- DE Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Deere & Company (DE) DEF 14ADefinitive proxy

Filed: 8 Jan 21, 6:50am

| Filed by the Registrant [X] | ||

| Filed by a Party other than the Registrant [ ] | ||

| Check the appropriate box: | ||

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 | |

| DEERE & COMPANY | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

| [ ] | Fee paid previously with preliminary materials. | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

John Deere is focused on delivering intelligent, connected machines and solutions to revolutionize our customers’ agriculture and construction businesses, unlocking economic value across the full lifecycle of our products in ways that are sustainable for all.

| WE RUN SO LIFE CAN LEAP FORWARD | OUR CORE VALUES | |

We conduct business essential to life. Running for the people who trust us and the planet that sustains us, we create products and solutions that enable lives to leap forward. We have been innovating to solve customer challenges since our founding in 1837. And we have continued to lead and innovate on behalf of our customers for nearly two centuries. Every day, our employees use their creativity to solve some of the biggest problems facing our world. In 2020, John Deere embarked on a pivotal journey of transforming our business to operate in a manner that aligns with how our customers operate their businesses. Through this new Smart Industrial Operating Model, we will ensure that we continue to revolutionize agriculture and construction through the rapid introduction of new technologies and services that deliver outcomes to our customers that are both more productive and more sustainable. When we do, we will create more sustainable outcomes for all our stakeholders – our customers, employees, dealers, suppliers, shareholders, and the communities we serve. | In conducting business, we are guided by four core values that company founder John Deere was known for— integrity, quality, commitment, and innovation. We apply those values in everything we do, from designing and manufacturing our products and services to delivering solutions to our customers that enable them to be more productive, profitable, and sustainable.

|

January 8, 2021

DEAR FELLOW SHAREHOLDERS,

On behalf of the Board of Directors and the senior management team, we cordially invite you to attend Deere & Company’s Annual Meeting of Shareholders, which will be held Wednesday, February 24, 2021, at 10 a.m. Central Standard Time at www.virtualshareholdermeeting.com/DE2021. As part of our precautions regarding the coronavirus and to support the health and well-being of our shareholders, the 2021 Annual Meeting of Shareholders will be held exclusively online. There will not be a physical location for the Annual Meeting and you will not be able to attend the meeting in person.

At this meeting, you will have a chance to vote on the matters set forth in the accompanying Notice of Annual Meeting and Proxy Statement, and we will share a report on our operations.

Your vote is important. Even if you plan to participate in the Annual Meeting, please vote by internet, telephone, or mail as soon as possible to ensure your vote is recorded promptly. The instructions set forth in the Proxy Statement and on the proxy card explain how to vote your shares.

On behalf of the Board of Directors, thank you for your ongoing support of Deere & Company.

Sincerely,

|  |

| John C. May | Charles O. Holliday, Jr. |

| Chairman of the Board | Presiding Director |

|  |

Notice of 2021 Annual Meeting of Shareholders

| DATE | TIME | WHERE | ||

| Wednesday, February 24, 2021 | 10 a.m. Central Standard Time | www.virtualshareholdermeeting.com/DE2021 |

Your opinion is very important. Please vote on the matters described in the accompanying Proxy Statement as soon as possible, even if you plan to participate in the online Annual Meeting. You can find voting instructions below and on page 74. In addition to the Proxy Statement, we are sending you our Annual Report, which includes our fiscal 2020 financial statements. If you wish to receive future proxy statements and annual reports electronically rather than receiving paper copies in the mail, please turn to the section entitled “Electronic Delivery of Proxy Statement and Annual Report” on page 78 for instructions. | IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE VIRTUAL ANNUAL MEETING TO BE HELD ON FEBRUARY 24, 2021: |

| At the Annual Meeting, shareholders will be asked to: | ||

| 1. | Elect the 11 director nominees named in the Proxy Statement (see page 7). | 2. | Approve the compensation of Deere’s named executives on an advisory basis (“say-on-pay”) (see page 26). | 3. | Ratify the appointment of Deloitte & Touche LLP as Deere’s independent registered public accounting firm for fiscal 2021 (see page 71). | 4. | Consider any other business properly brought before the meeting. |

| Please vote your shares | ||

| BY TELEPHONE | BY MAIL | BY INTERNET | DURING MEETING | |||

| In the U.S. or Canada, you can vote your shares by calling 1-800-690-6903. | You can vote by mail by marking, dating, and signing your proxy card or voting instruction form and returning it in the postage-paid envelope. | You can vote your shares online at www.proxyvote.com. You will need the 16-digit control number on the Notice of Internet Availability or proxy card. | You can vote electronically at the Annual Meeting.See page 74 for information on how to vote. | |||

On behalf of the Board of Directors, I thank you for exercising your right to vote your shares.

For the Board of Directors,

Todd E. Davies, Corporate Secretary

Moline, Illinois, January 8, 2021

This Proxy Statement is issued in connection with the solicitation of proxies by the Board of Directors of Deere & Company for use at the Annual Meeting and at any adjournment or postponement thereof. On or about January 8, 2021, we will begin distributing print or electronic materials regarding the Annual Meeting to each shareholder entitled to vote at the meeting. Shares represented by a properly executed proxy will be voted in accordance with instructions provided by the shareholder. |

| 1 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Proxy Summary

Meeting Agenda and Voting Recommendations

This summary highlights selected information contained in this Proxy Statement, but it does not contain all the information you should consider. We urge you to read the whole Proxy Statement before you vote. You also may wish to review Deere’s Annual Report on Form 10-K for the fiscal year ended November 1, 2020. Deere uses a 52/53 week fiscal year ending on the last Sunday in the reporting period. Deere’s 2020, 2019, and 2018 fiscal years ended on November 1, 2020, November 3, 2019, and October 28, 2018, respectively. Unless otherwise stated, all information presented in this Proxy Statement is based on Deere’s fiscal calendar.

Meeting Agenda and Voting Recommendations

| Item | Voting Standard | Vote Recommendation | Page Reference | ||||

| 1. | Annual election of directors | Majority of votes cast | FOR each nominee | 7 | |||

| 2. | Advisory vote on executive compensation | Majority of votes present in person or by proxy | FOR | 26 | |||

| 3. | Ratification of independent registered public accounting firm | Majority of votes present in person or by proxy | FOR | 71 | |||

Director Nominee Highlights

Every member of our Board of Directors is elected annually. You are being asked to vote on the election of these 11 nominees, all of whom currently serve as directors.

| Committee Memberships | ||||||||||||||

| Name | Age | Director Since | Executive | Audit Review | Compensation | Corporate Governance | Finance | |||||||

| Tamra A. Erwin Executive Vice President and Group CEO, Verizon Business Group | 56 | 2020 | ■ | ■ | ||||||||||

| Alan C. Heuberger Senior Manager, BMGI | 47 | 2016 | ■ | ■ | ||||||||||

| Charles O. Holliday, Jr. Chairman of Royal Dutch Shell plc | 72 | 2007-2016; since 2018 | ■ | ■ | ||||||||||

| Dipak C. Jain President (Europe), China Europe International Business School | 63 | 2002 | ■ | ■ | ||||||||||

| Michael O. Johanns Retired United States Senator from Nebraska | 70 | 2015 | ■ | ■ | ||||||||||

| Clayton M. Jones Retired Chairman, Rockwell Collins | 71 | 2007 | ■ | ■ | CHAIR | |||||||||

| John C. May Chairman, Chief Executive Officer, and President Deere & Company | 51 | 2019 | CHAIR | |||||||||||

| Gregory R. Page Chairman, Corteva, Inc. | 69 | 2013 | ■ | ■ | CHAIR | |||||||||

| Sherry M. Smith Former Executive VP and CFO, SuperValu | 59 | 2011 | ■ | CHAIR | ■ | |||||||||

| Dmitri L. Stockton Retired Special Advisor to Chairman and Senior VP, GE and Former Chairman, President, and CEO, GE Asset Management | 56 | 2015 | ■ | CHAIR | ■ | |||||||||

| Sheila G. Talton President and CEO, Gray Matter Analytics | 68 | 2015 | ■ | ■ | ||||||||||

| 2 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Proxy Summary

Director Nominee Highlights

The board regularly assesses the diversity of its members and nominees as part of its annual evaluation process. We believe the 11 director nominees represent a diverse and broad range of attributes, qualifications, experiences, and skills to provide an effective mix of viewpoints and knowledge.

| STRONG BOARD DIVERSITY |

DIVERSE REPRESENTATION | GLOBAL & GOVERNANCE PERSPECTIVE | ||

| |

| |

| 3 | female directors | ||

| 3 | ethnically diverse directors | ||

| 2 | Board committees led by diverse directors | ||

RANGE OF TENURES* | BALANCED MIX OF AGES* | INDEPENDENT OVERSIGHT | ||||

0-4 |  | 45-55 |  |  | ||

5-10 |  | 56-65 |  |

| ||

>10 |  | 66+ |  | 10 of 11independent director nominees 4Board committees led by independent directors | ||

Average Tenure: 7 years | Average Age: 62 | |||||

* Tenure and age are as of January 8, 2021.

