Exhibit 99.3

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT AUGUST 1, 2024 CUSTOMER COMMUNITY FINANCIAL EMPLOYEE CLEAN ENERGY RELIABILITY Exhibit 99.3

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT Safe Harbor Statement 1 All per - share amounts in this presentation are reported on a diluted basis. The only common equity securities that are publicly traded are common shares of Ev ersource Energy. The earnings discussion includes financial measures that are not recognized under generally accepted accounting principles (non - GAAP) referencing earnings and EP S excluding the impairment charge for the offshore wind investments, a loss on the disposition of land that was initially acquired to construct the Northern Pass Transmission project and was subsequently aba ndoned, and certain transaction and transition costs. EPS by business is also a non - GAAP financial measure and is calculated by dividing the net income attributable to common shareholders of each business by t he weighted average diluted Eversource Energy common shares outstanding for the period. The earnings and EPS of each business do not represent a direct legal interest in the assets and liabilities of such bus iness, but rather represent a direct interest in Eversource Energy’s assets and liabilities as a whole. Eversource Energy uses these non - GAAP financial measures to evaluate and provide details of earnings results by bus iness and to more fully compare and explain results without including these items. This information is among the primary indicators management uses as a basis for evaluating performance and planning an d f orecasting of future periods. Management believes the impacts of the impairment charge for the offshore wind investments, the loss on the disposition of land associated with an abandoned project, and trans act ion and transition costs are not indicative of Eversource Energy's ongoing costs and performance. Management views these charges as not directly related to the ongoing operations of the business and therefore n ot an indicator of baseline operating performance. Due to the nature and significance of the effect of these items on net income attributable to common shareholders and EPS, management believes that the non - GAAP pr esentation is a more meaningful representation of Eversource Energy's financial performance and provides additional and useful information to readers of this report in analyzing historical and fu tur e performance of the business. These non - GAAP financial measures should not be considered as alternatives to reported net income attributable to common shareholders or EPS determined in accordance with GA AP as indicators of Eversource Energy's operating performance. This document includes statements concerning Eversource Energy’s expectations, beliefs, plans, objectives, goals, strategies, assumptions o f f uture events, future financial performance or growth and other statements that are not historical facts. These statements are “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, readers can identify these forward - looking statements through the use of words or phrases such as “estimate,” “expect,” “anticipate,” “intend,” “plan,” “project,” “believe,” “fore cas t,” “should,” “could” and other similar expressions. Forward - looking statements involve risks and uncertainties that may cause actual results or outcomes to differ materially from those included in the forward - lookin g statements. Forward - looking statements are based on the current expectations, estimates, assumptions or projections of management and are not guarantees of future performance. These expectations, estimat es, assumptions or projections may vary materially from actual results. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, the following impor tan t factors that may cause our actual results or outcomes to differ materially from those contained in our forward - looking statements, including, but not limited to: cyberattacks or breaches, including those resulting in the compromise of the confidentiality of our proprietary information and the personal information of our customers; our ability to complete the sale of our offshore wind investments in the South Fork Wind and Re vol ution Wind projects on the timeline, terms and pricing we expect; if we and the counterparty are unable to satisfy all closing conditions and consummate the purchase and sale transaction with respect to th ese offshore wind assets; if we are unable to qualify for investment tax credits related to these projects; if we experience variability in the projected construction costs of these offshore wind projects, if there is a deterioration of market conditions in the offshore wind industry; and if the projects do not commence operation as scheduled or within budget or are not completed; disruptions in the capital markets or other events tha t m ake our access to necessary capital more difficult or costly; changes in economic conditions, including impact on interest rates, tax policies, and customer demand and payment ability; ability or inability t o c ommence and complete our major strategic development projects and opportunities; acts of war or terrorism, physical attacks or grid disturbances that may damage and disrupt our electric transmission and electric , n atural gas, and water distribution systems; actions or inaction of local, state and federal regulatory, public policy and taxing bodies; substandard performance of third - party suppliers and service providers; fluctuation s in weather patterns, including extreme weather due to climate change; changes in business conditions, which could include disruptive technology or development of alternative energy sources related to our cu rre nt or future business model; contamination of, or disruption in, our water supplies; changes in levels or timing of capital expenditures; changes in laws, regulations or regulatory policy, including compliance wit h environmental laws and regulations; changes in accounting standards and financial reporting regulations; actions of rating agencies; and other presently unknown or unforeseen factors. Other risk factors are detailed in Eversource Energy’s reports filed with the Securities and Exchange Commission (SEC). They ar e updated as necessary and available on Eversource Energy’s website at www.eversource.com and on the SEC’s website at www.sec.gov . All such factors are difficult to predict and contain uncertainties that may materially affect Eversource Energy’s actual res ults, many of which are beyond our control. You should not place undue reliance on the forward - looking statements, as each speaks only as of the date o n which such statement is made, and, except as required by federal securities laws, Eversource Energy undertakes no obligation to update any forward - looking statement or statements to reflect events or circ umstances after the date on which such statement is made or to reflect the occurrence of unanticipated events .

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT Agenda Business Update ▪ Overview ▪ Electric Transmission and Distribution Investment Growth ▪ Delivering an Equitable and Affordable Clean Energy Future 2 Joe Nolan Chairman, President & CEO John Moreira EVP, CFO & Treasurer Financial Update ▪ Q2 2024 Financial Results ▪ Regulatory Update ▪ Financing Activity Review

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT 3 Clean Energy Transition Provides Investment Growth Utility - scale solar EV charging buildout Energy efficiency solutions Battery energy storage Offshore wind interconnection Networked geothermal Achieving carbon neutrality in our own operations by 2030 Cambridge Substation Project

