EXCO Resources, Inc. July 8, 2013 Acquisitions Overview

2 EXCO Resources, Inc. EXCO/HGI Production Partners TGGT Holdings, LLC Haynesville Shale: Operate ~400 horizontal wells Marcellus Shale: Operate ~110 horizontal wells Currently utilizing 3 rigs, 28 at peak activity in 2011 EXCO operates ~1.25 Bcfe/d gross production ~650 employees Conventional asset MLP structure with Harbinger Group 25% equity ownership in LP and 50% interest in GP 1 rig operating in West Texas EXCO operates ~150 Mmcfe/d gross production ~110 employees 50% equity interest in midstream gathering system in the core of the Haynesville Shale Currently flowing ~1.3 Bcf/d ~115 employees EXCO Resources, Inc. Executing on 2013 Goals − Significant acquisitions in both existing core area and new play Adds production and resource potential More balanced exposure to oil, liquids and natural gas

3 Approximately 60% of purchase price allocated to proved developed wellbores Significant cash flow from producing assets; trailing 12 month EBITDA of approximately $165 million Substantial proved assets provide cash flow for future development Strategic Rationale Eagle Ford: Farmout acreage (approximately 147,000 net acres) Eagle Ford: Potential to exploit additional horizons across play (Buda & Austin Chalk) Eagle Ford: Operational efficiencies to be gained by shifting to manufacturing development Haynesville: Bossier formation in DeSoto Parish; operational efficiencies from existing EXCO infrastructure Entry into Eagle Ford DIVERSIFIES asset base Adds oil exposure with solid economic returns in the oil core area 120 producing wells reduces delineation risk Extensive inventory of identified drilling locations Significant PDP Cash Flow Eagle Ford Acquisition Upside Potential Haynesville Acquisition FORTIFIES LEADING POSITION in the core DeSoto Parish Haynesville area and adds locations Leverages our extensive experience and cost focused development program Core area of EXCO’s operations; perfect bolt‐on acquisition Increases inventory of locations in key focus area