DIVERSE AND BALANCED MIX OF ATTRIBUTES AND EXPERIENCE |

| 3 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Proxy Summary

Fiscal 2020 Performance Highlights

Annual Meeting of Shareholders

You are entitled to vote at the meeting if you were a holder of record of our common stock at the close of business on December 31, 2020. Please see “Additional Information – Voting and Meeting Information – How Do I Vote?” for instructions on how to vote your shares and other important Annual Meeting information. If you wish to attend the virtual only shareholder meeting see “Additional Information – Voting and Meeting Information – Virtual Meeting Information” for additional instructions.

Governance and Compensation Changes

Over our more than 180-year history, one of the things we have learned is the inevitability of change. As a result, we regularly assess what we do to determine how we can adapt and improve. This approach applies to our corporate governance and compensation plans as much as it does to our manufacturing processes and product innovation. Here is a summary of the changes we have made in recent years.

CORPORATE GOVERNANCE —We adopted a bylaw in 2016 allowing shareholders meeting certain requirements to nominate directors and have such nominees included in the proxy statement, commonly referred to as “proxy access.” —In 2017, we increased the retirement age for board members to 75 to reflect recent industry trends and to provide stability in the composition of our board. —In 2020, shareholders approved and we adopted a bylaw providing that certain legal actions involving the Company will be litigated exclusively in the courts located in the State of Delaware, where the company is incorporated. | COMPENSATION —The performance goals for our short-term incentive plan were significantly increased in 2018 to align more appropriately to our current enterprise strategy. —A downward TSR Modifier for LTIC was implemented for the performance periods ending in FY2017, FY2018, and FY2019. If TSR performance was below the 50th percentile, the payout would be reduced by the modifier. For performance periods ending in FY2020 and FY2021, the TSR modifier will be multiplicative and could adjust upward or downward based upon TSR performance as compared to the peer group. —Performance Stock Units (PSUs) are now based solely on a revenue growth metric. TSR as a standalone metric applies only to the cash portion of the long-term award. —The consolidated financials of the Wirtgen acquisition are excluded from the Equipment Operations Operating Return on Operating Assets (OROA) and Shareholder Value Added (SVA) for calculating variable compensation for fiscal 2018, 2019, and 2020 to allow for integration and to determine appropriate incentive metrics. Wirtgen is included in the revenue component of the variable pay metrics to incent executive leadership to drive for successful integration and continued growth of the business. |

Fiscal 2020 Performance Highlights

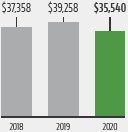

Despite the global pandemic, Deere reported strong financial results in 2020. Deere & Company (Deere or the Company) achieved net sales and revenues of $35.540 billion in fiscal 2020 compared with $39.258 billion in fiscal 2019.

Fiscal 2020 net income attributable to Deere & Company was $2.751 billion, the sixth best year in company history. This equated to $8.69 per share, compared with $3.253 billion, or $10.15 per share, in fiscal 2019. Common stock closed at $225.91 on Oct. 30, 2020, an increase of 28 percent compared to $176.11 in 2019.

In 2020, Deere introduced a new operating model that will be effective in 2021 that could have a transformative impact on the business. It focuses on our customers’ production systems, advanced technologies, and aligning resources with

the products and services that deliver the highest return. At the same time, customers responded positively to our new products and adopted precision technologies at a high rate.

Other financial highlights for the year include:

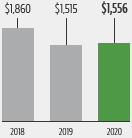

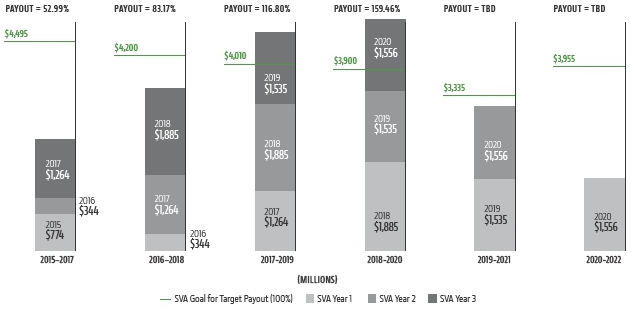

| — | Generating nearly $1.556 billion in economic profit, or Shareholder Value Added |

| — | Delivering an 18% increase in Ag & Turf division operating profit for the full year |

| — | Returning nearly $1.706 billion to stockholders in the form of dividends and share repurchases |

For more information regarding our fiscal 2020 financial performance, please see our Annual Report, which is available at www.JohnDeere.com/stock.

| 4 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Proxy Summary

Fiscal 2020 Performance Highlights

NET SALES |

| NET INCOME (1) |

| SHAREHOLDER |

| (1)Net income attributable to Deere & Company. (2)SVA is a non-GAAP measure and excludes Wirtgen. See Appendix B for details. |

|  |  | ||||

| Net sales and revenues declined 9% over fiscal 2019 due in part to declines in Construction & Forestry (C&F) and Ag & Turf (A&T) equipment sales. |

| Net income decreased 15% to $2.751 billion, from $3.253 billion in 2019. Earnings per share declined 14% to $8.69, from $10.15 in 2019. | Enterprise Shareholder Value Added (SVA) increased 3% for the year. Ag & Turf and Financial Services both delivered positive SVA. SVA represents operating profit less an implied charge for capital. | |||

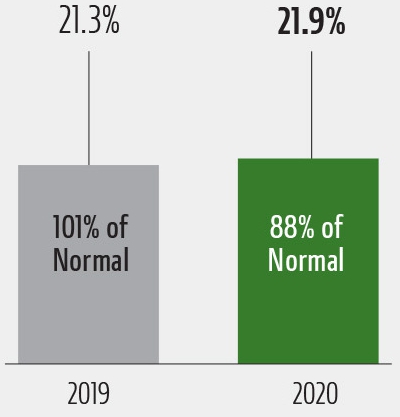

A&T OROA* | C&F OROA* | EQUIPMENT OPERATIONS | FINANCIAL SERVICES | |||

|  |  |  | |||

*As reported, OROA with inventories at standard cost. Normal means mid-cycle. OROA is a non-GAAP measure. See Appendix B for details. | ||||||

CASH FLOW FROM OPERATING ACTIVITIES Consolidated cash flow from operations totaled $7.5 billion. Cash flow funded important strategic projects and paid roughly $1.7 billion to investors in 2020 in the form of dividends and share repurchases. The company declared $3.04 in dividends per share for the year. |  | |||||

| 5 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Proxy Summary

Fiscal 2020 Executive Compensation Highlights

Fiscal 2020 Executive Compensation Highlights

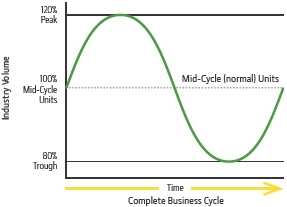

Our compensation programs and practices are designed to create incentive opportunities for advancing our shareholders’ long-term interests. We use metrics that align with our business strategy and motivate our executives to create value for shareholders at all points in the business cycle. For fiscal 2020, we had three separate variable pay components (described below) — Short-Term Incentive (STI), Long-Term Incentive Cash (LTIC), and Long-Term Incentive (LTI) — which stimulate complementary behaviors.

| This Metric | For this type of compensation | Contributes to this goal | ||

| Operating return on operating assets (OROA) (1)(2) | Annual cash bonus (known within Deere as STI) | exceptional operating performance for Equipment Operations | ||

| Return on equity (ROE) (1) | exceptional operating performance for Financial Services | |||

| Net Sales and Revenues | importance of sustainable growth in near-term decisions | |||

| Shareholder Value Added (SVA) (2) | Long-term cash (known within Deere as LTIC) | sustainable, profitable growth | ||

| Total Shareholder Return (TSR) | exceptional equity appreciation | |||

| Revenue growth | Long-term equity (known within Deere as LTI) | sustainable growth |

| (1) | OROA is a non-GAAP measure. The Equipment Operations OROA calculation excludes the assets from our Financial Services segment and certain corporate assets. Corporate assets are primarily the Equipment Operations’ retirement benefits, deferred income tax assets, marketable securities, and cash and cash equivalents. ROE is based solely on the Financial Services segment. See Appendix B for details. |

| (2) | Wirtgen is excluded from both the Equipment Operations OROA and SVA calculations for FY20 variable pay to allow time for integration and assimilation. See Appendix B for details. |

For information about the metrics we use to measure compensation and the resulting payouts, see the Executive Summary of the Compensation Discussion and Analysis (CD&A).

