UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-02992 |

| |

| Exact name of registrant as specified in charter: | | Dryden National Municipals Fund, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

| Date of fiscal year end: | | 12/31/2005 |

| |

| Date of reporting period: | | 12/31/2005 |

Item 1 – Reports to Stockholders – [ INSERT REPORT ]

Dryden National Municipals Fund, Inc.

| | |

| DECEMBER 31, 2005 | | ANNUAL REPORT |

FUND TYPE

Municipal bond

OBJECTIVE

High level of current income exempt from federal income taxes

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

JennisonDryden is a registered trademark of The Prudential Insurance Company of America.

February 16, 2006

Dear Shareholder:

We hope you find the annual report for the Dryden National Municipals Fund informative and useful. As a JennisonDryden mutual fund shareholder, you may be thinking about where you can find additional growth opportunities. You could invest in last year’s top-performing asset class and hope history repeats itself or you could stay in cash while waiting for the “right moment” to invest.

Instead, we believe it is better to take advantage of developing domestic and global investment opportunities through a diversified portfolio of stock and bond mutual funds. A diversified asset allocation offers two potential advantages. It helps you manage downside risk by not being overly exposed to any particular asset class, plus it gives you a better opportunity to have at least some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds covering all the basic asset classes and that reflects your personal investor profile and tolerance for risk.

JennisonDryden Mutual Funds gives you a wide range of choices that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of three leading asset managers. They are recognized and respected in the institutional market and by discerning investors for excellence in their respective strategies. JennisonDryden equity funds are advised by Jennison Associates LLC and/or Quantitative Management Associates LLC (QMA). Prudential Investment Management, Inc. (PIM) advises the JennisonDryden fixed income and money market funds. Jennison Associates, QMA, and PIM are registered investment advisors and Prudential Financial companies.

Thank you for choosing JennisonDryden Mutual Funds.

Sincerely,

Judy A. Rice, President

Dryden National Municipals Fund, Inc.

| | |

| Dryden National Municipals Fund, Inc. | | 1 |

Your Fund’s Performance

Fund objective

The investment objective of the Dryden National Municipals Fund, Inc. (the Fund) is to seek a high level of current income exempt from federal income taxes. There can be no assurance that the Fund will achieve its investment objective.

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. The maximum initial sales charge is 4.00% (Class A shares).

| | | | | | | | | | |

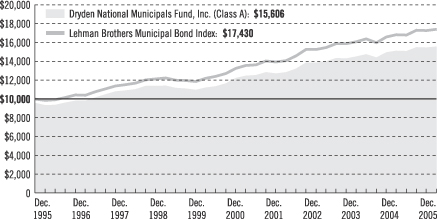

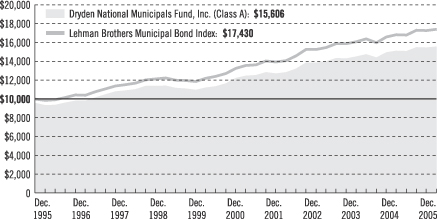

| Cumulative Total Returns1 as of 12/31/05 | | | | | |

| | | One Year | | | Five Years | | | Ten Years | | Since Inception2 |

Class A | | 3.02 | % | | 27.46 | % | | 62.56% (62.35) | | 164.25% (163.72) |

Class B | | 2.76 | | | 25.88 | | | 57.85 (57.64) | | 524.52 (523.28) |

Class C | | 2.50 | | | 24.33 | | | 53.98 (53.78) | | 74.25 (73.91) |

Class Z | | 3.27 | | | 29.05 | | | N/A | | 38.10 |

Lehman Brothers Municipal Bond Index3 | | 3.51 | | | 31.24 | | | 74.30 | | *** |

Lipper General Municipal Debt Funds Avg.4 | | 3.00 | | | 26.35 | | | 59.17 | | **** |

| | | | | | | | | | | | |

| Average Annual Total Returns1 as of 12/31/05 | | | | | | | | |

| | | One Year | | | Five Years | | | Ten Years | | Since Inception2 |

Class A | | –1.10 | % | | 4.12 | % | | 4.55% (4.54) | | 6.01% (6.00) |

Class B | | –2.16 | | | 4.55 | | | 4.67 (4.66) | | 7.39 (7.38) |

Class C | | 1.52 | | | 4.45 | | | 4.41 (4.40) | | 4.98 (4.96) |

Class Z | | 3.27 | | | 5.23 | | | N/A | | 4.76 |

Lehman Brothers Municipal Bond Index3 | | 3.51 | | | 5.59 | | | 5.71 | | *** |

Lipper General Municipal Debt Funds Avg.4 | | 3.00 | | | 4.78 | | | 4.74 | | **** |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Distributions and Yields1 as of 12/31/05 | | | | | | | | | | | |

| | | | | | | Total Distributions

Paid for 12 Months | | 30-Day

SEC Yield | | | Taxable Equivalent 30-Day Yield5

at Tax Rates of | |

| | | | | | | 33% | | | 35% | |

Class A | | | | | | $ | 0.68 | | 3.13 | % | | 4.67 | % | | 4.82 | % |

Class B | | | | | | $ | 0.64 | | 3.00 | | | 4.48 | | | 4.62 | |

Class C | | | | | | $ | 0.60 | | 2.75 | | | 4.10 | | | 4.23 | |

Class Z | | | | | | $ | 0.72 | | 3.51 | | | 5.24 | | | 5.40 | |

| | |

| 2 | | Visit our website at www.jennisondryden.com |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total returns performance quoted. Class A shares are subject to a maximum front-end sales charge of 4.00%. Under certain circumstances, Class A shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B and Class C shares are subject to a maximum CDSC of 5% and 1% respectively. Class Z shares are not subject to a sales charge.

1Source: Prudential Investments LLC and Lipper Inc. The average annual total returns take into account applicable sales charges. During certain periods shown, fee waivers and/or expense reimbursements were in effect. Without such fee waivers and expense reimbursements, the returns for the share classes would have been lower, as indicated in parentheses. Class A, Class B, and Class C shares are subject to an annual distribution and service (12b-1) fee of up to 0.30%, 0.50%, and 1.00% respectively. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Class Z shares are not subject to a 12b-1 fee. Except where noted, the returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

2Inception dates: Class A, 1/22/90; Class B, 4/25/80; Class C, 8/1/94; and Class Z, 1/22/99.

3The Lehman Brothers Municipal Bond Index is an unmanaged index of over 39,000 long-term investment-grade municipal bonds. It gives a broad look at how long-term investment-grade municipal bonds have performed.

4The Lipper General Municipal Debt Funds Average (Lipper Average) represents returns based on an average return of all funds in the Lipper General Municipal Debt Funds category for the periods noted. Funds in the Lipper Average invest primarily in municipal debt issues in the top four credit ratings.

5Some investors may be subject to the federal alternative minimum tax (AMT) and/or state and local taxes. Taxable equivalent yields reflect federal taxes only.

The returns for the Lehman Brothers Municipal Bond Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

***Lehman Brothers Municipal Bond Index Closest Month-End to Inception cumulative total returns are 186.75% for Class A, 611.70% for Class B, 99.52% for Class C, and 41.87% for Class Z. Lehman Brothers Municipal Bond Index Closest Month-End to Inception average annual total returns are 6.84% for Class A, 7.95% for Class B, 6.24% for Class C, and 5.19% for Class Z.

****Lipper Average Closest Month-End to Inception cumulative total returns are 164.69% for Class A, 592.56% for Class B, 81.79% for Class C, and 32.31% for Class Z. Lipper Average Closest Month-End to Inception average annual total returns are 6.29% for Class A, 7.78% for Class B, 5.36% for Class C, and 4.12% for Class Z.

| | |

| Dryden National Municipals Fund, Inc. | | 3 |

Your Fund’s Performance (continued)

| | | |

| Five Largest Issues expressed as a percentage of net assets as of 12/31/05 | | | |

Mercer Cnty. Poll. Control Rev., 7.20%, 06/30/13 | | 2.09 | % |

California St., G.O., M.B.I.A., 5.25%, 02/01/27 | | 2.08 | |

Houston Utility Systems Rev., Ser. A, F.S.A., 5.25%, 05/15/21 | | 1.92 | |

Met. Pier & Exposition Auth., 5.25%, 06/15/42 | | 1.76 | |

Mass St. Sch. Building Auth., 5.00%, 08/15/24 | | 1.67 | |

Issues are subject to change.

| | | |

| Credit Quality* expressed as a percentage of net assets as of 12/31/05 | | | |

Aaa | | 57.0 | % |

Aa | | 8.0 | |

A | | 15.3 | |

Baa | | 13.6 | |

Ba | | 0.2 | |

B | | 0.9 | |

Not Rated | | 3.5 | |

Total Investments | | 98.5 | |

Other assets in excess of liabilities | | 1.5 | |

Net Assets | | 100.0 | |

| | |

|

|

*Source: Moody’s rating, defaulting to S&P when not rated by Moody’s.

Credit Quality is subject to change.

| | |

| 4 | | Visit our website at www.jennisondryden.com |

Investment Subadvisor’s Report

Prudential Investment Management, Inc.

A noteworthy year in the municipal bond market

The municipal bond market experienced strong relative performance during the year to accompany the attractive tax-exempt income. In 2005 the market faced a trend toward higher short-term interest rates in the United States, and it had to absorb a record issuance of municipal bonds. Yet the tax-exempt market outperformed U.S. Treasury securities and the broader U.S. investment-grade fixed income market for the year.

