UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-CSR CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act file number: 811-02979 Morgan Stanley Tax-Exempt Securities Trust (Exact name of registrant as specified in charter) 522 Fifth Avenue, New York, New York 10036 (Address of principal executive offices) (Zip code) Ronald E. Robison 522 Fifth Avenue, New York, New York 10036 (Name and address of agent for service) Registrant's telephone number, including area code: 212-296-6990 Date of fiscal year end: December 31, 2007 Date of reporting period: June 30, 2007 Item 1 - Report to Shareholders

Welcome, Shareholder:

In this report, you’ll learn about how your investment in Morgan Stanley Tax-Exempt Securities Trust performed during the semiannual period. We will provide an overview of the market conditions, and discuss some of the factors that affected performance during the reporting period. In addition, this report includes the Fund’s financial statements and a list of Fund investments.

| This material must be preceded or accompanied by a prospectus for the fund being offered. |

| Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund’s shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks. |

| Fund Report | |

| For the six months ended June 30, 2007 | |

Total Return for the 6 Months Ended June 30, 2007

| Class A | Class B | Class C | Class D | Lehman Brothers Municipal Bond Index1 | Lipper General Municipal Debt Funds Index2 | |||||||||||||||||||||||||||

| −0.10 | % | −0.28 | % | −0.24 | % | 0.01 | % | 0.14 | % | 0.06 | % | |||||||||||||||||||||

The performance of the Fund’s four share classes varies because each has different expenses. The Fund’s total returns assume the reinvestment of all distributions but do not reflect the deduction of any applicable sales charges. Such costs would lower performance. See Performance Summary for standardized performance and benchmark information.

Market Conditions

Economic growth was initially sluggish but became decidedly more positive as the period progressed. Weaker consumer spending and rising energy prices weighed on the economy in the first quarter of 2007. At the same time, troubles in the sub-prime mortgage market surfaced, intensifying concerns about the already weak residential housing sector. Against this backdrop, speculation began to emerge that the Federal Open Market Committee (the ‘‘Fed’’) might reduce its target federal funds rate. As the months progressed, energy prices continued to rise and productivity gains slowed, but employment growth remained strong and various economic indicators began to improve. This led to anticipation of a rebound in economic growth and renewed concerns about inflation, which effectively dispelled expectations of a near-term ease in Fed monetary policy and yields moved higher across the Treasury curve. In the last weeks of June, however, yields declined when news of the failure of two of Bear Stearns’ mortgage-related hedge funds fueled a flight-to-quality Treasury market rally. Despite the market’s volatility and the changing outlook for the economy and monetary policy during the period, the target federal funds rate has remained unchanged at 5.25 percent for the past year.

Municipal bond yields generally followed the same path as Treasury yields, declining in January and February then rising for most of the remainder of the period. Yields on long-term issues (as represented by the 30-year AAA rated municipal bond) moved from 4.10 percent at the beginning of the period to 4.55 percent in mid-June, then declined to 4.45 percent by the end of the period. Yields on 10-year bonds moved in a similar pattern while yields on short-term municipals remained relatively stable. As such, the slope of the curve steepened for the overall period, with a 75 basis point yield advantage, or ‘‘pick-up’’, for 30-year maturities relative to one-year maturities at the end of June. Despite t he steepening, however, the curve still ended the period relatively flat in historic terms as the yield pick-up from one to 30 years has averaged 150 basis points over the past three years.

Long-term municipal bonds performed relatively in line with Treasuries until late June when the flight to quality helped Treasuries outperform. The 30-year municipal-to-Treasury yield ratio, which measures the relative attractiveness of these two sectors, held steady at 85 percent through March, then rose slightly

2

to end the period at 87 percent. A rising ratio indicates that municipals underperformed Treasuries but became more attractive on a relative price basis.

Issuance of municipal bonds jumped nearly 50 percent in the first calendar quarter, due primarily to a surge in refundings, but fell off in the second quarter as rising interest rates discouraged borrowers from issuing new debt at higher rates. Nonetheless, new issue volume for the first half of 2007 totaled $226 billion, a 27 percent increase versus the same six-month period in 2006. The top five issuing states during the reporting period were California, Texas, Florida, New York and Pennsylvania. Together, these states accounted for 47 percent of total market volume.

As a final note, the U.S. Supreme Court agreed in May to review Davis v. The State of Kentucky Department of Revenue , a case that questions whether differential tax treatment of in-state and out-of-state municipal bond interest is constitutional. The executive branch of the Commonwealth of Kentucky is seeking to overturn a state court ruling that it is unconstitutional to treat interest on bonds issued by government entities in their state more favorably for tax purposes than interest on bonds issued in other states. Given that the majority of states currently exempt only interest on their municipal bonds from state income taxes, the market will be closely watching this case.

Performance Analysis

All share classes of Morgan Stanley Tax-Exempt Securities Trust underperformed the Lehman Brothers Municipal Bond Index and the Lipper General Municipal Debt Funds Index for the six months ended June 30, 2007, assuming no deduction of applicable sales charges.

During the reporting period, the Fund’s interest-rate positioning continued to reflect our anticipation of higher rates. As a result, at the end of June, the Fund’s option-adjusted duration* stood at 7.0 years. This defensive posture proved additive to performance as interest rates rose for the overall period. The Fund’s performance was also enhanced by several holdings that appreciated when they were prerefunded.**

The Fund maintained its high quality bias with more than 80 percent of the portfolio rated A or better as of the end of the reporting period. In particular, the Fund was overweighted in higher-rated bonds in sectors such as public power, higher education, water & sewer and transportation. This high credit-quality profile impeded performance since lower-rated bonds outperformed during the period. That said, we have been adding to positions in BBB rated securities, which helped boost returns.

Reflecting a commitment to diversification, the Fund’s net assets of just over $1 billion were invested among 15 long-term sectors and 120 credits. As of the close of the period, the Fund’s largest allocations were to the transportation, public power and water & sewer sectors.

There is no guarantee that any sectors mentioned will continue to perform well or that securities in such sectors will be held by the Fund in the future.

3

* A measure of the sensitivity of a bond’s price to changes in interest rates, expressed in years. Each year of duration represents an expected 1 percent change in the price of a bond for every 1 percent change in interest rates. The longer a bond’s duration, the greater the effect of interest-rate movements on its price. Typically, funds with shorter durations perform better in rising-interest-rate environments, while funds with longer durations perform better when rates decline.

**Prerefunding, or advance refunding, is a financing structure under which new bonds are issued to repay an outstanding bond issue on its first call date.

| TOP FIVE SECTORS | ||||||

| Transportation | 19.6 | % | ||||

| Public Power | 11.6 | |||||

| Water & Sewer | 11.4 | |||||

| Hospital | 10.4 | |||||

| General Obligation | 8.8 | |||||

| LONG-TERM CREDIT ANALYSIS | ||||||

| Aaa/AAA | 59.3 | % | ||||

| Aa/AA | 10.1 | |||||

| A/A | 13.0 | |||||

| Baa/BBB | 12.1 | |||||

| Ba/BB or Less | 1.9 | |||||

| NR | 3.6 | |||||

Data as of June 30, 2007. Subject to change daily. All percentages for top five sectors are as a percentage of net assets and all percentages for long-term credit analysis are as a percentage of total long-term investments. These data are provided for informational purposes only and should not be deemed a recommendation to buy or sell the securities mentioned. Morgan Stanley is a full-service securities firm engaged in securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services.

Investment Strategy

The Fund will normally invest at least 80 percent of its assets in securities that pay interest exempt from federal income taxes. This policy is fundamental and may not be changed without shareholder approval. The Fund’s ‘‘Investment Adviser,’’ Morgan Stanley Investment Advisors Inc., generally invests the Fund’s assets in municipal obligations. Municipal obligations are bonds, notes or short-term commercial paper issued by state governments, local governments, and/or their respective agencies.

For More Information About

Portfolio Holdings

Each Morgan Stanley fund provides a complete schedule of portfolio holdings in its semiannual and annual reports within 60 days of the end of the fund’s second and fourth fiscal quarters. The semiannual reports and the annual reports are filed electronically with the Securities and Exchange Commission (SEC) on Form N-CSRS and Form N-CSR, respectively. Morgan Stanley also delivers the semiannual and annual reports to fund shareholders and makes these reports available on its public web site, www.morganstanley.com. Each Morgan Stanley fund also files a complete schedule of portfolio holdings with the SEC for the fund’s first and third fiscal quarters on Form N-Q. Morgan Stanley does not deliver the reports for the first and third fiscal quarters to shareholders, nor are the reports posted to the Morgan Stanley public web site. You may, however, obtain the Form N-Q filings (as well as the Form N-CSR and N-CSRS filings) by accessing the SEC’s web site, http://www.sec.gov. You may also revie w and copy them at the SEC’s public

4

reference room in Washington, DC. Information on the operation of the SEC’s public reference room may be obtained by calling the SEC at (800) SEC-0330. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC’s e-mail address (publicinfo@sec.gov) or by writing the public reference section of the SEC, Washington, DC 20549-0102.

Householding Notice

To reduce printing and mailing costs, the Fund attempts to eliminate duplicate mailings to the same address. The Fund delivers a single copy of certain shareholder documents, including shareholder reports, prospectuses and proxy materials, to investors with the same last name who reside at the same address. Your participation in this program will continue for an unlimited period of time unless you instruct us otherwise. You can request multiple copies of these documents by calling (800) 350-6414, 8:00 a.m. to 8:00 p.m., ET. Once our Customer Service Center has received your instructions, we will begin sending individual copies for each account within 30 days.

