UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Tridan Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

TRIDAN CORP.

P.O. Box 634, New City, N.Y. 10956

(212) 239-0515

ANNUAL REPORT

June 28, 2024

Dear Shareholder:

I am pleased to provide this annual report of Tridan Corp. for the fiscal year ended April 30, 2024, including the enclosed audited financial report for that period and for the corresponding period in 2023. Also enclosed are the notice of meeting, proxy statement for this year’s annual shareholders meeting on July 16, 2024, form of proxy, and the company’s privacy policy.

Fiscal Year Ended April 2024 Muni Market Review

Market Update: At the May Federal Open Market Committee (FOMC) meeting, Chair Powell acknowledged that economic growth was solid, the labor market was strong, and inflation was not coming down fast enough. Committee members signaled their willingness to keep rates higher for longer, but also that the direction of rates is more likely down than up given the view that restrictive policy should help bring inflation down. As of May 14th, the market is pricing just under two cuts later this year, down from about 5.5 cuts earlier in the year.

A higher for longer environment is expected with bouts of volatility given economic, political, and geopolitical uncertainties. Payroll growth, released in early May, was weaker than expected with only 175k jobs created. After six consecutive quarters of GDP growth over 2%, Q1 growth printed at 1.6%. Ten-year treasuries have traded in a range of 3.88% to 4.70% year-to-date (YTD) through April 30th.

Munis: Muni yields rose across the curve in April as the market priced in fewer rate cuts and pushed out the timing of the first rate cut. Munis outperformed taxables YTD on a pretax basis and over the prior three calendar years. The Bloomberg Municipal Bond Index returned -1.62%, outperforming the Bloomberg Aggregate, which returned -3.28% on a YTD basis. With rates up over the month and YTD, shorter duration and lower credit quality bonds outperformed, benefiting primarily from coupon cushion. Though BBB spreads are unchanged YTD, certain sectors played catchup this year. Muni high yield outperformed corporate high yield over the month and YTD. High yield also outperformed investment grade municipals.

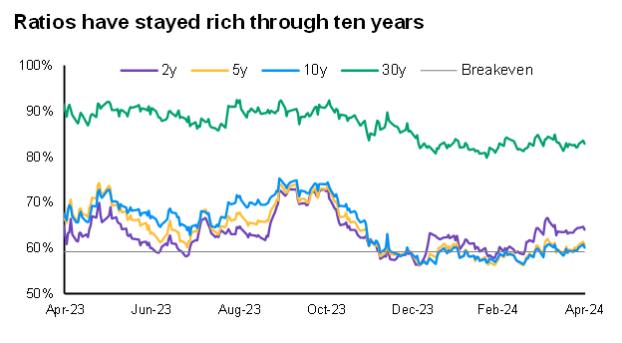

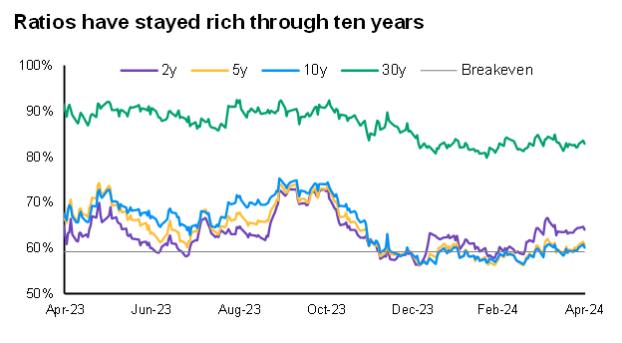

Valuations: Muni/treasury ratios have remained rich, especially through ten years. Muni ratios ended the month unchanged at 60% of treasuries. A shift to and tremendous inflows into separately managed accounts has richened ratios through ten years. The average ratio for ten-year bonds over the past ten years is 86%. The lack of growth in tax exempt financings amid tremendous wealth creation over the past ten years may keep ratios, on average, richer than the long-term averages. The muni curve shifted higher in April; there is still a 41bps inversion through ten years; we believe the spread between 10- and 20-year at 83bps may provide an appealing roll down.

Supply and Flows: Muni issuance totaled $147bn, up 32% year-over-year (YoY). In anticipation of a lighter summer calendar, investors may consider taking advantage of the heavier supply expected through June. Flows have been strong with $9.6bn into funds and ETFs and continued strong flows into SMAs.

TRIDAN CORP.

June 28, 2024

Page – 2 –

Credit: Though tax revenue growth is down, overall revenues are still strong and higher than pre-COVID levels. Rainy day funds continue to provide stability and flexibility not experienced in prior economic downturns. Several budget gaps are starting to develop; municipalities should fill the gaps with a blend of cuts, project deferrals, bond deals and spending cash. Officials in the state of California have indicated that they will rely heavily on expenditure cuts to fill the estimated $28bn budget gap, which is preferable to drawing heavily on reserves and one-time fixes.

From a ratings perspective, upgrades are still outpacing downgrades despite coming down from elevated levels as pandemic aid and strong economic growth boosted credit quality. Rating agency credit outlook is more balanced, reflecting more forward-looking expectations of a slower economy. Bankruptcies and default rates should remain low and concentrated in the higher risk credits, such as stand-alone hospitals, senior living facilities, and industrial development bonds.

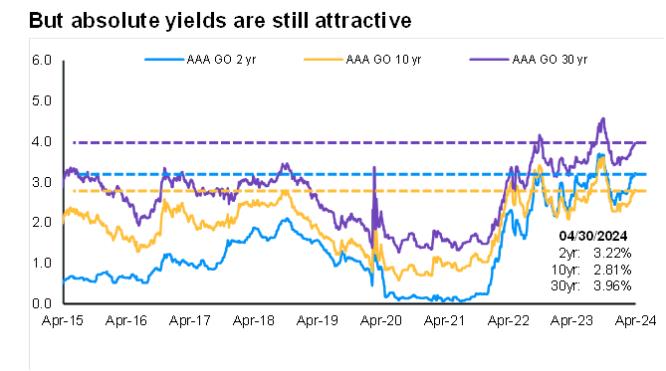

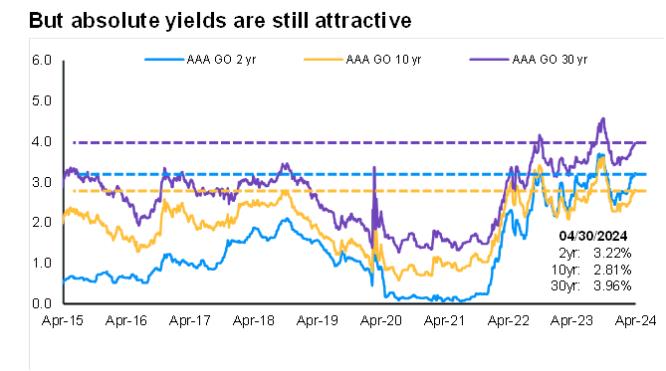

Outlook: Though ratios and spreads are tight, absolute yield levels are appealing and should drive continued strong demand. We expect supply will be higher this year between $425bn-$450bn with a boost from build America bonds (BAB) calls. With the Fed patient to cut rates, yields are and should remain higher on the short end of the curve, providing opportunities to add yield on the longer part of the curve, in particular tenures past ten years, as the curve is steep.

Performance of the Tridan Fund:

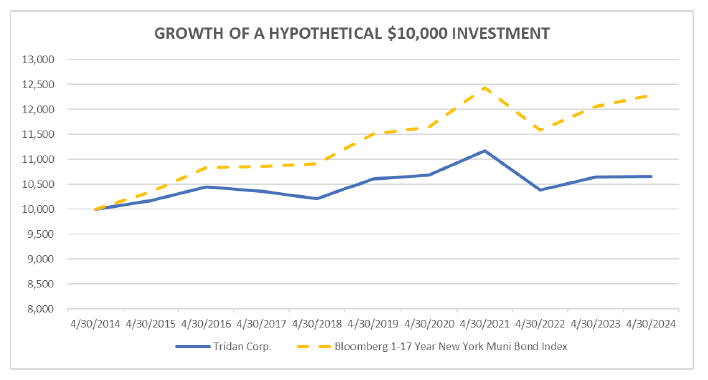

For the period ended April 30, 2024, the trailing 1-year gross of fees performance of the Fund was 1.37% vs. 1.87% for the index (Bloomberg NY Cmp Int Muni (1-17) Benchmark). For additional context, as of the date from our last Board meeting with performance through February 29, 2024 the trailing one year performance was 3.92% vs 4.87% for the index.