The Fund maintained a highly diversified portfolio allocated across the various sectors of the municipal bond market and geographical regions of the United States to spread risks. One of the most important changes we made to the portfolio was to emphasize longer-term bonds. This not only increased the Fund’s yield but also positioned it more advantageously in the complex interest-rate environment of 2005. For the year, the Fund lagged the Lehman Brothers Municipal Bond Index (the Index), which does not include the effect of mutual fund operating expenses. However, the cumulative total return of its Class A shares was in line with the Lipper General Municipal Debt Funds Average (the Lipper Average). Class Z shares exceeded the Lipper Average, and Class B and C shares trailed the Lipper Average.

Our municipal bond yield curve strategy worked well

A solid economic expansion in the United States, along with sound budgeting practices of many state governments, strengthened the fiscal position of many states. This encouraged strong investor demand for municipal bonds, which helped the market digest the record amount of bonds issued in 2005. Meanwhile, the Federal Reserve continued its campaign to raise short-term rates out of determination to prevent the vibrant U.S. economy from fueling higher inflationary pressures. From June 2004 through December 2005, the target for the federal funds rate on overnight loans between banks was increased 13 times in quarter-point increments, from 1.00% to 4.25%. Eight of the increases occurred in 2005.

Because shorter-term municipal bond yields are very sensitive to changes in the federal funds rate, they rose sharply, which pressured shorter-term bond prices as prices move inversely to yields. Yields on long-term municipal bonds primarily reflect inflation expectations. Inflation was largely contained, and longer-term municipal bond yields fluctuated in a range rather than moving sharply higher. Consequently there was considerable flattening in the municipal bond yield curve, which depicts yields on municipal bonds from the shortest to the longest maturity dates. To benefit from this development, we sold some of the Fund’s municipal bonds in the five-year maturity category and bought municipal bonds in the 20-year maturity category, which increased the Fund’s yield and its total return performance.

| | |

| Dryden National Municipals Fund, Inc. | | 5 |

Investment Subadviser’s Report (continued)

Overweight allocation to healthcare a positive for the Fund

From the perspective of sector allocation, the Fund benefited from its overweight exposure to healthcare bonds relative to the Index and favorable security selection within the sector. The healthcare sector performed well in 2005 due to favorable demographic trends in the United States and improving finances at many institutions. The Fund held bonds of Maryland State Health and Higher Educational Facilities Authority for the University of Maryland Medical System that was assigned a positive outlook by Moody’s Investors Service. Standard & Poor’s Ratings Services (S&P) upgraded the system’s rating from A to A-plus. The Fund also held bonds of the South Carolina Jobs Economic Development Authority for the Palmetto Health Alliance, which has a strong competitive position, several consecutive years of improved financial operations, and healthy cash balances. Moody’s upgraded these bonds from Baa2 to Baa1, and S&P raised them from BBB to BBB-plus.

Too many single-family housing bonds

The Fund had an overweight exposure to single-family housing municipal bonds relative to the Index that hurt its performance. While these bonds provide a relatively high yield, they can be retired prior to their maturity dates if homeowners refinance the underlying mortgages. Therefore the bonds did not perform as well as some other municipal market sectors, as concern about mortgage refinancing lingered amid the historically low level of longer-term interest rates in the United States. With that said, we maintain a considerable exposure to the sector because of the bonds’ defensive characteristics. Also, the bonds could perform relatively well if refinancing activity slows as a result of higher rates and/or lower home prices.

Tobacco-related bonds had mixed impact on the Fund

The tobacco-related sector of the municipal bond market remained volatile. However, certain legal developments widely believed to favor tobacco firms helped the sector perform particularly well in 2005, even though there is no assurance that these rulings will not be overturned, in whole or in part, by another court.

Our strategy in the tobacco-related sector had a mixed impact on the Fund’s relative performance. The Fund benefited from its overweight position in tobacco-related bonds that are described as “double-barreled.” For example, in New York, this means Tobacco Settlement Finance Corporation Asset-Backed Bonds are backed by funds paid by tobacco firms that participate in the Master Settlement Agreement (MSA) signed in 1998 and by funds appropriated from the New York State legislature, which would be used only if MSA funds are insufficient to pay debt service on the bonds. The Fund also held Golden State Tobacco Securitization Asset-Backed Bonds, some of which were refunded by the state of California. This means California placed in an

| | |

| 6 | | Visit our website at www.jennisondryden.com |

escrow account U.S. government securities whose interest and principal will be used to pay off the bonds. The refunded Golden State Tobacco Bonds no longer depend on MSA funds or appropriated monies.

Tobacco-related bonds backed solely by MSA funds also performed well in 2005. We added to the Fund’s holdings of these securities. However, its slight underweight exposure to these so-called unenhanced tobacco-related bonds detracted from its relative performance.

| | |

| Dryden National Municipals Fund, Inc. | | 7 |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on July 1, 2005, at the beginning of the period, and held through the six-month period ended December 31, 2005.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to Individual Retirement Accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of JennisonDryden or Strategic Partners Funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values

| | |

| 8 | | Visit our website at www.jennisondryden.com |

and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Dryden National

Municipals

Fund, Inc. | | Beginning Account

Value

July 1, 2005 | | Ending Account

Value December 31, 2005 | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month

Period* |

| | | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | $ | 1,006.20 | | 0.88 | % | | $ | 4.45 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,020.77 | | 0.88 | % | | $ | 4.48 |

| | | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | $ | 1,004.30 | | 1.13 | % | | $ | 5.71 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,019.51 | | 1.13 | % | | $ | 5.75 |

| | | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | $ | 1,003.00 | | 1.38 | % | | $ | 6.97 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.25 | | 1.38 | % | | $ | 7.02 |

| | | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | $ | 1,006.80 | | 0.63 | % | | $ | 3.19 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,022.03 | | 0.63 | % | | $ | 3.21 |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended December 31, 2005, and divided by the 365 days in the Fund’s fiscal year ending December 31, 2005 (to reflect the six-month period).

| | |

| Dryden National Municipals Fund, Inc. | | 9 |

This Page Intentionally Left Blank

Portfolio of Investments

as of December 31, 2005

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating (Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

LONG-TERM INVESTMENTS 98.3% | | | | | | | | |

| | | | | |

Alabama 0.4% | | | | | | | | | | | | |

Birmingham Baptist Med. Centers Special Care Facs. Financing Auth. Rev. | | Baa1 | | 5.00% | | 11/15/30 | | $ | 2,000 | | $ | 1,955,320 |

| | | | | |

Arizona 2.2% | | | | | | | | | | | | |

Arizona Sch. Facs. Brd. Rev. | | Aaa | | 5.00 | | 7/01/20 | | | 5,000 | | | 5,367,500 |

Pima Cnty. Ind. Dev. Auth. Rev., F.S.A. | | Aaa | | 7.25 | | 7/15/10 | | | 1,030 | | | 1,047,778 |

Pima Cnty. Uni. Sch. Dist., G.O., F.G.I.C. | | Aaa | | 7.50 | | 7/01/10 | | | 3,000 | | | 3,491,820 |

Tucson Cnty., G.O., Ser. A | | Aa3 | | 7.375 | | 7/01/12 | | | 1,100 | | | 1,328,921 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 11,236,019 |

| | | | | |

California 8.9% | | | | | | | | | | | | |

Anaheim Pub. Fin. Auth. Lease Rev., | | | | | | | | | | | | |

Ser. 641A, F.S.A., R.I.T.E.S.(i) 144A | | NR | | 6.00 | | 9/01/16 | | | 2,210 | | | 3,307,552 |

Ser. 641B, F.S.A., R.I.T.E.S.(i) 144A | | NR | | 6.00 | | 9/01/24 | | | 1,815 | | | 2,957,125 |

Califorina St., G.O. | | A2 | | 5.00 | | 3/01/27 | | | 3 | | | 3,143,610 |

California Poll. Ctrl. Fin. Auth. Sld. Wste. Disp. Rev., Wste. Mgmt., Inc. Proj., Ser. B, A.M.T. | | BBB(d) | | 5.00 | | 7/01/27 | | | 1,000 | | | 1,001,730 |

California St. Pub. Wks. Brd. Lease Rev., | | | | | | | | | | | | |

Dept. of Mental Health Coalinga, Ser. A | | A3 | | 5.50 | | 6/01/19 | | | 2,000 | | | 2,175,320 |

Dept. of Mental Health Coalinga, Ser. A | | A3 | | 5.50 | | 6/01/20 | | | 2,000 | | | 2,170,900 |

Dept. of Mental Health Coalinga, Ser. A | | A3 | | 5.50 | | 6/01/22 | | | 2,000 | | | 2,163,560 |

California St., G.O., M.B.I.A. | | Aaa | | 5.25 | | 2/01/27 | | | 9,900 | | | 10,524,789 |

California Statewide Cmnty. Dev. Auth. Rev., Kaiser Permanente, Ser. B | | A3 | | 3.90 | | 7/01/14 | | | 3,500 | | | 3,399,725 |

See Notes to Financial Statements.

| | |

| Dryden National Municipals Fund, Inc. | | 11 |

Portfolio of Investments

as of December 31, 2005 Cont’d.

