||||||||||||||||||

| 2,220 | Birmingham-Carraway Special Care Facilities Financing Authority, Alabama, Carraway Methodist Health Ser 1995 A (Connie Lee) | 5.875 | 08/15/15 | 2,304,871 | ||||||||||||||

| 2,000 | University of Arkansas, UAMS Campus Ser 2004 B (MBIA) | 5.00 | 11/01/34 | 2,058,600 | ||||||||||||||

| 5,000 | Illinois Health Facilities Authority, Loyola University Health Ser 2001 A | 6.00 | 07/01/21 | 5,244,900 | ||||||||||||||

| 6,000 | Maryland State Health & Higher Educational Facilities Authority, Medstar Health Refg Ser 2004 | 5.50 | 08/15/33 | 6,173,460 | ||||||||||||||

| 10,000 | Missouri Health & Educational Facilities Authority, Barnes-Jewish/ Christian Health Ser 1993 A | 5.25 | 05/15/14 | 11,053,300 | ||||||||||||||

| 3,000 | University of Missouri, Health Ser 1996 A (Ambac) | 5.50 | 11/01/16 | 3,209,820 | ||||||||||||||

| Henderson, Nevada, | ||||||||||||||||||

| 10,065 | Catholic Health West 1998 Ser A | 5.375 | 07/01/26 | 10,217,988 | ||||||||||||||

| 2,000 | Catholic Health West 1998 Ser A | 5.125 | 07/01/28 | 2,000,940 | ||||||||||||||

| New Jersey Health Care Facilities Financing Authority, | ||||||||||||||||||

| 9,000 | Robert Wood Johnson University Hospital Ser 2000 | 5.75 | 07/01/25 | 9,731,520 | ||||||||||||||

| 2,000 | St Barnabas Health Refg Ser 1998 B (MBIA) | 5.25 | 07/01/18 | 2,166,020 | ||||||||||||||

| 10,000 | New York State Dormitory Authority, Memorial Sloan-Kettering Cancer Center 2003 Ser I | 5.00 | 07/01/34 | 10,207,500 | ||||||||||||||

| 3,000 | Erie County Hospital Facility, Ohio, Firelands Regional Medical Center Ser 2002 | 5.625 | 08/15/32 | 3,114,720 | ||||||||||||||

| 5,000 | Lorain County, Ohio, Catholic Health Ser 9 2001 A | 5.25 | 10/01/33 | 5,092,650 | ||||||||||||||

| 5,000 | Lehigh County General Purpose Authority, Pennsylvania, St Luke's of Bethlehem Hospital Ser A 2003 | 5.375 | 08/15/33 | 5,091,150 | ||||||||||||||

| 2,350 | Pennsylvania Higher Educational Facilities Authority, University of Pennsylvania Ser A 1996 | 5.75 | 01/01/22 | 2,445,034 | ||||||||||||||

| 4,500 | South Carolina Jobs Economic Development Authority, Palmetto Health Alliance Refg Ser 2003 C | 6.875 | 08/01/27 | 5,027,175 | ||||||||||||||

| 5,000 | North Central Texas Health Facilities Development Corporation, University Medical Center Inc Ser 1997 (FSA) | 5.45 | 04/01/15 | 5,251,750 | ||||||||||||||

| 86,135 | 90,391,398 | |||||||||||||||||

See Notes to Financial Statements

13

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments  December 31, 2004 continued

December 31, 2004 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| Industrial Development/Pollution Control Revenue (3.9%) | ||||||||||||||||||

| $ | 1,600 | Hawaii Department of Budget & Finance, Hawaii Electric Co Ser 1995 A (AMT) (MBIA) | 6.60 | % | 01/01/25 | $ | 1,621,712 | |||||||||||

| Michigan Strategic Fund, | ||||||||||||||||||

| 10,000 | Detroit Edison Co Ser 1999 B (AMT) | 5.65 | 09/01/29 | 10,392,000 | ||||||||||||||

| 1,000 | Ford Motor Co Refg Ser 1991 A | 7.10 | 02/01/06 | 1,044,980 | ||||||||||||||

| New Jersey Economic Development Authority, | ||||||||||||||||||

| 6,000 | Continental Airlines Inc Ser 1999 (AMT) | 6.625 | 09/15/12 | 5,573,520 | ||||||||||||||

| 4,000 | Continental Airlines Inc Ser 1999 (AMT) | 6.25 | 09/15/19 | 3,409,680 | ||||||||||||||

| 2,500 | Ohio Water Development Authority, Dayton Power & Light Co Collateralized Refg 1992 Ser A | 6.40 | 08/15/27 | 2,562,375 | ||||||||||||||

| 5,000 | Brazos River Authority, Texas, TXU Electric Co Ser 1999 C (AMT) | 7.70 | 03/01/32 | 5,953,050 | ||||||||||||||

| 10,000 | Sabine River Authority, Texas, TXU Electric Co Refg Ser 2001 B (AMT) (Mandatory Tender 11/01/11) | 5.75 | 05/01/30 | 11,005,300 | ||||||||||||||

| 10,000 | Weston, Wisconsin, Wisconsin Public Service Co Refg Ser 1993 A | 6.90 | 02/01/13 | 10,235,300 | ||||||||||||||

| 50,100 | 51,797,917 | |||||||||||||||||

| Mortgage Revenue – Multi-Family (1.1%) | ||||||||||||||||||

| 7,000 | New Jersey Housing Agency, 1995 Ser A (Ambac) | 6.00 | 11/01/14 | 7,180,950 | ||||||||||||||

| New York City Housing Developement Corporation, New York, | ||||||||||||||||||

| 3,674 | Ruppert Project – FHA Ins Sec 223F | 6.50 | 11/15/18 | 3,863,831 | ||||||||||||||

| 3,518 | Stevenson Commons Project – FHA Ins Sec 223F | 6.50 | 05/15/18 | 3,699,335 | ||||||||||||||

| 14,192 | 14,744,116 | |||||||||||||||||

| Mortgage Revenue – Single Family (2.4%) | ||||||||||||||||||

| Alaska Housing Finance Corporation, | ||||||||||||||||||

| 15,000 | 1997 Ser A (MBIA) | 6.00 | 06/01/27 | 15,651,901 | ||||||||||||||

| 2,000 | Governmental 1995 Ser A (MBIA) | 5.875 | 12/01/24 | 2,076,620 | ||||||||||||||

| 2,440 | California Housing Finance Agency, Home 1983 Ser B | 0.00 | 08/01/15 | 1,012,600 | ||||||||||||||

| Colorado Housing & Finance Authority, | ||||||||||||||||||

| 220 | 1997 Ser B-2 (AMT) | 7.00 | 05/01/26 | 223,095 | ||||||||||||||

| 495 | 1998 Ser A-2 (AMT) | 6.60 | 05/01/28 | 508,187 | ||||||||||||||

| 360 | 1997 Ser C-2 (AMT) | 6.875 | 11/01/28 | 364,475 | ||||||||||||||

| 3,190 | Hawaii Housing Finance & Development Corporation, Purchase 1997 Ser A (AMT) | 5.75 | 07/01/30 | 3,211,309 | ||||||||||||||

| 5 | Idaho Housing Agency, Ser 1988 D-2 (AMT) | 8.25 | 01/01/20 | 5,125 | ||||||||||||||

| Chicago, Illinois, | ||||||||||||||||||

| 100 | GNMA-Backed Ser 1997 A (AMT) | 7.25 | 09/01/28 | 100,744 | ||||||||||||||

| 190 | GNMA-Backed Ser 1997 B (AMT) | 6.95 | 09/01/28 | 191,319 | ||||||||||||||

| 40 | Massachusetts Housing Finance Agency, Housing Ser 21 (AMT) | 7.125 | 06/01/25 | 40,042 | ||||||||||||||

