1

© PPL Corporation 2011

PPL Corporation

4th Quarter Earnings Call

February 4, 2011

Exhibit 99.2

2

© PPL Corporation 2011

Any statements made in this presentation about future operating

results or other future events are forward-looking statements under

the Safe Harbor Provisions of the Private Securities Litigation Reform

Act of 1995. Actual results may differ materially from such forward-

looking statements. A discussion of factors that could cause actual

results or events to vary is contained in the Appendix to this

presentation and in the Company’s SEC filings.

Cautionary Statements and Factors

That May Affect Future Results

3

© PPL Corporation 2011

J. H. Miller

P. A. Farr

W. H. Spence

Agenda

Fourth Quarter 2010 Earnings and 2011 Earnings

Forecast and Outlook

Operational Review

Segment Results and Financial Overview

Q&A

4

© PPL Corporation 2011

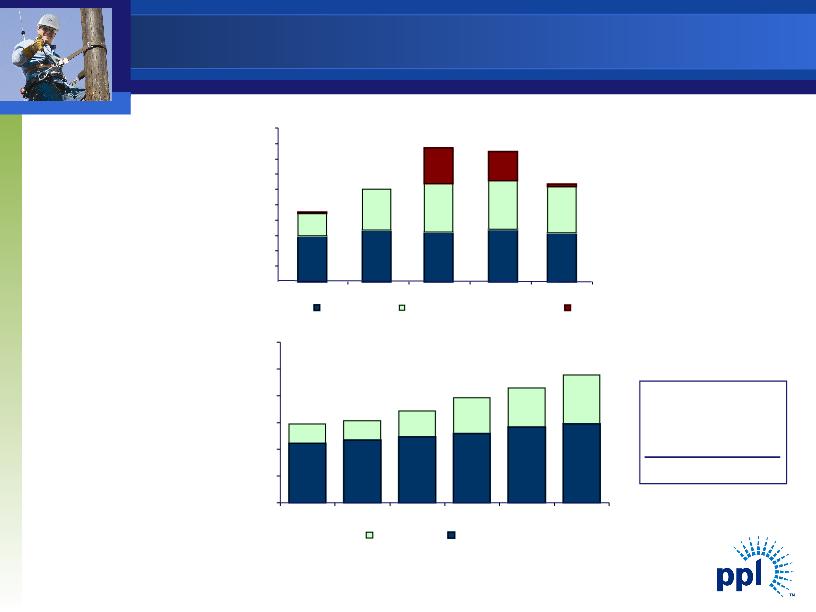

Fourth Quarter

Reported Earnings

Fourth Quarter

Earnings from Ongoing Operations

Note: See Appendix for the reconciliation of earnings from ongoing operations to reported earnings.

Year-to-Date

Reported Earnings

Year-to-Date

Earnings from Ongoing Operations

Earnings Results

5

© PPL Corporation 2011

PPL: Poised for Additional Growth

§ Three high-performing utilities with tangible rate

base growth

§ Well-positioned supply business with in-the-money

hedges and growth as market recovers

§ Strong track record of execution

6

© PPL Corporation 2011

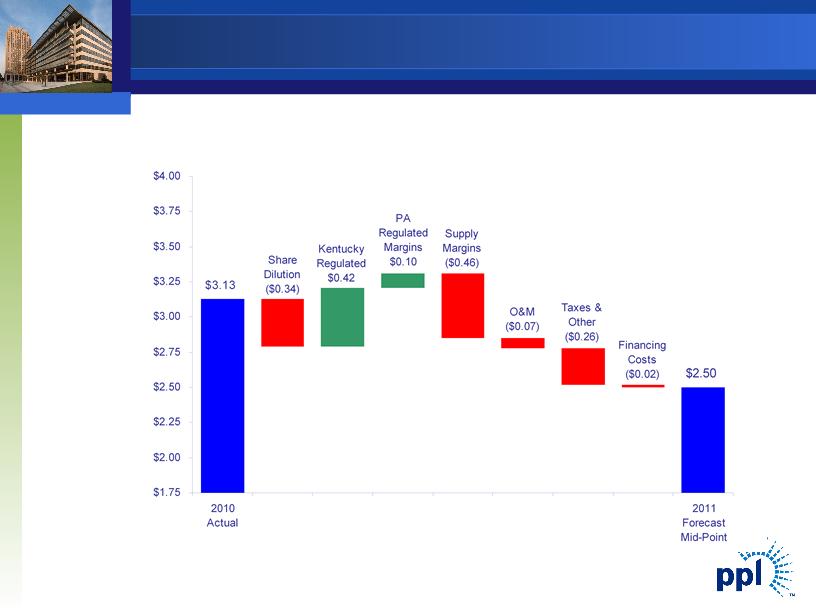

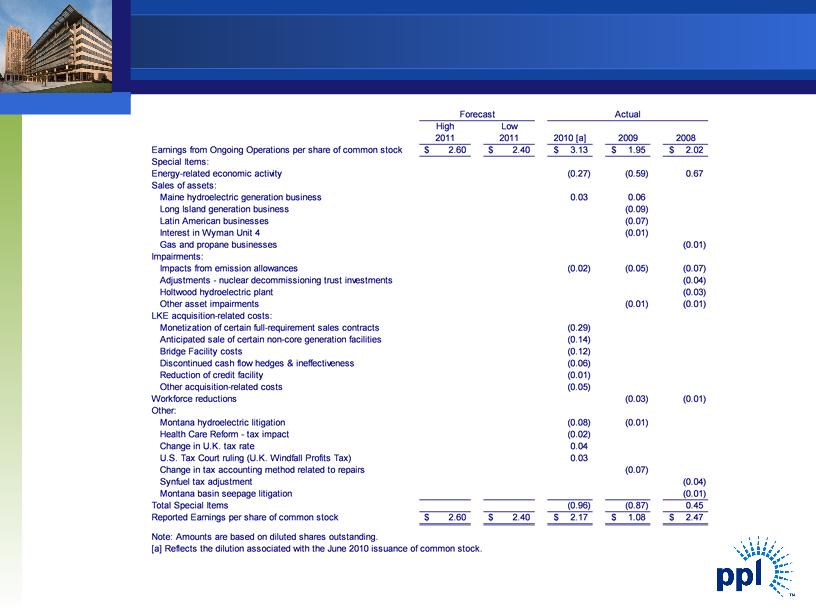

$3.13

$2.60

$/Share

(1) See appendix for reconciliation of earnings from ongoing operations to reported earnings.

(2) Based on mid-point of forecasted earnings range.

(1)

(2)

$2.40

73%

27%

50%

50%

2010A

2011E

2011 Earnings Forecast

7

© PPL Corporation 2011

Our Strengths

§ Strong regulatory relationships

§ Best in class reliability, customer service

§ Strong operating performance - regulated and

competitive

§ Strong carbon and other environmental position

§ Excellent cost-management

§ Knowledgeable, dedicated employees

§ Strong dividend with opportunity for growth

8

© PPL Corporation 2011

PPL Corporation

9

© PPL Corporation 2011

Kentucky Regulated Segment

Key Business and Value Drivers

§ Excellent customer service

§ Superior cost position and operational excellence

§ Constructive regulatory environment

§ Low rates and an opportunity for growth

LG&E and KU Are Among Best Performing Utilities in the U.S.

10

© PPL Corporation 2011

Significant EPA Regulations Impacting Kentucky

§ Environmental compliance spending associated with coal

combustion is recoverable through the ECR.

§ $2.9 billion recovered via mechanism since inception

§ NOx, SO2, Mercury, Particulate Regulations will increase capital

spending.

§ Exact remediation and incremental cost will not be known until final

regulations on all pollutants are completed.

11

© PPL Corporation 2011

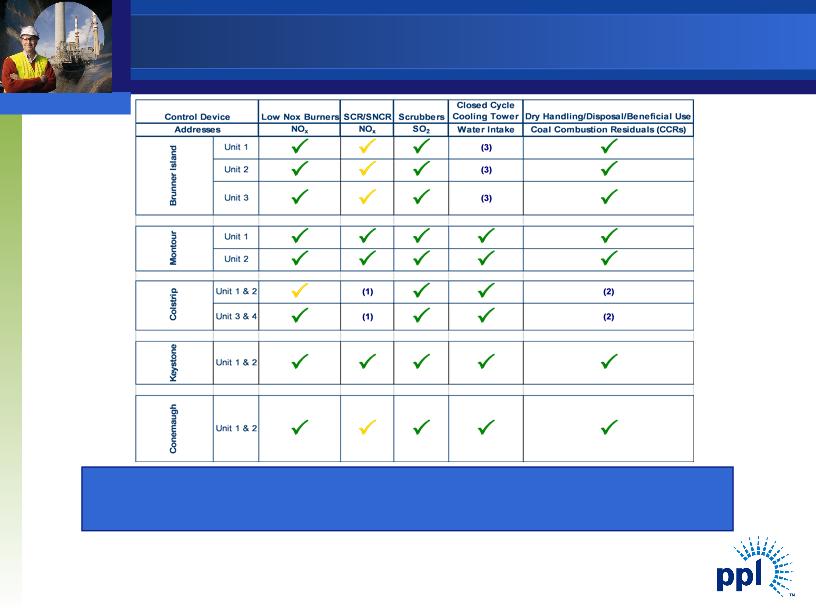

Current State of Environmental Controls

Kentucky Regulated Major Coal Plant Sites

(1) Dry handling disposal construction approved by KPSC and permitting underway at Trimble and Ghent.

