UNITED STATESSECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 20-F/A

Amendment No. 1

____________________________

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2012 |

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from _______________ to ________________ |

or

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | Date of event requiring this shell company report ______________ |

Commission File Number 0-9266

AVINO SILVER & GOLD MINES LTD.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

570 Granville Street, Suite 900 Vancouver, British Columbia V6C 3P1, Canada

(Address of principal executive offices)

David Wolfin, 570 Granville Street, Suite 900 Vancouver, British Columbia V6C 3P1, Canada,

Tel: 604-682-3701, Email: dwolfin@avino.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Common Shares, without Par Value | | NYSE Mkt |

| Title of Each Class | | Name of Each Exchange on Which Registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Not Applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Not Applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

There were 27,127,416 common shares, without par value, issued and outstanding as of December 31, 2012.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated File o Accelerated Filer o Non-Accelerated Filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP o | International Financial Reporting Standards as issued by the International Accounting Standards Board x | Other o |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes o No o

INTRODUCTION

We are filing this Amendment Number 1 to our Annual Report on Form 20-F to update certain Risk Factors contained in Item 3. D and information regarding our material properties contained in Item 4.D. This Amendment Number 1 (“Amendment”) should be read in conjunction with our Annual Report on Form 20-F for the year ended December 31, 2012, and unless otherwise amended in this Amendment, the information regarding the Company shall remain the same as in our Annual Report. All information is as of December 31, 2012 unless otherwise indicated. Further, unless otherwise indicated or as the context otherwise requires, the “Company”, “we”, “our” or “us” refers to Avino Silver & Gold Mines Ltd.

PART I

Item 3. Key Information

A. Selected Financial Data

The selected historical consolidated financial information set forth below has been derived from our annual audited consolidated financial statements for each of the years in the five-year period ended December 31, 2012.

For the years ended December 31, 2012, 2011, and 2010 we have prepared our consolidated financial statements in accordance with IFRS, as issued by the IASB. Our December 31, 2010 consolidated financial statements were initially prepared in accordance with Canadian GAAP, consistent with the prior years and the periods ended December 31, 2009, 2008 and 2007. We have adjusted our consolidated financial information at and for the year ended December 31, 2010, in accordance with IFRS 1, and therefore the financial information set forth in this annual report on Form 20-F for the year ended December 31, 2010 may differ from information previously published. We adopted IFRS with a transition date of January 1, 2010.

The selected historical consolidated financial information presented below is condensed and may not contain all of the information that you should consider. This selected financial data should be read in conjunction with our annual audited consolidated financial statements, the notes thereto and the section entitled ‘‘Item 5 — Operating and Financial Review and Prospects.’’

In accordance with IFRS

The tables below set forth selected consolidated financial data under IFRS for the years ended December 31, 2012, 2011 and 2010 and as at December 31, 2012, 2011 and 2010. The information has been derived from our annual audited consolidated financial statements set forth in ‘‘Item 17 — Financial Statements.’’

| | | Years Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | |

| Summary of Operations: | | | | | | | | | |

| Revenue | | $ | 2,255,376 | | | $ | - | | | $ | - | |

| Cost of sales | | | 1,434,569 | | | | - | | | | - | |

| Interest Income | | | 21,760 | | | | 78,857 | | | | 14,206 | |

| Other Income | | | 23,464 | | | | 10,499 | | | | - | |

| Expenses | | | | | | | | | | | | |

| Operating and administrative | | | 1,929,746 | | | | 4,042,647 | | | | 1,110,643 | |

| Unrealized (loss) gain in investments in related companies | | | (110,021 | ) | | | (212,966 | ) | | | 313,323 | |

| Foreign exchange gain | | | 116,562 | | | | 68,404 | | | | 19,951 | |

| Deferred income tax expense | | | (260,321 | ) | | | (86,498 | ) | | | (27,677 | ) |

| Net loss | | | (1,263,178 | ) | | | (4,184,351 | ) | | | (790,840 | ) |

| | | | | | | | | | | | | |

| Loss per share | | | (0.05 | ) | | | (0.16 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | |

| Weighted average number of shares outstanding | | | 27,072,053 | | | | 26,795,632 | | | | 21,059,008 | |

| | | 2012 | | | 2011 | | | 2010 | |

| Balance Sheet Data: | | | | | | | | | |

| Total assets | | $ | 26,191,608 | | | $ | 26,136,355 | | | $ | 26,578,517 | |

| Cash and cash equivalents | | $ | 4,035,985 | | | | 5,282,464 | | | | 9,051,848 | |

| Total liabilities | | $ | 4,244,230 | | | | 3,202,096 | | | | 2,662,727 | |

| Shareholders’ equity | | | 21,947,378 | | | | 22,934,259 | | | | 23,915,790 | |

In accordance with Canadian GAAP

The tables below for the years ended December 31, 2009 and 2008 contain selected financial data prepared in accordance with Canadian GAAP, which have been derived from our previously audited consolidated financial statements for the periods ending on such dates. The financial data presented below for 2009 and 2008 presented in accordance with Canadian GAAP and reconciled to United States GAAP, is not comparable to information prepared in accordance with IFRS.

| Canadian GAAP | | | |

| | | Years Ended December 31, | |

| | | 2009 | | | 2008 | |

| Summary of Operations: | | | | | | |

| Revenue | | $ | - | | | $ | - | |

| Interest Income | | | 68,224 | | | | 146,386 | |

| Expenses | | | | | | | | |

| Operating and administrative | | | 669,178 | | | | 1,575,913 | |

| Write-down of Exploration and evaluation assets | | | 608,118 | | | | - | |

| Mineral property option revenue | | | - | | | | 25,000 | |

| Future income tax benefit (expense) | | | 239,562 | | | | (98,653 | ) |

| Net loss | | | (987,759 | ) | | | (1,538,876 | ) |

| Loss per share | | | (0.05 | ) | | | (0.07 | ) |

| | | | | | | | | |

| Weighted average number of shares outstanding | | | 20,584,727 | | | | 20,584,727 | |

| | | As at December 31, | |

| | | 2009 | | | 2008 | |

| Balance Sheet Data: | | | | | | |

| Total assets | | $ | 19,206,278 | | | $ | 20,126,230 | |

| Cash and cash equivalents | | | 2,829,605 | | | | 3,575,241 | |

| Total liabilities | | | 2,241,179 | | | | 2,508,776 | |

| Shareholders’ equity | | | 16,965,099 | | | | 17,617,454 | |

| United States GAAP | | | | | | |

| | | Years Ended December 31, | |

| | | 2009 | | | 2008 | |

| Summary of Operations: | | | | | | |

| Net loss per Canadian GAAP | | $ | (987,759 | ) | | $ | (1,538,876 | ) |

| Adjustments | | | (95,108 | ) | | | (1,851,231 | ) |

| Net loss per US GAAP | | | (1,082,867 | ) | | | (3,390,107 | ) |

| Loss per share per US GAAP | | | (0.05 | ) | | | (0.17 | ) |

| | | As at December 31, | |

| | | 2009 | | | 2008 | |

| Balance Sheet Data: | | | | | | |

| Total assets under Canadian GAAP | | | 19,206,278 | | | | 20,126,230 | |

| Adjustments | | | (14,573,506 | ) | | | (14,861,524 | ) |

| Total assets under US GAAP | | | 4,632,772 | | | | 5,264,706 | |

| | | | | | | | | |

| Total equity under Canadian GAAP | | | 16,965,099 | | | | 17,617,454 | |

| Adjustments | | | (12,879,499 | ) | | | (12,927,955 | ) |

| Total equity under US GAAP | | | 4,085,600 | | | | 4,689,499 | |

Exchange Rates

The following table sets forth information as to the period end, average, the high and the low exchange rate for Canadian Dollars and U.S. Dollars for the periods indicated based on the noon buying rate in New York City for cable transfers in Canadian Dollars as certified for customs purposes by the Federal Reserve Bank of New York (Canadian dollar = US$1).

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| 2008 | | | | 1.0660 | | | | 1.2246 | | | | 1.2969 | | | | 0.9719 | |

| 2009 | | | | 1.1420 | | | | 1.0466 | | | | 1.3000 | | | | 1.0292 | |

| 2010 | | | | 1.0299 | | | | 0.9946 | | | | 1.0778 | | | | 0.9946 | |

| 2011 | | | | 0.9891 | | | | 1.0170 | | | | 1.0630 | | | | 0.9383 | |

| 2012 | | | | 0.9996 | | | | 0.9958 | | | | 1.0299 | | | | 0.9600 | |

The following table sets forth the high and low exchange rate for the past six months based on the noon buying rate. As of April 30, 2013, the exchange rate was CDN$0.9929 for each US$1.

| | | | | | | |

| November 2012 | | | | 1.0074 | | | | 0.9971 | |

| December 2012 | | | | 1.0162 | | | | 1.0042 | |

| January 2013 | | | | 1.0164 | | | | 0.9923 | |

| February 2013 | | | | 1.0041 | | | | 0.9722 | |

| March 2013 | | | | 0.9847 | | | | 0.9696 | |

| April 2013 | | | | 0.9929 | | | | 0.9737 | |

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

D. Risk Factors

In addition to the other information presented in this Annual Report, the following should be considered carefully in evaluating the Company and its business. This Annual Report contains forward-looking statements that involve risks and uncertainties. The Company’s actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed below and elsewhere in this Annual Report.

We will be required to raise additional capital to mine our properties. The Company is currently focusing on further defining an effective plan to mine its San Gonzalo ore body. Although the Company recently began mining operations at the San Gonzalo mine, the Company will still be required to raise capital to further develop the San Gonzalo mine. Our ability to raise funds will depend on several factors, including, but not limited to, current economic conditions, our perceived value for our properties, our prospects, metal prices, businesses competing for financing and our financial condition. There can be no assurance that we will be able to raise funds, or to raise funds on commercially reasonable terms. Historically, the Company has raised funds through equity financing and the exercise of options and warrants. The raising of capital may have a dilutive effect on the Company’s per share book value.

We have incurred net losses since our inception and expect losses to continue. We have not been profitable since our inception. For the year ended December 31, 2012, we had a net loss of $1,263,178 and an accumulated deficit at December 31, 2012 of $29,458,319. On October 1, 2012, the Company began to generate net income its operations at the San Gonzalo mine however there is no assurance that any of the Company’s operations will be profitable in the future.

As of December 31, 2012, our internal control over financial reporting were ineffective, and if we continue to fail to improve such controls and procedures, investors could lose confidence in our financial and other reports, the price of our shares of common stock may decline, and we may be subject to increased risks and liabilities.

As a public company, we are subject to the reporting requirements of the Exchange Act and the Sarbanes-Oxley Act of 2002. The Exchange Act requires, among other things, that we file annual reports with respect to our business and financial condition. Section 404 of the Sarbanes-Oxley Act requires, among other things, that we include a report of our management on our internal control over financial reporting. We are also required to include certifications of our management regarding the effectiveness of our disclosure controls and procedures. For the year ended December 31, 2012, our management has concluded that our disclosure controls and procedures and internal control over financial reporting were ineffective due to the following material weaknesses: (i) inadequate segregation of duties and effective risk assessment; (ii) insufficient written policies and procedures for accounting, financial reporting and corporate governance; and (iii) insufficient disaster recovery plans. To remediate such weaknesses, we plan to implement the following changes: (i) address inadequate segregation of duties and ineffective risk management; (ii) adopt sufficient written policies and procedures for accounting, financial reporting and corporate governance; and (iii) implement a disaster recovery plan. If we cannot effectively and efficiently improve our controls and procedures, we could suffer material misstatements in our financial statements and other information we report and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our reported financial and other information. This could lead to a decline in the trading price of our common shares.

We have no proven or probable reserves and our decision to commence commercial production is not based on a study demonstrating economic recovery of any mineral reserves and is therefore inherently risky. Any funds spent by us on exploration or development could be lost.

We have not established the presence of any proven or probable mineral reserves, as defined by the SEC, at any of our properties. Under Guide 7, the SEC has defined a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Any mineralized material discovered or produced by us should not be considered proven or probable reserves.

In order to demonstrate the existence of proven or probable reserves, it would be necessary for us to perform additional exploration to demonstrate the existence of sufficient mineralized material with satisfactory continuity and obtain a positive feasibility study which demonstrates with reasonable certainty that the deposit can be economically and legally extracted and produced. We have not completed a feasibility study with regard to all or a portion of any of our properties to date. Since we commenced commercial production of mineralized material at the San Gonzalo Mine without a feasibility study, there is inherent uncertainty as to whether the mineralized material can be economically produced or if so, for what period of time. The absence of proven or probable reserves makes it more likely that our properties may cease to be profitable and that the money we spend on exploration and development may never be recovered.

We have decided to begin production at the San Gonzalo Mine without preparing a pre-feasibility study or Bankable feasibility study which may subject us to more risks.

We have decided to begin production at the San Gonzalo Mine without preparing a pre-feasibility study or bankable feasibility study which is a more common practice within the mining industry and therefore may subject us to more business risks. Our decision to begin production at the San Gonzalo Mine was based on limited prior historical information, bulk sample drilling programs, small pilot plant and bench scale testing. Therefore our decision to begin production at the San Gonzalo Mine was based on limited information which may or may not be representative of information regarding the mine had we otherwise prepare a more comprehensive study. In addition, basing our decision to begin production on limited information may make us susceptible to risks including:

| · | certain difficulties in obtaining expected metallurgical recoveries when scaling up to production scale from pilot plant scale; |

| · | the preliminary nature of mine plans and processing concepts and applying them to full scale production; |

| · | determining operating/capital costs estimates and possible variance associated with constructing, commissioning and operating the San Gonzalo facilities based on limited information; |

| · | that metallurgical flow sheets and recoveries are in development and may not be representative of results of the San Gonzalo Mine; and |

| · | that we may under estimate capital and operating costs without a comprehensive bankable feasibility study. |

The mining industry is highly speculative and involves substantial risks. Even when mining is conducted on properties known to contain significant quantities of mineral deposits it is generally accepted in the mining industry that most exploration projects do not result in the discovery of mineable deposits of ore that can be extracted in a commercially economical manner. There may be limited availability of water, which is essential to milling operations, and interruptions may be caused by adverse weather conditions. Operations are subject to a variety of existing laws and regulations relating to exploration and development, permitting procedures, safety precautions, property reclamation, employee health and safety, air quality standards, pollution and other environmental protection controls. Mining activities are subject to substantial operating hazards, some of which are not insurable or may not be insured for economic reasons.

The commercial quantities of ore cannot be accurately predicted. Whether an ore body will be commercially viable depends on a number of factors including the particular attributes of the deposit, such as size, grade and proximity to infrastructure, as well as mineral prices and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in a mineral deposit being unprofitable.

There are no assurances that we can produce minerals on a commercially viable basis. The Company’s ability to generate revenue and profit is expected to occur through exploration of its existing properties as well as through acquisitions of interests in new properties. Substantial expenditures will be incurred in an attempt to establish the economic feasibility of mining operations by identifying mineral deposits and establishing ore reserves through drilling and other techniques, developing metallurgical processes to extract metals from ore, designing facilities and planning mining operations. The economic feasibility of a project depends on numerous factors, including the cost of mining and production facilities required to extract the desired minerals, the total mineral deposits that can be mined using a given facility, the proximity of the mineral deposits to refining facilities, and the market price of the minerals at the time of sale. There is no assurance that existing or future exploration programs or acquisitions will result in the identification of deposits that can be mined profitably.

Mining operations and exploration activities are subject to various federal, provincial and local laws and regulations. Laws and regulation govern the development, mining, production, importing and exporting of minerals, taxes, labour standards, occupational health, waste disposal, protection of the environment, mine safety, toxic substances, and other matters. In many cases, licenses and permits are required to conduct mining operations. Amendments to current laws and regulations governing operations and activities of mining companies or more stringent implementation thereof could have a substantial adverse impact on the Company. Applicable laws and regulations will require the Company to make certain capital and operating expenditures to initiate new operations. Under certain circumstances, the Company may be required to close an operation once it is started until a particular problem is remedied or to undertake other remedial actions.

Operating Hazards and Risks. The operation and development of a mine or mineral property involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include:

| · | industrial accidents and explosions; |

| · | the encountering of unusual or unexpected geological formations; |

| · | ground fall and cave-ins; |

| · | periodic interruptions due to inclement or hazardous weather conditions. |

These occurrences could result in environmental damage and liabilities, work stoppages and delayed production, increased production costs, damage to, or destruction of, Exploration and evaluation assets or production facilities, personal injury or death, asset write downs, monetary losses and other liabilities. Liabilities that the Company incurs may exceed the policy limits of its insurance coverage or may not be insurable, in which event the Company could incur significant costs that could adversely impact its business, operations or profitability.

Metal Market Prices are highly speculative and volatile. The market price of metals is highly speculative and volatile. Instability in metal prices may affect the interest in mining properties and the development of and production of such properties.

Canadian Title risks. The validity and ownership of mining property holdings can be uncertain and may be contested. Although the Company owns its properties in Canada, there are currently a number of pending and potential native title or traditional land owner claims in Canada. Accordingly, there can be no assurance that the Company’s properties in Canada will not be affected.

Competition for mineral land. There is a limited supply of desirable mineral lands available for acquisition, claim staking or leasing in the areas where the Company contemplates expanding its operations and conducting exploration activities. Many participants are engaged in the mining business, including large, established mining companies. Accordingly, there can be no assurance that the Company will be able to compete successfully for new mining properties.

Uncertainty of exploration and development programs. The Company’s profitability is significantly affected by the costs and results of its exploration and development programs. As mines have limited lives based on proven and probable mineral reserves, the Company actively seeks to expand its mineral reserves, primarily through exploration, development and strategic acquisitions. Exploration for minerals is highly speculative in nature, involves many risks and is frequently unsuccessful. Among the many uncertainties inherent in any gold and silver exploration and development program are the location of economic ore bodies, the development of appropriate metallurgical processes, the receipt of necessary governmental permits and the construction of mining and processing facilities. Assuming the discovery of an economic deposit, depending on the type of mining operation involved, several years may elapse from the initial phases of drilling until commercial operations are commenced and, during such time, the economic feasibility of production may change. Accordingly, the Company’s exploration and development programs may not result in any new economically viable mining operations or yield new mineral reserves to expand current mineral reserves.

Licenses and permits. The operations of the Company require licenses and permits from various governmental authorities. The Company believes that it holds all necessary licenses and permits under applicable laws and regulations and believes that it is presently complying in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that the Company will be able to obtain or maintain all necessary licenses and permits as are required to explore and develop its properties, commence construction or operation of mining facilities and properties under exploration or development or to maintain continued operations that economically justify the cost.

Political or economic instability or unexpected regulatory change. Certain of our properties are located in countries, provinces and states more likely to be subject to political and economic instability, or unexpected legislative change, than is usually the case in certain other countries, provinces and states. Our mineral exploration activities could be adversely effected by:

| · | political instability and violence; |

| · | war and civil disturbances; |

| · | expropriation or nationalization; |

| · | changing fiscal regimes; |

| · | fluctuations in currency exchange rates; |

| · | high rates of inflation; |

| · | underdeveloped industrial and economic infrastructure; |

| · | changes in the regulatory environment governing Exploration and evaluation assets ; and |

| · | unenforceability of contractual rights, |

any of which may adversely affect our business in that country.

We may be adversely affected by fluctuations in foreign exchange rates. We maintain our bank accounts mainly in Canadian and U.S. Dollars. Any appreciation in the currency of Mexico or other countries where we may carryout exploration activities against the Canadian or U.S. Dollar will increase our costs of carrying out operations in such countries. In addition, any decrease in the U.S. Dollar against the Canadian Dollar will result in a loss on our books to the extent we hold funds in U.S. Dollars.

Land reclamation requirements. Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize the long term effects of land disturbance. Reclamation may include requirements to control dispersion of potentially deleterious effluents and reasonably re-establish pre-disturbance land forms and vegetation. In order to carry out reclamation obligations imposed on us in connection with our mineral exploration we must allocate financial resources that might otherwise be spent on further exploration programs.

Acquisitions. The Company undertakes evaluations of opportunities to acquire additional gold and silver mining properties. Any resultant acquisitions may be significant in size, may change the scale of the Company’s business, and may expose the Company to new geographic, political, operating, financial and geological risks. The Company’s success in its acquisition activities depends on its ability to identify suitable acquisition candidates, acquire them on acceptable terms, and integrate their operations successfully. Any acquisitions would be accompanied by risks, such as a significant decline in the price of gold or silver, the ore body proving to be below expectations, the difficulty of assimilating the operations and personnel of any acquired companies, the potential disruption of the Company’s ongoing business, the inability of management to maximize the financial and strategic position of the Company through the successful integration of acquired assets and businesses, the maintenance of uniform standards, controls, procedures and policies, the impairment of relationships with customers and contractors as a result of any integration of new management personnel and the potential unknown liabilities associated with acquired mining properties. There can be no assurance that the Company would be successful in overcoming these risks or any other problems encountered in connection with such acquisitions.

Conflict of interest. Certain directors and officers of the Company are officers and/or directors of, or are associated with, other natural resource companies that acquire interests in Exploration and evaluation assets. Such associations may give rise to conflicts of interest from time to time. The directors are required by law, however, to act honestly and in good faith with a view to the best interests of the Company and to disclose any personal interest which they may have in any material transaction which is proposed to be entered into with the Company and to abstain from voting as a director for the approval of any such transaction.

Dependence on management. We are dependent on the services of key executives including our President and Chief Executive Officer and other highly skilled and experienced executives and personnel focused on advancing our corporate objectives as well as the identification of new opportunities for growth and funding. Due to our relatively small size, the loss of these persons or our inability to attract and retain additional highly skilled employees required for our activities may have a material adverse effect on our business and financial condition.

Competition for recruitment and retention of qualified personnel. We compete with other exploration companies, many of which have greater financial resources than us or are further in their development, for the recruitment and retention of qualified employees and other personnel. Competition for exploration resources at all levels is currently very intense, particularly affecting the availability of manpower, drill rigs and supplies. If we require and are unsuccessful in acquiring additional personnel or other exploration resources, we will not be able to grow at the rate we desire or at all

Limited and volatile trading volume. Although the Company’s common shares are listed on the NYSE Mkt, the TSX Venture Exchange, referred to as the “TSX-V” and the Frankfurt Stock Exchange, referred to as the “FSE”, the volume of trading has been limited and volatile in the past and is likely to continue to be so in the future, reducing the liquidity of an investment in the Company’s common shares and making it difficult for investors to readily sell their common shares in the open market. Without a liquid market for the Company’s common shares, investors may be unable to sell their shares at favorable times and prices and may be required to hold their shares in declining markets or to sell them at unfavorable prices.

Volatility of share price. In recent years, securities markets in general have experienced a high level of price volatility. The market price of many resource companies, particularly those, like the Company, that are considered speculative exploration companies, have experienced wide fluctuations in price, resulting in substantial losses to investors who have sold their shares at a low price point. These fluctuations are based only in part on the level of progress of exploration, and can reflect general economic and market trends, world events or investor sentiment, and may sometimes bear no apparent relation to any objective factors or criteria. Significant fluctuations in the Company’s common share price is likely to continue.

Penny stock rules may make it more difficult to trade the Company’s common shares. The SEC has adopted regulations which generally define a “penny stock” to be any equity security that has a market price, as defined, less than US$5.00 per share or an exercise price of less than US$5.00 per share, subject to certain exceptions. Our common shares may be covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors such as institutions with assets in excess of US$5,000,000 or an individual with net worth in excess of US$1,000,000 or annual income exceeding US$200,000 or US$300,000 jointly with his or her spouse. For transactions covered by this rule, the broker-dealers must make a special suitability determination for the purchase and receive the purchaser’s written agreement of the transaction prior to the sale. Consequently, the rule may affect the ability of broker-dealers to sell our common shares and also affect the ability of our investors to sell their common shares in the secondary market.

Difficulty for United States investors to effect services of process against the Company. The Company is incorporated under the laws of the Province of British Columbia, Canada. Consequently, it will be difficult for United States investors to affect service of process in the United States upon the directors or officers of the Company, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under the Exchange Act. The majority of the Company’s directors and officers are residents of Canada and all of the Company’s assets are located outside of the United States. A judgment of a United States court predicated solely upon such civil liabilities would probably be enforceable in Canada by a Canadian court if the United States court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter. There is substantial doubt whether an original action could be brought successfully in Canada against any of such persons or the Company predicated solely upon such civil liabilities.

Item 4. Information on the Company

Cautionary Note to United States Investors

In Canada, an issuer is required to provide technical information with respect to mineralization, including reserves and resources, if any, on its mineral exploration properties in accordance with Canadian requirements, which differ significantly from the requirements of the SEC applicable to registration statements and reports filed by United States companies pursuant to the Securities Act, or the Exchange Act. As such, information contained in this annual report concerning descriptions of mineralization under Canadian standards may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of the SEC. In particular, this annual report on Form 20-F includes the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource” and “inferred mineral resource”. Investors are advised that these terms are defined in and required to be disclosed under Canadian rules by National Instrument 43-101 (“NI 43-101”). U.S. Investors are cautioned not to assume that any part of the mineral deposits in these categories will ever be converted into reserves. However, these terms are not defined terms under SEC Industry Guide 7 and are not recognized in reports and registration statements filed with the SEC by U.S. domestic issuers. In addition, NI 43-101 permits disclosure of “contained ounces” of mineralization. In contrast, the SEC only permits issuers to report mineralization as in place tonnage and grade without reference to unit measures.

The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Industry Guide 7. Under SEC Industry Guide 7 (under the Exchange Act), as interpreted by the staff of the SEC, mineralization may not be classified as a “reserve” for United States reporting purposes unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards.

United States investors are cautioned not to assume that any part or all of the mineral deposits identified as an “indicated mineral resource,” “measured mineral resource” or “inferred mineral resource” will ever be converted to reserves as defined in NI 43-101 or SEC Industry Guide 7. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities legislation, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, or economic studies. U.S. investors are cautioned not to assume that part or all of an inferred mineral resource exists, or is economically or legally mineable.

A. History and Development of the Company

The Company was incorporated by Memorandum of Association under the laws of the Province of British Columbia on May 15, 1968, and on August 22, 1969, by virtue of an amalgamation with Ace Mining Company Ltd., became a public company whose common shares are registered under the Exchange Act, changing its name to Avino Mines & Resources Limited. On April 12, 1995, the Company changed its corporate name to International Avino Mines Ltd. and effected a reverse stock split of one common share for every five common shares outstanding. On August 29, 1997, the Company changed its corporate name to Avino Silver & Gold Mines Ltd., its current name, to better reflect the business of the Company of exploring for and mining silver and gold. In January 2008, the Company announced the change of its financial year end from January 31 to December 31. The change was completed in order to align the Company’s financial statement reporting requirements with its Mexico subsidiaries which operate on a calendar fiscal year.

The Company is a reporting issuer in the Province of British Columbia and Alberta, a foreign private issuer with the SEC and trades on the TSX Venture Exchange, Tier 2 status under the symbol “ASM”, listed on the NYSE-MKT under the symbol “ASM” and on the Berlin & Frankfurt Stock Exchange under the symbol “GV6”. In July, 2012, the Company’s listing on the TSX Venture Exchange was reclassified to Tier 2 status. The principal executive office of the Company is located at Suite 900, 570 Granville Street, Vancouver, British Columbia V6C 3P1, and its telephone number is 604-682-3701.

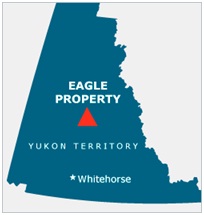

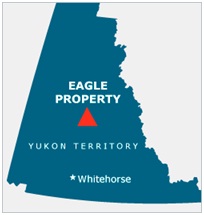

The Company is a natural resource company, primarily engaged in the acquisition, exploration and development of natural resource properties. The Company’s principal business activities have been the exploration and development of a mineral property located in the State of Durango, Mexico. The Company also owns other Exploration and evaluation assets in British Columbia and the Yukon Territory, Canada.

Significant Acquisitions and Significant Dispositions

On July 17, 2006, the Company completed the acquisition of Compañía Minera Mexicana de Avino, S.A. de C.V. (“Avino Mexico”), a Mexican corporation, through the acquisition of an additional 39.25% interest in Avino Mexico which combined with the Company’s pre-existing 49% share of Avino Mexico, brought the Company’s ownership interest in Avino Mexico to 88.25%. The additional 39.25% interest in Avino Mexico was obtained through the acquisition of 76.88% of the common shares of Promotora Avino S.A. De C.V., referred to as “Promotora”, which in turn owns 49.75% of Avino Mexico’s common shares, and the direct acquisition of 1% of the common shares of Avino Mexico.

The July 17, 2006 acquisition was accomplished by a share exchange by which the Company issued 3,164,702 shares as consideration, which we refer to as the “Payment Shares”, for the purchase of the additional 39.25% interest in Avino Mexico. The Payment Shares were valued based on the July 17, 2006 closing market price of the Company’s shares on the TSX-V.

The Company acquired a further 1.1% interest in Avino Mexico through the acquisition from an estate subject to approval and transfer of the shares to the Company by the trustee for the estate. On December 21, 2007 approval was received and the Company obtained the 1.1% interest from the estate for no additional consideration.

On February 16, 2009 and on June 4, 2013, the Company converted existing loans advanced to Avino Mexico in to new additional shares of Avino Mexico. As a result, the Company’s ownership interest in Avino Mexico increased to 99.66%.

The Company has no other significant acquisitions or dispositions of property, except as disclosed in this Annual Report.

B. Business Overview

Operations and Principal Activities

The Company is a Canadian-based resource firm focused on silver and gold production and exploration. The Company has a long prior history of operation, beginning in 1968 with the development of the Avino Silver Mine, located in the state of Durango, Mexico (the “Avino Mine”). From 1974 to 2001, the Avino Mine produced silver, gold, copper and lead and provided hundreds of jobs for the Durango region before closing due to depressed metal prices and closing of smelter. Beginning in 2002, the Company re-directed its corporate strategy to focus almost entirely on silver and began acquiring silver properties in North America. The Company acquired the Eagle property in Canada’s Yukon Territory and the Aumax silver and gold property in British Columbia. Each property produced positive assays for silver through drilling and sampling however, in late April 2012, the Company relinquished its interest in the Aumax silver and gold property to focus on its property in Mexico. The Avino Mine in Mexico and surrounding mineral leases continue to hold silver potential. These properties, along with other silver and gold projects, will remain the Company’s principal focus for the foreseeable future.

Presently, the Company is a “production stage company”. On October 1, 2012 the Company declared commercial production for the San Gonzalo mine. The decision to declare commercial production was based on the following criteria:

| · | All major capital expenditures to bring the San Gonzalo Mine into the condition necessary for it to be capable of in the manner intended by management had been completed; |

| · | The Company completed testing of the mine plant for a significant period time and tuned it into a level appropriate for efficient profitable operations; |

| · | The Company proved the ability to produce a saleable bulk concentrate – this was established by conducting the bulk sample program in 2010 and 2011; |

| · | The mine is operated by its own operating personnel with the exception of underground mine development for which it uses a mining contractor to achieve more efficiency; |

| · | The mill has reached the pre-determined percentage of design capacity which is 250 tpd for processing San Gonzalo; |

| · | Mineral recoveries are at and above expected production levels; and |

| · | The Company has demonstrated the ability to sustain ongoing production or ore at steady level. |

With the recent acquisition of the new equipment the Company expects production of ore to increase in the coming months.

The above factors were considered in making the decision to move to commercial production and management is confident that its decision to declare commercial production is appropriate and accurately reflects the stage the Company is in.

Avino’s Canadian properties are all at the exploration stage. In order to determine if a commercially viable mineral deposit exists in any of the Company’s Canadian properties, further geological work will need to be done and a final evaluation based upon the results obtained to conclude economic and legal feasibility. The Company is currently focusing on production at the Avino mines and its Canadian properties are not deemed to be material and are subject to care and maintenance for further development, if any.

Competition

The mining industry in which the Company is engaged is highly competitive. Competitors include well-capitalized mining companies, independent mining companies and other companies having financial and other resources far greater than those of the Company. The Company competes with other mining companies in connection with the acquisition of gold, silver and other precious metal properties. In general, properties with a higher grade of recoverable mineral and/or which are more readily mined afford the owners a competitive advantage in that the cost of production of the final mineral product is lower.

Seasonality

Certain of our operations are conducted in British Columbia and the Yukon Territory. The weather during the colder seasons in these areas can be extreme and can cause interruptions or delays in our operations. As a result, the preferable time for activities in these regions is the spring and summer when costs are more reasonable and access to the properties is easier. In the summer months, however, if the weather has been unusually hot and dry, access to the Company’s properties may be limited as a result of access restrictions being imposed to monitor the risks of forest fires.

Governmental Regulation

The current and anticipated future operations of the Company, including development activities and commencement of production on its properties, require permits from various federal, territorial and local governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Such operations and exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that the Company obtain permits from various governmental agencies. The Company believes it is in substantial compliance with all material laws and regulations which currently apply to its activities. There can be no assurance, however, that all permits which the Company may require for construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms or that such laws and regulations, or that new legislation or modifications to existing legislation, would not have an adverse effect on any exploration or mining project which the Company might undertake.

Mineral exploration and mining in Mexico is covered under the Mining Law as first published in June 1992, and amended in April 2005. Mining operations in Mexico are administered by the Ministry of Economy. Environmental regulations are covered under “Ley General del Equilibrio Ecológio y la Protección al Ambiente” (General Law of Ecological Balance and Environmental Protection) and its regulations. Certain other environmental laws, including “Ley de Aguas Nacionales” (Law of National Waters) and “Ley Forestal” (Forestry Law) and their associated regulations may also cover certain operations. The kind of permits or authorizations required to conduct mining or mineral exploration operations in Mexico depend upon the type of operation. Common exploration activities do not require prior environmental authorization or licenses, but it is advisable to request a confirmation from the National Water Commission that planned operations will not affect the water table. It is also necessary to confirm that any planned operations will not be conducted in protected natural areas.

The Company believes it has obtained all necessary permits and authorizations required for its current exploration. The Company has had no material costs related to compliance and/or permits in recent years, and anticipates no material costs in the next year. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact on the Company and cause increases in capital expenditures which could result in a cessation of operations by the Company.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in exploration and mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violation of applicable laws or regulations.

The enactment of new laws or amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in the development of new mining properties.

C. Organizational Structure

The Company’s Mexican subsidiaries are the wholly owned subsidiary of Oniva Silver and Gold Mines S.A. de C.V., referred to as “Oniva”, Promotora, in which the Company has direct ownership of 79.09%, and Avino Mexico in which the Company has a 98.39% direct ownership and an additional 1.27% of Avino Mexico is held through Promotora. The Company’s total effective ownership interest in Avino Mexico is 99.66%. All of the above subsidiaries are incorporated under the laws of Mexico.

D. Property, Plants and Equipment

The Company is producing a bulk concentrate at the San Gonzalo Mine located on the Avino property in Durango Mexico. The Company is also working to re-open the main Avino Mine as well as exploring options to re-process a large tailings resource left from past mining on the property. In addition the Company is exploring three silver and gold projects in Canada. All of the Company’s mineral property interests in Canada are wholly-owned by the Company. In Mexico, the Company has a 99.66% interest in Avino Mexico, a Mexican company which is involved in the mining of commercial ores and resource exploration and development, including the operation of the Avino Mine. Avino Mexico is not involved with any exploration activities in Canada. The Company owns and manages these properties. Exploration in Canada has in recent years, been limited to prospecting, trenching and drill programs on the Eagle, Olympic-Kelvin, and Minto, and Aumax properties. However, as disclosed above, the Company relinquished its interest in the Aumax property to focus on its property in Mexico.

The Company uses detailed sampling to provide the basis for quality estimates and grades of its mineral discoveries. Samples are collected under the supervision of a qualified person who then follows procedures for the collection, sample preparation and chain of custody guidelines for the shipment of the samples to a certified commercial laboratory as set out in National Instrument 43-101. These commercial labs have standard Quality Assurance/Quality Control protocols in place for the various assaying methods that are being used on the samples. In addition, blanks, standards and duplicates are generally used to confirm the validity of the results before they are reported.

Avino Property, Durango, Mexico

Location

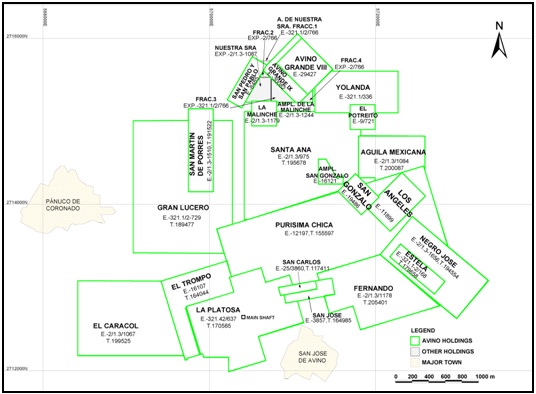

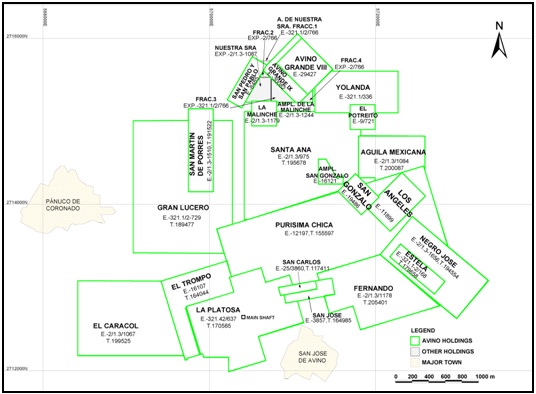

The property is located in Durango State in North Central Mexico, within the Sierra Madre Silver Belt on the eastern edge of the Sierra Madre Occidental mountain range. The nearest major center is the city of Durango, 82 km to the southwest of the property. The property is within the municipality of Pánuco de Coronado between the towns of Pánuco de Coronado and San José de Avino. The property is located at latitude N 24° 53', longitude W 104° 31', 14 km northwest of Highway 40D.

The property is situated as illustrated in the figures below:

General Property Location Map

Accessibility and Local Resources

The property is accessible by road and is an important part of the local community from which skilled workers are available. Access is provided by Highway 40, a four-lane highway leading from Durango, past the airport and on to the city of Torreon in Coahuila. Successive turn-offs for the property are at Francisco I Madero, Ignacio Zaragoza, and San José de Avino (Slim 2005d). The Avino mineral concessions are covered by a network of dirt roads which provide easy transport access between all areas of interest on the Property and the mill at the main Avino Mine (Gunning 2009).

The nearest major city is Durango, with a population of approximately 465,000. Durango is a major mining center in Mexico where experienced labour and services can be obtained. The two towns nearest the mine are Pánuco de Coronado and San José de Avino, where the majority of the employees lived while working at the mine when it was in operation. Pánuco de Coronado has a population of approximately 12,000, and San José de Avino is a small center with a population of less than 1,000.

Geology and Mineralization

The property is located within the Sierra de Gamon, on the east flank of the Sierra Madre Occidental. The area is a geological window into the Lower Volcanic series and consists mainly of volcanic flows, sills, and tuffaceous layers of andesite, rhyolite, and trachyte. Individual rock units vary from 300 to 800 m in thickness. Andesitic rocks outcrop over most of the region with other rock types occurring more sparsely to the north (Slim, 2005d).

A large monzonitic intrusion is observed in the region in the form of dykes and small stocks, which appear to be linked to the onset of the Avino vein mineralization. Other post-mineralization dykes of intermediate to felsic composition outcrop in various areas and appear to cause minor structural displacements. A number of thin mafic sills are also found in various parts of the region and are related to recent volcanism.

Regionally, the Avino concession is situated within a 12 km north-south by 8.5 km caldera, which hosts numerous low sulphidation epithermal veins, breccias, stockwork and silicified zones. These zones grade into a “near porphyry” environment, particularly in the Avino Mine area. The caldera has been uplifted by regional north trending block faulting (a graben structure), exposing a window of andesitic pyroclastic rocks of the lower volcanic sequence, a favourable host rock, within the caldera. This sequence is overlain by rhyolite to trachytes with extensive ignimbrite layers forming the upper volcanic sequence and is intruded by monzonite bodies. The basal andesite-bearing conglomerate and underlying Paleozoic basement sedimentary rocks (consisting of shales, sandstones and conglomerates) have been identified on the Avino concession in the south-central portion of the caldera, covering the Guadalupe, Santiago, San Jorge, the San Gonzalo Trend, Malinche, Porterito and Yolanda areas. A northerly trending felsic dyke, probably a feeder to the upper volcanic sequence, transects the Property and many of the veins. The Aguila Mexicana low temperature vein system, with significant widths but overall low precious metal values, trends north-northwest, similar to the felsic dyke and with similar continuity across the property. The two structures may occupy deep crustal faults that controlled volcanism and mineralization, with the felsic dyke structure controlling the emplacement of the Avino, Nuestra Senora and El Fuerte-Potosina volcanic centres and the Aguila Mexicana controlling the Cerro San Jose and El Fuerte-Potosina volcanic centres (Paulter 2006).

Silver- and gold-bearing veins cross-cut the various lithologies and are generally oriented north-northwest to south-southeast and northwest to southeast. The rocks have been weathered and leached in the upper sections, as a result of contact with atmospheric waters. The oxide tailings material is primarily from this source, whereas the sulphide tailings are predominantly from material sourced at depth from the underground workings. In Mexico, these types of deposits can have large lateral extents, but can be limited in the vertical continuity of grades.

The valuable minerals found during the period of mining of the oxide zone were reported to be argentite, bromargyrite, chalcopyrite, chalcocite, galena, sphalerite, bornite, native silver, gold and native copper. The gangue minerals include hematite, chlorite, quartz, barite, pyrite, arsenopyrite and pyrrhotite. Malachite, anglesite, and limonite are common in the quartz zones of the weathered parts of the oxide material.

Property Ownership

The current Property is comprised of 23 mineral concessions, totalling 1,103.934 ha.

In 1968, Avino Mines and Resources Ltd. acquired a 49% interest in Avino Mexico and Minera San José de Avino SA, which together held mineral claims totalling 2,626 ha (6,488 ac). Avino Mines and Resources Ltd. retained Vancouver based Cannon-Hicks & Associates Ltd. (Cannon-Hicks), a mining consulting firm, to conduct the exploration and development of the Property. Cannon-Hicks exploration activities included surface and underground sampling and diamond drilling (VSE 1979).

In early 1970, Avino Mines and Resources Ltd. signed a letter of intent with Denison Mines Ltd. for the future development of the Avino Mine. However, the agreement was never signed.

In May 1970, Avino Mines and Resources Ltd. signed a formal agreement with Selco Mining and Development (Selco), a division of Selection Trust Company. Due to other commitments, Selco abandoned its interest in the Project in 1973 (VSE 1979).

In October 1973, Avino Mines and Resources Ltd. signed a new agreement with S.G.L. Ltd. and Sheridan Geophysics Ltd. Under the terms of the agreement, S.G.L. Ltd. was to provide up to $500,000 plus the management to erect a production plant. The agreement provided for the return of the capital from first cash flow, plus a management fee and interest payment together with an option to convert a portion of the advanced funds to common shares. The agreement with S.G.L. Ltd. was terminated in mid-1976.

On July 17, 2006, the Company completed the acquisition of Compañía Minera Mexicana de Avino, S.A. de C.V. (“Avino Mexico”), a Mexican corporation, through the acquisition of an additional 39.25% interest in Avino Mexico which combined with the Company’s pre-existing 49% share of Avino Mexico, brought the Company’s ownership interest in Avino Mexicoto 88.25%. The additional 39.25% interest in Avino Mexico was obtained through the acquisition of 76.88% of the common shares of Promotora Avino S.A. De C.V., referred to as “Promotora”, which in turn owns 49.75% of Avino Mexico’s common shares, and the direct acquisition of 1% of the common shares of Avino Mexico.

The July 17, 2006 acquisition was accomplished by a share exchange by which the Company issued 3,164,702 shares as consideration, which we refer to as the “Payment Shares”, for the purchase of the additional 39.25% interest in Avino Mexico. The Payment Shares were valued based on the July 17, 2006 closing market price of the Company’s shares on the TSX-V.

The Company acquired a further 1.1% interest in Avino Mexico through the acquisition from an estate subject to approval and transfer of the shares to the Company by the trustee for the estate. On December 21, 2007 approval was received and the Company obtained the 1.1% interest from the estate for no additional consideration.

On February 16, 2009, the Company converted existing loans advanced to Avino Mexico in to new additional shares of Avino Mexico. As a result, the Company’s ownership interest in Avino Mexico increased to 99.28%.

On June 4, 2013, the Company converted existing loans advanced to its subsidiary Compania Minera Mexicana de Avino, S.A. de C.V. (“Avino Mexico”) into new additional shares, resulting in the Company’s ownership increasing by 0.38% to an effective 99.66%. The inter-company loans and investments are eliminated upon consolidation of the financial statements. The Company had a pre-existing effective ownership interest of 99.28% in Cia Minera prior to the 0.38% increase. The issuance of shares to the Company by Cia Minera on June 4, 2013 resulted in a reduction in the non-controlling interest from 0.72% to 0.34%.

Summary of Property Ownership

| Company | Relationship to Avino Silver and Gold Mines Ltd. | Effective Ownership of Avino Mine Property (%) |

| Avino Mexico | Subsidiary | 98.39 |

| Promotora Avino, S.A. de C.V. | Subsidiary | 1.27 |

| Total Effective Ownership of Avino Mine Property | - | 99.66 |

| Estate of Ysita | Non-controlling interest | 0.34 |

| Total | - | 100.00 |

Mineral Concessions and Agreements

The current Property is comprised of 23 mineral concessions, totalling 1,103.934 ha. Of these, 22 mineral concessions totalling 1,005.104 ha, are held by Avino Mexico (Avino’s Mexican subsidiary company), Promotora Avino SA de CV, and Susesion de la Sra. Elena del Hoyo Algara de Ysita. Ownership proportions and mineral concessions are summarized in the tables below:

Claim Staking and Mineral Tenure in Mexico

In 1992, a new Mining Law was enacted and has been amended from time to time since then. In general, and for North American companies in particular, Mexican law permits direct or indirect 100% foreign ownership of exploration and mining properties. For practical purposes, most foreign companies establish Mexican subsidiaries. Mining companies are subject to the normal corporate income tax rate of 28%. There are no government royalties.

In December 2005, amendments to the mining law eliminated the distinction between "exploration" and "exploitation" concessions. Currently, the mining act and regulations provide solely for mining concessions (Concesiones Mineras), which are issued for a term of fifty years, renewable for an additional term of fifty years.

Owners of mining concessions are obliged to:

| · | Execute work under the terms and conditions established in the Mining Law; |

| · | Pay fees to the Secretaria de Economia on a semi-annual basis; |

| · | Locate on the ground a starting point (mojonera) for the location of the concession, and maintain the mojonera in good condition; |

| · | Begin work on the concession within 90 days of receiving the Mining Title; |

| · | File Annual Reports describing the Work completed and the amount spent doing the Reported Work* |

| · | The Direccion General de Minas has the right to Audit the receipts and verify that Reported Work was completed in the field; |

| · | Failure to comply with the Obligations or assist the DGM with an Audit will result in cancellation of the Mining Concession. |

Mineral Concessions – Avino Property

Concession Name | Concession No. | Claim Type | Location | Hectares (ha) | Date Acquired | Expiration Date | Cost (US$/ha) | Payment (US$) |

| Agrupamiento San Jose (Purisma Chica) | 155597 | Lode | Pánuco | 136.708 | 30/09/1971 | 29/09/2021 | 124.74 | 17,052.91 |

| Agrupamiento (San Jose) | 164985 | Lode | Pánuco | 8 | 13/08/1979 | 12/8/2029 | 124.74 | 997.92 |

| Agrupamiento San Jose (El Trompo) | 184397 | Lode | Pánuco | 81.547 | 13/10/1989 | 12/10/2039 | 124.74 | 10,172.12 |

| Agrupamiento San Jose (Gran Lucero) | 189477 | Lode | Pánuco | 161.468 | 5/12/1990 | 4/12/2040 | 124.74 | 20,141.57 |

| Agrupamiento San Jose (San Carlos) | 117411 | Lode | Pánuco | 4.451 | 5/2/1961 | 16/12/2061 | 124.74 | 555.16 |

| Agrupamiento San Jose (San Pedro Y San Pablo) | 139615 | Lode | Pánuco | 12 | 22/06/1959 | 21/06/2061 | 124.74 | 1,496.88 |

| Aguila Mexicana | 215733 | Lode | Pánuco | 36.768 | 12/3/2004 | 29/06/2044 | 70.88 | 2,606.12 |

| Ampliacion La Malinche | 204177 | Lode | Pánuco | 6.01 | 18/12/1996 | 17/12/2046 | 124.74 | 749.72 |

| Ampliacion San Gonzalo | 191837 | Lode | Pánuco | 5.85 | 19/12/1991 | 18/12/2041 | 124.74 | 729.67 |

| Avino Grande Ix | 216005 | Lode | Pánuco | 19.558 | 2/4/2002 | 1/4/2052 | 70.88 | 1,386.24 |

| Avino Grande Viii | 215224 | Lode | Pánuco | 22.882 | 14/02/2002 | 13/02/2052 | 70.88 | 1,621.85 |

| El Caracol | 215732 | Lode | Pánuco | 102.382 | 12/3/2002 | 28/04/2044 | 70.88 | 7,256.84 |

| El Potrerito | 185328 | Lode | Pánuco | 9 | 14/12/1989 | 13/12/2039 | 124.74 | 1,122.66 |

| Fernando | 205401 | Lode | Pánuco | 72.129 | 29/08/1997 | 28/08/2047 | 124.74 | 8,997.33 |

| La Estela | 179658 | Lode | Pánuco | 14 | 11/12/1986 | 12/12/2036 | 124.74 | 1,746.36 |

| La Malinche | 203256 | Lode | Pánuco | 9 | 28/06/1996 | 27/06/2046 | 124.74 | 1,122.66 |

| Los Angeles | 154410 | Lode | Pánuco | 23.713 | 25/03/1971 | 24/03/2021 | 124.74 | 2,957.96 |

| Negro Jose | 218252 | Lode | Pánuco | 58 | 17/10/2002 | 16/10/2052 | 70.88 | 4,111.04 |

| San Gonzalo | 190748 | Lode | Pánuco | 12 | 29/04/1991 | 28/04/2041 | 124.74 | 1,496.88 |

| San Martin De Porres | 222909 | Lode | Pánuco | 30 | 15/09/2004 | 14/09/2054 | 70.88 | 2,126.40 |

| Santa Ana | 195678 | Lode | Pánuco | 136.182 | 14/09/1992 | 13/09/2042 | 124.74 | 16,987.38 |

| Yolanda | 191083 | Lode | Pánuco | 43.458 | 29/04/1991 | 28/04/2041 | 124.74 | 5,420.91 |

| Total | - | | - | 1,005.106 | - | - | - | - |

Note: Concession “La Platosa” is not included because it is not held by Avino.

Map of Avino Mine Property Concessions

On February 18, 2012, through its subsidiary company Avino Mexico, Avino re-entered into an agreement (the Agreement) with Minerales, whereby Minerales has indirectly granted to Avino the exclusive mining and occupation rights to the La Platosa concession. The La Platosa concession covers 98.83 ha and hosts the Avino vein and ET Zone.

