UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3010

Fidelity Advisor Series VII

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end:

| July 31

|

|

|

Date of reporting period:

| July 31, 2005

|

Item 1. Reports to Stockholders

Fidelity Advisor Focus Funds®

Class A, Class T, Class B and Class C

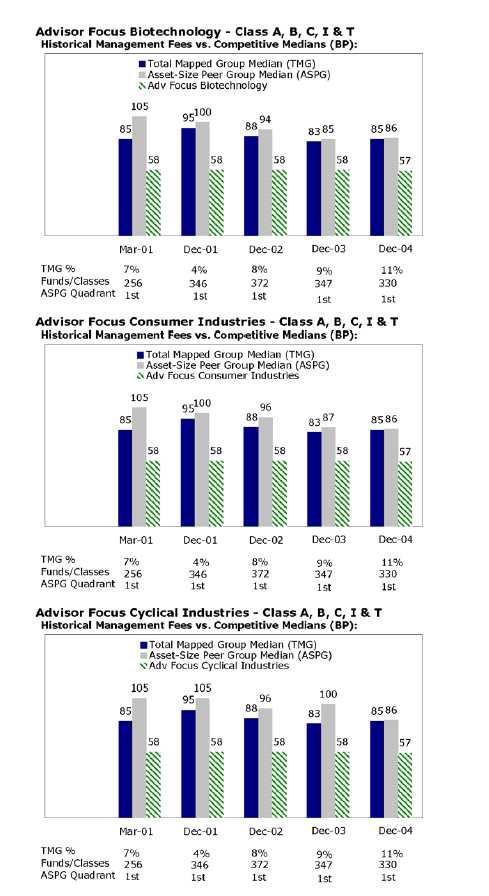

Biotechnology

Consumer Industries

Cyclical Industries

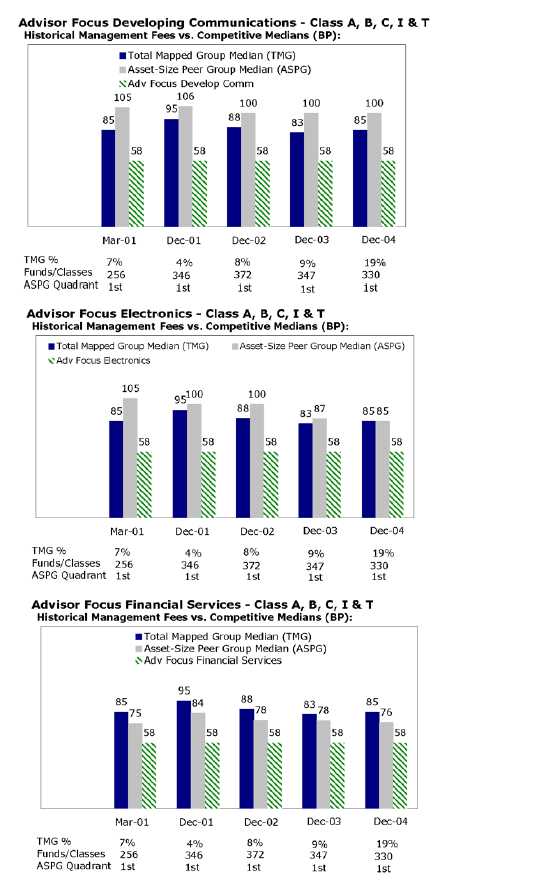

Developing Communications

Electronics

Financial Services

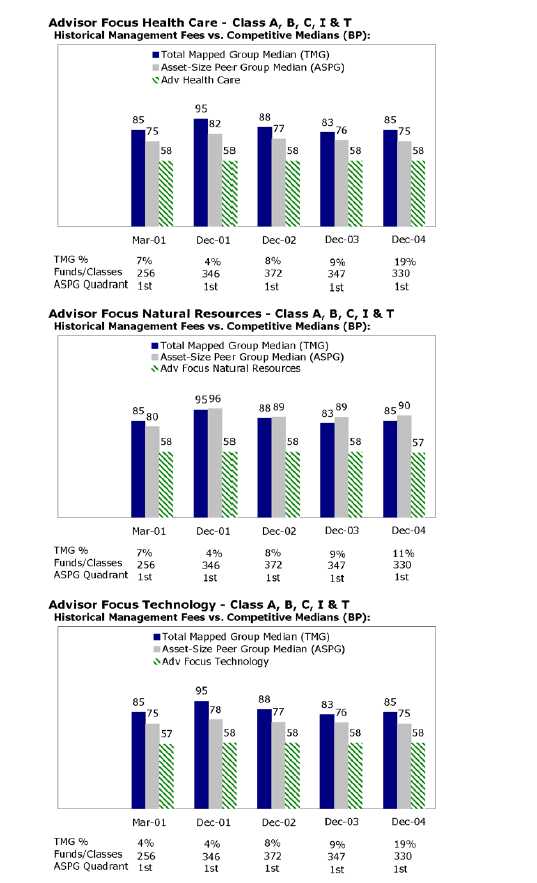

Health Care

Natural Resources

Technology

Telecommunications & Utilities Growth

Annual Report

July 31, 2005

Contents

| Biotechnology | | A-4 | | Performance |

| | | A-5 | | Management’s Discussion |

| | | A-6 | | Shareholder Expense Example |

| | | A-7 | | Investment Changes |

| | | A-8 | | Investments |

| | | A-10 | | Financial Statements |

| | | A-14 | | Notes to the Financial Statements |

| |

| Consumer Industries | | A-18 | | Performance |

| | | A-19 | | Management’s Discussion |

| | | A-20 | | Shareholder Expense Example |

| | | A-21 | | Investment Changes |

| | | A-22 | | Investments |

| | | A-25 | | Financial Statements |

| | | A-29 | | Notes to the Financial Statements |

| |

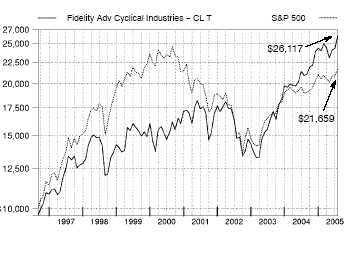

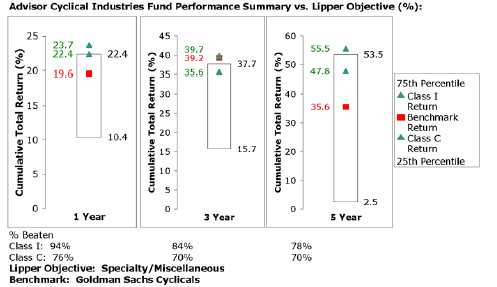

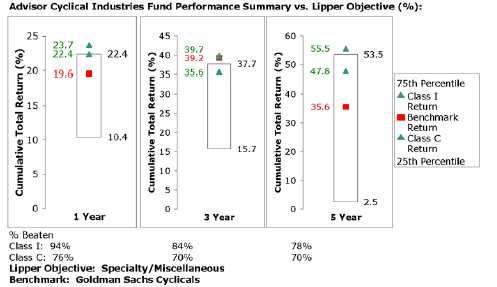

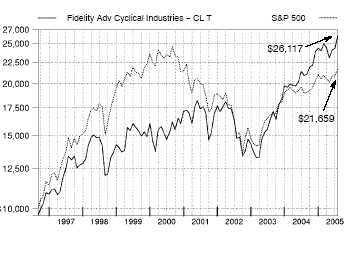

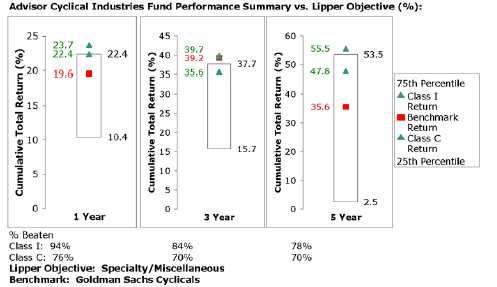

| Cyclical Industries | | A-34 | | Performance |

| | | A-35 | | Management’s Discussion |

| | | A-36 | | Shareholder Expense Example |

| | | A-37 | | Investment Changes |

| | | A-38 | | Investments |

| | | A-42 | | Financial Statements |

| | | A-46 | | Notes to the Financial Statements |

| |

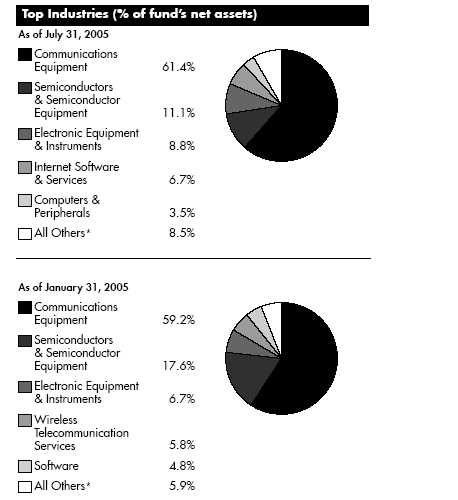

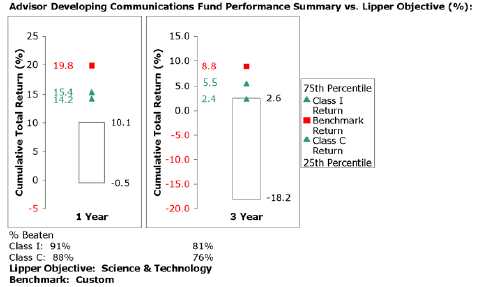

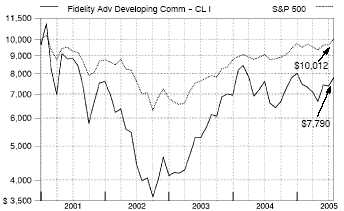

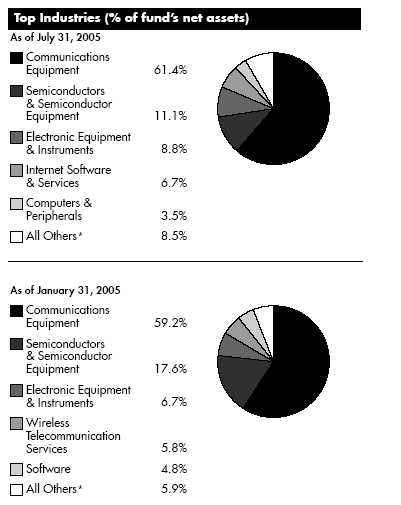

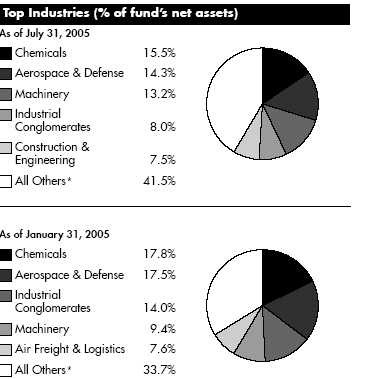

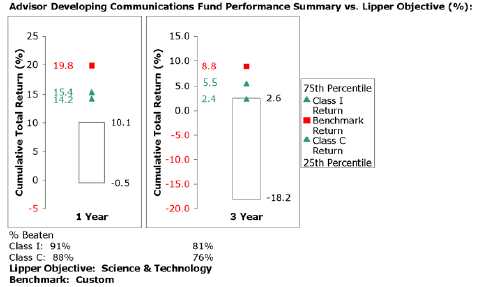

| Developing Communications | | A-51 | | Performance |

| | | A-52 | | Management’s Discussion |

| | | A-53 | | Shareholder Expense Example |

| | | A-54 | | Investment Changes |

| | | A-55 | | Investments |

| | | A-57 | | Financial Statements |

| | | A-61 | | Notes to the Financial Statements |

| |

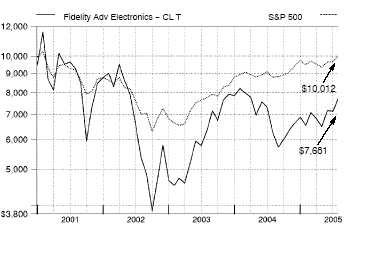

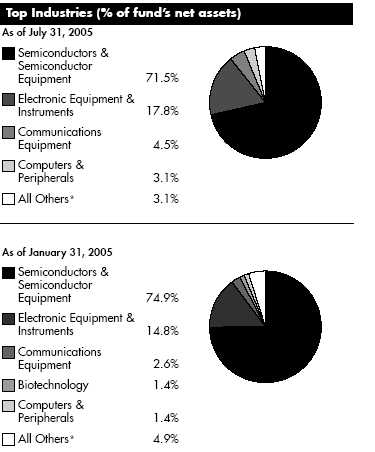

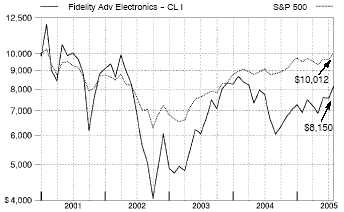

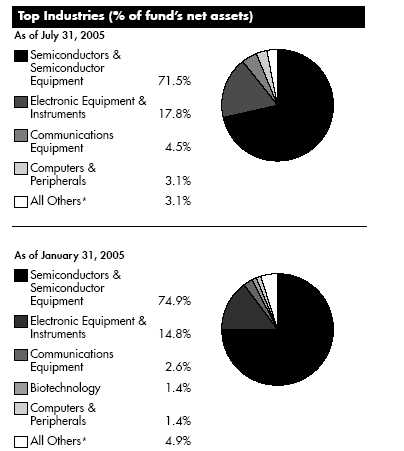

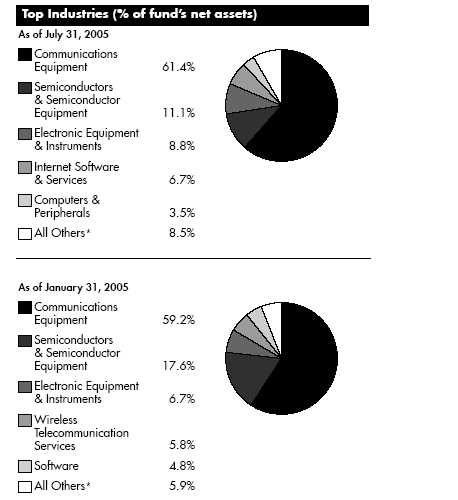

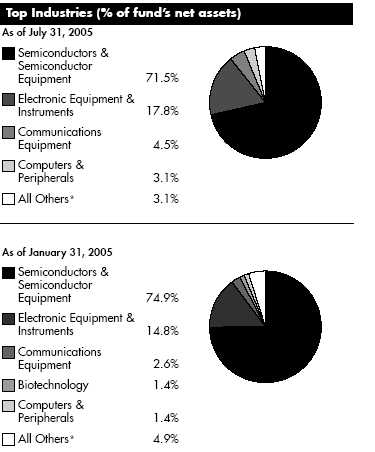

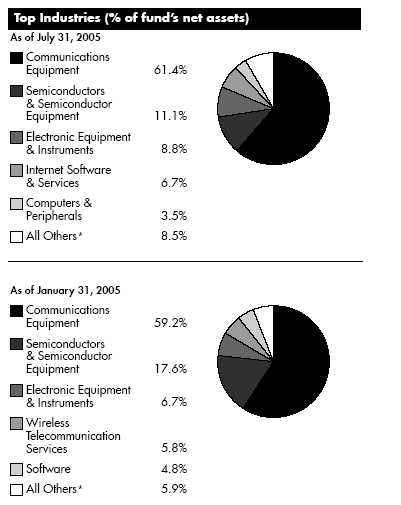

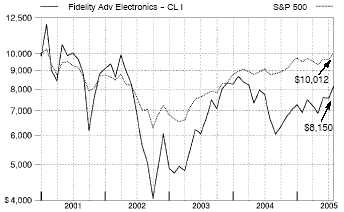

| Electronics | | A-65 | | Performance |

| | | A-66 | | Management’s Discussion |

| | | A-67 | | Shareholder Expense Example |

| | | A-68 | | Investment Changes |

| | | A-69 | | Investments |

| | | A-70 | | Financial Statements |

| | | A-74 | | Notes to the Financial Statements |

| |

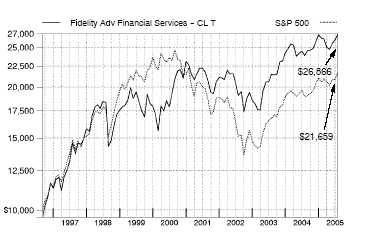

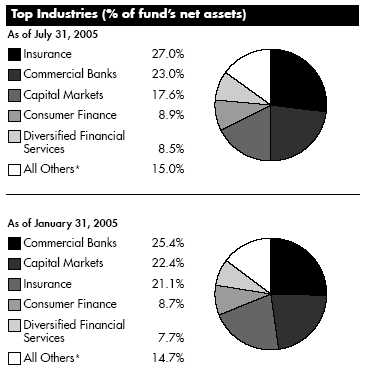

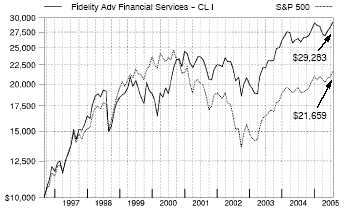

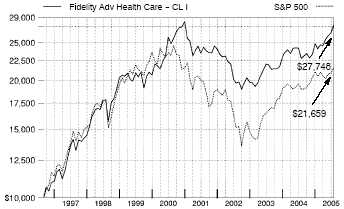

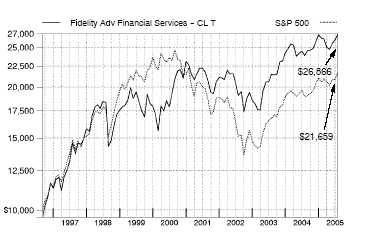

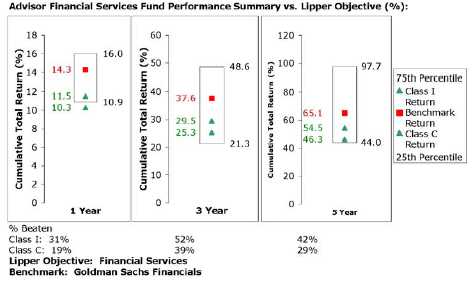

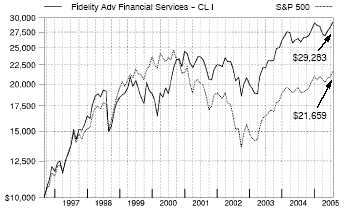

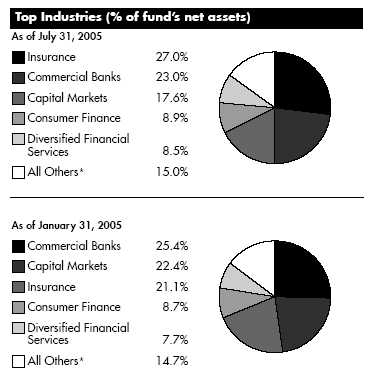

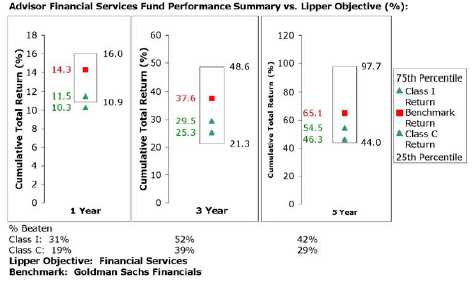

| Financial Services | | A-78 | | Performance |