(2) Wet ash impoundments exist at all plants.

(3) Construction underway. Scheduled to be in service 2012.

P= Installed

P = Under consideration

12

© PPL Corporation 2011

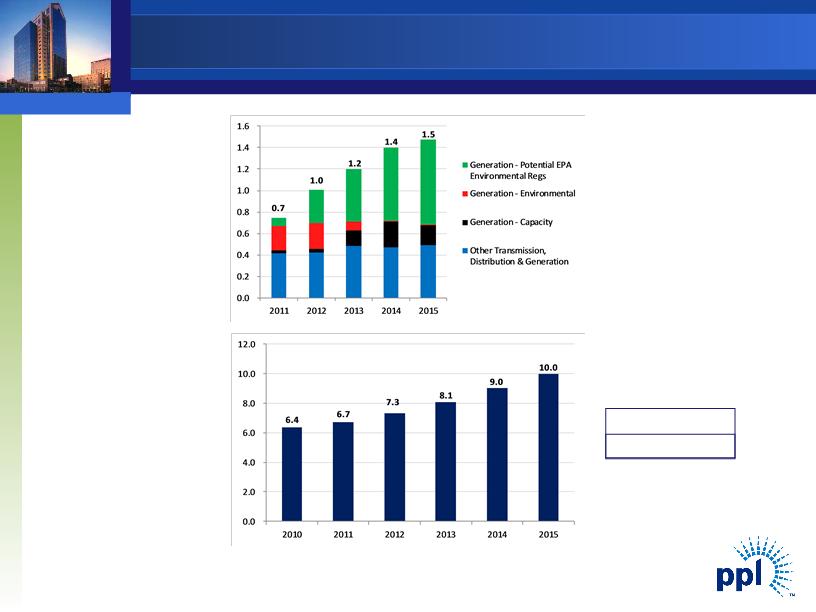

Estimated

Annual CAPEX

$ Billions

Estimated Rate

Base (Utility

Capitalization) (1)

$ Billions

CAGR (2011-2015)

10.5%

Kentucky Regulated Capital

Expenditures and Rate Base Growth

(1) Represents year-end amounts

6.4 6.7 7.3 8.1 9.0 10.0 0.0 2.0 4.0 6.0 8.0 10.0 12.0 2010 2011 2012 2013 2014 2015 Estimated Annual CAPEX $ Billions Estimated Rate Base (Utility Capitalization) (1) $ Billions CAGR (2011-2015) 10.5% Kentucky Regulated Capital Expenditures and Rate Base Growth (1) Represents year-end amounts 0.7 1.0 1.2 1.4 1.5 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 2011 2012 2013 2014 2015 Generation -Potential EPA Environmental Regs Generation -Environmental Generation -Capacity Other Transmission, Distribution & Generation

14

© PPL Corporation 2011

International Regulated Segment

Key Business and Value Drivers

§ Electricity distribution businesses are regulated by the UK’s Office of Gas and

Electricity Markets (Ofgem).

§ Current price control period is April 1, 2010 to March 31, 2015.

§ Business growth is driven by capital investment in aging infrastructure and

load-related assets.

§ $2.0 billion investment in current price control period (2010 - 2015); 31%

higher than previous price control period.

§ Regulatory Incentive mechanisms provide opportunity for enhanced returns.

§ Customer service and reliability.

§ Cost efficiency.

§ $240 million awarded during DPCR5 and $130 million awarded during

DPCR4 reviews

15

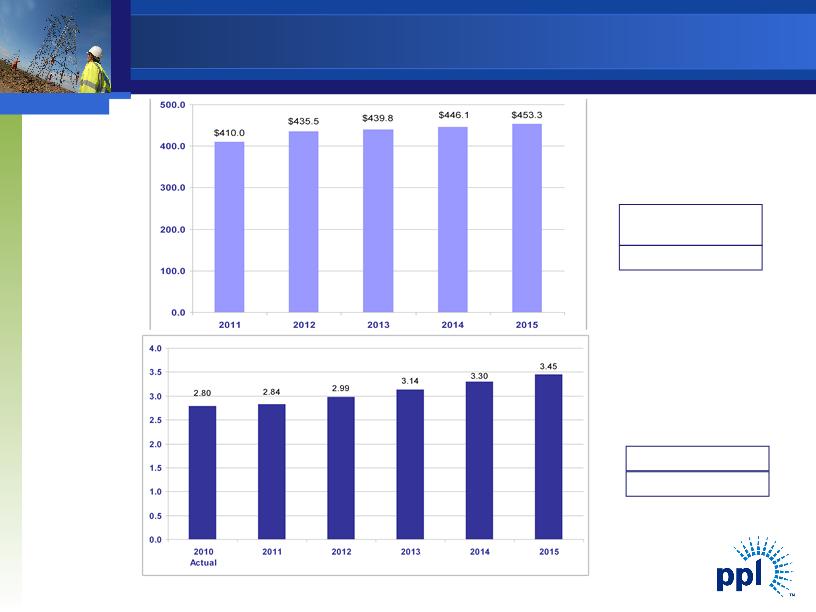

© PPL Corporation 2011

International Regulated Segment

Capital Expenditures and Rate Base Growth

CAGR (2011-2015)

5.0%

Regulatory Period

(DPCR5)

$2.0 BB

(1) Represents year-end amounts

Estimated

Annual CAPEX

$ Millions

Estimated

RAV (1)

$ Billions

16

© PPL Corporation 2011

Outstanding Operational Performance

Ombudsman Complaints

Complaints to Ombudsman per 100,000 customers

Ofgem Telephony Incentive Scheme

1 Hour Restoration Rate

Year ended 31 March 1999 - 51.9%

Year ended 31 March 2001 - 57.6%

Year ended 31 March 2003 - 80.0%

Year ended 31 March 2005 - 84.8%

Year ended 31 March 2007 - 84.6%

Year ended 31 March 2008 - 85.5%

Year ended 31 March 2009 - 86.3%

Year to date 31 December 2010 - 87.4%

Best in UK

0.00

0.13

0.19

0.26

0.30

0.71

1.10

0.41

0.00

0.20

0.40

0.60

0.80

1.00

1.20

Capex Efficiency in DPCR5

Performance against Peers

16 Outstanding Operational Performance Ombudsman Complaints Complaints to Ombudsman per 100,000 customers Ofgem Telephony Incentive Scheme Score (out of 5) 4.63 4.60 4.50 4.40 4.39 4.39 4.36 4.33 4.28 4.18 4.16 4.07 3.95 3 5 WPDSWales WPDSWest SPManweb CNEast SPD CEYEDL CNWest CENEDL EDFEEPN EDFESPN SSESouthern EDFELPN SSEHydro ENW 1 Hour Restoration Rate &# 160;Year ended 31 March 1999 -51.9% Year ended 31 March 2001 -57.6% Year ended 31 March 2003 -80.0% Year ended 31 March 2005 -84.8% Year ended 31 March 2007 -84.6% Year ended 31 March 2008 -85.5% Year ended 31 March 2009 -86.3% Year to date 31 December 2010 -87.4% Best in UK 0.00 0.13 0.19 0.26 0.30 0.71 1.10 0.41 0.00 0.20 0.40 0.60 0.80 1.00 1.20 WPD CE CN SP SSE EDF ENW AVERAGE Capex Efficiency in DPCR5 Performance against Peers

17

© PPL Corporation 2011

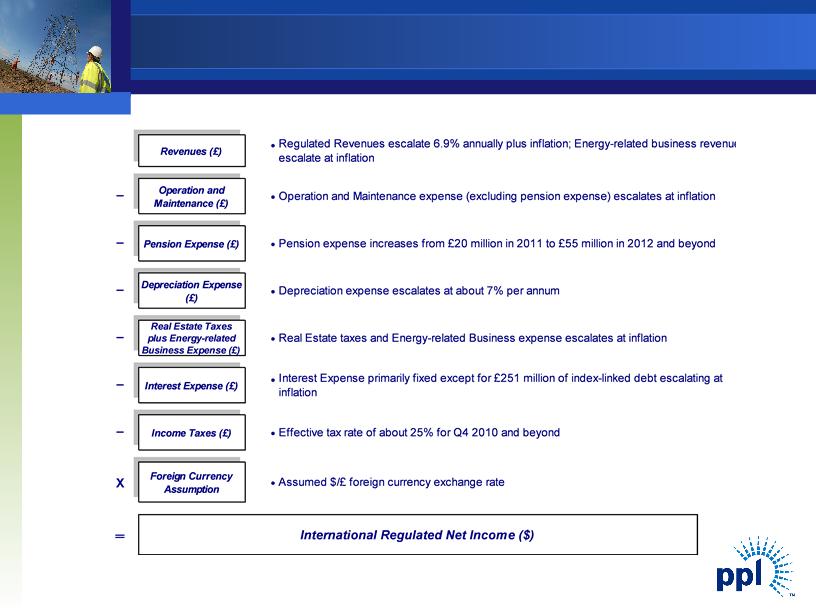

International - Modeling Parameters

17 International -Modeling Parameters X - . International Regulated Net Income ($) Foreign Currency Assumption .Assumed $/£ foreign currency exchange rate Interest Expense (£) Income Taxes (£) Depreciation expense escalates at about 7% per annum Interest Expense primarily fixed except for £251 million of index-linked debt escalating at inflation . . Effective tax rate of about 25% for Q4 2010 and beyond Real Estate taxes and Energy-related Business expense escalates at inflation Depreciation Expense (£) Real Estate Taxes plus Energy-related Business Expense (£) Revenues (� 3;) . Regulated Revenues escalate 6.9% annually plus inflation; Energy-related business revenue escalate at inflation . Operation and Maintenance expense (excluding pension expense) escalates at inflation Pension expense increases from £20 million in 2011 to £55 million in 2012 and beyond Operation and Maintenance (£) Pension Expense (£)

