Exhibit 10(c)2

Confidential Trade Secret Information - Subject to Restricted Procedures

AMENDMENT NO. 6

TO

ENGINEERING, PROCUREMENT AND CONSTRUCTION

AGREEMENT

BETWEEN

GEORGIA POWER COMPANY, FOR ITSELF AND AS AGENT

FOR OGLETHORPE POWER CORPORATION (AN ELECTRIC

MEMBERSHIP CORPORATION), MUNICIPAL ELECTRIC

AUTHORITY OF GEORGIA AND THE CITY OF DALTON,

GEORGIA, ACTING BY AND THROUGH ITS BOARD OF WATER,

LIGHT AND SINKING FUND COMMISSIONERS, AS OWNERS

AND

A CONSORTIUM CONSISTING OF WESTINGHOUSE ELECTRIC

COMPANY LLC AND STONE & WEBSTER, INC., AS

CONTRACTOR

FOR

UNITS 3 & 4 AT THE VOGTLE ELECTRIC GENERATING PLANT

SITE

IN WAYNESBORO, GEORGIA

DATED AS OF APRIL 8, 2008

Confidential Trade Secret Information - Subject to Restricted Procedures

AMENDMENT NO. 6 TO

ENGINEERING, PROCUREMENT AND CONSTRUCTION AGREEMENT

This AMENDMENT NO. 6 (this "Amendment") TO THE ENGINEERING, PROCUREMENT AND CONSTRUCTION AGREEMENT, dated April 8, 2008, as amended (the "Agreement") by and between GEORGIA POWER COMPANY, a Georgia corporation ("GPC"), acting for itself and as agent for OGLETHORPE POWER CORPORATION (AN ELECTRIC MEMBERSHIP CORPORATION), an electric membership corporation formed under the laws of the State of Georgia, MUNICIPAL ELECTRIC AUTHORITY OF GEORGIA, a public body corporate and politic and an instrumentality of the State of Georgia, and THE CITY OF DALTON, GEORGIA, an incorporated municipality in the State of Georgia acting by and through its Board of Water, Light and Sinking Fund Commissioners (hereinafter referred to collectively as “Owners”), and a consortium consisting of WESTINGHOUSE ELECTRIC COMPANY LLC, a Delaware limited liability company having a place of business in Monroeville, Pennsylvania ("Westinghouse"), and STONE & WEBSTER, INC. a Louisiana corporation having a place of business in Charlotte, North Carolina ("Stone & Webster") (hereinafter referred to collectively as "Contractor"), is entered into as of the 23rd day of January 2014.

RECITALS

WHEREAS, Owners and Contractor entered into the Agreement, as of April 8, 2008, to provide for, among other things, the design, engineering, procurement, installation, construction and technical support of start-up and testing of equipment, materials and structures comprising the Facility;

WHEREAS, in connection with the construction of the Facility, certain of the Owners plan to enter into definitive loan guarantee agreements with the United States Department of Energy (“DOE”), pursuant to which the DOE would provide federal loan guarantees pursuant to Title XVII of the Energy Policy Act of 2005 (the “Title XVII”) with respect to certain borrowings of such Owners (any such definitive loan guarantee agreement, a “Definitive Loan Guarantee Agreement”);

WHEREAS, pursuant to Section 1702(k) of the Energy Policy Act, all laborers and mechanics employed by contractors and subcontractors in the performance of construction work financed in whole or in part by a loan guarantee under Title XVII must be paid wages at rates not less than those prevailing on projects of a character similar in the locality as determined by the Secretary of Labor in accordance with subchapter IV of Chapter 31 of Title 40 of the United States (the “Davis-Bacon Act”) and all regulations of the Department of Labor set forth in Parts 1, 3 and 5 of title 29 of the Code of Federal Regulations (the “Davis-Bacon Act Regulations”);

WHEREAS, pursuant to the Davis-Bacon Act Regulations, each Definitive Loan Guarantee Agreement will require that certain contract provisions be incorporated in each contract, agreement or other arrangement subject to the requirements of the Davis-Bacon Act and the Davis-Bacon Act Regulations; and

Confidential Trade Secret Information - Subject to Restricted Procedures

WHEREAS, the Parties agree that, with the exception of the changes expressly stated herein, this Amendment will not change the terms and conditions of the Agreement.

NOW, THEREFORE, in consideration of the recitals, the mutual promises herein and other good and valuable consideration, the receipt and sufficiency of which the Parties acknowledge, the Parties, intending to be legally bound, stipulate and agree as follows:

1. This Amendment shall not be effective until one or more Owners have entered into a Definitive Loan Guarantee Agreement. GPC shall provide prompt written notice to Contractor of the occurrence of such actions.

2. Revise Article 35, “Federal Acquisition Regulations Requirements,” to add a new Section 35.4, as follows:

“35.4 Davis-Bacon Act Required Contract Clauses. The contract clauses contained under the heading “Davis-Bacon Act Required Contract Clauses” in Exhibit AA to this Agreement shall, as if set forth herein in full text, be incorporated into and form a part of this Agreement (and, for the avoidance of doubt, shall be considered a part of Article 35 for purposes of the provisions of Exhibit Y to this Agreement), and Contractor shall comply therewith if the amount of this Agreement and the circumstances surrounding its performance require any Owner to include such clauses in this Agreement.”

| |

| (a) | The Parties will cooperate in seeking appropriate exemptions from disclosure under the Freedom of Information Act, 5 U.S.C. § 552, and associated regulations for certified payroll data provided to federal agencies in the course of compliance with the Davis-Bacon Act and the Davis-Bacon Act Regulations. |

| |

| (b) | The Parties will implement the DAVIS-BACON AND RELATED ACTS COMPLIANCE PROGRAM FOR VOGTLE UNITS 3&4 PROJECT, attached as Exhibit BB. |

3. Add a new Exhibit AA to the Agreement, the text of which is set forth in Attachment A to this Amendment No. 6.

4. Add a new Exhibit BB to the Agreement, the text of which is set forth in Attachment B to this Amendment No. 6.

5. Miscellaneous.

| |

| 5.1 | Capitalized terms used herein and not defined herein have the meaning assigned in the Agreement. |

| |

| 5.2 | This Amendment shall be construed in connection with and as part of the Agreement, and all terms, conditions, and covenants contained in the Agreement, except as herein modified, shall be and shall remain in full force and effect. The Parties hereto agree that they are bound by the terms, conditions and covenants of the Agreement as amended hereby. |

Confidential Trade Secret Information - Subject to Restricted Procedures

| |

| 5.3 | This Amendment may be executed simultaneously in two or more counterparts, each of which shall be deemed and original but both of which together shall constitute one and the same instrument. |

| |

| 5.4 | The validity, interpretation, and performance of this Amendment and each of its provisions shall be governed by the laws of the State of Georgia. |

| |

| 5.5 | Except as expressly provided for in this Amendment, all other Articles, Sections and Exhibits of and to the Agreement remain unchanged. |

IN WITNESS WHEREOF, the Parties have duly executed this Amendment as of the date first above written.

|

| | | |

| WESTINGHOUSE ELECTRIC COMPANY LLC | |

| | | | |

| By: | /s/Scott W. Gray | | |

| Name: Scott W. Gray | |

| Title: Vice President and Project Director | |

| | | | |

| STONE & WEBSTER, INC. | |

| | | | |

| By: | /s/Clarence Ray | | /s/ Mark McKain |

| Name: Clarence Ray | Mark McKain |

| Title: Director | |

| | | | |

| GEORGIA POWER COMPANY, as an Owner | |

| and as agent for the other Owners | |

| | | | |

| By: | /s/Joseph Miller | | |

| Name: Joseph (Buzz) Miller | |

| Title: EVP - Nuclear Development | |

Confidential Trade Secret Information - Subject to Restricted Procedures

Attachment A to Amendment No. 6 to EPC Agreement (April 8, 2008)

The following sets forth the text of a new Exhibit AA to the EPC Agreement:

“Davis-Bacon Act Required Contract Clauses

SECTION (a) MINIMUM WAGES, ETC.

(1) Minimum wages.

(i) All laborers and mechanics employed or working upon the site of the work (or under the United States Housing Act of 1937 or under the Housing Act of 1949 in the construction or development of the project), will be paid unconditionally and not less often than once a week, and without subsequent deduction or rebate on any account (except such payroll deductions as are permitted by regulations issued by the Secretary of Labor under the Copeland Act (29 CFR part 3)), the full amount of wages and bona fide fringe benefits (or cash equivalents thereof) due at time of payment computed at rates not less than those contained in the wage determination of the Secretary of Labor which is attached hereto and made a part hereof, regardless of any contractual relationship which may be alleged to exist between the contractor and such laborers and mechanics.

Contributions made or costs reasonably anticipated for bona fide fringe benefits under section 1(b)(2) of the Davis-Bacon Act on behalf of laborers or mechanics are considered wages paid to such laborers or mechanics, subject to the provisions of paragraph (a)(1)(iv) of this section; also, regular contributions made or costs incurred for more than a weekly period (but not less often than quarterly) under plans, funds, or programs which cover the particular weekly period, are deemed to be constructively made or incurred during such weekly period. Such laborers and mechanics shall be paid the appropriate wage rate and fringe benefits on the wage determination for the classification of work actually performed, without regard to skill, except as provided in Sec. 5.5(a)(4) [paragraph (a)(4) below]. Laborers or mechanics performing work in more than one classification may be compensated at the rate specified for each classification for the time actually worked therein: Provided, That the employer's payroll records accurately set forth the time spent in each classification in which work is performed. The wage determination (including any additional classification and wage rates conformed under paragraph (a)(1)(ii) of this section) and the Davis-Bacon poster (WH-1321) shall be posted at all times by the contractor and its subcontractors at the site of the work in a prominent and accessible place where it can be easily seen by the workers.

(ii)(A) The contracting officer shall require that any class of laborers or mechanics, including helpers, which is not listed in the wage determination and which is to be employed under the contract shall be classified in conformance with the wage determination. The contracting officer shall approve an additional classification and wage rate and fringe benefits therefore only when the following criteria have been met:

(1) The work to be performed by the classification requested is not

Confidential Trade Secret Information - Subject to Restricted Procedures

performed by a classification in the wage determination; and

(2) The classification is utilized in the area by the construction industry; and

(3) The proposed wage rate, including any bona fide fringe benefits, bears a reasonable relationship to the wage rates contained in the wage determination.

(ii)(B) If the contractor and the laborers and mechanics to be employed in the classification (if known), or their representatives, and the contracting officer agree on the classification and wage rate (including the amount designated for fringe benefits where appropriate), a report of the action taken shall be sent by the contracting officer to the Administrator of the Wage and Hour Division, Employment Standards Administration, U.S. Department of Labor, Washington, DC 20210. The Administrator, or an authorized representative, will approve, modify, or disapprove every additional classification action within 30 days of receipt and so advise the contracting officer or will notify the contracting officer within the 30-day period that additional time is necessary.

(ii)(C) In the event the contractor, the laborers or mechanics to be employed in the classification or their representatives, and the contracting officer do not agree on the proposed classification and wage rate (including the amount designated for fringe benefits, where appropriate), the contracting officer shall refer the questions, including the views of all interested parties and the recommendation of the contracting officer, to the Administrator for determination. The Administrator, or an authorized representative, will issue a determination within 30 days of receipt and so advise the contracting officer or will notify the contracting officer within the 30-day period that additional time is necessary.

(ii)(D) The wage rate (including fringe benefits where appropriate) determined pursuant to paragraphs (a)(1)(ii) (B) or (C) of this section, shall be paid to all workers performing work in the classification under this contract from the first day on which work is performed in the classification.

(iii) Whenever the minimum wage rate prescribed in the contract for a class of laborers or mechanics includes a fringe benefit which is not expressed as an hourly rate, the contractor shall either pay the benefit as stated in the wage determination or shall pay another bona fide fringe benefit or an hourly cash equivalent thereof.

