UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

STARWOOD HOTELS & RESORTS WORLDWIDE, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

One StarPoint

Stamford, CT 06902

April 17, 2015

Dear Stockholder:

We cordially invite you to attend our 2015 Annual Meeting of Stockholders (or Annual Meeting), which will be held on May 28, 2015, at 10:00 a.m., local time, at The Westin Peachtree Plaza, located at 210 Peachtree Street, N.W., Atlanta, Georgia 30303.

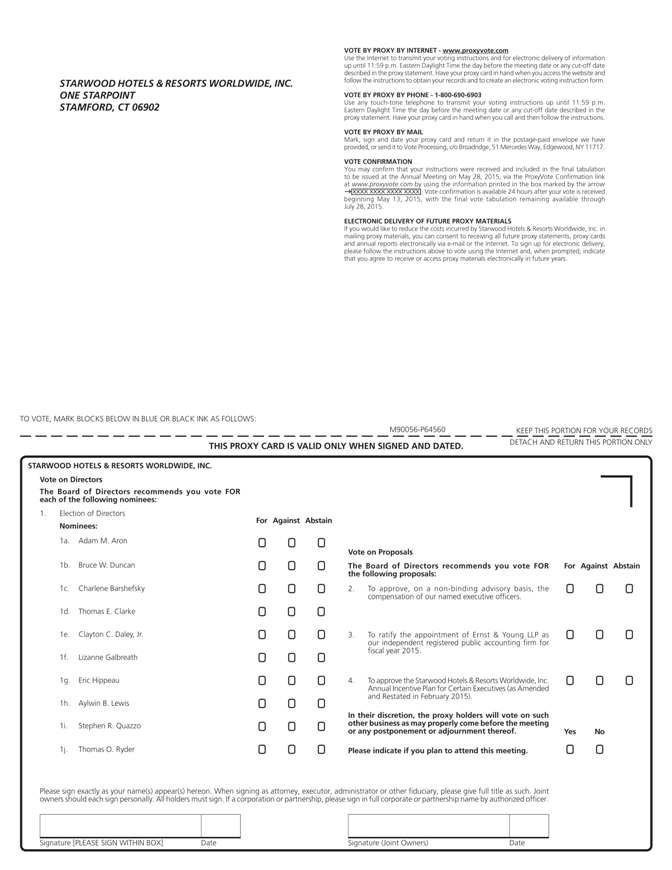

At the Annual Meeting, you will be asked to (i) elect ten director nominees to serve on our board of directors until the 2016 Annual Meeting of Stockholders, (ii) approve, on a non-binding advisory basis, the compensation of our named executive officers, (iii) ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015, (iv) approve the Starwood Hotels & Resorts Worldwide, Inc. Annual Incentive Plan for Certain Executives (As Amended and Restated in February 2015), and (v) act on any other matters that may be properly presented at the Annual Meeting or any adjournment or postponement thereof.

We hope you will attend the Annual Meeting, but whether or not you are planning to attend, we encourage you to vote your shares. You can vote in person at the Annual Meeting or authorize proxies to vote your shares either by telephone, electronically through the Internet, or by completing, signing and returning your proxy card by mail prior to the Annual Meeting. To ensure your vote is counted, please vote as promptly as possible.

We thank you for your continued support and look forward to seeing you at the Annual Meeting.

Sincerely,

| | |

| |  |

| Adam M. Aron | | Bruce W. Duncan |

| Chief Executive Officer | | Chairman of the Board |

YOUR VOTE IS IMPORTANT.

PLEASE PROMPTLY SUBMIT YOUR PROXY BY MAIL, TELEPHONE OR OVER THE INTERNET.

|

Notice of Annual Meeting of Stockholders |

May 28, 2015

10:00 a.m. local time

The Westin Peachtree Plaza, located at 210 Peachtree Street, N.W., Atlanta, Georgia 30303

ITEMS OF BUSINESS:

| 1. | To elect ten directors to serve until the 2016 Annual Meeting of Stockholders and until their successors are duly elected and qualify; |

| 2. | To consider and vote upon a proposal to approve, on a non-binding advisory basis, the compensation of our named executive officers; |

| 3. | To consider and vote upon a proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2015; |

| 4. | To consider and vote upon a proposal to approve the Starwood Hotels & Resorts Worldwide, Inc. Annual Incentive Plan for Certain Executives (As Amended and Restated in February 2015); and |

| 5. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

RECORD DATE:

Holders of record at the close of business on April 2, 2015 are entitled to notice of, and to vote at, the meeting and any adjournment or postponement thereof.

PROXY MATERIALS:

This year we will again seek to conserve natural resources and reduce costs by electronically disseminating annual meeting materials as permitted by the Securities and Exchange Commission. Unless an election has been affirmatively made to receive printed paper copies of the materials by mail, stockholders will receive a Notice of Internet Availability of Proxy Materials with instructions for accessing the annual meeting materials free of charge over the Internet.

By Order of the Board of Directors,

Kenneth S. Siegel

Corporate Secretary

April 17, 2015

Stamford, Connecticut

THE BOARD OF DIRECTORS URGES YOU TO VOTE IN PERSON AT THE ANNUAL MEETING

OR TO AUTHORIZE PROXIES TO VOTE YOUR SHARES BY TELEPHONE,

OVER THE INTERNET OR BY COMPLETING, SIGNING AND RETURNING YOUR PROXY CARD

PRIOR TO THE ANNUAL MEETING.

Table of Contents

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references (“XX”) are supplied to help you find further information in this proxy statement.

2015 ANNUAL MEETING OF STOCKHOLDERS

Date and Time:

Thursday, May 28, 2015, at 10:00 a.m. local time

Location:

The Westin Peachtree Plaza, located at 210 Peachtree Street, N.W., Atlanta, Georgia 30303

Record Date:

April 2, 2015

AGENDA AND VOTING RECOMMENDATIONS

| | |

| | | Our Board’s Recommendation |

Election of Directors (page 13) | | FOR each Director Nominee |

Advisory Vote to Approve Named Executive Officer Compensation (page 22) | | FOR |

Ratification of Appointment of Independent Registered Public Accounting Firm (page 23) | | FOR |

Approval of the Starwood Hotels & Resorts Worldwide, Inc. Annual Incentive Plan for Certain Executives (As Amended and Restated in February 2015) (page 24) | | FOR |

ADVANCE VOTING METHODS

Even if you plan to attend the 2015 Annual Meeting of Stockholders in person, please vote as soon as possible using one of the following advance voting methods described below.Make sure to have yourproxy card or Notice of Meeting and Internet Availability of Proxy Materials (or Notice) in hand and follow the provided instructions.

You can vote in advance in one of the following ways:

| • | | VIA THE INTERNET: Visit the website listed on your proxy card or Notice. |

| • | | BY TELEPHONE: Call the telephone number on your proxy card or follow the instructions on the Notice. |

| • | | BY MAIL: Follow the instructions on the Notice to request a paper copy of the materials, which will include a proxy card that you mark, sign, date and mail in the provided postage-paid envelope. |

CORPORATE GOVERNANCE HIGHLIGHTS (page 11)

For 2014, our Corporate Governance Highlights included:

| | • | | An independent Board of Directors, with the sole exception of our former President and Chief Executive Officer. |

| | • | | Four standing committees comprised solely of independent directors. |

| | • | | An independent non-executive Chairman. |

| | • | | The annual election of all directors. |

| | • | | Majority voting standard and a director resignation policy in uncontested director elections. | |

| | • | | Executive sessions of independent directors held at regularly scheduled Board meetings. | |

| | • | | Policies prohibiting the hedging and pledging of Company stock and other equity securities. | |

| | • | | An independent Board, with the sole exception of our former President and Chief Executive Officer. | |

| | • | | Board oversight of risk management. | |

| | | | |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement | | | 1 | |

DIRECTOR NOMINEES (page 13)

The following table provides summary information about each director nominee.

| | | | | | | | | | | | | | | | |

| | | | | Director

Since | | | | | | Committee Memberships(1) |

| Directors | | Age | | | Primary Occupation | | Independent | | Audit | | Capital | | Comp | | Gov |

Adam M. Aron | | 60 | | 2006 | | CEO of Starwood Hotels & Resorts Worldwide, Inc. | | No | | | | | | | | |

Charlene Barshefsky | | 64 | | 2001 | | Senior International Partner at WilmerHale, LLP | | Yes | | ü | | | | | | Chair |

