UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03010

Fidelity Advisor Series VII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | January 31, 2024 |

Item 1.

Reports to Stockholders

Contents

Top Holdings (% of Fund's net assets) | ||

| AbbVie, Inc. | 23.7 | |

| Amgen, Inc. | 13.4 | |

| Regeneron Pharmaceuticals, Inc. | 8.2 | |

| Cytokinetics, Inc. | 3.7 | |

| Ascendis Pharma A/S sponsored ADR | 3.7 | |

| Alnylam Pharmaceuticals, Inc. | 3.5 | |

| Gilead Sciences, Inc. | 3.5 | |

| Vaxcyte, Inc. | 2.5 | |

| Argenx SE ADR | 2.4 | |

| Sarepta Therapeutics, Inc. | 1.6 | |

| 66.2 | ||

| Industries (% of Fund's net assets) | ||

| Biotechnology | 94.5 | |

| Pharmaceuticals | 3.6 | |

| Health Care Providers & Services | 0.2 | |

| Health Care Technology | 0.2 | |

| Financial Services | 0.1 | |

| Common Stocks - 96.6% | |||

| Shares | Value ($) | ||

| Biotechnology - 93.0% | |||

| Biotechnology - 93.0% | |||

| AbbVie, Inc. | 2,429,180 | 399,357,190 | |

| Acelyrin, Inc. (a) | 764,147 | 5,822,800 | |

| Aerovate Therapeutics, Inc. (a)(b) | 224,000 | 4,325,440 | |

| Allakos, Inc. (b) | 1,918,400 | 2,436,368 | |

| Allogene Therapeutics, Inc. (b) | 526,700 | 1,853,984 | |

| Alnylam Pharmaceuticals, Inc. (b) | 342,486 | 59,219,254 | |

| ALX Oncology Holdings, Inc. (a)(b) | 649,295 | 9,356,341 | |

| Amgen, Inc. | 718,103 | 225,671,049 | |

| Annexon, Inc. (b) | 1,315,548 | 5,466,102 | |

| Apogee Therapeutics, Inc. (a) | 470,123 | 15,749,121 | |

| Arcellx, Inc. (b) | 220,700 | 13,648,088 | |

| Argenx SE ADR (b) | 104,900 | 39,915,499 | |

| Arrowhead Pharmaceuticals, Inc. (b) | 399,890 | 12,836,469 | |

| Ascendis Pharma A/S sponsored ADR (a)(b) | 474,825 | 61,694,012 | |

| Astria Therapeutics, Inc. (b) | 1,069,551 | 13,936,250 | |

| Astria Therapeutics, Inc. warrants (b)(c) | 247,630 | 2 | |

| AVROBIO, Inc. (c)(d)(e) | 136,300 | 1,689,995 | |

| Blueprint Medicines Corp. (b) | 223,626 | 17,784,976 | |

| BridgeBio Pharma, Inc. (e) | 393,764 | 13,502,168 | |

| Cargo Therapeutics, Inc. | 189,051 | 4,161,013 | |

| Celldex Therapeutics, Inc. (b) | 513,652 | 18,090,823 | |

| Cogent Biosciences, Inc. (b) | 1,198,600 | 5,309,798 | |

| Crinetics Pharmaceuticals, Inc. (b) | 576,300 | 21,023,424 | |

| Cytokinetics, Inc. (b) | 805,171 | 62,908,010 | |

| Dianthus Therapeutics, Inc. (b) | 197,696 | 3,756,224 | |

| Dianthus Therapeutics, Inc. (unlisted) (e) | 302,966 | 5,468,536 | |

| Exact Sciences Corp. (b) | 105,000 | 6,867,000 | |

| Fusion Pharmaceuticals, Inc. (b) | 646,714 | 7,514,817 | |

| Fusion Pharmaceuticals, Inc. (e) | 505,596 | 5,875,026 | |

| Gilead Sciences, Inc. | 742,750 | 58,127,615 | |

| Insmed, Inc. (b) | 381,000 | 10,591,800 | |

| Janux Therapeutics, Inc. (a)(b) | 391,585 | 3,351,968 | |

| Keros Therapeutics, Inc. (b) | 409,600 | 22,675,456 | |

| Kymera Therapeutics, Inc. (b) | 9,900 | 324,522 | |

| Madrigal Pharmaceuticals, Inc. (a)(b) | 53,400 | 11,572,314 | |

| Monte Rosa Therapeutics, Inc. (a)(b) | 632,258 | 3,347,806 | |

| Moonlake Immunotherapeutics (a)(b) | 204,962 | 11,453,277 | |

| Morphic Holding, Inc. (b) | 217,512 | 6,892,955 | |

| Neurocrine Biosciences, Inc. (b) | 30,900 | 4,318,893 | |

| Nuvalent, Inc. Class A (b) | 338,477 | 25,443,316 | |

| ORIC Pharmaceuticals, Inc. (a)(b) | 581,716 | 6,393,059 | |

| Regeneron Pharmaceuticals, Inc. (b) | 146,800 | 138,400,104 | |

| Revolution Medicines, Inc. (b) | 456,000 | 12,654,000 | |

| Sarepta Therapeutics, Inc. (b) | 221,100 | 26,308,689 | |

| Scholar Rock Holding Corp. (a)(b) | 1,257,080 | 17,536,266 | |

| Scholar Rock Holding Corp. warrants 12/31/25 (b)(e) | 6,000 | 45,931 | |

| Shattuck Labs, Inc. (a)(b) | 1,398,244 | 13,199,423 | |

| Spyre Therapeutics, Inc. (b) | 24,000 | 621,840 | |

| Spyre Therapeutics, Inc. (e) | 455,168 | 11,203,733 | |

| Tango Therapeutics, Inc. (a)(b) | 406,869 | 4,780,711 | |

| Tango Therapeutics, Inc. (e) | 317,852 | 3,734,761 | |

| Tyra Biosciences, Inc. (a)(b) | 604,900 | 8,105,660 | |

| Vaxcyte, Inc. (b) | 598,729 | 42,761,225 | |

| Verve Therapeutics, Inc. (a)(b) | 374,194 | 4,048,779 | |

| Viking Therapeutics, Inc. (a)(b) | 705,587 | 17,032,870 | |

| Viridian Therapeutics, Inc. (a)(b) | 1,284,907 | 24,734,460 | |

| Xenon Pharmaceuticals, Inc. (b) | 495,158 | 22,391,045 | |

| Zentalis Pharmaceuticals, Inc. (a)(b) | 613,646 | 7,271,705 | |

| 1,564,563,962 | |||

| Pharmaceuticals - 3.6% | |||

| Pharmaceuticals - 3.6% | |||

| Afferent Pharmaceuticals, Inc. rights 12/31/24 (b)(c) | 1,915,787 | 383,157 | |

| Amylyx Pharmaceuticals, Inc. (b) | 260,100 | 4,161,600 | |

| CymaBay Therapeutics, Inc. (b) | 230,000 | 5,407,300 | |

| Edgewise Therapeutics, Inc. (b) | 566,300 | 10,097,129 | |

| Enliven Therapeutics, Inc. (a)(b) | 676,113 | 10,614,974 | |

| Enliven Therapeutics, Inc. rights (b)(c) | 739,725 | 7 | |

| Ikena Oncology, Inc. (b) | 1,208,666 | 1,619,612 | |

| Intra-Cellular Therapies, Inc. (b) | 110,600 | 7,447,804 | |

| Longboard Pharmaceuticals, Inc. (b) | 339,270 | 7,206,095 | |

| Neumora Therapeutics, Inc. (a) | 306,900 | 4,572,810 | |

| Structure Therapeutics, Inc. ADR | 224,700 | 9,801,414 | |

| 61,311,902 | |||

| TOTAL COMMON STOCKS (Cost $1,064,917,538) | 1,625,875,864 | ||

| Convertible Preferred Stocks - 2.0% | |||

| Shares | Value ($) | ||

| Biotechnology - 1.5% | |||

| Biotechnology - 1.5% | |||

| Bright Peak Therapeutics AG Series B (b)(c)(e) | 1,920,122 | 3,187,403 | |

| Fog Pharmaceuticals, Inc. Series D (b)(c)(e) | 239,281 | 1,447,650 | |

| LifeMine Therapeutics, Inc. Series C (b)(c)(e) | 1,950,028 | 3,685,553 | |

| Rapport Therapeutics, Inc. Series B (c)(e) | 1,430,189 | 2,602,944 | |

| Sonoma Biotherapeutics, Inc.: | |||

| Series B (b)(c)(e) | 1,967,762 | 5,431,023 | |

| Series B1 (b)(c)(e) | 1,049,456 | 3,284,797 | |

| T-Knife Therapeutics, Inc. Series B (b)(c)(e) | 1,300,097 | 5,135,383 | |

| Treeline Biosciences Series A (b)(c)(e) | 47,600 | 371,280 | |

| 25,146,033 | |||

| Financial Services - 0.1% | |||

| Diversified Financial Services - 0.1% | |||

| Kartos Therapeutics, Inc. Series C (c)(e) | 530,692 | 3,014,331 | |

| Health Care Providers & Services - 0.2% | |||

| Health Care Facilities - 0.2% | |||

| Boundless Bio, Inc. Series B (b)(c)(e) | 3,703,704 | 3,370,371 | |

| Health Care Technology - 0.2% | |||

| Health Care Technology - 0.2% | |||

| Wugen, Inc. Series B (b)(c)(e) | 580,277 | 3,290,171 | |

| Pharmaceuticals - 0.0% | |||

| Pharmaceuticals - 0.0% | |||

| Afferent Pharmaceuticals, Inc. Series C (b)(c)(e) | 1,915,787 | 19 | |

| TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $43,818,204) | 34,820,925 | ||

| Money Market Funds - 7.8% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 5.39% (f) | 21,885,142 | 21,889,519 | |