See Notes to Financial Statements

14

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments  December 31, 2004 continued

December 31, 2004 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| $ | 155 | Minnesota Housing Finance Agency, Ser 1992 H (AMT) | 6.50 | % | 01/01/26 | $ | 155,818 | |||||||||||

| Missouri Housing Development Commission, | ||||||||||||||||||

| 470 | Homeownership 1996 Ser C (AMT) | 7.45 | 09/01/27 | 473,497 | ||||||||||||||

| 235 | Homeownership 1997 Ser A-2 ( AMT) | 7.30 | 03/01/28 | 236,485 | ||||||||||||||

| 820 | Homeownership 1997 Ser C-1 | 6.55 | 09/01/28 | 827,511 | ||||||||||||||

| 125 | Homeownership 1998 Ser B-2 (AMT) | 6.40 | 03/01/29 | 125,783 | ||||||||||||||

| 425 | Homeownership Ser 2000 B-1 (AMT) | 7.45 | 09/01/31 | 428,098 | ||||||||||||||

| 1,080 | New Hampshire Housing Finance Authority, Mortgage Acquisition 2000 Ser B (AMT) | 6.70 | 07/01/29 | 1,097,647 | ||||||||||||||

| 5,235 | Ohio Housing Finance Agency, Residential 1996 Ser B-2 (AMT) | 6.10 | 09/01/28 | 5,327,502 | ||||||||||||||

| 32,585 | 32,057,758 | |||||||||||||||||

| Nursing & Health Related Facilities Revenue (0.2%) | ||||||||||||||||||

| 200 | Marion, Iowa, AHF/Kentucky-Iowa Inc Ser 2003 | 6.50# | # | 01/01/29 | 198,798 | |||||||||||||

| 405 | Kentucky Economic Development Financing Authority, AHF/Kentucky-Iowa Inc Ser 2003 | 6.50# | # | 01/01/29 | 402,566 | |||||||||||||

| 1,710 | Chester County Industrial Development Authority, Pennsylvania, RHA/PA Nursing Home Inc Ser 1989 | 8.50 | 05/01/32 | 1,727,322 | ||||||||||||||

| 2,315 | 2,328,686 | |||||||||||||||||

| Public Facilities Revenue (2.8%) | ||||||||||||||||||

| 3,710 | Jefferson County, Alabama, School Ser 2004-A | 5.25 | 01/01/23 | 3,884,704 | ||||||||||||||

| 9,000 | Arizona School Facilities Board, School Ser 2001 | 5.50 | 07/01/18 | 10,099,530 | ||||||||||||||

| 2,000 | North City West School Facilities Authority, California, Community Dist #1 Special Tax Ser 1995 B (FSA) | 6.00 | 09/01/19 | 2,157,440 | ||||||||||||||

| 2,500 | Jacksonville, Florida, Sales Tax Ser 2001 (Ambac) | 5.50 | 10/01/17 | 2,809,325 | ||||||||||||||

| 3,495 | Illinois, Civic Center Dedicated Tax Ser 1991 (Ambac) | 6.25 | 12/15/20 | 4,282,808 | ||||||||||||||

| 4,000 | Michigan, 525 Redevco Inc COPs (Ambac) | 5.50 | 06/01/27 | 4,340,120 | ||||||||||||||

| 3,000 | Albuquerque, New Mexico, Gross Receipts Lodgers' Tax Refg Ser 2004 (FSA) | 5.00 | 07/01/37 | 3,062,550 | ||||||||||||||

| 5,000 | Ohio Building Authority, 2001 Ser A (FSA) | 5.50 | 10/01/18 | 5,609,050 | ||||||||||||||

| 500 | Laredo ISD Public Facility Corporation, Texas, 2004 Ser A (Ambac) | 5.00 | 08/01/29 | 507,965 | ||||||||||||||

| 33,205 | 36,753,492 | |||||||||||||||||

| Recreational Facilities Revenue (2.4%) | ||||||||||||||||||

| Metropolitan Football Stadium District, Colorado, | ||||||||||||||||||

| 4,000 | Sales Tax Ser 1999 A (MBIA) | 0.00 | 01/01/10 | 3,386,120 | ||||||||||||||

| 1,650 | Sales Tax Ser 1999 A (MBIA) | 0.00 | 01/01/11 | 1,331,072 | ||||||||||||||

| 9,000 | Mashantucket (Western) Pequot Tribe, Connecticut, Special 1997 Ser B (a) | 5.75 | 09/01/27 | 9,275,310 | ||||||||||||||

See Notes to Financial Statements

15

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments  December 31, 2004 continued

December 31, 2004 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| $ | 20,000 | Metropolitan Pier & Exposition Authority, Illinois, Refg Ser 2002 B (MBIA) | 0.00# | ##% | 06/15/22 | $ | 11,804,000 | |||||||||||

| 5,000 | Hamilton County, Ohio, Sales Tax Ser 2000 (Ambac) | 5.25 | 12/01/32 | 5,269,950 | ||||||||||||||

| 39,650 | 31,066,452 | |||||||||||||||||

| Resource Recovery Revenue (0.4%) | ||||||||||||||||||

| 5,000 | Northeast Maryland Waste Disposal Authority, Montgomery County Ser 2003 (AMT) (Ambac) | 5.50 | 04/01/16 | 5,479,950 | ||||||||||||||

| Retirement & Life Care Facilities Revenue (0.5%) | ||||||||||||||||||

| Riverside County Public Financing Authority, California, | ||||||||||||||||||

| 2,000 | Air Force Village West Inc COPs | 5.75 | 05/15/19 | 2,105,220 | ||||||||||||||

| 3,900 | Air Force Village West Inc COPs | 5.80 | 05/15/29 | 4,042,857 | ||||||||||||||

| 5,900 | 6,148,077 | |||||||||||||||||

| Tax Allocation Revenue (0.4%) | ||||||||||||||||||

| 5,000 | Rosemead Redevelopment Agency, California, Project #1 Ser 1993 A | 5.60 | 10/01/33 | 5,024,650 | ||||||||||||||

