Exhibit 16.1

Sasol Limited group

Remuneration report 2014

Dear shareholder

The global remuneration arena is complex and dynamic and ‘best practices’ vary between industries, geographies as well as in time. Additionally, various views on what constitutes best practice do not always concur and sometimes clash. The committee’s key objectives are to ensure that remuneration is competitive, globally applicable and flexible. It has to stimulate a performance-driven culture over both the short term and long term yet align with shareholders’ interests. The policy should furthermore not be overly complex and be easy to maintain.

During the past two years the Remuneration Committee (“the committee”) has consulted various stakeholders on the features of Sasol’s remuneration policy. This input has been taken into account in designing a number of changes to our policy which will take further effect from the financial year 2015 (“FY15”). The result in our view, and that of the Sasol Limited Board, encapsulates a balanced package of practices which represent the best possible way forward for the next few years, to meet our business aspirations given our business models, global spread, specific challenges and people requirements.

In this report we present you with our remuneration policy as it applied to FY14 and report on remuneration outcomes for this year. In the tabulation below we highlight some important policy changes as they were applied during FY14 together with the enhancements for FY15.

Remuneration Component | | FY14

(the reporting year) | | FY15

(next financial year and beyond) |

Base Pay | | Target base pay positioning in a range of 80% - 120% around the market median. | | Broad pay bands for greatly reduced number of job levels. |

| | | | |

Short-Term Incentive (STI) Plan | | Introduction of execution targets for large capital projects. | | Targets linked to individual performance more broadly implemented throughout the Group. |

| | | | |

Long-Term Incentive (LTI) Plan | | · Ceased granting SARs, and delivered all long term incentive in the form of what were called Medium Term Incentives (MTIs) and are now called LTIs. · For international participants, the units are measured against the American Depository Receipt (ADR) on the NYSE. · Increase to 70% the proportion of units granted to top management that carry Corporate Performance Targets (CPTs). | | · Further increase to 100% the proportion of units granted to members of the GEC that will carry Corporate Performance Targets (CPTs). · Greater stretch in the targets. · Introduction of dividend equivalents with respect to vested units. |

Additionally, a balanced share ownership guideline will be applied to Executive Directors from FY15 to assist with long term focus and further shareholder alignment.

The committee solicits your support for Sasol’s remuneration policy.

Henk Dijkgraaf (Chairman) |

Mandla Gantsho | Peter Robertson |

Imogen Mkhize | Jürgen Schrempp |

1

Introduction

With the aim of enhancing transparency, this remuneration report is split into three sections covering the following matters:

1. Remuneration governance and the role of the committee

2. Sasol’s remuneration policy for FY14, including planned FY15 changes

3. Remuneration outcomes for FY14

Section 1: Remuneration governance

Board overview

The committee was established in 1989 to ensure remuneration arrangements support the strategic objectives of the company and enable the recruitment, motivation and retention of executives and employees at all levels, while complying with all requirements of law and regulation. The committee is mandated by the board to oversee all aspects of remuneration in accordance with the approved terms of reference. The terms of reference of the committee is reviewed annually by the board and is available on the company’s website at www.sasol.com. Key decisions taken at the committee meetings are reported to the board. Annually, a self-assessment of the effectiveness of the committee and the committee chairman is undertaken.

The members of the committee for the year under review were:

· Mr HG Dijkgraaf (Chairman)

· Dr MSV Gantsho (appointment effective 22 November 2013)

· Ms IN Mkhize

· Mrs TH Nyasulu (resigned effective 22 November 2013)

· Mr PJ Robertson

· Prof JE Schrempp

The committee met four times during the year. Attendance is reported in the corporate governance report.

Sasol complies with the relevant remuneration governance codes and statutes that apply in the various jurisdictions within which it operates. As in previous years, all remuneration principles and practices stated in the King Code of Governance Principles for South Africa 2009 (King III Code) are applied, with the exception of one practice relating to the non-executive directors’ fee structure, which is explained on page xx.

Independent External Advisors

The committee has continued to use independent external advisors from New Bridge Street, based in London, United Kingdom. New Bridge Street is a signatory to the UK Remuneration Consultants’ Code of Conduct. Vasdex & Associates are used to provide specific advice and services as required and requested by management and the company regularly participates in several external remuneration surveys globally to inform benchmarking exercises.

Key definitions

For clarity, the following terms are used in this report in respect of the FY14 organisational structure:

· The term group executive committee (GEC) refers to the members of the executive committee, who are responsible for the design and execution of the organisation’s strategy and long-term business plans. All members of the GEC report to the chief executive officer and are viewed as prescribed officers within the meaning of the Companies Act, no 71 of 2008, as amended (the Act);

· Top management is defined as the level below the GEC and;

· Senior management is defined as the two levels below top management.

2

Executive service contracts

The President and Chief Executive Officer is employed on a five year contract that commenced 1 June 2011. His service agreement is governed by Sasol’s policy for expatriate remuneration.

The Executive Directors and Prescribed Officers have permanent employment contracts with notice periods of three months. The contracts provide for salary and benefits to be offered to the executives as well as participation in incentive plans on the basis of performance and as approved by the board. GEC members and Directors are required to retire from the group and as directors from the board at the age of 60, unless requested by the board to extend their term.

A summary of the termination arrangements for prescribed officers has been included in table format at the end of this report.

Risk management

The following risk-mitigating controls are part of the design of the remuneration practices:

Mix of remuneration elements

The committee determines each component of remuneration, both separately and in totality, and ensures that the pay mix components provide for a balanced pay mix driven by sustainable business performance. The incentive plans are designed such that a balance is obtained between retention and performance over the business development cycle.

Mix of performance measures

Financial and non-financial measures are used in the incentive plans to ensure that performance related rewards are conditional upon achievement of a mix of measures. They aim at protecting shareholder interests and at rewarding company and individual performance.

Other controls

The caps on the maximum pay-out under the short-term incentive plan mitigate against unintended and inappropriate rewards. The board has given the committee the final discretion to approve the payments under all incentive plans.

Sasol Clawback Policy

Clawback may be implemented by the board for:

· any material misstatement of financial statements or where performance related to non-financial targets has been misrepresented and such misstatement has led to the overpayment of incentives to executives;

· errors made in the calculation of any performance condition whether financial or non-financial and which resulted in an overpayment; and

· gross misconduct on the part of the employee leading to dismissal (where, had the gross misconduct been known prior to the incentive / incentive gains being paid, it would have resulted in the payment not being made).

Section 2: Remuneration Policy

Overarching Principles of Remuneration Policy

The committee, following extensive engagement with institutional shareholders in 2012 and 2013, reviewed the remuneration policy to ensure that:

· it remains effective in supporting the achievement of the company’s business objectives;

· it is competitive and in line with best practices globally;

· it fairly rewards individuals for their contribution to the business, and

· it carries the support of our stakeholders.

The committee has full discretion to alter rewards offered in terms of the policy but will only do so in exceptional cases and will disclose such changes.

Sasol’s remuneration policy strives to reward corporate and individual performance through an appropriate balance of fixed pay and both short and long-term variable pay components. The committee considers the targets set for the different elements of performance related remuneration to ensure that these are both appropriate and demanding in the context of the business environment as well as complying with the provisions of appropriate governance codes and statutes.

Prominent within the Sasol group in FY14 was the focus on the successful execution of the Business Performance Enhancement Programme which includes the implementation of a new operating model and resultant organisational structures aiming to achieve greater efficiency and reduced costs. Some fundamental principles of the re-structure include increasing the span of control, de-layering parts of the organisation and thus reducing ambiguity, bureaucracy and ineffective processes. The restructure necessitated a review of remuneration practices resulting in changes for FY15. Accordingly, a new reward and organisation design framework will be introduced from FY15 to replace the 28 existing levels with nine structural layers designed around accountability, complexity and reporting lines. From FY15 onwards, top management will be known as the Business and Group Function Leadership layer, and senior management will be referred to as the Operational and Functional Leadership layer.

Due to the restructure, opportunities for voluntary retrenchment packages and voluntary early retirement were offered to affected employees under the Sasol Retrenchment policy. This process will continue into FY15.

3

Key Components of Sasol’s Executive Remuneration Policy

The key components and drivers of Sasol’s executive remuneration structure, which apply to all members of the top and senior management, are set out in the table below:

Remuneration

component | | Strategic intent and drivers | | Policy Application |

Base salary | | · Attraction and retention of key employees. · Internal and external equity. · Rewarding individual performance. | | · Base salary reflects individuals’ competencies and is normally reviewed annually with individual performance differentiated salary adjustments effective from 1 October each year. · Distribution is around the median as informed by benchmarks. |

| | | | |

Benefits | | · External market competitiveness. · Integrated approach towards wellness driving employee effectiveness and engagement. | | · Benefits include but are not limited to membership of a retirement plan and health insurance, disability and death cover to which contributions are made by both the company and the employee. |

| | | | |

Allowances | | · Compliance with legislation. · Negotiated and contractual commitments. | | · Offered in line with statutory requirements and either agreed or determined at collective bargaining forums. |

| | | | |

Short Term Incentive (STI) plan (<12 months) | | Alignment with group and business unit or functional performance in terms of: · Financial targets · Employment equity (South African employees only) · Safety performance (against both leading and lagging targets) · Reward performance against targets set at group, business unit and individual levels including targets for major capital projects and compliance issues where relevant. | | · Subject to the achievement of performance criteria, the short term incentive is paid following approval at the September committee meeting. · A single structure is applicable to all employees globally, other than certain employees who are aligned with production (Mining) or sales commission arrangements. |

| | | | |

Long-term incentive plan (LTI) | | Alignment with both group performance and retention objectives in terms of: · Attraction and retention of senior employees; · Direct alignment with shareholders’ interests by linking the vesting of awards to the achievement of CPTs where units can be forfeited or enhanced if targets are not met or exceeded, in terms of: · Efficiency; · Earnings; and · Relative Total Shareholders’ Return (TSR) | | · The long-term incentive arrangements are reviewed annually to ensure that they are appropriately aligned to strategic goals and provide an appropriate incentive for longer-term performance and shareholder alignment. · Awards are directly linked to role, group and individual performance. · Awards are made upon appointment, promotion or in terms of the annual supplementary process. · Of the total award to senior management, the following portion was linked to CPTs in FY14: · Top management and GEC: 70% · Senior management: 60% |

Total remuneration

Benchmarking

Executive remuneration is benchmarked against data provided in national executive remuneration surveys, as well as to information disclosed in the remuneration reports of organisations included in our benchmarking peer group. One of the committee’s key tasks is to preserve the relevance, integrity and consistency of this benchmarking exercise.

