January 24, 2023 4Q22 QUARTERLY EARNINGS SUPPLEMENT

2 2Ticker: BUSE Special Note Concerning Forward-Looking Statements Statements made in this document, other than those concerning historical financial information, may be considered forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, plans, objectives, future performance, and business of the Company. Forward-looking statements, which may be based upon beliefs, expectations, and assumptions of the Company’s management, and on information currently available to management, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should,” or other similar expressions. Additionally, all statements in this document, including forward-looking statements, speak only as of the date they are made, and the Company undertakes no obligation to update any statement in light of new information or future events. A number of factors, many of which are beyond the Company’s ability to control or predict, could cause actual results to differ materially from those in the Company’s forward- looking statements. These factors include, among others, the following: (i) the strength of the local, state, national, and international economy (including effects of inflationary pressures and supply chain constraints); (ii) the economic impact of any future terrorist threats or attacks, widespread disease or pandemics (including the Coronavirus Disease 2019 pandemic), or other adverse external events that could cause economic deterioration or instability in credit markets (including Russia’s invasion of Ukraine); (iii) changes in state and federal laws, regulations, and governmental policies concerning the Company’s general business; (iv) changes in accounting policies and practices; (v) changes in interest rates and prepayment rates of the Company’s assets (including the impact of The London Inter-bank Offered Rate phase-out); (vi) increased competition in the financial services sector and the inability to attract new customers; (vii) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (viii) the loss of key executives or associates; (ix) changes in consumer spending; (x) unexpected results of current and/or future acquisitions, which may include failure to realize the anticipated benefits of any acquisition and the possibility that transaction costs may be greater than anticipated; (xi) unexpected outcomes of existing or new litigation involving the Company; and (xii) the economic impact of exceptional weather occurrences such as tornadoes, hurricanes, floods, and blizzards. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning the Company and its business, including additional factors that could materially affect its financial results, is included in the Company’s filings with the Securities and Exchange Commission.

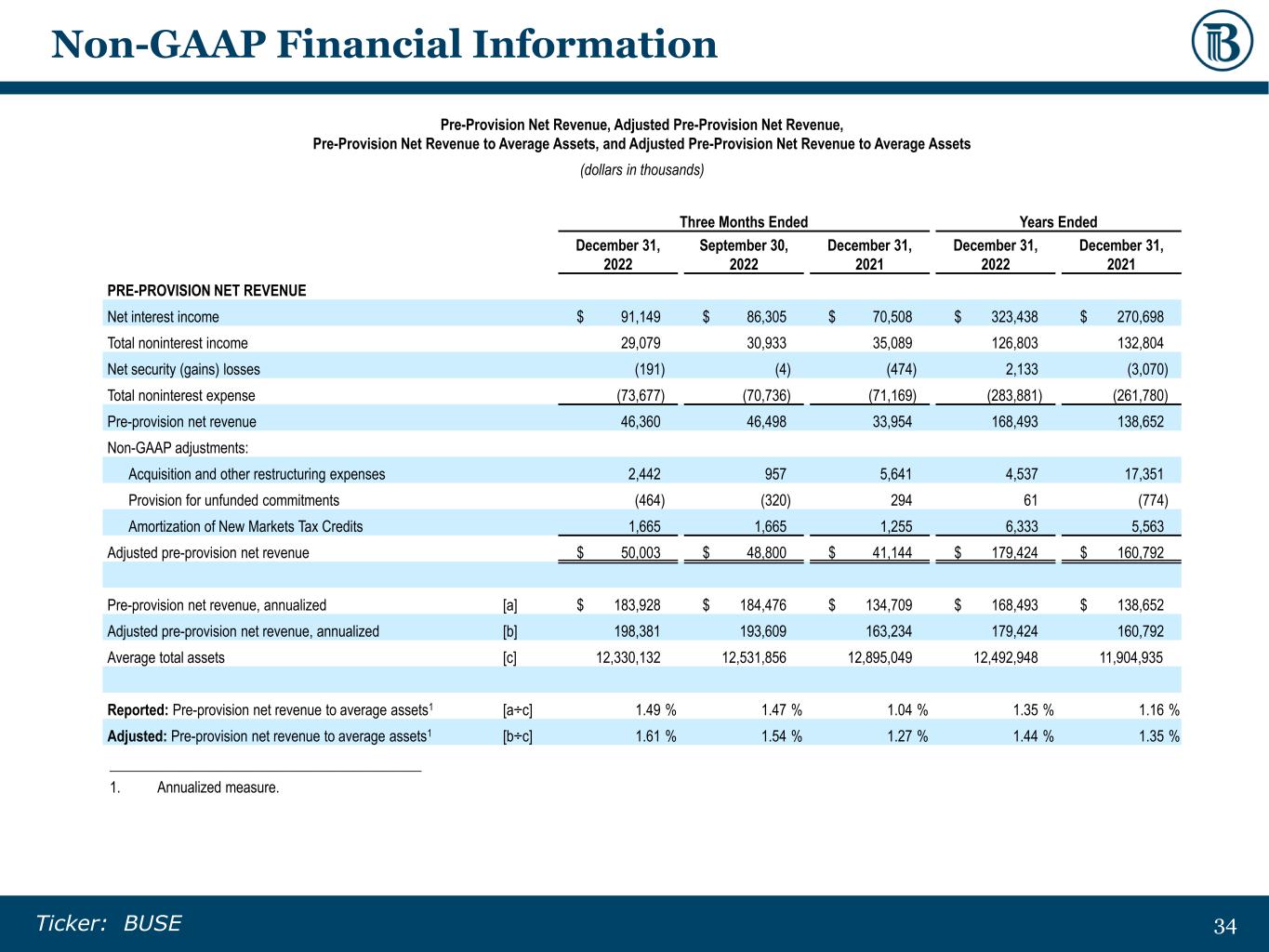

3 3Ticker: BUSE Non-GAAP Financial Information This document contains certain financial information determined by methods other than GAAP. Management uses these non- GAAP measures, together with the related GAAP measures, in analysis of the Company’s performance and in making business decisions, as well as comparison to the Company’s peers. The Company believes the adjusted measures are useful for investors and management to understand the effects of certain non-recurring noninterest items and provide additional perspective on the Company’s performance over time. A reconciliation to what management believes to be the most directly comparable GAAP financial measures—specifically, net interest income, total noninterest income, net security gains and losses, and total noninterest expense in the case of pre- provision net revenue, adjusted pre-provision net revenue, pre-provision net revenue to average assets, and adjusted pre- provision net revenue to average assets; net income in the case of adjusted net income, adjusted diluted earnings per share, adjusted return on average assets, return on average tangible common equity, and adjusted return on average tangible common equity; net interest income in the case of adjusted net interest income and adjusted net interest margin; net interest income, total noninterest income, and total noninterest expense in the case of adjusted noninterest expense, adjusted core expense, efficiency ratio, adjusted efficiency ratio, and adjusted core efficiency ratio; total stockholders’ equity in the case of tangible book value per common share; total assets and total stockholders’ equity in the case of tangible common equity and tangible common equity to tangible assets; portfolio loans in the case of core loans and core loans to portfolio loans; total deposits in the case of core deposits and core deposits to total deposits; and portfolio loans and total deposits in the case of core loans to core deposits— appears below. These non-GAAP disclosures have inherent limitations and are not audited. They should not be considered in isolation or as a substitute for operating results reported in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Tax effected numbers included in these non-GAAP disclosures are based on estimated statutory rates or effective rates as appropriate.

4 4Ticker: BUSE Table of Contents Overview of First Busey Corporation (BUSE) 5 Sizable Business Lines Provide for Innovative Solutions 6 Investment Highlights 7 Experienced Management Team 8 Strong Regional Operating Model 9 High Quality Loan Portfolio 10 Top Tier Core Deposit Franchise 11 Deposit Trends 12 Diversified and Significant Sources of Fee Income 13 Fully Integrated Wealth Management Platform 14 Wealth Management 15 Scalable Payment Technology Solutions Platform 16 FirsTech 17 Net Interest Margin 18 Focused Control on Expenses 19 Continued Investment in Technology Enterprise-Wide 20 Rising Digital Banking Adoption 21 Fortress Balance Sheet 22 Robust Capital Foundation 23 Pristine Credit Quality 24 Reserve Supports Credit & Growth Profile 25 Balanced, Low-Risk, Short-Duration Investment Portfolio 26 Actively Managing Asset-Sensitive Balance Sheet 27 Quarterly Earnings Review 28 Earnings Performance 29 Environmental, Social and Governance Responsibility 30 Appendix: High Quality Loan Portfolio, Non-GAAP Financial Information 31

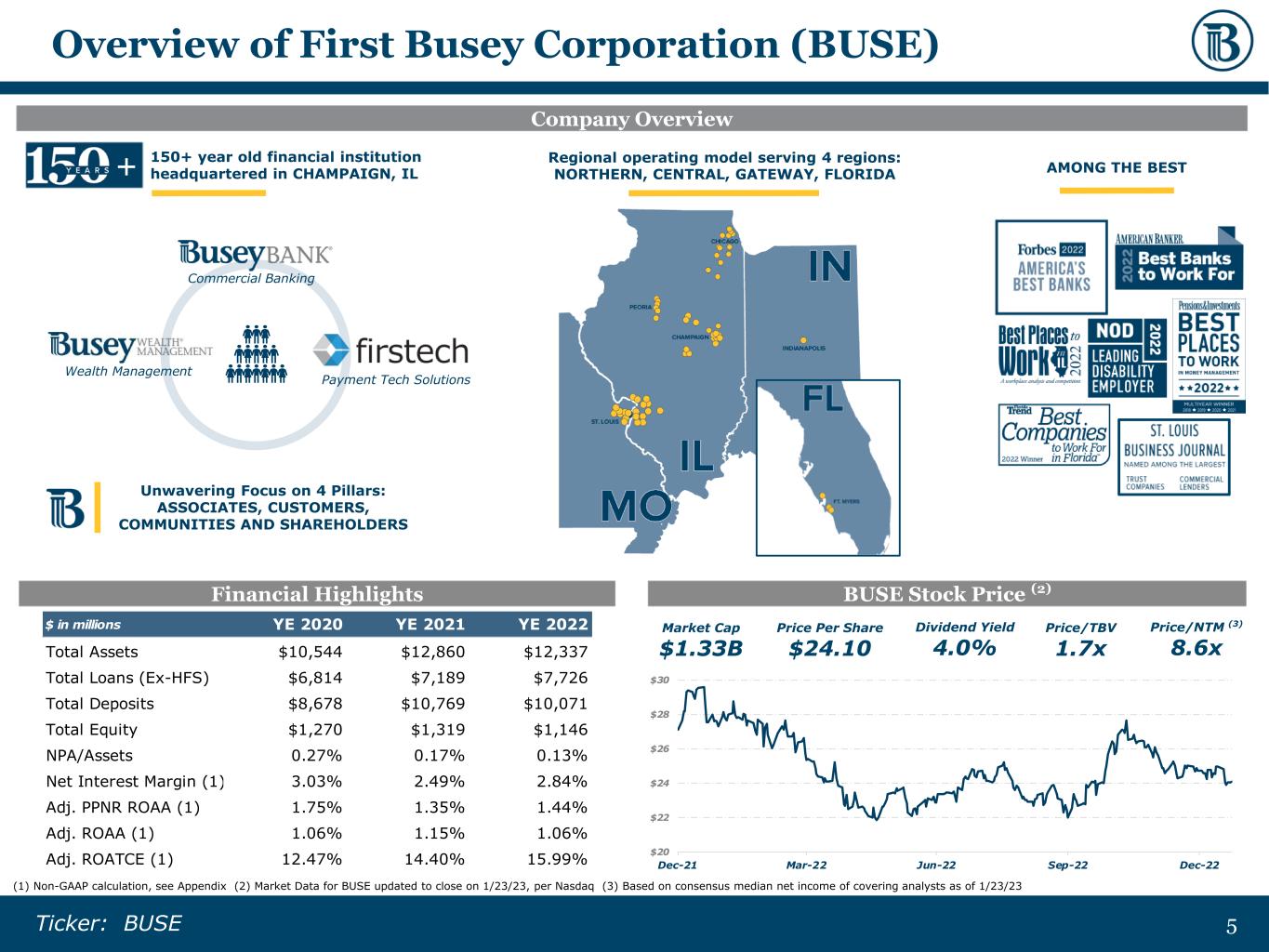

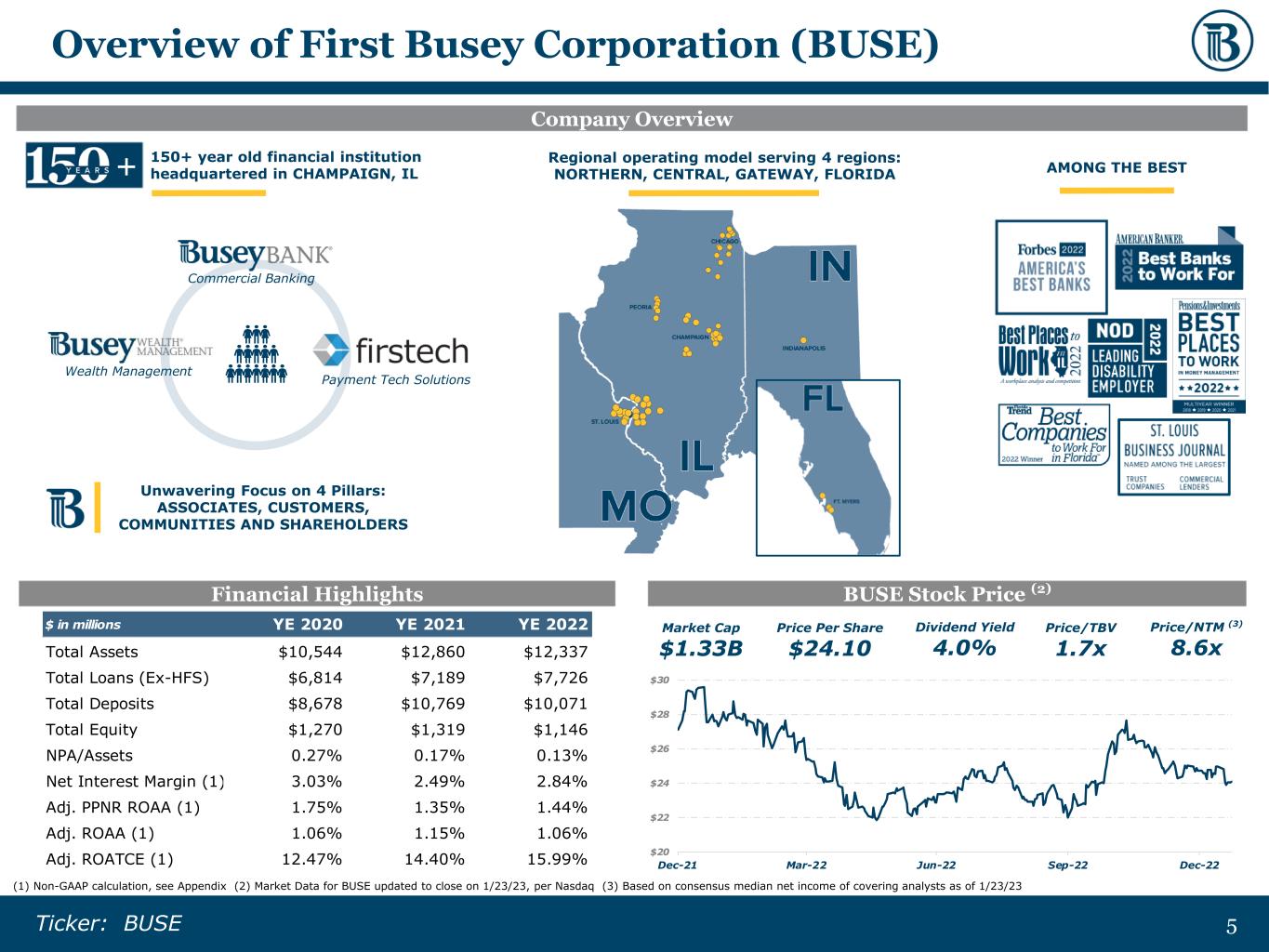

5 5Ticker: BUSE Unwavering Focus on 4 Pillars: ASSOCIATES, CUSTOMERS, COMMUNITIES AND SHAREHOLDERS Overview of First Busey Corporation (BUSE) Company Overview Financial Highlights (1) Non-GAAP calculation, see Appendix (2) Market Data for BUSE updated to close on 1/23/23, per Nasdaq (3) Based on consensus median net income of covering analysts as of 1/23/23 BUSE Stock Price (2) Price Per Share $24.10 Market Cap $1.33B Dividend Yield 4.0% Price/TBV 1.7x Price/NTM (3) 8.6x AMONG THE BEST+ 150+ year old financial institution headquartered in CHAMPAIGN, IL Regional operating model serving 4 regions: NORTHERN, CENTRAL, GATEWAY, FLORIDA Commercial Banking Payment Tech Solutions Wealth Management $ in millions YE 2020 YE 2021 YE 2022 Total Assets $10,544 $12,860 $12,337 Total Loans (Ex-HFS) $6,814 $7,189 $7,726 Total Deposits $8,678 $10,769 $10,071 Total Equity $1,270 $1,319 $1,146 NPA/Assets 0.27% 0.17% 0.13% Net Interest Margin (1) 3.03% 2.49% 2.84% Adj. PPNR ROAA (1) 1.75% 1.35% 1.44% Adj. ROAA (1) 1.06% 1.15% 1.06% Adj. ROATCE (1) 12.47% 14.40% 15.99% $20 $22 $24 $26 $28 $30 Dec-21 Mar-22 Jun-22 Sep-22 Dec-22

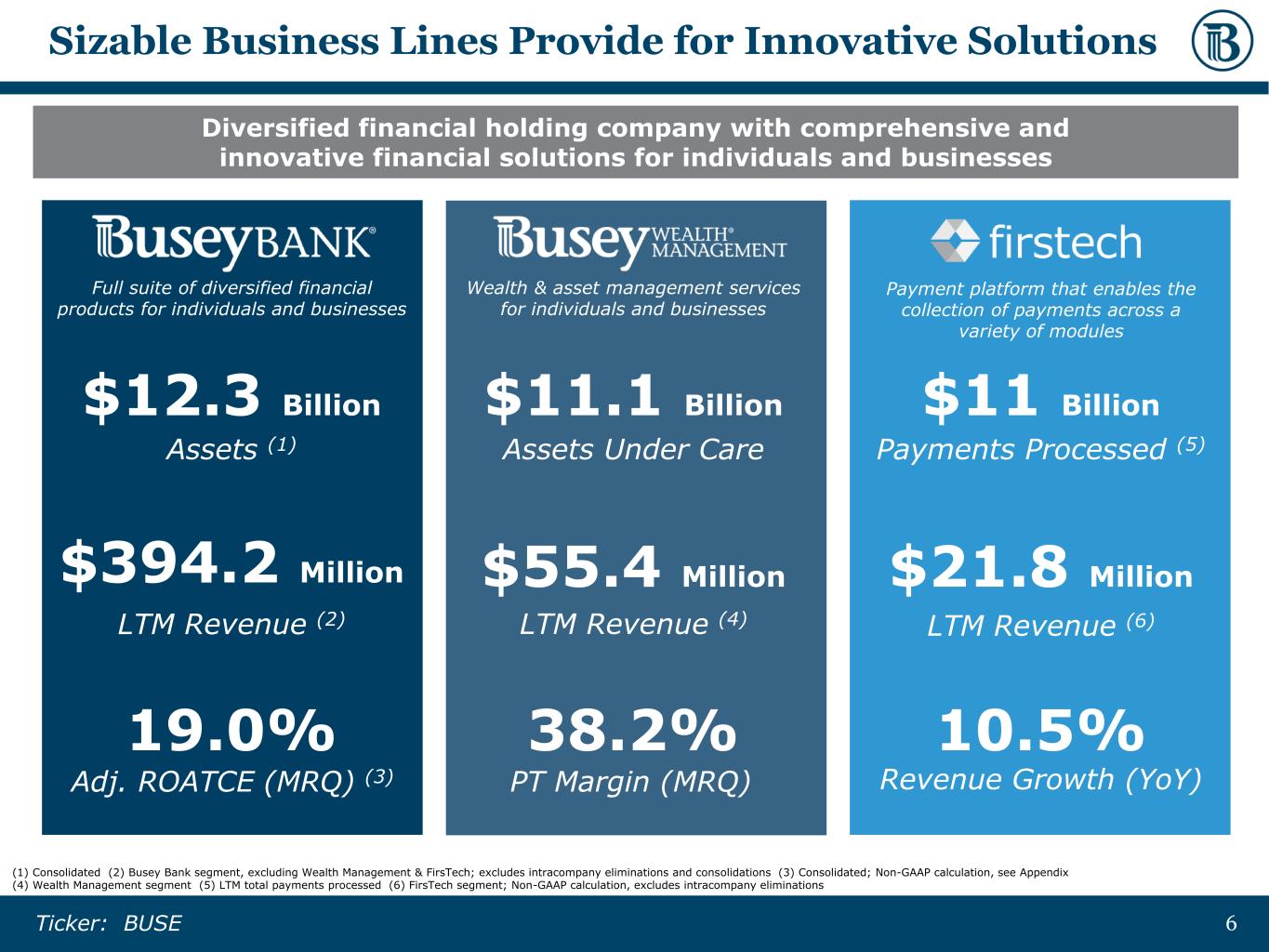

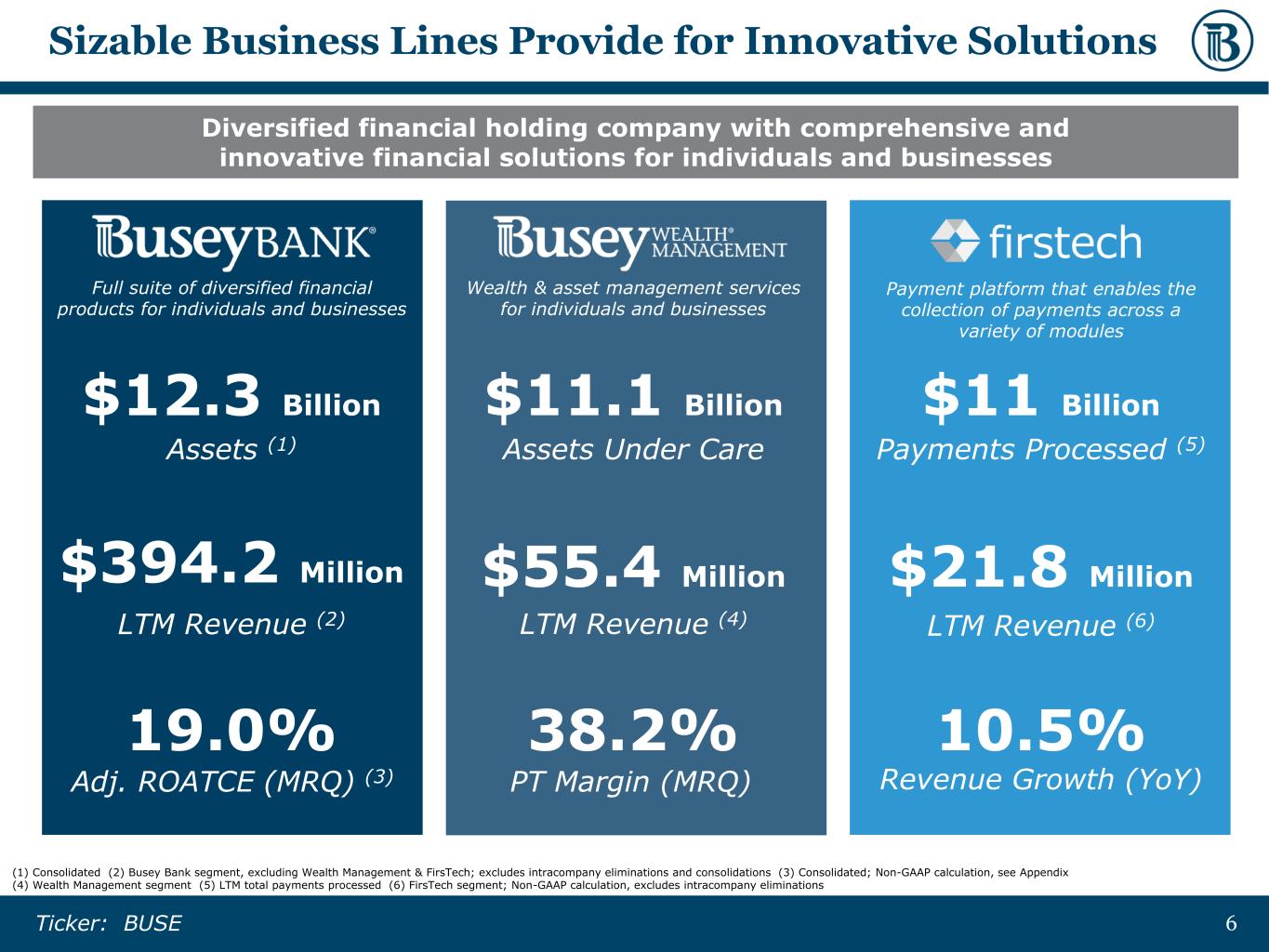

6 6Ticker: BUSE (1) Consolidated (2) Busey Bank segment, excluding Wealth Management & FirsTech; excludes intracompany eliminations and consolidations (3) Consolidated; Non-GAAP calculation, see Appendix (4) Wealth Management segment (5) LTM total payments processed (6) FirsTech segment; Non-GAAP calculation, excludes intracompany eliminations Diversified financial holding company with comprehensive and innovative financial solutions for individuals and businesses Sizable Business Lines Provide for Innovative Solutions $11 Billion 10.5% Payments Processed (5) Revenue Growth (YoY) Full suite of diversified financial products for individuals and businesses Wealth & asset management services for individuals and businesses Payment platform that enables the collection of payments across a variety of modules $12.3 Billion Assets (1) 19.0% Adj. ROATCE (MRQ) (3) $11.1 Billion Assets Under Care 38.2% PT Margin (MRQ) $394.2 Million LTM Revenue (2) $55.4 Million LTM Revenue (4) $21.8 Million LTM Revenue (6)

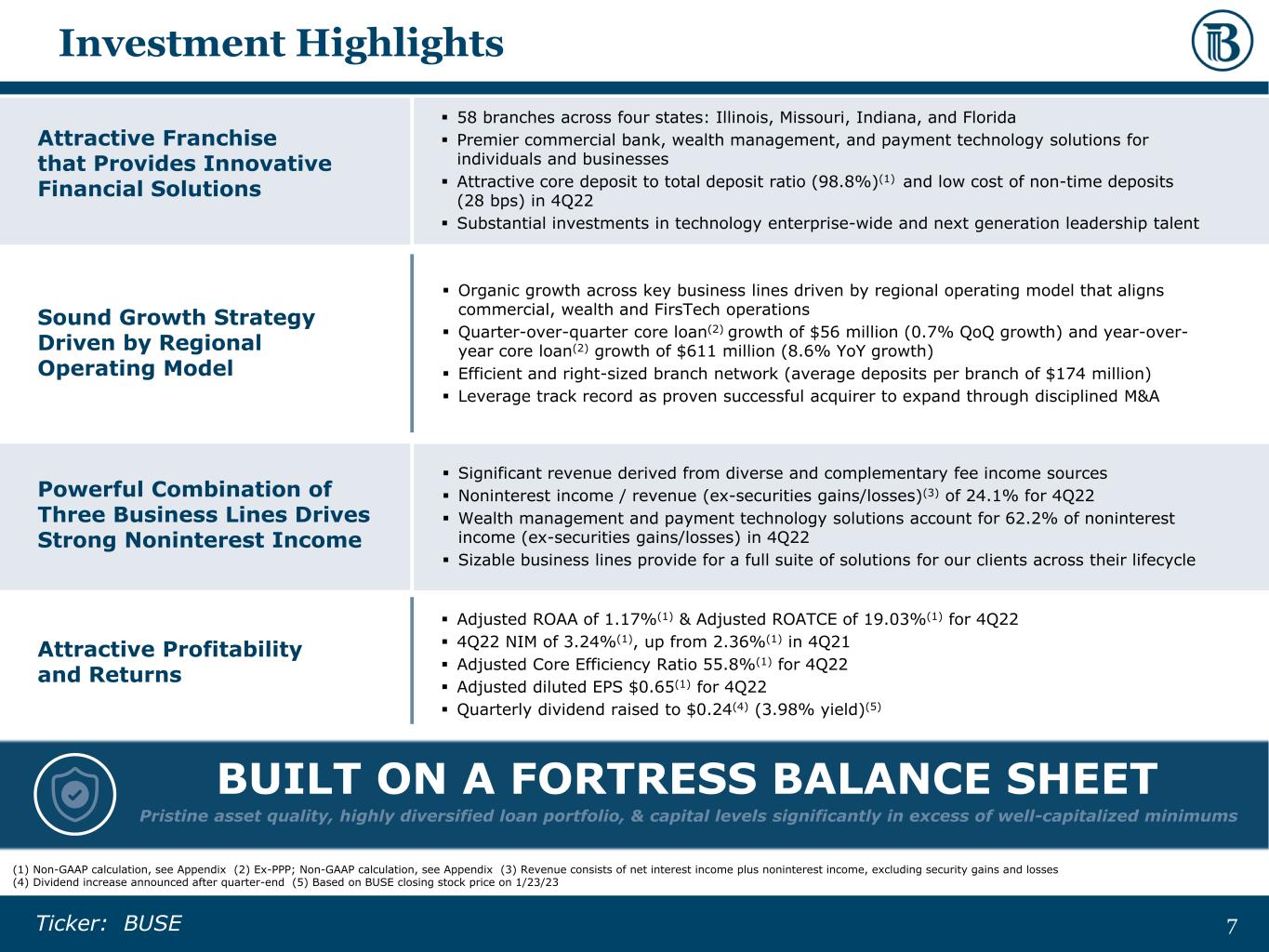

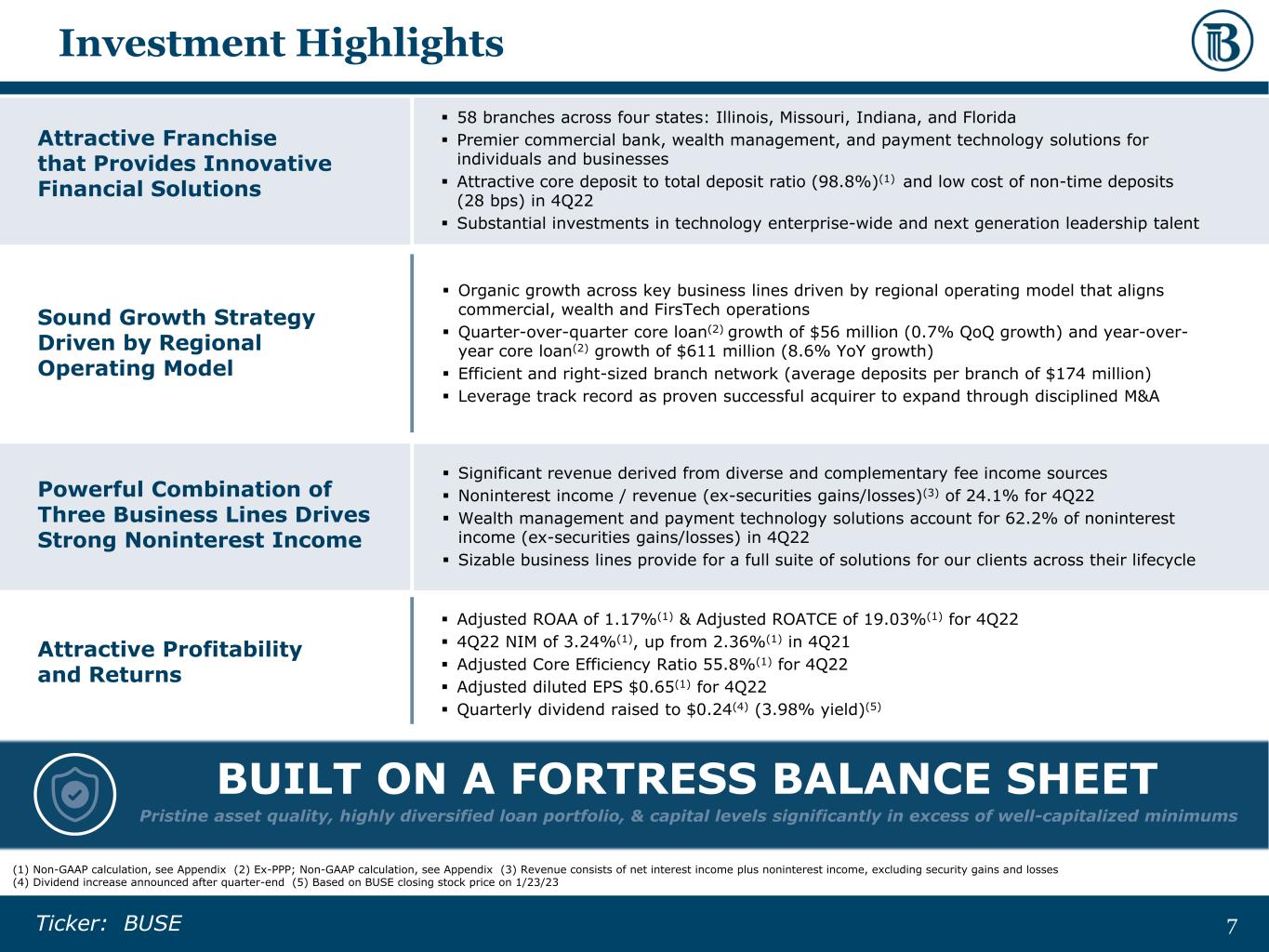

7 7Ticker: BUSE Investment Highlights ▪ 58 branches across four states: Illinois, Missouri, Indiana, and Florida ▪ Premier commercial bank, wealth management, and payment technology solutions for individuals and businesses ▪ Attractive core deposit to total deposit ratio (98.8%)(1) and low cost of non-time deposits (28 bps) in 4Q22 ▪ Substantial investments in technology enterprise-wide and next generation leadership talent Attractive Franchise that Provides Innovative Financial Solutions Attractive Profitability and Returns ▪ Adjusted ROAA of 1.17%(1) & Adjusted ROATCE of 19.03%(1) for 4Q22 ▪ 4Q22 NIM of 3.24%(1), up from 2.36%(1) in 4Q21 ▪ Adjusted Core Efficiency Ratio 55.8%(1) for 4Q22 ▪ Adjusted diluted EPS $0.65(1) for 4Q22 ▪ Quarterly dividend raised to $0.24(4) (3.98% yield)(5) Sound Growth Strategy Driven by Regional Operating Model ▪ Organic growth across key business lines driven by regional operating model that aligns commercial, wealth and FirsTech operations ▪ Quarter-over-quarter core loan(2) growth of $56 million (0.7% QoQ growth) and year-over- year core loan(2) growth of $611 million (8.6% YoY growth) ▪ Efficient and right-sized branch network (average deposits per branch of $174 million) ▪ Leverage track record as proven successful acquirer to expand through disciplined M&A Powerful Combination of Three Business Lines Drives Strong Noninterest Income ▪ Significant revenue derived from diverse and complementary fee income sources ▪ Noninterest income / revenue (ex-securities gains/losses)(3) of 24.1% for 4Q22 ▪ Wealth management and payment technology solutions account for 62.2% of noninterest income (ex-securities gains/losses) in 4Q22 ▪ Sizable business lines provide for a full suite of solutions for our clients across their lifecycle BUILT ON A FORTRESS BALANCE SHEET Pristine asset quality, highly diversified loan portfolio, & capital levels significantly in excess of well-capitalized minimums (1) Non-GAAP calculation, see Appendix (2) Ex-PPP; Non-GAAP calculation, see Appendix (3) Revenue consists of net interest income plus noninterest income, excluding security gains and losses (4) Dividend increase announced after quarter-end (5) Based on BUSE closing stock price on 1/23/23