| Transportation Facilities Revenue (18.4%) | ||||||||||||||||||

| 5,000 | California Infrastructure & Economic Development Bank, Bay Area Toll Bridges Seismic Retrofit First Lien Ser 2003 A (Ambac) | 5.00 | 07/01/36 | 5,138,700 | ||||||||||||||

| 5,000 | San Francisco Bay Area Rapid Transit District, California, Sales Tax Ser 1998 (Ambac) | 4.75 | 07/01/23 | 5,103,050 | ||||||||||||||

| E-470 Public Highway Authority, Colorado, | ||||||||||||||||||

| 15,000 | Ser 1997 B (MBIA) | 0.00 | 09/01/14 | 10,026,300 | ||||||||||||||

| 5,000 | Ser 1997 B (MBIA) | 0.00 | 09/01/16 | 2,998,900 | ||||||||||||||

| 10,000 | Metropolitan Washington Airport Authority, District of Columbia & Virginia, Ser 2001A (AMT) (MBIA)†† | 5.50 | 10/01/27 | 10,481,400 | ||||||||||||||

| 8,500 | Jacksonville, Florida, Transportation Ser 2001 (MBIA) | 5.00 | 10/01/26 | 8,771,915 | ||||||||||||||

| 7,980 | Mid-Bay Bridge Authority, Florida, Sr Lien Crossover Refg Ser 1993 A (Ambac) | 5.85 | 10/01/13 | 8,832,184 | ||||||||||||||

| Atlanta, Georgia, | ||||||||||||||||||

| 5,000 | Airport Ser 2000 A (FGIC) | 5.875 | 01/01/17 | 5,627,750 | ||||||||||||||

| 5,000 | Airport Passenger Facilities Charge Ser 2004 C (FSA) | 5.00 | 01/01/33 | 5,119,650 | ||||||||||||||

| 4,000 | Airport Passenger Facilities Charge Ser 2004 J (FSA) | 5.00 | 01/01/34 | 4,093,280 | ||||||||||||||

| 3,460 | Hawaii, Airport 2000 Ser B (AMT) (FGIC) | 6.625 | 07/01/17 | 3,980,315 | ||||||||||||||

| 8,000 | Chicago, Illinois, O'Hare Int'l Airport 3rd Lien Ser 2003 B-2 (AMT) (FSA) | 5.75 | 01/01/24 | 8,798,640 | ||||||||||||||

| 6,000 | Regional Transportation Authority, Illinois, Refg Ser 1999 (FSA) | 5.75 | 06/01/21 | 7,162,200 | ||||||||||||||

See Notes to Financial Statements

16

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments  December 31, 2004 continued

December 31, 2004 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| Kentucky Turnpike Authority, | ||||||||||||||||||

| $ | 9,000 | Economic Development Road Refg Ser 1995 (Ambac) | 6.50 | % | 07/01/08 | $ | 10,194,480 | |||||||||||

| 3,500 | Resource Recovery Road 1987 Ser A BIGS | 8.50 | 07/01/06 | 3,818,430 | ||||||||||||||

| 30,000 | Resource Recovery Road 1987 Ser A | 5.00 | 07/01/08 | 30,213,599 | ||||||||||||||

| 7,725 | Massachusetts Turnpike Authority, Western 1997 Ser A (MBIA) | 5.55 | 01/01/17 | 7,816,155 | ||||||||||||||

| 4,140 | Missouri Highways & Transportation Commission, Ser A 2001 | 5.125 | 02/01/19 | 4,447,685 | ||||||||||||||

| 5,000 | Clark County, Nevada, Airport Sub Lien Ser 2004 (AMT) (FGIC) | 5.50 | 07/01/23 | 5,421,300 | ||||||||||||||

| 5,000 | Nevada Department of Business & Industry, Las Vegas Monorail 1st Tier Ser 2000 (Ambac) | 5.375 | 01/01/40 | 5,186,000 | ||||||||||||||

| New Jersey Turnpike Authority, | ||||||||||||||||||

| 10,000 | Ser 2003 A (FGIC) | 5.00 | 01/01/27 | 10,375,000 | ||||||||||||||

| 3,000 | Ser 2003 A (Ambac) | 5.00 | 01/01/30 | 3,095,370 | ||||||||||||||

| 6,595 | Albuquerque, New Mexico, Airport Refg Ser 1997 (AMT) (Ambac) | 6.375 | 07/01/15 | 7,270,790 | ||||||||||||||

| Metropolitan Transportation Authority, New York, | ||||||||||||||||||

| 1,460 | Service Contract Ser 2002 A (MBIA) | 5.50 | 01/01/20 | 1,637,857 | ||||||||||||||

| 5,000 | Service Contract Ser 2002 B (MBIA) | 5.50 | 07/01/24 | 5,568,500 | ||||||||||||||

| 10,000 | Transportation Refg Ser 2002 A (Ambac) | 5.50 | 11/15/18 | 11,243,100 | ||||||||||||||

| 8,000 | Port Authority of New York & New Jersey, Cons 135th Ser (XLCA)†† | 5.00 | 09/15/29 | 8,273,680 | ||||||||||||||

| 10,000 | Puerto Rico Highway & Transportation Authority, Refg Ser X | 5.50 | 07/01/15 | 11,349,299 | ||||||||||||||

| 9,090 | Austin, Texas, Airport Prior Lien Ser 1995 A (AMT) (MBIA) | 6.125 | 11/15/25 | 9,544,046 | ||||||||||||||

| Dallas Fort Worth International Airport, Texas, | ||||||||||||||||||

| 4,000 | Refg Ser 1995 (FGIC) | 5.625 | 11/01/15 | 4,104,160 | ||||||||||||||

| 10,000 | Ser A (AMT) (FSA) | 5.25 | 11/01/24 | 10,481,600 | ||||||||||||||

| 5,000 | Houston, Texas, Airport Sub Lien Ser 2000 A (AMT) (FSA) | 5.875 | 07/01/17 | 5,479,400 | ||||||||||||||

| 234,450 | 241,654,735 | |||||||||||||||||

| Water & Sewer Revenue (12.6%) | ||||||||||||||||||

| 2,000 | Phoenix Civic Improvement Corporation, Arizona, Wastewater Ser 2004 (MBIA) | 5.00 | 07/01/27 | 2,083,680 | ||||||||||||||

| 2,000 | San Francisco Public Utilities Commission, California, Water 1996 Ser A | 5.00 | 11/01/21 | 2,055,820 | ||||||||||||||

| 4,000 | Atlanta, Georgia, Water & Wastewater Ser 2004 (FSA) | 5.00 | 11/01/24 | 4,230,600 | ||||||||||||||

| Augusta, Georgia, | ||||||||||||||||||

| 5,000 | Water & Sewer Ser 2000 (FSA) | 5.25 | 10/01/26 | 5,370,000 | ||||||||||||||

| 3,000 | Water & Sewer Ser 2004 A (FSA) | 5.25 | 10/01/39 | 3,177,990 | ||||||||||||||

| 5,000 | Fulton County, Georgia, Water & Sewerage Ser 1998 (FGIC) | 4.75 | 01/01/28 | 5,020,400 | ||||||||||||||

| 8,000 | Indiana Bond Bank, Revolving Fund Ser 2001A | 5.375 | 02/01/19 | 8,903,840 | ||||||||||||||

| 8,000 | Indianapolis Local Public Improvement Bond Bank, Indiana, Water Works Ser 2002 A (MBIA) | 5.125 | 07/01/27 | 8,346,320 | ||||||||||||||

