QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ |

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| / / | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| /x/ | | Soliciting Material Under Rule 14a-12

|

LA QUINTA CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| /x/ | | No fee required |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| / / | | Fee paid previously with preliminary materials. |

| / / | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

This filing contains forward-looking statements that are subject to a number of risks and uncertainties. Actual results and the timing or occurrence of certain events may differ materially from such forward-looking statements. A complete discussion regarding such forward-looking statements and the risks and uncertainties inherent therein and factors which may affect the achievement of any such forward-looking statements is set forth on page four of the Investor Presentation filed hereby. You are urged to read such forward-looking statements discussion in the Investor Presentation.

The following is an Investor Presentation which may, from time to time, be presented by the management of La Quinta Properties, Inc. and La Quinta Corporation (together, "La Quinta" or the "Companies") to members of the investment community and which will be made available to, among others, the Companies' stockholders on La Quinta's website beginning on October 17, 2001. The Investor Presentation relates to the Companies' restructuring and related transactions announced on October 16, 2001 as follows:

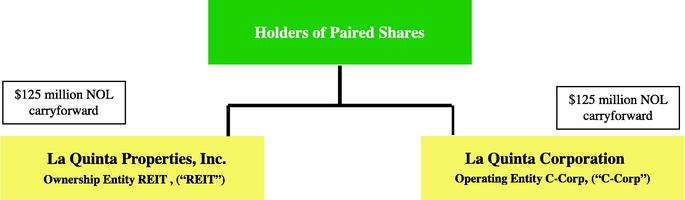

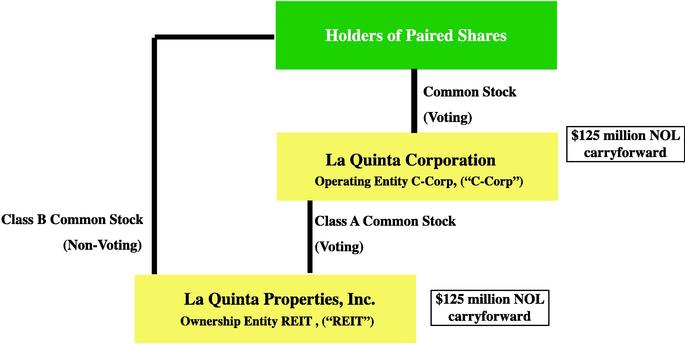

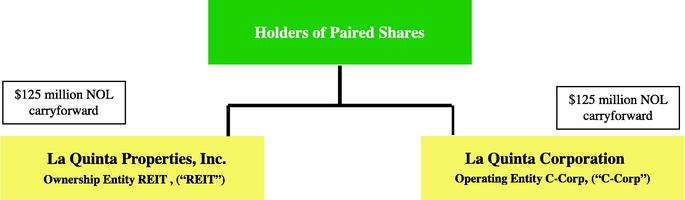

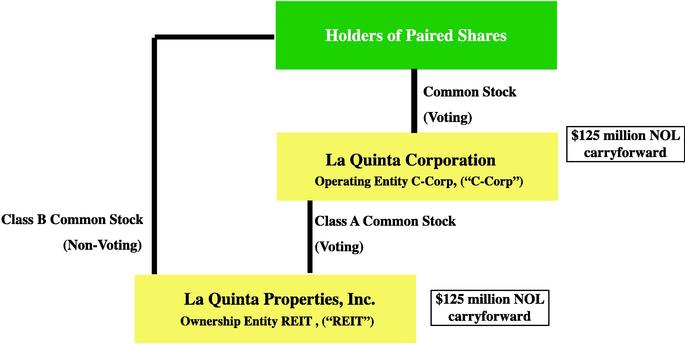

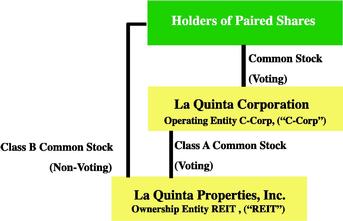

Proposed Restructuring. On October 16, 2001, La Quinta Properties, Inc. (the "REIT") and La Quinta Corporation (the "Corporation" and collectively, "La Quinta" or the "Companies") issued a press release announcing that the Boards of Directors of the Companies have unanimously approved, subject to stockholder approval, a restructuring of La Quinta. The restructuring, which will enable the Companies to maintain REIT status and to grow, will result in the REIT becoming a subsidiary controlled by the Corporation. In connection with the restructuring, the REIT will issue two new classes of securities: Class A common stock, which will be issued exclusively to the Corporation, and Class B common stock which will be exchanged for the REIT's common stock currently held by its shareholders. The terms of the Class A and Class B common stock are summarized in general in the press release filed with the Securities and Exchange Commission on October 16, 2001.

In addition, in connection with the restructuring, the REIT will be selling a portion of the economic value of the La Quinta® brand to the Corporation in exchange for shares of the Corporation's common stock. This transaction is structured to be a tax-free transaction. The transfer of a portion of the economic value of the La Quinta® brand from the REIT to the Corporation is structured to ease the REIT's increasing difficulty in satisfying the "income test" required to maintain its real estate investment trust status by reducing the amount of "bad" income generated by the REIT as a result of the royalty fees generated by the brand.