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating (Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

Folsom Cordova Uni. Sch. Dist. Sch. Facs. Impvt. Dist. No. 2, Ser. A, C.A.B.S., M.B.I.A. | | Aaa | | Zero | | 10/01/21 | | $ | 60 | | $ | 29,274 |

Loma Linda Hospial Rev. Loma Linda Univ. Med. Center, Ser. A | | Baa1 | | 5.00% | | 12/01/20 | | | 3,000 | | | 3,087,390 |

Pittsburg Redev. Agcy. Tax Alloc., Los Medanos Cmnty Dev. Proj., C.A.B.S., A.M.B.A.C. | | Aaa | | Zero | | 8/01/25 | | | 2,000 | | | 792,900 |

San Joaquin Hills Trans. Corridor Agcy. Toll Road Rev., Ser. A, C.A.B.S., M.B.I.A. | | Aaa | | Zero | | 1/15/36 | | | 11,000 | | | 2,557,170 |

Santa Margarita Dana Point Auth. Impvt. Rev., Dist. 3, 3A, 4, 4A, Ser. B, M.B.I.A. | | Aaa | | 7.25 | | 8/01/14 | | | 2,000 | | | 2,506,060 |

Univ. of California Rev.s Proj., Ser. B | | Aaa | | 5.00 | | 5/15/24 | | | 4,760 | | | 5,012,566 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 44,829,671 |

| | | | | |

Colorado 1.3% | | | | | | | | | | | | |

Adams & Arapahoe Counties Joint Sch. Dist. G.O. Number 28J Aurora, Ser. A, F.S.A. | | Aaa | | 5.25 | | 12/01/20 | | | 2,000 | | | 2,176,700 |

Boulder Cnty. Sales & Use Tax Rev., Ser. A, F.G.I.C. | | Aaa | | 6.00 | | 12/15/17 | | | 3,970 | | | 4,374,622 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 6,551,322 |

| | | | |

Connecticut 0.9% | | | | | | | | | | |

Connecticut St. Spl. Tax Oblig. Rev., Trans. Infrastructure Rev., Ser. A(b) | | Aaa | | 7.125 | | 6/01/10 | | | 1,000 | | | 1,133,680 |

Connecticut St., Rite-1060 R, Ser. C, G.O.(i) 144A | | AA(d) | | 5.65 | | 11/15/09 | | | 2,855 | | | 3,290,330 |

| | | | | �� | | | | | | |

|

|

| | | | | | | | | | | | | 4,424,010 |

| | | | | |

Delaware 0.6% | | | | | | | | | | | | |

Delaware River & Bay Auth.,

Rev. M.B.I.A. | | Aaa | | 5.00 | | 1/01/25 | | | 1,000 | | | 1,058,690 |

Delaware River & Bay Auth.,

Rev. M.B.I.A. | | Aaa | | 5.00 | | 1/01/27 | | | 1,000 | | | 1,053,320 |

Delaware St. Health Facs. Auth. Rev., Beebe Med. Center Proj., Ser. A | | Baa1 | | 5.00 | | 6/01/24 | | | 1,000 | | | 1,027,180 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 3,139,190 |

See Notes to Financial Statements.

| | |

| 12 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating

(Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

District of Columbia 0.9% | | | | | | | | | | | | |

Dist. of Columbia Rev., George Washington Univ., Ser. A, M.B.I.A. | | Aaa | | 5.125% | | 9/15/31 | | $ | 2,040 | | $ | 2,106,014 |

Dist. of Columbia, Ser. B, F.S.A. | | Aaa | | 5.00 | | 6/01/27 | | | 2,500 | | | 2,616,525 |

| | | | | | | | | | | |

|

|

| | | �� | | | | | | | | | | 4,722,539 |

| | | | | |

Florida 4.0% | | | | | | | | | | | | |

Broward Cnty. Rest. Recov. Rfdg., Wheelabrator, Ser. A | | A3 | | 5.50 | | 12/01/08 | | | 5,000 | | | 5,271,800 |

Florida St. Brd. of Ed., G.O. | | Aa1 | | 9.125 | | 6/01/14 | | | 1,260 | | | 1,610,721 |

Gainesville Florida Utility Systems Rev. Ser. A, F.S.A. | | Aaa | | 5.00 | | 10/01/23 | | | 3,000 | | | 3,190,260 |

Highlands Cnty. Health Facs. Auth., Rev., | | | | | | | | | | | | |

Adventist Health B | | A2 | | 5.00 | | 11/15/25 | | | 1,000 | | | 1,021,050 |

Adventist Health I | | A2 | | 5.00 | | 11/16/09 | | | 500 | | | 519,085 |

Miami Dade Cnty. Aviation Rev., Miami Int’l. Arpt. Hub, Ser. C, F.G.I.C. | | Aaa | | 5.00 | | 10/01/10 | | | 3,040 | | | 3,230,365 |

Palm Beach Cnty. Sch. Brd., | | | | | | | | | | | | |

Ser. A, C.O.P., F.G.I.C. | | Aaa | | 5.00 | | 8/01/22 | | | 1,350 | | | 1,423,143 |

Ser. A, C.O.P., F.G.I.C. | | Aaa | | 5.00 | | 8/01/23 | | | 2,555 | | | 2,685,918 |

Reunion West Cmnty. Dev. Dist. Spl. Assmt. Rev. | | NR | | 6.25 | | 5/01/36 | | | 1,000 | | | 1,055,170 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 20,007,512 |

| | | | | |

Georgia 0.3% | | | | | | | | | | | | |

Forsyth Cnty. Sch. Dist. Dev. G.O. Assmt. | | Aa2 | | 6.75 | | 7/01/16 | | | 500 | | | 608,465 |

Fulton Cnty. Sch. Dist. G.O. | | Aa2 | | 6.375 | | 5/01/17 | | | 750 | | | 910,868 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 1,519,333 |

| | | | | |

Hawaii 1.8% | | | | | | | | | | | | |

Hawaii St., Ser. DD, G.O., M.B.I.A. | | Aaa | | 5.25 | | 5/01/24 | | | 2,000 | | | 2,156,500 |

Honolulu Hawaii City & Cnty. Wste. Wtr. Systems Rev., Ser. A, F.G.I.C. | | Aaa | | 5.00 | | 7/01/24 | | | 4,285 | | | 4,523,803 |

Honolulu Hawaii City & Cnty., Ser. F, F.G.I.C. | | Aaa | | 5.25 | | 7/01/20 | | | 2,000 | | | 2,192,720 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 8,873,023 |

See Notes to Financial Statements.

| | |

| Dryden National Municipals Fund, Inc. | | 13 |

Portfolio of Investments

as of December 31, 2005 Cont’d.

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating

(Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

Illinois 5.6% | | | | | | | | | | | | |

Chicago O’Hare Int’l. Arpt. Rev., General Airport, 3rd Lein, Ser. B-1, X.L.C.A. | | Aaa | | 5.25% | | 1/01/34 | | $ | 1,975 | | $ | 2,083,131 |

Chicago, G.O., F.G.I.C. | | Aaa | | 5.25 | | 1/01/28 | | | 3,625 | | | 3,816,146 |

Gilberts Spl. Service Area Number 9 Spl. Tax,

Big Timber Proj.(b) | | AAA(d) | | 7.75 | | 3/01/11 | | | 2,000 | | | 2,400,700 |

Illinois Edl. Facs. Auth. Student Hsg. Rev., Edl. Advancement Fund, Univ. Center Proj. | | Baa3 | | 6.00 | | 5/01/22 | | | 1,500 | | | 1,622,850 |

Illinois Fin. Auth. Rev., Northwestern Mem. Hosp., Ser. A | | Aa2 | | 5.25 | | 8/15/34 | | | 5,000 | | | 5,265,350 |

McLean & Woodford Counties Cmnty. Unit Sch. Dist. Number 005, G.O., F.S.A.(b) | | Aaa | | 5.625 | | 12/01/11 | | | 4,000 | | | 4,381,360 |

Metro Pier & Expo. Auth. Dedicated St. Tax Rev., McCormick Place Expansion, Ser. A, M.B.I.A. | | Aaa | | 5.25 | | 6/15/42 | | | 8,500 | | | 8,926,786 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 28,496,323 |

| | | | | |

Kansas 2.6% | | | | | | | | | | | | |

Sedgwick & Shawnee Cnty. Sngl. Fam. | | | | | | | | | | | | |

Rev., Ser. A, A.M.T., G.N.M.A., F.N.M.A. | | Aaa | | 5.70 | | 12/01/27 | | | 2,335 | | | 2,457,634 |

Rev., Ser. A, A.M.T., G.N.M.A., F.N.M.A. | | Aaa | | 5.75 | | 6/01/27 | | | 2,385 | | | 2,461,225 |

Rev., Ser. A, A.M.T., G.N.M.A., F.N.M.A. | | Aaa | | 5.85 | | 12/01/27 | | | 2,240 | | | 2,364,970 |

Wyandotte Cnty. Unit Government Util. Systems Rev., Rfdg., Ser. 2004, A.M.B.A.C. | | Aaa | | 5.65 | | 9/01/19 | | | 5,000 | | | 5,720,999 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 13,004,828 |

| | | | | |

Louisiana 1.6% | | | | | | | | | | | | |

New Orleans, Rfdg., G.O., M.B.I.A. | | Aaa | | 5.25 | | 12/01/22 | | | 2,000 | | | 2,138,700 |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating

(Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

Orleans Parish Sch. Brd., E.T.M., M.B.I.A.(b) | | Aaa | | 8.90% | | 2/01/07 | | $ | 5,780 | | $ | 6,118,997 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 8,257,697 |

| | | | | |

Maryland 1.9% | | | | | | | | | | | | |

Baltimore Econ. Dev. Lease Rev., Armistead Partnership, Ser. A | | A(d) | | 7.00 | | 8/01/11 | | | 740 | | | 741,243 |

Maryland St. Health & Higher Ed. Facs. Auth. Rev., Univ. Maryland Med. Sys.(b) | | A3 | | 6.75 | | 7/01/10 | | | 5,000 | | | 5,712,050 |

