NYSE: BBX August 2018 Exhibit 99.1

Forward Looking Statements 2 This presentation contains forward-looking statements based largely on current expectations of BBX Capital or its subsidiaries that involve a number of risks and uncertainties. All opinions, forecasts, projections, future plans or other statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements may be identified by the use of words or phrases such as “plans,” “believes,” “will,” “expects,” “anticipates,” “intends,” “estimates,” “our view,” “we see,” “would” and words and phrases of similar import. The forward-looking statements in this presentation are also forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We can give no assurance that such expectations will prove to have been correct. Actual results, performance, or achievements could differ materially from those contemplated, expressed, or implied by the forward-looking statements contained herein. Forward-looking statements are subject to a number of risks and uncertainties that are subject to change based on factors which are, in many instances, beyond our control and the reader should not place undue reliance on any forward-looking statement, which speaks only as of the date made. This presentation also contains information regarding the past performance of the Company, its subsidiaries and their respective investments and operations, and the reader should note that prior or current performance is not a guarantee or indication of future performance. Future results could differ materially as a result of a variety of risks and uncertainties. Some factors which may affect the accuracy of the forward-looking statements apply generally to the industries in which the Company operates, including the development, operation, management and investment in residential and commercial real estate, the resort development and vacation ownership industries in which Bluegreen operates, the home improvement industry in which Renin operates, and the sugar and confectionery industry in which BBX Sweet Holdings operates as well as the pizza franchise industry in which the Company recently commenced activities. Risks and uncertainties include, without limitation, the risks and uncertainties affecting BBX Capital and its subsidiaries, and their respective results, operations, markets, products, services and business strategies, including risks associated with the ability to successfully implement currently anticipated plans and initiatives and to generate earnings, long term growth and increased value, the risks and uncertainties associated with the reorganization of BBX Sweet Holdings; the risk that the performance of entities in which BBX Capital has made investments may not be profitable or perform as anticipated; BBX Capital is dependent upon dividends from its subsidiaries, principally Bluegreen, to fund its operations; BBX Capital’s subsidiaries may not be in a position to pay dividends, dividend payments may be subject to certain restrictions, including restrictions contained in debt instruments, and may be subject to declaration by such subsidiary’s board of directors or managers; the risks relating to acquisitions, including acquisitions in diverse activities, including the risk that they will not perform as expected and will adversely impact the Company’s results; risks relating to the monetization of BBX Capital’s legacy assets; and risks related to litigation and other legal proceedings involving BBX Capital and its subsidiaries. The Company’s investment in Bluegreen Vacations Corporation exposes the Company to risks of Bluegreen’s business, including risks relating to its management contracts, marketing agreements and other strategic alliances and relationships, and risks inherent in the vacation ownership industry, as well as other risks relating to the ownership of Bluegreen’s common stock, and including those risks described in Bluegreen’s Annual and Quarterly Reports filed with the SEC. In addition, with respect to BBX Capital’s Real Estate and Middle Market Division, the risks and uncertainties include risks relating to the real estate market and real estate development, the risk that joint venture partners may not fulfill their obligations and the projects may not be developed as anticipated or be profitable, and the risk that contractual commitments may not be completed on the terms provided or at all; risks relating to acquisition and performance of operating businesses, including integration risks, risks regarding achieving profitability, the risk that new personnel will not be successful, foreign currency transaction risk, goodwill and other intangible impairment risks, and the risk that assets may be disposed of at a loss; and risks related to the Company’s MOD Pizza franchise activities, including that stores may not be opened when or in the number expected and that the stores once opened may not be profitable or otherwise perform as expected. Reference is also made to the other risks and uncertainties described in BBX Capital’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, and its Annual Report on Form 10-K for the year ended December 31, 2017. The Company cautions that the foregoing factors are not exclusive.

BBX Capital Corporation A Diversified Holding Company BBX Capital Corporation (NYSE: BBX) is a Florida-based, diversified holding company whose activities include its 90% ownership of Bluegreen Vacations Corporation (NYSE: BXG) as well as its Real Estate and Middle Market divisions. 3

Alan B. Levan John E. Abdo Jarett Levan Seth Wise Ray Lopez Chairman & CEOVice Chairman President BBX Capital Real Estate Chief Financial Officer President Led by an entrepreneurial team focused on creating value over the long term BBX Capital Executive Team 4

BBX’s Corporate Strategy Build long-term shareholder value as opposed to focusing on quarterly or annual earnings Objective Since many of BBX Capital’s assets do not generate income on a regular or predictable basis, our objective is to: Achieve long-term growth as measured by increases in book value and intrinsic value over time Goal 5

BBX Capital’s Current Portfolio 6

BBX Capital Corporation & Affiliates A family of companies dating back more than 45 years, led by a management team with a long history of entrepreneurship. Activities from 1972 to present day have included: Real Estate Acquisition and Management - $1 Billion+ Banking - 100 Branches, $6.5 Billion in Assets Commercial Real Estate Lending - $3 Billion+ Investment Banking & Brokerage - 1,000 Investment Professionals Homebuilding - Thousands of Homes Planned Community Development - 9,000 Acres Asian Themed Restaurants - 65 Locations Vacation Ownership Resort Network, including 69 resorts, and over 215,000+ vacation club owners 7

Past Activities Seeking to invest in companies at the right time and optimize BBX’s value add 8

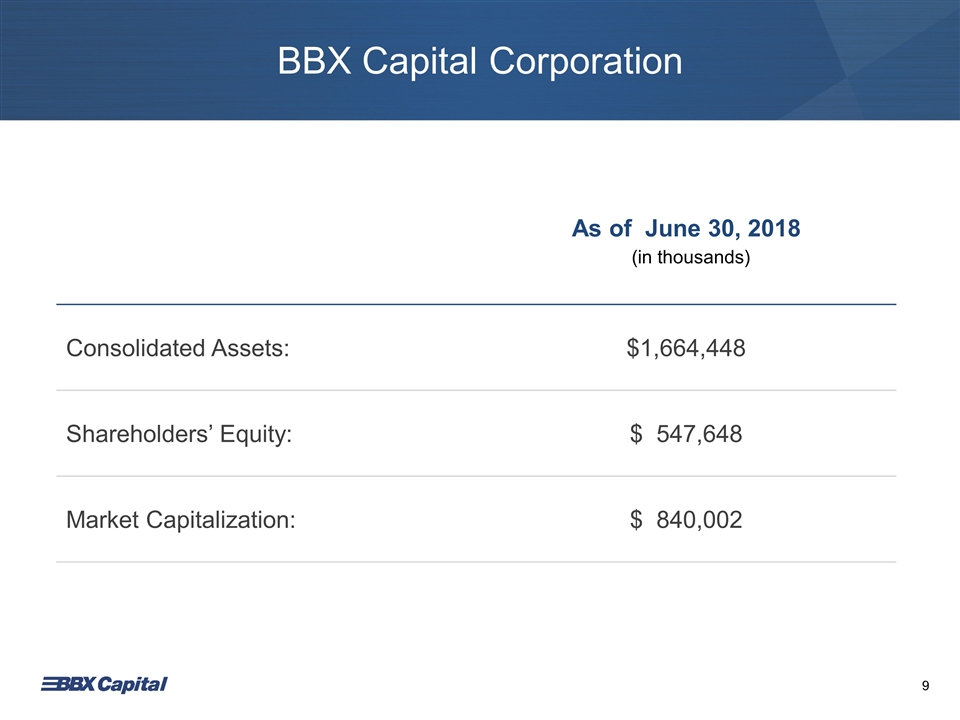

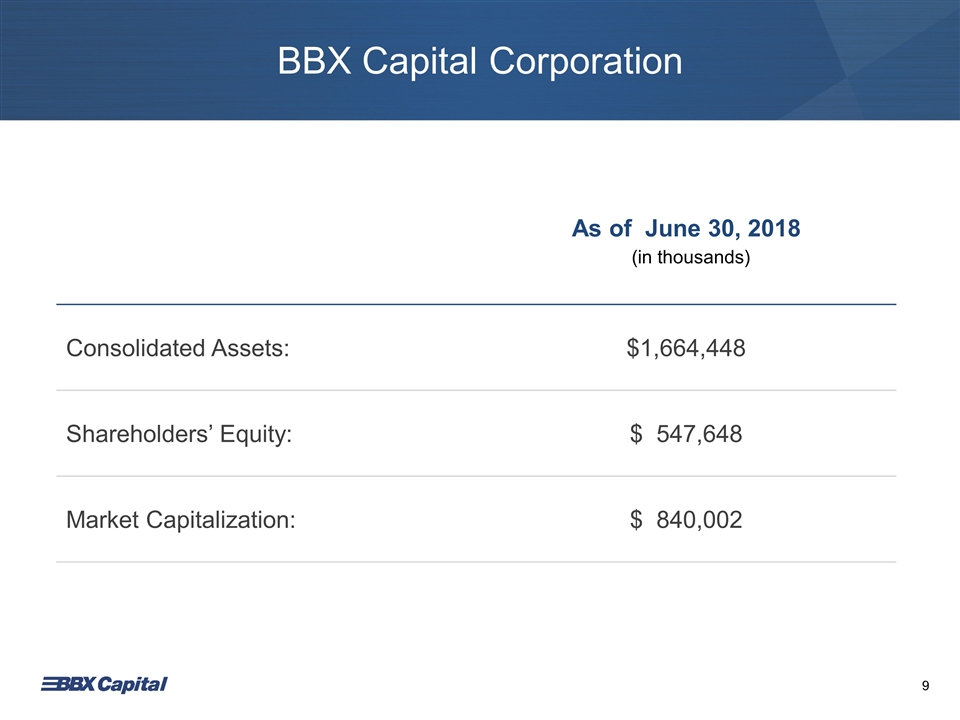

BBX Capital Corporation As of June 30, 2018 Consolidated Assets: $1,664,448 Shareholders’ Equity: $ 547,648 Market Capitalization: $ 840,002 (in thousands) 9

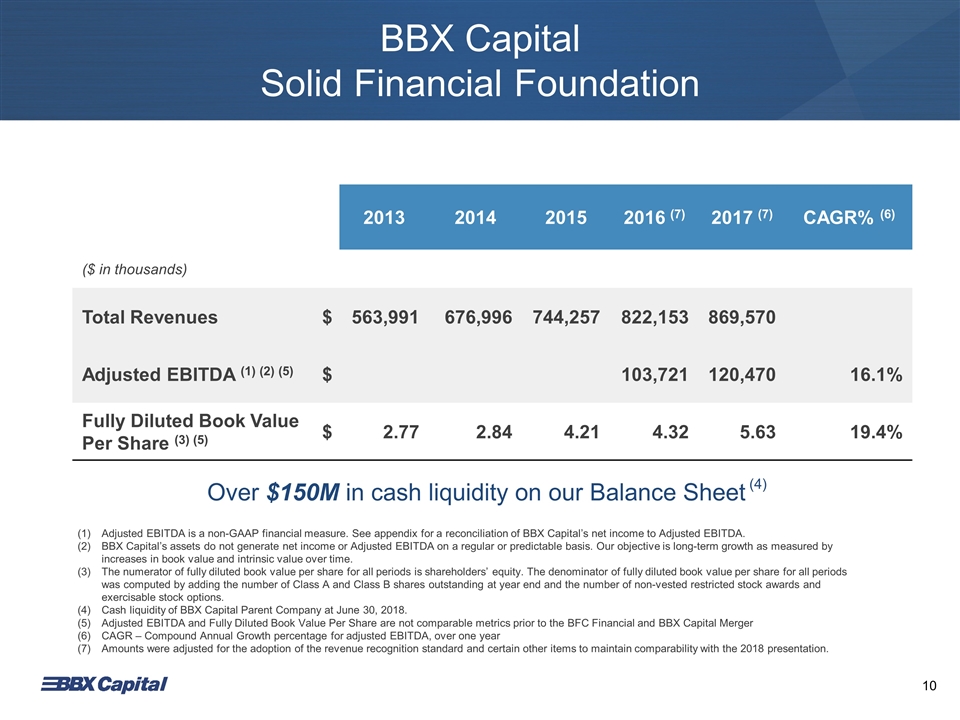

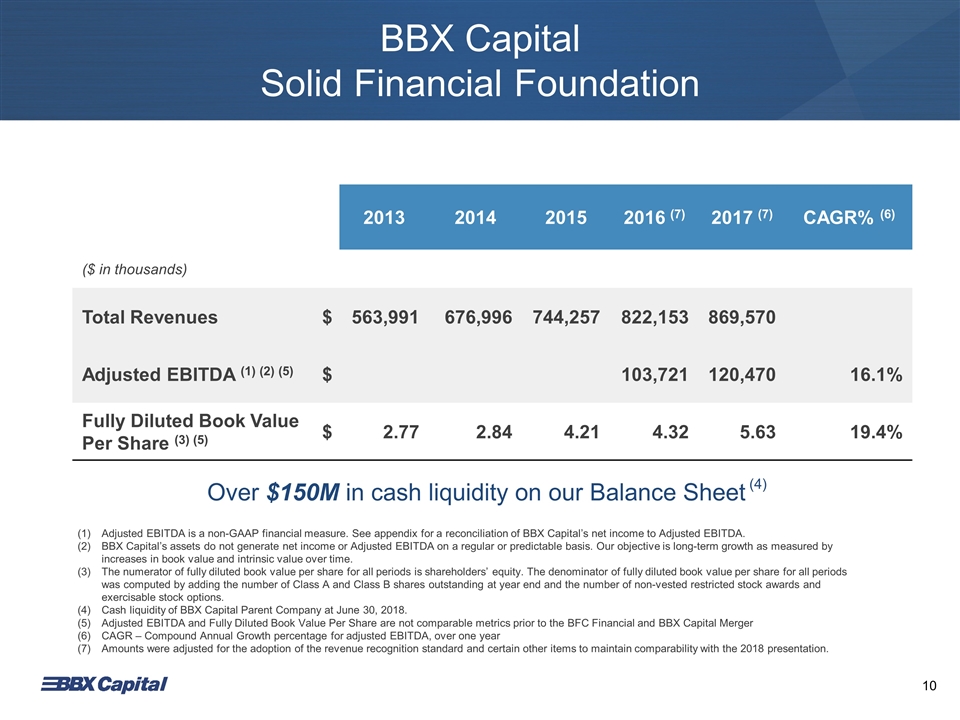

BBX Capital Solid Financial Foundation Over $150M in cash liquidity on our Balance Sheet 2013 2014 2015 2016 (7) 2017 (7) CAGR% (6) ($ in thousands) Total Revenues $ 563,991 676,996 744,257 822,153 869,570 Adjusted EBITDA (1) (2) (5) $ 103,721 120,470 16.1% Fully Diluted Book Value Per Share (3) (5) $ 2.77 2.84 4.21 4.32 5.63 19.4% Adjusted EBITDA is a non-GAAP financial measure. See appendix for a reconciliation of BBX Capital’s net income to Adjusted EBITDA. BBX Capital’s assets do not generate net income or Adjusted EBITDA on a regular or predictable basis. Our objective is long-term growth as measured by increases in book value and intrinsic value over time. The numerator of fully diluted book value per share for all periods is shareholders’ equity. The denominator of fully diluted book value per share for all periods was computed by adding the number of Class A and Class B shares outstanding at year end and the number of non-vested restricted stock awards and exercisable stock options. Cash liquidity of BBX Capital Parent Company at June 30, 2018. Adjusted EBITDA and Fully Diluted Book Value Per Share are not comparable metrics prior to the BFC Financial and BBX Capital Merger CAGR – Compound Annual Growth percentage for adjusted EBITDA, over one year Amounts were adjusted for the adoption of the revenue recognition standard and certain other items to maintain comparability with the 2018 presentation. (4) 10

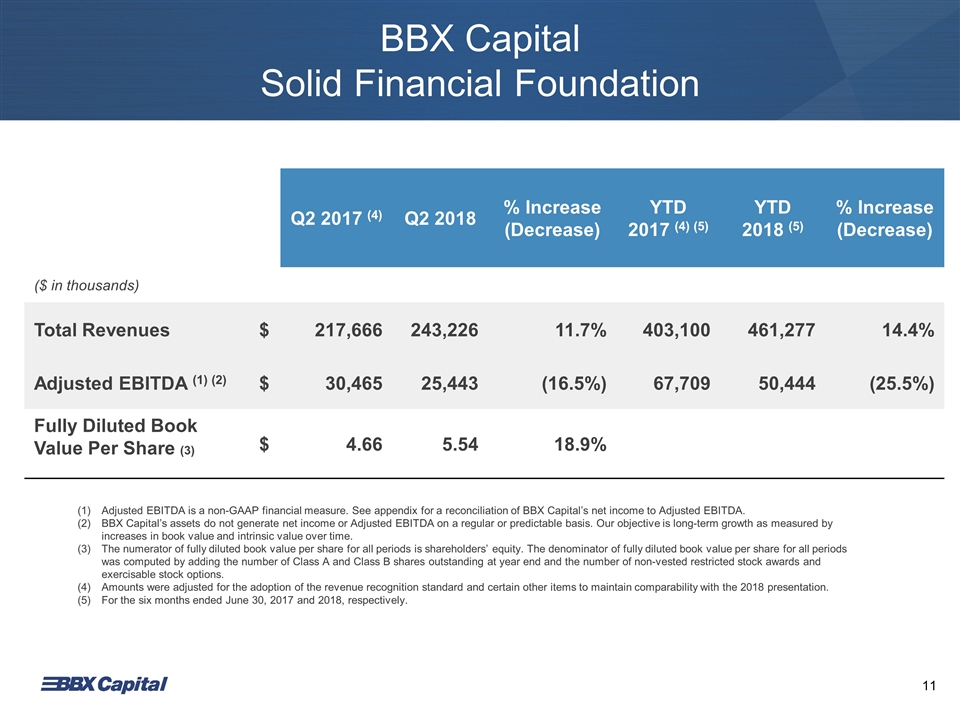

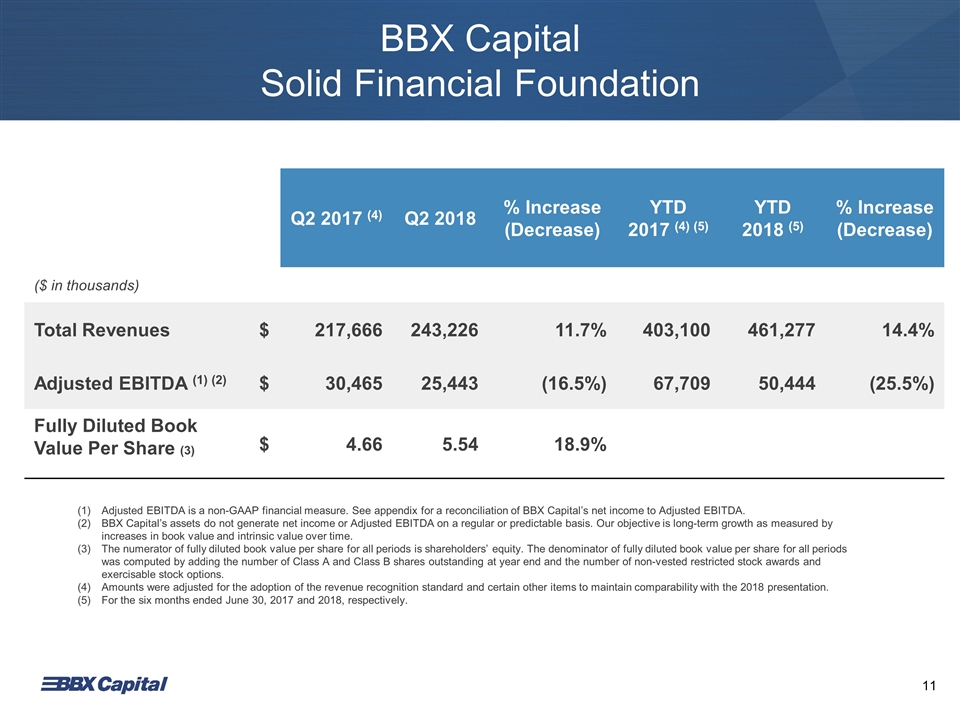

BBX Capital Solid Financial Foundation Q2 2017 (4) Q2 2018 % Increase (Decrease) YTD 2017 (4) (5) YTD 2018 (5) % Increase (Decrease) ($ in thousands) Total Revenues $ 217,666 243,226 11.7% 403,100 461,277 14.4% Adjusted EBITDA (1) (2) $ 30,465 25,443 (16.5%) 67,709 50,444 (25.5%) Fully Diluted Book Value Per Share (3) $ 4.66 5.54 18.9% Adjusted EBITDA is a non-GAAP financial measure. See appendix for a reconciliation of BBX Capital’s net income to Adjusted EBITDA. BBX Capital’s assets do not generate net income or Adjusted EBITDA on a regular or predictable basis. Our objective is long-term growth as measured by increases in book value and intrinsic value over time. The numerator of fully diluted book value per share for all periods is shareholders’ equity. The denominator of fully diluted book value per share for all periods was computed by adding the number of Class A and Class B shares outstanding at year end and the number of non-vested restricted stock awards and exercisable stock options. Amounts were adjusted for the adoption of the revenue recognition standard and certain other items to maintain comparability with the 2018 presentation. For the six months ended June 30, 2017 and 2018, respectively. 11

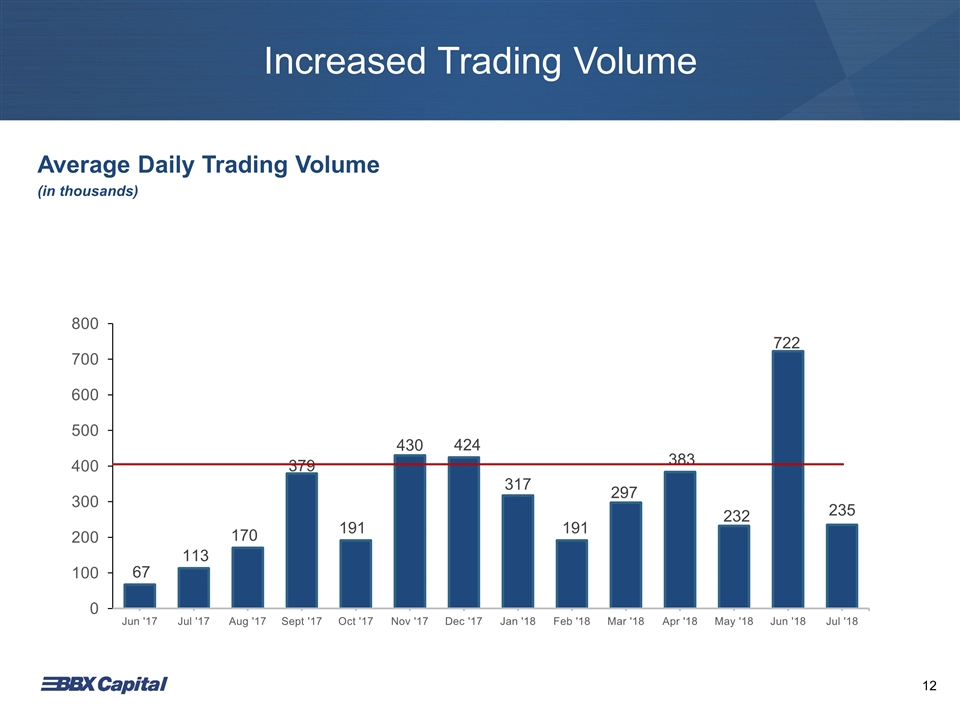

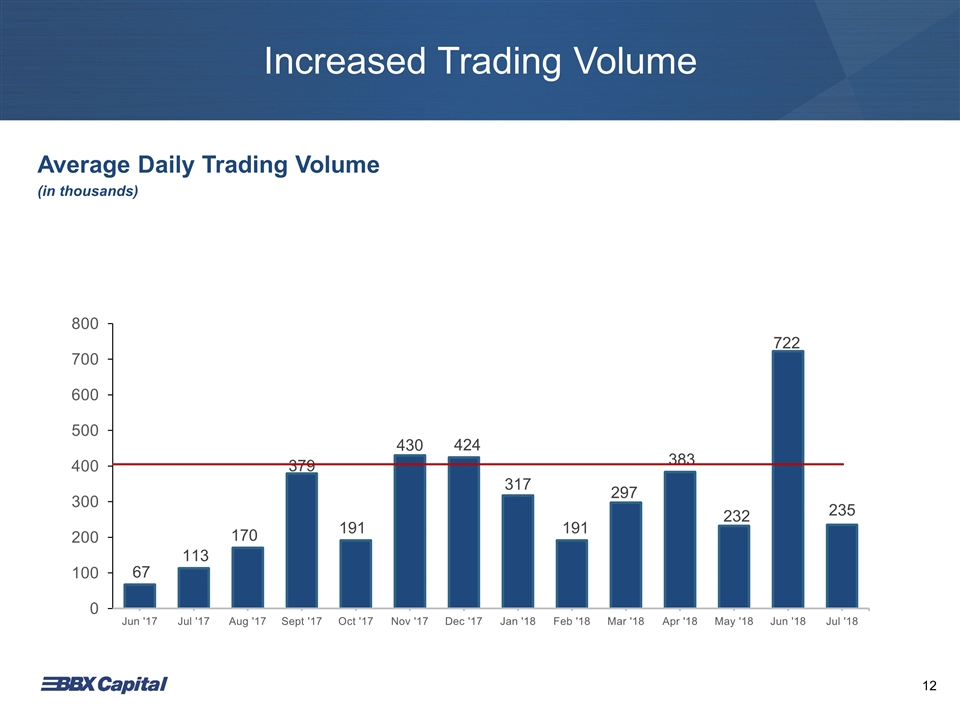

Increased Trading Volume Average Daily Trading Volume (in thousands) 12

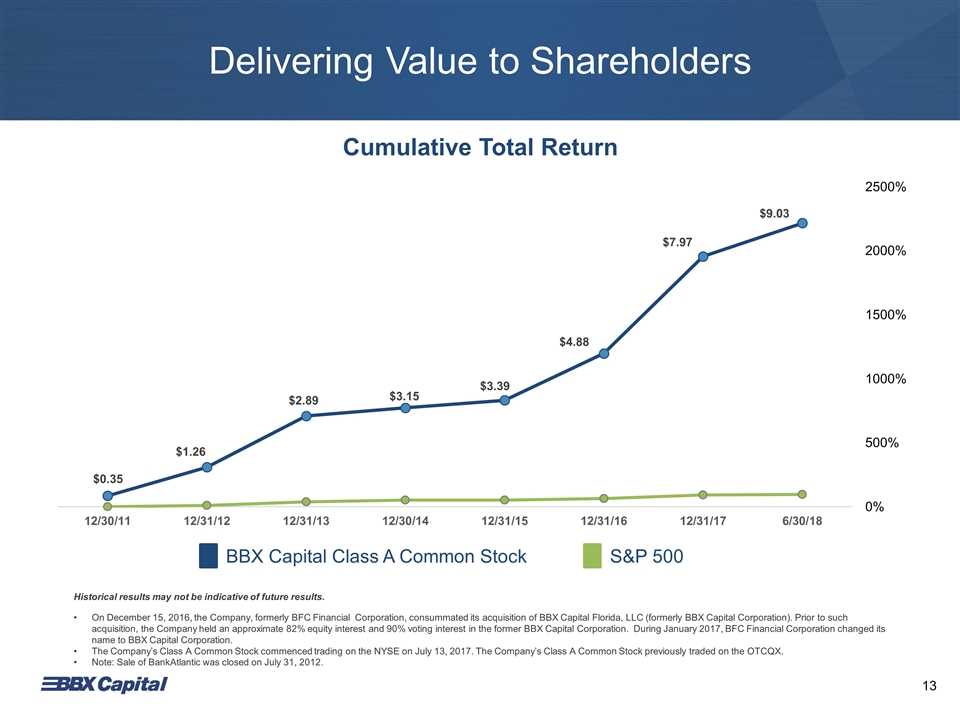

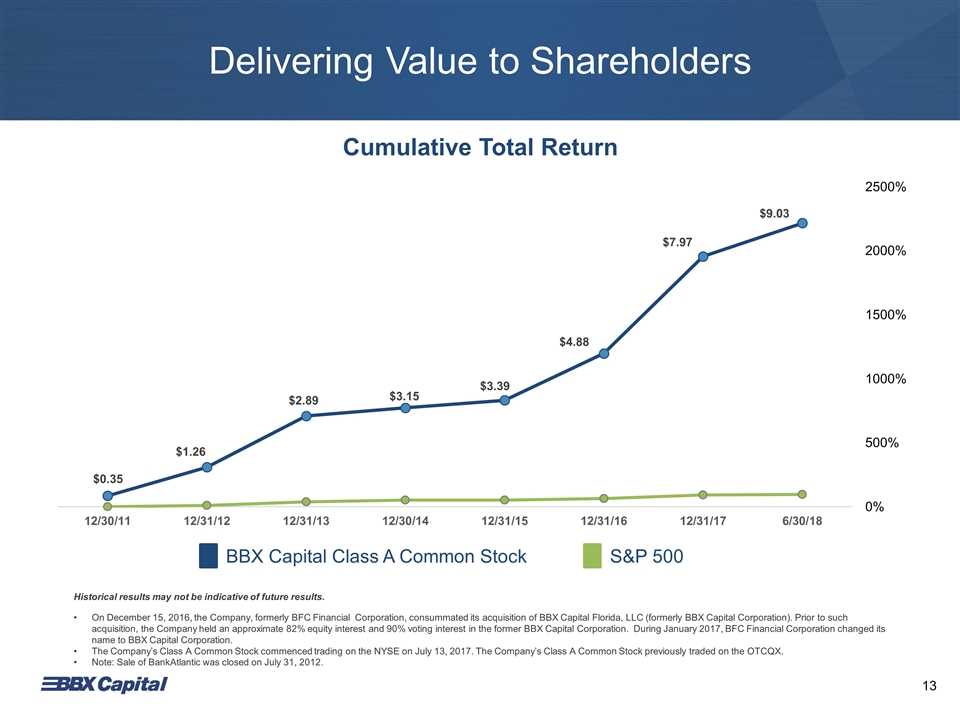

Delivering Value to Shareholders Cumulative Total Return Historical results may not be indicative of future results. On December 15, 2016, the Company, formerly BFC Financial Corporation, consummated its acquisition of BBX Capital Florida, LLC (formerly BBX Capital Corporation). Prior to such acquisition, the Company held an approximate 82% equity interest and 90% voting interest in the former BBX Capital Corporation. During January 2017, BFC Financial Corporation changed its name to BBX Capital Corporation. The Company’s Class A Common Stock commenced trading on the NYSE on July 13, 2017. The Company’s Class A Common Stock previously traded on the OTCQX. Note: Sale of BankAtlantic was closed on July 31, 2012. S&P 500 BBX Capital Class A Common Stock 2500% 2000% 1500% 1000% 500% 0% 13

Three Strategic Verticals HOSPITALITY REAL ESTATE MIDDLE MARKET Acquisition, Ownership, and Management of: Legacy Assets Developments Joint Ventures Subsidiaries: BBX Sweet Holdings IT’SUGAR Hoffman’s Chocolates Las Olas Brands Renin MOD Pizza Exclusive Florida MOD Pizza Franchisee 1 3 2 Bluegreen Vacations: NYSE: BXG 90% ownership interest 69 Resorts 215,000+ Vacation Club Owners (1) Data as of 6/30/18 (1) (1) 14

Three Strategic Verticals HOSPITALITY REAL ESTATE MIDDLE MARKET Subsidiaries: BBX Sweet Holdings IT’SUGAR Hoffman’s Chocolates Las Olas Brands Renin MOD Pizza Exclusive Florida MOD Pizza Franchisee Bluegreen Vacations: NYSE: BXG 90% ownership interest 69 Resorts 215,000+ Vacation Club Owners 1 3 2 Acquisition, Ownership, and Management of: Legacy Assets Developments Joint Ventures (1) Data as of 6/30/18 (1) (1) 15