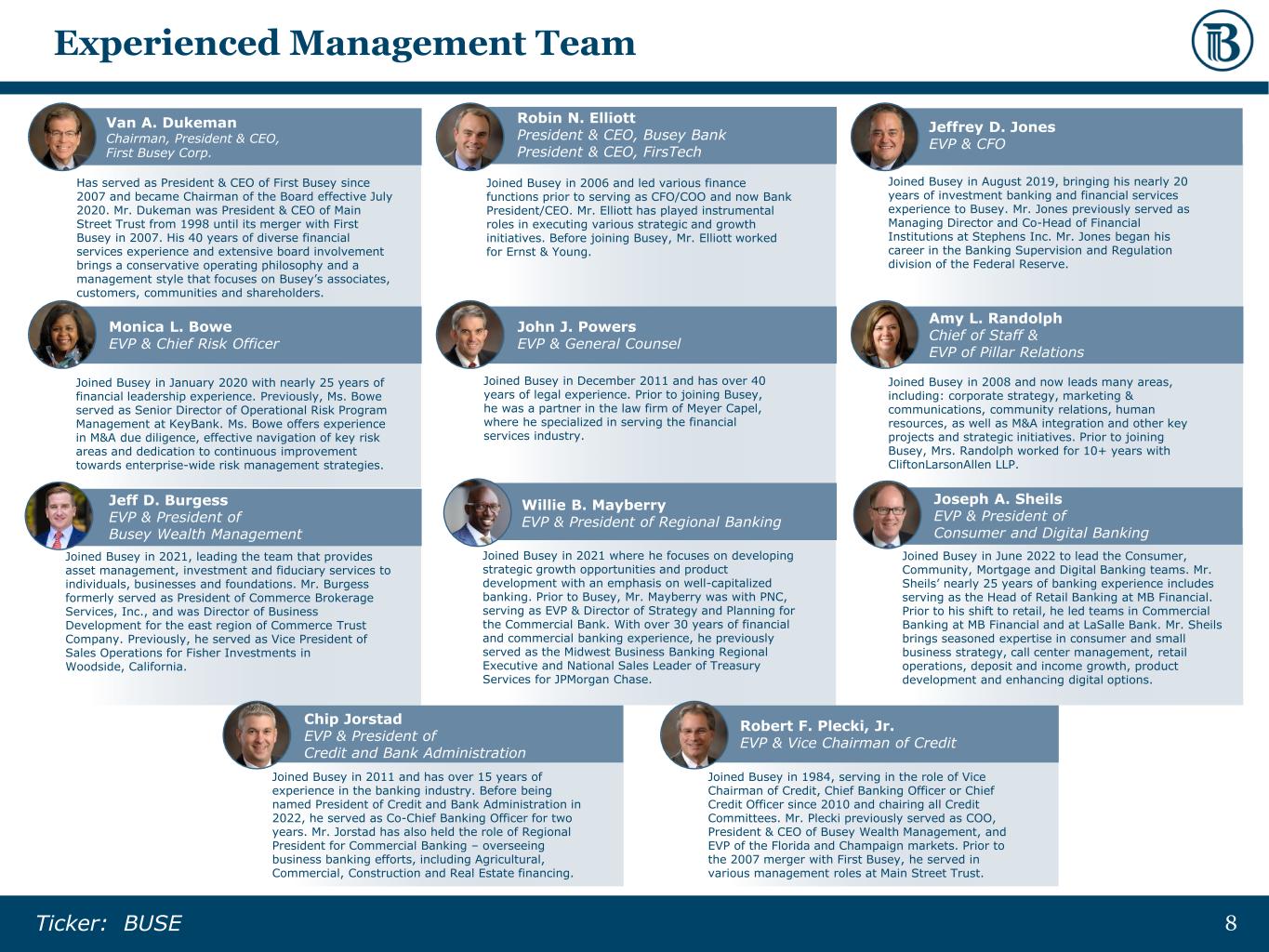

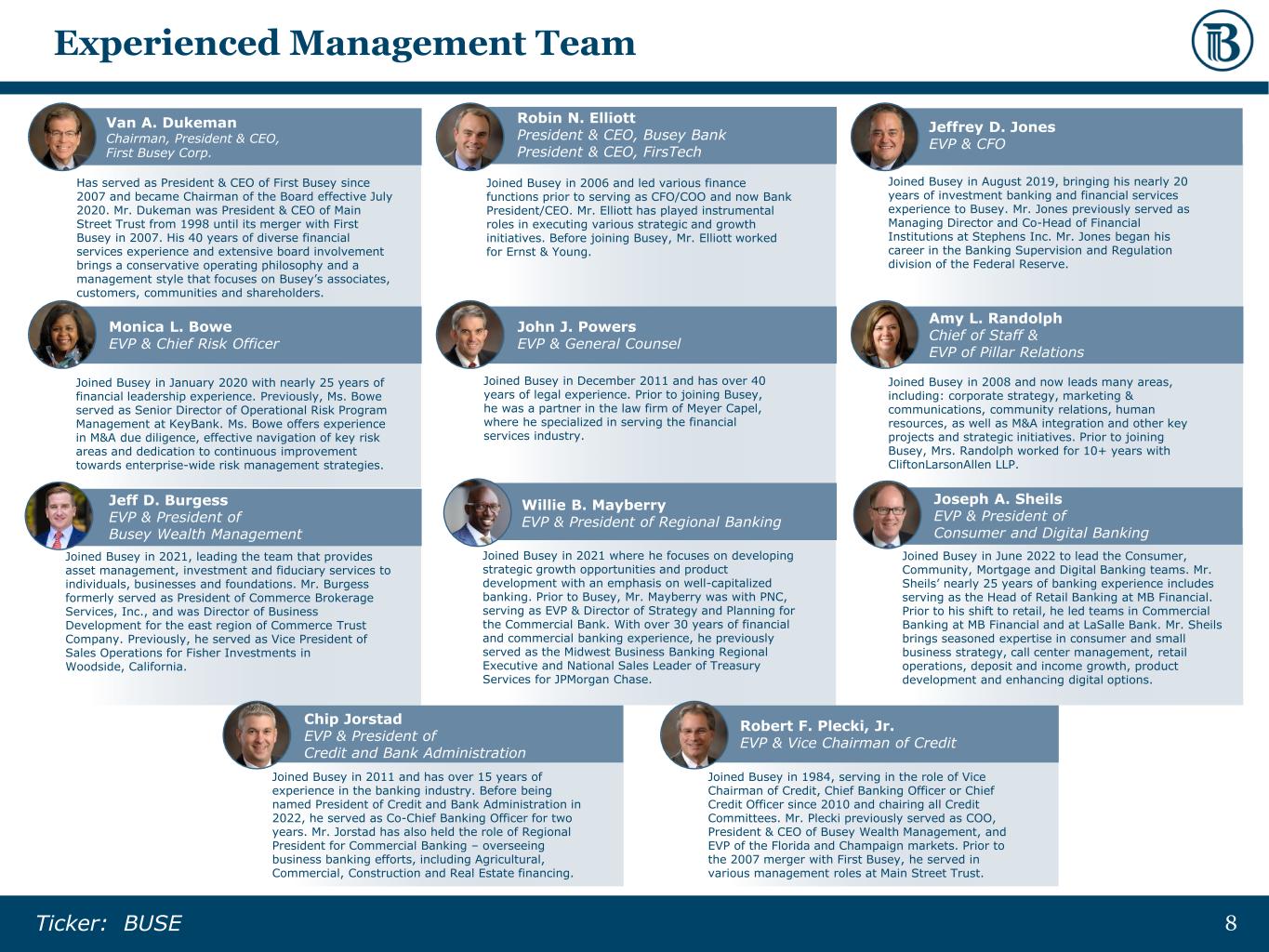

8 8Ticker: BUSE Joined Busey in 2006 and led various finance functions prior to serving as CFO/COO and now Bank President/CEO. Mr. Elliott has played instrumental roles in executing various strategic and growth initiatives. Before joining Busey, Mr. Elliott worked for Ernst & Young. Has served as President & CEO of First Busey since 2007 and became Chairman of the Board effective July 2020. Mr. Dukeman was President & CEO of Main Street Trust from 1998 until its merger with First Busey in 2007. His 40 years of diverse financial services experience and extensive board involvement brings a conservative operating philosophy and a management style that focuses on Busey’s associates, customers, communities and shareholders. Robin N. Elliott President & CEO, Busey Bank President & CEO, FirsTech Experienced Management Team Joined Busey in January 2020 with nearly 25 years of financial leadership experience. Previously, Ms. Bowe served as Senior Director of Operational Risk Program Management at KeyBank. Ms. Bowe offers experience in M&A due diligence, effective navigation of key risk areas and dedication to continuous improvement towards enterprise-wide risk management strategies. Monica L. Bowe EVP & Chief Risk Officer Joined Busey in December 2011 and has over 40 years of legal experience. Prior to joining Busey, he was a partner in the law firm of Meyer Capel, where he specialized in serving the financial services industry. John J. Powers EVP & General Counsel Joined Busey in 2008 and now leads many areas, including: corporate strategy, marketing & communications, community relations, human resources, as well as M&A integration and other key projects and strategic initiatives. Prior to joining Busey, Mrs. Randolph worked for 10+ years with CliftonLarsonAllen LLP. Amy L. Randolph Chief of Staff & EVP of Pillar Relations Joined Busey in 1984, serving in the role of Vice Chairman of Credit, Chief Banking Officer or Chief Credit Officer since 2010 and chairing all Credit Committees. Mr. Plecki previously served as COO, President & CEO of Busey Wealth Management, and EVP of the Florida and Champaign markets. Prior to the 2007 merger with First Busey, he served in various management roles at Main Street Trust. Robert F. Plecki, Jr. EVP & Vice Chairman of Credit Joined Busey in 2011 and has over 15 years of experience in the banking industry. Before being named President of Credit and Bank Administration in 2022, he served as Co-Chief Banking Officer for two years. Mr. Jorstad has also held the role of Regional President for Commercial Banking – overseeing business banking efforts, including Agricultural, Commercial, Construction and Real Estate financing. Chip Jorstad EVP & President of Credit and Bank Administration Joined Busey in 2021 where he focuses on developing strategic growth opportunities and product development with an emphasis on well-capitalized banking. Prior to Busey, Mr. Mayberry was with PNC, serving as EVP & Director of Strategy and Planning for the Commercial Bank. With over 30 years of financial and commercial banking experience, he previously served as the Midwest Business Banking Regional Executive and National Sales Leader of Treasury Services for JPMorgan Chase. Willie B. Mayberry EVP & President of Regional Banking Joined Busey in 2021, leading the team that provides asset management, investment and fiduciary services to individuals, businesses and foundations. Mr. Burgess formerly served as President of Commerce Brokerage Services, Inc., and was Director of Business Development for the east region of Commerce Trust Company. Previously, he served as Vice President of Sales Operations for Fisher Investments in Woodside, California. Jeff D. Burgess EVP & President of Busey Wealth Management Joined Busey in August 2019, bringing his nearly 20 years of investment banking and financial services experience to Busey. Mr. Jones previously served as Managing Director and Co-Head of Financial Institutions at Stephens Inc. Mr. Jones began his career in the Banking Supervision and Regulation division of the Federal Reserve. Jeffrey D. Jones EVP & CFO Joined Busey in June 2022 to lead the Consumer, Community, Mortgage and Digital Banking teams. Mr. Sheils’ nearly 25 years of banking experience includes serving as the Head of Retail Banking at MB Financial. Prior to his shift to retail, he led teams in Commercial Banking at MB Financial and at LaSalle Bank. Mr. Sheils brings seasoned expertise in consumer and small business strategy, call center management, retail operations, deposit and income growth, product development and enhancing digital options. Joseph A. Sheils EVP & President of Consumer and Digital Banking Van A. Dukeman Chairman, President & CEO, First Busey Corp.

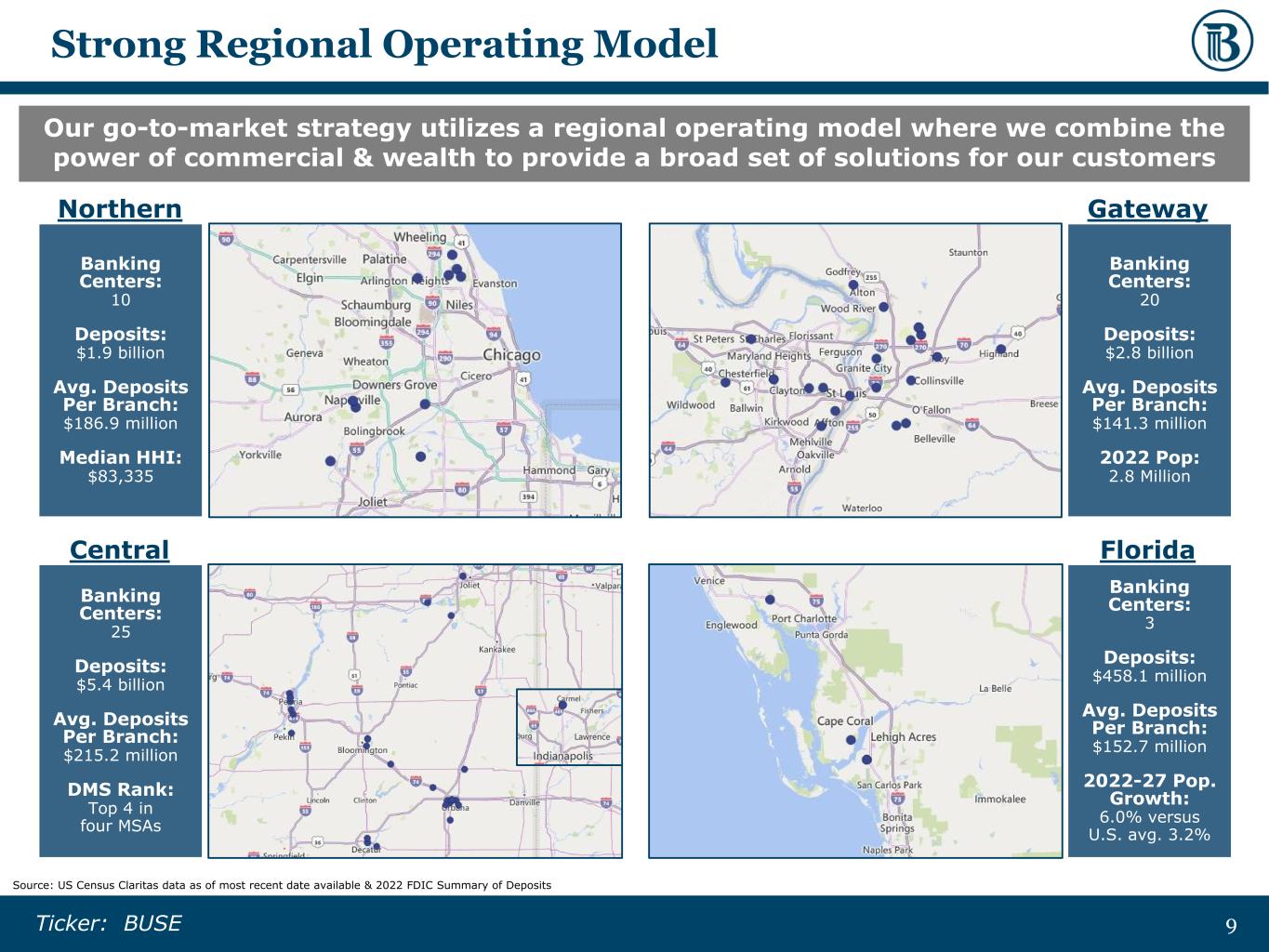

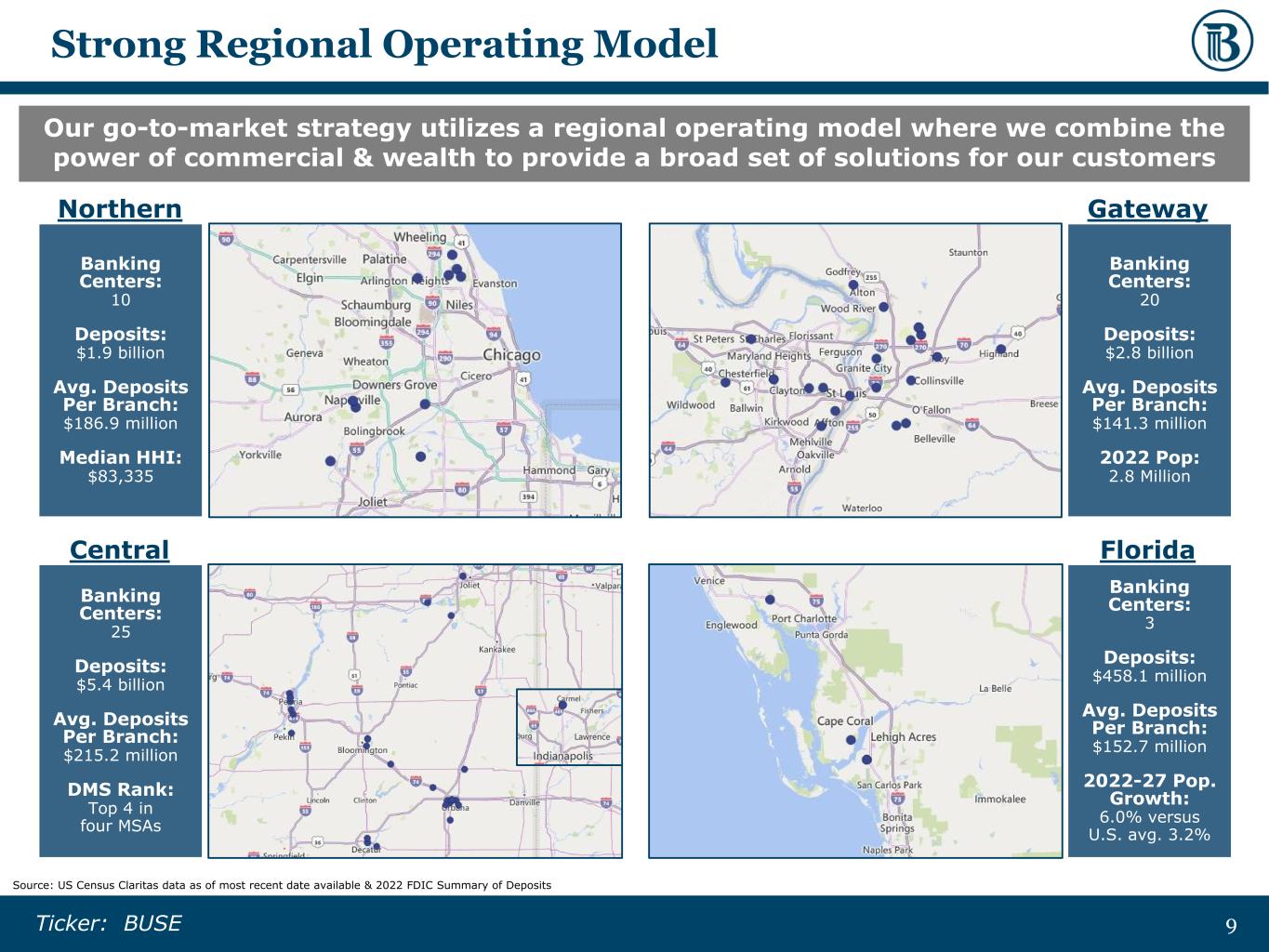

9 9Ticker: BUSE Banking Centers: 3 Deposits: $458.1 million Avg. Deposits Per Branch: $152.7 million 2022-27 Pop. Growth: 6.0% versus U.S. avg. 3.2% Banking Centers: 20 Deposits: $2.8 billion Avg. Deposits Per Branch: $141.3 million 2022 Pop: 2.8 Million Our go-to-market strategy utilizes a regional operating model where we combine the power of commercial & wealth to provide a broad set of solutions for our customers Northern Gateway Central Florida Source: US Census Claritas data as of most recent date available & 2022 FDIC Summary of Deposits Banking Centers: 10 Deposits: $1.9 billion Avg. Deposits Per Branch: $186.9 million Median HHI: $83,335 Banking Centers: 25 Deposits: $5.4 billion Avg. Deposits Per Branch: $215.2 million DMS Rank: Top 4 in four MSAs Strong Regional Operating Model

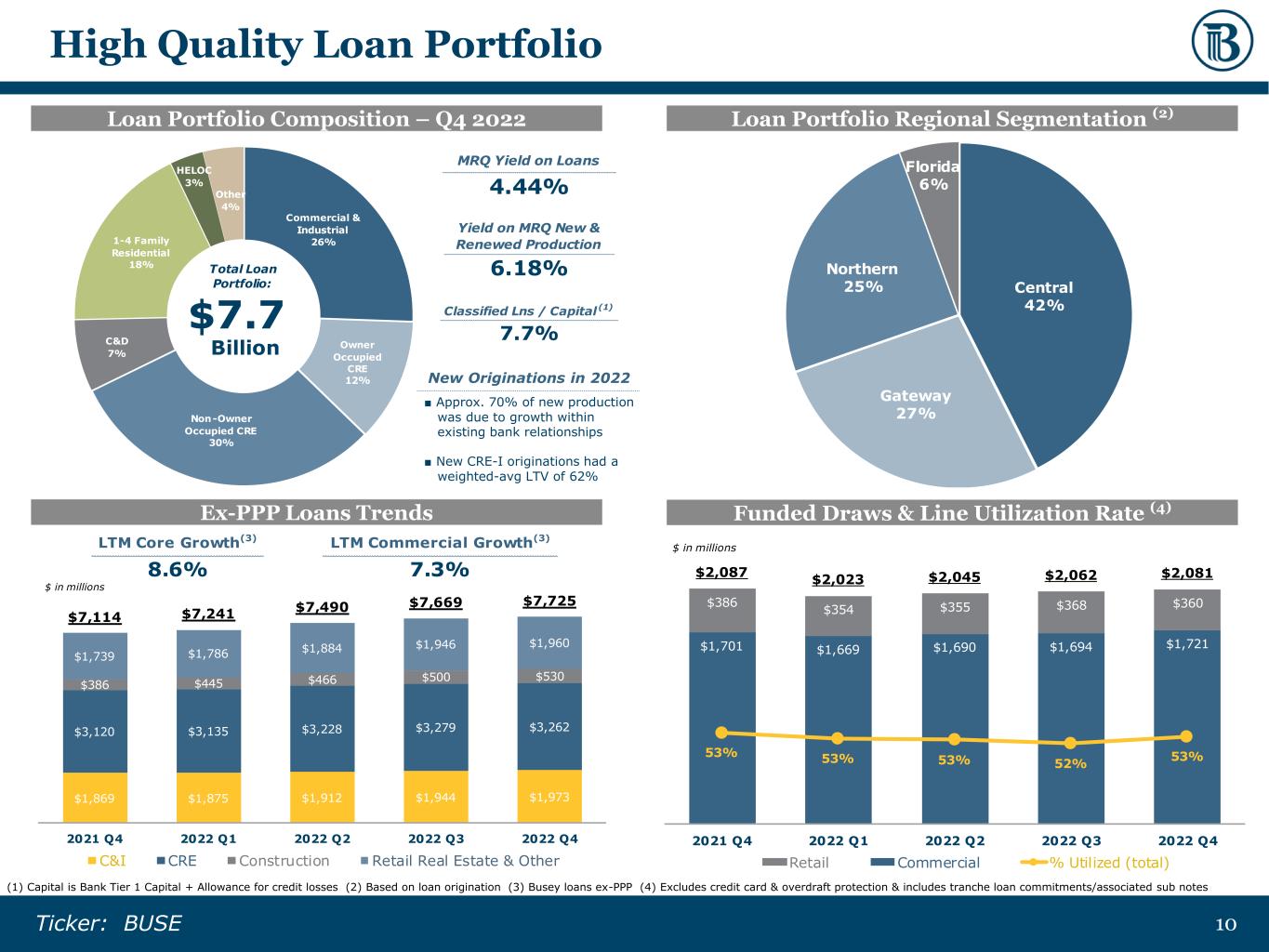

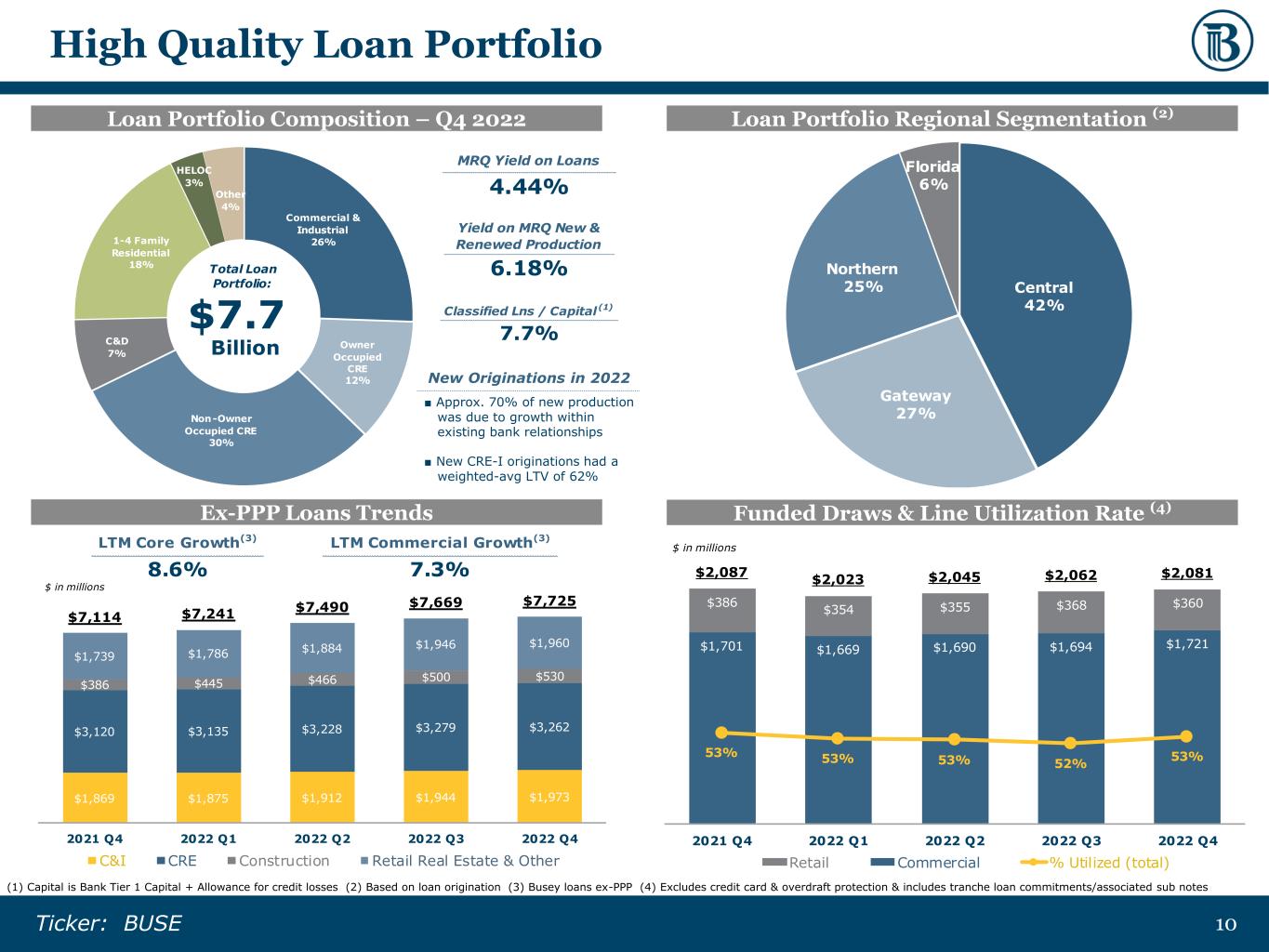

1010Ticker: BUSE $1,701 $1,669 $1,690 $1,694 $1,721 $386 $354 $355 $368 $360 $2,087 $2,023 $2,045 $2,062 $2,081 53% 53% 53% 52% 53% $1 $501 $1,001 $1,501 $2,001 $2,501 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Retail Commercial % Utilized (total) $ in millions New Originations in 2022 ■ Approx. 70% of new production was due to growth within existing bank relationships ■ New CRE-I originations had a weighted-avg LTV of 62% High Quality Loan Portfolio (1) Capital is Bank Tier 1 Capital + Allowance for credit losses (2) Based on loan origination (3) Busey loans ex-PPP (4) Excludes credit card & overdraft protection & includes tranche loan commitments/associated sub notes Loan Portfolio Composition – Q4 2022 Loan Portfolio Regional Segmentation (2) Ex-PPP Loans Trends Funded Draws & Line Utilization Rate (4) $1,869 $1,875 $1,912 $1,944 $1,973 $3,120 $3,135 $3,228 $3,279 $3,262 $386 $445 $466 $500 $530 $1,739 $1,786 $1,884 $1,946 $1,960 $7,114 $7,241 $7,490 $7,669 $7,725 $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 $8,000,000 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 C&I CRE Construction Retail Real Estate & Other $ in millions LTM Commercial Growth(3) 7.3% LTM Core Growth(3) 8.6% MRQ Yield on Loans 4.44% Classified Lns / Capital (1) 7.7% Yield on MRQ New & Renewed Production 6.18%

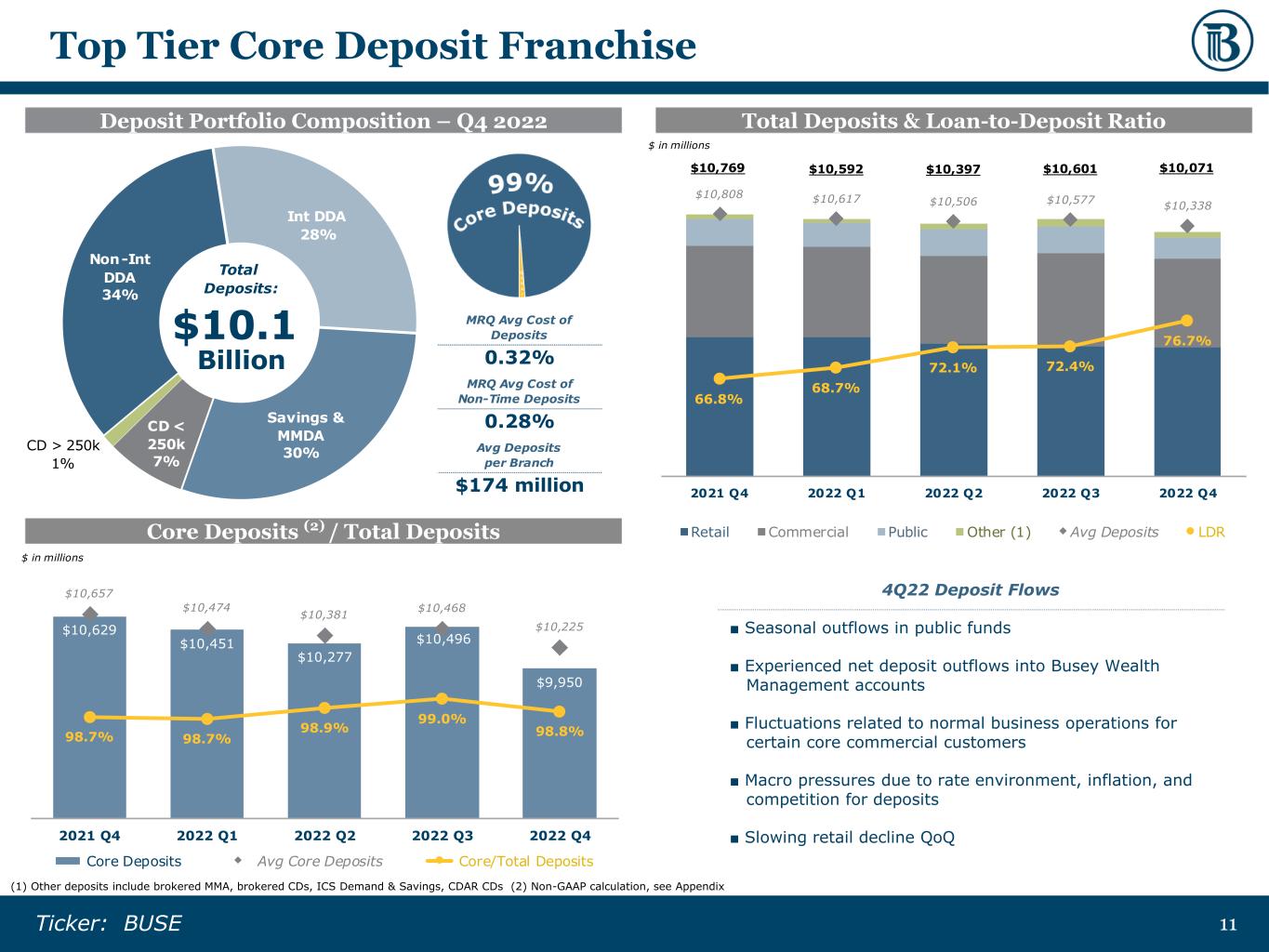

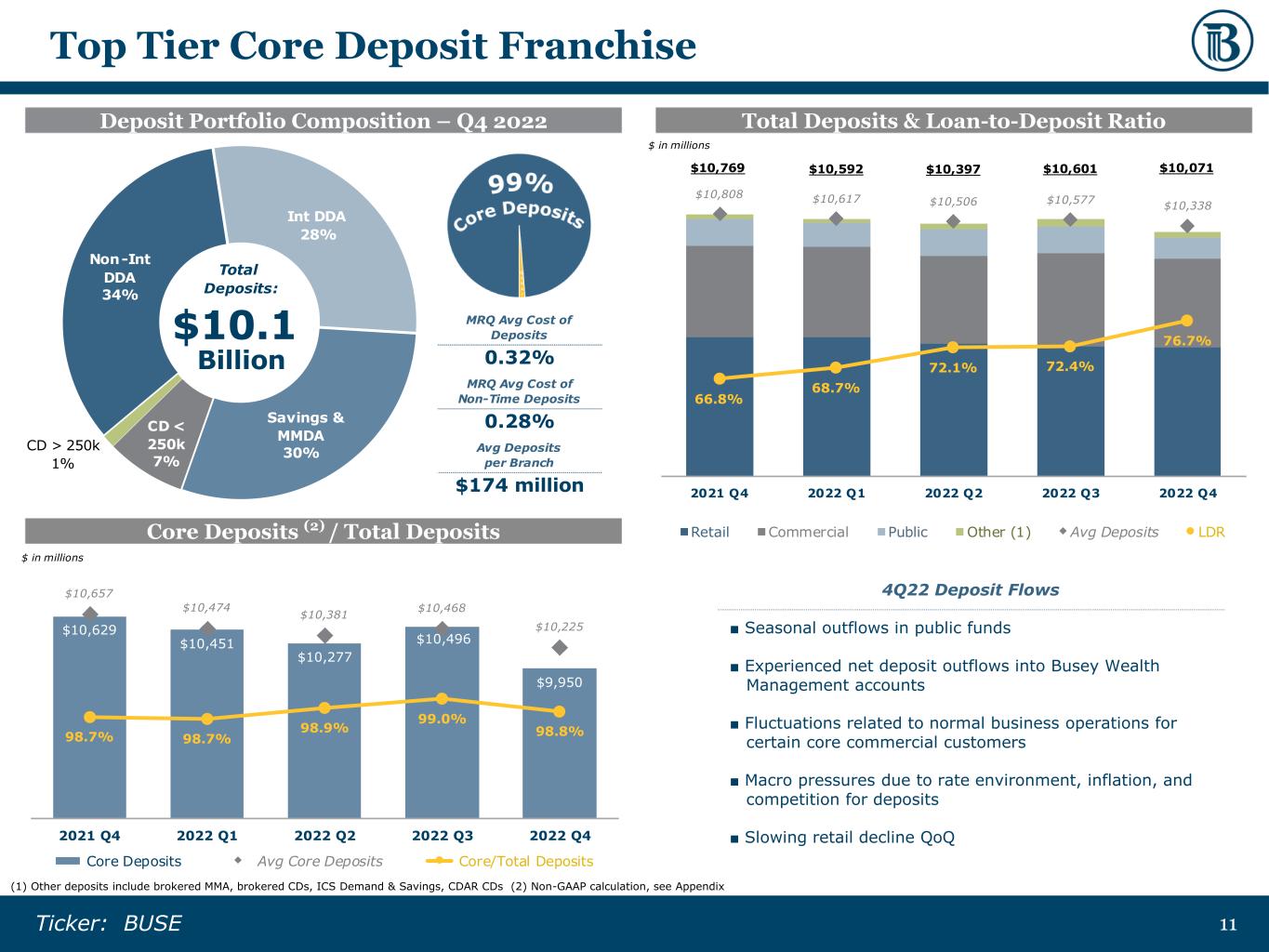

11 11Ticker: BUSE $10,769 $10,592 $10,397 $10,601 $10,071 $10,808 $10,617 $10,506 $10,577 $10,338 66.8% 68.7% 72.1% 72.4% 76.7% 50 .0 % 55 .0 % 60 .0 % 65 .0 % 70 .0 % 75 .0 % 80 .0 % 85 .0 % 90 .0 % 95 .0 % 10 0.0% $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Retail Commercial Public Other (1) Avg Deposits LDR $ in millions $10,629 $10,451 $10,277 $10,496 $9,950 $10,657 $10,474 $10,381 $10,468 $10,225 98.7% 98.7% 98.9% 99.0% 98.8% 97.0% 97.5% 98.0% 98.5% 99.0% 99.5% 100.0% 100.5% 101.0% 101.5% $8,000 $8,500 $9,000 $9,500 $10,000 $10,500 $11,000 $11,500 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Core Deposits Avg Core Deposits Core/Total Deposits $ in millions Top Tier Core Deposit Franchise Deposit Portfolio Composition – Q4 2022 Total Deposits & Loan-to-Deposit Ratio Core Deposits (2) / Total Deposits (1) Other deposits include brokered MMA, brokered CDs, ICS Demand & Savings, CDAR CDs (2) Non-GAAP calculation, see Appendix C 25 k MRQ Avg Cost of Deposits 0.32% MRQ Avg Cost of Non-Time Deposits 0.28% Avg Deposits per Branch $174 million 4Q22 Deposit Flows ■ Seasonal outflows in public funds ■ Experienced net deposit outflows into Busey Wealth Management accounts ■ Fluctuations related to normal business operations for certain core commercial customers ■ Macro pressures due to rate environment, inflation, and competition for deposits ■ Slowing retail decline QoQ