La Quinta Corporation 2002 Stock Option and Incentive Plan. The Companies' Boards of Directors also approved, subject to stockholder approval, the 2002 Stock Option and Incentive Plan. The 2002 Plan, which will replace the equity award plans currently in place for each of the REIT and the Corporation upon approval of the 2002 Plan, will provide for stock options and other stock-based awards that the Companies believe will help to attract, motivate and retain the caliber of directors, officers, employees and other key persons necessary for La Quinta's future growth.

Employee Stock Purchase Plan. The Companies have also announced the Boards of Directors approval, subject to stockholder approval, of a new Employee Stock Purchase Plan. This plan will authorize the issuance and purchase by La Quinta's employees of paired shares through payroll deductions.

Share Repurchase Program. The Companies Boards of Directors have also approved a share repurchase program, authorizing the Companies to repurchase up to $20 million of the Companies' equity securities. The program is designed to allow the Companies to take advantage of opportunities that exist from time to time to purchase La Quinta's common and preferred stock in the open market and privately negotiated transactions.

***

The following legends are required by Securities and Exchange Commission (SEC) regulations to appear on all written communications relating to the restructuring:

La Quinta Corporation, La Quinta Properties, Inc. and their directors and certain of their executive officers may be deemed to be participants in the solicitation of proxies from shareholders to approve the proposed restructuring transaction. Investors may obtain information about La Quinta Corporation, La Quinta Properties, Inc. and such directors and executive officers of La Quinta Corporation and La Quinta Properties, Inc. and their ownership of La Quinta Corporation and La Quinta Properties, Inc. common stock by reading the joint proxy statement for The La Quinta Companies 2001 annual meeting of shareholders. Investors may obtain additional information regarding the interests of such participants by reading the joint proxy statement that will be filed, and the prospectus that may be filed, with the SEC in connection with the restructuring transaction when such documents become available.

This material is not a substitute for the joint proxy statement La Quinta Corporation and La Quinta Properties, Inc. will file, and the prospectus that La Quinta Properties, Inc. may file, with the Securities and Exchange Commission. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT AND, IF APPLICABLE, THE PROSPECTUS AND OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION REGARDING THE RESTRUCTURING WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The joint proxy statement and other documents which will be filed by La Quinta Corporation and La Quinta Properties, Inc. with the Securities and Exchange Commission will be available free of charge at the SEC's website (www.sec.gov) or by directing a request when such a filing is made to La Quinta Corporation, 909 Hidden Ridge, Suite 600, Irving, Texas, Attn: Investor Relations, telephone (877) 777-6560; or by directing a request when such a filing is made to La Quinta Properties, Inc., 909 Hidden Ridge, Suite 600, Irving, Texas, Attn: Investor Relations, telephone (877) 777-6560.

***

The following is the Investor Presentation:

INVESTOR PRESENTATION

October 2001

Management looks forward to your continued support as we work to restructure

The La Quinta Companies

| • | | Current Structure |

| | | • | | Cannot maintain La Quinta Properties' REIT status |

| | | • | | Cannot grow La Quinta |

• |

|

Proposed Structure |

| | | • | | Maintain La Quinta Properties' REIT status |

| | | • | | Grow La Quinta |

| | | • | | Enhance shareholder value |

2

| | Current Structure

| | New Structure

|

|---|

| Existing Unit Improvements | | /x/ | | /x/ |

Franchising |

|

/ / |

|

/x/ |

Development |

|

/ / |

|

/x/ |

Acquisitions |

|

/ / |

|

/x/ |

Share Repurchase |

|

/ / |

|

/x/ |

3

Safe Harbor Statement

Certain matters discussed herein may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The La Quinta Companies (the "Companies"), consisting of La Quinta Properties, Inc. ("Realty") and La Quinta Corporation ("Operating"), intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements, and are including this statement for purposes of complying with these safe harbor provisions. Although the Companies believe the forward-looking statements are based on reasonable assumptions, the Companies can give no assurance that their expectations will be attained. Actual results and the timing of certain events could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors, including, without limitation, the satisfaction of the conditions to closing, including receipt of shareholder and regulatory approval, the tax-free nature of the restructuring, including the transfer of a portion of the economic value of the La Quinta® brand to La Quinta Corporation, the effect of the recent terrorist attacks on the Companies' industry and its business, the certainty that the lodging industry will react similarily in the future as it reacted to the challeninging industry environment of the early 1990s, general economic and real estate conditions, the cyclicality of the hotel business, increased supply and weak demand which could cause actual results to differ materially from historical results or those anticipated, increases in energy costs and other operating costs resulting in lower operating margins, the growth of our franchise program, identification of future acquisition candidates or development opportunities and financing, if any, required for such opportunities, the identification of satisfactory prospective buyers for healthcare related assets of the Companies' and the availability of financing for such prospective buyers, the availability of financing for the Companies' capital investment program, interest rates, competition for hotel services and healthcare facilities in a given market, competition in franchising the Companies' brands, the ultimate outcome of certain litigation filed against the Companies, the enactment of legislation further impacting the Companies' status as a paired share real estate investment trust ("REIT") or Realty's status as a REIT, the continued ability of Realty to qualify for taxation as a REIT, the further implementation of regulations governing payments to, as well as the financial conditions of, operators of Realty's healthcare related assets, including the filing for protection under the US Bankruptcy Code by any operators of the Companies healthcare assets, the impact of the protection offered under the US Bankruptcy Code for those operators who have already filed for such protection, and other risks detailed from time to time in the filings of Realty and Operating with the Securities and Exchange Commission ("SEC"), including, without limitation, the risks described in Item 7 of the Joint Annual Report on Form 10-K entitled "Certain Factors You Should Consider." The Companies disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise."

