As filed with the Securities and Exchange Commission on November 20, 2009

1933 Act Registration File No. 333- 162658

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

[ X ] Pre-Effective Amendment No. _ 1 __

[ ] Post-Effective Amendment No. ___

(Check appropriate box or boxes.)

FORUM FUNDS

(Exact Name of Registrant as Specified in Charter)

Three Canal Plaza, Suite 600

Portland, Maine 04101

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (207) 347-2090

Francine J. Rosenberger, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006

Copy to:

David L. Faherty, Esq.

Atlantic Fund Administration, LLC

Three Canal Plaza

Portland, ME 04101

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933.

It is proposed that this filing will become effective on November 2 3 , 2009 pursuant to Rule 4 61 .

No filing fee is due because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of securities.

CONTENTS OF REGISTRATION STATEMENT

| This Registration Statement contains the following papers and documents: | |

| | Contents of Registration Statement |

| | Letter to Limited Partners |

| | Part A - Proxy Statement and Prospectus |

| | Part B - Statement of Additional Information |

| | Part C - Other Information |

IMPORTANT NOTICE: PLEASE PROVIDE YOUR CONSENT BY TELEPHONE OR COMPLETE THE ENCLOSED WRITTEN CONSENT AND RETURN IT AS SOON AS POSSIBLE.

BMO PARTNERS FUND, L.P.

360 Madison Avenue, 18th Floor

New York, New York 10017

November 23, 2009

Dear Partners:

This Combined Proxy Statement/Prospectus (the “Proxy Statement”) is being sent to you in connection with the solicitation of your consent by Beck, Mack & Oliver LLC, the general partner (the “General Partner”) of the BMO Partners Fund, L.P. (the “Partnership”), to the General Partner’s recommendation to convert the Partnership into the Beck, Mack & Oliver Partners Fund (the “Acquiring Fund”), a series of Forum Funds (“Forum”). The Proxy Statement includes the form of a proposed Agreement and Plan of Reorganization by and among (1) the Partnership, (2) the General Partner, and (3) Forum, on behalf of the Acquiring Fund (the “Plan”).

The General Partner is soliciting your consent for the Partnership to enter into the Plan and to effectuate a proposed transaction in which: (a) the Partnership will transfer substantially all of its assets to the Acquiring Fund in exchange solely for shares of the Acquiring Fund and the Acquiring Fund’s assumption of certain of the Partnership’s liabilities; (b) the Partnership will then distribute the shares it received from the Acquiring Fund proportionately to its partners and terminate (the “Reorganization”).

A consent form that requests your vote on the Reorganization is enclosed with this mailing. The Plan describes the Reorganization and sets forth the basic information you should know before executing the consent form. After carefully reviewing the Proxy Statement and the Plan and considering the effects of the Reorganization, please follow the instructions on the consent form to provide your consent by telephone or complete and return the consent form in the enclosed postage-paid return envelope. If your telephonic consent, consent form or a suitable alternative written instrument is not received by the Partnership prior to November 30, 2009 you will be treated as not having provided your consent for the Partnership to enter into the Plan.

The General Partner believes the Reorganization is in the best interests of the limited partners of the Partnership (the “Limited Partners”) and intends to give written consent to the Plan if you consent to the Partnership entering into the Plan. In evaluating the Plan, please note that:

1. Investors in the Acquiring Fund will have more flexibility and liquidity than those in the Partnership due to their ability to redeem shares of the Acquiring Fund each Business Day (as defined below) and to purchase additional shares daily and in smaller amounts. They will also receive simplified tax reports (Forms 1099 for dividends and redemptions rather than Schedules K-1).

2. The Partnership and the Acquiring Fund pursue the same investment objective and have substantially similar investment strategies and policies. The Acquiring Fund will be managed in a manner substantially similar to that of the Partnership.

3. The Partnership and the Acquiring Fund will have substantially similar portfolio holdings.

4. The General Partner will continue to manage the Acquiring Fund at substantially similar management fees paid by the Partnership and the same portfolio manager will continue to manage the assets of the Acquiring Fund.

5. The Plan includes provisions intended to avoid dilution of the partnership interests of the Partnership. If you consent to the Plan, each partner of the Partnership will receive shares of the Acquiring Fund equal in value to the partner’s capital account in the Partnership.

6. The transactions contemplated under the Plan with respect to the Partnership and the Acquiring Fund will not cause the Partnership, the Limited Partners or the Acquiring Fund to recognize gain or loss for federal income tax purposes.

7. No sales charges will be imposed on the Limited Partners in connection with the Reorganization.

The General Partner believes that the Plan is important and recommends that you read the enclosed materials carefully and then provide your consent for the Partnership to enter into the Plan.

The General Partner and Atlantic Fund Administration, LLC will pay all costs incurred in connection with the Reorganization, including without limitation the costs associated with soliciting the consent of the Limited Partners to enter into the Plan and the costs associated with the organization and start-up of the Acquiring Fund.

PLEASE PROVIDE YOUR CONSENT BY TELEPHONE OR COMPLETE, DATE AND SIGN THE ENCLOSED CONSENT FORM AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF YOUR INTERESTS. NO POSTAGE NEED BE AFFIXED IF THE CONSENT FORM IS MAILED IN THE UNITED STATES. THE CONSENT IS REVOCABLE AT ANY TIME PRIOR TO ITS USE.

IF YOU HAVE ANY QUESTIONS CONCERNING THE ENCLOSED PROXY STATEMENT OR THE PROCEDURES TO BE FOLLOWED TO CONSENT BY TELEPHONE OR TO EXECUTE AND DELIVER A CONSENT FORM, PLEASE CONTACT THE GENERAL PARTNER, ATTN. ZACHARY A. WYDRA, AT (212) 661-2640.

| | Very truly yours, |

| | |

| | |

| | |

| | Senior Member, Beck, Mack & Oliver LLC |

COMBINED PROXY STATEMENT/PROSPECTUS

November 23, 2009

Acquisition of the Assets of

BMO PARTNERS FUND, L.P.

360 Madison Avenue, 18th Floor

New York, New York 10017

(212) 661-2640

By and in Exchange for

Shares of Beneficial Interest of

BECK, MACK & OLIVER PARTNERS FUND

a newly created series of

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

(207) 347-2000

On behalf of BMO Partners Fund, L.P. (the “Partnership”), a Delaware limited partnership, Beck, Mack & Oliver LLC (“BMO”), the general partner of the Partnership (the “General Partner”), intends to enter into an Agreement and Plan of Reorganization by and among: (1) the Partnership; (2) the General Partner; and (3) Forum Funds (“Forum”), a registered investment company, on behalf of the Beck, Mack & Oliver Partners Fund (the “Acquiring Fund”), a new series of Forum formed for the purpose of reorganizing the Partnership (the “Plan”), if the limited partners of the Partnership (the “Limited Partners”) give their consent to this action.

If the Limited Partners consent, the Partnership will (1) transfer substantially all of its assets to the Acquiring Fund in exchange solely for shares of the Acquiring Fund and the Acquiring Fund’s assumption of certain of the Partnership’s liabilities and (2) the Partnership will then distribute the shares received from the Acquiring Fund proportionately to the General Partner and Limited Partners and terminate (the “Reorganization”). Prior to the Partnership’s transfer of its assets to the Acquiring Fund under the Plan, the Acquiring Fund will not have made a public offering of its shares and will have only nominal assets.

The General Partner and Atlantic Fund Administration, LLC will pay all costs incurred in connection with the Reorganization, including without limitation the costs associated with soliciting the consent of the Limited Partners to the Partnership’s entering into the Plan and the costs associated with the organization and start-up of the Acquiring Fund.