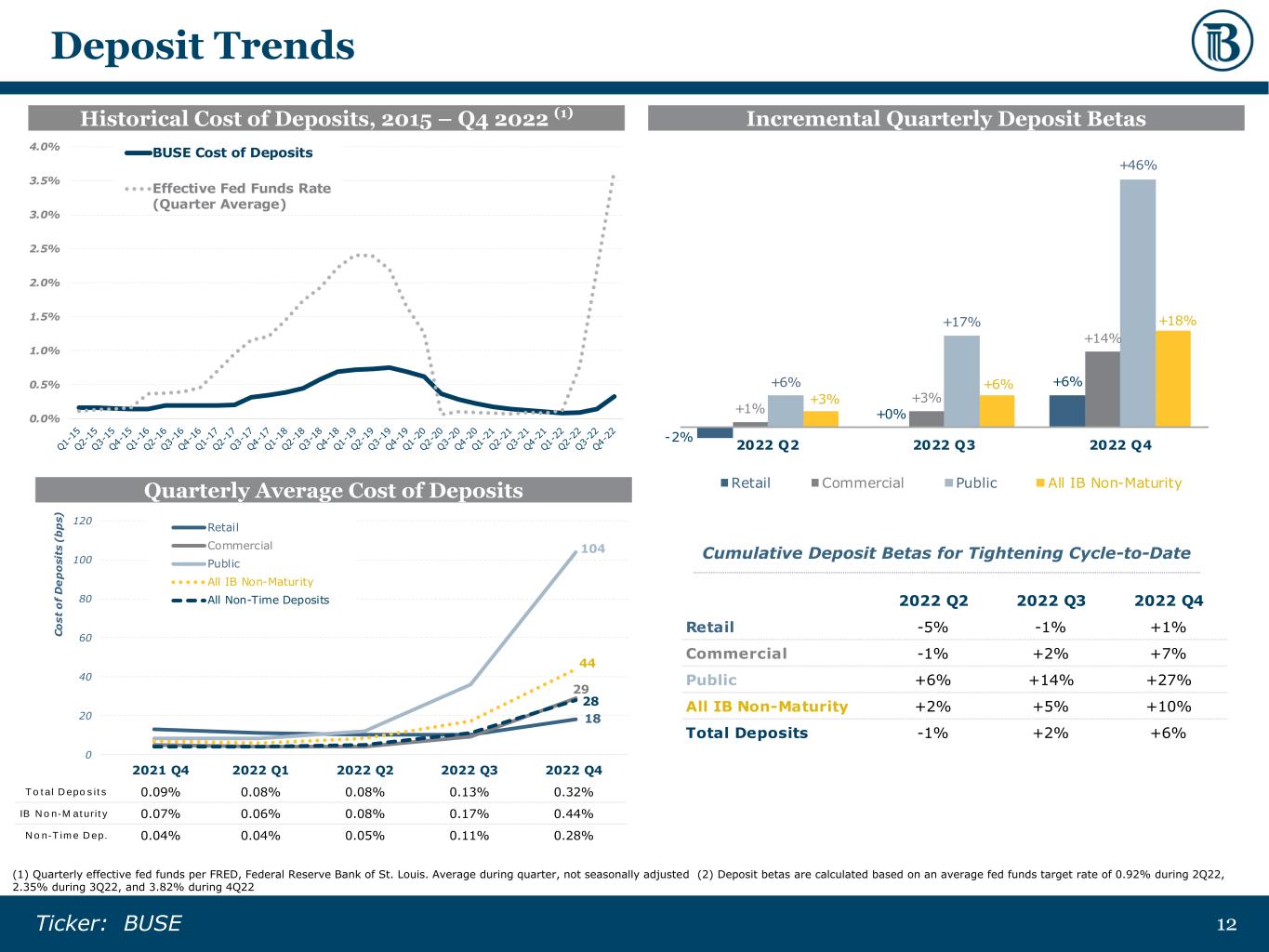

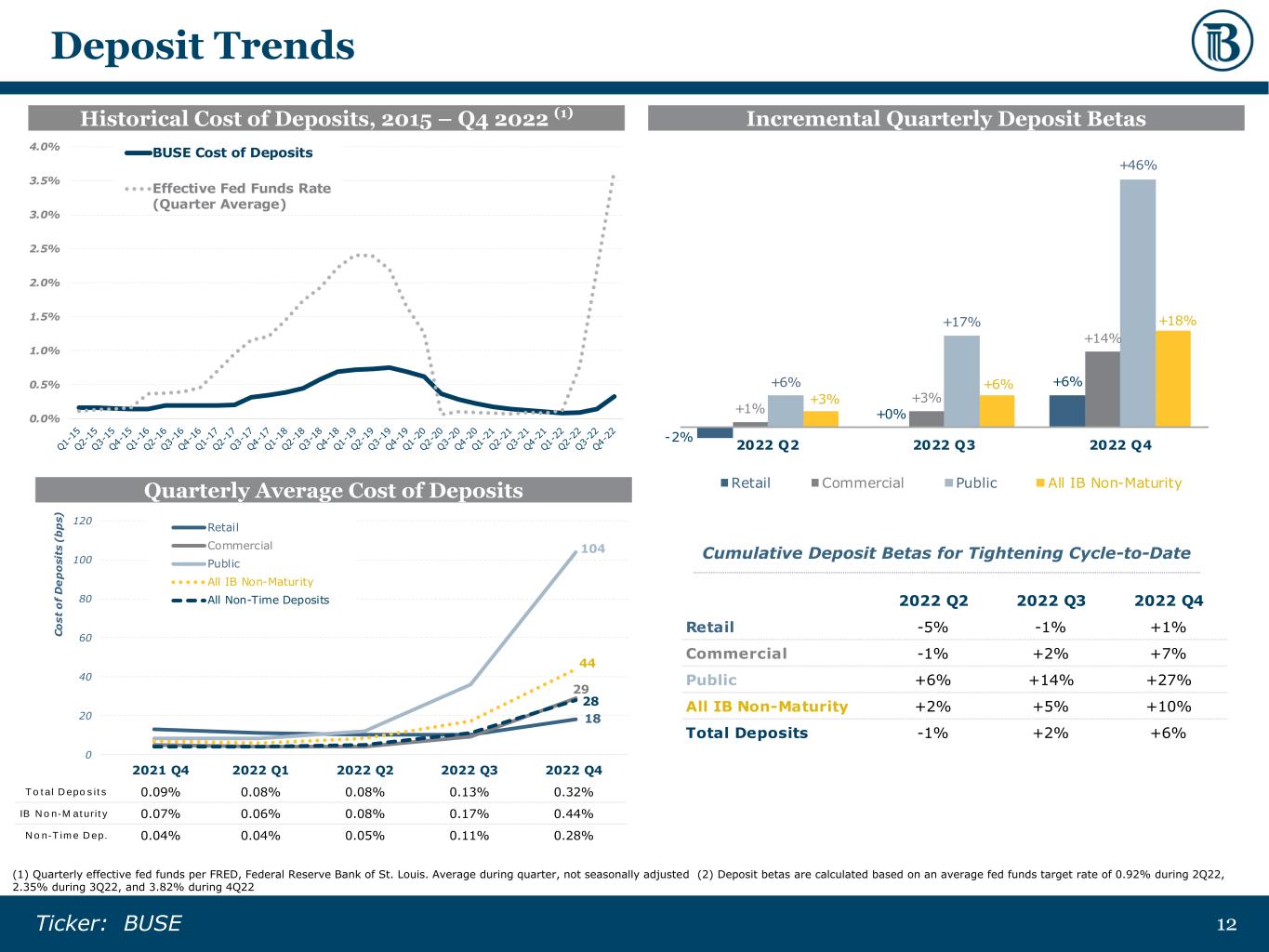

1212Ticker: BUSE 18 29 104 44 28 0 20 40 60 80 100 120 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 C o s t o f D e p o s it s ( b p s ) Retail Commercial Public All IB Non-Maturity All Non-Time Deposits Deposit Trends -2% +0% +6% +1% +3% +14% +6% +17% +46% +3% +6% +18% 2022 Q2 2022 Q3 2022 Q4 Retail Commercial Public All IB Non-Maturity Incremental Quarterly Deposit Betas Quarterly Average Cost of Deposits 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% BUSE Cost of Deposits Effective Fed Funds Rate (Quarter Average) Historical Cost of Deposits, 2015 – Q4 2022 (1) (1) Quarterly effective fed funds per FRED, Federal Reserve Bank of St. Louis. Average during quarter, not seasonally adjusted (2) Deposit betas are calculated based on an average fed funds target rate of 0.92% during 2Q22, 2.35% during 3Q22, and 3.82% during 4Q22 Cumulative Deposit Betas for Tightening Cycle-to-Date 2022 Q2 2022 Q3 2022 Q4 Retail -5% -1% +1% Commercial -1% +2% +7% Public +6% +14% +27% All IB Non-Maturity +2% +5% +10% Total Deposits -1% +2% +6% 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 T o tal D epo sits 0.09% 0.08% 0.08% 0.13% 0.32% IB N o n-M aturity 0.07% 0.06% 0.08% 0.17% 0.44% N o n-T ime D ep. 0.04% 0.04% 0.05% 0.11% 0.28%

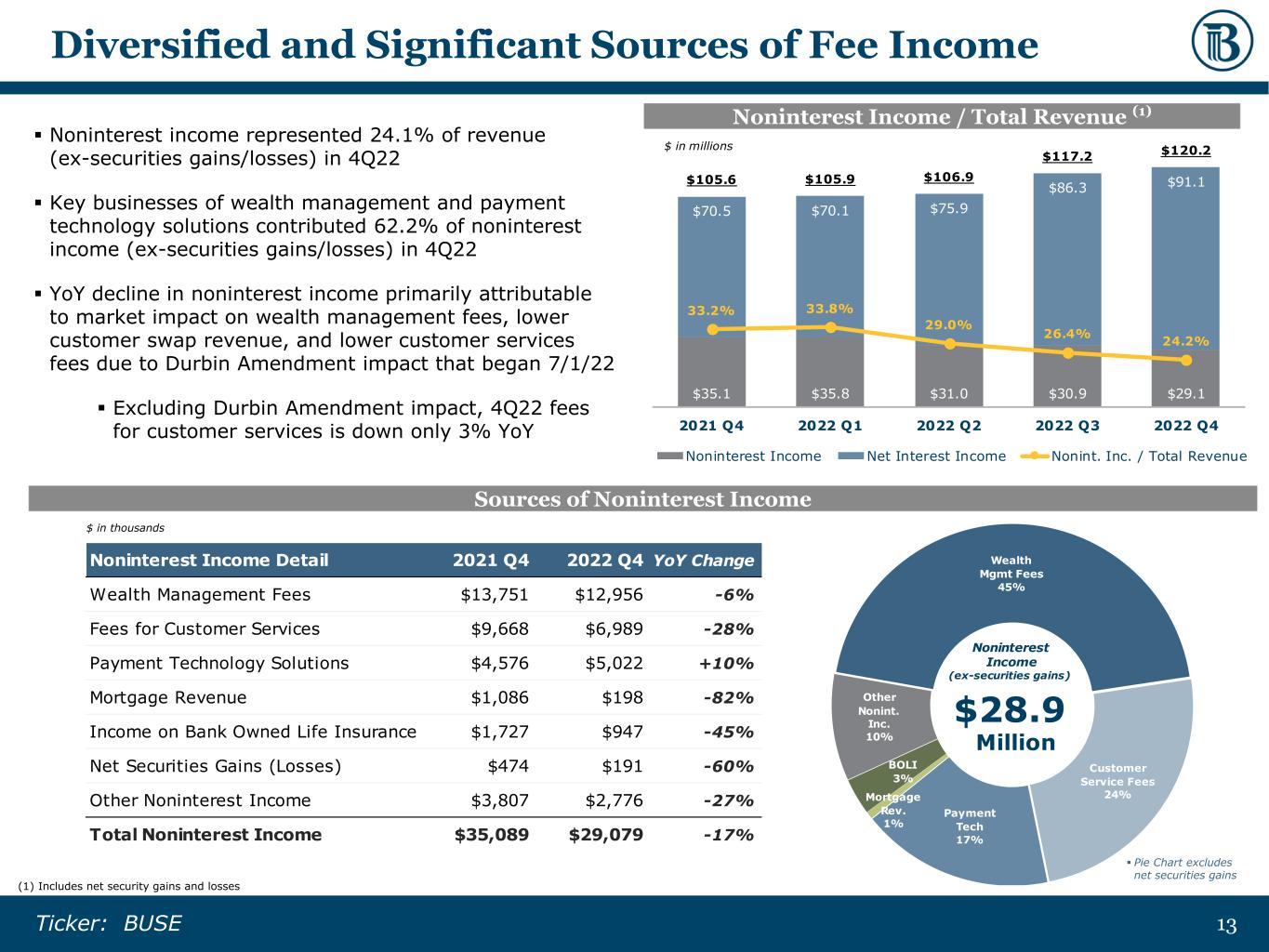

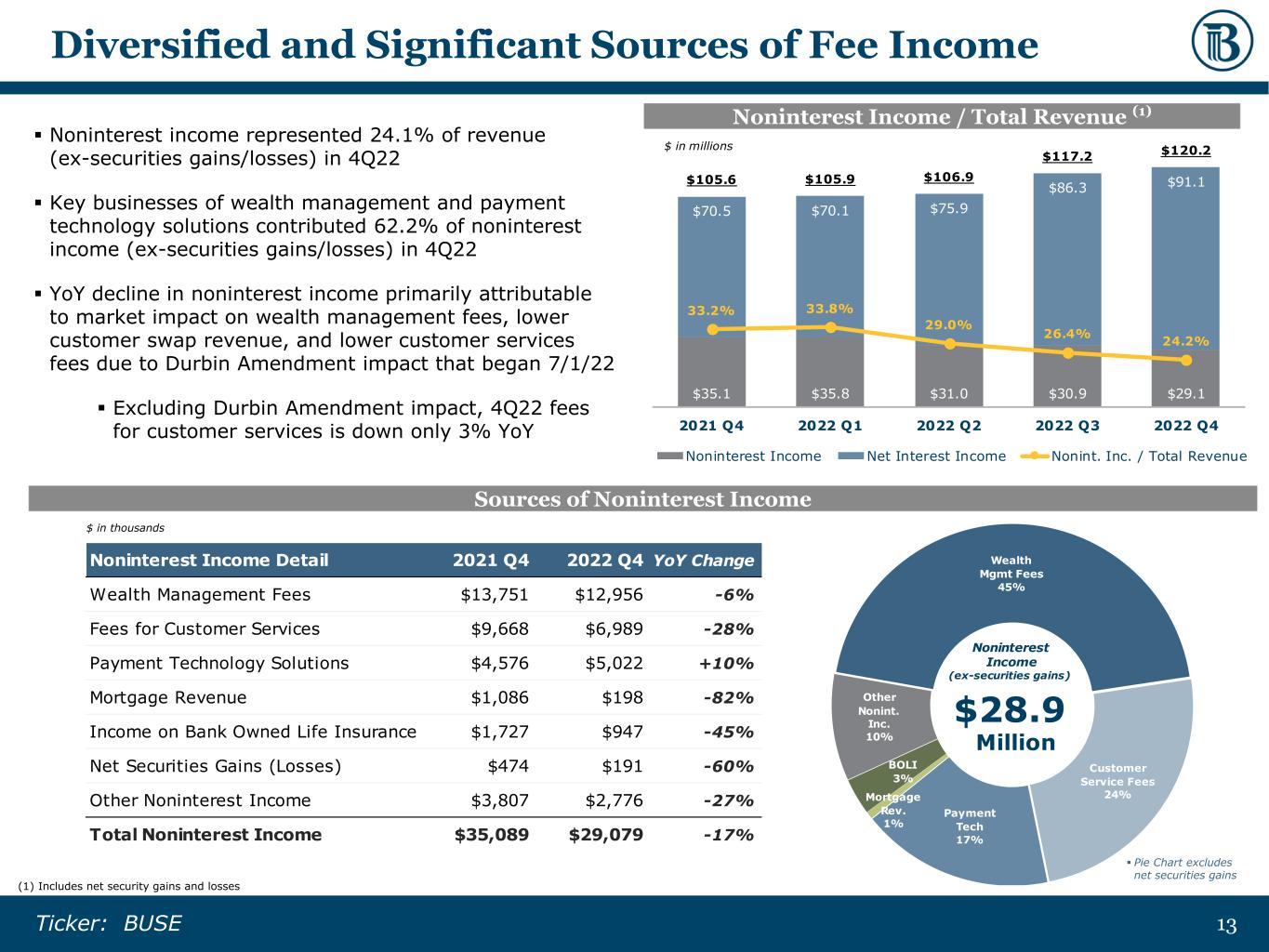

1313Ticker: BUSE $35.1 $35.8 $31.0 $30.9 $29.1 $70.5 $70.1 $75.9 $86.3 $91.1$105.6 $105.9 $106.9 $117.2 $120.2 33.2% 33.8% 29.0% 26.4% 24.2% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Noninterest Income Net Interest Income Nonint. Inc. / Total Revenue $ in millions ▪ Noninterest income represented 24.1% of revenue (ex-securities gains/losses) in 4Q22 ▪ Key businesses of wealth management and payment technology solutions contributed 62.2% of noninterest income (ex-securities gains/losses) in 4Q22 ▪ YoY decline in noninterest income primarily attributable to market impact on wealth management fees, lower customer swap revenue, and lower customer services fees due to Durbin Amendment impact that began 7/1/22 ▪ Excluding Durbin Amendment impact, 4Q22 fees for customer services is down only 3% YoY Diversified and Significant Sources of Fee Income Noninterest Income / Total Revenue (1) (1) Includes net security gains and losses Sources of Noninterest Income ▪ Pie Chart excludes net securities gains Noninterest Income Detail 2021 Q4 2022 Q4 YoY Change Wealth Management Fees $13,751 $12,956 -6% Fees for Customer Services $9,668 $6,989 -28% Payment Technology Solutions $4,576 $5,022 +10% Mortgage Revenue $1,086 $198 -82% Income on Bank Owned Life Insurance $1,727 $947 -45% Net Securities Gains (Losses) $474 $191 -60% Other Noninterest Income $3,807 $2,776 -27% Total Noninterest Income $35,089 $29,079 -17% $ in thousands

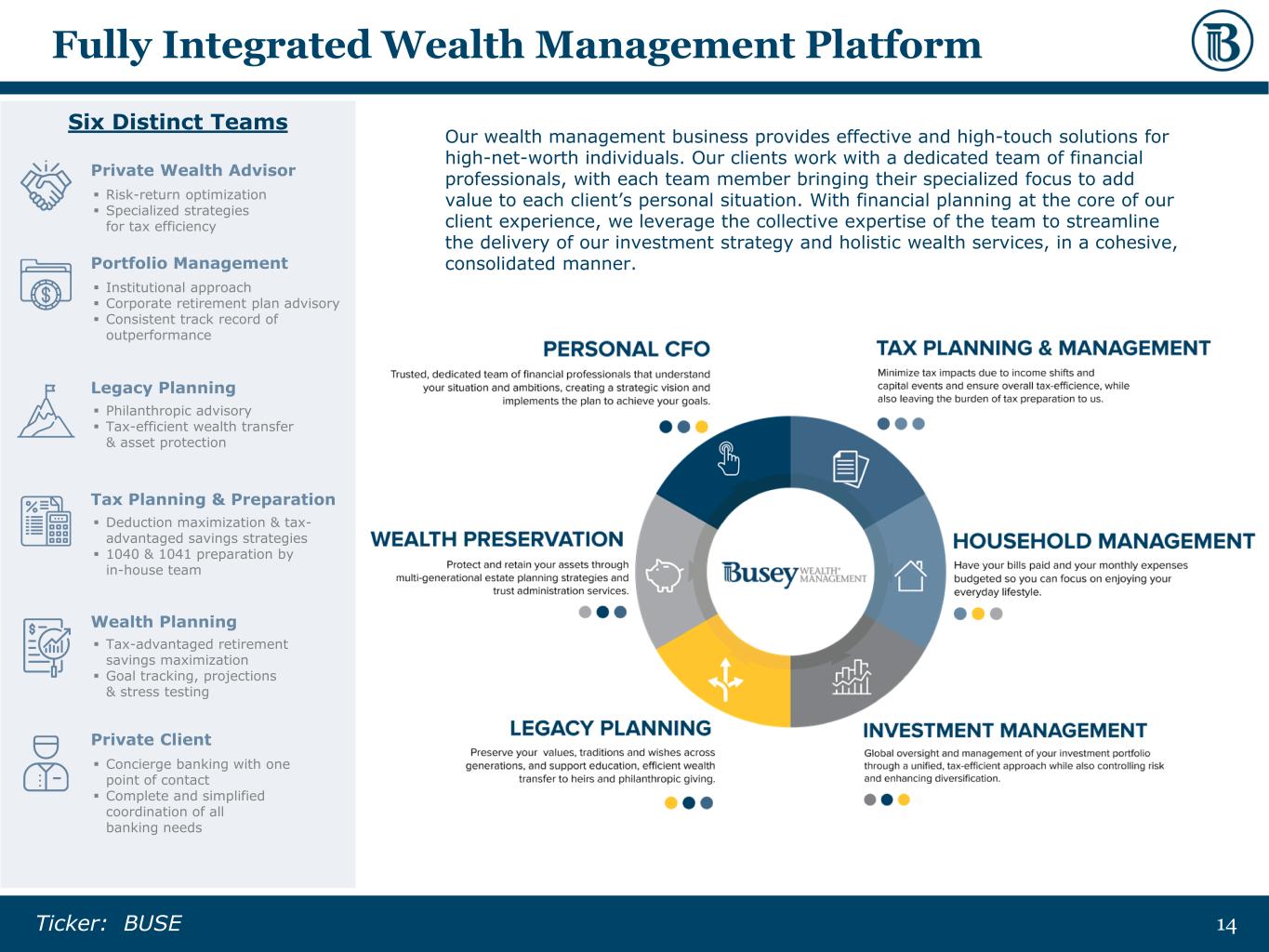

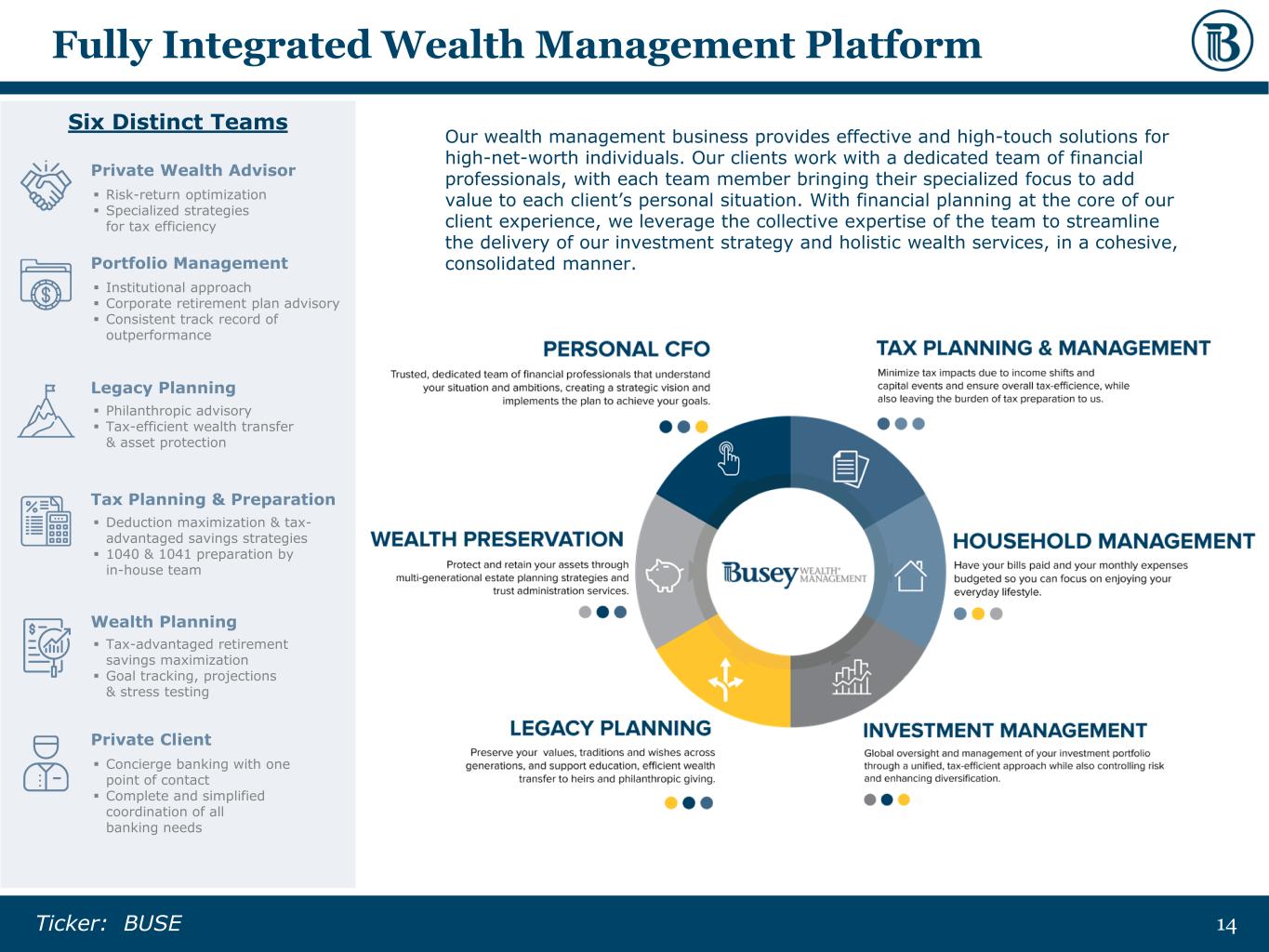

1414Ticker: BUSE Fully Integrated Wealth Management Platform Our wealth management business provides effective and high-touch solutions for high-net-worth individuals. Our clients work with a dedicated team of financial professionals, with each team member bringing their specialized focus to add value to each client’s personal situation. With financial planning at the core of our client experience, we leverage the collective expertise of the team to streamline the delivery of our investment strategy and holistic wealth services, in a cohesive, consolidated manner. Six Distinct Teams Private Wealth Advisor Wealth Planning Private Client Legacy Planning Tax Planning & Preparation Portfolio Management ▪ Concierge banking with one point of contact ▪ Complete and simplified coordination of all banking needs ▪ Tax-advantaged retirement savings maximization ▪ Goal tracking, projections & stress testing ▪ Deduction maximization & tax- advantaged savings strategies ▪ 1040 & 1041 preparation by in-house team ▪ Philanthropic advisory ▪ Tax-efficient wealth transfer & asset protection ▪ Institutional approach ▪ Corporate retirement plan advisory ▪ Consistent track record of outperformance ▪ Risk-return optimization ▪ Specialized strategies for tax efficiency

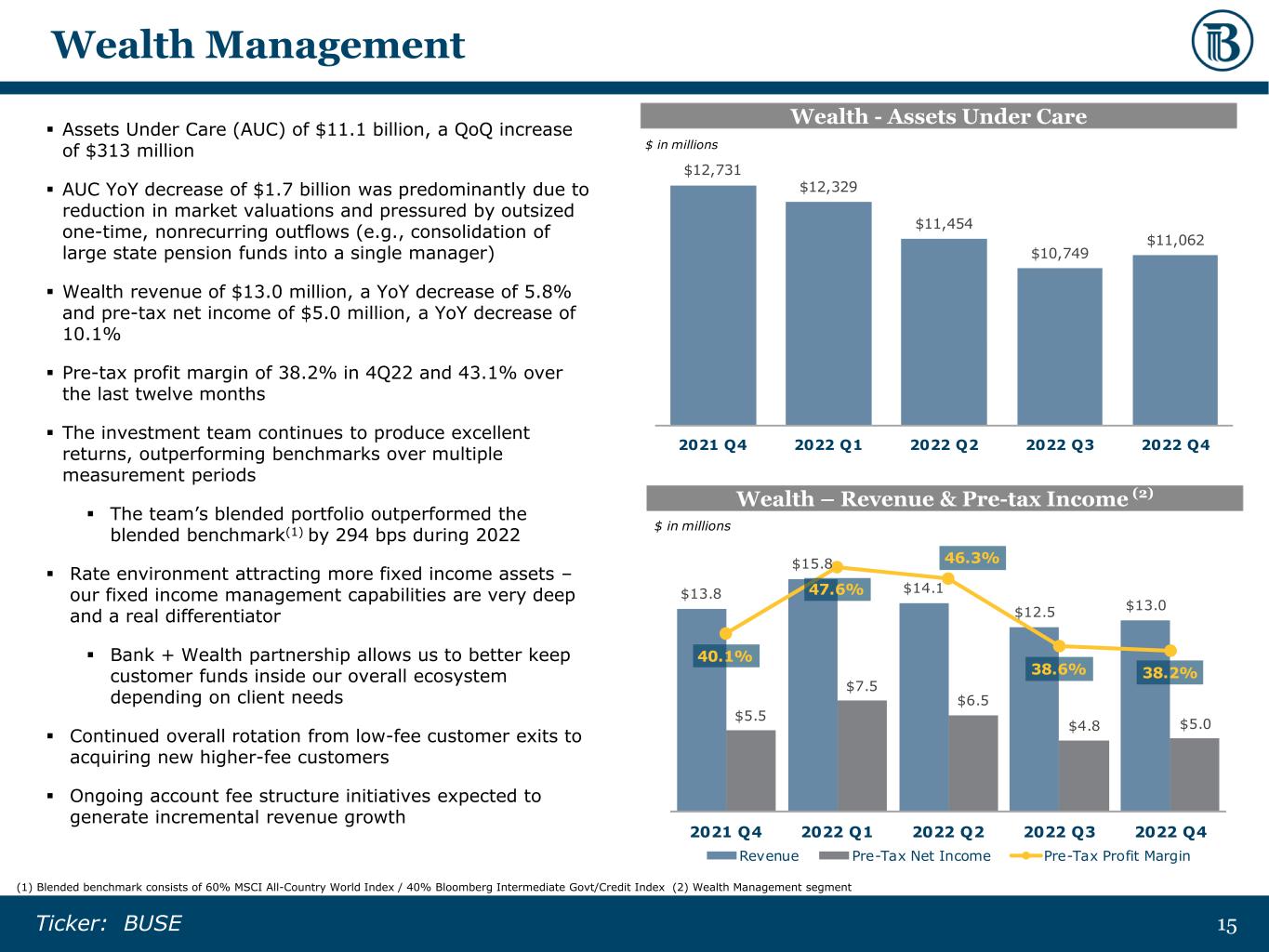

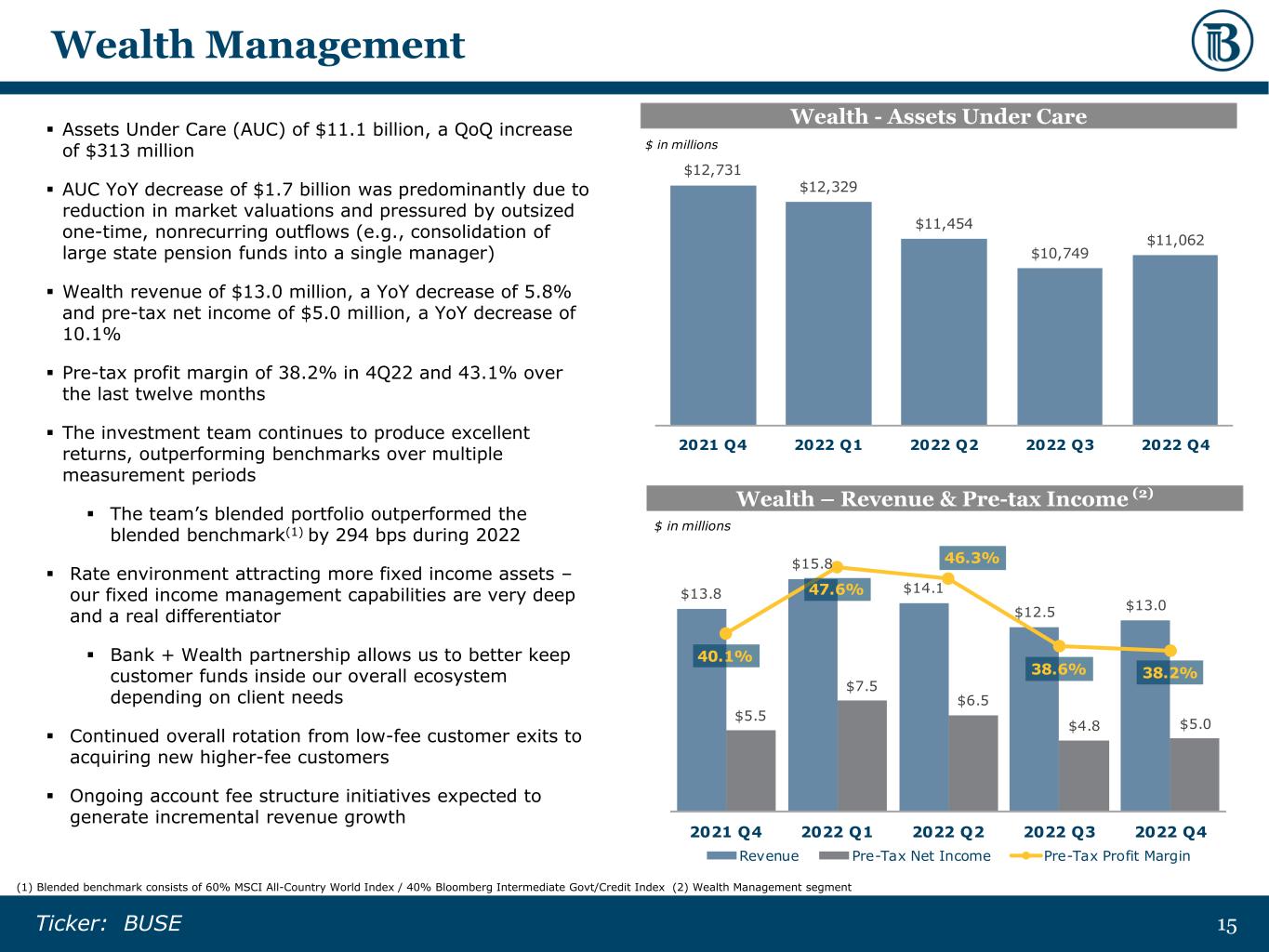

15 15Ticker: BUSE Wealth Management ▪ Assets Under Care (AUC) of $11.1 billion, a QoQ increase of $313 million ▪ AUC YoY decrease of $1.7 billion was predominantly due to reduction in market valuations and pressured by outsized one-time, nonrecurring outflows (e.g., consolidation of large state pension funds into a single manager) ▪ Wealth revenue of $13.0 million, a YoY decrease of 5.8% and pre-tax net income of $5.0 million, a YoY decrease of 10.1% ▪ Pre-tax profit margin of 38.2% in 4Q22 and 43.1% over the last twelve months ▪ The investment team continues to produce excellent returns, outperforming benchmarks over multiple measurement periods ▪ The team’s blended portfolio outperformed the blended benchmark(1) by 294 bps during 2022 ▪ Rate environment attracting more fixed income assets – our fixed income management capabilities are very deep and a real differentiator ▪ Bank + Wealth partnership allows us to better keep customer funds inside our overall ecosystem depending on client needs ▪ Continued overall rotation from low-fee customer exits to acquiring new higher-fee customers ▪ Ongoing account fee structure initiatives expected to generate incremental revenue growth (1) Blended benchmark consists of 60% MSCI All-Country World Index / 40% Bloomberg Intermediate Govt/Credit Index (2) Wealth Management segment Wealth - Assets Under Care Wealth – Revenue & Pre-tax Income (2) $12,731 $12,329 $11,454 $10,749 $11,062 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 $ in millions $13.8 $15.8 $14.1 $12.5 $13.0 $5.5 $7.5 $6.5 $4.8 $5.0 40.1% 47.6% 46.3% 38.6% 38.2% 20. 0% 25. 0% 30. 0% 35. 0% 40. 0% 45. 0% 50. 0% $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Revenue Pre-Tax Net Income Pre-Tax Profit Margin $ in millions

1616Ticker: BUSE Scalable Payment Technology Solutions Platform Renew & Expand Core Business Innovating for Growth BaaS Solution SMB Vertical ▪ Money movement that allows our customers to accelerate revenue realization ▪ Frictionless payments across FirsTech’s omnichannel, single vendor solution, online and offline ▪ Securely protects customers – FirsTech subject to Bank Regulatory Compliance and Audits ▪ Use the bank as a lab to build & perfect products for our customers ▪ Turnkey application that enables customers to move to an ecommerce platform & accept payments ▪ Strategy of leading with Merchant Processing equipment sales, then demonstrate value of upgrading to ecommerce platform to existing customers ▪ Out-of-the-box customized payment solution with attractive & adaptive UX ▪ Customers can offer white-labeled web & mobile platforms to their clients ▪ API connection to customer’s existing core for seamless integration ▪ Revenue generated from one-time setup fee, recurring SaaS fee, and revenue share per transaction above certain processing thresholds FirsTech’s customized payments platform Primary Core Verticals – Highly Regulated Industries Utilities Insurance Community Banks & Credit Unions Telecom Primary BaaS Vertical Municipalities

