SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

Fidelity Advisor Series I, Fidelity Advisor Series VII, Fidelity Advisor Series VIII, Fidelity Capital Trust, Fidelity Central Investment Portfolios LLC, Fidelity Commonwealth Trust, Fidelity Commonwealth Trust II, Fidelity Concord Street Trust, Fidelity Contrafund, Fidelity Covington Trust, Fidelity Destiny Portfolios, Fidelity Devonshire Trust, Fidelity Financial Trust, Fidelity Hanover Street Trust, Fidelity Hastings Street Trust, Fidelity Investment Trust, Fidelity Magellan Fund, Fidelity Mt. Vernon Street Trust, Fidelity Puritan Trust, Fidelity Securities Fund, Fidelity Select Portfolios, Fidelity Summer Street Trust, and Fidelity Trend Fund

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total Fee Paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

IMPORTANT

Proxy Materials

PLEASE CAST YOUR VOTE NOW!

FIDELITY ADVISOR SERIES I

FIDELITY ADVISOR SERIES VII

FIDELITY ADVISOR SERIES VIII

FIDELITY CAPITAL TRUST

FIDELITY CENTRAL INVESTMENT PORTFOLIOS LLC

FIDELITY COMMONWEALTH TRUST

FIDELITY COMMONWEALTH TRUST II

FIDELITY CONCORD STREET TRUST

FIDELITY CONTRAFUND

FIDELITY COVINGTON TRUST

FIDELITY DESTINY PORTFOLIOS

FIDELITY DEVONSHIRE TRUST

FIDELITY FINANCIAL TRUST

FIDELITY HANOVER STREET TRUST

FIDELITY HASTINGS STREET TRUST

FIDELITY INVESTMENT TRUST

FIDELITY MAGELLAN FUND

FIDELITY MT. VERNON STREET TRUST

FIDELITY PURITAN TRUST

FIDELITY SECURITIES FUND

FIDELITY SELECT PORTFOLIOS

FIDELITY SUMMER STREET TRUST

FIDELITY TREND FUND

Dear Shareholder:

A special meeting of shareholders of the above-named trusts (the trusts) will be held on July 16, 2024. Appendix A in the enclosed proxy statement contains a list of funds in the trusts (the funds). The purpose of the meeting is to provide you with the opportunity to vote on an important proposal that affects the funds and your investment in them. As a shareholder and a valued Fidelity customer, you can make your voice heard.

Proxy campaigns are costly, so your timely vote will help to control proxy expenses that are borne by shareholders. This letter and accompanying proxy statement contain important information about the proposal and the materials to use when casting your vote.

Please read the enclosed proxy materials and cast your vote on the proxy card(s). Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be.

The proposal to elect a Board of Trustees has been carefully reviewed by the Board of Trustees. The Trustees, most of whom are not affiliated with Fidelity, are responsible for protecting your interests as a shareholder. The Trustees believe that the proposal is in the best interests of shareholders. They recommend that you vote for this proposal.

The following Q&A is provided to assist you in understanding the proposal. The proposal is also described in greater detail in the enclosed proxy statement.

Voting is quick and easy. To cast your vote, you may:

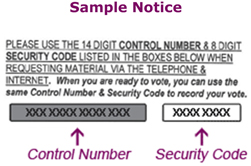

| • | Visit the web site indicated on your proxy card(s) or notice(s), enter the control number found on the card(s) or notice(s), and follow the on-line instructions, OR |

| • | Call the toll-free number on your proxy card(s) or available to you on the web site indicated on your notice(s), enter the control number found on the card(s) or notice(s), and follow the recorded instructions, OR; |

| • | If you have received a paper copy of the proxy card(s), complete the proxy card(s) and return the signed card(s) in the postage-paid envelope. |

If you have any questions before you vote, please call Fidelity at the toll-free number on your notice(s) or proxy card(s). We will be glad to help you submit your vote. Thank you for voting your shares and for your confidence in entrusting Fidelity with your investments.

Sincerely,

Robert A. Lawrence

Acting Chairman

Important information to help you understand and vote on the proposal

Please read the full text of the proxy statement. We have provided a brief overview of the proposal to be voted upon below. Your vote is important. We appreciate you placing your trust in Fidelity and look forward to helping you achieve your financial goals.

What proposal am I being asked to vote on?

You are being asked to elect a Board of Trustees.

What role does the Board play?

The Trustees serve as representatives of the funds’ shareholders. Members of the Board are fiduciaries and have an obligation to serve the best interests of shareholders, including consideration of policy changes. In addition, the Trustees review fund performance, oversee fund activities, and review contractual arrangements with companies that provide services to the funds.

Have the funds’ Board of Trustees approved the proposal?

Yes. The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

General Questions on the Proxy

Who is Computershare Fund Services?

Computershare Fund Services is a third party proxy vendor that has been hired to call shareholders and record proxy votes. In order to hold a shareholder meeting, quorum must be reached. If quorum is not met (or the required vote is not achieved), the meeting may adjourn to a future date. The campaign attempts to reach shareholders via multiple mailings to remind them to cast their vote. As the meeting approaches, phone calls may be made to clients who have not yet voted their shares so that the shareholder meeting does not have to be adjourned.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to call to you to solicit your vote.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each dollar of net asset value you own of each of the funds on the record date, with fractional dollar amounts entitled to a proportional fractional vote. The record date is May 20, 2024.

How do I vote my shares?

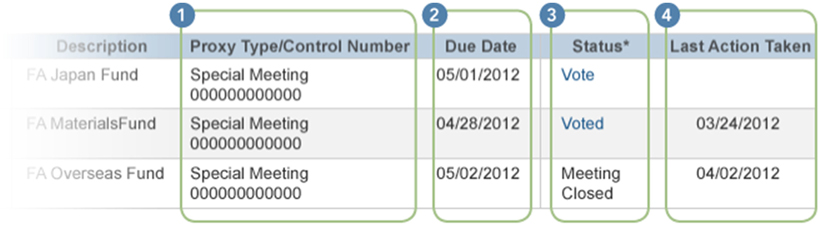

You can vote your shares by visiting the web site indicated on your proxy card(s) or notice(s), entering the control number found on the card(s) or notice(s), and following the on-line instructions. You may also vote by touch-tone telephone by calling the toll-free number on your proxy card(s) or available to you on the web site indicated on your notice(s) and following the recorded instructions. In addition, if you have requested paper proxy materials, you may vote by completing and signing the proxy card(s) and mailing them in the postage-paid envelope. If you need any assistance, or have any questions regarding the proposal or how to vote your shares, please call Fidelity at the toll-free number on your proxy card(s) or notice(s).

How do I sign the proxy card?

| Individual Accounts: | Shareholders should sign exactly as their names appear on the account registration shown on the card or form. | |

| Joint Accounts: | Either owner may sign, but the name of the person signing should conform exactly to a name shown in the registration. | |

| All Other Accounts: | The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, “Ann B. Collins, Trustee.” | |

| 1.9912385.100 EQP24-PXL-0524 |

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be held on July 16, 2024

The Letter to Shareholders, Notice of Meeting, and Proxy Statement are available at https://www.proxy-direct.com/Fidelity.

