UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended May 2, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file no: 1-4121

DEERE & COMPANY

(Exact name of registrant as specified in its charter)

| | |

Delaware | | 36-2382580 |

One John Deere Place

Moline, Illinois 61265

(Address of principal executive offices)

Telephone Number: (309) 765-8000

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | |

Title of each class | | Trading symbol | | Name of each exchange on which registered | |

Common stock, $1 par value | | DE | | New York Stock Exchange | |

8½% Debentures Due 2022 | | DE22 | | New York Stock Exchange | |

6.55% Debentures Due 2028 | | DE28 | | New York Stock Exchange | |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

At May 2, 2021, 311,942,092 shares of common stock, $1 par value, of the registrant were outstanding.

PART I. FINANCIAL INFORMATION

| | | | | | | |

ITEM 1. FINANCIAL STATEMENTS | | | | | | | |

DEERE & COMPANY | | | | | | | |

STATEMENT OF CONSOLIDATED INCOME | | | | | | | |

For the Three Months Ended May 2, 2021 and May 3, 2020 | | | | | | | |

(In millions of dollars and shares except per share amounts) Unaudited | | | | | | | |

|

| 2021 |

| 2020 |

| ||

Net Sales and Revenues | | | | | | | |

Net sales |

| $ | 10,998 | | $ | 8,224 | |

Finance and interest income | | | 809 | |

| 849 | |

Other income | | | 251 | |

| 180 | |

Total | | | 12,058 | |

| 9,253 | |

| | | | | | | |

Costs and Expenses | | | | | | | |

Cost of sales | | | 7,928 | |

| 6,294 | |

Research and development expenses | | | 377 | |

| 406 | |

Selling, administrative and general expenses | | | 838 | |

| 906 | |

Interest expense | | | 268 | |

| 342 | |

Other operating expenses | | | 335 | |

| 377 | |

Total | | | 9,746 | |

| 8,325 | |

| | | | | | | |

Income of Consolidated Group before Income Taxes | | | 2,312 | |

| 928 | |

Provision for income taxes | | | 530 | |

| 245 | |

| | | | | | | |

Income of Consolidated Group | | | 1,782 | |

| 683 | |

Equity in income (loss) of unconsolidated affiliates | | | 8 | |

| (17) | |

| | | | | | | |

Net Income | | | 1,790 | |

| 666 | |

Less: Net income attributable to noncontrolling interests | | | | |

| | |

Net Income Attributable to Deere & Company |

| $ | 1,790 | | $ | 666 | |

| | | | | | | |

Per Share Data | | | | | | | |

Basic |

| $ | 5.72 | | $ | 2.13 | |

Diluted |

| $ | 5.68 | | $ | 2.11 | |

| | | | | | | |

Average Shares Outstanding | | | | | | | |

Basic | | | 312.8 | |

| 313.2 | |

Diluted | | | 315.2 | |

| 316.2 | |

| | | | | | | |

See Condensed Notes to Interim Consolidated Financial Statements.

2

| | | | | | | |

DEERE & COMPANY | | | | | | | |

STATEMENT OF CONSOLIDATED COMPREHENSIVE INCOME | | | | | | | |

For the Three Months Ended May 2, 2021 and May 3, 2020 | | | | | | | |

(In millions of dollars) Unaudited | | | | | | | |

|

| 2021 |

| 2020 |

| ||

| | | | | | |

|

Net Income |

| $ | 1,790 | | $ | 666 | |

| | | | | | | |

Other Comprehensive Income (Loss), Net of Income Taxes | | | | | | | |

Retirement benefits adjustment | | | 91 | |

| 57 | |

Cumulative translation adjustment | | | 37 | |

| (441) | |

Unrealized gain (loss) on derivatives | | | 3 | |

| (8) | |

Unrealized gain (loss) on debt securities | | | (13) | |

| 6 | |

Other Comprehensive Income (Loss), Net of Income Taxes | | | 118 | |

| (386) | |

| | | | | | | |

Comprehensive Income of Consolidated Group | | | 1,908 | |

| 280 | |

Less: Comprehensive income attributable to noncontrolling interests | | | | |

| | |

Comprehensive Income Attributable to Deere & Company |

| $ | 1,908 | | $ | 280 | |

| | | | | | | |

See Condensed Notes to Interim Consolidated Financial Statements.

3

| | | | | | | |

DEERE & COMPANY | | | | | | | |

STATEMENT OF CONSOLIDATED INCOME | | | | | | | |

For the Six Months Ended May 2, 2021 and May 3, 2020 | | | | | | | |

(In millions of dollars and shares except per share amounts) Unaudited | | | | | | | |

|

| 2021 |

| 2020 |

| ||

Net Sales and Revenues | | | | | | | |

Net sales |

| $ | 19,049 | | $ | 14,754 | |

Finance and interest income | | | 1,644 | |

| 1,745 | |

Other income | | | 477 | |

| 385 | |

Total | | | 21,170 | |

| 16,884 | |

| | | | | | | |

Costs and Expenses | | | | | | | |

Cost of sales | | | 13,734 | |

| 11,371 | |

Research and development expenses | | | 743 | |

| 831 | |

Selling, administrative and general expenses | | | 1,607 | |

| 1,715 | |

Interest expense | | | 538 | |

| 678 | |

Other operating expenses | | | 708 | |

| 792 | |

Total | | | 17,330 | |

| 15,387 | |

| | | | | | | |

Income of Consolidated Group before Income Taxes | | | 3,840 | |

| 1,497 | |

Provision for income taxes | | | 838 | |

| 295 | |

| | | | | | | |

Income of Consolidated Group | | | 3,002 | |

| 1,202 | |

Equity in income (loss) of unconsolidated affiliates | | | 12 | |

| (18) | |

| | | | | | | |

Net Income | | | 3,014 | |

| 1,184 | |

Less: Net income attributable to noncontrolling interests | | | 1 | |

| 2 | |

Net Income Attributable to Deere & Company |

| $ | 3,013 | | $ | 1,182 | |

| | | | | | | |

Per Share Data | | | | | | | |

Basic |

| $ | 9.62 | | $ | 3.77 | |

Diluted |

| $ | 9.55 | | $ | 3.73 | |

| | | | | | | |

Average Shares Outstanding | | | | | | | |

Basic | | | 313.1 | |

| 313.3 | |

Diluted | | | 315.6 | |

| 316.7 | |

| | | | | | | |

See Condensed Notes to Interim Consolidated Financial Statements.

4

| | | | | | | |

DEERE & COMPANY | | | | | | | |

STATEMENT OF CONSOLIDATED COMPREHENSIVE INCOME | | | | | | | |

For the Six Months Ended May 2, 2021 and May 3, 2020 | | | | | | | |

(In millions of dollars) Unaudited | | | | | | | |

|

| 2021 |

| 2020 |

| ||

| | | | | | |

|

Net Income |

| $ | 3,014 | | $ | 1,184 | |

| | | | | | | |

Other Comprehensive Income (Loss), Net of Income Taxes | | | | | | | |

Retirement benefits adjustment | | | 154 | |

| 287 | |

Cumulative translation adjustment | | | 433 | |

| (398) | |

Unrealized gain (loss) on derivatives | | | 7 | |

| (8) | |

Unrealized gain (loss) on debt securities | | | (15) | |

| 11 | |

Other Comprehensive Income (Loss), Net of Income Taxes | | | 579 | |

| (108) | |

| | | | | | | |

Comprehensive Income of Consolidated Group | | | 3,593 | |

| 1,076 | |

Less: Comprehensive income attributable to noncontrolling interests | | | 1 | |

| 2 | |

Comprehensive Income Attributable to Deere & Company |

| $ | 3,592 | | $ | 1,074 | |

| | | | | | | |

See Condensed Notes to Interim Consolidated Financial Statements.

5

| | | | | | | | | | |

DEERE & COMPANY | | | | | | | | | | |

CONDENSED CONSOLIDATED BALANCE SHEET | | | | | | | | | | |

(In millions of dollars) Unaudited | | | | | | | | | | |

|

| May 2 |

| November 1 |

| May 3 |

| |||

| | 2021 | | 2020 | | 2020 |

| |||

Assets | | | | | | | | | | |

Cash and cash equivalents |

| $ | 7,182 | | $ | 7,066 | | $ | 8,900 | |

Marketable securities | | | 668 | |

| 641 | |

| 626 | |

Receivables from unconsolidated affiliates | | | 31 | |

| 31 | |

| 32 | |

Trade accounts and notes receivable – net | | | 6,158 | |

| 4,171 | |

| 5,986 | |

Financing receivables – net | | | 30,994 | |

| 29,750 | |

| 27,256 | |

Financing receivables securitized – net | | | 4,107 | |

| 4,703 | |

| 4,685 | |

Other receivables | | | 1,473 | |

| 1,220 | |

| 1,212 | |

Equipment on operating leases – net | | | 7,108 | |

| 7,298 | |

| 7,245 | |

Inventories | | | 6,042 | |

| 4,999 | |

| 6,171 | |

Property and equipment – net | | | 5,704 | |

| 5,817 | |

| 5,685 | |

Investments in unconsolidated affiliates | | | 182 | |

| 193 | |

| 192 | |

Goodwill | | | 3,190 | |

| 3,081 | |

| 2,917 | |

Other intangible assets – net | | | 1,310 | |

| 1,327 | |

| 1,311 | |

Retirement benefits | | | 951 | |

| 863 | |

| 960 | |

Deferred income taxes | | | 1,724 | |

| 1,499 | |

| 1,435 | |

Other assets | | | 2,155 | |

| 2,432 | |

| 2,713 | |

Total Assets |

| $ | 78,979 | | $ | 75,091 | | $ | 77,326 | |

| | | | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | | |

| | | | | | | | | | |

Liabilities | | | | | | | | | | |

Short-term borrowings | | $ | 9,911 | | $ | 8,582 | | $ | 11,179 | |

Short-term securitization borrowings | | | 4,106 | |

| 4,682 | |

| 4,640 | |

Payables to unconsolidated affiliates | | | 155 | |

| 105 | |

| 91 | |

Accounts payable and accrued expenses | | | 10,527 | |

| 10,112 | |

| 9,072 | |

Deferred income taxes | | | 533 | |

| 519 | |

| 475 | |

Long-term borrowings | | | 33,346 | |

| 32,734 | |

| 34,324 | |

Retirement benefits and other liabilities | | | 5,305 | |

| 5,413 | |

| 5,680 | |

Total liabilities | | | 63,883 | |

| 62,147 | |

| 65,461 | |

| | | | | | | | | | |

Commitments and contingencies (Note 18) | | | | | | | | | | |

| | | | | | | | | | |

Stockholders’ Equity | | | | | | | | | | |

Common stock, $1 par value (issued shares at | | | 4,999 | |

| 4,895 | |

| 4,713 | |

Common stock in treasury | | | (19,052) | |

| (18,065) | |

| (17,690) | |

Retained earnings | | | 34,105 | |

| 31,646 | |

| 30,556 | |

Accumulated other comprehensive income (loss) | | | (4,960) | |

| (5,539) | |

| (5,715) | |

Total Deere & Company stockholders’ equity | | | 15,092 | |

| 12,937 | |

| 11,864 | |

Noncontrolling interests | | | 4 | |

| 7 | |

| 1 | |

Total stockholders’ equity | | | 15,096 | |

| 12,944 | |

| 11,865 | |

Total Liabilities and Stockholders’ Equity | | $ | 78,979 | | $ | 75,091 | | $ | 77,326 | |

| | | | | | | | | | |

See Condensed Notes to Interim Consolidated Financial Statements.