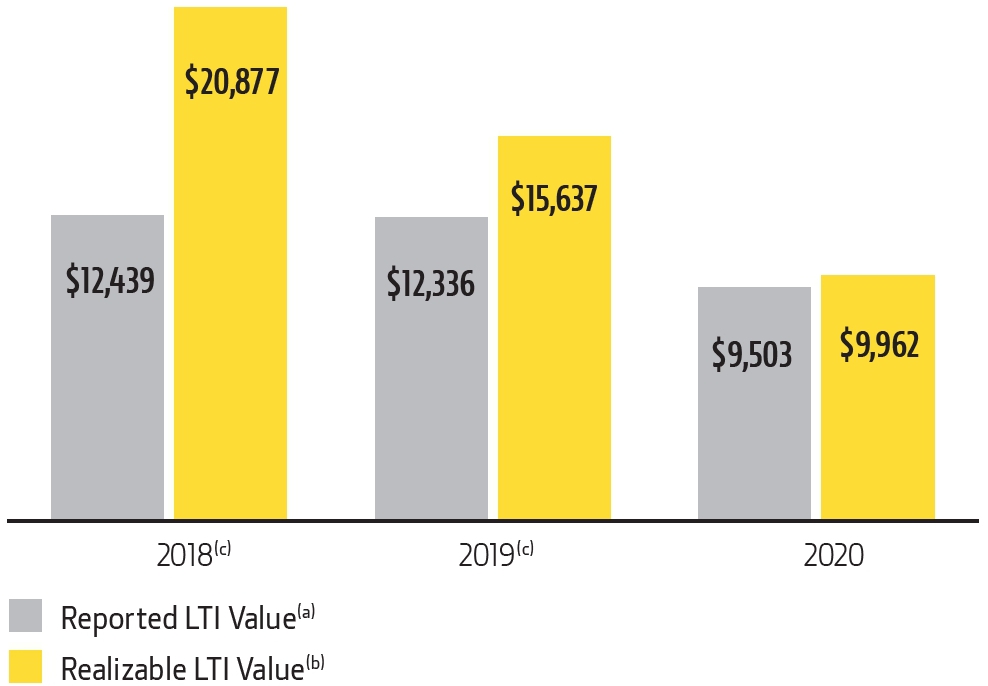

The table below highlights the 2020 compensation for the Chairman and CEO and, on average, for all the other named executive officers (NEOs) as disclosed in the Fiscal 2020 Summary Compensation Table. The table also shows how much compensation was delivered in cash (versus equity) and the significant portion that is performance-based and therefore at risk.

| Summary Compensation Table Elements | Salary | STI | LTIC | Performance Stock Units | Restricted Stock Units and Stock Options | Retirement and Other Compensation | Total |

| Chairman and CEO(a) | |||||||

| Compensation | $1,199,245 | $2,180,768 | $1,560,484 | $5,003,327 | $4,499,825 | $1,144,735 | $15,588,384 |

| % of Total | 8% | 14% | 10% | 32% | 29% | 7% | 100% |

| Cash vs. Equity | Total Cash 32% | Total Equity 61% | Other 7% | 100% | |||

| Short-Term vs. Long-Term | Short-Term 22% | Long-Term 78% | 100% | ||||

| Fixed vs. Performance-Based | Fixed 8% | Performance-Based 85% | Other 7% | 100% | |||

| Average Other NEO | |||||||

| Compensation | $769,352 | $932,686 | $1,364,587 | $1,316,352 | $1,183,991 | $739,366 | $6,306,334 |

| % of Total | 12% | 15% | 22% | 21% | 19% | 11% | 100% |

| Cash vs. Equity | Total Cash 49% | Total Equity 40% | Other 11% | 100% | |||

| Short-Term vs. Long-Term | Short-Term 27% | Long-Term 73% | 100% | ||||

| Fixed vs. Performance-Based | Fixed 12% | Performance-Based 77% | Other 11% | 100% | |||

| (a) | John C. May became the company’s Chief Executive Officer on November 4, 2019, and assumed the position of Chairman of the Board of Directors on May 1, 2020. |

| 6 | DEERE & COMPANY | 2021 PROXY STATEMENT |

| Item 1 – Election of Directors |

How We Identify and Evaluate Director Nominees

The Corporate Governance Committee of the Board is responsible for screening candidates and recommending director nominees to the full Board. The Board nominates the slate of directors for election at each Annual Meeting of Shareholders and elects directors to fill vacancies or newly created Board seats.

The Corporate Governance Committee considers candidates recommended by shareholders, directors, officers, and third-party search firms. Third-party search firms may be used to identify and provide information on director candidates. Tamra A. Erwin was recommended as a director by non-management directors and a third-party search firm. If you wish to nominate a director, please review the procedures described under “Additional Information – 2022 Shareholder Proposals and Nominations” in this Proxy Statement. The Corporate Governance Committee evaluates all candidates in the same manner, regardless of the source of the recommendation.

Deere’s Corporate Governance Policies, which are described in the “Corporate Governance” section of this Proxy Statement, establish the general criteria and framework for assessing director candidates. In particular, the Corporate Governance Committee considers each nominee’s skills, experience, international versus domestic background, age, and diversity, as well as legal and regulatory requirements and the particular needs of the Board at the time. The Committee implements these criteria, including diversity, by considering the information about the nominee provided by the proponent, the nominee, third parties and other sources. In addition, the Board assesses the diversity of its members and nominees as part of an annual performance evaluation by considering, among other factors, diversity in expertise, experience, background, ethnicity, and gender. We believe a Board composed of members with complementary skills, qualifications, experiences, and attributes is best equipped to meet its responsibilities effectively.

Any director who experiences a material change in occupation, career, or principal business activity, including retirement, must tender a resignation to the Board. Upon recommendation from the Corporate Governance Committee, the Board may decline to accept any such resignation. Directors must retire from the Board upon the first Annual Meeting of Shareholders after reaching the age of 75, except as approved by the Board.

| 7 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Board Diversity

Director Nominees

The Corporate Governance Committee has recommended and the Board has nominated each of Tamra A. Erwin, Alan C. Heuberger, Charles O. Holliday, Jr., Dipak C. Jain, Michael O. Johanns, Clayton M. Jones, John C. May, Gregory R. Page, Sherry M. Smith, Dmitri L. Stockton, and Sheila G. Talton to be elected for terms expiring at the Annual Meeting in 2022. All of the nominees are current members of the Board, but Deere’s Certificate of Incorporation and good governance practices require all members of the Board to be elected annually.

We have confidence that this talented slate of nominees will lead Deere capably in the year ahead. We discuss the nominees’ professional backgrounds and qualifications in the short biographies that follow.

| THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR ALL 11 NOMINEES. |

Board Diversity

The Corporate Governance Committee believes that our Board is most effective when it embodies a diverse set of viewpoints and practical experiences. To maintain an effective Board, the Corporate Governance Committee considers how each nominee’s particular background, experience, qualifications, attributes, and skills will contribute to Deere’s success. As shown below, the independent members of our Board have a range of viewpoints, backgrounds, expertise and attributes.

| DIVERSE BOARD REPRESENTATION | ||

| ||

| 3 | female directors | |

| 3 | ethnically diverse directors | |

| 2 | Board committees led by diverse directors | |

| RANGE OF TENURES* * Tenure and age are as of January 8, 2021. |

Average Tenure: 7 years |

| BALANCED MIX OF AGES |

Average Age: 62 |

BOARD MEMBER SKILLS

| Executive | Manufacturing | International | Government/ Academic | Agriculture | Technology/Data | Finance | Risk Management | Corporate Governance | |

| Tamra A. Erwin | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | |||

| Alan C. Heuberger | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ||||

| Charles O. Holliday, Jr. | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ||||

| Dipak C. Jain | ⬛ | ⬛ | ⬛ | ⬛ | |||||

| Michael O. Johanns | ⬛ | ⬛ | ⬛ | ⬛ | |||||

| Clayton M. Jones | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ||||

| John C. May | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ||||

| Gregory R. Page | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | |||

| Sherry M. Smith | ⬛ | ⬛ | ⬛ | ⬛ | |||||

| Dmitri L. Stockton | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ||||

| Sheila G. Talton | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ |

| ⬛ | Audit committee financial expert under Securities and Exchange Commission (SEC) rules |

| 8 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Item 1 – Election of Directors

