Investor Presentation

EnerCom’s

The 2008 Oil & Gas Conference

August 12, 2008

The 2008 Oil & Gas Conference

August 12, 2008

2

Forward-Looking Statements

u This presentation contains forward-looking statements.

u Forward-looking statements are based on management

assumptions and analyses.

assumptions and analyses.

u Actual experience may differ and such differences may be

material.

material.

u Backlog consists of written orders and estimates for our services

which we believe to be firm. In many instances contracts are

cancelable by customers so we may never realize some or all of

our backlog, which may lead to lower than expected financial

performance.

which we believe to be firm. In many instances contracts are

cancelable by customers so we may never realize some or all of

our backlog, which may lead to lower than expected financial

performance.

u Forward-looking statements are subject to uncertainties and

risks which are disclosed in Geokinetics’ Annual Report on Form

10-K.

risks which are disclosed in Geokinetics’ Annual Report on Form

10-K.

3

Market Data (at 8/1/2008)

• Exchange/Ticker: AMEX/GOK

• Market Capitalization: $181.6MM

• Enterprise Value $331.7MM*

Trading Data (at 8/1/2008)

• Common Shares Out. 10.3 MM

• Average Volume 31,715 shares/day

• Institutional Ownership 55%

Key Financial Data (at 6/30/2008)

• Cash $16.7MM

• Debt $103.3MM

• Debt to Total Cap 34.5%

* Debt, Preferred Equity and Cash as of 6/30/08

Corporate Information

4

About Geokinetics

u Large North America footprint

u Strong presence in profitable U.S. land seismic market

u Technology leader in Canada

u Significant international experience and diversity

u Industry leader in international transition zone

u Extensive recent investments in new multi-component

recording systems, both land and shallow water

recording systems, both land and shallow water

u Strong and diverse customer base

u Recent expansion into Africa and emerging OBC market

5

Source: Lehman Brothers The Original E&P Spending Survey

International Exploration and Production Expenditures ($B)

Industry Dynamics

u Global energy demand growth driving commodity prices

u Improved E&P economics = larger exploration budgets

u Technical advances are bringing new activity in regions

with known hydrocarbon systems

with known hydrocarbon systems

u U.S. shale plays

u Large discoveries are increasingly international and offshore

u Increasing demand for seabed seismic data acquisition

(Transition Zone, Ocean Bottom Cable and 4D)

(Transition Zone, Ocean Bottom Cable and 4D)