This Combined Proxy Statement/Prospectus (“Proxy Statement”) sets forth the basic information you should know before providing your consent. You should read it and keep it for future reference. Additional information relating to this Proxy Statement is set forth in the Statement of Additional Information (“SAI”) dated December 1, 2009, which is incorporated by this reference into this Proxy Statement. The SAI is included as Part B to this Proxy Statement.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES NOR HAS IT PASSED ON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The shares offered by this Proxy Statement are not deposits or obligations of any bank, and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. An investment in the Acquiring Fund involves investment risk, including the possible loss of principal.

| I. | THE PROPOSED REORGANIZATION | 1 |

| | A. OVERVIEW | 1 |

| | B. REASONS FOR THE REORGANIZATION | 1 |

| | C. CONSIDERATIONS BY THE GENERAL PARTNER | 1 |

| | D. COMPARISON OF INVESTMENT OBJECTIVES, PRINCIPAL INVESTMENT STRATEGIES AND POLICIES | 2 |

| | E. COMPARISON OF PRINCIPAL RISKS | 4 |

| | F. COMPARISON OF INVESTMENT RESTRICTIONS | 5 |

| | G. COMPARISON OF FEES AND EXPENSES | 5 |

| | H. PERFORMANCE INFORMATION | 7 |

| | I. COMPARISON OF INVESTMENT ADVISORY SERVICES AND FEES | 8 |

| | J. COMPARISON OF DISTRIBUTION, PURCHASE, REDEMPTION AND EXCHANGE PROCEDURES | 9 |

| | K. KEY INFORMATION ABOUT THE REORGANIZATION | 12 |

| | 1. SUMMARY OF THE PROPOSED REORGANIZATION | 12 |

| | 2. DESCRIPTION OF THE ACQUIRING FUND’S SHARES | 13 |

| | L. ADDITIONAL INFORMATION ABOUT THE FUNDS | 19 |

| APPENDIX A – Form of Agreement and Plan of Reorganization | A-1 |

| APPENDIX B – Valuation, Purchase, Redemption, Exchange and Tax Information for the Acquiring Fund | B-1 |

| APPENDIX C – Financial Statements - BMO Partners Fund, L.P | C-1 |

I. THE PROPOSED REORGANIZATION

A. OVERVIEW

The General Partner proposes that the Partnership convert to the Acquiring Fund and that each Limited Partner become a shareholder of the Acquiring Fund. On behalf of the Partnership, the General Partner intends to enter into the Plan if the Limited Partners give their consent to this action. The necessary consent requires the consent of a majority of the holders of more than 50% of the limited partnership interests.

If the Limited Partners consent, then under the Plan the Partnership will (1) transfer substantially all of its assets to the Acquiring Fund in exchange solely for shares of the Acquiring Fund and the Acquiring Fund’s assumption of certain of the Partnership’s liabilities and (2) the Partnership will then distribute the shares received from the Acquiring Fund proportionately to the General Partner and Limited Partners and terminate (the “Reorganization”). The Reorganization will occur as of the Closing Date (as defined in the Plan) or at a later date as agreed upon by the General Partner and the Board of Trustees of Forum (“Forum Board” or the “Board”) and only after the Partnership’s entering into the Plan is approved by the Limited Partners and all conditions under the Plan are satisfied. You will receive, without recognizing gain or loss for federal income tax purposes, shares of the Acquiring Fund equal in value to your partnership interests in the Partnership as of 12:00 P.M., Eastern time, on the Closing Date.

The General Partner believes that the Reorganization will constitute a tax-free transaction for federal income tax purposes. The Partnership and Forum will receive an opinion from tax counsel to Forum to such effect. Therefore, the partners should not recognize any gain or loss with respect to their Partnership interests for federal income tax purposes as a result of the Reorganization. Furthermore, the Partnership will not pay for the costs of the Reorganization. The General Partner and Atlantic Fund Administration, LLC will bear the costs associated with the Reorganization, including the expenses associated with preparing and filing the registration statement that includes this Proxy Statement and the cost of copying, printing and mailing proxy materials. In addition to solicitations by mail, the General Partner also may solicit proxies, without special compensation, by telephone, facsimile or otherwise.

B. REASONS FOR THE REORGANIZATION

The primary purpose of the Reorganization is to convert the Partnership to a series of an open-end management investment company and to incorporate the Partnership into the Forum Family of Funds. The General Partner intends to enter into the Plan on behalf of the Partnership after the Limited Partners provide their consent to its entering into the Plan. In considering the Plan, the General Partner has taken into consideration that the Reorganization would provide certain benefits to Limited Partners. The General Partner has considered that, among other benefits, the Limited Partners, as shareholders of a series of an open-end management investment company, will have increased flexibility and liquidity due to their ability to redeem shares of the Acquiring Fund each Business Day and to purchase additional shares daily and in smaller amounts. They will also receive simplified tax reports (Forms 1099 for dividends and redemptions rather than Schedules K-1). Based on these considerations and the factors set forth below, the General Partner recommends that the Limited Partners consent to the Partnership’s entering into the Plan.

C. CONSIDERATIONS BY THE GENERAL PARTNER

Based upon its evaluation of the relevant information presented to it, and in light of its fiduciary duties under federal and state law, the General Partner has determined that the Reorganization is in the best interests of the Partnership and the Limited Partners and that the interests of the Limited Partners will not be diluted as a result of the Reorganization.

The following facts have been reviewed by the General Partner:

The Terms and Conditions of the Reorganization. The Plan provides for the transfer of substantially all of the Partnership’s assets to the Acquiring Fund in exchange solely for shares of the Acquiring Fund and the Acquiring

1

Fund’s assumption of certain of the Partnership’s liabilities. No sales charges will be imposed on the Limited Partners in connection with the Reorganization.

Lack of Dilution. The Plan includes provisions intended to avoid dilution of the interests of the Limited Partners. Under the Plan, each Limited Partner will receive shares of the Acquiring Fund equal in value to the balance of its capital account (i.e., its share of the net assets of the Partnership).

Similarity of Investment Objectives and Policies. The Acquiring Fund’s and the Partnership’s investment objective is the same. Both seek capital appreciation consistent with the preservation of capital. The Acquiring Fund will be managed in a manner substantially similar to that of the Partnership.

The Experience and Expertise of the Investment Adviser. The General Partner considered the continuity of management for the Acquiring Fund. The General Partner will continue to manage the Acquiring Fund, and Zachary Wydra, the current portfolio manager who is responsible for the day-to-day management of the Partnership, will continue in this capacity for the Acquiring Fund.

Relative Expense Ratios and Cap on Expenses. The General Partner reviewed information regarding comparative expense ratios (current and pro forma expense ratios are set forth in the “Comparison of Fees” section below). The General Partner noted that the total annual fund operating expenses of the Acquiring Fund would be greater than the total annual fund operating expenses of the Partnership. However, the General Partner also noted that as the investment adviser of the Acquiring Fund, it will maintain the net annual fund operating expenses for the Acquiring Fund through July 31, 2011 at 1.00% of the Acquiring Fund’s average daily net assets , which is only slightly higher than the net annual fund operating expenses of the Partnership .

Cost. It is anticipated that the Reorganization will result in marginally higher expenses for the Limited Partners.

Economies of Scale. The General Partner considered the potential of both, the Acquiring Fund and the General Partner, as investment adviser of the Acquiring Fund, experiencing economies of scale, as a result of it being a series of Forum, concluding that the structure would benefit the former Limited Partners, as the Acquiring Fund grows.

Operational Efficiencies. The General Partner anticipates that the outsourcing of administration, transfer agency, and other services is likely to increase operational efficiency while providing a higher level of service to the Limited Partners.

Tax-Free Nature of the Reorganization. It is anticipated that the Reorganization will be accomplished without causing the Partnership, the Limited Partners, or the Acquiring Fund to recognize gain or loss for federal income tax purposes.

Transaction Costs. The General Partner and Atlantic Fund Administration, LLC will pay all costs incurred in connection with the Reorganization, including without limitation the costs associated with soliciting the consent of the Limited Partners to the Partnership’s entering into the Plan and the costs associated with the organization and start-up of the Acquiring Fund.

D. COMPARISON OF INVESTMENT OBJECTIVES, PRINCIPAL INVESTMENT STRATEGIES AND POLICIES

Investment Objectives

The investment objectives of the Partnership and the Acquiring Fund are identical – to seek long-term capital appreciation consistent with the preservation of capital. The Acquiring Fund’s portfolio is expected to be managed in a manner substantially similar to the management of the Partnership’s portfolio. The Partnership’s investment objective is fundamental, which means it may only be changed by an affirmative vote of Limited Partners holding a majority of interests in the Partnership. The Acquiring Fund��s investment objective is non-fundamental, which

2

means it can be changed by the Forum Board and without shareholder approval. There is no current intention to change the Acquiring Fund’s investment objective.

