- HURC Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Hurco Companies (HURC) DEF 14ADefinitive proxy

Filed: 29 Jan 25, 12:48pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ______)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Hurco Companies, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

HURCO COMPANIES, INC.

1 TECHNOLOGY WAY

INDIANAPOLIS, INDIANA 46268

(317) 293-5309

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

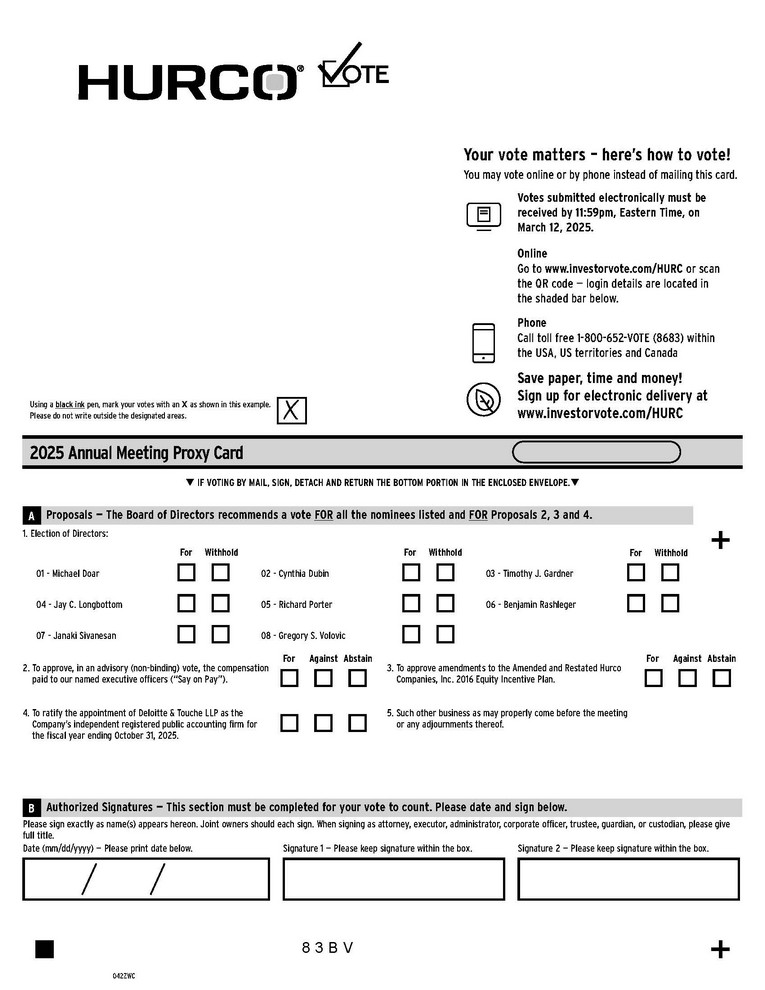

| When: March 13, 2025 at 10:00 a.m. Eastern Time |  | Where: Company Headquarters 1 Technology Way Indianapolis, Indiana 46268 |  | Record Date: January 17, 2025 |

The following items of business are more fully described in our proxy statement accompanying this notice. Please read our proxy statement carefully.

| Items of Business | Board’s Recommendation | Further Information | |

| 1 | To elect eight directors to serve until the next Annual Meeting of Shareholders and until their successors are duly elected and qualify | FOR each director nominee | Page 2 |

| 2 | To approve, in an advisory (non-binding) vote, the compensation paid to our named executive officers (“Say on Pay”) | FOR | Page 13 |

| 3 | To approve an amendment to the Amended and Restated Hurco Companies, Inc. 2016 Equity Incentive Plan | FOR | Page 46 |

| 4 | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending October 31, 2025 | FOR | Page 56 |

| 5 | To consider and transact any other business properly brought before the meeting or any adjournments thereof | ||

The Board of Directors recommends a vote FOR items 1, 2, 3, and 4. The persons named as proxies will use their discretion to vote on any other matters that may properly arise at the 2025 Annual Meeting.

Please mark, sign, and date the enclosed proxy card and return it in the enclosed return envelope, which requires no postage if mailed in the United States, or vote your shares via the Internet or by telephone as described in the proxy statement and on the proxy card.

Only shareholders of record as of the close of business on the record date of January 17, 2025, are entitled to notice of and to vote at the 2025 Annual Meeting of Shareholders (the “2025 Annual Meeting”) or any adjournments thereof. In the event there are not sufficient votes for approval of one or more of the above matters at the time of the 2025 Annual Meeting, the Company may adjourn the 2025 Annual Meeting to permit further solicitation of proxies.

By order of the Board of Directors,

Jonathon D. Wright, General Counsel & Corporate Secretary

Indianapolis, Indiana

January 29, 2025

YOUR VOTE IS IMPORTANT—Even if you plan to attend the 2025 Annual Meeting, we urge you to mark, date, and sign the enclosed proxy card and return it promptly in the enclosed envelope or to vote your shares via the Internet or by telephone as described on the proxy card.

Important Notice Regarding the Availability of Proxy Materials for the 2025 Annual Meeting to be Held on March 13, 2025

In accordance with the rules of the Securities and Exchange Commission, we are advising our shareholders of the availability of our proxy materials related to the 2025 Annual Meeting on the Internet. These rules allow companies to provide access to proxy materials in one of two ways. Because we have elected to utilize the “full set delivery” option, we are delivering to all shareholders paper copies of all the proxy materials, as well as providing access to those proxy materials on a publicly-accessible website.

This Notice of 2025 Annual Meeting and the corresponding proxy statement, form of proxy card, and our most recent annual report on Form 10-K are available at www.hurco.com/proxymaterials. If you plan to attend the 2025 Annual Meeting in person, you may obtain directions to the meeting site by written request directed to Jonathon D. Wright, Corporate Secretary, Hurco Companies, Inc., 1 Technology Way, Indianapolis, Indiana 46268, or by telephone at (317) 293-5309.

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

The statements included in this proxy statement regarding future performance and results, expectations, plans, strategies, priorities, commitments, and other statements that are not historical facts are forward-looking statements within the meaning of the federal securities laws. Forward-looking statements are based upon current beliefs, expectations, and assumptions and are subject to significant risks, uncertainties, and changes in circumstances that could cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended October 31, 2024. Readers of this proxy statement are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

HURCO COMPANIES, INC.

1 Technology Way

Indianapolis, Indiana 46268

2025 Annual Meeting of Shareholders

March 13, 2025

PROXY STATEMENT SUMMARY

This proxy statement and accompanying proxy are being furnished to the holders of common stock of Hurco Companies, Inc. (the “Company,” “Hurco,” “we,” or “us”) in connection with the solicitation of proxies by the Board of Directors (the “Board”) for the Company’s 2025 Annual Meeting of Shareholders (the “2025 Annual Meeting”). This proxy statement and the accompanying form of proxy are being mailed to our shareholders on or about January 29, 2025.

The following summary highlights information more fully described in our proxy statement accompanying this notice. Please read our proxy statement carefully.