6

| | | | | | | |

DEERE & COMPANY | | | | | | | |

STATEMENT OF CONSOLIDATED CASH FLOWS | | | | | | | |

For the Six Months Ended May 2, 2021 and May 3, 2020 | | | | | | | |

(In millions of dollars) Unaudited | | | | | | | |

|

| 2021 |

| 2020 |

| ||

Cash Flows from Operating Activities | | |

| | |

| |

Net income |

| $ | 3,014 | | $ | 1,184 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

Provision (credit) for credit losses | | | (24) | |

| 107 | |

Provision for depreciation and amortization | | | 1,054 | |

| 1,067 | |

Impairment charges | | | 50 | |

| 114 | |

Share-based compensation expense | | | 45 | |

| 48 | |

Undistributed earnings of unconsolidated affiliates | | | 11 | |

| (8) | |

Credit for deferred income taxes | | | (213) | |

| (61) | |

Changes in assets and liabilities: | | | | | | | |

Trade, notes, and financing receivables related to sales | | | (1,124) | |

| (491) | |

Inventories | | | (1,193) | |

| (496) | |

Accounts payable and accrued expenses | | | 318 | |

| (707) | |

Accrued income taxes payable/receivable | | | 54 | |

| (173) | |

Retirement benefits | | | (5) | |

| 58 | |

Other | | | (201) | |

| 134 | |

Net cash provided by operating activities | | | 1,786 | |

| 776 | |

| | | | | | | |

Cash Flows from Investing Activities | | | | | | | |

Collections of receivables (excluding receivables related to sales) | | | 10,367 | |

| 9,624 | |

Proceeds from maturities and sales of marketable securities | | | 47 | |

| 39 | |

Proceeds from sales of equipment on operating leases | | | 1,011 | |

| 898 | |

Cost of receivables acquired (excluding receivables related to sales) | | | (11,359) | |

| (9,367) | |

Acquisitions of businesses, net of cash acquired | | | (19) | |

| | |

Purchases of marketable securities | | | (74) | |

| (71) | |

Purchases of property and equipment | | | (320) | |

| (441) | |

Cost of equipment on operating leases acquired | | | (764) | |

| (960) | |

Collateral on derivatives – net | | | (255) | | | 319 | |

Other | | | (21) | |

| (11) | |

Net cash provided by (used for) investing activities | | | (1,387) | |

| 30 | |

| | | | | | | |

Cash Flows from Financing Activities | | | | | | | |

Increase in total short-term borrowings | | | 212 | |

| 1,138 | |

Proceeds from long-term borrowings | | | 3,967 | |

| 7,275 | |

Payments of long-term borrowings | | | (3,157) | |

| (3,315) | |

Proceeds from issuance of common stock | | | 116 | |

| 70 | |

Repurchases of common stock | | | (1,044) | |

| (263) | |

Dividends paid | | | (480) | |

| (481) | |

Other | | | (55) | |

| (81) | |

Net cash provided by (used for) financing activities | | | (441) | |

| 4,343 | |

| | | | | | | |

Effect of Exchange Rate Changes on Cash, Cash Equivalents, and Restricted Cash | | | 151 | |

| (102) | |

| | | | | | | |

Net Increase in Cash, Cash Equivalents, and Restricted Cash | | | 109 | | | 5,047 | |

Cash, Cash Equivalents, and Restricted Cash at Beginning of Period | | | 7,172 | |

| 3,956 | |

Cash, Cash Equivalents, and Restricted Cash at End of Period | | $ | 7,281 | | $ | 9,003 | |

| | | | | | | |

See Condensed Notes to Interim Consolidated Financial Statements.

7

| | | | | | | | | | | | | | | | | | | | | | | |

DEERE & COMPANY | | ||||||||||||||||||||||

STATEMENT OF CHANGES IN CONSOLIDATED STOCKHOLDERS’ EQUITY | | ||||||||||||||||||||||

For the Three and Six Months Ended May 2, 2021 and May 3, 2020 | | ||||||||||||||||||||||

(In millions of dollars) Unaudited | | ||||||||||||||||||||||

| | | | | Total Stockholders’ Equity | | | | | | |||||||||||||

| | | | | Deere & Company Stockholders | | |

| | | | | | ||||||||||

| | | | | | | | | | Accumulated | | | | | | | |||||||

| | Total | | | | | | | | Other | | | | | Redeemable | | |||||||

| | Stockholders’ | | Common | | Treasury | | Retained | | Comprehensive | | Noncontrolling | | | Noncontrolling | | |||||||

|

| Equity |

| Stock |

| Stock |

| Earnings |

| Income (Loss) |

| Interests |

|

| Interest | | |||||||

| | | | | | | | | | | | | | | | | |

| | | |

| |

Three Months Ended May 3, 2020 | | | | | | | | | | | | | | | | | | | | | |||

Balance February 2, 2020 |

| $ | 11,930 | | $ | 4,675 | | $ | (17,549) | | $ | 30,129 | | $ | (5,329) | | $ | 4 | | | $ | 14 | |

Net income | |

| 666 | | | | | | | | | 666 | | | | | | | | | | | |

Other comprehensive loss | |

| (386) | | | | | | | | | | | | (386) | | | | | | | | |

Repurchases of common stock | |

| (149) | | | | | | (149) | | | | | | | | | | | | | | |

Treasury shares reissued | |

| 8 | | | | | | 8 | | | | | | | | | | | | | | |

Dividends declared | |

| (241) | | | | | | | | | (238) | | | | | | (3) | | | | | |

Noncontrolling interest redemption (Note 22) | | | | | | | | | | | | | | | | | | | | | | (14) | |

Stock options and other | |

| 37 | | | 38 | | | | | | (1) | | | | | | | | | | | |

Balance May 3, 2020 | | $ | 11,865 | | $ | 4,713 | | $ | (17,690) | | $ | 30,556 | | $ | (5,715) | | $ | 1 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Six Months Ended May 3, 2020 | | | | | | | | | | | | | | |

| | | |

| | |||

Balance November 3, 2019 |

| $ | 11,417 | | $ | 4,642 | | $ | (17,474) | | $ | 29,852 | | $ | (5,607) | | $ | 4 | | | $ | 14 |

|

Net income | |

| 1,183 | | | | | | | | | 1,182 | | | | | | 1 | | | | 1 | |

Other comprehensive loss | |

| (108) | | | | | | | | | | | | (108) | | | | | | | | |

Repurchases of common stock | |

| (263) | | | | | | (263) | | | | | | | | | | | | | | |

Treasury shares reissued | |

| 47 | | | | | | 47 | | | | | | | | | | | | | | |

Dividends declared | |

| (480) | | | | | | | | | (477) | | | | | | (3) | | | | (1) | |

Noncontrolling interest redemption (Note 22) | | | | | | | | | | | | | | | | | | | | | | (14) | |

Stock options and other | |

| 69 | | | 71 | | | | | | (1) | | | | | | (1) | | | | | |

Balance May 3, 2020 | | $ | 11,865 | | $ | 4,713 | | $ | (17,690) | | $ | 30,556 | | $ | (5,715) | | $ | 1 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended May 2, 2021 | | | | | | | | | | | | | | | | | | | | | |||

Balance January 31, 2021 | | $ | 14,086 | | $ | 4,942 | | $ | (18,377) | | $ | 32,596 | | $ | (5,078) | | $ | 3 | | | | | |

Net income | | | 1,790 | | | | | | | | | 1,790 | | | | | | | | | | | |

Other comprehensive income | | | 118 | | | | | | | | | | | | 118 | | | | | | | | |

Repurchases of common stock | | | (692) | | | | | | (692) | | | | | | | | | | | | | | |

Treasury shares reissued | | | 17 | | | | | | 17 | | | | | | | | | | | | | | |

Dividends declared | | | (282) | | | | | | | | | (282) | | | | | | | | | | | |

Stock options and other | | | 59 | | | 57 | | | | | | 1 | | | | | | 1 | | | | | |

Balance May 2, 2021 | | $ | 15,096 | | $ | 4,999 | | $ | (19,052) | | $ | 34,105 | | $ | (4,960) | | $ | 4 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Six Months Ended May 2, 2021 | �� | | | | | | | | | | | | | | | | | | | | |||

Balance November 1, 2020 | | $ | 12,944 | | $ | 4,895 | | $ | (18,065) | | $ | 31,646 | | $ | (5,539) | | $ | 7 | | | | | |

ASU No. 2016-13 adoption (Note 3) | | | (35) | | | | | | | | | (35) | | | | | | | | | | | |

Net income | | | 3,014 | | | | | | | | | 3,013 | | | | | | 1 | | | | | |

Other comprehensive income | | | 579 | | | | | | | | | | | | 579 | | | | | | | | |

Repurchases of common stock | | | (1,044) | | | | | | (1,044) | | | | | | | | | | | | | | |

Treasury shares reissued | | | 57 | | | | | | 57 | | | | | | | | | | | | | | |

Dividends declared | | | (520) | | | | | | | | | (520) | | | | | | | | | | | |

Stock options and other | | | 101 | | | 104 | | | | | | 1 | | | | | | (4) | | | | | |

Balance May 2, 2021 | | $ | 15,096 | | $ | 4,999 | | $ | (19,052) | | $ | 34,105 | | $ | (4,960) | | $ | 4 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

See Condensed Notes to Interim Consolidated Financial Statements.