Survey reports from PwC Remchannel and Mercer Global Remuneration Solutions are used for benchmarking of South African remuneration levels. Since PwC has been appointed as the company auditors effective FY14, participation in the PwC Remchannel survey has been confirmed as independent by the Audit Committee Chairman. Survey data from the Hay Group, ECA, Mercer and Towers Watson are used in different locations in the international environment.

South African executive remuneration survey data is supplemented by the published remuneration information of a number of comparator organisations. The international data points carry a weighting of 30% with the balance linked to South African data points. This comparator group of companies includes:

· four global resources companies with significant South African interests namely BHP Billiton, Anglo American, Gold Fields and AngloGold Ashanti;

· two South African global industrials namely SAB Miller and Sappi; and

· six US and European energy and chemicals integrated companies namely ExxonMobil, Chevron, ConocoPhillips, Shell, BP and Total.

The committee requested that a comprehensive review of the peer group be done in FY15.

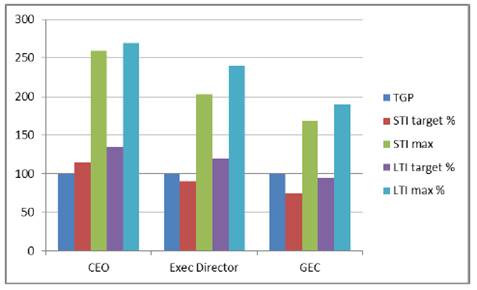

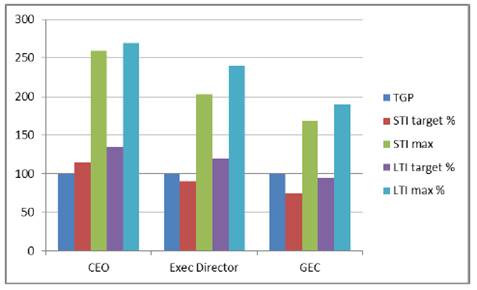

The ratios within the remuneration mix are structured for different management levels within the organisation and geographic location. The relative proportion of the remuneration components of the GEC within the approved remuneration mix is set out in the following chart:

*Total guaranteed package (TGP) is used in South Africa and equates to total cost of base salary and fixed allowances plus employer contributions to benefit funds

The chart indicates a balanced portfolio of reward allocated towards base salary / TGP, short term and long term incentives, tied to the achievement of group and individual targets set over the short and long term to ensure sustainable focus on the group’s strategic objectives. Bar for a small adjustment to the LTI fair values, the pay mix remains unchanged for FY15.

4

Total guaranteed package / base salary and benefits

South African employees who are not covered by collective bargaining agreements, receive a total guaranteed package (TGP) which includes employer contributions towards retirement, risk, life and health care benefits. The concept of TGP was introduced in 2008 for supervisory levels and above and in terms of this model, all changes to benefit contribution levels are cost neutral to the employer. All increases in the benefit pricing of employee and employer contributions reduce the net cash salary of employees.

Annual increases to total guaranteed package are determined with reference to the scope and nature of an employee’s role, market benchmarks, personal performance and competence, affordability and projected consumer price index figures. Annual increases for all employees outside of the collective bargaining councils take effect from 1 October. An overall annual increase of 6,5% was approved by the committee, with effect from 1 October 2013, for all employees outside the respective collective bargaining councils in South Africa. South African employees included in collective agreements received increases varying between 7,5% and 8,25%, for 2014. This is the 5th consecutive year that increases awarded to management are lower than what was agreed through collective bargaining forums for unionised employees.

Our employees outside of South Africa are remunerated on a base salary plus benefits approach and similar benefits are offered as for the South African employees. In FY14, increases awarded were in line with anticipated movements in remuneration in the international jurisdictions and in accordance with individual performance.

Short-term incentives

The short-term incentive (STI) plan is designed to recognise the achievement of a combination of group and business unit or group functional performance objectives.

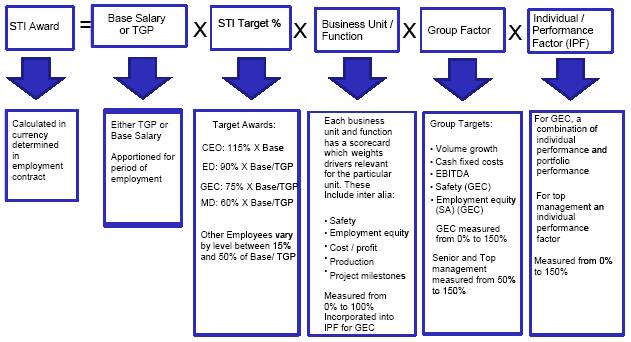

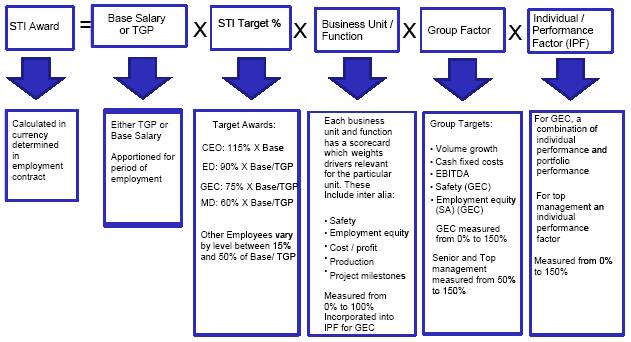

The following diagram indicates the basis for calculating the short-term incentive amounts for group executives and employees in top management:

TGP: total guaranteed package, CEO: chief executive officer, ED: executive director, GEC: group executive committee, EBITDA: earnings before interest, tax, depreciation and amortisation

Measures covering the execution of large capital projects have been incorporated into the performance agreements of those executives who are directly involved in the management and oversight of these projects.

The specific configuration and outcome of the STI calculation on Group targets, for each employee category is detailed separately in the paragraphs below.

5

Short term incentive — members of the GEC

The group targets applicable to the GEC, their weights and the resultant outcome of the group multiplier for FY14 are indicated in the following table.

Measure | | Weight | | Threshold

(0%) | | Target

(100%) | | Stretch Target

(150%) | | Achievement | | Weighted

achievement | |

| | | | | | | | | | | | | |

Year on year growth in EBITDA | | 55 | % | FY13 EBITDA + 0% | | FY13 EBITDA + CPI | | FY13 EBITDA + CPI + 8% | | FY13 EBITDA + 14% + 17,3% | | 82,50 | % |

| | | | | | | | | | | | | |

Year on year growth in fuel volumes measured in tons | | 10 | % | FY13 Volume + 0% | | FY13 + 1% | | FY13 + 2% | | FY13 + 1,65% | | 13,26 | % |

| | | | | | | | | | | | | |

Growth in Cash Fixed Costs (CFC) versus PPI | | 15 | % | FY13 CFC + Average PPI + 2% | | FY13 CFC + PPI | | FY13 CFC + PPI – 2% | | FY13 CFC + PPI – 1,8% | | 21,94 | % |

| | | | | | | | | | | | | |

Employment Equity | | 10 | % | 60% of all opportunities in targeted groups | | 60% of all opportunities in targeted groups | | 75% of all opportunities in targeted groups | | Snr Mgt 50,96% Mid Mgt: 41,25% | | 8,68 | % |

| | | | | | | | | | | | | |

Safety Lagging indicator | | 4 | % | RCR: 0,36 | | RCR: 0,30 | | RCR: 0,28 | | RCR = 0,36 less 5 fatalities | | 0,00 | % |

| | | | | | | | | | | | | |

Safety Leading indictor | | 6 | % | Weighted average of leading indicators for all BUs to be 70% | | Weighted average of leading indicators for all BUs to be 90% | | Weighted average of leading indicators for all BUs to be 100% | | 97,50% | | 8,28 | % |

| | | | | | | | | | | | | |

Overall weighted average | | | | | | | | | | | | 134,66 | % |

Since the portfolios of the GEC members cover a number of business units or group functions, a weighted combination of the relevant scores is included in a combined individual / portfolio score for each GEC member.