Age: 56 Director since: Committees: | TAMRA A. ERWIN Executive Vice President and Group Chief Executive Officer of Verizon Business Group | |||

Past Positions at Verizon Communications Inc. —Executive Vice President and Chief Operating Officer, Verizon Wireless Group – 2016 to 2019 —Group President, Consumer and Mass Business Markets Sales and Service – 2015 to 2016 —President, National Operations, Wireline/Consumer and Mass Business Markets – 2013 to 2015 —Corporate Chief Marketing Officer – 2012 to 2013 —President, West Area – 2008 to 2011 |

| |||

| Key Qualifications, Experiences, and Attributes | ||||

| In addition to her professional background and prior Deere Board experience, the following qualifications led the Board to conclude that Ms. Erwin should serve on Deere’s Board of Directors: her leadership qualities developed from her experience while serving as a senior executive and as Executive Vice President, Chief Executive Officer and Chief Operating Officer of Verizon Group businesses; the breadth of her experiences in product and service development, customer service operations and support, marketing, sales, and strategic planning, and other areas of oversight while serving as an executive officer of Verizon Communications Inc.; and her subject matter knowledge in the areas of advanced communications and information technology products and services, customer relations, and human resources. | ||||

Age: 47 Director since: Committees: | ALAN C. HEUBERGER Senior Manager, BMGI (since 2004) | |||

Past Positions at BMGI (private investment management) —Investment Analyst — 1996 to 2004 |

| |||

| Key Qualifications, Experiences, and Attributes | ||||

| In addition to his professional background and prior Deere Board experience, the following qualifications led the Board to conclude that Mr. Heuberger should serve on Deere’s Board of Directors: his leadership qualities developed from his service as Senior Manager of BMGI; the breadth of his experience in governance, strategy, and other areas of oversight while serving as a member of the boards of directors and advisors of various asset management entities and privately-held corporations; and his subject matter knowledge in the areas of agriculture industry investments, asset management, finance, and economics. | ||||

| 9 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Item 1 – Election of Directors

Age: 72 Director since: Committees: | CHARLES O. HOLLIDAY, JR. Chairman of Royal Dutch Shell plc | |||

Past Positions —Chairman of the National Academy of Engineering (nonprofit engineering institution) — 2012 to 2016 —Chairman of Bank of America Corporation (banking, investing, and asset management) — 2010 to 2014 —Chairman from 1999 to 2009 and Chief Executive Officer from 1998 through 2008 of DuPont (agricultural, electronics, material science, safety and security, and biotechnology) | Other Current Directorships —HCA Healthcare, Inc. —Royal Dutch Shell plc Previous Directorships —CH2M HILL Companies, Ltd. | |||

| Key Qualifications, Experiences, and Attributes | ||||

| In addition to his professional background and prior Deere Board experience, the following qualifications led the Board to conclude that Mr. Holliday should serve on Deere’s Board of Directors: his leadership qualities developed from his experiences while serving as Chairman of Royal Dutch Shell, Chairman of the National Academy of Engineering, Chairman of Bank of America Corporation, and Chairman and Chief Executive Officer of DuPont; the breadth of his experiences in auditing, compensation, and other areas of oversight while serving as a member of the boards of directors of other global corporations; and his subject matter knowledge in the areas of engineering, finance, business development, and corporate responsibility. | ||||

Age: 63 Director since: 2002 Committees: | DIPAK C. JAIN President (Europe), China Europe International Business School (since 2018) | |||

Past Positions —Co-President/Global Advisor, China Europe International Business School (international graduate business school) – 2017 to 2018 —Director, Sasin Graduate Institute of Business Administration — 2014 to 2017 —Chaired Professor of Marketing, INSEAD (international graduate business school) — 2013 to 2014 —Dean, INSEAD — 2011 to 2013 —Dean and Associate Dean for Academic Affairs, Kellogg School of Management, Northwestern University — 1996 to 2009 —Sandy and Morton Goldman Professor of Entrepreneurial Studies and Professor of Marketing, Kellogg School of Management, Northwestern University — 1994 to 2001 and since 2009 | Other Current Directorships —Reliance Industries Limited, India Previous Directorships —Global Logistics Properties Ltd., Singapore —Northern Trust Corporation | |||

| Key Qualifications, Experiences, and Attributes | ||||

| In addition to his professional background and prior Deere Board experience, the following qualifications led the Board to conclude that Mr. Jain should serve on Deere’s Board of Directors: his leadership qualities developed from his experiences while serving as Director or Dean at several prominent graduate business schools and as a foreign affairs advisor for the Prime Minister of Thailand; the breadth of his experiences in compensation, corporate governance, and other areas of oversight while serving as a member of the boards of directors of other global corporations; and his subject matter knowledge in the areas of marketing, global product diffusion, and new product forecasting and development. | ||||

| 10 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Item 1 – Election of Directors

Age: 70 Director since: 2015 Committees: | MICHAEL O. JOHANNS Retired U.S. Senator from Nebraska and former U.S. Secretary of Agriculture | |||

Past Positions —United States Senator from Nebraska — 2009 to 2015 —United States Secretary of Agriculture — 2005 to 2007 —Governor of Nebraska — 1999 to 2005 | Other Current Directorships —Corteva, Inc. | |||

| Key Qualifications, Experiences, and Attributes | ||||

| In addition to his professional background and prior Deere Board experience, the following qualifications l ed the Board to conclude that Mr. Johanns should serve on Deere’s Board of Directors: his leadership qualities developed from his service in state and federal government, including serving as Governor of Nebraska; the breadth of his experiences in law, governance, and other areas of oversight while serving as a partner of a law firm and a member of the U.S. Senate and various Senate committees; and his subject matter knowledge in the areas of agriculture, banking, commerce, and foreign trade. | ||||

Age: 71 Director since: 2007 Committees: | CLAYTON M. JONES Retired Chairman and Chief Executive Officer of Rockwell Collins, Inc. | |||

Past Positions at Rockwell Collins, Inc. —Chairman — 2013 to 2014 —Chairman and Chief Executive Officer — 2012 to 2013 —Chairman, President, and Chief Executive Officer — 2002 to 2012 | Other Current Directorships —Motorola Solutions, Inc. Previous Directorships — Cardinal Health, Inc. | |||

| Key Qualifications, Experiences, and Attributes | ||||

| In addition to his professional background and prior Deere Board experience, the following qualifications led the Board to conclude that Mr. Jones should serve on Deere’s Board of Directors: his leadership qualities developed from his service as Chairman and Chief Executive Officer of Rockwell Collins; the breadth of his experiences in corporate governance, finance, compensation, and other areas of oversight while serving as a member of the boards of directors of other global corporations; and his subject matter knowledge in the areas of technology, government affairs, and marketing. | ||||

| 11 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Item 1 – Election of Directors

Age: 51 Director since: 2019 | JOHN C. MAY Chairman, Chief Executive Officer and President of Deere & Company (since 2020) | |||

Past Positions at Deere & Company —Chief Executive Officer and President – November 2019 to May 2020 —President and Chief Operating Officer — April 2019 to November 2019 —President, Worldwide Agriculture & Turf Division, Global Harvesting and Turf Platforms, Ag Solutions (Americas and Australia) — 2018 to 2019 —President, Agricultural Solutions & Chief Information Officer — 2012 to 2018 —Vice President, Agriculture & Turf Global Platform, Turf & Utility — 2009 to 2012 —Factory Manager, John Deere Dubuque Works — 2007 to 2009 —Director, China Operations — 2004 to 2007 | ||||

| Key Qualifications, Experiences, and Attributes | ||||

| In addition to his professional background and prior Deere Board experience, the following qualifications led the Board to conclude that Mr. May should serve on Deere’s Board of Directors: his leadership experience as an officer of Deere since 2009; the breadth of his management experiences within, and knowledge of, Deere’s global operations, precision agriculture, and information technology; and his subject matter knowledge in the areas of leadership, manufacturing, and information technology. | ||||

Age: 69 Director since: 2013 Committees: | GREGORY R. PAGE Chairman of Corteva, Inc. (agricultural seeds, crop protection products, and digital solutions) (since 2019) | |||