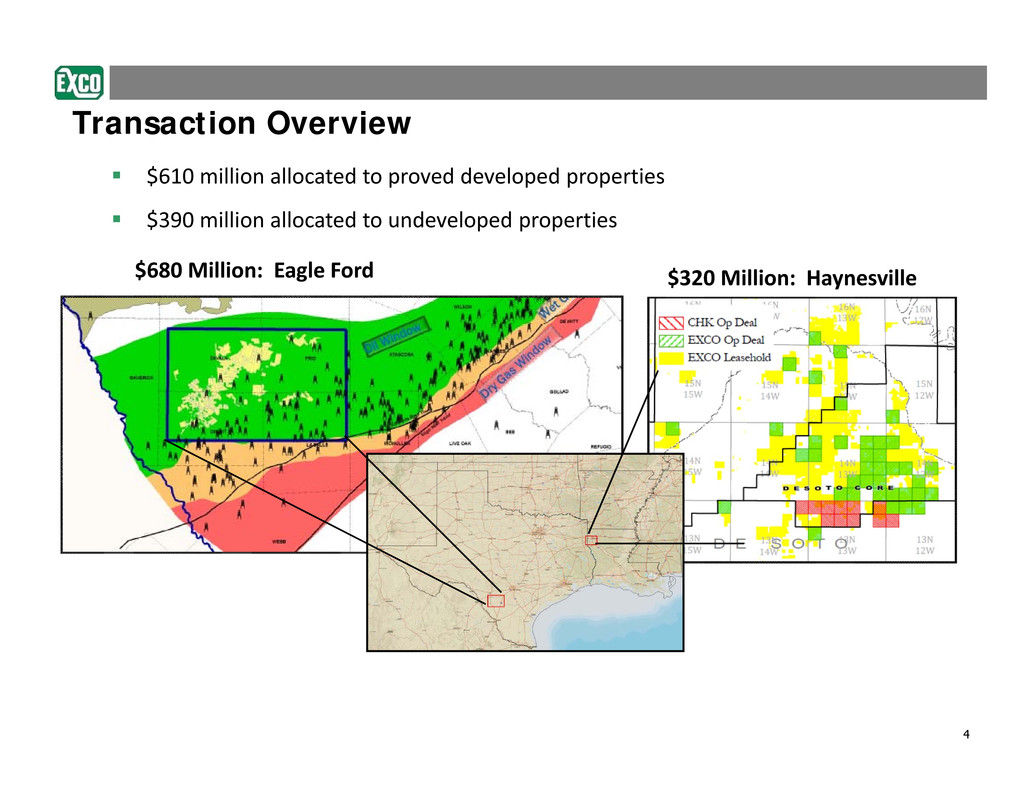

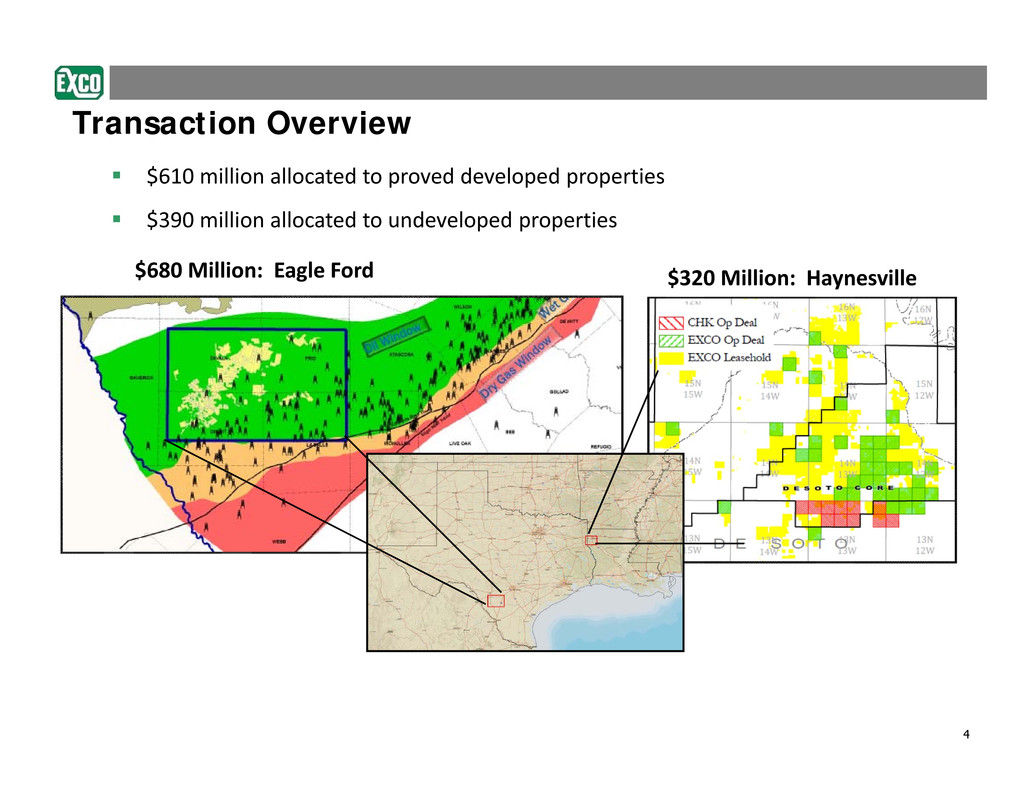

4 Transaction Overview $610 million allocated to proved developed properties $390 million allocated to undeveloped properties $680 Million: Eagle Ford $320 Million: Haynesville