6

Exploit

Seismic Data Acquisition and Processing

Needed at All Stages of the E&P Cycle

¿ Increase drilling success rates

¿ Reduce finding and development costs

E&P Project Cycle

7

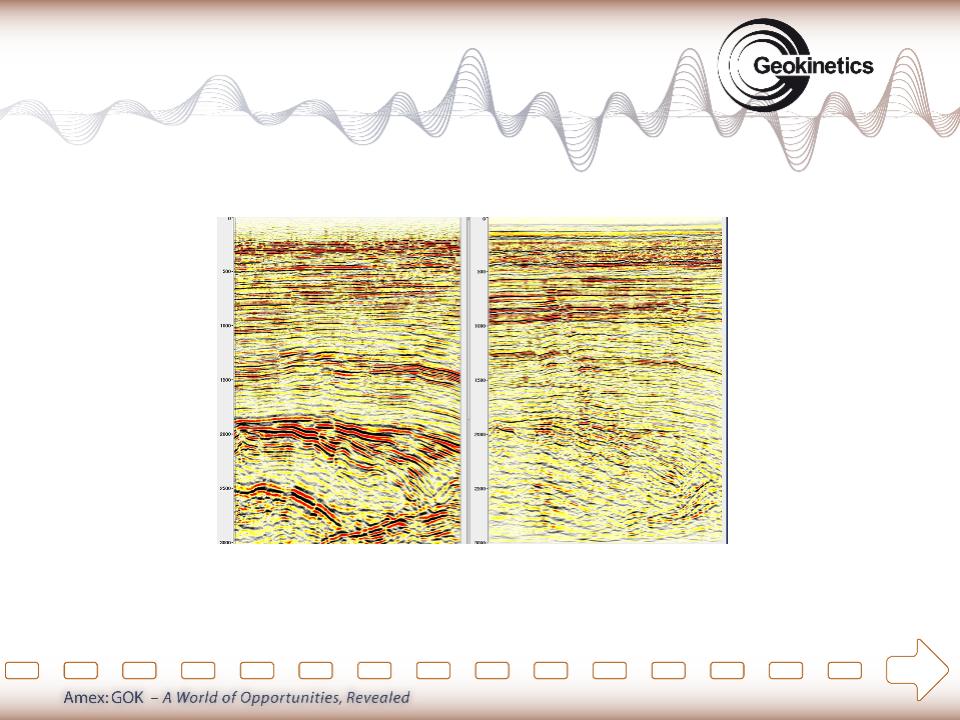

OBC

Streamer

The Value of Seismic Technology

“With 3-D seismic, we can understand the detailed geology much better than before. And

that translates to opportunities to drill new wells to bolster production in mature fields.”

that translates to opportunities to drill new wells to bolster production in mature fields.”

- ExxonMobil, The Lamp (2007 - Number 4)

8

u U.S. and Canada

combined are 27% of

global market

combined are 27% of

global market

u 73% of seismic market is

outside North America

outside North America

u Geokinetics operates in

five out of eight major

regions

five out of eight major

regions

Chart Source: IHS Energy.

Global Seismic Crew Count

9

u Consistent demand

outside of U.S.

outside of U.S.

u International prospects

focused on oil

focused on oil

u International E&P

spending in 2008

expected to rise 22% to

$293 billion*

spending in 2008

expected to rise 22% to

$293 billion*

Chart Source: Baker Hughes, WorldOil.com, Bloomberg.

*Source: Lehman Brothers The Original E&P Spending Survey - Midyear Update

*Source: Lehman Brothers The Original E&P Spending Survey - Midyear Update

International Seismic Market

10

u Technology increases

crew productivity (channel

growth vs. crew growth)

crew productivity (channel

growth vs. crew growth)

u Drilling activity tightly

linked to natural gas

prices

linked to natural gas

prices

u U.S. land is a steady and

profitable business

profitable business

u U.S. E&P spending in

2008 expected to rise 15%

to $98 billion*

2008 expected to rise 15%

to $98 billion*

Chart Source: Baker Hughes, WorldOil.com, Bloomberg.

*Source: Lehman Brothers The Original E&P Spending Survey - Midyear Update

*Source: Lehman Brothers The Original E&P Spending Survey - Midyear Update

U.S. Seismic Market

11

Company | Data Acquisition | M-C Data Library | Data Proc & Interp | Eqpmt. | Land Seismic Crews | ||||

Marine Streamer | Land | TZ | OBC | Intl | US | ||||

Geokinetics | | | | | | | |||

Dawson | | | | ||||||

Tidelands | | | | ||||||

PGS | | | | | | | |||

BGP | | | | | | | |||

CGGVeritas (Sercel) | | | | | | | | | |

WesternGeco (Schlumberger) | | | | | | | | | |

Mitcham | | ||||||||

ION Geophysical | | | | ||||||

Bolt Technologies | | ||||||||

OYO Geospace | | ||||||||

Geophysical Market Overview

12

Competitive Advantage

u Significant base in profitable U.S. land seismic market

u Significant international exposure

u Specialized expertise in transition zone niche

u Ability to operate in difficult, frontier environments

u Early entrant into emerging ocean bottom cable market

u Complementary data processing and interpretation

capabilities

capabilities

u Proven track record in health, safety and environment

13

Choice of Leading Operators

14

Grow Customer Base

& Expand into New

Markets

& Expand into New

Markets

Strengthen

Complementary

Service Offerings

Complementary

Service Offerings

¿ Leverage competitive advantage and expertise in

difficult land environments and offshore shallow

water zones to maximize profitability.

difficult land environments and offshore shallow

water zones to maximize profitability.

¿ Better assist customers with full range of

seismic services, from acquisition and

processing to interpretation and management.

seismic services, from acquisition and

processing to interpretation and management.

¿ Presence in 20 of 194 countries worldwide.