Annual Meeting Overview

|  |  |  | ||||

When: March 13, 2025 at 10:00 a.m. Eastern Time | Where: Company Headquarters 1 Technology Way Indianapolis, Indiana 46268 | Record Date: January 17, 2025 | Materials: Available at www.hurco.com/investors under “Proxy Materials” |

Proxy Voting Roadmap

Shareholders will be asked to vote on the following matters at the 2025 Annual Meeting:

| Board’s Recommendation | Further Information | ||

| 1 | To elect eight directors to serve until the next Annual Meeting of Shareholders and until their successors are duly elected and qualify | FOR each director nominee | Page 2 |

| 2 | To approve, in an advisory (non-binding) vote, the compensation paid to our named executive officers (“Say on Pay”) | FOR | Page 13 |

| 3 | To approve amendments to the Amended and Restated Hurco Companies, Inc. 2016 Equity Incentive Plan | FOR | Page 46 |

| 4 | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending October 31, 2025 | FOR | Page 56 |

Director Nominees

| # of | Committee Memberships | |||||||||||||

| Name | Age | Director Since | Independent | Other Public Company Boards | Audit | Compensation | Nominating and Governance | |||||||

| Michael Doar, Executive Chairman | 69 | 2000 | 1 | |||||||||||

| Cynthia Dubin | 63 | 2019 | ✓ | 0 | ✓ | |||||||||

| Timothy J. Gardner | 69 | 2017 | ✓ | 0 | Chair | ✓ | ||||||||

| Jay C. Longbottom | 71 | 2015 | ✓ | 0 | ✓ | ✓ | ||||||||

| Richard Porter | 69 | 2012 | ✓ | 0 | ✓ | Chair | ||||||||

| Benjamin Rashleger | 49 | New Nominee | ✓ | 0 | ||||||||||

| Janaki Sivanesan | 53 | 2008 | ✓ | 1 | Chair | |||||||||

| Gregory S. Volovic, President & CEO | 61 | 2019 | 0 | |||||||||||

1

PROPOSAL 1. ELECTION OF DIRECTORS

The Board currently consists of eight members. The Board, acting on the recommendation of our Nominating and Governance Committee, has nominated each of the current directors for reelection at the 2025 Annual Meeting, other than Thomas A. Aaro. Following discussions with Mr. Aaro, the Board did not nominate Mr. Aaro to stand for re-election at the 2025 Annual Meeting. The Board thanks Mr. Aaro for his years of service, dedication to the Board, and his many contributions to the Company. The Board, acting on the recommendation of our Nominating and Governance Committee, has nominated a new nominee for election at the annual meeting, Benjamin Rashleger. Mr. Rashleger was recommended to the Board for nomination as a director by the Nominating and Governance Committee. The Nominating and Governance Committee considered and reviewed Mr. Rashleger as a candidate for director after receiving a recommendation from the Executive Chairman and Chief Executive Officer.

No fees were paid to any third parties to identify or evaluate potential nominees. Unless authority is specifically withheld, the shares being voted by proxy will be voted in favor of each of these nominees. Each nominee who is elected will serve for a term of one year, which expires at our next Annual Meeting of Shareholders or such later date as his or her successor has been elected and qualified. Proxies cannot be voted for a greater number of persons than eight, which is the number of nominees named in this proxy statement.

If any of these nominees becomes unable to serve, we expect that the persons named in the proxy will exercise their voting power in favor of such other person or persons as the Board may recommend. Each of the nominees has consented to being named in this proxy statement and to serve if elected. The Board knows of no reason why any of the nominees would be unable to serve.

Director Nominees

The names of the persons who are nominees for election and their current positions and offices with Hurco, if any, are set forth below. There are no family relationships among any of our directors or officers.

| Nominees | Positions and Offices Held with Hurco | |

| Michael Doar | Executive Chairman and Director | |

| Cynthia Dubin | Director | |

| Timothy J. Gardner | Director | |

| Jay C. Longbottom | Director | |

| Richard Porter | Director | |

| Benjamin Rashleger | Director Nominee | |

| Janaki Sivanesan | Director | |

| Gregory S. Volovic | President, Chief Executive Officer, and Director |

Michael Doar, age 69, has been a member of the Board since 2000. Mr. Doar was elected Chairman of the Board and appointed our Chief Executive Officer (“CEO”) in fiscal year 2001, a position he held until March 2021, when he transitioned to the role of Executive Chairman. Mr. Doar also served as our President from November 2009 to March 2013. Prior to joining Hurco, Mr. Doar served as Vice President of Sales and Marketing of Ingersoll Contract Manufacturing Company, a subsidiary of Ingersoll International, an international engineering and machine tool systems business, having previously held various management positions with Ingersoll International from 1989. Mr. Doar also serves as a director of Twin Disc, Incorporated (“Twin Disc”), a manufacturer of marine and heavy duty off-highway power transmission equipment, and currently serves on Twin Disc’s Nominating & Governance and Compensation & Executive Development Committees.

Mr. Doar led Hurco for more than 20 years. As our current Executive Chairman and former CEO, Mr. Doar brings to our Board his in-depth knowledge of our business, strategy, people, operations, competition, and financial position.

2

Cynthia Dubin, age 63, has been a member of the Board since 2019. Ms. Dubin is an experienced chief financial officer and board director. In February 2019, Ms. Dubin was appointed to the board of the U.K. Competition and Markets Authority (“CMA”) and is currently the Chair of its Nominations Committee and Audit and Risk Assurance Committee. The CMA is a non-ministerial government department in the United Kingdom, responsible for strengthening business competition and preventing and reducing anti-competitive activities. Since December 2020, Ms. Dubin has also served as a director for ICE Futures Europe, an exchange for futures and options contracts for crude oil, interest rates, equity derivatives, natural gas, power, coal, emissions, and soft commodities, and is currently also the chair of its Risk and Audit Committee. From May 2021 to August 2023, Ms. Dubin served as a director, Chair of the Audit Committee, and member of the Compensation Committee for Franchise Group, Inc. (the “Franchise Group”). Franchise Group is a holding company for a franchising platform for an increasingly diverse collection of market-leading and emerging brands. From September 2020 through November 2022, Ms. Dubin served as a director, Chair of the Audit Committee, and a member of the Remuneration and Nomination Committees of Synthomer plc, a U.K. publicly-traded chemicals manufacturer specializing in aqueous polymers. From 2015 to September 2020, she served on the Board of Directors of Babcock & Wilcox Enterprises, Inc. (“B&W”), a NYSE-listed global provider of advanced energy and environmental technologies for the power and industrial markets with operations, subsidiaries, and joint ventures worldwide. During that time, she also served as Chair of B&W’s Audit Committee and a member of its Governance Committee. Ms. Dubin also served as the CFO of Pivot Power LLP, an emerging leader in power storage and electric vehicle infrastructure in the U.K., from August 2018 to March 2019; as CFO of JKX Oil & Gas Ltd. (“JKX”) from 2011 to 2016; and CFO for Canamens Ltd. (“Canamens”) from 2006 to 2011. JKX and Canamens are London Stock Exchange listed and private equity-backed oil and gas exploration and production companies, respectively. Additionally, Ms. Dubin was European CFO for Edison Mission Energy, a builder, owner, and operator of large-scale power generation projects, and started her career as a project finance banker with Irving Trust Company.

Ms. Dubin brings to our Board thorough knowledge and understanding of complex international corporate finance, mergers and acquisitions, capital markets, and risk management and oversight.

Timothy J. Gardner, age 69, has been a member of the Board since 2017. A seasoned leader in industrial and international manufacturing operations, from 2016 to March 2021, Mr. Gardner served as the Managing Director of Akoya Capital (“Akoya”), responsible for leading Akoya’s industrial product sector. From 2015 to December 2020, Mr. Gardner also served as a Senior Advisor for Pritzker Private Capital (“Pritzker”) and a board member of LBP Manufacturing, a packaging company acquired by Pritzker. From 2009 to 2014, Mr. Gardner served as the Executive Vice President of Illinois Tool Works (“ITW”) and led ITW’s consumer products segment, a $1.6 billion business focused on packaging and specialty decorating. Between 1997 and 2009, Mr. Gardner held various leadership positions within ITW.

Mr. Gardner brings to our Board extensive leadership experience in industrial and international manufacturing operations, as well as extensive knowledge and experience in finance and acquisitions and divestitures. During his tenure at ITW, Mr. Gardner led ten acquisitions and four divestitures and managed multiple division and group financial controllers.