5 Transaction Overview (continued) EXCO Resources, Inc. has agreed to purchase assets from Chesapeake Energy (“CHK”) for approximately $1 billion (subject to closing adjustments) Eagle Ford $680 million: CHK’s interests in approximately 120 producing wells, including 94 Eagle Ford oil window producing wells, with 4/1/13 effective date I. Average May net production of approximately 6,100 BOE/d on approximately 55,000 net acres II. Internally engineered reserves(1) of ~29 Mmboe(2) of which approximately 60% is developed with potential for over 92 Mmboe with the development of all locations III. Adds approximately 300 identified drilling locations IV. Farm‐out option on an additional approximately 147,000 net acres Haynesville $320 million: CHK’s interests in two Haynesville shale packages in EXCO’s core Haynesville position with 1/1/13 effective date I. Non‐operated interests in 170 EXCO operated wells in EXCO’s DeSoto Core II. Operated interests in 11 CHK operated wells directly offset EXCO’s DeSoto Core position III. Combined Haynesville transaction a. Average May net production of approximately 114 Mmcfe/d on approximately 9,600 net acres b. Internally engineered reserves(1) of over 365 Bcfe(3) of which approximately 35% is developed c. Adds approximately 55 additional Haynesville drilling locations on the 11 CHK sections plus an increased working interest in 75 EXCO operated drilling locations (1) Internally engineered reserves were run on a management price deck based off of NYMEX (2) SEC Proved Reserves of approximately 17 Mmboe (3) SEC Proved Reserves of approximately 145 Bcf of which 83% is Proved Developed

