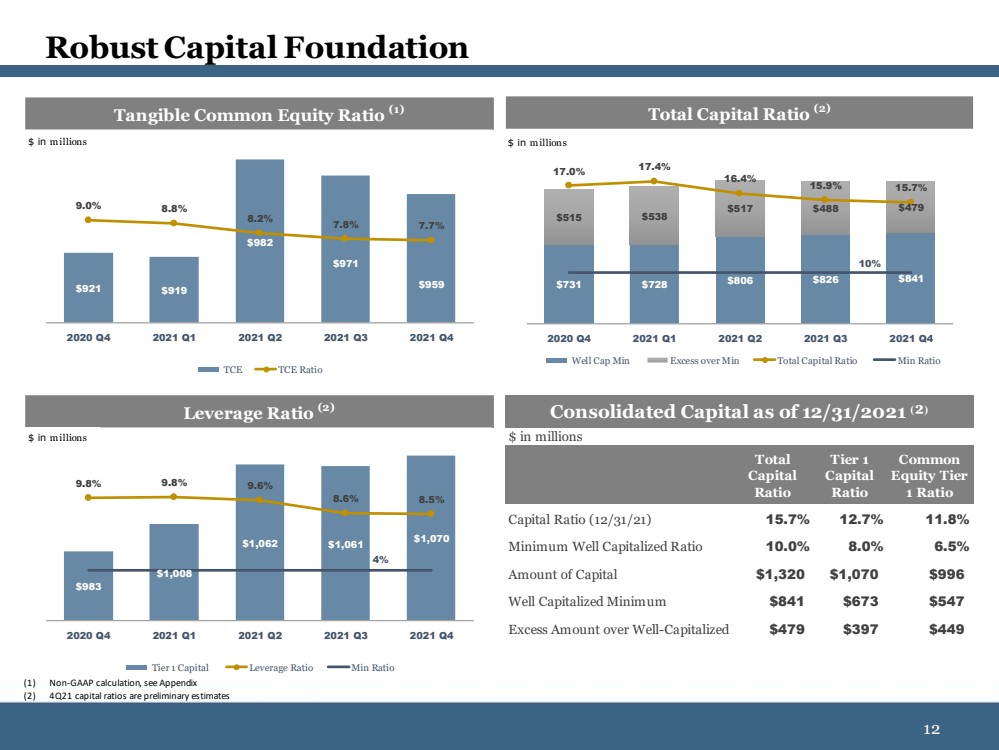

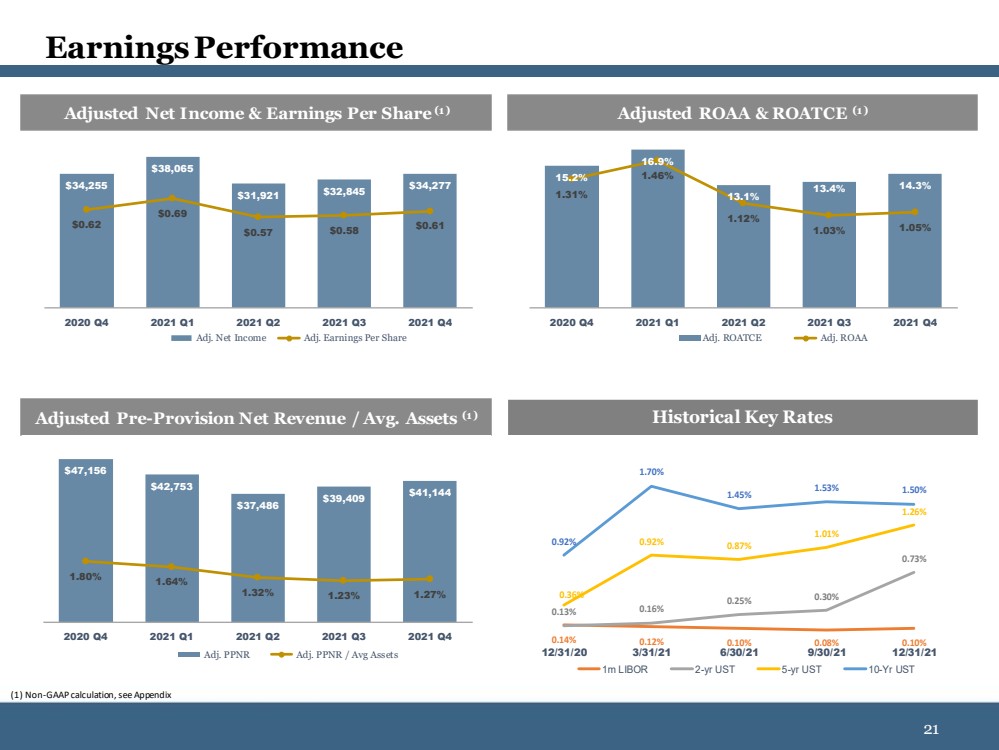

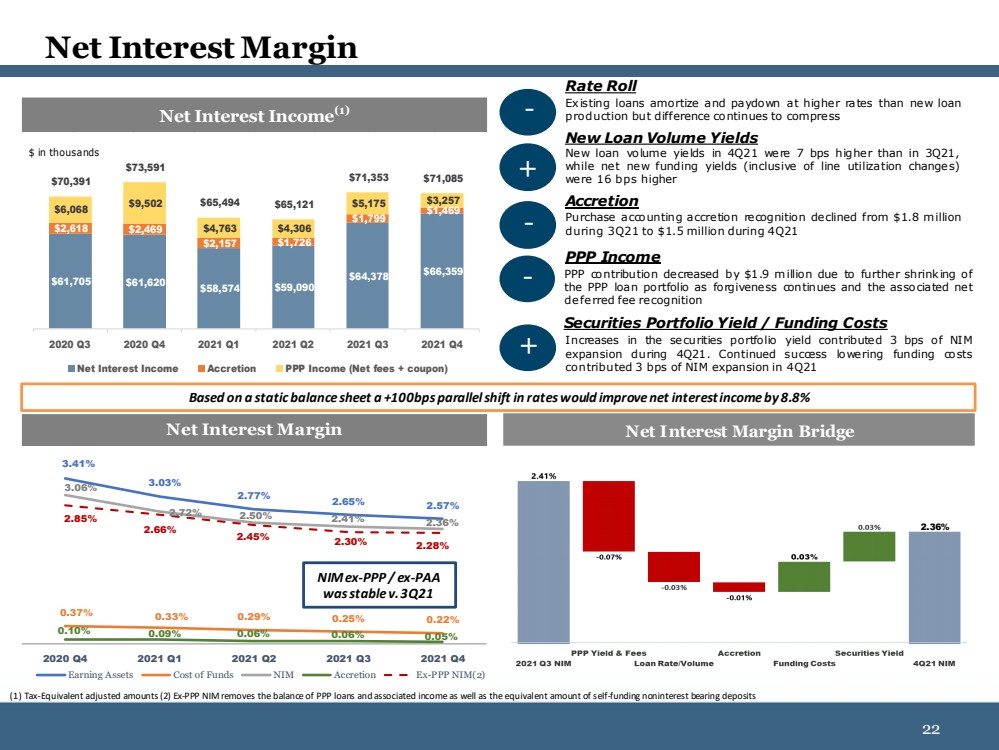

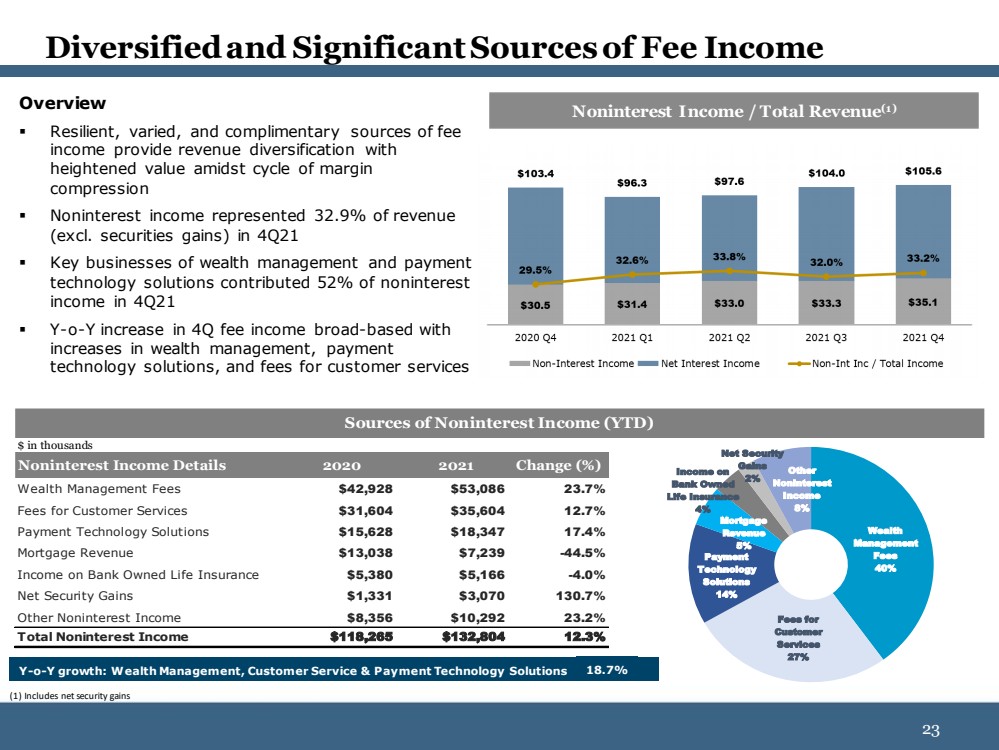

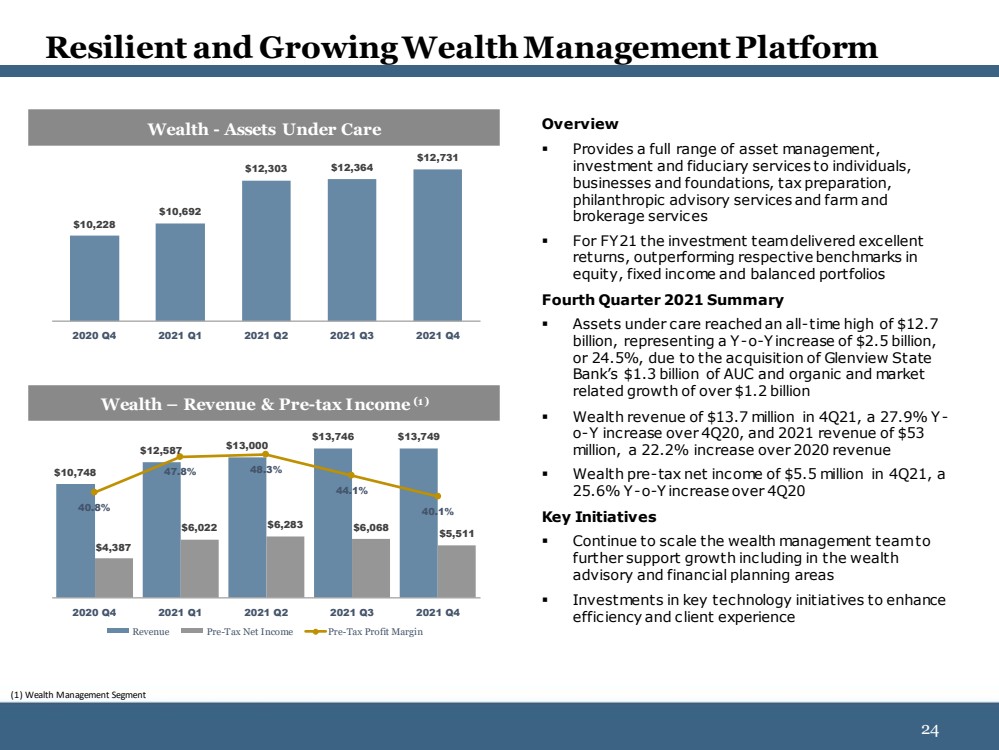

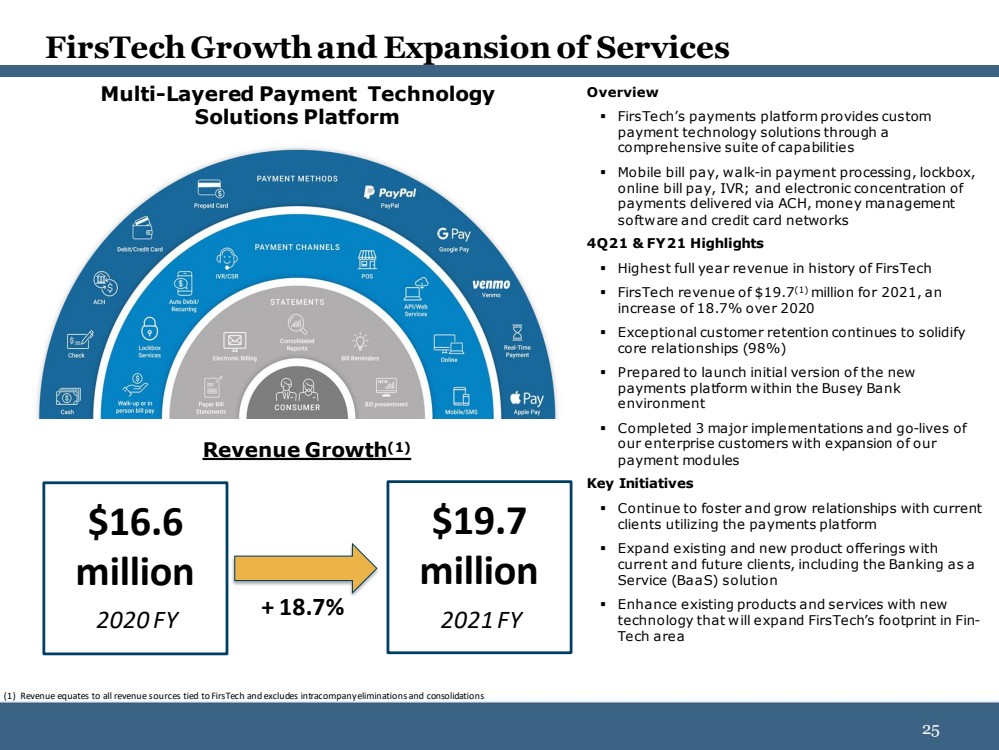

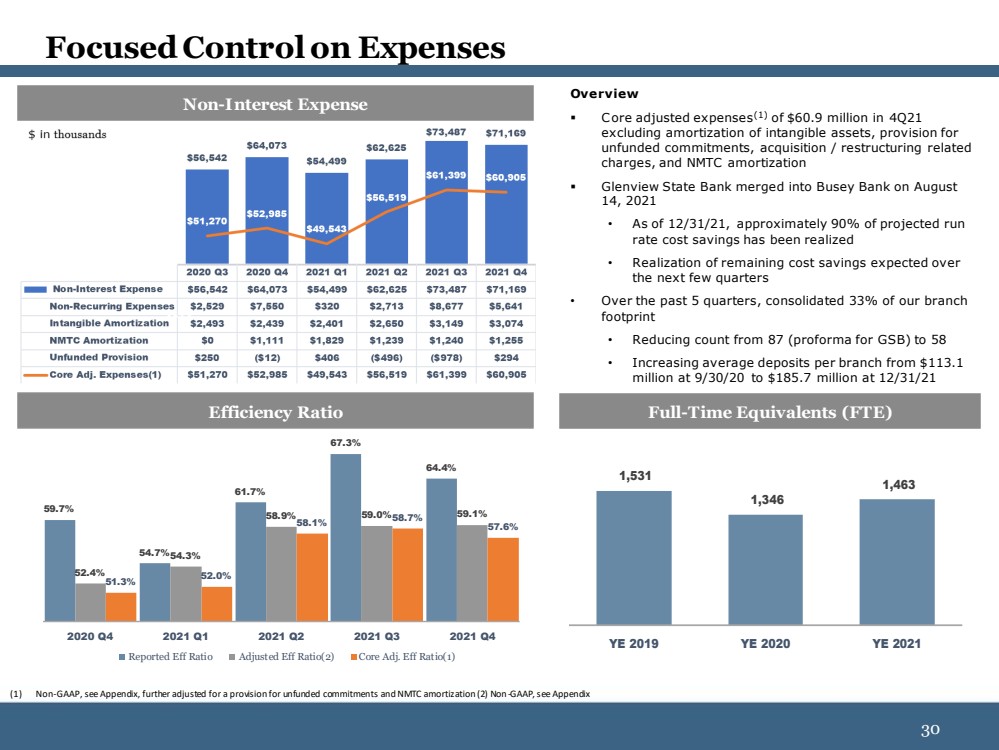

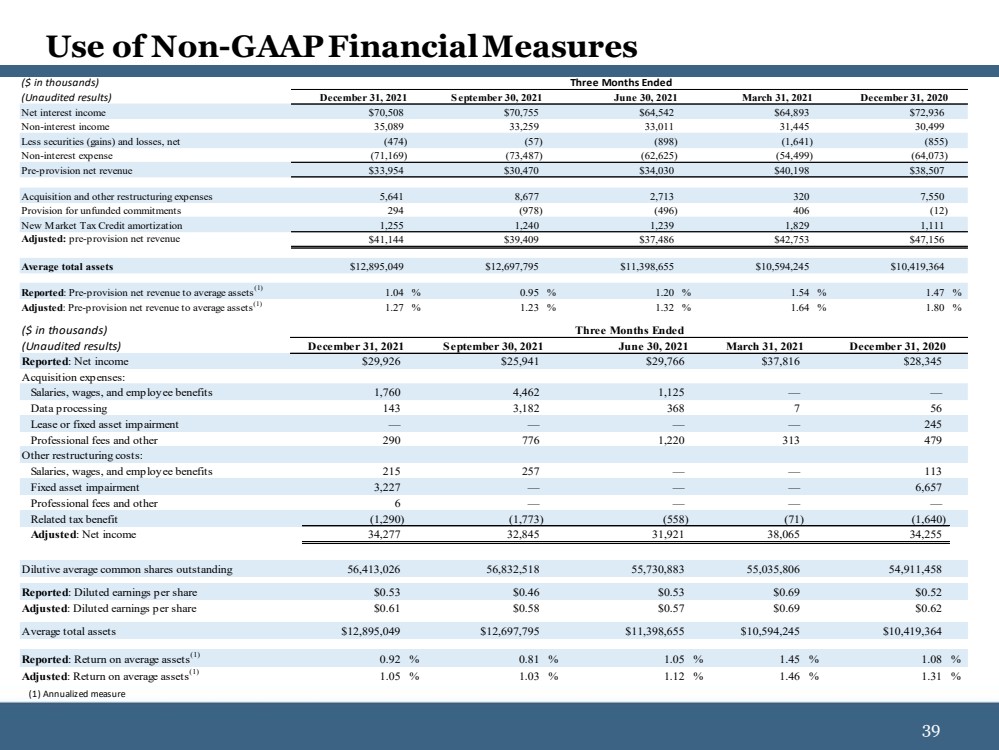

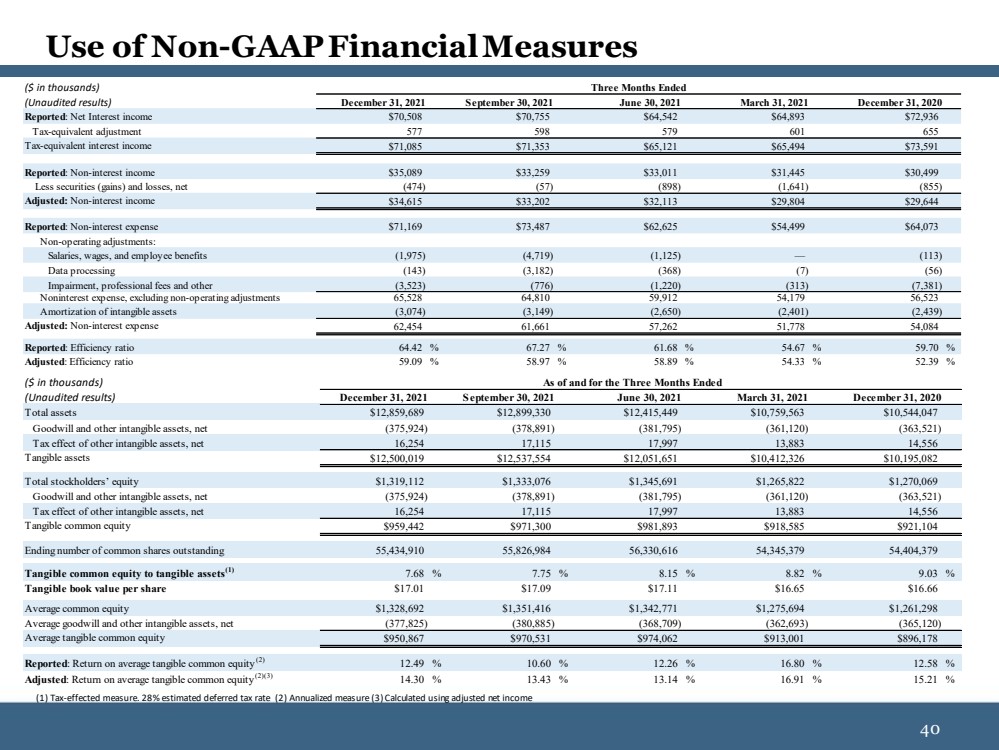

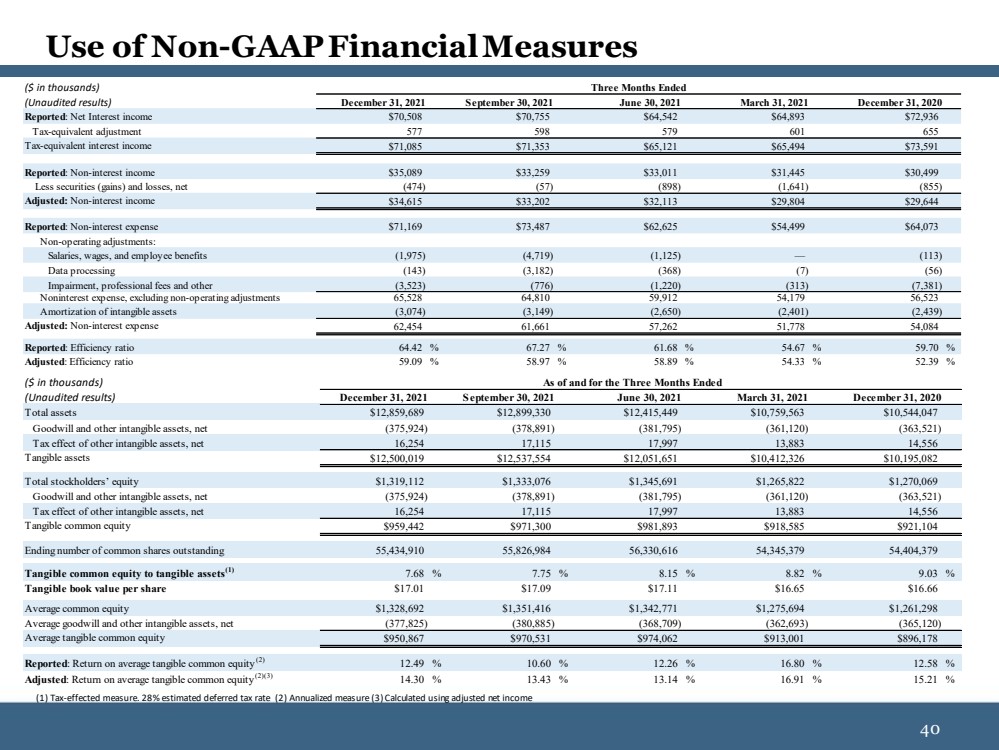