The table below provides details of all the factors and the final determination of annual short-term incentive award for FY14.

| | TGP/

Base Salary as at

30 June 2014 | | Target % | | Group

Factor % | | Individual

Performance

Factor

% | | FY14 Short term

incentive value* | |

| | A | | B | | C | | D | | E = AxBxCxD | |

DE Constable(1) | | US$ | 899 633 | | 115 | % | 134,66 | % | 123.3 | % | US$ | 1 717 770 | |

VN Fakude | | R | 7 452 913 | | 90 | % | 134,66 | % | 115 | % | R | 10 387 356 | |

P Victor(2) | | R | 4 000 000 | | 90 | % | 134,66 | % | 125 | % | R | 5 030 381 | |

SR Cornell(3) | | US$ | 650 000 | | 75 | % | 134,66 | % | 105 | % | US$ | 283 270 | |

FR Grobler(4) | | R | 4 349 248 | | 75 | % | 134,66 | % | 95 | % | R | 3 370 580 | |

VD Kahla | | R | 5 112 105 | | 75 | % | 134,66 | % | 105 | % | R | 5 421 119 | |

BE Klingenberg | | R | 5 931 050 | | 75 | % | 134,66 | % | 100 | % | R | 5 990 064 | |

E Oberholster(5) | | R | 4 431 548 | | 75 | % | 134,66 | % | 95 | % | R | 3 180 158 | |

M Radebe | | R | 4 550 000 | | 75 | % | 134,66 | % | 100 | % | R | 4 595 272 | |

CF Rademan | | R | 5 498 750 | | 75 | % | 134,66 | % | 115 | % | R | 6 386 482 | |

SJ Schoeman(6) | | R | 4 300 000 | | 75 | % | 134,66 | % | 95 | % | R | 689 491 | |

*Apportioned for employment period or period on the GEC.

(1) Net USD salary used to calculate net USD short term incentive.

(2) 50% target STI for 1/7/2013-31/08/2013; 90% target STI for 1/09/2013-30/06/2014. Calculation based on TGP including acting allowance.

(3) 75% target STI for 1/02/2014 -30/06/2014.

(4) 60% target STI for 1/7/2013-30/11/2013; 75% target STI for 1/12/2013-30/06/2014. Calculation based on net assignment salary paid whilst on expatriate contract in Germany.

(5) 60% target STI for 1/7/2013-31/09/2013; 75% target STI for 1/10/2013-30/06/2014.

(6) 60% target STI for 1/7/2013-30/04/2013; 75% target STI for 1/05/2013-30/06/2014.

The committee has the final discretion to determine the individual amounts that are paid out under the group short-term incentive plan considering overall performance versus predetermined targets. No changes were made to formulaic incentive calculations.

6

Short-term incentive — top and senior management

The group targets for the levels below the GEC are growth in volume, cash fixed costs and EBITDA respectively. Performance against the group targets is measured in a range of 50% - 150%. Safety, Employment Equity and targets relevant to the business unit (BU)/group functional annual business plans including project deliverables are measured at BU/Group Functional level. Excluding the group employment equity and safety scores (which are included in the respective BU / group functional scores), the group factor applied to this category is 144,71%.

Each business unit and group functional score is verified by internal audit. For FY14, BU/group functional scores varied between 35,36% and 87,98%. For members of top management, the individual performance factor (IPF) (0% - 150%) also applies. Application of the IPF is performed using a normal distribution to ensure that its implementation does not increase the total incentive pool made available for payment.

Short-term incentive — below senior management

The short-term incentive plans below senior management are considered collective performance arrangements and are thus based on business unit or group functional scores alone. The STI award is determined as follows:

As the impact on the group at large is minimal in these areas, and most employees in collective bargaining units do not have their remuneration tied to individual performance, these factors have been excluded from the formula.

Long-term incentive plans

Governance over the long-term incentive plans is provided by the Remuneration Committee. The committee approves grants in terms of the policy under the following circumstances:

· upon promotion of an employee to a qualifying role;

· upon appointment to the group in a qualifying role;

· an annual award to eligible employees; and

· discretionary awards for purposes of retention.

Long-term incentive plan

LTI awards give participating employees the opportunity, subject to the vesting conditions, to receive a future cash incentive payment calculated with reference to the market value of a Sasol ordinary share (or ADR for international employees) after a three year vesting period, subject to the achievement of corporate performance targets. The plan does not confer any right to acquire shares in Sasol Limited and for awards made up to August 2014, employees are not entitled to dividends or dividend equivalents. Awards made from September 2014 will receive the benefit of dividend equivalents on those units that vest.

Termination conditions include:

· for reasons of death, disability, retirement or retrenchment vesting is subject to the probability assessment of achieving the corporate performance targets as well as the period in service over the vesting period;

· for all other reasons, unvested rights are forfeited.

The following table sets out the fair value of annual LTI awards made to prescribed officers in FY14 as a multiple of the reference salary/TGP of the level that the position has been evaluated.

Role | | Multiple | |

President and Chief Executive Officer | | 135 | % |

Executive Directors | | 120 | % |

Group Executives | | 95 | % |

From FY15, awards will be made as a multiple of actual rather than the pay band reference salary/TGP.

The table below presents the progressive stance undertaken in aligning shareholder and management interests through increased weighting in terms of CPTs.

| | % of Award linked to CPTs |

Year | | SAR | | LTI |

FY12 | | 25% | | 50% |

FY13 | | 60% | | 60% |

FY14 | | No SARs

issued | | Top mgt: 70% Snr mgt: 60% |

FY15 | | No SARs

issued | | GEC: 100% Other participants: 60% |

7

The table below summarises the weightings and corporate performance targets under which the LTI rights were granted during FY14. Vesting is considered in terms of the weighted performance measured against three targets. If targets are not met, the performance based LTI awards are forfeited and if targets are exceeded the number of LTI awards that vest may be increased by up to 100% of the units tied to the CPTs, at vesting. There is no opportunity for retesting of targets.

Measure | | Weight (of the

portion linked to

the CPTs) | | Threshold (0%)(1) | | Target (100%) | | Stretch (over-

performance)

(200%) | | |

Increase in Tons produced per head (1) | | 25 | % | 0% improvement on FY13 base target | | 1% improvement on FY13 base target | | 2% improvement on FY13 base target | | |

Growth in Attributable Earnings (1) | | 25 | % | 80% - 100% of average CPI for the FY | | >100% to 120% of average CPI for the FY | | >120% of average CPI for the FY | | |

TSR(2) | | 25 | % | LQ of peers in the JSE RESI 10 | | Median of peers in the JSE RESI 10 | | UQ of peers in the JSE RESI 10 | | |

TSR | | 25 | % | LQ of peers included in the MSCI World Energy Index | | Median of peers included in the MSCI World Energy Index | | UQ of peers included in the MSCI World Energy Index | | |

(1) | Performance is assessed on a linear basis between threshold, target and stretch targets |

(2) | TSR = Total Shareholders’ Return |

A summary of outstanding LTI awards and vesting percentages is presented in the following table:

| | | | | | Weighting of Performance Targets | | | |

Year of

allocation | | Vesting

year | | Vesting

Range | | Attributable

Earnings

Growth | | Production

Volume

Growth | | Production

volume /

headcount

Growth | | Share Price

vs ACSI 40 | | TSR vs JSE

RESI 10 | | TSR vs MSCI World

Energy Index | | Vesting

results | |

2011 | | 2014 | | 50% to 150% | | 25 | % | 25 | % | | | 50 | % | | | | | 2014 =125% | |

2012 | | 2015 | | 50% to 150% | | 25 | % | 25 | % | | | 50 | % | | | | | Unvested | |

2013 | | 2016 | | 40% to 160% | | 25 | % | | | 25 | % | | | 25 | % | 25 | % | Unvested | |

2014 | | 2017 | | 30% to 170%(1) | | 25 | % | | | 25 | % | | | 25 | % | 25 | % | Unvested | |

| | | | 40% to 160%(2) | | | | | | | | | | | | | | | |

(1) | Top management |

(2) | Senior management |

The committee retains full authority as to the vesting of rights awarded to participants.

For FY15 the following changes will be introduced to the TSR conditions:

Measure | | Weight (of the

portion linked to

the CPTs) | | Threshold (0%) | | Target (100%) | | Stretch (over-

performance)

(200%) | | |

TSR – MSCI World Energy Index | | 35 | % | Below the 30th percentile of the peer group | | Median of the peer group | | 80th percentile of the peer group | | |

TSR – JSE Resources 10 Index (incl Sasol) | | 15 | % | 7th in peer group | | 5th in peer group | | 3rd in peer group | | |

Share appreciation rights (SARs) (no awards in FY14)

SARs gave participating employees the opportunity, subject to the vesting conditions, to receive a future cash incentive payment calculated with reference to the increase in the market value of a Sasol ordinary share from the date of grant, after the three, four and five year vesting periods respectively (up to FY12 over two, four and six years). The plan does not confer any rights to acquire shares in Sasol Limited and employees are not entitled to dividends. The maximum period for exercising SARs is nine years from the date of the grant after which they lapse.

Vesting of previously awarded SARs is considered in terms of the weighted performance measured against three targets. If targets are not met, the performance based SAR awards are forfeited and if targets are exceeded additional SARs are awarded. There is no opportunity for retesting of targets.

A summary of outstanding SAR allocations’ vesting percentages are presented in the table below:

8

| | | | | | Weighting of Performance Targets | | | | |

Financial

Year of

allocation | | Vesting

year | | Vesting Range | | Attributable

Earnings

Growth | | Production

Volume

Growth | | Production

volume /

headcount

growth | | Share Price

vs ACSI 40 | | TSR vs JSE

RESI 10 | | TSR vs MSCI

energy index | | Vesting results | | |

2010 | | 2012, 2014 & 2016 | | 75% to 125% | | 25 | % | 25 | % | | | 50 | % | | | | | 2012 = 106,25% 2014 = 112,50% 2016 = unvested | | |

2011 | | 2013, 2015 & 2017 | | 75% to 125% | | 25 | % | 25 | % | | | 50 | % | | | | | 2013 =112,50% 2015 = unvested 2017 = unvested | | |

2012 | | 2014, 2016 & 2018 | | 75% to 125% | | 25 | % | 25 | % | | | 50 | % | | | | | 2014 = 112,50% 2016 = unvested 2018 = unvested | | |

2013 | | 2016, 2017 & 2018 | | 40% to 160% | | 25 | % | | | 25 | % | | | 25 | % | 25 | % | Unvested | | |

2014 | | 2017, 2018 & 2019 | | 40% to 160% | | 25 | % | | | 25 | % | | | 25 | % | 25 | % | Unvested | | |

Sasol Inzalo Management Scheme

Sasol implemented the Sasol Inzalo black economic empowerment (BEE) transaction in 2008. As part of this transaction, senior black management (black managers), including black Executive Directors and members of the GEC, participated in the Sasol Inzalo Management Scheme and were awarded rights to Sasol ordinary shares. The rights entitle the employees from the inception of the scheme to receive dividends bi-annually and Sasol ordinary shares at the end of ten years, being the tenure of the transaction, subject to Sasol’s right to repurchase some of the shares issued to The Sasol Inzalo Management Trust (Management Trust) in accordance with a pre-determined repurchase formula. The formula takes into account the underlying value of the shares on 18 March 2008, the dividends not received by the Management Trust as a result of the pre-conditions attached to those shares and the price of Sasol ordinary shares at the end of the ten year period.