Northeast Wste. Disp. Auth., Rev., Baltimore City Sludge Corporate Proj.(f)(i) 144A | | NR | | 7.25 | | 7/01/07 | | | 1,161 | | | 1,206,035 |

Montgomery Cnty. Rest. Rec. Proj., Ser. A, A.M.T.(f)(i) 144A | | A2 | | 6.00 | | 7/01/07 | | | 1,000 | | | 1,026,830 |

Takoma Park Hosp. Facs. Rev., Washington Adventist Hosp., E.T.M., F.S.A.(b) | | Aaa | | 6.50 | | 9/01/12 | | | 1,000 | | | 1,121,640 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 9,807,798 |

| | | | | |

Massachusetts 6.2% | | | | | | | | | | | | |

Boston Ind. Dev. Fin. Auth. Swr. Facs. Rev., Harbor Elec. Energy Co. Proj., A.M.T. | | Aa3 | | 7.375 | | 5/15/15 | | | 1,195 | | | 1,227,731 |

Massachusetts St. Dev. Fin. Agcy. Rev., Concord Assabet Fam. Services(f) | | Ba2 | | 6.00 | | 11/01/28 | | | 640 | | | 645,536 |

Massachusetts St. Health & Ed.al Facs. | | | | | | | | | | | | |

Auth. Rev., Caritas Christi Obligation, Ser. B | | Baa3 | | 6.75 | | 7/01/16 | | | 3,590 | | | 4,019,436 |

Auth. Rev., Harvard Univ., Ser. W(b) | | Aaa | | 6.00 | | 7/01/10 | | | 500 | | | 557,485 |

Auth. Rev., Partners Healthcare Systems, Ser. F | | Aa3 | | 5.00 | | 7/01/22 | | | 1,500 | | | 1,576,425 |

Auth. Rev., Simmons College, Ser. D, A.M.B.A.C.(b) | | Aaa | | 6.05 | | 10/01/10 | | | 1,000 | | | 1,120,950 |

Auth. Rev., Univ. Massachusetts Proj., Ser. A, F.G.I.C.(b) | | Aaa | | 5.875 | | 10/01/10 | | | 500 | | | 556,720 |

Auth. Rev., Valley Region Health System, Ser. C | | Baa3 | | 7.00 | | 7/01/10 | | | 825 | | | 935,872 |

See Notes to Financial Statements.

| | |

| Dryden National Municipals Fund, Inc. | | 15 |

Portfolio of Investments

as of December 31, 2005 Cont’d.

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating (Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

Massachusetts St. Ind. Dev. Fin. Agcy. Rev., Bradford College(c)(g)(i) 144A | | NR | | Zero | | 11/01/28 | | $ | 970 | | $ | 242,610 |

Massachusetts St. Sch. Building Auth. Dedicated Sales Tax Rev., Ser. A, F.S.A. | | Aaa | | 5.00 | | 8/15/24 | | | 8,000 | | | 8,469,520 |

Massachusetts St. Special Obligation Dedicated Tax Rev., Rfdg., F.G.I.C. | | Aaa | | 5.25 | | 1/01/21 | | | 3,110 | | | 3,507,800 |

Rev. Ser. A, F.S.A. | | Aaa | | 5.50 | | 6/01/21 | | | 2,000 | | | 2,317,600 |

Massachusetts St. Wtr. Pollutant Abatement Trust, Pool Program, Ser. 9 | | Aaa | | 5.25 | | 8/01/33 | | | 2,500 | | | 2,663,925 |

Massachusetts St. Wtr. Resolution Auth. | | | | | | | | | | | | |

Rev., Ser. B, M.B.I.A. | | Aaa | | 6.25 | | 12/01/11 | | | 500 | | | 569,915 |

Rev., Ser. D, M.B.I.A. | | Aaa | | 6.00 | | 8/01/13 | | | 500 | | | 574,270 |

Massachusetts St., G.O., Ser. C(b) | | Aa2 | | 5.25 | | 11/01/12 | | | 1,425 | | | 1,551,868 |

Rail Connections, Inc., Rev., Route 128, Ser. B, C.A.B.S., A.C.A.(b) | | Aaa | | Zero | | 7/01/09 | | | 2,500 | | | 1,038,550 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 31,576,213 |

| | | | | |

Michigan 2.0% | | | | | | | | | | | | |

Harper Creek Cmnty. Sch. Dist., G.O.(b) | | Aa2 | | 5.50 | | 5/01/11 | | | 1,500 | | | 1,642,500 |

Michigan St. Building Auth. Rev., Rfdg. Facs. Prog., Ser. III | | Aa3 | | 5.375 | | 10/15/22 | | | 3,750 | | | 4,056,112 |

Michigan St. Hosp. Fin. Auth. Rev., Ascension Health, Ser. A | | Aa3 | | 5.00 | | 11/01/12 | | | 1,250 | | | 1,327,900 |

Okemos Pub. Sch. Dist., C.A.B.S. | | | | | | | | | | | | |

G.O., M.B.I.A. | | Aaa | | Zero | | 5/01/12 | | | 1,100 | | | 858,693 |

G.O., M.B.I.A. | | Aaa | | Zero | | 5/01/13 | | | 1,000 | | | 745,540 |

Wyandotte Elec. Rev., G.O., M.B.I.A. | | Aaa | | 6.25 | | 10/01/08 | | | 1,270 | | | 1,331,913 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 9,962,658 |

| | | | | |

Minnesota 1.1% | | | | | | | | | | | | |

Minnesota Hsg. Fin. Agcy. Rev., Sngl. Fam. Mtge., Ser. I, A.M.T. | | Aa1 | | 5.80 | | 1/01/19 | | | 3,190 | | | 3,306,786 |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating

(Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

Minnesota St. Mun. Powr. Agcy. Elec. Rev. | | A3 | | 5.25% | | 10/01/21 | | $ | 2,000 | | $ | 2,146,620 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 5,453,406 |

| | | | | |

Nevada 1.6% | | | | | | | | | | | | |

Clark Cnty. Ind. Dev. Rev., Nevada Pwr. Co. Proj., Ser. A | | B-(d) | | 5.60 | | 10/01/30 | | | 4,735 | | | 4,726,382 |

Clark Cnty. Sch. Dist. G.O., F.S.A. | | Aaa | | 5.00 | | 6/15/18 | | | 3,000 | | | 3,224,220 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 7,950,602 |

| | | | | |

New Hampshire 1.1% | | | | | | | | | | | | |

Manchester Hsg. & Redev. Auth. Rev., Ser. B, C.A.B.S., A.C.A. | | A(d) | | Zero | | 1/01/24 | | | 4,740 | | | 1,738,442 |

New Hampshire Health & Ed. Facs. Auth. Rev., College Issue(b) | | BBB-(d) | | 7.50 | | 1/01/11 | | | 3,000 | | | 3,544,290 |

New Hampshire Higher Ed. & Health Facs. Auth. Rev., New Hampshire College(b) | | BBB-(d) | | 6.30 | | 1/01/07 | | | 145 | | | 150,467 |

New Hampshire Higher Ed. & Health Facs. Auth. Rev., New Hampshire College | | BBB-(d) | | 6.30 | | 1/01/16 | | | 355 | | | 368,386 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 5,801,585 |

| | | | | |

New Jersey 3.5% | | | | | | | | | | | | |

Casino Reinvestment Dev. Auth., Room Fee, A.M.B.A.C. | | Aaa | | 5.25 | | 1/01/24 | | | 1,600 | | | 1,746,816 |

New Jersey Econ. Dev. Auth. Rev., Cigarette Tax | | Baa2 | | 5.625 | | 6/15/19 | | | 1,250 | | | 1,328,500 |

New Jersey Econ. Dev. Auth. Rev., Cigarette Tax | | Baa2 | | 5.75 | | 6/15/34 | | | 750 | | | 789,450 |

New Jersey Health Care Facs. Fin. Auth. Rev. | | | | | | | | | | | | |

Atlantic City Med. Center | | A2 | | 6.25 | | 7/01/17 | | | 2,175 | | | 2,434,304 |

Raritan Bay Med. Center Issue | | NR | | 7.25 | | 7/01/27 | | | 2,000 | | | 2,053,600 |

Saint Peter’s Univ. Hosp., Ser. A | | Baa1 | | 6.875 | | 7/01/30 | | | 2,000 | | | 2,188,680 |

South Jersey Hosp. | | Baa1 | | 6.00 | | 7/01/26 | | | 1,565 | | | 1,680,575 |

South Jersey Hosp. | | Baa1 | | 6.00 | | 7/01/32 | | | 1,000 | | | 1,066,930 |

New Jesery Econ. Dev. Auth. Rev. Sch. Facs. Construction, Ser. O | | A1 | | 5.25 | | 3/01/26 | | | 1,000 | | | 1,066,620 |

Newark Hsg. Auth., Port Auth., Newark Marine Terminal, M.B.I.A. | | Aaa | | 5.00 | | 1/01/34 | | | 3,000 | | | 3,112,110 |

See Notes to Financial Statements.

| | |

| Dryden National Municipals Fund, Inc. | | 17 |

Portfolio of Investments

as of December 31, 2005 Cont’d.

