UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03010

Fidelity Advisor Series VII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | July 31, 2021 |

Item 1.

Reports to Stockholders

Fidelity Advisor Focus Funds®

Fidelity Advisor® Biotechnology Fund

Fidelity Advisor® Communications Equipment Fund

Fidelity Advisor® Consumer Discretionary Fund

Fidelity Advisor® Energy Fund

Fidelity Advisor® Financial Services Fund

Fidelity Advisor® Health Care Fund

Fidelity Advisor® Industrials Fund

Fidelity Advisor® Semiconductors Fund

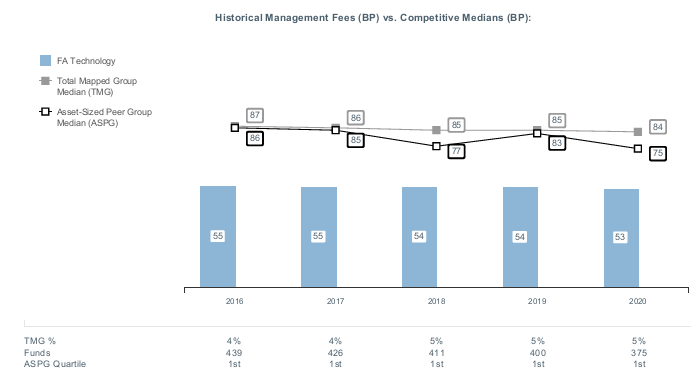

Fidelity Advisor® Technology Fund

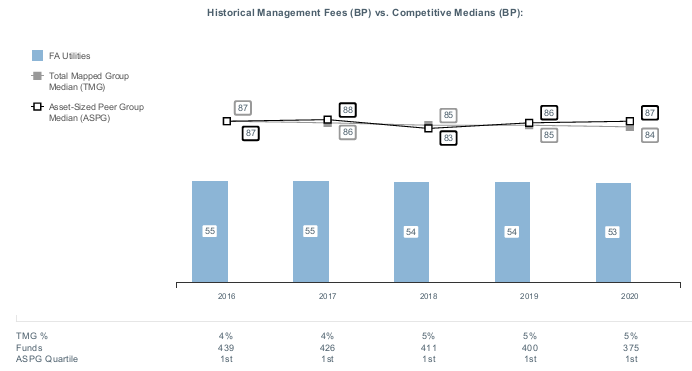

Fidelity Advisor® Utilities Fund

July 31, 2021

Contents

Fidelity Advisor® Biotechnology Fund | |

Fidelity Advisor® Communications Equipment Fund | |

Fidelity Advisor® Consumer Discretionary Fund | |

Fidelity Advisor® Energy Fund | |

Fidelity Advisor® Financial Services Fund | |

Fidelity Advisor® Health Care Fund | |

Fidelity Advisor® Industrials Fund | |

Fidelity Advisor® Semiconductors Fund | |

Fidelity Advisor® Technology Fund | |

Fidelity Advisor® Utilities Fund | |

Board Approval of Investment Advisory Contracts and Management Fees | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, 2020 the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Fidelity Advisor® Biotechnology Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended July 31, 2021 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 5.75% sales charge) | 7.48% | 11.25% | 16.81% |

| Class M (incl. 3.50% sales charge) | 9.71% | 11.43% | 16.73% |

| Class C (incl. contingent deferred sales charge) | 12.15% | 11.74% | 16.81% |

| Class I | 14.34% | 12.87% | 17.84% |

| Class Z | 14.49% | 12.95% | 17.88% |

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

The initial offering of Class Z shares took place on October 2, 2018. Returns prior to October 2, 2018, are those of Class I.