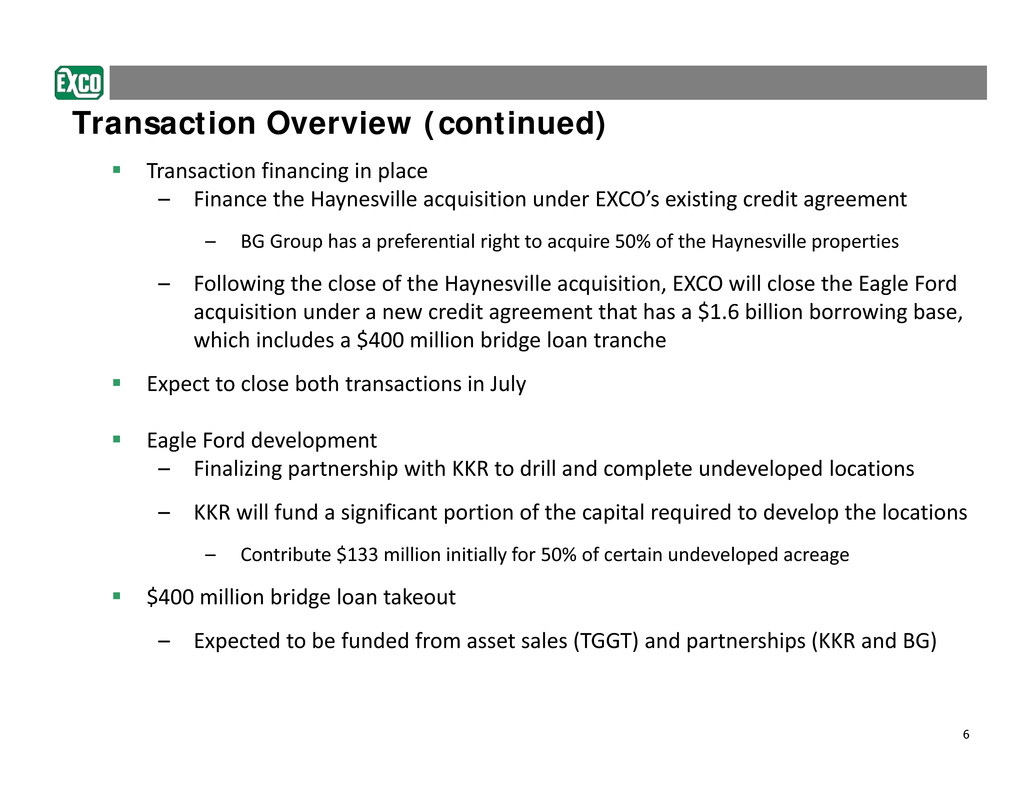

6 Transaction Overview (continued) Transaction financing in place – Finance the Haynesville acquisition under EXCO’s existing credit agreement – BG Group has a preferential right to acquire 50% of the Haynesville properties – Following the close of the Haynesville acquisition, EXCO will close the Eagle Ford acquisition under a new credit agreement that has a $1.6 billion borrowing base, which includes a $400 million bridge loan tranche Expect to close both transactions in July Eagle Ford development – Finalizing partnership with KKR to drill and complete undeveloped locations – KKR will fund a significant portion of the capital required to develop the locations – Contribute $133 million initially for 50% of certain undeveloped acreage $400 million bridge loan takeout – Expected to be funded from asset sales (TGGT) and partnerships (KKR and BG)