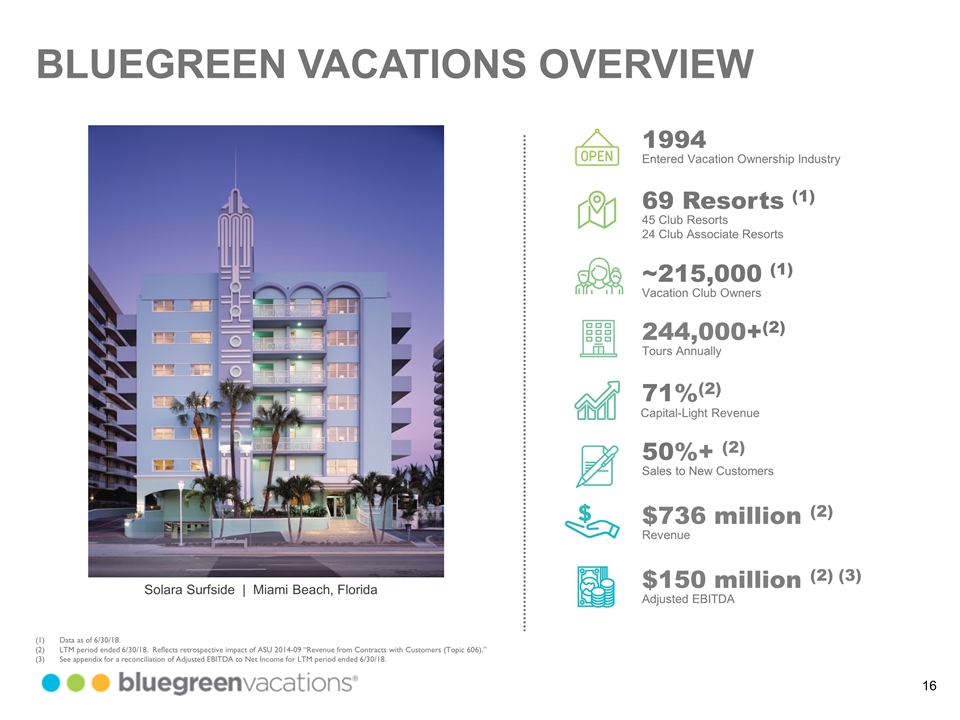

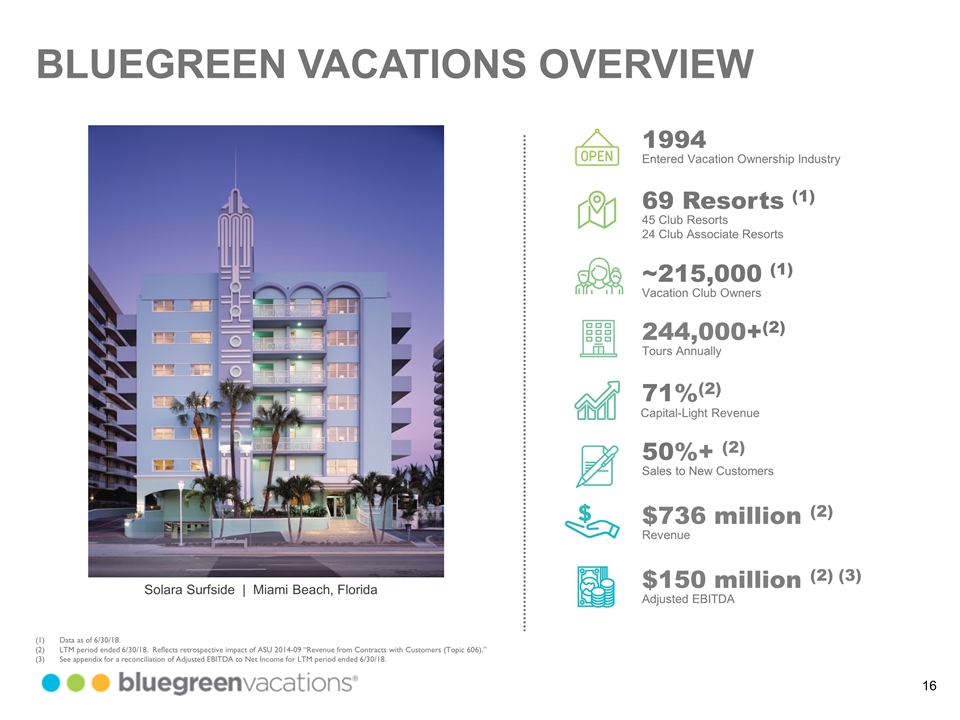

BLUEGREEN VACATIONS OVERVIEW Solara Surfside | Miami Beach, Florida 1994 69 Resorts (1) ~215,000 (1) 244,000+(2) 71%(2) 50%+ (2) $736 million (2) $150 million (2) (3) Entered Vacation Ownership Industry 45 Club Resorts 24 Club Associate Resorts Vacation Club Owners Tours Annually Capital-Light Revenue Sales to New Customers Revenue Adjusted EBITDA Data as of 6/30/18. LTM period ended 6/30/18. Reflects retrospective impact of ASU 2014-09 “Revenue from Contracts with Customers (Topic 606).” See appendix for a reconciliation of Adjusted EBITDA to Net Income for LTM period ended 6/30/18. 16

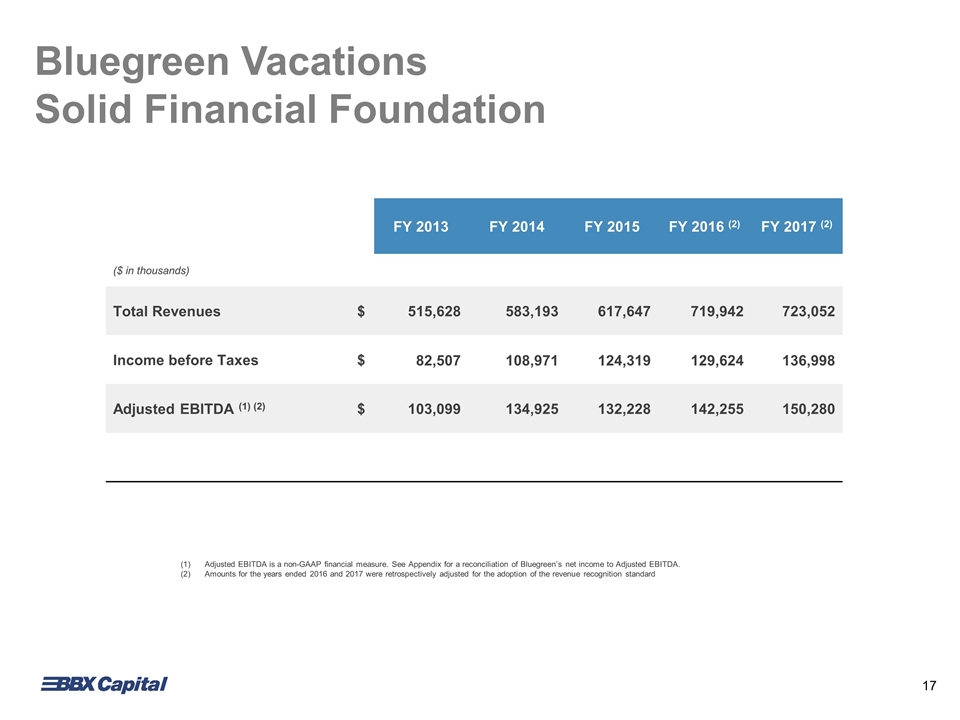

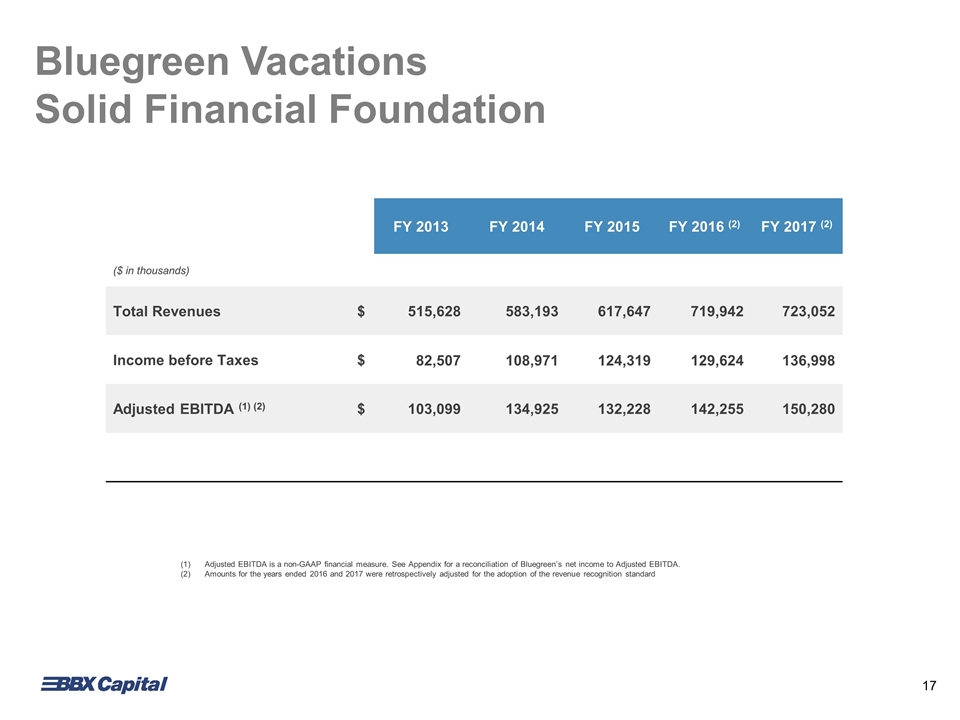

Bluegreen Vacations Solid Financial Foundation FY 2013 FY 2014 FY 2015 FY 2016 (2) FY 2017 (2) ($ in thousands) Total Revenues $ 515,628 583,193 617,647 719,942 723,052 Income before Taxes $ 82,507 108,971 124,319 129,624 136,998 Adjusted EBITDA (1) (2) $ 103,099 134,925 132,228 142,255 150,280 Adjusted EBITDA is a non-GAAP financial measure. See Appendix for a reconciliation of Bluegreen’s net income to Adjusted EBITDA. Amounts for the years ended 2016 and 2017 were retrospectively adjusted for the adoption of the revenue recognition standard 17

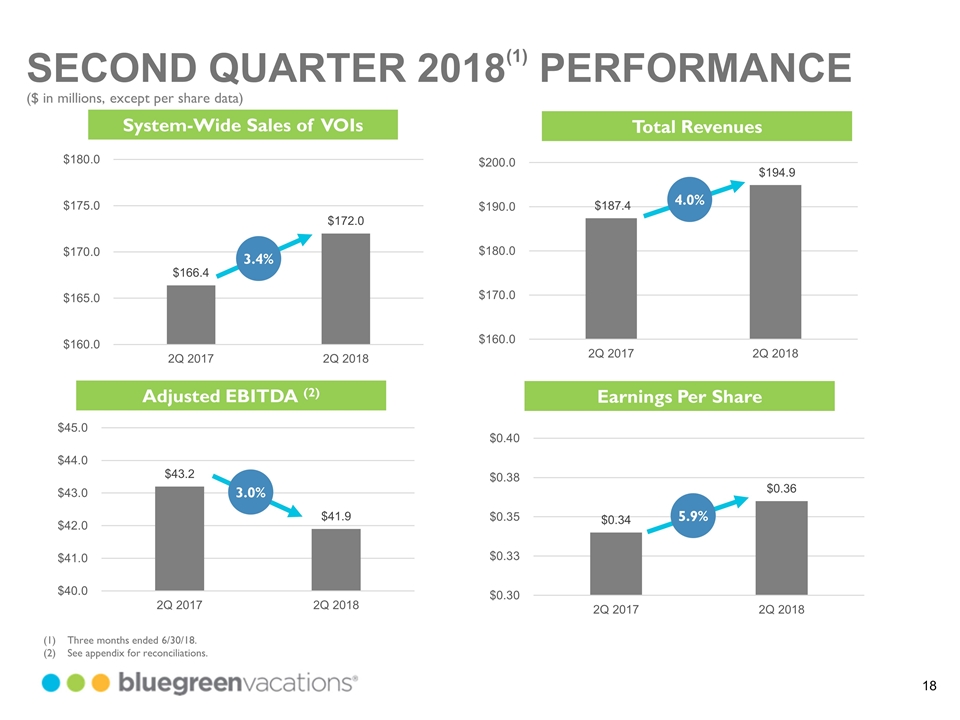

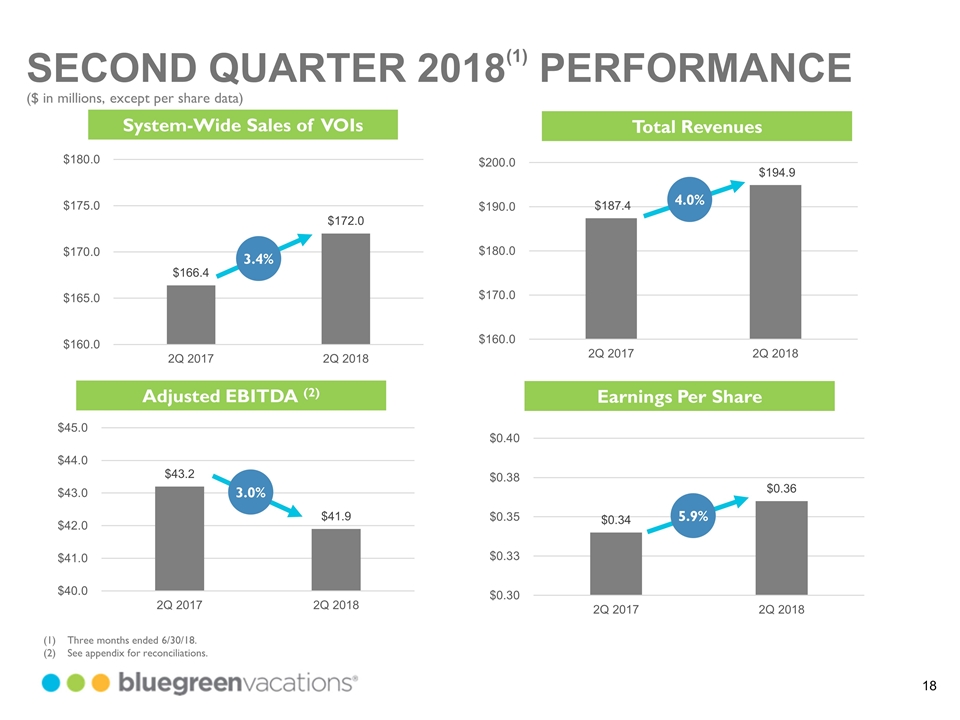

SECOND QUARTER 2018(1) PERFORMANCE Three months ended 6/30/18. See appendix for reconciliations. ($ in millions, except per share data) Total Revenues System-Wide Sales of VOIs Adjusted EBITDA (2) Earnings Per Share 3.4% 4.0% 3.0% 5.9% 18

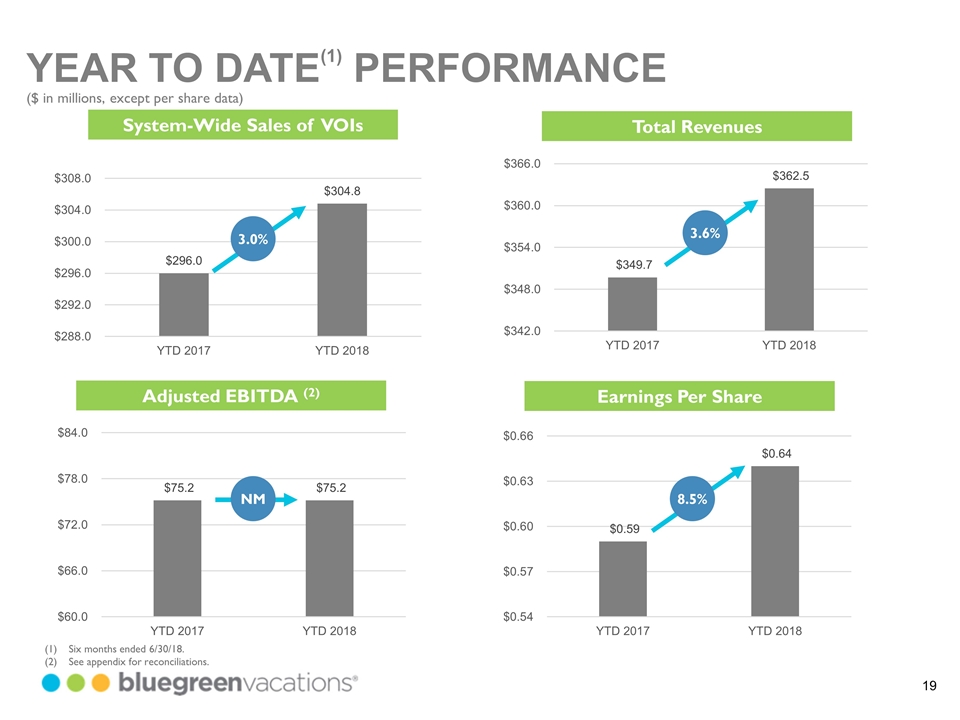

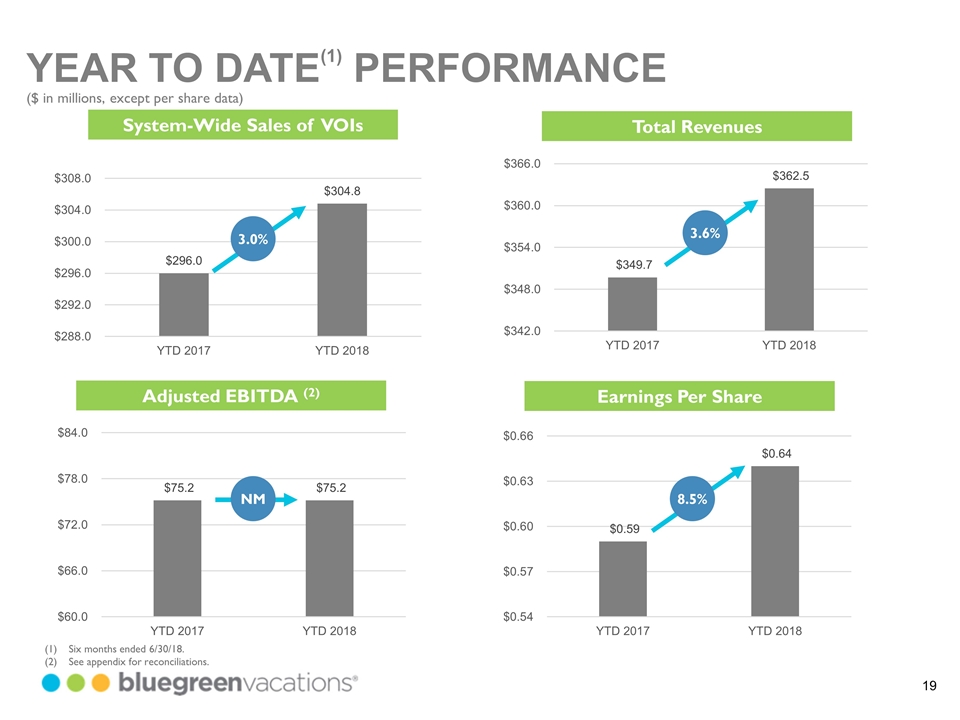

YEAR TO DATE(1) PERFORMANCE Six months ended 6/30/18. See appendix for reconciliations. ($ in millions, except per share data) Total Revenues System-Wide Sales of VOIs Adjusted EBITDA (2) Earnings Per Share 3.0% 3.6% 8.5% NM 19

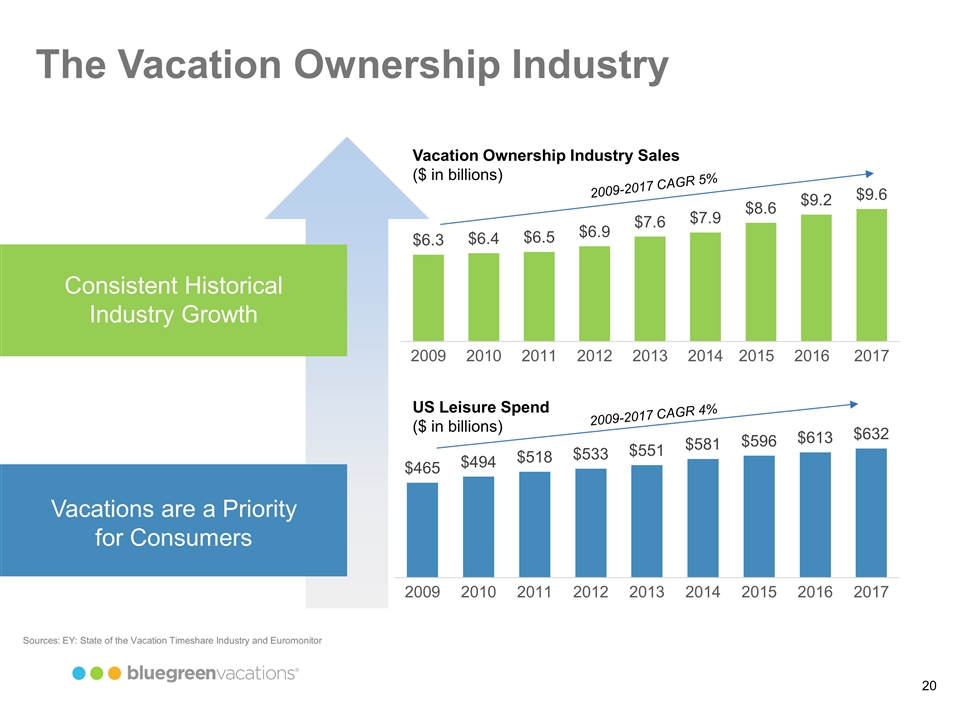

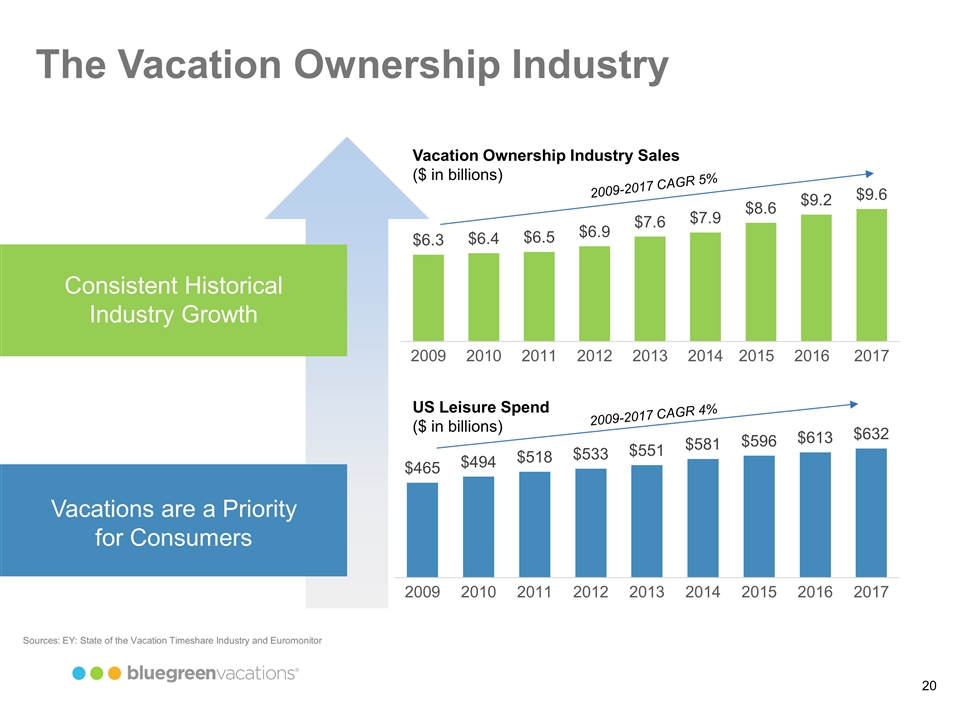

Consistent Historical Industry Growth Vacations are a Priority for Consumers Vacation Ownership Industry Sales ($ in billions) US Leisure Spend ($ in billions) 2009-2017 CAGR 5% 2009-2017 CAGR 4% Sources: EY: State of the Vacation Timeshare Industry and Euromonitor The Vacation Ownership Industry 20

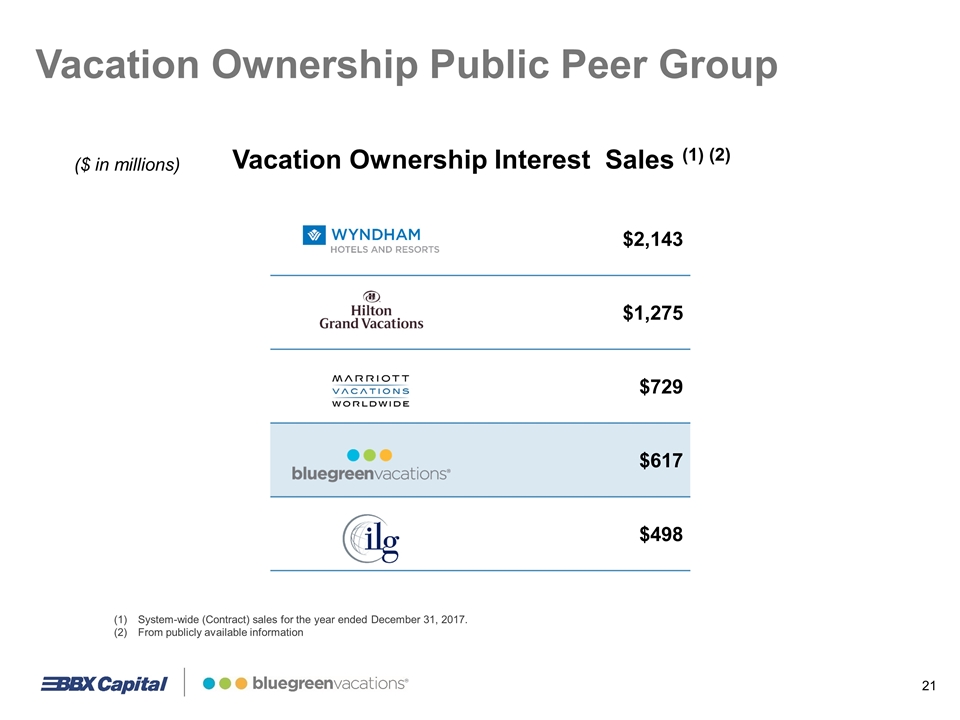

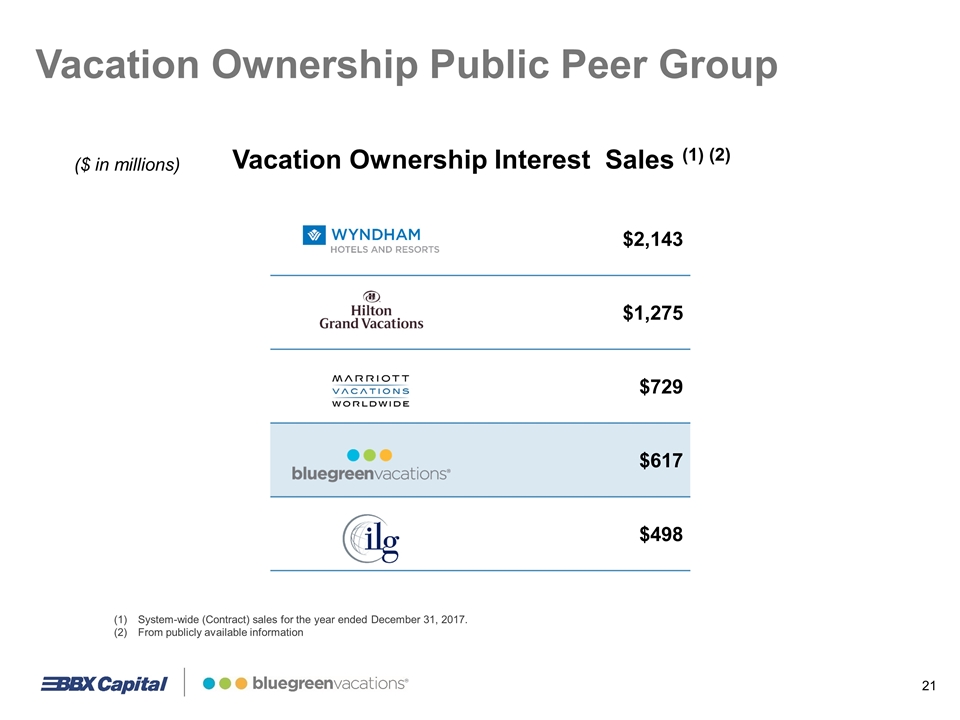

Vacation Ownership Public Peer Group Vacation Ownership Interest Sales (1) (2) ($ in millions) Vacation Ownership Public Peer Group $2,143 $1,275 $729 $617 $498 System-wide (Contract) sales for the year ended December 31, 2017. From publicly available information 21

Significant Fee-Based VOI Sales Strong Net Owner Growth Balanced Approach to Growth Differentiated Target Demographic Multiple Marketing Channels for New Owners Industry Innovator Potential Competitive Advantages 22

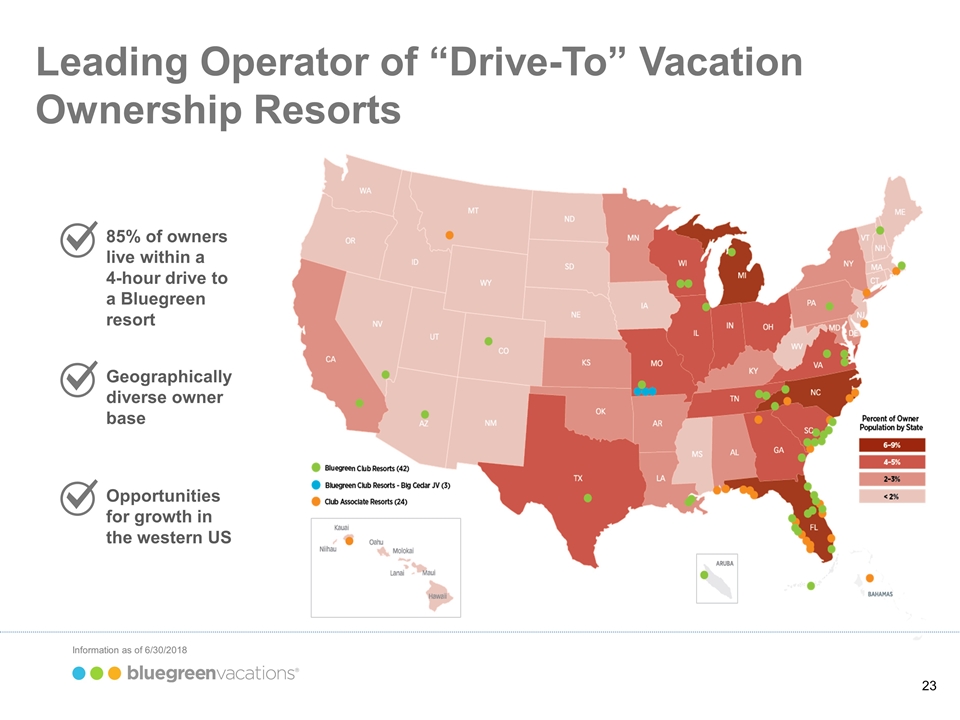

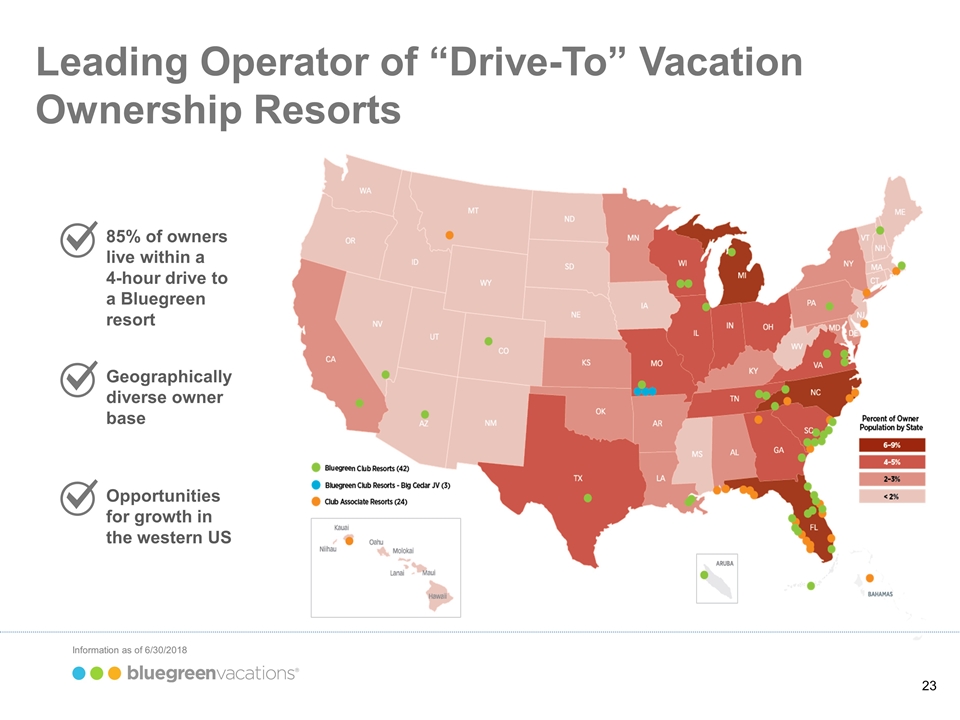

85% of owners live within a 4-hour drive to a Bluegreen resort Opportunities for growth in the western US Geographically diverse owner base Information as of 6/30/2018 Leading Operator of “Drive-To” Vacation Ownership Resorts 23