5

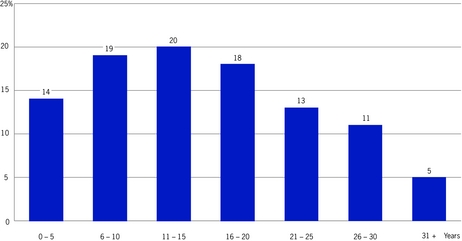

| Distribution by Maturity | |

| (% of Long-Term Portfolio) As of June 30, 2007 | |

Weighted Average Maturity: 16 Years(a)

| (a) | Where applicable maturities reflect mandatory tenders, puts and call dates. |

| Portfolio structure is subject to change. |

Geographic Summary of Investments

Based on Market Value as a Percent of Total Net Investments

| Alabama | 0.4 | % | ||||

| Alaska | 3.9 | |||||

| Arizona | 3.4 | |||||

| Arkansas | 0.2 | |||||

| California | 11.4 | |||||

| Colorado | 3.6 | |||||

| Connecticut | 1.3 | |||||

| District of Columbia | 2.3 | |||||

| Florida | 3.1 | |||||

| Georgia | 4.4 | |||||

| Hawaii | 0.5 | % | ||||

| Idaho | 0.1 | |||||

| Illinois | 4.7 | |||||

| Indiana | 0.9 | |||||

| Iowa | 1.4 | |||||

| Kansas | 0.8 | |||||

| Kentucky | 2.7 | |||||

| Maryland | 1.3 | |||||

| Massachusetts | 1.8 | |||||

| Michigan | 2.0 | |||||

| Missouri | 1.6 | % | ||||

| Nevada | 2.2 | |||||

| New Jersey | 5.7 | |||||

| New Mexico | 1.0 | |||||

| New York | 15.6 | |||||

| North Carolina | 1.2 | |||||

| Ohio | 2.6 | |||||

| Pennsylvania | 1.6 | |||||

| Puerto Rico | 2.1 | |||||

| South Carolina | 1.1 | |||||

| Tennessee | 1.2 | % | ||||

| Texas | 6.5 | |||||

| Utah | 1.6 | |||||

| Vermont | 0.3 | |||||

| Virginia | 1.2 | |||||

| Washington | 4.4 | |||||

| West Virginia | 0.4 | |||||

| Wisconsin | 0.2 | |||||

| Joint exemption* | (1.1 | ) | ||||

| Total** | 99.6 | % | ||||

| * | Joint exemption has been included in each geographic location. |

| ** | Does not include an investment in Morgan Stanley Institutional Liquidity Tax-Exempt Portfolio – Institutional Class of 0.4%. |

6

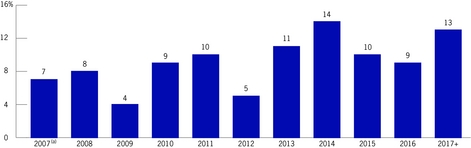

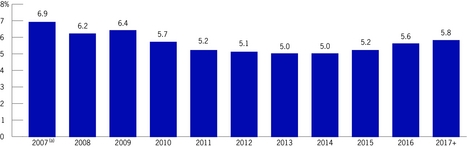

| Call and Cost (Book) Yield Structure | |

| (Based on Long-Term Portfolio) As of June 30, 2007 | |

Years Bonds Callable — Weighted Average Call Protection: 6 Years

Cost (Book) Yield(b) — Weighted Average Book Yield: 5.5%

| (a) | May include issues initially callable in previous years. |

| (b) | Cost or ‘‘book’’ yield is the annual income earned on a portfolio investment based on its original purchase price before the Fund’s operating expenses. For example, the Fund is earning a book yield of 6.9% on 7% of the long-term portfolio that is callable in 2007. |

| Portfolio structure is subject to change. |

7

| Performance Summary | |

Average Annual Total Returns — Period Ended June 30, 2007

| Class A Shares* (since 03/27/80) | Class B Shares** (since 07/28/97) | Class C Shares† (since 07/28/97) | Class D Shares†† (since 03/27/80) | |||||||||||||||||||||||

| Symbol | TAXAX | TAXBX | TAXCX | TAXDX | ||||||||||||||||||||||

| 1 Year | 4.41 %3 | 4.04 %3 | 3.93%3 | 4.57%3 | ||||||||||||||||||||||

| (0.03) 4 | (0.93) 4 | 2.94 4 | — | |||||||||||||||||||||||

| 5 Years | 4.52 3 | 4.08 3 | 3.98 3 | 4.71 3 | ||||||||||||||||||||||

| 3.62 4 | 3.75 4 | 3.98 4 | — | |||||||||||||||||||||||

| 10 Years | 5.03 3 | — | — | 5.22 3 | ||||||||||||||||||||||

| 4.57 4 | — | — | — | |||||||||||||||||||||||

| Since Inception | 7.70 3 | 4.51 3 | 4.31 3 | 7.95 3 | ||||||||||||||||||||||

| 7.53 4 | 4.51 4 | 4.31 4 | — | |||||||||||||||||||||||

| Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please visit www.morganstanley.com or speak with your Financial Advisor. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class A, Class B, Class C, and Class D shares will vary due to differences in sales charges and expenses. |

| Prior to July 28, 1997 the Fund offered only one class of shares. Because the distribution arrangement for Class A most closely resembled the distribution arrangement applicable prior to the implementation of multiple classes (i.e., Class A is sold with a front-end sales charge), historical performance information has been restated to reflect the actual maximum sales charge applicable to Class A (i.e., 4.25%) as compared to the 4.00% sales charge in effect prior to July 28, 1997. In addition, Class A shares are now subject to an ongoing 12b-1 fee which is reflected in the restated performance for that class. |

| Because all shares of the fund held prior to July 28, 1997 were designated Class D shares, the Fund’s historical performance has been restated to reflect the absence of any sales charge. |

| * | The maximum front-end sales charge for Class A is 4.25%. |

| ** | The maximum contingent deferred sales charge (CDSC) for Class B is 5.0%. The CDSC declines to 0% after six years. Effective April 2005, Class B shares will generally convert to Class A shares approximately eight years after the end of the calendar month in which the shares were purchased. Performance for periods greater than eight years reflects this conversion. |

| † | The maximum contingent deferred sales charge for Class C is 1.0% for shares redeemed within one year of purchase. |

| †† | Class D has no sales charge. |

| (1) | The Lehman Brothers Municipal Bond Index tracks the performance of municipal bonds rated at least Baa or BBB by Moody’s Investors Service, Inc. or Standard & Poor’s Corporation, respectively and with maturities of 2 years or greater. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index. |

| (2) | The Lipper General Municipal Debt Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper General Municipal Debt Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. The Fund is in the Lipper General Municipal Debt Funds classification as of the date of this report. |

| (3) | Figure shown assumes reinvestment of all distributions and does not reflect the deduction of any sales charges. |

| (4) | Figure shown assumes reinvestment of all distributions and the deduction of the maximum applicable sales charge. See the Fund’s current prospectus for complete details on fees and sales charges. |

8

| Expense Example | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees; and (2) ongoing costs, including advisory fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 01/01/07 – 06/30/07.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | ||||||||||||

| 01/01/07 | 06/30/07 | 01/01/07 – 06/30/07 | ||||||||||||

| Class A | ||||||||||||||

| Actual (–0.10% return) | $ | 1,000.00 | $ | 999.00 | $ | 4.81 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,019.98 | $ | 4.86 | ||||||||

| Class B | ||||||||||||||

| Actual (–0.28% return) | $ | 1,000.00 | $ | 997.20 | $ | 6.64 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,018.15 | $ | 6.71 | ||||||||

| Class C | ||||||||||||||

| Actual (–0.24% return) | $ | 1,000.00 | $ | 997.60 | $ | 7.13 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,017.65 | $ | 7.20 | ||||||||

| Class D | ||||||||||||||

| Actual (0.01% return) | $ | 1,000.00 | $ | 1,000.10 | $ | 3.67 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,021.12 | $ | 3.71 | ||||||||

| * | Expenses are equal to the Fund’s annualized expense ratios of 0.97%, 1.34%, 1.44% and 0.74% for Class A, Class B, Class C and Class D shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

9

Nature, Extent and Quality of Services

The Board reviewed and considered the nature and extent of the investment advisory services provided by the Investment Adviser under the Advisory Agreement, including portfolio management, investment research and fixed income securities trading. The Board also reviewed and considered the nature and extent of the non-advisory, administrative services provided by the Fund’s Administrator under the Administration Agreement, including accounting, clerical, bookkeeping, compliance, business management and planning, and the provision of supplies, office space and utilities at the Investment Adviser’s expense. (The Investment Adviser and the Administrator together are referred to as the ‘‘Adviser’&rsquo ; and the Advisory and Administration Agreements together are referred to as the ‘‘Management Agreement.’’) The Board also compared the nature of the services provided by the Adviser with similar services provided by non-affiliated advisers as reported to the Board by Lipper Inc. (‘‘Lipper’’).

The Board reviewed and considered the qualifications of the portfolio managers, the senior administrative managers and other key personnel of the Adviser who provide the advisory and administrative services to the Fund. The Board determined that the Adviser’s portfolio managers and key personnel are well qualified by education and/or training and experience to perform the services in an efficient and professional manner. The Board concluded that the nature and extent of the advisory and administrative services provided were necessary and appropriate for the conduct of the business and investment activities of the Fund. The Board also concluded that the overall quality of the advisory and administrative services was sati sfactory.

