Filed by The Charles Schwab Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 under

the Securities Exchange Act of 1934

Subject Company: optionsXpress Holdings, Inc.

Commission File No.: 001-32419

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include statements that refer to expectations, projections or other characterizations of future events or circumstances and are identified by words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “plan,” “will,” “may,” “aim,” “target,” “could,” “should,” “continue,” “build,” “improve,” “growth,” “increase”, and other similar expressions. These forward-looking statements relate to the business combination transaction involving The Charles Schwab Corporation (“Schwab”) and optionsXpress Holdings, Inc. (“optionsXpress”), including expected synergies; timing of closing; client and stockholder benefits; management; accretion; growth; client retention; and merger-related charges which reflect management’s beliefs, objectives and expectations as of the date hereof. Achievement of the expressed beliefs, objectives and expectations is subject to risks and uncertainties that could cause actual results to differ materially from those beliefs, objectives or expectations. Important transaction-related factors that may cause such differences include, but are not limited to, the risk that expected revenue, expense and other synergies from the transaction may not be fully realized or may take longer to realize than expected; the parties are unable to successfully implement their integration strategies; failure of the parties to satisfy the closing conditions in the merger agreement in a timely manner or at all, including regulatory approvals; failure of the optionsXpress stockholders to approve the merger; and disruptions to the parties’ businesses as a result of the announcement and pendency of the merger. Other important factors include general market conditions, including the level of interest rates, equity valuations and trading activity; the parties’ ability to attract and retain clients and grow client assets/relationships; competitive pressures on rates and fees; the level of client assets, including cash balances; the impact of changes in market conditions on money market fund fee waivers, revenues, expenses and pre-tax margins; capital needs; the parties’ ability to develop and launch new products, services and capabilities in a timely and successful manner; the effect of adverse developments in litigation or regulatory matters; any adverse impact of financial reform legislation and related regulations; and other factors set forth in Schwab’s and optionsXpress’ Annual Reports on Form 10-K for the fiscal year ended December 31, 2010. Schwab and optionsXpress disclaim any obligation and do not intend to update or revise any forward-looking statements.

In connection with the proposed transaction, Schwab will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a proxy statement/prospectus for the stockholders of optionsXpress. optionsXpress will mail the final proxy statement/prospectus to its stockholders. Investors and security holders are urged to read the proxy statement/prospectus regarding the proposed transaction and other relevant documents filed with the SEC when they become available because they will contain important information. Copies of all documents filed with the SEC regarding the proposed transaction may be obtained, free of charge, at the SEC’s website (http://www.sec.gov). These documents, when available, may also be obtained, free of charge, from Schwab’s website,www.aboutschwab.com/investor, under the tab “Financials and SEC Filings” or from optionsXpress’ website,www.optionsXpress.com/investor, under the item “SEC Filings”.

Schwab, optionsXpress and their respective directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from the optionsXpress stockholders in respect of the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed to be participants in the solicitation of the stockholders of optionsXpress in connection with the proposed transaction will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information about Schwab’s executive officers and

directors is available in Schwab’s Annual Report on Form 10-K filed with the SEC on February 25, 2011 and Schwab’s definitive proxy statement filed with the SEC on March 30, 2010. Information about optionsXpress’ executive officers and directors is available in optionsXpress’ definitive proxy statement filed with the SEC on April 15, 2010. You can obtain free copies of these documents from Schwab and optionsXpress using the contact information above.

The following is an investor presentation by Schwab and optionsXpress in connection with the proposed transaction.

