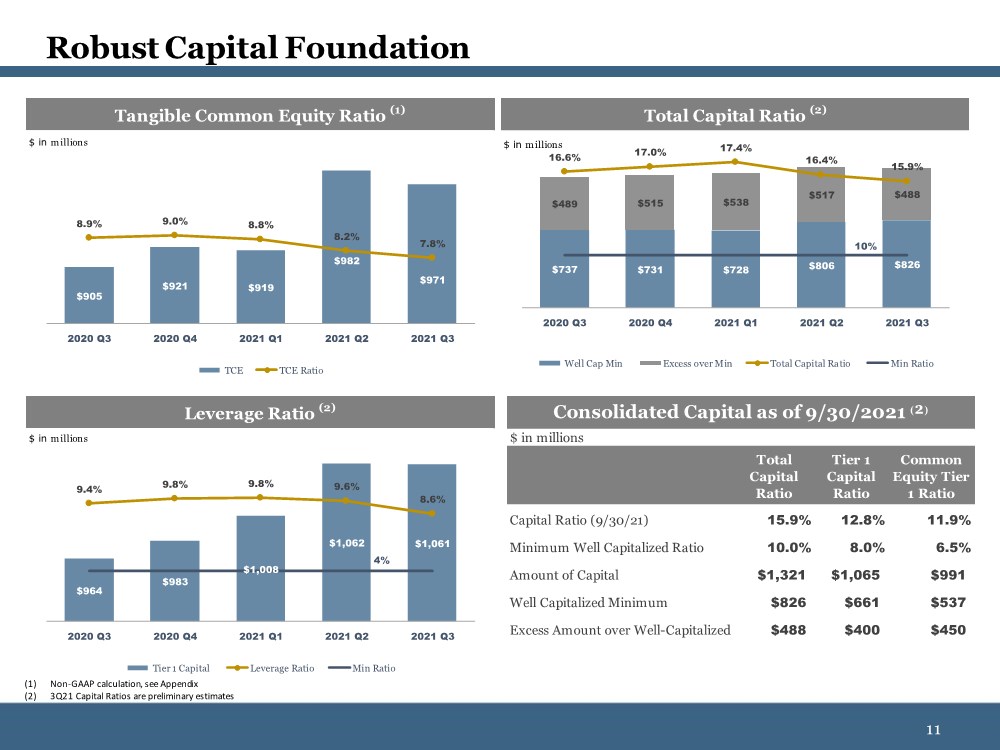

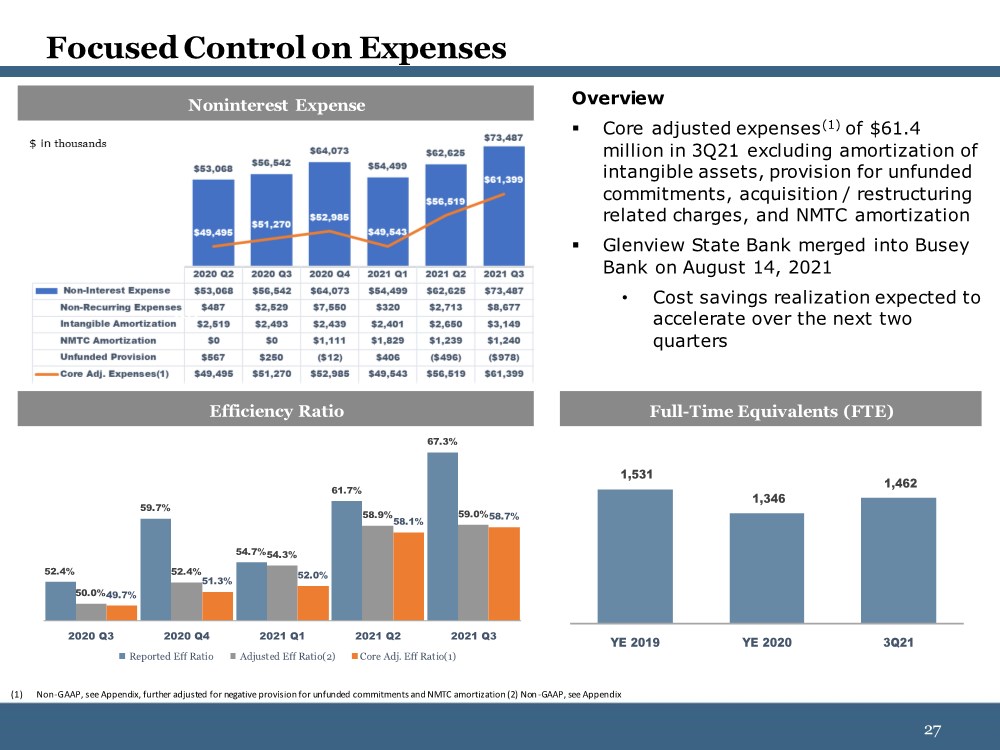

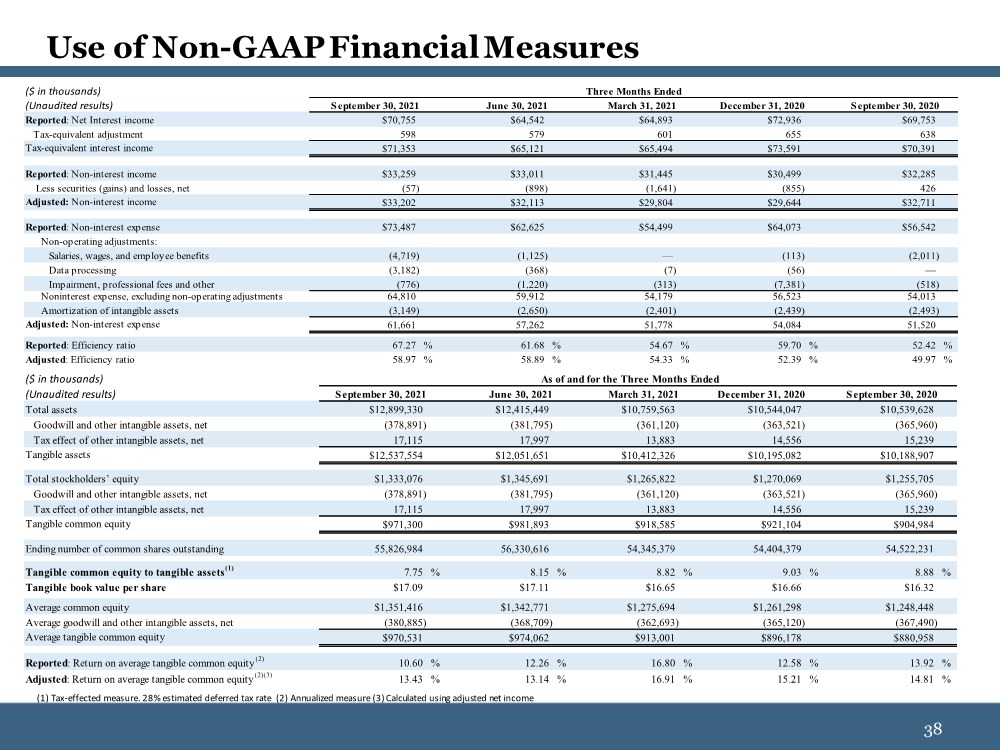

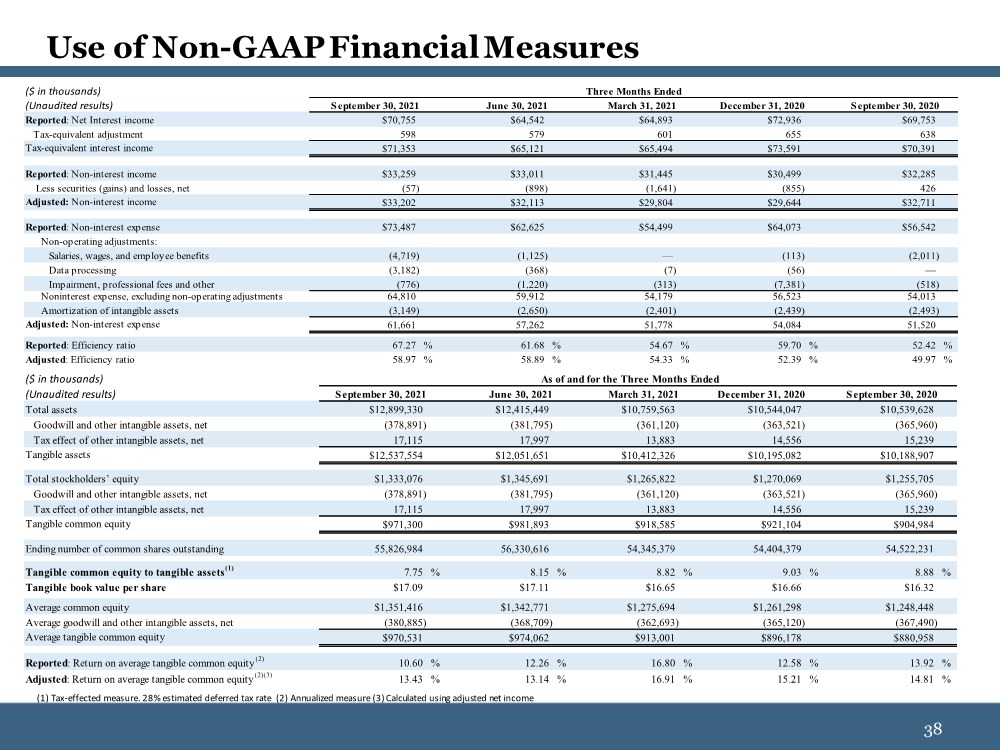

| 38 38 Use of Non-GAAP Financial Measures (1) Tax-effected measure. 28% estimated deferred tax rate (2) Annualized measure (3) Calculated using adjusted net income ($ in thousands) (Unaudited results) September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 Total assets $12,899,330 $12,415,449 $10,759,563 $10,544,047 $10,539,628 Goodwill and other intangible assets, net (378,891) (381,795) (361,120) (363,521) (365,960) Tax effect of other intangible assets, net 17,115 17,997 13,883 14,556 15,239 Tangible assets $12,537,554 $12,051,651 $10,412,326 $10,195,082 $10,188,907 Total stockholders’ equity $1,333,076 $1,345,691 $1,265,822 $1,270,069 $1,255,705 Goodwill and other intangible assets, net (378,891) (381,795) (361,120) (363,521) (365,960) Tax effect of other intangible assets, net 17,115 17,997 13,883 