- ECL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ecolab (ECL) DEF 14ADefinitive proxy

Filed: 20 Mar 20, 12:19pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| ||

Filed by a Party other than the Registrant ☐ | ||

| ||

Check the appropriate box: | ||

|

| |

☐ | Preliminary Proxy Statement | |

|

| |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

|

| |

☒ | Definitive Proxy Statement | |

|

| |

☐ | Definitive Additional Materials | |

|

| |

☐ | Soliciting Material under §240.14a-12 | |

|

| |

ECOLAB INC. | ||

| ||

(Name of Registrant as Specified In Its Charter) | ||

| ||

| ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| ||

Payment of Filing Fee (Check the appropriate box): | ||

| ||

☒ No fee required. | ||

| ||

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| ||

(1) | Title of each class of securities to which transaction applies: | |

|

| |

(2) | Aggregate number of securities to which transaction applies: | |

|

| |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

| |

(4) | Proposed maximum aggregate value of transaction: | |

|

| |

(5) | Total fee paid: | |

|

| |

|

| |

☐ Fee paid previously with preliminary materials. | ||

|

| |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

|

| |

(1) | Amount Previously Paid: | |

|

| |

(2) | Form, Schedule or Registration Statement No.: | |

|

| |

(3) | Filing Party: | |

|

| |

(4) | Date Filed: | |

|

| |

Notice of 2020 Annual Meeting and

Proxy Statement

Annual Meeting to be Held on May 7, 2020

March 23, 2020

DEAR FELLOW STOCKHOLDER:

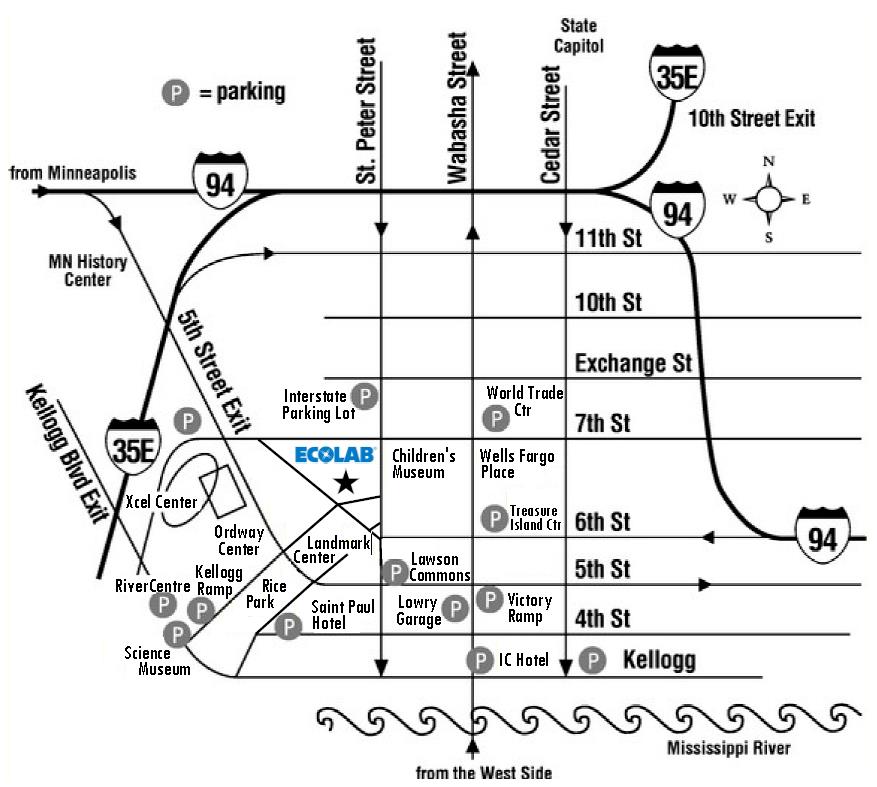

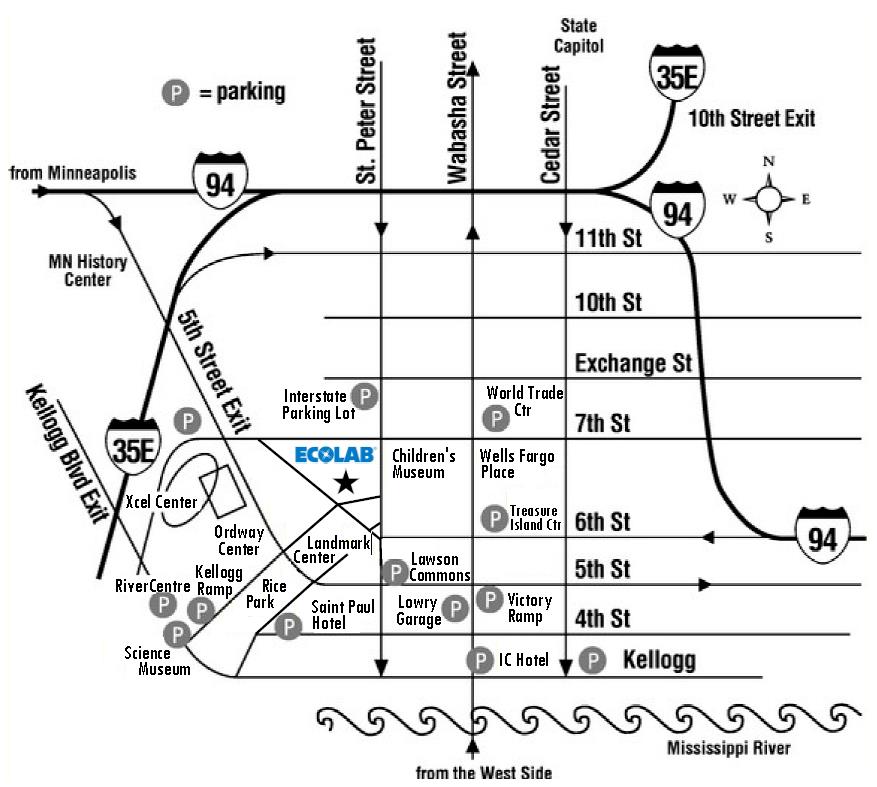

You are cordially invited to join us for our Annual Meeting of Stockholders, to be held at 9:30 a.m. on Thursday, May 7, 2020, at the Ecolab Global Headquarters, 1 Ecolab Place, Saint Paul, Minnesota 55102. The Notice of Annual Meeting and the Proxy Statement that follow describe the business to be conducted at our Annual Meeting. We urge you to read both carefully.

We hope you plan to attend our Annual Meeting. However, if you will not be able to join us, we encourage you to exercise your right as a stockholder and vote. Please sign, date and promptly return the accompanying proxy card, or make use of either our telephone or Internet voting services. Stockholders not in attendance may listen to a broadcast of the meeting on the Internet. Webcast instructions will be available on-line at www.investor.ecolab.com.

As a company whose business proposition is founded on providing customers best-in-class results while reducing water and energy use, advancing sustainable outcomes for our customers and within our own operations is key to our success. To ensure our ability to solve the most pressing customer and societal challenges, we strive to have a talented and diverse associate base with the ideas and know-how to help us reach our goals. In addition to our governance principles discussed in this proxy, we encourage shareholders to access our website at www.ecolab.com and review our annual report, sustainability report and GRI report to learn more about our work to deliver the right results, the right way for the long-term benefit of our customers and shareholders.

| Sincerely, |

|

|

| Douglas M. Baker, Jr. |

| Chairman of the Board |

YOUR VOTE IS IMPORTANT!

PLEASE SUBMIT YOUR PROXY TODAY.

Your vote is a valuable part of the investment made in our Company and is the best way to influence corporate governance and decision-making. Please take time to read the enclosed materials and vote!

Whether or not you plan to attend the meeting, please complete the accompanying proxy and return it in the enclosed envelope. Alternatively, you may vote by telephone or the Internet. If you attend the meeting, you may vote your shares in person even though you have previously returned your proxy by mail, telephone or the Internet.