**********

|

Redefining Full-Service Investing A Best-in-Class Trading Platform for Clients |

|

2 Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include statements that refer to expectations, projections or other characterizations of future events or circumstances and are identified by words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “plan,” “will,” “may,” “aim,” “target,” “could,” “should,” “continue,” “build,” “improve,” “growth,” “increase”, and other similar expressions. These forward-looking statements relate to the business combination transaction involving Schwab and optionsXpress, including expected synergies; timing of closing; client and stockholder benefits; management; accretion; growth; client retention; and merger-related charges. These forward-looking statements, which reflect management’s beliefs, objectives and expectations as of today, are necessarily estimates based on the best judgment of the companies’ senior management. Achievement of the expressed beliefs, expectations and objectives is subject to risks and uncertainties that could cause actual results to differ materially from those beliefs, objectives or expectations. Important factors that may cause such differences are discussed in Schwab’s and optionsXpress’ filings with the Securities and Exchange Commission, including their Annual Reports on Form 10-K. Other important transaction- related factors include, but are not limited to, the risk that expected revenue, expense and other synergies from the transaction may not be fully realized or may take longer to realize than expected; the parties are unable to successfully implement their integration strategies; failure of the parties to satisfy the closing conditions in the merger agreement in a timely manner or at all, including regulatory approvals; failure of the optionsXpress stockholders to approve the merger; and disruptions to the parties’ businesses as a result of the announcement and pendency of the merger. Other important factors include general market conditions, including the level of interest rates, equity valuations and trading activity; the parties’ ability to attract and retain clients and grow client assets/relationships; competitive pressures on rates and fees; the level of client assets, including cash balances; the impact of changes in market conditions on money market fund fee waivers, revenues, expenses and pre-tax margins; capital needs; the parties’ ability to develop and launch new products, services and capabilities in a timely and successful manner; the effect of unanticipated adverse developments in litigation or regulatory matters; and any adverse impact of financial reform legislation and related regulations. The information in this presentation speaks only as of March 21, 2011 (or such earlier date as may be specified herein). The company makes no commitment to update any of this information. |

|

3 Two financial services leaders are joining forces… The Charles Schwab Corporation, one of the nation’s largest brokerage service providers is acquiring optionsXpress Holdings, Inc, a pioneer in online brokerage focused on derivatives Unites complementary trading platform strengths across equities, options and futures Combines broad range of investment products and services with extensive trading tools, analytics and education for the benefit of all investors Increases stockholder value through enhanced growth and operating leverage |

|

4 Transaction Summary Structured as a stock-for-stock exchange • $17.91 per share based on 3/18 close • 1.02 shares of SCHW per share of OXPS • Approximately $1.0 billion total purchase price • Purchase price implies valuation multiples of 10.0x and 8.6x 2011 and 2012 EBITDA, respectively (1) Targeted to close Q3 2011 Expected to be accretive (~1-2%) over first full year, including synergies in the valuable options and futures trading arena • Increases Schwab total DART by 15% • Approximately $80 million in synergies Voting agreement representing approximately 23% of outstanding shares Requires approvals from regulators and optionsXpress stockholders; subject to customary closing conditions (1) Based on I/B/E/S analyst consensus estimates. |