FIDELITY ADVISOR SERIES I

FIDELITY ADVISOR SERIES VII

FIDELITY ADVISOR SERIES VIII

FIDELITY CAPITAL TRUST

FIDELITY CENTRAL INVESTMENT PORTFOLIOS LLC

FIDELITY COMMONWEALTH TRUST

FIDELITY CONCORD STREET TRUST

FIDELITY CONTRAFUND

FIDELITY COVINGTON TRUST

FIDELITY DESTINY PORTFOLIOS

FIDELITY DEVONSHIRE TRUST

FIDELITY FINANCIAL TRUST

FIDELITY HANOVER STREET TRUST

FIDELITY HASTINGS STREET TRUST

FIDELITY INVESTMENT TRUST

FIDELITY MAGELLAN FUND

FIDELITY MT. VERNON STREET TRUST

FIDELITY PURITAN TRUST

FIDELITY SECURITIES FUND

FIDELITY SELECT PORTFOLIOS

FIDELITY SUMMER STREET TRUST

FIDELITY TREND FUND

245 Summer Street, Boston, Massachusetts 02210

1-800-544-8544 (Retail funds and/or classes)

1-800-FIDELITY (Fidelity ETFs)

1-877-208-0098 (Advisor funds and/or classes)

1-800-835-5092 (K6 funds and/or Class K)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of the above trusts:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the Meeting) of the above-named trusts (the trusts) will be held on July 16, 2024, at 8:00 a.m. Eastern Time (ET). Appendix A contains a list of the funds in the trusts (the funds).

The purpose of the Meeting is to consider and act upon the following proposal and to transact such other business as may properly come before the Meeting or any adjournments thereof.

| 1. | To elect a Board of Trustees. |

The Board of Trustees has fixed the close of business on May 20, 2024, as the record date for the determination of the shareholders of each of the funds entitled to notice of, and to vote at, such Meeting and any adjournments thereof.

By order of the Board of Trustees,

MARGARET CAREY

Secretary and Chief Legal Officer

May 20, 2024

Your vote is important – please vote your shares promptly.

The Meeting will be held in a virtual format only. Shareholders are invited to attend the Meeting by means of remote audio communication at meetnow.global/MQZDHHG. You will not be able to attend the Meeting in person. You will be required to enter the control number found on your proxy card, voting instruction form or notice you previously received. If you have lost or misplaced your control number, please email Computershare Fund Services, the proxy tabulator for the Meeting (“Computershare”), at shareholdermeetings@computershare.com (include your full name, street address, city, state & zip code) to verify your identity and obtain your control number.

If your shares are held through a brokerage account or by a bank or other holder of record you will need to request a legal proxy in order to receive access to the virtual Meeting. To do so, you must submit proof of your proxy power (legal proxy) reflecting your holdings, along with your name and email address, to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. ET on Thursday, July, 11, 2024. You will receive a confirmation of your registration by email that includes the control number necessary to access and vote at the Meeting. Requests for registration should be directed to Computershare at shareholdermeetings@computershare.com.

Questions from shareholders to be considered at the Meeting must be submitted to Computershare at shareholdermeetings@computershare.com no later than 8:00 a.m. ET on Monday, July 15, 2024.

Any shareholder who does not expect to virtually attend the Meeting is urged to vote using the touch-tone telephone or internet voting instructions that follow or by indicating voting instructions on the enclosed proxy card, dating and signing it, and returning it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask for your cooperation in responding promptly, no matter how large or small your holdings may be. If you wish to wait until the Meeting to vote your shares, you will need to follow the instructions available on the Meeting’s website during the Meeting in order to do so.

INSTRUCTIONS FOR EXECUTING PROXY CARD

The following general rules for executing proxy cards may be of assistance to you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

| 1. | Individual Accounts: Your name should be signed exactly as it appears in the registration on the proxy card. |

| 2. | Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration. |

| 3. | All other accounts should show the capacity of the individual signing. This can be shown either in the form of the account registration itself or by the individual executing the proxy card. For example: |

REGISTRATION | VALID SIGNATURE | |||||||

| A. | 1) | ABC Corp. | John Smith, Treasurer | |||||

| 2) | ABC Corp. | John Smith, Treasurer | ||||||

| c/o John Smith, Treasurer | ||||||||

| B. | 1) | ABC Corp. Profit Sharing Plan | Ann B. Collins, Trustee | |||||

| 2) | ABC Trust | Ann B. Collins, Trustee | ||||||

| 3) | Ann B. Collins, Trustee | Ann B. Collins, Trustee | ||||||

| u/t/d 12/28/78 | ||||||||

| C. | 1) | Anthony B. Craft, Cust. | Anthony B. Craft | |||||

| f/b/o Anthony B. Craft, Jr. | ||||||||

| UGMA | ||||||||

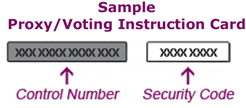

INSTRUCTIONS FOR VOTING BY TOUCH-TONE TELEPHONE OR THROUGH THE INTERNET

| 1. | Read the proxy statement, and have your proxy card or notice handy. |

| 2. | Call the toll-free number or visit the web site indicated on your proxy card or notice. |

| 3. | Enter the number found in either the box on the front of your proxy card or on the proposal page(s) of your notice. |

| 4. | Follow the recorded or on-line instructions to cast your vote up until 11:59 p.m. ET on July 15, 2024. |

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS OF

FIDELITY ADVISOR SERIES I

FIDELITY ADVISOR SERIES VII

FIDELITY ADVISOR SERIES VIII

FIDELITY CAPITAL TRUST

FIDELITY CENTRAL INVESTMENT PORTFOLIOS LLC

FIDELITY COMMONWEALTH TRUST

FIDELITY CONCORD STREET TRUST

FIDELITY CONTRAFUND

FIDELITY COVINGTON TRUST

FIDELITY DESTINY PORTFOLIOS

FIDELITY DEVONSHIRE TRUST

FIDELITY FINANCIAL TRUST

FIDELITY HANOVER STREET TRUST

FIDELITY HASTINGS STREET TRUST

FIDELITY INVESTMENT TRUST

FIDELITY MAGELLAN FUND

FIDELITY MT. VERNON STREET TRUST

FIDELITY PURITAN TRUST

FIDELITY SECURITIES FUND

FIDELITY SELECT PORTFOLIOS

FIDELITY SUMMER STREET TRUST

FIDELITY TREND FUND

TO BE HELD ON JULY 16, 2024

This Proxy Statement is furnished in connection with a solicitation of proxies made by, and on behalf of, the Board of Trustees of the above-named trusts (the trusts) to be used at the Special Meeting of Shareholders and at any adjournments thereof (the Meeting), to be held on July 16, 2024 at 8:00 a.m. ET. The Board of Trustees and Fidelity Management & Research Company LLC (FMR) have determined that the Meeting will be held in a virtual format only. The Meeting will be accessible solely by means of remote audio communication. You will not be able to attend the meeting in person. Appendix A contains a list of the funds in each trust (the funds).

The purpose of the Meeting is set forth in the accompanying Notice. The solicitation is being made primarily by the mailing of the Notice of Internet Availability of Proxy Materials and the distribution of this Proxy Statement and the accompanying proxy card on or about May 20, 2024. Supplementary solicitations may be made by mail, telephone, facsimile, electronic means or by personal interview by representatives of the trusts. In addition, Computershare Limited (Computershare) may be paid on a per-call basis to solicit shareholders by telephone on behalf of the funds in the trusts. The funds may also arrange to have votes recorded by telephone. Computershare may be paid on a per-call basis for vote-by-phone solicitations on behalf of the funds. The approximate anticipated total cost of these services is detailed in Appendix B.