Further expand geographic presence and

services offered.

Further expand geographic presence and

services offered.

¿ Continue to monitor opportunities for prudent

expansion.

expansion.

Capture New Market

Opportunities

Opportunities

¿ Leverage operational expertise to pursue

opportunities in complementary markets such

as OBC

opportunities in complementary markets such

as OBC

Continue to Leverage

Competitive Advantage

Competitive Advantage

Pursue Strategic

Acquisitions / Alliances

As Appropriate

Acquisitions / Alliances

As Appropriate

Growth Strategy

15

Lower | Higher |

Business Strength

u Reinvest cash flows generated from North American land seismic

u Penetrate fast-growing international land markets

u Look for TZ and OBC opportunities in international markets

Strategic Growth Plan

16

u Channel growth drives increases in revenue

104% CAGR

(Revenue)

(Revenue)

Growth Focus

17

u Penetrating High-Growth Markets via TZ and OBC

International Revenue Rising

18

Global Operations Map

19

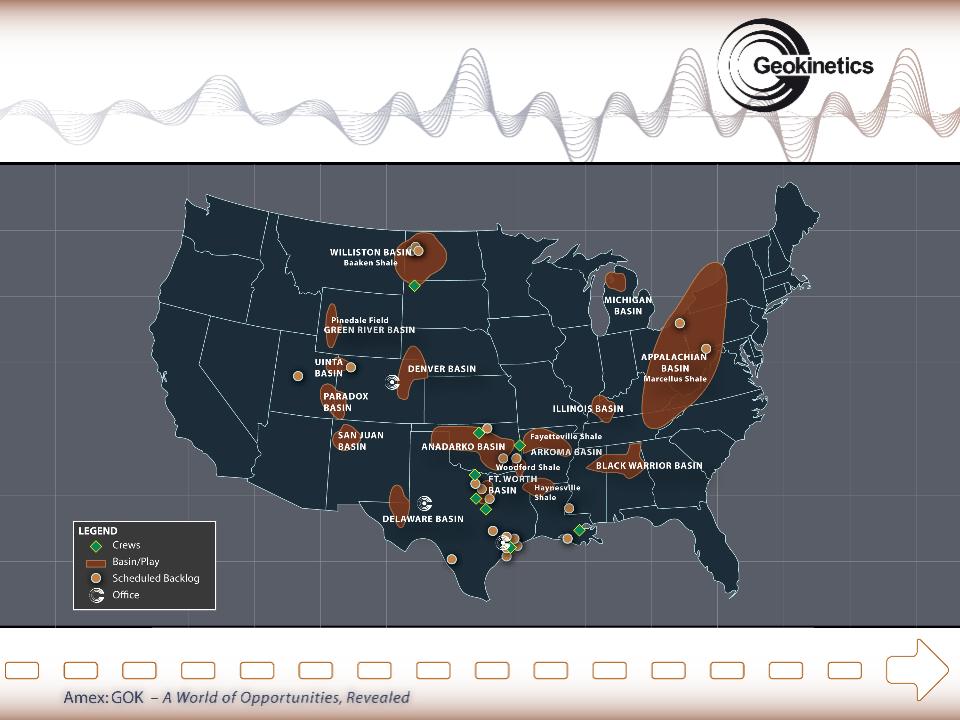

U.S. Operations

20

There’s No “Average” Job

u North America:

§ Energy Sources: Vibrator Trucks vs. Dynamite

§ Contract Types: Term vs. Turnkey

§ Third party

u International:

§ Crew customized to job

§ Highly variable crew size (#’s of people and equipment):