On retirement at normal retirement age, early retirement, retrenchment due to operational requirements or on leaving the employ of Sasol due to ill health during the tenure of the Sasol Inzalo transaction, the black managers (as defined in the Deed of Trust for The Sasol Inzalo Management Trust) will retain their entire allocation of rights until the end of the ten year period, subject to Sasol’s repurchase right referred to above. The nominated beneficiaries or heirs of those black managers, who die at any time during the transaction period, will succeed to their entire allocation of rights. On resignation within the first three years of having been granted these rights, all rights were forfeited. On resignation after three years or more from being granted the rights, the black managers forfeit 10% of their rights for each full year or part thereof remaining from the date of resignation until the end of the transaction period. Black managers leaving the employment of Sasol during the 10 year period by reason of dismissal, or for reasons other than operational requirements, will forfeit their rights to Sasol ordinary shares.

See note 47 of the annual financial statements for the outstanding rights under the Sasol Share Inzalo Management Scheme.

Share ownership guideline

The committee approved a share ownership guideline for Executive Directors effective 1 July 2014, under which the board requires Executive Directors to hold Sasol shares or ADRs to 200% of the annual base salary for the Chief Executive, 150% and 100% of annual pensionable remuneration for the Chief Financial Officer and Executive Directors respectively.

The requirement should be fully achieved within five years from 1 July 2014, or from the date of appointment if after this date.

Sasol Share Incentive Scheme

The SAR plan replaced the previous Sasol Share Incentive Scheme, which has been closed since 2007. The Sasol Share Incentive Scheme, had vesting periods of 2, 4 and 6 years, and options could be implemented up to a maximum of nine years from the date of grant. If options are not implemented by this date, they will lapse. The Scheme will be closed in 2016. See Note 47 of the annual financial statements for the options which remain exercisable under the Sasol Share Incentive Scheme.

Retention and sign-on payments

A sign-on payment policy may be used in the external recruitment of candidates in highly specialised or scarce skill positions mostly in senior management levels. Sign-on payments are linked to retention agreements.

During FY14, scarce skills / retention awards were approved to the total value of R12,6m to 24 employees.

Section 3: Remuneration in 2014

The appointment and re-election dates of Executive Directors are outlined below:

Executive

directors | | Employment

date in the

group of

companies | | Date first

appointed to the

board | | Date last

re-elected as a

director | | Date due for

re-election (1) | | |

DE Constable | | 1 June 2011 | | 1 July 2011 | | 30 November 2012 | | 21 November 2014 | | |

VN Fakude | | 1 October 2005 | | 1 October 2005 | | 22 November 2013 | | 4 December 2015 | | |

P Victor | | 6 December 2000 | | 10 September 2013 | | 22 November 2013 | | 2016(2) | | |

(1) Projected date of retirement by rotation based on 14 directors in office.

(2) The date of the 2016 annual general meeting has not yet been determined.

9

President and Chief Executive Officer and executive directors’ remuneration

The President and Chief Executive Officer’s salary and short term incentive is paid to him on a net of tax basis in USD.

The required Rand based disclosure is impacted by the Rand: US Dollar exchange rate. In the past financial year the rate has fluctuated between R9,58 and R11,31 which gives a distorted picture of the movement in the actual remuneration that is received. Therefore to facilitate comprehensive remuneration disclosure the table below provides the actual year-on-year increase in his net base salary and STI since 2012.

D E Constable | | 2012 | | 2013 | | 2014 | | |

Net Base salary | | $ | 827 782 | | $ | 865 032 | | $ | 899 633 | | |

Net STI | | $ | 839 803 | | $ | 1 320 231 | | $ | 1 717 770 | | |

Remuneration and benefits paid and short-term incentives approved in respect of 2014 for Executive Directors were as follows:

Directors | | Salary

R’000 | | Retirement

funding

R’000 | | Other

benefits(1)

R’000 | | Annual

Incentives(2)

R’000 | | Total(3)

2014

R’000 | | Total(4)

2013

R’000 | | |

DE Constable (5) | | 15 303 | | 196 | | 5 847 | | 30 616 | | 51 962 | | 53 668 | | |

VN Fakude | | 5 612 | | 1 604 | | 356 | | 10 387 | | 17 959 | | 14 604 | | |

KC Ramon(6) | | 617 | | 692 | | 8 326 | | — | | 9 635 | | 13 584 | | |

P Victor(7) | | 1 837 | | 276 | | 1 088 | | 5 030 | | 8 231 | | — | | |

Total | | 23 369 | | 2 768 | | 15 617 | | 46 033 | | 87 787 | | 81 856 | | |

(1) | Other benefits detailed in the next table. |

(2) | Incentives approved on the group results for the 2014 financial year and payable in the following year. Incentives are calculated as a percentage of total guaranteed package/net base salary as at 30 June 2014.The difference between the amount approved as at 5 September 2014 and the total amount accrued as at 30 June 2014 represents an under provision of R12,1 million. The under provision for 2013 of R14.4 million was reversed in 2014. |

(3) | Total remuneration for the financial excludes gains derived from the long term incentive schemes which are separately disclosed. |

(4) | Includes incentives approved on the group results for the 2013 financial year and paid in 2014. |

(5) | Salary and short term incentive paid in US dollars and grossed up for tax and reflected at the exchange rate of the month of payment for the salaries, and 5 September 2014 for the FY14 short term incentive being the date of approval of the consolidated annual financial statements. |

(6) | Ms KC Ramon resigned as Chief Financial Officer with effect from 9 September 2013, and resigned from the group on 30 November 2013. |

(7) | Mr P Victor was appointed as Director and acting Chief Financial Officer with effect from 10 September 2013. |

Benefits and payments made in 2014 disclosed in the table above as “other benefits” include the following:

Directors | | Vehicle

Benefits

R’000 | | Medical

benefits

R’000 | | Vehicle

insurance

fringe

benefits

R’000 | | Security

benefit

R’000 | | Other

R’000 | | Total

other

benefits

2014

R’000 | | Total

other

benefits

2013

R’000 | | |

| | | | | | | | | | | | | | | | |

DE Constable(1) | | — | | 265 | | 6 | | 653 | | 4 923 | | 5 847 | | 18 911 | | |

VN Fakude | | 60 | | 39 | | 6 | | 251 | | — | | 356 | | 309 | | |

KC Ramon (2) | | 227 | | 16 | | 2 | | — | | 8 081 | | 8 326 | | 1 418 | | |

P Victor(3) | | 83 | | — | | 5 | | — | | 1 000 | | 1 088 | | — | | |

Total | | 370 | | 320 | | 19 | | 904 | | 14 004 | | 15 617 | | 20 638 | | |

(1) | Cost of benefits and/or tax gross up of benefits offered under the expatriation policy i.e. security (R 435 181), medical aid (R 176 467); accommodation (R 1 561 083), home flights (R 615 745), car insurance (R 4 160), risk and personal accident (R 130 977). medical benefits include international cover for dependents. Balance of R 1 999 416 staggered sign on payment, paid in 2012 but accounted for in 2014 due to the 24 month retention period that started on the date of payment. |

(2) | Payments made to Ms KC Ramon in terms of a restraint of trade agreement. |

(3) | Acting allowance paid to Mr P Victor upon appointment as Acting Chief Financial Officer. |

10

Prescribed officers

Remuneration and benefits paid and short-term incentives approved in respect of 2014 for prescribed officers were as follows:

Prescribed

officers | | Salary

R’000 | | Retirement

funding

R’000 | | Other

benefits(1)

R’000 | | Annual

Incentive(2)

R’000 | | Total

2014(3)

R’000 | | Total

2013(4)

R’000 | | |

| | | | | | | | | | | | | | |

SR Cornell(5) | | 2 786 | | 146 | | 1 712 | | 2 944 | | 7 588 | | — | | |

AM de Ruyter(6) | | 1 724 | | 806 | | 146 | | — | | 2 676 | | 11 818 | | |

FR Grobler(7) | | 3 189 | | 138 | | 1 695 | | 3 371 | | 8 393 | | — | | |

VD Kahla | | 4 383 | | 578 | | 522 | | 5 421 | | 10 904 | | 9 450 | | |

BE Klingenberg | | 4 399 | | 1 129 | | 304 | | 5 990 | | 11 822 | | 10 009 | | |

E Oberholster(8) | | 2 264 | | 1 010 | | 61 | | 3 180 | | 6 515 | | — | | |

M Radebe | | 3 163 | | 624 | | 360 | | 4 595 | | 8 742 | | 6 981 | | |

CF Rademan | | 3 967 | | 1 039 | | 410 | | 6 386 | | 11 802 | | 9 312 | | |

SJ Schoeman(9) | | 606 | | 66 | | 46 | | 689 | | 1 407 | | — | | |

GJ Strauss(10) | | 1 270 | | 265 | | 65 | | 1 205 | | 2 805 | | 12 042 | | |

Total | | 27 751 | | 5 801 | | 5 321 | | 33 781 | | 72 654 | | 59 612 | | |

(1) | Other benefits are listed in the table below. |

(2) | Incentives approved on the group results for the 2014 financial year and payable in the following year. Incentives are calculated as a percentage of total guaranteed package or base salary as at 30 June 2014. The difference between the amount approved as at 5 September 2014 and the total amount accrued as at 30 June 2014 represents an under provision of R0,4 million. The under provision for 2013 of R8,8 million was reversed in 2014. |