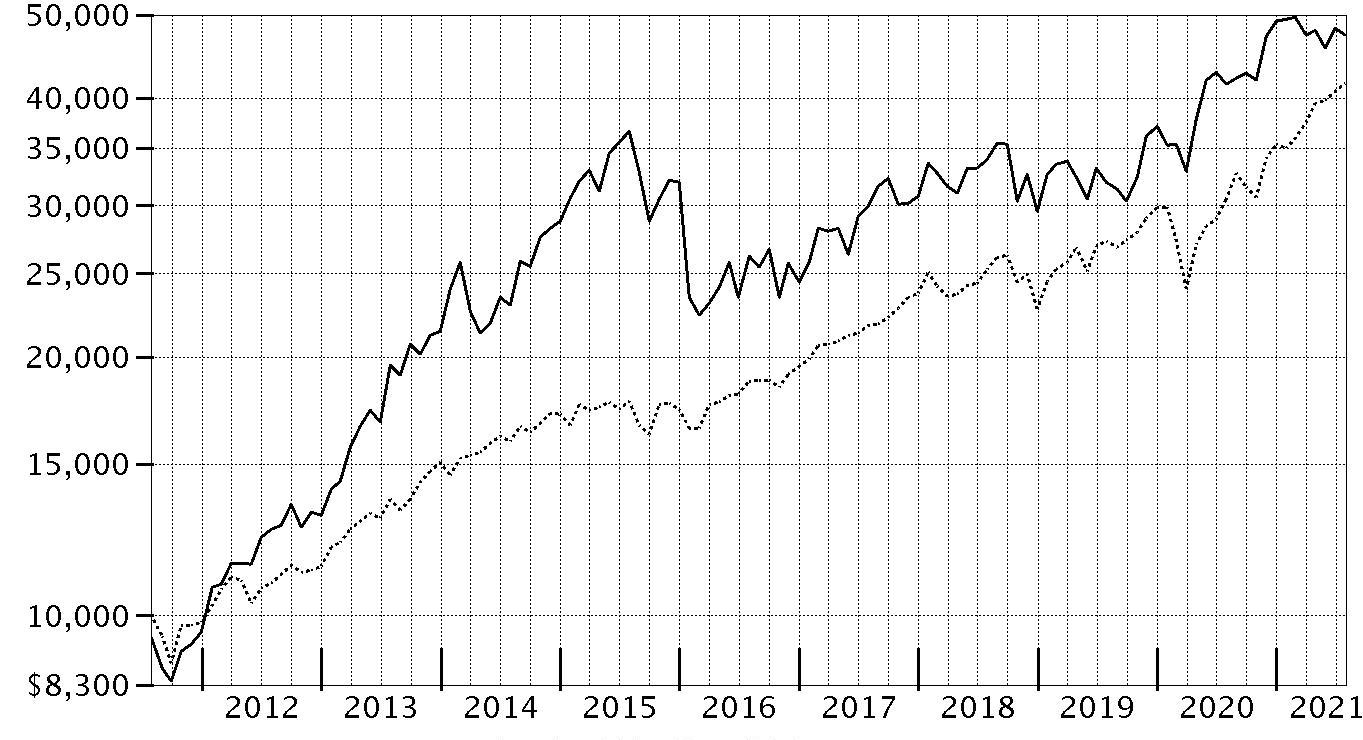

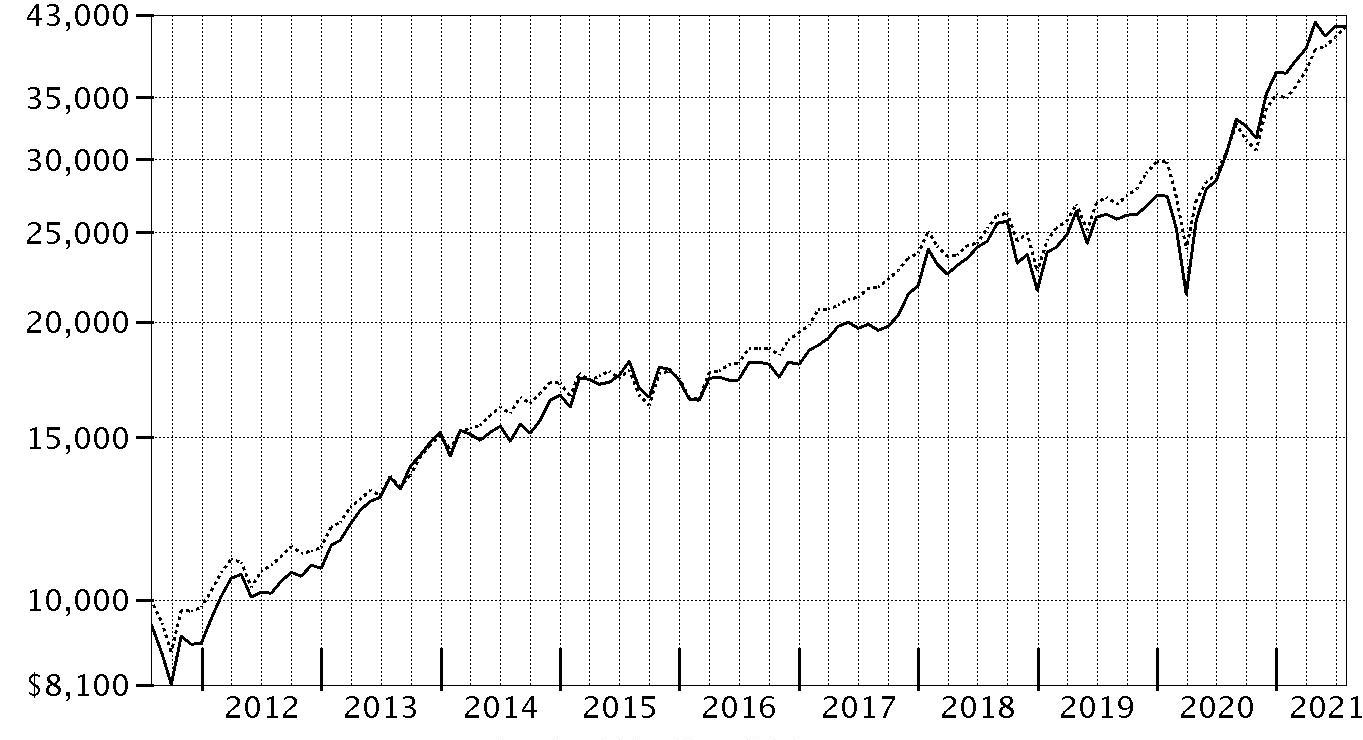

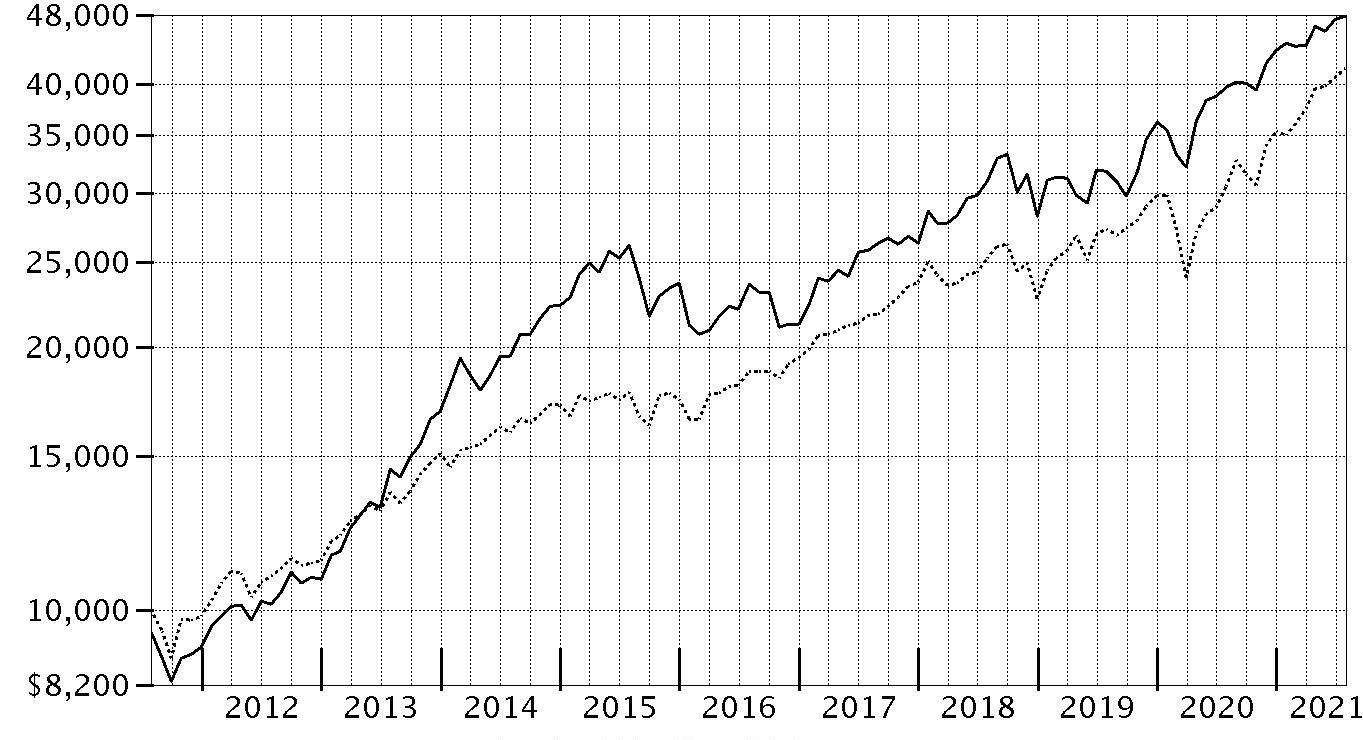

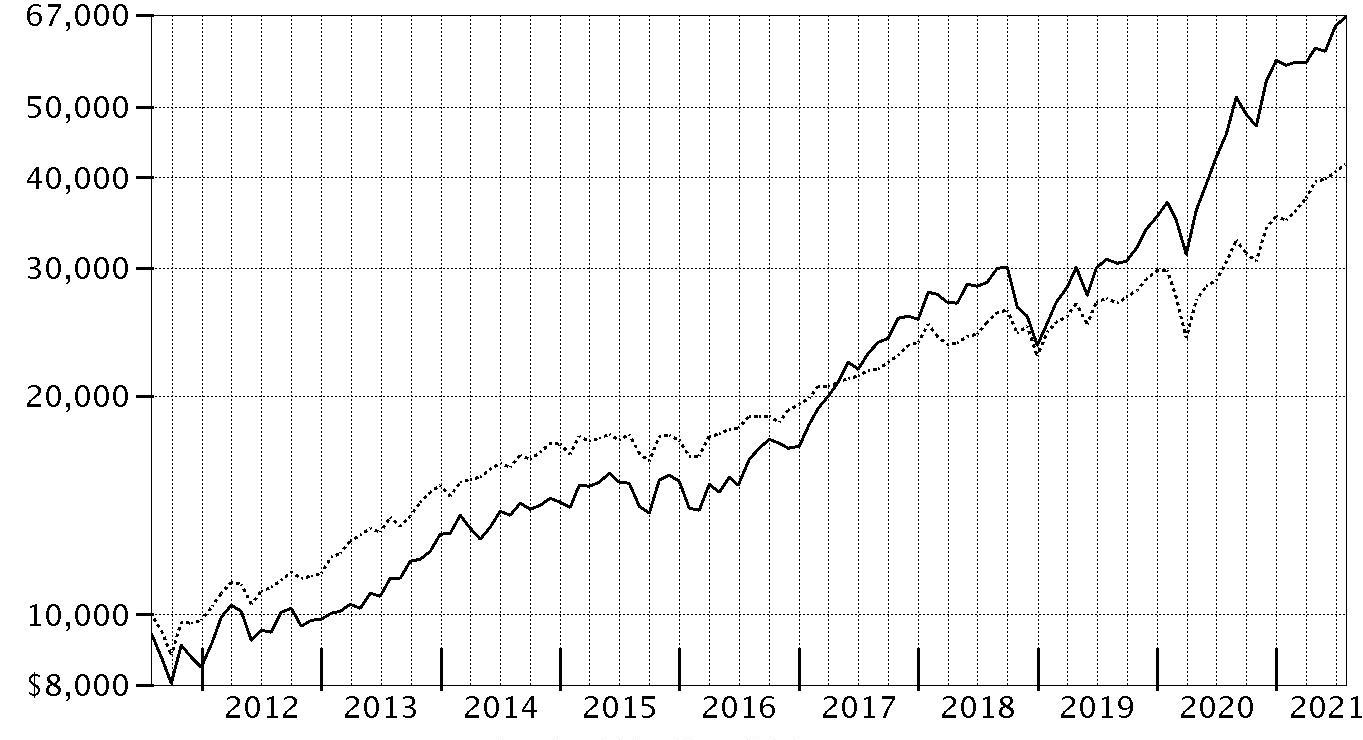

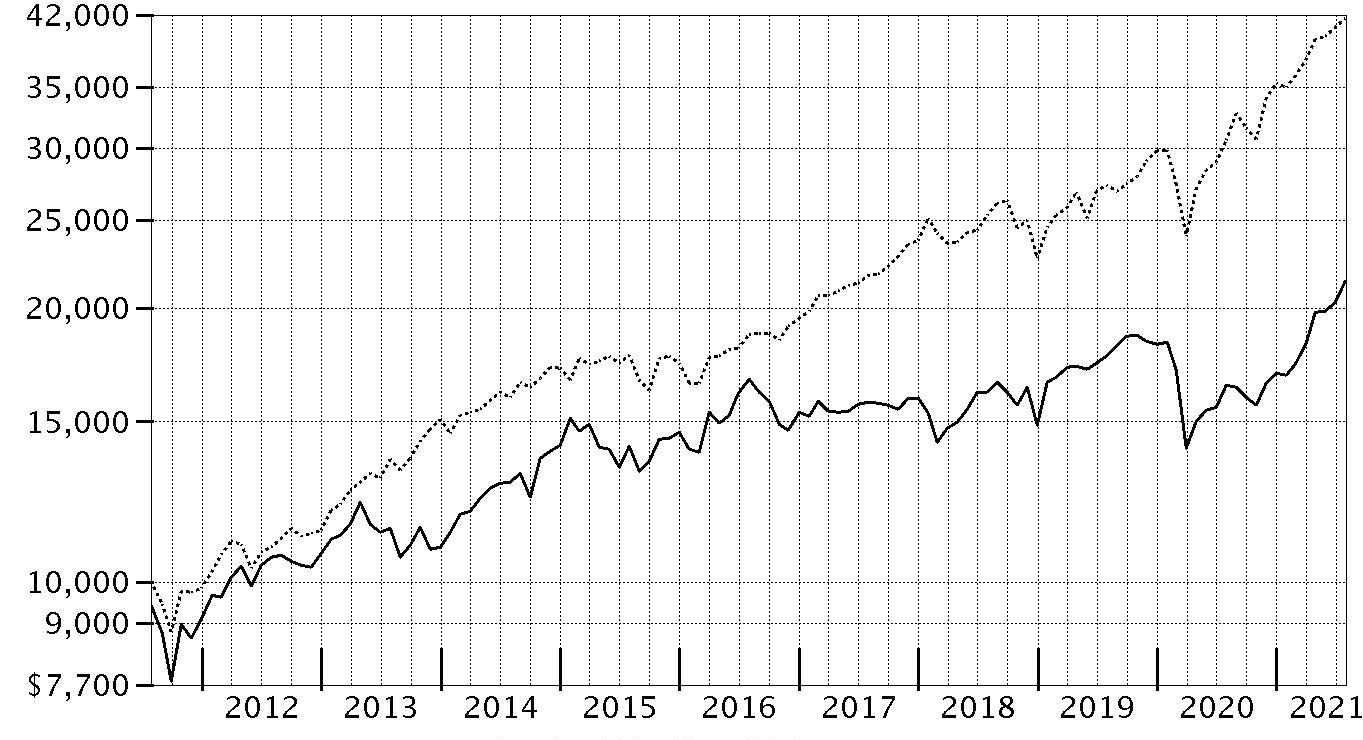

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Biotechnology Fund - Class A on July 31, 2011, and the current 5.75% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values | ||

| $47,313 | Fidelity Advisor® Biotechnology Fund - Class A | |

| $41,689 | S&P 500® Index | |

Fidelity Advisor® Biotechnology Fund

Management's Discussion of Fund Performance

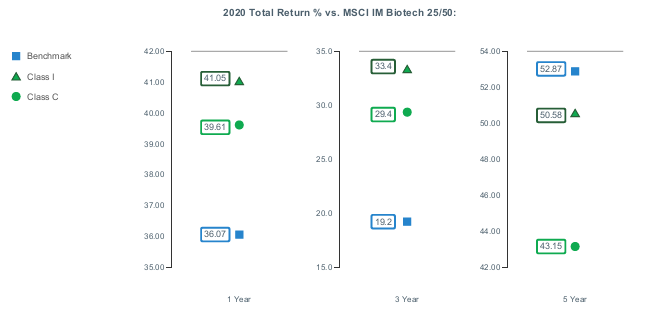

Market Recap: The S&P 500® index gained 36.45% for the 12 months ending July 31, 2021, as U.S. equities continued a historic rebound following a steep but brief decline due to the early-2020 outbreak and spread of COVID-19. A confluence of powerful forces propelled risk assets, returning the stock market to pre-pandemic highs by late August 2020. The rally slowed in September, when stocks began a two-month retreat amid Congress’s inability to reach a deal on additional fiscal stimulus, as well as uncertainty about the election. But as the calendar turned, investors grew hopeful. The rollout of three COVID-19 vaccines was underway, the U.S. Federal Reserve pledged to hold interest rates near zero until the economy recovered, and the federal government planned to deploy trillions of dollars to boost consumers and the economy. This backdrop fueled a sharp rotation, with small-cap value usurping leadership from large growth. As part of the “reopening” theme, investors moved out of tech-driven mega-caps that had thrived due to the work-from-home trend in favor of cheap smaller companies that stood to benefit from a broad cyclical recovery. A flattish May reflected concerns about inflation and jobs, but the uptrend resumed through July, driven by corporate earnings. Notably, this leg saw momentum shift back to large growth, as easing rates and a hawkish Fed stymied the reflation trade. By sector, financials (+55%) led, driven by banks (+63%), whereas utilities (+12%) and consumer staples (+18%) notably lagged.Comments from Portfolio Manager Eirene Kontopoulos: For the fiscal year ending July 31, 2021, the fund's share classes (excluding sales charges, if applicable) gained about 13% to 14%, trailing the 18.34% advance of the MSCI US IMI Biotechnology 25/50 Index, as well as the broad-based S&P 500® index. Versus the industry index, an overweighting in pharmaceuticals and stock selection in biotechnology each detracted meaningfully the past 12 months. Not owning Moderna, an index component that gained 377%, was by far the biggest individual relative detractor. The fund's non-index stake in Ascendis Pharma, one of our largest holdings, returned -14% and also hurt. Also hindering performance was our overweighting in Exelixis, which returned -27%. We added to our position the past year. Conversely, the biggest contributor to performance versus the industry index was stock selection in pharmaceuticals. Our non-index stake in MyoKardia was the fund's largest individual relative contributor, driven by a rise of 145%. MyoKardia was not held at period end. Also lifting performance was an underweighting in Amgen (+2%). Amgen was not held at period end. Another notable relative contributor was our overweighting in Immunomedics (+102%), a position not held at period end. Notable changes in positioning include increased exposure to the pharmaceuticals subindustry.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity Advisor® Biotechnology Fund