• New Zealand - 1,400 channels : 50 people : $2MM job

• Bolivia - 9,500 channels : 1,200 people : $20MM job

• Bangladesh - 6,500 channels : 1,800 people : $10MM job

21

From Deepwater

150 feet

150 feet

To Shallow

Up the

Escarpment

Escarpment

To Level

Ground

Ground

Elements of Transition Zone

22

Leader in Transition Zone

u Purpose-built vessels designed for cost-effective mobilization by air,

land or sea

land or sea

§ Up to 65’ in length,

ultra shallow draft vessels

ultra shallow draft vessels

§ Fit into 40’ containers

§ Capable of operating

150 ft. water depth

150 ft. water depth

§ 3 Active Crews

23

Emerging OBC Market

u Launched OBC operations Q4 2007

u Sole provider of Sercel SeaRay (2 Systems)

u Offshore capabilities up to 500 ft. water depth

u Expanding OBC capabilities near-term

§ Enhancing operating efficiency

§ Expanding operations

§ One active crew, potential to split

24

Processing & Interpretation

Capabilities

Capabilities

u Full suite of onshore and offshore proprietary seismic data processing services

and interpretation products

and interpretation products

§ Geophysical processing

§ Interpretation / well log analysis (existing database)

§ Software

§ Consulting Services

u Advanced Technologies for processing new data and reprocessing

old data with new methods

old data with new methods

§ AVO, pre-stack time and depth imaging

§ Multi-component and 4D

u Global Reach

§ Offices in US and UK

§ P&I services stretch to all regions of the globe

u Complements data acquisition services

§ GROWTH OPPORTUNITY for follow on work to Company field crews;

currently less than 5%

currently less than 5%

Financial Highlights

26

12/31/2006 | 12/31/2007 | 6/30/2008 | |

Cash, equivalents and restricted cash (1) | $ 22,059 | $ 16,843 | $ 16,710 |

Long-term debt and capital leases (including current portion): | |||

Credit facility | 0 | 40,537 | 60,334 |

Floating rate notes | 110,000 | 0 | 0 |

Other debt | 7,169 | 39,375 | 42,960 |

Total debt | 117,169 | 79,912 | 103,294 |

Debt as % capitalization | 58.1% | 29.4% | 34.4% |

Convertible preferred stock | 56,077 | 60,926 | 63,496(2) |

Stockholders’ equity | 28,595 | 130,965 | 133,106 |

Total capitalization | $201,841 | $271,803 | $299,896 |

(1) Includes $1.7 million, $1.3 million and $1.2 million of restricted cash at 12/31/06, 12/31/07 and 6/30/08, respectively.

(2) Completed the sale of 120,000 additional shares of convertible preferred stock and 240,000 warrants for gross proceeds of $30.0 million on July 28, 2008.

(2) Completed the sale of 120,000 additional shares of convertible preferred stock and 240,000 warrants for gross proceeds of $30.0 million on July 28, 2008.

Capitalization

27

Note: Adjusted EBITDA reflects $727k of Grant’s Abandoned IPO expenses and $12.9 million of expenses related to the Grant Acquisition consisting primarily of investment

advisor and professional fees, payout under phantom stock plan and completion bonuses which are added back in 2006 as well as $3.2 million of one-time severance costs

in 2007.

advisor and professional fees, payout under phantom stock plan and completion bonuses which are added back in 2006 as well as $3.2 million of one-time severance costs

in 2007.

Adjusted Revenue and

EBITDA Growth

EBITDA Growth

28

Note: Adjusted EBITDA reflects $727k of Grant’s Abandoned IPO expenses and $12.9 million of expenses related to the Grant Acquisition consisting primarily of investment advisor

and professional fees, payout under phantom stock plan and completion bonuses which are added back in 3Q06 as well as $3.2 million of one-time severance costs in 3Q07.

and professional fees, payout under phantom stock plan and completion bonuses which are added back in 3Q06 as well as $3.2 million of one-time severance costs in 3Q07.

Pro Forma Quarterly Revenue ($MM)

Pro Forma Adjusted EBITDA ($MM)

Quarterly Results

u Seasonality is prevalent in operations

§ Results from a variety of factors including Canadian working season in 1Q and thaw in