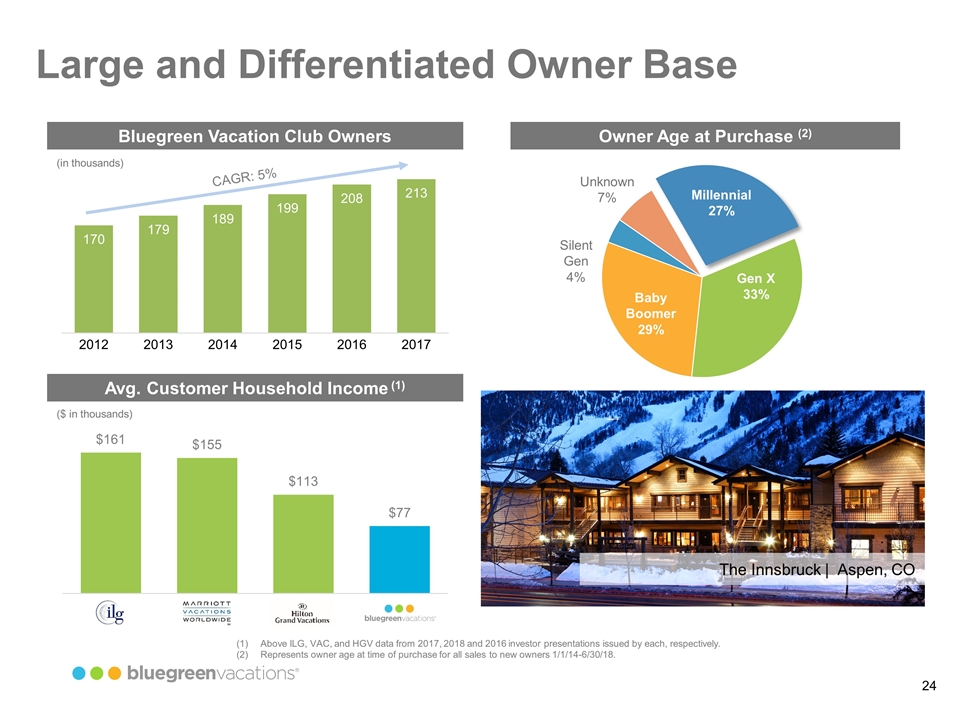

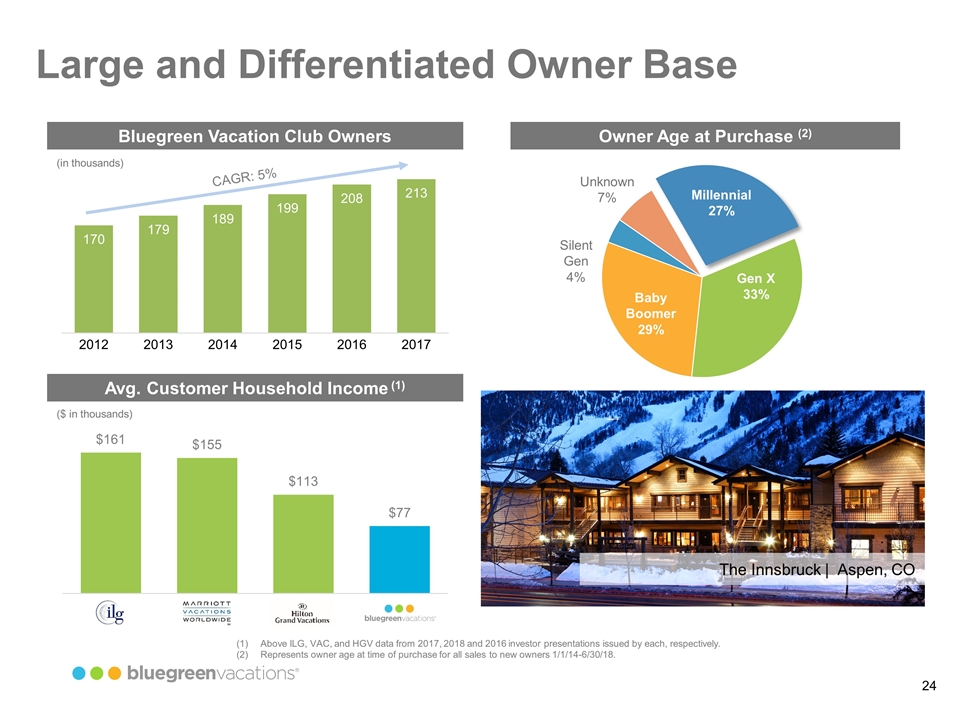

Large and Differentiated Owner Base Bluegreen Vacation Club Owners CAGR: 5% Avg. Customer Household Income (1) Owner Age at Purchase (2) Above ILG, VAC, and HGV data from 2017, 2018 and 2016 investor presentations issued by each, respectively. Represents owner age at time of purchase for all sales to new owners 1/1/14-6/30/18. ($ in thousands) (in thousands) Millennial 27% Gen X 33% Baby Boomer 29% Silent Gen 4% Unknown 7% The Innsbruck | Aspen, CO 24

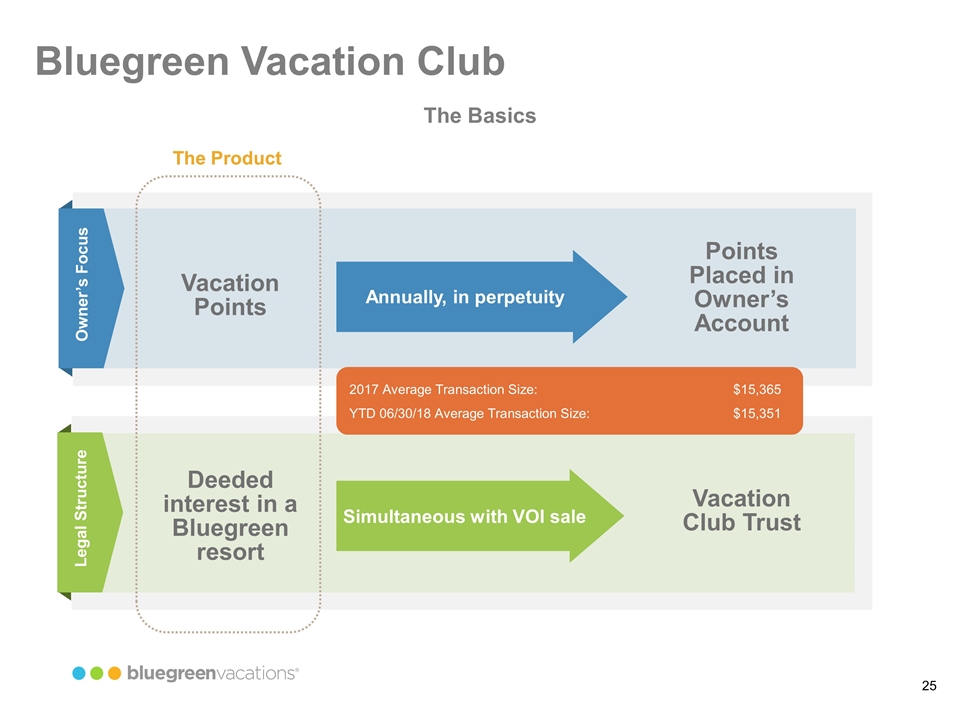

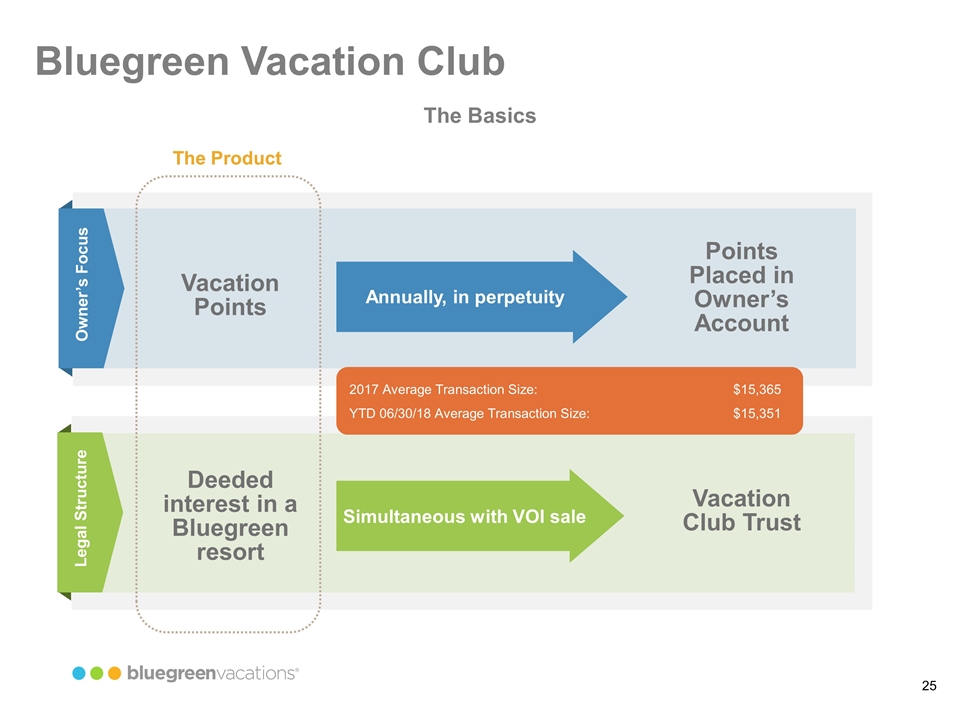

The Basics The Product Vacation Points Owner’s Focus Annually, in perpetuity The Product Points Placed in Owner’s Account $13,727 Deeded interest in a Bluegreen resort Legal Structure Simultaneous with VOI sale Vacation Club Trust 2017 Average Transaction Size: $15,365 YTD 06/30/18 Average Transaction Size: $15,351 Bluegreen Vacation Club 25

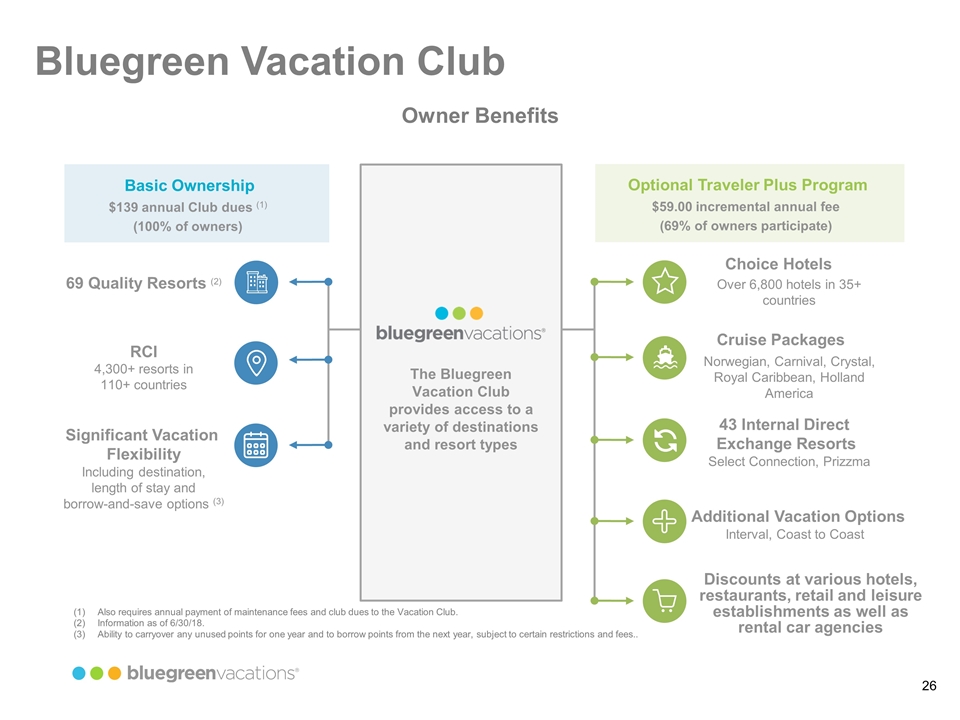

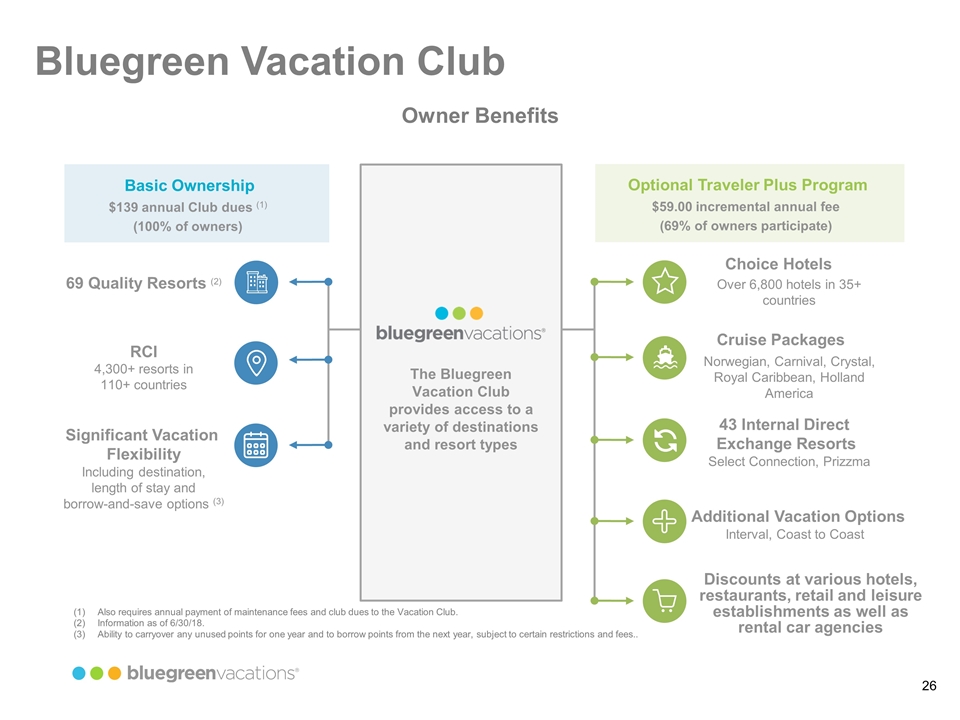

Bluegreen Vacation Club Optional Traveler Plus Program $59.00 incremental annual fee (69% of owners participate) Choice Hotels Over 6,800 hotels in 35+ countries Cruise Packages Norwegian, Carnival, Crystal, Royal Caribbean, Holland America 43 Internal Direct Exchange Resorts Select Connection, Prizzma Additional Vacation Options Interval, Coast to Coast Discounts at various hotels, restaurants, retail and leisure establishments as well as rental car agencies Basic Ownership $139 annual Club dues (1) (100% of owners) 69 Quality Resorts (2) RCI 4,300+ resorts in 110+ countries Significant Vacation Flexibility Including destination, length of stay and borrow-and-save options (3) Owner Benefits The Bluegreen Vacation Club provides access to a variety of destinations and resort types Also requires annual payment of maintenance fees and club dues to the Vacation Club. Information as of 6/30/18. Ability to carryover any unused points for one year and to borrow points from the next year, subject to certain restrictions and fees.. 26

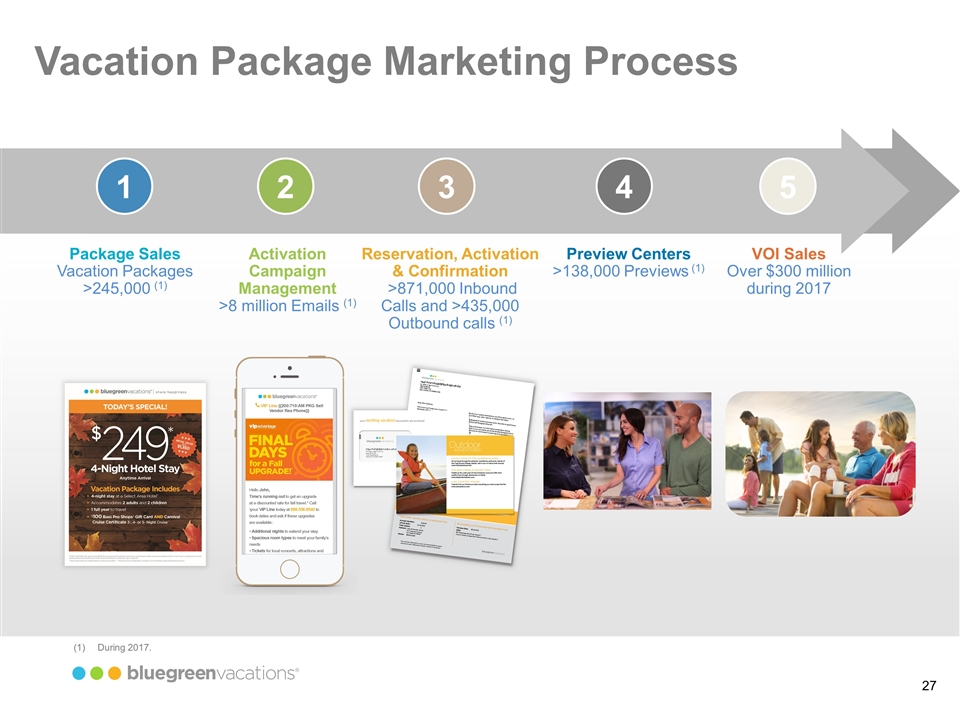

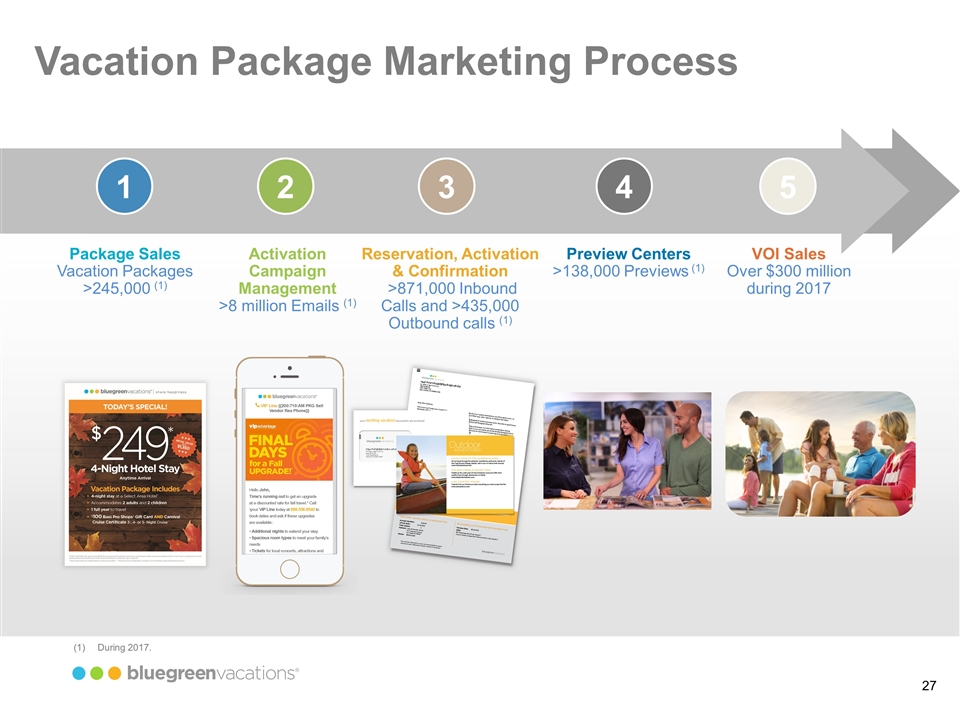

Vacation Package Marketing Process 1 Package Sales Vacation Packages >245,000 (1) 2 3 4 5 Activation Campaign Management >8 million Emails (1) Reservation, Activation & Confirmation >871,000 Inbound Calls and >435,000 Outbound calls (1) Preview Centers >138,000 Previews (1) VOI Sales Over $300 million during 2017 During 2017. 27

Vacation Packages & Leads Tanger Outlets | Premium Outlets | Simon Malls Tours Sales In-House Tours Owners 231,000+ Vacation Packages Sold Annually (1) 243,000+ Annual Tours (New Customer & Existing Owners) (1) $628 Million System-Wide VOI Sales (1) 215,000 Vacation Club Owners (2) Marketing Mix by % of Sales (1) New Customer Sales Existing Owner Sales Other New Customer 29% LTM period ended 6/3018. As of 6/30/18. Sales & Marketing Driven Business 28

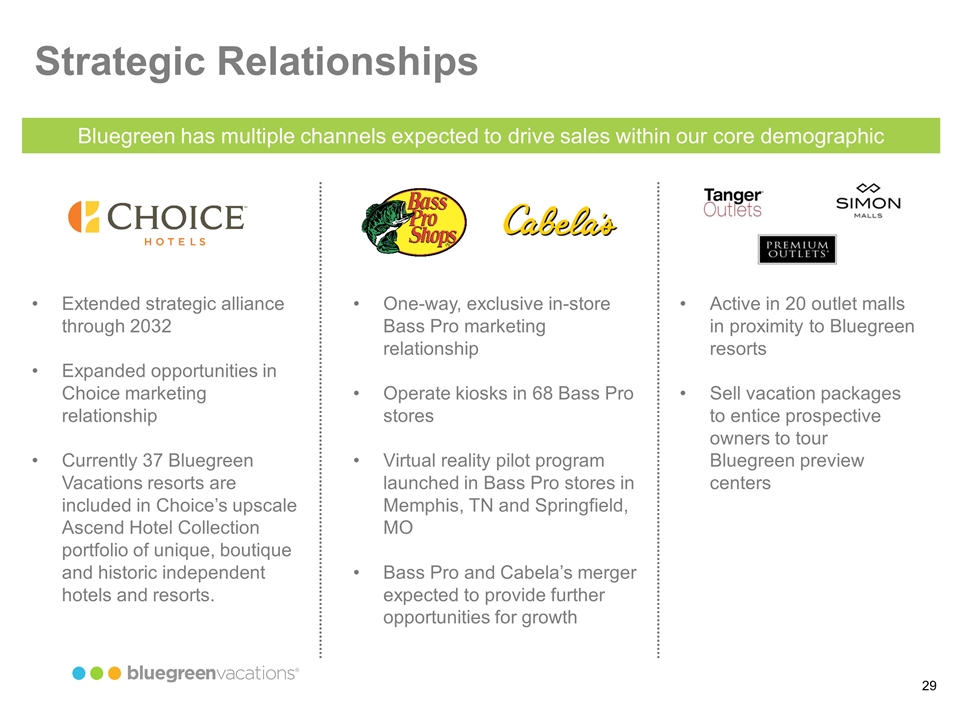

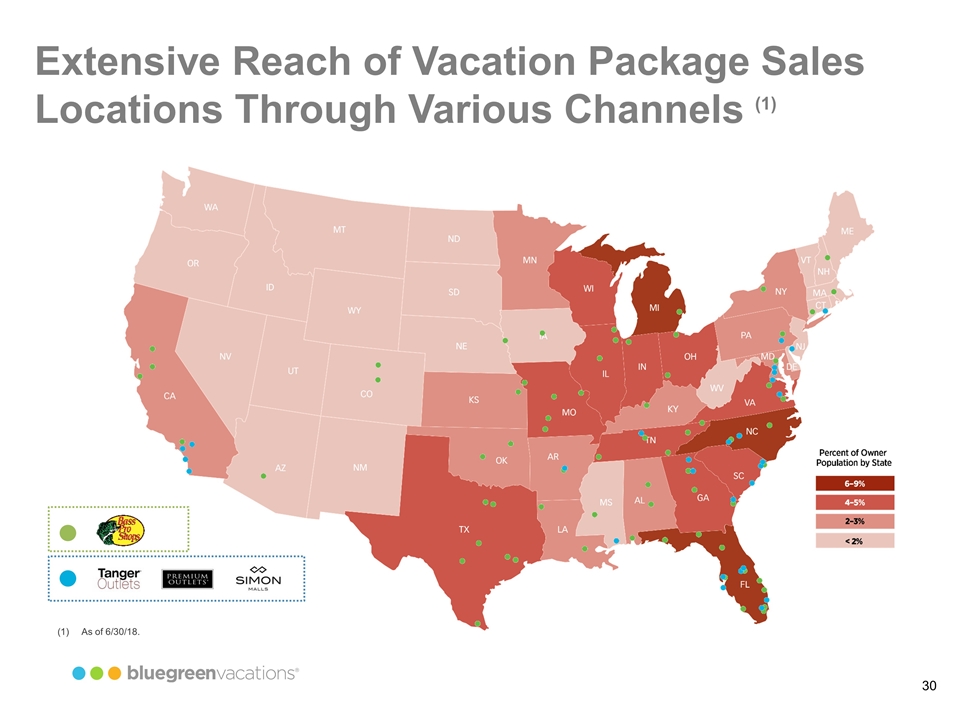

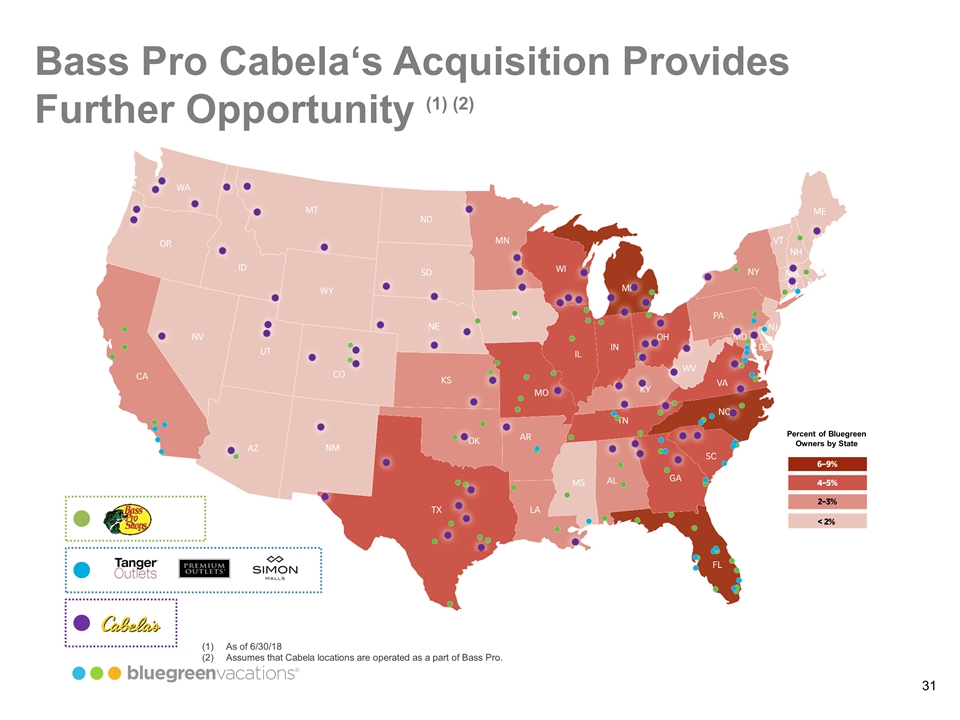

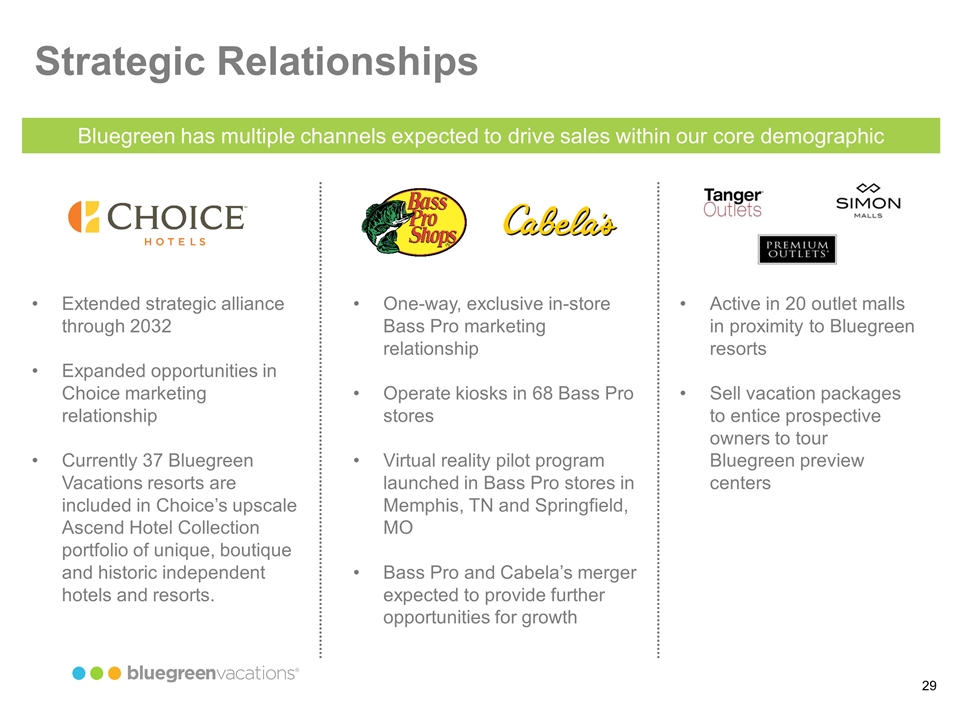

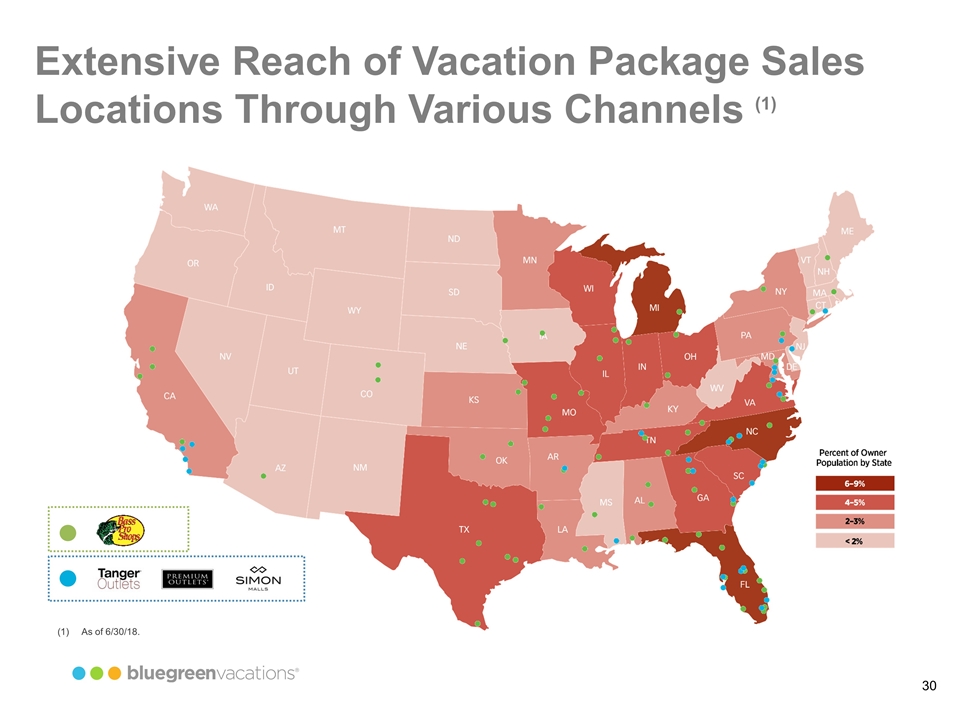

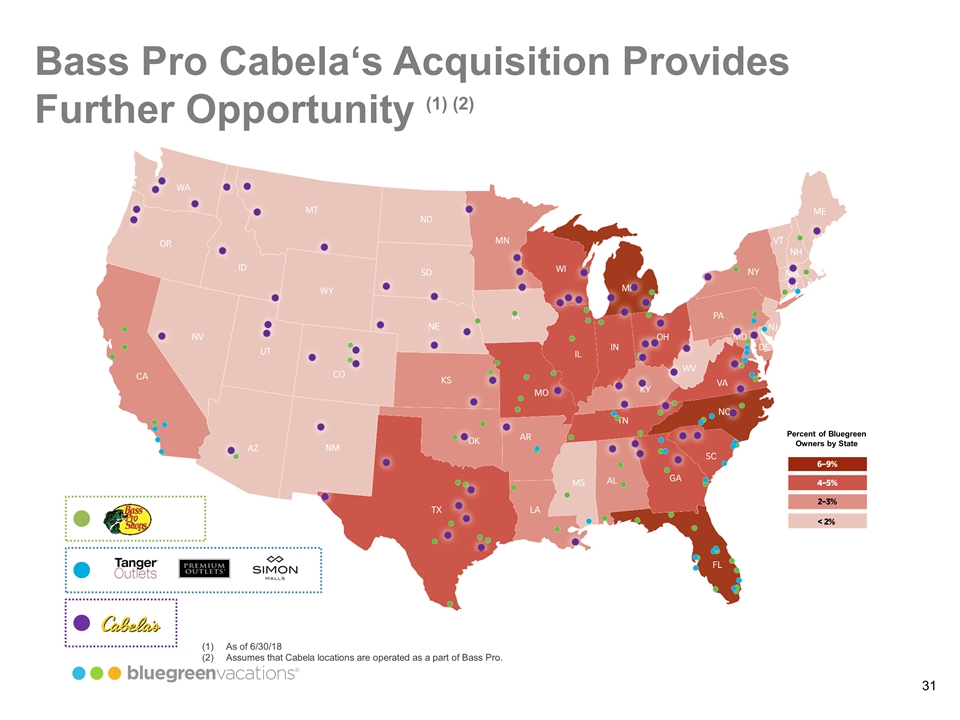

Bluegreen has multiple channels expected to drive sales within our core demographic One-way, exclusive in-store Bass Pro marketing relationship Operate kiosks in 68 Bass Pro stores Virtual reality pilot program launched in Bass Pro stores in Memphis, TN and Springfield, MO Bass Pro and Cabela’s merger expected to provide further opportunities for growth Extended strategic alliance through 2032 Expanded opportunities in Choice marketing relationship Currently 37 Bluegreen Vacations resorts are included in Choice’s upscale Ascend Hotel Collection portfolio of unique, boutique and historic independent hotels and resorts. Active in 20 outlet malls in proximity to Bluegreen resorts Sell vacation packages to entice prospective owners to tour Bluegreen preview centers Strategic Relationships 29