|

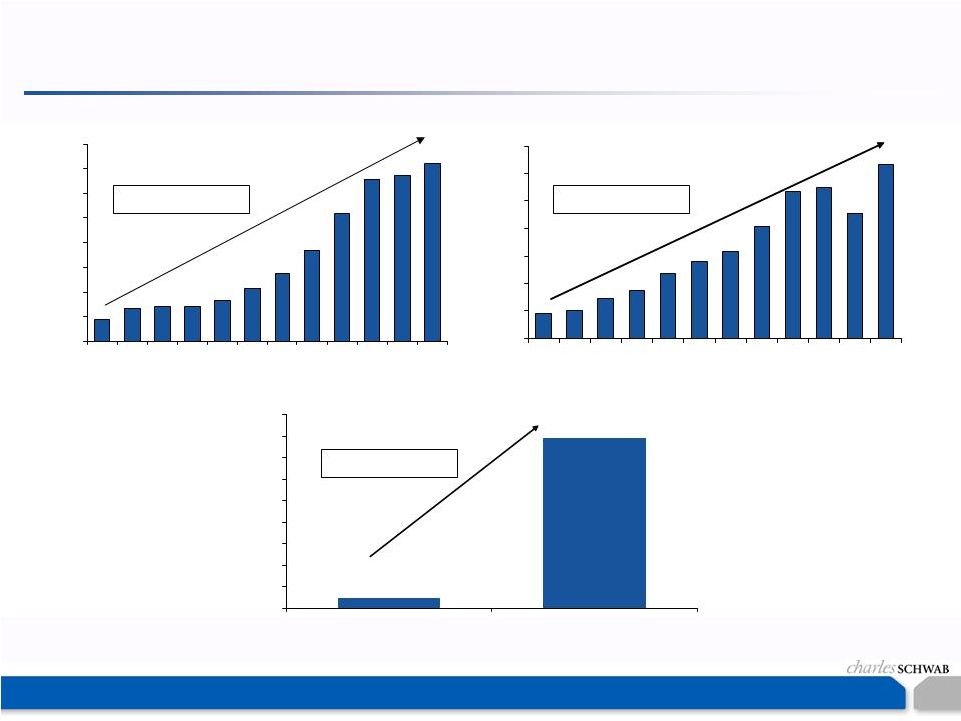

5 The opportunity: derivatives trading volume continues to expand, … Source: OCC (options), BIS (futures), and Aite Group (forex). Global Retail FX Trading Volumes ($ in Billions) Global Futures Volume (Contracts in Millions) U.S. Listed Equity Options (Contracts in Millions) CAGR = 21.0% CAGR = 19.2% 0 1,000 3,000 4,000 5,000 6,000 7,000 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 2001 2010 CAGR = 35.9% 2,000 |

|

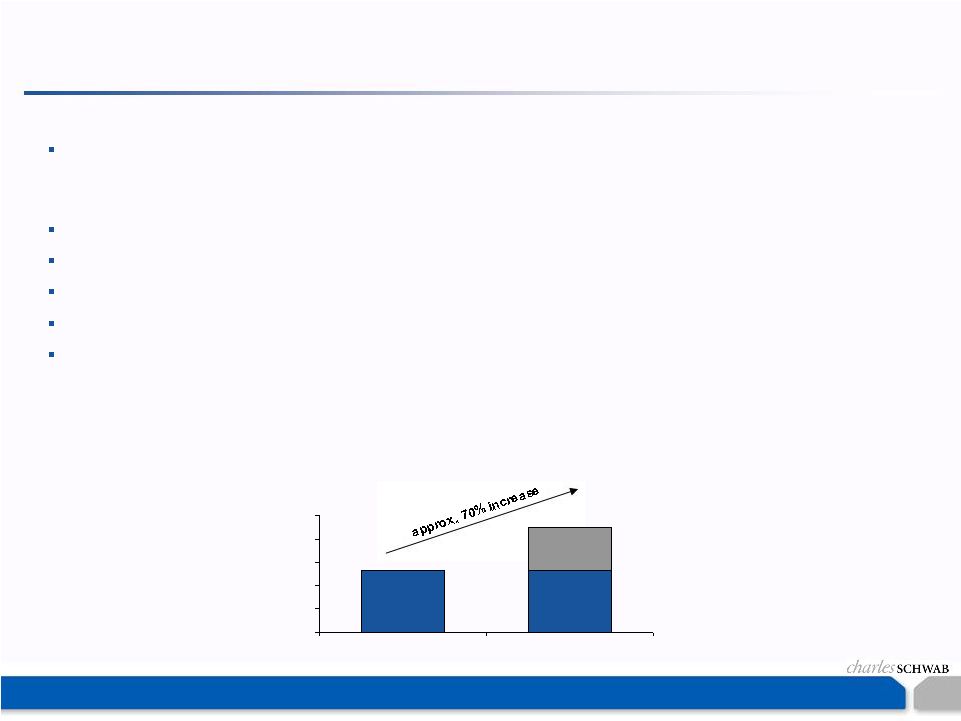

6 …the investors using these instruments represent a large and valuable client segment… We believe there are 750K – 1MM U.S. investors trading at least 120 times/year. Estimated growth rates range into double digits Compared to our average Investor Services client, option traders at Schwab have: 3X the assets held at the company 2X the estimated assets held outside 6X the trading activity 2X the Schwab bank product utilization rate 25% longer Schwab tenure Schwab clients are increasingly utilizing derivatives to generate income and mitigate risk, with approximately 10% of DARTs coming from options. 4Q 2010 Options DARTs 45K (000’s) 27K 0 10 20 30 40 50 SCHW SCHW + OXPS 27K 27K 18K |

|

7 …and we recognize the importance of offering a full range of investment platform capabilities to meet client needs. The general investor population needs ease, convenience and education – Schwab offers branch/phone/web access, a broad range of investment products and services including advice; integrated brokerage and banking capabilities; and a host of resources to help investors achieve better outcomes. optionsXpress’ client-focused approach to derivatives trading includes “all-in-one” account functionality; a choice of platforms; and an extensive education program that includes tutorials, webinars and workshops. Active investors need access to a full suite of products and tools and the ability to execute more complex transactions, without losing ease and convenience – Schwab’s StreetSmart Edge is the company’s most powerful, flexible and intuitive securities trading platform to date. optionsXpress combines web-based, software and mobile applications; online trading tools that are both easy to use and powerful; and expert client support to help derivatives traders execute both the simplest and most sophisticated strategies. |