PLEASE REFER TO THE ACCOMPANYING MATERIALS FOR VOTING INSTRUCTIONS.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Ecolab Inc.:

The Annual Meeting of Stockholders of Ecolab Inc. will be held on Thursday, May 7, 2020, at 9:30 a.m., at the Ecolab Global Headquarters, 1 Ecolab Place, Saint Paul, Minnesota 55102, for the following purposes (which are more fully explained in the Proxy Statement):

1. | To elect as directors to a one-year term ending in 2021 the 12 nominees named in the Proxy Statement; |

2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the current year ending December 31, 2020; |

3. | To approve, on an advisory basis, the compensation of executives disclosed in the Proxy Statement; |

4. | To consider and vote on a stockholder proposal regarding proxy access, if properly presented; and |

5. | To transact such other business as may properly come before our Annual Meeting and any adjournment or postponement thereof. |

Our Board of Directors has fixed the close of business on March 9, 2020 as the record date for the determination of stockholders entitled to notice of, and to vote at, the meeting.

Important NOTE: | |

We intend to hold our annual meeting in person. However, we are actively monitoring the coronavirus (COVID-19). We are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state and local governments may impose. If it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. Please monitor our Events & Presentations webpage of our website at www.investor.ecolab.com/events-and-presentations for updated information. If you are planning to attend our meeting, please check the website one week before the meeting date. As always, we encourage you to vote your shares before the annual meeting. | |

| |

| By Order of the Board of Directors, |

|

|

| Michael C. McCormick |

| Executive Vice President, General Counsel |

| March 23, 2020 |

TABLE OF CONTENTS

1 |

| 28 | ||

3 |

| 28 | ||

8 |

| 33 | ||

8 |

| 34 | ||

8 |

| 35 | ||

8 |

| 35 | ||

9 |

| 37 | ||

11 |

| 37 | ||

12 |

| 38 | ||

Future Stockholder Proposals and Director Nomination Process | 12 |

| 42 | |

15 |

| 43 | ||

15 |

| 43 | ||

15 |

| 44 | ||

16 |

| 44 | ||

16 |

| 44 | ||

16 |

| 45 | ||

17 |

| 46 | ||

18 |

| 48 | ||

18 |

| 49 | ||

19 |

| 50 | ||

19 |

| 51 | ||

19 |

| 54 | ||

20 |

| 56 | ||

21 |

| 61 | ||

21 |

| 62 | ||

22 |

| 64 | ||

23 |

| 65 | ||

PROPOSAL 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 24 |

| 65 | |

25 |

| 66 | ||

26 |

| Important Notice Regarding the Availability of Proxy Materials | 67 | |

PROPOSAL 3 ADVISORY VOTE TO APPROVE THE COMPENSATION OF EXECUTIVES DISCLOSED IN THE PROXY STATEMENT | 27 |

| 67 | |

28 |

| 67 |

PROXY STATEMENT

This proxy summary is intended to provide a broad overview of the items that you will find elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and we encourage you to read the entire Proxy Statement carefully before voting. We are first mailing this Proxy Statement and accompanying form of proxy to our stockholders on or about March 23, 2020.

References made below to “Ecolab,” “the Company,” “we,” “our,” or “us” are to Ecolab Inc.

Annual Meeting of Stockholders

Date and Time: Thursday, May 7, 2020, at 9:30 a.m.

Location: Ecolab Global Headquarters, 1 Ecolab Place, Saint Paul, Minnesota 55102

Record Date: March 9, 2020

Meeting Agenda and Items of Business

|

| |||||

|

| |||||

Proposal | Board’s Voting |

| Page | |||

1. | Elect as directors to a one-year term ending in 2021 the 12 nominees named in this Proxy Statement | FOR |

| 3 | ||

2. | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the current year ending December 31, 2020 | FOR |

| 24 | ||

3. | Approve, on an advisory basis, the compensation of executives disclosed in the Proxy Statement | FOR |

| 27 | ||

4. | Consider and vote on a stockholder proposal regarding proxy access, if properly presented | AGAINST |

| 62 | ||

|

|

|

|

|

|

|

|

| |

Name of Director Nominee |

| Age |

| Years of Service |

| Occupation | |||

Non-Independent Directors |

|

|

|

|

|

| |||

Douglas M. Baker, Jr. |

| 61 |

| 16 |

| Chairman of the Board and Chief Executive Officer, Ecolab Inc. | |||

Independent Directors |

|

|

|

|

|

| |||

Shari L. Ballard |

| 53 |

| 1 |

| Former Senior Executive Vice President and President, Multi-Channel Retail, Best Buy Co., Inc. | |||

Barbara J. Beck |

| 59 |

| 12 |

| Executive Advisor to American Securities LLC | |||

Jeffrey M. Ettinger |

| 61 |

| 5 |

| Retired Chairman and Chief Executive Officer, Hormel Foods Corporation | |||

Arthur J. Higgins |

| 64 |

| 10 |

| President and Chief Executive Officer, Assertio Therapeutics, Inc.(1) | |||

Michael Larson |

| 60 |

| 8 |

| Chief investment officer to William H. Gates III | |||

David W. MacLennan |

| 60 |

| 5 |

| Chairman and Chief Executive Officer, Cargill, Incorporated | |||

Tracy B. McKibben |

| 50 |

| 5 |

| Founder and Chief Executive Officer, MAC Energy Advisors LLC | |||

Lionel L. Nowell, III |

| 65 |

| 1 |

| Former Senior Vice President and Treasurer, PepsiCo, Inc. | |||

Victoria J. Reich |

| 62 |

| 10 |

| Former Senior Vice President and Chief Financial Officer, Essendant Inc. | |||

Suzanne M. Vautrinot |

| 60 |

| 6 |

| President, Kilovolt Consulting Inc. | |||

John J. Zillmer |

| 64 |

| 14 |

| Chief Executive Officer, Aramark | |||

(1) | On March 16, 2020, Assertio Therapeutics announced the acquisition of Zyla Life Sciences, upon the closing of which Mr. Higgins plans to step down as President and Chief Executive Officer and become the non-executive Chairman of the combined company. The acquisition is expected to close in the second quarter of 2020. Accordingly, upon closing, Mr. Higgins will no longer serve as an executive officer of a public company. |

The Board of Directors of Ecolab Inc. is asking you to elect 12 director nominees. The table above provides summary information about the director nominees. A nominee will only be elected if the number of votes cast for the nominee’s election is greater than the number of votes cast against the nominee. For more information, see page 3.

|

|

ECOLAB - 2020 Proxy Statement | 1 |

|

|

Ratification of Independent Accountants

The Board of Directors is asking you to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm to audit our consolidated financial statements for the year ending December 31, 2020. For more information, see page 24.

Advisory Vote to Approve Executive Compensation

The Board of Directors is asking you to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement. For more information, see page 27.

Stockholder Proposal Regarding Proxy Access

The Board of Directors recommends that you vote AGAINST a stockholder proposal regarding proxy access, if properly presented. For more information, see page 62.

Summary of Compensation Practices

How did we perform? |

| ✔ New product introductions, new business wins and improved operating efficiency drove growth in sales, earnings and free cash flows |

| ✔ Increased pricing was achieved and more than offset recent delivered product cost increases | |

| ✔ Other accomplishments include completing major North American ERP implementation, separating Upstream Energy business (ChampionX) to facilitate a merger with Apergy Corporation, expanding sustainability commitments and performance, and continuing growth in digital platforms | |

|

|

|

What did we change for 2019? |

| ✔ More than 91% of shareholders voted in favor of our Say-on-Pay; the Compensation Committee took this favorable support into account in deciding to retain the overall structure of the current program |

| ✔ Amended compensation recovery policy to, among other matters, expand the nature of misconduct addressed by the policy and add a financial restatement recovery provision | |

|

|

|

How do we determine pay? |

| ✔ Our executive compensation program is designed to be market-competitive in order to attract, motivate and retain our executives in a manner that is in the best interests of our stockholders |

| ✔ Our executive compensation program is further designed to reinforce and complement ethical and sustainable management practices, promote sound risk management and align management interests (such as sustainable long-term growth) with those of our stockholders | |

| ✔ Our philosophy is to position base salary, annual cash incentives, and long-term equity incentives in the median range of our competitive market, adjusted for the Company’s size | |

|

|

|

How did we pay our NEOs? |

| ✔ Fiscal year 2019 base salaries and annual incentives for the NEOs relative to the 19-company Comparison Group aligned with relative Company performance |

| ✔ Base salaries for fiscal year 2019 were increased between 3.0% and 5.3%, excluding promotions, and reflect each NEO's competitive market, scope of responsibility, individual performance, and time in position | |

| ✔ 2019 annual cash incentive payout for the CEO was 116% of target, and ranged from 86% to 124% of target for the other NEOs based on achievement of Company and business unit performance | |

| ✔ 2017 to 2019 performance-based restricted stock units ("PBRSUs") paid out at 100% of target (maximum payout) based on achievement of Company performance | |

| ✔ Long-term equity incentives granted at target levels using a portfolio of stock options and PBRSUs | |

| ✔ PBRSUs vest based on average annual adjusted ROIC goals over a three-year performance period | |

| ✔ No excessive perquisites for any of our NEOs |

For more information on our compensation practices, see page 31.