| Fidelity Securities Lending Cash Central Fund 5.39% (f)(g) | 109,057,905 | 109,068,811 | |

| TOTAL MONEY MARKET FUNDS (Cost $130,954,207) | 130,958,330 | ||

| TOTAL INVESTMENT IN SECURITIES - 106.4% (Cost $1,239,689,949) | 1,791,655,119 |

NET OTHER ASSETS (LIABILITIES) - (6.4)% | (108,446,215) |

| NET ASSETS - 100.0% | 1,683,208,904 |

| (a) | Security or a portion of the security is on loan at period end. |

| (b) | Non-income producing |

| (c) | Level 3 security |

| (d) | Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

| (e) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $76,341,075 or 4.5% of net assets. |

| (f) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (g) | Investment made with cash collateral received from securities on loan. |

| Additional information on each restricted holding is as follows: | ||

| Security | Acquisition Date | Acquisition Cost ($) |

| Afferent Pharmaceuticals, Inc. Series C | 7/01/15 | 0 |

| AVROBIO, Inc. | 1/30/24 | 1,689,995 |

| Boundless Bio, Inc. Series B | 4/23/21 | 5,000,000 |

| BridgeBio Pharma, Inc. | 9/25/23 | 10,737,944 |

| Bright Peak Therapeutics AG Series B | 5/14/21 | 7,499,997 |

| Dianthus Therapeutics, Inc. (unlisted) | 5/03/23 - 1/22/24 | 4,142,189 |

| Fog Pharmaceuticals, Inc. Series D | 11/17/22 | 2,575,405 |

| Fusion Pharmaceuticals, Inc. | 2/13/23 | 1,719,026 |

| Kartos Therapeutics, Inc. Series C | 8/22/23 | 3,000,002 |

| LifeMine Therapeutics, Inc. Series C | 2/15/22 | 3,971,408 |

| Rapport Therapeutics, Inc. Series B | 8/11/23 | 2,398,813 |

| Scholar Rock Holding Corp. warrants 12/31/25 | 6/17/22 | 0 |

| Sonoma Biotherapeutics, Inc. Series B | 7/26/21 | 3,888,888 |

| Sonoma Biotherapeutics, Inc. Series B1 | 7/26/21 | 3,111,112 |

| Spyre Therapeutics, Inc. | 6/22/23 - 12/07/23 | 6,651,451 |

| T-Knife Therapeutics, Inc. Series B | 6/30/21 | 7,500,000 |

| Tango Therapeutics, Inc. | 8/09/23 | 1,636,938 |

| Treeline Biosciences Series A | 7/30/21 | 372,589 |

| Wugen, Inc. Series B | 7/09/21 | 4,499,990 |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 14,192,363 | 314,847,261 | 307,150,105 | 280,206 | - | - | 21,889,519 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 200,794,912 | 334,583,187 | 426,309,288 | 765,736 | - | - | 109,068,811 | 0.4% |

| Total | 214,987,275 | 649,430,448 | 733,459,393 | 1,045,942 | - | - | 130,958,330 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Common Stocks | 1,625,875,864 | 1,607,084,503 | 16,718,200 | 2,073,161 |

| Convertible Preferred Stocks | 34,820,925 | - | - | 34,820,925 |

| Money Market Funds | 130,958,330 | 130,958,330 | - | - |

| Total Investments in Securities: | 1,791,655,119 | 1,738,042,833 | 16,718,200 | 36,894,086 |

| Investments in Securities: | |||

| Convertible Preferred Stocks | |||

| Beginning Balance | $ | 39,058,366 | |

| Net Realized Gain (Loss) on Investment Securities | - | ||

| Net Unrealized Gain (Loss) on Investment Securities | (1,858,108) | ||

| Cost of Purchases | 5,398,815 | ||

| Proceeds of Sales | (3,734,583) | ||

| Amortization/Accretion | - | ||

| Transfers into Level 3 | - | ||

| Transfers out of Level 3 | (4,043,565) | ||

| Ending Balance | $ | 34,820,925 | |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2024 | $ | (1,860,614) | |

| Other Investments in Securities | |||

| Beginning Balance | $ | 3,827,453 | |

| Net Realized Gain (Loss) on Investment Securities | - | ||

| Net Unrealized Gain (Loss) on Investment Securities | (1,685,891) | ||

| Cost of Purchases | 1,689,995 | ||

| Proceeds of Sales | - | ||

| Amortization/Accretion | - | ||

| Transfers into Level 3 | - | ||

| Transfers out of Level 3 | (1,758,396) | ||

| Ending Balance | $ | 2,073,161 | |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at January 31, 2024 | $ | (1,685,891) | |

| The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Cost of purchases and proceeds of sales may include securities received and/or delivered through in-kind transactions, corporate actions or exchanges. Transfers into Level 3 were attributable to a lack of observable market data resulting from decreases in market activity, decreases in liquidity, security restructurings or corporate actions. Transfers out of Level 3 were attributable to observable market data becoming available for those securities. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations. | |||

| Statement of Assets and Liabilities | ||||

January 31, 2024 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $105,171,978) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $1,108,735,742) | $ | 1,660,696,789 | ||

Fidelity Central Funds (cost $130,954,207) | 130,958,330 | |||

| Total Investment in Securities (cost $1,239,689,949) | $ | 1,791,655,119 | ||

| Receivable for fund shares sold | 1,321,131 | |||

| Dividends receivable | 3,765,229 | |||

| Distributions receivable from Fidelity Central Funds | 180,083 | |||

| Prepaid expenses | 5,097 | |||

Total assets | 1,796,926,659 | |||

| Liabilities | ||||

| Payable for investments purchased | ||||

Regular delivery | $ | 62,755 | ||

Delayed delivery | 1,689,995 | |||

| Payable for fund shares redeemed | 1,591,936 | |||

| Accrued management fee | 731,137 | |||

| Distribution and service plan fees payable | 276,593 | |||

| Other affiliated payables | 285,266 | |||

| Other payables and accrued expenses | 44,365 | |||

| Collateral on securities loaned | 109,035,708 | |||

| Total Liabilities | 113,717,755 | |||

| Net Assets | $ | 1,683,208,904 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 1,182,905,229 | ||

| Total accumulated earnings (loss) | 500,303,675 | |||

| Net Assets | $ | 1,683,208,904 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($673,288,497 ÷ 23,631,524 shares)(a) | $ | 28.49 | ||

| Maximum offering price per share (100/94.25 of $28.49) | $ | 30.23 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($121,231,478 ÷ 4,649,059 shares)(a) | $ | 26.08 | ||

| Maximum offering price per share (100/96.50 of $26.08) | $ | 27.03 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($101,768,297 ÷ 4,545,151 shares)(a) | $ | 22.39 | ||

| Class I : | ||||

Net Asset Value, offering price and redemption price per share ($715,600,915 ÷ 22,987,744 shares) | $ | 31.13 | ||

| Class Z : | ||||

Net Asset Value, offering price and redemption price per share ($71,319,717 ÷ 2,286,645 shares) | $ | 31.19 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Six months ended January 31, 2024 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 10,346,038 | ||

| Income from Fidelity Central Funds (including $765,736 from security lending) | 1,045,942 | |||

| Total Income | 11,391,980 | |||

| Expenses | ||||

| Management fee | $ | 3,960,459 | ||

| Transfer agent fees | 1,344,612 | |||

| Distribution and service plan fees | 1,521,294 | |||

| Accounting fees | 210,216 | |||

| Custodian fees and expenses | 3,156 | |||

| Independent trustees' fees and expenses | 4,454 | |||

| Registration fees | 70,714 | |||

| Audit | 34,805 | |||

| Legal | 3,987 | |||

| Interest | 10,909 | |||

| Miscellaneous | 4,573 | |||

| Total expenses before reductions | 7,169,179 | |||

| Expense reductions | (65,874) | |||

| Total expenses after reductions | 7,103,305 | |||

| Net Investment income (loss) | 4,288,675 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 1,816,724 | |||

| Total net realized gain (loss) | 1,816,724 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 190,769,569 | |||

| Unfunded commitments | 100,846 | |||

| Total change in net unrealized appreciation (depreciation) | 190,870,415 | |||

| Net gain (loss) | 192,687,139 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 196,975,814 | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2024 (Unaudited) | Year ended July 31, 2023 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 4,288,675 | $ | 1,917,025 |

| Net realized gain (loss) | 1,816,724 | 80,783,949 | ||

| Change in net unrealized appreciation (depreciation) | 190,870,415 | 158,023,113 | ||

| Net increase (decrease) in net assets resulting from operations | 196,975,814 | 240,724,087 | ||

| Distributions to shareholders | (18,817,059) | - | ||

| Share transactions - net increase (decrease) | (128,087,809) | (240,917,348) | ||

| Total increase (decrease) in net assets | 50,070,946 | (193,261) | ||

| Net Assets | ||||

| Beginning of period | 1,633,137,958 | 1,633,331,219 | ||

| End of period | $ | 1,683,208,904 | $ | 1,633,137,958 |

| Fidelity Advisor® Biotechnology Fund Class A |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 25.34 | $ | 22.00 | $ | 32.58 | $ | 31.03 | $ | 25.48 | $ | 27.80 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .06 | .02 | (.06) | .07 | .03 | .03 | ||||||

| Net realized and unrealized gain (loss) | 3.41 | 3.32 | (5.16) | 4.42 | 7.40 | (1.76) | ||||||

| Total from investment operations | 3.47 | 3.34 | (5.22) | 4.49 | 7.43 | (1.73) | ||||||

| Distributions from net investment income | (.32) | - | (.11) | (.13) | - | - | ||||||

| Distributions from net realized gain | - | - | (5.25) | (2.81) | (1.88) | (.59) | ||||||

| Total distributions | (.32) | - | (5.36) | (2.94) | (1.88) | (.59) | ||||||

| Net asset value, end of period | $ | 28.49 | $ | 25.34 | $ | 22.00 | $ | 32.58 | $ | 31.03 | $ | 25.48 |