Performance Relative to Comparable Funds Managed by Other Advisers

On a regular basis, the Board reviews the performance of all funds in the Morgan Stanley Fund Complex, including the Fund, compared to their peers, paying specific attention to the underperforming funds. In addition, the Board specifically reviewed the Fund’s performance for the one-, three- and five-year periods ended November 30, 2006, as shown in a report provided by Lipper (the ‘‘Lipper Report’’), compared to the performance of comparable funds selected by Lipper (the ‘‘performance peer group’’). The Board also discussed with the Adviser the performance goals and the actual results achieved in managing the Fund. The Board concluded that the Fund’s performance was competitive with that of its performance peer group.

Fees Relative to Other Priority Funds Managed by the Adviser with Comparable

Investment Strategies

The Board noted that the Adviser did not manage any other proprietary funds with investment strategies comparable to those of the Fund.

Fees and Expenses Relative to Comparable Funds Managed by Other Advisers

The Board reviewed the advisory and administrative fee (together, the ‘‘management fee’’) rate and total expense ratio of the Fund as compared to the average management fee rate and average total expense ratio for funds, selected by Lipper (the ‘‘expense peer group’’), managed by other advisers with investment strategies comparable to those of the Fund, as shown in the Lipper Report. The Board concluded that the Fund’s management fee rate and total expense ratio were competitive with those of its expense peer group.

10

Breakpoints and Economies of Scale

The Board reviewed the structure of the Fund’s management fee schedule under the Management Agreement and noted that it includes breakpoints. The Board also reviewed the level of the Fund’s management fee and noted that the fee, as a percentage of the Fund’s net assets, would decrease as net assets increase because the management fee includes breakpoints. The Board concluded that the Fund’s management fee would reflect economies of scale as assets increase.

Profitability of the Adviser and Affiliates

The Board considered information concerning the costs incurred and profits realized by the Adviser and affiliates during the last year from their relationship with the Fund and during the last two years from their relationship with the Morgan Stanley Fund Complex and reviewed with the Adviser the cost allocation methodology used to determine the profitability of the Adviser and affiliates. Based on its review of the information it received, the Board concluded that the profits earned by the Adviser and affiliates were not excessive in light of the advisory, administrative and other services provided to the Fund.

Fall-Out Benefits

The Board considered so-called ‘‘fall-out benefits’’ derived by the Adviser and affiliates from their relationship with the Fund and the Morgan Stanley Fund Complex, such as sales charges on sales of Class A shares and ‘‘float’’ benefits derived from handling of checks for purchases and sales of Fund shares, through a broker-dealer affiliate of the Adviser. The Board also considered that a broker-dealer affiliate of the Adviser receives from the Fund 12b-1 fees for distribution and shareholder services. The Board concluded that the float benefits were relatively small and the sales charges and 12b-1 fees were competitive with those of other broker-dealers.

Soft Dollar Benefits

The Board considered whether the Adviser realizes any benefits from commissions paid to brokers who execute securities transactions for the Fund (‘‘soft dollars’’). The Board noted that the Fund invests only in fixed income securities, which do not generate soft dollars.

Adviser Financially Sound and Financially Capable of Meeting the Fund’s Needs

The Board considered whether the Adviser is financially sound and has the resources necessary to perform its obligations under the Management Agreement. The Board concluded that the Adviser has the financial resources necessary to fulfill its obligations under the Management Agreement.

Historical Relationship Between the Fund and the Adviser

The Board also reviewed and considered the historical relationship between the Fund and the Adviser, including the organizational structure of the Adviser, the policies and procedures formulated and adopted by the Adviser for managing the Fund’s operations and the Board’s confidence in the competence and integrity of the senior managers and key personnel of the Adviser. The Board concluded that it is beneficial for the Fund to continue its relationship with the Adviser.

11

Other Factors and Current Trends

The Board considered the controls and procedures adopted and implemented by the Adviser and monitored by the Fund’s Chief Compliance Officer and concluded that the conduct of business by the Adviser indicates a good faith effort on its part to adhere to high ethical standards in the conduct of the Fund’s business.

General Conclusion

On April 25, 2007, after considering and weighing all of the above factors, the Board concluded that it would be in the best interest of the Fund and its shareholders to approve renewal of the Management Agreement for another year until April 30, 2008. On June 20, 2007, the Board again considered and weighed all of the above factors and concluded that it would be in the best interest of the Fund and its shareholders to approve renewal of the Management Agreement to continue until June 30, 2008.

12

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments![]() June 30, 2007 (unaudited)

June 30, 2007 (unaudited)

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| �� | Tax-Exempt Municipal Bonds (100.7%) | |||||||||||||||||

| General Obligation (8.8%) | ||||||||||||||||||

| North Slope Borough, Alaska, | ||||||||||||||||||

| $ | 9,500 | Ser 1999 A (MBIA) | 0.00 | % | 06/30/10 | $ | 8,427,355 | |||||||||||

| 25,000 | Ser 2000 B (MBIA) | 0.00 | 06/30/11 | 21,276,500 | ||||||||||||||

| California, | ||||||||||||||||||

| 10,000 | Economic Recovery, Ser 2004 A | 5.00 | 07/01/16 | 10,404,300 | ||||||||||||||

| 5,000 | Various Purpose Dtd 04/01/02 | 6.00 | 04/01/19 | 5,735,200 | ||||||||||||||

| 20,000 | Various Purpose Dtd 06/01/07 | 5.00 | 06/01/37 | 20,446,800 | ||||||||||||||

| 4,000 | Connecticut, College Savings 1989 Ser A | 0.00 | 07/01/08 | 3,854,840 | ||||||||||||||

| Chicago, Illinois, | ||||||||||||||||||

| 5,000 | Refg Ser 1995 A-2 (Ambac) | 6.25 | 01/01/14 | 5,606,900 | ||||||||||||||

| 2,000 | Refg 2001 A (MBIA) | 0.00 | # | 01/01/17 | 1,802,280 | |||||||||||||

| 4,280 | Chicago Park District, Illinois, Ser 2004 A (Ambac) | 5.00 | 01/01/26 | 4,413,836 | ||||||||||||||

| 3,000 | Clark County, Nevada, Transportation Ser 1992 A (Ambac) | 6.50 | 06/01/17 | 3,535,050 | ||||||||||||||

| 4,810 | New York State, Refg Ser 1995 B | 5.70 | 08/15/10 | 4,821,303 | ||||||||||||||

| 92,590 | 90,324,364 | |||||||||||||||||

| Appropriation (2.7%) | ||||||||||||||||||

| 8,000 | Golden State Tobacco Securitization Corporation, California, Enhanced Asset Backed Ser 2005 A | 5.00 | 06/01/45 | 8,090,960 | ||||||||||||||

| 12,000 | District of Columbia, Ballpark Ser 2006 B-1 (FGIC) | 5.00 | 02/01/31 | 12,375,600 | ||||||||||||||

| 2,500 | Miami-Dade County, Florida, Ser 2005 (MBIA) | 0.00 | # | 10/01/35 | 2,339,975 | |||||||||||||

| 5,000 | Charleston Educational Excellence Financing Corporation, South Carolina, Charleston County School District Ser 2005 | 5.25 | 12/01/30 | 5,237,050 | ||||||||||||||

| 27,500 | 28,043,585 | |||||||||||||||||

| Dedicated Tax (6.5%) | ||||||||||||||||||

| 3,710 | Jefferson County, Alabama, School Ser 2004-A | 5.25 | 01/01/23 | 3,885,631 | ||||||||||||||

| 1,650 | Metropolitan Football Stadium District, Colorado, Sales Tax Ser 1999 A (MBIA) | 0.00 | 01/01/11 | 1,433,157 | ||||||||||||||

| 8,500 | Jacksonville, Florida, Transportation Ser 2001 (MBIA) | 5.00 | 10/01/26 | 8,647,560 | ||||||||||||||

| 3,495 | Illinois, Civic Center Dedicated Tax Ser 1991 (Ambac) | 6.25 | 12/15/20 | 4,069,263 | ||||||||||||||

| 3,000 | Wyandotte County/Kansas City, Kansas, Area B Refg Ser 2005 | 5.00 | 12/01/20 | 3,067,140 | ||||||||||||||

| New Jersey Economic Development Authority, | ||||||||||||||||||

| 2,000 | Cigarette Tax Ser 2004 | 5.50 | 06/15/31 | 2,091,360 | ||||||||||||||

| 2,500 | Cigarette Tax Ser 2004 | 5.75 | 06/15/34 | 2,650,900 | ||||||||||||||

See Notes to Financial Statements

13

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments![]() June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| $ | 3,000 | Albuquerque, New Mexico, Gross Receipts Lodgers’ Tax Refg Ser 2004 A (FSA) | 5.00 | % | 07/01/37 | $ | 3,072,060 | |||||||||||

| 5,000 | New York City Industrial Development Agency, New York, Yankee Stadium Ser 2006 (MBIA) | 4.75 | 03/01/46 | 5,001,550 | ||||||||||||||

| New York City Transitional Finance Authority, New York, | ||||||||||||||||||

| 7,000 | Refg 2003 Ser D (MBIA) | 5.25 | 02/01/21 | 7,382,060 | ||||||||||||||

| 8,000 | Refg 2003 Ser A | 5.50 | 11/01/26 | 8,457,200 | ||||||||||||||

| 5,000 | New York Local Government Assistance Corporation, Ser 1993 C | 5.50 | 04/01/17 | 5,487,850 | ||||||||||||||