Corporate Governance Highlights

How do we address risk and governance? |

| ✔ Provide an appropriate balance of short- and long-term compensation, with payouts based on the Company's achievement of certain financial metrics and specific business area objectives |

| ✔ Follow practices that promote good governance and serve the interests of our stockholders, with maximum payout caps for annual cash incentives and long-term performance awards, and policies on clawbacks, anti-pledging, anti-hedging, insider trading, and stock ownership | |

| ✔ Solicit "say-on-pay" shareholder vote annually at shareholder meeting |

For more information on our corporate governance, see page 8.

|

|

|

|

2 | ECOLAB - 2020 Proxy Statement |

|

|

PROPOSAL 1: ELECTION OF DIRECTORS

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors currently consists of 13 members. Mr. Biller will be retiring from the Board as of the 2020 Annual Meeting. Accordingly, the Board has taken action to reduce the size of the Board to 12 members effective immediately prior to the time of the 2020 Annual Meeting. The 12 nominees, if elected, will serve a one-year term ending as of the 2021 Annual Meeting expected to be held on May 6, 2021.

Pursuant to the recommendation of the Governance Committee, Mses. Ballard, Beck, McKibben, Reich and Vautrinot and Messrs. Baker, Ettinger, Higgins, Larson, MacLennan, Nowell and Zillmer were nominated for election as Directors. The Board of Directors has no reason to believe that any of the named nominees is not available or will not serve if elected.

Board of Directors’ Recommendation – The Board of Directors recommends a vote FOR the election of the 12 nominees named in this Proxy Statement. Unless a contrary choice is specified, proxies solicited by our Board of Directors will be voted FOR each of the nominees named in this Proxy Statement.

The following information with regard to business experience, qualifications and directorships has been furnished by the respective director nominees or obtained from our records.

Nominees for Election to the Board of Directors (Term Ending in May 2021)

DOUGLAS M. BAKER, JR. | |||

|

|

|

|

| Years of Service: 16 Board Committees: Safety, Health and Environment |

| Officer in July 2004, and added the position of Chairman of the Board in May 2006. Mr. Baker relinquished the office of President in December 2011 upon completion of the Nalco merger. Prior to joining Ecolab in 1989, Mr. Baker was employed by The Procter & Gamble Company in various marketing and management positions. Qualifications Mr. Baker has more than 25 years of Ecolab marketing, sales and general management experience, including leadership roles in Ecolab’s Institutional, Europe and Kay businesses before becoming Ecolab’s Chief Operating Officer in 2002 and Chief Executive Officer in 2004. He has deep and direct knowledge of Ecolab’s businesses and operations. In addition, his experience at The Procter & Gamble Company included various marketing and management positions, including in the institutional market in which Ecolab operates. As a director of other public companies, Mr. Baker also has extensive corporate governance experience. Other directorships held during the past five years Lead Director of Target Corporation. Formerly a director of U.S. Bancorp. |

Biography Chairman of the Board and Chief Executive Officer of Ecolab. Director of Ecolab since 2004. Member of the Safety, Health and Environment Committee. Since joining Ecolab in 1989, Mr. Baker has held various leadership positions within our Institutional, Europe and Kay operations. Mr. Baker was named Ecolab’s President and Chief Operating Officer in August 2002, was promoted to President and Chief Executive | |||

|

|

|

|

| Years of Service: 1 Board Committees: Audit |

| Buy stores, e-commerce, customer call centers, Best Buy Mexico and real estate strategy. Ms. Ballard also held roles as President, U.S. Retail from 2014 to 2017; Chief Human Resources Officer from 2013-2016; President – International from 2012 to 2014, with responsibility for business in Canada, China, Europe and Mexico; and President – Americas from 2010 to 2012, with responsibility for business in the U.S. and Mexico. Qualifications Ms. Ballard is a seasoned executive with deep retail experience. She brings significant business group management and e-commerce experience, as well as extensive talent management experience for large scale, geographically distributed organizations. In addition to her corporate functional experience in human resources, call centers and real estate, she has held several international roles, which included responsibility for transformation efforts in Canada, China, Europe and Mexico. Her roles at Best Buy have also given her extensive background and practical skills in change management during a remarkable turnaround period at Best Buy. Other directorships held during the past five years Formerly a director of Delhaize Group, a Belgium-based food retailer, from 2012 until its 2015 merger with Ahold to form Ahold Delhaize. |

Biography Former Senior Executive Vice President and President, Multi-Channel Retail of Best Buy Co., Inc., a consumer electronics products and services retailer. Director of Ecolab since 2018. Member of the Audit and Safety, Health and Environment Committees. Ms. Ballard retired from Best Buy in March 2019. During her 25-year career at Best Buy, Ms. Ballard last served as an Advisor at Best Buy Co., Inc. after transitioning from her position as Senior Executive Vice President and President, Multi-Channel Retail, a position that she held from March 2017 to July 2018, with responsibility for all U.S. Best | |||

|

|

ECOLAB - 2020 Proxy Statement | 3 |

|

|

PROPOSAL 1: ELECTION OF DIRECTORS

BARBARA J. BECK | |||

|

|

|

|

| Years of Service: 12 Board Committees: Governance

|

| Prior to joining Learning Care Group, Ms. Beck spent nine years as an executive of Manpower Inc., a world leader in the employment services industry. From 2006 to 2011, Ms. Beck was President of Manpower’s EMEA operations, overseeing Europe (excluding France), the Middle East and Africa. She previously served as Executive Vice President of Manpower’s U.S. and Canada business unit from 2002 to 2005. Prior to joining Manpower, Ms. Beck was an executive of Sprint, a global communications company, serving in various operating and leadership roles for 15 years. Qualifications Ms. Beck has extensive general management and operational experience, including as a tenured CEO, allowing her to contribute to Ecolab’s strategic vision particularly as it relates to value creation strategies. With her Manpower knowledge of the impact of labor market trends on global and local economies combined with her knowledge of employment services, which tend to be leading economic indicators, she provides timely insight into near-term projections of general economic activity. As an executive at Sprint, Ms. Beck gained expertise in the information technology field, relevant to Ecolab’s emerging technology strategies. Other directorships held during the past five years Director of Performance Food Group Company. Formerly a director of Learning Care Group, Inc. |

Biography Executive Advisor to American Securities, LLC, a leading U.S. private equity firm, as a member of the American Securities Executive Council. Director of Ecolab since 2008. Chair of the Safety, Health and Environment Committee and member of the Governance Committee. Ms. Beck currently is an Executive Advisor to American Securities, LLC, after recently retiring from her position as Chief Executive Officer of Learning Care Group, Inc., a global for-profit early education provider, which she held from March 2011 to June 2019. Learning Care Group is a portfolio company of American Securities, LLC. | |||

|

|

|

|

| Years of Service: 5 Lead Director Board Committees: Compensation |

| During his 28-year career at Hormel, Mr. Ettinger held the offices of Chairman from 2006 to 2017, Chief Executive Officer from 2006 to 2016 and President from 2004 to 2015. Prior to being named President of Hormel Foods, Mr. Ettinger served as President of Jennie-O Turkey Store, the largest subsidiary of Hormel Foods, and in various other positions including Treasurer, Product Manager for Hormel® chili products, and corporate and senior attorney. Qualifications With more than 25 years of experience with Hormel Foods, a public food products company with global operations, Mr. Ettinger brings directly relevant operational experience in one of Ecolab’s major end-markets. From his experience as Chairman and Chief Executive Officer of a Fortune 500 public company with global operations, Mr. Ettinger possesses executive leadership attributes and provides relevant insight and guidance with respect to numerous issues important to Ecolab, including public company governance, mergers and acquisitions and regulatory matters. Other directorships held during the past five years Director of The Toro Company. Formerly a director of Hormel Foods Corporation. |