(iv) If the contractor does not make payments to a trustee or other third person, the contractor may consider as part of the wages of any laborer or mechanic the amount of any costs reasonably anticipated in providing bona fide fringe benefits under a plan or program, Provided, That the Secretary of Labor has found, upon the written request of the contractor, that the applicable standards of the Davis-Bacon Act have been met. The Secretary of Labor may require the contractor to set aside in a separate account assets for the meeting of obligations under the plan or program.

(2) Withholding.

Confidential Trade Secret Information - Subject to Restricted Procedures

The Department of Energy ("DOE") shall upon its own action or upon written request of an authorized representative of the Department of Labor withhold or cause to be withheld from the contractor under this contract or any other Federal contract with the same prime contractor, or any other federally-assisted contract subject to Davis-Bacon prevailing wage requirements, which is held by the same prime contractor, so much of the accrued payments or advances as may be considered necessary to pay laborers and mechanics, including apprentices, trainees, and helpers, employed by the contractor or any subcontractor the full amount of wages required by the contract. In the event of failure to pay any laborer or mechanic, including any apprentice, trainee, or helper, employed or working on the site of the work (or under the United States Housing Act of 1937 or under the Housing Act of 1949 in the construction or development of the project), all or part of the wages required by the contract, DOE may, after written notice to the contractor, sponsor, applicant, or owner, take such action as may be necessary to cause the suspension of any further payment, advance, or guarantee of funds until such violations have ceased.

(3) Payrolls and basic records.

(i) Payrolls and basic records relating thereto shall be maintained by the contractor during the course of the work and preserved for a period of three years thereafter for all laborers and mechanics working at the site of the work (or under the United States Housing Act of 1937, or under the Housing Act of 1949, in the construction or development of the project). Such records shall contain the name, address, and social security number of each such worker, his or her correct classification, hourly rates of wages paid (including rates of contributions or costs anticipated for bona fide fringe benefits or cash equivalents thereof of the types described in section 1(b)(2)(B) of the Davis-Bacon Act), daily and weekly number of hours worked, deductions made and actual wages paid. Whenever the Secretary of Labor has found under 29 CFR 5.5(a)(1)(iv) that the wages of any laborer or mechanic include the amount of any costs reasonably anticipated in providing benefits under a plan or program described in section 1(b)(2)(B) of the Davis-Bacon Act, the contractor shall maintain records which show that the commitment to provide such benefits is enforceable, that the plan or program is financially responsible, and that the plan or program has been communicated in writing to the laborers or mechanics affected, and records which show the costs anticipated or the actual cost incurred in providing such benefits. Contractors employing apprentices or trainees under approved programs shall maintain written evidence of the registration of apprenticeship programs and certification of trainee programs, the registration of the apprentices and trainees, and the ratios and wage rates prescribed in the applicable programs.

(ii)(A) The contractor shall submit weekly for each week in which any contract work is performed a copy of all payrolls to the DOE) if the agency is a party to the contract, but if the agency is not such a party, the contractor will submit the payrolls to the applicant, sponsor, or owner, as the case may be, for transmission to DOE. The payrolls submitted shall set out accurately and completely all of the information required to be maintained under 29 CFR 5.5(a)(3)(i), except that full social security numbers and home addresses

Confidential Trade Secret Information - Subject to Restricted Procedures

shall not be included on weekly transmittals. Instead the payrolls shall only need to include an individually identifying number for each employee (e.g., the last four digits of the employee's social security number). The required weekly payroll information may be submitted in any form desired. Optional Form WH-347 is available for this purpose from the Wage and Hour Division Web site at http://www.dol.gov/esa/whd/forms/wh347instr.htm or its successor site. The prime contractor is responsible for the submission of copies of payrolls by all subcontractors. Contractors and subcontractors shall maintain the full social security number and current address of each covered worker, and shall provide them upon request to DOE if the agency is a party to the contract, but if the agency is not such a party, the contractor will submit them to the applicant, sponsor, or owner, as the case may be, for transmission to DOE, the contractor, or the Wage and Hour Division of the Department of Labor for purposes of an investigation or audit of compliance with prevailing wage requirements. It is not a violation of this section for a prime contractor to require a subcontractor to provide addresses and social security numbers to the prime contractor for its own records, without weekly submission to the sponsoring government agency (or the applicant, sponsor, or owner).

(ii)(B) Each payroll submitted shall be accompanied by a ``Statement of Compliance,'' signed by the contractor or subcontractor or his or her agent who pays or supervises the payment of the persons employed under the contract and shall certify the following:

(1) That the payroll for the payroll period contains the information required to be provided under Sec. 5.5 (a)(3)(ii) of Regulations, 29 CFR part 5, the appropriate information is being maintained under Sec. 5.5 (a)(3)(i) of Regulations, 29 CFR part 5, and that such information is correct and complete;

(2) That each laborer or mechanic (including each helper, apprentice, and trainee) employed on the contract during the payroll period has been paid the full weekly wages earned, without rebate, either directly or indirectly, and that no deductions have been made either directly or indirectly from the full wages earned, other than permissible deductions as set forth in Regulations, 29 CFR part 3;

(3) That each laborer or mechanic has been paid not less than the applicable wage rates and fringe benefits or cash equivalents for the classification of work performed, as specified in the applicable wage determination incorporated into the contract.

(ii)(C) The weekly submission of a properly executed certification set forth on the reverse side of Optional Form WH-347 shall satisfy the requirement for submission of the ``Statement of Compliance'' required by paragraph (a)(3)(ii)(B) of this section.

(ii)(D) The falsification of any of the above certifications may subject the contractor or subcontractor to civil or criminal prosecution under section 1001 of title 18 and section 231 of title 31 of the United States Code.

(iii) The contractor or subcontractor shall make the records required under paragraph (a)(3)(i) of this section available for inspection, copying, or transcription by authorized representatives of DOE or the Department of Labor, and shall permit

Confidential Trade Secret Information - Subject to Restricted Procedures

such representatives to interview employees during working hours on the job. If the contractor or subcontractor fails to submit the required records or to make them available, the Federal agency may, after written notice to the contractor, sponsor, applicant, or owner, take such action as may be necessary to cause the suspension of any further payment, advance, or guarantee of funds. Furthermore, failure to submit the required records upon request or to make such records available may be grounds for debarment action pursuant to 29 CFR 5.12.

(4) Apprentices and trainees

(i) Apprentices. Apprentices will be permitted to work at less than the predetermined rate for the work they performed when they are employed pursuant to and individually registered in a bona fide apprenticeship program registered with the U.S. Department of Labor, Employment and Training Administration, Office of Apprenticeship Training, Employer and Labor Services, or with a State Apprenticeship Agency recognized by the Office, or if a person is employed in his or her first 90 days of probationary employment as an apprentice in such an apprenticeship program, who is not individually registered in the program, but who has been certified by the Office of Apprenticeship Training, Employer and Labor Services or a State Apprenticeship Agency (where appropriate) to be eligible for probationary employment as an apprentice. The allowable ratio of apprentices to journeymen on the job site in any craft classification shall not be greater than the ratio permitted to the contractor as to the entire work force under the registered program. Any worker listed on a payroll at an apprentice wage rate, who is not registered or otherwise employed as stated above, shall be paid not less than the applicable wage rate on the wage determination for the classification of work actually performed. In addition, any apprentice performing work on the job site in excess of the ratio permitted under the registered program shall be paid not less than the applicable wage rate on the wage determination for the work actually performed. Where a contractor is performing construction on a project in a locality other than that in which its program is registered, the ratios and wage rates (expressed in percentages of the journeyman's hourly rate) specified in the contractor's or subcontractor's registered program shall be observed. Every apprentice must be paid at not less than the rate specified in the registered program for the apprentice's level of progress, expressed as a percentage of the journeymen hourly rate specified in the applicable wage determination. Apprentices shall be paid fringe benefits in accordance with the provisions of the apprenticeship program. If the apprenticeship program does not specify fringe benefits, apprentices must be paid the full amount of fringe benefits listed on the wage determination for the applicable classification. If the Administrator determines that a different practice prevails for the applicable apprentice classification, fringes shall be paid in accordance with that determination. In the event the Office of Apprenticeship Training, Employer and Labor Services, or a State Apprenticeship Agency recognized by the Office, withdraws approval of an apprenticeship program, the contractor will no longer be permitted to utilize apprentices at less than the applicable predetermined rate for the work performed until an acceptable program is approved.

Confidential Trade Secret Information - Subject to Restricted Procedures

(ii) Trainees. Except as provided in 29 CFR 5.16, trainees will not be permitted to work at less than the predetermined rate for the work performed unless they are employed pursuant to and individually registered in a program which has received prior approval, evidenced by formal certification by the U.S. Department of Labor, Employment and Training Administration. The ratio of trainees to journeymen on the job site shall not be greater than permitted under the plan approved by the Employment and Training Administration. Every trainee must be paid at not less than the rate specified in the approved program for the trainee's level of progress, expressed as a percentage of the journeyman hourly rate specified in the applicable wage determination. Trainees shall be paid fringe benefits in accordance with the provisions of the trainee program. If the trainee program does not mention fringe benefits, trainees shall be paid the full amount of fringe benefits listed on the wage determination unless the Administrator of the Wage and Hour Division determines that there is an apprenticeship program associated with the corresponding journeyman wage rate on the wage determination which provides for less than full fringe benefits for apprentices. Any employee listed on the payroll at a trainee rate who is not registered and participating in a training plan approved by the Employment and Training Administration shall be paid not less than the applicable wage rate on the wage determination for the classification of work actually performed. In addition, any trainee performing work on the job site in excess of the ratio permitted under the registered program shall be paid not less than the applicable wage rate on the wage determination for the work actually performed. In the event the Employment and Training Administration withdraws approval of a training program, the contractor will no longer be permitted to utilize trainees at less than the applicable predetermined rate for the work performed until an acceptable program is approved.

(iii) Equal employment opportunity. The utilization of apprentices, trainees and journeymen under this part shall be in conformity with the equal employment opportunity requirements of Executive Order 11246, as amended, and 29 CFR part 30.

(5) Compliance with Copeland Act requirements.

The contractor shall comply with the requirements of 29 CFR part 3, which are incorporated by reference in this contract.

(6) Subcontracts.

The contractor or subcontractor shall insert in any subcontracts the clauses contained in 29 CFR 5.5(a)(1) through (10) and such other clauses as DOE may by appropriate instructions require, and also a clause requiring the subcontractors to include these clauses in any lower tier subcontracts. The prime contractor shall be responsible for the compliance by any subcontractor or lower tier subcontractor with all the contract clauses in 29 CFR 5.5.

Confidential Trade Secret Information - Subject to Restricted Procedures

(7) Contract termination: debarment.

A breach of the contract clauses in 29 CFR 5.5 may be grounds for termination of the contract, and for debarment as a contractor and a subcontractor as provided in 29 CFR 5.12.

(8) Compliance with Davis-Bacon and Related Act requirements.

All rulings and interpretations of the Davis-Bacon and Related Acts contained in 29 CFR parts 1, 3, and 5 are herein incorporated by reference in this contract.

(9) Disputes concerning labor standards.

Disputes arising out of the labor standards provisions of this contract shall not be subject to the general disputes clause of this contract. Such disputes shall be resolved in accordance with the procedures of the Department of Labor set forth in 29 CFR parts 5, 6, and 7. Disputes within the meaning of this clause include disputes between the contractor (or any of its subcontractors) and the contracting agency, the U.S. Department of Labor, or the employees or their representatives.

(10) Certification of eligibility.

(i) By entering into this contract, the contractor certifies that neither it (nor he or she) nor any person or firm who has an interest in the contractor's firm is a person or firm ineligible to be awarded Government contracts by virtue of section 3(a) of the Davis-Bacon Act or 29 CFR 5.12(a)(1).

(ii) No part of this contract shall be subcontracted to any person or firm ineligible for award of a Government contract by virtue of section 3(a) of the Davis-Bacon Act or 29 CFR 5.12(a)(1).

(iii) The penalty for making false statements is prescribed in the U.S. Criminal Code, 18 U.S.C. 1001.”