14,556 15,239 Tangible common equity $971,300 $981,893 $918,585 $921,104 $904,984 Ending number of common shares outstanding 55,826,984 56,330,616 54,345,379 54,404,379 54,522,231 Tangible common equity to tangible assets(1) 7.75 % 8.15 % 8.82 % 9.03 % 8.88 % Tangible book value per share $17.09 $17.11 $16.65 $16.66 $16.32 Average common equity $1,351,416 $1,342,771 $1,275,694 $1,261,298 $1,248,448 Average goodwill and other intangible assets, net (380,885) (368,709) (362,693) (365,120) (367,490) Average tangible common equity $970,531 $974,062 $913,001 $896,178 $880,958 Reported: Return on average tangible common equity(2) 10.60 % 12.26 % 16.80 % 12.58 % 13.92 % Adjusted: Return on average tangible common equity(2)(3) 13.43 % 13.14 % 16.91 % 15.21 % 14.81 % As of and for the Three Months Ended ($ in thousands) (Unaudited results) September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 Reported: Net Interest income $70,755 $64,542 $64,893 $72,936 $69,753 Tax-equivalent adjustment 598 579 601 655 638 Tax-equivalent interest income $71,353 $65,121 $65,494 $73,591 $70,391 Reported: Non-interest income $33,259 $33,011 $31,445 $30,499 $32,285 Less securities (gains) and losses, net (57) (898) (1,641) (855) 426 Adjusted: Non-interest income $33,202 $32,113 $29,804 $29,644 $32,711 Reported: Non-interest expense $73,487 $62,625 $54,499 $64,073 $56,542 Non-operating adjustments: Salaries, wages, and employee benefits (4,719) (1,125) — (113) (2,011) Data processing (3,182) (368) (7) (56) — Impairment, professional fees and other (776) (1,220) (313) (7,381) (518) Noninterest expense, excluding non-operating adjustments 64,810 59,912 54,179 56,523 54,013 Amortization of intangible assets (3,149) (2,650) (2,401) (2,439) (2,493) Adjusted: Non-interest expense 61,661 57,262 51,778 54,084 51,520 Reported: Efficiency ratio 67.27 % 61.68 % 54.67 % 59.70 % 52.42 % Adjusted: Efficiency ratio 58.97 % 58.89 % 54.33 % 52.39 % 49.97 % Three Months Ended |