(3) | Total remuneration in the financial year excludes gains derived from the long term incentive plans which are separately disclosed. |

(4) | Includes incentives on the group results for the 2013 financial year. |

(5) | Mr SR Cornell was appointed as a member of the Group Executive Committee with effect from 1 February 2014. Details reflect the period of service on the GEC. Mr Cornell, under his US employment contract, is paid in USD and the amount reflected above, for purposes of disclosure only, has been converted to rand using the average exchange rate over the period. |

(6) | Mr AM de Ruyter resigned from the Group with effect from 30 November 2013. |

(7) | Mr FR Grobler was appointed as a member of the Group Executive Committee with effect from 1 December 2013. His salary was paid in euros under the expatriate contract to Germany; grossed up for tax and converted to rand for disclosure purposes. His short term incentive was calculated on his nett assignment salary that applied for the period that he was on expatriate contract in Germany. |

(8) | Mr E Oberholster was appointed as a member of the Group Executive Committee with effect from 1 October 2013. Details reflect the period of service on the GEC. |

(9) | Mr SJ Schoeman was appointed as a member of the Group Executive Committee with effect from 1 May 2014. Details reflect the period of service on the GEC. |

(10) | Mr GJ Strauss retired from the group with effect from 30 September 2013. He remained entitled to a pro rata short term incentive for the period 1 July 2013 — 30 September 2013. |

Benefits and payments made in 2014 disclosed in the table above as “other benefits” include the following:

Prescribed

officers | | Vehicle

benefits

R’000 | | Medical

benefits

R’000 | | Vehicle

insurance

fringe

benefits

R’000 | | Security

benefits

R’000 | | Other

benefits

R’000 | | Total

other

benefits

2014

R’000 | | Total

other

benefits

2013

R’000 | | |

| | | | | | | | | | | | | | | | |

SR Cornell(1) | | — | | 82 | | 0 | | — | | 1 630 | | 1 712 | | — | | |

AM de Ruyter | | 114 | | 29 | | 3 | | — | | — | | 146 | | 355 | | |

FR Grobler(2) | | — | | — | | — | | — | | 1 695 | | 1 695 | | — | | |

VD Kahla | | — | | 68 | | 6 | | 448 | | — | | 522 | | 1 377 | | |

BE Klingenberg | | 212 | | 68 | | 6 | | 18 | | — | | 304 | | 298 | | |

E Oberholster | | — | | 49 | | 5 | | 7 | | — | | 61 | | — | | |

M Radebe | | 264 | | 68 | | 6 | | 22 | | — | | 360 | | 349 | | |

CF Rademan | | 320 | | 59 | | 6 | | 25 | | — | | 410 | | 469 | | |

SJ Schoeman | | 33 | | 12 | | 1 | | — | | — | | 46 | | — | | |

GJ Strauss | | 30 | | 14 | | 2 | | 19 | | — | | 65 | | 191 | | |

Total | | 973 | | 449 | | 35 | | 539 | | 3 325 | | 5 321 | | 3 039 | | |

(1) | Sign on payment of $ 750 000 paid to Mr SR Cornell with his first salary linked to a retention period of 36 months, from February 2014. This amount reflects the portion related to his period in service for the financial year ($ 750 000*5)/36). A deferred sign on payment of $500 000 payable in tranches upon achievement of significant milestones on the US Mega Projects, was also agreed as part of his employment contract. |

(2) | Allowances payable under Mr FR Grobler’s previous expatriate contract, including tax gross up. |

3.2 Non-Executive Directors

Non-Executive Directors are appointed to the Sasol Limited board based on their ability to contribute competence, insight and experience appropriate to assisting the group to set and achieve its objectives. Consequently, fees are set at levels to attract and retain the calibre of Director necessary to contribute to a highly effective board. They do not receive short-term incentives, nor do they participate in long-term incentive plans. No arrangement exists for compensation in respect of loss of office.

As an exception to the recommended remuneration practice of the King III Code, and as in previous years, the fee structure for Non-Executive Directors is not split between a base fee and an attendance fee. Board members are paid a fixed annual fee in respect of their board membership, as well as supplementary fees for committee membership and an ad hoc committee fee for formally scheduled board and committee meetings which do not form part of the annual calendar of meetings. The fee structure reflects the responsibilities of the Directors that extend beyond the attendance of meetings and the requirement for directors to be available between scheduled meetings, when required. Non-Executive Directors receive fixed fees for services on boards and board committees.

11

Actual fees and the fee structure are reviewed annually. In setting fees, consideration is given to the increased responsibility placed on Non-Executive Directors due to onerous legal and regulatory requirements and the commensurate risk assumed. Benchmarking information of companies of similar complexity and projected inflation rates are taken into consideration. Proposals for fees are prepared with the support of internal and external reward specialists, for consideration by the committee. The board recommends the fees payable to the chairman and Non-Executive Directors for approval by the shareholders.

The revised fees of the non-executive directors will be submitted to the shareholders for approval at the annual general meeting to be held on 21 November 2014, and implemented with retroactive effect from 1 July 2014, once approval by way of special resolution has been obtained. In the event that shareholder approval is not obtained then the current fee structure will remain in place until such time as shareholders approve a new structure.

Annual Non-Executive Directors’ fees are as follows for the two past financial years:

| | 2014 | | 2013 | |

| | Member | | Chairman | | Member | | Chairman | |

| | | | | | | | | |

Chairman of the board, inclusive of fees payable for attendance or membership of board committees and directorship of the company | | | | R4 800 000 | | | | R4 520 000 | |

| | | | | | | | | |

Resident fees: | | | | | | | | | |

| | | | | | | | | |

Non-Executive Directors | | R490 000 | | | | R460 000 | | | |

Audit Committee Members | | R194 000 | | R388 000 | | R183 000 | | R366 000 | |

Remuneration Committee Members | | R130 000 | | R260 000 | | R118 500 | | R237 000 | |

Risk and Safety, Health and Environment Committee | | R112 500 | | R225 000 | | R108 150 | | R216 300 | |

Nomination and Governance Committee | | R112 500 | | R225 000 | | R108 150 | | R216 300 | |

Share Incentive Plan Trustees (resident and non-resident) | | R67 000 | | R134 000 | | R67 000 | | R134 000 | |

Lead Independent Director fee (additional fee) | | R168 000 | | | | R156 500 | | | |

Attendance of formally scheduled ad hoc board and committee meetings (per meeting) | | R19 700 | | | | R18 500 | | | |

| | | | | | | | | |

Non-resident fees: | | | | | | | | | |

| | | | | | | | | |

Non-Executive Directors | | US$143 000 | | | | US$138 000 | | | |

Audit Committee Members | | US$26 500 | | US$53 000 | | US$26 000 | | US$52 000 | |

Remuneration Committee Members | | US$20 000 | | US$40 000 | | US$18 750 | | US$37 500 | |

Risk and Safety, Health and Environment Committee | | US$18 000 | | US$36 000 | | US$17 500 | | US$35 000 | |

Nomination and Governance Committee | | US$18 000 | | US$36 000 | | US$17 500 | | US$35 000 | |

Lead Independent Director fee (additional fee) | | US$50 050 | | | | US$48 300 | | | |

The Chairman of a Board Committee is paid double the committee meeting fees of a member of such a committee. Executive Directors do not receive directors’ fees.

A Non-Executive Director is required to retire at the end of the calendar year in which the Director turns 70, unless the board, subject to the memorandum of incorporation and by unanimous resolution on a year-to-year basis, extends the director’s term of office until the end of the year in which he or she turns 73.

Details of the appointments of Non-Executive Directors in office are listed below:

Non-executive directors | | Date first appointed to the board | | Date last re-elected as a director | | Date due for

re-election |

MSV Gantsho (Chairman) | | 1 June 2003 | | 22 November 2013 | | 4 December 2015 |

JE Schrempp (Lead Independent Director) | | 21 November 1997 | | 30 November 2012 | | 4 December 2015 |

C Beggs | | 8 July 2009 | | 30 November 2012 | | 21 November 2014 |

HG Dijkgraaf | | 16 October 2006 | | 30 November 2012 | | 21 November 2014 |

NNA Matyumza | | 8 September 2014 | | n/a | | 21 November 2014 |

IN Mkhize | | 1 January 2005 | | 22 November 2013 | | 4 December 2015 |

ZM Mkhize | | 29 November 2011 | | 30 November 2012 | | 21 November 2014 |

MJN Njeke | | 4 February 2009 | | 22 November 2013 | | 4 December 2015 |

B Nqwababa | | 5 December 2013 | | n/a | | 21 November 2014 |

PJ Robertson | | 1 July 2012 | | 30 November 2012 | | 21 November 2014 |

S Westwell | | 1 June 2012 | | 30 November 2012 | | 4 December 2015 |

12

Non-executive directors’ remuneration for the year was as follows:

Non-executive directors | | Board meeting

fees | | Lead director

fees | | Committee

fees | | Share incentive

trustee fees | | Ad Hoc Special

Board -

Committee

Meeting | | Total

2014 | | Total 2013 | |

MSV Gantsho (Chairman)(1) | | 3 004 | | — | | 128 | | — | | — | | 3 132 | | 825 | |

TH Nyasulu(2) | | 2 000 | | — | | — | | — | | — | | 2 000 | | 4 520 | |

JE Schrempp (Lead Independent Director)(3) | | 1 499 | | 525 | | 398 | | 67 | | — | | 2 489 | | 2 146 | |

C Beggs | | 490 | | — | | 501 | | | | 20 | | 1 011 | | 1 027 | |

HG Dijkgraaf(3) | | 1 499 | | — | | 797 | | 67 | | 20 | | 2 383 | | 2 317 | |

IM Mkhize | | 490 | | — | | 549 | | 134 | | 20 | | 1 193 | | 839 | |

ZM Mkhize | | 490 | | — | | 113 | | — | | — | | 603 | | 605 | |

MJN Njeke | | 490 | | — | | 194 | | — | | 20 | | 704 | | 717 | |

B Nqwababa(4) | | 286 | | — | | 113 | | — | | 20 | | 419 | | — | |

PJ Robertson(3) | | 1 499 | | — | | 210 | | 67 | | 20 | | 1 796 | | 1 460 | |

S Westwell(3) | | 1 499 | | — | | 466 | | — | | 20 | | 1 985 | | 1 725 | |

Total | | 13 246 | | 525 | | 3 469 | | 335 | | 140 | | 17 715 | | 16 181 | |

(1) Appointed as Chairman effective 22 November 2013.