Principal Investment Strategies

The principal investment strategies of the Partnership and the Acquiring Fund are substantially similar. Both the Partnership and the Acquiring Fund are non-diversified and invest primarily in a portfolio of common stocks and securities convertible into or exercisable for common stocks. Each also may invest in preferred stocks and fixed, variable and floating rate fixed income securities, such as investment grade notes, bonds and debentures. The Partnership and the Acquiring Fund both generally seek to invest in equity securities of domestic and foreign companies that they believe have sound, long-term fundamentals. Equity investments typically have been made by the Partnership, and will be made by the Acquiring Fund, in companies that BMO believes are financially strong and appear to have attractive prospects for growth.

The Partnership and the Acquiring Fund each may invest up to 10% of its net assets in fixed income securities rated below investment grade. Investment grade debt securities are debt securities rated in the category BBB- or higher by Standard & Poor’s or Baa3 or higher by Moody’s Investors Service, Inc. or the equivalent by another national rating organization or, if unrated, determined by BMO to be of comparable quality.

The Adviser’s Process

BMO’s process for identifying portfolio investments is substantially similar for the Partnership and the Acquiring Fund.

Although the Partnership’s portfolio primarily consists of marketable equity securities of U.S. and foreign issuers, the General Partner has flexibility in portfolio management of the Partnership and will retain such flexibility as the investment adviser to the Acquiring Fund. In this regard, portfolio investments may include preferred stocks, corporate notes, bonds and debentures and securities issued and guaranteed as to principal and interest by the U.S. Government or its agencies or instrumentalities.

BMO will rely primarily on fundamental analyses of prospective companies to identify companies that, in its judgment, are financially strong and possess high quality assets and above average growth and/or appreciation potential. BMO will also use fundamental analyses to identify sectors, industries and companies that it believes are experiencing growth, but whose growth has not been recognized by the market, measuring the anticipated appreciation potential of the companies’ securities against existing market prices. BMO aims to purchase portfolio securities at low price levels relative to earnings and intrinsic valuations.

With respect to the investments in fixed income securities, BMO will monitor interest rate outlooks, the shape of the yield curve and other economic factors to determine an appropriate maturity profile for the investment portfolio consistent with the investment objective. In particular, BMO will watch the yield spreads between higher and lower quality debt securities, between different sectors of the economy and between different types of debt securities to identify those securities that provide the highest yield at the best price. The Partnership and the Acquiring Fund may invest in debt securities of any maturity.

BMO will monitor the companies in the investment portfolio to determine if there have been any fundamental changes in the companies. BMO may sell a security if, in its judgment:

· The underlying company experiences a decline in financial condition

· The underlying company experiences a significant erosion in profitability, earnings or cash flow

· The security is overvalued compared to its fundamentals

· A security holding is overweighted compared to other holdings

· There are negative trends in inflation, recession or interest rates

3

Temporary Defensive Measure

The Partnership and the Acquiring Fund each may assume a temporary defensive position that is inconsistent with its principal investment strategies in order to respond to adverse market, economic, political or other conditions and invest, without limitation, in cash and prime quality cash equivalents (including commercial paper, certificates of deposit, banker’s acceptances and time deposits). A defensive position, taken at the wrong time, may have an adverse impact on performance. As a result, the Partnership and the Acquiring Fund each may be unable to achieve its investment objective during the employment of a temporary defensive measure.

E. COMPARISON OF PRINCIPAL RISKS

Risk is the chance that you will lose money on your investment or that it will not earn as much as you expect. In general, the greater the risk, the more money your investment can earn for you and the more you can lose. The principal risks of investing in the Partnership and the Acquiring Fund are discussed below. There is no guarantee that either the Partnership or the Acquiring Fund will achieve its investment objectives or will not lose principal value. Investments in the Partnership and the Acquiring Fund are not deposits of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The main risks of investing in the Partnership and the Acquiring Fund are substantially similar. The risks of investing in the Acquiring Fund and the Partnership are set forth below.

General Market Risks. Investments in the Partnership and the Acquiring Fund are not deposits of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The market value of securities in which the Partnership and the Acquiring Fund invest is based upon the market’s perception of value and is not necessarily an objective measure of a security’s value. In addition, the Acquiring Fund’s net asset value (“NAV”) and total return will fluctuate based upon changes in the value of its portfolio securities. Unlike the Acquiring Fund, the Partnership does not calculate a daily NAV. There is no assurance that either the Partnership or the Acquiring Fund will achieve its investment objective. An investment in the Partnership or the Acquiring Fund is not by itself a complete or balanced investment program. You could lose money on your investment or the investment could under perform other investments due to, among other things, poor investment decisions by the Adviser.

Equity and Convertible Securities Risk. The value of the Partnership’s or the Acquiring Fund’s stock holdings may decline in price because of changes in prices of its holdings or a broad stock market decline. These fluctuations could be a sustained trend or a drastic movement. The stock markets generally move in cycles, with periods of rising prices followed by periods of declining prices. The value of your investment may reflect these fluctuations. The value of convertible securities tends to decline as interest rates rise and, because of the conversion, tends to vary with fluctuations in the market value of the underlying securities.

Risks of Foreign Securities. The value of foreign investments may be affected by the imposition of new or amended government regulations, changes in diplomatic relations between the United States and another country, political and economic instability, the imposition or tightening of exchange controls or other limitations on repatriation of foreign capital, or nationalization, increased taxation or confiscation of investors’ assets. Changes in the exchange rate between U.S. dollars and a foreign currency may reduce the value of an investment made in a security denominated in that foreign currency. Also, foreign securities are subject to the risk that an issuer’s securities may not reflect the issuer’s condition because there is not sufficient publicly available information about the issuer.

Management Risk. The Partnership and the Acquiring Fund are actively managed. Accordingly, their performance reflects the Adviser’s ability to make investment decisions which are suited to achieving the Fund’s investment objectives. Due to their active management, Partnership and the Acquiring Fund, could under perform mutual funds with similar investment objectives.

Risks of Debt Securities. Because the Partnership and the Acquiring Fund invest in debt securities, each has the following additional risks: (1) the value of most debt securities falls when interest rates rise; typically, the longer a debt

4

security’s maturity and the lower its credit quality, the more likely it i s that the value of the debt security, whether or not investment grade, will fall in response to an increase in interest rates . This is because, among other reasons, higher interest rates may limit a lower credit quality issuer’s access to capital ; (2) issuers may prepay fixed rate securities when interest rates fall, forcing the Partnership and the Acquiring Fund to invest in securities with lower interest rates; and (3) the Partnership and the Acquiring Fund are subject to the risk that the financial condition of an issuer may cause the issuer to default or become unable to pay interest or principal due on the issuer’s securities. This risk generally increases as security credit ratings decrease.

Non-Investment Grade Securities Risk. Securities rated below investment grade, i.e., BA or BB and lower (“junk bonds”) are subject to greater risk of loss than higher rated securities. Compared with issuers of investment grade fixed-income securities, junk bonds are more likely to encounter financial difficulties and to be materially affected by those difficulties.

Liquidity Risk. Certain fixed income securities may be difficult (or impossible) to sell at the time and at the price the Adviser would like. As a result, the Acquiring Fund may have to hold these securities longer than it would like and may forego other investment opportunities. There is the possibility that the Acquiring Fund may lose money or be prevented from realizing capital gains if it cannot sell a security at a particular time and price.

Non-Diversification Risk. The Partnership and the Acquiring Fund is non-diversified and may focus its investments in the securities of a comparatively small number of issuers. Investing in a limited number of issuers exposes the Partnership and the Acquiring Fund to greater risk and losses than if its assets were more diversified.