Attachment B to Amendment No. 6 to EPC Agreement (April 8, 2008)

Davis-Bacon and Related Acts

Compliance Program

For Vogtle Units 3 & 4 Project

TABLE OF CONTENTS

|

| | | |

| Title | | Page | |

| | | | |

| Article 1: | Introduction | 3 | |

| | | | |

| Article 2: | The Davis-Bacon and Related Acts | 6 | |

| | | | |

| Article 3: | DBRA Guidance | 8 | |

| | | | |

| Article 4: | DBRA Compliance Process | 11 | |

| | | | |

|

| | | | | |

| Appendix |

| | | | | | |

| | 1. | Contractor / Subcontractor Compliance Package | 15 | |

| | | | | | |

| | | a. | DBA Cover Letter to CLA Subcontractors | 15 | |

| | | | | | |

| | | b. | DBA Cover Letter to non-CLA Subcontractors | 21 | |

| | | | | | |

| | | c. | Required DBA Contract Language | 26 | |

| | | | | | |

| | | d. | DBRA Compliance Outline for CLA Contractors | 35 | |

| | | | | | |

| | | e. | DBRA Compliance Outline for non-CLA Contractors | 51 | |

| | | | | | |

| | | f. | Area Wage Determinations | 67 | |

| | | | | | |

| | 2. | PwC Agreed Upon Procedures (AUP) | 81 | |

ARTICLE 1: INTRODUCTION

1.Purpose

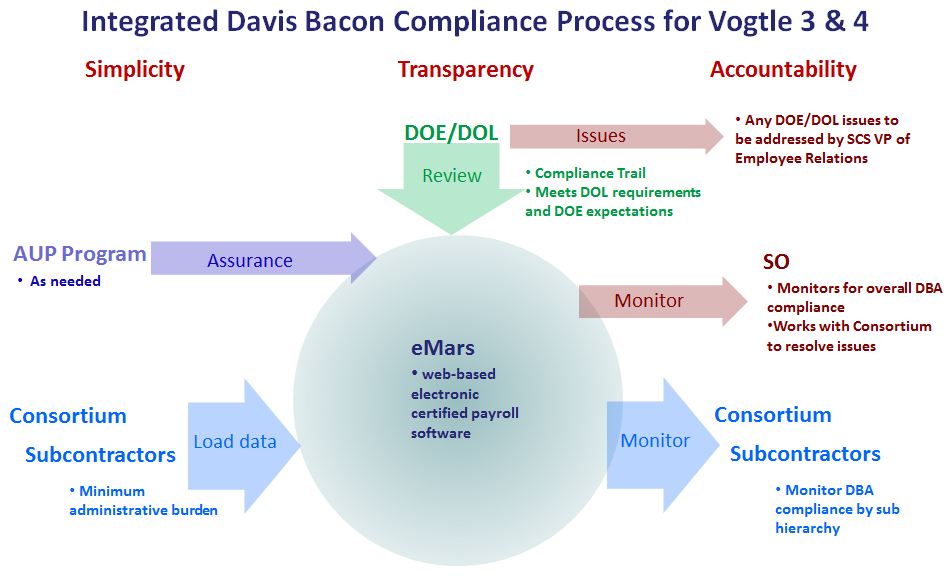

(a)The purpose of this Compliance Program is to explain how all entities involved on the Vogtle Units 3 & 4 Project (“Project”) will comply with the requirements of the Davis-Bacon and Related Acts (DBRA). The Compliance Program employs a streamlined web-based solution of simplicity to acquire the requisite payroll data, provides transparency of certified payrolls through eMars web-based certified payroll software and guarantees accountability through monitoring and compliance activities. The documents referenced herein are provided in the Appendix. All Parties in Article 1, Section 3 below agree to abide by this Compliance Program.

2.The Project

(a)Georgia Power Company, Oglethorpe Power Corporation, Municipal Electric Authority of Georgia, and Dalton Utilities (collectively “Owners”) are currently constructing two new nuclear reactors in Burke County, Georgia, known as Vogtle Units 3 & 4 (“Vogtle 3 & 4”). These will be the first new nuclear reactors built in the United States in over 30 years.

(b)Vogtle 3 & 4 will use two Westinghouse “AP1000” (Advanced Pressurized) nuclear units. The AP1000 is the safest and most economical nuclear power plant available in the worldwide commercial marketplace, and is the only Generation III+ reactor to receive Design Certification from the U.S. Nuclear Regulatory Commission (NRC). Each nuclear unit will have a generating capacity of approximately 1,100 megawatts.

(c)Excavation of the sites for Vogtle 3 & 4 began in 2009, and construction is ongoing. Vogtle Units 3 & 4 are expected to be placed in service in 2017 and 2018 respectively.

3.The Parties

(a)The owners (collectively “Owners”) of this Project and their respective ownership interests are as follows:

(1)Georgia Power Company (GPC) - 45.7%;

(2)Oglethorpe Power Corporation - 30%;

(3)Municipal Electric Authority of Georgia - 22.7%; and

(4)Dalton Utilities - 1.6%.

(b)The Owners have designated GPC as the lead owner in charge of administering Davis-Bacon Act compliance and this Compliance Program. This Compliance Program is intended to encompass all of the Parties’ DBRA compliance obligations.

(c)The Owners have hired Southern Nuclear Operating Company (“Southern Nuclear”) to be the Operator of the Vogtle 3 & 4 Project.

(d)Southern Company (“SO”) is the parent company of GPC and Southern Nuclear.

(e)Southern Company Services (“SCS”) is a shared services subsidiary of Southern Company.

(f)The Owners entered into an Engineering, Procurement and Construction (“EPC”) agreement with Stone and Webster, Inc. (“Stone and Webster”) and Westinghouse Electric Company, LLC (“Westinghouse”). In February of 2013, Stone and Webster became a wholly-owned subsidiary of Chicago Bridge & Iron (“CB&I”).

(g)Stone and Webster and Westinghouse are collectively referred to as the “Consortium.”

(h)The Owners and Consortium may be referred to individually as a “Party” and collectively as the “Parties.”

(i)The Nuclear Power Construction Labor Agreement (CLA) is one of the collective bargaining agreements among the various contractors and labor unions that will perform construction work on this Project.

(j)eMars is a web-based DBRA certified payroll reporting system that all DBRA-covered contractors and subcontractors will use on this Project.

(k)PricewaterhouseCoopers (PwC) has developed an “Agreed Upon Procedures” (AUP) program to conduct compliance activities and monitor ongoing DBRA compliance on the Project.

4.Primary DBRA Contacts

(a)SO / GPC - Christopher S. Miller

SCS VP and Associate General Counsel

(b)Consortium

(1)Mary Yerace

Site Davis Bacon Administrator, CB&I

(2)Joseph (“Lee”) Woodcock

Site Contract Manager, Westinghouse Electric Company

(c)eMars - Woodrow Chamberlain

President eMars

(d)AUP / PwC - Christopher Lorenz

5.Project Timeline

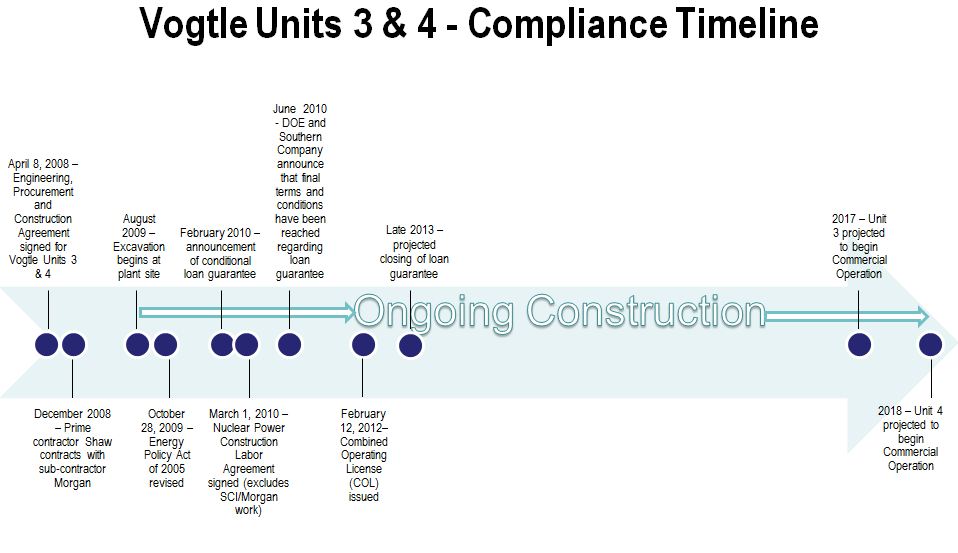

(a)A timeline of events pertinent to Vogtle Units 3 and 4 and DBRA coverage is as follows:

(1)2005 - Initial planning and preparation for a new nuclear plant.

(2)April 8, 2008 - EPC Agreement signed. Compliance with Davis Bacon and Related Acts was not contemplated at the time of the contract.

(3)April 2009 - GPC provided the Westinghouse-Shaw Consortium full notice to proceed on Plant Vogtle Units 3 and 4. Shaw and Westinghouse began mobilizing at the plant site and performing activities to support construction.

(4)August 2009 - Excavation of the area where the new units are planned began at the plant site.

(5)October 28, 2009 - Energy Policy Act of 2005 is revised, and Section 1702(k) is added requiring DBRA compliance.

(6)February 16, 2010 - In response to GPC’s conditional loan guarantee request, President Obama and DOE Secretary Steven Chu announce the award of conditional loan guarantees for Vogtle Units 3 and 4.

(7)March 1, 2010 - Nuclear Power Construction Labor Agreement signed.

(8)June 18, 2010 - Southern Company and the Department of Energy announce that preliminary terms and conditions have been reached regarding the loan guarantees for the new Vogtle units.

(9)June 18, 2010 - The Department of Labor approves a waiver of any retroactive application of the Davis-Bacon Act and confirms that the Davis-Bacon Act will not apply until the closing of the loan guarantee.

(10)February 12, 2012 - Combined Operating License (COL) issued.

(11)Late 2013 - Projected closing on the loan guarantee.

(12)2017 - Unit 3 projected to begin commercial operation.

(13)2018 - Unit 4 projected to begin commercial operation.

(b)For a more detailed timeline including construction details and other regulatory activities, see http://www.southerncompany.com/nuclearenergy/milestones.aspx.

ARTICLE2: THE DAVIS-BACON AND RELATED ACTS

1.Overview of the DBRA and the Basis for DBRA Coverage

(a)For purposes of this Compliance Program, the term Davis-Bacon and Related Acts (DBRA) refers to two federal statutes: the Davis-Bacon Act (40 U.S.C. § 3141), and the Copeland “Anti-Kickback” Act (40 U.S.C. § 3145 and 18 U.S.C. § 874. The Davis-Bacon Act (“DBA”) requires the payment of locally prevailing wages and fringe benefits, as defined in the applicable wage determination, to laborers and mechanics employed for construction, alteration or repair on the site of the work. Contractors and subcontractors must pay their workers weekly and must submit weekly certified payrolls. The Copeland Anti-Kickback Act prohibits the kickbacks of wages and back wages from employees to employers.

(b)The Davis-Bacon Act was enacted in 1931 to ensure that local workers were hired and paid locally prevailing wages on federal construction projects during the Great Depression. The original intention of the DBA contemplated the Federal Government as the

owner of the project and as a party to the contract for the construction of a public building or public work for the Government. However, Congress and the Department of Labor (DOL) have since expanded the reach of the DBA and made it applicable to other construction contracts, to which the Federal Government is not a party. Here, the Department of Energy (DOE) has reached an agreement with GPC to provide a loan guarantee for the Vogtle 3 & 4 construction through the Energy Policy Act of 2005. Section 1702(k) was added to the Energy Policy Act in October 2009 and requires the payment of DBA wages on all construction projects funded under this Section. Therefore, the DBRA is applicable to Vogtle 3 & 4.

