Dear Fellow Aon Shareholder:

As outlined in our proxy statement made available to shareholders on April 26, 2019 for our Annual General Meeting of Shareholders to be held on June 21, 2019, we are requesting that you approve the amended Aon plc 2011 Incentive Compensation Plan. Holders of Class A Ordinary Shares at the close of business on April 23, 2019 are entitled to vote at the Annual General Meeting.

In 2011 and most recently in 2014, we received shareholder approval for employee stock awards under the 2011 Plan. As of March 31, 2019, there were approximately 3.8 million shares remaining available for issuance under the previously approved plans. At the Annual General Meeting of Shareholders, we are requesting shareholder approval for 5.0 million additional shares under the amended and restated 2011 Plan. Similar to the original plan, these 8.8 million shares in total are expected to provide continuity of both our short and long-term incentive compensation programs, while providing flexibility of issuance for a minimum of three years of awards, and potentially longer subject to share price and financial performance.

Our programs have been in place since 2006 and we have made no material changes in the structure of the 2011 Plan. We believe Aon’s programs have been successful at driving financial results, and they are critical to Aon’s success in attracting and retaining key talent and motivating its senior leaders to achieve superior performance. Awards were broad based in 2018, with 95% of the total awards, excluding awards to the chief executive officer, distributed to more than 3,000 employees globally.

Equity compensation aligns management interests with shareholder interests, as our largest programs are based on adjusted operating income and adjusted multi-year EPS performance, in addition to providing a strong retention element of critical talent. Key programs have been successful in driving substantial increases in both adjusted operating margin (+1,200 bps) and adjusted earnings per share (+15% CAGR) from 2006 to 2018. In addition, Aon has consistently delivered double-digit Total Shareholder Return (TSR) since 2006, outperforming the broader market and creating substantial shareholder value creation:

| | |

| | | Annualized TSR |

Aon plc | | 17.0% |

S&P 500 | | 7.0% |

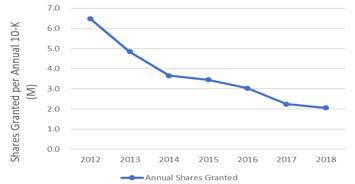

We recognize the significance of equity dilution to our shareholders and actively manage dilution both through plan practice and effective capital management. Total spend for granted awards has been held relatively flat at approximately $315 million annually on average over the most recent plan period (2014-2018), while creating leverage against a rising stock price. Continued discipline for the most recent period has further reduced annual grants from 3.7 million shares in 2014 to 2.1 million shares in 2018, as noted in our annual10-K filings.

In addition, effective capital management and benefits from our share repurchase program has further reduced the total number of diluted shares outstanding from 299.6 million in 2014 to 247.0 million in 2018. As a result, both share issuance and share dilution as a percent of outstanding shares has declined and is expected to continue to decline due to plan management discipline, strong financial performance and stock price appreciation.

This approach has been effective as evidenced by our financial success over the long-term. We want to thank you for your continued support of our incentive compensation programs and as a shareholder in Aon. Please support our efforts to continue building shareholder value by votingFOR approval to amend the Aon plc 2011 Incentive Plan. If you feel you cannot support this proposal, management would appreciate the opportunity to discuss further in advance of your vote. Please reach out to Scott Malchow, our Head of Investor Relations at scott.malchow@aon.com to arrange a call to discuss your concerns.

Thank you.

Greg Case, CEO