19

© PPL Corporation 2011

PA Regulated Segment Key Business

and Value Drivers

§ Superior customer service -

§ 16th JD Power awards, most in nation

§ 1st place JD Power East Region Large Utilities -

Business Customers

§ 83% “very satisfied” with customer transactions

§ Constructive regulatory relationships

§ Attractive future rate base investment

opportunities to support reliability

§ Rate Base growth from $3.0 Billion in 2010 to

$4.8 Billion in 2015

20

© PPL Corporation 2011

$1,000

100

200

300

400

500

600

700

800

900

2011

2012

2013

2014

2015

Distribution

Transmission (excluding S-R)

Susquehanna-Roseland

$452

$629

$868

$821

$667

CAGR (2011-2015)

Distribution = 6.5%

Transmission = 22.5%

Combined = 11.6%

$3,113

$3,410

$3,932

$4,391

$4,833

$2,998

$797

$862

$995

$1,357

$1,639

$1,938

$2,201

$2,251

$2,415

$2,575

$2,752

$2,895

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

2010

2011

2012

2013

2014

2015

Transmission

Distribution

Estimated

Annual CAPEX

$ Millions

Estimated Rate

Base (Utility

Capitalization) (1)

$ Millions

(1) Represents year-end amounts

PA Regulated Segment

Capex and Rate Base Growth

21

© PPL Corporation 2011

PPL Generation

PPL EnergyPlus

22

© PPL Corporation 2011

Supply Segment Key Business

and Value Drivers

§ Our efficient, diverse generating fleet with the ability

to meet proposed EPA regulations without

substantial increase in capital or operating cost

§ Our ability to control spending and optimize

operations in a low commodity business cycle

§ Current and future capacity additions to our low cost,

carbon-free nuclear and hydro facilities

§ Our active hedging strategy to protect and enhance

the value of our competitive generation fleet

§ Improved supply/demand fundamentals

23

© PPL Corporation 2011

Actively Managing Environmental Uncertainty

P= Installed

P = Under

Consideration

PPL’s proactive approach to environmental compliance has

made the EPA’s pending regulations manageable

(1) At this time we believe that SCR/SNCRs are not required at Colstrip to meet the proposed NOx emission units.

(2) PPL has begun to assess dry handling/disposal of CCRs at Colstrip.

(3) If required, once through cooling towers could be converted to closed cycle.

24

© PPL Corporation 2011

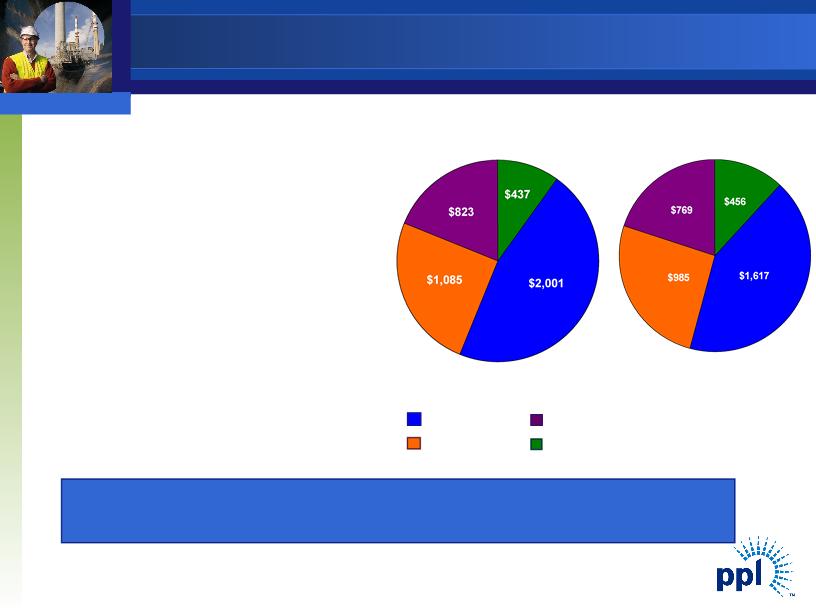

PPL’s proactive approach to controlling spending and optimizing

operations is maximizing value

Total 2010-2014:

$3,827

Previous

Plan

Sustenance

Growth

Nuclear Fuel

Environmental & Regulatory

Total 2010-2014:

$4,346

Current

Plan

§ Controlling Capital

§ Reducing capital spending by

over $500 million over the 5

year plan

§ Optimizing Operation

§ Operating at minimums during

low priced off-peak periods

§ Reducing unit minimums

§ Analyzing fuel options

§ Controlling operating costs

Operating in a Down Commodity Cycle

25

© PPL Corporation 2011

Capacity revenues are expected to be $430 million, $385 million and $590 million for 2011, 2012 and 2013, respectively.

As of December 31, 2010

(1) Represents expected sales based on current business plan assumptions.

(2) The 2011 average hedge energy prices are based on the fixed price swaps as of December 31, 2010; the prior collars have all been converted to fixed swaps.

(3) The 2012 ranges of average energy prices for existing hedges were estimated by determining the impact on the existing collars resulting from 2012 power prices at

the 5th and 95th percentile confidence levels.

| | | 2011 | | 2012 | | |

Baseload | | | | | | | |

Expected Generation(1) (Million MWhs) | | | 51.4 | | 54.7 | | |

East | | | 43.1 | | 46.2 | | |

West | | | 8.3 | | 8.5 | | |

| | | | | | | |

Current Hedges (%) | | | 99% | | 68% | | |

East | | | 100% | | 63% | | |

West | | | 95% | | 94% | | |

| | | | | | | |

Average Hedged Price (Energy Only) ($/MWh) (2) (3) | | | | | | | |

East | | | $56 | | $59-61 | | |

West | | | $54 | | $53-54 | | |

| | | | | | | |

Current Coal Hedges (%) | | | 99% | | 96% | | |

East | | | 99% | | 94% | | |

West | | | 100% | | 100% | | |

| | | | | | | |

Average Hedged Consumed Coal Price (Delivered $/Ton) | | | | | | | |

East | | | $73-74 | | $76-80 | | |

West | | | $23-28 | | $23-29 | | |

| | | | | | | |

Intermediate/Peaking | | | | | | | |

Expected Generation(1) (Million MWhs) | | | 6.0 | | 6.2 | | |

Current Hedges (%) | | | 34% | | 7% | | |

Enhancing Value Through Active Hedging

26

© PPL Corporation 2011

Source: PJM Load Forecast Report (December 28, 2010)

ATSI - First Energy

DEOK - Duke Energy Ohio & Kentucky

Supply & Demand - Catalysts for Growth

§ Economic recovery driving

increases in electric

demand

§ Existing forward prices

provide little incentive to

build

§ Proposed EPA regulations

are expected to be a net

benefit given our mix of

generation

26 Date of Report RFC/PJM Nationwide Impact by PPL Dec-10 5-12 GW 2019 Brattle Nov-2010 12-19 GW 50-65 GW 2020 NERC Oct-2010 3-11 GW 10-35 GW 2018 Credit Suisse Sep-2010 12-24 GW 35-100 GW (60 GW Base) 2017 ICF/INGAA May-2010 25-30 GW 50 GW 2018 Impact on Coal Capacity Supply & Demand -Catalysts for Growth .Economic recovery driving increases in electric demand .Existing forward prices provide little incentive to build .Proposed EPA regulations are expected to be a net benefit given our mix of generation PJM Summer Peak Forecasted Reserve Margin&# 160; 15.0% 17.0% 19.0% 21.0% 23.0% 25.0% 27.0% 2010/11 2011/12 2012/13 2013/14 2014/15 Planning Year Reserve Margin (%) PJM PPL PJM Annual Net Energy Forecast (w/o ATSI & DEOK) (35,000) (25,000) (15,000) (5,000) 5,000 15,000 25,000 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Net Energy(GWhs) Source: PJM Load Forecast Report (December 28, 2010) ATSI – First Energy DEOK – Duke Energy Ohio & Kentucky