2.Beginning of DBRA Compliance

(a)Based on a request from the Department of Energy (DOE), the DOE and GPC have received written confirmation from the Department of Labor (DOL) that the DBRA will not apply to this Project prior to the closing of the loan guarantee. The DOL also confirmed that the DBRA will apply to the Project after the closing of the Loan Guarantee Agreement (LGA), which DOE acknowledges in the LGA . As indicated in the timeline above, the closing is anticipated in late 2013.

3.DBRA Roles & Obligations

(a)As an Owner of the Project and as the loan guarantee recipient from the DOE, GPC is responsible for compliance by contractors and subcontractors on this Project.

(1)GPC will be responsible for submitting all certified payrolls for all contractors and subcontractors each week to the DOE. 29 C.F.R. § 5.5(a)(3)(ii)(A).

(2)GPC will also be the point of contact for all communications with the DOE / DOL.

(b)Each Consortium member will be responsible for using reasonable efforts to ensure that it and all of its contractors and subcontractors comply with the applicable DBRA requirements and obligations including those identified in this Compliance Program.

ARTICLE 3: DBRA GUIDANCE

1.Guidance

(a)Guidance for DBRA compliance can be found in the Contractor / Subcontractor Compliance Package in Appendix 1.

(b)Appendix 1 contains the following information:

(1)an initial cover letter (for contractor’s optional use) to any contractors or subcontractors working on the Project explaining that the DBRA applies to this Project and identifying their obligations (Appx. 1a and 1b);

(2)DBRA contract language that must be inserted into any and all contracts or subcontracts which fall within the scope of the Davis-Bacon Act and which are in effect on or after the closing of the loan guarantee agreement (Appx. 1c);

(3)a DBRA Compliance Outline of What Your Organization Must Do to Meet Its Responsibilities (Appx. 1d and 1e); and