Performance was positive for the trailing 1-year period ended April 30, 2024, even with rates being higher across the curve, especially at the longer end of the curve (see US Treasury yield table below). As there has been a lot of interest rate volatility year-to-date, especially within longer-term interest rates, the Adviser kept Tridan’s duration shorter than the benchmark. Over the same time period, down-in-quality municipal bonds outperformed. Tridan has an up-in-credit quality bias based on guidelines. The rise in interest rates and Tridan’s bias towards up-in-credit quality caused the underperformance versus the benchmark for the trailing year ended April 30, 2024.

U.S. Treasury Curve Yields

TRIDAN CORP.

June 28, 2024

Page – 3 –

| | | | | | | | | | | | |

| | | Apr 30, 24 | | | Apr 30, 23 | | | Change y/y | |

3-month | | | 5.40 | % | | | 5.06 | % | | | 0.34 | % |

6-month | | | 5.40 | % | | | 5.02 | % | | | 0.38 | % |

1-year | | | 5.24 | % | | | 4.76 | % | | | 0.48 | % |

2-year | | | 5.04 | % | | | 4.01 | % | | | 1.03 | % |

3-year | | | 4.88 | % | | | 3.72 | % | | | 1.16 | % |

5-year | | | 4.72 | % | | | 3.49 | % | | | 1.23 | % |

7-year | | | 4.71 | % | | | 3.46 | % | | | 1.25 | % |

10-year | | | 4.68 | % | | | 3.43 | % | | | 1.25 | % |

30-year | | | 4.79 | % | | | 3.68 | % | | | 1.11 | % |

Yields remain attractive and ratios remain rich

TRIDAN CORP.

June 28, 2024

Page – 4 –

But absolute yields are still attractive

Sources: JPMAM, TM3, Bloomberg. Data as of 4/30/2024.

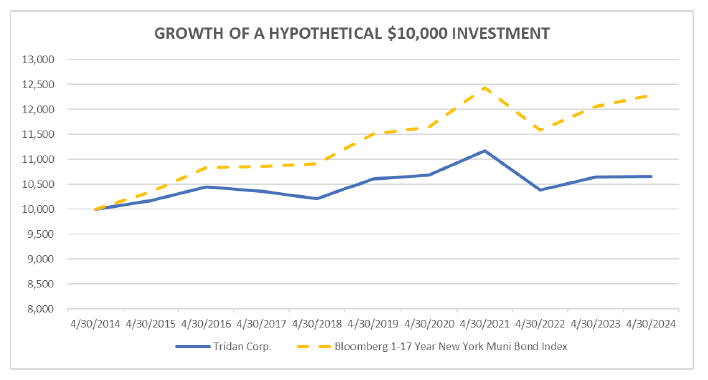

The following graph shows the value as of April 30, 2024 of a hypothetical $10,000 investment in the Company. For comparative purposes, the performance of the Bloomberg 1-17 Year New York Muni Bond Index is shown.

TRIDAN CORP.

June 28, 2024

Page – 5 –

| | | | | | | | | | | | |

| | | Average Annual Total Returns | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Tridan Corp. (NAV) | | | 0.22 | % | | | 0.11 | % | | | 0.65 | % |

Bloomberg 1-17 Year New York Muni Bond Index | | | 1.87 | % | | | 1.32 | % | | | 2.08 | % |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares may be worth more or less than their original cost. All performance shown assumes reinvestment of dividends and capital gains distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

A schedule of the company’s portfolio holdings at April 30, 2024, consisting entirely of municipal obligations, is included in the financial report. The company invests exclusively in non-voting securities, and accordingly has not voted any proxies for the year ended June 30, 2023. The company files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission for the first and third fiscal quarters of each fiscal year on Form N-PORT. The company’s filings on Form N-PORT are available on the Commission’s website at http://www.sec.gov.

The net asset value per share at April 30, 2024 was $11.47 compared with $11.59 at April 30, 2023. Net investment income per share for the years ended April 30, 2024 and April 30, 2023 was $0.16 and $0.14, respectively. Distributions to shareholders amounted to $0.15 per share for fiscal year 2024 and $0.16 per share for fiscal year 2023.

At the company’s last annual meeting on July 18, 2023, the reappointment of Mazars USA LLP as the company’s auditors for the fiscal year ending April 30, 2024 was ratified by the shareholders as follows:

| | | | |

Shares Voted For | | | 1,935,613.3343 | |

Shares Voted Against | | | 0.0000 | |

Shares Abstaining | | | 0.0000 | |

At the company’s last annual meeting, the then incumbent directors, all of whom are named below, were all reelected to serve as directors until the next annual meeting of shareholders, or until their successors are elected and have qualified.

| | | | | | | | |

| | | Shares Voted For | | | Shares Withheld | |

Mark Goodman | | | 1,935,613.3343 | | | | 0 | |

Russell J. Stoever | | | 1,935,613.3343 | | | | 0 | |

Joan G. Rall | | | 1,935,613.3343 | | | | 0 | |

Benjamin Cope | | | 1,935,613.3343 | | | | 0 | |

TRIDAN CORP.

June 28, 2024

Page – 6 –

The following Tables A and B set forth information concerning the directors, and Table C sets forth information concerning non-director officers of the company. The Table A directors (Mark Goodman and Bejamin B Cope) are each an “interested person” of Tridan as defined in Section 2(a)19 of the Investment Company Act of 1940, and the Table B directors (Ms. Rall and Mr. Stoever) are not “interested persons” of Tridan. Mark Goodman is an “interested person” because he is an officer and holder of more than 5% of the shares of the Company and therefore is an “affiliated person” of Tridan. Mr. Cope is an “interested person” of Tridan because as the stepson of Mark Goodman, Mr. Cope is a member of the immediate family of Mr. Goodman.

Table A

| | | | | | | | | | |

Name, Address

and Age | | Position(s) in

Tridan Corp. | | Director

Since | | Principal

Occupations

During Past

5 Years | | Number of

Portfolios

Overseen | | Other

Directorships

During Past

5 Years |

Interested Persons: | | | | | | | | | | |

Mark Goodman 276 Nantasket Road Hull, MA 02045 Age 70 | | Director, President, Treasurer | | 1999 | | Pianist and Teacher | | 1 | | None |

| | | | | |

Benjamin Cope 25 Sheldon Street Milton, MA 02186 Age 30 | | Director | | 2021 | | Senior Marketing Manager, Recorded Future | | 1 | | None |

|

| Table B |

| | | | | |

Name, Address and Age | | Position(s) in Tridan Corp. | | Director Since | | Principal Occupations During Past 5 Years | | Number of

Portfolios

Overseen | | Other

Directorships During Past 5 Years |

Disinterested Persons: | | | | | | | | | | |

Joan G. Rall 55 East 9th Street, #11F New York, NY 10003 Age 70 | | Director, Audit Committee Member | | 2017 | | Retired Partner, Ernst & Young LLP (certified public Accountants) | | 1 | | None |

| | | | | |

Russell Jude Stoever 15 Rockleigh Road Rockleigh, NJ 07647 Age 79 | | Director, Audit Committee Member | | 1995 | | Vice-President, Stoever Glass & Co., Inc. (a registered broker-dealer) | | 1 | | None |

TRIDAN CORP.

June 28, 2024

Page – 7 –

Table C

| | | | | | | | |

| | | | |

Name, Address

and Age | | Positions

in Tridan Corp. | | Principal

Occupations

During Past

5 Years | | Number of

Portfolios

Overseen | | Other

Directorships

Held |

Non-director Officers: | | | | | | | | |

John H. Lively 11300 Tomahawk Creek Parkway, Suite 310 Leawood, KS 66211 Age 55 | | Secretary | | Attorney, Practus, LLP | | None | | None |

| | | | |

Soth Chin 6219 29th Street Arlington, VA 22207 Age 58 | | Chief Compliance Officer | | Managing Member, Fit Compliance | | None | | None |

The board of directors governs the Company and is responsible for protecting the interests of shareholders. The directors meet periodically throughout the year to oversee the Company’s activities and review its performance. Each of the directors is committed to regular and active participation in board and committee meetings. The board believes that, collectively, the directors have balanced and diverse experience, qualifications, attributes, and skills which allow the board to operate effectively in governing the Company and protecting the interests of shareholders. Information is provided below about the specific experience, skills, attributes and qualifications of each director.