8

Condensed Notes to Interim Consolidated Financial Statements (Unaudited)

(1) Organization and Consolidation

The information in the notes and related commentary are presented in a format which includes data grouped as follows:

Consolidated – Represents the consolidation of the equipment operations and financial services. References to “Deere & Company” or “the Company” refer to the entire enterprise.

Equipment Operations – Represents the enterprise without financial services, while including the Company’s production and precision agriculture operations, small agriculture and turf operations, construction and forestry operations, and other corporate assets, liabilities, revenues, and expenses not reflected within financial services.

Financial Services – Includes primarily the Company’s financing operations.

Beginning in fiscal year 2021, the Company implemented a new strategy, operating model, and reporting structure. With this change, the Company’s agriculture and turf operations were divided into two new segments: production and precision agriculture and small agriculture and turf. There were no changes to the construction and forestry and financial services segments. In addition, at the beginning of fiscal year 2021 the Company also reclassified goodwill from identifiable operating assets to corporate assets for segment reporting, as goodwill is no longer considered in evaluating the operating performance of the segments. Additional information on the new segments and the segment financial results are presented in Note 10. Prior period segment information was recast for a consistent presentation. References to agriculture and turf include both production and precision agriculture and small agriculture and turf.

The Company uses a 52/53 week fiscal year with quarters ending on the last Sunday in the reporting period. The second quarter ends for fiscal year 2021 and 2020 were May 2, 2021 and May 3, 2020, respectively. Both second quarters contained 13 weeks, while both year-to-date periods contained 26 weeks.

Prior to November 2, 2020, the operating results of the Wirtgen Group (Wirtgen) were incorporated into the Company’s consolidated financial statements using a one-month lag period. In the first quarter of 2021, the reporting lag was eliminated resulting in one additional month of Wirtgen activity in the first quarter and the year-to-date period. The effect was an increase to “Net sales” of $270 million, which the Company considers immaterial to construction and forestry’s annual net sales. Prior period results were not restated.

Variable Interest Entities

The Company consolidates certain variable interest entities (VIEs) related to retail note securitizations (see Note 12).

The Company also has an interest in a joint venture that manufactures construction equipment in Brazil for local and overseas markets. The joint venture is a VIE; however, the Company is not the primary beneficiary. Therefore, the entity’s financial results are not fully consolidated in the Company’s consolidated financial statements, but are included on the equity basis. The maximum exposure to loss was $7 million, $5 million, and $13 million at May 2, 2021, November 1, 2020, and May 3, 2020, respectively.

(2) Summary of Significant Accounting Policies and Cash Flow Information

The interim consolidated financial statements of Deere & Company have been prepared by the Company, without audit, pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (SEC). Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the U.S. have been condensed or omitted as permitted by such rules and regulations. All adjustments, consisting of normal recurring adjustments, have been included. Management believes the disclosures are adequate to present fairly the financial position, results of operations, and cash flows at the dates and for the periods presented. It is suggested these interim consolidated financial statements be read in conjunction with the consolidated financial statements and the notes thereto appearing in the Company’s latest annual report on Form 10-K. Results for interim periods are not necessarily indicative of those to be expected for the fiscal year.

The preparation of financial statements in conformity with accounting principles generally accepted in the U.S. requires management to make estimates and assumptions that affect the reported amounts and related disclosures. The COVID pandemic has resulted in uncertainties in the Company’s business, which may result in actual results differing from those estimates.

9

Cash Flow Information

All cash flows from the changes in trade accounts and notes receivable are classified as operating activities in the statement of consolidated cash flows as these receivables arise from sales to the Company’s customers. Cash flows from financing receivables that are related to sales to the Company’s customers are also included in operating activities. The remaining financing receivables are related to the financing of equipment sold by independent dealers and are included in investing activities.

The Company had the following non-cash operating and investing activities that were not included in the statement of consolidated cash flows. The Company transferred inventory to equipment on operating leases of approximately $267 million and $254 million in the first six months of 2021 and 2020, respectively. The Company also had accounts payable related to purchases of property and equipment of approximately $40 million and $46 million at May 2, 2021 and May 3, 2020, respectively.

The Company’s restricted cash held at May 2, 2021, November 1, 2020, May 3, 2020, and November 3, 2019 was as follows in millions of dollars:

| | | | | | | | | | | | | |

| | May 2 | | November 1 | | May 3 | | November 3 | | ||||

| | 2021 | | 2020 | | 2020 | | 2019 | | ||||

Equipment operations | | $ | 12 | | $ | 11 | | $ | 11 | | $ | 21 | |

Financial services | | | 87 | | | 95 | | | 92 | | | 78 | |

Total | | $ | 99 | | $ | 106 | | $ | 103 | | $ | 99 | |

The equipment operations’ restricted cash relates to miscellaneous operational activities. The financial services restricted cash primarily relates to securitization of financing receivables (see Note 12). The restricted cash is recorded in “Other assets” in the consolidated balance sheet.

(3) New Accounting Standards

New Accounting Standards Adopted

In the first quarter of 2021, the Company adopted Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) No. 2016-13, Measurement of Credit Losses on Financial Instruments, which establishes Accounting Standards Codification (ASC) 326, Financial Instruments - Credit Losses. This ASU was adopted using a modified-retrospective approach. The ASU, along with related amendments, revised the measurement of credit losses for financial assets measured at amortized cost from an incurred loss to an expected loss methodology. The ASU affects receivables, debt securities, net investment in leases, and most other financial assets that represent a right to receive cash.

The Company holds deposits from dealers (dealer deposits), which are recorded in “Accounts payable and accrued liabilities” to absorb certain credit losses. Prior to adopting this ASU, the allowance for credit losses was estimated on probable credit losses incurred after consideration of recoveries from dealer deposits. The ASU considers dealer deposits and certain credit insurance contracts as freestanding credit enhancements. As a result, after adoption, credit losses recovered from dealer deposits and certain credit insurance contracts are presented in “Other income” and no longer as part of the allowance for credit losses or the provision for credit losses. The ASU also modified the treatment of the estimated write-off of delinquent receivables by no longer including the estimated benefit of charges to the dealer deposits in the write-off amount. This change increases the estimated write-offs on delinquent financing receivables with the benefit of credit losses recovered from dealer deposits presented in “Other income.” This benefit, in both situations, is recorded when the dealer deposits are charged and no longer based on estimated recoveries.

The effects of adopting the ASU on the consolidated balance sheet were as follows in millions of dollars:

| | | | | | | | | | |

| | November 1 | | Cumulative Effect | | November 2 | | |||

| | 2020 | | from Adoption | | 2020 | | |||

Assets | | | | | | | | | | |

Trade accounts and note receivable - net | | $ | 4,171 | | $ | 2 | | $ | 4,173 | |

Financing receivables - net | | | 29,750 | | | (27) | | | 29,723 | |

Financing receivables securitized - net | | | 4,703 | | | (4) | | | 4,699 | |

Deferred income taxes | | | 1,499 | | | 1 | | | 1,500 | |

| | | | | | | | | | |

Liabilities | | | | | | | | | | |

Accounts payable and accrued expenses | | $ | 10,112 | | $ | 14 | | $ | 10,126 | |

Deferred income taxes | | | 519 | | | (7) | | | 512 | |

| | | | | | | | | | |

Stockholders’ equity | | | | | | | | | | |

Retained earnings | | $ | 31,646 | | $ | (35) | | $ | 31,611 | |

10

Note 11 contains additional disclosures as well as the Company’s updated allowance for credit losses accounting policy.

The Company also adopted the following standards in 2021, none of which had a material effect on the Company’s consolidated financial statements:

| | |

No. 2018-15 | Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract, which amends ASC 350-40, Intangibles – Goodwill and Other – Internal-Use Software | |

No. 2019-04 | Codification Improvements to Topic 326, Financial Instruments – Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments | |

No. 2021-01 | Reference Rate Reform (Topic 848): Scope | |

New Accounting Standards to be Adopted

The Company will adopt the following standards in future periods, none of which are expected to have a material effect on the Company’s consolidated financial statements:

| | |

No. 2019-12 | Simplifying the Accounting for Income Taxes, which amends ASC 740, Income Taxes | |

No. 2020-08 | Codification Improvements to Subtopic 310-20, Receivables – Nonrefundable Fees and Other Costs | |

(4) Revenue Recognition

The Company’s revenue by primary geographical market, major product line, and timing of revenue recognition was as follows in millions of dollars:

| | | | | | | | | | | | | | | | |

| | Three Months Ended May 2, 2021 | | |||||||||||||

|

| Production & Precision Ag |

| Small Ag & Turf |

| Construction |

| Financial |

| Total | | |||||

Primary geographical markets: | | | | | | | | | | | |

| | |

| |

United States | | $ | 2,211 | | $ | 1,838 | | $ | 1,481 | | $ | 608 | | $ | 6,138 | |

Canada | | | 252 | | | 144 | | | 320 | |

| 153 | |

| 869 | |

Western Europe | | | 589 | | | 738 | | | 514 | |

| 26 | |

| 1,867 | |

Central Europe and CIS | | | 531 | | | 160 | | | 209 | |

| 9 | |

| 909 | |

Latin America | | | 700 | | | 103 | | | 220 | |

| 60 | |

| 1,083 | |

Asia, Africa, Australia, New Zealand, and Middle East | | | 319 | | | 444 | | | 393 | | | 36 | | | 1,192 | |