Biography Retired Chairman of the Board and Chief Executive Officer of Hormel Foods Corporation, a processor and marketer of meat and food products. Director of Ecolab since 2015. Lead Director, Chair of the Governance Committee and member of the Compensation Committee.

| |||

ARTHUR J. HIGGINS | |||

|

|

|

|

| Years of Service: 10 Board Committees: Compensation |

| Qualifications Mr. Higgins has extensive leadership experience in the global healthcare market. Through leadership positions with large healthcare developers and manufacturers in both the United States and Europe, Mr. Higgins has gained deep knowledge of the healthcare market and the strategies for developing and marketing products in this highly regulated area. This knowledge and industry background allows him to provide valuable insight to Ecolab’s growing Healthcare business, which is developing in both the U.S. and Europe. In addition, his global perspective from years of operating global businesses and his background in working with high growth companies fits well with Ecolab’s ambitions for global growth and provide him experiences from which to draw to advise Ecolab on strategies for sustainable growth. In his role as Chief Executive Officer of Bayer HealthCare, he gained significant exposure to enterprise risk management as well as quality and operating risk management necessary in a highly regulated industry such as healthcare. Other directorships held during the past five years Director of Assertio Therapeutics, Inc. and Zimmer Biomet Holdings, Inc. Formerly a director of Endo International plc. (1)On March 16, 2020 Assertio Therapeutics announced the acquisition of Zyla Life Sciences, upon the closing of which Mr. Higgins plans to step down as President and Chief Executive Officer and become the non-executive Chairman of the combined company. The acquisition is expected to close in the second quarter of 2020. Accordingly, upon closing, Mr. Higgins will no longer serve as an executive officer of a public company. |

Biography President and Chief Executive Officer and member of the Board of Directors of Assertio Therapeutics, Inc.(1), a specialty pharmaceutical company. Director of Ecolab since 2010. Member of the Compensation and Safety, Health and Environment Committees. Prior to joining Assertio Therapeutics in March 2017, Mr. Higgins served as Senior Advisor to Blackstone Healthcare Partners from May 2010 to March 2017; served at Bayer HealthCare AG as Chairman of the Board of Management from January 2006 to May 2010 and as Chairman of the Executive Committee from July 2004 to May 2010; served as Chairman, President and Chief Executive Officer at Enzon Pharmaceuticals, Inc. from 2001 until 2004; and held several executive leadership positions at Abbott Laboratories from 1998 to 2001. He is a past member of the Board of Directors of the Pharmaceutical Research and Manufacturers of America (PHRMA), of the Council of the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA) and President of the European Federation of Pharmaceutical Industries and Associations (EFPIA). | |||

|

|

|

|

4 | ECOLAB - 2020 Proxy Statement |

|

|

PROPOSAL 1: ELECTION OF DIRECTORS

MICHAEL LARSON | |||

|

|

|

|

| Years of Service: 8 Board Committees: Finance

|

| investments as well as the investment assets of the Bill & Melinda Gates Foundation Trust. Previously, Mr. Larson was at Harris Investment Management, Putnam Management Company and ARCO. Qualifications With more than 30 years of portfolio management experience, Mr. Larson has deep investment expertise and broad understanding of the capital markets, business cycles and capital efficiency and allocation practices. He also has served on several other public company boards providing him relevant corporate governance experience. In addition, as a professional investor and as the investment officer of Ecolab’s largest shareholder, Mr. Larson brings a long-term shareholder perspective to the Board. Other directorships held during the past five years Director of Republic Services, Inc. and Fomento Economico Mexicano, S.A.B. de C.V. In addition, he is Chairman of the Board of Trustees of two funds in the Western Asset Management fund complex. Formerly a director of AutoNation, Inc. |

Biography Chief investment officer to William H. Gates III. Director of Ecolab since 2012. Member of the Finance and Safety, Health and Environment Committees. Mr. Larson has been chief investment officer for Mr. Gates and the Business Manager of Cascade Investment, L.L.C. since 1994. He is responsible for Mr. Gates’ non-Microsoft | |||

|

|

|

|

| Years of Service: 5 Board Committees: Audit

|

| Mr. MacLennan has served as Chairman of the Board of Cargill since 2015 and as Chief Executive Officer since 2013. He held the offices of Chief Operating Officer and President from 2011 until his appointment as Chief Executive Officer in 2013. Prior to these roles, Mr. MacLennan held several other positions with Cargill, including Chief Financial Officer, President of Cargill Energy and Managing Director of the Value Investment Group. He has also held various management positions with US Bancorp Piper Jaffray and Goldberg Securities. Qualifications With more than 25 years of leadership experience at Cargill, Mr. MacLennan has developed significant leadership and strategic planning skills, as well as extensive knowledge and insight in corporate governance, risk management, financial management and global business practices. Other directorships held during the past five years Director of Cargill, Incorporated. Formerly a director of C.H. Robinson Worldwide, Inc. |

Biography Chairman and Chief Executive Officer of Cargill, Incorporated, a privately held company and world-leading producer and marketer of food, agricultural, financial, and industrial products and services. Director of Ecolab since 2015. Member of the Audit and Governance Committees.

| |||

TRACY B. MCKIBBEN | |||

|

|

|

|

| Years of Service: 5 Board Committees: Audit |

| to August 2007 as Director of European Economic Affairs and EU Relations and as Acting Senior Director for European Affairs. Before joining the National Security Council, she served in various senior advisory roles in the U.S. Department of Commerce from March 2001 to July 2003. Qualifications Ms. McKibben has more than 15 years of experience in the energy sector, with a focus on alternative energy, water and infrastructure. In this role and in her prior role at Citigroup, Ms. McKibben developed considerable strategic and financial experience advising energy companies and multinational corporations on strategic investments, M&A, and energy policy. In addition to her experience in the energy and financial sectors, Ms. McKibben has gained extensive public sector and international experience working at the U.S. Department of Commerce and within the National Security Council at The White House where she advised the President of the United States, Cabinet Secretaries and other senior officials on political, security, commercial and international trade issues. Other directorships held during the past five years Director of Huntington Ingalls Industries, Inc. Formerly a director of GlassBridge Enterprises, Inc. and ROI Acquisition Corp. II. |

Biography Founder and Chief Executive Officer of MAC Energy Advisors LLC, an investment consulting company that provides integrated and innovative energy solutions to help clients utilize capital strategically around the globe. Director of Ecolab since 2015. Member of the Audit and Finance Committees. Ms. McKibben has been the head of MAC Energy Advisors since its founding in 2010. From September 2007 to August 2009, she served as Managing Director and Head of Environmental Banking Strategy at Citigroup Global Markets. Prior to joining Citigroup, Ms. McKibben served in the National Security Council at the White House from July 2003 | |||

|

|

ECOLAB - 2020 Proxy Statement | 5 |

|

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

|

|

|

| Years of Service: 1 Board Committees: Audit

|

| Financial Officer of The Pepsi Bottling Group and Controller of PepsiCo, Inc. Prior to PepsiCo, he served as Senior Vice President, Strategy and Business Development at RJR Nabisco, Inc. and held various senior financial roles at the Pillsbury division of Diageo plc, including Chief Financial Officer of its Pillsbury North America, Pillsbury Foodservice and Häagen-Dazs divisions. Qualifications Mr. Nowell is a highly experienced board member, with extensive financial expertise and understanding of various regulatory environments through his service on the boards of several multinational corporations. With his more than 30 years of operational and financial management experience in the consumer products industry, including his service as the senior vice president and treasurer of a multi-national food and beverage company, Mr. Nowell brings to the Board strong leadership skills and extensive knowledge in the areas of strategy development and execution, corporate finance, credit and treasury, financial analysis and reporting, accounting and controls, capital markets, acquisition/divestiture negotiations, international business ventures, strategic planning and risk management. Other directorships held during the past five years Director of American Electric Power Company (retiring April 2020), Bank of America Corporation and Textron Inc. Formerly a director of British American Tobacco plc, Darden Restaurants, Inc., HD Supply Holdings, Inc. and Reynolds American Inc. |