Mark Goodman – Mr. Goodman has been a director since 1999. He is the son of Peter Goodman, who had been the President and a director of the company. Mark Goodman has been a shareholder of Tridan since before its 1980 conversion to an investment company. He is knowledgeable in the history and activities of the Company. Also, he has broad investment experience in fixed income securities, including municipal bonds.

Joan G. Rall – Ms. Rall is a former certified public accountant and is retired from a career with Ernst & Young LLP as an Assurance and Advisory Partner. She has extensive experience in accounting, auditing, enterprise risk management, technology risk and assurance, and personnel management. She was an Adjunct Professor of Accounting at NYU and is Co-Founder and President of a biotech startup, Genusetics Inc.

Russell J. Stoever – Mr. Stoever has been a director since 1995. He is vice president and sales manager of Stoever, Glass & Co., Inc., a registered broker-dealer. He has been employed there since 1971 and became a principal of that corporation in 1982 with involvement in all aspects of municipal finance. He is not an “interested person” of Tridan Corp., as defined in the Investment Company Act, in that he does not execute any portfolio transactions for, or engage in any principal

TRIDAN CORP.

June 28, 2024

Page – 8 –

transactions with, Tridan or its investment adviser or any accounts over which the adviser has brokerage placement discretion, or any other investment company having the same investment adviser. Mr. Stoever brings to the board a keen analysis of economic and market conditions and trends, and his views concerning portfolio management.

Benjamin B. Cope – Mr. Cope is Senior Manager of Enterprise Growth Marketing at Recorded Future. He has broad experience in implementing commercial growth strategies, revenue forecasting and analysis, and scaling technology companies from early venture funding to initial public offering.

No director or officer received compensation from the Company during the last fiscal year, except for the fees of $12,000 during each year to each director, plus an additional $5,000 to Joan G. Rall, who served as chair of the audit committee. The Company does not have a bonus, profit sharing, or any other compensation plan, contract or arrangement with anyone, nor any pension or retirement plan; nor has the Company ever granted anyone any options, warrants or other rights to purchase securities.

Executive officers of the Company received compensation comprised solely of said directors’ fees aggregating $12,000 during fiscal 2024. Mr. Lively receives no fees for his service as Secretary of the Company, although Practus receives fees from the Company for services as counsel. Mr. Chin receives fees from the Company for his service as the Company’s Chief Compliance Officer.

Additional information about directors may be requested by any shareholder without charge by telephoning the Company’s administrator, PKF O’Connor Davies, LLP at 201-712-9800.

The following information is a summary of certain changes since April 30, 2023. This information may not reflect all of the changes that have occurred since you purchased shares of the Company:

Effective February 16, 2024, Mr. Rick Taormina, a portfolio manager of the Company has resigned from the Company’s adviser, J.P. Morgan Asset Management. Mr. Taormina was replaced as a portfolio manager of the Company by Rachel Betton effective February 16, 2024. Ms. Betton, Managing Director, is a member of the Global Fixed Income, Currency & Commodities Group. Based in New York, Ms. Betton is a senior portfolio manager for the Municipal Strategies Team. Prior to joining the firm in July 2023, Ms. Betton spent the last 10 years at PIMCO where she was a senior member of the municipal portfolio management team where she managed investment grade funds and ETFs, as well as high yield, interval and state-specific strategies. Before that, she was an institutional municipal trader at Morgan Stanley where she focused on high yield. She has a B.A. in College of Social Studies from Wesleyan University.

Effective June 1, 2024, Mazars USA LLP (“Mazars”) entered into a transaction with FORVIS, LLP (“FORVIS”) whereby substantially all of the partners and employees of Mazars joined Forvis. As a result, on the effective date of June 1, 2024 FORVIS, LLP changed its name to Forvis Mazars, LLP and Mazars resigned as the Company’s independent registered public accounting firm. The audit committee and the Board of Directors has appointed Forvis Mazars, LLP to serve as Tridan’s independent registered public accounting firm effective June 1, 2024 for

TRIDAN CORP.

June 28, 2024

Page – 9 –

Tridan’s April 30, 2024 audited financial statements. The reports of Mazars on the financial statements of Tridan as of and for the fiscal years ended April 30, 2023 and April 30, 2024 did not contain an adverse opinion or a disclaimer of opinion, and was not qualified or modified as to uncertainties, audit scope or accounting principles. During the fiscal years ended April 30, 2023 and April 30, 2024: (i) there were no disagreements between Tridan and Mazars on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Mazars, would have caused it to make reference to the subject matter of the disagreements in its reports on the financial statements of Tridan for such period; and (ii) there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

Tridan requested that Mazars furnish it with a letter addressed to the U.S. Securities and Exchange Commission stating that it agrees with the above statements.

During the fiscal years ended April 30, 2023 and April 30, 2024, neither Tridan, nor anyone acting on its behalf, consulted with FORVIS on behalf of Tridan regarding the application of accounting principles to a specified transaction (either completed or proposed), the type of audit opinion that might be rendered on Tridan’s financial statements, or any matter that was either: (i) the subject of a “disagreement,” as defined in Item 304(a)(1)(iv) of Regulation S-K and the instructions thereto; or (ii) “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K.

Tridan’s Investment Objective, Policies and Risks

Tridan’s investment objective is to achieve a high level of current income through investment primarily in fixed income securities which are exempt from federal income tax and which investments are consistent with flexible maturity and investment grade quality standards. Tridan intends to invest at least 50% of its invested assets in fixed income obligations of states, territories and possessions of the United States and the District of Columbia and their political subdivisions, agencies, authorities and instrumentalities, which constitute Tridan’s major portfolio emphasis, including industrial revenue bonds and other bonds, eases, tax anticipation notes, bond anticipation notes, revenue anticipation notes, project notes and other notes. Tridan may also invest in nonmunicipal fixed income securities including obligations of the U.S. government and its agencies and instrumentalities, bank obligations, debt securities of corporate issuers, asset backed and mortgaged related securities and repurchase agreements. Tridan will invest only in securities of the type described above which have at the time of purchase (i) for municipal securities on a rating of Baa or higher by Moody’s Investors Service, Inc., or BBB or higher by Standard & Poor’s Corporation, (ii) for non-municipal securities B a rating of A1 or higher by Moody’s, or A+ or higher by Standard & Poor’s, or (iii) a credit quality which, in the opinion of the investment adviser, is equivalent to such ratings although the rating agencies may ascribe lower ratings or in the case of unrated securities. Such objective may be changed without the vote of the holders of a majority of Tridan’s outstanding voting securities.

There have been no changes in Tridan’s investment objective, policies or risks since the April 30, 2023 annual shareholder report.

TRIDAN CORP.

June 28, 2024

Page – 10 –

Recital of Fundamental Policies

Tridan has the following policy with respect to each of the activities described below, which may not be changed without the approval of a majority of Tridan’s outstanding voting securities. Tridan will not:

| | • | | issue any senior securities. |

| | • | | make short sales of securities, purchase any securities on margin (except for such short-term credits as are necessary for the clearance of transactions) or write, purchase or sell puts, calls or combinations thereof, except that Tridan may purchase securities which have an attached put, i.e., the right to resell to the seller at an agreed-upon price or yield on a specified date or within a specified period (which will be prior to the maturity date of such security). |

| | • | | borrow money, except for temporary or emergency purposes (but not for investment purposes) in an amount up to 5 percent of the value of its assets (including the amount borrowed) less liabilities (not including the amount borrowed) at the time the borrowing is made. |

| | • | | underwrite securities issued by others. Tridan will not invest in restricted securities (securities which must be registered under the Securities Act of 1933 before they may be offered or sold to the public). |

| | • | | purchase or sell real estate or real estate mortgage loans, except that Tridan reserves the freedom to invest in leases and in securities which are secured by, or have their revenues derived from, real estate or interests therein, provided that such investments are consistent with Tridan’s investment objective and fundamental policies. |

| | • | | purchase or sell commodities or commodity contracts, including futures contracts in a contract market or other futures market. |

| | • | | lend money or securities, except that Tridan may purchase debt securities in private placement transactions or public offerings in accordance with its investment objective and fundamental policies. |

Tridan will invest at least 50% of its invested assets in debt obligations issued by or on behalf of states, territories and possessions of the United States and the District of Columbia and their political subdivisions, agencies and instrumentalities, or multi-state agencies or authorities, the interest from which is exempt from federal income tax. Tridan may also invest up to 50% of its invested assets in nonmunicipal fixed income securities including obligations of the U.S. government and its agencies and instrumentalities, bank obligations, debt securities of corporate issuers, asset backed and mortgage related securities and repurchase agreements.