Past Positions at Cargill, Incorporated (agricultural, food, financial, and industrial products and services) —Executive Director — 2015 to 2016 —Executive Chairman — 2013 to 2015 —Chairman and Chief Executive Officer — 2011 to 2013 —Chairman, Chief Executive Officer, and President — 2007 to 2011 | Other Current Directorships —Eaton Corporation plc —3M Company —Corteva, Inc. Previous Directorships —Cargill, Incorporated | |||

| Key Qualifications, Experiences, and Attributes | ||||

| In addition to his professional background and prior Deere Board experience, the following qualifications led the Board to conclude that Mr. Page should serve on Deere’s Board of Directors: his leadership qualities developed from his experiences while serving as Chairman of Corteva, Inc. and Chairman and Chief Executive Officer of Cargill; the breadth of his experiences in auditing, corporate governance, and other areas of oversight while serving as a member of the boards of directors of other global corporations; and his subject matter knowledge in the areas of commodities, agriculture, operating processes, finance, and economics. | ||||

| 12 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Item 1 – Election of Directors

Age: 59 Director since: 2011 Committees: | SHERRY M. SMITH Former Executive Vice President and Chief Financial Officer of SuperValu Inc. | |||

Past Positions at SuperValu Inc. (retail and wholesale grocery and retail general merchandise products) —Executive Vice President and Chief Financial Officer — 2010 to 2013 —Senior Vice President, Finance — 2005 to 2010 —Senior Vice President, Finance and Treasurer — 2002 to 2005 | Other Current Directorships —Piper Sandler Companies —Realogy Holdings Corp. —Tuesday Morning Corp. | |||

| Key Qualifications, Experiences, and Attributes | ||||

| In addition to her professional background and prior Deere Board experience, the following qualifications led the Board to conclude that Ms. Smith should serve on Deere’s Board of Directors: her leadership qualities developed from her experience while serving as a senior executive and as Chief Financial Officer of SuperValu; the breadth of her experiences in auditing, finance, accounting, compensation, strategic planning, and other areas of oversight while serving as a member of the boards of directors of other public corporations; her family farming background; and her subject matter knowledge in the areas of finance, accounting, and food and supply chain management. | ||||

Age: 56 Director since: 2015 Committees: | DMITRI L. STOCKTON Retired Special Advisor to Chairman and Senior Vice President of General Electric Company and Former Chairman, President, and Chief Executive Officer of GE Asset Management Incorporated | |||

Past Positions —Special Advisor to the Chairman and Senior Vice President of GE (power and water, aviation, oil and gas, healthcare, appliances and lighting, energy management, transportation and financial services) — 2016 to 2017 —Chairman, President, and Chief Executive Officer of GE Asset Management Incorporated (global investments) and Senior Vice President of General Electric Company — 2011 to 2016 —President and Chief Executive Officer of GE Capital Global Banking and Senior Vice President of GE London — 2008 to 2011 | Other Current Directorships —Ryder System, Inc. —Stanley Black & Decker, Inc. —Target Corp. Previous Directorships —GE Asset Management Incorporated —GE RSP U.S. Equity Fund and GE RSP Income Fund —Elfun Funds (six directorships) | |||

| Key Qualifications, Experiences, and Attributes | ||||

In addition to his professional background and prior Deere Board experience, the following qualifications led the Board to conclude that Mr. Stockton should serve on Deere’s Board of Directors: his leadership qualities developed from his service as Chairman, President, and Chief Executive Officer of GE Asset Management and as a senior officer of other global operations; the breadth of his experiences in risk management, governance, regulatory compliance, and other areas of oversight while serving as a member of the boards of directors and trustees of global asset management, investment, and employee benefit entities; and his subject matter knowledge in the areas of finance, banking, and asset management. | ||||

| 13 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Item 1 – Election of Directors

Age: 68 Director since: 2015 Committees: | SHEILA G. TALTON President and Chief Executive Officer of Gray Matter Analytics | |||

Past Positions —President and Chief Executive Officer of SGT Ltd. (strategy and technology consulting services) — 2011 to 2013 —Vice President of Cisco Systems, Inc. (information technology and solutions) — 2008 to 2011 | Other Current Directorships —OGE Energy Corp. —Sysco Corp. Previous Directorships —Wintrust Financial Corp. | |||

| Key Qualifications, Experiences, and Attributes | ||||

| In addition to her professional background and prior Deere Board experience, the following qualifications led the Board to conclude that Ms. Talton should serve on Deere’s Board of Directors: her leadership qualities developed from her service as President and Chief Executive Officer of Gray Matter Analytics and as an officer of other global technology and consulting firms; the breadth of her experiences in compensation, governance, risk management, and other areas of oversight while serving as a member of the boards of directors of other global public corporations; and her subject matter knowledge in the areas of technology, data analytics, and global strategies. | ||||

| 14 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Corporate Governance Highlights

At Deere, we recognize that strong corporate governance contributes to long-term shareholder value.

We are committed to sound governance practices, including those described below:

INDEPENDENCE —All of our director nominees, except our Chairman and CEO, are independent —The independent Presiding Director has a role with significant governance responsibilities —All standing Board committees other than the Executive Committee are composed wholly of independent directors —Independent directors meet regularly in executive session without management present | BEST PRACTICES —Directors may not stand for re-election after their 75th birthday, absent Board approval under rare circumstances —Our recoupment policy requires an executive to return any incentive compensation found to have been awarded erroneously due to accounting misconduct —Directors and executives are subject to stock ownership requirements —Directors and executives are prohibited from hedging or pledging their Deere stock | |

ACCOUNTABILITY —All directors are elected annually —In uncontested elections, directors are elected by majority vote —The Board and each Board committee conducts an annual performance self-evaluation —Shareholders have the ability to include nominees in our proxy statement (so-called proxy access rights) | RISK OVERSIGHT —The Board oversees Deere’s overall risk-management structure —Individual Board committees oversee certain risks related to their specific areas of responsibility —We have robust risk management processes throughout the company |

Our Values

At Deere, our actions are guided by our core values: integrity, quality, commitment, and innovation. We strive to live up to these values in everything we do — not just because it is good business, but because we are committed to strong corporate governance. We are committed to strong corporate governance as a means of upholding these values and ensuring that we are accountable to our shareholders.

Director Independence

The Board has adopted categorical standards (see Appendix A) that help us evaluate each director’s independence. Specifically, these standards are intended to assist the Board in determining whether certain relationships between our directors and Deere or its affiliates are “material relationships” for purposes of the New York Stock Exchange (NYSE) independence standards. The categorical standards establish thresholds, short of which any such relationship is deemed not to be material. In addition, each director’s independence is evaluated under our Related Person Transactions Approval Policy, as discussed in the “Review and Approval of Related Person Transactions” section. Deere’s independence standards meet or exceed the NYSE’s independence requirements.

| 15 | DEERE & COMPANY | 2021 PROXY STATEMENT |

In November 2020, we reviewed the independence of each then-sitting director, applying the independence standards set forth in our Corporate Governance Policies. The reviews considered relationships and transactions between each director (and the director’s immediate family and affiliates) and Deere, Deere’s management, and Deere’s independent registered public accounting firm. Based on this review, the Board affirmatively determined at its regular December 2020 meeting that no director other than Mr. May has a material relationship with Deere and its affiliates and that each director other than Mr. May is independent as defined in our Corporate Governance Policies and the NYSE’s listing standards. Mr. May is not independent because of his employment relationship with Deere.

Board Leadership Structure

John C. May currently serves as Deere’s Chairman, Chief Executive Officer and President. The position of Chairman has traditionally been held by Deere’s Chief Executive Officer. The Board believes the decisions as to who should serve as Chairman and as Chief Executive Officer and whether the offices shall be combined or separated is the proper responsibility of the Board. The Board also believes that having an independent Chairman is unnecessary in normal circumstances. The Board’s governance processes preserve Board independence by ensuring discussion among independent directors and independent evaluation of and communication with members of senior management. Additionally, the enhanced role of the independent Presiding Director provides a strong counterbalance to the non-independent Chairman and Chief Executive Officer roles.

Presiding Director

Charles O. Holliday, Jr. has served as our independent Presiding Director since the 2020 Annual Meeting.

The Presiding Director is elected by a majority of the independent directors upon a recommendation from the Corporate Governance Committee. The Presiding Director is appointed for a one-year term beginning upon election and expiring upon the selection of a successor.

The Board has assigned the Presiding Director the following duties and responsibilities:

| — | Preside at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors; |

| — | Serve as liaison between the Chairman and the independent directors; |

| — | In consultation with the Chairman, review and approve the schedule of meetings of the Board, the proposed agendas, and the materials to be sent to the Board; |

| — | Call meetings of the independent directors when necessary; and |

| — | Remain available for consultation and direct communication with Deere’s shareholders. |

The Board believes the role of the Presiding Director exemplifies Deere’s continuing commitment to strong corporate governance and Board independence.