| 40 40 Use of Non - GAAP Financial Measures (1) Tax - effected measure. 28% estimated deferred tax rate (2) Annualized measure (3) Calculated using adjusted net income ($ in thousands) (Unaudited results) December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 Total assets $12,859,689 $12,899,330 $12,415,449 $10,759,563 $10,544,047 Goodwill and other intangible assets, net (375,924) (378,891) (381,795) (361,120) (363,521) Tax effect of other intangible assets, net 16,254 17,115 17,997 13,883 14,556 Tangible assets $12,500,019 $12,537,554 $12,051,651 $10,412,326 $10,195,082 Total stockholders’ equity $1,319,112 $1,333,076 $1,345,691 $1,265,822 $1,270,069 Goodwill and other intangible assets, net (375,924) (378,891) (381,795) (361,120) (363,521) Tax effect of other intangible assets, net 16,254 17,115 17,997 13,883 14,556 Tangible common equity $959,442 $971,300 $981,893 $918,585 $921,104 Ending number of common shares outstanding 55,434,910 55,826,984 56,330,616 54,345,379 54,404,379 Tangible common equity to tangible assets (1) 7.68 % 7.75 % 8.15 % 8.82 % 9.03 % Tangible book value per share $17.01 $17.09 $17.11 $16.65 $16.66 Average common equity $1,328,692 $1,351,416 $1,342,771 $1,275,694 $1,261,298 Average goodwill and other intangible assets, net (377,825) (380,885) (368,709) (362,693) (365,120) Average tangible common equity $950,867 $970,531 $974,062 $913,001 $896,178 Reported : Return on