See Notes to Financial Statements

17

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments  December 31, 2004 continued

December 31, 2004 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| $ | 5,000 | Louisville & Jefferson County Metropolitan Sewer District, Kentucky, Ser 1998 A (FGIC) | 4.75 | % | 05/15/28 | $ | 5,017,350 | |||||||||||

| 6,000 | Boston Water & Sewer Commission, Massachusetts, 1998 Ser D (FGIC) | 4.75 | 11/01/22 | 6,122,940 | ||||||||||||||

| 4,925 | Detroit, Michigan, Water Supply Sr Lien Ser 2001 A (FGIC) | 5.25 | 07/01/33 | 5,193,856 | ||||||||||||||

| 9,000 | Passaic Valley Sewerage Commissioners, New Jersey, Ser F (FGIC) | 5.00 | 12/01/19 | 9,679,590 | ||||||||||||||

| 5,000 | New York City Municipal Water Finance Auhtority, New York, Water & Sewer 2004 Ser B (Ambac) | 5.00 | 06/15/28 | 5,184,500 | ||||||||||||||

| 2,995 | Cleveland, Ohio, Waterworks Impr & Refg 1998 Ser I (FSA) | 5.00 | 01/01/23 | 3,153,615 | ||||||||||||||

| 5,000 | Spartanburg, South Carolina, Jr Lien Water Ser 1998 (FGIC) | 5.25 | 06/01/28 | 5,342,500 | ||||||||||||||

| Metropolitan Government of Nashville & Davidson County, Tennessee, | ||||||||||||||||||

| 2,000 | Refg 1986 | 5.50 | 01/01/16 | 2,005,180 | ||||||||||||||

| 5,000 | Refg Ser 1998 A (FGIC) | 4.75 | 01/01/22 | 5,101,400 | ||||||||||||||

| 7,100 | Austin, Texas, Water & Wastewater Refg Ser 2001 A (FSA) | �� | 5.75 | 05/15/17 | 8,031,023 | |||||||||||||

| Houston, Texas, Combined Utility, | ||||||||||||||||||

| 20,000 | First Lien Refg Ser 2004 A (FSA) | 5.25 | 05/15/22 | 21,733,400 | ||||||||||||||

| 5,000 | First Lien Refg Ser 2004 A (MBIA) | 5.25 | 05/15/25 | 5,380,950 | ||||||||||||||

| San Antonio, Texas, | ||||||||||||||||||

| 1,000 | Water & Refg Ser 2002 (FSA) | 5.50 | 05/15/19 | 1,113,050 | ||||||||||||||

| 5,000 | Water & Refg Ser 2002 (FSA) | 5.00 | 05/15/28 | 5,118,850 | ||||||||||||||

| 5,000 | Tarrant Regional Water District, Texas, Water Ser 2002 (FSA) | 5.375 | 03/01/16 | 5,551,900 | ||||||||||||||

| 1,300 | Wichita Falls, Texas, Water & Sewer Ser 2001 (Ambac) | 5.375 | 08/01/24 | 1,414,829 | ||||||||||||||

| 10,000 | Richmond, Virginia, Public Utilities Refg Ser 2002 (FSA) | 5.00 | 01/15/33 | 10,228,900 | ||||||||||||||

| Seattle, Washington, | ||||||||||||||||||

| 10,000 | Water Refg 2003 (MBIA) | 5.00 | 09/01/20 | 10,639,100 | ||||||||||||||

| 10,000 | Water Refg 2003 (MBIA) | 5.00 | 09/01/23 | 10,505,100 | ||||||||||||||

| 156,320 | 165,706,683 | |||||||||||||||||

| Other Revenue (3.7%) | ||||||||||||||||||

| 10,000 | California, Economic Recovery Ser 2004 A | 5.00 | 07/01/16 | 10,694,300 | ||||||||||||||

| New Jersey Economic Development Authority, | ||||||||||||||||||

| 2,000 | Cigarette Tax Ser 2004 | 5.50 | 06/15/31 | 2,055,600 | ||||||||||||||

| 2,500 | Cigarette Tax Ser 2004 | 5.75 | 06/15/34 | 2,602,175 | ||||||||||||||

| New York City Transitional Finance Authority, New York, | ||||||||||||||||||

| 8,000 | Refg 2003 Ser A | 5.50 | 11/01/26 | 8,996,080 | ||||||||||||||

| 7,000 | Refg 2003 Ser D (MBIA) | 5.25 | 02/01/21 | 7,586,460 | ||||||||||||||

| 5,000 | New York Local Government Assistance Corporation, Ser 1993 C | 5.50 | 04/01/17 | 5,738,750 | ||||||||||||||

| 10,000 | Sales Tax Asset Receivable Corporation, New York, 2005 Ser A (Ambac) | 5.00 | 10/15/29 | 10,371,600 | ||||||||||||||

| 44,500 | 48,044,965 | |||||||||||||||||

See Notes to Financial Statements

18

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments  December 31, 2004 continued

December 31, 2004 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| Refunded (11.0%) | ||||||||||||||||||

| $ | 5,000 | Denver, Colorado, Civic Center Ser 2000 B COPs (Ambac) | 5.50 | % | 12/01/10 | † | $ | 5,728,000 | ||||||||||

| 2,500 | Mid-Bay Bridge Authority, Florida, Ser 1991 A (ETM) | 6.875 | 10/01/22 | 3,328,400 | ||||||||||||||

| 800 | Northern Palm Beach County Improvement District, Florida, Water Control & Impr #9A Ser 1996 A (ETM) | 6.80 | 08/01/06 | 836,944 | ||||||||||||||

| 8,000 | Hawaii, 1999 Ser CT (FSA) | 5.875 | 09/01/09 | † | 9,185,680 | |||||||||||||

| 5,000 | Hawaii Department of Budget & Finance, Queen's Health 1996 Ser A | 6.00 | 07/01/06 | † | 5,371,350 | |||||||||||||

| 2,700 | Kansas Development Finance Authority, Public Water Supply Ser 2000-2 (Ambac) | 5.75 | 10/01/10 | † | 3,096,252 | |||||||||||||