If the funds record votes by telephone or through the internet, they will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Proxies voted by telephone or through the internet may be revoked at any time before they are voted.

Some shareholders will not automatically receive a copy of this entire Proxy Statement in the mail, but will instead receive a notice that informs them of how to access all of the proxy materials on a publicly available website (commonly referred to as “notice and access”). Shareholders who receive such a notice will not be able to return the notice to have their vote recorded. However, they can access the proxy materials at https://www.proxy-direct.com/Fidelity to vote eligible shares or may use the instructions on the notice to request a paper or email copy of the proxy materials at no charge.

Unless otherwise indicated in Appendix A, (i) the expenses in connection with preparing this Proxy Statement, its enclosures, and all solicitations and (ii) the expenses associated with reimbursing brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares, will be borne by each fund.

For a fund whose management contract with FMR obligates FMR to pay certain fund level expenses, the expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be borne by FMR. FMR will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares.

1

Appendix A lists each fund’s auditor and fiscal year end. The principal business address of FMR, each fund’s investment adviser, is 245 Summer Street, Boston, Massachusetts 02210. Each fund’s sub-adviser(s) and each sub-adviser’s principal business address are included in Appendix C. The principal business address of Fidelity Distributors Company LLC, each fund’s principal underwriter and distribution agent, is 100 Salem Street, Smithfield, Rhode Island 02917.

If the enclosed proxy is executed and returned, or an internet or telephonic vote is delivered, that vote may nevertheless be revoked at any time prior to its use by written notification received by a trust, by the execution of a later-dated proxy, by a trust’s receipt of a subsequent valid internet or telephonic vote, or by attending the virtual Meeting and voting.

All proxies solicited by the Board of Trustees that are properly executed and received by the Secretary prior to the Meeting, and are not revoked, will be voted at the Meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on a properly executed proxy, it will be voted FOR the matters specified on the proxy. All shares that are voted and votes to ABSTAIN will be counted towards establishing a quorum, as will broker non-votes. (Broker non-votes are shares for which (i) the beneficial owner has not voted and (ii) the broker holding the shares does not have discretionary authority to vote on the particular matter.)

With respect to fund shares held in Fidelity individual retirement accounts (including Traditional, Rollover, SEP, SARSEP, Roth and SIMPLE IRAs), the IRA Custodian will vote those shares for which it has received instructions from shareholders only in accordance with such instructions. If Fidelity IRA shareholders do not vote their shares, the IRA Custodian will vote their shares for them, in the same proportion as other Fidelity IRA shareholders have voted. For Fidelity fund investments in a Fidelity Series Fund, Fidelity generally will vote in a manner consistent with the recommendation of the Fidelity Series Fund’s Board of Trustees on both proposals.

One-third of each trust’s outstanding voting securities entitled to vote constitutes a quorum for the transaction of business at the Meeting. If a quorum is not present at a Meeting, or if a quorum is present at a Meeting but sufficient votes to approve one or more of the proposed items are not received, or if other matters arise requiring shareholder attention, the persons named as proxy agents may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting or represented by proxy. When voting on a proposed adjournment, the persons named as proxy agents will vote FOR the proposed adjournment all shares that they are entitled to vote with respect to each item, unless directed to vote AGAINST an item, in which case such shares will be voted AGAINST the proposed adjournment with respect to that item. A shareholder vote may be taken on one or more of the items in this Proxy Statement prior to such adjournment if sufficient votes have been received and it is otherwise appropriate.

Shares of each fund and class, if applicable, issued and outstanding as of March 31, 2024 are indicated in Appendix D.

Information regarding record and/or beneficial ownership of each fund and class, as applicable, is included in Appendix E.

Certain shares are registered to FMR or an FMR affiliate. To the extent that FMR and/or another entity or entities of which FMR LLC is the ultimate parent has discretion to vote, these shares will be voted at the Meeting FOR Proposal 1. Otherwise, these shares will be voted in accordance with the plan or agreement governing the shares. Although the terms of the plans and agreements vary, generally the shares must be voted either (i) in accordance with instructions received from shareholders or (ii) in accordance with instructions received from shareholders and, for shareholders who do not vote, in the same proportion as certain other shareholders have voted. Certain funds and accounts that are managed by FMR or its affiliates (including funds of funds) invest in other funds and may at times have substantial investments in one or more funds. Although these funds generally intend to vote their shares of underlying funds using echo voting procedures (that is, in the same proportion as the holders of all other shares of the particular underlying fund), they reserve the right, on a case-by-case basis, to vote in another manner, which may include voting all shares as recommended by the Board.

Shareholders of record at the close of business on May 20, 2024 will be entitled to vote at the Meeting. Each such shareholder will be entitled to one vote for each dollar of net asset value held on that date, with fractional dollar amounts entitled to a proportional fractional vote.

For a free copy of each fund’s annual and/or semiannual reports, call Fidelity at 1-800-544-8544 (Retail funds and/or classes), 1-800-FIDELITY (Fidelity ETFs), 1-877-208-0098 (Advisor funds and/or classes), or 1-800-835-5092 (K6 funds and/or Class K), visit Fidelity’s web sites at www.fidelity.com, institutional.fidelity.com, or www.401k.com (plan accounts), or write to Fidelity Distributors Company LLC at 100 Salem Street, Smithfield, Rhode Island 02917.

VOTE REQUIRED: Approval of Proposal 1 requires the affirmative vote of a plurality of the shares of the applicable trust present or represented by proxy at the Meeting. Votes to ABSTAIN and broker non-votes will have no effect.

2

PROPOSAL 1

TO ELECT A BOARD OF TRUSTEES

The purpose of this proposal is to elect a Board of Trustees of each trust. Pursuant to the provisions of the Declaration of Trust of each trust, the Trustees have determined that the number of Trustees shall be fixed at 13 for all trusts other than Fidelity Advisor Series VIII, Fidelity Concord Street Trust, Fidelity Investment Trust, Fidelity Puritan Trust, and Fidelity Securities Fund, and at 14 for Advisor Series VIII, Fidelity Concord Street Trust, Fidelity Investment Trust, Fidelity Puritan Trust, and Fidelity Securities Fund. It is intended that the enclosed proxy will be voted for the nominees listed below unless such authority has been withheld in the proxy.

Appendix F shows the composition of the Board of Trustees of each trust and the length of service of each Trustee and Member of the Advisory Board. All nominees named below are currently Trustees or Advisory Board Members of the trusts and have served in that capacity continuously since originally elected or appointed. Certain nominees were previously elected by shareholders to serve as Trustees of certain trusts, while other nominees were initially appointed by the Trustees and have not yet been elected by shareholders of all trusts. With respect to the nominees not previously elected by shareholders of one or more trusts, a third-party search firm identified Vijay C. Advani, Thomas P. Bostick, Thomas A. Kennedy, Oscar Munoz, and Karen B. Peetz as candidates. The Governance and Nominating Committee has recommended all Independent Trustee candidates.

In the election of Trustees, those nominees receiving the highest number of votes cast at the Meeting, provided a quorum is present, shall be elected. A nominee shall be elected immediately upon shareholder approval. For each such trust other than Fidelity Advisor Series Advisor Series VIII, Fidelity Concord Street Trust, Fidelity Investment Trust, Fidelity Puritan Trust, and Fidelity Securities Fund, the election of the nominees will result in a board comprised of 13 Trustees, and for Fidelity Advisor Series VIII, Fidelity Concord Street Trust, Fidelity Investment Trust, Fidelity Puritan Trust, and Fidelity Securities Fund, the election of the nominees will result in a board comprised of 14 Trustees, the maximum number permitted under each trust’s organizational documents.