Thomas E. Clarke | | 63 | | 2008 | | President, Innovation of Nike, Inc. | | Yes | | | | | | Chair | | ü |

Clayton C. Daley, Jr. | | 63 | | 2008 | | Retired; former CFO and Vice Chairman of The Procter & Gamble Company | | Yes | | Chair | | | | ü | | |

Bruce W. Duncan(2) | | 63 | | 1999 | | President and CEO of First Industrial Realty Trust, Inc. | | Yes | | | | | | | | ü |

Lizanne Galbreath | | 57 | | 2005 | | Managing Partner of Galbreath & Company | | Yes | | | | ü | | ü | | ü |

Eric Hippeau | | 63 | | 1999 | | Managing Director with Lerer Hippeau Ventures | | Yes | | ü | | | | ü | | |

Aylwin B. Lewis | | 60 | | 2013 | | President and CEO of Potbelly Corporation | | Yes | | ü | | ü | | | | |

Stephen R. Quazzo | | 55 | | 1999 | | CEO of Pearlmark Real Estate Partners, L.L.C. | | Yes | | ü | | Chair | | | | |

Thomas O. Ryder | | 70 | | 2001 | | Retired; former Chairman and CEO of The Reader’s Digest Association, Inc. | | Yes | | | | ü | | ü | | |

| (1) | Full committee names are as follows: |

| | Capital – Capital Committee |

| | Comp – Compensation and Option Committee |

| | Gov – Corporate Governance and Nominating Committee |

FINANCIAL HIGHLIGHTS (page 33)

For 2014, our Business Highlights included:

| | • | | Grew Same-Store Worldwide Systemwide revenue per available room (or REVPAR) by 5.8% in constant dollars compared to 2013 and management fees, franchise fees and other income increased by 9.5% compared to 2013. |

| | • | | Opened 74 new managed and franchised hotels with approximately 15,000 rooms. |

| | • | | Signed 175 new hotel management and franchise contracts, our second best signing year in the Company’s history. |

| | • | | Sold eight wholly-owned hotels and one unconsolidated joint venture for gross cash proceeds of approximately $817 million. | |

| | • | | Returned approximately $2.4 billion to stockholders through our dividend and stock repurchases of approximately 20.3 million shares. | |

| | |

| 2 | | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement |

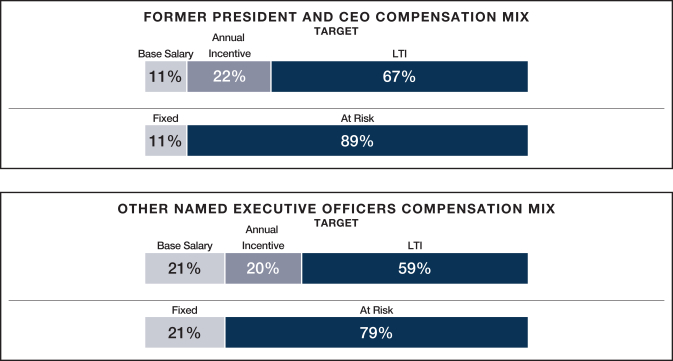

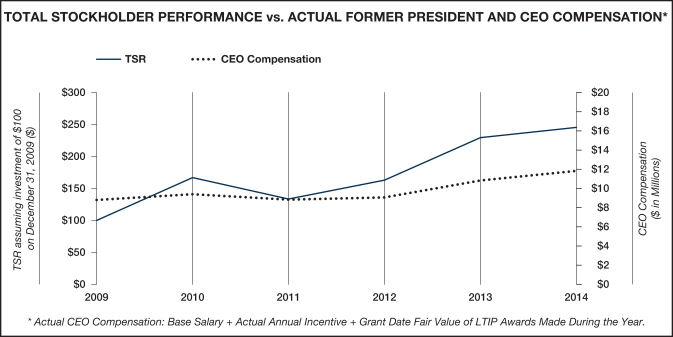

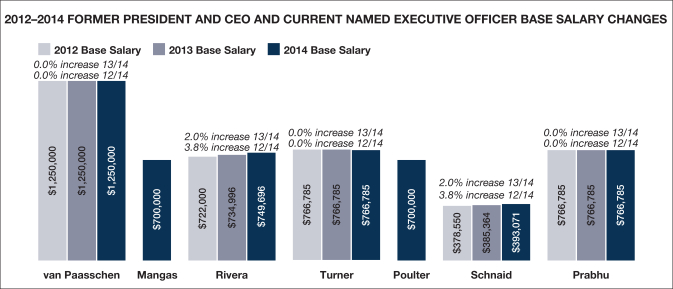

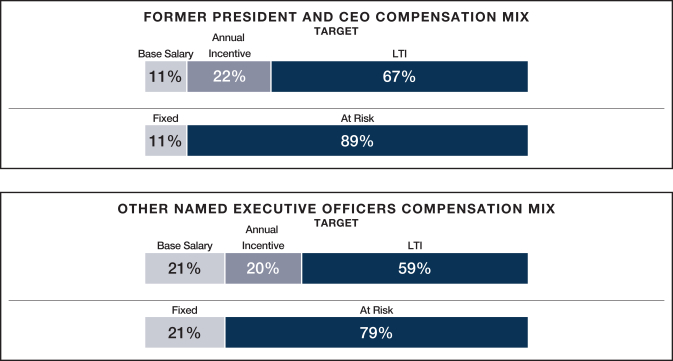

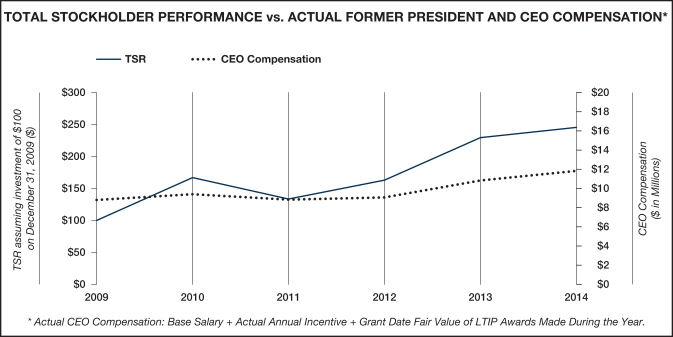

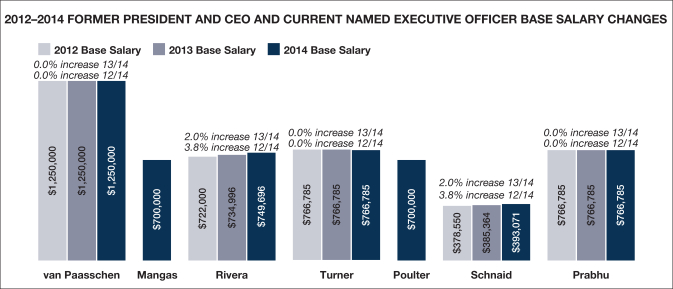

EXECUTIVE COMPENSATION HIGHLIGHTS (page 33)

For 2014, our Named Executive Officer Executive Compensation Highlights included:

| | • | | Our executive pay continued to be based in large part on our performance, reflected by the fact that 75% of our named executive officers’ total target annual cash incentive opportunity was tied to our 2014 adjusted EBITDA and earnings per share (or EPS) results, and payouts for the Company financial portion of the annual incentive award was 100% for 2014. | |

| | • | | We continue to grant performance shares as a significant portion of our named executive officers’ long-term equity incentive pay, which performance shares will be earned based on our three-year total stockholder return relative to peers. | |

| | • | | We generally maintained base salaries for our named executive officers at 2013 rates, except for a 2.0% increase for each of Sergio Rivera and Alan Schnaid in light of competitive pay comparisons. In addition, the Compensation Committee established base salaries for Thomas Mangas and Martha Poulter at what it determined to be competitive levels compared to the market. | |

| | • | | Our former President and Chief Executive Officer’s target total compensation continued to be largely based on variable or “at risk” elements (89% for 2014), which further aligned our former President and Chief Executive Officer’s compensation interests with the investment interests of our stockholders. | |

| | • | | We no longer provide for any tax gross-ups for excise tax. | |

| | • | | In addition to an Anti-Hedging Policy, we implemented an Anti-Pledging Policy that restricts our directors and executive officers from pledging, hypothecating or otherwise encumbering our stock or equity securities as collateral for indebtedness. | |

Additionally, for 2014, we engaged in (or refrained from) certain pay practices with respect to our named executive officer compensation program, which activity we believe aligns with market best practices:

What We Do

| | þ | Use Stringent Short-Term and Long-Term Incentive Award Performance Goals | |

| | þ | Benchmark Executive Compensation Against a Peer Group at Competitive Levels | |

| | þ | Subject Incentive Awards to Clawback | |

| | þ | Provide Equity Grants That Are 50% or More Performance-Based | |

| | þ | Require Double-Trigger Change in Control Provisions for Equity Awards | |

| | þ | Maintain Meaningful Stock Ownership Guidelines | |

| | þ | Retain Independent Compensation Consultants | |

What We Don’t Do

| | x | No Multi-Year Guaranteed Incentive Awards | |

| | x | No Dividend Equivalents on Unearned Performance Shares | |

| | x | No Repricing Underwater Stock Options | |

| | x | No Tax Gross-Ups for Perquisites in Any New Agreements | |

| | x | No Excise Tax Gross-Ups Upon Change in Control in Any New Agreements | |

| | x | No Pledging or Hedging of Company Stock | |

| | | | |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement | | | 3 | |

2014 EXECUTIVE COMPENSATION PROGRAM OBJECTIVES (page 36)

As a consumer lifestyle company with a branded hotel portfolio at its core, we operate in a competitive, dynamic and challenging business environment. In step with this mission and environment, the key objectives of our compensation program for our named executive officers for 2014 were to (1) attract and retain talented executives from within and outside the hospitality industry who understand the importance of innovation, brand enhancement and consumer experience, (2) motivate our executives to sustain high performance and achieve our financial and individual goals over the course of business cycles in various market conditions and (3) align the investment interests of stockholders and the compensation interests of our executives by linking a significant portion of the executive compensation to our annual business results and stock performance.

NAMED EXECUTIVE OFFICER COMPENSATION SUMMARY FOR 2014 (page 56)

The following is a summary of the 2014 compensation for each named executive officer. See the notes and narrative accompanying the2014 Summary Compensation Table on page 56 of this proxy statement for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Salary ($) | | | Bonus ($) | | | Stock

Awards ($) | | | Option

Awards ($) | | | Non-Equity

Incentive Plan

Compensation ($) | | | All Other

Compensation ($) | | | Total ($) | |

Frits van Paasschen Former President and Chief Executive Officer | | | 1,250,000 | | | | — | | | | 8,695,815 | | | | — | | | | 1,875,000 | | | | 181,128 | | | | 12,001,943 | |

Thomas B. Mangas Chief Financial Officer | | | 180,303 | | | | 675,000 | | | | 2,000,036 | | | | — | | | | 43,750 | | | | — | | | | 2,899,089 | |

Sergio D. Rivera President, The Americas | | | 747,246 | | | | — | | | | 3,659,416 | | | | — | | | | 737,810 | | | | 56,083 | | | | 5,200,555 | |

Simon M. Turner President, Global Development | | | 766,785 | | | | — | | | | 3,171,992 | | | | — | | | | 766,785 | | | | 59,089 | | | | 4,764,651 | |

Martha Poulter Chief Information Officer | | | 365,909 | | | | 500,000 | | | | 3,000,038 | | | | — | | | | 700,000 | | | | — | | | | 4,565,947 | |

Alan M. Schnaid Corporate Controller and Principal Accounting Officer | | | 391,787 | | | | 127,748 | | | | 358,068 | | | | — | | | | 268,271 | | | | 10,400 | | | | 1,156,274 | |

Vasant M. Prabhu Former Vice Chairman and Chief Financial Officer | | | 363,729 | | | | — | | | | 3,398,536 | | | | — | | | | — | | | | 120,674 | | | | 3,882,939 | |

| | |

| 4 | | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement |

PROXY STATEMENT

FOR 2015 ANNUAL MEETING OF STOCKHOLDERS

Our Board of Directors (or Board) solicits your proxy for the 2015 Annual Meeting (or Annual Meeting) of Stockholders of Starwood Hotels & Resorts Worldwide, Inc., a Maryland corporation, which we refer to in this document as we, us, Starwood or the Company, to be held on May 28, 2015, at 10:00 a.m. local time, at The Westin Peachtree Plaza, located at 210 Peachtree Street, N.W., Atlanta, Georgia 30303, and at any postponement or adjournment thereof. Proxy materials or a Notice of Meeting and Internet Availability of Proxy Materials were first sent to stockholders on or about April 17, 2015.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS. THE PROXY STATEMENT FOR THE 2015 ANNUAL MEETING OF STOCKHOLDERS AND THE ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014 ARE AVAILABLE FREE OF CHARGE OVER THE INTERNET ATwww.starwoodhotels.com/corporate/about/investor/index.html.

THE ANNUAL MEETING AND VOTING —

QUESTIONS AND ANSWERS

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders. These include: the election of the ten director nominees, a non-binding advisory vote to approve the compensation of our named executive officers, ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, a vote to approve the Starwood Hotels & Resorts Worldwide, Inc. Annual Incentive Plan for Certain Executives (As Amended and Restated in February 2015) and any other matters that may be properly presented at the meeting. We are not aware of any matters to be presented at the meeting, other than those described in this proxy statement. If any matters not described in the proxy statement are properly presented at the meeting, or any adjournment or postponement thereof, the proxies may vote your shares pursuant to the discretionary authority granted in the proxy.

Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials?

The Securities and Exchange Commission (or SEC) has adopted rules permitting the electronic delivery of proxy materials. In accordance with those rules, we have elected to provide access to our proxy materials, which include the Notice of Annual Meeting of Stockholders, 2015 Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2014 at www.starwoodhotels.com/corporate/about/investor/index.html. We sent a Notice of Meeting and Internet Availability of Proxy Materials (or Notice) to our stockholders of record and beneficial owners as of the close of business on April 2, 2015, directing them to a website where they can access the proxy materials and view instructions on how to authorize proxies to vote their shares over the Internet or by telephone. Stockholders who previously indicated a preference for paper copies of our proxy materials received paper copies. If you received a Notice but would like to request paper copies of our proxy materials going forward, you may still do so by following the instructions described in the Notice.

Choosing to receive your proxy materials over the Internet will help conserve natural resources and reduce the costs associated with the printing and mailing of the proxy materials to you. Unless you affirmatively elect to receive paper copies of our proxy materials in the future by following the instructions included in the Notice, you will continue to receive a Notice directing you to a website for electronic access to our proxy materials.

| | | | |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement | | | 5 | |

| | | | | | | | |

| THE ANNUAL MEETING AND VOTING — QUESTIONS AND ANSWERS | | | | | | | | |

When and where will the Annual Meeting be held?

The Annual Meeting will be held on May 28, 2015 at 10:00 a.m., local time, at The Westin Peachtree Plaza, located at 210 Peachtree Street, N.W., Atlanta, Georgia 30303.

Seating will begin at 9:00 a.m. If you plan to attend the Annual Meeting and have a disability or require special assistance, please contact our Investor Relations department at (203) 351-3500.

Who can attend the Annual Meeting?

Only stockholders of record at the close of business on April 2, 2015, the record date, or their duly authorized proxies, may attend the Annual Meeting. To gain admittance, you must present valid photo identification, such as a driver’s license or passport.

If you hold your shares in “street name” (through a broker, bank or other nominee), you will also need to bring a copy of a brokerage statement or a letter from your broker or other nominee (in a name matching your photo identification) reflecting your stock ownership as of the record date.

If you are a representative of a corporate or institutional stockholder, you must present valid photo identification, along with proof that you are a representative of such stockholder.

Please note that cameras, phones, or other similar electronic devices and large bags, packages or sound or video recording equipment will not be permitted in the meeting room.

How many shares must be present to hold the Annual Meeting?

In order for us to conduct the Annual Meeting, holders of a majority of the shares entitled to vote as of the close of business on the record date must be present in person or by proxy. This constitutes a quorum for the transaction of business at the Annual Meeting.

You are counted as present if you attend the Annual Meeting and vote in person, if you properly authorize proxies to vote your shares over the Internet or by telephone or if you properly execute and return a proxy card by mail prior to the Annual Meeting.

Abstentions and broker non-votes are counted as present for purposes of determining whether a quorum is present at the Annual Meeting.

If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained. Whether or not a quorum is present when the Annual Meeting is convened, the presiding officer may adjourn the Annual Meeting to a date not more than 120 days after April 2, 2015, the record date, without notice other than announcement at the Annual Meeting. If a motion is made to adjourn the Annual Meeting, the persons named as proxies on the enclosed proxy card may vote your shares pursuant to the discretionary authority granted in the proxy.