F. COMPARISON OF INVESTMENT RESTRICTIONS

Although the investment restrictions of the Partnership and the Acquiring Fund are substantially similar, there are certain differences that are inherent in the organizational differences between the Partnership, which is a Delaware limited partnership, and the Acquiring Fund, which is a series of a registered management investment company subject to the Investment Company Act of 1940, as amended (the “1940 Act”). The Partnership’s investment restrictions are fundamental, which means that they may not be changed without the affirmative vote of the Limited Partners holding a majority of the Partnership interests. By comparison, the Acquiring Fund has fundamental and non-fundamental investment restrictions. The Acquiring Fund’s fundamental investment restrictions can be changed only by a vote of a majority of the Acquiring Fund’s outstanding voting securities, as that term is defined in Section 2(a)(42) of the 1940 Act. The Acquiring Fund’s non-fundamental investment restrictions can be changed by the Forum Board without a shareholder vote. The Acquiring Fund has retained certain of the Partnership’s fundamental investment restrictions, and has either deleted or adopted as non-fundamental, the Partnership’s investment restrictions that are unlikely to have a bearing on the day-to-day management of the Acquiring Fund’s assets. The Partnership’s fundamental investment restrictions can be found in the Partnership’s Private Placement Memorandum. The Acquiring Fund’s investment restrictions may be found in the SAI.

The Partnership and the Acquiring Fund have substantially similar fundamental investment restrictions pertaining to senior securities, concentration, underwriting securities, loans, investments in real estate and commodities. The Acquiring Fund has adopted a fundamental investment restriction permitting borrowing in an amount up to 33-1/3 of the Acquiring Fund’s total assets and for other than emergency purposes, as permitted by the 1940 Act. However, for consistency with the Partnership’s investment restrictions, the Acquiring Fund has adopted a non-fundamental investment limitation limiting the Acquiring Fund’s borrowing for temporary or emergency purposes to up to 10% of the Acquiring Fund’s total assets. For consistency with the Partnership’s investment restrictions, the Acquiring Fund also has adopted non-fundamental investment restrictions with respect to: (1) pledging; (2) investments in other investment companies; (3) margin and short selling; and (4) illiquid securities. Like the Partnership, the Acquiring Fund limits investments in the voting securities of foreign corporations to 10% of its total assets.

G. COMPARISON OF FEES AND EXPENSES

Like all investment funds and mutual funds, the Partnership and the Acquiring Fund incur certain expenses in their operations and, as a Limited Partner or a shareholder, you pay these expenses indirectly. The following tables compare the various fees and expenses, on a pro forma basis, that a shareholder could expect to incur from an investment in the Acquiring Fund, and the various fees and expenses that a partner of the Partnership incurred for

5

| Shareholder Fees (fees paid directly from your investment) | Partnership | Acquiring Fund |

| Maximum Sales Charge (Load) Imposed on Purchases (as a % of the offering price) | N/A | None |

| Maximum Sales Charge (Load) Imposed on Reinvested Distributions (as a percentage of the offering price) | N/A | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the sales price) | N/A | None |

Redemption Fee (as a % of value of shares redeemed) (1) | N/A | 2.00% |

| Exchange Fee (as a % of value of shares redeemed) | N/A | None |

| Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | Partnership | Acquiring Fund |

| Management Fees | 0.93%(2) | 1.00% |

| Distribution/Service (12b-1) Fees | None | None |

| Other Expenses | 0.12% | 0. 79 % |

| Total Annual Fund Operating Expenses | 1.05% | 1. 79 % |

| Fee Reimbursement | (0.17%) | (0. 79 %)(3) |

| Net Annual Fund Operating Expenses | 0.88%(4) | 1.00% |

| (1) | Only shares redeemed or exchanged within 60 days of purchase will be charged a 2.00% fee. This fee will not be assessed on Limited Partners who redeem or exchange their shares in the Acquiring Fund within 60 days of the Reorganization. |

| (2) | The Partnership paid the General Partner a management fee computed at an annual rate of 1% on the first $5,000,000 in average daily net assets, 0.75% on the second $5,000,000 in average daily net assets, and 0.50% on average daily net assets over $10,000,000. |

| (3) | The Adviser has contractually agreed to waive its fee and/or reimburse Fund expenses to the extent that the total annual fund operating expenses exceed 1.00% (excluding taxes, interest, portfolio transaction expenses, and extraordinary expenses) through July 31, 2011. The contractual waiver may be changed or eliminated only with the consent of the Board of Trustees. |

| (4) | Based on operating expenses for the twelve month period ended September 30, 2009. |

EXAMPLE OF EFFECT ON ACQUIRING FUND EXPENSES

The following is a hypothetical example intended to help you compare the cost of investing in the Partnership with the costs of investing in the Acquiring Fund after the Reorganization. This example assumes that you invest $10,000 for the time periods indicated and then redeem all of your interests or shares at the end of those periods. The example also assumes that your investment has a 5% annual rate of return, that Total Annual Operating Expenses of the fund remain the same as stated in the above table and that all dividends and distributions are reinvested. Although your actual costs may be higher or lower, under these assumptions your costs would be:

6

| | Partnership | Pro Forma/Acquiring Fund |

| 1 Year | $ 90 | $ 102 |

| 3 Years | $ 317 | $ 486 |

Your cost would be the same if you did not redeem your shares during the time periods indicated above. The Acquiring Fund’s estimated net expenses are used to calculate costs for the first year only, and the Acquiring Fund’s total annual operating expenses are used to calculate costs for the other years.

H. PERFORMANCE INFORMATION

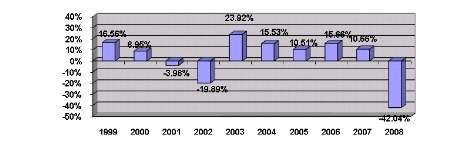

The Acquiring Fund will adopt the performance history and financial statements of the Partnership. The bar chart and the performance table below provide some indication of the risks of an investment in the Acquiring Fund by showing changes in the Partnership’s performance from year to year and by showing how the Partnership’s average annual returns for 1-, 5- and 10-years compare with a broad measure of market performance. Performance information represents only past performance, before and after taxes, and does not necessarily indicate future results.

The Acquiring Fund’s performance for periods prior to December 1, 2009 is that of the Partnership and reflects the expenses of the Partnership, which were lower than the Acquiring Fund’s current net expenses, except for 2008, when the Partnership’s expenses were higher. The performance prior to December 1, 2009 is based on calculations that are different than the standardized method of calculations accepted by the SEC. If the Partnership’s performance had been readjusted to reflect the estimated expenses of the Acquiring Fund, the performance would have been lower. The Partnership was not registered under the 1940 Act and was not subject to certain restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, as amended (the “Code”), which, if applicable, may have adversely affected its performance.

The calendar year-to-date return as of September 30, 2009 was 18.38%.

During the periods shown in the chart, the highest quarterly return was 13.40% (for the quarter ended June 30, 2003) and the lowest quarterly return was -28.38% (for the quarter ended December 31, 2008).

The following table compares the Acquiring Fund’s average annual total return before taxes as of December 31, 2008 to its primary performance benchmark, the Standard & Poor’s 500 Composite Stock Index® (the “S&P 500 Index®”). The following table also includes information concerning the Acquiring Fund’s secondary performance benchmarks, the Russell 1000 Index®, the Russell 1000 Value Index®, and the Russell 3000 Index®.

| Beck, Mack & Oliver Partners Fund | 1 Year | 5 Years | 10 Years |

| Return Before Taxes | -42.04% | -1.08% | 1.38% |

The S&P 500 Index® (refl (Reflects no deduction for fees, expenses or taxes) | -37.00% | -2.19% | -1.38% |

The Russell 1000 Index® (refl (Reflects no deduction for fees, expenses or taxes) | -37.60% | -2.04% | -1.09% |

7

| Beck, Mack & Oliver Partners Fund | 1 Year | 5 Years | 10 Years |

The Russell 1000 Value Index® (refl (Reflects no deduction for fees, expenses or taxes) | -36.85% | -0.79% | 1.36% |

The Russell 3000 Index® (ref (Reflects no deduction for fees, expenses or taxes) | -37.31% | -1.95% | -0.80% |

The S&P 500 Index is a market index of common stock. The S&P 500 Index is unmanaged and reflects the reinvestment of dividends. Unlike the performance figures of the Fund, the S&P 500 Index’s performance does not reflect the effect of expenses.