(2) Resigned as Chairman and non-executive director effective 22 November 2013.

(3) Board and committee fees paid in US dollars.

(4) Appointed as Non-Executive Director effective 5 December 2013.

Long-term incentives previously granted, exercised, implemented, settled and/or vested

The interests of the Directors in the form of long-term incentive instruments are shown in the tables below. During the year to 30 June 2014, the highest and lowest closing market prices for the company’s shares were R420,00 on 5 July 2013 and R645,10 on 13 June 2014 and the closing market price on 30 June 2014 was R632,36. Refer to note 47 of the consolidated annual financial statements for the year ended 30 June 2014 for further details of the incentive plans.

No variations have been made to the terms and conditions of the long term incentive awards during the relevant period.

Directors

Long-term incentive holdings

Directors | | Balance

at

beginning

of year | | Granted | | Average

offer price

per share | | Grant

date | | Effect of

change in

composition

of board

of directors | | Effect of

corporate

performance

targets | | Long-term

incentive

rights

lapsed | | Long-

term

incentive

rights

settled | | Balance at

end of

year | |

| | (number) | | (number) | | (Rand) | | | | (number) | | (number) | | (number) | | (number) | | (number) | |

DE Constable | | 91 744 | | 41 694 | | 0,00 | | 12 Sep 2013 | | — | | 6 750 | | — | | (60 750 | ) | 79 438 | |

VN Fakude | | 56 359 | | 30 446 | | 0,00 | | 12 Sep 2013 | | — | | 2 643 | | — | | (23 792 | ) | 65 656 | |

KC Ramon(1) | | 49 584 | | — | | 0,00 | | 12 Sep 2013 | | — | | 1 097 | | (40 808 | ) | (9 873 | ) | — | |

P Victor(2) | | — | | 7 368 | | 0,00 | | 12 Sep 2013 | | 5 399 | | 159 | | — | | (1 431 | ) | 11 495 | |

Total | | 197 687 | | 79 508 | | | | | | 5 399 | | 10 649 | | (40 808 | ) | (95 846 | ) | 156 589 | |

(1) Ms KC Ramon resigned as Chief Financial Officer with effect from 9 September 2013, and resigned from the group on 30 November 2013.

(2) Mr P Victor was appointed as Director and Acting Chief Financial Officer with effect from 10 September 2013.

13

Long-term incentive rights vested during the year

| | | | Long-term

incentive

rights | | Average

offer price | | Market

price per | | Gain on settlement of

long-term incentive

rights | |

Directors | | Vesting dates | | vested | | per share | | share | | 2014 | | 2013 | |

| | | | (number) | | (Rand) | | (Rand) | | R’000 | | R’000 | |

DE Constable | | 3 June 2014 | | 60 750 | | 0.00 | | 603,05 | | 36 635 | | — | |

VN Fakude | | | | | 23 792 | | | | | | 12 946 | | | 1 436 | |

| | | 16 September 2013 | | 11 847 | | 0.00 | | 484,74 | | 5 743 | | | | |

| | | 3 June 2014 | | 11 945 | | 0.00 | | 603,05 | | 7 203 | | | | |

KC Ramon(1) | | 16 September 2013 | | 9 873 | | 0.00 | | 484,74 | | 4 786 | | 1 661 | |

P Victor(2) | | 16 September 2013 | | 1 431 | | 0.00 | | 484,74 | | 694 | | — | |

Total | | | | 95 846 | | | | | | 55 061 | | 3 097 | |

(1) Ms KC Ramon resigned as Chief Financial Officer with effect from 9 September 2013, and resigned from the group on 30 November 2013.

(2) Mr P Victor was appointed as Director and Acting Chief Financial Officer with effect from 10 September 2013.

Long-term incentives unvested at the end of the year vest during the following periods

Directors | | Within one year | | One to two

years | | Two to three

years | | Total | | |

| | (number) | | (number) | | (number) | | (number) | | |

DE Constable | | 25 082 | | 12 662 | | 41 694 | | 79 438 | | |

VN Fakude | | 13 970 | | 21 240 | | 30 446 | | 65 656 | | |

KC Ramon(1) | | — | | — | | — | | — | | |

P Victor(2) | | 1 603 | | 2 524 | | 7 368 | | 11 495 | | |

Total | | 40 655 | | 36 426 | | 79 508 | | 156 589 | | |

(1) Ms KC Ramon resigned as Chief Financial Officer with effect from 9 September 2013, and resigned from the group on 30 November 2013.

(2) Mr P Victor was appointed as Director and Acting Chief Financial Officer with effect from 10 September 2013.

Share appreciation rights, with performance targets

Directors | | Balance

at

beginning

of year | | Granted | | Average

offer

price per

share | | Grant

date | | Effect of

change in

composition

of board of

directors | | Effect of

corporate

performance

targets | | Share

appreciation

rights

lapsed | | Share

appreciation

rights

exercised | | Balance at

end of year | |

| | (number) | | (number) | | (Rand) | | | | (number) | | (number) | | (number) | | (number) | | (number) | |

DE Constable | | 355 900 | | — | | — | | — | | — | | 9 762 | | — | | — | | 365 662 | |

VN Fakude | | 221 487 | | — | | — | | — | | — | | 3 618 | | — | | (69 518 | ) | 155 587 | |

KC Ramon(1) | | 202 725 | | — | | — | | — | | — | | 2 187 | | (146 300 | ) | (58 612 | ) | — | |

P Victor(2) | | — | | — | | — | | — | | 17 218 | | 300 | | — | | (3 318 | ) | 14 200 | |

Total | | 780 112 | | — | | | | | | 17 218 | | 15 867 | | (146 300 | ) | (131 448 | ) | 535 449 | |

(1) Ms KC Ramon resigned as Chief Financial Officer with effect from 9 September 2013, and resigned from the group on 30 November 2013.

(2) Mr P Victor was appointed as Director and Acting Chief Financial Officer with effect from 10 September 2013.

Share appreciation rights, with performance targets exercised

| | | | | Share

appreciation

rights | | Average

offer price | | Market

price per | | Gain on exercise of

share appreciation

rights | | |

Directors | | | Exercise dates | | exercised | | per share | | share | | 2014 | | | 2013 | | |

| | | | | (number) | | (Rand) | | (Rand) | | R’000 | | | R’000 | | |

VN Fakude | | | | | 69 518 | | | | | | 16 069 | | | — | | |

| | | 4 October 2013 | | 6 600 | | 289,99 | | 488,66 | | 1 311 | | | | | |

| | | 19 March 2014 | | 6 600 | | 289,99 | | 582,29 | | 1 929 | | | | | |

| | | 4 October 2013 | | 15 800 | | 298,65 | | 488,66 | | 3 002 | | | | | |

| | | 19 March 2014 | | 16 893 | | 347,03 | | 582,29 | | 3 974 | | | | | |

| | | 19 March 2014 | | 23 625 | | 334,53 | | 582,29 | | 5 853 | | | | | |

KC Ramon | | | | | 58 612 | | | | | | 9 672 | | | — | | |

| | | 11 September 2013 | | 21 725 | | 289,99 | | 488,00 | | 4 302 | | | | | |

| | | 11 September 2013 | | 17 200 | | 347,03 | | 488,00 | | 2 425 | | | | | |

| | | 16 September 2013 | | 17 500 | | 334,53 | | 484,74 | | 2 629 | | | | | |

| | | 17 September 2013 | | 2 187 | | 334,53 | | 478,89 | | 316 | | | | | |

P Victor | | | | | 3 318 | | | | | | 591 | | | — | | |

| | | 21 October 2013 | | 500 | | 299,90 | | 506,22 | | 103 | | | | | |

| | | 21 October 2013 | | 118 | | 298,65 | | 506,22 | | 24 | | | | | |

| | | 21 October 2013 | | 2 700 | | 334,53 | | 506,22 | | 464 | | | | | |

Total | | | | | 131 448 | | | | | | 26 332 | | | — | | |

Share appreciation rights, with performance targets, outstanding at the end of the year vest during the following periods

Directors | | Already vested | | Within

one year | | One to

two years | | Two to five

years | | More than

five years | | Total | | |

| | (number) | | (number) | | (number) | | (number) | | (number) | | (number) | | |

DE Constable | | 128 362 | | 81 000 | | 37 600 | | 118 700 | | — | | 365 662 | | |

VN Fakude | | 987 | | 31 700 | | 41 900 | | 81 000 | | — | | 155 587 | | |

KC Ramon(1) | | — | | — | | — | | — | | — | | — | | |

P Victor(2) | | — | | 1 900 | | 4 700 | | 7 600 | | — | | 14 200 | | |

Total | | 129 349 | | 114 600 | | 84 200 | | 207 300 | | — | | 535 449 | | |

14

(1) Ms KC Ramon resigned as Chief Financial Officer with effect from 9 September 2013, and resigned from the group on 30 November 2013.