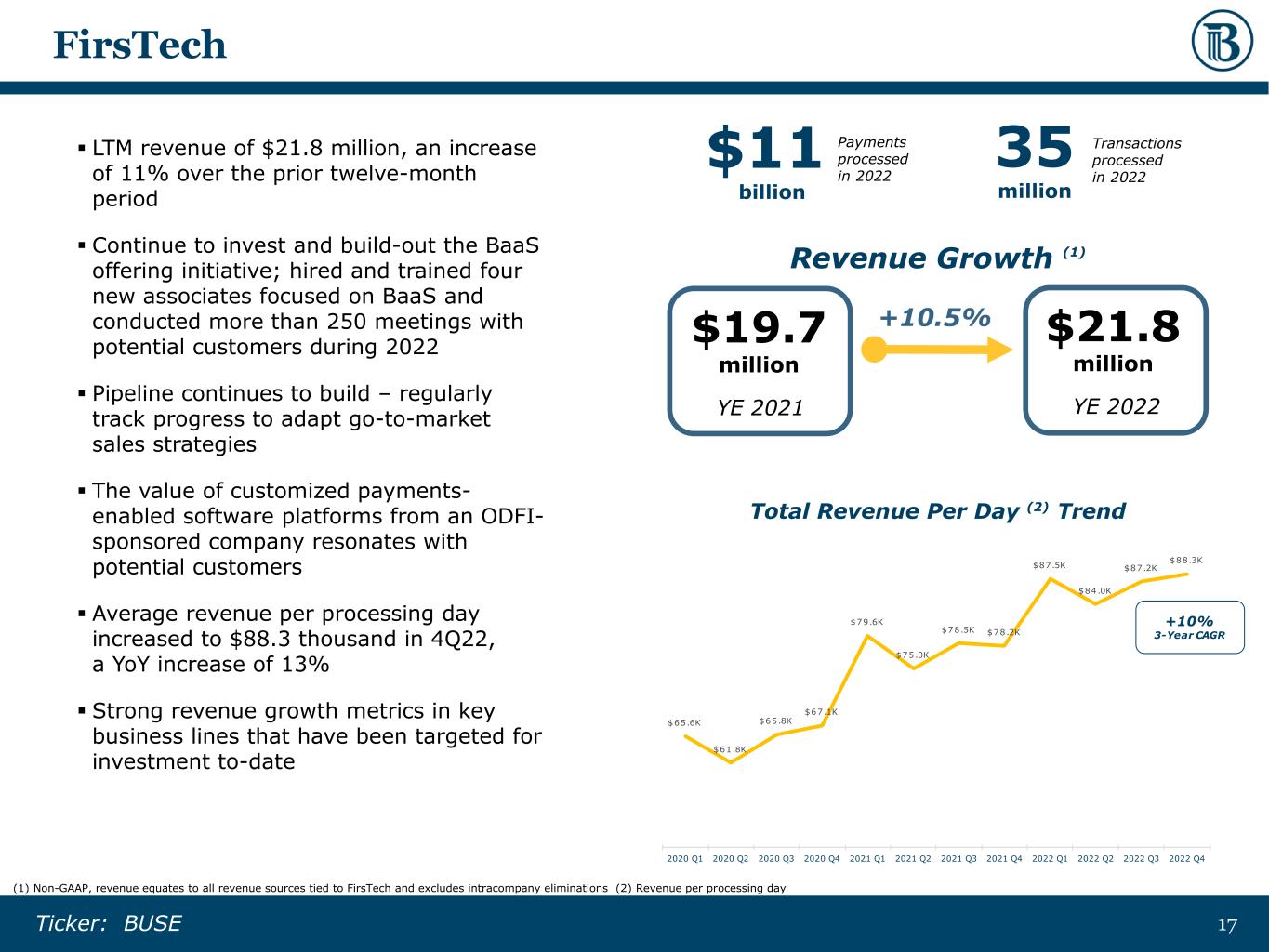

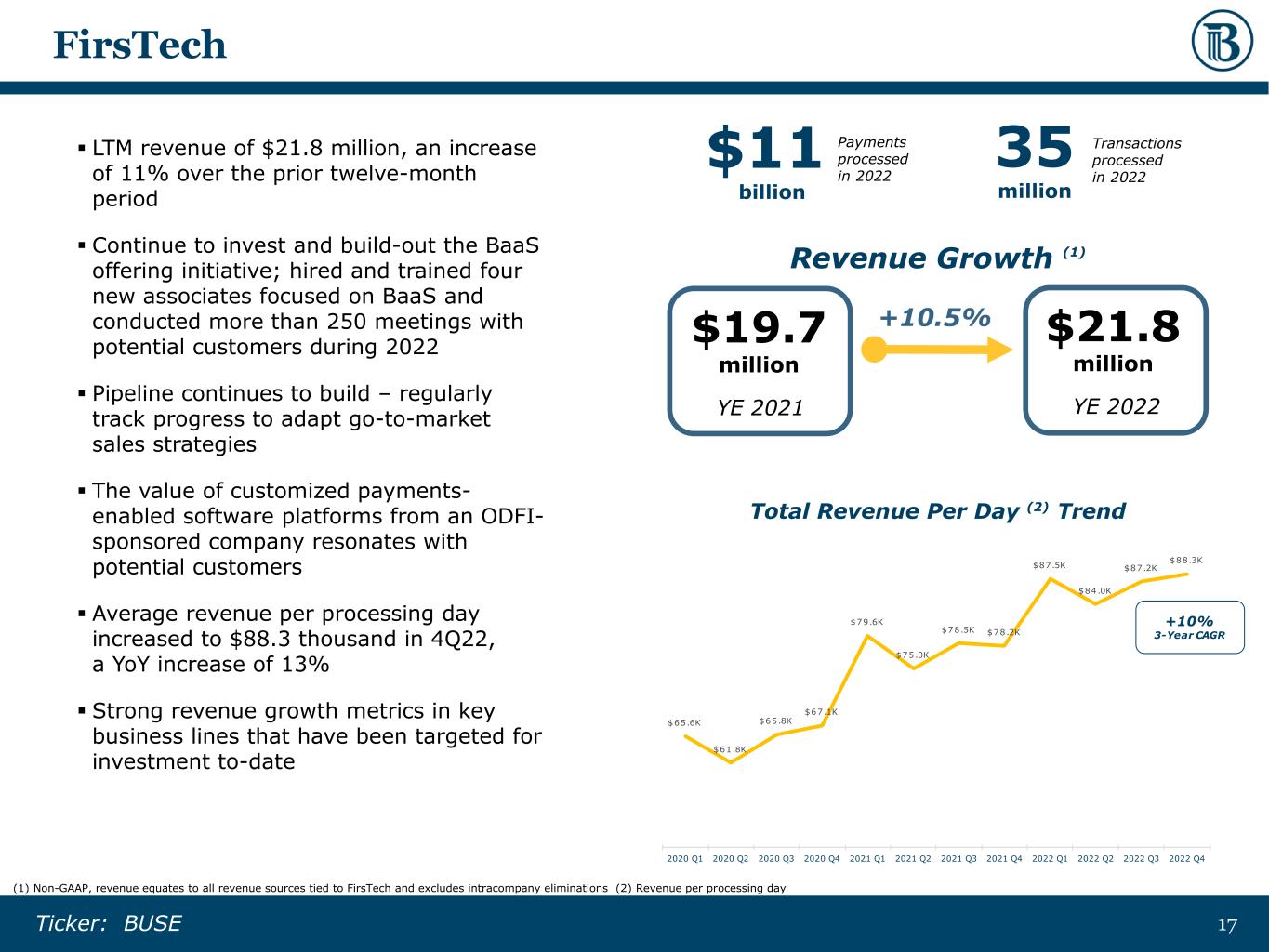

17 17Ticker: BUSE $65.6K $61.8K $65.8K $67.1K $79.6K $75.0K $78.5K $78.2K $87.5K $84.0K $87.2K $88.3K $50,000 $55,000 $60,000 $65,000 $70,000 $75,000 $80,000 $85,000 $90,000 $95,000 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 +10% 3-Year CAGR FirsTech ▪ LTM revenue of $21.8 million, an increase of 11% over the prior twelve-month period ▪ Continue to invest and build-out the BaaS offering initiative; hired and trained four new associates focused on BaaS and conducted more than 250 meetings with potential customers during 2022 ▪ Pipeline continues to build – regularly track progress to adapt go-to-market sales strategies ▪ The value of customized payments- enabled software platforms from an ODFI- sponsored company resonates with potential customers ▪ Average revenue per processing day increased to $88.3 thousand in 4Q22, a YoY increase of 13% ▪ Strong revenue growth metrics in key business lines that have been targeted for investment to-date (1) Non-GAAP, revenue equates to all revenue sources tied to FirsTech and excludes intracompany eliminations (2) Revenue per processing day Revenue Growth (1) YE 2021 YE 2022 $21.8 million +10.5%$19.7 million Transactions processed in 2022 35 million $11 billion Payments processed in 2022 Total Revenue Per Day (2) Trend

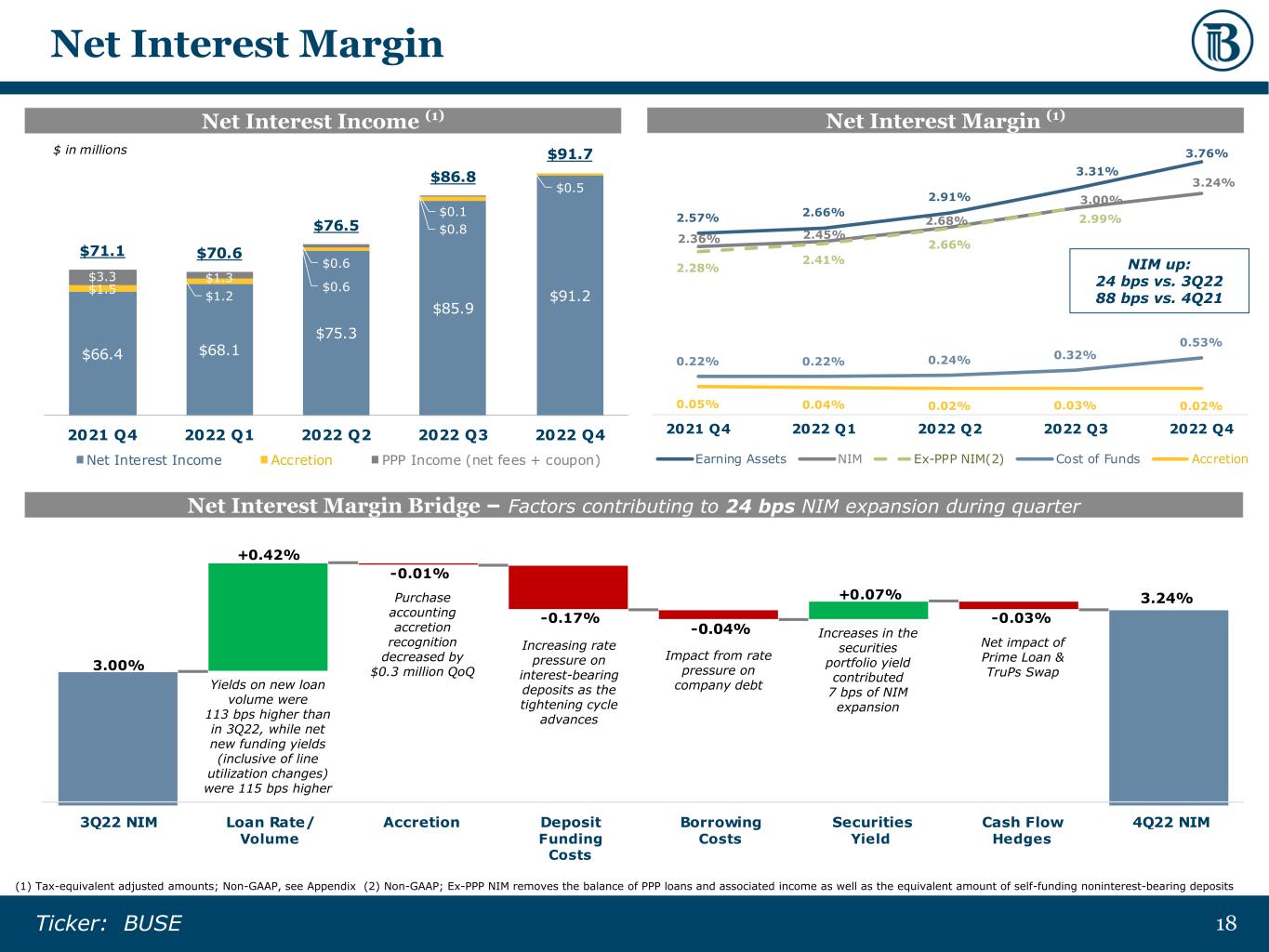

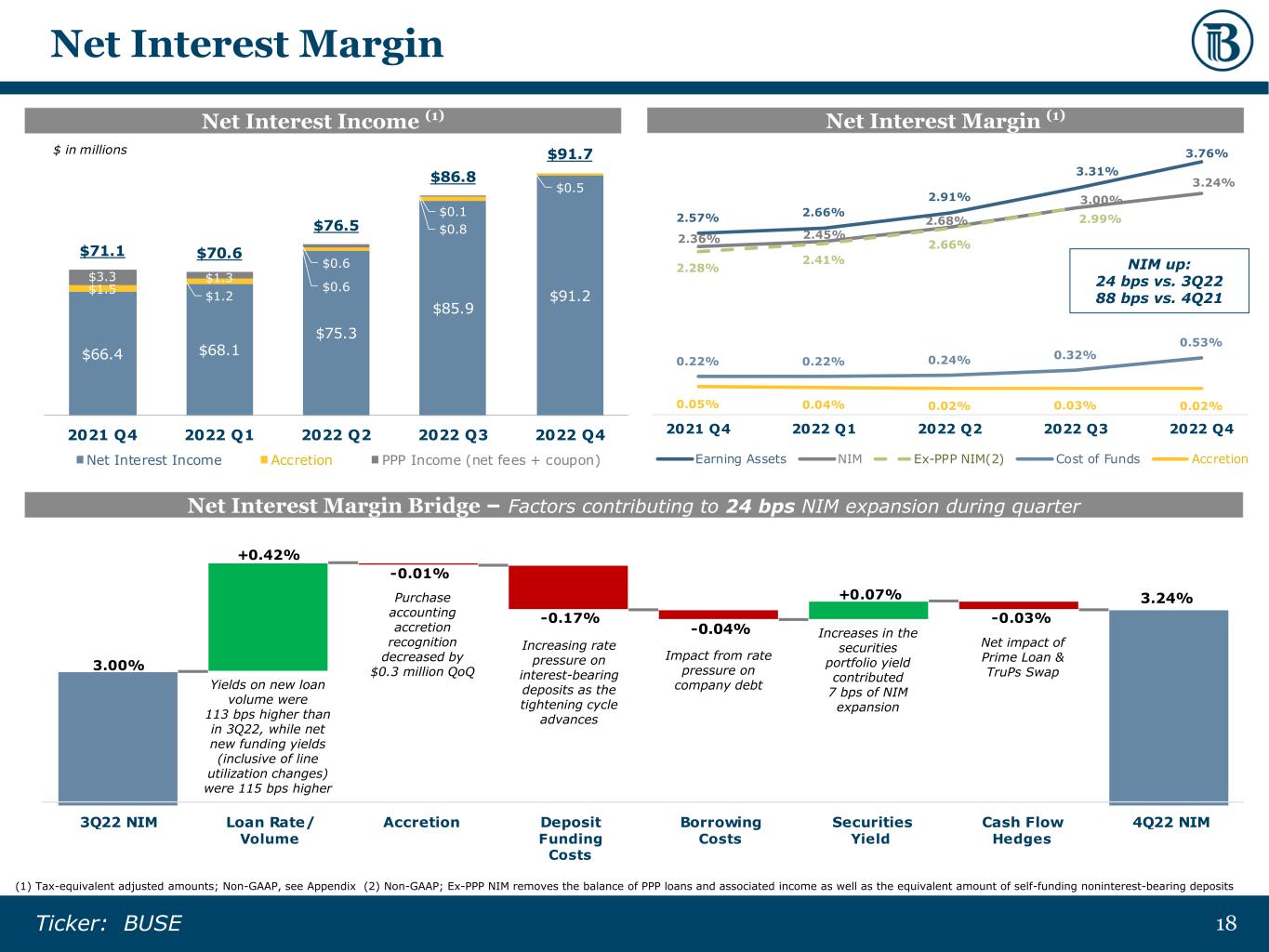

1818Ticker: BUSE $66.4 $68.1 $75.3 $85.9 $91.2 $1.5 $1.2 $0.6 $0.8 $0.5 $3.3 $1.3 $0.6 $0.1 $71.1 $70.6 $76.5 $86.8 $91.7 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Net Interest Income Accretion PPP Income (net fees + coupon) $ in millions 2.57% 2.66% 2.91% 3.31% 3.76% 2.36% 2.45% 2.68% 3.00% 3.24% 2.28% 2.41% 2.66% 2.99% 0.22% 0.22% 0.24% 0.32% 0.53% 0.05% 0.04% 0.02% 0.03% 0.02% 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Earning Assets NIM Ex-PPP NIM(2) Cost of Funds Accretion Net Interest Margin Net Interest Margin Bridge – Factors contributing to 24 bps NIM expansion during quarter (1) Tax-equivalent adjusted amounts; Non-GAAP, see Appendix (2) Non-GAAP; Ex-PPP NIM removes the balance of PPP loans and associated income as well as the equivalent amount of self-funding noninterest-bearing deposits Net Interest Margin (1)Net Interest Income (1) NIM up: 24 bps vs. 3Q22 88 bps vs. 4Q21 3.24% Yields on new loan volume were 113 bps higher than in 3Q22, while net new funding yields (inclusive of line utilization changes) were 115 bps higher Purchase accounting accretion recognition decreased by $0.3 million QoQ Increases in the securities portfolio yield contributed 7 bps of NIM expansion Increasing rate pressure on interest-bearing deposits as the tightening cycle advances Net impact of Prime Loan & TruPs Swap Impact from rate pressure on company debt

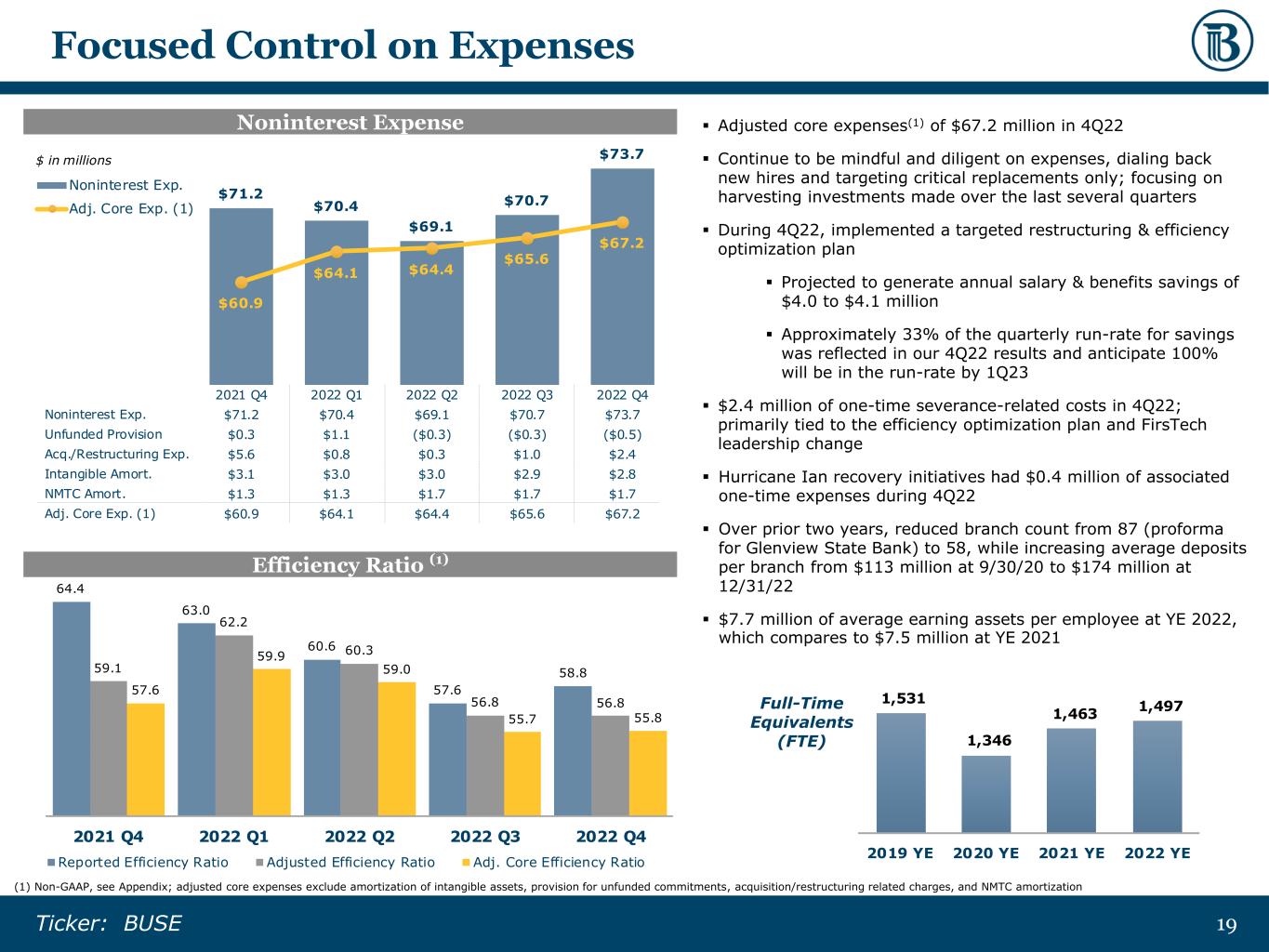

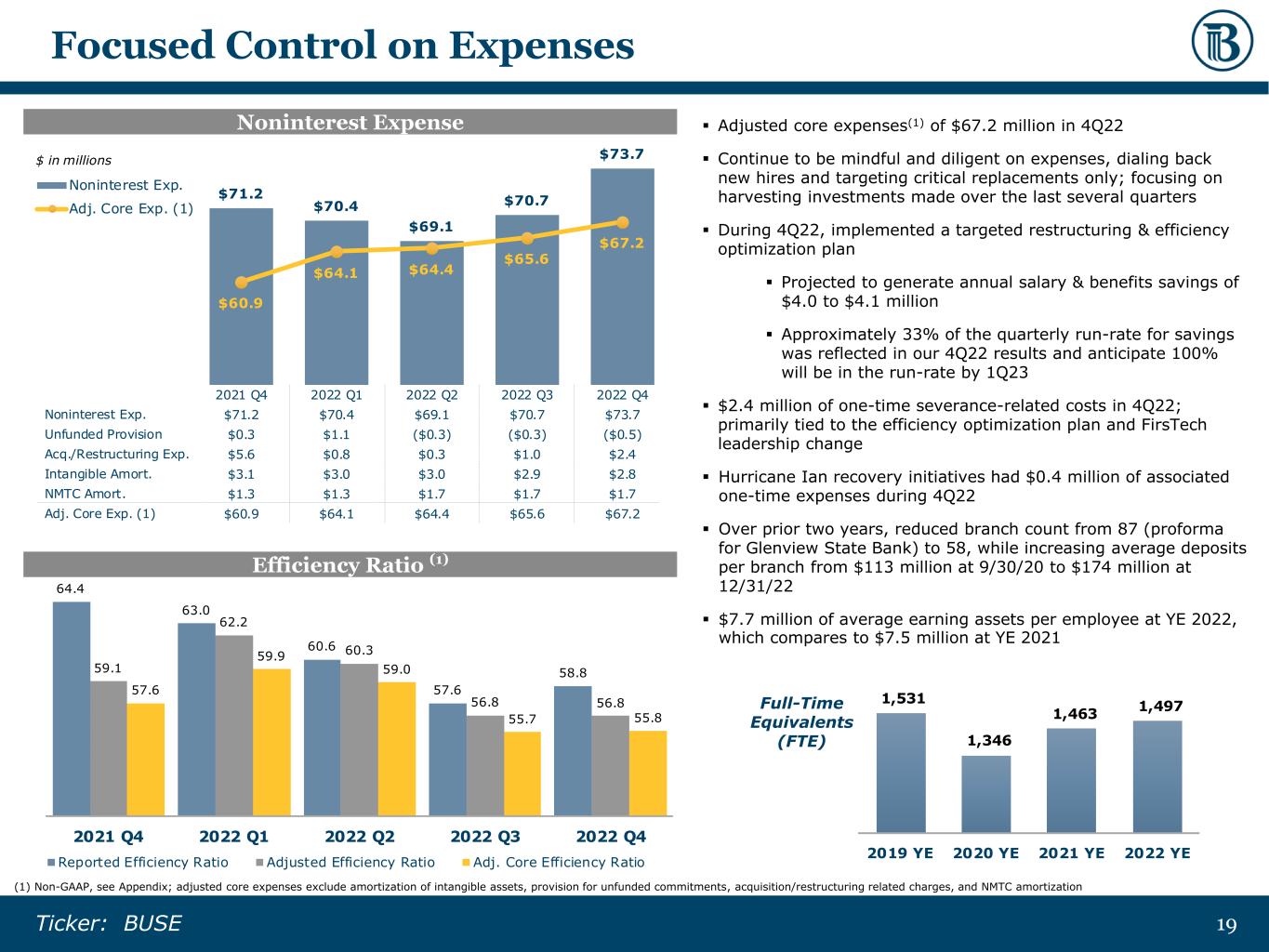

1919Ticker: BUSE 64.4 63.0 60.6 57.6 58.859.1 62.2 60.3 56.8 56.8 57.6 59.9 59.0 55.7 55.8 50.0 52.0 54.0 56.0 58.0 60.0 62.0 64.0 66.0 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Reported Efficiency Ratio Adjusted Efficiency Ratio Adj. Core Efficiency Ratio $71.2 $70.4 $69.1 $70.7 $73.7 $60.9 $64.1 $64.4 $65.6 $67.2 $50.0 $55.0 $60.0 $65.0 $70.0 $75.0 $60.0 $62.0 $64.0 $66.0 $68.0 $70.0 $72.0 $74.0 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Noninterest Exp. $71.2 $70.4 $69.1 $70.7 $73.7 Unfunded Provision $0.3 $1.1 ($0.3) ($0.3) ($0.5) Acq./Restructuring Exp. $5.6 $0.8 $0.3 $1.0 $2.4 Intangible Amort. $3.1 $3.0 $3.0 $2.9 $2.8 NMTC Amort. $1.3 $1.3 $1.7 $1.7 $1.7 Adj. Core Exp. (1) $60.9 $64.1 $64.4 $65.6 $67.2 Noninterest Exp. Adj. Core Exp. (1) $ in millions 1,531 1,346 1,463 1,497 2019 YE 2020 YE 2021 YE 2022 YE Focused Control on Expenses (1) Non-GAAP, see Appendix; adjusted core expenses exclude amortization of intangible assets, provision for unfunded commitments, acquisition/restructuring related charges, and NMTC amortization ▪ Adjusted core expenses(1) of $67.2 million in 4Q22 ▪ Continue to be mindful and diligent on expenses, dialing back new hires and targeting critical replacements only; focusing on harvesting investments made over the last several quarters ▪ During 4Q22, implemented a targeted restructuring & efficiency optimization plan ▪ Projected to generate annual salary & benefits savings of $4.0 to $4.1 million ▪ Approximately 33% of the quarterly run-rate for savings was reflected in our 4Q22 results and anticipate 100% will be in the run-rate by 1Q23 ▪ $2.4 million of one-time severance-related costs in 4Q22; primarily tied to the efficiency optimization plan and FirsTech leadership change ▪ Hurricane Ian recovery initiatives had $0.4 million of associated one-time expenses during 4Q22 ▪ Over prior two years, reduced branch count from 87 (proforma for Glenview State Bank) to 58, while increasing average deposits per branch from $113 million at 9/30/20 to $174 million at 12/31/22 ▪ $7.7 million of average earning assets per employee at YE 2022, which compares to $7.5 million at YE 2021 Noninterest Expense Efficiency Ratio (1) Full-Time Equivalents (FTE)

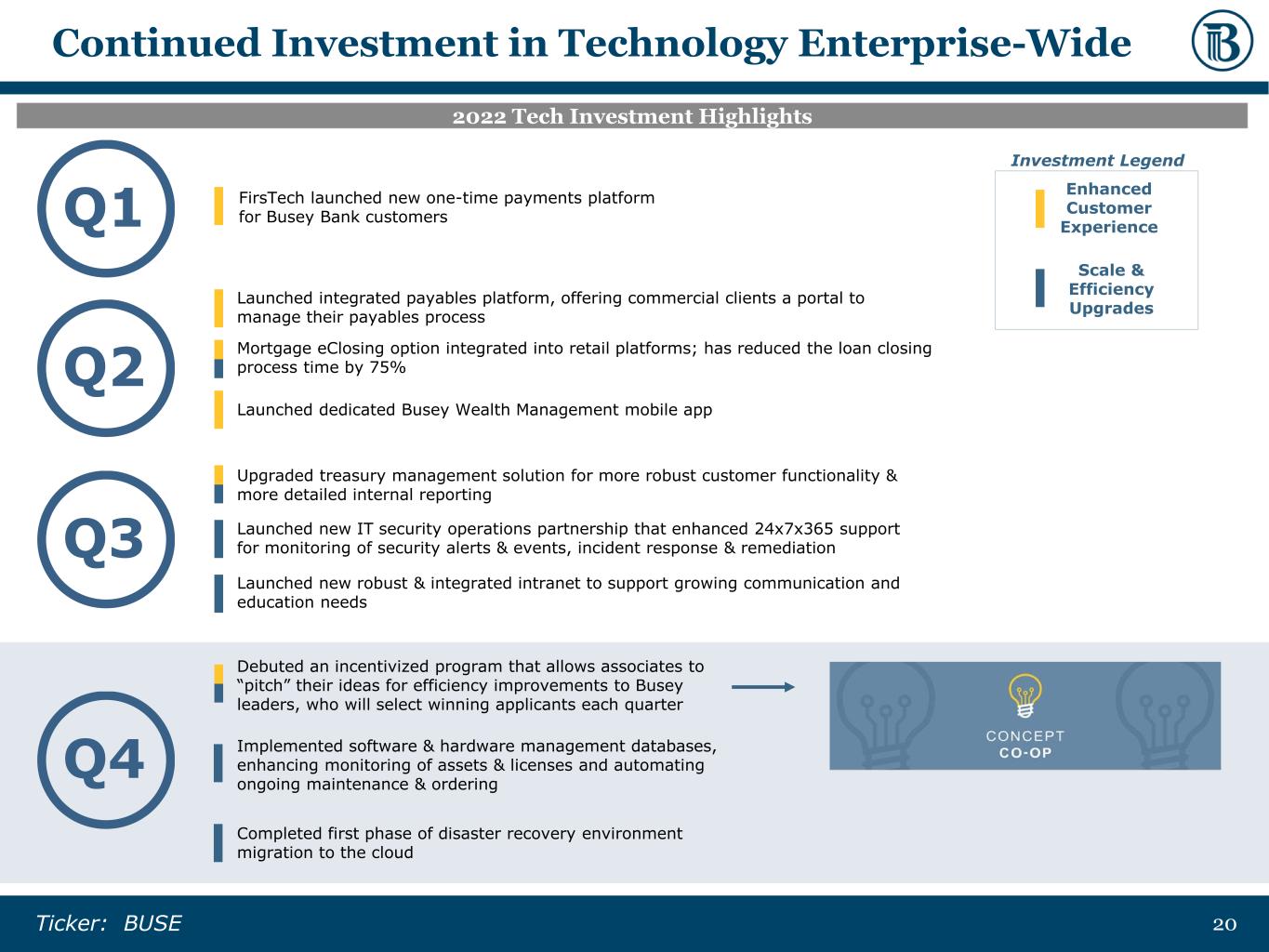

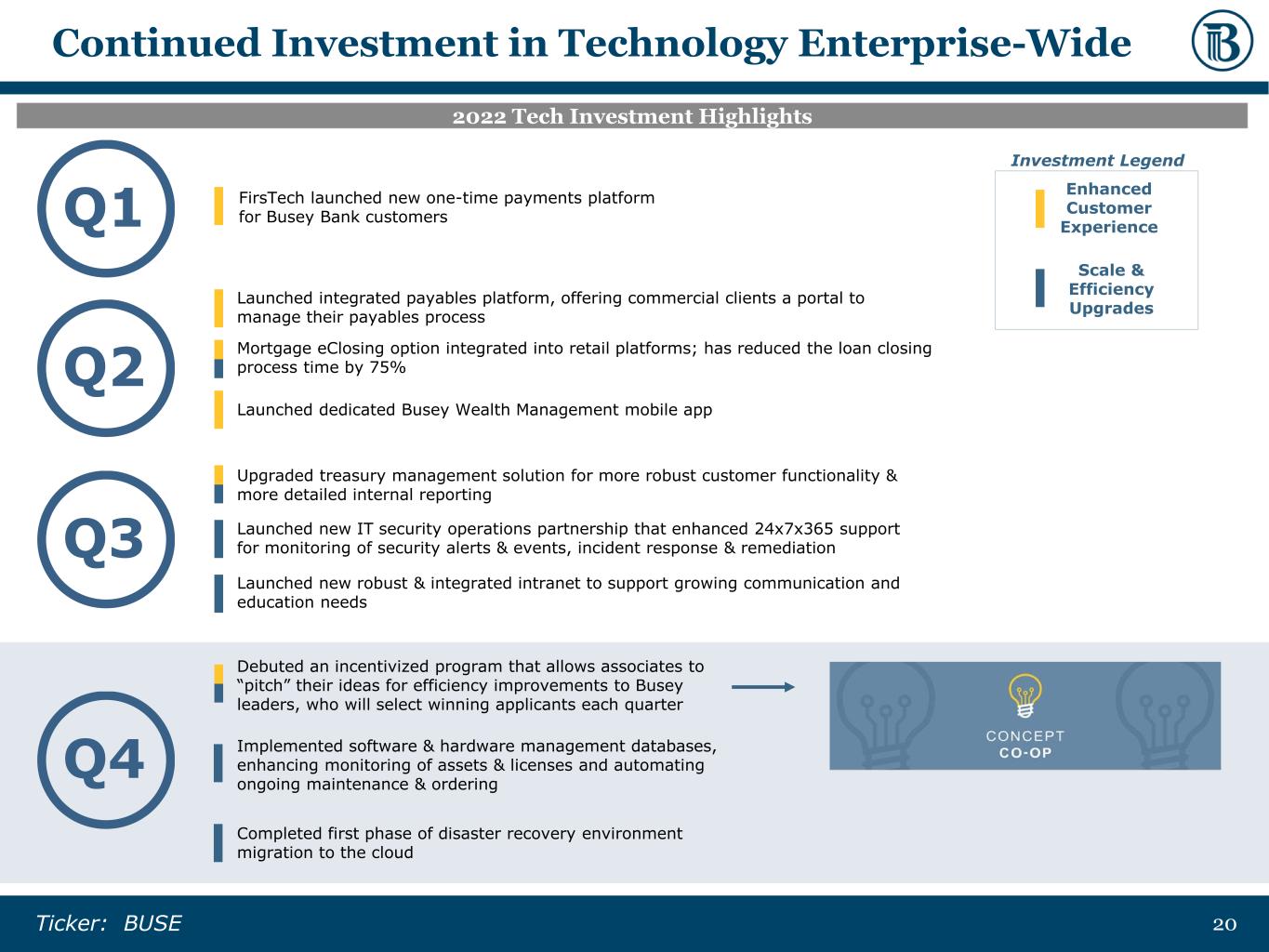

2020Ticker: BUSE Implemented software & hardware management databases, enhancing monitoring of assets & licenses and automating ongoing maintenance & ordering Continued Investment in Technology Enterprise-Wide Launched dedicated Busey Wealth Management mobile app FirsTech launched new one-time payments platform for Busey Bank customers 2022 Tech Investment Highlights Enhanced Customer Experience Investment Legend Launched integrated payables platform, offering commercial clients a portal to manage their payables process Upgraded treasury management solution for more robust customer functionality & more detailed internal reporting Scale & Efficiency Upgrades Launched new robust & integrated intranet to support growing communication and education needs Launched new IT security operations partnership that enhanced 24x7x365 support for monitoring of security alerts & events, incident response & remediation Mortgage eClosing option integrated into retail platforms; has reduced the loan closing process time by 75% Debuted an incentivized program that allows associates to “pitch” their ideas for efficiency improvements to Busey leaders, who will select winning applicants each quarter Completed first phase of disaster recovery environment migration to the cloud

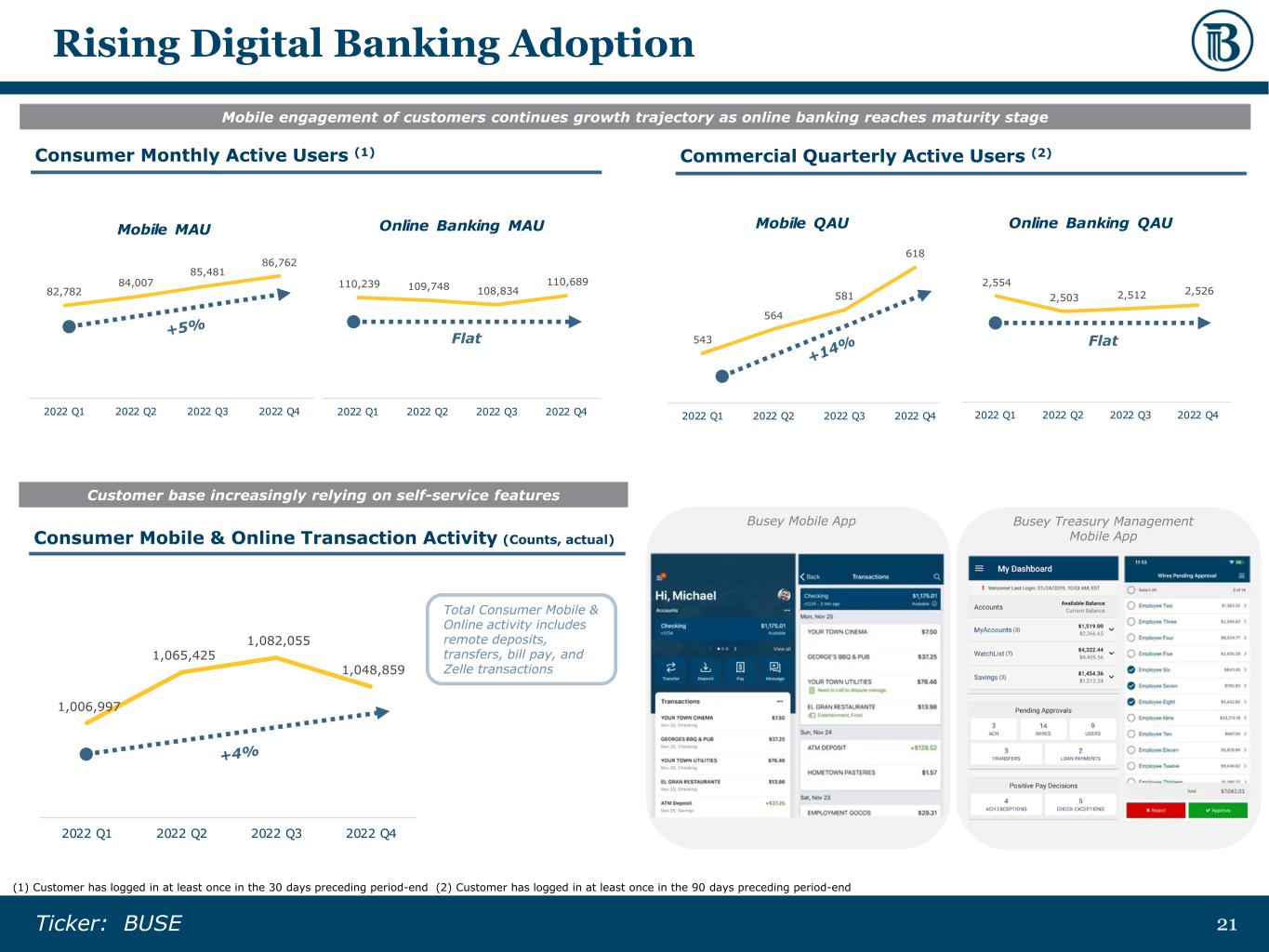

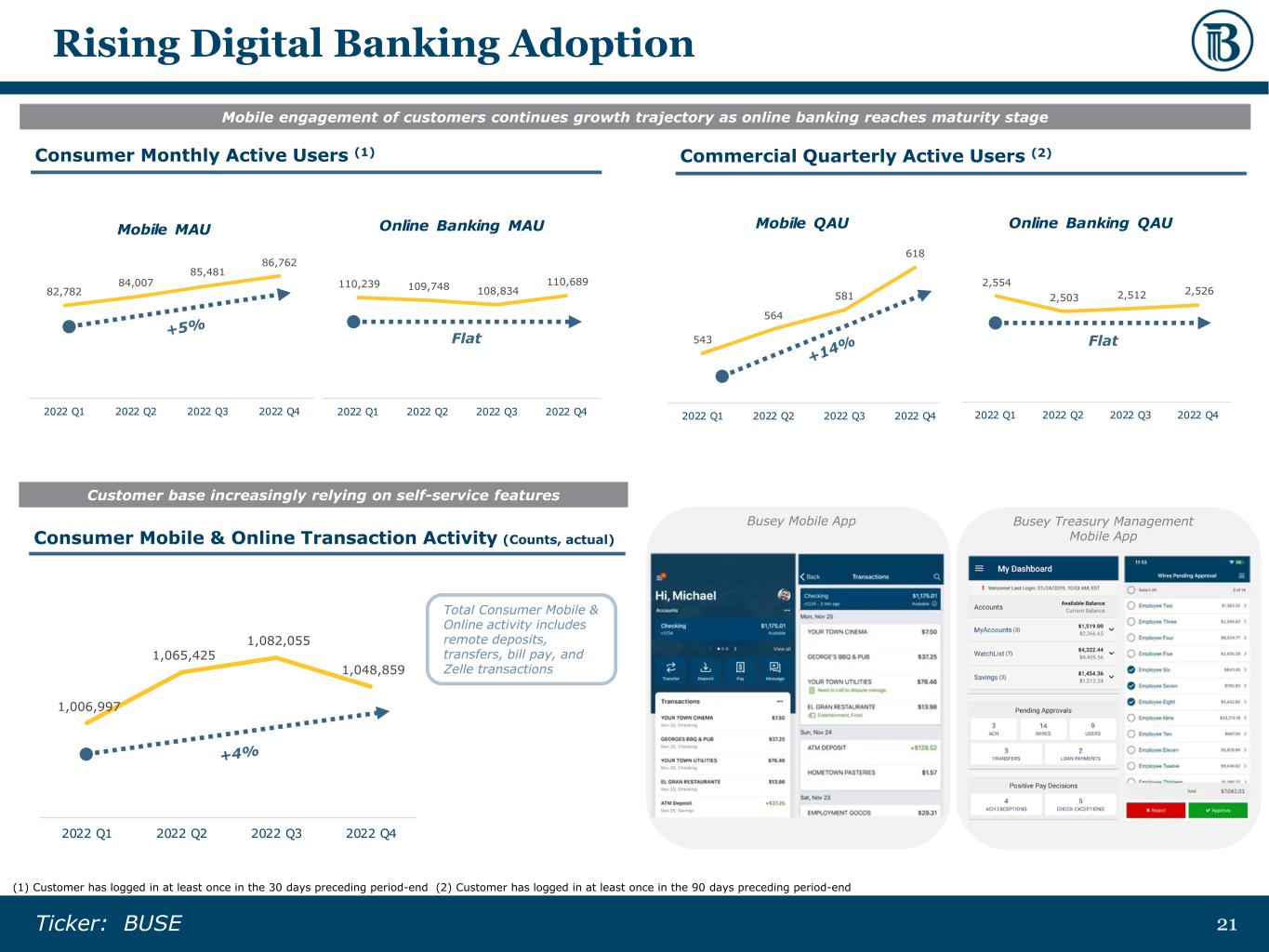

2121Ticker: BUSE 1,006,997 1,065,425 1,082,055 1,048,859 900,000 950,000 1,000,000 1,050,000 1,100,000 1,150,000 2022 Q1 2022 Q2 2022 Q3 2022 Q4 543 564 581 618 500 520 540 560 580 600 620 640 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Mobile QAU 2,554 2,503 2,512 2,526 2,200 2,250 2,300 2,350 2,400 2,450 2,500 2,550 2,600 2,650 2,700 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Online Banking QAU 110,239 109,748 108,834 110,689 90,00 95,00 100, 00 105, 00 110, 00 115, 00 120, 00 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Online Banking MAU 82,782 84,007 85,481 86,762 70,000 72,000 74,000 76,000 78,000 80,000 82,000 84,000 86,000 88,000 90,000 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Mobile MAU Total Consumer Mobile & Online activity includes remote deposits, transfers, bill pay, and Zelle transactions Rising Digital Banking Adoption Customer base increasingly relying on self-service features (1) Customer has logged in at least once in the 30 days preceding period-end (2) Customer has logged in at least once in the 90 days preceding period-end Consumer Monthly Active Users (1) Commercial Quarterly Active Users (2) Consumer Mobile & Online Transaction Activity (Counts, actual) Mobile engagement of customers continues growth trajectory as online banking reaches maturity stage Flat Busey Mobile App Busey Treasury Management Mobile App Flat

