Pre-Effective Amendment No. 2 /X/

Post-Effective Amendment No. //

T. Rowe Price Tax-Exempt Money Fund, Inc.

Title of Securities Being Registered: Shares of common stock (par value $0.01 per share) of the Registrant.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

T. Rowe Price California Tax-Free Money Fund

T. Rowe Price New York Tax-Free Money Fund

June 30, 2021

Dear Shareholder:

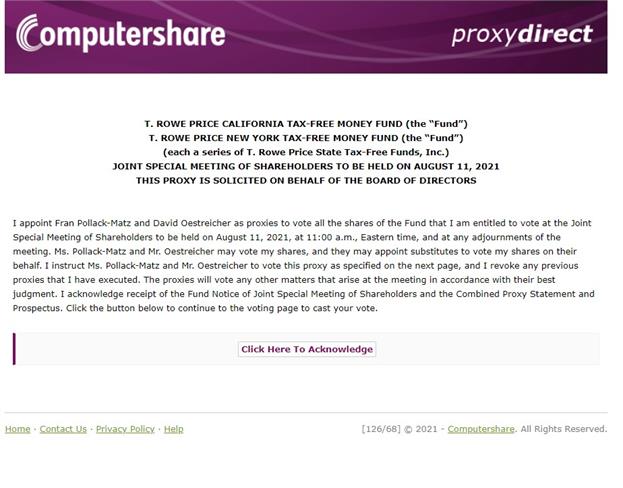

We cordially invite you to attend a joint special meeting of shareholders of the T. Rowe Price California Tax-Free Money Fund (the “California Tax-Free Money Fund”) and the T. Rowe Price New York Tax-Free Money Fund (the “New York Tax-Free Money Fund”) (each a “Target Fund” and together, the “Target Funds”), each a series of T. Rowe Price State Tax-Free Funds, Inc. (the “Corporation”), on Wednesday, August 11, 2021. The meeting will be conducted as a virtual meeting hosted by means of a live webcast. The Corporation’s Board of Directors (the “Board”) has implemented a virtual meeting format primarily to reflect our global concerns regarding the spread of COVID-19. Shareholders will be able to listen, vote, and submit questions from their home or any location with internet connectivity.

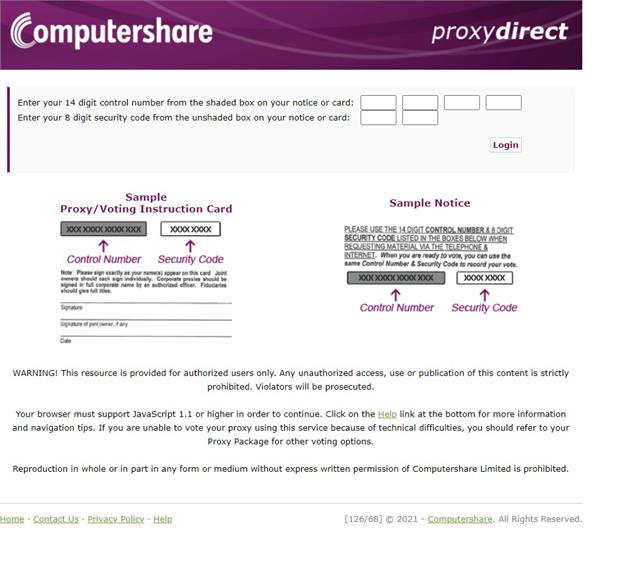

You or your proxyholder will be able to attend the meeting online, vote, and submit questions by visiting the following website: meetings.computershare.com/MKKCTHY and using a control number assigned by Computershare Fund Services, the proxy tabulator for the meeting. To register and receive access to the virtual meeting, you will need to follow the instructions provided in the Notice of Joint Special Meeting of Shareholders and combined proxy statement and prospectus that follow.

The purpose of the meeting is to vote on a proposed transaction pursuant to which your Target Fund will be reorganized into the T. Rowe Price Tax-Exempt Money Fund (“Tax-Exempt Money Fund” and together with the Target Funds, the “Funds,” and each a “Fund”). Each transaction was approved and recommended by the Board. Under the proposed reorganization between your Target Fund and the Tax-Exempt Money Fund, you would become a shareholder of the Tax-Exempt Money Fund. Shareholders who currently own shares of a Target Fund’s Investor Class and I Class will become shareholders of the Tax-Exempt Money Fund’s Investor Class and I Class, respectively. The value of your account in the Tax-Exempt Money Fund will be the same as it was in your Target Fund on the effective date of the transactions, which is expected to be on or around August 23, 2021, subject to obtaining approval of the Target Fund’s shareholders at the joint special meeting on August 11, 2021. Neither reorganization is contingent upon the approval or completion of the other reorganization. The reasons the Board is recommending these transactions are briefly summarized below. The accompanying combined proxy statement and prospectus

contain detailed information on the transactions and comparisons of the Funds. We ask you to read the enclosed information carefully and to submit your vote.

The Funds offer similar investment programs although there are some differences. The Funds are money market funds subject to the maturity, credit quality, diversification, liquidity, and other requirements of Rule 2a-7 under the Investment Company Act of 1940, as amended. The California Tax-Free Money Fund invests at least 65% of its total assets in California municipal securities, and at least 80% of the Fund’s income is expected to be exempt from federal and California state income taxes. The New York Tax-Free Money Fund invests at least 65% of its total assets in New York municipal securities, and at least 80% of the Fund’s income is expected to be exempt from federal, New York state, and New York City income taxes. Normally, at least 80% of the Tax-Exempt Money Fund’s income will be exempt from federal income taxes. As a result of each Target Fund’s reorganization into the Tax-Exempt Money Fund, shareholders of the Target Fund will no longer be invested in a Fund of which monthly dividends are expected to be exempt from applicable state and local taxes in addition to federal income taxes, but instead will be invested in a Fund of which monthly dividends are expected to be exempt from federal income taxes. Up to 20% of each Target Fund’s income could be derived from securities that are subject to the alternative minimum tax (“AMT”), whereas the Tax-Exempt Money Fund does not purchase securities that are subject to AMT. Historically, securities subject to AMT provided slightly higher income than those not subject to AMT. However, the Tax-Exempt Money Fund has had consistently better performance than each of the Target Funds.

Each of the Target Funds is relatively small. Less than 1% of T. Rowe Price clients residing in California and New York are shareholders of the California Tax-Free Money Fund and the New York Tax-Free Money Fund, respectively. We believe that offering a single tax-free money market fund to a wide variety of investors will allow all shareholders to take advantage of potential economies of scale and reduce inefficiencies that can result from offering similar funds.

Target Fund shareholders will benefit from moving to a fund with a lower overall net expense ratio as a result of the transactions:

Comparison of Investor Class Expenses. Once the assets of the three Funds are combined, the net expense ratio of the Investor Class of the Tax-Exempt Money Fund is estimated to be approximately 0.32% of the Fund’s average daily net assets (as of February 28, 2021). The net expense ratio of the Tax-Exempt Money Fund’s Investor Class was 0.33% as of February 28, 2021 (after restating the Fund’s management fee to reflect current fees), which is lower than the California Tax-Free Money Fund’s Investor Class net expense ratio of 0.55% and New York Tax-Free Money Fund’s Investor Class net expense ratio of 0.55% (each as of February 28, 2021, and including the effect of a contractual management fee waiver and an expense limitation agreement that will be in place through at least June 30, 2022). The gross expense ratio of the Tax-Exempt Money Fund’s Investor Class was approximately 0.52% as of February 28, 2021, which is lower than the California Tax-Free Money Fund’s Investor Class gross

expense ratio of 0.83% and New York Tax-Free Money Fund’s Investor Class gross expense ratio of 0.89% (each as of February 28, 2021).

Comparison of I Class Expenses. Once the assets of the three Funds are combined, the net expense ratio of the I Class of the Tax-Exempt Money Fund is estimated to be approximately 0.24% of the Fund’s average daily net assets (as of February 28, 2021, and including the effect of an expense limitation agreement that will be in place through at least June 30, 2022). The net expense ratio of the Tax-Exempt Money Fund’s I Class was 0.24% as of February 28, 2021 (after restating the Fund’s management fee to reflect current fees and including the effect of an expense limitation agreement that will be in place through at least June 30, 2022), which is lower than the California Tax-Free Money Fund’s I Class net expense ratio of 0.33% and New York Tax-Free Money Fund’s I Class net expense ratio of 0.33% (each as of February 28, 2021, and including the effect of a contractual management fee waiver and an expense limitation agreement that will be in place through at least June 30, 2022). The gross expense ratio of the Tax-Exempt Money Fund’s I Class was approximately 0.45% as of February 28, 2021, which is lower than the California Tax-Free Money Fund’s I Class gross expense ratio of 0.73% and New York Tax-Free Money Fund’s I Class gross expense ratio of 0.78% (each as of February 28, 2021).

In an effort to maintain a zero or positive net yield for each Fund, T. Rowe Price Associates, Inc. (“T. Rowe Price”) may voluntarily waive all or a portion of the management fee it is entitled to receive from the Fund or reimburse all or a portion of the Fund’s operating expenses. T. Rowe Price may amend or terminate this voluntary fee waiver arrangement at any time without prior notice.

If the transaction involving your Target Fund is approved at the joint special shareholder meeting, your Investor Class shares or I Class shares of the Target Fund will automatically be converted, on or around August 23, 2021, for Investor Class shares or I Class shares, respectively, of the Tax-Exempt Money Fund of equal value. Please note that each reorganization is not a taxable event but redeeming or exchanging your Target Fund shares prior to the applicable reorganization may be a taxable event depending on your individual tax situation. The cost basis and holding periods of Target Fund shares will carry over to the corresponding class of shares of the Tax-Exempt Money Fund that you will receive in connection with the applicable transaction.

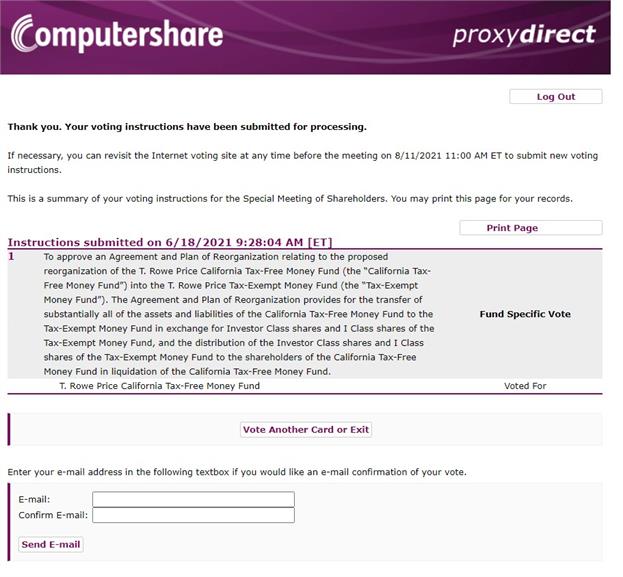

Whether or not you plan to be present at the virtual meeting, your vote is very important. If you do not plan to be present at the virtual meeting, you can vote by signing, dating, and returning the enclosed proxy card promptly or by using the Internet or telephone voting options as described on your proxy card. By voting promptly, you can help the Target Funds avoid the expense of additional mailings.