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2021

| % of fund's net assets | |

| AbbVie, Inc. | 21.6 |

| Regeneron Pharmaceuticals, Inc. | 8.9 |

| Alnylam Pharmaceuticals, Inc. | 6.9 |

| Vertex Pharmaceuticals, Inc. | 5.1 |

| Novavax, Inc. | 3.8 |

| Argenx SE ADR | 3.3 |

| Ascendis Pharma A/S sponsored ADR | 2.4 |

| TG Therapeutics, Inc. | 2.2 |

| Exelixis, Inc. | 2.1 |

| Protagonist Therapeutics, Inc. | 2.0 |

| 58.3 |

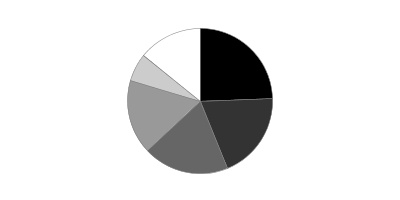

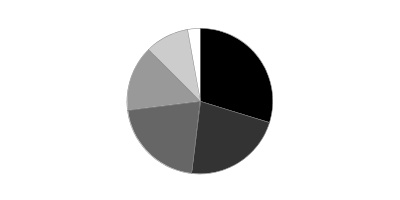

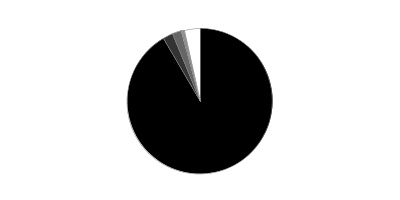

Top Industries (% of fund's net assets)

| As of July 31, 2021 | ||

| Biotechnology | 94.0% | |

| Pharmaceuticals | 5.1% | |

| Consumer Finance | 0.2% | |

| Diversified Financial Services | 0.2% | |

| Health Care Providers & Services | 0.2% | |

| All Others* | 0.3% | |

* Includes short-term investments and net other assets (liabilities).

Fidelity Advisor® Biotechnology Fund

Schedule of Investments July 31, 2021

Showing Percentage of Net Assets

| Common Stocks - 98.0% | |||

| Shares | Value | ||

| Biotechnology - 92.8% | |||

| Biotechnology - 92.8% | |||

| AbbVie, Inc. | 4,679,980 | $544,281,674 | |

| ACADIA Pharmaceuticals, Inc. (a) | 614,700 | 13,295,961 | |

| Acceleron Pharma, Inc. (a) | 230,289 | 28,799,942 | |

| ADC Therapeutics SA (a)(b) | 259,223 | 5,454,052 | |

| Aerovate Therapeutics, Inc. (b) | 432,100 | 5,552,485 | |

| Agios Pharmaceuticals, Inc. (a)(b) | 726,943 | 34,958,689 | |

| Allakos, Inc. (a)(b) | 425,300 | 33,836,868 | |

| Alnylam Pharmaceuticals, Inc. (a) | 976,386 | 174,714,511 | |

| Ambrx Biopharma, Inc.: | |||

| ADR | 21,300 | 416,415 | |

| ADR | 434,097 | 7,637,937 | |

| Annexon, Inc. (a)(b) | 191,975 | 4,042,994 | |

| Apellis Pharmaceuticals, Inc. (a) | 201,115 | 12,869,349 | |

| Arcutis Biotherapeutics, Inc. (a)(b) | 820,433 | 19,140,702 | |

| Argenx SE ADR (a) | 273,100 | 83,139,833 | |

| Ascendis Pharma A/S sponsored ADR (a) | 505,946 | 59,797,758 | |

| Aurinia Pharmaceuticals, Inc. (a)(b) | 1,966,900 | 26,671,164 | |

| Autolus Therapeutics PLC ADR (a)(b) | 996,000 | 5,298,720 | |

| BeiGene Ltd. (a) | 109,800 | 2,593,541 | |

| BeiGene Ltd. ADR (a) | 41,500 | 13,138,485 | |

| BioAtla, Inc. (b) | 229,990 | 9,427,290 | |

| Bolt Biotherapeutics, Inc. | 496,400 | 5,534,860 | |

| C4 Therapeutics, Inc. | 69,700 | 3,006,858 | |

| Celldex Therapeutics, Inc. (a) | 630,503 | 27,584,506 | |

| Century Therapeutics, Inc. | 21,900 | 638,385 | |

| Century Therapeutics, Inc. | 460,571 | 12,083,080 | |

| Cerevel Therapeutics Holdings (a)(b) | 415,228 | 10,231,218 | |

| ChemoCentryx, Inc. (a) | 548,074 | 8,100,534 | |

| Connect Biopharma Holdings Ltd. ADR (a)(b) | 704,200 | 15,499,442 | |

| Crinetics Pharmaceuticals, Inc. (a) | 732,707 | 13,174,072 | |

| Cullinan Oncology, Inc. | 234,600 | 5,379,378 | |

| Cytokinetics, Inc. (a)(b) | 1,370,007 | 40,661,808 | |

| Day One Biopharmaceuticals, Inc. (a) | 38,600 | 915,592 | |

| Eledon Pharmaceuticals, Inc. (a) | 103,364 | 670,832 | |

| Erasca, Inc. | 270,441 | 5,679,261 | |

| Exelixis, Inc. (a) | 3,189,300 | 53,739,705 | |

| Forma Therapeutics Holdings, Inc. (a)(b) | 661,252 | 15,136,058 | |

| Fusion Pharmaceuticals, Inc. (a)(b) | 1,061,662 | 8,652,545 | |

| Global Blood Therapeutics, Inc. (a)(b) | 935,418 | 25,564,974 | |

| Gossamer Bio, Inc. (a)(b) | 697,166 | 5,479,725 | |

| Graphite Bio, Inc. | 35,500 | 758,280 | |

| Graphite Bio, Inc. | 420,780 | 8,089,075 | |

| Icosavax, Inc. | 14,600 | 362,810 | |

| Imago BioSciences, Inc. | 132,827 | 2,433,391 | |

| Immunocore Holdings PLC | 93,760 | 3,037,149 | |

| Instil Bio, Inc. (a)(b) | 725,196 | 10,914,200 | |

| Instil Bio, Inc. | 852,386 | 12,186,989 | |

| Iovance Biotherapeutics, Inc. (a) | 451,900 | 10,063,813 | |

| Janux Therapeutics, Inc. (b) | 69,320 | 2,248,048 | |

| Keros Therapeutics, Inc. (a)(b) | 343,600 | 12,644,480 | |

| Kinnate Biopharma, Inc. | 8,800 | 189,904 | |

| Kinnate Biopharma, Inc. (c) | 208,710 | 4,503,962 | |

| Kura Oncology, Inc. (a)(b) | 522,300 | 9,892,362 | |

| Magenta Therapeutics, Inc. (a)(b) | 672,300 | 4,786,776 | |

| Mirati Therapeutics, Inc. (a) | 204,720 | 32,767,483 | |

| Monte Rosa Therapeutics, Inc. | 30,700 | 752,764 | |

| Monte Rosa Therapeutics, Inc. | 477,858 | 10,545,370 | |

| Morphic Holding, Inc. (a) | 203,400 | 11,719,908 | |

| Novavax, Inc. (a)(b) | 526,647 | 94,443,607 | |

| Nuvalent, Inc. | 673,254 | 11,058,197 | |

| Nuvalent, Inc. Class A | 46,953 | 856,892 | |

| ORIC Pharmaceuticals, Inc. (a)(b) | 434,800 | 7,239,420 | |

| Passage Bio, Inc. (a)(b) | 438,459 | 5,173,816 | |

| Poseida Therapeutics, Inc. (a)(b) | 428,946 | 3,478,752 | |

| Praxis Precision Medicines, Inc. | 209,600 | 3,269,760 | |

| Prelude Therapeutics, Inc. | 120,636 | 3,865,177 | |

| Prelude Therapeutics, Inc. (c) | 413,234 | 13,240,017 | |

| Protagonist Therapeutics, Inc. (a) | 1,040,133 | 51,413,774 | |

| PTC Therapeutics, Inc. (a) | 789,040 | 30,243,903 | |

| Regeneron Pharmaceuticals, Inc. (a) | 391,192 | 224,782,835 | |

| Relay Therapeutics, Inc. (a)(b) | 596,164 | 19,339,560 | |

| Repare Therapeutics, Inc. (a)(b) | 438,247 | 14,637,450 | |

| Revolution Medicines, Inc. (a)(b) | 361,916 | 10,365,274 | |

| Sarepta Therapeutics, Inc. (a) | 361,681 | 24,514,738 | |

| Scholar Rock Holding Corp. (a)(b) | 424,230 | 13,257,188 | |

| Shattuck Labs, Inc. (b) | 694,934 | 15,316,345 | |

| Silverback Therapeutics, Inc. | 16,200 | 490,536 | |

| Silverback Therapeutics, Inc. (c) | 98,114 | 2,970,892 | |

| Stoke Therapeutics, Inc. (a)(b) | 239,519 | 6,857,429 | |

| Syros Pharmaceuticals, Inc. (a)(b) | 701,833 | 3,242,468 | |

| Taysha Gene Therapies, Inc. (b) | 358,039 | 6,190,494 | |

| Tenaya Therapeutics, Inc. | 407,412 | 6,253,774 | |

| Tenaya Therapeutics, Inc. | 402,187 | 5,556,213 | |

| TG Therapeutics, Inc. (a) | 1,556,200 | 54,451,438 | |

| Vaxcyte, Inc. (a)(b) | 685,551 | 14,862,746 | |

| Vera Therapeutics, Inc. (a) | 251,300 | 4,523,400 | |

| Vera Therapeutics, Inc. | 729,168 | 11,812,522 | |

| Vertex Pharmaceuticals, Inc. (a) | 630,627 | 127,121,791 | |

| Verve Therapeutics, Inc. | 23,700 | 1,408,491 | |

| Xenon Pharmaceuticals, Inc. (a) | 849,835 | 14,676,650 | |

| Y-mAbs Therapeutics, Inc. (a) | 194,803 | 6,447,979 | |

| Zentalis Pharmaceuticals, Inc. (a) | 553,853 | 29,470,518 | |

| Zymeworks, Inc. (a)(b) | 415,853 | 13,344,723 | |

| 2,336,876,736 | |||

| Consumer Finance - 0.2% | |||

| Consumer Finance - 0.2% | |||

| Celularity, Inc. Class A (a)(b) | 644,600 | 5,672,480 | |

| Diversified Financial Services - 0.2% | |||

| Other Diversified Financial Services - 0.2% | |||

| BCTG Acquisition Corp. (a) | 479,300 | 4,793,000 | |

| Health Care Providers & Services - 0.0% | |||

| Health Care Services - 0.0% | |||

| Precipio, Inc. (a)(d) | 30 | 93 | |

| Pharmaceuticals - 4.8% | |||

| Pharmaceuticals - 4.8% | |||

| Afferent Pharmaceuticals, Inc. rights 12/31/24 (a)(e) | 1,915,787 | 3,122,733 | |