Board Meetings

Under Deere’s bylaws, regular meetings of the Board are held at least quarterly. Our typical practice is to schedule at least one Board meeting per year at a company location other than our World Headquarters so directors have an opportunity to observe different aspects of our business first-hand. The Board met four times during fiscal 2020.

Directors are expected to attend Board meetings, meetings of committees on which they serve, and shareholder meetings. More to the point, directors are expected to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. During fiscal 2020, all incumbent directors attended 75% or more of the meetings of the Board and committees on which they served. Overall attendance at Board and committee meetings was 98%. All directors then in office attended the Annual Meeting of Shareholders in February 2020.

Each Board meeting normally begins or ends with a session between the CEO and the independent directors. This provides a platform for discussions outside the presence of the non-Board management attendees. The independent directors may meet in executive session, without the CEO, at any time, but such non-management executive sessions are scheduled and typically occur at each regular Board meeting. The Presiding Director presides over these executive sessions.

| 16 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Board Committees

The Board has delegated some of its authority to five committees: the Executive Committee, the Audit Review Committee, the Compensation Committee, the Corporate Governance Committee, and the Finance Committee.

Periodically, the Board approves the rotation of certain directors’ committee memberships. The Board believes that committee rotation is generally desirable to ensure that committees regularly benefit from new perspectives. Effective November 2020, Dipak C. Jain was appointed to the Compensation Committee and left the Audit Review Committee, and Clayton M. Jones was appointed to the Audit Review Committee and left the Compensation Committee.

Each of our Board committees has adopted a charter that complies with current NYSE rules relating to corporate governance matters. Copies of the committee charters are available at www.JohnDeere.com/corpgov and may also be obtained upon request to the Deere & Company Shareholder Relations Department. Each committee (other than the Executive Committee, which did not meet in 2020 and of which Mr. May serves as chair) is composed solely of independent directors.

The committee structure and memberships described below reflect the changes that become effective in November 2020. Every committee other than the Executive Committee regularly reports on its activities to the full Board.

EXECUTIVE COMMITTEE 2020 meetings: 0 | —Acts on matters requiring Board action between meetings of the full Board —Has authority to act on certain significant matters, limited by our bylaws and applicable law —All members, other than Mr. May, are independent |

AUDIT REVIEW COMMITTEE 2020 meetings: 5 | —Oversees the independent registered public accounting firm’s qualifications, independence, and performance —Assists the Board in overseeing the integrity of our financial statements, compliance with legal requirements, and the performance of our internal auditors —Pre-approves all audit and allowable non-audit services by the independent registered public accounting firm —With the assistance of management, approves the selection of the independent registered public accounting firm’s lead engagement partner —All members have been determined to be independent and financially literate under current NYSE listing standards, including those standards applicable specifically to audit committee members —The Board has determined that Ms. Smith, Mr. Heuberger, Mr. Jones and Mr. Page are “audit committee financial experts” as defined by the SEC and that each has accounting or related financial management expertise as required by NYSE listing standards |

| 17 | DEERE & COMPANY | 2021 PROXY STATEMENT |

COMPENSATION COMMITTEE 2020 meetings: 5 | —Makes recommendations to the Board regarding incentive and equity-based compensation plans —Evaluates and approves the compensation of our executive officers (except for the compensation of our CEO, which is approved by the full Board), including reviewing and approving the performance goals and objectives that will affect that compensation —Evaluates and approves compensation granted pursuant to Deere’s equity-based and incentive compensation plans, policies, and programs —Retains, oversees, and assesses the independence of compensation consultants and other advisors —Oversees our policies on structuring compensation programs for executive officers relative to tax deductibility —Reviews and discusses the CD&A with management and determines whether to recommend to the Board that the CD&A be included in our filings with the SEC —All members have been determined to be independent under current NYSE listing standards, including those standards applicable specifically to compensation committee members |

CORPORATE GOVERNANCE 2020 meetings: 4 | —Monitors corporate governance policies and oversees our Center for Global Business Conduct —Reviews senior management succession plans and identifies and recommends to the Board individuals to be nominated as directors —Makes recommendations concerning the size, composition, committee structure, and fees for the Board —Reviews and reports to the Board on the performance and effectiveness of the Board —Oversees the evaluation of our management —Monitors and oversees aspirations and activities related to environmental, social, and governance matters —All members have been determined to be independent under current NYSE listing standards |

FINANCE COMMITTEE 2020 meetings: 4 | —Reviews the policies, practices, strategies, and risks relating to Deere’s financial affairs —Exercises oversight of the business of Deere’s Financial Services segment —Formulates our pension funding policies —Oversees our pension plans —All members have been determined to be independent under current NYSE listing standards |

| 18 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Board Oversight of Risk Management

The Board believes that strong and effective internal controls and risk management processes are essential for achieving long-term shareholder value. The Board, directly and through its committees, is responsible for monitoring risks that may affect Deere.

RISK MANAGEMENT APPROACH

We maintain a structured risk management approach to facilitate our strategic business objectives. To that end, we identify and categorize risks and then escalate them as needed. Our internal risk management structure is administered by a Management Risk Committee consisting of the CEO and his direct reports. This committee provides periodic reports to the Board regarding Deere’s risk management processes and reviews with the Board high-priority areas of enterprise risk.

Dedicated risk management reports typically take place at regularly scheduled Board meetings, and risk management topics are discussed as needed at other Board and committee meetings.

BOARD AND COMMITTEE RISK OVERSIGHT RESPONSIBILITIES

Each Board committee is responsible for oversight of risk categories related to its specific area of focus, while the full Board exercises ultimate responsibility for overseeing the risk management function as a whole and has direct oversight responsibility for many risk categories, including cyber security risks.

The areas of risk oversight exercised by the Board and its committees are:

| Who is responsible? | Primary areas of risk oversight | |

| Full Board | Oversees overall risk management function and regularly receives and evaluates reports and presentations from the chairs of the individual Board committees on risk-related matters falling within each committee’s oversight responsibilities. | |

| Audit Review Committee | Monitors operational, strategic, and legal and regulatory risks by regularly reviewing reports and presentations given by management, including our Senior Vice President and General Counsel, Senior Vice President and Chief Financial Officer, and Vice President, Internal Audit, as well as other operational personnel. Regularly reviews our risk management practices and risk-related policies (for example, Deere’s risk management and insurance portfolio, and legal and regulatory reviews, evaluates potential risks related to internal control over financial reporting and information system risks, and shares with the full Board oversight responsibility for cyber security risks). | |

| Compensation Committee | Monitors potential risks related to the design and administration of our compensation plans, policies, and programs, including our performance-based compensation programs, to promote appropriate incentives that do not encourage executive officers or employees to take unnecessary and/or excessive risks. | |

| Corporate Governance Committee | Monitors potential risks related to our governance practices by, among other things, reviewing succession plans and performance evaluations of the Board and CEO, monitoring legal developments and trends regarding corporate governance practices, monitoring the Code of Business Conduct, and evaluating potential related person transactions. Monitors product safety and other compliance matters. | |

| Finance Committee | Monitors operational and strategic risks related to Deere’s financial affairs, including capital structure and liquidity risks, and reviews the policies and strategies for managing financial exposure and contingent liabilities. Monitors potential risks related to funding our U.S. qualified pension plans (other than the defined contribution savings and investment plans) and monitors compliance with applicable laws and internal policies and objectives. |

| 19 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Corporate Governance

Shareholder Outreach

To ensure the continued delivery of sustainable, long-term value to our shareholders, we engage in regular dialogue with them. During 2020, we discussed governance, executive compensation, sustainability, and other issues with shareholders representing more than 40% of our outstanding shares. The Board considers feedback from these conversations during its deliberations, and we regularly review and adjust our corporate governance structure and executive compensation policies and practices in response to comments from our shareholders.

Communication with the Board

If you wish to communicate with the Board, you may send correspondence to: Corporate Secretary, Deere & Company, One John Deere Place, Moline, Illinois 61265-8098. The Corporate Secretary will submit your correspondence to the Board or the appropriate committee, as applicable.

You may communicate directly with the Presiding Director by sending correspondence to: Presiding Director, Board of Directors, Deere & Company, Department A, One John Deere Place, Moline, Illinois 61265-8098.

Corporate Governance Policies

Because we believe corporate governance is integral to creating long-term shareholder value, our Board of Directors has adopted company-wide Corporate Governance Policies, which are periodically reviewed and revised as appropriate to ensure that they reflect the Board’s corporate governance objectives.