| | | A-79 | | Management’s Discussion |

| | | A-80 | | Shareholder Expense Example |

| | | A-81 | | Investment Changes |

| | | A-82 | | Investments |

| | | A-85 | | Financial Statements |

| | | A-89 | | Notes to the Financial Statements |

| |

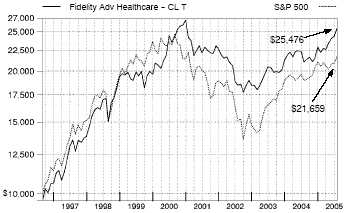

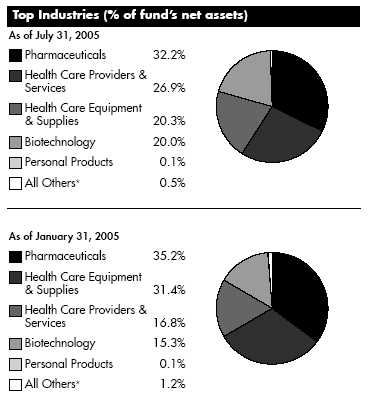

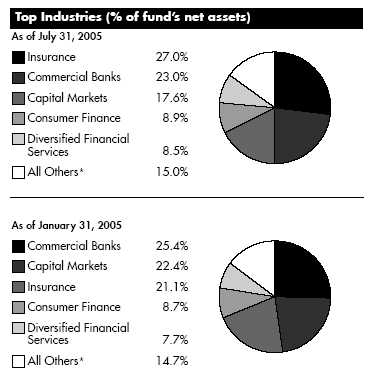

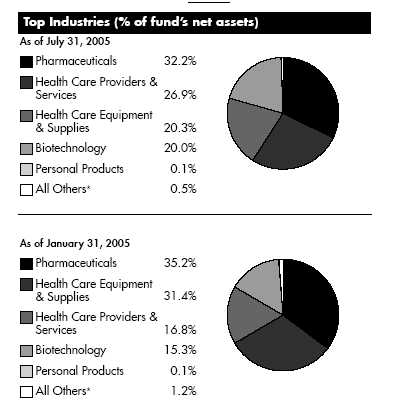

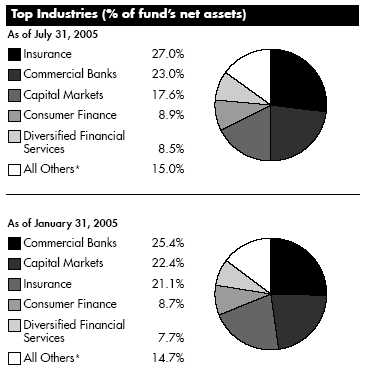

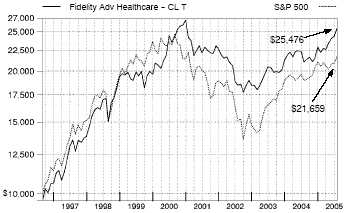

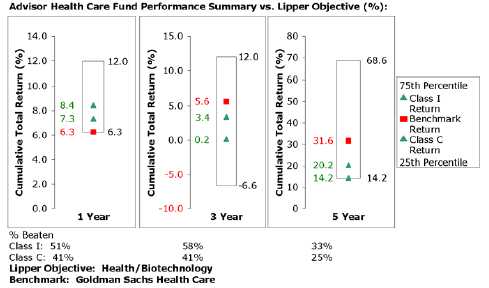

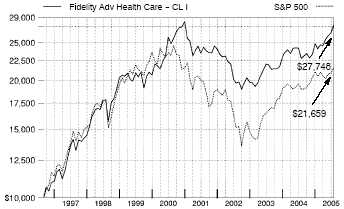

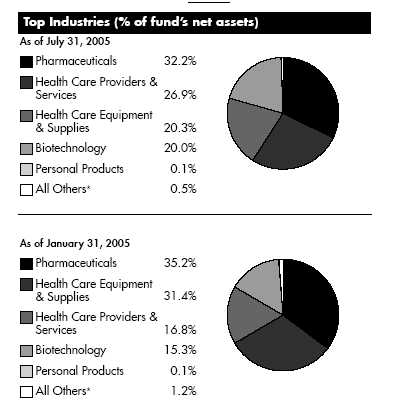

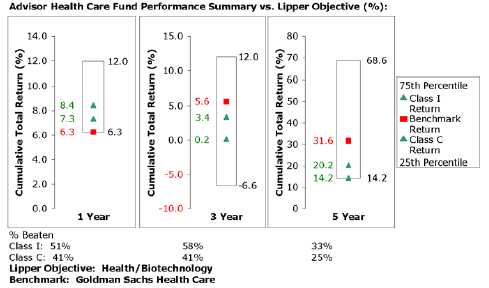

| Health Care | | A-94 | | Performance |

| | | A-95 | | Management’s Discussion |

| | | A-96 | | Shareholder Expense Example |

| | | A-97 | | Investment Changes |

| | | A-98 | | Investments |

| | | A-101 | | Financial Statements |

| | | A-105 | | Notes to the Financial Statements |

Annual Report A-2

A-2

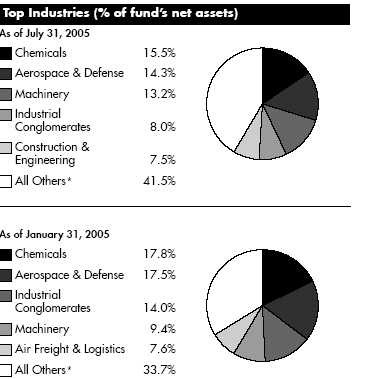

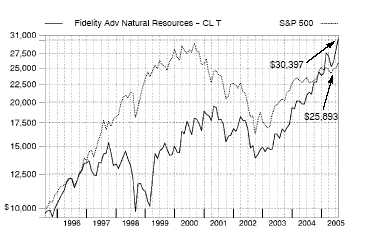

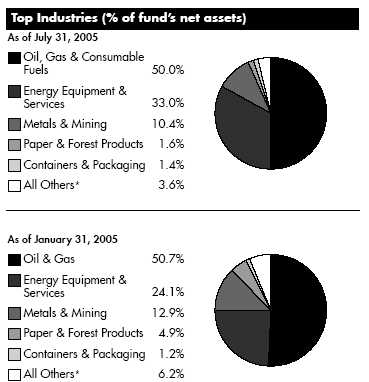

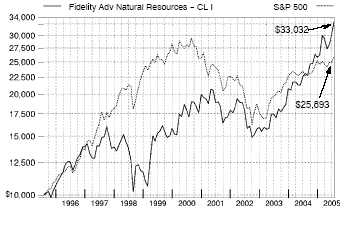

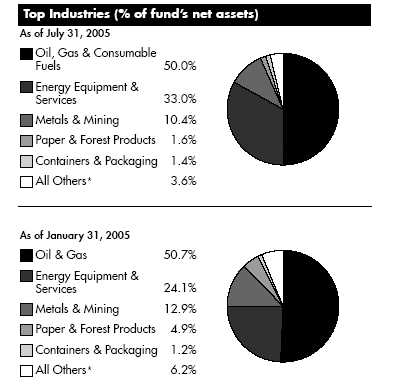

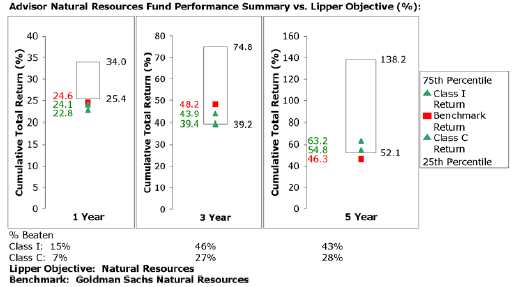

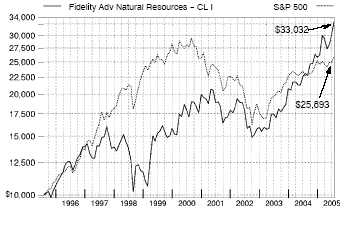

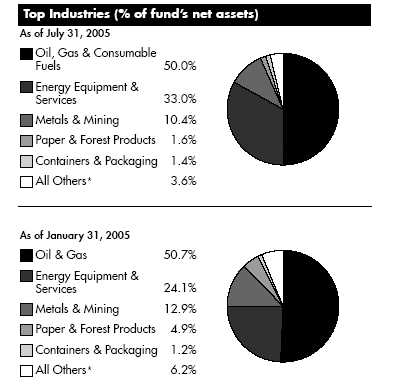

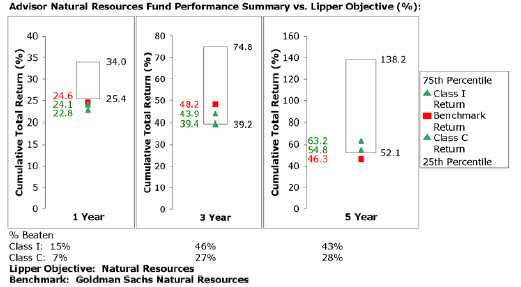

| Natural Resources | | A-109 | | Performance |

| | | A-110 | | Management’s Discussion |

| | | A-111 | | Shareholder Expense Example |

| | | A-112 | | Investment Changes |

| | | A-113 | | Investments |

| | | A-116 | | Financial Statements |

| | | A-120 | | Notes to the Financial Statements |

| |

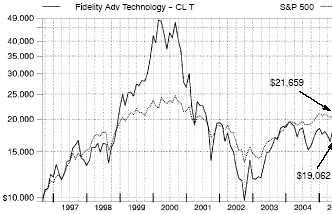

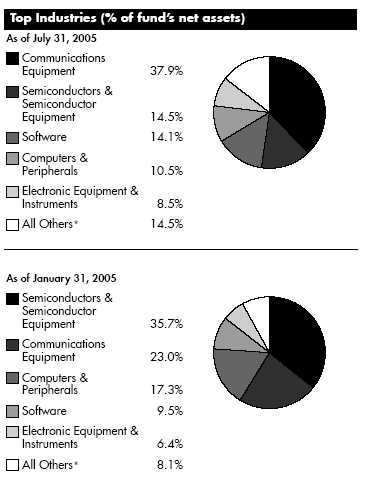

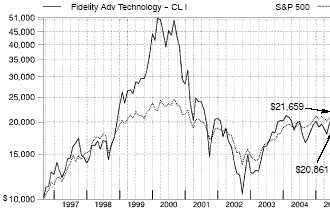

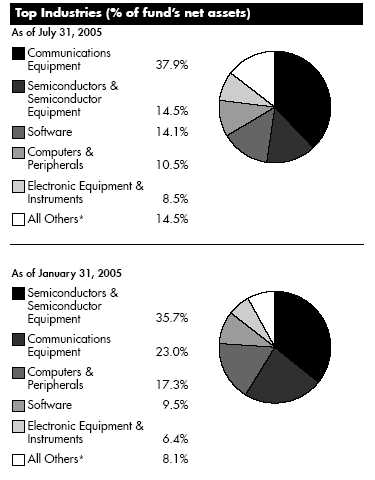

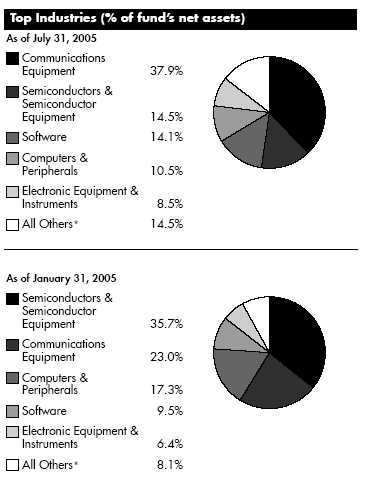

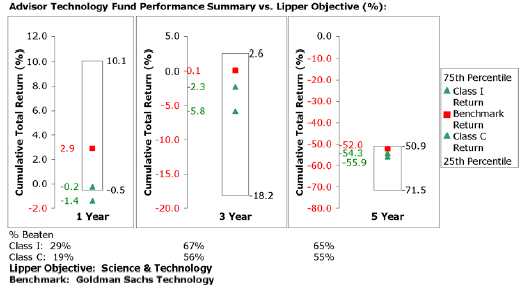

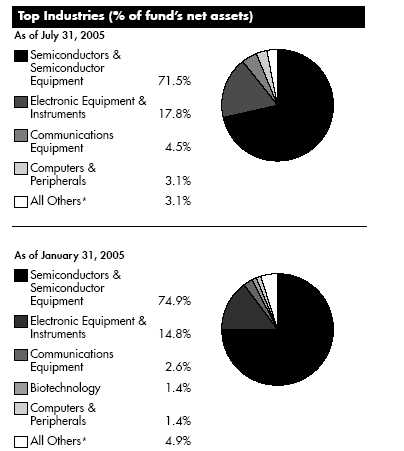

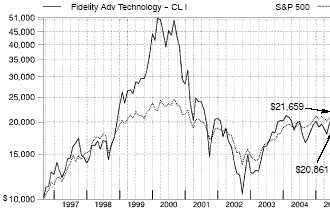

| Technology | | A-125 | | Performance |

| | | A-126 | | Management’s Discussion |

| | | A-127 | | Shareholder Expense Example |

| | | A-128 | | Investment Changes |

| | | A-129 | | Investments |

| | | A-132 | | Financial Statements |

| | | A-136 | | Notes to the Financial Statements |

| |

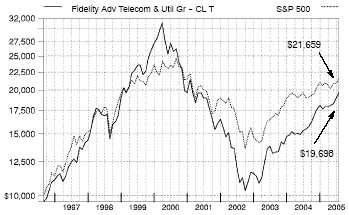

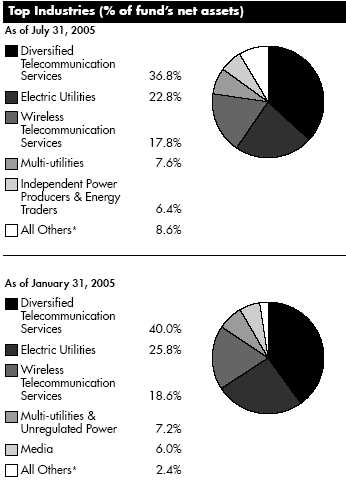

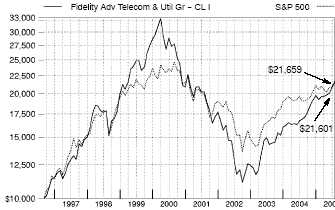

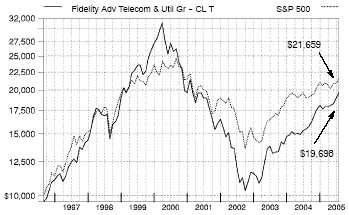

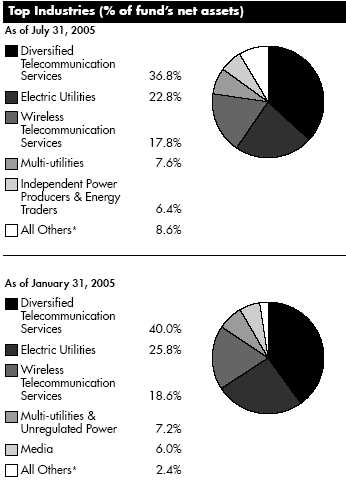

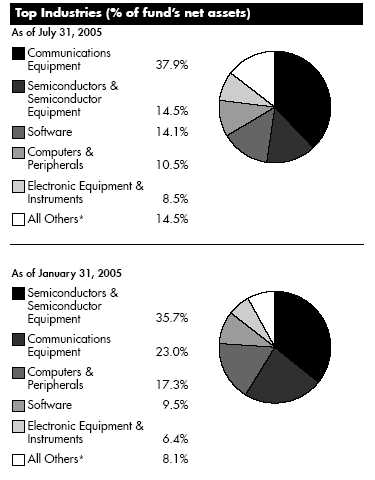

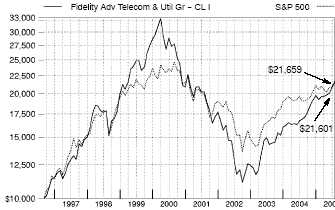

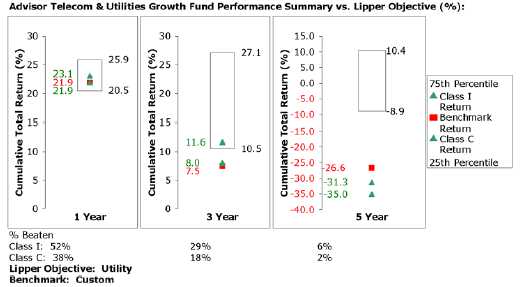

| Telecommunications & | | | | |

| Utilities Growth | | A-141 | | Performance |

| | | A-142 | | Management’s Discussion |

| | | A-143 | | Shareholder Expense Example |

| | | A-144 | | Investment Changes |

| | | A-145 | | Investments |

| | | A-147 | | Financial Statements |

| | | A-151 | | Notes to the Financial Statements |

| |

| Report of Independent | | A-156 | | |

| Registered Public | | | | |

| Accounting Firm | | | | |

| Trustees and Officers | | A-157 | | |

| |

| Distributions | | A-163 | | |

| |

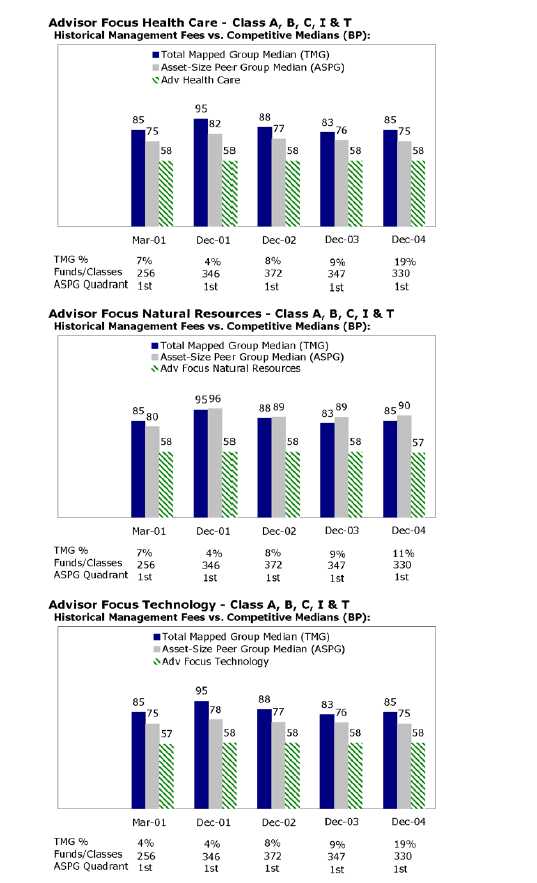

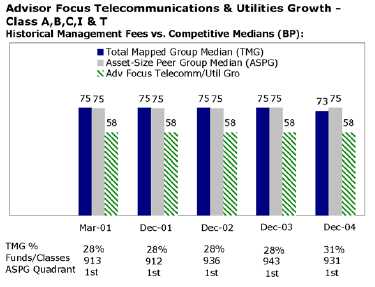

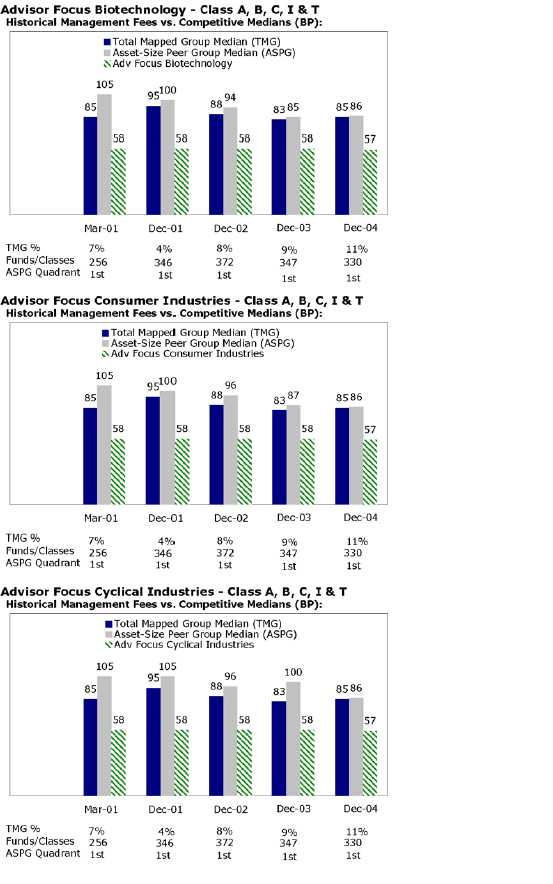

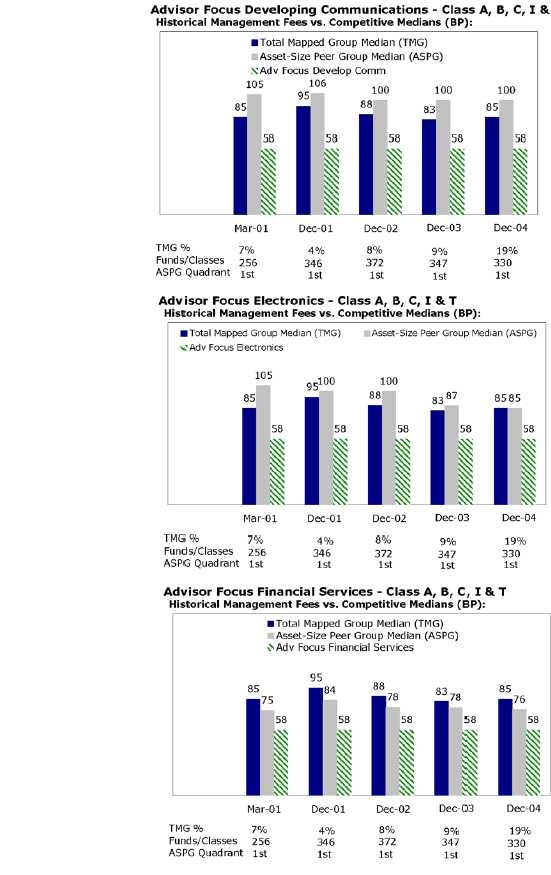

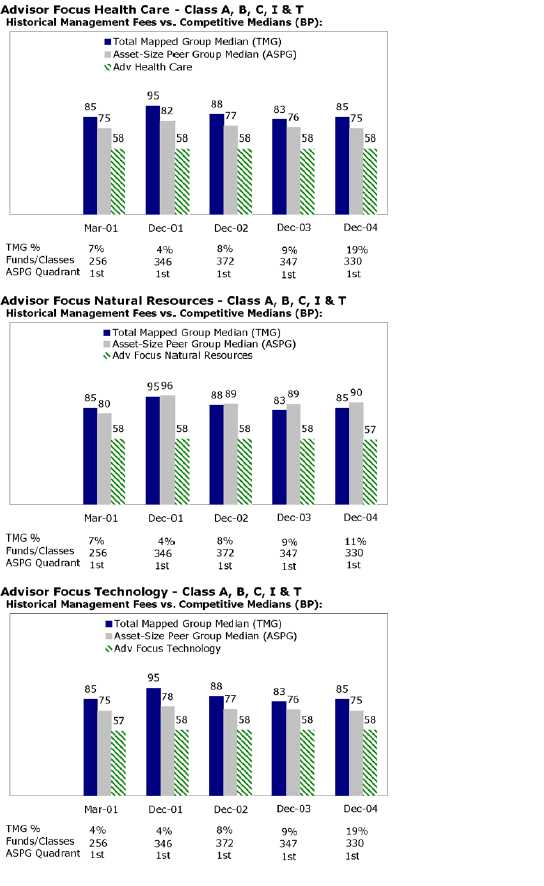