| Arvinas Holding Co. LLC (a) | 318,000 | 32,149,800 | |

| Axsome Therapeutics, Inc. (a)(b) | 100,800 | 4,897,872 | |

| Chiasma, Inc. warrants 12/16/24 (a) | 81,298 | 43,957 | |

| Cyteir Therapeutics, Inc. | 652,343 | 12,557,603 | |

| Edgewise Therapeutics, Inc. (a)(b) | 420,800 | 7,368,208 | |

| GH Research PLC (b) | 311,000 | 6,126,700 | |

| Ikena Oncology, Inc. (a)(b) | 519,514 | 5,148,384 | |

| Ikena Oncology, Inc. | 282,736 | 2,661,818 | |

| IMARA, Inc. (a)(b) | 310,346 | 1,672,765 | |

| Intra-Cellular Therapies, Inc. (a) | 115,015 | 3,948,465 | |

| Longboard Pharmaceuticals, Inc. (a)(b) | 379,100 | 3,411,900 | |

| NGM Biopharmaceuticals, Inc. (a) | 210,553 | 4,293,176 | |

| Pharvaris BV | 172,633 | 3,067,688 | |

| Pliant Therapeutics, Inc. (a)(b) | 381,173 | 7,699,695 | |

| Reata Pharmaceuticals, Inc. (a)(b) | 49,800 | 6,240,438 | |

| Stemcentrx, Inc. rights 12/31/21 (a)(e) | 208,907 | 2 | |

| Terns Pharmaceuticals, Inc. (b) | 906,792 | 6,800,940 | |

| Theravance Biopharma, Inc. (a)(b) | 746,326 | 9,687,311 | |

| 120,899,455 | |||

| TOTAL COMMON STOCKS | |||

| (Cost $1,858,863,213) | 2,468,241,764 | ||

| Convertible Preferred Stocks - 1.9% | |||

| Biotechnology - 1.2% | |||

| Biotechnology - 1.2% | |||

| Bright Peak Therapeutics AG Series B (d)(e) | 1,920,122 | 7,499,997 | |

| Sonoma Biotherapeutics, Inc.: | |||

| Series B (d)(e) | 1,967,762 | 4,565,208 | |

| Series B1 (d)(e) | 1,049,456 | 2,434,738 | |

| T-Knife Therapeutics, Inc. Series B (d)(e) | 1,300,097 | 7,500,000 | |

| ValenzaBio, Inc. Series A (d)(e) | 951,971 | 8,472,950 | |

| 30,472,893 | |||

| Health Care Providers & Services - 0.2% | |||

| Health Care Facilities - 0.2% | |||

| Boundless Bio, Inc. Series B (d)(e) | 3,703,704 | 5,000,000 | |

| Health Care Technology - 0.2% | |||

| Health Care Technology - 0.2% | |||

| Wugen, Inc. Series B (d)(e) | 580,277 | 4,499,990 | |

| Pharmaceuticals - 0.3% | |||

| Pharmaceuticals - 0.3% | |||

| Afferent Pharmaceuticals, Inc. Series C (a)(d)(e) | 1,915,787 | 19 | |

| Aristea Therapeutics, Inc. Series B (d)(e) | 677,328 | 6,244,964 | |

| 6,244,983 | |||

| Textiles, Apparel & Luxury Goods - 0.0% | |||

| Textiles - 0.0% | |||

| Treeline Biosciences Series A (d)(e) | 47,600 | 372,589 | |

| TOTAL CONVERTIBLE PREFERRED STOCKS | |||

| (Cost $44,080,110) | 46,590,455 | ||

| Money Market Funds - 9.4% | |||

| Fidelity Cash Central Fund 0.06% (f) | 19,150,658 | 19,154,488 | |

| Fidelity Securities Lending Cash Central Fund 0.06% (f)(g) | 217,599,843 | 217,621,603 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $236,771,968) | 236,776,091 | ||

| TOTAL INVESTMENT IN SECURITIES - 109.3% | |||

| (Cost $2,139,715,291) | 2,751,608,310 | ||

| NET OTHER ASSETS (LIABILITIES) - (9.3)% | (233,829,717) | ||

| NET ASSETS - 100% | $2,517,778,593 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $20,714,871 or 0.8% of net assets.

(d) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $46,590,548 or 1.9% of net assets.

(e) Level 3 security

(f) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(g) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| Afferent Pharmaceuticals, Inc. Series C | 7/1/15 | $0 |

| Aristea Therapeutics, Inc. Series B | 10/6/20 - 7/27/21 | $3,734,584 |

| Boundless Bio, Inc. Series B | 4/23/21 | $5,000,000 |

| Bright Peak Therapeutics AG Series B | 5/14/21 | $7,499,997 |

| Precipio, Inc. | 2/3/12 | $161,441 |

| Sonoma Biotherapeutics, Inc. Series B | 7/26/21 | $3,888,888 |

| Sonoma Biotherapeutics, Inc. Series B1 | 7/26/21 | $3,111,112 |

| T-Knife Therapeutics, Inc. Series B | 6/30/21 | $7,500,000 |

| Treeline Biosciences Series A | 7/30/21 | $372,589 |

| ValenzaBio, Inc. Series A | 3/25/21 | $8,472,951 |

| Wugen, Inc. Series B | 7/9/21 | $4,499,990 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $19,645 |

| Fidelity Securities Lending Cash Central Fund | 736,788 |

| Total | $756,433 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.06% | $40,119,716 | $1,014,540,483 | $1,035,502,587 | $559 | $(3,683) | $19,154,488 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 0.06% | 81,419,588 | 1,211,452,067 | 1,075,250,052 | -- | -- | 217,621,603 | 0.7% |

| Total | $121,539,304 | $2,225,992,550 | $2,110,752,639 | $559 | $(3,683) | $236,776,091 |

Investment Valuation

The following is a summary of the inputs used, as of July 31, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Common Stocks | $2,468,241,764 | $2,377,813,181 | $87,305,848 | $3,122,735 |

| Convertible Preferred Stocks | 46,590,455 | -- | -- | 46,590,455 |

| Money Market Funds | 236,776,091 | 236,776,091 | -- | -- |

| Total Investments in Securities: | $2,751,608,310 | $2,614,589,272 | $87,305,848 | $49,713,190 |

| Net unrealized depreciation on unfunded commitments | $(215,400) | $ | $( 215,400) | $ |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value:

| Investments in Securities: | |

| Common Stocks | |

| Beginning Balance | $15,230,959 |

| Total Realized Gain (Loss) | 9,006,191 |

| Total Unrealized Gain (Loss) | (6,531,423) |

| Cost of Purchases | -- |

| Proceeds of Sales | (14,582,992) |

| Amortization/Accretion | -- |

| Transfers in to Level 3 | -- |

| Transfers out of Level 3 | -- |

| Ending Balance | $3,122,735 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at July 31, 2021 | $(172,421) |

| Convertible Preferred Stocks | |

| Beginning Balance | $ 17,868,960 |

| Total Realized Gain (Loss) | -- |

| Total Unrealized Gain (Loss) | 2,510,325 |

| Cost of Purchases | 44,080,111 |

| Proceeds of Sales | -- |

| Amortization/Accretion | -- |

| Transfers in to Level 3 | -- |

| Transfers out of Level 3 | (17,868,941) |

| Ending Balance | $46,590,455 |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at July 31, 2021 | $2,510,325 |

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Cost of purchases and proceeds of sales may include securities received and/or delivered through in-kind transactions. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations.

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 89.5% |

| Netherlands | 3.3% |

| Denmark | 2.4% |

| Canada | 2.2% |

| Cayman Islands | 1.9% |

| Others (Individually Less Than 1%) | 0.7% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor® Biotechnology Fund

Financial Statements

Statement of Assets and Liabilities

| July 31, 2021 | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $207,932,411) — See accompanying schedule: Unaffiliated issuers (cost $1,902,943,323) | $2,514,832,219 | |

| Fidelity Central Funds (cost $236,771,968) | 236,776,091 | |

| Total Investment in Securities (cost $2,139,715,291) | $2,751,608,310 | |

| Receivable for investments sold | 17,808,561 | |

| Receivable for fund shares sold | 1,017,233 | |

| Dividends receivable | 6,512,194 | |

| Distributions receivable from Fidelity Central Funds | 82,388 | |

| Prepaid expenses | 13,840 | |

| Other receivables | 60,533 | |

| Total assets | 2,777,103,059 | |

| Liabilities | ||

| Payable for investments purchased | $34,298,706 | |

| Payable for fund shares redeemed | 5,040,004 | |

| Accrued management fee | 1,131,405 | |

| Distribution and service plan fees payable | 524,171 | |

| Other affiliated payables | 446,872 | |

| Unrealized depreciation on unfunded commitments | 215,400 | |

| Other payables and accrued expenses | 79,408 | |

| Collateral on securities loaned | 217,588,500 | |

| Total liabilities | 259,324,466 | |

| Net Assets | $2,517,778,593 | |

| Net Assets consist of: | ||

| Paid in capital | $1,620,960,288 | |

| Total accumulated earnings (loss) | 896,818,305 | |

| Net Assets | $2,517,778,593 | |

| Net Asset Value and Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($808,609,852 ÷ 24,821,445 shares)(a) | $32.58 | |

| Maximum offering price per share (100/94.25 of $32.58) | $34.57 | |

| Class M: | ||

| Net Asset Value and redemption price per share ($161,618,605 ÷ 5,325,394 shares)(a) | $30.35 | |

| Maximum offering price per share (100/96.50 of $30.35) | $31.45 | |

| Class C: | ||

| Net Asset Value and offering price per share ($328,416,607 ÷ 12,257,365 shares)(a) | $26.79 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($1,129,492,474 ÷ 32,272,195 shares) | $35.00 | |

| Class Z: | ||

| Net Asset Value, offering price and redemption price per share ($89,641,055 ÷ 2,557,598 shares) | $35.05 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Year ended July 31, 2021 | ||

| Investment Income | ||

| Dividends | $30,855,006 | |

| Income from Fidelity Central Funds (including $736,788 from security lending) | 756,433 | |

| Total income | 31,611,439 | |

| Expenses | ||

| Management fee | $13,877,275 | |

| Transfer agent fees | 4,675,677 | |

| Distribution and service plan fees | 6,694,056 | |

| Accounting fees | 780,939 | |

| Custodian fees and expenses | 66,954 | |

| Independent trustees' fees and expenses | 11,424 | |

| Registration fees | 119,070 | |

| Audit | 66,947 | |

| Legal | 5,735 | |

| Interest | 570 | |

| Miscellaneous | 15,213 | |

| Total expenses before reductions | 26,313,860 | |

| Expense reductions | (161,873) | |

| Total expenses after reductions | 26,151,987 | |

| Net investment income (loss) | 5,459,452 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 577,410,681 | |