TRIDAN CORP.

June 28, 2024

Page – 11 –

In addition to the policies listed above, Tridan deems the following to be fundamental policies. Tridan will not:

| | • | | purchase securities of other investment companies, except to the extent permitted by Section 12(d) of the Investment Company Act of 1940 and consistent with Tridan’s investment objective and fundamental policies, or as they may be acquired in connection with a merger, consolidation, reorganization or acquisition of assets. |

| | • | | invest for the purpose of exercising control or management of another company. |

| | • | | invest in interests in oil, gas or mineral exploration or development programs. |

| | • | | participate on a joint or a joint and several basis in any trading account in securities. |

Recital of Investment Policies

Tridan has the following investment policies which, although significant, are not deemed fundamental and may be changed without shareholder approval:

At the close of each fiscal quarter, at least 50% of the value of Tridan’s total assets will be represented by cash and cash items (including receivables) and securities which are issued or guaranteed as to principal or interest by the United States, and other securities limited in respect of any one issuer to an amount not greater in value than 5% of the value of Tridan’s total assets.

At the close of each fiscal quarter, not more than 25% of the value of Tridan’s total assets will be invested in the securities of any one issuer, other than securities which are issued or guaranteed as to principal or interest by the United States.

Investment Risks

Tridan is subject to management risk and may not achieve its objective if the adviser’s expectations regarding particular instruments or markets are not met. Tridan’s main risks are noted below, any of which may adversely affect Tridan’s performance and ability to achieve its investment objective.

Interest Rate Risk. Tridan mainly invests in bonds and other debt securities. These securities will increase or decrease in value based on changes in interest rates. If rates increase, the value of Tridan’s investments generally declines. Securities with greater interest rate sensitivity and longer maturities generally are subject to greater fluctuations in value. Tridan may face a heightened level of interest rate risk due to certain changes in monetary policy. During periods when interest rates are low or there are negative interest rates, Tridan’s yield (and total return) also may be low or Tridan may be unable to maintain positive returns.

New York Geographic Concentration Risk. Because Tridan invests primarily in municipal obligations issued by the State of New York and New York City, their political subdivisions, authorities, and agencies, its performance will be affected by the fiscal and economic health of that state, the city and their political subdivisions. As the nation’s financial capital, New York’s and New York City’s economy is heavily dependent on the financial sector and may be sensitive to economic problems affecting the sector.

TRIDAN CORP.

June 28, 2024

Page – 12 –

Municipal Obligations Risk. The risk of a municipal obligation generally depends on the financial and credit status of the issuer. Changes in the financial health of a municipal issuer may make it difficult for the issuer to make interest and principal payments when due. This could decrease Tridan’s income or hurt the ability to preserve capital and liquidity. Under some circumstances, municipal obligations might not pay interest unless the state legislature or municipality authorizes money for that purpose. Municipal obligations may be more susceptible to downgrades or defaults during recessions or similar periods of economic stress. In addition, since some municipal obligations may be secured or guaranteed by banks and other institutions, the risk to Tridan could increase if the banking or financial sector suffers an economic downturn and/or if the credit ratings of the institutions issuing the guarantee are downgraded or at risk of being downgraded by a national rating organization. Such a downward revision or risk of being downgraded may have an adverse effect on the market prices of the bonds and thus the value of Tridan’s investments. In addition to being downgraded, an insolvent municipality may file for bankruptcy. The reorganization of a municipality’s debts may significantly affect the rights of creditors and the value of the securities issued by the municipality and the value of Tridan’s investments.

Credit Risk. Tridan’s investments are subject to the risk that issuers and/or counterparties will fail to make payments when due or default completely. If an issuer’s or a counterparty’s financial condition worsens, the credit quality of the issuer or counterparty may deteriorate. Credit spreads may increase, which may reduce the market values of Tridan’s securities. Credit spread risk is the risk that economic and market conditions or any actual or perceived credit deterioration may lead to an increase in the credit spreads (i.e., the difference in yield between two securities of similar maturity but different credit quality) and a decline in price of the issuer’s securities.

Government Securities Risk. Tridan may invest in securities issued or guaranteed by the U.S. government or its agencies and instrumentalities. U.S. government securities are subject to market risk, interest rate risk and credit risk. Securities, such as those issued or guaranteed by the U.S. Treasury, that are backed by the full faith and credit of the United States are guaranteed only as to the timely payment of interest and principal when held to maturity and the market prices for such securities will fluctuate. Notwithstanding that these securities are backed by the full faith and credit of the United States, circumstances could arise that would prevent the payment of interest or principal. This would result in losses to Tridan. Securities issued or guaranteed by U.S. government related organizations, such as Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. government and no assurance can be given that the U.S. government will provide financial support. Therefore, U.S. government related organizations may not have the funds to meet their payment obligations in the future. U.S. government securities include zero coupon securities, which tend to be subject to greater market risk than interest-paying securities of similar maturities.

TRIDAN CORP.

June 28, 2024

Page – 13 –

Mortgage-Related and Other Asset-Backed Securities Risk. To the extent that Tridan invests in mortgage and other asset-backed securities, it will be subject to this risk. Mortgage-related and asset-backed securities, including certain municipal housing authority obligations, are subject to certain other risks. The value of these securities will be influenced by the factors affecting the housing market and the assets underlying such securities. As a result, during periods of declining asset values, difficult or frozen credit markets, significant changes in interest rates, or deteriorating economic conditions, mortgage-related and asset-backed securities may decline in value, face valuation difficulties, become more volatile and/or become illiquid. These securities are also subject to prepayment and call risk. In periods of declining interest rates, Tridan may be subject to contraction risk which is the risk that borrowers will increase the rate at which they prepay the maturity value of mortgages and other obligations. When mortgages and other obligations are prepaid and when securities are called, Tridan may have to reinvest in securities with a lower yield or fail to recover additional amounts (i.e., premiums) paid for securities with higher interest rates, resulting in an unexpected capital loss and/or a decrease in the amount of dividends and yield. In periods of either rising or declining interest rates, Tridan may be subject to extension risk which is the risk that the expected maturity of an obligation will lengthen in duration due to a decrease in prepayments. As a result, in certain interest rate environments, Tridan may exhibit additional volatility. Additionally, asset-backed, mortgage-related and mortgage-backed securities are subject to risks associated with their structure and the nature of the assets underlying the securities and the servicing of those assets. Certain asset-backed, mortgage-related and mortgage-backed securities may face valuation difficulties and may be less liquid than other types of asset-backed, mortgage-related and mortgage-backed securities, or debt securities.

Debt Securities and Other Callable Securities Risk. The issuers of debt these securities and other callable securities may be able to repay principal in advance, especially when interest rates fall. Changes in prepayment rates can affect the return on investment and yield of these securities. When debt obligations are prepaid and when securities are called, Tridan may have to reinvest in securities with a lower yield. Tridan also may fail to recover additional amounts (i.e., premiums) paid for securities with higher interest rates, resulting in an unexpected capital loss.

Bank Obligations Risk: Bank obligations include bankers’ acceptances, certificates of deposit and time deposits. Bankers’ acceptances are bills of exchange or time drafts drawn on and accepted by a commercial bank. Maturities are generally six months or less. Certificates of deposit are negotiable certificates issued by a bank for a specified period of time and earning a specified return. Time deposits are non-negotiable receipts issued by a bank in exchange for the deposit of funds. These bank obligations are subject to credit and interest rate risk.

Repurchase Agreements Risk: A repurchase agreement is the purchase of a security and the simultaneous commitment to return the security to the seller at an agreed upon price on an agreed upon date. This is treated as a loan. Repurchase agreements are subject to credit and liquidity risks.

Fellow shareholders, thanks very much for your continuing investment in Tridan Corp.

|

| Sincerely, |

|

| TRIDAN CORP. |

|

/s/ Mark Goodman |

| Mark Goodman, President |

TRIDAN CORP.

P.O. Box 634

New City, NY 10956

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JULY 16, 2024

To the Shareholders of Tridan Corp.:

The Annual Meeting of Shareholders of Tridan Corp. (the “Company”) will be held on Tuesday, July 16, 2024, at 10:00 A.M. at the offices of the Company’s administrator, PKF O’Connor Davies, 300 Tice Boulevard, Suite 315, Woodcliff Lake, New Jersey 07677.