As of 6/30/18. Extensive Reach of Vacation Package Sales Locations Through Various Channels (1) 30

As of 6/30/18 Assumes that Cabela locations are operated as a part of Bass Pro. Percent of Bluegreen Owners by State Bass Pro Cabela‘s Acquisition Provides Further Opportunity (1) (2) 31

Choice Hotels Bluegreen Vacations is the official vacation ownership provider of Choice Hotels Exclusive relationship since 2013, renewed in 2017 for 15+ years World’s second largest hotel company (1) Industry’s fastest growing loyalty program with 35 million members (2) Only hotel company on 2017 Forbes list of 100 top innovative companies “Soft-branded” 37 Bluegreen resorts into Choice’s Ascend Hotel Collection Close demographic match with Bluegreen Choice Privileges Membership (2) #1 Hotel Program #2 Hotel Program In terms of units. Choice Hotels company filings 32

Three Strategic Verticals HOSPITALITY REAL ESTATE MIDDLE MARKET Subsidiaries: BBX Sweet Holdings IT’SUGAR Hoffman’s Chocolates Las Olas Brands Renin MOD Pizza Exclusive Florida MOD Pizza Franchisee Bluegreen Vacations: NYSE: BXG 90% ownership interest 69 Resorts 215,000+ Vacation Club Owners 1 3 2 Acquisition, Ownership, and Management of: Legacy Assets Developments Joint Ventures (1) Data as of 6/30/18 (1) (1) 33

BBX Capital Middle Market Operations Acquisition, investment and management of middle market operating businesses. 2 : 34

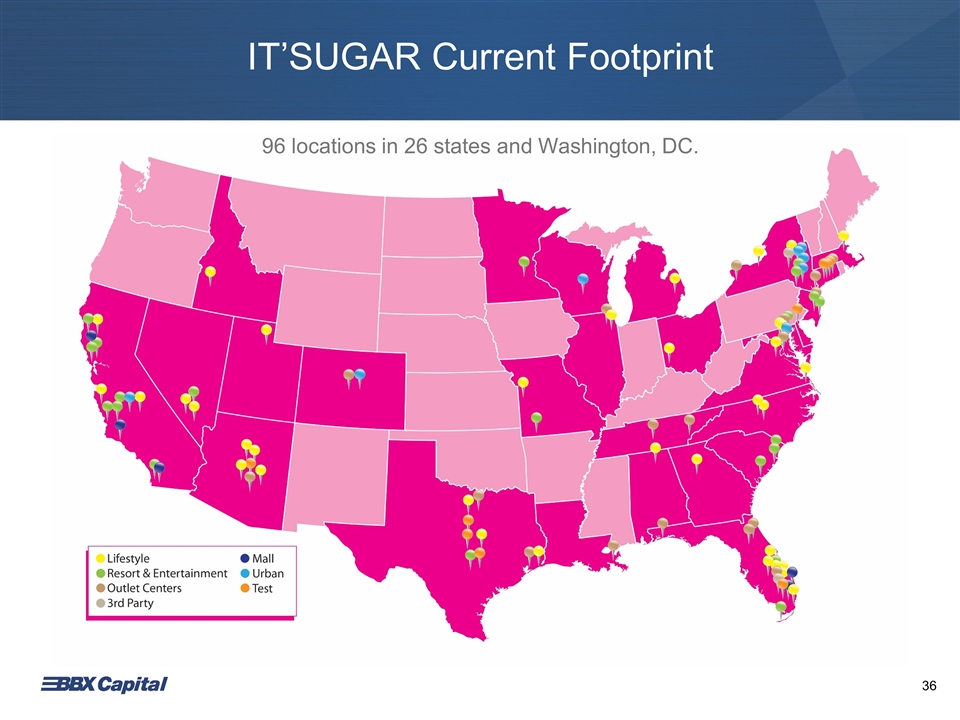

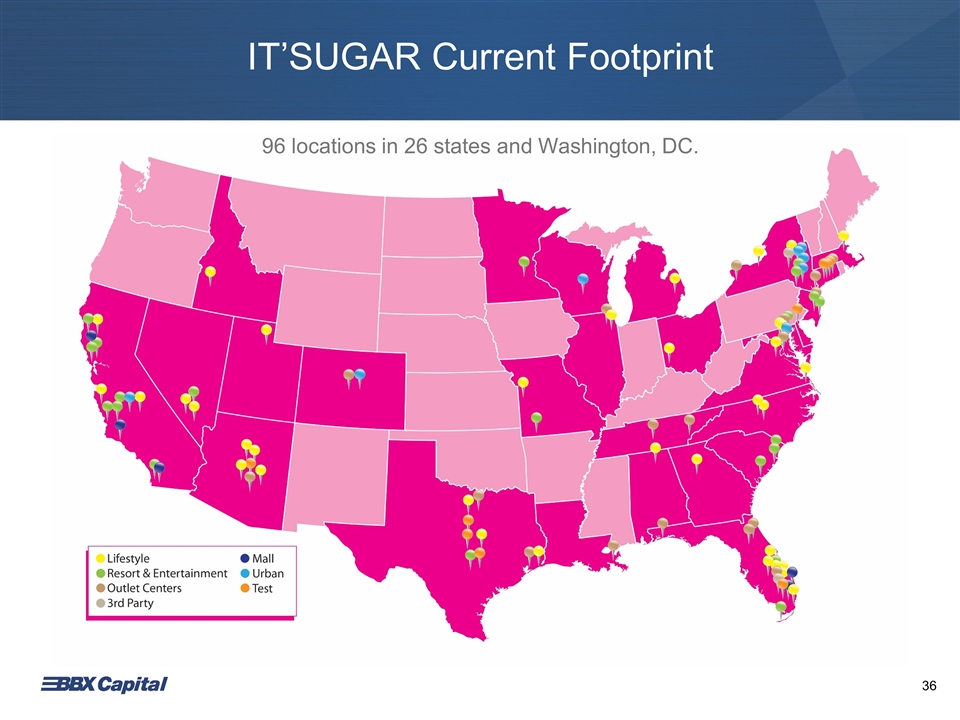

BBX Capital Middle Market Operations Headquartered in Deerfield Beach, Florida, IT’SUGAR, LLC (“IT’SUGAR”) is the largest specialty candy retailer in the United States with 96 locations in 26 states and Washington, DC. BBX Sweet Holdings acquired IT’SUGAR in June 2017 for a purchase price of approximately $58.4 million, net of cash acquired. 35

IT’SUGAR Current Footprint 96 locations in 26 states and Washington, DC. 36

IT’SUGAR New Stores Opened 37

BBX Sweet Holdings Operates in a Fragmented $34B* Industry Specialty Candy Brands Source: IRI segmentation data, 52 weeks ending 12/31/17. 38

Chocolatier Class in Greenacres Students from Catholic University Habitat for Humanity visit Las Olas store Easter in Delray 39

Anastasia Coconut Cashew Crunch 2017 SOFI - Product of the Year 2017 NCA’s Sweets & Snacks Expo Most Innovative New Product 2017 Gold SOFI - Best Sweet Snack Award-Winning Products Droga Money on Honey 2018 Gold SOFI - Best Chocolate NEW Toasted Coconut Almond 2016 Gold SOFI - Best Chocolate French Sea Salt 40

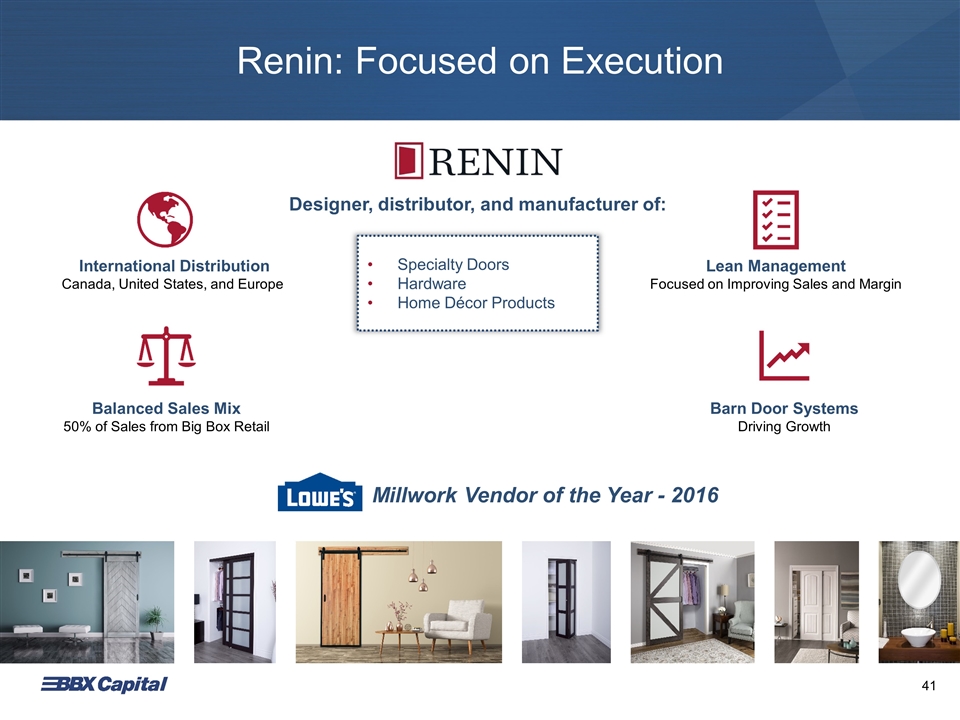

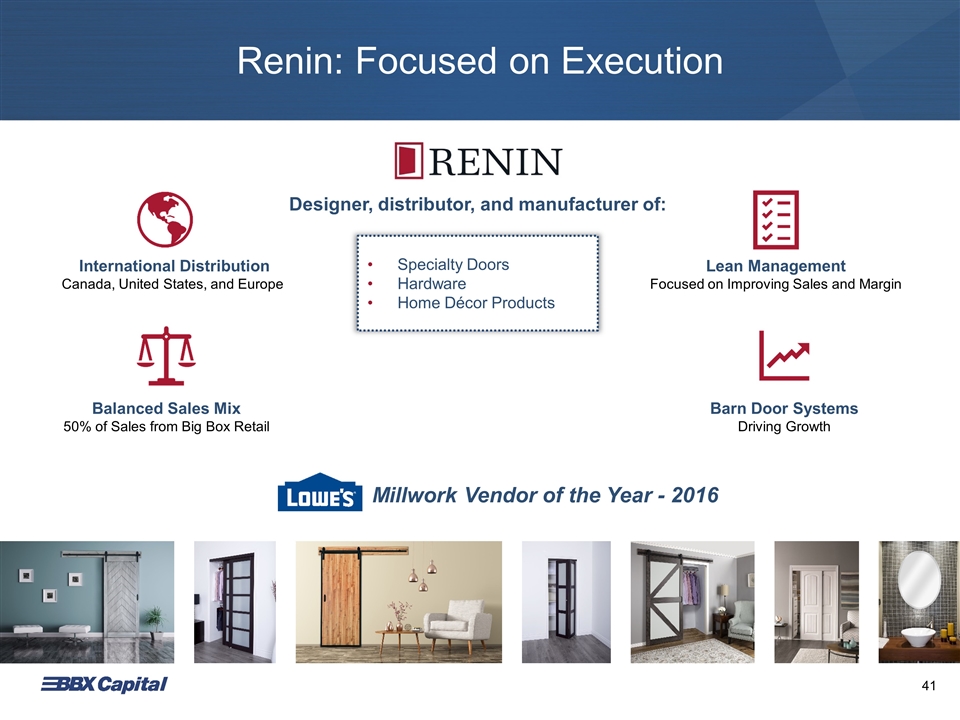

Renin: Focused on Execution Specialty Doors Hardware Home Décor Products International Distribution Canada, United States, and Europe Barn Door Systems Driving Growth Balanced Sales Mix 50% of Sales from Big Box Retail Lean Management Focused on Improving Sales and Margin Designer, distributor, and manufacturer of: Millwork Vendor of the Year - 2016 41

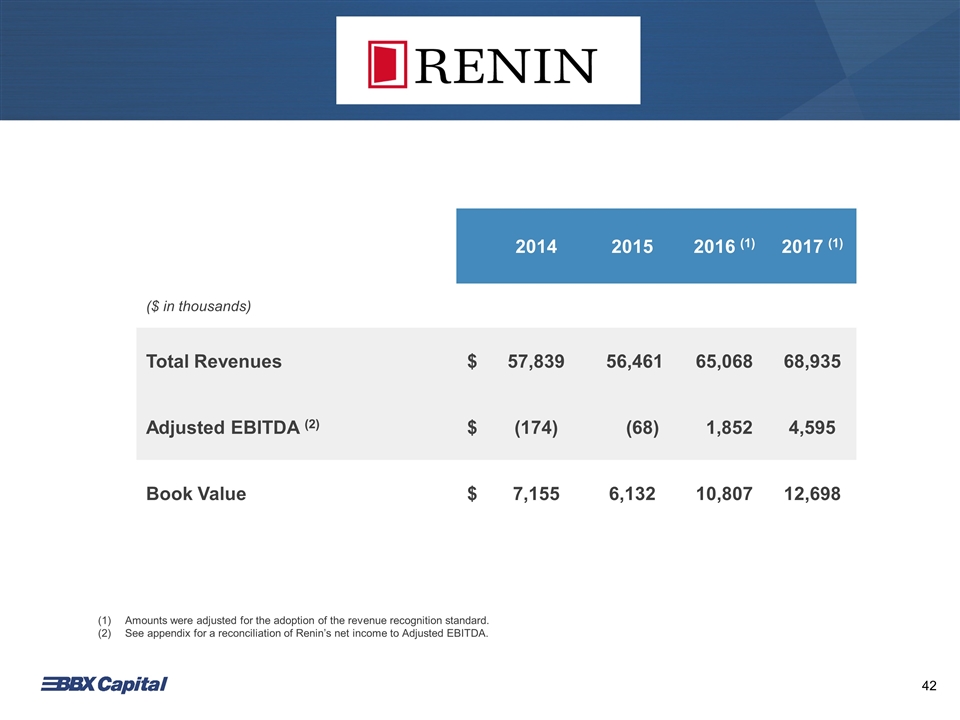

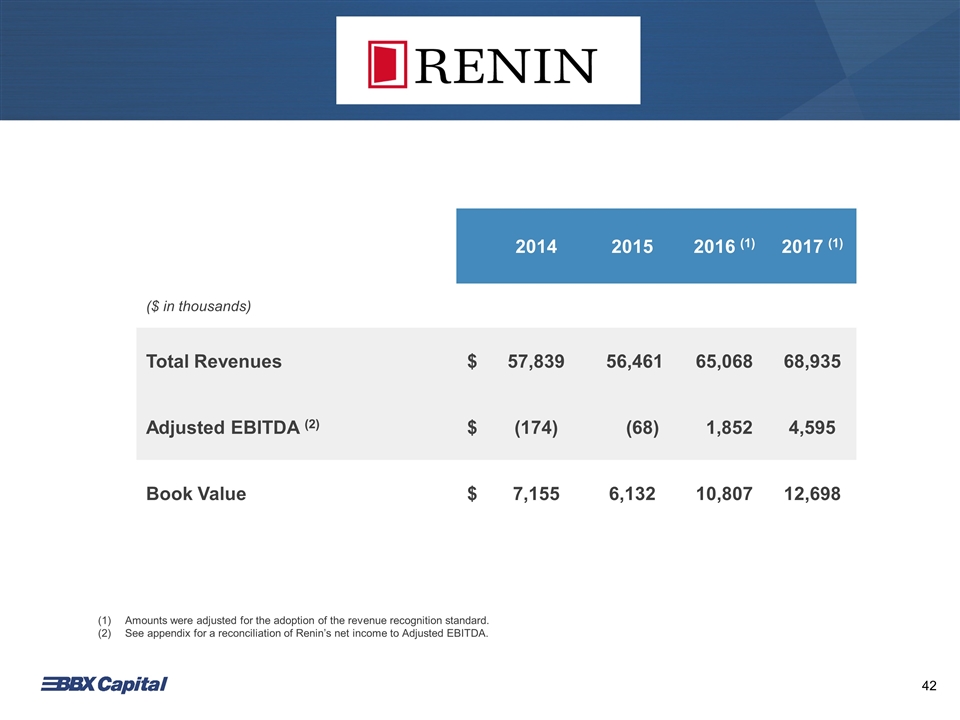

2014 2015 2016 (1) 2017 (1) ($ in thousands) Total Revenues $ 57,839 56,461 65,068 68,935 Adjusted EBITDA (2) $ (174) (68) 1,852 4,595 Book Value $ 7,155 6,132 10,807 12,698 Amounts were adjusted for the adoption of the revenue recognition standard. See appendix for a reconciliation of Renin’s net income to Adjusted EBITDA. 42

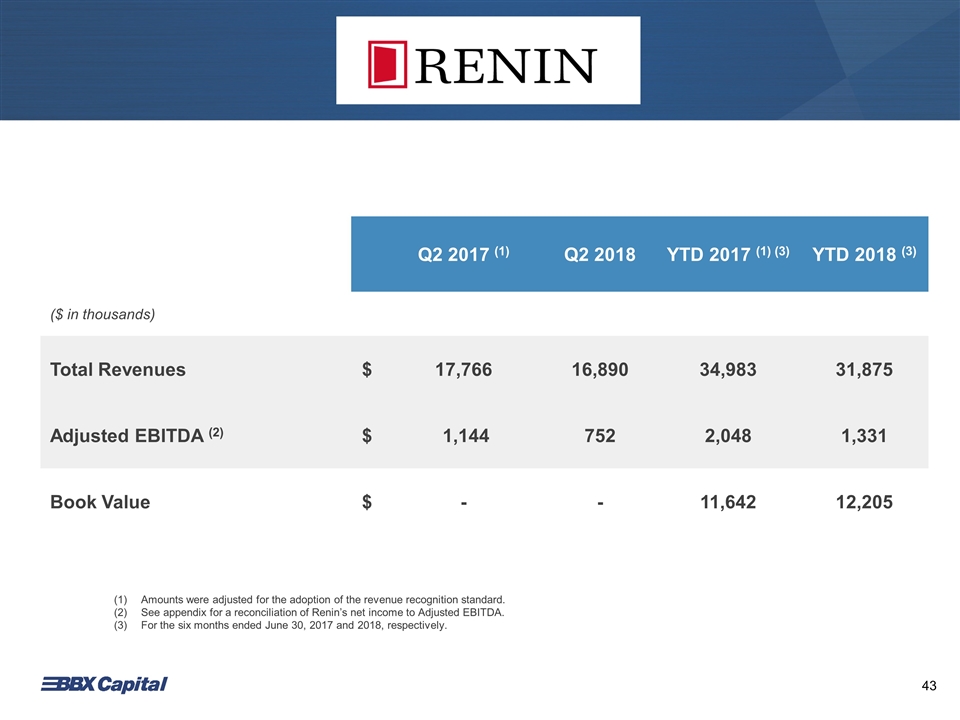

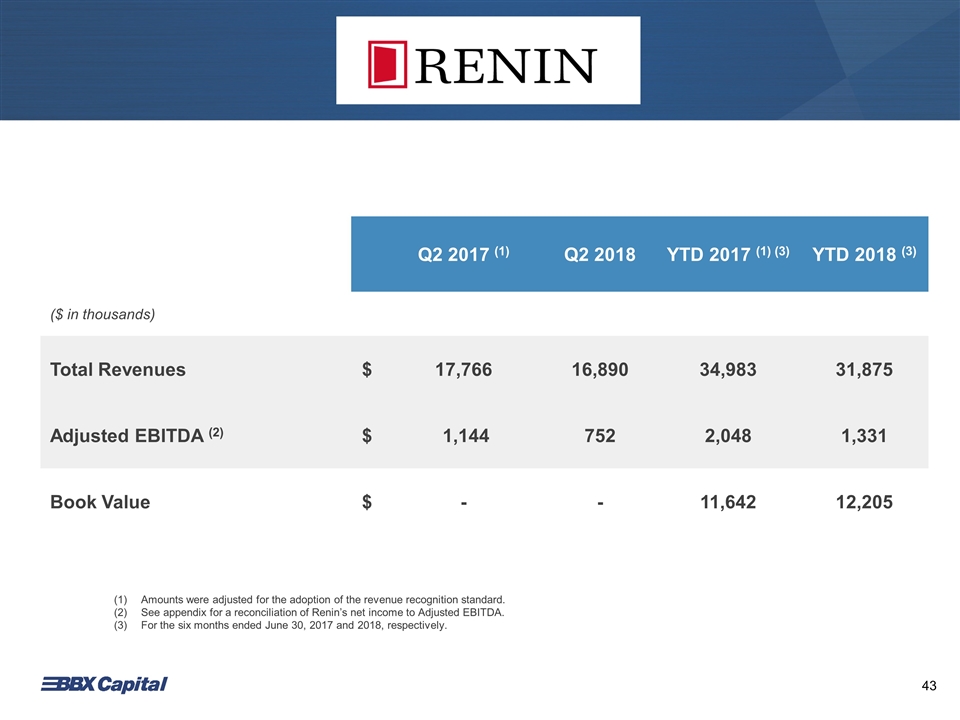

Amounts were adjusted for the adoption of the revenue recognition standard. See appendix for a reconciliation of Renin’s net income to Adjusted EBITDA. For the six months ended June 30, 2017 and 2018, respectively. Q2 2017 (1) Q2 2018 YTD 2017 (1) (3) YTD 2018 (3) ($ in thousands) Total Revenues $ 17,766 16,890 34,983 31,875 Adjusted EBITDA (2) $ 1,144 752 2,048 1,331 Book Value $ - - 11,642 12,205 43

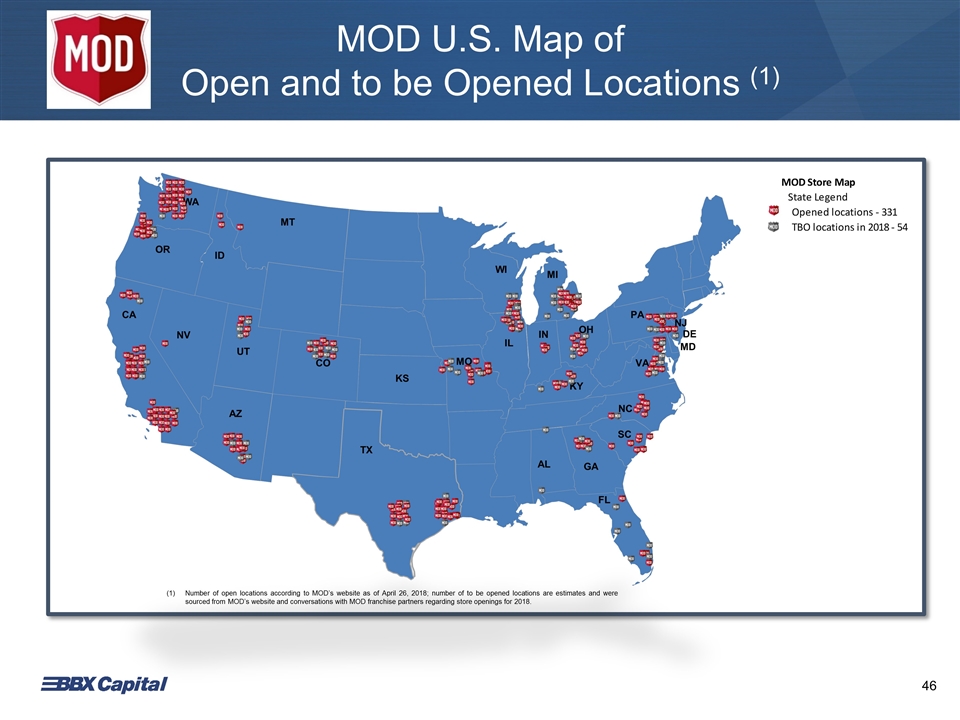

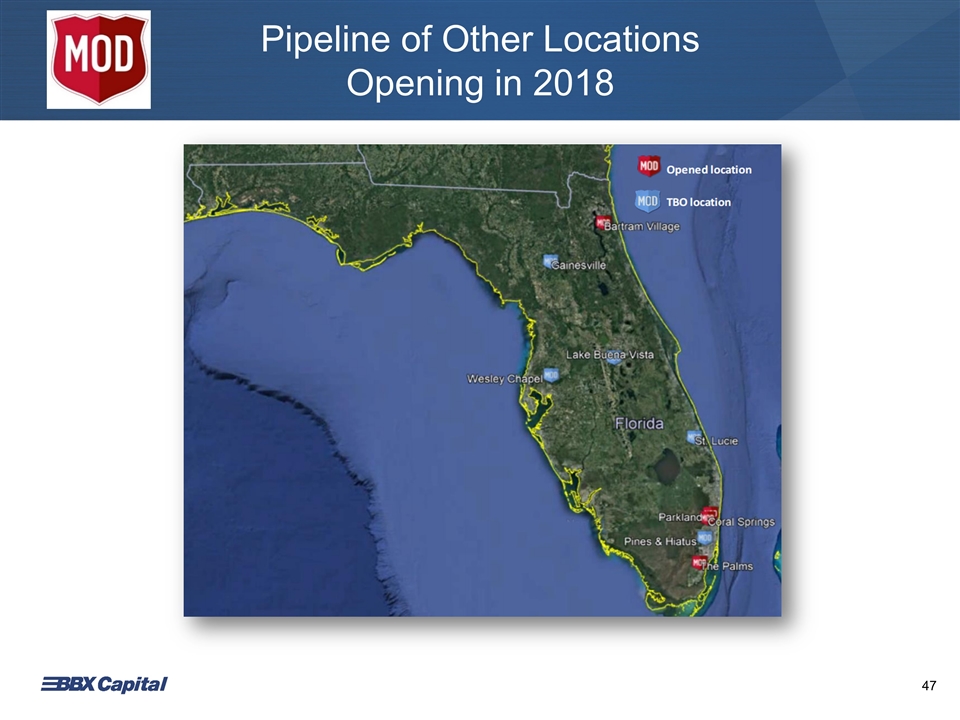

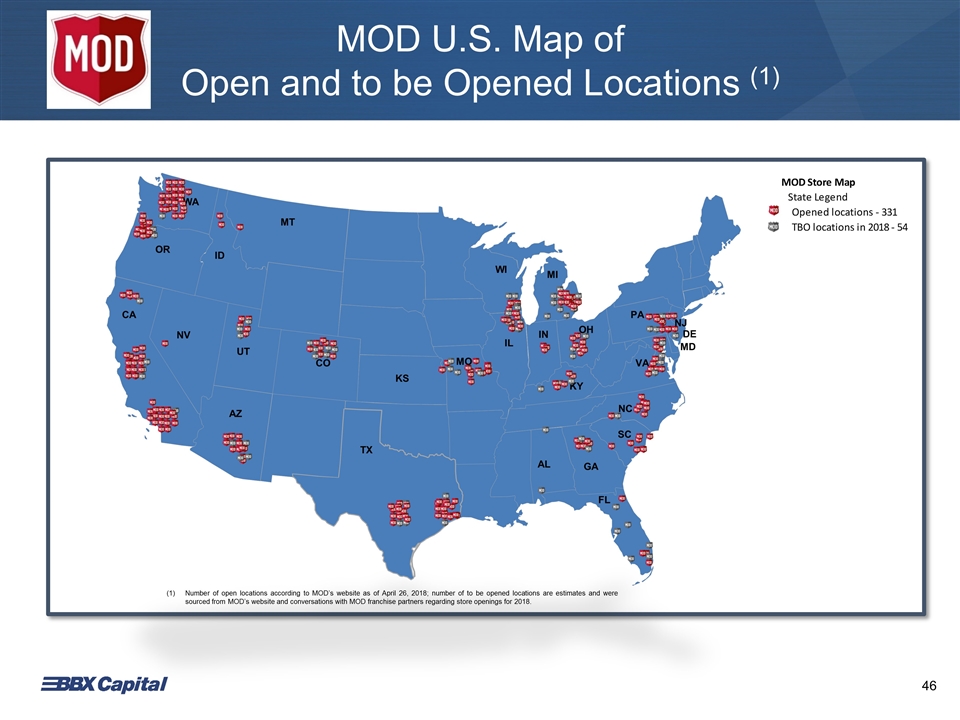

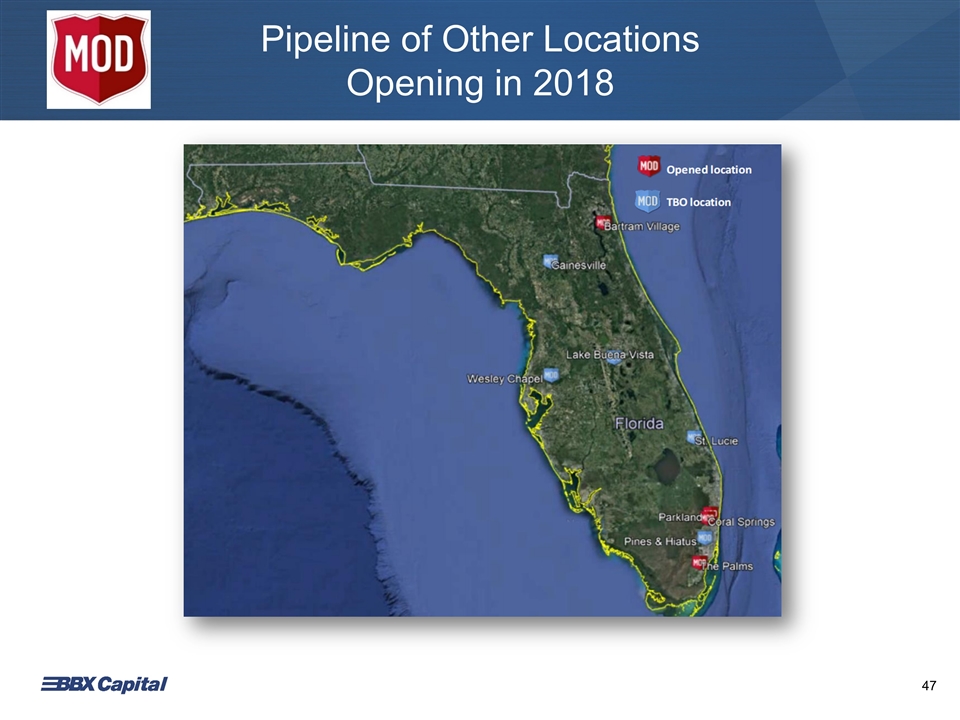

MOD Pizza: Pipeline for Future Growth BBX is the exclusive franchisee in Florida Goal of developing 60+ locations over the next 6 years Target markets include: Miami Fort Lauderdale West Palm Beach Jacksonville Orlando Tampa Poised to deliver growth in markets that capitalize on BBX’s expertise In 2016, MOD Pizza was named America’s fastest growing chain restaurant by Technomic Franchisor is headquartered in Seattle, WA Currently over 330 locations in 26 states and the UK FAST CASUAL PIZZA 44

$1M in sales! 4 stores opened! MOD Pizza 45

Number of open locations according to MOD’s website as of April 26, 2018; number of to be opened locations are estimates and were sourced from MOD’s website and conversations with MOD franchise partners regarding store openings for 2018. AZ CA CO ID IL KY MD MI MO NC NJ OH OR PA SC TX VA WA WI FL DE GA AL IN KS MT NV UT MOD U.S. Map of Open and to be Opened Locations (1) 46

Pipeline of Other Locations Opening in 2018 47

Three Strategic Verticals HOSPITALITY REAL ESTATE MIDDLE MARKET Subsidiaries: BBX Sweet Holdings IT’SUGAR Hoffman’s Chocolates Las Olas Brands Renin MOD Pizza Exclusive Florida MOD Pizza Franchisee Bluegreen Vacations: NYSE: BXG 90% ownership interest 69 Resorts 215,000+ Vacation Club Owners 1 3 2 Acquisition, Ownership, and Management of: Legacy Assets Developments Joint Ventures (1) Data as of 6/30/18 (1) (1) 48

BBX Capital Real Estate Acquisition, ownership and management of joint ventures and investments in real estate and real estate development projects. 3 : 49

BBX Capital Real Estate The following are case studies of legacy and non-legacy asset developments. These represent investments and joint ventures in real estate development projects. See appendix for additional details. 50

Bonterra – CC Homes | Hialeah, Florida Approximately 50 acres 394 single-family homes Homes were sold at an average price of $395K Initial Investment date – Q3 2015 Investment Completed – Q4 2017 Joint Venture with CC Homes, a Codina-Carr Company Bonterra – Master Planned Development Altis at Bonterra | Hialeah, Florida Approximately 14 acres Developed 314 rental apartment units Stabilized and 96% occupied Average rents of $1,965 or $1.86/SF Initial Investment date – Q4 2015 Joint Venture with Altman Companies 51

Gardens on Millenia – Master Planned Development Orlando, Florida Approximately 86.5 acres Re-entitled the property and completed master development work (including filling in the lake) Developed 292 Apartments developed and stabilized through a joint venture with ContraVest 143,078 SF Retail built and sold through a joint venture with Stiles Corporation Two outparcels developed. One was sold. Executed a ground lease on the other one. Approximately 15 acres of the land was developed and sold to Costco. Costco built a ~152,000 sf store and a gas station Gardens on Millenia – Master Planned Development 52