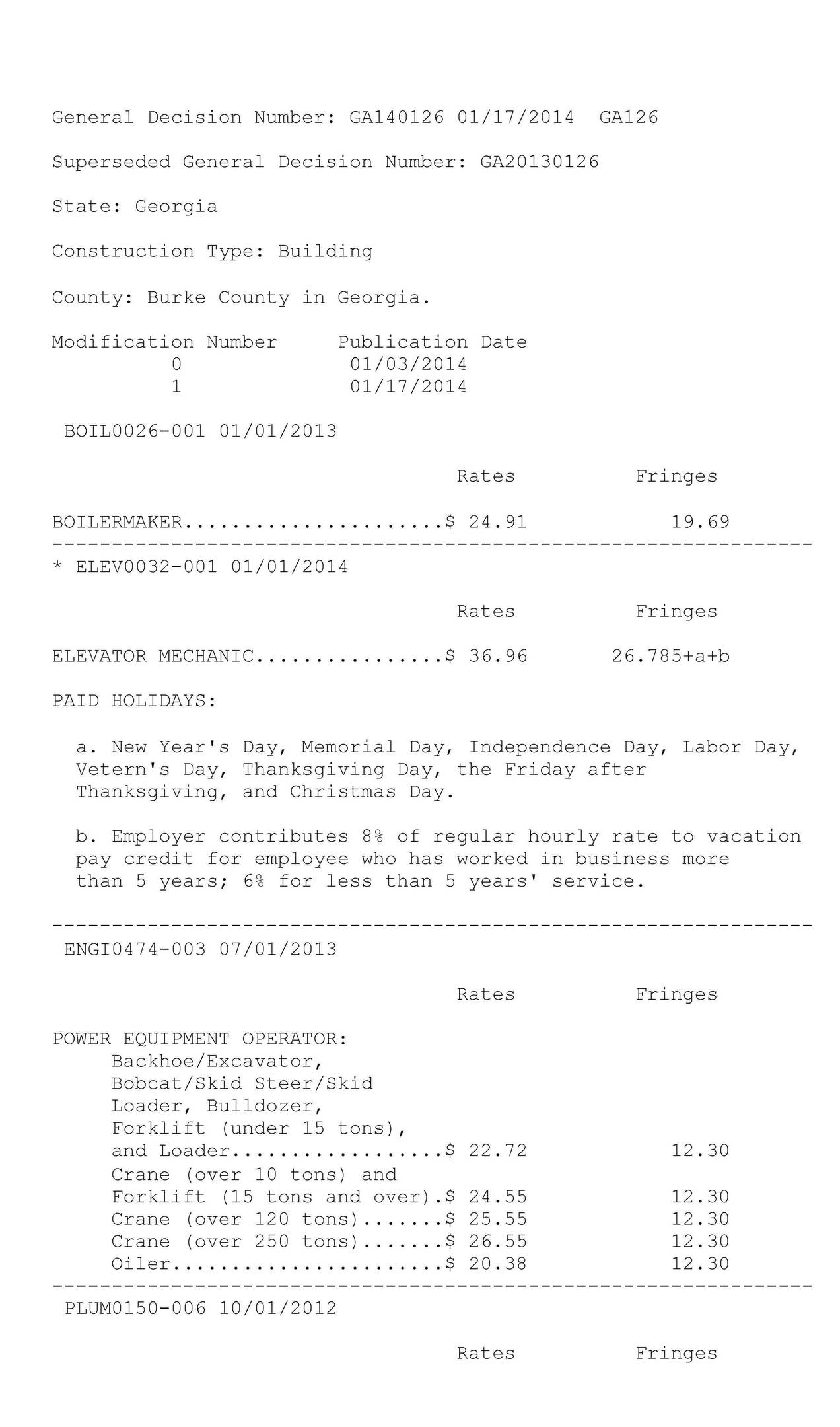

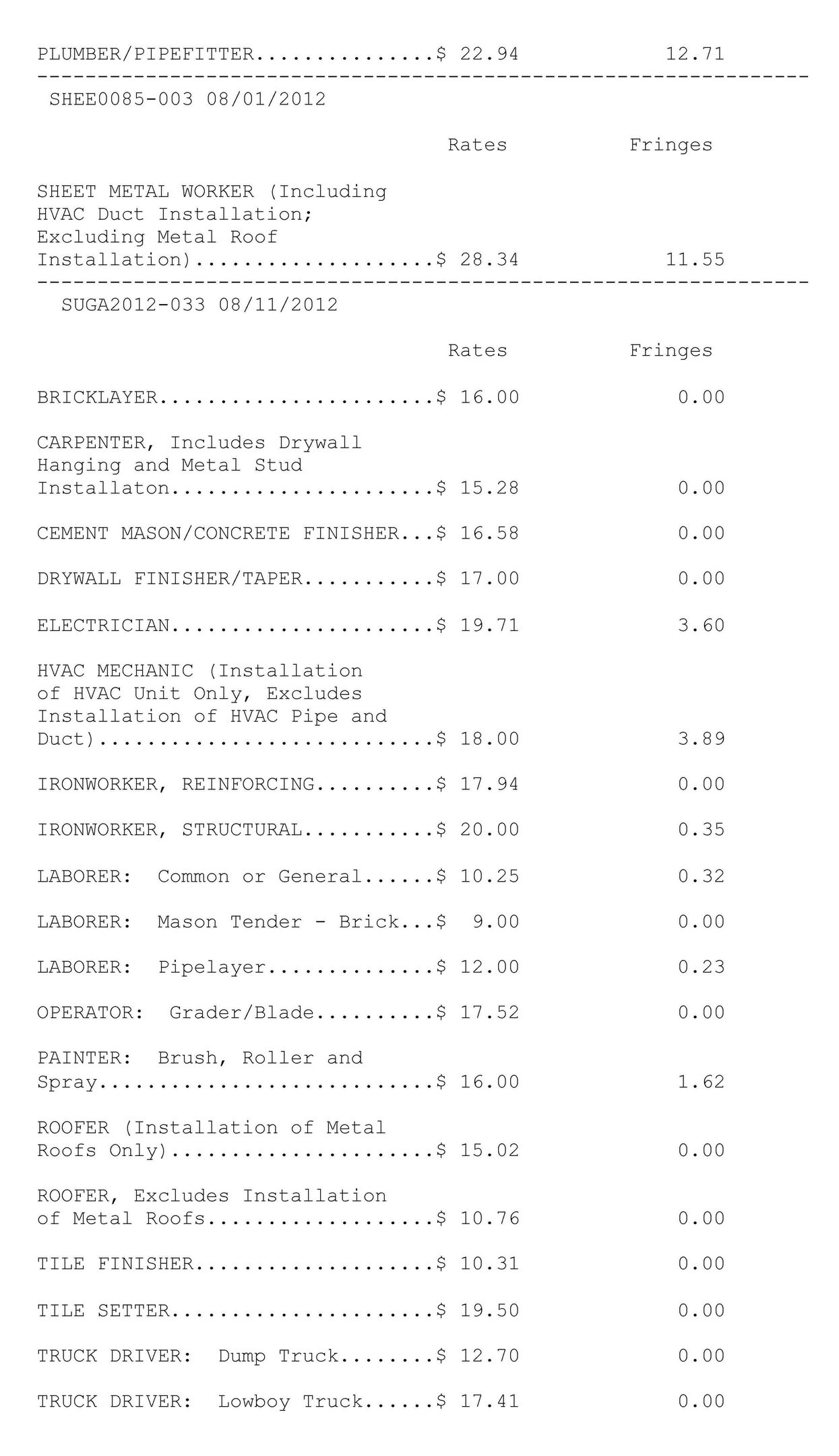

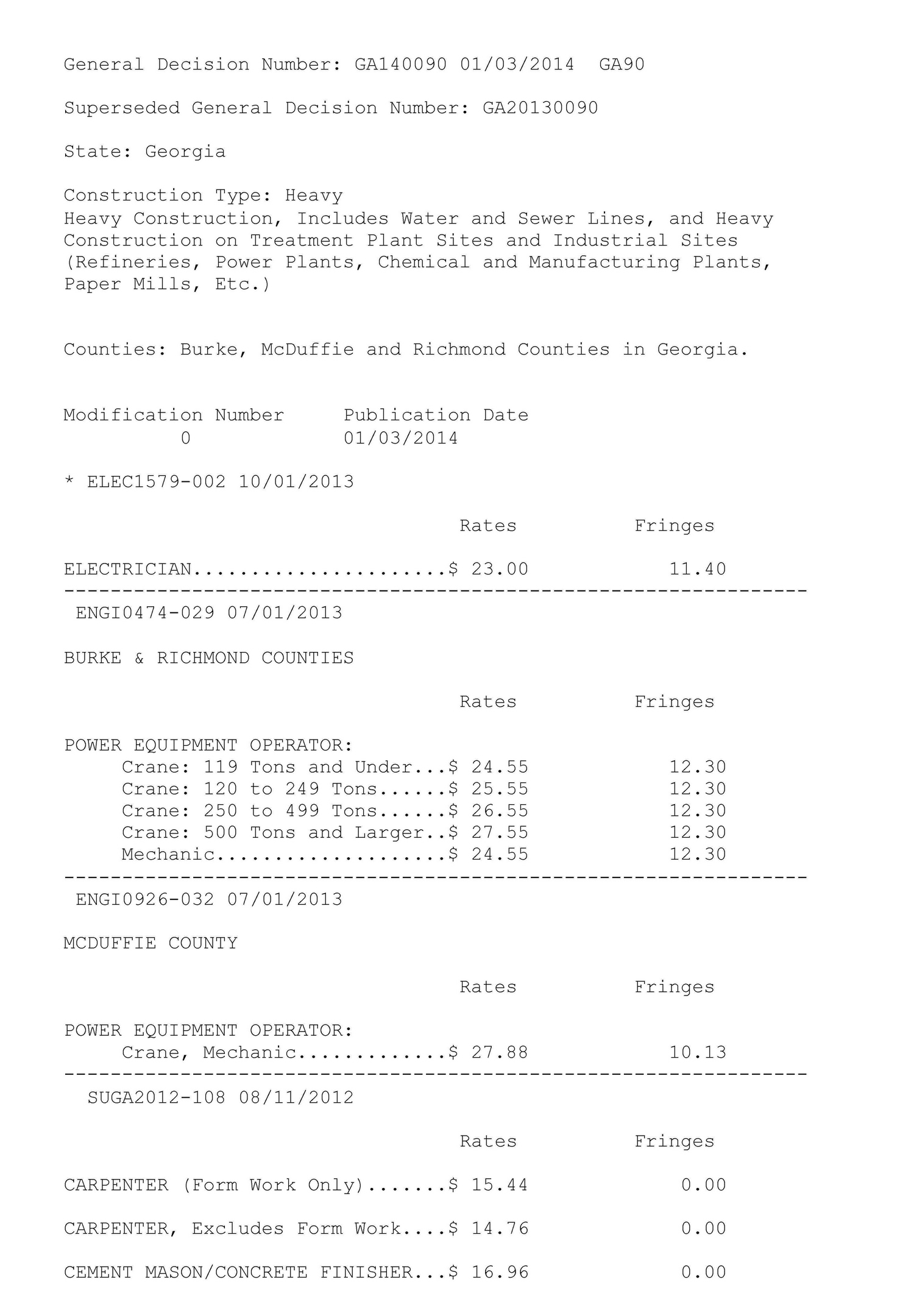

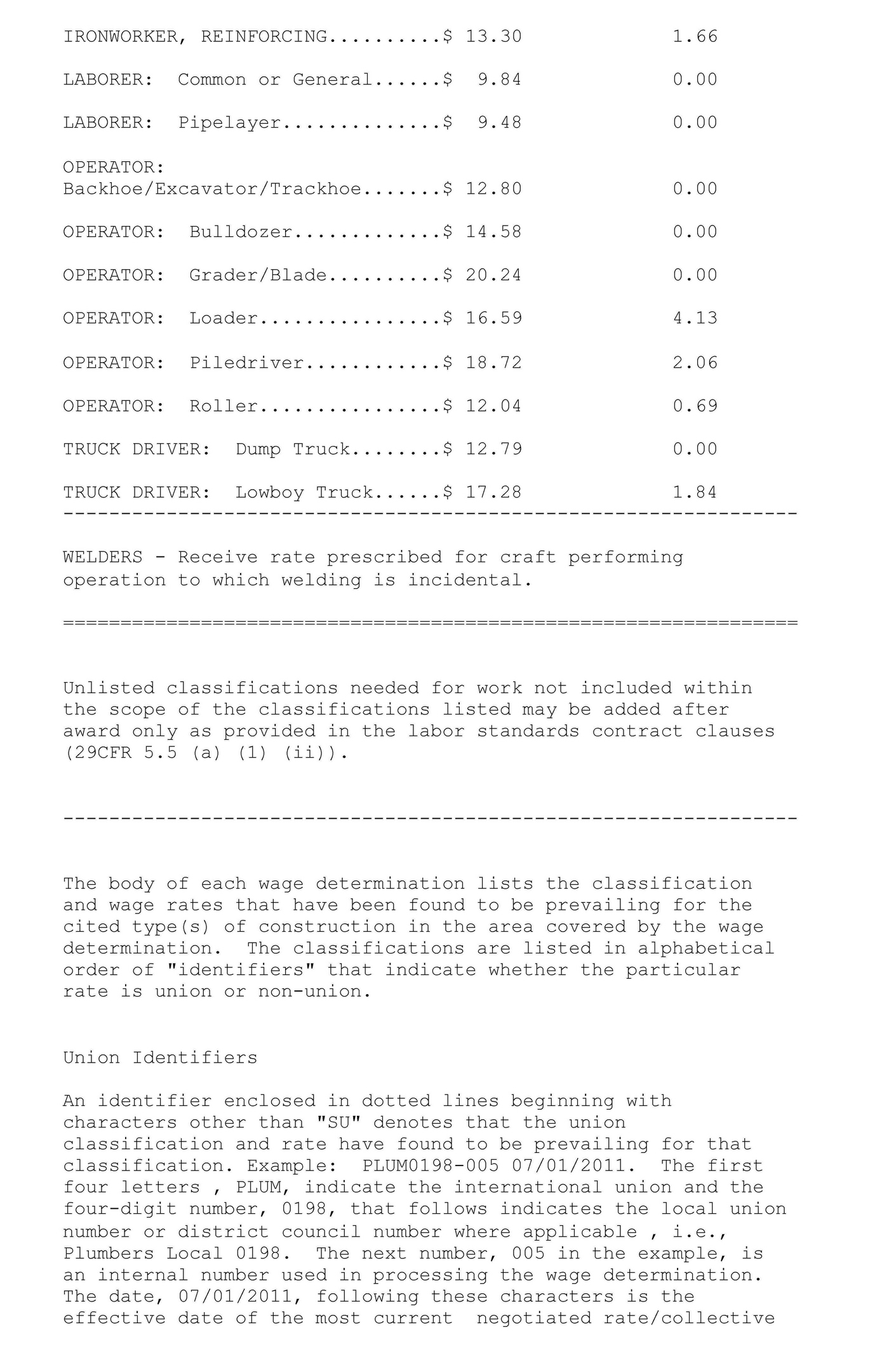

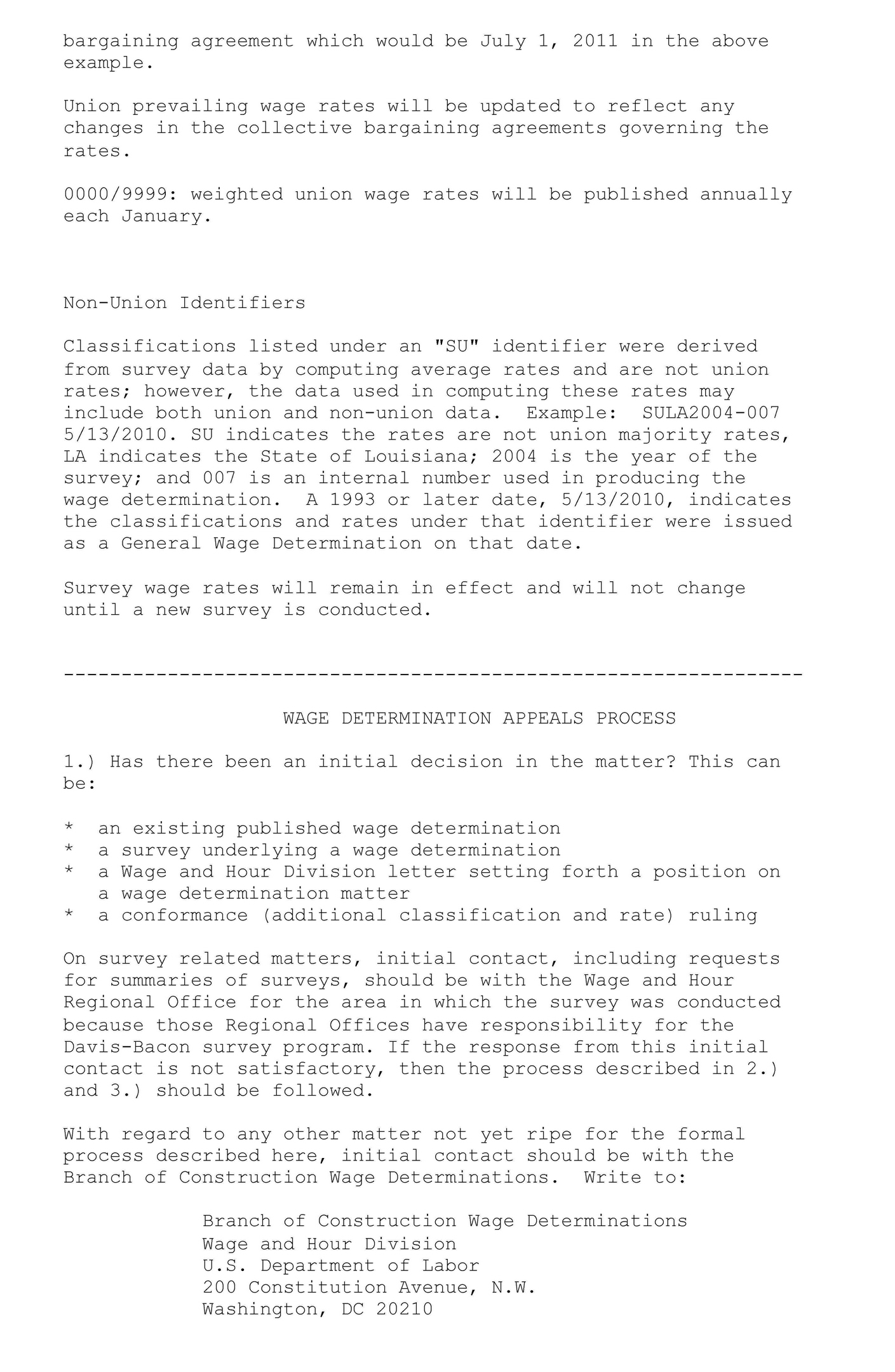

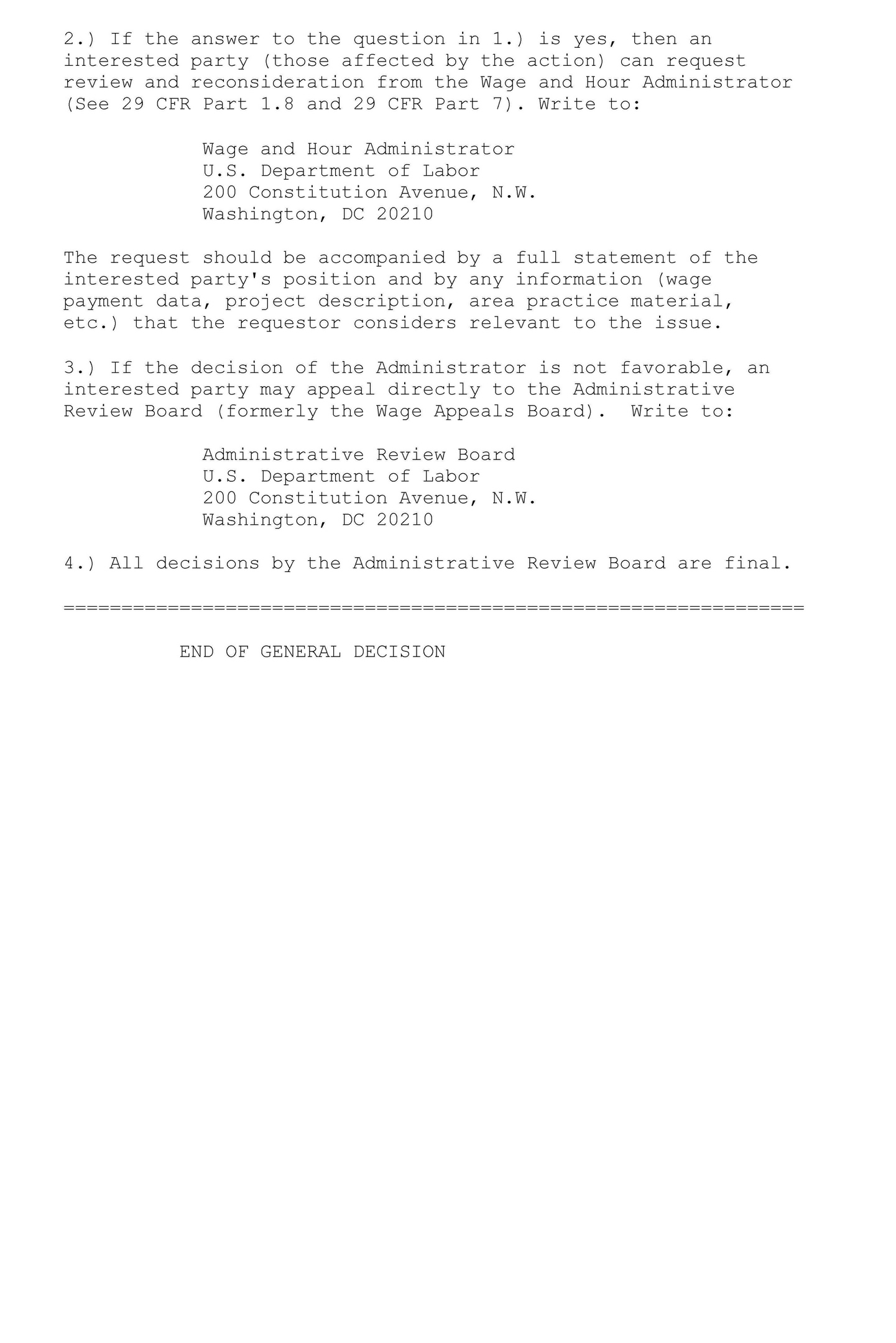

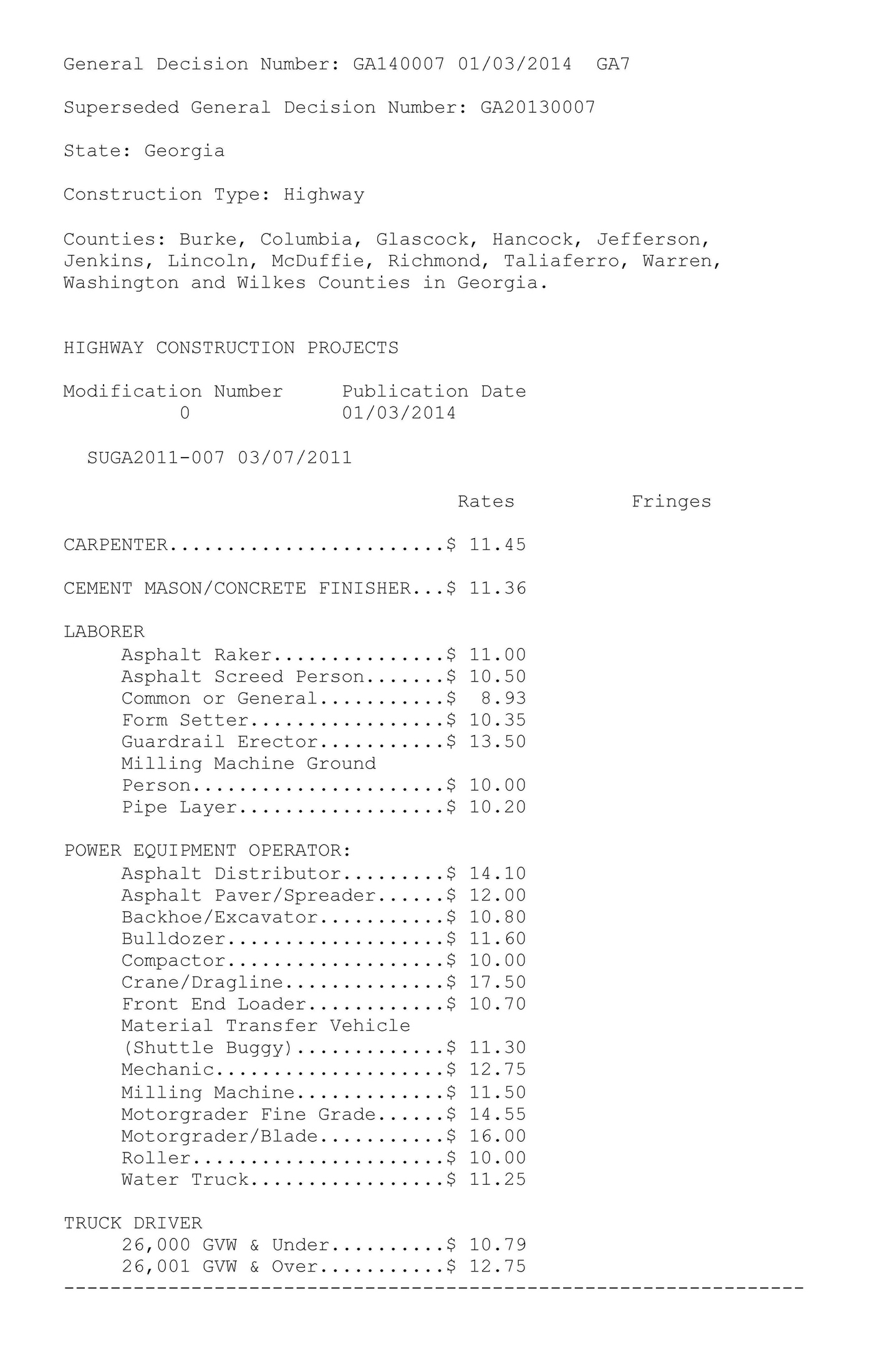

(4)the applicable Area Wage Determinations (AWD) for Heavy, Building, and Highway construction in Burke County, Georgia (Appx. 1f).

(c)All contractors and subcontractors should closely review, analyze, and utilize these documents throughout construction of the Project.

(d)Some of the Davis-Bacon Act requirements for all contractors and subcontractors include:

(1)paying prevailing wages and fringe benefits;

(2)paying workers weekly;

(3)submitting certified payrolls;

(4)keeping records; and

(5)posting notices.

For all DBRA requirements, see Appendix 1 and 29 C.F.R. § 5 (excluding §5.5(b)).

| |

| 2. | Southern Nuclear Davis-Bacon Act Compliance Roles and Responsibilities |

(a)The key SO personnel with DBRA responsibility will be:

(1)SCS DBA Compliance Specialist [title subject to change]

i.The SCS DBA Compliance Specialist will be responsible for the overall day-to-day activities surrounding DBRA compliance. He or she will ensure that a weekly certified payroll is entered in eMars every week for every DBRA-covered contractor or subcontractor and will contact the responsible party, either Stone and Webster or Westinghouse, for any sub-tier contractors whose payrolls are delinquent or incomplete, or contain compliance errors/issues. The SCS DBA Compliance Specialist will report any DBA-related complaints he or she receives to the SCS VP, Employee Relations.

(2)SCS DBA Compliance Liaison [title subject to change]

i.The SCS DBA Compliance Liaison will supervise the SCS DBA Compliance Specialist, verify that DBA contract clauses are inserted into all DBRA-covered contracts and subcontracts, and act as a liaison between SO and the Consortium. The SCS DBA Compliance Liaison will report any DBA-related complaints he or she receives to the SCS VP, Employee Relations.

(3)VP, Vogtle 3 & 4 Construction Support

i.The VP-Vogtle 3 & 4 Construction Support will work to ensure DBA compliance and communicate any instructions regarding DBRA compliance to all contractors and subcontractors. The VP, Vogtle 3 & 4 Construction Support will report any DBA-related complaints he or she receives to the SCS VP, Employee Relations.

(4)SCS VP, Employee Relations

i.The SCS VP, Employee Relations is responsible for all communications with the DOE / DOL related to DBRA compliance, including the reporting of DBA-related complaints.

(b)Complaints. All DBRA-related complaints received through any Company channels must be reported to one of the key SO personnel identified in Article 2(a) above. Such channels shall include:

(1)DBRA-related complaints received by any on-site SNC, GPC, or SCS managers, or Co-Owners’ on-site management

(2)DBRA-related complaints received through the Concerns hotline

i. Confidentiality of the Concerns program will be respected. However, investigation reports will be forwarded to the SCS VP, Employee Relations.

3.Consortium Davis-Bacon Act Compliance Roles and Responsibilities

(a)The key Consortium personnel with DBRA responsibility will be:

(1)DBA Compliance Specialist, or similar employee of Consortium, will be responsible for communicating the importance of DBRA compliance and be available to answer questions regarding compliance for all subcontractors on the project. DBA Compliance Specialist will also act as a resource by informing appropriate subcontractor personnel of available training material for eMars.

(b)Complaints. All DBRA-related complaints received by the Consortium must be reported to one of the key SO personnel identified in Article 2(a) above. Such channels shall include:

(1)DBRA-related complaints received through Consortium channels (e.g. DBA Compliance Specialist, Labor Relations, Payroll, Concerns program).

(2)Grievances filed under the CLA related specifically to DBRA-related issues.

i.SO will defer to the existing grievance process for the investigation and disposition of DBRA-related grievances. However, a report on the content and disposition of such grievances shall be provided to the SCS VP, Employee Relations, on a quarterly basis.