If you have questions, please call one of our service representatives at 1-800-638-8790. Your participation in this vote is extremely important.

Sincerely,

Robert W. Sharps

Head of Investments

T. Rowe Price California Tax-Free Money Fund

T. Rowe Price New York Tax-Free Money Fund

(each a series of the T. Rowe Price State Tax-Free Funds, Inc.)

Notice of Joint Special Meeting of Shareholders

T. Rowe Price Funds

100 East Pratt Street

Baltimore, Maryland 21202

Fran Pollack-Matz

Secretary

June 30, 2021

Notice is hereby given that a joint special meeting of shareholders (the “Shareholder Meeting”) of the T. Rowe Price California Tax-Free Money Fund (the “California Tax-Free Money Fund”) and the T. Rowe Price New York Tax-Free Money Fund (the “New York Tax-Free Money Fund”), each a series of T. Rowe Price State Tax-Free Funds, Inc., will be held virtually on Wednesday, August 11, 2021, at 11:00 a.m., eastern time, by means of a live webcast.

The following matters will be considered and acted upon at that time:

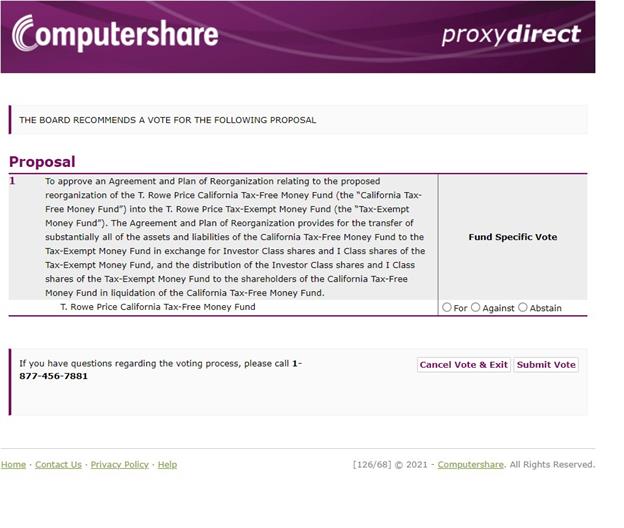

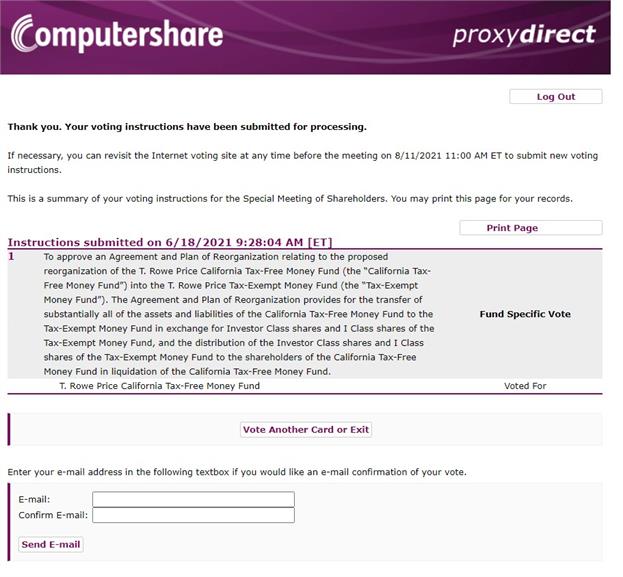

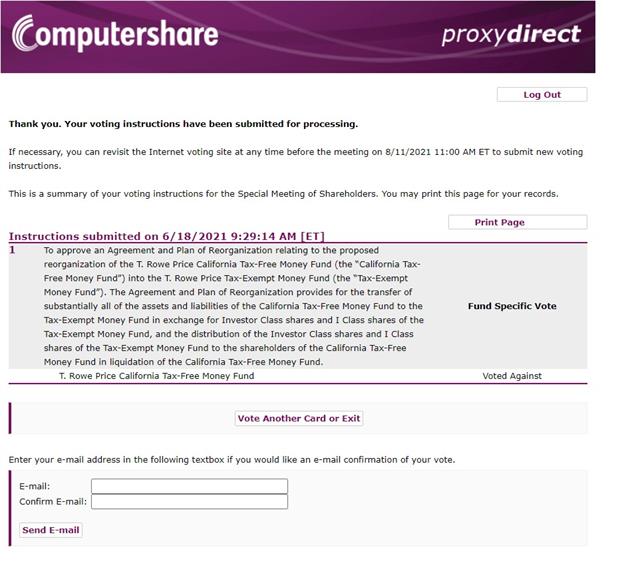

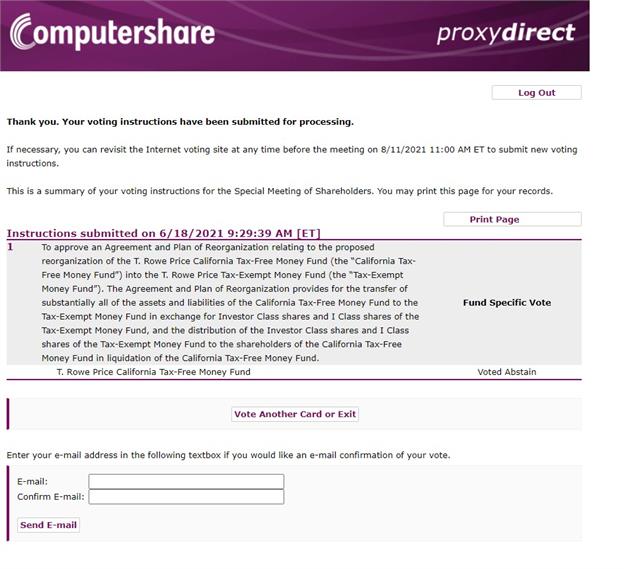

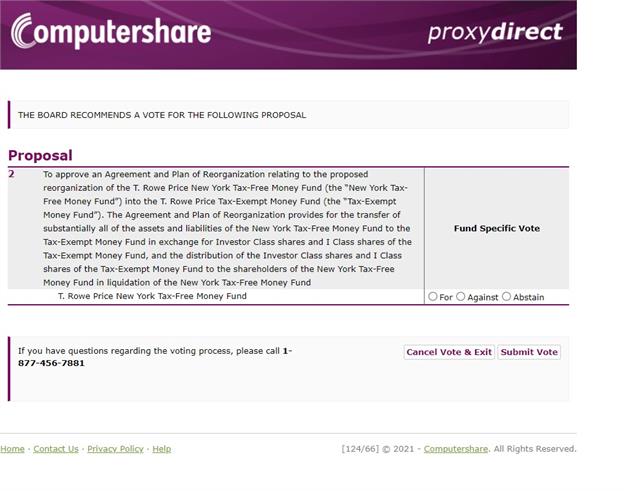

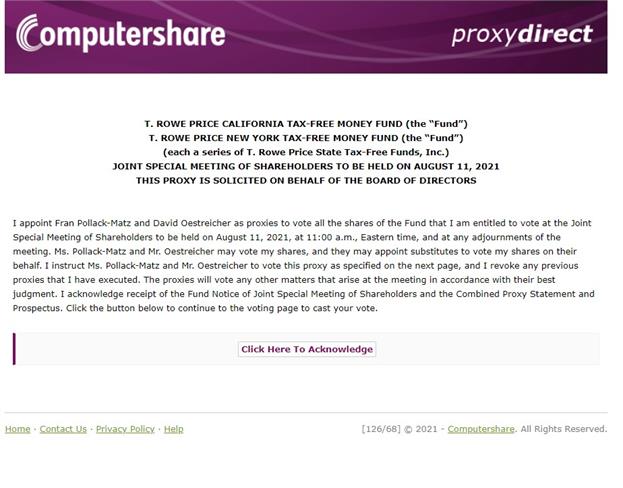

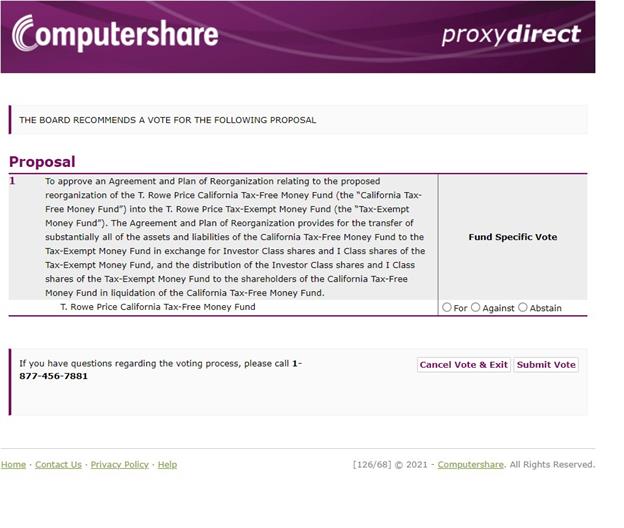

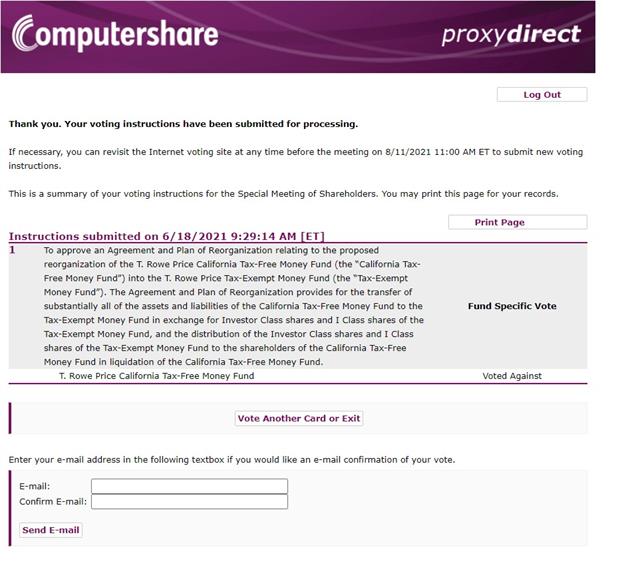

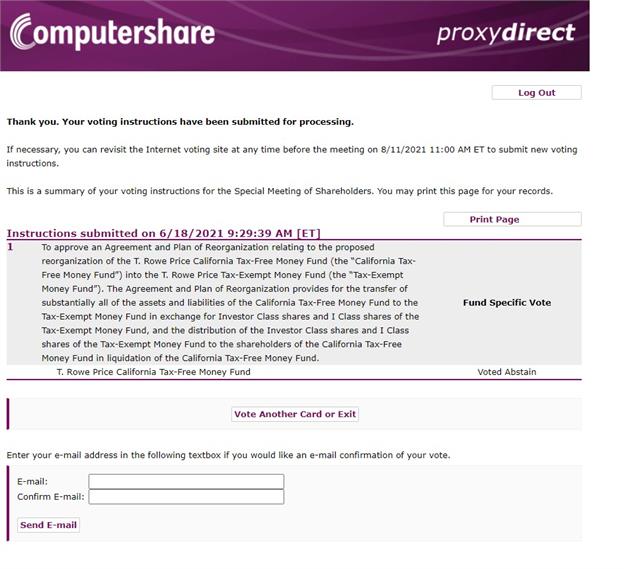

1. A proposal to approve an Agreement and Plan of Reorganization relating to the proposed reorganization of the California Tax-Free Money Fund into the T. Rowe Price Tax-Exempt Money Fund (the “Tax-Exempt Money Fund”). The Agreement and Plan of Reorganization provides for the transfer of substantially all of the assets and liabilities of the California Tax-Free Money Fund to the Tax-Exempt Money Fund in exchange for Investor Class shares and I Class shares of the Tax-Exempt Money Fund, and the distribution of the Investor Class shares and I Class shares of the Tax-Exempt Money Fund to the shareholders of the California Tax-Free Money Fund in liquidation of the California Tax-Free Money Fund;