(2) Mr P Victor was appointed as Director and acting Chief Financial Officer with effect from 10 September 2013.

Share appreciation rights, without performance targets

Directors | | Balance at

beginning

of year | | Granted | | Average

offer

price per

share | | Grant

date | | Effect of

change in

composition

of board of

directors | | Share

appreciation

rights

lapsed | | Share

appreciation

rights

exercised | | Balance

at end of

year | | |

| | (number) | | (number) | | (Rand) | | | | (number) | | (number) | | (number) | | (number) | | |

VN Fakude | | 39 500 | | — | | — | | — | | — | | — | | (32 100 | ) | 7 400 | | |

KC Ramon(1) | | 23 200 | | — | | — | | — | | — | | (7 800 | ) | (15 400 | ) | — | | |

P Victor(2) | | — | | — | | — | | — | | 13 600 | | — | | (6 600 | ) | 7 000 | | |

Total | | 62 700 | | — | | — | | — | | 13 600 | | (7 800 | ) | (54 100 | ) | 14 400 | | |

(1) Ms KC Ramon resigned as Chief Financial Officer with effect from 9 September 2013, and resigned from the group on 30 November 2013.

(2) Mr P Victor was appointed as Director and Acting Chief Financial Officer with effect from 10 September 2013.

Share appreciation rights, without performance targets exercised

| | | | Share

appreciation

rights | | Average

offer

price per | | Market

price per | | Gain on exercise of

share appreciation

rights | | |

Directors | | Exercise dates | | exercised | | share | | share | | 2014 | | | 2013 | | |

| | | | (number) | | (Rand) | | (Rand) | | R’000 | | | R’000 | | |

VN Fakude | | | | 32 100 | | | | | | 7 230 | | | — | | |

| | 4 October 2013 | | 17 100 | | 294,50 | | 488,66 | | 3 320 | | | | | |

| | 12 June 2014 | | 15 000 | | 352,10 | | 612,78 | | 3 910 | | | | | |

| | | | | | | | | | | | | | | |

KC Ramon(1) | | 11 September 2013 | | 15 400 | | 352,10 | | 488,00 | | 2 093 | | | — | | |

P Victor(2) | | | | 6 600 | | | | | | 1 365 | | | — | | |

| | 21 October 2013 | | 700 | | 294,50 | | 506,22 | | 148 | | | | | |

| | 21 October 2013 | | 5 900 | | 300,00 | | 506,22 | | 1 217 | | | | | |

Total | | | | 54 100 | | | | | | 10 688 | | | — | | |

(1) Ms KC Ramon resigned as Chief Financial Officer with effect from 9 September 2013, and resigned from the group on 30 November 2013.

(2) Mr P Victor was appointed as Director and Acting Chief Financial Officer with effect from 10 September 2013.

Share appreciation rights, without performance targets, outstanding at the end of the year vest during the following periods

Directors | | Already vested | | Within

one year | | One to

two years | | Two to five

years | | More than

five years | | Total | | |

| | (number) | | (number) | | (number) | | (number) | | (number) | | (number) | | |

VN Fakude | | — | | 7 400 | | — | | — | | — | | 7 400 | | |

P Victor(1) | | — | | 7 000 | | — | | — | | — | | 7 000 | | |

Total | | — | | 14 400 | | — | | — | | — | | 14 400 | | |

(1) Mr P Victor was appointed as Director and Acting Chief Financial Officer with effect from 10 September 2013.

Sasol share incentive scheme - share options

There are no outstanding share options previously awarded under the Sasol Share Incentive Scheme and no options were exercised during the course of the financial year.

Sasol Inzalo Management Scheme Rights

At the grant date on 3 June 2008, the issue price of the underlying share of R366,00 which represented the 60 day volume weighted average price of Sasol ordinary shares to 18 March 2008. The shares were issued to The Sasol Inzalo Management Trust at R0,01 per share.

Directors | | Balance at

beginning of

year | | Rights granted | | Value of

underlying share | | Grant date | | Effect of

resignations | | Balance at

end of year | | |

| | (number) | | (number) | | (Rand) | | | | (number) | | (number) | | |

VN Fakude | | 25 000 | | — | | — | | — | | — | | 25 000 | | |

KC Ramon(1) | | 25 000 | | — | | — | | — | | (25 000 | ) | — | | |

Total | | 50 000 | | — | | | | | | (25 000 | ) | 25 000 | | |

(1) Ms KC Ramon resigned as Chief Financial Officer with effect from 9 September 2013, and resigned from the group on 30 November 2013. She was treated as a good leaver under the Scheme Rules and thus allowed to retain all her Inzalo Rights.

15

Prescribed officers

Long-term incentive right holdings

Prescribed

Officers | | Balance

at

beginning

of year | | Granted | | Average

offer price

per share | | Grant date | | Effect of

change in

composition of

Prescribed

Officers | | Effect of

corporate

performance

targets | | Long-term incentive

rights settled | | Long-term

incentive

rights lapsed | | Balance at end

of year | |

| | (number) | | (number) | | (Rand/USD) | | | | (number) | | (number) | | (number) | | (number) | | (number) | |

SR Cornell(1) | | — | | 37 000 | | 0,00 | | 13 March 2014 | | — | | — | | — | | — | | 37 000 | |

AM de Ruyter(2) | | 64 184 | | 20 551 | | 0,00 | | 12 September 2013 | | — | | 4 982 | | (44 850 | ) | (44 867 | ) | — | |

FR Grobler | | — | | — | | — | | — | | 29 672 | | — | | — | | — | | 29 672 | |

VD Kahla | | 24 871 | | 12 489 | | 0,00 | | 12 September 2013 | | — | | 1 602 | | (14 423 | ) | — | | 24 539 | |

BE Klingenberg | | 23 719 | | 17 769 | | 0,00 | | 12 September 2013 | | — | | 642 | | (5 785 | ) | — | | 36 345 | |

E Oberholster | | — | | 10 973 | | 0,00 | | 20 November 2013 | | 21 605 | | 316 | | (2 850 | ) | — | | 30 044 | |

M Radebe | | 28 290 | | 12 489 | | 0,00 | | 12 September 2013 | | — | | 1 918 | | (17 273 | ) | — | | 25 424 | |

CF Rademan | | 24 994 | | 14 808 | | 0,00 | | 12 September 2013 | | — | | 642 | | (5 785 | ) | — | | 34 659 | |

SJ Schoeman | | — | | 10 000 | | — | | 5 June 2014 | | 22 327 | | 528 | | (4 755 | ) | — | | 28 100 | |

GJ Strauss(3) | | 62 675 | | — | | — | | — | | — | | 9 975 | | (72 650 | ) | — | | — | |

Total | | 228 733 | | 136 079 | | | | | | 73 604 | | 20 605 | | (168 371 | ) | (44 867 | ) | 245 783 | |

(1) Mr SR Cornell was appointed in the US and therefore his LTIs are valued at the Sasol ADR price on the NYSE.

(2) Mr AM de Ruyter resigned from the group with effect from 30 November 2013 and thus forfeited all outstanding LTI units.

(3) Mr GJ Strauss retired from the group with effect from 30 September 2013. He was treated as a good leaver under the Scheme rules.

Long-term incentive rights vested during the year

Prescribed | | | | Long-term

incentive | | Average

offer price | | Market

price per | | Gain on settlement of long-

term incentive rights | | |

Officers | | Vesting dates | | rights vested | | per share | | share | | 2014 | | 2013 | | |

| | | | (number) | | (Rand) | | (Rand) | | R’000 | | R’000 | | |

AM de Ruyter(1) | | 16 September 2013 | | 44 850 | | 0,00 | | 484,74 | | 21 741 | | — | | |

VD Kahla | | 27 March 2014 | | 14 423 | | 0,00 | | 575,40 | | 8 299 | | — | | |

BE Klingenberg | | 16 September 2013 | | 5 785 | | 0,00 | | 484,74 | | 2 804 | | 601 | | |

E Oberholster | | 27 March 2014 | | 2 850 | | 0,00 | | 575,40 | | 1 640 | | — | | |

M Radebe | | | | 17 273 | | | | | | 8 650 | | 507 | | |

| | 16 September 2013 | | 2 850 | | 0,00 | | 484,74 | | 1 382 | | | | |

| | 24 November 2013 | | 14 423 | | 0,00 | | 503,90 | | 7 268 | | | | |

CF Rademan | | 16 September 2013 | | 5 785 | | 0,00 | | 484,74 | | 2 804 | | 601 | | |

SJ Schoeman | | 2 June 2014 | | 4 755 | | 0,00 | | 595,26 | | 2 830 | | — | | |

GJ Strauss(2) | | | | 72 650 | | | | | | 35 162 | | 1 278 | | |

| | 16 September 2013 | | 40 907 | | 0,00 | | 484,74 | | 19 829 | | | | |

| | 30 September 2013 | | 31 743 | | 0,00 | | 483,04 | | 15 333 | | | | |

Total | | | | 168 371 | | | | | | 83 930 | | 2 987 | | |

(1) Mr AM de Ruyter resigned from the group with effect from 30 November 2013 and thus forfeited all outstanding LTI units.

(2) Mr GJ Strauss retired from the group with effect from 30 September 2013. He was treated as a good leaver under the Scheme rules.