4

Additional Information and Where To Find It

This material is not a substitute for the joint proxy statement La Quinta Corporation and La Quinta Properties, Inc. will file, in the prospectus that La Quinta Properties, Inc. may file, with the Securities and Exchange Commission. Investors are urged to read the joint proxy statement, and, if applicable, the prospectus, which will contain important information, including detailed risk factors, when it becomes available. The joint proxy statement and other documents which will be filed by La Quinta Corporation and La Quinta Properties, Inc. with the Securities and Exchange Commission will be available free of charge at the SEC's website (www.sec.gov) or by directing a request when such a filing is made to La Quinta Corporation, 909 Hidden Ridge, Suite 600, Irving, Texas, Attn: Investor Relations, telephone (877) 777-6560; or by directing a request when such a filing is made to La Quinta Properties, Inc., 909 Hidden Ridge, Suite 600, Irving, Texas, Attn: Investor Relations, telephone (877) 777-6560.

The La Quinta Companies, its directors, and certain of its executive officers may be considered participants in the solicitation of proxies in connection with the proposed transactions. Information about the directors and executive officers of La Quinta Corporation and La Quinta Properties, Inc. and their ownership of La Quinta Corporation and La Quinta Properties, Inc. stock is set forth in the proxy statement for The La Quinta Companies' 2001 annual meeting of shareholders. Investors may obtain additional information regarding the interests of such participants by reading the joint proxy statement when it becomes available.

5

Agenda

| • | | Successful Turnaround |

• |

|

Operations in Review |

• |

|

Need for Restructuring |

• |

|

Future Growth |

6

| • | | Successful Turnaround |

• |

|

Operations in Review |

• |

|

Need for Restructuring |

• |

|

Future Growth |

7

Successful Turnaround

Experienced Lodging Management Team Now Leading La Quinta

Name

| | Title

| | Industry Experience

|

|---|

| Butch Cash * | | President & Chief Executive Officer | | 29 years |

| David Rea * | | EVP — Chief Financial Officer & Treasurer | | 15 years |

| Alan Tallis * | | EVP — Chief Development Officer | | 24 years |

| Steve Parker * | | EVP — Chief Marketing Officer | | 30 years |

| John Novak * | | SVP — Chief Information Officer | | 10 years |

| Brent Spaeth | | SVP — Human Resources & Administration | | 28 years |

| Wayne Goldberg * | | SVP — Operations | | 21 years |

* Joined La Quinta in 2000 or 2001

Successful track records with name brand lodging companies, including:

Marriott, Cendant, Disney, Choice, Red Roof Inns and La Quinta

8

Successful Turnaround

New Management Team Has Delivered on Turnaround Plan

| Sell Healthcare Assets | | /x/ | | • | | Sold $1.6 billion in healthcare assets |