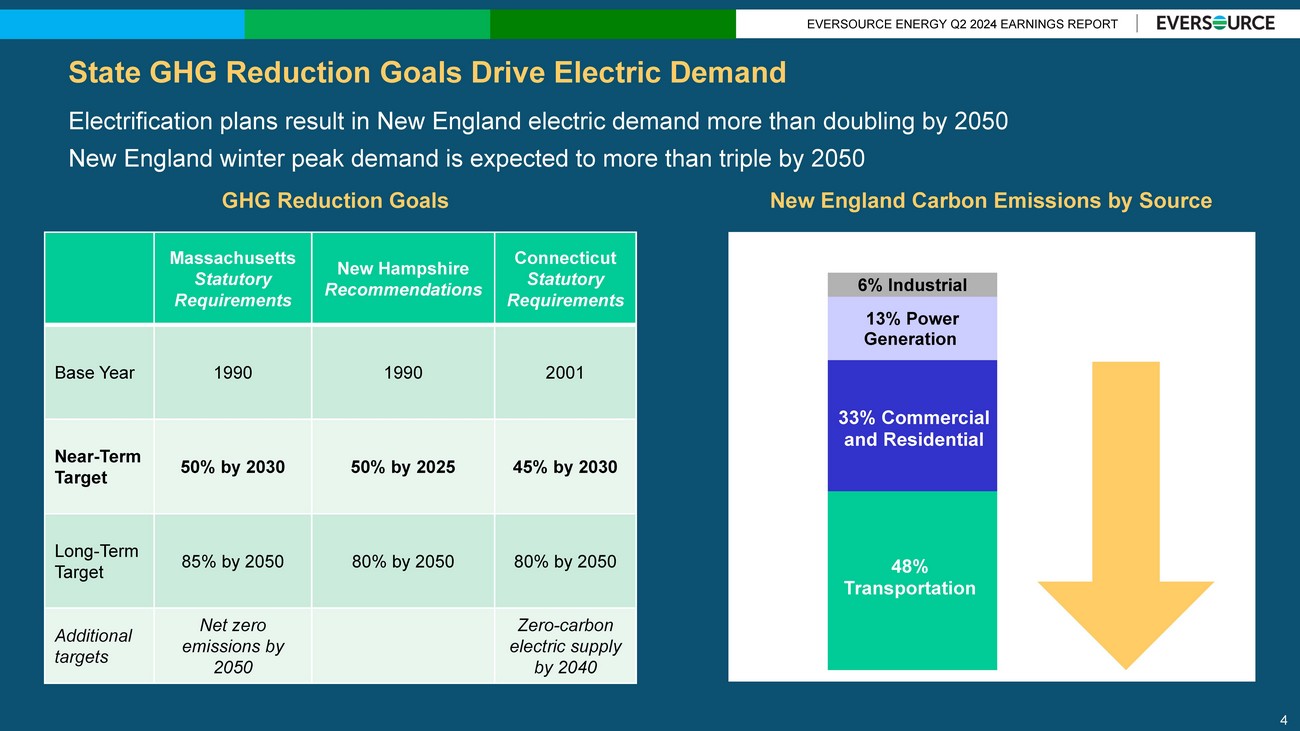

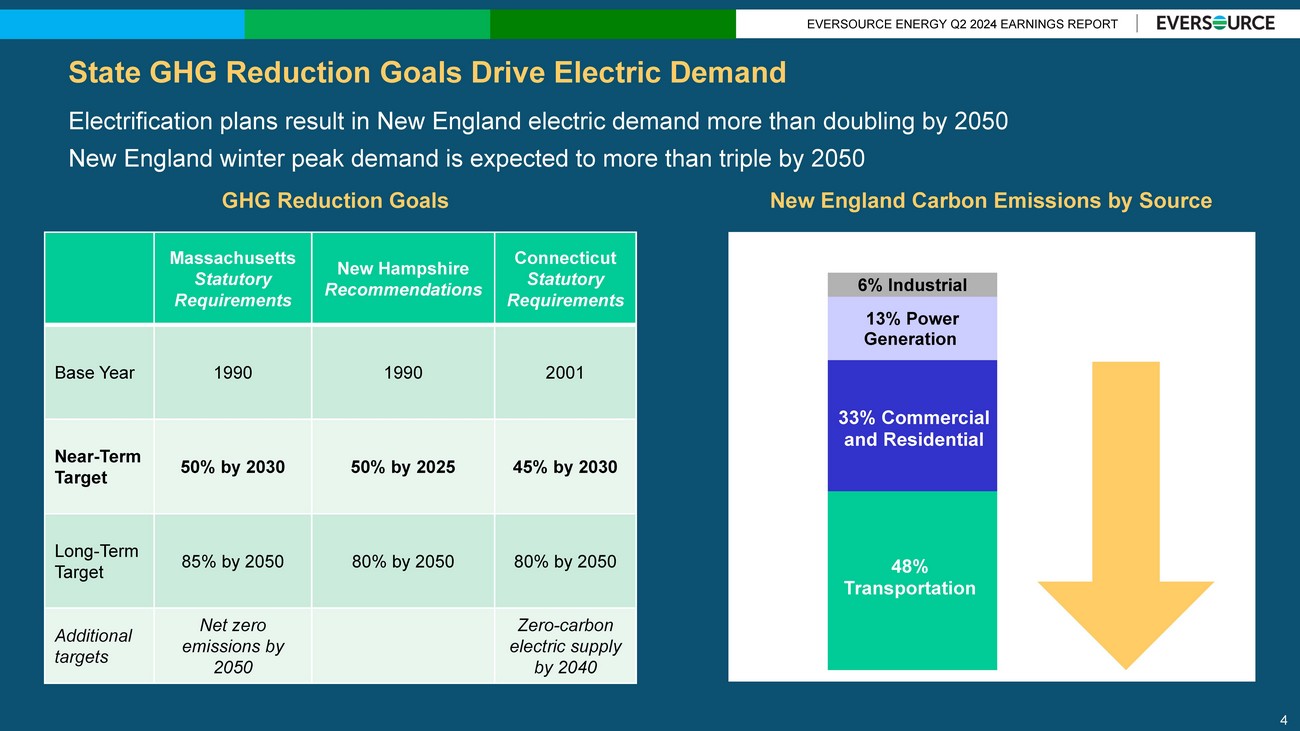

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT State GHG Reduction Goals Drive Electric Demand 4 Massachusetts Statutory Requirements New Hampshire Recommendations Connecticut Statutory Requirements Base Year 1990 1990 2001 Near - Term Target 50% by 2030 50% by 2025 45% by 2030 Long - Term Target 85% by 2050 80% by 2050 80% by 2050 Additional targets Net zero emissions by 2050 Zero - carbon electric supply by 2040 48% Transportation 33% Commercial and Residential 13% Power Generation 6% Industrial GHG Reduction Goals New England Carbon Emissions by Source Electrification plans result in New England electric demand more than doubling by 2050 New England winter peak demand is expected to more than triple by 2050

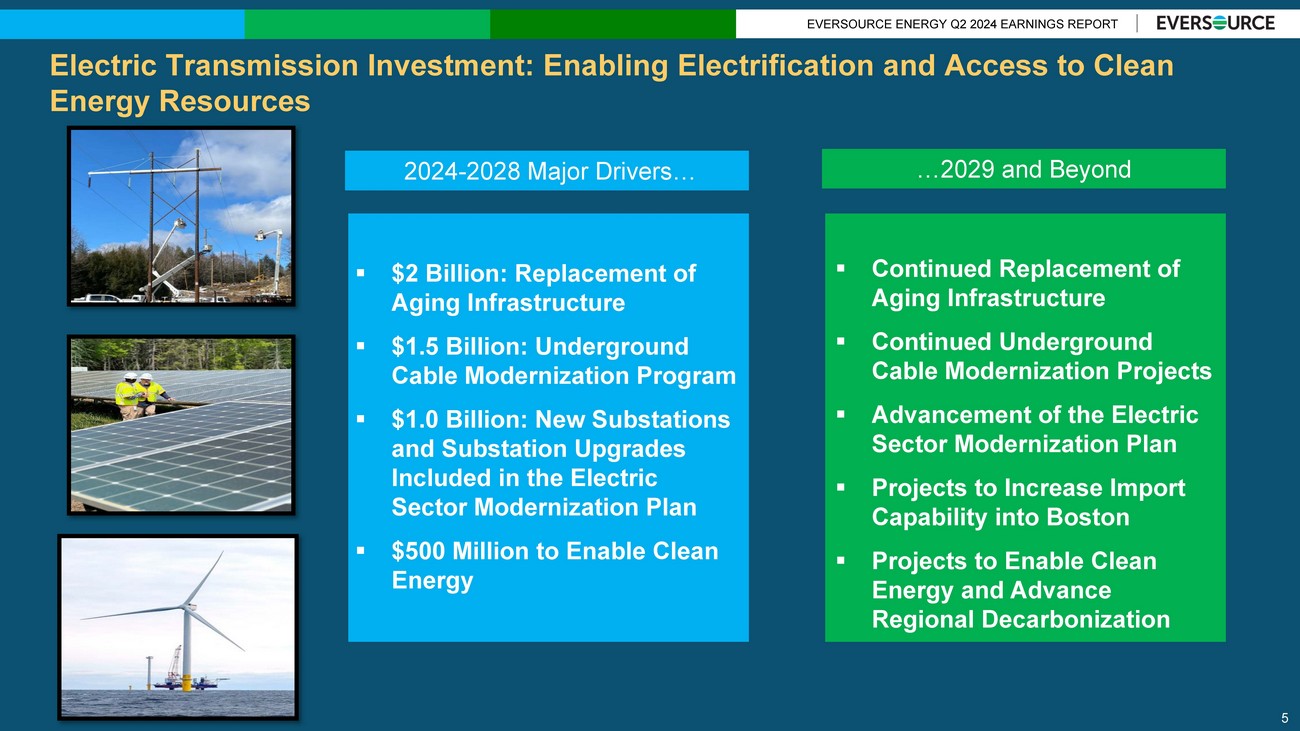

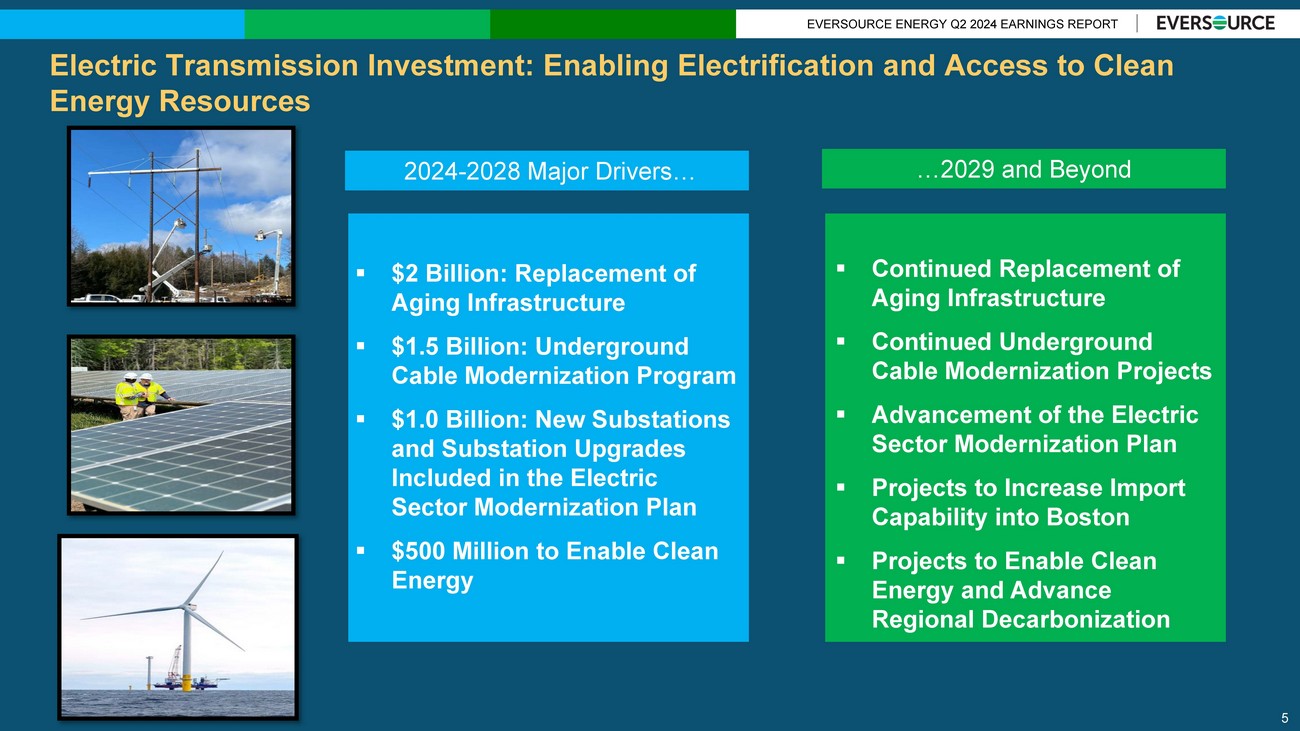

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT Electric Transmission Investment: Enabling Electrification and Access to Clean Energy Resources 5 ▪ $2 Billion: Replacement of Aging Infrastructure ▪ $1.5 Billion: Underground Cable Modernization Program ▪ $1.0 Billion: New Substations and Substation Upgrades Included in the Electric Sector Modernization Plan ▪ $500 Million to Enable Clean Energy 2024 - 2028 Major Drivers… … 2029 and Beyond ▪ Continued Replacement of Aging Infrastructure ▪ Continued Underground Cable Modernization Projects ▪ Advancement of the Electric Sector Modernization Plan ▪ Projects to Increase Import Capability into Boston ▪ Projects to Enable Clean Energy and Advance Regional Decarbonization