Except for Mr. Advani and Ms. Peetz, each of the nominees currently oversees 323 Fidelity funds. Mr. Advani currently oversees 216 Fidelity funds. Ms. Peetz is currently a Member of the Advisory Board of each trust and has served in that capacity continuously since originally appointed.

Jonathan Chiel currently serves as trustee of Fidelity Advisor Series VIII, Fidelity Concord Street Trust, Fidelity Investment Trust, Fidelity Puritan Trust, and Fidelity Securities Fund. Mr. Chiel is not nominated for election by shareholders but will continue to serve as a Trustee of such trusts following the election of the nominees. Mr. Chiel currently oversees 192 Fidelity funds.

The nominees you are being asked to elect as Trustees of the funds are as follows:

Interested Nominees*:

Correspondence intended for each Interested Nominee (that is, the nominees that are interested persons (as defined in the 1940 Act)) may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Bettina Doulton (1964)

Ms. Doulton also serves as Trustee of other Fidelity® funds. Prior to her retirement, Ms. Doulton served in a variety of positions at Fidelity Investments, including as a managing director of research (2006-2007), portfolio manager to certain Fidelity® funds (1993-2005), equity analyst and portfolio assistant (1990-1993), and research assistant (1987-1990). Ms. Doulton currently owns and operates Phi Builders + Architects and Cellardoor Winery. Previously, Ms. Doulton served as a member of the Board of Brown Capital Management, LLC (2014-2018).

Robert A. Lawrence (1952)

Chair of the Board of Trustees

Mr. Lawrence also serves as Trustee of other funds. Previously, Mr. Lawrence served as a Trustee and Member of the Advisory Board of certain funds. Prior to his retirement in 2008, Mr. Lawrence served as Vice President of certain Fidelity® funds (2006-2008), Senior Vice President, Head of High Income Division of Fidelity Management & Research Company (investment adviser firm, 2006-2008), and President of Fidelity Strategic Investments (investment adviser firm, 2002-2005).

| * | Determined to be an “Interested Nominee” by virtue of, among other things, his or her affiliation with the trusts or various entities under common control with FMR. |

| + | The information includes each nominee’s principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the nominee’s qualifications to serve as a Trustee, which led to the conclusion that the nominee should serve as a Trustee for each fund. |

3

Independent Nominees:

Correspondence intended for each Independent Nominee (that is, the nominees that are not interested persons (as defined in the 1940 Act)) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Vijay C. Advani (1960)

Mr. Advani also serves as Trustee or Member of the Advisory Board of other funds. Previously, Mr. Advani served as Executive Chairman (2020-2022), Chief Executive Officer (2017-2020) and Chief Operating Officer (2016-2017) of Nuveen (global investment manager). He also served in various capacities at Franklin Resources (global investment manager), including Co-President (2015-2016), Executive Vice President, Global Advisory Services (2008-2015), Head of Global Retail Distribution (2005-2008), Executive Managing Director, International Retail Development (2002-2005), Managing Director, Product Developments, Sales & Marketing, Asia, Eastern Europe and Africa (2000-2002) and President, Templeton Asset Management India (1995-2000). Mr. Advani also served as Senior Investment Officer of International Finance Corporation (private equity and venture capital arm of The World Bank, 1984-1995). Mr. Advani is Chairman Emeritus of the U.S. India Business Council (2018-present), a Director of The Global Impact Investing Network (2019-present), a Director of LOK Capital (Mauritius) (2022-present), a member of the Advisory Council of LOK Capital (2022-present), a Senior Advisor of Neuberger Berman (2021-present), a Senior Advisor of Seviora Holdings Pte. Ltd (Temasek-Singapore) (2021-present), a Director of Seviora Capital (Singapore) (2021-present) and an Advisor of EQUIAM (2021-present). Mr. Advani formerly served as a member of the Board of BowX Acquisition Corp. (special purpose acquisition company, 2020-2021), a member of the Board of Intellecap (advisory arm of The Aavishkaar Group, 2018-2020), a member of the Board of Nuveen Investments, Inc. (2017-2020) and a member of the Board of Docusign (software, 2016-2019).

Thomas P. Bostick (1956)

Lieutenant General Bostick also serves as Trustee of other Fidelity® funds. Prior to his retirement, General Bostick (United States Army, Retired) held a variety of positions within the U.S. Army, including Commanding General and Chief of Engineers, U.S. Army Corps of Engineers (2012-2016) and Deputy Chief of Staff and Director of Human Resources, U.S. Army (2009-2012). General Bostick currently serves as a member of the Board and Finance and Governance & Sustainability Committees of CSX Corporation (transportation, 2020-present) and a member of the Board and Corporate Governance and Nominating Committee of Perma-Fix Environmental Services, Inc. (nuclear waste management, 2020-present). General Bostick serves as Chief Executive Officer of Bostick Global Strategies, LLC (consulting, 2016-present), as a member of the Board of HireVue, Inc. (video interview and assessment, 2020-present), as a member of the Board of Allonnia (biotechnology and engineering solutions, 2022-present) and on the Advisory Board of Solugen, Inc. (specialty bio-based chemicals manufacturer, 2022-present). Previously, General Bostick served as a Member of the Advisory Board of certain Fidelity® funds (2021), President, Intrexon Bioengineering (2018-2020) and Chief Operating Officer (2017-2020) and Senior Vice President of the Environment Sector (2016-2017) of Intrexon Corporation (biopharmaceutical company).

Donald F. Donahue (1950)

Mr. Donahue also serves as Trustee of other Fidelity® funds. Mr. Donahue serves as President and Chief Executive Officer of Miranda Partners, LLC (risk consulting for the financial services industry, 2012-present). Previously, Mr. Donahue served as Chief Executive Officer (2006-2012), Chief Operating Officer (2003-2006) and Managing Director, Customer Marketing and Development (1999-2003) of The Depository Trust & Clearing Corporation (financial markets infrastructure). Mr. Donahue currently serves as a member (2007-present) and Co-Chairman (2016-present) of the Board of United Way of New York. Mr. Donahue previously served as a member of the Advisory Board of certain Fidelity® funds (2015-2018) and as a member of the Board of The Leadership Academy (previously NYC Leadership Academy) (2012-2022).

Vicki L. Fuller (1957)

Ms. Fuller also serves as Trustee of other Fidelity® funds. Previously, Ms. Fuller served as a member of the Advisory Board of certain Fidelity® funds (2018-2020), Chief Investment Officer of the New York State Common Retirement Fund (2012-2018) and held a variety of positions at AllianceBernstein L.P. (global asset management, 1985-2012), including Managing Director (2006-2012) and Senior Vice President and Senior Portfolio Manager (2001-2006). Ms. Fuller currently serves as a member of the Board, Audit Committee and Nominating and Governance Committee of two Blackstone business development companies (2020-present), as a member of the Board of Treliant, LLC (consulting, 2019-present), as a member of the Board of Ariel Alternatives, LLC (private equity, 2022-present) and as a member of the Board and Chair of the Audit Committee of Gusto, Inc. (software, 2021-present). In addition, Ms. Fuller currently serves as a member of the Board of Roosevelt University (2019-present) and as a member of the Executive Board of New York University’s Stern School of Business. Ms. Fuller previously served as a member of the Board, Audit Committee and Nominating and Governance Committee of The Williams Companies, Inc. (natural gas infrastructure, 2018-2021).