Reduce Debt |

|

/x/ |

|

• |

|

Reduced debt by $1.6 billion and completed $375 million credit facility |

Strengthen Lodging |

|

/x/ |

|

• |

|

Improved lodging operations and initiated innovative franchising program |

9

Successful Turnaround

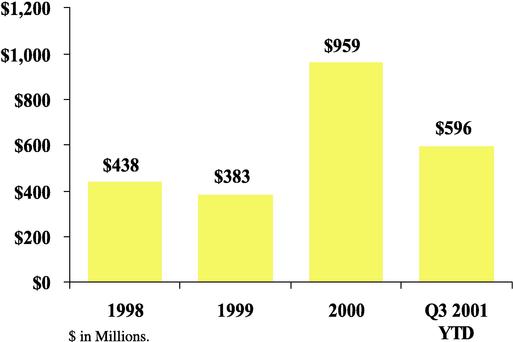

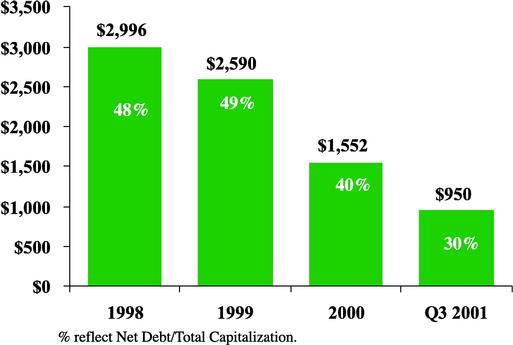

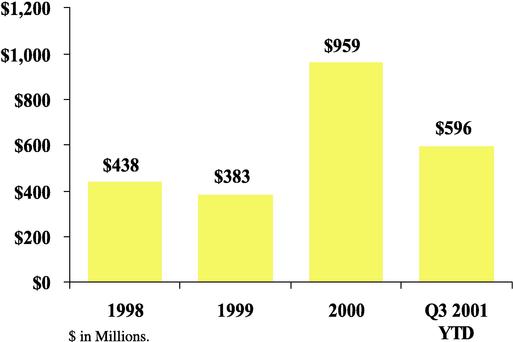

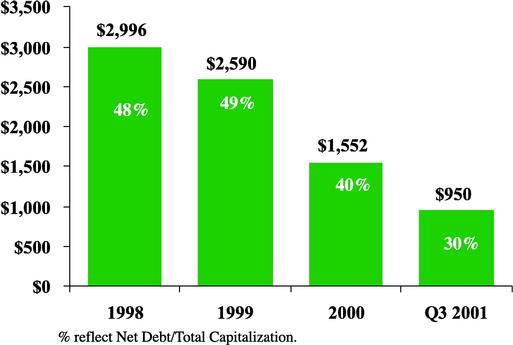

Debt Reduction from Healthcare Asset Sales

| ASSET SALES | | TOTAL NET DEBT |

|

|

|

Application of asset sale proceeds has significantly reduced indebtedness

10

Successful Turnaround

Strategic Repositioning

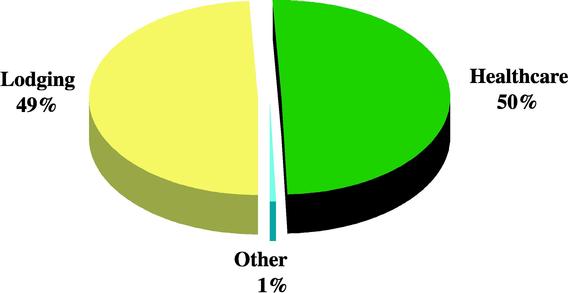

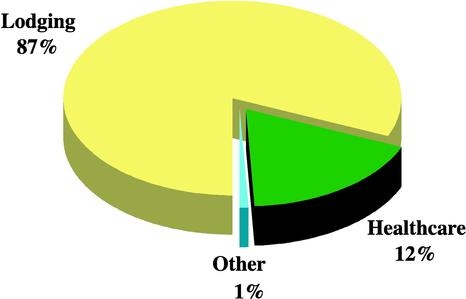

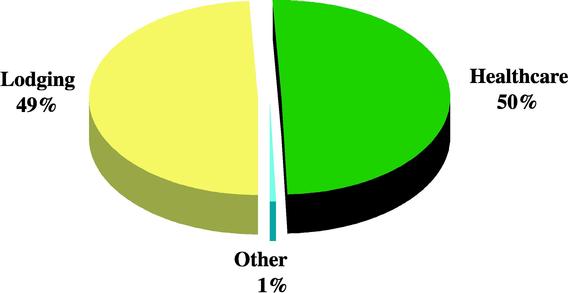

| FISCAL 1999 EBITDA | | LTM PRO FORMA EBITDA(1) |

|

|

|

| | | (1) At September 30, 2001, pro forma for healthcare asset sales |

Significant progress in transitioning to a focused lodging company

11

Successful Turnaround

Improved Lodging Business

| • | | Enhanced RevPAR performance |

• |

|

Reduced costs per rented room |

• |

|

Improved information systems |

• |

|

Launched new sales and marketing programs |

• |

|

Strengthened properties with capital improvements |

• |

|

Initiated innovative franchising program |

New management team has made an immediate and positive impact

12

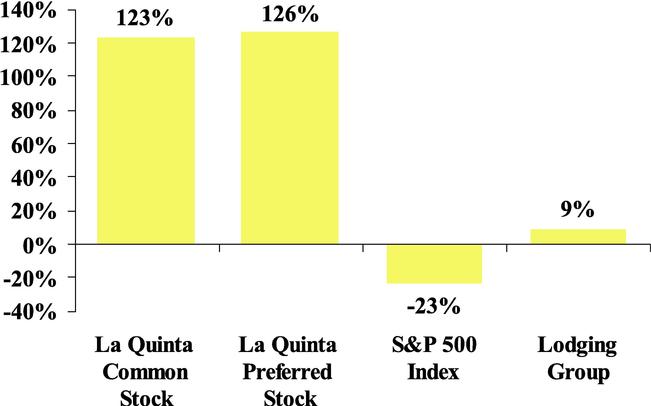

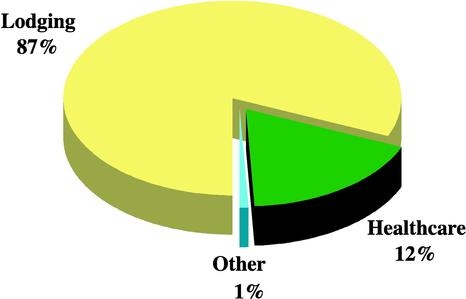

Successful Turnaround

Significantly Improved Equity Valuations

EQUITY MARKET PERFORMANCE SINCE THE ARRIVAL

OF NEW MANAGEMENT TEAM AT LA QUINTA

Since April 17, 2000

Lodging Group: Marriott International, Inc., Starwood Hotels & Resorts Worldwide, Inc., Hilton Hotels Corporation