| Board Approval of | | A-166 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

To view a fund’s proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Wash-ington, DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity’s web site at http://www.advisor.fidelity.com.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

A-3 Annual Report

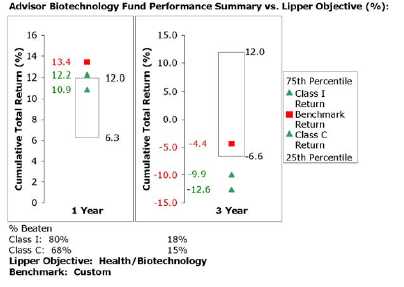

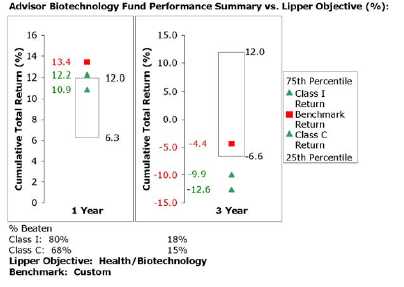

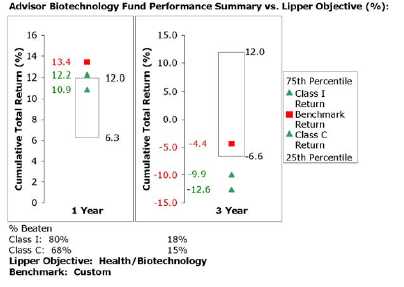

Advisor Biotechnology Fund — Class A, T, B, and C

Performance

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns | | | | |

| Periods ended July 31, 2005 | | Past 1 | | Life of |

| | | year | | fundA |

| Class A (incl. 5.75% sales charge) | | 6.82% | | --9.23% |

| Class T (incl. 3.50% sales charge) | | 8.99% | | --9.00% |

| Class B (incl. contingent deferred | | | | |

| sales charge)B | | 7.33% | | --9.17% |

| Class C (incl. contingent deferred | | | | |

| sales charge)C | | 11.50% | | --8.74% |

A From December 27, 2000.

B Class B shares’ contingent deferred sales charges included in the past one year and life of fund total return figures are 5% and 2%, respectively.

C Class C shares’ contingent deferred sales charges included in the past one year and life of fund total return figures are 1% and 0%, respectively.

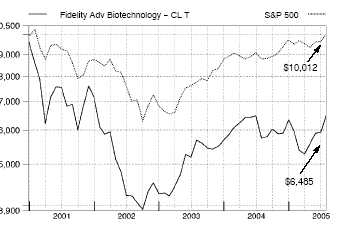

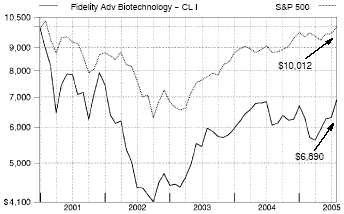

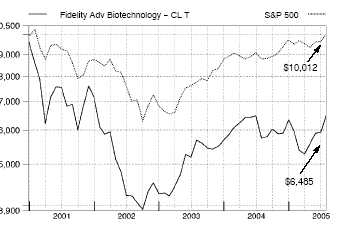

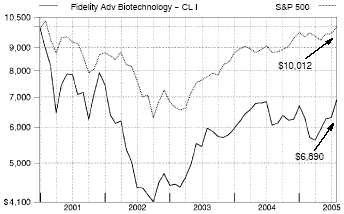

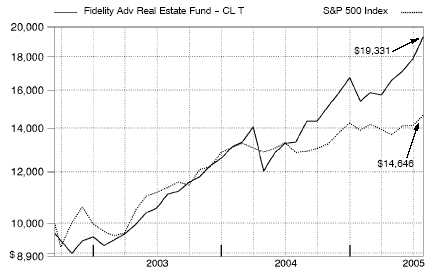

$10,000 Over Life of Fund

Let’s say hypothetically that $10,000 was invested in Fidelity® Advisor Biotechnology Fund — Class T on December 27, 2000, when the fund started, and the current 3.50% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Biotechnology A-4

A-4

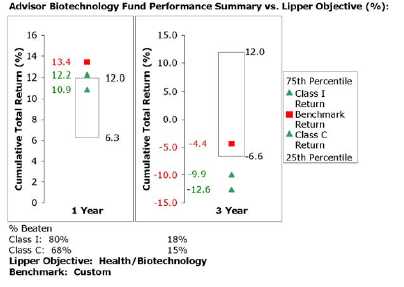

Advisor Biotechnology Fund

|

Management’s Discussion of Fund Performance

Comments from Harlan Carere, Portfolio Manager of Fidelity® Advisor Biotechnology Fund

A late-inning rally on Wall Street helped push some key U.S. equity indexes to four-year highs by the conclusion of the 12-month period ending July 31, 2005. Spurred on by bullish economic data and strong corporate earnings, investors enjoyed a stellar month of July, capping off a turbulent 12-month period for U.S. equity markets. Stock prices bounced up and down during most of the year, moving in cadence with gyrations in the price of crude oil and investors’ gathering and ebbing concerns about inflation. The Federal Reserve Board raised short-term interest rates eight times during the period, also affecting overall market sentiment. Despite their fluctuations, the major equity indexes finished on a high note, with the Standard & Poor’s 500SM Index and the NASDAQ Composite® Index posting gains of 14.05% and 16.51%, respectively, for the period. The small-cap Russell 2000® Index rose 24.78% and the Russell Midcapr Index jumped 28.93%, while the blue-chips’ Dow Jones Industrial AverageSM advanced only 7.29% .