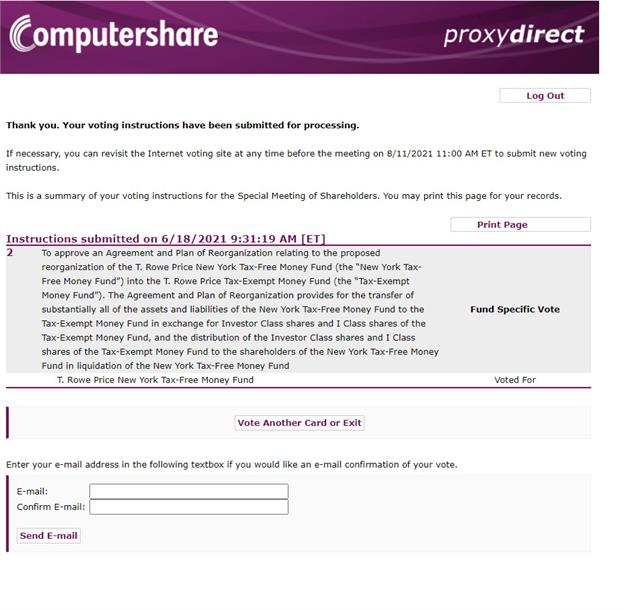

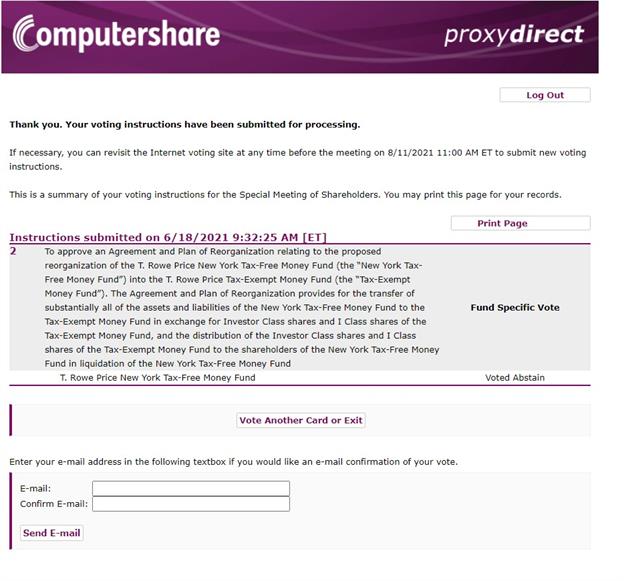

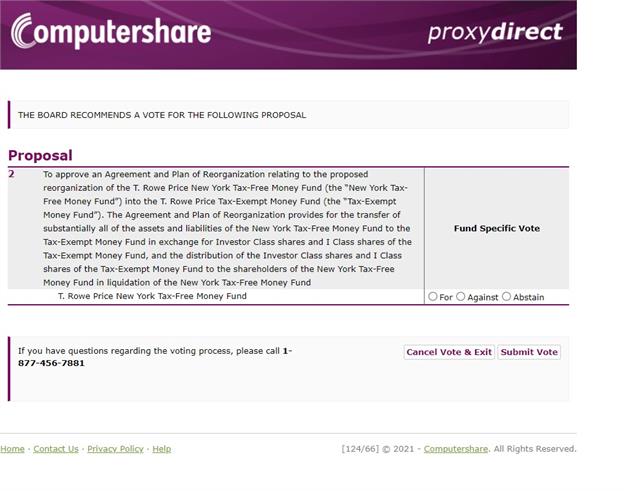

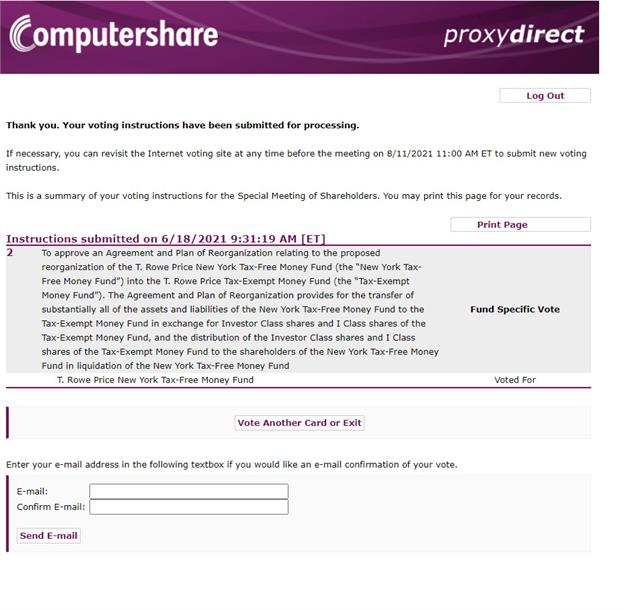

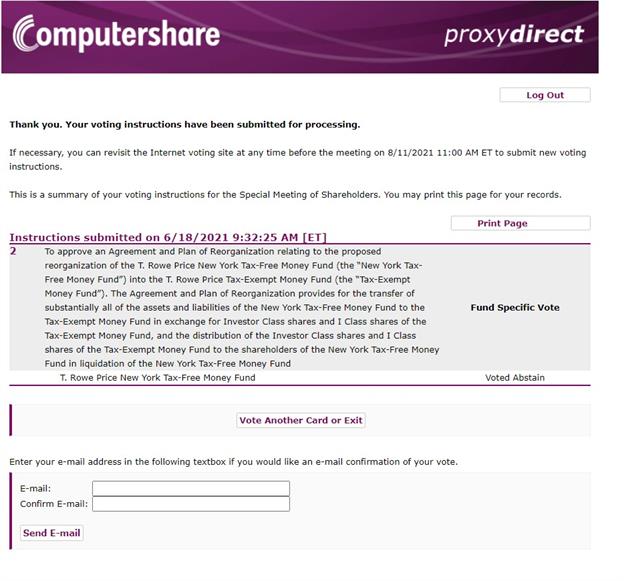

2. A proposal to approve an Agreement and Plan of Reorganization relating to the proposed reorganization of the New York Tax-Free Money Fund into the Tax-Exempt Money Fund. The Agreement and Plan of Reorganization provides for the transfer of substantially all of the assets and liabilities of the New York Tax-Free Money Fund to the Tax-Exempt Money Fund in exchange for Investor Class shares and I Class shares of the Tax-Exempt Money Fund, and the distribution of the Investor Class shares and I Class shares of the Tax-Exempt Money Fund to the shareholders of the New York Tax-Free Money Fund in liquidation of the New York Tax-Free Money Fund; and

3. To transact such other business as may properly come before the Shareholder Meeting and any adjournments thereof.

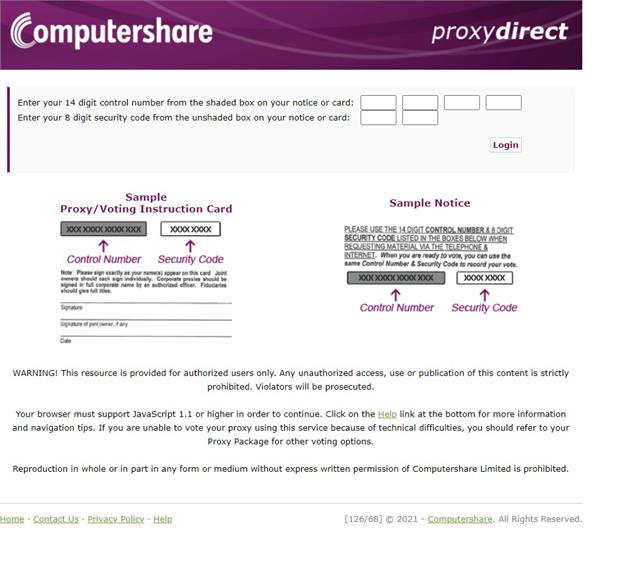

You will be able to attend the Shareholder Meeting online, submit your questions during the Shareholder Meeting and vote your shares electronically at the meeting by going to the following website: meetings.computershare.com/MKKCTHY and entering your control number, which is included on the enclosed proxy card.

If your shares are held through a brokerage account or by a bank or other holder of record you will need to request a legal proxy in order to receive access to the virtual Shareholder Meeting. To do so, you must submit proof of your proxy power (legal proxy) reflecting your holdings along with your name and email address to Computershare Fund Services, the proxy tabulator for the Shareholder Meeting (“Computershare”). Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., eastern time, on August 6, 2021. You will receive a confirmation of your registration by email that includes the control number necessary to access and vote at the Shareholder Meeting. Requests for registration should be directed to Computershare at shareholdermeetings@computershare.com.

The Shareholder Meeting webcast will begin promptly at 11:00 a.m., eastern time. We encourage you to access the Shareholder Meeting prior to the start time. For additional information on how you can attend and participate in the virtual Shareholder Meeting, please see the instructions under the heading SUMMARY beginning on page 1 of the combined proxy statement and prospectus that follows. Because the Shareholder Meeting will be a completely virtual meeting, there will be no physical location for shareholders to attend.

Only shareholders of record at the close of business on May 31, 2021, are entitled to notice of, and to vote at, this Shareholder Meeting or any adjournment thereof. The Board of each Target Fund recommends that you vote in favor of the applicable proposal.