13

| • | | Successful Turnaround |

• |

|

Operations in Review |

• |

|

Need for Restructuring |

• |

|

Future Growth |

14

Operations in Review

Introduction

| • | | La Quinta hotel chain was founded in San Antonio, Texas in 1968 |

| | | • | | Among the largest self-operated, limited service lodging chains in the country |

| | | • | | 300+ properties with 38,000+ rooms in 30 states |

• |

|

High-quality accommodations at reasonable prices make La Quinta attractive to both business and leisure travelers |

• |

|

Strong brand awareness and loyalty |

| | | • | | Appeals to both business and leisure travelers |

| | | • | | Attracts high level of repeat visitation |

| | | • | | 820,000 member Returns Club |

15

Operations in Review

Well-Maintained Properties

| 1993-1994 | | |

| $70 Million | | Image Enhancement Program |

1995-1997 |

|

|

| $200 Million | | Renovation of 30,000 rooms

(Gold Medal Room Program) |

1996-1999 |

|

|

| $630 Million | | 70 La Quinta Inn & Suites built |

1993-2000 |

|

|

| $196 Million | | Maintenance CapEx |

Over $1 billion invested in brand over the last seven years

16

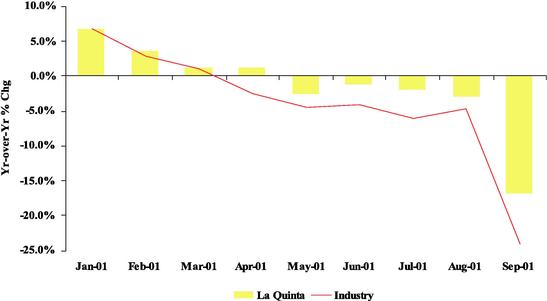

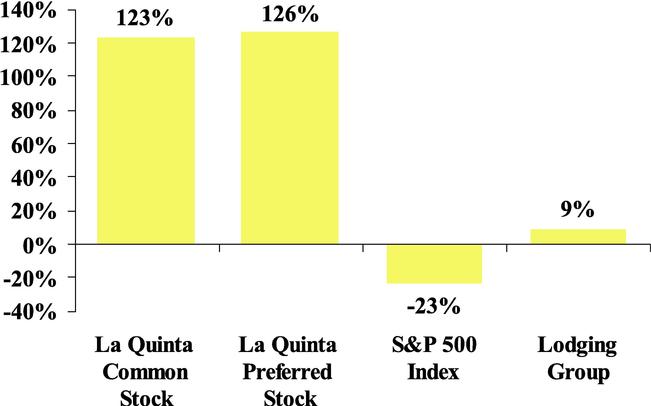

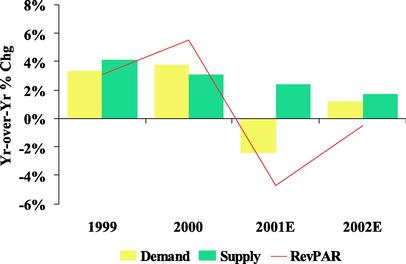

Operations in Review

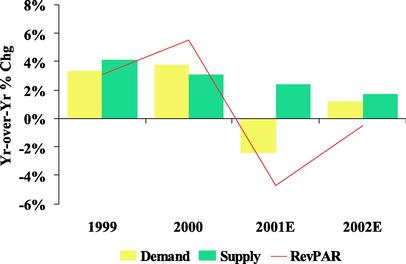

Challenging Industry Environment

| • | | Prior to Sept 11th, business travel was reduced as the economy slowed |

• |

|

After Sept 11th, both business and leisure travel have been reduced |

REVPAR PERFORMANCE

Source: Smith Travel Research

17

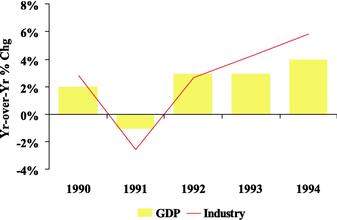

Operations in Review

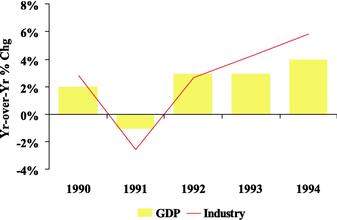

Challenging Industry Environment - Historical Perspective

| • | | Lodging industry battered in 1991 with U.S. economic recession and Persian Gulf War |