| 10,000 | Sales Tax Asset Receivable Corporation, New York, 2005 Ser A (Ambac) | 5.00 | 10/15/29 | 10,373,400 | ||||||||||||||

| 1,110 | Hamilton County, Ohio, Sales Tax 2000 (Ambac) | 5.25 | 12/01/32 | 1,147,829 | ||||||||||||||

| 63,965 | 66,766,960 | |||||||||||||||||

| Education (2.4%) | ||||||||||||||||||

| 2,000 | University of Arkansas, UAMS Campus Ser 2004 B (MBIA) | 5.00 | 11/01/34 | 2,059,900 | ||||||||||||||

| 1,000 | University of Idaho, Student Fee Ser H (FGIC) | 5.25 | 04/01/31 | 1,034,660 | ||||||||||||||

| 2,000 | Maryland Health & Educational Facilities Authority, The Johns Hopkins University Refg Ser 1998 | 5.125 | 07/01/20 | 2,059,100 | ||||||||||||||

| New York State Dormitory Authority, | ||||||||||||||||||

| 5,000 | City University Ser 2000 A (Ambac) | 6.125 | 07/01/13 | 5,355,700 | ||||||||||||||

| 2,000 | State University 1990 Ser | 7.50 | 05/15/13 | 2,342,740 | ||||||||||||||

| 5,000 | State University 1993 Ser | 5.25 | 05/15/15 | 5,284,900 | ||||||||||||||

| 2,000 | University of North Carolina at Wilmington, Student Housing Ser 2005 COPs (FGIC) | 5.00 | 06/01/31 | 2,055,880 | ||||||||||||||

| University of West Virginia, | ||||||||||||||||||

| 2,000 | Ser C 2004 (FGIC) | 5.00 | 10/01/27 | 2,068,060 | ||||||||||||||

| 2,000 | Ser C 2004 (FGIC) | 5.00 | 10/01/28 | 2,066,800 | ||||||||||||||

| 23,000 | 24,327,740 | |||||||||||||||||

| Hospital (10.4%) | ||||||||||||||||||

| Glendale, Industrial Development Authority, Arizona, | ||||||||||||||||||

| 3,250 | John C Lincoln Health Ser 2005 B | 5.25 | 12/01/23 | 3,330,990 | ||||||||||||||

| 2,250 | John C Lincoln Health Ser 2005 B | 5.25 | 12/01/25 | 2,302,942 | ||||||||||||||

| California Statewide Communities Development Authority, | ||||||||||||||||||

| 5,000 | Adventist Healthwest 2005 Ser A | 5.00 | 03/01/30 | 5,037,700 | ||||||||||||||

| 2,500 | Huntington Memorial Hospital Ser 2005 | 5.00 | 07/01/35 | 2,521,325 | ||||||||||||||

| 7,000 | John Muir Health Ser 2006 A | 5.00 | 08/15/32 | 7,089,180 | ||||||||||||||

| 3,560 | Loma Linda, California, Loma Linda University Medical Center Ser 2005 A | 5.00 | 12/01/22 | 3,580,506 | ||||||||||||||

See Notes to Financial Statements

14

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments![]() June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| $ | 4,000 | Highlands County Health Facilities Authority, Florida, Adventist Health/Sunbelt Ser 2006 C | 5.25 | % | 11/15/36 | $ | 4,093,440 | |||||||||||

| 18,000 | South Miami Health Facilities Authority, Florida, Baptist Health Ser 2007 ‡‡ | 5.00 | 08/15/42 | 18,220,230 | ||||||||||||||

| 1,275 | Washington County Hospital, Iowa, Ser 2006 | 5.50 | 07/01/32 | 1,302,680 | ||||||||||||||

| 2,000 | University of Kansas Hospital Authority, KU Health Ser 2002 | 4.50 | 09/01/32 | 1,832,140 | ||||||||||||||

| 6,000 | Maryland Health & Higher Educational Facilities Authority, Medstar Health Refg Ser 2004 | 5.50 | 08/15/33 | 6,265,380 | ||||||||||||||

| Michigan Hospital Finance Authority, | ||||||||||||||||||

| 4,000 | Henry Ford Health Refg Ser 2006 A | 5.25 | 11/15/32 | 4,104,040 | ||||||||||||||

| 5,000 | Henry Ford Health Refg Ser 2006 A | 5.25 | 11/15/46 | 5,097,250 | ||||||||||||||

| 10,000 | Missouri Health & Educational Facilities Authority, Barnes-Jewish/Christian Health Ser 1993 A | 5.25 | 05/15/14 | 10,544,700 | ||||||||||||||

| 9,000 | New Jersey Health Care Facilities Financing Authority, Robert Wood Johnson University Hospital Ser 2000 | 5.75 | 07/01/25 | 9,430,200 | ||||||||||||||

| 10,000 | New York State Dormitory Authority, Memorial Sloan-Kettering Cancer Center 2003 Ser I | 5.00 | 07/01/34 | 10,213,100 | ||||||||||||||

| 3,000 | Erie County, Ohio, Firelands Regional Medical Center Ser 2002 | 5.625 | 08/15/32 | 3,141,210 | ||||||||||||||

| 5,000 | Lorain County, Ohio, Catholic Health Ser 9 2001 A | 5.25 | 10/01/33 | 5,162,200 | ||||||||||||||

| 2,500 | Wisconsin Health & Education Facilities Authority, Marshfield Clinic Ser 2006 A | 5.375 | 02/15/34 | 2,577,275 | ||||||||||||||

| 103,335 | 105,846,488 | |||||||||||||||||

| Housing (2.1%) | ||||||||||||||||||

| California Housing Finance Agency, | ||||||||||||||||||

| 1,460 | Home 1983 Ser B | 0.00 | 08/01/15 | 715,239 | ||||||||||||||

| 4,000 | Home 2006 Ser K (AMT)‡‡ | 4.70 | 08/01/31 | 3,838,860 | ||||||||||||||

| 4,000 | Home 2006 Ser K (AMT)‡‡ | 4.75 | 08/01/36 | 3,844,460 | ||||||||||||||

| Colorado Housing & Finance Authority, | ||||||||||||||||||

| 225 | 1998 Ser A-2 (AMT) | 6.60 | 05/01/28 | 231,151 | ||||||||||||||

| 140 | 1997 Ser C-2 (AMT) | 6.875 | 11/01/28 | 141,760 | ||||||||||||||

| 985 | Hawaii Housing Finance & Development Corporation, Purchase 1997 Ser A (AMT) | 5.75 | 07/01/30 | 997,785 | ||||||||||||||

| Missouri Housing Development Commission, | ||||||||||||||||||

| 150 | Homeownership 1996 Ser C (AMT) | 7.45 | 09/01/27 | 152,267 | ||||||||||||||

| 460 | Homeownership 1997 Ser C-1 | 6.55 | 09/01/28 | 474,228 | ||||||||||||||

| 190 | Homeownership Ser 2000 B-1 (AMT) | 7.45 | 09/01/31 | 195,751 | ||||||||||||||

| 475 | New Hampshire Housing Finance Authority, Mortgage Acquisition 2000 Ser B (AMT) | 6.70 | 07/01/29 | 486,828 | ||||||||||||||

See Notes to Financial Statements

15

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments![]() June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| $ | 3,279 | New York City Housing Development Corporation, New York, Ruppert – FHA Ins Sec 223F | 6.50 | % | 11/15/18 | $ | 3,447,534 | |||||||||||

| 3,400 | Ohio Housing Finance Agency, Residential 1996 Ser B-2 (AMT) | 6.10 | 09/01/28 | 3,454,536 | ||||||||||||||

| Pennsylvania Housing Finance Agency, | ||||||||||||||||||

| 1,760 | Ser 2006-96A (AMT)‡‡ | 4.65 | 10/01/31 | 1,663,402 | ||||||||||||||

| 2,240 | Ser 2006-96A (AMT)‡‡ | 4.70 | 10/01/37 | 2,117,058 | ||||||||||||||

| 22,764 | 21,760,859 | |||||||||||||||||

| Industrial Development/Pollution Control (6.7%) | ||||||||||||||||||

| 10,000 | Michigan Strategic Fund, Detroit Edison Co Ser 1999 B (AMT) | 5.65 | 09/01/29 | 10,361,500 | ||||||||||||||

| 4,000 | New Jersey Economic Development Authority, Continental Airlines Inc Ser 1999 (AMT) | 6.25 | 09/15/19 | 4,126,200 | ||||||||||||||

| New York City Industrial Development Agency, New York, | ||||||||||||||||||

| 12,000 | American Airlines Inc Ser 2005 (AMT) | 7.625 | 08/01/25 | 14,153,280 | ||||||||||||||

| 6,000 | 7 World Trade Center, LLC Ser A | 6.25 | 03/01/15 | 6,309,360 | ||||||||||||||

| 5,000 | 7 World Trade Center, LLC Ser A | 6.50 | 03/01/35 | 5,275,650 | ||||||||||||||

| 16,000 | Tennessee Energy Acquisition Corporation, Ser 2006 A ‡‡ | 5.25 | 09/01/19 | 17,060,080 | ||||||||||||||

| 5,000 | Brazos River Authority, Texas, TXU Electric Co Ser 1999 C (AMT) | 7.70 | 03/01/32 | 5,622,350 | ||||||||||||||

| 5,000 | Sabine River Authority, Texas, TXU Electric Co Refg Ser 2001 B (AMT) (Mandatory Tender 11/01/11) | 5.75 | 05/01/30 | 5,091,000 | ||||||||||||||