The Russell 1000 Index is a market index that measures the performance of the large-cap segment of the U.S. equity market. The Russell 1000 Index is unmanaged and reflects the reinvestment of dividends. Unlike the performance figures of the Fund, the Russell 1000 Index’s performance does not reflect the effect of expenses.

The Russell 1000 Value Index is a market index that measures the performance of the large-cap value segment of the U.S. equity market. The Russell 1000 Value Index is unmanaged and reflects the reinvestment of dividends. Unlike the performance figures of the Fund, the Russell 1000 Value Index’s performance does not reflect the effect of expenses.

The Russell 3000 Index is a market index that measures the performance of the largest 3000 U.S. companies in the U.S. equity market. The Russell 3000 Index is unmanaged and reflects the reinvestment of dividends. Unlike the performance figures of the Fund, the Russell 3000 Index’s performance does not reflect the effect of expenses.

I. COMPARISON OF INVESTMENT ADVISORY SERVICES AND FEES

Subject to the general oversight of the Forum Board, BMO will serve as investment adviser to the Acquiring Fund pursuant to an investment advisory agreement with Forum (the “Advisory Agreement”). BMO will make decisions regarding the investment and reinvestment of the Acquiring Fund’s assets. Under the Advisory Agreement, BMO will furnish, at its own expense, all services, facilities and personnel necessary in connection with managing the Acquiring Fund’s investments and effecting portfolio transactions for the Acquiring Fund. BMO also may pay fees to certain brokers/dealers to have the Acquiring Fund available for sale through such institutions as well as for certain shareholder services provided to customers purchasing Acquiring Fund shares through such institutions. For advisory services provided to the Acquiring Fund, BMO will receive an advisory fee at an annual rate of 1.00% of the Acquiring Fund’s average daily net assets.

The General Partner determines appropriate investment strategies for the Partnership, and identifies and monitors the ongoing performance of the Partnership’s invested funds. The General Partner has full responsibility for the management of the Partnership and receives quarterly a management fee equal to: 1% per annum of the first $5 million of the Partnership’s net assets, 3/4 of 1% per annum of the next $5 million of the Partnership’s net assets and 1/2 of 1% per annum of net assets in excess of $10 million. The Partnership bears its own general and administrative expenses and all of the investment expenses incurred directly by the Partnership.

Mr. Zachary Wydra is responsible for substantially all of the day-to-day management of the Partnership. Mr. Wydra will continue as portfolio manager of the Acquiring Fund. Mr. Wydra has over 10 years of experience in the investment industry. Mr. Wydra has served as a portfolio manager at the Adviser since 2005, and was admitted to the Partnership in 2007. Prior to joining the Adviser, Mr. Wydra served as an analyst at Water Street Capital from 2003 through 2005.

8

J. COMPARISON OF DISTRIBUTION, PURCHASE, REDEMPTION AND EXCHANGE PROCEDURES

Comparison of Sales Charges

Neither the Acquiring Fund nor the Partnership impose sales charges on purchases of shares or interests, respectively.

Comparison of Purchase Procedures

You may purchase shares of the Acquiring Fund on each weekday that the New York Stock Exchange (“NYSE”) is open (“Business Day”) at the NAV per share, computed after the purchase order and monies are received by the Acquiring Fund’s transfer agent or certain financial intermediaries. You may generally purchase shares of the Acquiring Fund by check, wire, ACH payment, systematic investment plan (discussed below) or through your financial institution. All checks must be payable in U.S. dollars, drawn on U.S. financial institutions and made payable to “Beck, Mack & Oliver Partners Fund.” In the absence of the granting of an exception consistent with the Trust’s anti-money laundering procedures adopted by the Fund, the Fund does not accept purchases made by credit card check, starter check, cash or cash equivalents (for instance, you may not pay by money order, bank draft, cashier’s check or traveler’s check).

Foreside Fund Services, LLC (the “Distributor”) is the distributor for the Acquiring Fund. The Distributor is obligated to sell shares of the Acquiring Fund on a best efforts basis only against purchase orders for the shares. Shares of the Acquiring Fund will be offered to the public on a continuous basis at the relevant NAV. The Distributor is a registered broker-dealer and member of the Financial Industry Regulatory Authority (“FINRA”). The Acquiring Fund’s shares are sold on a no-load basis and, therefore, the Distributor receives no sales commission or sales load for providing such services. With respect to the Acquiring Fund, Forum has not currently entered into any plan or agreement for the payment of fees pursuant to Rule 12b-1 under the 1940 Act.

Additional shareholder account information for the Acquiring Fund is available in Appendix B to this Proxy Statement.

Purchases of limited partnership interests in the Partnership are valued at the amount contributed to the Partnership. Admission as a Limited Partner of the Partnership is not open to the general public. Each new Limited Partner must make a capital contribution of at least $100,000 unless the General Partner exercises its discretion to waive the minimum requirement. New Limited Partners may contribute capital to the Partnership on at least 10 days’ prior written notice to the General Partner on the first day of each calendar quarter. Additional capital contributions may be made by existing Limited Partners on at least 10 days’ prior written notice to the General Partner on the first day of each calendar quarter, provided that each capital contribution is at least $10,000, unless the General Partner exercises its discretion to waive the minimum requirement. Limited Partners may be admitted and additional capital contributions may also be made as of such date or dates as the General Partner shall determine.

Neither the Partnership nor the Acquiring Fund issue share certificates.

Key Differences. Because the Partnership is a limited partnership, the method of purchasing Partnership interests is different from purchasing shares of the Acquiring Fund. The Acquiring Fund continuously offers its shares through its distributor. If you purchase shares directly from the Acquiring Fund, you receive monthly account statements and a confirmation of every transaction. Shares of the Acquiring Fund may be purchased through a financial intermediary. You may purchase shares of the Acquiring Fund on each Business Day. Limited Partners may only be admitted upon the prior consent of the General Partner, on such date as the General Partner determine. Additionally, the Acquiring Fund has also reserved the right to redeem shares “in kind.”

Comparison of Exchange Procedures

You may exchange your shares of the Acquiring Fund for shares of the Beck, Mack & Oliver Global Equity Fund (the “BMO Global Equity Fund”), which is another series of the Forum advised by the Adviser. The BMO Global

9

Equity Fund may not be available for exchange in your state, and the Acquiring Fund’s transfer agent will provide, upon request, information regarding whether it is available. An exchange is a sale and purchase of shares and generally will have tax consequences. If you exchange your shares within 60 days of purchase, you will be charged a 2.00% redemption fee; however, no redemption fee will be imposed on a Limited Partner who exchanges his or her shares of the Acquiring Fund within 60 days of the Reorganization.

More information regarding the Acquiring Fund’s exchange privileges is available in Appendix B to this Proxy Statement.

The Partnership has no exchange privileges with any other investment vehicle.

Key Differences. The Partnership has no exchange privileges with any other investment vehicle. The Acquiring Fund permits exchanges of shares for shares of the BMO Global Equity Fund.

Comparison of Redemption Procedures.

You may redeem shares of the Acquiring Fund on any weekday that the NYSE is open. You may generally redeem shares of the Acquiring Fund by mail, wire, telephone, through a systematic withdrawal plan (discussed below), or through your financial institution. The Acquiring Fund processes redemption orders received in good order at the next calculated NAV. Under normal circumstances, the Acquiring Fund will send redemption proceeds to you within a week. If the Acquiring Fund has not yet collected payment for the shares you are selling, it may delay sending redemption proceeds until such payment is received, which may be up to 15 calendar days.

If you redeem your shares within 60 days of purchase, you will be charged a redemption fee of 2.00% of the NAV of shares redeemed. The fee is charged for the benefit of remaining shareholders and will be paid to the Acquiring Fund to help offset transaction costs. To calculate redemption fees, after first redeeming any shares associated with reinvested distributions, the Acquiring Fund will use the first-in, first-out (FIFO) method to determine the holding period. Under this method, the date of the redemption will be compared with the earliest purchase date of shares held in the account.