Please visit the Corporate Governance section of our website (www.JohnDeere.com/corpgov) to learn more about our corporate governance practices and to access the following materials:

| — | Leadership Biographies |

| — | Core Values |

| — | Code of Ethics |

| — | Corporate Governance Policies |

| — | Charters for our Board Committees |

| — | Code of Business Conduct |

| — | Supplier Code of Conduct |

| — | Support of Human Rights in Our Business Practices |

| — | Conflict Minerals Policy |

Political Contributions

To promote transparency and good corporate citizenship we have provided voluntary disclosure relating to the political contributions of Deere and its political action committee. This information is publicly available at www.JohnDeere.com/politicalcontributions.

| 20 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Compensation of Directors

| Compensation of Directors |

We have structured the compensation of our non-employee directors with the following objectives in mind:

| — | Recognize the substantial investment of time and expertise necessary for the directors to discharge their duties to oversee Deere’s global affairs |

| — | Align the directors’ interests with the long-term interests of our shareholders |

| — | Ensure that compensation is easy to understand and is regarded positively by our shareholders and employees |

We pay non-employee directors an annual retainer. In addition, committee chairpersons and the Presiding Director receive fees for assuming those responsibilities. Directors who are employees receive no additional compensation for serving on the Board. We do not pay committee member retainers or meeting fees, but we do reimburse directors for expenses related to meeting attendance.

To supplement their cash compensation and align their interests with those of our shareholders, non-employee directors are awarded restricted stock units (RSUs) after each Annual Meeting. A person who serves a partial term as a non-employee director will receive a prorated retainer and a prorated RSU award.

Compensation for non-employee directors is reviewed annually by the Corporate Governance Committee. At its December 2018 meeting, the Board approved compensation as noted below for non-employee directors as recommended by the Corporate Governance Committee. The cash components are effective on January 1 following approval and the equity component is effective for the annual award in March following approval.

The following chart describes amounts we pay and the value of awards we grant to non-employee directors:

| Date Approved by Corporate Governance Committee: Effective Date of Annual Amounts: | December 2018 January & March 2019 | ||

| Retainer | $ | 135,000 | |

| Equity Award | $ | 160,000 | |

| Presiding Director Fee | $ | 30,000 | |

| Audit Review Committee Chair Fee | $ | 25,000 | |

| Compensation Committee Chair Fee | $ | 20,000 | |

| Corporate Governance Committee Chair Fee | $ | 15,000 | |

| Finance Committee Chair Fee | $ | 15,000 | |

Under our Non-employee Director Deferred Compensation Plan, directors may choose to defer some or all of their annual retainers until they retire from the Board. For deferrals through December 2016, a director could elect to have these deferrals invested in either an interest-bearing account or an account with a return equivalent to an investment in Deere common stock. For deferrals effective in January 2017 and later, directors may choose from a list of investment options, none of which yields an above-market earnings rate.

Our stock ownership guidelines require each non-employee director to own Deere common stock equivalent in value to at least three times the director’s annual cash retainer. This ownership level must be achieved within five years of the date the director joins the Board. Restricted shares (regularly granted to non-employee directors prior to 2008), RSUs, and any common stock held personally by the non-employee director are included in determining whether the applicable ownership threshold has been reached. Each non-employee director, except Ms. Erwin, who was appointed on May 1, 2020, has achieved stockholdings in excess of the applicable multiple as of the date of this Proxy Statement.

| 21 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Compensation of Directors

We require non-employee directors to hold all equity awards until the occurrence of one of the following triggering events: retirement from the Board, total and permanent disability, death, or a change in control of Deere combined with a qualifying termination of the director’s service with the company. Directors may not sell, gift, or otherwise dispose of their equity awards before the occurrence of a triggering event. While the restrictions are in effect, non-employee directors may vote their restricted shares (but not shares underlying RSUs) and receive dividends on the restricted shares and dividend equivalents on the RSUs.

During fiscal 2020, Samuel R. Allen served as our Executive Chairman until he elected to resign as Executive Chairman and as a Director, effective April 30, 2020. In his capacity as an Executive Officer during fiscal 2020, Mr. Allen received base salary of $551,894, STI of $802,873, LTIC for the performance period ended in fiscal 2020 of $2,944,374, a Long-Term Incentive Restricted Stock Unit award of $999,872 and other compensation of $300,135. Mr. Allen did not qualify as a Named Executive Officer for fiscal 2020. Mr. Allen did not receive any additional compensation for his service as a Director.

In fiscal 2020, we provided the following compensation to our non-employee directors:

| Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | Nonqualified Deferred Compensation Earnings (3) | Total | |||||

| Tamra A. Erwin (4) | $67,500 | $113,597 | $0 | $ | 181,097 | ||||

| Alan C. Heuberger | $135,000 | $159,855 | $0 | $ | 294,855 | ||||

| Charles O. Holliday, Jr. | $155,000 | $159,855 | $0 | $ | 314,855 | ||||

| Dipak C. Jain | $135,000 | $159,855 | $51,814 | $ | 346,669 | ||||

| Michael O. Johanns | $135,000 | $159,855 | $0 | $ | 294,855 | ||||

| Clayton M. Jones | $150,000 | $159,855 | $0 | $ | 309,855 | ||||

| Gregory R. Page | $150,000 | $159,855 | $970 | $ | 310,825 | ||||

| Sherry M. Smith | $160,000 | $159,855 | $2,697 | $ | 322,552 | ||||

| Dmitri L. Stockton | $148,334 | $159,855 | $0 | $ | 308,189 | ||||

| Sheila G. Talton | $135,000 | $159,855 | $0 | $ | 294,855 | ||||

| (1) | All fees earned in fiscal 2020 for services as a director, including committee chairperson and Presiding Director fees, whether paid in cash or deferred under the Non-employee Director Deferred Compensation Plan, are included in this column. |

| (2) | Represents the aggregate grant date fair value of RSUs computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation – Stock Compensation and does not correspond to the actual value that will be realized by the non-employee directors. The values in this column exclude the effect of estimated forfeitures. All grants are fully expensed in the fiscal year granted based on the grant price (the average of the high and low price for Deere common stock on the grant date). For fiscal 2020, the grant date was March 4, 2020, and the grant price was $161.96. |

| The non-employee director grant date is seven calendar days after the Annual Meeting. The assumptions made in valuing the RSUs reported in this column are discussed in Note 23, “Stock Option and Restricted Stock Awards,” of our consolidated financial statements filed with the SEC as part of our annual report on Form 10-K for the fiscal year 2020. The following table lists the cumulative restricted shares and RSUs held by the non-employee directors as of November 1, 2020: |

| Director Name | Restricted Stock | RSUs | Director Name | Restricted Stock | RSUs | ||||||

| Tamra A. Erwin | - | 811 | Clayton M. Jones | 824 | 18,941 | ||||||

| Alan C. Heuberger | - | 4,476 | Gregory R. Page | - | 9,393 | ||||||

| Charles O. Holliday, Jr. | - | 3,121 | Sherry M. Smith | - | 11,543 | ||||||

| Dipak C. Jain | 13,234 | 18,941 | Dmitri L. Stockton | - | 6,687 | ||||||

| Michael O. Johanns | - | 7,203 | Sheila G. Talton | - | 6,687 |

| (3) | Directors are eligible to participate in the Non-employee Director Deferred Compensation Plan. Under this plan, participants may defer part or all of their annual cash compensation. Through December 2016, two investment choices were available for these deferrals: | |

| – | an interest-bearing alternative that pays interest at the end of each calendar quarter (i) for amounts deferred between fiscal 2010 through December 2016, at a rate based on the Moody’s “A”-rated Corporate Bond Rate and (ii) for amounts deferred prior to fiscal 2010, at a rate based on the prime rate as determined by the Federal Reserve Statistical Release plus 2% | |

| – | an equity alternative denominated in units of Deere common stock that earns additional shares each quarter at the quarterly dividend rate on Deere common stock | |

| Amounts included in this column represent the above-market earnings on any amounts deferred under the Non-employee Director Deferred Compensation Plan. Above-market earnings represent the difference between the interest rate used to calculate earnings under the applicable investment choice and 120% of the applicable federal long-term rate. | ||

| (4) | Ms. Erwin was elected to the Board effective May 1, 2020. Her compensation amounts reflect a pro-rated retainer fee for the period from May 2020 through October 2020 and a pro-rated RSU award granted in May 2020. | |

| 22 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Security Ownership of Certain Beneficial Owners and Management

| Security Ownership of Certain Beneficial Owners and Management |

The following table shows the number of shares of Deere common stock beneficially owned as of December 31, 2020, (unless otherwise indicated) by:

| — | each person who, to our knowledge, beneficially owns more than 5% of our common stock |

| — | each individual who was serving as a non-employee director as of December 31, 2020 |

| — | each of the named executive officers listed in the Summary Compensation Table of this Proxy Statement |

| — | all individuals who served as directors or executive officers on December 31, 2020, as a group |

A beneficial owner of stock (represented in column (a)) is a person who has sole or shared voting power (meaning the power to control voting decisions) or sole or shared investment power (meaning the power to cause the sale or other disposition of the stock). A person also is considered the beneficial owner of shares to which that person has the right to acquire beneficial ownership (within the meaning of the preceding sentence) within 60 days. For this reason, the following table includes exercisable stock options (represented in column (b)), restricted shares, and RSUs that could become exercisable or be settled within 60 days of December 31, 2020, at the discretion of an individual identified in the table (represented in column (c)).