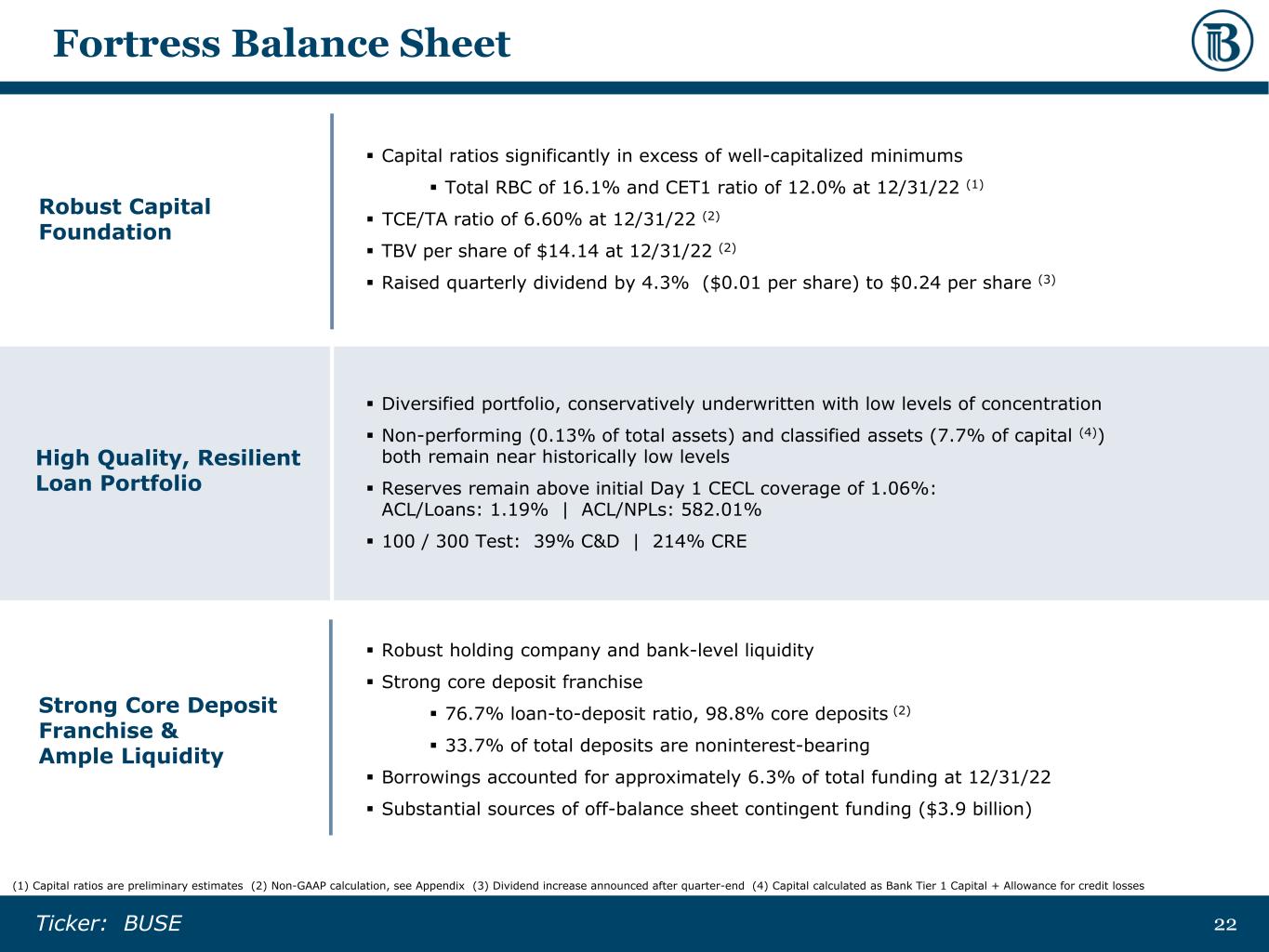

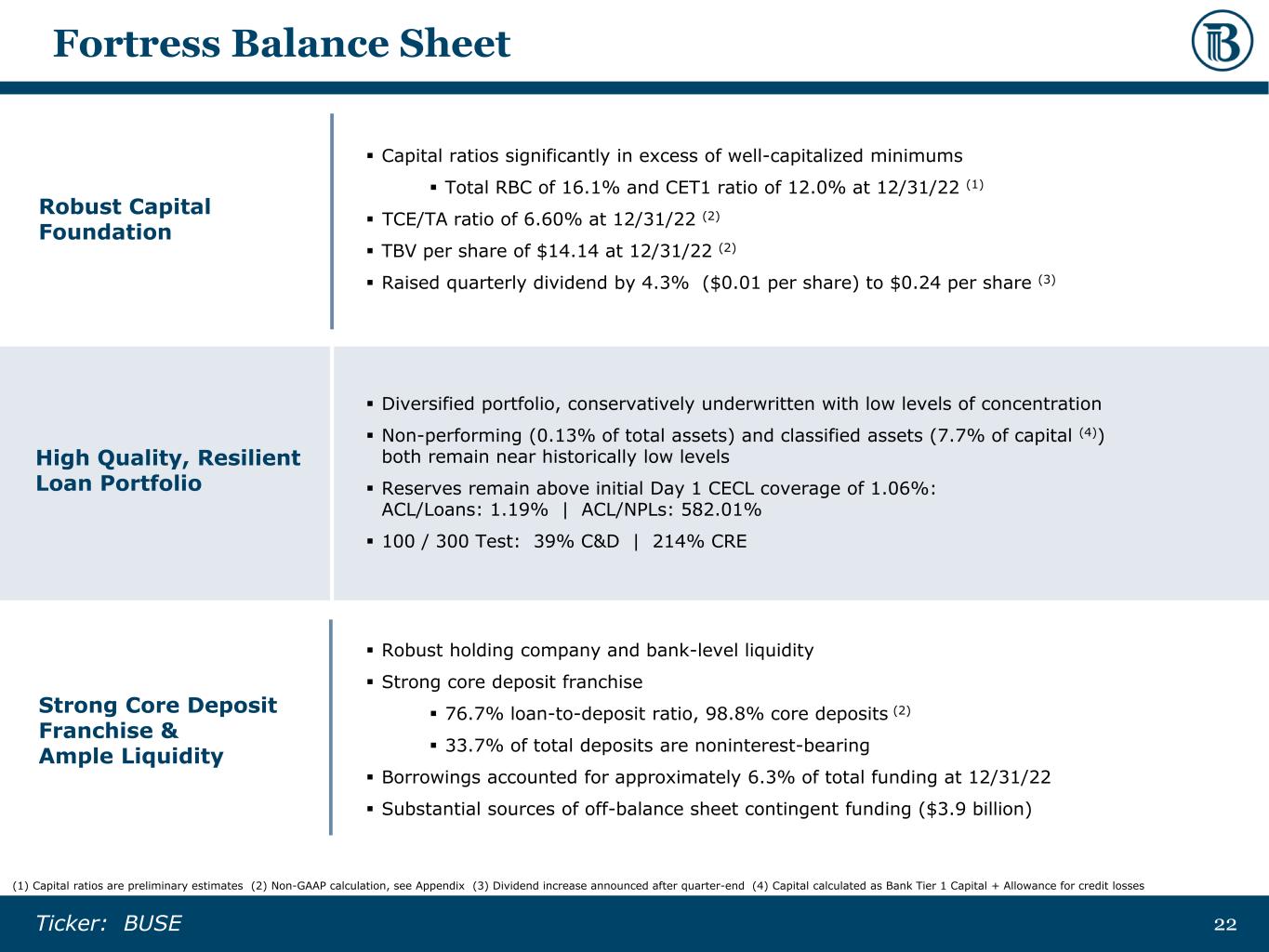

2222Ticker: BUSE ▪ Capital ratios significantly in excess of well-capitalized minimums ▪ Total RBC of 16.1% and CET1 ratio of 12.0% at 12/31/22 (1) ▪ TCE/TA ratio of 6.60% at 12/31/22 (2) ▪ TBV per share of $14.14 at 12/31/22 (2) ▪ Raised quarterly dividend by 4.3% ($0.01 per share) to $0.24 per share (3) Robust Capital Foundation High Quality, Resilient Loan Portfolio ▪ Diversified portfolio, conservatively underwritten with low levels of concentration ▪ Non-performing (0.13% of total assets) and classified assets (7.7% of capital (4)) both remain near historically low levels ▪ Reserves remain above initial Day 1 CECL coverage of 1.06%: ACL/Loans: 1.19% | ACL/NPLs: 582.01% ▪ 100 / 300 Test: 39% C&D | 214% CRE ▪ Robust holding company and bank-level liquidity ▪ Strong core deposit franchise ▪ 76.7% loan-to-deposit ratio, 98.8% core deposits (2) ▪ 33.7% of total deposits are noninterest-bearing ▪ Borrowings accounted for approximately 6.3% of total funding at 12/31/22 ▪ Substantial sources of off-balance sheet contingent funding ($3.9 billion) Strong Core Deposit Franchise & Ample Liquidity Fortress Balance Sheet (1) Capital ratios are preliminary estimates (2) Non-GAAP calculation, see Appendix (3) Dividend increase announced after quarter-end (4) Capital calculated as Bank Tier 1 Capital + Allowance for credit losses

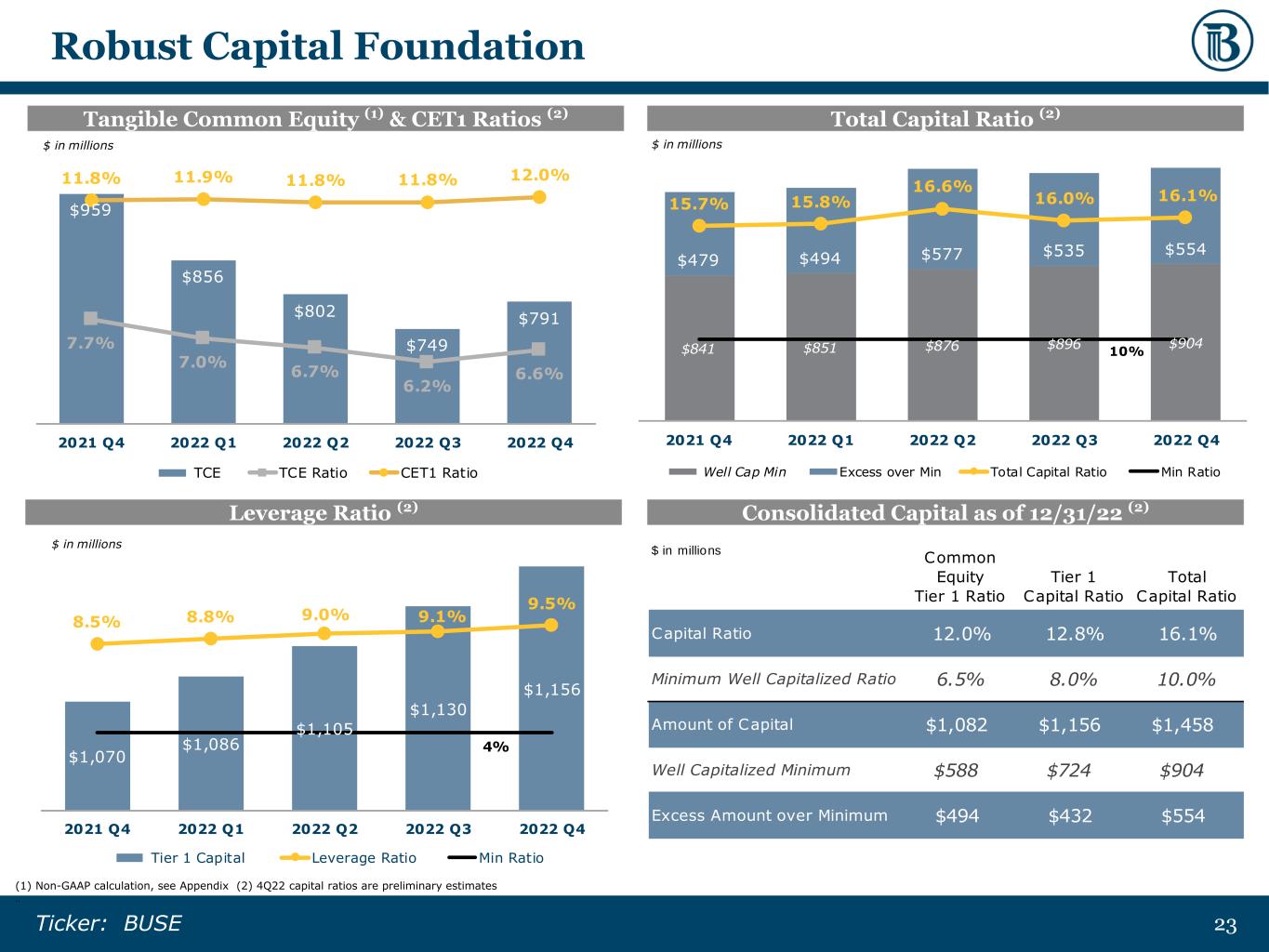

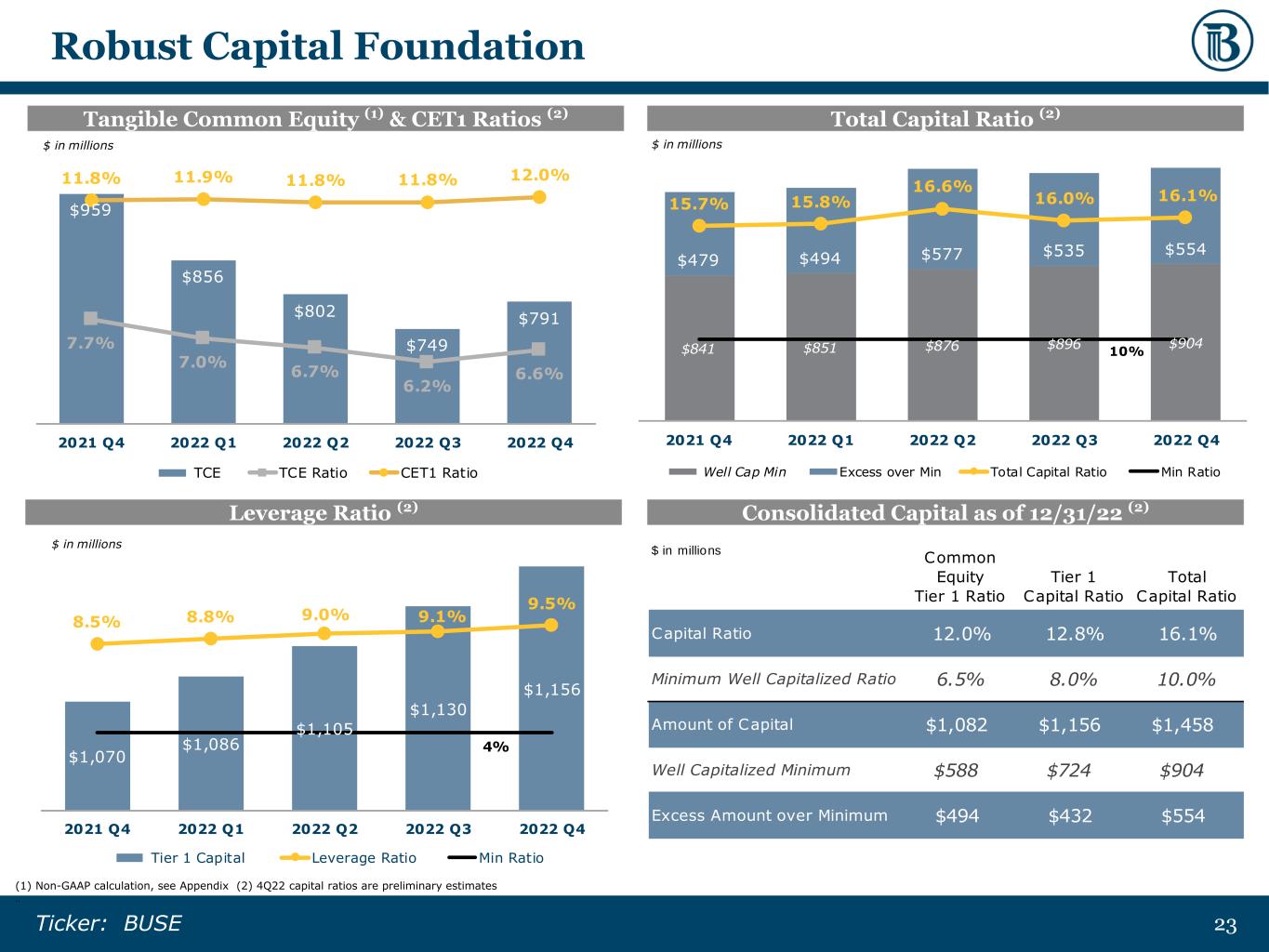

2323Ticker: BUSE $841 $851 $876 $896 $904 $479 $494 $577 $535 $554 15.7% 15.8% 16.6% 16.0% 16.1% 10% 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Well Cap Min Excess over Min Total Capital Ratio Min Ratio $ in millions $1,070 $1,086 $1,105 $1,130 $1,156 8.5% 8.8% 9.0% 9.1% 9.5% 4% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% $1,000 $1,020 $1,040 $1,060 $1,080 $1,100 $1,120 $1,140 $1,160 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Tier 1 Capital Leverage Ratio Min Ratio $ in millions $959 $856 $802 $749 $791 7.7% 7.0% 6.7% 6.2% 6.6% 11.8% 11.9% 11.8% 11.8% 12.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10. 0% 11. 0% 12. 0% 13. 0% $600 $650 $700 $750 $800 $850 $900 $950 $1, 000 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 TCE TCE Ratio CET1 Ratio $ in millions Robust Capital Foundation (1) Non-GAAP calculation, see Appendix (2) 4Q22 capital ratios are preliminary estimates .. Tangible Common Equity (1) & CET1 Ratios (2) Total Capital Ratio (2) Leverage Ratio (2) Consolidated Capital as of 12/31/22 (2) $ in millions Common Equity Tier 1 Ratio Tier 1 Capital Ratio Total Capital Ratio Capital Ratio 12.0% 12.8% 16.1% Minimum Well Capitalized Ratio 6.5% 8.0% 10.0% Amount of Capital $1,082 $1,156 $1,458 Well Capitalized Minimum $588 $724 $904 Excess Amount over Minimum $494 $432 $554

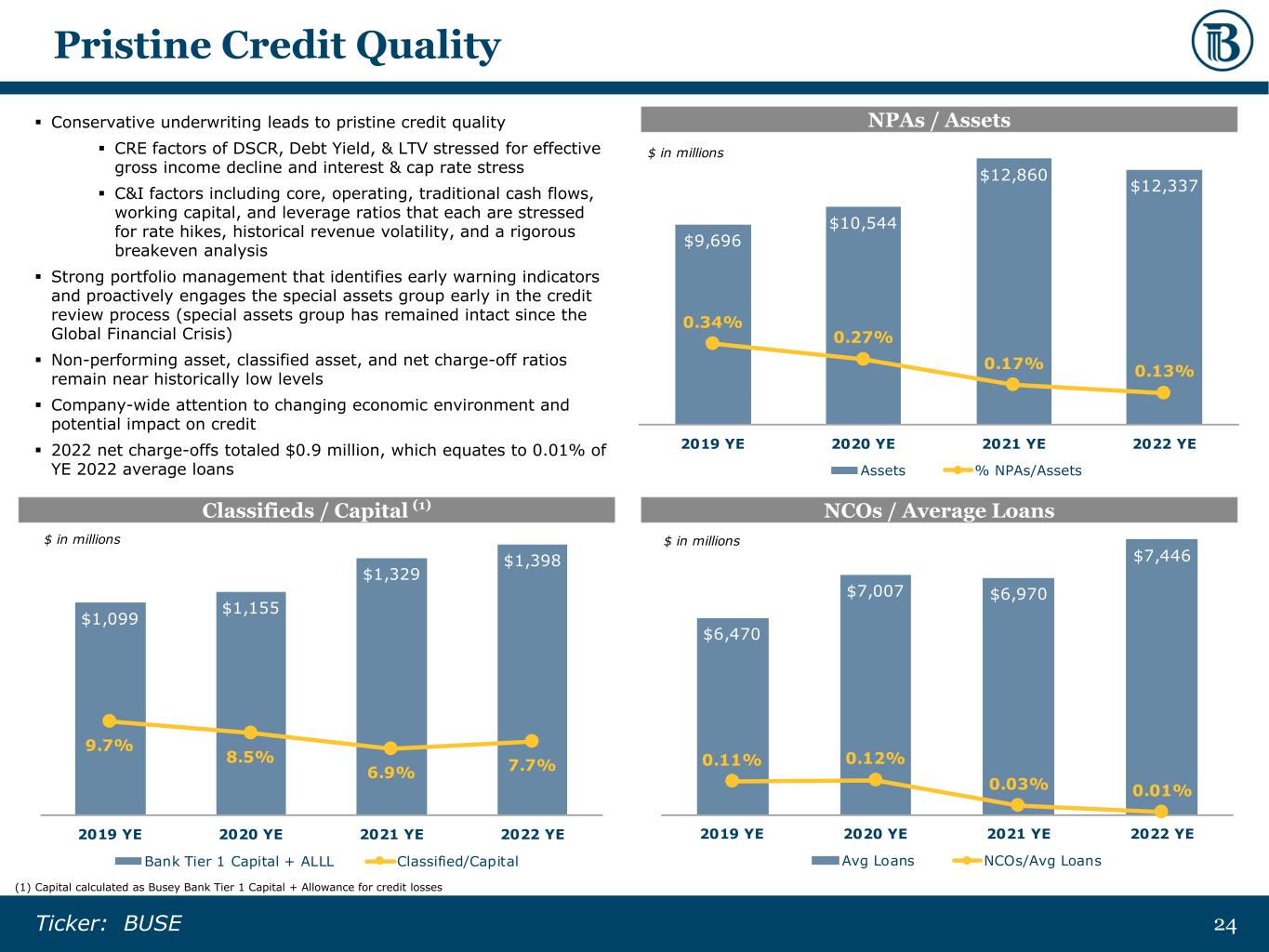

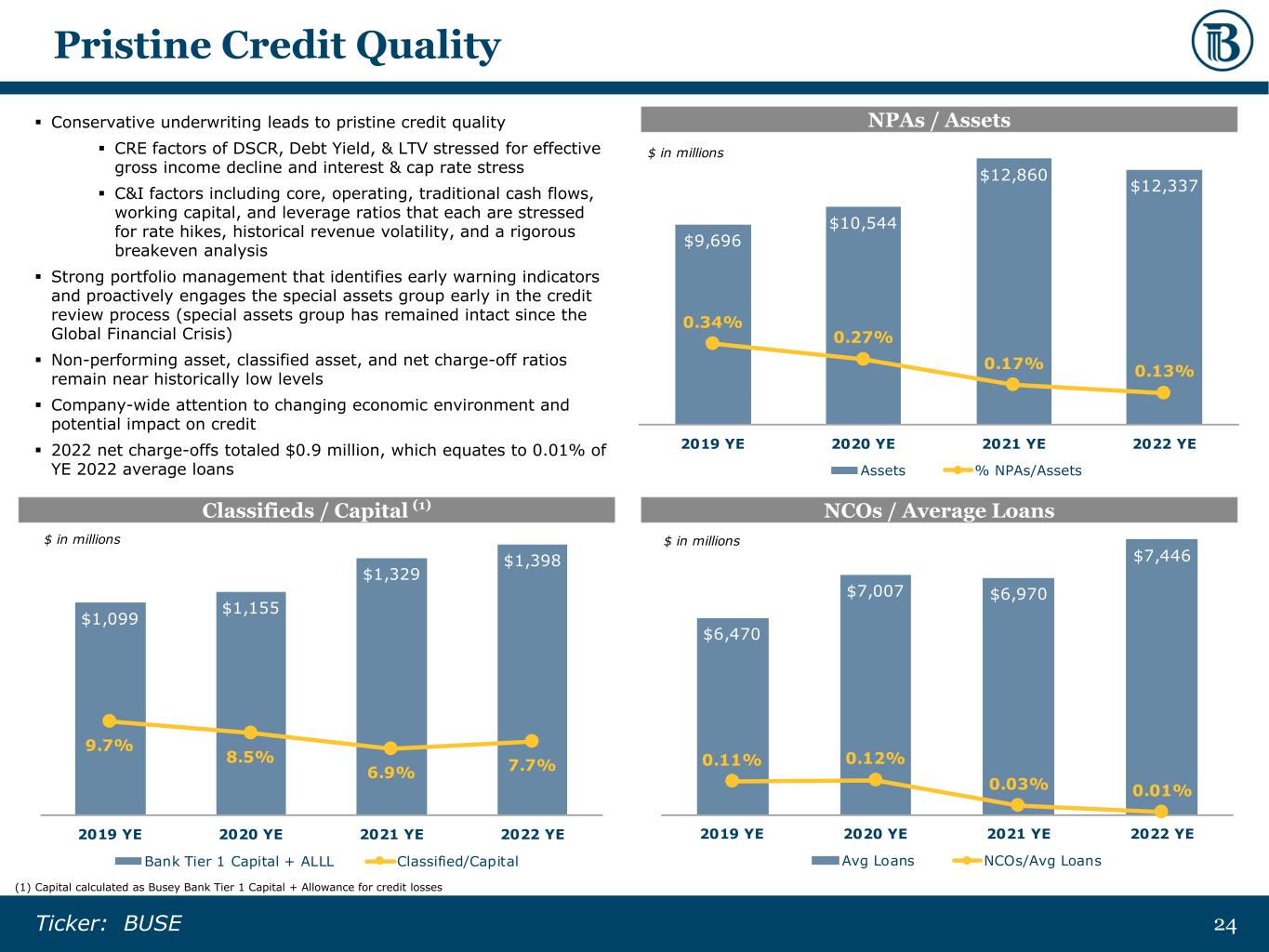

2424Ticker: BUSE $6,470 $7,007 $6,970 $7,446 0.11% 0.12% 0.03% 0.01% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% $4,000 $4,500 $5,000 $5,500 $6,000 $6,500 $7,000 $7,500 2019 YE 2020 YE 2021 YE 2022 YE Avg Loans NCOs/Avg Loans $ in millions $1,099 $1,155 $1,329 $1,398 9.7% 8.5% 6.9% 7.7% 0.0% 5.0% 10. 0% 15. 0% 20. 0% 25. 0% 30. 0% $0 $200 $400 $600 $800 $1, 000 $1, 200 $1, 400 2019 YE 2020 YE 2021 YE 2022 YE Bank Tier 1 Capital + ALLL Classified/Capital $ in millions Pristine Credit Quality ▪ Conservative underwriting leads to pristine credit quality ▪ CRE factors of DSCR, Debt Yield, & LTV stressed for effective gross income decline and interest & cap rate stress ▪ C&I factors including core, operating, traditional cash flows, working capital, and leverage ratios that each are stressed for rate hikes, historical revenue volatility, and a rigorous breakeven analysis ▪ Strong portfolio management that identifies early warning indicators and proactively engages the special assets group early in the credit review process (special assets group has remained intact since the Global Financial Crisis) ▪ Non-performing asset, classified asset, and net charge-off ratios remain near historically low levels ▪ Company-wide attention to changing economic environment and potential impact on credit ▪ 2022 net charge-offs totaled $0.9 million, which equates to 0.01% of YE 2022 average loans (1) Capital calculated as Busey Bank Tier 1 Capital + Allowance for credit losses NPAs / Assets Classifieds / Capital (1) NCOs / Average Loans $9,696 $10,544 $12,860 $12,337 0.34% 0.27% 0.17% 0.13% 2019 YE 2020 YE 2021 YE 2022 YE Assets % NPAs/Assets $ in millions

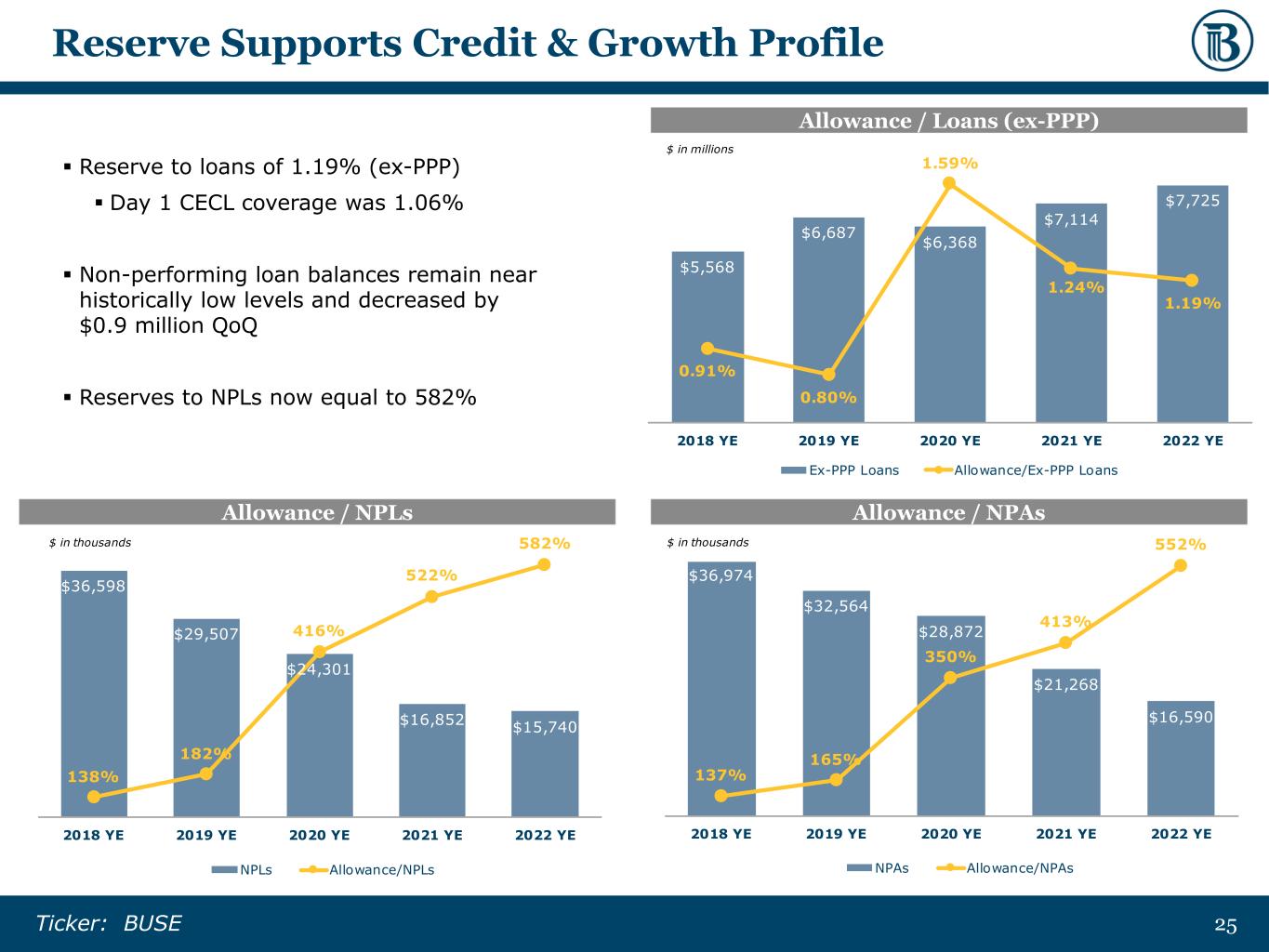

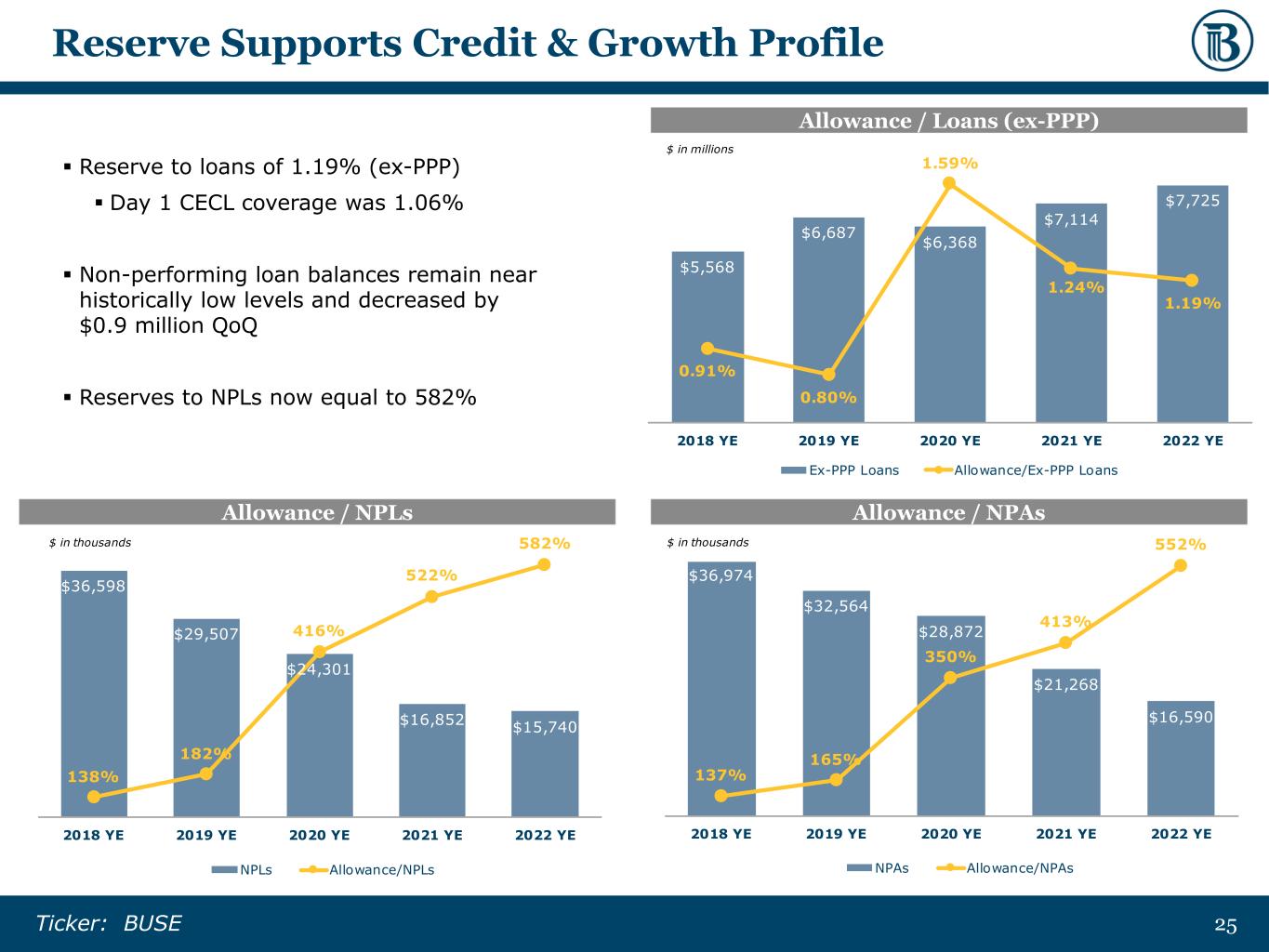

2525Ticker: BUSE $5,568 $6,687 $6,368 $7,114 $7,725 0.91% 0.80% 1.59% 1.24% 1.19% 2018 YE 2019 YE 2020 YE 2021 YE 2022 YE Ex-PPP Loans Allowance/Ex-PPP Loans $ in millions $36,598 $29,507 $24,301 $16,852 $15,740 138% 182% 416% 522% 582% 100% 200% 300% 400% 500% 600% $0 $5, 000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 2018 YE 2019 YE 2020 YE 2021 YE 2022 YE NPLs Allowance/NPLs $ in thousands Reserve Supports Credit & Growth Profile Allowance / NPLs Allowance / NPAs Allowance / Loans (ex-PPP) ▪ Reserve to loans of 1.19% (ex-PPP) ▪ Day 1 CECL coverage was 1.06% ▪ Non-performing loan balances remain near historically low levels and decreased by $0.9 million QoQ ▪ Reserves to NPLs now equal to 582% $36,974 $32,564 $28,872 $21,268 $16,590 137% 165% 350% 413% 552% 100% 150% 200% 250% 300% 350% 400% 450% 500% 550% 600% $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 2018 YE 2019 YE 2020 YE 2021 YE 2022 YE NPAs Allowance/NPAs $ in thousands