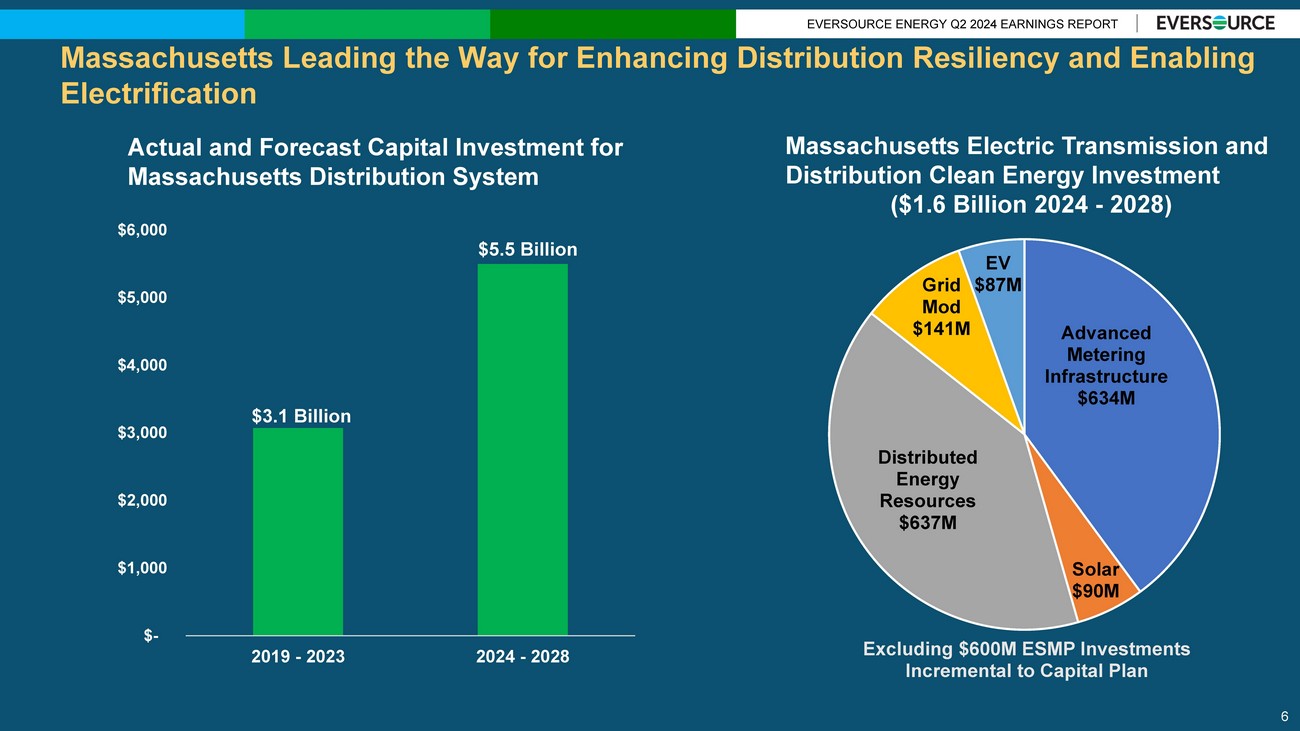

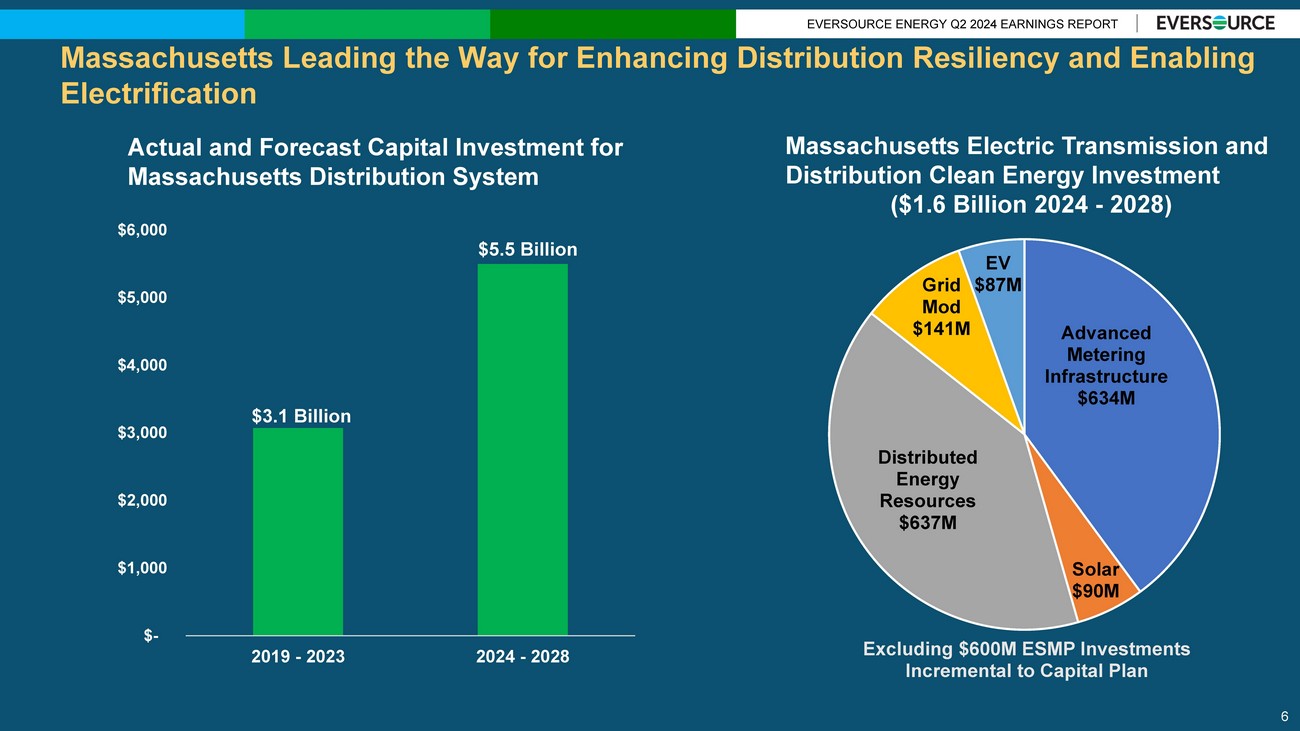

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT Massachusetts Leading the Way for Enhancing Distribution Resiliency and Enabling Electrification 6 $3.1 Billion $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2019 - 2023 2024 - 2028 $5.5 Billion Advanced Metering Infrastructure $ 634 M Solar $ 90 M Distributed Energy Resources $ 637 M Grid Mod $ 141 M EV $ 87 M Excluding $600M ESMP Investments Incremental to Capital Plan Actual and Forecast Capital Investment for Massachusetts Distribution System Massachusetts Electric Transmission and Distribution Clean Energy Investment ($1.6 Billion 2024 - 2028)