(c)DOE/DOL DBRA Adverse Determinations. Any resolution of a DBRA dispute with DOE/DOL by a Consortium member or contractor at any tier must be promptly reported to the SCS VP, Employee Relations, for his review and consent, such consent not to be unreasonably withheld. In addition to the reporting responsibilities, should any Consortium member or contractor at any tier receive an adverse DOE/DOL DBRA determination and not resolve it with DOE/DOL, and the Consortium member or contractor desires to appeal the determination through DOL’s administrative/enforcement processes, the Consortium member/contractor shall first request permission from the SCS VP, Employee Relations to do so, such consent not to be unreasonably withheld. Similarly, the Owners may request the Consortium member/contractor to appeal an adverse DOE/DOL DBRA determination, such consent not to be unreasonably withheld. In either situation, the requesting party shall assume all costs relating to the appeal and subsequent administrative/judicial proceedings including any

judgment or withholding of contract funds and the requesting party shall indemnify and hold harmless the non-requesting party for all costs, including any judgment or withholding of contract funds resulting from the appeal.

4.Mutual Notice and Cooperation

Each party agrees to promptly notify the other Party of the existence of any DBRA dispute with the DOE/DOL or any other potential non-compliance issue (collectively referred to as a “Compliance Issue”) with respect to the Project. The Parties further agree to cooperate with respect to any action (e.g. corrective action, payment under the applicable contract, continuation, termination, etc.) that either Party takes in connection with a Compliance Issue to the extent such action is reasonable and consistent with the agreement between the Parties regarding the Consortium’s DBRA compliance.

ARTICLE 4: DBRA COMPLIANCE PROCESS

1.DBRA Compliance Objectives

(a)To create a process and procedure to:

(1)Simply input and acquire the requisite payroll data through a web-based certified payroll reporting system;

(2) Securely verify and store all certified payrolls, while simultaneously providing transparency and an audit trail for the DOE/DOL; and

(3)Hold parties accountable through monitoring and compliance activities.

2.Simplicity

(a)One of the goals of this DBRA Compliance Program is to simplify inputting, collecting, and submitting certified payrolls pursuant to DBRA.

(b)All DBRA-covered contractors and subcontractors will use eMars, a web-based service, to enter, store, and submit their certified payrolls pursuant to DBRA.

(c)eMars allows contractors and subcontractors to quickly and easily submit certified payrolls electronically. It also provides the ability to electronically certify and sign certified payrolls.

(d)eMars permits contractors and subcontractors to manually input their payrolls, or they can import certified payroll information from their existing electronic payroll systems.

(e)GPC is providing all contractors and subcontractors, with training and access to the eMars program, at no cost to them; GPC will cover the cost of access to and use of the eMars program.

3.Transparency

(a)Transparency in certified payrolls and in other DBRA obligations is mandated by law and enforced by the DOL / DOE.

(b)eMars will automatically check submitted certified payrolls for errors, including incorrect wage rates, improper deductions, improper job classifications not found on the wage determination, missing apprenticeship certificates, etc.

(c)eMars will instantaneously notify the contractor or subcontractor who submitted the certified payroll of any errors or other problems, and the contractor or subcontractor will have an opportunity to correct errors immediately and submit a revised certified payroll.

(d)eMars will also provide full access to all certified payroll data and to other basic records to the DOL / DOE at their request. The DOL / DOE will be able to review a clear audit trail, including all previous versions of certified payrolls and any corrections, deficiencies, etc.

(1)Even though the EPC agreement contains confidentiality conditions regarding the receipt, use, or release of the Consortium’s project costs, the DBRA mandates that all contractors or subcontractors “make the records … available for inspection” by the DOE / DOL. 29 C.F.R.§ 5.5(a)(3)(iii). Failure to provide access to the records may result in a breach of GPC's obligations in the Loan Guarantee Agreement and/or contractor debarment.