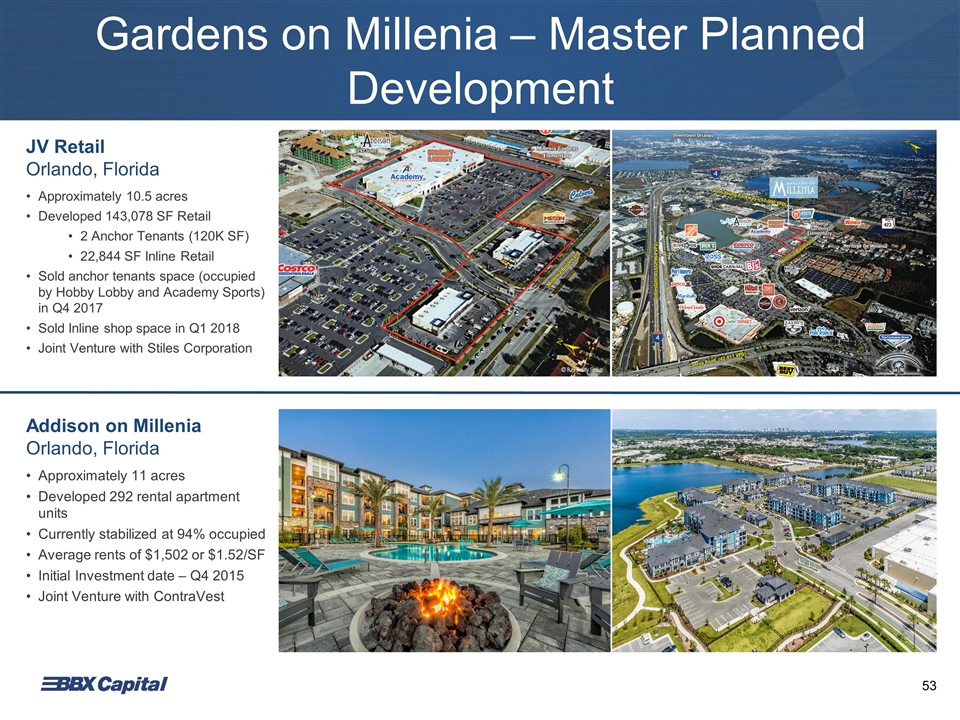

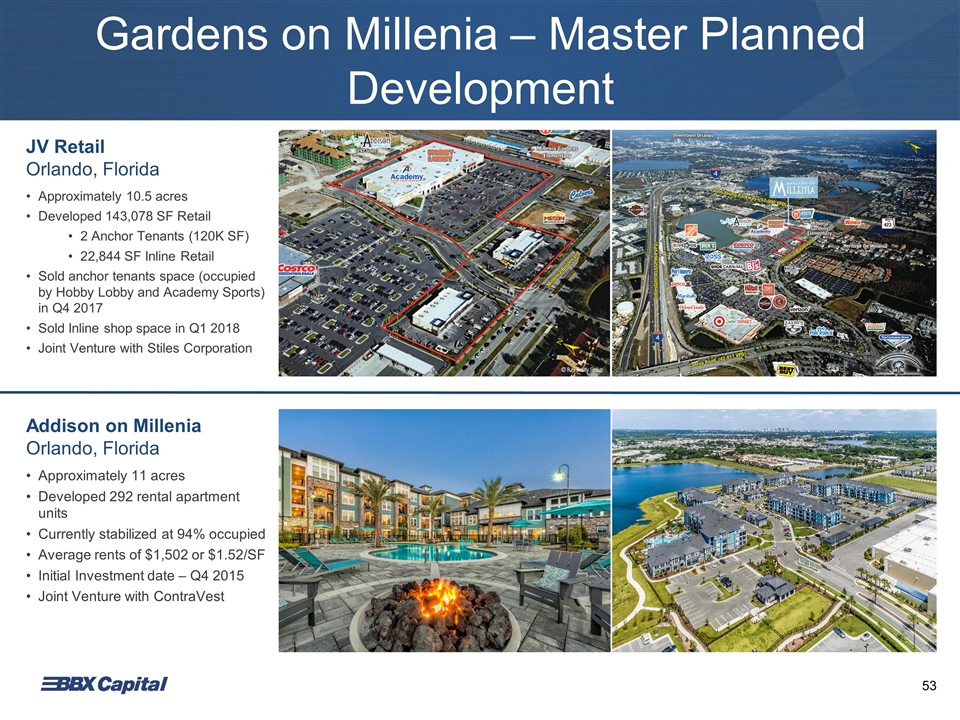

Gardens on Millenia – Master Planned Development JV Retail Orlando, Florida Approximately 10.5 acres Developed 143,078 SF Retail 2 Anchor Tenants (120K SF) 22,844 SF Inline Retail Sold anchor tenants space (occupied by Hobby Lobby and Academy Sports) in Q4 2017 Sold Inline shop space in Q1 2018 Joint Venture with Stiles Corporation Addison on Millenia Orlando, Florida Approximately 11 acres Developed 292 rental apartment units Currently stabilized at 94% occupied Average rents of $1,502 or $1.52/SF Initial Investment date – Q4 2015 Joint Venture with ContraVest 53

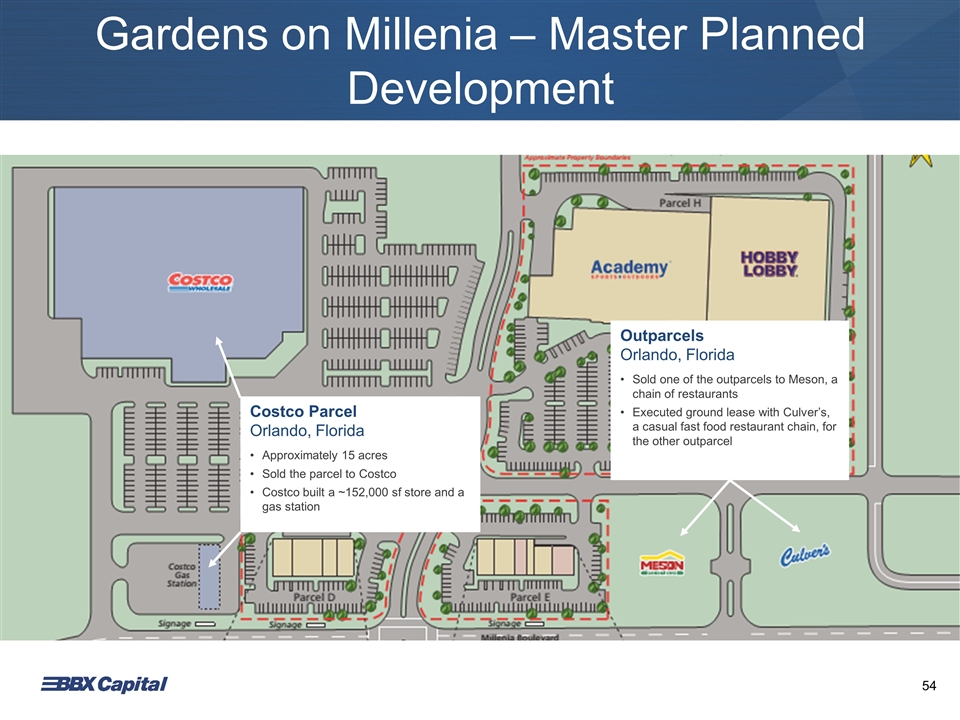

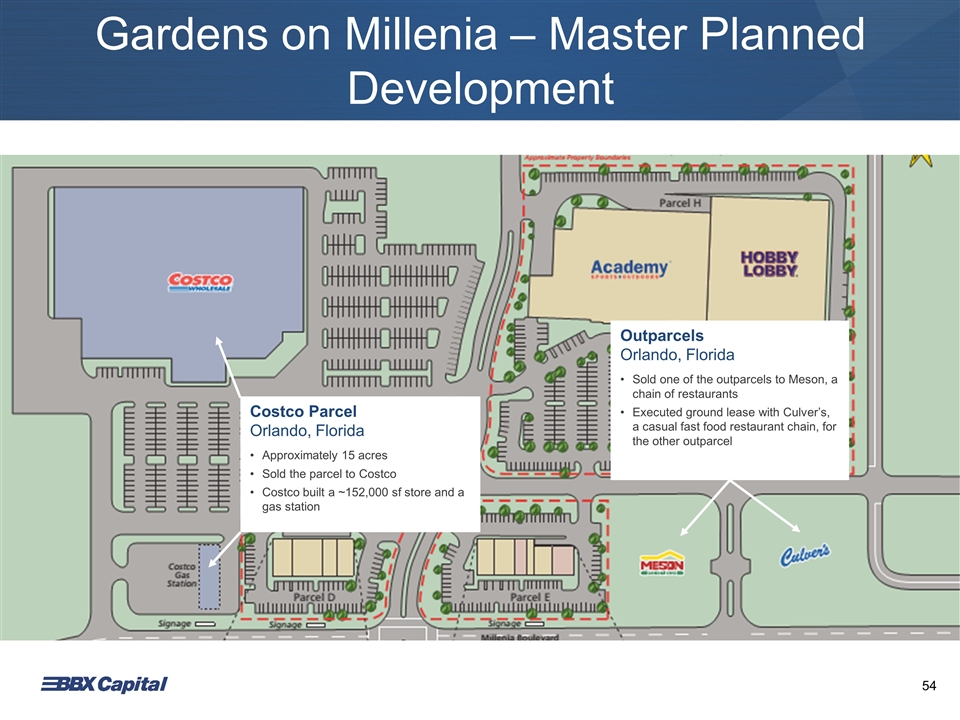

Gardens on Millenia – Master Planned Development Outparcels Orlando, Florida Sold one of the outparcels to Meson, a chain of restaurants Executed ground lease with Culver’s, a casual fast food restaurant chain, for the other outparcel Costco Parcel Orlando, Florida Approximately 15 acres Sold the parcel to Costco Costco built a ~152,000 sf store and a gas station 54

Villa San Michelle Villa San Michelle | Tallahassee, Florida Approximately 10.5 acres Adjacent to 10.6 acre vacant land that was previously approved for 586 beds (177 units) Existing 272 Beds (82 units student housing property) Located Less Than 1.5 Miles From TCC and Less Than 3 Miles from FSU and FAMU The asset was inherited as a part of REO portfolio BBX executed light rehab strategy and repositioned the asset Villa San Michelle was sold in Q1 2018 55

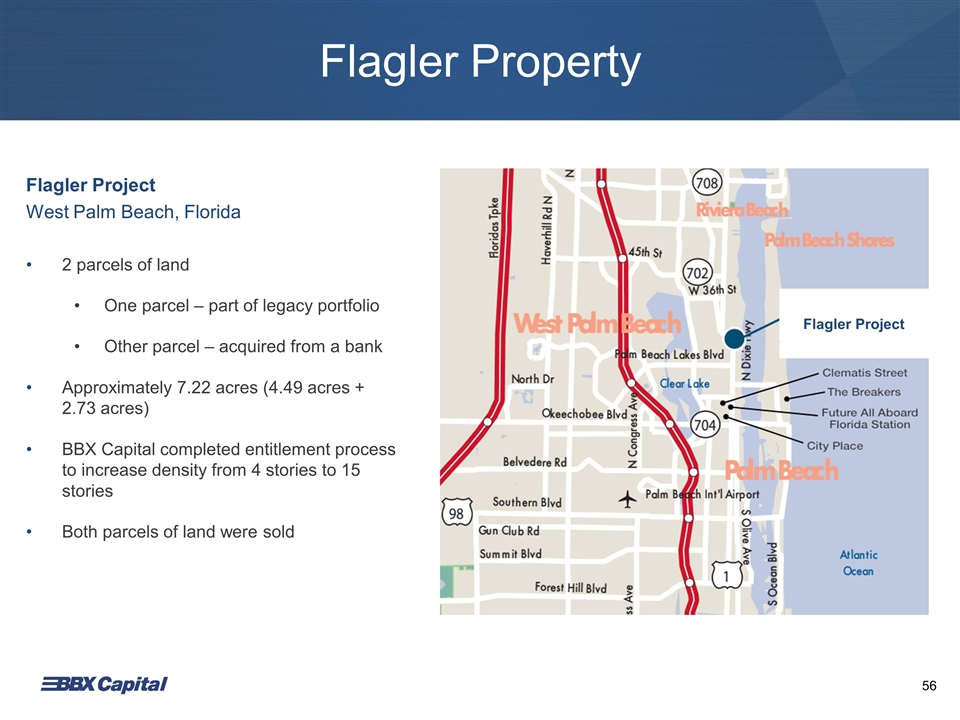

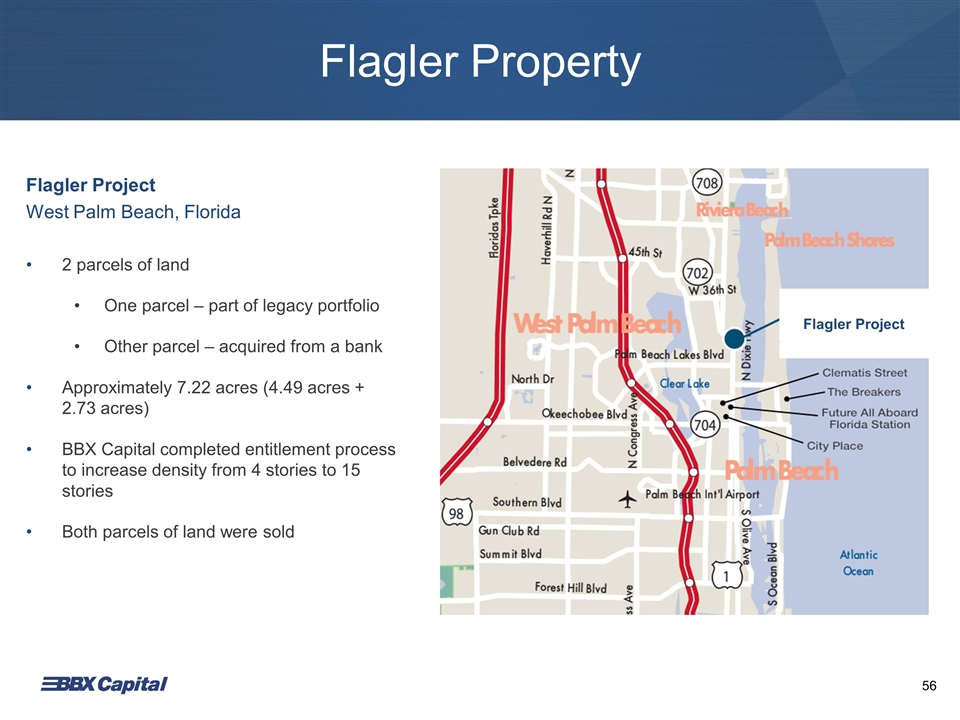

Flagler Property Flagler Project West Palm Beach, Florida 2 parcels of land One parcel – part of legacy portfolio Other parcel – acquired from a bank Approximately 7.22 acres (4.49 acres + 2.73 acres) BBX Capital completed entitlement process to increase density from 4 stories to 15 stories Both parcels of land were sold Flagler Project 56

Beacon Lake – Master Planned Development Beacon Lake – Master Planned Development Jacksonville, Florida Approximately 632 acres Master Planned 1,476 Lots 1,280 single family lots 196 townhome lots Development is staged in phases Achieved commitments to purchase lots from two homebuilders: Dream Finders Homes and Mattamy Homes Phase I 57

Beacon Lake – Master Planned Development Beacon Lake – Phase I Jacksonville, Florida 302 Lots 151 Lot commitment with Dream Finders Homes 151 Lot commitment with Mattamy Homes Land development for Phase I is substantially complete Entry feature is substantially complete Construction of amenity center is underway 122 Lots were taken down to date 112 Homes sold by homebuilders to date Grand Opening had excellent attendance – approximately 650 people Models are now open 58

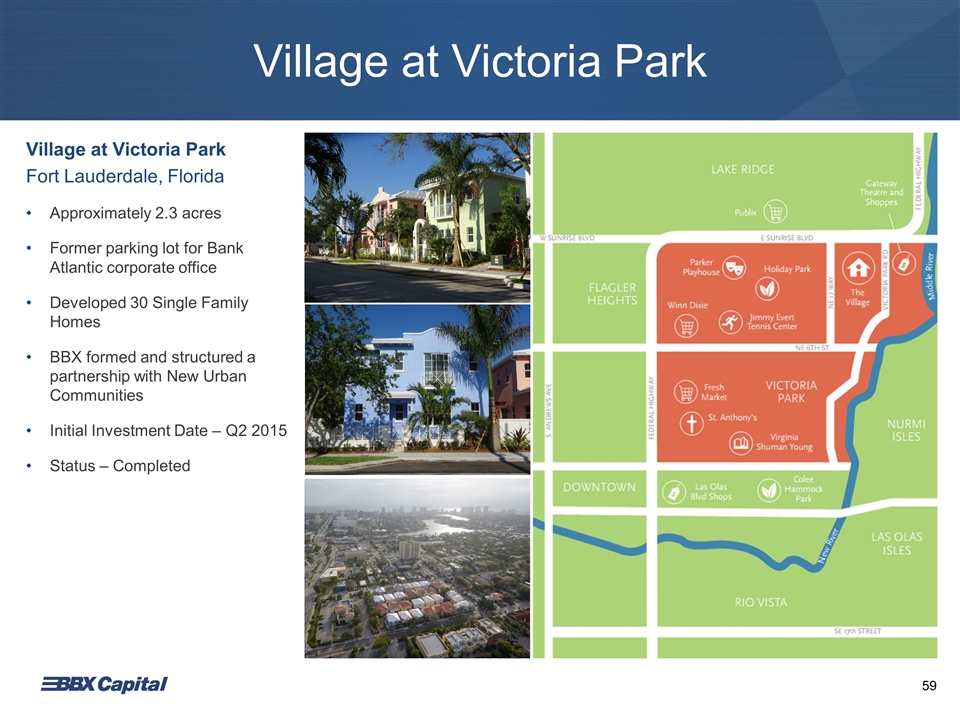

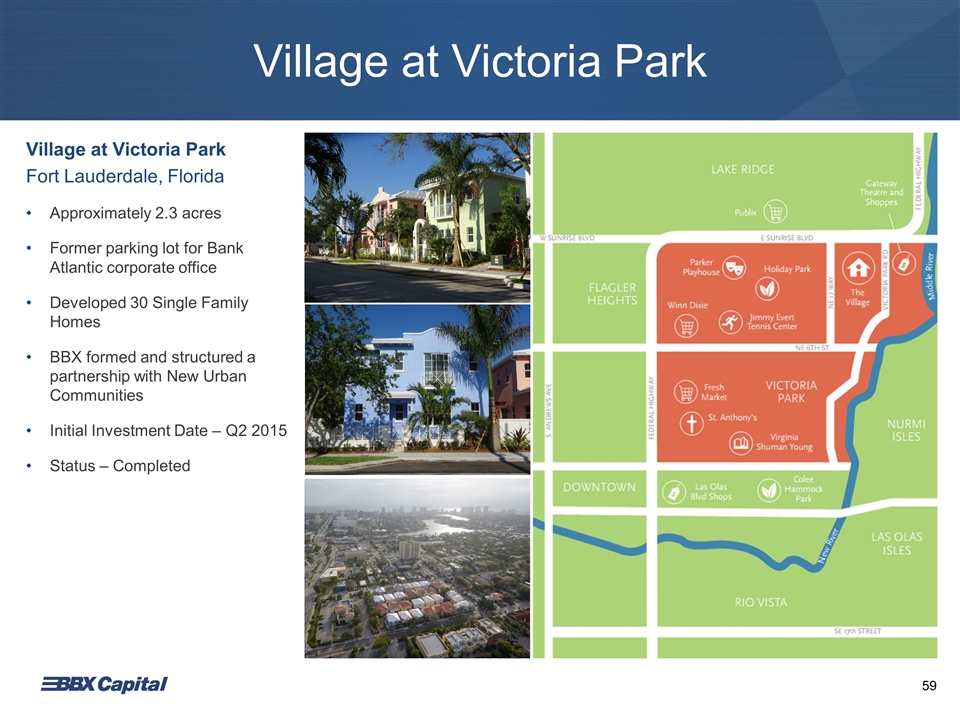

Village at Victoria Park Village at Victoria Park Fort Lauderdale, Florida Approximately 2.3 acres Former parking lot for Bank Atlantic corporate office Developed 30 Single Family Homes BBX formed and structured a partnership with New Urban Communities Initial Investment Date – Q2 2015 Status – Completed 59

Bayview Property - Redevelopment Bayview Master Development Fort Lauderdale, Florida Approximately 3 acres The existing building consists of 84.5 SF of office and retail space and is 57% occupied Current development plans include 284 rental apartment units and 159 hotel rooms BBX formed and structured a joint venture with Procacci Development Corporation 60

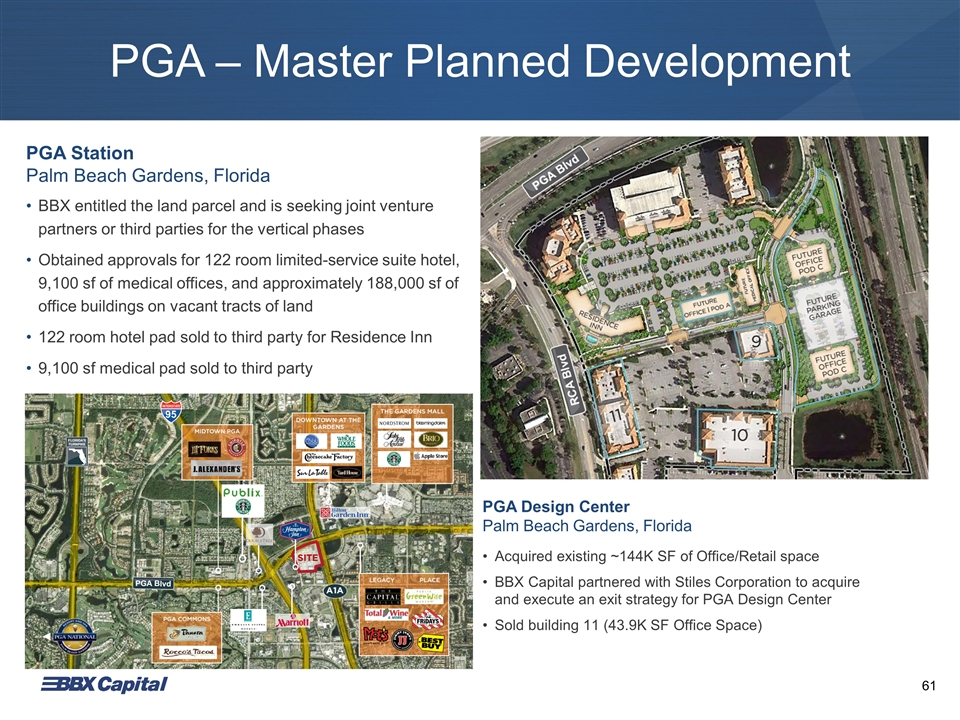

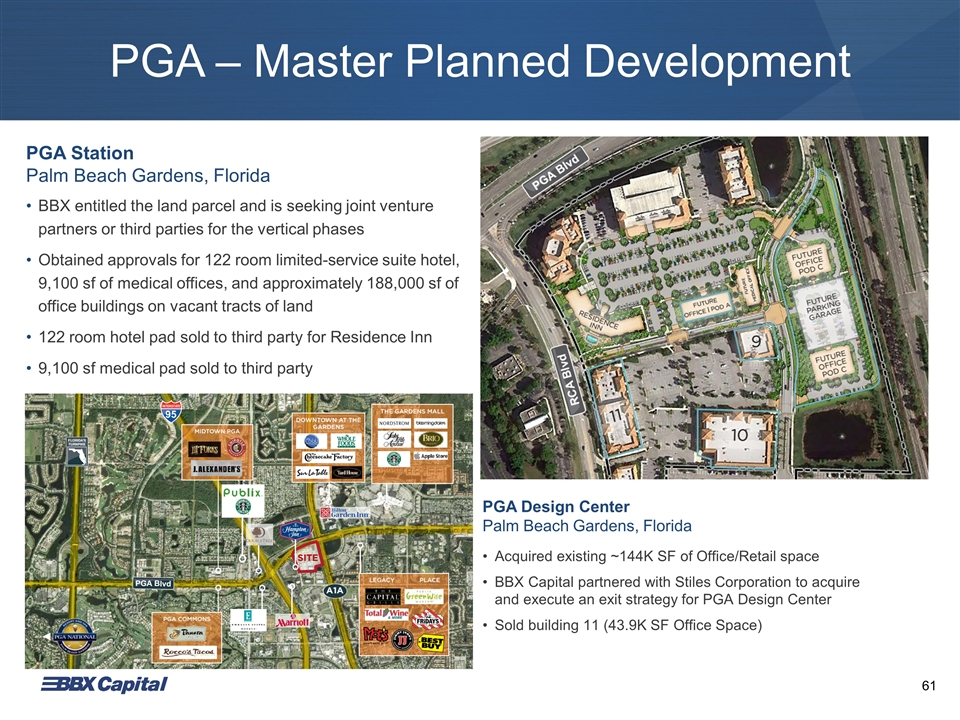

PGA – Master Planned Development PGA Station Palm Beach Gardens, Florida BBX entitled the land parcel and is seeking joint venture partners or third parties for the vertical phases Obtained approvals for 122 room limited-service suite hotel, 9,100 sf of medical offices, and approximately 188,000 sf of office buildings on vacant tracts of land 122 room hotel pad sold to third party for Residence Inn 9,100 sf medical pad sold to third party PGA Design Center Palm Beach Gardens, Florida Acquired existing ~144K SF of Office/Retail space BBX Capital partnered with Stiles Corporation to acquire and execute an exit strategy for PGA Design Center Sold building 11 (43.9K SF Office Space) 61

Chapel Grove – New Development Chapel Grove Pembroke Pines, Florida Approximately 2 acres Developed 125 Luxury Townhomes Prices range from mid $300K to low $400K BBX formed and structured a partnership with Label & Co Land work is substantially completed Vertical construction is currently underway 57 townhomes contracted to date Initial Investment date – Q4 2017 62

Altis at Grand Central Altis at Grand Central Tampa, Florida Developing 314 Rental Apartments Initial Investment Date – Q4 2017 Status – Under Construction Partner – Altman Companies 63

Other Active Projects Altis at Shingle Creek Kissimmee, Florida Developed 356 Rental Apartments Initial Investment Date – Q2 2016 Status – Completed, Lease-up Partner – Altman Companies Altis at Promenade Lutz, Florida Developing 338 Rental Apartments Initial Investment Date – Q4 2017 Status – Under Development Partner – Altman Companies Altis at Lakeline Austin, Texas Developed 354 Rental Apartments Initial Investment Date – Q4 2014 Status – Completed/Stabilized Partner – Altman Companies Altis at Kendall Square Kendall, Florida Developed 321 Rental Apartments Initial Investment Date – Q1 2013 Status – Completed/Sold Partner – Altman Companies Centra Falls (Phases I and II) Pembroke Pines, Florida Developed150 Townhomes Initial Investment Date – Q3 2015 Status – Substantially Completed & Sold Partner – Label & Co CC Homes Miramar Miramar, Florida Developing 193 Single Family Homes Initial Investment Date – Q2 2015 Status – Predevelopment Partner – Codina-Carr Company 64

Three Strategic Verticals HOSPITALITY REAL ESTATE MIDDLE MARKET Acquisition, Ownership, and Management of: Legacy Assets Developments Joint Ventures Subsidiaries: BBX Sweet Holdings IT’SUGAR Hoffman’s Chocolates Las Olas Brands Renin MOD Pizza Exclusive Florida MOD Pizza Franchisee 1 3 2 (1) Data as of 6/30/18 (1) (1) Bluegreen Vacations: NYSE: BXG 90% ownership interest 69 Resorts 215,000+ Vacation Club Owners 65

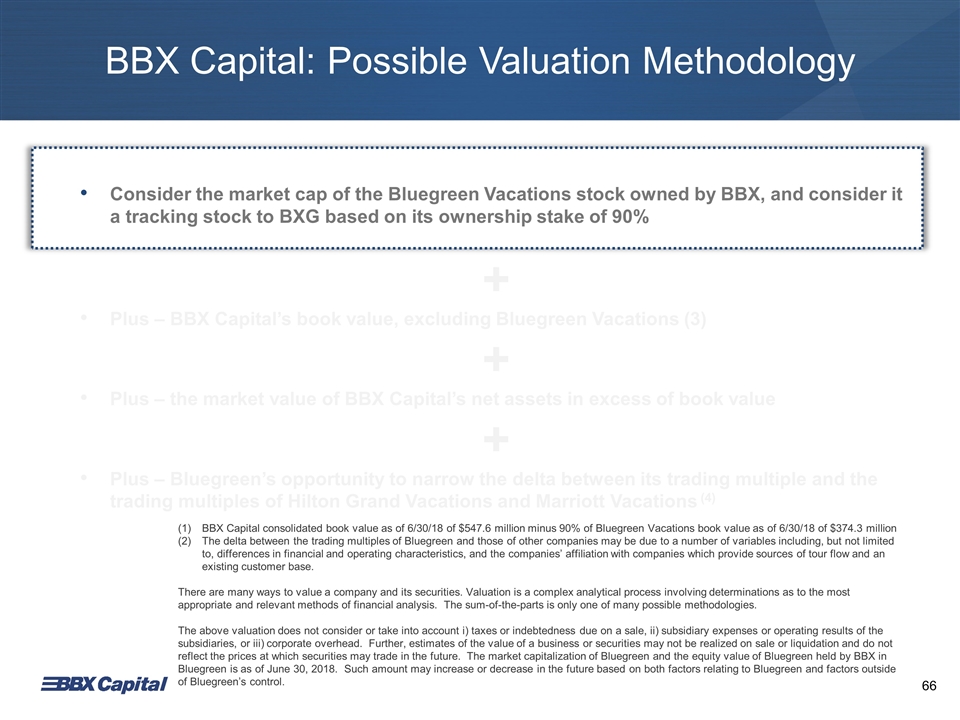

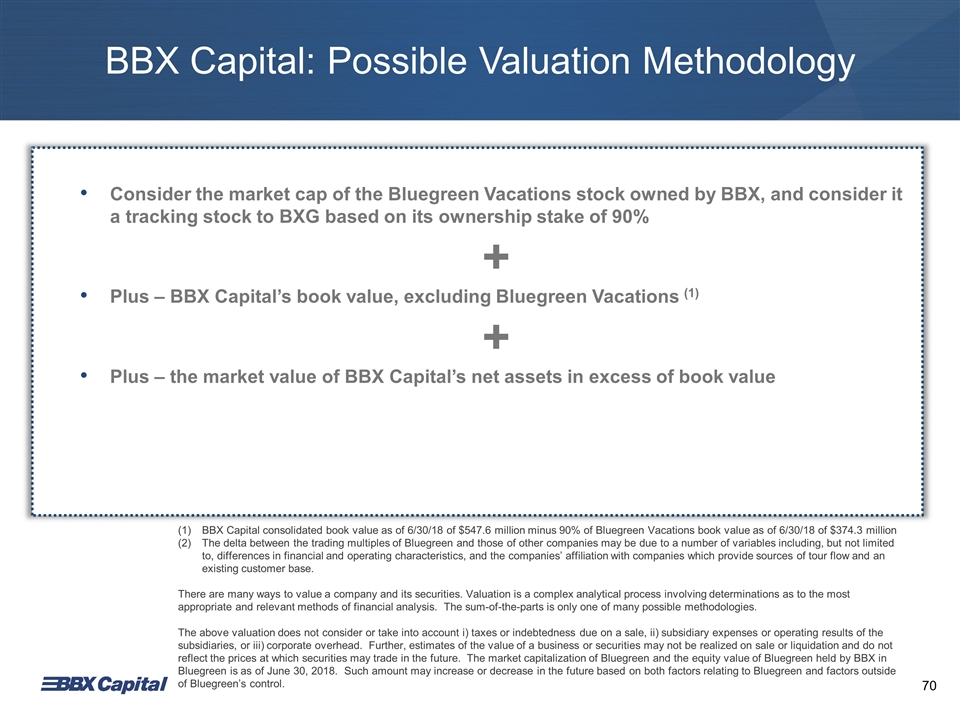

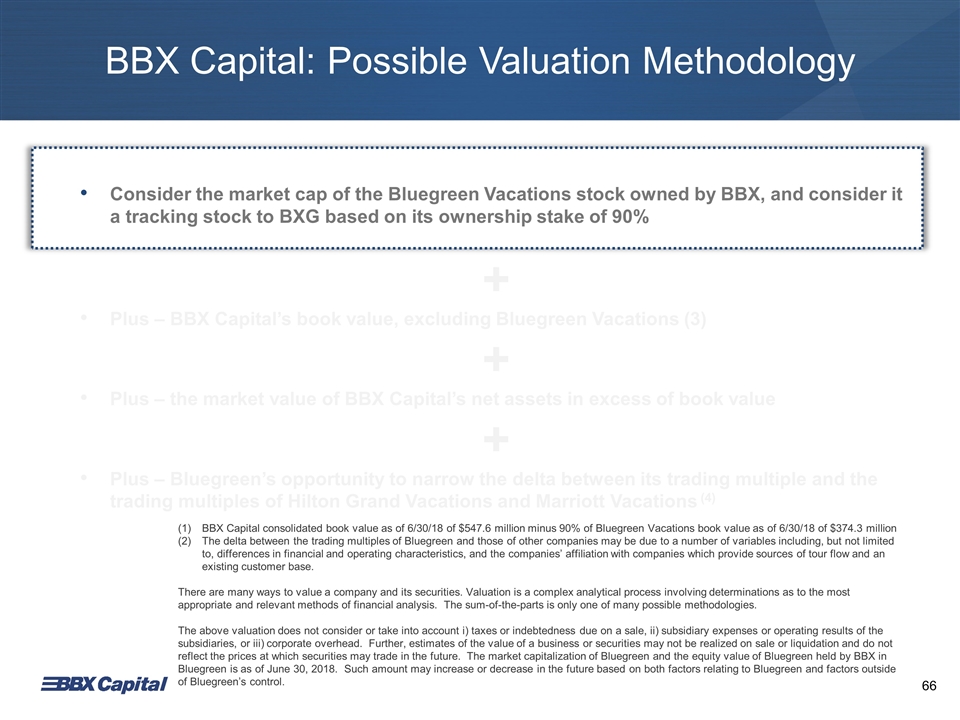

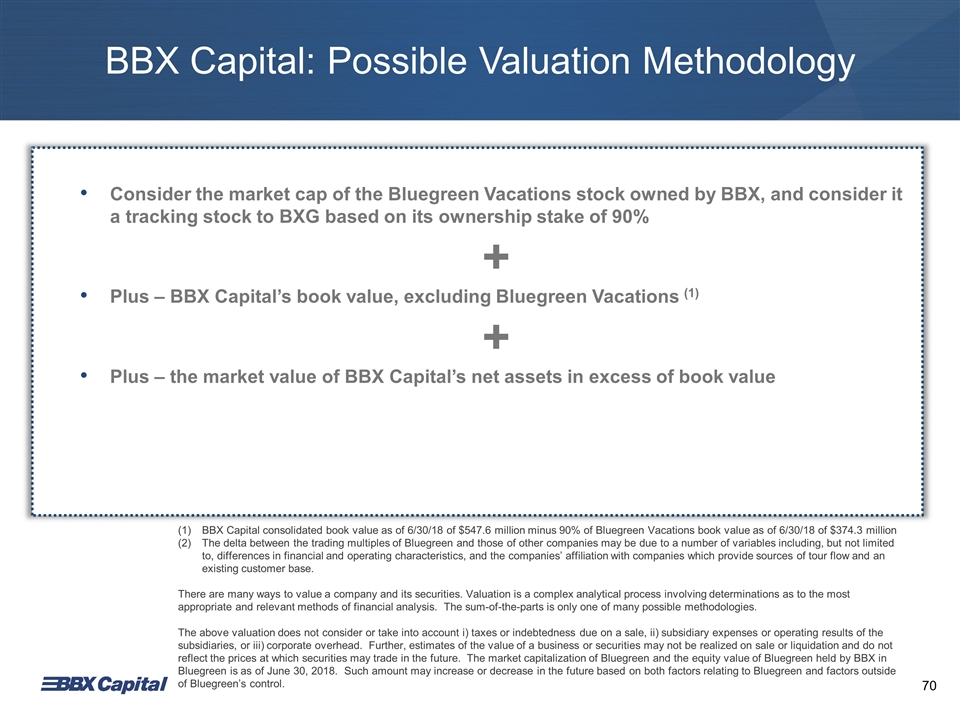

BBX Capital consolidated book value as of 6/30/18 of $547.6 million minus 90% of Bluegreen Vacations book value as of 6/30/18 of $374.3 million The delta between the trading multiples of Bluegreen and those of other companies may be due to a number of variables including, but not limited to, differences in financial and operating characteristics, and the companies’ affiliation with companies which provide sources of tour flow and an existing customer base. There are many ways to value a company and its securities. Valuation is a complex analytical process involving determinations as to the most appropriate and relevant methods of financial analysis. The sum-of-the-parts is only one of many possible methodologies. The above valuation does not consider or take into account i) taxes or indebtedness due on a sale, ii) subsidiary expenses or operating results of the subsidiaries, or iii) corporate overhead. Further, estimates of the value of a business or securities may not be realized on sale or liquidation and do not reflect the prices at which securities may trade in the future. The market capitalization of Bluegreen and the equity value of Bluegreen held by BBX in Bluegreen is as of June 30, 2018. Such amount may increase or decrease in the future based on both factors relating to Bluegreen and factors outside of Bluegreen’s control. BBX Capital: Possible Valuation Methodology Consider the market cap of the Bluegreen Vacations stock owned by BBX, and consider it a tracking stock to BXG based on its ownership stake of 90% + Plus – BBX Capital’s book value, excluding Bluegreen Vacations (3) + Plus – the market value of BBX Capital’s net assets in excess of book value + Plus – Bluegreen’s opportunity to narrow the delta between its trading multiple and the trading multiples of Hilton Grand Vacations and Marriott Vacations (4) 66

