SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant¨ Filed by a Party other than the Registrantx

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

KOREA EQUITY FUND, INC.

(Name of Registrant as Specified In Its Charter)

PRESIDENT AND FELLOWS OF HARVARD COLLEGE

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount previously paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

President and Fellows of Harvard College is providing the following information to Institutional Shareholder Services, Inc.:

Background Information on Closed-End Country Funds

In early 1990s, many single country funds issued to invest in markets with limited direct access

Allowed portfolio managers to invest in illiquid securities without concern redemptions would impact performance

Many funds traded at premiums to NAV in the early the 80’s and early 90’s because they were the only way for retail investors to access those markets

In the late 90’s / early 2000’s many funds began trading at discounts

Underlying markets opened; less need for closed end funds

Investment alternatives (ADRs, ETFs) developed

In response to discounts, many funds instituted programs to limit them

Buy-backs

One time tender offers (cash and in-kind)

Periodic tenders – “interval” status – (cash and in-kind)

Tenders triggered by discount levels

Conversion to open-end mutual fund

Some funds liquidated due to a combination of:

Poor performance

Small size, illiquid trading

High expense ratios

Persistent discounts

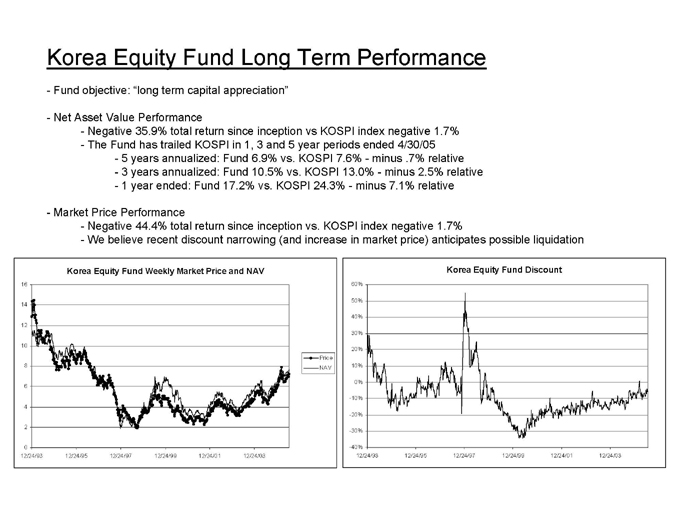

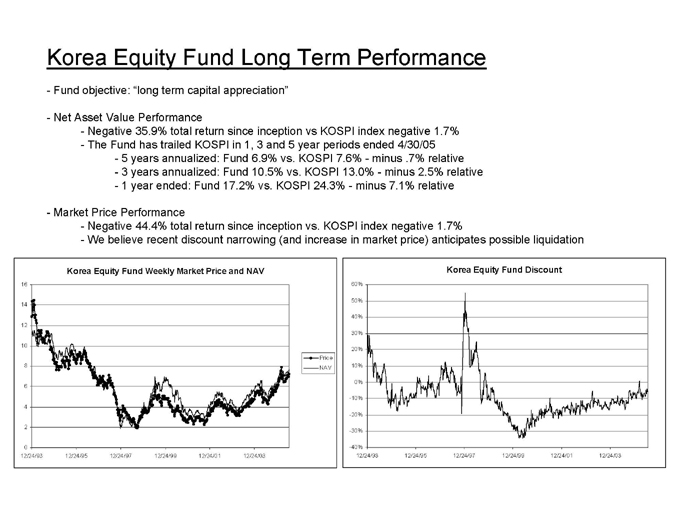

Korea Equity Fund Long Term Performance

Fund objective: “long term capital appreciation”

Net Asset Value Performance

Negative 35.9% total return since inception vs KOSPI index negative 1.7%

The Fund has trailed KOSPI in 1, 3 and 5 year periods ended 4/30/05

5 years annualized: Fund 6.9% vs. KOSPI 7.6% - minus .7% relative

3 years annualized: Fund 10.5% vs. KOSPI 13.0% - minus 2.5% relative

1 year ended: Fund 17.2% vs. KOSPI 24.3% - minus 7.1% relative

Market Price Performance

Negative 44.4% total return since inception vs. KOSPI index negative 1.7%

We believe recent discount narrowing (and increase in market price) anticipates possible liquidation

