UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-02992 |

| |

| Exact name of registrant as specified in charter: | | Prudential National Muni Fund, Inc. |

| |

| Address of principal executive offices: | | Gateway Center 3, |

| | 100 Mulberry Street, |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | Gateway Center 3, |

| | 100 Mulberry Street, |

| �� | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 8/31/2013 |

| |

| Date of reporting period: | | 8/31/2013 |

Item 1 – Reports to Stockholders

PRUDENTIAL INVESTMENTS»MUTUAL FUNDS

PRUDENTIAL NATIONAL MUNI FUND, INC.

ANNUAL REPORT · AUGUST 31, 2013

Fund Type

Municipal Bond

Objective

High level of current income exempt from federal income taxes

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS). Prudential Fixed Income is a unit of Prudential Investment Management, Inc. (PIM), a registered investment adviser. PIMS and PIM are Prudential Financial companies. © 2013 Prudential Financial, Inc., and its related entities. Prudential Investments, Prudential, the Prudential logo, Bring Your Challenges, and the Rock symbol are service marks of Prudential Financial, Inc., and its related entities, registered in many jurisdictions worldwide.

October 15, 2013

Dear Shareholder:

We hope you find the annual report for the Prudential National Muni Fund, Inc., informative and useful. The report covers performance for the 12-month period that ended August 31, 2013.

We recognize that ongoing market volatility may make it a difficult time to be an investor. We continue to believe a prudent response to uncertainty is to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals.

Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. Keep in mind, however, that diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

Prudential Investments® is dedicated to helping you solve your toughest investment challenges—whether it’s capital growth, reliable income, or protection from market volatility and other risks. We offer the expertise of Prudential Financial’s affiliated asset managers* that strive to be leaders in a broad range of funds to help you stay on course to the future you envision. They also manage money for major corporations and pension funds around the world, which means you benefit from the same expertise, innovation, and attention to risk demanded by today’s most sophisticated investors.

Thank you for choosing the Prudential Investments family of funds.

Sincerely,

Stuart S. Parker, President

Prudential National Muni Fund, Inc.

*Most of Prudential Investments’ equity funds are advised by Jennison Associates LLC, Quantitative Management Associates LLC (QMA), or Prudential Real Estate Investors. Prudential Investments’ fixed income and money market funds are advised by Prudential Investment Management, Inc. (PIM) through its Prudential Fixed Income unit. Jennison Associates, QMA, and PIM are registered investment advisers and Prudential Financial companies. Prudential Real Estate Investors is a unit of PIM.

| | | | |

| Prudential National Muni Fund, Inc. | | | 1 | |

Your Fund’s Performance (Unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | |

Cumulative Total Returns (Without Sales Charges) as of 8/31/13 | |

| | | One Year | | | Five Years | | | Ten Years | |

Class A | | | –5.53 | % | | | 20.51 | % | | | 44.65 | % |

Class B | | | –5.67 | | | | 19.12 | | | | 41.21 | |

Class C | | | –6.21 | | | | 16.86 | | | | 36.80 | |

Class Z | | | –5.24 | | | | 22.04 | | | | 48.32 | |

Barclays Municipal Bond Index | | | –3.70 | | | | 24.75 | | | | 54.96 | |

Lipper General Municipal Debt Funds Average | | | –4.94 | | | | 21.18 | | | | 43.48 | |

| | | | | | | | | | | | |

Average Annual Total Returns (With Sales Charges) as of 9/30/13 | |

| | | One Year | | | Five Years | | | Ten Years | |

Class A | | | –7.58 | % | | | 4.53 | % | | | 3.28 | % |

Class B | | | –8.58 | | | | 4.98 | | | | 3.46 | |

Class C | | | –5.36 | | | | 4.72 | | | | 3.13 | |

Class Z | | | –3.50 | | | | 5.66 | | | | 3.97 | |

Barclays Municipal Bond Index | | | –2.21 | | | | 5.98 | | | | 4.40 | |

Lipper General Municipal Debt Funds Average | | | –3.44 | | | | 5.56 | | | | 3.59 | |

| | | | | | | | | | | | |

Average Annual Total Returns (With Sales Charges) as of 8/31/13 | |

| | | One Year | | | Five Years | | | Ten Years | |

Class A | | | –9.31 | % | | | 2.96 | % | | | 3.34 | % |

Class B | | | –10.23 | | | | 3.39 | | | | 3.51 | |

Class C | | | –7.12 | | | | 3.17 | | | | 3.18 | |

Class Z | | | –5.24 | | | | 4.06 | | | | 4.02 | |

| | | | | | | | | | | | |

Average Annual Total Returns (Without Sales Charges) as of 8/31/13 | |

| | | One Year | | | Five Years | | | Ten Years | |

Class A | | | –5.53 | % | | | 3.80 | % | | | 3.76 | % |

Class B | | | –5.67 | | | | 3.56 | | | | 3.51 | |

Class C | | | –6.21 | | | | 3.17 | | | | 3.18 | |

Class Z | | | –5.24 | | | | 4.06 | | | | 4.02 | |

| | |

| 2 | | Visit our website at www.prudentialfunds.com |

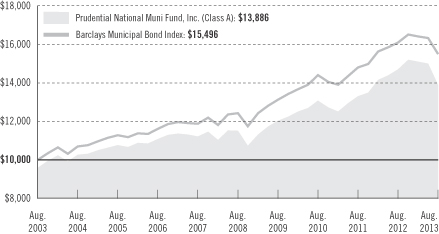

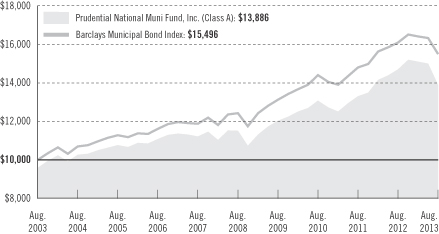

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund’s Class A shares with a similar investment in the Barclays Municipal Bond Index by portraying the initial account values at the beginning of the 10-year period for Class A shares (August 31, 2003) and the account values at the end of the current fiscal year (August 31, 2013) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) the maximum applicable front-end sales charge was deducted from the initial $10,000 investment in Class A shares; (b) all recurring fees (including management fees) were deducted; and (c) all dividends and distributions were reinvested. The line graph provides information for Class A shares only. As indicated in the tables provided earlier, performance for Class B, Class C, and Class Z shares will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursement, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

The returns in the tables reflect the share class expense structure in effect at the close of the fiscal period.

| | | | |

| Prudential National Muni Fund, Inc. | | | 3 | |

Your Fund’s Performance (continued)

The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | |

| | Class A | | Class B | | Class C | | Class Z |

Maximum initial sales charge | | 4.00% of

the public

offering price | | None | | None | | None |

Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or sale proceeds) | | 1% on sales

of $1 million

or more

made within

12 months of

purchase | | 5% (Yr. 1)

4% (Yr. 2)

3% (Yr. 3)

2% (Yr. 4)

1% (Yr. 5/6)

0% (Yr. 7) | | 1% on sales

made within

12 months

of purchase | | None |

Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | .30%

(.25%

currently) | | .50% | | 1% | | None |

Benchmark Definitions

Barclays Municipal Bond Index

The Barclays Municipal Bond Index (the Index) is an unmanaged index of over 39,000 long-term investment-grade municipal bonds. It gives a broad look at how long-term investment-grade municipal bonds have performed.

Lipper General Municipal Debt Funds Average

The Lipper General Municipal Debt Funds Average (Lipper Average) represents returns based on an average return of all funds in the Lipper General Municipal Debt Funds category for the periods noted. Funds in the Lipper Average invest primarily in municipal debt issues in the top four credit ratings.

Investors cannot invest directly in an index or average. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

| | | | |

Five Largest Issues expressed as a percentage of net assets as of 8/31/13 | | | | |

Massachusetts St., Series B, AGC, GO, 5.250%, 09/01/24 | | | 1.5 | % |

Denver City & Cnty. Arpt. Rev. Sys., Series A, NATL, 5.000%, 11/15/25 | | | 1.5 | |

Anaheim Pub. Fin. Auth. Lease Rev., AGC, Sub. Pub. Impvts. Proj., Series C, 6.000%, 09/01/16 | | | 1.0 | |

California St., Var. Purp., GO, 5.000%, 04/01/12 | | | 1.0 | |

New York City, Series E, GO, 5.000%, 08/01/17 | | | 1.0 | |

Issues are subject to change.

| | |

| 4 | | Visit our website at www.prudentialfunds.com |

| | | | | | | | | | | | | | | | |

Distributions and Yields as of 8/31/13 | | | | | | | | | |

| | | Total Dividends

Paid for 12 Months | | | 30-Day

SEC Yield | | | Taxable Equivalent 30-Day Yield*

at Federal Tax Rates of | |

| | | | | 38.8% | | | 43.4% | |

Class A | | $ | 0.56 | | | | 3.19 | % | | | 5.21 | % | | | 5.64 | % |

Class B | | | 0.53 | | | | 3.06 | | | | 5.00 | | | | 5.41 | |

Class C | | | 0.45 | | | | 2.56 | | | | 4.18 | | | | 4.52 | |

Class Z | | | 0.60 | | | | 3.58 | | | | 5.85 | | | | 6.33 | |

*Some investors may be subject to the federal alternative minimum tax (AMT) and/or state and local taxes. Taxable equivalent yields reflect federal taxes only.

| | | | |

Credit Quality* expressed as a percentage of net assets as of 8/31/13 | | | | |

Aaa | | | 3.7 | % |

Aa | | | 32.7 | |

A | | | 42.2 | |

Baa | | | 13.7 | |

Ba | | | 1.2 | |

B | | | 3.0 | |

Less than Caa** | | | 0.0 | |

Not Rated | | | 2.2 | |

Total Investments | | | 98.7 | |

Other assets in excess of liabilities | | | 1.3 | |

Net Assets | | | 100.0 | % |

| | | | |

*Source: Moody’s rating, defaulting to S&P when not rated by Moody’s.

**Less than 0.05%

Credit Quality is subject to change.

| | | | |

| Prudential National Muni Fund, Inc. | | | 5 | |

Strategy and Performance Overview

How did the Fund perform?