Total Return C,D,E | 13.83% | 15.18% | (18.95)% | 14.03% | 30.00% | (6.17)% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | 1.01% H | 1.01% | 1.00% | 1.01% | 1.02% | 1.04% | ||||||

| Expenses net of fee waivers, if any | 1.00% H | 1.00% | 1.00% | 1.00% | 1.02% | 1.03% | ||||||

| Expenses net of all reductions | 1.00% H | 1.00% | 1.00% | 1.00% | 1.02% | 1.03% | ||||||

| Net investment income (loss) | .50% H | .07% | (.23)% | .20% | .11% | .13% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 673,288 | $ | 636,505 | $ | 594,911 | $ | 808,610 | $ | 722,896 | $ | 616,894 |

Portfolio turnover rate I | 87% H | 78% | 43% | 72% | 66% | 62% |

| Fidelity Advisor® Biotechnology Fund Class M |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 23.17 | $ | 20.17 | $ | 30.35 | $ | 29.08 | $ | 24.02 | $ | 26.32 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .03 | (.05) | (.13) | (.02) | (.05) | (.04) | ||||||

| Net realized and unrealized gain (loss) | 3.11 | 3.05 | (4.73) | 4.14 | 6.96 | (1.67) | ||||||

| Total from investment operations | 3.14 | 3.00 | (4.86) | 4.12 | 6.91 | (1.71) | ||||||

| Distributions from net investment income | (.23) | - | (.07) | (.07) | - | - | ||||||

| Distributions from net realized gain | - | - | (5.25) | (2.78) | (1.85) | (.59) | ||||||

| Total distributions | (.23) | - | (5.32) | (2.85) | (1.85) | (.59) | ||||||

| Net asset value, end of period | $ | 26.08 | $ | 23.17 | $ | 20.17 | $ | 30.35 | $ | 29.08 | $ | 24.02 |

Total Return C,D,E | 13.70% | 14.87% | (19.18)% | 13.69% | 29.64% | (6.44)% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | 1.28% H | 1.29% | 1.28% | 1.28% | 1.32% | 1.34% | ||||||

| Expenses net of fee waivers, if any | 1.27% H | 1.28% | 1.28% | 1.28% | 1.32% | 1.34% | ||||||

| Expenses net of all reductions | 1.27% H | 1.28% | 1.28% | 1.28% | 1.31% | 1.34% | ||||||

| Net investment income (loss) | .23% H | (.20)% | (.51)% | (.07)% | (.18)% | (.18)% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 121,231 | $ | 113,960 | $ | 109,815 | $ | 161,619 | $ | 144,568 | $ | 119,312 |

Portfolio turnover rate I | 87% H | 78% | 43% | 72% | 66% | 62% |

| Fidelity Advisor® Biotechnology Fund Class C |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 19.75 | $ | 17.27 | $ | 26.79 | $ | 25.97 | $ | 21.71 | $ | 23.96 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | (.02) | (.13) | (.21) | (.15) | (.15) | (.14) | ||||||

| Net realized and unrealized gain (loss) | 2.66 | 2.61 | (4.07) | 3.71 | 6.26 | (1.52) | ||||||

| Total from investment operations | 2.64 | 2.48 | (4.28) | 3.56 | 6.11 | (1.66) | ||||||

| Distributions from net investment income | - | - | - | (.01) | - | - | ||||||

| Distributions from net realized gain | - | - | (5.24) | (2.73) | (1.85) | (.59) | ||||||

| Total distributions | - | - | (5.24) | (2.74) | (1.85) | (.59) | ||||||

| Net asset value, end of period | $ | 22.39 | $ | 19.75 | $ | 17.27 | $ | 26.79 | $ | 25.97 | $ | 21.71 |

Total Return C,D,E | 13.37% | 14.36% | (19.54)% | 13.15% | 29.07% | (6.87)% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | 1.77% H | 1.76% | 1.75% | 1.75% | 1.77% | 1.78% | ||||||

| Expenses net of fee waivers, if any | 1.76% H | 1.76% | 1.74% | 1.75% | 1.77% | 1.77% | ||||||

| Expenses net of all reductions | 1.76% H | 1.76% | 1.74% | 1.75% | 1.76% | 1.77% | ||||||

| Net investment income (loss) | (.26)% H | (.69)% | (.97)% | (.55)% | (.63)% | (.61)% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 101,768 | $ | 119,843 | $ | 168,797 | $ | 328,417 | $ | 384,420 | $ | 398,749 |

Portfolio turnover rate I | 87% H | 78% | 43% | 72% | 66% | 62% |

| Fidelity Advisor® Biotechnology Fund Class I |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 27.71 | $ | 23.99 | $ | 35.00 | $ | 33.16 | $ | 27.08 | $ | 29.42 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .10 | .09 | .01 | .17 | .11 | .11 | ||||||

| Net realized and unrealized gain (loss) | 3.73 | 3.63 | (5.61) | 4.72 | 7.88 | (1.86) | ||||||

| Total from investment operations | 3.83 | 3.72 | (5.60) | 4.89 | 7.99 | (1.75) | ||||||

| Distributions from net investment income | (.41) | - | (.16) | (.21) | - | - | ||||||

| Distributions from net realized gain | - | - | (5.25) | (2.85) | (1.91) | (.59) | ||||||

| Total distributions | (.41) | - | (5.41) | (3.05) C | (1.91) | (.59) | ||||||

| Net asset value, end of period | $ | 31.13 | $ | 27.71 | $ | 23.99 | $ | 35.00 | $ | 33.16 | $ | 27.08 |

Total Return D,E | 14.00% | 15.51% | (18.74)% | 14.34% | 30.32% | (5.89)% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .74% H | .74% | .73% | .74% | .75% | .76% | ||||||

| Expenses net of fee waivers, if any | .73% H | .73% | .73% | .74% | .75% | .76% | ||||||

| Expenses net of all reductions | .73% H | .73% | .73% | .74% | .75% | .76% | ||||||

| Net investment income (loss) | .78% H | .34% | .04% | .47% | .38% | .40% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 715,601 | $ | 701,786 | $ | 697,079 | $ | 1,129,492 | $ | 1,092,145 | $ | 1,006,084 |

Portfolio turnover rate I | 87% H | 78% | 43% | 72% | 66% | 62% |

| Fidelity Advisor® Biotechnology Fund Class Z |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 A | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 27.81 | $ | 24.04 | $ | 35.05 | $ | 33.22 | $ | 27.10 | $ | 30.06 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) B,C | .12 | .13 | .05 | .21 | .15 | .16 | ||||||

| Net realized and unrealized gain (loss) | 3.73 | 3.64 | (5.62) | 4.74 | 7.90 | (2.53) | ||||||

| Total from investment operations | 3.85 | 3.77 | (5.57) | 4.95 | 8.05 | (2.37) | ||||||

| Distributions from net investment income | (.47) | - | (.19) | (.26) | (.02) | - | ||||||

| Distributions from net realized gain | - | - | (5.25) | (2.87) | (1.91) | (.59) | ||||||

| Total distributions | (.47) | - | (5.44) | (3.12) D | (1.93) | (.59) | ||||||

| Net asset value, end of period | $ | 31.19 | $ | 27.81 | $ | 24.04 | $ | 35.05 | $ | 33.22 | $ | 27.10 |

Total Return E,F | 14.04% | 15.68% | (18.63)% | 14.49% | 30.53% | (7.83)% | ||||||

Ratios to Average Net Assets C,G,H | ||||||||||||

| Expenses before reductions | .61% I | .61% | .61% | .61% | .62% | .63% I | ||||||

| Expenses net of fee waivers, if any | .60% I | .60% | .60% | .61% | .62% | .63% I | ||||||

| Expenses net of all reductions | .60% I | .60% | .60% | .61% | .62% | .62% I | ||||||

| Net investment income (loss) | .90% I | .47% | .16% | .60% | .51% | .73% I | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 71,320 | $ | 61,044 | $ | 62,729 | $ | 89,641 | $ | 62,743 | $ | 30,116 |