| Massachusetts, | ||||||||||||||||||

| 10,000 | 2000 Ser C (original maturity 10/01/14) | 5.75 | 10/01/10 | † | 11,365,600 | |||||||||||||

| 10,000 | 2000 Ser C (original maturity 10/01/19) | 5.75 | 10/01/10 | † | 11,365,600 | |||||||||||||

| 2,500 | Massachusetts, Health & Educational Facilities Authority, Malden Hospital – FHA Ins Mtge Ser A | 5.00 | 08/01/10 | † | 2,692,425 | |||||||||||||

| New Jersey Highway Authority, | ||||||||||||||||||

| 7,000 | Senior Parkway 1999 Ser | 5.625 | 01/01/10 | † | 7,982,870 | |||||||||||||

| 10,000 | Senior Parkway 2001 Ser (FGIC) | 5.25 | 01/01/12 | † | 11,273,200 | |||||||||||||

| New York State Dormitory Authority, | ||||||||||||||||||

| 7,800 | State University Ser 2000 B | 5.375 | 05/15/10 | † | 8,862,672 | |||||||||||||

| 12,175 | Suffolk County Judicial Ser 1986 (ETM) | 7.375 | 07/01/16 | 15,045,500 | ||||||||||||||

| Charlotte, North Carolina, | ||||||||||||||||||

| 4,000 | Water & Sewer Ser 2000 (original maturity 06/01/19) | 5.75 | 06/01/10 | † | 4,606,320 | |||||||||||||

| 4,000 | Water & Sewer Ser 2000 (original maturity 06/01/20) | 5.75 | 06/01/10 | † | 4,606,320 | |||||||||||||

| 5,000 | Water & Sewer Ser 2000 | 5.25 | 06/01/10 | † | 5,633,350 | |||||||||||||

| 15,000 | South Carolina Public Service Authority, 1995 Refg Ser A (Ambac) | 6.25 | 01/01/06 | † | 15,895,800 | |||||||||||||

| 10,000 | South Carolina Transportation Infrastructure Bank, Ser 1999 A (Ambac) | 5.50 | 10/01/09 | † | 11,335,200 | |||||||||||||

| 5,000 | Salt Lake City, Utah, IHC Hospital Inc Ser 1983 (ETM) | 5.00 | 06/01/15 | 5,538,350 | ||||||||||||||

| 126,475 | 143,749,833 | |||||||||||||||||

| 1,195,237 | Total Tax-Exempt Municipal Bonds (Cost $1,145,604,164) | 1,248,784,426 | ||||||||||||||||

| Short-Term Tax-Exempt Municipal Obligations (3.5%) | ||||||||||||||||||

| 9,000 | Los Angeles Convention & Exhibition Center Authority, California, Ser 1985 COPs | 9.00 | 12/01/05 | † | 9,565,560 | |||||||||||||

| 7,430 | Indiana Health Facility Financing Authority, Clarian Health Obligated Group Ser 2000 B (Demand 01/03/05) | 2.22 | * | 03/01/30 | 7,430,000 | |||||||||||||

| 7,000 | Indiana University, Student Fee Ser K (MBIA) | 5.875 | 08/01/05 | † | 7,294,560 | |||||||||||||

| 8,500 | Massachusetts Industrial Finance Agency, Eastern Edison Co Refg Ser 1993 (called for redemption 01/10/05) | 5.875 | 08/01/08 | 8,593,245 | ||||||||||||||

| 5,000 | Ohio Building Authority, 1985 Ser C | 9.75 | 10/01/05 | 5,093,550 | ||||||||||||||

See Notes to Financial Statements

19

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments  December 31, 2004 continued

December 31, 2004 continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| $ | 7,700 | Harris County Health Facilities Development Corporation, Texas, Methodist Hospital Ser 2002 (Demand 01/03/05) | 2.20* | % | 12/01/32 | $ | 7,700,000 | |||||||||||

| 44,630 | Total Short-Term Tax-Exempt Municipal Obligations (Cost $44,350,916) | 45,676,915 | ||||||||||||||||

| $ | 1,239,867 | Total Investments (Cost $1,189,955,080) (b) | 98.8 | % | 1,294,461,341 | |||||||||||||

| Other Assets in Excess of Liabilities | 1.2 | 16,032,806 | ||||||||||||||||

| Net Assets | 100.0 | % | $ | 1,310,494,147 | ||||||||||||||

| AMT | Alternative Minimum Tax. |

| BIGS | Bond Income Growth Securities. |

| COPs | Certificates of Participation. |

| ETM | Escrowed to maturity. |

| INFLOS | Inverse Floating Rate Securities (Illiquid securities). |

| RITES | Residual Interest Tax-Exempt Securities (Illiquid securities). |

| † | Prerefunded to call date shown. |

| †† | Joint exemption in locations shown. |

| ‡ | Current coupon rate for inverse floating rate municipal obligation. This rate resets periodically as the auction rate on the related security changes. Positions in inverse floating rate municipal obligations have a total value of $59,639,425 which represents 4.6% of net assets. |

| # | Currently a zero coupon security; will convert to 5.38% on January 1, 2011. |

| ## | Currently a 6.50% coupon security; will convert to 8.00% on January 1, 2009. |

| ### | Currently a zero coupon security; will convert to 5.65% on June 15, 2017. |

| * | Current coupon of variable rate demand obligation. |

| (a) | Resale is restricted to qualified institutional investors. |

| (b) | The aggregate cost for federal income tax purposes is $1,189,472,282. The aggregate gross unrealized appreciation is $105,876,966 and the aggregate gross unrealized depreciation is $887,907, resulting in net unrealized appreciation of $104,989,059. |

| Bond Insurance: |

| Ambac | Ambac Assurance Corporation. |

| Connie Lee | Connie Lee Insurance Company – A wholly owned subsidiary of Ambac Assurance Corporation. |