|

8 optionsXpress is a pioneer in equity options and futures trading… Launched in 2001, headquartered in Chicago, 408 employees (Dec. 2010) Leading online broker focusing on equity options, futures and foreign exchange • 379K client accounts; $7.8 billion client assets, 44K DARTs in 2010 Offers three distinct platforms – browser-based, downloadable software and mobile - to provide a range of solutions for retail active investors • Trade securities and futures from same platform • Culture of persistent innovation – portfolio margining, IDEAS, Universal Trade Ticket Education Services offers a range of education products covering equities, market analysis, options, financial planning and foreign exchange Consistently top-rated by multiple publications Commissions currently 2/3 of revenue, followed by education, interest and other • Options and futures account for over 75% of retail DARTs |

|

9 …that will help our combined organization offer active investors an unparalleled level of service and platform capabilities. A more flexible & extendable technology platform that positions Schwab to better meet active investor client needs today and in the future. Schwab Strong equity trading capabilities Broad product lineup, including mutual funds, ETFs and bonds Range of help and advice options Relentless client focus optionsXpress Strong derivatives trading capabilities Options and futures, also foreign exchange Trading tools and education for all experience levels Relentless client focus |

|

10 Pro Forma Client and Financial Data – 4Q 2010 Schwab optionsXpress Combined Brokerage Accounts 7,998K 379K 8,377K Client Assets $1,574.5B $7.8B $1,582.3B DARTs 272K 43K 315K Options/DARTs 10% 43% 14% Trading Revenue $206 $45 $251 Total Revenue $1,127 $56 $1,183 |

|

11 Synergies and 2012 Accretion Accretion – 1-2% based on issuing approximately 60 million shares (1) Total synergies = $80 million in the first full year. Expenses – 25% • Public company expense, redundancies, duplicative project and marketing spend Revenues – 75% • Sweep cash – optionsXpress client cash balances roughly 40% of total client assets at February 2010 • Incremental options and futures trading by Schwab clients, portfolio margining offer, incremental asset gathering / share-of-wallet among optionsXpress clients Restructuring / merger-related charges = $55 million. optionsXpress will join Schwab Investor Services, initially maintaining brand and existing operations / locations. David Fisher will continue as President of optionsXpress and be named a Schwab Senior Vice President. (1) Based on current fully-diluted shares of optionsXpress and 1.02 fixed exchange ratio. |

|

12 This combination helps to build a best-in-class full-service investing experience. Improves the organization’s scale, long-term growth and client retention Complementary strengths across equities, options and futures optionsXpress’ derivative trading tools, analytics and education, as well as foreign exchange capabilities, for Schwab’s existing client base Schwab’s breadth of products and services for optionsXpress clients A more flexible & extendable technology platform that positions Schwab to better meet active investor client needs today and in the future. |

|

Redefining Full-Service Investing A Best-in-Class Trading Platform for Clients |

|

14 Additional Information In connection with the proposed transaction, Schwab will file with the Securities and Exchange Commission (SEC) a registration statement on Form S-4 that will include a proxy statement/prospectus for the stockholders of optionsXpress. optionsXpress will mail the final proxy statement/prospectus to its stockholders. Investors and security holders are urged to read the proxy statement/prospectus regarding the proposed transaction and other relevant documents filed with the SEC when they become available because they will contain important information. Copies of all documents filed with the SEC regarding the proposed transaction may be obtained, free of charge, at the SEC’s website These documents, when available, may also be obtained, free of charge, from Schwab’s website, under the tab “Financials and SEC Filings” or from optionsXpress’ website, under the item “SEC Filings”. Schwab, optionsXpress and their respective directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from the optionsXpress stockholders in respect of the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed to be participants in the solicitation of the stockholders of optionsXpress in connection with the proposed transaction will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information about Schwab’s executive officers and directors is available in Schwab’s Annual Report on Form 10-K filed with the SEC on February 25, 2011 and Schwab’s definitive proxy statement filed with the SEC on March 30, 2010. Information about optionsXpress’ executive officers and directors is available in optionsXpress’ definitive proxy statement filed with the SEC on April 15, 2010. You can obtain free copies of these documents from Schwab and optionsXpress using the contact information above. (http://www.sec.gov). www.aboutschwab.com/investor, www.optionsXpress.com/investor, |