Pursuant to an election filed with the SEC, the Acquiring Fund reserves the right to pay redemption proceeds in portfolio securities rather than in cash. To the extent the Acquiring Fund redeems its shares in kind, the shareholder assumes any risk of the market price of such securities fluctuating. In addition, the shareholder will bear any brokerage and related costs incurred in disposing or selling the portfolio securities it receives from the Acquiring Fund.

Additional information regarding the Acquiring Fund’s redemption policies is available in Appendix B to this Proxy Statement.

Any Limited Partner, by contrast, may only withdraw all or any part of his or her capital account as of the first day of each calendar quarter, upon giving 30 days’ prior written notice to the General Partner, provided that Limited Partners who do not retain at least $100,000 in their capital accounts may be required to withdraw from the Partnership by the General Partner. The General Partner has the right to require any Limited Partner to withdraw from the Partnership at any time for any reason. The General Partner may withdraw all or any portion of its capital account on any date on which a Limited Partner may make withdrawals.

On the first day of each calendar quarter, a Limited Partner may, on 30 days’ prior written notice to the General Partner, withdraw all of his capital account. A withdrawing Limited Partner will receive an amount equal to the value of his capital account with the Partnership in cash or securities or both, as the General Partner may, in its sole discretion, determine. As soon as practicable after the first day of a calendar quarter prior to which proper written notice to withdraw his capital account, the Partnership will pay to such Limited Partner or his or her representative the amount, if any, to which such Limited Partner is entitled.

Key Differences. The Partnership permits redemptions of partnership interests less frequently than the Acquiring Fund permits redemptions of shares. The Acquiring Fund may accept and process redemption orders on any

10

Business Day, or under unusual circumstances, when the NYSE is closed if deemed appropriate by Forum’s officers. The Partnership only permits redemptions on the first day of each calendar quarter on 30 days prior written notice to the General Partner. Consequently, an investment in the Partnership is less liquid than an investment in the Acquiring Fund. In addition, you may redeem shares of the Acquiring Fund through its transfer agent by mail, wire or telephone while you may redeem partnership interests in the Partnership only through the General Partner. Because the Acquiring Fund must stand ready to redeem shareholders each Business Day, there may be slight differences in portfolio management techniques (such as investments in liquid securities) in order to ensure that the Acquiring Fund can meet shareholder redemption requests. Although the Partnership has more flexibility to invest in illiquid securities, it generally has invested in liquid securities.

Systematic Investment/Withdrawal Plans. The Acquiring Fund offers systematic investment and withdrawal plans. A shareholder of the Acquiring Fund may establish a systematic investment plan to automatically invest a specified amount of money (up to $25,000 per transaction) into their account on a specified day and frequency not to exceed two investments per month. Payments for systematic investments are automatically debited from a designated savings or checking account via ACH. Systematic investments must be for at least $250 per occurrence. A shareholder of the Acquiring Fund may establish a systematic withdrawal plan to automatically redeem a specified amount of money or shares from their account on a specified date and frequency not to exceed one withdrawal per month. These payments are sent from a designated account by check to the shareholders address of record, or to a designated bank account by ACH payment. Systematic withdrawals must be for at least $250.

The Partnership does not have a systematic investment or systematic withdrawal plan.

Comparison of Minimum Initial/Subsequent Investment Requirements

The following tables summarize the minimum initial and subsequent investment requirements of the Partnership and the Acquiring Fund.

| | Partnership | Acquiring Fund |

| INITIAL INVESTMENT | | |

| Standard Accounts | $100,000 | $2,500 |

| Systematic Investment Plans | N/A | N/A |

| Traditional Individual Retirement Accounts (“IRAs”) and Roth IRAs | N/A | $2,000 |

| SUBSEQUENT INVESTMENTS | | |

| Standard Accounts | $10,000 | $1,000 |

| Systematic Investment Plans | N/A | $250 |

| Traditional and Roth IRAs | N/A | $1,000 |

Comparison of Distribution Policies

The Acquiring Fund declares distributions from net investment income and pays those distributions annually. Any net capital gain (i.e., the excess of net long-term capital gain over net short-term capital loss) it realizes Fund will be distributed at least annually. Most mutual fund investors have their dividends reinvested in additional shares of the fund. If a shareholder chooses this option, or if a shareholder does not indicate any choice, all distributions will be reinvested. Alternatively, a shareholder may choose to have his or her distributions sent directly to his or her bank account or a check may be mailed if the distribution amount is $10 or more. However, if a distribution amount is

11

less than $10, the proceeds will be reinvested. If five or more of dividend or capital gains checks remain uncashed after 180 days, all subsequent distributions may be reinvested, in the Acquiring Fund’s discretion. For federal income tax purposes, distributions are treated the same whether they are received in cash or reinvested.

The net capital appreciation or net capital depreciation of the Partnership as of the end of each completed fiscal period is allocated to the General Partner and each Limited Partner in the proportion that its, his or her capital account balance bears to the aggregate of all the capital account balances as of the beginning of that fiscal period. Net capital appreciation and depreciation of the Partnership is determined in accordance with generally accepted accounting principles consistently applied.

Comparison of Distribution and Shareholder Servicing Fees

Neither the Partnership nor the Acquiring Fund has adopted a distribution and shareholder services plan pursuant to Rule 12b-1 under the 1940 Act.

Comparison of Net Asset Value Calculation Procedures

The Acquiring Fund calculates its NAV as of the close of the NYSE (normally 4:00 p.m., Eastern time) on each Business Day. The time at which the Acquiring Fund calculates its NAV may change in case of an emergency. The Acquiring Fund’s NAV is determined by taking the market value of all securities owned by the Acquiring Fund (plus all other assets such as cash), subtracting liabilities, and then dividing the result (net assets) by the number of shares outstanding. In determining the Acquiring Fund’s NAV, securities for which market quotations are readily available are valued at current market value using the last reported sales price provided by independent pricing services. If no sale price is reported, the average of the last bid and ask price is used. If no average price is available, the last bid price is used. If market quotations are not readily available, or the Adviser believes that the prices or values available are unreliable, then securities are valued at fair value pursuant to procedures adopted by the Forum Board.

More information regarding the Acquiring Fund’s NAV calculation procedures is available in Appendix B to this Proxy Statement.

The Partnership does not calculate a NAV daily. Under its Offering Memorandum, the Partnership calculates its net capital appreciation or depreciation at the end of each fiscal period and allocates such net capital appreciation or depreciation to the General Partner and each Limited Partner.

K. KEY INFORMATION ABOUT THE REORGANIZATION

The following is a summary of key information concerning the Reorganization. Keep in mind that more detailed information appears in the Plan, a copy of the form of which is attached to this Proxy Statement as Appendix A.

1. SUMMARY OF THE REORGANIZATION

The Limited Partners are being asked to provide their consent for the Partnership to enter into the Plan and effectuate the Reorganization. The Acquiring Fund is a newly organized fund that will commence operations upon consummation of the Reorganization. If the Limited Partners provide that consent, then under the Plan the Partnership will transfer substantially all of its assets to the Acquiring Fund in exchange solely for shares of the Acquiring Fund and the Acquiring Fund’s assumption of certain of the Partnership’s liabilities. The Plan further provides that the Partnership will then distribute the shares received from the Acquiring Fund proportionately to the General Partner and Limited Partners and terminate. The General Partner and each Limited Partner will receive full and fractional shares of the Acquiring Fund equal in value to that of its, his or her partnership interest in the Partnership.

The Plan may be terminated if certain conditions precedent have not been satisfied or if the General Partner or the Forum Board determines that consummation of the Reorganization is not in the best interests of the Partnership or the Acquiring Fund, respectively. Under the Plan, the General Partner and Atlantic Fund Administration, LLC will

12

pay all costs incurred in connection with the Reorganization, including without limitation the costs associated with soliciting the consent of the Limited Partners to the Partnership’s entering into the Plan and the costs associated with the organization and start-up of the Acquiring Fund.