| FHA | Federal Housing Administration. |

| FGIC | Financial Guaranty Insurance Company. |

| FSA | Financial Security Assurance Inc. |

| MBIA | Municipal Bond Investors Assurance Corporation. |

| XLCA | XL Capital Assurance Inc. |

See Notes to Financial Statements

20

Morgan Stanley Tax-Exempt Securities Trust

Financial Statements

Statement of Assets and Liabilities

December 31, 2004

| Assets: | ||||||

| Investments in securities, at value | ||||||

| (cost $1,189,955,080) | $ | 1,294,461,341 | ||||

| Cash | 7,555 | |||||

| Receivable for: | ||||||

| Interest | 20,239,786 | |||||

| Investments sold | 1,841,373 | |||||

| Shares of beneficial interest sold | 386,485 | |||||

| Prepaid expenses and other assets | 43,244 | |||||

| Total Assets | 1,316,979,784 | |||||

| Liabilities: | ||||||

| Payable for: | ||||||

| Dividends and distributions to | ||||||

| shareholders | 5,361,840 | |||||

| Investment advisory fee | 383,583 | |||||

| Shares of beneficial interest | ||||||

| redeemed | 209,582 | |||||

| Distribution fee | 147,915 | |||||

| Administration fee | 88,952 | |||||

| Accrued expenses and other payables | 293,765 | |||||

| Total Liabilities | 6,485,637 | |||||

| Net Assets | $ | 1,310,494,147 | ||||

| Composition of Net Assets: | ||||||

| Paid-in-capital | $ | 1,205,861,449 | ||||

| Net unrealized appreciation | 104,506,261 | |||||

| Accumulated undistributed net investment | ||||||

| income | 136,694 | |||||

| Distributions in excess of net realized gain | (10,257 | ) | ||||

| Net Assets | $ | 1,310,494,147 | ||||

| Class A Shares: | ||||||

| Net Assets | $ | 128,577,954 | ||||

| Shares Outstanding (unlimited authorized, | ||||||

| $.01 par value) | 10,875,056 | |||||

| Net Asset Value Per Share | $ | 11.82 | ||||

| Maximum Offering Price Per Share, | ||||||

| (net asset value plus 4.44% of net | ||||||

| asset value) | $ | 12.34 | ||||

| Class B Shares: | ||||||

| Net Assets | $ | 195,858,545 | ||||

| Shares Outstanding (unlimited authorized, $.01 par value) | 16,497,231 | |||||

| Net Asset Value Per Share | $ | 11.87 | ||||

| Class C Shares: | ||||||

| Net Assets | $ | 35,265,420 | ||||

| Shares Outstanding (unlimited authorized, $.01 par value) | 2,978,526 | |||||

| Net Asset Value Per Share | $ | 11.84 | ||||

| Class D Shares: | ||||||

| Net Assets | $ | 950,792,228 | ||||

| Shares Outstanding (unlimited authorized, | ||||||

| $.01 par value) | 80,462,232 | |||||

| Net Asset Value Per Share | $ | 11.82 | ||||

Statement of Operations

For the year ended December 31, 2004

| Net Investment Income: | ||||||

| Interest Income | $ | 69,977,567 | ||||

| Expenses | ||||||

| Investment advisory fee | 5,575,184 | |||||

| Distribution fee (Class A shares) | 166,758 | |||||

| Distribution fee (Class B shares) | 1,262,686 | |||||

| Distribution fee (Class C shares) | 257,208 | |||||

| Transfer agent fees and expenses | 816,239 | |||||

| Administration fee | 175,458 | |||||

| Shareholder reports and notices | 95,698 | |||||

| Professional fees | 87,251 | |||||

| Registration fees | 64,256 | |||||

| Custodian fees | 57,593 | |||||

| Trustees' fees and expenses | 34,421 | |||||

| Other | 90,795 | |||||

| Total Expenses | 8,683,547 | |||||

| Less: expense offset | (55,581 | ) | ||||

| Net Expenses | 8,627,966 | |||||

| Net Investment Income | 61,349,601 | |||||

| Net Realized and Unrealized Gain (Loss): | ||||||

| Net Realized Gain (Loss) on: | ||||||

| Investments | 7,848,904 | |||||

| Futures contracts | (369,519 | ) | ||||

| Net Realized Gain | 7,479,385 | |||||

| Net Change in Unrealized Appreciation/Depreciation on: | ||||||

| Investments | (18,616,505 | ) | ||||

| Futures contracts | 59,869 | |||||

| Net Depreciation | (18,556,636 | ) | ||||

| Net Loss | (11,077,251 | ) | ||||

| Net Increase | $ | 50,272,350 | ||||

See Notes to Financial Statements

21

Morgan Stanley Tax-Exempt Securities Trust

Financial Statements continued

Statement of Changes in Net Assets

| FOR THE YEAR ENDED DECEMBER 31, 2004 | FOR THE YEAR ENDED DECEMBER 31, 2003 | |||||||||

| Increase (Decrease) in Net Assets: | ||||||||||

| Operations: | ||||||||||

| Net investment income | $ | 61,349,601 | $ | 69,825,830 | ||||||

| Net realized gain | 7,479,385 | 154,875 | ||||||||

| Net change in unrealized appreciation/depreciation | (18,556,636 | ) | 10,666,085 | |||||||

| Net Increase | 50,272,350 | 80,646,790 | ||||||||

| Dividends and Distributions to Shareholders from: | ||||||||||

| Net investment income | ||||||||||

| Class A shares | (5,439,670 | ) | (5,540,847 | ) | ||||||

| Class B shares | (8,501,332 | ) | (9,743,115 | ) | ||||||

| Class C shares | (1,445,596 | ) | (1,491,039 | ) | ||||||

| Class D shares | (46,269,847 | ) | (52,242,854 | ) | ||||||

| Net realized gain | ||||||||||

| Class A shares | (652,885 | ) | (140,274 | ) | ||||||

| Class B shares | (993,065 | ) | (265,399 | ) | ||||||

| Class C shares | (178,948 | ) | (45,679 | ) | ||||||

| Class D shares | (4,841,384 | ) | (1,228,841 | ) | ||||||

| Total Dividends and Distributions | (68,322,727 | ) | (70,698,048 | ) | ||||||

| Net decrease from transactions in shares of beneficial interest | (131,266,079 | ) | (88,585,763 | ) | ||||||

| Net Decrease | (149,316,456 | ) | (78,637,021 | ) | ||||||

| Net Assets: | ||||||||||

| Beginning of period | 1,459,810,603 | 1,538,447,624 | ||||||||

| End of Period (Including accumulated undistributed net investment income of $136,694 and $364,785, respectively) | $ | 1,310,494,147 | $ | 1,459,810,603 | ||||||

See Notes to Financial Statements

22

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  December 31, 2004

December 31, 2004

1. Organization and Accounting Policies

Morgan Stanley Tax-Exempt Securities Trust (the "Fund") is registered under the Investment Company Act of 1940, as amended the ("Act"), as a diversified, open-end management investment company. The Fund's investment objective is to provide a high level of current income which is exempt from federal income tax, consistent with the preservation of capital. The Fund was incorporated in Maryland in 1979, commenced operations on March 27, 1980 and reorganized as a Massachusetts business trust on April 30, 1987. On July 28, 1997, the Fund converted to a multiple class share structure.

The Fund offers Class A shares, Class B shares, Class C shares and Class D shares. The four classes are substantially the same except that most Class A shares are subject to a sales charge imposed at the time of purchase and some Class A shares, and most Class B shares and Class C shares are subject to a contingent deferred sales charge imposed on shares redeemed within one year, six years and one year, respectively. Class D shares are not subject to a sales charge. Additionally, Class A shares, Class B shares and Class C shares incur distribution expenses.