The following subjects will be considered and acted upon at the meeting:

| | (1) | Election of four directors; |

| | (2) | Ratification of the selection of Forvis Mazars, LLP as auditors of the Company for the fiscal year ending April 30, 2025; |

| | (3) | Transaction of such other business as may properly come before the meeting or any adjournment or adjournments thereof |

The subjects referred to above are discussed in the Proxy Statement enclosed with this notice. Each shareholder is invited to attend the Annual Meeting of Shareholders in person. Shareholders of record at the close of business on June 28, 2024 have the right to vote at the meeting. If you cannot be present at the meeting, we urge you to fill in, sign and promptly return the enclosed proxy in order that your shares will be represented at the meeting.

|

| By Order of the Board of Directors |

|

/s/ John H. Lively |

| John H. Lively, Secretary |

June 28, 2024

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held July 16, 2024

This Notice of Annual Meeting, together with the attached Proxy Statement, Form of Proxy, Annual Report to Shareholders, and Privacy Policy are also available at www.tridancorp.com.

As in the past, the Company also intends to mail those materials to shareholders with respect to all future shareholder meetings, in addition to posting them to its website as required by Security and Exchange Commission Rules.

TRIDAN CORP.

P.O. Box 634

New City, NY 10956

PROXY STATEMENT

This statement is furnished in connection with the solicitation by the board of directors of Tridan Corp., a New York corporation (the “Company”), of proxies to be voted at the Annual Meeting of Shareholders to be held on July 16, 2024 and any and all adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

All proxies which have been properly executed and received by the time of the meeting will be voted at the meeting in accordance with the instructions thereon. Any shareholder executing a proxy may revoke it in writing by execution of another proxy or by any other legal method at any time before the shares subject to the proxy are voted at the meeting. The board of directors recommends that shares be voted, and if no choice is specified on the proxy, the shares will be voted FOR the election as directors of the nominees hereinafter named and FOR ratification of the selection of Forvis Mazars, LLP, as auditors, and in the discretion of the proxy holders on such other matters as may properly come before the meeting.

As of June 28, 2024, there were issued and outstanding 2,998,460.3712 shares of capital stock, par value $.02 per share, of the Company, which is the only class of capital stock of the Company. Shareholders will be entitled to one vote for each share held, with pro rata voting rights for any fractional shares. Holders of record of such shares at the close of business on June 28, 2024 will be entitled to vote at the meeting.

The participants in the Tridan Corp. Employees’ Stock Ownership Trust are the beneficial shareholders of the shares held under the trust, and the shares held for such participants will be voted only if and as directed by the participant for whose account such shares are held of record by the trustees of the trust. Accordingly, the attached notice, this proxy statement and the form of proxy have been mailed to each person who was a participant on the record date, and the shares beneficially owned by such participants will be voted in accordance with their proxies.

The Company will pay the cost of preparing, assembling, and mailing the form of proxy and the material used in connection with solicitation of proxies. In addition to solicitation by use of the mails, certain officers and directors of the Company, who will receive no compensation for their services (other than their regular compensation) may solicit the return of proxies personally or by telephone or electronic communication.

An Annual Report covering the operations of the Company for its fiscal years ended April 30, 2024 and 2023 is enclosed herewith, but does not constitute a part of the material for the solicitation of proxies.

ELECTION OF DIRECTORS

At the meeting, four directors are to be elected to hold office until the next annual meeting of shareholders and until their respective successors shall have been chosen and qualified, or as otherwise provided in the by-laws of the Company. The election of a board of directors shall be by a plurality vote of the shares present in person or by proxy at the meeting. A majority of the issued and outstanding shares of record present in person or by proxy shall constitute a quorum for the meeting.

It is intended that the persons named in the accompanying proxy will vote such proxy, if signed and returned, for the election of the nominees listed below. If for any reason any of said nominees shall become unavailable for election, which is not anticipated, the proxies may be voted for a substitute nominee designated by the board of directors. The board of directors has no reason to expect that any of the nominees will fail to be a candidate at the meeting and, accordingly, does not have in mind any substitute.

The following Tables A and B set forth information concerning four directors for election as director for a term of one year.

Table C sets forth information concerning the non-director officers of the Company. The Table A nominees (Mark Goodman and Benjamin B. Cope) are each an “interested person” of Tridan as defined in Section 2(a)(19) of the Investment Company Act of 1940, and the Table B nominees (Ms. Rall and Mr. Stoever) are not “interested persons” of Tridan.

Mark Goodman is an “interested person” because he is an officer and the holder of more than 5% of the shares of the Company, and is therefore an affiliated person of Tridan. Mr. Benjamin B. Cope is an “interested person” of Tridan because as Mr. Goodman’s stepson, he is a member of the immediate family of Mr. Goodman. As of June 28, 2024, Mark Goodman owned beneficially 612,926.9097 shares of the Company, and Benjamin B. Cope owned beneficially 5,000 shares of the Company.

Table A

| | | | | | | | | | |

Name, Address

and Age | | Position(s) in

Tridan Corp. | | Director

Since | | Principal

Occupations

During Past

5 years | | Number of

Portfolios

Overseen | | Other

Directorships

During Past

5 Years |

Interested Persons: | | | | | | | | | | |

| | | | | |

Mark Goodman 276 Nantasket Road Hull, MA 02045 Age 70 | | Director, President and Treasurer | | 1999 | | Pianist and Teacher | | 1 | | None |

| | | | | |

Benjamin B. Cope 25 Sheldon Street Milton, MA 02186 Age 30 | | Director | | 2021 | | Sr. Marketing Manager, Recorded Future | | 1 | | None |

|

| Table B |

Name, Address and Age | | Position(s) in Tridan Corp. | | Director

Since | | Principal Occupations During Past 5 years | | Number

of

Portfolios

Overseen | | Other

Directorships

During

Past

5 Years |

Disinterested Persons: | | | | | | | | | | |

| | | | | |

Joan G. Rall 55 East 9th Street, #11F New York, NY 10003 Age 70 | | Director, Audit Committee Chair | | 2017 | | Retired Partner, Ernst & Young LLP (certified public accountants) | | 1 | | None |

| | | | | |

Russell Jude Stoever 15 Rockleigh Road Rockleigh, NJ 07647 Age 79 | | Director, Audit Committee Member | | 1995 | | Vice-President and Sales Manager, Stoever Glass & Co., Inc. (a registered broker-dealer) | | 1 | | None |

Table C

| | | | | | | | |

| | | | |

Name, Address

and Age | | Position(s) in Tridan Corp. | | Principal

Occupations

During Past

5-years | | Number of

Portfolios

Overseen | | Other

Directorships

Held |

Non-director Officers: | | | | | | | | |

| | | | |

John H. Lively 11300 Tomahawk Creek Parkway, Suite 310, Leawood, KS 66211 Age 55 | | Secretary | | Attorney, Practus, LLP | | None | | None |

| | | | |

Soth Chin 6219 29th Street Arlington, VA 22207 Age 58 | | Chief Compliance Officer | | Managing Member, Fit Compliance, LLC | | None | | None |

The following table sets forth the dollar range of equity securities beneficially owned by each nominee for election as director:

| | | | |

Name of Nominee | | Dollar Range of Equity

Securities in Tridan

Corp. | |

Interested Person: | | | | |

Mark Goodman | | | Over $100,000 | |

Disinterested Persons: | | | | |

Russell Jude Stoever | | | None | |

Joan G. Rall | | | None | |

Benjamin B. Cope | | $ | 50,001 to $100,000 | |

QUALIFICATIONS OF DIRECTORS

The board of directors governs the Company and is responsible for protecting the interests of shareholders. The directors meet periodically throughout the year to oversee the Company’s activities and review its performance. Each of the directors is committed to regular and active participation in board and committee meetings. The board believes that, collectively, the directors have balanced and diverse experience, qualifications, attributes, and skills which allow the board to operate effectively in governing the Company and protecting the interests of shareholders. Information about the specific experience, skills, attributes and qualifications of each director and nominee is provided below, each of whom the board proposes for election.

Mark Goodman – Mr. Goodman has been a director since 1999. He has been a shareholder of Tridan since before its 1980 conversion to an investment company. He is knowledgeable in the history and activities of the Company, and has also had broad investment experience in fixed income securities, including municipal bonds.

Russell J. Stoever – Mr. Stoever has been a director since 1995. He is vice president and sales manager of Stoever, Glass & Co., Inc., a registered broker-dealer. He has been employed there since 1971 and became a principal of that corporation in 1982, with involvement in all aspects of municipal finance. He is not an “interested person” of Tridan Corp., as defined in the Investment Company Act, in that he does not execute any portfolio transactions for, or engage in any principal transactions with, Tridan or its investment adviser or any accounts over which the adviser has brokerage placement discretion, or any other investment company having the same investment adviser. Mr. Stoever brings to the board a keen analysis of economic and market conditions and trends, and his views concerning portfolio management.