Jay C. Longbottom, age 71, has been a member of the Board since 2015. Mr. Longbottom is currently an Operating Partner of the BERKS Group, a privately held investment initiative, a position he has held since 2018. Previously, from 2013 to 2017, Mr. Longbottom was CEO of Robert Family Holdings (“RFH”), a privately-held company that manages a portfolio of specialty manufacturers, was a board member of RFH from 2008 to 2017, and served as RFH’s Audit Committee Chair from 2008 to 2013. For one year prior to his RFH tenure, Mr. Longbottom served as CEO of Trostel, LLC, a rubber products company. Additionally, from 2002 to 2012, Mr. Longbottom was an executive of Haldex AB, a Swedish, publicly-traded company that provides proprietary and innovative solutions to improve safety, vehicle dynamics, and environmental sustainability in the global commercial vehicle industry. Mr. Longbottom served as the CEO and President of Haldex AB from 2011 to 2012. Prior to 2011, he was the Executive Vice President and Head of the Commercial Vehicle Systems Division and the President of the Hydraulics Division of Haldex Group.

Mr. Longbottom brings to our Board significant knowledge in finance, mergers and acquisitions, and international manufacturing operations. His experience as a CEO of a Swedish, publicly-traded company is also relevant to understanding regulations and capital market requirements. Mr. Longbottom currently serves as a director of two privately-held companies, was a director of RFH for nine years, and has served as a director for a number of international companies.

Richard Porter, age 69, has been a member of the Board since 2012. Mr. Porter has managed a private equity portfolio of manufacturing companies since 2007. Previously, he was President of CB Manufacturing, a cutting tool company, and President of Ingersoll Contract Manufacturing Company, a subsidiary of Ingersoll International.

Mr. Porter brings to our Board extensive experience in the machine tool industry, particularly in product and contract manufacturing. Mr. Porter also has experience serving on the boards of a number of private companies with annual revenues ranging from approximately $40 million to $480 million.

3

Benjamin Rashleger, age 49, is a director nominee and a machine tool industry executive, having held leadership positions with multiple organizations in each of the industry’s market segments, including a manufacturer of CNC equipment, an end-user manufacturing company specializing in CNC machining, and a multi-state distributor of CNC equipment. Mr. Rashleger is currently the President of Machine Tools for Concept Advanced Manufacturing Solutions, a large multi-state distributor of CNC and metrology equipment, where he is responsible for the machine tool division, a position he has held since 2019. Previously, from 2009 to 2017, Mr. Rashleger was the Chief Executive Officer and director of WSI Industries, a publicly-traded contract manufacturer that specialized in CNC machining and assembly, serving primarily the recreational products, aerospace, defense and energy markets. From 1991 to 2008, Mr. Rashleger held multiple roles with Milltronics Manufacturing Company, ultimately the President and CFO prior to the sale of that business, and thereafter he served as the Director of Operations of that business.

Mr. Rashleger would bring to the Board a broad knowledge of the CNC machining space, specifically in manufacturing, distribution, product development, sales and marketing, finance, mergers and acquisitions, and international operations. Mr. Rashleger also has served, and currently sits, on multiple boards including private equity owned, public, ESOP and non-profit organizations. He currently is a director for a private waterjet CNC equipment manufacturer and a private contract manufacturer in CNC machining.

Janaki Sivanesan, age 53, has been a member of the Board since 2008. Ms. Sivanesan is a practicing attorney and founding principal of a private equity firm focused on middle-market investments. She previously served as a partner at a large, New York law firm. She was admitted to the bars of the States of New York and Georgia in 2007 and 1996, respectively. Since 2020, Ms. Sivanesan has also served as a director of Essential Properties Realty Trust, Inc., a publicly-traded real estate investment trust that acquires, owns, and manages primarily single-tenant properties that are net leased on a long-term basis to companies operating service-oriented or experience-based businesses. Ms. Sivanesan has experience in a wide range of corporate transactions, from mergers and acquisitions to corporate finance, including private debt, equity investments, and venture capital transactions. Ms. Sivanesan also has experience in cross-border transactions related to manufacturing and outsourcing and is particularly knowledgeable with respect to business operations in India. Ms. Sivanesan served as the General Counsel and Chief Compliance Officer of Hayfin Capital Management, LLC (formerly known as Kingsland Capital Management, LLC), from 2011 to 2018, and has been self-employed as an attorney in private practice since 2009.

Ms. Sivanesan provides to the Board and Audit Committee thorough knowledge and understanding of complex legal and capital markets transactions, as well as corporate mergers and acquisitions.

Gregory S. Volovic, age 61, has been a member of the Board since 2019. He has been employed by us since 2005, was appointed as our President in 2013, and served as our Chief Operating Officer from 2019 until he was appointed as our CEO in March 2021. Mr. Volovic oversees all of Hurco’s operations, including worldwide sales, service, end-to-end management of research and development, new product development activities, and operational initiatives. He has held various positions within Hurco, most recently Executive Vice President, Software and Engineering, before becoming President in 2013. Prior to joining Hurco, Mr. Volovic led the advanced manufacturing equipment development program for the CRT division of RCA/Thomson and the worldwide development of Information Technology (IT) and E-business/Knowledge Management technologies. He also held various positions within Thomson, including Director of E-Business, Engineering, and Information Technology. Mr. Volovic started his career as a software developer for Unisys Corporation, where he was a Linux programmer. Mr. Volovic also serves on the boards of two private industrial and manufacturing companies and is a board member of the Association of Manufacturing Technology (AMT).

Mr. Volovic brings to our Board his significant knowledge of the machine tool industry, as well as his experience and understanding of our technologies, product development, business strategies, people, and operations. Mr. Volovic also provides leadership and vision for the development and execution of our strategic plans and the achievement of our business goals and objectives.

4

Board Diversity, Director Nominee Experience and Qualifications, and Board Composition

While neither the Board nor the Nominating and Governance Committee has a separate formal written policy regarding director diversity, each body considers the diversity of backgrounds and experience when selecting nominees for director election and in evaluating Board composition and performance. Not only has this informal approach to the promotion of diversity resulted in a group of director nominees that we believe to be individuals of substantial accomplishment with demonstrated leadership capabilities, but, as indicated in the following charts, it has also resulted in a group of director nominees that possess diversity of thought, perspective, experience, and backgrounds.

| Director Nominee Experience & Qualifications | ||||||||||||||||

| Michael Doar | Cynthia Dubin | Timothy J. Gardner | Jay C. Longbottom | Richard Porter | Benjamin Rashleger | Janaki Sivanesan | Gregory S. Volovic | |||||||||

| Public Company Board | ● | ● | ● | ● | ||||||||||||

| Public Company Executive | ● | ● | ● | ● | ● | ● | ||||||||||

| Manufacturing Industry | ● | ● | ● | ● | ● | ● | ● | |||||||||

| International Business / Global Operations | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||

| Risk Management | ● | ● | ● | ● | ||||||||||||

| Financial Analysis / Accounting | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Information Technology / Cyber Security | ● | ● | ||||||||||||||

| Project Management | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Environmental Sustainability | ● | ● | ● | ● | ||||||||||||

| Sales & Marketing | ● | ● | ● | ● | ● | ● | ● | |||||||||

| Supply Chain / Logistics | ● | ● | ● | ● | ● | |||||||||||

| Strategic Planning | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||

| Government Relations, Public Policy or Regulatory | ● | ● | ||||||||||||||

| Mergers & Acquisitions / Business Development | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||

| Human Capital Management | ● | ● | ● | ● | ● | ● | ||||||||||

Board Diversity Matrix (As of January 29, 2025) | ||||||||

| Total Number of Directors: 8 | Female | Male | Non-Binary | Did Not Disclose Gender | ||||

| Part I: Gender Identity | ||||||||

| Directors | 2 | 6 | ||||||

| Part II: Demographic Background | ||||||||

| Asian | 1 | |||||||

| White | 7 | |||||||

In further demonstration of the value the Board places on diversity, it also considers the diversity of background and experience when appointing our executive officers. To that end, and as indicated in the chart below, our executive officer team is a diverse group of individuals representative of both Hurco’s global footprint and the communities in which we operate.

Officer Diversity Matrix (As of January 29, 2025) | ||||||||

| Total Number of Executive Officers: 5 | Female | Male | Non-Binary | Did Not Disclose Gender | ||||

| Part I: Gender Identity | ||||||||

| Executive Officers | 2 | 3 | ||||||

| Part II: Demographic Background | ||||||||

| Asian | 1 | |||||||

| White | 3 | |||||||

| Two or More Races or Ethnicities | 1 | |||||||

The Board of Directors recommends a vote “FOR” each of the nominees for director.