| 63,000 | 67,999,420 | |||||||||||||||||

| Life Care (2.0%) | ||||||||||||||||||

| Riverside County Public Financing Authority, California, | ||||||||||||||||||

| 2,000 | Air Force Village West Inc COPs | 5.75 | 05/15/19 | 2,048,100 | ||||||||||||||

| 3,900 | Air Force Village West Inc COPs | 5.80 | 05/15/29 | 3,996,408 | ||||||||||||||

| 2,500 | Baltimore County, Maryland, Oak Crest Village Ser 2007 A | 5.00 | 01/01/37 | 2,502,800 | ||||||||||||||

| 2,000 | Maryland Health & Higher Educational Facilities Authority, King Farm Presbyterian Community 2006 Ser B | 5.00 | 01/01/17 | 2,002,860 | ||||||||||||||

| 2,000 | Montgomery County, Pennsylvania, White Marsh Ser 2005 | 6.125 | 02/01/28 | 2,096,800 | ||||||||||||||

| 5,000 | Lubbock Health Facilities Development Corporation, Texas, Carillon Senior Life Care Ser 2005 A | 6.625 | 07/01/36 | 5,243,650 | ||||||||||||||

| 2,550 | Vermont Economic Development Authority, Wake Robin Corp Ser 2006 A | 5.375 | 05/01/36 | 2,583,634 | ||||||||||||||

| 19,950 | 20,474,252 | |||||||||||||||||

| Nursing & Health Services (0.2%) | ||||||||||||||||||

| 1,710 | Chester County Industrial Development Authority, Pennsylvania, | |||||||||||||||||

| RHA/PA Nursing Home Inc Ser 1989 | 8.50 | 05/01/32 | 1,693,977 | |||||||||||||||

See Notes to Financial Statements

16

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments![]() June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| Public Power (11.6%) | ||||||||||||||||||

| $ | 25,000 | Salt River Project Agricultural Improvement & Power District, Arizona, Refg 1993 Ser C (Secondary MBIA) | 5.50 | % | 01/01/10 | $ | 25,973,250 | |||||||||||

| 9,000 | Southern California Public Power Authority, Mead-Adelanto 1994 Ser A (Ambac) | 6.44‡ | 07/01/15 | 10,259,730 | ||||||||||||||

| 15,000 | Colorado Springs, Colorado, Utilities Refg Ser 2002 (Ambac) | 5.375 | 11/15/20 | 15,895,350 | ||||||||||||||

| 9,420 | Georgia Municipal Electric Power Authority, Fifth Ser (Secondary MBIA) | 6.50 | 01/01/17 | 10,751,329 | ||||||||||||||

| 3,050 | Wyandotte County/Kansas City, Kansas, Utility Ser 2004 B (FSA) | 5.00 | 09/01/27 | 3,152,785 | ||||||||||||||

| 4,000 | Missouri Joint Municipal Electrical Utility Commission, Plum Point Ser 2006 (MBIA) | 5.00 | 01/01/25 | 4,155,800 | ||||||||||||||

| 5,000 | Long Island Power Authority, New York, Ser 2000 A (FSA) | 0.00 | 06/01/17 | 3,283,350 | ||||||||||||||

| North Carolina Municipal Power Agency, | ||||||||||||||||||

| 5,000 | Catawba Ser 1998 A (MBIA) | 5.50 | 01/01/15 | 5,443,250 | ||||||||||||||

| 4,000 | Catawba Ser 2003 A (MBIA) | 5.25 | 01/01/19 | 4,197,520 | ||||||||||||||

| 15,000 | Puerto Rico Electric Power Authority, Power Ser O | 0.00 | 07/01/17 | 9,502,350 | ||||||||||||||

| 5,000 | South Carolina Public Service Authority, Refg Ser 2002 D (FSA) | 5.00 | 01/01/21 | 5,173,650 | ||||||||||||||

| Grant County Public Utility District # 2, Washington, | ||||||||||||||||||

| 5,000 | Refg Ser 2001 H (FSA) | 5.375 | 01/01/18 | 5,219,050 | ||||||||||||||

| 5,000 | Wanapum Hydro Refg Ser A 2005 | 5.00 | 01/01/38 | 5,114,550 | ||||||||||||||

| 7,330 | Seattle Municipal Light & Power, Washington, Impr & Refg Ser 2001 (FSA) | 5.50 | 03/01/18 | 7,669,746 | ||||||||||||||

| 3,000 | Washington Public Power Supply System, Project #2 Refg Ser 1994 A (FGIC) | 0.00 | 07/01/09 | 2,773,110 | ||||||||||||||

| 119,800 | 118,564,820 | |||||||||||||||||

| Tobacco Settlement (5.9%) | ||||||||||||||||||

| 9,000 | Northern Tobacco Securitization Corporation, Alaska, Asset-Backed Ser 2006 A | 5.00 | 06/01/32 | 8,707,050 | ||||||||||||||

| 3,000 | California County Tobacco Securitization Agency, Los Angeles County Securitization Corporation Ser 2006 | 0.00# | 06/01/28 | 2,572,920 | ||||||||||||||

| Golden State Tobacco Securitization Corporation, California, | ||||||||||||||||||

| 12,000 | Enhanced Asset Backed Ser A-1‡‡ | 5.125 | 06/01/47 | 11,740,080 | ||||||||||||||

| 50,000 | Enhanced Asset Backed Ser 2005 A (Ambac) | 0.00 | 06/01/47 | 5,010,000 | ||||||||||||||

| Tobacco Settlement Authority, Iowa, | ||||||||||||||||||

| 5,000 | Ser 2005 C | 5.375 | 06/01/38 | 5,047,900 | ||||||||||||||

| 7,000 | Ser 2005 C | 5.50 | 06/01/42 | 7,178,010 | ||||||||||||||

See Notes to Financial Statements

17

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments![]() June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| Tobacco Settlement Financing Corporation, New Jersey, | ||||||||||||||||||

| $ | 7,000 | Ser 2007-1A | 4.625 | % | 06/01/26 | $ | 6,501,950 | |||||||||||

| 5,000 | Ser 2007-1B | 0.00 | 06/01/41 | 745,950 | ||||||||||||||

| 9,355 | Nassau County, New York, Tobacco Settlement Corp Ser 2006 | 5.00 | 06/01/35 | 9,414,217 | ||||||||||||||

| 3,000 | Westchester Tobacco Asset Securitization Corporation, New York, Ser 2005 | 5.125 | 06/01/38 | 3,042,780 | ||||||||||||||

| 110,355 | 59,960,857 | |||||||||||||||||

| Transportation (19.6%) | ||||||||||||||||||

| 10,000 | Foothill/Eastern Transportation Corridor Agency, California, Ser 1999 | 0.00# | 01/15/27 | 9,276,700 | ||||||||||||||

| 5,000 | San Francisco Bay Area Rapid Transit District, California, Sales Tax Ser 1998 (Ambac) | 4.75 | 07/01/23 | 5,043,150 | ||||||||||||||

| E-470 Public Highway Authority, Colorado, | ||||||||||||||||||

| 20,000 | Ser 1997 B (MBIA) | 0.00 | 09/01/14 | 14,802,600 | ||||||||||||||

| 5,000 | Ser 1997 B (MBIA) | 0.00 | 09/01/16 | 3,361,200 | ||||||||||||||

| 10,000 | Metropolitan Washington Airport Authority, District of Columbia & Virginia, Ser 2001A (AMT) (MBIA) †† | 5.50 | 10/01/27 | 10,465,000 | ||||||||||||||

| 6,895 | Mid-Bay Bridge Authority, Florida, Sr Lien Crossover Refg Ser 1993 A (Ambac) | 5.85 | 10/01/13 | 7,182,315 | ||||||||||||||

| Atlanta, Georgia, | ||||||||||||||||||

| 5,000 | Airport Ser 2000 A (FGIC) | 5.875 | 01/01/17 | 5,275,250 | ||||||||||||||

| 5,000 | Airport Passenger Facilities Charge Ser 2004 C (FSA) | 5.00 | 01/01/33 | 5,123,100 | ||||||||||||||

| 4,000 | Airport Passenger Facilities Charge Ser 2004 J (FSA) | 5.00 | 01/01/34 | 4,101,840 | ||||||||||||||

| 3,460 | Hawaii, Airport 2000 Ser B (AMT) (FGIC) | 6.625 | 07/01/17 | 3,721,576 | ||||||||||||||

| 5,000 | Chicago, Illinois, O’Hare International Airport Ser 2005 A (MBIA) | 5.25 | 01/01/24 | 5,286,100 | ||||||||||||||

| 6,000 | Regional Transportation Authority, Illinois, Refg Ser 1999 (FSA) | 5.75 | 06/01/21 | 6,839,700 | ||||||||||||||

| Kentucky Turnpike Authority, | ||||||||||||||||||

| 9,000 | Economic Development Road Refg Ser 1995 (Ambac) | 6.50 | 07/01/08 | 9,241,560 | ||||||||||||||

| 11,835 | Resource Recovery Road 1987 Ser A | 5.00 | 07/01/08 | 11,896,069 | ||||||||||||||

| Massachusetts Turnpike Authority, | ||||||||||||||||||

| 11,000 | Metropolitan Highway 1997 Ser A (MBIA)‡‡ | 5.00 | 01/01/37 | 11,117,480 | ||||||||||||||

| 6,540 | Western 1997 Ser A (MBIA) | 5.55 | 01/01/17 | 6,750,196 | ||||||||||||||