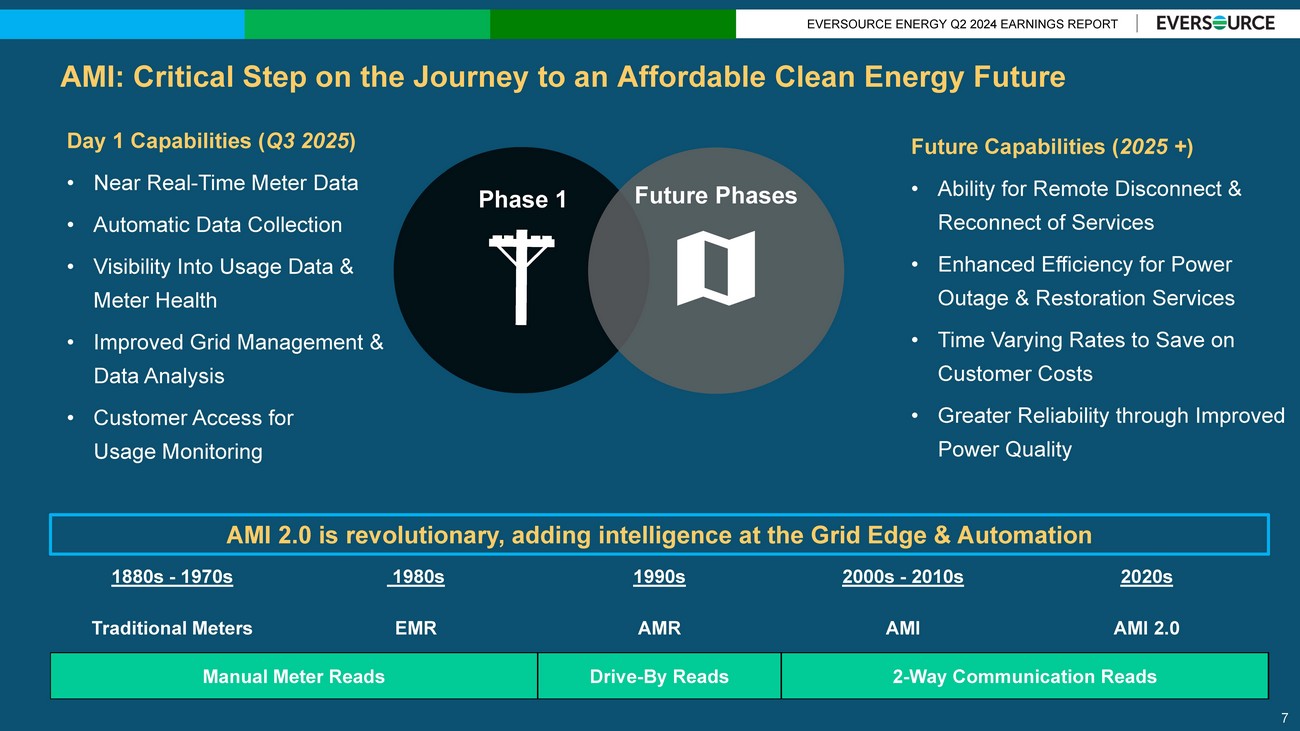

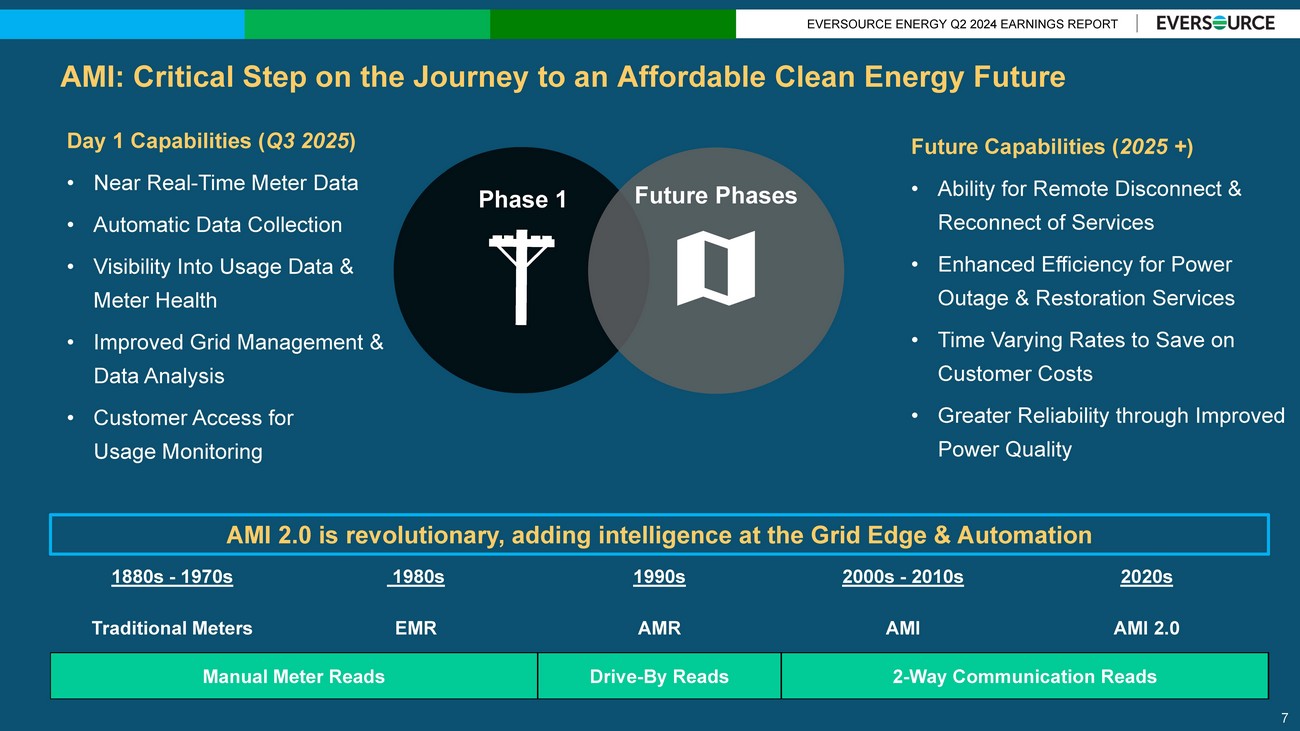

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT AMI: Critical Step on the Journey to an Affordable Clean Energy Future 7 1880s - 1970s 1980s 1990s 2000s - 2010s 2020s Traditional Meters EMR AMR AMI AMI 2.0 Manual Meter Reads Drive - By Reads 2 - Way Communication Reads AMI 2.0 is revolutionary, adding intelligence at the Grid Edge & Automation Day 1 Capabilities ( Q3 2025 ) • Near Real - Time Meter Data • Automatic Data Collection • Visibility Into Usage Data & Meter Health • Improved Grid Management & Data Analysis • Customer Access for Usage Monitoring Phase 1 Future Phases Future Capabilities ( 2025 + ) • Ability for Remote Disconnect & Reconnect of Services • Enhanced Efficiency for Power Outage & Restoration Services • Time Varying Rates to Save on Customer Costs • Greater Reliability through Improved Power Quality

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT Eversource 2023 Sustainability and Diversity, Equity and Inclusion Reports ▪ Highlights our commitment to environmental, social and governance (ESG) priorities and 2023 progress ▪ Submission of application to have a new GHG reduction target validated with the Science Based Targets initiative ▪ Enabling a clean energy transition while maintaining our focus on reliability 2023 Diversity, Equity & Inclusion Report 2023 Sustainability Report ▪ Includes overview of our DE&I strategy, goals and accomplishments ▪ Report includes metrics on workforce composition and key DE&I corporate performance measures 8