average tangible common equity (2) 12.49 % 10.60 % 12.26 % 16.80 % 12.58 % Adjusted : Return on average tangible common equity (2)(3) 14.30 % 13.43 % 13.14 % 16.91 % 15.21 % As of and for the Three Months Ended ($ in thousands) (Unaudited results) December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 Reported : Net Interest income $70,508 $70,755 $64,542 $64,893 $72,936 Tax-equivalent adjustment 577 598 579 601 655 Tax-equivalent interest income $71,085 $71,353 $65,121 $65,494 $73,591 Reported : Non-interest income $35,089 $33,259 $33,011 $31,445 $30,499 Less securities (gains) and losses, net (474) (57) (898) (1,641) (855) Adjusted: Non-interest income $34,615 $33,202 $32,113 $29,804 $29,644 Reported : Non-interest expense $71,169 $73,487 $62,625 $54,499 $64,073 Non-operating adjustments: Salaries, wages, and employee benefits (1,975) (4,719) (1,125) — (113) Data processing (143) (3,182) (368) (7) (56) Impairment, professional fees and other (3,523) (776) (1,220) (313) (7,381) Noninterest expense, excluding non-operating adjustments 65,528 64,810 59,912 54,179 56,523 Amortization of intangible assets (3,074) (3,149) (2,650) (2,401) (2,439) Adjusted: Non-interest expense 62,454 61,661 57,262 51,778 54,084 Reported : Efficiency ratio 64.42 % 67.27 % 61.68 % 54.67 % 59.70 % Adjusted : Efficiency ratio 59.09 % 58.97 % 58.89 % 54.33 % 52.39 % Three Months Ended |