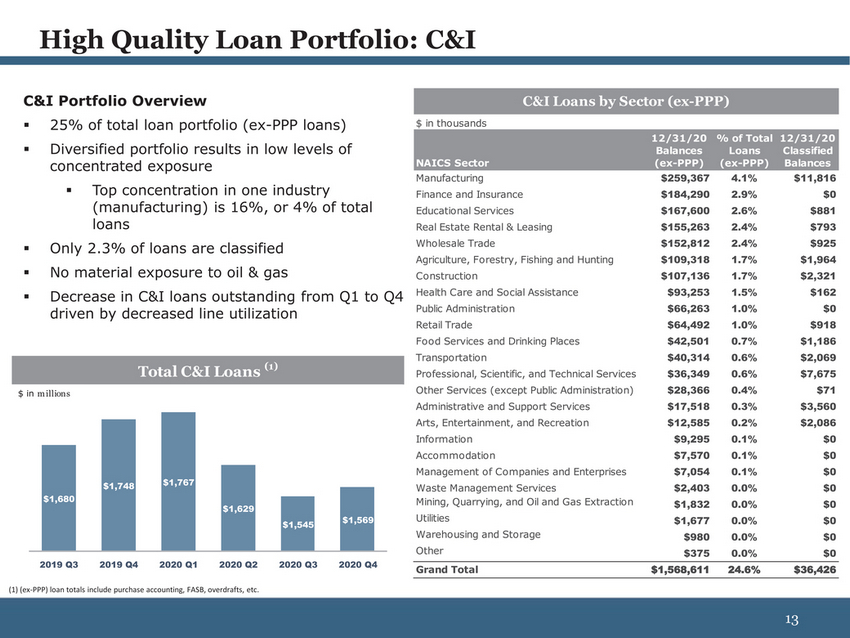

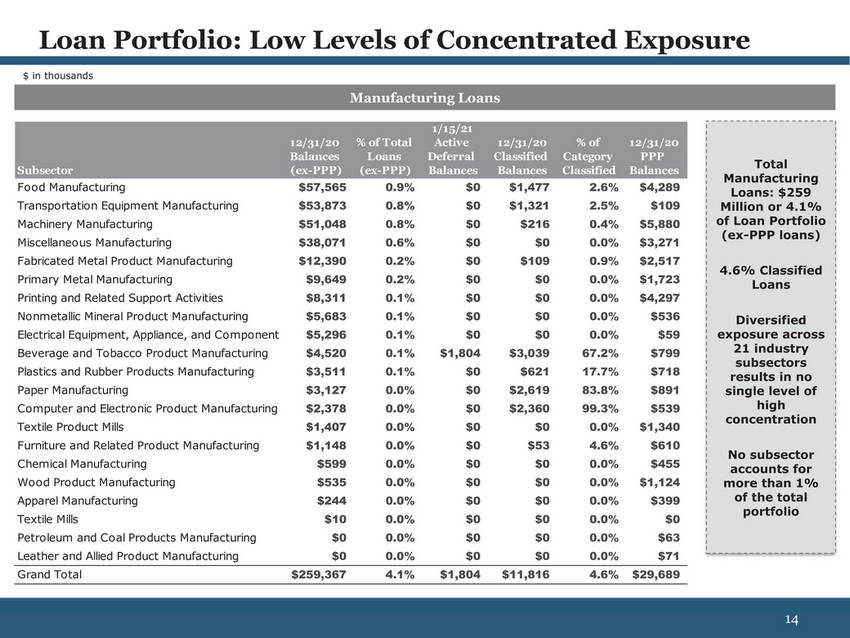

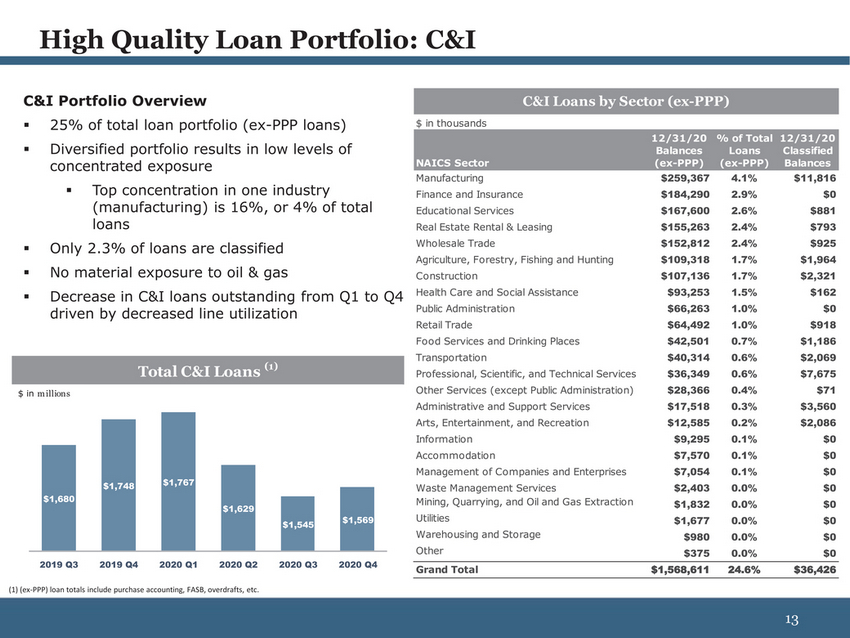

| C&I Portfolio Overview 25% of total loan portfolio (ex-PPP loans) C&I Loans by Sector (ex-PPP) $ in thousands Diversified portfolio results in low levels of concentrated exposure NAICS Sector 12/31/20 Balances (ex-PPP) % of Total Loans (ex-PPP) 12/31/20 Classified Balances Manufacturing$259,3674.1%$11,816 (manufacturing) is 16%, or 4% of total loans Only 2.3% of loans are classified No material exposure to oil & gas Decrease in C&I loans outstanding from Q1 to Q4 driven by decreased line utilization Total C&I Loans (1) $ in m illions $1,748$1,767 $1,680 $1,629 Educational Services $167,600 2.6% $881 Real Estate Rental & Leasing $155,263 2.4% $793 Wholesale Trade $152,812 2.4% $925 Agriculture, Forestry, Fishing and Hunting $109,318 1.7% $1,964 Construction $107,136 1.7% $2,321 Health Care and Social Assistance $93,253 1.5% $162 Public Administration $66,263 1.0% $0 Retail Trade $64,492 1.0% $918 Food Services and Drinking Places $42,501 0.7% $1,186 Transportation $40,314 0.6% $2,069 Professional, Scientific, and Technical Services $36,349 0.6% $7,675 Other Services (except Public Administration) $28,366 0.4% $71 Administrative and Support Services $17,518 0.3% $3,560 Arts, Entertainment, and Recreation $12,585 0.2% $2,086 Information $9,295 0.1% $0 Accommodation $7,570 0.1% $0 Management of Companies and Enterprises $7,054 0.1% $0 Waste Management Services $2,403 0.0% $0 Mining, Quarrying, and Oil and Gas Extraction $1,832 0.0% $0 $1,545$1,569 2019 Q32019 Q42020 Q12020 Q22020 Q32020 Q4 Utilities$1,6770.0%$0 Warehousing and Storage$9800.0%$0 Other$3750.0%$0 Grand Total$1,568,61124.6%$36,426 (ex-PPP) loan totals include purchase accounting, FASB, overdrafts, etc. |