Total | | $ | 4,602 | | $ | 3,427 | | $ | 3,137 | | $ | 892 | | $ | 12,058 | |

| | | | | | | | | | | | | | | | |

Major product lines: | | | | | | | | | | | |

| | |

| |

Production agriculture | | $ | 4,466 | | | | | | | | | | | $ | 4,466 | |

Small agriculture | | | | | $ | 2,417 | | | | |

| | |

| 2,417 | |

Turf | | | | | | 898 | | | | |

| | |

| 898 | |

Construction | | | | | | | | $ | 1,232 | |

| | |

| 1,232 | |

Compact construction | | | | | | | | | 396 | | | | | | 396 | |

Roadbuilding | | | | | | | | | 1,066 | |

| | |

| 1,066 | |

Forestry | | | | | | | | | 343 | |

| | |

| 343 | |

Financial products | | | 12 | | | 10 | | | 5 | | $ | 892 | |

| 919 | |

Other | | | 124 | | | 102 | | | 95 | |

| | |

| 321 | |

Total | | $ | 4,602 | | $ | 3,427 | | $ | 3,137 | | $ | 892 | | $ | 12,058 | |

| | | | | | | | | | | | | | | | |

Timing of revenue recognition: | | | | | | | | | | | |

| | |

| |

Revenue recognized at a point in time | | $ | 4,562 | | $ | 3,412 | | $ | 3,114 | | $ | 26 | | $ | 11,114 | |

Revenue recognized over time | | | 40 | | | 15 | | | 23 | | | 866 | | | 944 | |

Total | | $ | 4,602 | | $ | 3,427 | | $ | 3,137 | | $ | 892 | | $ | 12,058 | |

11

| | | | | | | | | | | | | | | | |

|

| Six Months Ended May 2, 2021 | | |||||||||||||

| | Production & Precision Ag |

| Small Ag & Turf |

| Construction |

| Financial |

| Total | | |||||

Primary geographical markets: | | | | | | | | | | | | | | | | |

United States | | $ | 3,820 | | $ | 3,261 | | $ | 2,683 | | $ | 1,206 | | $ | 10,970 | |

Canada | | | 364 | | | 223 | | | 508 | |

| 307 | |

| 1,402 | |

Western Europe | | | 1,038 | | | 1,224 | | | 953 | |

| 50 | |

| 3,265 | |

Central Europe and CIS | | | 692 | | | 244 | | | 387 | |

| 18 | |

| 1,341 | |

Latin America | | | 1,213 | | | 180 | | | 390 | |

| 119 | |

| 1,902 | |

Asia, Africa, Australia, New Zealand, and Middle East | | | 623 | | | 845 | | | 746 | | | 76 | | | 2,290 | |

Total | | $ | 7,750 | | $ | 5,977 | | $ | 5,667 | | $ | 1,776 | | $ | 21,170 | |

| | | | | | | | | | | | | | | | |

Major product lines: | | | | | | | | | | | |

| | |

| |

Production agriculture | | $ | 7,478 | | | | | | | | | | | $ | 7,478 | |

Small agriculture | | | | | $ | 4,228 | | | | |

| | |

| 4,228 | |

Turf | | | | | | 1,549 | | | | |

| | |

| 1,549 | |

Construction | | | | | | | | $ | 2,119 | |

| | |

| 2,119 | |

Compact construction | | | | | | | | | 742 | | | | | | 742 | |

Roadbuilding | | | | | | | | | 1,976 | |

| | |

| 1,976 | |

Forestry | | | | | | | | | 633 | | | | |

| 633 | |

Financial products | | | 28 | | | 20 | | | 12 | | $ | 1,776 | |

| 1,836 | |

Other | | | 244 | | | 180 | | | 185 | |

| | |

| 609 | |

Total | | $ | 7,750 | | $ | 5,977 | | $ | 5,667 | | $ | 1,776 | | $ | 21,170 | |

| | | | | | | | | | | | | | | | |

Timing of revenue recognition: | | | | | | | | | | | |

| | |

| |

Revenue recognized at a point in time | | $ | 7,668 | | $ | 5,946 | | $ | 5,614 | | $ | 50 | | $ | 19,278 | |

Revenue recognized over time | | | 82 | | | 31 | | | 53 | | | 1,726 | | | 1,892 | |

Total | | $ | 7,750 | | $ | 5,977 | | $ | 5,667 | | $ | 1,776 | | $ | 21,170 | |

| | | | | | | | | | | | | | | | |

| | Three Months Ended May 3, 2020 | | |||||||||||||

|

| Production & Precision Ag |

| Small Ag & Turf |

| Construction |

| Financial |

| Total | | |||||

Primary geographical markets: | | | | | | | | | | | |

| | |

| |

United States | | $ | 1,841 | | $ | 1,540 | | $ | 1,263 | | $ | 604 | | $ | 5,248 | |

Canada | | | 177 | | | 89 | | | 166 | |

| 151 | |

| 583 | |

Western Europe | | | 540 | | | 571 | | | 358 | | | 22 | |

| 1,491 | |

Central Europe and CIS | | | 258 | | | 80 | | | 140 | | | 8 | |

| 486 | |

Latin America | | | 394 | | | 64 | | | 135 | | | 60 | |

| 653 | |

Asia, Africa, Australia, New Zealand, and Middle East | | | 221 | | | 290 | | | 251 | | | 30 | | | 792 | |

Total | | $ | 3,431 | | $ | 2,634 | | $ | 2,313 | | $ | 875 | | $ | 9,253 | |

| | | | | | | | | | | | | | | | |

Major product lines: | | | | | | | | | | | |

| | |

| |

Production agriculture | | $ | 3,280 | | | | | | | | | | | $ | 3,280 | |

Small agriculture | | | | | $ | 1,771 | | | | |

| | |

| 1,771 | |

Turf | | | | | | 806 | | | | |

| | |

| 806 | |

Construction | | | | | | | | $ | 877 | |

| | |

| 877 | |

Compact construction | | | | | | | | | 339 | | | | | | 339 | |

Roadbuilding | | | | | | | | | 723 | |

| | |

| 723 | |

Forestry | | | | | | | | | 254 | |

| | |

| 254 | |

Financial products | | | 13 | | | 8 | | | 6 | | $ | 875 | |

| 902 | |

Other | | | 138 | | | 49 | | | 114 | |

| | |

| 301 | |

Total | | $ | 3,431 | | $ | 2,634 | | $ | 2,313 | | $ | 875 | | $ | 9,253 | |

| | | | | | | | | | | | | | | | |

Timing of revenue recognition: | | | | | | | | | | | |

| | |

| |

Revenue recognized at a point in time | | $ | 3,396 | | $ | 2,620 | | $ | 2,287 | | $ | 26 | | $ | 8,329 | |

Revenue recognized over time | | | 35 | | | 14 | | | 26 | | | 849 | | | 924 | |

Total | | $ | 3,431 | | $ | 2,634 | | $ | 2,313 | | $ | 875 | | $ | 9,253 | |

12

| | | | | | | | | | | | | | | | |

| | Six Months Ended May 3, 2020 | | |||||||||||||

|

| Production & Precision Ag |

| Small Ag & Turf |

| Construction |

| Financial |

| Total | | |||||

Primary geographical markets: | | | | | | | | | | | | | | | | |

United States | | $ | 3,276 | | $ | 2,605 | | $ | 2,283 | | $ | 1,247 | | $ | 9,411 | |

Canada | | | 261 | | | 143 | | | 338 | | | 307 | |

| 1,049 | |

Western Europe | | | 905 | | | 984 | | | 697 | | | 44 | |

| 2,630 | |

Central Europe and CIS | | | 389 | | | 169 | | | 299 | | | 18 | |

| 875 | |

Latin America | | | 778 | | | 135 | | | 294 | | | 126 | |

| 1,333 | |

Asia, Africa, Australia, New Zealand, and Middle East | | | 410 | | | 605 | | | 507 | | | 64 | | | 1,586 | |

Total | | $ | 6,019 | | $ | 4,641 | | $ | 4,418 | | $ | 1,806 | | $ | 16,884 | |

| | | | | | | | | | | | | | | | |

Major product lines: | | | | | | | | | | | |

| | |

| |

Production agriculture | | $ | 5,706 | | | | | | | | | | | $ | 5,706 | |

Small agriculture | | | | | $ | 3,249 | | | | | | | |

| 3,249 | |

Turf | | | | | | 1,274 | | | | | | | |

| 1,274 | |

Construction | | | | | | | | $ | 1,718 | | | | |

| 1,718 | |

Compact construction | | | | | | | | | 627 | | | | | | 627 | |

Roadbuilding | | | | | | | | | 1,328 | | | | |

| 1,328 | |

Forestry | | | | | | | | | 528 | | | | |

| 528 | |

Financial products | | | 34 | | | 14 | | | 13 | | $ | 1,806 | |

| 1,867 | |

Other | | | 279 | | | 104 | | | 204 | | | | |

| 587 | |

Total | | $ | 6,019 | | $ | 4,641 | | $ | 4,418 | | $ | 1,806 | | $ | 16,884 | |

| | | | | | | | | | | | | | | | |

Timing of revenue recognition: | | | | | | | | | | | |

| | |

| |

Revenue recognized at a point in time | | $ | 5,941 | | $ | 4,615 | | $ | 4,366 | | $ | 52 | | $ | 14,974 | |

Revenue recognized over time | | | 78 | | | 26 | | | 52 | | | 1,754 | | | 1,910 | |

Total | | $ | 6,019 | | $ | 4,641 | | $ | 4,418 | | $ | 1,806 | | $ | 16,884 | |

Following is a description of the Company’s major product lines:

Production agriculture – Includes net sales of large and certain mid-size tractors and associated attachments, combines, cotton pickers, cotton strippers, and sugarcane harvesters, sugarcane loaders and pull behind scrapers, tillage, seeding, and application equipment, including sprayers, nutrient management and soil preparation machinery, and related attachments and service parts.

Small agriculture – Includes net sales of mid-size and utility tractors, self-propelled forage harvesters, hay and forage equipment, balers, mowers, and related attachments and service parts.