5

CORPORATE GOVERNANCE

Policies on Corporate Governance

Our Board believes that good corporate governance is important to ensure that our Company is managed for the long-term benefit of our shareholders. The Board or one of its committees periodically reviews our Corporate Governance Principles, the written charters for each of the standing committees of the Board, and our Code of Business Conduct and Ethics, and amends them as appropriate to reflect new policies or practices.

Board Leadership Structure

Our Board is currently led by our Executive Chairman, Mr. Doar. Mr. Doar has held this position since March 2021. Prior to transitioning to the role of Executive Chairman, Mr. Doar served as our Chairman and CEO since 2001. Therefore, he has experience in leading the Company through a range of changes in business environments and has vast institutional knowledge about our business, industry, and people.

The Board regularly reevaluates our Board leadership structure and succession planning and may determine that a different leadership structure is appropriate in the future. The Board currently believes that it is most efficient and effective for an executive officer of the Company to serve as Executive Chairman of the Board. Assumption of the Chairman role by an executive officer facilitates continuous and broad Board access to, and communication with, the CEO, management team, and the Company’s outside advisors. It also promotes responsibility and accountability, effective decision-making, and a cohesive corporate strategy. Our Board possesses considerable experience and knowledge of the challenges and opportunities that we face as a company. We feel the Board is well qualified to evaluate our current and future needs and to assess how the capabilities of our senior management can be most effectively organized to meet those needs.

Our Board currently has six independent directors. We have three standing committees, and one of our independent directors serves as our Presiding Independent Director. The independent directors have designated Mr. Porter to serve as Presiding Independent Director. The Presiding Independent Director oversees executive sessions of the independent directors and plays an active role in setting Board agendas and facilitating interactions between the independent directors, on the one hand, and the full Board or management, on the other. The Board evaluates the appropriateness of its leadership structure on an ongoing basis and may change it as circumstances warrant. We believe that each of these measures counterbalances any risk that may exist in having Mr. Doar serve as both an executive employee of the Company and as Executive Chairman of the Board. For these reasons, our Board believes this leadership structure is effective for our company.

Board Role in Risk Oversight

Our Board regularly receives reports from our CEO and other members of our senior management team regarding areas of significant risk to us, including strategic, operational, financial, legal, regulatory, and reputational risks. However, management is responsible for assessing and managing our various risk exposures on a day-to-day basis. In this regard, management, with the assistance, where appropriate, of counsel and other advisors, has established functions that focus on particular risks, such as legal matters, regulatory compliance, treasury management, research and development, cyber security, supply chain, and quality control, and has developed a comprehensive and integrated approach to overall risk management, which includes the identification of risks and mitigation plans in the strategic planning process.

Our Board’s role is primarily one of oversight. Our Board oversees our risk management processes to determine whether those processes are functioning as intended and are consistent with our business and strategy. Our Board conducts this oversight primarily through the Audit Committee, although some aspects of risk oversight are performed by the full Board or another committee. The Audit Committee is assigned with, among other things, oversight of our risks relating to accounting matters, financial reporting, and legal and regulatory compliance. The Audit Committee meets regularly with our Chief Financial Officer (“CFO”), external auditors, internal auditors, legal counsel, and management to discuss our major financial risk exposures and the steps management has taken to monitor and control such exposures, including our risk assessment and risk management policies. The Audit Committee also receives regular reports regarding issues such as the status and findings of audits being conducted by our independent auditors, the status of material litigation, and material accounting changes or proposed audit adjustments that could affect our financial statements. Our Audit Committee has standing items on its quarterly meeting agendas relating to these responsibilities. The Audit Committee members, as well as all other directors, have access to our CFO, internal auditors, and any other member of our management for discussions between meetings, as warranted. The Audit Committee provides reports to the full Board on risk-related items.

The activities of the Compensation Committee with respect to risks relating to our compensation policies and procedures are discussed below in the Executive Compensation section of this proxy statement.

6

Director Independence and Board Meetings

The Board has determined that each of our non-employee directors and the new director nominee—Mr. Aaro, Ms. Dubin, Mr. Gardner, Mr. Longbottom, Mr. Porter, Mr. Rashleger, and Ms. Sivanesan—is “independent” as defined by the listing standards of The Nasdaq Stock Market (the market in which our common stock trades) (“Nasdaq”), and the director independence rules of the Securities and Exchange Commission (the “SEC”). The Board has affirmatively determined that none of these persons has any relationship with us that would impair their independence.

Directors are expected to attend Board meetings, meetings of committees on which they serve, and our Annual Meeting of Shareholders, and to spend the time needed and meet as frequently as necessary to properly discharge their fiduciary duties and responsibilities. The Board held 5 meetings during fiscal year 2024. All directors attended at least 75% of the aggregate number of meetings of the Board and the committees on which they served during fiscal year 2024. All incumbent directors and director nominees, as of that date, attended our 2024 Annual Meeting of Shareholders.

Board Committees and Committee Meetings

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee.

The Audit Committee Chair: Janaki Sivanesan | ||

Additional Committee Members: Thomas A. Aaro Cynthia Dubin

All members are “independent” as such term is defined for audit committee members under the Nasdaq rules and SEC Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

Each of Ms. Dubin and Ms. Sivanesan qualifies as an “audit committee financial expert,” as defined by the Securities and Exchange Commission

Meetings Held in Fiscal Year 2024: 5 | The Committee’s primary responsibilities include: ● overseeing our accounting, financial reporting, and internal audit activities; ● appointing our independent registered public accounting firm and meeting with that firm, our internal audit team, and our CFO to review the scope, cost, and results of our annual audit, and to review our internal accounting controls, policies, and procedures; ● overseeing, reviewing, and discussing with management, and reporting to the Board, our cybersecurity, information technology, data security and business continuity risks and threats and management’s processes, procedures, and actions to identify, manage, and mitigate such risks; ● reviewing and approving all related-person transactions or potential conflicts of interest in which any director, director nominee, executive officer, or significant shareholder of the Company (or any of their immediate family members) has a director o indirect material interest; ● establishing and maintaining procedures for the receipt and treatment of complaints received by us regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; ● reviewing with management and our internal audit department our major financial risk exposures and the steps management has taken to monitor and control such exposures; ● reviewing and monitoring our compliance with internal policies and procedures related to hedging and financial derivative transactions; and ● discussing with management and legal counsel legal matters that may have a material impact on our financial statements or compliance policies.

The Report of the Audit Committee is included on page 58 of this proxy statement.

The Audit Committee operates under a written charter, a copy of which is available on our website at www.hurco.com/investors under “Corporate Governance.” | |

7

The Compensation Committee Chair: Timothy J. Gardner | ||

Additional Committee Members: Jay C. Longbottom Richard Porter

All members are “independent” as such term is defined for compensation committee members under the Nasdaq rules and SEC Rule 10C-1 promulgated under the Exchange Act.

Meetings Held in Fiscal Year 2024: 5 | The Committee’s primary responsibilities include: ● annually reviewing the performance of our executive officers and determining their compensation; ● monitoring total personnel costs and providing input on guidelines for the general wage structure of our entire workforce; ● overseeing the process for identifying and addressing any material risks relating to our compensation policies and practices for all employees, including our executive officers; ● overseeing the administration of our employee benefit plans; ● discussing with management the Compensation Discussion and Analysis and, if appropriate, recommending its inclusion in our Annual Report on Form 10-K and proxy statement; ● overseeing, monitoring, and administering our stock ownership guidelines and recoupment or clawback policies applicable to our executive officers; ● reviewing our policies concerning non-employee director compensation and recommending to the Board for final determination any changes in the form or amount of non-employee director compensation; and ● reviewing our policies on perquisites for executive officers.

The Report of the Compensation Committee is included on page 30 of this proxy statement.