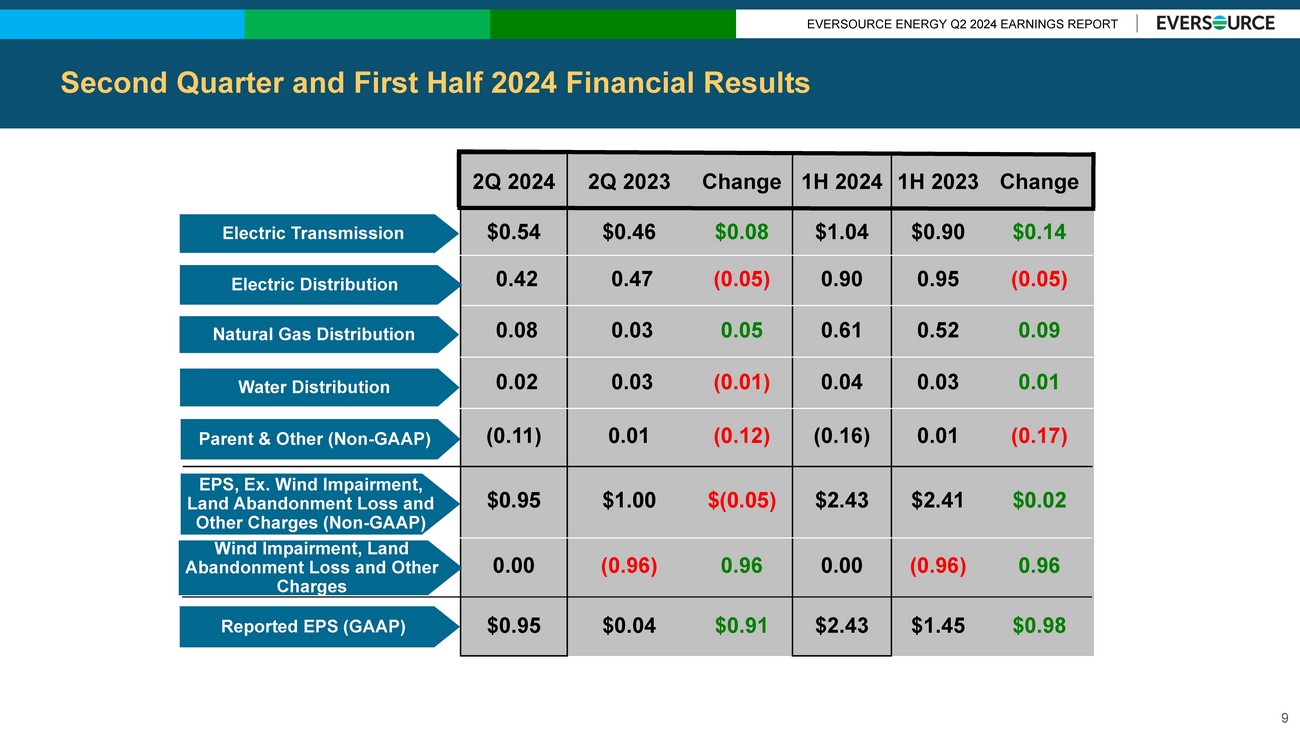

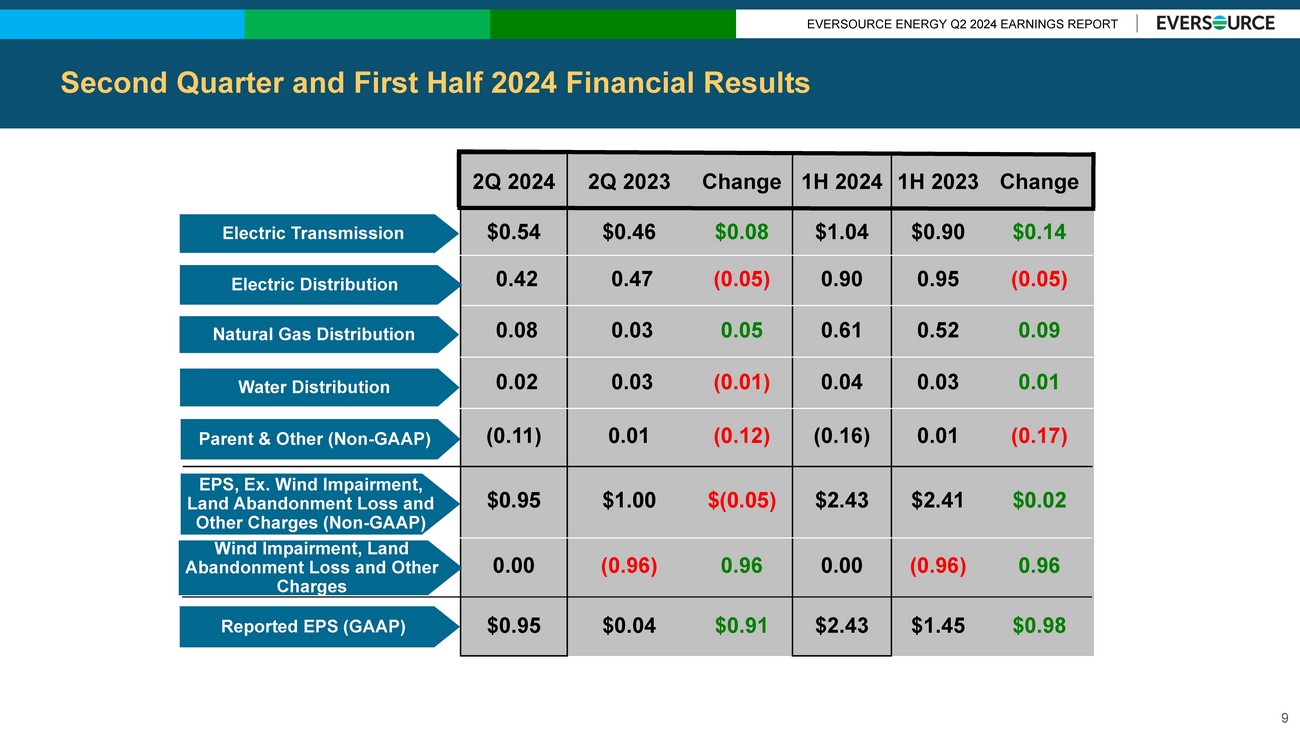

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT Second Quarter and First Half 2024 Financial Results 9 2Q 2024 2Q 2023 Change 1H 2024 1H 2023 Change $0.54 $0.46 $0.08 $1.04 $0.90 $0.14 0.42 0.47 (0.05) 0.90 0.95 (0.05) 0.08 0.03 0.05 0.61 0.52 0.09 0.02 0.03 (0.01) 0.04 0.03 0.01 (0.11) 0.01 (0.12) (0.16) 0.01 (0.17) $0.95 $1.00 $(0.05) $2.43 $2.41 $0.02 0.00 (0.96) 0.96 0.00 (0.96) 0.96 $0.95 $0.04 $0.91 $2.43 $1.45 $0.98 Electric Transmission Electric Distribution Natural Gas Distribution Water Distribution Parent & Other (Non - GAAP) EPS, Ex. Wind Impairment, Land Abandonment Loss and Other Charges (Non - GAAP) Wind Impairment, Land Abandonment Loss and Other Charges Reported EPS (GAAP)

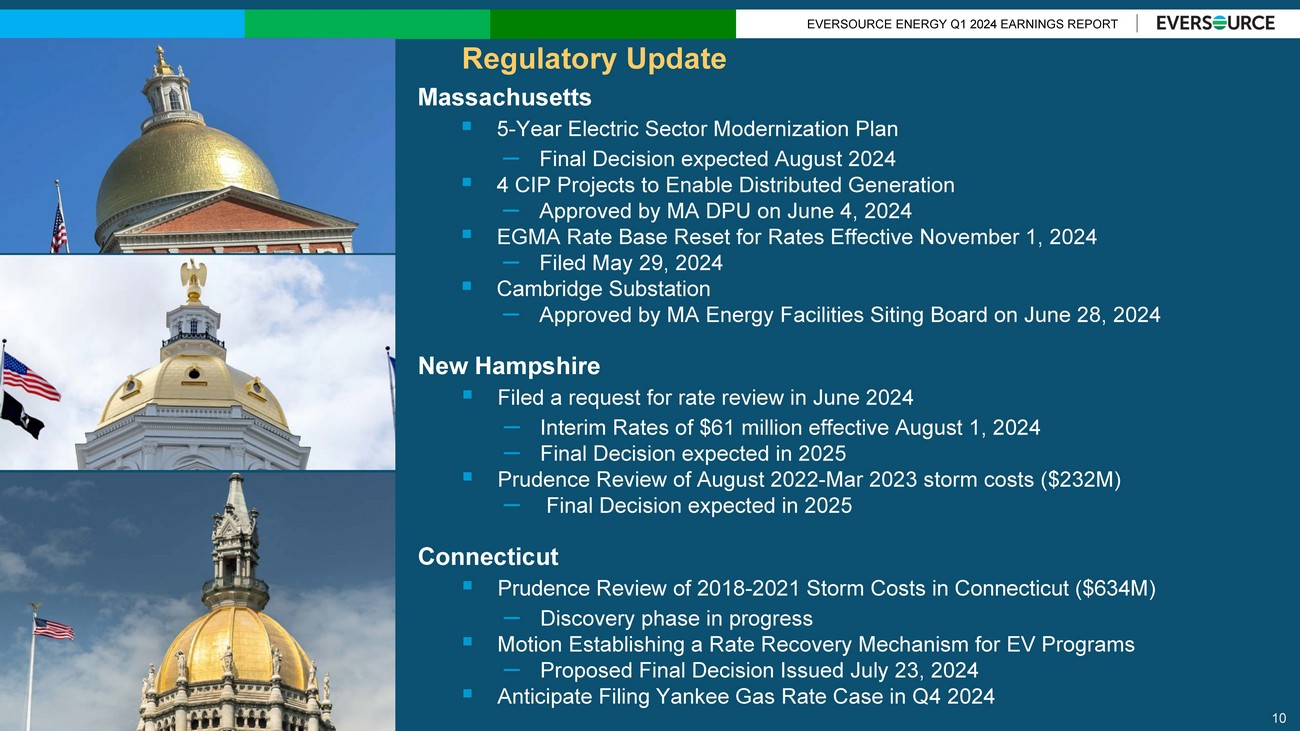

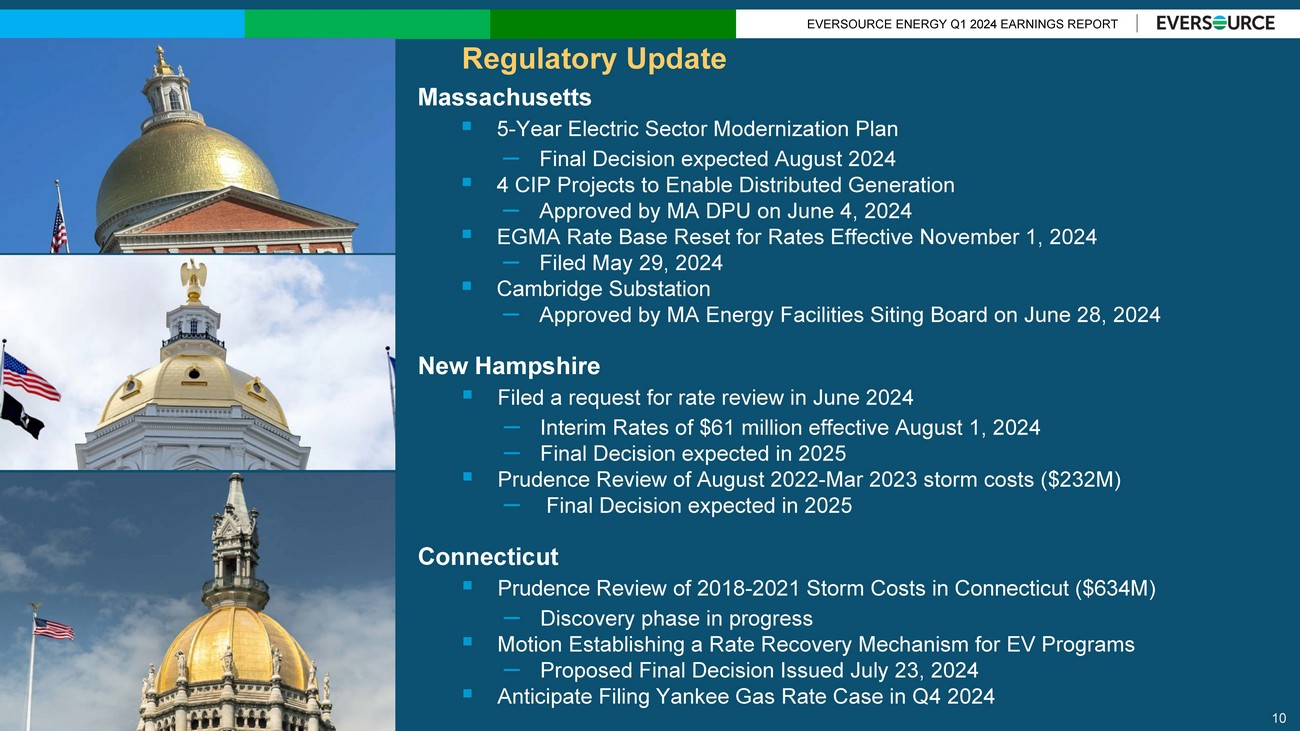

EVERSOURCE ENERGY Q1 2024 EARNINGS REPORT Regulatory Update 10 Massachusetts ▪ 5 - Year Electric Sector Modernization Plan – Final Decision expected August 2024 ▪ 4 CIP Projects to Enable Distributed Generation – Approved by MA DPU on June 4, 2024 ▪ EGMA Rate Base Reset for Rates Effective November 1, 2024 – Filed May 29, 2024 ▪ Cambridge Substation – Approved by MA Energy Facilities Siting Board on June 28, 2024 New Hampshire ▪ Filed a request for rate review in June 2024 – Interim Rates of $61 million effective August 1, 2024 – Final Decision expected in 2025 ▪ Prudence Review of August 2022 - Mar 2023 storm costs ($232M) – Final Decision expected in 2025 Connecticut ▪ Prudence Review of 2018 - 2021 Storm Costs in Connecticut ($634M) – Discovery phase in progress ▪ Motion Establishing a Rate Recovery Mechanism for EV Programs – Proposed Final Decision Issued July 23, 2024 ▪ Anticipate Filing Yankee Gas Rate Case in Q4 2024