Fran Pollack-Matz

Secretary

| |

YOUR VOTE IS IMPORTANT |

Shareholders are urged to designate their choice on the matters to be acted upon by using one of the following four methods: 1. Vote online.* · Read the combined proxy statement and prospectus. · Go to the Internet voting site found on your proxy card. · Enter the control number found on your proxy card. · Follow the instructions using your proxy card as a guide. 2. Vote by telephone.* · Read the combined proxy statement and prospectus. · Call the toll-free number found on your proxy card. · Enter the control number found on your proxy card. · Follow the recorded instructions using your proxy card as a guide. 3. Vote by mail. · Read the combined proxy statement and prospectus. · Date, sign, and return the enclosed proxy card in the envelope provided, which requires no postage if mailed in the United States. 4. Attend the virtual Shareholder Meeting. · Read the combined proxy statement and prospectus. · Vote your shares electronically during the live webcast virtual Shareholder Meeting by going to the following website: meetings.computershare.com/MKKCTHY and entering your control number, which is included on the enclosed proxy card. *If you vote online or by telephone, your vote must be received no later than 10:59 a.m. on August 11, 2021. If you vote by mail, your vote must be received at the address referenced on the proxy card on or before August 10, 2021. Your prompt response will help to achieve a quorum at the Shareholder Meeting and avoid the potential for additional expenses to each Target Fund and its shareholders of further solicitation. |

Transfer of the Assets of the

T. ROWE PRICE CALIFORNIA TAX-FREE MONEY FUND

T. ROWE PRICE NEW YORK TAX-FREE MONEY FUND

(each a series of T. Rowe Price State Tax-Free Funds, Inc.)

By and in Exchange for Investor Class Shares and I Class Shares of the

T. ROWE PRICE TAX-EXEMPT MONEY FUND

100 East Pratt Street

Baltimore, MD 21202

Joint Special Meeting of Shareholders—August 11, 2021

COMBINED PROXY STATEMENT AND PROSPECTUS

June 30, 2021

This Combined Proxy Statement and Prospectus (“Statement”) was first transmitted to shareholders on or about June 30, 2021.

This Statement is being furnished to shareholders of the T. Rowe Price California Tax-Free Money Fund (the “California Tax-Free Money Fund”) and the T. Rowe Price New York Tax-Free Money Fund (the “New York Tax-Free Money Fund”) (each a “Target Fund” and together, the “Target Funds”), each a series of T. Rowe Price State Tax-Free Funds, Inc., for use at a joint special meeting of shareholders of each Target Fund to be held on Wednesday, August 11, 2021 (the “Shareholder Meeting”). At the Shareholder Meeting, shareholders of each Target Fund will be asked to approve an Agreement and Plan of Reorganization (a “Plan”) relating to the proposed reorganization ( a “Reorganization”) of such Target Fund into the T. Rowe Price Tax-Exempt Money Fund (the “Tax-Exempt Money Fund” and together with the Target Funds, the “Funds” and each, a “Fund”).

Each Plan provides for the transfer of substantially all of the assets and liabilities of the respective Target Fund to the Tax-Exempt Money Fund, in exchange for Investor Class shares of the Tax-Exempt Money Fund (the “Investor Class” or the “Tax-Exempt Money Fund—Investor Class”) and I Class shares of the Tax-Exempt Money Fund (the “I Class” or the “Tax-Exempt Money Fund—I Class”). Following the transfer, the Investor Class shares and I Class shares received in the exchange will be distributed to Target Fund shareholders in complete liquidation of the respective Target Fund. Shareholders of Investor Class of each Target Fund will receive Tax-Exempt Money Fund—Investor Class shares, and shareholders of I Class of each Target Fund will receive Tax-Exempt Money Fund—I Class shares, each having an aggregate net asset value equal to the aggregate net asset value of their Target Fund Investor Class shares

and I Class shares, respectively, on the business day immediately preceding the closing date of each Reorganization.

If the applicable transaction is approved by shareholders of your Target Fund, you will become a shareholder in the Tax-Exempt Money Fund’s Investor Class or I Class, as applicable, and the value of the share balance in your account will be the same as it was in your Target Fund on the business day preceding the day of the applicable Reorganization. The Funds are money market funds whose shares are valued at amortized cost. Accordingly, it is expected that the shares you receive in the applicable Reorganization will have a net asset value at amortized cost of $1.00 per share.

The Funds have similar investment objectives and investment programs, although the Target Funds are subject to an additional investment restriction that is not applicable to the Tax-Exempt Money Fund. See “Comparison of Investment Objectives, Policies, and Restrictions.”

This Statement concisely sets forth the information you should know about the Tax-Exempt Money Fund and its classes and each Plan. Please read this Statement and keep it for future reference. It is both a proxy statement for each Target Fund and a prospectus for the Tax-Exempt Money Fund.

The following documents have been filed with the Securities and Exchange Commission (“SEC”) and are incorporated into this Statement by reference:

· The Statement of Additional Information dated June 30, 2021, relating to the Reorganizations (“SAI”)

· The prospectus of the California Tax-Free Money Fund dated July 1, 2020, as supplemented to date

· The prospectus of the New York Tax-Free Money Fund dated July 1, 2020, as supplemented to date

· The prospectus of the Tax-Exempt Money Fund dated July 1, 2020, as supplemented to date

· The Statement of Additional Information of the Funds dated May 24, 2021

· The annual shareholder report of the California Tax-Free Money Fund dated February 28, 2021

· The annual shareholder report of the New York Tax-Free Money Fund dated February 28, 2021

· The annual shareholder report of the Tax-Exempt Money Fund dated February 28, 2021

Each Fund’s prospectus includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully. The Funds’ Statement of Additional Information, which contains additional detailed information about the

relevant Fund, is not a prospectus but should be read in conjunction with the prospectus.

The shareholder reports contain information about Fund investments, including a review of market conditions and the portfolio manager’s recent investment strategies and their impact on performance. Copies of each prospectus, annual and semiannual shareholder reports, Statements of Additional Information for the Funds, and the SAI are all available at no cost by calling 1-800-225-5132; by writing to T. Rowe Price Associates, Inc. (“T. Rowe Price”), Three Financial Center, 4515 Painters Mill Road, Owings Mills, Maryland 21117; or by visiting our website at troweprice.com. All of the above-referenced documents are also on file with the SEC and available through its website at http://www.sec.gov. Copies of this information may be obtained, after paying a duplicating fee, by electronic request at publicinfo@sec.gov.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS COMBINED PROXY STATEMENT AND PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

No person has been authorized to give any information or to make any representations other than what is in this Statement or in the materials expressly incorporated herein by reference. Any such other information or representation should not be relied upon as having been authorized by the Funds.

SUMMARY

The information contained in this summary is qualified by reference to the more detailed information appearing elsewhere in this Statement, and in each Plan, a form of which is included as Exhibit A to this Statement.

What are shareholders being asked to vote on?

At a meeting held on March 9, 2021, the Boards of Directors of the Funds (each, a “Board” and together, the “Boards”), including a majority of the independent directors, approved the proposed reorganization of each of the California Tax-Free Money Fund and the New York Tax-Free Money Fund into the Tax-Exempt Money Fund and the submission of each Plan to shareholders of the respective Target Fund. Each Plan provides for the transfer of substantially all the assets and liabilities of the respective Target Fund to the Tax-Exempt Money Fund in exchange for Investor Class Shares and I Class shares of the Tax-Exempt Money Fund. Following the transfer, the Investor Class Shares and I Class shares of the Tax-Exempt Money Fund received in the exchange will be distributed to shareholders of the respective Target Fund in complete liquidation of such Target Fund. As a result of the proposed transaction: (1) you will cease being a shareholder of your respective Target Fund; (2) instead you will become an owner of Investor Class shares or I Class shares, as applicable, of the Tax-Exempt Money Fund; and (3) the value of your account in the Tax-Exempt Money Fund will equal the value of your account in your respective Target Fund as of the close of the business day immediately preceding the closing date of the applicable transaction.

How can shareholders access the virtual Shareholder Meeting?

The Shareholder Meeting will be a virtual meeting conducted exclusively via live webcast starting at 11:00 a.m., eastern time on Wednesday, August 11, 2021. You will be able to attend the Shareholder Meeting online, submit your questions during the Shareholder Meeting, and vote your shares electronically at the Shareholder Meeting by going to the following website: meetings.computershare.com/MKKCTHY and entering your control number, which is included on the proxy card that you received.

Because the Shareholder Meeting is completely virtual and being conducted via live webcast, shareholders will not be able to attend the Shareholder Meeting in person.

If your shares are held through a brokerage account or by a bank or other holder of record you will need to request a legal proxy in order to receive access to the virtual meeting. To do so, you must submit proof of your proxy power (legal proxy) reflecting your holdings along with your name and email address to Computershare Fund Services (“Computershare”). Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., eastern time, on August 6, 2021. You will receive a confirmation of your registration by email that includes the control number necessary to access and vote at the Shareholder Meeting. Requests for

1

registration should be directed to Computershare at shareholdermeetings@computershare.com.

In light of the rapidly changing developments related to the ongoing global COVID-19 pandemic caused by the novel coronavirus, SARS-CoV-2, we are pleased to offer our shareholders a completely virtual Shareholder Meeting, which provides worldwide access and communication, while protecting the health and safety of our shareholders, directors, management, and other stakeholders. We are committed to ensuring that shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. We will reserve time at the end of the Shareholder Meeting (prior to the final vote tabulation) to answer as many shareholder-submitted questions as time permits; however, we reserve the right to exclude questions that are not pertinent to Shareholder Meeting matters or that are otherwise inappropriate. If substantially similar questions are received, we will group such questions together and provide a single response to avoid repetition.

Can I access the Shareholder Meeting without a control number?

The Shareholder Meeting will be accessible to shareholders without a control number; however, only those with a control number will be able to vote during the Shareholder Meeting and ask questions.

Your control number is included on the enclosed proxy card. If you are unable to locate your control number, please contact Computershare by emailing shareholdermeetings@computershare.com. Any requests for a control number must be received no later than 5:00 p.m., eastern time, on August 6, 2021.

What vote is required to approve the Plan?

Approval of each Plan requires an affirmative vote of the lesser of: (a) 67% or more of the respective Target Fund’s shares represented at the Shareholder Meeting if the holders of more than 50% of the outstanding shares of such Target Fund are present at the virtual Shareholder Meeting or by proxy; or (b) more than 50% of the respective Target Fund’s outstanding shares. Each Board recommends that shareholders of the respective Target Fund vote FOR the proposal.

Will there be any tax consequences to a Target Fund or its shareholders?

Each Reorganization will be structured to have no adverse tax consequences to the applicable Target Fund or its shareholders.