The Prudential National Muni Fund’s Class A shares declined 5.53% for the 12-months ended August 31, 2013, underperforming the 3.70% decline of the Barclays Municipal Bond Index (the Index) and the 4.94% decline of the Lipper General Municipal Debt Funds Average.

What were conditions like in the municipal bond market?

Municipal securities started the reporting period with strong returns but declined considerably after May 3, 2013, in response to a surprisingly strong labor report indicating an improving economic outlook. In addition, at their June meeting, Federal Reserve (“Fed”) officials suggested that tapering of asset purchases under the Fed’s asset purchase program could begin by year-end.

| | • | | During the fourth quarter of 2012, municipal bonds generated robust results, driven by solid investor demand and limited supply. Municipal bonds continued to offer investors an attractive, higher income alternative in the ultra-low interest rate environment. |

| | • | | U.S. budget negotiations were front and center during the final weeks of 2012. And while there was some concern that a budget resolution would reduce the value of municipal bond tax exemption, that fear was not realized. In fact municipal bond tax exemption became more valuable as personal income tax rates for top wage earners increased to 39.6% from 35%. In the first quarter of 2013, municipal securities underperformed U.S. Treasuries as interest rates crept up and technical factors, such as supply and demand, weighed on the market. During late March 2013 and into April, the market was pressured by steady outflows as investors withdrew funds to meet tax obligations. |

| | • | | Interest rates rose after Federal Reserve Chair Ben Bernanke indicated in June 2013 that the U.S. central bank might begin reducing purchases under its asset purchase programs. Treasury yields climbed and their prices, which move in the opposite direction of yields, declined. Municipal yields rose at a faster pace than Treasuries as flows out of municipal bond mutual funds accelerated. |

| | • | | Municipal fund outflows were further fueled by the news in July 2013 that the City of Detroit had filed for bankruptcy protection. Despite the magnitude of this filing and the impact on the market, the view is that such filings remain the exception, not the rule. |

| | • | | Early in the reporting period, investors had responded negatively when all three credit rating agencies had downgraded the general obligation debt of Puerto Rico, which continues to struggle with a weak economy, high debt levels, and large structural budget gaps. A relatively large issuance of Puerto |

| | |

| 6 | | Visit our website at www.prudentialfunds.com |

| | Rico Electric Authority debt in August 2013 led to wider spreads and higher yields for all Puerto Rico issuers. |

| | • | | June and July are typically large reinvestment months in the municipal market, but the negative credit headlines kept investor capital on the sidelines. In fact municipal yields continued their move higher, especially on the long end. By the end of the reporting period, the relative value provided by higher municipal yields attracted crossover buyers, generally non-traditional buyers such as institutions that would not benefit from municipals’ tax exemption. |

| | • | | Issuance declined during the reporting period overall as interest rates rose and the number of refunding deals declined. In a refunding deal, an issuer reduces its interest expense by redeeming outstanding bonds and issuing new bonds at a lower interest rate. |

| | • | | In general, state and local governments continued to generate higher revenues through increased tax receipts, which provided for timely balanced budgets. Unfunded pension obligations remain a broader long-term concern. |

What types of municipal bonds contributed negatively to the Fund’s performance?

Conditions in the municipal bond market were challenging as sellers outnumbered buyers for the reporting period overall. The Fund maintained a portfolio of tax-exempt bonds drawn from sectors within the municipal market to spread risk and take advantage of potential opportunities.

| | • | | The Fund’s overweight in tobacco bonds detracted from performance. Tobacco bonds are backed by payments from tobacco companies participating in the Master Settlement Agreement. |

| | • | | Exposure to hospital bonds also dampened results during the reporting period. |

What other factors contributed negatively to performance?

| | • | | The Fund’s overweight in longer-term municipal bonds, versus those in the Index, detracted from performance. As spreads (the difference in yields) between longer-term municipal bonds and intermediate- and shorter-term maturities widened, the prices of longer-term municipal bonds declined. |

What factors contributed positively to the Fund’s performance?

| | • | | The Fund benefited from its underweight relative to the Index in municipal securities issued by the city of Detroit. |

| | • | | The Fund held futures contracts on U.S. Treasuries to shorten the portfolio’s duration, which reduced its sensitivity to changes in the level of rates. Overall, this strategy had a positive impact on performance as interest rates rose during the reporting period. |

| | | | |

| Prudential National Muni Fund, Inc. | | | 7 | |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on March 1, 2013, at the beginning of the period, and held through the six-month period ended August 31, 2013. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on this page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of

| | |

| 8 | | Visit our website at www.prudentialfunds.com |

Prudential Investments funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Prudential National

Muni Fund, Inc. | | Beginning Account

Value

March 1, 2013 | | | Ending Account

Value

August 31, 2013 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| | | | | | | | | | | | | | | | | | |

Class A | | Actual | | $ | 1,000.00 | | | $ | 919.40 | | | | 0.82 | % | | $ | 3.97 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.07 | | | | 0.82 | % | | $ | 4.18 | |

| | | | | | | | | | | | | | | | | | |

Class B | | Actual | | $ | 1,000.00 | | | $ | 919.20 | | | | 1.07 | % | | $ | 5.18 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,019.81 | | | | 1.07 | % | | $ | 5.45 | |

| | | | | | | | | | | | | | | | | | |

Class C | | Actual | | $ | 1,000.00 | | | $ | 916.10 | | | | 1.57 | % | | $ | 7.58 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,017.29 | | | | 1.57 | % | | $ | 7.98 | |

| | | | | | | | | | | | | | | | | | |

Class Z | | Actual | | $ | 1,000.00 | | | $ | 921.10 | | | | 0.57 | % | | $ | 2.76 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,022.33 | | | | 0.57 | % | | $ | 2.91 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended August 31, 2013, and divided by the 365 days in the Fund’s fiscal year ended August 31, 2013 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | | | |

| Prudential National Muni Fund, Inc. | | | 9 | |

Fees and Expenses (continued)

The Fund’s annual expense ratios for the year ended August 31, 2013 are as follows:

| | | | |

Class | | Gross Operating Expenses | | Net Operating Expenses |

A | | 0.87% | | 0.82% |

B | | 1.07% | | 1.07% |

C | | 1.57% | | 1.57% |

Z | | 0.57% | | 0.57% |

Net operating expenses shown above reflect fee waivers and/or expense reimbursements. Additional information on Fund expenses and any fee waivers and/or expense reimbursements can be found in the “Financial Highlights” tables in this report and in the Notes to the Financial Statements in this report.

| | |

| 10 | | Visit our website at www.prudentialfunds.com |

Portfolio of Investments

as of August 31, 2013

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS 98.6% | |

|

Alaska 0.3% | |

Alaska Student Loan Corp. Ed. Ln. Rev., Series A-2, AMT | | AAA(a) | | 5.000% | | | 06/01/18 | | | | 2,000 | | | $ | 2,167,560 | |

| | | | | |

Arizona 3.2% | | | | | | | | | | | | | | | | |

Apache Cnty. Indl. Dev. Auth. Poll. Ctl. Rev., Tuscon Elec. Pwr. Co., Series A | | Baa2 | | 4.500 | | | 03/01/30 | | | | 1,000 | | | | 893,440 | |

Arizona Hlth. Facs. Auth. Rev., Banner Hlth., Series D | | AA-(a) | | 5.500 | | | 01/01/38 | | | | 2,500 | | | | 2,554,850 | |

Arizona St. Ctfs. Part. Dept. Admin., Series A, AGC | | A1 | | 5.250 | | | 10/01/28 | | | | 2,000 | | | | 2,086,580 | |

Phoenix Civic Impt. Corp., Jr. Lien, Series A | | Aa2 | | 5.000 | | | 07/01/39 | | | | 5,000 | | | | 5,034,850 | |

Arpt. Rev. Rfdg., Sr. Lien, AMT | | Aa3 | | 5.000 | | | 07/01/32 | | | | 1,500 | | | | 1,489,050 | |

Pima Cnty. Indl. Dev. Auth., Tucson Elec. Pwr. | | Baa2 | | 4.000 | | | 09/01/29 | | | | 2,000 | | | | 1,685,360 | |

Salt River Proj. Arizona Agric. Impt. & Pwr. Dist. Elec. Sys. Rev., Series A | | Aa1 | | 5.000 | | | 01/01/39 | | | | 5,000 | | | | 5,039,250 | |

Salt Verde Fin. Corp.,

Sr. Gas Rev. | | Baa2 | | 5.000 | | | 12/01/32 | | | | 1,410 | | | | 1,318,801 | |

Sr. Gas Rev. | | Baa2 | | 5.000 | | | 12/01/37 | | | | 3,070 | | | | 2,804,169 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 22,906,350 | |

| | | | | |

California 12.6% | | | | | | | | | | | | | | | | |

Anaheim Pub. Fin. Auth.

Lease Rev., AGC,

Sr. Pub. Impvts. Proj., Series A | | A1 | | 6.000 | | | 09/01/24 | | | | 5,500 | | | | 6,267,030 | |

Sub. Pub. Impvts. Proj., Series C | | A2 | | 6.000 | | | 09/01/16 | | | | 6,690 | | | | 7,442,357 | |

California Cnty. Tob. Securitization Corp., Tob. Conv. Bonds Asset Bk., Series B | | NR | | 5.100 | | | 06/01/28 | | | | 1,250 | | | | 1,051,825 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 11 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

California (cont’d.) | | | | | | | | | | | | | | | | |

California Hlth. Facs. Fin. Auth. Rev., Rfdg.,

Children’s Hosp., Series A | | A-(a) | | 5.250 % | | | 11/01/41 | | | | 2,000 | | | $ | 1,928,640 | |

Scripps Hlth., Series A | | Aa3 | | 5.000 | | | 11/15/36 | | | | 1,000 | | | | 971,830 | |

Stanford Hosp., Series B | | Aa3 | | 5.000 | | | 11/15/36 | | | | 3,000 | | | | 2,899,830 | |

Sutter Hlth., Series D | | Aa3 | | 5.250 | | | 08/15/31 | | | | 1,000 | | | | 1,034,800 | |

California Poll. Ctl. Fin. Auth. Wtr. Facs. Rev., Amern. Wtr. Cap. Corp. Proj., 144A | | Baa1 | | 5.250 | | | 08/01/40 | | | | 1,250 | | | | 1,186,150 | |