Biography Former Senior Vice President and Treasurer of PepsiCo, Inc., a food and beverage company. Director of Ecolab since 2018. Member of the Audit and Finance Committees. Mr. Nowell currently serves on the board of American Electric Power Company since July 2004, where he is a member of the Committee on Directors & Corporate Governance, the Executive Committee, the Finance Committee and the Policy Committee; Bank of America Corporation since January 2013, as a member of the Audit and Corporate Governance Committees; and Textron Inc. since January 2020, where he is a member of the Audit and Nominating & Corporate Governance Committees. Mr. Nowell retired in 2009 as Senior Vice President and Treasurer of PepsiCo, Inc. He was also formerly Chief | |||

VICTORIA J. REICH | |||

|

|

|

|

| Years of Service: 10 Board Committees: Audit |

| Brunswick Corporation, last serving as President - Brunswick European Group, and previously as Senior Vice President and Chief Financial Officer. Before joining Brunswick, Ms. Reich was employed for 17 years at General Electric Company in various financial management positions. Qualifications As a former Chief Financial Officer of a public company, Ms. Reich possesses relevant financial leadership experience with respect to all financial management disciplines relevant to Ecolab, including public reporting, strategic planning, treasury, IT and financial analysis. Her financial management background at Essendant, Brunswick and General Electric, combined with her experience in European general management at Brunswick, enables her to provide strategic input as well as financial discipline. Essendant operates a cleaning supplies distribution business which provided Ms. Reich familiarity with the institutional market, one of our largest end-markets. Other directorships held during the past five years Director of H&R Block, Inc. and Ingredion Incorporated.

|

Biography Former Senior Vice President and Chief Financial Officer of Essendant Inc. (formerly United Stationers Inc.), a broad line wholesale distributor of business products. Director of Ecolab since 2009. Chair of the Audit Committee and member of the Governance Committee. From 2007 to 2011 Ms. Reich was Senior Vice President and Chief Financial Officer of Essendant. Prior to joining Essendant, Ms. Reich spent ten years as an executive with | |||

|

|

|

|

6 | ECOLAB - 2020 Proxy Statement |

|

|

PROPOSAL 1: ELECTION OF DIRECTORS

SUZANNE M. VAUTRINOT | |||

|

|

|

|

| Years of Service: 6 Board Committees: Compensation

|

| operations. Prior to that, General Vautrinot was the Director of Plans and Policy, U.S. Cyber Command and the Special Assistant to the Vice Chief of Staff of the U.S. Air Force. On multiple occasions, she was selected by military leaders and White House officials to spearhead high-profile engagements. General Vautrinot is the recipient of the Symantec Cyber Award, Women in Aerospace Leadership Award, Aerospace Citation of Honor and the Presidential Award for Training. During her career, she has also been awarded numerous medals and commendations, including the Distinguished Service Medal. She was inducted into the National Academy of Engineering in 2017. Qualifications General Vautrinot brings a unique perspective to the Board with her 31-year military career. Having led large and complex organizations, she provides insights into the challenges facing large global organizations. As an expert in cyber security, she can advise Ecolab on appropriate protections for its networks. In addition, General Vautrinot has significant experience in strategic planning, organizational design and change management, which allows her to provide advice and insight to Ecolab as its business grows and develops. Other directorships held during the past five years Director of CSX Corporation, Parsons Corporation and Wells Fargo & Company. Formerly a director of NortonLifeLock Inc. (formerly Symantec Corporation).

|

Biography President of Kilovolt Consulting, Inc., a cyber security strategy and technology consulting firm. Retired Major General of the U.S. Air Force. Director of Ecolab since 2014. Member of the Compensation and Finance Committees. General Vautrinot retired from the Air Force in 2013. During her 31-year career in the Air Force, she served in various assignments, including cyber operations, plans and policy, strategic security and space operations. General Vautrinot commanded at the squadron, group, wing and numbered Air Force levels, as well as the Air Force Recruiting Service. She has served on the Joint Staff, the staffs at major command headquarters and Air Force headquarters. From 2011 to 2013, she was Commander, 24th Air Force and Commander, Air Forces Cyber, where she was responsible for cyber defense | |||

JOHN J. ZILLMER | |||

|

|

|

|

| Years of Service: 14 Board Committees: Compensation

|

| management business, from 2005 until the merger of Allied Waste with Republic Services, Inc. in December 2008. During his earlier career at Aramark from 1986 until 2005, Mr. Zillmer held various senior executive positions, ultimately becoming President of Global Food and Support Services. Qualifications As the Chief Executive Officer of Aramark and previously of Univar and of Allied Waste, Mr. Zillmer has experience leading both public and large private companies. His experience leading various Aramark operations has given him deep knowledge of the institutional market, particularly the contract catering segment, which is a large market for Ecolab. With Univar, he became intimately familiar with the chemical market, including with respect to chemicals that Ecolab uses to manufacture its products. He also has extensive knowledge of the environmental aspects of chemicals manufacturing and distribution. His roles on the boards of CSX, Veritiv, Performance Food Group, Reynolds American, Univar and Allied Waste have provided him with significant public company board experience. Other directorships held during the past five years Director of Aramark, CSX Corporation and Veritiv Corporation (retiring April 2020). Formerly a director of Performance Food Group Company and Reynolds American Inc.

|

Biography Chief Executive Officer and Director of Aramark, a global provider of food, facilities management and uniform services. Director of Ecolab since 2006. Chair of the Compensation Committee and member of the Governance Committee. Mr. Zillmer returned to Aramark in October 2019 as Chief Executive Officer and Director. Prior to joining Aramark, Mr. Zillmer served as President and Chief Executive Officer of Univar, Inc., a global distributor of industrial chemicals, from 2009 to 2012 and became Executive Chairman until December 2012 when he retired from Univar. Mr. Zillmer served as Chairman and Chief Executive Officer of Allied Waste Industries, a solid waste | |||

|

|

ECOLAB - 2020 Proxy Statement | 7 |

|

|

CORPORATE GOVERNANCE

Corporate Governance Materials and Code of Conduct

Our Company is managed under the overall direction of our Board of Directors for the benefit of all stockholders. Written materials concerning policies of our Board of Directors, corporate governance principles and corporate ethics practices, including our Code of Conduct as last amended in 2012, are available on our website at www.investor.ecolab.com/corporate-governance.

We intend to promptly disclose on our website should there be any amendments to, or waivers by the Board of Directors of, the Code of Conduct.

Under our Corporate Governance Principles, the preferable size of the Board is between 11 and 15 members, in order to facilitate effective discussion and decision-making, adequate staffing of Board Committees, and a desired mix of diversified experience and background. Our Board of Directors currently consists of 13 members. As described on page 3 under Proposal 1: Election of Directors, 12 nominees, if elected, will serve a one-year term ending as of the 2021 Annual Meeting expected to be held on May 6, 2021.

|

| |

BOARD DIVERSITY | ||

|

|

|

| | |

AVERAGE BOARD TENURE: 8.5 YEARS | ||

●●●● | ●●●● | ●●●●● |

0-4 years: 4 | 5-9 years: 4 | 10+ years: 5 |

Our Board of Directors is led by Douglas M. Baker, Jr., our Chairman, who is also our Chief Executive Officer. Mr. Baker has served as our Chief Executive Officer and as a director since 2004, and he was elected Chairman in 2006.

As stated in our Corporate Governance Principles, the Board believes that it is best not to have a fixed policy on whether the offices of Chairman and Chief Executive Officer are to be held by one person or two. In May 2019, the Board determined that its current board leadership structure remains appropriate and best serves the interests of stockholders at this time. In making that annual determination, the Board considered numerous factors, including the benefits to the decision-making process with a leader who is both Chairman and Chief Executive Officer; the significant operating experience and qualifications of Mr. Baker; the importance of deep Ecolab knowledge in exercising business judgment in leading the Board; the size and complexity of our business; the significant business experience and tenure of our directors; and the qualifications and role of our Lead Director.

|

|

|

|

8 | ECOLAB - 2020 Proxy Statement |

|

|

CORPORATE GOVERNANCE

In accordance with our Corporate Governance Principles, the independent directors, after recommendation of the Governance Committee, re-appointed Jeffrey M. Ettinger as Lead Director in May 2019. As detailed in Mr. Ettinger’s biography and qualifications on page 4, Mr. Ettinger has extensive public company board experience. Mr. Ettinger also is independent and has considerable knowledge of our business. Specific responsibilities of the Lead Director, as enumerated in our Corporate Governance Principles, include:

· | presiding over meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors; |

· | acting as a liaison between the Chairman and the independent directors; |

· | reviewing and approving information sent to the Board; |

· | reviewing and approving meeting agendas for the Board; |

· | reviewing and approving meeting schedules to assure that there is sufficient time for discussion of all agenda items; |

· | at the discretion of the Lead Director, calling meetings of the independent directors; and |

· | if requested by significant stockholders, ensuring that he or she is available for consultation and direct communication. |

Mr. Baker works closely with Mr. Ettinger to ensure the smooth and effective operation of the Board.