The Compensation Committee operates under a written charter, a copy of which is available on our website at www.hurco.com/investors under “Corporate Governance.” | |

The Nominating and Governance Committee Chair: Richard Porter | ||

Additional Committee Members: Timothy J. Gardner Jay C. Longbottom

All members are independent directors as defined by Nasdaq rules.

Meetings Held in Fiscal Year 2024: 4 | The Committee’s primary responsibilities include: ● reviewing the effectiveness of the Board’s leadership structure and recommending to the Board any proposed changes thereto; ● identifying individuals qualified to become Board members and recommending to the Board director nominees for election at each annual meeting of shareholders; ● maintaining our Corporate Governance Principles and Code of Business Conduct and Ethics; ● leading the Board and its standing committees in an annual self-evaluation; ● recommending members and chairs for each standing committee; ● determining and evaluating succession plans for our CEO and other senior management positions; ● overseeing, monitoring, and administering stock ownership guidelines applicable to our non-employee directors; and ● reviewing our environmental, social, corporate responsibility and sustainability programs, initiatives, and policies and making recommendations to the Board and/or our management regarding the same.

The Nominating and Governance Committee operates under a written charter, a copy of which is available on our website at www.hurco.com/investors under “Corporate Governance.” | |

8

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee was, at any time during fiscal year 2024, or at any other time before fiscal year 2024, an officer or an employee of the Company. In addition, none of the members of the Compensation Committee was involved in a relationship requiring disclosure as an interlocking executive officer or director under Item 407(e)(4) of Regulation S-K of the Exchange Act. None of our executive officers served as a member of the Compensation Committee at any time during or before fiscal year 2024.

Director Recommendations

The Nominating and Governance Committee is responsible for identifying potential Board members or nominees. The Nominating and Governance Committee considers the diversity of backgrounds and experiences of director candidates when identifying director nominees and evaluating the Board’s composition and performance. The Nominating and Governance Committee also examines the following qualifications and skills of director candidates, among other things: their business or professional experience, their integrity and judgment, their records of public service, their ability to devote sufficient time to the affairs of the Company, and the needs of the Board for certain skills or experiences. The Nominating and Governance Committee also believes that all nominees should be individuals of substantial accomplishment with demonstrated leadership capabilities.

The Nominating and Governance Committee will consider candidates for director who are recommended by shareholders. A shareholder who wishes to recommend a director candidate for consideration by the committee should send such recommendation to our Corporate Secretary at 1 Technology Way, Indianapolis, Indiana 46268, who will forward it to the committee. Any such recommendation should include a description of the candidate’s qualifications for Board service and contact information for the shareholder and the candidate.

A shareholder who wishes to nominate an individual as a candidate for director without the recommendation of the Nominating and Governance Committee must comply with the advance notice and informational requirements set forth in our By-Laws, which are more fully explained later in this proxy statement under “Shareholder Proposals for our 2026 Annual Meeting.”

Shareholder Communications

The Board has implemented a process whereby shareholders may send communications to its attention. The process for communicating with the Board is set forth in our Corporate Governance Principles, which are available on our website at www.hurco.com/investors under “Corporate Governance.”

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics, which applies to all of our directors, executive officers, and employees, including our principal executive officer and principal financial officer. If we grant any waiver to the Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, we will disclose the nature of such waiver in a Current Report on Form 8-K that we will file with the SEC or on our website at www.hurco.com/investors under “Corporate Governance.” A copy of the Code of Business Conduct and Ethics is available on our website at www.hurco.com/investors under “Corporate Governance.” We will disclose any amendments or updates to our Code of Business Conduct and Ethics by posting such amendments or updates on our website.

Certain Relationships and Related Person Transactions

Under our Code of Business Conduct and Ethics, which is available on our website at www.hurco.com/investors under “Corporate Governance,” our directors, officers, and employees are not permitted to conduct business on our behalf with a member of his or her family, or a business organization with which he or she or a family member has an interest or employment relationship that could be considered significant in terms of potential conflict of interest, unless such business dealings have been disclosed to, and approved by, our Audit Committee.

Further, under our Audit Committee’s charter, which is available on our website at www.hurco.com/investors under “Corporate Governance,” our Audit Committee must review and approve all related person transactions in which any director, director nominee, executive officer, or significant shareholder of the Company, or any of their immediate family members, has a direct or indirect material interest.

During fiscal year 2023, we sold a machine for approximately $499,000 to a company in which Mr. Doar is a beneficial owner of more than 10% of its equity and in which Mr. Doar’s son is an owner and officer. The machine was sold in the ordinary course of business at pricing, and on other terms, generally available to all direct customers of the Company.

During fiscal year 2024, we did not have any related-person transactions requiring disclosure in this proxy statement.

9

Environmental, Social, and Governance Matters

Our Board has adopted an Environmental, Social, and Governance Policy (the “ESG Policy”), which is both set forth immediately below and available on our website at www.hurco.com/investors under “Corporate Governance.”

Hurco Companies, Inc. (“Hurco,” “we,” “us,” or “our”) believes that: (1) business, at its best, serves the public good, improves the quality of peoples’ lives, and leaves the world a better place; (2) it is an inherent and critical component of sound corporate citizenship to be responsive to environmental, social, and governance-related (“ESG”) matters that directly impact our business, industry, stakeholders, and the communities in which we operate; (3) as a global, industrial technology company, we are in a unique position to help address a variety of ESG issues; and (4) profitable growth and meaningful responsiveness to ESG matters are not mutually exclusive.

Accordingly, Hurco is committed to being responsive to ESG matters that are important to our business and stakeholders, including our customers, employees, shareholders, business partners, and the communities in which we operate. We are dedicated to operating our business with integrity; being responsible fiscal and environmental stewards; maintaining a diverse, inclusive, and caring culture with an emphasis on employee safety, development, and well-being; and having strong corporate governance practices that foster principled actions, informed and effective decision-making, appropriate monitoring of our compliance and performance, and accountability. To that end, our Board of Directors has direct oversight of our ESG strategy and its implementation.

We believe Hurco’s approach in addressing ESG matters should be thoughtful, proactive, practical, and risk-based – with priority given to ESG issues that are both material to our business and otherwise aligned with our corporate strategies. Through our business activities, we want to be economically successful and create value for society. In that regard, Hurco will strive to evaluate and respond to ESG issues in a manner that is intended to create long-term value both for our stakeholders and for our business. More specifically, we will aim to focus on ESG initiatives that we believe are the most impactful to both and that will make Hurco a better company.

Our Board has direct oversight over ESG matters pertaining to the Company. In addition, the Charter of the Nominating and Governance Committee requires that committee to periodically review the Company’s environmental, social, and sustainability programs, initiatives, and policies, and encourages such committee to make recommendations to the Board and/or our management regarding the same, to the extent the committee determines such recommendations are justified, in each case after taking into account the interests of all of the Company’s stakeholders, including shareholders. A copy of the charter of the Nominating and Governance Committee is available on our website at www.hurco.com/investors under “Corporate Governance.”

We also believe that all companies have a responsibility to respect human rights. In recognition of the foregoing, our Board has adopted a Human Rights Policy representing the Company’s public expression of (1) its commitment to respect internationally recognized fundamental human rights standards and (2) its belief that all human beings should be treated with dignity, fairness, and respect. A copy of the Company’s Human Rights Policy is available at our website at www.hurco.com/investors under “Corporate Governance.”

Through our Supplier Code of Conduct, we communicate our expectation that our suppliers, vendors, and other supply chain partners adhere to certain standards related to corporate integrity, fair and ethical business practices, responsible product sourcing, and the safety and wellbeing of workers across our global supply chain. A copy of our Supplier Code of Conduct is also available on our website at www.hurco.com/investors under “Corporate Governance.”

