| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

FORM N-CSR |

| |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| |

| |

| |

| Investment Company Act File Number: 811-2603 |

|

| |

| T. Rowe Price Prime Reserve Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

| |

| |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| |

| |

| Date of fiscal year end: May 31 |

| |

| |

| Date of reporting period: May 31, 2010 |

Item 1: Report to Shareholders| Prime Reserve Fund | May 31, 2010 |

The views and opinions in this report were current as of May 31, 2010. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

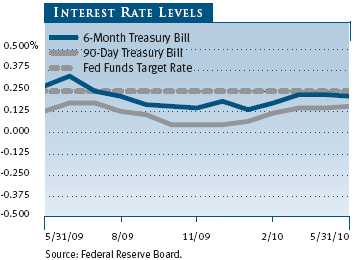

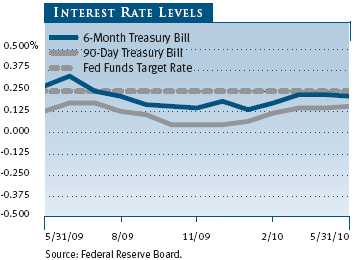

Yields on money market securities remained near all-time lows throughout the 12-month period ended May 31, 2010, as the Federal Reserve kept its fed funds target rate in an all-time low range since the end of 2008. While ultra-low short-term rates provided very little income for money market fund investors over the last year, they continue to lift the economy and financial markets from their dismal state of late 2008 and early 2009.

ECONOMY AND INTEREST RATES

The U.S. economic recovery, which started in the third quarter of 2009, seems to be gaining traction, though questions persist as to its sustainability. According to the most recent estimates, gross domestic product grew at a brisk annualized rate of 5.6% in the fourth quarter of 2009 and 3.0% in the first quarter of 2010. Other encouraging signs include a resumption of employment growth, stabilizing residential real estate markets in some cities, increased demand for automobiles and capital goods, and the significant rebound in equities over the last 12 months. We expect economic growth to moderate in 2010 as concerns of sovereign risk emanating from Europe dampen confidence, thereby limiting job growth, business fixed investment, and consumer spending.

Although the economy is growing again, the Federal Reserve’s commitment to keeping interest rates exceptionally low for an extended period continues to compress all money market rates to near 0%. With no signs of inflation, a stubbornly high unemployment rate, and the persistent drag from the housing slowdown, the Federal Reserve is clearly in no hurry to raise short-term interest rates. Further, the looming sovereign debt crisis that started in Greece and is now slowly spreading to other European countries suggests further incentive for easy monetary policy. The Fed has taken steps away from the emergency measures of 2008–2009, for example, by lifting the discount rate—the interest rate for banks that borrow directly from the central bank—from 0.50% to 0.75% in mid-February, but higher rates remain well into the future.

PORTFOLIO REVIEW

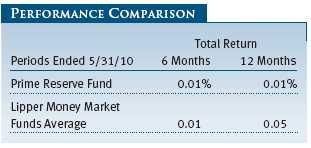

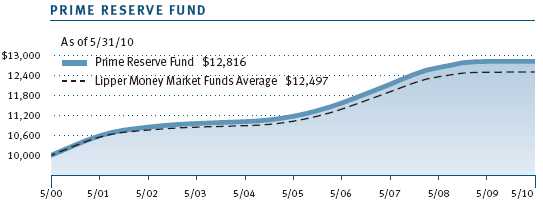

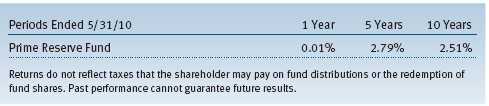

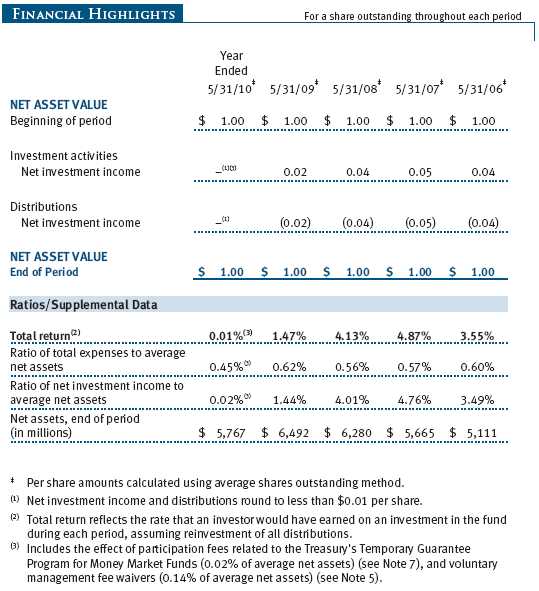

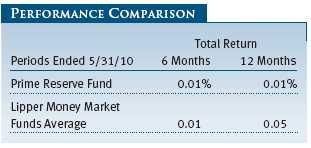

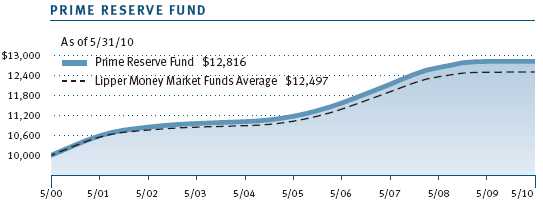

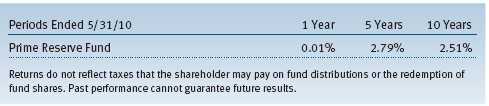

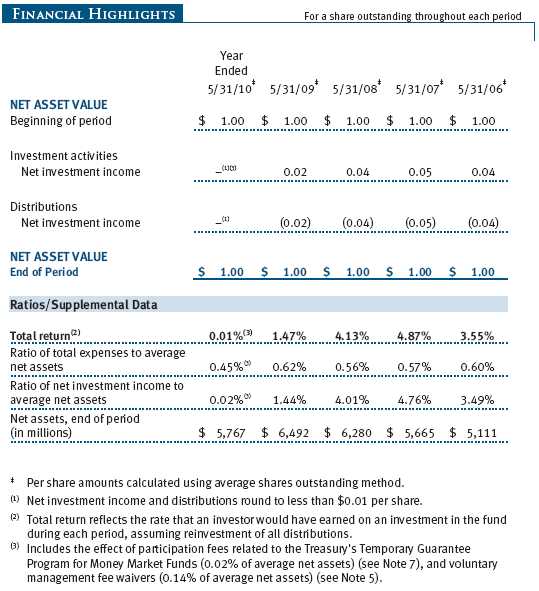

Your fund returned 0.01% in both the 6- and the 12-month periods ended May 31, 2010. As shown in the Performance Comparison table, the fund performed roughly in line with the Lipper Money Market Funds Average in both periods.

While the current extreme low yield environment makes short-term comparisons difficult, the longer-term returns for the fund have placed it consistently in or near the top quartile of all taxable money funds. (Based on cumulative total return, Lipper ranked the Prime Reserve Fund 191 out of 295, 62 out of 280, 51 out of 257, and 40 out of 205 money market instrument funds for the 1-, 3-, 5-, and 10-year periods ended May 31, 2010, respectively. Results will vary for other time periods. Past performance cannot guarantee future results.)

For most of the past six months since our last report, money market rates have crept only marginally higher. “Risk-free” investments such as Treasury bills and agency discount notes have moved higher in yield by eight to 15 basis points. The benchmark 90-day Treasury bill yield rose 11 basis points since our last report, ending May at 0.16%, while yields of agency securities with similar maturities rose 13 basis points to 0.20%. More recently, growing concerns over potentially untenable levels of debt among euro zone countries such as Greece, Portugal, and Spain have directed attention to European banks that own much of that debt. This has resulted in LIBOR rates (a measure of the rates at which banks are willing to lend to each other) moving substantially higher in April and May. The benchmark 90-day LIBOR rate (against which most money market securities are priced), which began the reporting period at 0.25%, ended May at 0.54%—with more than half of that move coming in the last four weeks. A resolution to the European debt crisis will take time, so we expect LIBOR rates to remain high relative to the fed funds target rate of 0.00% to 0.25%.