Turf – Includes net sales of turf and utility equipment, including riding lawn equipment, golf course equipment, utility vehicles, and commercial mowing equipment, along with a broad line of associated implements, other outdoor power products, and related service parts.

Construction – Includes net sales of a broad range of machines used in construction, earthmoving, and material handling, including backhoe loaders, crawler dozers and loaders, four-wheel-drive loaders, excavators, motor graders, articulated dump trucks, and related attachments and service parts.

Compact construction – Includes net sales of smaller construction equipment, including compact excavators, compact track loaders, compact wheel loaders, skid steers, landscape loaders, and related attachments and service parts.

Roadbuilding – Includes net sales of equipment used in roadbuilding and renovation, including milling machines, recyclers, slipform pavers, surface miners, asphalt pavers, compactors, tandem and static rollers, mobile crushers and screens, mobile and stationary asphalt plants, and related attachments and service parts.

Forestry – Includes net sales of equipment used in timber harvesting, including log skidders, feller bunchers, log loaders, log forwarders, log harvesters, and related attachments and service parts.

Financial products – Includes finance and interest income primarily from retail notes related to sales of John Deere equipment to end customers, wholesale financing to dealers of John Deere equipment, and revolving charge accounts; lease income from retail leases of John Deere equipment; and revenue from extended warranties.

13

Other – Includes sales of components to other equipment manufacturers that are included in “Net sales”; and revenue earned over time from precision guidance, telematics, and other information enabled solutions, revenue from service performed at Company owned dealerships and service centers, gains on disposition of property and businesses, trademark licensing revenue, and other miscellaneous revenue items that are included in “Other income.”

The Company invoices in advance of recognizing the sale of certain products and the revenue for certain services. These items are primarily for premiums for extended warranties, advance payments for future equipment sales, and subscription and service revenue related to precision guidance and telematic services. These advanced customer payments are presented as deferred revenue, a contract liability, in “Accounts payable and accrued expenses” in the consolidated balance sheet. The deferred revenue received, but not recognized in revenue, including extended warranty premiums also shown in Note 18, was $1,249 million, $1,090 million, and $1,077 million at May 2, 2021, November 1, 2020, and May 3, 2020, respectively. The contract liability is reduced as the revenue is recognized. During the three months ended May 2, 2021 and May 3, 2020, $111 million and $97 million, respectively, of revenue was recognized from deferred revenue that was recorded as a contract liability at the beginning of the respective fiscal year. During the six months ended May 2, 2021 and May 3, 2020, $335 million and $278 million, respectively, of revenue was recognized from deferred revenue that was recorded as a contract liability at the beginning of the respective fiscal year.

The Company entered into contracts with customers to deliver equipment and services that have not been recognized at May 2, 2021 because the equipment or services have not been provided. These contracts primarily relate to extended warranty and certain precision guidance and telematic services. The amount of unsatisfied performance obligations for contracts with an original duration greater than one year is $962 million at May 2, 2021. The estimated revenue to be recognized by fiscal year follows in millions of dollars: remainder of 2021 - $199, 2022 - $318, 2023 - $224, 2024 - $130, 2025 - $58, 2026 - $30 and later years - $3. The Company discloses unsatisfied performance obligations with an original contract duration greater than one year. The contracts with an expected duration of one year or less are generally for sales to dealers and end customers for equipment, service parts, repair services, and certain telematics services.

During 2020, and to a much lesser extent in 2021, the Company provided short-term payment relief on trade accounts and notes receivables to independent dealers and certain other customers that were negatively affected by the economic effects of COVID. The relief was provided both in regional programs and case-by-case situations with creditworthy customers. This relief generally included payment deferrals not exceeding three months, extending interest-free periods for up to an additional three months with the total interest-free period not to exceed one year, or reducing interest rates for a maximum of three months. The trade receivable balance granted relief since the beginning of the pandemic that remained outstanding at May 2, 2021 was not material.

(5) Other Comprehensive Income Items

The after-tax changes in accumulated other comprehensive income (loss) was as follows in millions of dollars:

| | | | | | | | | | | | | | | | |

|

| |

| | |

| | |

| | |

| Total |

| ||

| | | | | | | Unrealized | | Unrealized | | Accumulated | | ||||

| | Retirement | | Cumulative | | Gain (Loss) | | Gain (Loss) | | Other | | |||||

| | Benefits | | Translation | | on | | on | | Comprehensive | | |||||

| | Adjustment | | Adjustment | | Derivatives | | Debt Securities | | Income (Loss) | | |||||

Balance November 3, 2019 | | $ | (3,915) | | $ | (1,651) |

| $ | (60) | | $ | 19 | | $ | (5,607) | |

Other comprehensive income (loss) items before reclassification | |

| 186 | | | (398) | | | (13) | | | 11 | |

| (214) | |

Amounts reclassified from accumulated other comprehensive income | |

| 101 | | | | | | 5 | | | | |

| 106 | |

Net current period other comprehensive income (loss) | |

| 287 | |

| (398) | |

| (8) | |

| 11 | |

| (108) | |

Balance May 3, 2020 | | $ | (3,628) | | $ | (2,049) | | $ | (68) | | $ | 30 | | $ | (5,715) | |

| | | | | | | | | | | | | | | | |

Balance November 1, 2020 | | $ | (3,918) | | $ | (1,596) | | $ | (58) | | $ | 33 | | $ | (5,539) | |

Other comprehensive income (loss) items before reclassification | | | 31 | | | 433 | | | | | | (15) | | | 449 | |

Amounts reclassified from accumulated other comprehensive income | | | 123 | | | | | | 7 | | | | | | 130 | |

Net current period other comprehensive income (loss) | | | 154 | | | 433 | | | 7 | | | (15) | | | 579 | |

Balance May 2, 2021 | | $ | (3,764) |

| $ | (1,163) |

| $ | (51) |

| $ | 18 |

| $ | (4,960) | |

14

Following are amounts recorded in and reclassifications out of other comprehensive income (loss), and the income tax effects, in millions of dollars. Retirement benefits adjustment reclassifications for actuarial gain (loss), prior service (credit) cost, and settlements are included in net periodic pension and other postretirement benefit costs (see Note 8).

| | | | | | | | | | |

|

| Before |

| Tax |

| After |

| |||

| | Tax | | (Expense) | | Tax |

| |||

Three Months Ended May 2, 2021 | | Amount | | Credit | | Amount |

| |||

Cumulative translation adjustment | | $ | 37 | | | | | $ | 37 | |

Unrealized gain (loss) on derivatives: | | | | | | | | | | |

Reclassification of realized (gain) loss to: | | | | | | | | | | |

Interest rate contracts – Interest expense | | | 4 | | $ | (1) | | | 3 | |

Net unrealized gain (loss) on derivatives | | | 4 | | | (1) | | | 3 | |

Unrealized gain (loss) on debt securities: | | | | | | | | | | |

Unrealized holding gain (loss) | | | (14) | | | 1 | | | (13) | |

Net unrealized gain (loss) on debt securities | | | (14) | | | 1 | | | (13) | |

Retirement benefits adjustment: | | | | | | | | | | |

Net actuarial gain (loss) | | | 41 | | | (9) | | | 32 | |

Reclassification to Other operating expenses through amortization of: | | | | | | | | | | |

Actuarial (gain) loss | | | 72 | | | (19) | | | 53 | |

Prior service (credit) cost | | | 2 | | | | | | 2 | |

Settlements | | | 5 | | | (1) | | | 4 | |

Net unrealized gain (loss) on retirement benefits adjustment | | | 120 | | | (29) | | | 91 | |

Total other comprehensive income (loss) |

| $ | 147 | | $ | (29) | | $ | 118 | |

| | | | | | | | | | |

|

| Before |

| Tax |

| After |

| |||

| | Tax | | (Expense) | | Tax |

| |||

Six Months Ended May 2, 2021 | | Amount | | Credit | | Amount |

| |||

Cumulative translation adjustment |

| $ | 431 | | $ | 2 | | $ | 433 | |

Unrealized gain (loss) on derivatives: | | | | | | | | | | |

Reclassification of realized (gain) loss to: | | | | | | | | | | |

Interest rate contracts – Interest expense | | | 9 | | | (2) | | | 7 | |

Net unrealized gain (loss) on derivatives | | | 9 | | | (2) | | | 7 | |

Unrealized gain (loss) on debt securities: | | | | | | | | | | |

Unrealized holding gain (loss) | | | (17) | | | 2 | | | (15) | |

Net unrealized gain (loss) on debt securities | | | (17) | | | 2 | | | (15) | |

Retirement benefits adjustment: | | | | | | | | | | |

Net actuarial gain (loss) | | | 40 | | | (9) | | | 31 | |

Reclassification to Other operating expenses through amortization of: | | | | | | | | | | |

Actuarial (gain) loss | | | 142 | | | (36) | | | 106 | |

Prior service (credit) cost | | | 4 | | | (1) | | | 3 | |

Settlements | | | 18 | | | (4) | | | 14 | |

Net unrealized gain (loss) on retirement benefits adjustment | | | 204 | | | (50) | | | 154 | |

Total other comprehensive income (loss) |

| $ | 627 | | $ | (48) | | $ | 579 | |

15

| | | | | | | | | | |

|

| Before |

| Tax |

| After |

| |||

| | Tax | | (Expense) | | Tax |

| |||

Three Months Ended May 3, 2020 | | Amount | | Credit | | Amount |

| |||

Cumulative translation adjustment |

| $ | (441) | | | | | $ | (441) | |

Unrealized gain (loss) on derivatives: | | | | | | | | | | |

Unrealized hedging gain (loss) | | | (15) | | $ | 3 | | | (12) | |

Reclassification of realized (gain) loss to: | | | | | | | | | | |

Interest rate contracts – Interest expense | | | 4 | | | | | | 4 | |

Net unrealized gain (loss) on derivatives | | | (11) | | | 3 | | | (8) | |

Unrealized gain (loss) on debt securities: | | | | | | | | | | |

Unrealized holding gain (loss) | | | 8 | | | (2) | | | 6 | |

Net unrealized gain (loss) on debt securities | | | 8 | | | (2) | | | 6 | |

Retirement benefits adjustment: | | | | | | | | | | |

Net actuarial gain (loss) | | | 1 | | | (1) | | | | |

Reclassification to Other operating expenses through amortization of: | | | | | | | | | | |

Actuarial (gain) loss | | | 69 | | | (17) | | | 52 | |

Prior service (credit) cost | | | 2 | | | | | | 2 | |

Settlements | | | 3 | | | | | | 3 | |

Net unrealized gain (loss) on retirement benefits adjustment | | | 75 | | | (18) | | | 57 | |

Total other comprehensive income (loss) |

| $ | (369) | | $ | (17) | | $ | (386) | |

| | | | | | | | | | |

|

| Before |

| Tax |

| After |

| |||

| | Tax | | (Expense) | | Tax |

| |||

Six Months Ended May 3, 2020 | | Amount | | Credit | | Amount |

| |||

Cumulative translation adjustment |

| $ | (398) |

| | | | $ | (398) | |

Unrealized gain (loss) on derivatives: | | | | | | | | | | |

Unrealized hedging gain (loss) | | | (17) | | $ | 4 | | | (13) | |

Reclassification of realized (gain) loss to: | | | | | | | | | | |

Interest rate contracts – Interest expense | | | 6 | | | (1) | | | 5 | |

Net unrealized gain (loss) on derivatives | | | (11) | | | 3 | | | (8) | |

Unrealized gain (loss) on debt securities: | | | | | | | | | | |

Unrealized holding gain (loss) | | | 14 | | | (3) | | | 11 | |

Net unrealized gain (loss) on debt securities | | | 14 | | | (3) | | | 11 | |

Retirement benefits adjustment: | | | | | | | | | | |

Net actuarial gain (loss) | | | 247 | | | (61) | | | 186 | |

Reclassification to Other operating expenses through amortization of: | | | | | | | | | | |

Actuarial (gain) loss | | | 138 | | | (45) | | | 93 | |

Prior service (credit) cost | | | 4 | | | (1) | | | 3 | |

Settlements | | | 6 | | | (1) | | | 5 | |

Net unrealized gain (loss) on retirement benefits adjustment | | | 395 | | | (108) | | | 287 | |

Total other comprehensive income (loss) |

| | | | $ | (108) | | $ | (108) | |

(6) Dividends Declared and Paid

Dividends declared and paid on a per share basis were as follows:

| | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| ||||||||

| | May 2 | | May 3 | | May 2 | | May 3 |

| ||||

| | 2021 | | 2020 | | 2021 | | 2020 |

| ||||

Dividends declared |

| $ | .90 |

| $ | .76 |

| $ | 1.66 |

| $ | 1.52 | |

Dividends paid | | $ | .76 | | $ | .76 | | $ | 1.52 | | $ | 1.52 | |

16

(7) Earnings Per Share

A reconciliation of basic and diluted net income per share attributable to Deere & Company follows in millions, except per share amounts:

| | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| ||||||||

| | May 2 | | May 3 | | May 2 | | May 3 |

| ||||

| | 2021 | | 2020 | | 2021 | | 2020 |

| ||||

Net income attributable to Deere & Company |

| $ | 1,790 |

| $ | 666 |

| $ | 3,013 |

| $ | 1,182 | |

Average shares outstanding | | | 312.8 | |

| 313.2 | | | 313.1 | |

| 313.3 | |

Basic per share | | $ | 5.72 | | $ | 2.13 | | $ | 9.62 | | $ | 3.77 | |

| | | | | | | | | | | | | |

Average shares outstanding | | | 312.8 | |

| 313.2 | | | 313.1 | |

| 313.3 | |

Effect of dilutive share-based compensation | | | 2.4 | |

| 3.0 | | | 2.5 | |

| 3.4 | |

Total potential shares outstanding | | | 315.2 | |

| 316.2 | | | 315.6 | |

| 316.7 | |

Diluted per share | | $ | 5.68 | | $ | 2.11 | | $ | 9.55 | | $ | 3.73 | |

During the second quarter and first six months of 2021, 0 shares were antidilutive. During the second quarter and first six months of 2020, 1.0 million shares and .6 million shares, respectively, were excluded from the above per share computation because the incremental shares would have been antidilutive.

(8) Pension and Other Postretirement Benefits

The Company has several defined benefit pension plans and postretirement benefit (OPEB) plans, primarily health care and life insurance plans, covering its U.S. employees and employees in certain foreign countries.

The worldwide components of net periodic pension cost consisted of the following in millions of dollars:

| | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| ||||||||

| | May 2 | | May 3 | | May 2 | | May 3 |

| ||||

| | 2021 | | 2020 | | 2021 | | 2020 |

| ||||

Service cost |

| $ | 83 |

| $ | 77 |

| $ | 168 |

| $ | 161 | |

Interest cost | | | 69 | |

| 87 | | | 138 | |

| 174 | |

Expected return on plan assets | | | (200) | |

| (204) | | | (400) | |

| (409) | |

Amortization of actuarial loss | | | 65 | |

| 62 | | | 128 | |

| 124 | |

Amortization of prior service cost | | | 3 | |

| 3 | | | 6 | |

| 6 | |

Settlements | | | 5 | |

| 3 | | | 18 | |

| 6 | |

Net cost | | $ | 25 | | $ | 28 | | $ | 58 | | $ | 62 | |

The worldwide components of net periodic OPEB cost consisted of the following in millions of dollars:

| | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| ||||||||

| | May 2 | | May 3 | | May 2 | | May 3 |

| ||||

| | 2021 | | 2020 | | 2021 | | 2020 |

| ||||

Service cost |

| $ | 12 |

| $ | 12 |

| $ | 24 |

| $ | 24 | |

Interest cost | | | 25 | |

| 35 | | | 51 | |

| 72 | |

Expected return on plan assets | | | (20) | |

| (12) | | | (39) | |

| (24) | |

Amortization of actuarial loss | | | 7 | |

| 7 | | | 14 | |

| 14 | |

Amortization of prior service credit | | | (1) | |

| (1) | | | (2) | |

| (2) | |

Curtailments | | | | | | | | | | | | 21 | |

Net cost | | $ | 23 | | $ | 41 | | $ | 48 | | $ | 105 | |

The components of net periodic pension and OPEB costs excluding the service cost component are included in the line item “Other operating expenses” in the statement of consolidated income.

17

In the first quarter of 2020, the Company remeasured the U.S. salary OPEB health care plans due to the U.S. voluntary employee-separation program (see Note 22), which resulted in a $21 million curtailment loss.

During the first six months of 2021, the Company contributed approximately $68 million to its pension plans and $85 million to its OPEB plans. The Company presently anticipates contributing an additional $33 million to its pension plans and $757 million to its OPEB plans during the remainder of fiscal year 2021. The anticipated OPEB contributions include a voluntary $700 million in the fourth quarter to a U.S. plan, which will increase plan assets. The pension and OPEB contributions exceeding the voluntary amount primarily include direct benefit payments from Company funds.

(9) Income Taxes

The Company’s unrecognized tax benefits at May 2, 2021, November 1, 2020, and May 3, 2020 were $751 million, $668 million, and $610 million, respectively. The liability at May 2, 2021, November 1, 2020, and May 3, 2020 consisted of approximately $189 million, $134 million, and $145 million, respectively, which would affect the effective tax rate if the tax benefits were recognized. The remaining liability was related to tax positions for which there are offsetting tax receivables, or the uncertainty was only related to timing. The Company expects that any reasonably possible change in the amounts of unrecognized tax benefits in the next 12 months would not be significant.

(10) Segment Reporting

Beginning in fiscal year 2021, the Company implemented a new strategy, operating model, and reporting structure. With this change, the Company’s agriculture and turf operations were divided into two new segments, which are described as follows:

The production and precision agriculture segment is responsible for defining, developing, and delivering global equipment and technology solutions to unlock customer value for production-scale growers of large grains, small grains, cotton, and sugar. Main products include large and certain mid-size tractors, combines, cotton pickers, sugarcane harvesters and loaders, and soil preparation, seeding, application and crop care equipment.

The small agriculture and turf segment is responsible for defining, developing, and delivering market-driven products to support mid-size and small growers and producers globally as well as turf customers. The operations are principally organized to support production systems for dairy and livestock, high-value crops, and turf and utility operators. Primary products include certain mid-size and small tractors, as well as hay and forage equipment, riding and commercial lawn equipment, golf course equipment, and utility vehicles.

There were no reporting changes for the construction and forestry and financial services segments. As a result, the Company has four reportable segments.

18

Worldwide net sales and revenues, operating profit, and identifiable assets by segment were as follows in millions of dollars. Operating profit is income from continuing operations before corporate expenses, certain external interest expense, certain foreign exchange gains and losses, and income taxes. Operating profit of the financial services segment includes the effect of interest expense and foreign exchange gains and losses. Reconciling items to net income are primarily corporate expenses, certain external interest expense, certain foreign exchange gains and losses, pension and OPEB benefit costs excluding the service cost component, and net income attributable to noncontrolling interests.

| | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| ||||||||||||

| | May 2 | | May 3 | | % | | May 2 | | May 3 | | % |

| ||||

| | 2021 | | 2020 | | Change | | 2021 | | 2020 | | Change |

| ||||

Net sales and revenues: |

| |

|

| |

|

|

|

| | |

| |

|

|

| |

Production & precision ag net sales |

| $ | 4,529 | | $ | 3,365 | | +35 |

| $ | 7,599 | | $ | 5,872 | | +29 | |

Small ag & turf net sales | | | 3,390 | | | 2,603 | | +30 | | | 5,904 | | | 4,583 | | +29 | |

Construction & forestry net sales | | | 3,079 | |

| 2,256 | | +36 | | | 5,546 | |

| 4,299 | | +29 | |

Financial services revenues | | | 892 | |

| 875 | | +2 | | | 1,776 | |

| 1,806 | | -2 | |

Other revenues | | | 168 | |

| 154 | | +9 | | | 345 | |

| 324 | | +6 | |

Total net sales and revenues |

| $ | 12,058 | | $ | 9,253 | | +30 |

| $ | 21,170 | | $ | 16,884 | | +25 | |

Operating profit: | | | | | | | | | | | | | | | | | |

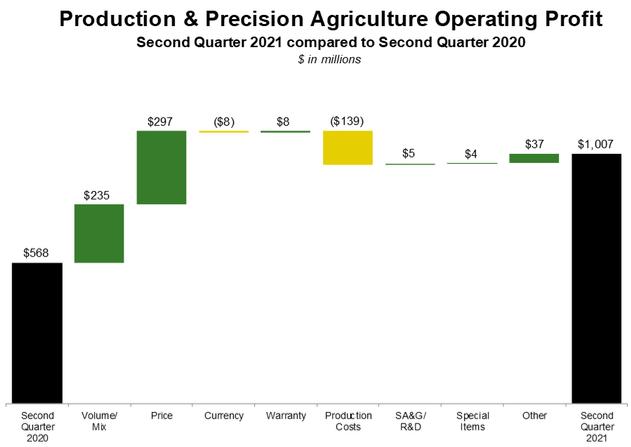

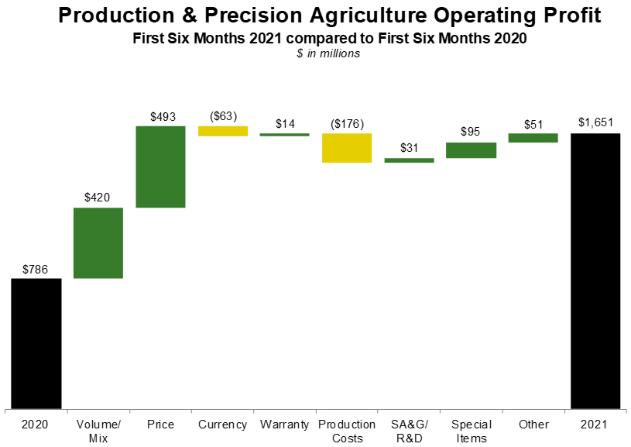

Production & precision ag |

| $ | 1,007 | | $ | 568 | | +77 |

| $ | 1,651 | | $ | 786 | | +110 | |

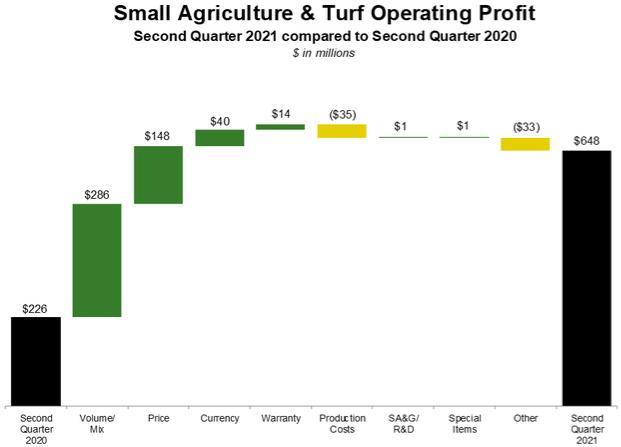

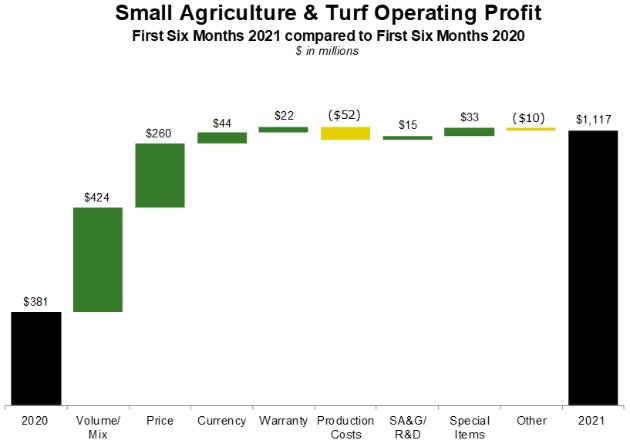

Small ag & turf | | | 648 | | | 226 | | +187 | | | 1,117 | | | 381 | | +193 | |

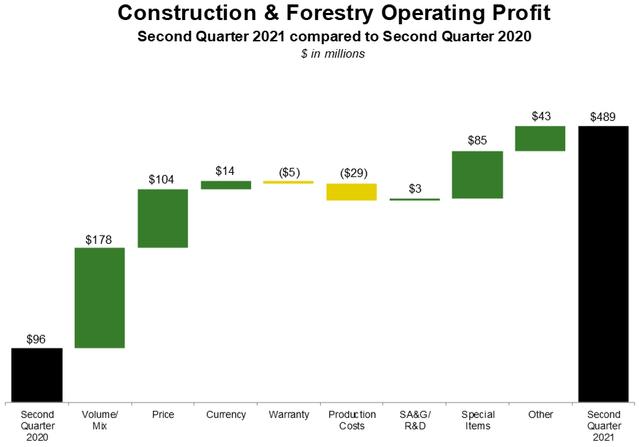

Construction & forestry | | | 489 | |

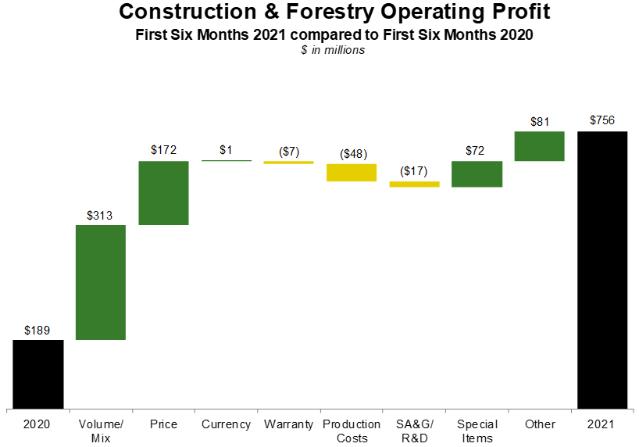

| 96 | | +409 | | | 756 | |

| 189 | | +300 | |

Financial services | | | 295 | |

| 75 | | +293 | | | 553 | |

| 254 | | +118 | |

Total operating profit | | | 2,439 | |

| 965 | | +153 | | | 4,077 | |

| 1,610 | | +153 | |

Reconciling items | | | (119) | |

| (54) | | +120 | | | (226) | |

| (133) | | +70 | |

Income taxes | | | (530) | |

| (245) | | +116 | | | (838) | |

| (295) | | +184 | |

Net income attributable to Deere & Company |

| $ | 1,790 | | $ | 666 | | +169 |

| $ | 3,013 | | $ | 1,182 | | +155 | |

| | | | | | | | | | | | | | | | | |

Intersegment sales and revenues: | | | | | | | | | | | | | | | | | |

Production & precision ag net sales |

| $ | 7 | | $ | 7 | | |

| $ | 13 | | $ | 14 | | -7 | |

Small ag & turf net sales | | | 4 | | | 1 | | +300 | | | 8 | | | 1 | | +700 | |

Construction & forestry net sales | | | | | | | | | | | | |

| | | | |

Financial services | | | 62 | |

| 93 | | -33 | | | 112 | |

| 159 | | -30 | |

| | | | | | | | | | | | | | | | | |

Outside the U.S. and Canada: | | | | | | | | | | | | | | | | | |

Net sales and revenues |

| $ | 5,051 | | $ | 3,422 | | +48 |

| $ | 8,798 | | $ | 6,424 | | +37 | |

Operating profit | | | 1,003 | |

| 232 | | +332 | | | 1,633 | |

| 533 | | +206 | |

At the beginning of fiscal year 2021, the Company reclassified goodwill from identifiable operating segment assets to corporate assets for segment reporting, as goodwill is no longer considered in evaluating the operating performance of the segments. Prior period amounts have been restated for a consistent presentation.

| | | | | | | | | | |

|

| May 2 |

| November 1 | | May 3 |

| |||

| | 2021 | | 2020 | | 2020 |

| |||

Identifiable assets: | | | | | | | | | | |

Production & precision ag |

| $ | 6,602 | | $ | 5,708 | | $ | 6,328 | |

Small ag & turf | | | 3,605 | | | 3,266 | | | 3,485 | |

Construction & forestry | | | 6,500 | |

| 6,322 | |

| 6,984 | |

Financial services | | | 50,849 | |

| 48,719 | |

| 48,664 | |

Corporate | | | 11,423 | |

| 11,076 | |

| 11,865 | |

Total assets |

| $ | 78,979 | | $ | 75,091 | | $ | 77,326 | |

19

(11) Financing Receivables

The Company monitors the credit quality of financing receivables based on delinquency status. Past due balances of financing receivables still accruing finance income represent the total balance held (principal plus accrued interest) with any payment amounts 30 days or more past the contractual payment due date. Non-performing financing receivables represent loans for which the Company has ceased accruing finance income. The Company ceases accruing finance income, and accrued finance income previously recognized is reversed when these receivables are generally 90 days delinquent. Generally, when receivables are 120 days delinquent the estimated uncollectible amount from the customer is written off to the allowance for credit losses. Finance income for non-performing receivables is recognized on a cash basis. Accrual of finance income is generally resumed when the receivable becomes contractually current and collections are reasonably assured.

Due to the economic effects of COVID, the Company provided short-term payment relief to dealers and retail customers during 2020, and to a much lesser extent in 2021. The relief was provided in regional programs and on a case-by-case basis with customers that were generally current in their payment obligations. Financing receivables granted relief since the beginning of the pandemic that remained outstanding at May 2, 2021 represented approximately 4 percent of the financing receivables balance. The majority of financing receivables granted short-term relief are beyond the deferral period and have either resumed making payments or are reported as delinquent based on the modified payment schedule.

While the Company implemented a new strategy in fiscal year 2021 resulting in new operating segments, assets managed by financial services, including most financing receivables and equipment on operating leases, continue to be evaluated by market (agriculture and turf or construction and forestry).