| Fidelity Central Funds | 559 | |

| Total net realized gain (loss) | 577,411,240 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (244,610,197) | |

| Fidelity Central Funds | (3,683) | |

| Unfunded commitments | (215,400) | |

| Total change in net unrealized appreciation (depreciation) | (244,829,280) | |

| Net gain (loss) | 332,581,960 | |

| Net increase (decrease) in net assets resulting from operations | $338,041,412 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Year ended July 31, 2021 | Year ended July 31, 2020 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $5,459,452 | $1,962,344 |

| Net realized gain (loss) | 577,411,240 | 5,639,561 |

| Change in net unrealized appreciation (depreciation) | (244,829,280) | 538,898,836 |

| Net increase (decrease) in net assets resulting from operations | 338,041,412 | 546,500,741 |

| Distributions to shareholders | (228,190,286) | (142,937,680) |

| Share transactions - net increase (decrease) | 1,156,643 | (167,947,129) |

| Total increase (decrease) in net assets | 111,007,769 | 235,615,932 |

| Net Assets | ||

| Beginning of period | 2,406,770,824 | 2,171,154,892 |

| End of period | $2,517,778,593 | $2,406,770,824 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Advisor Biotechnology Fund Class A

| Years ended July 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $31.03 | $25.48 | $27.80 | $24.45 | $21.39 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .07 | .03 | .03 | (.14) | (.15)B |

| Net realized and unrealized gain (loss) | 4.42 | 7.40 | (1.76) | 3.49 | 3.21 |

| Total from investment operations | 4.49 | 7.43 | (1.73) | 3.35 | 3.06 |

| Distributions from net investment income | (.13) | – | – | – | – |

| Distributions from net realized gain | (2.81) | (1.88) | (.59) | – | – |

| Total distributions | (2.94) | (1.88) | (.59) | – | – |

| Redemption fees added to paid in capitalA | – | – | – | – | –C |

| Net asset value, end of period | $32.58 | $31.03 | $25.48 | $27.80 | $24.45 |

| Total ReturnD,E | 14.03% | 30.00% | (6.17)% | 13.70% | 14.31% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | 1.01% | 1.02% | 1.04% | 1.06% | 1.05% |

| Expenses net of fee waivers, if any | 1.00% | 1.02% | 1.03% | 1.06% | 1.05% |

| Expenses net of all reductions | 1.00% | 1.02% | 1.03% | 1.06% | 1.04% |

| Net investment income (loss) | .20% | .11% | .13% | (.53)% | (.69)%B |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $808,610 | $722,896 | $616,894 | $766,303 | $787,802 |

| Portfolio turnover rateH | 72% | 66% | 62% | 45% | 30% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.01 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been (.71) %.

C Amount represents less than $.005 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Biotechnology Fund Class M

| Years ended July 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $29.08 | $24.02 | $26.32 | $23.22 | $20.39 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | (.02) | (.05) | (.04) | (.21) | (.21)B |

| Net realized and unrealized gain (loss) | 4.14 | 6.96 | (1.67) | 3.31 | 3.04 |

| Total from investment operations | 4.12 | 6.91 | (1.71) | 3.10 | 2.83 |

| Distributions from net investment income | (.07) | – | – | – | – |

| Distributions from net realized gain | (2.78) | (1.85) | (.59) | – | – |

| Total distributions | (2.85) | (1.85) | (.59) | – | – |

| Redemption fees added to paid in capitalA | – | – | – | – | –C |

| Net asset value, end of period | $30.35 | $29.08 | $24.02 | $26.32 | $23.22 |

| Total ReturnD,E | 13.69% | 29.64% | (6.44)% | 13.35% | 13.88% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | 1.28% | 1.32% | 1.34% | 1.38% | 1.38% |

| Expenses net of fee waivers, if any | 1.28% | 1.32% | 1.34% | 1.38% | 1.38% |

| Expenses net of all reductions | 1.28% | 1.31% | 1.34% | 1.38% | 1.38% |

| Net investment income (loss) | (.07)% | (.18)% | (.18)% | (.84)% | (1.02)%B |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $161,619 | $144,568 | $119,312 | $135,879 | $127,734 |

| Portfolio turnover rateH | 72% | 66% | 62% | 45% | 30% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.01 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been (1.05) %.

C Amount represents less than $.005 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Biotechnology Fund Class C

| Years ended July 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $25.97 | $21.71 | $23.96 | $21.23 | $18.71 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | (.15) | (.15) | (.14) | (.29) | (.27)B |

| Net realized and unrealized gain (loss) | 3.71 | 6.26 | (1.52) | 3.02 | 2.79 |

| Total from investment operations | 3.56 | 6.11 | (1.66) | 2.73 | 2.52 |

| Distributions from net investment income | (.01) | – | – | – | – |

| Distributions from net realized gain | (2.73) | (1.85) | (.59) | – | – |

| Total distributions | (2.74) | (1.85) | (.59) | – | – |

| Redemption fees added to paid in capitalA | – | – | – | – | –C |

| Net asset value, end of period | $26.79 | $25.97 | $21.71 | $23.96 | $21.23 |

| Total ReturnD,E | 13.15% | 29.07% | (6.87)% | 12.86% | 13.47% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | 1.75% | 1.77% | 1.78% | 1.80% | 1.79% |

| Expenses net of fee waivers, if any | 1.75% | 1.77% | 1.77% | 1.80% | 1.79% |

| Expenses net of all reductions | 1.75% | 1.76% | 1.77% | 1.80% | 1.79% |

| Net investment income (loss) | (.55)% | (.63)% | (.61)% | (1.27)% | (1.43)%B |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $328,417 | $384,420 | $398,749 | $558,420 | $593,489 |

| Portfolio turnover rateH | 72% | 66% | 62% | 45% | 30% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.01 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been (1.46) %.

C Amount represents less than $.005 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Biotechnology Fund Class I

| Years ended July 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $33.16 | $27.08 | $29.42 | $25.80 | $22.52 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .17 | .11 | .11 | (.07) | (.10)B |

| Net realized and unrealized gain (loss) | 4.72 | 7.88 | (1.86) | 3.69 | 3.38 |

| Total from investment operations | 4.89 | 7.99 | (1.75) | 3.62 | 3.28 |

| Distributions from net investment income | (.21) | – | – | – | – |

| Distributions from net realized gain | (2.85) | (1.91) | (.59) | – | – |

| Total distributions | (3.05)C | (1.91) | (.59) | – | – |

| Redemption fees added to paid in capitalA | – | – | – | – | –D |

| Net asset value, end of period | $35.00 | $33.16 | $27.08 | $29.42 | $25.80 |

| Total ReturnE | 14.34% | 30.32% | (5.89)% | 14.03% | 14.56% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | .74% | .75% | .76% | .79% | .78% |

| Expenses net of fee waivers, if any | .74% | .75% | .76% | .79% | .78% |

| Expenses net of all reductions | .74% | .75% | .76% | .79% | .77% |

| Net investment income (loss) | .47% | .38% | .40% | (.26)% | (.42)%B |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $1,129,492 | $1,092,145 | $1,006,084 | $1,307,833 | $1,156,358 |

| Portfolio turnover rateH | 72% | 66% | 62% | 45% | 30% |

A Calculated based on average shares outstanding during the period.

B Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $.01 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been (.44) %.

C Total distributions per share do not sum due to rounding.

D Amount represents less than $.005 per share.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Biotechnology Fund Class Z

| Years ended July 31, | 2021 | 2020 | 2019 A |

| Selected Per–Share Data | |||

| Net asset value, beginning of period | $33.22 | $27.10 | $30.06 |

| Income from Investment Operations | |||

| Net investment income (loss)B | .21 | .15 | .16 |

| Net realized and unrealized gain (loss) | 4.74 | 7.90 | (2.53) |

| Total from investment operations | 4.95 | 8.05 | (2.37) |

| Distributions from net investment income | (.26) | (.02) | – |

| Distributions from net realized gain | (2.87) | (1.91) | (.59) |

| Total distributions | (3.12)C | (1.93) | (.59) |

| Redemption fees added to paid in capitalB | – | – | – |

| Net asset value, end of period | $35.05 | $33.22 | $27.10 |

| Total ReturnD,E | 14.49% | 30.53% | (7.83)% |

| Ratios to Average Net AssetsF,G | |||

| Expenses before reductions | .61% | .62% | .63%H |

| Expenses net of fee waivers, if any | .61% | .62% | .63%H |

| Expenses net of all reductions | .61% | .62% | .62%H |

| Net investment income (loss) | .60% | .51% | .73%H |

| Supplemental Data | |||

| Net assets, end of period (000 omitted) | $89,641 | $62,743 | $30,116 |

| Portfolio turnover rateI | 72% | 66% | 62%H |

A For the period October 2, 2018 (commencement of sale of shares) to July 31, 2019.

B Calculated based on average shares outstanding during the period.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor® Communications Equipment Fund

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended July 31, 2021 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 5.75% sales charge) | 21.02% | 10.12% | 7.89% |