• |

|

With improved economy and favorable supply-demand fundamentals, industry went on to produce record RevPAR |

|

|

|

| REVPAR PERFORMANCE | | SUPPLY-DEMAND |

|

|

|

| |  |

Source: Smith Travel Research

18

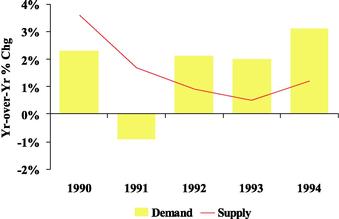

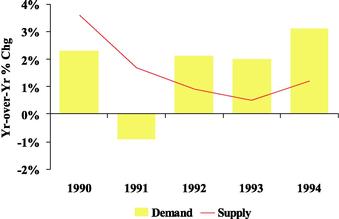

Operations in Review

Challenging Industry Environment – Favorable Supply Outlook

| • | | Supply growth is expected to fall below 2% - lowest level in six years |

• |

|

When demand returns, reduced supply growth should lead to healthy RevPAR gains |

SUPPLY-DEMAND

Source: Smith Travel Research

19

Operations in Review

La Quinta's Ability to Manage in a Weak Environment – Excellent Liquidity

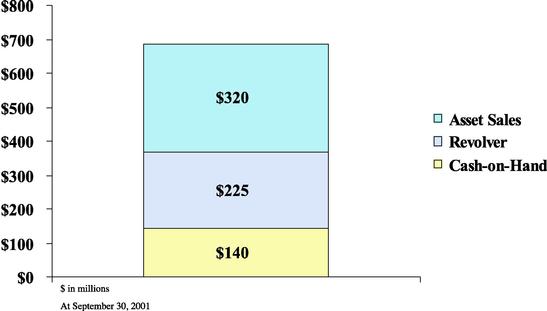

| | ($ in Millions)

|

|---|

| Cash | | $ | 140 |

| Revolver | | | 225 |

| | |

|

| | | $ | 365 |

2001 Debt Maturities |

|

$ |

55 |

| 2002 Debt Maturities | | | 37 |

| | |

|

| | | $ | 92 |

At September 30, 2001

20

Operations in Review

La Quinta's Ability to Manage in a Weak Environment - Strong Balance Sheet

| | ($ in Millions)

| |

|---|

| Total Debt (1) | | $ | 1,090 | |

| Cash (1) | | | 140 | |

| | |

| |

| Net Debt | | $ | 950 | |

| Healthcare Assets (1,2) | | | 320 | |

| | |

| |

| Pro Forma Remaining Debt | | $ | 630 | |

| Pro Forma Net Debt/Total Capitalization (3) | | | 25 | % |

(1) At September 30, 2001

(2) Healthcare assets after valuation allowances of $100 million

(3) Pro forma at June 30, 2001 for proposed restructuring transaction

21

Operations in Review

La Quinta's Ability to Manage in a Weak Environment - Strong Free Cash Flow

| | ($ in Millions)

| | Notes

|

|---|

| Interest Expense | | $ | 80 | | Current run-rate |

| Preferred Dividends | | | 18 | | |

| CapEx | | | 85 | | Includes discretionary |

| | |

| | |

| Breakeven EBITDA | | $ | 183 | | |

|

|

|

|

|

|

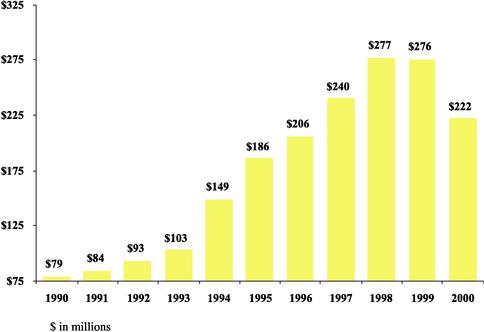

| EBITDA: | | | | | |

| | Lodging | | $ | 222 | | 2000 Results |

| | Healthcare & Other | | | 35 | | Current run-rate |

| | |

| | |

| | Total | | $ | 257 | | |

22

Operations in Review

La Quinta's Ability to Manage in a Weak Environment - Low Breakeven

| • | | La Quinta Results for Year 2000 |

| | | • | | Occupancy | | | 63.4 | % | |

| | | • | | Average Daily Rate | | $ | 62.62 | | |

• |

|

Lodging Breakeven – EBITDA |

| | | • | | At an average rate of $61, occupancy can drop to 35% |

| | | • | | Includes all operating expenses and corporate overhead |

• |

|

Total Company Breakeven – Free Cash Flow |

| | | • | | At an average rate of $61, occupancy can drop to 54% |

| | | • | | Includes interest, preferred dividends and maintenance CapEx |

High percentage of variable costs permit La Quinta to manage to demand levels

23

| • | | Successful Turnaround |

• |

|

Operations in Review |

• |

|

Need for Restructuring |

• |

|

Future Growth |

24

Need for Restructuring

Challenges with the Current "Grandfathered" Paired Share Structure

| • | | Inability to continue to meet REIT qualifications |

| | | • | | REITs are required to have no more than 5% of their gross income from non-qualified sources ("bad income") |

| | | • | | La Quinta's healthcare asset sales have reduced good income |

| | | • | | La Quinta's generation of hotel royalty fees have increased bad income |

| | | • | | La Quinta will eventually exceed limits allowed for REITs, resulting in a loss of REIT status within the next 12-18 months |