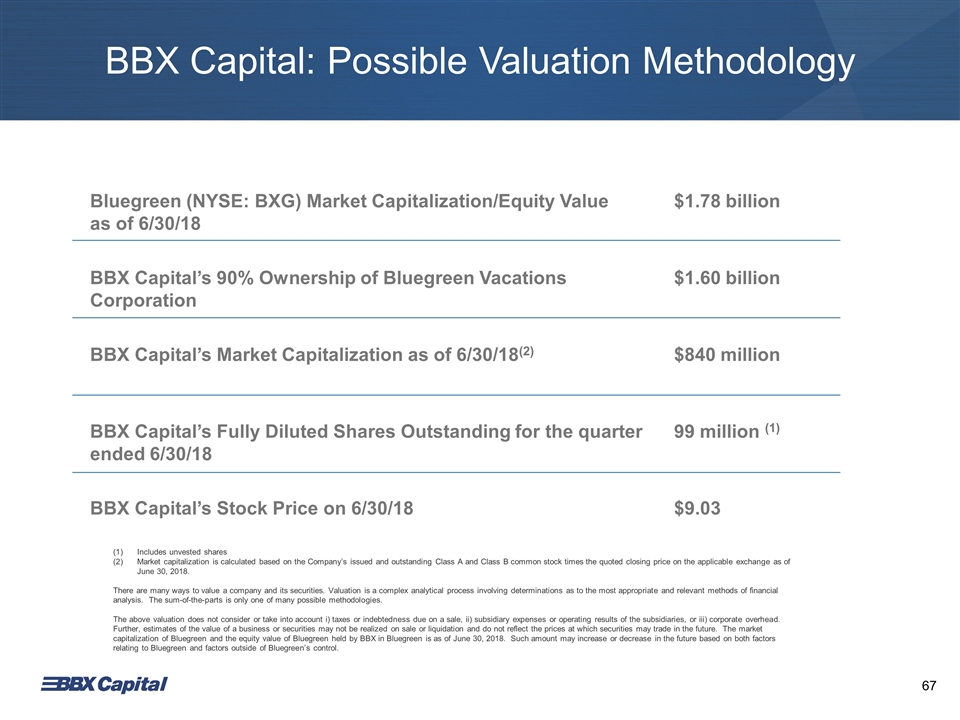

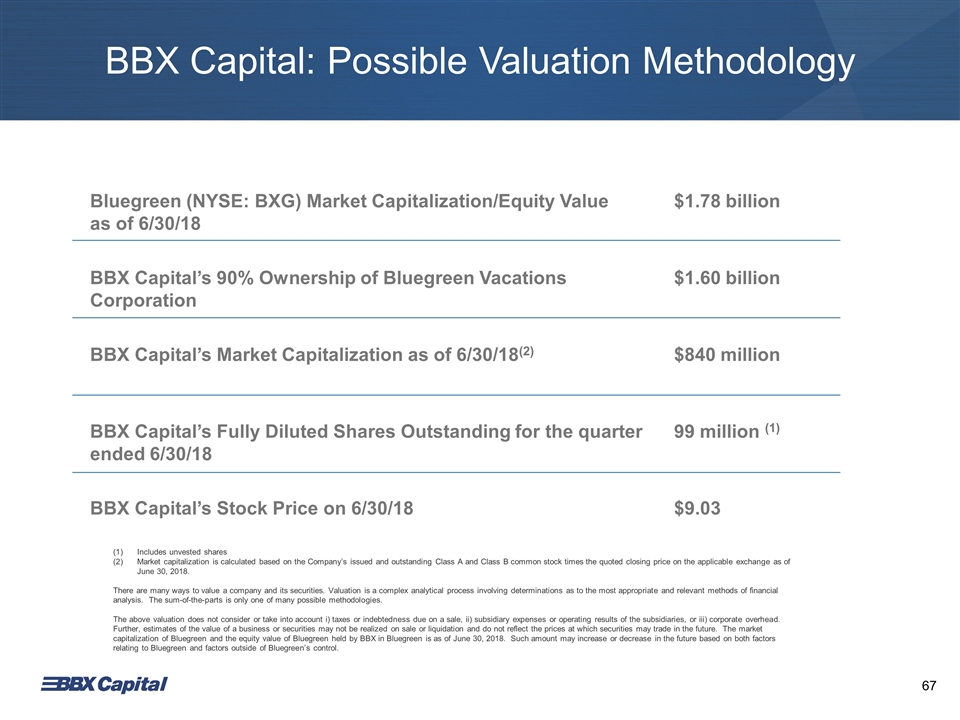

BBX Capital: Possible Valuation Methodology Bluegreen (NYSE: BXG) Market Capitalization/Equity Value as of 6/30/18 $1.78 billion BBX Capital’s 90% Ownership of Bluegreen Vacations Corporation $1.60 billion BBX Capital’s Market Capitalization as of 6/30/18(2) $840 million BBX Capital’s Fully Diluted Shares Outstanding for the quarter ended 6/30/18 99 million (1) BBX Capital’s Stock Price on 6/30/18 $9.03 Includes unvested shares Market capitalization is calculated based on the Company’s issued and outstanding Class A and Class B common stock times the quoted closing price on the applicable exchange as of June 30, 2018. There are many ways to value a company and its securities. Valuation is a complex analytical process involving determinations as to the most appropriate and relevant methods of financial analysis. The sum-of-the-parts is only one of many possible methodologies. The above valuation does not consider or take into account i) taxes or indebtedness due on a sale, ii) subsidiary expenses or operating results of the subsidiaries, or iii) corporate overhead. Further, estimates of the value of a business or securities may not be realized on sale or liquidation and do not reflect the prices at which securities may trade in the future. The market capitalization of Bluegreen and the equity value of Bluegreen held by BBX in Bluegreen is as of June 30, 2018. Such amount may increase or decrease in the future based on both factors relating to Bluegreen and factors outside of Bluegreen’s control. 67

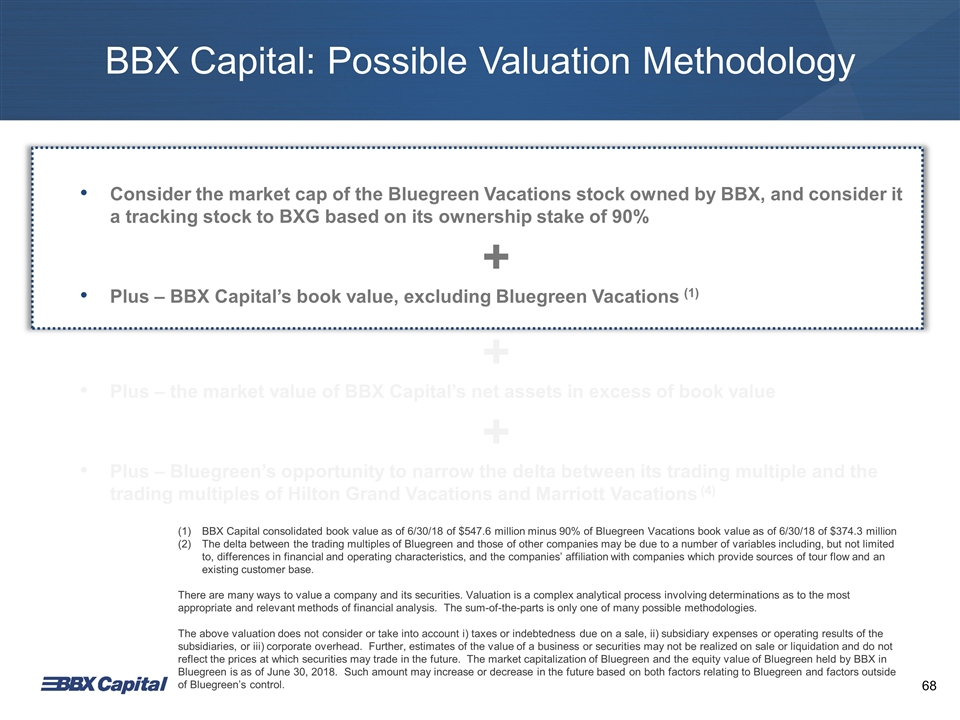

BBX Capital consolidated book value as of 6/30/18 of $547.6 million minus 90% of Bluegreen Vacations book value as of 6/30/18 of $374.3 million The delta between the trading multiples of Bluegreen and those of other companies may be due to a number of variables including, but not limited to, differences in financial and operating characteristics, and the companies’ affiliation with companies which provide sources of tour flow and an existing customer base. There are many ways to value a company and its securities. Valuation is a complex analytical process involving determinations as to the most appropriate and relevant methods of financial analysis. The sum-of-the-parts is only one of many possible methodologies. The above valuation does not consider or take into account i) taxes or indebtedness due on a sale, ii) subsidiary expenses or operating results of the subsidiaries, or iii) corporate overhead. Further, estimates of the value of a business or securities may not be realized on sale or liquidation and do not reflect the prices at which securities may trade in the future. The market capitalization of Bluegreen and the equity value of Bluegreen held by BBX in Bluegreen is as of June 30, 2018. Such amount may increase or decrease in the future based on both factors relating to Bluegreen and factors outside of Bluegreen’s control. BBX Capital: Possible Valuation Methodology Consider the market cap of the Bluegreen Vacations stock owned by BBX, and consider it a tracking stock to BXG based on its ownership stake of 90% + Plus – BBX Capital’s book value, excluding Bluegreen Vacations (1) + Plus – the market value of BBX Capital’s net assets in excess of book value + Plus – Bluegreen’s opportunity to narrow the delta between its trading multiple and the trading multiples of Hilton Grand Vacations and Marriott Vacations (4) 68

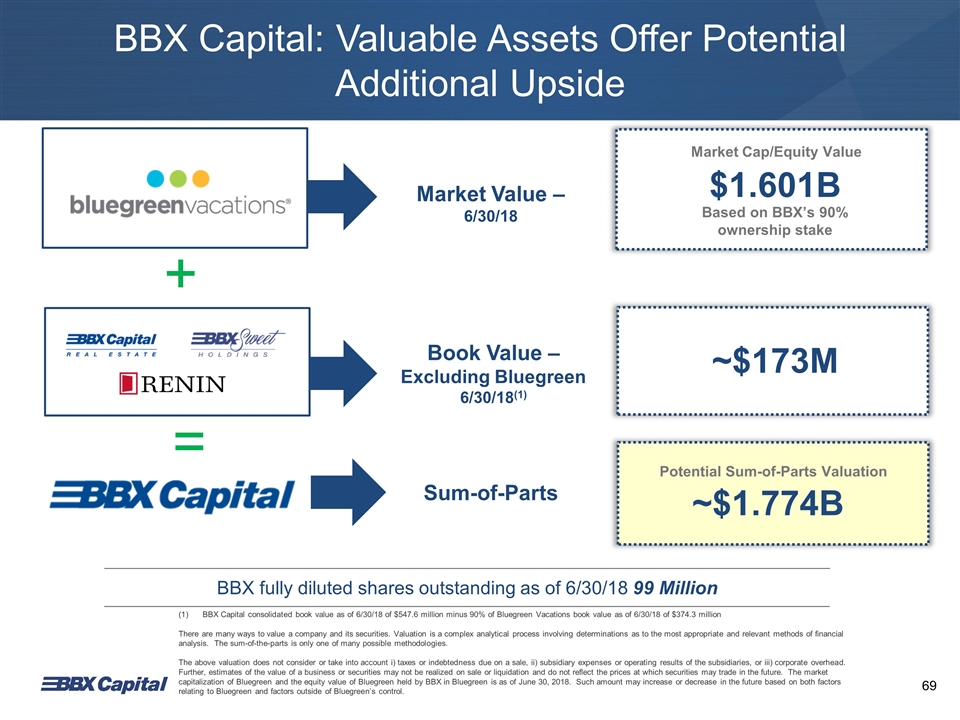

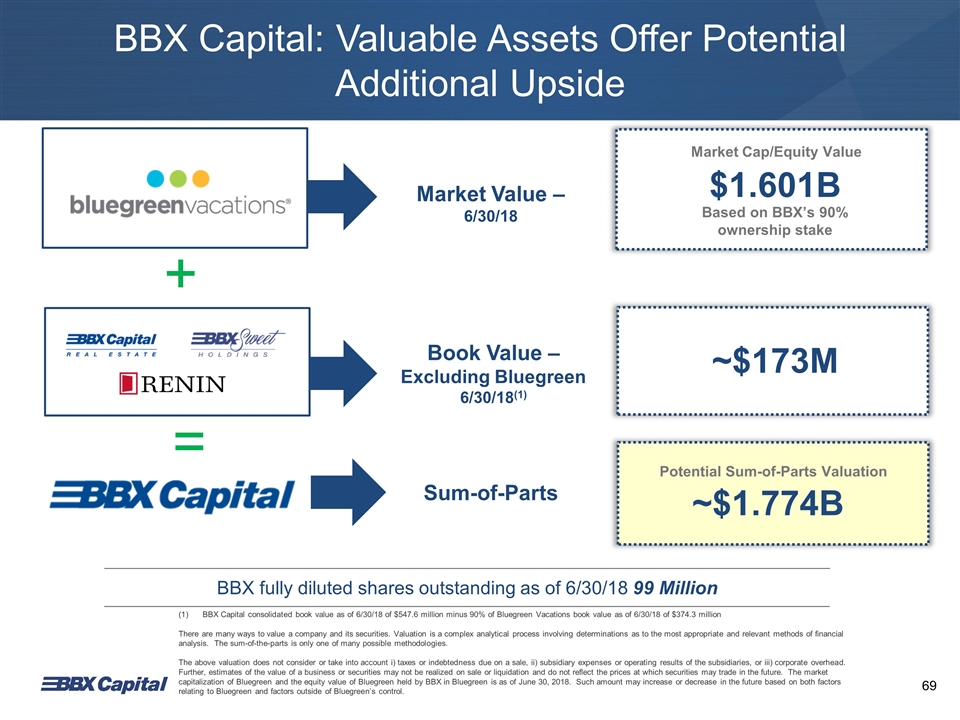

BBX Capital: Valuable Assets Offer Potential Additional Upside BBX fully diluted shares outstanding as of 6/30/18 99 Million + Based on BBX’s 90% ownership stake = $1.601B Market Cap/Equity Value ~$173M BBX Capital consolidated book value as of 6/30/18 of $547.6 million minus 90% of Bluegreen Vacations book value as of 6/30/18 of $374.3 million There are many ways to value a company and its securities. Valuation is a complex analytical process involving determinations as to the most appropriate and relevant methods of financial analysis. The sum-of-the-parts is only one of many possible methodologies. The above valuation does not consider or take into account i) taxes or indebtedness due on a sale, ii) subsidiary expenses or operating results of the subsidiaries, or iii) corporate overhead. Further, estimates of the value of a business or securities may not be realized on sale or liquidation and do not reflect the prices at which securities may trade in the future. The market capitalization of Bluegreen and the equity value of Bluegreen held by BBX in Bluegreen is as of June 30, 2018. Such amount may increase or decrease in the future based on both factors relating to Bluegreen and factors outside of Bluegreen’s control. ~$1.774B Potential Sum-of-Parts Valuation Market Value – 6/30/18 Sum-of-Parts Book Value – Excluding Bluegreen 6/30/18(1) 69

BBX Capital: Possible Valuation Methodology Consider the market cap of the Bluegreen Vacations stock owned by BBX, and consider it a tracking stock to BXG based on its ownership stake of 90% + Plus – BBX Capital’s book value, excluding Bluegreen Vacations (1) + Plus – the market value of BBX Capital’s net assets in excess of book value BBX Capital consolidated book value as of 6/30/18 of $547.6 million minus 90% of Bluegreen Vacations book value as of 6/30/18 of $374.3 million The delta between the trading multiples of Bluegreen and those of other companies may be due to a number of variables including, but not limited to, differences in financial and operating characteristics, and the companies’ affiliation with companies which provide sources of tour flow and an existing customer base. There are many ways to value a company and its securities. Valuation is a complex analytical process involving determinations as to the most appropriate and relevant methods of financial analysis. The sum-of-the-parts is only one of many possible methodologies. The above valuation does not consider or take into account i) taxes or indebtedness due on a sale, ii) subsidiary expenses or operating results of the subsidiaries, or iii) corporate overhead. Further, estimates of the value of a business or securities may not be realized on sale or liquidation and do not reflect the prices at which securities may trade in the future. The market capitalization of Bluegreen and the equity value of Bluegreen held by BBX in Bluegreen is as of June 30, 2018. Such amount may increase or decrease in the future based on both factors relating to Bluegreen and factors outside of Bluegreen’s control. 70

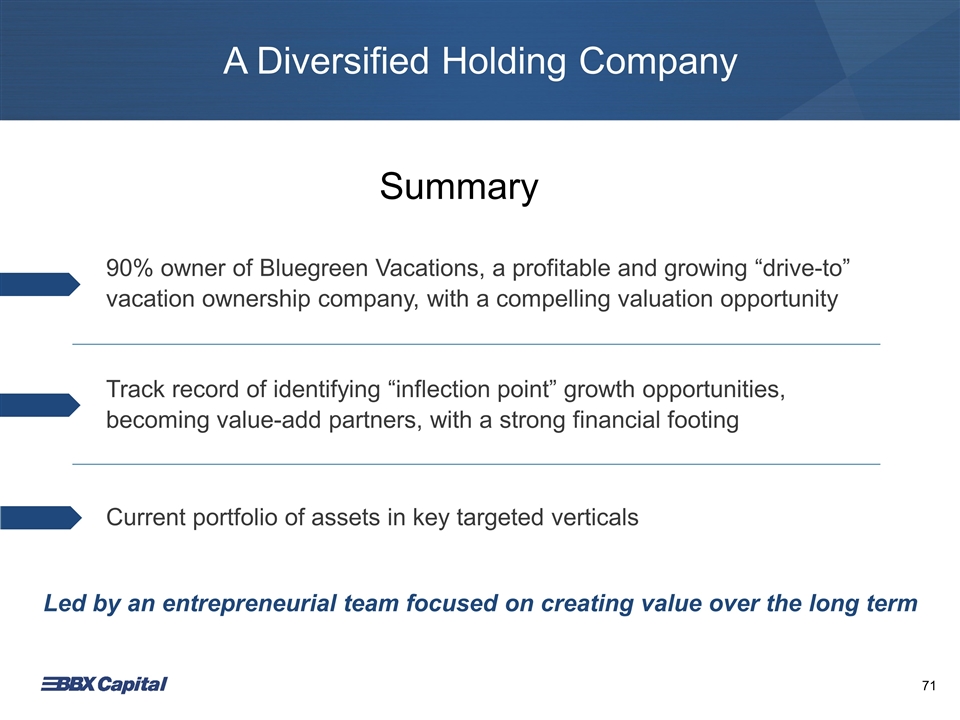

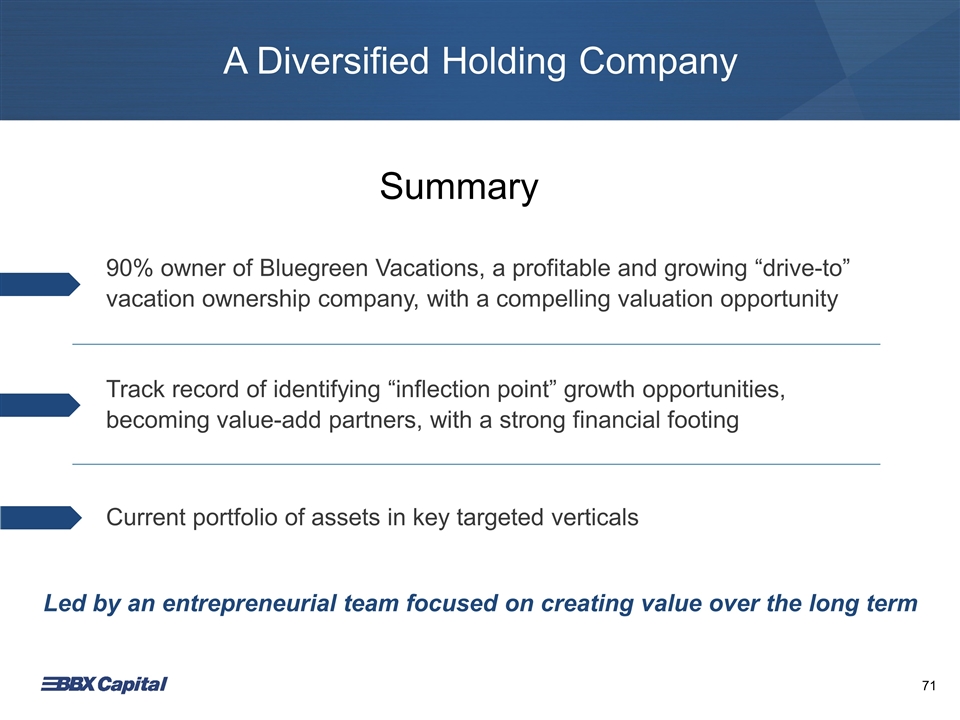

A Diversified Holding Company Led by an entrepreneurial team focused on creating value over the long term 90% owner of Bluegreen Vacations, a profitable and growing “drive-to” vacation ownership company, with a compelling valuation opportunity Track record of identifying “inflection point” growth opportunities, becoming value-add partners, with a strong financial footing Current portfolio of assets in key targeted verticals Summary 71

NYSE: BBX Thank You!

Appendix: Leo Hinkley Managing Director, IRO 954-940-5300

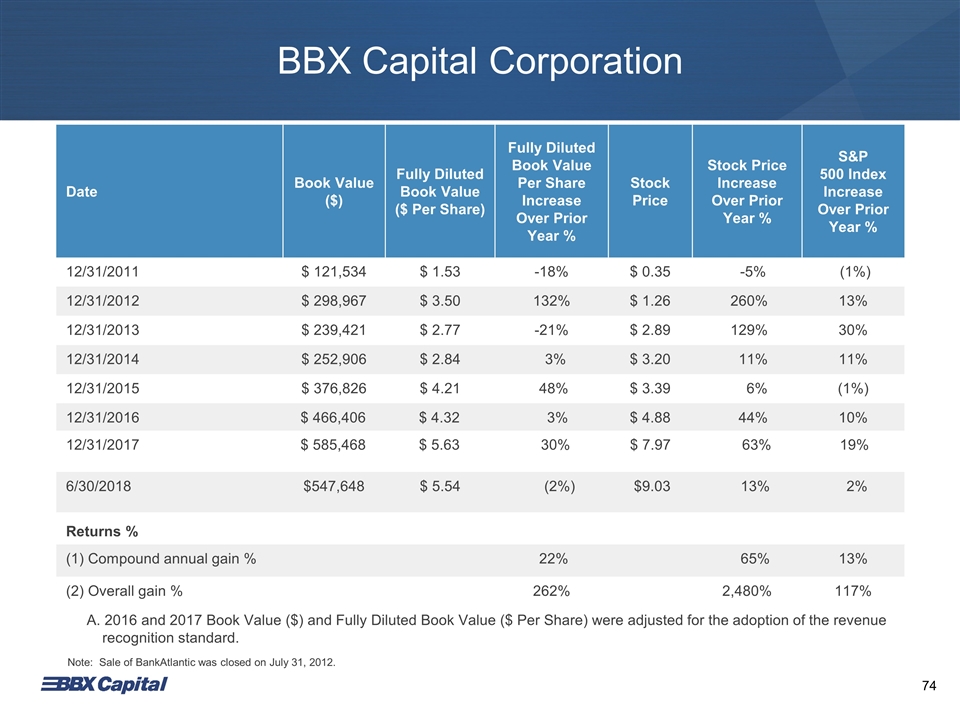

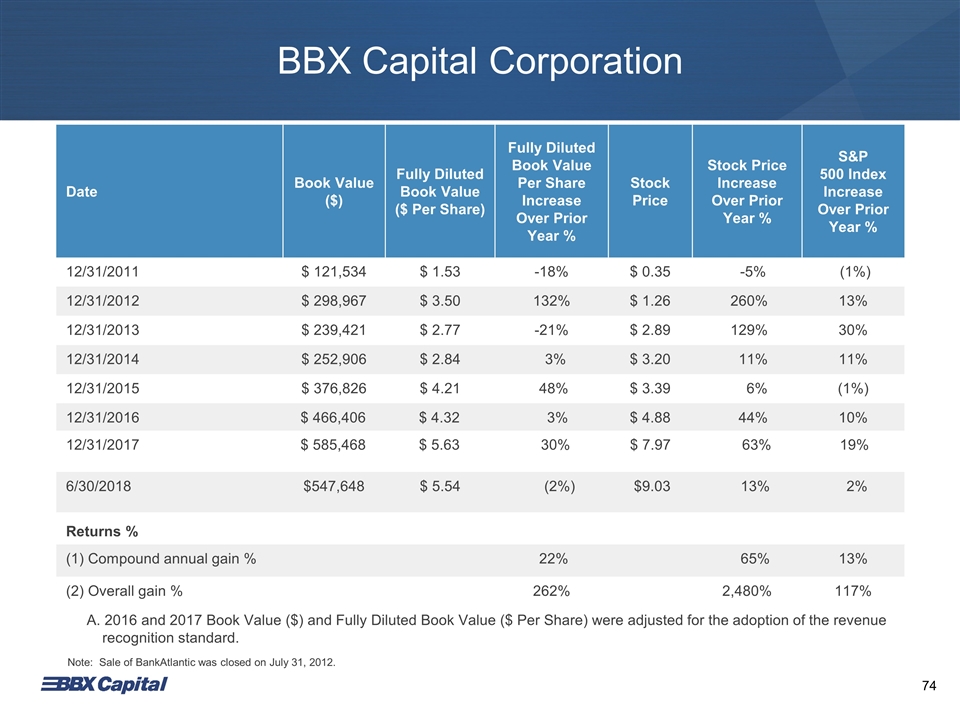

BBX Capital Corporation Date Book Value ($) Fully Diluted Book Value ($ Per Share) Fully Diluted Book Value Per Share Increase Over Prior Year % Stock Price Stock Price Increase Over Prior Year % S&P 500 Index Increase Over Prior Year % 12/31/2011 $ 121,534 $ 1.53 -18% $ 0.35 -5% (1%) 12/31/2012 $ 298,967 $ 3.50 132% $ 1.26 260% 13% 12/31/2013 $ 239,421 $ 2.77 -21% $ 2.89 129% 30% 12/31/2014 $ 252,906 $ 2.84 3% $ 3.20 11% 11% 12/31/2015 $ 376,826 $ 4.21 48% $ 3.39 6% (1%) 12/31/2016 $ 466,406 $ 4.32 3% $ 4.88 44% 10% 12/31/2017 $ 585,468 $ 5.63 30% $ 7.97 63% 19% 6/30/2018 $547,648 $ 5.54 (2%) $9.03 13% 2% Returns % (1) Compound annual gain % 22% 65% 13% (2) Overall gain % 262% 2,480% 117% A. 2016 and 2017 Book Value ($) and Fully Diluted Book Value ($ Per Share) were adjusted for the adoption of the revenue recognition standard. Note: Sale of BankAtlantic was closed on July 31, 2012. 74