Who is entitled to vote at the Annual Meeting?

If you were a stockholder of record at the close of business on April 2, 2015, the record date, you are entitled to notice of, and to vote at, the Annual Meeting, or at any adjournment or postponement thereof, on any matter that is properly presented and submitted to a vote. On April 2, 2015, there were 171,147,640 shares of common stock issued, outstanding and entitled to vote. Each owner of record on the record date is entitled to one vote for each share of common stock held.

| | |

| 6 | | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement |

| | | | | | | | |

| | | | | | | | THE ANNUAL MEETING AND VOTING — QUESTIONS AND ANSWERS |

How do I vote my shares?

In Person. If you are a stockholder of record, you may vote in person at the Annual Meeting. If you hold shares in “street name” (through a broker, bank or other nominee), you may also vote in person at the Annual Meeting provided you have legal proxy from such broker, bank or other nominee to vote the shares held on your behalf. Please contact your broker, bank or other nominee for further information on such proxy. You will not be able to vote your shares at the Annual Meeting without a legal proxy from your broker, bank or other nominee. You will need to bring the legal proxy with you to the Annual Meeting and hand it in with a signed ballot that will be made available and distributed at the Annual Meeting. If you do not plan to attend the Annual Meeting or do not wish to vote in person, you may authorize proxies to vote your shares by written proxy, by telephone or over the Internet.

By Written Proxy. If you are a stockholder of record and wish to authorize proxies to vote your shares by written proxy, you may request a proxy card at any time by following the instructions on the Notice. If you hold shares in “street name,” you should receive instructions on how you may vote by written proxy from your broker, bank or other nominee.

By Telephone or Internet. If you are a stockholder of record and wish to authorize proxies to vote your shares by telephone or over the Internet, you may use the toll-free telephone number or access the electronic link to the proxy voting site by following the instructions on the Notice. If you hold shares in “street name,” you may authorize proxies to vote your shares by telephone or over the Internet if your broker, bank or other nominee makes these methods available, in which case you will receive instructions with the proxy materials.

Each share represented by a properly completed written proxy or properly authorized proxy by telephone or over the Internet will be voted at the Annual Meeting in accordance with the stockholder’s instructions specified in the proxy, unless such proxy has been revoked. If no instructions are specified, the shares will be voted“FOR”the election of each of the ten nominees for director named in this proxy statement,“FOR”the approval, on a non-binding advisory basis, of the compensation of our named executive officers,“FOR”ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2015,“FOR”the approval of the Starwood Hotels & Resorts Worldwide, Inc. Annual Incentive Plan for Certain Executives (As Amended and Restated in February 2015) and, with respect to other matters to properly come before the meeting, pursuant to the discretionary authority granted in the proxy to the proxy holder.

How many Notices will I receive? What does it mean if I receive more than one Notice?

If you are a stockholder of record, you will receive only one Notice (or proxy card upon request) for all of the shares of common stock you hold in certificate form, book entry form and in any of our savings plans.

If you hold shares in “street name” (through a broker, bank or other nominee), you will receive one Notice or voting instruction form for each account you have with a bank or broker. If you hold shares in multiple accounts, you may need to provide voting instructions for each account. Please sign and return all proxy cards or voting instruction forms you receive to ensure that all of the shares you hold are voted.

What if I hold shares through the Company’s 401(k) savings plan or employee stock purchase plan?

If you participate in the Company’s Savings and Retirement Plan (or Savings Plan) or Employee Stock Purchase Plan (or ESPP), your proxy card or vote by telephone or over the Internet will serve as a voting instruction for the trustee of the Savings Plan or ESPP. Whether you authorize your vote by proxy card, telephone or over the Internet, you must transmit your vote to the transfer agent on or prior to 11:59 p.m., Eastern Time on May 25, 2015. If you participate in the Savings Plan and your vote is not received by the transfer agent by that date or if you sign and return your proxy card without specifying your voting instructions, the trustee for the Savings Plan will vote your shares in the same proportion as the other shares for which such trustee has received timely voting instructions unless contrary to the Employee Retirement Income Security Act of 1974, as amended (or ERISA). If you participate in the ESPP and your proxy card is not received by the transfer agent by that date or if you sign and return your proxy card without specifying your voting instructions, the trustee of the ESPP will not vote your shares.

| | | | |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement | | | 7 | |

| | | | | | | | |

| THE ANNUAL MEETING AND VOTING — QUESTIONS AND ANSWERS | | | | | | | | |

If I submit a proxy, may I later revoke it and/or change my vote?

If you are a stockholder of record or hold shares in “street name” (through a broker, bank or other nominee), you may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting by:

| • | | signing and returning another proxy card with a later date; |

| • | | submitting a proxy on a later date by telephone or over the Internet (only your latest proxy will be counted); or |

| • | | attending the meeting and voting in person if you hold your shares in your own name or, provided you have obtained a legal proxy from your broker, bank or other nominee, if you are a stockholder who holds shares in “street name.” |

Are votes confidential? Who counts the votes?

The votes of all stockholders are kept confidential except:

| • | | as necessary to meet applicable legal requirements and to assert or defend claims for or against us; |

| • | | in case of a contested proxy solicitation; |

| • | | if a stockholder makes a written comment on the proxy card or otherwise communicates his or her vote to management; or |

| • | | to allow the independent inspector of election to certify the results of the vote. |

We have retained Broadridge Financial Solutions, Inc. to tabulate the votes. We have retained The Carideo Group, Inc. to act as independent inspector of the election.

How can I confirm my vote was counted?

In furtherance of our commitment to the highest standards of corporate governance practices, we are once again offering our stockholders the opportunity to confirm that their votes were cast in accordance with their instructions. We believe that a vote confirmation mechanism promotes a more fair and transparent electoral process. Beginning May 13, 2015 through July 28, 2015, you may confirm your vote beginning twenty-four hours after

your vote is received, whether it was cast by proxy card, electronically or telephonically. To obtain vote confirmation, log ontowww.proxyvote.comusing your control number (located on your Notice or proxy card) and receive confirmation on how your vote was cast. If you hold your shares through a bank or brokerage account, the ability to confirm your vote may be affected by the rules of your bank or broker and the confirmation will not confirm whether your bank or broker allocated the correct number of shares to you.

How does the Board recommend that I vote?

The Board of Directors recommends that you vote:

| • | | “FOR”each of the ten director nominees; |

| • | | “FOR”approval, on a non-binding advisory basis, of the compensation of our named executive officers; |

| • | | “FOR”ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2015; and |

| • | | “FOR” approval of the Starwood Hotels & Resorts Worldwide, Inc. Annual Incentive Plan for Certain Executives (As Amended and Restated in February 2015). |

| | |

| 8 | | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement |

| | | | | | | | |

| | | | | | | | THE ANNUAL MEETING AND VOTING — QUESTIONS AND ANSWERS |

What vote is needed to approve each proposal?

The election of directors requires a majority of votes cast in the election of directors at the Annual Meeting, either in person or by proxy. The ten nominees must receive more“FOR”votes than“AGAINST” votes to be elected to serve as directors until the 2016 Annual Meeting of Stockholders and until their successors are elected and qualify, unless the number of nominees for election at such meeting exceeds the number of directors to be elected, in which case a plurality vote standard will apply. Brokers are not permitted to vote on the election of directors without instructions from the beneficial owner, so if you hold your shares through a broker or other nominee, your shares will not be voted in the election of directors unless you affirmatively vote your shares in accordance with the voting instructions provided by such broker or other nominee. Instructions to“ABSTAIN”will have no effect on the result of the vote.

Adoption of a resolution approving, on a non-binding advisory basis, the compensation of our named executive officers requires a majority of the votes cast at the Annual Meeting on the matter, either in person or by proxy. Abstentions and broker non-votes will have no effect on the result of the vote. The Board of Directors expects to take the result of the advisory vote into consideration when making future compensation decisions.

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2015 requires a majority of the votes cast at the Annual Meeting on the matter, either in person or by proxy. Brokers may vote uninstructed shares on this matter. Abstentions will have no effect on the result of the vote. If a majority of the votes cast are“AGAINST” ratification of the appointment of Ernst & Young LLP, the Board of Directors and the Audit Committee will reconsider the appointment.