Portfolio turnover rate J | 87% I | 78% | 43% | 72% | 66% | 62% |

Top Holdings (% of Fund's net assets) | ||

| Amazon.com, Inc. | 24.4 | |

| Tesla, Inc. | 9.4 | |

| The Home Depot, Inc. | 5.0 | |

| Lowe's Companies, Inc. | 4.4 | |

| TJX Companies, Inc. | 4.0 | |

| Hilton Worldwide Holdings, Inc. | 3.0 | |

| NIKE, Inc. Class B | 2.9 | |

| McDonald's Corp. | 2.9 | |

| Dick's Sporting Goods, Inc. | 2.3 | |

| Booking Holdings, Inc. | 2.3 | |

| 60.6 | ||

| Industries (% of Fund's net assets) | ||

| Broadline Retail | 25.0 | |

| Specialty Retail | 23.7 | |

| Hotels, Restaurants & Leisure | 18.8 | |

| Automobiles | 11.0 | |

| Textiles, Apparel & Luxury Goods | 10.8 | |

| Household Durables | 4.1 | |

| Automobile Components | 3.6 | |

| Consumer Staples Distribution & Retail | 2.1 | |

| Building Products | 0.7 | |

| Leisure Products | 0.3 | |

| Commercial Services & Supplies | 0.2 | |

| Common Stocks - 100.3% | |||

| Shares | Value ($) | ||

| Automobile Components - 3.6% | |||

| Automotive Parts & Equipment - 3.6% | |||

| Adient PLC (a) | 80,721 | 2,801,826 | |

| Aptiv PLC (a) | 121,610 | 9,890,541 | |

| Magna International, Inc. Class A (b) | 61,370 | 3,488,885 | |

| 16,181,252 | |||

| Automobiles - 11.0% | |||

| Automobile Manufacturers - 11.0% | |||

| General Motors Co. | 180,200 | 6,991,760 | |

| Tesla, Inc. (a) | 226,025 | 42,332,222 | |

| 49,323,982 | |||

| Broadline Retail - 25.0% | |||

| Broadline Retail - 25.0% | |||

| Amazon.com, Inc. (a) | 706,669 | 109,675,029 | |

| Ollie's Bargain Outlet Holdings, Inc. (a) | 36,043 | 2,592,573 | |

| 112,267,602 | |||

| Building Products - 0.7% | |||

| Building Products - 0.7% | |||

| The AZEK Co., Inc. (a) | 83,891 | 3,234,837 | |

| Commercial Services & Supplies - 0.2% | |||

| Diversified Support Services - 0.2% | |||

| Vestis Corp. | 30,275 | 647,885 | |

| Consumer Staples Distribution & Retail - 2.1% | |||

| Consumer Staples Merchandise Retail - 1.1% | |||

| Dollar Tree, Inc. (a) | 36,524 | 4,770,765 | |

| Food Distributors - 1.0% | |||

| Performance Food Group Co. (a) | 63,872 | 4,642,217 | |

TOTAL CONSUMER STAPLES DISTRIBUTION & RETAIL | 9,412,982 | ||

| Hotels, Restaurants & Leisure - 18.8% | |||

| Casinos & Gaming - 2.6% | |||

| Caesars Entertainment, Inc. (a) | 50,541 | 2,217,234 | |

| Churchill Downs, Inc. | 29,134 | 3,524,340 | |

| Penn Entertainment, Inc. (a) | 90,905 | 2,049,908 | |

| Red Rock Resorts, Inc. | 69,420 | 3,795,886 | |

| 11,587,368 | |||

| Hotels, Resorts & Cruise Lines - 8.1% | |||

| Booking Holdings, Inc. (a) | 2,927 | 10,266,365 | |

| Hilton Worldwide Holdings, Inc. | 71,845 | 13,719,521 | |

| Marriott International, Inc. Class A | 35,824 | 8,588,088 | |

| Royal Caribbean Cruises Ltd. (a) | 31,370 | 3,999,675 | |

| 36,573,649 | |||

| Restaurants - 8.1% | |||

| Aramark | 58,999 | 1,715,691 | |

| Brinker International, Inc. (a) | 26,720 | 1,143,349 | |

| Chipotle Mexican Grill, Inc. (a) | 2,913 | 7,016,747 | |

| Domino's Pizza, Inc. | 19,979 | 8,515,449 | |

| Dutch Bros, Inc. (a) | 22,330 | 599,561 | |

| McDonald's Corp. | 44,331 | 12,976,570 | |

| Starbucks Corp. | 48,570 | 4,518,467 | |

| 36,485,834 | |||

TOTAL HOTELS, RESTAURANTS & LEISURE | 84,646,851 | ||

| Household Durables - 4.1% | |||

| Home Furnishings - 1.9% | |||

| Tempur Sealy International, Inc. | 171,415 | 8,551,894 | |

| Homebuilding - 2.2% | |||

| KB Home | 66,990 | 3,991,934 | |

| PulteGroup, Inc. | 55,930 | 5,848,041 | |

| 9,839,975 | |||

TOTAL HOUSEHOLD DURABLES | 18,391,869 | ||

| Leisure Products - 0.3% | |||

| Leisure Products - 0.3% | |||

| Brunswick Corp. | 17,800 | 1,436,104 | |

| Specialty Retail - 23.7% | |||

| Apparel Retail - 5.9% | |||

| Aritzia, Inc. (a) | 177,000 | 4,306,348 | |

| Burlington Stores, Inc. (a) | 22,013 | 4,207,785 | |

| TJX Companies, Inc. | 190,659 | 18,095,446 | |

| 26,609,579 | |||

| Automotive Retail - 1.0% | |||

| O'Reilly Automotive, Inc. (a) | 4,280 | 4,378,654 | |

| Home Improvement Retail - 11.0% | |||

| Floor & Decor Holdings, Inc. Class A (a)(b) | 73,268 | 7,367,830 | |

| Lowe's Companies, Inc. | 91,747 | 19,527,431 | |

| The Home Depot, Inc. | 63,493 | 22,410,489 | |

| 49,305,750 | |||

| Homefurnishing Retail - 1.3% | |||

| Wayfair LLC Class A (a) | 13,895 | 698,224 | |

| Williams-Sonoma, Inc. (b) | 26,370 | 5,099,694 | |

| 5,797,918 | |||

| Other Specialty Retail - 4.5% | |||

| Academy Sports & Outdoors, Inc. | 77,800 | 4,880,394 | |

| Bath & Body Works, Inc. | 24,508 | 1,045,511 | |

| Dick's Sporting Goods, Inc. | 70,394 | 10,493,634 | |

| Five Below, Inc. (a) | 13,650 | 2,449,629 | |

| Sally Beauty Holdings, Inc. (a) | 113,780 | 1,401,770 | |

| 20,270,938 | |||

TOTAL SPECIALTY RETAIL | 106,362,839 | ||

| Textiles, Apparel & Luxury Goods - 10.8% | |||

| Apparel, Accessories & Luxury Goods - 5.5% | |||

| Levi Strauss & Co. Class A (b) | 88,810 | 1,445,827 | |

| lululemon athletica, Inc. (a) | 19,470 | 8,835,875 | |

| LVMH Moet Hennessy Louis Vuitton SE | 2,077 | 1,728,186 | |

| PVH Corp. | 43,419 | 5,221,569 | |

| Tapestry, Inc. | 145,804 | 5,655,737 | |

| VF Corp. | 107,340 | 1,766,816 | |

| 24,654,010 | |||

| Footwear - 5.3% | |||

| Deckers Outdoor Corp. (a) | 10,452 | 7,877,986 | |

| NIKE, Inc. Class B | 127,912 | 12,986,905 | |

| On Holding AG (a)(b) | 31,484 | 836,215 | |

| Skechers U.S.A., Inc. Class A (sub. vtg.) (a) | 21,600 | 1,348,704 | |

| Wolverine World Wide, Inc. | 113,980 | 952,873 | |

| 24,002,683 | |||

TOTAL TEXTILES, APPAREL & LUXURY GOODS | 48,656,693 | ||

| TOTAL COMMON STOCKS (Cost $245,580,994) | 450,562,896 | ||

| Money Market Funds - 2.4% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 5.39% (c) | 969,520 | 969,714 | |

| Fidelity Securities Lending Cash Central Fund 5.39% (c)(d) | 9,803,770 | 9,804,750 | |

| TOTAL MONEY MARKET FUNDS (Cost $10,774,464) | 10,774,464 | ||

| TOTAL INVESTMENT IN SECURITIES - 102.7% (Cost $256,355,458) | 461,337,360 |

NET OTHER ASSETS (LIABILITIES) - (2.7)% | (12,090,874) |

| NET ASSETS - 100.0% | 449,246,486 |

| (a) | Non-income producing |

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 7,175,962 | 28,458,591 | 34,664,839 | 35,809 | - | - | 969,714 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 8,748,675 | 62,006,842 | 60,950,767 | 12,136 | - | - | 9,804,750 | 0.0% |

| Total | 15,924,637 | 90,465,433 | 95,615,606 | 47,945 | - | - | 10,774,464 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Common Stocks | 450,562,896 | 448,834,710 | 1,728,186 | - |

| Money Market Funds | 10,774,464 | 10,774,464 | - | - |

| Total Investments in Securities: | 461,337,360 | 459,609,174 | 1,728,186 | - |

| Statement of Assets and Liabilities | ||||

January 31, 2024 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $9,322,201) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $245,580,994) | $ | 450,562,896 | ||

Fidelity Central Funds (cost $10,774,464) | 10,774,464 | |||

| Total Investment in Securities (cost $256,355,458) | $ | 461,337,360 | ||

| Foreign currency held at value (cost $21,151) | 19,714 | |||

| Receivable for investments sold | 2,036,466 | |||

| Receivable for fund shares sold | 90,112 | |||

| Dividends receivable | 149,796 | |||

| Distributions receivable from Fidelity Central Funds | 2,574 | |||

| Prepaid expenses | 854 | |||

| Other receivables | 2,314 | |||

Total assets | 463,639,190 | |||

| Liabilities | ||||

| Payable to custodian bank | $ | 14,825 | ||

| Payable for investments purchased | 1,747,965 | |||

| Payable for fund shares redeemed | 2,428,143 | |||

| Accrued management fee | 199,432 | |||

| Distribution and service plan fees payable | 89,443 | |||

| Other affiliated payables | 78,527 | |||

| Other payables and accrued expenses | 29,794 | |||

| Collateral on securities loaned | 9,804,575 | |||

| Total Liabilities | 14,392,704 | |||

| Net Assets | $ | 449,246,486 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 232,918,423 | ||

| Total accumulated earnings (loss) | 216,328,063 | |||

| Net Assets | $ | 449,246,486 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($209,985,569 ÷ 5,425,068 shares)(a) | $ | 38.71 | ||

| Maximum offering price per share (100/94.25 of $38.71) | $ | 41.07 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($33,747,875 ÷ 956,337 shares)(a) | $ | 35.29 | ||

| Maximum offering price per share (100/96.50 of $35.29) | $ | 36.57 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($35,392,401 ÷ 1,219,798 shares)(a) | $ | 29.01 | ||

| Class I : | ||||

Net Asset Value, offering price and redemption price per share ($134,348,058 ÷ 3,138,964 shares) | $ | 42.80 | ||

| Class Z : | ||||

Net Asset Value, offering price and redemption price per share ($35,772,583 ÷ 831,078 shares) | $ | 43.04 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Six months ended January 31, 2024 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 1,706,024 | ||

| Income from Fidelity Central Funds (including $12,136 from security lending) | 47,945 | |||