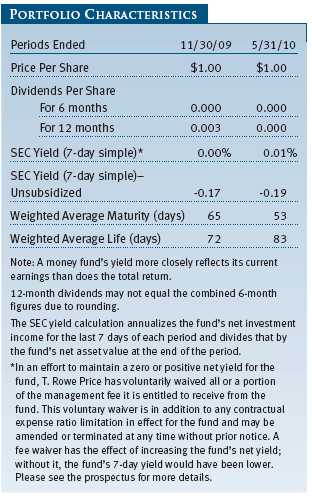

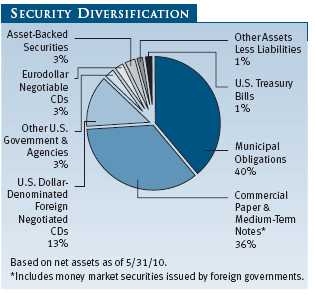

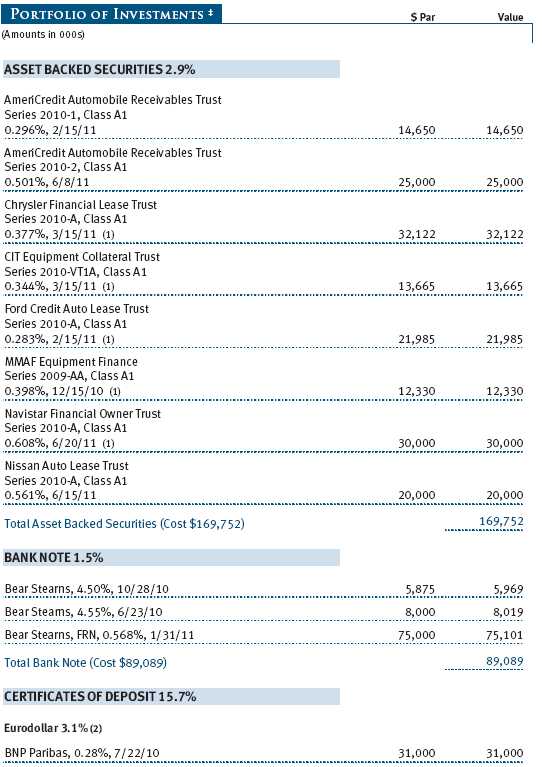

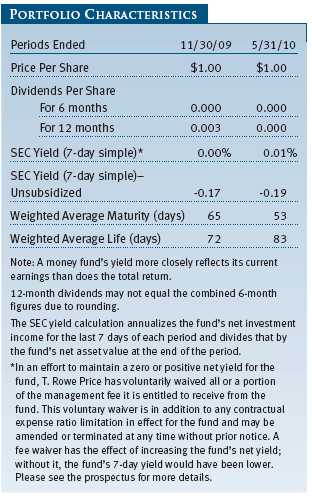

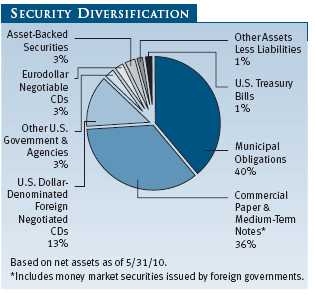

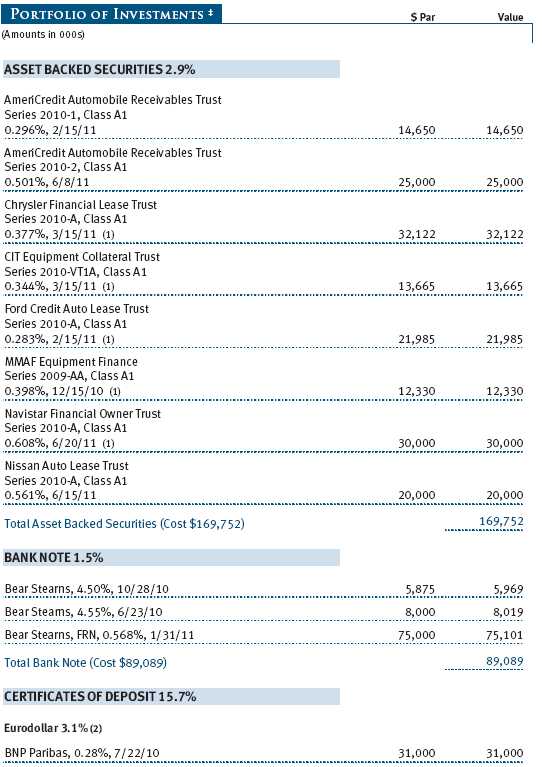

The fund’s strategy has been based upon our assessment that the Fed remains on hold, placing interest rate risk at a minimum. Therefore, we felt comfortable maintaining a weighted average maturity somewhat longer than that of our peer group. While we are comfortable investing in longer-term money market securities, we have remained highly selective in the credit risks we are willing to take. The financials sector still faces serious headwinds, as evidenced by the situation in Europe, and we remain focused on high-quality banks such as JPMorgan Chase, Commonwealth Bank of Australia, and Toronto-Dominion Bank. (Please refer to our portfolio of investments for a complete listing of holdings and the amount each represents in the portfolio.)

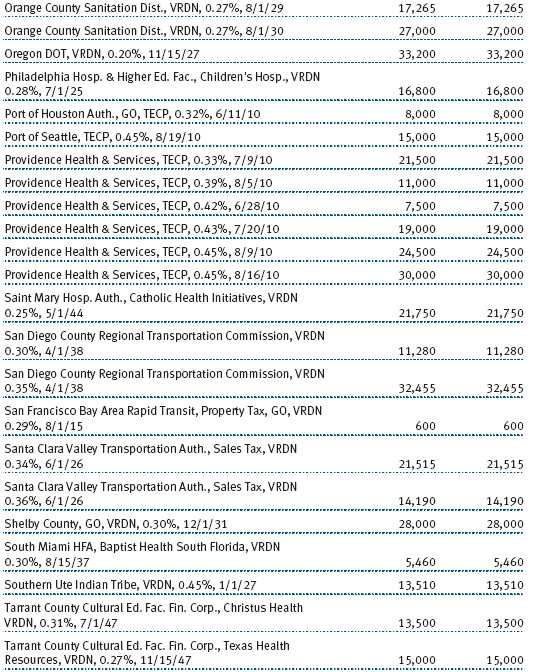

In an unusual turnabout in this low interest rate environment, a significant portion of the portfolio has been invested in municipal debt carrying yields above those of comparable taxable debt. (Municipal yields are usually lower due to their tax-exempt nature.) The majority of these municipal investments features terms of one to seven days as well as additional liquidity support from Tier 1 banks—those that are financially the strongest. With consumer credit trends improving, we continue to add to our investments backed by consumer debt.

OUTLOOK

We expect money market rates to remain compressed near 0% for some time. The current fears that a European debt crisis could grow more prominent make it clear that the global financial system remains fragile and that the process of deleveraging will be quite protracted. In response, we will continue to identify and invest in only the highest-quality names, while maintaining a highly liquid portfolio as we watch for signs of higher rates.

Respectfully submitted,

Joseph K. Lynagh

Chairman of the fund’s Investment Advisory Committee

June 8, 2010

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF INVESTING IN MONEY MARKET SECURITIES

Since money market funds are managed to maintain a constant $1.00 share price, there should be little risk of principal loss. However, there is no assurance the fund will avoid principal losses if fund holdings default or are downgraded or if interest rates rise sharply in an unusually short period. In addition, the fund’s yield will vary; it is not fixed for a specific period like the yield on a bank certificate of deposit. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in it.

GLOSSARY

Fed funds target rate: An overnight lending rate set by the Federal Reserve and used by banks to meet reserve requirements. Banks also use the fed funds rate as a benchmark for their prime lending rates.

LIBOR: The London Interbank Offered Rate is a taxable money market benchmark.

Lipper average: Consists of all the mutual funds in a particular category as tracked by Lipper Inc.