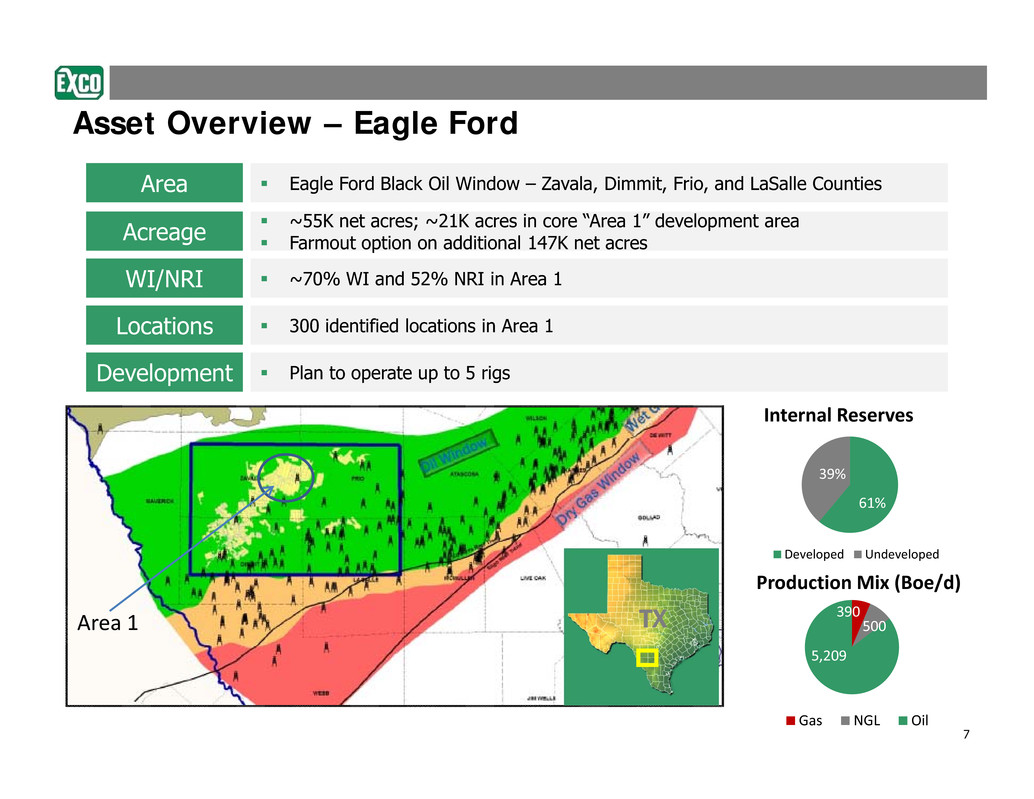

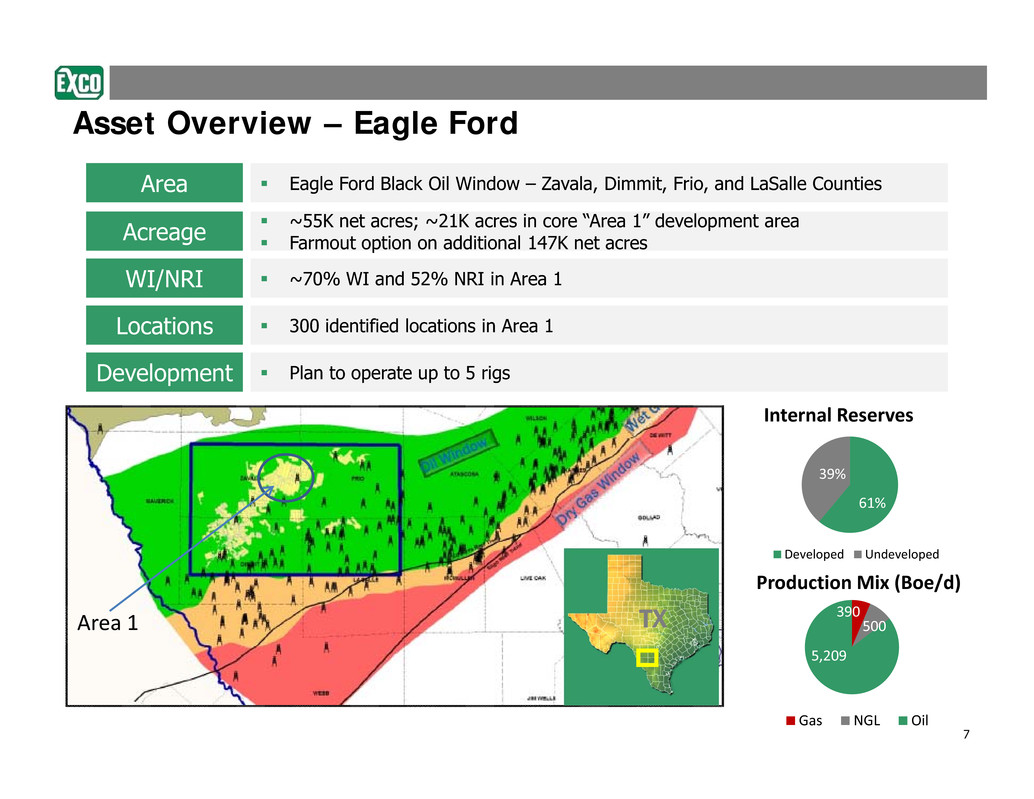

7 Asset Overview – Eagle Ford Area Eagle Ford Black Oil Window – Zavala, Dimmit, Frio, and LaSalle Counties Acreage ~55K net acres; ~21K acres in core “Area 1” development area Farmout option on additional 147K net acres WI/NRI ~70% WI and 52% NRI in Area 1 Locations 300 identified locations in Area 1 Development Plan to operate up to 5 rigs 61% 39% Internal Reserves Developed Undeveloped 390 500 5,209 Production Mix (Boe/d) Gas NGL Oil Area 1 TX

8 Asset Overview – Haynesville Area Haynesville Core – DeSoto Parish Acreage ~5,600 net acres in EXCO operated sections; ~4,000 in CHK operated sections WI Additional 22% in the 42 EXCO operated sections; 62% in the 11 CHK operated sections Locations 55 identified new Haynesville locations on the 11 CHK sections plus an increased working interest in 75 EXCO operated drilling locations Development Plan to high grade locations and develop Haynesville core with 3 rigs 34% 66% Internal Reserves Developed Undeveloped 114 Mmcfe/d Production Mix (Mmcfe/d) Gas NGL Oil

9 CLOSING − EXCO is executing its strategy − Deal increases earnings and cash flow in a meaningful way due to high percentage of production − Diversifies our exposure with Eagle Ford oil opportunity − Strong financing support from our bank group − Concluding asset sales (TGGT) and partnership deals (KKR and BG) are next on the agenda QUESTIONS