Approval of the Starwood Hotels & Resorts Worldwide, Inc. Annual Incentive Plan for Certain Executives (As Amended and Restated in February 2015) requires“FOR” votes from a majority of the votes cast at the Annual Meeting on the matter, either in person or by proxy. Abstentions and broker non-votes will have no effect on the result of the vote. If a majority of the votes cast at the Annual Meeting vote“AGAINST” the approval of the Starwood Hotels & Resorts Worldwide, Inc. Annual Incentive Plan for Certain Executives (As Amended and Restated in February 2015), such plan will not be used for annual incentive awards and the Company will grant no further awards under the current version of the Annual Incentive Plan for Certain Executives.

What are broker non-votes?

If you hold shares in “street name” through a broker, bank or other nominee, you may give voting instructions to such party and the broker, bank or other nominee must vote as you directed. If you do not give any instructions, the broker, bank or other nominee may vote on all routine matters, such as ratification of the appointment of an independent registered public accounting firm, at its discretion. A broker, bank or other nominee, however, may not vote uninstructed shares on non-routine matters, such as the election of directors, or the advisory vote on executive compensation, at its discretion. This is referred to as a broker non-vote.

What happens if a director nominee does not receive a “majority” of the votes cast?

Our Bylaws provide for a majority voting standard in uncontested director elections. Under the majority vote standard, in order to be elected to the Board of Directors, a director nominee must receive a greater number of votes cast“FOR” than“AGAINST.”A director nominee who receives more “AGAINST” votes than “FOR” votes is required to tender his or her resignation for consideration by the Board of Directors. The Corporate Governance and Nominating Committee will then make a recommendation to the Board of Directors as to whether the Board of Directors should accept or reject such resignation. The Board of Directors will act on the tendered resignation and publicly disclose its decision within 90 days following certification of the election results. The director nominee in question will not participate in the deliberation process.

| | | | |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement | | | 9 | |

| | | | | | | | |

| THE ANNUAL MEETING AND VOTING — QUESTIONS AND ANSWERS | | | | | | | | |

When are stockholder proposals for the 2016 Annual Meeting of Stockholders due?

In order to be eligible for inclusion in our proxy statement for our 2016 Annual Meeting of Stockholders, stockholder proposals must be received no later than December 16, 2015 and must comply with the rules of the SEC. Stockholder proposals received after December 16, 2015 will be deemed untimely.

In order to be eligible for consideration at our 2016 Annual Meeting of Stockholders but not included in our proxy statement, stockholder proposals must be received no later than March 14, 2016 nor earlier than February 18, 2016 and must comply with the then current advance notice provisions and other requirements set forth in the Company’s Bylaws.

All stockholder proposals must be in writing and received by the deadlines described above at our principal executive offices at Starwood Hotels & Resorts Worldwide, Inc., One StarPoint, Stamford, Connecticut 06902, Attention: Kenneth S. Siegel, Corporate Secretary. Stockholder proposals must be in the form and include the information provided in our Bylaws. If we do not receive the required information on a timely basis, the proposal may be excluded from the proxy statement and from consideration at the 2016 Annual Meeting of Stockholders.

Where can I find more information about my voting rights as a stockholder?

The SEC has an informational website that provides stockholders with general information about how to cast their vote and why voting should be an important consideration for stockholders. You may access that information at investor.gov or atwww.sec.gov/spotlight/proxymatters.shtml.

| | |

| 10 | | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement |

Overview

We are committed to maintaining the highest standards of corporate governance and ethical business conduct across all aspects of our operations and decision-making processes.

Important documents governing our corporate governance practices include our Articles of Incorporation (or Charter), Amended and Restated Bylaws (or Bylaws), Corporate Governance Guidelines, Board of Directors’ Committee Charters, Code of Business Conduct and Ethics, Finance Code of Ethics, and Corporate Opportunity and Related Person Transaction Policy. These documents can be accessed on our website atwww.starwoodhotels.com and are discussed in more detail below.

Board Leadership Structure

Our Board leadership structure currently consists of Adam M. Aron, Chief Executive Officer of the Company on an interim basis, and nine independent outside directors, including the Chairman and four committee Chairs. The Board believes that having a separate independent director serve as Chairman promotes clear, independent board leadership and engagement. The Board also believes it is well served by having our Chief Executive Officer serve as a member of the Board, as the Chief Executive Officer of the Company has primary responsibility for managing our day-to-day operations and, consequently, a unique understanding of our business, and the hotel and leisure industry generally. Bruce W. Duncan currently serves as the Chairman of the Board and presides over executive sessions of non-management directors.

Board Role in Risk Oversight

The Board regularly receives reports from members of our senior management regarding any strategic, operational, financial, legal, regulatory or reputational risk that we may be facing. The Board then reviews management’s assessment, discusses options for mitigating any such risk with management, and directs management to manage and minimize our exposure. Management is ultimately responsible for identifying any such risk, and for developing and implementing mitigation plans throughout various planning processes, including during the strategic planning process.

The Board’s role is one of oversight. The Board’s four standing committees assist it with the risk oversight function as follows:

| • | | the Audit Committee oversees the Company’s controls and compliance activities and management’s process for identifying and quantifying risks facing the Company; |

| • | | the Compensation and Option Committee oversees risk associated with our compensation policies and practices and structures our incentive compensation in a way that discourages the taking of excessive risks and requires multiple risk-mitigating provisions in our pay programs; |

| • | | the Corporate Governance and Nominating Committee oversees Board processes and corporate governance-related risk and reviews legal and regulatory risk; and |

| • | | the Capital Committee oversees risks related to our hotel portfolio, capital improvement plans and capital budgets, and any investments, divestitures, significant asset sales, mergers and acquisitions and other extraordinary transactions. |

Corporate Governance Policies

In addition to our Charter and Bylaws, we have adopted the Corporate Governance Guidelines (or Guidelines), which are posted on our website atwww.starwoodhotels.com/corporate/about/investor/ governance.html. The Guidelines address significant corporate governance matters and provide the

| | | | |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement | | | 11 | |

framework for our corporate governance policies and practices including: board and committee composition, director and executive stock ownership guidelines, incentive recouping, anti-hedging and anti-pledging policies, and board and committee assessment. The Corporate Governance and Nominating Committee is responsible for overseeing and reviewing the Guidelines and for reporting and recommending to the Board any changes to the Guidelines.

We have adopted a Finance Code of Ethics (or Finance Code), applicable to our Chief Executive Officer, Chief Financial Officer, Corporate Controller, Treasurer, Senior Vice President – Taxes and Vice President – Internal Audit and other persons performing similar functions. The Finance Code is posted on our website atwww.starwoodhotels.com/corporate/about/investor/governance.html. We intend to post amendments to, and waivers from, the Finance Code on our website, as required by applicable rules of the SEC.

We also have a Code of Business Conduct and Ethics (or Code of Conduct), applicable to all employees and directors, that addresses legal and ethical issues that may be encountered in carrying out Company duties and responsibilities. Subject to applicable law, employees are required to report any conduct they believe to be a violation of the Code of Conduct. The Code of Conduct is posted on the Company’s website atwww.starwoodhotels.com/corporate/about/investor/governance.html.

To further promote transparency and ensure accurate and adequate disclosure, we have established a Disclosure Committee comprised of certain senior executives to design, establish and maintain our internal controls and other procedures with respect to the preparation of periodic reports required to be filed with the SEC, earnings releases and other written information that we decide to disclose to the investment community. The Disclosure Committee evaluates the effectiveness of our disclosure controls and procedures and maintains written records of its meetings.

The Board also has certain policies relating to retirement and a change in a director’s principal occupation. The Guidelines provide that directors who are not employees of the Company or any of its subsidiaries may not stand for re-election after reaching the age of 72 and that directors who are employees of the Company must retire from the Board upon retirement from the Company. The Guidelines provide that in the event a director changes his or her principal occupation (including through retirement), such director should voluntarily tender his or her resignation to the Board. The Corporate Governance and Nominating Committee will then make a recommendation to the Board as to whether the Board should accept or reject such resignation.

We indemnify our directors and officers to the fullest extent permitted by law so that they will be free from undue concern about personal liability in connection with their service to the Company. Indemnification is required pursuant to our Charter and we have entered into agreements with its directors and executive officers undertaking a contractual obligation to provide the same.