Our By-Laws permit the Board of Directors to designate Committees, each comprised of three or more directors, to assist the Board in carrying out its duties. The Board annually reviews its Committee structure as well as the Charter and composition of each Committee and makes modifications as necessary. The Charters for the Board’s five standing Committees - Audit, Compensation, Finance, Governance and Safety, Health and Environment - were reviewed and approved by the Board in May 2019. The Charters of each of our Committees are available on our website at www.investor.ecolab.com/corporate-governance. The separately designated standing Audit Committee meets the requirements of Section 3(a)(58)(A) of the Exchange Act. The members of the Audit, Compensation and Governance Committees meet the “independence” and other requirements established by the rules and regulations of the SEC, the Internal Revenue Code of 1986, as amended (the “IRS Code”), the New York Stock Exchange and our Board, as applicable.

The Committee fulfills, and assists the Board of Directors’ oversight of, its responsibilities to monitor: (i) the quality and integrity of our consolidated financial statements and management’s financial control of operations; (ii) the qualifications, independence and performance of the independent accountants; (iii) the role and performance of the internal audit function; (iv) our compliance with legal and regulatory requirements; and (v) our cybersecurity program and related risks. The Committee meets regularly and privately with our management and internal auditors and with our independent registered public accounting firm, PricewaterhouseCoopers LLP.

A report of the Audit Committee is found under the heading “Audit Committee Report” at page 25.

The Board of Directors has determined that each member of the Audit Committee is “independent” and meets the independence and other requirements of Sections 303A.02 and 303A.07 of the listing standards of the New York Stock Exchange, and Rule 10A-3 under the Exchange Act, as well as of our Board. The Board has determined that each of Mses. McKibben and Reich and Messrs. MacLennan and Nowell is an “audit committee financial expert” under the SEC’s rules and should be so designated. Further, the Board has determined, in its business judgment, that each of Mses. McKibben and Reich and Messrs. MacLennan and Nowell has “accounting and related financial management expertise” and that each member of the Audit Committee is “financially literate” under the New York Stock Exchange’s listing standards.

|

|

ECOLAB - 2020 Proxy Statement | 9 |

|

|

CORPORATE GOVERNANCE

· | Compensation Committee – The Compensation Committee members are Ms. Vautrinot and Messrs. Biller, Ettinger, Higgins and Zillmer (Chair). The Committee met five times during 2019. The principal functions of this Committee are to: (i) review and approve or recommend to the Board, as applicable, with respect to the establishment, amendment and administration of any compensation plans, benefits plans, severance arrangements and long-term incentives for directors and any executive officers (including the CEO); (ii) review and approve our overall compensation policy and annual executive salary plan, including CEO compensation; and (iii) administer our director stock option and deferred compensation plans, executive and employee stock incentive plans, stock purchase plans, cash incentive programs and stock retention and ownership guidelines. The Committee may not delegate its primary responsibilities with respect to overseeing executive officer compensation. In accordance with the terms of our 2010 Stock Incentive Plan, the Committee has delegated to the CEO (in his capacity as a director) the authority to grant long-term incentives to employees who are not officers or directors, subject to specified thresholds and applicable law. A report by the Committee is located on page 28 of this Proxy Statement. |

To assist the Committee in the design and review of the executive and director compensation programs, the Committee has selected and retained Frederic W. Cook & Co., Inc. (“FW Cook”), an independent compensation consulting firm, which reports directly to the Committee. As requested from time to time on behalf of the Committee, FW Cook provides the Committee with market data regarding various components of executive and director compensation, reviews the methodology on which compensation is based and designed, and informs the Committee of market trends in executive and director compensation. FW Cook performs no services for us other than those performed on behalf of the Committee.

The Committee has considered the independence of FW Cook in light of SEC rules and New York Stock Exchange listing standards. In connection with this process, the Committee has reviewed, among other items, a letter from FW Cook addressing the independence of FW Cook and the members of the consulting team serving the Committee, including the following factors: (i) other services provided to us by FW Cook; (ii) fees paid by us as a percentage of FW Cook’s total revenue; (iii) policies or procedures of FW Cook that are designed to prevent conflicts of interest; (iv) any business or personal relationships between the senior advisor of the consulting team and any member of the Committee; (v) any Ecolab stock owned by the senior advisor; and (vi) any business or personal relationships between our executive officers and the senior advisor. The Committee discussed these considerations and concluded that the work performed by FW Cook and its senior advisor involved in the engagement did not raise any conflict of interest.

The Board of Directors has determined that each member of the Compensation Committee meets the independence requirements of the SEC (including Rule 16b-3), the New York Stock Exchange, and Section 162(m) of the IRS Code and of our Board.

· | Finance Committee – The current Finance Committee members are Mses. McKibben and Vautrinot and Messrs. Biller (Chair), Larson, Nowell and Zillmer. The Committee met six times during 2019. The principal functions of this Committee are to review and make recommendations to the Board concerning: (i) management’s financial and tax policies and standards; (ii) our financing requirements, including the evaluation of management’s proposals concerning funding to meet such requirements; (iii) share repurchases and dividends; (iv) our capital expenditure budget; (v) adequacy of insurance coverage; and (vi) our use of derivatives to limit financial risk. The Committee also evaluates specific acquisition, divestiture and capital expenditure projects from a financial standpoint and reviews the financial impact of our significant retirement plans. |

· | Governance Committee – The Governance Committee members are Mses. Beck and Reich and Messrs. Ettinger (Chair) and MacLennan. The Committee met four times during 2019. Certain functions of the Governance Committee are described starting on page 13 of this Proxy Statement under the heading “Director Nomination Process.” In addition, the principal functions of this Committee include: (i) lead the annual review of Board performance and effectiveness; (ii) review the Board’s organizational structure and operations (including appointing a lead director for executive sessions of non-management directors) and its relationship to senior management; (iii) review issues of senior management succession; (iv) lead the annual Chief Executive Officer performance review and oversee the evaluation process for senior management; (v) review Certificate of Incorporation, By-Law or stockholder rights plan issues or changes in fundamental corporate charter provisions; (vi) review various corporate governance matters (including any necessary modifications to the Corporate Governance Principles); (vii) review and recommend to the Board with respect to director independence determinations and review, approve or ratify reportable related-person transactions; (viii) receive reports from management with regard to relevant social responsibility issues and report to the Board as appropriate; (ix) review our |

|

|

|

|

10 | ECOLAB - 2020 Proxy Statement |

|

|

CORPORATE GOVERNANCE

Company’s efforts to achieve its affirmative action and diversity goals; (x) review director orientation, training and continuing education; (xi) review our political contributions policy as well as our corporate contributions; and (xii) undertake special projects which do not fall within the jurisdiction of other committees of the Board. |

The Board of Directors has determined that each member of the Governance Committee meets the “independence” requirements of the SEC, the New York Stock Exchange and of our Board.

· | Safety, Health and Environment Committee – The members of the Safety, Health and Environment Committee are Mses. Ballard and Beck (Chair) and Messrs. Baker, Higgins and Larson. The Committee met four times during 2019. This Committee monitors compliance with applicable safety, health and environmental (“SHE”) laws and regulations. The principle functions of this Committee include: (i) review SHE policies, programs and practices, SHE risks, SHE statistics, pending SHE matters, security risks and industry best practices; (ii) review regulatory, environmental and health and safety trends, issues and concerns which affect or could affect our SHE practices; (iii) review the implementation of our SHE practices and related compliance with applicable policies; and (iv) review our Sustainability Report. |

Board’s Role in Risk Oversight

The Board of Directors, in exercising its overall responsibility to direct the business and affairs of the Company, has established various processes and procedures with respect to risk management. First, annually as a core agenda item of the full Board, management presents to the Board a comprehensive and detailed risk assessment of the Company after following a vigorous enterprise risk review and analysis. Pursuant to the risk assessment, the Company has categorized the most relevant risks as follows: strategic, operating, reporting and compliance. As part of the annual risk assessment, the Board determines whether any of the Company’s overall risk management processes or control procedures requires modification or enhancement.