| Total Income | 1,753,969 | |||

| Expenses | ||||

| Management fee | $ | 1,217,434 | ||

| Transfer agent fees | 386,980 | |||

| Distribution and service plan fees | 524,125 | |||

| Accounting fees | 82,395 | |||

| Custodian fees and expenses | 3,075 | |||

| Independent trustees' fees and expenses | 1,367 | |||

| Registration fees | 59,920 | |||

| Audit | 32,960 | |||

| Legal | 560 | |||

| Miscellaneous | 1,066 | |||

| Total expenses before reductions | 2,309,882 | |||

| Expense reductions | (20,210) | |||

| Total expenses after reductions | 2,289,672 | |||

| Net Investment income (loss) | (535,703) | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 7,294,392 | |||

| Redemptions in-kind | 15,311,646 | |||

| Foreign currency transactions | (1,906) | |||

| Total net realized gain (loss) | 22,604,132 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (14,471,114) | |||

| Assets and liabilities in foreign currencies | (470) | |||

| Total change in net unrealized appreciation (depreciation) | (14,471,584) | |||

| Net gain (loss) | 8,132,548 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 7,596,845 | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2024 (Unaudited) | Year ended July 31, 2023 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | (535,703) | $ | (990,830) |

| Net realized gain (loss) | 22,604,132 | 11,406,804 | ||

| Change in net unrealized appreciation (depreciation) | (14,471,584) | 43,207,276 | ||

| Net increase (decrease) in net assets resulting from operations | 7,596,845 | 53,623,250 | ||

| Distributions to shareholders | - | (17,163,089) | ||

| Share transactions - net increase (decrease) | (66,460,317) | 30,658,500 | ||

| Total increase (decrease) in net assets | (58,863,472) | 67,118,661 | ||

| Net Assets | ||||

| Beginning of period | 508,109,958 | 440,991,297 | ||

| End of period | $ | 449,246,486 | $ | 508,109,958 |

| Fidelity Advisor® Consumer Discretionary Fund Class A |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 37.68 | $ | 35.05 | $ | 45.74 | $ | 33.70 | $ | 29.83 | $ | 28.22 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | (.05) | (.09) | (.16) | (.20) | (.04) | (.02) | ||||||

| Net realized and unrealized gain (loss) | 1.08 | 4.07 | (7.62) | 12.82 | 4.73 | 1.90 | ||||||

| Total from investment operations | 1.03 | 3.98 | (7.78) | 12.62 | 4.69 | 1.88 | ||||||

| Distributions from net realized gain | - | (1.35) | (2.91) | (.58) | (.82) | (.27) | ||||||

| Total distributions | - | (1.35) | (2.91) | (.58) | (.82) | (.27) | ||||||

| Net asset value, end of period | $ | 38.71 | $ | 37.68 | $ | 35.05 | $ | 45.74 | $ | 33.70 | $ | 29.83 |

Total Return C,D,E | 2.73% | 12.14% | (18.26)% | 37.68% | 16.03% | 6.81% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | 1.04% H | 1.04% | 1.01% | 1.03% | 1.07% | 1.08% | ||||||

| Expenses net of fee waivers, if any | 1.03% H | 1.04% | 1.01% | 1.03% | 1.07% | 1.08% | ||||||

| Expenses net of all reductions | 1.03% H | 1.04% | 1.01% | 1.03% | 1.06% | 1.07% | ||||||

| Net investment income (loss) | (.28)% H | (.27)% | (.38)% | (.48)% | (.14)% | (.09)% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 209,986 | $ | 203,468 | $ | 188,092 | $ | 259,488 | $ | 159,603 | $ | 159,298 |

Portfolio turnover rate I | 25% H,J | 43% | 34% | 35% | 41% J | 60% |

| Fidelity Advisor® Consumer Discretionary Fund Class M |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 34.40 | $ | 32.20 | $ | 42.23 | $ | 31.23 | $ | 27.78 | $ | 26.36 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | (.09) | (.16) | (.24) | (.29) | (.11) | (.09) | ||||||

| Net realized and unrealized gain (loss) | .98 | 3.71 | (7.02) | 11.87 | 4.38 | 1.78 | ||||||

| Total from investment operations | .89 | 3.55 | (7.26) | 11.58 | 4.27 | 1.69 | ||||||

| Distributions from net realized gain | - | (1.35) | (2.77) | (.58) | (.82) | (.27) | ||||||

| Total distributions | - | (1.35) | (2.77) | (.58) | (.82) | (.27) | ||||||

| Net asset value, end of period | $ | 35.29 | $ | 34.40 | $ | 32.20 | $ | 42.23 | $ | 31.23 | $ | 27.78 |

Total Return C,D,E | 2.59% | 11.87% | (18.49)% | 37.32% | 15.70% | 6.56% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | 1.30% H | 1.31% | 1.28% | 1.30% | 1.34% | 1.34% | ||||||

| Expenses net of fee waivers, if any | 1.29% H | 1.30% | 1.27% | 1.30% | 1.34% | 1.34% | ||||||

| Expenses net of all reductions | 1.29% H | 1.30% | 1.27% | 1.29% | 1.33% | 1.34% | ||||||

| Net investment income (loss) | (.54)% H | (.53)% | (.64)% | (.75)% | (.41)% | (.35)% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 33,748 | $ | 35,811 | $ | 35,219 | $ | 48,288 | $ | 33,896 | $ | 32,792 |

Portfolio turnover rate I | 25% H,J | 43% | 34% | 35% | 41% J | 60% |

| Fidelity Advisor® Consumer Discretionary Fund Class C |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 28.35 | $ | 26.92 | $ | 35.82 | $ | 26.69 | $ | 23.97 | $ | 22.90 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | (.14) | (.25) | (.36) | (.40) | (.21) | (.19) | ||||||

| Net realized and unrealized gain (loss) | .80 | 3.03 | (5.87) | 10.11 | 3.75 | 1.53 | ||||||

| Total from investment operations | .66 | 2.78 | (6.23) | 9.71 | 3.54 | 1.34 | ||||||

| Distributions from net realized gain | - | (1.35) | (2.67) | (.58) | (.82) | (.27) | ||||||

| Total distributions | - | (1.35) | (2.67) | (.58) | (.82) | (.27) | ||||||

| Net asset value, end of period | $ | 29.01 | $ | 28.35 | $ | 26.92 | $ | 35.82 | $ | 26.69 | $ | 23.97 |

Total Return C,D,E | 2.33% | 11.32% | (18.88)% | 36.66% | 15.14% | 6.02% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | 1.80% H | 1.80% | 1.77% | 1.79% | 1.82% | 1.83% | ||||||

| Expenses net of fee waivers, if any | 1.79% H | 1.79% | 1.76% | 1.79% | 1.82% | 1.83% | ||||||

| Expenses net of all reductions | 1.79% H | 1.79% | 1.76% | 1.79% | 1.82% | 1.82% | ||||||

| Net investment income (loss) | (1.03)% H | (1.02)% | (1.13)% | (1.24)% | (.90)% | (.83)% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 35,392 | $ | 43,294 | $ | 54,035 | $ | 85,549 | $ | 65,223 | $ | 70,890 |

Portfolio turnover rate I | 25% H,J | 43% | 34% | 35% | 41% J | 60% |

| Fidelity Advisor® Consumer Discretionary Fund Class I |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 41.61 | $ | 38.45 | $ | 49.91 | $ | 36.63 | $ | 32.27 | $ | 30.42 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | - C | - C | (.05) | (.10) | .04 | .06 | ||||||

| Net realized and unrealized gain (loss) | 1.19 | 4.51 | (8.36) | 13.96 | 5.14 | 2.06 | ||||||

| Total from investment operations | 1.19 | 4.51 | (8.41) | 13.86 | 5.18 | 2.12 | ||||||

| Distributions from net realized gain | - | (1.35) | (3.05) | (.58) | (.82) | (.27) | ||||||

| Total distributions | - | (1.35) | (3.05) | (.58) | (.82) | (.27) | ||||||

| Net asset value, end of period | $ | 42.80 | $ | 41.61 | $ | 38.45 | $ | 49.91 | $ | 36.63 | $ | 32.27 |

Total Return D,E | 2.86% | 12.45% | (18.04)% | 38.05% | 16.34% | 7.10% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .77% H | .77% | .75% | .77% | .79% | .80% | ||||||

| Expenses net of fee waivers, if any | .76% H | .76% | .74% | .76% | .79% | .80% | ||||||

| Expenses net of all reductions | .76% H | .76% | .74% | .76% | .79% | .80% | ||||||

| Net investment income (loss) | (.01)% H | .01% | (.11)% | (.22)% | .13% | .19% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 134,348 | $ | 139,088 | $ | 118,859 | $ | 259,846 | $ | 134,907 | $ | 159,613 |

Portfolio turnover rate I | 25% H,J | 43% | 34% | 35% | 41% J | 60% |

| Fidelity Advisor® Consumer Discretionary Fund Class Z |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 A | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 41.82 | $ | 38.59 | $ | 50.10 | $ | 36.72 | $ | 32.31 | $ | 31.56 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) B,C | .02 | .05 | - D | (.04) | .09 | .10 | ||||||

| Net realized and unrealized gain (loss) | 1.20 | 4.53 | (8.38) | 14.00 | 5.14 | .92 | ||||||

| Total from investment operations | 1.22 | 4.58 | (8.38) | 13.96 | 5.23 | 1.02 | ||||||

| Distributions from net realized gain | - | (1.35) | (3.13) | (.58) | (.82) | (.27) | ||||||

| Total distributions | - | (1.35) | (3.13) | (.58) | (.82) | (.27) | ||||||

| Net asset value, end of period | $ | 43.04 | $ | 41.82 | $ | 38.59 | $ | 50.10 | $ | 36.72 | $ | 32.31 |