Korea Equity Fund Weekly Market Price and NAV

12/24/93 12/24/95 12/24/97 12/24/99 12/24/01 12/24/03

16 14 12 10 8 6 4 2 0

Price

NAV

Korea Equity Fund Discount

12/24/93 12/24/95 12/24/97 12/24/99 12/24/01 12/24/03

60% 50% 40% 30% 20% 10% 0% -10% -20% -30% -40%

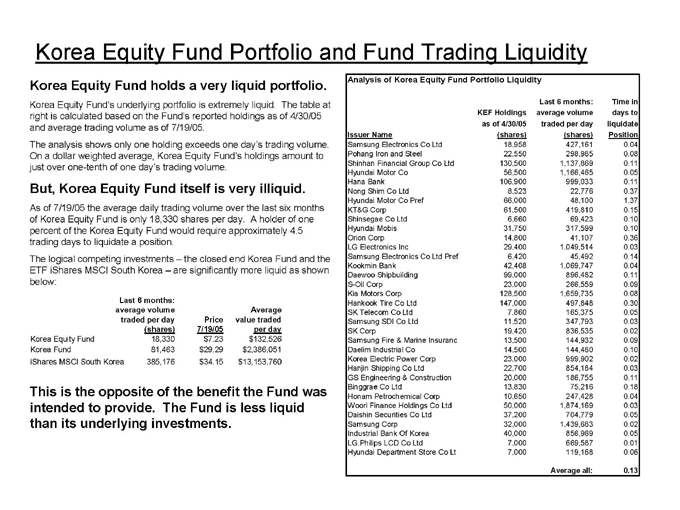

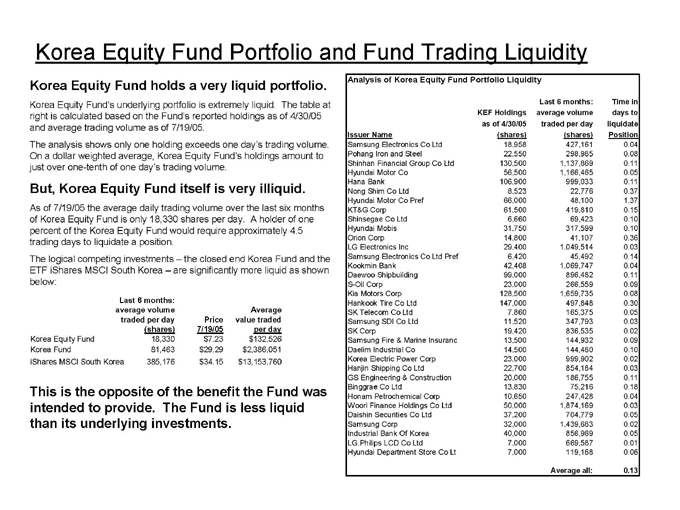

Korea Equity Fund Portfolio and Fund Trading Liquidity

Korea Equity Fund holds a very liquid portfolio.

Korea Equity Fund’s underlying portfolio is extremely liquid. The table at right is calculated based on the Fund’s reported holdings as of 4/30/05 and average trading volume as of 7/19/05.

The analysis shows only one holding exceeds one day’s trading volume. On a dollar weighted average, Korea Equity Fund’s holdings amount to just over one-tenth of one day’s trading volume.

But, Korea Equity Fund itself is very illiquid.

As of 7/19/05 the average daily trading volume over the last six months of Korea Equity Fund is only 18,330 shares per day. A holder of one percent of the Korea Equity Fund would require approximately 4.5 trading days to liquidate a position.