(2)GPC agrees that if DOE receives a FOIA request for the certified payrolls, GPC will request that DOE designate such certified payrolls as exempt from delivery in connection with any such FOIA request. However, GPC understands that DOE is obligated under FOIA to deliver information requested in a FOIA request unless such information is exempt from disclosure in accordance with all applicable law, and, therefore, GPC cannot warrant or guarantee that DOE will designate such certified payrolls as exempt from delivery under FOIA. If GPC is notified by DOE that DOE has received a FOIA request involving Consortium members or their subcontractors or organizations doing business with them, GPC will identify to DOE both Consortium members as parties to be notified. Upon any such notice from GPC to the Consortium members, the Consortium members shall be responsible for notifying the subcontractor or organization doing business with them at any tier to the extent such organization's records have been requested.

4.Accountability

(a)As prime contractor, GPC is responsible for submitting all certified payrolls for all contractors and subcontractors each week to the DOE. 29 C.F.R. § 5.5(a)(3)(ii)(A).

(b)The EPC agreement between GPC and the Consortium has strict confidentiality provisions. The Consortium considers their project costs to be a confidential trade secret.

(c)In order for GPC to satisfactorily confirm DBRA compliance by all contractors and subcontractors on the Project, monitoring and compliance activities will occur at various levels and by various entities.

(d)SCS personnel will perform periodic reviews of certified payrolls submitted by all contractors and subcontractors.

(1)All SO personnel who have access to the eMars system will sign a Non-Disclosure Agreement related to information accessed through eMars. The use of such information shall be specifically limited to DBA compliance purposes and may not be disclosed except as otherwise required under statute/regulations. Such personnel shall be limited to:

i.SCS DBA Compliance Specialist (referenced in Article 3(2)(a)(1) of this Compliance Program)

ii.SCS DBA Compliance Liaison (referenced in Article 3(2)(a)(2) of this Compliance Program)

iii.SCS employees working in the Employee Relations/General Counsel organization

iv.SCS employees working in the Internal Auditing organization

(e)The Consortium will have full access to all of their contractors’ and subcontractors’ certified payrolls in the eMars system.

(1)This access will allow the Consortium to review whether its contractors and subcontractors have timely submitted certified payrolls, whether those payrolls have any error warnings, what those error warnings are, the amount of any deficiency, apprentice certificates, etc.

(f)Finally, PricewaterhouseCoopers (PwC) will conduct compliance activities on certified payrolls and other DBRA compliance for all DBRA-covered contractors and subcontractors throughout the Project.

(1)PwC will conduct its compliance activities according to the Agreed Upon Procedures (AUP) program, to which all parties have consented. The AUP program can be found in Appendix 2.

(2)All of PwC’s compliance activities costs will be paid for by GPC.

(3)GPC will instruct PwC to perform such compliance activities at such frequency as GPC deems necessary, which shall be no less than once per year during the life of the project.

(4)All parties will be provided with a minimum of two weeks’ notice prior to the commencement of PwC’s compliance activities. Such notice shall include a tentative schedule of activities and initial request for documents.

Appendix 1(a)

DBA Cover Letter to CLA Subcontractors

Contractor Letterhead

----- DRAFT -----

[DATE]

[contact name]

[Contractor or Subcontractor]

[Address]

[City, ST Zip]

RE: Davis-Bacon and Related Acts Compliance for Contractors Subject to the CLA

Vogtle Units 3 & 4 Project

Dear [Contractor or Subcontractor Contact Name]:

You have been hired to [insert description of work] on the Vogtle Units 3 & 4 Project (“Project”) located in Burke County, Georgia (“site”). Georgia Power Company (“GPC”) and the other owners of the Project are in the process of being awarded a loan guarantee for the Project through the Department of Energy (“DOE”). One condition to receive the loan guarantee is that all contractors and subcontractors who perform construction work at the site must comply with the Davis-Bacon Act and Related Acts (collectively, “DBRA”) as implemented through Sec. 1702(k) of the Energy Policy Act of 2005.. As a contractor who will perform construction work, it is important for your organization to understand that you will be required to comply with all the requirements of the DBRA. You will be required to fully comply with all DBRA requirements from the date of closing on the loan guarantee forward. As a contractor who will perform construction work on this Project, you will also be subject to the Nuclear Power Construction Labor Agreement (CLA). The CLA is one of the collective bargaining agreements among the various contractors and labor unions that will perform construction work on the Project.

This correspondence is intended to provide you with a summary of DBRA requirements, CLA requirements, and references so that additional information about DBRA and associated standards can be obtained. Enclosed with this letter are the following documents:

| |

| 1. | Davis-Bacon and Related Acts Compliance: An Outline of What Your Organization Must Do to Meet Its Responsibilities; |

| |

| 2. | Davis-Bacon Act Required Contract Language (to be inserted in all subcontracts); |

| |

| 3. | Wage Determinations for Burke County, GA (Heavy Construction, Building Construction, and Highway Construction). |

By sending this information, we are not intending to provide legal advice. In addition to DBRA and CLA requirements, you are expected to comply with all Federal and State employment and other applicable laws. For example, the recordkeeping requirements of DBRA summarized, herein, are, in addition to, the recordkeeping requirements that cover your employees under the Fair Labor Standards Act (FLSA). Other employment laws that may apply include Title VII of the Civil Rights Act of 1964, the Americans With Disabilities Act, the Age Discrimination Employment Act, Executive Order 11246, the Family Medical Leave Act, and E*Verify requirements contained in Executive Order 12989. For a complete explanation and advice of the applicability of Federal and State law, we recommend you discuss with your legal counsel.

The Davis-Bacon and Related Acts

The Davis-Bacon Act ("DBA") requires all contractors and subcontractors performing services on federally-assisted contracts to pay their laborers and mechanics (employees performing construction and related work) not less than the prevailing wage rates and fringe benefits listed for the job classifications identified in the applicable current DBA Area Wage Determination (AWD). It is important to keep in mind, that the DBA labor standards clauses included in your contract must be included in any contract you enter into with another organization to perform work at the site of this Project.

The Copeland “Anti-Kickback” Act prohibits contractors, from, in any way, inducing an employee to give up any part of their compensation, and requires contractors to submit a weekly statement of the wages paid to each employee performing DBRA covered work. (www.dol.gov/whd/regs/statutes/copeland.htm)

You must pay all employees weekly, and your organization, as the employer, must submit weekly-certified payroll records electronically using eMars, a web-based service that allows users to easily enter, certify, sign, and submit their certified payrolls pursuant to DBRA.

Once the loan guarantee agreement is executed by GPC and DOE, as an employer performing work covered by the labor standards of the DBRA, you must post the WH-1321 “Employee Rights Under the Davis-Bacon Act” poster at the site of the work, in a location where your employees may easily see it. Your organization must also post the AWDs. (www.dol.gov/whd/programs/dbra/wh1321.htm) Please note that the DBRA and AWD are in addition to other Federal and State required postings.1

Payroll and basic records for all laborers and mechanics (all the job classifications identified in the AWD) employed by you at the site, must be maintained during the work, and for three years after completion of the Project. Records that must be maintained include:

_________________________

1 Posting requirements under eight Federal laws (Title VII, ADEA, ADA, EPA, E.O. 11246, GINA, §503 of the Rehabilitation Act of 1973, and VEVRAA) are combined into the single "Equal Employment Opportunity is THE LAW" Poster, a copy of which is available on the Department of Labor's website at http://www.dol.gove/ofccp/regs/compliance/posters/pdf/eeopost.pdf. The combined poster does not cover other Federal posting requirements under USERRA, FLSA, FMLA, NLRA Rights under Executive Order 13496, E-Verify (two posting requirements), EPPA, OSHA, or postings required by the State of Georgia.

| |

| ◦ | Name, address and Social Security number of each employee, |

| |

| ◦ | Each employee’s work classification(s), |

| |

| ◦ | Hourly rates of pay, including the rates of contributions or costs anticipated for fringe benefits or their cash equivalents, |

| |

| ◦ | Daily and weekly numbers of hours worked, |

| |

| ◦ | If applicable, detailed information regarding various fringe benefit programs, including records that show that the program has been communicated in writing to the laborers and the mechanics affected, |

| |

| ◦ | If applicable, detailed information regarding approved apprenticeship or trainee programs. |

You organization must, on a weekly basis, submit an electronic certified payroll through the eMars system. You must also electronically certify a “Statement of Compliance” and electronically sign the certified payroll through eMars. Submission of weekly payrolls must be completed and submitted within seven days after the regular pay date for the pay period.

GPC has hired PricewaterhouseCoopers (PwC) to conduct monitoring and compliance activities on certified payrolls and other DBRA compliance for all contractors and subcontractors throughout the Project. You must cooperate fully with PwC during their compliance activities.

In the future, you may also be asked to submit, via survey or otherwise, wage data and other information to the Wage and Hour Division (“WHD”) of the U.S. Department of Labor (“DOL”). [Contractor Name] encourages your organization to fully cooperate with the WHD and other divisions of DOL.

If a contractor disregards its obligations to its employees or the DOL in violation of the DBRA, that organization may be subject to contract termination and debarment from future federal or federally assisted contracts for up to three years. In the event of actual or suspected violations, contract payments may be withheld in sufficient amounts to satisfy actual or potential liabilities for unpaid wages that result from violations of DBRA.

Once DBRA requirements are imposed as a result of the loan guarantee agreement, falsification of certified payroll records or the kickback of wages in violation of the Copeland “Anti-Kickback” Act may subject your organization to civil or criminal prosecution resulting in fines and/or imprisonment.

The Nuclear Power Construction Labor Agreement versus the DBRA

The CLA is one of the collective bargaining agreements among the various contractors and labor unions that will perform construction work on the Project. The CLA sets forth applicable hourly wages and benefits for each union craft. It also provides the terms and conditions of working on the Project, including but not limited to, safety issues, hours of work, shifts, attendance policy, no strike policy, and grievance procedures. As a contractor on this Project, you must comply with the terms and conditions set forth in the CLA.

Both the DBRA and the CLA apply to construction workers, both exempt certain executives, and both require you to pay workers weekly. However, there are instances where the DBRA and the CLA impose different obligations. One important area where the DBRA and the CLA may impose different obligations is the wage rates and fringe benefits. If the wage rate and/ or fringe benefits for a job classification or craft are different between the DBRA and the CLA, you should pay the higher wage rate and/or fringe benefits.

Furthermore, the CLA limits its applicability to the site outlined in Appendix B. If construction work is performed outside this area that fits within the DBRA’s definition of site of work (see the attached Compliance Outline Section 3.2 and see 29 C.F.R. § 5.2(l)), then you must still comply with the DBRA for this work, even though it may be exempt from the CLA. The CLA also has some additional overtime and shift requirements that the DBRA does not require; you should comply with these CLA requirements.

Finally, there may be some differences with regards to apprentices and helpers on this Project. Both the DBRA and the CLA allow a certain ratio of apprentices to journeymen on this Project; to the extent these ratios differ, you must keep your ratio within the lower ratio. The DBRA only permits apprentices who are registered in a bona fide apprentice program that is recognized by the DOL; to the extent the CLA might allow other “apprentices” to work under it, apprentices that are not recognized under the DBRA are not permitted to work and be paid as apprentices on this Project. The CLA also allows for helpers, pre-apprentices, and/or sub-journeymen; the DBRA only allows “helpers” if a helper is listed as a separate job classification on the wage determination. On the current versions of the DBRA wage determinations which are attached hereto, there are no helper classifications; therefore, at this time, no helpers, pre-apprentices, or sub-journeymen may be paid under these classifications on this Project.

Concluding Thoughts

[Contractor Name] expects and requires absolute compliance by your organization with all DBRA and CLA requirements. Irrespective of DOE or DOL action, violations may result in the termination of your contract. To facilitate compliance, we have prepared the attached “Davis-Bacon and Related Acts Compliance: An Outline of What Your Organization Must Do to Meet Its Responsibilities.” Should you have questions regarding compliance, please do not hesitate to contact the undersigned. We are here to assist you in fully complying with these requirements.