Total Return E,F | 2.92% | 12.59% | (17.93)% | 38.23% | 16.48% | 3.36% | ||||||

Ratios to Average Net Assets C,G,H | ||||||||||||

| Expenses before reductions | .64% I | .64% | .62% | .64% | .66% | .67% I | ||||||

| Expenses net of fee waivers, if any | .63% I | .64% | .62% | .64% | .66% | .66% I | ||||||

| Expenses net of all reductions | .63% I | .64% | .62% | .64% | .66% | .66% I | ||||||

| Net investment income (loss) | .12% I | .13% | .01% | (.09)% | .26% | .39% I | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 35,773 | $ | 86,450 | $ | 44,785 | $ | 87,644 | $ | 48,668 | $ | 6,786 |

Portfolio turnover rate J | 25% I,K | 43% | 34% | 35% | 41% K | 60% |

Top Holdings (% of Fund's net assets) | ||

| Exxon Mobil Corp. | 24.1 | |

| Canadian Natural Resources Ltd. | 5.5 | |

| Chevron Corp. | 5.3 | |

| Marathon Petroleum Corp. | 4.8 | |

| Schlumberger Ltd. | 4.8 | |

| Occidental Petroleum Corp. | 4.8 | |

| Cenovus Energy, Inc. (Canada) | 4.7 | |

| Hess Corp. | 4.1 | |

| Valero Energy Corp. | 3.9 | |

| ConocoPhillips Co. | 3.6 | |

| 65.6 | ||

| Industries (% of Fund's net assets) | ||

| Oil, Gas & Consumable Fuels | 82.2 | |

| Energy Equipment & Services | 16.6 | |

| Machinery | 0.6 | |

| Independent Power and Renewable Electricity Producers | 0.5 | |

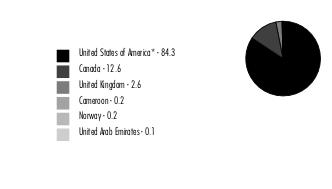

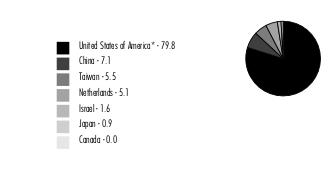

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Common Stocks - 99.9% | |||

| Shares | Value ($) | ||

| Energy Equipment & Services - 16.6% | |||

| Oil & Gas Drilling - 3.5% | |||

| Noble Corp. PLC | 148,300 | 6,544,479 | |

| Odfjell Drilling Ltd. | 691,156 | 2,579,369 | |

| Patterson-UTI Energy, Inc. | 1,180,996 | 13,097,246 | |

| Shelf Drilling Ltd. (a)(b)(c) | 513,728 | 1,470,271 | |

| Valaris Ltd. (a) | 247,500 | 15,312,825 | |

| 39,004,190 | |||

| Oil & Gas Equipment & Services - 13.1% | |||

| Halliburton Co. | 990,400 | 35,307,760 | |

| NOV, Inc. | 628,100 | 12,254,231 | |

| Oceaneering International, Inc. (a) | 473,500 | 9,839,330 | |

| ProFrac Holding Corp. (a)(b) | 279,500 | 2,210,845 | |

| ProPetro Holding Corp. (a) | 425,100 | 3,596,346 | |

| Schlumberger Ltd. | 1,093,318 | 53,244,587 | |

| TechnipFMC PLC | 1,519,700 | 29,390,998 | |

| 145,844,097 | |||

TOTAL ENERGY EQUIPMENT & SERVICES | 184,848,287 | ||

| Independent Power and Renewable Electricity Producers - 0.5% | |||

| Independent Power Producers & Energy Traders - 0.5% | |||

| Vistra Corp. | 127,100 | 5,214,913 | |

| Machinery - 0.6% | |||

| Industrial Machinery & Supplies & Components - 0.6% | |||

| Chart Industries, Inc. (a)(b) | 58,300 | 6,804,776 | |

| Oil, Gas & Consumable Fuels - 82.2% | |||

| Integrated Oil & Gas - 41.4% | |||

| Cenovus Energy, Inc. (Canada) | 3,234,500 | 52,398,683 | |

| Chevron Corp. | 396,708 | 58,486,660 | |

| Exxon Mobil Corp. | 2,605,661 | 267,888,008 | |

| Imperial Oil Ltd. | 214,100 | 12,349,626 | |

| Occidental Petroleum Corp. | 914,400 | 52,642,008 | |

| Occidental Petroleum Corp. warrants 8/3/27 (a) | 36,987 | 1,319,696 | |

| Suncor Energy, Inc. | 437,800 | 14,497,271 | |

| 459,581,952 | |||

| Oil & Gas Exploration & Production - 24.2% | |||

| Antero Resources Corp. (a) | 428,600 | 9,574,924 | |

| APA Corp. | 123,100 | 3,856,723 | |

| Canadian Natural Resources Ltd. | 951,400 | 60,886,203 | |

| Chord Energy Corp. | 40,430 | 6,216,517 | |

| Civitas Resources, Inc. | 12,944 | 838,901 | |

| ConocoPhillips Co. | 361,450 | 40,435,412 | |

| Devon Energy Corp. | 149,200 | 6,269,384 | |

| Diamondback Energy, Inc. | 115,600 | 17,772,344 | |

| EOG Resources, Inc. | 84,386 | 9,602,283 | |

| Hess Corp. | 323,500 | 45,461,455 | |

| National Energy Services Reunited Corp. (a) | 1,636,771 | 12,112,105 | |

| Northern Oil & Gas, Inc. | 60,030 | 2,011,005 | |

| Ovintiv, Inc. | 531,200 | 22,533,504 | |

| Pioneer Natural Resources Co. | 74,525 | 17,128,081 | |

| Range Resources Corp. | 381,500 | 11,078,760 | |

| SM Energy Co. | 99,300 | 3,682,044 | |

| 269,459,645 | |||

| Oil & Gas Refining & Marketing - 10.0% | |||

| Marathon Petroleum Corp. | 323,378 | 53,551,397 | |

| Phillips 66 Co. | 100,018 | 14,433,598 | |

| Valero Energy Corp. | 310,300 | 43,100,670 | |

| 111,085,665 | |||

| Oil & Gas Storage & Transportation - 6.6% | |||

| Cheniere Energy, Inc. | 231,600 | 37,980,084 | |

| Energy Transfer LP | 1,745,700 | 24,963,510 | |

| Golar LNG Ltd. | 119,400 | 2,604,114 | |

| New Fortress Energy, Inc. (b) | 233,100 | 7,745,913 | |

| 73,293,621 | |||

TOTAL OIL, GAS & CONSUMABLE FUELS | 913,420,883 | ||

| TOTAL COMMON STOCKS (Cost $680,882,562) | 1,110,288,859 | ||

| Money Market Funds - 1.4% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 5.39% (d) | 5,178,065 | 5,179,101 | |

| Fidelity Securities Lending Cash Central Fund 5.39% (d)(e) | 10,501,339 | 10,502,389 | |

| TOTAL MONEY MARKET FUNDS (Cost $15,681,490) | 15,681,490 | ||

| TOTAL INVESTMENT IN SECURITIES - 101.3% (Cost $696,564,052) | 1,125,970,349 |

NET OTHER ASSETS (LIABILITIES) - (1.3)% | (14,504,434) |

| NET ASSETS - 100.0% | 1,111,465,915 |

| (a) | Non-income producing |

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $1,470,271 or 0.1% of net assets. |

| (d) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (e) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 4,273,105 | 97,944,996 | 97,039,000 | 108,719 | - | - | 5,179,101 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.39% | 39,722,849 | 463,727,656 | 492,948,116 | 36,147 | - | - | 10,502,389 | 0.0% |

| Total | 43,995,954 | 561,672,652 | 589,987,116 | 144,866 | - | - | 15,681,490 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Common Stocks | 1,110,288,859 | 1,110,288,859 | - | - |

| Money Market Funds | 15,681,490 | 15,681,490 | - | - |

| Total Investments in Securities: | 1,125,970,349 | 1,125,970,349 | - | - |

| Statement of Assets and Liabilities | ||||

January 31, 2024 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $9,880,392) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $680,882,562) | $ | 1,110,288,859 | ||

Fidelity Central Funds (cost $15,681,490) | 15,681,490 | |||

| Total Investment in Securities (cost $696,564,052) | $ | 1,125,970,349 | ||

| Foreign currency held at value (cost $50,348) | 50,376 | |||

| Receivable for fund shares sold | 610,686 | |||

| Dividends receivable | 413,352 | |||

| Distributions receivable from Fidelity Central Funds | 14,330 | |||

| Prepaid expenses | 2,235 | |||

| Other receivables | 140,801 | |||

Total assets | 1,127,202,129 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 2,474,822 | ||

| Payable for fund shares redeemed | 1,723,389 | |||

| Accrued management fee | 485,380 | |||

| Distribution and service plan fees payable | 181,782 | |||

| Other affiliated payables | 185,210 | |||

| Other payables and accrued expenses | 183,566 | |||

| Collateral on securities loaned | 10,502,065 | |||

| Total Liabilities | 15,736,214 | |||

| Net Assets | $ | 1,111,465,915 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 858,145,792 | ||

| Total accumulated earnings (loss) | 253,320,123 | |||

| Net Assets | $ | 1,111,465,915 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($351,192,555 ÷ 8,266,822 shares)(a) | $ | 42.48 | ||

| Maximum offering price per share (100/94.25 of $42.48) | $ | 45.07 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($100,144,273 ÷ 2,289,999 shares)(a) | $ | 43.73 | ||

| Maximum offering price per share (100/96.50 of $43.73) | $ | 45.32 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($79,428,427 ÷ 2,046,174 shares)(a) | $ | 38.82 | ||

| Class I : | ||||

Net Asset Value, offering price and redemption price per share ($485,020,928 ÷ 10,762,360 shares) | $ | 45.07 | ||