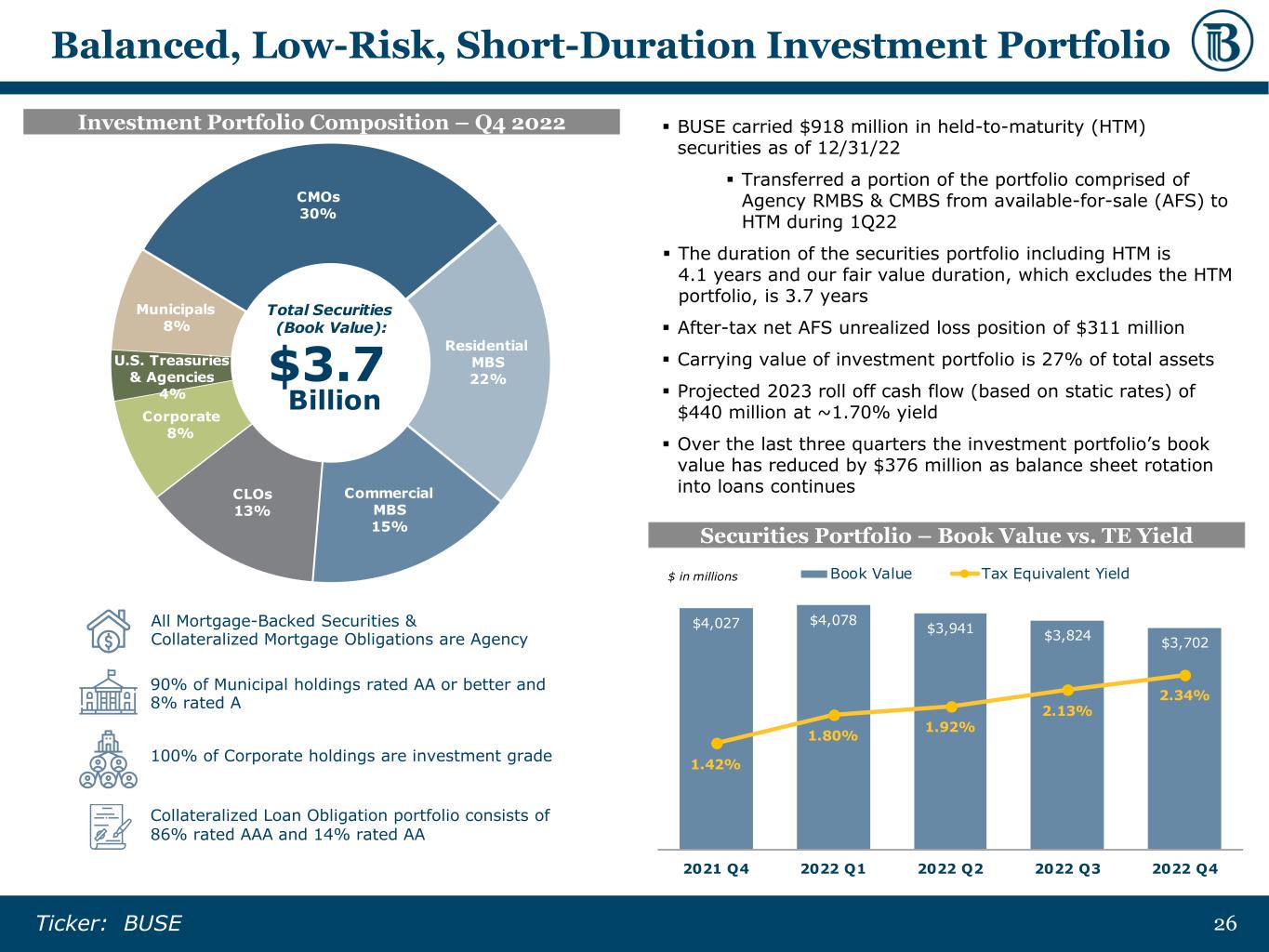

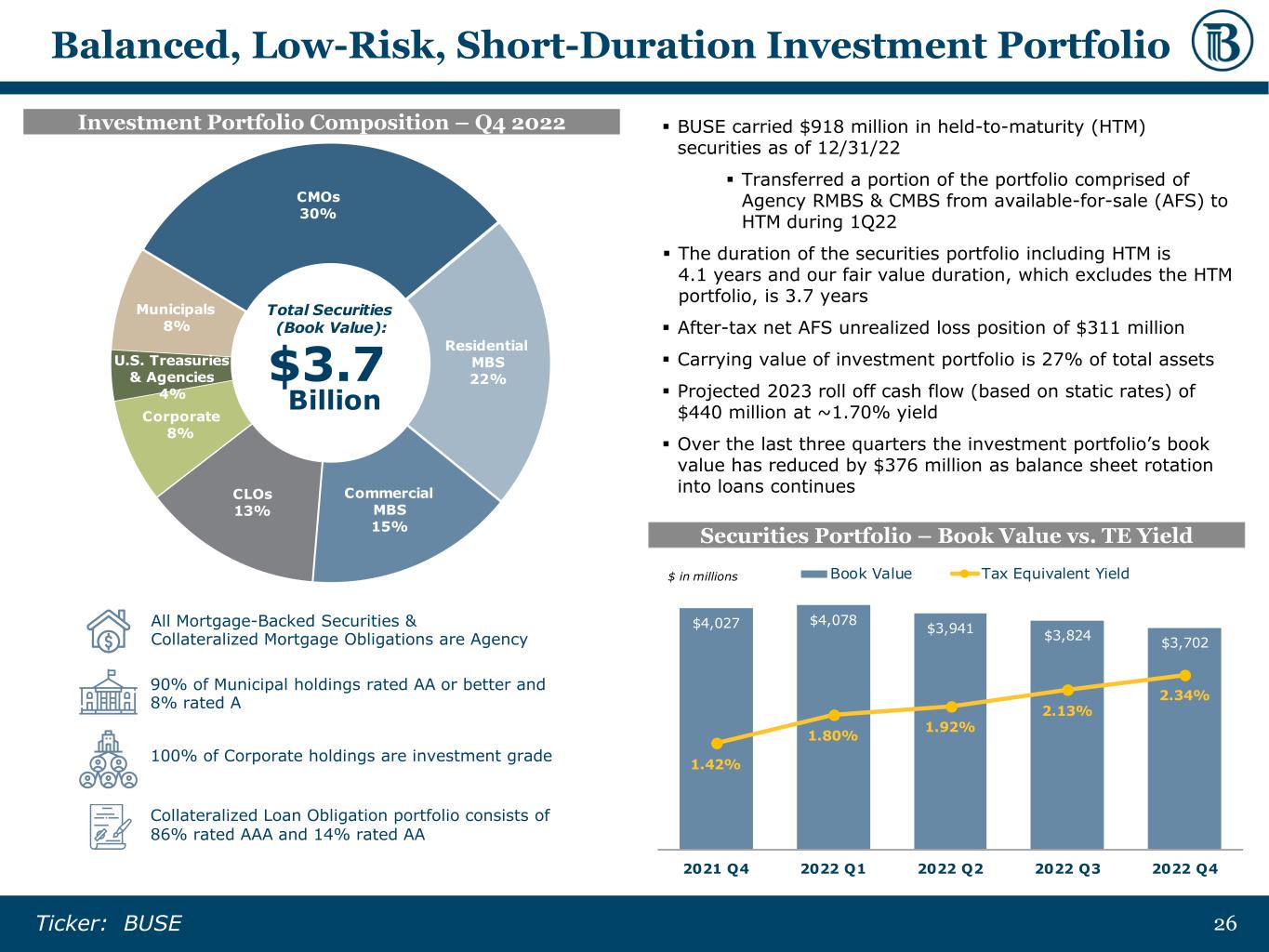

2626Ticker: BUSE $4,027 $4,078 $3,941 $3,824 $3,702 1.42% 1.80% 1.92% 2.13% 2.34% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% $00 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Book Value Tax Equivalent Yield$ in millions Balanced, Low-Risk, Short-Duration Investment Portfolio ▪ BUSE carried $918 million in held-to-maturity (HTM) securities as of 12/31/22 ▪ Transferred a portion of the portfolio comprised of Agency RMBS & CMBS from available-for-sale (AFS) to HTM during 1Q22 ▪ The duration of the securities portfolio including HTM is 4.1 years and our fair value duration, which excludes the HTM portfolio, is 3.7 years ▪ After-tax net AFS unrealized loss position of $311 million ▪ Carrying value of investment portfolio is 27% of total assets ▪ Projected 2023 roll off cash flow (based on static rates) of $440 million at ~1.70% yield ▪ Over the last three quarters the investment portfolio’s book value has reduced by $376 million as balance sheet rotation into loans continues Securities Portfolio – Book Value vs. TE Yield All Mortgage-Backed Securities & Collateralized Mortgage Obligations are Agency 90% of Municipal holdings rated AA or better and 8% rated A 100% of Corporate holdings are investment grade Collateralized Loan Obligation portfolio consists of 86% rated AAA and 14% rated AA Investment Portfolio Composition – Q4 2022

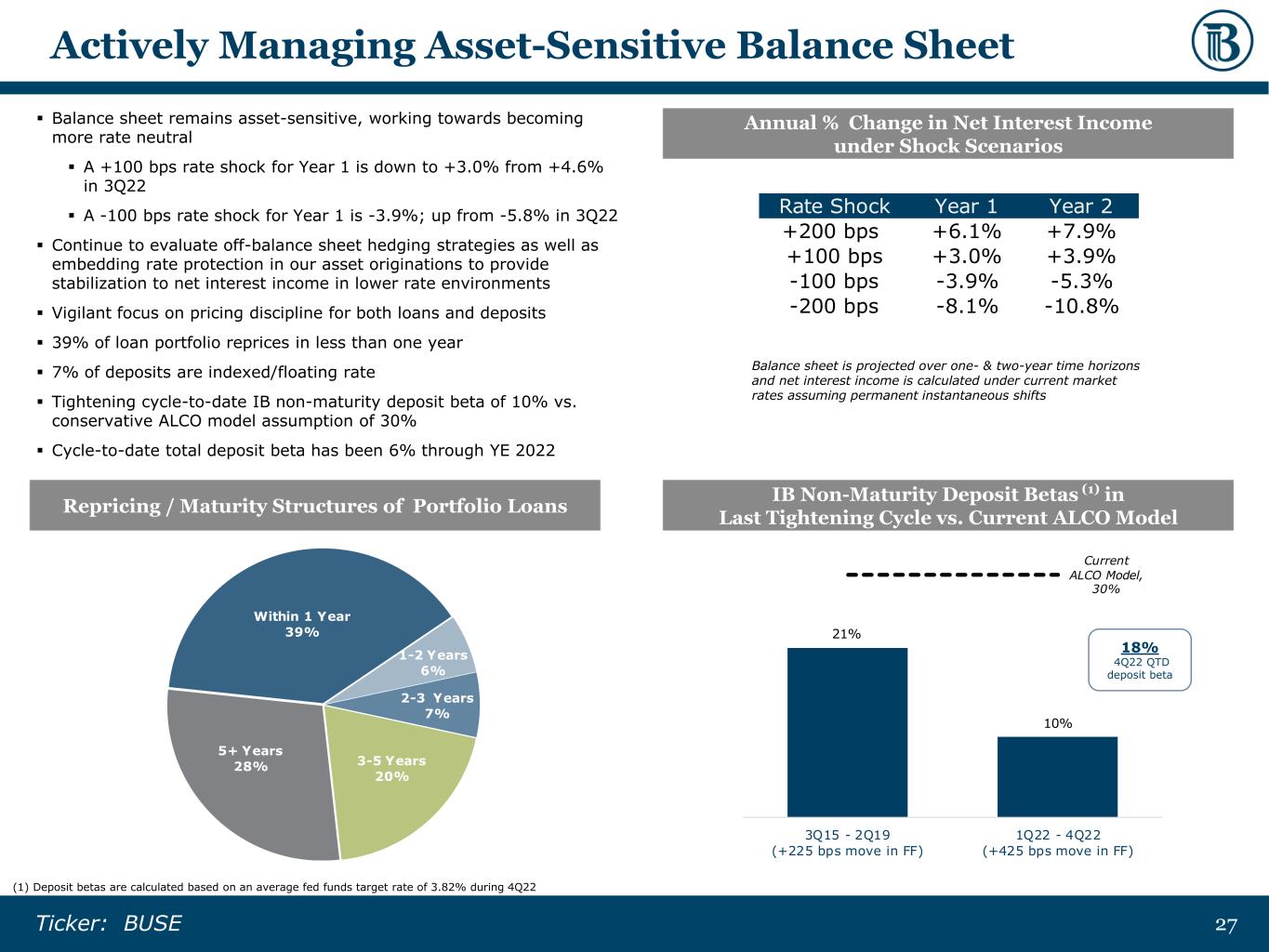

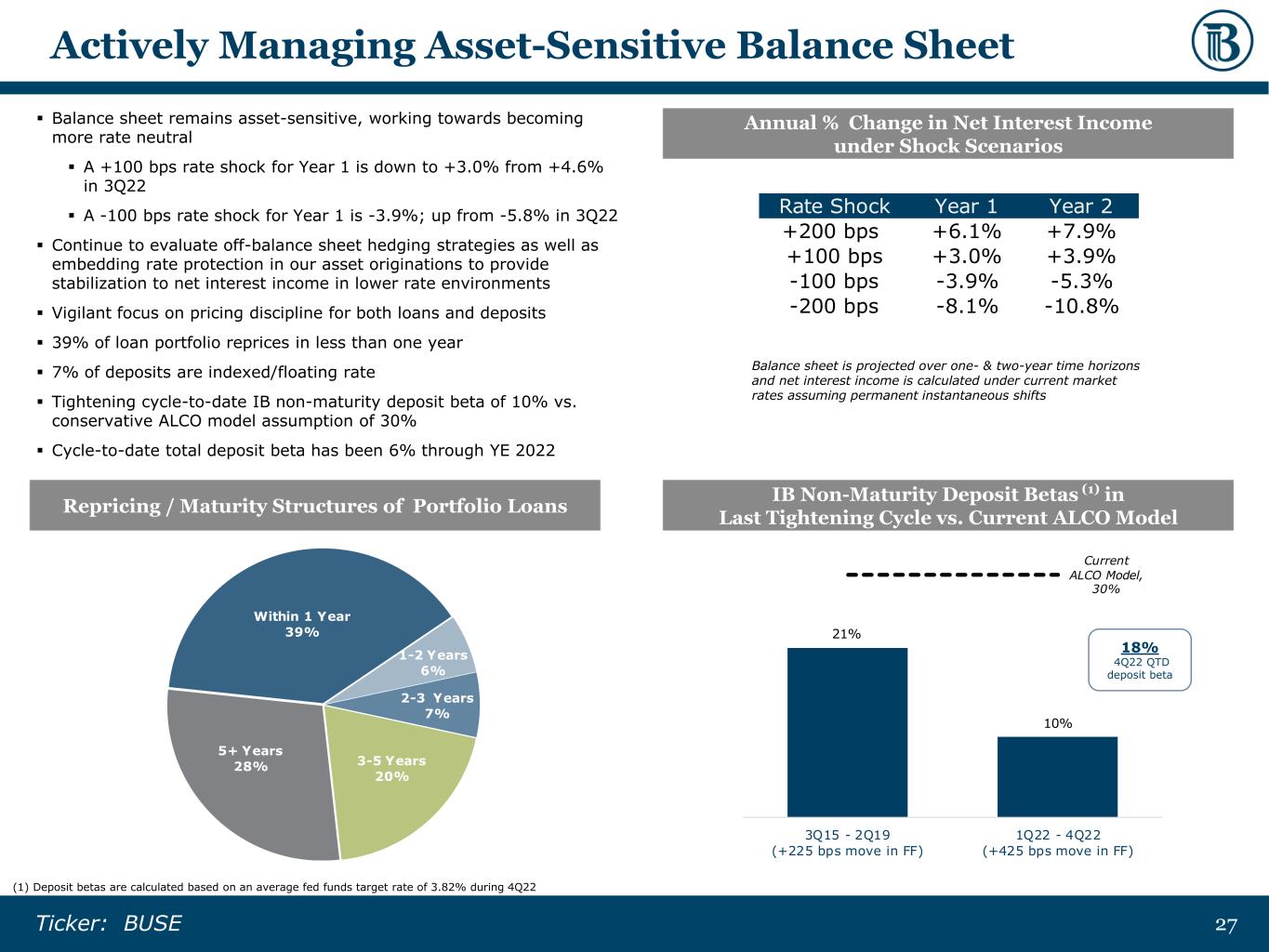

2727Ticker: BUSE 21% 10% Current ALCO Model, 30% 3Q15 - 2Q19 (+225 bps move in FF) 1Q22 - 4Q22 (+425 bps move in FF) Actively Managing Asset-Sensitive Balance Sheet IB Non-Maturity Deposit Betas (1) in Last Tightening Cycle vs. Current ALCO Model Repricing / Maturity Structures of Portfolio Loans 18% 4Q22 QTD deposit beta Annual % Change in Net Interest Income under Shock Scenarios ▪ Balance sheet remains asset-sensitive, working towards becoming more rate neutral ▪ A +100 bps rate shock for Year 1 is down to +3.0% from +4.6% in 3Q22 ▪ A -100 bps rate shock for Year 1 is -3.9%; up from -5.8% in 3Q22 ▪ Continue to evaluate off-balance sheet hedging strategies as well as embedding rate protection in our asset originations to provide stabilization to net interest income in lower rate environments ▪ Vigilant focus on pricing discipline for both loans and deposits ▪ 39% of loan portfolio reprices in less than one year ▪ 7% of deposits are indexed/floating rate ▪ Tightening cycle-to-date IB non-maturity deposit beta of 10% vs. conservative ALCO model assumption of 30% ▪ Cycle-to-date total deposit beta has been 6% through YE 2022 Balance sheet is projected over one- & two-year time horizons and net interest income is calculated under current market rates assuming permanent instantaneous shifts Rate Shock Year 1 Year 2 +200 bps +6.1% +7.9% +100 bps +3.0% +3.9% -100 bps -3.9% -5.3% -200 bps -8.1% -10.8% (1) Deposit betas are calculated based on an average fed funds target rate of 3.82% during 4Q22 Within 1 Year 39% 1-2 Years 6% 2-3 Years 7% 3-5 Years 20% 5+ Years 28%

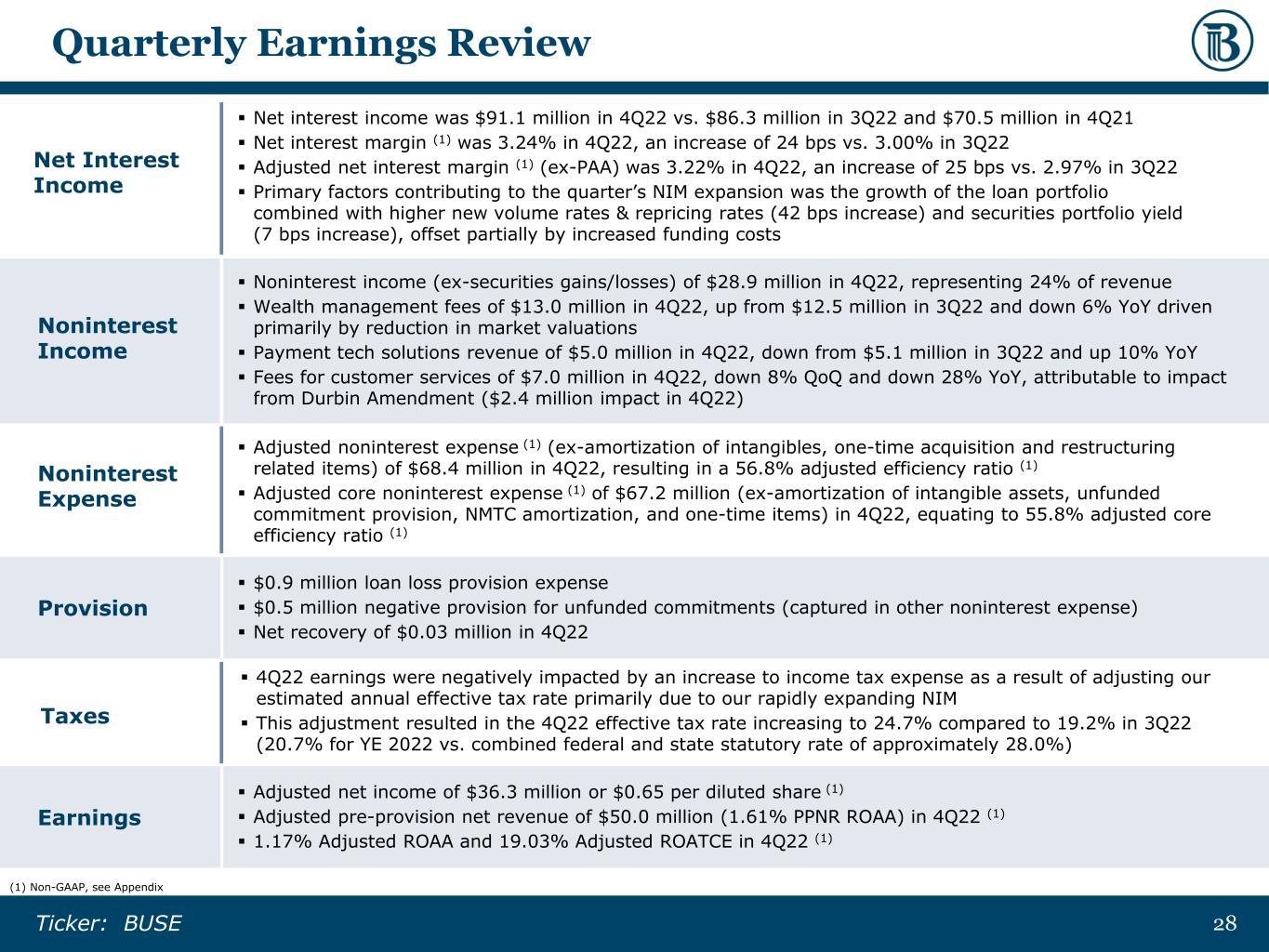

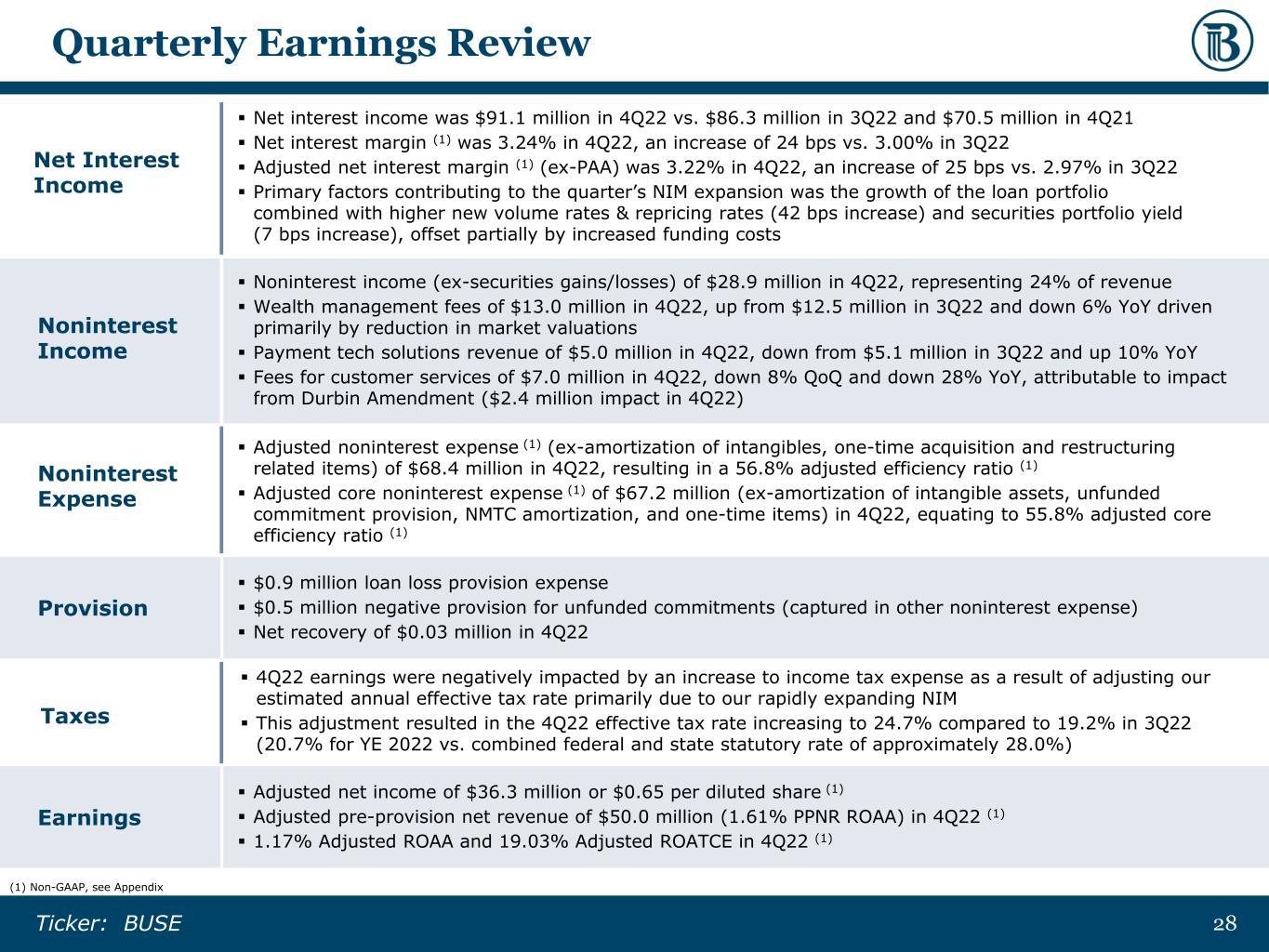

2828Ticker: BUSE ▪ Net interest income was $91.1 million in 4Q22 vs. $86.3 million in 3Q22 and $70.5 million in 4Q21 ▪ Net interest margin (1) was 3.24% in 4Q22, an increase of 24 bps vs. 3.00% in 3Q22 ▪ Adjusted net interest margin (1) (ex-PAA) was 3.22% in 4Q22, an increase of 25 bps vs. 2.97% in 3Q22 ▪ Primary factors contributing to the quarter’s NIM expansion was the growth of the loan portfolio combined with higher new volume rates & repricing rates (42 bps increase) and securities portfolio yield (7 bps increase), offset partially by increased funding costs Net Interest Income Noninterest Income ▪ Noninterest income (ex-securities gains/losses) of $28.9 million in 4Q22, representing 24% of revenue ▪ Wealth management fees of $13.0 million in 4Q22, up from $12.5 million in 3Q22 and down 6% YoY driven primarily by reduction in market valuations ▪ Payment tech solutions revenue of $5.0 million in 4Q22, down from $5.1 million in 3Q22 and up 10% YoY ▪ Fees for customer services of $7.0 million in 4Q22, down 8% QoQ and down 28% YoY, attributable to impact from Durbin Amendment ($2.4 million impact in 4Q22) ▪ Adjusted noninterest expense (1) (ex-amortization of intangibles, one-time acquisition and restructuring related items) of $68.4 million in 4Q22, resulting in a 56.8% adjusted efficiency ratio (1) ▪ Adjusted core noninterest expense (1) of $67.2 million (ex-amortization of intangible assets, unfunded commitment provision, NMTC amortization, and one-time items) in 4Q22, equating to 55.8% adjusted core efficiency ratio (1) Noninterest Expense Provision ▪ $0.9 million loan loss provision expense ▪ $0.5 million negative provision for unfunded commitments (captured in other noninterest expense) ▪ Net recovery of $0.03 million in 4Q22 ▪ Adjusted net income of $36.3 million or $0.65 per diluted share (1) ▪ Adjusted pre-provision net revenue of $50.0 million (1.61% PPNR ROAA) in 4Q22 (1) ▪ 1.17% Adjusted ROAA and 19.03% Adjusted ROATCE in 4Q22 (1) Earnings Quarterly Earnings Review (1) Non-GAAP, see Appendix Taxes ▪ 4Q22 earnings were negatively impacted by an increase to income tax expense as a result of adjusting our estimated annual effective tax rate primarily due to our rapidly expanding NIM ▪ This adjustment resulted in the 4Q22 effective tax rate increasing to 24.7% compared to 19.2% in 3Q22 (20.7% for YE 2022 vs. combined federal and state statutory rate of approximately 28.0%)

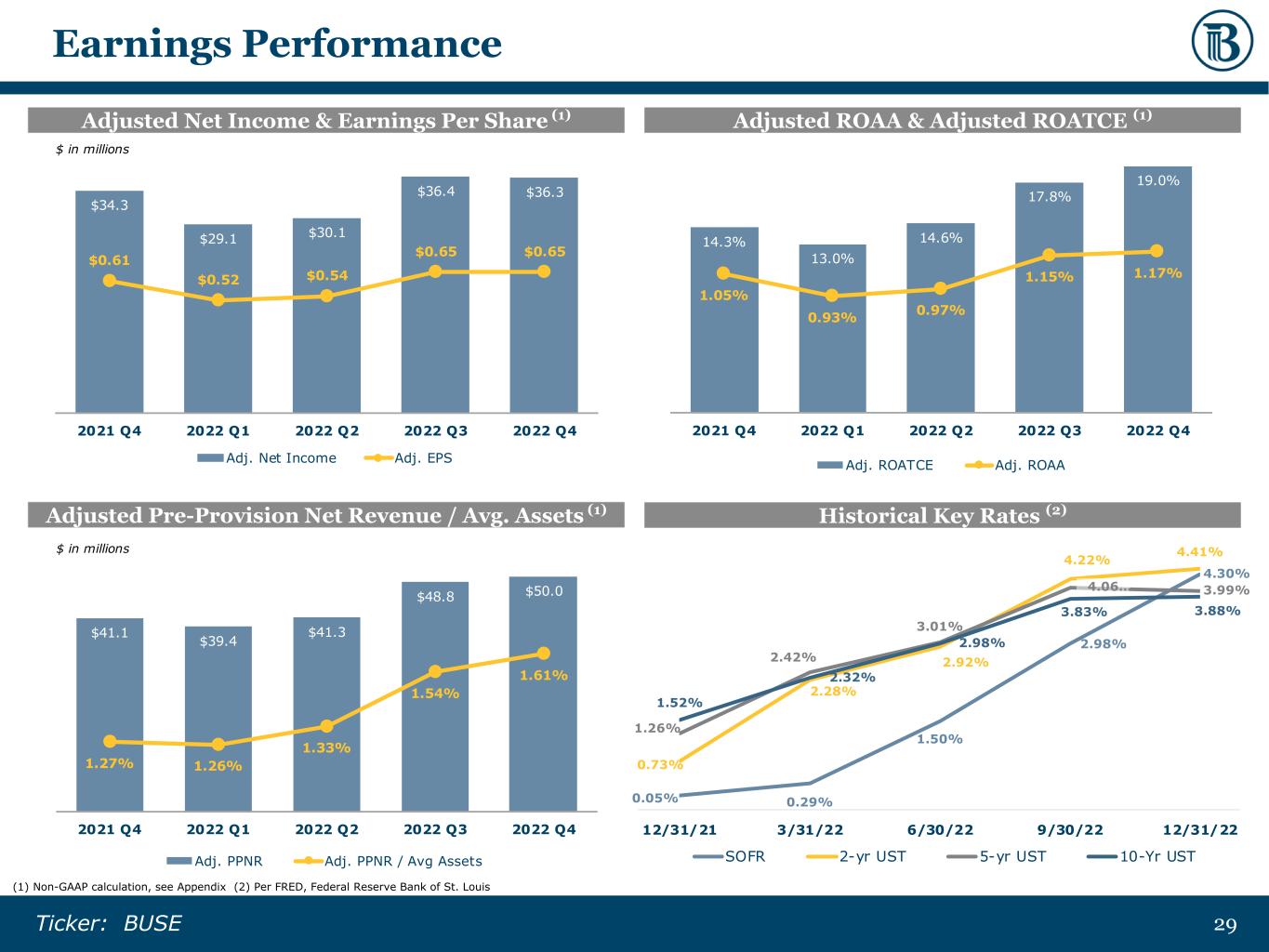

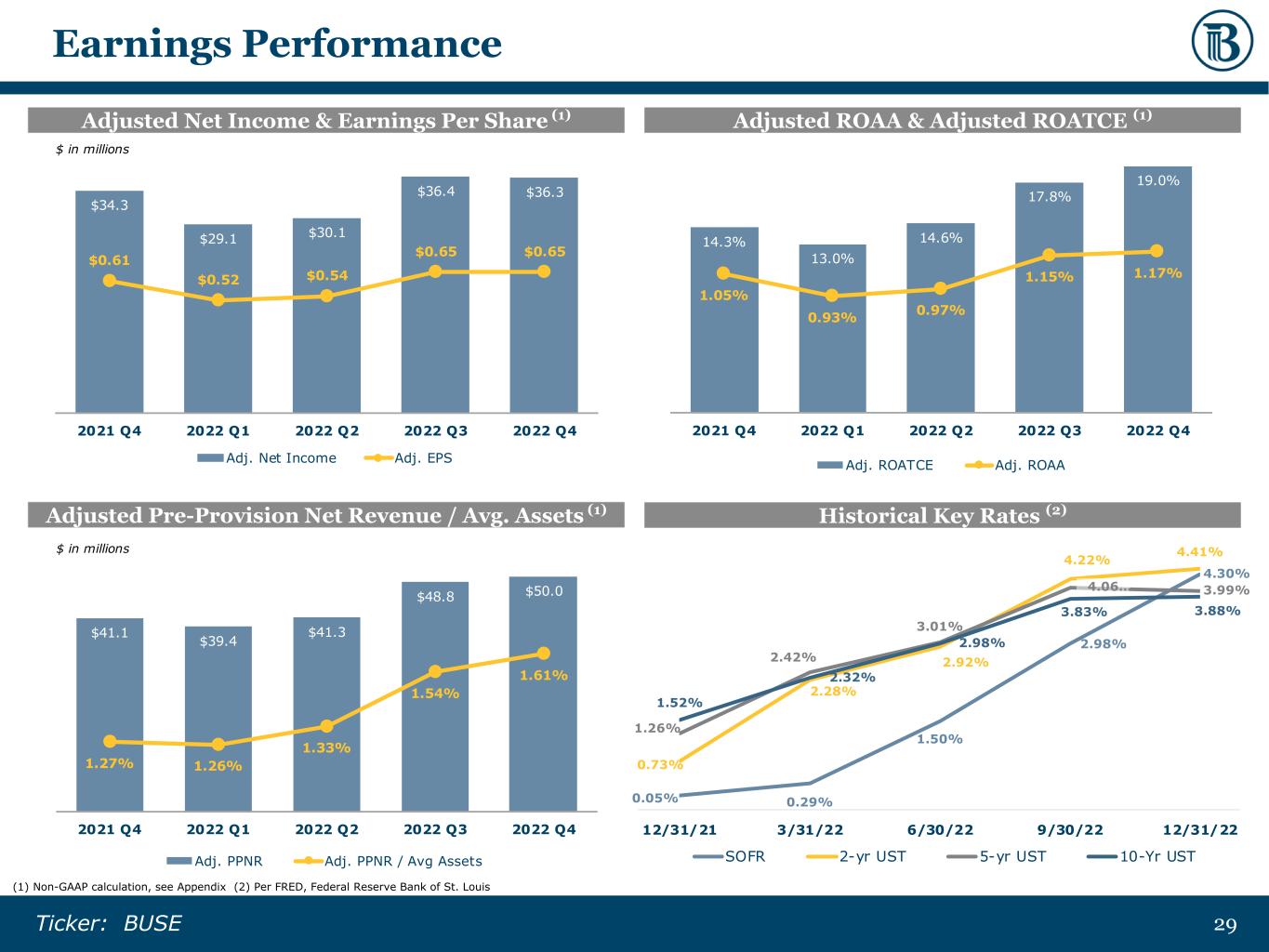

2929Ticker: BUSE 0.05% 0.29% 1.50% 2.98% 4.30% 0.73% 2.28% 2.92% 4.22% 4.41% 1.26% 2.42% 3.01% 4.06… 3.99% 1.52% 2.32% 2.98% 3.83% 3.88% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 SOFR 2-yr UST 5-yr UST 10-Yr UST Earnings Performance (1) Non-GAAP calculation, see Appendix (2) Per FRED, Federal Reserve Bank of St. Louis Adjusted ROAA & Adjusted ROATCE (1) Adjusted Pre-Provision Net Revenue / Avg. Assets (1) Adjusted Net Income & Earnings Per Share (1) Historical Key Rates (2) $41.1 $39.4 $41.3 $48.8 $50.0 1.27% 1.26% 1.33% 1.54% 1.61% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% $0. 0 $10.0 $20.0 $30.0 $40.0 $50.0 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Adj. PPNR Adj. PPNR / Avg Assets $ in millions 14.3% 13.0% 14.6% 17.8% 19.0% 1.05% 0.93% 0.97% 1.15% 1.17% 0.30% 0.50% 0.70% 0.90% 1.10% 1.30% 1.50% 1.70% 0.0% 2.0% 4.0% 6.0% 8.0% 10. 0% 12. 0% 14. 0% 16. 0% 18. 0% 20. 0% 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Adj. ROATCE Adj. ROAA $34.3 $29.1 $30.1 $36.4 $36.3 $0.61 $0.52 $0.54 $0.65 $0.65 $0. 00 $0. 20 $0. 40 $0. 60 $0. 80 $1. 00 $1. 20 $0. 0 $5. 0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 Adj. Net Income Adj. EPS $ in millions

