Filed Pursuant to 424(b)(5)

Registration No. 333-251156

PROSPECTUS SUPPLEMENT

(To Prospectus dated December 4, 2020)

The Charles Schwab Corporation

$500,000,000 Floating Rate Senior Notes due 2027

$1,500,000,000 2.450% Senior Notes due 2027

$1,000,000,000 2.900% Senior Notes due 2032

This is an offering of $500,000,000 aggregate principal amount of Floating Rate Senior Notes due 2027 (the “2027 floating rate notes”), $1,500,000,000 aggregate principal amount of 2.450% Senior Notes due 2027 (the “2027 fixed rate notes”) and $1,000,000,000 aggregate principal amount of 2.900% Senior Notes due 2032 (the “2032 fixed rate notes”) to be issued by The Charles Schwab Corporation (“CSC”). We refer in this prospectus supplement to the 2027 floating rate notes as the “floating rate notes”, to the 2027 fixed rate notes and the 2032 fixed rate notes, as the “fixed rate notes”, and to the fixed rate notes and the floating rate notes as the “notes”.

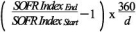

The 2027 floating rate notes will mature on March 3, 2027. The 2027 fixed rate notes will mature on March 3, 2027. The 2032 fixed rate notes will mature on March 3, 2032. Interest on the 2027 floating rate notes will reset quarterly and will be equal to compounded SOFR (as defined below) applicable to the relevant interest period (as defined below) plus 1.050%, as described under “Description of the Notes—Interest—Floating Rate Notes.” The 2027 fixed rate notes will pay interest at 2.450% per annum and the 2032 fixed rate notes will pay interest at 2.900% per annum.

Interest on the 2027 floating rate notes will be payable quarterly on each March 3, June 3, September 3 and December 3 of each year, commencing on June 3, 2022. Interest on the 2027 fixed rate notes will be paid each March 3 and September 3, commencing on September 3, 2022 and interest on the 2032 fixed rate notes will be paid each March 3 and September 3, commencing on September 3, 2022. The notes will be our senior unsecured obligations, ranking equally with all of our other unsecured senior indebtedness.

At our option, we may redeem the notes on terms described under the caption “Description of the Notes—Optional Redemption.”

We do not intend to apply for listing of the notes on any securities exchange or for inclusion of the notes in any automated dealer quotation system. Currently, there is no public market for the notes.

Investing in the notes involves risk. See “Risk Factors” beginning on page S-6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The notes are not insured by the Federal Deposit Insurance Corporation or any other governmental agency. The notes are not savings accounts, deposits or other obligations of any bank.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Price to Public(1) | | | Underwriting Discount | | | Proceeds to CSC | |

| | | Per Note | | | Total | | | Per Note | | | Total | | | Per Note | | | Total | |

2027 Floating Rate Notes | | | 100.000 | % | | $ | 500,000,000 | | | | 0.600 | % | | $ | 3,000,000 | | | | 99.400 | % | | $ | 497,000,000 | |

2027 Fixed Rate Notes | | | 99.892 | % | | $ | 1,498,380,000 | | | | 0.600 | % | | $ | 9,000,000 | | | | 99.292 | % | | $ | 1,489,380,000 | |

2032 Fixed Rate Notes | | | 99.776 | % | | $ | 997,760,000 | | | | 0.650 | % | | $ | 6,500,000 | | | | 99.126 | % | | $ | 991,260,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Combined Total | | | | | | $ | 2,996,140,000 | | | | | | | $ | 18,500,000 | | | | | | | $ | 2,977,640,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Plus accrued interest, if any, from March 3, 2022 if settlement occurs after that date. |

The underwriters expect to deliver the notes in book-entry form only through the facilities of The Depository Trust Company for the accounts of its participants, including Euroclear Bank, S.A./N.V. and Clearstream Banking, société anonyme, and its indirect participants, against payment in New York, New York on or about March 3, 2022.

Joint Book-Running Managers

| | | | | | | | | | |

| BofA Securities | | Citigroup | | Credit Suisse | | J.P. Morgan | | Morgan Stanley | | Wells Fargo Securities |

Senior Co-Manager

Goldman Sachs & Co. LLC

Co-Managers

| | | | | | |

| Barclays | | HSBC | | PNC Capital Markets LLC | | US Bancorp |

March 1, 2022