For the 12-month period ending July 31, 2005, the fund’s Class A, Class T, Class B and Class C shares returned 13.33%, 12.94%, 12.33% and 12.50%, respectively, trailing both the Goldman Sachs® Health Care Index, which rose 18.58%, and the S&P 500®. The fund lagged the sector index largely because of unfavorable stock selection in the biotechnology and pharmaceuticals industries, even though its positioning in those industries produced strongly positive results. The fund also fell short because — given its narrow focus on biotech and pharma — it missed the upside of other stronger-performing segments within the sector, such as managed care. Biotech pioneer Biogen Idec and Irish pharmaceuticals manufacturer Elan saw their share prices fall sharply in response to the voluntary recall of a jointly developed multiple sclerosis drug with dangerous unforeseen side effects. The stocks of certain other drug makers — among them ImClone and Cephalon — also disappointed by not living up to investors’ expectations. On the plus side, performance was helped by the fund’s large stakes in such biotech leaders as Genentech and Celgene, whose stocks did well on strong sales of their flagship cancer drugs, as well as by its holding in Invitrogen.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Advisor Biotechnology Fund

Shareholder Expense Example

|

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2005 to July 31, 2005).

The first line of the table below for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

|

The second line of the table below for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | Expenses Paid |

| | | Beginning | | | | Ending | | During Period* |

| | | Account Value | | | | Account Value | | February 1, 2005 |

| | | February 1, 2005 | | | | July 31, 2005 | | to July 31, 2005 |

| Class A | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ | | 1,093.20 | | $ | | 7.27 |

| HypotheticalA | | $ 1,000.00 | | $ | | 1,017.85 | | $ | | 7.00 |

| Class T | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ | | 1,092.70 | | $ | | 8.56 |

| HypotheticalA | | $ 1,000.00 | | $ | | 1,016.61 | | $ | | 8.25 |

| Class B | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ | | 1,089.70 | | $ | | 11.14 |

| HypotheticalA | | $ 1,000.00 | | $ | | 1,014.13 | | $ | | 10.74 |

| Class C | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ | | 1,091.40 | | $ | | 11.15 |

| HypotheticalA | | $ 1,000.00 | | $ | | 1,014.13 | | $ | | 10.74 |

| Institutional Class | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ | | 1,097.10 | | $ | | 5.41 |

| HypotheticalA | | $ 1,000.00 | | $ | | 1,019.64 | | $ | | 5.21 |

| |

| A 5% return per year before expenses | | | | | | | | | | |

* Expenses are equal to each Class’ annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| | | Annualized |

| | | Expense Ratio |

| Class A | | 1.40% |

| Class T | | 1.65% |

| Class B | | 2.15% |

| Class C | | 2.15% |

| Institutional Class | | 1.04% |

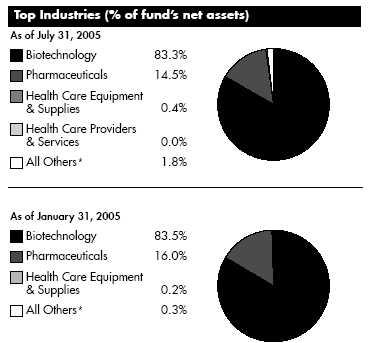

| | Advisor Biotechnology Fund

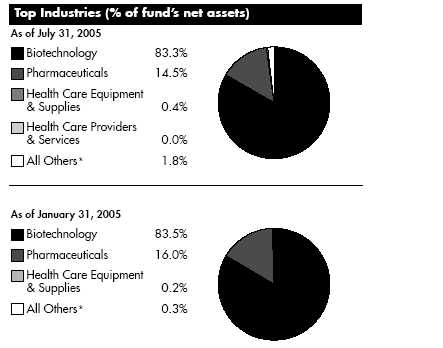

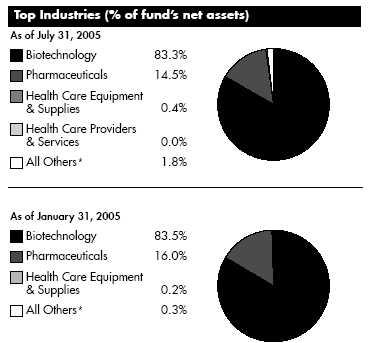

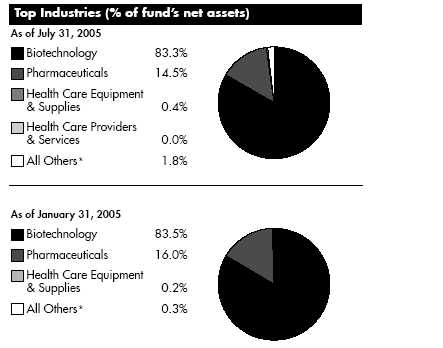

Investment Changes

|

| Top Ten Stocks as of July 31, 2005 | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Genentech, Inc. | | 11.7 | | 9.2 |

| Celgene Corp. | | 7.1 | | 7.0 |

| Amgen, Inc. | | 6.3 | | 2.9 |

| Genzyme Corp. | | 5.0 | | 4.7 |

| Biogen Idec, Inc. | | 5.0 | | 11.0 |

| Gilead Sciences, Inc. | | 4.9 | | 4.0 |

| MedImmune, Inc. | | 4.4 | | 5.5 |

| Sepracor, Inc. | | 4.2 | | 4.8 |

| Invitrogen Corp. | | 4.0 | | 4.0 |

| Cephalon, Inc. | | 4.0 | | 5.2 |

| | | 56.6 | | |

* Includes short term investments and net other assets.