The following is a summary of significant accounting policies:

A. Valuation of Investments — (1) portfolio securities are valued by an outside independent pricing service approved by the Trustees. The pricing service uses both a computerized grid matrix of tax-exempt securities and evaluations by its staff, in each case based on information concerning market transactions and quotations from dealers which reflect the mean between the last reported bid and asked price. The portfolio securities are thus valued by reference to a combination of transactions and quotations for the same or other securities believed to be comparable in quality, coupon, maturity, type of issue, call provisions, trading characteristics and other features deemed to be relevant. The Trustees believe that timely and reliable market quotations are generally not readily available for purposes of valuing tax-exempt securities and that the valuations supplied by the pricing service are more likely to approximate the fair value of such securities; (2) futures are valued at the latest sale price on the commodities exchange on which they trade unless it is determined that such price does not reflect their market value, in which case they will be valued at their fair value as determined in good faith under procedures established by and under the supervision of the Trustees; and (3) short-term debt securities having a maturity date of more than sixty days at time of purchase are valued on a mark-to-market basis until sixty days prior to maturity and thereafter at amortized cost based on their value on the 61st day. Short-term debt securities having a maturity date of sixty days or less at the time of purchase are valued at amortized cost.

B. Accounting for Investments — Security transactions are accounted for on the trade date (date the order to buy or sell is executed). Realized gains and losses on security transactions are determined by the identified cost method. Discounts are accreted and premiums are amortized over the life of the respective securities. Interest income is accrued daily.

23

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  December 31, 2004 continued

December 31, 2004 continued

C. Multiple Class Allocations — Investment income, expenses (other than distribution fees), and realized and unrealized gains and losses are allocated to each class of shares based upon the relative net asset value on the date such items are recognized. Distribution fees are charged directly to the respective class.

D. Futures Contracts — A futures contract is an agreement between two parties to buy and sell financial instruments or contracts based on financial indices at a set price on a future date. Upon entering into such a contract, the Fund is required to pledge to the broker cash, U.S. Government securities or other liquid portfolio securities equal to the minimum initial margin requirements of the applicable futures exchange. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in the value of the contract. Such receipts or payments known as variation margin are recorded by the Fund as unrealized gains and losses. Upon closing of the contract, the Fund realizes a gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

E. Federal Income Tax Policy — It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable and nontaxable income to its shareholders. Accordingly, no federal income tax provision is required.

F. Dividends and Distributions to Shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

G. Use of Estimates — The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates.

2. Investment Advisory/Administration Agreements

Effective November 1, 2004, pursuant to an Investment Advisory Agreement with Morgan Stanley Investment Advisors Inc. (the "Investment Adviser"), the Fund pays the Investment Adviser an advisory fee, accrued daily and payable monthly, by applying the following annual rates to the Fund's net assets determined as of the close of each business day: 0.42% to the portion of daily net assets not exceeding $500 million; 0.345% to the portion of daily net assets exceeding $500 million but not exceeding $750 million; 0.295% to the portion of daily net assets exceeding $750 million but not exceeding $1 billion; 0.27% to the portion of daily net assets exceeding $1 billion but not exceeding $1.25 billion; 0.245% to the portion of daily net assets exceeding $1.25 billion but not exceeding $2.5 billion; and 0.22% to the portion of daily net assets exceeding $2.5 billion.

Effective November 1, 2004, pursuant to an Administration Agreement with Morgan Stanley Services Company Inc. (the "Administrator"), an affiliate of the Investment Adviser, the Fund pays an administration fee, accrued daily and payable monthly, by applying the annual rate of 0.08% to the Fund's daily net assets.

24

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  December 31, 2004 continued

December 31, 2004 continued

Prior to November 1, 2004, the Fund had retained the Investment Adviser to provide administrative services and to manage the investment of the Fund's assets pursuant to an investment management agreement pursuant to which the Fund paid the Investment Adviser a monthly management fee accrued daily and payable monthly, by applying the following annual rates to the Fund's net assets determined as of the close of each business day: 0.50% to the portion of daily net assets not exceeding $500 million; 0.425% to the portion of daily net assets exceeding $500 million but not exceeding $750 million; 0.375% to the portion of daily net assets exceeding $750 million but not exceeding $1 billion; 0.35% to the portion of daily net assets exceeding $1 billion but not exceeding $1.25 billion; 0.325% to the portion of daily net assets exceeding $1.25 billion but not exceeding $2.5 billion; and 0.30% to the portion of daily net assets exceeding $2.5 billion.

3. Plan of Distribution

Shares of the Fund are distributed by Morgan Stanley Distributors Inc. (the "Distributor"), an affiliate of the Investment Adviser and Administrator. The Fund has adopted a Plan of Distribution (the "Plan") pursuant to Rule 12b-1 under the Act. The Plan provides that the Fund will pay the Distributor a fee which is accrued daily and paid monthly at the following annual rates: (i) Class A – up to 0.25% of the average daily net assets of Class A; (ii) Class B – up to 0.60% of the average daily net assets of Class B; and (iii) Class C – up to 0.70% of the average daily net assets of Class C.

In the case of Class B shares, provided that the Plan continues in effect, any cumulative expenses incurred by the Distributor but not yet recovered may be recovered through the payment of future distribution fees from the Fund pursuant to the Plan and contingent deferred sales charges paid by investors upon redemption of Class B shares. Although there is no legal obligation for the Fund to pay expenses incurred in excess of payments made to the Distributor under the Plan and the proceeds of contingent deferred sales charges paid by investors upon redemption of shares, if for any reason the Plan is terminated, the Trustees will consider at that time the manner in which to treat such expenses. The Distributor has advised the Fund that such excess amounts totaled $5,700,376 at December 31, 2004.

In the case of Class A shares and Class C shares, expenses incurred pursuant to the Plan in any calendar year in excess of 0.25% or 0.70% of the average daily net assets of Class A or Class C, respectively, will not be reimbursed by the Fund through payments in any subsequent year, except that expenses representing a gross sales credit to Morgan Stanley Financial Advisors or other selected broker-dealer representatives may be reimbursed in the subsequent calendar year. For the year ended December 31, 2004, the distribution fee was accrued for Class A shares and Class C shares at the annual rate of 0.14% and 0.70%, respectively.

The Distributor has informed the Fund that for the year ended December 31, 2004, it received contingent deferred sales charges from certain redemptions of the Fund's Class A shares, Class B shares and Class C

25

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  December 31, 2004 continued

December 31, 2004 continued

shares of $720, $401,772 and $11,197, respectively and received $209,162 in front-end sales charges from sales of the Fund's Class A shares. The respective shareholders pay such charges which are not an expense of the Fund.

4. Security Transactions and Transactions with Affiliates

The cost of purchases and proceeds from sales of portfolio securities, excluding short-term investments, for the year ended December 31, 2004, aggregated $185,406,361 and $329,983,582, respectively. Included in the aforementioned transactions are purchases and sales of $15,822,775 and $10,329,400, respectively, with other Morgan Stanley funds, including net realized losses of $180,014.