California St., Infra. & Econ. Dev. Bank

Walt Dis. Fam. Musm. | | A1 | | 5.250 | | | 02/01/38 | | | | 3,000 | | | | 3,001,020 | |

California St.,

FGIC, TCRS, GO | | A1 | | 4.750 | | | 09/01/23 | | | | 155 | | | | 158,019 | |

GO | | A1 | | 5.250 | | | 11/01/40 | | | | 1,250 | | | | 1,267,038 | |

Var. Purp., GO | | A1 | | 5.000 | | | 10/01/29 | | | | 2,000 | | | | 2,054,780 | |

Var. Purp., GO | | A1 | | 5.000 | | | 09/01/41 | | | | 4,250 | | | | 4,218,337 | |

Var. Purp., GO | | A1 | | 5.000 | | | 10/01/41 | | | | 1,250 | | | | 1,240,613 | |

Var. Purp., GO | | A1 | | 5.000 | | | 04/01/42 | | | | 7,000 | | | | 6,947,010 | |

Var. Purp., GO | | A1 | | 5.250 | | | 04/01/35 | | | | 1,250 | | | | 1,280,313 | |

Var. Purp., GO | | A1 | | 5.500 | | | 11/01/39 | | | | 1,000 | | | | 1,043,980 | |

Var. Purp., GO | | A1 | | 6.000 | | | 03/01/33 | | | | 1,500 | | | | 1,688,550 | |

Var. Purp., GO | | A1 | | 6.000 | | | 04/01/38 | | | | 3,500 | | | | 3,871,140 | |

Var. Purp., GO | | A1 | | 6.000 | | | 11/01/39 | | | | 2,000 | | | | 2,229,360 | |

California St. Univ. Rev., Series A | | Aa2 | | 5.000 | | | 11/01/37 | | | | 1,250 | | | | 1,265,800 | |

California Statewide Cmntys. Dev. Auth. Rev., Cottage Hlth. | | A+(a) | | 5.000 | | | 11/01/40 | | | | 1,600 | | | | 1,551,344 | |

Sutter Hlth., Series A | | Aa3 | | 6.000 | | | 08/15/42 | | | | 3,000 | | | | 3,299,550 | |

Folsom Cordova Uni. Sch. Dist., Sch. Facs. Impvt. Dist., No. 2, Series A, CABS, GO, NATL | | Aa3 | | 4.090(b) | | | 10/01/21 | | | | 60 | | | | 43,257 | |

Foothill-De Anza Cmnty. College Dist., GO Series C | | Aaa | | 5.000 | | | 08/01/40 | | | | 1,250 | | | | 1,273,688 | |

Golden St. Tob. Securitization Corp., Tob. Settlement Rev., CABS Asset Bkd., Series A-2 | | B3 | | 5.300 | | | 06/01/37 | | | | 5,000 | | | | 3,513,050 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

California (cont’d.) | | | | | | | | | | | | | | | | |

Golden St. Tob. Securitization Rev.,

Asset Bkd., Series A-1 | | B3 | | 4.500 % | | | 06/01/27 | | | | 2,240 | | | $ | 1,881,645 | |

Asset Bkd., Series A-1 | | B3 | | 5.750 | | | 06/01/47 | | | | 1,000 | | | | 734,050 | |

CABS Asset Bkd., Series A, AMBAC (Converted to 4.6% on 6/1/10) | | A2 | | 4.600 | | | 06/01/23 | | | | 2,000 | | | | 2,027,140 | |

Enhanced Asset Bkd., Series A | | A2 | | 5.000 | | | 06/01/45 | | | | 1,000 | | | | 914,080 | |

Long Beach Bond Fin. Auth. Natural Gas Purchase Rev., Series A | | Baa2 | | 5.250 | | | 11/15/19 | | | | 1,000 | | | | 1,097,890 | |

Series A | | Baa2 | | 5.500 | | | 11/15/37 | | | | 1,000 | | | | 993,290 | |

Los Angeles Reg. Arpt. Impvt. Corp., Lease Rev., Rfdg., Facs. Laxfuel Corp. LA Int’l., AMT | | A(a) | | 5.000 | | | 01/01/32 | | | | 1,000 | | | | 957,100 | |

M-S-R Energy Auth., Calif., Series A | | A-(a) | | 6.500 | | | 11/01/39 | | | | 2,000 | | | | 2,181,400 | |

Pittsburg Redev. Agcy. Tax Alloc., Los Medanos Cmnty. Dev. Proj., CABS, AMBAC | | BBB+(a) | | 5.810(b) | | | 08/01/25 | | | | 2,000 | | | | 1,010,160 | |

Port of Oakland, Rfdg., Sr. Lien Series P, AMT | | A2 | | 5.000 | | | 05/01/33 | | | | 1,750 | | | | 1,659,595 | |

San Diego Cmnty. College Dist., GO, Election 2006 | | Aa1 | | 5.000 | | | 08/01/41 | | | | 1,500 | | | | 1,525,440 | |

San Diego Cnty. Regl. Arpt. Auth., Series B, Sr. AMT | | A1 | | 5.000 | | | 07/01/43 | | | | 2,000 | | | | 1,840,360 | |

San Francisco City & Cnty. Airports Commission, 2nd, Series, Series A, AMT | | A1 | | 5.250 | | | 05/01/33 | | | | 1,000 | | | | 1,006,710 | |

Rfdg., Second Series, Series F, AMT | | A1 | | 5.000 | | | 05/01/28 | | | | 1,635 | | | | 1,646,281 | |

Santa Margarita Dana Point Auth. Impt. Rev., Dists. 3, 3A, 4, 4A, Series B, NATL | | Baa1 | | 7.250 | | | 08/01/14 | | | | 2,000 | | | | 2,102,720 | |

Tuolumne Wind Proj. Auth. Calif. Rev., Tuolumne Co. Proj., Series A | | A2 | | 5.625 | | | 01/01/29 | | | | 1,000 | | | | 1,085,360 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 13 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

California (cont’d.) | | | | | | | | | | | | | | | | |

University Calif. Rev. Gen., Series Q | | Aa1 | | 5.000 % | | | 05/15/34 | | | | 1,000 | | | $ | 1,032,650 | |

Series O | | Aa1 | | 5.750 | | | 05/15/34 | | | | 750 | | | | 841,185 | |

Ventura Cnty. Cmnty. College, Election 2002, Series C, GO | | Aa2 | | 5.500 | | | 08/01/33 | | | | 2,000 | | | | 2,194,460 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 89,460,827 | |

| | | | | |

Colorado 3.0% | | | | | | | | | | | | | | | | |

Colorado Hlth. Facs. Auth. Rev., Catholic Hlth., Series A | | Aa3 | | 5.000 | | | 02/01/41 | | | | 3,000 | | | | 2,874,690 | |

Denver City & Cnty. Arpt. Rev. Sys.,

Series A, AMT, Rfdg. | | A1 | | 5.250 | | | 11/15/22 | | | | 1,000 | | | | 1,096,680 | |

Series A, NATL | | A1 | | 5.000 | | | 11/15/25 | | | | 10,000 | | | | 10,337,900 | |

Series B, NATL | | A1 | | 5.000 | | | 11/15/37 | | | | 1,000 | | | | 976,600 | |

Series B, NATL, AMT | | A1 | | 5.000 | | | 11/15/15 | | | | 2,500 | | | | 2,722,875 | |

Platte Riv. Pwr. Auth. Colo. Pwr. Rev., Series HH | | Aa2 | | 5.000 | | | 06/01/27 | | | | 1,500 | | | | 1,660,755 | |

University Colo. Enterprise Sys. Rev., Series A | | Aa2 | | 5.375 | | | 06/01/32 | | | | 1,000 | | | | 1,084,750 | |

University Colo. Hosp. Auth. Rev., Series A | | A1 | | 5.000 | | | 11/15/42 | | | | 750 | | | | 704,010 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 21,458,260 | |

| | | | | |

Connecticut 0.3% | | | | | | | | | | | | | | | | |

Connecticut St. Dev. Auth. Rev., Series A, Light & Pwr. Co. Proj., Rfdg. | | A3 | | 4.375 | | | 09/01/28 | | | | 1,000 | | | | 978,990 | |

Connecticut St. Hlth. & Edl. Facs. Auth. Rev., Western Conn. Hlth., Series M | | A(a) | | 5.375 | | | 07/01/41 | | | | 1,250 | | | | 1,252,675 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 2,231,665 | |

| | | |

District of Columbia 3.6% | | | | | | | | | | | | |

Dist. of Columbia, Rev.,

Kipp. Chrt. Schl. | | BBB+(a) | | 6.000 | | | 07/01/43 | | | | 850 | | | | 853,986 | |

Kipp. Chrt. Schl. | | BBB+(a) | | 6.000 | | | 07/01/48 | | | | 725 | | | | 718,649 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | |

District of Columbia (cont’d.) | | | | | | | | | | | | |

District of Columbia, Series E, BHAC, GO | | Aa1 | | 5.000 % | | | 06/01/28 | | | | 5,000 | | | $ | 5,190,400 | |

District of Columbia Rev., Assoc. Amer. Med. College, Series A, Rmkt. | | A+(a) | | 4.000 | | | 10/01/41 | | | | 750 | | | | 600,533 | |

Assoc. Amer. Med. College, Series B | | A+(a) | | 5.000 | | | 10/01/41 | | | | 2,500 | | | | 2,451,800 | |

Brookings Inst. | | Aa3 | | 5.750 | | | 10/01/39 | | | | 5,000 | | | | 5,192,900 | |

Gallaudet Univ. | | A2 | | 5.500 | | | 04/01/34 | | | | 600 | | | | 613,020 | |

District of Columbia Wtr. & Swr. Auth., Pub. Util. Rev., Series A | | Aa2 | | 5.500 | | | 10/01/39 | | | | 2,000 | | | | 2,058,960 | |

Metropolitan Washington DC Arpt. Auth. Sys.,

Series A, AMT | | A1 | | 5.000 | | | 10/01/31 | | | | 2,500 | | | | 2,491,050 | |

Series A, AMT | | A1 | | 5.250 | | | 10/01/27 | | | | 1,000 | | | | 1,029,370 | |

Series B, AMT | | A1 | | 5.000 | | | 10/01/25 | | | | 3,000 | | | | 3,123,270 | |