Each Reorganization is conditioned upon the receipt of an opinion of tax counsel to the applicable Funds that, for federal income tax purposes:

· no gain or loss will be recognized by the applicable Target Fund, the Tax-Exempt Money Fund, or their shareholders as a result of the Reorganization;

· the holding period and adjusted basis of the Tax-Exempt Money Fund shares received by a shareholder will have the same holding period and adjusted basis of the shareholder’s shares of the applicable Target Fund; and

2

· the Tax-Exempt Money Fund will assume the holding period and adjusted basis of each asset (with certain exceptions) of the applicable Target Fund that is transferred to the Tax-Exempt Money Fund that the asset had immediately prior to the Reorganization. See “Information About the Reorganizations—Tax Considerations” for more information.

The receipt of an opinion of tax counsel is a nonwaivable condition of the Reorganization. It is anticipated that substantially all of each Target Fund’s portfolio holdings will transfer to the Tax-Exempt Money Fund as part of its Reorganization. Each Target Fund’s investment program allows up to 20% of its income to be derived from securities subject to the alternative minimum tax (“AMT”), whereas the Tax-Exempt Money Fund is not permitted to invest in securities subject to AMT. Each Target Fund intends to allow any securities that may be incompatible with the Tax-Exempt Money Fund’s investment program to mature prior to its Reorganization, and to exercise certain demand features prior to its Reorganization. Although unlikely, some securities may be sold prior to a Target Fund’s Reorganization.

It is expected that shareholders will not recognize a gain or loss for federal income tax purposes as a direct result of a Reorganization. Shareholders will receive, in one or more distributions, all or a portion of which may be taxable, their share of the net investment income (including net tax-exempt interest income) and net capital gain realized in the normal course of each Target Fund’s operations and not previously distributed for taxable years ending on or prior to August 23, 2021, or such other closing date as is agreed to by each Target Fund and the Tax-Exempt Money Fund (each, a “Closing Date”). See “Information About the Reorganizations—Tax Considerations” for more information.

As a result of each Target Fund’s reorganization into the Tax-Exempt Money Fund, shareholders of the Target Fund will no longer be invested in a Fund of which monthly dividends are expected to be exempt from applicable state and local taxes in addition to federal income taxes, but instead will be invested in a Fund of which monthly dividends are expected to be exempt from federal income taxes.

Who will pay for the Reorganizations?

The expenses incurred to execute each Reorganization, including all direct and indirect expenses, will be paid by the respective Funds and their shareholders since each Reorganization is expected to benefit the Funds. The total estimated expenses associated with the Reorganizations are $50,700, which includes costs associated with soliciting shareholders, professional expenses (including legal and auditing fees), and transaction costs (which are expected to be de minimis). Professional fees (legal and audit) will be allocated equally among the Funds, while printing and postage costs will be borne solely by the Target Funds. The California Tax-Free Money Fund, the New York Tax-Free Money Fund, and the Tax-Exempt Money Fund are each estimated to pay $20,500, $20,000, and $10,200, respectively, in connection with the Reorganizations. The Funds will pay these expenses whether or not the

3

Reorganizations are approved at the Shareholder Meeting. See “Who pays for the costs involved with the proxy?” for more information.

Will I have to pay any sales charge, commission, redemption, or other similar fee in connection with the applicable Reorganization?

No, you will not have to pay any sales charge, commission, redemption, or other similar fee in connection with the applicable Reorganization. Neither the Investor Class nor the I Class of the Tax-Exempt Money Fund imposes sales charges, commissions, or redemption fees. However, you may incur brokerage commissions and other charges when buying or selling Investor Class or I Class shares through a financial intermediary.

What if I redeem or exchange my shares before the applicable Reorganization takes place?

If you choose to redeem or exchange your shares before the applicable Reorganization takes place, the transaction will be treated as a normal sale of shares and will be processed according to the respective Target Fund’s policies and procedures in effect at the time of the redemption or exchange.

If a Reorganization is not approved at the Shareholder Meeting, will the respective Target Fund continue to operate?

Yes, if a Reorganization is not approved at the Shareholder Meeting, the respective Target Fund will continue to operate. Neither Reorganization is contingent upon the approval or completion of the other Reorganization.

What are the investment objectives and principal investment strategies of the Tax-Exempt Money Fund and each Target Fund?

The investment objectives of the Funds are similar. The California Tax-Free Money Fund’s investment objective is to seek to provide preservation of capital, liquidity, and, consistent with these objectives, the highest level of income exempt from federal and California state income taxes. The New York Tax-Free Money Fund’s investment objective is to seek to provide preservation of capital, liquidity, and, consistent with these objectives, the highest level of income exempt from federal, New York state, and New York City income taxes. The Tax-Exempt Money Fund’s investment objective is to seek to provide preservation of capital, liquidity, and consistent with these objectives, the highest current income exempt from federal income taxes.

The Funds have similar investment programs although there are some differences. The Funds are retail money market funds managed in compliance with Rule 2a-7 under the Investment Company Act of 1940 (the “1940 Act”). The Funds are each managed to provide a stable share price of $1.00 by investing in high-quality U.S. dollar-denominated municipal securities whose income is expected to be exempt from federal income taxes. Money market securities are generally high-quality, short-term obligations issued by companies or governmental entities.

4

The California Tax-Free Money Fund invests at least 65% of its total assets in California municipal securities, and at least 80% of the Fund’s income is expected to be exempt from federal and California state income taxes. The New York Tax-Free Money Fund invests at least 65% of its total assets in New York municipal securities, and at least 80% of the Fund’s income is expected to be exempt from federal, New York state, and New York City income taxes. Normally, at least 80% of the Tax-Exempt Money Fund’s income will be exempt from federal income taxes. Up to 20% of each Target Fund’s income could be derived from securities that are subject to AMT, whereas the Tax-Exempt Money Fund does not purchase securities that are subject to AMT.

Each Target Fund may invest a significant portion of assets in securities that are not general obligations of the applicable state. These may be issued by local governments or public authorities and are rated according to their particular creditworthiness, which may vary from the applicable state’s general obligation securities. From time to time, each Fund may invest a significant portion of their assets in sectors with special risks, such as health care, transportation, utilities, or private activity bonds (including, in the case of the Target Funds, industrial revenue bonds), which are municipal bonds issued by a government agency on behalf of a private sector company and, in most cases, are not backed by the credit of the issuing municipality. Each Target Fund may at times invest more than 25% of its net assets overall in industrial revenue bonds, but investments in industrial revenue bonds related to the same industry may not exceed 25% of the Target Fund’s net assets.

Each Fund may sell holdings for a variety of reasons, such as to adjust the portfolio’s average maturity, duration, or overall credit quality, or to shift assets into and out of higher- or lower-yielding securities or certain sectors.

In accordance with the requirements for “retail money market funds” under Rule 2a-7, each Fund has implemented policies and procedures designed to limit accounts to only those beneficially owned by natural persons. The Funds have also obtained assurances from financial intermediaries that sell the Funds that they have developed adequate procedures to limit accounts to only those beneficially owned by natural persons. Any new investors wishing to purchase shares will be required to demonstrate eligibility (for example, by providing their Social Security number).

Pursuant to Rule 2a-7, if a Fund’s weekly liquid assets fall below 30% of its total assets, the Fund’s Board, in its discretion, may impose liquidity fees of up to 2% of the value of the shares redeemed or temporarily suspend redemptions from the Fund for up to 10 business days during any 90-day period (i.e., a “redemption gate”). In addition, if one of the Fund’s weekly liquid assets fall below 10% of its total assets at the end of any business day, the Fund must impose a 1% liquidity fee on shareholder redemptions unless the Fund’s Board determines that not doing so is in the best interests of the Fund. Pursuant to Rule 2a-7, weekly liquid assets include cash, U.S. Treasuries, other government securities with remaining maturities of 60 days or less, or securities that mature or are subject to a demand feature within five business days.

5

What are the principal risks of investing in these three Funds?

Because of their similar investment objectives and similar investment strategies, each Fund is subject to similar risks. With respect to the differences in risks, those risks of a Target Fund that are not shared with the Tax-Exempt Money Fund are generally as a result of differences in the Funds’ principal investment strategies described above.

As with any mutual fund, there can be no guarantee a Fund will achieve its objective(s). You could lose money by investing in a Fund. Although each Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. Each Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in a Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. T. Rowe Price has no legal obligation to provide financial support to the Funds, and you should not expect that T. Rowe Price will provide financial support to the Funds at any time.

Money market funds have experienced significant pressures from shareholder redemptions, issuer credit downgrades, illiquid markets, and historically low yields on the securities they can hold. There have been a very small number of money market funds in other fund complexes that have “broken the buck,” which means that those funds’ investors did not receive $1.00 per share for their investment in those funds.

Each Fund is subject to the applicable risks described below. Once the Funds are combined, the Tax-Exempt Money Fund will be managed in accordance with its investment objective, investment strategies, and investment policies described above and subject to the risks described below. The potential for realizing a loss of principal in each Fund could derive from:

Municipal securities The Fund may be highly impacted by events tied to the overall municipal securities markets, which can be very volatile and significantly affected by unfavorable legislative or political developments and adverse changes in the financial conditions of municipal securities issuers and the global, national, and/or local economies. Income from municipal securities held by the Fund could become taxable because of changes in tax laws or interpretations by taxing authorities, or noncompliant conduct of a state municipality. Other changes in tax laws, including changes to individual or corporate tax rates, could alter the attractiveness and overall demand for municipal bonds.

Certain sectors of the municipal bond market have special risks and could be affected by certain developments more significantly than the market as a whole. For example: health care can be negatively impacted by rising expenses and dependency on third party reimbursements; transportation can be negatively impacted by declining revenues or unexpectedly high construction or fuel costs; utilities are subject to governmental rate regulation; and private activity bonds

6

(including industrial development bonds) rely on project revenues and the creditworthiness of the corporate user as opposed to governmental support. Investing significantly in municipal obligations backed by revenues of similar types of industries or projects may make the Fund more susceptible to developments affecting those industries and projects.

Market conditions The value of the Fund’s investments may decrease, sometimes rapidly or unexpectedly, due to factors affecting an issuer held by the Fund, particular industries, or the overall securities markets. A variety of factors can increase the volatility of the Fund’s holdings and markets generally, including political or regulatory developments, recessions, inflation, rapid interest rate changes, war or acts of terrorism, natural disasters, and outbreaks of infectious illnesses or other widespread public health issues. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others. These adverse developments may cause broad declines in market value due to short-term market movements or for significantly longer periods during more prolonged market downturns.

Stable net asset value The Fund may not be able to maintain a stable $1.00 share price at all times. The Fund’s shareholders should not rely on or expect the Fund’s investment adviser or an affiliate to purchase distressed assets from the Fund, enter into capital support agreements with the Fund, make capital infusions into the Fund, or take other actions to help the Fund maintain a stable $1.00 share price.