| 5,000 | Clark County, Nevada, Airport Sub Lien Ser 2004 (AMT) (FGIC) | 5.50 | 07/01/23 | 5,294,500 | ||||||||||||||

| 5,000 | Nevada Department of Business & Industry, Las Vegas Monorail 1st Tier Ser 2000 (Ambac) | 5.375 | 01/01/40 | 5,122,800 | ||||||||||||||

| New Jersey Turnpike Authority, | ||||||||||||||||||

| 10,000 | Ser 2003 A (FGIC) | 5.00 | 01/01/27 | 10,313,600 | ||||||||||||||

| 3,000 | Ser 2003 A (Ambac) | 5.00 | 01/01/30 | 3,081,330 | ||||||||||||||

See Notes to Financial Statements

18

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments![]() June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| $ | 6,595 | Albuquerque, New Mexico, Airport Refg Ser 1997 (AMT) (Ambac) | 6.375 | % | 07/01/15 | $ | 6,738,573 | |||||||||||

| Metropolitan Transportation Authority, New York, | ||||||||||||||||||

| 1,460 | Service Contract Ser 2002 A (MBIA) | 5.50 | 01/01/20 | 1,554,710 | ||||||||||||||

| 5,000 | Service Contract Ser 2002 B (MBIA) | 5.50 | 07/01/24 | 5,320,850 | ||||||||||||||

| 10,000 | Transportation Refg Ser 2002 A (Ambac) | 5.50 | 11/15/18 | 10,701,400 | ||||||||||||||

| 10,000 | Puerto Rico Highway & Transportation Authority, Refg Ser X | 5.50 | 07/01/15 | 10,715,300 | ||||||||||||||

| 10,000 | Dallas Fort Worth International Airport, Texas, Ser A (AMT) (FSA) | 5.25 | 11/01/24 | 10,364,400 | ||||||||||||||

| 5,000 | Houston, Texas, Airport Sub Lien Ser 2000 A (AMT) (FSA) | 5.875 | 07/01/17 | 5,217,650 | ||||||||||||||

| 6,420 | Port of Seattle, Washington, Passenger Facility Ser 1998 A (MBIA)‡‡ | 5.00 | 12/01/23 | 6,526,080 | ||||||||||||||

| 201,205 | 200,435,029 | |||||||||||||||||

| Water & Sewer (11.4%) | ||||||||||||||||||

| 2,000 | Phoenix Civic Improvement Corporation, Arizona, Wastewater Ser 2004 (MBIA) | 5.00 | 07/01/27 | 2,066,180 | ||||||||||||||

| 4,000 | Atlanta, Georgia, Water and Wastewater Ser 2004 (FSA) | 5.00 | 11/01/24 | 4,142,560 | ||||||||||||||

| Augusta, Georgia, | ||||||||||||||||||

| 5,000 | Water & Sewer Ser 2000 (FSA) | 5.25 | 10/01/26 | 5,194,400 | ||||||||||||||

| 3,000 | Water & Sewer Ser 2004 A (FSA) | 5.25 | 10/01/39 | 3,150,060 | ||||||||||||||

| 5,000 | Fulton County, Georgia, Water & Sewerage Ser 1998 (FGIC) | 4.75 | 01/01/28 | 5,014,550 | ||||||||||||||

| 8,000 | Indiana Bond Bank, Revolving Fund Ser 2001A | 5.375 | 02/01/19 | 8,533,200 | ||||||||||||||

| 5,000 | Louisville & Jefferson County Metropolitan Sewer District, Kentucky, Ser 1998 A (FGIC) | 4.75 | 05/15/28 | 5,013,750 | ||||||||||||||

| 6,000 | Boston Water & Sewer Commission, Massachusetts, 1998 Ser D (FGIC) | 4.75 | 11/01/22 | 6,043,200 | ||||||||||||||

| 9,000 | Passaic Valley Sewerage Commissioners, New Jersey, Ser F (FGIC) | 5.00 | 12/01/19 | 9,378,180 | ||||||||||||||

| 5,000 | New York City Municipal Water Finance Authority, New York, Water & Sewer 2005 Ser B (Ambac) | 5.00 | 06/15/28 | 5,174,500 | ||||||||||||||

| 2,725 | Cleveland, Ohio, Waterworks Impr & Refg 1998 Ser I (FSA) | 5.00 | 01/01/23 | 2,763,831 | ||||||||||||||

| Metropolitan Government of Nashville & Davidson County, Tennessee, | ||||||||||||||||||

| 2,000 | Refg 1986 | 5.50 | 01/01/16 | 2,060,700 | ||||||||||||||

| 5,000 | Refg Ser 1998 A (FGIC) | 4.75 | 01/01/22 | 5,038,700 | ||||||||||||||

| Houston, Texas Combined Utility, | ||||||||||||||||||

| 20,000 | First Lien Refg Ser 2004 A (FSA) | 5.25 | 05/15/22 | 21,156,600 | ||||||||||||||

| 5,000 | First Lien Refg Ser 2004 A (MBIA) | 5.25 | 05/15/25 | 5,280,000 | ||||||||||||||

| San Antonio, Texas, | ||||||||||||||||||

| 1,000 | Water & Refg Ser 2002 (FSA) | 5.50 | 05/15/19 | 1,060,600 | ||||||||||||||

| 5,000 | Water & Refg Ser 2002 (FSA) | 5.00 | 05/15/28 | 5,100,450 | ||||||||||||||

See Notes to Financial Statements

19

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments![]() June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| Seattle, Washington, | ||||||||||||||||||

| $ | 10,000 | Water Refg 2003 (MBIA) | 5.00 | % | 09/01/20 | $ | 10,378,100 | |||||||||||

| 10,000 | Water Refg 2003 (MBIA) | 5.00 | 09/01/23 | 10,320,600 | ||||||||||||||

| 112,725 | 116,870,161 | |||||||||||||||||

| Other Revenue (2.2%) | ||||||||||||||||||

| 9,000 | Mashantucket (Western) Pequot Tribe, Connecticut, Special 1997 Ser B (a) | 5.75 | 09/01/27 | 9,159,750 | ||||||||||||||

| 20,000 | Metropolitan Pier & Exposition Authority, Illinois, Refg Ser 2002 B (MBIA) | 0.00# | 06/15/22 | 12,991,400 | ||||||||||||||

| 29,000 | 22,151,150 | |||||||||||||||||

| Refunded (8.2%) | ||||||||||||||||||

| 5,000 | California Infrastructure & Economic Development Bank, Bay Area Toll Bridges Seismic Retrofit First Lien Ser 2003 A (Ambac) | 5.00 | 01/01/28† | 5,413,100 | ||||||||||||||

| 2,500 | Mid-Bay Bridge Authority, Florida, Ser 1991 A (ETM) | 6.875 | 10/01/22 | 3,149,050 | ||||||||||||||

| 5,000 | Illinois Health Facilities Authority, Loyola University Health Ser 2001 A | 6.00 | 07/01/11† | 5,346,700 | ||||||||||||||

| 1,555 | Massachusetts, Health & Educational Facilities Authority, Malden Hospital – FHA Ins Mtge Ser A | 5.00 | 08/01/10† | 1,576,988 | ||||||||||||||

| 7,760 | Henderson, Nevada, Catholic Health West 1998 Ser A | 5.375 | 07/01/08† | 7,955,319 | ||||||||||||||

| 7,000 | New Jersey Highway Authority, Senior Parkway 1999 Ser | 5.625 | 01/01/10† | 7,355,110 | ||||||||||||||

| New York State Dormitory Authority, | ||||||||||||||||||

| 7,800 | State University Ser 2000 B | 5.375 | 05/15/10† | 8,191,716 | ||||||||||||||

| 10,420 | Suffolk County Judicial Ser 1986 (ETM) | 7.375 | 07/01/16 | 12,050,313 | ||||||||||||||

| 10,000 | South-Western City School District, Ohio, Ser 1999 (Ambac) | 4.75 | 12/01/09† | 10,209,400 | ||||||||||||||

| 5,000 | Lehigh County General Purpose Authority, Pennsylvania, St Luke’s of Bethlehem Hospital Ser A 2003 | 5.375 | 08/15/13† | 5,342,100 | ||||||||||||||

| 10,000 | Pennsylvania, First Ser 2003 (MBIA)‡‡ | 5.00 | 01/01/13† | 10,502,350 | ||||||||||||||

| 5,000 | Salt Lake City, Utah, IHC Hospital Inc Ser 1983 (ETM) | 5.00 | 06/01/15 | 5,253,600 | ||||||||||||||

| 1,000 | Tobacco Settlement Financing Corporation, Virginia, Ser 2005 | 5.50 | 06/01/12† | 1,077,930 | ||||||||||||||

| 78,035 | 83,423,676 | |||||||||||||||||

| 1,068,934 | Total Tax-Exempt Municipal Bonds (Cost $980,702,046) | 1,028,643,338 | ||||||||||||||||