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

A-7 A-7 Annual Report

Advisor Biotechnology Fund

Investments July 31, 2005

Showing Percentage of Net Assets

|

| Common Stocks — 98.2% | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| BIOTECHNOLOGY – 83.3% | | | | | | |

| Biotechnology – 83.3% | | | | | | |

| Abgenix, Inc. (a) | | 10,900 | | $ | | 113,033 |

| Actelion Ltd. (Reg.) (a) | | 12,478 | | | | 1,338,399 |

| Affymetrix, Inc. (a) | | 41,300 | | | | 1,928,297 |

| Alkermes, Inc. (a) | | 42,740 | | | | 662,470 |

| Alnylam Pharmaceuticals, Inc. (a) | | 300 | | | | 2,925 |

| Amgen, Inc. (a) | | 44,210 | | | | 3,525,748 |

| Amylin Pharmaceuticals, Inc. (a) | | 7,600 | | | | 141,816 |

| Biogen Idec, Inc. (a) | | 71,434 | | | | 2,806,642 |

| BioMarin Pharmaceutical, Inc. (a) | | 4,800 | | | | 40,800 |

| Celgene Corp. (a) | | 82,741 | | | | 3,959,157 |

| Cephalon, Inc. (a) | | 52,899 | | | | 2,216,468 |

| Chiron Corp. (a) | | 13,800 | | | | 499,974 |

| Curis, Inc. (a) | | 40,700 | | | | 191,494 |

| CV Therapeutics, Inc. (a) | | 500 | | | | 14,085 |

| Dendreon Corp. (a) | | 100 | | | | 588 |

| DOV Pharmaceutical, Inc. (a) | | 43,900 | | | | 928,485 |

| Dyax Corp. (a) | | 4,200 | | | | 25,662 |

| Enzon Pharmaceuticals, Inc. (a) | | 25,200 | | | | 198,576 |

| Exelixis, Inc. (a) | | 11,200 | | | | 99,232 |

| Genentech, Inc. (a) | | 73,000 | | | | 6,521,087 |

| Genta, Inc. (a) | | 13,700 | | | | 16,440 |

| Genzyme Corp. (a) | | 37,720 | | | | 2,806,745 |

| Gilead Sciences, Inc. (a) | | 60,900 | | | | 2,728,929 |

| Harvard Bioscience, Inc. (a) | | 300 | | | | 975 |

| Human Genome Sciences, Inc. (a) | | 51,900 | | | | 760,335 |

| Icagen, Inc. | | 10,700 | | | | 85,493 |

| ICOS Corp. (a) | | 23,600 | | | | 594,956 |

| Idenix Pharmaceuticals, Inc. | | 5,600 | | | | 142,576 |

| ImClone Systems, Inc. (a) | | 44,364 | | | | 1,539,431 |

| ImmunoGen, Inc. (a) | | 53,500 | | | | 374,500 |

| Immunomedics, Inc. (a) | | 8,600 | | | | 15,394 |

| Incyte Corp. (a) | | 3,100 | | | | 24,707 |

| Invitrogen Corp. (a) | | 26,250 | | | | 2,251,463 |

| Ligand Pharmaceuticals, Inc. Class B (a) . | | 1,300 | | | | 10,140 |

| Medarex, Inc. (a) | | 27,590 | | | | 269,003 |

| MedImmune, Inc. (a) | | 86,700 | | | | 2,463,147 |

| Millennium Pharmaceuticals, Inc. (a) | | 205,071 | | | | 2,118,383 |

| Myogen, Inc. (a) | | 13,500 | | | | 147,690 |

| Neurocrine Biosciences, Inc. (a) | | 19,000 | | | | 942,020 |

| NPS Pharmaceuticals, Inc. (a) | | 400 | | | | 4,348 |

| Oscient Pharmaceuticals Corp. (a) | | 2,600 | | | | 6,942 |

| OSI Pharmaceuticals, Inc. (a) | | 12,000 | | | | 495,600 |

| Pharmion Corp. (a) | | 14,304 | | | | 352,451 |

| Protein Design Labs, Inc. (a) | | 46,400 | | | | 1,057,456 |

| | | Shares | | Value (Note 1) |

| Regeneron Pharmaceuticals, Inc. (a) | | 23,622 | | $ | | 227,716 |

| Seattle Genetics, Inc. (a) | | 24,600 | | | | 148,092 |

| Serologicals Corp. (a) | | 23,900 | | | | 549,700 |

| Tanox, Inc. (a) | | 10,700 | | | | 149,693 |

| Techne Corp. (a) | | 16,010 | | | | 785,611 |

| Tercica, Inc. (a) | | 17,300 | | | | 171,097 |

| Threshold Pharmaceuticals, Inc. | | 1,408 | | | | 14,291 |

| ViaCell, Inc. | | 500 | | | | 4,270 |

| XOMA Ltd. (a) | | 49,300 | | | | 81,838 |

| | | | | | | 46,556,370 |

| |

| HEALTH CARE EQUIPMENT & SUPPLIES – 0.4% | | | | | | |

| Health Care Equipment – 0.3% | | | | | | |

| Aspect Medical Systems, Inc. (a) | | 200 | | | | 6,600 |

| Cholestech Corp. (a) | | 3,800 | | | | 42,788 |

| Cyberonics, Inc. (a) | | 500 | | | | 19,310 |

| Epix Pharmaceuticals, Inc. (a) | | 3,100 | | | | 27,373 |

| IntraLase Corp. | | 300 | | | | 6,255 |

| Syneron Medical Ltd. | | 1,000 | | | | 38,550 |

| | | | | | | 140,876 |

| Health Care Supplies – 0.1% | | | | | | |

| Gen-Probe, Inc. (a) | | 1,400 | | | | 61,726 |

| |

| TOTAL HEALTH CARE EQUIPMENT & SUPPLIES | | | | 202,602 |

| |

| HEALTH CARE PROVIDERS & SERVICES – 0.0% | | | | | | |

| Health Care Facilities – 0.0% | | | | | | |

| Corporacion Dermoestetica SA | | 2,000 | | | | 26,675 |

| PHARMACEUTICALS – 14.5% | | | | | | |

| Pharmaceuticals – 14.5% | | | | | | |

| Adams Respiratory Therapeutics, Inc. | | 100 | | | | 2,950 |

| Connetics Corp. (a) | | 200 | | | | 3,742 |

| Cypress Bioscience, Inc. (a) | | 2,600 | | | | 35,620 |

| Guilford Pharmaceuticals, Inc. (a) | | 28,300 | | | | 99,616 |

| IVAX Corp. (a) | | 4,800 | | | | 122,304 |

| Kos Pharmaceuticals, Inc. (a) | | 23,400 | | | | 1,673,100 |

| Medicines Co. (a) | | 16,300 | | | | 355,829 |

| Merck KGaA | | 10,826 | | | | 964,012 |

| MGI Pharma, Inc. (a) | | 34,900 | | | | 952,770 |

| NitroMed, Inc. (a) | | 7,500 | | | | 174,300 |

| Novartis AG sponsored ADR | | 7,400 | | | | 360,454 |

| Roche Holding AG (participation | | | | | | |

| certificate) | | 5,648 | | | | 768,000 |

| Salix Pharmaceuticals Ltd. (a) | | 8,200 | | | | 158,260 |

| Sanofi-Aventis sponsored ADR | | 100 | | | | 4,330 |

| Sepracor, Inc. (a) | | 44,896 | | | | 2,350,306 |

| SkyePharma PLC (a) | | 80,613 | | | | 84,300 |

| | | | | | | 8,109,893 |

| |

| TOTAL COMMON STOCKS | | | | | | |

| (Cost $48,439,037) | | | | 54,895,540 |

See accompanying notes which are an integral part of the financial statements.

Biotechnology A-8

| Money Market Funds — 1.6% | | | | | | |

| | | Shares | | | | Value (Note 1) |

| Fidelity Cash Central Fund, 3.31% (b) | | | | | | |

| (Cost $868,635) | | 868,635 | | | | $ 868,635 |

| TOTAL INVESTMENT PORTFOLIO - 99.8% | | | | |

| (Cost $49,307,672) | | | | | | 55,764,175 |

| |

| NET OTHER ASSETS – 0.2% | | | | | | 136,549 |

| NET ASSETS – 100% | | | | $ | | 55,900,724 |

Legend

(a) Non-income producing

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund’s holdings as of its most recent quarter end is available upon request.

Income Tax Information

At July 31, 2005, the fund had a capital loss carryforward of approximately $8,849,791 all of which will expire on July 31, 2011.

See accompanying notes which are an integral part of the financial statements.

A-9 A-9 Annual Report

Advisor Biotechnology Fund

Financial Statements

|

| Statement of Assets and Liabilities | | |

| | | | | | | July 31, 2005 |

| |

| Assets | | | | | | |

| Investment in securities, at value (cost | | | | |

| $49,307,672) — See accompany- | | | | |

| ing schedule | | | | $ | | 55,764,175 |

| Receivable for investments sold | | | | | | 292,300 |

| Receivable for fund shares sold | | | | | | 145,593 |

| Dividends receivable | | | | | | 986 |

| Interest receivable | | | | | | 1,510 |

| Prepaid expenses | | | | | | 92 |

| Receivable from investment adviser for | | | | |

| expense reductions | | | | | | 7,686 |

| Other receivables | | | | | | 7,490 |

| Total assets | | | | | | 56,219,832 |

| |

| Liabilities | | | | | | |

| Payable to custodian bank | | $ | | 42,806 | | |

| Payable for investments purchased | | | | 58,259 | | |

| Payable for fund shares redeemed | | | | 105,132 | | |

| Accrued management fee | | | | 25,694 | | |

| Transfer agent fee payable | | | | 18,336 | | |

| Distribution fees payable | | | | 31,628 | | |

| Other affiliated payables | | | | 1,851 | | |

| Other payables and accrued expenses | | 35,402 | | |

| Total liabilities | | | | | | 319,108 |

| |

| Net Assets | | | | $ | | 55,900,724 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | $ | | 58,876,674 |

| Accumulated undistributed net realized | | | | |

| gain (loss) on investments and for- | | | | |

| eign currency transactions | | | | | | (9,432,385) |

| Net unrealized appreciation (depreci- | | | | |

| ation) on investments and assets and | | | | |

| liabilities in foreign currencies | | | | | | 6,456,435 |

| Net Assets | | | | $ | | 55,900,724 |

| Calculation of Maximum Offering Price | | | | |

| Class A: | | | | | | |

| Net Asset Value and redemption | | | | | | |

| price per share ($11,022,278 ÷ | | | | |

| 1,620,043 shares) | | | | $ | | 6.80 |

| Maximum offering price per share | | | | | | |

| (100/94.25 of $6.80) | | | | $ | | 7.21 |

| Class T: | | | | | | |

| Net Asset Value and redemption | | | | | | |

| price per share ($14,176,708 ÷ | | | | |

| 2,108,651 shares) | | | | $ | | 6.72 |

| Maximum offering price per share | | | | | | |

| (100/96.50 of $6.72) | | | | $ | | 6.96 |

| Class B: | | | | | | |

| Net Asset Value and offering price | | | | |

| per share ($16,920,801 ÷ | | | | | | |

| 2,577,536 shares)A | | | | $ | | 6.56 |

| Class C: | | | | | | |

| Net Asset Value and offering price | | | | |

| per share ($12,538,171 ÷ | | | | | | |

| 1,909,300 shares)A | | | | $ | | 6.57 |

| Institutional Class: | | | | | | |

| Net Asset Value, offering price and | | | | |

| redemption price per share | | | | | | |

| ($1,242,766 ÷ 180,455 shares) . | | $ | | 6.89 |

| Statement of Operations | | | | |

| | | | | Year ended July 31, 2005 |

| |

| Investment Income | | | | | | |

| Dividends | | | | $ | | 15,541 |

| Special Dividends | | | | | | 3,455 |

| Interest | | | | | | 11,544 |

| Security lending | | | | | | 11,707 |

| | | | | | | 42,247 |

| Less foreign taxes withheld | | | | | | (2,833) |

| Total income | | | | | | 39,414 |

| |

| Expenses | | | | | | |

| Management fee | | $ | | 300,662 | | |

| Transfer agent fees | | | | 257,402 | | |

| Distribution fees | | | | 373,191 | | |

| Accounting and security lending | | | | | | |

| fees | | | | 27,759 | | |

| Independent trustees’ compensation | | 277 | | |

| Custodian fees and expenses | | | | 8,069 | | |

| Registration fees | | | | 56,077 | | |

| Audit | | | | 44,163 | | |

| Legal | | | | 189 | | |

| Miscellaneous | | | | 804 | | |

| Total expenses before reductions | | 1,068,593 | | |

| Expense reductions | | | | (76,505) | | 992,088 |

| |

| Net investment income (loss) | | | | | | (952,674) |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities | | | | 3,413,981 | | |

| Foreign currency transactions | | | | 1,175 | | |

| Total net realized gain (loss) | | | | | | 3,415,156 |

| Change in net unrealized appreci- | | | | |

| ation (depreciation) on: | | | | | | |

| Investment securities | | | | 3,818,042 | | |

| Assets and liabilities in foreign | | | | | | |

| currencies | | | | (68) | | |

| Total change in net unrealized | | | | | | |

| appreciation (depreciation) | | | | | | 3,817,974 |

| Net gain (loss) | | | | | | 7,233,130 |

| Net increase (decrease) in net as- | | | | |

| sets resulting from operations | | | | $ | | 6,280,456 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