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating (Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

Tobacco Settlement Financing Corporation, Asset Bkd. Rev. | | Baa3 | | 6.00% | | 6/01/37 | | $ | 400 | | $ | 414,828 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 17,882,413 |

| | | | | |

New Mexico 2.2% | | | | | | | | | | | | |

New Mexico Mtge. Fin. Auth. Rev., Sngl. | | | | | | | | | | | | |

Fam. Mtge., Ser. A, G.N.M.A., F.N.M.A., F.H.L.M.C., A.M.T. | | Aaa | | 5.50 | | 7/01/36 | | | 2,500 | | | 2,633,050 |

Fam. Mtge., Ser. B, G.N.M.A., F.N.M.A., F.H.L.M.C., A.M.T. | | AAA(d) | | 4.75 | | 7/01/35 | | | 4,800 | | | 4,872,528 |

Fam. Mtge., Ser. C-2, G.N.M.A., F.N.M.A., A.M.T. | | AAA(d) | | 6.15 | | 3/01/32 | | | 1,145 | | | 1,189,964 |

New Mexico Mtge. Fin. Auth., Sngl. Fam. Mtge. Program, Ser. E, A.M.T., G.N.M.A., F.N.M.A., F.H.L.M.C. | | AAA(d) | | 5.50 | | 7/01/35 | | | 2,495 | | | 2,635,144 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 11,330,686 |

| | | | | |

New York 14.2% | | | | | | | | | | | | |

Erie Cnty. Ind. Dev. Agcy. | | | | | | | | | | | | |

Sch. Facility Rev., City of Buffalo Proj., F.S.A. | | Aaa | | 5.75 | | 5/01/19 | | | 1,250 | | | 1,386,788 |

Sch. Facility Rev., City of Buffalo Proj., F.S.A. | | Aaa | | 5.75 | | 5/01/23 | | | 3,030 | | | 3,352,574 |

Sch. Facility Rev., City of Buffalo Proj., F.S.A. | | Aaa | | 5.75 | | 5/01/24 | | | 6,765 | | | 7,338,943 |

Liberty Dev. Corporate Rev., Goldman Sachs Headquarters | | Aa3 | | 5.25 | | 10/01/35 | | | 2,500 | | | 2,818,975 |

Met. Trans. Auth. Rev., Ser. A, A.M.B.A.C. | | Aaa | | 5.50 | | 11/15/18 | | | 4,000 | | | 4,402,760 |

New York City Transitional Fin. Auth. Rev., | | | | | | | | | | | | |

Future Tax Sec’d., Ser. A-1 | | Aa1 | | 5.00 | | 11/01/24 | | | 2,000 | | | 2,117,660 |

Future Tax Sec’d., Ser. C | | Aa1 | | 5.50 | | 11/01/20 | | | 210 | | | 229,471 |

Ser. C | | Aa1 | | 5.50 | | 2/15/16 | | | 2,500 | | | 2,725,900 |

New York City, G.O., Ser. D | | A1 | | 7.65 | | 2/01/07 | | | 45 | | | 45,153 |

New York City, G.O., Ser. J, F.S.A. | | Aaa | | 5.00 | | 3/01/18 | | | 2,745 | | | 2,934,240 |

New York St. Dorm. Auth. Rev., Ref. Sec’d. | | | | | | | | | | | | |

Hosp. Catskill Region, F.G.I.C. | | Aaa | | 5.25 | | 2/15/17 | | | 2,160 | | | 2,357,726 |

Hosp. Catskill Region, F.G.I.C. | | Aaa | | 5.25 | | 2/15/18 | | | 2,300 | | | 2,505,045 |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | | |

New York St. Environ. Facs. Corp. Poll. Control Rev., St. Wtr. Revolv. Fdg., Ser. C | | Aaa | | 5.80% | | 1/15/06 | | | $ | 20 | | $ | 20,420 |

New York St. Environ. Facs. Corp. Poll. Control Rev., St. Wtr. Revolv. Fdg., Ser. C | | Aaa | | 5.80 | | 1/15/14 | | | | 1,260 | | | 1,287,758 |

New York St. Mun. Brd. Bank Agcy. Supply Sch., Ser. C | | A+(d) | | 5.25 | | 6/01/22 | | | | 3,200 | | | 3,441,728 |

New York St. Mun. Brd. Bank Agcy. Supply Sch., Ser. C | | A+(d) | | 5.25 | | 12/01/22 | | | | 3,595 | | | 3,866,566 |

New York St. Tollway Auth. Hwy. & Brdge.s, Ser. B, A.M.B.A.C. | | Aaa | | 5.50 | | 4/01/20 | | | | 5,000 | | | 5,778,900 |

Tobacco Settlement Financing Corporation, | | | | | | | | | | | | | |

Asset Bkd., Ser. A-1 | | A1 | | 5.50 | | 6/01/16 | | | | 3,000 | | | 3,214,410 |

Asset Bkd., Ser. A-1 | | A1 | | 5.50 | | 6/01/18 | | | | 3,000 | | | 3,264,840 |

Asset Bkd., Ser. A-1 | | A1 | | 5.50 | | 6/01/19 | | | | 5,000 | | | 5,487,300 |

Asset Bkd., Ser. A-1 | | A1 | | 5.50 | | 6/01/14 | | | | 4,125 | | | 4,377,656 |

Asset Bkd., Ser. C-1 | | A1 | | 5.50 | | 6/01/14 | | | | 3,000 | | | 3,178,770 |

Asset Bkd., Ser. C-1 | | A1 | | 5.50 | | 6/01/15 | | | | 500 | | | 535,735 |

United Nations Dev. Corporation Rev., Ser. A | | A3 | | 5.25 | | 7/01/17 | | | | 2,000 | | | 2,063,600 |

United Nations Dev. Corporation Rev., Ser. A | | A3 | | 5.25 | | 7/01/21 | | | | 1,370 | | | 1,413,566 |

United Nations Dev. Corporation Rev., Ser. A | | A3 | | 5.25 | | 7/01/25 | | | | 1,000 | | | 1,030,830 |

| | | | | | | | | | | | |

|

|

| | | | | | | | | | | | | | 71,177,314 |

| | | | | |

North Carolina 2.7% | | | | | | | | | | | | | |

Charlotte Airport Rev., Ser. B, A.M.T., M.B.I.A. | | Aaa | | 6.00 | | 7/01/24 | | | | 1,000 | | | 1,076,190 |

Charlotte Storm Wtr. Fee Rev.(b) | | Aa2 | | 6.00 | | 6/01/10 | | | | 500 | | | 556,350 |

No. Carolina Eastern Mun. Powr. Agcy., | | | | | | | | | | | | | |

Powr. Systems Rev., A.M.B.A.C. | | Aaa | | 6.00 | | 1/01/18 | | | | 1,000 | | | 1,178,700 |

Powr. Systems Rev., Ser. A(b) | | Aaa | | 6.00 | | 1/01/22 | | | | 650 | | | 795,613 |

Powr. Systems Rev., Ser. A, E.T.M. | | Aaa | | 6.50 | | 1/01/18 | | | | 2,635 | | | 3,269,481 |

Powr. Systems Rev., Ser. A, E.T.M. | | Aaa | | 6.50 | | 1/01/18 | | | | 1,005 | | | 1,221,176 |

See Notes to Financial Statements.

| | |

| Dryden National Municipals Fund, Inc. | | 19 |

Portfolio of Investments

as of December 31, 2005 Cont’d.

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating

(Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

Powr. Systems Rev., Ser. A, M.B.I.A. | | Aaa | | 6.40% | | 1/01/21 | | $ | 1,000 | | $ | 1,219,050 |

No. Carolina Hsg. Fin. Agcy., Home Ownership, Ser. 6 A, A.M.T. | | Aa2 | | 6.20 | | 1/01/29 | | | 760 | | | 788,432 |

No. Carolina Mun. Powr. Agcy., Number 1 Catawba Elec. Rev., M.B.I.A. | | Aaa | | 6.00 | | 1/01/10 | | | 1,250 | | | 1,365,775 |

Piedmont Triad Airport Auth. Rev., Ser. B, A.M.T., F.S.A. | | Aaa | | 6.00 | | 7/01/21 | | | 1,000 | | | 1,076,190 |

Pitt Cnty. Rev., Mem. Hosp., E.T.M.(b) | | Aaa | | 5.25 | | 12/01/21 | | | 1,000 | | | 1,046,340 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 13,593,297 |

| | | |

North Dakota 2.1% | | | | | | | | |

Mercer Cnty. Poll. Control Rev., Antelope Valley Station, A.M.B.A.C. | | Aaa | | 7.20 | | 6/30/13 | | | 9,000 | | | 10,571,220 |

| | | | | |

Ohio 4.0% | | | | | | | | | | | | |

Brecksville Broadview Heights City Sch. Dist., G.O., F.G.I.C. | | Aaa | | 6.50 | | 12/01/16 | | | 1,000 | | | 1,048,120 |

Columbus Citation Hsg. Dev. Corporate, Mtge. Rev., A.M.T., F.H.A.(b) | | NR | | 7.625 | | 1/01/15 | | | 1,640 | | | 1,999,193 |

Cuyahoga Cnty. Hosp. Facs. Rev., Canton, Inc. Proj. | | Baa2 | | 7.50 | | 1/01/30 | | | 5,000 | | | 5,587,699 |

Hamilton Cnty. Sales Tax Rev., Sub., Ser. B, A.M.B.A.C., C.A.B.S. | | Aaa | | Zero | | 12/01/20 | | | 2,000 | | | 1,017,700 |

Hilliard Sch. Dist. Sch. Impvt., C.A.B.S., F.G.I.C. | | Aaa | | Zero | | 12/01/19 | | | 1,720 | | | 920,768 |

Lucas Cnty. Health Care Facs. Rev., Rfdg. & Impvt., Sunset Ret., Ser. A | | NR | | 6.625 | | 8/15/30 | | | 1,000 | | | 1,074,030 |

Lucas Cnty. Health Care Facs. Rev., Ref. Presbyterian Services, Ser. A | | NR | | 6.625 | | 7/01/14 | | | 1,750 | | | 1,816,588 |