All individuals listed in the table have sole voting and investment power over the shares unless otherwise noted.

As of December 31, 2020, Deere had no preferred stock issued or outstanding.

| Shares Beneficially Owned and Held (a) | Exercisable Options (b) | Options, Restricted Shares, and RSUs Available Within 60 Days (c) | Total | Percent of Shares Outstanding | ||||||

Greater Than 5% Owners | 31,510,573 | — | — | 31,510,573 | 10.0% | |||||

| The Vanguard Group, Inc. (2) 100 Vanguard Blvd. Malvern, PA 19355 | 23,636,226 | — | — | 23,636,226 | 7.5% | |||||

| BlackRock, Inc.(3) 55 East 52nd Street New York, NY 10055 | 18,403,744 | — | — | 18,403,744 | 5.9% | |||||

| Wellington Management Group, LLP(4) 280 Congress St. Boston, MA, 02210 | 16,762,167 | — | — | 16,762,167 | 5.3% | |||||

| 23 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Security Ownership of Certain Beneficial Owners and Management

| Shares Beneficially Owned and Held (a) | Exercisable Options (b) | Options, Restricted Shares, and RSUs Available Within 60 Days (c) | Total | Percent of Shares Outstanding | ||||||

| Non-Employee Directors (5) | ||||||||||

| Tamra A. Erwin | — | — | 811 | 811 | * | |||||

| Alan C. Heuberger | 100 | — | 4,476 | 4,576 | * | |||||

| Charles O. Holliday, Jr. | 11,905 | — | 3,121 | 15,026 | * | |||||

| Dipak C. Jain | — | — | 32,175 | 32,175 | * | |||||

| Michael O. Johanns | — | — | 7,203 | 7,203 | * | |||||

| Clayton M. Jones | — | — | 19,765 | 19,765 | * | |||||

| Gregory R. Page | — | — | 9,393 | 9,393 | * | |||||

| Sherry M. Smith | — | — | 11,543 | 11,543 | * | |||||

| Dmitri L. Stockton | — | — | 6,687 | 6,687 | * | |||||

| Sheila G. Talton | — | — | 6,687 | 6,687 | * | |||||

| Named Executive Officers (6) | ||||||||||

| John C. May | 50,420 | 39,336 | - | 89,756 | * | |||||

| Ryan D. Campbell | 4,223 | 12,033 | - | 16,256 | * | |||||

| Mary K. W. Jones | 42,889 | 84,184 | - | 127,073 | * | |||||

| Rajesh Kalathur | 48,961 | 115,960 | - | 164,921 | * | |||||

| Cory J. Reed | 17,504 | 36,380 | - | 53,884 | * | |||||

| James M. Field | 52,531 | 72,365 | 17,138 | 124,896 | * | |||||

| All directors and executive officers as a group (19 persons) (7) | 306,284 | 517,963 | 149,147 | 973,394 | * |

| * Less than 1% of the outstanding shares of Deere common stock. |

| (1) | The ownership information for Cascade Investment, L.L.C. is based on information supplied by Cascade in an initial statement of beneficial ownership on Form 3 filed with the SEC on September 6, 2019. All shares of common stock held by Cascade may be deemed beneficially owned by William H. Gates III as the sole member of Cascade. Cascade has sole voting power and sole dispositive power over 31,510,573 shares owned. |

| (2) | The ownership information for The Vanguard Group, Inc. is based on information supplied by Vanguard in a statement on Amendment No. 5 to Schedule 13G filed with the SEC on February 12, 2020. Vanguard holds the shares in its capacity as a registered investment advisor on behalf of numerous investment advisory clients, none of which is known to own more than five percent of Deere’s shares. Vanguard has sole voting power over 463,523 shares owned and sole dispositive power over 23,116,498 shares owned. |

| (3) | The ownership information for BlackRock, Inc. (“BlackRock”) is based on information supplied by BlackRock in a statement on Amendment No. 3 to Schedule 13G filed with the SEC on February 2, 2020. BlackRock holds the shares in its capacity as a registered investment advisor on behalf of numerous investment advisory clients, none of which is known to own more than five percent of Deere’s shares. BlackRock has sole voting power over 15,710,923 shares owned and sole dispositive power over 18,403,744 shares owned. |

| (4) | The ownership information for Wellington Management Group LLP (“Wellington”) is based on information supplied by Wellington in a statement on Schedule 13G filed with the SEC on January 28, 2020. Wellington holds the shares in its capacity as a registered investment advisor on behalf of numerous investment advisory clients, none of which is known to own more than five percent of Deere’s shares. Wellington has sole voting power over 0 shares owned and sole dispositive power over 0 shares owned. |

| (5) | The table includes restricted shares and RSUs awarded to directors under the Deere & Company Non-employee Director Stock Ownership Plan (see footnote (2) to the Fiscal 2020 Director Compensation Table). Restricted shares and RSUs may not be transferred prior to retirement as a director. RSUs are payable only in Deere common stock following retirement and have no voting rights until they are settled in shares of stock. In addition, directors own the following number of deferred stock units, which are payable solely in cash under the terms of the Non-employee Director Deferred Compensation Plan: |

| Director | Deferred Units | |

| Dipak C. Jain | 9,133 | |

| Michael O. Johanns | 3,149 | |

| Gregory R. Page | 4,107 | |

| Dmitri L. Stockton | 2,530 |

| (6) | See the Outstanding Equity Awards table for additional information regarding equity ownership for NEOs. |

| (7) | The number of shares shown for all directors and executive officers as a group includes 85,381 shares owned jointly with family members over which the directors and executive officers share voting and investment power. |

| 24 | DEERE & COMPANY | 2021 PROXY STATEMENT |

Election of Directors

Review and Approval of Related Person Transactions

The Board has adopted a written Related Person Transactions Approval Policy that assigns our Corporate Governance Committee the responsibility for reviewing, approving, or ratifying all related person transactions.

The written Related Person Transactions Approval Policy is concerned with three types of “related persons”:

| 1. | executive officers and directors of Deere |

| 2. | any holder of 5% or more of Deere’s voting securities |

| 3. | immediate family members of anyone in category (1) or (2) |

Each year, our directors and executive officers complete questionnaires designed to elicit information about potential related person transactions. In addition, the directors and officers must promptly advise our Corporate Secretary if there are any changes to the information they previously provided. After consultation with our General Counsel, management, and outside counsel, as appropriate, our Corporate Secretary determines whether any transaction is reasonably likely to be a related person transaction. Transactions deemed reasonably likely to be related person transactions are submitted to the Corporate Governance Committee for consideration at its next meeting, unless action is required sooner. In such a case, the transaction would be submitted to the Chairperson of the Corporate Governance Committee, whose determination would be reported to the full committee at its next meeting.

When evaluating potential related person transactions, the Corporate Governance Committee or its Chairperson, as applicable, considers all reasonably available relevant facts and circumstances and approves only those related person transactions determined in good faith to be in compliance with or not inconsistent with our Code of Ethics and Code of Business Conduct and in the best interests of our shareholders.

The sister of Mary K. W. Jones, Senior Vice President, General Counsel, and Worldwide Public Affairs is an employee in the Company’s corporate communications department. Ms. Jones does not directly or indirectly supervise her sister. During fiscal 2020, the employee earned approximately $147,369 in direct cash compensation along with customary employee benefits available to salaried employees generally. The employee’s compensation is consistent with that of other employees at the same grade level. Pursuant to the Related Person Transactions Approval Policy, this transaction was approved by the Corporate Governance Committee after determining that it is not inconsistent with our Code of Ethics or Code of Business Conduct.