Long-term incentives unvested at the end of the year vest during the following periods

Prescribed

Officers | | Within one

year | | One to

two years | | Two to three

years | | Total | | |

| | (number) | | (number) | | (number) | | (number) | | |

SR Cornell | | — | | — | | 37 000 | | 37 000 | | |

AM de Ruyter(1) | | — | | — | | — | | — | | |

FR Grobler | | 2 695 | | 6 841 | | 20 136 | | 29 672 | | |

VD Kahla | | 3 540 | | 8 510 | | 12 489 | | 24 539 | | |

BE Klingenberg | | 6 376 | | 12 200 | | 17 769 | | 36 345 | | |

E Oberholster | | 3 234 | | 5 701 | | 21 109 | | 30 044 | | |

M Radebe | | 4 425 | | 8 510 | | 12 489 | | 25 424 | | |

CF Rademan | | 7 651 | | 12 200 | | 14 808 | | 34 659 | | |

SJ Schoeman | | 1 123 | | 6 841 | | 20 136 | | 28 100 | | |

Total | | 29 044 | | 60 803 | | 155 936 | | 245 783 | | |

(1) Mr AM de Ruyter resigned from the group with effect from 30 November 2013 and thus forfeited all outstanding LTI units.

16

Share appreciation rights, with performance targets

Prescribed

Officers | | Balance

at

beginning

of year | | Granted | | Average

offer

price

per

share | | Grant

date | | Effect of

change in

composition of

Prescribed

Officers | | Effect

of

corporate

performance

targets | | Share

appreciation

rights

lapsed | | Share

appreciation

rights

exercised | | Balance at

end of year | |

| | (number) | | (number) | | (Rand) | | | | (number) | | (number) | | | | (number) | | (number) | |

AM de Ruyter(1) | | 256 736 | | — | | — | | — | | — | | 1 875 | | (178 200 | ) | (80 411 | ) | — | |

FR Grobler | | — | | — | | — | | — | | 50 618 | | — | | — | | — | | 50 618 | |

VD Kahla | | 91 800 | | — | | — | | — | | — | | 662 | | — | | (26 362 | ) | 66 100 | |

BE Klingenberg | | 84 981 | | — | | — | | — | | — | | 1 200 | | — | | — | | 86 181 | |

E Oberholster | | — | | — | | — | | — | | 44 787 | | — | | — | | (3 800 | ) | 40 987 | |

M Radebe | | 114 537 | | — | | — | | — | | — | | 825 | | — | | — | | 115 362 | |

CF Rademan | | 80 061 | | — | | — | | — | | — | | 1 437 | | — | | (16 098 | ) | 65 400 | |

SJ Schoeman | | — | | — | | — | | — | | 41 193 | | — | | — | | — | | 41 193 | |

GJ Strauss(2) | | 205 956 | | — | | — | | — | | (179 600 | ) | 2 250 | | — | | (28 606 | ) | — | |

Total | | 834 071 | | — | | | | | | (43 002 | ) | 8 249 | | (178 200 | ) | (155 277 | ) | 465 841 | |

(1) Mr AM de Ruyter resigned from the group with effect from 30 November 2013 and thus forfeited all outstanding LTI units.

(2) Mr GJ Strauss retired from the group with effect from 30 September 2013. He was treated as a good leaver under the Scheme rules.

Share appreciation rights, with performance targets exercised during the year

Prescribed | | | | Share

appreciation

rights | | Average offer | | Market price | | Gain on exercise of share

appreciation rights | | |

Officers | | Exercise dates | | exercised | | price per share | | per share | | 2014 | | 2013 | | |

| | | | (number) | | (Rand) | | (Rand) | | R’000 | | R’000 | | |

AM de Ruyter | | | | 80 411 | | | | | | 14 033 | | — | | |

| | 13 September 2013 | | 63 400 | | 298,65 | | 481,31 | | 11 581 | | | | |

| | 17 September 2013 | | 75 | | 334,53 | | 478,89 | | 11 | | | | |

| | 17 September 2013 | | 136 | | 298,65 | | 478,89 | | 25 | | | | |

| | 18 September 2013 | | 16 800 | | 334,53 | | 478,34 | | 2 416 | | | | |

| | | | | | | | | | | | | | |

VD Kahla | | | | 26 362 | | | | | | 3 651 | | — | | |

| | 16 October 2013 | | 20 400 | | 372,00 | | 502,01 | | 2 652 | | | | |

| | 16 October 2013 | | 5 962 | | 334,53 | | 502,01 | | 999 | | | | |

| | | | | | | | | | | | | | |

E Oberholster | | 26 March 2014 | | 3 800 | | 372,00 | | 586,28 | | 814 | | — | | |

CF Rademan | | | | 16 098 | | | | | | 2 884 | | 1 043 | | |

| | 5 May 2014 | | 2 800 | | 289,99 | | 597,28 | | 860 | | | | |

| | 26 September 2013 | | 12 937 | | 334,53 | | 485,89 | | 1 958 | | | | |

| | 13 September 2013 | | 361 | | 298,65 | | 481,31 | | 66 | | | | |

GJ Strauss | | | | 28 606 | | | | | | 5 092 | | 6 127 | | |

| | 31 January 2014 | | 5 800 | | 289,99 | | 537,94 | | 1 438 | | | | |

| | 16 September 2013 | | 20 250 | | 334,53 | | 484,74 | | 3 042 | | | | |

| | 31 January 2014 | | 2 556 | | 298,65 | | 537,94 | | 612 | | | | |

Total | | | | 155 277 | | | | | | 26 474 | | 7 170 | | |

Share appreciation rights, with performance targets, outstanding at the end of the year vest during the following periods

Prescribed

Officers | | Already

vested | | Within

one year | | One to

two years | | Two to

five years | | Total | | |

| | (number) | | (number) | | (number) | | (number) | | (number) | | |

AM de Ruyter | | — | | — | | — | | — | | — | | |

FR Grobler | | 18 918 | | 1 900 | | 14 700 | | 15 100 | | 50 618 | | |

VD Kahla | | — | | 19 200 | | 11 000 | | 35 900 | | 66 100 | | |

BE Klingenberg | | 24 581 | | 7 700 | | 20 400 | | 33 500 | | 86 181 | | |

E Oberholster | | 287 | | 8 400 | | 11 500 | | 20 800 | | 40 987 | | |

M Radebe | | 36 662 | | 23 000 | | 14 600 | | 41 100 | | 115 362 | | |

CF Rademan | | — | | 7 700 | | 22 300 | | 35 400 | | 65 400 | | |

SJ Schoeman | | 8 393 | | 7 900 | | 6 300 | | 18 600 | | 41 193 | | |

Total | | 88 841 | | 75 800 | | 100 800 | | 200 400 | | 465 841 | | |

17

Share appreciation rights, without performance targets

Prescribed

Officers | | Balance at

beginning

of year | | Granted | | Effect of change

in composition of

Prescribed

Officers | | Share

appreciation

rights

lapsed | | Share

appreciation

rights

exercised | | Balance at

end of year | | |

| | (number) | | (number) | | (number) | | (number) | | (number) | | (number) | | |

AM de Ruyter(1) | | 11 100 | | — | | — | | (2 300 | ) | (8 800 | ) | — | | |

FR Grobler | | — | | — | | 12 700 | | — | | — | | 12 700 | | |

BE Klingenberg | | 80 400 | | — | | — | | — | | — | | 80 400 | | |

E Oberholster | | — | | — | | 8 200 | | — | | — | | 8 200 | | |

M Radebe | | 11 400 | | — | | — | | — | | — | | 11 400 | | |

CF Rademan | | 49 800 | | — | | — | | — | | (24 300 | ) | 25 500 | | |

SJ Schoeman | | 0 | | — | | 19 100 | | — | | — | | 19 100 | | |

GJ Strauss(2) | | 21 200 | | — | | (5 800 | ) | — | | (15 400 | ) | — | | |

Total | | 173 900 | | — | | 34 200 | | (2 300 | ) | (48 500 | ) | 157 300 | | |

(1) Mr AM de Ruyter resigned form the group with effect from 30 November 2013 and thus forfeited all outstanding LTI units.

(2) Mr GJ Strauss retired from the group with effect from 30 September 2013. He was treated as a good leaver under the scheme rules.

Share appreciation rights, without performance targets, exercised

Prescribed | | Exercise | | Share

appreciation

rights | | Average

offer

price

per | | Market

price per | | Gain on exercise of share

appreciation rights | | |

Officers | | dates | | implemented | | share | | share | | 2014 | | 2013 | | |

| | (number) | | (number) | | (Rand) | | (Rand) | | R’000 | | R’000 | | |

AM de Ruyter | | | | 8 800 | | | | | | 1 379 | | | | |

| | 13 September 2013 | | 4 200 | | 294,50 | | 481,31 | | 785 | | | | |

| | 13 September 2013 | | 4 600 | | 352,10 | | 481,31 | | 594 | | | | |

CF Rademan | | | | 24 300 | | | | | | 7 104 | | 2 665 | | |

| | 13 September 2013 | | 1 800 | | 294,50 | | 481,31 | | 336 | | | | |

| | 12 March 2014 | | 12 000 | | 289,99 | | 585,04 | | 3 541 | | | | |

| | 5 May 2014 | | 10 500 | | 289,99 | | 597,28 | | 3 227 | | | | |

GJ Strauss | | | | 15 400 | | | | | | 2 466 | | 807 | | |

| | 16 September 2013 | | 4 000 | | 294,50 | | 484,74 | | 761 | | | | |

| | 25 October 2013 | | 11 400 | | 352,10 | | 501,67 | | 1 705 | | | | |

Total | | | | 48 500 | | | | | | 10 949 | | 3 472 | | |

Share appreciation rights, without performance targets, outstanding at the end of the year vest during the following periods

Prescribed