Lucas Cnty. Hosp. Rev. Ref., Healthcare Group, Ser. B, A.M.B.A.C. | | Aaa | | 5.00 | | 11/15/21 | | | 3,935 | | | 4,154,534 |

Newark, Ltd. Tax, G.O., C.A.B.S. A.M.B.A.C. | | Aaa | | Zero | | 12/01/06 | | | 805 | | | 780,761 |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating (Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

Ohio St. Higher Ed. Facility Cmnty. Rev., Case Western Reserve Univ., Ser. B | | A1 | | 6.50% | | 10/01/20 | | $ | 750 | | $ | 918,923 |

Richland Cnty. Hosp. Facs. Rev., Medcentral Health Systems, Ser. B | | A-(d) | | 6.375 | | 11/15/22 | | | 1,000 | | | 1,092,000 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 20,410,316 |

Oklahoma 1.8% | | | | | | | | | | | | |

Oklahoma Hsg. Fin. Agcy. Home Ownership, Ser. B-1, G.N.M.A., F.N.M.A., A.M.T. | | Aaa | | 4.875 | | 9/01/33 | | | 3,050 | | | 3,108,225 |

Oklahoma St. Tpke. Auth. Rev., Second Sr., Ser. B, F.G.I.C. | | Aaa | | 5.00 | | 1/01/16 | | | 5,900 | | | 6,141,664 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 9,249,889 |

| | | | | |

Pennsylvania 2.2% | | | | | | | | | | | | |

Clarion Cnty. Hosp. Auth. Rev., Clarion Hosp. Proj. | | BBB-(d) | | 5.60 | | 7/01/10 | | | 685 | | | 700,371 |

Monroe Cnty. Hosp. Auth. Rev., Pocono Med. Center | | BBB+(d) | | 6.00 | | 1/01/43 | | | 1,750 | | | 1,868,178 |

Philadelphia Wtr. & Wste.Water Rev., Ser. A, F.S.A. | | Aaa | | 5.00 | | 7/01/12 | | | 4,645 | | | 4,999,506 |

Pittsburgh, G.O., Ser. A, M.B.I.A. | | Aaa | | 5.00 | | 9/01/11 | | | 1,500 | | | 1,603,575 |

Westmoreland Cnty. Ind. Rev., Valley Landfill Proj., A.M.T. Waste Mgmt., Inc. | | BBB(d) | | 5.10 | | 5/01/09 | | | 2,000 | | | 2,064,360 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 11,235,990 |

| | | |

Puerto Rico 1.5% | | | | | | | | |

Puerto Rico Comwlth. Hwy. & Trans. Auth. | | | | | | | | | | | | |

Rev., Ser. G, F.G.I.C. | | Aaa | | 5.25 | | 7/01/18 | | | 2,250 | | | 2,453,580 |

Rev., Ser. K | | Baa2 | | 5.00 | | 7/01/14 | | | 2,000 | | | 2,111,940 |

Puerto Rico Comwlth., G.O., R.I.T.E.S., | | | | | | | | | | | | |

PA625, A.M.B.A.C.,

T.C.R.S.(i) 144A | | NR | | 9.685 | | 7/01/10 | | | 500 | | | 646,880 |

PA642B, M.B.I.A.(i) 144A | | NR | | 7.772 | | 7/01/12 | | | 1,000 | | | 1,249,800 |

Puerto Rico Mun. Fin. Agcy. | | Baa2 | | 5.00 | | 8/01/12 | | | 1,000 | | | 1,054,700 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 7,516,900 |

See Notes to Financial Statements.

| | |

| Dryden National Municipals Fund, Inc. | | 21 |

Portfolio of Investments

as of December 31, 2005 Cont’d.

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating

(Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

South Carolina 3.3% | | | | | | |

Charleston Edl. Excellence Financing Corporation Rev., Charleston Cnty. Sch. Dist. | | A1 | | 5.25% | | 12/01/25 | | $ | 5,000 | | $ | 5,326,050 |

Charleston Wtr.Wks. & Swr. Rev., E.T.M.(b) | | Aaa | | 10.375 | | 1/01/10 | | | 5,250 | | | 5,949,615 |

South Carolina Jobs Econ. Dev. Auth. Hosp. Facs. Rev., Rfdg. & Impvt., Palmetto Health, Ser. C | | Baa1 | | 6.875 | | 8/01/27 | | | 3,000 | | | 3,470,160 |

Tobacco Settlement Rev., Ser. B | | Baa3 | | 6.375 | | 5/15/28 | | | 2,000 | | | 2,141,460 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 16,887,285 |

| | | |

South Dakota 0.2% | | | | | | | | |

Edl. Enhancement Fdg. Corporation, SD Tobacco Ser. B | | Baa3 | | 6.50 | | 6/01/32 | | | 1,000 | | | 1,070,550 |

| | |

Tennessee 2.2% | | | | | | |

Bristol Health & Edl. Facility Rev., Bristol Mem. Hosp., F.G.I.C.(f) | | Aaa | | 6.75 | | 9/01/10 | | | 5,000 | | | 5,583,500 |

Shelby Cnty. Health Edl & Hsg. Facility Brd. Hosp. Rev., Methodist Health Care, | | A3 | | 6.50 | | 9/01/26 | | | 560 | | | 653,688 |

Shelby Cnty. Health Edl & Hsg. Facility Brd. Hosp. Rev., Methodist Health Care, | | A3 | | 6.50 | | 9/01/12 | | | 940 | | | 1,097,262 |

Tennessee Hsg. Dev. Agcy. Rev., Homeownership Program, A.M.T. | | Aa2 | | 5.00 | | 7/01/34 | | | 3,710 | | | 3,775,148 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 11,109,598 |

| | | |

Texas 5.6% | | | | | | | | |

Brazos River Auth. Poll. Control Rev., | | | | | | | | | | | | |

TXU Energy Company LLC Proj. | | Baa2 | | 5.40 | | 5/01/29 | | | 1,500 | | | 1,508,985 |

TXU Energy Company LLC Proj., Ser. C, A.M.T. | | Baa2 | | 6.75 | | 10/01/38 | | | 1,255 | | | 1,393,326 |

TXU Energy Company LLC Proj., Ser. D | | Baa2 | | 5.40 | | 10/01/14 | | | 1,000 | | | 1,064,820 |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating

(Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

Brazos River Auth. Rev., Houston Inds., Inc. Proj. B, A.M.B.A.C. | | Aaa | | 5.125% | | 11/01/20 | | $ | 3,500 | | $ | 3,684,765 |

Cash Supply Utility Dist. Rev., Rfdg., Rev. & Impvt., M.B.I.A. | | Aaa | | 5.25 | | 9/01/22 | | | 1,765 | | | 1,909,059 |

Houston Utility Systems Rev., Ser. A, F.S.A. | | Aaa | | 5.25 | | 5/15/21 | | | 9,000 | | | 9,700,560 |

Lower Co. River Auth. Transmission Contract Rev., LCRA Trans. Services Corporate Proj., Ser. C, A.M.B.A.C. | | Aaa | | 5.25 | | 5/15/25 | | | 2,250 | | | 2,412,090 |

Matagorda Cnty. Nav. Dist. Number 1, Rev., Rfdg., Centerpoint Energy Proj. | | Baa2 | | 5.60 | | 3/01/27 | | | 2,000 | | | 2,098,040 |

Sabine River Auth. Poll. Control Rev., TXU Energy Company LLC Proj., Ser. B | | Baa2 | | 6.15 | | 8/01/22 | | | 1,000 | | | 1,095,060 |

Southwest Texas Indpt. Sch. Dist., Rfdg. P.S.F.G. | | AAA(d) | | 5.25 | | 2/01/22 | | | 1,000 | | | 1,085,570 |

Texas St. Pub. Fin. Auth. Rev., Southern Univ. Fin. Systems, M.B.I.A. | | Aaa | | 5.50 | | 11/01/18 | | | 2,240 | | | 2,438,061 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 28,390,336 |

| | | | | |

U.S. Virgin Islands 0.3% | | | | | | | | | | | | |

U.S. Virgin Islands Pub. Fin. Auth., Sr. Lien Matching Fd. Loan Note A | | BBB(d) | | 5.25 | | 10/01/21 | | | 1,500 | | | 1,607,445 |

| | | | | |

Virginia 2.4% | | | | | | | | | | | | |

Gloucester Cnty. Ind. Dev., Auth. Sld. Wste. Disp. Rev., Wste. Mgmt. Services, Ser. A, A.M.T. | | BBB(d) | | 5.125 | | 5/01/14 | | | 2,300 | | | 2,390,758 |

Henrico Cnty. Econ. Dev. Auth. Rev., Bon Secours Health Systems, Inc., Ser. A | | A3 | | 5.60 | | 11/15/30 | | | 850 | | | 891,803 |

Richmond Va. Met. Auth. Expy. Rev., Rfdg., F.G.I.C. | | Aaa | | 5.25 | | 7/15/17 | | | 5,775 | | | 6,358,506 |

Sussex Cnty. Ind. Dev. Auth. Sld. Wste. Disp. Rev., Atlantic Wste., Ser. A, A.M.T. | | BBB(d) | | 5.125 | | 5/01/14 | | | 1,400 | | | 1,455,244 |

Tobacco Settlement Financing Corporation, Asset Bkd. | | Baa3 | | 5.625 | | 6/01/37 | | | 1,000 | | | 1,008,310 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 12,104,621 |

See Notes to Financial Statements.

| | |

| Dryden National Municipals Fund, Inc. | | 23 |

Portfolio of Investments

as of December 31, 2005 Cont’d.