Joan G. Rall - Ms. Rall is a former certified public accountant and retired from a career with Ernst & Young LLP as an Assurance and Advisory Partner. She has extensive experience in accounting, auditing, enterprise risk management, technology risk and assurance, and personnel management. She was an Adjunct Professor of Accounting at NYU, and is Co-Founder and President of a biotech startup, Genusetics Inc.

Benjamin B. Cope – Mr. Cope is Senior Manager of Enterprise Growth Marketing at Recorded Future. He has broad experience in implementing commercial growth strategies, revenue forecasting and analysis, and scaling technology companies from early venture funding to initial public offering.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

No director or officer received any compensation from the Company during the last fiscal year, except for the fees of $12,000 paid during each year to each director, plus an additional $5,000 to Joan G. Rall, who served as chair of the audit committee. The Company does not have any bonus, profit sharing, or other compensation plan, contract or arrangement with anyone, nor any pension or retirement plan; nor has the Company ever granted to anyone any options, warrants or other rights to purchase securities.

All executive officers of the Company as a group (Mr. Goodman and Mr. Lively) received compensation (comprised solely of said directors’ fees) aggregating $12,000 during fiscal 2024, all of which was paid to Mr. Goodman. Mr. Lively receives no compensation for his service as Secretary of the Company, although Practus receives fees from the Company for services as counsel. Mr. Chin receives fees from the Company for his services as the Company’s Chief Compliance Officer.

COMMITTEES

Audit Committee

The audit committee consists of two directors appointed by the board. The committee members are Joan G. Rall, and Russell J. Stoever. They are independent as defined in Section 2(a)(19) of the Investment Company Act of 1940. The board has determined that Joan G. Rall qualifies as an audit committee financial expert, as defined by applicable SEC rules and regulations.

The audit committee operates under its charter, which it reviews annually and which is then submitted for approval by the board of directors. A copy of the charter is attached as an appendix to this proxy statement.

The audit committee assists the board of directors in fulfilling their oversight responsibilities relating to the quality of the Company’s accounting and auditing practices, including its financial statements and financial reporting process, disclosure controls and procedures and internal control over financial reporting, the annual independent audit of the Company’s financial statements, and compliance with the Company’s ethics program and with regulatory requirements. The audit committee is directly responsible for the appointment, compensation and oversight of the Company’s independent registered public accounting firm. The committee met four times during the fiscal year ended April 30, 2024.

Audit Committee Report

The audit committee has reviewed and discussed the Company’s April 30, 2024 audited financial statements with management and with Forvis Mazars, LLP, the Company’s independent registered certified public accountants. Effective June 1, 2024, Mazars USA LLP (“Mazars”) entered into a transaction with FORVIS, LLP (“FORVIS”) whereby substantially all of the partners and employees of Mazars joined Forvis. As a result, on the effective date of June 1, 2024 FORVIS, LLP changes its name to Forvis Mazars, LLP and Mazars resigned as the Company’s independent registered public accounting firm. The audit committee has appointed Forvis Mazars, LLP to serve as the Company’s independent registered public accounting firm effective June 1, 2024 for the Company’s April 30, 2024 audited financial statements. The audit committee has also discussed with said auditors the matters required to be discussed by PCAOB Auditing Standard No. 1301, “Communications with Audit Committees”, has received from them the written disclosures and letter required by PCAOB Rule 3526 “Communications with Audit Committees Concerning Independence”, and has discussed with them their independence from the Company. The audit committee met with the independent registered certified public accountants to discuss the results of their examination and their observations and recommendations. Based on the foregoing review and discussions, the audit committee has recommended to the board that the audited financial statements as of April 30, 2024 be issued to shareholders and filed with the SEC.

Audit Committee Members:

Joan G. Rall, Chair, and Russell J. Stoever

Nominating Committee

The Company does not have a standing nominating committee, because of the small size of the board of directors and the infrequency of its turnover.

Rather, on those rare occasions when a new candidate is proposed for consideration, whether by a shareholder or by others, the entire board considers the candidate and the board itself acts as a nominating committee. The board considers a candidate’s experience, familiarity with business and investments, knowledge about issues affecting the Company, and willingness to spend the time necessary to read applicable materials and attend meetings.

In instances where the board determines that a candidate will be a valuable replacement or addition to the board of directors, the board recommends such candidate’s election by the shareholders.

This procedure has been followed successfully and without issue since 1980, when the Company first became a registered investment company, and the board believes it continues to be appropriate.

CONDUCT OF AND ATTENDANCE AT MEETINGS

Mark Goodman is the president and chief executive officer of Tridan Corp. There is no chairman of the board. Board meetings are conducted by John H. Lively, who is the Company’s corporate secretary and his law firm, Practus, LLP serves as Company counsel. This structure is appropriate for the Company considering the long-time involvement of Mr. Mark Goodman in the Company’s operations and the retention of counsel with knowledge and experience with investment companies.

During the fiscal year ended April 30, 2024, there were four meetings of the board of directors and four meetings of the audit committee. Each of the directors attended at least 75% of the aggregate number of meetings of the board and of the audit committee on which he or she served. Although the Company has no formal policy regarding director attendance at the annual shareholders’ meetings, directors are expected to attend, and all members of the board attended last year’s annual meeting.

SHAREHOLDER COMMUNICATIONS WITH DIRECTORS

The board of directors has not established a formal process for shareholders to send communications to the board. In the board’s view, it is appropriate for the Company not to have such process, because the directors are few in number, and any shareholder who wishes to do so may address a letter to the attention of the entire board, care of the Company at its principal office, or to individual board members either at that address or at their personal addresses listed in the proxy statement.

PRINCIPAL AND MANAGEMENT SHAREHOLDERS

The following table sets forth certain information concerning directors of the Company and persons believed by the Company to be the record owners of more than five percent (5%) of the Company’s voting securities as of June 28, 2024:

| | | | | | | | | | |

Title of Class | | Name and Address of Beneficial Owner | | Number of Shares

Beneficially Owned

on June 28, 2024 | | | Percent

Of Class on

June 28, 2024 | |

Capital Stock (par value $.02) | | Thomas Goodman 111-20 73rd Avenue, Apt. 6F Forest Hills, NY 11375 | | | 701,000.0000 1/ | | | | 23.38 | % |

| | Elizabeth Smith Goodman 1074 Clayton Mill River Rd Mill River, MA 01244 | | | 627,926.9097 2/ | | | | 20.94 | % |

| | Geoffrey Adams Goodman Putrich Str. 6 Munich, Germany 81667 | | | 627,926.9097 2/ | | | | 20.94 | % |

| | Mark Goodman 276 Nantasket Road Hull, MA 02045 | | | 612,926.9097 2/ | | | | 20.44 | % |

| | Erda Erdos 549 Fairview Terrace York, PA 17403 | | | 323,640.1115 | | | | 10.79 | % |

| | All officers and directors as a group (6 persons) | | | 617,926.9097 | | | | 20.61 | % |

| 1/ | Including 600,000 shares owned by the Thomas Goodman Trust. |

| 2/ | Elisabeth Smith Goodman, Geoffrey Adams Goodman and Mark Goodman are each trustees of certain trusts, representing 312,693.0698 shares inherited from the estate of Peter Goodman. In 2022, the estate of Peter Goodman disposed of 940,280.7292 shares, representing 30.805% of the shares. |

PKF O’Connor Davies, LLP is the Company’s administrator, located at 300 Tice Boulevard, Suite 315, Woodcliff Lake, NJ 07677.

RELATIONSHIP WITH AND RATIFICATION OF

INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

The audit committee is responsible for approving the engagement of the Company’s independent public accountants prior to their engagement. The audit committee and board of directors have unanimously approved the selection of Forvis Mazars, LLP as independent public accountants for the Company for the fiscal year ending April 30, 2025. Although shareholder ratification is not required by law, to be consistent with past practice the firm’s selection is being submitted for ratification by the shareholders, which requires the affirmative vote of a majority of the shares of the Company present at the meeting. If shareholders do not ratify their selection, the board will reconsider the matter and will decide whether to retain that firm. The audit committee and board of directors reviewed the services performed by Forvis Mazars, LLP during the last fiscal year and determined that such services did not affect their independence. The firm has no direct or indirect financial interest in the Company, except for fees received by it for services which were furnished at customary rates and terms. Representatives of the firm are expected to be present at the meeting, will be given an opportunity to make such statements as they feel appropriate, and will be available to respond to appropriate questions.