27

© PPL Corporation 2011

Financial Overview

28

© PPL Corporation 2011

| Q4 | | Q4 | | |

| 2010 | | 2009 | | Change |

Kentucky Regulated | $0.07 | | $0.00 | | $0.07 |

International Regulated | 0.07 | | 0.18 | | (0.11) |

Pennsylvania Regulated | 0.05 | | 0.09 | | (0.04) |

Supply | 0.64 | | 0.25 | | 0.39 |

Total | $0.83 | | $0.52 | | $0.31 |

| | | | | |

| | | | | |

Note: See Appendix for the reconciliation of earnings from ongoing operations to reported earnings. |

| 2010 | | 2009 | | Change |

Kentucky Regulated | $0.06 | | $0.00 | | $0.06 |

International Regulated | 0.53 | | 0.72 | | (0.19) |

Pennsylvania Regulated | 0.27 | | 0.35 | | (0.08) |

Supply | 2.27 | | 0.88 | | 1.39 |

Total | $3.13 | | $1.95 | | $1.18 |

| | | | | |

| | | | | |

Ongoing Earnings Overview

29

© PPL Corporation 2011

Note: See Appendix for the reconciliation of earnings from ongoing operations to reported earnings. |

| 2010 |

2009 EPS - Ongoing Earnings | | $0.72 |

Delivery Revenue | 0.08 | |

O&M | (0.09) | |

Financing | (0.10) | |

Effect of Exchange Rates | 0.04 | |

Income Taxes & Other | (0.05) | |

Dilution | (0.07) | |

Total | | (0.19) |

2010 EPS - Ongoing Earnings | | $0.53 |

International Regulated Segment

Earnings Drivers

30

© PPL Corporation 2011

Note: See Appendix for the reconciliation of earnings from ongoing operations to reported earnings. |

| 2010 |

2009 EPS - Ongoing Earnings | | $0.35 |

O&M | (0.06) | |

Other | 0.01 | |

Dilution | (0.03) | |

Total | | (0.08) |

2010 EPS - Ongoing Earnings | | $0.27 |

Pennsylvania Regulated Segment

Earnings Drivers

31

© PPL Corporation 2011

Note: See Appendix for the reconciliation of earnings from ongoing operations to reported earnings. |

| 2010 |

2009 EPS - Ongoing Earnings | | $0.88 |

Margins - East | 1.56 | |

Margins - West | 0.03 | |

O&M | (0.08) | |

Depreciation | (0.07) | |

Income Taxes & Other | 0.24 | |

Discontinued Operations | 0.04 | |

Dilution | (0.33) | |

Total | | 1.39 |

2010 EPS - Ongoing Earnings | | $2.27 |

Supply Segment

Earnings Drivers

32

© PPL Corporation 2011

Earnings Per Share

2010 to 2011 Earnings Walk

32 2010 to 2011 Earnings Walk $2.50 Taxes & Other ($0.26) O&M ($0.07) Supply Margins ($0.46) PA Regulated Margins $0.10 Financing Costs ($0.02) Share Dilution ($0.34) Kentucky Regulated $0.42 $3.13 $1.75 $2.00 $2.25 $2.50 $2.75 $3.00 $3.25 $3.50 $3.75 $4.00 2010 Actual 2011 Forecast Mid-Point Earnings Per Share

33

© PPL Corporation 2011

Millions of Dollars

2010 Free Cash Flow includes two months of the results of the Kentucky

Regulated segment

Note: See Appendix for reconciliation of free cash flow before dividends to cash from operations.

$600

$531

$275

$0

$100

$200

$300

$400

$500

$600

$700

2009

Actual

2010

Actual

2011

Forecast

Free Cash Flow before Dividends

34

© PPL Corporation 2011

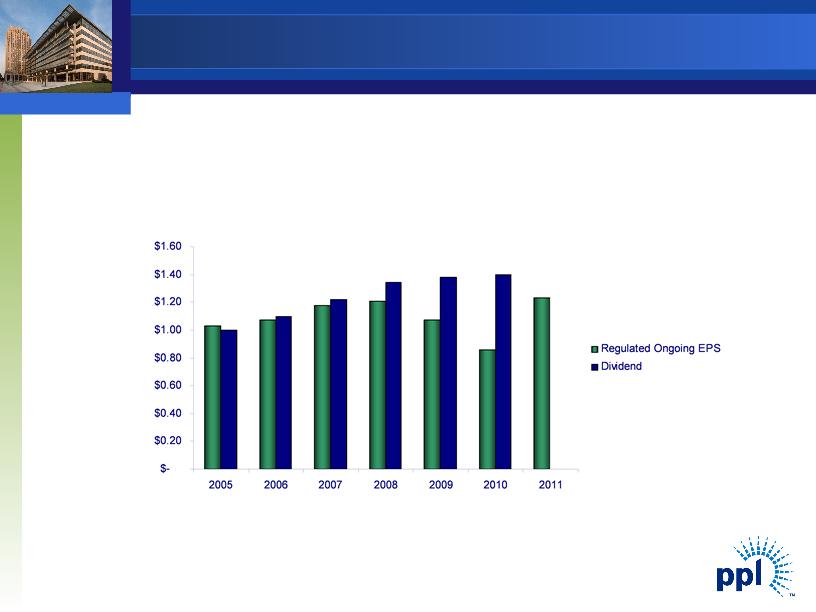

$/Share

Annualized

A significantly more rate-regulated business mix provides strong

support for current dividend and a platform for future growth

(1) Regulated EPS based on mid-point of forecast. Dividend to be determined by Board of Directors.

(1)

Dividend Profile

35

© PPL Corporation 2011

Key Expected Earnings Drivers - 2012 and 2013

§ Higher domestic regulated earnings as a result of higher rate bases and planned

distribution rate filings

§ Continued benefits from WPD’s current distribution price control review

§ Lower Supply margins as a result of depressed energy prices

§ Higher O&M

§ Positive Fundamentals in Supply

§ Heat rate expansion

§ Load recovery

36

© PPL Corporation 2011

Appendix

37

© PPL Corporation 2011

Kentucky Rate Mechanisms

§Fuel Adjustment Clause (FAC) - Collects or refunds difference between base

rate fuel component and actual fuel cost monthly with a two-month lag

§Gas Supply Clause (GSC) - Actual cost of gas supply passed through to

customers with rates reset quarterly based on projected cost with balancing

mechanism

§ Performance-Based Rate Component - Utility retains 25% of savings vs.

benchmark gas costs

§ Weather Normalization Adjustment (WNA) - Applies to residential and

commercial gas customers during winter months

§Environmental Cost Recovery Surcharge (ECR) - Entitled to recovery of and

on costs of complying with environmental regulations with a two-month lag

§Construction Work in Progress (CWIP) - Recovery on CWIP included in base

rates and ECR

§Demand-Side Management Cost Recovery Mechanism (DSMRM) - Provides

for concurrent recovery of DSM costs and provides incentive for implementing

DSM programs, including lost revenue

38

© PPL Corporation 2011

UK Electricity Distribution Regulation

§ Electricity distribution revenues are set through a Distribution Price Control

Review (DPCR) process.

§ Based on a forward looking assessment of income sufficient to finance

an efficient business.

§ Revenues cover operating and capital costs at an efficient level for the

service territory.

§ Efficiency is determined through a detailed comparable analysis of all UK

electricity distribution companies.

§ Annual adjustments for inflation

§ An incentive / penalty arrangement exists for reliability and customer

service levels.

§ The revenue that a company can earn in each rate period is the sum of:

§ The Regulator’s view of efficient costs,

§ A return on the value of Regulated Asset Value (“RAV”),

§ A return of capital being the depreciation of the RAV, and

§ Incentive payments for performance.

§ Rate set through March 31, 2015.

39

© PPL Corporation 2011

Morony

Ryan

Cochrane

Rainbow

Black Eagle

Kerr

Thompson Falls

Holter

Hauser

Madison

Mystic Lake

Corette

Colstrip

Montour

Keystone

Conemaugh

Lake

Wallenpaupack

Susquehanna

Martins Creek

Lower Mount Bethel

Ironwood

Brunner

Island

Holtwood

Hydro

Coal

Nuclear

Gas/Oil

Renewables

Key

Montana

Generating capacity - 1,278 MW

Madison

Morony

Mystic Lake

Rainbow

Ryan

Thompson Falls

Other generating stations

Pennsylvania

Generating capacity - 9,482 MW

Susquehanna

Conemaugh

Keystone

Ironwood

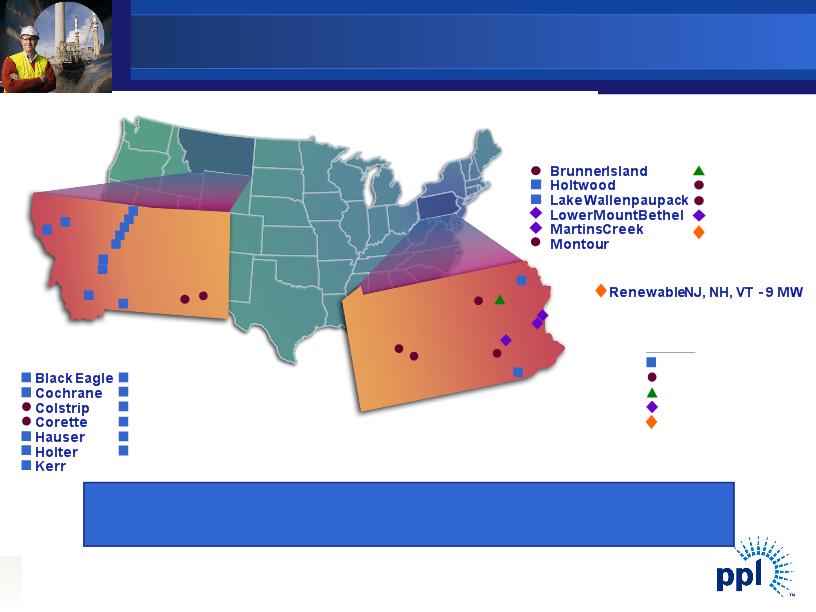

Diverse Competitive Generation Portfolio

Our size, location and diverse mix of competitive generation

gives us flexibility to adapt in a variety of market conditions

Renewable

39 Morony Ryan Cochrane Rainbow Black Eagle Kerr Thompson Falls Holter Hauser Madison Mystic Lake Corette Colstrip Montour Keystone Conemaugh Lake Wallenpaupack Susquehanna Martins Creek Lower Mount Bethel Ironwood Brunner Island Holtwood HydroCoal Nuclear Gas/Oil Renewables Key Montana Generating capacity – 1,278 MW Black Eagle Cochrane Colstrip Corette Hauser Holter Kerr Madison Morony Mystic Lake Rainb ow Ryan Thompson Falls Other generating stations Renewable NJ, NH, VT – 9 MW Pennsylvania Generating capacity – 9,482 MW Brunner Island Holtwood Lake Wallenpaupack Lower Mount Bethel Martins Creek Montour Susquehanna Conemaugh Keystone Ironwood Diverse Competitive Generation Portfolio Our size, location and diverse mix of competitive generation gives us flexibility to adapt in a variety of market conditions Renewable