In addition, the DOL provides employers with easy-to-access information on DBRA compliance, including the DBRA Forms (http://www.dol.gov/whd/programs/dbra/forms.htm). Other compliance assistance includes the Davis-Bacon and Related Acts (“DBRA”) Web page (http://www.dol.gov/whd/programs/dbra/index.htm) and regulatory and interpretive materials available on the Compliance Assistance “By Laws" (http://www.dol.gov/compliance/laws/comp-

dbra.htm) web page. DOE’s Desk Guide may also be helpful (though some portions, such as those relating to CWHSSA, do not apply to this project. (http://www1.eere.energy.gov/wip/pdfs/doe_dba_desk_guide.pdf)

Should you have any questions concerning your organization’s DBRA obligations or our attached DBRA Compliance Outline, please call me.

Sincerely,

[name]

DBA Compliance Specialist

[phone]

[email]

Enclosures

Appendix 1(b)

DBA Cover Letter to Non-CLA Subcontractors

Contractor Letterhead

----- DRAFT -----

[DATE]

[contact name]

[Contractor or Subcontractor]

[Address]

[City, ST Zip]

RE: Davis-Bacon and Related Acts Compliance

Vogtle Units 3 & 4 Project

Dear [Contractor or Subcontractor Contact Name]:

You have been hired to [insert description of work] on the Vogtle Units 3 & 4 Project (“Project”) located in Burke County, Georgia (“site”). Georgia Power Company (“GPC”) and the other owners of the Project are in the process of being awarded a loan guarantee for the Project through the Department of Energy (“DOE”). One condition to receive the loan guarantee is that all contractors and subcontractors who perform construction work at the site must comply with the Davis-Bacon Act and Related Acts (collectively, “DBRA”), as implemented through Sec. 1702(k) of the Energy Policy Act of 2005.. As a contractor who will perform construction work, it is important for your organization to understand that you will be required to comply with all the requirements of the DBRA. You will be required to fully comply with all DBRA requirements from the date of closing on the loan guarantee forward.

This correspondence is intended to provide you with a summary of DBRA requirements and references so that additional information about DBRA and associated standards can be obtained. Enclosed with this letter are the following documents:

| |

| 1. | Davis-Bacon and Related Acts Compliance: An Outline of What Your Organization Must Do to Meet Its Responsibilities; |

| |

| 2. | Davis-Bacon Act Required Contract Language (to be inserted in all subcontracts); |

| |

| 3. | Wage Determinations for Burke County, GA (Heavy Construction, Building Construction, and Highway Construction). |

By sending this information, we are not intending to provide legal advice. In addition to DBRA requirements, you are expected to comply with all Federal and State employment and other applicable laws. For example, the recordkeeping requirements of DBRA summarized, herein,

are, in addition to, the recordkeeping requirements that cover your employees under the Fair Labor Standards Act (FLSA). Other employment laws that may apply include Title VII of the Civil Rights Act of 1964, the Americans With Disabilities Act, the Age Discrimination Employment Act, Executive Order 11246, the Family Medical Leave Act, and E*Verify requirements contained in Executive Order 12989. For a complete explanation and advice of the applicability of Federal and State law, we recommend you discuss with your legal counsel.

The Davis-Bacon and Related Acts

The Davis-Bacon Act ("DBA") requires all contractors and subcontractors performing services on federally-assisted contracts to pay their laborers and mechanics (employees performing construction and related work) not less than the prevailing wage rates and fringe benefits listed for the job classifications identified in the applicable current DBA Area Wage Determination (AWD). It is important to keep in mind, that the DBA labor standards clauses included in your contract must be included in any contract you enter into with another organization to perform work at the site of this Project.

The Copeland “Anti-Kickback” Act prohibits contractors, from, in any way, inducing an employee to give up any part of their compensation, and requires contractors to submit a weekly statement of the wages paid to each employee performing DBRA covered work. (www.dol.gov/whd/regs/statutes/copeland.htm)

You must pay all employees weekly, and your organization, as the employer, must submit weekly-certified payroll records electronically using eMars, a web-based service that allows users to easily enter, certify, sign, and submit their certified payrolls pursuant to DBRA.

Once the loan guarantee agreement is executed by GPC and DOE, as an employer performing work covered by the labor standards of the DBRA, you must post the WH-1321 “Employee Rights Under the Davis-Bacon Act” poster at the site of the work, in a location where your employees may easily see it. Your organization must also post the AWDs. (www.dol.gov/whd/programs/dbra/wh1321.htm) Please note that the DBRA and AWD are in addition to other Federal and State required postings.1

Payroll and basic records for all laborers and mechanics (all the job classifications identified in the AWD) employed by you at the site, must be maintained during the work, and for three years after completion of the Project. Records that must be maintained include:

| |

| ◦ | Name, address and Social Security number of each employee, |

| |

| ◦ | Each employee’s work classification(s), |

_______________________________

1 Posting requirements under eight Federal laws (Title VII, ADEA, ADA, EPA, E.O. 11246, GINA, §503 of the Rehabilitation Act of 1973, and VEVRAA) are combined into the single "Equal Employment Opportunity is THE LAW" Poster, a copy of which is available on the Department of Labor's website at http://www.dol.gove/ofccp/regs/compliance/posters/pdf/eeopost.pdf. The combined poster does not cover other Federal posting requirements under USERRA, FLSA, FMLA, NLRA Rights under Executive Order 13496, E-Verify (two posting requirements), EPPA, OSHA, or postings required by the State of Georgia.

| |

| ◦ | Hourly rates of pay, including the rates of contributions or costs anticipated for fringe benefits or their cash equivalents, |

| |

| ◦ | Daily and weekly numbers of hours worked, |

| |

| ◦ | If applicable, detailed information regarding various fringe benefit programs, including records that show that the program has been communicated in writing to the laborers and the mechanics affected, |

| |

| ◦ | If applicable, detailed information regarding approved apprenticeship or trainee programs. |

You organization must, on a weekly basis, submit an electronic certified payroll through the eMars system. You must also electronically certify a “Statement of Compliance” and electronically sign the certified payroll through eMars. Submission of weekly payrolls must be completed and submitted within seven days after the regular pay date for the pay period.

GPC has hired PricewaterhouseCoopers (PwC) to conduct monitoring and compliance activities on certified payrolls and other DBRA compliance for all contractors and subcontractors throughout the Project. You must cooperate fully with PwC during their compliance activities.

In the future, you may also be asked to submit, via survey or otherwise, wage data and other information to the Wage and Hour Division (“WHD”) of the U.S. Department of Labor (“DOL”). [Contractor Name] encourages your organization to fully cooperate with the WHD and other divisions of DOL.

If a contractor disregards its obligations to its employees or the DOL in violation of the DBRA, that organization may be subject to contract termination and debarment from future federal or federally assisted contracts for up to three years. In the event of actual or suspected violations, contract payments may be withheld in sufficient amounts to satisfy actual or potential liabilities for unpaid wages that result from violations of DBRA.

Once DBRA requirements are imposed as a result of the loan guarantee agreement, falsification of certified payroll records or the kickback of wages in violation of the Copeland “Anti-Kickback” Act may subject your organization to civil or criminal prosecution resulting in fines and/or imprisonment.

Concluding Thoughts

[Contractor Name] expects and requires absolute compliance by your organization with all DBRA requirements. Irrespective of DOE or DOL action, violations may result in the

termination of your contract. To facilitate compliance, we have prepared the attached “Davis-Bacon and Related Acts Compliance: An Outline of What Your Organization Must Do to Meet Its Responsibilities.” Should you have questions regarding compliance, please do not hesitate to contact the undersigned. We are here to assist you in fully complying with these requirements.

In addition, the DOL provides employers with easy-to-access information on DBRA compliance, including the DBRA Forms (http://www.dol.gov/whd/programs/dbra/forms.htm). Other compliance assistance includes the Davis-Bacon and Related Acts (“DBRA”) Web page (http://www.dol.gov/whd/programs/dbra/index.htm) and regulatory and interpretive materials available on the Compliance Assistance “By Laws" (http://www.dol.gov/compliance/laws/comp-dbra.htm) web page. DOE’s Desk Guide may also be helpful (though some portions, such as those relating to CWHSSA, do not apply to this project. (http://www1.eere.energy.gov/wip/pdfs/doe_dba_desk_guide.pdf)

Should you have any questions concerning your organization’s DBRA obligations or our attached DBRA Compliance Outline, please call me.

Sincerely,

[name]

DBA Compliance Specialist

[phone]

[email]

Enclosures

Appendix 1(c)

Required DBA Contract Language

Davis-Bacon Act Required Contract Clauses

SECTION (a) MINIMUM WAGES, ETC.

(1) Minimum wages.

(i) All laborers and mechanics employed or working upon the site of the work (or under the United States Housing Act of 1937 or under the Housing Act of 1949 in the construction or development of the project), will be paid unconditionally and not less often than once a week, and without subsequent deduction or rebate on any account (except such payroll deductions as are permitted by regulations issued by the Secretary of Labor under the Copeland Act (29 CFR part 3)), the full amount of wages and bona fide fringe benefits (or cash equivalents thereof) due at time of payment computed at rates not less than those contained in the wage determination of the Secretary of Labor which is attached hereto and made a part hereof, regardless of any contractual relationship which may be alleged to exist between the contractor and such laborers and mechanics.

Contributions made or costs reasonably anticipated for bona fide fringe benefits under section 1(b)(2) of the Davis-Bacon Act on behalf of laborers or mechanics are considered wages paid to such laborers or mechanics, subject to the provisions of paragraph (a)(1)(iv) of this section; also, regular contributions made or costs incurred for more than a weekly period (but not less often than quarterly) under plans, funds, or programs which cover the particular weekly period, are deemed to be constructively made or incurred during such weekly period. Such laborers and mechanics shall be paid the appropriate wage rate and fringe benefits on the wage determination for the classification of work actually performed, without regard to skill, except as provided in Sec. 5.5(a)(4) [paragraph (a)(4) below]. Laborers or mechanics performing work in more than one classification may be compensated at the rate specified for each classification for the time actually worked therein: Provided, That the employer's payroll records accurately set forth the time spent in each classification in which work is performed. The wage determination (including any additional classification and wage rates conformed under paragraph (a)(1)(ii) of this section) and the Davis-Bacon poster (WH-1321) shall be posted at all times by the contractor and its subcontractors at the site of the work in a prominent and accessible place where it can be easily seen by the workers.

(ii)(A) The contracting officer shall require that any class of laborers or mechanics, including helpers, which is not listed in the wage determination and which is to be employed under the contract shall be classified in conformance with the wage determination. The contracting officer shall approve an additional classification and wage rate and fringe benefits therefore only when the following criteria have been met:

(1) The work to be performed by the classification requested is not performed by a classification in the wage determination; and

(2) The classification is utilized in the area by the construction industry; and

(3) The proposed wage rate, including any bona fide fringe benefits, bears a reasonable relationship to the wage rates contained in the wage determination.

(ii)(B) If the contractor and the laborers and mechanics to be employed in the classification (if known), or their representatives, and the contracting officer agree on the classification and wage rate (including the amount designated for fringe benefits where appropriate), a report of the action taken shall be sent by the contracting officer to the Administrator of the Wage and Hour Division, Employment Standards Administration, U.S. Department of Labor, Washington, DC 20210. The Administrator, or an authorized representative, will approve, modify, or disapprove every additional classification action within 30 days of receipt and so advise the contracting officer or will notify the contracting officer within the 30-day period that additional time is necessary.

(ii)(C) In the event the contractor, the laborers or mechanics to be employed in the classification or their representatives, and the contracting officer do not agree on the proposed classification and wage rate (including the amount designated for fringe benefits, where appropriate), the contracting officer shall refer the questions, including the views of all interested parties and the recommendation of the contracting officer, to the Administrator for determination. The Administrator, or an authorized representative, will issue a determination within 30 days of receipt and so advise the contracting officer or will notify the contracting officer within the 30-day period that additional time is necessary.

(ii)(D) The wage rate (including fringe benefits where appropriate) determined pursuant to paragraphs (a)(1)(ii) (B) or (C) of this section, shall be paid to all workers performing work in the classification under this contract from the first day on which work is performed in the classification.