Redemptions The Fund may be subject to periods of increased redemptions that could cause the Fund to sell its assets at disadvantageous times or at a depressed value or loss, particularly during periods of declining or illiquid markets, and that could affect the Fund’s ability to maintain a stable $1.00 share price. Periods of heavy redemptions may result in the Fund’s level of weekly liquid assets falling below certain minimums required by Rule 2a-7, which may result in the Fund’s Board of Directors imposing a liquidity fee or redemption gate.

Liquidity The Fund may not be able to sell a holding in a timely manner at its current carrying value. Periods of reduced liquidity in money markets could require the Fund to liquidate its assets at inopportune times or at a depressed value, cause the Fund to be unable to meet redemption requests without dilution of the remaining shareholders’ interests in the Fund, and potentially affect the Fund’s ability to maintain a $1.00 share price. In addition, the Fund’s Board of Directors has discretion to impose a liquidity fee, to temporarily suspend Fund redemptions when permitted by applicable regulations, or to liquidate the Fund if the Fund’s weekly liquid assets fall below 10%.

7

Credit quality An issuer of a debt instrument could suffer an adverse change in financial condition that results in a payment default (failure to make scheduled interest or principal payments), rating downgrade, or inability to meet a financial obligation. Although the Fund only purchases securities that present minimal credit risk in the opinion of T. Rowe Price, the credit quality of the Fund’s holdings could change rapidly during periods of market stress.

Interest rates A decline in interest rates may lower the Fund’s yield, or a rise in the overall level of interest rates may cause a decline in the prices of fixed income securities held by the Fund. The Fund’s yield will vary; it is not fixed for a specific period like the yield on a bank certificate of deposit. This is a disadvantage when interest rates are falling because the Fund would have to reinvest at lower interest rates.

Cybersecurity breaches The Fund could be harmed by intentional cyberattacks and other cybersecurity breaches, including unauthorized access to the Fund’s assets, customer data and confidential shareholder information, or other proprietary information. In addition, a cybersecurity breach could cause one of the Fund’s service providers or financial intermediaries to suffer unauthorized data access, data corruption, or loss of operational functionality.

In addition to the risks described above, each Target Fund is subject to the following risks, which are not risks of the Tax-Exempt Money Fund:

State-specific focus A tax-free fund investing primarily within a single state typically involves more risk than a fund that can invest in a larger universe of municipal securities and does not focus its investments in a single state. Overall economic conditions within a particular state can be unpredictable and change rapidly at any time. Therefore, the Fund is subject to the risk that developments in California (in the case of the California Tax-Free Money Fund) or New York (in the case of the New York Tax-Free Money Fund) will negatively affect the values of securities held by the Fund or that are available for investment, which could harm the Fund’s performance and increase the Fund’s overall risk level. Such developments may include economic or political policy changes, tax base erosion, unfunded pension and healthcare liabilities, constitutional limits on tax increases, budget deficits and other financial difficulties, unfavorable developments in one or more industries critical to the state’s economy, and changes in the credit ratings assigned to California municipal issuers (in the case of the California Tax-Free Money Fund) or New York municipal issuers (in the case of the New York Tax-Free Money Fund). An adverse change in any one of these or other areas could affect the ability of the state’s municipal issuers to meet their obligations. For more detailed information about the specific risks affecting municipal securities issuers in California (in the case of the California Tax-Free Money Fund) or New

8

York (in the case of the New York Tax-Free Money Fund), please refer to the Statement of Additional Information of the Funds.

Alternative minimum tax The income from certain types of bonds, such as private activity bonds, may be tax-exempt but must be included for purposes of the alternative minimum tax calculation. As a result, the portion of the Fund’s income attributable to these bonds may be taxable to those shareholders subject to the federal alternative minimum tax.

Will the Reorganization result in higher Fund expenses?

Each Reorganization is not expected to result in higher net expenses for the respective Target Fund. The net annual fund operating expense ratio for each of the Tax-Exempt Money Fund—Investor Class and the Tax-Exempt Money Fund—I Class is expected to be lower than that of the Investor Class and I Class, respectively, of each Target Fund after the applicable Reorganization takes place.

Comparison of Investor Class Expenses. Once the assets of the three Funds are combined, the net expense ratio of the Investor Class of the Tax-Exempt Money Fund is estimated to be approximately 0.32% of the Fund’s average daily net assets (as of February 28, 2021). The net expense ratio of the Tax-Exempt Money Fund’s Investor Class was 0.33% as of February 28, 2021 (after restating the Fund’s management fee to reflect current fees), which is lower than the California Tax-Free Money Fund’s Investor Class net expense ratio of 0.55% and New York Tax-Free Money Fund’s Investor Class net expense ratio of 0.55% (each as of February 28, 2021, and including the effect of a contractual management fee waiver and an expense limitation agreement that will be in place through at least June 30, 2022). The gross expense ratio of the Tax-Exempt Money Fund’s Investor Class was approximately 0.52% as of February 28, 2021, which is lower than the California Tax-Free Money Fund’s Investor Class gross expense ratio of 0.83% and New York Tax-Free Money Fund’s Investor Class gross expense ratio of 0.89% (each as of February 28, 2021).

Comparison of I Class Expenses. Once the assets of the three Funds are combined, the net expense ratio of the I Class of the Tax-Exempt Money Fund is estimated to be approximately 0.24% of the Fund’s average daily net assets (as of February 28, 2021, and including the effect of an expense limitation agreement that will be in place through at least June 30, 2022). The net expense ratio of the Tax-Exempt Money Fund’s I Class was 0.24% as of February 28, 2021 (after restating the Fund’s management fee to reflect current fees and including the effect of an expense limitation agreement that will be in place through at least June 30, 2022), which is lower than the California Tax-Free Money Fund’s I Class net expense ratio of 0.33% and New York Tax-Free Money Fund’s I Class net expense ratio of 0.33% (each as of February 28, 2021, and including the effect of a contractual management fee waiver and an expense limitation agreement that will be in place through at least June 30, 2022). The gross expense ratio of the Tax-Exempt Money Fund’s I Class was approximately 0.45% as of February 28, 2021, which is lower than the California Tax-Free Money Fund’s I Class

9

gross expense ratio of 0.73% and New York Tax-Free Money Fund’s I Class gross expense ratio of 0.78% (each as of February 28, 2021).

Each Target Fund pays T. Rowe Price a management fee that consists of two components—an “individual fund fee,” which reflects the Fund’s particular characteristics, and a “group fee.” The group fee, which is designed to reflect the benefits of the shared resources of T. Rowe Price, is calculated daily based on the combined net assets of all T. Rowe Price funds (except the funds-of-funds, T. Rowe Price Reserve Funds, Multi-Sector Account Portfolios, and any index or private-label mutual funds). The group fee schedule is graduated, declining as the combined assets of the T. Rowe Price Funds rise, so shareholders benefit from the overall growth in mutual fund assets. On February 28, 2021, the annual group fee rate was 0.28%. The individual fund fee, also applied to the Fund’s average daily net assets, is 0.10%. Based on the group fee rate and individual fund fee rate, each Target Fund’s overall management fee as of February 28, 2021, was 0.38%.

With respect to each Target Fund, T. Rowe Price has contractually agreed (at least through June 30, 2022) to waive a portion of its management fees in order to limit the Fund’s management fees to 0.28% of the Fund’s average daily net assets. Thereafter, this agreement will automatically renew for one-year terms unless terminated by the Fund’s Board. Any fees waived under this agreement are not subject to reimbursement to T. Rowe Price by a Target Fund.

Effective April 1, 2021, the separate group fee and individual fund fee components of the Tax-Exempt Money Fund’s management fee (as described below) were eliminated and the Tax-Exempt Money Fund pays T. Rowe Price an annual investment management fee of 0.19% of average daily net assets of the Tax-Exempt Money Fund. Prior to April 1, 2021, the Tax-Exempt Money Fund paid T. Rowe Price an annual investment management fee of 0.39% (comprising an individual fund fee of 0.10%, and a group fee, which was 0.29% as of February 28, 2021) of average daily net assets from the Tax-Exempt Fund.

Also effective April 1, 2021, the arrangement limiting the overall management fee of the Tax-Exempt Money Fund to 0.28% (as described below) was terminated. Prior to April 1, 2021, with respect to the Tax-Exempt Money Fund, T. Rowe Price had contractually agreed at least through June 30, 2021, to waive a portion of its management fees in order to limit the Tax-Exempt Money Fund’s management fees to 0.28% of the Fund’s average daily net assets.

In addition, in an effort to maintain a zero or positive net yield for a Fund, T. Rowe Price may voluntarily waive all or a portion of the management fee it is entitled to receive from the Fund or reimburse all or a portion of the Fund’s operating expenses. T. Rowe Price may amend or terminate this voluntary fee waiver arrangement at any time without prior notice.

With respect to Investor Class Shares of each Target Fund, T. Rowe Price has contractually agreed (at least through June 30, 2022) to waive its fees and/or bear any

10

expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses) that would cause the class’ ratio of expenses to exceed 0.55% of the class’ average daily net assets. The agreement may only be terminated at any time after June 30, 2022, with approval by the Target Fund’s Board of Directors. Any fees waived and expenses paid under this agreement (and a previous limitation of 0.55%) are subject to reimbursement to T. Rowe Price by the Fund whenever the class’ expense ratio is below 0.55%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The Fund may only make repayments to T. Rowe Price if such repayment does not cause the class’ expense ratio (after the repayment is taken into account) to exceed the lesser of: (1) the expense limitation in place at the time such amounts were waived; or (2) the class’ current expense limitation.

With respect to I Class Shares of each Fund, T. Rowe Price has contractually agreed (at least through June 30, 2022) to pay the operating expenses of the Fund’s I Class excluding management fees; interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses (“I Class Operating Expenses”), to the extent the I Class Operating Expenses exceed 0.05% of the class’ average daily net assets. The agreement may only be terminated with respect to a Fund at any time after June 30, 2022, with approval by the Fund’s Board of Directors. Any expenses paid under this agreement are subject to reimbursement to T. Rowe Price by the Fund whenever the Fund’s I Class Operating Expenses are below 0.05%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The Fund may only make repayments to T. Rowe Price if such repayment does not cause the I Class Operating Expenses (after the repayment is taken into account) to exceed the lesser of: (1) the limitation on I Class Operating Expenses in place at the time such amounts were waived; or (2) the current expense limitation on I Class Operating Expenses.

In addition to the management fee, the Tax-Exempt Money Fund pays its operating expenses, and the Investor Class and I Class each pays its pro-rata portion of Tax-Exempt Money Fund operating expenses and class-specific operating expenses.