40

© PPL Corporation 2011

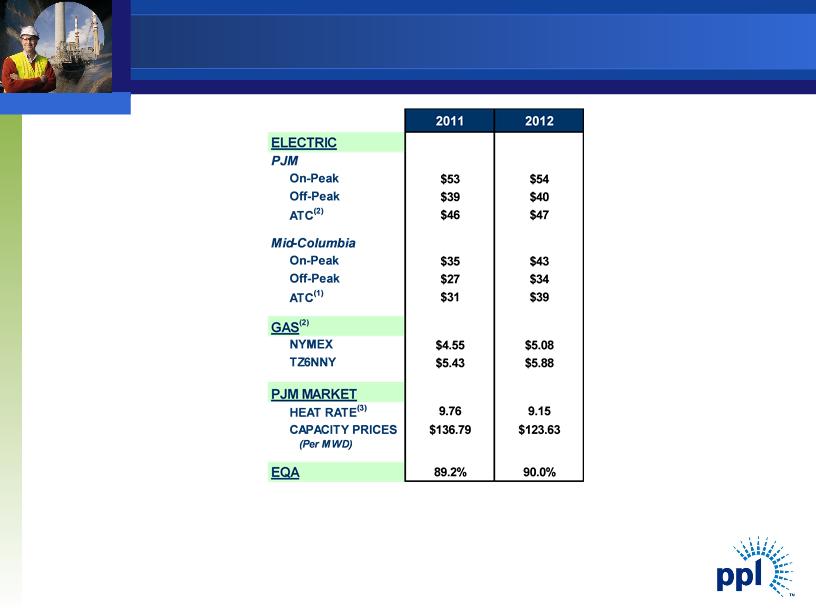

Market Prices

| |

(1) | 24-hour average |

(2) | NYMEX and TZ6NNY forward gas prices on 12/31/2010 |

(3) | Market Heat Rate = PJM on-peak power price divided by TZ6NNY gas price |

40 Market Prices 2011 2012 $53 $54 $39 $40 $46 $47 $35 $43 $27 $34 $31 $39 $4.55 $5.08 $5.43 $5.88 9.76 9.15 $136.79 $123.63 89.2% 90.0% (Per MWD) EQA HEAT RATE(3) TZ6NNY PJM MARKET ATC(1) NYMEX GAS(2) CAPACITY PRICES Mid-Columbia On-Peak Off-Peak ATC(2) ELECTRIC PJM On-Peak Off-Peak (1) 24-hour average (2) NYMEX and TZ6NNY forward gas prices on 12/31/2010 (3) Market Heat Rate = PJM on-peak power price divided by TZ6NNY gas price

41

© PPL Corporation 2011

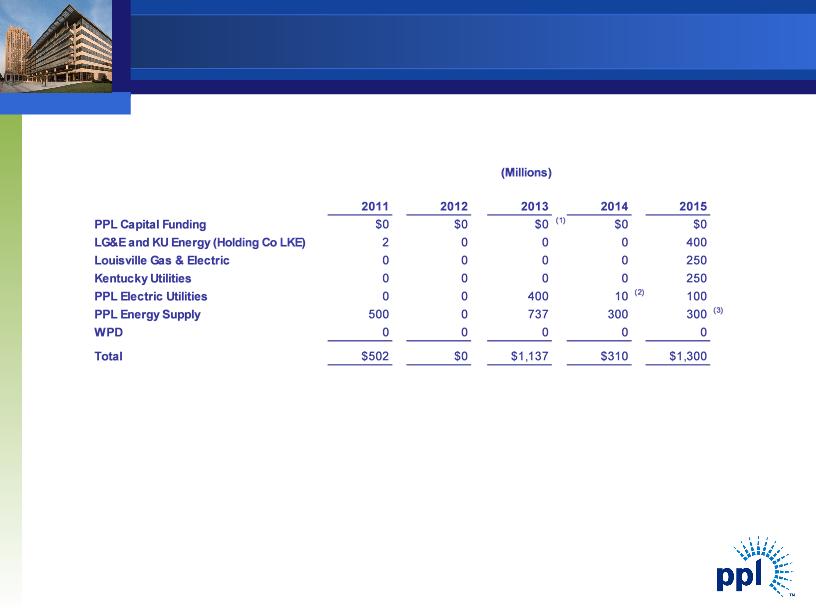

Note: As of December 31, 2010

(1) Excludes $1.15 billion of junior subordinated notes due 2018 that are a component of PPL’s Equity Units and may be

put back to PPL Capital Funding if the remarketing in 2013 is not successful.

(2) Bonds defeased in substance in 2008 by depositing sufficient funds with the trustee.

(3) Represents REset Put Securities due 2035 that are required to be put by the holders in October 2015 either for (a)

purchase and remarketing by a remarketing dealer or (b) repurchase by PPL Energy Supply.

Debt Maturities

41 Debt Maturities Note: As of December 31, 2010 (1) Excludes $1.15 billion of junior subordinated notes due 2018 that are a component of PPL’s Equity Units and may be put back to PPL Capital Funding if the remarketing in 2013 is not successful (2) Bonds defeased in substance in 2008 by depositing sufficient funds with the trustee (3) Represents REset Put Securities due 2035 that are required to be put by the holders in October 2015 either for (a) purchase and remarketing by a remarketing dealer or (b) repurchase by PPL Energy Supply. 2011 2012 2013 2014 2015 PPL Capital Funding $0 $0 $0 (1) $0 $0 LG&E and KU Energy (Holding Co LKE) 2 0 0 0 400 ; Louisville Gas & Electric 0 0 0 0 250 Kentucky Utilities 0 0 0 0 250 PPL Electric Utilities 0 0 400 10 (2) 100 PPL Energy Supply 500 0 737 300 300 (3) WPD 0 0 0 0 0 Total $502 $0 $1,137 $310 $1,300 (Millions)

42

© PPL Corporation 2011

Domestic facilities consist of a diverse bank group, with no bank and its

affiliates providing an aggregate commitment of more than 12% of the total

committed capacity.

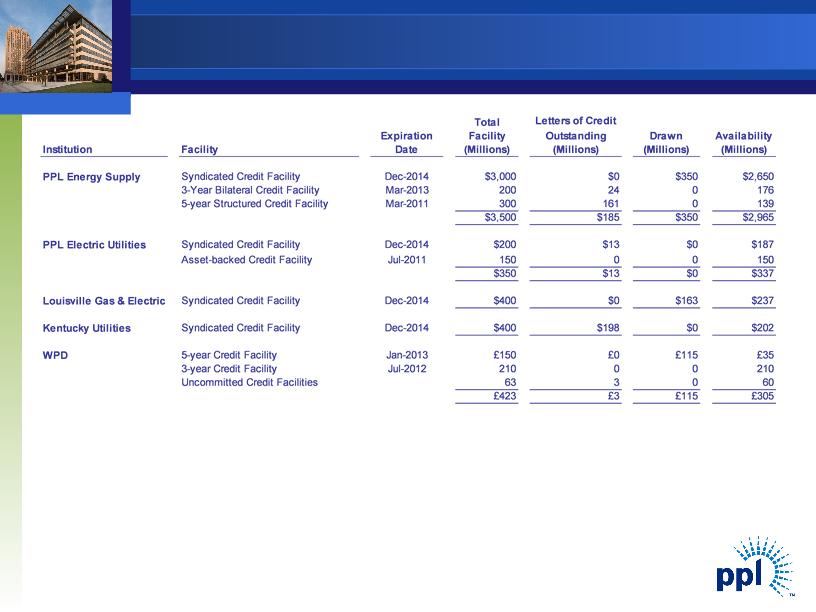

Liquidity Profile

42 Liquidity Profile Domestic facilities consist of a diverse bank group, with no bank and its affiliates providing an aggregate commitment of more than 12% of the total committed capacity. Institution Facility Expiration Date Total Facility (Millions) Letters of Credit Outstanding (Millions) Drawn (Millions) Availability (Millions) PPL Energy Supply Syndicated Credit Facility Dec-2014 $3,000 $0 $350 $2,650 3-Year Bilateral Credit Facility Mar-2013 200 24 0 176 5-year Structured Credit Facility Mar-2011 300 161 0 139 $3,500 $185 $350 $2,965 ;PPL Electric Utilities Syndicated Credit Facility Dec-2014 $200 $13 $0 $187 Asset-backed Credit Facility Jul-2011 150 0 0 150 $350 $13 $0 $337 Louisville Gas & Electric Syndicated Credit Facility Dec-2014 $400 $0 $163 $237 Kentucky Utilities Syndicated Credit Facility Dec-2014 $400 $198 $0 $202 WPD 5-year Credit Facility Jan-2013 £150 £0 £115 £35 3-year Credit Facility Jul-2012 210 0 0 210 Uncommitted Credit Facilities 63 3 0 60 £423 £3 £115 £305