4

Patricia L. Kampling (1959)

Ms. Kampling also serves as Trustee of other Fidelity® funds. Prior to her retirement, Ms. Kampling served as Chairman of the Board and Chief Executive Officer (2012-2019), President and Chief Operating Officer (2011-2012) and Executive Vice President and Chief Financial Officer (2010-2011) of Alliant Energy Corporation. Ms. Kampling currently serves as a member of the Board, Finance Committee and Governance, Compensation and Nominating Committee of Xcel Energy Inc. (utilities company, 2020-present) and as a member of the Board, Audit, Finance and Risk Committee and Safety, Environmental, Technology and Operations Committee and Chair of the Executive Development and Compensation Committee of American Water Works Company, Inc. (utilities company, 2019-present). In addition, Ms. Kampling currently serves as a member of the Board of the Nature Conservancy, Wisconsin Chapter (2019-present). Previously, Ms. Kampling served as a Member of the Advisory Board of certain Fidelity® funds (2020), a member of the Board, Compensation Committee and Executive Committee and Chair of the Audit Committee of Briggs & Stratton Corporation (manufacturing, 2011-2021), a member of the Board of Interstate Power and Light Company (2012-2019) and Wisconsin Power and Light Company (2012-2019) (each a subsidiary of Alliant Energy Corporation) and as a member of the Board and Workforce Development Committee of the Business Roundtable (2018-2019).

Thomas A. Kennedy (1955)

Mr. Kennedy also serves as Trustee of other Fidelity® funds. Previously, Mr. Kennedy served as a Member of the Advisory Board of certain Fidelity® funds (2020) and held a variety of positions at Raytheon Company (aerospace and defense, 1983-2020), including Chairman and Chief Executive Officer (2014-2020) and Executive Vice President and Chief Operating Officer (2013-2014). Mr. Kennedy served as Executive Chairman of the Board of Directors of Raytheon Technologies Corporation (aerospace and defense, 2020-2021). Mr. Kennedy serves as a Director of the Board of Directors of Textron Inc. (aerospace and defense, 2023-present).

Oscar Munoz (1959)

Mr. Munoz also serves as Trustee of other Fidelity® funds. Prior to his retirement, Mr. Munoz served as Executive Chairman (2020-2021), Chief Executive Officer (2015-2020), President (2015-2016) and a member of the Board (2010-2021) of United Airlines Holdings, Inc. Mr. Munoz currently serves as a member of the Board of CBRE Group, Inc. (commercial real estate, 2020-present), a member of the Board of Univision Communications, Inc. (Hispanic media, 2020-present), a member of the Board of Archer Aviation Inc. (2021-present), a member of the Defense Business Board of the United States Department of Defense (2021-present) and a member of the Board of Salesforce.com, Inc. (cloud-based software, 2022-present). Previously, Mr. Munoz served as a Member of the Advisory Board of certain Fidelity® funds (2021).

Karen B. Peetz (1955)

Ms. Peetz also serves as a Member of the Advisory Board of other funds. Previously, Ms. Peetz served as Chief Administration Officer (2020-2023) of Citigroup Inc. (a diversified financial service company). She also served in various capacities at Bank of New York Mellon Corporation, including President (2013-2016), Vice Chairman, Senior Executive Vice President and Chief Executive Officer of Financial Markets & Treasury Services (2010-2013), Senior Executive Vice President and Chief Executive Officer of Global Corporate Trust (2003-2008), Senior Vice President and Division Manager of Global Payments & Trade Services (2002-2003) and Senior Vice President and Division Manager of Domestic Corporate Trust (1998-2002). Ms. Peetz also served in various capacities at Chase Manhattan Corporation (1982-1998), including Senior Vice President and Manager of Corporate Trust International Business (1996-1998), Managing Director and Manager of Corporate Trust Services (1994-1996) and Managing Director and Group Manager of Financial Institution Sales (1990-1993). Ms. Peetz currently serves as Chair of Amherst Holdings Advisory Council (2018-present), Trustee of Johns Hopkins University (2016-present), Chair of the Carey Business School Advisory Council, Member of the Johns Hopkins Medicine Board and Finance Committee and Chair of the Lyme and Tick Related Disease Institute Advisory Council. Ms. Peetz previously served as a member of the Board of Guardian Life Insurance Company of America (2019-2023), a member of the Board of Trane Technologies (2018-2022), a member of the Board of Wells Fargo Corp. (2017-2019), a member of the Board of SunCoke Energy Inc. (2012-2016), a member of the Board of Private Export Funding Corporation (2010-2016) and as a Trustee of Penn State University (2010-2014) and the United Way of New York City (2008-2010).

David M. Thomas (1949)

Lead Independent Trustee

Mr. Thomas also serves as Trustee of other Fidelity® funds. Previously, Mr. Thomas served as Executive Chairman (2005-2006) and Chairman and Chief Executive Officer (2000-2005) of IMS Health, Inc. (pharmaceutical and healthcare information solutions). Mr. Thomas currently serves as a member of the Board of Fortune Brands Home and Security (home and security products, 2004-present) and as Director (2013-present) and Non-Executive Chairman of the Board (2022-present) of Interpublic Group of Companies, Inc. (marketing communication).

5

Susan Tomasky (1953)

Ms. Tomasky also serves as Trustee of other Fidelity® funds. Prior to her retirement, Ms. Tomasky served in various executive officer positions at American Electric Power Company, Inc. (1998-2011), including most recently as President of AEP Transmission (2007-2011). Ms. Tomasky currently serves as a member of the Board and Sustainability Committee and as Chair of the Audit Committee of Marathon Petroleum Corporation (2018-present) and as a member of the Board, Executive Committee, Corporate Governance Committee and Organization and Compensation Committee and as Lead Director of the Board of Public Service Enterprise Group, Inc. (utilities company, 2012-present) and as a member of the Board of its subsidiary company, Public Service Electric and Gas Co. (2021-present). In addition, Ms. Tomasky currently serves as a member (2009-present) and President (2020-present) of the Board of the Royal Shakespeare Company – America (2009-present), as a member of the Board of the Columbus Association for the Performing Arts (2011-present) and as a member of the Board and Kenyon in the World Committee of Kenyon College (2016-present). Previously, Ms. Tomasky served as a Member of the Advisory Board of certain Fidelity® funds (2020), as a member of the Board of the Columbus Regional Airport Authority (2007-2020), as a member of the Board (2011-2018) and Lead Independent Director (2015-2018) of Andeavor Corporation (previously Tesoro Corporation) (independent oil refiner and marketer) and as a member of the Board of Summit Midstream Partners LP (energy, 2012-2018).

Michael E. Wiley (1950)

Mr. Wiley also serves as Trustee of other Fidelity® funds. Previously, Mr. Wiley served as a member of the Advisory Board of certain Fidelity® funds (2018-2020), Chairman, President and CEO of Baker Hughes, Inc. (oilfield services, 2000-2004). Mr. Wiley also previously served as a member of the Board of Andeavor Corporation (independent oil refiner and marketer, 2005-2018), a member of the Board of Andeavor Logistics LP (natural resources logistics, 2015-2018) and a member of the Board of High Point Resources (exploration and production, 2005-2020).

| + | The information includes the nominee’s principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the nominee’s qualifications to serve as a Trustee, which led to the conclusion that the nominee should serve as a Trustee for each fund. |

As of March 31, 2024, the Trustees and nominees for election as Trustee and the officers of the trusts and each fund owned, in the aggregate, less than 1% of each fund’s outstanding shares apart from Fidelity Climate Action Fund. As of March 31, 2024, the Trustees, Members of the Advisory Board (if any), and officers of the Fidelity Climate Action Fund owned, in the aggregate, 1.67% of Fidelity Climate Action Fund’s total outstanding shares.