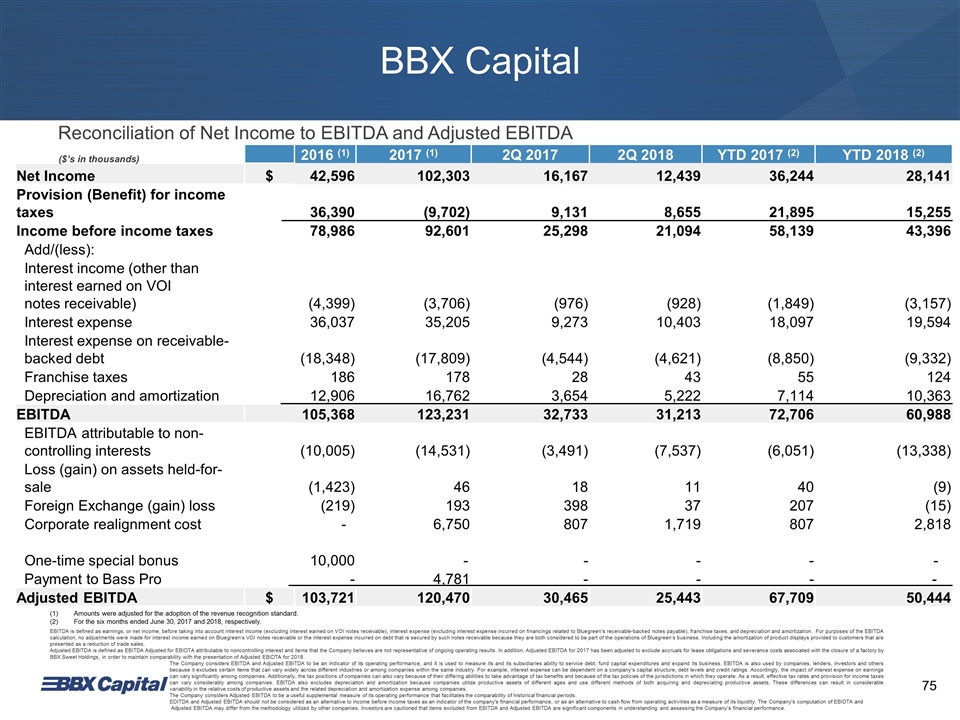

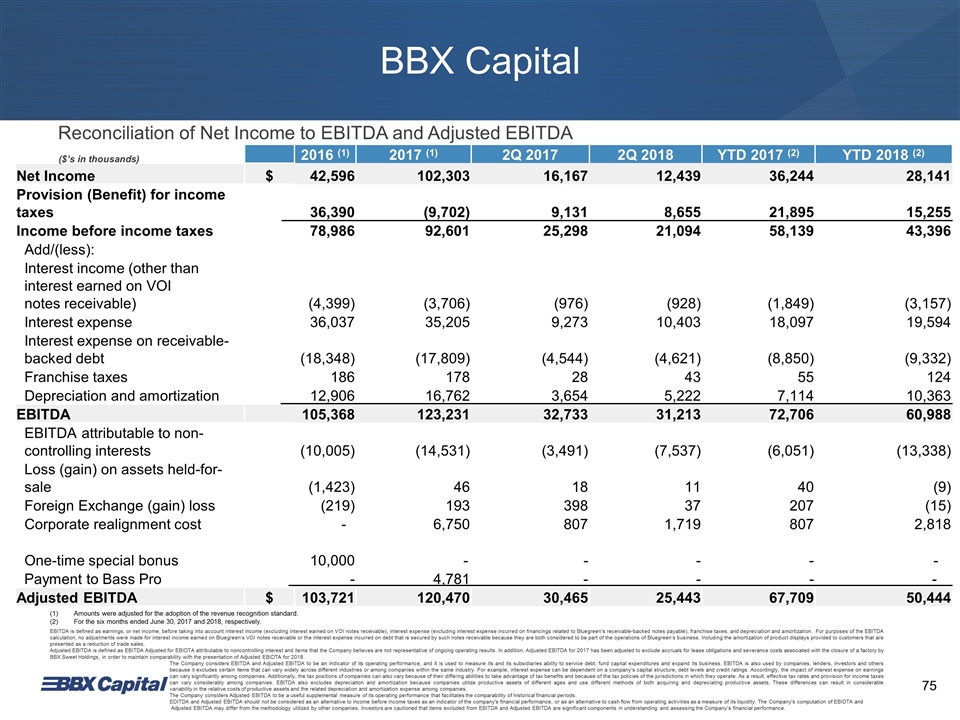

BBX Capital Reconciliation of Net Income to EBITDA and Adjusted EBITDA 2016 (1) 2017 (1) 2Q 2017 2Q 2018 YTD 2017 (2) YTD 2018 (2) Net Income $ 42,596 102,303 16,167 12,439 36,244 28,141 Provision (Benefit) for income taxes 36,390 (9,702) 9,131 8,655 21,895 15,255 Income before income taxes 78,986 92,601 25,298 21,094 58,139 43,396 Add/(less): Interest income (other than interest earned on VOI notes receivable) (4,399) (3,706) (976) (928) (1,849) (3,157) Interest expense 36,037 35,205 9,273 10,403 18,097 19,594 Interest expense on receivable-backed debt (18,348) (17,809) (4,544) (4,621) (8,850) (9,332) Franchise taxes 186 178 28 43 55 124 Depreciation and amortization 12,906 16,762 3,654 5,222 7,114 10,363 EBITDA 105,368 123,231 32,733 31,213 72,706 60,988 EBITDA attributable to non-controlling interests (10,005) (14,531) (3,491) (7,537) (6,051) (13,338) Loss (gain) on assets held-for-sale (1,423) 46 18 11 40 (9) Foreign Exchange (gain) loss (219) 193 398 37 207 (15) Corporate realignment cost - 6,750 807 1,719 807 2,818 One-time special bonus 10,000 - - - - - Payment to Bass Pro - 4,781 - - - - Adjusted EBITDA $ 103,721 120,470 30,465 25,443 67,709 50,444 ($’s in thousands) Amounts were adjusted for the adoption of the revenue recognition standard. For the six months ended June 30, 2017 and 2018, respectively. EBITDA is defined as earnings, or net income, before taking into account interest income (excluding interest earned on VOI notes receivable), interest expense (excluding interest expense incurred on financings related to Bluegreen’s receivable-backed notes payable), franchise taxes, and depreciation and amortization. For purposes of the EBITDA calculation, no adjustments were made for interest income earned on Bluegreen’s VOI notes receivable or the interest expense incurred on debt that is secured by such notes receivable because they are both considered to be part of the operations of Bluegreen’s business. Including the amortization of product displays provided to customers that are presented as a reduction of trade sales. Adjusted EBITDA is defined as EBITDA Adjusted for EBIDTA attributable to noncontrolling interest and items that the Company believes are not representative of ongoing operating results. In addition, Adjusted EBITDA for 2017 has been adjusted to exclude accruals for lease obligations and severance costs associated with the closure of a factory by BBX Sweet Holdings, in order to maintain comparability with the presentation of Adjusted EBIDTA for 2018. The Company considers EBITDA and Adjusted EBITDA to be an indicator of its operating performance, and it is used to measure its and its subsidiaries ability to service debt, fund capital expenditures and expand its business. EBITDA is also used by companies, lenders, investors and others because it excludes certain items that can vary widely across different industries or among companies within the same industry. For example, interest expense can be dependent on a company’s capital structure, debt levels and credit ratings. Accordingly, the impact of interest expense on earnings can vary significantly among companies. Additionally, the tax positions of companies can also vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the jurisdictions in which they operate. As a result, effective tax rates and provision for income taxes can vary considerably among companies. EBITDA also excludes depreciation and amortization because companies utilize productive assets of different ages and use different methods of both acquiring and depreciating productive assets. These differences can result in considerable variability in the relative costs of productive assets and the related depreciation and amortization expense among companies. The Company considers Adjusted EBITDA to be a useful supplemental measure of its operating performance that facilitates the comparability of historical financial periods. EDITDA and Adjusted EBITDA should not be considered as an alternative to income before income taxes as an indicator of the company's financial performance, or as an alternative to cash flow from operating activities as a measure of its liquidity. The Company's computation of EBIDTA and Adjusted EBITDA may differ from the methodology utilized by other companies. Investors are cautioned that items excluded from EBITDA and Adjusted EBITDA are significant components in understanding and assessing the Company’s financial performance. 75

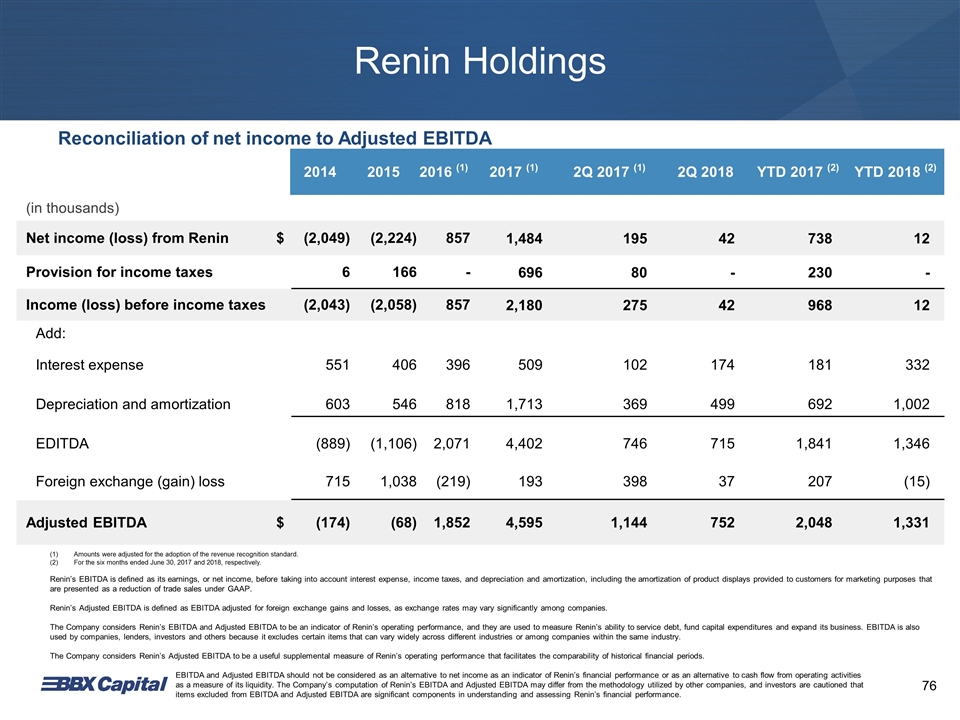

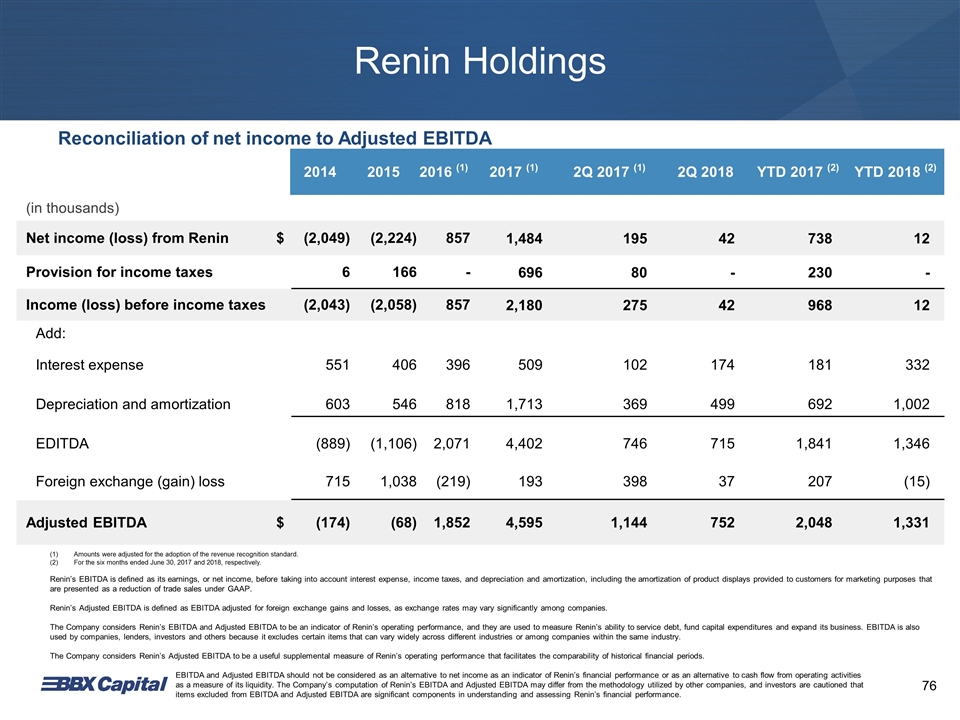

Renin Holdings Reconciliation of net income to Adjusted EBITDA 2014 2015 2016 (1) 2017 (1) 2Q 2017 (1) 2Q 2018 YTD 2017 (2) YTD 2018 (2) (in thousands) Net income (loss) from Renin $ (2,049) (2,224) 857 1,484 195 42 738 12 Provision for income taxes 6 166 - 696 80 - 230 - Income (loss) before income taxes (2,043) (2,058) 857 2,180 275 42 968 12 Add: Interest expense 551 406 396 509 102 174 181 332 Depreciation and amortization 603 546 818 1,713 369 499 692 1,002 EDITDA (889) (1,106) 2,071 4,402 746 715 1,841 1,346 Foreign exchange (gain) loss 715 1,038 (219) 193 398 37 207 (15) Adjusted EBITDA $ (174) (68) 1,852 4,595 1,144 752 2,048 1,331 Renin’s EBITDA is defined as its earnings, or net income, before taking into account interest expense, income taxes, and depreciation and amortization, including the amortization of product displays provided to customers for marketing purposes that are presented as a reduction of trade sales under GAAP. Renin’s Adjusted EBITDA is defined as EBITDA adjusted for foreign exchange gains and losses, as exchange rates may vary significantly among companies. The Company considers Renin’s EBITDA and Adjusted EBITDA to be an indicator of Renin’s operating performance, and they are used to measure Renin’s ability to service debt, fund capital expenditures and expand its business. EBITDA is also used by companies, lenders, investors and others because it excludes certain items that can vary widely across different industries or among companies within the same industry. The Company considers Renin’s Adjusted EBITDA to be a useful supplemental measure of Renin’s operating performance that facilitates the comparability of historical financial periods. EBITDA and Adjusted EBITDA should not be considered as an alternative to net income as an indicator of Renin’s financial performance or as an alternative to cash flow from operating activities as a measure of its liquidity. The Company’s computation of Renin’s EBITDA and Adjusted EBITDA may differ from the methodology utilized by other companies, and investors are cautioned that items excluded from EBITDA and Adjusted EBITDA are significant components in understanding and assessing Renin’s financial performance. Amounts were adjusted for the adoption of the revenue recognition standard. For the six months ended June 30, 2017 and 2018, respectively. 76

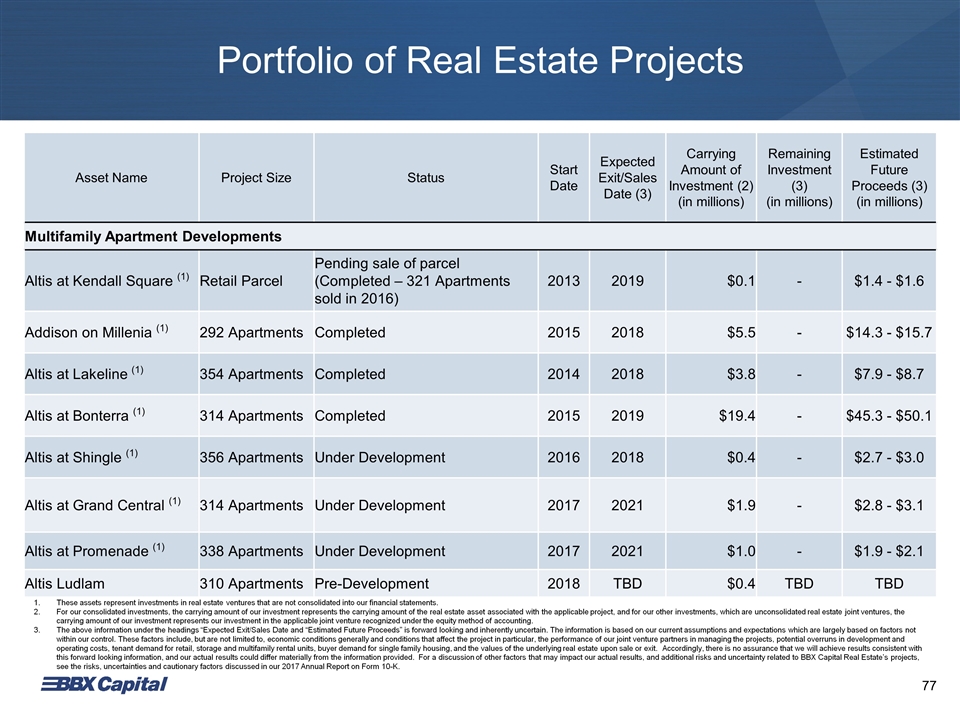

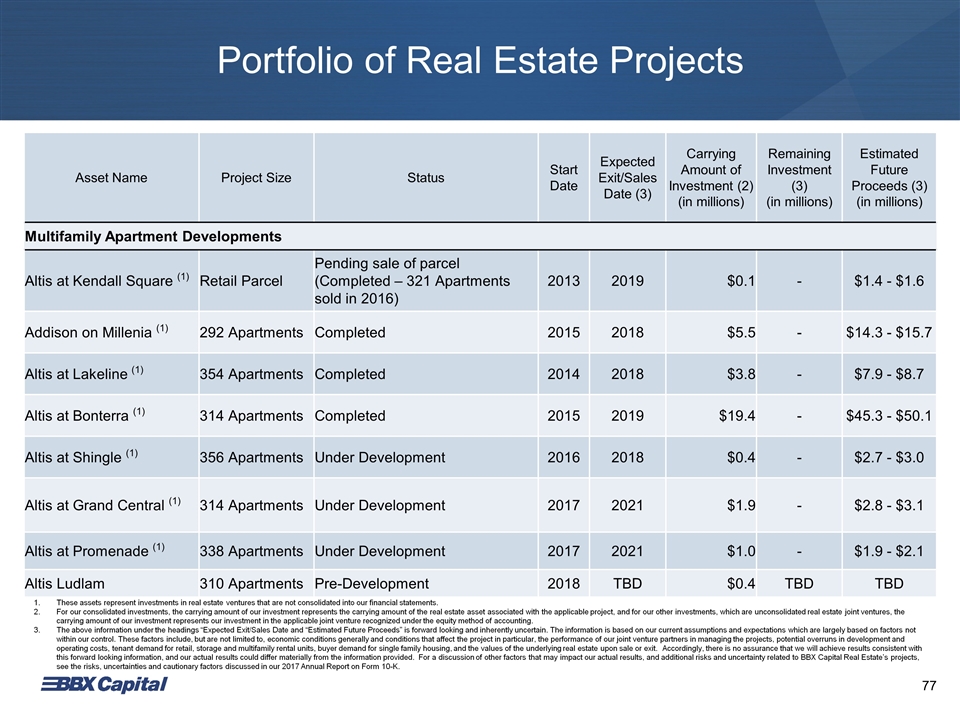

Portfolio of Real Estate Projects Asset Name Project Size Status Start Date Expected Exit/Sales Date (3) Carrying Amount of Investment (2) (in millions) Remaining Investment (3) (in millions) Estimated Future Proceeds (3) (in millions) Multifamily Apartment Developments Altis at Kendall Square (1) Retail Parcel Pending sale of parcel (Completed – 321 Apartments sold in 2016) 2013 2019 $0.1 - $1.4 - $1.6 Addison on Millenia (1) 292 Apartments Completed 2015 2018 $5.5 - $14.3 - $15.7 Altis at Lakeline (1) 354 Apartments Completed 2014 2018 $3.8 - $7.9 - $8.7 Altis at Bonterra (1) 314 Apartments Completed 2015 2019 $19.4 - $45.3 - $50.1 Altis at Shingle (1) 356 Apartments Under Development 2016 2018 $0.4 - $2.7 - $3.0 Altis at Grand Central (1) 314 Apartments Under Development 2017 2021 $1.9 - $2.8 - $3.1 Altis at Promenade (1) 338 Apartments Under Development 2017 2021 $1.0 - $1.9 - $2.1 Altis Ludlam 310 Apartments Pre-Development 2018 TBD $0.4 TBD TBD These assets represent investments in real estate ventures that are not consolidated into our financial statements. For our consolidated investments, the carrying amount of our investment represents the carrying amount of the real estate asset associated with the applicable project, and for our other investments, which are unconsolidated real estate joint ventures, the carrying amount of our investment represents our investment in the applicable joint venture recognized under the equity method of accounting. The above information under the headings “Expected Exit/Sales Date and “Estimated Future Proceeds” is forward looking and inherently uncertain. The information is based on our current assumptions and expectations which are largely based on factors not within our control. These factors include, but are not limited to, economic conditions generally and conditions that affect the project in particular, the performance of our joint venture partners in managing the projects, potential overruns in development and operating costs, tenant demand for retail, storage and multifamily rental units, buyer demand for single family housing, and the values of the underlying real estate upon sale or exit. Accordingly, there is no assurance that we will achieve results consistent with this forward looking information, and our actual results could differ materially from the information provided. For a discussion of other factors that may impact our actual results, and additional risks and uncertainty related to BBX Capital Real Estate’s projects, see the risks, uncertainties and cautionary factors discussed in our 2017 Annual Report on Form 10-K. 77

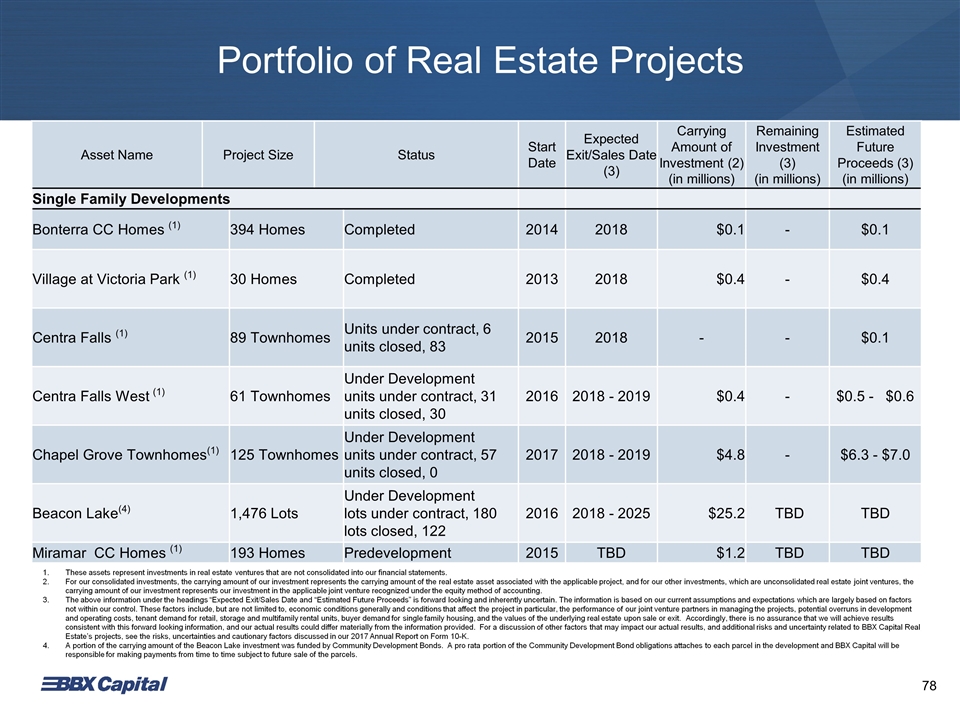

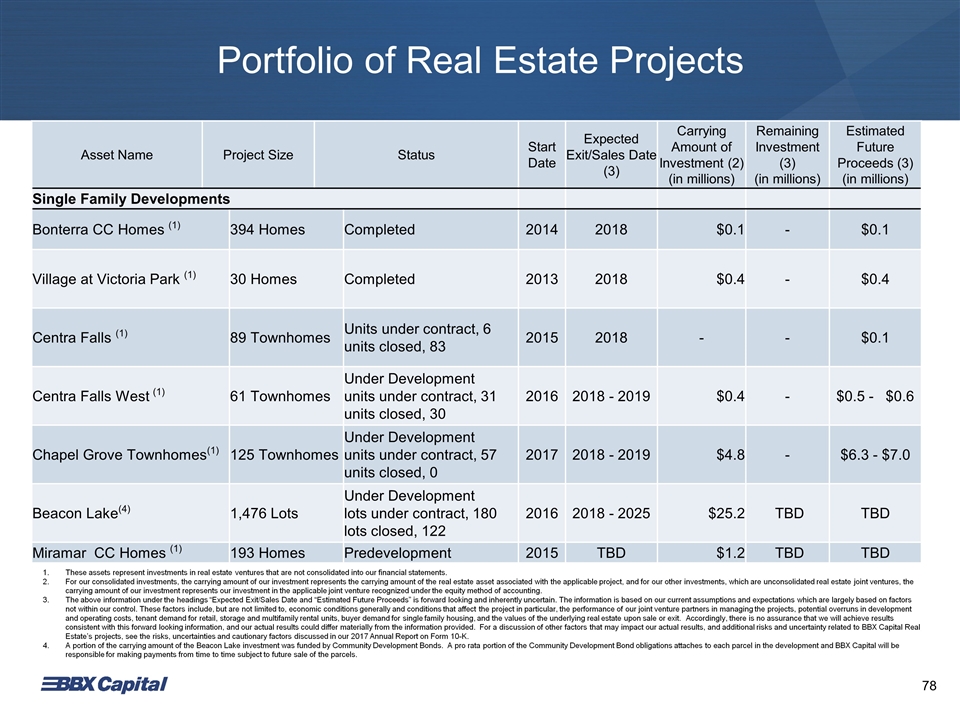

Asset Name Project Size Project Size Status Start Date Expected Exit/Sales Date (3) Carrying Amount of Investment (2) (in millions) Remaining Investment (3) (in millions) Estimated Future Proceeds (3) (in millions) Single Family Developments Bonterra CC Homes (1) 394 Homes Completed Completed 2014 2018 $0.1 - $0.1 Village at Victoria Park (1) 30 Homes Under Development - 5 units under contract, 25 units closed Completed 2013 2018 $0.4 - $0.4 Centra Falls (1) 89 Townhomes Under Development - 8 units under contract, 81 units closed Units under contract, 6 units closed, 83 2015 2018 - - $0.1 Centra Falls West (1) 61 Townhomes Under Development -50 units under contract, 0 units closed Under Development units under contract, 31 units closed, 30 2016 2018 - 2019 $0.4 - $0.5 - $0.6 Chapel Grove Townhomes(1) 125 Townhomes Under Development – 19 units under contract, 0 units closed Under Development units under contract, 57 units closed, 0 2017 2018 - 2019 $4.8 - $6.3 - $7.0 Beacon Lake(4) 1,476 Lots Under Development - 219 lots under contract, 83 lots closed Under Development lots under contract, 180 lots closed, 122 2016 2018 - 2025 $25.2 TBD TBD Miramar CC Homes (1) 193 Homes Predevelopment Predevelopment 2015 TBD $1.2 TBD TBD These assets represent investments in real estate ventures that are not consolidated into our financial statements. For our consolidated investments, the carrying amount of our investment represents the carrying amount of the real estate asset associated with the applicable project, and for our other investments, which are unconsolidated real estate joint ventures, the carrying amount of our investment represents our investment in the applicable joint venture recognized under the equity method of accounting. The above information under the headings “Expected Exit/Sales Date and “Estimated Future Proceeds” is forward looking and inherently uncertain. The information is based on our current assumptions and expectations which are largely based on factors not within our control. These factors include, but are not limited to, economic conditions generally and conditions that affect the project in particular, the performance of our joint venture partners in managing the projects, potential overruns in development and operating costs, tenant demand for retail, storage and multifamily rental units, buyer demand for single family housing, and the values of the underlying real estate upon sale or exit. Accordingly, there is no assurance that we will achieve results consistent with this forward looking information, and our actual results could differ materially from the information provided. For a discussion of other factors that may impact our actual results, and additional risks and uncertainty related to BBX Capital Real Estate’s projects, see the risks, uncertainties and cautionary factors discussed in our 2017 Annual Report on Form 10-K. A portion of the carrying amount of the Beacon Lake investment was funded by Community Development Bonds. A pro rata portion of the Community Development Bond obligations attaches to each parcel in the development and BBX Capital will be responsible for making payments from time to time subject to future sale of the parcels. Portfolio of Real Estate Projects 78

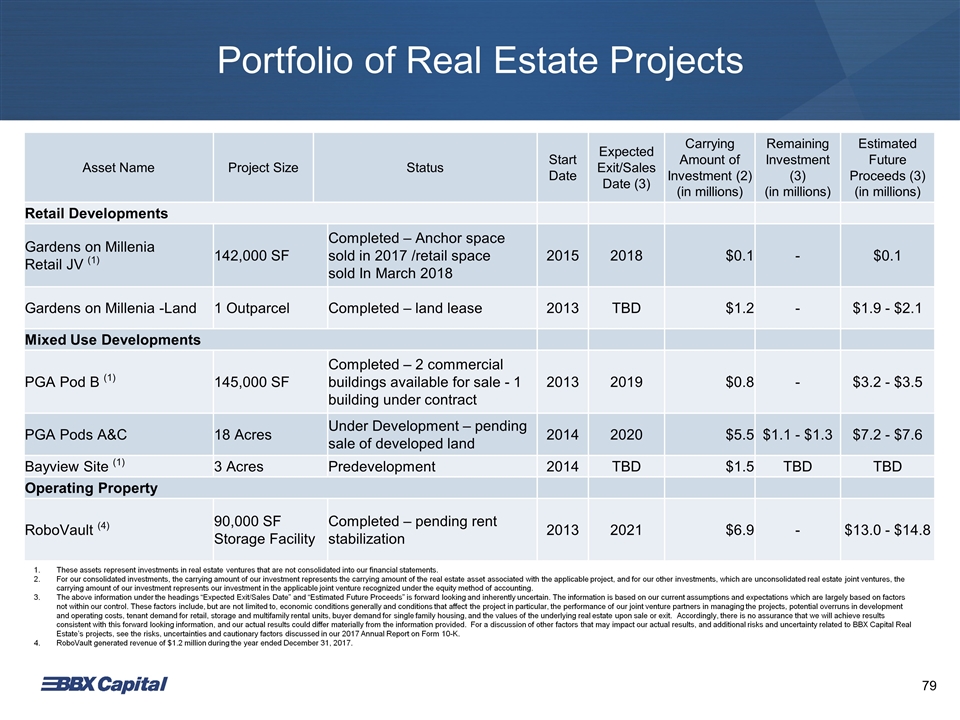

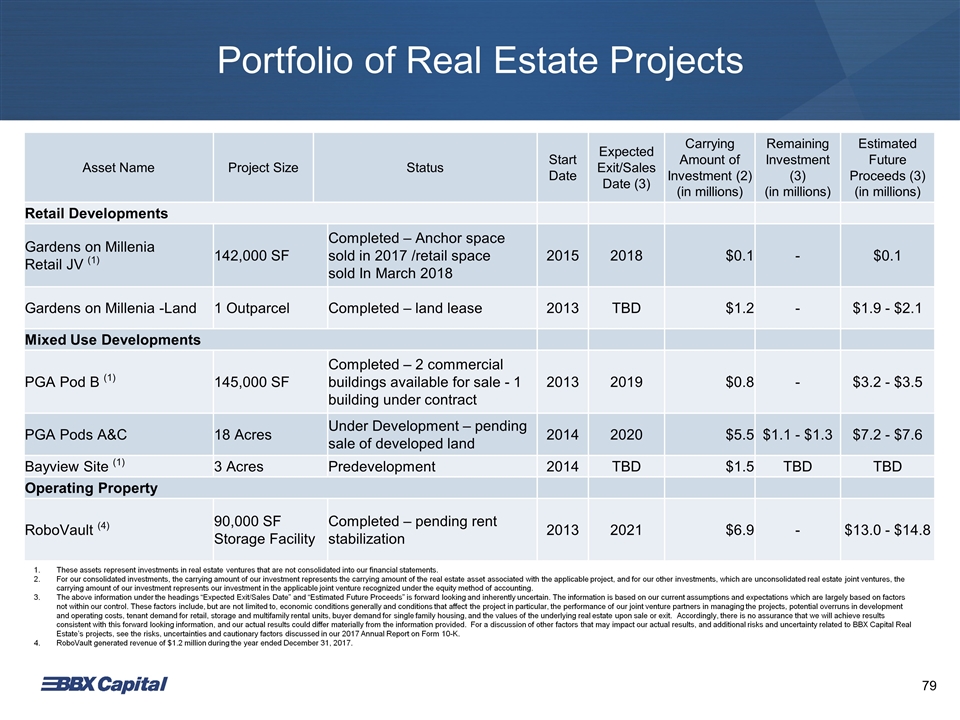

Asset Name Project Size Status Start Date Expected Exit/Sales Date (3) Carrying Amount of Investment (2) (in millions) Remaining Investment (3) (in millions) Estimated Future Proceeds (3) (in millions) Retail Developments Gardens on Millenia Retail JV (1) 142,000 SF Completed – Anchor space sold in 2017 /retail space sold In April 2018 Completed – Anchor space sold in 2017 /retail space sold In March 2018 2015 2018 $0.1 - $0.1 Gardens on Millenia -Land 1 Outparcel Completed – land lease Completed – land lease 2013 TBD $1.2 - $1.9 - $2.1 Mixed Use Developments PGA Pod B (1) 145,000 SF Completed – 2 commercial buildings available for sale - 1 building under contract Completed – 2 commercial buildings available for sale - 1 building under contract 2013 2019 $0.8 - $3.2 - $3.5 PGA Pods A&C 18 Acres Under Development – pending sale of developed land Under Development – pending sale of developed land 2014 2020 $5.5 $1.1 - $1.3 $7.2 - $7.6 Bayview Site (1) 3 Acres Predevelopment Predevelopment 2014 TBD $1.5 TBD TBD Operating Property RoboVault (4) 90,000 SF Storage Facility Completed – pending rent stabilization Completed – pending rent stabilization 2013 2021 $6.9 - $13.0 - $14.8 These assets represent investments in real estate ventures that are not consolidated into our financial statements. For our consolidated investments, the carrying amount of our investment represents the carrying amount of the real estate asset associated with the applicable project, and for our other investments, which are unconsolidated real estate joint ventures, the carrying amount of our investment represents our investment in the applicable joint venture recognized under the equity method of accounting. The above information under the headings “Expected Exit/Sales Date” and “Estimated Future Proceeds” is forward looking and inherently uncertain. The information is based on our current assumptions and expectations which are largely based on factors not within our control. These factors include, but are not limited to, economic conditions generally and conditions that affect the project in particular, the performance of our joint venture partners in managing the projects, potential overruns in development and operating costs, tenant demand for retail, storage and multifamily rental units, buyer demand for single family housing, and the values of the underlying real estate upon sale or exit. Accordingly, there is no assurance that we will achieve results consistent with this forward looking information, and our actual results could differ materially from the information provided. For a discussion of other factors that may impact our actual results, and additional risks and uncertainty related to BBX Capital Real Estate’s projects, see the risks, uncertainties and cautionary factors discussed in our 2017 Annual Report on Form 10-K. RoboVault generated revenue of $1.2 million during the year ended December 31, 2017. Portfolio of Real Estate Projects 79