10 Forward Looking Statements This presentation contains forward‐looking statements, as defined in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. These forward‐looking statements relate to, among other things, the following: • our future financial and operating performance and results; • our business strategy; • market prices for oil, natural gas and natural gas liquids; • our future use of derivative financial instruments; and • our plans and forecasts. We have based these forward‐looking statements on our current assumptions, expectations and projections about future events. We use the words "may," "expect," "anticipate," "estimate," "believe," "continue," "intend," "plan," "budget" and other similar words to identify forward‐looking statements. The statements that contain these words should be read carefully because they discuss future expectations, contain projections of results of operations or our financial condition and/or state other "forward‐looking" information. We do not undertake any obligation to update or revise publicly any forward‐looking statements, except as required by applicable securities law. These statements also involve risks and uncertainties that could cause our actual results or financial condition to materially differ from our expectations in this presentation, including, but not limited to: • fluctuations in the prices of oil, natural gas and natural gas liquids; • the availability of foreign oil, natural gas and natural gas liquids; • future capital requirements and availability of financing; • disruption of credit and capital markets and the ability of financial institutions to honor their commitments; • estimates of reserves and economic assumptions; • geological concentration of our reserves; • risks associated with drilling and operating wells; • exploratory risks, including our Marcellus shale play in Appalachia and our Haynesville and Bossier shale plays in East Texas/North Louisiana; • risks associated with operation of natural gas pipelines and gathering systems; • discovery, acquisition, development and replacement of oil and natural gas reserves; • cash flow and liquidity; • timing and amount of future production of oil and natural gas; • availability of drilling and production equipment; • marketing of oil and natural gas; • political and economic conditions and events in oil‐producing and natural gas‐producing countries; • title to our properties; • litigation; • competition; • general economic conditions, including costs associated with drilling and operation of our properties; • environmental or other governmental regulations, including legislation to reduce emissions of greenhouse gases, legislation of derivative financial instruments, regulation of hydraulic fracture stimulation and elimination of income tax incentives available to our industry; • receipt and collectability of amounts owed to us by purchasers of our production and counterparties to our derivative financial instruments; • decisions whether or not to enter into derivative financial instruments; • potential acts of terrorism; • actions of third party co‐owners of interests in properties in which we also own an interest; • fluctuations in interest rates; and • our ability to effectively integrate companies and properties that we acquire..

11 Forward Looking Statements (continued) We believe that it is important to communicate our expectations of future performance to our investors. However, events may occur in the future that we are unable to accurately predict, or over which we have no control. We caution users of the financial statements not to place undue reliance on a forward‐looking statement. When considering our forward‐looking statements, keep in mind the risk factors and other cautionary statements in this presentation, and the risk factors included in our Annual Report on Form 10‐K for the year ended December 31, 2012, filed with the Securities and Exchange Commission, or the SEC, on February 21, 2013, and our Quarterly Reports on Form 10‐Q. Our revenues, operating results and financial condition substantially depend on prevailing prices for oil and natural gas and the availability of capital from our credit agreement, or the EXCO Resources Credit Agreement. Declines in oil or natural gas prices may have a material adverse effect on our financial condition, liquidity, results of operations, the amount of oil or natural gas that we can produce economically and the ability to fund our operations. Historically, oil and natural gas prices and markets have been volatile, with prices fluctuating widely, and they are likely to continue to be volatile. The SEC permits oil and gas companies, in their filings with the SEC, to disclose not only "proved" reserves (i.e., quantities of oil and gas that are estimated to be recoverable with a high degree of confidence), but also "probable" reserves (i.e., quantities of oil and gas that are as likely as not to be recovered) as well as "possible" reserves (i.e., additional quantities of oil and gas that might be recovered, but with a lower probability than probable reserves). In addition unless otherwise noted, certain proved reserve numbers and other reserve numbers provided herein are not SEC “case” numbers using flat commodity prices, but a management case price deck using escalating prices for a period of time. As noted above, statements of reserves are only estimates and may not correspond to the ultimate quantities of oil and gas recovered. Any reserve estimates provided in this presentation that are not specifically designated as being estimates of proved reserves may include estimated reserves not necessarily calculated in accordance with, or contemplated by, the SEC's latest reserve reporting guidelines. Investors are urged to consider closely the disclosure in our Annual Report on Form 10‐K for the year ended December 31, 2012, which is available on our website at www.excoresources.com under the Investor Relations tab or by calling us at 214‐368‐2084.