During the period June 1, 2022 through March 31, 2024, no transactions were entered into by Trustees and nominees as Trustee of the trust involving more than 1% of the voting common, non-voting common and equivalent stock, or preferred stock of FMR LLC.

If elected, the Trustees will hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) a Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. In case a vacancy shall for any reason exist, the remaining Trustees will fill such vacancy by appointing another Trustee, so long as, immediately after such appointment, at least two-thirds of the Trustees have been elected by shareholders. If, at any time, less than a majority of the Trustees holding office has been elected by the shareholders, the Trustees then in office will promptly call a shareholders’ meeting for the purpose of electing a Board of Trustees. Otherwise, there will normally be no meeting of shareholders for the purpose of electing Trustees.

Appendix G sets forth the number of Board meetings held during each fund’s last fiscal year.

For more information about the current Trustees who are not nominees in this Proxy Statement, refer to the section entitled “Trustees, Advisory Board Members, and Officers of the Funds.” For information about the funds’ Board structure and risk oversight function, and current standing committees of the funds’ Trustees, refer to the section entitled “Board Structure and Oversight Function and Standing Committees of the Funds’ Trustees.”

The dollar range of equity securities beneficially owned as of March 31, 2024 by each nominee and Trustee in each fund and in all funds in the aggregate within the same fund family overseen or to be overseen by the nominee or Trustees is included in Appendix H.

Trustee compensation information for each fund covered by this Proxy Statement is included in Appendix I.

The Board of Trustees recommends that shareholders vote FOR the Proposal.

6

OTHER BUSINESS

The Board knows of no other business to be brought before the Meeting. However, if any other matters properly come before the Meeting, it is the intention that proxies that do not contain specific instructions to the contrary will be voted on such matters in accordance with the judgment of the persons therein designated.

TRUSTEES, ADVISORY BOARD MEMBERS, AND

OFFICERS OF THE FUNDS

Appendix F shows the composition of the Board of Trustees of each trust and the Advisory Board Members, if any, of each trust. The officers of the funds include: Heather Bonner, Craig S. Brown, John J. Burke III, Margaret Carey, William C. Coffey, Timothy M. Cohen, Jonathan Davis, Laura M. Del Prato, Colm A. Hogan, Pamela R. Holding, Chris Maher, Jason P. Pogorelec, Brett Segaloff, Stacie M. Smith, and Jim Wegmann. Additional information about Mr. Chiel and the officers of the funds can be found in the following table.

Interested Trustees*:

Correspondence intended for a Trustee who is an interested person may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Jonathan Chiel (1957)

Mr. Chiel also serves as Trustee of other Fidelity® funds. Mr. Chiel is General Counsel (2012-present) and Head of Legal, Risk and Compliance (2022-present). Mr Chiel serves as Executive Vice President and General Counsel for FMR LLC (diversified financial services company, 2012-present) and Director and President for OH Company LLC (holding company, 2018-present). Previously, Mr. Chiel served as general counsel (2004-2012) and senior vice president and deputy general counsel (2000-2004) for John Hancock Financial Services; a partner with Choate, Hall & Stewart (1996-2000) (law firm); and an Assistant United States Attorney for the United States Attorney’s Office of the District of Massachusetts (1986-95), including Chief of the Criminal Division (1993-1995). Mr. Chiel is a director on the boards of the Boston Bar Foundation and the Maimonides School.

| * | Determined to be an “Interested Trustee” by virtue of, among other things, his affiliation with the trusts or various entities under common control with FMR. |

| + | The information includes the Trustee’s principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee’s qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for each fund. |

Advisory Board Members and Officers:

The officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Information about Ms. Peetz, a nominee, is included in Proposal 1. Correspondence intended for each officer and Advisory Board Member may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupation

Peter S. Lynch (1944)

Year of Election or Appointment: 2003

Member of the Advisory Board

Mr. Lynch also serves as a Member of the Advisory Board of other Fidelity® funds. Mr. Lynch is Vice Chairman and a Director of Fidelity Management & Research Company LLC (investment adviser firm). In addition, Mr. Lynch serves as a Trustee of Boston College and as the Chairman of the Inner-City Scholarship Fund. Previously, Mr. Lynch served as Vice Chairman and a Director of FMR Co., Inc. (investment adviser firm) and on the Special Olympics International Board of Directors (1997-2006).

Heather Bonner (1977)

Year of Election or Appointment: 2023

Assistant Treasurer

Ms. Bonner also serves as an officer of other funds. Ms. Bonner is a Senior Vice President (2022-present) and is an employee of Fidelity Investments (2022-present). Ms. Bonner serves as Vice President, Treasurer, or Assistant Treasurer of certain Fidelity entities. Prior to joining Fidelity, Ms. Bonner served as Managing Director at AQR Capital Management (2013-2022) and was the Treasurer and Principal Financial Officer of the AQR Funds (2013-2022).

7

Craig S. Brown (1977)

Year of Election or Appointment: 2022

Deputy Treasurer

Mr. Brown also serves as an officer of other funds. Mr. Brown is a Vice President (2015-present) and is an employee of Fidelity Investments. Mr. Brown serves as Assistant Treasurer of FIMM, LLC (2021-present). Previously, Mr. Brown served as Assistant Treasurer of certain Fidelity® funds (2019-2022).

John J. Burke III (1964)

Year of Election or Appointment: 2018

Chief Financial Officer

Mr. Burke also serves as Chief Financial Officer of other funds. Mr. Burke is Head of Fidelity Fund and Investment Operations (2018-present) and is an employee of Fidelity Investments. Mr. Burke serves as President, Executive Vice President, or Director of certain Fidelity entities. Previously Mr. Burke served as head of Asset Management Investment Operations (2012-2018).

Margaret Carey (1973)

Year of Election or Appointment: 2023

Secretary and Chief Legal Officer (CLO)

Ms. Carey also serves as an officer of other funds and as CLO of certain Fidelity entities. Ms. Carey is a Senior Vice President, Deputy General Counsel (2019-present) and is an employee of Fidelity Investments.

William C. Coffey (1969)

Year of Election or Appointment: 2019

Assistant Secretary

Mr. Coffey also serves as Assistant Secretary of other funds. Mr. Coffey is a Senior Vice President, Deputy General Counsel (2010-present) and is an employee of Fidelity Investments. Previously, Mr. Coffey served as Secretary and CLO of certain funds (2018-2019); CLO, Secretary, or Senior Vice President of certain Fidelity entities and Assistant Secretary of certain funds (2009-2018).

Timothy M. Cohen (1969)

Year of Election or Appointment: 2018

Vice President

Mr. Cohen also serves as Vice President of other funds. Mr. Cohen is Co-Head of Equity (2018-present) and is an employee of Fidelity Investments. Mr. Cohen serves as Director of Fidelity Management & Research (Japan) Limited (investment adviser firm, 2016-present). Previously, Mr. Cohen served as Executive Vice President of Fidelity SelectCo, LLC (2019) and Head of Global Equity Research (2016-2018).