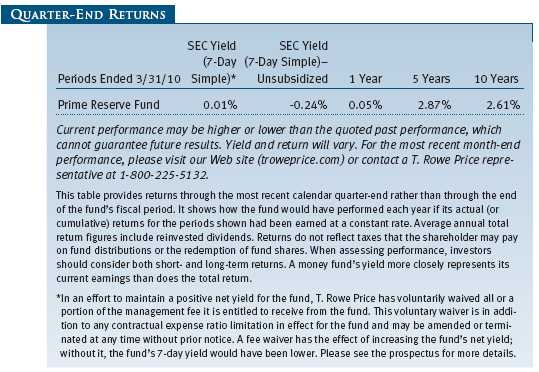

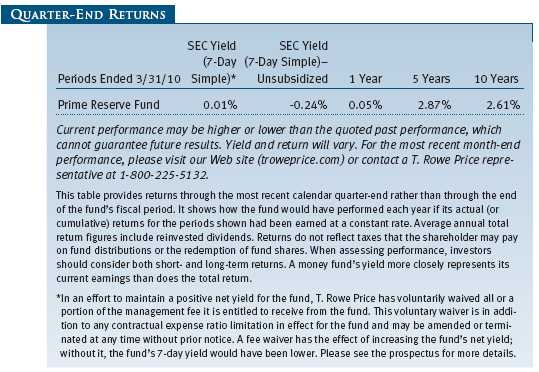

SEC yield (7-day unsubsidized simple): A method of calculating a money fund’s yield by annualizing the fund’s net investment income for the last seven days of each period divided by the fund’s net asset value at the end of the period. Yield will vary and is not guaranteed.

Weighted average life: A measure of a fund’s credit quality risk. In general, the longer the average life, the greater the fund’s credit quality risk. The average life is the dollar-weighted average maturity of a portfolio’s individual securities without taking into account interest rate readjustment dates. Money funds must maintain a weighted average life of less than 120 days.

Weighted average maturity: A measure of a fund’s interest rate sensitivity. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account the interest rate readjustment dates for certain securities. Money funds must maintain a weighted average maturity of less than 60 days.

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate.

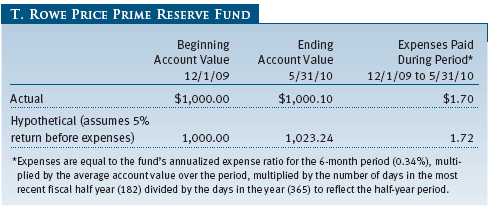

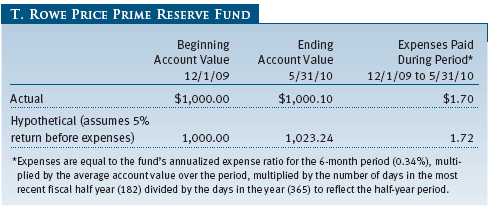

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

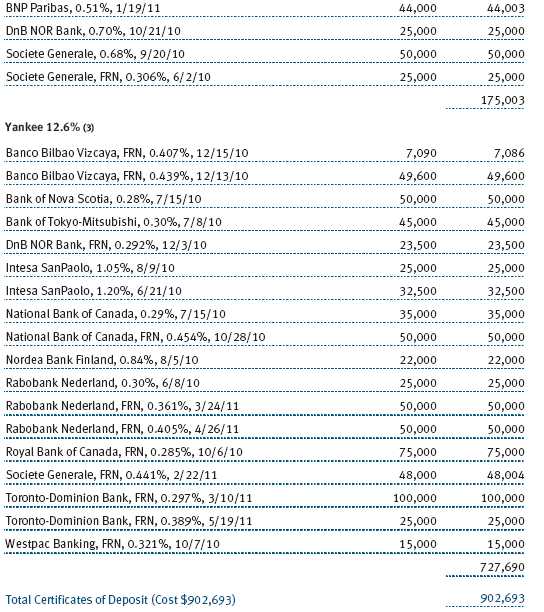

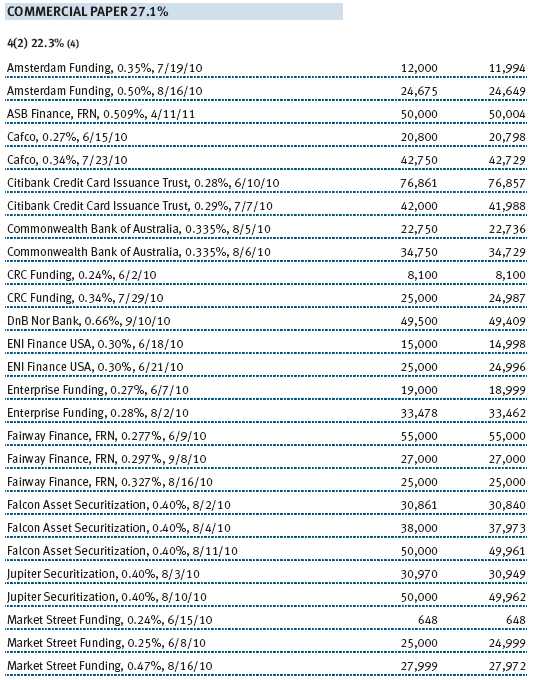

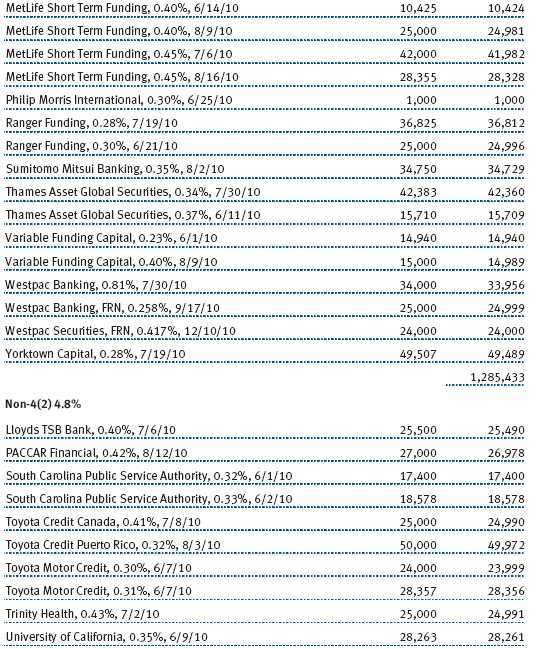

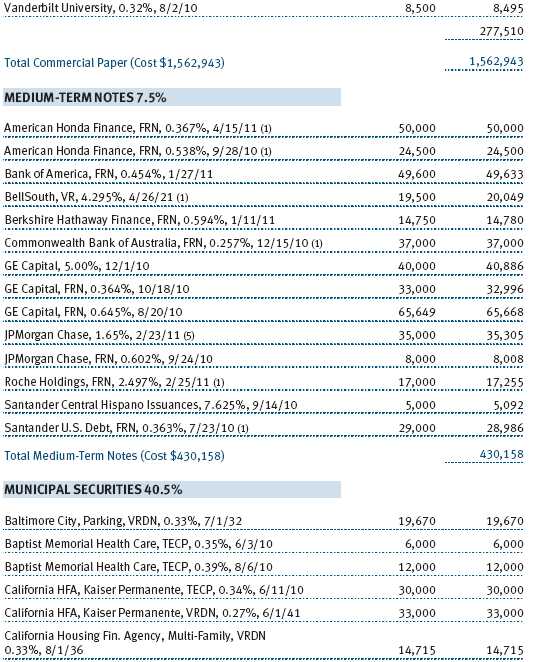

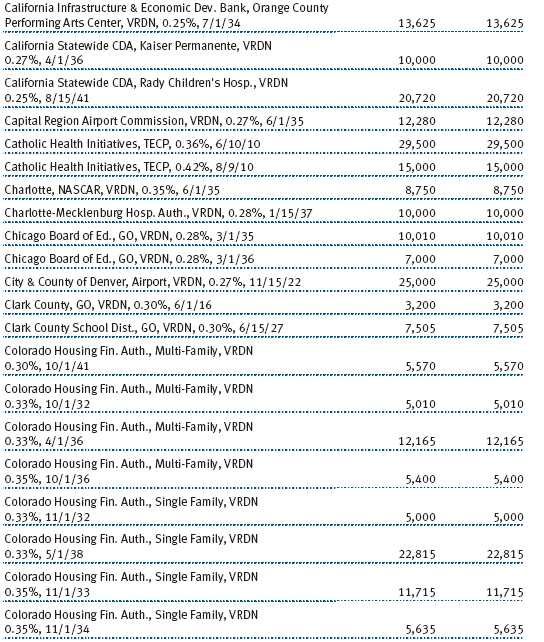

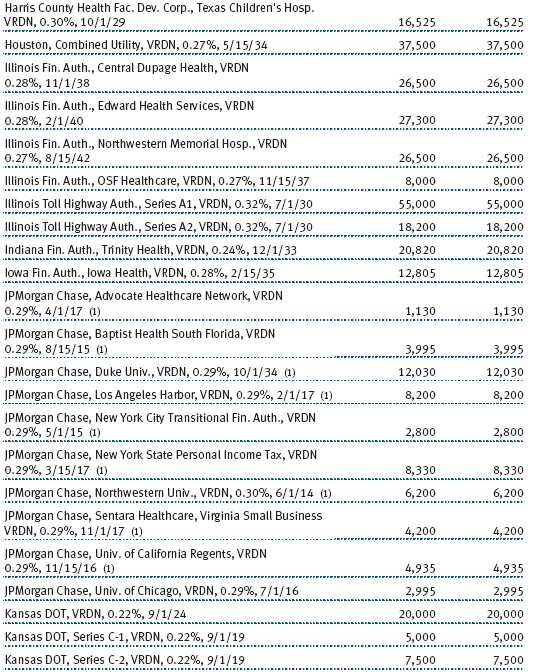

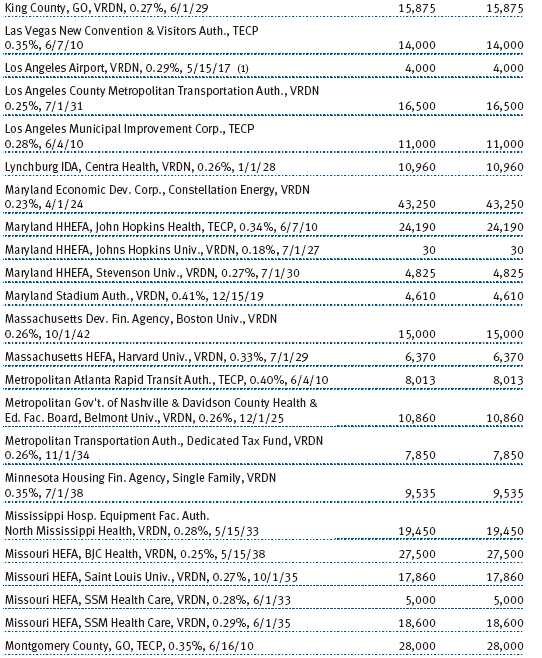

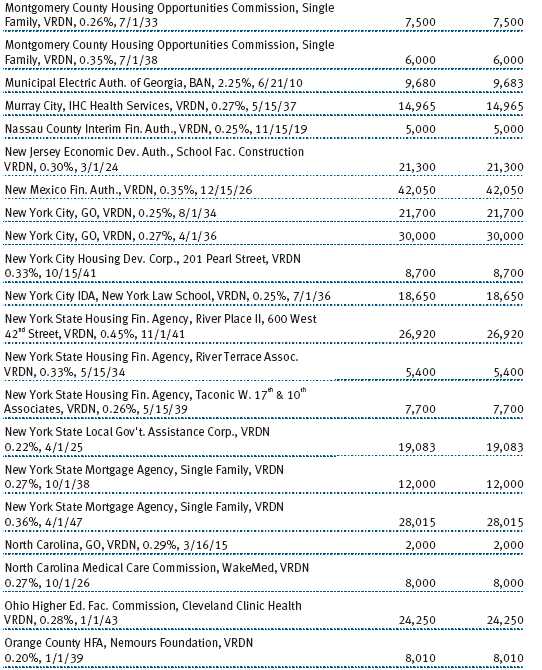

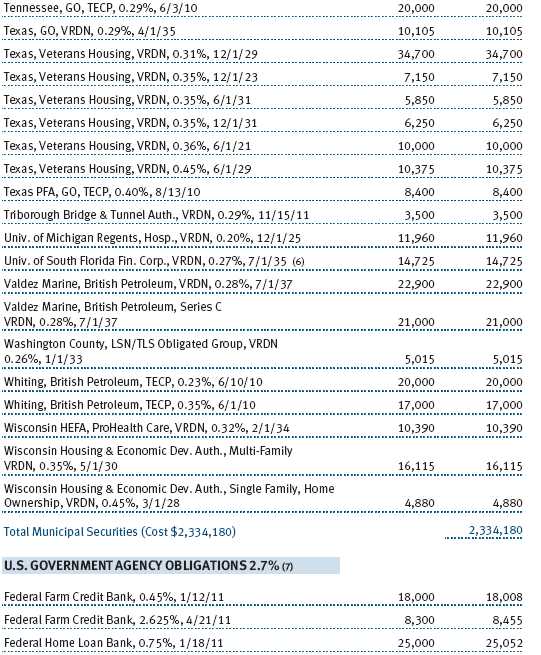

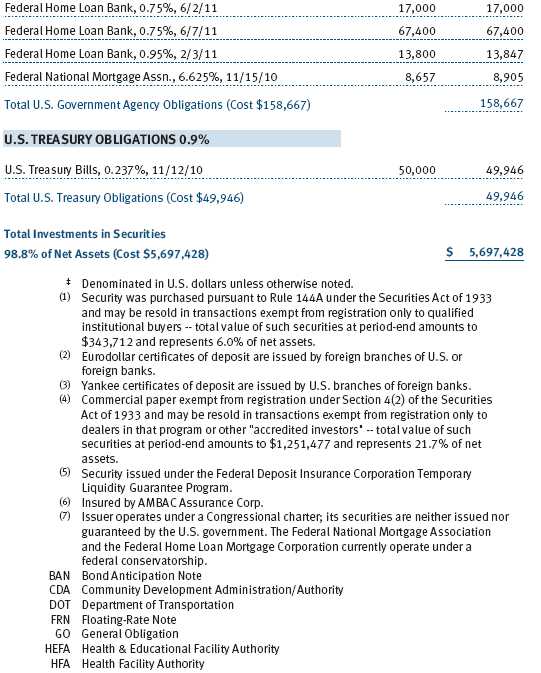

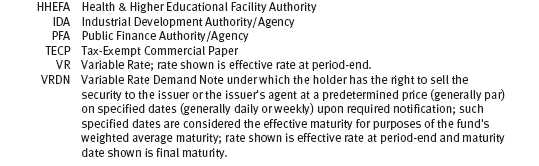

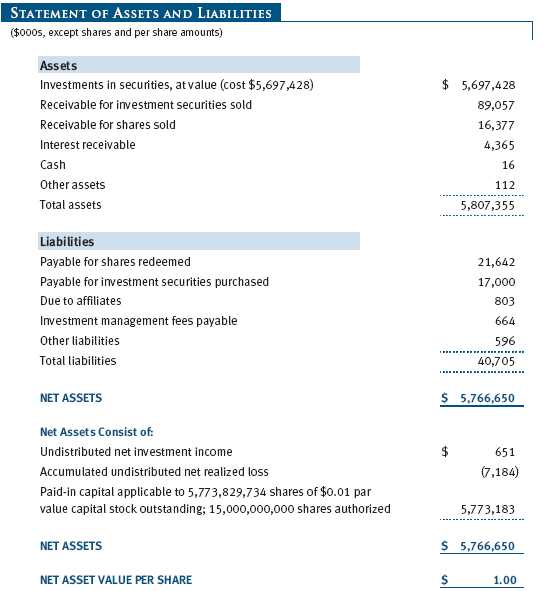

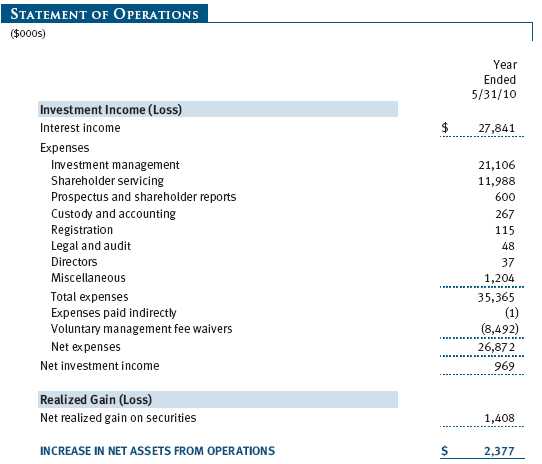

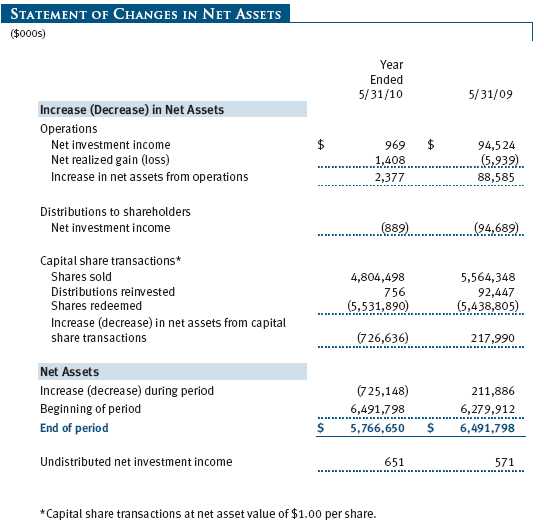

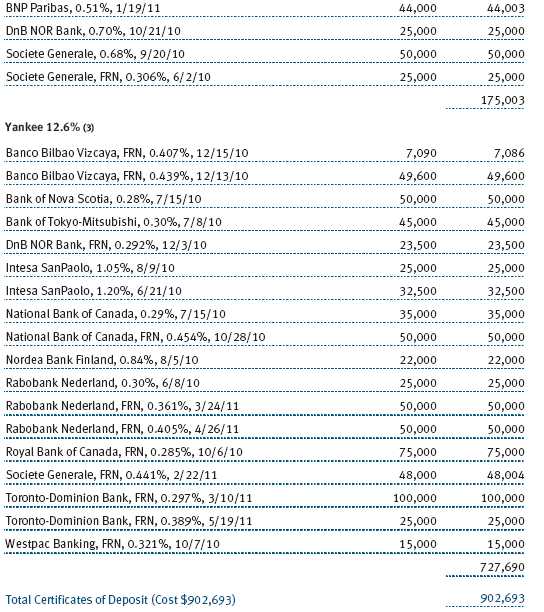

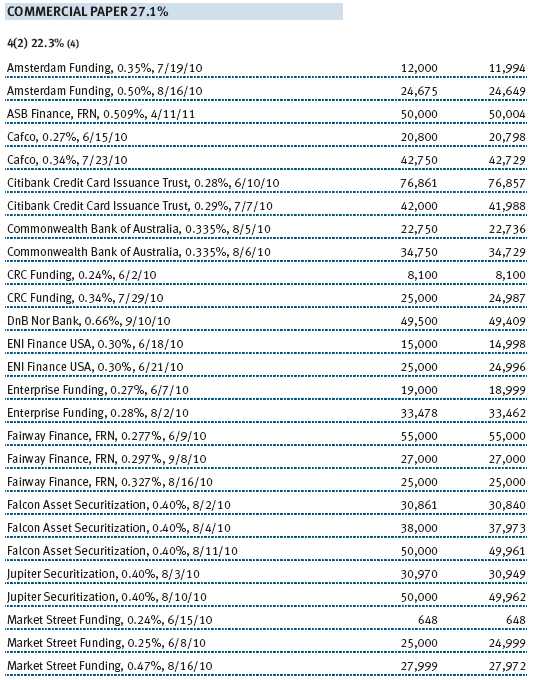

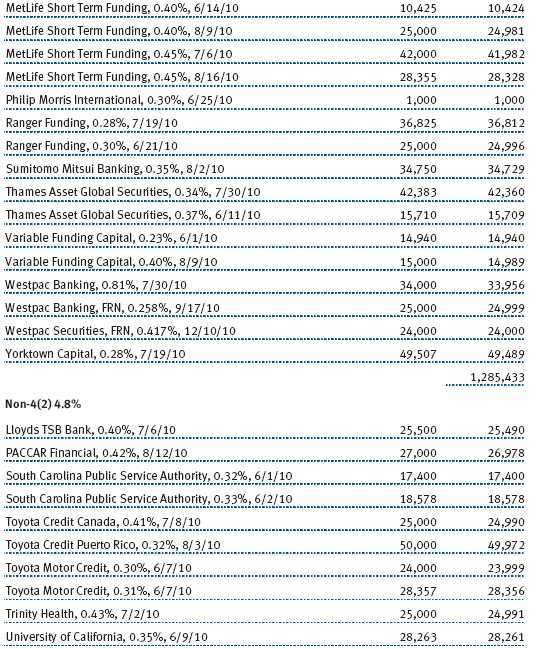

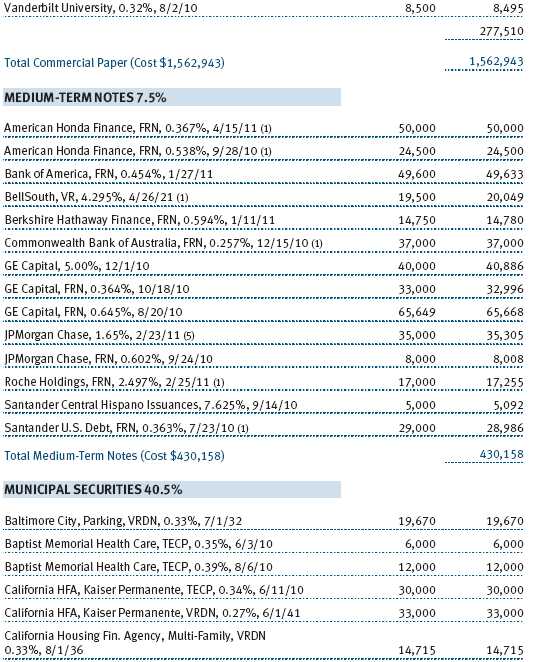

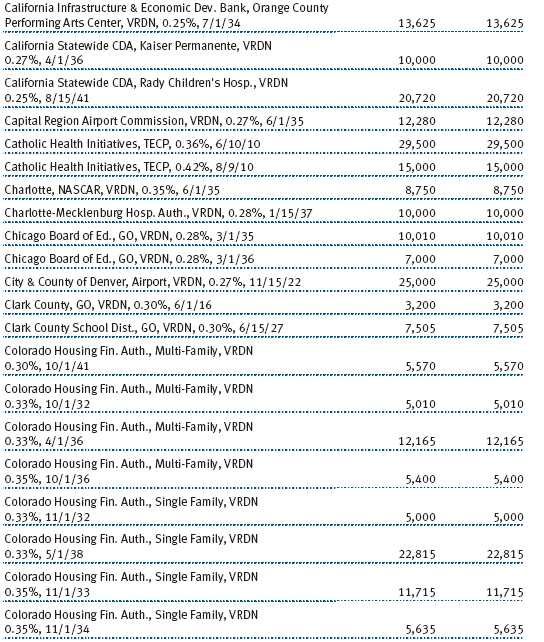

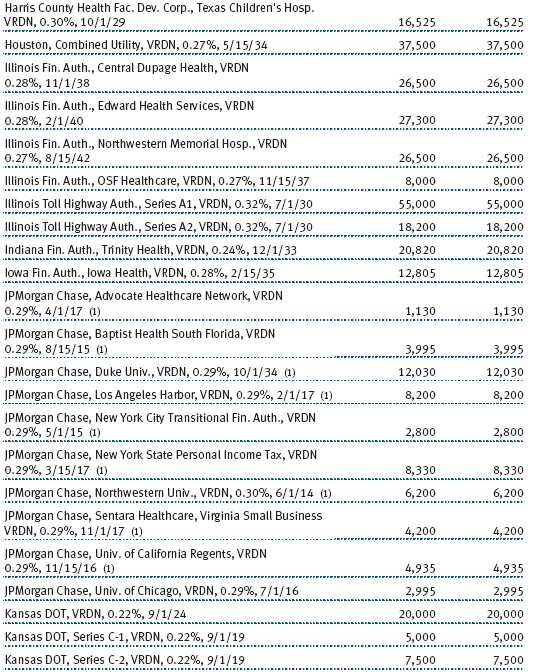

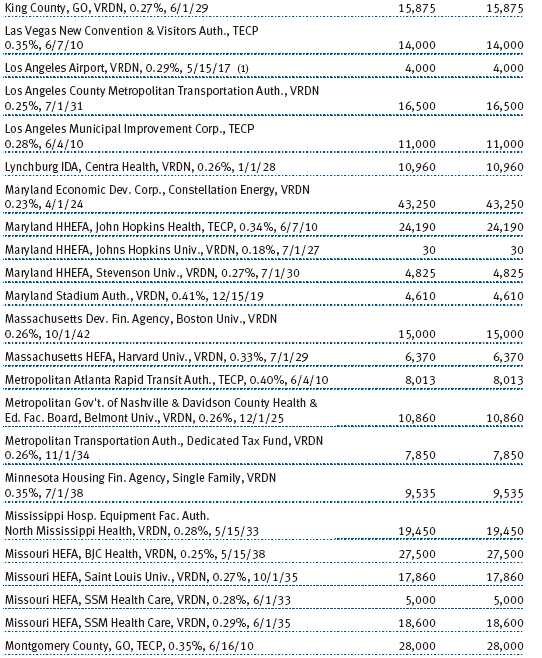

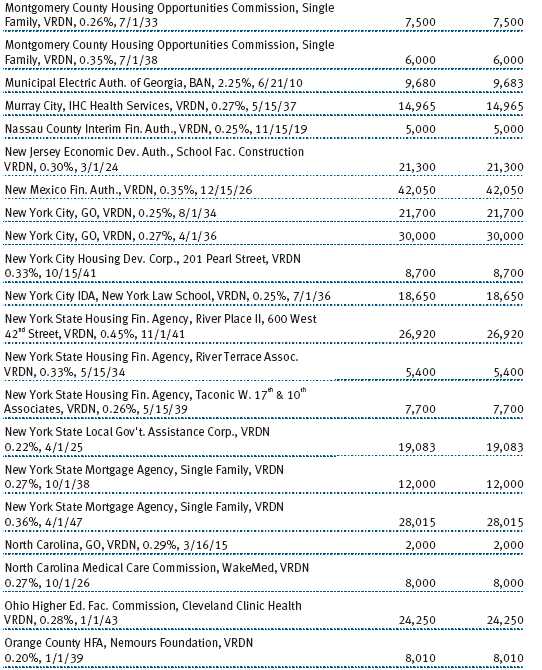

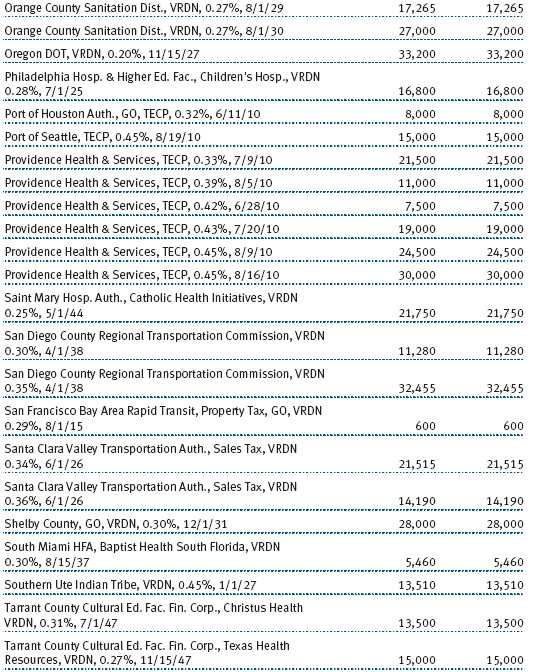

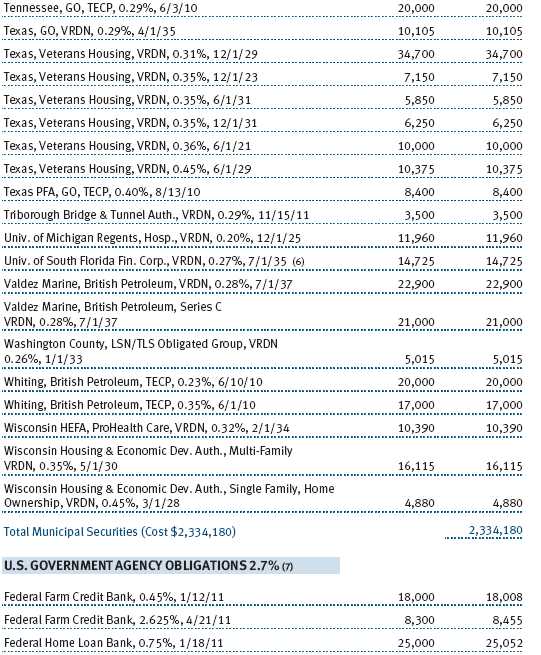

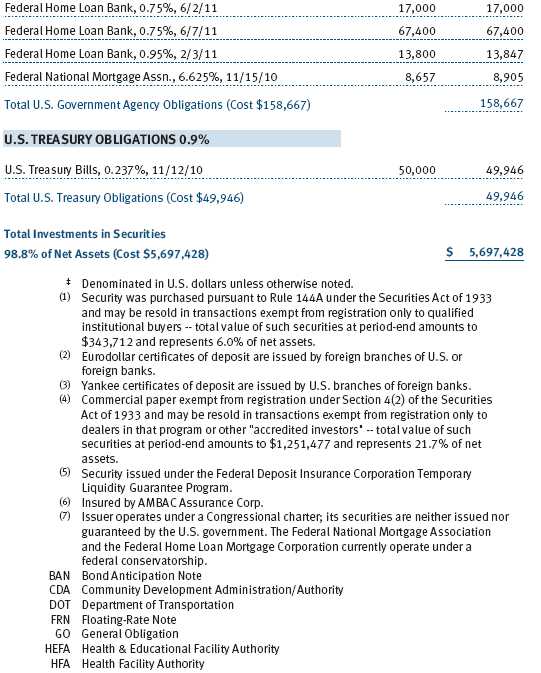

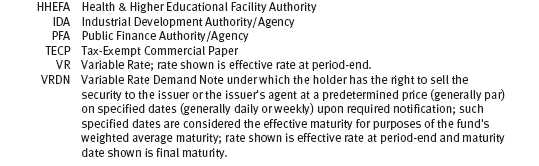

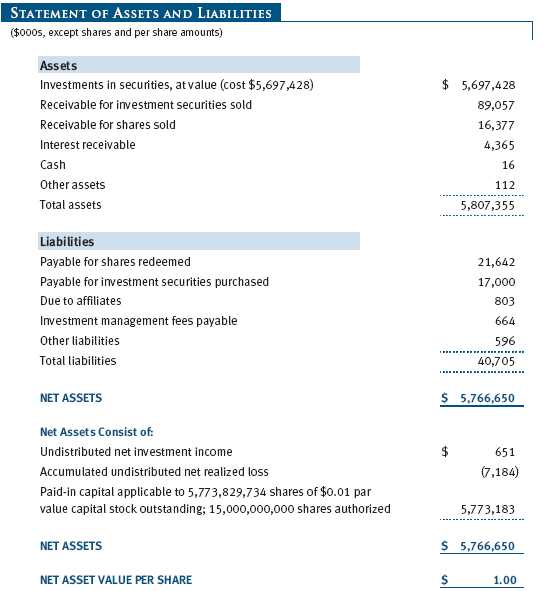

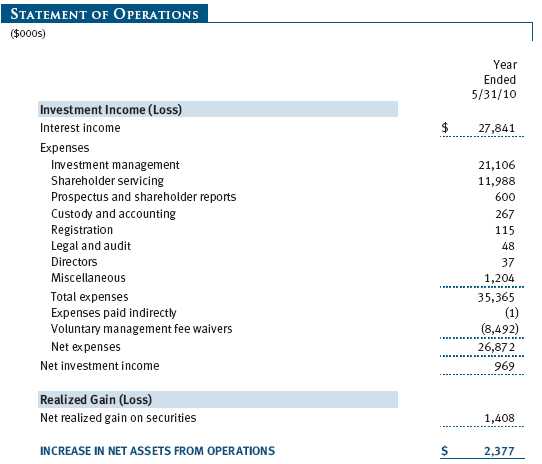

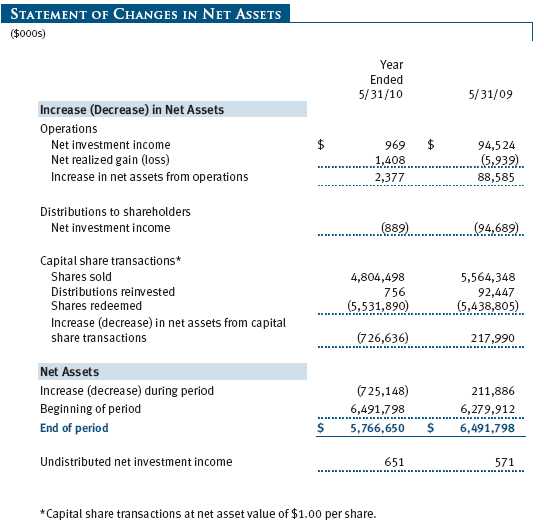

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| NOTES TO FINANCIAL STATEMENTS |

T. Rowe Price Prime Reserve Fund (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund commenced operations on January 26, 1976. The fund seeks preservation of capital, liquidity, and, consistent with these, the highest possible current income.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale of securities.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Paydown gains and losses are recorded as an adjustment to interest income. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared daily and paid monthly.

Credits The fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits, which are reflected as expenses paid indirectly.

New Accounting Pronouncement In January 2010, new accounting guidance was issued that requires enhanced disclosures about fair value measurements in the financial statements; it is effective for fiscal years and interim periods beginning after December 15, 2009. Management expects that adoption of this guidance will have no impact on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

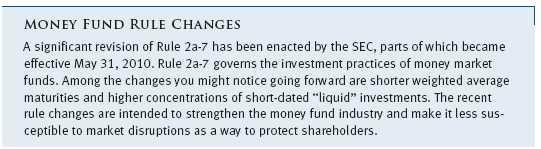

The fund values its investments and computes its net asset value per share each day that the New York Stock Exchange is open for business. In accordance with Rule 2a-7 under the 1940 Act, securities are valued at amortized cost, which approximates fair value. Securities for which amortized cost is deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

Various inputs are used to determine the value of the fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market. On May 31, 2010, all of the fund’s investments were classified as Level 2, based on the inputs used to determine their values.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after filing of the tax return but could be longer in certain circumstances.

Distributions during the years ended May 31, 2010 and May 31, 2009, totaled $889,000 and $94,689,000, respectively, and were characterized as ordinary income for tax purposes. At May 31, 2010, the tax-basis cost of investments and components of net assets were as follows:

The fund intends to retain realized gains to the extent of available capital loss carryforwards. During the year ended May 31, 2010, the fund utilized $1,408,000 of capital loss carryforwards. The fund’s unused capital loss carryforwards as of May 31, 2010, all expire in fiscal 2017.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.05% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At May 31, 2010, the effective annual group fee rate was 0.30%.

Price Associates may voluntarily waive all or a portion of its management fee to the extent necessary for the fund to maintain a zero or positive net yield. Any amounts waived under this voluntary agreement are not subject to repayment by the fund. Price Associates may amend or terminate this voluntary waiver at any time without prior notice. For the year ended May 31, 2010, the total management fees waived were $8,492,000.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share price and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the fund. For the year ended May 31, 2010, expenses incurred pursuant to these service agreements were $94,000 for Price Associates; $5,994,000 for T. Rowe Price Services, Inc.; and $2,303,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

As of May 31, 2010, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 208,915,916 shares of the fund, representing 4% of the fund’s net assets.

NOTE 6 - INTERFUND BORROWING PROGRAM

The manager has developed a program that provides temporary liquidity under an interfund borrowing agreement between the fund and other T. Rowe Price-sponsored mutual funds. The program permits the borrowing and lending of cash at rates beneficial to both the borrowing and lending funds. Pursuant to program guidelines, the fund may lend up to 15% of its net assets and no more than 5% of its net assets may be lent to any one borrower. Loans totaling 10% or more of a borrowing fund’s total assets require collateralization at 102% of the value of the loan; loans of less than 10% are unsecured. During the year ended May 31, 2010, the fund earned $4,000 in interest income related to loans made to other funds on 24 days in the average amount of $5,708,000 and at an average annual rate of 1.19%. At May 31, 2010, there were no loans outstanding.

NOTE 7 - TREASURY’S TEMPORARY GUARANTEE PROGRAM

The fund’s Board of Directors approved participation in the Temporary Guarantee Program for Money Market Funds (the program), established by the U.S. Treasury Department, through September 18, 2009. Subject to certain conditions and limitations, the program guaranteed that shareholders in the fund as of the close of business on September 19, 2008, would receive $1.00 for each fund share held. Shares not guaranteed under the program would be redeemed at net asset value per share. The guarantee applied only if a participating money market fund’s net asset value per share fell below $0.995 and the fund subsequently decided to liquidate.

In total, the fund paid $3,836,000, equal to 0.06% of the net asset value of the fund as of the close of business on September 19, 2008, to participate in the full 12-month term of the program that expired on September 18, 2009. The participation fees were borne by the fund and recognized in expenses ratably over the period of participation in the program. Accordingly, $1,147,000 of participation fees were recognized during the year ended May 31, 2010.

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Board of Directors and Shareholders of

T. Rowe Price Prime Reserve Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Prime Reserve Fund, Inc. (the “Fund”) at May 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at May 31, 2010 by correspondence with the custodian, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