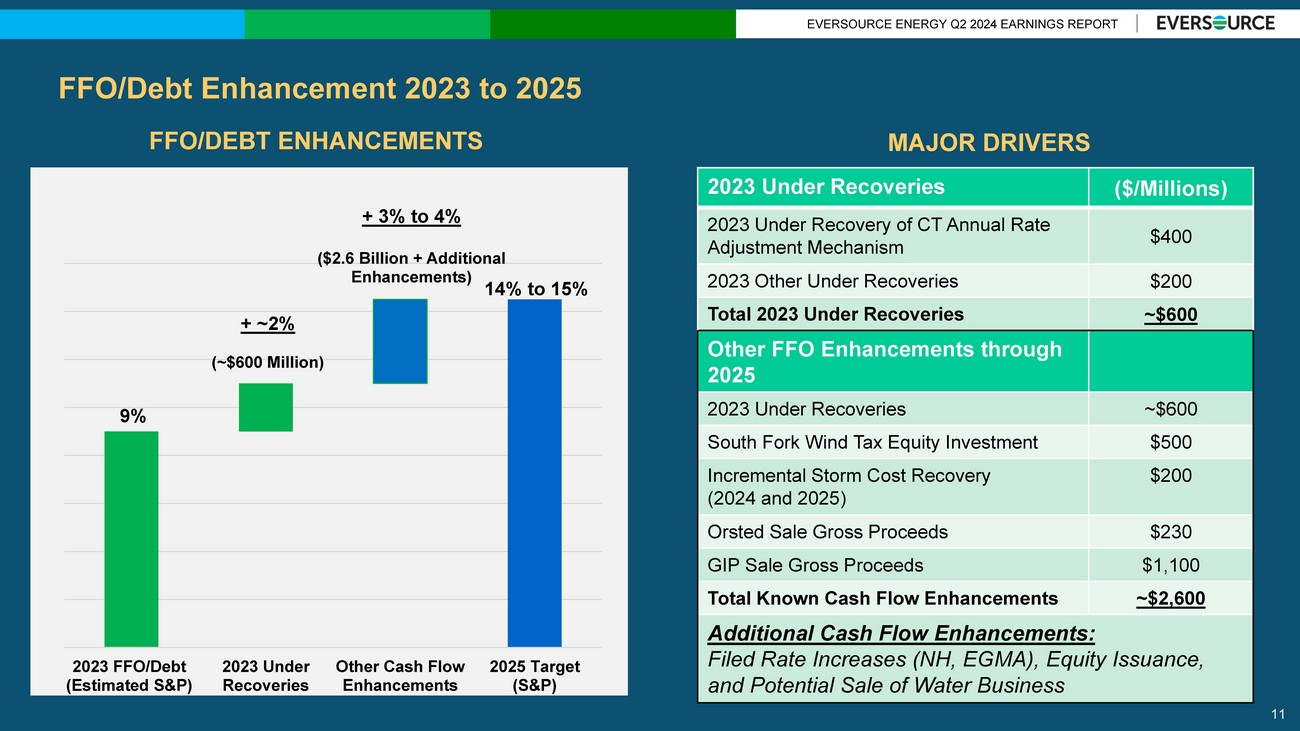

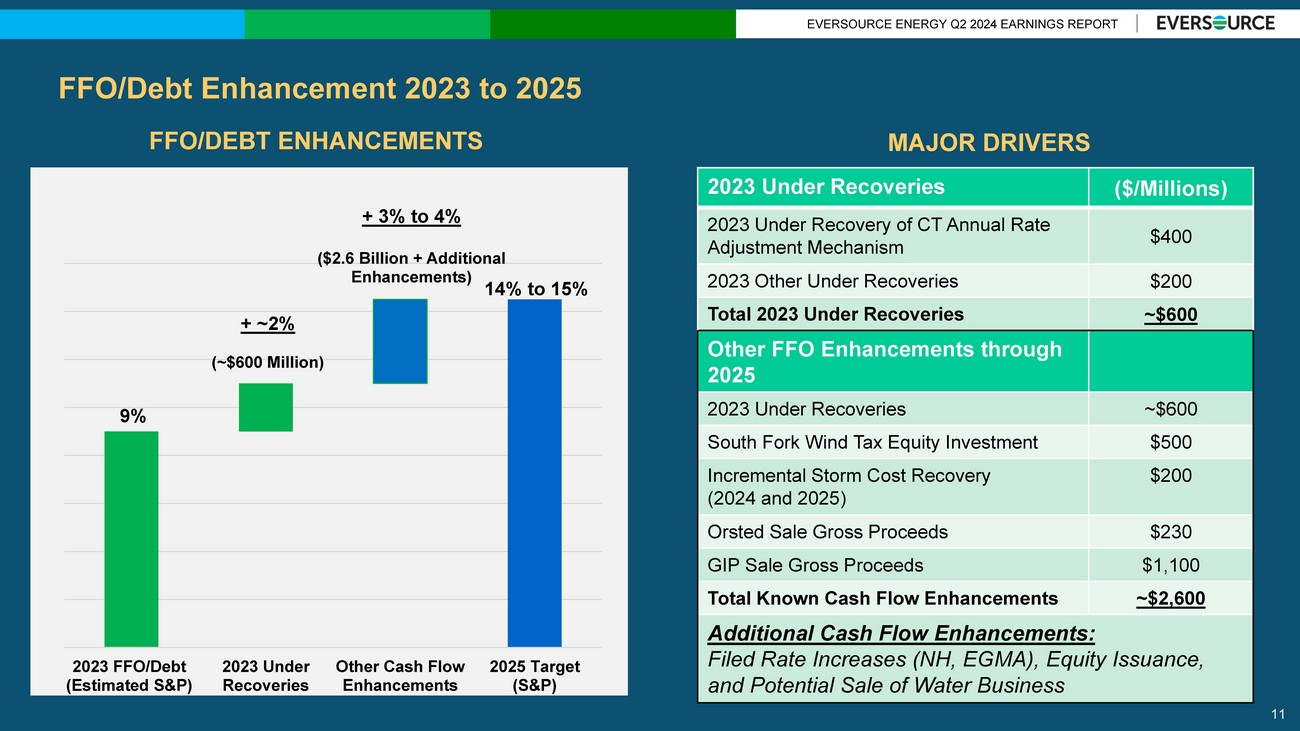

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT FFO/Debt Enhancement 2023 to 2025 11 FFO/DEBT ENHANCEMENTS 9% + ~2% (~$600 Million) + 3% to 4% ($2.6 Billion + Additional Enhancements) 14% to 15% 2023 FFO/Debt (Estimated S&P) 2023 Under Recoveries Other Cash Flow Enhancements 2025 Target (S&P) 2023 Under Recoveries ($/Millions) 2023 Under Recovery of CT Annual Rate Adjustment Mechanism $400 2023 Other Under Recoveries $200 Total 2023 Under Recoveries ~$600 Other FFO Enhancements through 2025 2023 Under Recoveries ~$600 South Fork Wind Tax Equity Investment $500 Incremental Storm Cost Recovery (2024 and 2025) $200 Orsted Sale Gross Proceeds $230 GIP Sale Gross Proceeds $1,100 Total Known Cash Flow Enhancements ~$2,600 Additional Cash Flow Enhancements: Filed Rate Increases (NH, EGMA), Equity Issuance, and Potential Sale of Water Business MAJOR DRIVERS