Audit Fees –Mazars USA LLP billed the Company a total of $54,000 for the 2024 fiscal year and $53,000 for the 2023 fiscal year, for the audit of the Company’s annual financial statements and in connection with statutory and regulatory filings for those years.

Audit-Related Fees – No fees were billed to the Company for the last two fiscal years for any audit-related services.

Tax Fees – No fees were billed to the Company for the last two fiscal years for tax compliance, tax advice or tax planning.

All Other Fees – No fees were billed to the Company for the last two fiscal years for any other services.

INVESTMENT ADVISER

The Company’s investment adviser is J.P. Morgan Investment Management Inc., (“JPMorgan”), 277 Park Avenue, New York, NY 10172. An affiliated company, J.P. Morgan Chase Bank, N.A. provides custodial services. The Investment Advisory Agreement dated July 1, 2000 was approved by the shareholders at the annual meeting on June 20, 2000 and the amendment thereto dated June 1, 2020 was approved by the shareholders at the annual meeting on June 17, 2021. The Investment Advisory Agreement as Amended was scheduled to expire on June 30, 2024. On June 24, 2024, the board of directors (including the Company’s independent directors) unanimously approved a continuation of the Agreement as Amended until June 30, 2025, subject to the early termination provisions contained in the Agreement as Amended.

Under the Agreement, JPMorgan, subject to the general supervision of the Company’s board of directors and in conformance with the stated policies of the Company, manages investment operations and the composition of the Company’s portfolio of securities and investments. In this regard, it is the responsibility of JPMorgan to make investment decisions for the Company and to place the purchase and sale orders for the portfolio transactions of the Company.

The investment advisory services of JPMorgan to the Company are not exclusive under the terms of the Agreement. JPMorgan is free to, and does, render investment advisory services to others, including numerous funds.

JPMorgan seeks to obtain the best price and execution of orders placed for the Company’s assets considering all of the circumstances. If transactions are executed in the over-the-counter market, JPMorgan will deal with the principal market makers, unless more favorable prices and executions are otherwise obtainable. When circumstances relating to a proposed transaction indicate that a particular broker or dealer is in a position to provide the best execution considering all factors including price, the order is placed with that broker or dealer. This may or may not be a broker or dealer which has provided statistical or other factual information to JPMorgan. While JPMorgan does not expect to utilize soft dollars for research with respect to Tridan, JPMorgan may, subject to the requirement of seeking the best price and execution, in certain circumstances in which two or more brokers are in a position to offer comparable prices and execution, give preference to a broker or dealer which has provided statistical and other factual information to it. In recognition of the brokerage execution services, JPMorgan may pay a brokerage commission in excess of that which another broker might have charged for the same transaction. JPMorgan periodically evaluates the overall reasonableness of brokerage commissions paid by the Company. The factors considered in these evaluations include the competitive negotiated rate structure at the time the commission is charged and the effectiveness of the broker’s execution.

INVESTMENT ADVISORY AGREEMENT RENEWAL

Throughout the year, the directors receive and analyze a substantial quantity of comprehensive information and written materials, including ongoing analysis of the company’s existing portfolio and JPMorgan’s recommendations in light of its forecasts for the economy, employment trends, business conditions, inflation, municipal bond yield curve, and return trends including yield comparisons between tax-exempt and US Treasury bonds, appropriate duration and maturities, quality, yields, and sector allocation. Written materials received by the directors before each meeting include reports, statistics, charts, graphs, performance records, comparisons with other funds and the like. JPMorgan is questioned regarding its economic outlook for New York municipal bonds, the company’s portfolio holdings and its performance.

In addition to the foregoing, JPMorgan submits each year its audited financial statements and detailed information regarding JPMorgan’s business, personnel and operations, advisory services, compensation matters, portfolio strategy and investment process, investment performance, sources of information, fee comparisons, compliance programs, and other matters of significance to the relationship between Tridan and its investment adviser, all of which material is furnished to each Director. The Directors considered the annual renewal of the Advisory Agreement with JPMorgan at a Board meeting held on June 24, 2024. The Directors reviewed and discussed this material, as well as their own views on JPMorgan’s performance and relationship with Tridan, with particular attention to the following areas:

Investment Performance

At each meeting, the directors receive, review and discuss with JPMorgan’s representatives the various data showing Tridan’s portfolio characteristics, including market value, average duration, credit quality, coupon, yield statistics, and breakdown information regarding duration, credit, and investment sectors. JPMorgan’s quarterly presentation also includes the portfolio performance over three months, year to date, one year, three years and five years compared with the JPMorgan New York Tax Free Bond Fund, Sanford Bernstein Intermediate New York Municipal Fund, and Bloomberg New York Competitive Intermediate (1-17 Year) Index. At the meeting held on June 24, 2024, the Directors also compared Tridan’s performance with the median performance of certain New York municipal bond funds as compiled by Morningstar. Based on their review, the directors have concluded that Tridan’s relative investment performance has been satisfactory.

Nature, Extent and Quality of Service

The board’s analysis of the nature, extent and quality of JPMorgan’s services to Tridan is based on knowledge gained over time from discussions with management and at the board’s regular meetings. In addition, the Directors review the qualifications, education and experience of JPMorgan’s personnel involved in rendering those services. As Tridan’s investment adviser, JPMorgan manages the investment of the company’s assets, including purchases and sales of securities. JPMorgan also prepares and issues periodic reports to the board of directors in connection with board meetings. The board also considers the adviser’s monitoring adherence to the company’s investment policies, guidelines and restrictions, JPMorgan’s responsiveness to requests by Tridan’s counsel for periodic information, reports required for compliance with federal securities laws and regulations and maintaining and monitoring its compliance programs in light of today’s extensive regulatory requirements. The board has concluded that the nature, extent and quality of the services provided by JPMorgan to the company have been and continue to be satisfactory and beneficial to Tridan.

Fees, Economies of Scale and Profitability; Ancillary Benefits to the Advisor

Under its Investment Advisory Agreement dated July 1, 2000 with JPMorgan, which was amended as of June 1, 2020 to reduce the compensation payable to JPMorgan, for the services provided, and the expenses borne pursuant to this Agreement, the Company will pay to the Advisor as full compensation therefor a fee at an annual rate equal to 0.25 of 1% of the Company’s net assets. This fee will be computed based on net assets on the last business day of each calendar quarter and will be paid to the Advisor quarterly during the succeeding calendar month. The Directors noted that the advisory fee payable to JPMorgan does not change based on Tridan’s assets, and so economies of scale are not realized in the advisory fee.

Tridan also pays 0.02% (2 basis points) to JPMorgan’s affiliate, J.P. Morgan Chase Bank, N.A. for custodial services. The Advisory Agreement requires JPMorgan to bear all expenses incurred by it in connection with its activities under the agreement. For the year ended April 30, 2024, JPMorgan’s advisory fees were $87,061, and the custodial fees were $6,939. Further, the Directors noted that JPMorgan was profitable with respect to the advisory services it provides to Tridan. The Directors considered the advisory fees and overall fees charged to another investment company which invests principally in the same type of securities as Tridan, the Sanford Bernstein Intermediate New York Municipal Fund, and the median advisory fee of a comparable Morningstar peer group of New York municipal bond funds. The Directors also considered the advisory fee and overall fees paid by the JP Morgan New York Tax Free Bond Fund, which invests in the same type of securities as Tridan. The Directors noted that the Sanford Bernstein Intermediate New York Municipal Fund and the JP Morgan New York Tax Free Bond Fund have significantly more assets than Tridan. The Directors further considered that Tridan’s advisory fee is priced below the standard institutional rate for other JP Morgan institutional clients. Other than the custody fees paid to an affiliate of JPMorgan, the Directors did not identify other benefits to be realized by the Advisor or its affiliates from its relationship with Tridan.