2Q, Colombian rainy season in Q2 and budgeting cycle of international companies

2Q, Colombian rainy season in Q2 and budgeting cycle of international companies

u 2Q07 impacted primarily by severe weather in the U.S. and a job being declared force

majeure

majeure

u Quarterly volatility reflects varying crew profitability due to fluctuations in size, job, location,

utilization of crews and the timing of crew moves

utilization of crews and the timing of crew moves

29

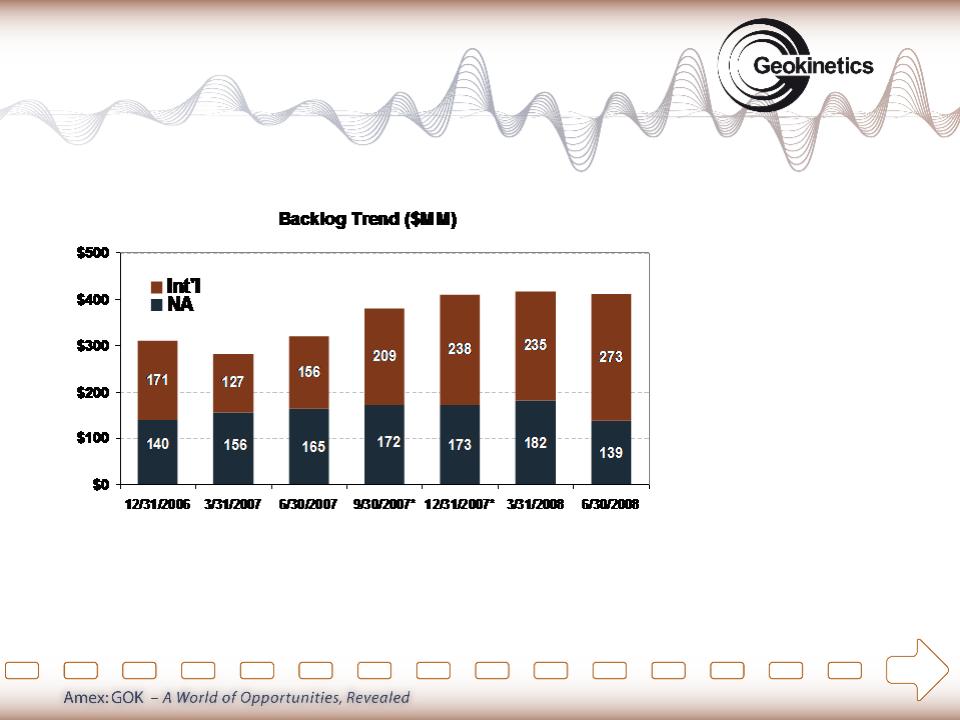

u Solid seismic data

acquisition and data

processing backlog

of $412 million as of

June 30, 2008

acquisition and data

processing backlog

of $412 million as of

June 30, 2008

u Substantial amount

of 2008 covered by

current backlog,

remainder to be

completed in 2009

and 2010

of 2008 covered by

current backlog,

remainder to be

completed in 2009

and 2010

*Includes a $59 million job in Argentina which has been removed from current backlog due to continued delays

and uncertainty.

and uncertainty.

412

417

411

381

321

283

311

Rising Backlog

30

$50.7 MM

YTD

Spending

YTD

Spending

$80.0

$94.7

$158.0

$24.5

Investing for Growth

u 2008 capital budget recently increased 24% to $80MM

u Investments in transition zone, OBC markets, international markets

31

Sercel SeaRay

Capital Investments

u Invested $95 million in 2007:

§ New state-of-the-art equipment

(67% received in second half of year)

(67% received in second half of year)

§ Upgraded U.S. crews

§ Expanded recording capacity

§ Entered OBC market

u 2008 capital expenditure budget

of $80 million, $51 million invested in 1H08

of $80 million, $51 million invested in 1H08

§ Focus on increasing international channel

count and seabed acquisition capacity

count and seabed acquisition capacity

u Maintenance CAPEX averages 3% to 4%

of revenues

of revenues

u Capital investment decisions are based

on an average expected payback of

less than three years EBITDA

on an average expected payback of

less than three years EBITDA

32

Why Buy GOK?

u Robust backlog provides visible growth through 2008 and into 2009

u Strong presence in profitable North American land seismic market

u High degree of international exposure

u Leader in high-value transition zone

u Penetrating strategic growth markets with long-term visibility

u Improving data acquisition operating margins

u Integration of acquired companies substantially complete

u Recent investments of $145 million in crew upgrades

and additional revenue-generating capacity

and additional revenue-generating capacity