Director Independence

In accordance with the New York Stock Exchange (or NYSE) rules, the Board makes an annual determination as to the independence of the directors and director nominees. A director or director nominee is not deemed independent unless the Board affirmatively determines that such director or director nominee has no material relationship with us, directly or as an officer, stockholder or partner of an organization that has a relationship with us. The Board observes all criteria for independence established by the NYSE listing standards and other governing laws and regulations. When assessing materiality of a director’s relationship with us, the Board considers all relevant facts and circumstances, not merely from the director’s standpoint, but from that of the persons or organizations with which the director has an affiliation, and the frequency or regularity of the services, whether the services are being carried out at arm’s length in the ordinary course of business and whether the services are being provided substantially on the same terms to us as those prevailing at the time from unrelated parties for comparable transactions. Material relationships can include any commercial, banking, consulting, legal, accounting, charitable or other business relationships each director or director nominee may have with us. In addition, the Board consults with our external legal counsel to ensure that the Board’s determinations are consistent with all relevant securities laws and other applicable laws and regulations regarding the definition of “independent director,” including but not limited to those set forth in pertinent listing standards of the NYSE.

| | |

| 12 | | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement |

Our Board has determined that each of the directors and director nominees, with the exception of Mr. Aron, is “independent” under the NYSE rules and that these directors have no material relationship with us that would prevent the directors from being considered independent. Mr. Aron, who was an independent director prior to his appointment as the Company’s Chief Executive Officer on an interim basis, is not an “independent” director under the NYSE rules following his appointment.

In addition, it was taken into account that five of the non-employee directors, Messrs. Daley, Duncan, Hippeau and Quazzo and Ms. Galbreath, have no relationship with us except as a director and stockholder of the Company and that the remaining four non-employee directors have relationships with our stockholders or companies that do business with us that are consistent with the NYSE independence standards as well as independence standards adopted by the Board.

Communications with the Board

We have adopted a policy which permits stockholders and other interested parties to contact the Board. If you are a stockholder or interested party and would like to contact the Board, you may send a letter to the Board of Directors, c/o the Corporate Secretary of the Company, One StarPoint, Stamford, Connecticut 06902 or contact us online atwww.hotethics.com. It is important that you identify yourself as a stockholder or an interested party in the correspondence. If the correspondence contains complaints about our Company’s accounting, internal or auditing matters, the Corporate Secretary will advise a member of the Audit Committee. If the correspondence concerns other matters or is directed to the non-employee directors, the Corporate Secretary will forward the correspondence to the director to whom it is addressed or otherwise as would be appropriate under the circumstances, attempt to handle the inquiry directly (for example where it is a request for information or a stock-related matter), or not forward the communication altogether if it is primarily commercial in nature or relates to an improper or irrelevant topic. At each regularly scheduled Board meeting, the Corporate Secretary or his designee will present a summary of all such communications received since the last meeting that were not forwarded and shall make those communications available to the directors upon request. This policy is also posted on our website atwww.starwoodhotels.com/corporate/about/investor/ governance.html.

Posted Documents

You may obtain a copy of any of the aforementioned posted documents free of charge on our investor relations webpage on our website atwww.starwoodhotels.com/corporate/about/investor/index.html.

Choosing to receive your proxy materials over the Internet will help conserve natural resources and reduce the costs associated with the printing and mailing of the proxy materials to you. While we encourage stakeholders to download the proxy materials electronically, if hard copies are preferred, a request can be made by following the instructions provided in the Notice.

Please note that the information on our website is not incorporated by reference in this proxy statement.

PROPOSAL 1: ELECTION OF DIRECTORS

Under our Charter, each of our directors is elected to serve until the next annual meeting of stockholders and until his or her successor is duly elected and qualifies. Set forth below is information as of April 2, 2015 regarding the director nominees, which has been confirmed by each of them for inclusion in this proxy statement. Each director nominee has agreed to serve on the Board if elected. If a director nominee becomes unavailable for election, proxy holders and stockholders may vote for another director nominee proposed by the Board or, as an alternative, the Board may reduce the number of directors to be elected at the meeting.

| | | | |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement | | | 13 | |

The director nominees, if elected, will serve until the 2016 Annual Meeting and until their successors are duly elected and qualify.

| | | | | | | | |

| | ADAM M. ARON | | | | | | |

| | | | | | Mr. Aron has been Chief Executive Officer on an interim basis of the Company since February 14, 2015. Since 2006, he has also been an advisor to Apollo Management L.P., a private equity, debt and capital markets investor, and Chief Executive Officer of World Leisure Partners, Inc., a personal consultancy that he founded. He served as Chief Executive Officer of the Philadelphia 76ers, a professional basketball team, from 2011 to 2013. From 1996 through 2006, Mr. Aron was Chairman and Chief Executive Officer of Vail Resorts, Inc., an owner and operator of ski resorts and hotels. From 1993 through 1996, he was President and Chief Executive Officer of Norwegian Cruise Line Holdings Ltd., a global cruise operator. Earlier in his career, Mr. Aron was Senior Vice President of Marketing for United Airlines and for Hyatt Hotels Corporation. Mr. Aron is also currently a director of Norwegian Cruise Line Holdings Ltd. and a member of the Council on Foreign Relations. Mr. Aron has been a director of the Company since 2006. Immediately prior to serving as Chief Executive Officer, Mr. Aron resigned as a member of the Capital Committee and Corporate Governance and Nominating Committee and, earlier in 2014, served on the Audit Committee and Compensation and Option Committee. |

| | | Chief Executive Officer | | | | | |

| | Age: 60 Director since: 2006 | | | | | |

| | Committees served in 2014: Audit, Capital, Compensation and Option, Corporate Governance and Nominating | | | | | | Skills and Expertise • Senior leadership experience, including as CEO on an interim basis of our Company and as a CEO serving other companies for more than fifteen years • Significant industry experience, particularly in hotels and resorts • Global business experience • Public company director and committee experience |

| | Other Current Public Boards: Norwegian Cruise Line Holdings Ltd. | | | | | |

| | |

| | | | | |

| | BRUCE W. DUNCAN | | | | | | |

| | | | | | Mr. Duncan has been President, Chief Executive Officer and a director of First Industrial Realty Trust, Inc., a real estate investment trust that engages in the ownership, management, acquisition, sale, development and redevelopment of industrial real estate properties, since January 2009. From April to September 2007, Mr. Duncan served as Chief Executive Officer of the Company on an interim basis. He also has been a senior advisor to Kohlberg Kravis & Roberts & Co., a global investment firm, from July 2008 to January 2009. He was also a private investor from January 2006 to January 2009. From May 2005 to December 2005, Mr. Duncan was Chief Executive Officer and Trustee of Equity Residential (or EQR), a publicly traded real estate investment trust, and held various positions at EQR from March 2002 to December 2005, including President, Chief Executive Officer and Trustee from January 2003 to May 2005, and President and Trustee from March 2002 to December 2002. Mr. Duncan is also currently a director of First Industrial Realty Trust, Inc. and T. Rowe Price Mutual Funds. Mr. Duncan has been a director of the Company since 1999 and is the current Chairman of the Board. He currently serves on the Corporate Governance and Nominating Committee. |

| | | President, Chief Executive Officer and a director of First Industrial Realty Trust, Inc. | | | | | |

| | Age: 63 Director since: 1999 and current Chairman of the Board | | | | | |

| | Committees served: Corporate Governance and Nominating | | | | | | Skills and Expertise • Senior leadership experience, including as President and CEO of First Industrial Realty Trust • Significant industry experience, particularly in real estate and as former interim CEO of our Company • Real estate investment, management, acquisition and development experience • Public company director and committee experience |

| | Other Current Public Boards: First Industrial Realty Trust, Inc. and T. Rowe Price Mutual Funds | | | | | |

| | |

| 14 | | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement |

| | | | | | | | |

| | CHARLENE BARSHEFSKY | | | | | | |

| | | | Ambassador Barshefsky has been Senior International Partner at the law firm of WilmerHale, LLP, in Washington, D.C. since September 2001. From March 1997 to January 2001, Ambassador Barshefsky was the United States Trade Representative, the chief trade negotiator and principal trade policymaker for the United States and a member of the President’s Cabinet. Ambassador Barshefsky is a member of the Council on Foreign Relations and a Trustee of the Howard Hughes Medical Institute. In the past five years, Ambassador Barshefsky also served as a director of the Council on Foreign Relations and was a member of the Global Advisory Board of Moelis & Company. Ambassador Barshefsky is also currently a director of The Estee Lauder Companies, Inc., American Express Company and Intel Corporation. Ambassador Barshefsky has been a director of the Company since 2001 and is currently the Chair of the Corporate Governance and Nominating Committee and also serves on the Audit Committee. |

| | | Senior International Partner at the law firm of WilmerHale, LLP | | | | | |