Series C, AMT | | A1 | | 5.000 | | | 10/01/27 | | | | 1,000 | | | | 1,024,340 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 25,348,278 | |

| | | | | |

Florida 8.9% | | | | | | | | | | | | | | | | |

Bayside Impt. Cmnty. Dev. Dist., Cap. Impvt. Rev., Series A | | NR | | 6.300 | | | 05/01/18 | | | | 255 | | | | 247,962 | |

Citizens Ppty. Ins. Corp., High Risk Sr. Secd., High Act-A-1, Series A-1 | | A2 | | 6.000 | | | 06/01/16 | | | | 1,500 | | | | 1,690,875 | |

High Risk Sr. Secd., Series A-1 | | A2 | | 5.250 | | | 06/01/17 | | | | 1,000 | | | | 1,120,680 | |

Sr. Secd. Coastal, Series A-1 | | A2 | | 5.000 | | | 06/01/19 | | | | 1,250 | | | | 1,379,250 | |

Sr. Secd. Series A-1 | | A2 | | 5.000 | | | 06/01/22 | | | | 1,000 | | | | 1,070,900 | |

Cityplace Cmnty. Dev. Dist. Rev., Rfdg. | | NR | | 5.000 | | | 05/01/26 | | | | 1,000 | | | | 1,006,810 | |

Florida St. Brd. Ed. Lottery Rev., Series B | | A1 | | 5.000 | | | 07/01/23 | | | | 5,185 | | | | 5,660,309 | |

Greater Orlando Aviation Auth. Arpt. Facs. Rev., Series A, AGC, AMT | | Aa3 | | 5.000 | | | 10/01/23 | | | | 2,240 | | | | 2,368,083 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 15 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Florida (cont’d.) | | | | | | | | | | | | | | | | |

Highlands Cnty. Dev. Dist. Rev., Spl. Assmt.(c) | | NR | | 5.550 % | | | 05/01/36 | | | | 205 | | | $ | 118,381 | |

Highlands Cnty. Hlth. Facs. Auth. Rev.,

Adventist Hlth., Unrefunded Bal., Series B | | Aa3 | | 5.000 | | | 11/15/25 | | | | 1,410 | | | | 1,476,425 | |

Adventist Hlth./Sunbelt, Rmkt., Series B | | Aa3 | | 6.000 | | | 11/15/37 | | | | 2,440 | | | | 2,699,641 | |

Adventist Hlth., Series B (Pre-refunded Date 11/15/15)(d) | | Aa3 | | 5.000 | | | 11/15/25 | | | | 205 | | | | 224,936 | |

Hillsborough Cnty. Aviation Auth. Rev., Tampa Int’l. Arpt., Series A, AMT, NATL | | A1 | | 5.500 | | | 10/01/15 | | | | 1,000 | | | | 1,004,350 | |

Jacksonville FL. Trans. Rev. Port Auth. Rdfg., AMT | | A2 | | 5.000 | | | 11/01/38 | | | | 500 | | | | 468,045 | |

Miami Dade Cnty. Aviation Rev., Miami Int’l. Arpt., Series A, AMT, AGC | | A2 | | 5.500 | | | 10/01/24 | | | | 2,665 | | | | 2,938,349 | |

Series B | | A2 | | 5.000 | | | 10/01/41 | | | | 2,500 | | | | 2,408,600 | |

Series C, AMT, AGC | | A2 | | 5.250 | | | 10/01/26 | | | | 5,000 | | | | 5,199,250 | |

Miami Dade Cnty. Wtr. & Swr. Rev., Rfdg. Sys.,

Series B, AGC | | Aa3 | | 5.250 | | | 10/01/22 | | | | 5,000 | | | | 5,684,200 | |

North Sumter Cnty. Util. Dependent District, Dist., Wtr. & Swr. Rev. | | BBB+(a) | | 5.750 | | | 10/01/43 | | | | 1,500 | | | | 1,516,425 | |

Orlando Util. Commn. Sys. Rev., Series A | | Aa2 | | 5.250 | | | 10/01/39 | | | | 5,000 | | | | 5,166,000 | |

Palm Beach Cnty. Arpt. Sys. Rev.,

Series A, AMT, NATL | | A2 | | 5.000 | | | 10/01/22 | | | | 3,065 | | | | 3,265,206 | |

Series A, AMT, NATL | | A2 | | 5.000 | | | 10/01/23 | | | | 2,350 | | | | 2,464,751 | |

South Lake Cnty. Hosp. Dist. Rev.,

South Lake Hosp., Inc. | | A2 | | 5.250 | | | 10/01/34 | | | | 750 | | | | 748,065 | |

South Lake Hosp., Inc.,

Series A | | Baa1 | | 6.250 | | | 04/01/39 | | | | 2,500 | | | | 2,619,550 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Florida (cont’d.) | | | | | | | | | | | | | | | | |

South Miami Hlth. Facs. Auth. Hosp. Rev., Baptist Hlth. South Fl. Grp. | | Aa2 | | 5.000 % | | | 08/15/27 | | | | 3,750 | | | $ | 3,883,575 | |

Tampa Fl. Hlth. Sys. Rev., Baycare Hlth. Sys., Series A | | Aa2 | | 5.000 | | | 11/15/33 | | | | 3,000 | | | | 2,984,670 | |

Tampa-Hillsborough Cnty. Expy. Auth. Rev., Rfdg., Series B | | A3 | | 5.000 | | | 07/01/42 | | | | 3,000 | | | | 2,889,000 | |

West Palm Beach Cmnty. Redev. Agy., Northwood-Pleasant Cmnty. Redev., Tax Allocation Rev. | | A(a) | | 5.000 | | | 03/01/35 | | | | 1,000 | | | | 932,630 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 63,236,918 | |

| | | | | |

Georgia 2.1% | | | | | | | | | | | | | | | | |

Athens Clarke Cnty. Univs., Govt. Wtr. & Swr. Rev. | | Aa2 | | 5.625 | | | 01/01/33 | | | | 2,000 | | | | 2,206,160 | |

Atlanta Arpt. & Marina Rev., Rfdg., Gen., Series C | | A1 | | 6.000 | | | 01/01/30 | | | | 3,250 | | | | 3,594,240 | |

Atlanta Arpt. Rev., Gen., Series B, AMT | | A1 | | 5.000 | | | 01/01/30 | | | | 500 | | | | 496,110 | |

Burke Cnty. Dev. Auth. Poll. Ctl. Rev., Oglethorpe Pwr. Vogtle. Proj., Series B | | Baa1 | | 5.500 | | | 01/01/33 | | | | 750 | | | | 774,427 | |

Forsyth Cnty. Sch. Dist. Dev., GO | | Aa1 | | 6.750 | | | 07/01/16 | | | | 385 | | | | 423,816 | |

Fulton Cnty. Sch. Dist., Rfdg., GO | | Aa1 | | 6.375 | | | 05/01/17 | | | | 750 | | | | 883,500 | |

Gwinnett Cnty. Hosp. Auth. Rev., Gwinnett Hosp. Sys., Series D, AGC | | A2 | | 5.500 | | | 07/01/41 | | | | 1,500 | | | | 1,517,025 | |

Private Colleges & Univs. Auth. Rev., Emory Univ., Series C | | Aa2 | | 5.250 | | | 09/01/39 | | | | 5,000 | | | | 5,165,950 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 15,061,228 | |

| | | | | |

Guam 0.1% | | | | | | | | | | | | | | | | |

Guam Govt. Wtrwks. Auth., Wtr. & Wastewtr. Sys. Rev. | | Ba2 | | 6.000 | | | 07/01/25 | | | | 500 | | | | 504,700 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 17 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Hawaii 0.2% | | | | | | | | | | | | | | | | |

Hawaii Pac. Hlth. Spl. Purp. Rev., Series B | | A3 | | 5.750% | | | 07/01/40 | | | | 500 | | | $ | 509,280 | |

Hawaii St. Dept. Budg. & Fin. Pac. Hlth. Rev., Series A | | A3 | | 5.500 | | | 07/01/40 | | | | 1,000 | | | | 992,980 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 1,502,260 | |

| | | | | |

Idaho 0.2% | | | | | | | | | | | | | | | | |

Idaho Hlth. Facs. Auth. Rev., Trinity Hlth. Grp., Series B | | Aa2 | | 6.250 | | | 12/01/33 | | | | 1,000 | | | | 1,123,400 | |

| | | | | |

Illinois 9.4% | | | | | | | | | | | | | | | | |

Chicago Brd. Edu., Rfdg., Dedicated Rev., Series F, GO | | A3 | | 5.000 | | | 12/01/31 | | | | 2,500 | | | | 2,329,675 | |

Chicago O’Hare Int’l. Arpt. Rev., Gen. Arpt., 3rd Lien, Series A, NATL | | A2 | | 5.250 | | | 01/01/26 | | | | 6,000 | | | | 6,197,880 | |

Series B, Rfdg., AMT | | A2 | | 5.000 | | | 01/01/32 | | | | 2,000 | | | | 1,883,060 | |

Series B, Rfdg., NATL | | A2 | | 5.250 | | | 01/01/15 | | | | 1,000 | | | | 1,063,450 | |

Series B-1, XLCA | | A2 | | 5.250 | | | 01/01/34 | | | | 1,975 | | | | 1,987,166 | |

Series C | | A2 | | 6.500 | | | 01/01/41 | | | | 1,000 | | | | 1,154,560 | |

Chicago Rfdg. Proj.,

Series A, AGC, GO | | A2 | | 5.000 | | | 01/01/29 | | | | 5,000 | | | | 4,718,150 | |

Series A, GO | | A3 | | 5.000 | | | 01/01/40 | | | | 2,000 | | | | 1,790,140 | |

Chicago Trans. Auth. Sales Tax Recpts. Rev. | | Aa3 | | 5.250 | | | 12/01/40 | | | | 1,000 | | | | 1,001,240 | |

Illinois Fin. Auth. Rev., Advocate Healthcare, Series B | | Aa2 | | 5.375 | | | 04/01/44 | | | | 2,000 | | | | 2,016,680 | |

Central DuPage Hlth., | | AA(a) | | 5.250 | | | 11/01/39 | | | | 2,000 | | | | 1,997,020 | |