In light of the nature, extent and quality of the services received by Tridan from JPMorgan, as well as the affiliate’s custodial fees, the Directors consider the fees paid to Tridan to be reasonable and within the range of advisory fees that could have been negotiated at arms-length considering all of the surrounding circumstances. It was the conclusion of the Directors that it would be in the best interests of Tridan Corp. and its shareholders for the board to renew the investment advisory agreement with J.P. Morgan Investment Management Inc. for another one-year period. The names and principal occupations of the directors and principal executive officers of JPMorgan are as follows. Each of them may be reached c/o J.P. Morgan Investment Management Inc., 277 Park Avenue, New York, NY 10172:

LIST OF J.P. MORGAN INVESTMENT MANAGEMENT EXECUTIVE OFFICERS

| | |

Name | | Title |

| Mary Erodes | | CHIEF EXECUTIVE OFFICER/ASSET & WEALTH MANAGEMENT (AWM) |

| |

| George Gatch | | CHIEF EXECUTIVE OFFICER/ASSET MANAGEMENT (AM) |

| |

| Camille Raimondi | | SECRETARY /EXECUTIVE DIRECTOR |

| |

| Paul Quinsee | | DIRECTOR / HEAD OF GLOBAL EQUITIES / MANAGING DIRECTOR |

| |

| Andrew Powell | | DIRECTOR / CHIEF ADMINISTRATIVE OFFICER (CAO) / HEAD OF GLOBAL CLIENT SERVICE / MANAGING DIRECTOR |

| |

| John Donohue | | DIRECTOR / CEO AM AMERICAS, HEAD OF GLOBAL LIQUIDITY/ MANAGING DIRECTOR |

| |

| Robert Michele | | DIRECTOR / HEAD OF GLOBAL FIXED INCOME, CURRENCY & COMMODITIES / MANAGING DIRECTOR |

| |

| John Oliva | | CHIEF COMPLIANCE OFFICER / MANAGING DIRECTOR |

| |

| Anton Pil | | DIRECTOR / HEAD OF GLOBAL ALTERNATIVES / MANAGING DIRECTOR |

| |

| Kristian West | | DIRECTOR/HED OF INVESTMENT PLATFORM/MANAGING DIRECTOR |

| |

| Jennifer Wu | | DIRECTOR/HEAD OF GLOBAL SUSTAINABLE INVESTING/MANAGING DIRECTOR |

| |

| Jedediah Laskowitz | | DIRECTOR/HEAD OF GLOBAL ASSET MANAGEMENT SOLUTIONS / MANAGING DIRECTOR |

| |

| Bob Michele | | DIRECTOR/HEAD OF GLOBAL FIXED INC, CURRENCY & COMMODITIES/MANAGING DIRECTOR |

| |

| Andrea Lisher | | DIRECTOR/HEAD OF AMERICAS CLIENT / MANAGING DIRECTOR |

| |

| Patrick Thomson | | DIRECTOR/CEO AM EMEA, HEAD OF AM EMEA CLIENT/MANAGING DIRECTOR |

| |

| Dan Watkins | | DIRECTOR/CEO AM APAC, HEAD OF AM APAC CLIENT/MANAGING DIRECTOR |

| |

| James Peagam | | DIRECTOR/HEAD OF GLOBALINSURANCE/MANAGING DIRECTOR |

| |

| Shari Schiffman | | DIRECTOR/HEAD OF GLOBAL PRODUCT STRATEGY/MANAGING DIRECTOR |

| |

| Steve Clark | | DIRECTOR/HEAD OF TECHNOLOGY/MANAGING DIRECTOR |

| |

| Fred Crosnier | | DIRECTOR/HEAD OF OPERATIONS/MANAGING DIRECTOR |

| |

| Sarah Gill | | DIRECTOR/CHIEF DATA OFFICER AND HEAD OF PORTFOLIO ANALYTICS |

| |

| Luciano Santos | | DIRECTOR/CHIEF RISK OFFICER/MANAGING DIRECTOR |

| |

| Ben Hesse | | DIRECTOR/AWM CFO AND HEAD OF STRATEGY & BUSINESS DEVELOPMENT/MANAGING DIRECTOR |

| |

| Mark Campbell James | | DIRECTOR/CHIEF FINANCIAL OFFICER/MANAGING DIRECTOR |

| |

| Severine Blond | | DIRECTOR/HEAD OF CONTROL MANAGEMENT/MANAGING DIRECTOR |

| | |

| Peter Bonanno | | DIRECTOR/GENERAL COUNSEL/MANAGING DIRECTOR |

| |

| Joanna Lazarides | | DIRECTOR/HEAD OF HUMAN RESOURCES/MANAGING DIRECTOR |

| |

| Kaire Vung | | DIRECTOR/AUDIT SENIOR DIRECTOR/MANAGING DIRECTOR |

| |

| Brandon Robinson | | DIRECTOR/DEPUTY GLOBAL HEAD OF ALTERNATIVES/MANAGING DIRECTOR |

| * | Managing Director is an officer’s title. Those who hold it are not necessarily directors of JPMorgan. |

SUPPLEMENTAL INFORMATION

Mr. Mark Goodman is the Company’s President and Treasurer and serves as the executive officer of the Company. Mr. Goodman serves at the pleasure of Tridan’s board of directors as concerns his service as President and Treasurer. Peter Goodman, who was the father of Mark Goodman and who passed away in January 2021, had served as President since the Company registered with the U.S. Securities and Exchange Commission as an investment company in April 1980.

SHAREHOLDER PROPOSALS

FOR 2025 ANNUAL MEETING

Next year’s annual meeting of shareholders of the Company will be scheduled for July 15, 2025. Shareholders wishing to have their proposals included in the Company’s Proxy Statement which will relate to that meeting must submit their proposals, preferably by certified mail, return receipt requested, to the Company at its address listed on the first page of this Proxy Statement so that the proposals are received no later than February 15, 2025.

OTHER MATTERS

As of the date of this Proxy Statement, the board of directors is not aware of any matters to be presented for action at the meeting other than those described above. Should other business properly be brought before the meeting, the persons named in the proxy have discretionary authority to vote in accordance with their best judgment in the interest of the Company.

| | | | | | |

| Dated: June 28, 2024 | | | | | | By Order of the Board of Directors |

| | | |

| | | | | | /s/ John H. Lively |

| | | | | | John H. Lively, Secretary |

Tridan Corp.

Financial Statements

April 30, 2024 and 2023

Tridan Corp.

Contents

April 30, 2024 and 2023

| | | | |

| | | Page(s) | |

Report of Independent Registered Public Accounting Firm | | | 1-2 | |

(Forvis Mazars, LLP, Iselin, New Jersey PCAOB ID 686) | | | | |

| |

Report of Independent Registered Public Accounting Firm | | | 3-4 | |

(Mazars USA LLP, New York, New York, PCAOB ID 339) | | | | |

| |

Financial Statements | | | | |

| |

Statements of Assets and Liabilities April 30, 2024 and2023 | | | 5 | |

| |

Schedules of Investments in Municipal Obligations April 30, 2024 and 2023 | | | 6-11 | |

| |

Statements of Operations Years Ended April 30, 2024 and2023 | | | 12 | |

| |

Statements of Changes in Net Assets Years Ended April 30, 2024, 2023 and 2022 | | | 13 | |

| |

Notes to Financial Statements | | | 14-20 | |

| | | | |

Forvis Mazars, LLP 200 South Wood Avenue, Suite 125 Iselin, NJ 08830 forvismazars.us | | |  | |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Tridan Corp.

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of Tridan Corp. (the “Company”), including the schedule of investments in municipal obligations as of April 30, 2024, the related statement of operations and statement of changes in net assets for the year then ended, the financial highlights for the year ended April 30, 2024, and the related notes, collectively referred to as the “financial statements and financial highlights”). In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Company as of April 30, 2024, the results of its operations for the year then ended, the changes in its net assets for the year ended April 30, 2024, and financial highlights for the year ended April 30, 2024, in conformity with accounting principles generally accepted in

the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements and financial highlights based on our audit.

We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchanges Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights and other data are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our procedures included confirmation of securities owned, as of April 30, 2024, by correspondence with the custodian. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audit provides a reasonable basis for our opinion.

Forvis Mazars, LLP is an independent member of Forvis Mazars Global Limited

We have served as the Company’s auditor since 2024.

Iselin, New Jersey

June 28, 2024

| | |

| | Mazars USA LLP

200 South Wood Avenue Suite 125 Iselin, New Jersey 08830 Tel: 732.549.2800 www.mazars.us |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Tridan Corp.

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statements of assets and liabilities of Tridan Corp. (the “Company”), including the schedules of investments in municipal obligations, as of April 30, 2023, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period ended April 30, 2023, the financial highlights for each of the four years in the period ended April 30, 2023, and the related notes, collectively referred to as the “financial statements and financial highlights”). In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Company as of April 30, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended April 30, 2023, and financial highlights for each of the four years in the period ended April 30, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchanges Commission and the PCAOB.