2. DESCRIPTION OF THE ACQUIRING FUND’S SHARES

Forum is organized as a Delaware statutory trust. Forum may issue an unlimited number of authorized shares of beneficial interest, no par value. The Forum Board may, without shareholder approval, divide the authorized shares into an unlimited number of separate portfolios or series. Each share of a Series, such as the Acquiring Fund, represents an equal proportionate interest in the assets and liabilities belonging to the Series with each other share of such Series and is entitled to receive distributions out of the net assets belonging to the respective Series as are declared by the applicable Board of Trustees.

Each share of the Acquiring Fund has equal dividend, liquidation and voting rights, and fractional shares have those rights proportionately. the Acquiring Fund pays all of its other expenses (including expenses for advisory services, custodial services, transfer agent services, administrative services, shareholder services, accounting and legal services fees, brokerage fees and commissions, expenses of redemption of shares, insurance premiums, expenses of preparing prospectuses and reports to shareholders, interest, bookkeeping, fees for independent trustees, taxes, fees for registering fund shares and extraordinary expenses).

Delaware law does not require Forum to hold annual meetings of shareholders, and generally, Forum will hold shareholder meetings only when specifically required by Federal or state law.

There are no conversion or preemptive rights in connection with shares of the Acquiring Fund. All shares of the Acquiring Fund are fully paid and non-assessable. A shareholder of the Acquiring Fund will receive a pro rata share of all distributions arising from the Acquiring Fund’s assets and, upon redeeming shares, will receive the portion of the Acquiring Fund’s net assets represented by the redeemed shares.

3. COMPARISON OF FORMS OF ORGANIZATION AND SHAREHOLDER RIGHTS

Set forth below is a discussion of the material differences between the Partnership and the Acquiring Fund and the rights of their shareholders.

Comparison of Business Structures

The Acquiring Fund is a series of Forum, a Delaware statutory trust that is registered under the 1940 Act as an open-end, management investment company. Forum commenced operations on March 24, 1980 as a Maryland corporation and reorganized into a Delaware statutory trust on January 5, 1996. Presently, there are twenty-seven separate series of Forum (each series of Forum, a “Series”), including the Acquiring Fund. The business of Forum and each of its Series is managed under the direction of the Forum Board.

The Partnership is a Delaware limited partnership organized on March 8, 1991. The business of the Partnership is managed under the direction of its General Partner, Beck, Mack & Oliver, LLC a limited liability company organized under the laws of the State of New York, and Robert Beck is its Senior Member.

The General Partner and the Forum Board formulate the general policies of the Partnership and the Acquiring Fund, respectively. The General Partner and the Forum Board also meet periodically to review performance, investment activities and practices, and to discuss other matters relating to the Partnership and the Acquiring Fund, respectively.

13

Shares of the Acquiring Fund can be sold to retail investors in a public offering, regardless of their net worth. There is no maximum number of investors that may purchase shares of the Acquiring Fund. Interests in the Partnership are offered only in private placements to “accredited investors,” as that term is defined in Rule 501(a) of the Securities Act of 1933, as amended. Accredited investors must meet certain net worth requirements. The maximum number of investors who may be Limited Partners of the Partnership is 100.

As shareholders of a series of an open-end management investment company, former Limited Partners will have increased flexibility and liquidity due to their ability to redeem shares of beneficial interest each Business Day. The NYSE is open every week, Monday through Friday, except when the following holidays are celebrated: New Year’s Day, Martin Luther King, Jr. Day (the third Monday in January), President’s Day (the third Monday in February), Good Friday, Memorial Day (the last Monday in May), Independence Day, Labor Day (the first Monday in September), Thanksgiving Day (the fourth Thursday in November) and Christmas Day. Exchange holiday schedules are subject to change without notice. The NYSE may close early on the day before each of these holidays and the day after Thanksgiving Day.

Shareholders of the Acquiring Fund will also receive simplified tax reports (Form 1099s for dividends rather than Schedule K-1s).

Shareholder or Partner Rights

The following chart provides information with respect to the material differences in the rights of shareholders and partners under Delaware law and the respective governing documents of Forum and the Partnership.

| SHAREHOLDER OR PARTNER RIGHTS | FORUM | | PARTNERSHIP | | EFFECT OF DIFFERENCE |

| Division of series into separate classes | The Forum Board may divide Series into separate classes without a shareholder vote. | | The General Partner cannot divide Partnership interests into separate series/classes without amending the Limited Partnership Agreement. | | If Forum decides to authorize a division of Series into classes, the division will not require a shareholder vote. |

| Calling a shareholder meeting | Shareholders representing 10% of Forum’s (or a Series’) outstanding shares entitled to vote may call meetings any purpose related to Forum (or a Series), including for the purpose of voting on removal of one or more Trustees. | | The Limited Partners have no authority to call a meeting. The consent of the General Partner is required to amend the Limited Partnership Agreement or remove a General Partner. | | The shareholders of Forum and its Series have some power to call a meeting of Forum (or a Series). |

| Liquidation of Trust or Series | Shareholder approval is required prior to the liquidation of Forum. Shareholder approval is not required prior to the liquidation of the Acquiring Fund. | | The General Partner of the Partnership may dissolve the Partnership at any time. | | After the Reorganization, the Trustees could decide to terminate the Acquiring Fund without a shareholder vote, which is identical to the General Partner’s authority to dissolve the Partnership at any time. |

14

| SHAREHOLDER OR PARTNER RIGHTS | FORUM | | PARTNERSHIP | | EFFECT OF DIFFERENCE |

| Shareholder liability | Delaware law provides that Forum shareholders are entitled to the same limitations of personal liability extended to stockholders of private corporations for profit There is, however, a remote possibility that, under certain circumstances, shareholders of a Delaware statutory trust might be held personally liable for the Trust’s obligations to the extent the courts of another state do not recognize such limited liability were to apply the laws of such state to a controversy involving such obligations. Forum’s trust instrument contains an express disclaimer of shareholder liability for the debts, liabilities, obligations and expenses of Forum (or a series). Forum’s trust instrument provides for indemnification out of each Series’ property of any shareholder or former shareholder held personally liable solely by reason of his being or having been a shareholder and not because of his acts or omissions for some other reason for the obligations of the Series. Forum’s trust instrument also provides that each series shall, upon request, assume the defense of any claim made against any shareholder for any act or obligations of a Series and satisfy any judgment thereon from the assets of the Series. | | Delaware law provides that a Limited Partner of the Partnership is not liable for the obligations of the Partnership unless he or she is also a general partner, or in addition to the exercise of the rights and powers of a Limited Partner, he or she participates in the control of the business. If, however, a Limited Partner does not participate in the control of the business, he or she is liable only to persons who transact business with the Partnership reasonably believing, based on the Limited Partner’s conduct, that the Limited Partners is a general partner. The Partnership Agreement limits the liability of a Limited Partner for the debts and obligations of the Partnership only to the extent of his or her interest in the Partnership during the fiscal year, or relevant portions thereof to which such debts and obligations are attributable. | | Except for a Limited Partners exercising control of the business of the Partnership, an investor, an investor in the Acquiring Fund or the Partnership is not subject to liability for the obligations of Forum or the Partnership. |

15

| SHAREHOLDER OR PARTNER RIGHTS | FORUM | | PARTNERSHIP | | EFFECT OF DIFFERENCE |

| Amendments to Governing Instrument | The Board may amend Forum’s trust instrument without a shareholder vote if the amendment (1) does not affect shareholder voting rights; (2) does not amend the provisions of the trust instrument addressing amendments thereto; (3) is not an amendment required by law or by Forum’s registration statement filed with the SEC; and (4) is not an amendment submitted to shareholders for a vote by the Trustees. | | The Partnership Agreement may be amended by (1) the General Partner in any manner that does not adversely affect the Limited Partners or (2) by action taken by both the General Partner and a majority of the Limited Partners Partnership interests. | | The Acquiring Fund shareholders have a greater opportunity to vote on proposed amendments to Forum’s trust instrument than the Limited Partners have to amend the Partnership agreement. |