| | | | | | | | | | | | |

| Description (a) | | Moody’s

Rating (Unaudited) | | Interest

Rate | | Maturity

Date | | Principal

Amount (000) | | Value (Note 1) |

| | | | | | | | | | | | | |

Washington 3.6% | | | | | | | | | | | | |

Cowlitz Cnty. Sch. Dist. No. 122, Longview, G.O., F.S.A. | | Aaa | | 5.50 | | 12/01/19 | | $ | 3,500 | | $ | 3,810,695 |

Energy Northwest Elec. Rev., Columbia Generating, Ser. B, A.M.B.A.C. | | Aaa | | 6.00 | | 7/01/18 | | | 4,000 | | | 4,497,920 |

Proj. No. 1, Ser. B, M.B.I.A. | | Aaa | | 6.00 | | 7/01/17 | | | 3,000 | | | 3,382,650 |

Proj. No. 3, Ser. A, F.S.A. | | Aaa | | 5.50 | | 7/01/18 | | | 4,010 | | | 4,377,797 |

Tobacco Settlement Auth. Rev., Settlement Rev., Asset Bkd. | | Baa3 | | 6.50 | | 6/01/26 | | | 1,945 | | | 2,098,908 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 18,167,970 |

West Virginia 0.5% | | | | | | | | | | | | |

West Virginia St. Hosp. Fin. Auth., Oak Hill Hosp. Rev., Ser. B(b)(i) | | A2 | | 6.75% | | 9/01/10 | | | 2,000 | | | 2,291,220 |

| | | | | |

Wisconsin 1.0% | | | | | | | | | | | | |

Badger Tobacco Asset Securitization Corp., Asset Bkd. | | Baa3 | | 6.125 | | 6/01/27 | | | 2,905 | | | 3,066,140 |

Wisconsin St. Hlth. & Ed Facs. Auth. Rev., Marshfield Clinic, Ser. B | | BBB+(d) | | 6.00 | | 2/15/25 | | | 2,000 | | | 2,134,680 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 5,200,820 |

| | | | | | | | | | | |

|

|

Total long-term investments

(cost $475,302,952) | | | | | | | | | | | | 497,366,919 |

| | | | | | | | | | | |

|

|

SHORT-TERM INVESTMENTS 0.2% | | | | | | | | |

| | | | | |

Alabama 0.2% | | | | | | | | | | | | |

Mcintosh Ind. Dev. Brd. Environ. Impvt. Rev., A.M.T., F.R.D.D. (cost $1,100,000)(e) | | P2 | | 4.08 | | 1/3/06 | | | 1,100 | | | 1,100,000 |

| | | | | | | | | | | |

|

|

Total Investments 98.5%

(cost $476,402,952; Note 5) | | | | | | | | | | 498,466,919 |

Other assets in excess of liabilities(h) 1.5% | | | | | | | | | | 7,685,621 |

| | | | | | | | | | | |

|

|

Net Assets 100.0% | | | | | | | | | | | $ | 506,152,540 |

| | | | | | | | | | | |

|

|

| (a) | The following abbreviations are used in the portfolio descriptions: |

A.C.A.—American Capital Access

A.M.B.A.C.—American Municipal Bond Assurance Corporation

See Notes to Financial Statements.

| | |

| 24 | | Visit our website at www.jennisondryden.com |

A.M.T.—Alternative Minimum Tax

C.A.B.S.—Capital Appreciation Bonds

C.O.P.—Certificates of Participation

E.T.M.—Escrowed to Maturity

F.G.I.C.—Financial Guaranty Insurance Company

F.H.A.—Federal Housing Administration

F.H.L.M.C.—Federal Home Loan Mortgage Corporation

F.N.M.A.—Federal National Mortgage Association

F.R.D.D.—Floating Rate (Daily) Demand

F.S.A.—Financial Security Assurance

G.N.M.A.—Government National Mortgage Association

G.O.—General Obligation

LLC.—Limited Liability Corporation

M.B.I.A.—Municipal Bond Insurance Corporation

T.C.R.S.—Transferable Custodial Receipts

P.S.F.G.—Permanent School Fund Guaranty

R.I.T.E.S.—Residual Interest Tax Exempt Securities Receipts

X.L.C.A.—X.L. Capital Assurance

| 144A | Security was pursuant to Rule 144A under the Securities Act of 1993 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted, 144A securities are deemed to be liquid. |

| (b) | Prerefunded issues are secured by escrowed cash and/or direct U.S. guaranteed obligations. |

| (c) | Represents issuer in default of interest payments; non-income producing security. |

| (d) | Standard & Poor’s rating. |

| (e) | Indicates a variable rate security. The maturity date presented for these instruments is the latter of the next date on which the security can be redeemed at a par or the next date on which the rate of interest is adjusted. The interest rate shown reflects the rate in effect at December 31, 2005. |

| (f) | All or portion of security segregated as collateral for financial futures contracts. |

| (g) | Security represents 0.05% of the total market value was fair valued in accordance with the policies adopted by the Board of Directors. |

| (h) | Other assets in excess of liabilities include net unrealized appreciation (depreciation) on financial futures as follows: |

Open futures contracts outstanding at December 31, 2005:

| | | | | | | | | | | | | | |

Number of

Contracts

| | Type

| | Expiration

Date

| | Value at

December 31,

2005

| | Value at

Trade Date

| | Unrealized

Appreciation

(Depreciation)

| |

| | | Long Positions: | | | | | | | | | | | | |

| 50 | | 5 yr. U.S. T-Note | | Mar. 2006 | | $ | 5,317,188 | | $ | 5,297,917 | | $ | 19,271 | |

| 8 | | 2 yr. U.S. T-Note (CBT) | | Mar. 2006 | | | 1,641,500 | | | 1,642,049 | | | (549 | ) |

| | | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | | 18,722 | |

| | | | | | | | | | | | |

|

|

|

| | | Short Positions: | | | | | | | | | | | | |

| 168 | | 10 yr. U.S. T-Note | | Mar. 2006 | | | 18,380,250 | | | 18,236,682 | | | (143,568 | ) |

| 209 | | 30 yr. U.S. T-Note (CBT) | | Mar. 2006 | | | 23,865,188 | | | 23,537,281 | | | (327,907 | ) |

| | | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | | (471,475 | ) |

| | | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | $ | (452,753 | ) |

| | | | | | | | | | | | |

|

|

|

(i) Indicates a security that is an inverse floating rate bond or has been deemed illiquid.

NR—Not Rated by Moody’s or Standard & Poor’s.

The Fund’s current Prospectus contains a description of Moody’s and Standard & Poor’s ratings.

See Notes to Financial Statements.

| | |

| Dryden National Municipals Fund, Inc. | | 25 |

Portfolio of Investments

as of December 31, 2005

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of December 31, 2005 was as follows:

| | | |

Health Care | | 15.6 | % |

Education | | 11.1 | |

General Obligation | | 10.6 | |

Power | | 9.2 | |

Special Tax/Assessment | | 8.6 | |

Transportation | | 8.6 | |

Leased Backed Certificate of Participation | | 8.0 | |

Housing | | 6.2 | |

Tobacco | | 5.9 | |

Corporate Backed IDB & PCR | | 5.7 | |

Water & Sewer | | 5.7 | |

Solid Waste/Resource Recovery | | 1.5 | |

Pooled Financing | | 1.0 | |

Other | | 0.8 | |

| | |

|

|

| | | 98.5 | |

Other assets in excess of liabilities | | 1.5 | |

| | |

|

|

| | | 100.0 | % |

| | |

|

|

See Notes to Financial Statements.

| | |

| 26 | | Visit our website at www.jennisondryden.com |

Financial Statements

| | |

| DECEMBER 31, 2003 | | ANNUAL REPORT |

Dryden National Municipal Fund, Inc.

Statement of Assets and Liabilities

as of December 31, 2005

| | | |

Assets | | | |

Unaffiliated investment at value (cost $476,402,952) | | $ | 498,466,919 |

Cash | | | 790,497 |

Interest receivable | | | 7,707,712 |

Receivable for Fund shares sold | | | 522,020 |

Due from broker—variation margin | | | 65,997 |

Prepaid expenses | | | 27,121 |

| | |

|

|

Total assets | | | 507,580,266 |

| | |

|

|

| |

Liabilities | | | |

Payable for Fund shares reacquired | | | 632,254 |

Dividends payable | | | 274,464 |

Accrued expenses | | | 144,977 |

Management fee payable | | | 209,259 |

Distribution fee payable | | | 114,014 |

Deferred directors’ fees | | | 32,870 |

Transfer agent fee payable | | | 19,888 |

| | |

|

|

Total liabilities | | | 1,427,726 |

| | |

|

|

| |

Net Assets | | $ | 506,152,540 |

| | |

|

|

| | | | |

Net assets were comprised of: | | | |

Common stock, at par | | $ | 335,389 |

Paid-in capital in excess of par | | | 483,175,716 |

| | |

|

|

| | | | 483,511,105 |

Undistributed net investment income | | | 353,860 |

Accumulated net realized gain on investments | | | 676,361 |

Net unrealized appreciation on investments | | | 21,611,214 |

| | |

|

|

Net assets, December 31, 2005 | | $ | 506,152,540 |

| | |

|

|

See Notes to Financial Statements.

| | |

| 28 | | Visit our website at www.jennisondryden.com |

| | | |

Class A | | | |

Net asset value and redemption price per share

($472,491,267 ÷ 31,313,552 shares of common stock issued and outstanding) | | $ | 15.09 |