Below are just a few representative examples demonstrating Hurco’s commitment to ESG matters:

| Culture | Charitable Giving |

| Fostering a strong corporate culture that promotes high standards of ethics and compliance for our businesses, including policies and principles to guide employee, officer, director, and vendor conduct (e.g., our Code of Business Conduct and Ethics, ESG Policy, Human Rights Policy, and Supplier Code of Conduct). | Supporting charitable organizations that aid the communities in which we operate our business and/or that promote ESG matters. For example, since 2022, we have partnered with One Tree Planted® and donated funds to plant one tree for every machine sold by the Company. |

10

| Energy Usage | Sustainability |

| Developing software, hardware, and product design enhancements that have the potential to reduce the amount of power or energy required by end users to produce parts. For example, an internal Hurco study found that, assuming consistent levels of part geometry, finishing, and quality for the same production operation, a 2023 VMX42 requires approximately 28% less power (i.e., 7,049 kWh/a) than a 2011 VMX42 (i.e., 9,756 kWh/a) to produce the same part. | Promoting the acceptance of emerging and clean technologies that support environmental sustainability (e.g., by (1) increasing the number of electric vehicles in our owned or leased automobile sales and service fleets and installing electric vehicle charging stations at several of our locations, (2) installing LED or other energy efficient lighting sources at our corporate headquarters, corporate warehousing and manufacturing facilities, and several of our international subsidiaries’ locations, and (3) implementing recycling and sustainable water programs at various global locations). |

| Employee Focus | Whistleblower Policy |

| Developing, training, and maintaining a skilled manufacturing and machinist workforce to support advancements in manufacturing technology and the industries we serve. For example, in 2020, we initiated the Hurco Apprenticeship Program, educating and training the next generation of skilled machinists, advanced manufacturing skilled labor, and automation specialists. | Maintaining a whistleblower policy providing for the confidential reporting of any suspected policy violations or unethical business conduct on the part of our businesses, employees, officers, directors, or vendors and the provision of training and education to our global workforce with respect to our Code of Business Conduct and Ethics and anti-corruption and anti-bribery policies. |

| Environmental Awareness | Safety |

| Fostering environmental awareness (i.e., evaluating our products and supply chain for conflict minerals and carbon emissions, holding our suppliers to high quality standards, and maintaining our Code of Business Conduct and Ethics and our Supplier Code of Conduct). | Providing safe and high-quality products and services that meet customer and regulatory requirements and demonstrate continuous improvement, including ISO 9001 certification. |

| Diversity | Governance Documents |

| Promoting an inclusive and diverse workforce and environment that is representative of our global footprint and the communities in which we operate at all levels of the organization. See “Proposal 1. Election of Directors” for more information about the diversity of our Board and executive officers. | Amending our governance documents to incorporate feedback received from shareholders or other emerging best corporate governance practices (e.g., a new Hurco Companies, Inc. Insider Trading Policy, our Executive Compensation Recovery Policy, updates to all charters of Board standing committees, and amendments to our Articles of Incorporation and By-Laws effectuated in 2024 to provide shareholders with the right to amend our By-Laws). |

| Dedicated ESG Leader | Executive Accountability |

| In fiscal year 2023, appointing a senior leader to serve in a new independent and dedicated ESG role and creating an ESG Task Force focused on employee-led ESG initiatives. | Since 2022, including ESG-related metrics as strategic objectives in the short-term executive compensation arrangements for our named executive officers. |

11

COMPENSATION OF DIRECTORS

Director Compensation Table

| Fees Earned or | Stock | ||||||||

| Paid in Cash | Awards | Total | |||||||

| ($) | ($)1 | ($) | |||||||

| Thomas A. Aaro | 52,5002 | 79,997 | 132,497 | ||||||

| Cynthia Dubin | 50,000 | 79,997 | 129,997 | ||||||

| Timothy J. Gardner | 52,500 | 79,997 | 132,497 | ||||||

| Jay C. Longbottom | 45,000 | 79,997 | 124,997 | ||||||

| Richard Porter | 61,2502 | 79,997 | 141,247 | ||||||

| Janaki Sivanesan | 55,000 | 79,997 | 134,997 |

| 1 | Amounts reflect the grant date fair value of restricted shares issued to each non-employee director during the year ended October 31, 2024, calculated in accordance with Accounting Standards Codification Topic 718 (“ASC 718”). Each non-employee director received 3,813 restricted shares on March 14, 2024, the date of our 2024 Annual Meeting of Shareholders, pursuant to our non-employee director compensation program. The grant date fair value is calculated by multiplying the closing price of our common stock on Nasdaq on the date of grant, which was $20.98, by the number of restricted shares awarded. The restricted shares vest one year from the date of grant or upon the Company’s next Annual Meeting of Shareholders, whichever is earlier. |

| 2 | Fees paid to Mr. Aaro and Mr. Porter during fiscal year 2024 include an additional $2,500 for Mr. Aaro and an additional $1,250 for Mr. Porter paid to them as corrections to committee compensation resulting from changes in the composition of our Audit Committee during fiscal year 2023.

|

Mr. Doar’s compensation and Mr. Volovic’s compensation for fiscal year 2024 are set forth in the Summary Compensation Table and the following tables and narrative. Neither are included in the table above, because they did not receive any additional compensation for their services as directors.

Director Compensation Program

In fiscal year 2024, the fees earned by, or paid in cash to, our non-employee directors were as follows:

| 1st Quarter ($) | 2nd Quarter ($) | 3rd Quarter ($) | 4th Quarter ($) | Total ($) | |||||||||||

| Non-employee directors retainer | 11,250 | 11,250 | 11,250 | 11,250 | 45,000 | ||||||||||

| Presiding Independent Director retainer | 3,750 | 3,750 | 3,750 | 3,750 | 15,000 | ||||||||||

| Audit Committee chair retainer | 2,500 | 2,500 | 2,500 | 2,500 | 10,000 | ||||||||||

| Compensation Committee chair retainer | 1,875 | 1,875 | 1,875 | 1,875 | 7,500 | ||||||||||

| Audit Committee member retainer | 1,250 | 1,250 | 1,250 | 1,250 | 5,000 |

We also paid our directors’ travel expenses incurred to attend Board meetings, which are not included in the Director Compensation Table above.

12

PROPOSAL 2. ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

The second proposal to be considered at the 2025 Annual Meeting is the advisory vote to approve the compensation paid to our named executive officers as disclosed in this proxy statement pursuant to the SEC’s compensation disclosure rules (which disclosure includes the Compensation Discussion and Analysis, the compensation tables, and the narrative discussion following the compensation tables), also known as the say-on-pay vote. Consistent with the preference expressed by shareholders at the 2011, 2017, and 2023 Annual Meetings of Shareholders, we have been conducting say-on-pay votes on an annual basis.

The Compensation Discussion and Analysis beginning on page 14 of this proxy statement describes our executive compensation program, in detail, and explains the philosophy of the program, the elements of compensation, and the factors considered by the Compensation Committee in determining the compensation of our named executive officers for fiscal years 2024 and 2025.

At our 2024 Annual Meeting of Shareholders, approximately 99% of the votes cast on the annual say-on-pay vote were voted to approve the proposal. That strong support level followed several years of high shareholder support on annual say-on-pay votes, with average approval levels of 93% and 92% for the preceding three-year and five-year periods, respectively. The Compensation Committee believes that the consistently high levels of shareholder support at those meetings indicate that our executive compensation program is aligned with market practices and generally meets shareholders’ expectations.

Accordingly, the Board of Directors recommends that our shareholders vote FOR the following resolution at the 2025 Annual Meeting:

“Resolved, that the compensation paid to Hurco Companies, Inc.’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion in this proxy statement, is approved.”

Because it is advisory, the results of the say-on-pay vote are not binding upon the Board or the Compensation Committee. However, as was the case with the results of the say-on-pay vote at prior Annual Meetings of Shareholders, we expect that the Compensation Committee, which is responsible for designing and administering our executive compensation program, will consider the outcome of the vote when making future compensation decisions for our named executive officers.

The Board of Directors recommends a vote “FOR” the advisory proposal to approve the compensation of our named executive officers as disclosed in this proxy statement.