Jonathan Davis (1968)

Year of Election or Appointment: 2010

Assistant Treasurer

Mr. Davis also serves as an officer of other funds. Mr. Davis is a Vice President (2006-present) and is an employee of Fidelity Investments. Mr. Davis serves as Assistant Treasurer of certain Fidelity entities.

Laura M. Del Prato (1964)

Year of Election or Appointment: 2018

Assistant Treasurer

Ms. Del Prato also serves as an officer of other funds. Ms. Del Prato is a Senior Vice President (2017-present) and is an employee of Fidelity Investments. Ms. Del Prato serves as Vice President or Assistant Treasurer of certain Fidelity entities. Previously, Ms. Del Prato served as President and Treasurer of The North Carolina Capital Management Trust: Cash Portfolio and Term Portfolio (2018-2020).

Colm A. Hogan (1973)

Year of Election or Appointment: 2020

Assistant Treasurer

Mr. Hogan also serves as an officer of other funds. Mr. Hogan is a Vice President (2016-present) and is an employee of Fidelity Investments. Mr. Hogan serves as Assistant Treasurer of certain Fidelity entities. Previously, Mr. Hogan served as Deputy Treasurer of certain Fidelity® funds (2016-2020) and Assistant Treasurer of certain Fidelity® funds (2016-2018).

8

Pamela R. Holding (1964)

Year of Election or Appointment: 2018

Vice President

Ms. Holding also serves as Vice President of other funds. Ms. Holding is Co-Head of Equity (2018-present) and is an employee of Fidelity Investments. Previously, Ms. Holding served as Executive Vice President of Fidelity SelectCo, LLC (2019) and as Chief Investment Officer of Fidelity Institutional Asset Management (2013-2018).

Chris Maher (1972)

Year of Election or Appointment: 2020

Deputy Treasurer

Mr. Maher also serves as an officer of other funds. Mr. Maher is a Vice President (2008-present) and is an employee of Fidelity Investments. Mr. Maher serves as Assistant Treasurer of certain Fidelity entities. Previously, Mr. Maher served as Assistant Treasurer of certain funds (2013-2020).

Jason P. Pogorelec (1975)

Year of Election or Appointment: 2020

Chief Compliance Officer

Mr. Pogorelec also serves as Chief Compliance Officer of other funds. Mr. Pogorelec is a Senior Vice President of Asset Management Compliance (2020-present) and is an employee of Fidelity Investments. Mr. Pogorelec serves as Compliance Officer of Fidelity Management & Research Company LLC (investment adviser firm, 2023-present) and Ballyrock Investment Advisors LLC (2023-present). Previously, Mr. Pogorelec served as a Vice President, Associate General Counsel for Fidelity Investments (2010-2020) and Assistant Secretary of certain Fidelity® funds (2015-2020).

Brett Segaloff (1972)

Year of Election or Appointment: 2021

Anti-Money Laundering (AML) Officer

Mr. Segaloff also serves as AML Officer of other funds. Mr. Segaloff is a Vice President (2022-present) and is an employee of Fidelity Investments. Mr. Segaloff serves as Anti Money Laundering Compliance Officer or Anti Money Laundering/Bank Secrecy Act Compliance Officer of certain Fidelity entities.

Stacie M. Smith (1974)

Year of Election or Appointment: 2016

President and Treasurer

Ms. Smith also serves as an officer of other funds. Ms. Smith is a Senior Vice President (2016-present) and is an employee of Fidelity Investments. Ms. Smith serves as Assistant Treasurer of certain Fidelity entities and has served in other fund officer roles.

Jim Wegmann (1979)

Year of Election or Appointment: 2019

Assistant Treasurer

Mr. Wegmann also serves as an officer of other funds. Mr. Wegmann is a Vice President (2016-present) and is an employee of Fidelity Investments. Mr. Wegmann serves as Assistant Treasurer of FIMM, LLC (2021-present). Previously, Mr. Wegmann served as Assistant Treasurer of certain Fidelity® funds (2019-2021).

BOARD STRUCTURE AND OVERSIGHT FUNCTION AND

STANDING COMMITTEES OF THE FUNDS’ TRUSTEES

Correspondence intended for each Independent Trustee may be sent to the attention of the individual Trustee or to the Board of Trustees at Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235. Correspondence intended for each Interested Trustee may be sent to the attention of the individual Trustee or to the Board of Trustees at Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210. The current process for collecting and organizing shareholder communications requires that the Board of Trustees receive copies of all communications addressed to it. All communications addressed to the Board of Trustees or any individual Trustee are logged and sent to the Board or individual Trustee. The funds do not hold annual meetings and therefore do not have a policy with regard to Trustees’ attendance at such meetings. However, as a matter of practice, at least one Trustee attends special meetings.

Mr. Lawrence is an interested person and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the funds. Independent Trustees exercise their informed business judgment to appoint an individual of

9

their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Mr. Thomas serve as Lead Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity® funds are overseen by different Boards of Trustees. The funds’ Board oversees Fidelity’s high income and certain equity funds, and other Boards oversee Fidelity’s alternative investment, investment-grade bond, money market, asset allocation, and other equity funds. The asset allocation funds may invest in Fidelity® funds overseen by the funds’ Board. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity® funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity® funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the funds, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the funds’ activities and associated risks. The Board, acting through its committees, has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the funds’ business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the funds are carried out by or through FMR, its affiliates, and other service providers, the funds’ exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board’s committees has responsibility for overseeing different aspects of the funds’ activities, oversight is exercised primarily through the Operations, Audit, and Compliance Committees. Appropriate personnel, including but not limited to the funds’ Chief Compliance Officer (CCO), the adviser’s internal auditor, the independent accountants, the funds’ Treasurer and portfolio management personnel, make periodic reports to the Board’s committees, as appropriate, including an annual review of Fidelity’s risk management program for the Fidelity® funds.

The Board of Trustees has established various committees to support the Independent Trustees in acting independently in pursuing the best interests of the funds and their shareholders. Currently, the Board of Trustees has 9 standing committees. The members of each committee are Independent Trustees. Advisory Board Members may be invited to attend meetings of the committees. See Appendix G for the number of meetings each standing committee held during each fund’s last fiscal year.

The Operations Committee is composed of all of the Independent Trustees, with Mr. Thomas currently serving as Chair and Mr. Wiley serving as Vice Chair. The committee serves as a forum for consideration of issues of importance to, or calling for particular determinations by, the Independent Trustees. The committee also considers matters involving potential conflicts of interest between the funds and FMR and its affiliates and reviews proposed contracts and the proposed continuation of contracts between the funds and FMR and its affiliates, and reviews and makes recommendations regarding contracts with third parties unaffiliated with FMR, including insurance coverage and custody agreements. The committee also monitors additional issues including the nature, levels and quality of services provided to shareholders and significant litigation. The committee also has oversight of compliance issues not specifically within the scope of any other committee. The committee is also responsible for definitive action on all compliance matters involving the potential for significant reimbursement by FMR.

The Fair Value Oversight Committee is composed of Mses. Fuller (Chair) and Tomasky, and Messrs. Advani, Bostick, and Donahue. The Fair Value Oversight Committee oversees the valuation of fund investments by the valuation designee, receives and reviews related reports and information, and monitors matters of disclosure to the extent required to fulfill its statutory responsibilities.