25

Need for Restructuring

Challenges with the Current "Grandfathered" Paired Share Structure

| • | | Inability to grow and create shareholder value |

| | | • | | Due to federal legislation enacted over the past several years, "grandfathered" paired share REITs are restricted in growth |

| | | • | | La Quinta will lose its REIT status sooner if the company attempted to grow |

| | | • | | La Quinta cannot benefit from the NOLs created in the C-Corp |

26

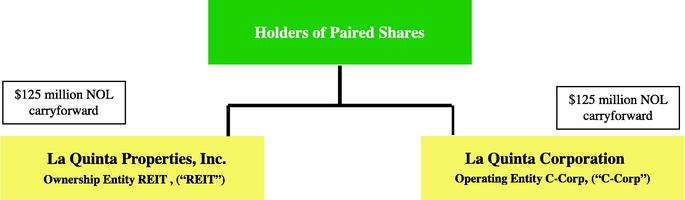

Need for Restructuring

New Corporate Structure Resolves Challenges of Current Structure

| • | | Reduces REIT "bad income" |

| | | • | | Part of the La Quinta® brand will be acquired tax-free by LQ Corporation |

| | | • | | LQ Properties will more easily satisfy "good income" REIT requirement |

• |

|

No longer subject to "grandfathered" paired share REIT restrictions |

| | | • | | By issuing Class A shares, majority of the REIT's value will be owned by LQ Corporation |

| | | • | | By issuing Class B shares, LQ Properties meets minimum ownership requirement to maintain REIT status |

27

Need for Restructuring

Benefits of the New Structure

| • | | Future growth |

| | | • | | Real estate assets |

| | | • | | Management operations |

| | | • | | Franchising program |

| | | • | | Brand acquisitions |

• |

|

Maintain the REIT structure |

| | | • | | Ability to pay tax-advantaged dividends in the future |

| | | • | | Maintain tax deductibility of preferred dividends |

| | | • | | Transfer interest in the La Quinta® brand tax-free |

| | | • | | Future flexibility |

• |

|

Financial incentive |

| | | • | | Flexibility to retain capital |

| | | • | | Less dependence on capital markets |

| | | • | | Efficient use of NOLs |

28

Need for Restructuring

Terms of the New Structure

La Quinta Corporation

No material change in terms of common stock which will remain outstanding | |  |

La Quinta Properties, Inc.

| | Class A

| | Class B

|

|---|

| Holders: | | Owned 100% by LQ Corporation | | Owned 100% by existing shareholders |

Value: |

|

>50% of the value of LQ Properties |

|

<50% of the value of LQ Properties |

Voting Rights: |

|

Voting |

|

Non-voting |

Liquidation Preference: |

|

2000 YE REIT equity less Pref. Stk. plus 90% of remaining distribution |

|

Rights to 10% of remaining distribution amounts |

Redemption Rights: |

|

None |

|

May be redeemed by LQ Properties |

Dividends: |

|

100% of dividends subject to Class B preference beginning in 2005 |

|

Preference of $0.10 per share per year beginning in 2005 |

29

Need for Restructuring

Common Stock Dividend Policy

| • | | La Quinta Corporation |

| | | • | | Common Stock (continue to be owned directly by shareholders) |

| | | | | — | | Has never paid dividends |

| | | | | — | | No dividends expected to be paid |

• |

|

La Quinta Properties, Inc. |

| | | • | | Class B Common Stock (owned directly by shareholders) |

| | | | | — | | Entitled to preferential dividend, if common stock dividends are declared, of approximately $15 million (or $0.10 per share) per year, payable quarterly beginning in 2005 |

| | | | | — | | Designed to utilize NOLs from both LQ Properties and LQ Corporation (combined total of approximately $250 million) |

|

|

• |

|

Class A Common Stock (owned directly by LQ Corporation) |

| | | | | — | | Will receive remaining REIT distribution, if any, for use in growing La Quinta |

30

Need for Restructuring

Other Issues

| • | | Tax treatment |

| | | • | | Tax-free transaction |

| | | • | | Treated as a recapitalization |

| | | • | | Shareholders will not recognize gains or losses |

• |

|

Accounting treatment |

| | | • | | Treated as a reorganization |

| | | • | | Reclassify $200 million of preferred equity to minority interest |

| | | • | | Approximately $400 million in non-recurring, non-cash charges to be recorded in the quarter the transaction closes |