13

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

INTRODUCTION

This Compensation Discussion and Analysis (“CD&A”) describes our compensation program and practices as they relate to our named executive officers (“NEOs”), which consist of the following officers for fiscal year 2024: (1) Gregory S. Volovic, President and CEO; (2) Michael Doar, Executive Chairman; (3) Sonja K. McClelland, Executive Vice President, Treasurer, and Chief Financial Officer; (4) HaiQuynh Jamison, Corporate Controller and Principal Accounting Officer; and (5) Jonathon D. Wright, General Counsel and Corporate Secretary.

EXECUTIVE SUMMARY

The responsibilities of the Compensation Committee of the Board (referred to as the Committee in this section) include administering our compensation programs and approving or ratifying all compensation-related decisions for the NEOs.

Philosophy

The goals of our executive compensation program are to foster the creation of shareholder value while, at the same time, motivating and retaining managerial personnel. Our executive compensation program has been designed to hold executives accountable for the financial and operational performance of the Company, as well as to reflect the value of the Company’s stock. Therefore, a substantial amount of our executives’ annual and long-term compensation is both at risk and tied to the performance of the Company. Our compensation program includes the use of Company common stock (through restricted stock and performance stock units) and stock ownership guidelines that serve to align the interests of our executives with the interests of our shareholders.

Our compensation program is designed to reward executives at levels comparable to our peers to promote fairness and success in attracting and retaining executives. We believe that our compensation program does not promote excessive risk-taking and various elements of our policies that are in place (such as capped incentive opportunities, stock ownership guidelines, recoupment policies, and governance processes) serve to mitigate excessive risk. Any written employment agreements with our NEOs that provide for a change in control severance benefit have a “double-trigger” (i.e., requires both a change in control and termination of the executive’s employment in order to receive that benefit).

Fiscal Year 2024 Highlights

We have seen the demand for machine tools fluctuate over the last three years. Our industry has continued to face global headwinds due to changing economic conditions. During fiscal year 2024, our sales and service fees were $186.6 million, a decrease of $41.2 million, or 18%, compared to fiscal year 2023 and included an unfavorable currency impact of $1.8 million, or less than 1%, when translating foreign sales to U.S. dollars for financial reporting purposes. Sales decreased year-over-year due primarily to a decreased volume of shipments of higher-performance Hurco, Takumi, and Milltronics machines in the Americas, Germany, the United Kingdom, Italy and China, as well as decreased shipments of electro-mechanical components and accessories manufactured by our wholly-owned subsidiary, LCM Precision Technology S.r.l. For fiscal year 2024, we reported a net loss of $16.6 million, or $(2.56) per diluted share, compared to net income of $4.4 million, or $0.66 per diluted share, for fiscal year 2023. The net loss for fiscal year 2024 included a non-cash tax valuation allowance of $8.6 million recorded in provision for income taxes.

14

Summary of 2024 Compensation Actions

Below is a summary of fiscal year 2024 compensation decisions and amounts paid. Further information is available below under “Compensation Decisions for Fiscal Year 2024.”

Base Salary

In early fiscal 2024, the Committee approved a base salary increase of 11% for our CEO, and base salary changes ranging from a decrease of 8% to an increase of 15% for our other NEOs. Below are the fiscal 2024 base salary amounts for our NEOs as originally approved by the Committee.

| Fiscal Year 2024 | ||||

| Base Salary | ||||

| Gregory S. Volovic | $ | 659,812 | ||

| Michael Doar | $ | 414,221 | ||

| Sonja K. McClelland | $ | 417,768 | ||

| HaiQuynh Jamison | $ | 230,160 | ||

| Jonathon D. Wright | $ | 301,530 | ||

During fiscal year 2024, as part of a comprehensive global cost-cutting program implemented to help offset the impact of lower sales volumes and address continued uncertainty in the cyclical machine tool market, our NEOs voluntarily submitted to the Committee, and the Committee ultimately approved, a temporary reduction to each of their base salaries. The reductions in NEO base salaries were 5% for each of Ms. Jamison and Mr. Wright, and 10% for each of Mr. Volovic, Mr. Doar, and Ms. McClelland, and were effective for the payroll period beginning April 22, 2024, through the payroll period ended on October 20, 2024. The table above does not reflect these voluntary reductions to base salary, but the reductions are reflected in the base salaries listed in the Summary Compensation Table after the CD&A.

Short-Term Incentive Compensation

As in recent years, for the fiscal 2024 short-term incentive compensation program, the Committee utilized objective performance measures based on our operating income margin and certain strategic objectives for each NEO.

Due to the amount of our net loss for fiscal year 2024, there were no payout amounts under the 2024 short-term incentive compensation program, under either of the operating income margin metric or the strategic objectives.

Long-Term Incentive Compensation

In fiscal 2024, the Committee decided to both (1) maintain the overall general allocation of award value between restricted shares (targeted at approximately 25% of long-term incentive compensation award value) and performance stock units (“PSUs”) (targeted at approximately 75% of long-term incentive compensation award value) and (2) similar to the 2023 arrangement, tie the vesting and earning of the PSUs to the performance measures of net income (loss) and free cash flow.

The Committee granted the awards of restricted shares and target number of PSUs to the NEOs effective as of January 4, 2024, as follows:

| Grant Date Value of Restricted Shares | Grant Date Value of Target PSUs – NI | Grant Date Value of Target PSUs – FCF | ||||||||||

| Gregory S. Volovic | $ | 312,500 | $ | 500,000 | $ | 437,500 | ||||||

| Michael Doar | $ | 225,000 | $ | 360,000 | $ | 315,000 | ||||||

| Sonja K. McClelland | $ | 187,500 | $ | 300,000 | $ | 262,500 | ||||||

| HaiQuynh Jamison | $ | 25,000 | $ | 40,000 | $ | 35,000 | ||||||

| Jonathon D. Wright | $ | 37,500 | $ | 60,000 | $ | 52,500 | ||||||

The amounts shown in the table above as the grant date value represent the amounts that the Committee approved for each award. The actual grant date value of each award differed slightly due to rounding, as shown in the “Grants of Plan-Based Awards in 2024” table.

Total Target Direct Compensation Mix

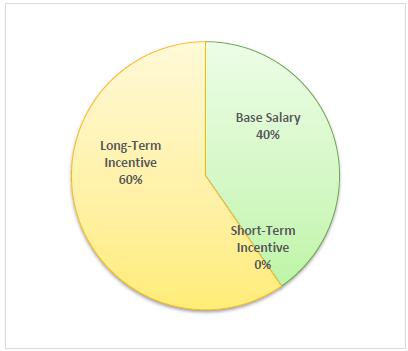

In fiscal 2024, the NEOs received, on average, 45% of their total target direct compensation in performance-based pay, and 60% of their total target direct compensation in equity awards. For these purposes, we consider the base salary paid in fiscal 2024, the target annual cash incentive for 2024, and the target award value of equity (the dollar amount of such awards as approved by the Committee) granted in fiscal 2024 for the fiscal 2024-2027 performance period.

15

The following charts display the total compensation mix for our NEOs based on actual compensation for fiscal year 2024. The chart on the top summarizes the breakdown of total compensation for the NEOs for fiscal year 2024 among base salary, short-term incentive compensation, and long-term incentive compensation. The chart on the bottom summarizes the allocation of compensation mix for the NEOs based upon fixed, time-based, and performance-based compensation for fiscal year 2024.