| | Age: 64 Director since: 2001 | | | | | |

| | Committees served: Audit, Corporate Governance and Nominating | | | | | | Skills and Expertise • Senior leadership experience, including as a Senior International Partner of WilmerHale, LLP • Government, legal and public policy experience, particularly as the United States Trade Representative • Global business experience • Public company director and committee experience |

| | Other Current Public Boards: The Estee Lauder Companies, Inc., American Express Company and Intel Corporation | | | | | |

| | | |

| | | | | | | |

| | THOMAS E. CLARKE | | | | | | |

| | | | | | Dr. Clarke has been President, Innovation of Nike, Inc., a designer, developer and marketer of footwear, apparel and accessory products, since 2013. Dr. Clarke joined Nike in 1980 and was appointed Divisional Vice President in charge of marketing in 1987, Corporate Vice President in 1990, served as President and Chief Operating Officer from 1994 to 2000, and served as President, New Business Development from 2001 to 2013. Dr. Clarke previously held various positions with Nike, primarily in research, design, development and marketing. Dr. Clarke is also currently a director of Newell Rubbermaid Inc. Dr. Clarke has been a director of the Company since 2008 and is currently the Chair of the Compensation and Option Committee and also serves on the Corporate Governance and Nominating Committee. |

| | | President, Innovation of Nike, Inc. | | | | | |

| | Age: 63 Director since: 2008 | | | | | |

| | Committees served: Compensation and Option, Corporate Governance and Nominating | | | | | | Skills and Expertise • Senior leadership experience, including in various senior executive roles at Nike, Inc. • Branding, product development and strategy experience • Global business experience • Public company director and committee experience |

| | Other Current Public Boards: Newell Rubbermaid Inc. | | | | | |

| | | | |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement | | | 15 | |

| | | | | | | | |

| | CLAYTON C. DALEY, JR. | | | | | | |

| | | | | | Mr. Daley spent his entire professional career with The Procter & Gamble Company, a global consumer packaged goods company, joining the company in 1974, and he has held a number of key accounting and finance positions including Chief Financial Officer and Vice Chairman of Procter & Gamble; Comptroller, U.S. Operations of Procter & Gamble USA; Vice President and Comptroller of Procter & Gamble International; and Vice President and Treasurer of Procter & Gamble. Mr. Daley retired from Procter & Gamble in October 2009. In the past five years, Mr. Daley served as a director of Boy Scouts of America. In addition, Mr. Daley was Senior Advisor to TPG Capital until October 2012. Mr. Daley is also currently a director of SunEdison, Inc. Mr. Daley has been a director of the Company since 2008 and is currently the Chair of the Audit Committee and also serves on the Compensation and Option Committee. |

| | | Retired Chief Financial Officer of Procter & Gamble | | | | | |

| | Age: 63 Director since: 2008 | | | | | | Skills and Expertise • Senior leadership experience, including as CFO and Vice Chairman of Procter & Gamble (retired) • Significant corporate finance and accounting experience • Global business experience • Public company director and committee experience |

| | Committees served: Audit, Compensation and Option | | | | | |

| | Other Current Public Boards: SunEdison, Inc. | | | | | |

| | | |

| | | | | | | |

| | LIZANNE GALBREATH | | | | | | |

| | | | | | Ms. Galbreath has been the Managing Partner of Galbreath & Company, a real estate investment firm, since 1999. From April 1997 to 1999, Ms. Galbreath was Managing Director of LaSalle Partners/Jones Lang LaSalle, a real estate services and investment management firm, where she also served as a director. From 1984 to 1997, Ms. Galbreath served as a Managing Director, Chairman and Chief Executive Officer of The Galbreath Company, the predecessor entity of Galbreath & Company. Ms. Galbreath is also currently a director of Paramount Group, Inc. Ms. Galbreath has been a director of the Company since 2005 and currently serves on the Capital Committee, Compensation and Option Committee and Corporate Governance and Nominating Committee. |

| | | Managing Partner of Galbreath & Company | | | | | |

| | Age: 57 Director since: 2005 | | | | | | Skills and Expertise • Senior leadership experience, including as Managing Partner of Galbreath & Company • Significant industry experience, particularly in real estate • Real estate investment, development and strategy experience • Extensive management and corporate governance experience |

| | Committees served: Capital, Compensation and Option, Corporate Governance and Nominating | | | | | |

| | Other Current Public Boards: Paramount Group, Inc. | | | | | |

| | |

| 16 | | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement |

| | | | | | | | |

| | ERIC HIPPEAU | | | | | | |

| | | | | | Mr. Hippeau has been a Managing Director with Lerer Hippeau Ventures, formerly known as Lerer Ventures, a venture capital fund, since June 2011. From 2009 to 2011 he was the Chief Executive Officer of The Huffington Post, a news website. From 2000 to 2009, he was a Managing Partner of Softbank Capital, a technology venture capital firm. Mr. Hippeau served as Chairman and Chief Executive Officer of Ziff-Davis Inc., an integrated media and marketing company, from 1993 to March 2000 and held various other positions with Ziff-Davis from 1989 to 1993. In the past five years, Mr. Hippeau served as a director of the Huffington Post and Yahoo! Inc. Mr. Hippeau has been a director of the Company since 1999 and currently serves on the Audit Committee and Compensation and Option Committee. Skills and Expertise • Senior leadership experience, including as Partner of Lerer Hippeau Ventures • Extensive investment and venture capital experience • Significant experience in information technology, marketing and new media • Public company director and committee experience |

| | | Managing Director with Lerer Hippeau Ventures | | | |

| | Age: 63 Director since: 1999 | | | |

| | Committees served: Audit, Compensation and Option | | | |

| |

| | | |

| | AYLWIN B. LEWIS | | | | | | |

| | | | | | Mr. Lewis has served as President and Chief Executive Officer of Potbelly Corporation, formerly known as Potbelly Sandwich Works, LLC, since June 2008. From September 2005 to February 2008, Mr. Lewis was President and Chief Executive Officer of Sears Holdings Corporation, a nationwide retailer. Prior to being named Chief Executive Officer of Sears, Mr. Lewis was President of Sears Holdings and Chief Executive Officer of KMart and Sears Retail following Sears’ acquisition of KMart Holding Corporation in March 2005. Prior to that, Mr. Lewis was President and Chief Executive Officer of KMart since October 2004. Mr. Lewis was Chief Multi-Branding and Operating Officer of YUM! Brands, Inc., a franchisor and licensor of quick service restaurants including KFC, Long John Silver’s, Pizza Hut, Taco Bell and A&W, from 2003 until October 2004, Chief Operating Officer of YUM! Brands from 2000 until 2003 and Chief Operating Officer of Pizza Hut from 1996. Mr. Lewis is also currently a director of The Walt Disney Company. Mr. Lewis has been a director since 2013 and currently serves on the Audit Committee and Capital Committee. Skills and Expertise • Senior leadership experience, including as CEO of Potbelly Corporation • Branding, product development and strategy experience • Global franchise experience • Public company director and committee experience |

| | | President and Chief Executive Officer of Potbelly Corporation | | | | | |

| | Age: 60 Director since:2013 | | | | | |

| | Committees served: Audit, Capital | | | | | |

| | Other Current Public Boards: The Walt Disney Company | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

| | | | |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement | | | 17 | |

| | | | | | | | |

| | STEPHEN R. QUAZZO | | | | | | |

| | | | | | Mr. Quazzo is the Chief Executive Officer and has been the Managing Director and co-founder of Pearlmark Real Estate Partners, L.L.C., formerly known as Transwestern Investment Company, L.L.C., a real estate principal investment firm, since March 1996. From April 1991 to March 1996, Mr. Quazzo was President of Equity Institutional Investors, Inc., a private investment firm and a subsidiary of Equity Group Investments, Inc. Mr. Quazzo is also currently a director of Phillips Edison Grocery REIT I, Inc. Mr. Quazzo has been a director of the Company since 1999 and is currently the Chair of the Capital Committee and also serves on the Audit Committee. |

| | | Chief Executive Officer of Pearlmark Real Estate Partners | | | | | |

| | Age: 55 Director since: 1999 | | | | | | Skills and Expertise • Senior leadership experience, including as CEO of Pearlmark Real Estate Partners • Significant industry experience, particularly in real estate • Investment, development and strategy experience • Public company director and committee experience |

| | Committees served: Audit, Capital | | | | | |

| | Other Current Public Boards: Phillips Edison Grocery REIT I, Inc. | | | | | |