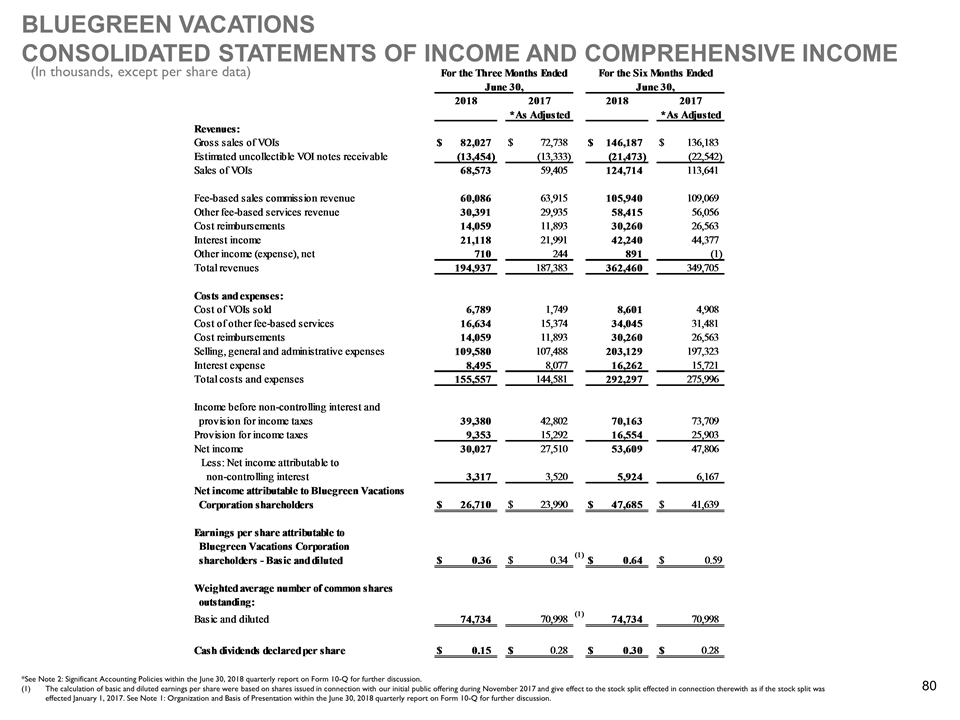

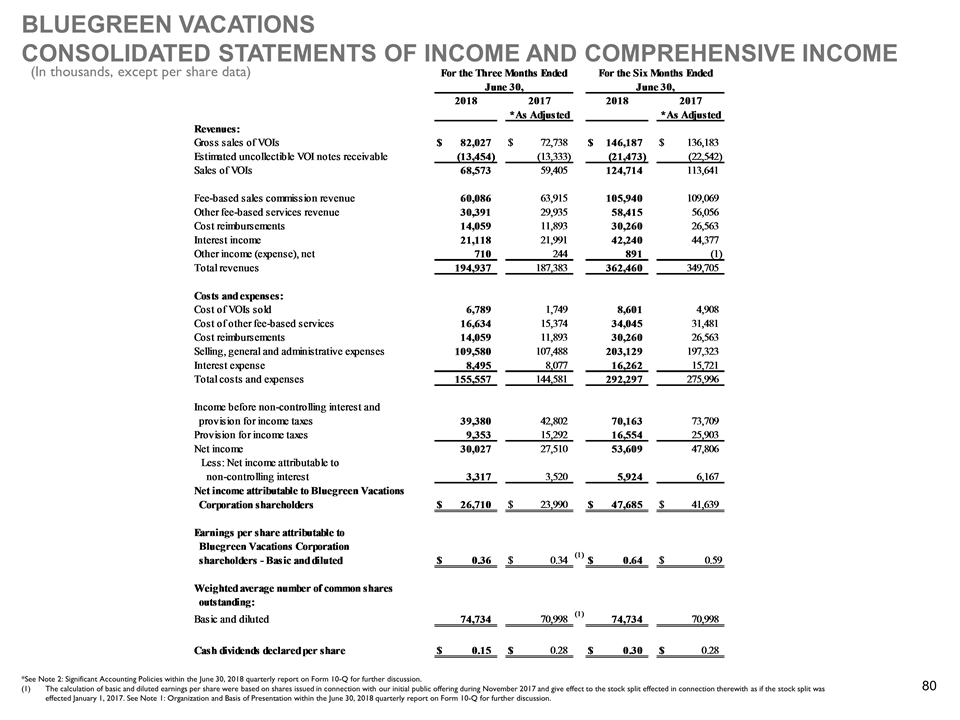

BLUEGREEN VACATIONS CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (In thousands, except per share data) *See Note 2: Significant Accounting Policies within the June 30, 2018 quarterly report on Form 10-Q for further discussion. The calculation of basic and diluted earnings per share were based on shares issued in connection with our initial public offering during November 2017 and give effect to the stock split effected in connection therewith as if the stock split was effected January 1, 2017. See Note 1: Organization and Basis of Presentation within the June 30, 2018 quarterly report on Form 10-Q for further discussion. 80

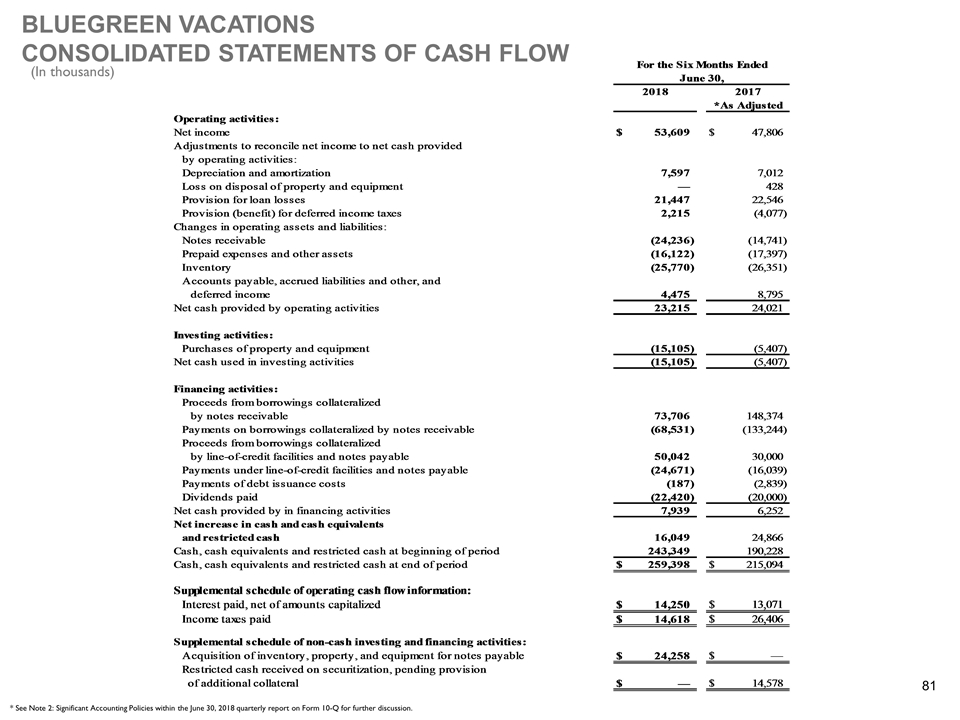

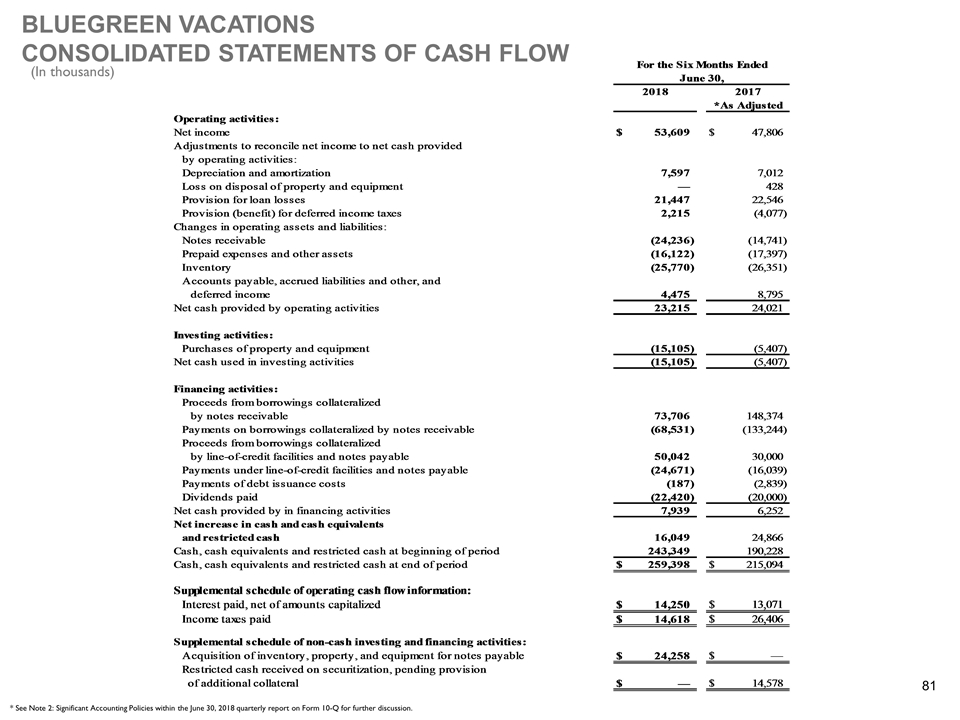

(In thousands) * See Note 2: Significant Accounting Policies within the June 30, 2018 quarterly report on Form 10-Q for further discussion. BLUEGREEN VACATIONS CONSOLIDATED STATEMENTS OF CASH FLOW 81

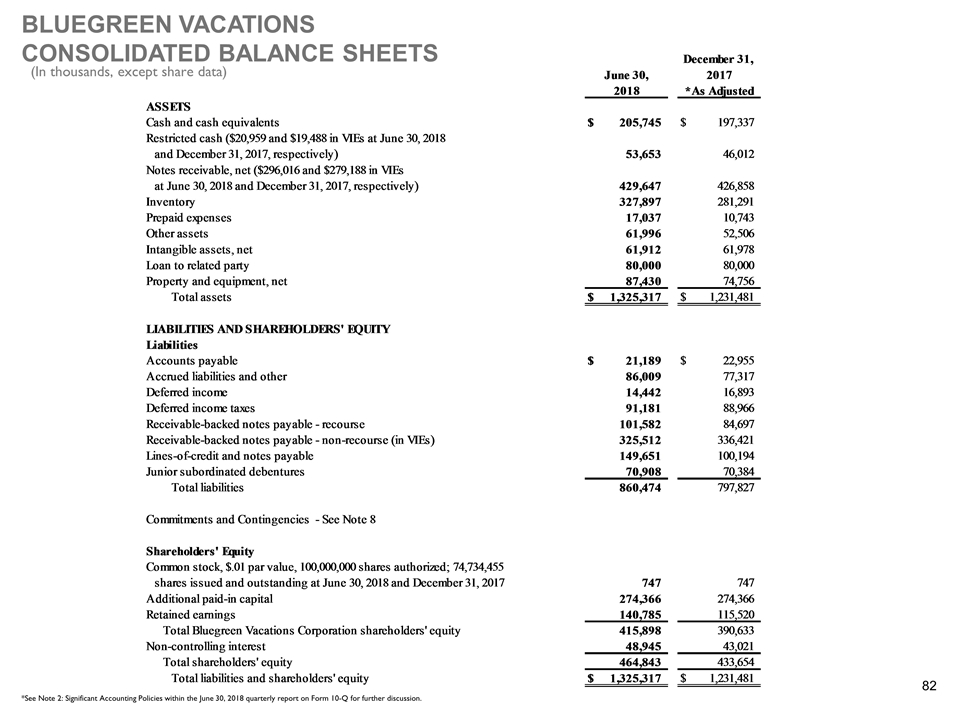

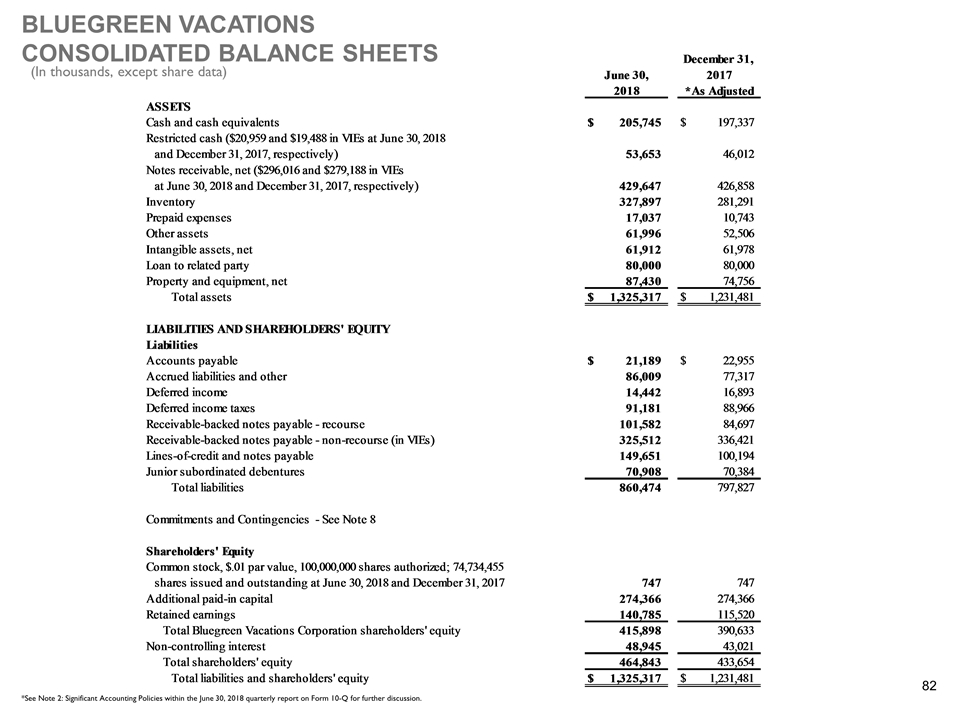

(In thousands, except share data) *See Note 2: Significant Accounting Policies within the June 30, 2018 quarterly report on Form 10-Q for further discussion. BLUEGREEN VACATIONS CONSOLIDATED BALANCE SHEETS 82

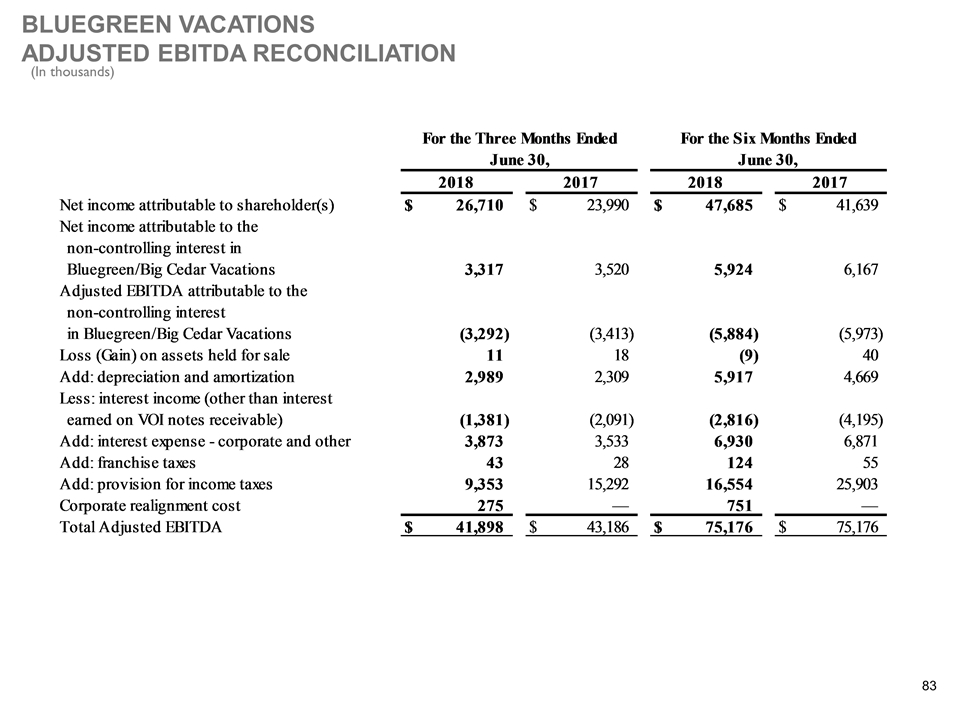

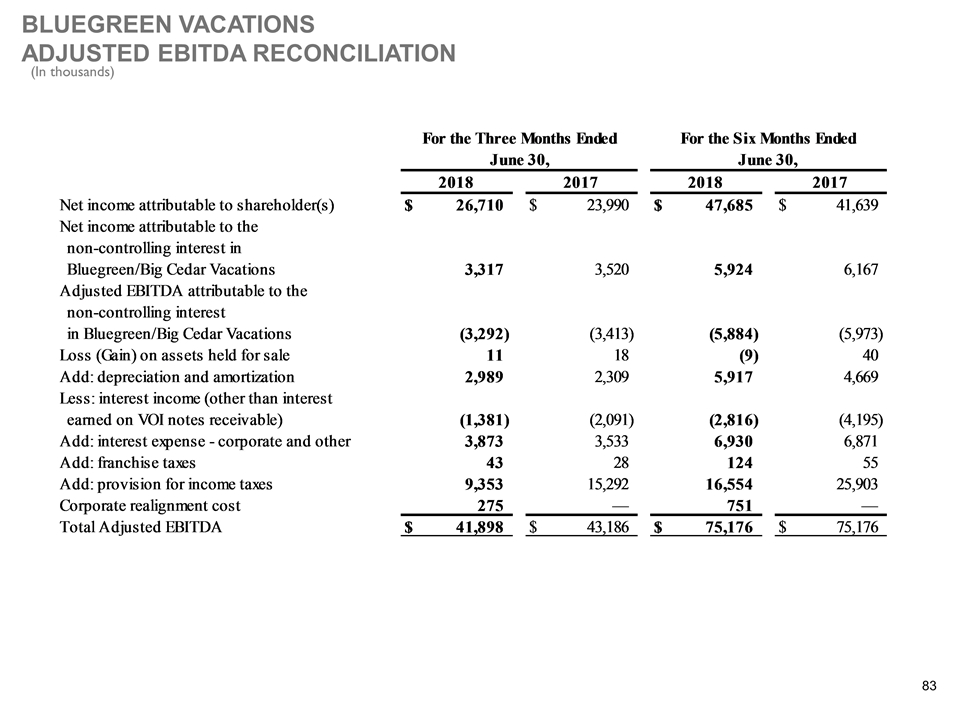

(In thousands) BLUEGREEN VACATIONS ADJUSTED EBITDA RECONCILIATION 83

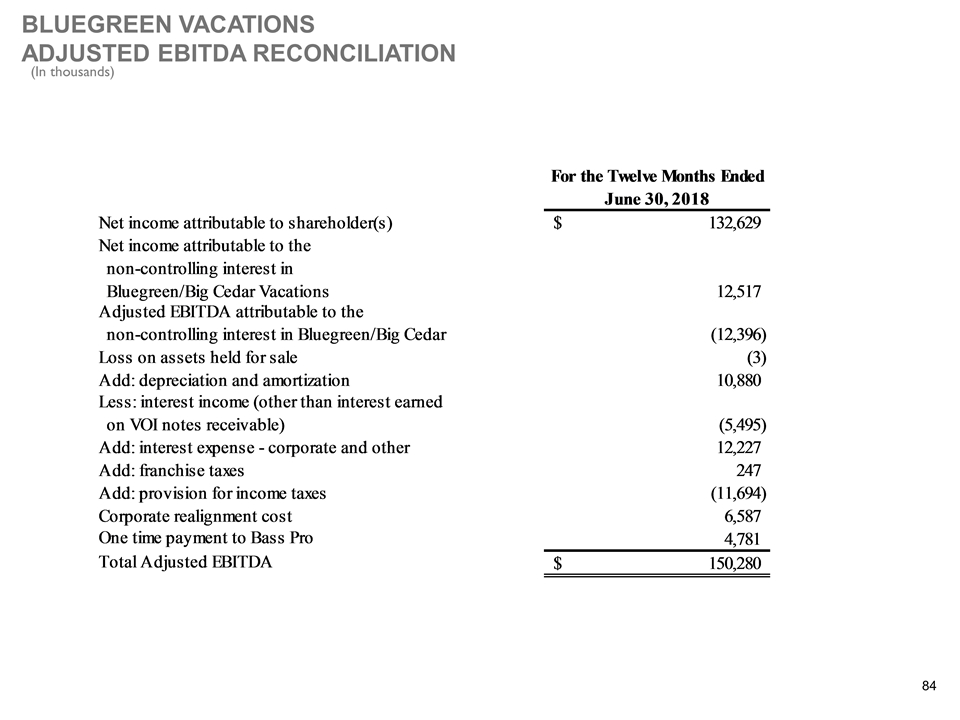

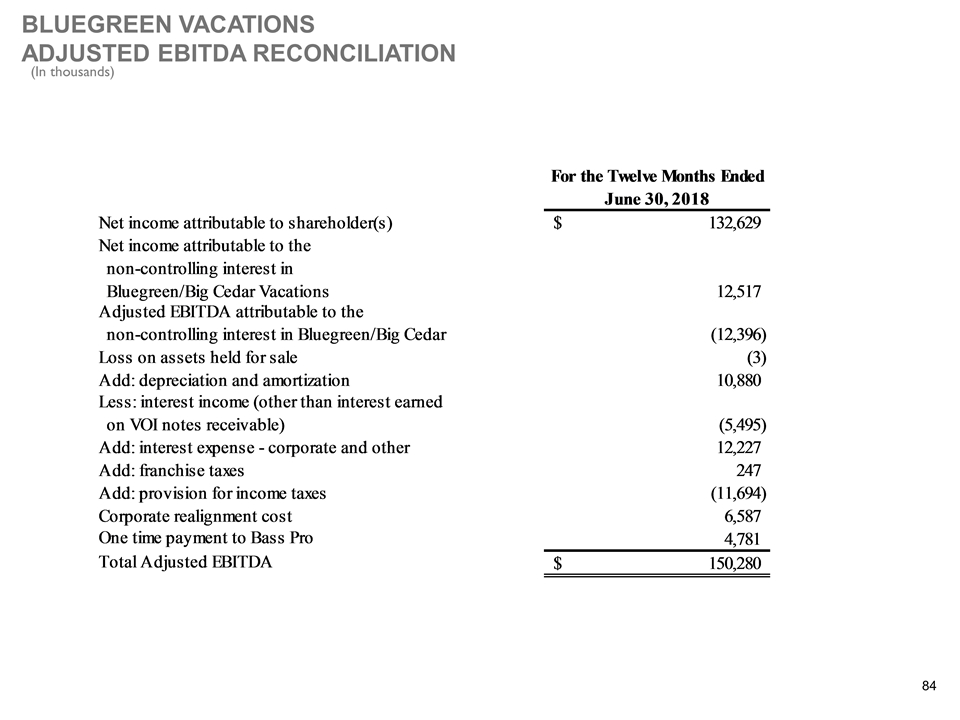

(In thousands) BLUEGREEN VACATIONS ADJUSTED EBITDA RECONCILIATION 84

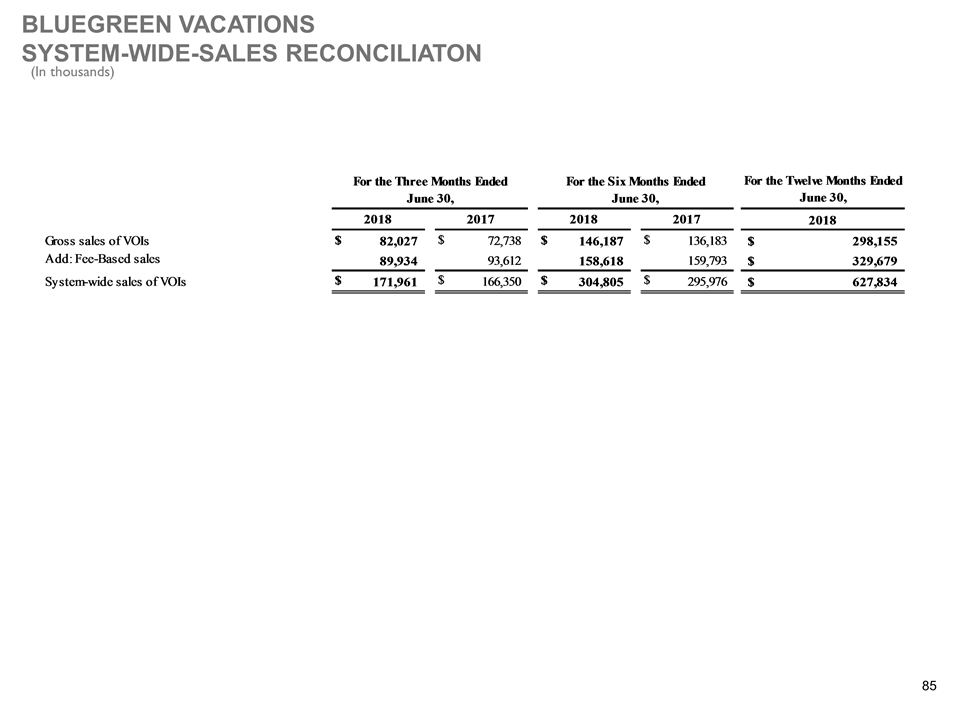

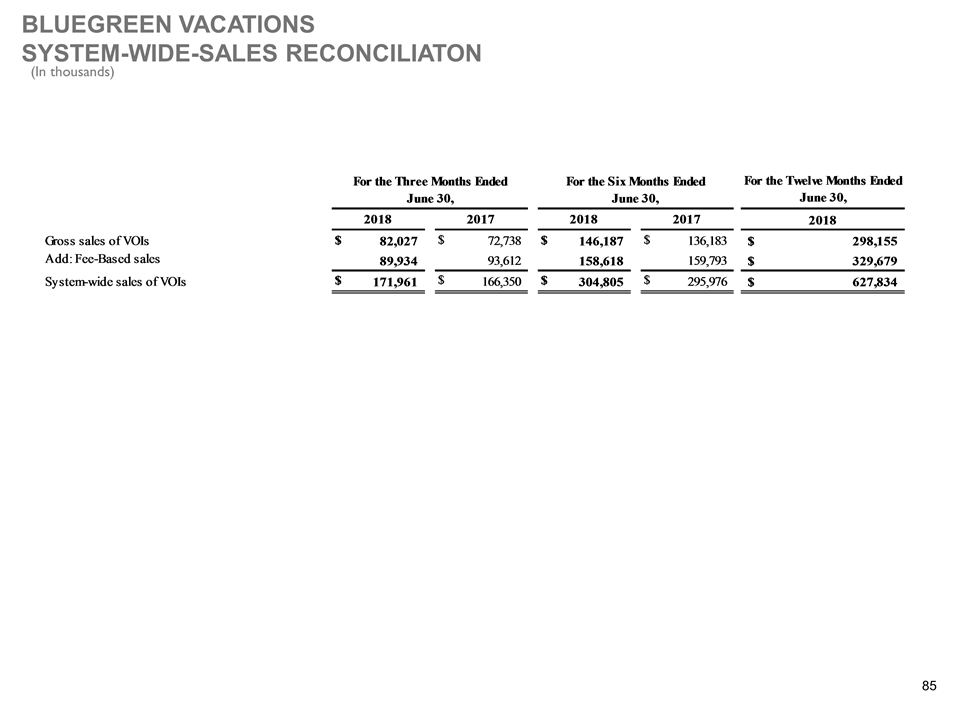

(In thousands) BLUEGREEN VACATIONS SYSTEM-WIDE-SALES RECONCILIATON 85

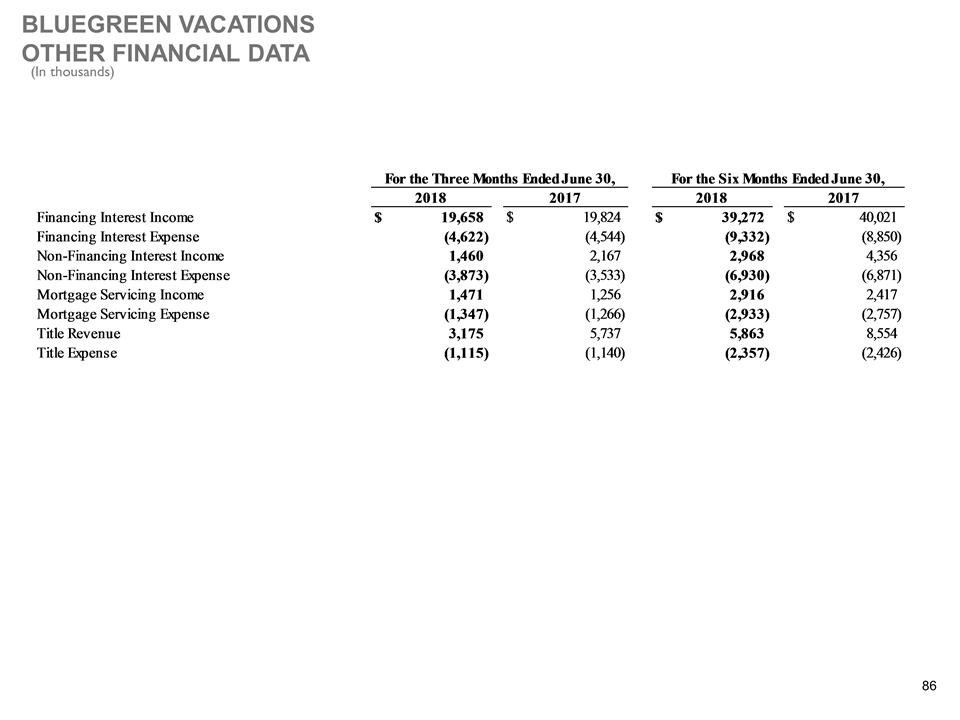

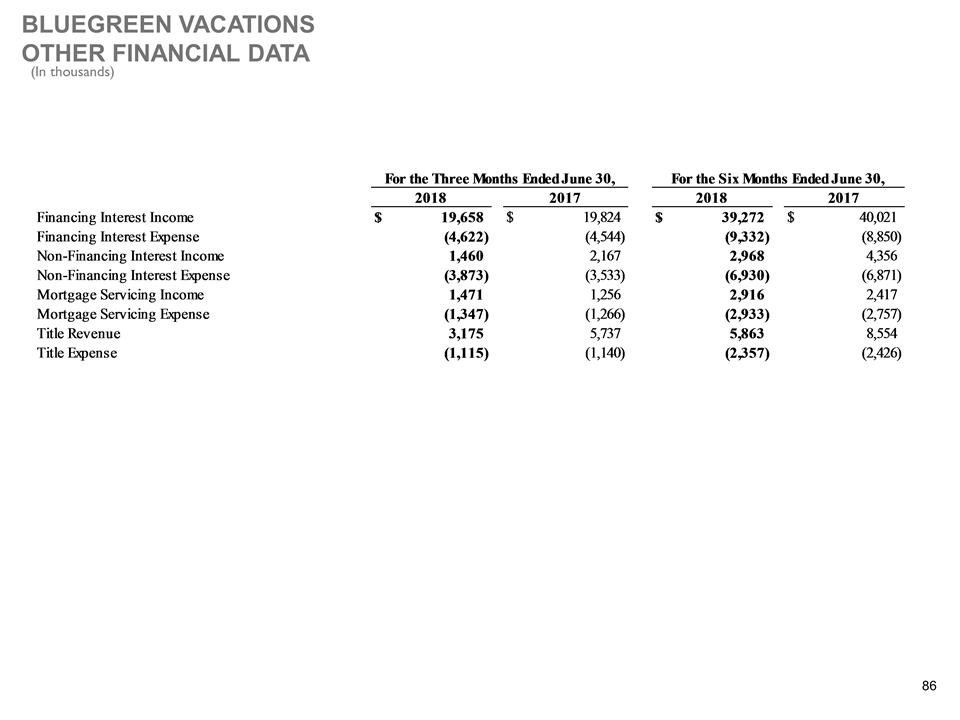

(In thousands) BLUEGREEN VACATIONS OTHER FINANCIAL DATA 86