Morgan Stanley Trust, an affiliate of the Investment Adviser, Administrator and Distributor, is the Fund's transfer agent. At December 31, 2004, the Fund had transfer agent fees and expenses payable of approximately $60,800.

The Fund has an unfunded noncontributory defined benefit pension plan covering certain independent Trustees of the Fund who will have served as independent Trustees for at least five years at the time of retirement. Benefits under this plan are based on factors which include years of service and compensation. Aggregate pension costs for the year ended December 31, 2004, included in Trustees' fees and expenses in the Statement of Operations amounted to $15,592. At December 31, 2004, the Fund had an accrued pension liability of $122,498 which is included in accrued expenses in the Statement of Assets and Liabilities. On December 2, 2003, the Trustees voted to close the plan to new participants and eliminate the future benefits growth due to increases to compensation after July 31, 2003.

Effective April 1, 2004, the Fund began an unfunded Deferred Compensation Plan (the "Compensation Plan") which allows each independent Trustee to defer payment of all, or a portion, of the fees he receives for serving on the Board of Trustees. Each eligible Trustee generally may elect to have the deferred amounts credited with a return equal to the total return on one or more of the Morgan Stanley funds that are offered as investment options under the Compensation Plan. Appreciation/depreciation and distributions received from these investments are recorded with an offsetting increase/decrease in the deferred compensation obligation and do not affect the net asset value of the Fund.

26

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  December 31, 2004 continued

December 31, 2004 continued

5. Shares of Beneficial Interest

Transactions in shares of beneficial interest were as follows:

| FOR THE YEAR ENDED DECEMBER 31, 2004 | FOR THE YEAR ENDED DECEMBER 31, 2003 | ||||||||||||||||||

| SHARES | AMOUNT | SHARES | AMOUNT | ||||||||||||||||

| CLASS A SHARES | |||||||||||||||||||

| Sold | 2,673,050 | $ | 31,459,356 | 14,862,986 | $ | 176,951,492 | |||||||||||||

| Reinvestment of dividends and distributions | 383,151 | 4,525,839 | 363,677 | 4,316,619 | |||||||||||||||

| Redeemed | (2,140,978 | ) | (25,329,649 | ) | (15,421,715 | ) | (183,534,432 | ) | |||||||||||

| Net increase (decrease) – Class A | 915,223 | 10,655,546 | (195,052 | ) | (2,266,321 | ) | |||||||||||||

| CLASS B SHARES | |||||||||||||||||||

| Sold | 1,243,741 | 14,840,921 | 3,526,482 | 42,027,370 | |||||||||||||||

| Reinvestment of dividends and distributions | 401,060 | 4,758,984 | 402,699 | 4,801,131 | |||||||||||||||

| Redeemed | (4,380,329 | ) | (51,922,900 | ) | (4,419,289 | ) | (52,506,680 | ) | |||||||||||

| Net decrease – Class B | (2,735,528 | ) | (32,322,995 | ) | (490,108 | ) | (5,678,179 | ) | |||||||||||

| CLASS C SHARES | |||||||||||||||||||

| Sold | 518,287 | 6,175,758 | 2,336,446 | 27,820,281 | |||||||||||||||

| Reinvestment of dividends and distributions | 88,239 | 1,044,089 | 80,533 | 957,683 | |||||||||||||||

| Redeemed | (1,103,515 | ) | (13,099,616 | ) | (1,432,682 | ) | (17,004,757 | ) | |||||||||||

| Net increase (decrease) – Class C | (496,989 | ) | (5,879,769 | ) | 984,297 | 11,773,207 | |||||||||||||

| CLASS D SHARES | |||||||||||||||||||

| Sold | 1,577,615 | 18,705,671 | 3,735,691 | 44,187,423 | |||||||||||||||

| Reinvestment of dividends and distributions | 2,190,563 | 25,868,902 | 2,218,901 | 26,329,042 | |||||||||||||||

| Redeemed | (12,569,676 | ) | (148,293,434 | ) | (13,750,120 | ) | (162,930,935 | ) | |||||||||||

| Net decrease – Class D | (8,801,498 | ) | (103,718,861 | ) | (7,795,528 | ) | (92,414,470 | ) | |||||||||||

| Net decrease in Fund | (11,118,792 | ) | $ | (131,266,079 | ) | (7,496,391 | ) | $ | (88,585,763 | ) | |||||||||

6. Federal Income Tax Status

The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations which may differ from generally accepted accounting principles. These "book/tax" differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed net investment income and net realized capital gains for tax purposes are reported as distributions of paid-in-capital.

27

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  December 31, 2004 continued

December 31, 2004 continued

The tax character of distributions paid was as follows:

| FOR THE YEAR ENDED DECEMBER 31, 2004 | FOR THE YEAR ENDED DECEMBER 31, 2003 | |||||||||

| Tax-exempt income | $ | 61,267,339 | $ | 69,017,855 | ||||||

| Ordinary income | 389,106 | — | ||||||||

| Long-term capital gains | 6,666,282 | 1,680,193 | ||||||||

| Total distributions | $ | 68,322,727 | $ | 70,698,048 | ||||||

As of December 31, 2004, the tax-basis components of accumulated earnings were as follows:

| Net accumulated earnings | — | |||||||||

| Post-October losses | $ | (10,243 | ) | |||||||

| Temporary differences | (346,118 | ) | ||||||||

| Net unrealized appreciation | 104,989,059 | |||||||||

| Total accumulated earnings | $ | 104,632,698 | ||||||||

As of December 31, 2004, the Fund had temporary book/tax differences primarily attributable to post-October losses (capital losses incurred after October 31 within the taxable year which are deemed to arise on the first business day of the Fund's next taxable year), book amortization of discounts on debt securities and dividend payable and permanent book/tax differences primarily attributable to tax adjustments on debt securities sold by the Fund. To reflect reclassifications arising from the permanent differences, distributions in excess of net realized gain was charged $86,811, paid-in-capital was credited $8,058, and accumulated undistributed net investment income was credited $78,753.

7. Expense Offset

The expense offset represents a reduction of the custodian fees for earnings on cash balances maintained by the Fund.

8. Risks Relating to Certain Financial Instruments

The Fund may invest a portion of its assets in residual interest bonds, which are inverse floating rate municipal obligations. The prices of these securities are subject to greater market fluctuations during periods of changing prevailing interest rates than are comparable fixed rate obligations.

28

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  December 31, 2004 continued

December 31, 2004 continued

To hedge against adverse interest rate changes, the Fund may invest in financial futures contracts or municipal bond index futures contracts ("futures contracts").

These futures contracts involve elements of market risk in excess of the amount reflected in the Statement of Assets and Liabilities. The Fund bears the risk of an unfavorable change in the value of the underlying securities. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

9. Legal Matters