| Class Z : | ||||

Net Asset Value, offering price and redemption price per share ($95,679,732 ÷ 2,126,526 shares) | $ | 44.99 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Six months ended January 31, 2024 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 17,264,737 | ||

| Income from Fidelity Central Funds (including $36,147 from security lending) | 144,866 | |||

| Total Income | 17,409,603 | |||

| Expenses | ||||

| Management fee | $ | 3,398,055 | ||

| Transfer agent fees | 1,042,606 | |||

| Distribution and service plan fees | 1,188,472 | |||

| Accounting fees | 183,171 | |||

| Custodian fees and expenses | 22,213 | |||

| Independent trustees' fees and expenses | 3,930 | |||

| Registration fees | 75,168 | |||

| Audit | 28,042 | |||

| Legal | 1,105 | |||

| Interest | 5,888 | |||

| Miscellaneous | 2,897 | |||

| Total expenses before reductions | 5,951,547 | |||

| Expense reductions | (55,073) | |||

| Total expenses after reductions | 5,896,474 | |||

| Net Investment income (loss) | 11,513,129 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 66,208,267 | |||

| Redemptions in-kind | 42,342,401 | |||

| Foreign currency transactions | (32,081) | |||

| Total net realized gain (loss) | 108,518,587 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (163,162,222) | |||

| Assets and liabilities in foreign currencies | (490) | |||

| Total change in net unrealized appreciation (depreciation) | (163,162,712) | |||

| Net gain (loss) | (54,644,125) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (43,130,996) | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2024 (Unaudited) | Year ended July 31, 2023 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 11,513,129 | $ | 35,265,025 |

| Net realized gain (loss) | 108,518,587 | 43,349,912 | ||

| Change in net unrealized appreciation (depreciation) | (163,162,712) | 113,842,540 | ||

| Net increase (decrease) in net assets resulting from operations | (43,130,996) | 192,457,477 | ||

| Distributions to shareholders | (23,514,165) | (33,434,847) | ||

| Share transactions - net increase (decrease) | (183,176,892) | (175,324,623) | ||

| Total increase (decrease) in net assets | (249,822,053) | (16,301,993) | ||

| Net Assets | ||||

| Beginning of period | 1,361,287,968 | 1,377,589,961 | ||

| End of period | $ | 1,111,465,915 | $ | 1,361,287,968 |

| Fidelity Advisor® Energy Fund Class A |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 44.81 | $ | 39.49 | $ | 23.59 | $ | 16.59 | $ | 27.88 | $ | 37.52 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .37 | .96 | .80 | .65 C | .57 | .35 | ||||||

| Net realized and unrealized gain (loss) | (1.82) | 5.26 | 15.68 | 6.94 | (11.42) | (9.76) | ||||||

| Total from investment operations | (1.45) | 6.22 | 16.48 | 7.59 | (10.85) | (9.41) | ||||||

| Distributions from net investment income | (.88) | (.90) | (.58) | (.59) | (.44) | (.18) D | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.05) D | ||||||

| Total distributions | (.88) | (.90) | (.58) | (.59) | (.44) | (.23) | ||||||

| Net asset value, end of period | $ | 42.48 | $ | 44.81 | $ | 39.49 | $ | 23.59 | $ | 16.59 | $ | 27.88 |

Total Return E,F,G | (3.23)% | 15.94% | 71.12% | 46.78% | (39.54)% | (25.07)% | ||||||

Ratios to Average Net Assets B,H,I | ||||||||||||

| Expenses before reductions | 1.01% J | 1.01% | 1.05% | 1.11% | 1.14% | 1.10% | ||||||

| Expenses net of fee waivers, if any | 1.01% J | 1.01% | 1.04% | 1.11% | 1.14% | 1.10% | ||||||

| Expenses net of all reductions | 1.01% J | 1.01% | 1.04% | 1.11% | 1.12% | 1.09% | ||||||

| Net investment income (loss) | 1.67% J | 2.29% | 2.43% | 3.15% C | 2.62% | 1.14% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 351,193 | $ | 379,351 | $ | 361,023 | $ | 175,221 | $ | 114,321 | $ | 190,992 |

Portfolio turnover rate K | 35% J,L | 21% | 37% | 45% | 84% L | 47% |

| Fidelity Advisor® Energy Fund Class M |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 46.03 | $ | 40.53 | $ | 24.20 | $ | 17.00 | $ | 28.53 | $ | 38.36 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .32 | .88 | .73 | .60 C | .53 | .27 | ||||||

| Net realized and unrealized gain (loss) | (1.87) | 5.39 | 16.11 | 7.13 | (11.71) | (9.97) | ||||||

| Total from investment operations | (1.55) | 6.27 | 16.84 | 7.73 | (11.18) | (9.70) | ||||||

| Distributions from net investment income | (.75) | (.77) | (.51) | (.53) | (.35) | (.08) D | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.05) D | ||||||

| Total distributions | (.75) | (.77) | (.51) | (.53) | (.35) | (.13) | ||||||

| Net asset value, end of period | $ | 43.73 | $ | 46.03 | $ | 40.53 | $ | 24.20 | $ | 17.00 | $ | 28.53 |

Total Return E,F,G | (3.35)% | 15.64% | 70.66% | 46.37% | (39.66)% | (25.28)% | ||||||

Ratios to Average Net Assets B,H,I | ||||||||||||

| Expenses before reductions | 1.27% J | 1.27% | 1.31% | 1.38% | 1.40% | 1.37% | ||||||

| Expenses net of fee waivers, if any | 1.26% J | 1.27% | 1.31% | 1.38% | 1.40% | 1.36% | ||||||

| Expenses net of all reductions | 1.26% J | 1.27% | 1.31% | 1.38% | 1.38% | 1.36% | ||||||

| Net investment income (loss) | 1.41% J | 2.04% | 2.16% | 2.88% C | 2.36% | .88% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 100,144 | $ | 109,406 | $ | 114,014 | $ | 62,519 | $ | 43,768 | $ | 87,147 |

Portfolio turnover rate K | 35% J,L | 21% | 37% | 45% | 84% L | 47% |

| Fidelity Advisor® Energy Fund Class C |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 40.83 | $ | 36.08 | $ | 21.60 | $ | 15.23 | $ | 25.58 | $ | 34.39 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .19 | .59 | .51 | .45 C | .39 | .12 | ||||||

| Net realized and unrealized gain (loss) | (1.65) | 4.80 | 14.38 | 6.38 | (10.52) | (8.93) | ||||||

| Total from investment operations | (1.46) | 5.39 | 14.89 | 6.83 | (10.13) | (8.81) | ||||||

| Distributions from net investment income | (.55) | (.64) | (.41) | (.46) | (.22) | - | ||||||

| Total distributions | (.55) | (.64) | (.41) | (.46) | (.22) | - | ||||||

| Net asset value, end of period | $ | 38.82 | $ | 40.83 | $ | 36.08 | $ | 21.60 | $ | 15.23 | $ | 25.58 |

Total Return D,E,F | (3.57)% | 15.09% | 69.86% | 45.68% | (39.95)% | (25.62)% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | 1.76% I | 1.76% | 1.79% | 1.84% | 1.86% | 1.82% | ||||||

| Expenses net of fee waivers, if any | 1.75% I | 1.75% | 1.78% | 1.84% | 1.86% | 1.82% | ||||||

| Expenses net of all reductions | 1.75% I | 1.75% | 1.78% | 1.84% | 1.84% | 1.81% | ||||||

| Net investment income (loss) | .93% I | 1.55% | 1.69% | 2.42% C | 1.90% | .42% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 79,428 | $ | 94,348 | $ | 105,747 | $ | 56,068 | $ | 45,212 | $ | 90,437 |

Portfolio turnover rate J | 35% I,K | 21% | 37% | 45% | 84% K | 47% |

| Fidelity Advisor® Energy Fund Class I |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 47.54 | $ | 41.83 | $ | 24.95 | $ | 17.51 | $ | 29.39 | $ | 39.57 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .46 | 1.14 | .97 | .74 C | .67 | .47 | ||||||

| Net realized and unrealized gain (loss) | (1.93) | 5.57 | 16.57 | 7.35 | (12.02) | (10.31) | ||||||

| Total from investment operations | (1.47) | 6.71 | 17.54 | 8.09 | (11.35) | (9.84) | ||||||

| Distributions from net investment income | (1.00) | (1.00) | (.66) | (.65) | (.53) | (.30) D | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.05) D | ||||||

| Total distributions | (1.00) | (1.00) | (.66) | (.65) | (.53) | (.34) E | ||||||

| Net asset value, end of period | $ | 45.07 | $ | 47.54 | $ | 41.83 | $ | 24.95 | $ | 17.51 | $ | 29.39 |

Total Return F,G | (3.08)% | 16.25% | 71.63% | 47.26% | (39.33)% | (24.85)% | ||||||

Ratios to Average Net Assets B,H,I | ||||||||||||

| Expenses before reductions | .74% J | .74% | .76% | .79% | .82% | .80% | ||||||

| Expenses net of fee waivers, if any | .73% J | .74% | .76% | .79% | .82% | .80% | ||||||

| Expenses net of all reductions | .73% J | .74% | .76% | .79% | .80% | .79% | ||||||

| Net investment income (loss) | 1.94% J | 2.57% | 2.71% | 3.47% C | 2.95% | 1.44% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 485,021 | $ | 511,737 | $ | 533,005 | $ | 177,248 | $ | 154,575 | $ | 224,599 |