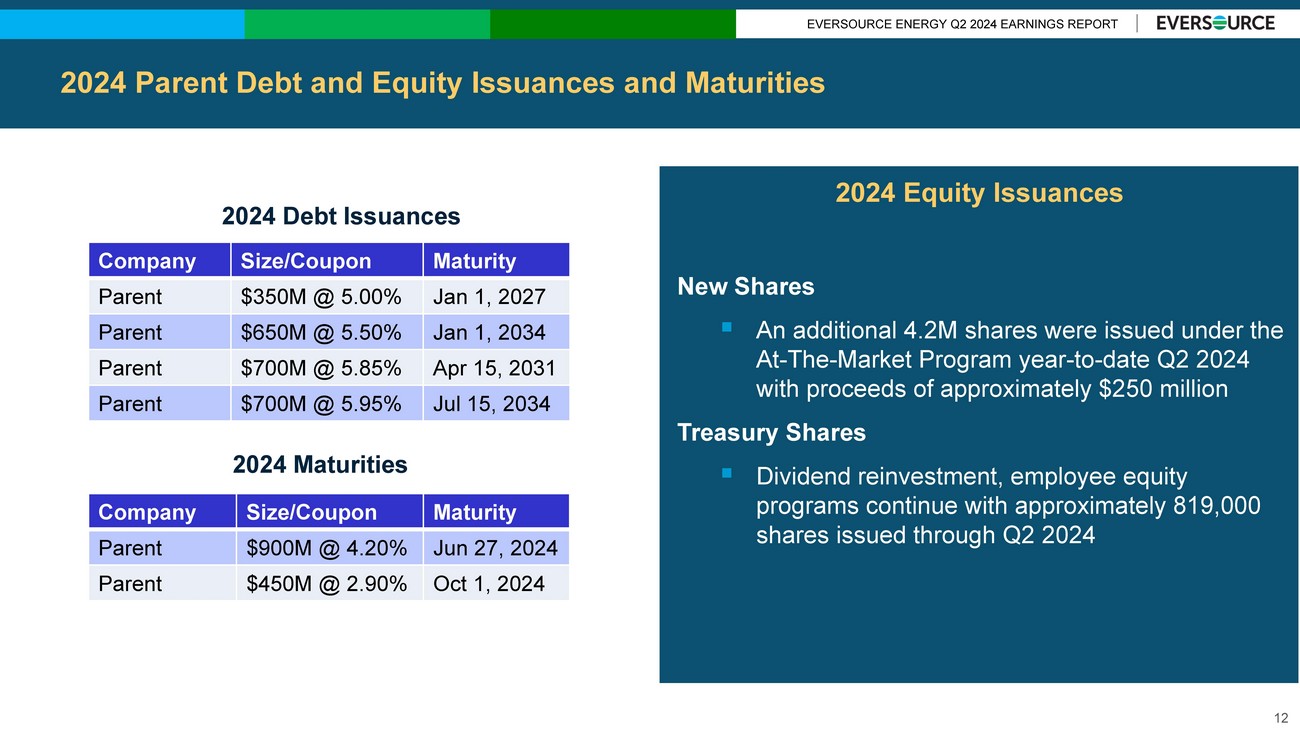

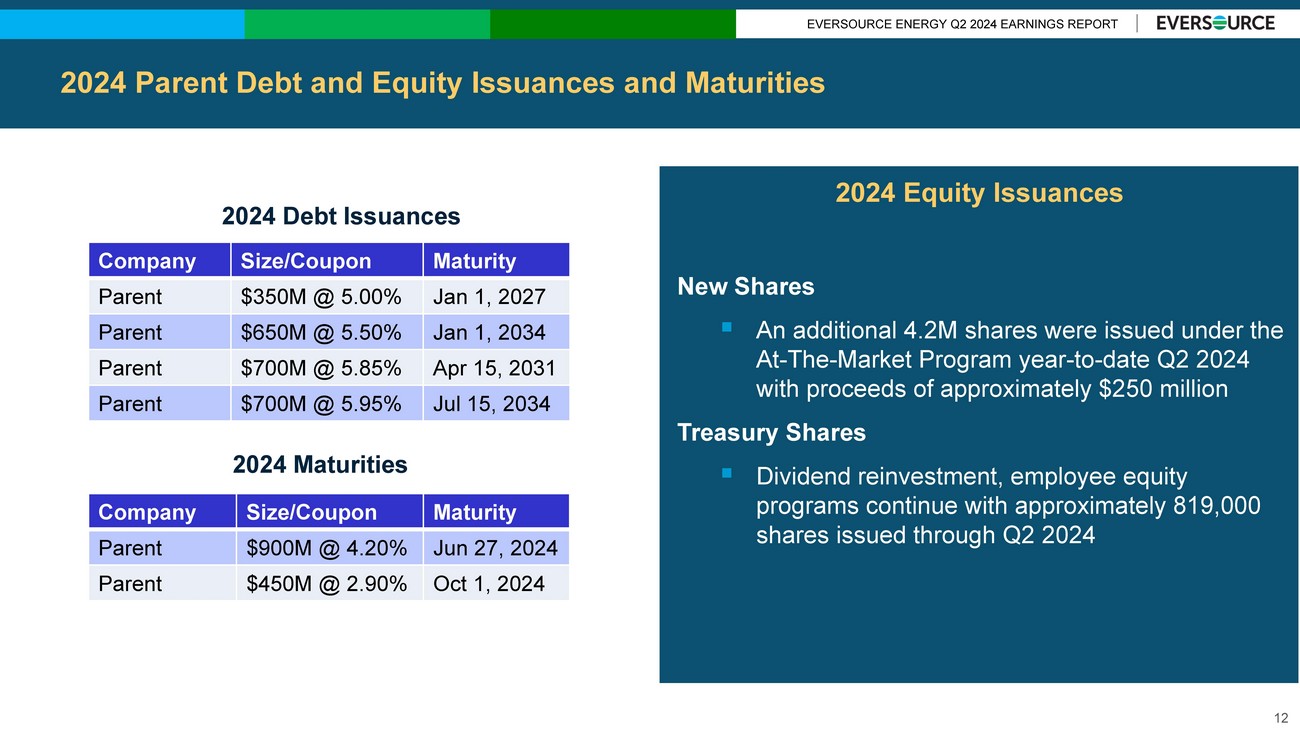

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT 2024 Parent Debt and Equity Issuances and Maturities Company Size/Coupon Maturity Parent $900M @ 4.20% Jun 27, 2024 Parent $450M @ 2.90% Oct 1, 2024 2024 Debt Issuances 2024 Maturities Company Size/Coupon Maturity Parent $350M @ 5.00% Jan 1, 2027 Parent $650M @ 5.50% Jan 1, 2034 Parent $700M @ 5.85% Apr 15, 2031 Parent $700M @ 5.95% Jul 15, 2034 New Shares ▪ An additional 4.2 M shares were issued under the At - The - Market Program year - to - date Q2 2024 with proceeds of approximately $ 250 million Treasury Shares ▪ Dividend reinvestment, employee equity programs continue with approximately 819,000 shares issued through Q2 2024 2024 Equity Issuances 12