|

Biotechnology A-10

| Statement of Changes in Net Assets | | | | | | |

| | | Year ended | | | | Year ended |

| | | July 31, | | | | July 31, |

| | | 2005 | | | | 2004 |

| Increase (Decrease) in Net Assets | | | | | | |

| Operations | | | | | | |

| Net investment income (loss) | | $ (952,674) | | $ | | (954,269) |

| Net realized gain (loss) | | 3,415,156 | | | | 2,867,187 |

| Change in net unrealized appreciation (depreciation) | | 3,817,974 | | | | (2,278,403) |

| Net increase (decrease) in net assets resulting from operations | | 6,280,456 | | | | (365,485) |

| Share transactions -- net increase (decrease) | | (5,129,068) | | | | 10,289,718 |

| Redemption fees | | 6,345 | | | | 18,272 |

| Total increase (decrease) in net assets | | 1,157,733 | | | | 9,942,505 |

| |

| Net Assets | | | | �� | | |

| Beginning of period | | 54,742,991 | | | | 44,800,486 |

| End of period | | $ 55,900,724 | | $ | | 54,742,991 |

| Financial Highlights — Class A | | | | | | | | | | |

| Years ended July 31, | | 2005 | | 2004 | | 2003 | | 2002 | | 2001G |

| Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | | $ 6.00 | | $ 5.94 | | $ 4.39 | | $ 7.09 | | $ 10.00 |

| Income from Investment Operations | | | | | | | | | | |

| Net investment income (loss)E | | (.08)F | | (.09) | | (.05) | | (.07) | | (.04) |

| Net realized and unrealized gain (loss) | | 88 | | .15 | | 1.60 | | (2.64) | | (2.88) |

| Total from investment operations | | 80 | | .06 | | 1.55 | | (2.71) | | (2.92) |

| Redemption fees added to paid in capitalE | | —I | | —I | | —I | | .01 | | .01 |

| Net asset value, end of period | | $ 6.80 | | $ 6.00 | | $ 5.94 | | $ 4.39 | | $ 7.09 |

| Total ReturnB, C, D | | 13.33% | | 1.01% | | 35.31% | | (38.08)% | | (29.10)% |

| Ratios to Average Net AssetsH | | | | | | | | | | |

| Expenses before expense reductions | | 1.56% | | 1.68% | | 2.04% | | 1.99% | | 3.07%A |

| Expenses net of voluntary waivers, if any | | 1.45% | | 1.50% | | 1.50% | | 1.50% | | 1.50%A |

| Expenses net of all reductions | | 1.43% | | 1.48% | | 1.47% | | 1.46% | | 1.49%A |

| Net investment income (loss) | | (1.36)%F | | (1.38)% | | (1.11)% | | (1.19)% | | (.94)%A |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ 11,022 | | $ 10,197 | | $ 7,718 | | $ 4,657 | | $ 4,232 |

| Portfolio turnover rate | | 30% | | 50% | | 71% | | 113% | | 64%A |

| | A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Investment income per share reflects a special dividend which amounted to $.0004 per share. Excluding the special dividend, the ratio of net investment income to average net assets would have been (1.37)% .

G For the period December 27, 2000 (commencement of operations) to July 31, 2001.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not

represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term operating periods. Expenses net of any voluntary

waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

|

See accompanying notes which are an integral part of the financial statements.

A-11 Annual Report

| Financial Highlights — Class T | | | | | | | | | | |

| Years ended July 31, | | 2005 | | 2004 | | 2003 | | 2002 | | 2001G |

| Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | | $ 5.95 | | $ 5.90 | | $ 4.37 | | $ 7.07 | | $ 10.00 |

| Income from Investment Operations | | | | | | | | | | |

| Net investment income (loss)E | | (.10)F | | (.10) | | (.06) | | (.09) | | (.05) |

| Net realized and unrealized gain (loss) | | 87 | | .15 | | 1.59 | | (2.62) | | (2.89) |

| Total from investment operations | | 77 | | .05 | | 1.53 | | (2.71) | | (2.94) |

| Redemption fees added to paid in capitalE | | —I | | —I | | —I | | .01 | | .01 |

| Net asset value, end of period | | $ 6.72 | | $ 5.95 | | $ 5.90 | | $ 4.37 | | $ 7.07 |

| Total ReturnB, C, D | | 12.94% | | .85% | | 35.01% | | (38.19)% | | (29.30)% |

| Ratios to Average Net AssetsH | | | | | | | | | | |

| Expenses before expense reductions | | 1.93% | | 2.10% | | 2.39% | | 2.27% | | 3.29%A |

| Expenses net of voluntary waivers, if any | | 1.70% | | 1.75% | | 1.75% | | 1.75% | | 1.75%A |

| Expenses net of all reductions | | 1.68% | | 1.73% | | 1.72% | | 1.72% | | 1.74%A |

| Net investment income (loss) | | (1.61)%F | | (1.63)% | | (1.36)% | | (1.45)% | | (1.19)%A |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ 14,177 | | $ 13,367 | | $ 10,281 | | $ 6,861 | | $ 7,721 |

| Portfolio turnover rate | | 30% | | 50% | | 71% | | 113% | | 64%A |

| | | | | | | | | | |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Investment income per share reflects a special dividend which amounted to $.0004 per share. Excluding the special dividend, the ratio of net investment income to average net assets would have been (1.61)% .

G For the period December 27, 2000 (commencement of operations) to July 31, 2001.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not

represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term operating periods. Expenses net of any voluntary

waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

|

| Financial Highlights — Class B | | | | | | | | | | |

| Years ended July 31, | | 2005 | | 2004 | | 2003 | | 2002 | | 2001G |

| Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | | $ 5.84 | | $ 5.82 | | $ 4.33 | | $ 7.05 | | $ 10.00 |

| Income from Investment Operations | | | | | | | | | | |

| Net investment income (loss)E | | (.13)F | | (.13) | | (.09) | | (.12) | | (.07) |

| Net realized and unrealized gain (loss) | | 85 | | .15 | | 1.58 | | (2.61) | | (2.89) |

| Total from investment operations | | 72 | | .02 | | 1.49 | | (2.73) | | (2.96) |

| Redemption fees added to paid in capitalE | | —I | | —I | | —I | | .01 | | .01 |

| Net asset value, end of period | | $ 6.56 | | $ 5.84 | | $ 5.82 | | $ 4.33 | | $ 7.05 |

| Total ReturnB, C, D | | 12.33% | | .34% | | 34.41% | | (38.58)% | | (29.50)% |

| Ratios to Average Net AssetsH | | | | | | | | | | |

| Expenses before expense reductions | | 2.33% | | 2.46% | | 2.78% | | 2.74% | | 3.83%A |

| Expenses net of voluntary waivers, if any | | 2.19% | | 2.25% | | 2.25% | | 2.25% | | 2.25%A |

| Expenses net of all reductions | | 2.18% | | 2.22% | | 2.22% | | 2.22% | | 2.24%A |

| Net investment income (loss) | | (2.11)%F | | (2.12)% | | (1.86)% | | (1.95)% | | (1.69)%A |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ 16,921 | | $ 16,819 | | $ 15,154 | | $ 10,218 | | $ 8,875 |

| Portfolio turnover rate | | 30% | | 50% | | 71% | | 113% | | 64%A |

| A | | | | | | | | | | |

| | Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Investment income per share reflects a special dividend which amounted to $.0004 per share. Excluding the special dividend, the ratio of net investment income to average net assets would have been (2.11)% .

G For the period December 27, 2000 (commencement of operations) to July 31, 2001.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not

represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term operating periods. Expenses net of any voluntary

waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

|

See accompanying notes which are an integral part of the financial statements.

Biotechnology A-12

| Financial Highlights — Class C | | | | | | | | | | |

| Years ended July 31, | | 2005 | | 2004 | | 2003 | | 2002 | | 2001G |

| Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | | $ 5.84 | | $ 5.82 | | $ 4.33 | | $ 7.05 | | $ 10.00 |

| Income from Investment Operations | | | | | | | | | | |

| Net investment income (loss)E | | (.13)F | | (.13) | | (.09) | | (.12) | | (.07) |

| Net realized and unrealized gain (loss) | | 86 | | .15 | | 1.58 | | (2.61) | | (2.89) |

| Total from investment operations | | 73 | | .02 | | 1.49 | | (2.73) | | (2.96) |

| Redemption fees added to paid in capitalE | | —I | | —I | | —I | | .01 | | .01 |

| Net asset value, end of period | | $ 6.57 | | $ 5.84 | | $ 5.82 | | $ 4.33 | | $ 7.05 |

| Total ReturnB, C, D | | 12.50% | | .34% | | 34.41% | | (38.58)% | | (29.50)% |

| Ratios to Average Net AssetsH | | | | | | | | | | |

| Expenses before expense reductions | | 2.24% | | 2.31% | | 2.58% | | 2.57% | | 3.73%A |

| Expenses net of voluntary waivers, if any | | 2.19% | | 2.25% | | 2.25% | | 2.25% | | 2.25%A |

| Expenses net of all reductions | | 2.18% | | 2.23% | | 2.22% | | 2.22% | | 2.24%A |

| Net investment income (loss) | | (2.11)%F | | (2.13)% | | (1.86)% | | (1.95)% | | (1.69)%A |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ 12,538 | | $ 13,215 | | $ 10,493 | | $ 8,204 | | $ 6,321 |

| Portfolio turnover rate | | 30% | | 50% | | 71% | | 113% | | 64%A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Investment income per share reflects a special dividend which amounted to $.0004 per share. Excluding the special dividend, the ratio of net investment income to average net assets would have been (2.11)% .

G For the period December 27, 2000 (commencement of operations) to July 31, 2001.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not

represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term operating periods. Expenses net of any voluntary

waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

|

| Financial Highlights — Institutional Class | | | | | | | | | | |

| Years ended July 31, | | 2005 | | 2004 | | 2003 | | 2002 | | 2001F |

| Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | | $ 6.06 | | $ 5.97 | | $ 4.40 | | $ 7.09 | | $ 10.00 |

| Income from Investment Operations | | | | | | | | | | |

| Net investment income (loss)D | | (.06)E | | (.06) | | (.04) | | (.06) | | (.03) |

| Net realized and unrealized gain (loss) | | 89 | | .15 | | 1.61 | | (2.64) | | (2.89) |

| Total from investment operations | | 83 | | .09 | | 1.57 | | (2.70) | | (2.92) |

| Redemption fees added to paid in capitalD | | —H | | —H | | —H | | .01 | | .01 |

| Net asset value, end of period | | $ 6.89 | | $ 6.06 | | $ 5.97 | | $ 4.40 | | $ 7.09 |

| Total ReturnB, C | | 13.70% | | 1.51% | | 35.68% | | (37.94)% | | (29.10)% |

| Ratios to Average Net AssetsG | | | | | | | | | | |

| Expenses before expense reductions | | 1.10% | | 1.16% | | 1.37% | | 1.41% | | 2.58%A |

| Expenses net of voluntary waivers, if any | | 1.10% | | 1.16% | | 1.25% | | 1.25% | | 1.25%A |

| Expenses net of all reductions | | 1.09% | | 1.14% | | 1.22% | | 1.22% | | 1.24%A |

| Net investment income (loss) | | (1.02)%E | | (1.04)% | | (.86)% | | (.94)% | | (.69)%A |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ 1,243 | | $ 1,146 | | $ 1,153 | | $ 857 | | $ 911 |

| Portfolio turnover rate | | 30% | | 50% | | 71% | | 113% | | 64%A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Investment income per share reflects a special dividend which amounted to $.0004 per share. Excluding the special dividend, the ratio of net investment income to average net assets would have been (1.02)% .

F For the period December 27, 2000 (commencement of operations) to July 31, 2001.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not

represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start up periods may not be representative of longer term operating periods. Expenses net of any voluntary

waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

|

See accompanying notes which are an integral part of the financial statements.

A-13 Annual Report

Notes to Financial Statements

For the period ended July 31, 2005

|

1. Significant Accounting Policies.

|

Fidelity Advisor Biotechnology Fund (the fund) is a non-diversified fund of Fidelity Advisor Series VII (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

The fund offers Class A, Class T, Class B, Class C and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions also differ by class.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Net asset value per share (NAV calculation) is calculated as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Equity securities, including restricted securities, for which market quotations are available are valued at the last sale price or official closing price (closing bid price or last evaluated quote if no sale has occurred) on the primary market or exchange on which they trade. If prices are not readily available or do not accurately reflect fair value for a security, or if a security’s value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded, that security may be valued by another method that the Board of Trustees believes accurately reflects fair value. A security’s valuation may differ depending on the method used for determining value. Price movements in futures contracts and ADRs, market and trading trends, the bid/ask quotes of brokers and off-exchange institutional trading may be reviewed in the course of making a good faith determination of a security’s fair value. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued on the basis of amortized cost. Investments in open-end investment companies are valued at their net asset value each business day.

Foreign Currency. The fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts’ terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Large, non-recurring dividends recognized by the fund are presented separately on the Statement of Operations as “Special Dividends” and the impact of these dividends is presented in the Financial Highlights. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust.

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

| | 1. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Book-tax differences are primarily due to foreign currency transactions, capital loss carryforwards and losses deferred due to wash sales.