The logical competing investments – the closed end Korea Fund and the ETF iShares MSCI South Korea – are significantly more liquid as shown below:

Last 6 months: average volume traded per day (shares) Price 7/19/05 Average value traded per day

Korea Equity Fund 18,330 $7.23 $132,526

Korea Fund 81,463 $29.29 $2,386,051

iShares MSCI South Korea 385,176 $34.15 $13,153,760

This is the opposite of the benefit the Fund was intended to provide. The Fund is less liquid than its underlying investments.

Analysis of Korea Equity Fund Portfolio Liquidity

Issuer Name KEF Holdings as of 4/30/05 (shares) Last 6 months: average volume traded per day (shares) Time in days to liquidate Position

Samsung Electronics Co Ltd 18,958 427,161 0.04

Pohang Iron and Steel 22,550 298,985 0.08

Shinhan Financial Group Co Ltd 130,500 1,137,869 0.11

Hyundai Motor Co 56,500 1,166,465 0.05

Hana Bank 106,900 999,033 0.11

Nong Shim Co Ltd 8,523 22,776 0.37

Hyundai Motor Co Pref 66,000 48,100 1.37

KT&G Corp 61,500 419,810 0.15

Shinsegae Co Ltd 6,660 69,423 0.10

Hyundai Mobis 31,750 317,599 0.10

Orion Corp 14,800 41,107 0.36

LG Electronics Inc 29,400 1,049,514 0.03

Samsung Electronics Co Ltd Pref 6,420 45,492 0.14

Kookmin Bank 42,408 1,069,747 0.04

Daewoo Shipbuilding 99,000 896,482 0.11

S-Oil Corp 23,000 266,559 0.09

Kia Motors Corp 128,500 1,659,735 0.08

Hankook Tire Co Ltd 147,000 497,848 0.30

SK Telecom Co Ltd 7,860 165,375 0.05

Samsung SDI Co Ltd 11,520 347,793 0.03

SK Corp 19,420 836,535 0.02

Samsung Fire & Marine Insuranc 13,500 144,932 0.09

Daelim Industrial Co 14,500 144,480 0.10

Korea Electric Power Corp 23,000 999,902 0.02

Hanjin Shipping Co Ltd 22,700 854,184 0.03

GS Engineering & Construction 20,000 186,755 0.11

Binggrae Co Ltd 13,830 75,216 0.18

Honam Petrochemical Corp 10,650 247,428 0.04

Woori Finance Holdings Co Ltd 50,000 1,874,169 0.03

Daishin Securities Co Ltd 37,200 704,779 0.05

Samsung Corp 32,000 1,439,683 0.02

Industrial Bank Of Korea 40,000 856,969 0.05

LG.Philips LCD Co Ltd 7,000 669,587 0.01

Hyundai Department Store Co Lt 7,000 119,168 0.06

Average all: 0.13

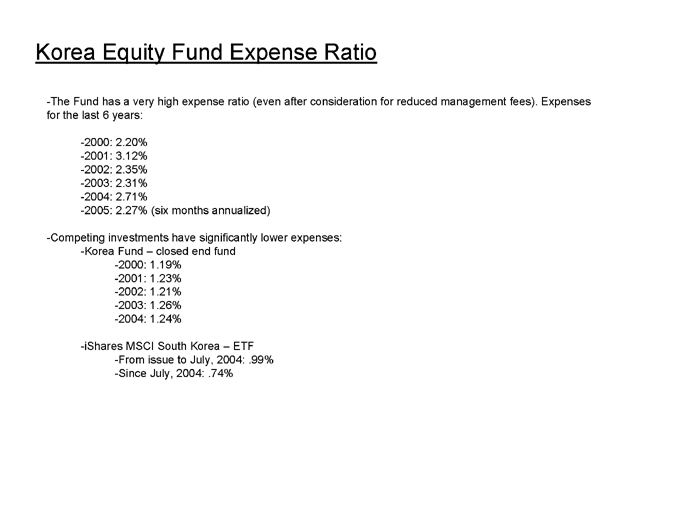

Korea Equity Fund Expense Ratio

The Fund has a very high expense ratio (even after consideration for reduced management fees). Expenses for the last 6 years:

2000: 2.20%

2001: 3.12%

2002: 2.35%

2003: 2.31%

2004: 2.71%

2005: 2.27% (six months annualized)

Competing investments have significantly lower expenses:

Korea Fund – closed end fund

2000: 1.19%

2001: 1.23%

2002: 1.21%

2003: 1.26%

2004: 1.24%

iShares MSCI South Korea – ETF

From issue to July, 2004: .99%

Since July, 2004: .74%

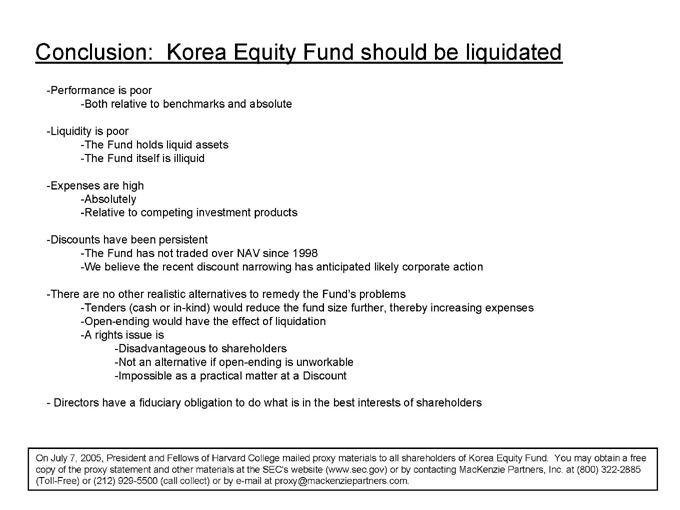

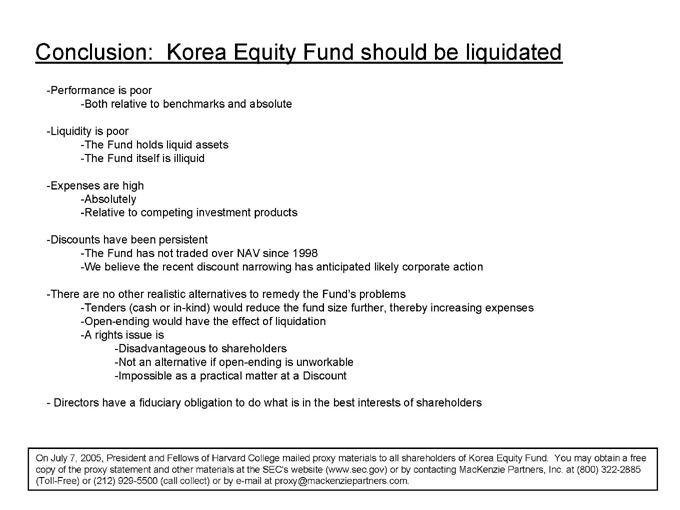

Conclusion: Korea Equity Fund should be liquidated

Performance is poor

Both relative to benchmarks and absolute

Liquidity is poor

The Fund holds liquid assets The Fund itself is illiquid

Expenses are high Absolutely

Relative to competing investment products

Discounts have been persistent

The Fund has not traded over NAV since 1998

We believe the recent discount narrowing has anticipated likely corporate action

There are no other realistic alternatives to remedy the Fund’s problems

Tenders (cash or in-kind) would reduce the fund size further, thereby increasing expenses

Open-ending would have the effect of liquidation

A rights issue is

Disadvantageous to shareholders

Not an alternative if open-ending is unworkable

Impossible as a practical matter at a Discount

Directors have a fiduciary obligation to do what is in the best interests of shareholders

On July 7, 2005, President and Fellows of Harvard College mailed proxy materials to all shareholders of Korea Equity Fund. You may obtain a free copy of the proxy statement and other materials at the SEC’s website (www.sec.gov) or by contacting MacKenzie Partners, Inc. at (800) 322-2885 (Toll-Free) or (212) 929-5500 (call collect) or by e-mail at proxy@mackenziepartners.com.