Maximum sales charge (4% of offering price) | | | 0.63 |

| | |

|

|

Maximum offering price to public | | $ | 15.72 |

| | |

|

|

| |

Class B | | | |

Net asset value, offering price and redemption price per share

($27,013,313 ÷ 1,785,263 shares of common stock issued and outstanding) | | $ | 15.13 |

| | |

|

|

| |

Class C | | | |

Net asset value, offering price and redemption price per share

($3,481,733 ÷ 230,098 shares of common stock issued and outstanding) | | $ | 15.13 |

| | |

|

|

| |

Class Z | | | |

Net asset value, offering price and redemption price per share

($3,166,227 ÷ 209,971 shares of common stock issued and outstanding) | | $ | 15.08 |

| | |

|

|

See Notes to Financial Statements.

| | |

| Dryden National Municipals Fund, Inc. | | 29 |

Statement of Operations

Year Ended December 31, 2005

| | | | |

Net Investment Income | | | | |

Income | | | | |

Interest | | $ | 25,539,600 | |

| | |

|

|

|

| |

Expenses | | | | |

Management fee | | | 2,581,962 | |

Distribution fee—Class A | | | 1,230,377 | |

Distribution fee—Class B | | | 161,726 | |

Distribution fee—Class C | | | 28,665 | |

Transfer agent’s fee and expenses (including affiliated expense of $249,000) | | | 330,000 | |

Custodian’s fees and expenses | | | 167,000 | |

Reports to shareholders | | | 75,000 | |

Registration fees | | | 44,000 | |

Legal fees and expenses | | | 40,000 | |

Audit fee | | | 24,000 | |

Directors’ fees | | | 19,000 | |

Insurance | | | 11,000 | |

Miscellaneous | | | 17,567 | |

| | |

|

|

|

Total expenses | | | 4,730,297 | |

| | |

|

|

|

Net investment income | | | 20,809,303 | |

| | |

|

|

|

| |

Realized And Unrealized Gain (Loss) On Investments | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | 3,124,851 | |

Financial futures transactions | | | (173,540 | ) |

| | |

|

|

|

| | | | 2,951,311 | |

| | |

|

|

|

Net change in unrealized depreciation on: | | | | |

Investments | | | (7,635,525 | ) |

Financial futures contracts | | | (256,529 | ) |

| | |

|

|

|

| | | | (7,892,054 | ) |

| | |

|

|

|

Net (loss) on investments | | | (4,940,743 | ) |

| | |

|

|

|

Net Increase In Net Assets Resulting From Operations | | $ | 15,868,560 | |

| | |

|

|

|

See Notes to Financial Statements.

| | |

| 30 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2005 | | | 2004 | |

Increase (Decrease) In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 20,809,303 | | | $ | 21,851,387 | |

Net realized gain on investments | | | 2,951,311 | | | | 1,419,121 | |

Net change in unrealized depreciation on investments | | | (7,892,054 | ) | | | (1,034,176 | ) |

| | |

|

|

| |

|

|

|

Net increase in net assets resulting from operations | | | 15,868,560 | | | | 22,236,332 | |

| | |

|

|

| |

|

|

|

Dividends and distributions (Note 1) | | | | | | | | |

Dividends from net investment income | | | | | | | | |

Class A | | | (19,342,671 | ) | | | (20,194,829 | ) |

Class B | | | (1,189,557 | ) | | | (1,405,277 | ) |

Class C | | | (131,024 | ) | | | (154,500 | ) |

Class Z | | | (158,092 | ) | | | (166,467 | ) |

| | |

|

|

| |

|

|

|

| | | | (20,821,344 | ) | | | (21,921,073 | ) |

| | |

|

|

| |

|

|

|

Distributions from net realized gains | | | | | | | | |

Class A | | | (2,658,359 | ) | | | (7,569,892 | ) |

Class B | | | (162,179 | ) | | | (572,854 | ) |

Class C | | | (18,650 | ) | | | (63,998 | ) |

Class Z | | | (19,119 | ) | | | (59,064 | ) |

| | |

|

|

| |

|

|

|

| | | | (2,858,307 | ) | | | (8,265,808 | ) |

| | |

|

|

| |

|

|

|

| | |

Fund share transactions (net of share conversions) (Note 6) | | | | | | | | |

Net proceeds from shares sold | | | 15,906,773 | | | | 16,199,361 | |

Net asset value of shares issued in

reinvestment of dividends and distributions | | | 15,136,662 | | | | 19,342,938 | |

Cost of shares reacquired | | | (70,305,881 | ) | | | (75,554,314 | ) |

| | |

|

|

| |

|

|

|

Decrease in net assets from Fund share transactions | | | (39,262,446 | ) | | | (40,012,015 | ) |

| | |

|

|

| |

|

|

|

Total decrease | | | (47,073,537 | ) | | | (47,962,564 | ) |

| | |

Net Assets | | | | | | | | |

Beginning of year | | | 553,226,077 | | | | 601,188,641 | |

| | |

|

|

| |

|

|

|

End of year(a) | | $ | 506,152,540 | | | $ | 553,226,077 | |

| | |

|

|

| |

|

|

|

(a) Includes undistributed net investment income of: | | $ | 353,860 | | | $ | 406,658 | |

| | |

|

|

| |

|

|

|

See Notes to Financial Statements.

| | |

| Dryden National Municipals Fund, Inc. | | 31 |

Notes to Financial Statements

Dryden National Municipals Fund, Inc. (the “Fund”), is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The investment objective of the Fund is to seek a high level of current income exempt from federal income taxes by investing substantially all of its total assets in carefully selected long-term municipal bonds of medium quality. The ability of the issuers of debt securities held by the Fund to meet their obligations may be affected by economic or political developments in a specific state, industry or region.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuations: The Fund values municipal securities (including commitments to purchase such securities on a “when-issued” basis) as of the close of trading on the New York Stock Exchange, on the basis of prices provided by a pricing service which uses information with respect to transactions in comparable securities and various relationships between securities in determining values. Securities listed on a securities exchange (other than options on securities and indices) are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked prices, or at the last bid price on such day in the absence of an asked price. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”) in consultation with the subadvisor, to be over-the-counter, are valued at market value using prices provided, by an independent pricing agent or principal market maker. Futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading on such exchange or board of trade or, if there was no sale on the applicable commodities exchange or board of trade on such day, at the mean between the most recently quoted prices on such exchange or board of trade or at the last bid price in the absence of an asked price. Securities for which reliable market quotations are not readily available or for which the pricing service does not provide a valuation methodology, or does not present fair value, are valued at fair value in accordance with Board of Directors’ approved fair valuation procedures. When determining the fair valuation of securities, some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and capitalization of the issuer; the prices of any recent transactions or bids/offers for

| | |

| 32 | | Visit our website at www.jennisondryden.com |

such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values. As of December 31, 2005, there were no securities whose values were adjusted in accordance with procedures approved by the Board of Directors.

Investments in mutual funds are valued at their net asset value as of the close of the New York Stock Exchange on the date of valuation.

Short-term securities which mature in sixty days or less are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term securities which mature in more than sixty days are valued at current market quotations.

Inverse Floaters: The Fund invests in variable rate securities commonly called “inverse floaters”. The interest rates on these securities have an inverse relationship to interest rate of other securities or the value of an index. Changes in interest rates on the other security or index inversely affect the rate paid on the inverse floater, and the inverse floater’s price will be more volatile than that of a fixed-rate bond. Additionally, some of these securities contain a “leverage factor” whereby the interest rate moves inversely by a “factor” to the benchmark rate. Certain interest rate movements and other market factors can substantially affect the liquidity of inverse floating rate notes.

Interest Rate Swaps: The Fund may enter into interest rate swaps. In a simple interest rate swap, one investor pays a floating rate of interest on a notional principal amount and receives a fixed rate of interest on the same notional principal amount for a specified period of time. Alternatively, an investor may pay a fixed rate and receive a floating rate. Net interest payments/receipts are included in interest income in the Statement of Operations.

During the term of the swap, changes in the value of the swap are recorded as unrealized gains or losses by “marking-to-market” to reflect the market value of the swap. When the swap is terminated, the Fund will record a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transaction and the Fund’s basis in the contract, if any.

| | |

| Dryden National Municipals Fund, Inc. | | 33 |

Notes to Financial Statements

Cont’d

The Fund is exposed to credit risk in the event of non-performance by the other party to the interest rate swap. However, the Fund does not anticipate non-performance by any counterparty.

Financial Futures Contracts: A financial futures contract is an agreement to purchase (long) or sell (short) an agreed amount of securities at a set price for delivery on a future date. Upon entering into a financial futures contract, the Fund is required to pledge to the broker an amount of cash and/or other assets equal to a certain percentage of the contract amount. This amount is known as the “initial margin.” Subsequent payments, known as “variation margin,” are made or received by the Fund each day, depending on the daily fluctuations in the value of the underlying security. Such variation margin is recorded for financial statement purposes on a daily basis as unrealized gain or loss. When the contract expires or is closed, the gain or loss is realized and is presented in the statement of operations as net realized gain (loss) on financial futures contracts.

The Fund invests in financial futures contracts in order to hedge existing portfolio securities, or securities the Fund intends to purchase, against fluctuations in value caused by changes in prevailing interest rates. Should interest rates move unexpectedly, the Fund may not achieve the anticipated benefits of the financial futures contracts and may realize a loss. The use of futures transactions involves the risk of imperfect correlation in movements in the price of futures contracts, interest rates and the underlying hedged assets.

Written Options, financial future contracts and swap contracts involve elements of both market and credit risk in excess of the amounts reflected on the Statement of Assets and Liabilities.