The tax-basis components of distributable earnings and the federal tax cost as of period end were as follows:

|

| Unrealized appreciation | | $ 13,476,712 |

| Unrealized depreciation | | (7,602,876) |

| Net unrealized appreciation (depreciation) | | 5,873,836 |

| Capital loss carryforward | | (8,849,791) |

| |

| Cost for federal income tax purposes | | $ 49,890,339 |

| | Short-Term Trading (Redemption) Fees. Shares held in the fund less than 60 days are subject to a redemption fee equal to 1.00% of the proceeds of

the redeemed shares. All redemption fees, including any estimated redemption fees paid by Fidelity Management & Research Company (FMR), are

retained by the fund and accounted for as an addition to paid in capital.

2. Operating Policies.

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the fund

and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements.

The fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non-

government securities. Collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty.

The fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (in-

cluding accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the

value of the collateral may decline.

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and U.S. government securities, aggregated $15,702,703 and $20,996,789,

respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the fund with investment management related services for which the fund pays a monthly manage-

ment fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the fund’s average net assets and a

group fee rate that averaged .27% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR.

The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total

annual management fee rate was .57% of the fund’s average net assets.

Distribution and Service Plan. In accordance with Rule 12b-1 of the 1940 Act, the fund has adopted separate Distribution and Service Plans for each

class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of FMR, separate Distribution and Service Fees, each of which

is based on an annual percentage of each class’ average net assets. In addition, FDC may pay financial intermediaries for selling shares of the fund and

providing shareholder support services. For the period, the Distribution and Service Fee rates and the total amounts paid to and retained by FDC were

as follows:

|

| | | Distribution | | Service | | | | Paid to | | | | Retained |

| | | Fee | | Fee | | | | FDC | | | | by FDC |

| Class A | | 0% | | .25% | | $ | | 25,177 | | $ | | 33 |

| Class T | | 25% | | .25% | | | | 65,020 | | | | 62 |

| Class B | | 75% | | .25% | | | | 159,674 | | | | 119,826 |

| Class C | | 75% | | .25% | | | | 123,320 | | | | 23,648 |

| |

| | | | | | | $ | | 373,191 | | $ | | 143,569 |

Sales Load. FDC receives a front-end sales charge of up to 5.75% for selling Class A shares, and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the fund. FDC receives the proceeds of contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. These charges depend on the holding period. The deferred sales charges range from 5% to 1% for Class B, 1% for Class C, and .25% for certain purchases of Class A and Class T shares.

A-15 Annual Report

Notes to Financial Statements - continued

4. Fees and Other Transactions with Affiliates - continued

Sales Load - continued

|

| For the period, sales charge amounts retained by FDC were as follows: | | | | |

| | | | | Retained |

| | | | | by FDC |

| Class A | | $ | | 12,047 |

| Class T | | | | 10,155 |

| Class B* | | | | 61,464 |

| Class C* | | | | 3,776 |

| | | $ | | 87,442 |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servicing agent for each class of the fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the fund. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period the total transfer agent fees paid by each class to FIIOC, were as follows:

| | | | | | | % of |

| | | | | | | Average |

| | | | | Amount | | Net Assets |

| Class A | | $ | | 47,844 | | .48 |

| Class T | | | | 77,635 | | .60 |

| Class B | | | | 79,137 | | .50 |

| Class C | | | | 49,905 | | .40 |

| Institutional Class | | | | 2,881 | | .27 |

| |

| | | $ | | 257,402 | | |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the fund’s accounting records. The

accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The

security lending fee is based on the number and duration of lending transactions.

Central Funds. The fund may invest in affiliated Central Funds managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of

FMR. The Central Funds are open-end investment companies available only to investment companies and other accounts managed by FMR and its

affiliates. The Money Market Central Funds seek preservation of capital and current income. The Central Funds do not pay a management fee. Income

distributions earned by the fund are recorded as income in the accompanying financial statements and totaled $40,321 for the period.

Brokerage Commissions. The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser.

The commissions paid to these affiliated firms were $2,231 for the period.

5. Committed Line of Credit.

The fund participates with other funds managed by FMR in a $4.2 billion credit facility (the “line of credit”) to be utilized for temporary or emergency

purposes to fund shareholder redemptions or for other short-term liquidity purposes. The fund has agreed to pay commitment fees on its pro rata

portion of the line of credit. During the period, there were no borrowings on this line of credit.

6. Security Lending.

The fund lends portfolio securities from time to time in order to earn additional income. The fund receives collateral (in the form of U.S. Treasury

obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of

the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any

additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned

because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the

collateral. Cash collateral is invested in the Fidelity Securities Lending Cash Central Fund. At period end there were no security loans outstanding.

|

Biotechnology A-16

FMR voluntarily agreed to reimburse each class to the extent annual operating expenses exceeded certain levels of average net assets as noted in the table below. Some expenses, for example interest expense, are excluded from this reimbursement.

| The following classes were in reimbursement during the period: | | | | | | | | |

| | | Expense | | Reimbursement |

| | | Limitations | | from adviser |

| Class A | | 1.50% | | -- 1.40%* | | $ | | 11,540 |

| Class T | | 1.75% | | -- 1.65%* | | | | 30,869 |

| Class B | | 2.25% | | -- 2.15%* | | | | 22,104 |

| Class C | | 2.25% | | -- 2.15%* | | | | 5,763 |

| |

| | | | | | | $ | | 70,276 |

| |

| * Expense limitation in effect at period end. | | | | | | | | |

Many of the brokers with whom FMR places trades on behalf of the fund provided services to the fund in addition to trade execution. These services included payments of certain expenses on behalf of the fund totaling $6,229 for the period.

The fund’s organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.

| 9. Share Transactions. | | | | | | | | | | | | |

| |

| Transactions for each class of shares were as follows: | | | | | | | | | | | | |

| | | | | Shares | | | | | | Dollars | | |

| Years ended July 31, | | 2005 | | | | 2004 | | 2005 | | | | 2004 |

| Class A | | | | | | | | | | | | |

| Shares sold | | 550,671 | | | | 878,734 | | $ 3,418,022 | | $ | | 5,475,076 |

| Shares redeemed | | (629,006) | | | | (480,064) | | (3,853,963) | | | | (2,905,863) |

| Net increase (decrease) | | (78,335) | | | | 398,670 | | $ (435,941) | | $ | | 2,569,213 |

| Class T | | | | | | | | | | | | |

| Shares sold | | 621,575 | | | | 1,105,179 | | $ 3,773,646 | | $ | | 6,864,105 |

| Shares redeemed | | (760,267) | | | | (601,131) | | (4,599,360) | | | | (3,678,218) |

| Net increase (decrease) | | (138,692) | | | | 504,048 | | $ (825,714) | | $ | | 3,185,887 |

| Class B | | | | | | | | | | | | |

| Shares sold | | 527,483 | | | | 951,709 | | $ 3,194,512 | | $ | | 5,766,243 |

| Shares redeemed | | (831,184) | | | | (675,608) | | (4,925,475) | | | | (4,063,659) |

| Net increase (decrease) | | (303,701) | | | | 276,101 | | $ (1,730,963) | | $ | | 1,702,584 |

| Class C | | | | | | | | | | | | |

| Shares sold | | 395,212 | | | | 962,707 | | $ 2,374,238 | | $ | | 5,865,287 |

| Shares redeemed | | (749,216) | | | | (502,895) | | (4,454,466) | | | | (3,048,910) |

| Net increase (decrease) | | (354,004) | | | | 459,812 | | $ (2,080,228) | | $ | | 2,816,377 |

| Institutional Class | | | | | | | | | | | | |

| Shares sold | | 56,540 | | | | 64,860 | | $ 351,953 | | $ | | 427,262 |

| Shares redeemed | | (65,245) | | | | (68,780) | | (408,175) | | | | (411,605) |

| Net increase (decrease) | | (8,705) | | | | (3,920) | | $ (56,222) | | $ | | 15,657 |

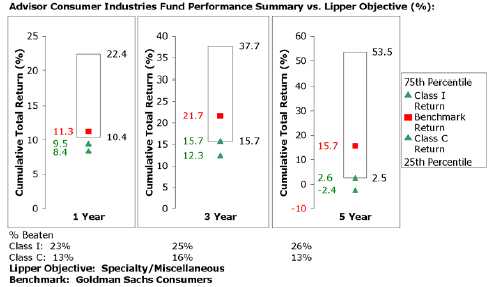

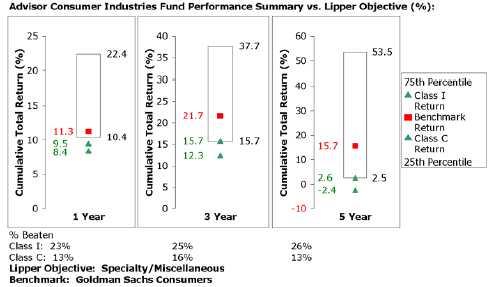

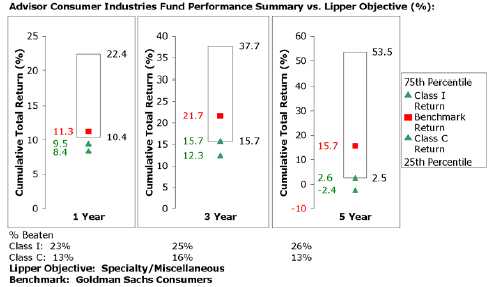

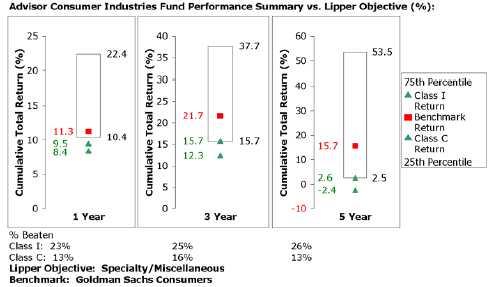

Advisor Consumer Industries Fund — Class A, T, B, and C

Performance

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow. Returns may reflect the conversion of Class B shares to Class A shares after a maximum of seven years.

| Average Annual Total Returns | | | | |

| Periods ended July 31, 2005 | | Past 1 | | Past 5 | | Life of |

| | | year | | years | | fundA |

| Class A (incl. 5.75% sales charge) | | 12.01% | | 2.06% | | 8.55% |

| Class T (incl. 3.50% sales charge) | | 14.37% | | 2.30% | | 8.54% |

| Class B (incl. contingent deferred | | | | | | |

| sales charge)B | | 12.97% | | 2.16% | | 8.58% |

| Class C (incl. contingent deferred | | | | | | |

| sales charge)C | | 16.94% | | 2.52% | | 8.47% |

A From September 3, 1996.

B Class B shares bear a 1.00% 12b-1 fee. The initial offering of Class B shares took place

on March 3, 1997. Returns prior to March 3, 1997 are those of Class T and reflect a 0.50%

12b-1 fee. Had Class B shares’ 12b-1 fee been reflected, returns prior to March 3, 1997

would have been lower. Class B shares’ contingent deferred sales charges included in the

past one year, five year, and life of fund total return figures are 5%, 2% and 0%,

respectively.

C Class C shares bear a 1.00% 12b-1 fee. The initial offering of Class C shares took place

on November 3, 1997. Returns between March 3, 1997 and November 3, 1997 are those of

Class B shares and reflect Class B shares’ 1.00% 12b-1 fee. Returns prior to March 3, 1997

are those of Class T and reflect a 0.50% 12b-1 fee. Had Class C shares’ 12b-1 fee been

reflected, returns prior to March 3, 1997 would have been lower. Class C shares’ contin-

gent deferred sales charges included in the past one year, five year, and life of fund total

return figures are 1%, 0% and 0%, respectively.

|

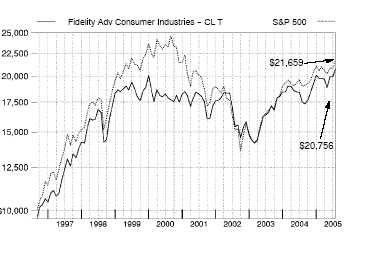

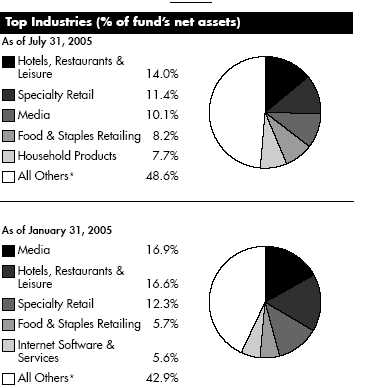

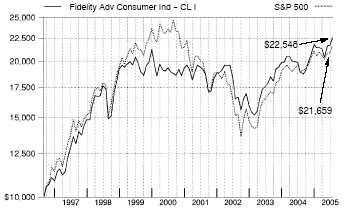

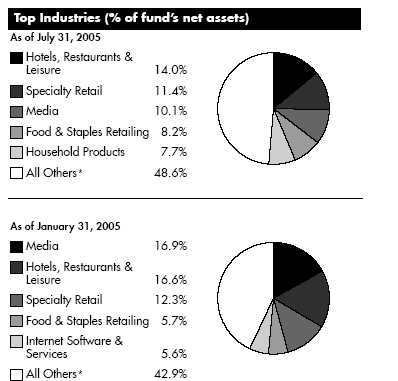

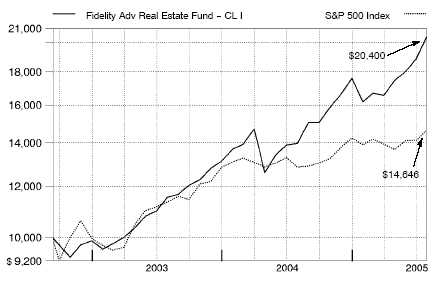

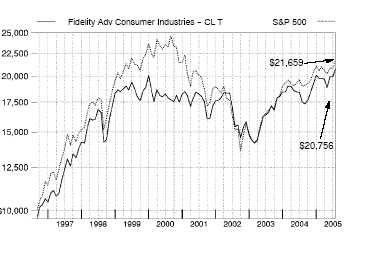

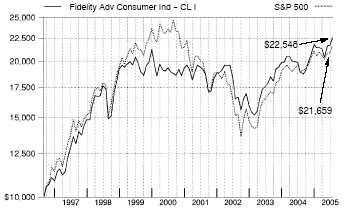

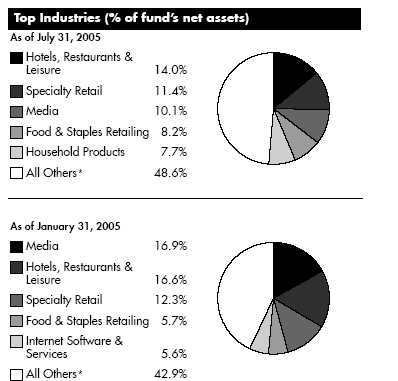

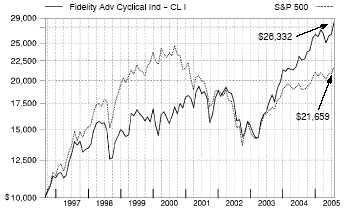

$10,000 Over Life of Fund

Let’s say hypothetically that $10,000 was invested in Fidelity Advisor Consumer Industries Fund — Class T on September 3, 1996, when the fund started, and the current 3.50% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Advisor Consumer Industries Fund — Class A, T, B, and C