| | |

| | | | | |

| | THOMAS O. RYDER | | | | | | |

| | | | | | Mr. Ryder retired as Chairman of the Board of The Reader’s Digest Association, Inc., a global media and direct marketing company, in January 2007, a position he had held since January 2006. Mr. Ryder was Chairman of the Board and Chief Executive Officer of that company from April 1998 through December 2005. In addition, Mr. Ryder was Chairman of the Board and Chairman of the Audit Committee of Virgin Mobile USA, Inc., a wireless service provider, from October 2007 to November 2009. Mr. Ryder was President, American Express Travel Related Services International, a division of American Express Company, which provides travel, financial and network services, from October 1995 to April 1998. In the past five years, Mr. Ryder also served as a director of World Color Press, Inc., a company acquired by Quad/Graphics, Inc. in July 2010. Mr. Ryder is also currently a director of Amazon.com, Inc., Quad/Graphics, Inc. and RPX Corporation. Mr. Ryder has been a director of the Company since 2001 and currently serves on the Capital Committee and the Compensation and Option Committee. |

| | | Retired Chairman of the Board of The Reader’s Digest Association, Inc. | | | | | |

| | Age: 70 Director since: 2001 | | | | | |

| | Committees served: Capital, Compensation and Option | | | | | | Skills and Expertise • Senior leadership experience, including as Chairman and CEO of The Reader’s Digest (retired) • Branding, development and strategy experience • Global business, media and marketing experience • Public company director and committee experience |

| | Other Current Public Boards: Amazon.com, Inc., Quad/Graphics, Inc. and RPX Corporation | | | | | |

| | | | | | | |

The Board of Directors unanimously recommends a vote “FOR” the election of each of these nominees.

| | |

| 18 | | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement |

Board Meeting, Committee Meeting and Annual Meeting Attendance

Directors are expected to attend Board meetings, meetings of committees on which they serve and the annual meeting of stockholders. We encourage all directors to attend all meetings and believe that attendance at the annual meeting is as important as attendance at meetings of the Board and its committees. All of our incumbent directors who were directors at the time of the 2014 Annual Meeting of Stockholders attended such meeting.

During the year ended December 31, 2014, the Board held six meetings. In addition, directors attended meetings of individual Board committees. Each incumbent director who was a member of the Board in 2014 attended at least 75% of the meetings of the Board and the Board committees on which he or she served.

Board Committees

The Board has established four standing committees: the Audit Committee, the Capital Committee, the Compensation and Option Committee and the Corporate Governance and Nominating Committee. Each of the standing committees is comprised solely of independent directors. Accordingly, Mr. van Paasschen did not serve on any of the standing committees during 2014 and Mr. Aron, in his capacity as a member of the Board prior to serving as Chief Executive Officer in 2015, served on each of the four standing committees during 2014. Each of the standing committees operates pursuant to a written charter adopted by the Board, which is available on our website atwww.starwoodhotels.com/corporate/about/investor/governance.html. Each committee’s principal functions are described below:

Audit Committee

The Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (or Exchange Act), is currently comprised of Messrs. Daley (chairperson), Hippeau, Lewis and Quazzo and Ambassador Barshefsky, all of whom are “independent” directors, as determined by the Board in accordance with NYSE listing requirements and applicable federal securities laws. The Board has determined that each of Messrs. Daley, Hippeau and Lewis is an “audit committee financial expert” under federal securities laws. The Board has adopted a written charter for the Audit Committee which states that the Audit Committee provides oversight regarding accounting, auditing and financial reporting practices of the Company. The Audit Committee selects and engages our independent registered public accounting firm to audit our annual consolidated financial statements and discusses with it the scope and results of the audit. The Audit Committee also discusses with the independent registered public accounting firm, and with management, financial accounting and reporting principles, policies and practices and the adequacy of the Company’s accounting, financial, operating and disclosure controls. The Audit Committee met ten times during 2014.

Capital Committee

The Capital Committee is currently comprised of Messrs. Quazzo (chairperson), Lewis and Ryder and Ms. Galbreath, all of whom are “independent” directors, as determined by the Board in accordance with NYSE listing requirements and applicable federal securities laws. The Capital Committee was established in November 2005 to exercise some of the power of the Board relating to, among other things, capital plans and needs, mergers and acquisitions, divestitures and other significant corporate opportunities between meetings of the Board. The Capital Committee met four times during 2014.

Compensation and Option Committee

Under the terms of its charter, the Compensation and Option Committee (or Compensation Committee) is required to consist of three or more members of the Board who meet the independence requirements of the NYSE, are “non-employee directors” pursuant to Exchange Act Rule 16b-3, and are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (or Code). The Compensation Committee is currently comprised of Messrs. Clarke (chairperson), Daley, Hippeau and Ryder and Ms. Galbreath, all of whom are

| | | | |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement | | | 19 | |

“independent” directors, as determined by the Board in accordance with the NYSE listing requirements and applicable federal securities laws. The Compensation Committee makes recommendations to the Board with respect to the salary and other compensation (other than incentive awards, which the Board ratifies after approval by the Compensation Committee) to be paid to our Chief Executive Officer and reviews and authorizes the salaries, annual incentives, equity and other compensation to be paid to our other executive officers. The Compensation Committee also administers our employee benefits plans, including retirement plans and severance protection, and our 2013 Long-Term Incentive Compensation Plan, including grants to our senior executive officers under such plan. The Compensation Committee met six times during 2014.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee (or Governance Committee) operates pursuant to a written charter and is currently comprised of Ambassador Barshefsky (chairperson), Ms. Galbreath, and Messrs. Clarke and Duncan, all of whom are “independent” directors, as determined by the Board in accordance with NYSE listing requirements and applicable federal securities laws. The Governance Committee establishes, or assists in the establishment of, our governance policies (including policies that govern potential conflicts of interest) and monitors and advises us as to compliance with those policies. The Governance Committee reviews, analyzes, advises and makes recommendations to the Board with respect to situations, opportunities, relationships and transactions that are governed by such policies, such as opportunities in which a director or executive officer or their affiliates has a personal interest. In addition, the Governance Committee is responsible for making recommendations for candidates to the Board (taking into account suggestions made by officers, directors, employees and stockholders), recommending directors for service on Board committees, developing and reviewing background information for candidates, monitoring our executive succession plan and making recommendations to the Board for changes to the Guidelines related to the nomination or qualifications of directors or the size or composition of the Board. The Governance Committee met four times during 2014.

There are no firm prerequisites to qualify as a candidate for the Board, although the Board seeks a diverse group of candidates who possess the background, skills and expertise relevant to our business, or candidates that possess a particular geographical or international perspective. The Board looks for candidates with qualities that include strength of character, an inquiring and independent mind, practical wisdom and mature judgment. The Board seeks to ensure that at least two-thirds of the directors are independent under the Guidelines, and that members of the Audit Committee meet the financial literacy requirements under the rules of the NYSE and at least one of them qualifies as an “audit committee financial expert” under applicable federal securities laws. The Governance Committee does not have a set policy for considering or weighing diversity in identifying nominees but does seek to have a diversity of backgrounds, skills and perspectives among Board members, and considers how the background, skills and perspectives of each nominee would contribute to the total mix of backgrounds, skills and perspectives that would be available to the Board as a whole. The Governance Committee reviews the qualifications and backgrounds of the directors and the overall composition of the Board on an annual basis, and recommends to the full Board of Directors the slate of directors to be recommended for nomination for election at the next annual meeting of stockholders.

The Governance Committee may from time to time utilize the services of a search firm to help identify and evaluate candidates for director who meet the criteria and qualifications outlined above.

The Governance Committee will consider candidates for nomination recommended by stockholders and submitted for consideration. Although it has no formal policy regarding stockholder candidates, the Governance Committee believes that stockholder candidates should be reviewed in substantially the same manner as other candidates.

Under our current Bylaws, stockholder nominations of individuals to be elected as directors at an annual meeting of our stockholders must be made in writing and delivered to our Corporate Secretary at One StarPoint, Stamford, Connecticut 06902, and be received by the Corporate Secretary no later than the close of business on the 75th day nor earlier than the close of business on the 100th day prior to the first anniversary of the preceding year’s annual meeting. In accordance with our current Bylaws, in addition to other required information specified in the Bylaws, such notice shall set forth as to each proposed nominee (i) the name, age and business address of each nominee proposed in such notice, and a statement as to the qualification of each nominee, (ii) the principal occupation or employment of each such nominee, (iii) the number of shares which are beneficially owned and owned of record by the nominating stockholder,

| | |

| 20 | | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. -2015 Proxy Statement |