| Class M (incl. 3.50% sales charge) | 23.62% | 10.38% | 7.88% |

| Class C (incl. contingent deferred sales charge) | 26.44% | 10.61% | 7.88% |

| Class I | 28.74 % | 11.73% | 8.80% |

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

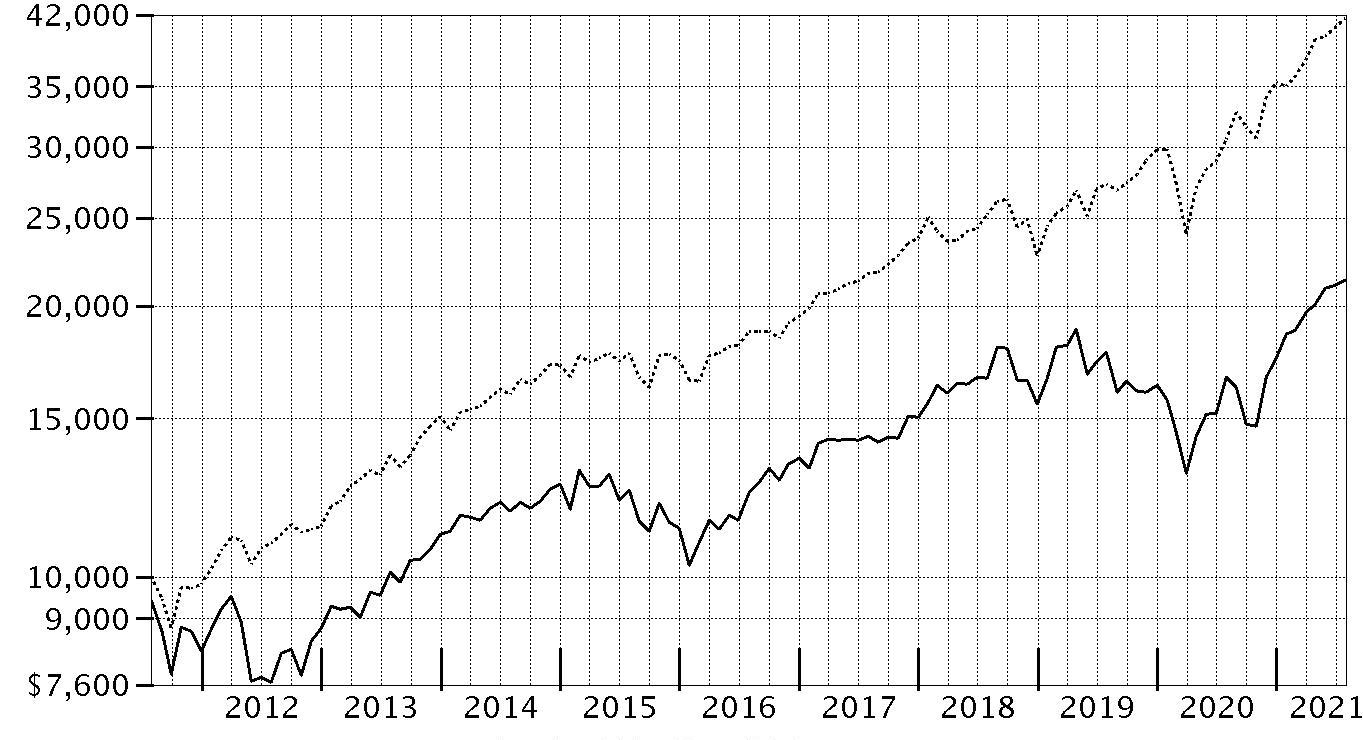

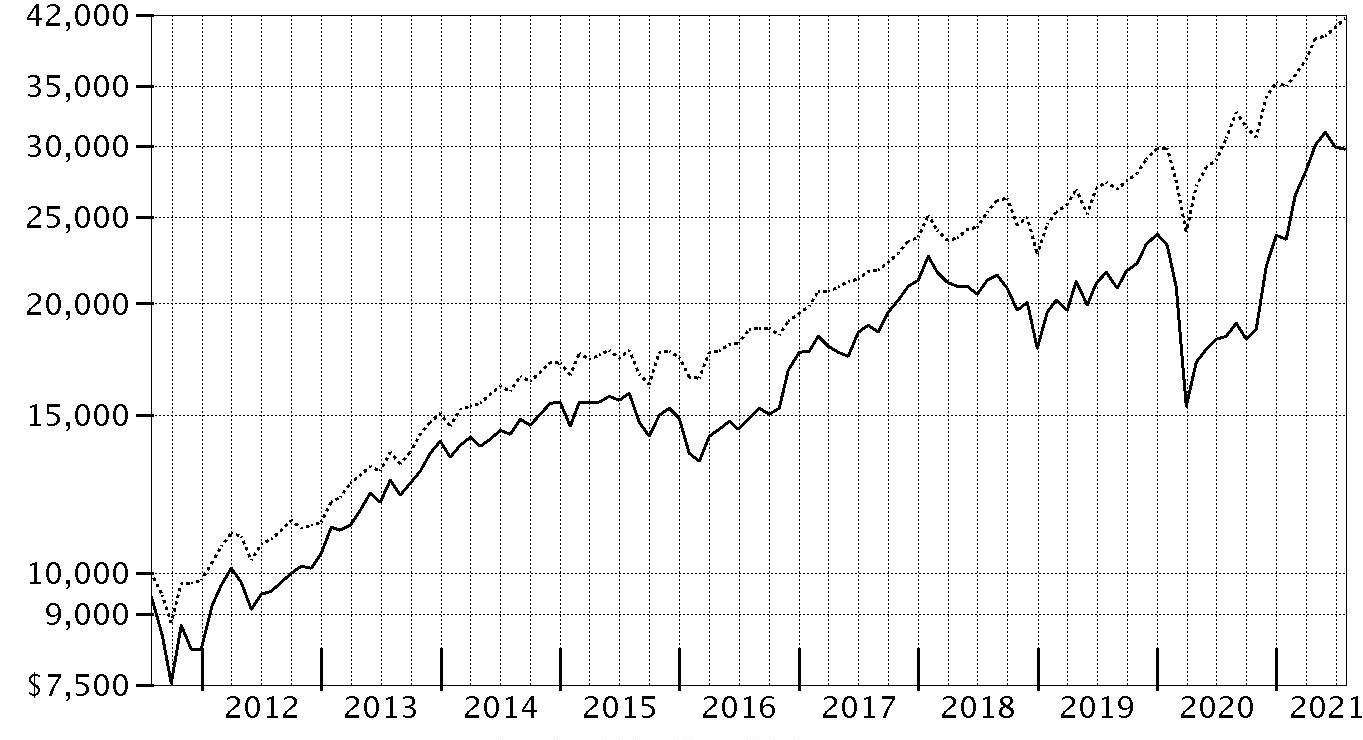

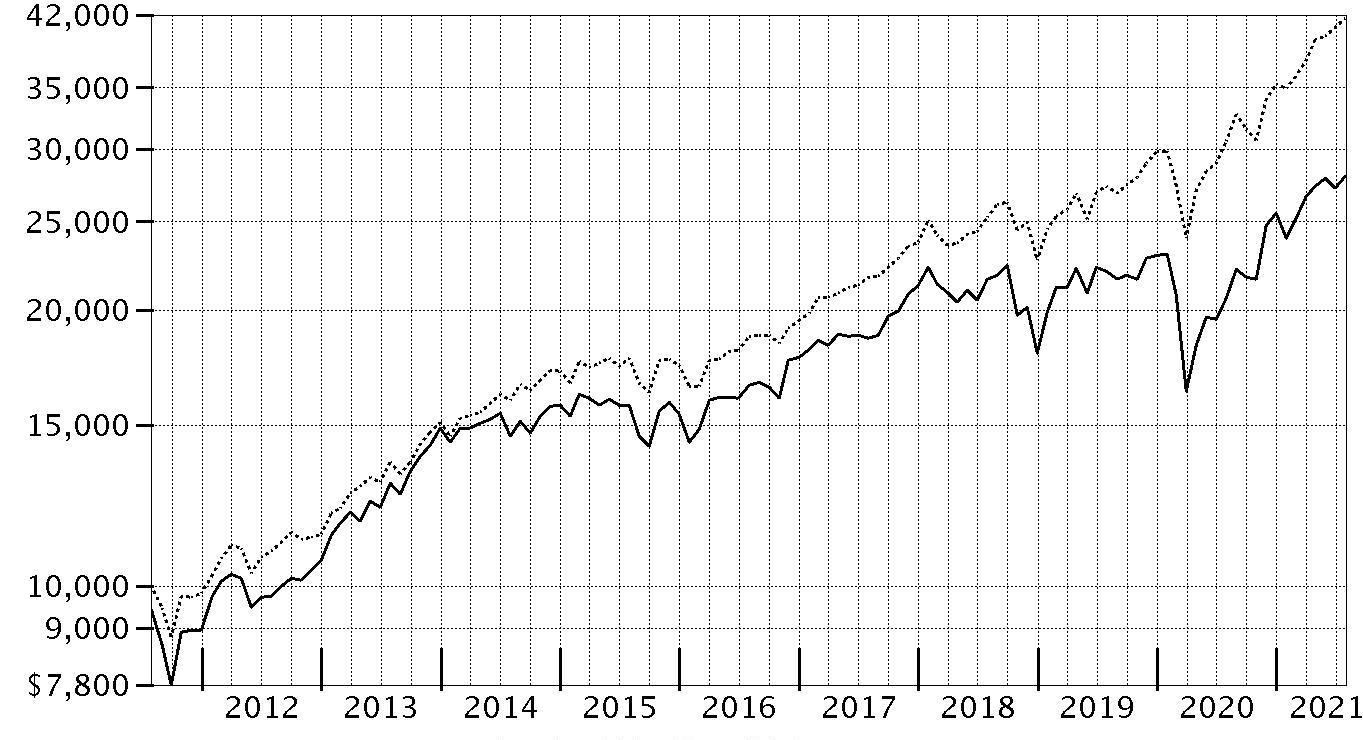

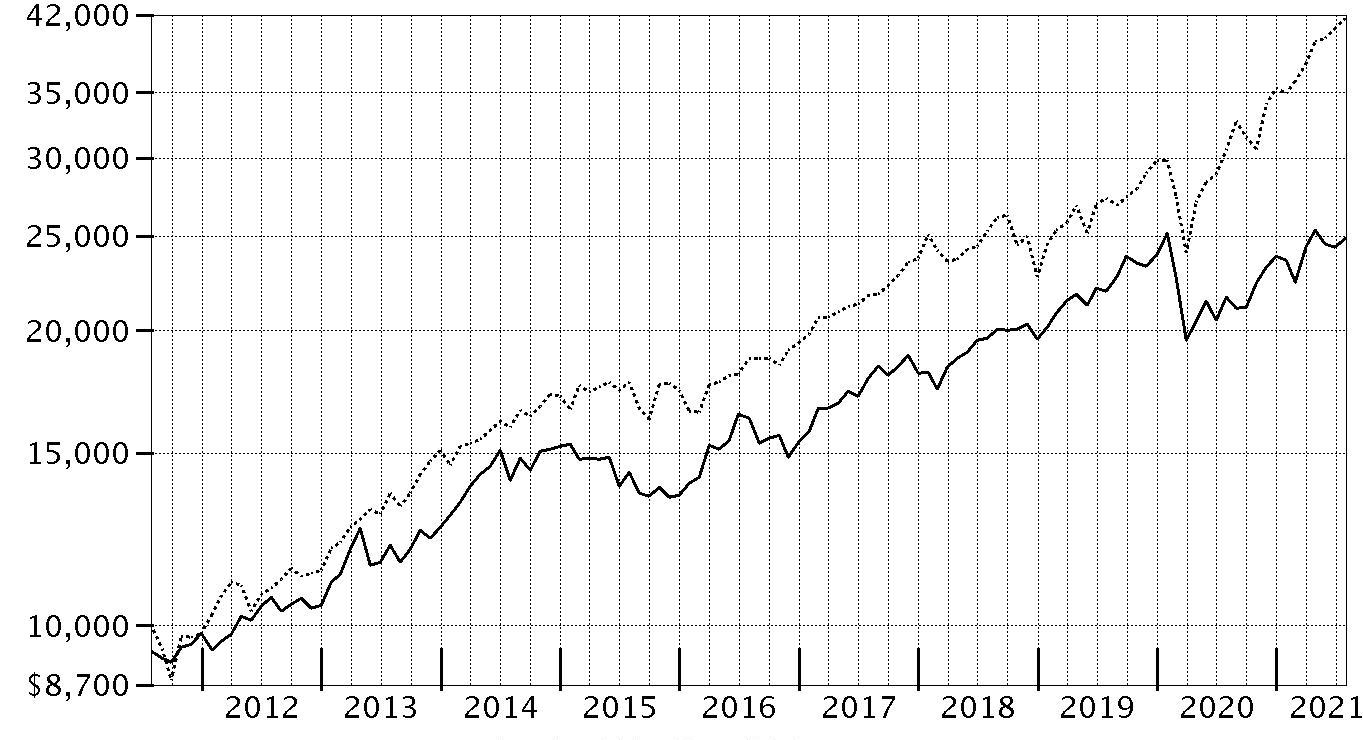

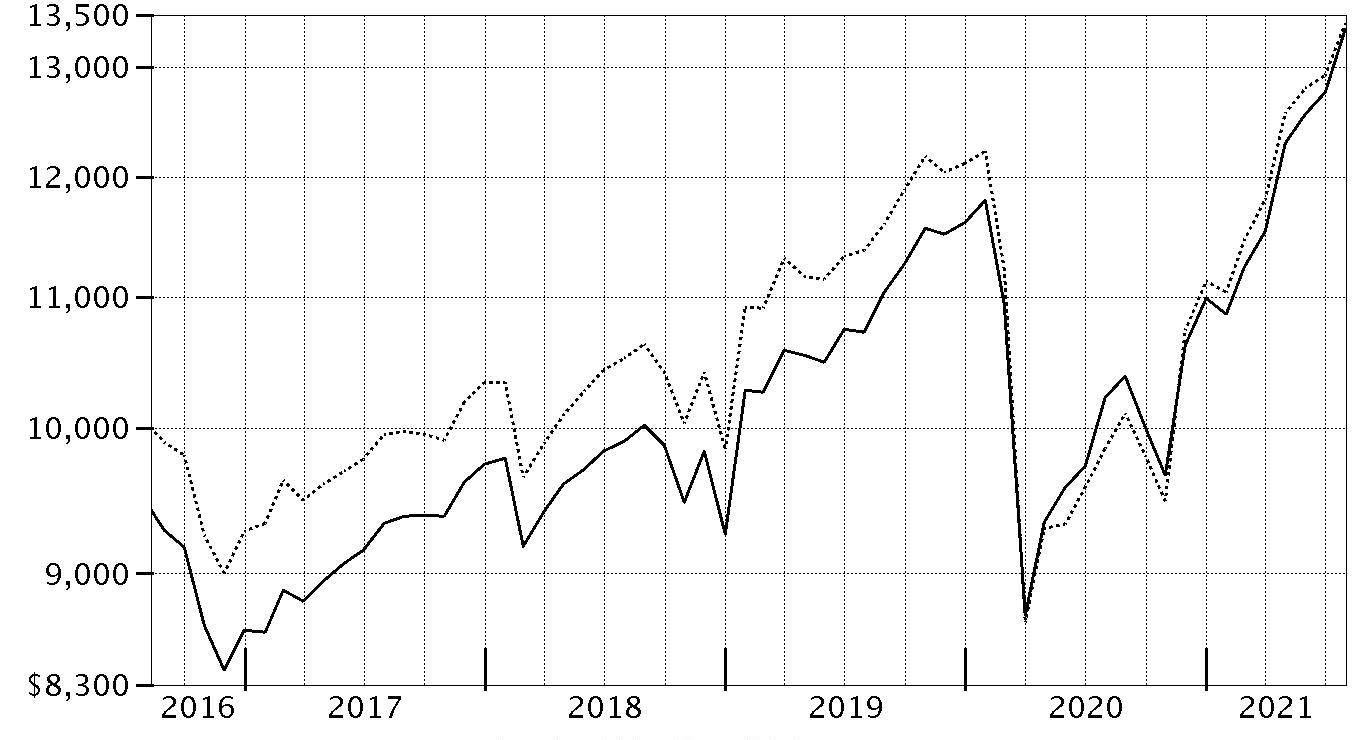

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Communications Equipment Fund - Class A on July 31, 2011, and the current 5.75% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values | ||

| $21,373 | Fidelity Advisor® Communications Equipment Fund - Class A | |

| $41,689 | S&P 500® Index | |

Fidelity Advisor® Communications Equipment Fund

Management's Discussion of Fund Performance

Market Recap: The S&P 500® index gained 36.45% for the 12 months ending July 31, 2021, as U.S. equities continued a historic rebound following a steep but brief decline due to the early-2020 outbreak and spread of COVID-19. A confluence of powerful forces propelled risk assets, returning the stock market to pre-pandemic highs by late August 2020. The rally slowed in September, when stocks began a two-month retreat amid Congress’s inability to reach a deal on additional fiscal stimulus, as well as uncertainty about the election. But as the calendar turned, investors grew hopeful. The rollout of three COVID-19 vaccines was underway, the U.S. Federal Reserve pledged to hold interest rates near zero until the economy recovered, and the federal government planned to deploy trillions of dollars to boost consumers and the economy. This backdrop fueled a sharp rotation, with small-cap value usurping leadership from large growth. As part of the “reopening” theme, investors moved out of tech-driven mega-caps that had thrived due to the work-from-home trend in favor of cheap smaller companies that stood to benefit from a broad cyclical recovery. A flattish May reflected concerns about inflation and jobs, but the uptrend resumed through July, driven by corporate earnings. Notably, this leg saw momentum shift back to large growth, as easing rates and a hawkish Fed stymied the reflation trade. By sector, financials (+55%) led, driven by banks (+63%), whereas utilities (+12%) and consumer staples (+18%) notably lagged.Comments from Portfolio Manager Caroline Tall: For the fiscal year ending July 31, 2021, the fund's share classes (excluding sales charges, if applicable) gained roughly 27% to 29%, roughly in line with the 27.58% gain of the MSCI North America IMI + ADR Custom Communications Equipment 25/50 Linked Index, but underperforming the broad-based S&P 500® index. Versus the industry index, out-of-index exposure to the systems software industry was a meaningful contributor. Security selection in communications equipment also lifted the fund's relative result. Our top individual relative contributor was an out-of-index stake in Cloudflare (+197%). Also boosting value was our outsized stake in Calix Networks, which gained about 133%. Calix Networks was among our largest holdings. Another notable relative contributor was our lighter-than-index stake in index heavyweight Cisco Systems (+21%), which was the fund's biggest holding. Conversely, the primary detractor from performance versus the industry index was a small non-index stake in internet services & infrastructure. Security selection in application software also hindered relative performance. The biggest individual relative detractor was an underweight position in Nokia (+27%), which was among the fund's largest holdings. The fund's non-index stake in Ping Identity Holding, a position not held at period end, returned -34%. Another notable relative detractor was an underweighting in Arista Networks (+46%).The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Fidelity Advisor® Communications Equipment Fund