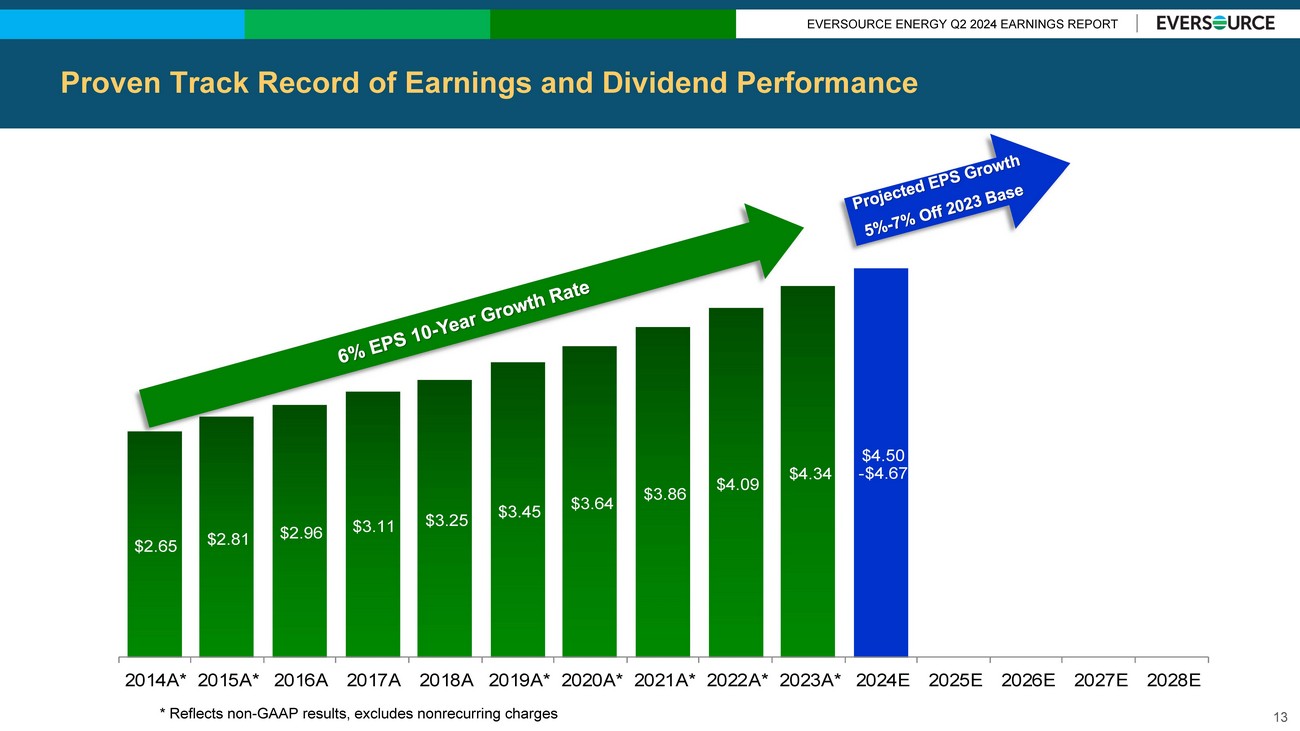

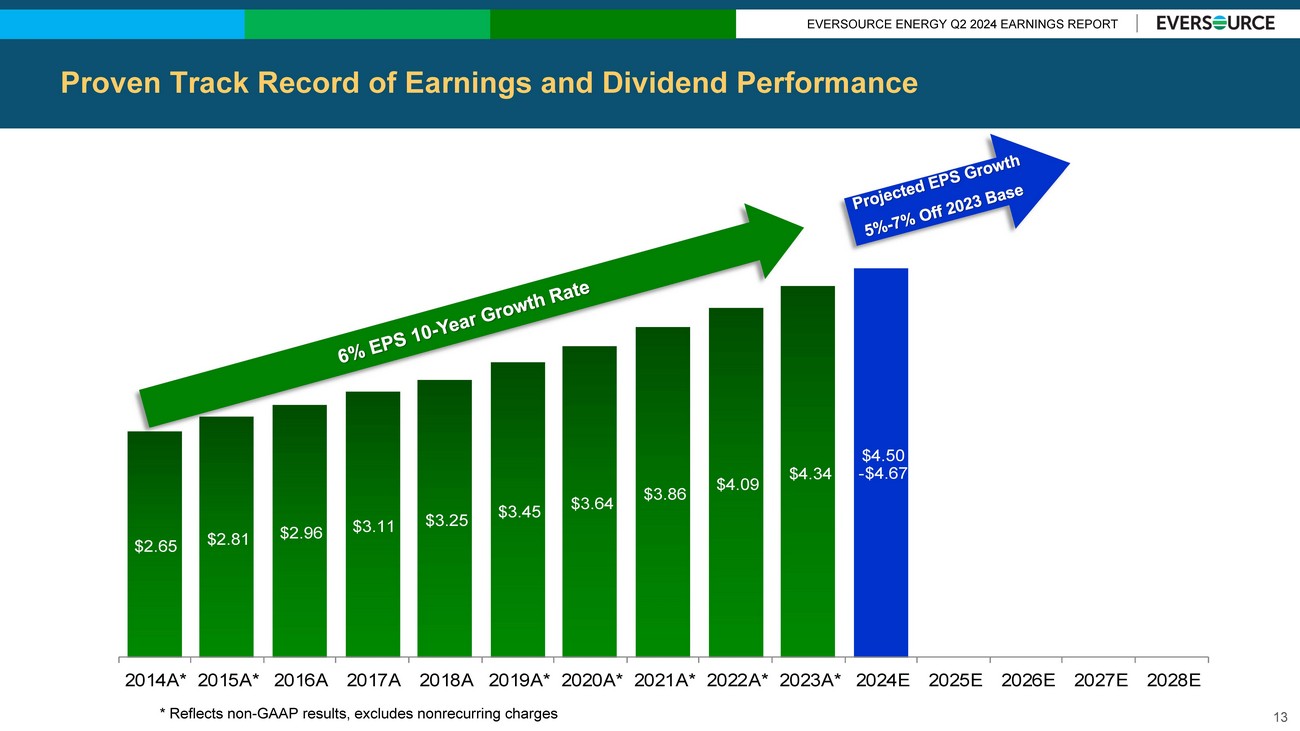

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT $2.65 $2.81 $2.96 $3.11 $3.25 $3.45 $3.64 $3.86 $4.09 $4.34 $4.50 - $4.67 2014A* 2015A* 2016A 2017A 2018A 2019A* 2020A* 2021A* 2022A* 2023A* 2024E 2025E 2026E 2027E 2028E * Reflects non - GAAP results, excludes nonrecurring charges 13 Proven Track Record of Earnings and Dividend Performance

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT APPENDIX 14

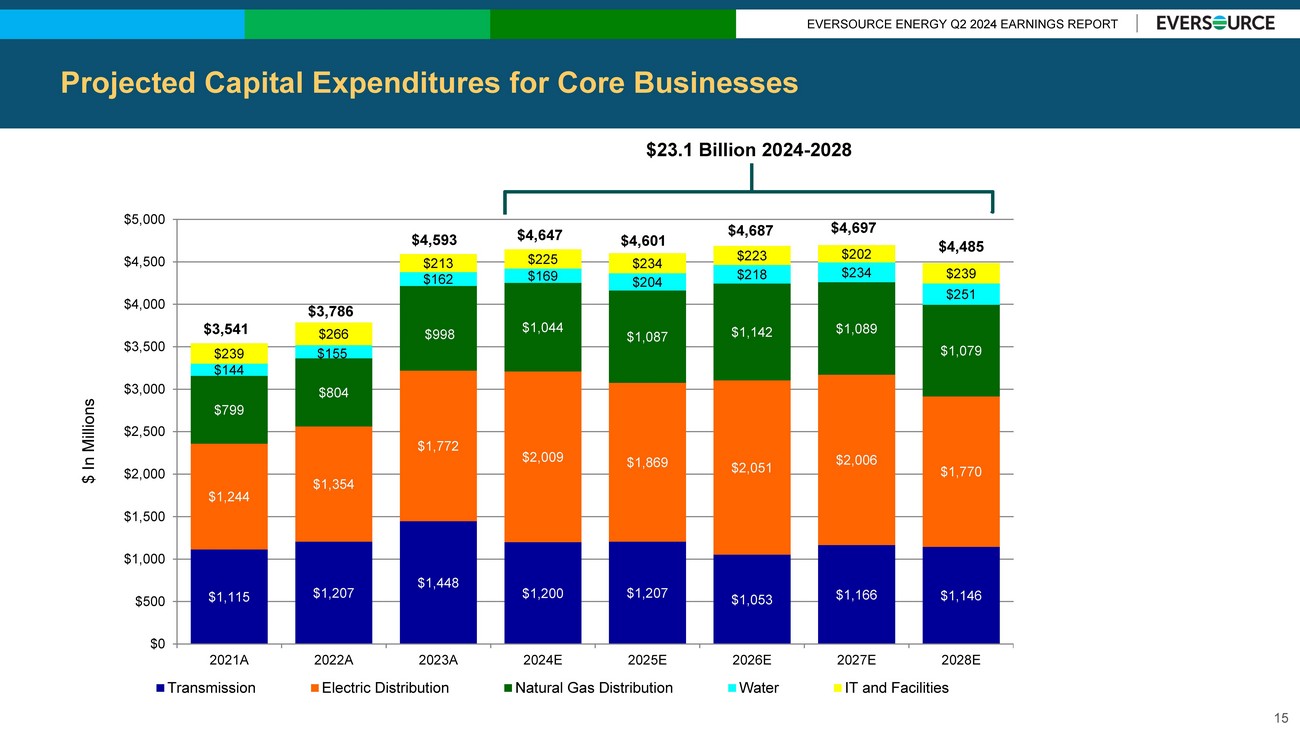

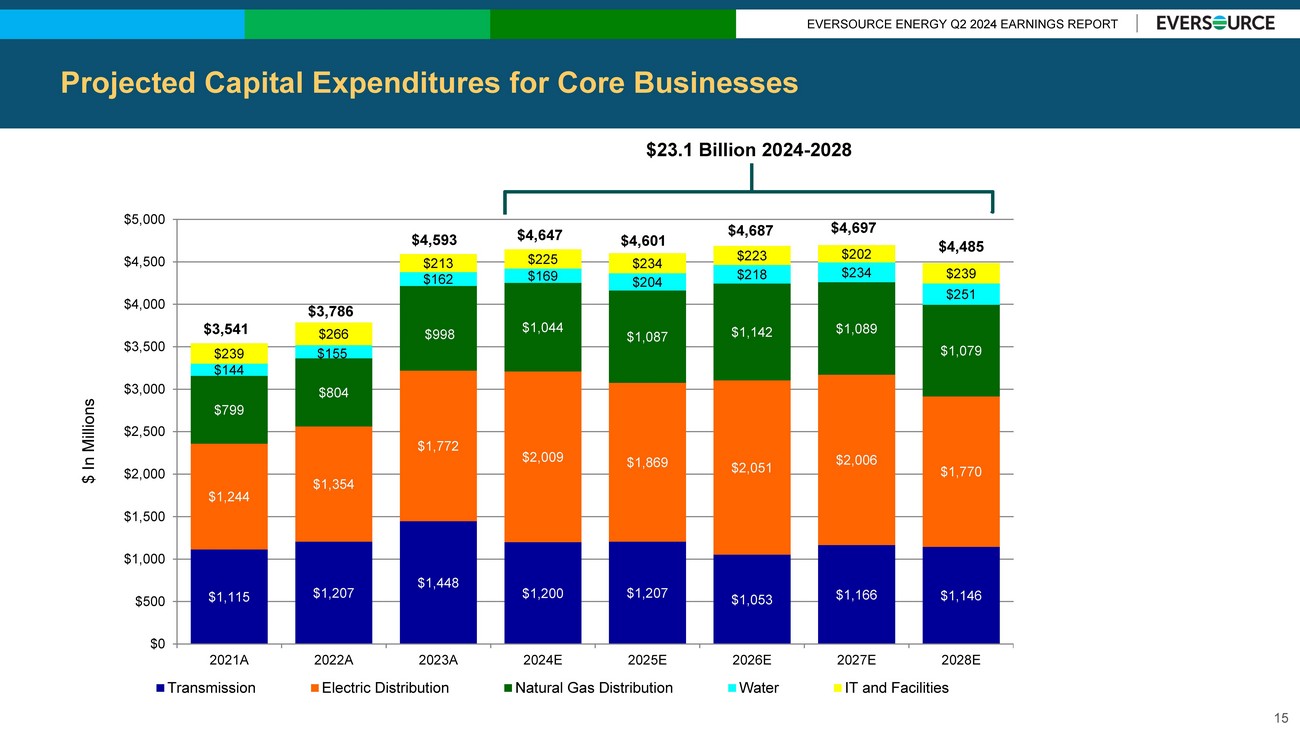

EVERSOURCE ENERGY Q2 2024 EARNINGS REPORT $1,115 $1,207 $1,448 $1,200 $1,207 $1,053 $1,166 $1,146 $1,244 $1,354 $1,772 $2,009 $1,869 $2,051 $2,006 $1,770 $799 $804 $998 $1,044 $1,087 $1,142 $1,089 $1,079 $144 $155 $162 $169 $204 $218 $234 $251 $239 $266 $213 $225 $234 $223 $202 $239 $3,541 $3,786 $4,593 $4,647 $4,601 $4,687 $4,697 $4,485 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2021A 2022A 2023A 2024E 2025E 2026E 2027E 2028E Transmission Electric Distribution Natural Gas Distribution Water IT and Facilities $ In Millions $23.1 Billion 2024 - 2028 Projected Capital Expenditures for Core Businesses 15