43

© PPL Corporation 2011

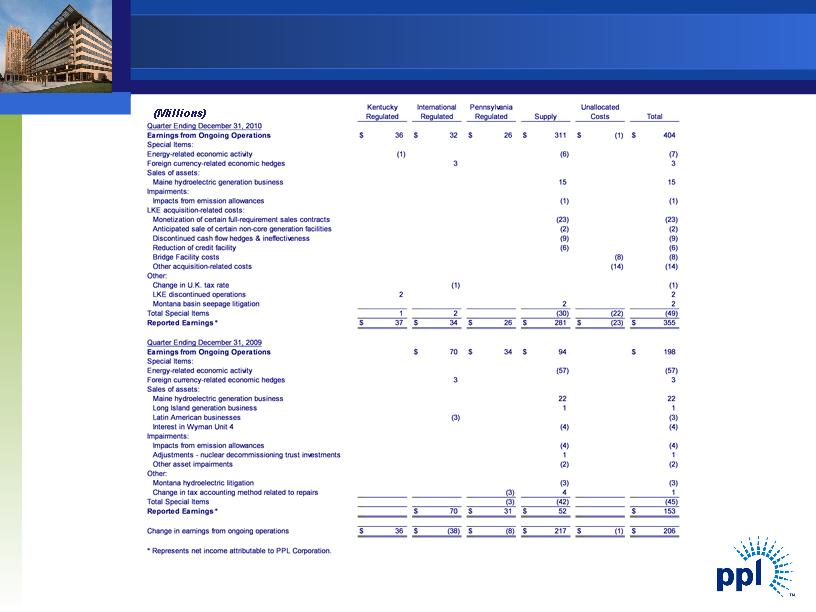

Reconciliation of Fourth Quarter Earnings from

Ongoing Operations to Reported Earnings

43 Reconciliation of Fourth Quarter Earnings from Ongoing Operations to Reported Earnings (Millions) Quarter Ending December 31, 2010 $ 36 $ 32 $ 26 $ 311 $ (1) $ 404 (1) (6) (7) 3 3 Maine hydroelectric generation business 15 15 Impacts from emission allowances (1) (1) Monetization of certain full-requirement sales contracts (23) (23) Anticipated sale of certain non-core generation facilities (2) (2) Discontinued cash flow hedges & ineffectiveness (9) (9) Reduction of credit facility (6) (6) Bridge Facility costs (8) (8) Other acquisition-related costs (14) (14) Change in U.K. tax rate (1) (1) LKE discontinued operations 2 2 Montana basin seepage litigation 2 2 1 2 (30) (22) (49) $ 37 $ 34 $ 26 $ 281 $ (23) $ 355 Quarter Ending December 31, 2009 $ 70 $ 34 $ 94 $ 198 (57) (57) 3 3 Maine hydroelectric generation business 22 22 Long Island generation business 1 1 Latin American businesses (3) (3) Interest in Wyman Unit 4 (4) (4) Impacts from emission allowances (4) (4) Adjustments -nuclear decommissioning trust investments 1 1 Other asset impairments (2) (2) Montana hydroelectric litigation (3) (3) Change in tax accounting method related to repairs (3) 4 1 (3) (42) (45) $ 70 $ 31 $ 52 $ 153 Change in earnings from ongoing operations $ 36 $ (38) $ (8) $ 217 $ (1) $ 206 * Represents net income attributable to PPL Corporation. Other: Total Special Ite ms Reported Earnings * Energy-related economic activity Foreign currency-related economic hedges Sales of assets: Impairments: Total Special Items Reported Earnings * Earnings from Ongoing Operations Special Items: Sales of assets: Impairments: LKE acquisition-related costs: Other: Earnings from Ongoing Operations Special Items: Energy-related economic activity Foreign currency-related economic hedges Regulated Supply Pennsylvania Kentucky International Regulated Regulated Unallocated Costs Total

44

© PPL Corporation 2011

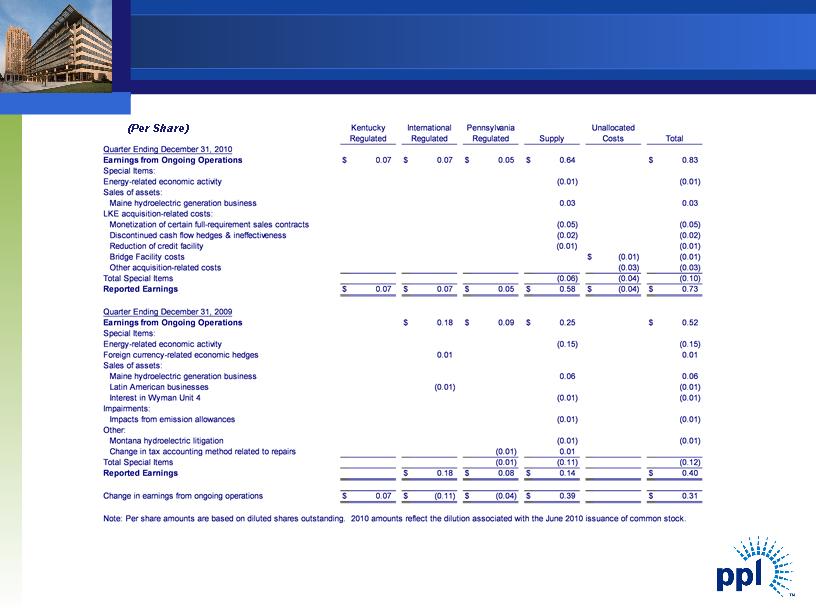

Reconciliation of Fourth Quarter Earnings from

Ongoing Operations to Reported Earnings

44 Reconciliation of Fourth Quarter Earnings from Ongoing Operations to Reported Earnings (Per Share) Quarter Ending December 31, 2010 $ 0.07 $ 0.07 $ 0.05 $ 0.64 $ 0.83 (0.01) (0.01) Maine hydroelectric generation business 0.03 0.03 Monetization of certain full-requirement sales contracts (0.05) (0.05) Discontinued cash flow hedges & ineffectiveness (0.02) (0.02) Reduction of credit facility (0.01) (0.01) Bridge Facility costs $ (0.01) (0.01) Other acquisition-related costs (0.03) (0.03) (0.06) (0.04) (0.10) $ 0.07 $ 0.07 $ 0.05 $ 0.58 $ (0.04) $ 0.73 Quarter Ending December 31, 2009 $ 0.1 8 $ 0.09 $ 0.25 $ 0.52 (0.15) (0.15) 0.01 0.01 Maine hydroelectric generation business 0.06 0.06 Latin American businesses (0.01) (0.01) Interest in Wyman Unit 4 (0.01) (0.01) Impacts from emission allowances (0.01) (0.01) Montana hydroelectric litigation (0.01) (0.01) Change in tax accounting method related to repairs (0.01) 0.01 (0.01) (0.11) (0.12) $ 0.18 $ 0.08 $ 0.14 $ 0.40 Change in earnings from ongoing operations $ 0.07 $ (0.11) $ (0.04) $ 0.39 $ 0.31 Note: Per share amounts are based on diluted shares outstanding. 2010 amounts reflect the dilution associated with the June 2010 issuance of common stock. Unallocated Costs Total Kentucky International Regulated Regulated Regulated Supply Pennsylvania Earnings from Ongoing Operations Special Items: Earnings from Ongoing Operations & #160;Special Items: Energy-related economic activity Sales of assets: LKE acquisition-related costs: Total Special Items Reported Earnings Total Special Items Reported Earnings Energy-related economic activity Foreign currency-related economic hedges Sales of assets: Impairments: Other:

45

© PPL Corporation 2011

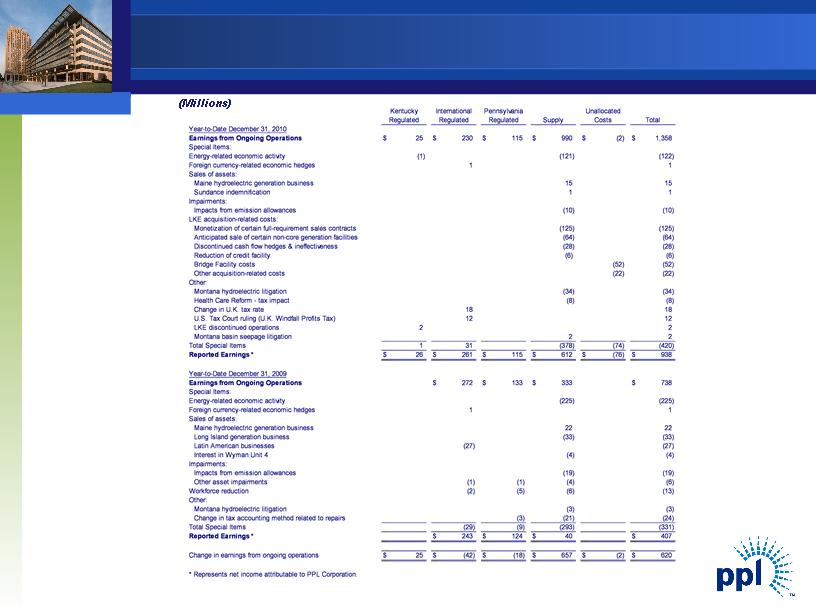

Reconciliation of Year-to-Date Earnings from

Ongoing Operations to Reported Earnings

45 Reconciliation of Year-to-Date Earnings from Ongoing Operations to Reported Earnings (Millions) Year-to-Date December 31, 2010 $ 25 $ 230 $ 115 $ 990 $ (2) $ 1,358 (1) (121) (122) 1 1 Maine hydroelectric generation business 15 15 Sundance indemnification 1 1 Impacts from emission allowances (10) (10) Monetization of certain full-requirement sales contracts (125) (125) Anticipated sale of certain non-core generation facilities (64) (64) Discontinued cash flow hedges & ineffectiveness (28) (28) Reduction of credit facility (6) (6) Bridge Facility costs (52) (52) Other acquisition-related c osts (22) (22) Montana hydroelectric litigation (34) (34) Health Care Reform -tax impact (8) (8) Change in U.K. tax rate 18 18 U.S. Tax Court ruling (U.K. Windfall Profits Tax) 12 12 LKE discontinued operations 2 2 Montana basin seepage litigation 2 2 1 31 (378) (74) (420) $ 26 $ 261 $ 115 $ 612 $ (76) $ 938 Year-to-Date December 31, 2009 $ 272 $ 133 $ 333 $ 738 (225) (225) 1 1 Maine hydroelectric generation business 22 22 Long Island generation business (33) (33) Latin American businesses (27) (27) Interest in Wyman Unit 4 (4) (4) Impacts from emission allowances (19) (19) Other asset impairments (1) (1) (4) (6) (2) (5) (6) (13) Montana hydroelectric litigation (3) (3) Change in tax accounting method related to repairs (3) (21) (24) (29) (9) (293) (331) $ 243 $ 124 $ 40 $ 407 Change in earnings from ongoing operations $ 25 $ (42) $ (18) $ 657 $ (2) $ 620 * Represents net income attributable to PPL Corporation. Unallocated Costs Total Kentucky International Regulated Regulated Regulated Supply Pennsylvania Earnings from Ongoing Operations Special Items: Energy-related economic activity Foreign currency-related economic hedges Sales of assets: Impairments: LKE acquisition-related costs: Other: Total Special Items Reported Earnings * Earnings from Ongoing Operations Special Items: Total Special Items Reported Earnings * Energy-related economic activity Foreign currency-related economic hedges Sales of assets: Impairments: Workforce reduction Other:

46

© PPL Corporation 2011

Reconciliation of Year-to-Date Earnings from

Ongoing Operations to Reported Earnings

46 Reconciliation of Year-to-Date Earnings from Ongoing Operations to Reported Earnings (Per Share) Year-to-Date December 31, 2010 $ 0.06 $ 0.53 $ 0.27 $ 2.27 $ 3.13 (0.27) (0.27) Maine hydroelectric generation business 0.03 0.03 Impacts from emission allowances (0.02) (0.02) Monetization of certain full-requirement sales contracts (0.29) (0.29) Anticipated sale of certain non-core generation facilities (0.14) (0.14) Discontinued cash flow hedges & ineffectiveness (0.06) (0.06) Reduction of credit facility (0.01) (0.01) Bridge Facility costs $ (0.12) (0.12) Other acquisition-related costs (0.05) (0.05) � 0;Montana hydroelectric litigation (0.08) (0.08) Health Care Reform -tax impact (0.02) (0.02) Change in U.K. tax rate 0.04 0.04 U.S. Tax Court ruling (U.K. Windfall Profits Tax) 0.03 0.03 0.07 (0.86) (0.17) (0.96) $ 0.06 $ 0.60 $ 0.27 $ 1.41 $ (0.17) $ 2.17 Year-to-Date December 31, 2009 $ 0.72 $ 0.35 $ 0.88 $ 1.95 (0.59) (0.59) Maine hydroelectric generation business 0.06 0.06 Long Island generation business (0.09) (0.09) Latin American businesses (0.07) (0.07) Interest in Wyman Unit 4 (0.01) (0.01) Impacts from emission allowances (0.05) (0.05) Other asset impairments (0.01) (0.01) (0.01) (0.01) (0.01) (0.03) Montana hydroelectric litigation (0.01) (0.01) Change in tax accounting method related to repairs (0.01) (0.06) (0.07) (0.08) (0.02) (0.77) (0.87) $ 0.64 $ 0.33 $ 0.11 $ 1.08 Change in earnings from ongoing operations $ 0.06 $ (0.19) $ (0.08) $ 1.39 $ 1.18 Note: Per share amounts are based on diluted shares outstanding. 2010 amounts reflect the dilution associated with the June 2010 issuance of common stock. Unallocated Earnings from Ongoing Operations Special Items: Earnings from Ongoing Operations Special Items: Energy-related economic activity Sales of assets: LKE acquisition-related costs: Other: Costs Total Kentucky International Regulated Regulated Regulated Supply Pennsylvania Impairments: Total Special Items Reported Earnings Total Special Items Reported Earnings Energy-related economic activity Sales of assets: Impairments: Workforce reduction Other:

47

© PPL Corporation 2011

(Per Share)

Reconciliation of PPL’s Earnings from Ongoing

Operations to Reported Earnings

47 Reconciliation of PPL’s Earnings from Ongoing Operations to Reported Earnings High Low 2011 2011 2010 [a] 2009 2008 Earnings from Ongoing Operations per share of common stock 2.60 $ 2.40 $ 3.13 $ 1.95 $ 2.02 $ Special Items: Energy-related economic activity (0.27) (0.59) 0.67 Sales of assets: Maine hydroelectric generation business 0.03 0.06 Long Island generation business (0.09) Latin American businesses (0.07) Interest in Wyman Unit 4 (0.01) Gas and propane businesses (0.01) Impairments: Impacts from emission allowances (0.02) (0.05) (0.07) Adjustments -nuclear decommissioning trust investments (0.04) Holtwood hydroelectric plant (0.03) Other asset impairments (0.01) (0.01) LKE acquisition-related costs: Monetization of certain full-requirement sales contracts (0.29) Anticipated sale of certain non-core generation facilities (0.14) Bridge Facility costs (0.12) Discontinued cash flow hedges & ineffectiveness (0.06) Reduction of credit facility (0.01) Other acquisition-related costs (0.05) Workforce reductions (0.03) (0.01) Other: Montana hydroelectric litigation (0.08) (0.01) Health Care Reform -tax impact (0.02) Change in U.K. tax rate 0.04 U.S. Tax Court ruling (U.K. Windfall Profits Tax) 0.03 Change in tax accounting method related to repairs (0.07) Synfuel tax adjustment (0.04) Montana basin seepage litigation (0.01) Total Special Items (0.96) (0.87) 0.45 Reported Earnings per share of common stock 2.60 $ 2.40 $ 2.17 $ 1.08 $ 2.47 $ Note: Amounts are based on diluted shares outstanding. [a] Reflects the dilution associated with the June 2010 issuance of common stock. Forecast Actual (Per Share)

48

© PPL Corporation 2011

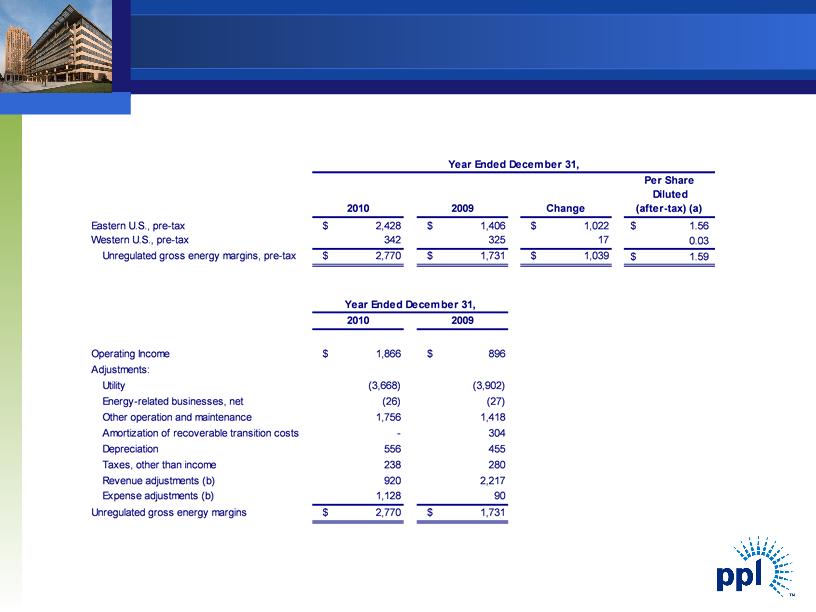

A-10

(Millions of Dollars)

(a) Excludes dilution associated with the June 2010 issuance of common stock. (b) See additional information on the following slide. |

Reconciliation of Year-to-Date Operating Income

to Unregulated Gross Energy Margins

48 Reconciliation of Year-to-Date Operating Income to Unregulated Gross Energy Margins 2010 2009 Change Per Share Diluted (after-tax) (a) Eastern U.S., pre-tax $ 2,428 $ 1,406 $ 1,022 1.56 $ Western U.S., pre-tax 342 325 17 0.03 Unregulated gross energy margins, pre-tax $ 2,770 $ 1,731 $ 1,039 1.59 $ 2010 2009 Operating Income $ 1,866 $ 896 Adjustments: Utility (3,668) (3,902) Energy-related businesses, net (26) (27) Other operation and maintenance 1,756 1,418 Amortization of recoverable transition costs -304 Depreciation 556 455 Taxes, other than income 238 280 ;Revenue adjustments (b) 920 2,217 Expense adjustments (b) 1,128 90 Unregulated gross energy margins $ 2,770 $ 1,731 Year Ended December 31, Year Ended December 31, A-10 (Millions of Dollars) (a) Excludes dilution associated with the June 2010 issuance of common stock. (b) See additional information on the following slide.