Central DuPage Hlth., Series B | | AA(a) | | 5.500 | | | 11/01/39 | | | | 1,500 | | | | 1,527,120 | |

Northwestern Mem. Healthcare, Rfdg. | | Aa2 | | 5.000 | | | 08/15/43 | | | | 1,000 | | | | 978,690 | |

Northwestern Mem. Hosp., Series A | | Aa2 | | 6.000 | | | 08/15/39 | | | | 1,000 | | | | 1,095,080 | |

People’s Gas Light & Coke, Rfdg. | | A1 | | 4.000 | | | 02/01/33 | | | | 500 | | | | 421,210 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Illinois (cont’d.) | | | | | | | | | | | | | | | | |

Illinois Fin. Auth. Rev., (cont’d) | | | | | | | | | | | | | | |

Provena Hlth., Series A | | Baa1 | | 6.000 % | | | 05/01/28 | | | | 1,500 | | | $ | 1,566,780 | |

Univ. of Chicago, Series B | | Aa1 | | 6.250 | | | 07/01/38 | | | | 5,000 | | | | 5,461,100 | |

Northwestern Mem. Hosp., Series A (Pre-refunded Date 08/15/14)(d) | | NR | | 5.250 | | | 08/15/34 | | | | 5,000 | | | | 5,234,450 | |

Illinois Fin. Auth. Student Hsg. Rev., Advancement Fund, Series B | | Baa3 | | 5.000 | | | 05/01/30 | | | | 4,000 | | | | 3,717,200 | |

Illinois St. Sales Tax Rev., Rfdg., Build Illinois Bonds | | AAA(a) | | 5.000 | | | 06/15/20 | | | | 2,000 | | | | 2,274,920 | |

Rfdg., GO, AGC | | A2 | | 5.000 | | | 01/01/23 | | | | 3,000 | | | | 3,090,060 | |

Illinois St. Toll Hwy. Auth. Rev., Series A | | Aa3 | | 5.000 | | | 01/01/38 | | | | 1,000 | | | | 963,140 | |

Illinois Toll Hwy. Auth. Rev., Series B | | Aa3 | | 5.500 | | | 01/01/33 | | | | 2,000 | | | | 2,110,120 | |

Sr. Priority, Sr. A-1, AGC | | Aa3 | | 5.000 | | | 01/01/24 | | | | 5,000 | | | | 5,388,900 | |

Metropolitan Pier & Exposition Auth. Dedicated St. Tax Rev., McCormick Place Expansion, Series A, NATL, CABS | | Baa1 | | 6.220(b) | | | 12/15/34 | | | | 10,000 | | | | 2,714,000 | |

Series A, NATL, CABS | | Baa1 | | 6.340(b) | | | 06/15/37 | | | | 7,500 | | | | 1,698,825 | |

Railsplitter Tob. Settlement Auth. Rev., Series 2010 | | A-(a) | | 6.000 | | | 06/01/28 | | | | 2,250 | | | | 2,419,875 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 66,800,491 | |

| | | | | |

Indiana 0.5% | | | | | | | | | | | | | | | | |

Indiana St. Fin. Auth., Private Activity, OH River Brid., Series A, AMT | | BBB(a) | | 5.250 | | | 01/01/51 | | | | 2,000 | | | | 1,701,880 | |

Indiana St. Fin. Auth., Var. Duke Energy Indl., Series B | | A(a) | | 6.000 | | | 08/01/39 | | | | 1,000 | | | | 1,069,650 | |

Indianapolis Loc. Pub. Impt. Bd. Bk. Wtr. Wks. Proj., Series A | | A2 | | 5.750 | | | 01/01/38 | | | | 1,000 | | | | 1,041,790 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 3,813,320 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 19 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Kansas 1.0% | | | | | | | | | | | | | | | | |

Kansas St. Dev. Fin. Auth. Hosp. Rev., Adventist Hlth. | | Aa3 | | 5.750 % | | | 11/15/38 | | | | 1,000 | | | $ | 1,075,210 | |

Sedgwick & Shawnee Cnty. Sngl. Fam. Hsg. Rev., Proj., Series A-4, AMT, GNMA, FNMA | | Aaa | | 5.700 | | | 12/01/27 | | | | 325 | | | | 342,459 | |

Series A, AMT, GNMA, FNMA | | Aaa | | 5.850 | | | 12/01/27 | | | | 320 | | | | 336,848 | |

Series A-5, AMT, GNMA, FNMA | | Aaa | | 5.750 | | | 06/01/27 | | | | 205 | | | | 211,265 | |

Wyandotte Cnty. Kansas City Unified Gov. Util. Sys. Rev., Rfdg., Series 2004, AMBAC | | A+(a) | | 5.650 | | | 09/01/19 | | | | 5,000 | | | | 5,482,350 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 7,448,132 | |

| | | | | |

Kentucky 0.7% | | | | | | | | | | | | | | | | |

Kentucky Econ. Dev. Fin. Auth. Hosp. Facs. Rev., Owensboro Med. Hlth. Sys., Series A | | Baa2 | | 6.375 | | | 06/01/40 | | | | 3,500 | | | | 3,609,900 | |

Owen Cnty. Wtrwks. Sys.

Rev.,

Amer. Wtr. Co. Proj., Series A | | Baa1 | | 6.250 | | | 06/01/39 | | | | 500 | | | | 519,725 | |

Var. Amer. Wtr. Co., Series B | | Baa1 | | 5.625 | | | 09/01/39 | | | | 500 | | | | 497,630 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 4,627,255 | |

| | | | | |

Louisiana 0.8% | | | | | | | | | | | | | | | | |

Louisiana Loc. Govt. Environ. Facs. & Cmnty. Dev. Auth., Jefferson Parish, Series A | | Aa2 | | 5.375 | | | 04/01/31 | | | | 1,000 | | | | 1,047,780 | |

Louisiana Pub. Facs. Auth. Hosp. Rev., Franciscan Missionaries | | A2 | | 6.750 | | | 07/01/39 | | | | 1,000 | | | | 1,080,200 | |

Louisiana St. Citizens Pty. Inc., Corp. Assmt. Rev., Rmkt., Series C-2, AGC | | A3 | | 6.750 | | | 06/01/26 | | | | 2,000 | | | | 2,225,160 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Louisiana (cont’d.) | | | | | | | | | | | | | | | | |

Saint Charles Parish Gulf Zone Opp. Zone Rev., Valero Energy Corp. (Mandatory Put Date 06/01/22) | | Baa2 | | 4.000%(e) | | | 12/01/40 | | | | 1,500 | | | $ | 1,477,170 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 5,830,310 | |

| | | | | |

Maryland 0.7% | | | | | | | | | | | | | | | | |

Frederick Cnty. Spl. Oblig., Urbana Cmnty. Dev. Auth. Rev., Series A | | A-(a) | | 5.000 | | | 07/01/40 | | | | 3,000 | | | | 2,969,190 | |

Maryland St. Hlth. & Higher Edl. Facs. Auth. Rev., Lifebridge Hlth. | | A2 | | 6.000 | | | 07/01/41 | | | | 400 | | | | 424,044 | |

Series A | | A2 | | 4.000 | | | 07/01/43 | | | | 1,000 | | | | 764,480 | |

Maryland St. Indl. Dev. Fin. Auth., Synagro Baltimore, Series A, Rfdg., AMT | | NR | | 5.250 | | | 12/01/13 | | | | 600 | | | | 605,076 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 4,762,790 | |

| | | | | |

Massachusetts 5.0% | | | | | | | | | | | | | | | | |

Boston Indl. Dev. Fin. Auth. Swr. Facs. Rev., Harbor Elec. Energy Co. Proj., AMT | | Aa3 | | 7.375 | | | 05/15/15 | | | | 390 | | | | 391,806 | |

Massachusetts Bay Trans. Auth. Rev.,

Assmt., Series A | | Aa1 | | 5.250 | | | 07/01/34 | | | | 2,000 | | | | 2,114,860 | |

Mass. Sales Tax, Series B, NATL | | Aa2 | | 5.500 | | | 07/01/27 | | | | 1,325 | | | | 1,501,318 | |

Massachusetts Edl. Fin. Auth. Rev., Series B, AMT | | AA(a) | | 5.500 | | | 01/01/23 | | | | 715 | | | | 754,997 | |

Massachusetts St., Cons. Ln., Series C, AGC, GO | | Aa1 | | 5.000 | | | 08/01/19 | | | | 2,000 | | | | 2,276,280 | |

Massachusetts St., Series B, AGC, GO | | Aa1 | | 5.250 | | | 09/01/24 | | | | 9,000 | | | | 10,466,640 | |

Massachusetts St. Dev. Fin. Agcy. Rev., Series K-6, Partners Healthcare | | Aa2 | | 5.375 | | | 07/01/41 | | | | 5,000 | | | | 5,078,150 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 21 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Massachusetts (cont’d.) | | | | | | | | | | | | | | | | |

Massachusetts St. Hlth. & Edl. Facs. Auth. Rev.,

Harvard Univ., Series A | | Aaa | | 5.500 % | | | 11/15/36 | | | | 3,500 | | | $ | 3,866,450 | |

Tufts Univ., Series M | | Aa2 | | 5.500 | | | 02/15/28 | | | | 3,000 | | | | 3,336,570 | |

Massachusetts St. Port Auth., Series A, AMT | | Aa3 | | 5.000 | | | 07/01/42 | | | | 1,000 | | | | 958,700 | |

Massachusetts St. Port Auth. Spl. Facs. Rev., Bosfuel Proj., AMT, NATL | | A2 | | 5.000 | | | 07/01/32 | | | | 5,000 | | | | 4,782,100 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 35,527,871 | |

| | | | | |

Michigan 1.3% | | | | | | | | | | | | | | | | |

Detroit Sewer Disp. Rev., Sr. Lien-Rmkt., Ser 2009B, A.G.C. | | A2 | | 7.500 | | | 07/01/33 | | | | 1,000 | | | | 1,079,910 | |

Michigan St. Bldg. Auth. Rev., Rfdg., Facs. Proj., Series I-A | | Aa3 | | 5.375 | | | 10/15/41 | | | | 750 | | | | 757,567 | |

Michigan St. Hosp. Fin. Auth. Rev., McLaren Healthcare | | Aa3 | | 5.750 | | | 05/15/38 | | | | 1,000 | | | | 1,067,240 | |