Strategic risk, which relates to the Company properly defining and achieving its high-level goals and mission, and operating risk, which relates to the effective and efficient use of resources and pursuit of opportunities, are regularly monitored and managed by the full Board through the Board’s regular and consistent review of the Company’s operating performance and strategic plan. For example, at each of the Board’s five regularly scheduled meetings throughout the year, management provided the Board presentations on the Company’s various business units as well as the Company’s performance as a whole. Agenda items were included for significant developments as appropriate, for example, significant acquisitions, important market developments and senior management succession. Pursuant to the Board’s established monitoring procedures, Board approval is required for the Company’s strategic plan and annual plan which are reported on by management at each Board meeting. Similarly, significant transactions, such as acquisitions and financings, are brought to the Board for approval.

Reporting risk, which relates to the reliability of the Company’s financial reporting, and compliance risk, which relates to the Company’s compliance with applicable laws and regulations, are primarily overseen by the Audit Committee. The Audit Committee meets at least six times per year and, pursuant to its charter and core agendas, receives input directly from management as well as from the Company’s independent registered public accounting firm, PricewaterhouseCoopers LLP, regarding the Company’s financial reporting process, internal controls and public filings. The Committee also receives regular updates from the Company’s General Counsel and the Chief Compliance Officer regarding any Code of Conduct issues or legal compliance concerns and annually receives a summary of all Code of Conduct incidents during the preceding year from the Chief Compliance Officer. See “Board Committees – Audit Committee” on page 9 for further information on how the Audit Committee monitors, and assists the Board of Directors’ oversight of, reporting and compliance risks.

The Company believes that its leadership structure, discussed in detail above, supports the risk oversight function of the Board. While the Company has a combined Chairman of the Board and Chief Executive Officer, our Lead Director has substantial and clearly delineated authority pursuant to our Corporate Governance Principles, strong directors’ chair the various Board Committees involved in risk oversight, there is open communication between management and directors, and all directors are actively involved in the risk oversight function.

|

|

ECOLAB - 2020 Proxy Statement | 11 |

|

|

CORPORATE GOVERNANCE

Our stakeholders and other interested parties, including our stockholders and employees, can send substantive communications to our Board using the following methods published on our website at www.investor.ecolab.com/corporate-governance:

· | to correspond with the Board’s Lead Director, please complete and submit the on-line “Contact Lead Director” form; |

· | to report potential issues regarding accounting, internal controls and other auditing matters to the Board’s Audit Committee, please complete and submit the on-line “Contact Audit Committee” form; or |

· | to make a stockholder recommendation for a potential candidate for nomination to the Board, please submit an e-mail to the Board’s Governance Committee, in care of our Corporate Secretary, at investor.info@ecolab.com. |

All substantive communications regarding governance matters or potential accounting, control, compliance or auditing irregularities are promptly relayed or brought to the attention of the Lead Director or Chair of the Audit Committee following review by our management. Communications not requiring the substantive attention of our Board, such as employment inquiries, sales solicitations, questions about our products and other such matters, are handled directly by our management. In such instances, we respond to the communicating party on behalf of the Board. Nonetheless, our management periodically updates the Board on all of the on-line communications received, whether or not our management believes they are substantive. In addition to on-line communications, interested parties may direct correspondence to our Board of Directors, our Board Committees or to individual directors at our headquarters address, referenced on page 1 of this Proxy Statement.

Future Stockholder Proposals and Director Nomination Process

Any stockholder proposal, other than those for director nominations, must comply with advance notice procedures set forth in Article II, Section 4 of our By-Laws. As described in more detail below, stockholder proposals for director nominations must comply with Article II, Section 3 and Section 15 of our By-Laws. Under our By-Laws, to be in proper written form, the stockholder’s notice to our Corporate Secretary must set forth as to each matter such stockholder proposes to bring before the Annual Meeting a brief description of the business desired to be brought before the Annual Meeting and the reasons for conducting such business at the Annual Meeting and, as to the stockholder giving the notice and any Stockholder Associated Person (i.e., any person acting in concert, directly or indirectly, with such stockholder and any person controlling, controlled by or under common control with such stockholder): (i) the name and record address of such person, (ii) the class or series and the number of shares beneficially owned by the stockholder, (iii) the nominee holder for, and number of, shares owned beneficially but not of record by such person, (iv) whether and the extent to which any hedging or other transaction or series of transactions has been entered into by or on behalf of, or any other agreement or arrangement has been made, the effect or intent of which is to mitigate loss to or manage risk or benefit of share price changes for, or to increase or decrease the voting power of, such person with respect to any share of stock of the Company, (v) to the extent known, the name and address of any other stockholder supporting the proposal, (vi) a description of all arrangements or understandings between or among such persons in connection with the proposal and any material interest in such proposal, and (vii) a representation by the stockholder that he or she intends to appear at the Annual Meeting to present the business. Any ownership information shall be supplemented by the stockholder giving the notice not later than ten (10) days after the record date for the meeting as of the record date. This summary is qualified in its entirety by reference to the full text of our By-Laws, which can be found on our website at www.investor.ecolab.com/corporate-governance. If the presiding Chairperson of the Annual Meeting of Stockholders determines that business, or a nomination, was not brought before the meeting in accordance with the By-Law provisions, that business will not be transacted or the defective nomination will not be accepted.

· | Deadline for Inclusion in the Proxy Statement – All proposals, other than with respect to director nominees (as discussed below), to be considered by the Board for inclusion in the Proxy Statement and form of proxy for next year’s Annual Meeting of Stockholders expected to be held on May 6, 2021, must be received by the Corporate Secretary at our headquarters address, referenced on page 1 of this Proxy Statement, no later than November 23, 2020. |

· | Deadline for Consideration – Stockholder proposals not included in a Company proxy statement for an annual meeting as well as proposed stockholder nominations for the election of directors for inclusion in the Company’s proxy statement and form of proxy at an annual meeting must each comply with advance notice procedures set forth in our By-Laws in order to be properly brought before that annual meeting of stockholders. In general, written notice of a stockholder proposal or a director nomination must be received by the Corporate Secretary not less than 120 days nor more than 150 days prior to the anniversary date of the preceding annual meeting of stockholders. With regard to next year’s Annual Meeting of Stockholders, expected to be held on May 6, 2021, the written notice must be received between December 8, 2020 and January 7, 2021, inclusive. |

|

|

|

|

12 | ECOLAB - 2020 Proxy Statement |

|

|

CORPORATE GOVERNANCE

- | Review and recommend to the Board of Directors policies for the composition of the Board, including such criteria as: |

§ | size of the Board; |

§ | diversity of gender, race, ethnicity, experience, employment, background and other relevant factors of Board members; |

§ | the proportion of the Board to be comprised of non-management directors; |

§ | qualifications for new or continued membership on the Board, including experience, employment, background and other relevant considerations; and |

§ | director retirement requirements or standards. |

- | Review any director nominee candidates recommended by stockholders. |

- | Identify, interview and evaluate director nominee candidates and have sole authority to: |

§ | retain and terminate any search firm to be used to assist the Committee in identifying director candidates; and |

§ | approve the search firm’s fees and other retention terms. |

- | Recommend to the Board: |

§ | the slate of director nominees to be presented by the Board for election at the Annual Meeting of Stockholders; |

§ | the director nominees to fill vacancies on the Board; and |

§ | the members of each Board Committee. |

(i) | the name, age, business address, residence address and record address of such person, |

(ii) | the principal occupation or employment of such person, |

(iii) | the following information regarding such person: |

(A) | the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by such person, |

(B) | any option, warrant, convertible security, stock appreciation right, or similar derivative instrument related to any class or series of shares of the Company that is directly or indirectly owned beneficially by such person; |

(C) | any proxy, contract, agreement, arrangement, understanding, or relationship pursuant to which such person has a right to vote any shares of any security of the Company; |

(D) | any “short interest” in any security of the Company; |

(E) | any rights to dividends on the shares of the Company owned beneficially by such person that are separated or separable from the underlying shares of the Company; |

(F) | any proportionate interest in shares of the Company or derivative instruments held, directly or indirectly, by a general or limited partnership in which such person is a general partner or, directly or indirectly, beneficially owns an interest in a general partner; and |

(G) | any performance-related fees (other than an asset-based fee) to which such person is entitled based on any increase or decrease in the value of shares of the Company or any derivative instruments, if any, as of the date of such notice, including, without limitation, any such interests held by members of such person’s immediate family sharing the same household, |

|

|

ECOLAB - 2020 Proxy Statement | 13 |

|

|

CORPORATE GOVERNANCE

(iv) any information relating to such person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder,

(v) the nominee holder for, and number of, shares owned beneficially but not of record by such person,

(vi) to the extent known by the stockholder giving the notice, the name and address of any other stockholder supporting the nominee for election or reelection as a director on the date of such stockholder’s notice,

(vii) a description of all arrangements or understandings between or among such persons pursuant to which the nomination(s) are to be made by the stockholder, and

(viii) a representation that such stockholder intends to appear in person or by proxy at the meeting to nominate the persons named in its notice.