|

|

|

|

$230 million |

|

deferred tax liabilities |

| | | | | 170 | | intangible write-offs |

| | | | |

| | |

| | | | | $400 million | | |

31

Need for Restructuring

New Equity Incentive Plan

| • | | New Equity Incentive Plan Needed to Replace Old Plans |

|

|

Current Plans

|

|

New Plan

|

|---|

| Shares Available | | 8,520,267 | | 9,400,000 |

| Repricing of Options | | Allowed | | Eliminated |

| Grants Below Market Value | | Allowed | | Eliminated |

| Non-Option Grants | | No Limit | | Limited to 25% of Total |

| • | | Employee Stock Purchase Plan |

| | | • | | 500,000 shares reserved |

| | | • | | Customary employee stock purchase plan |

| | | • | | Provides for broader employee ownership |

New plans are more shareholder friendly

32

| • | | Successful Turnaround |

• |

|

Operations in Review |

• |

|

Need for Restructuring |

• |

|

Future Growth |

33

Future Growth

Enhanced Shareholder Value

34

Future Growth

Opportunity for Expansion

35

Future Growth

Support for Growth

| • | | Management Team with a Proven Track Record |

• |

|

Valuable Brand with Loyal Customer Base |

• |

|

Benefits from Upgrading Lodging Portfolio |

• |

|

Significant Free Cash Flow from Existing Operations |

• |

|

Strong Balance Sheet with Large Cash Balances |

• |

|

Availability Under the Revolving Line of Credit |

• |

|

Upside from Future Healthcare Asset Sales |

36

Future Growth

Existing Unit Improvements

| • | | Grow RevPAR |

| | | • | | Increase repeat business from frequent guests |

| | | • | | Aggressively target new business |

• |

|

Improve EBITDA Margins |

| | | • | | Decrease costs per rented room |

| | | • | | Improve operating efficiencies |

| | | • | | Reduce corporate overhead |

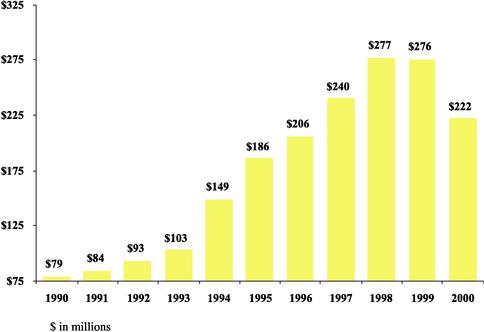

TOTAL LA QUINTA EBITDA

37

Future Growth

Franchising

| • | | Increase market share |

• |

|

Grow through minimal capital investment |

• |

|

Generate high margin, recurring fee income |

• |

|

Leverage La Quinta's 30+ year brand history and operating experience |

• |

|

Maintain strict control over product and service quality |

| | | • | | Strict, enforceable contract terms |

| | | • | | Poor operators are expelled, marginal operators will not be awarded additional franchises |

| | | • | | Rebate a portion of Royalty Fee based upon Guest Satisfaction Survey |

| | | • | | Inn cannot be opened until all requirements are met |

• |

|

Planned Openings |

| | | • | | 2001 – 15 hotels (1,200 rooms) |

| | | • | | 2002 – 35 hotels (2,800 rooms) |

| | | • | | 2003 – 50 hotels (4,000 rooms) |

38

Future Growth

Capacity for Growth

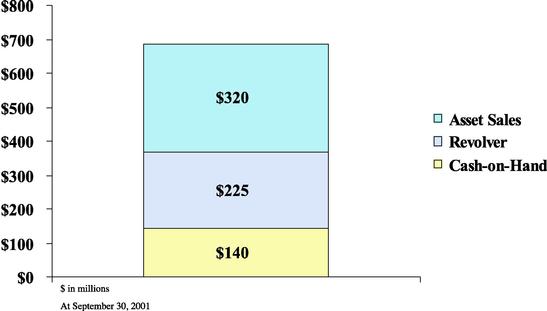

AVAILABLE CAPITAL

La Quinta will have almost three-quarters of $1 billion of capital available for growth

39

Future Growth

Development and Acquisitions

| • | | Development |

| | | • | | Redevelop Existing Locations |

| | | | | — | | High-demand markets |

| | | | | — | | Improve property economics |

| | | • | | Joint Venture on New Development |

| | | | | — | | Flagship locations |

| | | | | — | | Retain franchise & management fees as well as percentage of cash flow |

• |

|

Acquisitions |

| | | • | | La Quinta Conversions |

| | | | | — | | Small, regional hotel chains |

| | | | | — | | Must conform to La Quinta® brand standards |

| | | • | | Complementary Brand Additions |

| | | | | — | | Nationwide or "super-regional" brands |

| | | | | — | | Quality brands with growth potential |

| | | | | — | | Complementary segments |

40

Future Growth

Share Repurchase

| • | | Boards of Directors have authorized $20 million of repurchases of La Quinta's equity securities |

• |

|

Purchases will include common stock and preferred stock |

• |

|

Purchases will be conducted from time-to-time through open market and privately-negotiated transactions |

• |

|

Bank covenants provide for additional share repurchase programs in the future |

41

Future Growth

Enhanced Shareholder Value

42

Management looks forward to your continued support as we work to restructure

The La Quinta Companies

| • | | Current Structure |

| | | • | | Cannot maintain La Quinta Properties' REIT status |

| | | • | | Cannot grow La Quinta |

• |

|

Proposed Structure |

| | | • | | Maintain La Quinta Properties' REIT status |

| | | • | | Grow La Quinta |

| | | • | | Enhance shareholder value |

43

| | Current Structure

| | New Structure

|

|---|

| Existing Unit Improvements | | /x/ | | /x/ |

| Franchising | | / / | | /x/ |

| Development | | / / | | /x/ |

| Acquisitions | | / / | | /x/ |

| Share Repurchase | | / / | | /x/ |

44

INVESTOR PRESENTATION

October 2001

QuickLinks