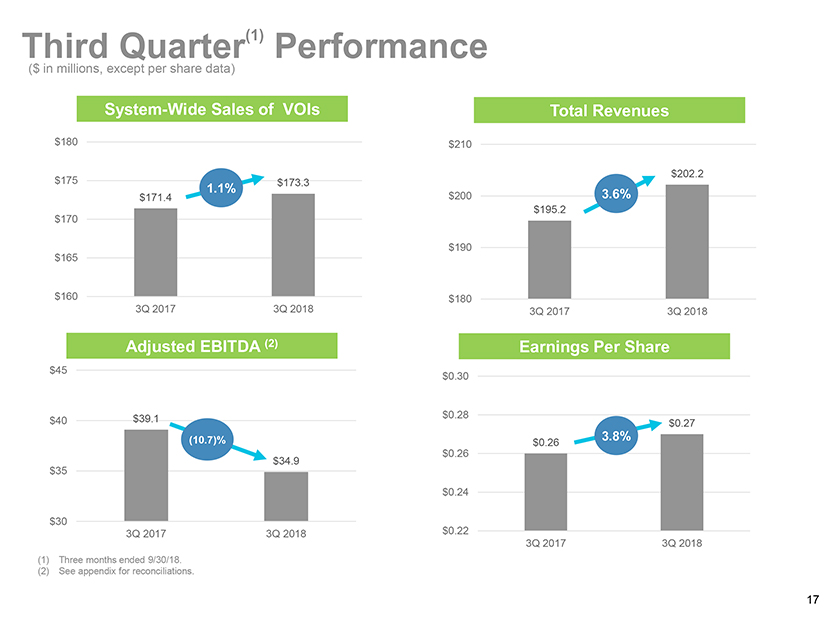

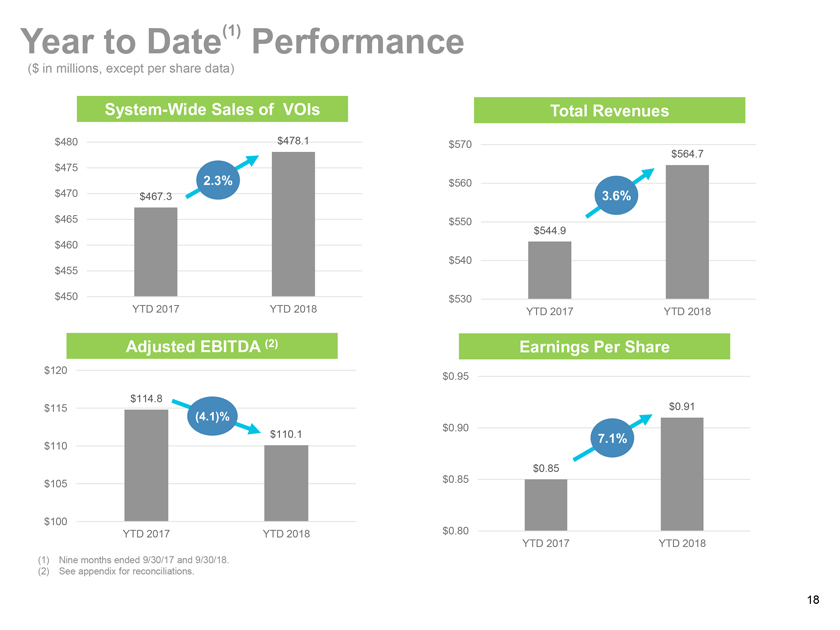

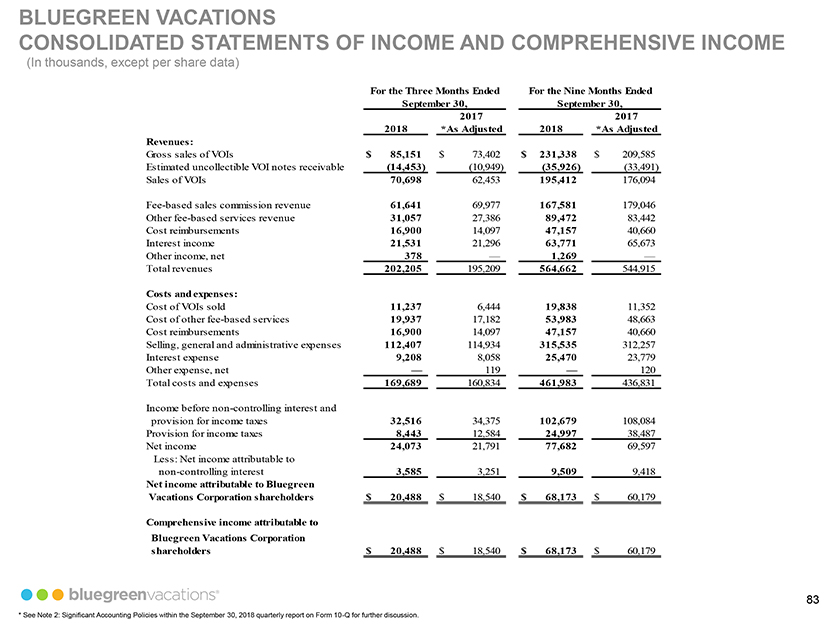

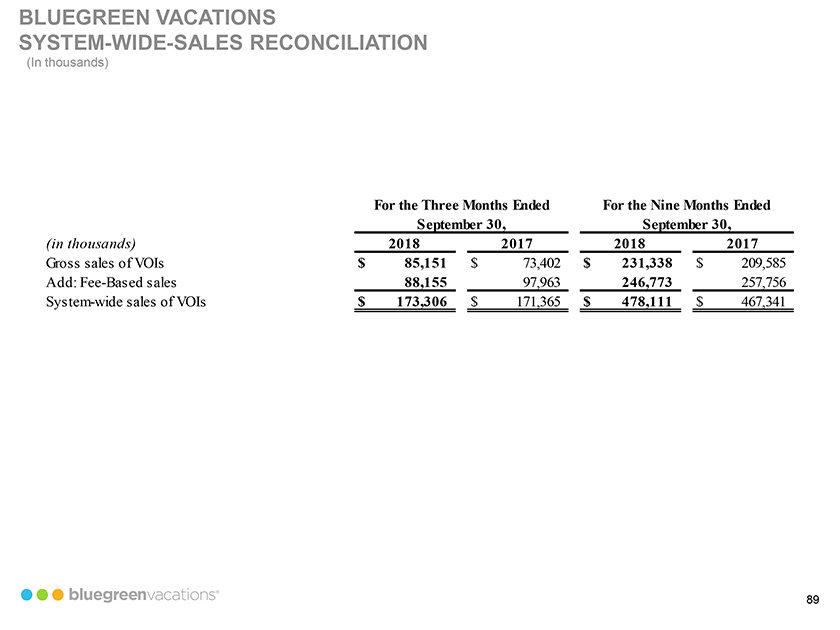

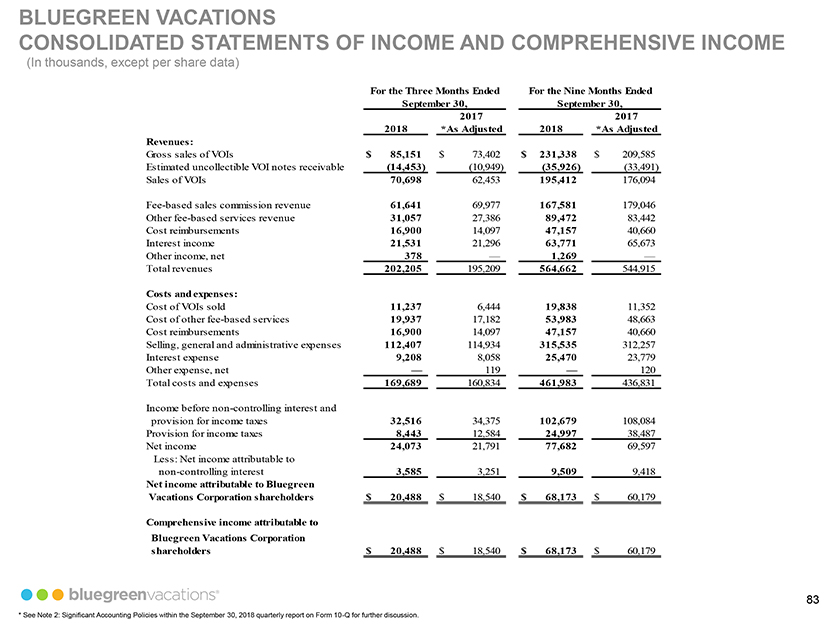

BLUEGREEN VACATIONS CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (In thousands, except per share data) For the Three Months Ended For the Nine Months Ended September 30, September 30, 2017 2017 2018 *As Adjusted 2018 *As Adjusted Revenues: Gross sales of VOIs $ 85,151 $ 73,402 $ 231,338 $ 209,585 Estimated uncollectible VOI notes receivable (14,453) (10,949) (35,926) (33,491) Sales of VOIs 70,698 62,453 195,412 176,094Fee-based sales commission revenue 61,641 69,977 167,581 179,046 Otherfee-based services revenue 31,057 27,386 89,472 83,442 Cost reimbursements 16,900 14,097 47,157 40,660 Interest income 21,531 21,296 63,771 65,673 Other income, net 378 — 1,269 — Total revenues 202,205 195,209 564,662 544,915 Costs and expenses: Cost of VOIs sold 11,237 6,444 19,838 11,352 Cost of otherfee-based services 19,937 17,182 53,983 48,663 Cost reimbursements 16,900 14,097 47,157 40,660 Selling, general and administrative expenses 112,407 114,934 315,535 312,257 Interest expense 9,208 8,058 25,470 23,779 Other expense, net — 119 — 120 Total costs and expenses 169,689 160,834 461,983 436,831 Income beforenon-controlling interest and provision for income taxes 32,516 34,375 102,679 108,084 Provision for income taxes 8,443 12,584 24,997 38,487 Net income 24,073 21,791 77,682 69,597 Less: Net income attributable tonon-controlling interest 3,585 3,251 9,509 9,418 Net income attributable to Bluegreen Vacations Corporation shareholders $ 20,488 $ 18,540 $ 68,173 $ 60,179 Comprehensive income attributable to Bluegreen Vacations Corporation shareholders $ 20,488 $ 18,540 $ 68,173 $ 60,179 83 * See Note 2: Significant Accounting Policies within the September 30, 2018 quarterly report on Form10-Q for further discussion.