Portfolio turnover rate K | 35% J,L | 21% | 37% | 45% | 84% L | 47% |

| Fidelity Advisor® Energy Fund Class Z |

Six months ended (Unaudited) January 31, 2024 | Years ended July 31, 2023 | 2022 | 2021 | 2020 | 2019 A | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 47.46 | $ | 41.75 | $ | 24.91 | $ | 17.48 | $ | 29.35 | $ | 39.35 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) B,C | .50 | 1.19 | 1.02 | .80 D | .69 | .45 | ||||||

| Net realized and unrealized gain (loss) | (1.94) | 5.56 | 16.52 | 7.30 | (11.97) | (10.03) | ||||||

| Total from investment operations | (1.44) | 6.75 | 17.54 | 8.10 | (11.28) | (9.58) | ||||||

| Distributions from net investment income | (1.03) | (1.04) | (.70) | (.67) | (.59) | (.37) E | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.05) E | ||||||

| Total distributions | (1.03) | (1.04) | (.70) | (.67) | (.59) | (.42) | ||||||

| Net asset value, end of period | $ | 44.99 | $ | 47.46 | $ | 41.75 | $ | 24.91 | $ | 17.48 | $ | 29.35 |

Total Return F,G | (3.02)% | 16.40% | 71.83% | 47.47% | (39.22)% | (24.34)% | ||||||

Ratios to Average Net Assets C,H,I | ||||||||||||

| Expenses before reductions | .61% J | .62% | .63% | .65% | .66% | .65% J | ||||||

| Expenses net of fee waivers, if any | .60% J | .61% | .62% | .64% | .66% | .64% J | ||||||

| Expenses net of all reductions | .60% J | .61% | .62% | .64% | .64% | .64% J | ||||||

| Net investment income (loss) | 2.07% J | 2.69% | 2.85% | 3.62% D | 3.10% | 1.82% J | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 95,680 | $ | 266,447 | $ | 263,802 | $ | 81,903 | $ | 40,742 | $ | 9,255 |

Portfolio turnover rate K | 35% J,L | 21% | 37% | 45% | 84% L | 47% |

Top Holdings (% of Fund's net assets) | ||

| MasterCard, Inc. Class A | 9.8 | |

| Wells Fargo & Co. | 7.7 | |

| Bank of America Corp. | 6.4 | |

| Reinsurance Group of America, Inc. | 3.8 | |

| Chubb Ltd. | 3.3 | |

| Citigroup, Inc. | 3.0 | |

| Morgan Stanley | 2.5 | |

| Moody's Corp. | 2.5 | |

| Apollo Global Management, Inc. | 2.3 | |

| PNC Financial Services Group, Inc. | 2.2 | |

| 43.5 | ||

| Industries (% of Fund's net assets) | ||

| Banks | 36.2 | |

| Insurance | 21.5 | |

| Financial Services | 19.5 | |

| Capital Markets | 18.2 | |

| Consumer Finance | 3.5 | |

| Professional Services | 1.0 | |

| Common Stocks - 99.9% | |||

| Shares | Value ($) | ||

| Banks - 36.2% | |||

| Diversified Banks - 22.7% | |||

| Bank of America Corp. | 817,556 | 27,805,080 | |

| Citigroup, Inc. | 231,905 | 13,026,104 | |

| KeyCorp | 473,000 | 6,872,690 | |

| PNC Financial Services Group, Inc. | 62,700 | 9,480,867 | |

| U.S. Bancorp | 188,100 | 7,813,674 | |

| Wells Fargo & Co. | 659,328 | 33,085,079 | |

| 98,083,494 | |||

| Regional Banks - 13.5% | |||

| Associated Banc-Corp. | 203,900 | 4,283,939 | |

| BOK Financial Corp. | 28,800 | 2,414,592 | |

| Cadence Bank | 96,224 | 2,561,483 | |

| East West Bancorp, Inc. (a) | 71,100 | 5,176,791 | |

| Eastern Bankshares, Inc. | 159,300 | 2,223,828 | |

| First Hawaiian, Inc. | 121,500 | 2,635,335 | |

| First Interstate Bancsystem, Inc. | 146,052 | 4,019,351 | |

| Heartland Financial U.S.A., Inc. | 75,628 | 2,682,525 | |

| M&T Bank Corp. | 58,588 | 8,091,003 | |

| Popular, Inc. | 102,571 | 8,764,692 | |

| Truist Financial Corp. | 197,900 | 7,334,174 | |

| UMB Financial Corp. | 37,100 | 3,060,750 | |

| WesBanco, Inc. | 84,400 | 2,476,296 | |

| Wintrust Financial Corp. | 24,366 | 2,363,015 | |

| 58,087,774 | |||

TOTAL BANKS | 156,171,268 | ||

| Capital Markets - 18.2% | |||

| Asset Management & Custody Banks - 7.6% | |||

| AllianceBernstein Holding LP | 168,100 | 5,639,755 | |

| Bank of New York Mellon Corp. | 103,600 | 5,745,656 | |

| Blue Owl Capital, Inc. Class A | 175,400 | 2,725,716 | |

| Carlyle Group LP | 46,900 | 1,876,938 | |

| Northern Trust Corp. | 63,800 | 5,081,032 | |

| Patria Investments Ltd. | 281,300 | 4,014,151 | |

| State Street Corp. | 104,800 | 7,741,576 | |

| 32,824,824 | |||

| Financial Exchanges & Data - 4.3% | |||

| Bolsa Mexicana de Valores S.A.B. de CV | 1,735,900 | 3,516,883 | |

| MarketAxess Holdings, Inc. | 18,100 | 4,081,731 | |

| Moody's Corp. | 27,500 | 10,781,100 | |

| 18,379,714 | |||

| Investment Banking & Brokerage - 6.3% | |||

| Lazard, Inc. Class A | 107,852 | 4,204,071 | |

| Morgan Stanley | 124,000 | 10,817,760 | |

| Raymond James Financial, Inc. | 47,750 | 5,261,095 | |

| Stifel Financial Corp. | 66,900 | 4,880,355 | |

| Virtu Financial, Inc. Class A | 124,060 | 2,082,967 | |

| 27,246,248 | |||

TOTAL CAPITAL MARKETS | 78,450,786 | ||

| Consumer Finance - 3.5% | |||

| Consumer Finance - 3.5% | |||

| Discover Financial Services | 74,100 | 7,819,032 | |

| FirstCash Holdings, Inc. | 41,971 | 4,817,012 | |

| OneMain Holdings, Inc. | 57,400 | 2,732,240 | |

| 15,368,284 | |||

| Financial Services - 19.5% | |||

| Commercial & Residential Mortgage Finance - 1.5% | |||

| Essent Group Ltd. | 76,800 | 4,236,288 | |

| Walker & Dunlop, Inc. | 23,500 | 2,269,865 | |

| 6,506,153 | |||

| Diversified Financial Services - 3.5% | |||

| Apollo Global Management, Inc. | 99,500 | 9,989,800 | |

| Corebridge Financial, Inc. | 211,301 | 5,107,145 | |

| 15,096,945 | |||

| Multi-Sector Holdings - 0.6% | |||

| Cannae Holdings, Inc. (b) | 128,540 | 2,602,935 | |

| Transaction & Payment Processing Services - 13.9% | |||

| Fiserv, Inc. (b) | 56,600 | 8,029,842 | |

| FleetCor Technologies, Inc. (b) | 15,000 | 4,348,950 | |

| Global Payments, Inc. | 42,100 | 5,608,983 | |

| MasterCard, Inc. Class A | 93,800 | 42,137,772 | |

| 60,125,547 | |||

TOTAL FINANCIAL SERVICES | 84,331,580 | ||

| Insurance - 21.5% | |||

| Insurance Brokers - 4.6% | |||

| Arthur J. Gallagher & Co. | 25,700 | 5,966,512 | |

| BRP Group, Inc. (b) | 202,504 | 4,544,190 | |

| Marsh & McLennan Companies, Inc. | 47,800 | 9,265,552 | |

| 19,776,254 | |||

| Life & Health Insurance - 1.3% | |||

| Globe Life, Inc. | 46,427 | 5,702,164 | |

| Multi-Line Insurance - 0.0% | |||

| Assurant, Inc. | 200 | 33,590 | |

| Property & Casualty Insurance - 11.7% | |||

| American Financial Group, Inc. | 49,200 | 5,923,680 | |

| Beazley PLC | 483,300 | 3,334,987 | |

| Chubb Ltd. | 59,000 | 14,455,000 | |

| Direct Line Insurance Group PLC (b) | 1,510,900 | 3,243,610 | |

| Fidelity National Financial, Inc. | 83,400 | 4,172,502 | |

| First American Financial Corp. | 49,819 | 3,006,577 | |

| Hartford Financial Services Group, Inc. | 85,500 | 7,435,080 | |

| Hiscox Ltd. | 423,800 | 5,580,279 | |

| Lancashire Holdings Ltd. | 426,200 | 3,278,548 | |

| 50,430,263 | |||

| Reinsurance - 3.9% | |||

| Enstar Group Ltd. (b) | 1,149 | 306,657 | |

| Reinsurance Group of America, Inc. | 94,900 | 16,502,161 | |

| 16,808,818 | |||

TOTAL INSURANCE | 92,751,089 | ||

| Professional Services - 1.0% | |||

| Research & Consulting Services - 1.0% | |||

| Dun & Bradstreet Holdings, Inc. | 365,000 | 4,230,350 | |

| TOTAL COMMON STOCKS (Cost $349,755,765) | 431,303,357 | ||

| Money Market Funds - 1.4% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 5.39% (c) | 1,037,696 | 1,037,904 | |

| Fidelity Securities Lending Cash Central Fund 5.39% (c)(d) | 4,941,406 | 4,941,900 | |

| TOTAL MONEY MARKET FUNDS (Cost $5,979,804) | 5,979,804 | ||

| TOTAL INVESTMENT IN SECURITIES - 101.3% (Cost $355,735,569) | 437,283,161 |

NET OTHER ASSETS (LIABILITIES) - (1.3)% | (5,774,553) |

| NET ASSETS - 100.0% | 431,508,608 |

| (a) | Security or a portion of the security is on loan at period end. |

| (b) | Non-income producing |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |