EXHIBIT 10.1

|

| Report to: |

Avino Gold & Silver Mines Ltd.  | |

Amended Mineral Resource Estimate Update for the

Avino Property, Durango, Mexico | |

704-EG-VMIN03003-02 | |

| |

| Report to: | |

AVINO GOLD & SILVER MINES LTD.

|

AMENDED MINERAL RESOURCE ESTIMATE UPDATE FOR THE AVINO PROPERTY, DURANGO, MEXICO |

EFFECTIVE DATE: FEBRUARY 21, 2018 AMENDED DATE: DECEMBER 19, 2018 |

Prepared by: | Hassan Ghaffari, P. Eng |

| Michael F. O’Brien, P.Geo., M.Sc., Pr.Sci,Nat., FAusIMM, FSAIMM |

| Mark Horan, P.Eng. |

| Jianhui (John) Huang, Ph.D., P.Eng. |

| | |

| | |

| | |

HG/vc | | |

| | |

| | |

| |

| |

Suite 1000, 885 Dunsmiur Street, Vancouver, British Columbia V6C 1N5 Phone: 604.408.3788 Fax: 604.684.6241 |

REVISION HISTORY

REV. NO | ISSUE DATE | PREPARED BY AND DATE | REVIEWED BY AND DATE | APPROVED BY AND DATE | DESCRIPTION OF REVISION |

| 29 Mar 18 | All QPs | All QPs | Hassan Ghaffari | Draft to Client |

| 03 Apr 18 | All QPs | All QPs | Hassan Ghaffari | Draft to Client |

| 04 Apr 18 | All QPs | All QPs | Hassan Ghaffari | Final Report |

| 06 Apr 18 | All QPs | All QPs | Hassan Ghaffari | Final Report (Revised) |

| 18 Dec 18 | All QPs | All QPs | Hassan Ghaffari | Ammended Report (Draft) |

TABLE OF CONTENTS

1.0 | SUMMARY | | 1-1 | |

| 1.1 | INTRODUCTION | | 1-1 | |

| 1.2 | PROPERTY DESCRIPTION AND LOCATION | | 1-1 | |

| 1.3 | GEOLOGY AND MINERALIZATION | | 1-2 | |

| | 1.3.1 | THE AVINO VEIN | | 1-4 | |

| | 1.3.2 | THE SAN GONZALO VEIN | | 1-4 | |

| | 1.3.3 | THE OXIDE TAILINGS | | 1-4 | |

| 1.4 | RESOURCE ESTIMATES | | 1-5 | |

| 1.5 | MINERAL PROCESSING, METALLURGICAL TESTING AND RECOVERY METHODS | | 1-7 | |

| | 1.5.1 | AVINO VEIN | | 1-7 | |

| | 1.5.2 | SAN GONZALO VEIN | | 1-8 | |

| | 1.5.3 | OXIDE TAILINGS | | 1-8 | |

| | 1.5.4 | SULPHIDE TAILINGS | | 1-8 | |

| 1.6 | MINING METHODS | | 1-9 | |

| | 1.6.1 | AVINO VEIN | | 1-9 | |

| | 1.6.2 | SAN GONZALO VEIN | | 1-10 | |

| | 1.6.3 | OXIDE TAILINGS | | 1-10 | |

| 1.7 | PROJECT INFRASTRUCTURE | | 1-11 | |

| 1.8 | ENVIRONMENTAL | | 1-11 | |

| 1.9 | CAPITAL AND OPERATING COSTS | | 1-12 | |

| | 1.9.1 | CAPITAL COST ESTIMATES | | 1-12 | |

| | 1.9.2 | OPERATING COST ESTIMATES | | 1-13 | |

| 1.10 | ECONOMIC ANALYSIS | | 1-15 | |

| | 1.10.1 | AVINO AND SAN GONZALO VEINS | | 1-15 | |

| | 1.10.2 | TAILINGS RESOURCES | | 1-15 | |

| 1.11 | RECOMMENDATIONS | | 1-16 | |

| | | | | |

2.0 | INTRODUCTION | | 2-1 | |

| 2.1 | EFFECTIVE DATES | | 2-1 | |

| 2.2 | QUALIFIED PERSONS | | 2-1 | |

| 2.3 | INFORMATION AND DATA SOURCES | | 2-3 | |

| 2.4 | UNITS OF MEASUREMENT | | 2-3 | |

| | | | | |

3.0 | RELIANCE ON OTHER EXPERTS | | 3-1 | |

| | | | |

4.0 | PROPERTY DESCRIPTION AND LOCATION | | 4-1 | |

| 4.1 | LOCATION | | 4-1 | |

| 4.2 | PROPERTY OWNERSHIP | | 4-2 | |

| 4.3 | MINERAL CONCESSIONS AND AGREEMENTS | | 4-3 | |

|

|

5.0 | ACCESSIBILITY, CLIMATE, INFRASTRUCTURE, LOCAL RESOURCES, AND PHYSIOGRAPHY | | 5-1 | |

| 5.1 | TOPOGRAPHY, ELEVATION AND VEGETATION | | 5-1 | |

| 5.2 | ACCESSIBILITY AND LOCAL RESOURCES | | 5-1 | |

| 5.3 | CLIMATE AND LENGTH OF OPERATING SEASON | | 5-1 | |

| 5.4 | INFRASTRUCTURE | | 5-1 | |

| | | | | | |

6.0 | HISTORY | | 6-1 | |

| 6.1 | AVINO MINE, 1555-1968 | | 6-1 | |

| | 6.1.1 | AVINO VEIN SYSTEM DEPOSIT | | 6-1 | |

| 6.2 | SAN GONZALO VEIN DEPOSIT | | 6-2 | |

| 6.3 | GUADALUPE VEIN DEPOSIT | | 6-2 | |

| 6.4 | SAN JUVENTINO VEIN DEPOSIT | | 6-2 | |

| | | | | | |

7.0 | GEOLOGICAL SETTING AND MINERALIZATION | | 7-1 | |

| 7.1 | REGIONAL GEOLOGY | | 7-1 | |

| 7.2 | PROPERTY GEOLOGY AND MINERALIZATION | | 7-2 | |

| | 7.2.1 | AVINO VEIN | | 7-3 | |

| | 7.2.2 | SAN GONZALO VEIN | | 7-5 | |

| | 7.2.3 | OXIDE AND SULPHIDE TAILINGS | | 7-5 | |

| | | | | | |

8.0 | DEPOSIT TYPES | | 8-1 | |

| | | | | | |

9.0 | EXPLORATION | | 9-1 | |

| 9.1 | EARLY EXPLORATION (PRIOR TO MINE CLOSURE), 1968 TO 2001 | | 9-1 | |

| 9.2 | RECENT EXPLORATION, 2001 TO PRESENT | | 9-2 | |

| | 9.2.1 | TAILINGS INVESTIGATIONS (OXIDES), 2003 AND 2004 | | 9-2 | |

| | 9.2.2 | TAILINGS SAMPLING (SULPHIDES), 2005 | | 9-3 | |

| | 9.2.3 | BULK SAMPLE PROGRAM OF SAN GONZALO VEIN, 2011 | | 9-3 | |

| | 9.2.4 | UNDERGROUND CHANNEL SAMPLING OF SAN GONZALO AND AVINO VEINS, 2010 TO PRESENT | | 9-3 | |

| | 9.2.5 | UNDERGROUND CHANNEL SAMPLING OF SAN GONZALO AND ANGELICA VEINS, 2010-PRESENT | | 9-5 | |

| | | | | | |

10.0 | DRILLING | | 10-1 | |

| 10.1 | EARLY DRILLING (PRIOR TO MINE CLOSURE), 1968 TO 2001 | | 10-1 | |

| | 10.1.1 | AVINO VEIN | | 10-1 | |

| | 10.1.2 | OXIDE TAILINGS, 1990 TO 1991 | | 10-1 | |

| 10.2 | RECENT DRILLING (POST-MINE CLOSURE), 2001 TO PRESENT | | 10-1 | |

| | 10.2.1 | AVINO VEIN | | 10-2 | |

| | 10.2.2 | SAN GONZALO VEIN | | 10-2 | |

| | 10.2.3 | SAN JUVENTINO AND GUADALUPE VEINS | | 10-2 | |

| | 10.2.4 | OXIDE TAILINGS | | 10-8 | |

| | 10.2.5 | SPECIFIC GRAVITY RESULTS | | 10-12 | |

| | | | | | |

11.0 | SAMPLE PREPARATION, ANALYSIS AND SECURITY | | 11-1 | |

| 11.1 | DRILLING AND TRENCHING OF OXIDE TAILINGS, 1990 TO 1991 | | 11-1 | |

|

|

| 11.2 | TAILINGS INVESTIGATIONS (TEST PITS IN OXIDE TAILINGS), 2004 | | 11-1 | |

| 11.3 | DRILLING PROGRAM, SAN GONZALO, 2007 TO PRESENT | | 11-2 | |

| 11.4 | DRILLING PROGRAMS, ET ZONE OF THE AVINO VEIN, 2006 TO PRESENT | | 11-3 | |

| 11.5 | UNDERGROUND CHANNEL SAMPLING OF SAN GONZALO VEIN, 2010 TO PRESENT | | 11-3 | |

| 11.6 | AVINO LABORATORY | | 11-4 | |

| 11.7 | SPECIFIC GRAVITY SAMPLES | | 11-4 | |

| | 11.7.1 | CALIPER VOLUME CALCULATION METHOD | | 11-4 | |

| | 11.7.2 | WATER DISPLACEMENT METHOD | | 11-5 | |

| 11.8 | QP OPINION | | 11-5 | |

| | | | | | |

12.0 | DATA VERIFICATION | | 12-1 | |

| 12.1 | AVINO AND SAN GONZALO VEIN DRILLHOLE DATABASE VERIFICATION | | 12-1 | |

| | 12.1.1 | COLLAR AND ASSAY DATA | | 12-1 | |

| | 12.1.2 | DOWNHOLE SURVEY DATA | | 12-3 | |

| | 12.1.3 | GEOLOGY DATA AND INTERPRETATION | | 12-3 | |

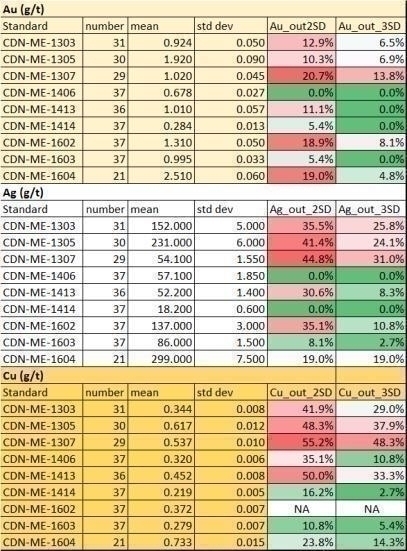

| | 12.1.4 | REVIEW OF DRILLHOLE QUALITY ASSURANCE/QUALITY CONTROL SAMPLES | | 12-3 | |

| | | | | | |

| 12.2 | BULK DENSITY | | 12-16 | |

| | 12.2.1 | AVINO AND SAN GONZALO VEIN BULK DENSITY | | 12-16 | |

| 12.3 | OXIDE TAILINGS DRILLHOLE DATABASE | | 12-17 | |

| | 12.3.1 | ASSAY VERIFICATION OF 1990/1991 DRILLHOLES IN OXIDE TAILINGS | | 12-17 | |

| | 12.3.2 | OXIDE TAILINGS VERIFICATION SAMPLES | | 12-17 | |

| 12.4 | SITE VISIT | | 12-18 | |

| 12.5 | ARANZ GEO CONCLUSIONS AND OPINION | | 12-18 | |

| | 12.5.1 | AVINO AND SAN GONZALO VEINS | | 12-18 | |

| | 12.5.2 | OXIDE TAILINGS | | 12-19 | |

| | 12.5.3 | QP OPINION | | 12-19 | |

| | | | | | |

13.0 | MINERAL PROCESSING AND METALLURGICAL TESTING | | 13-1 | |

| 13.1 | AVINO VEIN | | 13-1 | |

| 13.2 | SAN GONZALO VEIN | | 13-2 | |

| 13.3 | OXIDE TAILINGS | | 13-2 | |

| 13.4 | SULPHIDE TAILINGS | | 13-21 | |

| | | | | | |

14.0 | MINERAL RESOURCE ESTIMATES | | 14-1 | |

| 14.1 | RESOURCE SUMMARY | | 14-1 | |

| 14.2 | DATA | | 14-4 | |

| 14.3 | AVINO VEIN | | 14-4 | |

| | 14.3.1 | GEOLOGICAL INTERPRETATION | | 14-4 | |

| | 14.3.2 | WIREFRAMING | | 14-4 | |

| 14.4 | SAN GONZALO VEIN | | 14-7 | |

| | 14.4.1 | GEOLOGICAL INTERPRETATION | | 14-7 | |

| | 14.4.2 | WIREFRAMING | | 14-7 | |

| 14.5 | OXIDE TAILINGS | | 14-9 | |

| | 14.5.1 | GEOLOGICAL INTERPRETATION | | 14-9 | |

|

|

| | 14.5.2 | WIREFRAMING | | 14-10 | |

| 14.6 | EXPLORATORY DATA ANALYSIS | | 14-11 | |

| | 14.6.1 | RAW DATA ASSAYS AND STATISTICS | | 14-11 | |

| | 14.6.2 | OUTLIER MANAGEMENT AND CAPPING STRATEGY | | 14-14 | |

| | 14.6.3 | DRILLHOLE COMPOSITING | | 14-15 | |

| 14.7 | DENSITY | | 14-15 | |

| | 14.7.1 | DENSITY DATA | | 14-15 | |

| 14.8 | BISMUTH | | 14-16 | |

| 14.9 | VARIOGRAPHY AND SPATIAL ANALYSIS | | 14-17 | |

| 14.10 | INTERPOLATION PLAN AND KRIGING PARAMETERS | | 14-24 | |

| | 14.10.1 | AVINO | | 14-25 | |

| | 14.10.2 | SAN GONZALO | | 14-25 | |

| | 14.10.3 | OXIDE TAILINGS | | 14-25 | |

| 14.11 | RESOURCE BLOCK MODELS | | 14-28 | |

| | 14.11.1 | BLOCK MODEL CONFIGURATIONS | | 14-28 | |

| | 14.11.2 | INTERPOLATION | | 14-29 | |

| 14.12 | MODEL VALIDATION | | 14-29 | |

| | 14.12.1 | STATISTICS | | 14-29 | |

| | 14.12.2 | SECTIONS | | 14-32 | |

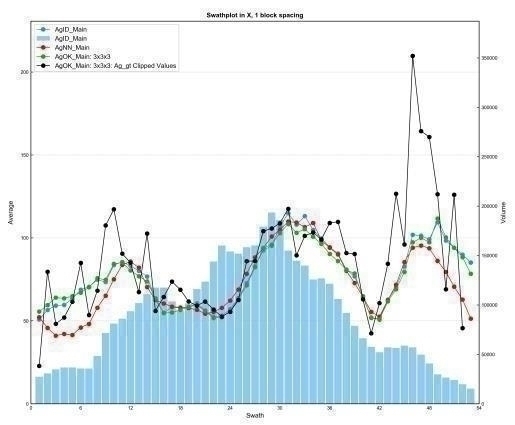

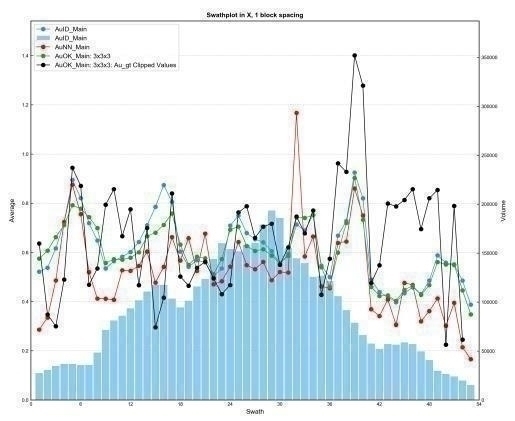

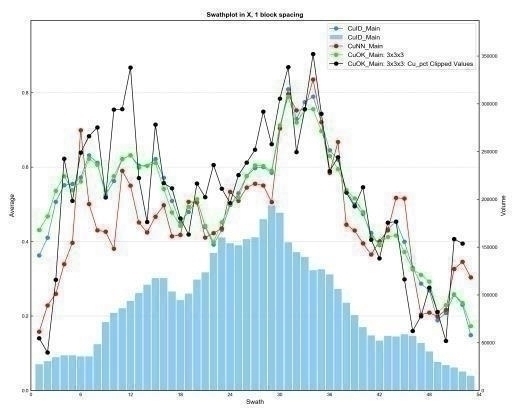

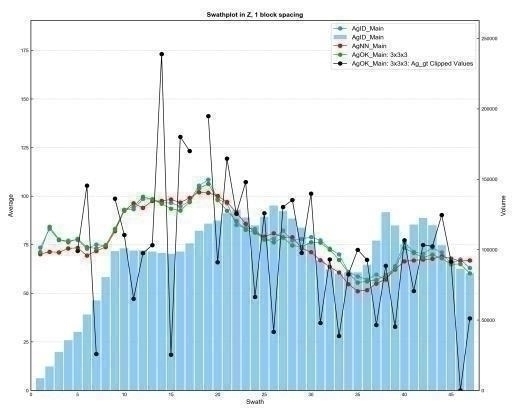

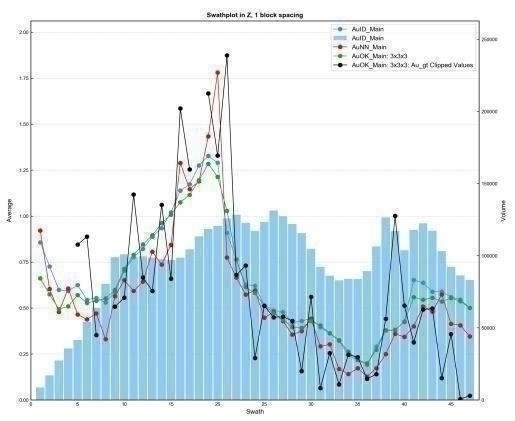

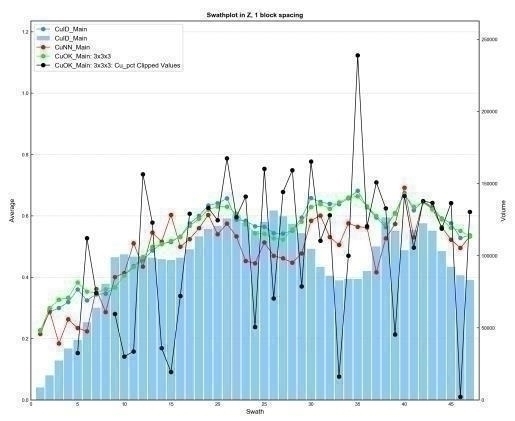

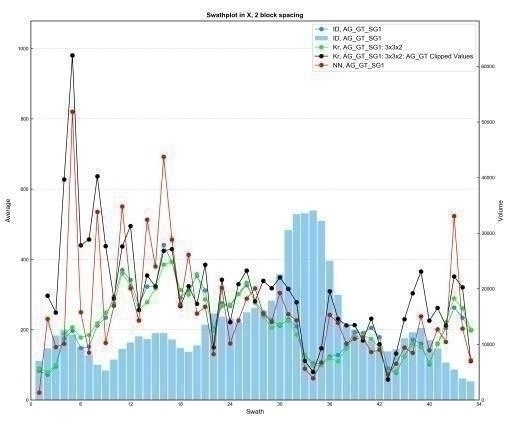

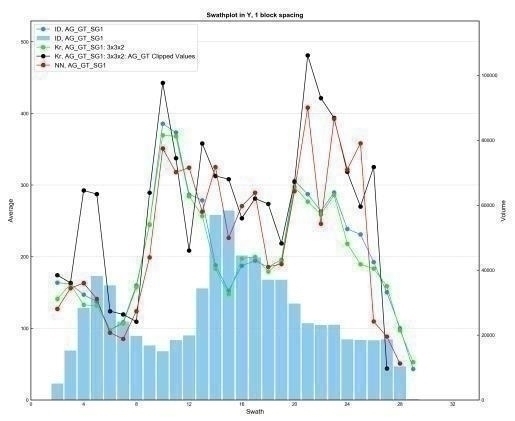

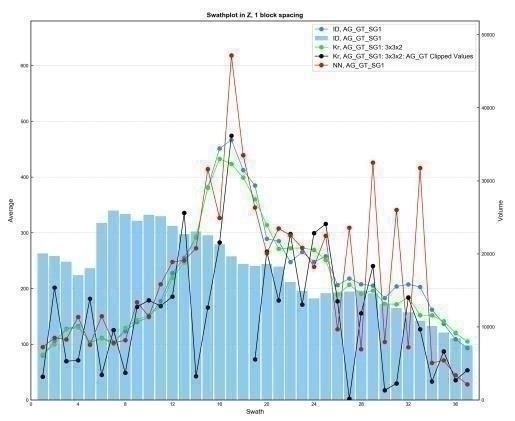

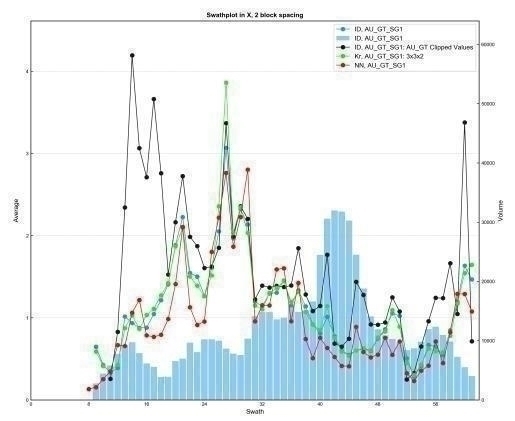

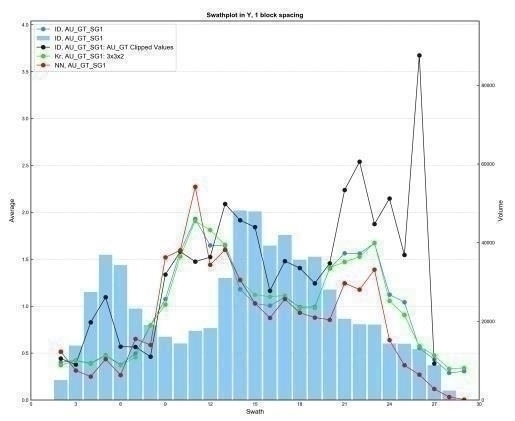

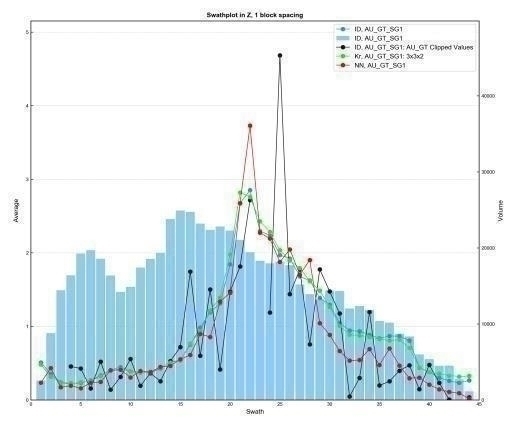

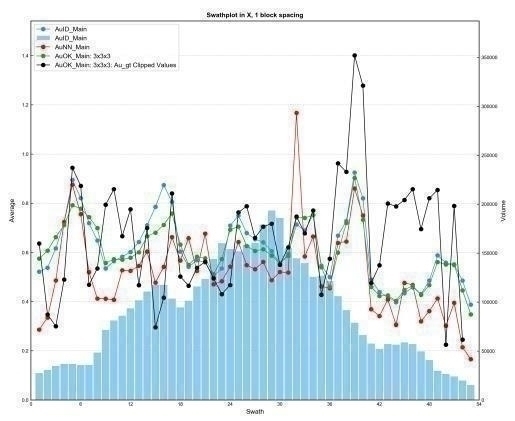

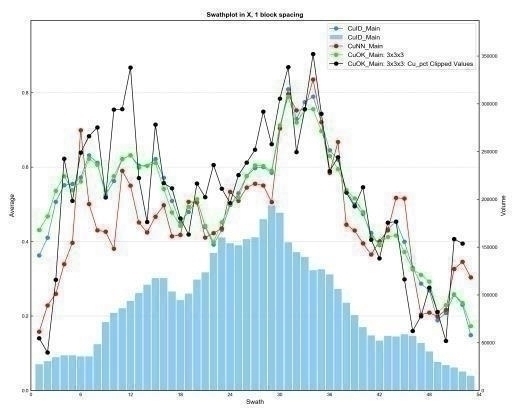

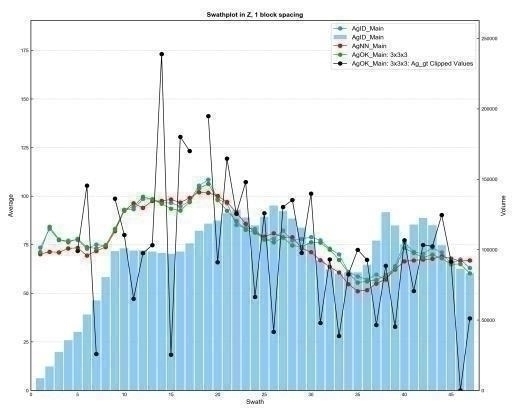

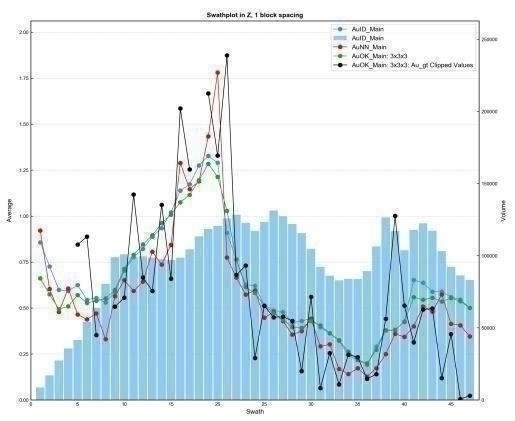

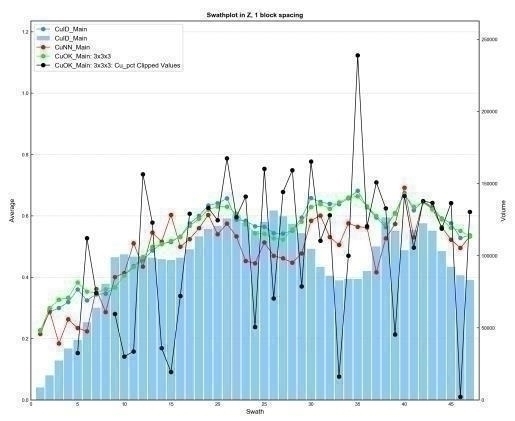

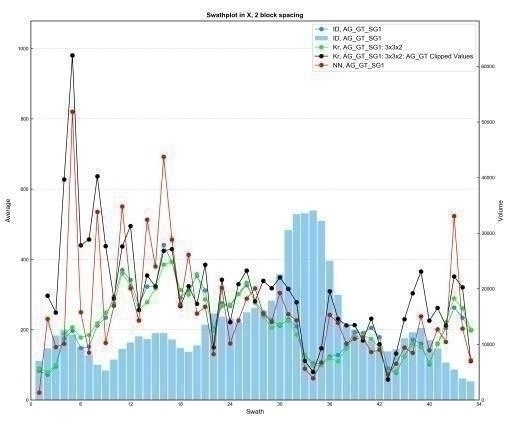

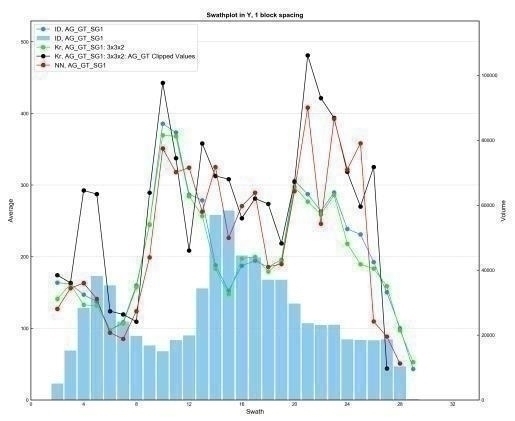

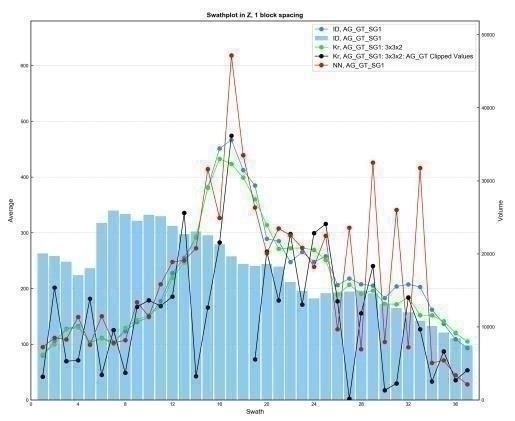

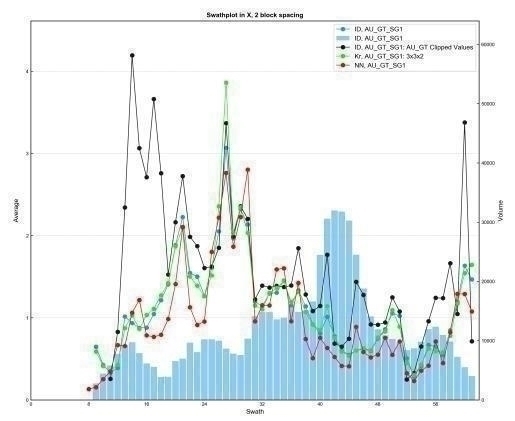

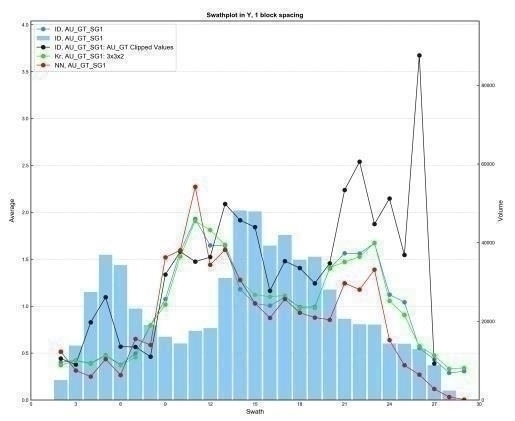

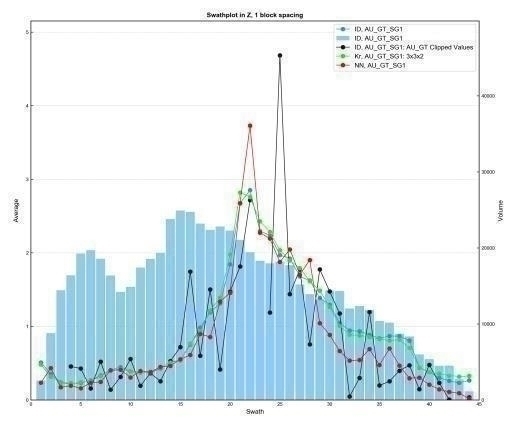

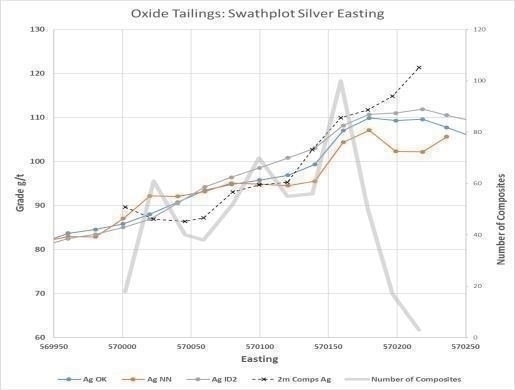

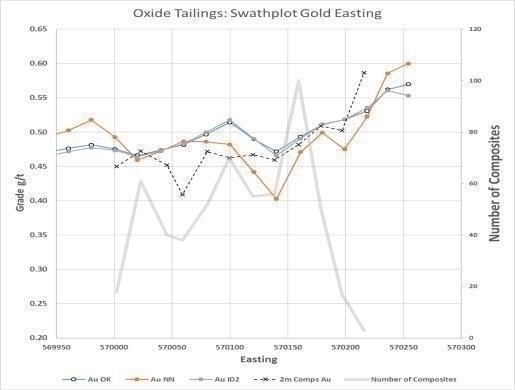

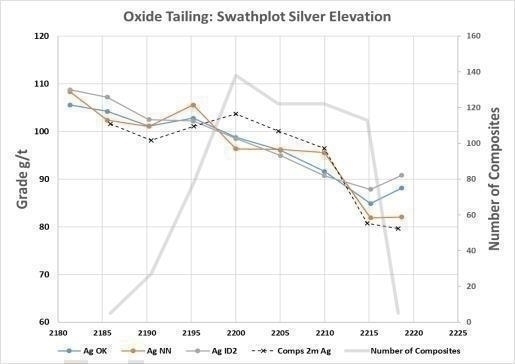

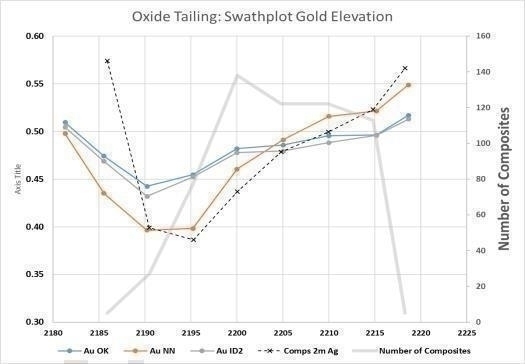

| | 14.12.3 | SWATH PLOTS | | 14-38 | |

| 14.13 | MINERAL RESOURCE CLASSIFICATION | | 14-55 | |

| | 14.13.1 | INTRODUCTION | | 14-55 | |

| 14.14 | MINERAL RESOURCE TABULATION | | 14-59 | |

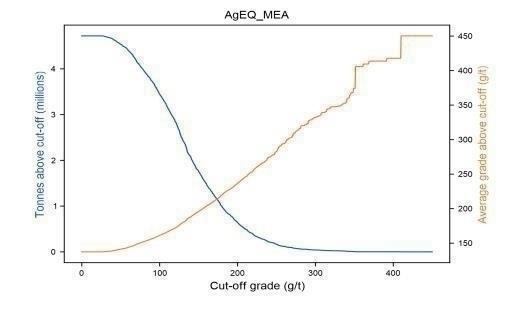

| | 14.14.1 | CUT-OFFS AND SILVER EQUIVALENT CALCULATIONS | | 14-59 | |

| | 14.14.1 | GRADE-TONNAGE TABLES | | 14-62 | |

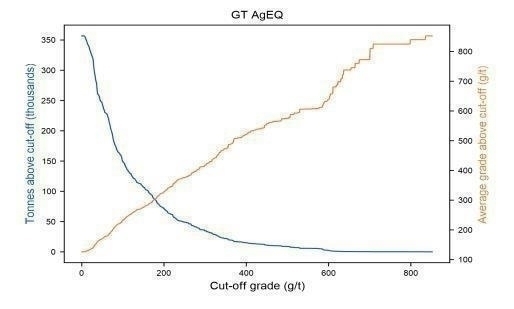

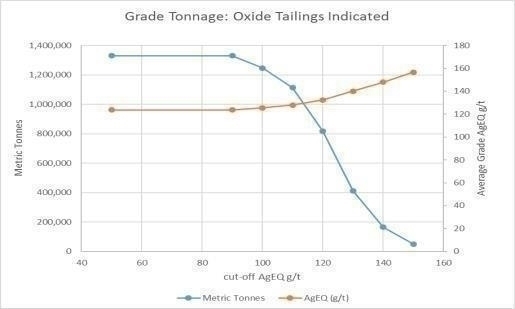

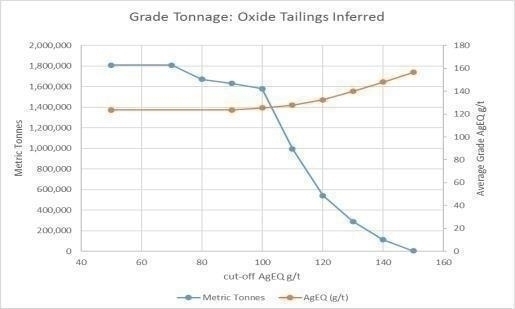

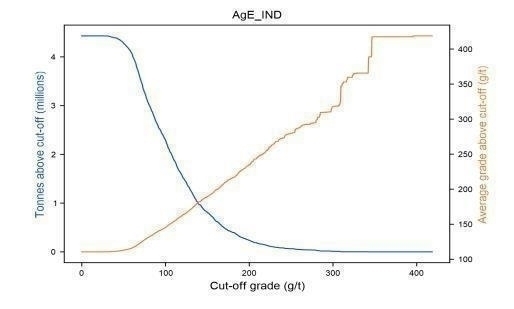

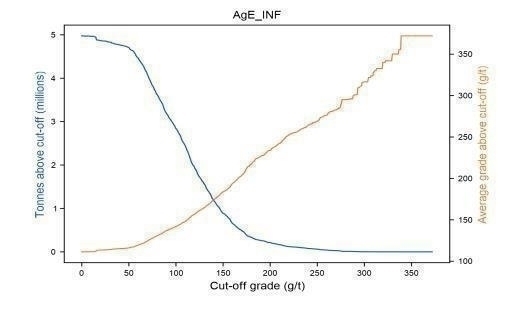

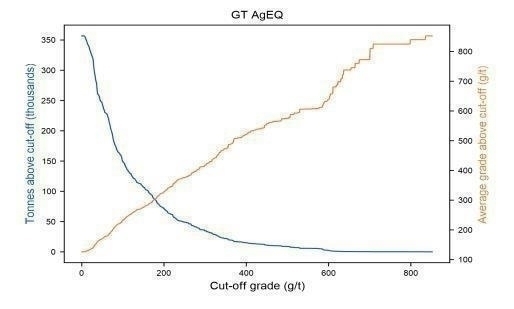

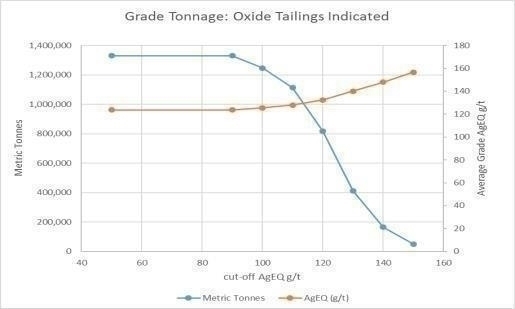

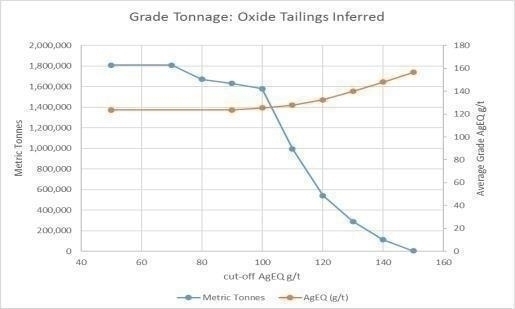

| | 14.14.2 | GRADE-TONNAGE GRAPHS | | 14-64 | |

| 14.15 | SULPHIDE TAILINGS | | 14-69 | |

| | | | | | |

15.0 | MINERAL RESERVE ESTIMATES | | 15-1 | |

| | | | | | |

16.0 | MINING METHODS | | 16-1 | |

| 16.1 | MINING AT THE AVINO PROPERTY | | 16-1 | |

| 16.2 | AVINO VEIN | | 16-1 | |

| 16.3 | SAN GONZALO VEIN | | 16-2 | |

| | 16.3.1 | BULK SAMPLE PROGRAM | | 16-3 | |

| | 16.3.2 | PRODUCTION | | 16-4 | |

| | 16.3.3 | MINE DESIGN | | 16-4 | |

| 16.4 | OXIDE TAILINGS | | 16-5 | |

| | 16.4.1 | SCHEDULE | | 16-5 | |

| | 16.4.2 | EQUIPMENT | | 16-5 | |

| | 16.4.3 | MODIFYING SITE CONSIDERATIONS | | 16-5 | |

| 16.5 | SULPHIDE TAILINGS | | 16-5 | |

| | | | | | |

17.0 | RECOVERY METHODS | | 17-1 | |

| 17.1 | AVINO VEIN | | 17-1 | |

| 17.2 | SAN GONZALO VEIN | | 17-4 | |

|

|

| 17.3 | TAILINGS MATERIAL | | 17-4 | |

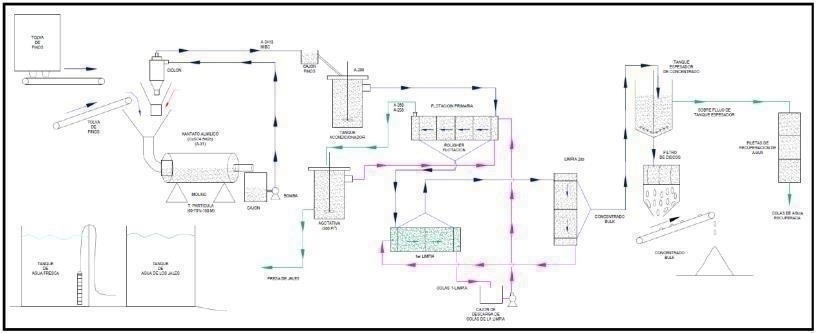

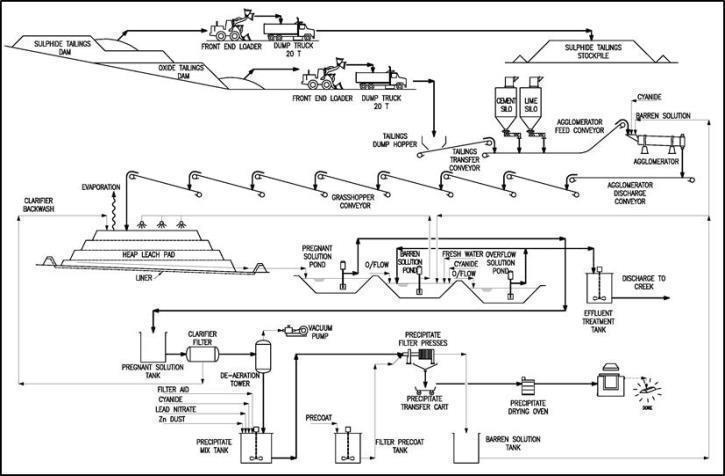

| | 17.3.1 | OXIDE TAILINGS | | 17-5 | |

| | 17.3.2 | SULPHIDE TAILINGS | | 17-10 | |

| | | | | | |

18.0 | PROJECT INFRASTRUCTURE | | 18-1 | |

| 18.1 | INTRODUCTION | | 18-1 | |

| 18.2 | ACCESSIBILITY | | 18-3 | |

| 18.3 | POWER | | 18-3 | |

| 18.4 | WATER SUPPLY | | 18-3 | |

| 18.5 | WATER TREATMENT PLANT | | 18-3 | |

| | | | | | |

19.0 | MARKET STUDIES AND CONTRACTS | | 19-1 | |

| 19.1 | MINED MATERIAL HAULAGE FROM UNDERGROUND | | 19-1 | |

| 19.2 | FLOTATION CONCENTRATES | | 19-1 | |

| 19.3 | GOLD-SILVER DORÉ | | 19-1 | |

| | | | | | |

20.0 | ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT | | 20-1 | |

| 20.1 | ENVIRONMENTAL STUDIES | | 20-1 | |

| | 20.1.1 | ENVIRONMENTAL SETTING | | 20-1 | |

| 20.2 | ENVIRONMENTAL PERMITTING | | 20-3 | |

| | 20.2.1 | CURRENT PERMITS FOR THE OXIDE TAILINGS | | 20-4 | |

| | 20.2.2 | CURRENT PERMITS FOR THE SAN GONZALO MINE (ADJACENT) | | 20-4 | |

| | 20.2.3 | APPLICABLE LEGISLATION | | 20-5 | |

| 20.3 | ENVIRONMENTAL MONITORING AND REPORTING | | 20-7 | |

| 20.4 | ENVIRONMENTAL MANAGEMENT | | 20-7 | |

| 20.5 | WATER MANAGEMENT | | 20-7 | |

| 20.6 | SULPHIDE TAILINGS MANAGEMENT | | 20-7 | |

| 20.7 | MINE CLOSURE AND RECLAMATION | | 20-8 | |

| 20.8 | SOCIO-ECONOMIC AND COMMUNITY CONSIDERATIONS | | 20-9 | |

| | 20.8.1 | PROJECT LOCATION | | 20-9 | |

| | 20.8.2 | CONSULTATION WITH COMMUNITIES | | 20-9 | |

| | | | | | |

21.0 | CAPITAL AND OPERATING COST ESTIMATES | | 21-1 | |

| 21.1 | AVINO AND SAN GONZALO VEINS | | 21-1 | |

| | 21.1.1 | CAPITAL COSTS | | 21-1 | |

| | 21.1.2 | OPERATING COSTS | | 21-2 | |

| 21.2 | TAILINGS RESOURCES | | 21-3 | |

| | 21.2.1 | OXIDE TAILINGS | | 21-3 | |

| | 21.2.2 | SULPHIDE TAILINGS | | 21-3 | |

| | | | | | |

22.0 | ECONOMIC ANALYSIS | | 22-1 | |

| 22.1 | AVINO AND SAN GONZALO VEINS | | 22-1 | |

| 22.2 | TAILINGS RESOURCES | | 22-1 | |

| | 22.2.1 | OXIDE TAILINGS | | 22-1 | |

| | 22.2.2 | SULPHIDE TAILINGS | | 22-3 | |

|

|

23.0 | ADJACENT PROPERTIES | | 23-1 | |

| | | | | | |

24.0 | OTHER RELEVANT DATA AND INFORMATION | | 24-1 | |

| | | | | | |

25.0 | INTERPRETATIONS AND CONCLUSIONS | | 25-1 | |

| 25.1 | GEOLOGY | | 25-1 | |

| 25.2 | RESOURCE ESTIMATES | | 25-1 | |

| 25.3 | MINERAL PROCESSING | | 25-4 | |

| 25.4 | MINING | | 25-4 | |

| 25.5 | CAPITAL AND OPERATING COSTS | | 25-4 | |

| | 25.5.1 | AVINO VEIN AND SAN GONZALO VEIN | | 25-4 | |

| | 25.5.2 | TAILINGS RESOURCES | | 25-5 | |

| 25.6 | ECONOMIC ANALYSIS | | 25-6 | |

| | | | | | |

26.0 | RECOMMENDATIONS | | 26-1 | |

| 26.1 | GEOLOGY | | 26-1 | |

| | 26.1.1 | DATABASE MANAGEMENT | | 26-1 | |

| | 26.1.2 | UNDERGROUND SAMPLING | | 26-1 | |

| | 26.1.3 | SPECIFIC GRAVITY SAMPLING AND ANALYSIS | | 26-2 | |

| | 26.1.4 | QA/QC SAMPLING | | 26-2 | |

| | 26.1.5 | SULPHIDE TAILINGS DRILLING | | 26-2 | |

| | 26.1.6 | DENSITY MEASUREMENTS | | 26-2 | |

| | 26.1.7 | BISMUTH | | 26-3 | |

| | 26.1.8 | RESOURCE ESTIMATION | | 26-3 | |

| | 26.1.9 | EXPLORATION FOR THE WESTERN EXTENSION OF THE AVINO VEIN | | 26-3 | |

| 26.2 | MINING | | 26-3 | |

| | 26.2.1 | LONG-TERM MINE PLANNING | | 26-3 | |

| | 26.2.2 | SUBLEVEL MINING (WITH ROOM AND PILLAR ON SUBLEVELS) | | 26-3 | |

| 26.3 | PROCESS | | 26-4 | |

| | 26.3.1 | AVINO AND SAN GONZALO VEINS | | 26-4 | |

| | 26.3.2 | OXIDE AND SULPHIDE TAILINGS | | 26-4 | |

| 26.4 | ENVIRONMENTAL | | 26-5 | |

| 26.5 | MINING OF OXIDE TAILINGS | | 26-5 | |

| 26.6 | PROJECT DEVELOPMENT | | 26-5 | |

| | | | | | |

27.0 | REFERENCES | | 27-1 | |

APPENDICES

LIST OF TABLES

Table 1.1 | Mineral Resources at the Avino Property | | 1-6 | |

Table 1.2 | Recent Production from the Avino Vein | | 1-9 | |

Table 1.3 | Recent Production from the San Gonzalo Vein | | 1-10 | |

Table 1.4 | Capital Costs for the Avino Vein (US$) | | 1-12 | |

Table 1.5 | Capital Costs for the San Gonzalo Vein (US$) | | 1-13 | |

Table 1.6 | Operating Costs for the Avino Vein (US$) | | 1-14 | |

Table 1.7 | Operating Costs for the San Gonzalo Vein (US$) | | 1-14 | |

Table 2.1 | Summary of QPs | | 2-2 | |

Table 4.1 | Summary of Property Ownership | | 4-3 | |

Table 4.2 | Mineral Concessions – Avino Property | | 4-4 | |

Table 9.1 | Summary Underground Channel Sampling by Level for the Avino (ET) Underground Mines | | 9-4 | |

Table 9.2 | Summary of Underground Channel Sampling by Level for the San Gonzalo Mine | | 9-4 | |

Table 10.1 | Drillholes Completed from 2007 to 2016 on the San Gonzalo Vein | | 10-3 | |

Table 10.2 | Drillholes Completed from 2001 to 2017 at ET Mine (includes San Luis, Avino vein and Chirumbo | | 10-6 | |

Table 10.3 | Drillholes Completed from 2017 to 2018 at Guadalupe and San Juventino | | 10-8 | |

Table 10.4 | Drillholes Drilled on Oxide Tailings 2003-2016 | | 10-9 | |

Table 10.5 | Avino and San Gonzalo Density Data Summary | | 10-12 | |

Table 12.1 | Number of Records and Discrepancies for the Avino Drillhole Data | | 12-2 | |

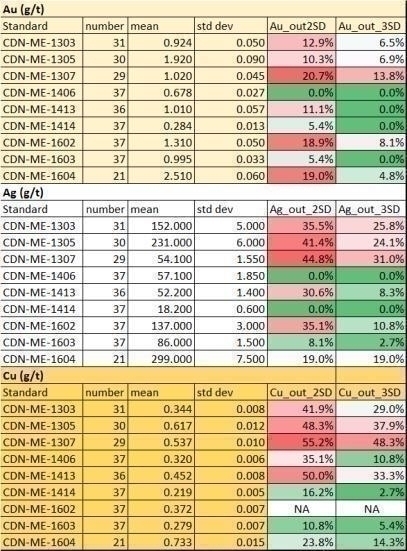

Table 12.2 | Standards Specification and Performance | | 12-4 | |

Table 14.1 | Avino Mine – Mineral Resources | | 14-2 | |

Table 14.2 | Metal Grade Statistics for 2 m Composites for the Avino and San Gonzalo Vein Systems | | 14-12 | |

Table 14.3 | Oxide Tailings Samples by Sampling Campaign | | 14-13 | |

Table 14.4 | Oxide Tailings Assays by Unit | | 14-14 | |

Table 14.5 | Avino Vein System Density Data Summary | | 14-15 | |

Table 14.6 | San Gonzalo Vein System Density Data Summary | | 14-15 | |

Table 14.7 | Avino Vein System Variogram and Search Parameters | | 14-26 | |

Table 14.8 | San Gonzalo Vein System: Variogram and Search Parameters | | 14-27 | |

Table 14.9 | Oxide Tailings Deposit: Variogram and Search Parameters | | 14-27 | |

Table 14.10 | Estimation Block Model Specifications | | 14-28 | |

Table 14.11 | Explanation of Table 14-10 | | 14-28 | |

Table 14.12 | Avino Vein: Block Estimates and Composite Sample Grades | | 14-30 | |

Table 14.13 | San Gonzalo Vein: Block Estimates and Composite Sample Grades | | 14-31 | |

Table 14.14 | Oxide Tailings: Block Estimates and Composite Sample Grades | | 14-32 | |

Table 14.15 | Criteria for Classification of Underground Mineral Resources | | 14-58 | |

Table 14.16 | Silver Equivalent Based Metal Prices and Operational Recovery Parameters | | 14-59 | |

Table 14.17 | Mineral Resource Statement for the Avino Property | | 14-60 | |

Table 14.18 | Avino Vein (ET and San Luis) – High Confidence/Measured | | 14-62 | |

Table 14.19 | Avino Vein (ET and San Luis) – Medium Confidence/Indicated | | 14-62 | |

Table 14.20 | Avino Vein (ET and San Luis) – Low Confidence/Inferred | | 14-62 | |

Table 14.21 | San Gonzalo Vein – High Confidence/Measured | | 14-63 | |

Table 14.22 | San Gonzalo – Medium Confidence/Indicated | | 14-63 | |

Table 14.23 | San Gonzalo – Low Confidence/Inferred | | 14-63 | |

Table 14.24 | Oxide Tailings – Medium Confidence/Indicated | | 14-64 | |

|

|

Table 14.25 | Oxide Tailings – Low Confidence/Inferred | | 14-64 | |

Table 16.1 | Recent Production from the Avino Vein | | 16-2 | |

Table 16.2 | Recent Production from the San Gonzalo Vein | | 16-3 | |

Table 16.3 | Mining Production Schedule | | 16-5 | |

Table 17.1 | Avino Vein Mill Production | | 17-2 | |

Table 17.2 | San Gonzalo Vein Mill Production | | 17-4 | |

Table 20.1 | Mammal Species Listed by NOM-059-SEMARNAT-2001 or in CITES within the San Gonzalo Mine | | 20-2 | |

Table 20.2 | Bird Species Listed by NOM-059-SEMARNAT-2001 or in CITES within the San Gonzalo Mine | | 20-2 | |

Table 20.3 | Reptile Species Listed by NOM-059-SEMARNAT-2001 or in CITES within the San Gonzalo Mine | | 20-3 | |

Table 20.4 | Amphibian Species Listed by NOM-059-SEMARNAT-2001 or in CITES within the San Gonzalo Mine | | 20-3 | |

Table 21.1 | Capital Costs for the Avino Vein (US$) | | 21-1 | |

Table 21.2 | Capital Costs for the San Gonzalo Vein (US$) | | 21-2 | |

Table 21.3 | Operating Costs for the Avino Vein (US$) | | 21-2 | |

Table 21.4 | Operating Costs for the San Gonzalo Vein (US$) | | 21-2 | |

Table 25.1 | Mineral Resources at the Avino Mine Property | | 25-2 | |

LIST OF FIGURES

Figure 1.1 | General Location of the Property | | 1-2 | |

Figure 1.2 | Perspective View of the Property Looking North and Showing the Three Deposits | | 1-4 | |

Figure 4.1 | General Location of the Property | | 4-1 | |

Figure 4.2 | Local Property Location | | 4-2 | |

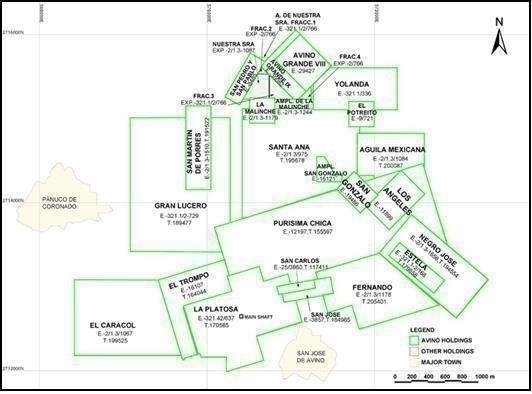

Figure 4.3 | Map of Avino Property Concessions | | 4-5 | |

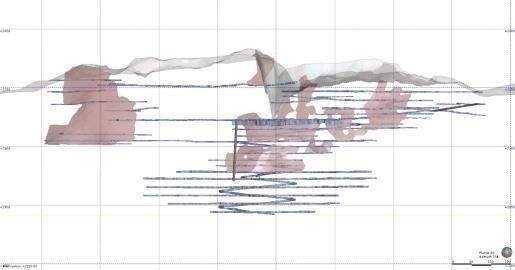

Figure 6.1 | Avino Mine: Vertical Section View Showing Development and Stoping | | 6-2 | |

Figure 6.2 | San Gonzalo Mine: Vertical Section View Showing Development and Stoping | | 6-3 | |

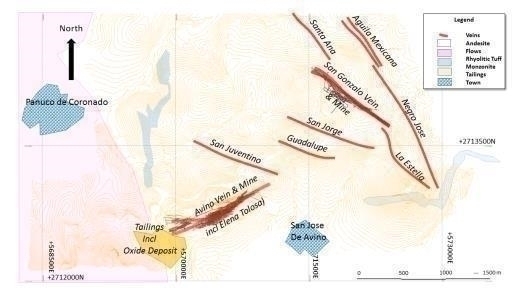

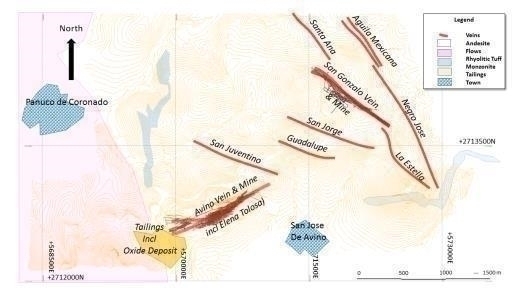

Figure 7.1 | General Map of Property Geology | | 7-2 | |

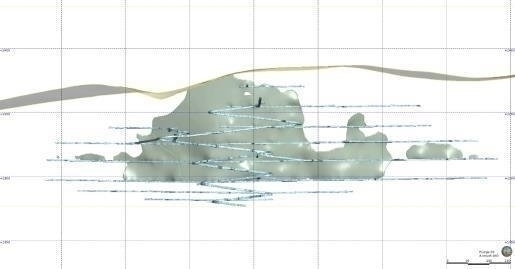

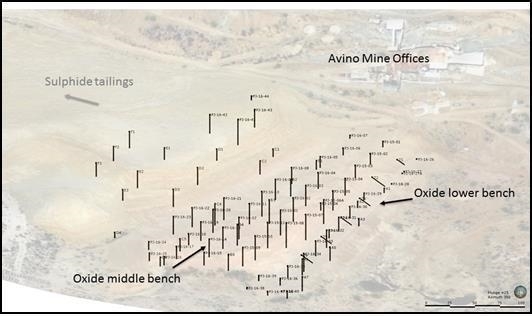

Figure 7.2 | Orthogonal View of the Oxide Tailings Deposit and Drillholes | | 7-6 | |

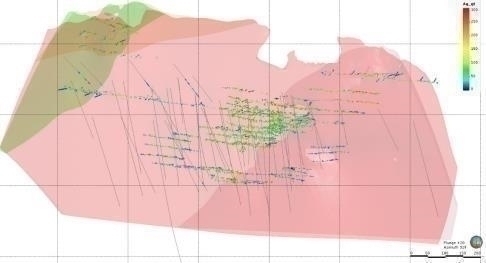

Figure 9.1 | Channel and Drillhole Samples, Colour Coded by Silver Grade, within the Avino System | | 9-5 | |

Figure 9.2 | Channel Samples, Colour Coded by Silver Grade, within the San Gonzalo Vein System | | 9-5 | |

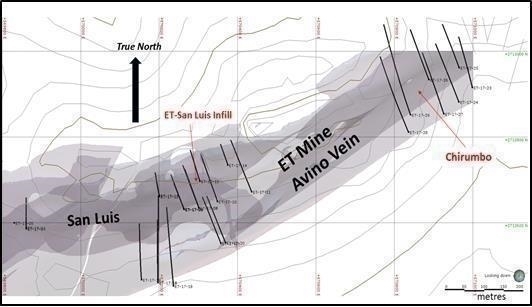

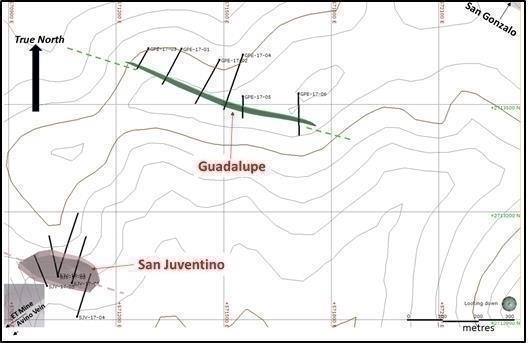

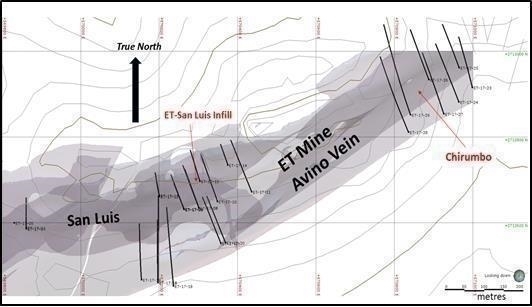

Figure 10.1 | Drillholes Completed from 2016 to 2017 on the Avino-San Luis Infill and Chirumbo, Guadalupe and San Juventino Areas | | 10-2 | |

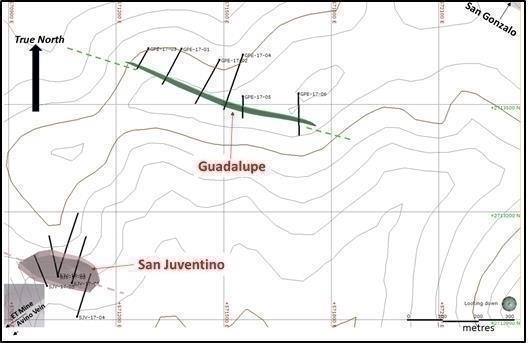

Figure 10.2 | Location of Drillholes Completed from 2016 to 2017 on Drillholes Completed from 2016 to 2017 on the Guadalupe and San Juventino Veins | | 10-3 | |

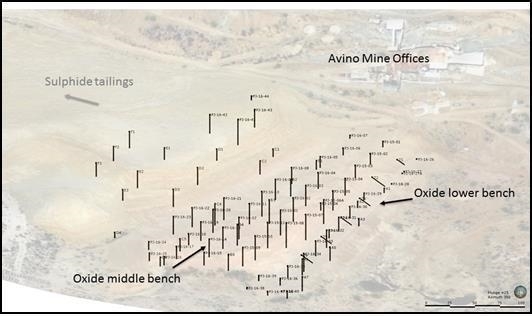

Figure 10.3 | Location of Drillholes Completed from 2015 to 2016 on the Oxide Tailings | | 10-11 | |

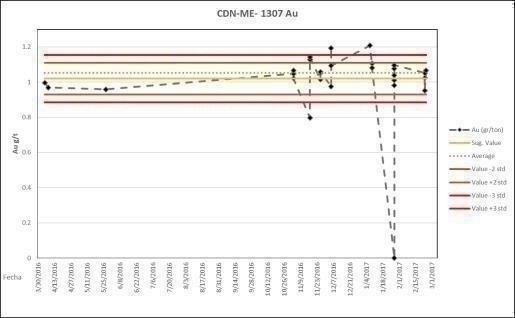

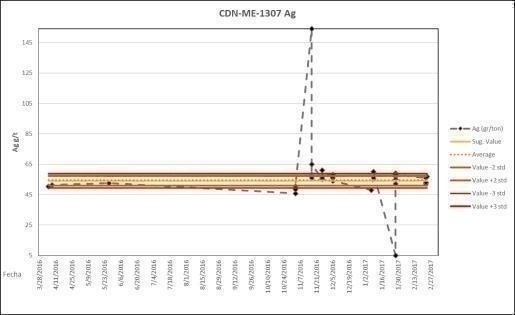

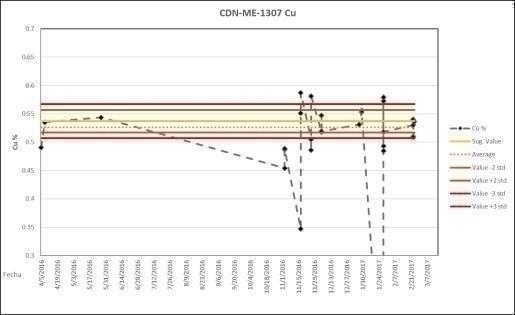

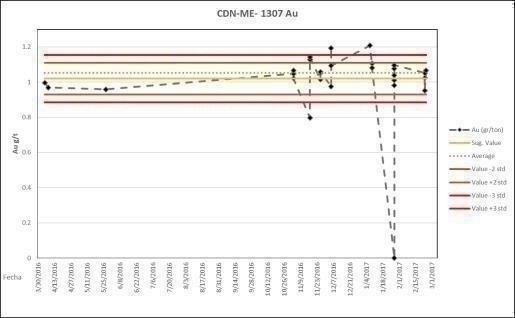

Figure 12.1 | Standard 1307_ME-1307 – Gold Performance | | 12-5 | |

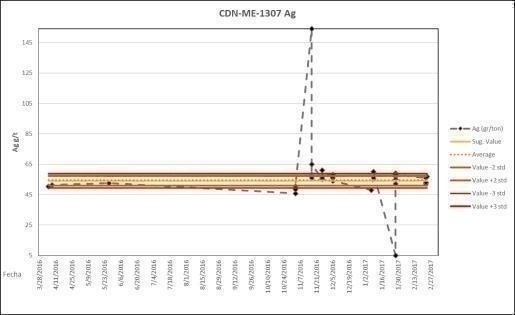

Figure 12.2 | Standard CDN-ME-1307 – Silver Performance | | 12-6 | |

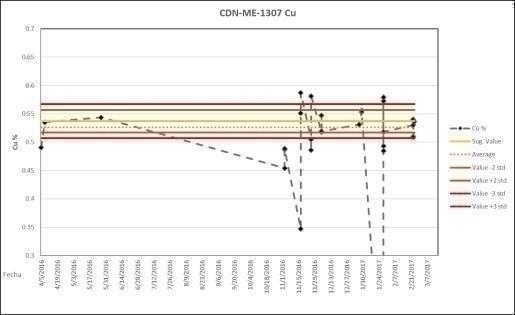

Figure 12.3 | Standard CDN-ME-1307 – Copper Performance | | 12-6 | |

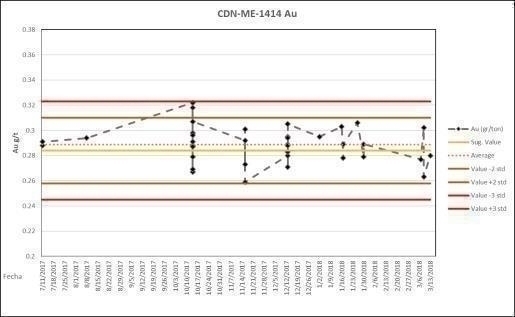

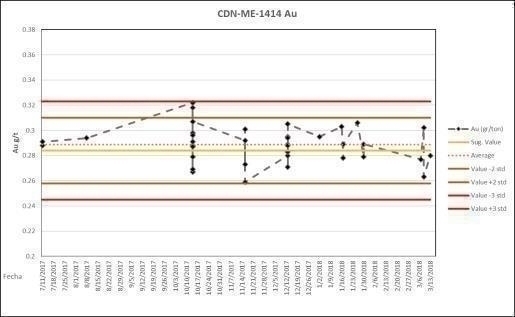

Figure 12.4 | Standard CDN-ME-1414 – Gold Performance | | 12-7 | |

|

|

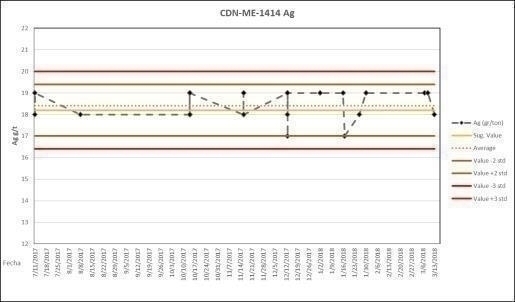

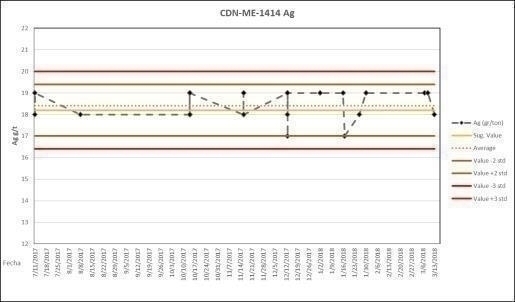

Figure 12.5 | Standard CDN-ME-1414 – Silver Performance | | 12-8 | |

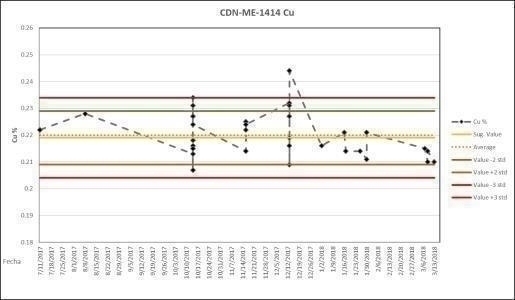

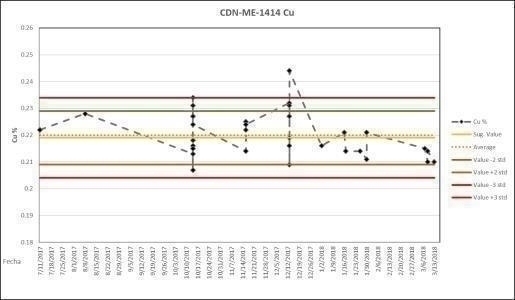

Figure 12.6 | Standard CDN-ME-1414 – Copper Performance | | 12-8 | |

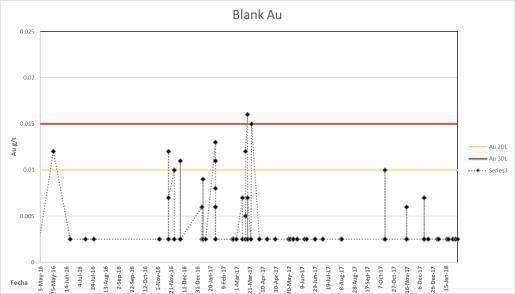

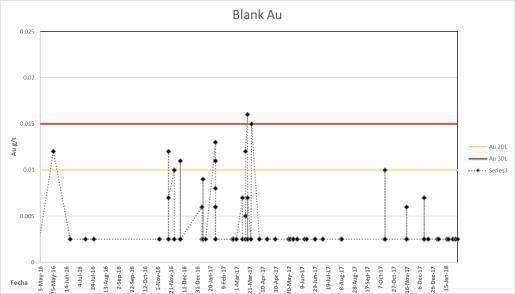

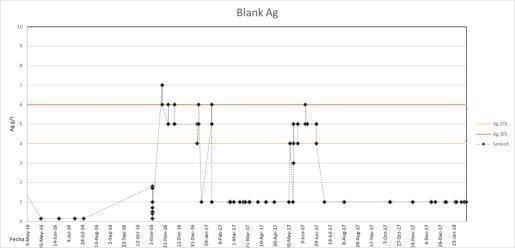

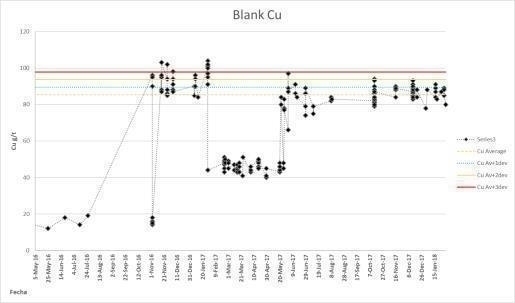

Figure 12.7 | Blank – Gold Performance | | 12-9 | |

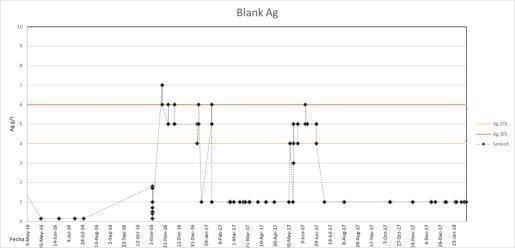

Figure 12.8 | Blank – Silver Performance | | 12-10 | |

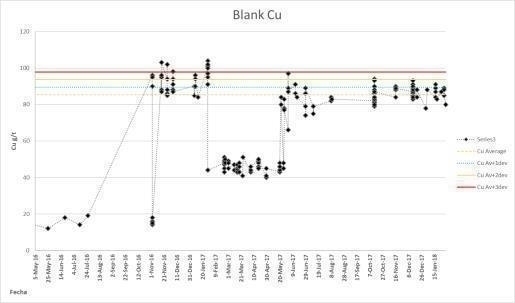

Figure 12.9 | Blank – Copper Performance | | 12-10 | |

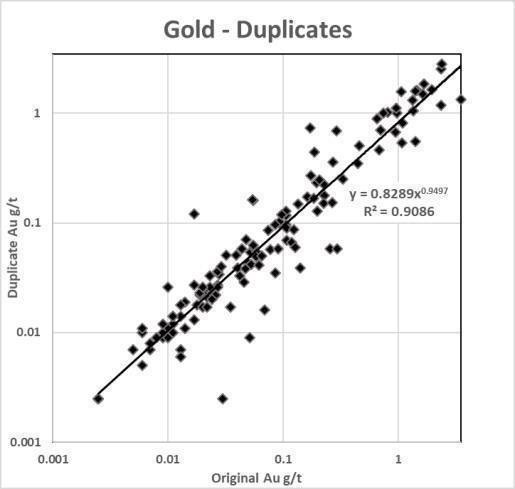

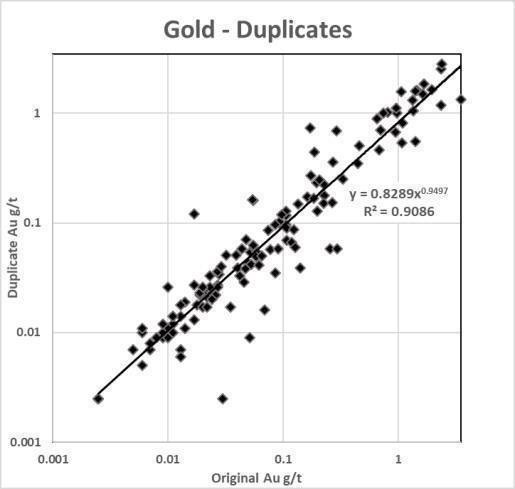

Figure 12.10 | Gold – Duplicate Correlation | | 12-11 | |

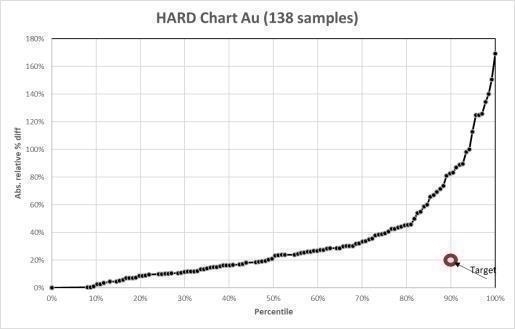

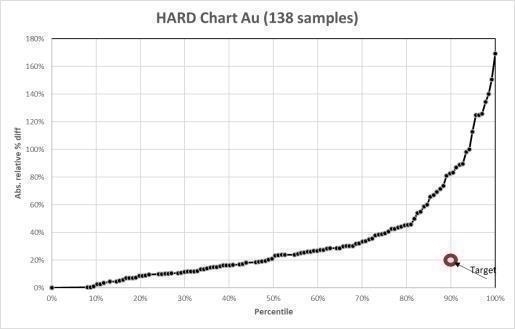

Figure 12.11 | Gold – Half Absolute Relative Difference Chart | | 12-12 | |

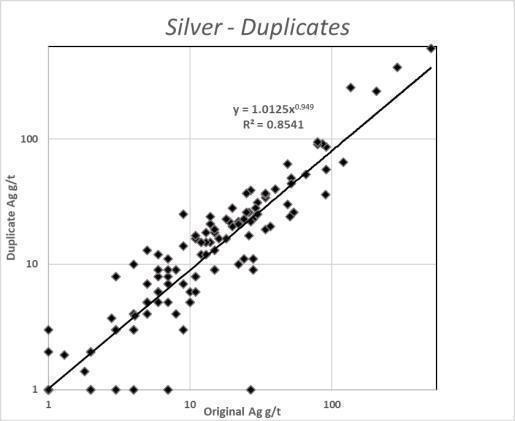

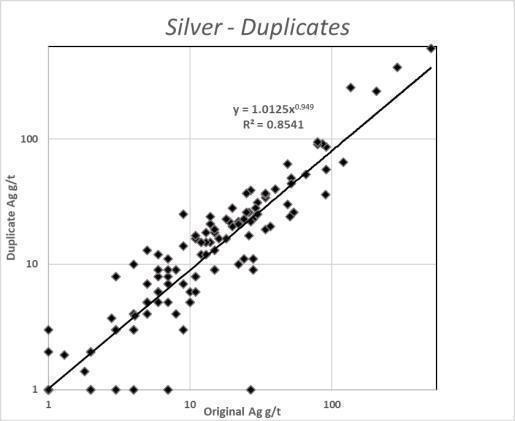

Figure 12.12 | Silver – Duplicate Correlation | | 12-13 | |

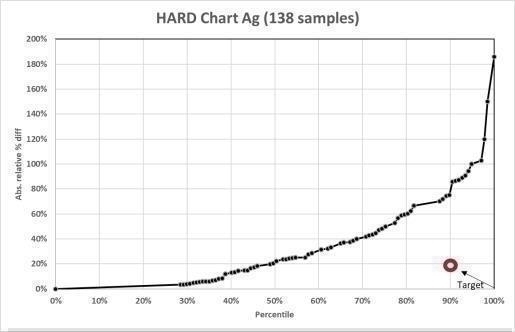

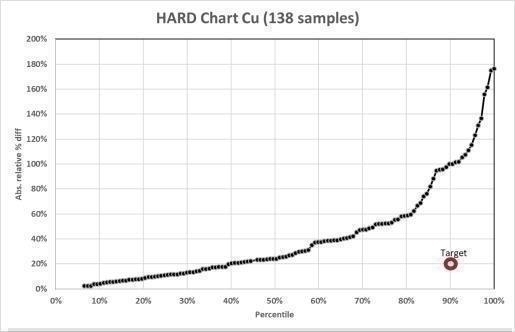

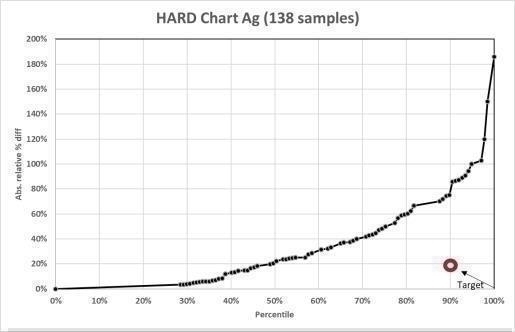

Figure 12.13 | Silver – Half Absolute Relative Difference Chart | | 12-14 | |

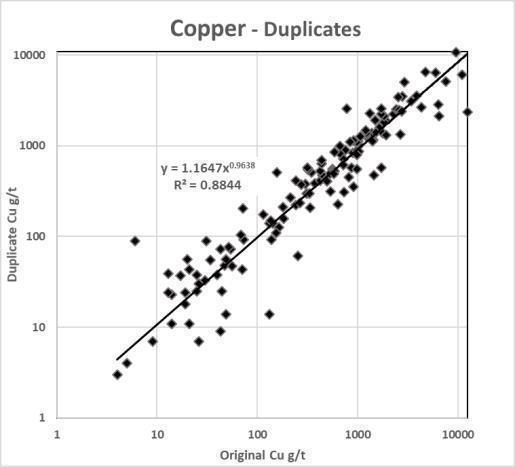

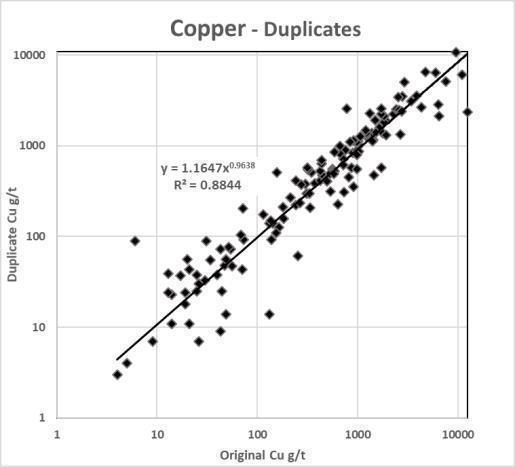

Figure 12.14 | Copper – Duplicate Correlation | | 12-15 | |

Figure 12.15 | Copper – Half Absolute Relative Difference Chart | | 12-16 | |

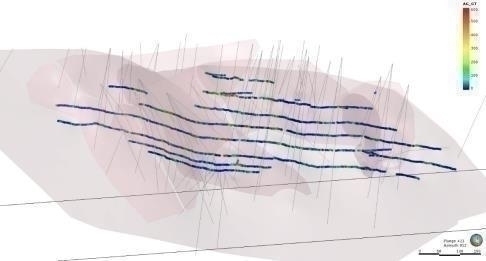

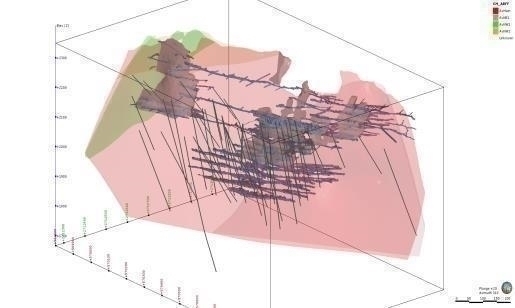

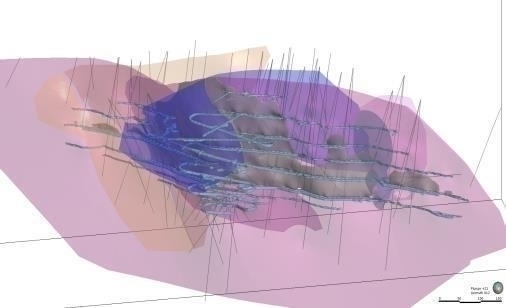

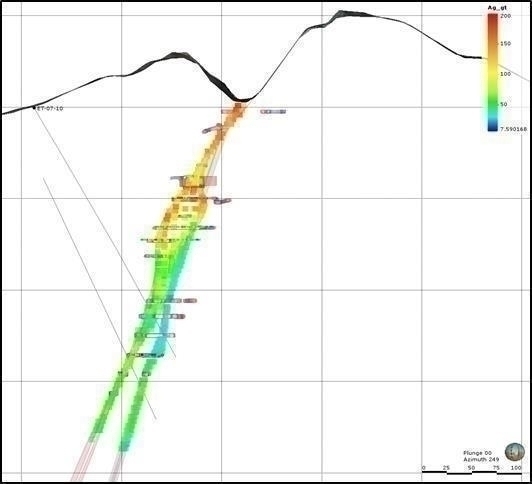

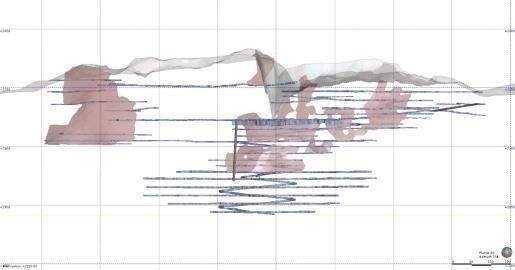

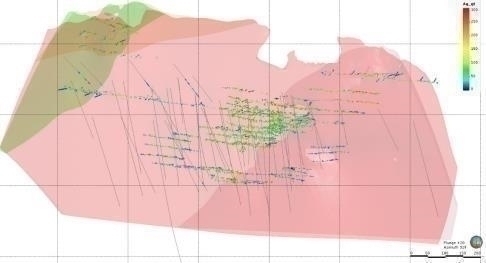

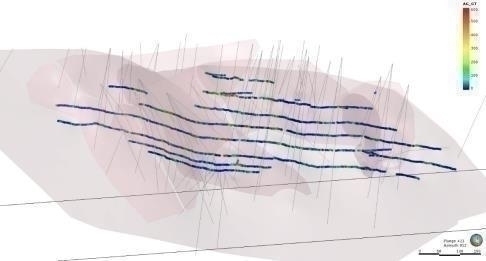

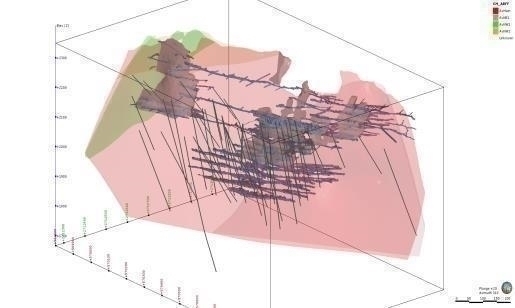

Figure 14.1 | Oblique View, Looking North, of the Avino Vein System Model | | 14-5 | |

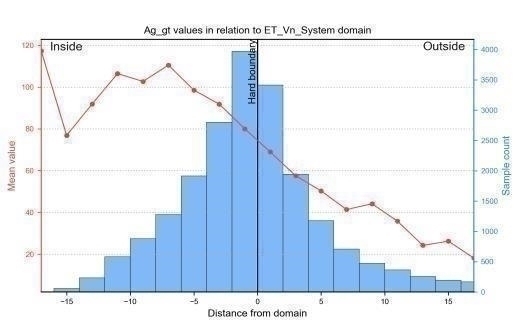

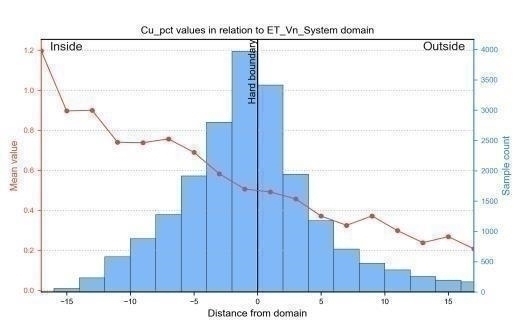

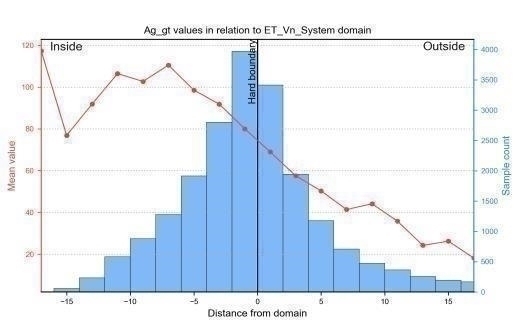

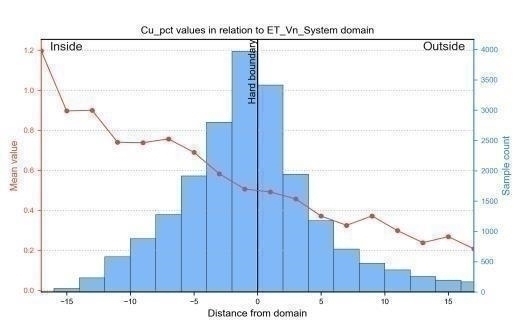

Figure 14.2 | Silver Grade Profiles Across the Avino Vein System Contacts | | 14-6 | |

Figure 14.3 | Copper Grade Profile Across the Avino Vein System Contacts | | 14-7 | |

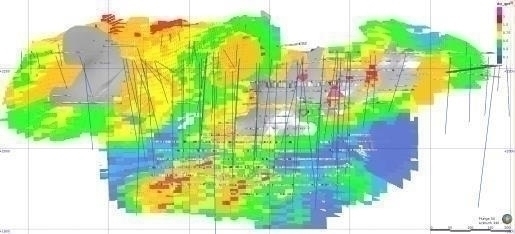

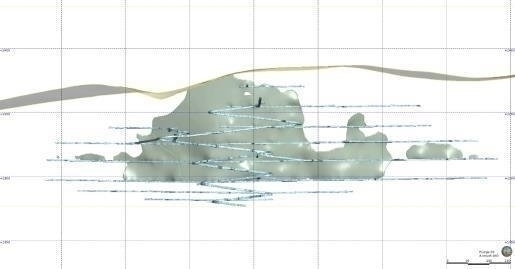

Figure 14.4 | Oblique View, Looking North, of the San Gonzalo Vein System Model | | 14-8 | |

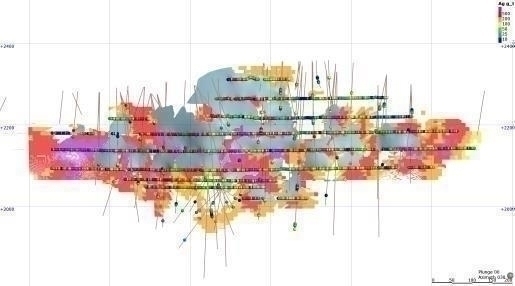

Figure 14.5 | Silver and Gold Grade Profiles Across the Main San Gonzalo Vein Contacts | | 14-8 | |

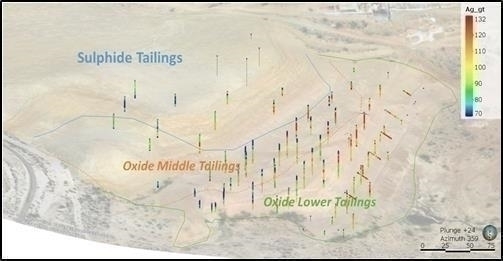

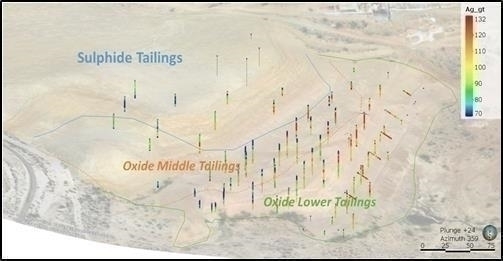

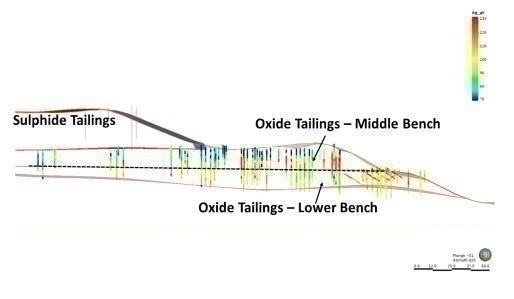

Figure 14.6 | Perspective View of Oxide Tailings Drilling and Silver Assays | | 14-9 | |

Figure 14.7 | Section View, Looking Northeast, Showing Silver Grades in Oxide Tailings Benches | | 14-10 | |

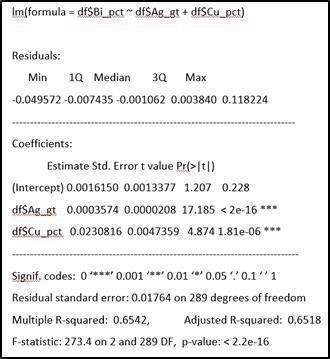

Figure 14.8 | Linear Regression Model Coefficients for Bismuth Estimation | | 14-16 | |

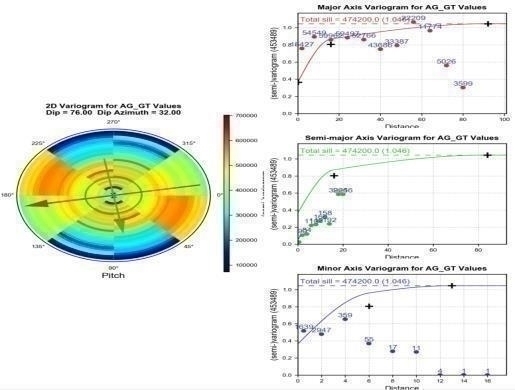

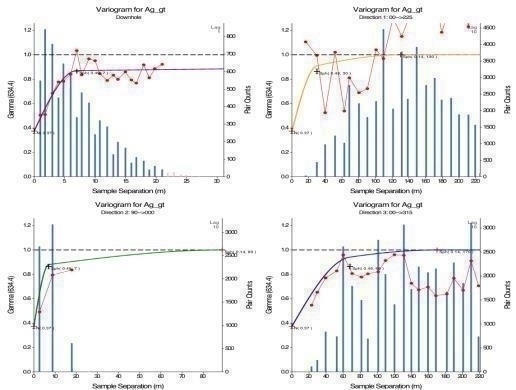

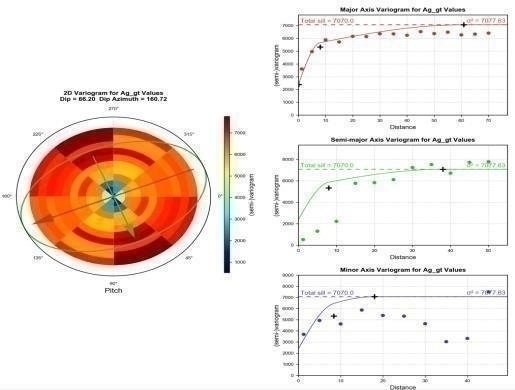

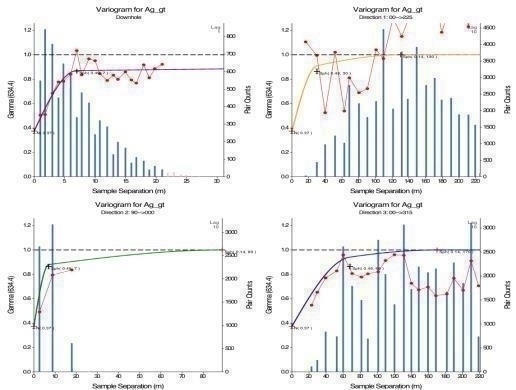

Figure 14.9 | Avino Vein: Main Zone Experimental and Modelled Silver Variograms | | 14-18 | |

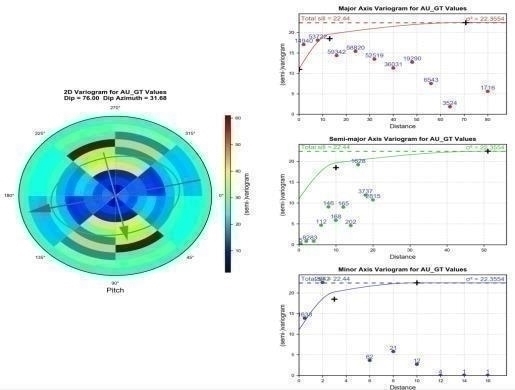

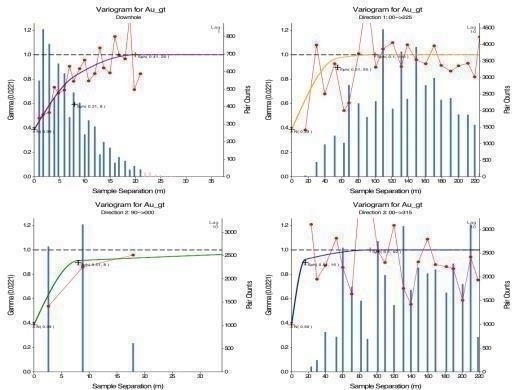

Figure 14.10 | Avino Vein: Main Zone Experimental and Modelled Gold Variograms | | 14-19 | |

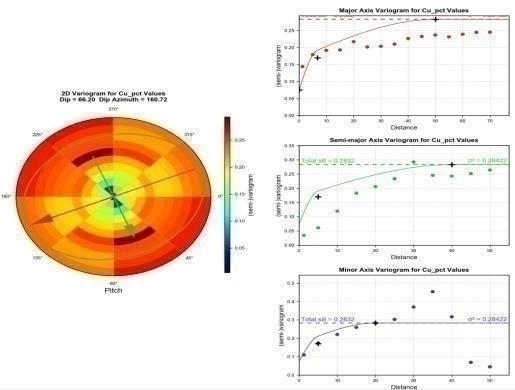

Figure 14.11 | Avino Vein: Main Zone Experimental and Modelled Copper Variograms | | 14-20 | |

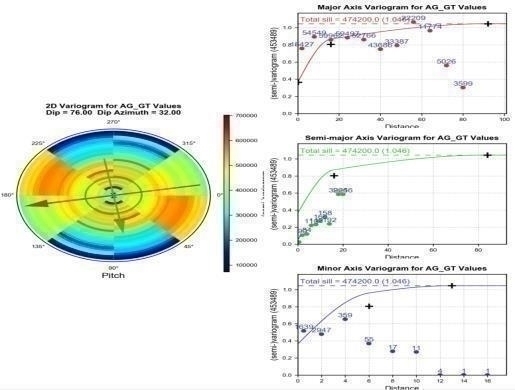

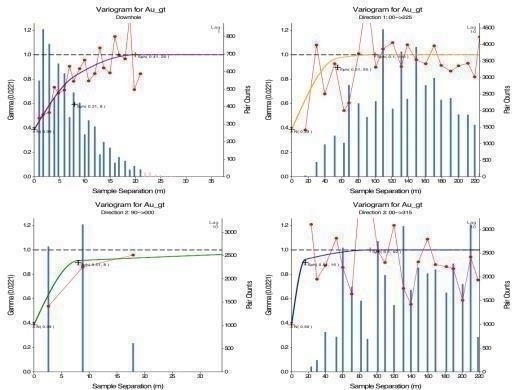

Figure 14.12 | San Gonzalo Vein: SG1 Experimental and Modelled Silver Variograms | | 14-21 | |

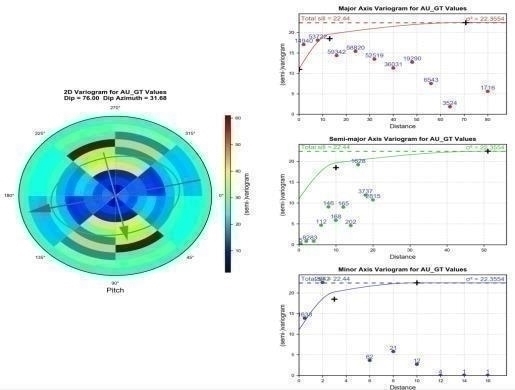

Figure 14.13 | San Gonzalo Vein: SG1 Experimental and Modelled Gold Variograms | | 14-22 | |

Figure 14.14 | Oxide Tailings: Domain 10 Experimental Silver Variograms | | 14-23 | |

Figure 14.15 | Oxide Tailings: Domain 10 Experimental Silver Variograms | | 14-24 | |

Figure 14.16 | Avino Vein: Typical Transverse Section, Looking East through Drillhole ET07-10, Showing the Block Model Centroids Colour Coded by Silver Grade | | 14-33 | |

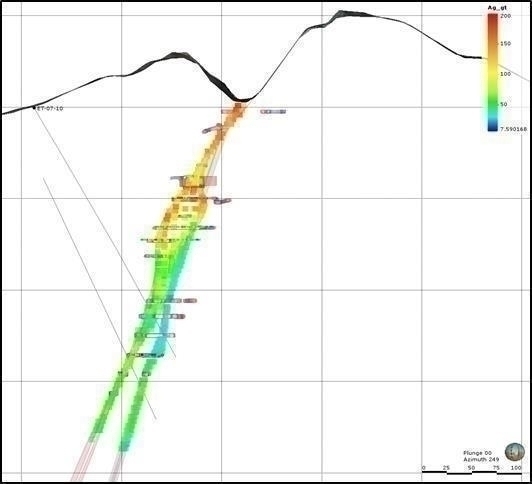

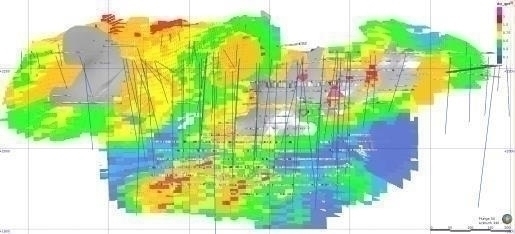

Figure 14.17 | Avino Vein: Longitudinal Section Showing the Block Model Centroids Colour Coded by Silver Grade | | 14-34 | |

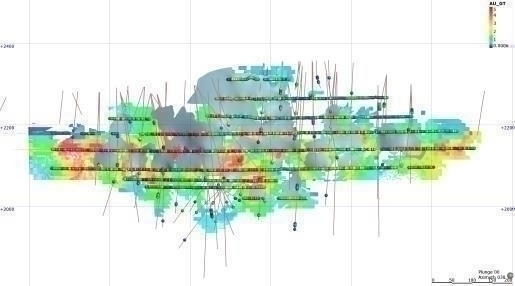

Figure 14.18 | Avino Vein: Longitudinal Section Showing the Block Model Centroids Colour Coded by Gold Grade | | 14-34 | |

Figure 14.19 | Avino Vein: Longitudinal Section Showing the Block Model Centroids Colour Coded by Coper Grade | | 14-35 | |

Figure 14.20 | San Gonzalo Vein: Typical Transverse Section, Looking East Aligned Along Drillhole SG1115 Showing the Block Model Centroids Colour Coded by Silver Grade | | 14-36 | |

Figure 14.21 | San Gonzalo Vein: Longitudinal Section Showing the Block Model Centroids Colour Coded by Silver Grade | | 14-37 | |

Figure 14.22 | San Gonzalo Vein: Longitudinal Section Showing the Block Model Centroids Color Coded by Gold Grade | | 14-37 | |

Figure 14.23 | San Gonzalo Vein: Longitudinal Section Showing the Block Model Centroids Colour Coded by Silver Equivalent | | 14-38 | |

Figure 14.24 | Avino Vein, Swathplot for Silver, Eastings | | 14-39 | |

Figure 14.25 | Avino Vein, Swathplot for Gold Eastings | | 14-40 | |

Figure 14.26 | Avin Vein, Swathplot for Copper, Eastings | | 14-41 | |

Figure 14.27 | Avino Vein, Swathplot for Silver, Elevation | | 14-42 | |

Figure 14.28 | Avino Vein, Swathplot for Gold, Elevation | | 14-43 | |

Figure 14.29 | Avino Vein, Swathplot for Copper, Elevation | | 14-44 | |

Figure 14.30 | San Gonzalo Vein, Swathplot for Silver, Eastings | | 14-45 | |

|

|

Figure 14.31 | San Gonzalo Vein, Swathplot for Silver, Northings | | 14-46 | |

Figure 14.32 | San Gonzalo Vein, Swathplot for Silver, Elevation | | 14-47 | |

Figure 14.33 | San Gonzalo Vein, Swathplot for Gold, Eastings | | 14-48 | |

Figure 14.34 | San Gonzalo Vein, Swathplot for Gold, Northings | | 14-49 | |

Figure 14.35 | San Gonzalo Vein, Swathplot for Gold, Elevation | | 14-50 | |

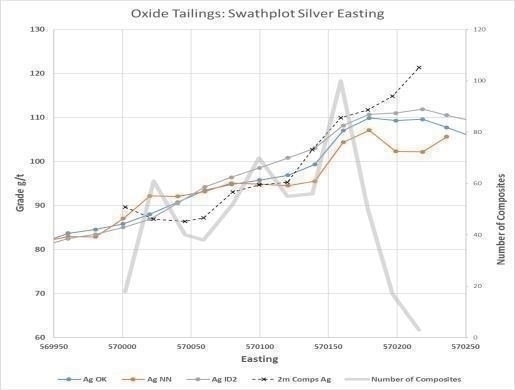

Figure 14.36 | Oxide Tailings Deposit, Swathplot for Silver, Easting | | 14-51 | |

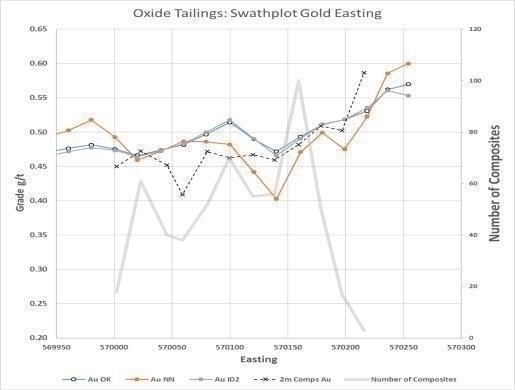

Figure 14.37 | Oxide Tailings Deposit, Swathplot for Gold, Easting | | 14-52 | |

Figure 14.38 | Oxide Tailings Deposit, Swathplot for Silver, Northing | | 14-53 | |

Figure 14.39 | Oxide Tailings Deposits, Swathplot for Gold, Northing | | 14-53 | |

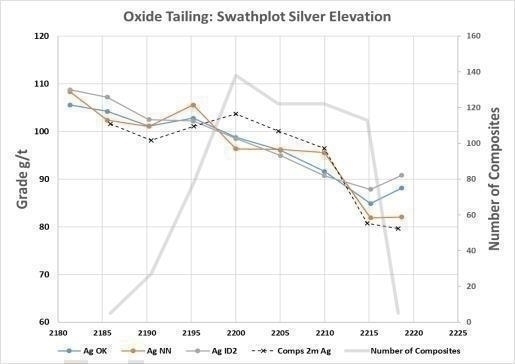

Figure 14.40 | Oxide Tailings Deposit, Swathplot for Silver, Elevation | | 14-54 | |

Figure 14.41 | Oxide Tailings Deposit, Swathplot for Gold, Elevation | | 14-54 | |

Figure 14.42 | Grade Tonnage Graph of Avino Vein Material at Measured Confidence Level | | 14-65 | |

Figure 14.43 | Grade Tonnage Graph of Avino Vein Material at Indicated Confidence Level | | 14-65 | |

Figure 14.44 | Grade Tonnage Graph of Avino Vein Material at Inferred Confidence Level | | 14-66 | |

Figure 14.45 | Grade Tonnage Graph of San Gonzalo Vein Material at Measured Confidence Level | | 14-66 | |

Figure 14.46 | Grade Tonnage Graph of San Gonzalo Vein Material at Indicated Confidence Level | | 14-67 | |

Figure 14.47 | Grade Tonnage Graph of San Gonzalo Vein Material at Inferred Confidence Level | | 14-67 | |

Figure 14.48 | Grade Tonnage Graph of Oxide Tailings Material at Indicated Confidence Level | | 14-68 | |

Figure 14.49 | Grade Tonnage Graph of Oxide Tailings Material at Inferred Confidence Level | | 14-68 | |

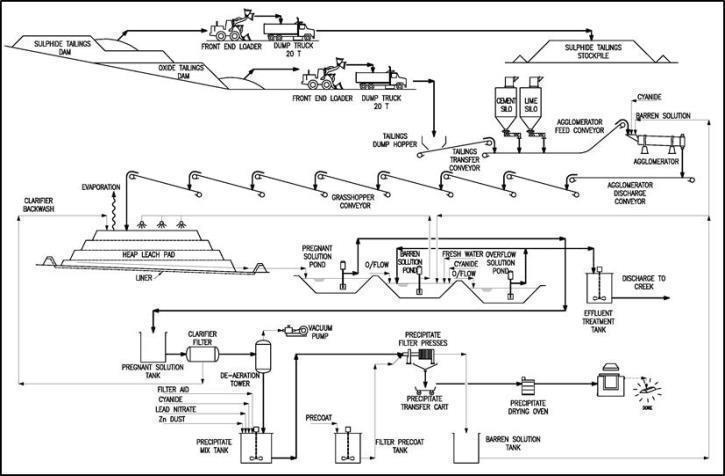

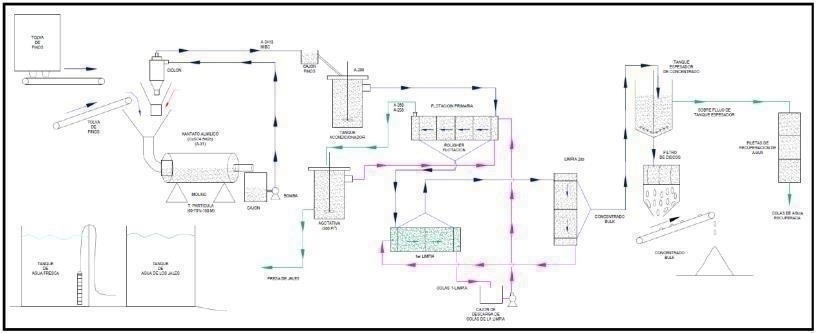

Figure 17.1 | Simplified Flowsheet – Avino Vein | | 17-3 | |

Figure 17.2 | Proposed Process Flowsheet – Oxide Tailings | | 17-5 | |

GLOSSARY

UNITS OF MEASURE

above mean sea level | | amsl | |

acre | | ac | |

ampere | | A | |

annum (year) | | a | |

billion | | B | |

billion tonnes | | Bt | |

billion years ago | | Ga | |

British thermal unit | | BTU | |

centimetre | | cm | |

cubic centimetre | | cm3 | |

cubic feet per minute | | cfm | |

cubic feet per second | | ft3/s | |

cubic foot | | ft3 | |

cubic inch | | in3 | |

cubic metre | | m3 | |

cubic yard | | yd3 | |

Coefficients of Variation | | CVs | |

day | | d | |

days per week | | d/wk | |

days per year (annum) | | d/a | |

dead weight tonnes | | DWT | |

decibel adjusted | | dBa | |

decibel | | dB | |

degree | | ° | |

degrees Celsius | | °C | |

diameter | | ø | |

dollar (American) | | US$ | |

dollar (Canadian) | | Cdn$ | |

dry metric ton | | dmt | |

foot | | ft | |

gallon | | gal | |

gallons per minute (US) | | gpm | |

Gigajoule | | GJ | |

gigapascal | | GPa | |

gigawatt | | GW | |

gram | | g | |

grams per litre | | g/L | |

grams per tonne | | g/t | |

greater than | | > | |

hectare (10,000 m2) | | ha | |

hertz | | Hz | |

horsepower | | hp | |

hour | | h | |

hours per day | | h/d | |

hours per week | | h/wk | |

hours per year | | h/a | |

inch | | in | |

kilo (thousand) | | k | |

kilogram | | kg | |

kilograms per cubic metre | | kg/m3 | |

kilograms per hour | | kg/h | |

kilograms per square metre | | kg/m2 | |

kilometre | | km | |

kilometres per hour | | km/h | |

kilopascal | | kPa | |

kilotonne | | kt | |

kilovolt | | kV | |

kilovolt-ampere | | kVA | |

kilovolts | | kV | |

kilowatt | | kW | |

kilowatt hour | | kWh | |

kilowatt hours per tonne | | kWh/t | |

kilowatt hours per year | | kWh/a | |

less than | | < | |

litre | | L | |

litres per minute | | L/m | |

megabytes per second | | Mb/s | |

megapascal | | MPa | |

megavolt-ampere | | MVA | |

megawatt | | MW | |

metre | | m | |

metres above sea level | | masl | |

metres Baltic sea level | | mbsl | |

metres per minute | | m/min | |

metres per second | | m/s | |

microns | | µm | |

milligram | | mg | |

milligrams per litre | | mg/L | |

millilitre | | mL | |

millimetre | | mm | |

million | | M | |

million bank cubic metres | | Mbm3 | |

million bank cubic metres per annum | | Mbm3/a | |

million tonnes | | Mt | |

minute (plane angle) | | ' | |

minute (time) | | min | |

month | | mo | |

ounce | | oz | |

pascal | | Pa | |

centipoise | | mPa∙s | |

parts per million | | ppm | |

parts per billion | | ppb | |

percent | | % | |

pound(s) | | lb | |

pounds per square inch | | psi | |

pounds per square inch (gauge) | | psig | |

revolutions per minute | | rpm | |

second (plane angle) | | " | |

second (time) | | s | |

short ton (2,000 lb) | | st | |

short tons per day | | st/d | |

short tons per year | | st/y | |

specific gravity | | SG | |

square centimetre | | cm2 | |

square foot | | ft2 | |

square inch | | in2 | |

square kilometre | | km2 | |

square metre | | m2 | |

three-dimensional | | 3D | |

tonne (1,000 kg) (metric ton) | | t | |

tonnes per day | | t/d | |

tonnes per hour | | t/h | |

tonnes per year | | t/a | |

tonnes seconds per hour metre cubed | | ts/hm3 | |

volt | | V | |

week | | wk | |

weight/weight | | w/w | |

wet metric ton | | wmt | |

yard | | yd | |

ABBREVIATIONS AND ACRONYMS

acid-base accounting | | ABA | |

Aranz Geo Expert Services | | Aranz Geo | |

atomic absorption | | AA | |

Avino Silver & Gold Mines Ltd. | | Avino | |

caliper volume | | CV | |

Canadian Institute of Mining, Metalurgy, and Petroleum | | CIM | |

Cannon-Hicks & Associates Ltd. | | Cannon-Hicks | |

certified reference material | | CRM | |

Compañía Minera Mexicana de Avino | | CMMA | |

Compañía Minera Mexicana de Avino, S.A. de C.V. | | Avino Mexico | |

Convention on International Trade in Endangered Species of Wild Fauna and Flora | | CITES | |

copper sulphate | | CuS04 | |

copper | | Cu | |

dissolved oxygen | | dO2 | |

east | | E | |

Electrometals Electrowinning | | EMEW | |

Elena Toloso Mine | | ET | |

San Gonzalo Mine | | SG | |

Environmental Impact Assessment Matter Regulation/ | | | |

|

|

Reglamento en Materia de Evaluacion del Impacto Ambiental | | REIA | |

Environmental Impact Assessment/Evaluación de Impacto Ambiental | | EIA | |

Environmental Impact Statement/Manifestación de Impacto Ambiental | | EIS/MIA | |

Environmental Quality Monitoring Program/ | | | |

Programa de Seguimiento de la Calidad Ambiental | | EQMP | |

Federal Attorney for Environmental Protection/ | | | |

Procuraduría Federal de Proteccíon al Ambiente | | PROFEPA | |

general and administrative | | G&A | |

General Law for the Prevention and Comprehensive Management of Waste/ | | | |

Ley General Para la Prevención y Gestión Integral de Residuos | | LGPyGIR | |

General Law for the Prevention and Management of Waste/ | | | |

Ley General Para la Prevención y Gestión Integral de los Residuos | | LGPGIR | |

General Law of Ecological Equilibrium and Environmental Protection/ | | | |

Ley General del Equilibrio Ecológico y la Protección al Ambiente | | LGEEPA | |

global positioning system | | GPS | |

gold equivalent | | AuEQ | |

gold | | Au | |

induced polarization | | IP | |

inductively coupled plasma | | ICP | |

inductively coupled plasma-method spectroscopy | | ICP-MS | |

internal rate of return | | IRR | |

International Organization for Standardization | | ISO | |

inverse distance squared | | ID2 | |

kriging neighbourhood analysis | | KRN | |

lead | | Pb | |

life-of-mine | | LOM | |

Minerales de Avino, Sociedad Anonima de Capital Variable | | Minerales | |

MineStart Management Inc. | | MMI | |

Ministry of Environment and Natural Resources/ | | | |

Secretaría de Medio Ambiente y Recursos Naturales | | MENR/SEMARNAT | |

National Instrument 43-101 | | NI 43-101 | |

nearest neighbour | | NN | |

net present value | | NPV | |

net smelter return | | NSR | |

north | | N | |

ordinary kriging | | OK | |

potassium amyl xanthate | | PAX | |

preliminary economic assessment | | PEA | |

PricewaterhouseCoopers | | PwC | |

Process Research Associates Ltd. | | PRA | |

Qualified Person | | QP | |

quality assurance | | QA | |

quality control | | QC | |

silver equivalent | | Ag_Eq | |

silver | | Ag | |

sodium carbonate | | Na2CO3 | |

sodium cyanide | | NaCN | |

south | | S | |

special mining duty | | SMD | |

standard reference material | | SRM | |

tailings storage facility | | TSF | |

the Avino Mine | | the Property or | |

| | the Project | |

Toronto Stock Exchange | | TSX | |

Universal Transverse Mercator | | UTM | |

water displacement | | WD | |

west | | W | |

zinc | | Zn | |

1.1 INTRODUCTION

Avino Silver & Gold Mines Ltd. (Avino) is a Canadian-based mining and exploration company listed on the Toronto Stock Exchange (TSX) and the NYSE-American with precious metal properties in Mexico and Canada.

The Avino Mine (the Property or the Project), near Durango, Mexico, is Avino’s principal asset and is the subject of this Technical Report, which includes a current Mineral Resource estimate for the Avino Veins at the Elena Tolosa Mine (ET), San Gonzalo Veins at the San Gonzalo Mine (SG) and for the oxide tailings deposit.

Avino holds a 99.67% interest in the Property through its subsidiary companies called Compañía Minera Mexicana de Avino, S.A. de C.V. (CMMA) and Promotora Avino, S.A. de C.V. Avino commenced development, including drilling and bulk sampling, on the San Gonzalo Vein in 2010 and this work is ongoing. This marks the resumption of activity on the Property since 2001, when low metal prices and the closure of a key smelter caused the mine to close after having been in operation continuously for 27 years. Between 1976 and 2001, the mine produced approximately 497 t of silver, 3 t of gold, and 11,000 t of copper (Slim 2005a) as well as an apparently undocumented amount of lead.

The majority of the information has been sourced from the data provided by Avino: Avino internal reports; Tetra Tech (2013); Tetra Tech (2017); Slim (2005d), and Gunning (2009). The majority of the information was provided in English, but some information was written in Spanish and subsequently translated into English.

The purpose of this report is to support an updated Mineral Resource estimated as a result of modified current metal price parameters, new drilling information at the ET Mine (Avino and San Luis) and improved interpretation of the San Gonzalo mineralization trends. There has been no change to the oxide tailings estimate.

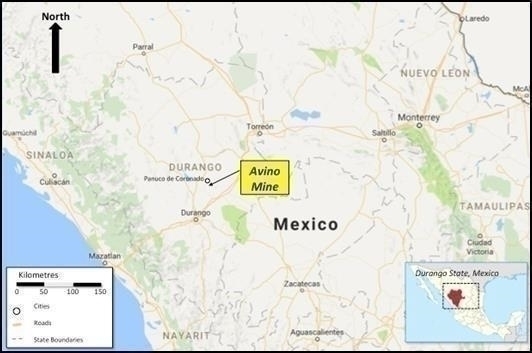

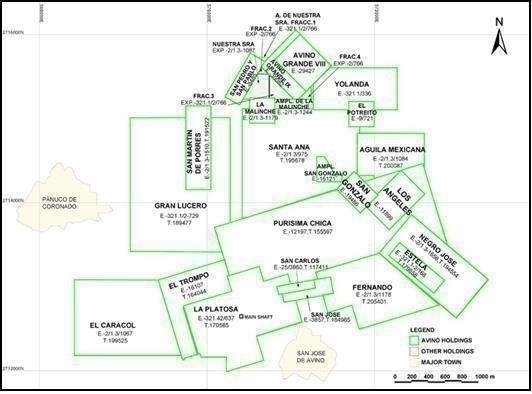

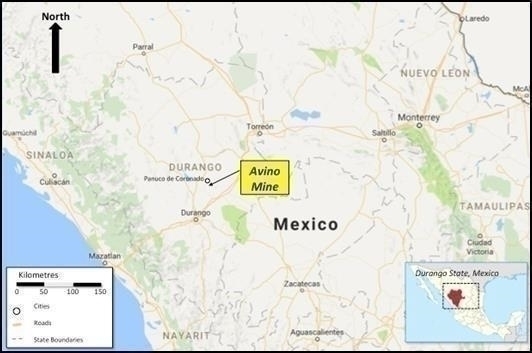

1.2 PROPERTY DESCRIPTION AND LOCATION

The Property is located in Durango State in North Central Mexico, within the Sierra Madre Silver Belt, 82 km northeast of Durango City (Figure 1.1). The current Property is comprised of 23 mineral concessions, totalling 1,103.934 ha. Of these, 22 mineral concessions, totalling 1,005.104 ha, are held by CMMA (Avino’s Mexican subsidiary company), by Promotora Avino SA de CV, and by Susesion de la Sra. Elena del Hoyo Algara de Ysita.

Avino Silver & Gold Mines Ltd. | 1-1 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

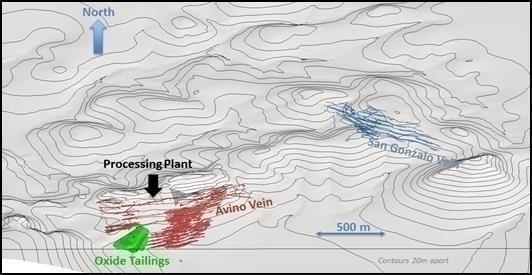

Figure 1.1 General Location of the Property

Avino entered into an agreement (the Agreement) on February 18, 2012 through its subsidiary company, with Minerales de Avino, Sociedad Anonima de Capital Variable (Minerales), whereby Minerales has indirectly granted to Avino the exclusive mining and occupation rights to the La Platosa concession. The La Platosa concession covers 98.83 ha and hosts the Avino Vein and ET Zone (ET Zone).

Pursuant to the Agreement, Avino has the exclusive right to explore and mine the concession for an initial period of 15 years, with the option to extend the agreement for another 5 years. In consideration of the grant of these rights, Avino has paid to Minerales the sum of US$250,000 by the issuance of 135,189 common shares of Avino. Avino has also agreed to pay to Minerales a royalty equal to 3.5% of net smelter returns (NSRs), at the commencement of commercial production from the concession.

All concessions are current and up to date based on information received. Mineral concessions in Mexico do not include surface rights and Avino has entered into agreements with communal landowners (Ejidos) of San Jose de Avino, Panuco de Coronado and Zaragoza for the temporary occupation and surface rights of the concessions.

1.3 GEOLOGY AND MINERALIZATION

The Property is located within the Sierra de Gamon, on the east flank of the Sierra Madre Occidental. The area is a geological window into the Lower Volcanic series and consists of volcanic rocks of mainly Andesitic affiliation with other rock types occurring more sparsely to the north (Slim 2005d).

Avino Silver & Gold Mines Ltd. | 1-2 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

A large monzonitic intrusion is observed in the region in the form of dykes and small stocks, which may be related to the Avino Vein mineralization. Several younger thin mafic sills are also found in various parts of the region.

The Avino concession is situated within a 12 km north-south by 8.5 km caldera, which hosts numerous low sulphidation epithermal veins, breccias, stockwork and silicified zones. These zones grade into a “near porphyry” environment in the general vicinity of the Avino property. The caldera has been uplifted by regional north trending block faulting (a graben structure), exposing a window of andesitic pyroclastic rocks of the lower volcanic sequence which is a favourable host rock. The upper volcanic sequence consists of rhyolite to trachytes with extensive ignimbrite and is intruded by monzonite bodies. The basal andesite-bearing conglomerate and underlying Paleozoic basement sedimentary rocks (consisting of shales, sandstones and conglomerates) have been identified on the Avino concession in the south-central portion of the caldera, covering the Guadalupe, Santiago, San Jorge, the San Gonzalo Trend, Malinche, Porterito and Yolanda areas.

A northerly trending felsic dyke, probably a feeder to the upper volcanic sequence, transects the Property and many of the veins. The Aguila Mexicana low temperature vein system, with significant widths but overall low precious metal values, trends north-northwest, similar to the felsic dyke and with similar continuity across the Property. The two structures may occupy deep crustal faults that controlled volcanism and mineralization, with the felsic dyke structure controlling the emplacement of the Avino, Nuestra Senora and El Fuerte-Potosina volcanic centres and the Aguila Mexicana controlling the Cerro San Jose and El Fuerte-Potosina volcanic centres (Paulter 2006).

Silver- and gold-bearing veins crosscut the various lithologies and are generally oriented north-northwest to south-southeast (the Avino Vein trend) and northwest to southeast the San Gonzalo trend). In Mexico, these vein deposits may have large lateral extents, but can be limited in the vertical continuity of grades due to the effects of pressure on boiling levels for mineralizing fluids. The rocks have been weathered and leached in the upper sections, as a result of contact with atmospheric waters. The oxide tailings material is derived primarily from these shallow zones, whereas the sulphide tailings are predominantly from material sourced at depth from the underground workings.

The valuable minerals found during the period of mining of the oxide zone are reported to be argentite, bromargyrite, chalcopyrite, chalcocite, galena, sphalerite, bornite, native silver and gold, and native copper.

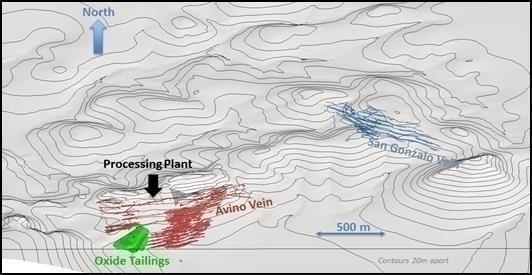

Three deposits, the Avino Vein, the San Gonzalo Vein and the oxide tailings deposit, are the subject of Mineral Resource estimates disclosed in this report. Recent exploration drilling reported at the Guadalupe and San Juventino veins is at an early stage and no Mineral Resources have been estimated for these two veins.

Avino Silver & Gold Mines Ltd. | 1-3 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

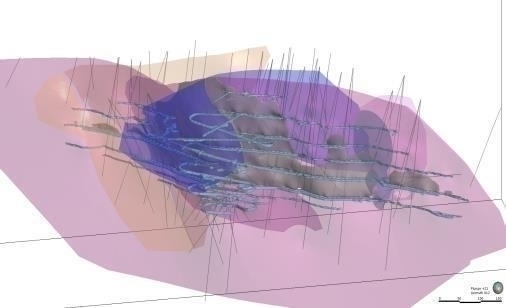

Figure 1.2 Perspective View of the Property Looking North and Showing the Three Deposits

1.3.1 THE AVINO VEIN

The Avino Vein (see Figure 1.2 for location) has been and continues to be the primary deposit mined on the Property since at least the 19th century. It is 1.6 km long and up to 60 m wide on the surface. The deepest level is at the 1,930 m amsl level (430 m below surface).

1.3.2 THE SAN GONZALO VEIN

The San Gonzalo Vein system (see Figure 1.2 for location), including the crosscutting Angelica vein, is located 2 km northeast of the Avino Vein. It constitutes a strongly developed vein system over 25 m across, trending 300 to 325°/80° northeast to 77° south. Banded textures and open-space filling are common and individual veins have an average width of less than 2 m. The vein was mined historically and underground workings extend approximately 1.1 km along strike and to the 1,970 m amsl (300 m below surface).

1.3.3 THE OXIDE TAILINGS

The oxide tailings deposit (see Figure 1.2 for location) comprises historic recovery plant residue material that was wasted from processing plants during the earlier period of open pit mining of the Avino Vein. The oxide tailings are partially covered by younger unconsolidated sulphide tailings on the northwest side.

Avino Silver & Gold Mines Ltd. | 1-4 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

1.4 RESOURCE ESTIMATES

The Avino system, San Gonzalo system, and oxide tailings Mineral Resources were modelled and estimated using Leapfrog EDGE™ software version 4.2.3. The reported Mineral Resource estimated by ARANZ Geo Expert Services (ARANZ Geo) was interpolated using ordinary kriging (OK) and capped grades and inverse distance squared (ID2) and nearest neighbour (NN) for model validation purposes. The Avino system was estimated for silver, gold, copper. The San Gonzalo Vein system and oxide tailings were estimated for silver and gold. Under current economic and technical conditions gold and silver and copper are recoverable from the Avino system and all three metals are included in the mineral resource and for the silver equivalent (AgEQ) calculation for the Avino system. Under current economic and technical conditions only gold and silver are recoverable from the San Gonzalo system and the oxide tailings and consequently only silver and gold are included in the Mineral Resource and for the silver equivalent calculation for the San Gonzalo system and oxide tailings. Cut-off reporting (to consider “eventual prospects for eventual economic extraction”) utilizes an AgEQ calculation where the total metal value is converted into an in situ silver resource. For reporting purposes, a base-case AgEQ cut-off of 60 g/t is used for the Avino system, an AgEQ cut-off of 130 g/t is used for the San Gonzalo system, and an AgEQ cut-off of 50 g/t is used for the oxide tailings based on current economic parameters.

Table 1.1 is the Mineral Resource statement. Other grade tonnage graphs and tables found in Section 14.0 are intended to show sensitivity of the mineralized material and must not be considered Mineral Resources.

It must be noted that no Mineral Resource has been estimated for the sulphide tailings portion of the Property.

Avino Silver & Gold Mines Ltd. | 1-5 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

Table 1.1 Mineral Resources at the Avino Property

| | | | | | | | | | Grade | | | Metal Contents | |

Resource Category | | Deposit | | Cut-off(AgEQ g/t) | | | Tonnes (t) | | | AgEQ (g/t) | | | Ag (g/t) | | | Au (g/t) | | | Cu (%) | | | AgEQ(million tr oz)* | | | Ag(million tr oz) | | | Au(thousand tr oz) | | | Cu (t) | |

Measured and Indicated Mineral Resources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Measured | | Avino – ET | | | 60 | | | | 3,890,000 | | | | 141 | | | | 71 | | | | 0.54 | | | | 0.55 | | | | 17.6 | | | | 8.9 | | | | 67.4 | | | | 21,000 | |

Measured | | Avino – San Luis | | | 60 | | | | 650,000 | | | | 142 | | | | 67 | | | | 0.70 | | | | 0.49 | | | | 3.0 | | | | 1.4 | | | | 14.6 | | | | 3,000 | |

Measured | | San Gonzalo System | | | 130 | | | | 290,000 | | | | 397 | | | | 314 | | | | 1.65 | | | | 0.00 | | | | 3.7 | | | | 2.9 | | | | 15.4 | | | | 0 | |

Total Measured | | All Deposits | | | - | | | | 4,830,000 | | | | 156 | | | | 85 | | | | 0.63 | | | | 0.51 | | | | 24.3 | | | | 13.2 | | | | 97.4 | | | | 24,000 | |

Indicated | | Avino – ET | | | 60 | | | | 2,640,000 | | | | 105 | | | | 49 | | | | 0.56 | | | | 0.34 | | | | 8.9 | | | | 4.2 | | | | 47.6 | | | | 9,000 | |

Indicated | | Avino – San Luis | | | 60 | | | | 1,620,000 | | | | 126 | | | | 54 | | | | 0.82 | | | | 0.36 | | | | 6.6 | | | | 2.8 | | | | 42.9 | | | | 6,000 | |

Indicated | | San Gonzalo System | | | 130 | | | | 240,000 | | | | 319 | | | | 257 | | | | 1.25 | | | | 0.00 | | | | 2.5 | | | | 2.0 | | | | 9.6 | | | | 0 | |

Indicated | | Oxide Tailings | | | 50 | | | | 1,330,000 | | | | 124 | | | | 98 | | | | 0.46 | | | | 0.00 | | | | 5.3 | | | | 4.2 | | | | 19.8 | | | | 0 | |

Total Indicated | | All Deposits | | | - | | | | 5,830,000 | | | | 124 | | | | 70 | | | | 0.64 | | | | 0.25 | | | | 23.3 | | | | 13.1 | | | | 119.8 | | | | 15,000 | |

Total Measured and Indicated | | All Deposits | | | - | | | | 10,660,000 | | | | 139 | | | | 77 | | | | 0.63 | | | | 0.37 | | | | 47.5 | | | | 26.3 | | | | 217.2 | | | | 39,000 | |

Inferred Mineral Resources |

Inferred | | Avino – ET | | | 60 | | | | 2,380,000 | | | | 111 | | | | 58 | | | | 0.51 | | | | 0.33 | | | | 8.5 | | | | 4,4 | | | | 39.1 | | | | 8,000 | |

Inferred | | Avino – San Luis | | | 60 | | | | 1,780,000 | | | | 124 | | | | 57 | | | | 0.72 | | | | 0.38 | | | | 7.1 | | | | 3.2 | | | | 41.2 | | | | 7,000 | |

Inferred | | San Gonzalo System | | | 130 | | | | 120,000 | | | | 262 | | | | 219 | | | | 0.86 | | | | 0.00 | | | | 1.0 | | | | 0.8 | | | | 3.3 | | | | 0 | |

Inferred | | Oxide Tailings | | | 50 | | | | 1,810,000 | | | | 113 | | | | 88 | | | | 0.44 | | | | 0.00 | | | | 6.6 | | | | 5.1 | | | | 25.6 | | | | 0 | |

Total Inferred | | All Deposits | | | - | | | | 6,090,000 | | | | 118 | | | | 70 | | | | 0.56 | | | | 0.24 | | | | 23.2 | | | | 13.6 | | | | 109.2 | | | | 15,000 | |

Notes: | Figures may not add to totals shown due to rounding. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The Mineral Resource estimate is classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s (CIM) Definition Standards For Mineral Resources and Mineral Reserves incorporated by reference into National Instrument 43-101 (NI 43-101) Standards of Disclosure for Mineral Projects. Mineral Resources are reported at cut-off grades 60 g/t, 130 g/t, and 50 g/t AgEQ grade for ET, San Gonzalo, an oxide tailings, respectively. AgEQ or silver equivalent ounces are notational, based on the combined value of metals expressed as silver ounces Cut-off grades were calculated using the following assumptions: For Avino (ET and San Luis), San Gonzalo: gold price of US$1,300/oz, silver price of US$17.50/oz, and copper price of US$3.00/lb For Oxide Tailings: gold price of US$1,250/oz, silver price of US$19.50/oz A net smelter return (NSR) was calculated and the silver equivalent was back calculated using the following formulas: For ET: AgEQ = (24.06 x Au (g/t) + 0.347 x Ag (g/t) + 43.0 x Cu (%) – 151.8 x Bi (%)) / 0.347 For San Gonzalo: AgEQ = (0.03 x Au (g/t) + 0.385 x Ag (g/t) – 4.03/0.385 For Oxide Tailings: AqEQ = 69.37 x Au (g/t) + Ag (g/t) No Mineral Resource has been estimated for the sulphide tailings portion of the Property. Au – gold; Ag – silver; Cu – copper. |

Avino Silver & Gold Mines Ltd. | 1-6 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

1.5 MINERAL PROCESSING, METALLURGICAL TESTING AND RECOVERY METHODS

There are three separate mineralization sources in the Property, including the Avino and San Gonzalo mines, which are currently in operation, and the potential tailings resource from previous milling operations. The San Gonzalo Mine entered commercial production in October 2012, followed by reopening the Avino Mine in January 2015. The two mines feed a conventional flotation mill that has three separate circuits and a capacity of 1,500 t/d.

From January 2017, Avino has been constructing a new separate processing line identified as Circuit #4. The addition of Circuit #4 will have an identical throughput capacity as Circuit #3 which currently used for processing the materials from the Avino mine. The mill expansion is expected to increase overall mill capacity to 2,500 t/d.

The existing crushing plant will be upgraded to accommodate the higher throughput with a new larger tertiary cone crusher. The equipment in grinding, flotation and dewatering circuits planned for the expansion are similar in size to the existing equipment used for Circuit #3. The initial mill feed to Circuit #4 will be from the existing surface stockpiles although the additional circuit will be mainly used for processing the materials from San Luis of the Avino mine.

Avino has not based its production decisions on a Feasibility Study or Mineral Reserves demonstrating economic and technical viability, and as a result there is increased uncertainty and multiple technical and economic risks of failure that are associated with these production decisions. These risks, among others, include areas that would be analyzed in more detail in a Feasibility Study, such as applying economic analysis to Mineral Resources and Mineral Reserves, more detailed metallurgy, and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts. Information in this section was provided by Avino.

1.5.1 AVINO VEIN

Avino is currently conducting mining activity on the Avino Vein and processing Avino Vein material at the mine plant. Historically, prior to the mine shutting down in 2001, Avino operated a 1,000 t/d processing plant, achieving up to 1,300 t/d, producing a copper concentrate that was sold to a smelter in San Luis Potosi for approximately 27 years. The mine and mill operations were then suspended. Following several years of redevelopment, Avino completed the Avino Mine and mill expansion in Q4 2014. On January 1, 2015, full scale operations commenced and commercial production was declared effective April 1, 2016 following a 19 month advancement and test period.

The plant consists of a conventional three-stage crushing circuit with the tertiary crusher in closed circuit with a screen. The crushed material is fed to a ball mill and classified with a hydrocyclone at a grind size of approximately 65% passing 200 mesh. The fines from the hydrocyclone reports to the flotation circuit where typical flotation reagents for copper minerals are used. The concentrates from the rougher and scavenger circuits are upgraded in a cleaner circuit with the final concentrate reporting to a thickener and pressure filter. The moisture of the filter cake is approximately 8% and then shipped for sale overseas. Flotation tailing is pumped to the permitted tailings impoundment where decant water is reclaimed for process use.

Avino Silver & Gold Mines Ltd. | 1-7 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

1.5.2 SAN GONZALO VEIN

Avino is currently conducting mining activity on the San Gonzalo Vein, including processing of San Gonzalo Vein material at the mill plant at the Avino Mine site.

The process plant consists of crushing and grinding circuits, followed by a gravity and flotation to recover and upgrade silver and gold from the feed material. Common reagents are used within the flotation circuit. The flotation concentrate is thickened, filtered to 9.9% moisture content, and sent to the concentrate stockpile for subsequent shipping to customers.

The final flotation tailings is disposed of in the existing permitted tailings storage facility.

1.5.3 OXIDE TAILINGS

Currently there is no metal recovery operation on the stored tailings. As reported by MineStart Management Inc. (MMI) and Process Research Associates Ltd. (PRA), several metallurgical work programs were conducted to investigate silver and gold recovery from the tailings.

The test work investigated various treatment methods, including gravity separation, flotation, and cyanide leaching (tank leaching and heap leaching). The preliminary test results appear to show that the tailings materials responded reasonably well to the cyanide leaching treatment, including tank leaching and column leaching testing procedures. An updated preliminary economical assessment was conducted in 2017 to evaluate the recovery of silver and gold from the oxide tailings using heap leaching technology followed by the Merrill Crown treatment on the pregnant leach solution .

The processing step will consist of tailings reclamation, agglomeration, and cyanide heap leaching followed by the Merrill-Crowe process to recover silver and gold from the pregnant solution. The process plant will operate at a throughput rate of 1,370 t/d on a 24 h/d, 365 d/a basis, with an overall utilization of 90%.

1.5.4 SULPHIDE TAILINGS

Avino is not currently conducting mining activity on the sulphide tailings. Because some of the oxide tailings and sulphide tailings were co-deposited, and the oxide tailings are partially covered by younger unconsolidated sulphide tailings on the northwest side of the tailings storage dam, the sulphide tailings materials will be reclaimed as required during the oxide tailings reclamation. The reclaimed sulphide tailings is planned to be stored in a separate sulphide tailings storage facility for further evaluation, while some of the sulphide tailings could be used for constructing the heap leach pad and facilities for the oxide tailings retreatment; however, no quantities have been estimated at this stage. In addition, no recovery methods are currently proposed for the sulphide tailings, which have been excluded from this estimate.

Avino Silver & Gold Mines Ltd. | 1-8 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

1.6 MINING METHODS

1.6.1 AVINO VEIN

Avino is currently conducting mining activity on the Avino Vein using sublevel stoping and room and pillar mining methods.

Avino has not based its production decisions on a Feasibility Study or Mineral Reserves demonstrating economic and technical viability, and as a result there is increased uncertainty and multiple technical and economic risks of failure that are associated with these production decisions. These risks, among others, include areas that would be analyzed in more detail in a Feasibility Study, such as applying economic analysis to Mineral Resources and Mineral Reserves, more detailed metallurgy, and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts. Information in this section was provided by Avino.

Production from the Avino Vein is summarized in Table 1.2.

Table 1.2 Recent Production from the Avino Vein

Production Description | | 2015 | | | 2016 | | | 2017 | |

Mill Feed Tonnage | |

Tonnes Milled (t) | | | 396,113 | | | | 429,289 | | | | 460,890 | |

Feed Grade |

Silver (g/t) | | | 65 | | | | 67 | | | | 64 | |

Gold (g/t) | | | 0.29 | | | | 0.42 | | | | 0.52 | |

Copper (%) | | | 0.62 | | | | 0.50 | | | | 0.48 | |

Recovery |

Silver (%) | | | 87 | | | | 85 | | | | 85 | |

Gold (%) | | | 75 | | | | 64 | | | | 69 | |

Copper (%) | | | 87 | | | | 90 | | | | 89 | |

Total Metal Produced |

Silver Produced (oz) | | | 717,901 | | | | 789,372 | | | | 803,438 | |

Gold Produced (oz) | | | 2,757 | | | | 3,691 | | | | 5,259 | |

Copper Produced (lb) | | | 4,743,691 | | | | 4,206,585 | | | | 4,373,166 | |

AgEQ Produced (oz) | | | 1,801,997 | | | | 1,606,272 | | | | 1,911,428 | |

Source: Avino (2018c; 2017a; 2017b)

Avino Silver & Gold Mines Ltd. | 1-9 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

1.6.2 SAN GONZALO VEIN

Avino is currently conducting mining activity on the San Gonzalo Vein using cut-and-fill and shrinkage stoping mining methods.

Avino has not based its production decisions on a Feasibility Study or Mineral Reserves demonstrating economic and technical viability, and as a result there is increased uncertainty and multiple technical and economic risks of failure that are associated with these production decisions. These risks, among others, include areas that would be analyzed in more detail in a Feasibility Study, such as applying economic analysis to Mineral Resources and Mineral Reserves, more detailed metallurgy, and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts. Information in this section was provided by Avino.

Production from the San Gonzalo Vein is summarized in Table 1.3.

Table 1.3 Recent Production from the San Gonzalo Vein

Production Description | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | |

Mill Feed Tonnage | |

Total Mill Feed (t) | | | 19,539 | | | | 78,415 | | | | 79,729 | | | | 121,774 | | | | 115,047 | | | | 81,045 | |

Feed Grade |

Silver (g/t) | | | 259 | | | | 288 | | | | 337 | | | | 279 | | | | 267 | | | | 269 | |

Gold (g/t) | | | 1.04 | | | | 1.34 | | | | 1.88 | | | | 1.48 | | | | 1.25 | | | | 1.32 | |

Recovery |

Silver (%) | | | 79 | | | | 83 | | | | 84 | | | | 83 | | | | 83 | | | | 84 | |

Gold (%) | | | 70 | | | | 73 | | | | 78 | | | | 75 | | | | 74 | | | | 78 | |

Total Produced |

Silver (oz) | | | 128,607 | | | | 602,233 | | | | 724,931 | | | | 907,384 | | | | 822,689 | | | | 590,765 | |

Gold (oz) | | | 455 | | | | 2,473 | | | | 3,740 | | | | 4,326 | | | | 3,427 | | | | 2,675 | |

AgEQ Produced (oz) | | | 151,372 | | | | 751,462 | | | | 958,702 | | | | 1,218,351 | | | | 1,073,062 | | | | 789,157 | |

Source: Avino (2018c; 2017a; 2017b)

1.6.3 OXIDE TAILINGS

The oxide tailings Mineral Resource will be mined/moved using a conventional truck/loader surface mining method. The production cycle consists of loading and trucking. The production schedule has been developed for the oxide tailings based on a treatment rate of 500 kt/a, which would be equivalent to a throughput rate of 1,370 t/d. This will give an overall project duration of approximately eight years. This eight-year period includes a one-year pre-production period and excludes the time required for remediation of the heap after the leaching process has been completed. Only oxide tailings will be considered for treatment, while sulphide materials will be considered waste.

Avino Silver & Gold Mines Ltd. | 1-10 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

1.7 PROJECT INFRASTRUCTURE

The Property is easily accessible by road and is an important part of the local community from which skilled workers are available. The history of operations at the Avino Mine provides ample evidence of sufficient infrastructure and services in the area. The San Gonzalo Mine entered commercial production in October 2012, followed by reopening the Avino Mine in January 2015. The two mines feed a conventional flotation mill that has three separate circuits and a capacity of 1,500 t/d. From January 2017, Avino has been constructing a new separate processing line identified as Circuit #4. The addition of Circuit #4 will have an identical throughput capacity as Circuit #3 which currently used for processing the materials from the Avino mine. The existing crushing plant will be upgraded to accommodate the higher throughput with a new larger tertiary cone crusher. The mill expansion is expected to increase overall mill capacity to 2,500 t/d.

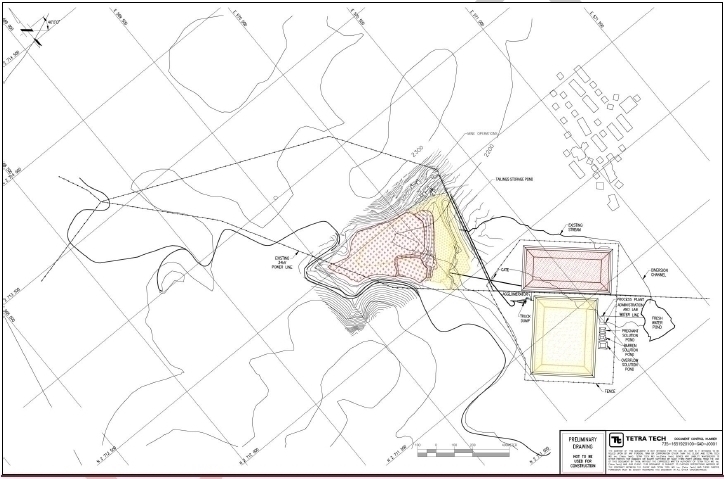

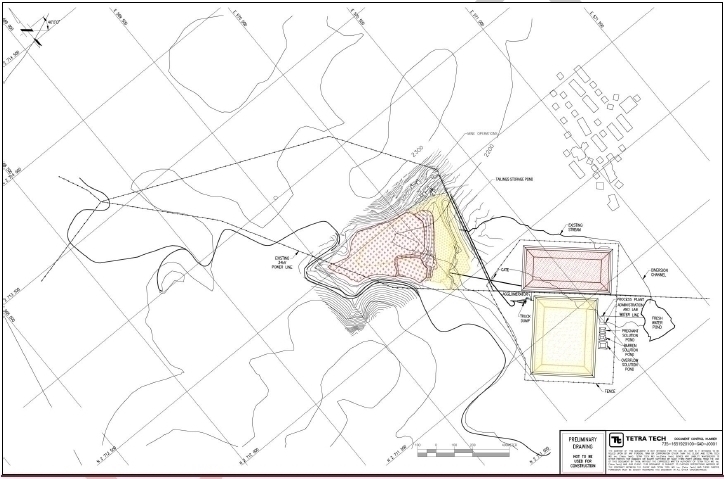

The existing tailings deposition facility has been upgraded and is fully permitted and operational for approximately another 500,000 t of tailings. The offices, miner’s quarters, secured explosives storage facilities, warehouse, laboratory and other associated facilities are all in place. The proposed tailings leach facilities are planned to be located southeast of the existing tailings storage pond.

Before 2016, the mill was serviced with an existing power line providing only 1,000 kW of power with 500 kW servicing the mill, 400 kW for San Gonzalo and the balance for the well at Galeana, employee accommodation facility, and water reclaim from the tailings dam. The new power line from Guadelupe Victoria to the mine site was completed in June 2016. The power line was energized and tested on June 8th, 2016. The line was fully functional at the design capacity of 5 MW. Current power consumption at the mine is approximately 2 MW, leaving sufficient additional power for potential future expansion projects, including the planned Circuit #4 mill expansion, the proposed oxide tailings retreatment project using heap leach followed by gold and silver recovery by Merrill-Crowe precipitation and possible further expansion or upgrading of the processing plant. Additionally, the existing power line was left in place to service local communities and provide backup power for the mine. A C-27 CAT diesel power generator, which can produce 700 kW, is now used as backup.

There is a water treatment plant for treating excess water from the Avino underground mine operation before discharging to El Caracol Dam. The effluent is being monitored on a daily basis when the treatment plant is operational.

1.8 ENVIRONMENTAL

Environmental settings, permits and registrations, and environmental management strategies that may be required for the Project are summarized in Section 20.0. Permits and authorizations required for the operation of the Project may include an operating permit, an application for surface tenures, a waste water discharge registration, a hazardous waste generator’s registration, and an Environmental Impact Assessment (EIA) or Evaluación de Impacto Ambiental. Acid-base accounting (ABA) tests have indicated that mild acid generation may already have started on the tailings dam. A gap analysis and additional tests to further characterize current conditions of the tailings should be completed to properly design a tailings management plan.

Avino Silver & Gold Mines Ltd. | 1-11 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

1.9 CAPITAL AND OPERATING COSTS

1.9.1 CAPITAL COST ESTIMATES

AVINO VEIN AND SAN GONZALO VEIN

Avino is currently conducting mining activity on the Avino and San Gonzalo veins. There is no cost estimate applicable and all costs are based on actual expenditure.

Avino has not based its production decisions on a Feasibility Study or Mineral Reserves demonstrating economic and technical viability, and as a result there is increased uncertainty and multiple technical and economic risks of failure that are associated with these production decisions. These risks, among others, include areas that would be analyzed in more detail in a Feasibility Study, such as applying economic analysis to Mineral Resources and Mineral Reserves, more detailed metallurgy, and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts.

The actual capital expenditures (in US dollars) to date on the Avino Vein and San Gonzalo Vein operations are summarized in Table 1.4 and Table 1.5, respectively. The capital expenditures have been broken down by year and area.

Table 1.4 Capital Costs for the Avino Vein (US$)

Description | | Q1-Q3 2017 | | | 2016 | | | 2015 | | | 2014 | |

Office Furniture | | | 19,035 | | | | 8,625 | | | | 7,093 | | | | 6,521 | |

Computer Equipment | | | 5,023 | | | | 14,913 | | | | 17,233 | | | | 33,178 | |

Mill Machinery and Processing Equipment | | | 703,475 | | | | 70,653 | | | | 525,067 | | | | 2,832,627 | |

Mine Machinery and Transportation Equipment | | | 203,922 | | | | 1,985,446 | | | | 1,918,764 | | | | 2,125,229 | |

Buildings and Construction | | | 1,985,450 | | | | 485,757 | | | | 590,639 | | | | 313,875 | |

ET Mineral Property | | | 609,423 | | | | 4,330,125 | | | | 0 | | | | 0 | |

Total Capital Costs | | | 3,526,327 | | | | 6,895,518 | | | | 3,058,796 | | | | 5,311,429 | |

Source: Avino

Avino Silver & Gold Mines Ltd. | 1-12 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

Table 1.5 Capital Costs for the San Gonzalo Vein (US$)

Description | | Q1-Q3 2017 | | | 2016 | | | 2015 | | | 2014 | |

Office Furniture | | | 16,119 | | | | 7,248 | | | | 3,725 | | | | 6,521 | |

Computer Equipment | | | 4,973 | | | | 12,575 | | | | 17,233 | | | | 32,937 | |

Mill Machinery and Processing Equipment | | | 951,881 | | | | 188,884 | | | | 100,537 | | | | 264,178 | |

Mine Machinery and Transportation Equipment | | | 181,954 | | | | 40,294 | | | | 133,248 | | | | 646,981 | |

Buildings and Construction | | | 76,773 | | | | 443,135 | | | | 55,819 | | | | 356,300 | |

San Gonzalo Vein Mineral Property | | | 332,073 | | | | 1,080,889 | | | | 577,462 | | | | 697,107 | |

ET Mineral Property | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

Total Capital Costs | | | 1,563,774 | | | | 1,773,024 | | | | 888,024 | | | | 2,004,023 | |

Source: Avino

TAILINGS RESOURCES

The capital costs for retreating the oxide tailings portion of the Property, including reclaiming the oxide tailings, constructing the heap leach pad and the treatment facilities, were estimated and reported in the technical report entitled “Technical Report on the Avino Property”, dated April 11, 2017.

The estimated capital cost was US$28.8 million (US$24.4 million of initial capital plus US$4.4 million sustaining capital).

A PEA should not be considered to be a Prefeasibility or Feasibility study, as the economics and technical viability of the Project have not been demonstrated at this time. The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Furthermore, there is no certainty that the conclusions or results reported in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Avino is not currently conducting mining activity on the sulphide tailings portion of the Property. No capital costs have been estimated for any potential mining activity on the sulphide tailings portion of the Property.

1.9.2 OPERATING COST ESTIMATES

AVINO VEIN AND SAN GONZALO VEIN

Avino is currently conducting mining activity on the Avino and San Gonzalo veins. There is no cost estimate applicable and all costs are based on actual expenditures.

Avino has not based its production decisions on a Feasibility Study or Mineral Reserves demonstrating economic and technical viability, and as a result there is increased uncertainty and multiple technical and economic risks of failure that are associated with these production decisions. These risks, among others, include areas that would be analyzed in more detail in a Feasibility Study, such as applying economic analysis to Mineral Resources and Mineral Reserves, more detailed metallurgy, and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts.

Avino Silver & Gold Mines Ltd. | 1-13 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

The actual operating costs (in US dollars) for the Avino Vein and the San Gonzalo Vein in 2016 and 2017 are presented in Table 1.6 and Table 1.7.

The mine and milling costs include operating and maintenance labour together with the operation associated consumable supplies. The cost for electrical power is included in the milling costs. The geological component is mostly related to technical labour.

Table 1.6 Operating Costs for the Avino Vein (US$)

Description | | Q1-Q3 2017 | | | 2016 | |

Mining Cost | | | 5,046,904 | | | | 5,306,208 | |

Milling Cost | | | 3,214,053 | | | | 2,947,585 | |

Geological and Other | | | 2,571,758 | | | | 2,300,243 | |

Royalties | | | 544,571 | | | | 610,797 | |

Depletion and Depreciation | | | 1,079,003 | | | | 919,756 | |

Total Direct Costs | | | 12,456,289 | | | | 12,084,590 | |

G&A | | | 3,295,481 | | | | 2,817,256 | |

Total Operating Costs | | | 15,751,770 | | | | 14,901,845 | |

Source: Avino

Table 1.7 Operating Costs for the San Gonzalo Vein (US$)

Description | | Q1-Q3 2017 | | | 2016 | |

Mining Cost | | | 2,340,070 | | | | 1,798,503 | |

Milling Cost | | | 495,546 | | | | 212,467 | |

Geological and Other | | | 487,751 | | | | 318,843 | |

Royalties | | | 0 | | | | 0 | |

Depletion and Depreciation | | | 675,072 | | | | 485,732 | |

Total Direct Costs | | | 3,998,439 | | | | 2,815,545 | |

G&A | | | 1,063,226 | | | | 607,351 | |

Total Operating Costs | | | 5,061,666 | | | | 3,422,897 | |

Source: Avino

TAILINGS RESOURCES

The operating costs for retreating the oxide tailings portion of the Property, including reclaiming the oxide tailings, were estimated to be US$15.06/t. The detailed estimates are reported in the technical report entitled “Technical Report on the Avino Property”, dated April 11, 2017.

A PEA should not be considered to be a Prefeasibility or Feasibility study, as the economics and technical viability of the Project have not been demonstrated at this time. The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Furthermore, there is no certainty that the conclusions or results reported in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Avino Silver & Gold Mines Ltd. | 1-14 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

Avino is not currently conducting mining activity on the sulphide tailings portion of the Property. No operating costs have been estimated for any potential mining activity on the sulphide tailings portion of the Property.

1.10 ECONOMIC ANALYSIS

1.10.1 AVINO AND SAN GONZALO VEINS

Avino is currently conducting mining activity, including mineral processing, on the Avino and San Gonzalo Veins. There is no economic analysis performed on both the Veins.

Avino has not based its production decisions on a Feasibility study or Mineral Reserves demonstrating economic and technical viability, and as a result there is increased uncertainty and multiple technical and economic risks of failure, which are associated with these production decisions. These risks, among others, include areas that would be analyzed in more detail in a Feasibility study, such as applying economic analysis to Mineral Resources and Mineral Reserves, more detailed metallurgy, and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts.

1.10.2 TAILINGS RESOURCES

In 2017, Tetra Tech prepared a preliminary economic assessment (PEA) technical report for the silver and gold recoveries from the oxide tailings, entitled “Technical Report on the Avino Property”, dated April 11, 2017.

A PEA should not be considered to be a Prefeasibility or Feasibility study, as the economics and technical viability of the Project have not been demonstrated at this time. The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Furthermore, there is no certainty that the conclusions or results reported in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Avino Silver & Gold Mines Ltd. | 1-15 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

The report includes a preliminary economic evaluation for the oxide tailings retreatment based on a pre-tax financial model. Metal prices used in the base case for the preliminary economic evaluation were:

| · | gold – US$1,250/oz |

| | |

| · | silver – US$18.50/oz. |

The pre-tax financial results were:

| · | 48.4% internal rate of return (IRR) |

| | |

| · | 2.0-year payback period |

| | |

| · | US$40.5 million net present value (NPV) at an 8% discount rate. |

Avino commissioned PricewaterhouseCoopers (PwC) in Vancouver to prepare the tax component of the model for the post-tax economic evaluation for this updated PEA with the inclusion of applicable income and mining taxes.

The following post-tax financial results were calculated:

| · | 32% IRR |

| | |

| · | 2.6-year payback period |

| | |

| · | US$22.2 million NPV at an 8% discount rate. |

Avino is not currently conducting mining activity on the sulphide tailings portion of the Property. No economical assessments have been conducted for any potential mining activity on the sulphide tailings portion of the Property.

1.11 RECOMMENDATIONS

The recommendations for the further Mineral Resource estimates are presented in Section 26.0.

Avino Silver & Gold Mines Ltd. | 1-16 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

Avino is a Canadian-based mining and exploration company listed on the TSX and the NYSE-American trading under the symbol ASM. Avino has precious metal properties in Mexico and Canada and has a head office located at 900-570 Granville Street, Vancouver, British Columbia, Canada, V6C 3P1.

Avino retained Tetra Tech, in conjuction with ARANZ Geo, to prepare an update of resource estimate on the Avino Property in Durango, Mexico. The purpose of this report is to disclose three updated mineral resource estimates for the Avino Vein, the San Gonzalo Vein and Oxide Tailings portions of the Property. The report also includes a summary of the information previously disclosed in Tetra Tech report filed in 2017, comprising preliminary economic assessment on the oxide tailings portion of the Property. This report has been prepared in accordance with National Instrument 43-101 (NI 43-101) and Form 43-101F.

2.1 EFFECTIVE DATES

The effective date of this report is February 21, 2018 and the amended date is December 19th, 2018. The effective date of the Mineral Resource estimate is January 31, 2018.

2.2 QUALIFIED PERSONS

A summary of the Qualified Persons (QPs) responsible for this report is provided in Table 2.1. The following QPs conducted site visits of the Property:

| · | Hassan Ghaffari, P.Eng. M.A.Sc., visited the site March 30, 2011 and December 12, 2017 for two days. |

| | |

| · | Mark Horan, P.Eng. M.Sc., visited the site December12, 2017 for one day. |

| | |

| · | Michael F. O’Brien, P.Geo., M.Sc., Pr.Scit.Nat., FAusIMM, FSAIMM visited the site June 12 to 15, 2017, inclusive. |

Avino Silver & Gold Mines Ltd. | 2-1 | 704-ENG-VMIN03003-02 |

Amended Mineral Resource Estimate Update for the Avino Property, Durango, Mexico | | |

Table 2.1 Summary of QPs

Report Section | | Company | | QP |

1.0 Summary | | All | | Sign-off by Section |

2.0 Introduction | | Tetra Tech | | Hassan Ghaffari, P.Eng. |

3.0 Reliance on Other Experts | | ARANZ Geo Tetra Tech | | Michael F. O’Brien, P.Geo., M.Sc., Pr.Sci.Nat., FAusIMM, FSAIMM Mark Horan., P.Eng. Jianhui (John) Huang, Ph.D., P.Eng. Hassan Ghaffari, P.Eng. |

4.0 Property Description and Location | | ARANZ Geo | | Michael F. O’Brien, P.Geo., M.Sc., Pr.Sci.Nat., FAusIMM, FSAIMM |

5.0 Accessibility, Climate, Local Resources, Infrastructure and Physiography | | ARANZ Geo | | Michael F. O’Brien, P.Geo., M.Sc., Pr.Sci.Nat., FAusIMM, FSAIMM |

6.0 History | | ARANZ Geo | | Michael F. O’Brien, P.Geo., M.Sc., Pr.Sci.Nat., FAusIMM, FSAIMM |

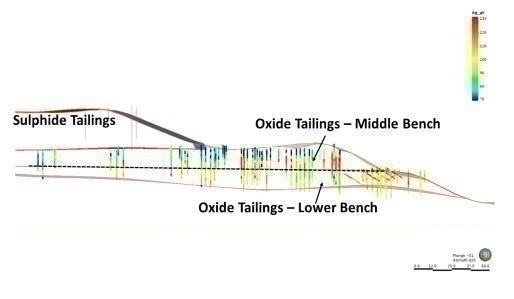

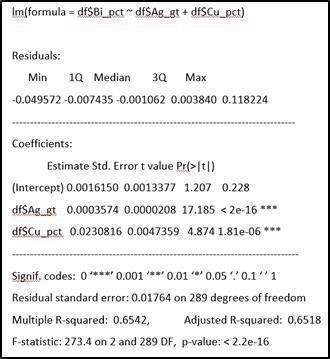

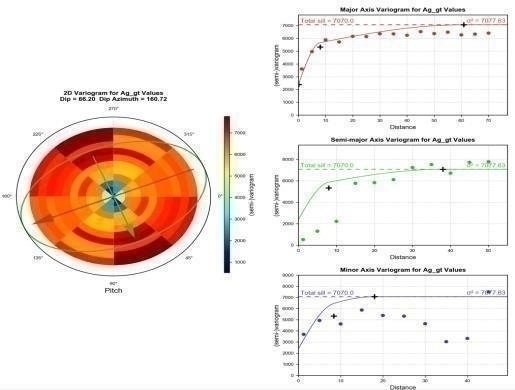

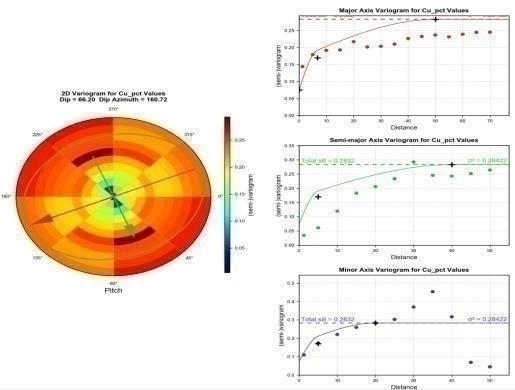

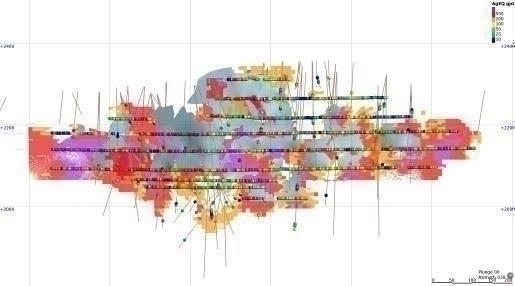

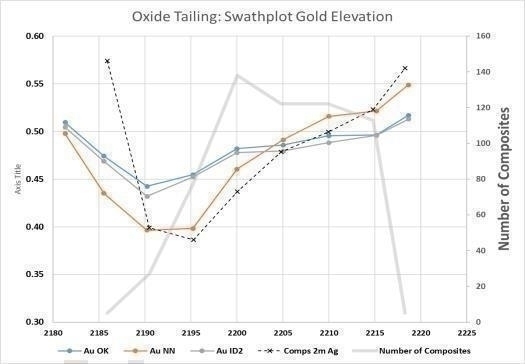

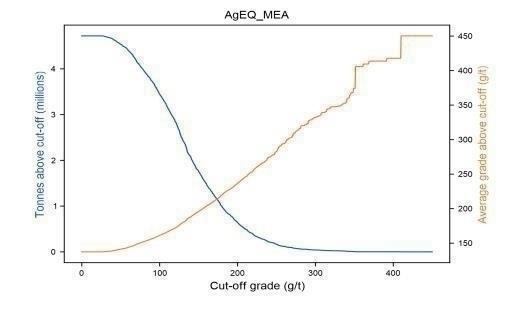

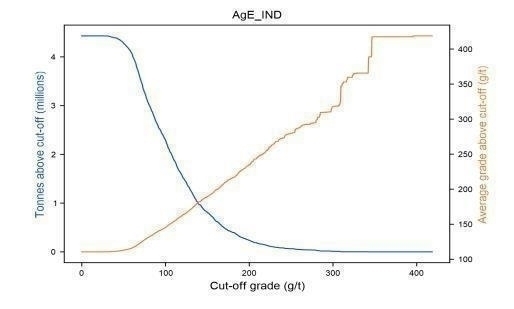

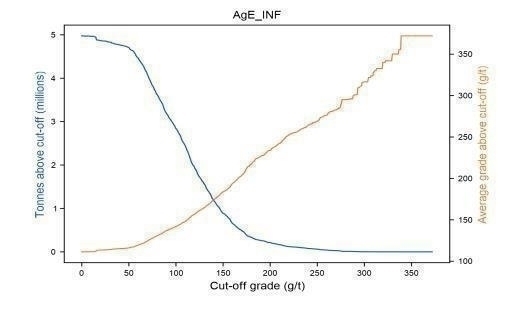

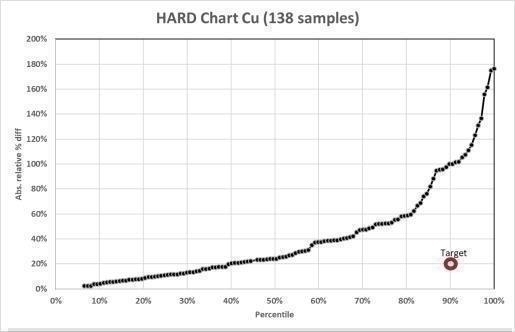

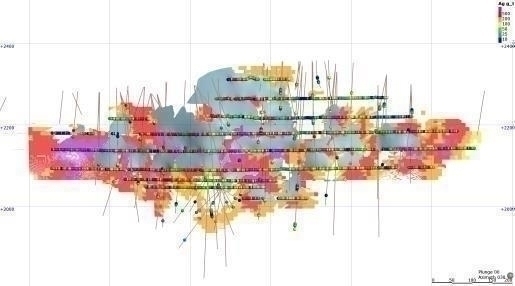

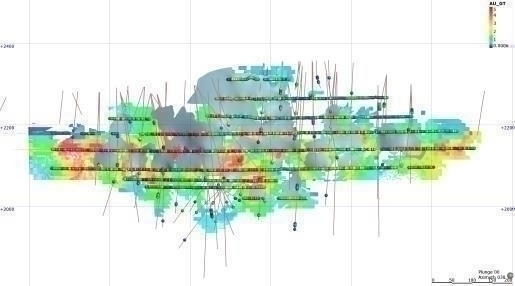

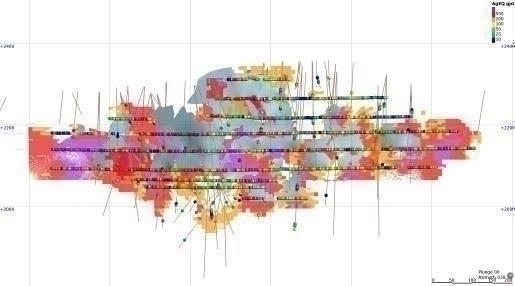

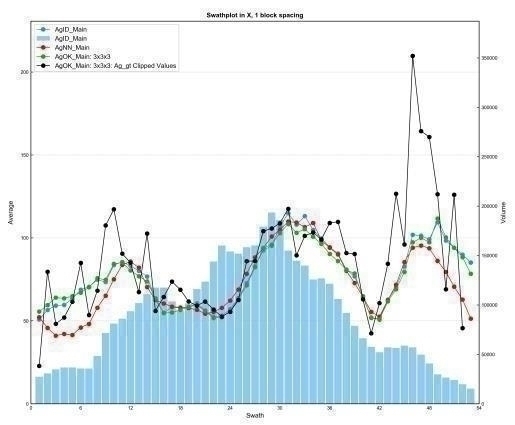

7.0 Geological Setting and Mineralisation | | ARANZ Geo | | Michael F. O’Brien, P.Geo., M.Sc., Pr.Sci.Nat., FAusIMM, FSAIMM |