The Board of Trustees has established two Fund Oversight Committees: the Equity I Committee (composed of Ms. Tomasky (Chair) and Messrs. Advani, Bostick, Donahue, and Munoz) and the Equity II Committee (composed of Messrs. Kennedy (Chair), Thomas, and Wiley, and Mses. Fuller, Kampling, and Peetz). Each committee develops an understanding of and reviews the investment objectives, policies, and practices of each fund under its oversight. Each committee also monitors investment performance, compliance by each relevant fund with its investment policies and restrictions and reviews appropriate benchmarks, competitive universes, unusual or exceptional investment matters, the personnel and other resources devoted to the management of each fund and all other matters bearing on each fund’s investment results. Each committee will review and recommend any required action to the Board in respect of specific funds, including new funds, changes in fundamental and non-fundamental investment policies and restrictions, partial or full closing to new investors, fund mergers, fund name changes, and liquidations of funds. The members of each committee may organize working groups to make recommendations concerning issues related to funds that are within the scope of the committee’s review. These working groups report to the committee or to the Independent Trustees, or both, as appropriate. Each working group may request from FMR such information from FMR as may be appropriate to the working group’s deliberations.

10

The Shareholder, Distribution, Brokerage and Proxy Voting Committee is composed of Ms. Kampling (Chair) and Messrs. Kennedy, Munoz, Thomas, and Wiley. Regarding shareholder services, the committee considers the structure and amount of the funds’ transfer agency fees and fees, including direct fees to investors (other than sales loads), such as bookkeeping and custodial fees, and the nature and quality of services rendered by FMR and its affiliates or third parties (such as custodians) in consideration of these fees. The committee also considers other non-investment management services rendered to the funds by FMR and its affiliates, including pricing and bookkeeping services. The committee monitors and recommends policies concerning the securities transactions of the funds, including brokerage. The committee periodically reviews the policies and practices with respect to efforts to achieve best execution, commissions paid to firms supplying research and brokerage services or paying fund expenses, and policies and procedures designed to assure that any allocation of portfolio transactions is not influenced by the sale of fund shares. The committee also monitors brokerage and other similar relationships between the funds and firms affiliated with FMR that participate in the execution of securities transactions. Regarding the distribution of fund shares, the committee considers issues bearing on the various distribution channels employed by the funds, including issues regarding Rule 18f-3 plans and related consideration of classes of shares, sales load structures (including breakpoints), load waivers, selling concessions and service charges paid to intermediaries, Rule 12b-1 plans, contingent deferred sales charges, and finder’s fees, and other means by which intermediaries are compensated for selling fund shares or providing shareholder servicing, including revenue sharing. The committee also considers issues bearing on the preparation and use of advertisements and sales literature for the funds, policies and procedures regarding frequent purchase of fund shares, and selective disclosure of portfolio holdings. Regarding proxy voting, the committee reviews the fund’s proxy voting policies, considers changes to the policies, and reviews the manner in which the policies have been applied. The committee will receive reports on the manner in which proxy votes have been cast under the proxy voting policies and reports on consultations between the fund’s investment advisers and portfolio companies concerning matters presented to shareholders for approval. The committee will address issues relating to the fund’s annual voting report filed with the SEC. The committee will receive reports concerning the implementation of procedures and controls designed to ensure that the proxy voting policies are implemented in accordance with their terms. The committee will consider FMR’s recommendations concerning certain non-routine proposals not covered by the proxy voting policies. The committee will receive reports with respect to steps taken by FMR to assure that proxy voting has been done without regard to any other FMR relationships, business or otherwise, with that portfolio company. The committee will make recommendations to the Board concerning the casting of proxy votes in circumstances where FMR has determined that, because of a conflict of interest, the proposal to be voted on should be reviewed by the Board.

The Audit Committee is composed of Messrs. Donahue (Chair), Advani, and Kennedy, and Mses. Peetz and Tomasky. All committee members must be able to read and understand fundamental financial statements, including a company’s balance sheet, income statement, and cash flow statement. At least one committee member will be an “audit committee financial expert” as defined by the SEC. The committee meets separately at least annually with the funds’ Treasurer, with the funds’ Chief Financial Officer, with personnel responsible for the internal audit function of FMR LLC, with the funds’ independent auditors, and with the funds’ CCO. The committee has direct responsibility for the appointment, compensation, and oversight of the work of the independent auditors employed by the funds. The committee assists the Trustees in fulfilling their responsibility to oversee: (i) the systems relating to internal control over financial reporting of the funds and the funds’ service providers; (ii) the funds’ auditors and the annual audits of the funds’ financial statements; (iii) the financial reporting processes of the funds; (iv) the handling of whistleblower reports relating to internal accounting and/or financial control matters; (v) the accounting policies and disclosures of the funds; and (vi) studies of fund profitability and other comparative analyses relevant to the board’s consideration of the investment management contracts for the funds. The committee considers and acts upon (i) the provision by any independent auditor of any non-audit services for any fund, and (ii) the provision by any independent auditor of certain non-audit services to fund service providers and their affiliates to the extent that such approval (in the case of this clause (ii)) is required under applicable regulations of the SEC. In furtherance of the foregoing, the committee has adopted (and may from time to time amend or supplement) and provides oversight of policies and procedures for non-audit engagements by independent auditors of the funds. The committee is responsible for approving all audit engagement fees and terms for the funds and for resolving disagreements between a fund and any independent auditor regarding any fund’s financial reporting. Auditors of the funds report directly to the committee. The committee will obtain assurance of independence and objectivity from the independent auditors, including a formal written statement delineating all relationships between the auditor and the funds and any service providers consistent with the rules of the Public Company Accounting Oversight Board. It will discuss regularly and oversee the review of internal controls of and the management of risks by the funds and their service providers with respect to accounting and financial matters (including financial reporting relating to the funds), including a review of: (i) any significant deficiencies or material weaknesses in the design or operation of internal control over financial reporting that are reasonably likely to adversely affect the funds’ ability to record, process, summarize, and report financial data; (ii) any change in the fund’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the fund’s internal control over financial reporting; and (iii) any fraud, whether material or not, that involves management or other employees who have a significant role in the funds’ or service providers’ internal control over financial reporting. The committee will also review periodically the funds’ major exposures relating to internal control over financial reporting and the steps that have been taken to monitor and control such exposures. In connection to such reviews the committee will receive periodic reports on the funds’ service providers’ internal control over financial reporting. It will also review any correspondence with regulators or governmental agencies or published reports that raise material issues regarding the

11

funds’ financial statements or accounting policies. These matters may also be reviewed by the Compliance Committee or the Operations Committee. The Chair of the Audit Committee will coordinate with the Chairs of other committees, as appropriate. The committee reviews at least annually a report from each independent auditor describing any material issues raised by the most recent internal quality control, peer review, or Public Company Accounting Oversight Board examination of the auditing firm and any material issues raised by any inquiry or investigation by governmental or professional authorities of the auditing firm and in each case any steps taken to deal with such issues. The committee will oversee and receive reports on the funds’ financial reporting process, will discuss with FMR, the funds’ Treasurer, independent auditors and, if appropriate, internal audit personnel of FMR LLC, their qualitative judgments about the appropriateness and acceptability of accounting principles and financial disclosure practices used or proposed for adoption by the funds. The committee will review with FMR, the funds’ Treasurer, independent auditor, and internal audit personnel of FMR LLC and, as appropriate, legal counsel the results of audits of the funds’ financial statements.