Michigan St. Strategic Fd. Ltd. Oblig. Rev., Adj. Rfdg., Dow Chemical Rmkt., Series B-1 | | Baa2 | | 6.250 | | | 06/01/14 | | | | 1,000 | | | | 1,033,860 | |

Royal Oak Hosp. Fin. Auth. Rev., William Beaumont, Rfdg., Series W | | A1 | | 6.000 | | | 08/01/39 | | | | 2,000 | | | | 2,079,500 | |

Wayne Cnty. Arpt. Auth. Rev., Det. Met. Arpt.,

Series A, Rfdg., AMT | | A2 | | 5.000 | | | 12/01/18 | | | | 1,500 | | | | 1,664,520 | |

Series D, Rfdg., AMT | | A2 | | 5.000 | | | 12/01/28 | | | | 1,500 | | | | 1,467,015 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 9,149,612 | |

| | | | | |

Nebraska 0.8% | | | | | | | | | | | | | | | | |

Central Plains Energy Proj., Gas Proj. Rev., Proj. #3 | | A3 | | 5.000 | | | 09/01/42 | | | | 1,250 | | | | 1,126,538 | |

Lincoln Cnty. Hosp. Auth. Rev., Great Plains Regl., Med. Ctr. | | A-(a) | | 5.000 | | | 11/01/42 | | | | 2,000 | | | | 1,847,200 | |

Omaha Pub. Pwr. Dist., Series B | | Aa2 | | 5.000 | | | 02/01/39 | | | | 2,500 | | | | 2,541,725 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 5,515,463 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Nevada 0.4% | | | | | | | | | | | | | | | | |

Clark Cnty. Passenger Facs. Charge Rev., Las Vegas McCarran Int’l. Arpt., Series A | | A1 | | 5.125 % | | | 07/01/34 | | | | 3,000 | | | $ | 3,054,180 | |

| | | | | |

New Jersey 4.6% | | | | | | | | | | | | | | | | |

Camden Cnty. Impvt. Auth., Cooper Hlth. Sys. Oblig. Group | | Baa3 | | 5.750 | | | 02/15/42 | | | | 1,500 | | | | 1,415,955 | |

Cape May Cnty. Indl. Poll. Ctrl., Fin. Auth. Rev., Atlantic City Elec. Co., Series A, NATL | | Baa1 | | 6.800 | | | 03/01/21 | | | | 2,615 | | | | 3,129,292 | |

Clearview Reg. High Sch. Dist., GO, NATL | | Baa1 | | 5.375 | | | 08/01/15 | | | | 595 | | | | 622,560 | |

Jersey City Sew. Auth., Swr., Rfdg., AMBAC | | NR | | 6.250 | | | 01/01/14 | | | | 1,075 | | | | 1,092,135 | |

New Jersey Econ., Dev. Auth. Rev.,

Masonic Charity Fdn. Proj. | | A-(a) | | 5.875 | | | 06/01/18 | | | | 250 | | | | 250,558 | |

Masonic Charity Fdn. Proj. | | A-(a) | | 6.000 | | | 06/01/25 | | | | 1,150 | | | | 1,151,035 | |

New Jersey Healthcare Facs. Fin. Auth. Rev.,

AHS Hosp. Corp., Rfdg. | | A1 | | 6.000 | | | 07/01/41 | | | | 500 | | | | 559,180 | |

Holy Name Med. Ctr., Rfdg | | Baa2 | | 5.000 | | | 07/01/25 | | | | 1,625 | | | | 1,633,304 | |

RWJ Univ. Hosp. | | A2 | | 5.500 | | | 07/01/43 | | | | 1,000 | | | | 995,560 | |

Virtua Hlth., AGC | | AA-(a) | | 5.500 | | | 07/01/38 | | | | 2,000 | | | | 2,023,700 | |

New Jersey St. Tpke. Auth., Tpke. Rev., Growth & Income Secs., Series B, AMBAC, CABS (Converts to 5.150% on 01/01/15) | | A3 | | 5.450(b) | | | 01/01/35 | | | | 3,000 | | | | 2,689,350 | |

New Jersey St. Tpke. Auth., Tpke. Rev., Series A | | A3 | | 5.000 | | | 01/01/43 | | | | 3,000 | | | | 2,940,960 | |

New Jersey St. Trans. Trust Fund Auth. Rev.,

Series A | | A1 | | 5.500 | | | 12/15/23 | | | | 3,000 | | | | 3,435,450 | |

Series A | | A1 | | 5.875 | | | 12/15/38 | | | | 3,000 | | | | 3,296,310 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 23 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

New Jersey (cont’d.) | | | | | | | | | | | | | | | | |

New Jersey St. Trans. Trust Fund Auth. Rev. (cont’d.) | | | | | | | | | | | | | | | | |

Series B | | A1 | | 5.500 % | | | 06/15/31 | | | | 1,000 | | | $ | 1,049,620 | |

Rutgers St. Univ. of New Jersey, Series L | | Aa3 | | 5.000 | | | 05/01/38 | | | | 1,500 | | | | 1,541,595 | |

Tob. Settlement Fin. Corp. Rev., Asset Bkd.,

Series 1A | | B1 | | 4.500 | | | 06/01/23 | | | | 3,160 | | | | 2,827,189 | |

Series 1A | | B1 | | 4.625 | | | 06/01/26 | | | | 3,000 | | | | 2,330,460 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 32,984,213 | |

| | | | | |

New Mexico 0.1% | | | | | | | | | | | | | | | | |

New Mexico Mtge. Fin. Auth. Rev., Sngl. Fam. Mtge., Series E, GNMA, FNMA, FHLMC, AMT | | AA+(a) | | 5.500 | | | 07/01/35 | | | | 660 | | | | 688,083 | |

| | | | | |

New York 7.0% | | | | | | | | | | | | | | | | |

Brooklyn Arena Loc. Dev. Corp., Barclays Ctr. Proj. | | Baa3 | | 6.375 | | | 07/15/43 | | | | 750 | | | | 792,247 | |

Long Island Pwr. Auth. Elec. Sys. Rev.,

Gen., Series A | | Baa1 | | 6.000 | | | 05/01/33 | | | | 1,000 | | | | 1,089,020 | |

Series A | | Baa1 | | 6.250 | | | 04/01/33 | | | | 500 | | | | 552,535 | |

Series A, BHAC | | Aa1 | | 5.500 | | | 05/01/33 | | | | 2,000 | | | | 2,147,620 | |

Metropolitan Trans. Auth. Rev.,

Series D | | A2 | | 5.250 | | | 11/15/40 | | | | 2,000 | | | | 2,016,540 | |

Series 2008C | | A2 | | 6.500 | | | 11/15/28 | | | | 2,500 | | | | 2,907,075 | |

Monroe Cnty. Indl. Dev. Agcy. Civic Fac. Rev., Rfdg., Highland Hosp. Rochester | | A2 | | 5.000 | | | 08/01/22 | | | | 2,000 | | | | 2,068,280 | |

New York City, GO

Series E | | Aa2 | | 5.000 | | | 08/01/17 | | | | 6,000 | | | | 6,843,780 | |

Series I-1 | | Aa2 | | 5.250 | | | 04/01/28 | | | | 2,000 | | | | 2,159,080 | |

New York City Indl. Dev. Agcy. Spl. Facs. Rev., Terminal One Group Assn. Proj., AMT | | A3 | | 5.500(e) | | | 01/01/24 | | | | 1,500 | | | | 1,612,065 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

New York (cont’d.) | | | | | | | | | | | | | | | | |

New York City Mun. Wtr. Fin. Auth., Rev., Wtr. & Swr., Fiscal 2009, Series A | | Aa1 | | 5.750% | | | 06/15/40 | | | | 1,000 | | | $ | 1,101,990 | |

New York City Trans. Fin. Auth. Bldg. Aid. Rev.,

Fiscal 2009, Series S-3 | | Aa3 | | 5.250 | | | 01/15/39 | | | | 1,500 | | | | 1,586,955 | |

Sub. Series S-1A | | Aa3 | | 5.250 | | | 07/15/37 | | | | 3,000 | | | | 3,081,540 | |

New York City Trans. Fin. Auth. Future Tax Rev., Future Tax Secd. Sub., Series D-1 | | Aa1 | | 5.000 | | | 11/01/38 | | | | 3,000 | | | | 3,056,190 | |

New York Liberty Dev. Corp., 4 World Trade Center Proj., Rfdg. | | A+(a) | | 5.750 | | | 11/15/51 | | | | 1,750 | | | | 1,837,325 | |

7 World Trade Center Proj., Class 1, Rfdg. | | Aaa | | 5.000 | | | 09/15/40 | | | | 1,000 | | | | 1,008,280 | |

New York St. Dorm. Auth. Rev., City Univ. Sys. Cons., Series B | | Aa3 | | 6.000 | | | 07/01/14 | | | | 470 | | | | 487,376 | |

Mount Sinai Sch. of Medicine, Series A | | A3 | | 5.000 | | | 07/01/21 | | | | 1,685 | | | | 1,868,800 | |

Rochester Inst. Tech., Series A, AMBAC | | A1 | | 5.250 | | | 07/01/20 | | | | 2,100 | | | | 2,415,924 | |

Rochester Inst. Tech., Series A, AMBAC | | A1 | | 5.250 | | | 07/01/21 | | | | 2,000 | | | | 2,286,640 | |

New York St. Environ. Facs. Corp. Rev., Clean Wtr. & Drinking Revolving Fds. Pooled Fin., New York City Mun. Wtr. Proj. | | Aaa | | 5.000 | | | 06/15/34 | | | | 2,000 | | | | 2,047,700 | |

New York St. Environ. Facs. Corp. Rev., Clean Wtr. & Drinking Revolving Fds. Pooled Fin.,

Series B | | Aaa | | 5.500 | | | 10/15/23 | | | | 3,750 | | | | 4,473,262 | |

Series E | | Aaa | | 6.500 | | | 06/15/14 | | | | 5 | | | | 5,026 | |

New York St. Local Gov’t. Assist. Corp. Rev., Series E | | Aa2 | | 6.000 | | | 04/01/14 | | | | 1,015 | | | | 1,049,683 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 25 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

New York (cont’d.) | | | | | | | | | | | | | | | | |

Port Auth. of NY & NJ, Spl. Oblig. Rev., JFK Int’l. Air Terminal | | Baa3 | | 5.000% | | | 12/01/20 | | | | 500 | | | $ | 535,075 | |

Suffolk Cnty. Indl. Dev. Agy. Rev., Keyspan-Port Jeferson, AMT | | Baa1 | | 5.250 | | | 06/01/27 | | | | 1,000 | | | | 1,007,960 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 50,037,968 | |

| | | | | |

North Carolina 2.0% | | | | | | | | | | | | | | | | |

Charlotte-Mecklenburg Hosp. Auth. Healthcare Sys. Rev., Rfdg., Carolinas, Series A | | Aa3 | | 5.000 | | | 01/15/43 | | | | 2,000 | | | | 1,891,120 | |

North Carolina Eastern Mun. Powr. Agcy., Powr. Sys. Rev., Rfdg., AMBAC | | Baa1 | | 6.000 | | | 01/01/18 | | | | 1,000 | | | | 1,172,580 | |

Series A, ETM(d) | | Aaa | | 6.500 | | | 01/01/18 | | | | 2,635 | | | | 3,186,031 | |

Series A, NATL, Unrefunded Bal. | | Baa1 | | 6.500 | | | 01/01/18 | | | | 1,005 | | | | 1,198,362 | |

Series C, AGC | | A3 | | 6.000 | | | 01/01/19 | | | | 500 | | | | 552,805 | |

Series A (Pre-refunded Date 01/01/22)(d) | | Aaa | | 6.000 | | | 01/01/26 | | | | 650 | | | | 807,482 | |

Series A, ETM(d) | | Baa1 | | 6.400 | | | 01/01/21 | | | | 1,000 | | | | 1,183,530 | |

North Carolina Med. Care Commn. Healthcare Facs. Rev., Duke Univ. Hlth. Sys., Series A | | Aa2 | | 5.000 | | | 06/01/42 | | | | 3,500 | | | | 3,390,800 | |

Pitt Cnty. Rev., Mem. Hosp., ETM(d) | | Aaa | | 5.250 | | | 12/01/21 | | | | 1,000 | | | | 1,050,160 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 14,432,870 | |

| | | | | |

North Dakota 0.1% | | | | | | | | | | | | | | | | |

Mclean Cnty. Solid Wste. Facs. Rev., Great River Energy Proj., Series A | | Baa1 | | 4.875 | | | 07/01/26 | | | | 1,000 | | | | 1,007,750 | |

| | | | | |

Ohio 4.1% | | | | | | | | | | | | | | | | |

Akron Bath Copley Joint Twp., Hosp. Dist., Rfdg., Med. Ctr. Akron | | A1 | | 5.000 | | | 11/15/42 | | | | 640 | | | | 605,229 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Ohio (cont’d.) | | | | | | | | | | | | | | | | |

Buckeye Ohio Tob. Settlement, Asset Bkd. Sr. Turbo, Series A-2 | | B3 | | 5.125 % | | | 06/01/24 | | | | 5,690 | | | $ | 4,369,806 | |

Series A-2 | | B3 | | 5.875 | | | 06/01/30 | | | | 3,500 | | | | 2,526,545 | |

Series A-2 | | B3 | | 6.500 | | | 06/01/47 | | | | 4,250 | | | | 3,129,147 | |

Cleveland Arpt. Sys. Rev., Rfdg., Series A | | Baa1 | | 5.000 | | | 01/01/29 | | | | 1,000 | | | | 992,530 | |

Columbus Citation Hsg. Dev. Corp., Mtge. Rev., FHA (Pre-refunded Date 01/01/15)(d) | | NR | | 7.625 | | | 01/01/22 | | | | 1,110 | | | | 1,203,939 | |

Franklin Cnty. Hosp. Facs. Rev., Ohio Hlth. Corp., Series A | | Aa2 | | 5.000 | | | 11/15/41 | | | | 2,000 | | | | 1,915,340 | |

Hamilton Cnty. Healthcare Facs. Rev., Christ Hosp. Proj. | | Baa1 | | 5.000 | | | 06/01/42 | | | | 1,250 | | | | 1,151,688 | |

Hancock Cnty. Hosp. Rev., Rfdg., Blanchard Valley Regl. Hlth. Ctr. | | A2 | | 6.250 | | | 12/01/34 | | | | 400 | | | | 424,124 | |

Hilliard Sch. Dist. Sch. Impvt., CABS, GO, NATL | | Aa1 | | 2.380(b) | | | 12/01/19 | | | | 1,720 | | | | 1,483,156 | |

Lucas Cnty. Hosp. Rev., Rfdg., Promedica Healthcare, Series A | | Aa3 | | 6.000 | | | 11/15/41 | | | | 750 | | | | 809,348 | |

Series A | | Aa3 | | 6.500 | | | 11/15/37 | | | | 875 | | | | 981,794 | |

Middleburg Heights Hosp. Rev. Facs., Rfdg., Southwest Gen. | | A2 | | 5.250 | | | 08/01/41 | | | | 800 | | | | 759,576 | |

Ohio St. Air Quality Dev. Auth. Rev., Poll Ctl. First Energy, Rfdg., Series C | | Baa2 | | 5.625 | | | 06/01/18 | | | | 500 | | | | 553,040 | |

Ohio St. Higher Ed. Facs., Comm., Case Western Resv. Univ., Series B | | A1 | | 6.500 | | | 10/01/20 | | | | 750 | | | | 878,130 | |

Ohio St. Higher Ed. Facs., Comm., Cleveland Clinic Hlth. Sys., Series A-1, GO | | Aa2 | | 5.000 | | | 01/01/42 | | | | 2,000 | | | | 1,926,560 | |

Ohio St. Tpke. Comm., Jr. Lien—Infrastracture Pro., Series A-1 | | A1 | | 5.000 | | | 02/15/48 | | | | 2,350 | | | | 2,284,035 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 27 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Ohio (cont’d.) | | | | | | | | | | | | | | | | |

Ohio St. Wtr. Dev. Auth. Rev., Poll. Ctl. First Energy, Rfdg., Series A (Mandatory Put date 06/01/16) | | Baa2 | | 5.875%(e) | | | 06/01/33 | | | | 500 | | | $ | 540,850 | |

Poll. Ctl. Ln. Fd. Wtr. Quality, Series A | | Aaa | | 5.000 | | | 12/01/29 | | | | 2,150 | | | | 2,332,449 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 28,867,286 | |

| | | | | |

Oklahoma 0.4% | | | | | | | | | | | | | | | | |

Oklahoma St. Dev., Fin. Auth., Rfdg., St. Johns Hlth. Sys. | | A2 | | 5.000 | | | 02/15/42 | | | | 1,500 | | | | 1,449,180 | |

Tulsa Airpts. Impvt. Tr. Gen. Rev., Series A | | A3 | | 5.375 | | | 06/01/24 | | | | 1,000 | | | | 1,029,860 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 2,479,040 | |

| | | | | |

Oregon 0.5% | | | | | | | | | | | | | | | | |

Oregon St. Dept. Trans. Hwy. User Tax Rev., Sr. Lien., Series A | | Aa1 | | 5.000 | | | 11/15/33 | | | | 3,500 | | | | 3,651,410 | |

| | | | | |

Pennsylvania 3.4% | | | | | | | | | | | | | | | | |

Berks Cnty. Mun. Auth., Reading Hosp. Med. Center, Series A | | Aa3 | | 5.000 | | | 11/01/40 | | | | 2,000 | | | | 1,883,820 | |

Central Bradford Progress Auth., Guthrie Healthcare Sys. | | AA-(a) | | 5.375 | | | 12/01/41 | | | | 2,700 | | | | 2,686,149 | |

Erie Parking Auth. Facs. Rev. Gtd., AGC (Pre-refunded Date 09/01/13)(d) | | A2 | | 5.000 | | | 09/01/26 | | | | 60 | | | | 60,008 | |

Geisinger Auth. Hlth. Sys., Series A-1 | | Aa2 | | 5.125 | | | 06/01/41 | | | | 2,000 | | | | 1,986,660 | |

Monroe Cnty. Hosp. Auth. Rev., Pocono Med. Ctr. Hosp. (Pre-refunded Date 01/01/14)(d) | | NR | | 6.000 | | | 01/01/43 | | | | 2,500 | | | | 2,548,350 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Pennsylvania (cont’d.) | | | | | | | | | | | | | | | | |

Pennsylvania Econ. Dev. Fin. Auth. Exempt Facs. Rev., Rfdg., Amtrak Proj., Series A, AMT | | A1 | | 5.000 % | | | 11/01/41 | | | | 1,000 | | | $ | 930,080 | |

Pennsylvania Econ. Dev. Fin. Auth. Res. Recov. Rev., Rfdg., Colver Proj.,

Series F, AMBAC, AMT | | Ba1 | | 4.625 | | | 12/01/18 | | | | 3,500 | | | | 3,427,130 | |

Series F, AMBAC, AMT | | Ba1 | | 5.000 | | | 12/01/15 | | | | 3,000 | | | | 3,062,850 | |

Pennsylvania St. Tpke. Commn. Rev., Sr. Lien, Series A | | A1 | | 5.000 | | | 12/01/42 | | | | 1,000 | | | | 970,030 | |

Pennsylvania Tpke. Comm., Series C | | A1 | | 5.000 | | | 12/01/43 | | | | 1,225 | | | | 1,185,947 | |

Philadelphia Arpt. Rev., Rfdg., Series A, AMT | | A2 | | 5.000 | | | 06/15/27 | | | | 2,500 | | | | 2,485,275 | |

Philadelphia, Ser. B, AGC, GO | | A2 | | 7.125 | | | 07/15/38 | | | | 1,500 | | | | 1,664,040 | |

Pittsburgh Urban Redev. Auth., Wtr. & Swr. Sys. Rev., Unrefunded Bal. Rfdg., Series A, NATL | | Baa1 | | 6.500 | | | 09/01/13 | | | | 750 | | | | 750,120 | |