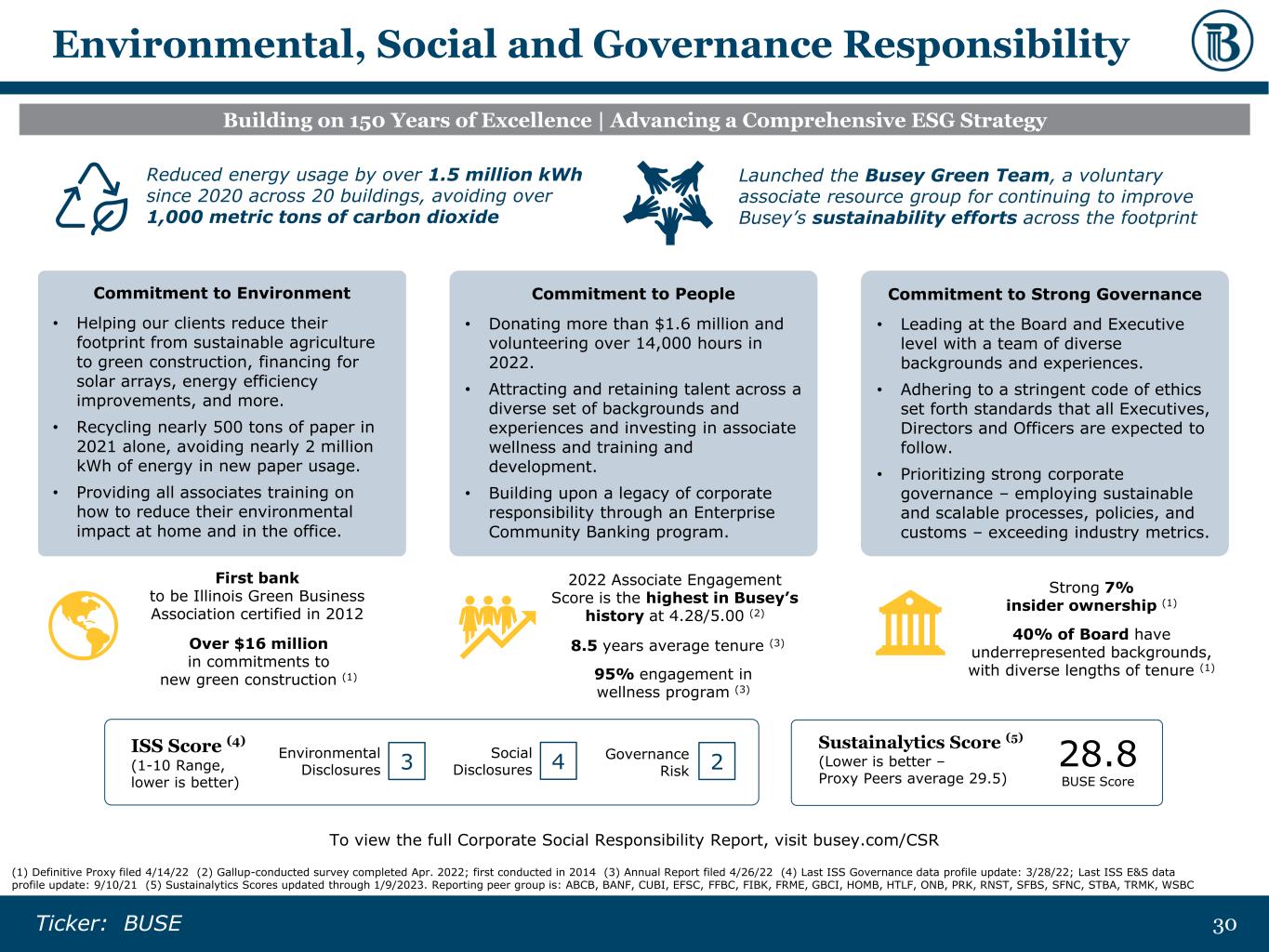

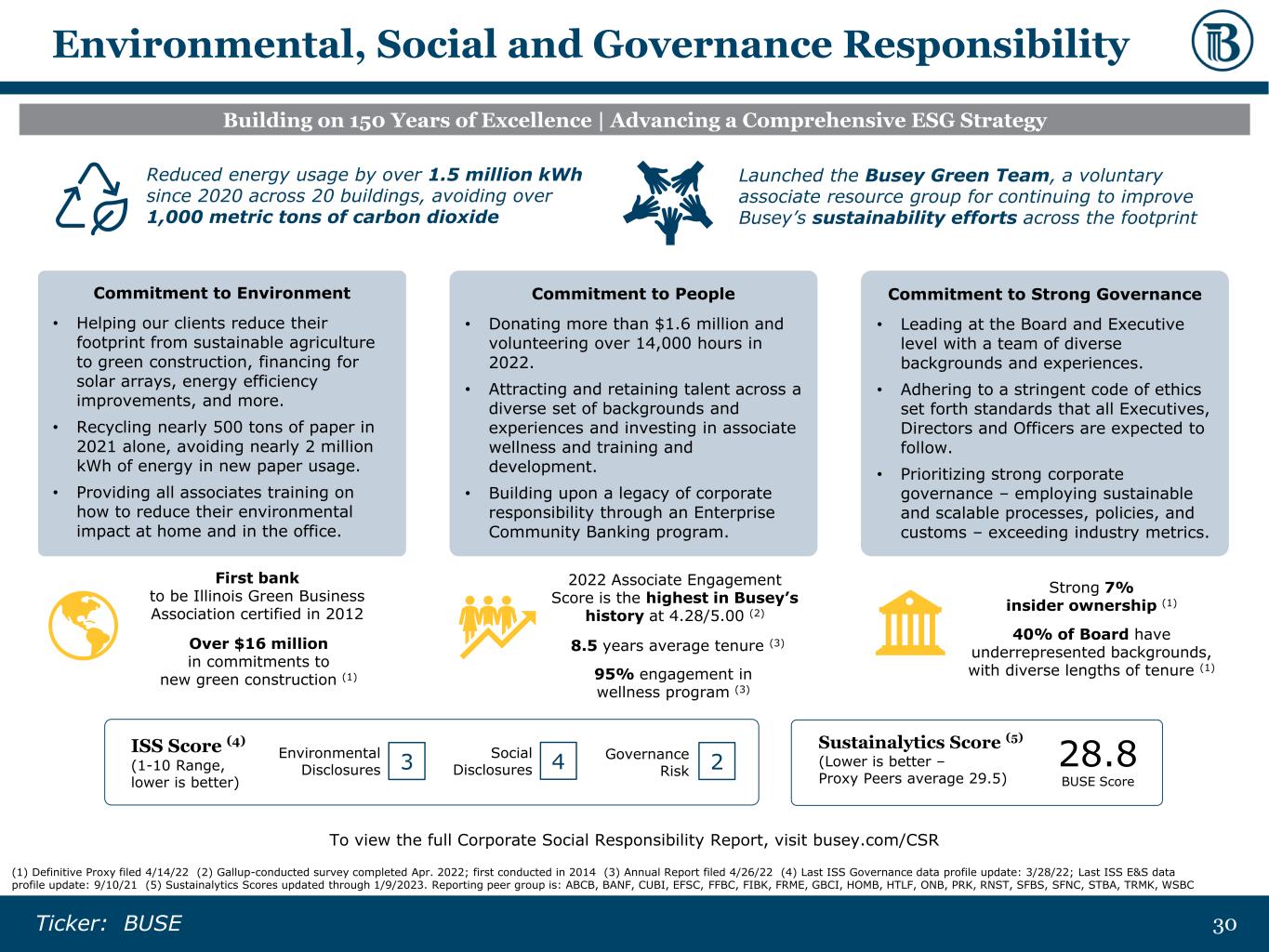

3030Ticker: BUSE Environmental, Social and Governance Responsibility Building on 150 Years of Excellence | Advancing a Comprehensive ESG Strategy Commitment to Environment • Helping our clients reduce their footprint from sustainable agriculture to green construction, financing for solar arrays, energy efficiency improvements, and more. • Recycling nearly 500 tons of paper in 2021 alone, avoiding nearly 2 million kWh of energy in new paper usage. • Providing all associates training on how to reduce their environmental impact at home and in the office. Commitment to People • Donating more than $1.6 million and volunteering over 14,000 hours in 2022. • Attracting and retaining talent across a diverse set of backgrounds and experiences and investing in associate wellness and training and development. • Building upon a legacy of corporate responsibility through an Enterprise Community Banking program. Commitment to Strong Governance • Leading at the Board and Executive level with a team of diverse backgrounds and experiences. • Adhering to a stringent code of ethics set forth standards that all Executives, Directors and Officers are expected to follow. • Prioritizing strong corporate governance – employing sustainable and scalable processes, policies, and customs – exceeding industry metrics. To view the full Corporate Social Responsibility Report, visit busey.com/CSR ISS Score (4) (1-10 Range, lower is better) Sustainalytics Score (5) (Lower is better – Proxy Peers average 29.5) Environmental Disclosures 3 Social Disclosures 4 Governance Risk 2 95% engagement in wellness program (3) 2022 Associate Engagement Score is the ’ history at 4.28/5.00 (2) 8.5 years average tenure (3) 40% of Board have underrepresented backgrounds, with diverse lengths of tenure (1) Strong 7% insider ownership (1) First bank to be Illinois Green Business Association certified in 2012 Over $16 million in commitments to new green construction (1) (1) Definitive Proxy filed 4/14/22 (2) Gallup-conducted survey completed Apr. 2022; first conducted in 2014 (3) Annual Report filed 4/26/22 (4) Last ISS Governance data profile update: 3/28/22; Last ISS E&S data profile update: 9/10/21 (5) Sustainalytics Scores updated through 1/9/2023. Reporting peer group is: ABCB, BANF, CUBI, EFSC, FFBC, FIBK, FRME, GBCI, HOMB, HTLF, ONB, PRK, RNST, SFBS, SFNC, STBA, TRMK, WSBC Reduced energy usage by over 1.5 million kWh since 2020 across 20 buildings, avoiding over 1,000 metric tons of carbon dioxide 28.8 BUSE Score Launched the Busey Green Team, a voluntary associate resource group for continuing to improve Busey’s sustainability efforts across the footprint

3131Ticker: BUSE APPENDIX

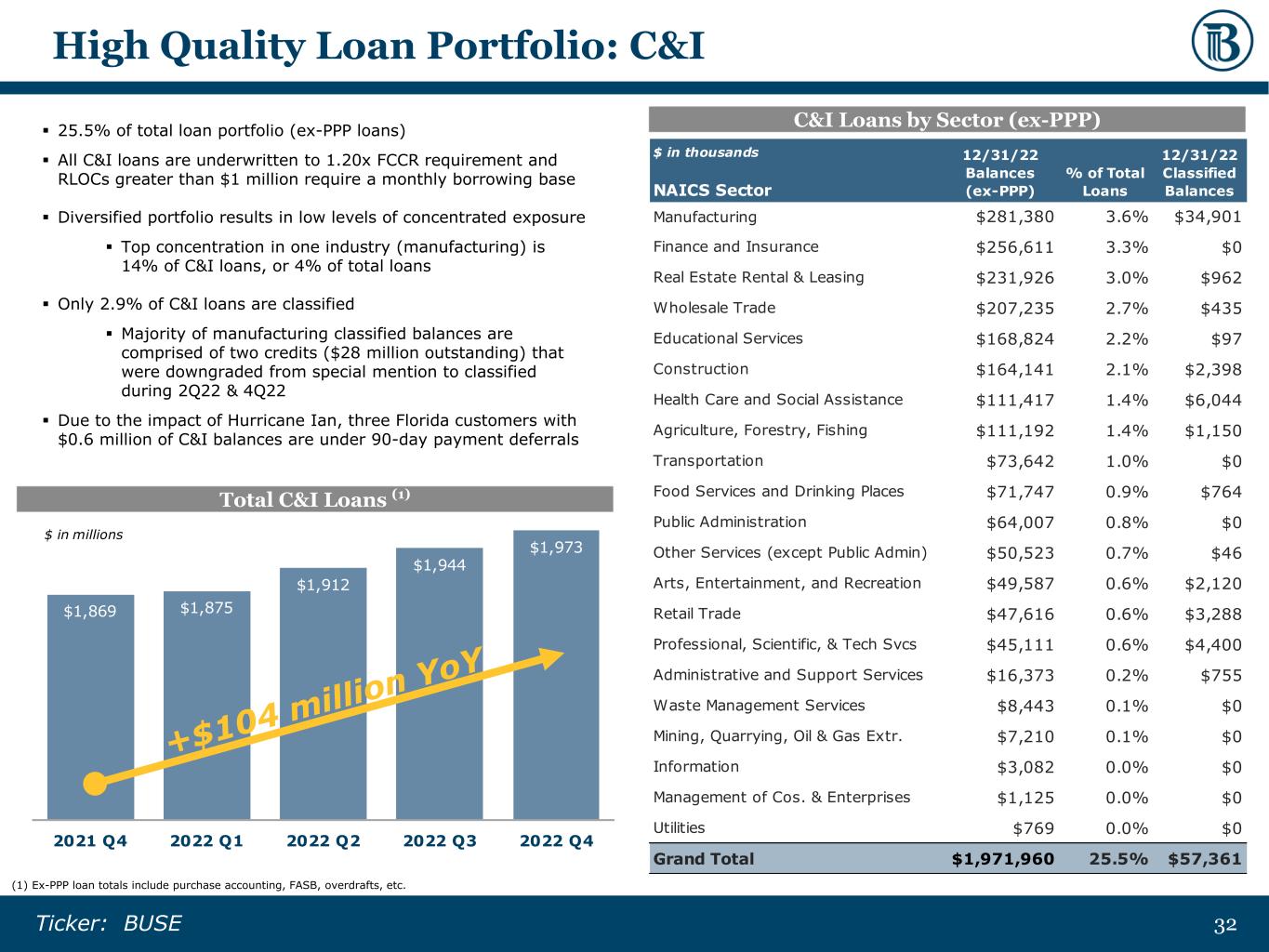

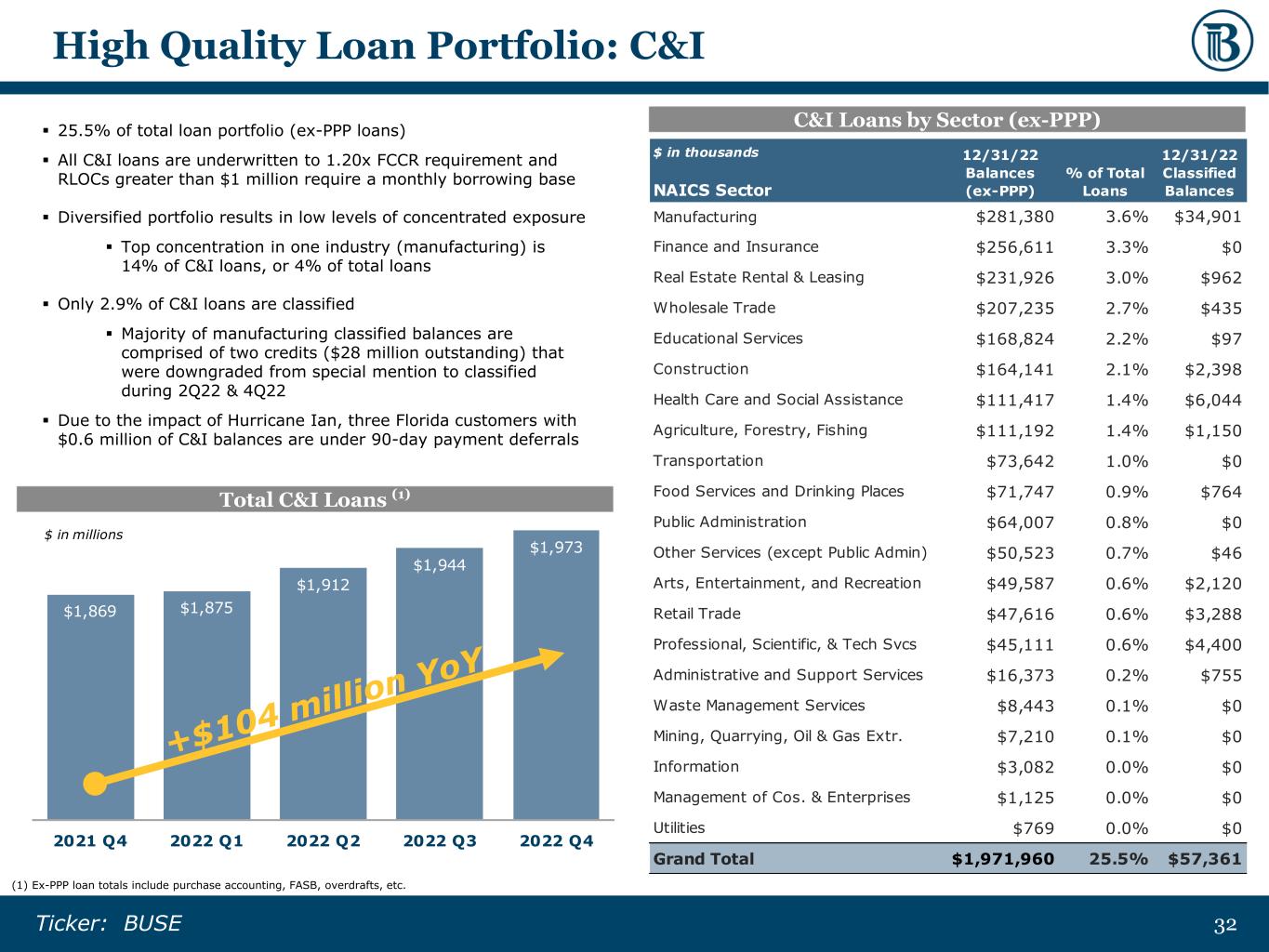

3232Ticker: BUSE $1,869 $1,875 $1,912 $1,944 $1,973 $1,500 $1,550 $1,600 $1,650 $1,700 $1,750 $1,800 $1,850 $1,900 $1,950 $2,000 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 $ in millions High Quality Loan Portfolio: C&I ▪ 25.5% of total loan portfolio (ex-PPP loans) ▪ All C&I loans are underwritten to 1.20x FCCR requirement and RLOCs greater than $1 million require a monthly borrowing base ▪ Diversified portfolio results in low levels of concentrated exposure ▪ Top concentration in one industry (manufacturing) is 14% of C&I loans, or 4% of total loans ▪ Only 2.9% of C&I loans are classified ▪ Majority of manufacturing classified balances are comprised of two credits ($28 million outstanding) that were downgraded from special mention to classified during 2Q22 & 4Q22 ▪ Due to the impact of Hurricane Ian, three Florida customers with $0.6 million of C&I balances are under 90-day payment deferrals (1) Ex-PPP loan totals include purchase accounting, FASB, overdrafts, etc. C&I Loans by Sector (ex-PPP) Total C&I Loans (1) $ in thousands NAICS Sector 12/31/22 Balances (ex-PPP) % of Total Loans 12/31/22 Classified Balances Manufacturing $281,380 3.6% $34,901 Finance and Insurance $256,611 3.3% $0 Real Estate Rental & Leasing $231,926 3.0% $962 Wholesale Trade $207,235 2.7% $435 Educational Services $168,824 2.2% $97 Construction $164,141 2.1% $2,398 Health Care and Social Assistance $111,417 1.4% $6,044 Agriculture, Forestry, Fishing $111,192 1.4% $1,150 Transportation $73,642 1.0% $0 Food Services and Drinking Places $71,747 0.9% $764 Public Administration $64,007 0.8% $0 Other Services (except Public Admin) $50,523 0.7% $46 Arts, Entertainment, and Recreation $49,587 0.6% $2,120 Retail Trade $47,616 0.6% $3,288 Professional, Scientific, & Tech Svcs $45,111 0.6% $4,400 Administrative and Support Services $16,373 0.2% $755 Waste Management Services $8,443 0.1% $0 Mining, Quarrying, Oil & Gas Extr. $7,210 0.1% $0 Information $3,082 0.0% $0 Management of Cos. & Enterprises $1,125 0.0% $0 Utilities $769 0.0% $0 Grand Total $1,971,960 25.5% $57,361

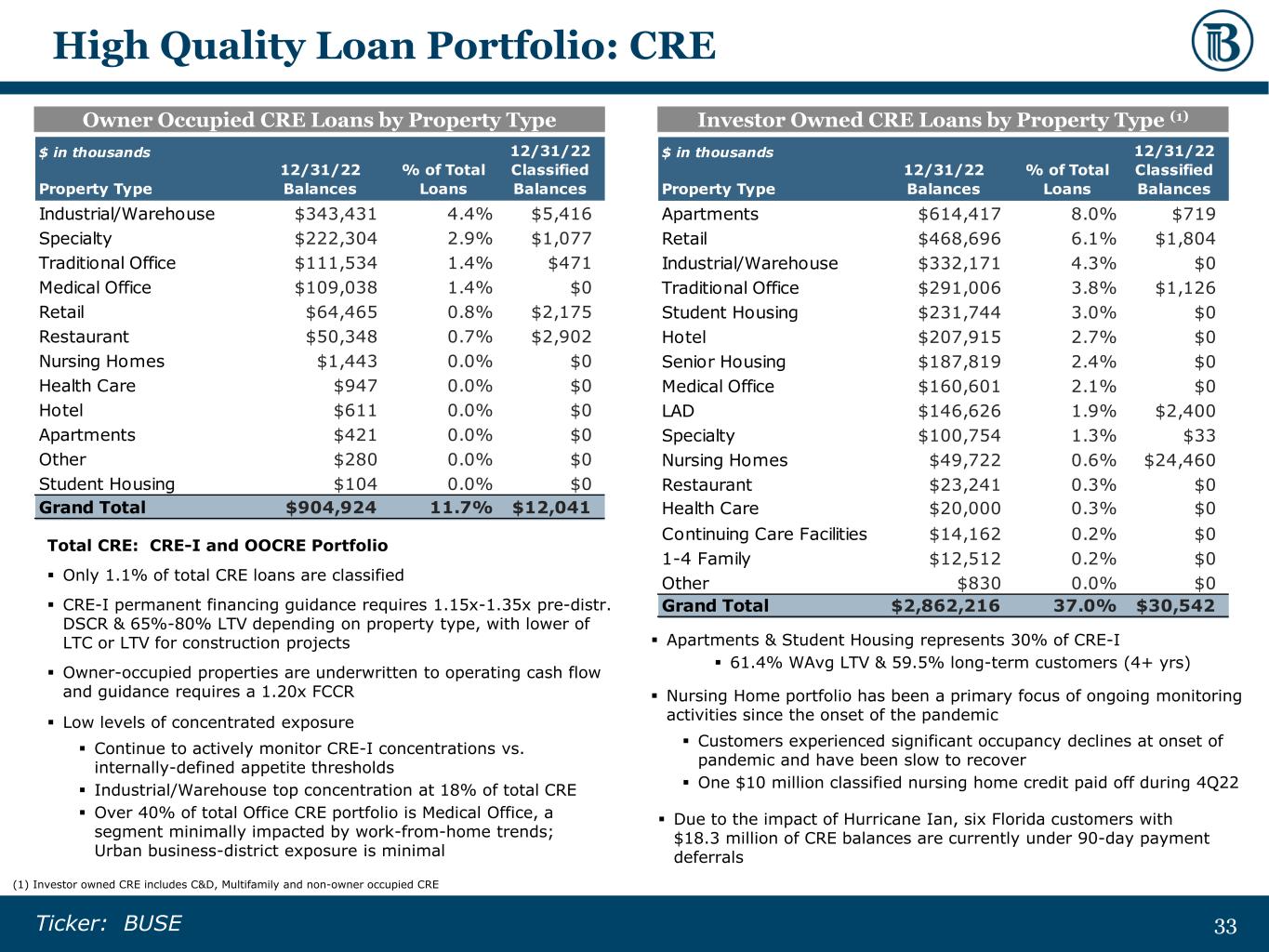

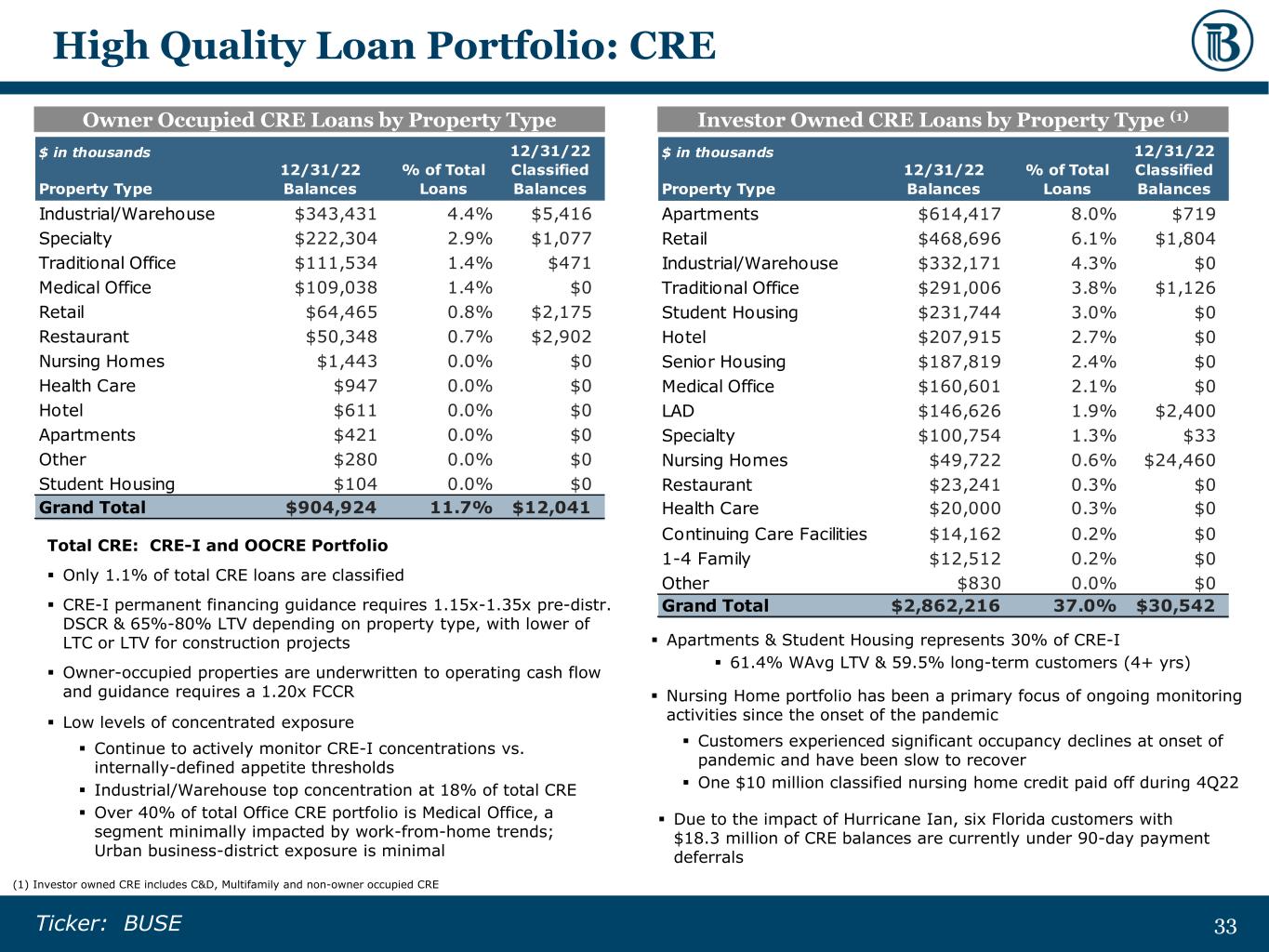

3333Ticker: BUSE High Quality Loan Portfolio: CRE Total CRE: CRE-I and OOCRE Portfolio ▪ Only 1.1% of total CRE loans are classified ▪ CRE-I permanent financing guidance requires 1.15x-1.35x pre-distr. DSCR & 65%-80% LTV depending on property type, with lower of LTC or LTV for construction projects ▪ Owner-occupied properties are underwritten to operating cash flow and guidance requires a 1.20x FCCR (1) Investor owned CRE includes C&D, Multifamily and non-owner occupied CRE Investor Owned CRE Loans by Property Type (1)Owner Occupied CRE Loans by Property Type ▪ Nursing Home portfolio has been a primary focus of ongoing monitoring activities since the onset of the pandemic ▪ Customers experienced significant occupancy declines at onset of pandemic and have been slow to recover ▪ One $10 million classified nursing home credit paid off during 4Q22 ▪ Low levels of concentrated exposure ▪ Continue to actively monitor CRE-I concentrations vs. internally-defined appetite thresholds ▪ Industrial/Warehouse top concentration at 18% of total CRE ▪ Over 40% of total Office CRE portfolio is Medical Office, a segment minimally impacted by work-from-home trends; Urban business-district exposure is minimal ▪ Apartments & Student Housing represents 30% of CRE-I ▪ 61.4% WAvg LTV & 59.5% long-term customers (4+ yrs) $ in thousands Property Type 12/31/22 Balances % of Total Loans 12/31/22 Classified Balances Apartments $614,417 8.0% $719 Retail $468,696 6.1% $1,804 Industrial/Warehouse $332,171 4.3% $0 Traditional Office $291,006 3.8% $1,126 Student Housing $231,744 3.0% $0 Hotel $207,915 2.7% $0 Senior Housing $187,819 2.4% $0 Medical Office $160,601 2.1% $0 LAD $146,626 1.9% $2,400 Specialty $100,754 1.3% $33 Nursing Homes $49,722 0.6% $24,460 Restaurant $23,241 0.3% $0 Health Care $20,000 0.3% $0 Continuing Care Facilities $14,162 0.2% $0 1-4 Family $12,512 0.2% $0 Other $830 0.0% $0 Grand Total $2,862,216 37.0% $30,542 $ in thousands Property Type 12/31/22 Balances % of Total Loans 12/31/22 Classified Balances Industrial/Warehouse $343,431 4.4% $5,416 Specialty $222,304 2.9% $1,077 Traditional Office $111,534 1.4% $471 Medical Office $109,038 1.4% $0 Retail $64,465 0.8% $2,175 Restaurant $50,348 0.7% $2,902 Nursing Homes $1,443 0.0% $0 Health Care $947 0.0% $0 Hotel $611 0.0% $0 Apartments $421 0.0% $0 Other $280 0.0% $0 Student Housing $104 0.0% $0 Grand Total $904,924 11.7% $12,041 ▪ Due to the impact of Hurricane Ian, six Florida customers with $18.3 million of CRE balances are currently under 90-day payment deferrals

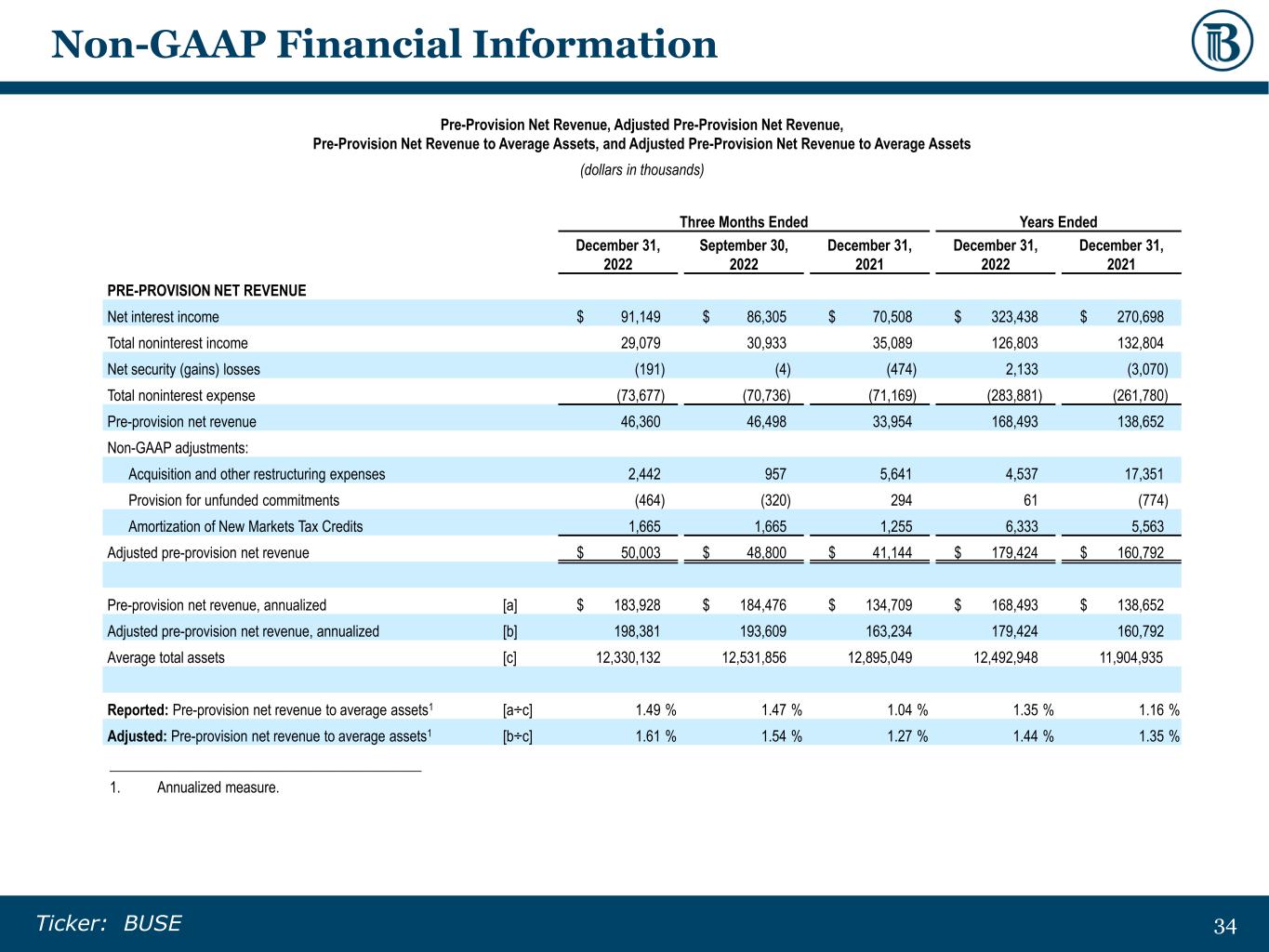

3434Ticker: BUSE Non-GAAP Financial Information Pre-Provision Net Revenue, Adjusted Pre-Provision Net Revenue, Pre-Provision Net Revenue to Average Assets, and Adjusted Pre-Provision Net Revenue to Average Assets (dollars in thousands) Three Months Ended Years Ended December 31, 2022 September 30, 2022 December 31, 2021 December 31, 2022 December 31, 2021 PRE-PROVISION NET REVENUE Net interest income $ 91,149 $ 86,305 $ 70,508 $ 323,438 $ 270,698 Total noninterest income 29,079 30,933 35,089 126,803 132,804 Net security (gains) losses (191) (4) (474) 2,133 (3,070) Total noninterest expense (73,677) (70,736) (71,169) (283,881) (261,780) Pre-provision net revenue 46,360 46,498 33,954 168,493 138,652 Non-GAAP adjustments: Acquisition and other restructuring expenses 2,442 957 5,641 4,537 17,351 Provision for unfunded commitments (464) (320) 294 61 (774) Amortization of New Markets Tax Credits 1,665 1,665 1,255 6,333 5,563 Adjusted pre-provision net revenue $ 50,003 $ 48,800 $ 41,144 $ 179,424 $ 160,792 Pre-provision net revenue, annualized [a] $ 183,928 $ 184,476 $ 134,709 $ 168,493 $ 138,652 Adjusted pre-provision net revenue, annualized [b] 198,381 193,609 163,234 179,424 160,792 Average total assets [c] 12,330,132 12,531,856 12,895,049 12,492,948 11,904,935 Reported: Pre-provision net revenue to average assets1 [a÷c] 1.49 % 1.47 % 1.04 % 1.35 % 1.16 % Adjusted: Pre-provision net revenue to average assets1 [b÷c] 1.61 % 1.54 % 1.27 % 1.44 % 1.35 % ___________________________________________ 1. Annualized measure.

3535Ticker: BUSE Non-GAAP Financial Information Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted Return on Average Assets, Return on Average Tangible Common Equity, and Adjusted Return on Average Tangible Common Equity (dollars in thousands, except per share amounts) Three Months Ended Years Ended December 31, 2022 September 30, 2022 December 31, 2021 December 31, 2022 December 31, 2021 NET INCOME ADJUSTED FOR NON-OPERATING ITEMS Net income [a] $ 34,387 $ 35,661 $ 29,926 $ 128,311 $ 123,449 Non-GAAP adjustments: Acquisition expenses: Salaries, wages, and employee benefits — — 1,760 587 7,347 Data processing — — 143 214 3,700 Professional fees, occupancy, and other 16 4 290 258 2,599 Other restructuring expenses: Salaries, wages, and employee benefits 2,409 — 215 2,409 472 Loss on leases or fixed asset impairment 10 877 3,227 986 3,227 Professional fees, occupancy, and other 7 76 6 83 6 Related tax benefit (539) (183) (1,290) (938) (3,692) Adjusted net income [b] $ 36,290 $ 36,435 $ 34,277 $ 131,910 $ 137,108 DILUTED EARNINGS PER SHARE Diluted average common shares outstanding [c] 56,177,790 56,073,164 56,413,026 56,137,164 56,008,805 Reported: Diluted earnings per share [a÷c] $ 0.61 $ 0.64 $ 0.53 $ 2.29 $ 2.20 Adjusted: Diluted earnings per share [b÷c] $ 0.65 $ 0.65 $ 0.61 $ 2.35 $ 2.45 RETURN ON AVERAGE ASSETS Net income, annualized [d] $ 136,427 $ 141,481 $ 118,728 $ 128,311 $ 123,449 Adjusted net income, annualized [e] 143,977 144,552 135,990 131,910 137,108 Average total assets [f] 12,330,132 12,531,856 12,895,049 12,492,948 11,904,935 Reported: Return on average assets1 [d÷f] 1.11 % 1.13 % 0.92 % 1.03 % 1.04 % Adjusted: Return on average assets1 [e÷f] 1.17 % 1.15 % 1.05 % 1.06 % 1.15 % RETURN ON AVERAGE TANGIBLE COMMON EQUITY Average common equity $ 1,122,547 $ 1,181,448 $ 1,328,692 $ 1,195,171 $ 1,324,862 Average goodwill and other intangible assets, net (366,127) (368,981) (377,825) (370,424) (372,593) Average tangible common equity [g] $ 756,420 $ 812,467 $ 950,867 $ 824,747 $ 952,269 Reported: Return on average tangible common equity1 [d÷g] 18.04 % 17.41 % 12.49 % 15.56 % 12.96 % Adjusted: Return on average tangible common equity1 [e÷g] 19.03 % 17.79 % 14.30 % 15.99 % 14.40 % ___________________________________________ 1. Annualized measure.