The following tables describe the fees and expenses that you may pay if you buy and hold Investor Class shares and I Class shares of the Funds. The information in the tables reflects, with respect to each of Investor Class shares and I Class shares: (i) the fees and expenses incurred by each Target Fund and the Tax-Exempt Money Fund for the fiscal year ended February 28, 2021, (ii) the pro forma fees and expenses of the combined Fund for the 12-month period ended February 28, 2021, assuming only the Reorganization of the California Tax-Free Money Fund into the Tax-Exempt Money Fund had taken place on March 1, 2020, (iii) the pro forma fees and expenses of the combined Fund for the 12-month period ended February 28, 2021, assuming only the Reorganization of the New York Tax-Free Money Fund into the Tax-Exempt Money Fund had taken place on March 1, 2020, and (iv) the pro forma fees and expenses of

11

the combined Fund for the 12-month period ended February 28, 2021, assuming both Reorganizations had taken place on March 1, 2020.

Fees and Expenses

Fees and Expenses of the Funds—Investor Class

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | California Tax-Free Money Fund—Investor Classa | New York Tax-Free Money Fund—Investor Classa | Tax-Exempt Money Fund—Investor Classa | Pro Forma Combined—Investor Class (California Tax-Free Money Fund into Tax-Exempt Money Fund)a | Pro Forma Combined—Investor Class (New York Tax-Free Money Fund into Tax-Exempt Money Fund)a | Pro Forma Combined—Investor Class (Both Target Funds into Tax-Exempt Money Fund)a |

Shareholder fees (fees paid directly from your investment) |

| | | | | | | | | | | | | |

Maximum account fee | $20 | b | $20 | b | $20 | b | $20 | b | $20 | b | $20 | b |

Annual fund operating expenses

(expenses that you pay each year as a

percentage of the value of your investment) |

Management fees | 0.39 | %c | 0.39 | %c | 0.19 | %d | 0.19 | % | 0.19 | % | 0.19 | % |

| | | | | | | | | |

Distribution and service (12b-1) fees | — | | — | | — | | — | | — | | — | |

| | | | | | | | | | | | | |

Other expenses | 0.44 | | 0.50 | | 0.14 | | 0.13 | | 0.13 | | 0.13 | |

| | | | | | | | | |

Total annual fund operating expenses | 0.83 | | 0.89 | | 0.33 | d | 0.32 | | 0.32 | | 0.32 | |

| | | | | | | | | |

Fee waiver/expense reimbursement | (0.28) | c,e | (0.34) | c,e | — | | — | | — | | — | |

| | | | | | | | | |

Total annual fund operating expenses after fee waiver/expense reimbursement | 0.55 | c,e | 0.55 | c,e | 0.33 | d | 0.32 | | 0.32 | | 0.32 | |

a As of February 28, 2021, the fiscal year-end of each Fund.

b Subject to certain exceptions, accounts with a balance of less than $10,000 are charged an annual $20 fee.

c T. Rowe Price has contractually agreed (at least through June 30, 2022) to waive a portion of its management fees in order to limit the Fund’s management fees to 0.28% of the Fund’s average daily net assets. Thereafter, this agreement will automatically renew for one-year terms unless terminated by the Fund’s Board of Directors. Any fees waived under this agreement are not subject to reimbursement to T. Rowe Price by the Fund.

d Restated to reflect current fees.

e T. Rowe Price has contractually agreed (at least through June 30, 2022) to waive its fees and/or bear any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; nonrecurring,

12

extraordinary expenses; and acquired fund fees and expenses) that would cause the class’ ratio of expenses to exceed 0.55% of the class’ average daily net assets. The agreement may only be terminated at any time after June 30, 2022, with approval by the Fund’s Board. Any fees waived and expenses paid under this agreement (and a previous limitation of 0.55%) are subject to reimbursement to T. Rowe Price by the Fund whenever the class’ expense ratio is below 0.55%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The fund may only make repayments to T. Rowe Price if such repayment does not cause the class’ expense ratio (after the repayment is taken into account) to exceed the lesser of: (1) the expense limitation in place at the time such amounts were waived; or (2) the class’ current expense limitation.

Example This example is intended to help you compare the cost of investing in Investor Class shares of the Funds with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Funds for the time periods indicated and then redeem all of your shares at the end of those periods, that your investment has a 5% return each year, and that the Fund’s operating expenses remain the same. The example also assumes that an expense limitation arrangement currently in place is not renewed; therefore, the figures have been adjusted to reflect fee waivers or expense reimbursements only in the periods for which the expense limitation arrangement is expected to continue. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | |

Fund | 1 year | 3 years | 5 years | 10 years |

California Tax-Free Money Fund—Investor Class | $56 | $237 | $433 | $999 |

New York Tax-Free Money Fund—Investor Class | $56 | $250 | $460 | $1,065 |

Tax-Exempt Money Fund—Investor Class | $34 | $106 | $185 | $418 |

Pro Forma Combined—Investor Class (California Tax-Free Money Fund into Tax-Exempt Money Fund) | $33 | $103 | $180 | $406 |

Pro Forma Combined—Investor Class (New York Tax-Free Money Fund into Tax-Exempt Money Fund) | $33 | $103 | $180 | $406 |

Pro Forma Combined—Investor Class (Both Target Funds into Tax-Exempt Money Fund) | $33 | $103 | $180 | $406 |

13

Fees and Expenses of the Funds—I Class

| | | | | | | | | | | | | | | | | | | |

| | California Tax-Free Money Fund—I Classa | New York Tax-Free Money Fund—I Classa | Tax-Exempt Money Fund—I Classa | Pro Forma Combined—I Class (California Tax-Free Money Fund into Tax-Exempt Money Fund)a | Pro Forma Combined—I Class (New York Tax-Free Money Fund into Tax-Exempt Money Fund) | Pro Forma Combined—I Class (Both Target Funds into Tax-Exempt Money Fund) |

Annual fund operating expenses

(expenses that you pay each year as a

percentage of the value of your investment) |

Management fees | 0.39 | %b | 0.39 | %b | 0.19 | %c | 0.19 | % | 0.19 | % | 0.19 | % |

| | | | | | | | | |

Distribution and service (12b-1) fees | — | | — | | — | | — | | — | | — | |

| | | | | | | | | | | | | |

Other expenses | 0.34 | d | 0.39 | d | 0.07 | d | 0.06 | | 0.06 | | 0.06 | |

| | | | | | | | | |

Total annual fund operating expenses | 0.73 | | 0.78 | | 0.26 | c | 0.25 | | 0.25 | | 0.25 | |

| | | | | | | | | |

Fee waiver/expense reimbursement | (0.40) | b,d | (0.45) | b,d | (0.02) | d | (0.01) | d | (0.01) | d | (0.01) | d |

| | | | | | | | | |

Total annual fund operating expenses after fee waiver/expense reimbursement | 0.33 | b,d | 0.33 | b,d | 0.24 | c,d | 0.24 | c | 0.24 | d | 0.24 | d |

a As of February 28, 2021, the fiscal year-end of each Fund.

b T. Rowe Price has contractually agreed (at least through June 30, 2022) to waive a portion of its management fees in order to limit the Fund’s management fees to 0.28% of the Fund’s average daily net assets. Thereafter, this agreement will automatically renew for one-year terms unless terminated by the Fund’s Board of Directors. Any fees waived under this agreement are not subject to reimbursement to T. Rowe Price by the Fund.

c Restated to reflect current fees.

d T. Rowe Price Associates, Inc., has contractually agreed (at least through June 30, 2022) to pay the operating expenses of the Fund’s I Class excluding management fees; interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses (“I Class Operating Expenses”), to the extent the I Class Operating Expenses exceed 0.05% of the class’ average daily net assets. The agreement may only be terminated at any time after June 30, 2022, with approval by the Fund’s Board. Any expenses paid under this agreement (and a previous limitation of 0.05%) are subject to reimbursement to T. Rowe Price Associates, Inc., by the Fund whenever the Fund’s I Class Operating Expenses are below 0.05%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The Fund may only make repayments to T. Rowe Price Associates, Inc., if such repayment does not cause the I Class Operating Expenses (after the repayment is taken into account) to exceed the lesser of: (1) the limitation on I Class Operating Expenses in place at the time such amounts were waived; or (2) the current expense limitation on I Class Operating Expenses.

14

Example This example is intended to help you compare the cost of investing in I Class shares of the Funds with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Funds for the time periods indicated and then redeem all of your shares at the end of those periods, that your investment has a 5% return each year, and that the Fund’s operating expenses remain the same. The example also assumes that an expense limitation arrangement currently in place is not renewed; therefore, the figures have been adjusted to reflect fee waivers or expense reimbursements only in the periods for which the expense limitation arrangement is expected to continue. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | |

Fund | 1 year | 3 years | 5 years | 10 years |

California Tax-Free Money Fund—I Class | $34 | $193 | $367 | $869 |

New York Tax-Free Money Fund—I Class | $34 | $204 | $389 | $924 |

Tax-Exempt Money Fund—I Class | $25 | $82 | $144 | $329 |

Pro Forma Combined—I Class (California Tax-Free Money Fund into Tax-Exempt Money Fund) | $25 | $79 | $140 | $317 |

Pro Forma Combined—I Class (New York Tax-Free Money Fund into Tax-Exempt Money Fund) | $25 | $79 | $140 | $317 |

Pro Forma Combined—I Class (Both Target Funds into Tax-Exempt Money Fund) | $25 | $79 | $140 | $317 |

A discussion about the factors considered by each Fund’s Board and its conclusions in approving the Fund’s investment management agreement appear in the Fund’s semiannual report to shareholders for the period ended August 31, 2020.

What are the Funds’ management arrangements?

Each Fund is advised and managed by T. Rowe Price, 100 East Pratt Street, Baltimore, Maryland 21202. As of March 31, 2021, T. Rowe Price and its affiliates had approximately $1.52 trillion in assets under management and provided investment management for 6.5 million individual and institutional investor accounts.

T. Rowe Price has established an Investment Advisory Committee with respect to each Fund. The committee chair is ultimately responsible for the day-to-day management of each Fund’s portfolio and works with the committee in developing and executing the Fund’s investment program. Douglas D. Spratley currently serves as Chair of each Fund’s committee. The following information provides the year that the chair (portfolio manager) first joined the Firm and the chair’s specific business experience during the past five years (although the chair may have had portfolio management

15

responsibilities for a longer period). Mr. Spratley became cochair of each Fund’s committee in 2020 and has served as the sole portfolio manager and a chair of each Fund’s committee effective January 1, 2021. Mr. Spratley joined the Firm in 2008 and his investment experience dates from 1996. For the past five years, he has served as the head of U.S. Fixed Income Trading Money Markets, as a money market trader, and as a portfolio manager (beginning in 2020) at the Firm.