In addition to the information required pursuant to Section 3, our By-Laws provide that the Company may require any proposed nominee to furnish such other information:

(i) as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as an independent director under the rules and listing standards of the principal United States securities exchanges upon which the Common Stock of the Company is listed or traded, any applicable rules of the U.S. Securities and Exchange Commission or any publicly disclosed standards used by the Board of Directors in determining and disclosing the independence of the Company’s directors,

(ii) that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of such nominee, or

(iii) that may reasonably be requested by the Company to determine the eligibility of such nominee to serve as a director of the Company.

Any ownership information shall be supplemented by the stockholder giving the notice not later than ten (10) days after the record date for the meeting as of the record date. The notice must be accompanied by a written consent of the proposed nominee to being named as a nominee and to serve as a director if elected. No person shall be eligible for election as a director of the Company unless nominated in accordance with the foregoing procedures. This summary is qualified in its entirety by reference to the full text of our By-Laws, which can be found on our website at www.investor.ecolab.com/corporate-governance.

· | Proxy Access – Under our By-Laws, a stockholder or a group of up to 20 stockholders owning 3% or more of the Company’s outstanding shares continuously for at least three years may nominate and include in our proxy materials director candidates constituting up to the greater of two individuals or 20% of the Board, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in our By-Laws. Our proxy access by-law limits the number of stockholders that may aggregate their shares to satisfy the 3% test to 20 stockholders. For purposes of the 20 stockholder limit, certain related funds are counted as one stockholder. |

In terms of our principles for composition of the Board generally, and qualifications for director nominees specifically, we refer you to our Corporate Governance Principles, which can be found on our website at www.investor.ecolab.com/corporate-governance. Under these provisions, for example:

· | No more than three Board members will be from current management. These management members normally would be the Chief Executive Officer, the Chairman (if an employee of the Company and not the CEO) and the President (if an employee of the Company and not the CEO) but may be any other officer deemed appropriate by the Board; |

· | It is desired that the members of the Board represent a geographical dispersion and variety of business disciplines so as to bring to the work of the Board a diversity of experience and background, with the predominance of members being chief or executive officers from different industries; and |

· | A continuing effort is made to seek well-qualified women and minority group members for the Board, but these persons must be sought out and evaluated as individuals rather than as representatives of specific groups. The Board of Directors is committed to actively seeking out highly-qualified women and minority candidates for each search the Board undertakes. |

|

|

|

|

14 | ECOLAB - 2020 Proxy Statement |

|

|

CORPORATE GOVERNANCE

In identifying, evaluating and recommending director nominee candidates, the Committee will consider diversity of gender and ethnicity within the Board, the criteria set forth in the section above entitled “Director Nomination Process,” and such other factors as the Committee deems appropriate. The Board conducts a periodic review of its efforts to achieve such diversity among its members.

Other criteria relevant to service as a director of our Company are also set forth in our Corporate Governance Principles.

New Director Selection Process

As provided in our Corporate Governance Principles, the Governance Committee focuses on candidates with broad perspectives, backgrounds, experience and knowledge and who demonstrate independent judgment. Diversity of business experience, gender and race are highly valued, and a high degree of interest and involvement are key requisites for membership on our Board of Directors. The Governance Committee seeks candidates with significant organizational leadership experience, including individuals who were chief executive officers or otherwise managed a large and complex organization, and qualified candidates with experience relevant to our key end-markets and with technical competencies in areas such as digital technology, finance and cybersecurity. The Committee seeks to ensure that women and people of color are considered each time the Governance Committee undertakes a formal search process to recruit director candidates.

The Compensation Committee has established an annual process and criteria for assessing risk in our compensation programs and has directed management to apply that process and criteria to all compensation plans and practices that have the potential to give rise to behavior that creates risks that are reasonably likely to have a material adverse effect on the Company and to report the results to the Compensation Committee. As part of the process in 2019, the Company took the following steps to complete the assessment: (1) we agreed on a materiality framework for determining which compensation plans and practices to review; (2) we inventoried plans and practices that fell within the materiality framework; (3) we reviewed the identified plans and practices against our evaluation framework established in consultation with the Compensation Committee’s independent compensation consultant, FW Cook; (4) we identified factors, processes or procedures in place which may mitigate any risks in identified plans and practices; and (5) the Compensation Committee reviewed the results of the analysis with FW Cook. Our risk assessment revealed that our compensation programs do not create risks that are reasonably likely to have a material adverse effect on the Company. In making this determination, we took into account the compensation mix for our employees as well as various risk control and mitigation features of our programs, including varied and balanced performance targets, review procedures for incentive pay calculations, appropriate incentive payout caps, the Company’s rights to cancel incentive awards for employee misconduct, discretionary authority of the Compensation Committee to reduce award pay-outs, internal controls around customer and distributor pricing and contract terms, our stock ownership guidelines, prohibition on hedging Company stock and our compensation recovery (“clawback”) policy.

There were eight meetings of the Board of Directors during the year ended December 31, 2019. Each incumbent director attended at least 94% of all Board meetings and meetings held by all Committees on which he or she served. Overall attendance at Board and Committee meetings was 99%. Directors are expected, but are not required, to attend our Annual Meeting of Stockholders. All of the directors then serving who were continuing to serve following the meeting attended last year’s Annual Meeting.

|

|

ECOLAB - 2020 Proxy Statement | 15 |

|

|

DIRECTOR COMPENSATION FOR 2019

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is comprised of five non-employee, independent directors: Ms. Vautrinot and Messrs. Biller, Ettinger, Higgins and Zillmer (Chair). No member of the Compensation Committee is or was formerly an officer or an employee of the Company or had any related person transaction required to be disclosed in which the Company was a participant during the last fiscal year. In addition, no executive officer of the Company serves on the compensation committee or board of directors of a company for which any of the Company’s directors serves as an executive officer.

DIRECTOR COMPENSATION FOR 2019

The following table summarizes the compensation that our non-employee directors received during 2019.

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

| |||||||

Name |

| Fees Earned or |

| Stock |

| Option |

| Total | |||||||

Shari L. Ballard(4) |

| 120,000 |

| 115,000 |

| 78,069 |

| 313,069 | |||||||

Barbara J. Beck |

| 125,000 |

| 115,000 |

| 55,621 |

| 295,621 | |||||||

Leslie S. Biller |

| 125,000 |

| 115,000 |

| 55,621 |

| 295,621 | |||||||

Stephen I. Chazen(5) |

| 40,549 |

| 38,860 |

| 0 |

| 79,409 | |||||||

Jeffrey M. Ettinger |

| 150,000 |

| 115,000 |

| 55,621 |

| 320,621 | |||||||

Arthur J. Higgins |

| 110,000 |

| 115,000 |

| 55,621 |

| 280,621 | |||||||

Michael Larson |

| 110,000 |

| 115,000 |

| 55,621 |

| 280,621 | |||||||

David W. MacLennan |

| 120,000 |

| 115,000 |

| 55,621 |

| 290,621 | |||||||

Tracy B. McKibben |

| 120,000 |

| 115,000 |

| 55,621 |

| 290,621 | |||||||

Lionel L. Nowell, III(4) |

| 120,000 |

| 115,000 |

| 78,069 |

| 313,069 | |||||||

Victoria J. Reich |

| 130,000 |

| 115,000 |