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2021

| % of fund's net assets | |

| Cisco Systems, Inc. | 24.3 |

| Ericsson (B Shares) sponsored ADR | 14.4 |

| Motorola Solutions, Inc. | 6.2 |

| Nokia Corp. sponsored ADR | 5.3 |

| Ciena Corp. | 5.0 |

| F5 Networks, Inc. | 4.9 |

| Calix, Inc. | 4.7 |

| Juniper Networks, Inc. | 4.5 |

| Lumentum Holdings, Inc. | 3.8 |

| CommScope Holding Co., Inc. | 3.7 |

| 76.8 |

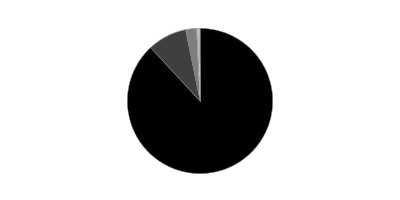

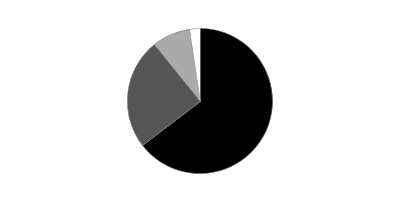

Top Industries (% of fund's net assets)

| As of July 31, 2021 | ||

| Communications Equipment | 97.7% | |

| Software | 2.3% | |

| IT Services | 0.5% | |

| All Others*,** | (0.5)% | |

* Includes short-term investments and net other assets (liabilities).

** Not included in pie chart.

Fidelity Advisor® Communications Equipment Fund

Schedule of Investments July 31, 2021

Showing Percentage of Net Assets

| Common Stocks - 100.5% | |||

| Shares | Value | ||

| Communications Equipment - 97.7% | |||

| Communications Equipment - 97.7% | |||

| ADTRAN, Inc. | 14,479 | $324,474 | |

| Arista Networks, Inc. (a) | 1,605 | 610,526 | |

| Calix, Inc. (a) | 19,773 | 924,981 | |

| Cambium Networks Corp. (a) | 6,233 | 274,564 | |

| Casa Systems, Inc. (a) | 7,819 | 58,721 | |

| Ciena Corp. (a) | 16,757 | 974,252 | |

| Cisco Systems, Inc. | 85,862 | 4,754,180 | |

| CommScope Holding Co., Inc. (a) | 34,170 | 723,037 | |

| Digi International, Inc. (a) | 6,780 | 140,210 | |

| EchoStar Holding Corp. Class A (a)(b) | 14,786 | 329,728 | |

| Ericsson (B Shares) sponsored ADR | 244,105 | 2,814,531 | |

| Evertz Technologies Ltd. | 4,790 | 54,749 | |

| Extreme Networks, Inc. (a) | 30,409 | 334,803 | |

| F5 Networks, Inc. (a) | 4,620 | 954,076 | |

| Harmonic, Inc. (a) | 16,874 | 149,335 | |

| Inseego Corp. (a)(b) | 7,934 | 68,946 | |

| Juniper Networks, Inc. | 31,111 | 875,464 | |

| Lumentum Holdings, Inc. (a) | 8,885 | 746,251 | |

| Motorola Solutions, Inc. | 5,401 | 1,209,392 | |

| NetScout Systems, Inc. (a) | 13,120 | 377,331 | |

| Nokia Corp. sponsored ADR (a) | 168,968 | 1,027,325 | |

| Radware Ltd. (a) | 19 | 612 | |

| Ribbon Communications, Inc. (a) | 10,842 | 74,918 | |

| Sierra Wireless, Inc. (a) | 10,356 | 199,965 | |

| ViaSat, Inc. (a) | 10,273 | 509,952 | |

| Viavi Solutions, Inc. (a) | 35,058 | 585,118 | |

| 19,097,441 | |||

| Electronic Equipment & Components - 0.0% | |||

| Electronic Components - 0.0% | |||

| Corning, Inc. | 33 | 1,381 | |

| IT Services - 0.5% | |||

| Internet Services & Infrastructure - 0.5% | |||

| Rackspace Technology, Inc. (a)(b) | 5,027 | 89,229 | |

| Software - 2.3% | |||

| Application Software - 0.1% | |||

| Citrix Systems, Inc. | 1 | 101 | |

| Smith Micro Software, Inc. (a) | 2,800 | 15,848 | |

| 15,949 | |||

| Systems Software - 2.2% | |||

| Cloudflare, Inc. (a) | 2,682 | 318,166 | |

| Fortinet, Inc. (a) | 436 | 118,697 | |

| 436,863 | |||

| TOTAL SOFTWARE | 452,812 | ||

| TOTAL COMMON STOCKS | |||

| (Cost $11,460,865) | 19,640,863 | ||

| Money Market Funds - 0.8% | |||

| Fidelity Securities Lending Cash Central Fund 0.06% (c)(d) | |||

| (Cost $158,575) | 158,559 | 158,575 | |

| TOTAL INVESTMENT IN SECURITIES - 101.3% | |||

| (Cost $11,619,440) | 19,799,438 | ||

| NET OTHER ASSETS (LIABILITIES) - (1.3)% | (257,522) | ||

| NET ASSETS - 100% | $19,541,916 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Investment made with cash collateral received from securities on loan.