See Notes to Financial Statements

20

Morgan Stanley Tax-Exempt Securities Trust

Portfolio of Investments![]() June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

| PRINCIPAL AMOUNT IN THOUSANDS | COUPON RATE | MATURITY DATE | VALUE | |||||||||||||||

| Short-Term Tax-Exempt Municipal Obligation (1.0%) | ||||||||||||||||||

| $ | 10,105 | Intermountain Power Agency, Utah, Refg 1997 Ser B (MBIA) | ||||||||||||||||

| (Called for Redemption 07/01/07) (Cost $9,752,123) | 5.75 | % | 07/01/19 | $ | 10,322,460 | |||||||||||||

| Short-Term Investment (0.4%) Investment Company | ||||||||||||||||||

| 3,707 | Morgan Stanley Institutional Liquidity Tax-Exempt Portfolio – Institutional Class (Cost $3,707,134) (b) | 3,707,134 | ||||||||||||||||

| 1,082,746 | Total Investments (Cost $994,161,303) | 1,042,672,932 | ||||||||||||||||

| Floating Rate Note Obligations Related to Securities Held (−6.0%) | ||||||||||||||||||

| (61,570 | ) | Notes with interest rates ranging from 3.74% to 3.83% at | ||||||||||||||||

| June 30, 2007 and contractual maturities of collateral ranging from 01/01/13 to 06/01/47(See Note 1D)††† (Cost $(61,570,000)) | (61,570,000 | ) | ||||||||||||||||

| $ | 1,021,176 | Total Net Investments (Cost $932,591,303) (c) | 96.1% | 981,102,932 | ||||||||||||||

| Other Assets in Excess of Liabilities | 3.9 | 39,854,848 | ||||||||||||||||

| Net Assets | 100.0% | $ | 1,020,957,780 | |||||||||||||||

| AMT | Alternative Minimum Tax. |

| COPs | Certificates of Participation. |

| ETM | Escrowed to Maturity. |

| † | Prerefunded to call date shown. |

| †† | Joint exemption in locations shown. |

| ††† | Floating rate note obligations related to securities held. The interest rates shown reflect the rates in effect at June 30, 2007. |

| # | Security is a ‘‘step-up’’ bond where the coupon increases on a predetermined future date. |

| ‡ | Current coupon rate for an inverse floating rate municipal obligation (see Note 6). This rate resets periodically as the auction rate on the related security changes. Position in an inverse floating rate municipal obligation has a total value of $10,259,730 which represents 1.0% of net assets. |

| ‡‡ | Underlying security related to inverse floaters entered into by the Fund (See Note 1D). |

| (a) | Resale is restricted to qualified institutional investors. |

| (b) | See Note 4 to the financial statements regarding investments in Morgan Stanley Institutional Liquidity Tax-Exempt Portfolio – Institutional Class. |

| (c) | The aggregate cost for federal income tax purposes approximates the aggregate cost for book purposes. The aggregate gross unrealized appreciation is $50,656,634 and the aggregate gross unrealized depreciation is $2,145,005, resulting in net unrealized appreciation of $48,511,629. |

| Bond Insurance: |

| Ambac | Ambac Assurance Corporation. |

| FGIC | Financial Guaranty Insurance Company. |

| FHA | Federal Housing Administration. |

| FSA | Financial Security Assurance Inc. |

| MBIA | Municipal Bond Investors Assurance Corporation. |

See Notes to Financial Statements

21

Morgan Stanley Tax-Exempt Securities Trust

Financial Statements

Statement of Assets and Liabilities

June 30, 2007 (unaudited)

| Assets: | ||||||

| Investments in securities, at value (cost $990,454,169) | $ | 1,038,965,798 | ||||

| Investments in affiliates (cost $3,707,134) | 3,707,134 | |||||

| Receivable for: | ||||||

| Investments sold | 25,756,622 | |||||

| Interest | 15,303,724 | |||||

| Shares of beneficial interest sold | 62,408 | |||||

| Dividends from affiliates | 6,181 | |||||

| Prepaid expenses and other assets | 119,432 | |||||

| Total Assets | 1,083,921,299 | |||||

| Liabilities: | ||||||

| Floating rate note obligations | 61,570,000 | |||||

| Payable for: | ||||||

| Shares of beneficial interest redeemed | 427,234 | |||||

| Investment advisory fee | 309,254 | |||||

| Dividends to shareholders | 252,151 | |||||

| Distribution fee | 93,052 | |||||

| Administration fee | 67,278 | |||||

| Transfer agent fee | 11,874 | |||||

| Accrued expenses and other payables | 232,676 | |||||

| Total Liabilities | 62,963,519 | |||||

| Net Assets | $ | 1,020,957,780 | ||||

| Composition of Net Assets: | ||||||

| Paid-in-capital | $ | 967,262,084 | ||||

| Net unrealized appreciation | 48,511,629 | |||||

| Accumulated undistributed net investment income | 991,931 | |||||

| Accumulated undistributed net realized gain | 4,192,136 | |||||

| Net Assets | $ | 1,020,957,780 | ||||

| Class A Shares: | ||||||

| Net Assets | $ | 171,761,606 | ||||

| Shares Outstanding (unlimited authorized, $.01 par value) | 15,200,086 | |||||

| Net Asset Value Per Share | $ | 11.30 | ||||

| Maximum Offering Price Per Share (net asset value plus 4.44% of net asset value) | $ | 11.80 | ||||

| Class B Shares: | ||||||

| Net Assets | $ | 83,363,860 | ||||

| Shares Outstanding (unlimited authorized, $.01 par value) | 7,345,628 | |||||

| Net Asset Value Per Share | $ | 11.35 | ||||

| Class C Shares: | ||||||

| Net Assets | $ | 28,133,809 | ||||

| Shares Outstanding (unlimited authorized, $.01 par value) | 2,486,103 | |||||

| Net Asset Value Per Share | $ | 11.32 | ||||

| Class D Shares: | ||||||

| Net Assets | $ | 737,698,505 | ||||

| Shares Outstanding (unlimited authorized, $.01 par value) | 65,316,691 | |||||

| Net Asset Value Per Share | $ | 11.29 | ||||

See Notes to Financial Statements

22

Morgan Stanley Tax-Exempt Securities Trust

Financial Statements continued

Statement of Operations

For the six months ended June 30, 2007 (unaudited)

| Net Investment Income: | ||||||

| Income | ||||||

| Interest | $ | 27,907,567 | ||||

| Dividends from affiliates | 6,181 | |||||

| Total Income | 27,913,748 | |||||

| Expenses | ||||||

| Investment advisory fee | 1,914,542 | |||||

| Interest and residual trust expenses | 924,919 | |||||

| Administration fee | 420,341 | |||||

| Distribution fee (Class A shares) | 196,128 | |||||

| Distribution fee (Class B shares) | 274,126 | |||||

| Distribution fee (Class C shares) | 102,119 | |||||

| Transfer agent fees and expenses | 248,286 | |||||

| Shareholder reports and notices | 162,222 | |||||

| Professional fees | 61,142 | |||||

| Registration fees | 41,089 | |||||

| Custodian fees | 28,922 | |||||

| Trustees’ fees and expenses | 15,341 | |||||

| Other | 55,293 | |||||

| Total Expenses | 4,444,470 | |||||

| Less: expense offset | (1,699 | ) | ||||

| Net Expenses | 4,442,771 | |||||

| Net Investment Income | 23,470,977 | |||||

| Net Realized and Unrealized Gain (Loss): | ||||||

| Net realized gain | 4,192,497 | |||||

| Net change in unrealized appreciation | (27,398,090 | ) | ||||

| Net Loss | (23,205,593 | ) | ||||

| Net Increase | $ | 265,384 | ||||

See Notes to Financial Statements

23

Morgan Stanley Tax-Exempt Securities Trust

Financial Statements continued

Statements of Changes in Net Assets

| FOR THE SIX MONTHS ENDED JUNE 30, 2007 | FOR THE YEAR ENDED DECEMBER 31, 2006 | |||||||||

| (unaudited) | ||||||||||

| Increase (Decrease) in Net Assets: | ||||||||||

| Operations: | ||||||||||

| Net investment income | $ | 23,470,977 | $ | 49,988,975 | ||||||

| Net realized gain | 4,192,497 | 6,369,484 | ||||||||

| Net change in unrealized appreciation/depreciation | (27,398,090 | ) | 1,517,023 | |||||||

| Net Increase | 265,384 | 57,875,482 | ||||||||

| Dividends and Distributions to Shareholders from: | ||||||||||

| Net investment income | ||||||||||

| Class A shares | (3,668,537 | ) | (7,174,144 | ) | ||||||

| Class B shares | (1,814,406 | ) | (4,474,601 | ) | ||||||

| Class C shares | (563,728 | ) | (1,192,501 | ) | ||||||

| Class D shares | (17,396,647 | ) | (37,392,210 | ) | ||||||

| Net realized gain | ||||||||||

| Class A shares | (73,317 | ) | (1,083,673 | ) | ||||||

| Class B shares | (36,237 | ) | (650,894 | ) | ||||||

| Class C shares | (12,116 | ) | (191,057 | ) | ||||||

| Class D shares | (317,758 | ) | (5,086,709 | ) | ||||||

| Total Dividends and Distributions | (23,882,746 | ) | (57,245,789 | ) | ||||||

| Net decrease from transactions in shares of beneficial interest | (49,642,134 | ) | (77,010,697 | ) | ||||||

| Net Decrease | (73,259,496 | ) | (76,381,004 | ) | ||||||

| Net Assets: | ||||||||||

| Beginning of period | 1,094,217,276 | 1,170,598,280 | ||||||||

| End of Period (Including accumulated undistributed net investment income of $991,931 and $964,272, respectively) | $ | 1,020,957,780 | $ | 1,094,217,276 | ||||||

See Notes to Financial Statements

24

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  June 30, 2007 (unaudited)

June 30, 2007 (unaudited)

1. Organization and Accounting Policies

Morgan Stanley Tax-Exempt Securities Trust (the ‘‘Fund’’) is registered under the Investment Company Act of 1940, as amended the (‘‘Act’’), as a diversified, open-end management investment company. The Fund’s investment objective is to provide a high level of current income which is exempt from federal income tax, consistent with the preservation of capital. The Fund was incorporated in Maryland in 1979, commenced operations on March 27, 1980 and reorganized as a Massachusetts business trust on April 30, 1987. On July 28, 1997, the Fund converted to a multiple class share structure.