Pittsburgh Wtr. & Swr. Auth. Sys. Rev., Series A, FGIC, ETM(d) | | Baa1 | | 6.500 | | | 09/01/13 | | | | 670 | | | | 670,114 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 24,310,573 | |

| | | | | |

Puerto Rico 3.1% | | | | | | | | | | | | | | | | |

Puerto Rico Comnwlth., Aqueduct & Swr. Auth. Rev., Series A | | Ba1 | | 5.750 | | | 07/01/37 | | | | 1,260 | | | | 918,250 | |

Series A | | Ba1 | | 6.000 | | | 07/01/47 | | | | 1,050 | | | | 759,507 | |

Puerto Rico Comnwlth., Hwy. & Trans. Auth. Rev., Rfdg., Series CC | | Baa2 | | 5.500 | | | 07/01/28 | | | | 2,500 | | | | 1,993,825 | |

Series K | | Baa3 | | 5.000 | | | 07/01/14 | | | | 2,000 | | | | 2,012,000 | |

Series J (Pre-refunded Date 07/01/14)(d) | | Baa3 | | 5.500 | | | 07/01/23 | | | | 1,320 | | | | 1,378,067 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 29 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Puerto Rico (cont’d.) | | | | | | | | | | | | | | | | |

Puerto Rico Comnwlth., Pub. Impvt., Rfdg.,

Series A, GO | | Baa3 | | 5.500 % | | | 07/01/39 | | | | 2,000 | | | $ | 1,455,420 | |

Series C, GO | | Baa3 | | 6.000 | | | 07/01/39 | | | | 800 | | | | 625,536 | |

Puerto Rico Elec. Pwr. Auth. Rev., Rfdg., LIBOR, | | | | | | | | | | | | | | | | |

Series A | | Baa3 | | 6.750 | | | 07/01/36 | | | | 1,000 | | | | 869,660 | |

Series UU, FGIC | | Baa3 | | 0.884(e) | | | 07/01/31 | | | | 5,000 | | | | 2,958,800 | |

Series XX | | Baa3 | | 5.250 | | | 07/01/40 | | | | 2,000 | | | | 1,396,040 | |

Puerto Rico Pub. Bldgs. Auth. Rev., Gtd. Govt. Facs., Rfdg., Series P | | Baa3 | | 6.750 | | | 07/01/36 | | | | 1,000 | | | | 869,660 | |

Puerto Rico Sales Tax Fin. Corp. Sales Tax Rev., First Sub., Series A | | A3 | | 5.500 | | | 08/01/42 | | | | 1,750 | | | | 1,420,667 | |

First Sub., Series A | | A3 | | 5.750 | | | 08/01/37 | | | | 1,600 | | | | 1,370,928 | |

First Sub., Series A | | A3 | | 6.000 | | | 08/01/42 | | | | 2,800 | | | | 2,485,952 | |

First Sub., Series A-1 | | A3 | | 5.000 | | | 08/01/43 | | | | 750 | | | | 560,048 | |

First Sub., Series A-1 | | A3 | | 5.250 | | | 08/01/43 | | | | 750 | | | | 583,320 | |

Series C | | Aa3 | | 5.250 | | | 08/01/40 | | | | 750 | | | | 647,632 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 22,305,312 | |

| | | | | |

Rhode Island 0.3% | | | | | | | | | | | | | | | | |

Rhode Island Hlth. & Ed. Bldg. Corp. Higher Ed. Facs. Rev., Lifespan Oblig., Series A., AGC | | A3 | | 7.000 | | | 05/15/39 | | | | 2,000 | | | | 2,184,540 | |

| | | | | |

South Carolina 1.1% | | | | | | | | | | | | | | | | |

South Carolina Pub. Svc. Auth. Rev., Santee Cooper, Series A | | A1 | | 5.125 | | | 12/01/43 | | | | 2,000 | | | | 1,987,300 | |

Series A | | A1 | | 5.500 | | | 01/01/38 | | | | 2,500 | | | | 2,620,425 | |

Series A | | A1 | | 5.750 | | | 12/01/43 | | | | 3,000 | | | | 3,200,850 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 7,808,575 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

South Dakota 0.4% | | | | | | | | | | | | | | | | |

Ed Enhancement Funding Corp. Rev., Tob., Series B | | A-(a) | | 5.000 % | | | 06/01/27 | | | | 1,000 | | | $ | 1,039,990 | |

South Dakota St. Hlth. & Edl. Facs. Auth. Rev., Rfdg., Avera Hlth., Series A | | A1 | | 5.000 | | | 07/01/42 | | | | 1,600 | | | | 1,506,864 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 2,546,854 | |

| | | | | |

Tennessee 0.8% | | | | | | | | | | | | | | | | |

Knox Cnty. Tenn. Hlth. Edl. & Hsg. Facs. Brd. Hosp. Facs., Covenant Hlth. Rev., Rfdg. & Impvt., Series A, CABS | | A-(a) | | 6.010(b) | | | 01/01/35 | | | | 1,000 | | | | 282,690 | |

Memphis Shelby Cnty. Arpt. Auth. Rev., Rfdg., Series B, AMT | | A3 | | 5.750 | | | 07/01/25 | | | | 1,000 | | | | 1,067,960 | |

Tennessee Energy Acquisition Corp. Gas Rev.,

Series C | | Baa3 | | 5.000 | | | 02/01/18 | | | | 2,000 | | | | 2,147,920 | |

Series C | | Baa3 | | 5.000 | | | 02/01/22 | | | | 1,000 | | | | 1,041,900 | |

Series C | | Baa3 | | 5.000 | | | 02/01/25 | | | | 1,000 | | | | 1,008,650 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 5,549,120 | |

| | | | | |

Texas 9.2% | | | | | | | | | | | | | | | | |

Austin Elec. Util. Sys. Rev., Rfdg., Series A, AMBAC | | A1 | | 5.000 | | | 11/15/22 | | | | 4,610 | | | | 5,064,454 | |

Austin Tex. Wtr. & Wstewtr. Sys. Rev., Austin Wtr. & Swr., Series A | | Aa2 | | 5.125 | | | 11/15/29 | | | | 2,000 | | | | 2,121,880 | |

Brazos River Auth. Poll. Ctl. Rev.,

TXU Energy Co. LLC Proj., Series D (Mandatory Put Date 10/01/14) | | C | | 5.400(e) | | | 10/01/29 | | | | 1,000 | | | | 129,940 | |

TXU Rmkt., AMT | | NR | | 5.400 | | | 05/01/29 | | | | 1,500 | | | | 82,500 | |

Central Tex. Regl. Mobility Auth. Rev.,

Rfdg., Sr. Lien, Series A | | Baa2 | | 5.000 | | | 01/01/43 | | | | 500 | | | | 425,265 | |

Sr. Lien | | Baa2 | | 6.000 | | | 01/01/41 | | | | 1,000 | | | | 985,370 | |

See Notes to Financial Statements.

| | | | |

| Prudential National Muni Fund, Inc. | | | 31 | |

Portfolio of Investments

as of August 31, 2013 continued

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |

Texas (cont’d.) | | | | | | | | | | | | | | | | |

Dallas-Fort Worth Int’l. Arpt. Rev.,

Series A., AMT | | A2 | | 5.000 % | | | 11/01/45 | | | | 2,500 | | | $ | 2,236,400 | |

Series E, AMT, Rfdg. | | A2 | | 5.000 | | | 11/01/35 | | | | 7,000 | | | | 6,453,230 | |

Grand Parkway Trans. Corp., 1st Tier Toll Rev., Series A | | BBB(a) | | 5.125 | | | 10/01/43 | | | | 2,000 | | | | 1,843,400 | |

Harris Cnty. Cultural Ed. Facs. Fin. Corp. Rev, Children’s Hosp. Proj. | | Aa2 | | 5.500 | | | 10/01/39 | | | | 1,500 | | | | 1,592,685 | |

Harris Cnty. Indl. Dev. Corp., Solid Wste. Disp. Rev., Deer Park Fin. Proj., LP | | A2 | | 5.000 | | | 02/01/23 | | | | 750 | | | | 786,000 | |

Harris Cnty. Metro. Trans. Auth. Rev., Series A | | Aa2 | | 5.000 | | | 11/01/36 | | | | 3,000 | | | | 3,039,960 | |

Houston Arpt. Sys. Rev.,

Sr. Lien, Series A, Rfdg. | | Aa3 | | 5.500 | | | 07/01/39 | | | | 1,000 | | | | 1,064,470 | |

Sub. Lien, Series A, AMT, Rfdg. | | A(a) | | 5.000 | | | 07/01/25 | | | | 575 | | | | 596,861 | |

Sub. Lien, Series A, AMT, Rfdg. | | A(a) | | 5.000 | | | 07/01/32 | | | | 1,000 | | | | 937,270 | |

Sub. Lien, Series B, AMT, Rfdg. | | A(a) | | 5.000 | | | 07/01/32 | | | | 2,000 | | | | 1,975,840 | |

Houston Util. Sys. Rev., Rfdg., Comb., 1st Lien, Series A, AGC | | Aa2 | | 5.250 | | | 11/15/33 | | | | 1,510 | | | | 1,591,208 | |

Lower Colo. Riv. Auth. Tex. Rev.,

Rfdg., BHAC | | Aa1 | | 5.250 | | | 05/15/28 | | | | 2,000 | | | | 2,159,960 | |

Rfdg. (Pre-refunded Date 05/15/15)(d) | | A1 | | 5.750 | | | 05/15/28 | | | | 2,680 | | | | 2,923,987 | |

Rfdg. (Pre-refunded Date 05/15/15)(d) | | NR | | 5.750 | | | 05/15/28 | | | | 235 | | | | 255,548 | |

Unrefunded, Rfdg. | | A1 | | 5.750 | | | 05/15/28 | | | | 290 | | | | 305,796 | |

North Tex. Twy. Auth. Rev., First Tier, Rfdg. | | A2 | | 6.000 | | | 01/01/38 | | | | 1,000 | | | | 1,046,330 | |

First Tier, Rfdg., Series A | | A2 | | 5.750 | | | 01/01/40 | | | | 1,500 | | | | 1,568,865 | |

First Tier, Series A | | A2 | | 6.250 | | | 01/01/39 | | | | 1,500 | | | | 1,605,210 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Moody’s

Ratings†

(Unaudited) | | Interest

Rate | | Maturity

Date | | | Principal

Amount (000)# | | | Value (Note 1) | |

LONG-TERM INVESTMENTS (Continued) | |

| | | | | |