Pursuant to the Agreement, Avino has the exclusive right to explore and mine the concession for an initial period of 15 years, with the option to extend the agreement for another 5 years. In consideration of the grant of these rights, Avino must pay to Minerales the sum of US$250,000, by the issuance of common shares of Avino. Avino will have a period of 24 months for the development of mining facilities.

Avino has agreed to pay to Minerales a royalty equal to 3.5% of NSRs, at the commencement of commercial production monthly processing rate of the mine facilities is less than 15,000 t, then Avino must pay to Minerales in any event a minimum royalty equal to the applicable NSR royalty based on processing at a minimum monthly rate of 15,000 t. In the event of a force majeure, Avino shall pay the minimum royalty as follows:

first quarter: payment of 100% of the minimum royalty;

second quarter: payment of 75% of the minimum royalty;

third quarter: payment of 50% of the minimum royalty;

fourth quarter: payment of 25% of the minimum royalty; and

in the case of force majeure still in place after one-year of payments, payment shall recommence at a rate of 100% of the minimum royalty and shall continue being made as per the quarterly schedule.

Minerales has also granted to Avino the exclusive right to purchase a 100% interest in the concession at any time during the term of the Agreement (or any renewal thereof), upon payment of US$8 million within 15 days of Avino's notice of election to acquire the Property. The purchase would be completed under a separate purchase agreement for the legal transfer of the concession. This agreement replaces all other previous agreements.

During the month of May of each year, Avino must file assessment work made on each concession for the immediately preceding calendar year. During the months of January and July of each year, Avino must pay in advance the mining taxes which are based on the surface of the concession and the number of years that have elapsed since it was issued.

Consistent with the mining regulations of Mexico, cadastral surveys have been carried out for all the listed mineral concessions as part of the field staking prior to recording (Slim 2005d). It is believed that all concessions are current and up to date. Mineral concessions in Mexico do not include surface rights. Avino has entered into agreements with communal land owners (Ejidos) of San José de Avino, for the temporary occupation and surface rights of the concessions.

A current title opinion dated March 15, 2013, has been prepared by Juan Manuel González Olguin of the Mexican law firm Bufete González Olguin SC. Based on the review of legal opinion, issued title certificates and the unhindered residence on the Property, Tetra Tech has verified that Avino owns the concessions through its Mexican subsidiary company, Avino Mexico, and that there is no indication of any encumbrances at the site. Furthermore, the legal document prepared by Jesús Bermúdez Fernández, dated February 18, 2012, delineating the terms of the agreement on the La Platosa concession has been sourced for information.

History

Avino Mine

The Avino deposit was originally discovered around 1555 by the Spanish conquistador, Don Francisco de Ibarra. In 1562, Francisco de Ibarra, was appointed governor of the newly formed province of Nueva Vizcaya, in the Viceroyalty of Nueva España (New Spain) and, in 1563, founded the town of Durango. Francisco de Ibarra led several expeditions in search of silver deposits in the region and is recognized as having established Minas de Avino, present day Avino Mine; San Martín, Durango; and Pánuco, Sinaloa. Mining operations at the Avino Mine are said to have commenced in 1562-1563 and have been in production until the early 1900s. Operations at the Avino Mine continued up to the onset of the War of Independence (1810) when operations were interrupted but continued through to the early 1900s.

In 1880, the mines were taken over by Avino Mines Ltd., a company controlled by American and English interests. With aid of new industrial technology the Avino mine developed into a more efficient mining operation. By 1908, the Avino Mine was considered one of the largest open pit mines in the world and equipped with one of the largest lixification smelters (Gallegos 1960; Bannon 1970; VSE 1977; Slim 2005d).

During the outbreak of the Mexican Revolution in 1910, proceeds from the mine supplied funds to the revolutionary forces. Since much of the fighting occurred in and around Durango and the risk posed by brigands hiding in the mountains was high, the mine was abandoned in 1912.

Between 1912 and 1968, the mine was worked intermittently on a very small scale (Avino Annual Report 1980). There is no known historical record of production from the Avino Mine during this period. The Avino Property was acquired under current ownership in 1968.

In 1968, the current operators of the Avino property acquired an initial 49% interest in the property. Initial mining was by open-cut in the oxide material from 1976 until 1992 when the stripping ratio was becoming excessive and sulphide content increasing at which date the production was transferred to underground. This necessitated a mill change from the prior lead concentrate production to one of copper carrying silver and gold. In the 1990s a larger ball mill was installed, to increase throughput to 1, 000 t/d.

During the underground mining period starting in 1992, Trackless mining was adopted, with all underground development headings sized at 4 x 4 m. Mine access from surface was by a spiral ramp from a portal on the south side of the hill and there is a secondary ramp– Rampo El Trompo – to the north side, close to the maintenance shop.

Production was by sub-level stoping with a sub-vertical increment restricted from 11 to 15 m to countermine dilution arising from an occasional, semi-incompetent hanging-wall. Stopes were started by raising, and then slashing to the designated width. Blasting was by parallel holes drilled with a traditional drill wagon. Rib and sill pillars were left but are generally considered asnon–recoverable.

Standard mine development was by using boom jumbo with waste being dumped where possible into old stopes. Ore mucking and haulage was by scoop tram and dumped on surface at the main portal. The ore was then picked up and transferred to the plant ROM hopper about 300 m away.

A surface-stacked, downstream tailings-system was adopted with cyclones on the tails discharge line to provide coarse wall-material. Decant water was recovered by a back-slope gradient and pumping, for mill re-circulation. A second, stepped-back bench was created, possibly about 1986 or 7. A third bench was started, apparently in 1990, with about two years placement of final oxide material then continued with the sulphide tails.

The Avino Mine and processing plant were serviced by a heavy equipment repair shop, mechanical and electrical shops, assay office, metallurgical laboratory, warehouse and other auxiliary facilities. Electric power was supplied by the government-owned Federal Electricity Commission.

In November 2001, delays in payments, low metals prices and the closure of the toll smelter led to the suspension of mine operations. During the 27 year production run starting in 1974, the Avino mine had produced about 497 tons of silver, three tons of gold, and 11,000 tons of copper. When mining operations stopped, level 12 of the mine had been reached.

The property was mainly dormant from 2002 to 2006, largely due to low copper and silver prices.

San Gonzalo Mine

The history of the San Gonzalo deposit is not well known. Shallow workings from an old mine are present in the San Gonzalo vein, and consist of small underground workings which were originally accessed by a five-level vertical shaft. These workings were sampled by M. Evans in 1954. The workings are accessible through a raise that was driven in 2012 which is being used for ventilation. No attempts have been made to duplicate the results of the 1954 sampling. The limits of past workings have been taken from old maps but are assumed to be reasonably accurate (Gunning 2009).

Current Condition

San Gonzalo Mine

Avino gained control of the property in July 2006 and exploration (see exploration section below) resumed that year; this led to the discovery of new mineralization at San Gonzalo.

The original underground workings extend over an area approximately 150 m along strike and 136 m in depth. In 2007-08 Avino conducted a 42-hole, 9,204 metre drill program to explore the San Gonzalo deposit. Drilling produced encouraging results which were input into a resource calculation in 2009.

Following a 2009 mineral resource estimate, independently verified preliminary metallurgical testing on a composite sample of San Gonzalo material was completed at SGS Minerals Services in Durango, Mexico. The results indicated the silver and gold minerals from the San Gonzalo vein at lower levels would respond favorably to flotation with gold recoveries of 89 to 90% and silver recoveries of 92 to 93%.