July 16, 2010

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT |

On March 9, 2010, the fund’s Board of Directors (Board) unanimously approved the continuation of the investment advisory contract (Contract) between the fund and its investment manager, T. Rowe Price Associates, Inc. (Adviser). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Adviser during the course of the year, as discussed below:

Services Provided by the Adviser

The Board considered the nature, quality, and extent of the services provided to the fund by the Adviser. These services included, but were not limited to, management of the fund’s portfolio and a variety of related activities, as well as financial and administrative services, reporting, and communications. The Board also reviewed the background and experience of the Adviser’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Adviser.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total returns over the 1-, 3-, 5-, and 10-year periods, as well as the fund’s year-by-year returns, and compared these returns with a wide variety of previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the severity of the market turmoil during 2008 and 2009, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Adviser under the Contract and other benefits that the Adviser (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Adviser may receive some benefit from its soft-dollar arrangements pursuant to which it receives research from broker-dealers that execute the applicable fund’s portfolio transactions. The Board also received information on the estimated costs incurred and profits realized by the Adviser and its affiliates from advising T. Rowe Price mutual funds, as well as estimates of the gross profits realized from managing the fund in particular. The Board concluded that the Adviser’s profits were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Adviser. Under the Contract, the fund pays a fee to the Adviser composed of two components—a group fee rate based on the aggregate assets of certain T. Rowe Price mutual funds (including the fund) that declines at certain asset levels and an individual fund fee rate that is assessed on the assets of the fund. The Board concluded that the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees

The Board reviewed the fund’s management fee rate, operating expenses, and total expense ratio and compared them with fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board indicated that the fund’s management fee rate (including any reductions of the management fee rate as a result of any applicable fee waivers or expenses paid by the Adviser) was above the median for certain groups of comparable funds but below the median for other groups of comparable funds. The information also indicated that the fund’s total expense ratio was above the median for certain groups of comparable funds but at or below the median for other groups of comparable funds. The Board also reviewed the fee schedules for institutional accounts of the Adviser and its affiliates with smaller mandates. Management informed the Board that the Adviser’s responsibilities for institutional accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise and that the Adviser performs significant additional services and assumes greater risk for the fund and other T. Rowe Price mutual funds that it advises than it does for institutional accounts. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board was assisted by the advice of independent legal counsel and concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

| ABOUT THE FUND’S DIRECTORS AND OFFICERS |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of Board members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and T. Rowe Price International, Inc. (T. Rowe Price International); “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-225-5132.

| Independent Directors | |

| |

| Name | |

| (Year of Birth) | Principal Occupation(s) During Past Five Years and Directorships |

| Year Elected* | of Other Public Companies |

| | |

| William R. Brody | President and Trustee, Salk Institute for Biological Studies (2009 |

| (1944) | to present); Director, Novartis, Inc. (2009 to present); Director, IBM |

| 2009 | (2007 to present); President and Trustee, Johns Hopkins University |

| | (1996 to 2009); Chairman of Executive Committee and Trustee, |

| | Johns Hopkins Health System (1996 to 2009) |

| | |

| Jeremiah E. Casey | Director, National Life Insurance (2001 to 2005); Director, NLV |

| (1940) | Financial Corporation (2004 to 2005) |

| 2006 | |

| | |

| Anthony W. Deering | Chairman, Exeter Capital, LLC, a private investment firm (2004 |

| (1945) | to present); Director, Under Armour (2008 to present); Director, |

| 1979 | Vornado Real Estate Investment Trust (2004 to present); Director, |

| | Mercantile Bankshares (2002 to 2007); Member, Advisory Board, |

| | Deutsche Bank North America (2004 to present) |

| | |

| Donald W. Dick, Jr. | Principal, EuroCapital Partners, LLC, an acquisition and management |

| (1943) | advisory firm (1995 to present) |

| 2001 | |

| | |

| Karen N. Horn | Senior Managing Director, Brock Capital Group, an advisory and |

| (1943) | investment banking firm (2004 to present); Director, Eli Lilly and |

| 2003 | Company (1987 to present); Director, Simon Property Group (2004 |

| | to present); Director, Norfolk Southern (2008 to present); Director, |

| | Georgia Pacific (2004 to 2005); Director, Fannie Mae (2006 to 2008) |

| | |

| Theo C. Rodgers | President, A&R Development Corporation (1977 to present) |

| (1941) | |

| 2005 | |

| | |

John G. Schreiber | Owner/President, Centaur Capital Partners, Inc., a real estate | | (1946) | investment company (1991 to present); Cofounder and Partner, |

| 1992 | Blackstone Real Estate Advisors, L.P. (1992 to present) |

| | |

| Mark R. Tercek | President and Chief Executive Officer, The Nature Conservancy |

| (1957) | (2008 to present); Managing Director, The Goldman Sachs Group, |

| 2009 | Inc. (1984 to 2008) |

| |

| *Each independent director oversees 125 T. Rowe Price portfolios and serves until retirement, resignation, |

| or election of a successor. | |

| Inside Directors | |

| |

| Name | |

| (Year of Birth) | |

| Year Elected* | |

| [Number of T. Rowe Price | Principal Occupation(s) During Past Five Years and Directorships |

| Portfolios Overseen] | of Other Public Companies |

| | |

| Edward C. Bernard | Director and Vice President, T. Rowe Price; Vice Chairman of the |

| (1956) | Board, Director, and Vice President, T. Rowe Price Group, Inc.; |

| 2006 | Chairman of the Board, Director, and President, T. Rowe Price |

| [125] | Investment Services, Inc.; Chairman of the Board and Director, |

| | T. Rowe Price Global Asset Management Limited, T. Rowe Price |

| | Global Investment Services Limited, T. Rowe Price Retirement |

| | Plan Services, Inc., T. Rowe Price Savings Bank, and T. Rowe Price |

| | Services, Inc.; Director, T. Rowe Price International, Inc.; Chief |

| | Executive Officer, Chairman of the Board, Director, and President, |

| | T. Rowe Price Trust Company; Chairman of the Board, all funds |

| | |

| Michael C. Gitlin | Vice President, T. Rowe Price, T. Rowe Price Global Investment |

| (1970) | Services Limited, T. Rowe Price Group, Inc., and T. Rowe Price |

| 2010 | International, Inc.; Director of Fixed Income, T. Rowe Price (2009 |

| [39] | to present); Global Head of Trading, T. Rowe Price (2007 to 2009); |

| | formerly Head of U.S. Equity Sales, Citigroup Global Markets (2005 |

| | to 2007) |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | |

| |

| Name (Year of Birth) | |

| Position Held With Prime Reserve Fund | Principal Occupation(s) |

| | |

| Steve Boothe, CFA (1977) | Vice President, T. Rowe Price |

| Vice President | |

| | |

| Steven G. Brooks, CFA (1954) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| G. Richard Dent (1960) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Roger L. Fiery III, CPA (1959) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Group, Inc., T. Rowe Price International, Inc., |

| | and T. Rowe Price Trust Company |

| | |

| Alisa Fiumara-Yoch, CFA (1974) | Vice President, T. Rowe Price |

| Vice President | |

| | |

| John R. Gilner (1961) | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | |

| Gregory S. Golczewski (1966) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Trust Company |

| | |

| Gregory K. Hinkle, CPA (1958) | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer | Group, Inc., and T. Rowe Price Trust Company; |

| | formerly Partner, PricewaterhouseCoopers LLP |

| | (to 2007) |

| | |

| Dylan Jones, CFA (1971) | Assistant Vice President, T. Rowe Price |

| Vice President | |

| | |

| Alan D. Levenson, Ph.D. (1958) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Patricia B. Lippert (1953) | Assistant Vice President, T. Rowe Price and |

| Secretary | T. Rowe Price Investment Services, Inc. |

| | |

| Joseph K. Lynagh, CFA (1958) | Vice President, T. Rowe Price, T. Rowe Price |

| President | Group, Inc., and T. Rowe Price Trust Company |

| | |

| | |

David Oestreicher (1967) | Director and Vice President, T. Rowe Price | | Vice President | Investment Services, Inc., T. Rowe Price Trust |

| | Company, and T. Rowe Price Services, Inc.; Vice |

| | President, T. Rowe Price, T. Rowe Price Global |

| | Asset Management Limited, T. Rowe Price |

| | Global Investment Services Limited, T. Rowe |

| | Price Group, Inc., T. Rowe Price International, |

| | Inc., and T. Rowe Price Retirement Plan |

| | Services, Inc. |

| | |

| Deborah D. Seidel (1962) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Investment Services, Inc., and T. Rowe Price |

| | Services, Inc. |

| | |

| Susan G. Troll, CPA (1966) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Julie L. Waples (1970) | Vice President, T. Rowe Price |

| Vice President | |

| | |

| Edward A. Wiese, CFA (1959) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Group, Inc., and T. Rowe Price Trust Company; |

| | Chief Investment Officer, Director, and Vice |

| | President, T. Rowe Price Savings Bank |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least |

| five years. | |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Anthony W. Deering qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Deering is considered independent for purposes of Item 3 of Form N-CSR.

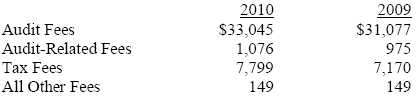

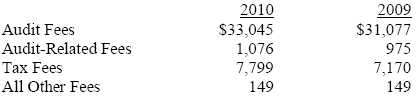

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,879,000 and $1,922,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price Prime Reserve Fund, Inc. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | July 16, 2010 |

| |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | July 16, 2010 |

| |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date | July 16, 2010 |