The credit quality analysis of retail notes, financing leases, and revolving charge accounts (collectively, customer receivables), was as follows in millions of dollars at May 2, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year of Origination | | ||||||||||||||||||||||

| | 2021 | | 2020 | | 2019 | | 2018 | | 2017 | | Prior | | Revolving Charge Accounts | | Total | | ||||||||

Customer receivables: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Agriculture and turf | | | | | | | | | | | | | | | | | | | | | | | | | |

Current | | $ | 6,017 | | $ | 8,375 | | $ | 4,436 | | $ | 2,402 | | $ | 1,136 | | $ | 494 | | $ | 3,221 | | $ | 26,081 | |

30-59 days past due | | | 20 | | | 64 | | | 41 | | | 19 | | | 10 | | | 5 | | | 20 | | | 179 | |

60-89 days past due | | | 5 | | | 34 | | | 18 | | | 9 | | | 4 | | | 2 | | | 5 | | | 77 | |

90+ days past due | | | | | | | | | 1 | | | 1 | | | | | | | | | | | | 2 | |

Non-performing | | | 2 | | | 51 | | | 69 | | | 54 | | | 29 | | | 33 | | | 16 | | | 254 | |

Construction and forestry | | | | | | | | | | | | | | | | | | | | | | | | | |

Current | | | 1,568 | | | 2,077 | | | 1,106 | | | 454 | | | 118 | | | 22 | | | 81 | | | 5,426 | |

30-59 days past due | | | 21 | | | 43 | | | 35 | | | 14 | | | 5 | | | 1 | | | 3 | | | 122 | |

60-89 days past due | | | 6 | | | 13 | | | 12 | | | 7 | | | 3 | | | 1 | | | 1 | | | 43 | |

90+ days past due | | | | | | 2 | | | 10 | | | 5 | | | 6 | | | 3 | | | | | | 26 | |

Non-performing | | | 1 | | | 38 | | | 37 | | | 22 | | | 11 | | | 7 | | | 1 | | | 117 | |

Total customer receivables | | $ | 7,640 | | $ | 10,697 | | $ | 5,765 | | $ | 2,987 | | $ | 1,322 | | $ | 568 | | $ | 3,348 | | $ | 32,327 | |

20

The credit quality analysis of customer receivables was as follows in millions of dollars at November 1, 2020 and May 3, 2020:

| | | | | | | | | | | | | | | | | | | |

| | November 1, 2020 | | May 3, 2020 | | ||||||||||||||

| | Retail Notes & Financing Leases | | Revolving Charge Accounts | | Total | | Retail Notes & Financing Leases | | Revolving Charge Accounts | | Total | | ||||||

Customer receivables: | | | | | | | | | | | | | | | | | | | |

Agriculture and turf | | | | | | | | | | | | | | | | | | | |

Current | | $ | 21,597 | | $ | 3,787 | | $ | 25,384 | | $ | 19,178 | | $ | 3,282 | | $ | 22,460 | |

30-59 days past due | | | 135 | | | 13 | | | 148 | | | 215 | | | 32 | | | 247 | |

60-89 days past due | | | 64 | | | 4 | | | 68 | | | 103 | | | 13 | | | 116 | |

90+ days past due | | | 2 | | | | | | 2 | | | 3 | | | | | | 3 | |

Non-performing | | | 263 | | | 6 | | | 269 | | | 310 | | | 42 | | | 352 | |

Construction and forestry | | | | | | | | | | | | | | | | | | | |

Current | | | 4,859 | | | 88 | | | 4,947 | | | 4,169 | | | 78 | | | 4,247 | |

30-59 days past due | | | 111 | | | 2 | | | 113 | | | 174 | | | 4 | | | 178 | |

60-89 days past due | | | 55 | | | 1 | | | 56 | | | 58 | | | 2 | | | 60 | |

90+ days past due | | | 14 | | | | | | 14 | | | 18 | | | | | | 18 | |

Non-performing | | | 106 | | | 1 | | | 107 | | | 176 | | | 1 | | | 177 | |

Total customer receivables | | $ | 27,206 | | $ | 3,902 | | $ | 31,108 | | $ | 24,404 | | $ | 3,454 | | $ | 27,858 | |

The credit quality analysis of wholesale receivables was as follows in millions of dollars at May 2, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year of Origination | | ||||||||||||||||||||||

| | 2021 | | 2020 | | 2019 | | 2018 | | 2017 | | Prior | | Revolving | | Total | | ||||||||

Wholesale receivables: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Agriculture and turf | | | | | | | | | | | | | | | | | | | | | | | | | |

Current | | $ | 191 | | $ | 144 | | $ | 55 | | $ | 13 | | $ | 4 | | $ | 1 | | $ | 2,146 | | $ | 2,554 | |

30-59 days past due | | | | | | | | | | | | | | | | | | | | | | | | | |

60-89 days past due | | | | | | | | | | | | | | | | | | | | | | | | | |

90+ days past due | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-performing | | | | | | | | | 22 | | | | | | | | | | | | | | | 22 | |

Construction and forestry | | | | | | | | | | | | | | | | | | | | | | | | | |

Current | | | 5 | | | 10 | | | 15 | | | 1 | | | 1 | | | 3 | | | 341 | | | 376 | |

30-59 days past due | | | | | | | | | | | | | | | | | | | | | | | | | |

60-89 days past due | | | | | | | | | | | | | | | | | | | | | | | | | |

90+ days past due | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-performing | | | | | | | | | | | | | | | | | | | | | | | | | |

Total wholesale receivables | | $ | 196 | | $ | 154 | | $ | 92 | | $ | 14 | | $ | 5 | | $ | 4 | | $ | 2,487 | | $ | 2,952 | |

The credit quality analysis of wholesale receivables was as follows in millions of dollars at November 1, 2020 and May 3, 2020:

| | | | | | | |

| | November 1 | | May 3 | | ||

| | 2020 | | 2020 | | ||

Wholesale receivables: | | | | | | | |

Agriculture and turf | | | | | | | |

Current | | $ | 3,010 | | $ | 3,704 | |

30-59 days past due | | | | | | | |

60-89 days past due | | | | | | | |

90+ days past due | | | | | | | |

Non-performing | | | 47 | | | 62 | |

Construction and forestry | | | | | | | |

Current | | | 472 | | | 510 | |

30-59 days past due | | | | | | | |

60-89 days past due | | | | | | | |

90+ days past due | | | | | | | |

Non-performing | | | | | | 2 | |

Total wholesale receivables | | $ | 3,529 | | $ | 4,278 | |

The allowance for credit losses is an estimate of the credit losses expected over the life of the Company’s receivable portfolio. The Company measures expected credit losses on a collective basis when similar risk characteristics exist. Risk characteristics

21

considered by the Company include finance product category, market, geography, credit risk, and remaining duration. Receivables that do not share risk characteristics with other receivables in the portfolio are evaluated on an individual basis. Non-performing financing receivables are included in the estimate of expected credit losses.

The Company utilizes loss forecast models, which are selected based on the size and credit risk of the underlying pool of receivables, to estimate expected credit losses. Transition matrix models are used for large and complex customer receivable pools, while weighted average remaining maturity models are used for smaller and less complex customer receivable pools. Expected credit losses on wholesale receivables are based on historical loss rates, adjusted for current economic conditions. The modeled expected credit losses are adjusted based on reasonable and supportable forecasts, which may include economic indicators such as commodity prices, industry equipment sales, unemployment rates, and housing starts. Management reviews each model’s output quarterly, and qualitative adjustments are incorporated as necessary.

An analysis of the allowance for credit losses and investment in financing receivables follows in millions of dollars during the periods:

| | | | | | | | | | | | | |

| | Retail Notes | | Revolving | | | | | | | | ||

| | & Financing | | Charge | | Wholesale | | | | | |||

| | Leases | | Accounts | | Receivables | | Total | | ||||

Three Months Ended May 2, 2021 | | | | | | | | | | | | | |

Allowance: |

|

|

|

|

|

|

|

|

|

| | |

|

Beginning of period balance |

| $ | 180 |

| $ | 24 | | $ | 7 | | $ | 211 | |

Provision (credit) | | | (17) | | | (6) | | | | | | (23) | |

Write-offs | | | (15) | | | (9) | | | | | | (24) | |

Recoveries | | | 4 | | | 10 | | | | | | 14 | |

End of period balance |

| $ | 152 |

| $ | 19 | | $ | 7 | | $ | 178 | |

| | | | | | | | | | | | | |

Six Months Ended May 2, 2021 | | | | | | | | | | | | | |

Allowance: |

| | | | | | | | | | | | |

Beginning of period balance |

| $ | 133 |

| $ | 43 | | $ | 8 | | $ | 184 | |

ASU No. 2016-13 adoption | | | 44 | | | (13) | | | | | | 31 | |

Provision (credit) | | | (13) | | | (16) | | | (1) | | | (30) | |

Write-offs | | | (23) | | | (14) | | | | | | (37) | |

Recoveries | | | 10 | | | 19 | | | | | | 29 | |

Translation adjustments | | | 1 | | | | | | | | | 1 | |

End of period balance |

| $ | 152 |

| $ | 19 | | $ | 7 | | $ | 178 | |

Financing receivables: | | | | | | | | | | | | | |

End of period balance |

| $ | 28,979 |

| $ | 3,348 | | $ | 2,952 | | $ | 35,279 | |

| | | | | | | | | | | | | |

| | Retail Notes | | Revolving | | | | | | |

| ||

| | & Financing | | Charge | | Wholesale | | | |

| |||

| | Leases | | Accounts | | Receivables | | Total | | ||||

Three Months Ended May 3, 2020 | | | | | | | | | | | | | |

Allowance: |

| |

|

| |

|

| |

|

| |

| |

Beginning of period balance | | $ | 106 |

| $ | 40 | | $ | 11 | | $ | 157 | |

Provision | |

| 65 | | | 20 | | | | |

| 85 | |

Write-offs | |

| (26) | | | (23) | | | | |

| (49) | |

Recoveries | |

| 3 | | | 6 | | | | |

| 9 | |

Translation adjustments | |

| (7) | | | | | | | |

| (7) | |

End of period balance | | $ | 141 | | $ | 43 | | $ | 11 | | $ | 195 | |

| | | | | | | | | | | | | |

Six Months Ended May 3, 2020 | | | | | | | | | | | | | |

Allowance: |

|