2024 Executive Compensation Mix

16

Executive Compensation Best Practices

The Committee has designed our executive compensation program and practices to align executives’ financial interests with those of our shareholders. Following is a description of key program features and practices that reflect that alignment:

| What We Do | What We Don’t Do | ||

| ✓ | Pay-for-performance: A significant percentage of target total direct compensation is in the form of variable compensation tied to company performance.

| X | No guaranteed base salary increases: Base salary levels are reviewed every year and periodically adjusted based on market competitiveness and internal equity. |

| ✓ | Multiple performance metrics: Payouts of our annual cash incentives and long-term incentives are determined based on the weighted results for several financial performance measures and structured to balance accountability for driving annual results with sustainable long-term performance.

| X | No hedging: We prohibit executive officers from engaging in hedging transactions in our securities. |

| ✓ | Stock ownership and retention requirements: Our executive officers and directors must comply with stock ownership requirements, and they must retain all net after-tax shares received from awards until they meet the required ownership level.

| X | No gross up of excise tax payments: We do not assist executives with taxes owed as a result of their compensation. |

| ✓ | Compensation-related risk review: The Committee regularly reviews compensation-related risks to confirm that any such risks are not likely to have a material adverse effect on the Company.

| X | No excessive executive perks: Executive perquisites are not excessive and are limited to certain insurance benefits and, solely for the Executive Chairman, use of company leased vehicles. |

| ✓ | Double-trigger requirement: Equity awards do not automatically vest in the event of a change in control. Instead, we impose a “double-trigger” requirement to accelerate vesting.

| X | No excessive severance upon a change in control: The level of severance benefits upon a change in control is not excessive and such benefits are not triggered absent a termination of the executives’ employment. |

| ✓ | Independent advisor to the Committee: The Committee regularly consults with an independent compensation consultant.

| X | No payment of unearned dividends: Dividends and dividend equivalents on unvested awards are not paid prior to vesting. |

| ✓ | Performance-based equity awards: A majority of the NEOs’ annual LTI award opportunity is delivered in PSUs that may be earned only if the Company achieves prescribed financial goals over a prospective three-year measurement period.

| ||

| ✓ | Clawback policy: The Company has a policy that provides for the recovery of incentive-based compensation from executives in the event of a financial restatement. | ||

ALIGNMENT OF EXECUTIVE PAY-FOR-PERFORMANCE

The compensation program for our NEOs is designed to provide competitive pay opportunities while aligning the incentive compensation realized by our NEOs with the interests of our shareholders – by linking pay with Company financial and stock performance. The Committee regularly reviews the alignment of the Company’s performance with its compensation to the NEOs and annually engages its independent compensation consultant to provide reports comparing such alignment to that of its peers.

In January 2024, the Committee approved the following four types of incentive compensation opportunities for our NEOs, which are intended to align their pay with Company and individual performance:

| ● | cash award opportunities under the short-term incentive compensation plan based on the Company’s operating income margin and certain strategic objectives set for fiscal year 2024; | |

| ● | restricted shares that vest in equal installments over three years granted to promote executive retention; |

17

| ● | PSUs that will be earned based on the Company’s average net income (“PSUs – NI”) for fiscal years 2024-2026; and | |

| ● | PSUs that will be earned based on the Company’s average free cash flow from operations (“PSUs – FCF ”) for fiscal years 2024-2026. |

The incentive compensation realized by our NEOs related to fiscal year 2024 consisted of the following:

| ● | the vesting in 2024 of a portion of the restricted shares granted in fiscal years 2021, 2022, and 2023; and | |

| ● | PSUs granted in fiscal year 2022 that were earned based on the Company’s total shareholder return performance, or TSR, relative to companies in an established peer group, for fiscal years 2022 through 2024. |

As discussed further below, and consistent with our pay for performance alignment, there were no payouts under the 2024 short-term incentive compensation program and none of the PSUs granted in fiscal year 2022 that were based on the Company’s average return on invested capital, or ROIC, for fiscal years 2022 through 2024 were earned.

In 2024, the Committee’s independent compensation consultant, Pay Governance, LLC (“Pay Governance”), conducted an assessment of whether pay and performance were aligned for our CEO over the preceding three-year and five-year fiscal periods. The Committee believes realizable pay-for-performance assessments provide the Committee and investors an alternative view of pay-for-performance alignment based on compensation actually earned/estimated to be earned relative to actual Company performance (rather than the target compensation levels often reported elsewhere in this proxy statement pursuant to regulatory requirements). The assessments considered our CEO’s “total realizable compensation” (as defined below), as well as certain key Company performance metrics, relative to those of our peer group.

For this purpose, “total realizable compensation” consists of:

| Base salary over the period | Actual bonus earned and paid during the period |

| The aggregate current value of restricted stock or restricted stock unit grants made during the period | The aggregate in-the-money value of stock option grants made during the period |

| The actual payouts of performance-based equity awards with performance periods beginning and ending during the period | The estimated payout for performance-based equity awards that were granted during the period but remaining unvested at its conclusion |

Total realizable compensation for our CEO was calculated in the same manner as for the CEOs of our peer group companies.

In defining the Company’s performance relative to peers, the assessments used the following indicators:

| ● | Operating income margin – a measure of profitability used in the Company’s annual incentive plan; |

| ● | ROIC – a measure of capital efficiency historically used in the Company’s long-term incentive plan prior to the fiscal year 2023 grants; and |

| ● | TSR – a measure of shareholder value creation historically used in the Company’s long-term incentive plan prior to the fiscal year 2023 grants. |

In developing a composite performance ranking, the assessments average the Company’s percentile rank for each performance metric relative to its peer group for compensation purposes based on their most recent fiscal year-end.

The result of the assessments indicated that total realizable compensation over the past three- and five-year periods is aligned with composite Company performance as follows:

| ● | Our CEO’s three-year (fiscal years 2021-2023) total realizable compensation was positioned at the 23rd percentile of the peer group and was generally aligned with composite Company performance ranked at the 41st percentile; and |

| ● | Our CEO’s five-year (fiscal years 2019-2023) total realizable compensation was positioned at the 10th percentile of the peer group and was generally aligned with composite Company performance ranked at the 32nd percentile. |

18

Based on the results of these assessments, the Committee believes the Company’s executive compensation program continues to have a strong pay-for-performance orientation, namely attributable to: (1) setting rigorous financial performance goals within the annual and long-term plans; (2) using incentive metrics that align with shareholder value creation; and (3) using a pay mix that is largely focused on variable compensation and that is at-risk based on the Company’s financial performance.

THE COMMITTEE’S PROCESSES

Role of Committee and Input from Management

The Committee is responsible for determining our executive compensation philosophy, objectives, policies, and programs and approves or ratifies all compensation-related decisions for the NEOs. When making executive compensation decisions, the Committee considers the input of Pay Governance and, for all executives other than our CEO and our Executive Chairman, the recommendation of our CEO. Our CEO recommends salary levels, short-term incentive compensation awards, equity-based compensation awards, and perquisites for our other NEOs other than the Executive Chairman. Our CEO’s and Executive Chairman’s compensation is determined solely by the Committee with the assistance of Pay Governance. The Compensation Committee applies the same principles for executive compensation in determining our CEO’s and Executive Chairman’s compensation that it applies in determining the compensation of our other NEOs.

Role of Compensation Consultant

In 2023 and 2024, the Committee engaged Pay Governance to advise and assist the Committee related to executive compensation matters. Pay Governance is retained directly by the Committee, reports directly to the Committee, and participates in certain Committee meetings. In this regard, from time to time, Pay Governance advises and assists the Compensation Committee in:

| ● | determining the appropriate objectives and goals of our executive compensation program; |

| ● | designing compensation programs that fulfill those objectives and goals; |

| ● | reviewing the primary components of that compensation; |

| ● | evaluating the effectiveness of our compensation programs, including pay-for-performance alignment, and assisting in compiling data, calculations, and disclosures required under corresponding pay versus performance rules; |

| ● | identifying appropriate pay positioning strategies and pay levels in our executive compensation program; |

| ● | evaluating the historical performance of our equity incentive plan, estimating the share reserve necessary to fund anticipated awards for NEOs and other personnel to accomplish the Company’s compensation program goals, and recommending retention or modification of other terms and conditions set forth in such plan; and |

| ● | identifying comparable companies and compensation surveys for the Committee to use to benchmark the appropriateness and competitiveness of our executive compensation program. |

Pay Governance may, from time to time, contact our executive officers for information necessary to fulfill its assignment and may make reports and presentations to and on behalf of the Committee that our executive officers also receive.

Pay Governance and its affiliates did not provide any other services to us or our affiliates during 2023 or 2024. In addition, the Committee has determined that the work of Pay Governance and its employees has not raised any conflict of interest.

Use of Peer Group Data