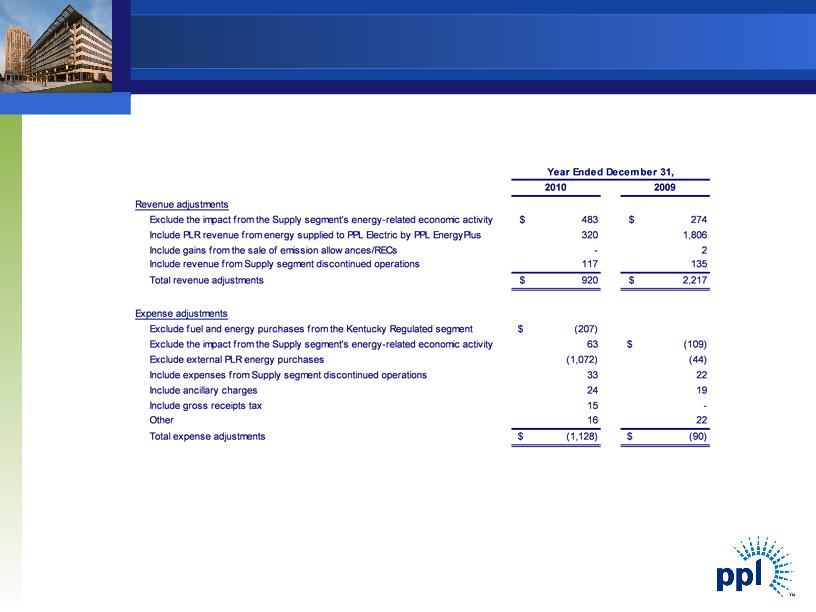

49

© PPL Corporation 2011

A-10

(Millions of Dollars)

Reconciliation of Year-to-Date Operating Income

to Unregulated Gross Energy Margins

49 © PPL Corporation 2011 A-10 Reconciliation of Year-to-Date Operating Income to Unregulated Gross Energy Margins (Millions of Dollars) 2010 2009 Revenue adjustments Exclude the impact from the Supply segment's energy-related economic activity $ 483 $ 274 Include PLR revenue from energy supplied to PPL Electric by PPL EnergyPlus 320 1,806 Include gains from the sale of emission allowances/RECs -2 Include revenue from Supply segment discontinued operations 117 135 Total revenue adjustments $ 920 $ 2,217 Expense adjustments Exclude fuel and energy purchases from the Kentucky Regulated segment $ (207) Exclude the impact from the Supply segment's energy-related economic activity 63 $ (109) Exclude external PLR energy purchases (1,072) (44) Include expenses from Supply segment discontinued operations 33 22 Include ancillary charges 24 19 Include gross receipts tax 15 - Other 16 22 Total expense adjustments $ (1,128) $ (90) Year Ended December 31,

50

© PPL Corporation 2011

| 2009 | | 2010 | | 2011 |

Cash from Operations | $1,852 | | $2,034 | | $2,399 |

Increase (Decrease) in cash due to: | | | | | |

Capital Expenditures | (1,265) | | (1,644) | | (2,505) |

Sale of Assets | 84 | | 161 | | 381 |

Other Investing Activities - Net | (71) | | (20) | | 0 |

Free Cash Flow before Dividends | $ 600 | | $ 531 | | $ 275 |

(Millions of Dollars)

PPL Corporation Reconciliation of Cash from

Operations to Free Cash Flow before Dividends

51

© PPL Corporation 2011

Statements contained in this news release, including statements with respect to future events and their timing, including statements

concerning the acquisition by PPL Corporation of E.ON U.S. LLC and its subsidiaries Louisville Gas and Electric Company and

Kentucky Utilities Company (collectively, the “Kentucky Entities”), the expected results of operations of any of the Kentucky Entities or

PPL Corporation both before or following PPL Corporation’s acquisition of the Kentucky Entities, as well as statements as to future

earnings, energy prices, margins and sales, growth, revenues, expenses, cash flow, credit profile, ratings, financing, asset disposition,

marketing performance, hedging, regulation, corporate strategy and generating capacity and performance, are “forward-looking

statements” within the meaning of the federal securities laws. Although PPL Corporation believes that the expectations and

assumptions reflected in these forward-looking statements are reasonable, these expectations, assumptions and statements are

subject to a number of risks and uncertainties, and actual results may differ materially from the results discussed in the statements.

The following are among the important factors that could cause actual results to differ materially from the forward-looking statements:

capital market conditions and decisions regarding capital structure; the market prices of equity securities and the impact on pension

income and resultant cash funding requirements for defined benefit pension plans; the securities and credit ratings of PPL Corporation

and its subsidiaries; stock price performance; receipt of necessary government permits, approvals, rate relief and regulatory cost

recovery; market demand and prices for energy, capacity and fuel; weather conditions affecting customer energy usage and operating

costs; competition in power markets; the effect of any business or industry restructuring; the profitability and liquidity of PPL

Corporation, the Kentucky Entities and either of their subsidiaries; new accounting requirements or new interpretations or applications

of existing requirements; operating performance of plants and other facilities; environmental conditions and requirements and the

related costs of compliance, including environmental capital expenditures and emission allowance and other expenses; system

conditions and operating costs; development of new projects, markets and technologies; performance of new ventures; asset

acquisitions and dispositions; any impact of hurricanes or other severe weather on our business, including any impact on fuel prices;

the impact of state, federal or foreign investigations applicable to PPL Corporation, the Kentucky Entities and either of their

subsidiaries; the outcome of litigation against PPL Corporation, the Kentucky Entities and either of their subsidiaries; political,

regulatory or economic conditions in states, regions or countries where PPL Corporation, the Kentucky Entities and either of their

subsidiaries conduct business, including any potential effects of threatened or actual terrorism or war or other hostilities; foreign

exchange rates; new state, federal or foreign legislation, including new tax or environmental legislation or regulation; and the

commitments and liabilities of PPL Corporation, the Kentucky Entities and each of their subsidiaries. Any such forward-looking

statements should be considered in light of such important factors and in conjunction with PPL Corporation’s Form 10-K and other

reports on file with the Securities and Exchange Commission.

Forward-Looking Information Statement

52

© PPL Corporation 2011

“Earnings from ongoing operations” should not be considered as an alternative to reported earnings, or net income attributable to PPL, which is an

indicator of operating performance determined in accordance with generally accepted accounting principles (GAAP). PPL believes that “earnings from

ongoing operations,” although a non-GAAP financial measure, is also useful and meaningful to investors because it provides management’s view of

PPL’s fundamental earnings performance as another criterion in making investment decisions. PPL’s management also uses “earnings from ongoing

operations” in measuring certain corporate performance goals. Other companies may use different measures to present financial performance.

“Earnings from ongoing operations” is adjusted for the impact of special items. Special items include:

• Energy-related economic activity (as discussed below).

• Foreign currency-related economic hedges.

• Gains and losses on sales of assets not in the ordinary course of business.

• Impairment charges (including impairments of securities in the company’s nuclear decommissioning trust funds).

• Workforce reduction and other restructuring impacts.

• Costs and charges related to the acquisition of E.ON U.S.

• Other charges or credits that are, in management’s view, not reflective of the company’s ongoing operations.

Energy-related economic activity includes the changes in fair value of positions used economically to hedge a portion of the economic value of PPL’s

generation assets, load-following and retail activities. This economic value is subject to changes in fair value due to market price volatility of the input

and output commodities (e.g., fuel and power). Also included in this special item are the ineffective portion of qualifying cash flow hedges and the

premium amortization associated with options classified as economic activity. These items are included in ongoing earnings over the delivery period

of the item that was hedged or upon realization. Management believes that adjusting for such amounts provides a better matching of earnings from

ongoing operations to the actual amounts settled for PPL’s underlying hedged assets. Please refer to the Notes to the Consolidated Financial

Statements and MD&A in PPL Corporation’s periodic filings with the Securities and Exchange Commission for additional information on energy-

related economic activity.

“Free cash flow before dividends” is derived by deducting capital expenditures and other investing activities-net, from cash flow from operations. Free

cash flow before dividends should not be considered as an alternative to cash flow from operations, which is determined in accordance with GAAP.

PPL believes that free cash flow before dividends, although a non-GAAP measure, is an important measure to both management and investors since

it is an indicator of the company’s ability to sustain operations and growth without additional outside financing beyond the requirement to fund

maturing debt obligations. Other companies may calculate free cash flow before dividends in a different manner.

Definitions of Non-GAAP Financial Measures