Management’s Discussion of Fund Performance

Comments from John Roth, Portfolio Manager of Fidelity® Advisor Consumer Industries Fund

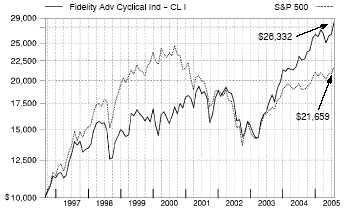

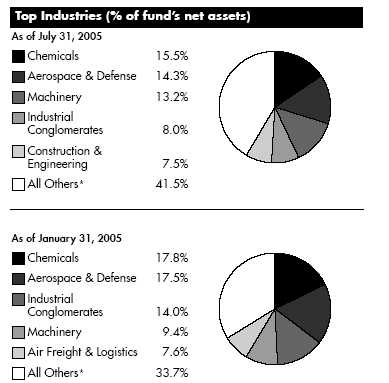

A late-inning rally on Wall Street helped push some key U.S. equity indexes to four-year highs by the conclusion of the 12-month period ending July 31, 2005. Spurred on by bullish economic data and strong corporate earnings, investors enjoyed a stellar month of July, capping off a turbulent 12-month period for U.S. equity markets. Stock prices bounced up and down during most of the year, moving in cadence with gyrations in the price of crude oil and investors’ gathering and ebbing concerns about inflation. The Federal Reserve Board raised short-term interest rates eight times during the period, also affecting overall market sentiment. Despite their fluctuations, the major equity indexes finished on a high note, with the Standard & Poor’s 500SM Index and the NASDAQ Composite® Index posting gains of 14.05% and 16.51%, respectively, for the period. The small-cap Russell 2000® Index rose 24.78% and the Russell Midcap® Index jumped 28.93%, while the blue-chips’ Dow Jones Industrial AverageSM advanced only 7.29% .

For the 12-month period ending July 31, 2005, the fund’s Class A, Class T, Class B and Class C shares returned 18.85%, 18.52%, 17.97% and 17.94%, respectively, solidly outperforming the Goldman Sachs® Consumer Industries Index, which rose 14.96%, and the S&P 500® index. During the period, advertisers continued to shift spending out of traditional media such as radio, television and print, and into Internet media such as search engines and portals. The fund benefited from that trend, relative to the sector index, by overweighting Internet firms such as Google and underweighting more-traditional media stocks such as Time Warner, which was sold out of the portfolio. In the retail area, performance was helped by an emphasis on smaller specialty apparel retailers that I believed offered superior growth potential — such as American Eagle Outfitters — and an underweighting in mega-retailers, particularly Wal-Mart. I avoided tobacco and food conglomerate Altria, a large component of the Goldman Sachs index, because of the firm’s tobacco-related legal problems. That decision hurt relative results during the period, as investors assumed the litigation would be resolved favorably and the stock climbed sharply. The fund’s positions in Krispy Kreme Doughnuts, which I sold, and in Avon Products hurt relative performance as well.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Advisor Consumer Industries Fund

Shareholder Expense Example

|

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2005 to July 31, 2005).

The first line of the table below for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

|

The second line of the table below for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | Expenses Paid |

| | | Beginning | | | | Ending | | During Period* |

| | | Account Value | | | | Account Value | | February 1, 2005 |

| | | February 1, 2005 | | | | July 31, 2005 | | to July 31, 2005 |

| Class A | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ | | 1,050.60 | | $ | | 7.12 |

| HypotheticalA | | $ 1,000.00 | | $ | | 1,017.85 | | $ | | 7.00 |

| Class T | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ | | 1,048.90 | | $ | | 8.38 |

| HypotheticalA | | $ 1,000.00 | | $ | | 1,016.61 | | $ | | 8.25 |

| Class B | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ | | 1,047.00 | | $ | | 10.91 |

| HypotheticalA | | $ 1,000.00 | | $ | | 1,014.13 | | $ | | 10.74 |

| Class C | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ | | 1,046.20 | | $ | | 10.91 |

| HypotheticalA | | $ 1,000.00 | | $ | | 1,014.13 | | $ | | 10.74 |

| Institutional Class | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ | | 1,051.30 | | $ | | 5.85 |

| HypotheticalA | | $ 1,000.00 | | $ | | 1,019.09 | | $ | | 5.76 |

| |

| A 5% return per year before expenses | | | | | | | | | | |

* Expenses are equal to each Class’ annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| | | Annualized |

| | | Expense Ratio |

| Class A | | 1.40% |

| Class T | | 1.65% |

| Class B | | 2.15% |

| Class C | | 2.15% |

| Institutional Class | | 1.15% |

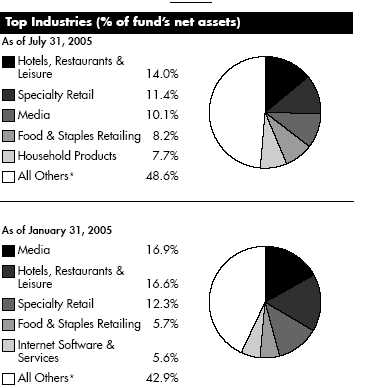

| | Advisor Consumer Industries Fund

Investment Changes

|

| Top Ten Stocks as of July 31, 2005 | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Procter & Gamble Co. | | 5.8 | | 3.5 |

| Google, Inc. Class A (sub. vtg.) | | 4.3 | | 2.8 |

| Wal-Mart Stores, Inc. | | 3.6 | | 2.9 |

| The Coca-Cola Co. | | 3.2 | | 2.0 |

| Target Corp. | | 3.2 | | 2.5 |

| eBay, Inc. | | 2.9 | | 2.0 |

| Yahoo!, Inc. | | 2.8 | | 2.4 |

| News Corp. Class A | | 2.2 | | 3.8 |

| McDonald’s Corp. | | 2.1 | | 3.0 |

| Brunswick Corp. | | 2.0 | | 1.7 |

| | | 32.1 | | |

* Includes short term investments and net other assets.

Prior period industry classifications reflect the categories in place as of the date indicated and have not been adjusted to reflect current industry classifications.

A-21 A-21 Annual Report

| | Advisor Consumer Industries Fund

Investments July 31, 2005

Showing Percentage of Net Assets

|

| Common Stocks — 98.2% | | | | | | |

| Shares | | Value (Note 1) |

| |

| AUTOMOBILES – 1.2% | | | | | | |

| Automobile Manufacturers – 0.5% | | | | | | |

| Thor Industries, Inc. | | 8,200 | | $ | | 293,560 |

| Motorcycle Manufacturers – 0.7% | | | | | | |

| Harley-Davidson, Inc. | | 9,000 | | | | 478,710 |

| TOTAL AUTOMOBILES | | | | | | 772,270 |

| |

| BEVERAGES – 6.5% | | | | | | |

| Distillers & Vintners – 1.1% | | | | | | |

| Brown-Forman Corp. Class B (non-vtg.) . | | 2,000 | | | | 116,900 |

| Diageo PLC sponsored ADR | | 10,400 | | | | 578,968 |

| | | | | | | 695,868 |

| Soft Drinks – 5.4% | | | | | | |

| Coca-Cola Enterprises, Inc. | | 19,700 | | | | 462,950 |

| PepsiCo, Inc. | | 16,500 | | | | 899,745 |

| The Coca-Cola Co. | | 46,500 | | | | 2,034,840 |

| | | | | | | 3,397,535 |

| |

| TOTAL BEVERAGES | | | | | | 4,093,403 |

| |

| COMMERCIAL SERVICES & SUPPLIES – 0.7% | | | | | | |

| Commercial Printing – 0.2% | | | | | | |

| R.R. Donnelley & Sons Co. | | 4,200 | | | | 151,410 |

| Diversified Commercial & Professional Services – 0.5% | | | | |

| Cendant Corp. | | 14,100 | | | | 301,176 |

| TOTAL COMMERCIAL SERVICES & SUPPLIES | | | | | | 452,586 |

| |

| DIVERSIFIED CONSUMER SERVICES – 2.7% | | | | | | |

| Education Services – 1.6% | | | | | | |

| Apollo Group, Inc. Class A (a) | | 10,800 | | | | 811,620 |

| Bright Horizons Family Solutions, Inc. (a) | | 4,854 | | | | 222,216 |

| | | | | | | 1,033,836 |

| Specialized Consumer Services – 1.1% | | | | | | |

| Steiner Leisure Ltd. (a) | | 10,972 | | | | 379,192 |

| Weight Watchers International, Inc. (a) . | | 5,200 | | | | 295,464 |

| | | | | | | 674,656 |

| |

| TOTAL DIVERSIFIED CONSUMER SERVICES | | | | | | 1,708,492 |

| |

| ELECTRICAL EQUIPMENT – 0.3% | | | | | | |

| Electrical Components & Equipment – 0.3% | | | | | | |

| Evergreen Solar, Inc. (a) | | 27,000 | | | | 190,350 |

| FOOD & STAPLES RETAILING – 8.2% | | | | | | |

| Drug Retail – 2.5% | | | | | | |

| CVS Corp. | | 19,000 | | | | 589,570 |

| Walgreen Co. | | 20,800 | | | | 995,488 |

| | | | | | | 1,585,058 |

| Food Retail – 1.1% | | | | | | |

| Whole Foods Market, Inc. | | 4,900 | | | | 668,899 |

| | | Shares | | Value (Note 1) |

| Hypermarkets & Super Centers – 4.6% | | | | | | |

| Costco Wholesale Corp. | | 13,700 | | $ | | 629,789 |

| Wal-Mart Stores, Inc. | | 46,580 | | | | 2,298,723 |

| | | | | | | 2,928,512 |

| |

| TOTAL FOOD & STAPLES RETAILING | | | | | | 5,182,469 |

| |

| FOOD PRODUCTS – 4.1% | | | | | | |

| Agricultural Products – 1.2% | | | | | | |

| Bunge Ltd. | | 10,900 | | | | 669,151 |

| Corn Products International, Inc. | | 5,100 | | | | 122,757 |

| | | | | | | 791,908 |

| Packaged Foods & Meats – 2.9% | | | | | | |

| Diamond Foods, Inc. | | 7,900 | | | | 174,985 |

| Lindt & Spruengli AG (participation | | | | | | |

| certificate) | | 188 | | | | 291,532 |

| Nestle SA sponsored ADR | | 9,150 | | | | 626,318 |

| Smithfield Foods, Inc. (a) | | 21,400 | | | | 558,968 |

| The J.M. Smucker Co. | | 4,000 | | | | 190,280 |

| | | | | | | 1,842,083 |

| |

| TOTAL FOOD PRODUCTS | | | | | | 2,633,991 |

| |

| HOTELS, RESTAURANTS & LEISURE – 14.0% | | | | | | |

| Casinos & Gaming – 2.3% | | | | | | |

| Aristocrat Leisure Ltd. | | 26,200 | | | | 246,744 |

| Harrah’s Entertainment, Inc. | | 2,233 | | | | 175,826 |

| International Game Technology | | 8,300 | | | | 227,088 |

| MGM MIRAGE (a) | | 11,400 | | | | 518,130 |

| Station Casinos, Inc. | | 1,800 | | | | 132,210 |

| WMS Industries, Inc. (a) | | 4,200 | | | | 136,878 |

| | | | | | | 1,436,876 |

| Hotels, Resorts & Cruise Lines – 5.4% | | | | | | |

| Carnival Corp. unit | | 16,000 | | | | 838,400 |

| Hilton Hotels Corp. | | 14,100 | | | | 348,975 |

| Kerzner International Ltd. (a) | | 3,000 | | | | 179,250 |

| Royal Caribbean Cruises Ltd. | | 11,800 | | | | 536,310 |

| Starwood Hotels & Resorts Worldwide, | | | | | | |

| Inc. unit | | 19,700 | | | | 1,247,404 |

| Wyndham International, Inc. Class A (a) | | 262,500 | | | | 299,250 |

| | | | | | | 3,449,589 |

| Leisure Facilities – 0.2% | | | | | | |

| International Speedway Corp. Class A | | 1,600 | | | | 93,024 |