The Fund offers Class A shares, Class B shares, Class C shares and Class D shares. The four classes are substantially the same except that most Class A shares are subject to a sales charge imposed at the time of purchase and some Class A shares, and most Class B shares and Class C shares are subject to a contingent deferred sales charge imposed on shares redeemed within eighteen months, six years and one year, respectively. Class D shares are not subject to a sales charge. Additionally, Class A shares, Class B shares and Class C shares incur distribution expenses.

The Fund will assess a 2% redemption fee, on Class A shares, Class B shares, Class C shares, and Class D shares, which is paid directly to the Fund, for shares redeemed within seven days of purchase, subject to certain exceptions. The redemption fee is designed to protect the Fund and its remaining shareholders from the effects of short-term trading.

The following is a summary of significant accounting policies:

A. Valuation of Investments — (1) portfolio securities are valued by an outside independent pricing service approved by the Trustees. The pricing service uses both a computerized grid matrix of tax-exempt securities and evaluations by its staff, in each case based on information concerning market transactions and quotations from dealers which reflect the mean between the last reported bid and asked price. The portfolio securities are thus valued by reference to a combination of transactions and quotations for the same or other securities believed to be comparable in quality, coupon, maturity, type of issue, call provisions, trading characteristics and other features deemed to be relevant. The Trustees believe that timely and reliable market quotations are generally not readily available for purposes of valuing tax-exempt securities and that the valuations supplied by the pricing service are more likely to approximate the fair value of such securities; (2) futures are valued at the latest sale price on the commodities exchange on which they trade unless it is determined that such price does not reflect their market value, in which case they will be valued at their fair value as determined in good faith under procedures established by and under the supervision of the Trustees; and (3) short-term debt securities having a maturity date of more than sixty days at time of purchase are valued on a mark-to-market basis until sixty days prior to maturity and thereafter at amortized cost based on their value on the 61st day. Short-term debt securities having a maturity date of sixty days or less at the time of purchase are valued at amortized cost.

25

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

B. Accounting for Investments — Security transactions are accounted for on the trade date (date the order to buy or sell is executed). Realized gains and losses on security transactions are determined by the identified cost method. Discounts are accreted and premiums are amortized over the life of the respective securities and are included in interest income. Interest income is accrued daily.

C. Multiple Class Allocations — Investment income, expenses (other than distribution fees), and realized and unrealized gains and losses are allocated to each class of shares based upon the relative net asset value on the date such items are recognized. Distribution fees are charged directly to the respective class.

D. Floating Rate Note Obligations Related to Securities Held — The Fund enters into transactions in which it transfers to Dealer Trusts (‘‘Dealer Trusts’’), fixed rate bonds in exchange for cash and residual interests in the Dealer Trusts’ assets and cash flows, which are in the form of inverse floating rate investments. The Dealer Trusts fund the purchases of the fixed rate bonds by issuing floating rate notes to third parties and allowing the Fund to retain residual interest in the bonds. The Fund enters into shortfall agreements with the Dealer Trusts which commit the Fund to pay the Dealer Trusts, in certain circumstances, the difference between the liquidation value of the fixed rate bonds held by the Dealer Trusts and the liquidation value of the floating rate notes held by third parties, as well as any shortfalls in interest cash flows. The residual i nterests held by the Fund (inverse floating rate investments) include the right of the Fund (1) to cause the holders of the floating rate notes to tender their notes at par at the next interest rate reset date, and (2) to transfer the municipal bond from the Dealer Trusts to the Fund, thereby collapsing the Dealer Trusts. The Fund accounts for the transfer of bonds to the Dealer Trusts as secured borrowings, with the securities transferred remaining in the Fund’s investment assets, and the related floating rate notes reflected as Fund liabilities under the caption ‘‘floating rate note obligations’’ on the Statement of Assets and Liabilities. The Fund records the interest income from the fixed rate bonds under the caption ‘‘Interest Income’’ and records the expenses related to floating rate note obligations and any administrative expenses of the Dealer Trusts under the caption ‘‘Interest and residual trust expenses’’ in the Fund&rsq uo;s Statement of Operations. The notes issued by the Dealer Trusts have interest rates that reset weekly and the floating rate note holders have the option to tender their notes to the Dealer Trusts for redemption at par at each reset date. At June 30, 2007, Fund investments with a value of $86,630,080 are held by the Dealer Trusts and serve as collateral for the $61,570,000 in floating rate note obligations outstanding at that date. Contractual maturities of the floating rate note obligations and interest rates in effect at June 30, 2007 are presented in the Portfolio of Investments.

E. Futures Contracts — A futures contract is an agreement between two parties to buy and sell financial instruments or contracts based on financial indices at a set price on a future date. Upon entering into such a contract, the Fund is required to pledge to the broker cash, U.S. Government securities or other liquid portfolio securities equal to the minimum initial margin requirements of the applicable futures exchange. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in the value of the contract. Such receipts or payments known as variation margin are

26

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

recorded by the Fund as unrealized gains and losses. Upon closing of the contract, the Fund realizes a gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

F. Federal Income Tax Policy — It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable and non-taxable income to its shareholders. Therefore, no provision for federal income taxes is required. The Fund files tax returns with the U.S. Internal Revenue Service and various states. Generally, the tax authorities can examine all tax returns filed for the last three years. If applicable, the Fund recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in other expenses in the Statement of Operations. The Fund adopted the provisions of the Financial Accounting Standards Board’s (FASB) Interpretation number 48 Accounting for Uncertainty in Income Taxes , on June 30, 2007. As of June 30, 2007, this did not result in an impact to the Fund’s financial statements.

G. Dividends and Distributions to Shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

H. Use of Estimates — The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates.

2. Investment Advisory/Administration Agreements

Pursuant to an Investment Advisory Agreement with Morgan Stanley Investment Advisors Inc. (the ‘‘Investment Adviser’’), the Fund pays the Investment Adviser an advisory fee, accrued daily and payable monthly, by applying the following annual rates to the Fund’s net assets determined as of the close of each business day: 0.42% to the portion of the daily net assets not exceeding $500 million; 0.345% to the portion of the daily net assets exceeding $500 million but not exceeding $750 million; 0.295% to the portion of the daily net assets exceeding $750 million but not exceeding $1 billion; 0.27% to the portion of the daily net assets exceeding $1 billion but not exceeding $1.25 billion; 0.2 45% to the portion of the daily net assets exceeding $1.25 billion but not exceeding $2.5 billion; and 0.22% to the portion of the daily net assets exceeding $2.5 billion.

Pursuant to an Administration Agreement with Morgan Stanley Services Company Inc. (the ‘‘Administrator’’), an affiliate of the Investment Adviser, the Fund pays an administration fee, accrued daily and payable monthly, by applying the annual rate of 0.08% to the Fund’s daily net assets.

3. Plan of Distribution

Shares of the Fund are distributed by Morgan Stanley Distributors Inc. (the ‘‘Distributor’’), an affiliate of the Investment Adviser and Administrator. The Fund has adopted a Plan of Distribution (the ‘‘Plan’’) pursuant to

27

Morgan Stanley Tax-Exempt Securities Trust

Notes to Financial Statements  June 30, 2007 (unaudited) continued

June 30, 2007 (unaudited) continued

Rule 12b-1 under the Act. The Plan provides that the Fund will pay the Distributor a fee which is accrued daily and paid monthly at the following annual rates: (i) Class A – up to 0.25% of the average daily net assets of Class A; (ii) Class B – up to 0.60% of the average daily net assets of Class B; and (iii) Class C – up to 0.70% of the average daily net assets of Class C.

In the case of Class B shares, provided that the Plan continues in effect, any cumulative expenses incurred by the Distributor but not yet recovered may be recovered through the payment of future distribution fees from the Fund pursuant to the Plan and contingent deferred sales charges paid by investors upon redemption of Class B shares. Although there is no legal obligation for the Fund to pay expenses incurred in excess of payments made to the Distributor under the Plan and the proceeds of contingent deferred sales charges paid by investors upon redemption of shares, if for any reason the Plan is terminated, the Trustees will consider at that time the manner in which to treat such expenses. The Distributor has advised the Fu nd that such excess amounts totaled $4,161,747 at June 30, 2007.

In the case of Class A shares and Class C shares, expenses incurred pursuant to the Plan in any calendar year in excess of 0.25% or 0.70% of the average daily net assets of Class A or Class C, respectively, will not be reimbursed by the Fund through payments in any subsequent year, except that expenses representing a gross sales credit to Morgan Stanley Financial Advisors and other authorized financial representatives at the time of sale may be reimbursed in the subsequent calendar year. For the six months ended June 30, 2007, the distribution fee was accrued for Class A shares and Class C shares at the annual rate of 0.23% and 0.70%, respectively.

The Distributor has informed the Fund that for the six months ended June 30, 2007, it received contingent deferred sales charges from certain redemptions of the Fund’s Class A shares, Class B shares and Class C shares of $13, $61,986 and $1,383, respectively, and received $52,903 in front-end sales charges from sales of the Fund’s Class A shares. The respective shareholders pay such charges which are not an expense of the Fund.

4. Security Transactions and Transactions with Affiliates