4. FEDERAL INCOME TAX CONSEQUENCES OF THE REORGANIZATION

The Reorganization is intended to qualify as a tax-free transfer to a corporation controlled by the transferors immediately after the transfer within the meaning of Section 351 of the Code. It is conditioned on receipt by the Partnership and Forum of an opinion by K&L Gates LLP, counsel to Forum, substantially to the effect that -- based on certain facts and assumptions and conditioned on certain representations made by Forum and the Partnership, including those in the Plan, being true and complete on the Closing Date and the Reorganization’s being consummated in accordance with the Plan (without the waiver or modification of any terms or conditions thereof) -- the Reorganization will qualify as such a transfer and will not constitute a “transfer of property to an investment company” within the meaning of Code Section 351(e)(1) and Treas. Reg. § 1.351-1(c)(1), and that, accordingly, for federal income tax purposes:

1. The Partnership will recognize no gain or loss on the transfer of substantially all of its assets (“Assets”) solely in exchange for Acquiring Fund shares and the Acquiring Fund’s assumption of certain of the Partnership’s liabilities (“Liabilities”) pursuant to the Reorganization;

2. The Partnership’s aggregate basis in those Acquiring Fund shares will equal its aggregate basis in the Assets, reduced by the sum of the Liabilities assumed by the Acquiring Fund or to which the Assets are subject;

3. The Partnership’s holding period for those Acquiring Fund shares will include the period during which the Partnership held the Assets, provided that the Assets were held as capital assets at the time of the Reorganization;

4. The Acquiring Fund will recognize no gain or loss on its acquisition of the Assets solely in exchange for those Acquiring Fund shares and its assumption of the Liabilities

5. The Acquiring Fund’s basis in each Asset will be the same as the Partnership’s basis therein immediately before the Reorganization;

16

6. The Acquiring Fund’s holding period for each Asset will include the Partnership’s holding period therefor;

7. The Partnership will recognize no gain or loss on the distribution of the Acquiring Fund shares to the General Partner and the Limited Partners in liquidation of their Partnership interests;

8. A Limited Partner that participates in the Reorganization will recognize no gain or loss on the distribution of Acquiring Fund shares by the Partnership to that Limited Partner in liquidation of its Partnership interest;

9. The aggregate basis in the Acquiring Fund shares a Limited Partner receives in liquidation of its Partnership interest will be the same as that Limited Partner’s adjusted basis in that Partnership interest; and

10. A Limited Partner’s holding period for those Acquiring Fund shares will include the period during which the Partnership is treated as having held those shares under paragraph 3 above.

The foregoing opinion will not be binding on the Internal Revenue Service or the courts. Moreover, the conclusions reached in that opinion will be based on current law and authorities, all of which are subject to change, possibly retroactively.

A portion of the assets transferred by the Partnership to the Acquiring Fund will include cash and other assets that the Partnership will have held for less than one year at the time of the Reorganization. Accordingly, pursuant to paragraphs 3 and 10 above, the Partnership (and, therefore, a Limited Partner) will have a split holding period (i.e., partially long-term and partially short-term) for the Acquiring Fund shares. Therefore, a portion of any gain realized by a Limited Partner who sells the Acquiring Fund shares within one year of the Reorganization may be characterized as short-term capital gain, rather than long-term capital gain, even though the Limited Partner held its interest in the Partnership for more than one year.

Each Limited Partner must include in taxable income for its tax year its share of the Partnership income for the Partnership taxable year that ends with or within that Limited Partner’s taxable year.

The discussion contained above and in the following two subsections is general in nature, is not intended as tax advice, and does not purport to be complete or to deal with all aspects of federal income taxation that may be relevant to specific taxpayers in light of their particular circumstances. Limited Partners should consult their own tax advisers regarding the tax consequences of the Reorganization to them, including federal, state, local and, if applicable, foreign tax consequences.

FEDERAL INCOME TAX STATUS OF THE ACQUIRING FUND

The Acquiring Fund intends to qualify each taxable year to be taxed as a regulated investment company under the Code (a “RIC”). As a RIC, the Acquiring Fund generally will not be liable for federal income and excise taxes on the net investment income and net capital gains it distributes to its shareholders. The Acquiring Fund intends to distribute all of its net investment income and net capital gains each year. Accordingly, the Acquiring Fund should thereby avoid liability for all federal income and excise taxes.

TAX CONSEQUENCES OF ACQUIRING FUND DISTRIBUTIONS

Distributions by the Acquiring Fund of its net investment income (including net short-term capital gains) will be taxable to its shareholders as ordinary income. Distributions by the Acquiring Fund of net capital gain (i.e., the excess of net long-term capital gain over net short-term capital loss) will be taxable to shareholders as long-term capital gain, regardless of how long a shareholder has held shares of the Acquiring Fund.

A portion of the Acquiring Fund’s distributions may be treated as “qualified dividend income,” taxable to individuals at a maximum federal tax rate of 15% (0% for individuals in lower tax brackets). A distribution will be treated as qualified dividend income to the extent that the Acquiring Fund receives dividend income from taxable

17

domestic corporations and certain qualified foreign corporations, provided that holding period and certain other requirements are met. To the extent the Acquiring Fund’s distributions are attributable to other sources, such as interest or capital gains, the distributions will not be treated as qualified dividend income. For federal income tax purposes, distributions are treated the same whether they are received in cash or reinvested. If you buy shares of the Acquiring Fund just before it makes a distribution, the distribution you receive will be taxable to you even though it represents a return of a portion of the purchase price you paid for the shares.

The sale (redemption) or exchange of shares of the Acquiring Fund will be a taxable transaction for federal income tax purposes. You will recognize a gain or loss on the transaction equal to the difference, if any, between the amount of your net redemption proceeds and your tax basis in the shares. Such gain or loss will be capital gain or loss if you held your shares as capital assets. Any capital gain or loss will be treated as long-term capital gain or loss if you held the shares for more than one year at the time of the transaction.

The Acquiring Fund will be required to withhold and remit to the U.S. Treasury 28% of dividends, capital gain distributions and, in the case of a failure described in clause (1) below, the proceeds of redemptions of shares (regardless of whether you realize a gain or a loss) otherwise payable to you if you are an individual or certain other non-corporate shareholder and (1) fail to provide the Acquiring Fund your correct taxpayer identification number, (2) are otherwise subject to backup withholding by the Internal Revenue Service for failure to report the receipt of interest or dividend income properly, or (3) fail to certify to the Acquiring Fund that you are not subject to backup withholding or that you are a corporation or other “exempt recipient.” Backup withholding is not an additional tax; rather, any amounts so withheld may be credited against your federal income tax liability or refunded.

Reports containing appropriate information with respect to the federal income tax status of the Acquiring Fund’s dividends and other distributions paid during each calendar year will be mailed to its shareholders shortly after the close of the year.

ERISA CONSIDERATIONS

The Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and United States Department of Labor ("DOL") regulations promulgated thereunder provide that the assets of the Partnership may be deemed to be “plan assets” within the meaning of ERISA if “benefit plan investors” (as defined in ERISA) hold 25% or more of any class of equity interests in the Partnership. "Benefit plan investors" include employee benefit plans subject to ERISA or Section 4975 of the Code and entities or accounts that are deemed to hold assets of such plans pursuant to ERISA and DOL regulations. As of the filing date of this Proxy Statement, the General Partner is not a benefit plan investor and benefit plan investors hold less than five percent of the outstanding Partnership interests. The General Partner does not anticipate that limited partners that are benefit plan investors will hold 25% or more of any class of equity interests in the Partnership prior to the Reorganization.

However, even if the assets of the Partnership were deemed to hold plan assets for purposes of ERISA, or the parallel provisions of the Code, the Reorganization may be permissible under ERISA and under one or more exemptions from ERISA’s prohibited transaction rules, including Prohibited Transaction Exemption 97-41 issued by the DOL. Each fiduciary of a benefit plan investor should consult its legal adviser concerning ERISA and other considerations discussed herein before indicating your consent to the Plan.

5. CAPITALIZATION

The following table shows the capitalization of the Partnership as of September 30, 2009 and the Acquiring Fund’s pro forma combined capitalization as of that date after giving effect to the Reorganization.