VIA EDGAR

Ms. Lisa Larkin, Esq.

Division of Investment Management, Disclosure Review Office

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

RE: FORUM FUNDS

Adalta International Fund (the "Fund")

(File Nos. 811-03023 and 002-67052)

Dear Ms. Larkin:

On August 1, 2016, Forum Funds ("Registrant") filed Post-Effective Amendment No. 540 ("PEA 540") to its Registration Statement on Form N-1A with the U.S. Securities and Exchange Commission (the "SEC") to reflect new and revised disclosure in the Fund's prospectus, statement of additional information, and Part C (accession number 0001435109-16-001877) (the "Registration Statement"). Below is a summary of the comments provided by the SEC staff ("Staff") via telephone on Wednesday, September 14, 2016 regarding PEA 540 and the Registrant's responses to the comments. Unless otherwise stated herein, defined terms have the same meaning as set forth in the Registration Statement. The changes to the Registration Statement described below have been incorporated in a post-effective amendment, which is expected to be filed on Thursday, September 29, 2016, pursuant to Rule 485(b) of Regulation C under the Securities Act of 1933, as amended ("1933 Act").

Registrant acknowledges that: (1) it is responsible for the adequacy and accuracy of the disclosure in its Registration Statement; (2) Staff comments or changes to disclosure in response to Staff comments in the Registration Statement reviewed by the Staff do not foreclose the SEC from taking any action with respect to its registration statement; and (3) it may not assert Staff comments as a defense in any proceeding initiated by the SEC under the federal securities laws of the United States, except to the extent otherwise legally permissible.

PROSPECTUS

Comment 1: Please confirm that acquired fund fees and expenses are appropriately excluded from the Fees and Expenses table (i.e., less than one basis point) in light of the Fund's disclosures relating to investments in other registered investment companies.

Response: Registrant confirms that the expenses incurred as a result of the Fund's investments in registered investment companies do not amount to a level that would require disclosure in the Fund's Fees and Expenses table (i.e., one basis point).

Comment 2: Please confirm that the term of the expense limitation agreement between the Adviser and the Registrant will be extended through the effective period of the Registration Statement in accordance with the conditions of Form N-1A that permit such disclosure in a footnote to the Fees and Expenses table.

Response: Registrant confirms that the expense limitation agreement between the Registrant and the Adviser extends through the effective period of the Registration Statement in accordance with the conditions of Form N-1A, permitting such disclosure in the Fees and Expenses table.

Comment 3: Please confirm that the figures provided for comparing the cost of investing in the Fund, as disclosed in the Expense Example, account for the expense cap in place over the corresponding periods. Please consider revising the narrative to state that the expense cap will be incorporated into the calculations over relevant periods.

Response: Registrant confirms that the figures in the Expense Example reflect the incorporation of the Expense Cap in the calculation. In addition, Registrant refers the Staff to the penultimate sentence in the narrative, which states that the Example reflects the Expense Cap through the time periods described.

Comment 4: In the Principal Investment Strategies, please consider revising the disclosure to make clear that the location of companies in which the Fund invests will be determined by the enumerated factors (as opposed to may be determined by the enumerated factors).

Response: Registrant has revised the disclosure consistent with the Staff's comment.

Comment 5: In the Principal Investment Strategies, please revise the disclosure to state how much the Fund intends to invest in private equity funds.

Response: Registrant refers the Staff to the statement in the Fund's principal investment strategies disclosing that the Fund may invest "up to 10% of its total assets in limited liability companies and limited partnerships which are not exchange traded." This investment limitation applies to the Fund's investments in private equity funds.

Comment 6: In the Principal Investment Risks, consider whether the Fund should include a risk disclosure for investments in growth companies.

Response: Registrant has revised the disclosure consistent with the Staff's comment.

Comment 7: In the Principal Investment Risks, consider whether the Fund should include a risk disclosure for investments in limited partnerships and limited liability companies.

Response: Registrant refers the Staff to the "Private Fund Risk," which Registrant believes sufficiently discloses the risks of investing in LPs and LLCs.

Comment 8: In the section entitled "Additional Information Regarding Principal Investment Strategies," include a statement referencing the requirement to provide 60 days' notice to shareholders in advance of any change to the Fund's investment objective.

Response: Registrant has revised the disclosure consistent with the Staff's comment.

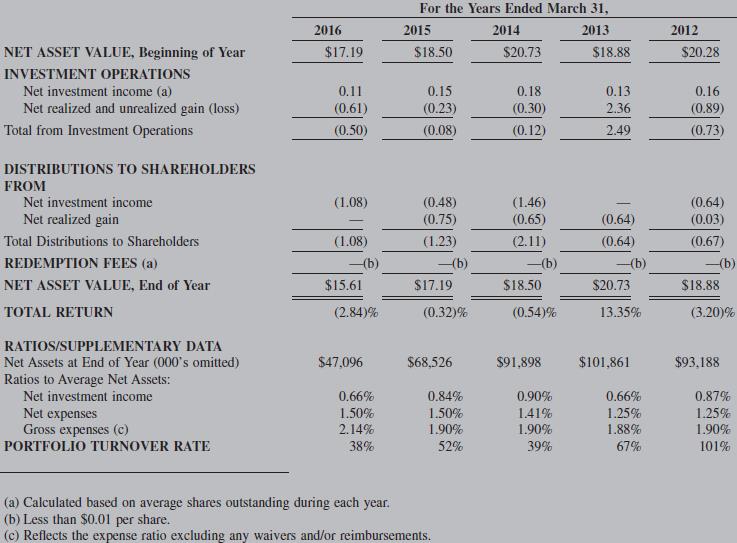

Comment 9: Please provide the Fund's financial highlights.

Response: Registrant has revised the disclosure to include the Fund's financial highlights, a copy of which has been reproduced below for the Staff's reference:

STATEMENT OF ADDITIONAL INFORMATION ("SAI")

Comment 10: On the cover page of the SAI, please update the contact information for obtaining copies of the Fund's most recent Annual Report and Semi-Annual, as they are not available at the website address currently disclosed.

Response: Registrant has revised the disclosure consistent with the Staff's comment.

Comment 11: In the section entitled "Ownership of Adviser," please state the basis of control and the general nature of the person's business in accordance with Item 19(a)(1) of Form N-1A.

Response: Registrant has revised the disclosure consistent with the Staff's comment.

Comment 12: In the section entitled "Information Concerning Compensation of Portfolio Managers," please enhance the disclosure to include additional detail regarding the portfolio managers' compensation arrangements in accordance with the requirements of Item 20(b) of Form N-1A.

Response: Registrant has revised the disclosure consistent with the Staff's comment.

Comment 13: With respect to the section entitled "Distributor," supplementally explain whether the Adviser pays the Distributor a fee in connection with distribution-related services.

Response: Because the Fund does not have a Rule 12b-1 Plan, the Fund does not compensate the Distributor for distribution-related (12b-1) services. Rather, the Adviser compensates the Distributor to serve as the Fund's statutory underwriter, consistent with Section 12(b) of the 1940 Act.

If you have any questions or concerns regarding the enclosed information, please do not hesitate to contact me directly at (207) 347-2076.

Kind regards,

/s/ Zachary R. Tackett

Zachary R. Tackett

cc: Stacy L. Fuller, Esq.

K&L Gates LLP