(d) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $299 |

| Fidelity Securities Lending Cash Central Fund | 5,889 |

| Total | $6,188 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.06% | $810,855 | $8,309,844 | $9,120,663 | $(36) | $-- | $-- | 0.0% |

| Fidelity Securities Lending Cash Central Fund 0.06% | 266,925 | 7,715,285 | 7,823,635 | -- | -- | 158,575 | 0.0% |

| Total | $1,077,780 | $16,025,129 | $16,944,298 | $(36) | $-- | $158,575 |

Investment Valuation

The following is a summary of the inputs used, as of July 31, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Common Stocks | $19,640,863 | $19,640,863 | $-- | $-- |

| Money Market Funds | 158,575 | 158,575 | -- | -- |

| Total Investments in Securities: | $19,799,438 | $19,799,438 | $-- | $-- |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 77.6% |

| Sweden | 14.4% |

| Finland | 5.3% |

| Cayman Islands | 1.4% |

| Canada | 1.3% |

| Others (Individually Less Than 1%) | 0.0% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor® Communications Equipment Fund

Financial Statements

Statement of Assets and Liabilities

| July 31, 2021 | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $149,810) — See accompanying schedule: Unaffiliated issuers (cost $11,460,865) | $19,640,863 | |

| Fidelity Central Funds (cost $158,575) | 158,575 | |

| Total Investment in Securities (cost $11,619,440) | $19,799,438 | |

| Receivable for investments sold | 645,198 | |

| Distributions receivable from Fidelity Central Funds | 48 | |

| Prepaid expenses | 87 | |

| Other receivables | 651 | |

| Total assets | 20,445,422 | |

| Liabilities | ||

| Payable to custodian bank | $506,599 | |

| Payable for fund shares redeemed | 178,420 | |

| Accrued management fee | 10,795 | |

| Distribution and service plan fees payable | 6,057 | |

| Other affiliated payables | 5,480 | |

| Other payables and accrued expenses | 37,805 | |

| Collateral on securities loaned | 158,350 | |

| Total liabilities | 903,506 | |

| Net Assets | $19,541,916 | |

| Net Assets consist of: | ||

| Paid in capital | $10,539,033 | |

| Total accumulated earnings (loss) | 9,002,883 | |

| Net Assets | $19,541,916 | |

| Net Asset Value and Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($10,484,689 ÷ 553,563 shares)(a) | $18.94 | |

| Maximum offering price per share (100/94.25 of $18.94) | $20.10 | |

| Class M: | ||

| Net Asset Value and redemption price per share ($4,746,728 ÷ 263,010 shares)(a) | $18.05 | |

| Maximum offering price per share (100/96.50 of $18.05) | $18.70 | |

| Class C: | ||

| Net Asset Value and offering price per share ($1,853,343 ÷ 114,356 shares)(a) | $16.21 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($2,457,156 ÷ 123,543 shares) | $19.89 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Year ended July 31, 2021 | ||

| Investment Income | ||

| Dividends | $225,461 | |

| Income from Fidelity Central Funds (including $5,889 from security lending) | 6,188 | |

| Total income | 231,649 | |

| Expenses | ||

| Management fee | $105,683 | |

| Transfer agent fees | 53,664 | |

| Distribution and service plan fees | 75,328 | |

| Accounting fees | 7,801 | |

| Custodian fees and expenses | 8,430 | |

| Independent trustees' fees and expenses | 85 | |

| Registration fees | 52,306 | |

| Audit | 45,557 | |

| Legal | 244 | |

| Miscellaneous | 196 | |

| Total expenses before reductions | 349,294 | |

| Expense reductions | (44,595) | |

| Total expenses after reductions | 304,699 | |

| Net investment income (loss) | (73,050) | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 2,250,915 | |

| Fidelity Central Funds | (36) | |

| Foreign currency transactions | 174 | |

| Total net realized gain (loss) | 2,251,053 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 2,789,919 | |

| Assets and liabilities in foreign currencies | (1) | |

| Total change in net unrealized appreciation (depreciation) | 2,789,918 | |

| Net gain (loss) | 5,040,971 | |

| Net increase (decrease) in net assets resulting from operations | $4,967,921 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Year ended July 31, 2021 | Year ended July 31, 2020 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $(73,050) | $(73,819) |

| Net realized gain (loss) | 2,251,053 | (974,368) |

| Change in net unrealized appreciation (depreciation) | 2,789,918 | (1,126,563) |

| Net increase (decrease) in net assets resulting from operations | 4,967,921 | (2,174,750) |

| Share transactions - net increase (decrease) | (4,536,847) | (8,916,500) |

| Total increase (decrease) in net assets | 431,074 | (11,091,250) |

| Net Assets | ||

| Beginning of period | 19,110,842 | 30,202,092 |

| End of period | $19,541,916 | $19,110,842 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Advisor Communications Equipment Fund Class A

| Years ended July 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $14.75 | $15.76 | $15.17 | $13.69 | $12.09 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | (.04) | (.03) | (.01) | .03 | .07 |

| Net realized and unrealized gain (loss) | 4.23 | (.98) | 1.04 | 2.08 | 1.76 |

| Total from investment operations | 4.19 | (1.01) | 1.03 | 2.11 | 1.83 |

| Distributions from net investment income | – | – | – | (.04)B | (.05) |

| Distributions from net realized gain | – | – | (.44) | (.59)B | (.18) |

| Total distributions | – | – | (.44) | (.63) | (.23) |

| Redemption fees added to paid in capitalA | – | – | – | –C | –C |

| Net asset value, end of period | $18.94 | $14.75 | $15.76 | $15.17 | $13.69 |

| Total ReturnD,E | 28.41% | (6.41)% | 7.09% | 15.86% | 15.24% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | 1.63% | 1.64% | 1.47% | 1.76% | 1.78% |

| Expenses net of fee waivers, if any | 1.40% | 1.41% | 1.40% | 1.40% | 1.40% |

| Expenses net of all reductions | 1.39% | 1.37% | 1.39% | 1.39% | 1.39% |

| Net investment income (loss) | (.24)% | (.20)% | (.09)% | .21% | .56% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $10,485 | $10,654 | $14,991 | $8,860 | $6,247 |

| Portfolio turnover rateH | 63% | 138% | 98% | 60% | 71% |

A Calculated based on average shares outstanding during the period.

B The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

C Amount represents less than $.005 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Communications Equipment Fund Class M

| Years ended July 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $14.09 | $15.09 | $14.59 | $13.18 | $11.65 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | (.08) | (.06) | (.05) | – | .04 |

| Net realized and unrealized gain (loss) | 4.04 | (.94) | .99 | 2.00 | 1.69 |

| Total from investment operations | 3.96 | (1.00) | .94 | 2.00 | 1.73 |

| Distributions from net investment income | – | – | – | (.02)B | (.02) |

| Distributions from net realized gain | – | – | (.44) | (.57)B | (.18) |

| Total distributions | – | – | (.44) | (.59) | (.20) |

| Redemption fees added to paid in capitalA | – | – | – | –C | –C |

| Net asset value, end of period | $18.05 | $14.09 | $15.09 | $14.59 | $13.18 |

| Total ReturnD,E | 28.11% | (6.63)% | 6.75% | 15.69% | 14.94% |

| Ratios to Average Net AssetsF,G | |||||

| Expenses before reductions | 1.90% | 1.91% | 1.80% | 2.11% | 2.11% |

| Expenses net of fee waivers, if any | 1.65% | 1.66% | 1.65% | 1.65% | 1.65% |

| Expenses net of all reductions | 1.64% | 1.62% | 1.64% | 1.64% | 1.64% |

| Net investment income (loss) | (.49)% | (.45)% | (.34)% | (.04)% | .31% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $4,747 | $4,197 | $5,242 | $4,943 | $4,236 |

| Portfolio turnover rateH | 63% | 138% | 98% | 60% | 71% |

A Calculated based on average shares outstanding during the period.

B The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

C Amount represents less than $.005 per share.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Communications Equipment Fund Class C

| Years ended July 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $12.72 | $13.69 | $13.34 | $12.10 | $10.74 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | (.14) | (.12) | (.11) | (.07) | (.02) |

| Net realized and unrealized gain (loss) | 3.63 | (.85) | .90 | 1.84 | 1.56 |

| Total from investment operations | 3.49 | (.97) | .79 | 1.77 | 1.54 |

| Distributions from net investment income | – | – | – | – | – |

| Distributions from net realized gain | – | – | (.44) | (.53) | (.18) |

| Total distributions | – | – | (.44) | (.53) | (.18) |

| Redemption fees added to paid in capitalA | – | – | – | –B | –B |

| Net asset value, end of period | $16.21 | $12.72 | $13.69 | $13.34 | $12.10 |

| Total ReturnC,D | 27.44% | (7.09)% | 6.25% | 15.06% | 14.39% |

| Ratios to Average Net AssetsE,F | |||||

| Expenses before reductions | 2.42% | 2.42% | 2.28% | 2.54% | 2.55% |

| Expenses net of fee waivers, if any | 2.15% | 2.16% | 2.15% | 2.15% | 2.15% |

| Expenses net of all reductions | 2.15% | 2.12% | 2.14% | 2.14% | 2.14% |

| Net investment income (loss) | (.99)% | (.95)% | (.84)% | (.54)% | (.19)% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $1,853 | $2,695 | $5,264 | $4,684 | $3,066 |

| Portfolio turnover rateG | 63% | 138% | 98% | 60% | 71% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity Advisor Communications Equipment Fund Class I

| Years ended July 31, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $15.45 | $16.47 | $15.79 | $14.22 | $12.54 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | –B | .01 | .03 | .07 | .11 |

| Net realized and unrealized gain (loss) | 4.44 | (1.03) | 1.09 | 2.16 | 1.83 |

| Total from investment operations | 4.44 | (1.02) | 1.12 | 2.23 | 1.94 |

| Distributions from net investment income | – | – | – | (.05)C | (.08) |

| Distributions from net realized gain | – | – | (.44) | (.61)C | (.18) |

| Total distributions | – | – | (.44) | (.66) | (.26) |

| Redemption fees added to paid in capitalA | – | – | – | –B | –B |

| Net asset value, end of period | $19.89 | $15.45 | $16.47 | $15.79 | $14.22 |

| Total ReturnD | 28.74% | (6.19)% | 7.39% | 16.21% | 15.55% |

| Ratios to Average Net AssetsE,F | |||||

| Expenses before reductions | 1.20% | 1.27% | 1.12% | 1.42% | 1.46% |

| Expenses net of fee waivers, if any | 1.15% | 1.16% | 1.12% | 1.15% | 1.15% |

| Expenses net of all reductions | 1.14% | 1.12% | 1.11% | 1.14% | 1.14% |

| Net investment income (loss) | .01% | .05% | .19% | .47% | .81% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $2,457 | $1,565 | $4,705 | $2,773 | $4,733 |

| Portfolio turnover rateG | 63% | 138% | 98% | 60% | 71% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.