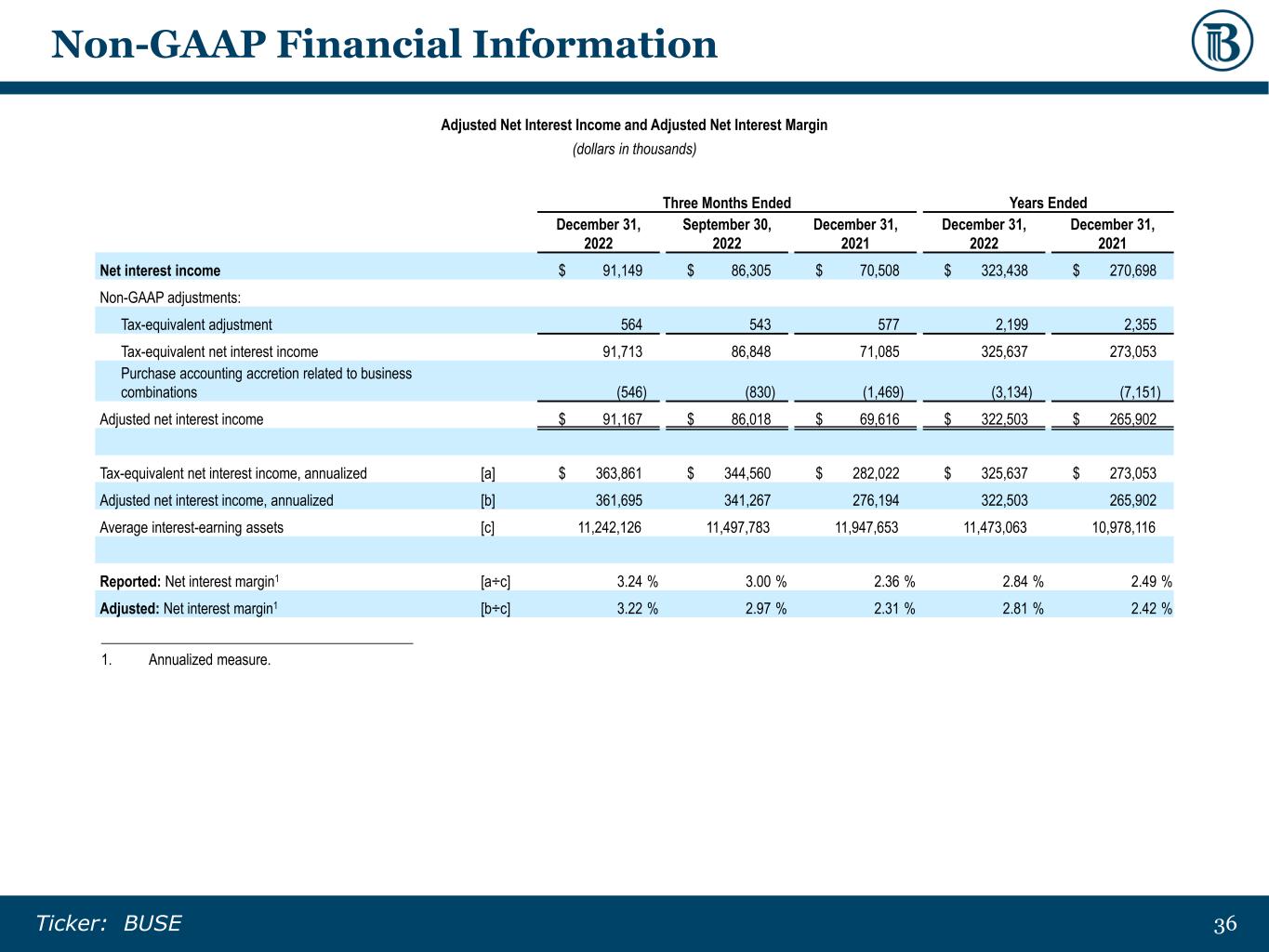

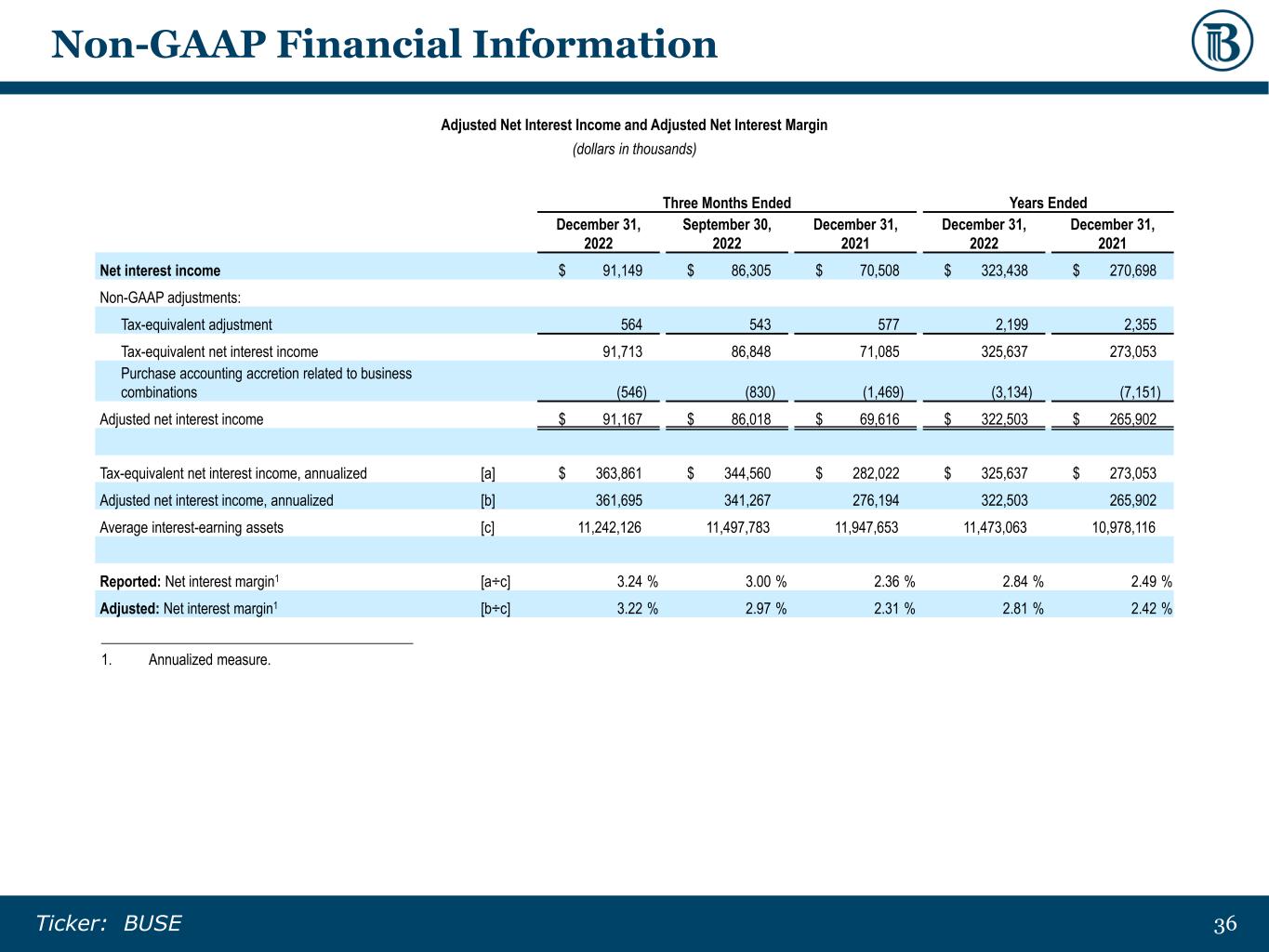

3636Ticker: BUSE Non-GAAP Financial Information Adjusted Net Interest Income and Adjusted Net Interest Margin (dollars in thousands) Three Months Ended Years Ended December 31, 2022 September 30, 2022 December 31, 2021 December 31, 2022 December 31, 2021 Net interest income $ 91,149 $ 86,305 $ 70,508 $ 323,438 $ 270,698 Non-GAAP adjustments: Tax-equivalent adjustment 564 543 577 2,199 2,355 Tax-equivalent net interest income 91,713 86,848 71,085 325,637 273,053 Purchase accounting accretion related to business combinations (546) (830) (1,469) (3,134) (7,151) Adjusted net interest income $ 91,167 $ 86,018 $ 69,616 $ 322,503 $ 265,902 Tax-equivalent net interest income, annualized [a] $ 363,861 $ 344,560 $ 282,022 $ 325,637 $ 273,053 Adjusted net interest income, annualized [b] 361,695 341,267 276,194 322,503 265,902 Average interest-earning assets [c] 11,242,126 11,497,783 11,947,653 11,473,063 10,978,116 Reported: Net interest margin1 [a÷c] 3.24 % 3.00 % 2.36 % 2.84 % 2.49 % Adjusted: Net interest margin1 [b÷c] 3.22 % 2.97 % 2.31 % 2.81 % 2.42 % ___________________________________________ 1. Annualized measure.

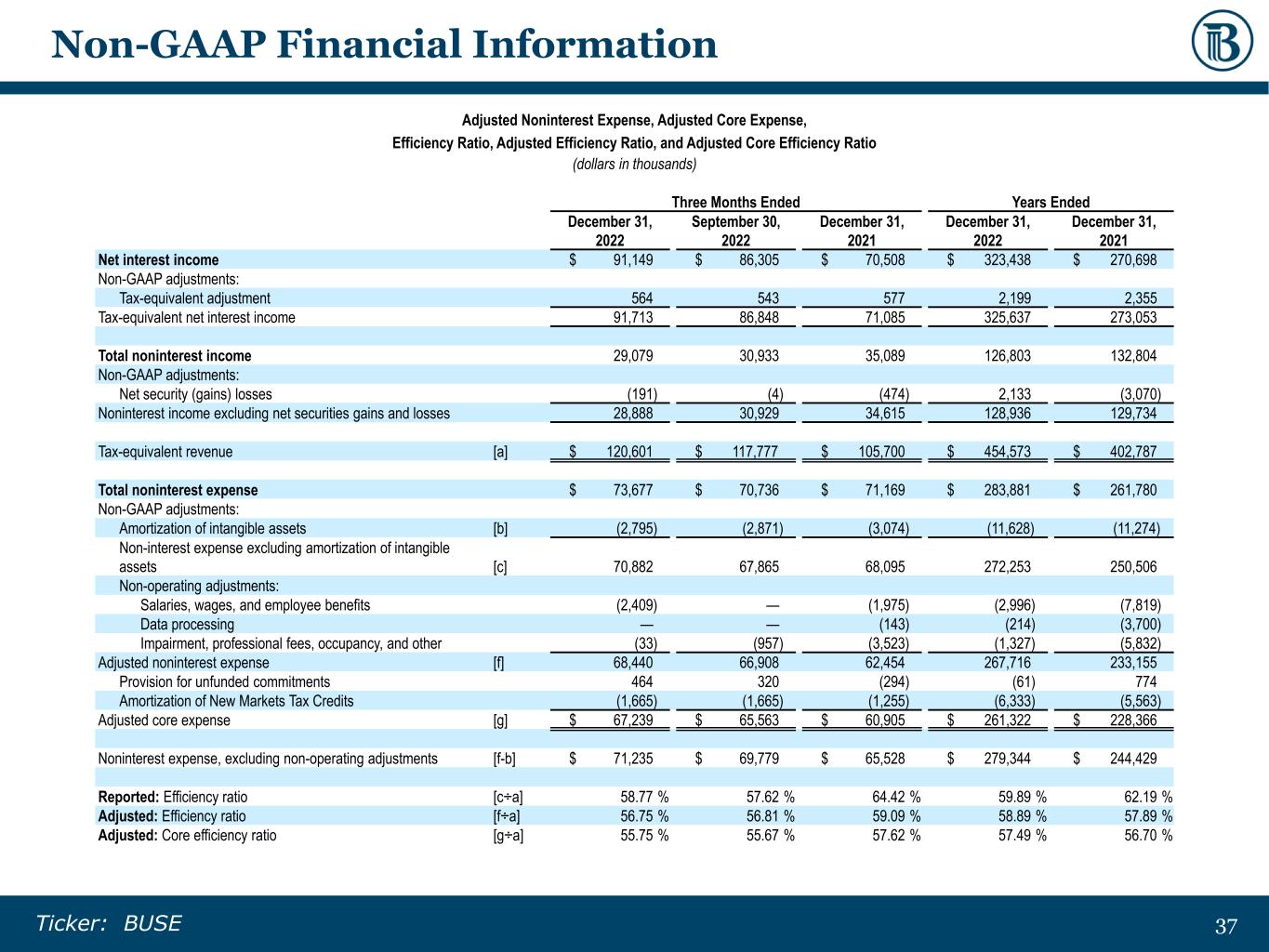

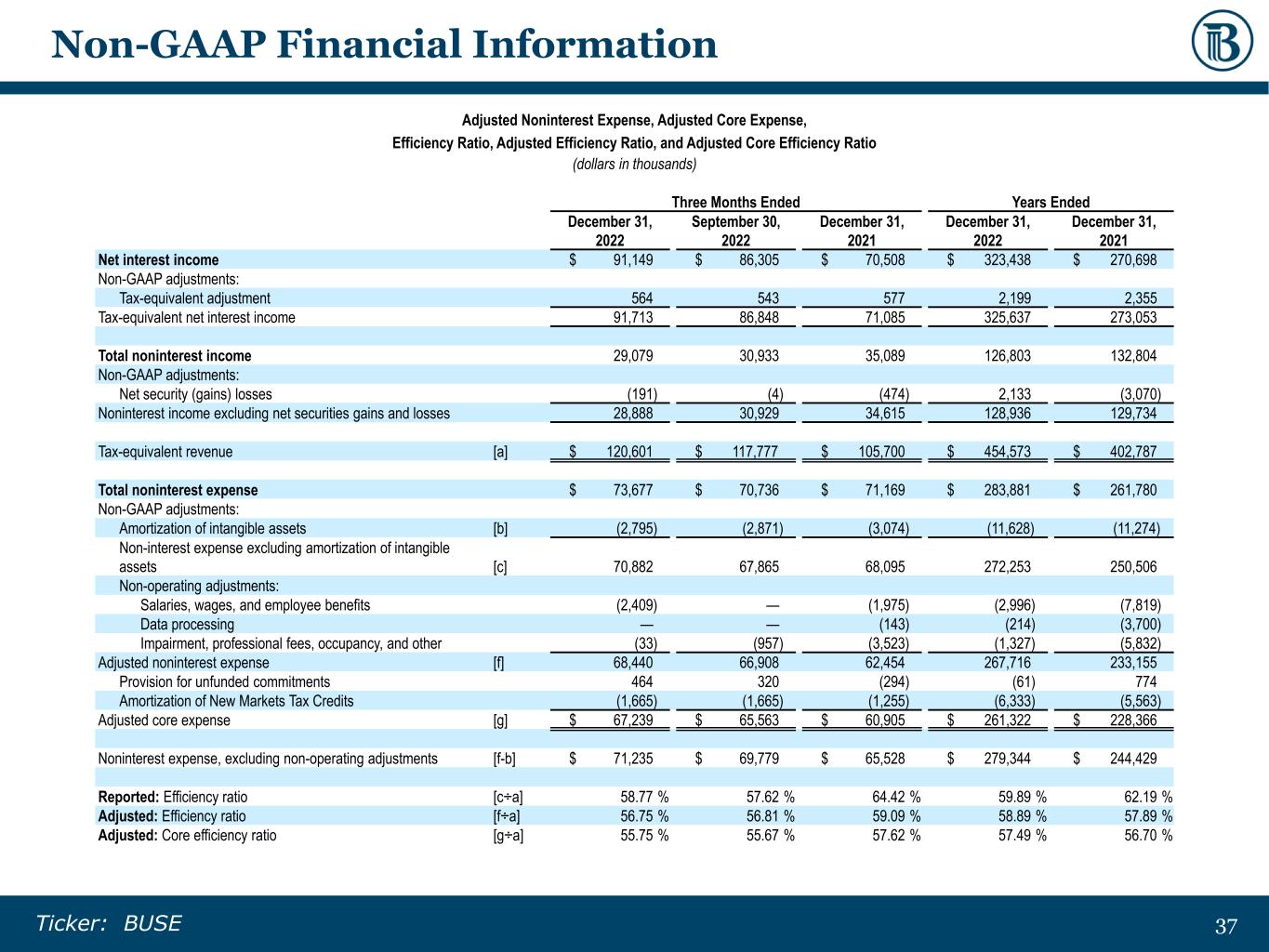

3737Ticker: BUSE Non-GAAP Financial Information Adjusted Noninterest Expense, Adjusted Core Expense, Efficiency Ratio, Adjusted Efficiency Ratio, and Adjusted Core Efficiency Ratio (dollars in thousands) Three Months Ended Years Ended December 31, 2022 September 30, 2022 December 31, 2021 December 31, 2022 December 31, 2021 Net interest income $ 91,149 $ 86,305 $ 70,508 $ 323,438 $ 270,698 Non-GAAP adjustments: Tax-equivalent adjustment 564 543 577 2,199 2,355 Tax-equivalent net interest income 91,713 86,848 71,085 325,637 273,053 Total noninterest income 29,079 30,933 35,089 126,803 132,804 Non-GAAP adjustments: Net security (gains) losses (191) (4) (474) 2,133 (3,070) Noninterest income excluding net securities gains and losses 28,888 30,929 34,615 128,936 129,734 Tax-equivalent revenue [a] $ 120,601 $ 117,777 $ 105,700 $ 454,573 $ 402,787 Total noninterest expense $ 73,677 $ 70,736 $ 71,169 $ 283,881 $ 261,780 Non-GAAP adjustments: Amortization of intangible assets [b] (2,795) (2,871) (3,074) (11,628) (11,274) Non-interest expense excluding amortization of intangible assets [c] 70,882 67,865 68,095 272,253 250,506 Non-operating adjustments: Salaries, wages, and employee benefits (2,409) — (1,975) (2,996) (7,819) Data processing — — (143) (214) (3,700) Impairment, professional fees, occupancy, and other (33) (957) (3,523) (1,327) (5,832) Adjusted noninterest expense [f] 68,440 66,908 62,454 267,716 233,155 Provision for unfunded commitments 464 320 (294) (61) 774 Amortization of New Markets Tax Credits (1,665) (1,665) (1,255) (6,333) (5,563) Adjusted core expense [g] $ 67,239 $ 65,563 $ 60,905 $ 261,322 $ 228,366 Noninterest expense, excluding non-operating adjustments [f-b] $ 71,235 $ 69,779 $ 65,528 $ 279,344 $ 244,429 Reported: Efficiency ratio [c÷a] 58.77 % 57.62 % 64.42 % 59.89 % 62.19 % Adjusted: Efficiency ratio [f÷a] 56.75 % 56.81 % 59.09 % 58.89 % 57.89 % Adjusted: Core efficiency ratio [g÷a] 55.75 % 55.67 % 57.62 % 57.49 % 56.70 %

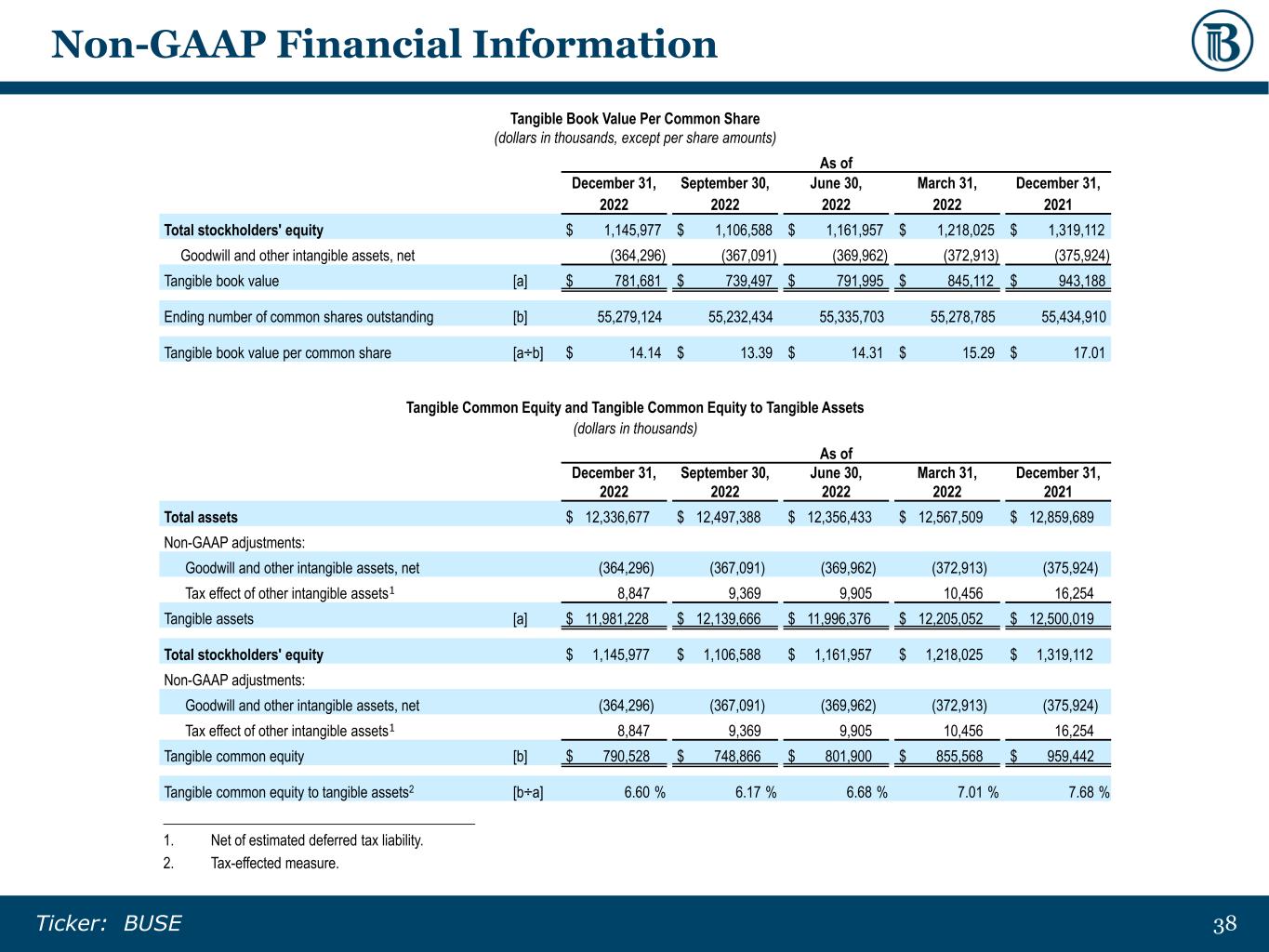

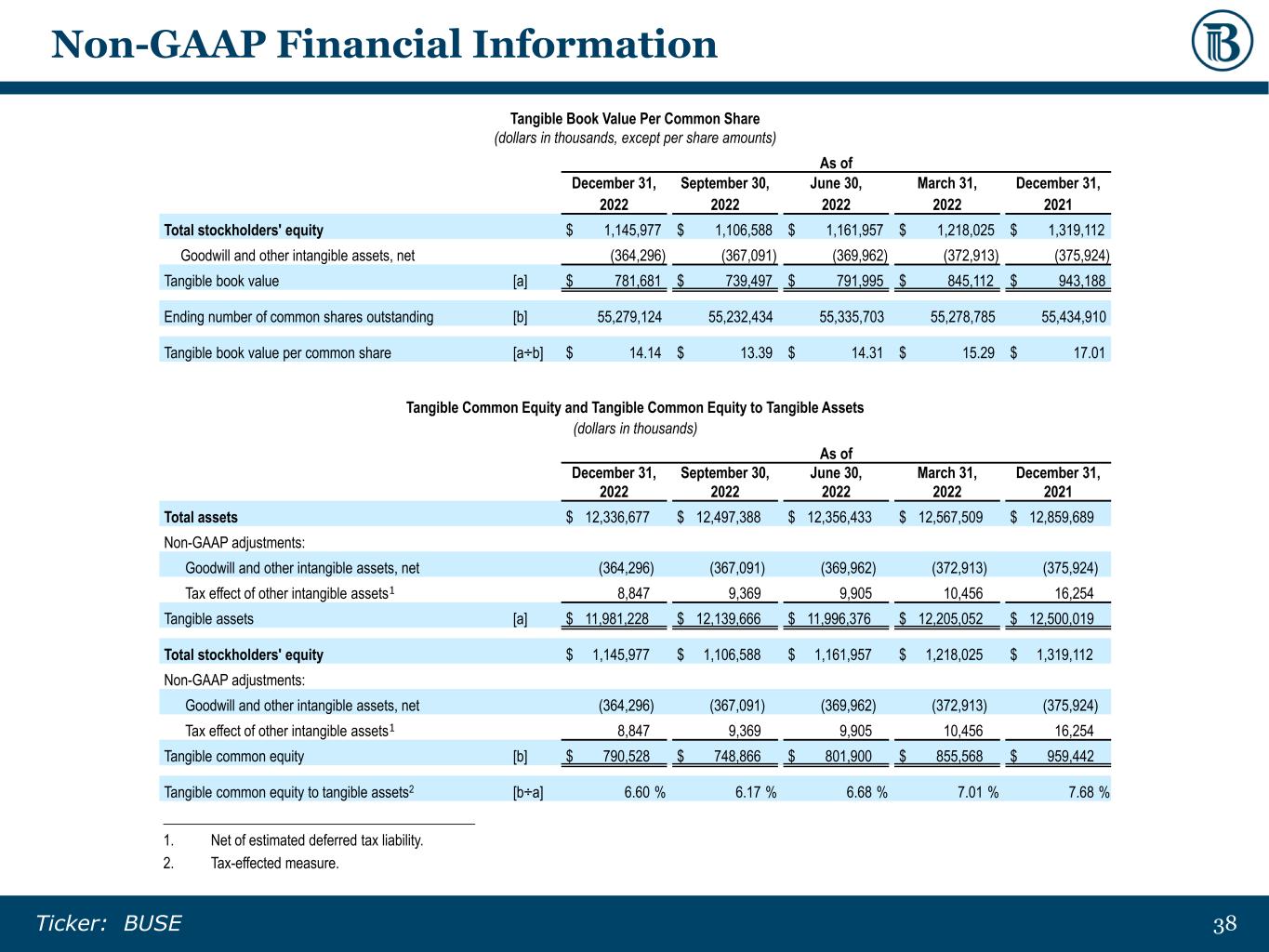

3838Ticker: BUSE Non-GAAP Financial Information Tangible Book Value Per Common Share (dollars in thousands, except per share amounts) As of December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 Total stockholders' equity $ 1,145,977 $ 1,106,588 $ 1,161,957 $ 1,218,025 $ 1,319,112 Goodwill and other intangible assets, net (364,296) (367,091) (369,962) (372,913) (375,924) Tangible book value [a] $ 781,681 $ 739,497 $ 791,995 $ 845,112 $ 943,188 Ending number of common shares outstanding [b] 55,279,124 55,232,434 55,335,703 55,278,785 55,434,910 Tangible book value per common share [a÷b] $ 14.14 $ 13.39 $ 14.31 $ 15.29 $ 17.01 Tangible Common Equity and Tangible Common Equity to Tangible Assets (dollars in thousands) As of December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 Total assets $ 12,336,677 $ 12,497,388 $ 12,356,433 $ 12,567,509 $ 12,859,689 Non-GAAP adjustments: Goodwill and other intangible assets, net (364,296) (367,091) (369,962) (372,913) (375,924) Tax effect of other intangible assets1 8,847 9,369 9,905 10,456 16,254 Tangible assets [a] $ 11,981,228 $ 12,139,666 $ 11,996,376 $ 12,205,052 $ 12,500,019 Total stockholders' equity $ 1,145,977 $ 1,106,588 $ 1,161,957 $ 1,218,025 $ 1,319,112 Non-GAAP adjustments: Goodwill and other intangible assets, net (364,296) (367,091) (369,962) (372,913) (375,924) Tax effect of other intangible assets1 8,847 9,369 9,905 10,456 16,254 Tangible common equity [b] $ 790,528 $ 748,866 $ 801,900 $ 855,568 $ 959,442 Tangible common equity to tangible assets2 [b÷a] 6.60 % 6.17 % 6.68 % 7.01 % 7.68 % ___________________________________________ 1. Net of estimated deferred tax liability. 2. Tax-effected measure.

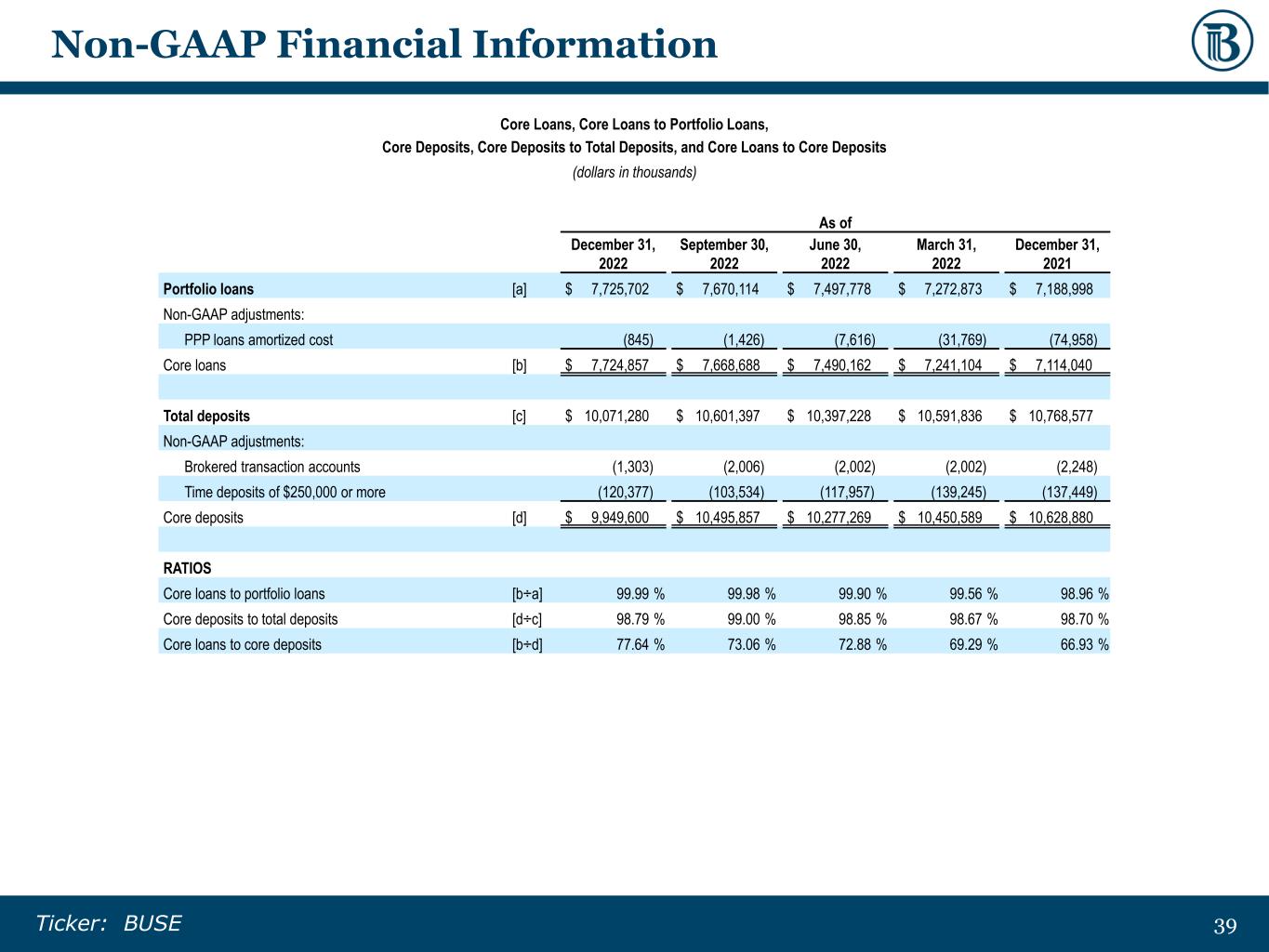

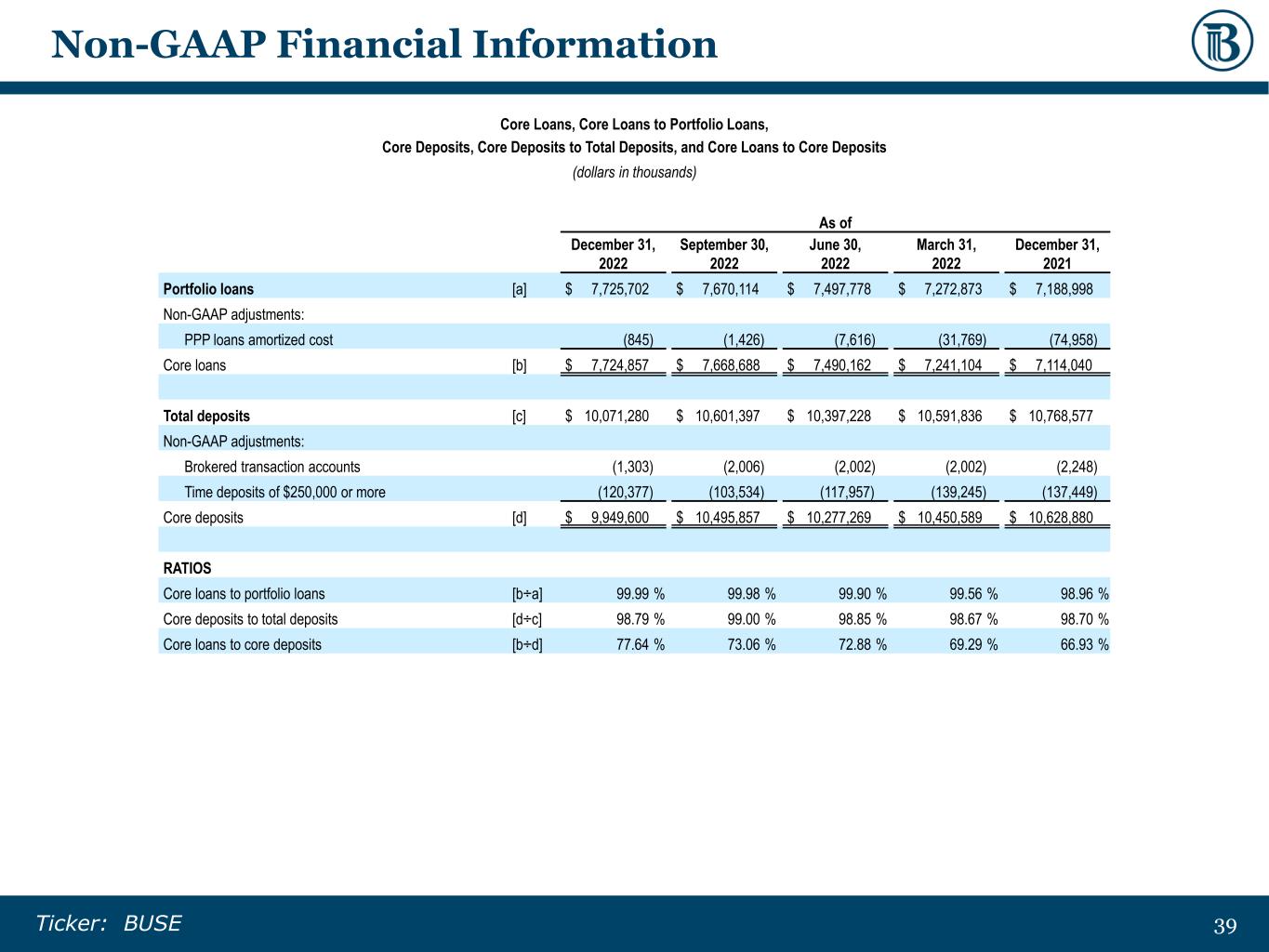

3939Ticker: BUSE Non-GAAP Financial Information Core Loans, Core Loans to Portfolio Loans, Core Deposits, Core Deposits to Total Deposits, and Core Loans to Core Deposits (dollars in thousands) As of December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 Portfolio loans [a] $ 7,725,702 $ 7,670,114 $ 7,497,778 $ 7,272,873 $ 7,188,998 Non-GAAP adjustments: PPP loans amortized cost (845) (1,426) (7,616) (31,769) (74,958) Core loans [b] $ 7,724,857 $ 7,668,688 $ 7,490,162 $ 7,241,104 $ 7,114,040 Total deposits [c] $ 10,071,280 $ 10,601,397 $ 10,397,228 $ 10,591,836 $ 10,768,577 Non-GAAP adjustments: Brokered transaction accounts (1,303) (2,006) (2,002) (2,002) (2,248) Time deposits of $250,000 or more (120,377) (103,534) (117,957) (139,245) (137,449) Core deposits [d] $ 9,949,600 $ 10,495,857 $ 10,277,269 $ 10,450,589 $ 10,628,880 RATIOS Core loans to portfolio loans [b÷a] 99.99 % 99.98 % 99.90 % 99.56 % 98.96 % Core deposits to total deposits [d÷c] 98.79 % 99.00 % 98.85 % 98.67 % 98.70 % Core loans to core deposits [b÷d] 77.64 % 73.06 % 72.88 % 69.29 % 66.93 %