The members of each Target Fund’s Investment Advisory Committee are as follows: Douglas D. Spratley, Chair, Colin T. Bando, Davis Collins, Maria H. Condez, Stephanie Angelique Gentile, Alan D. Levenson, Chen Shao, and Jeanny Silva. The members of the Tax-Exempt Money Fund’s Investment Advisory Committee are as follows: Douglas D. Spratley, Chair, Colin T. Bando, Maria H. Condez, Stephanie Angelique Gentile, Alan D. Levenson, Cheryl A. Mickel, Chen Shao, and Jeanny Silva.

The Funds’ Statement of Additional Information provides additional information about the portfolio manager’s compensation, other accounts managed by the portfolio manager, and the portfolio manager’s ownership of the Funds’ shares.

What are the Funds’ policies for purchasing, redeeming, exchanging, and pricing shares?

The Funds have identical procedures for purchasing, redeeming, exchanging, and pricing shares, although the Funds’ minimum initial and subsequent investments vary, as described below.

The Investor Class of the California Tax-Free Money Fund generally requires a $2,500 minimum initial investment ($1,000 minimum initial investment if opening an IRA, a custodial account for a minor, or a small business retirement plan account). Additional purchases generally require a $100 minimum. These investment minimums generally are waived for financial intermediaries and certain employer sponsored retirement plans submitting orders on behalf of their customers. The I Class of the California Tax-Free Money Fund requires a $1 million minimum initial investment and there is no minimum for additional purchases, although the initial investment minimum generally is waived for financial intermediaries, retirement plans, and certain institutional client accounts for which T. Rowe Price or its affiliate has discretionary investment authority.

The Investor Class of the New York Tax-Free Money Fund generally requires a $2,500 minimum initial investment ($1,000 minimum initial investment if opening an IRA, a custodial account for a minor, or a small business retirement plan account). Additional purchases generally require a $100 minimum. These investment minimums generally are waived for financial intermediaries and certain employer-sponsored retirement plans submitting orders on behalf of their customers. The I Class of New York-Tax Free Money Fund requires a $1 million minimum initial investment and there is no minimum for additional purchases, although the initial investment minimum generally is waived for financial intermediaries, retirement plans, and certain institutional client accounts for which T. Rowe Price or its affiliate has discretionary investment authority.

16

The Investor Class of the Tax-Exempt Money Fund generally requires a $2,500 minimum initial investment ($1,000 minimum initial investment if opening an IRA, a custodial account for a minor, or a small business retirement plan account). Additional purchases generally require a $100 minimum. These investment minimums generally are waived for financial intermediaries and certain employer sponsored retirement plans submitting orders on behalf of their customers. The I Class of the Tax-Exempt Money Fund requires a $1 million minimum initial investment and there is no minimum for additional purchases, although the initial investment minimum generally is waived for financial intermediaries, retirement plans, and certain institutional client accounts for which T. Rowe Price or its affiliate has discretionary investment authority.

T. Rowe Price may conduct periodic reviews of account balances. If your account balance in a Fund exceeds the minimum amount required for the I Class, T. Rowe Price may, but is not required to, automatically convert your Investor Class shares to I Class shares with advance notice.

For investors holding shares of the Funds directly with T. Rowe Price, you may purchase, redeem, or exchange Fund shares by mail; by telephone (1-800-225-5132 for IRAs and nonretirement accounts; 1-800-492-7670 for small business retirement plans; and 1-800-638-8790 for institutional investors and financial intermediaries); or, for certain accounts, by accessing your account online through troweprice.com.

If you hold shares through a financial intermediary or retirement plan, you must purchase, redeem, and exchange shares of the Fund through your intermediary or retirement plan. You should check with your intermediary or retirement plan to determine the investment minimums that apply to your account.

The Funds are money market funds that use amortized cost to maintain a stable share price of $1.00. Amortized cost allows money market funds to value a holding at the Fund’s acquisition cost with adjustments for any premiums or discounts and then round the net asset value per share to the nearest whole cent. The amortized cost method of valuation enables money market funds to maintain a $1.00 net asset value, but it may also result in periods during which the stated value of a security held by the Funds differs from the market-based price the Funds would receive if they sold that holding. The current market-based net asset value per share for each business day in the preceding six months is available for the retail and government money market funds through troweprice.com. These market-based net asset values are for informational purposes only and are not used to price transactions.

Shares of the Funds may be redeemed at their respective net asset values (which, under normal circumstances, is expected to be $1.00); however, large redemptions can adversely affect a portfolio manager’s ability to implement a Fund’s investment strategy by causing the premature sale of securities. Therefore, the Funds reserve the right (without prior notice) to pay all or part of redemption proceeds with securities from the Fund’s portfolio rather than in cash (redemption in-kind). The Funds’ procedures for pricing their shares are identical. Fund share prices are calculated at the close of the

17

New York Stock Exchange (normally 4 p.m. ET) each day the exchange is open for business. Fund share prices are calculated at the close of the New York Stock Exchange (normally 4 p.m. ET) each day the exchange is open for business.

For more detailed information, please refer to the section 3 of each Fund’s prospectus, entitled “Information About Accounts in T. Rowe Price Funds.”

What are the Funds’ policies on dividends and distributions?

The Funds’ policies on dividends and distributions are identical. Each Fund declares dividends daily and pays them on the first business day of each month. Any capital gains are declared and paid annually, usually in December. Each Fund intends to distribute income that is exempt from federal income taxes and, in the case of the Target Funds, state and local income taxes of the applicable state. However, a portion of each Fund’s distributions may be subject to federal income taxes or the alternative minimum tax. A redemption or exchange of Fund shares, and any capital gains distributed by the Fund, may be taxable.

As a result of each Target Fund’s reorganization into the Tax-Exempt Money Fund, shareholders of the Target Fund will no longer be invested in a Fund of which monthly dividends are expected to be exempt from applicable state and local taxes in addition to federal income taxes, but instead will be invested in a Fund of which monthly dividends are expected to be exempt from federal income taxes.

REASONS FOR THE REORGANIZATIONS

The Board of each Fund, including a majority of the independent directors, have unanimously determined that the proposed transaction(s) with respect to the respective Fund is in the best interests of the shareholders of the respective Fund and that the interests of shareholders of the respective Fund will not be diluted as a result of the proposed transaction(s).

In considering whether to recommend the approval of the transaction(s), each Board reviewed the following matters and concluded that the transaction(s) is in the best interest of the respective Fund for the reasons indicated below.

The Funds offers similar investment programs although there are some differences. The Tax-Exempt Money Fund incepted in 1981, and each Target Fund incepted in 1986. The California Tax-Free Money Fund invests at least 65% of its total assets in California municipal securities, and at least 80% of the Fund’s income is expected to be exempt from federal and California state income taxes. The New York Tax-Free Money Fund invests at least 65% of its total assets in New York municipal securities, and at least 80% of the Fund’s income is expected to be exempt from federal, New York state, and New York City income taxes. Normally, at least 80% of the Tax-Exempt Money Fund’s income will be exempt from federal income taxes. As a result of each Target Fund’s reorganization into the Tax-Exempt Money Fund, shareholders of the Target Fund will no longer be invested in a Fund of which monthly dividends are expected to

18

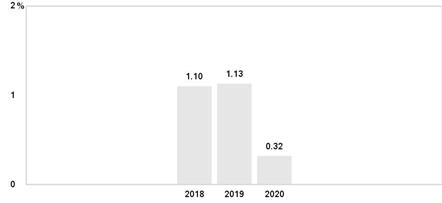

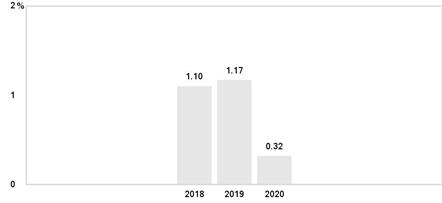

be exempt from applicable state and local taxes in addition to federal income taxes, but instead will be invested in a Fund of which monthly dividends are expected to be exempt from federal income taxes. Up to 20% of each Target Fund’s income could be derived from securities that are subject to the AMT, whereas the Tax-Exempt Money Fund does not purchase securities that are subject to AMT. Historically, securities subject to AMT provided slightly higher income than those not subject to AMT. However, the Tax-Exempt Money Fund has had consistently better performance than each of the Target Funds.

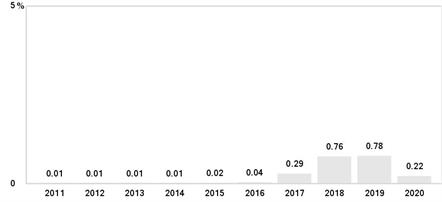

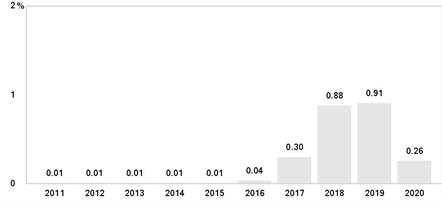

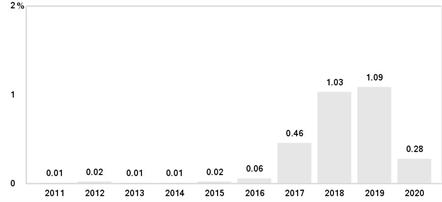

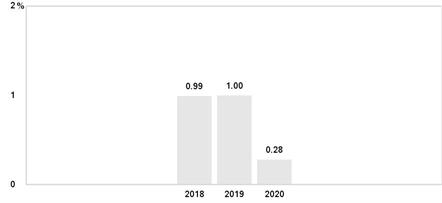

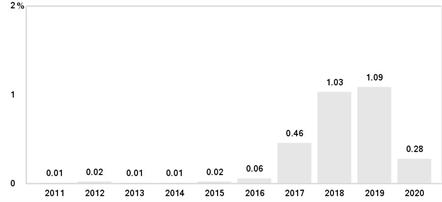

Each of the Target Funds is relatively small. Less than 1% of T. Rowe Price clients residing in California and New York are shareholders of the California Tax-Free Money Fund and the New York Tax-Free Money Fund, respectively. The Boards and fund management believe that offering a single tax-free money market fund to a wide variety of investors will allow all shareholders to take advantage of potential economies of scale and reduce inefficiencies that can result from offering similar funds. Target Fund shareholders will benefit from moving to a fund with a lower overall net expense ratio as a result of the Reorganizations. In particular, effective April 1, 2021, the Tax-Exempt Money Fund pays T. Rowe Price an annual investment management fee of 0.19% of average daily net assets of the Tax-Exempt Money Fund, whereas as of February 28, 2021, each Target Fund pays T. Rowe Price a management fee that consists of an annual group fee rate of 0.28% and an individual fund fee rate of 0.10% of the Target Fund’s average daily net assets, resulting in an overall management fee rate of 0.38% of average daily net assets. With respect to each Target Fund, T. Rowe Price has contractually agreed (at least through June 30, 2022) to waive a portion of its management fees in order to limit the Fund’s management fees to 0.28% of the Fund’s average daily net assets.